UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of March, 2020

Commission File Number 001-36671

Atento S.A.

(Translation of Registrant's name into English)

4, rue Lou Hemmer, L-1748 Luxembourg Findel

Grand Duchy of Luxembourg

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F:x Form 40-F:o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes:o No:x

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes:o No:x

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

Atento Reports Fiscal 2020 First Quarter Results

Three Horizon Plan continues gaining traction with strong Multisector growth YoY

Robust contingency plan to protect employees and other stakeholders

Improved cash generation in the quarter

Total liquidity of $163 million guaranteeing business stability

NEW YORK, May 7, 2020 -- Atento S.A. (NYSE: ATTO) (“Atento” or the “Company”), the largest provider of customer-relationship management and business-process outsourcing services in Latin America, and among the top five providers globally, today announced its first-quarter operating and financial results for the period ending March 31, 2020. All comparisons in this announcement are year-over-year (YoY) and in constant-currency (CCY), unless noted otherwise, and may differ from the corresponding 6-K filing due to certain intra-group eliminations.

Q1 2020 highlights

Three Horizon Plan continues gaining traction · Strong Multisector growth at higher margins · Profitability improvements via better revenue mix and effective cost management · Bulk of investments in digital transformation completed in 2019 2019 pipeline of acquired programs already showing results in Q1 2020 · 8.4% YoY Multisector growth across regions · Multisector reached 67.5% of total revenue, up 510 bps from 62.4% in Q1 2019 Reported EBITDA improved YoY · +10% EBITDA growth, with EBITDA margin expanding +120 bps · +150 bps Brazil margin, due to Multisector growth and positive impact from certain discontinued TEF programs · +60 bps Americas margin on improved revenue mix Cash generation improved under Three Horizon Plan and DSO reduction · Positive results of transformation plan combined with new working capital management policies · DSO reduction from stricter collection policy Robust contingency plan to protect employees and other stakeholders · Contributing toward helping assure the continuity of essential services for citizens around the world through remote and secure customer services · Over 60,000 work-at-home agents (WAHA), or approximately 55% of Company’s call center employees · Solid cash position of $163 million, reflecting strong operating cashflow and drawdown of credit facilities to enhance financial liquidity World leading institutional investors HPS, GIC and Farallon to invest independently in Atento, acquiring Bain Capital’s equity stake in the Company · Participation reflects confidence in Atento’s Three Horizon Plan · HPS, GIC and Farallon have each agreed to certain transfer restrictions with regards to their Atento shares for a period of 24 months · HPS will have the right to propose two directors, while GIC and Farallon will each have the right to propose one director. |

1 |

|

Message from the CEO and CFO

Carlos López-Abadia, Atento’s Chief Executive Officer, commented, “Atento responded early to the COVID-19 crisis, rapidly implementing measures to protect our employees, reinforcing our balance sheet, and ensuring that we continue to effectively deliver services, some of which are mission-critical, across our markets. I would like to thank each and every person on our teams for their commitment during this challenging period.

Our first quarter results were largely ahead of plan, as our transformation plan gained additional traction that further improved revenue mix, profitability and cash flow. While the economic effects of the crisis are impacting volumes and utilization rates, resulting market dynamics are creating opportunities with respect to the higher-growth in multisector customers, such as born-digital and tech.

We have also been able to continue building out our portfolio of next-generation services, such as digital, high-value voice, integrated multichannel and back office, which many companies continue purchasing as they seek to reduce costs in this difficult economic environment. In addition to safeguarding business continuity, our transition to a work-at-home model is providing access to a wider pool of talent, helping reduce absenteeism and turnover, as well as increase scale advantages and operating leverage. We expect, therefore, to emerge from the crisis far stronger than many of our competitors, near and far, enabling us to secure more profitable business opportunities and capture greater market share.”

José Azevedo, Atento’s Chief Financial Officer said, “Owing to significantly improved working capital policies, enhanced cash management, as well as stronger cost controls, we improved our first-quarter operating cash flow, helping increase our cash position in combination with drawdowns from Atento’s credit facilities, to navigate the pandemic crisis.

Although we have been able to further accelerate our transformation initiatives, the bulk of related investments are now behind us and we are being cautious and prudent in this complex business environment, postponing non-essential capital expenditures, further reducing indirect costs, and protecting hard-earned margin gains. And while we have largely completed the process of discontinuing unprofitable client programs, we will continually review remaining programs and make any necessary adjustments.

Looking ahead, we believe we will be able to continue effectively executing our Three Horizon Plan, through new growth avenues, next generation services and digital acceleration, as well as operational improvements and financial discipline.”

Institutional Investors to Acquire Bain Capital’s Equity Stake in Atento

On May 7, the Company announced arrangements to facilitate HPS Investment Partners, GIC and an investment fund affiliated with Farallon Capital Management’s acquisition of shares of the Company currently held indirectly by Bain Capital in exchange for notes currently held by them.

The transaction is subject to regulatory conditions, including anti-trust approvals in Brazil and Mexico. Following the transaction, Atento expects that HPS will hold approximately 25%, GIC 22% and Farallon 15% of the shares in the Company. The institutional investors will invest independently in Atento and will be able to propose candidates to be nominated to the Company’s Board of Directors, subject to shareholder approval. HPS will have the right to propose two directors, while GIC and Farallon will each have the right to propose one director.

Each of HPS, GIC and Farallon have also agreed to certain transfer restrictions with regards to their Atento shares for a period of 24 months from the date of completion of the transaction. The arrangements with these investors are intended to ensure that there are no impacts on Atento’s day-to-day business operations.

2 |

|

Summarized Financials

($ in millions except EPS) | Q1 2020 | Q1 2019 | CCY Growth(1) |

Income Statement | | | |

Revenue | 375.4 | 436.7 | -2.8% |

EBITDA(2) | 40.8 | 42.0 | 10.1% |

EBITDA Margin | 10.9% | 9.6% | 1.2p.p. |

Net Income | (7.4) | (45.6) | 83.1% |

Recurring Net Income( 3) | (3.4) | (5.5) | 50.8% |

Earnings Per Share(3) | (0.10) | (0.61) | 82.4% |

Recurring Earnings Per Share(3) | (0.05) | (0.07) | 43.8% |

Cash flow, Debt and Leverage | | | |

Net Cash (Used In)/ from Operating Activities | 4.4 | (39.8) | |

Cash and Cash Equivalents | 162.8 | 77.9 | |

Net Debt | 564.3 | 565.2 | |

Net Leverage | 3.7 | 3.2 | |

(1) Unless otherwise noted, all results are for Q1 2020; all revenue growth rates are on a constant currency basis, year-over-year.

(2) EBITDA, Recurring Net Income/Recurring EPS are Non-GAAP measures.

(3) Reported Net Income and Earnings per Share (EPS) attributable to Owners of the Parent Company and includes the impact of non-cash foreign exchange gains/losses on intercompany balances.

First Quarter Consolidated Operating Results

The first quarter of 2020 registered significant improvements in growth and quality coupled with higher margins, as a result of continued diversification of Atento’s client portfolio mix toward faster growing verticals and away from low-margin businesses, benefiting overall profitability.

Multisector remains the core growth engine of the Company, with sales in this segment increasing 8.4% across all regions to 67.5% of total revenue, up 510 bps compared to Q1 2019.

In Brazil, Multisector revenues increased 3.6%, mainly among born-digital clients and as a result of the pipeline acquired throughout 2019. In the Americas, higher volumes in the financials vertical, combined with the pipeline acquired last year among mostly tech and born-digital companies, also drove the 8.4% increase in Atento’s Multisector revenues, particularly in Mexico and Colombia. In EMEA, Multisector growth was driven by the pipeline acquired in 2H 2019, leading to a mix 840 bps higher than Q1 2019.

Telefónica revenues decreased 19.9%, mainly reflecting the discontinuation of lower margin programs in 2H 2019 in Brazil and lower volumes in EMEA.

Reported EBITDA increased 10.1% YoY to $40.8 million, with EBITDA Margin at 10.9%, a 120 bps improvement versus Q1 2019, fueled by Brazil and the Americas and extending a positive EBITDA trend as a result of (i) customer and service mix moving to more profitable verticals and services; (ii) operational improvement initiatives gaining additional traction; and (iii) exiting low-margin business.

3 |

|

Segment Reporting

Brazil

($ in millions) | Q1 2020 | Q1 2019 | CCY growth(1) |  |

Brazil Region | | | |

Revenue | 172.0 | 218.3 | -7.1% |

Adjusted EBITDA(2) | 24.4 | 27.8 | 4.5% |

Adjusted EBITDA Margin | 14.2% | 12.7% | 1.5p.p. |

Operating Income/(loss) | (8.2) | (5.9) | -70.3% |

(1) Unless otherwise noted, all results are for Q1 2020; all growth rates are on a constant currency basis and year-over-year

(2) EBITDA and Adj. EBITDA are Non-GAAP measures.

In Brazil, Atento’s flagship operation, first quarter Multisector revenue increased 3.6%, accounting for 76.3% of Brazilian revenues in the quarter, a 580 bps expansion year-over-year, mainly with born-digital clients and as a result of the pipeline acquired throughout 2019.

