ANALYST AND INVESTOR CONFERENCE JUNE 2018 SOFITEL NEW YORK NEW YORK, NY 1

OVERVIEW FORWARD-LOOKING INFORMATION Certain matters in this presentation, including our financial outlook, expectations and planning assumptions, and any estimates,projections, and statements relating to our business plans, objectives, or the acquisition of CoolSystems constitute forward-looking statements and are based upon management’s expectations and beliefs concerning future events impacting the Company. These statements are subject to risks and uncertainties, including currency exchange risks, cost savings and reductions, raw material, energy, and other input costs, competition, market demand, economic condition, S&IP separation execution and legislative and regulatory actions. There can be no assurance that these future events will occur as anticipated or that the Company’s results will be as estimated. Forward-looking statements speak only as of the date they were made, and we undertake no obligation to publicly update them. For a more complete listing and description of other factors that could cause the Company’s future results to differ materially from those expressed in any forward-looking statements, see the Company’s most recent Form 10-K and Quarterly Reports on Form 10-Q. NON-GAAP FINANCIAL MEASURES Management believes that non-GAAP financial measures enhance investors’ understanding and analysis of the company’s performance. As such, results and outlook have been adjusted to exclude certain items for relevant time periods as indicated in the non-GAAP reconciliations to the comparable GAAP financial measures included in this presentation posted on our website (www.halyardhealth.com/investors). 2

Welcome Dave Crawford, Vice President, Treasurer & Investor Relations Executive Introduction Joseph F. Woody, Chief Executive Officer Commercial Strategy John Tushar, President, Global Franchises Interventional Pain Lisa Kudlacz, Vice President & General Manager, Interventional Pain Guest Speaker Dr. John M. DiMuro, Owner, DiMuro Pain Management Acute Pain Roger Massengale, Vice President & General Manager, Acute Pain Guest Speaker Dr. Sonia Szlyk, Director of Regional Anesthesia at Inova Fair Oaks Hospital Chronic Care Tom Kupec, Vice President & General Manager, Chronic Care Break Q&A R&D Review Lee Burnes, Senior Vice President, Global R&D, Clinical & Medical Affairs Financial Review Steve Voskuil, Chief Financial Officer Q&A Closing Remarks Joseph F. Woody Product & R&D Showcase Lunch 3

INTRODUCING ∆V∆NOS JUNE 2018 JOE WOODY CHIEF EXECUTIVE OFFICER 1

∆V∆NOS: ACHIEVING THE IMPOSSIBLE Our Vision The best at getting patients back to the things that matter Our Mission We deliver clinically superior, breakthrough medical device solutions to improve patients’ quality of life Our Values Customer-Centric Results-Driven Collaborative Candor Speed Global Mindset 2

WHO WE ARE Global Medical Devices Company ~$10B Market-leading portfolio $600M+ in the U.S.: Global Revenue Addressable 7 products are #1 or #2 Market in their categories Pain Management Chronic Care Business Operations in Strong Momentum: Low 60s gross margin, 90+ countries 10% net sales delivering future operating CAGR1 margin expansion International Note: U.S. 1. 2015-2017 Medical Devices sales 3

DELIVERING SUPERIOR, BREAKTHROUGH MEDICAL DEVICE SOLUTIONS 100 million Americans Opioid dependency can begin Pain live in chronic pain within 3 days of initial use1 Management ~86% of hospital-associated 1/3 of patients enter the hospital pneumonia is linked with malnourished; another 1/3 develop Care Chronic mechanical ventilation2 malnutrition in the hospital3 Notes: 1. Centers for Disease Control and Prevention. Characteristics of Initial Prescription Episodes and Likelihood of Long-Term Opioid Use—United States, 2006-2015. 2. Richards MJ, Edwards JR, Culver DH, Gaynes RP. Nosocomial infections in medical intensive care units in the United States. National Nosocomial Infections Surveillance System. Crit Care Med. 1999 May;27(5):887-92. 3. Tappenden KA, Quatrara B, Parkhurst ML, Malone AM, Fanjiang G, Ziegler TR. Critical Role of Nutrition in Improving Quality of Care: An Interdisciplinary Call to Action to Address Adult Hospital Malnutrition. Journal of the Academy of Nutrition and Dietetics Getting patients back to the things that matter 4

TRACK RECORD OF STRONG PERFORMANCE Established pure-play medical devices business 1 Launched cost transformation and implementation of new IT system Announced acquisition of Game Ready Accelerated organic growth rate annually 2 Increased net sales by 10% CAGR1 Expanded operating margins by 420 bps1 Increased and focused R&D spend 3 Accelerated innovation across the portfolio Created robust development pipeline Introduced customer-centric mindset 4 Rebranded to reflect our mission and values Reinvigorated the culture Delivered 80% TSR since 20162 1 Based on 2015-2017 Medical Devices sales and operating margins 2 From 12/31/15 through 6/15/18 5

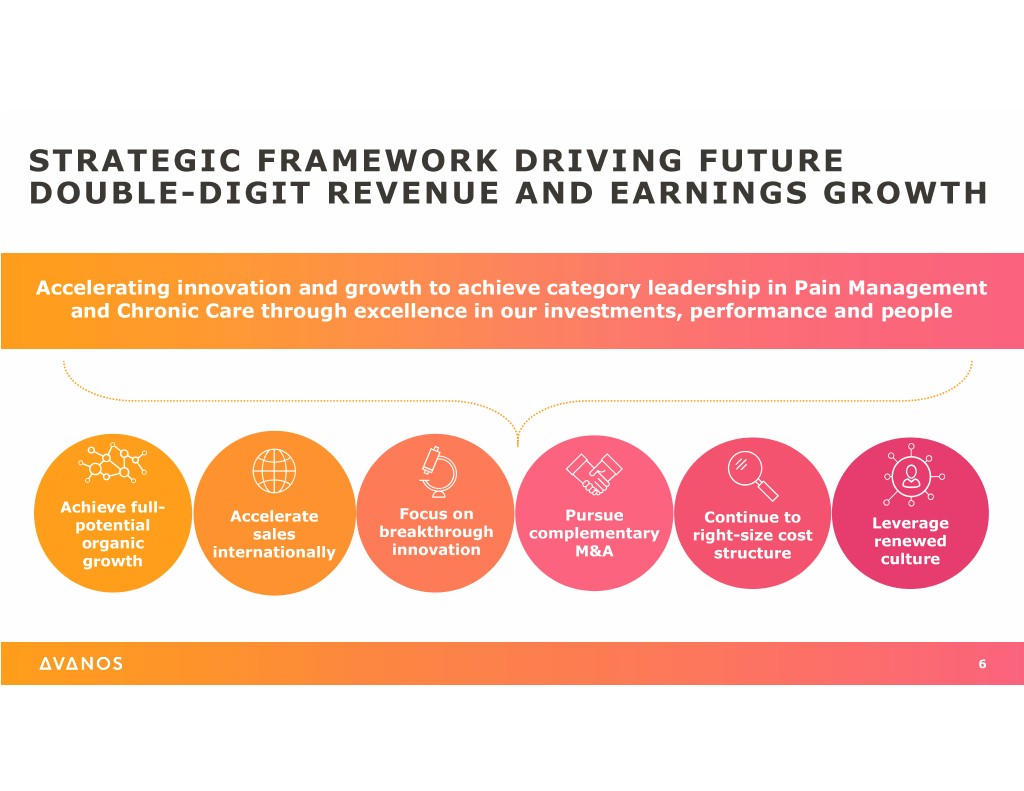

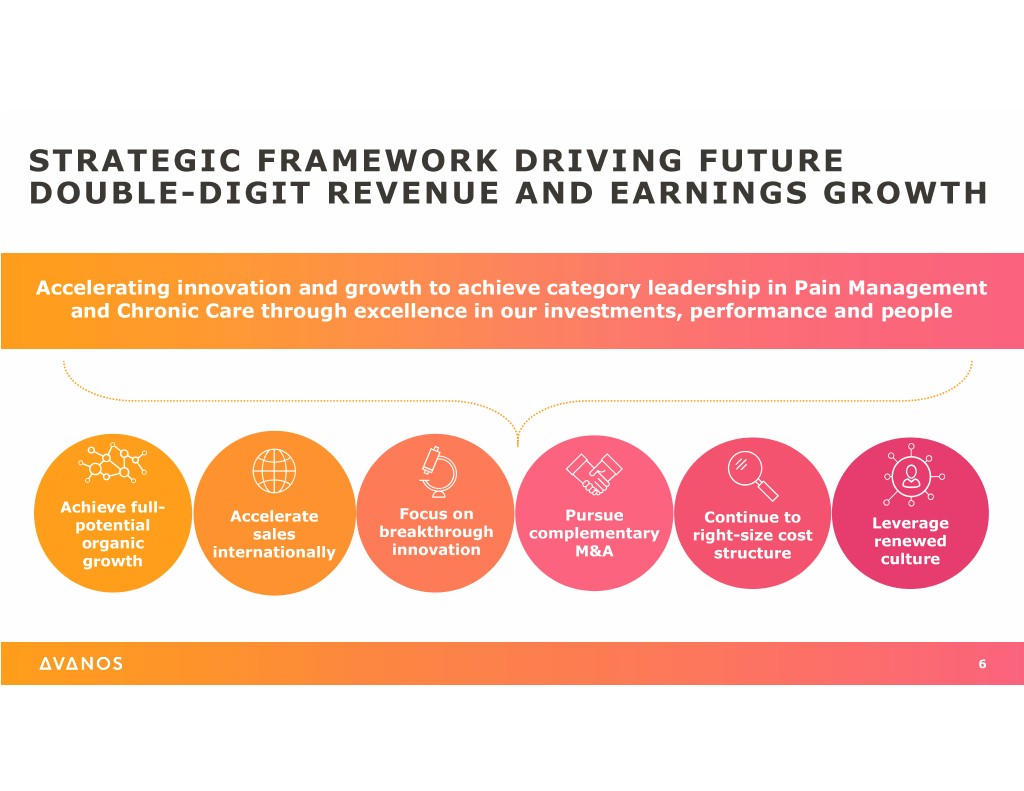

STRATEGIC FRAMEWORK DRIVING FUTURE DOUBLE-DIGIT REVENUE AND EARNINGS GROWTH Accelerating innovation and growth to achieve category leadership in Pain Management and Chronic Care through excellence in our investments, performance and people Achieve full- Accelerate Focus on Pursue Continue to potential Leverage sales breakthrough complementary right-size cost organic renewed internationally innovation M&A structure growth culture 6

TODAY’S AGENDA & PRESENTERS John Tushar Lisa Kudlacz Dr. John DiMuro Roger Massengale President, Vice President & Owner, Vice President & Global Franchises General Manager, DiMuro Pain Management General Manager, Interventional Pain Acute Pain Dr. Sonia Szlyk Tom Kupec Lee Burnes Steve Voskuil Director of Regional Anesthesia, Vice President & Senior Vice President, Senior Vice President, North American Partners in General Manager, Global R&D, Clinical & Medical Affairs Chief Financial Officer Anesthesia, Mid-Atlantic Chronic Care 7

THANK YOU 8

COMMERCIAL STRATEGY JUNE 2018 JOHN TUSHAR PRESIDENT, GLOBAL FRANCHISES 1

∆V∆NOS: STRONG FUNDAMENTALS A newly transformed, focused and scalable medical device business Performance momentum Market-leading product portfolio Resources to seize external opportunities Proven ability to drive internal innovation Equipped to best serve customers Able to attract top device industry talent Untapped opportunities for further growth 2

OUR STRATEGY Accelerating innovation and growth to achieve category leadership in Pain Management and Chronic Care through excellence in our investments, performance and people 3

DRIVING SHAREHOLDER VALUE Investments Performance People • Dual-track pursuit of growth through • Leveraging data for differentiation • Energized, focused workforce innovation and M&A & optimal reimbursement post-S&IP and renaming • Outcomes and economics-driven • Customer engagement • Leveraging HPMS to drive approach • Direct-to-customer marketing execution • Market expansion opportunities • Differentiated R&D talent 4

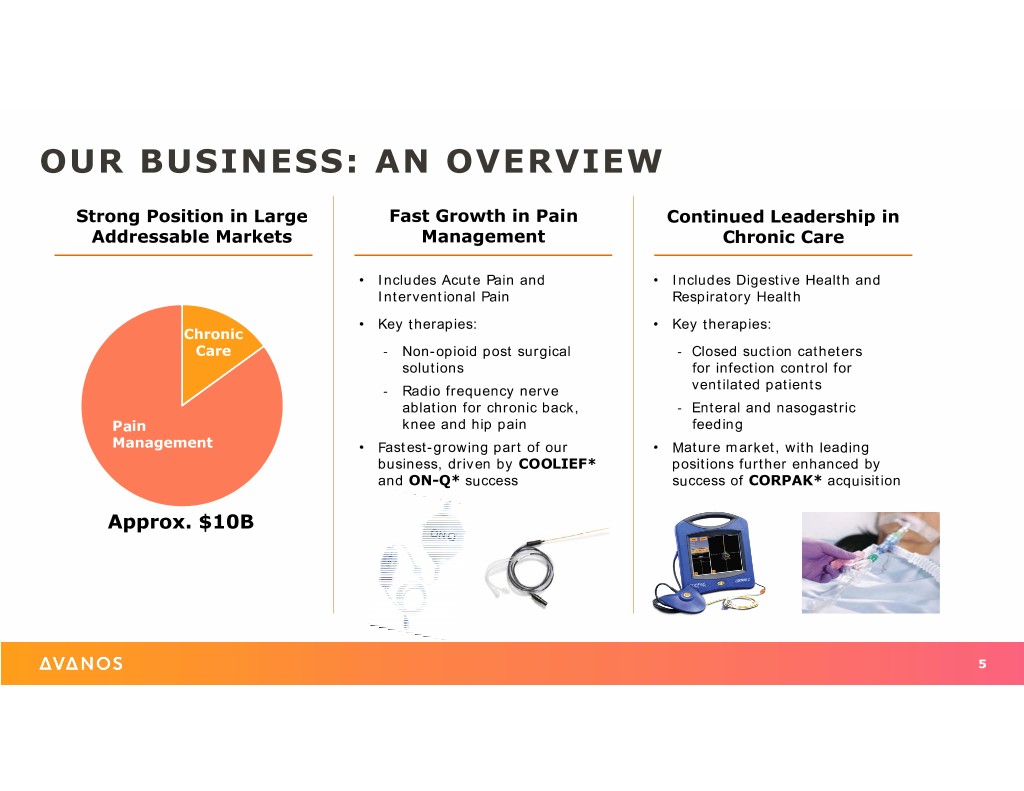

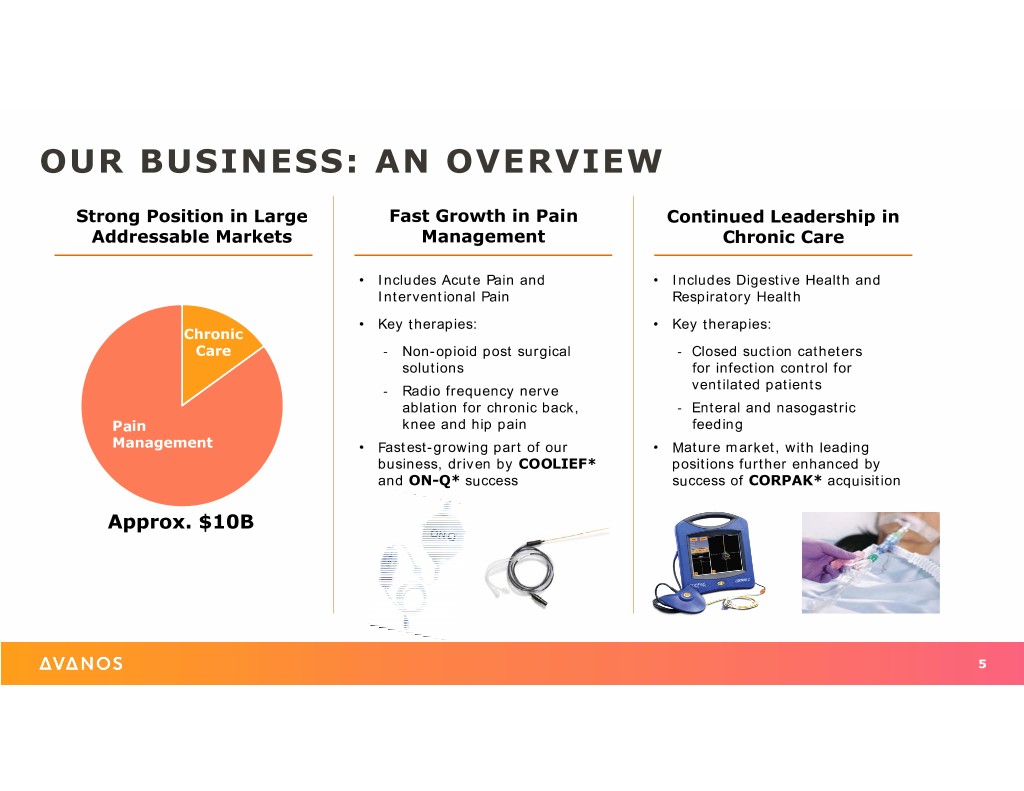

OUR BUSINESS: AN OVERVIEW Strong Position in Large Fast Growth in Pain Continued Leadership in Addressable Markets Management Chronic Care • Includes Acute Pain and • Includes Digestive Health and Interventional Pain Respiratory Health • Key therapies: • Key therapies: Chronic Care ‐ Non-opioid post surgical ‐ Closed suction catheters solutions for infection control for ‐ Radio frequency nerve ventilated patients ablation for chronic back, ‐ Enteral and nasogastric Pain knee and hip pain feeding Management • Fastest-growing part of our • Mature market, with leading business, driven by COOLIEF* positions further enhanced by and ON-Q* success success of CORPAK* acquisition Approx. $10B 5

INVESTING TO WIN IN AN EVOLVING MARKET Demand for Limited potential for Need for non- Continued barriers Movement to Increased patient evidence and incremental opioid pain to non-opioid outpatient and control in healthcare economic benefits innovation management alternatives alternative care decision-making settings strategic investments in… R&D Non-opioid Cross-audience Outcomes & Customer organization portfolio Advocacy & marketing with cost data to engagement with through reimbursement a focus on demonstrate beyond the breakthrough innovation & efforts direct-to- value hospital setting focus M&A patient 6

THE ∆V∆NOS DIFFERENCE Newly focused business with a strategy to continue driving innovation & growth Experienced management team with diverse backgrounds Sustainable leadership positions in attractive end markets Proven ability to create value through external and internal innovation 7

THANK YOU 8

INTERVENTIONAL PAIN JUNE 2018 LISA KUDLACZ VICE PRESIDENT & GENERAL MANAGER, INTERVENTIONAL PAIN 1

INTERVENTIONAL PAIN Interventional Pain Vision To be the world leader in minimally invasive solutions for the treatment of chronic pain Attractive Market Dynamics Large, growing category that lacks longer-term minimally invasive solutions for patients Significant Future Potential Investing in clinical evidence, sales and marketing and breakthrough technologies 2

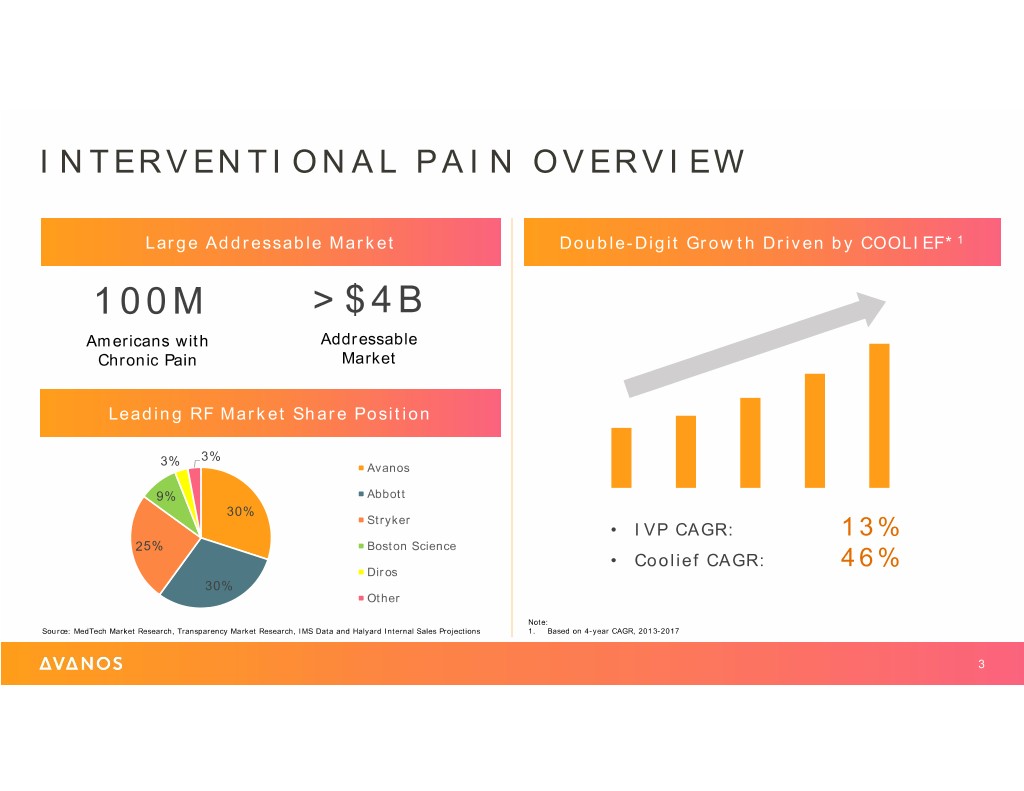

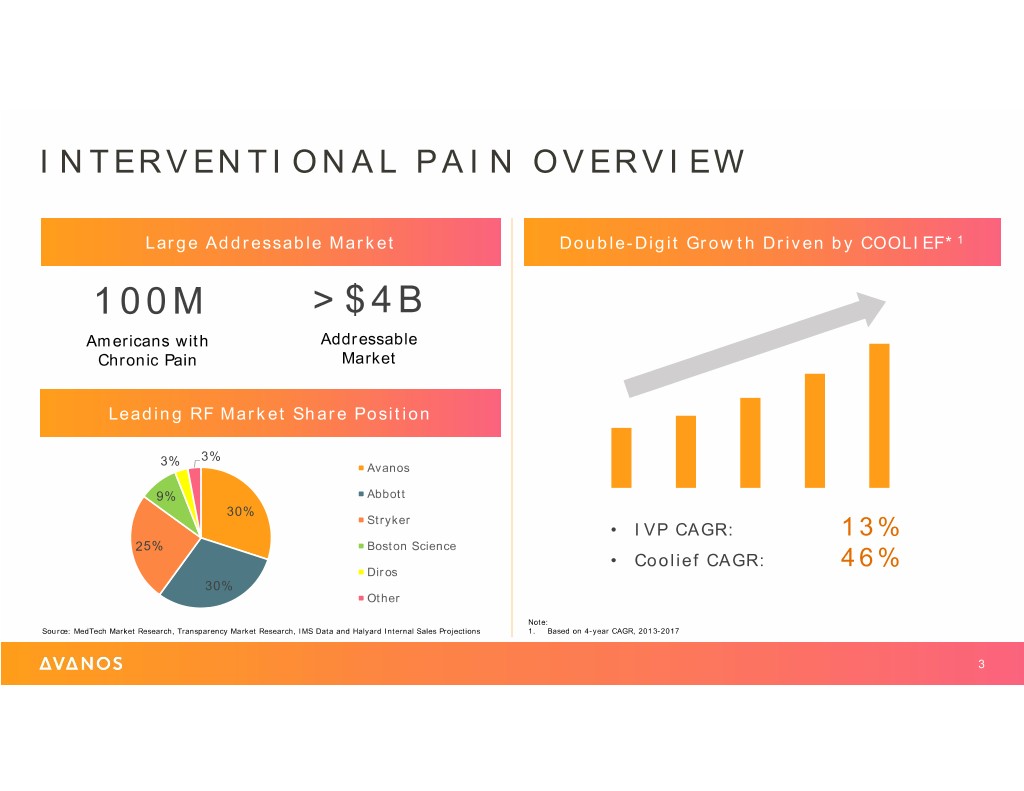

INTERVENTIONAL PAIN OVERVIEW Large Addressable Market Double-Digit Growth Driven by COOLIEF*1 100M >$4B Americans with Addressable Chronic Pain Market Leading RF Market Share Position 3% 3% Avanos 9% Abbott 30% Stryker • IVP CAGR: 13% 25% Boston Science • Coolief CAGR: 46% Diros 30% Other Note: Source: MedTech Market Research, Transparency Market Research, IMS Data and Halyard Internal Sales Projections 1. Based on 4-year CAGR, 2013-2017 3

