Exhibit 99.1

PRESS RELEASE

Atento Reports Third Quarter Fiscal 2015 Results

9.4% Growth in Revenue Increases Leadership Position in LatAm CRM/BPO Market

| | • | | Growth in revenue led by double-digit gains in Latin America |

| | • | | Improvement in adjusted EBITDA driven by revenue growth, increased productivity and efficiencies |

| | • | | Adjusted EPS of $0.31, up 35.4% |

| | • | | Positive free cash flow and strong liquidity enhance financial flexibility |

NEW YORK, NY, November 9, 2015 –Atento S.A. (NYSE: ATTO), the largest provider of customer relationship management and business process outsourcing services in Latin America and Spain, drove growth in both revenue and key profitability measures during the company’s fiscal-2015 third quarter ended September 30, 2015. All comparisons are on a constant currency (CCY) basis and year-over-year unless noted otherwise.

Summary

| | | | | | | | | | | | | | | | |

($ in millions) | | Q3 2015 | | | Q3 2014 | | | 9M 2015 | | | 9M 2014 | |

Revenue | | | 476.2 | | | | 589.6 | | | | 1,507.8 | | | | 1,743.3 | |

CCY growth(1) | | | 9.4 | % | | | | | | | 10.0 | % | | | | |

Adjusted EBITDA | | | 65.8 | | | | 88.2 | | | | 186.2 | | | | 219.8 | |

Margin | | | 13.8 | % | | | 15.0 | % | | | 12.3 | % | | | 12.6 | % |

CCY growth | | | 4.2 | % | | | | | | | 10.0 | % | | | | |

Adjusted EPS(2) | | $ | 0.31 | | | $ | 0.45 | | | $ | 0.73 | | | $ | 0.84 | |

CCY growth | | | 35.4 | % | | | | | | | 16.4 | % | | | | |

Leverage (x) (3) | | | 1.5 | | | | 1.4 | | | | 1.5 | | | | 1.4 | |

(1) | Constant currency revenue growth from continuing operations excludes the Czech Republic, which was divested in December 2014. |

(2) | Adjusted earnings per share, for the period ended September 30, 2015, were calculated considering the number of ordinary shares of 73,648,760. For the period ended September 30, 2014 the number of ordinary shares was 73,619,511. |

(3) | Considered the pro-forma Net Debt adjusted to give effect to the Reorganization Transaction, regarding Preferred Equity Certificates. |

“We achieved solid sustained, balanced growth and profitability in the third quarter despite operating in a challenging macroeconomic environment. We continue to deliver more value to our clients and provide them with the best and most efficient customer experience solutions,” said Alejandro Reynal, Atento´s Chief Executive Officer. “At the same time, we have further enhanced our overall financial strength and flexibility, by generating $15.3 million in free cash flow, and ending the quarter with $230 million in liquidity and a net leverage of 1.5 times. This strong financial position makes Atento an even more reliable partner for our clients, especially in this challenging environment.”

Mr. Reynal said that although not immune to current macroeconomic headwinds and its future uncertainties, the Company is extending its CRM/BPO leadership in Latin America. Atento is best positioned to continue gaining new business and market share thanks to its unique value proposition, scale, vertical expertise and long lasting client relationships. As a result, the Company is reaffirming its guidance for Fiscal 2015.

All growth rates are in constant currency and year-over-year unless noted otherwise

1

PRESS RELEASE

Consolidated Operating Results

Revenue for the quarter, excluding the Czech Republic which was divested in December 2014, increased 9.4%. This growth was driven by a 9.0% increase in Brazil, a 15.9% increase in the Americas, and improvement in sequential growth in EMEA. On a reported basis, revenue declined 19.2%.

Adjusted EBITDA increased 4.2% while adjusted EBITDA margin declined 120 basis points to 13.8%. This decline was driven by a shift in the mix of countries (particularly Brazil) due to material devaluation of currencies, and a shift in timing of pass through of wage inflation into price increases in Argentina, which had a neutral impact year-to-date. On a constant currency basis adjusted EBITDA margin was down 70 basis points to 14.3% in the quarter, and up 10 basis points to 12.7% year-to-date.

Adjusted EPS increased 35.4% to $0.31, driven by the increase in adjusted EBITDA, a decline in net interest expense and lower tax expense.

In the quarter, the Company generated $15.3 million in free cash flow.

Adjusted quarterly earnings and EBITDA are non-GAAP financial measures and are reconciled to their most directly comparable GAAP measures in the accompanying financial tables.

Segment Reporting

| | | | | | | | | | | | | | | | |

| | | Q3 2015 | | | Q3 2014 | | | 9M 2015 | | | 9M 2014 | |

Brazil Region | | | | | | | | | | | | | | | | |

Revenue | | | 216.5 | | | | 307.7 | | | | 737.6 | | | | 906.2 | |

CCY growth | | | 9.0 | % | | | | | | | 11.7 | % | | | | |

Adjusted EBITDA | | | 33.6 | | | | 46.8 | | | | 100.0 | | | | 123.7 | |

Margin | | | 15.5 | % | | | 15.2 | % | | | 13.6 | % | | | 13.7 | % |

CCY growth | | | 13.2 | % | | | | | | | 13.4 | % | | | | |

| | | | | | | | | | | | | | | | |

Americas Region | | | | | | | | | | | | | | | | |

Revenue | | | 200.3 | | | | 204.3 | | | | 585.9 | | | | 576.7 | |

CCY growth | | | 15.9 | % | | | | | | | 16.6 | % | | | | |

Adjusted EBITDA | | | 28.2 | | | | 35.5 | | | | 79.9 | | | | 85.2 | |

Margin | | | 14.1 | % | | | 17.4 | % | | | 13.6 | % | | | 14.8 | % |

CCY growth | | | -3.1 | % | | | | | | | 9.9 | % | | | | |

| | | | | | | | | | | | | | | | |

EMEA Region | | | | | | | | | | | | | | | | |

Revenue | | | 59.8 | | | | 77.7 | | | | 185.7 | | | | 260.8 | |

CCY growth(1) | | | -5.5 | % | | | | | | | -10.8 | % | | | | |

Adjusted EBITDA | | | 5.3 | | | | 6.5 | | | | 11.7 | | | | 17.4 | |

Margin | | | 8.9 | % | | | 8.4 | % | | | 6.3 | % | | | 6.7 | % |

CCY growth | | | -3.1 | % | | | | | | | -18.2 | % | | | | |

| | | | | | | | | | | | | | | | |

(1) | Constant currency revenue growth from continuing operations excludes the Czech Republic, which was divested in December 2014 |

2

PRESS RELEASE

Brazil Region

Revenue for the Brazil region increased 9.0% driven by a 16.9% increase in revenue from non-Telefónica clients. This growth was supported by new clients, increased share of wallet with existing clients, particularly in financial services, and an increase in the mix of higher value-added solutions. Revenue from Telefónica declined 2.4% due to macro-driven declines in volume. On a reported basis, revenue declined 29.6%.

Adjusted EBITDA improved 13.2% while margin increased 30 basis points to 15.5%. This improvement in profitability was driven by the strong growth in revenue and cost and efficiency initiatives, which were partially offset by the ramp of new clients and the increasing adverse macro-economic conditions. Excluding the impact of corporate cost allocations, adjusted EBITDA was $55.9 million and margin decreased 30 basis points to 16.3%.

Americas Region

Revenue for the Americas region increased 15.9% supported by a 23.1% increase in revenue from non-Telefónica clients and an 8.2% increase in revenue from Telefónica. The strong growth with non-Telefónica clients was supported by new and existing clients, especially in Peru, Colombia and U.S. nearshore. Growth in revenue from Telefónica was driven by Mexico, Peru and Argentina. On a reported basis revenue decreased 2.0%.

Adjusted EBITDA declined 3.1% and margin declined 330 basis points to 14.1%. Excluding the impact of corporate cost allocations, adjusted EBITDA was $38.2 million and margin decreased 270 basis points to 15.7%. The decline in profitability was mostly driven by a shift in the timing of the pass through of wage inflation into price increases in Argentina, which had a neutral impact year-to-date, as well as a shift in country mix.

EMEA Region

Revenue for the EMEA region declined 5.5%, driven by an 8.6% decrease in revenue from non-Telefónica clients. These declines were attributed to lower volumes from Public Administration contracts in Spain, which more than offset stronger growth from private sector clients. Revenue from Telefónica declined 3.6%. On a reported basis, revenue declined 23.0%.

Adjusted EBITDA declined 3.1%, largely driven by the decline in revenue, while adjusted EBITDA margin increased 50 basis points to 8.9%. The growth in adjusted EBITDA margin was driven by cost and efficiency initiatives partially offset by the ramp of new clients and shifts in revenue mix. Excluding the impact of corporate cost allocations, adjusted EBITDA was $6.5 million and margin increased 70 basis points to 9.1%.

Strong Balance Sheet and Ample Liquidity Enhancing Financial Flexibility

At September 30, 2015, the Company had cash, cash equivalents and short-term financial investments totaling $174.7 million, undrawn revolving credit facilities of €50 million and total net debt with third parties of $398.0 million, a decline of $32.6 million. The Company’s LTM adjusted EBITDA to net debt with third parties decreased to 1.5x.

During the third quarter of 2015, the Company invested $16.2 million, or 3.4% of revenue, in cash capital expenditures related to investments in maintenance and growth.

3

PRESS RELEASE

Fiscal 2015 Outlook

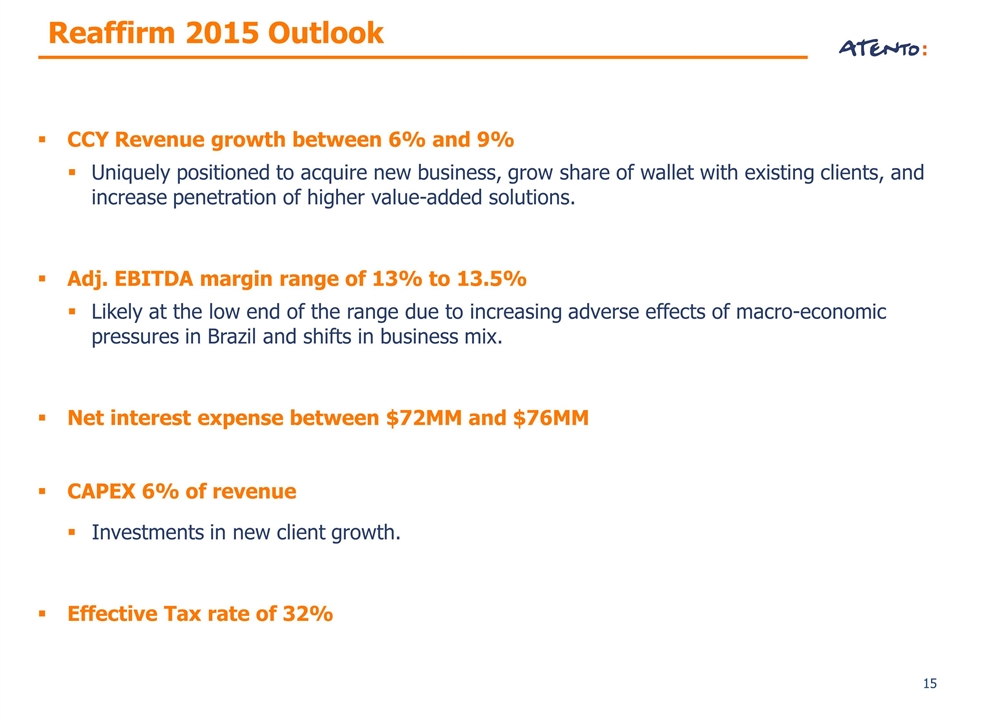

The Company reiterated its previously disclosed fiscal 2015 revenue growth target of 6% to 9%, and adjusted EBITDA margin in the range of 13% to 13.5%, both in constant currency. Given the increasing adverse effects of the negative macro-economic environment in Brazil, and shifts in business mix, the Company believes it will be at the low end of this margin range. The Company is targeting capex as a percent of revenue of 6% as it invests in the growth of new clients, net interest expense between $72 and $76 million, an effective tax rate of approximately 32%, and a fully diluted share count of approximately 73.8 million shares.

This guidance assumes no acquisitions or changes in the current operating environment, capital structure or exchange rates movements on the translation of our financial statements in USD.

Conference Call

Atento will host a conference call and webcast for analysts on Monday, November 9, 2015 at 8:00 am ET to discuss the financial results. The conference call can be accessed by dialing: +1 (877) 407-3982 toll free domestic, UK: (+44) 0 800 756 3429 toll free, Brazil: (+55) 0 800 891 6221 toll free, or Spain: (+34) 900 834 236 toll free. All other international callers can access the conference call by dialing: +1 (201) 493-6780 toll free. No passcode is required. Individuals who dial in will be asked to identify themselves and their affiliations. The conference call will also be webcasted through a link on Atento’s Investor Relations website at investors.atento.com. A web-based archive of the conference call will also be available at the above website.

