Investor Day June 20, 2023

Welcome & Opening Remarks Joe Woody Chief Executive Officer

Certain matters in this presentation, including expectations and planning assumptions, any comments about our expected performance, and any estimates, projections, or statements relating to our business plans, objectives, acquisitions and transformation initiatives, constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and are based upon current plans and management’s expectations and beliefs concerning future events impacting the Company. These statements are subject to risks and uncertainties that could cause our actual results to differ materially from those expressed or implied in such statements, including risks related to the ongoing COVID-19 pandemic, competition, market demand, cost savings and reductions, raw material, energy, and other input costs, supply chain disruptions (including availability of drugs used in our Acute Pain products), inflation, the ongoing conflict between Russia and Ukraine, our ability to successfully execute on or achieve the expected benefits of our transformation initiative, the effects of the recent financial conditions affecting the banking system and the potential threats to the solvency of commercial banks, economic conditions, currency exchange risks, human capital risks, cyber risks, intellectual property risks, and legislative and regulatory actions. There can be no assurance that these future events will occur as anticipated or that the Company’s results will be as estimated. Forward-looking statements speak only as of the date they were made, and we undertake no obligation to publicly update them. For a more complete listing and description of these and other factors that could cause the Company’s future results to differ materially from those expressed in any forward-looking statements, see the Company’s most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. This presentation includes financial measures that have not been calculated in accordance with accounting principles generally accepted in the U.S., or GAAP. The company provides these non-GAAP financial measures as supplemental information to its GAAP financial measures. Management believes that such non-GAAP financial measures enhance investors’ understanding and analysis of the Company’s performance. As such, results and outlook have been adjusted to exclude certain items for relevant time periods as indicated in the non-GAAP reconciliations to the comparable GAAP financial measures included in this presentation and posted on our website (www.avanos.com/investors). These non-GAAP financial measures should not be considered in isolation or as a substitute for analysis of our results as reported under GAAP. FORWARD-LOOKING INFORMATION NON-GAAP FINANCIAL MEASURES 3 DISCLAIMERS The information presented herein involves technologies and concepts in development that are not products and may never become products. For technology in development, the technologies or concepts are not being offered for sale and are not cleared or approved by the U.S. FDA or any other global regulator for commercial availability. This presentation contains trademarks, trade names and service marks which are the property of their respective owners. We do not intend our use or display of other parties' trademarks, trade names or service marks to imply, and such use or display should not be construed to imply, a relationship with, or endorsement or sponsorship of us by, these other parties.

Today’s Agenda & Speakers 4 Welcome & Opening Remarks Commercial Optimization Innovation Supply Chain Effectiveness Financial Transformation Closing Remarks Q&A Innovation Showcase 1 CEO Joe Woody SVP, Global R&D Lee Burnes SVP, Global Supply Chain & Procurement Sudhakar Varshney SVP, CFO & Chief Transformation Officer Michael Greiner SVP & Chief Commercial Officer Kerr Holbrook 2 3 4 5 6 7 8

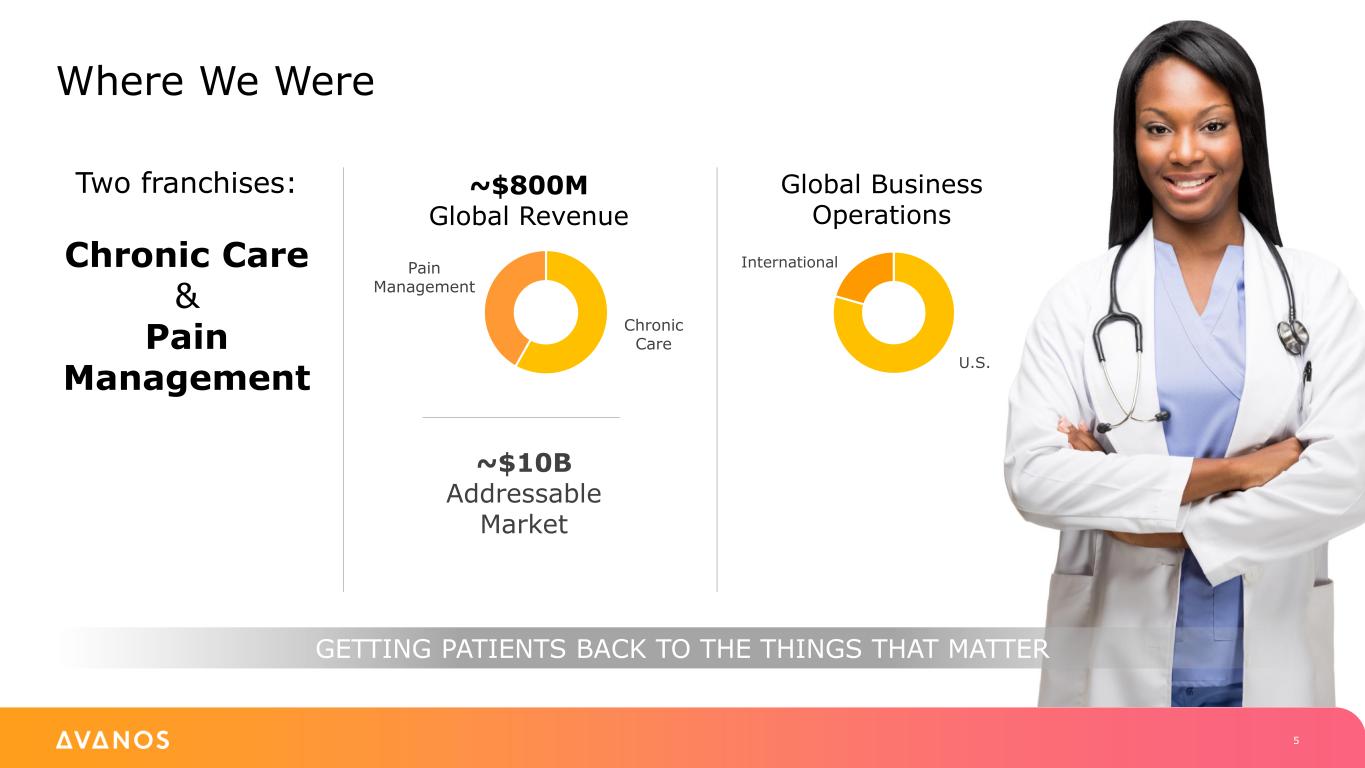

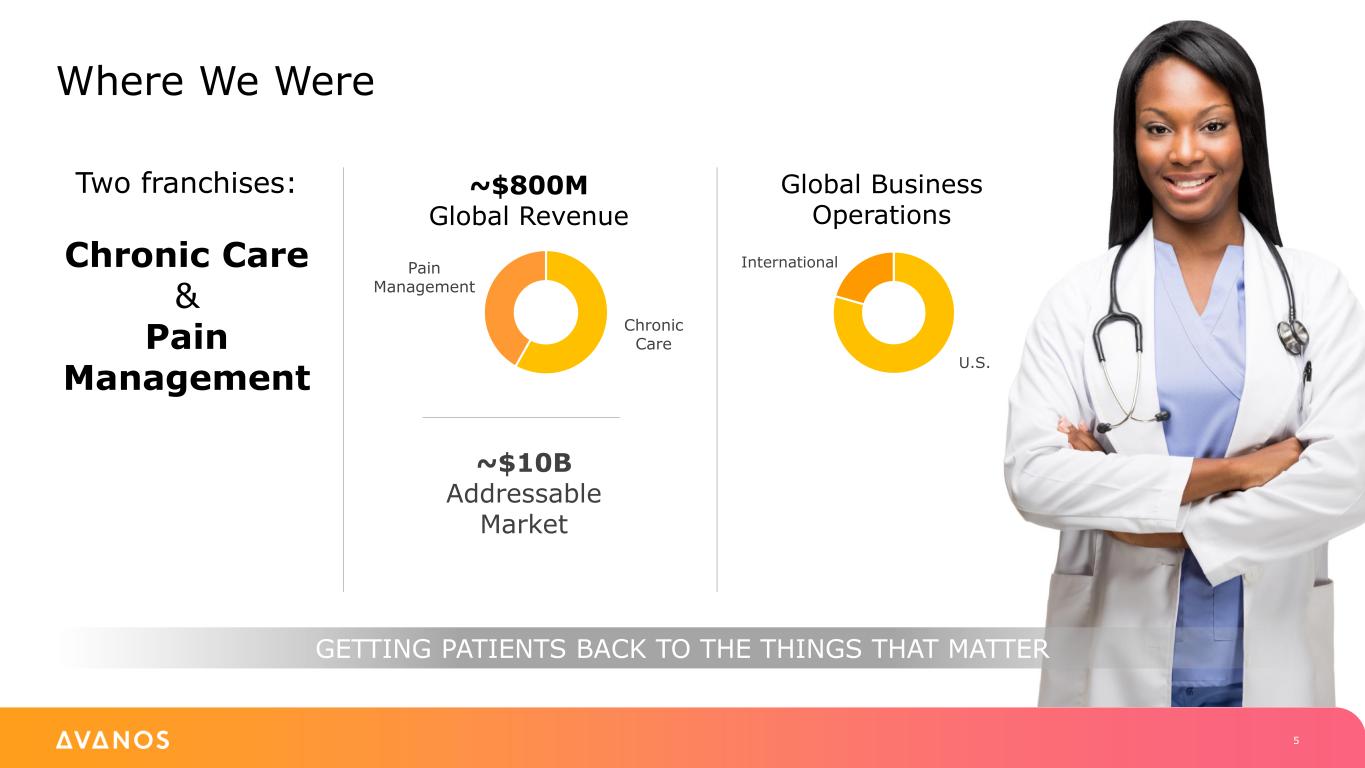

Where We Were Two franchises: Chronic Care & Pain Management ~$800M Global Revenue Pain Management Chronic Care ~$10B Addressable Market International Global Business Operations U.S. GETTING PATIENTS BACK TO THE THINGS THAT MATTER 5

Where We’re Going October 2022: Board reviewed 2023 - 2025 Strategic Plan to Reimagine the Business • January 2023: Launched 3-year Transformation • June 2023: Announced divestiture of Respiratory Health business to SunMed • June 2023: Announced acquisition of Diros Technology 6 PORTFOLIO CHANGE TO ACCELERATE GROWTH

Avanos Portfolio Evolution Completed spin-off as Halyard Health 2014 2016 2017 2018 2019 2021 2023 Acquired CORPAK* MedSystems Acquired CoolSystems (Game Ready) Acquired NEOMED*,an enteral feeding channel expansion (NICU) Acquired Summit Medical (AMBIT*) Acquired OrthogenRx, a leader in HA technology for the treatment of knee OA Announced divestiture of S&IP business to Owens & Minor Announced divestiture of Respiratory Health business to SunMed Announced acquisition of Diros Technology, a leader in RF technology for treatment of knee OA 7 • Execution • Pain Returns • Capital Deployment • Portfolio Management • Digestive Health Business • M&A • Balance Sheet • Transformation Plan *Registered Trademark or Trademark of Avanos Medical, Inc., or its affiliates. © 2018 AVNS. All rights reserved.

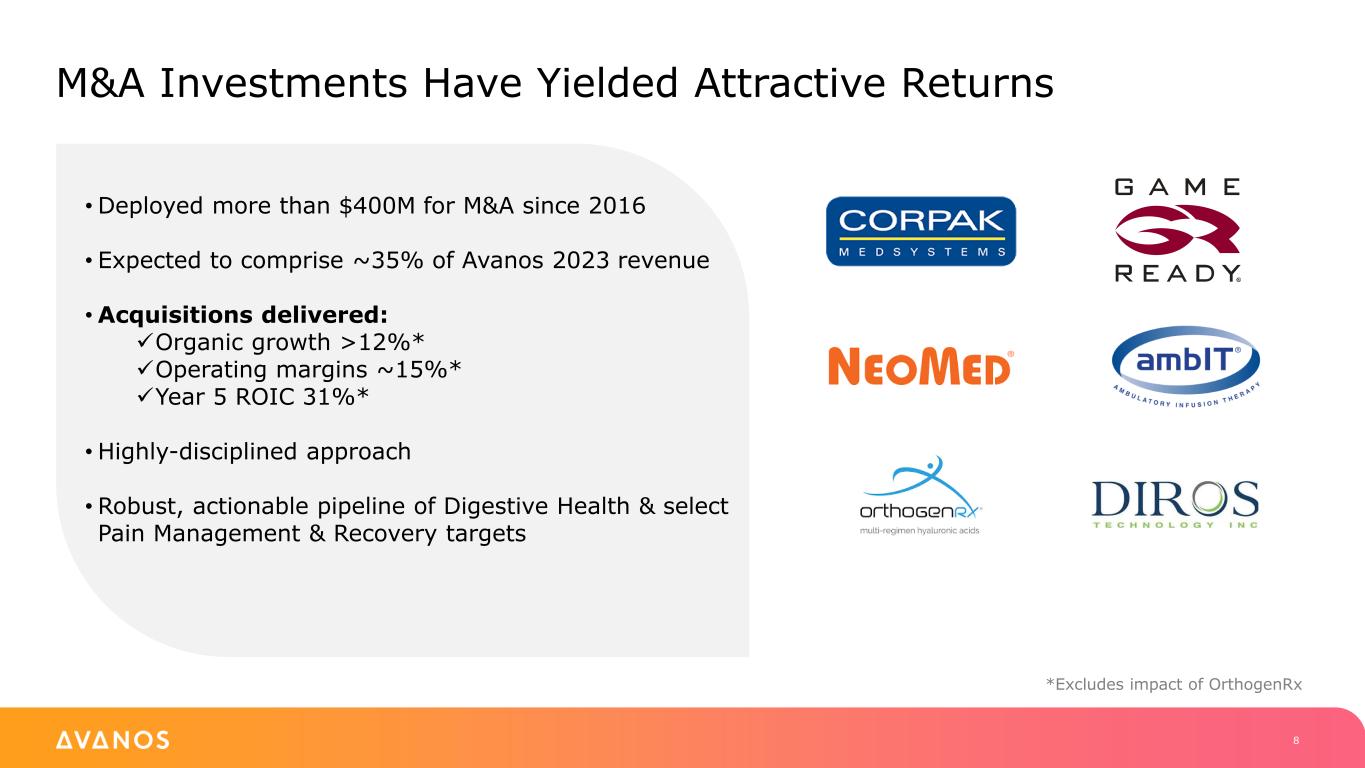

M&A Investments Have Yielded Attractive Returns 8 •Deployed more than $400M for M&A since 2016 • Expected to comprise ~35% of Avanos 2023 revenue •Acquisitions delivered: ✓Organic growth >12%* ✓Operating margins ~15%* ✓Year 5 ROIC 31%* •Highly-disciplined approach • Robust, actionable pipeline of Digestive Health & select Pain Management & Recovery targets *Excludes impact of OrthogenRx

Strategy Supporting Value Creation 9 Invest in and grow Digestive Health above market Execute on all transformation priorities MSD growth and profitability in Pain Management & Recovery Deploy capital in key international markets and M&A