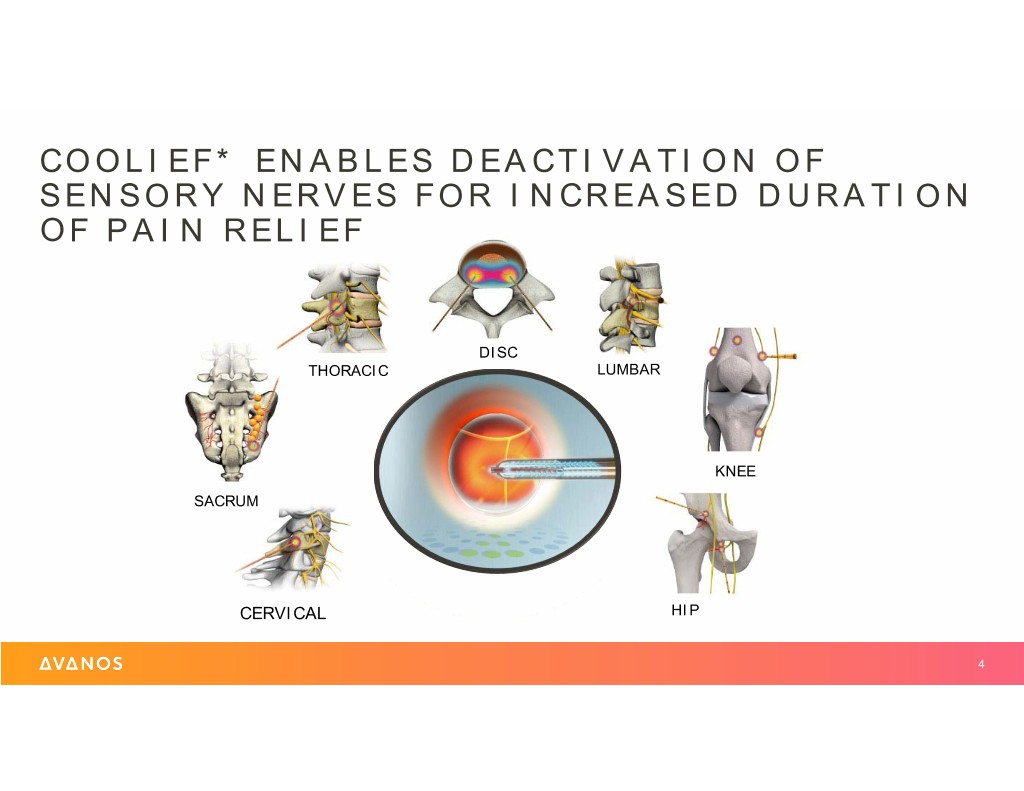

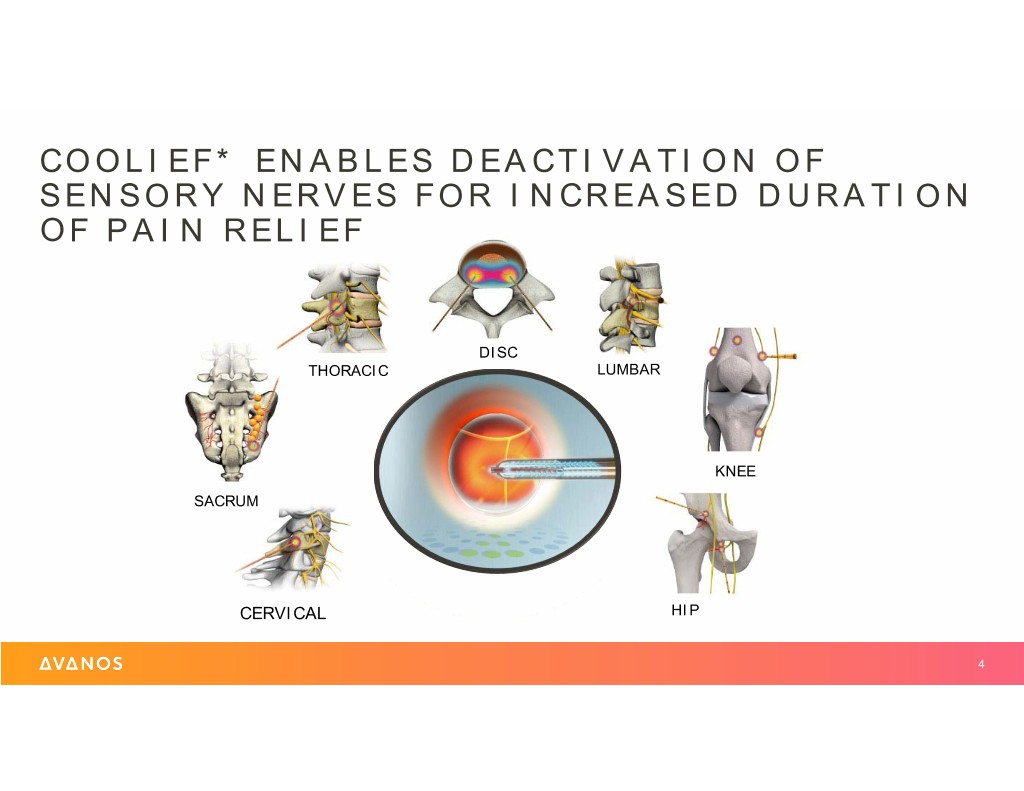

COOLIEF* ENABLES DEACTIVATION OF SENSORY NERVES FOR INCREASED DURATION OF PAIN RELIEF DISC THORACIC LUMBAR KNEE SACRUM CERVICAL HIP 4

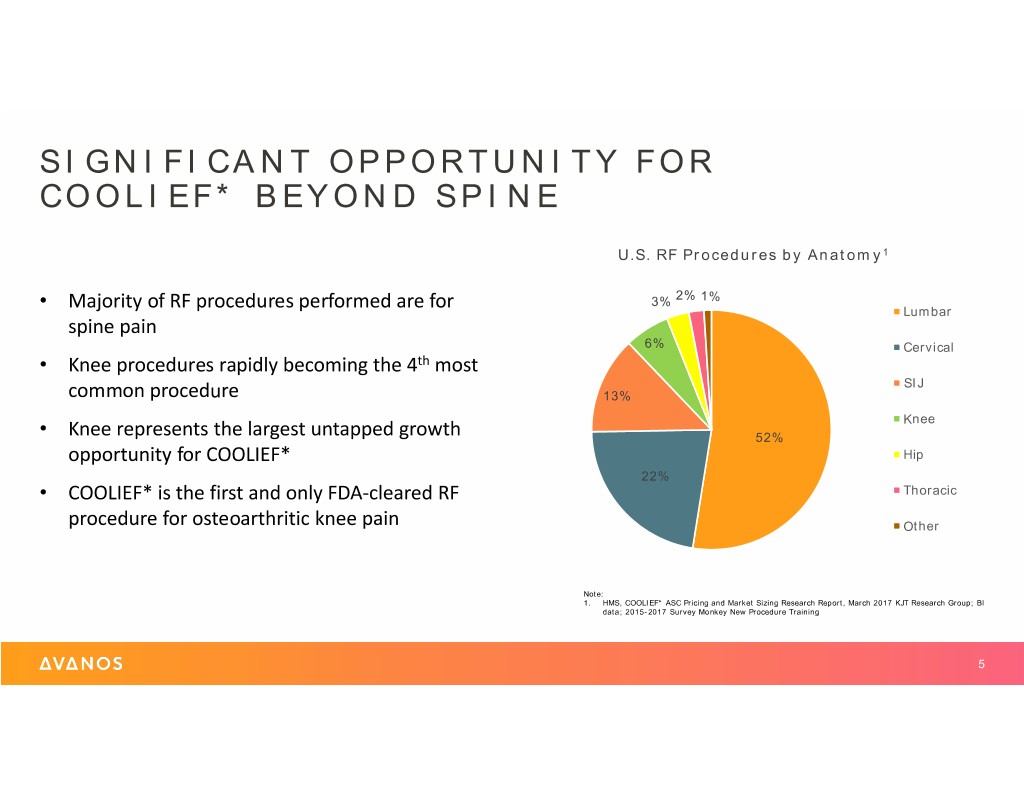

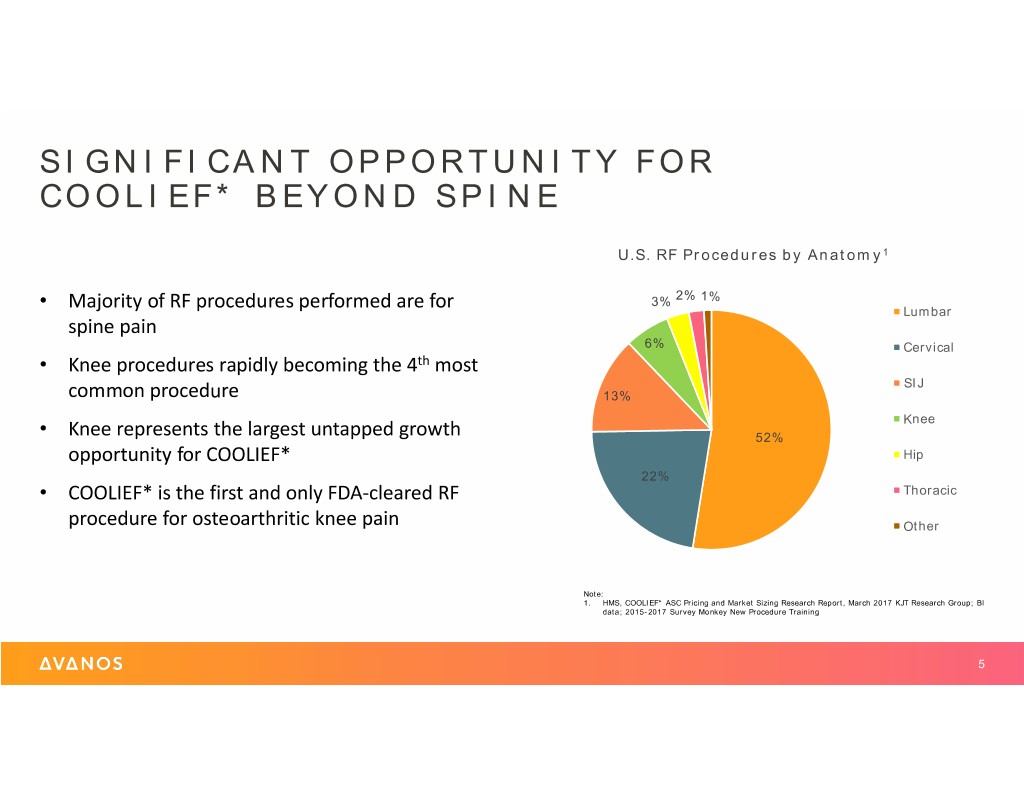

SIGNIFICANT OPPORTUNITY FOR COOLIEF* BEYOND SPINE U.S. RF Procedures by Anatomy1 • 3% 2% 1% Majority of RF procedures performed are for Lumbar spine pain 6% Cervical • Knee procedures rapidly becoming the 4th most SIJ common procedure 13% Knee • Knee represents the largest untapped growth 52% opportunity for COOLIEF* Hip 22% • COOLIEF* is the first and only FDA‐cleared RF Thoracic procedure for osteoarthritic knee pain Other Note: 1. HMS, COOLIEF* ASC Pricing and Market Sizing Research Report, March 2017 KJT Research Group; BI data; 2015-2017 Survey Monkey New Procedure Training 5

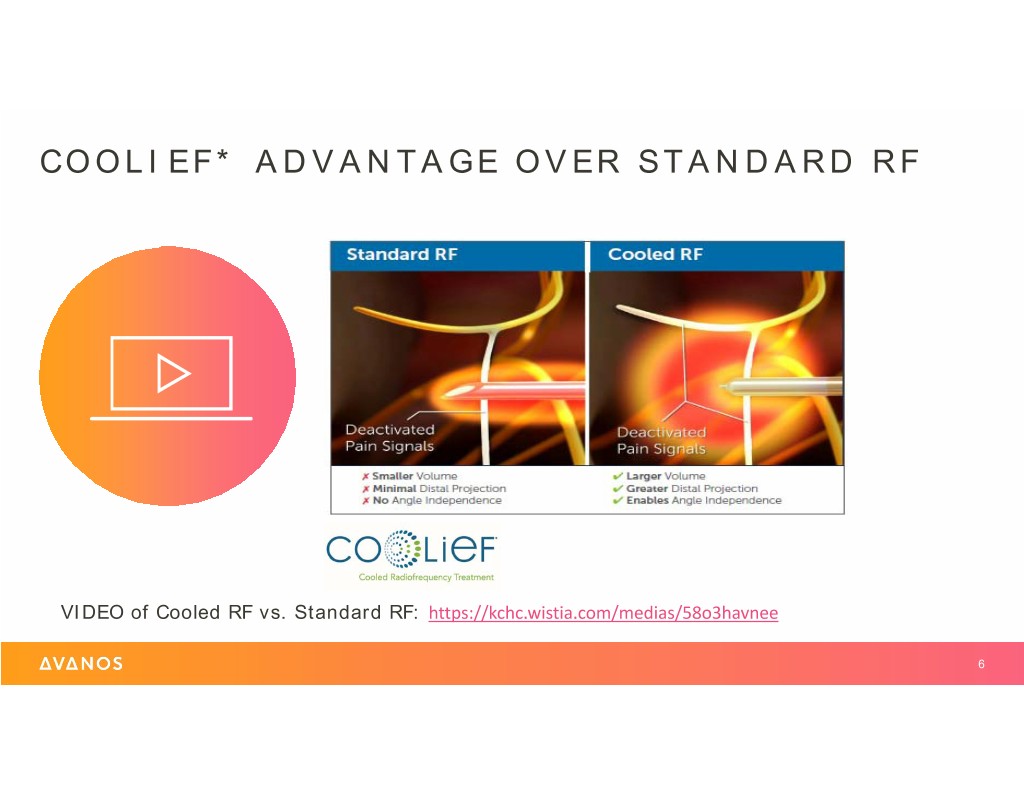

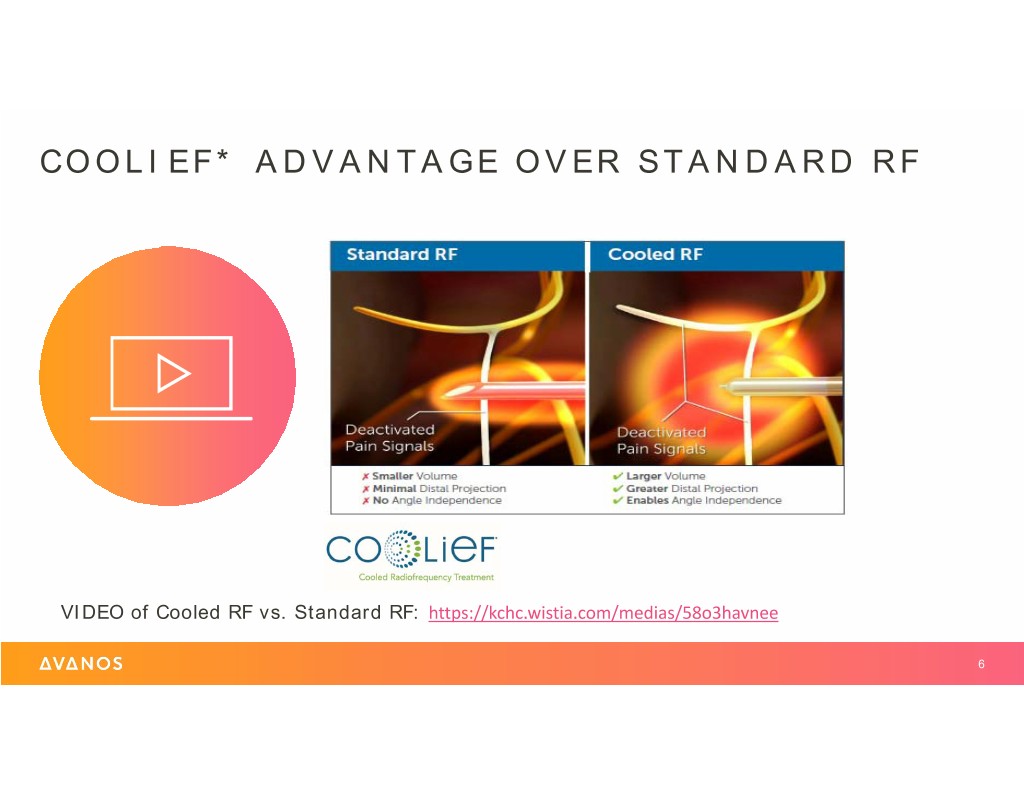

COOLIEF* ADVANTAGE OVER STANDARD RF VIDEO of Cooled RF vs. Standard RF: https://kchc.wistia.com/medias/58o3havnee 6

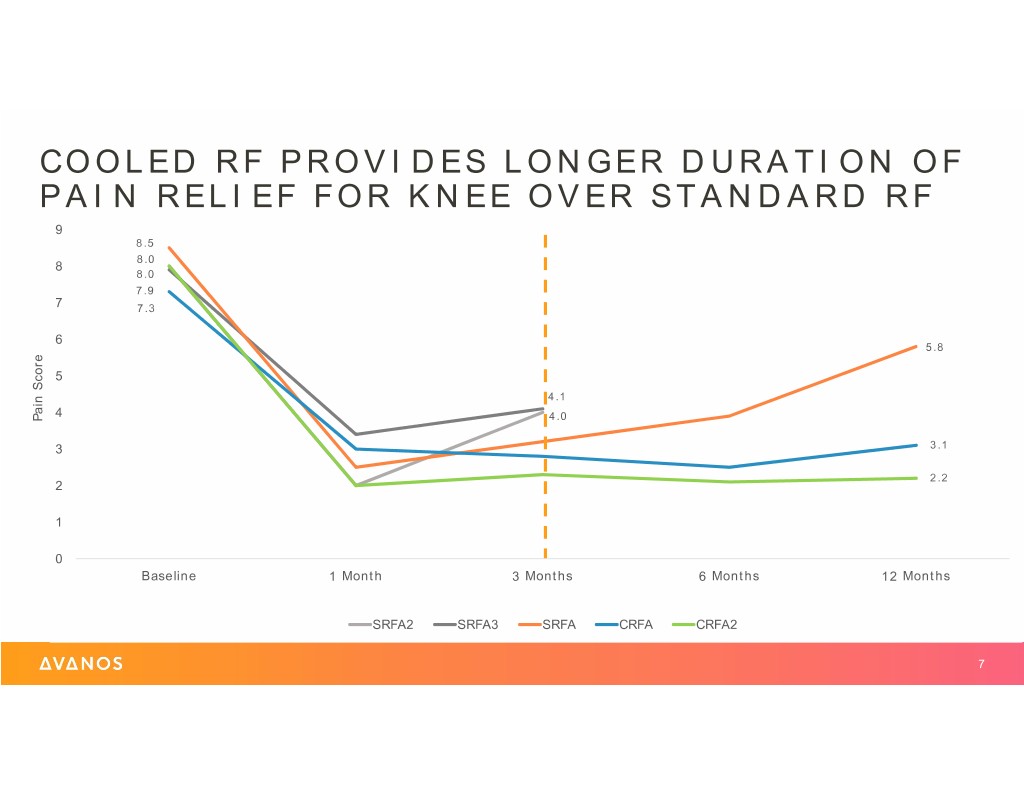

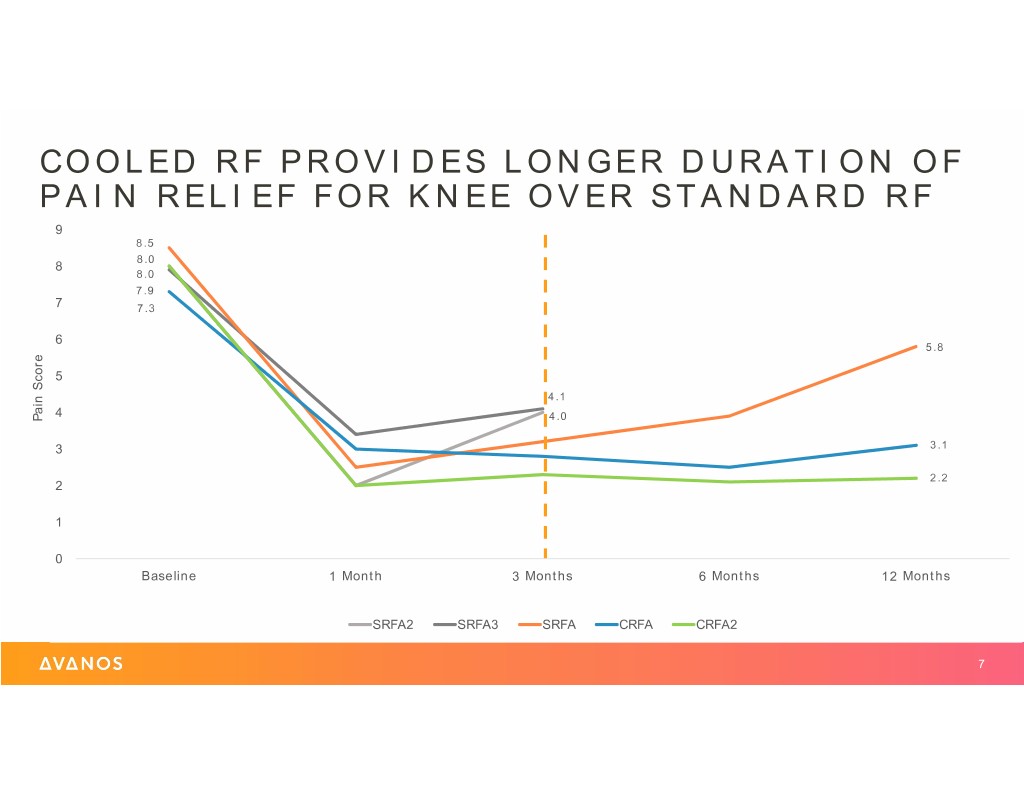

COOLED RF PROVIDES LONGER DURATION OF PAIN RELIEF FOR KNEE OVER STANDARD RF 9 8.5 8.0 8 8.0 7.9 7 7.3 6 5.8 5 4.1 4 Pain Score 4.0 3 3.1 2.2 2 1 0 Baseline 1 Month 3 Months 6 Months 12 Months SRFA2 SRFA3 SRFA CRFA CRFA2 7