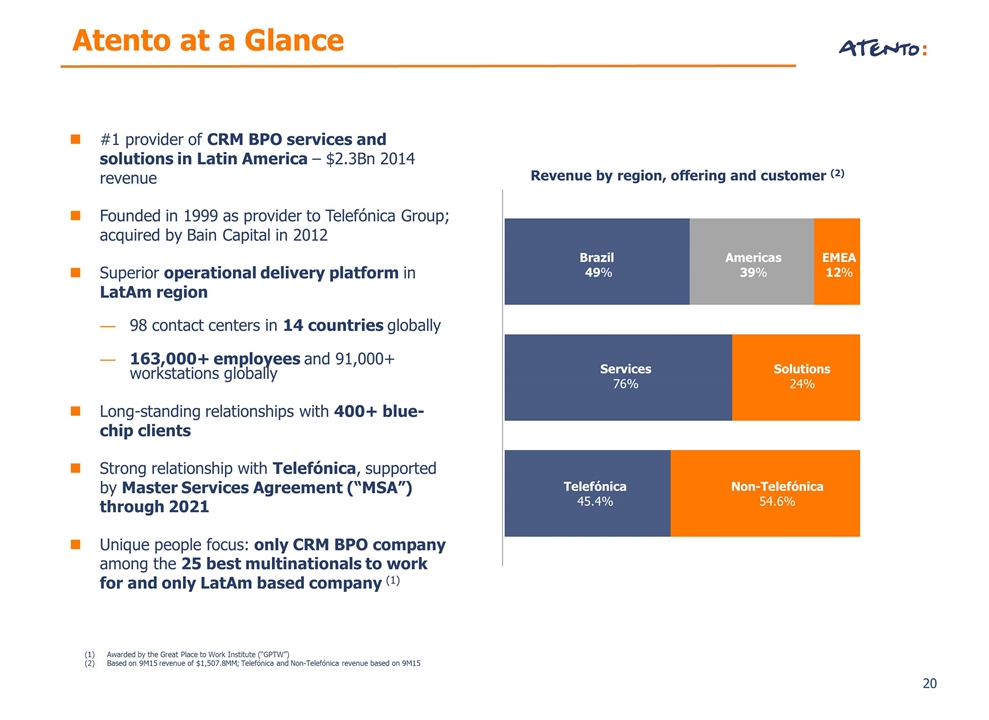

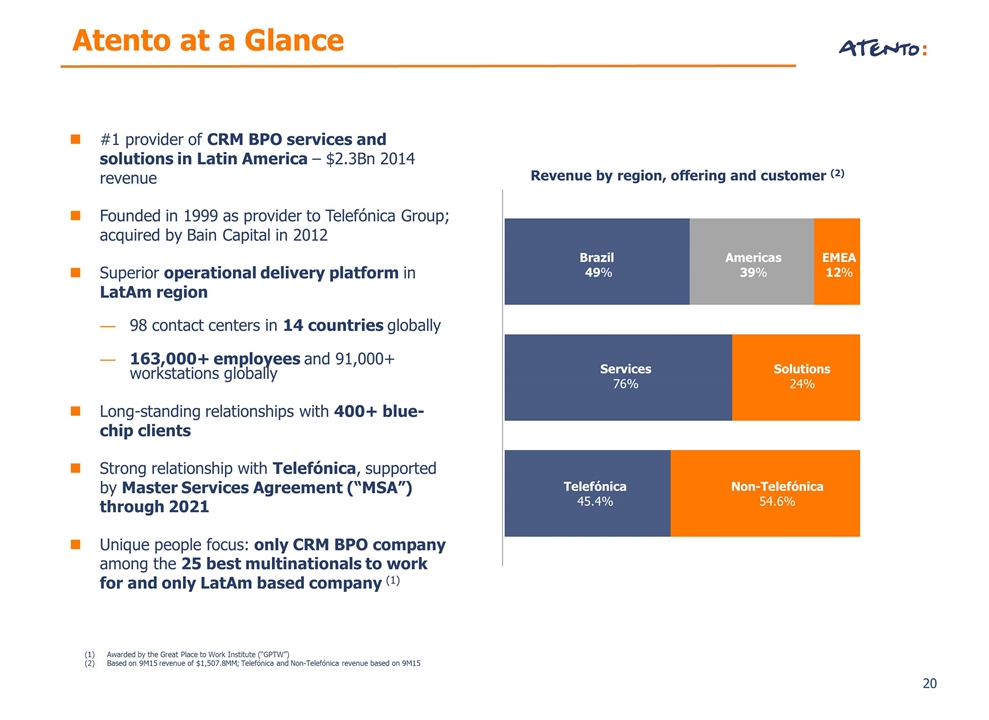

About Atento

Atento is the largest provider of customer relationship management and business process outsourcing (CRM BPO) services in Latin America and among the top three providers globally, based on revenues. Atento is also a leading provider for U.S.-based companies nearshoring CRM/BPO services to Latin America. Since 1999, the Company has developed its business model in 14 countries where it employs over 160,000 people. Atento has over 400 clients to whom it offers a wide range of CRM BPO services across multiple channels. Atento’s clients are mostly leading multinational corporations in sectors such as telecommunications, banking and financial services, media and technology, health, retail and public administrations, among others. Atento’s shares trade under the symbol ATTO on the New York Stock Exchange (NYSE). For more information visitwww.atento.com.

Investor Relations

Lynn Antipas Tyson + 1 914 485 1150

lynn.tyson@atento.com

Media

Maite Cordero + 34 917 40 74 47

media@atento.com

4

PRESS RELEASE

Forward-Looking Statements

This press release contains forward-looking statements. Forward-looking statements can be identified by the use of words such as “may,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “intends,” “continue” or similar terminology. These statements reflect only Atento’s current expectations and are not guarantees of future performance or results. These statements are subject to risks and uncertainties that could cause actual results to differ materially from those contained in the forward-looking statements. These risks and uncertainties include, but are not limited to, competition in Atento’s highly competitive industries; increases in the cost of voice and data services or significant interruptions in these services; Atento’s ability to keep pace with its clients’ needs for rapid technological change and systems availability; the continued deployment and adoption of emerging technologies; the loss, financial difficulties or bankruptcy of any key clients; the effects of global economic trends on the businesses of Atento’s clients; the non-exclusive nature of Atento’s client contracts and the absence of revenue commitments; security and privacy breaches of the systems Atento uses to protect personal data; the cost of pending and future litigation; the cost of defending Atento against intellectual property infringement claims; extensive regulation affecting many of Atento’s businesses; Atento’s ability to protect its proprietary information or technology; service interruptions to Atento’s data and operation centers; Atento’s ability to retain key personnel and attract a sufficient number of qualified employees; increases in labor costs and turnover rates; the political, economic and other conditions in the countries where Atento operates; changes in foreign exchange rates; Atento’s ability to complete future acquisitions and integrate or achieve the objectives of its recent and future acquisitions; future impairments of our substantial goodwill, intangible assets, or other long-lived assets; and Atento’s ability to recover consumer receivables on behalf of its clients. In addition, Atento is subject to risks related to its level of indebtedness. Such risks include Atento’s ability to generate sufficient cash to service its indebtedness and fund its other liquidity needs; Atento’s ability to comply with covenants contained in its debt instruments; the ability to obtain additional financing; the incurrence of significant additional indebtedness by Atento and its subsidiaries; and the ability of Atento’s lenders to fulfill their lending commitments. Atento is also subject to other risk factors described in documents filed by the company with the United States Securities and Exchange Commission.

These forward-looking statements speak only as of the date on which the statements were made. Atento undertakes no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

SELECTED FINANCIAL DATA

The following selected financial information should be read in conjunction with the interim consolidated financial statements and the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” presented elsewhere in the Form 6-K.

5

PRESS RELEASE

Consolidated Income Statement

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | For three months

ended September 30, | | | Change

excluding | | | For nine months

ended September 30, | | | Change

excluding | |

| | | 2015 | | | 2014 | | | FX (%) | | | 2015 | | | 2014 | | | FX (%) | |

| | | (unaudited) | | | | | | (unaudited) | | | | |

Revenue | | | 476.2 | | | | 589.6 | | | | 9.0 | | | | 1,507.8 | | | | 1,743.3 | | | | 9.5 | |

Other operating income | | | 0.8 | | | | 0.9 | | | | — | | | | 2.0 | | | | 1.8 | | | | 33.3 | |

Own work capitalized | | | — | | | | 0.2 | | | | N.M. | | | | — | | | | 0.4 | | | | N.M. | |

Other gains | | | — | | | | (0.4 | ) | | | N.M. | | | | — | | | | 34.5 | | | | N.M. | |

Supplies | | | (20.4 | ) | | | (27.1 | ) | | | 1.1 | | | | (59.8 | ) | | | (79.2 | ) | | | (3.2 | ) |

Employee benefit expenses | | | (338.3 | ) | | | (403.0 | ) | | | 12.4 | | | | (1,093.4 | ) | | | (1,246.4 | ) | | | 10.4 | |

Depreciation | | | (12.0 | ) | | | (14.9 | ) | | | 11.4 | | | | (38.4 | ) | | | (44.4 | ) | | | 10.1 | |

Amortization | | | (12.4 | ) | | | (15.1 | ) | | | 11.9 | | | | (40.4 | ) | | | (47.2 | ) | | | 9.5 | |

Changes in trade provisions | | | (0.4 | ) | | | 0.1 | | | | N.M. | | | | (0.9 | ) | | | (0.2 | ) | | | N.M. | |

Other operating expenses | | | (58.5 | ) | | | (83.2 | ) | | | (3.4 | ) | | | (182.7 | ) | | | (250.3 | ) | | | (6.8 | ) |

Impairment charges | | | — | | | | 0.4 | | | | N.M. | | | | — | | | | (32.5 | ) | | | N.M. | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total Operating Expenses | | | (442.0 | ) | | | (542.8 | ) | | | 9.6 | | | | (1,415.6 | ) | | | (1,700.2 | ) | | | 5.1 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

OPERATING PROFIT/(LOSS) | | | 35.0 | | | | 47.5 | | | | 2.7 | | | | 94.2 | | | | 79.8 | | | | 54.5 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Finance income | | | 4.9 | | | | 8.5 | | | | (9.4 | ) | | | 12.7 | | | | 13.4 | | | | 30.6 | |

Finance costs | | | (17.9 | ) | | | (32.4 | ) | | | (15.4 | ) | | | (58.0 | ) | | | (100.5 | ) | | | (23.5 | ) |

Net foreign exchange gains/(loss) | | | 3.5 | | | | (7.2 | ) | | | N.M. | | | | 14.6 | | | | (11.1 | ) | | | N.M. | |

| | | | | | | | | | | | | | | | | | | | | | | | |

NET FINANCE EXPENSE | | | (9.5 | ) | | | (31.1 | ) | | | (55.9 | ) | | | (30.7 | ) | | | (98.2 | ) | | | (55.8 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

PROFIT/(LOSS) BEFORE TAX | | | 25.5 | | | | 16.4 | | | | 114.0 | | | | 63.4 | | | | (18.4 | ) | | | (534.2 | ) |

| | | | | | | �� | | | | | | | | | | | | | | | | | |

Income tax expenses | | | (8.8 | ) | | | (8.4 | ) | | | 45.2 | | | | (19.7 | ) | | | 2.1 | | | | N.M. | |

PROFIT/(LOSS) FOR THE PERIOD ATTRIBUTABLE TO EQUITY HOLDERS OF THE PARENT | | | 16.7 | | | | 8.0 | | | | 186.3 | | | | 43.7 | | | | (16.3 | ) | | | N.M. | |

| | | | | | |

Adjusted Basic result per share (per U.S. dollars) | | | 0.23 | | | | 0.11 | | | | 186.3 | | | | 0.59 | | | | (0.22 | ) | | | N.M. | |

6

PRESS RELEASE

Reconciliation of EBITDA and Adjusted EBITDA to Profit/(Loss) for the Period from Continuing Operations

| | | | | | | | | | | | | | | | |

| | | For the three months

ended September 30, | | | For the nine months

ended September 30, | |

($ in millions) | | 2015 | | | 2014 | | | 2015 | | | 2014 | |

| | | (unaudited) | | | (unaudited) | |

Profit/(loss) for the period | | | 16.7 | | | | 8.0 | | | | 43.7 | | | | (16.3 | ) |

| | | | | | | | | | | | | | | | |

Net finance expense | | | 9.5 | | | | 31.1 | | | | 30.7 | | | | 98.2 | |

Income tax expense | | | 8.8 | | | | 8.4 | | | | 19.7 | | | | (2.1 | ) |

Depreciation and amortization | | | 24.4 | | | | 30.0 | | | | 78.8 | | | | 91.6 | |

| | | | | | | | | | | | | | | | |

EBITDA(2) (non-GAAP) | | | 59.4 | | | | 77.5 | | | | 172.9 | | | | 171.4 | |

| | | | | | | | | | | | | | | | |

Acquisition and integration related costs(a) | | | — | | | | 2.3 | | | | 0.1 | | | | 7.7 | |

Restructuring costs(b) | | | 4.1 | | | | 2.3 | | | | 7.8 | | | | 23.8 | |

Sponsor management fees(c) | | | — | | | | 2.5 | | | | — | | | | 7.3 | |

Site relocation costs(d) | | | — | | | | 0.4 | | | | 0.5 | | | | 1.4 | |

Financing and IPO fees (e) | | | — | | | | 3.5 | | | | 0.3 | | | | 11.1 | |

Asset impairments and Others(f) | | | 2.3 | | | | (0.3 | ) | | | 4.6 | | | | (2.9 | ) |

| | | | | | | | | | | | | | | | |

Adjusted EBITDA(2) (non-GAAP) | | | 65.8 | | | | 88.2 | | | | 186.2 | | | | 219.8 | |

| | | | | | | | | | | | | | | | |

(a) | Acquisition and integration related costs incurred for the three months ended September 30, 2014 primarily resulted from consulting fees incurred in connection with the full strategy review including our growth implementation plan and operational set-up with a leading consulting firm. During the three months ended September 30, 2015, we have no cost related to acquisition and integration process. These projects were substantially completed by the end of 2014. |

Acquisition and integration costs incurred for the nine months ended September 30, 2014 primarily resulted from consulting fees incurred in connection with the full strategy review including our growth implementation plan and operational set-up with a leading consulting firm, improving the efficiency in procurement and IT transformation projects. Acquisition and integration related costs incurred for the nine months ended September 30, 2015 are costs associated primarily with financial and operational improvements related to SAP IT transformation project cost incurred during the three months ended March 31, 2015.

(b) | Restructuring costs incurred for the three months ended September 30, 2014 primarily relate to headcount restructuring activities in Spain, restructuring cost in Argentina and the relocation of corporate headquarters. Restructuring costs incurred for the three months ended September 30, 2015 primarily relates to labor force optimization in Brazil to adapt the structure to business requirement and in EMEA as a consequence of a reduction in activity levels during 2015. |

(c) | Sponsor management fees represent the annual advisory fee paid to Bain Capital Partners, LLC that were expensed. The advisory agreement was terminated in connection with the initial public offering. |

7

PRESS RELEASE

(d) | Site relocation costs incurred for the three and nine months ended September 30, 2014 and 2015 include costs associated with our current strategic initiative of relocating call centers from tier 1 cities to tier 2 cities in Brazil in order to achieve efficiencies through rental cost reduction and attrition and absenteeism improvement. |

(e) | Financing and IPO fees for the three and nine months ended September 30, 2014 primarily relate to non-core professional fees incurred by us during the initial public offering process, including advisory, auditing and legal expenses among others. Financing and IPO fees for the three and nine months ended September 30, 2015 relate to remaining cost incurred during the three months ended March 31, 2015 in connection with the initial public offering process. |

(f) | Asset impairment and other costs for the three and nine months ended September 30, 2014 mainly relate to the goodwill and other intangible asset impairment relating to our operation in Czech Republic (divested in December 2014) of $3.7 million and Spain $28.8 million, offset by the amendment of the MSA with Telefónica, by which the minimum revenue commitment for Spain was reduced against a $34.5 million penalty fee compensated by Telefónica. |

Asset impairment and other costs for the three and nine months ended September 30, 2015 mainly refer to costs in Brazil, Spain and Mexico ($2.5 million) of efficiency projects, fees incurred during the three months ended March 31, 2015, related to Czech Republic divested operation in December 2014 ($2.5 million).

