THIRD QUARTER 2016 EARNINGS CALL November 2, 2016

THIRD QUARTER EARNINGS CALL AGENDA 2 Third Quarter 2016 Earnings Call Third Quarter Update – Robert Abernathy, Chairman and Chief Executive Officer Third Quarter Results and 2016 Outlook – Steve Voskuil, Chief Financial Officer

CONFERENCE CALL REMINDERS 3 Third Quarter 2016 Earnings Call FORWARD-LOOKING INFORMATION Certain matters in this presentation and conference call, including our 2016 outlook, expectations and planning assumptions, and any estimates, projections, and statements relating to our business plans or objectives, constitute forward-looking statements and are based upon management’s expectations and beliefs concerning future events impacting the Company. These statements are subject to risks and uncertainties, including currency exchange risks, cost savings and reductions, raw material, energy, and other input costs, competition, market demand, economic condition, and legislative and regulatory actions. There can be no assurance that these future events will occur as anticipated or that the Company’s results will be as estimated. Forward-looking statements speak only as of the date they were made, and we undertake no obligation to publicly update them. For a more complete listing and description of other factors that could cause the Company’s future results to differ materially from those expressed in any forward-looking statements, see the Company’s most recent Form 10-K and Quarterly Reports on Form 10-Q. NON-GAAP FINANCIAL MEASURES Management believes that non-GAAP financial measures enhance investors’ understanding and analysis of the company’s performance. As such, results and outlook have been adjusted to exclude certain items for relevant time periods as indicated in the non-GAAP reconciliations to the comparable GAAP financial measures included in this presentation and in today’s earnings release posted on our website (www.halyardhealth.com/investors).

THIRD QUARTER UPDATE ROBERT ABERNATHY, CHAIRMAN AND CHIEF EXECUTIVE OFFICER

SECOND ANNIVERSARY 5 • Established Halyard and introduced our long- term strategy: - Transform Halyard into leading medical devices company • Made meaningful advances against goals Third Quarter 2016 Earnings Call

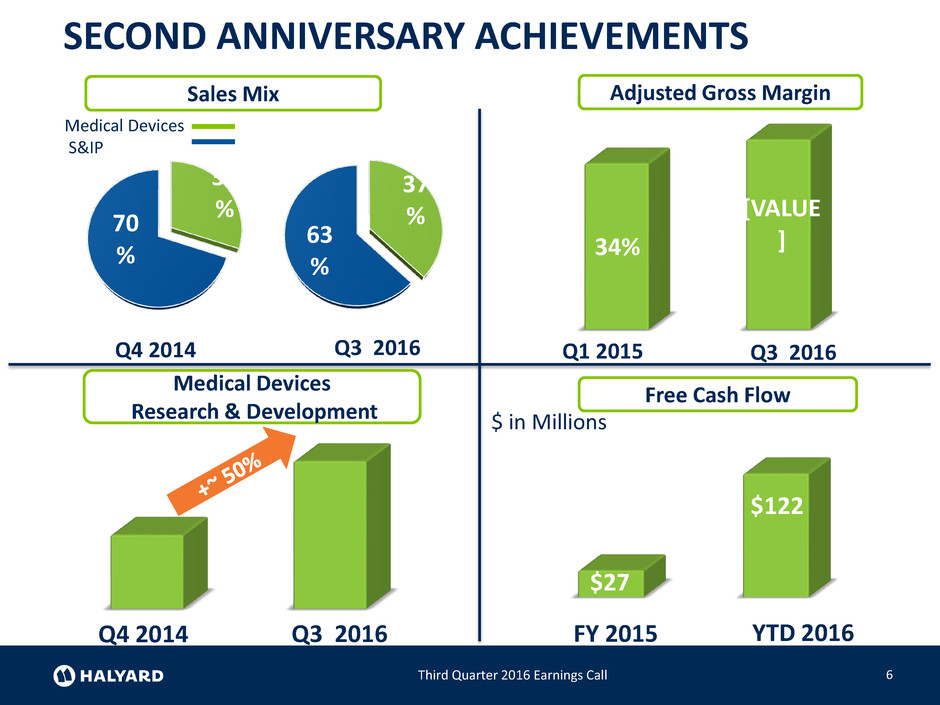

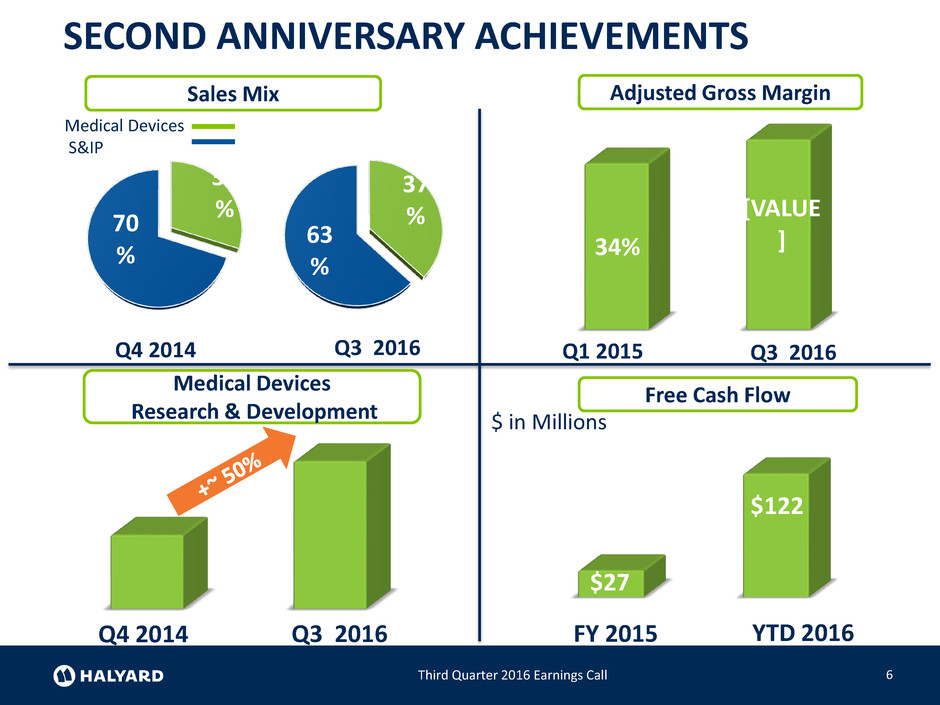

SECOND ANNIVERSARY ACHIEVEMENTS 6 Third Quarter 2016 Earnings Call 30 % 70 % 37 % 63 % Adjusted Gross Margin 34% [VALUE ] Sales Mix Medical Devices Research & Development Free Cash Flow $27 $122 Q4 2014 Q3 2016 Q1 2015 Q3 2016 FY 2015 YTD 2016 $ in Millions Q3 2016 Q4 2014 Medical Devices S&IP

EXECUTING OUR TWO PRIORITIES 7 Third Quarter 2016 Earnings Call Delivering our 2016 plan Fueling our growth pipeline

FUELING GROWTH PIPELINE 8 Third Quarter 2016 Earnings Call • CORPAK results better than expected - Accelerated synergies in our headquarters and sales teams - Effective integration • Largely driven by CORPAK, raising full-year adjusted diluted EPS to $1.87 to $1.97 • Leveraging Digestive Health portfolio - Deepen relationships with existing customers - Create new sales opportunities - Drive growth in new geographies CORPAK Acquisition

FUELING GROWTH PIPELINE 9 Third Quarter 2016 Earnings Call • Differentiate portfolio through innovation - On track to deliver new product launches • Launched ON-Q Trac, a mobile app - Enables healthcare providers access to real-time patient generated data - Improves patient engagement, outcomes and quality of care Research and Development

FUELING PIPELINE GROWTH 10 Third Quarter 2016 Earnings Call • Fund growth investments with our strong balance sheet and ability to generate cash • Capital deployment - Repay CORPAK related borrowing - Build capacity to fund additional investments

DELIVERING OUR 2016 PLAN 11 Third Quarter 2016 Earnings Call • Delivered another solid quarter • Reported adjusted diluted EPS of $0.48 • Net sales of $398 million - Up 2 percent over last year

DELIVERING OUR 2016 PLAN 12 Third Quarter 2016 Earnings Call • Medical Devices sales increased 15 percent - Bolstered by CORPAK - Organic growth at the mid-point of guidance • S&IP sales declined 4 percent, constant currency - 3 percent price erosion in line with expectations • Recently launched S&IP products resonating well with healthcare professionals