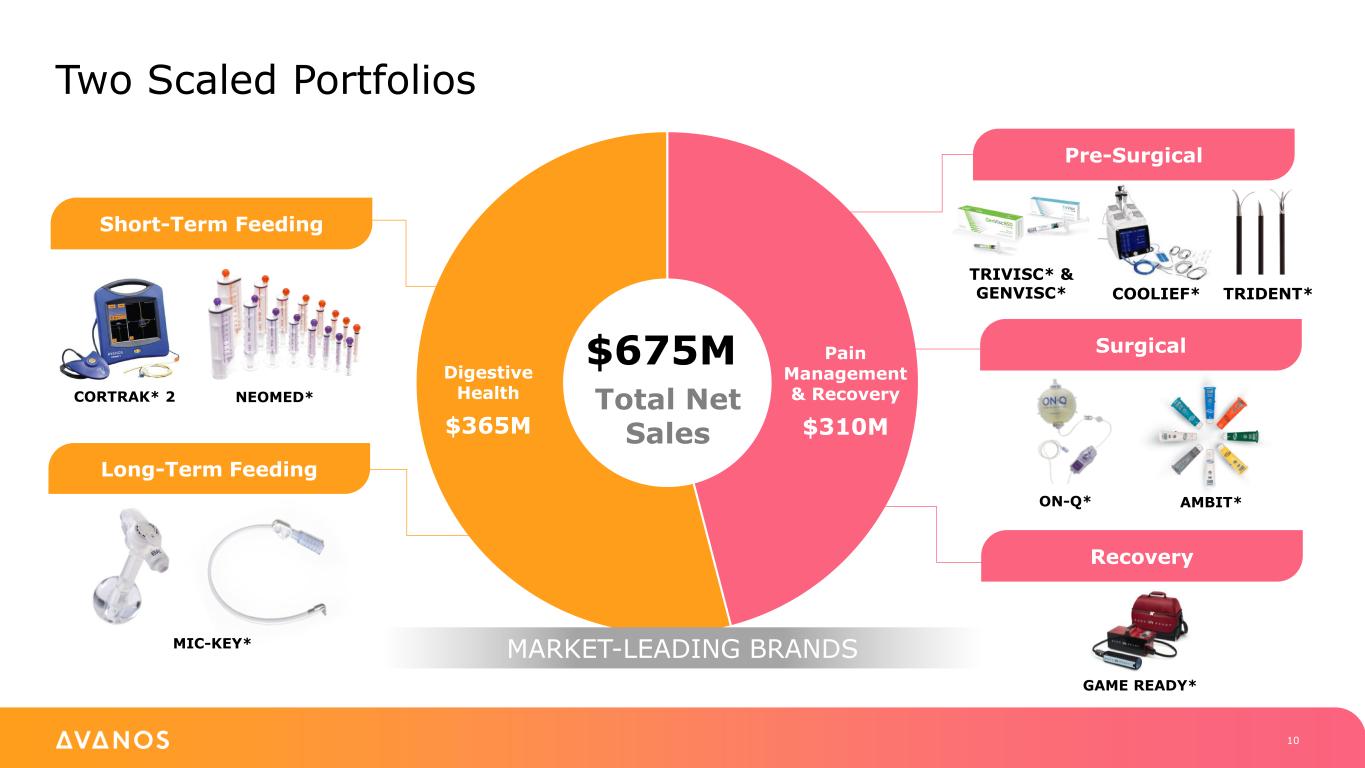

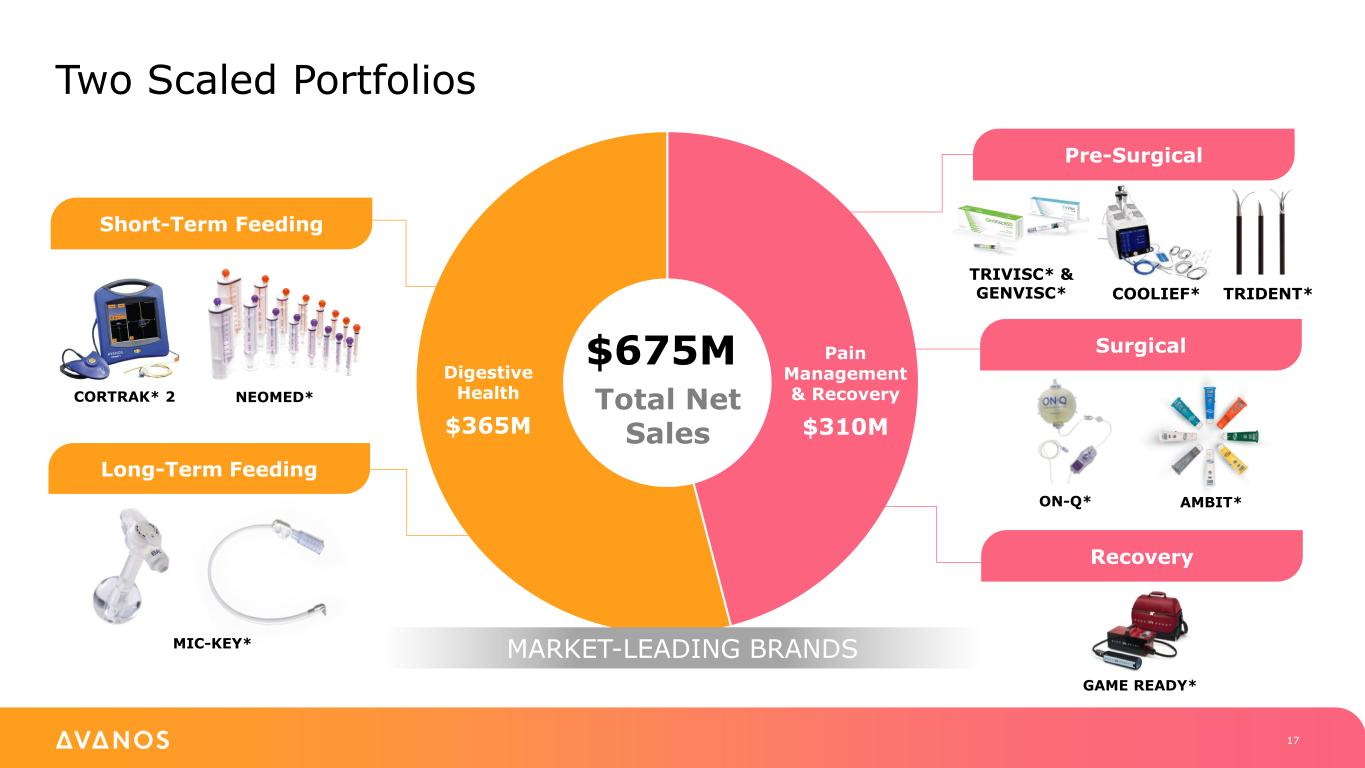

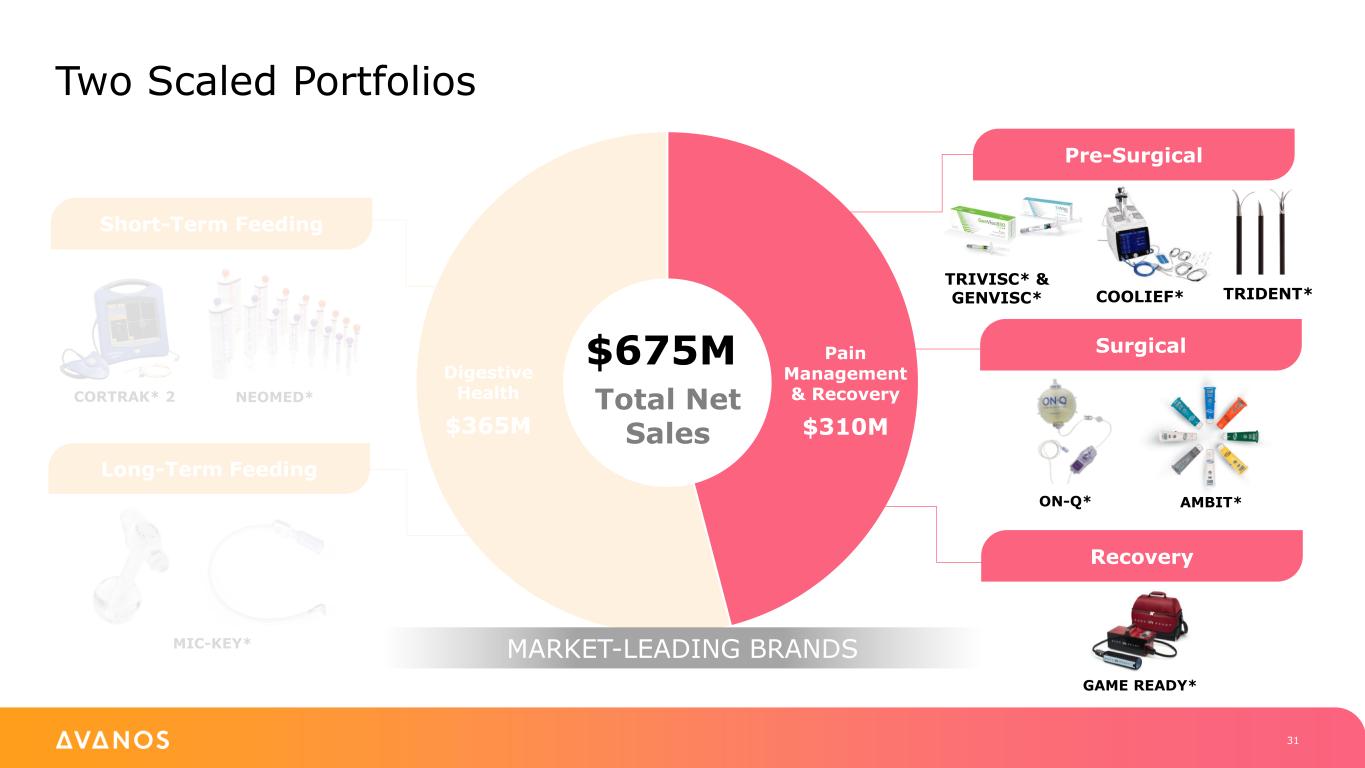

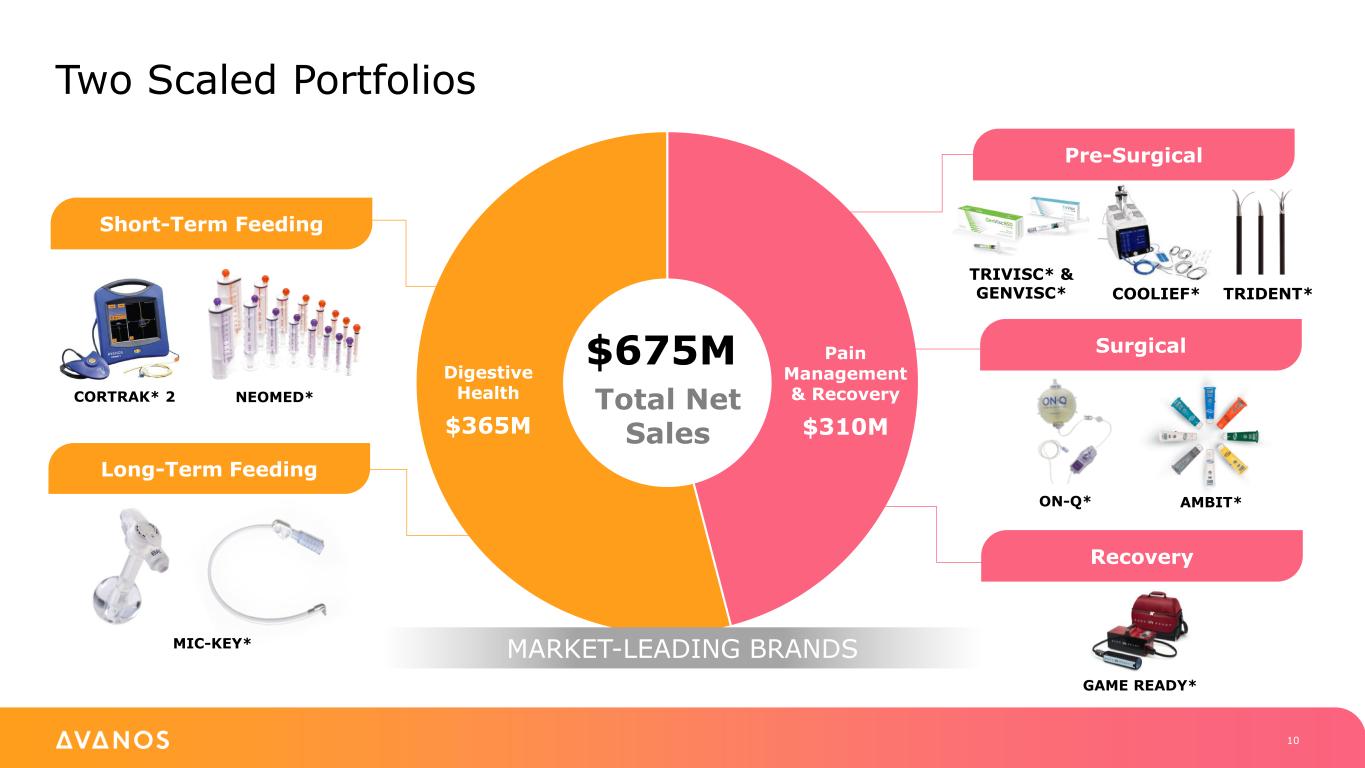

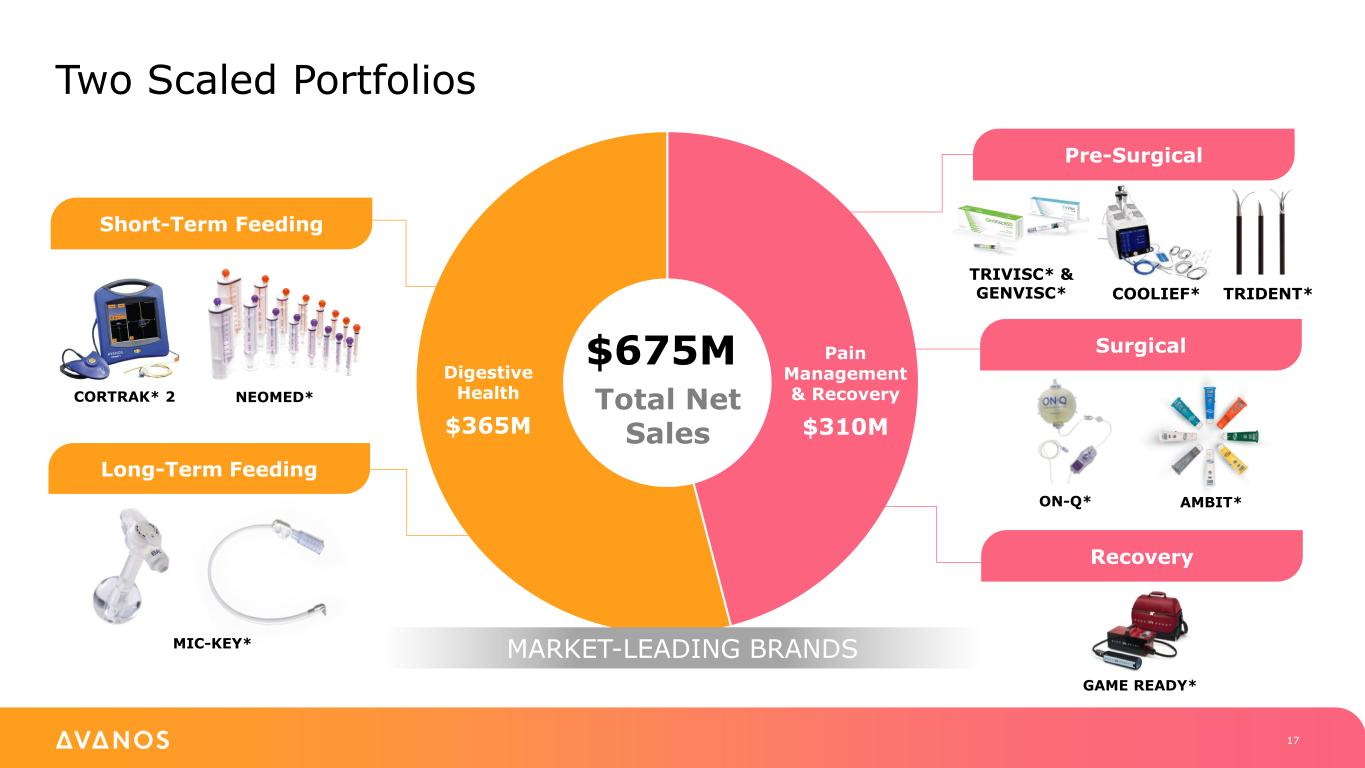

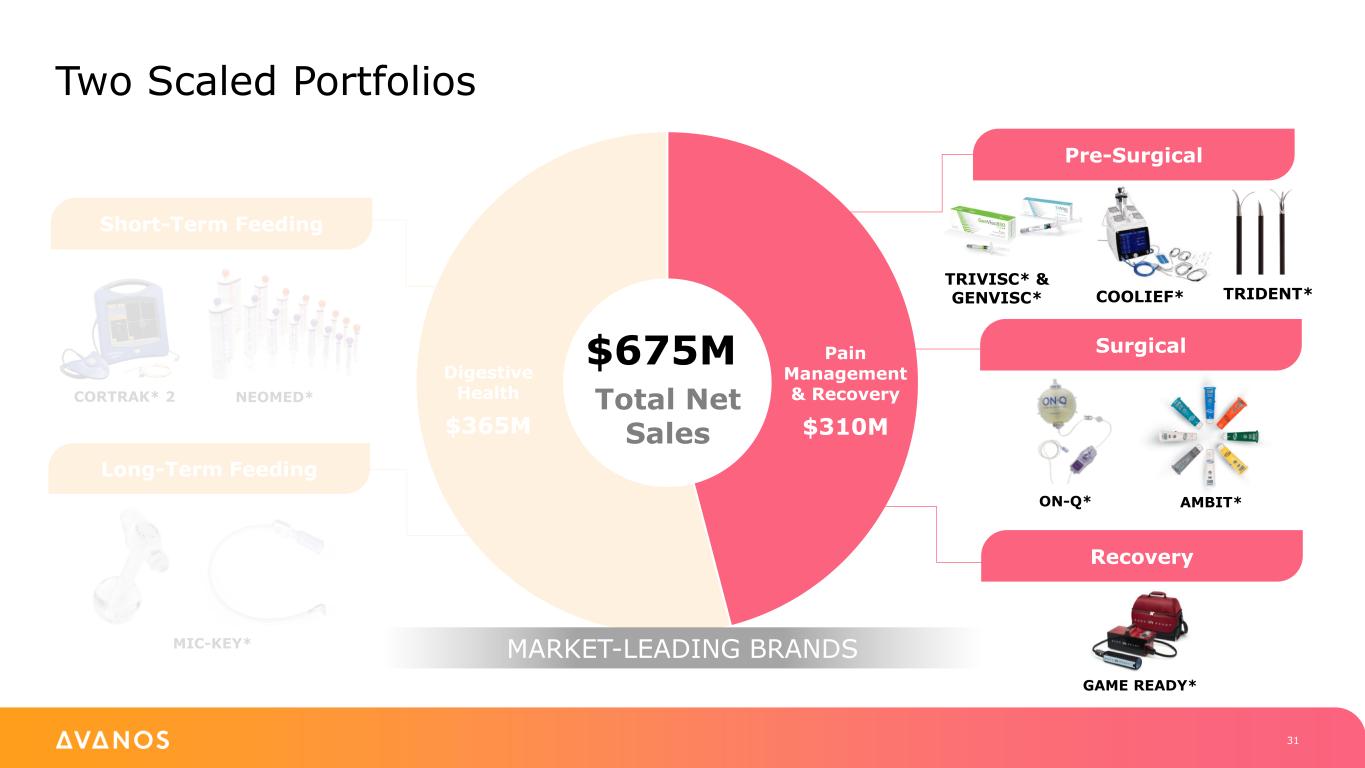

Digestive Health $365M Pain Management & Recovery $310M $675M Total Net Sales Two Scaled Portfolios 10 Short-Term Feeding CORTRAK* 2 NEOMED* TRIVISC* & GENVISC* COOLIEF* Pre-Surgical ON-Q* AMBIT* Surgical GAME READY* Recovery MIC-KEY* Long-Term Feeding MARKET-LEADING BRANDS TRIDENT*

Transformation Priorities: 2023–2025 11 Strategic & Commercial Optimization 1 Transform the Product Portfolio 2 Additional Cost Management Initiatives to Enhance Operating Profitability 3 Continued Efficient Capital Allocation Strategies to Expand Return on Invested Capital 4 DELIVERING VALUE TO ALL STAKEHOLDERS

Transformation Priorities: 2023–2025 Strategic & Commercial Optimization 1 Transform the Product Portfolio 2 12 Portfolio focus by increasing investments in product categories: • Digestive Health (MIC-KEY*, CORTRAK* and NEOMED*) • Pain Management & Recovery (GAME READY*, COOLIEF*, AMBIT*, ORTHOGENRX* and Diros) • New commercial leadership with synergistic opportunities • Grow market share in alternate sites (e.g., Ambulatory Surgery Center setting) • Exit low-margin and low-growth product categories • Advance SKU rationalization, price increases, and divestitures • Focus M&A on core and near-adjacent categories DELIVERING VALUE TO ALL STAKEHOLDERS

Transformation Priorities: 2023–2025 Additional Cost Management Initiatives to Enhance Operating Profitability Continued Efficient Capital Allocation Strategies to Expand Return on Invested Capital 13 • Reduce indirect spend • Pursue outsourcing opportunities as appropriate • Simplify supply chain/other functions through product focus and improved plant execution • Deliver SG&A as percentage of revenue between 38%-39% • Direct internal capital allocation toward focus categories • Maintain M&A discipline and conservative leverage level (current <1.0x) • Continue share repurchases when market is dislocated vs our internal intrinsic value estimates 3 4 DELIVERING VALUE TO ALL STAKEHOLDERS

14 Avanos Investment Thesis Solid core categories with consistent organic growth Direct adjacencies to add growth and margin improvement Clearly defined set of transformation priorities already in motion Leverageable financial model to generate material free cash flow and high ROIC

Commercial Optimization Kerr Holbrook Senior Vice President & Chief Commercial Officer

Transformation Priorities: 2023–2025 Strategic & Commercial Optimization 1 Transform the Product Portfolio 2 Additional Cost Management Initiatives to Enhance Operating Profitability 3 Continued Efficient Capital Allocation Strategies to Expand Return on Invested Capital 4 16 DELIVERING VALUE TO ALL STAKEHOLDERS

Digestive Health $365M Pain Management & Recovery $310M $675M Total Net Sales Two Scaled Portfolios 17 Short-Term Feeding CORTRAK* 2 NEOMED* TRIVISC* & GENVISC* COOLIEF* Pre-Surgical ON-Q* AMBIT* Surgical GAME READY* Recovery MIC-KEY* Long-Term Feeding MARKET-LEADING BRANDS TRIDENT*

Digestive Health (DH) Summary 18 • Leadership and consistent above-market growth in >$1B core market • MSD growth expected with existing portfolio and commercial execution • ~60% gross margin • Acceleration via innovation and M&A in $6B+ adjacencies

Long-Term Feeding: Months to Life 19 Short-Term Feeding Long-Term FeedingGastrostomy Tube Placement & Replacement Initial Feeding Tube Placement Indicates current make-up of DH portfolio Short-Term Feeding: Less than 30 days Enteral Pump, Nutrition and Supplements are not part of the current DH Portfolio Providing Short- & Long-Term Enteral Feeding Solutions