The decision to discontinue unprofitable programs in 2H 2019, which has also contributed to improved margins, led to a 30.2% decrease in Telefónica revenues during the quarter.

Reported EBITDA totaled $24.4 million, 4.5% higher than first quarter 2019, reflecting the improved revenue mix. The corresponding margin expanded 150 bps to 14.2%, driven by a 130 bps positive impact from discontinuing lower margin programs.

Americas Region

($ in millions) | Q1 2020 | Q1 2019 | CCY

growth(1) |

|

Americas Region | | | |

Revenue | 147.4 | 161.7 | 1.1% |

Adjusted EBITDA(2) | 13.7 | 14.1 | 1.3% |

Adjusted EBITDA Margin | 9.3% | 8.7% | 0.6p.p. |

Operating Income/(loss) | (6.9) | (7.6) | 9.0% |

(1) Unless otherwise noted, all results are for Q1 2020; all growth rates are on a constant currency basis and year-over-year

(2) EBITDA and Adj. EBITDA are Non-GAAP measures.

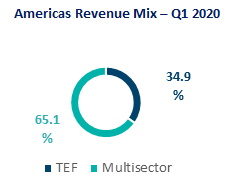

First quarter revenue in the Americas region grew 1.1% year-over-year to $147.4 million, mainly driven by higher volumes in tech and born-digital companies, combined with the pipeline acquired in 2019. Volumes were particularly strong in Mexico and Colombia, leading to an 8.4% increase in Multisector sales, up 360 bps to 65.1% of total revenue. TEF revenues declined 10.3%, mainly due to lower volumes in Peru.

EBITDA in the first quarter totaled $13.7 million, up 1.3%, with a corresponding margin of 9.3%, 60 bps higher than last year’s comparable quarter. Most countries in the region reported higher profitability stemming from an improved service mix and better margins associated with tech and born-digital verticals, among others.

4 |

|

EMEA Region

($ in millions) | Q1 2020 | Q1 2019 | CCY growth(1) |

|

EMEA Region | | | |

Revenue | 57.5 | 62.1 | -4.8% |

Adjusted EBITDA(2) | 3.7 | 6.3 | -39.2% |

Adjusted EBITDA Margin | 6.5% | 10.1% | -3.6p.p. |

Operating Income/(loss) | (0.6) | (4.0) | 85.8% |

(1) Unless otherwise noted, all results are for Q1 2020; all growth rates are on a constant currency basis and year-over-year

(2) EBITDA and Adj. EBITDA are Non-GAAP measures.

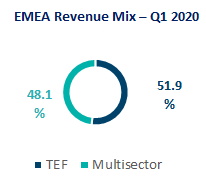

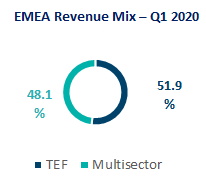

Multisector sales grew 16.5% during the first quarter, driven by a pipeline of clients acquired during 2H 2019. Multisector sales represented 48.1% of total revenue, 840 bps higher when compared to Q1 2019.

TEF revenues decreases 18.5%, due to lower volumes, which led to a decrease of 4.8% in total revenues.

EMEA’s reported EBITDA totaled $3.7 million in the first quarter, down 39.2% year-over-year. The corresponding margin was 6.5%, 360 bps lower versus Q1 2019 as a result of decreased TEF volumes, partially offset by a margin recovery associated with Multisector customers and stricter control of indirect costs.

Cash Flow

($ in millions) | Q1 2020 | Q1 2019 |

Consolidated Cash Flow Statement | | |

Cash and cash equivalents at beginning of period | 124.7 | 133.5 |

Net Cash (used in) from Operating activities | 4.4 | (39.8) |

Net Cash used in Investing activities | (11.3) | (16.7) |

Net Cash provided by Financing activities | 58.8 | 1.8 |

Net (increase/decrease) in cash and cash equivalents | 51.9 | (54.6) |

Effect of changes in exchanges rates | (13.9) | (1.0) |

Cash and cash equivalents at end of period | 162.8 | 77.9 |

Operational improvements under the transformation plan, along with enhanced contract and working capital management policies, led to a significant improvement in working capital during the first quarter, with net cash flow generated from operating activities totaling $4.4 million , compared to an outflow of $39.8 during the prior year’s comparable period. Among the improvements in working capital was a reduction in days sales outstanding (DSO) resulting from a stricter collection that led to one-off overdue collection, which were highlighted during Atento’s fourth quarter earnings conference call.

Cash capex was 3.0% of first quarter revenue, compared to 3.8% in Q1 2019, and still reflects the supplier payments carry-over related to projects executed in the 2H 2019, per the Company’s Q4 2019 financial results materials. Due to risks associated with the COVID-19 pandemic, the company is postponing, for the foreseeable future, all non-essential capex.

5 |

|

Capital Structure

($ in millions) as of March 31, 2020 | Maturity | Interest Rate | Outstanding Balance Q1 20 |

Indebtedness | | | |

Senior Secured Notes | 2022 | USD 6.125% | 495.3 |

Super Senior Credit Facility | 2020 | USD 5.223% | 50.0 |

Other Credit Facilities | 2020 | CDI + 2.40% | 29.9 |

Other borrowings and leases | 2023 | Variable | 9.8 |

BNDES (BRL) | 2022 | TJLP + 2.0% | 0.8 |

Debt with third parties | 585.8 |

Leasing (IFRS16) | 141.3 |

Gross Debt (third parties + IFRS16) | 727.1 |

Cash and Cash Equivalents | 162.8 |

Net Debt | 564.3 |

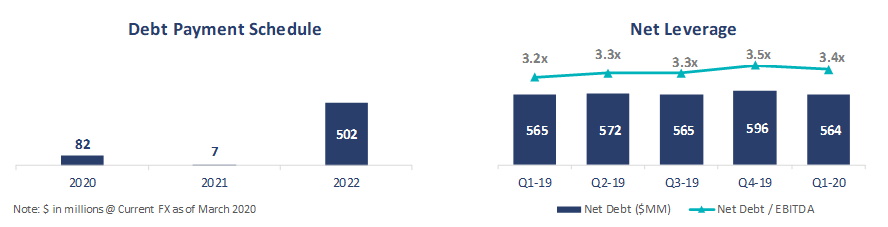

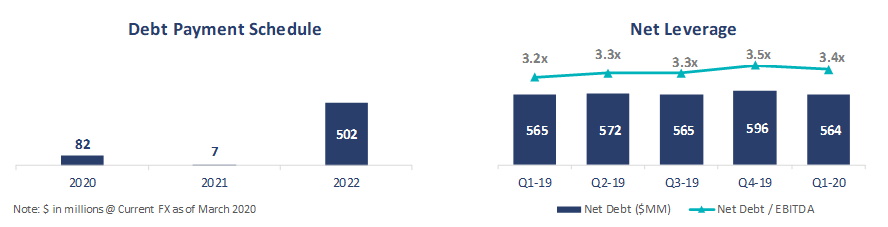

At March 31, 2020, cash and cash equivalents totaled $162.8 million, which included a drawdown of approximately $77 million from available revolving credit lines. Additionally, on April 6, 2020, Atento paid down a daily revolver line of $8.6 million, as part of a negotiation to increase the credit line to $21.7 million for a 12-month period, which was subsequently drawn upon on April 9th, bolstering the Company’s cash position and financial flexibility.

Net debt was $564.3 million at the end of the first quarter, which included an additive effect of $141.3 related to IFRS16. Atento’s total debt with third parties has an average maturity of 2.1 years and an average LTM cost of 7.0% per annum. At the end of the first quarter, reported net debt-to-EBITDA was 3.7x, compared to 3.9x in Q4 2019. Approximately $502 million, or 85.5% of the Company’s debt with third parties, will mature in August 2022.

Update On COVID-19 Response: Executing on Immediate Plan and Preparing the Company for the Post-crisis

As a socially responsible company, Atento is fully committed to helping ensure that many essential services remain available to citizens around the world through remote and secure customer services. This commitment includes the implementation of a robust plan to protect the health and safety of Atento employees and to ensure business continuity, in response to the COVID-19 pandemic. The national governments of many of the countries in which the company operates have designated Atento’s services as essential, three of which are using the Company’s services to facilitate information management and delivery during the pandemic.

Currently, Atento has over 60,000 work-at-home agents (WAHA), or approximately 55% of the Company’s call center employees. For agents still working at Atento facilities, distances between workstations have been increased and personal work equipment (individual headset, keyboard, mouse, etc.) made available. The implementation of strict health and safety measures in all operations has allowed Atento to keep almost all of its work sites open, which gives the Company broad capacity to meet the needs of all clients. The transition to Telework by Atento employees has been facilitated by the digital transformation process underway since last year, which has included re-skilling and digital recruiting, among other forms of employee development that are being strengthened under the Company’s transformation plan.