8

PRESS RELEASE

Reconciliation of Adjusted Earnings to Earnings/(Loss) for the Period from Continuing Operations

| | | | | | | | | | | | | | | | |

| | | For the three months

ended September 30, | | | For the nine months

ended September 30, | |

($ in millions, except percentage changes) | | 2015 | | | 2014 | | | 2015 | | | 2014 | |

| | | (unaudited) | | | (unaudited) | |

Profit/(Loss) attributable to equity holders of the parent | | | 16.7 | | | | 8.0 | | | | 43.7 | | | | (16.3 | ) |

| | | | | | | | | | | | | | | | |

Acquisition and integration related Costs(a) | | | — | | | | 2.3 | | | | 0.1 | | | | 7.7 | |

Amortization of Acquisition related Intangible assets(b) | | | 7.0 | | | | 8.9 | | | | 21.6 | | | | 28.5 | |

Restructuring Costs(c) | | | 4.1 | | | | 2.3 | | | | 7.8 | | | | 23.8 | |

Sponsor management fees(d) | | | — | | | | 2.5 | | | | — | | | | 7.3 | |

Site relocation costs(e) | | | — | | | | 0.4 | | | | 0.5 | | | | 1.4 | |

Financing and IPO fees(f) | | | — | | | | 3.5 | | | | 0.3 | | | | 11.1 | |

PECs interest expense(g) | | | — | | | | 7.2 | | | | — | | | | 25.8 | |

Asset impairments and Others(h) | | | 2.3 | | | | (0.3 | ) | | | 4.6 | | | | (2.9 | ) |

Net foreign exchange gain of financial instruments(i) | | | — | | | | — | | | | (14.0 | ) | | | — | |

Net foreign exchange impacts(j) | | | (3.5 | ) | | | 7.2 | | | | (0.6 | ) | | | 11.1 | |

Tax effect(k) | | | (4.1 | ) | | | (9.2 | ) | | | (10.2 | ) | | | (35.4 | ) |

| | | | | | | | | | | | | | | | |

Adjusted Earnings (non-GAAP) (unaudited) | | | 22.5 | | | | 32.8 | | | | 53.6 | | | | 62.1 | |

| | | | | | | | | | | | | | | | |

Adjusted Earnings per share - Basic (in U.S. dollars)(*) | | | 0.31 | | | | 0.45 | | | | 0.73 | | | | 0.84 | |

| | | | | | | | | | | | | | | | |

(a) | Acquisition and integration related costs incurred for the three months ended September 30, 2014 primarily resulted from consulting fees incurred in connection with the full strategy review including our growth implementation plan and operational set-up with a leading consulting firm. During the three months ended September 30, 2015, we have no cost related to acquisition and integration process. These projects were substantially completed by the end of 2014. |

Acquisition and integration costs incurred for the nine months ended September 30, 2014 primarily resulted from consulting fees incurred in connection with the full strategy review including our growth implementation plan and operational set-up with a leading consulting firm, improving the efficiency in procurement and IT transformation projects. Acquisition and integration related costs incurred for the nine months ended September 30, 2015 are costs associated primarily with financial and operational improvements related to SAP IT transformation project cost incurred during the three months ended March 31, 2015.

(b) | Amortization of Acquisition related intangible assets represents the amortization expense of intangible assets resulting from the Acquisition and has been adjusted to eliminate the impact of the amortization arising from the Acquisition which is not in the ordinary course of our daily operations and distorts comparison with peers and results for prior periods. Such intangible assets primarily include contractual relationships with clients, for which the useful life has been estimated at primarily nine years. |

(c) | Restructuring costs incurred for the three months ended September 30, 2014 primarily relate to headcount restructuring activities in Spain, restructuring cost in Argentina and the relocation of corporate headquarters. Restructuring costs incurred for the three months ended September 30, 2015 primarily relates to labor force |

9

PRESS RELEASE

optimization in Brazil to adapt the structure to business requirement and in EMEA as a consequence of a reduction in activity levels during 2015.

(d) | Sponsor management fees represent the annual advisory fee paid to Bain Capital Partners, LLC that were expensed. The advisory agreement was terminated in connection with the initial public offering. |

(e) | Site relocation costs incurred for the three and nine months ended September 30, 2014 and 2015 include costs associated with our current strategic initiative of relocating call centers from tier 1 cities to tier 2 cities in Brazil in order to achieve efficiencies through rental cost reduction and attrition and absenteeism improvement. |

(f) | Financing and IPO fees for the three and nine months ended September 30, 2014 primarily relate to non-core professional fees incurred by us during the initial public offering process, including advisory, auditing and legal expenses among others. Financing and IPO fees for the three and nine months ended September 30, 2015 relate to remaining cost incurred during the three months ended March 31, 2015 in connection with the initial public offering process. |

(g) | PECs interest expense represents accrued interest on the preferred equity certificates. In the fourth quarter of 2014, the PECs were capitalized in connection with the IPO. |

(h) | Asset impairment and other costs for the three and nine months ended September 30, 2014 mainly relate to the goodwill and other intangible asset impairment relating to our operation in Czech Republic (divested in December 2014) of $3.7 million and Spain $28.8 million, offset by the amendment of the MSA with Telefónica, by which the minimum revenue commitment for Spain was reduced against a $34.5 million penalty fee compensated by Telefónica. |

Asset impairment and other costs for the three and nine months ended September 30, 2015 mainly refer to costs in Brazil, Spain and Mexico ($2.5 million) of efficiency projects, fees incurred during the three months ended March 31, 2015, related to Czech Republic divested operation in December 2014 ($2.5 million).

(i) | As of April 1, 2015, the Company designated the foreign currency risk on certain of its subsidiaries as net investment hedges using financial instruments as the hedging items. As a consequence, any gain or loss on the hedging instrument, related to the effective portion of the hedge will be recognized in other comprehensive income (equity) as from that date. The gain or loss related to the ineffective portion will be recognized in the income statement. Cumulative net foreign exchange gain of such instruments was reversed from Equity to profit/(loss) in the three months ended March 31, 2015 in the amount of $13.0 million in the three months ended September 30, 2015 an amount of $1.0 million. For comparability, this one off adjustment was added back to calculate adjusted earnings. |

(j) | As of 2015, management analyzes the Company financial condition performance excluding net foreign exchange impacts, which eliminates the volatility to foreign exchange variances from our operational results. For comparability purposes, 2014 adjusted earnings was restated by the net foreign exchange non-cash results from currency fluctuations impacting loans between group companies and other minor effects. |

(k) | The tax effect represents the tax impact of the total adjustments based on a tax rate of 34.3% for the period from July 1, 2014, to September 30, 2014 and 30.4% for the period from July 1, 2015, to September 30, 2015, 34.5% for the period from January 1, 2014, to September 30, 2014 and 29.4% for the period from January 1, 2015 to September 30, 2015. |

(*) | The adjusted earnings per share, for the period presented in the table above, were calculated considering the |

10

PRESS RELEASE

| | number of ordinary shares of 73,648,760 (weighted average number of ordinary shares) as of September 30, 2015. For the period ended September 30, 2014 the number of ordinary shares was 73,619,511. |

11

PRESS RELEASE

Reconciliation of Total Debt to Net Debt with Third Parties

| | | | | | | | |

| | | As of September 30, | |

| | | (unaudited) | |

($ in millions, except Net Debt/Adj. EBITDA LTM) | | 2015 | | | 2014 | |

Cash and cash equivalents | | | 174.7 | | | | 190.7 | |

Short term financial investments | | | — | | | | 52.6 | |

Debt: | | | | | | | | |

7.375% Sr. Sec. Notes due 2020 | | | 295.9 | | | | 294.4 | |

Brazilian Debentures | | | 172.4 | | | | 267.7 | |

Vendor Loan Note(1) | | | — | | | | — | |

Contingent Value Instrument | | | 35.5 | | | | 36.1 | |

Preferred Equity Certificates | | | — | | | | — | |

Finance Lease Payables | | | 4.7 | | | | 8.7 | |

Other Borrowings | | | 64.2 | | | | 67.0 | |

| | | | | | | | |

Total Debt | | | 572.7 | | | | 673.9 | |

| | | | | | | | |

Preferred Equity Certificates | | | — | | | | — | |

| | | | | | | | |

Total Debt excluding PECs | | | 572.7 | | | | 673.9 | |

| | | | | | | | |

Net Debt with third parties(2) (unaudited) | | | 398.0 | | | | 430.6 | |

| | | | | | | | |

Adjusted EBITDA LTM(3) (non - GAAP) (unaudited) | | | 271.8 | | | | 305.4 | |

| | | | | | | | |

Net Debt/Adjusted EBITDA LTM(4) (non-GAAP) (unaudited) | | | 1.5x | | | | 1.4x | |

(1) | Reflects the prepayment to Telefónica of the entire indebtedness under the Vendor Loan Note. The loan was liquidated in connection with the IPO. |

(2) | In considering our financial condition, our management analyzes net debt with third parties, which is defined as total debt less cash, cash equivalents, and short-term financial investments. Net debt with third parties is not a measure defined by IFRS and it has limitations as an analytical tool. Net debt is neither a measure defined by or presented in accordance with IFRS nor a measure of financial performance, and should not be considered in isolation or as an alternative financial measure determined in accordance with IFRS. Net debt is not necessarily comparable to similarly titled measures used by other companies. |

(3) | Adjusted EBITDA LTM (Last Twelve Months) is defined as EBITDA adjusted to exclude acquisition and integration related costs, restructuring costs, sponsor management fees, asset impairments, site-relocation costs, financing fees, IPO costs and other items, which are not related to our core results of operations for the last twelve months. |

12

PRESS RELEASE

Free Cash Flow

| | | | | | | | | | | | | | | | |

($ in millions) | | For the three months

ended September 30, | | | For the nine months

ended September 30, | |

| | | 2015 | | | 2014 | | | 2015 | | | 2014 | |

| | | (unaudited) | | | (unaudited) | |

Net cash flow from operating activities | | | 38.7 | | | | 43.5 | | | | (3.3 | ) | | | 109.4 | |

Cash payments for acquisition of property, plant, equipment and intangible assets | | | (23.4 | ) | | | (36.0 | ) | | | (60.7 | ) | | | (81.2 | ) |

| | | | | | | | | | | | | | | | |

Free cash flow (non-GAAP) (unaudited) | | | 15.3 | | | | 7.5 | | | | (64.0 | ) | | | 28.2 | |

| | | | | | | | | | | | | | | | |

13

Atento Fiscal 2015 Third Quarter Results November 9, 2015 Lynn Antipas Tyson Vice President Investor Relations +1-914-485-1150 lynn.tyson@atento.com

Disclaimer This presentation has been prepared by Atento. The information contained in this presentation is for informational purposes only. The information contained in this presentation is not investment or financial product advice and is not intended to be used as the basis for making an investment decision. This presentation has been prepared without taking into account the investment objectives, financial situation or particular needs of any particular person. This presentation contains forward-looking statements within the meaning of the U.S. federal securities laws, that are subject to risks and uncertainties. All statements other than statements of historical fact included in this presentation are forward-looking statements. Forward-looking statements give our current expectations and projections relating to our financial condition, results of operations, plans, objectives, future performance and business. Forward-looking statements can be identified by the use of words such as "may," "should," "expects," "plans," "anticipates," "believes," "estimates," "predicts," "intends," "continue“, the negative thereof and other words and terms of similar meaning in connection with any discussion of the timing or nature of future operating or financial performance or other events. These forward-looking statements are based on assumptions that we have made in light of our industry experience and on our perceptions of historical trends, current conditions, expected future developments and other factors we believe are appropriate under the circumstances. As you consider this presentation, you should understand that these statements are not guarantees of performance or results. They involve risks, uncertainties (some of which are beyond our control) and assumptions. Although we believe that these forward-looking statements are based on reasonable assumptions, you should be aware that many factors could affect our actual financial results and cause them to differ materially from those anticipated in the forward-looking statements. Other factors that could cause our results to differ from the information set forth herein are included in the reports that we file with the U.S. Securities and Exchange Commission. We refer you to those reports for additional detail, including the section entitled “Risk Factors” in our Annual Report on Form 20-F. Because of these factors, we caution that you should not place undue reliance on any of our forward-looking statements. Further, any forward-looking statement speaks only as of the date on which it is made. New risks and uncertainties arise from time to time, and it is impossible for us to predict those events or how they may affect us. We have no duty to, and do not intend to, update or revise the forward-looking statements in this presentation after the date of this presentation. The historical and projected financial information in this presentation includes financial information that is not presented in accordance with International Financial Reporting Standards (“IFRS”). We refer to these measures as “non-GAAP financial measurers.” The non-GAAP financial measures may not be comparable to other similarly titled measures of other companies and have limitations as analytical tools and should not be considered in isolation or as a substitute for analysis of our operating results as reported under IFRS. Additional information about Atento can be found at www.atento.com.

Presenters: Alejandro Reynal, CEO Mauricio Montilha, CFO

Strategic Overview and Third Quarter Highlights

Key Topics Important milestone - one year since IPO. Significant progress made in the execution of our long-term strategy and the strengthening of our competitive position. Measurable and sustained progress against our strategic initiatives through our commitments to growth, best-in-class operations, and our people. Macro-economic headwinds are a reality. We are applying our business model to grow market share and achieve the optimal mix of growth, profitability and liquidity. Long-term strategy remains on track. A clear roadmap to selectively make investments that strengthen our competitive advantage for the long term, and deliver sustainable value for our shareholders.

Quarter Highlights (1) Notes: Unless otherwise noted, all results are for Q3 2015; all growth rates are on a constant currency basis, year-over-year, and exclude Czech Republic that was divested in December 2014. Liquidity defined as cash and cash equivalents plus undrawn revolving credit facilities. Measurable and sustained progress against strategic initiatives Revenue up 9.4% with 11.7% growth in Latin America. Revenue up 10% year-to-date. Non-TEF revenue up 16.9% in Brazil and 23.1% in Americas. Acquired new clients, grew share of wallet with existing clients. Increased penetration of higher-value solutions. Against backdrop of challenging macros. Operational and financial levers provide competitive advantage Adj. EBITDA up 4.2%, up 10% year-to-date. Adj. EPS of $0.31, up 35.4% Operational rigor and excellence with industry leading performance. FY15: Reaffirm Guidance Atento continues to be the reference partner for the CRM/BPO needs of our clients. Best-in-class operations drive cost and operating efficiencies, however not completely immune to macro pressures. Well positioned to extend leadership position and deliver balanced results FCF in quarter of $15.3MM, liquidity of $230MM(2) and leverage of 1.5x.

Progress Against Long Term Strategy Above-Market Growth Best-in-Class Operations Inspiring People ~3.1K+ WS won, ~ 40% with new clients, ~85% with non-telco verticals in 3Q. Penetration of solutions ~24% of revenue, up 140 basis points since beginning of 2014. ~1.3k+ WS won in U.S. nearshore over the last 12 months to serve key clients. Variable billable versus payable ratio increased 440 basis points to 63.6% vs Q3 last year, a record high level. Turnover, a driver of employee costs, declined 40 basis points vs Q3 last year. Two regional operations command centers inaugurated in Q3. Strengthened leadership – over the last 18 months 45% of Top 80 leaders are new hires or have new roles. Recognized for the third year in a row as one of the 25 Best Multinational Workplaces by GPTW. Only CRM/BPO provider and only LatAm company to receive recognition.