SUMMARY 13 Third Quarter 2016 Earnings Call • Encouraged by progress year-to-date • Advanced our transformation • Three solid quarters • Poised to achieve 2016 objectives

THIRD QUARTER 2016 RESULTS STEVE VOSKUIL, CHIEF FINANCIAL OFFICER

THIRD QUARTER SUMMARY 15 Third Quarter 2016 Earnings Call • Exceeded adjusted diluted EPS expectations • On track to meet planning assumptions

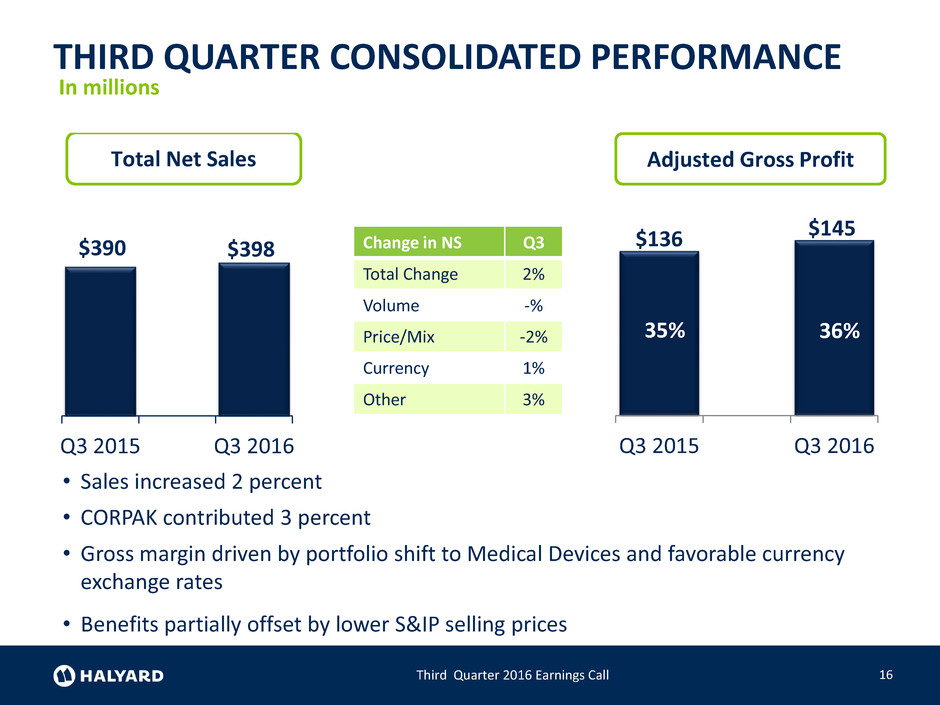

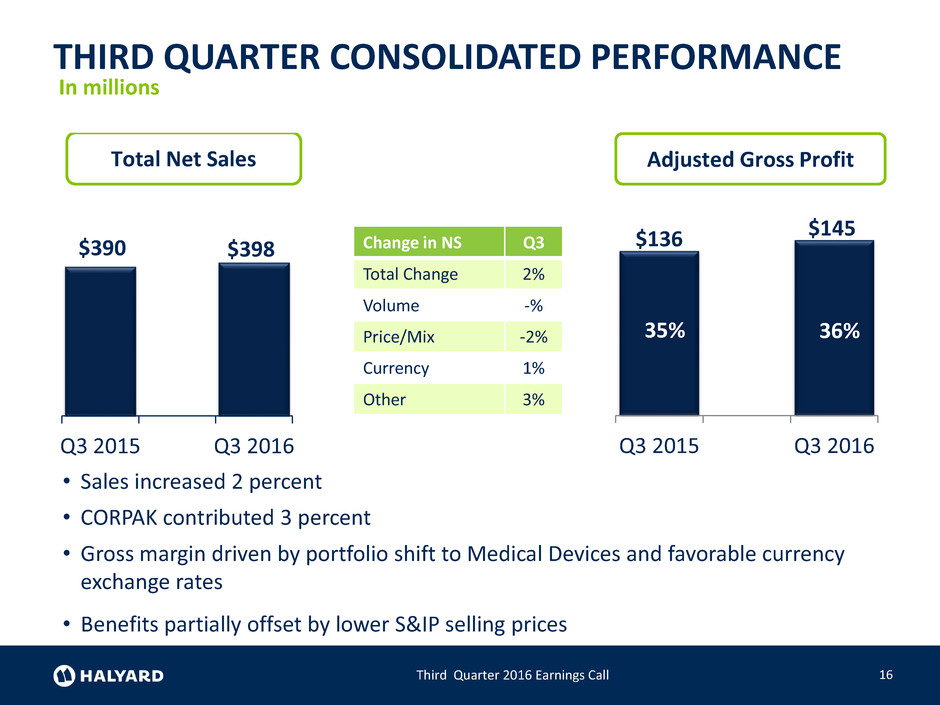

THIRD QUARTER CONSOLIDATED PERFORMANCE 16 Third Quarter 2016 Earnings Call $390 $398 Q3 2015 Q3 2016 Total Net Sales 36% 15% • Sales increased 2 percent • CORPAK contributed 3 percent • Gross margin driven by portfolio shift to Medical Devices and favorable currency exchange rates • Benefits partially offset by lower S&IP selling prices Change in NS Q3 Total Change 2% Volume -% Price/Mix -2% Currency 1% Other 3% In millions $136 $145 Q3 2015 Q3 2016 Adjusted Gross Profit 36% 35%