6 |

|

While limited on-site capacity in most countries has been partially offset by expanding WAHA operations, slowing economies across markets have resulted in lower volumes. On the other hand, relevant changes in market dynamics are taking place and are expected to create medium- and long-term opportunities. Accordingly, management is adjusting certain elements of the Three Horizon Plan to effectively capture these emerging market opportunities and enable Atento to emerge from the COVID-19 crisis as a stronger company. With regard to pursuing new growth avenues within the CRM-BPO market, greater emphasis is being placed on global accounts, while continuing to attract born-digital and other Multisector clients and expanding in the US market. With respect to expanding Atento’s portfolio of next-generation services and accelerating the development of related digital capabilities, WAHA is a new key capability that will hasten and facilitate the transformation of the Company’s services portfolio. Additionally, as initiatives under the operational excellence plan continue to be implemented, improving financial and cost controls as well the performance of client programs will play an even greater role in Atento leading Next Generation Customer Experience in its markets.

Share Repurchase Program

On February 26, 2020, Atento’s Board of Directors approved a new share buyback program, following approval at the Ordinary General Meeting of Shareholders on February 4, 2020. Under the program, the Company is authorized to repurchase up to $30 million of Atento shares for a period of 12 months, beginning March 10, 2020. The Company did not repurchase shares during the first quarter.

Conference Call

The Company will host a conference call and webcast on Friday, May 8, 2020 at 10:00 am ET to discuss its financial results. The conference call can be accessed by dialing: +1 (877) 407-3982 toll free domestic, UK: (+44) 0 800 756 3429 toll free, Brazil: (+55) 0800 891 6221 toll free, or Spain: (+34) 900 834 236 toll free. All other international callers can access the conference call by dialing: +1 (201) 493-6780 toll free. No passcode is required. Individuals who dial in will be asked to identify themselves and their affiliations. The live webcast of the conference call will be available on Atento's Investor Relations website at investors.atento.com. A web-based archive of the conference call will also be available at the website.

About Atento

Atento is the largest provider of customer relationship management and business process outsourcing (CRM BPO) solutions in Latin America, and among the top five providers globally, based on revenues. Atento is also a leading provider of nearshoring CRM/BPO services to companies that carry out their activities in the United States. Since 1999, the company has developed its business model in 13 countries where it employs 150,000 people. Atento has over 400 clients to whom it offers a wide range of CRM/BPO services through multiple channels. Atento's clients are mostly leading multinational corporations in sectors such as telecommunications, banking and financial services, health, retail and public administrations, in addition to born-digital ones, among others. Atento´s shares trade under the symbol ATTO on the New York Stock Exchange (NYSE). In 2019, Atento was named one of the World’s 25 Best Multinational Workplaces and one of the Best Multinationals to Work for in Latin America by Great Place to Work®. For more information visit www.atento.com.

Investor Relations

Shay Chor

+ 55 11 3293-5926

shay.chor@atento.com | Investor Relations Fernando Schneider + 55 11 3779-8119 fernando.schneider@atento.com | Media Relations

Pablo Sánchez Pérez +34 670031347

pablo.sanchez@atento.com |

7 |

|

Forward-Looking Statements

This press release contains forward-looking statements. Forward-looking statements can be identified by the use of words such as "may," "should," "expects," "plans," "anticipates," "believes," "estimates," "predicts," "intends," "continue" or similar terminology. These statements reflect only Atento's current expectations and are not guarantees of future performance or results. Forward-looking statements by their nature address matters that are, to different degrees, uncertain, such as statements about the potential impacts of the COVID-19 pandemic on our business operations, financial results and financial position and on the world economy. These statements are subject to risks and uncertainties that could cause actual results to differ materially from those contained in the forward-looking statements. These risks and uncertainties include, but are not limited to, competition in Atento's highly competitive industries; increases in the cost of voice and data services or significant interruptions in these services; Atento's ability to keep pace with its clients' needs for rapid technological change and systems availability; the continued deployment and adoption of emerging technologies; the loss, financial difficulties or bankruptcy of any key clients; the effects of global economic trends on the businesses of Atento's clients; the non-exclusive nature of Atento's client contracts and the absence of revenue commitments; security and privacy breaches of the systems Atento uses to protect personal data; the cost of pending and future litigation; the cost of defending Atento against intellectual property infringement claims; extensive regulation affecting many of Atento's businesses; Atento's ability to protect its proprietary information or technology; service interruptions to Atento's data and operation centers; Atento's ability to retain key personnel and attract a sufficient number of qualified employees; increases in labor costs and turnover rates; the political, economic and other conditions in the countries where Atento operates; changes in foreign exchange rates; Atento's ability to complete future acquisitions and integrate or achieve the objectives of its recent and future acquisitions; future impairments of our substantial goodwill, intangible assets, or other long-lived assets; and Atento's ability to recover consumer receivables on behalf of its clients. In addition, Atento is subject to risks related to its level of indebtedness. Such risks include Atento's ability to generate sufficient cash to service its indebtedness and fund its other liquidity needs; Atento's ability to comply with covenants contained in its debt instruments; the ability to obtain additional financing; the incurrence of significant additional indebtedness by Atento and its subsidiaries; and the ability of Atento's lenders to fulfill their lending commitments. Atento is also subject to other risk factors described in documents filed by the company with the United States Securities and Exchange Commission.

These forward-looking statements speak only as of the date on which the statements were made. Atento undertakes no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

8 |

|

SELECTED FINANCIAL DATA:The following selected financial information should be read in conjunction with the interim consolidated financial statements presented elsewhere in the Form 6-K.

| | | For the three months ended March 31, |

($ in millions) | | | 2019 | | 2020 |

| | |

| | | | | |

(Loss)/profit for the period | | | (45.6) | | (7.4) |

Net finance expense | | | 17.3 | | 16.9 |

Income tax expense | | | (2.9) | | (0.2) |

Write-off of deferred tax assets | | | 37.8 | | - |

Depreciation and amortization | | | 35.3 | | 31.5 |

EBITDA (non-GAAP) (unaudited) | | | 42.0 | | 40.8 |

Adjusted EBITDA (non-GAAP) (unaudited) | | | 42.0 | | 40.8 |

| | | | |

| | For the three months ended March 31, |

($ in millions) | | 2019 | | 2020 |

| |

(Loss)/profit for the period | | (45.6) | | (7.4) |

Amortization of acquisition related intangible assets (a) | | 5.1 | | 5.0 |

Net foreign exchange gain/(loss) (b) | | 1.6 | | 3.5 |

Tax effect (c) | | 33.2 | | (4.5) |

Other | | 0.6 | | - |

Total of add-backs | | 40.8 | | 4.0 |

Adjusted Earnings (non-GAAP) (unaudited) (*) | | (5.1) | | (3.4) |

Adjusted Earnings per share (in U.S. dollars) (unaudited) (**) | | (0.07) | | (0.05) |

Adjusted Earnings attributable to Owners of the parent (non-GAAP) (unaudited) | | (5.5) | | (3.4) |

Adjusted Earnings per share attributable to Owners of the parent (in U.S. dollars) (**) (unaudited) | | (0.07) | | (0.05) |

(*) | We define non-recurring items as items that are limited in number, clearly identifiable, unusual, are unlikely to be repeated in the near future in the ordinary course of business and that have a material impact on the consolidated results of operations. Non-recurring items can be summarized as demonstrated below: |

| (a) | Amortization of acquisition related intangible assets represents the amortization expense of customer base, recorded as intangible assets. This customer base represents the fair value (within the business combination involving the acquisition of control of Atento Group) of the intangible assets arising from service agreements (tacit or explicitly formulated in contracts) with Telefónica Group and with other customers. |

| (b) | Since April 1, 2015, the Company designated the foreign currency risk on certain of its subsidiaries as net investment hedges using financial instruments as the hedging items. As a consequence, any gain or loss on the hedging instrument, related to the effective portion of the hedge is recognized in other comprehensive income (equity) as from that date. The gains or losses related to the ineffective portion are recognized in the statements of operations and for comparability, and those adjustments are added back to calculate Adjusted Earnings. |

| (c) | The tax effect represents the impact of the taxable adjustments based on tax nominal rate by country. For the three months ended March 31, 2019, in the context of a global Tax Audit of the periods 2013-2016, Atento Spain, as the representative company of the tax group comprised of the Spanish direct subsidiaries of Atento S.A., signed a tax agreement with the Spanish tax authorities. The criteria adopted by the Tax Administration was in connection with certain aspects, among others, of the deductibility of certain specific intercompany financing and operating expenses originated during the acquisition of Atento Spain, which was different from the tax treatment applied by the Company. As a result of this discrepancy, the amount of the tax credits of the Spanish tax group, together with the corresponding effects in subsequent tax periods, has being reduced in an amount of $33.2 million. |

(**) | Adjusted Earnings per share is calculated based on weighted average number of ordinary shares outstanding of 74,300,199 and 71,179,765 for the three months ended December 31, 2018 and 2019, respectively. |