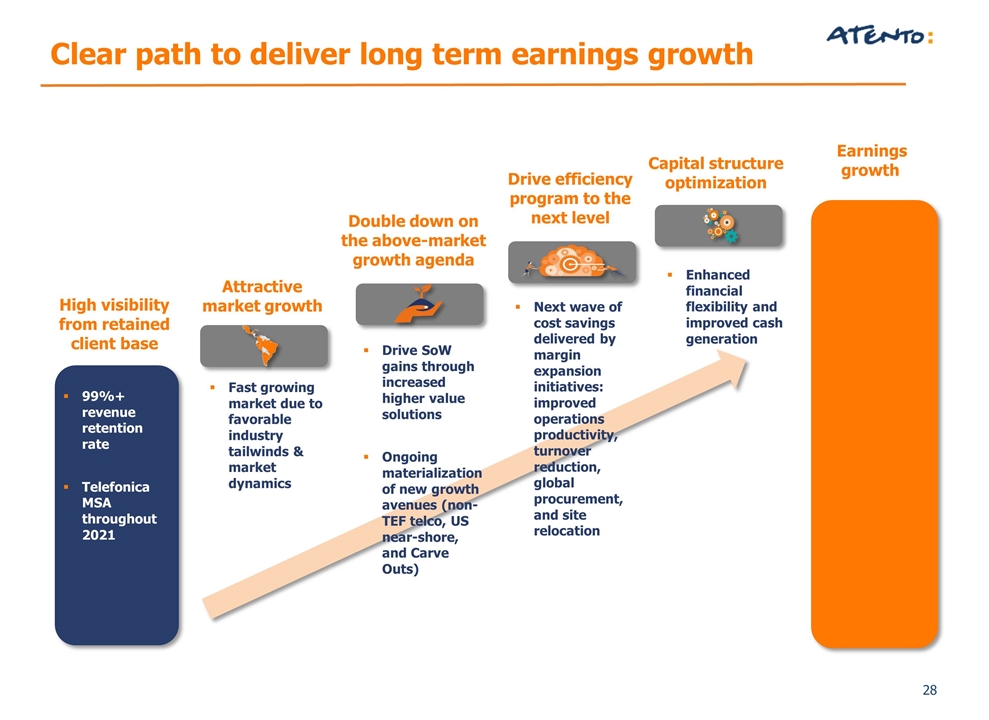

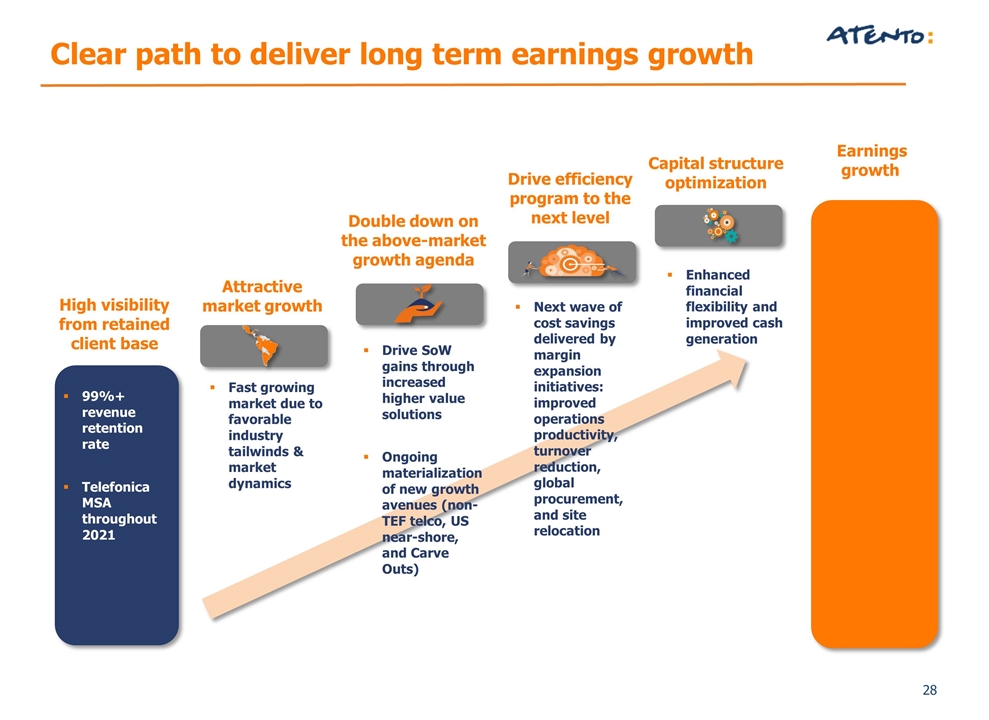

Long Term Strategy on Track Earnings growth High revenue visibility 99%+ revenue retention rate TEF MSA throughout 2021 Multi-pronged growth agenda Share of wallet gains through an increase in higher value solutions New growth avenues: non-TEF telco, financial, US near-shore, and Carve Outs Operations efficiency program Margin expansion initiatives: Operations productivity Lower turnover Global procurement Site relocation Capital structure optimization Enhanced financial flexibility Attractive market growth Growing market due to favorable industry tailwinds & market dynamics Largest CRM/BPO provider in $10.4Bn Latin America market. Well positioned to extend leadership as market grows to $15bn by 2020. Strategic investments to support long term competitive and financial position. Driving optimal balance of growth, profitability and liquidity.

Third Quarter Financial Performance

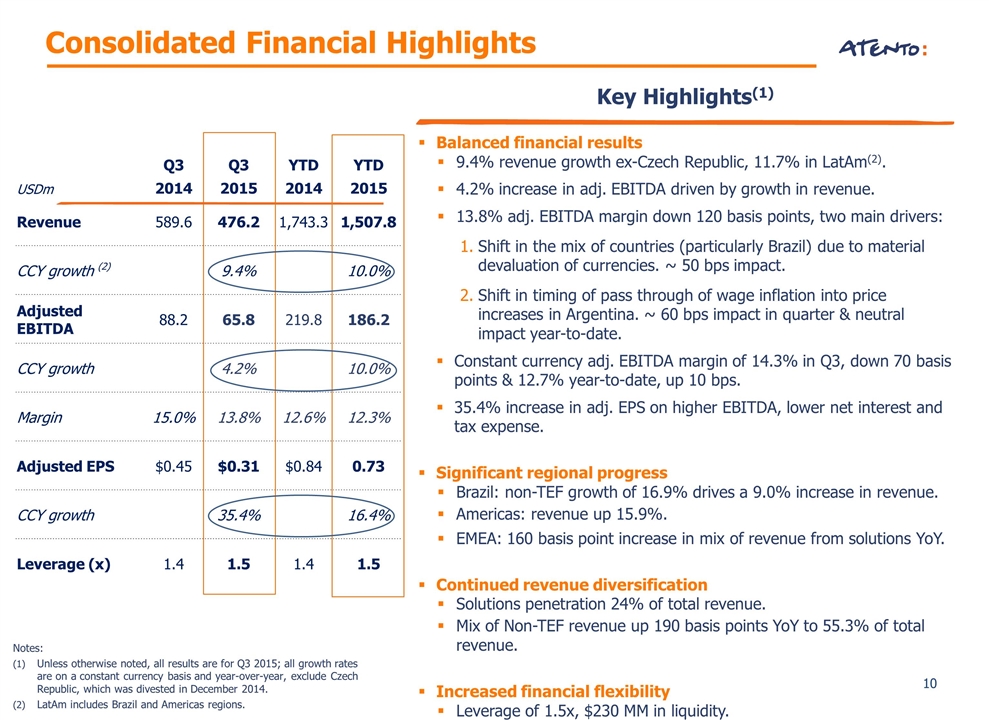

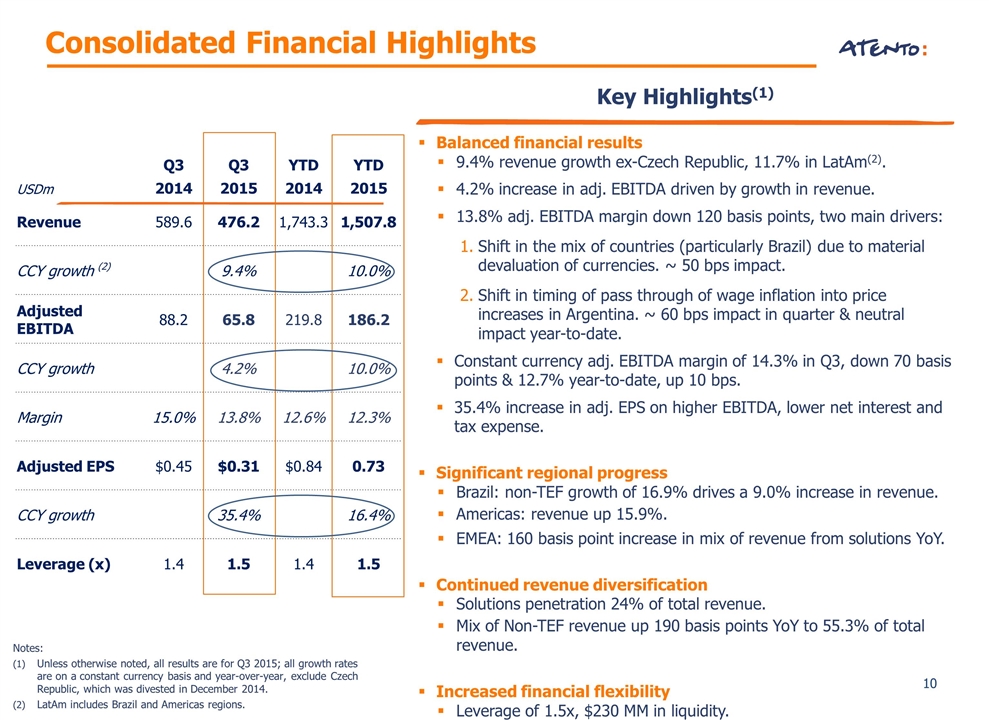

Q3 Q3 YTD YTD USDm 2014 2015 2014 2015 Revenue 589.6 476.2 1,743.3 1,507.8 CCY growth (2) 9.4% 10.0% Adjusted EBITDA 88.2 65.8 219.8 186.2 CCY growth 4.2% 10.0% Margin 15.0% 13.8% 12.6% 12.3% Adjusted EPS $0.45 $0.31 $0.84 0.73 CCY growth 35.4% 16.4% Leverage (x) 1.4 1.5 1.4 1.5 Consolidated Financial Highlights Key Highlights(1) Balanced financial results 9.4% revenue growth ex-Czech Republic, 11.7% in LatAm(2). 4.2% increase in adj. EBITDA driven by growth in revenue. 13.8% adj. EBITDA margin down 120 basis points, two main drivers: Shift in the mix of countries (particularly Brazil) due to material devaluation of currencies. ~ 50 bps impact. Shift in timing of pass through of wage inflation into price increases in Argentina. ~ 60 bps impact in quarter & neutral impact year-to-date. Constant currency adj. EBITDA margin of 14.3% in Q3, down 70 basis points & 12.7% year-to-date, up 10 bps. 35.4% increase in adj. EPS on higher EBITDA, lower net interest and tax expense. Significant regional progress Brazil: non-TEF growth of 16.9% drives a 9.0% increase in revenue. Americas: revenue up 15.9%. EMEA: 160 basis point increase in mix of revenue from solutions YoY. Continued revenue diversification Solutions penetration 24% of total revenue. Mix of Non-TEF revenue up 190 basis points YoY to 55.3% of total revenue. Increased financial flexibility Leverage of 1.5x, $230 MM in liquidity. Notes: Unless otherwise noted, all results are for Q3 2015; all growth rates are on a constant currency basis and year-over-year, exclude Czech Republic, which was divested in December 2014. LatAm includes Brazil and Americas regions.

Brazil Summary Revenue 9.0% growth despite challenging macros. Significant commercial wins: Approximately 1,300 workstations won with new and existing clients. Non-TEF up 16.9% driven by new clients and increased share of wallet with existing clients, particularly in Financial Services. Mix now at a record 63,2% of revenue, up 430 basis points YoY. TEF down 2.4% due to macro-driven declines in volume. Adjusted EBITDA Adj. EBITDA up 13.2% driven by revenue increase. Benefits of cost and efficiency initiatives offset ramp of new clients, inflationary pressures and changes in revenue mix. Increasingly challenging and protracted macro economic environment are expected to put pressure on margins. Excluding the allocation of corporate costs, adj. EBITDA margins declined 30 basis points to 16.3%. Notes: Unless otherwise noted, all results are for Q3 2015; all growth rates are on a constant currency basis and year-over-year. Key Highlights(1) Q3 Q3 YTD YTD USDm 2014 2015 2014 2015 Revenue 307.7 216.5 906.2 737.6 CCY growth 9.0% 11.7% Q3 Q3 YTD YTD USDm 2014 2015 2014 2015 Adjusted EBITDA 46.8 33.6 123.7 100.0 CCY growth 13.2% 13.4% Margin 15.2% 15.5% 13.7% 13.6% Margin ex-corp costs allocation 16.6% 16.3% 14.4% 14.4%