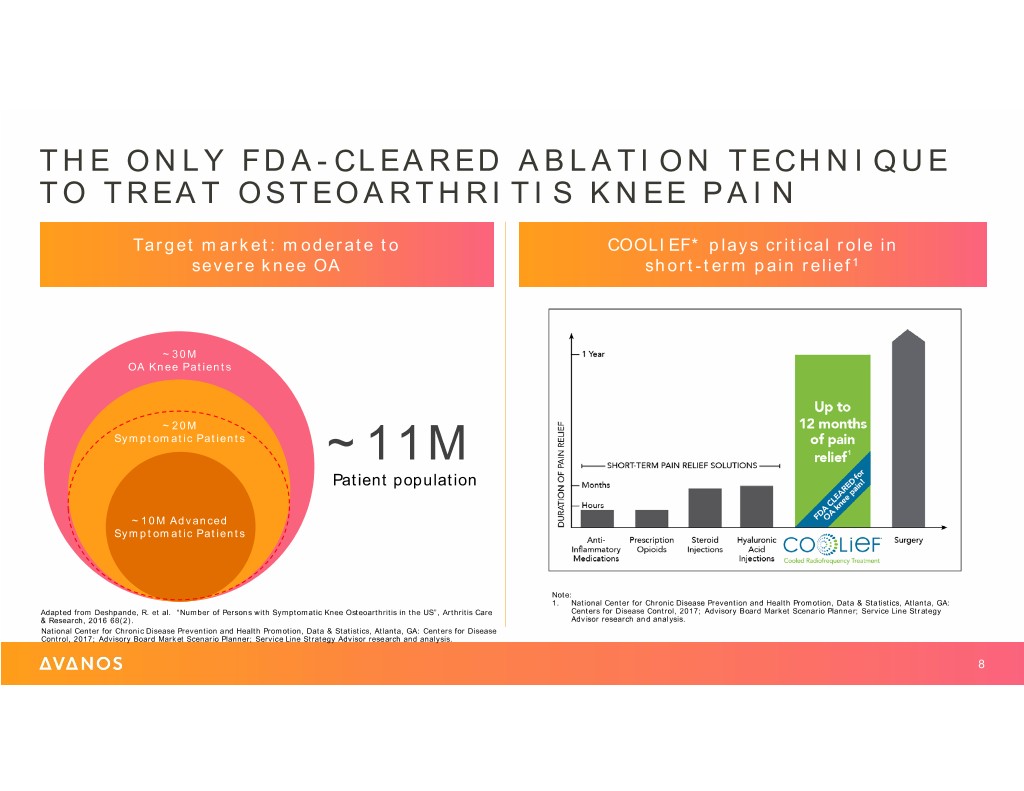

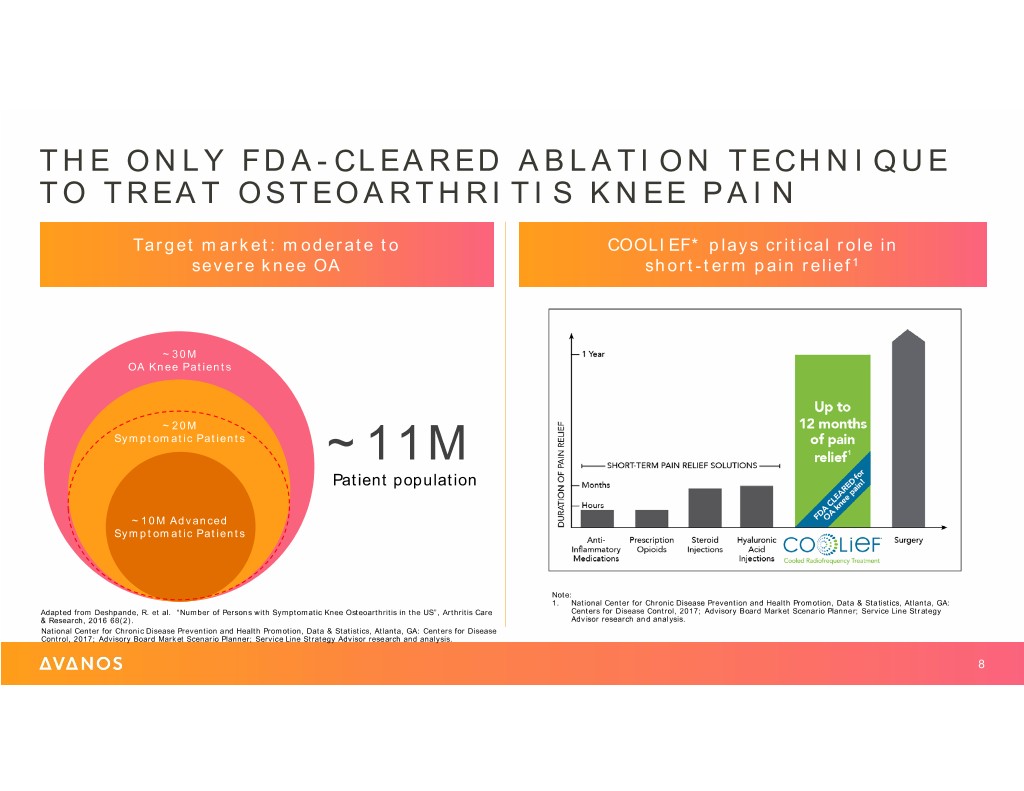

THE ONLY FDA-CLEARED ABLATION TECHNIQUE TO TREAT OSTEOARTHRITIS KNEE PAIN Target market: moderate to COOLIEF* plays critical role in severe knee OA short-term pain relief1 ~30M OA Knee Patients ~20M Symptomatic Patients ~11M Patient population ~10M Advanced Symptomatic Patients Note: 1. National Center for Chronic Disease Prevention and Health Promotion, Data & Statistics, Atlanta, GA: Adapted from Deshpande, R. et al. “Number of Persons with Symptomatic Knee Osteoarthritis in the US”, Arthritis Care Centers for Disease Control, 2017; Advisory Board Market Scenario Planner; Service Line Strategy & Research, 2016 68(2). Advisor research and analysis. National Center for Chronic Disease Prevention and Health Promotion, Data & Statistics, Atlanta, GA: Centers for Disease Control, 2017; Advisory Board Market Scenario Planner; Service Line Strategy Advisor research and analysis. 8

THE POWER OF COOLIEF* FROM A PATIENT’S PERSPECTIVE https://kchc.wistia.com/medias/lotgfp09zq 9

HOW WE WILL WIN A balanced investment approach Expand patient advertising to drive procedure demand 1 Utilize targeted physician value proposition campaigns supported by demand generation programs Increase investment in clinical data: 13 studies across 3 2 indications over next 3 years Show efficacy/safety/differentiation to standard RF Ensure appropriate coverage and payment for the physician to perform in preferred site of service 3 Expand physician coverage in the US and internationally Expand marketing programs globally Advance research in nerve ablation to further enhance 4 technology development Explore new technologies in adjacent Chronic Pain markets, such as migraine 10

BRIGHT FUTURE FOR INTERVENTIONAL PAIN MANAGEMENT Building on solid foundation with differentiated product portfolio and market-leading position Large growing category that lacks longer term minimally invasive solutions for patients Solid investments in clinical evidence that create value with physicians, patients and payers Multi-pronged growth strategy aimed at patient and physician awareness, targeted international expansion & product portfolio development through R&D and M&A 11

THANK YOU 12

THE POWER OF COOLIEF JUNE 2018 DR. JOHN M. DIMURO OWNER, DIMURO PAIN MANAGEMENT 1

DISCLOSURE • Avanos, Inc. is sponsoring this presentation, and I am being compensated by Avanos to make this presentation. • The information provided in this presentation is intended for health care professionals and is intended for training and education purposes. • For complete product information, including indications, contraindications, warnings, precautions, and potential adverse effects, see the IFU for the respective product(s). • The information provided in this presentation represents my surgical technique. Surgical techniques can vary depending on the individual expertise, experience, and school-of-thought of the physician utilizing the respective product(s). 2

Julia Mancuso 4 time Olympic medalist 3 time Olympian The Power of

ACUTE PAIN JUNE 2018 ROGER MASSENGALE VICE PRESIDENT & GENERAL MANAGER, ACUTE PAIN 1

ACUTE PAIN Acute Pain Vision To be the leader in reducing or eliminating opioids for surgical patients Attractive Market Dynamics Significant need for solutions to battle the opioid crisis and demonstrate healthcare economic benefits Significant Future Potential Differentiated products and services in underpenetrated markets with substantial upside 2

It’s a Matter of Days… IT’S A MATTER OF DAYS. Every DAY a patient takes opioids, their risk of forming a life-threatening addiction increases1 Note: 1. Centers for Disease Control and Prevention. Characteristics of Initial Prescription Episodes and Likelihood of Long-Term Opioid Use—United States, 2006-2015. 3

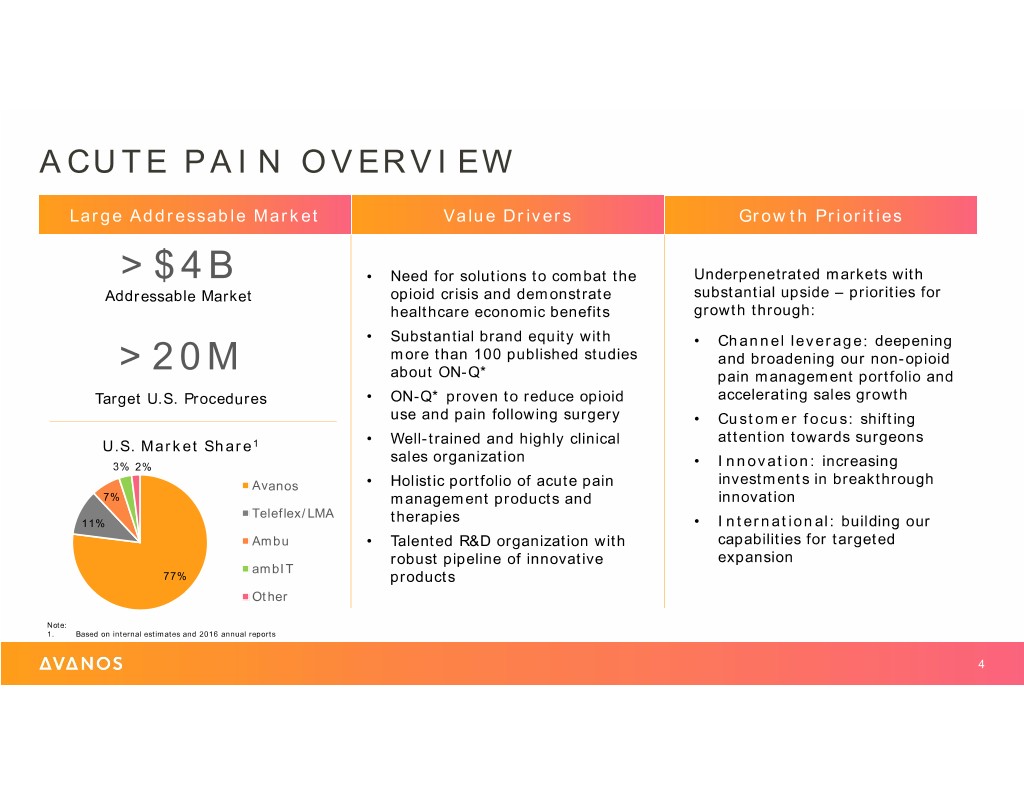

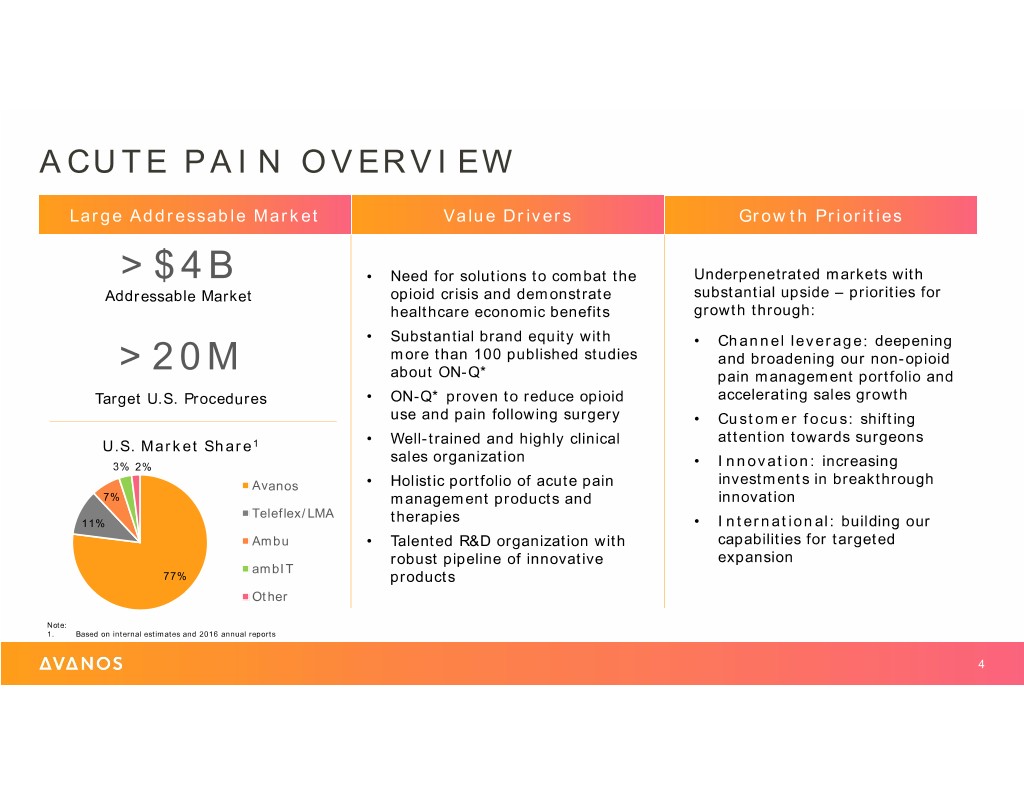

ACUTE PAIN OVERVIEW Large Addressable Market Value Drivers Growth Priorities >$4B • Need for solutions to combat the Underpenetrated markets with Addressable Market opioid crisis and demonstrate substantial upside – priorities for healthcare economic benefits growth through: • Substantial brand equity with • Channel leverage: deepening more than 100 published studies and broadening our non-opioid >20M about ON-Q* pain management portfolio and Target U.S. Procedures • ON-Q* proven to reduce opioid accelerating sales growth use and pain following surgery • Customer focus: shifting • Well-trained and highly clinical attention towards surgeons U.S. Market Share1 sales organization 3% 2% • Innovation: increasing Avanos • Holistic portfolio of acute pain investments in breakthrough 7% management products and innovation Teleflex/LMA 11% therapies • International: building our Ambu • Talented R&D organization with capabilities for targeted robust pipeline of innovative expansion ambIT 77% products Other Note: 1. Based on internal estimates and 2016 annual reports 4

ACUTE PAIN PORTFOLIO Complete portfolio of products to manage and monitor patients’ pain with reduced cost to the healthcare system 5

LARGE ADDRESSABLE MARKET: MORE THAN 20 MILLION U.S. PROCEDURES PER YEAR Estimated Market Opportunity by Specialty1 GENERAL SURGERY CV/CT Colorectal Thoracotomy/ Sternotomy 9% Orthopedic 8% General 5% ORTHO/ TRAUMA TKA, Rotator Cuff, OB/GYN Hip Fx 17% 61% CVCT OB/GYN Other C-section, Hysterectomy Note: 1. MedTech, June 2013 and LSI Procedural Data, December 2011 An estimated more than 50% of ON-Q* sales are in orthopedic procedures 6

OPIOIDS ARE A SIGNIFICANT BURDEN ON THE HEALTHCARE SYSTEM Between 1999 and 2013, the Every opioid-related, in-hospital prescription opioid overdose 3 rate for adults aged 55 to adverse event increases costs 64 increased more than by an average of $4,700 1 7x Opioid side effects such as constipation can prolong postoperative length of stay by an average of 1.4 days2 Avanos has 44 published studies demonstrating reduced pain and opioid use with ON-Q* Notes: 1. Oderda GM, Gan TJ, Johnson BH, Robinson SB. Effect of opioid-related adverse events on outcomes in selected surgical patients. J Pain Palliat Care Pharmacother. 2013;27:62-70; Kessler ER, Shah M, Gruschkus SK, Raju A. Cost and quality implications of opioid-based postsurgical pain control using administrative claims data from a large health system: opioid-related adverse events and their impact on clinical and economic outcomes. Pharmacotherapy. 2013;33(4): 383-391. 2. Data on file 3. CDC. Opioid painkiller prescribing varies widely among states. 7

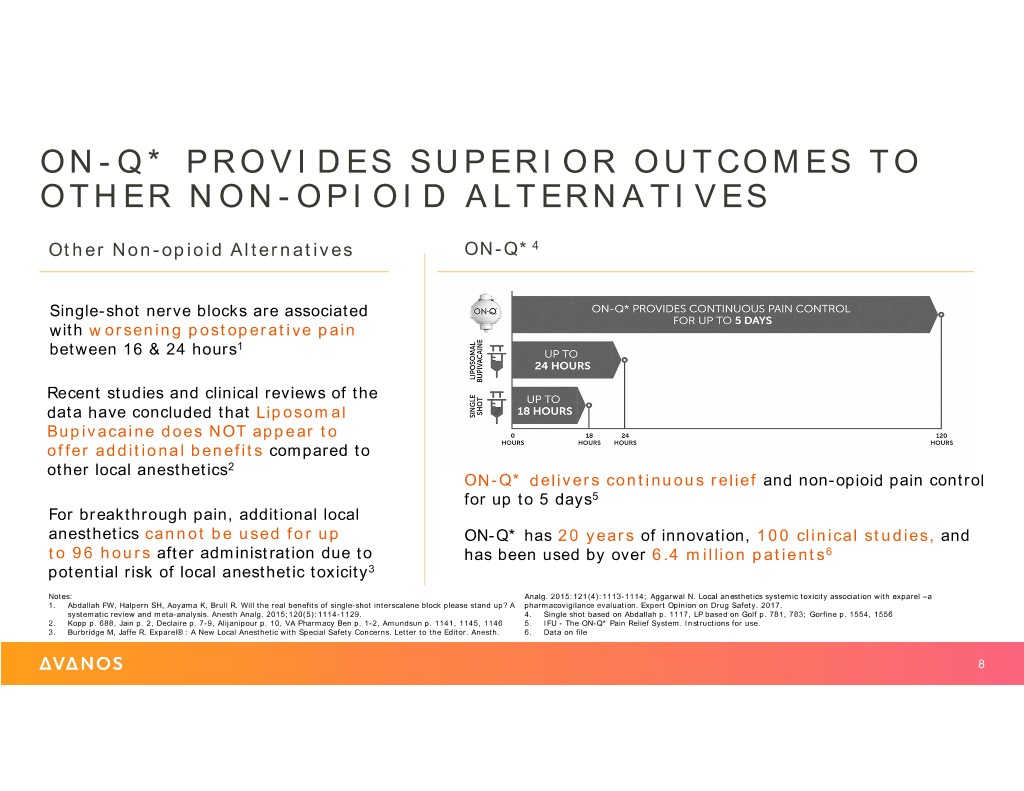

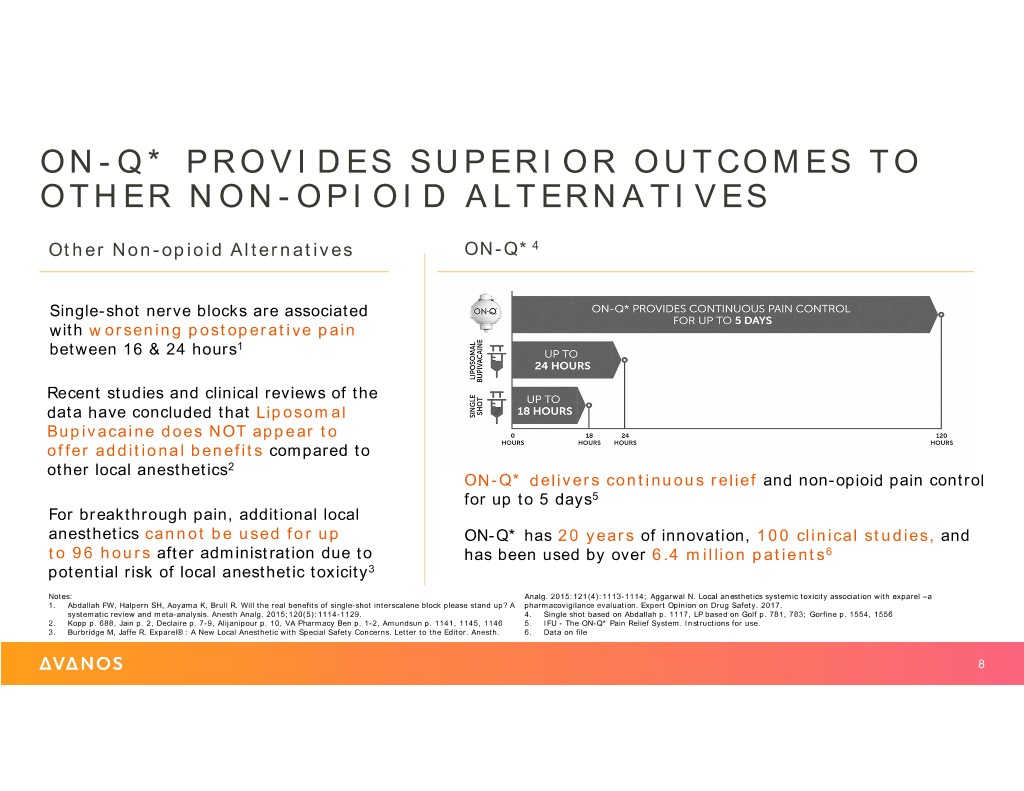

ON-Q* PROVIDES SUPERIOR OUTCOMES TO OTHER NON-OPIOID ALTERNATIVES Other Non-opioid Alternatives ON-Q*4 Single-shot nerve blocks are associated with worsening postoperative pain between 16 & 24 hours1 Recent studies and clinical reviews of the data have concluded that Liposomal Bupivacaine does NOT appear to offer additional benefits compared to other local anesthetics2 ON-Q* delivers continuous relief and non-opioid pain control for up to 5 days5 For breakthrough pain, additional local anesthetics cannot be used for up ON-Q* has 20 years of innovation, 100 clinical studies, and to 96 hours after administration due to has been used by over 6.4 million patients6 potential risk of local anesthetic toxicity3 Notes: Analg. 2015:121(4):1113-1114; Aggarwal N. Local anesthetics systemic toxicity association with exparel –a 1. Abdallah FW, Halpern SH, Aoyama K, Brull R. Will the real benefits of single-shot interscalene block please stand up? A pharmacovigilance evaluation. Expert Opinion on Drug Safety. 2017. systematic review and meta-analysis. Anesth Analg. 2015;120(5):1114-1129. 4. Single shot based on Abdallah p. 1117, LP based on Golf p. 781, 783; Gorfine p. 1554, 1556 2. Kopp p. 688, Jain p. 2, Declaire p. 7-9, Alijanipour p. 10, VA Pharmacy Ben p. 1-2, Amundsun p. 1141, 1145, 1146 5. IFU - The ON-Q* Pain Relief System. Instructions for use. 3. Burbridge M, Jaffe R. Exparel®: A New Local Anesthetic with Special Safety Concerns. Letter to the Editor. Anesth. 6. Data on file 8

ON-Q* IS CRITICAL TO A MULTIMODAL APPROACH TO POSTOP PAIN MANAGEMENT TREATMENT GOALS Reduce opioid use Provide pain relief for Reduce complications days, not just hours due to opioid use Offer customizable Improve cost-effectiveness Holistic approach to clinical sales, control with ability to turn by limiting factors like training and implementation analgesia on and off length of stay support to drive customer $ satisfaction 9

THE BENEFITS OF ON-Q* FROM A PATIENT’S PERSPECTIVE [Insert patient video] 10

GAME READY: EXPANDING NON-OPIOID PORTFOLIO AND CHANNEL ACCESS • Cold therapy and compression are well- Our Objectives known solutions for post-surgical inflammation and pain, and widely used by orthopedic surgeons Expand our non-opioid pain portfolio • Game Ready is a well-established brand with a premium product Accelerate sales growth • Game Ready has a large addressable market and is growing above the rate of Avanos Focus on surgeons • Increases access for ON-Q* with Game Ready orthopedic surgeons and key 1099 Increase investments in partners breakthrough innovation • Another strong weapon in the fight to eliminate or reduce opioids for the Build international capabilities surgical patient 11

GAME READY PORTFOLIO 12

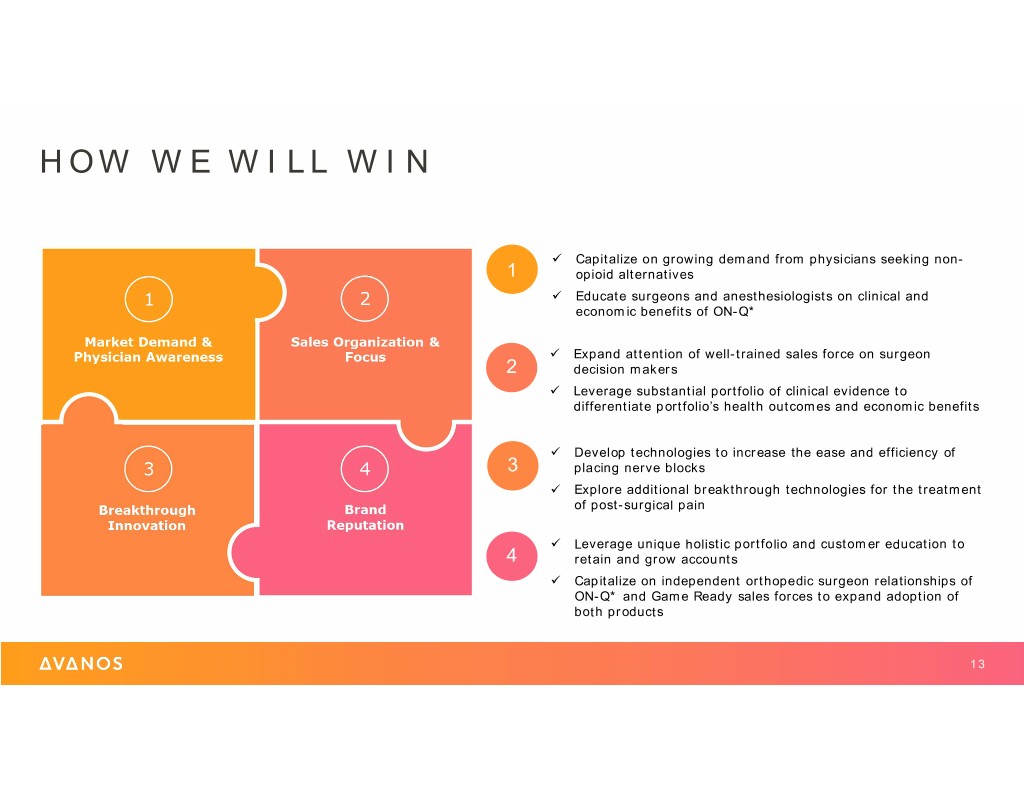

HOW WE WILL WIN Capitalize on growing demand from physicians seeking non- 1 opioid alternatives Educate surgeons and anesthesiologists on clinical and economic benefits of ON-Q* Expand attention of well-trained sales force on surgeon 2 decision makers Leverage substantial portfolio of clinical evidence to differentiate portfolio’s health outcomes and economic benefits Develop technologies to increase the ease and efficiency of 3 placing nerve blocks Explore additional breakthrough technologies for the treatment of post-surgical pain Leverage unique holistic portfolio and customer education to 4 retain and grow accounts Capitalize on independent orthopedic surgeon relationships of ON-Q* and Game Ready sales forces to expand adoption of both products 13