9 |

|

Financing Arrangements

Net debt with third parties as of March 31, 2019 and 2020 is as follow:

| | |

($ in millions, except Net Debt/Adj. EBITDA LTM) | | On March 31, 2019 | | On March 31, 2020 |

| | | | | |

Cash and cash equivalents | | 77.9 | | 162.8 |

Debt: | | | | |

Senior Secured Notes | | 394.5 | | 495.3 |

Super Senior Credit Facility | | 0.0 | | 50.0 |

Brazilian Debentures | | 15.0 | | 0.0 |

BNDES | | 19.0 | | 0.8 |

Lease Liabilities (3) | | 179.9 | | 146.1 |

Other Borrowings | | 34.8 | | 35.03 |

Total Debt | | 643.2 | | 727.1 |

Net Debt with third parties (1) (unaudited) | | 565.2 | | 564.3 |

EBITDA LTM (2) (non-GAAP) (unaudited) | | 177.0 | | 152.2 |

Net Debt/Adjusted EBITDA LTM (non-GAAP) (unaudited) | | 3.2x | | 3.7x |

(1) | In considering our financial condition, our management analyzes Net debt with third parties, which is defined as total debt less cash and cash equivalents. Net debt with third parties is not a measure defined by IFRS and it has limitations as an analytical tool. Net debt with third parties is neither a measure defined by or presented in accordance with IFRS nor a measure of financial performance and should not be considered in isolation or as an alternative financial measure determined in accordance with IFRS. Net debt is not necessarily comparable to similarly titled measures used by other companies. |

(2) | EBITDA LTM (Last Twelve Months) |

(3) | Consider the impact in March 31, 2020 of application of IFRS16 (former operating leases not related to short-term or low-value leases are now shown as debt) was $141.3 million and $4.8 million of other financial leases. |

10 |

|

Consolidated Statements of Operations for the Three Months Ended March 31, 2019 and 2020 |

| | | | | | | | |

($ in millions, except percentage changes) | For the three months ended

March 31, | | Change

(%) | | Change excluding FX (%) |

2019 | | 2020 | | |

| | (unaudited) | | | | |

Revenue | 436.7 | | 375.4 | | (14.0) | | (2.8) |

Other operating income | 0.6 | | 0.9 | | 35.4 | | 43.0 |

Other gains and own work capitalized | - | | - | | 30.1 | | 33.9 |

Operating expenses: | | | | | | | |

Supplies | (16.8) | | (16.7) | | (0.6) | | 11.0 |

Employee benefit expenses | (339.3) | | (289.0) | | (14.8) | | (3.6) |

Depreciation | (21.8) | | (19.8) | | (9.3) | | 1.6 |

Amortization | (13.5) | | (11.7) | | (13.6) | | (3.1) |

Changes in trade provisions | - | | (0.5) | | N.M. | | N.M. |

Impairment charges | - | | - | | N.M. | | (150.0) |

Other operating expenses | (39.2) | | (29.3) | | (25.3) | | (15.9) |

Total operating expenses | (430.6) | | (367.0) | | (14.8) | | (3.7) |

Operating profit | 6.7 | | 9.3 | | 38.7 | | 68.3 |

Finance income | 2.4 | | 2.4 | | 2.1 | | 40.7 |

Finance costs | (18.1) | | (15.9) | | (12.6) | | (4.0) |

Net foreign exchange loss | (1.6) | | (3.5) | | 118.7 | | N.M. |

Net finance (expense)/benefit | (17.3) | | (16.9) | | (2.5) | | 16.8 |

Loss before income tax | (10.6) | | (7.6) | | (28.5) | | (15.1) |

Income tax (expense)/benefit | (35.0) | | 0.2 | | (100.5) | | (100.5) |

Loss for the period | (45.6) | | (7.4) | | (83.7) | | (83.1) |

Loss attributable to: | | | | | | | |

Owners of the parent | (46.0) | | (7.4) | | (83.8) | | (83.1) |

Non-controlling interest | 0.4 | | - | | (100.0) | | N.M. |

Loss for the period | (45.6) | | (7.4) | | (83.7) | | (83.1) |

Other financial data: | | | | | | | |

EBITDA(1) (unaudited) | 42.0 | | 40.8 | | (3.0) | | 10.1 |

Adjusted EBITDA(1) (unaudited) | 42.0 | | 40.8 | | (3.0) | | 10.1 |

N.M. means not meaningful

11 |

|

Consolidated Statements of Operations by Segment for the Three Months Ended March 31, 2019 and 2020 |

| | | | | | | | |

($ in millions, except percentage changes) | For the three months ended March 31, | | Change

(%) | | Change Excluding FX

(%) |

2019 | | 2020 | | |

| | (unaudited) |

Revenue: | | | | | | | |

Brazil | 218.3 | | 172.0 | | (21.2) | | (7.1) |

Americas | 161.7 | | 147.4 | | (8.8) | | 1.1 |

EMEA | 62.1 | | 57.5 | | (7.5) | | (4.8) |

Other and eliminations(1) | (5.4) | | (1.5) | | (73.0) | | (71.8) |

Total revenue | 436.7 | | 375.4 | | (14.0) | | (2.8) |

Operating expenses: | | | | | | | |

Brazil | (215.1) | | (167.8) | | (22.0) | | (8.0) |

Americas | (164.8) | | (149.2) | | (9.5) | | 0.7 |

EMEA | (61.8) | | (58.4) | | (5.5) | | (2.7) |

Other and eliminations(1) | 11.1 | | 8.4 | | (24.0) | | (8.7) |

Total operating expenses | (430.6) | | (367.0) | | (14.8) | | (3.7) |

Operating profit/(loss): | | | | | | | |

Brazil | 3.3 | | 4.3 | | 29.7 | | 46.2 |

Americas | (2.9) | | (1.5) | | (47.5) | | (26.0) |

EMEA | 0.7 | | (0.4) | | N.M. | | N.M. |

Other and eliminations(1) | 5.7 | | 7.0 | | 22.3 | | 71.4 |

Total operating profit | 6.7 | | 9.3 | | 38.7 | | 68.3 |

Net finance expense: | | | | | | | |

Brazil | (12.1) | | (16.5) | | 37.0 | | 63.6 |

Americas | (5.3) | | (4.1) | | (21.5) | | (6.4) |

EMEA | (0.7) | | - | | (97.9) | | (97.8) |

Other and eliminations(1) | 0.7 | | 3.8 | | N.M. | | N.M. |

Total net finance expense | (17.3) | | (16.9) | | (2.5) | | 16.8 |

Income tax benefit/(expense): | | | | | | | |

Brazil | 2.9 | | 4.0 | | 40.0 | | 71.4 |

Americas | 0.6 | | (1.2) | | N.M. | | N.M. |

EMEA | (4.0) | | (0.2) | | (96.0) | | (95.9) |

Other and eliminations(1) | (34.5) | | (2.5) | | (92.8) | | (92.6) |

Total income tax benefit/(expense) | (35.0) | | 0.2 | | (100.5) | | (100.5) |

Profit/(loss) for the period: | | | | | | | |

Brazil | (5.9) | | (8.2) | | 39.5 | | 70.3 |

Americas | (7.6) | | (6.9) | | (9.8) | | 9.0 |

EMEA | (4.0) | | (0.6) | | (86.1) | | (85.8) |

Other and eliminations(1) | (28.1) | | 8.3 | | (129.4) | | (128.5) |

(Loss)/profit for the period | (45.6) | | (7.4) | | (83.7) | | (83.1) |

(Loss)/profit attributable to: | | | | | | | |

Owners of the parent | (46.0) | | (7.4) | | (83.8) | | (83.1) |

Non-controlling interest | 0.4 | | - | | (100.0) | | N.M. |

Other financial data: | | | | | | | |

EBITDA: | | | | | | | |

Brazil | 22.4 | | 21.0 | | (6.3) | | 9.7 |

Americas | 9.9 | | 10.1 | | 2.5 | | 2.2 |

EMEA | 3.9 | | 2.6 | | (35.0) | | (32.8) |

Other and eliminations(1) | 5.8 | | 7.0 | | 22.0 | | 70.2 |

Total EBITDA (unaudited) | 42.0 | | 40.8 | | (3.0) | | 10.1 |

Adjusted EBITDA: | | | | | | | |

Brazil | 27.8 | | 24.4 | | (12.1) | | 4.5 |

Americas | 14.1 | | 13.7 | | (3.0) | | 1.3 |

EMEA | 6.3 | | 3.7 | | (41.0) | | (39.2) |

Other and eliminations(1) | (6.2) | | (1.1) | | (82.7) | | (82.1) |

Total Adjusted EBITDA (unaudited) | 42.0 | | 40.8 | | (3.0) | | 10.1 |

(1) Included revenue and expenses at the holding-company level (such as corporate expenses and acquisition related expenses), as applicable, as well as consolidation adjustments.