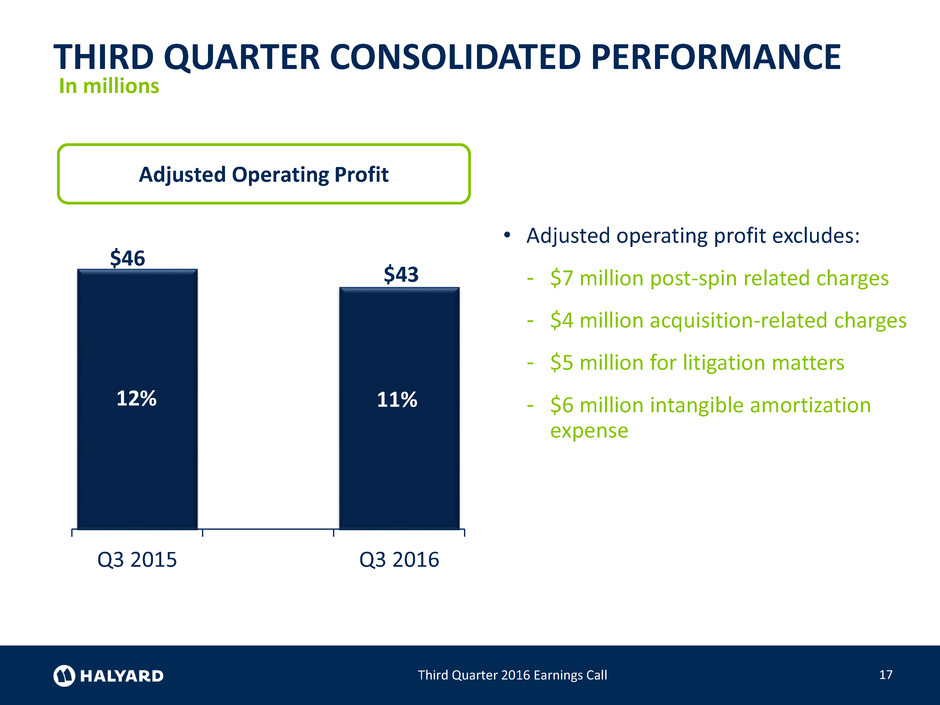

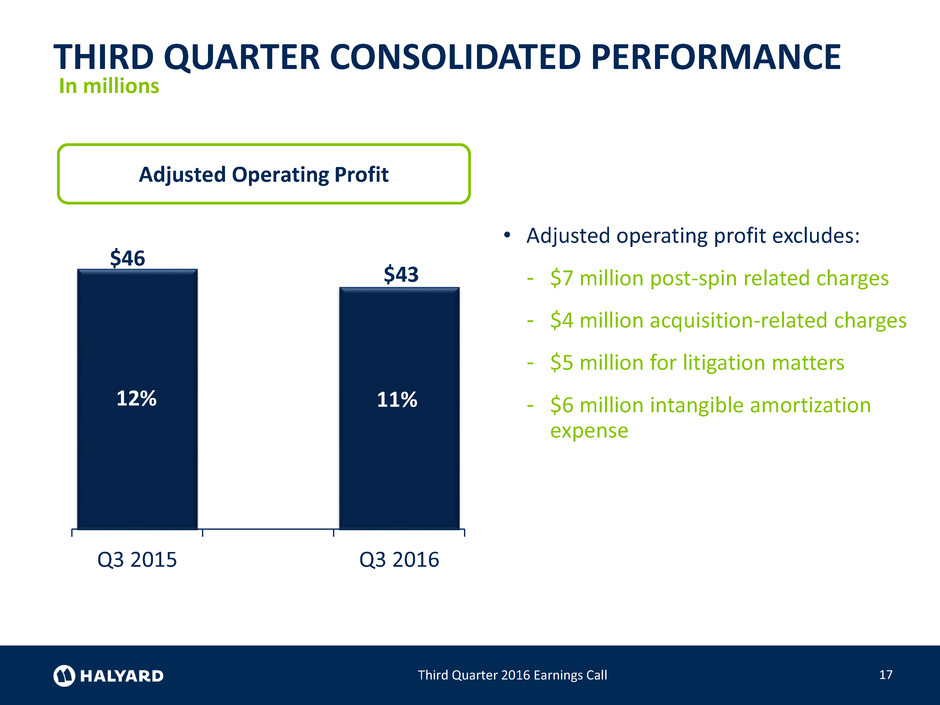

THIRD QUARTER CONSOLIDATED PERFORMANCE 17 Third Quarter 2016 Earnings Call $46 $43 Q3 2015 Q3 2016 Adjusted Operating Profit 12% 11% 36% 15% • Adjusted operating profit excludes: - $7 million post-spin related charges - $4 million acquisition-related charges - $5 million for litigation matters - $6 million intangible amortization expense In millions

18 Third Quarter 2016 Earnings Call • Adjusted EBITDA of $53 million • Reported adjusted diluted EPS of $0.48 • Performance strengthened by: - Accelerated CORPAK synergies Anticipate slightly smaller year-over- year CORPAK earnings increase in 2017 - Shift in timing of some SG&A expenses to the fourth quarter THIRD QUARTER SUMMARY

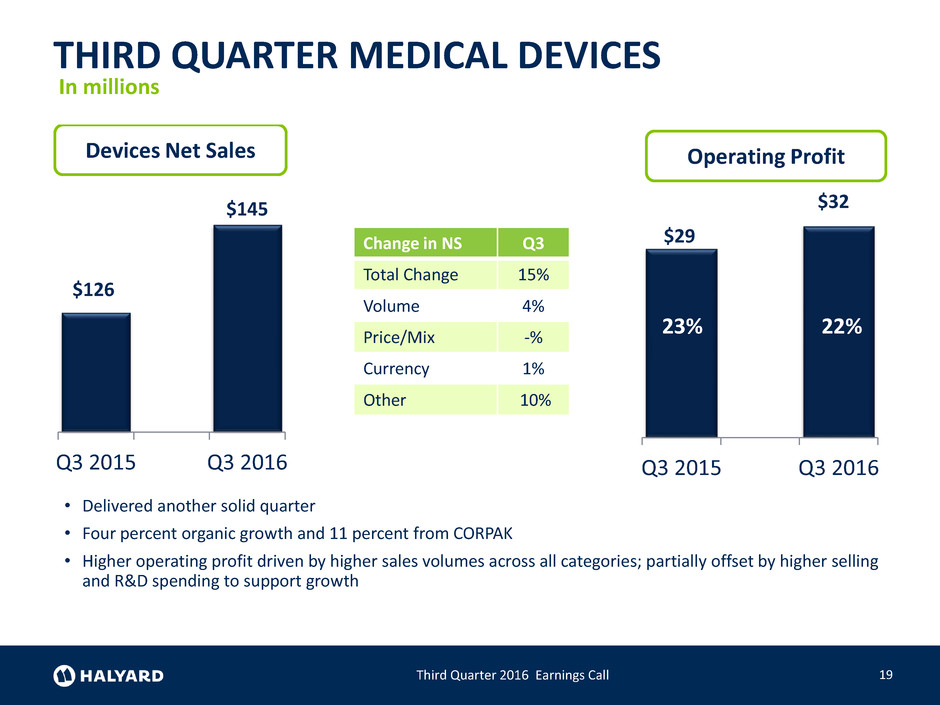

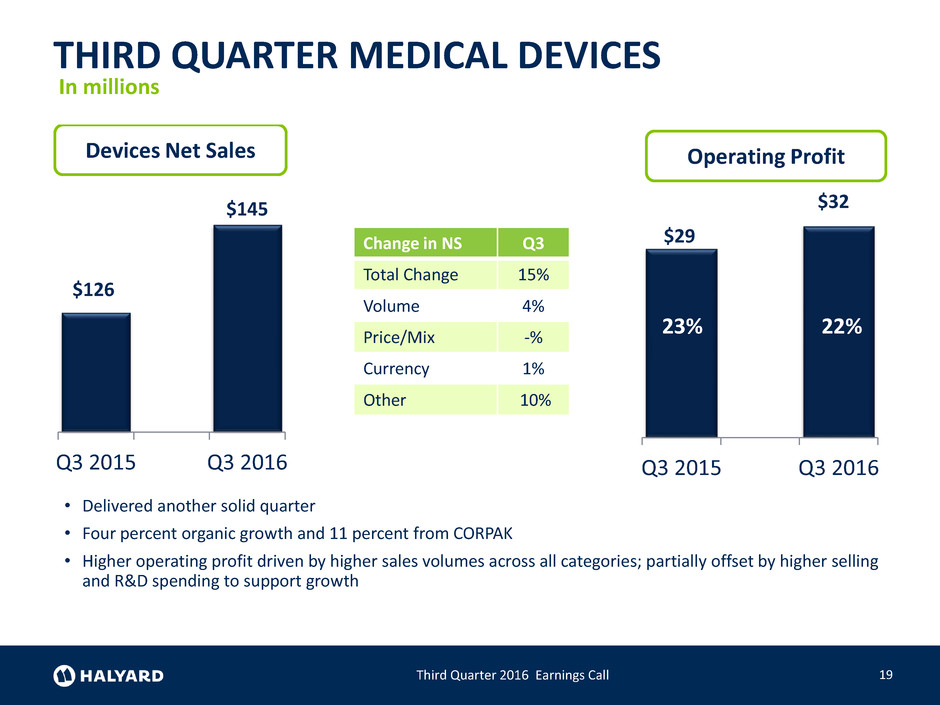

$29 $32 Q3 2015 Q3 2016 Operating Profit 22% 23% THIRD QUARTER MEDICAL DEVICES 19 Third Quarter 2016 Earnings Call $126 $145 Q3 2015 Q3 2016 Devices Net Sales 36% 15% • Delivered another solid quarter • Four percent organic growth and 11 percent from CORPAK • Higher operating profit driven by higher sales volumes across all categories; partially offset by higher selling and R&D spending to support growth Change in NS Q3 Total Change 15% Volume 4% Price/Mix -% Currency 1% Other 10% In millions