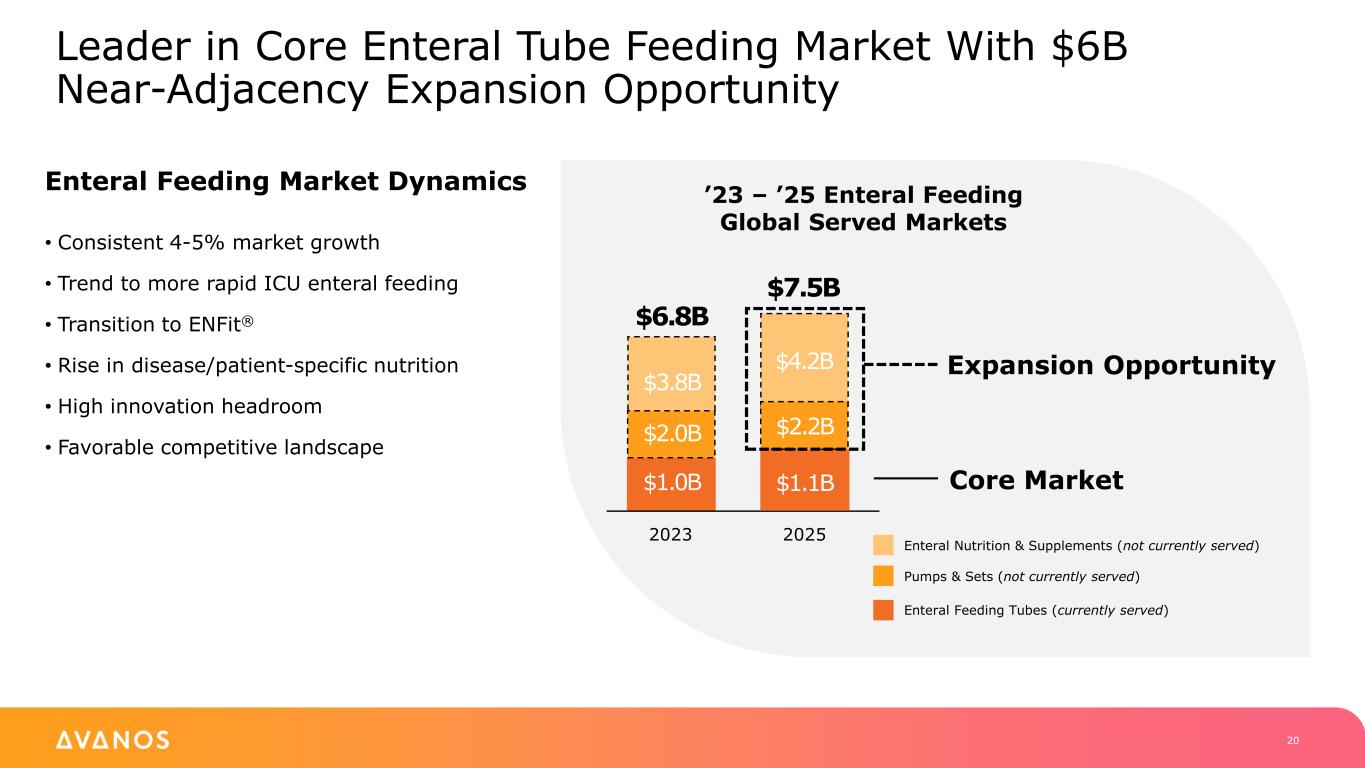

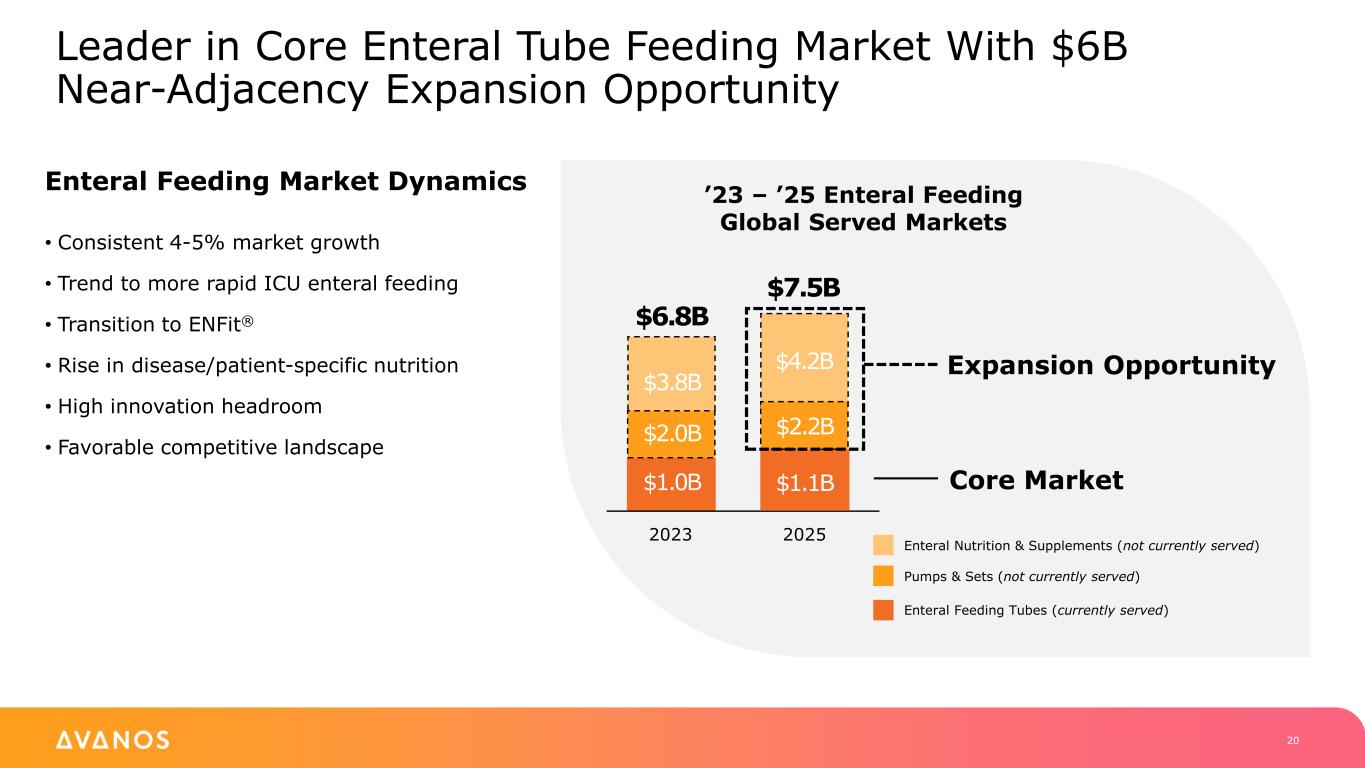

’23 – ’25 Enteral Feeding Global Served Markets Enteral Feeding Tubes (currently served) Pumps & Sets (not currently served) Enteral Nutrition & Supplements (not currently served) Leader in Core Enteral Tube Feeding Market With $6B Near-Adjacency Expansion Opportunity 20 2023 2025 Expansion Opportunity $8.1B $1.0B 6B $4.2B $6.8B $1.1B $2.0B $3.8B $2.2B $7.5B Core Market Enteral Feeding Market Dynamics • Consistent 4-5% market growth • Trend to more rapid ICU enteral feeding • Transition to ENFit® • Rise in disease/patient-specific nutrition • High innovation headroom • Favorable competitive landscape

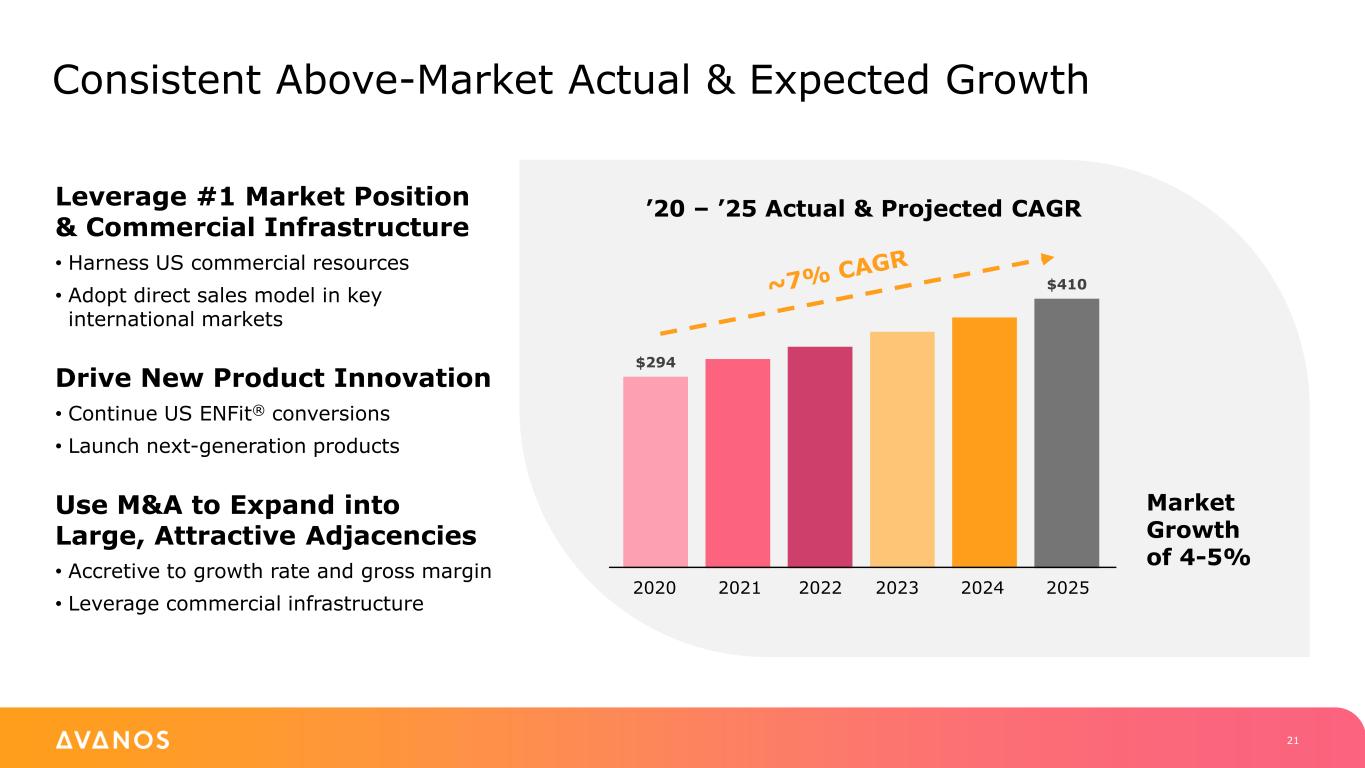

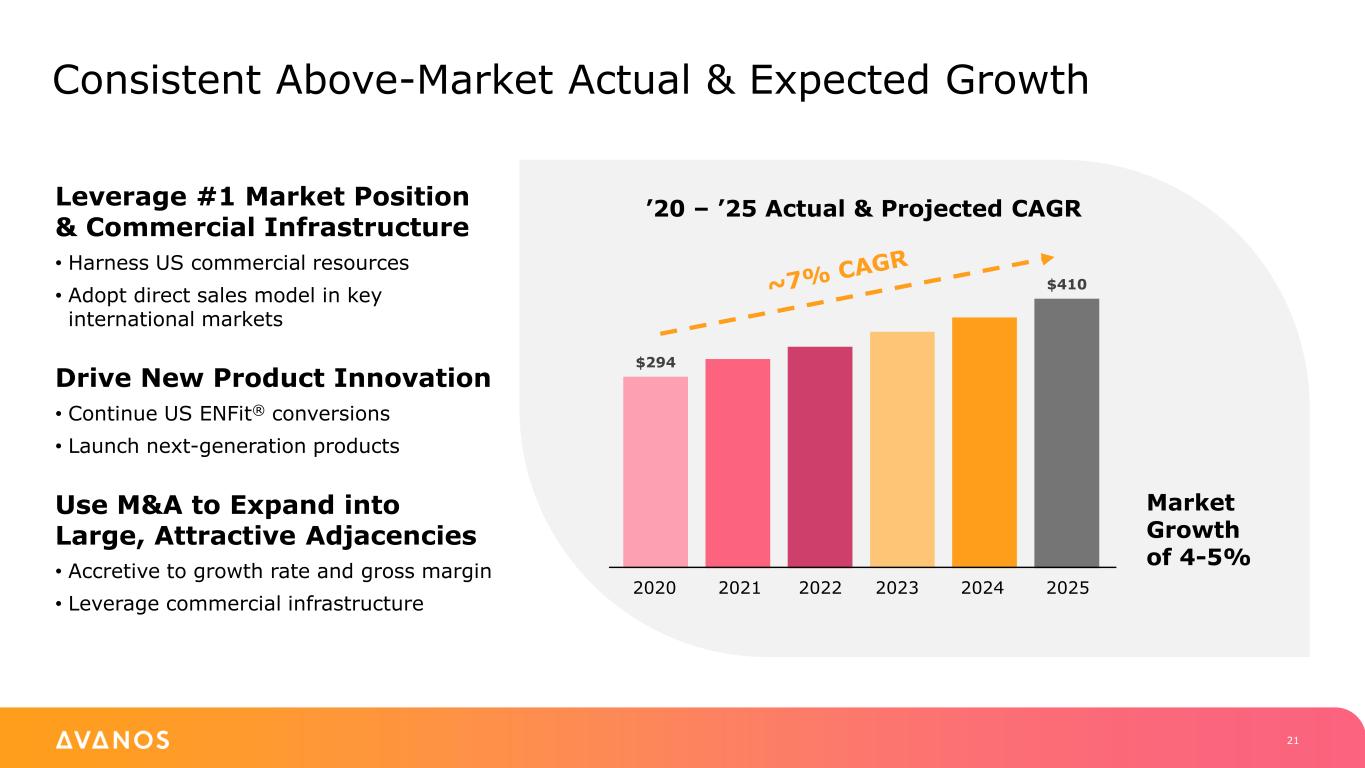

’20 – ’25 Actual & Projected CAGR Consistent Above-Market Actual & Expected Growth 21 Leverage #1 Market Position & Commercial Infrastructure • Harness US commercial resources • Adopt direct sales model in key international markets Drive New Product Innovation • Continue US ENFit® conversions • Launch next-generation products Use M&A to Expand into Large, Attractive Adjacencies • Accretive to growth rate and gross margin • Leverage commercial infrastructure Market Growth of 4-5% $294 $410 2020 2021 2022 2023 2024 2025

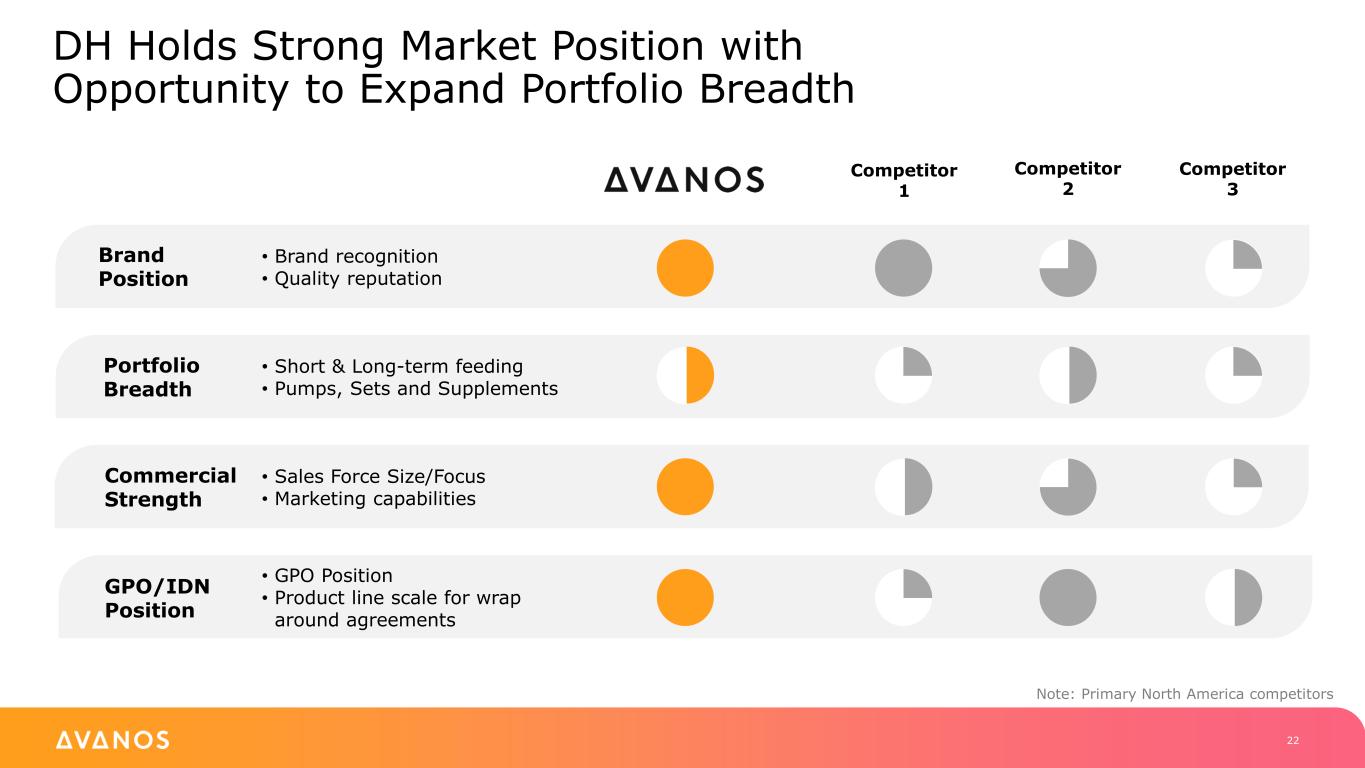

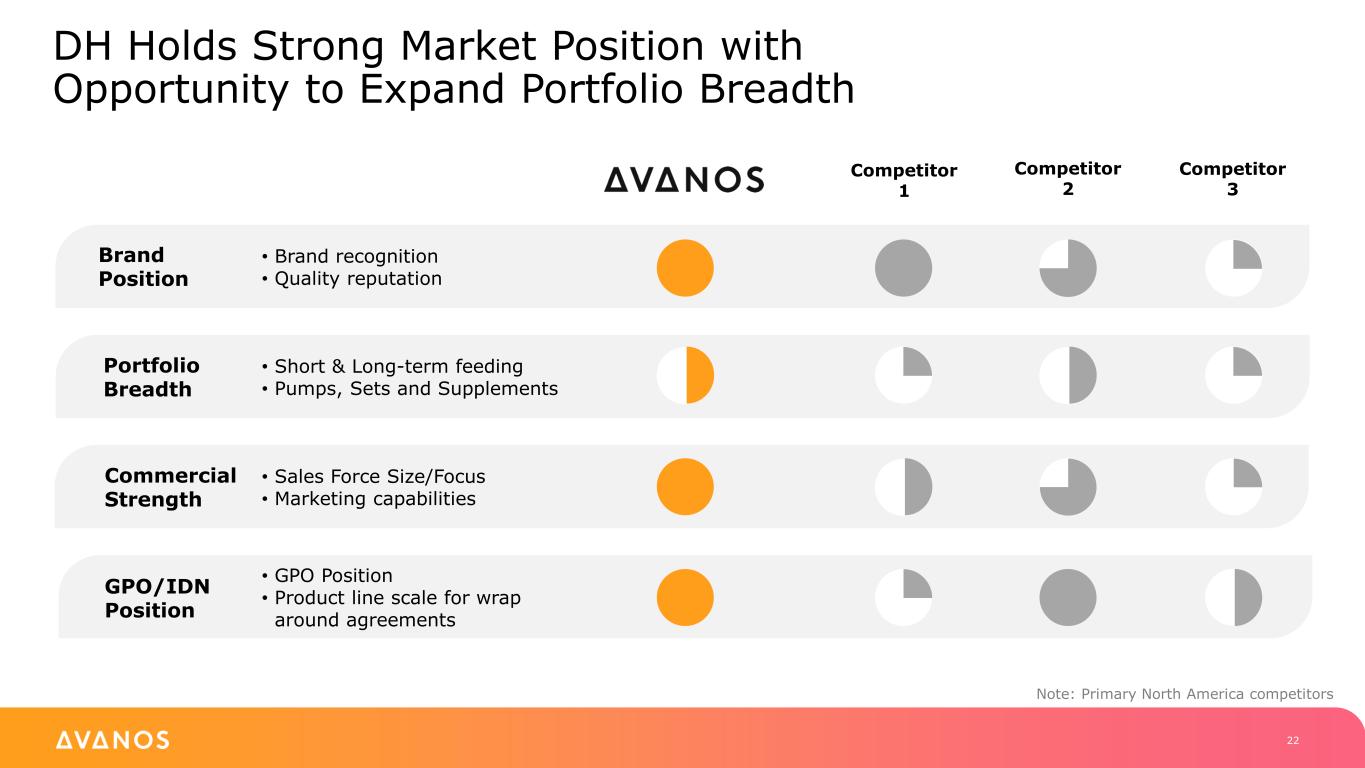

DH Holds Strong Market Position with Opportunity to Expand Portfolio Breadth Competitor 1 Competitor 2 Portfolio Breadth • Short & Long-term feeding • Pumps, Sets and Supplements Commercial Strength • Sales Force Size/Focus • Marketing capabilities Brand Position • Brand recognition • Quality reputation Competitor 3 22 • GPO Position • Product line scale for wrap around agreements GPO/IDN Position Note: Primary North America competitors

