1 UPDATE & TRANSFORMATION DISCUSSION JOE WOODY CHIEF EXECUTIVE OFFICER JANUARY 11, 2023

2 FORWARD-LOOKING INFORMATION NON-GAAP FINANCIAL MEASURES Certain matters in this presentation, including expectations and planning assumptions, any comments about our expected performance, and any estimates, projections, or statements relating to our business plans, objectives, acquisitions and transformation initiatives, constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and are based upon current plans and management’s expectations and beliefs concerning future events impacting the Company. These statements are subject to risks and uncertainties that could cause our actual results to differ materially from those expressed or implied in such statements, including risks related to the ongoing COVID-19 pandemic, competition, market demand, cost savings and reductions, raw material, energy, and other input costs, supply chain disruptions (including availability of drugs used in our Acute Pain products), inflation, the ongoing conflict between Russia and Ukraine, economic conditions, currency exchange risks, human capital risks, cyber risks, intellectual property risks, and legislative and regulatory actions. There can be no assurance that these future events will occur as anticipated or that the Company’s results will be as estimated. Forward-looking statements speak only as of the date they were made, and we undertake no obligation to publicly update them. For a more complete listing and description of these and other factors that could cause the Company’s future results to differ materially from those expressed in any forward-looking statements, see the Company’s most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. This presentation includes financial measures that have not been calculated in accordance with accounting principles generally accepted in the U.S., or GAAP. The company provides these non-GAAP financial measures as supplemental information to its GAAP financial measures. Management believes that such non-GAAP financial measures enhance investors’ understanding and analysis of the Company’s performance. As such, results and outlook have been adjusted to exclude certain items for relevant time periods as indicated in the non-GAAP reconciliations to the comparable GAAP financial measures included in this presentation and posted on our website (www.avanos.com/investors). These non-GAAP financial measures should not be considered in isolation or as a substitute for analysis of our results as reported under GAAP.

3 WHO WE ARE $815M+ Global Revenue* Pain Management Chronic Care Diversified portfolio with 8 market-leading products in the U.S. International Business operations in 90+ countries U.S. ~$10B Addressable Market *Est. 2022 figure Our Vision: To be the best at getting patients back to the things that matter Our two franchises – Chronic Care and Pain Management – address some of today’s most important healthcare needs.