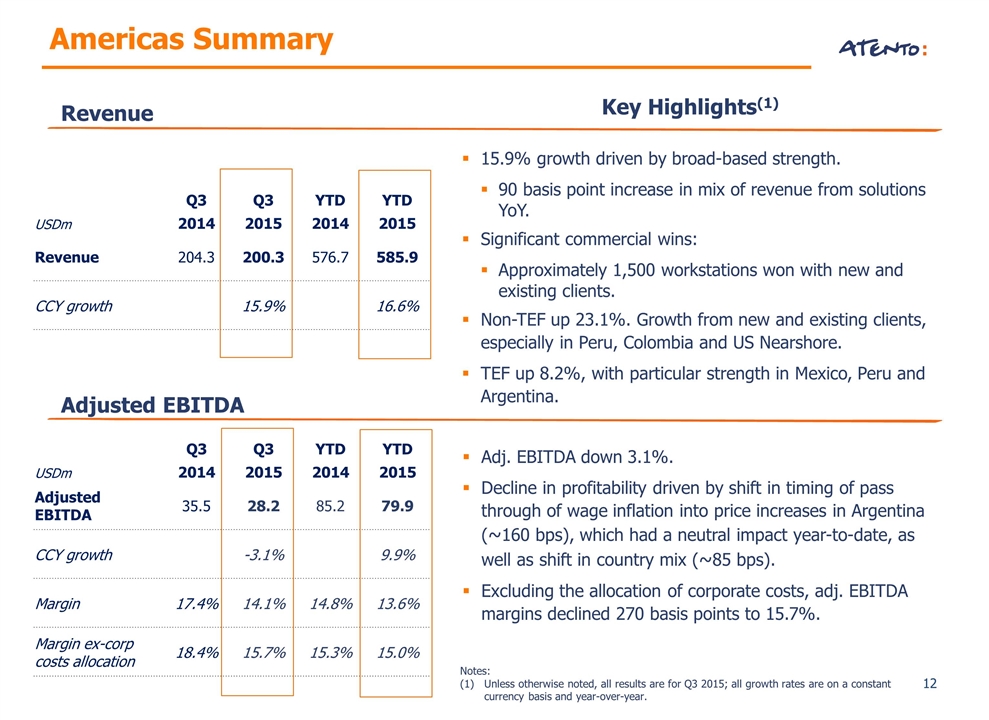

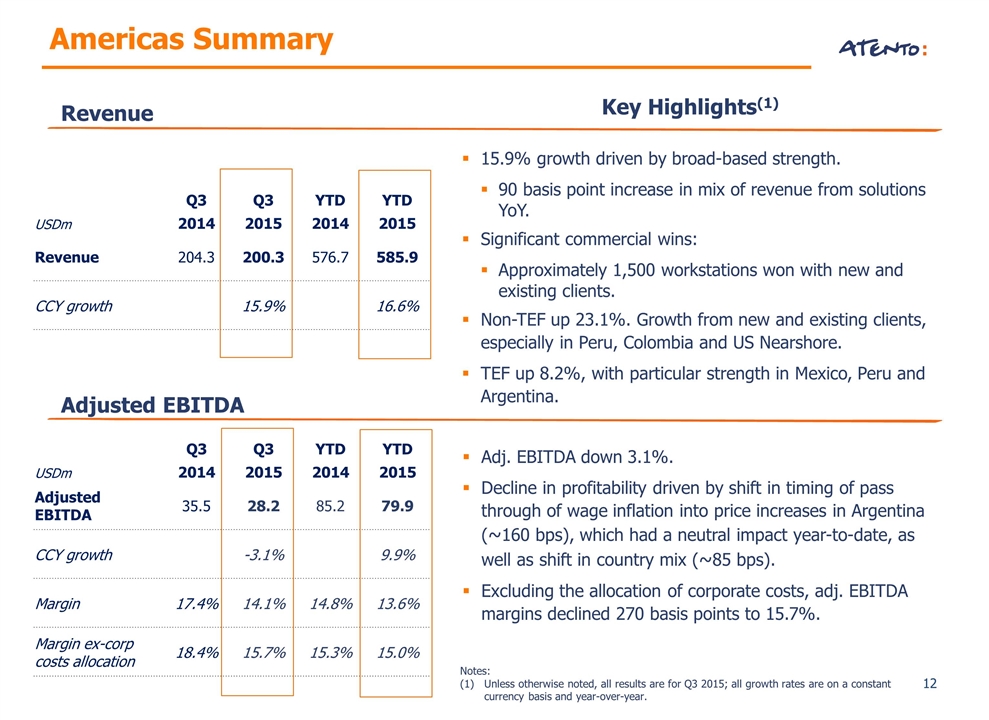

Q3 Q3 YTD YTD USDm 2014 2015 2014 2015 Adjusted EBITDA 35.5 28.2 85.2 79.9 CCY growth -3.1% 9.9% Margin 17.4% 14.1% 14.8% 13.6% Margin ex-corp costs allocation 18.4% 15.7% 15.3% 15.0% Adj. EBITDA down 3.1%. Decline in profitability driven by shift in timing of pass through of wage inflation into price increases in Argentina (~160 bps), which had a neutral impact year-to-date, as well as shift in country mix (~85 bps). Excluding the allocation of corporate costs, adj. EBITDA margins declined 270 basis points to 15.7%. Americas Summary Revenue 15.9% growth driven by broad-based strength. 90 basis point increase in mix of revenue from solutions YoY. Significant commercial wins: Approximately 1,500 workstations won with new and existing clients. Non-TEF up 23.1%. Growth from new and existing clients, especially in Peru, Colombia and US Nearshore. TEF up 8.2%, with particular strength in Mexico, Peru and Argentina. Adjusted EBITDA Key Highlights(1) Notes: Unless otherwise noted, all results are for Q3 2015; all growth rates are on a constant currency basis and year-over-year. Q3 Q3 YTD YTD USDm 2014 2015 2014 2015 Revenue 204.3 200.3 576.7 585.9 CCY growth 15.9% 16.6%

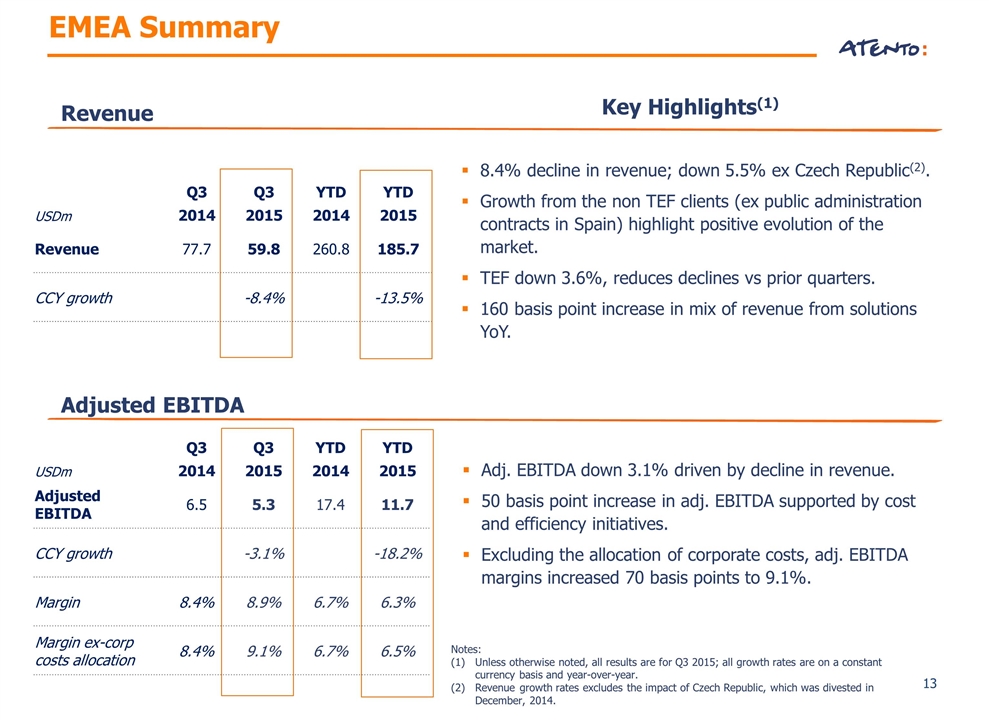

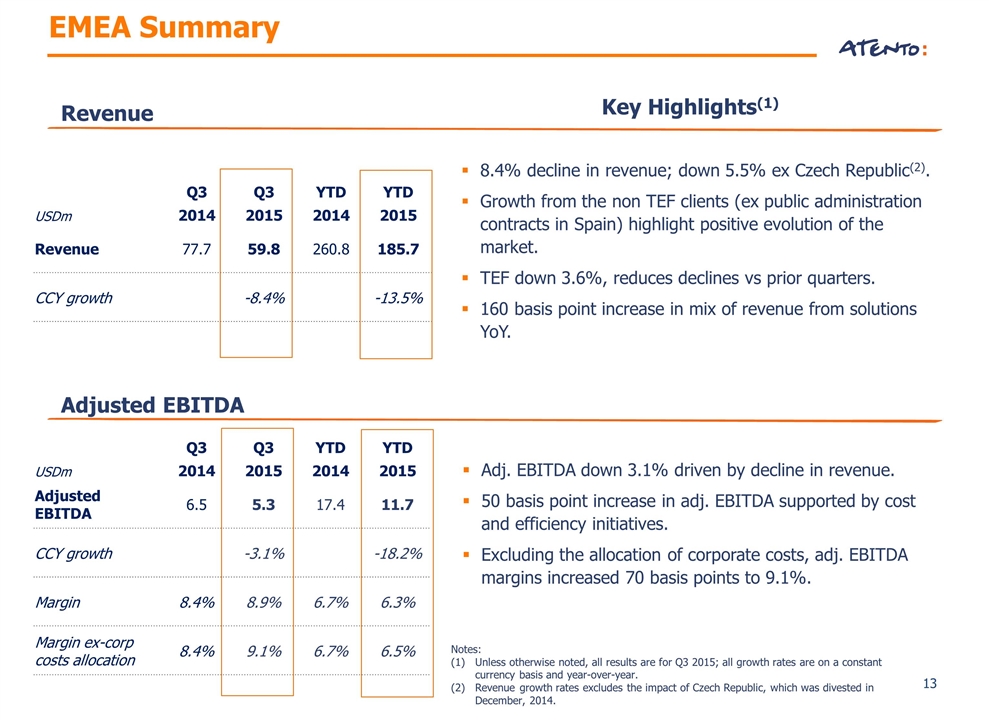

EMEA Summary Revenue Adjusted EBITDA Notes: Unless otherwise noted, all results are for Q3 2015; all growth rates are on a constant currency basis and year-over-year. Revenue growth rates excludes the impact of Czech Republic, which was divested in December, 2014. Key Highlights(1) 8.4% decline in revenue; down 5.5% ex Czech Republic(2). Growth from the non TEF clients (ex public administration contracts in Spain) highlight positive evolution of the market. TEF down 3.6%, reduces declines vs prior quarters. 160 basis point increase in mix of revenue from solutions YoY. Adj. EBITDA down 3.1% driven by decline in revenue. 50 basis point increase in adj. EBITDA supported by cost and efficiency initiatives. Excluding the allocation of corporate costs, adj. EBITDA margins increased 70 basis points to 9.1%. Q3 Q3 YTD YTD USDm 2014 2015 2014 2015 Adjusted EBITDA 6.5 5.3 17.4 11.7 CCY growth -3.1% -18.2% Margin 8.4% 8.9% 6.7% 6.3% Margin ex-corp costs allocation 8.4% 9.1% 6.7% 6.5% Q3 Q3 YTD YTD USDm 2014 2015 2014 2015 Revenue 77.7 59.8 260.8 185.7 CCY growth -8.4% -13.5%

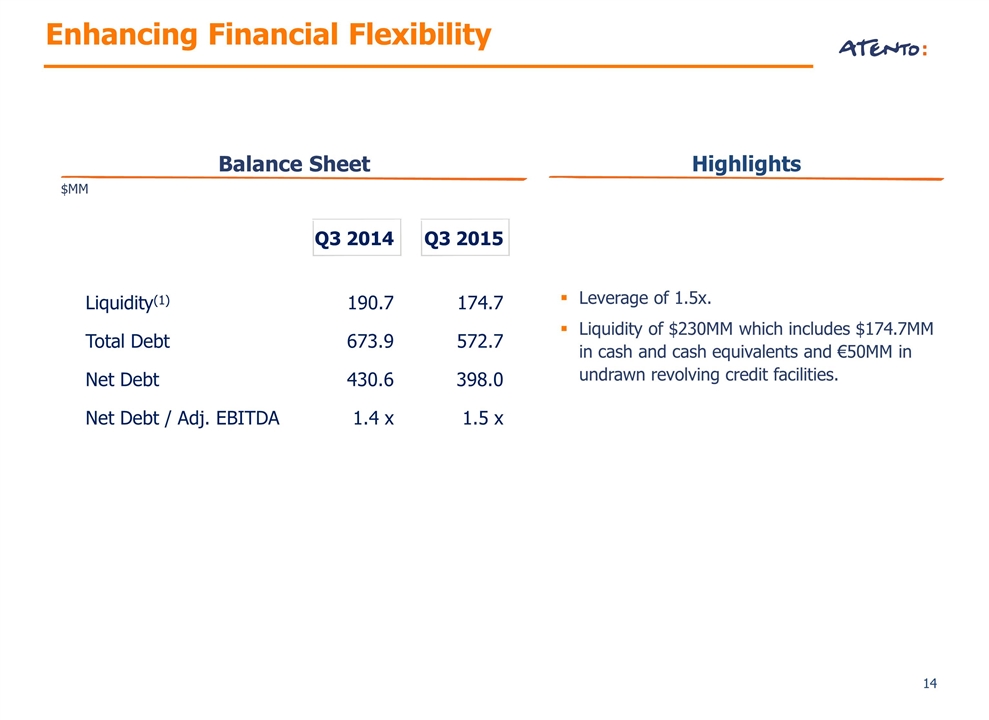

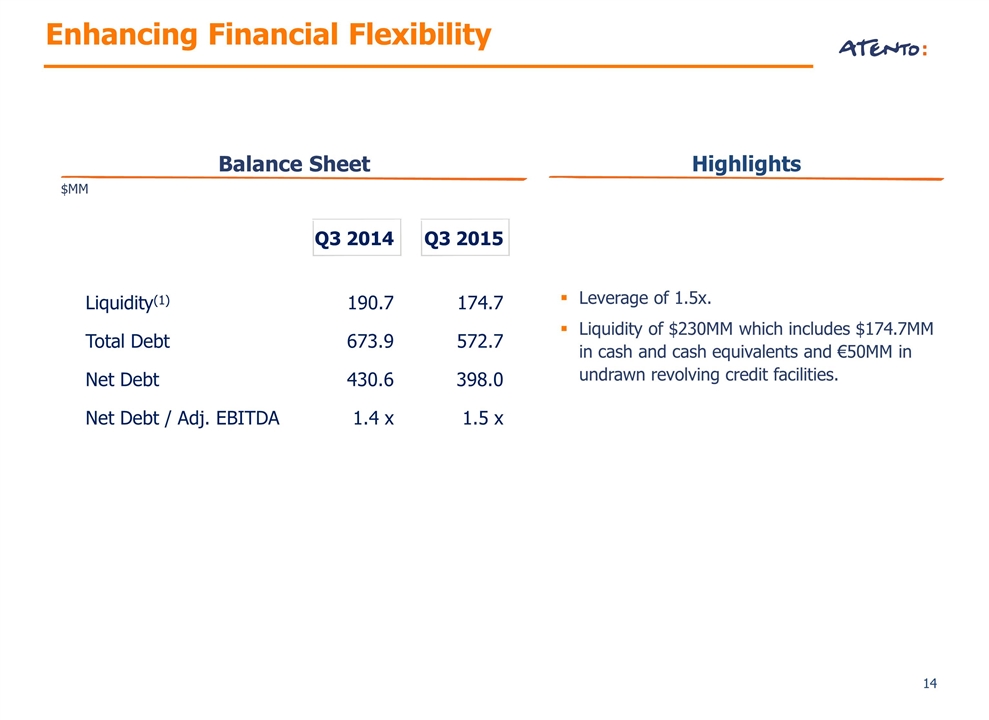

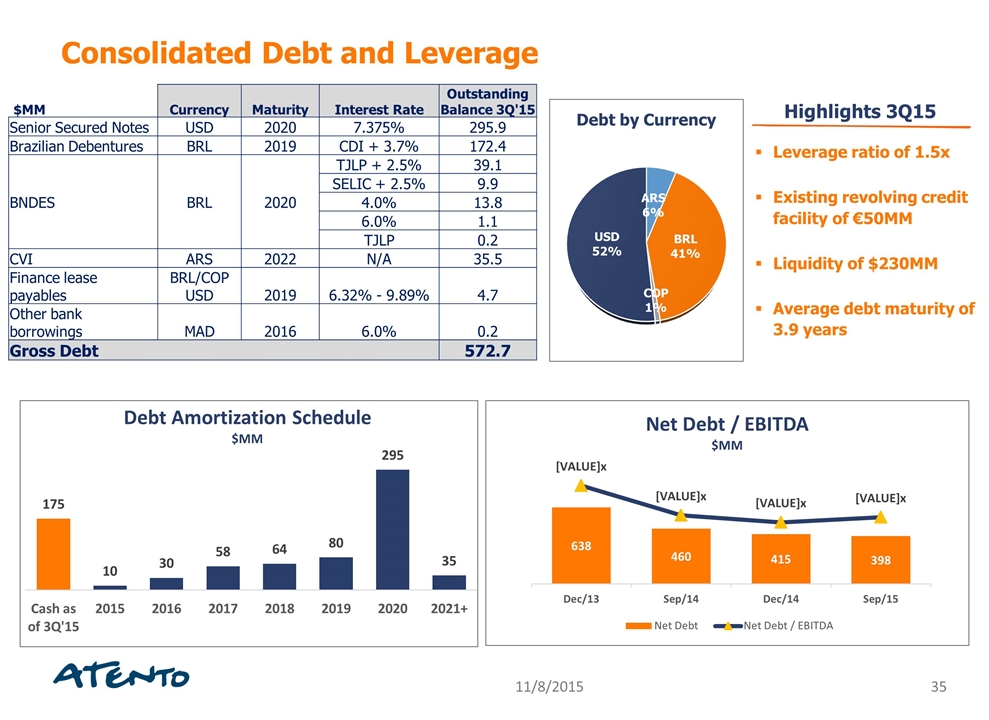

Balance Sheet Highlights $MM Leverage of 1.5x. Liquidity of $230MM which includes $174.7MM in cash and cash equivalents and €50MM in undrawn revolving credit facilities. Enhancing Financial Flexibility Q3 2014 Q3 2015 Liquidity(1) 190.7 174.7 Total Debt 673.9 572.7 Net Debt 430.6 398.0 Net Debt / Adj. EBITDA 1.4 x 1.5 x