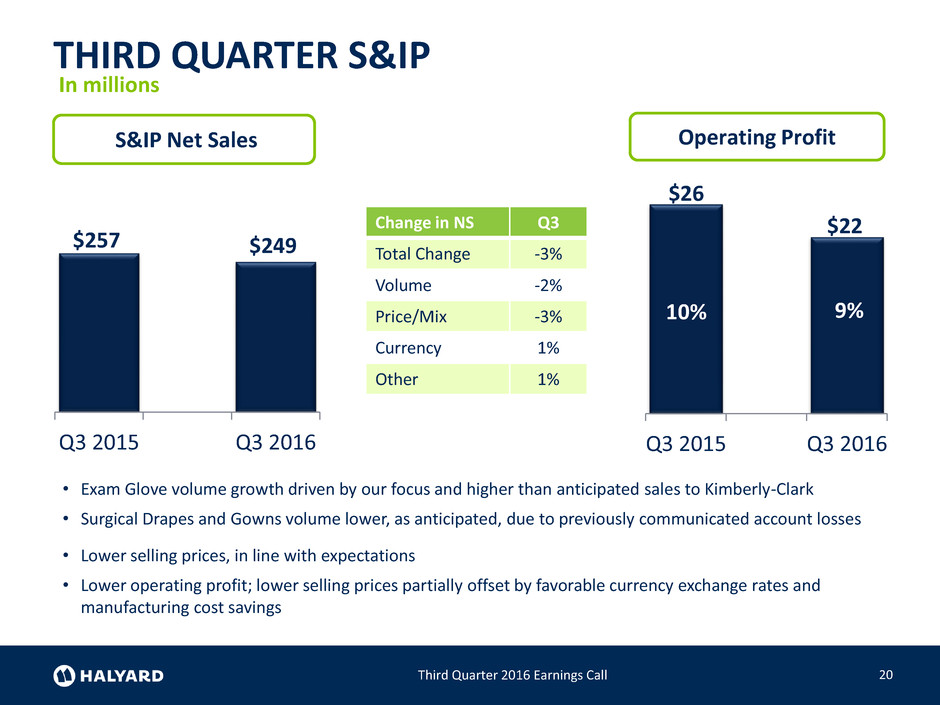

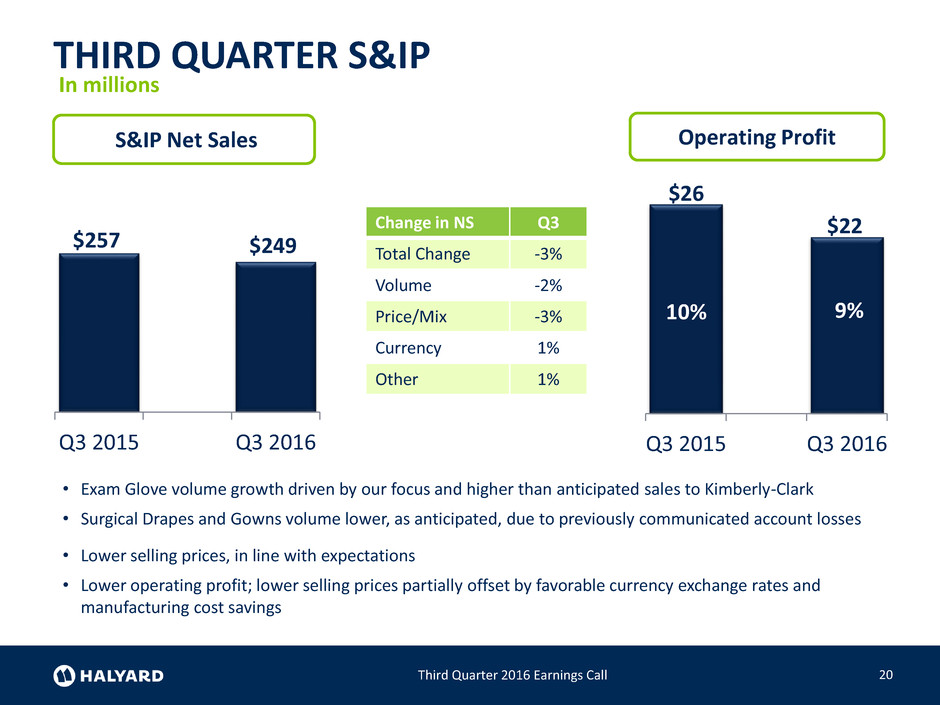

THIRD QUARTER S&IP 20 Third Quarter 2016 Earnings Call $257 $249 Q3 2015 Q3 2016 S&IP Net Sales 36% 15% $26 $22 Q3 2015 Q3 2016 Operating Profit 9% • Exam Glove volume growth driven by our focus and higher than anticipated sales to Kimberly-Clark • Surgical Drapes and Gowns volume lower, as anticipated, due to previously communicated account losses • Lower selling prices, in line with expectations • Lower operating profit; lower selling prices partially offset by favorable currency exchange rates and manufacturing cost savings 10% Change in NS Q3 Total Change -3% Volume -2% Price/Mix -3% Currency 1% Other 1% In millions

BALANCE SHEET AND CASH FLOW 21 Third Quarter 2016 Earnings Call • Ended the quarter with $87 million of cash • Generated free cash flow of $42 million for the quarter and $122 million YTD • Rebuilding acquisition capacity faster than anticipated