SIGNIFICANT FUTURE POTENTIAL IN ACUTE PAIN MANAGEMENT Building on solid foundation with strong products and services and market-leading positions Underpenetrated markets with substantial upside Comprehensive growth plan to deepen and broaden account penetration Investing in innovative opioid-sparing pain therapies 14

THANK YOU 15

GETTING TO YES: PAIN MANAGEMENT DONE RIGHT JUNE 2018 SONIA SZLYK, MD DIRECTOR OF REGIONAL ANESTHESIA, NORTH AMERICAN PARTNERS IN ANESTHESIA, MID-ATLANTIC 1

DISCLOSURE • Avanos, Inc. is sponsoring this presentation, and I am being compensated by Avanos to make this presentation. • The information provided in this presentation is intended for health care professionals and is intended for training and education purposes. • For complete product information, including indications, contraindications, warnings, precautions, and potential adverse effects, see the IFU for the respective product(s). • The information provided in this presentation represents my surgical technique. Surgical techniques can vary depending on the individual expertise, experience, and school-of-thought of the physician utilizing the respective product(s). 2

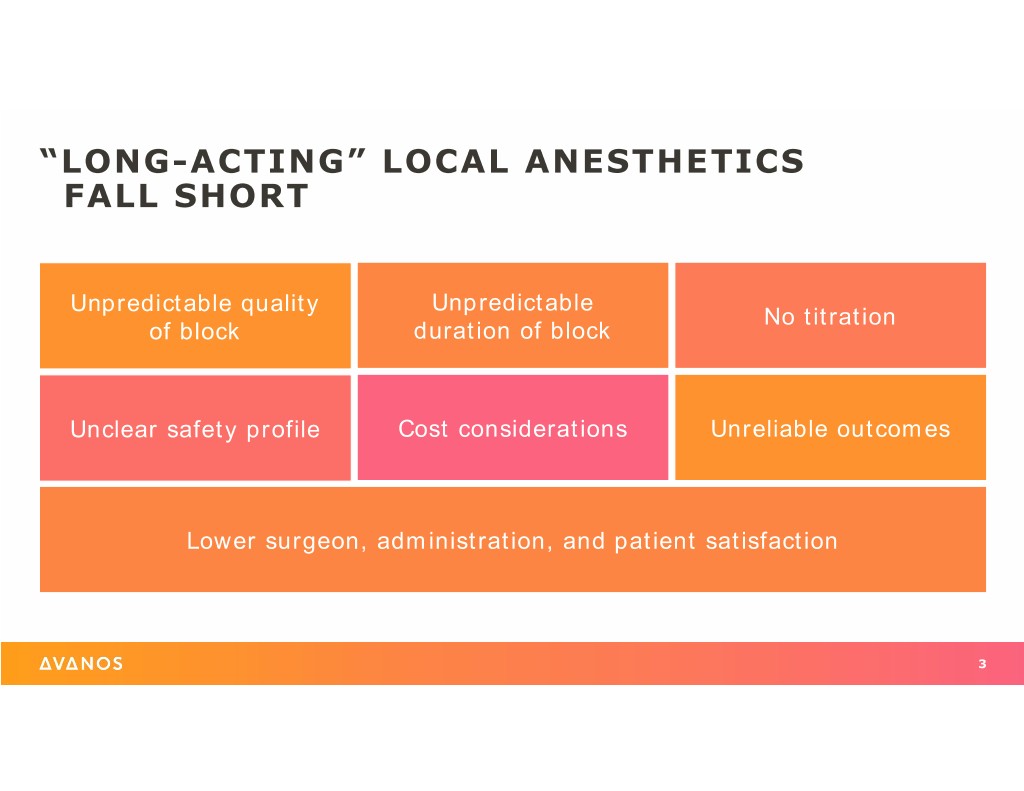

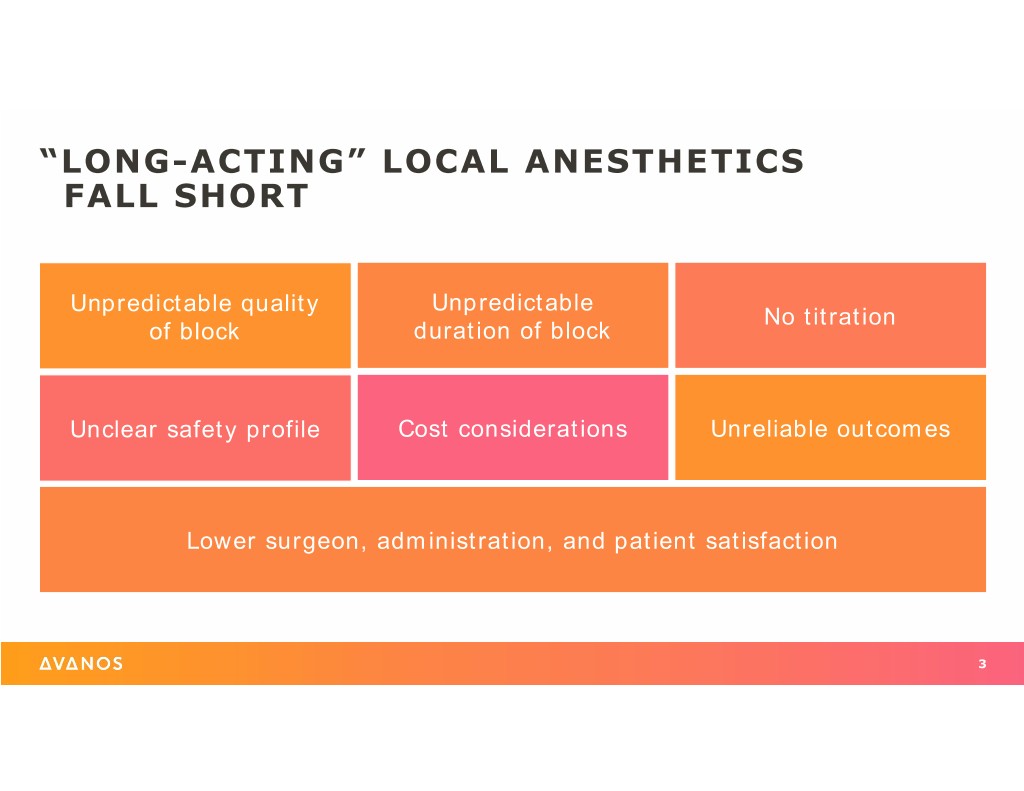

“LONG-ACTING” LOCAL ANESTHETICS FALL SHORT Unpredictable quality Unpredictable No titration of block duration of block Unclear safety profile Cost considerations Unreliable outcomes Lower surgeon, administration, and patient satisfaction 3

CAN WE… Reduce opioid use? Decrease length of stay? Increase discharge to home? Ensure patient & surgeon satisfaction? YES, there’s a BLOCK for that! 4

POSTOPERATIVE PAIN MANAGEMENT What surgery did this patient have 4 hours ago? Total Knee Replacement! 5

THE ERA OF VALUE-BASED CARE Patient Satisfaction Prevent Lower Cost Readmission Better Outcomes Coordinated Care 6

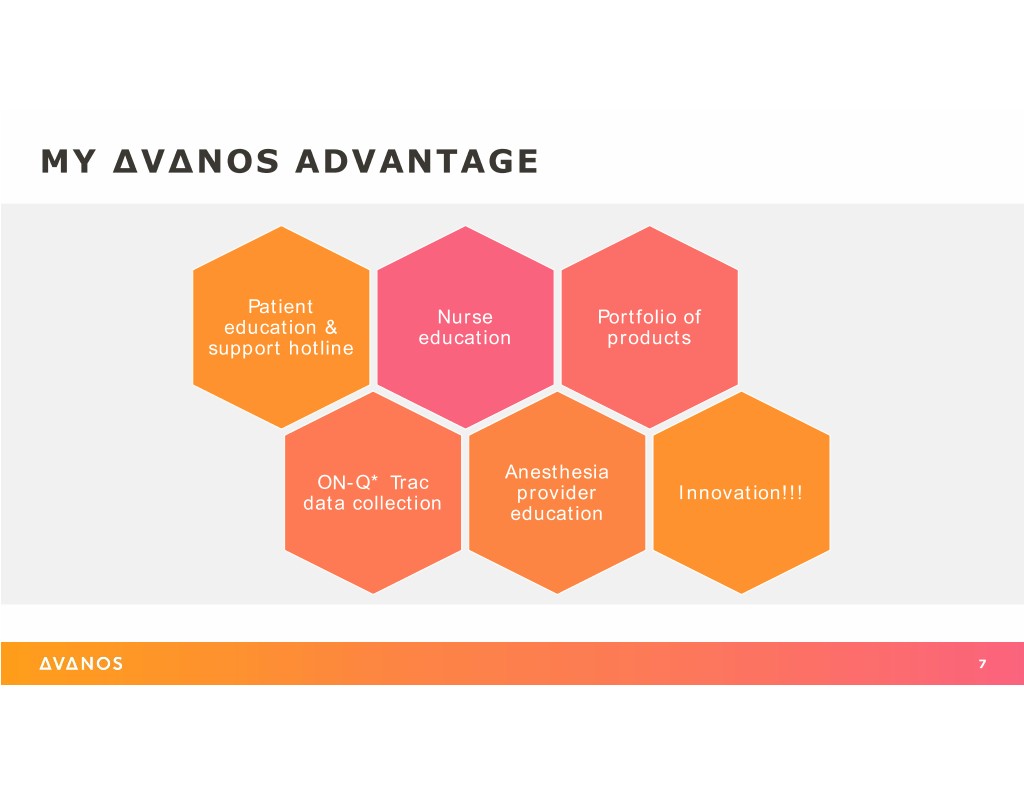

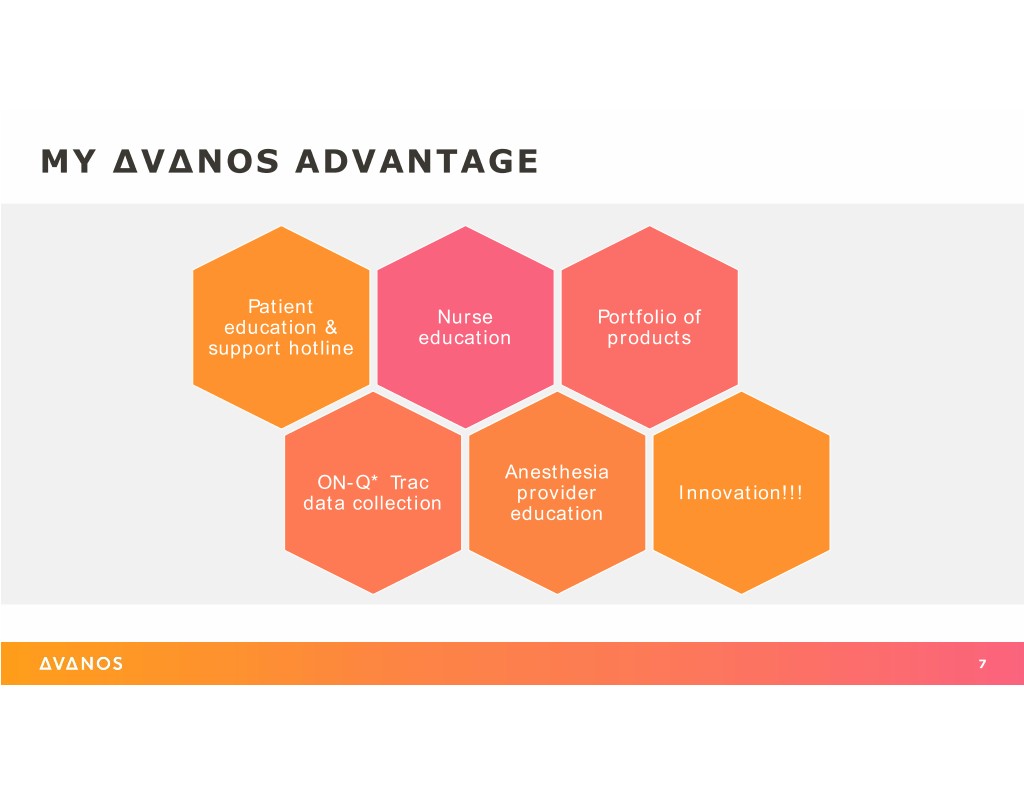

MY ∆V∆NOS ADVANTAGE Patient Nurse Portfolio of education & education products support hotline Anesthesia ON-Q* Trac provider Innovation!!! data collection education 7

Anesthesia Team Physical Therapist Nurses Surgeon Success! Patient Physician 8

THANK YOU 9

CHRONIC CARE JUNE 2018 TOM KUPEC VICE PRESIDENT & GENERAL MANAGER, CHRONIC CARE 1

RESPIRATORY HEALTH Respiratory Health Vision To be the global market leader in diagnosing and treating chronic respiratory diseases Attractive Market Dynamics Large growing markets supported by an aging global population and highly prevalent disease states Significant Future Potential Evaluating expansion opportunities into adjacent markets such as COPD 2

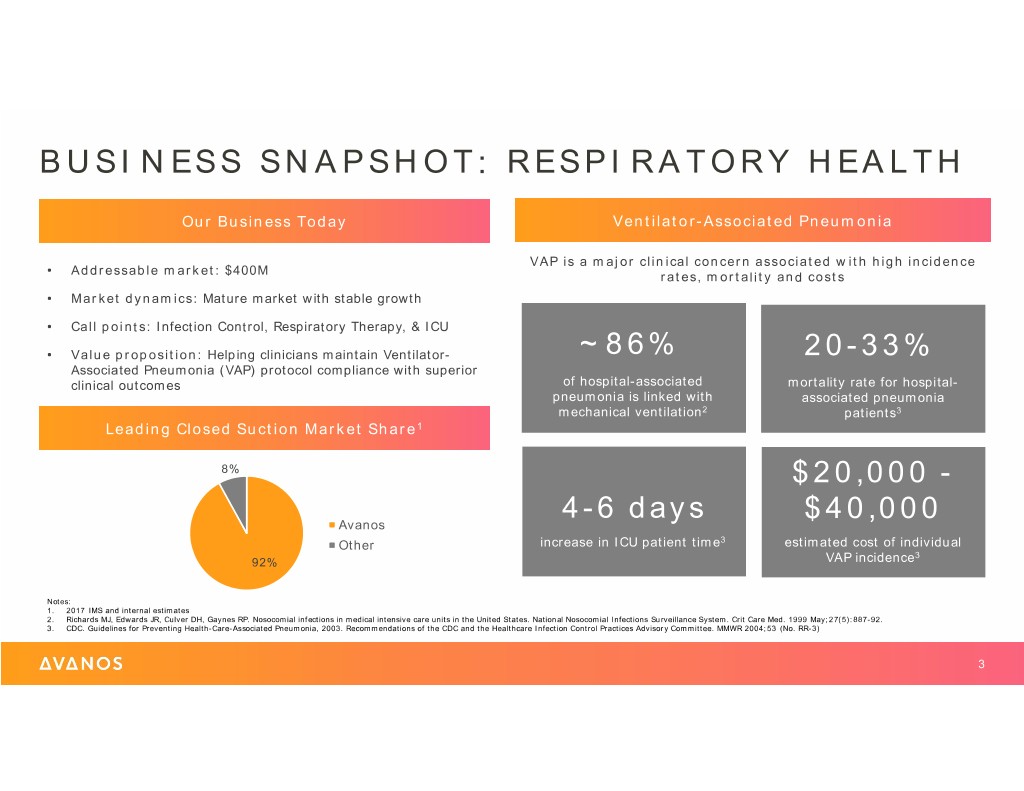

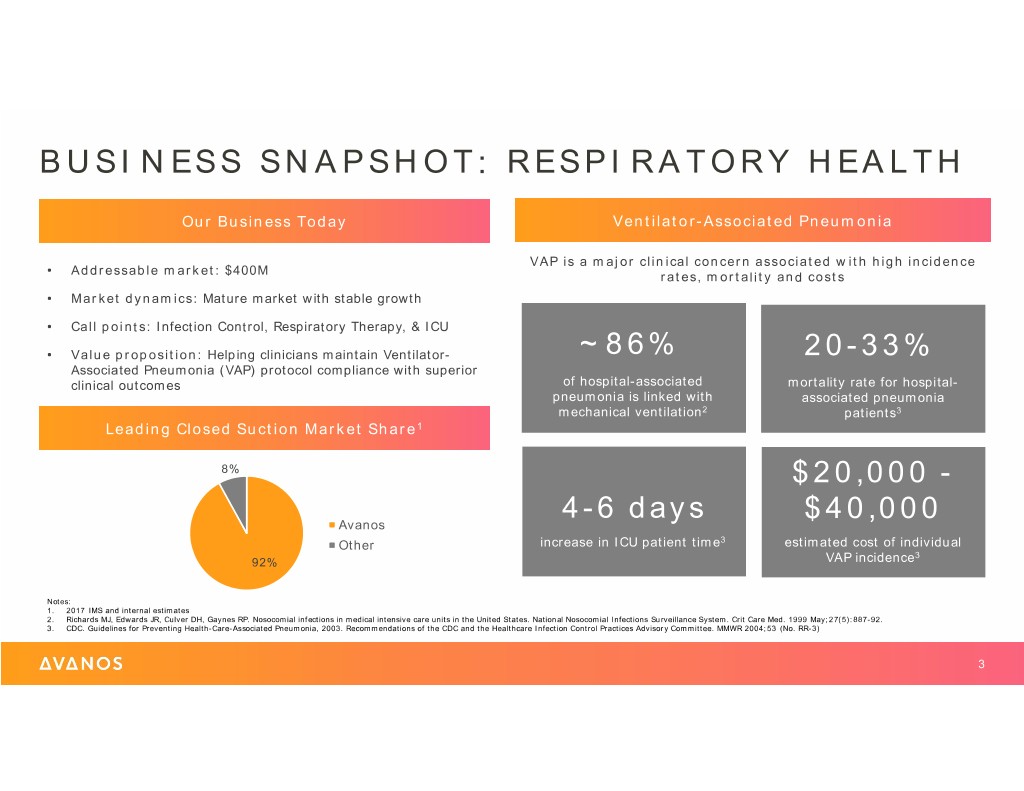

BUSINESS SNAPSHOT: RESPIRATORY HEALTH Our Business Today Ventilator-Associated Pneumonia VAP is a major clinical concern associated with high incidence • Addressable market: $400M rates, mortality and costs • Market dynamics: Mature market with stable growth • Call points: Infection Control, Respiratory Therapy, & ICU • Value proposition: Helping clinicians maintain Ventilator- ~86% 20-33% Associated Pneumonia (VAP) protocol compliance with superior clinical outcomes of hospital-associated mortality rate for hospital- pneumonia is linked with associated pneumonia mechanical ventilation2 patients3 Leading Closed Suction Market Share1 8% $20,000 - 4-6 days $40,000 Avanos Other increase in ICU patient time3 estimated cost of individual 3 92% VAP incidence Notes: 1. 2017 IMS and internal estimates 2. Richards MJ, Edwards JR, Culver DH, Gaynes RP. Nosocomial infections in medical intensive care units in the United States. National Nosocomial Infections Surveillance System. Crit Care Med. 1999 May;27(5):887-92. 3. CDC. Guidelines for Preventing Health-Care-Associated Pneumonia, 2003. Recommendations of the CDC and the Healthcare Infection Control Practices Advisory Committee. MMWR 2004;53 (No. RR-3) 3

RESPIRATORY HEALTH PRODUCT PORTFOLIO Airway Access Tubes Airway Suctioning & Accessories Oral Hygiene (EndoTracheal tubes) 4

DIGESTIVE HEALTH Digestive Health Vision To be our global customers’ Preferred Enteral Partner Attractive Market Dynamics Multiple underlying disease states. There is no alternative to enteral feeding Significant Future Potential Investing in breakthrough technologies such as MIC-KEY SF* and our next generation of CORTRAK* to improve the standard of care in enteral feeding 5

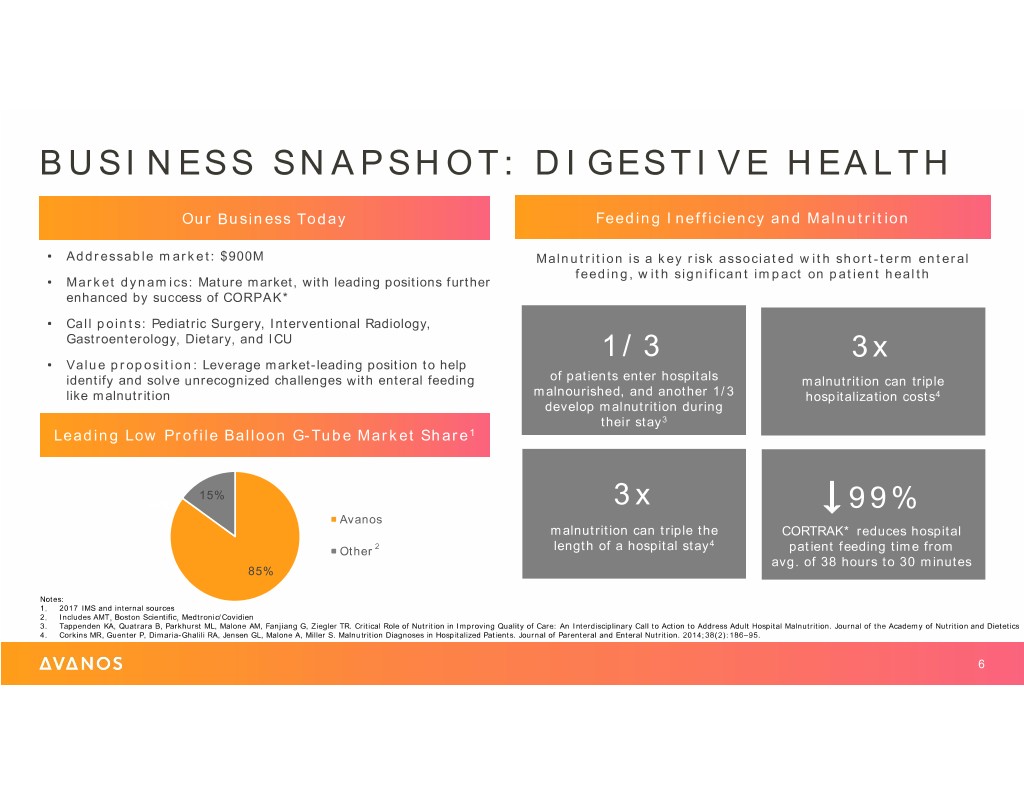

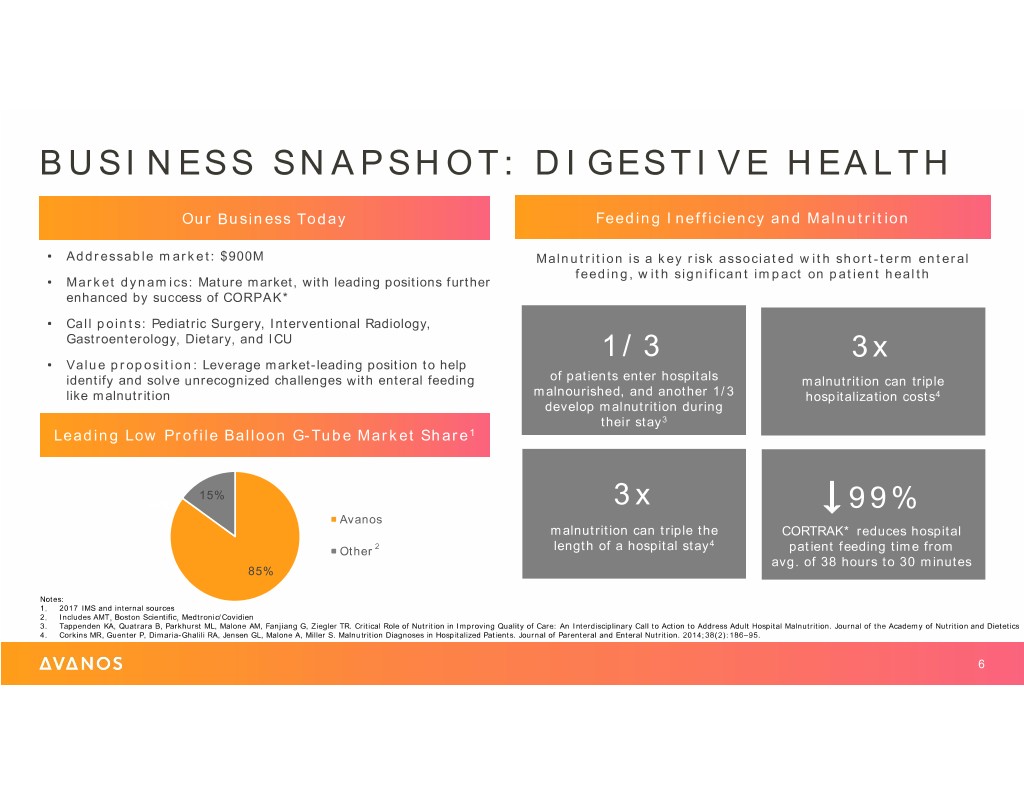

BUSINESS SNAPSHOT: DIGESTIVE HEALTH Our Business Today Feeding Inefficiency and Malnutrition • Addressable market: $900M Malnutrition is a key risk associated with short-term enteral feeding, with significant impact on patient health • Market dynamics: Mature market, with leading positions further enhanced by success of CORPAK* • Call points: Pediatric Surgery, Interventional Radiology, Gastroenterology, Dietary, and ICU 1/3 3x • Value proposition: Leverage market-leading position to help identify and solve unrecognized challenges with enteral feeding of patients enter hospitals malnutrition can triple like malnutrition malnourished, and another 1/3 hospitalization costs4 develop malnutrition during their stay3 Leading Low Profile Balloon G-Tube Market Share1 15% 3x HYH ↓ 99% Avanos malnutrition can triple the CORTRAK* reduces hospital 4 Other 2 length of a hospital stay patient feeding time from avg. of 38 hours to 30 minutes 85% Notes: 1. 2017 IMS and internal sources 2. Includes AMT, Boston Scientific, Medtronic/Covidien 3. Tappenden KA, Quatrara B, Parkhurst ML, Malone AM, Fanjiang G, Ziegler TR. Critical Role of Nutrition in Improving Quality of Care: An Interdisciplinary Call to Action to Address Adult Hospital Malnutrition. Journal of the Academy of Nutrition and Dietetics 4. Corkins MR, Guenter P, Dimaria-Ghalili RA, Jensen GL, Malone A, Miller S. Malnutrition Diagnoses in Hospitalized Patients. Journal of Parenteral and Enteral Nutrition. 2014;38(2):186–95. 6