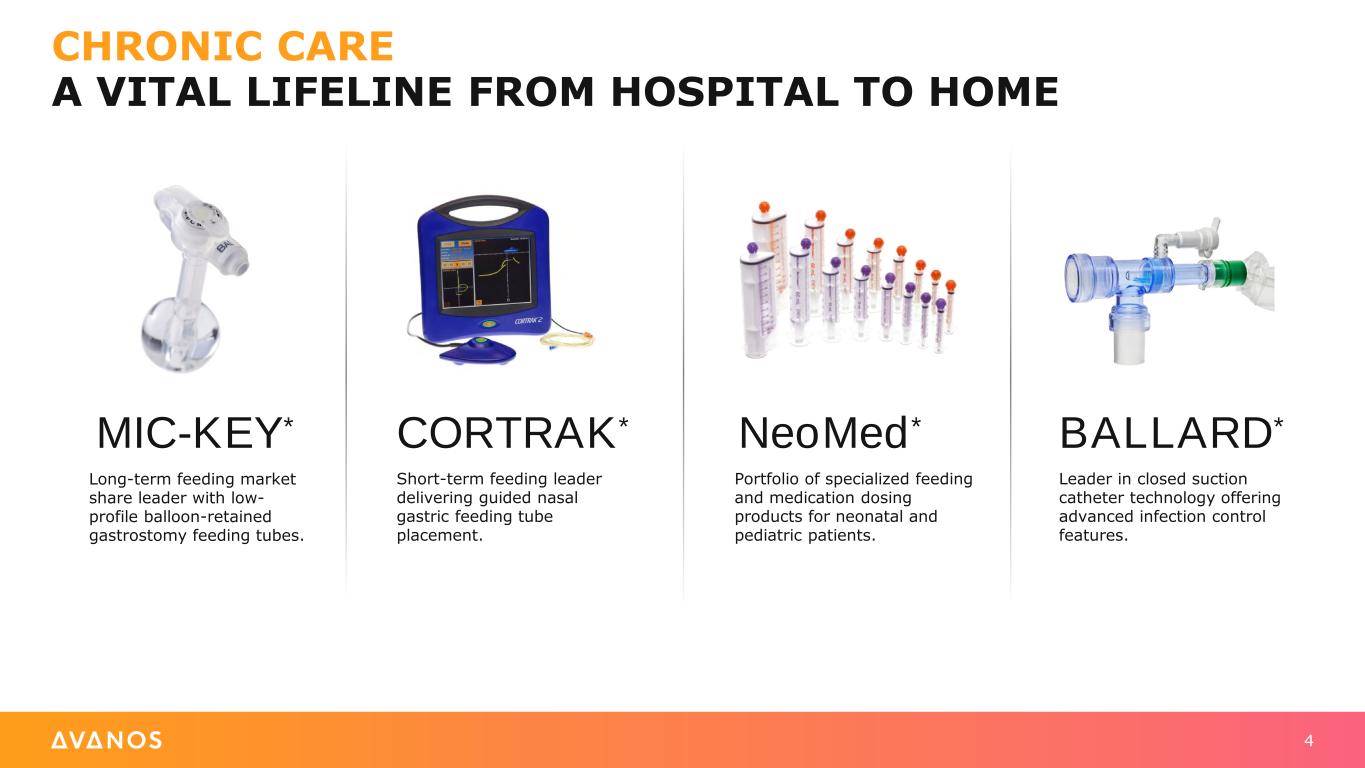

4 CHRONIC CARE A VITAL LIFELINE FROM HOSPITAL TO HOME MIC-KEY* Long-term feeding market share leader with low- profile balloon-retained gastrostomy feeding tubes. CORTRAK* Short-term feeding leader delivering guided nasal gastric feeding tube placement. BALLARD* Leader in closed suction catheter technology offering advanced infection control features. NeoMed* Portfolio of specialized feeding and medication dosing products for neonatal and pediatric patients.

5 Market-leading provider of cold and compression therapy systems. Portfolio of non-opioid post- surgical pain relief infusion pumps and accessories. Cooled and standard radiofrequency nerve ablation for thermal treatment of chronic pain. ambIT* Electronic ambulatory infusion pumps for various infusion therapy needs. Multi-regimen hyaluronic acid treatment relieving mild-to- moderate knee pain. PAIN MANAGEMENT GETTING BACK TO LIFE

✓ Capital deployment via M&A and $55M share repurchases ✓ Successful OrthogenRx integration; ahead of plan ✓ Organization transformation underway STRATEGIC ✓ Meaningful gross and EBITDA margin improvement ✓ Effective OpEx management; below 40% SG&A as % of revenue ✓ Delivered strong free cash flow ✓ Uneven sales performance due to supply chain and currency headwinds CORE EXECUTION 2022 IN REVIEW … SETTING UP TRANSFORMATION 6

7 STRATEGIC AND COMMERCIAL OPTIMIZATION TRANSFORM THE PRODUCT PORTFOLIO TRANSFORMATION PRIORITIES: 2023 - 2025 DELIVERING VALUE TO ALL STAKEHOLDERS CONTINUED EFFICIENT CAPITAL ALLOCATION STRATEGIES TO EXPAND RETURN ON INVESTED CAPITAL ADDITIONAL COST MANAGEMENT INITIATIVES TO ENHANCE OPERATING PROFITABILITY