12 |

|

N.M. means not meaningful

Revenue Mix by Service Type

| | For the three months ended March 31, |

2019 | | 2020 |

Customer Service | 51.7% | | 56.4% |

Sales | 17.0% | | 13.3% |

Collection | 7.9% | | 7.1% |

Back Office | 12.8% | | 13.5% |

Technical Support | 6.7% | | 6.1% |

Others | 3.9% | | 3.6% |

Total | 100.0% | | 100.0% |

Number of Workstations and Delivery Centers

| | Number of Workstations | | Number of Service Delivery Centers (1) |

Q1 2019 | | Q1 2020 | | Q1 2019 | | Q1 2020 |

Brazil | 49,547 | | 49,821 | | 34 | | 33 |

Americas | 37,423 | | 39,659 | | 51 | | 48 |

Argentina (2) | 4,475 | | 4,358 | | 12 | | 12 |

Central America (3) | 2,338 | | 2,516 | | 4 | | 3 |

Chile | 2,878 | | 2,549 | | 4 | | 4 |

Colombia | 8,854 | | 9,087 | | 10 | | 9 |

Mexico | 9,203 | | 11,437 | | 15 | | 14 |

Peru | 8,322 | | 8,475 | | 3 | | 3 |

United States (4) | 1,353 | | 1,237 | | 3 | | 3 |

EMEA | 5,471 | | 5,376 | | 15 | | 15 |

Spain | 5,471 | | 5,471 | | 15 | | 15 |

Total | 92,441 | | 94,856 | | 100 | | 96 |

(1) Includes service delivery centers at facilities operated by us and those owned by our clients where we provide operations personnel and workstations. (2) Includes Uruguay. |

(3) Includes Guatemala and El Salvador. |

(4) Includes Puerto Rico. |

FX Rates

| | 2019 | | 2019 | | 2020 |

| | Average FY | | December 31 | | Average Q1 | | March 31, | | Average Q1 | | March 31, |

Euro (EUR) | 0.89 | | 0.89 | | 0.88 | | 0.89 | | 0.91 | | 0.91 |

Brazil (BRL) | 3.94 | | 4.03 | | 3.77 | | 3.90 | | 4.46 | | 5.20 |

Mexico (MXN) | 19.25 | | 18.86 | | 19.20 | | 19.38 | | 20.00 | | 23.48 |

Colombia (COP) | 3,281.35 | | 3,277.14 | | 3,135.29 | | 3,190.94 | | 3,534.22 | | 4,064.81 |

Chile (CLP) | 702.77 | | 744.62 | | 667.01 | | 681.09 | | 802.78 | | 846.30 |

Peru (PEN) | 3.34 | | 3.32 | | 3.32 | | 3.32 | | 3.40 | | 3.44 |

Argentina (ARS) | 48.22 | | 59.89 | | 39.05 | | 43.35 | | 61.55 | | 64.47 |

13 |

|

Balance Sheet ($ Thousands)

ASSETS | | | | | |

| | December 31, | | March 31, |

| | 2019 | | 2020 |

| | | (audited) | | (unaudited) |

NON-CURRENT ASSETS | | | 765,839 | | 621,770 |

| | | | | |

Intangible assets | | | 160,041 | | 113,371 |

Goodwill | | | 119,902 | | 100,746 |

Right-of-use assets | | | 181,564 | | 140,346 |

Property, plant and equipment | | | 116,893 | | 94,012 |

Non-current financial assets | | | 82,158 | | 75,01 |

Trade and other receivables | | | 22,124 | | 17,200 |

Other non-current financial assets | | | 54,652 | | 42,811 |

Derivative financial instruments | | | 5,382 | | 15,090 |

Other taxes receivable | | | 5,650 | | 4,639 |

Deferred tax assets | | | 99,631 | | 93,555 |

| | | | | |

CURRENT ASSETS | | | 538,772 | | 528,757 |

| | | | | |

Trade and other receivables | | | 388,308 | | 341,711 |

Trade and other receivables | | | 359,599 | | 318,176 |

Current income tax receivable | | | 28,709 | | 23,535 |

Derivative financial instruments | | | - | | 1,335 |

Other taxes receivable | | | 24,664 | | 21,719 |

Other current financial assets | | | 1,094 | | 1,233 |

Cash and cash equivalents | | | 124,706 | | 162,759 |

| | | | | |

TOTAL ASSETS | | | 1,304,611 | | 1,150,527 |

14 |

|

| | | | | |

EQUITY AND LIABILITIES | | | December 31, | | March 31, |

| | 2019 | | 2020 |

| | | (audited) | | (unaudited) |

| | | | | |

TOTAL EQUITY | | | 207,020 | | 99,149 |

EQUITY ATTRIBUTABLE TO: | | | | | |

OWNERS OF THE PARENT COMPANY | | | 207,020 | | 99,149 |

| | | | | |

Share capital | | | 49 | | 49 |

Share premium | | | 619,461 | | 613,647 |

Treasury shares | | | (19,319) | | (11,012) |

Retained losses | | | (127,070) | | (136,063) |

Translation differences | | | (271,273) | | (339,328) |

Hedge accounting effects | | | (8,872) | | (39,188) |

Stock-based compensation | | | 14,044 | | 11,044 |

| | | | | |

NON-CURRENT LIABILITIES | | | 718,989 | | 663,079 |

| | | | | |

Deferred tax liabilities | | | 20,378 | | 16,772 |

Debt with third parties | | | 633,498 | | 595,755 |

Derivative financial instruments | | | 2,289 | | 4,490 |

Provisions and contingencies | | | 48,326 | | 34,669 |

Non-trade payables | | | 11,744 | | 9,330 |

Other taxes payable | | | 2,754 | | 2,063 |

| | | | | |

CURRENT LIABILITIES | | | 378,602 | | 388,290 |

| | | | | |

Debt with third parties | | | 87,117 | | 132,716 |

Derivative financial instruments | | | 167 | | - |

Trade and other payables | | | 272,547 | | 233,330 |

Trade payables | | | 71,676 | | 72,590 |

Income tax payables | | | 12,671 | | 13,480 |

Other taxes payables | | | 93,765 | | 72,265 |

Other non-trade payables | | | 94,435 | | 74,995 |

Provisions and contingencies | | | 18,771 | | 22,253 |

TOTAL EQUITY AND LIABILITIES | | | 1,304,611 | | 1,150,527 |

15 |

|

Cash Flow ($ thousand)

| | For the three months ended March 31, |

| | 2019 | | 2020 |

| | (unaudited) |

Operating activities | | | | |

Profit before income tax | | (10,624) | | (7,593) |

Adjustments to reconcile profit before income tax to net cash flows: | | | | |

Amortization and depreciation | | 35,324 | | 31,454 |

Changes in trade provisions | | 3 | | 537 |

Share-based payment expense | | 565 | | 585 |

Change in provisions | | 9,555 | | 4,108 |

Grants released to income | | (239) | | (183) |

Losses on disposal of property, plant and equipment | | 45 | | 216 |

Losses on disposal of financial assets | | (2) | | - |

Finance income | | (2,391) | | (2,441) |

Finance costs | | 18,138 | | 15,861 |

Net foreign exchange differences | | 1,595 | | 3,490 |

Changes in other (gains)/losses and own work capitalized | | 9,475 | | (1,266) |

| | 72,068 | | 52,361 |

Changes in working capital: | | | | |

Changes in trade and other receivables | | (71,637) | | (37,249) |

Changes in trade and other payables | | (2,531) | | 10,235 |

Other assets | | 4,604 | | 3,159 |

| | (69,564) | | (22,393) |

| | | | |

Interest paid | | (18,338) | | (19,645) |

Interest received | | (45) | | 9,728 |

Income tax paid | | (3,703) | | (7,148) |

Other payments | | (9,567) | | (915) |

| | (31,653) | | (17,980) |

Net cash flows (used in)/from operating activities | | (39,773) | | 4,395 |

Investing activities | | | | |

Payments for acquisition of intangible assets | | (15,060) | | (124) |

Payments for acquisition of property, plant and equipment | | (3,324) | | (10,932) |

Payments for financial instruments | | (243) | | (269) |

Proceeds from sale of PP&E and intangible assets | | 1,959 | | - |

Net cash flows used in investing activities | | (16,668) | | (11,325) |

Financing activities | | | | |

Proceeds from borrowing from third parties | | 36,575 | | 77,621 |

Repayment of borrowing from third parties | | (21,094) | | (9,370) |

Payments of lease liabilities | | (13,672) | | (9,402) |

Net cash flows provided by financing activities | | 1,809 | | 58,849 |

Net (decrease)/increase in cash and cash equivalents | | (54,632) | | 51,919 |

Foreign exchange differences | | (964) | | (13,866) |

Cash and cash equivalents at beginning of period | | 133,526 | | 124,706 |

Cash and cash equivalents at end of period | | 77,930 | | 162,759 |

16 |

|

ATENTO S.A.