DH Commercial Potential Channel & Patient Engagement Create Advantage Hospital (Short-Term Feeding) • #1 market position in short-term feeding • ~100 dedicated sales reps • Corporate Accounts team • Medical society partnerships Home (Long-Term Feeding) • #1 market position in long-term feeding • Durable Medical Equipment sales team • Direct-to-patient programs • Nurse Hotline 23

24 Short-Term Feeding (CORTRAK* 2) Convert ICUs from blind placement to CORTRAK* 2; HSD growth Current Situation • ~$300M global served market; ~6% CAGR • #1 share in US guided placement • ~80% US market not converted to guided placement • Dedicated CORTRAK* 2 sales team Growth Strategy • Continue conversion from blind placement to CORTRAK* 2 • Launch next-gen CORTRAK* 2 “Patient care has improved significantly with the use of CORTRAK* 2.” 1 – Clinical Nutrition Manager Actual testimonial, individual experience may vary

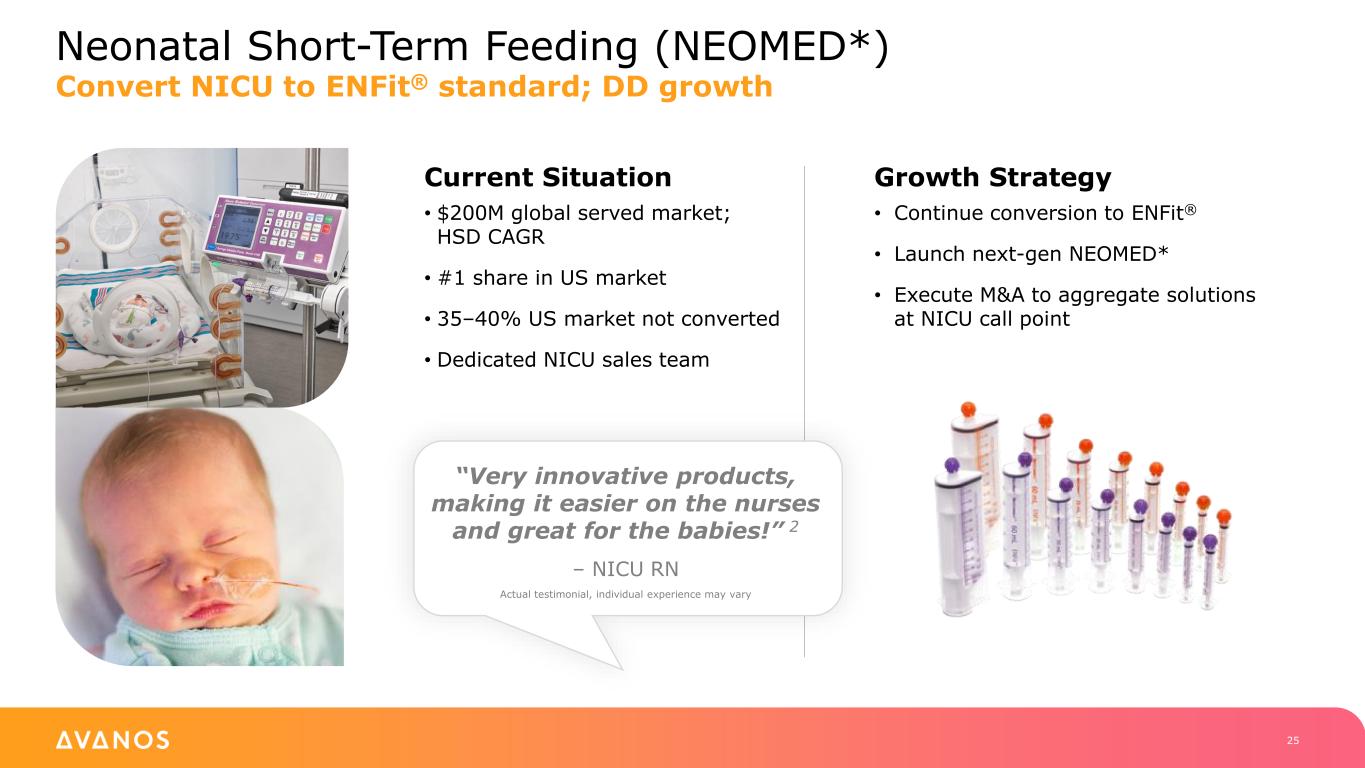

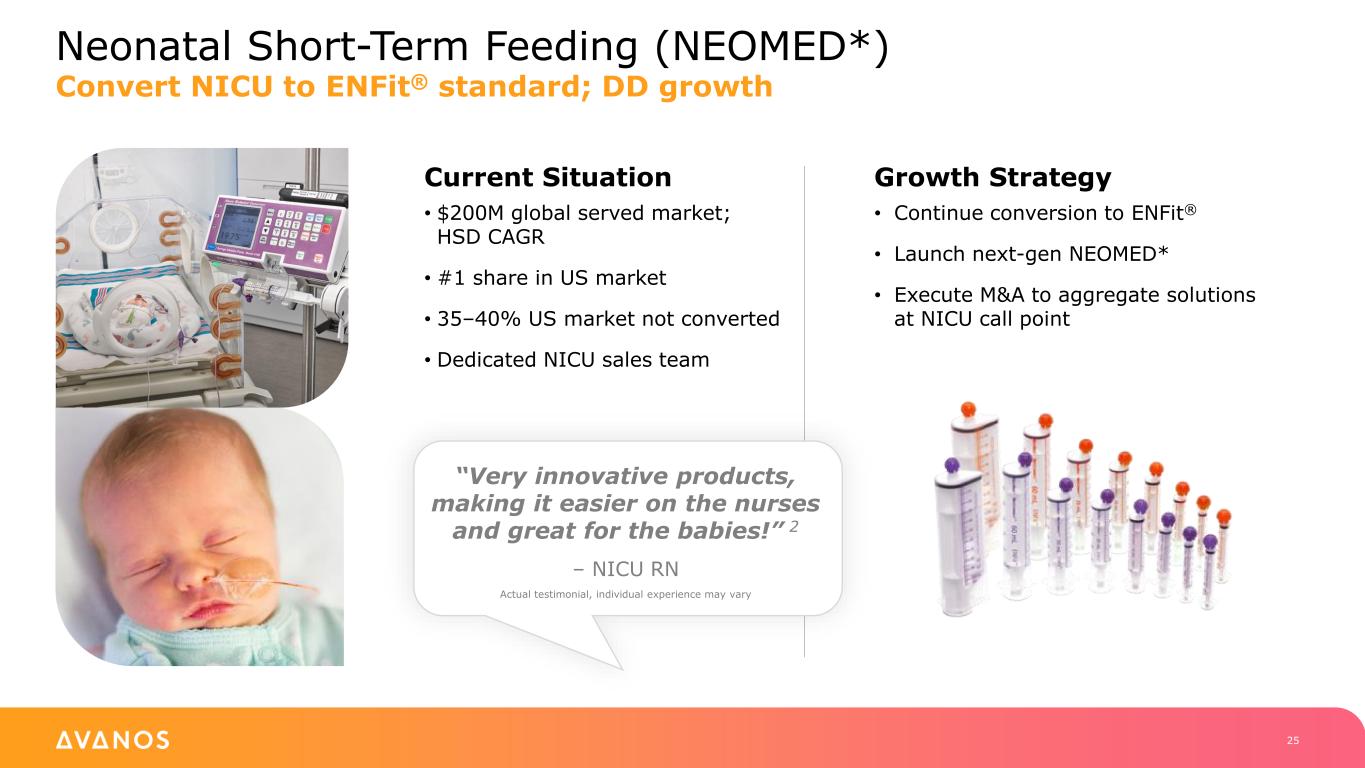

25 Neonatal Short-Term Feeding (NEOMED*) Convert NICU to ENFit® standard; DD growth Current Situation • $200M global served market; HSD CAGR • #1 share in US market • 35–40% US market not converted • Dedicated NICU sales team Growth Strategy Growth Strategy • Continue conversion to ENFit® • Launch next-gen NEOMED* • Execute M&A to aggregate solutions at NICU call point “Very innovative products, making it easier on the nurses and great for the babies!” 2 – NICU RN Actual testimonial, individual experience may vary

Current Situation • ~$500M global served market; 4-5% CAGR • #1 share in US market • Dedicated US sales team • $6B in natural adjacencies 26 Long-Term Feeding (MIC-KEY* Portfolio) Extend global reach and launch next-gen portfolio; MSD growth Indicates current make-up of DH portfolio “MIC-KEY* will change your life.” 3 – MIC-KEY* Patient Actual testimonial, individual experience may vary Growth Strategy • Globalize MIC-KEY* brand in key markets • Launch next-gen MIC-KEY* portfolio • Execute M&A in attractive adjacencies Enteral Pump, Nutrition and Supplements are not part of the current DH Portfolio

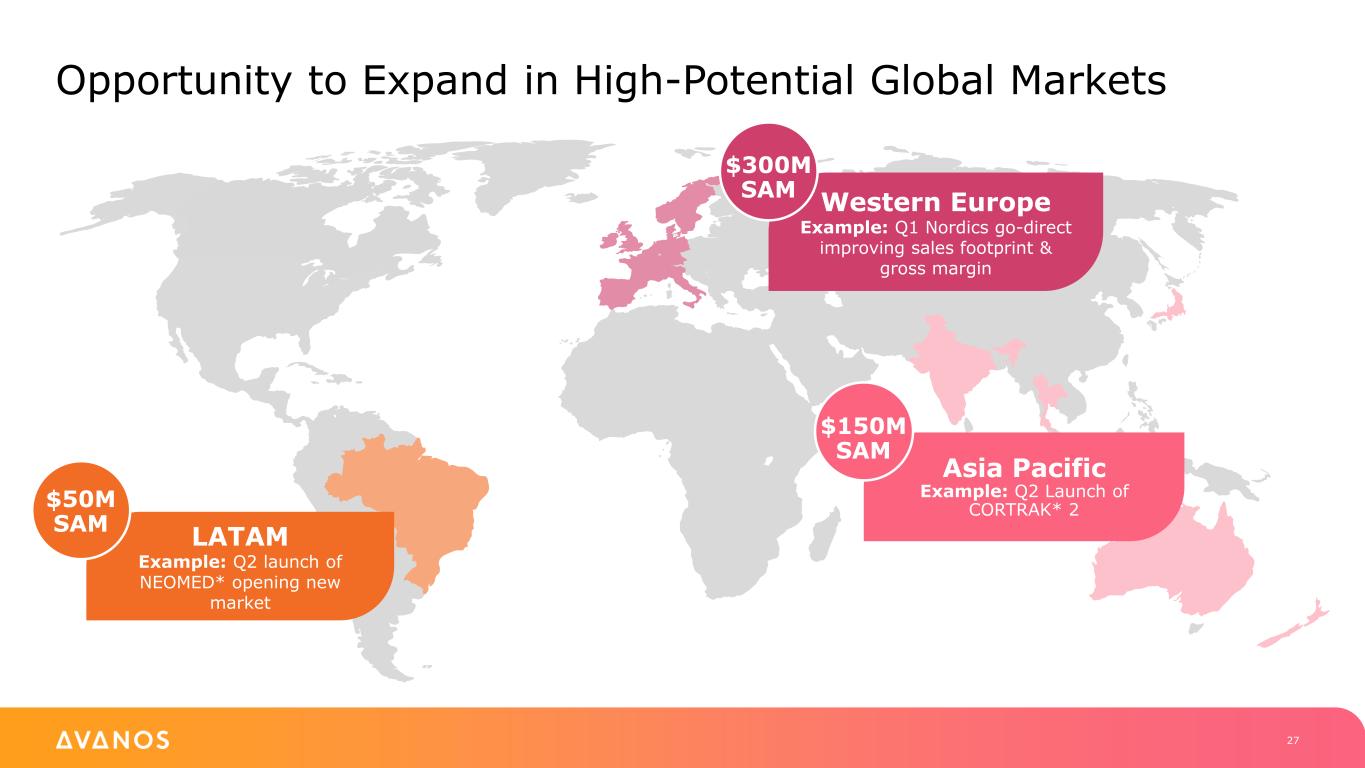

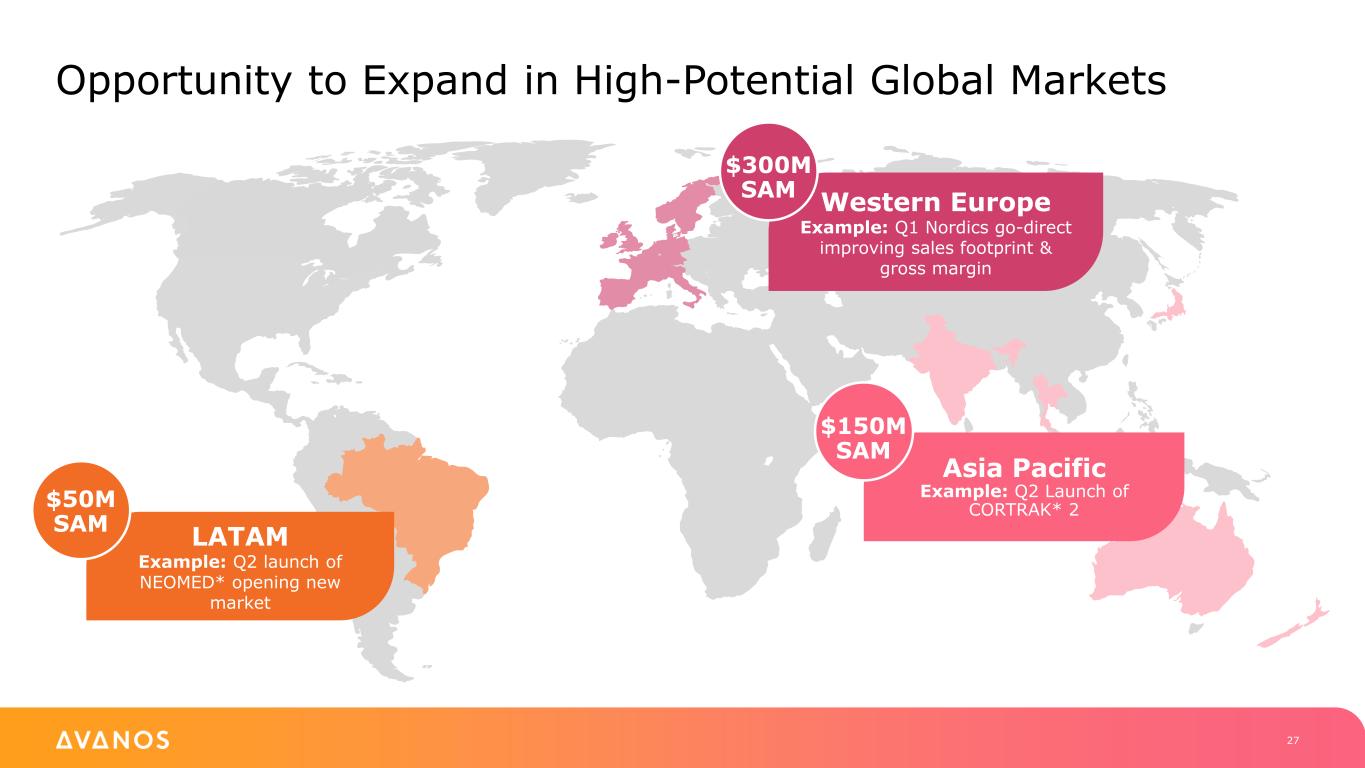

LATAM Example: Q2 launch of NEOMED* opening new market 27 Asia Pacific Example: Q2 Launch of CORTRAK* 2 Western Europe Example: Q1 Nordics go-direct improving sales footprint & gross margin $150M SAM $300M SAM $50M SAM Opportunity to Expand in High-Potential Global Markets