DIGESTIVE HEALTH PRODUCT PORTFOLIO Short-Term Feeding Long-Term Feeding Accessories CORTRAK* EAS MIC-KEY* G Tubes System Initial Placement Kit Nasoenteric Tubes Specialty Tubes (GJ/J) FARRELL VALVE 7

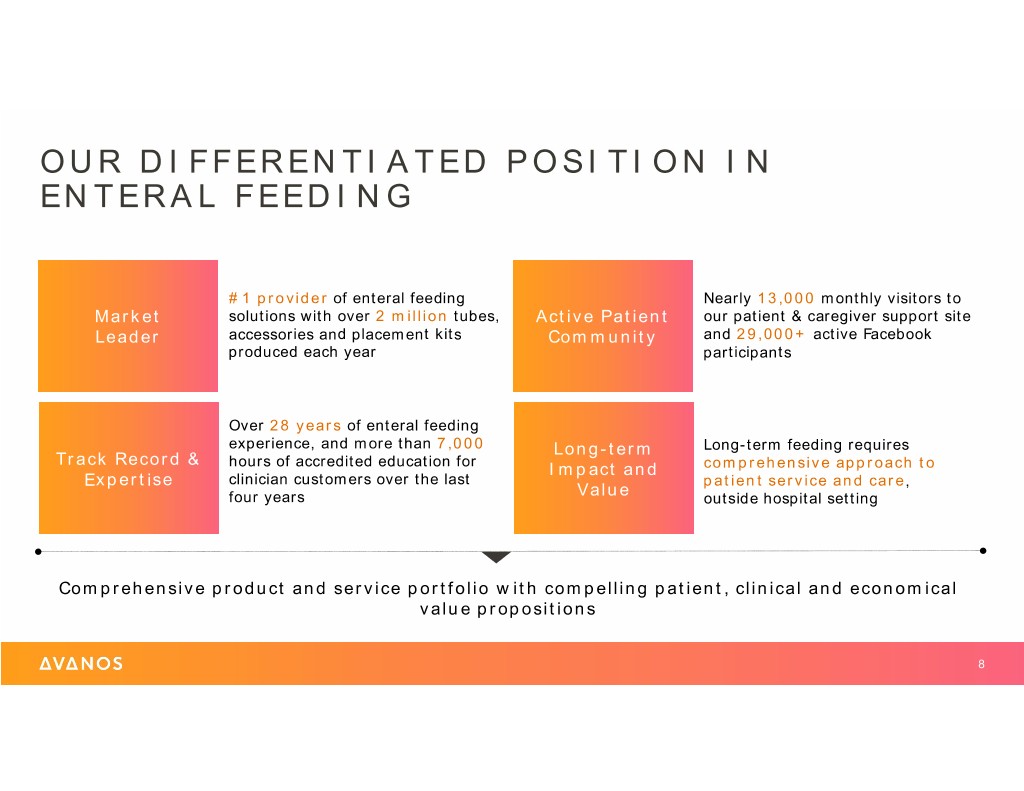

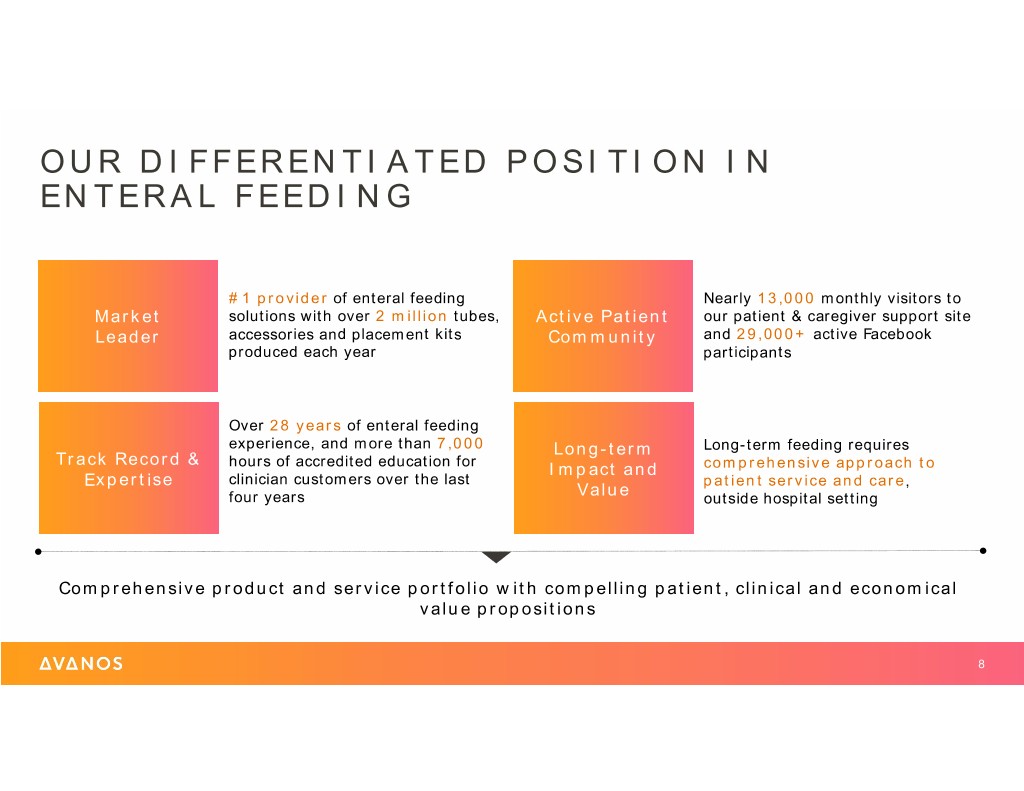

OUR DIFFERENTIATED POSITION IN ENTERAL FEEDING #1 provider of enteral feeding Nearly 13,000 monthly visitors to Market solutions with over 2 million tubes, Active Patient our patient & caregiver support site Leader accessories and placement kits Community and 29,000+ active Facebook produced each year participants Over 28 years of enteral feeding experience, and more than 7,000 Long-term Long-term feeding requires Track Record & hours of accredited education for Impact and comprehensive approach to Expertise clinician customers over the last patient service and care, Value four years outside hospital setting Comprehensive product and service portfolio with compelling patient, clinical and economical value propositions 8

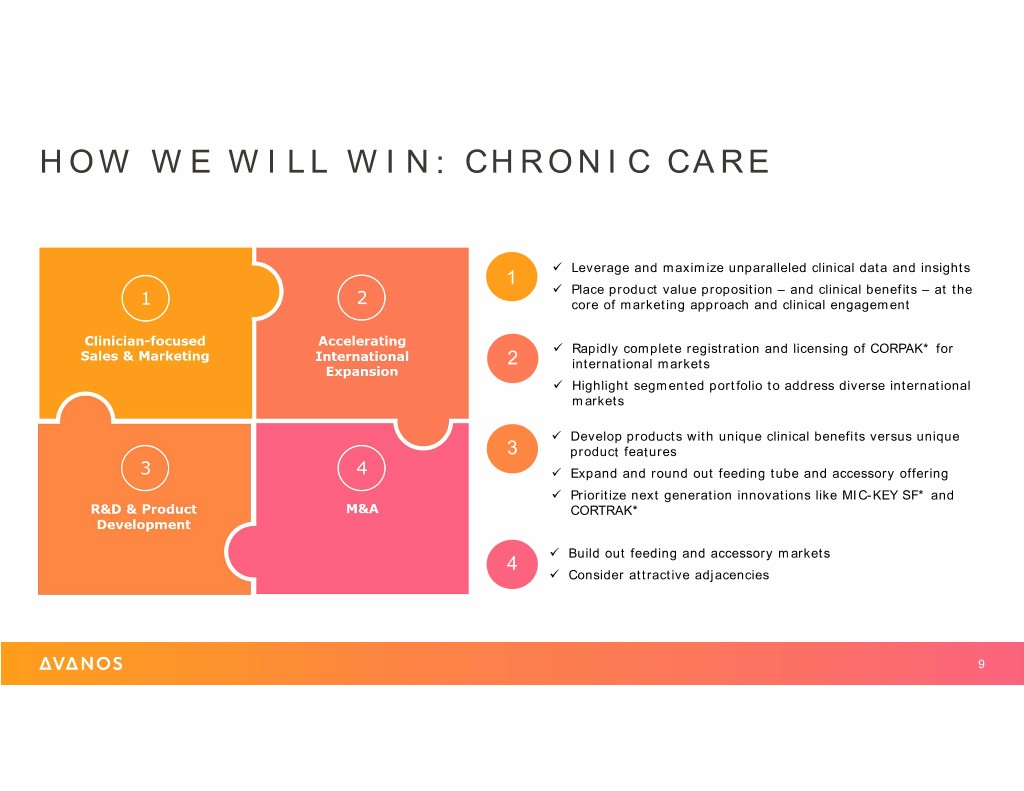

HOW WE WILL WIN: CHRONIC CARE Leverage and maximize unparalleled clinical data and insights 1 Place product value proposition – and clinical benefits – at the core of marketing approach and clinical engagement Rapidly complete registration and licensing of CORPAK* for 2 international markets Highlight segmented portfolio to address diverse international markets Develop products with unique clinical benefits versus unique 3 product features Expand and round out feeding tube and accessory offering Prioritize next generation innovations like MIC-KEY SF* and CORTRAK* Build out feeding and accessory markets 4 Consider attractive adjacencies 9

SOLID BUSINESS WITH ATTRACTIVE OUTLOOK Large markets fueled by multiple disease states with large prevalence Market-leading positions in most developed countries Strong brands in BALLARD*, MICROCUFF*, MIC-KEY*, CORTRAK*, CORFLO*, CORGRIP* and Farrell Valve Diverse product offerings with unique clinical and economical value proposition Dedicated and focused commercial teams 10

THANK YOU 11

R&D REVIEW JUNE 2018 LEE BURNES VICE PRESIDENT, GLOBAL R&D, CLINICAL & MEDICAL AFFAIRS 1

R&D OVERVIEW • Transformation of R&D talent, capabilities & portfolio • Investments in next generation platforms • Focus on breakthrough innovations in Pain Management • Building a strong R&D pipeline with consistent cadence of launches 2

TRANSFORMATION OF OUR CAPABILITIES & PORTFOLIO TALENT PROCESS • Built strong R&D team through targeted • Collecting & prioritizing user needs device industry recruitment • Agile & scalable product development process • Designed six sigma/culture of innovation • Integrated human-centered engineering • Created pain technology “center of excellence” • Disciplined portfolio investment criteria • Developed strong research partnerships Strong R&D talent with processes built to accelerate innovation 3

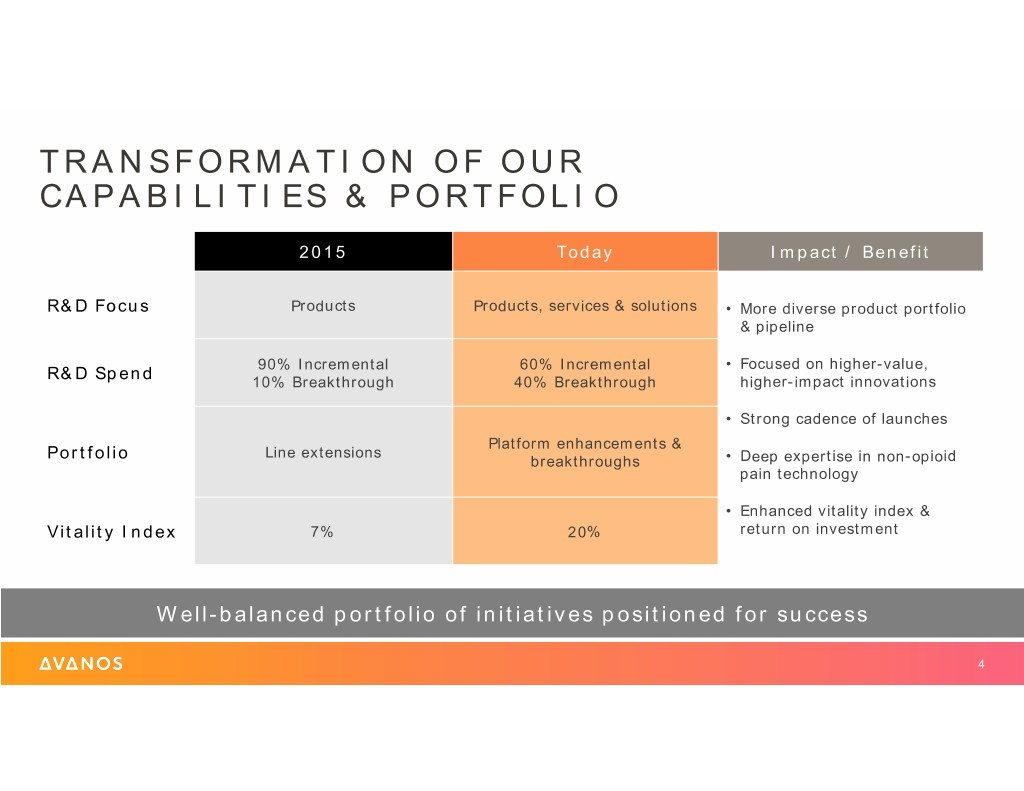

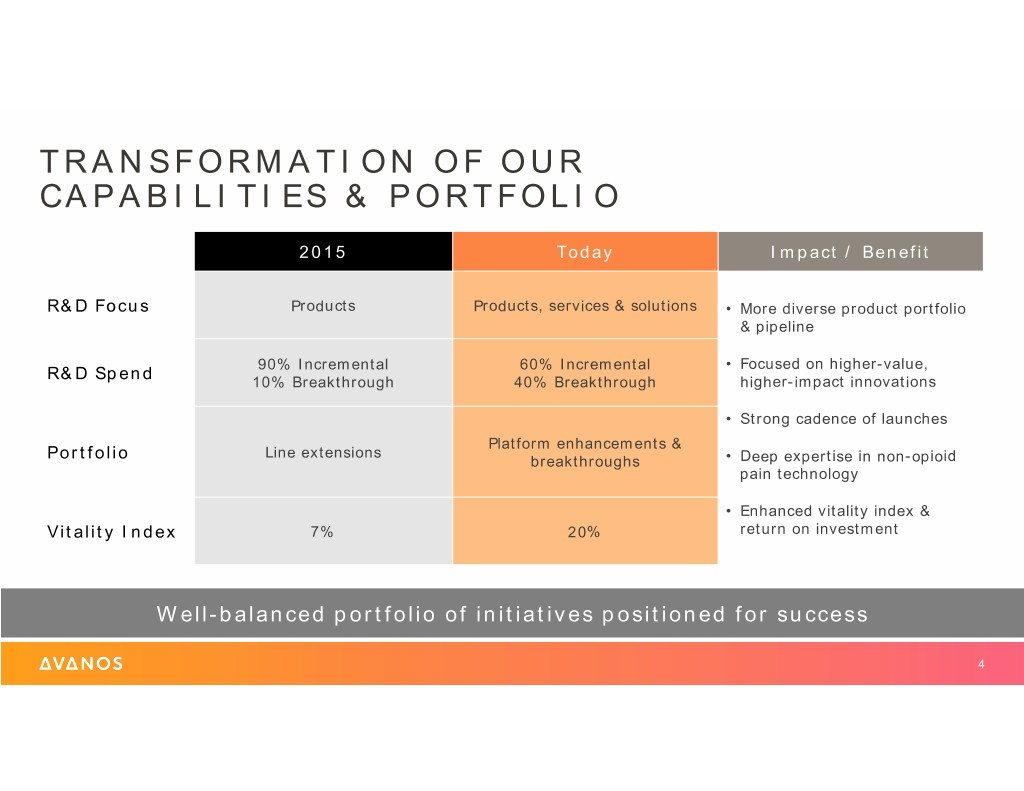

TRANSFORMATION OF OUR CAPABILITIES & PORTFOLIO 2015 Today Impact / Benefit R&D Focus Products Products, services & solutions • More diverse product portfolio & pipeline 90% Incremental 60% Incremental • Focused on higher-value, R&D Spend 10% Breakthrough 40% Breakthrough higher-impact innovations • Strong cadence of launches Platform enhancements & Portfolio Line extensions breakthroughs • Deep expertise in non-opioid pain technology • Enhanced vitality index & Vitality Index 7% 20% return on investment Well-balanced portfolio of initiatives positioned for success 4

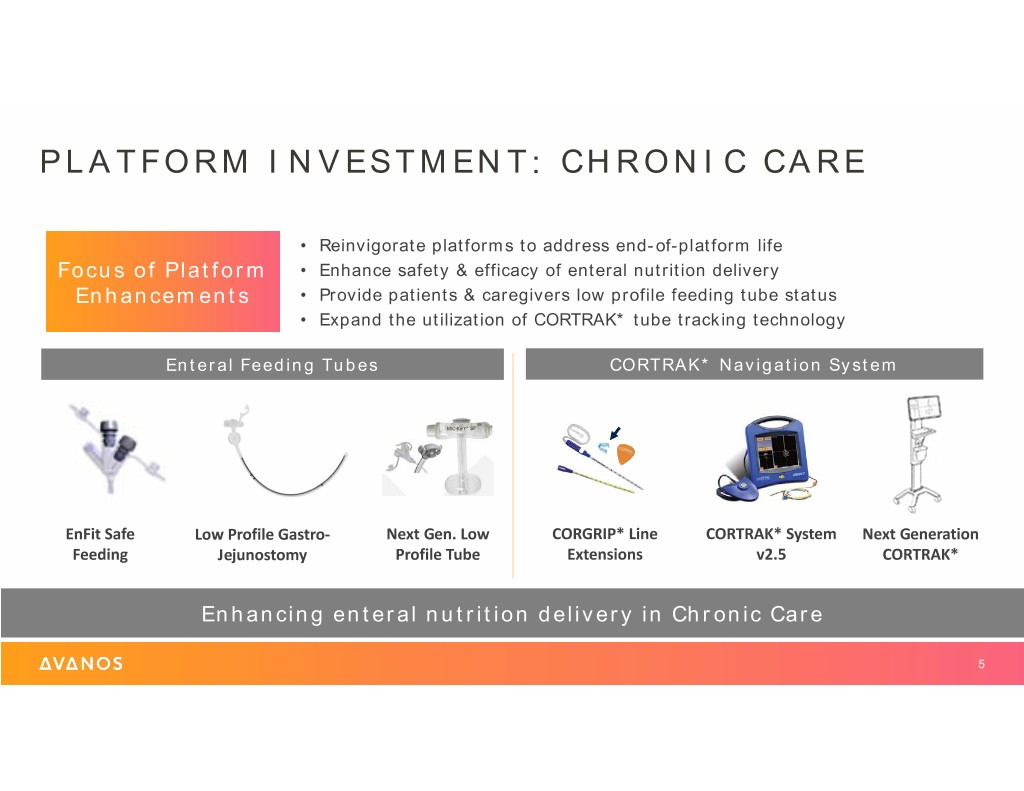

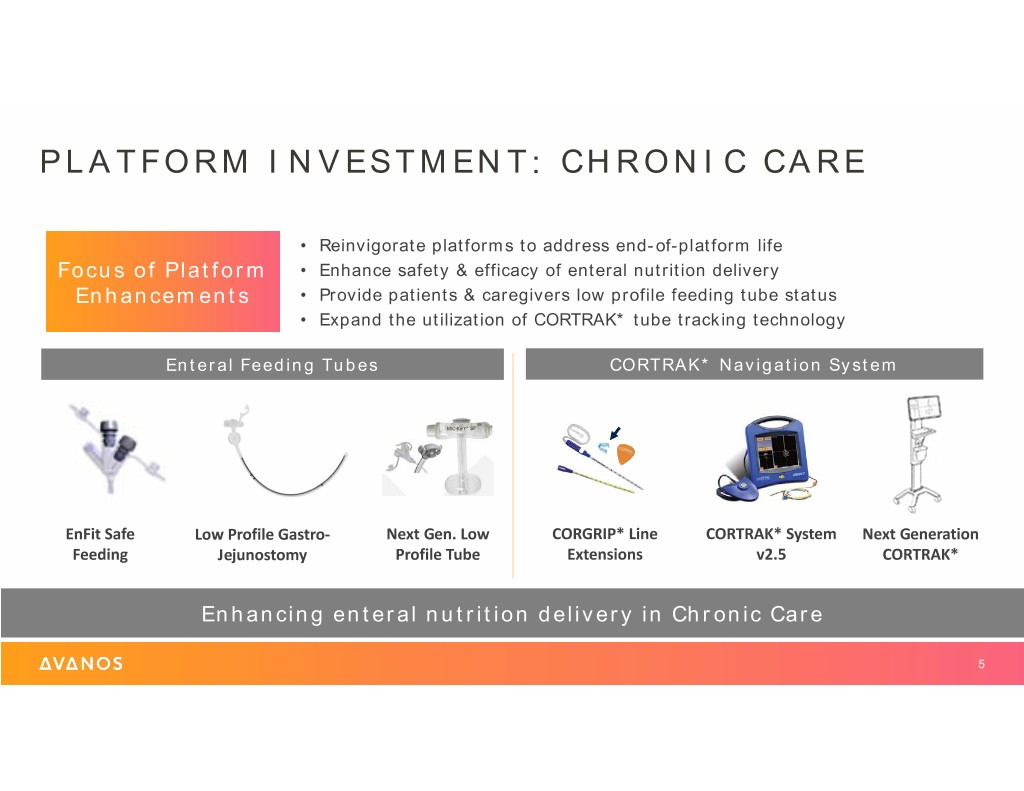

PLATFORM INVESTMENT: CHRONIC CARE • Reinvigorate platforms to address end-of-platform life Focus of Platform • Enhance safety & efficacy of enteral nutrition delivery Enhancements • Provide patients & caregivers low profile feeding tube status • Expand the utilization of CORTRAK* tube tracking technology Enteral Feeding Tubes CORTRAK* Navigation System EnFit Safe Low Profile Gastro‐ Next Gen. Low CORGRIP* Line CORTRAK* System Next Generation Feeding Jejunostomy Profile Tube Extensions v2.5 CORTRAK* Enhancing enteral nutrition delivery in Chronic Care 5

PLATFORM INVESTMENT: PAIN MANAGEMENT • Reinvigorate platforms to address end-of-platform life Focus of Platform • Enhance capabilities, improve ease of use & position for international growth Enhancements • Increase physician & patient engagement to drive utilization • Develop and expand into new procedures Acute Pain: ON-Q* Pain Pump Chronic Pain: COOLIEF* ES500 NxG ON‐Q* Digital Patient New COOLIEF* RF Next Generation Procedural Stimulator Pain Pumps Engagement Generator COOLIEF* Probes Expansion Advancing market-leading non-opioid pain management solutions 6