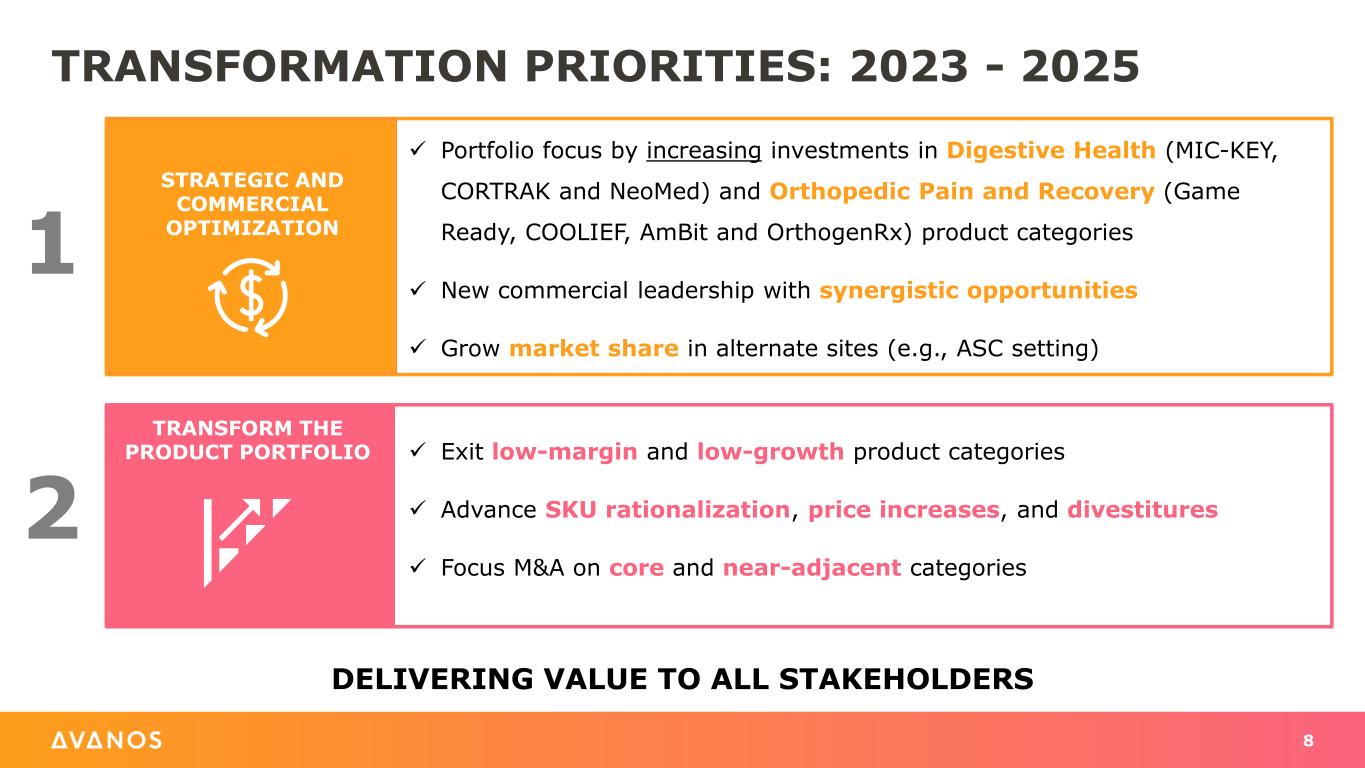

8 STRATEGIC AND COMMERCIAL OPTIMIZATION TRANSFORM THE PRODUCT PORTFOLIO TRANSFORMATION PRIORITIES: 2023 - 2025 ✓ Portfolio focus by increasing investments in Digestive Health (MIC-KEY, CORTRAK and NeoMed) and Orthopedic Pain and Recovery (Game Ready, COOLIEF, AmBit and OrthogenRx) product categories ✓ New commercial leadership with synergistic opportunities ✓ Grow market share in alternate sites (e.g., ASC setting) ✓ Exit low-margin and low-growth product categories ✓ Advance SKU rationalization, price increases, and divestitures ✓ Focus M&A on core and near-adjacent categories 2 1 DELIVERING VALUE TO ALL STAKEHOLDERS