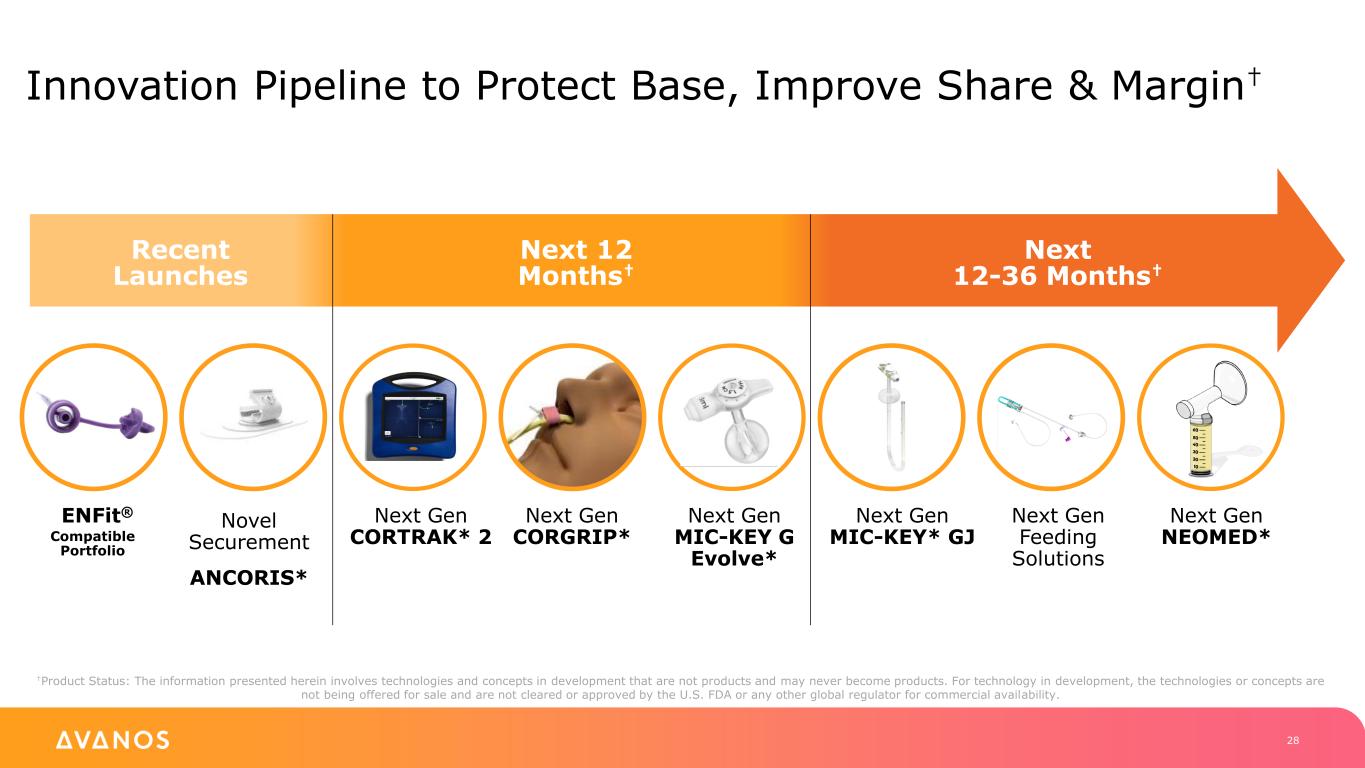

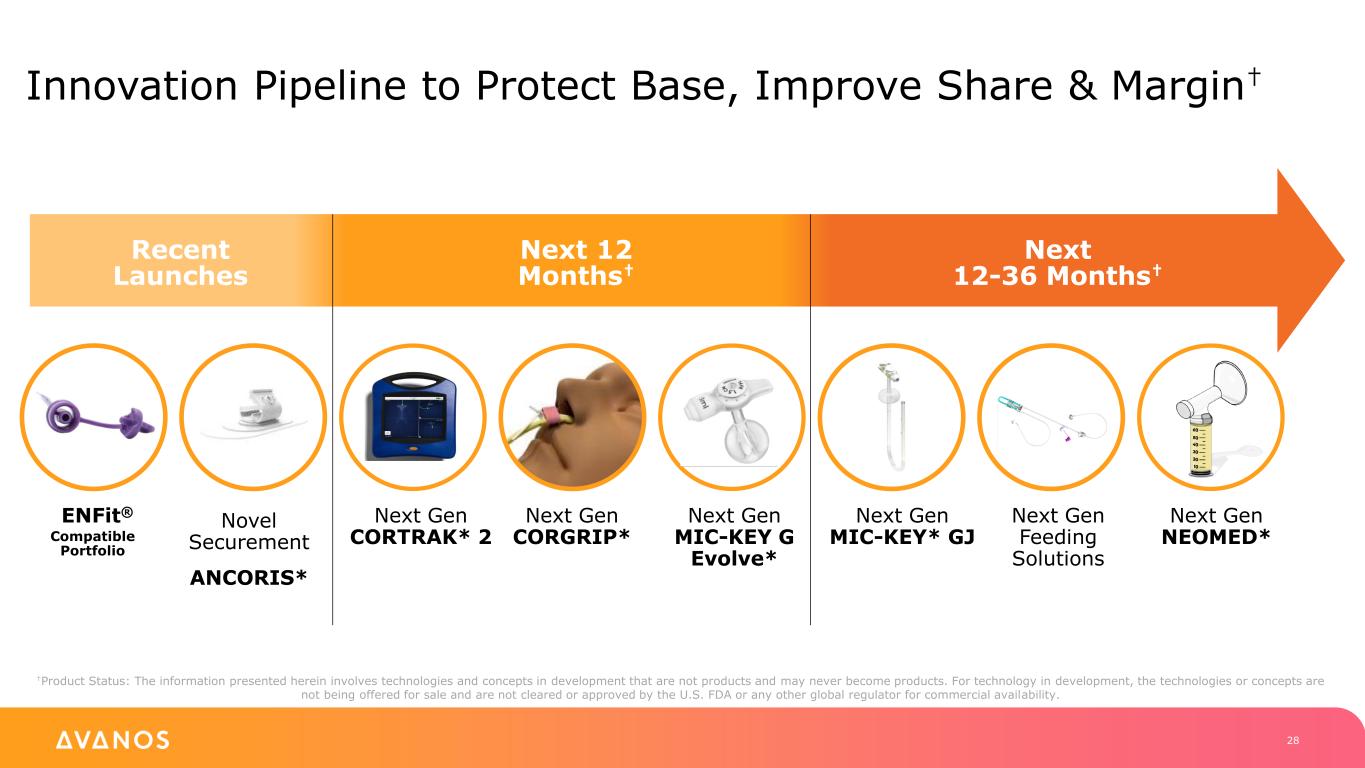

Innovation Pipeline to Protect Base, Improve Share & Margin† Next Gen MIC-KEY G Evolve* Next Gen CORTRAK* 2 Next Gen NEOMED* ENFit® Next Gen Feeding Solutions Recent Launches Next Gen MIC-KEY* GJ Next 12 Months† Next 12-36 Months† Next Gen CORGRIP* Novel Securement ANCORIS* 28 Compatible Portfolio †Product Status: The information presented herein involves technologies and concepts in development that are not products and may never become products. For technology in development, the technologies or concepts are not being offered for sale and are not cleared or approved by the U.S. FDA or any other global regulator for commercial availability.

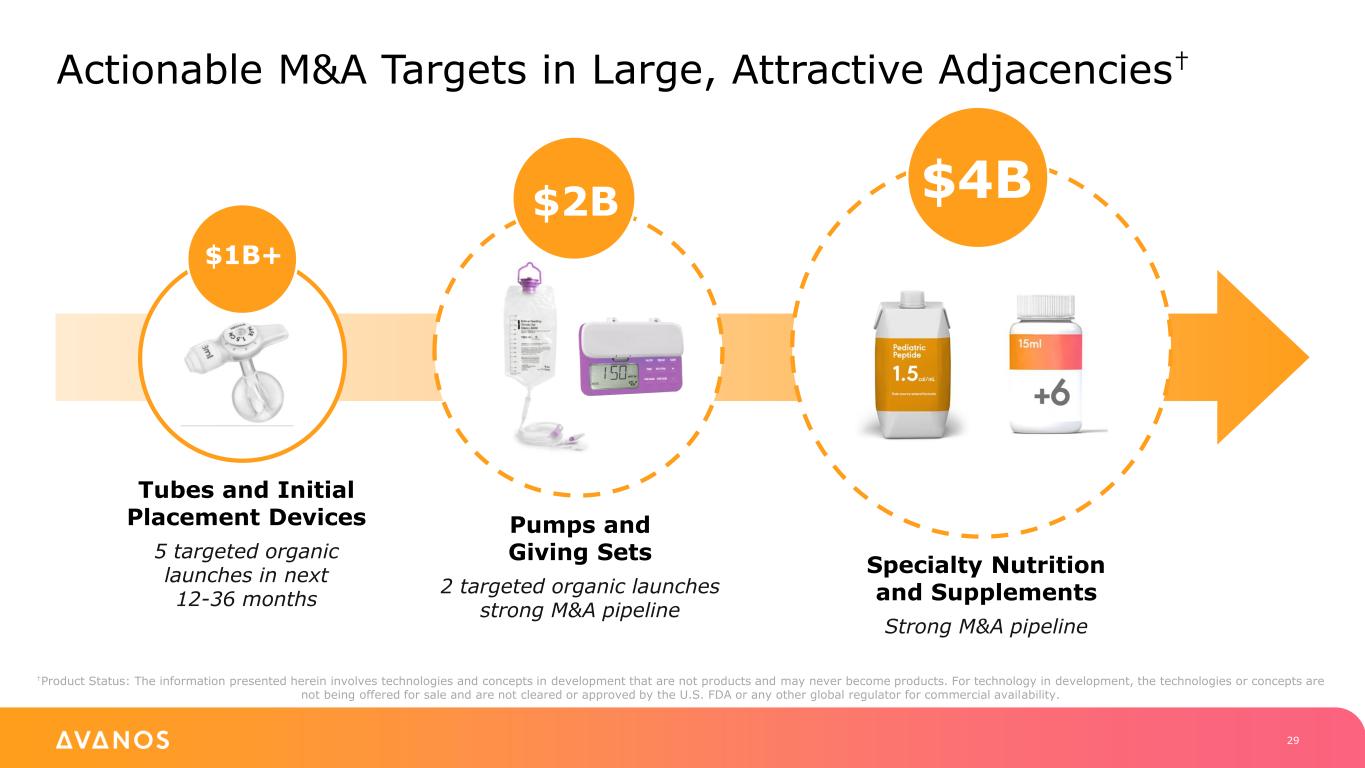

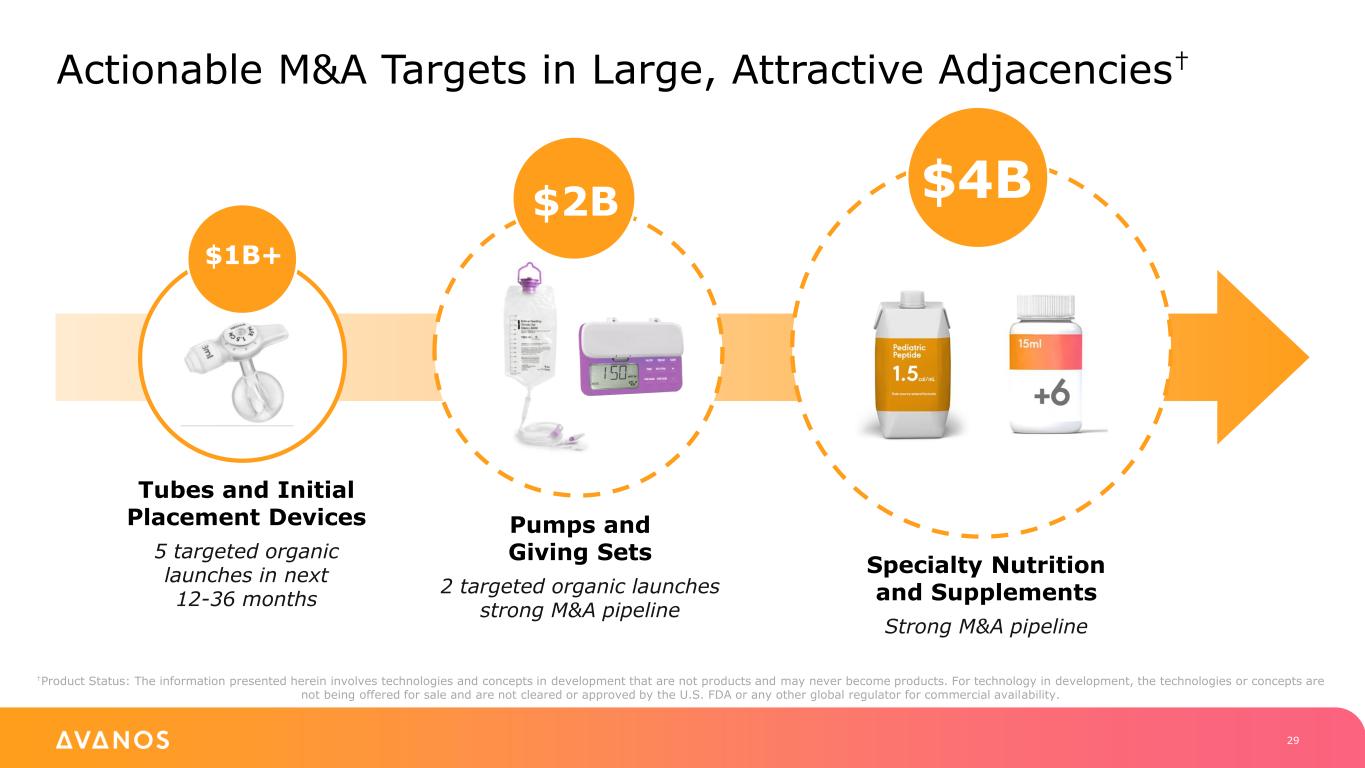

Actionable M&A Targets in Large, Attractive Adjacencies† 29 Tubes and Initial Placement Devices 5 targeted organic launches in next 12-36 months $1B+ Pumps and Giving Sets 2 targeted organic launches strong M&A pipeline $2B Specialty Nutrition and Supplements Strong M&A pipeline $4B †Product Status: The information presented herein involves technologies and concepts in development that are not products and may never become products. For technology in development, the technologies or concepts are not being offered for sale and are not cleared or approved by the U.S. FDA or any other global regulator for commercial availability.

Digestive Health Summary 30 • Leadership and consistent above-market growth in >$1B core market • MSD growth expected with existing portfolio and commercial execution • ~60% gross margin • Acceleration via innovation and M&A in $6B+ adjacencies

TRIVISC* & GENVISC* Digestive Health $365M Pain Management & Recovery $310M Two Scaled Portfolios 31 Short-Term Feeding CORTRAK* 2 NEOMED* Pre-Surgical ON-Q* AMBIT* Surgical GAME READY* Recovery MIC-KEY* Long-Term Feeding MARKET-LEADING BRANDS $675M Total Net Sales COOLIEF* TRIDENT*

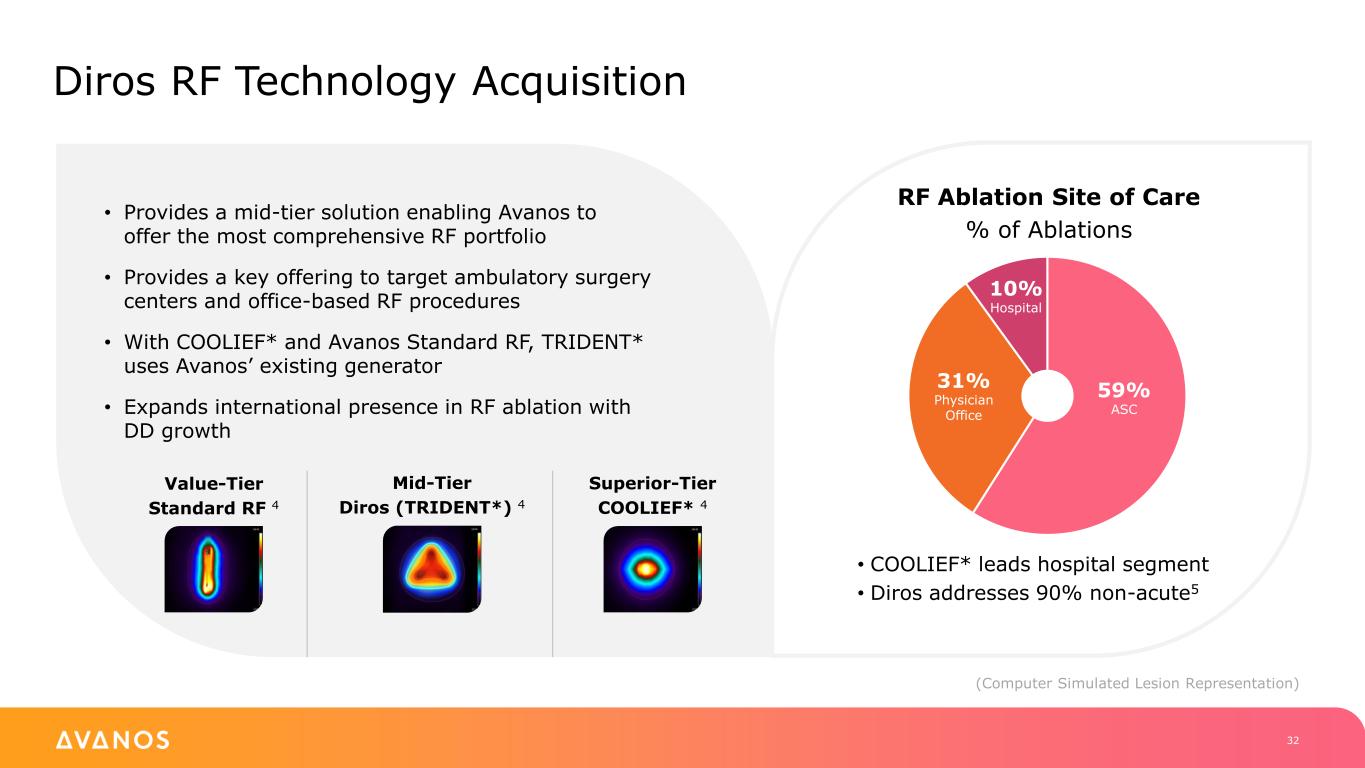

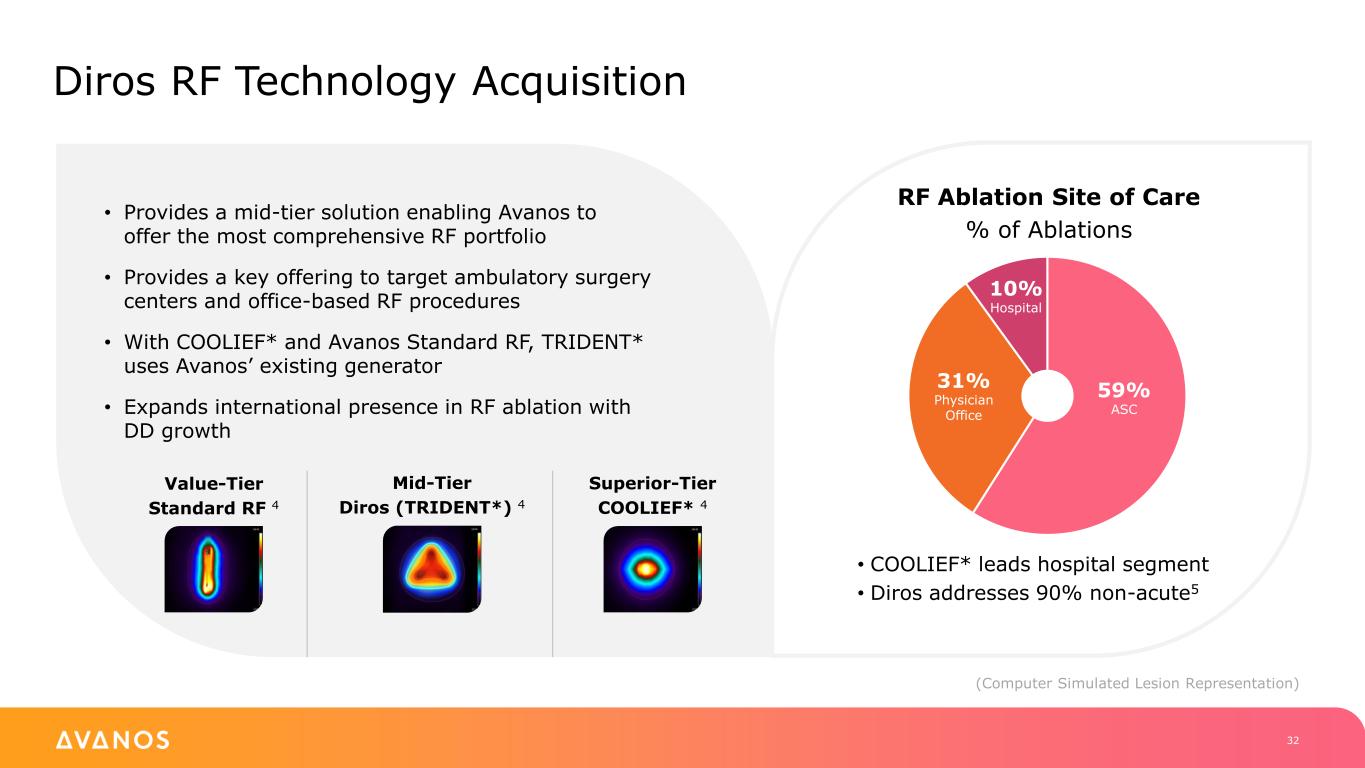

Diros RF Technology Acquisition 32 • Provides a mid-tier solution enabling Avanos to offer the most comprehensive RF portfolio • Provides a key offering to target ambulatory surgery centers and office-based RF procedures • With COOLIEF* and Avanos Standard RF, TRIDENT* uses Avanos’ existing generator • Expands international presence in RF ablation with DD growth RF Ablation Site of Care % of Ablations • COOLIEF* leads hospital segment • Diros addresses 90% non-acute5 Value-Tier Standard RF 4 Mid-Tier Diros (TRIDENT*) 4 Superior-Tier COOLIEF* 4 59% ASC 31% Physician Office 10% Hospital (Computer Simulated Lesion Representation)