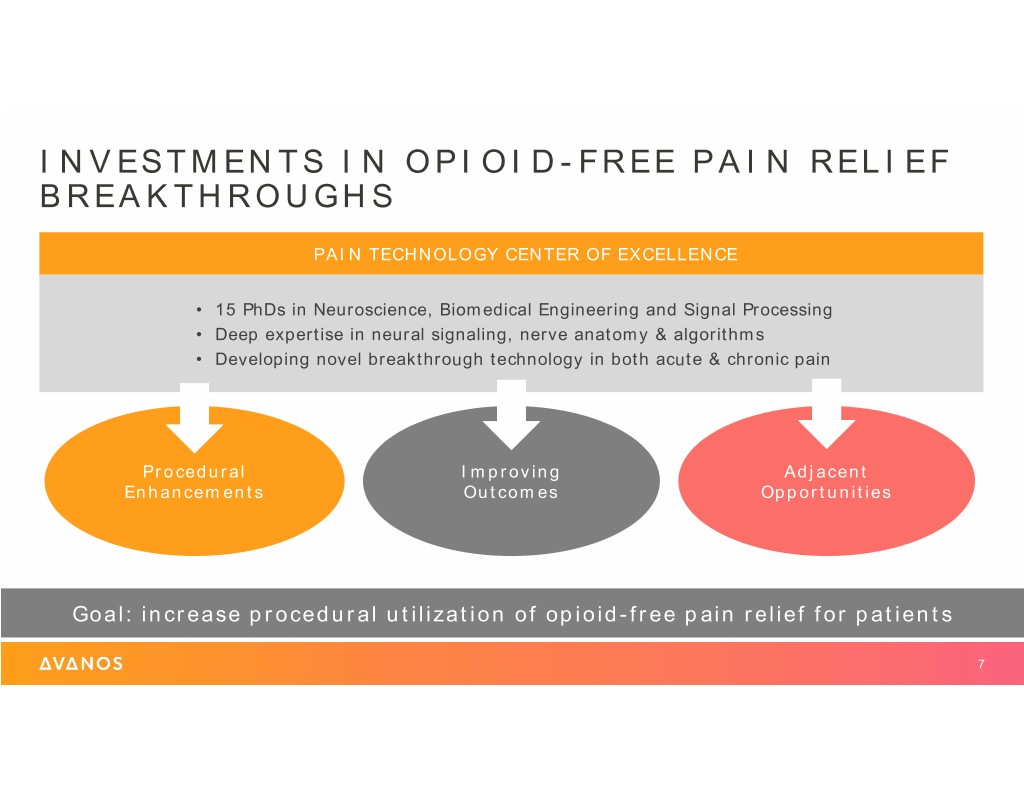

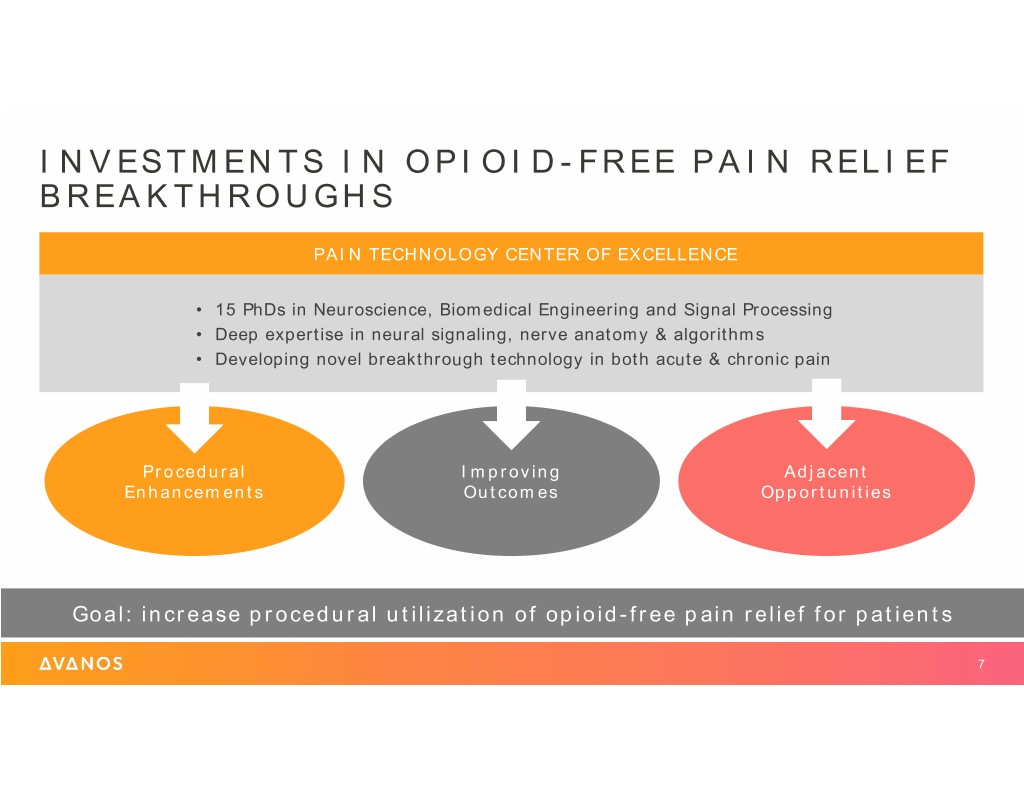

INVESTMENTS IN OPIOID-FREE PAIN RELIEF BREAKTHROUGHS PAIN TECHNOLOGY CENTER OF EXCELLENCE • 15 PhDs in Neuroscience, Biomedical Engineering and Signal Processing • Deep expertise in neural signaling, nerve anatomy & algorithms • Developing novel breakthrough technology in both acute & chronic pain Procedural Improving Adjacent Enhancements Outcomes Opportunities Goal: increase procedural utilization of opioid-free pain relief for patients 7

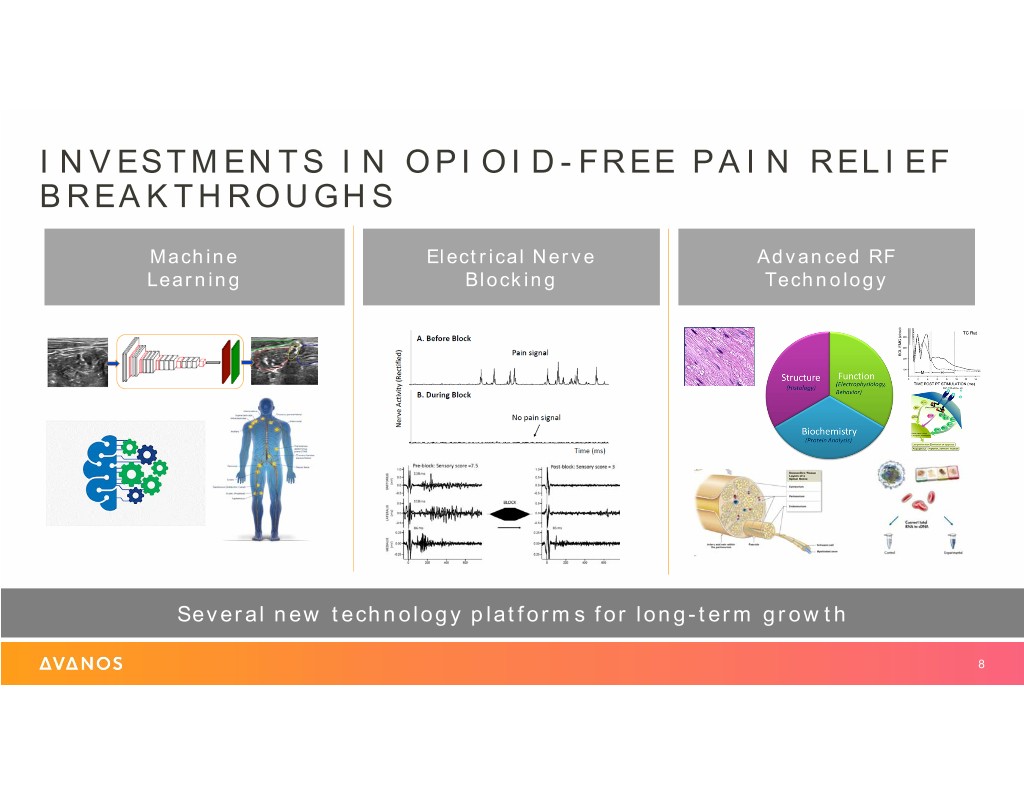

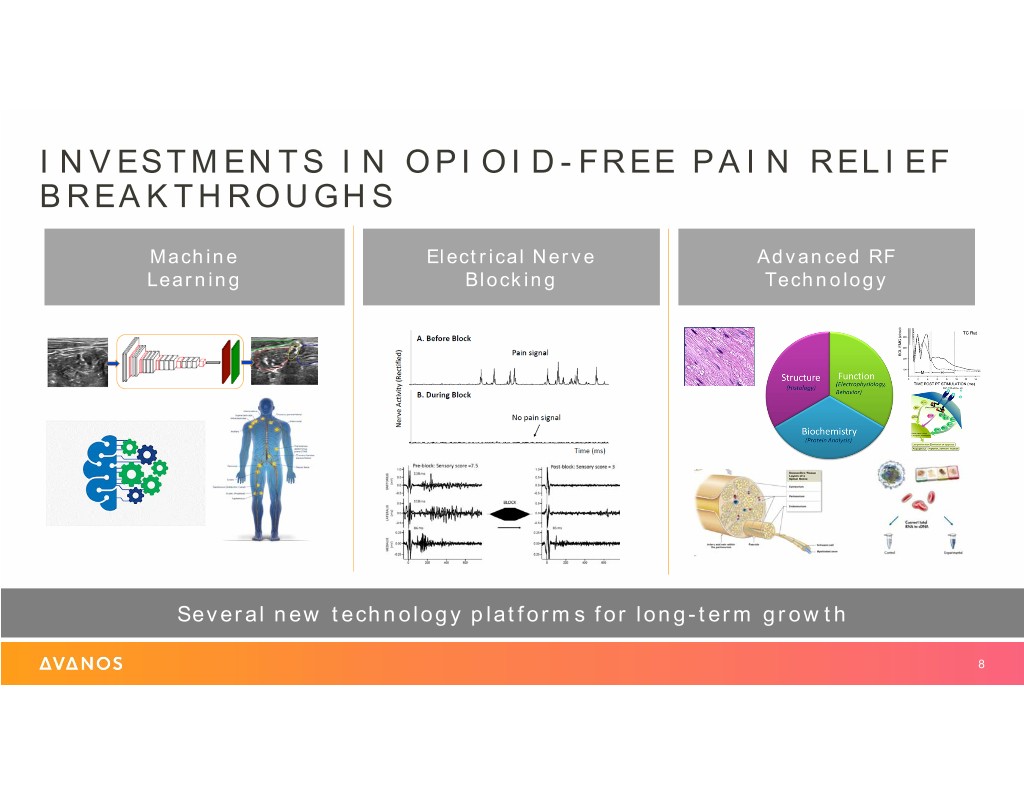

INVESTMENTS IN OPIOID-FREE PAIN RELIEF BREAKTHROUGHS Machine Electrical Nerve Advanced RF Learning Blocking Technology Several new technology platforms for long-term growth 8

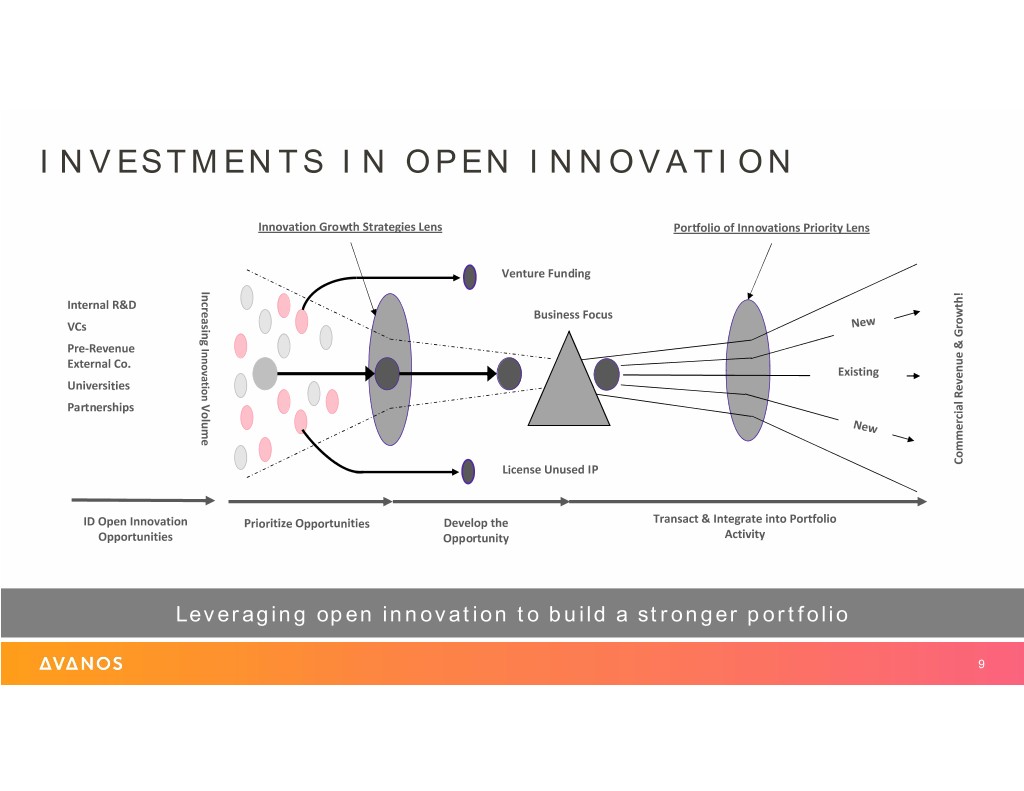

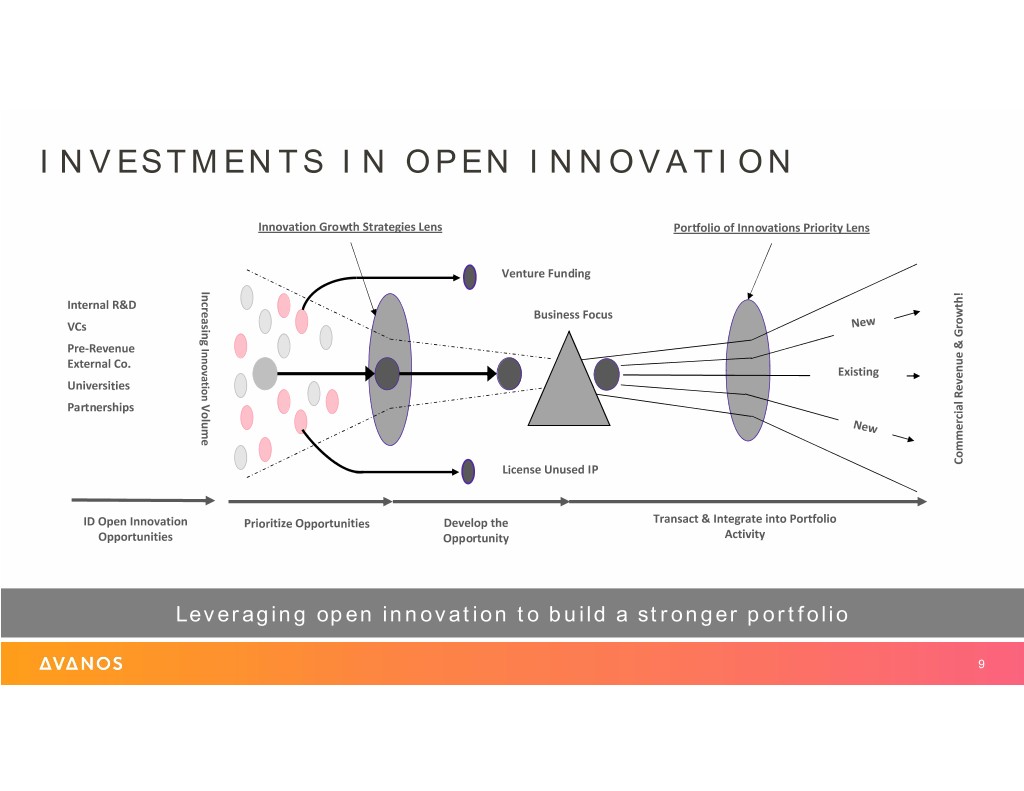

INVESTMENTS IN OPEN INNOVATION Innovation Growth Strategies Lens Portfolio of Innovations Priority Lens Venture Funding Increasing Internal R&D Business Focus VCs Growth! Innovation & Pre‐Revenue External Co. Existing Universities Revenue Partnerships Volume License Unused IP Commercial ID Open Innovation Prioritize Opportunities Develop the Transact & Integrate into Portfolio Opportunities Opportunity Activity Leveraging open innovation to build a stronger portfolio 9

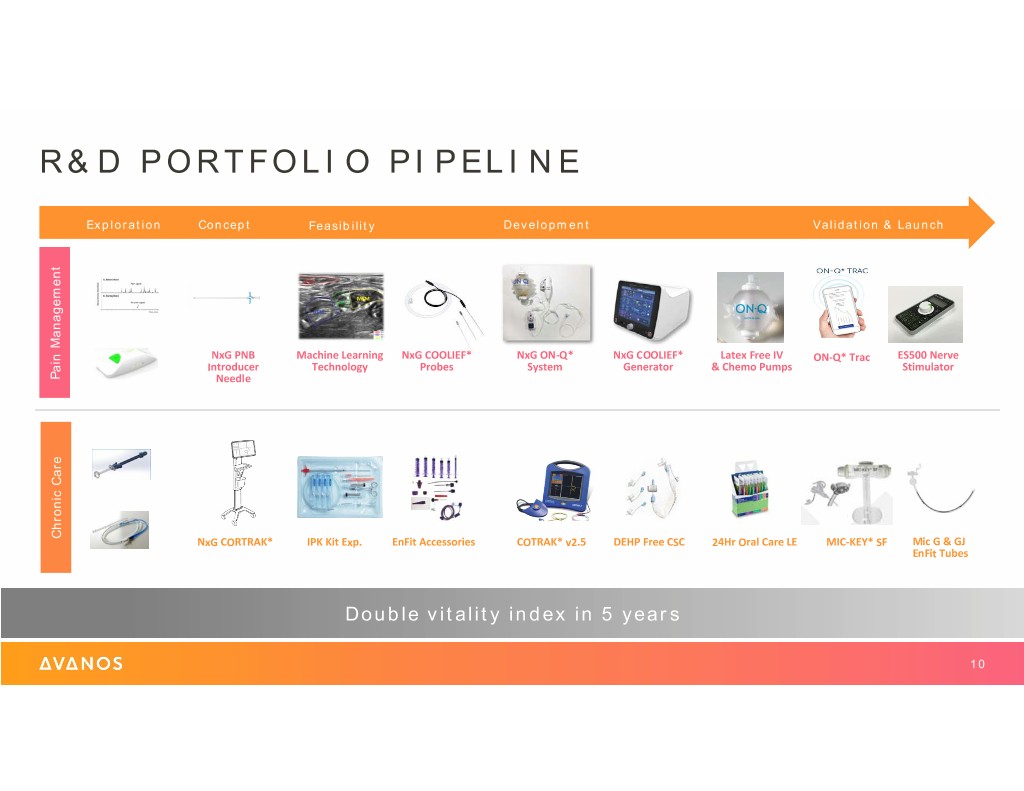

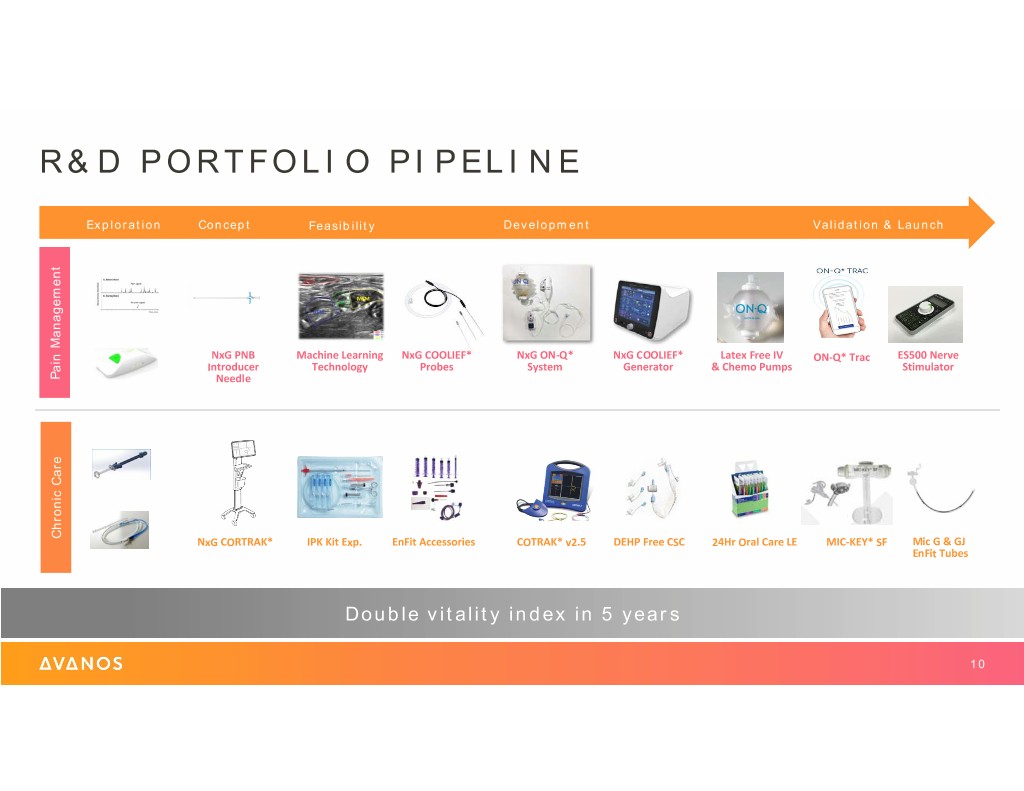

R&D PORTFOLIO PIPELINE Exploration Concept Feasibility Development Validation & Launch NxG PNB Machine Learning NxG COOLIEF* NxG ON‐Q* NxG COOLIEF* Latex Free IV ON‐Q* Trac ES500 Nerve Introducer Technology Probes System Generator & Chemo Pumps Stimulator Pain Management Pain Needle Chronic Care NxG CORTRAK* IPK Kit Exp. EnFit Accessories COTRAK* v2.5 DEHP Free CSC 24Hr Oral Care LE MIC‐KEY* SF Mic G & GJ EnFit Tubes Double vitality index in 5 years 10

CONCLUDING REMARKS R&D talent, capabilities & portfolio have been transformed Next generation platform investments strengthen market-leading positions Long-term breakthrough innovations in non-opioid pain relief Strong R&D pipeline with consistent cadence of launches established 11

THANK YOU 12

FINANCIAL OUTLOOK JUNE 2018 STEVE VOSKUIL SENIOR VICE PRESIDENT & CHIEF FINANCIAL OFFICER 1

MOMENTUM FOR PROFITABLE GROWTH Diversified Accelerating Focused portfolio in organic commercial attractive global top-line growth execution markets Operating Strong free cash M&A firepower Tax rate leverage from flow post with leverage scalable & restructuring demonstrated efficient disciplined capital infrastructure allocation 2