INDEX

Financial Information

For the Three Months Ended March 31, 2020

PART II - OTHER INFORMATION | 35 |

LEGAL PROCEEDINGS | 35 |

RISK FACTORS | 35 |

| |

| |

| |

| |

Atento s.a. AND SUBSIDIARIES

UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL INFORMATION FOR THE THREE MONTHS ENDED MARCH 31, 2020 |

3

| ATENTO S.A. AND SUBSIDIARIES |

INTERIM CONDENSED CONSOLIDATED STATEMENTS OF FINANCIAL POSITION |

As of December 31, 2019 and March 31, 2020 |

(In thousands of U.S. dollars, unless otherwise indicated) |

ASSETS | | Notes | | | | |

| | December 31, | | March 31, |

| | 2019 | | 2020 |

| | | | (audited) | | (unaudited) |

NON-CURRENT ASSETS | | | | 765,839 | | 621,770 |

| | | | | | |

Intangible assets | | | | 160,041 | | 113,371 |

Goodwill | | | | 119,902 | | 100,746 |

Right-of-use assets | | | | 181,564 | | 140,346 |

Property, plant and equipment | | | | 116,893 | | 94,012 |

Non-current financial assets | | | | 82,158 | | 75,101 |

Trade and other receivables | | 10 | | 22,124 | | 17,200 |

Other non-current financial assets | | 10 | | 54,652 | | 42,811 |

Derivative financial instruments | | 11 | | 5,382 | | 15,090 |

Other taxes receivable | | | | 5,650 | | 4,639 |

Deferred tax assets | | | | 99,631 | | 93,555 |

| | | | | | |

CURRENT ASSETS | | | | 538,772 | | 528,757 |

| | | | | | |

Trade and other receivables | | | | 388,308 | | 341,711 |

Trade and other receivables | | 10 | | 359,599 | | 318,176 |

Current income tax receivable | | | | 28,709 | | 23,535 |

Derivative financial instruments | | 11 | | - | | 1,335 |

Other taxes receivable | | | | 24,664 | | 21,719 |

Other current financial assets | | 10 | | 1,094 | | 1,233 |

Cash and cash equivalents | | 10 | | 124,706 | | 162,759 |

| | | | | | |

TOTAL ASSETS | | | | 1,304,611 | | 1,150,527 |

|

The accompanying notes are an integral part of the interim condensed consolidated financial statements. |

4

| ATENTO S.A. AND SUBSIDIARIES |

INTERIM CONDENSED CONSOLIDATED STATEMENTS OF FINANCIAL POSITION |

As of December 31, 2019 and March 31, 2020 |

(In thousands of U.S. dollars, unless otherwise indicated) |

| | | | | | |

EQUITY AND LIABILITIES | | Notes | | December 31, | | March 31, |

| | 2019 | | 2020 |

| | | | (audited) | | (unaudited) |

| | | | | | |

TOTAL EQUITY | | | | 207,020 | | 99,149 |

EQUITY ATTRIBUTABLE TO: | | | | | | |

OWNERS OF THE PARENT COMPANY | | | | 207,020 | | 99,149 |

| | | | | | |

Share capital | | 9 | | 49 | | 49 |

Share premium | | | | 619,461 | | 613,647 |

Treasury shares | | 9 | | (19,319) | | (11,012) |

Retained losses | | | | (127,070) | | (136,063) |

Translation differences | | | | (271,273) | | (339,328) |

Hedge accounting effects | | | | (8,872) | | (39,188) |

Stock-based compensation | | | | 14,044 | | 11,044 |

| | | | | | |

NON-CURRENT LIABILITIES | | | | 718,989 | | 663,079 |

| | | | | | |

Deferred tax liabilities | | | | 20,378 | | 16,772 |

Debt with third parties | | 11 | | 633,498 | | 595,755 |

Derivative financial instruments | | 11 | | 2,289 | | 4,490 |

Provisions and contingencies | | 12 | | 48,326 | | 34,669 |

Non-trade payables | | | | 11,744 | | 9,330 |

Other taxes payable | | | | 2,754 | | 2,063 |

| | | | | | |

CURRENT LIABILITIES | | | | 378,602 | | 388,299 |

| | | | | | |

Debt with third parties | | 11 | | 87,117 | | 132,716 |

Derivative financial instruments | | 12 | | 167 | | - |

Trade and other payables | | | | 272,547 | | 233,330 |

Trade payables | | | | 71,676 | | 72,590 |

Income tax payables | | | | 12,671 | | 13,480 |

Other taxes payables | | | | 93,765 | | 72,265 |

Other non-trade payables | | | | 94,435 | | 74,995 |

Provisions and contingencies | | 12 | | 18,771 | | 22,253 |

TOTAL EQUITY AND LIABILITIES | | | | 1,304,611 | | 1,150,527 |

|

The accompanying notes are an integral part of the interim condensed consolidated financial statements. |

5

| ATENTO S.A. AND SUBSIDIARIES |

INTERIM CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS |

For the three months ended March 31, 2019 and 2020 |

(In thousands of U.S. dollars, unless otherwise indicated) |

| | | | | |

| | | For the three months ended March 31, |

| Notes | | 2019 | | 2020 |

| | (unaudited) |

Revenue | | | 436,704 | | 375,406 |

Other operating income | | | 639 | | 866 |

Other gains and own work capitalized | | | 4 | | 5 |

Operating expenses: | | | | | |

Supplies | | | (16,823) | | (16,721) |

Employee benefit expenses | | | (339,293) | | (288,984) |

Depreciation | | | (21,800) | | (19,765) |

Amortization | | | (13,524) | | (11,689) |

Changes in trade provisions | | | (3) | | (537) |

Other operating expenses | | | (39,186) | | (29,264) |

OPERATING PROFIT | | | 6,718 | | 9,317 |

| | | | | |

Finance income | | | 2,391 | | 2,441 |

Finance costs | | | (18,138) | | (15,861) |

Net foreign exchange loss | | | (1,595) | | (3,490) |

NET FINANCE EXPENSE | | | (17,342) | | (16,910) |

PROFIT/(LOSS) BEFORE INCOME TAX | | | (10,624) | | (7,593) |

Income tax (expense)/benefit | 13 | | (34,986) | | 166 |

LOSS FOR THE PERIOD | | | (45,610) | | (7,427) |

LOSS ATTRIBUTABLE TO: | | | | | |

OWNERS OF THE PARENT | | | (45,974) | | (7,427) |

NON-CONTROLLING INTEREST | | | 364 | | - |

LOSS FOR THE PERIOD | | | (45,610) | | (7,427) |

LOSS PER SHARE: | | | | | |

Basic loss per share (in U.S. dollars) | 14 | | (0.62) | | (0.10) |

Diluted loss per share (in U.S. dollars) | 14 | | (0.62) | | (0.10) |

| | | | | |

The accompanying notes are an integral part of the interim condensed consolidated financial statements. |

6

ATENTO S.A. AND SUBSIDIARIES |

INTERIM CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME/(LOSS) |

For the three months ended March 31, 2019 and 2020 |

(In thousands of U.S. dollars, unless otherwise indicated) |

| | | |

| For the three months ended March 31, |

| 2019 | | 2020 |

| (unaudited) |

Loss for the period | (45,610) | | (7,427) |

Other comprehensive income/(loss) | | | |

Other comprehensive income/(loss) | | | |

Other comprehensive income/(loss) to be reclassified to profit and loss in subsequent periods: | | | |

Cash flow/net investment hedge | (3,839) | | 16,724 |

Exchange differences on translation of foreign operations | - | | (47,040) |

Translation differences | (12,032) | | (69,147) |

Other comprehensive income/(loss) | (15,871) | | (99,463) |

Total comprehensive income/(loss) | (61,481) | | (106,890) |

Total comprehensive income/(loss) attributable to: | | | |

Owners of the parent | (61,580) | | (106,890) |

Non-controlling interest | 99 | | - |

Total comprehensive income/(loss) | (61,481) | | (106,890) |

| | | |

The accompanying notes are an integral part of the interim condensed consolidated financial statements. |

7

| ATENTO S.A. AND SUBSIDIARIES |

INTERIM CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY |

For the three months ended March 31, 2019 and 2020 |

(In thousands of U.S. dollars, unless otherwise indicated) |

| | | | | | | | | | | | | | | | | | | | | |

| Share capital | | Share premium | | Treasury shares | | Reserve for acquisition of non-controlling interest | | Retained losses | | Translation differences | | Cash flow/net investment hedge | | Stock-based compensation | | Total owners of the parent company | | Non-controlling interest | | Total equity |

Balance at January 1, 2019 | 49 | | 615,288 | | (8,178) | | (23,531) | | (16,325) | | (257,122) | | 8,404 | | 12,966 | | 331,551 | | 8,541 | | 340,092 |

| | | | | | | | | | | | | | | | | | | | | |

Comprehensive income/(loss) for the period | - | | - | | - | | - | | (45,974) | | (11,767) | | (3,839) | | - | | (61,580) | | 99 | | (61,481) |

Profit/(loss) for the period | - | | - | | - | | - | | (45,974) | | - | | - | | - | | (45,974) | | 364 | | (45,610) |

Other comprehensive income/(loss), net of taxes | - | | - | | - | | - | | - | | (11,767) | | (3,839) | | - | | (15,606) | | (265) | | (15,871) |

Dividends | - | | - | | - | | - | | - | | - | | - | | - | | - | | (797) | | (797) |

Stock-based compensation | - | | 4,173 | | - | | - | | - | | - | | - | | (4,173) | | - | | - | | - |

Balance at March 31, 2019 (*) | 49 | | 619,461 | | (8,178) | | (23,531) | | (62,299) | | (268,889) | | 4,565 | | 8,793 | | 269,971 | | 7,845 | | 277,816 |

|

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

| Share capital | | Share premium | | Treasury shares | | Retained losses | | Translation differences | | Cash flow/net investment hedge | | Stock-based compensation | | Total owners of the parent company | | Total equity |

Balance at January 1, 2020 | 49 | | 619,461 | | (19,319) | | (127,070) | | (271,273) | | (8,872) | | 14,044 | | 207,020 | | 207,020 |

| | | | | | | | | | | | | | | | | |

Comprehensive income/(loss) for the period | - | | - | | - | | (7,427) | | (69,147) | | (30,316) | | - | | (106,890) | | (106,890) |

Loss for the period | - | | - | | - | | (7,427) | | - | | - | | - | | (7,427) | | (7,427) |