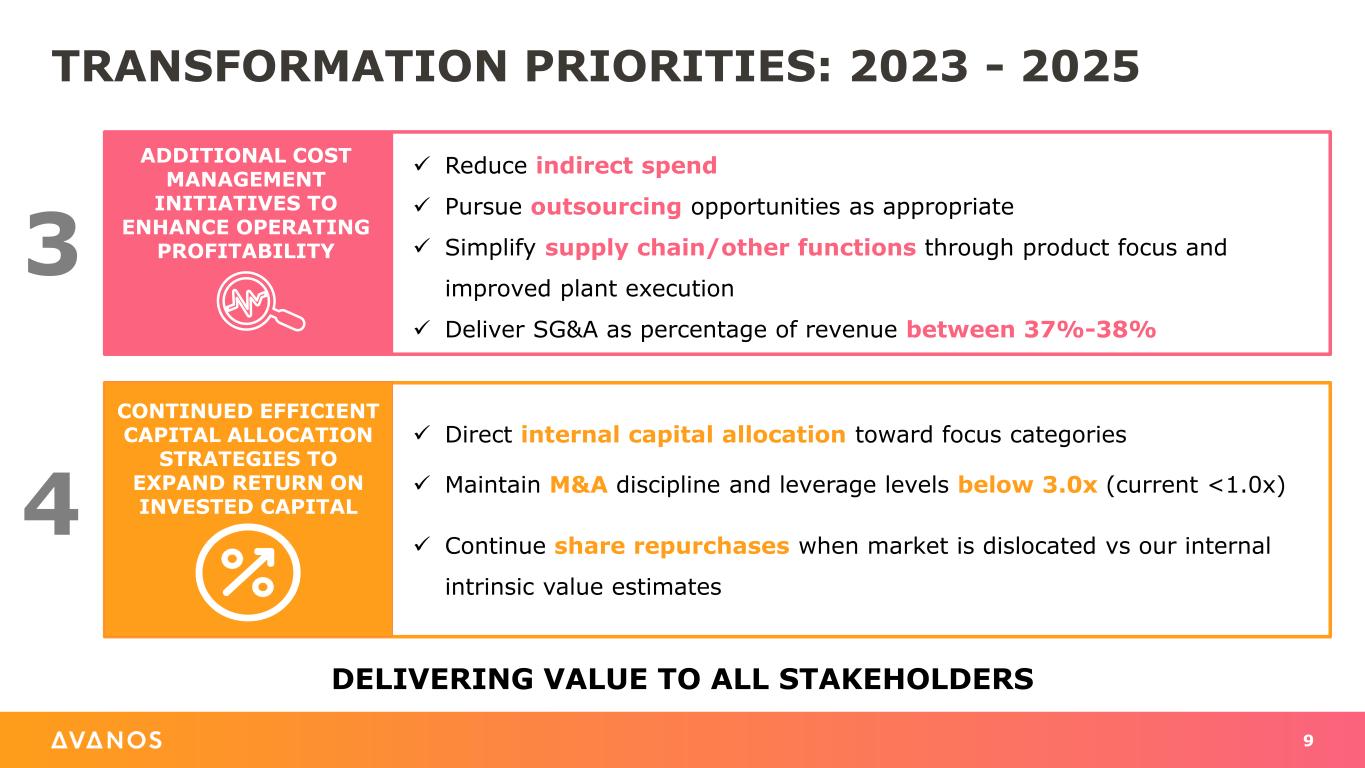

9 CONTINUED EFFICIENT CAPITAL ALLOCATION STRATEGIES TO EXPAND RETURN ON INVESTED CAPITAL ADDITIONAL COST MANAGEMENT INITIATIVES TO ENHANCE OPERATING PROFITABILITY ✓ Direct internal capital allocation toward focus categories ✓ Maintain M&A discipline and leverage levels below 3.0x (current <1.0x) ✓ Continue share repurchases when market is dislocated vs our internal intrinsic value estimates ✓ Reduce indirect spend ✓ Pursue outsourcing opportunities as appropriate ✓ Simplify supply chain/other functions through product focus and improved plant execution ✓ Deliver SG&A as percentage of revenue between 37%-38% 3 4 TRANSFORMATION PRIORITIES: 2023 - 2025 DELIVERING VALUE TO ALL STAKEHOLDERS