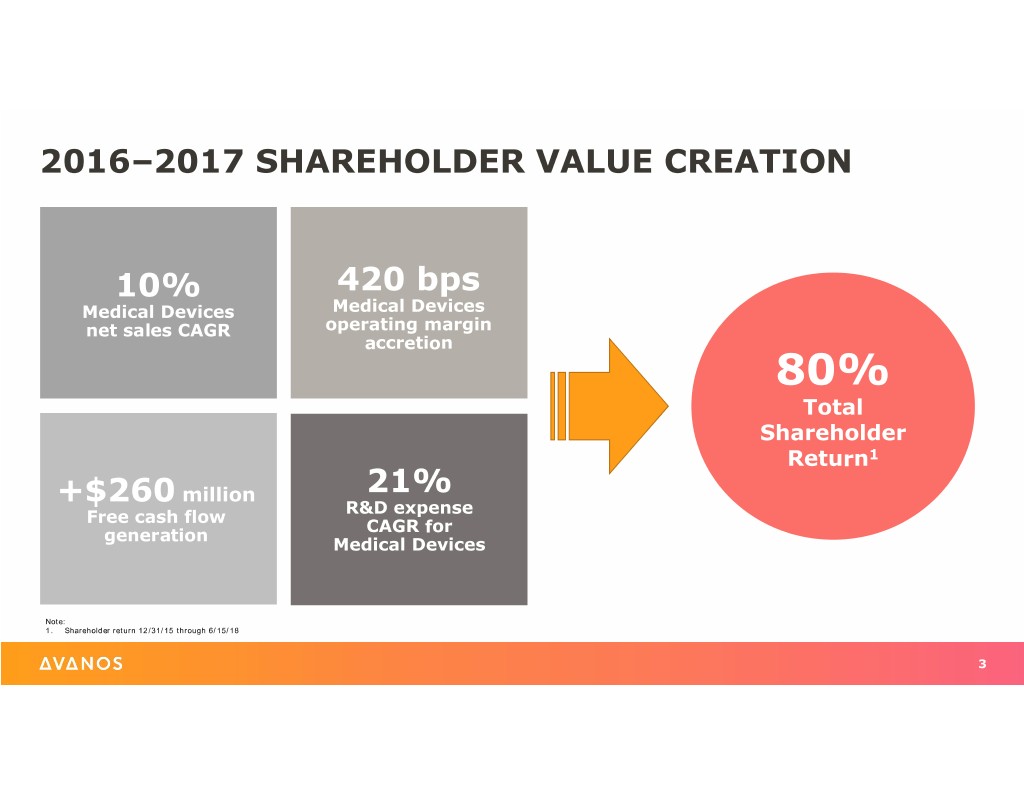

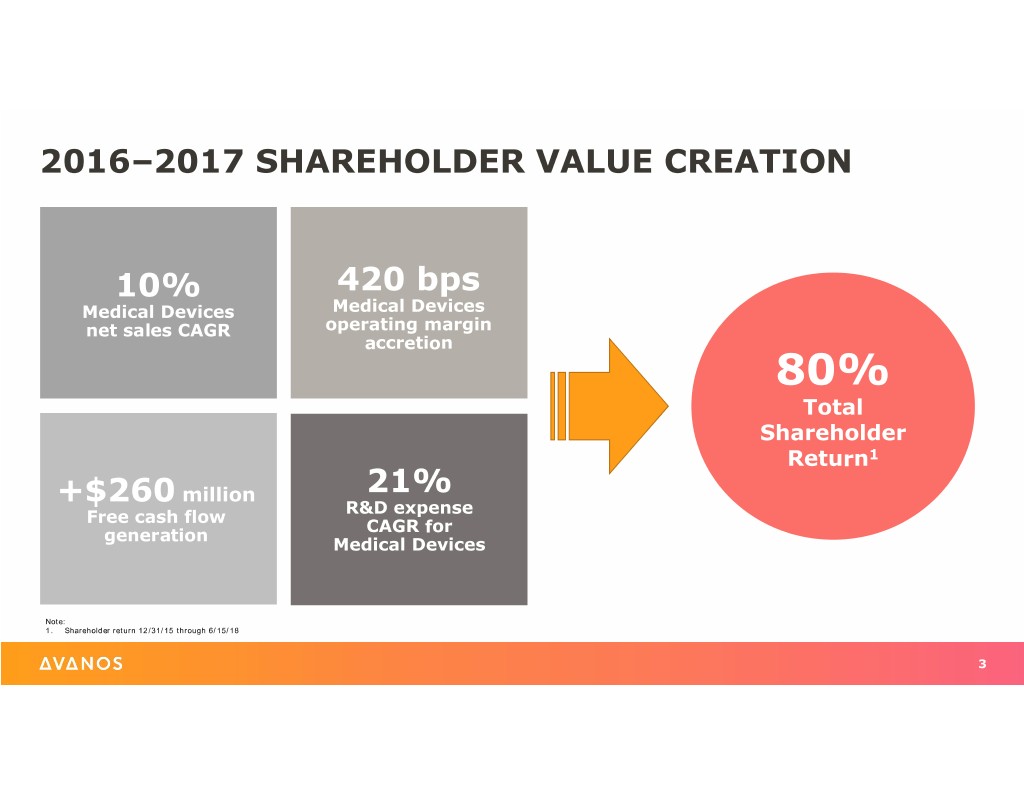

2016–2017 SHAREHOLDER VALUE CREATION 10% 420 bps Medical Devices Medical Devices net sales CAGR operating margin accretion 80% Total Shareholder Return1 +$260 million 21% R&D expense Free cash flow CAGR for generation Medical Devices Note: 1. Shareholder return 12/31/15 through 6/15/18 3

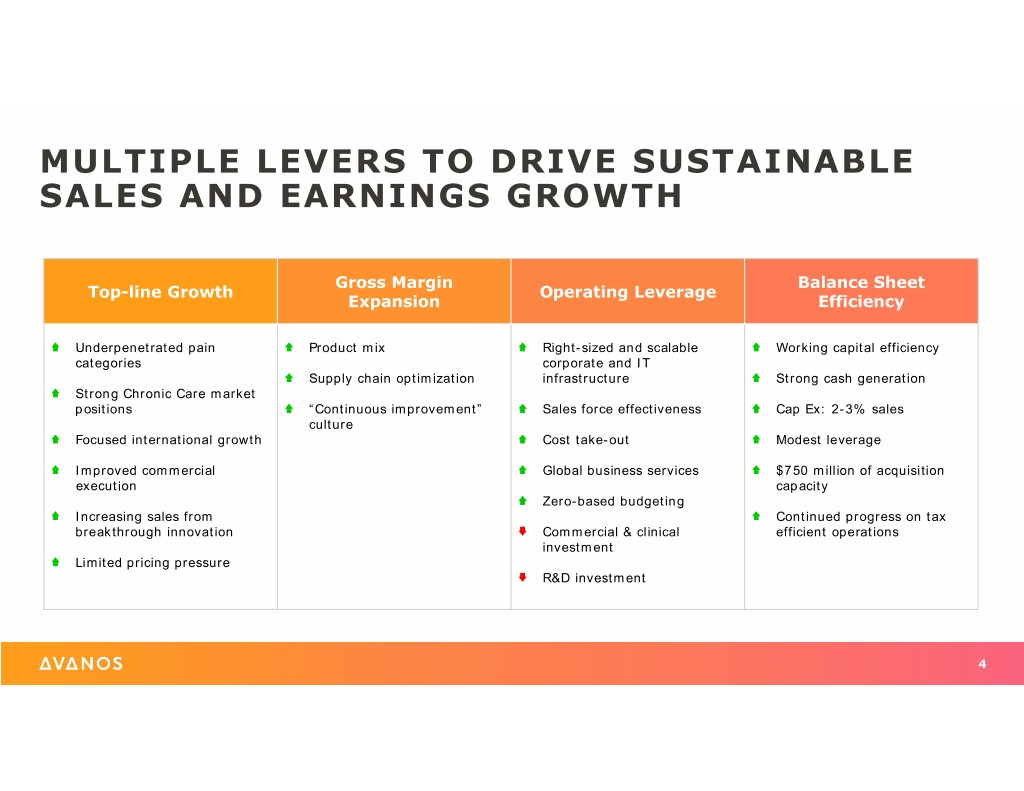

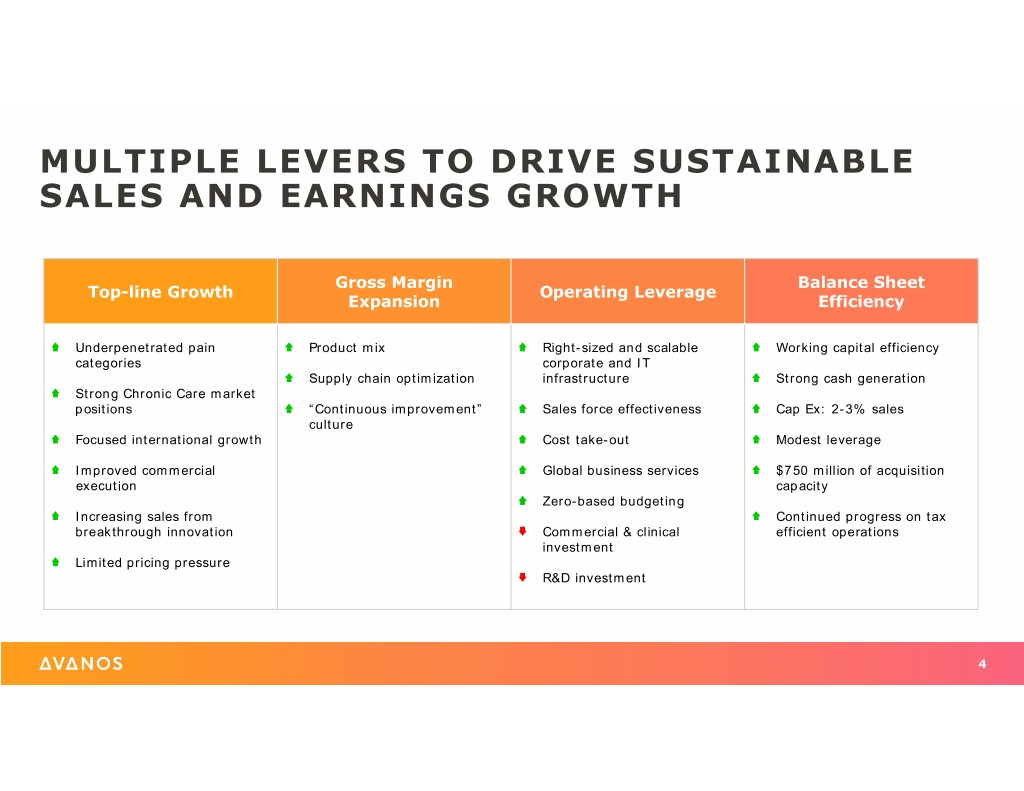

MULTIPLE LEVERS TO DRIVE SUSTAINABLE SALES AND EARNINGS GROWTH Gross Margin Balance Sheet Top-line Growth Operating Leverage Expansion Efficiency Underpenetrated pain Product mix Right-sized and scalable Working capital efficiency categories corporate and IT Supply chain optimization infrastructure Strong cash generation Strong Chronic Care market positions “Continuous improvement” Sales force effectiveness Cap Ex: 2-3% sales culture Focused international growth Cost take-out Modest leverage Improved commercial Global business services $750 million of acquisition execution capacity Zero-based budgeting Increasing sales from Continued progress on tax breakthrough innovation Commercial & clinical efficient operations investment Limited pricing pressure R&D investment 4

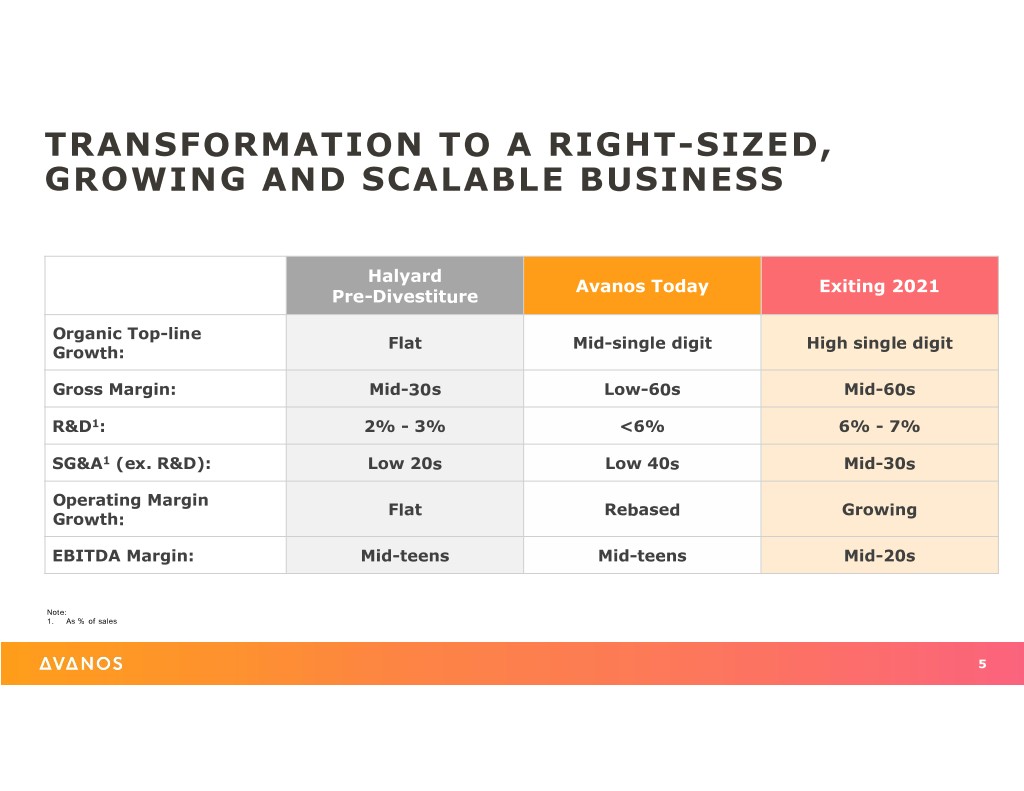

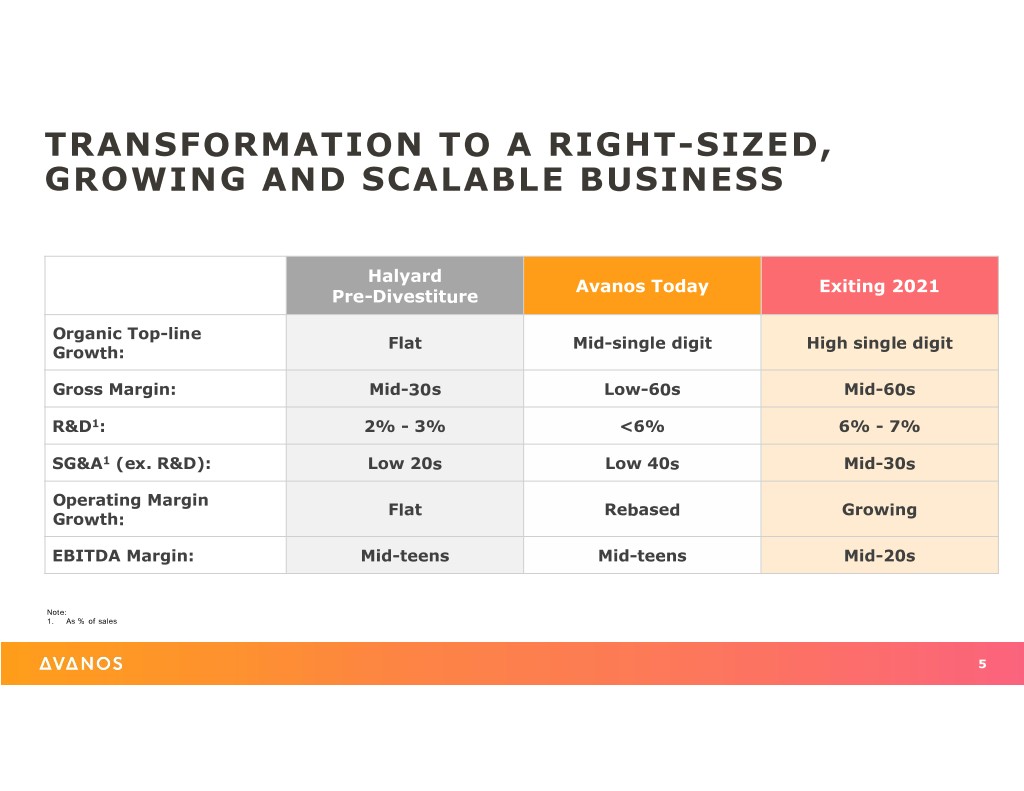

TRANSFORMATION TO A RIGHT-SIZED, GROWING AND SCALABLE BUSINESS Halyard Avanos Today Exiting 2021 Pre-Divestiture Organic Top-line Flat Mid-single digit High single digit Growth: Gross Margin: Mid-30s Low-60s Mid-60s R&D1: 2% - 3% <6% 6% - 7% SG&A1 (ex. R&D): Low 20s Low 40s Mid-30s Operating Margin Flat Rebased Growing Growth: EBITDA Margin: Mid-teens Mid-teens Mid-20s Note: 1. As % of sales 5

CAPITAL ALLOCATION PRIORITIES 1 2 3 Business Continuous M&A Investment Improvement Investment to support Sustainably improve Robust pipeline of strategic sustainable and accelerating productivity and profitability acquisitions and partnerships to organic growth enhance shareholder returns 6

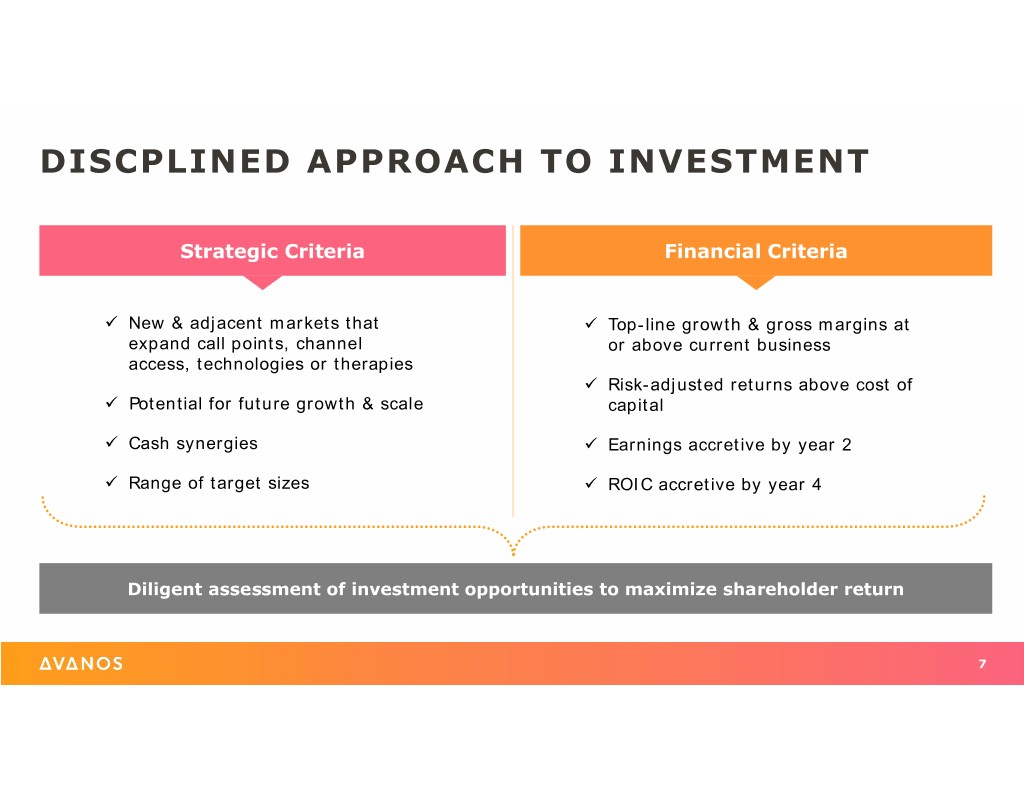

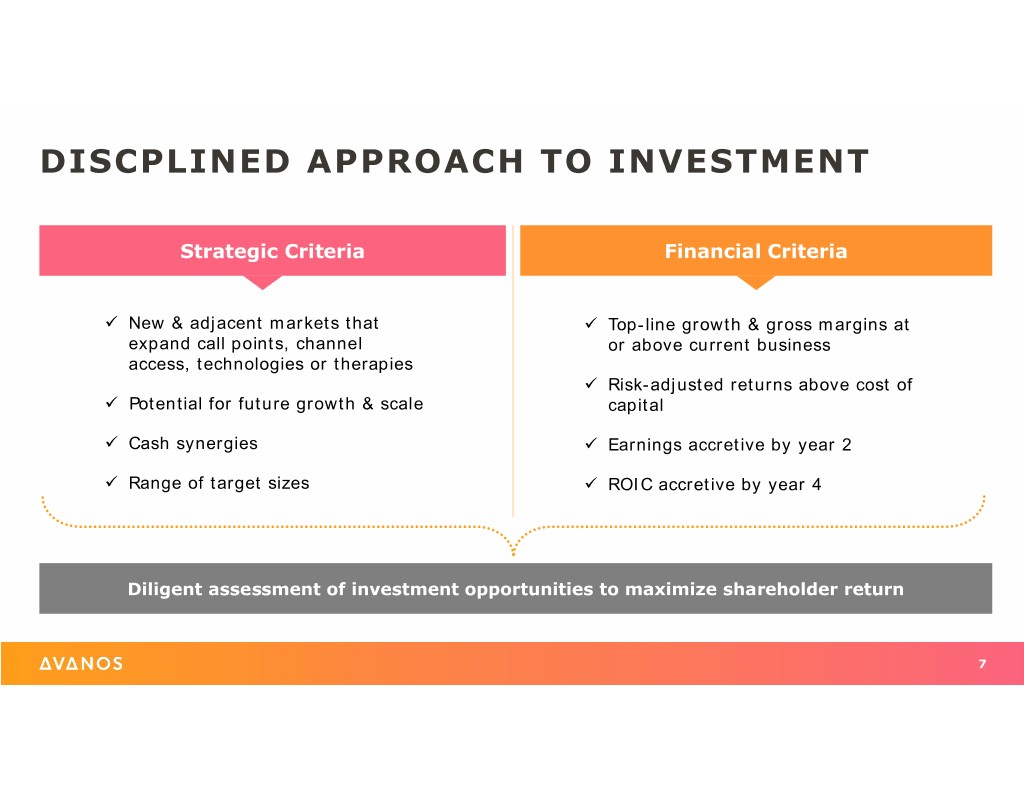

DISCPLINED APPROACH TO INVESTMENT Strategic Criteria Financial Criteria New & adjacent markets that Top-line growth & gross margins at expand call points, channel or above current business access, technologies or therapies Risk-adjusted returns above cost of Potential for future growth & scale capital Cash synergies Earnings accretive by year 2 Range of target sizes ROIC accretive by year 4 Diligent assessment of investment opportunities to maximize shareholder return 7

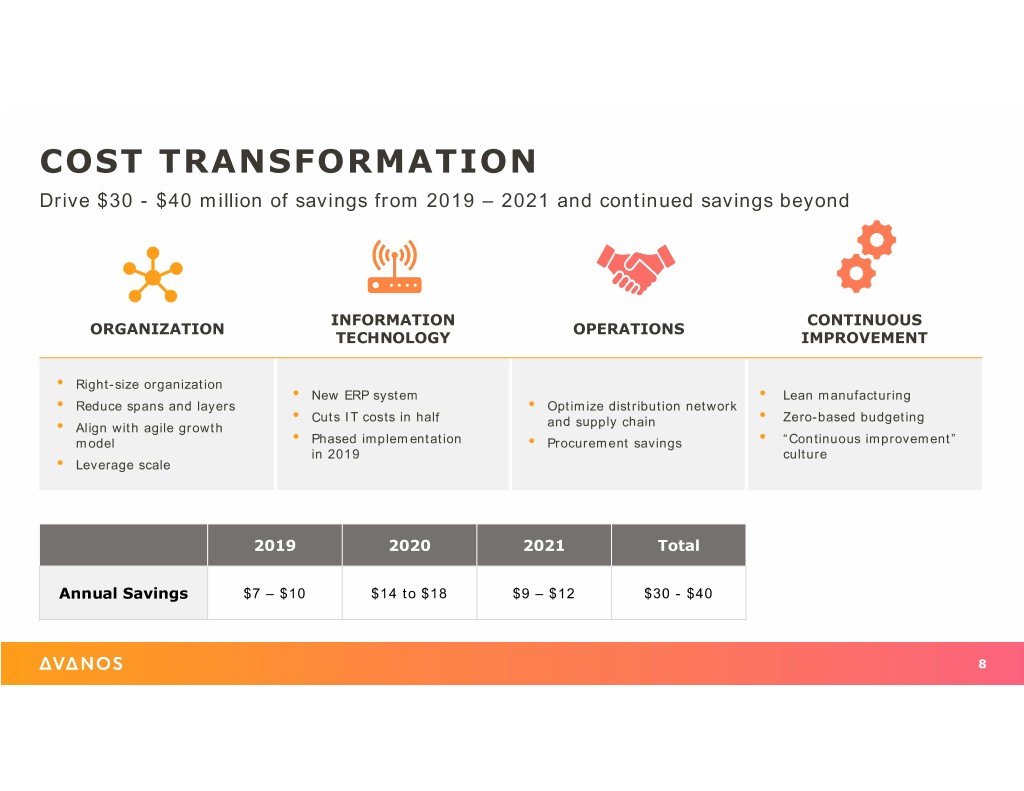

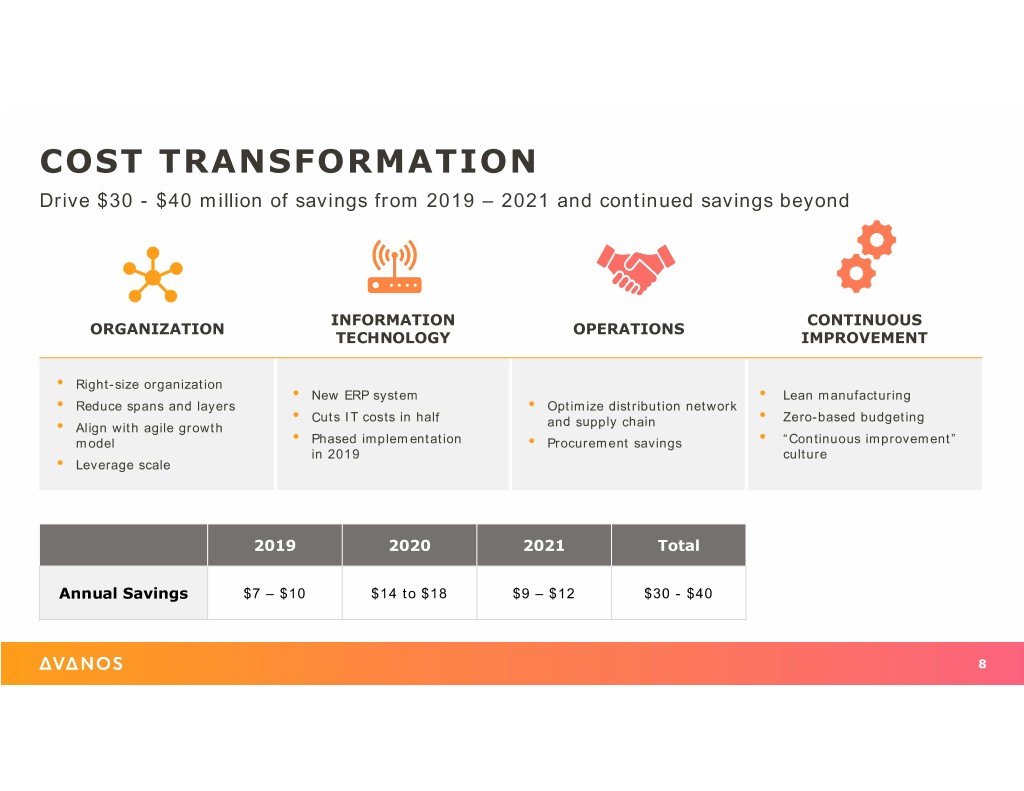

COST TRANSFORMATION Drive $30 - $40 million of savings from 2019 – 2021 and continued savings beyond INFORMATION CONTINUOUS ORGANIZATION OPERATIONS TECHNOLOGY IMPROVEMENT • Right-size organization • New ERP system • Lean manufacturing • Reduce spans and layers • Optimize distribution network • Cuts IT costs in half and supply chain • Zero-based budgeting • Align with agile growth model • Phased implementation • Procurement savings • “Continuous improvement” in 2019 culture • Leverage scale 2019 2020 2021 Total Annual Savings $7 – $10 $14 to $18 $9 – $12 $30 - $40 8