Reaffirm 2015 Outlook CCY Revenue growth between 6% and 9% Uniquely positioned to acquire new business, grow share of wallet with existing clients, and increase penetration of higher value-added solutions. Adj. EBITDA margin range of 13% to 13.5% Likely at the low end of the range due to increasing adverse effects of macro-economic pressures in Brazil and shifts in business mix. Net interest expense between $72MM and $76MM CAPEX 6% of revenue Investments in new client growth. Effective Tax rate of 32%

Key Takeaways Measurable and sustained progress against our strategic initiatives through our commitments to growth, best-in-class operations, and our people. Macro-economic headwinds are a reality. We are applying our business model to grow market share and achieve the optimal mix of growth, profitability and liquidity. Long-term strategy remains on track. A clear roadmap to selectively make investments that strengthen our competitive advantage for the long term, and deliver sustainable value for our shareholders.

Appendix About Atento Financial Reconciliations Debt Information Glossary of Terms

About Atento

Leader in attractive, high-growth LatAm market. Long-lasting client relationships due to vertical expertise and growing portfolio of services and solutions. Superior pan-LatAm operational delivery platform. Clear strategy for sustained growth and strong shareholder value creation. Experienced, proven management team with strong track record. Differentiated Competitive Advantages

Awarded by the Great Place to Work Institute (“GPTW”) Based on 9M15 revenue of $1,507.8MM; Telefónica and Non-Telefónica revenue based on 9M15 #1 provider of CRM BPO services and solutions in Latin America – $2.3Bn 2014 revenue Founded in 1999 as provider to Telefónica Group; acquired by Bain Capital in 2012 Superior operational delivery platform in LatAm region 98 contact centers in 14 countries globally 163,000+ employees and 91,000+ workstations globally Long-standing relationships with 400+ blue-chip clients Strong relationship with Telefónica, supported by Master Services Agreement (“MSA”) through 2021 Unique people focus: only CRM BPO company among the 25 best multinationals to work for and only LatAm based company (1) Revenue by region, offering and customer (2) Brazil 49% Americas 39% EMEA 12% Services 76% Solutions 24% Non-Telefónica 54.6% Telefónica 45.4% Atento at a Glance

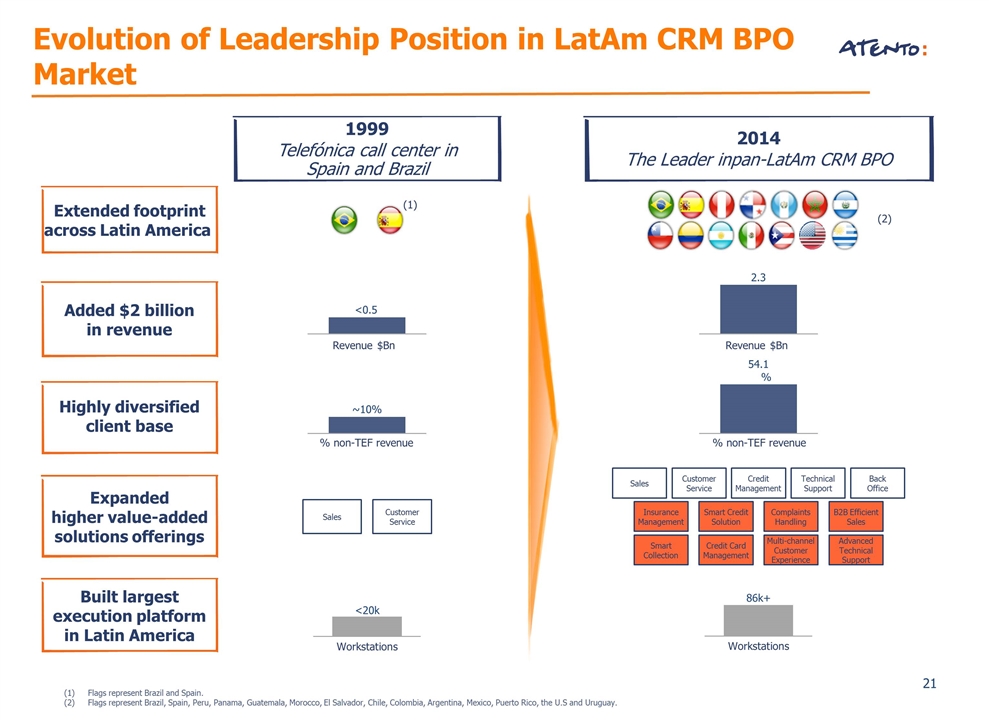

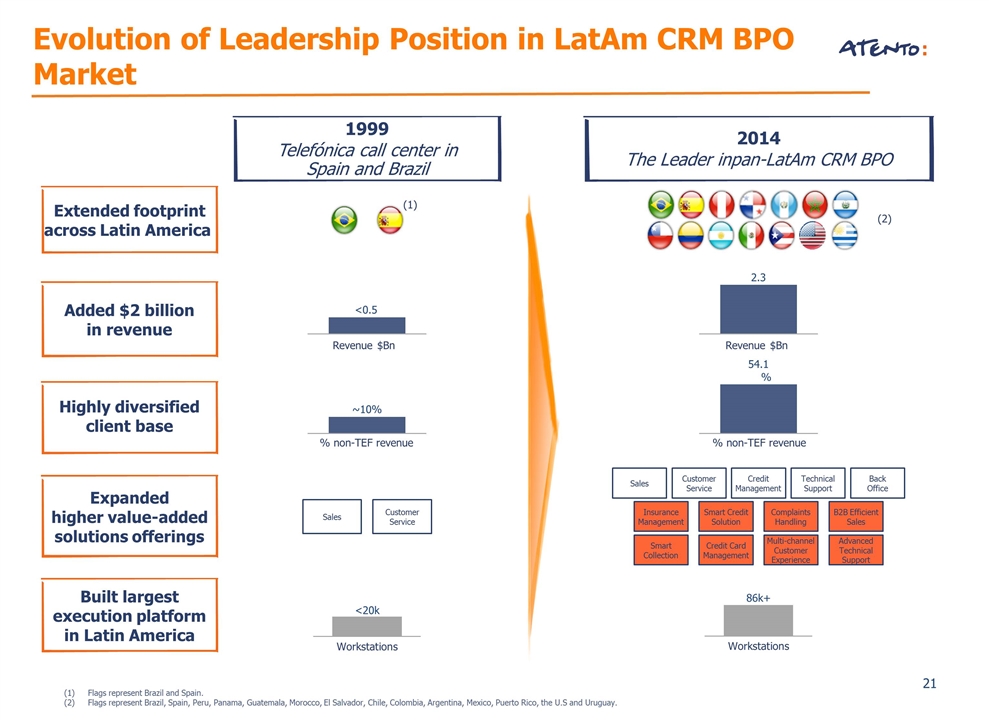

1999 Telefónica call center in Spain and Brazil Flags represent Brazil and Spain. Flags represent Brazil, Spain, Peru, Panama, Guatemala, Morocco, El Salvador, Chile, Colombia, Argentina, Mexico, Puerto Rico, the U.S and Uruguay. (1) 2014 The Leader inpan-LatAm CRM BPO (2) <0.5 2.3 <20k 86k+ ~10% 54.1% Customer Service Sales Extended footprint across Latin America Expanded higher value-added solutions offerings Added $2 billion in revenue Built largest execution platform in Latin America Highly diversified client base Revenue $Bn Revenue $Bn % non-TEF revenue % non-TEF revenue Customer Service Sales Back Office Technical Support Credit Management Smart Credit Solution Complaints Handling Multi-channel Customer Experience Smart Collection Credit Card Management B2B Efficient Sales Insurance Management Advanced Technical Support Evolution of Leadership Position in LatAm CRM BPO Market

Source: Frost & Sullivan Atento market share position as of 2014 (Management estimate) Market share in terms of revenue Largest CRM BPO Provider in Latin America 2014 CRM BPO market share (%) Mexico 17% Brazil (1) 26% Argentina 20% Chile 25% Peru 34% Colombia 8% Atento #1 market share position (2) Atento #5 market share position (2) Market leader in the largest markets... $10.4Bn LatAm CRM BPO market One of the largest players in the world… 2014 Revenue ($Bn) Pro forma for Stream acquisition (1)

Long-lasting relationships with market-leading clients Client retention based on 2013 revenues of clients retained in 2014 as a % of total 2013 revenues Excludes Telefónica 99% 2014 retention rate (1) 69% of revenue from clients with 10+ year relationship (2) Multi-sector Financial services Telecommunications

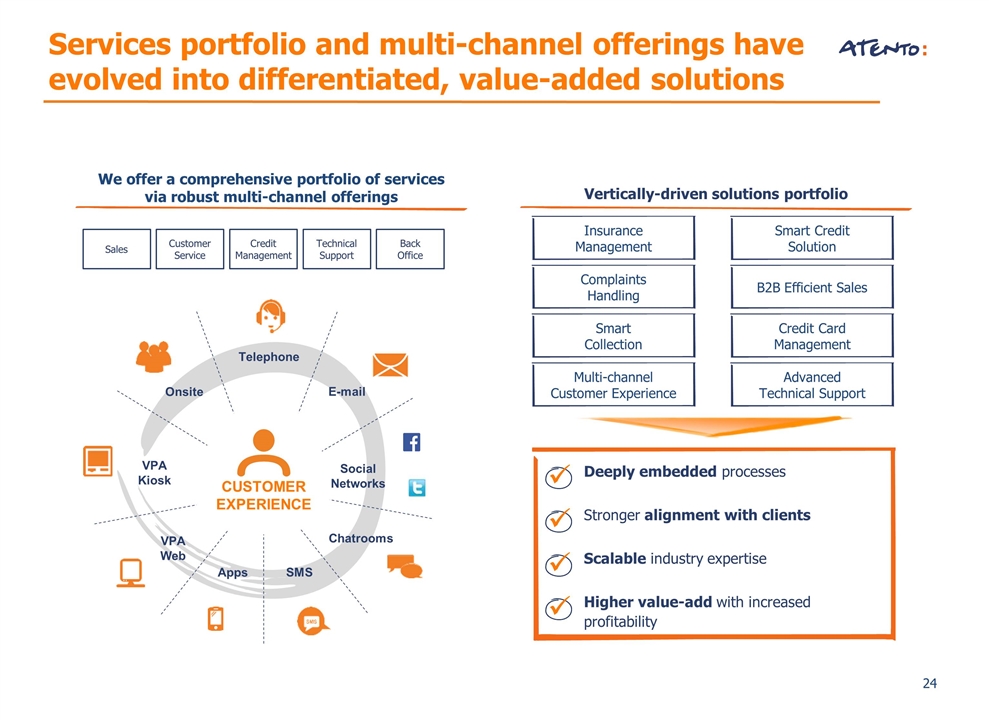

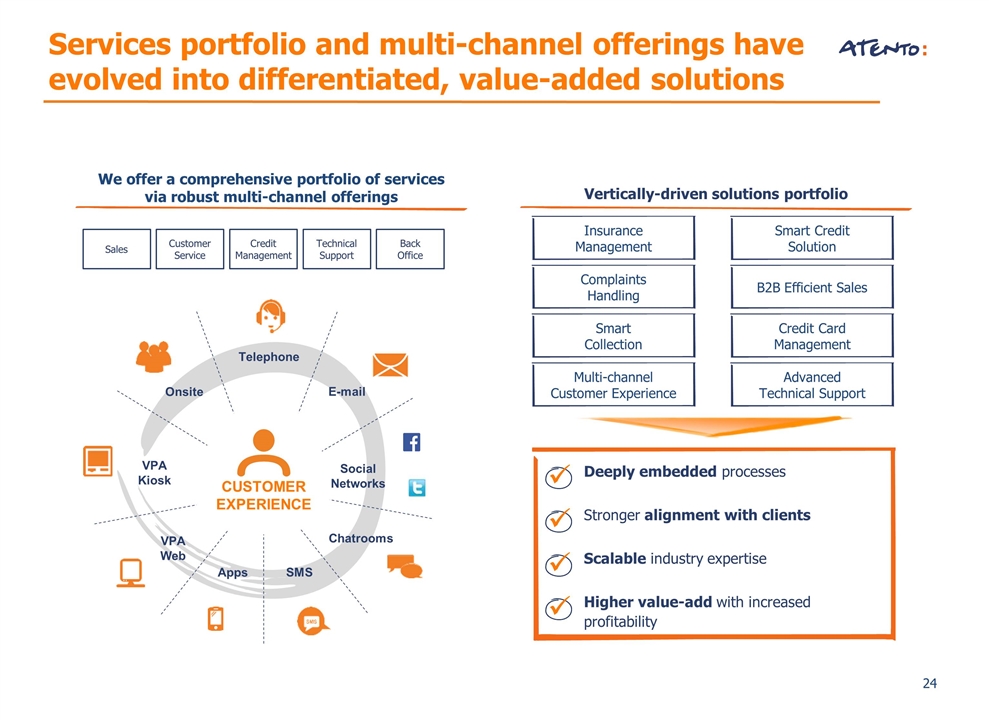

Services portfolio and multi-channel offerings have evolved into differentiated, value-added solutions Vertically-driven solutions portfolio Deeply embedded processes Stronger alignment with clients Scalable industry expertise Higher value-add with increased profitability We offer a comprehensive portfolio of services via robust multi-channel offerings Telephone E-mail Social Networks Chatrooms SMS Apps VPA Kiosk Onsite CUSTOMER EXPERIENCE VPA Web Customer Service Sales Back Office Technical Support Credit Management Insurance Management Smart Credit Solution Complaints Handling B2B Efficient Sales Smart Collection Credit Card Management Multi-channel Customer Experience Advanced Technical Support