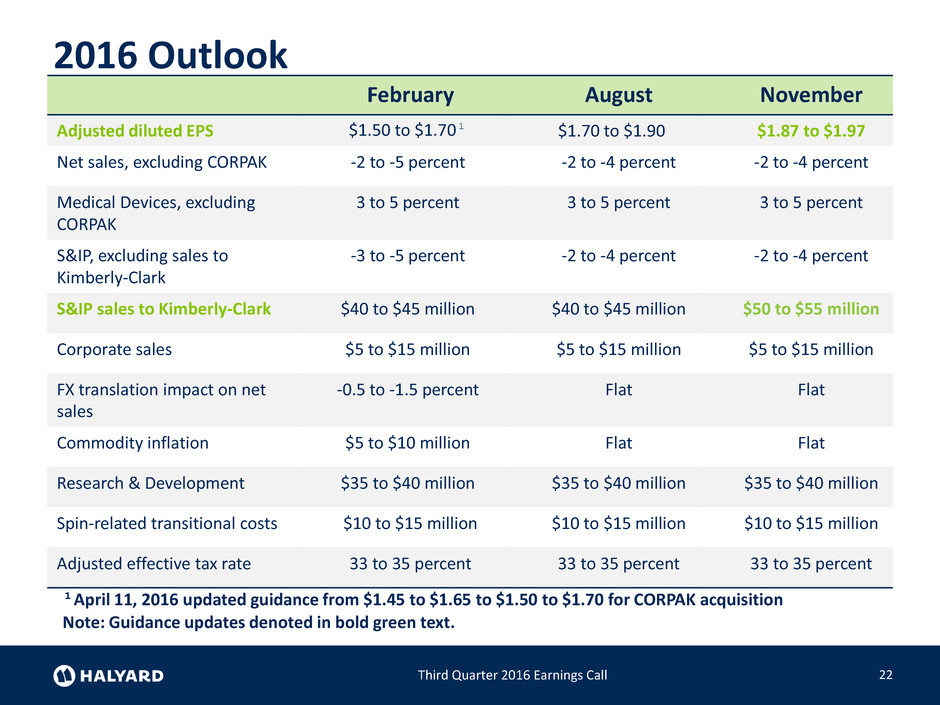

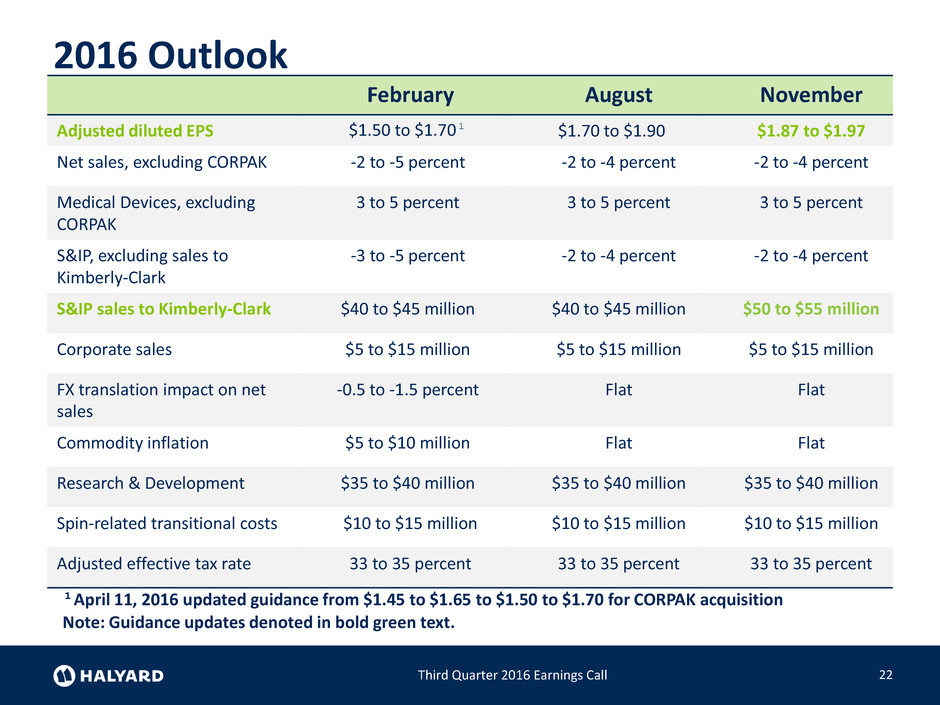

2016 Outlook 22 Third Quarter 2016 Earnings Call February August November Adjusted diluted EPS $1.50 to $1.70¹ $1.70 to $1.90 $1.87 to $1.97 Net sales, excluding CORPAK -2 to -5 percent -2 to -4 percent -2 to -4 percent Medical Devices, excluding CORPAK 3 to 5 percent 3 to 5 percent 3 to 5 percent S&IP, excluding sales to Kimberly-Clark -3 to -5 percent -2 to -4 percent -2 to -4 percent S&IP sales to Kimberly-Clark $40 to $45 million $40 to $45 million $50 to $55 million Corporate sales $5 to $15 million $5 to $15 million $5 to $15 million FX translation impact on net sales -0.5 to -1.5 percent Flat Flat Commodity inflation $5 to $10 million Flat Flat Research & Development $35 to $40 million $35 to $40 million $35 to $40 million Spin-related transitional costs $10 to $15 million $10 to $15 million $10 to $15 million Adjusted effective tax rate 33 to 35 percent 33 to 35 percent 33 to 35 percent ¹April 11, 2016 updated guidance from $1.45 to $1.65 to $1.50 to $1.70 for CORPAK acquisition Note: Guidance updates denoted in bold green text.

23 Third Quarter 2016 Earnings Call • We have made progress on transformation objectives • Strong balance sheet • Well-positioned to advance our strategic plan THIRD QUARTER SUMMARY

Q&A

APPENDICES

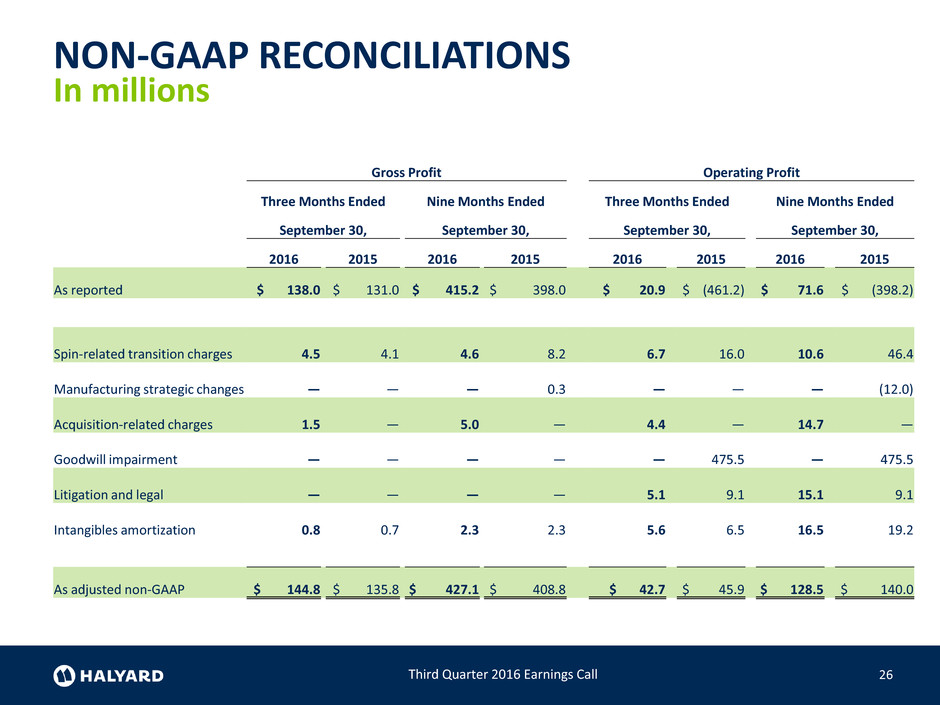

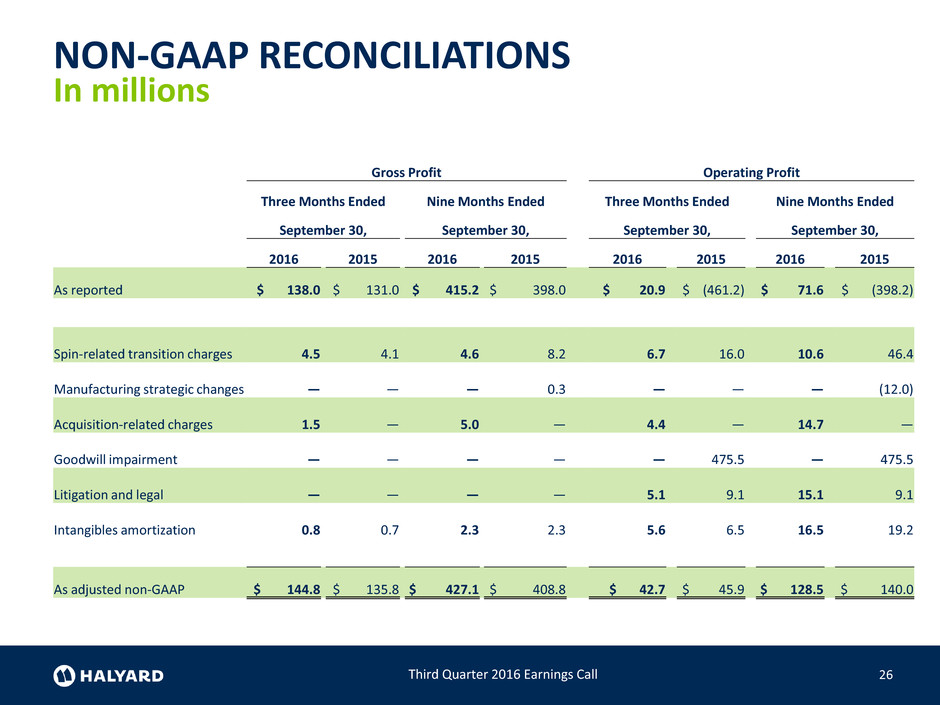

NON-GAAP RECONCILIATIONS In millions Third Quarter 2016 Earnings Call 26 Gross Profit Operating Profit Three Months Ended Nine Months Ended Three Months Ended Nine Months Ended September 30, September 30, September 30, September 30, 2016 2015 2016 2015 2016 2015 2016 2015 As reported $ 138.0 $ 131.0 $ 415.2 $ 398.0 $ 20.9 $ (461.2) $ 71.6 $ (398.2) Spin-related transition charges 4.5 4.1 4.6 8.2 6.7 16.0 10.6 46.4 Manufacturing strategic changes — — — 0.3 — — — (12.0) Acquisition-related charges 1.5 — 5.0 — 4.4 — 14.7 — Goodwill impairment — — — — — 475.5 — 475.5 Litigation and legal — — — — 5.1 9.1 15.1 9.1 Intangibles amortization 0.8 0.7 2.3 2.3 5.6 6.5 16.5 19.2 As adjusted non-GAAP $ 144.8 $ 135.8 $ 427.1 $ 408.8 $ 42.7 $ 45.9 $ 128.5 $ 140.0