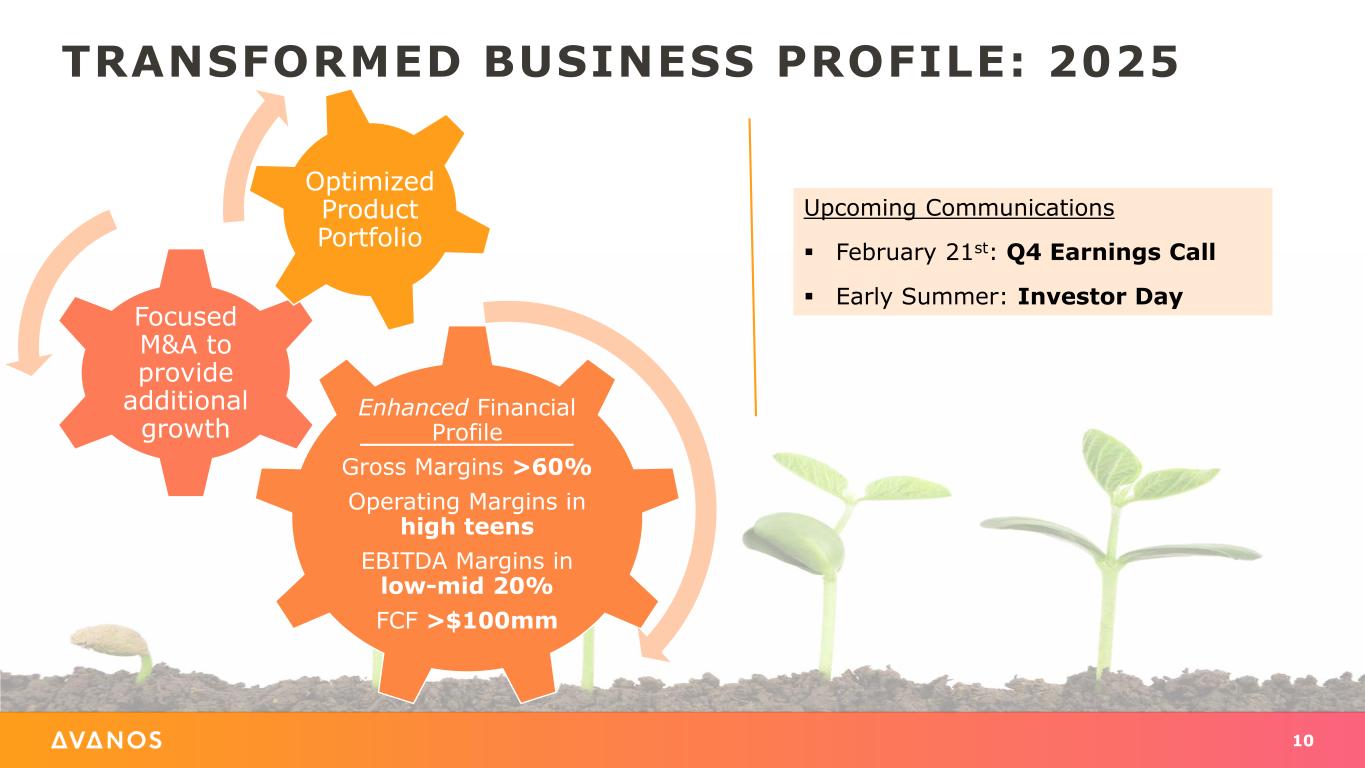

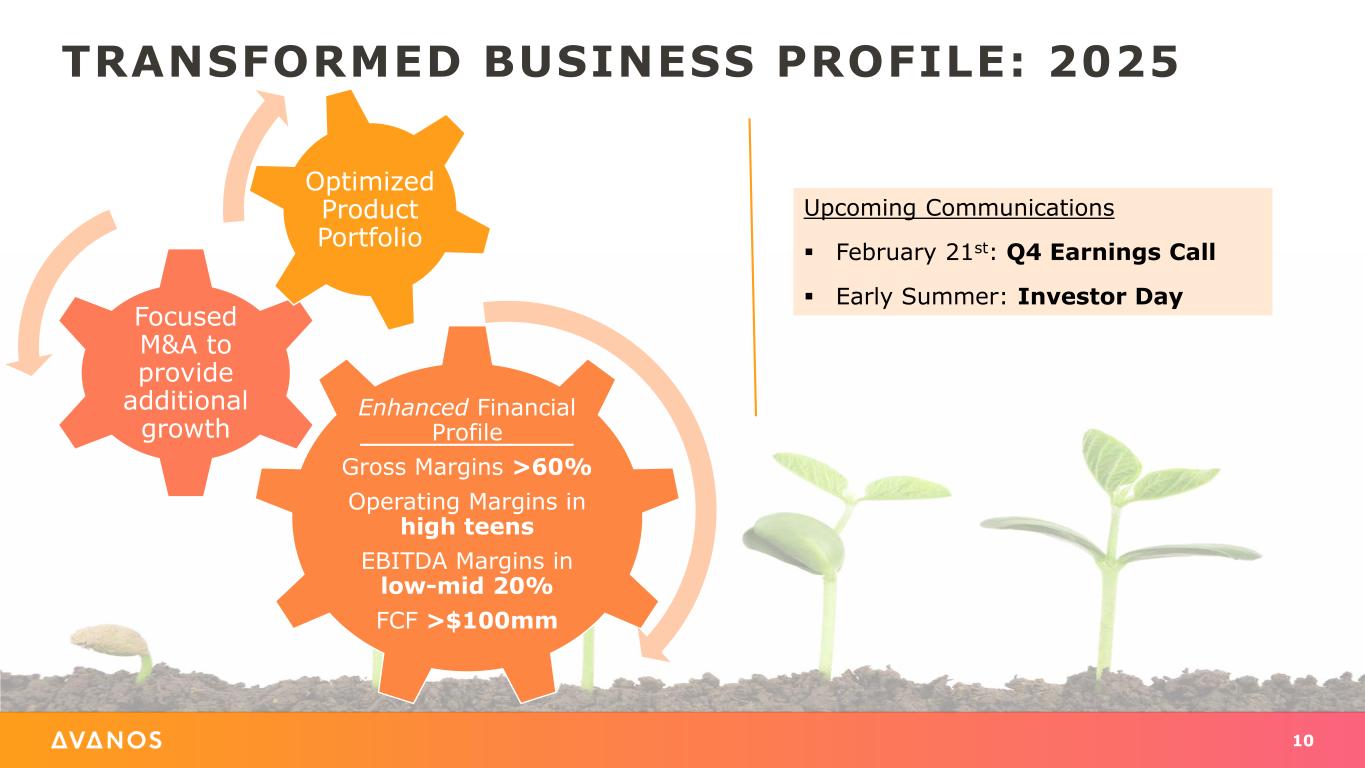

10 TRANSFORMED BUSINESS PROFILE: 2025 Enhanced Financial Profile Gross Margins >60% Operating Margins in high teens EBITDA Margins in low-mid 20% FCF >$100mm Focused M&A to provide additional growth Optimized Product Portfolio Upcoming Communications ▪ February 21st: Q4 Earnings Call ▪ Early Summer: Investor Day

11 The best at getting patients back to the things that matter