Superior pan-LatAm operational delivery platform State-of-the-art technology 0.02% Unscheduled downtime in 2015 YTD Standardized large-scale processes Three Globally connect Command Centers Highly motivated employees Industry leading culture and Globally recognized “Great Place to work” Great Place to Work in 10 countries (1) 2014 figures Blue-chip tech partners Avaya HP Nice Cisco Microsoft Verint Globally recognized as one of the 25 Best Multinationals to work for Only CRM BPO company in the top 25 Only LTAM based Company in the top 25 Robust, Globally Standard Processes Centralized, standard automated recruiting Performance based Learning 1,400,000+ applications (1) 15.6MM+ hours of training (1)

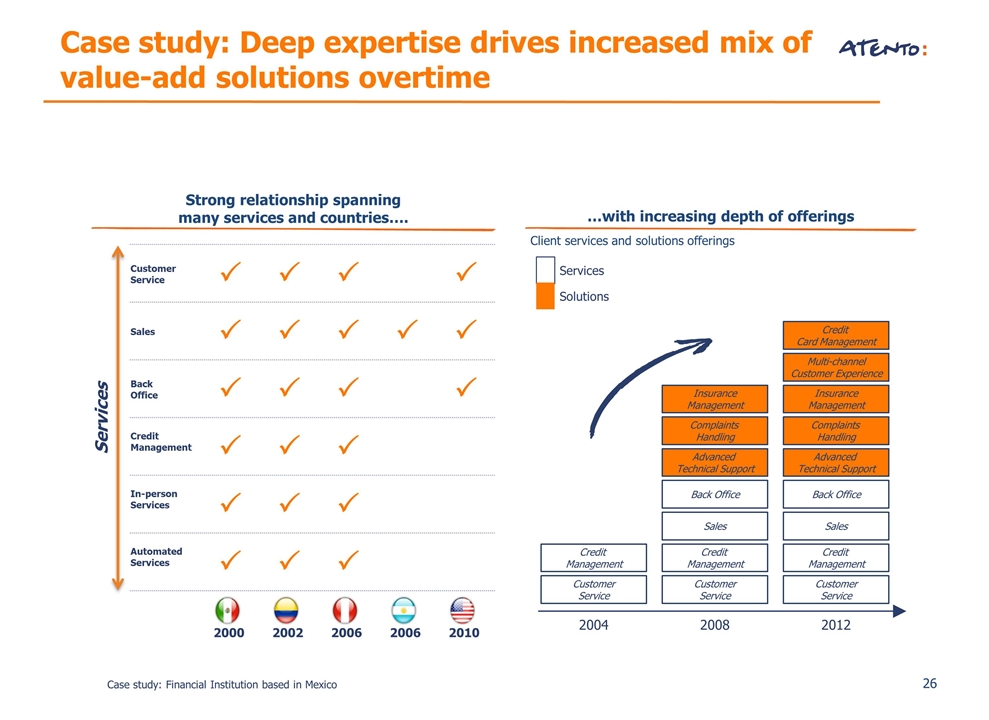

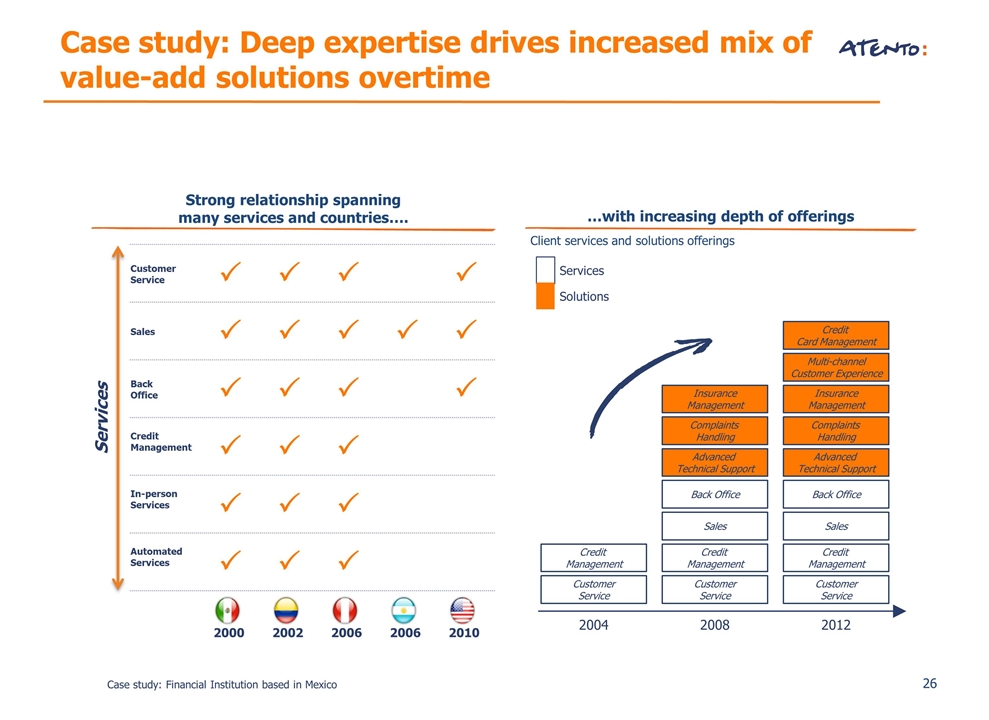

Client services and solutions offerings Services Solutions 2004 Customer Service Credit Management 2008 Back Office Sales Customer Service Credit Management Complaints Handling Insurance Management Advanced Technical Support Case study: Deep expertise drives increased mix of value-add solutions overtime Customer Service P P P P Sales P P P P P Back Office P P P P Credit Management P P P In-person Services P P P Automated Services P P P Strong relationship spanning many services and countries…. …with increasing depth of offerings 2000 2002 2006 2006 2010 Case study: Financial Institution based in Mexico 2012 Back Office Sales Customer Service Credit Management Complaints Handling Insurance Management Advanced Technical Support Multi-channel Customer Experience Credit Card Management Services

Strategy to achieve Sustained Growth and SHV Creation STRATEGIC PILLARS GLOBAL STRATEGIC INTITIATIVES Deliver CRM BPO solutions Aggressively grow client base Penetrate U.S. Near-Shore Above-Market Growth Addressing untapped client growth opportunities and increasing SoW to deliver accelerated growth Enhance operations productivity Increase HR effectiveness Deploy one procurement Drive consistent and efficient IT platform Optimize site footprint Best-in-Class Operations Leveraging economies of scale and driving consistency in operations Distinct culture and values Strengthen talent High performance organization Inspiring People Delivering our medium-term vision through our unique culture and people MID-TERM VISION Be the #1 customer experience solutions provider in the markets we serve. A truly multiclient business.

Earnings growth High visibility from retained client base 99%+ revenue retention rate Telefonica MSA throughout 2021 Double down on the above-market growth agenda Drive SoW gains through increased higher value solutions Ongoing materialization of new growth avenues (non-TEF telco, US near-shore, and Carve Outs) Drive efficiency program to the next level Next wave of cost savings delivered by margin expansion initiatives: improved operations productivity, turnover reduction, global procurement, and site relocation Capital structure optimization Enhanced financial flexibility and improved cash generation Attractive market growth Fast growing market due to favorable industry tailwinds & market dynamics Clear path to deliver long term earnings growth

Highly experienced management team with strong track record Reyes Cerezo Legal and Regulatory Compliance Director 12 years at Atento Iñaki Cebollero Human Resources Director 6 years at Atento Mauricio Montilha Chief Financial Officer Previously at SKY Brazil & Astra Zeneca Brazil Michael Flodin Operations Director Previously at Accenture Daniel V. Figueirido Chief Commercial Officer Previously at Accenture Alejandro Reynal CEO Nelson Armbrust Brazil Director 15 years at Atento Miguel Matey North America Director 14 years at Atento Juan E. Gamé South America Director 12 Years at Atento José Ma Pérez Melber EMEA Director Previously at Orange Spain Corporate functions Regions

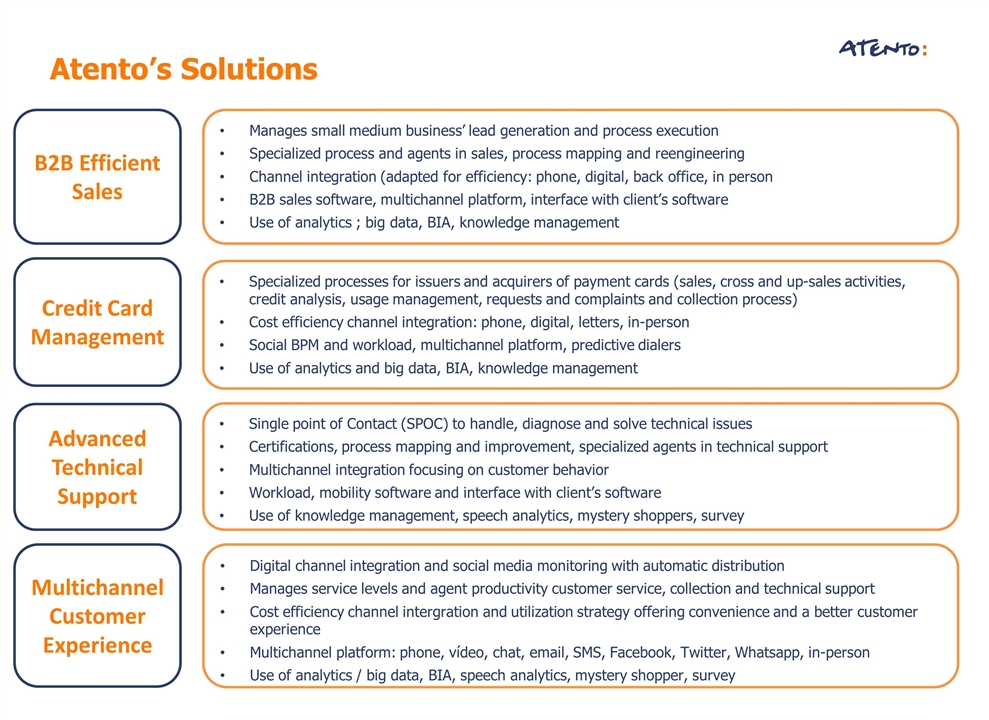

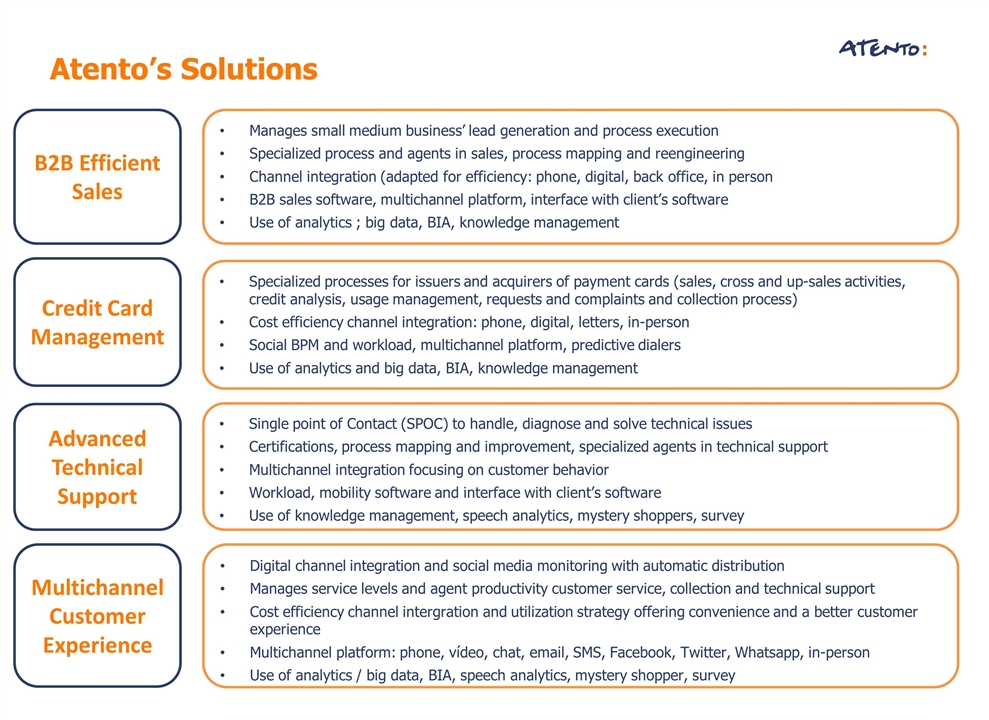

Atento’s Solutions Smart Collection Solutions to optimize collection/past due payments with specialized process and agents in credit management 100% variable compensation model that rewards efficiency of the agents and process Cost effective channel integration: phone, digital, in-person Collection software and automated enables (i.e voice mail, invoice letter Use of analytics / big data optimizing time to call and Contact channel Insurance Management End-to-end solution covering the sales process, customer services, and associated back office including credit management process Specialized process: integrated process mapping and improvement, and technical back office support Channel strategy throughout the customers’ lifecycle, managing “key events” (e.g claims and incidents) Social BPM and workload, mobility software and communications tools Use of Atento intelligent Database (BIA), knowledge management, mystery shopper, survey, speech analytics Smart Credit Solution Complaints Handling Manages the overall contract formalization and provides sales and customer service and credit management Specialized process: back office, sales, customer service and credit management Channel integration and self-service ensuring “just in time” information Social BPM and workload, multichannel platform interface with client’s software Use of big data, mystery shoppers, survey speech analytics Solution to prevent and manage the overall complaints process Specialized process: back office and customer service; process mapping and continuous improvement Multichannel integration focusing on customer behavior Social BPM and workload, multichannel platform interface with client’s software Use of knowledge management, speech analytics, mystery shoppers, survey

Atento’s Solutions B2B Efficient Sales Manages small medium business’ lead generation and process execution Specialized process and agents in sales, process mapping and reengineering Channel integration (adapted for efficiency: phone, digital, back office, in person B2B sales software, multichannel platform, interface with client’s software Use of analytics ; big data, BIA, knowledge management Credit Card Management Specialized processes for issuers and acquirers of payment cards (sales, cross and up-sales activities, credit analysis, usage management, requests and complaints and collection process) Cost efficiency channel integration: phone, digital, letters, in-person Social BPM and workload, multichannel platform, predictive dialers Use of analytics and big data, BIA, knowledge management Advanced Technical Support Multichannel Customer Experience Single point of Contact (SPOC) to handle, diagnose and solve technical issues Certifications, process mapping and improvement, specialized agents in technical support Multichannel integration focusing on customer behavior Workload, mobility software and interface with client’s software Use of knowledge management, speech analytics, mystery shoppers, survey Digital channel integration and social media monitoring with automatic distribution Manages service levels and agent productivity customer service, collection and technical support Cost efficiency channel intergration and utilization strategy offering convenience and a better customer experience Multichannel platform: phone, vídeo, chat, email, SMS, Facebook, Twitter, Whatsapp, in-person Use of analytics / big data, BIA, speech analytics, mystery shopper, survey