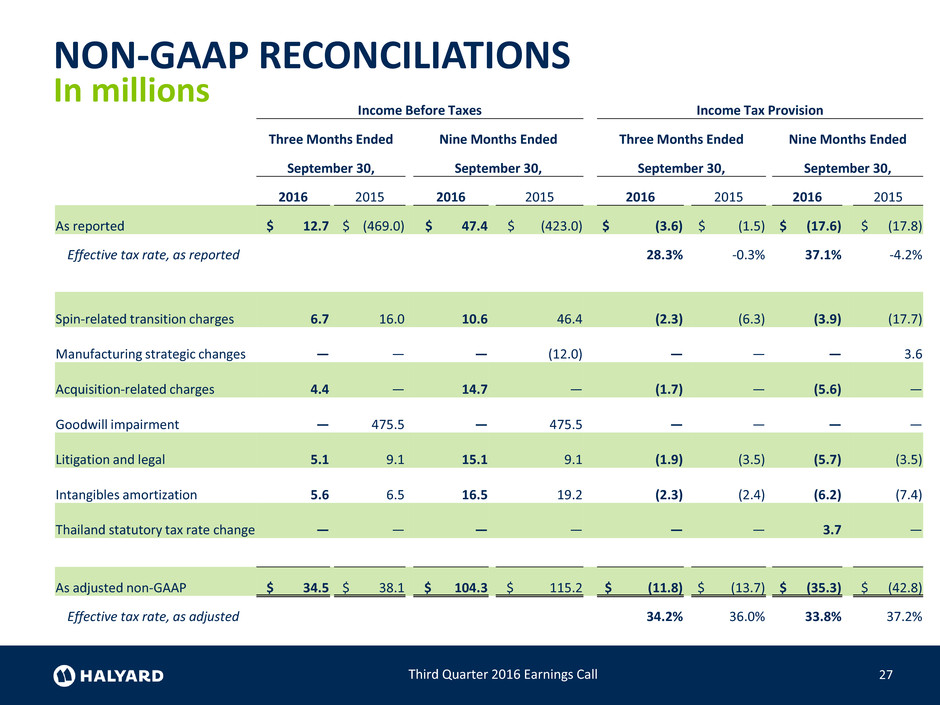

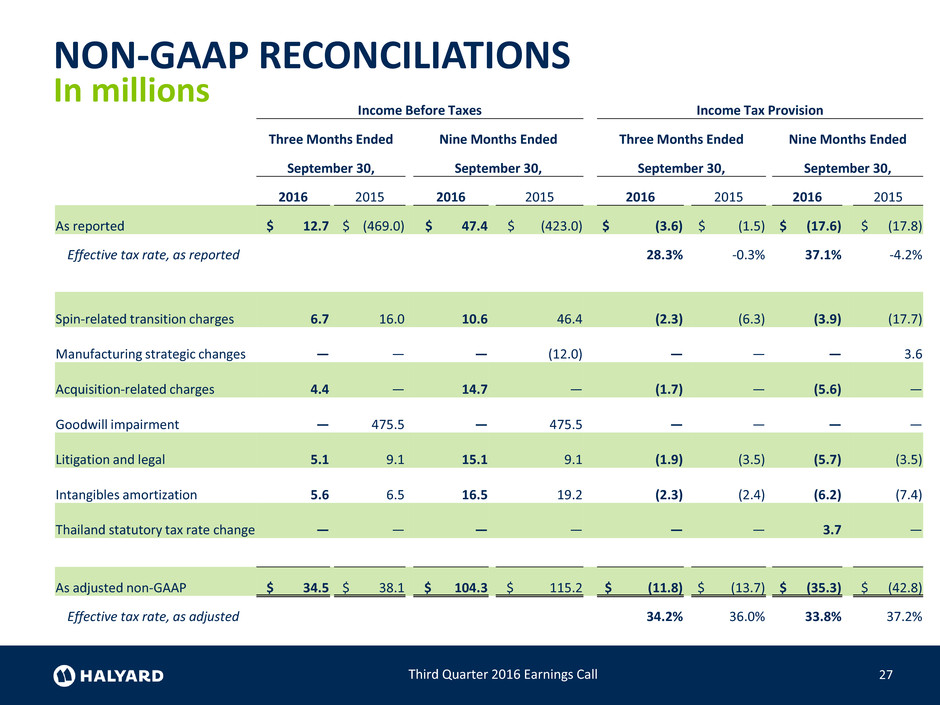

NON-GAAP RECONCILIATIONS In millions Third Quarter 2016 Earnings Call 27 Income Before Taxes Income Tax Provision Three Months Ended Nine Months Ended Three Months Ended Nine Months Ended September 30, September 30, September 30, September 30, 2016 2015 2016 2015 2016 2015 2016 2015 As reported $ 12.7 $ (469.0) $ 47.4 $ (423.0) $ (3.6) $ (1.5) $ (17.6) $ (17.8) Effective tax rate, as reported 28.3% -0.3% 37.1% -4.2% Spin-related transition charges 6.7 16.0 10.6 46.4 (2.3) (6.3) (3.9) (17.7) Manufacturing strategic changes — — — (12.0) — — — 3.6 Acquisition-related charges 4.4 — 14.7 — (1.7) — (5.6) — Goodwill impairment — 475.5 — 475.5 — — — — Litigation and legal 5.1 9.1 15.1 9.1 (1.9) (3.5) (5.7) (3.5) Intangibles amortization 5.6 6.5 16.5 19.2 (2.3) (2.4) (6.2) (7.4) Thailand statutory tax rate change — — — — — — 3.7 — As adjusted non-GAAP $ 34.5 $ 38.1 $ 104.3 $ 115.2 $ (11.8) $ (13.7) $ (35.3) $ (42.8) Effective tax rate, as adjusted 34.2% 36.0% 33.8% 37.2%