Pain Management & Recovery Summary 33 • Four strong brands that connect patient lifecycle • Portfolio expected to deliver MSD growth and 60% gross margin • Commercial reset will improve sales effectiveness and expected to deliver <40% SG&A • Very selective investment in innovation, M&A and international

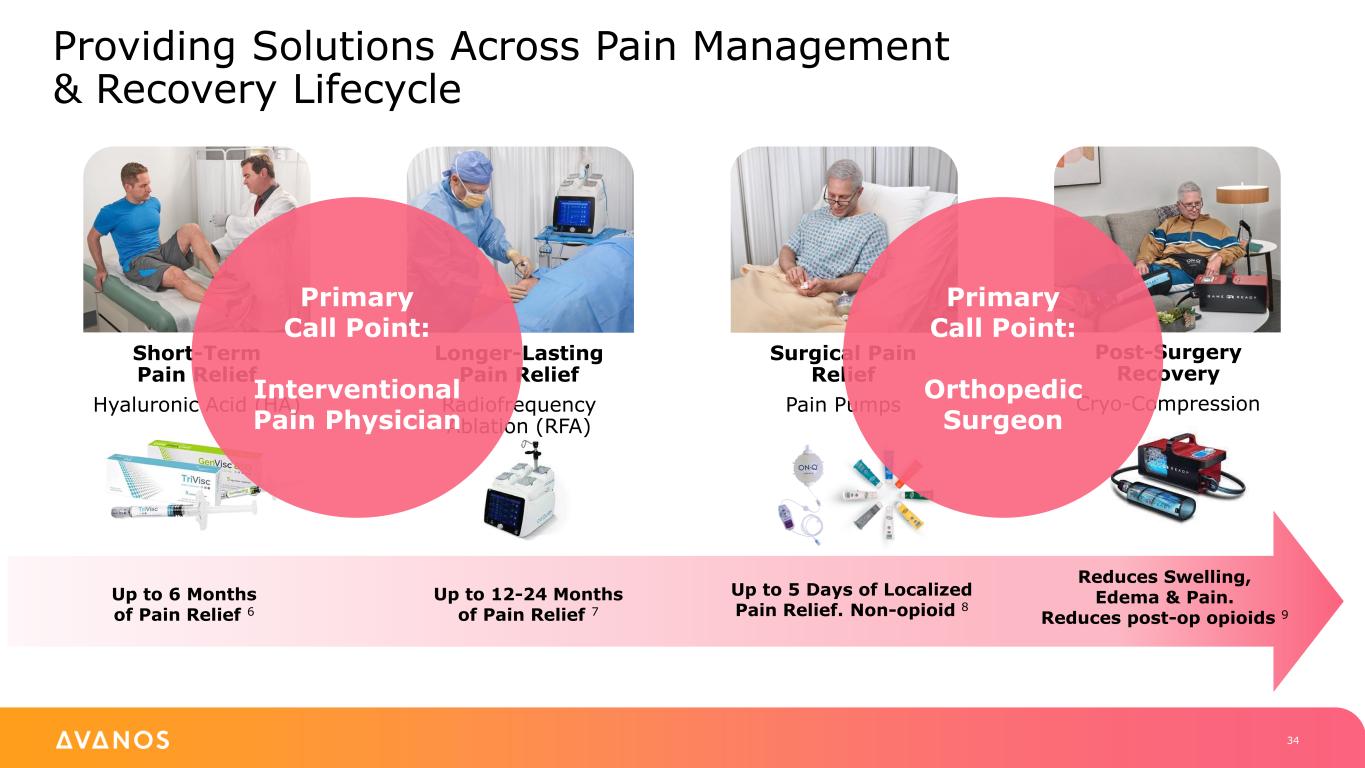

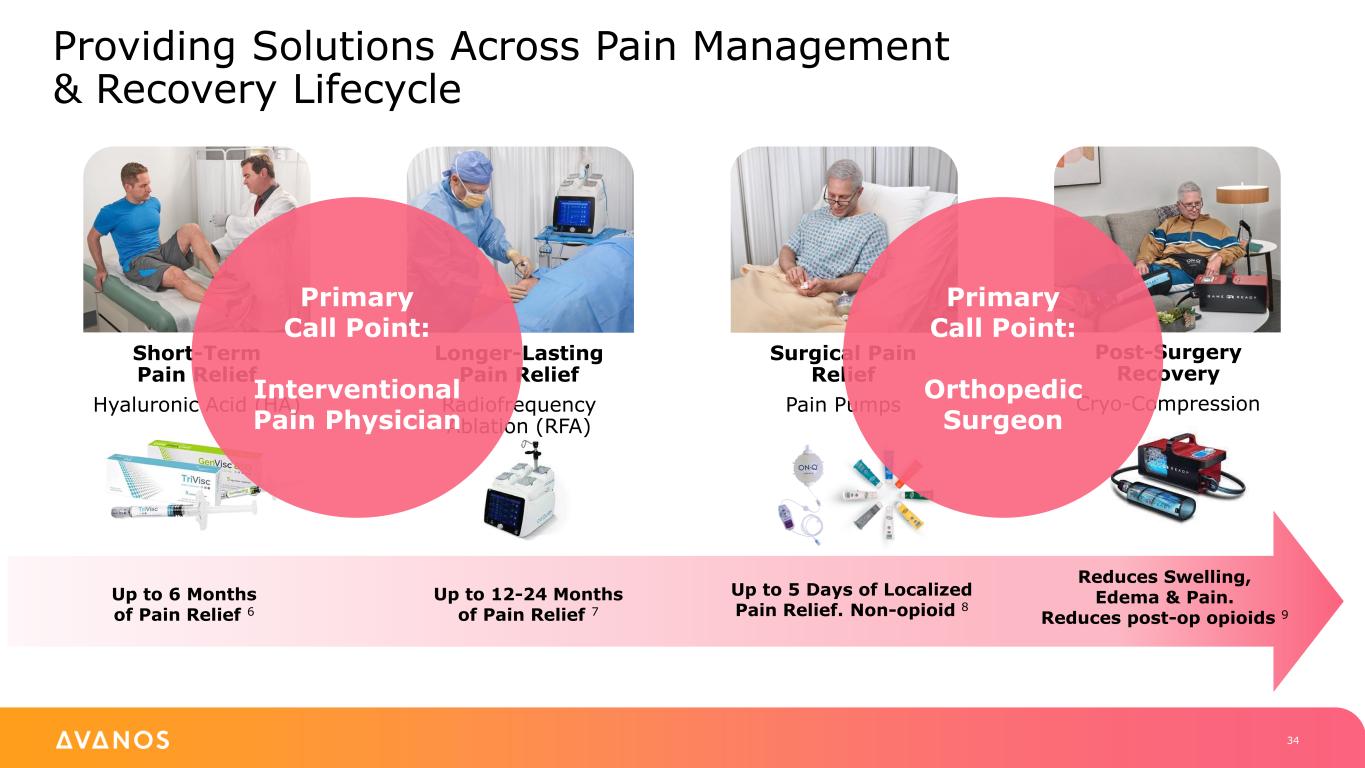

Providing Solutions Across Pain Management & Recovery Lifecycle Short-Term Pain Relief Hyaluronic Acid (HA) Surgical Pain Relief Pain Pumps Post-Surgery Recovery Cryo-Compression Longer-Lasting Pain Relief Radiofrequency Ablation (RFA) 34 Up to 6 Months of Pain Relief 6 Up to 12-24 Months of Pain Relief 7 Up to 5 Days of Localized Pain Relief. Non-opioid 8 Reduces Swelling, Edema & Pain. Reduces post-op opioids 9 Primary Call Point: Interventional Pain Physician Primary Call Point: Orthopedic Surgeon

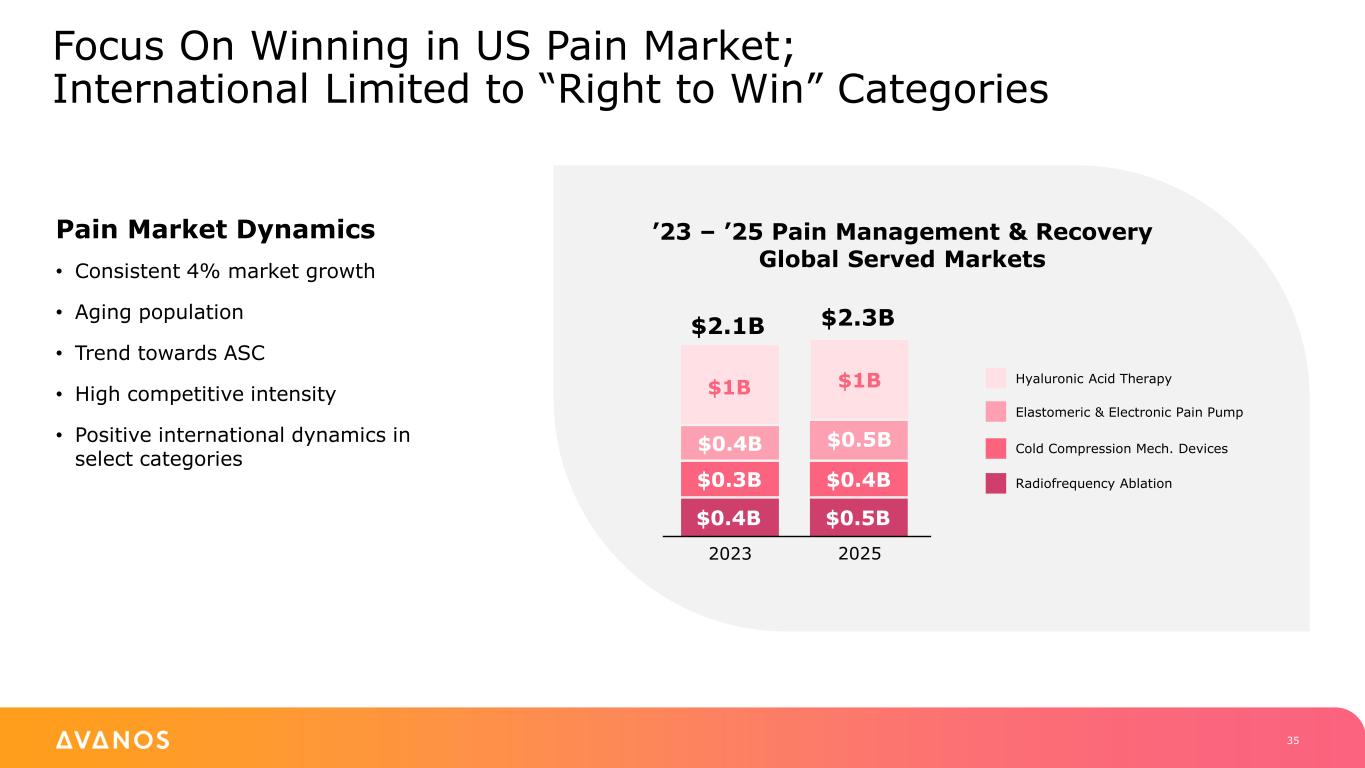

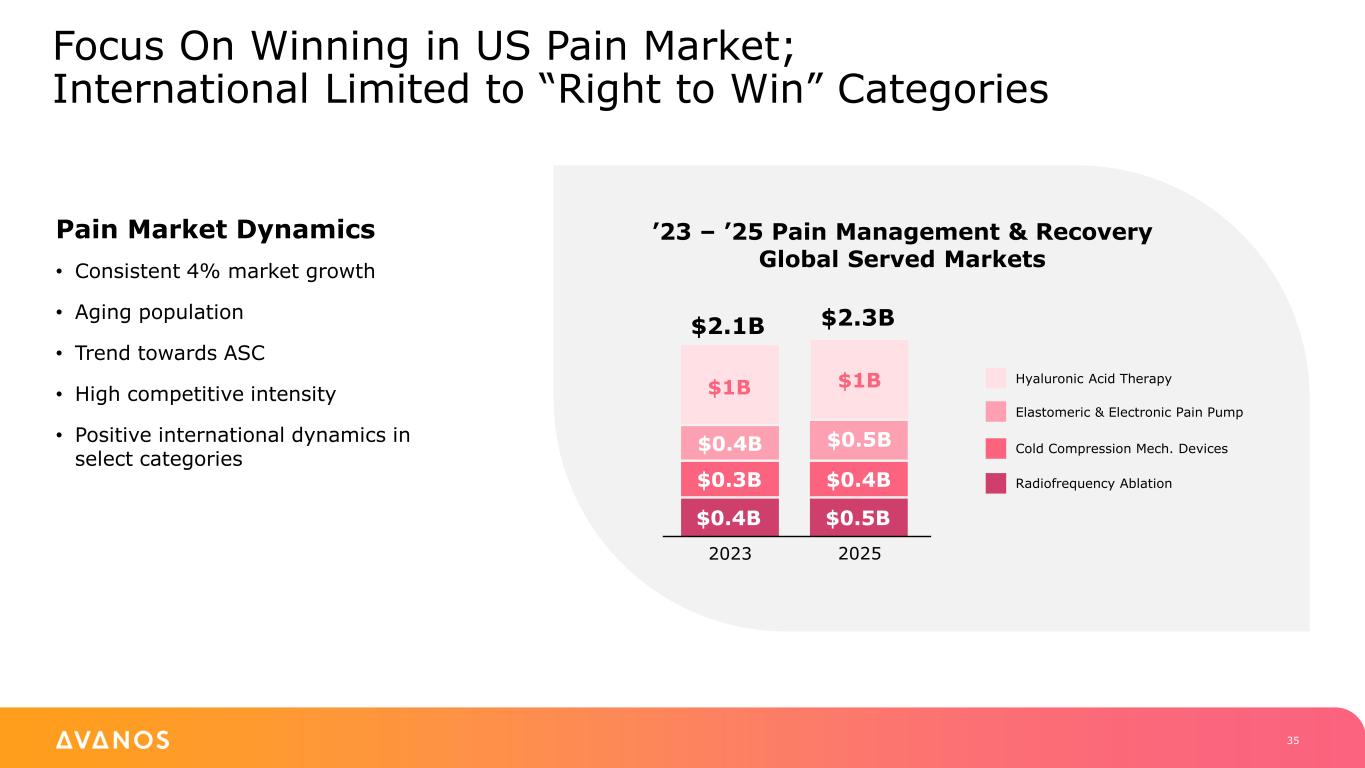

Focus On Winning in US Pain Market; International Limited to “Right to Win” Categories Pain Market Dynamics • Consistent 4% market growth • Aging population • Trend towards ASC • High competitive intensity • Positive international dynamics in select categories 35 ’23 – ’25 Pain Management & Recovery Global Served Markets Cold Compression Mech. Devices Elastomeric & Electronic Pain Pump Hyaluronic Acid Therapy Radiofrequency Ablation 2023 2025 $1B $2.1B $2.3B $0.5B $0.5B $0.4B $0.4B $0.4B $0.3B $1B