Financial Reconciliations

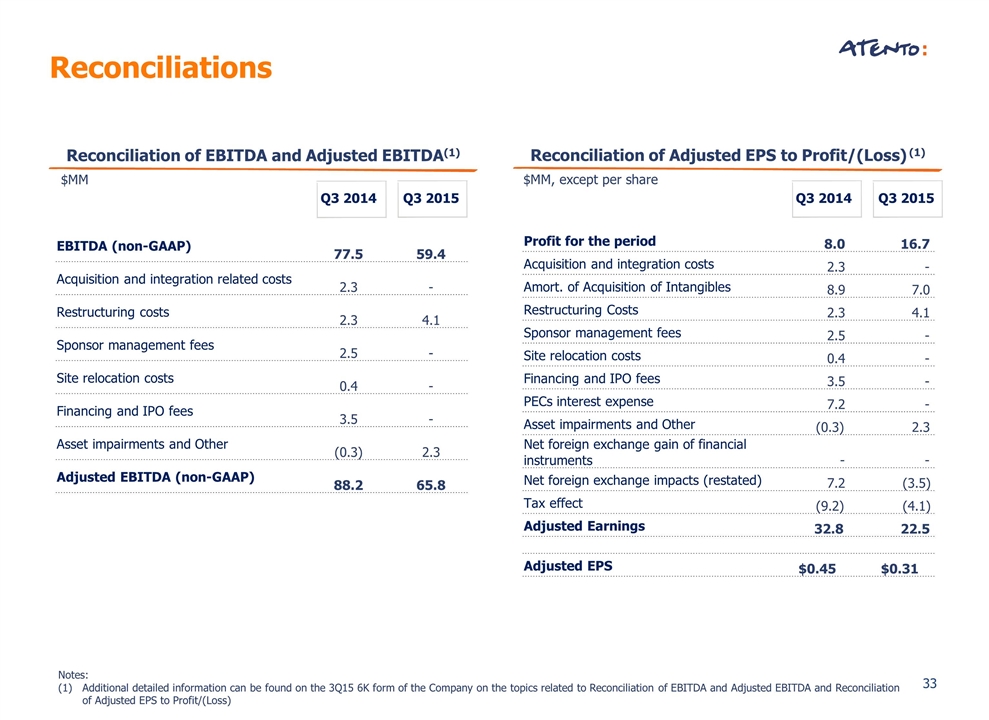

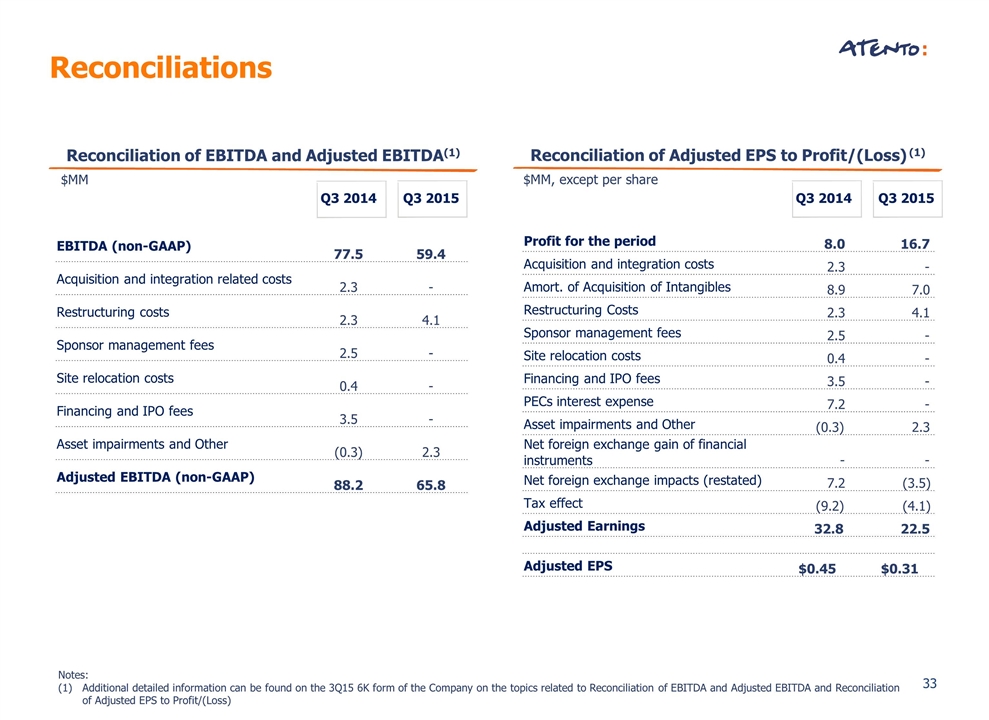

Q3 2014 Q3 2015 EBITDA (non-GAAP) 77.5 59.4 Acquisition and integration related costs 2.3 - Restructuring costs 2.3 4.1 Sponsor management fees 2.5 - Site relocation costs 0.4 - Financing and IPO fees 3.5 - Asset impairments and Other (0.3) 2.3 Adjusted EBITDA (non-GAAP) 88.2 65.8 Reconciliations Reconciliation of EBITDA and Adjusted EBITDA(1) $MM Q3 2014 Q3 2015 Profit for the period 8.0 16.7 Acquisition and integration costs 2.3 - Amort. of Acquisition of Intangibles 8.9 7.0 Restructuring Costs 2.3 4.1 Sponsor management fees 2.5 - Site relocation costs 0.4 - Financing and IPO fees 3.5 - PECs interest expense 7.2 - Asset impairments and Other (0.3) 2.3 Net foreign exchange gain of financial instruments - - Net foreign exchange impacts (restated) 7.2 (3.5) Tax effect (9.2) (4.1) Adjusted Earnings 32.8 22.5 Adjusted EPS $0.45 $0.31 Reconciliation of Adjusted EPS to Profit/(Loss) (1) $MM, except per share Notes: Additional detailed information can be found on the 3Q15 6K form of the Company on the topics related to Reconciliation of EBITDA and Adjusted EBITDA and Reconciliation of Adjusted EPS to Profit/(Loss)

Debt Information

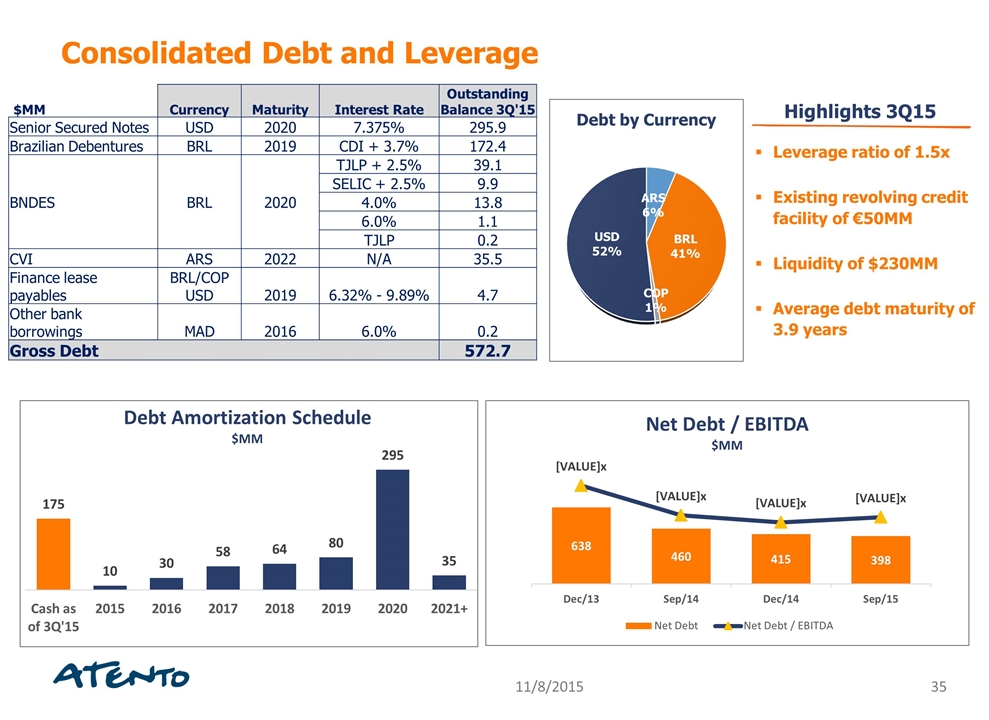

Consolidated Debt and Leverage $MM Currency Maturity Interest Rate Outstanding Balance 3Q'15 Senior Secured Notes USD 2020 7.375% 295.9 Brazilian Debentures BRL 2019 CDI + 3.7% 172.4 BNDES BRL 2020 TJLP + 2.5% 39.1 SELIC + 2.5% 9.9 4.0% 13.8 6.0% 1.1 TJLP 0.2 CVI ARS 2022 N/A 35.5 Finance lease payables BRL/COP USD 2019 6.32% - 9.89% 4.7 Other bank borrowings MAD 2016 6.0% 0.2 Gross Debt 572.7 Leverage ratio of 1.5x Existing revolving credit facility of €50MM Liquidity of $230MM Average debt maturity of 3.9 years Highlights 3Q15

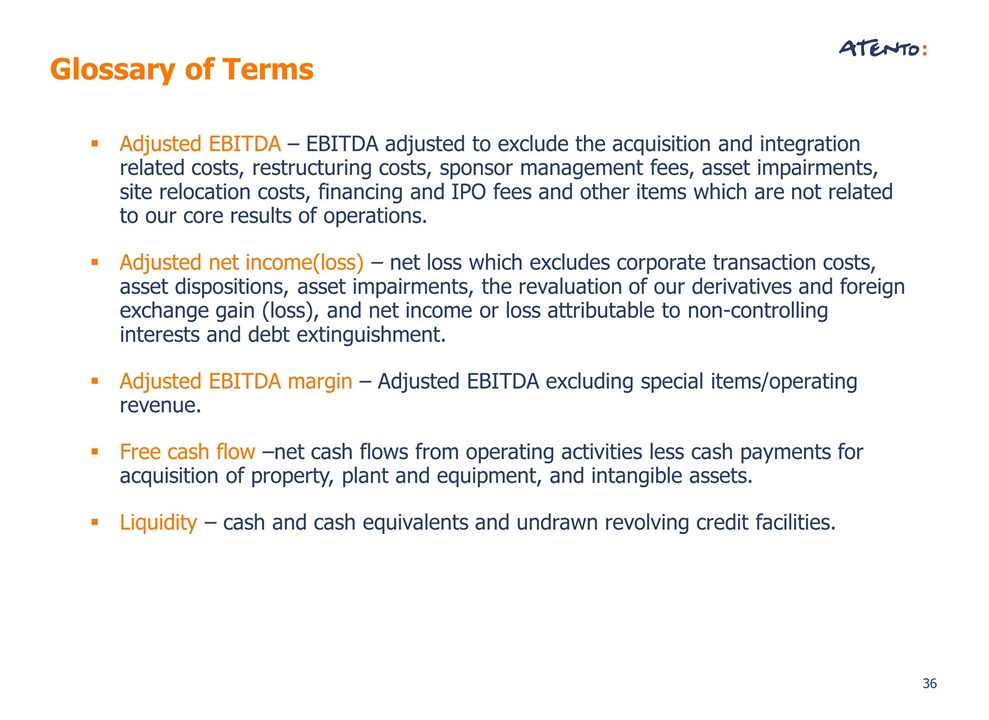

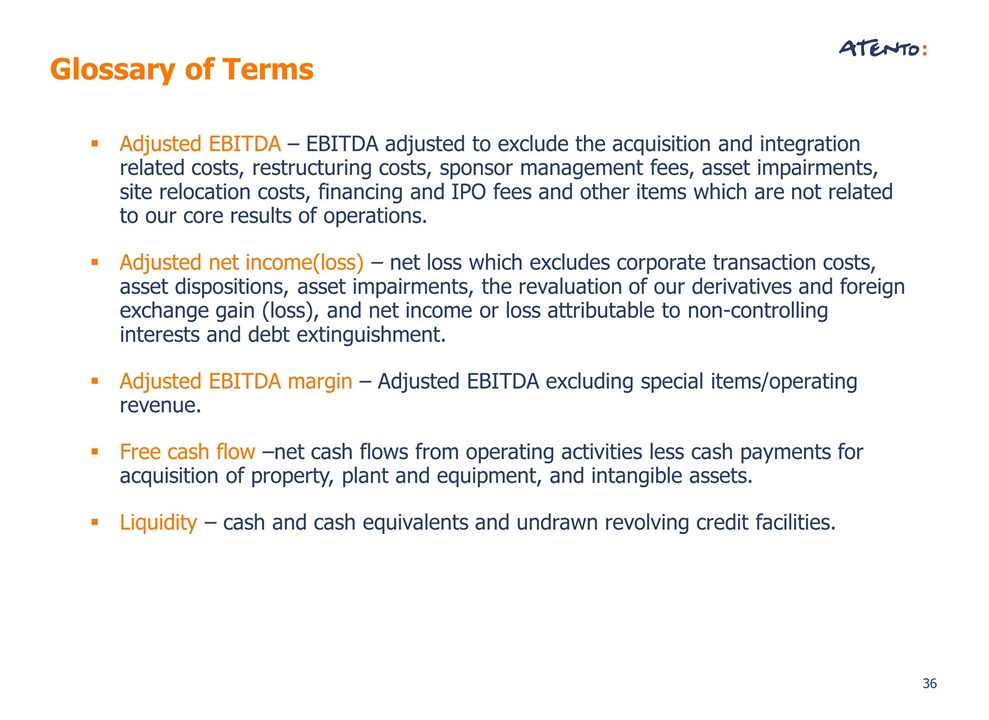

Glossary of Terms Adjusted EBITDA – EBITDA adjusted to exclude the acquisition and integration related costs, restructuring costs, sponsor management fees, asset impairments, site relocation costs, financing and IPO fees and other items which are not related to our core results of operations. Adjusted net income(loss) – net loss which excludes corporate transaction costs, asset dispositions, asset impairments, the revaluation of our derivatives and foreign exchange gain (loss), and net income or loss attributable to non-controlling interests and debt extinguishment. Adjusted EBITDA margin – Adjusted EBITDA excluding special items/operating revenue. Free cash flow –net cash flows from operating activities less cash payments for acquisition of property, plant and equipment, and intangible assets. Liquidity – cash and cash equivalents and undrawn revolving credit facilities.