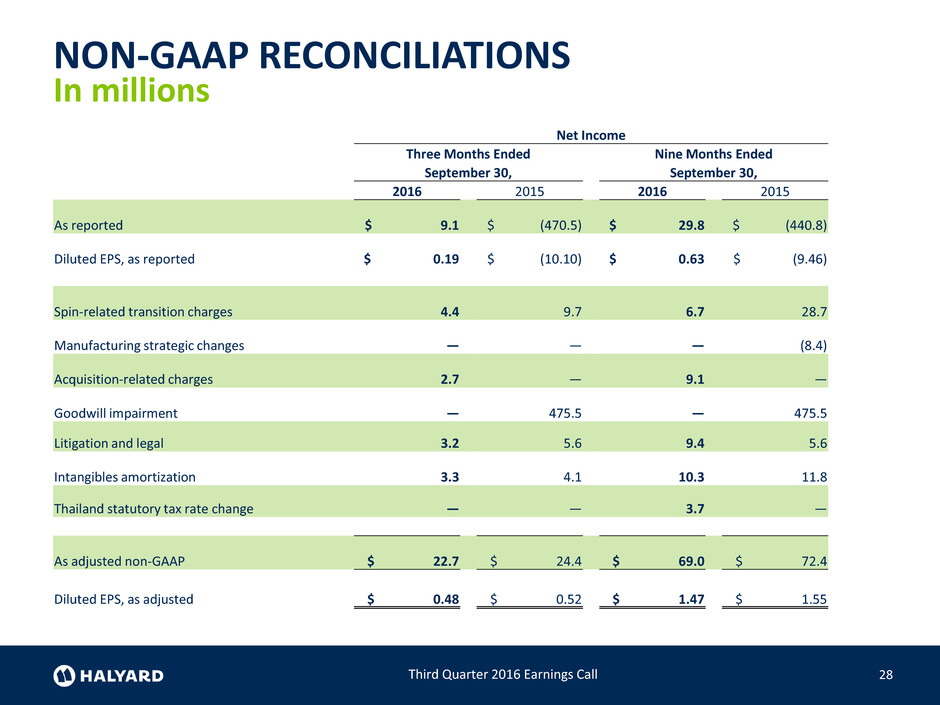

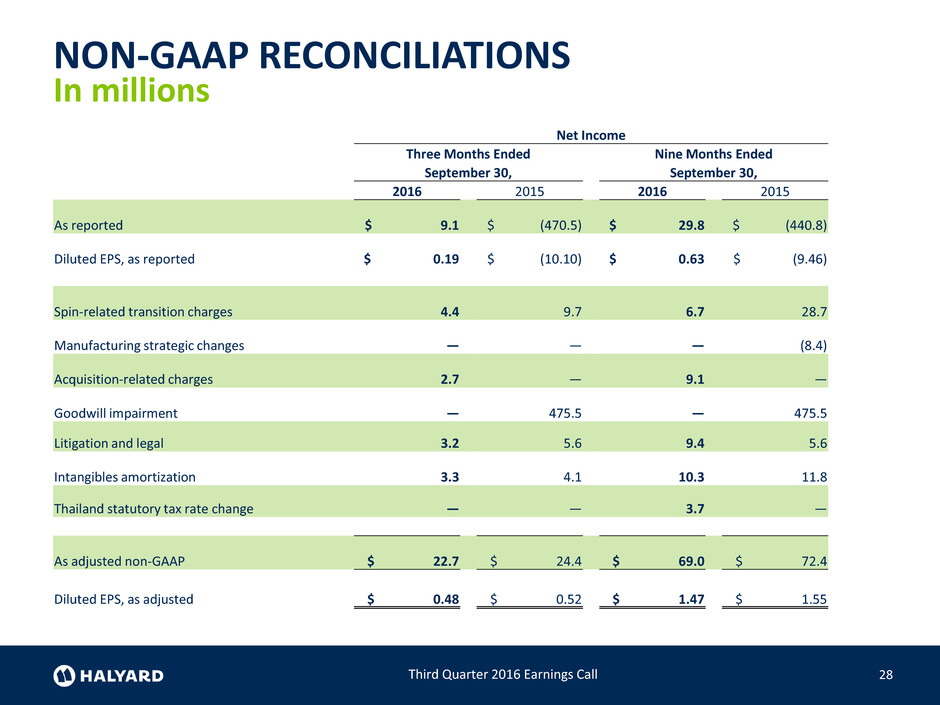

NON-GAAP RECONCILIATIONS In millions Third Quarter 2016 Earnings Call 28 Net Income Three Months Ended Nine Months Ended September 30, September 30, 2016 2015 2016 2015 As reported $ 9.1 $ (470.5) $ 29.8 $ (440.8) Diluted EPS, as reported $ 0.19 $ (10.10) $ 0.63 $ (9.46) Spin-related transition charges 4.4 9.7 6.7 28.7 Manufacturing strategic changes — — — (8.4) Acquisition-related charges 2.7 — 9.1 — Goodwill impairment — 475.5 — 475.5 Litigation and legal 3.2 5.6 9.4 5.6 Intangibles amortization 3.3 4.1 10.3 11.8 Thailand statutory tax rate change — — 3.7 — As adjusted non-GAAP $ 22.7 $ 24.4 $ 69.0 $ 72.4 Diluted EPS, as adjusted $ 0.48 $ 0.52 $ 1.47 $ 1.55

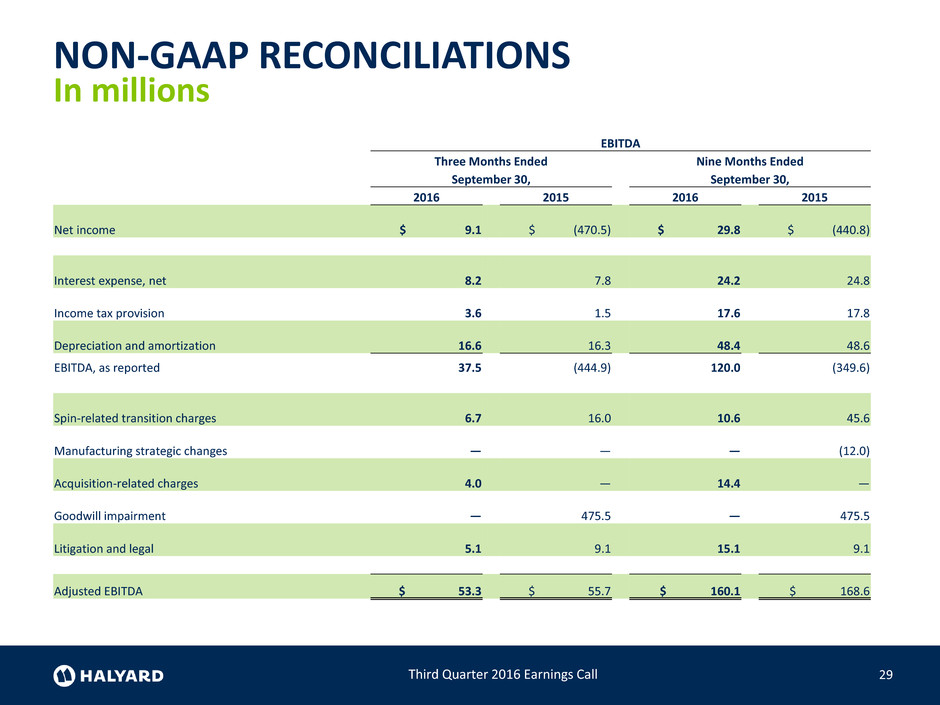

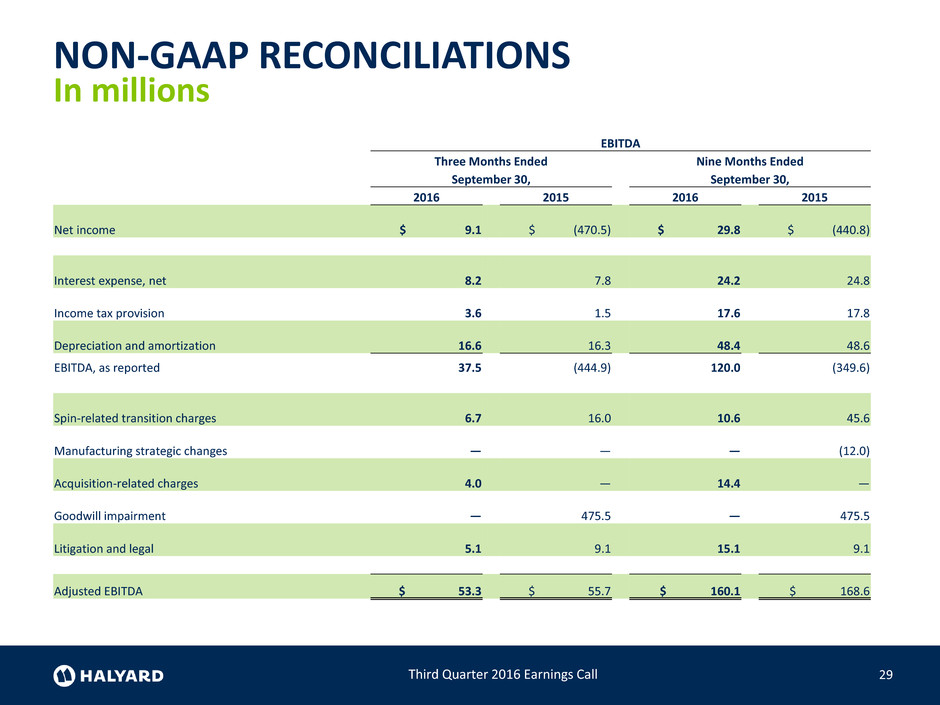

NON-GAAP RECONCILIATIONS In millions Third Quarter 2016 Earnings Call 29 EBITDA Three Months Ended Nine Months Ended September 30, September 30, 2016 2015 2016 2015 Net income $ 9.1 $ (470.5) $ 29.8 $ (440.8) Interest expense, net 8.2 7.8 24.2 24.8 Income tax provision 3.6 1.5 17.6 17.8 Depreciation and amortization 16.6 16.3 48.4 48.6 EBITDA, as reported 37.5 (444.9) 120.0 (349.6) Spin-related transition charges 6.7 16.0 10.6 45.6 Manufacturing strategic changes — — — (12.0) Acquisition-related charges 4.0 — 14.4 — Goodwill impairment — 475.5 — 475.5 Litigation and legal 5.1 9.1 15.1 9.1 Adjusted EBITDA $ 53.3 $ 55.7 $ 160.1 $ 168.6