Other comprehensive income/(loss), net of taxes | - | | - | | - | | - | | (69,147) | | (30,316) | | - | | (99,463) | | (99,463) |

Stock-based compensation | - | | - | | - | | - | | - | | - | | 585 | | 585 | | 585 |

Shares delivered | - | | (5,814) | | 8,307 | | - | | - | | - | | (2,493) | | - | | - |

Monetary correction caused by hyperinflation | - | | - | | - | | (1,566) | | - | | - | | - | | (1,566) | | (1,566) |

Balance at March 31, 2020 (*) | 49 | | 613,647 | | (11,012) | | (136,063) | | (340,420) | | (39,188) | | 12,136 | | 99,149 | | 99,149 |

| | | | | | | | | | | | | | | | | |

(*) unaudited | | | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of the interim condensed consolidated financial statements. | | |

8

| ATENTO S.A. AND SUBSIDIARIES |

INTERIM CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS |

For the three months ended March 31, 2019 and 2020 |

(In thousands of U.S. dollars, unless otherwise indicated) |

| | | | |

| | For the three months ended March 31, |

| | 2019 | | 2020 |

| | (unaudited) |

Operating activities | | | | |

Profit before income tax | | (10,624) | | (7,593) |

Adjustments to reconcile profit before income tax to net cash flows: | | | | |

Amortization and depreciation | | 35,324 | | 31,454 |

Changes in trade provisions | | 3 | | 537 |

Share-based payment expense | | 565 | | 585 |

Change in provisions | | 9,555 | | 4,108 |

Grants released to income | | (239) | | (183) |

Losses on disposal of property, plant and equipment | | 45 | | 216 |

Losses on disposal of financial assets | | (2) | | - |

Finance income | | (2,391) | | (2,441) |

Finance costs | | 18,138 | | 15,861 |

Net foreign exchange differences | | 1,595 | | 3,490 |

Changes in other (gains)/losses and own work capitalized | | 9,475 | | (1,266) |

| | 72,068 | | 52,361 |

Changes in working capital: | | | | |

Changes in trade and other receivables | | (71,637) | | (37,249) |

Changes in trade and other payables | | (2,531) | | 10,235 |

Other assets | | 4,604 | | 3,159 |

| | (69,564) | | (22,393) |

| | | | |

Interest paid | | (18,338) | | (19,645) |

Interest received | | (45) | | 9,728 |

Income tax paid | | (3,703) | | (7,148) |

Other payments | | (9,567) | | (915) |

| | (31,653) | | (17,980) |

Net cash flows (used in)/from operating activities | | (39,773) | | 4,395 |

Investing activities | | | | |

Payments for acquisition of intangible assets | | (15,060) | | (124) |

Payments for acquisition of property, plant and equipment | | (3,324) | | (10,932) |

Payments for financial instruments | | (243) | | (269) |

Proceeds from sale of PP&E and intangible assets | | 1,959 | | - |

Net cash flows used in investing activities | | (16,668) | | (11,325) |

Financing activities | | | | |

Proceeds from borrowing from third parties | | 36,575 | | 77,621 |

Repayment of borrowing from third parties | | (21,094) | | (9,370) |

Payments of lease liabilities | | (13,672) | | (9,402) |

Net cash flows provided by financing activities | | 1,809 | | 58,849 |

Net (decrease)/increase in cash and cash equivalents | | (54,632) | | 51,919 |

Foreign exchange differences | | (964) | | (13,866) |

Cash and cash equivalents at beginning of period | | 133,526 | | 124,706 |

Cash and cash equivalents at end of period | | 77,930 | | 162,759 |

| | | | |

The accompanying notes are an integral part of the interim condensed consolidated financial statements. |

9

NOTES TO THE INTERIM CONDENSED CONSOLIDATED FINANCIAL information FOR THE THREE MONTHS ENDED MARCH 31, 2020

1.ACTIVITY OF ATENTO S.A. AND CORPORATE INFORMATION

(a) Description of business

Atento S.A. (the “Company”) and its subsidiaries (“Atento Group”) offer customer relationship management services to their clients through contact centers or multichannel platforms.

The Company was incorporated on March 5, 2014 under the laws of the Grand Duchy of Luxembourg, with its registered office in Luxembourg at 4, Rue Lou Hemmer.

In 2019, the registered office of the Company has been moved to 1, Rue Hildegard Von Bingen, L-1282, Luxembourg, Grand Duchy of Luxembourg.The majority direct shareholder of the Company, ATALAYA Luxco PIKCo, S.C.A. (Luxembourg), is a holding company incorporated under the laws of the Grand-Duchy of Luxembourg.

Atento S.A. (the “Company”) and its subsidiaries (“Atento Group”) offer customer relationship management services to their clients through contact centers or multichannel platforms.

The Company was incorporated on March 5, 2014 under the laws of the Grand Duchy of Luxembourg, with its registered office in Luxembourg at 4, Rue Lou Hemmer.

In 2019, the registered office of the Company has been moved to 1, Rue Hildegard Von Bingen, L-1282, Luxembourg, Grand Duchy of Luxembourg.

The majority direct shareholder of the Company, ATALAYA Luxco PIKCo, S.C.A. (Luxembourg), is a holding company incorporated under the laws of the Grand-Duchy of Luxembourg.

The Company may also act as the guarantor of loans and securities, as well as assisting companies in which it holds direct or indirect interests or that form part of its group. The Company may secure funds, with the exception of public offerings, through any kind of lending, or through the issuance of bonds, securities or debt instruments in general.

The Company may also carry on any commercial, industrial, financial, real estate business or intellectual property related activity that it deems necessary to meet the aforementioned corporate purposes.

The corporate purpose of its subsidiaries, with the exception of the intermediate holding companies, is to establish, manage and operate CRM centers through multichannel platforms; provide telemarketing, marketing and “call center” services through service agencies or in any other format currently existing or which may be developed in the future by the Atento Group; provide telecommunications, logistics, telecommunications system management, data transmission, processing and internet services and to promote new technologies in these areas; offer consultancy and advisory services to clients in all areas in connection with telecommunications, processing, integration systems and new technologies, and other services related to the above. The Company’s ordinary shares are traded on NYSE under the symbol “ATTO”.

The interim condensed consolidated financial information was approved by the Board of Directors on April 21, 2020.

(b) Seasonality

Our performance is subject to seasonal fluctuations, which is primarily due to (i) our clients generally spending less in the first quarter of the year after the year end holiday season, (ii) the initial costs to train and hire new employees at new service delivery centers to provide additional services to our clients which are usually incurred in the first quarter of the year, and (iii) statutorily mandated minimum wage and salary increases of operators, supervisors and coordinators in many of the countries in which we operate which are generally implemented at the beginning of the first quarter of each year, whereas revenue increases related to inflationary adjustments and contracts negotiations generally take effect after the first quarter. We have also found that growth in our revenue increases in the last quarter of the year, especially in November and December, as the year end holiday season begins and we have an increase in business activity resulting from the handling of holiday season promotions offered by our clients. These seasonal effectsalso cause differences in revenue and expenses among the various quarters of any year, which means that the individual quarters of a year should not be directly compared with each other or used to predict annual operating results.

10

2. BASIS OF PRESENTATION OF THE INTERIM CONDENSED CONSOLIDATED FINANCIAL INFORMATION

The interim condensed consolidated financial information has been prepared in accordance with IAS 34 - Interim Financial Reporting as issued by the International Accounting Standards Board (“IASB”).

The information does not have all disclosure requirements for the presentation of full annual financial statements and thus should be read in conjunction with the consolidated financial statements prepared in accordance with International Financial Reporting Standards (“IFRS”) for the year ended December 31,2019.The interim condensed consolidated financial information have been prepared on a historical costs basis, with the exception of derivative financial instruments and financial liability related to the option for acquisition of non-controlling interest, which have been measured at fair value. The interim condensed consolidated financial information is for the Atento Group.

The figures in this interim condensed consolidated financial information is expressed in thousands of dollars, unless indicated otherwise. U.S. Dollar is the Atento Group’s presentation currency.

3. ACCOUNTING POLICIES

There were no significant changes in accounting policies and calculation methods used for the interim condensed consolidated financial information as of March 31, 2020 in relation to those presented in the annual financial statements for the year ended December 31, 2019.

a) Critical accounting estimates and assumptions

The preparation of the interim condensed consolidated financial information under IAS 34 requires the use of certain assumptions and estimates that affect the recognized amount of assets, liabilities, income and expenses, as well as the related disclosures.

Some of the accounting policies applied in preparing the accompanying interim condensed consolidated financial information required Management to apply significant judgments in order to select the most appropriate assumptions for determining these estimates. These assumptions and estimates are based on Management experience, the advice of consultants and experts, forecasts and other circumstances and expectations prevailing at year end. Management’s evaluation takes into account the global economic situation in the sector in which the Atento Group operates, as well as the future outlook for the business. By virtue of their nature, these judgments are inherently subject to uncertainty. Consequently, actual results could differ substantially from the estimates and assumptions used. Should this occur, the values of the related assets and liabilities would be adjusted accordingly.