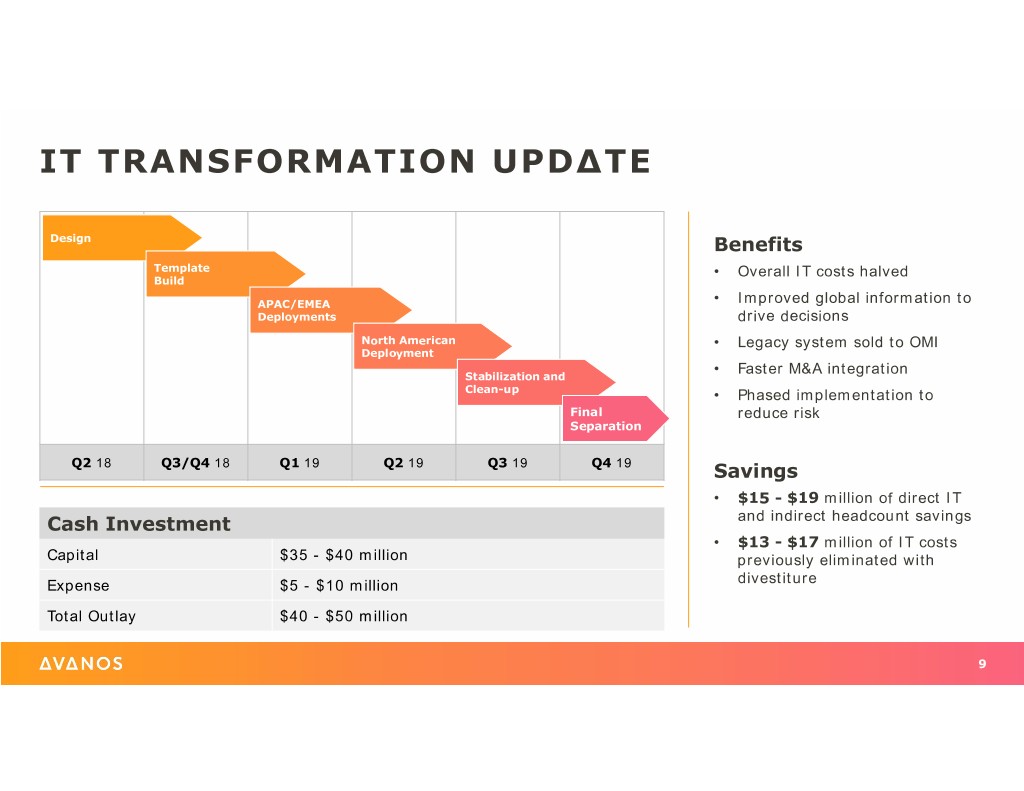

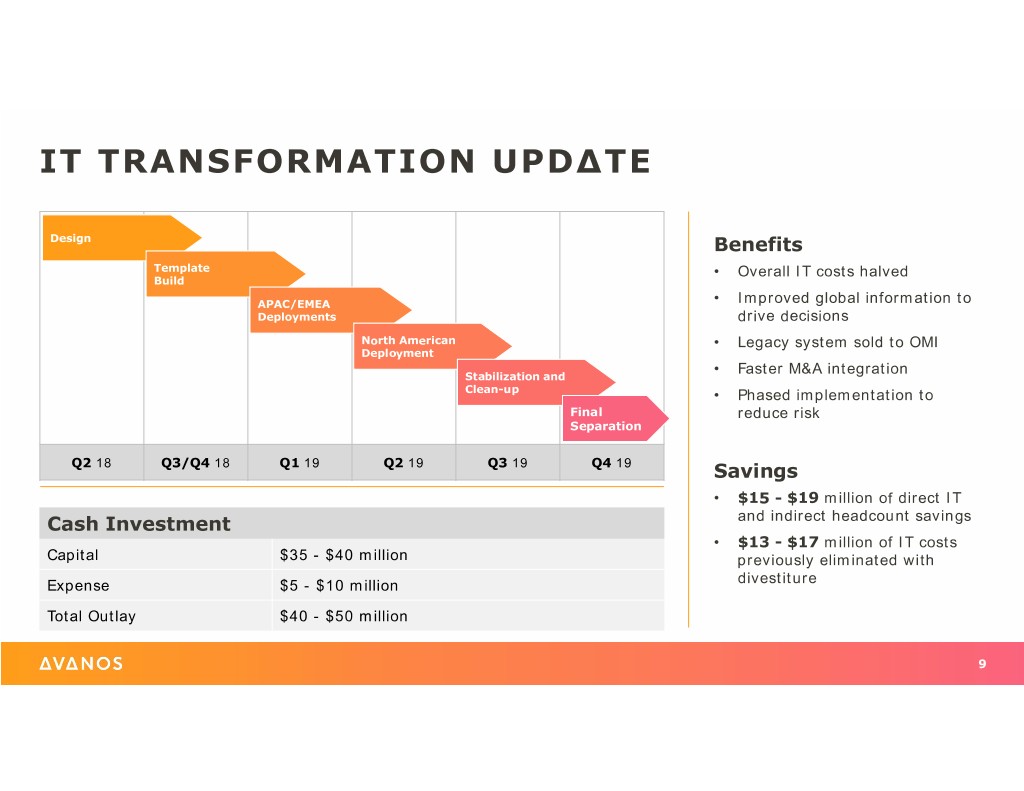

IT TRANSFORMATION UPD∆TE Design Benefits Template • Overall IT costs halved Build APAC/EMEA • Improved global information to Deployments drive decisions North American • Legacy system sold to OMI Deployment • Faster M&A integration Stabilization and Clean-up • Phased implementation to Final reduce risk Separation Q2 18 Q3/Q4 18 Q1 19 Q2 19 Q3 19 Q4 19 Savings • $15 - $19 million of direct IT Cash Investment and indirect headcount savings • $13 - $17 million of IT costs Capital $35 - $40 million previously eliminated with divestiture Expense $5 - $10 million Total Outlay $40 - $50 million 9

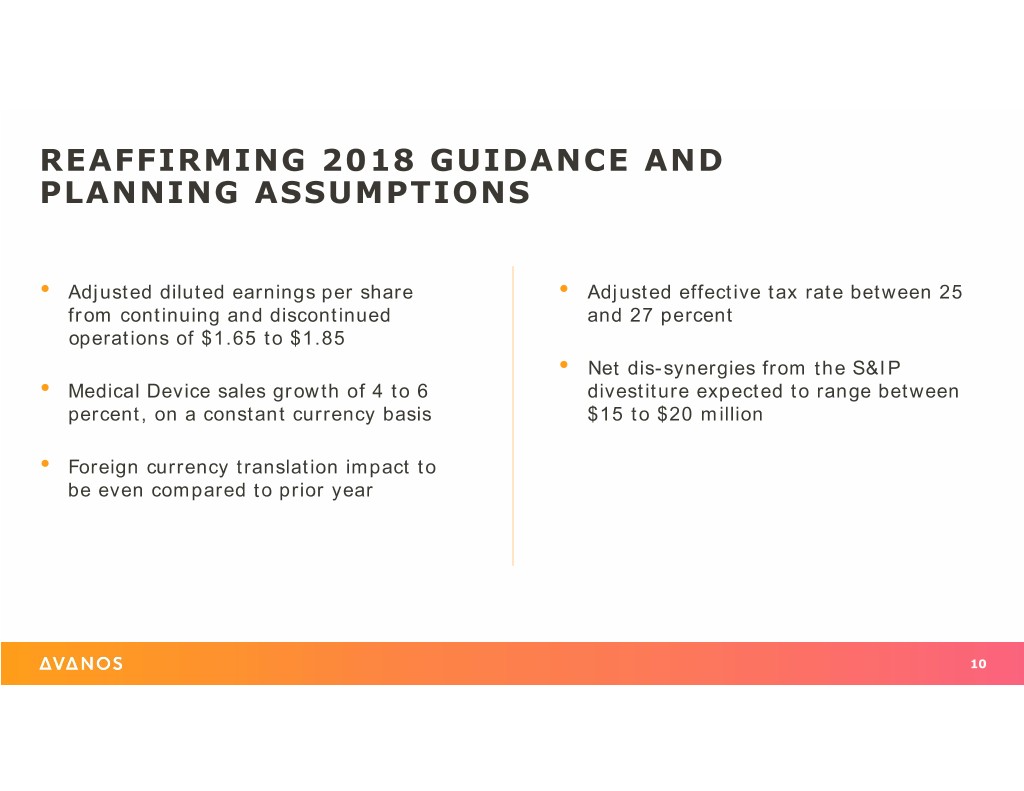

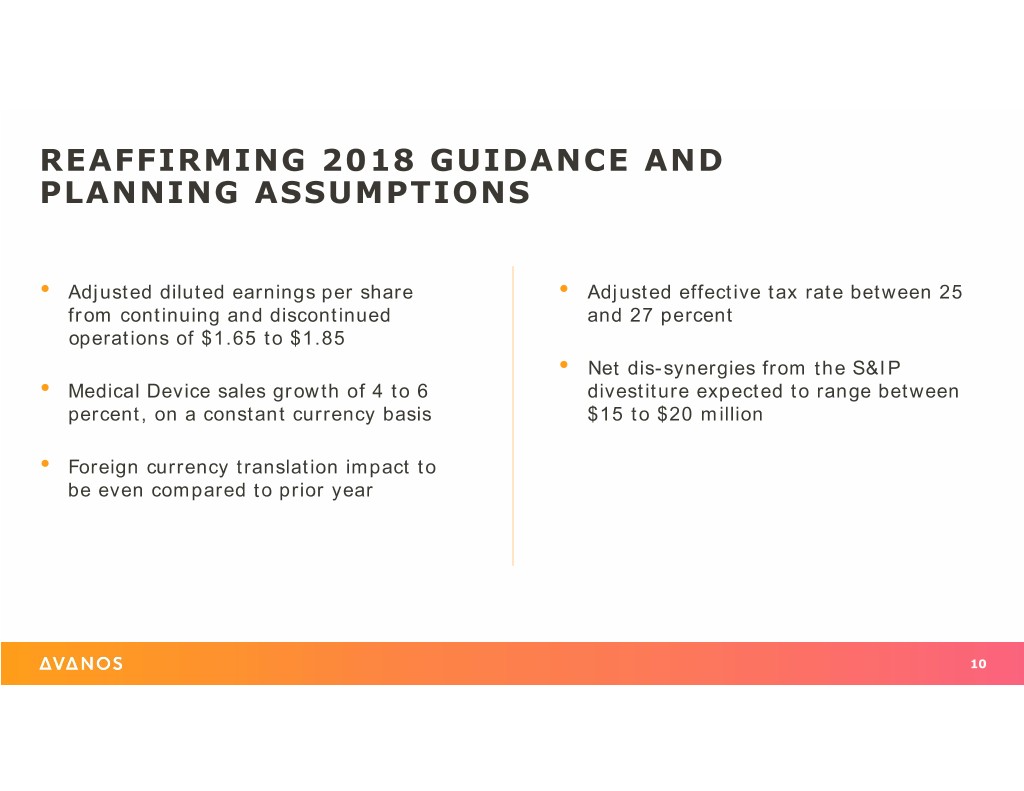

REAFFIRMING 2018 GUIDANCE AND PLANNING ASSUMPTIONS • Adjusted diluted earnings per share • Adjusted effective tax rate between 25 from continuing and discontinued and 27 percent operations of $1.65 to $1.85 • Net dis-synergies from the S&IP • Medical Device sales growth of 4 to 6 divestiture expected to range between percent, on a constant currency basis $15 to $20 million • Foreign currency translation impact to be even compared to prior year 10

POSITIONED TO ACCELERATE GROWTH AND INNOVATION Delivering top-quartile shareholder value 11

THANK YOU 12

TODAY’S PRESENTERS JOSEPH F. WOODY STEVE VOSKUIL Chief Executive Officer Senior Vice President and Chief Financial Officer As Chief Executive Officer and member of the Board of Directors, Joe Woody brings 20 In his role of Senior Vice President and Chief Financial Officer, Steve Voskuil is responsible for years of healthcare leadership experience and proven success driving revenue growth and Avanos’ global finance and accounting groups. Additionally, he also oversees the company’s expertise in spearheading portfolio transformations. global business services, investor relations and information and technology services. Prior to joining Avanos in 2017, Joe served as chief executive officer and president of Steve joined the company in 2014 following the spinoff from Kimberly-Clark, which he joined in Acelity, where he was responsible for overseeing the development and commercialization 1992. Since then, he has served in roles of increasing responsibility in business analysis, of their innovative wound care and regenerative medicine business. He also served as strategic analysis, emerging markets, mergers and acquisitions, for the company’s businesses global president, vascular therapies, for Covidien, creating their vascular division and worldwide. He later served as the corporation’s vice president and treasurer. leading the company’s acquisition and integration of ev3. Prior to accepting his current role, Steve served as vice president of finance for Kimberly- Before his time at Covidien, Joe served as Smith & Nephew’s global president, advanced Clark’s international operations. In that role, he was responsible for driving profitable growth, wound management, and Alliance Imaging’s vice president, Pacific operations. He leading strategic planning, driving cash and capital efficiency, managing enterprise risks and previously served as board director for Acelity, the Advanced Medical Technology building global leadership capability. He also served as the leader for global finance talent Association (AdvaMed) and Systagenix Wound Management. He also served as Chair of development. AdvaMed’s Wound Healing and Tissue Regeneration Sector. Steve holds a bachelor’s degree in business administration from the University of Wisconsin He holds a bachelor’s degree from California State University, Fullerton. and a master’s degree in management from the Stanford Graduate School of Business. 1

TODAY’S PRESENTERS LEE BURNES ARJUN SARKER Senior Vice President, Global R&D, Clinical & Medical Affairs Senior Vice President, International As Senior Vice President of Global R&D, Clinical and Medical Affairs, Lee Burnes leads an As Senior Vice President, International, Arjun Sarker oversees all commercial activity outside the organization focused on the development of products, technologies and solutions that United States. advance health and health care by preventing infection, eliminating pain and speeding Arjun joined Avanos in 2017 as Vice President and general manager of the company’s Asia-Pacific recovery. business. With a background in finance, he has a proven track-record of driving growth and business performance, as well as building high-performing teams. Lee has more than 25 years of medical device design and development experience. Prior to joining the company, he successfully led numerous R&D organizations at Covidien and Prior to joining the company, Arjun spent 10 years at Covidien/Medtronic where he held roles in built PMO and technology development organizations. Most recently, he was the vice general management and finance. He also worked for Honeywell in its specialty materials portfolio. president of R&D for the venous solutions franchise of Peripheral Vascular at Covidien. Additionally, he spent seven years with a British distribution group and four years with a public Under his leadership, teams have developed and brought to market more than 40 accounting firm in London. innovative solutions. Lee currently holds 10 US patents and has a number of additional Arjun is a chartered accountant from the Institute of Chartered Accountants in England and Wales. patents pending. He earned a bachelor’s degree from Delhi University in New Delhi, India as well as a degree in accounting from Oxford-Brookes University, UK. He earned a bachelor’s degree in plastics engineering from the University of Massachusetts at Lowell and a master’s of business administration from the University of He is a former member of the advisory board of CFO Asia magazine, a regular panelist at Economist Massachusetts at Amherst. CFO roundtables and was co-chairman of the Medical Devices committee in AMCHAM India. Lee is an active member of the Southeastern Medical Device Association (SEMDA) board. 2

TODAY’S PRESENTERS JOHN TUSHAR LISA KUDLACZ President, Global Franchises Vice President & General Manager – Interventional Pain As President, Global Franchises, John Tushar leads global franchise strategy as well as Lisa Kudlacz is the Vice President & General Manager for Avanos’ Interventional Pain strategic marketing for the Pain Management and Chronic Care businesses. He brings over 25 Management business. She is responsible for managing and implementing the global vision years of medical device experience spanning global marketing, sales management, M&A, for the Interventional Pain organization. Lisa is leading the execution of the Breakthrough corporate strategy and planning, portfolio management and executive leadership. Growth Ticket for Interventional Pain, focusing on COOLIEF* Reimbursement and the employment of the Orthopedic Growth Strategy. Prior to joining Avanos in 2018, John served as president and general manager of Teleflex Medical’s Surgical Division, where he was instrumental in leading the turnaround of Teleflex’s Lisa has over 25 years of healthcare marketing and sales experience. She has extensive oldest business unit. He also developed the business unit global strategy and enhanced the experience with strategic account development in healthcare integrated delivery networks. overall surgical product portfolio through innovative new products, and co-led six Prior to her current position, Lisa led a team that developed strategic and tactical growth acquisitions. John gained significant experience in global M&A as well as product and market plans for Integrated Healthcare Networks, focusing on selling the entire portfolio. During her development at Johnson & Johnson’s Ethicon Endo-Surgery and Ethicon, Inc. operating units. tenure, she has held roles in Sales, Sales Management, Operations, Go-To-Market Strategy, He also served in various sales and leadership roles with Abbott Laboratories, as well as and Corporate Account Leadership executive positions with three different medical device startups. John earned a bachelor’s degree in marketing and finance from the Lindner School of Lisa has a Bachelor of Science in Comprehensive Business Administration degree in Business, University of Cincinnati. He also earned a master’s degree in strategic management Management and Marketing from the University of Nebraska. with focus on global economics from Indiana University’s Kelley School of Business and completed an intense M&A program from the Wharton School Executive Program, University of Pennsylvania. He has served as an advisor to multiple startup businesses within the North Carolina Research Triangle Park region and is a frequent guest lecturer at The Fuqua Graduate School of Business, Duke University. He is also a board member of 410 Medical in Durham, NC. 3

TODAY’S PRESENTERS TOM KUPEC ROGER MASSENGALE Vice President & General Manager – Chronic Care Vice President & General Manager – Acute Pain Tom Kupec is the Vice President and General Manager for Avanos’ Chronic Care business, Roger Massengale is Vice President and General Manager of Avanos’ Acute Pain business where which is comprised of Digestive Health and Respiratory Health. He is responsible for leading he leads the North American Sales and Marketing organizations. the global vision as well as the implementation in North America for the Chronic Care. Roger has over 27 years of medical device experience where he has had leadership roles in Tom has over 25 years of experience in the medical device industry. He has extensive Manufacturing, R&D, Clinical Research, Marketing and Business Development. experience in driving global growth via new products, acquisitions, and sales resource Prior to Joining Avanos he was the Vice President of Business Development for I-Flow deployment. He started his career in sales with Baxter Healthcare. He then spent 14 years Corporation where he launched the ON-Q® Pain Relief System and led the acquisitions of with CR Bard—11 years leading the marketing department at Bard’s Davol division and then 3 years as the General Manager for Bard’s full portfolio in Asia Pacific. Prior to joining InfuSystem, Spinal Specialties, Acrymed and Lifetech. Avanos, Tom was the Vice President of Venous Intervention at AngioDynamics. He received a B.S. in Aerospace Engineering from UCLA and a Certificate in Business Management from UCSD. Roger has been granted over 100 U.S. and foreign patents in the He has a Bachelor of Arts in Communications from The University of North Carolina at Chapel areas of drug delivery and pain management. Hill and a Masters in Business Administration from The University of Rhode Island. 4

TODAY’S PRESENTERS DAVE CRAWFORD Vice President – Treasurer & Investor Relations As Vice President Treasurer and Investor Relations, Dave Crawford is responsible for leading Avanos’ Treasury and Investor Relation functions. Dave also led Financial Planning and Analysis along with the above roles following the company’s spin-off. Prior to this role, Dave served as Senior Finance Director for Kimberly-Clark’s Global Health Care business since March 2012. In this role, Dave served as the finance lead for spin-off from Kimberly-Clark, as well as leading the global finance team for the Health Care organization. He was a member of the Health Care leadership team responsible for developing and executing strategic business plans to achieve desired financial objectives. Previously for Kimberly-Clark, Dave worked as a Director in Corporate Strategy where he led corporate analysis of mergers, acquisitions and divestitures and strategic enterprise initiatives. Dave also served as the Assistant Treasurer for Global Capital Markets for three years. In his role Dave led activities related to K-C’s capital structure, corporate forecasting and financial risk management program. He joined Kimberly-Clark’s Treasury team as Manager Finance – Financial Risk Management in July 2006 where his responsibilities included foreign currency exposure management, commodity hedging and enterprise risk management. He also has worked in finance for Eli Lilly & Company and as a tax consultant for Arthur Andersen. Dave received his MBA from Duke University’s Fuqua School of Business and his BBA in accounting from the University of Notre Dame. 5

TODAY’S PRESENTERS DR. JOHN M. DIMURO DR. SONIA SZLYK Owner, DiMuro Pain Management Director of Regional Anesthesia, for North American Partners in Anesthesia Dr. DiMuro is the former Chief Medical Officer for the State of Nevada. He is fellowship- Sonia Szlyk, MD, is the Director of Regional Anesthesia for North American Partners in trained in pain medicine and dual board-certified in both Anesthesiology and Pain Medicine. Anesthesia’s Mid-Atlantic division. She is responsible for the clinical and administrative Dr. DiMuro was the co-writer of Nevada Governor Brian Sandoval’s controlled substance bill, oversight of all peripheral nerve blocks and catheters placed for inpatient and AB474, which passed unanimously in the 2017 Nevada State legislature. He served as the outpatient surgery. Dr. Szlyk is an accomplished lecturer and educator in ultrasound- Nevada State Opioid Treatment Authority (SOTA) as well as the State Health Officer (SHO) in guided peripheral nerve blocks and catheters with specialization in pain management addition to his many other roles within the state government. Currently he maintains a private modalities for joint replacement, sports medicine, general, and cosmetic surgery. pain medicine practice in both Las Vegas and Reno, Nevada and also serves as a Board Member for the Pharmacy Quality Alliance, a public and private partnership tasked with creating responsible opioid prescribing guidelines. He is the owner of DiMuro Pain Management with offices located in Reno and Las Vegas, Nevada. Dr. DiMuro has the distinction of using our Coolief™ technology for the longest duration having been the co-investigator for our Coolief™ technology back in 2005 and 2006. He has been proctoring other physicians in Coolief™ procedures since 2006 and was one of our principal research investigators for the hip and knee joint ablation procedures. 6