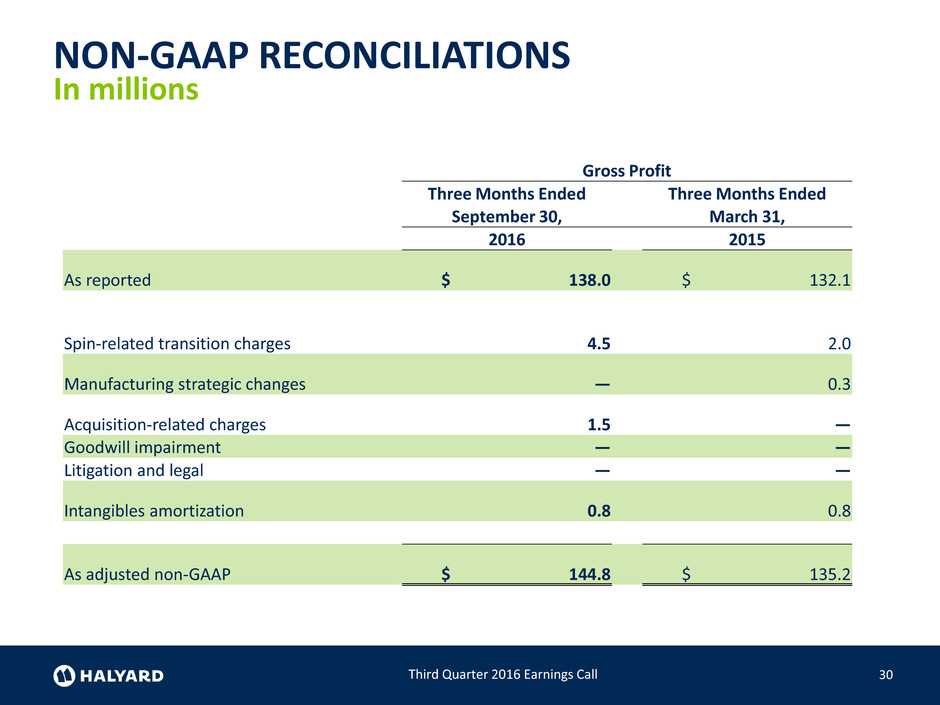

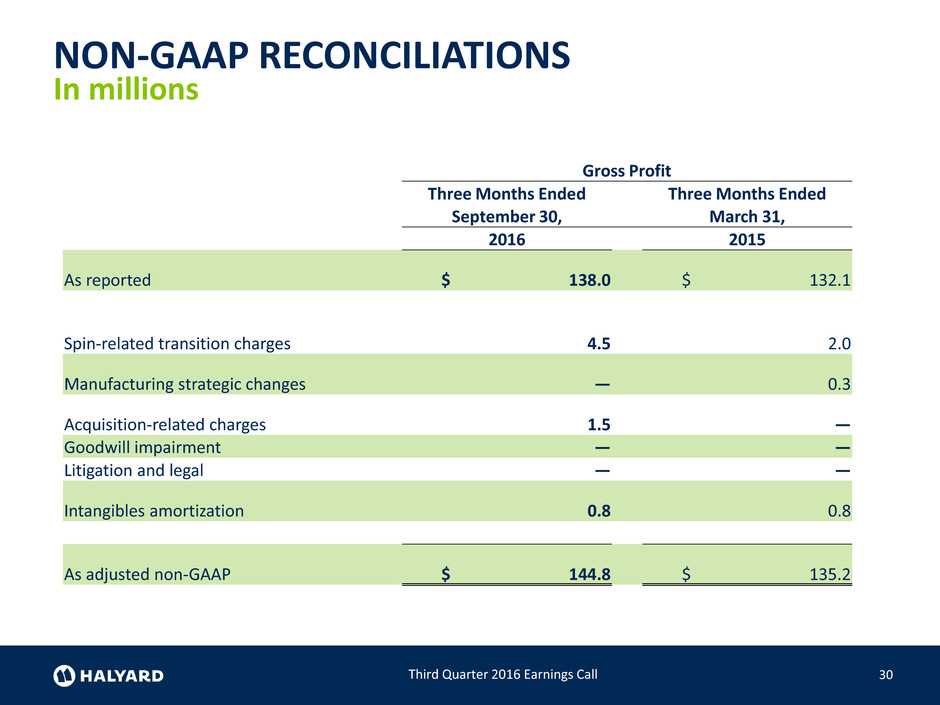

30 NON-GAAP RECONCILIATIONS In millions Gross Profit Three Months Ended Three Months Ended September 30, March 31, 2016 2015 As reported $ 138.0 $ 132.1 Spin-related transition charges 4.5 2.0 Manufacturing strategic changes — 0.3 Acquisition-related charges 1.5 — Goodwill impairment — — Litigation and legal — — Intangibles amortization 0.8 0.8 As adjusted non-GAAP $ 144.8 $ 135.2 Third Quarter 2016 Earnings Call

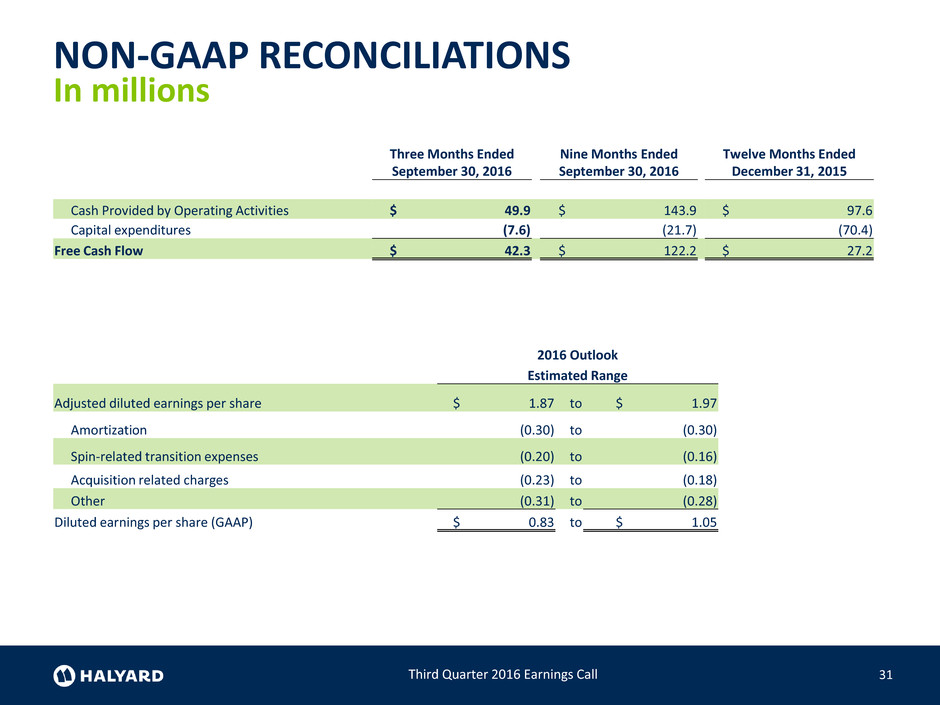

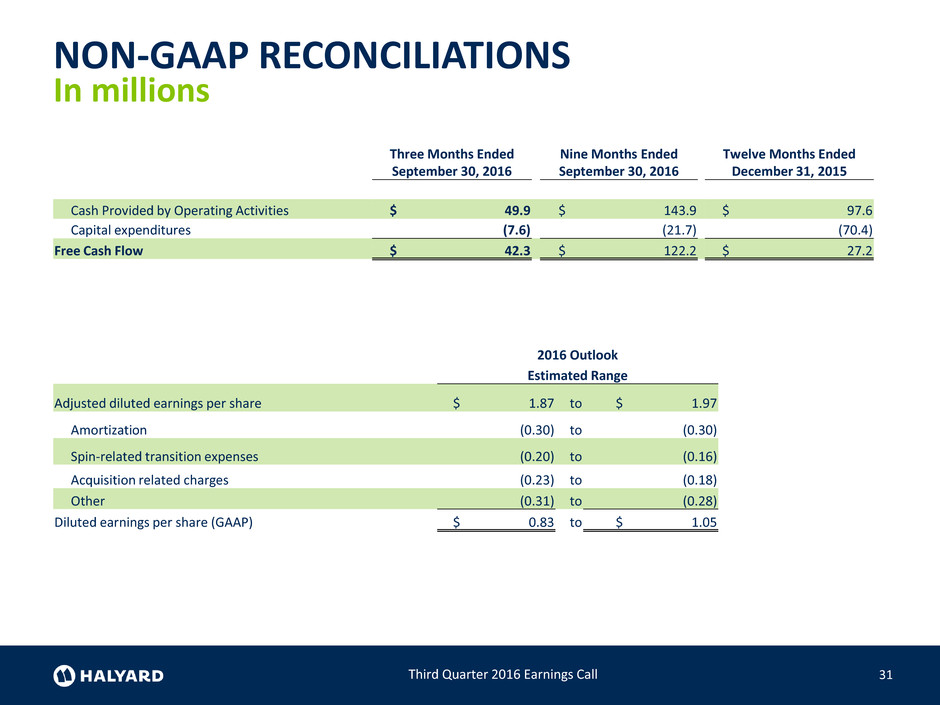

NON-GAAP RECONCILIATIONS In millions Third Quarter 2016 Earnings Call 31 2016 Outlook Estimated Range Adjusted diluted earnings per share $ 1.87 to $ 1.97 Amortization (0.30) to (0.30) Spin-related transition expenses (0.20) to (0.16) Acquisition related charges (0.23) to (0.18) Other (0.31) to (0.28) Diluted earnings per share (GAAP) $ 0.83 to $ 1.05 Three Months Ended September 30, 2016 Nine Months Ended September 30, 2016 Twelve Months Ended December 31, 2015 Cash Provided by Operating Activities $ 49.9 $ 143.9 $ 97.6 Capital expenditures (7.6) (21.7) (70.4) Free Cash Flow $ 42.3 $ 122.2 $ 27.2