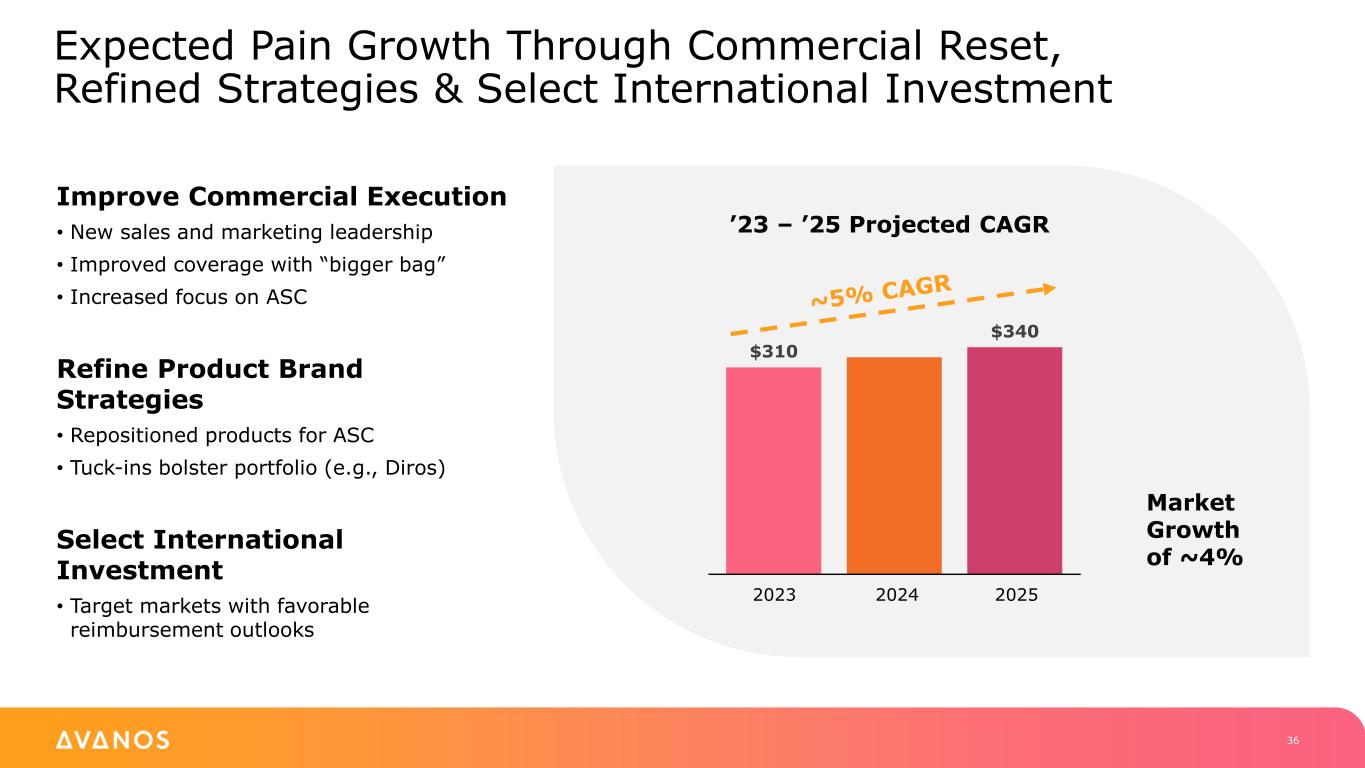

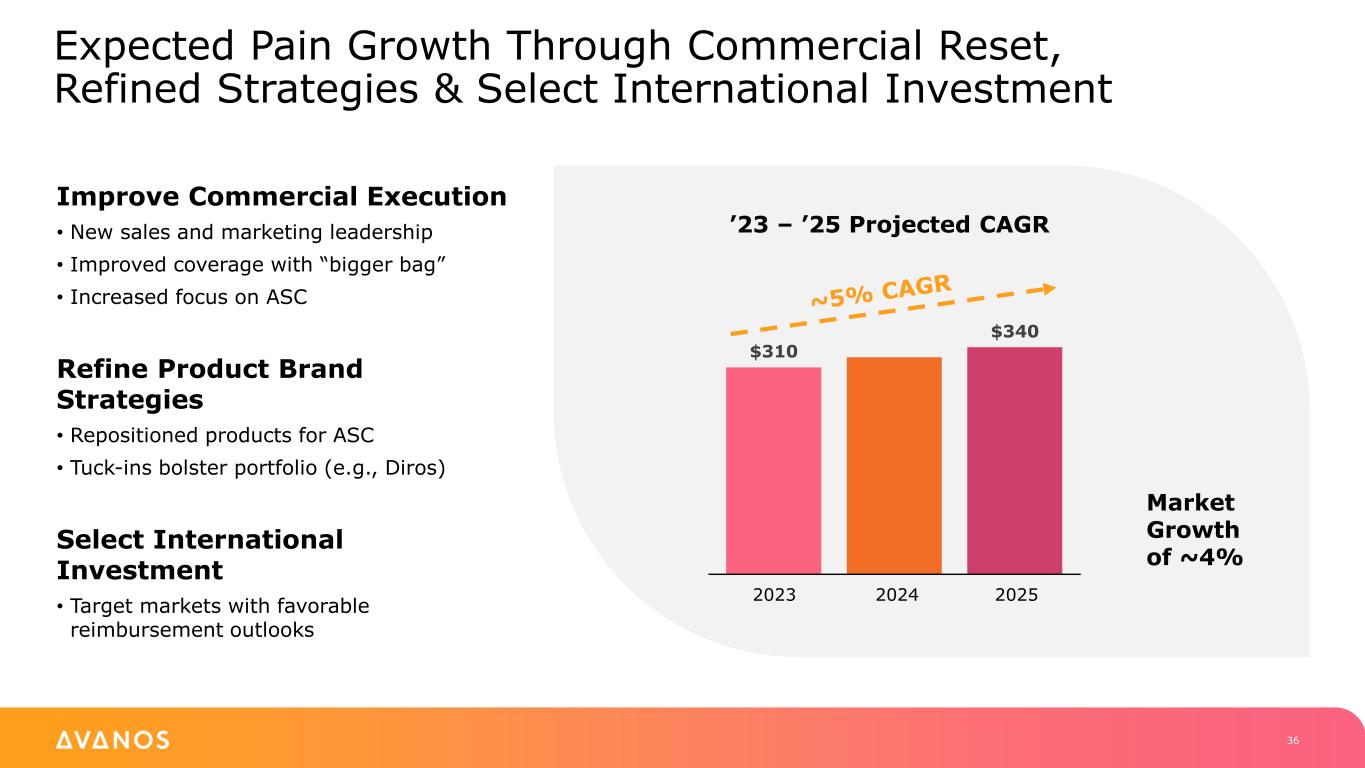

Expected Pain Growth Through Commercial Reset, Refined Strategies & Select International Investment 36 Improve Commercial Execution • New sales and marketing leadership • Improved coverage with “bigger bag” • Increased focus on ASC Refine Product Brand Strategies • Repositioned products for ASC • Tuck-ins bolster portfolio (e.g., Diros) Select International Investment • Target markets with favorable reimbursement outlooks ’23 – ’25 Projected CAGR $310 $340 Market Growth of ~4% 2023 2024 2025

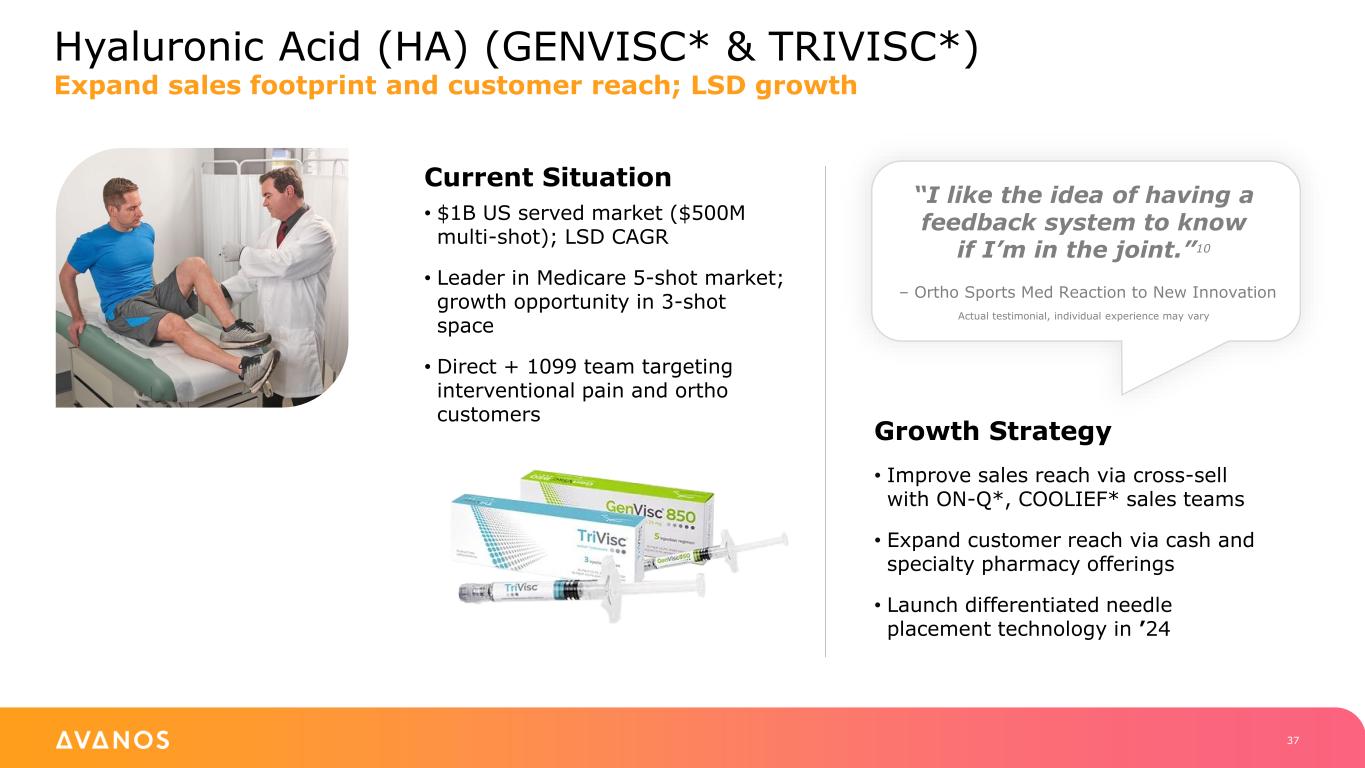

37 Hyaluronic Acid (HA) (GENVISC* & TRIVISC*) Expand sales footprint and customer reach; LSD growth Current Situation • $1B US served market ($500M multi-shot); LSD CAGR • Leader in Medicare 5-shot market; growth opportunity in 3-shot space • Direct + 1099 team targeting interventional pain and ortho customers Growth Strategy • Improve sales reach via cross-sell with ON-Q*, COOLIEF* sales teams • Expand customer reach via cash and specialty pharmacy offerings • Launch differentiated needle placement technology in ’24 “I like the idea of having a feedback system to know if I’m in the joint.”10 – Ortho Sports Med Reaction to New Innovation Actual testimonial, individual experience may vary

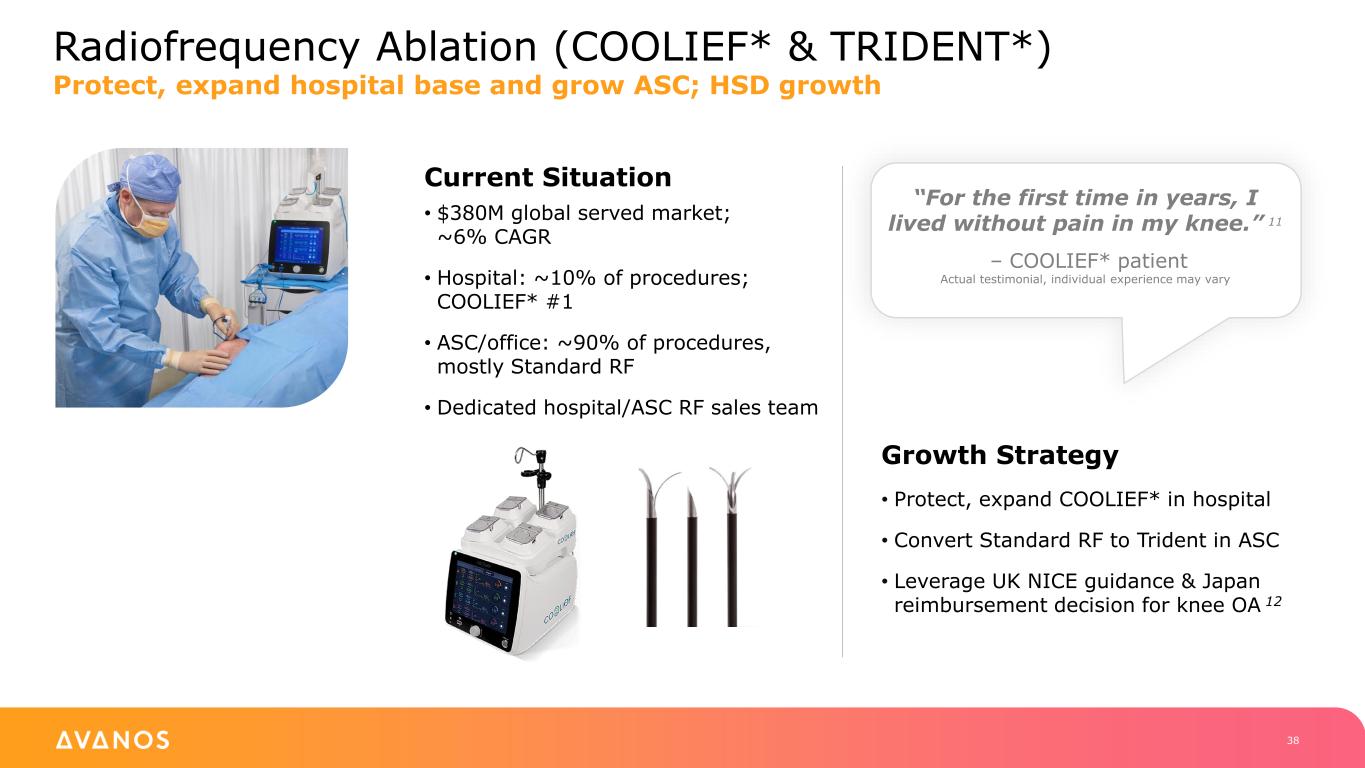

38 Radiofrequency Ablation (COOLIEF* & TRIDENT*) Protect, expand hospital base and grow ASC; HSD growth Current Situation • $380M global served market; ~6% CAGR • Hospital: ~10% of procedures; COOLIEF* #1 • ASC/office: ~90% of procedures, mostly Standard RF • Dedicated hospital/ASC RF sales team Growth Strategy • Protect, expand COOLIEF* in hospital • Convert Standard RF to Trident in ASC • Leverage UK NICE guidance & Japan reimbursement decision for knee OA 12 “For the first time in years, I lived without pain in my knee.” 11 – COOLIEF* patient Actual testimonial, individual experience may vary

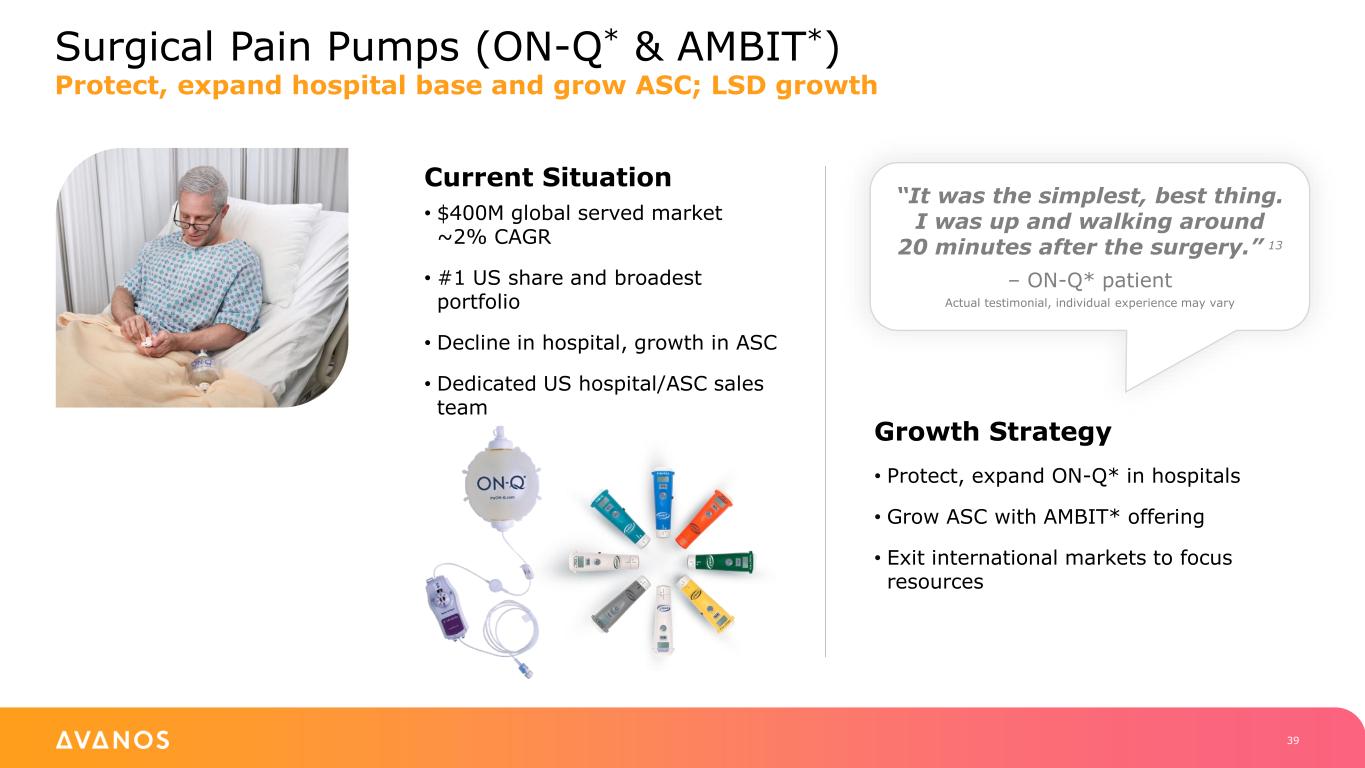

39 Surgical Pain Pumps (ON-Q* & AMBIT*) Protect, expand hospital base and grow ASC; LSD growth Current Situation • $400M global served market ~2% CAGR • #1 US share and broadest portfolio • Decline in hospital, growth in ASC • Dedicated US hospital/ASC sales team Growth Strategy • Protect, expand ON-Q* in hospitals • Grow ASC with AMBIT* offering • Exit international markets to focus resources “It was the simplest, best thing. I was up and walking around 20 minutes after the surgery.” 13 – ON-Q* patient Actual testimonial, individual experience may vary

40 Cryo-Compression (GAME READY*) Improve business model and profitability; MSD growth Current Situation • $300M global cryo-compression market; ~8% CAGR • Top brand across orthopedics, pro- athletes and physical therapists • US 1099 + direct teams targeting orthopedic customers Growth Strategy • Improve business model and process to unlock growth with orthopedics • Optimize sales and service execution • Launch next-gen GAME READY* offering “Game Ready provides a significant decrease in the need for pain medication and at least a 20% faster recovery.” 14 – Peter Millet, MD, MSD | The Steadman Clinic Actual testimonial, individual experience may vary

Pain Management & Recovery Summary 41 • Four strong brands that connect patient lifecycle • Portfolio expected to deliver MSD growth and 60% gross margin • Commercial reset expected to improve sales effectiveness and deliver <40% SG&A • Very selective investment in innovation, M&A and international

Innovation Optimization Lee Burnes Senior Vice President, Global Research & Development

Transformation Priorities: 2023–2025 Strategic & Commercial Optimization 1 Transform the Product Portfolio 2 Additional Cost Management Initiatives to Enhance Operating Profitability 3 Continued Efficient Capital Allocation Strategies to Expand Return on Invested Capital 4 43 DELIVERING VALUE TO ALL STAKEHOLDERS