Although these estimates were made on the basis of the best information available at each reporting date on the events analyzed, events that take place in the future might make it necessary to change these estimates in coming years. Changes in accounting estimates would be applied prospectively in accordance with the requirements of IAS 8, “Accounting Policies, Changes in Accounting Estimates and Errors”, recognizing the effects of the changes in estimates in the related interim condensed consolidated statements of operations.

An explanation of the estimates and judgments that entail a significant risk of leading to a material adjustment in the carrying amounts of assets and liabilities in the coming financial period is as follow:

Impairment of goodwill

The Atento Group tests goodwill for impairment annually, in accordance with the accounting principle disclosed in the consolidated financial statements for the year ended December 31, 2019. Goodwill is subject to impairment testing as part of the cash-generating unit to which it has been allocated. The recoverable amounts of cash-generating units defined in order to identify potentialimpairment in goodwill are determined on the basis of value in use, applying five-year financial forecasts based on the Atento Group’s strategic plans, approved and reviewed by Management. These calculations entail the use of assumptions and estimates and require a significant degree of judgment. The main variables considered in the sensitivity analyses are growth rates, discount rates using the Weighted Average Cost of Capital (“WACC”) and the key business variables.

11

Deferred taxes

The Atento Group assesses the recoverability of deferred tax assets based on estimates of future earnings. The ability to recover these deferred amounts depends ultimately on the Atento Group’s ability to generate taxable earnings over the period in which the deferred tax assets remain deductible. This analysis is based on the estimated timing of the reversal of deferred tax liabilities, as well as estimates of taxable earnings, which are sourced from internal projections and are continuously updated to reflect the latest trends.

The appropriate classification of tax assets and liabilities depends on a series of factors, including estimates as to the timing and realization of deferred tax assets and the projected tax payment schedule. Actual income tax receipts and payments could differ from the estimates made by the Atento Group as a result of changes in tax legislation or unforeseen transactions that could affect the tax balances.

The Atento Group has recognized deferred tax assets corresponding to losses carried forward since, based on internal projections, it is probable that it will generate future taxable profits against which they may be utilized.

The carrying amount of deferred income tax assets is reviewed at each reporting date and reduced to the extent that it is no longer probable that sufficient taxable profits will be available to allow all or part of that deferred tax asset to be utilized. Unrecognized deferred income tax assets are reassessed at each reporting date and are recognized to the extent that it has become probable that future taxable profits will allow the deferred tax asset to be recovered.

Provisions and contingencies

Provisions are recognized when the Atento Group has a present obligation as a result of a past event, it is probable that an outflow of resources will be required to settle the obligation and a reliable estimate can be made of the amount of the obligation. This obligation may be legal or constructive, deriving from, inter alia, regulations, contracts, customary practice or public commitments that would lead third parties to reasonably expect that the Atento Group will assume certain responsibilities. The amount of the provision is determined based on the best estimate of the outflow of resources embodying economic benefit that will be required to settle the obligation, taking into account all available information as of the reporting date, including the opinions of independent experts such as legal counsel or consultants.

No provision is recognized if the amount of liability cannot be estimated reliably. In such cases, the relevant information is disclosed in the notes to the interim condensed consolidated financial information.

Given the uncertainties inherent in the estimates used to determine the amount of provisions, actual outflows of resources may differ from the amounts recognized originally on the basis of these estimates.

Fair value of derivatives

The Atento Group uses derivative financial instruments to mitigate risks, primarily derived from possible fluctuations in interest and exchange rates. Derivatives are recognized at the inception of the contract at fair value.

The fair values of derivative financial instruments are calculated on the basis of observable market data available, either in terms of market prices or through the application of valuation techniques. The valuation techniques used to calculate the fair value of derivative financial instruments include the discounting of future cash flow associated with the instruments, applying assumptions based on market conditions at the valuation date or using prices established for similar instruments, among others. These estimates are based on available market information and appropriate valuation techniques. The fair values calculated could differ significantly if other market assumptions and/or estimation techniques were applied.

Update On COVID-19

The estimates and assumptions included in the financial statements include our assessment of potential impacts arising from the COVID-19 pandemic that may affect the amounts reported and the accompanying notes. To-date, no significant impacts on our collection experience and expected credit losses have been noted and we do not currently anticipate any material impairments of our long-lived assets or of our indefinite-lived intangible assets as a result of the COVID-19 pandemic. . We will continue to monitor the impacts and will prospectively revise our estimates as appropriate.

b) Standards issued but not yet effective

There are no other standards that are not yet effective and that would be expected to have a material impact on the Atento Group in the current or future reporting periods and on foreseeable future transactions.

12

4. MANAGEMENT OF FINANCIAL RISK

4.1 Financial risk factors

The Atento Group's activities are exposed to various types of financial risks: market risk (including currency risk, interest rate risk and country risk), credit risk and liquidity risk. The Atento Group's global risk management policy aims to minimize the potential adverse effects of these risks on the Atento Group's results of operations. The Atento Group also uses derivative financial instruments to hedge certain risk exposures.

This unaudited interim condensed consolidated financial information does not include all financial risk management information and disclosures required in the annual financial statements and therefore they should be read in conjunction with the Atento Group’s consolidated financial statements as of and for the year ended December 31, 2019. For the three months ended March 31, 2020 there have not been changes in any risk management policies.

Country Risk

To manage or mitigate country risk, we repatriate the funds generated in the Americas and Brazil that are not required for the pursuit of new profitable business opportunities in the region and subject to the restrictions of our financing agreements.

Interest Rate Risk

Interest rate risk arises mainly as a result of changes in interest rates which affect: finance costs of debt bearing interest at variable rates (or short-term maturity debt expected to be renewed), as a result of fluctuations in interest rates, and the value of non-current liabilities that bear interest at fixed rates.

Atento Group’s finance costs are exposed to fluctuation in interest rates. On March 31, 2020, 0.1% of Atento Group’s finance costs are exposed to fluctuations in interest rates (excluding the effect of financial derivative instruments), while on December 31, 2019 this amount was 0.2%. In both 2019 and 2020, the exposure was to the Brazilian CDI rate and the TJLP (Brazilian Long-Term Interest Rate).

The Atento Group’s policy is to monitor the exposure to interest at risk. As of March 31, 2020, there were no outstanding interest rate hedging instruments.

Foreign Currency Risk

Our foreign currency risk arises from our local currency revenues, receivables and payables while the U.S. dollar is our presentation currency. We benefit to a certain degree from the fact that the revenue we collect in each country, in which we have operations, is generally denominated in the same currency as the majority of the expenses we incur.

In accordance with our risk management policy, whenever we deem it appropriate, we manage foreign currency risk by using derivatives to hedge any exposure incurred in currencies other than those of the functional currency of the countries.

The main source of our foreign currency risk is related to the Senior Secured Notes due 2022 denominated in U.S. dollars. Upon issuance of the Notes, we entered into cross-currency swaps pursuant to which we exchange an amount of U.S. dollars for a fixed amount of Euro, Mexican Pesos, Peruvian Soles and Brazilian Reais. The total amount of interest (coupon) payments are covered (until maturity date). The principal portion that was originally covered until August 2020 was unwound in March 2020.

As of March 31, 2020, the estimated fair value of the cross-currency swaps designated as hedging instruments totaled a net asset of 10,469 thousand U.S. dollars (net asset of 3,093 thousand U.S. dollars, as of December 31, 2019).

13

Credit Risk

The Atento Group seeks to conduct all of its business with reputable national and international companies and institutions established in their countries of origin, to minimize credit risk. As a result of this policy, the Atento Group has no material adjustments to make to its credit accounts.

Accordingly, the Atento Group’s commercial credit risk management approach is based on continuous monitoring of the risks assumed and the financial resources necessary to manage the Group’s various units, in order to optimize the risk-reward relationship in the development and implementation of business plans in the course of their regular business.

Credit risk arising from cash and cash equivalents is managed by placing cash surpluses in high quality and highly liquid money-market assets. These placements are regulated by a master agreement revised annually on the basis of the conditions prevailing in the markets and the countries where Atento operate. The master agreement establishes: (i) the maximum amounts to be invested per counterparty, based on their ratings (long- and short-term debt rating); (ii) the maximum period of the investment; and (iii) the instruments in which the surpluses may be invested.

The Atento Group’s maximum exposure to credit risk is primarily limited to the carrying amounts of its financial assets. The Atento Group holds no guarantees as collection insurance.

Liquidity Risk

The Atento Group seeks to match its debt maturity schedule to its capacity to generate cash flow to meet the payments falling due, factoring in a degree of cushion. In practice, this has meant that the Atento Group’s average debt maturity must be longer than the length of time we required paying its debt (assuming that internal projections are met).

Capital Management

The Atento Group’s Finance Department, which is in charge of the capital management, takes various factors into consideration when determining the Group’s capital structure.

The Atento Group’s capital management goal is to determine the financial resources necessary both to continue its recurring activities and to maintain a capital structure that optimizes own and borrowed funds.

The Atento Group sets an optimal debt level in order to maintain a flexible and comfortable medium-term borrowing structure in order to be able to carry out its routine activities under normal conditions and to address new opportunities for growth. Debt levels are kept in line with forecast future cash flows and with quantitative restrictions imposed under financing contracts.

In addition to these general guidelines, we take into account other considerations and specifics when determining our financial structure, such as country risk, tax efficiency and volatility in cash flow generation.