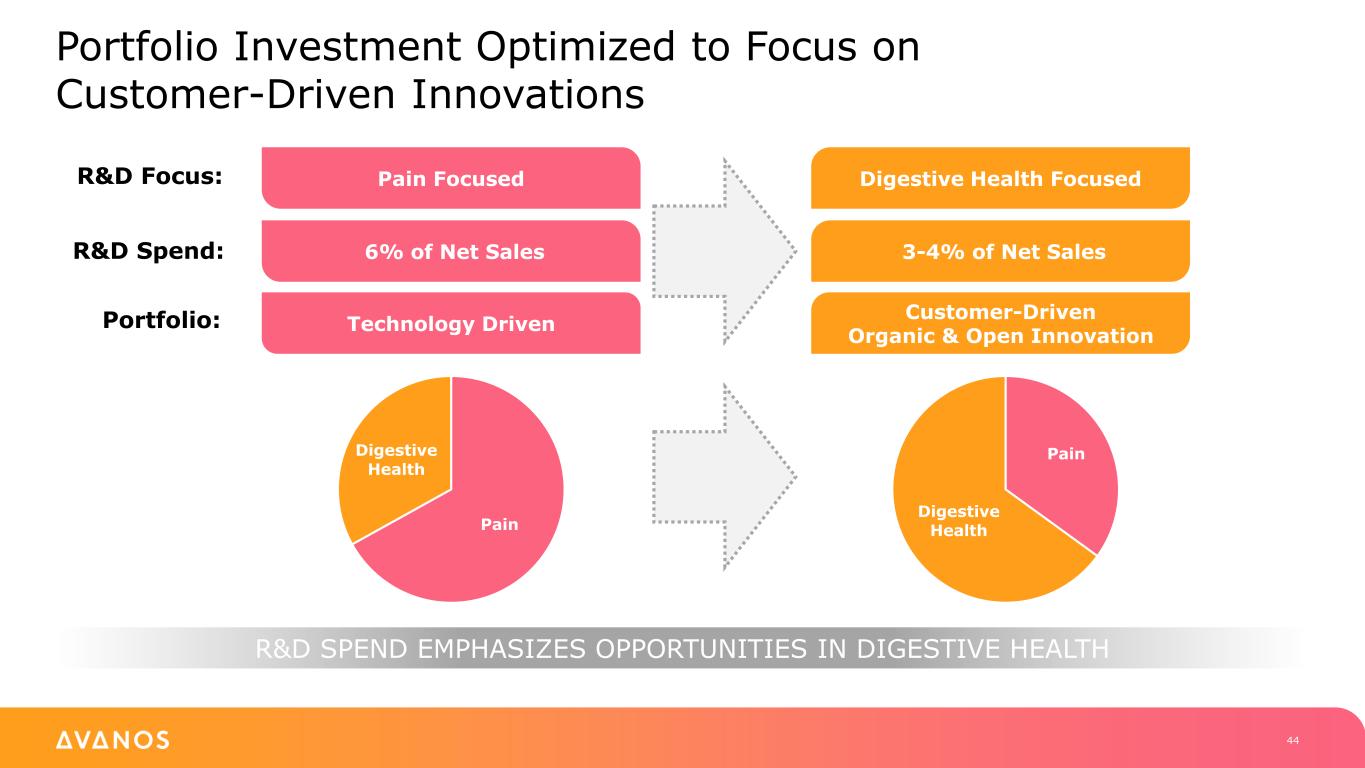

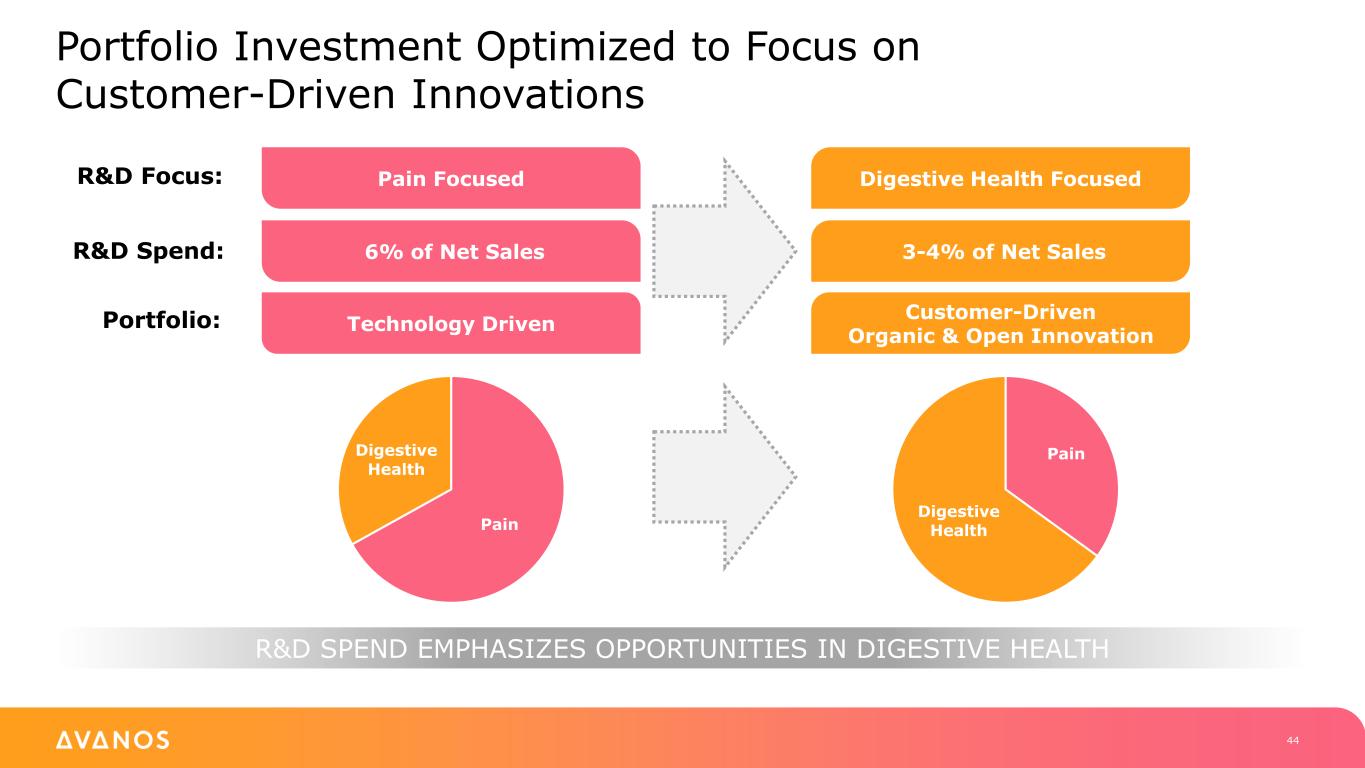

Portfolio Investment Optimized to Focus on Customer-Driven Innovations R&D Focus: Pain Focused Digestive Health Focused R&D Spend: 6% of Net Sales 3-4% of Net Sales Portfolio: Technology Driven Customer-Driven Organic & Open Innovation Pain Digestive Health Pain Digestive Health 44 R&D SPEND EMPHASIZES OPPORTUNITIES IN DIGESTIVE HEALTH

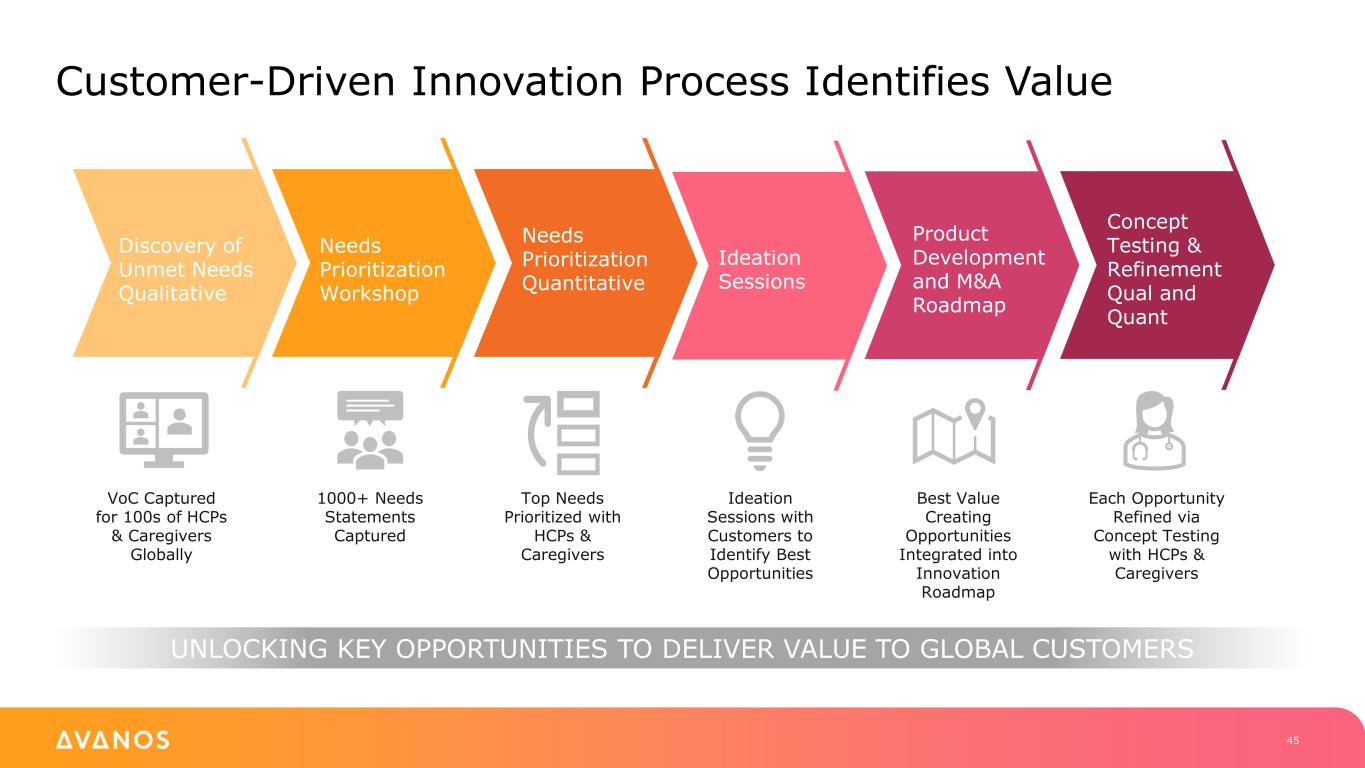

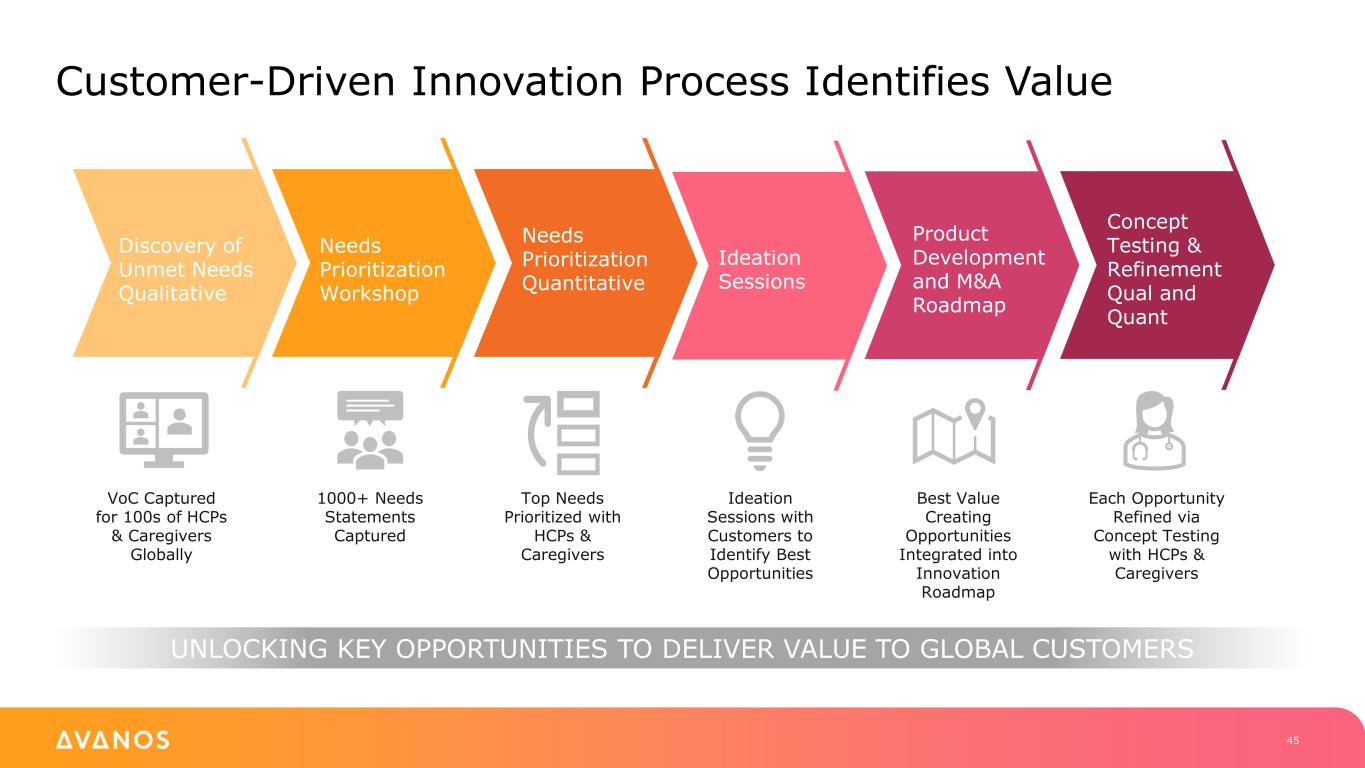

Customer-Driven Innovation Process Identifies Value Discovery of Unmet Needs Qualitative Needs Prioritization Workshop Needs Prioritization Quantitative Ideation Sessions Concept Testing & Refinement Qual and Quant Product Development and M&A Roadmap VoC Captured for 100s of HCPs & Caregivers Globally 1000+ Needs Statements Captured Top Needs Prioritized with HCPs & Caregivers Ideation Sessions with Customers to Identify Best Opportunities Best Value Creating Opportunities Integrated into Innovation Roadmap Each Opportunity Refined via Concept Testing with HCPs & Caregivers 45 UNLOCKING KEY OPPORTUNITIES TO DELIVER VALUE TO GLOBAL CUSTOMERS

Organic R&D Focused on Fast-to-Market Opportunities Deep Understanding of Customer Needs Disciplined Investment Criteria Innovation in “Right-to-Win” Categories Disciplined Investment Criteria Centers of Excellence Model Project Management-Led NPD 46 DRIVING A STEADY CADENCE OF INNOVATIONS TO MARKET

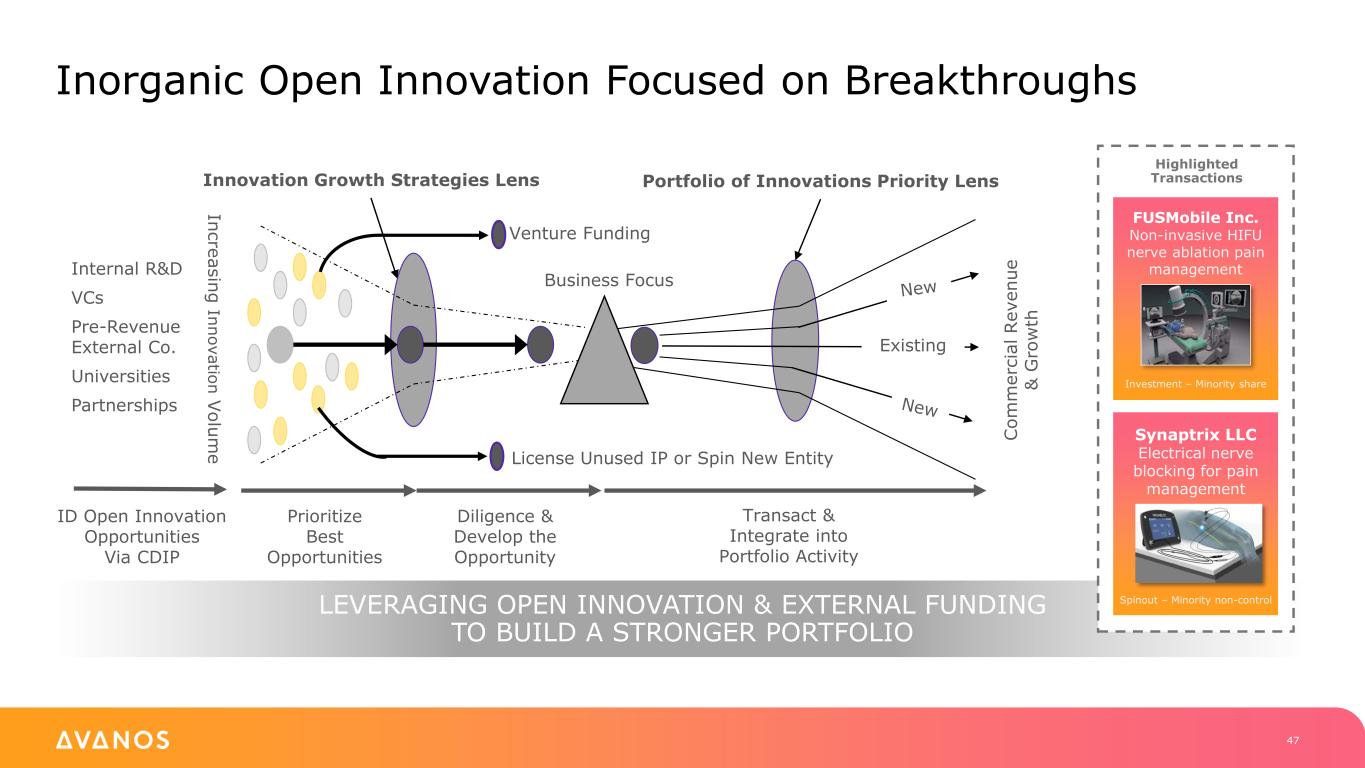

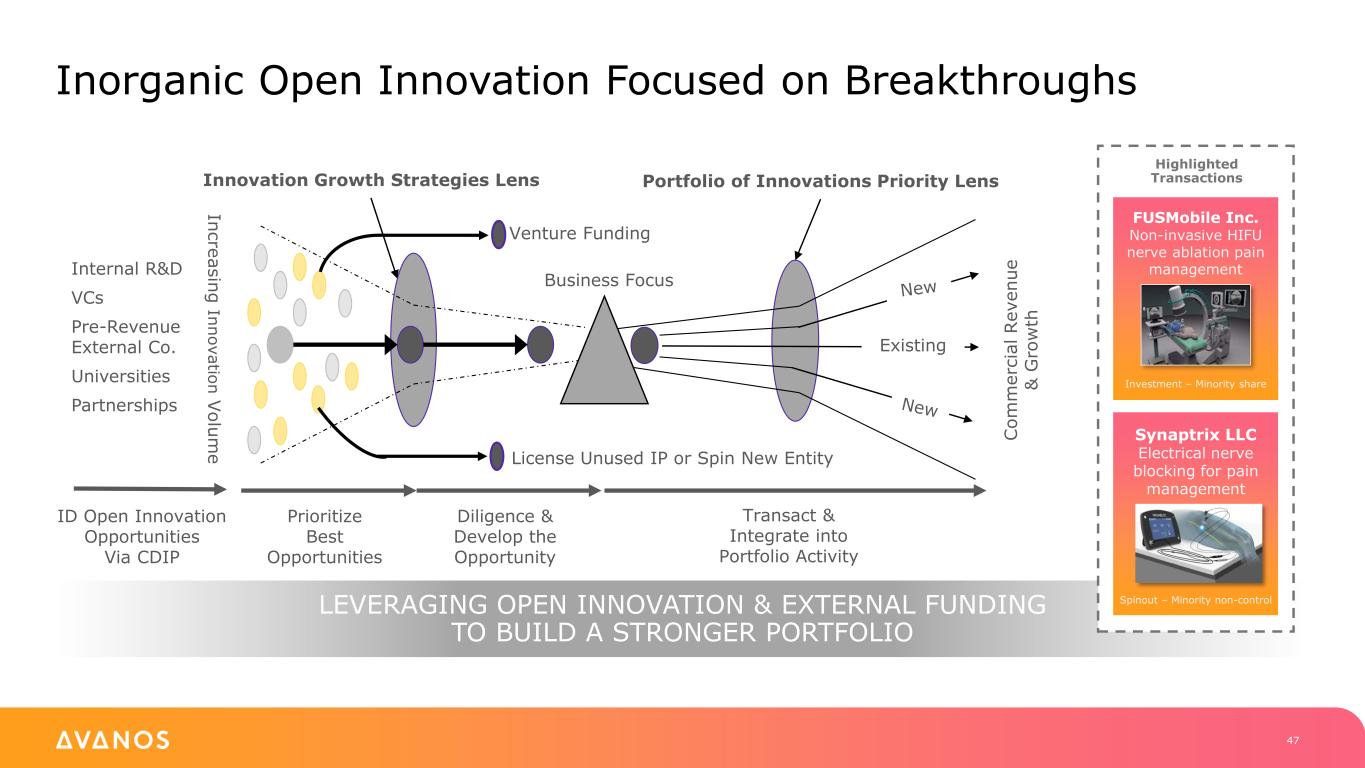

Inorganic Open Innovation Focused on Breakthroughs Internal R&D VCs Pre-Revenue External Co. Universities Partnerships Prioritize Best Opportunities Diligence & Develop the Opportunity In c re a s in g In n o v a tio n V o lu m e Transact & Integrate into Portfolio Activity Existing C o m m e rc ia l R e v e n u e & G ro w th License Unused IP or Spin New Entity Venture Funding Business Focus Innovation Growth Strategies Lens ID Open Innovation Opportunities Via CDIP Portfolio of Innovations Priority Lens 47 LEVERAGING OPEN INNOVATION & EXTERNAL FUNDING TO BUILD A STRONGER PORTFOLIO Spinout – Minority non-control Synaptrix LLC Electrical nerve blocking for pain management Highlighted Transactions Investment – Minority share FUSMobile Inc. Non-invasive HIFU nerve ablation pain management

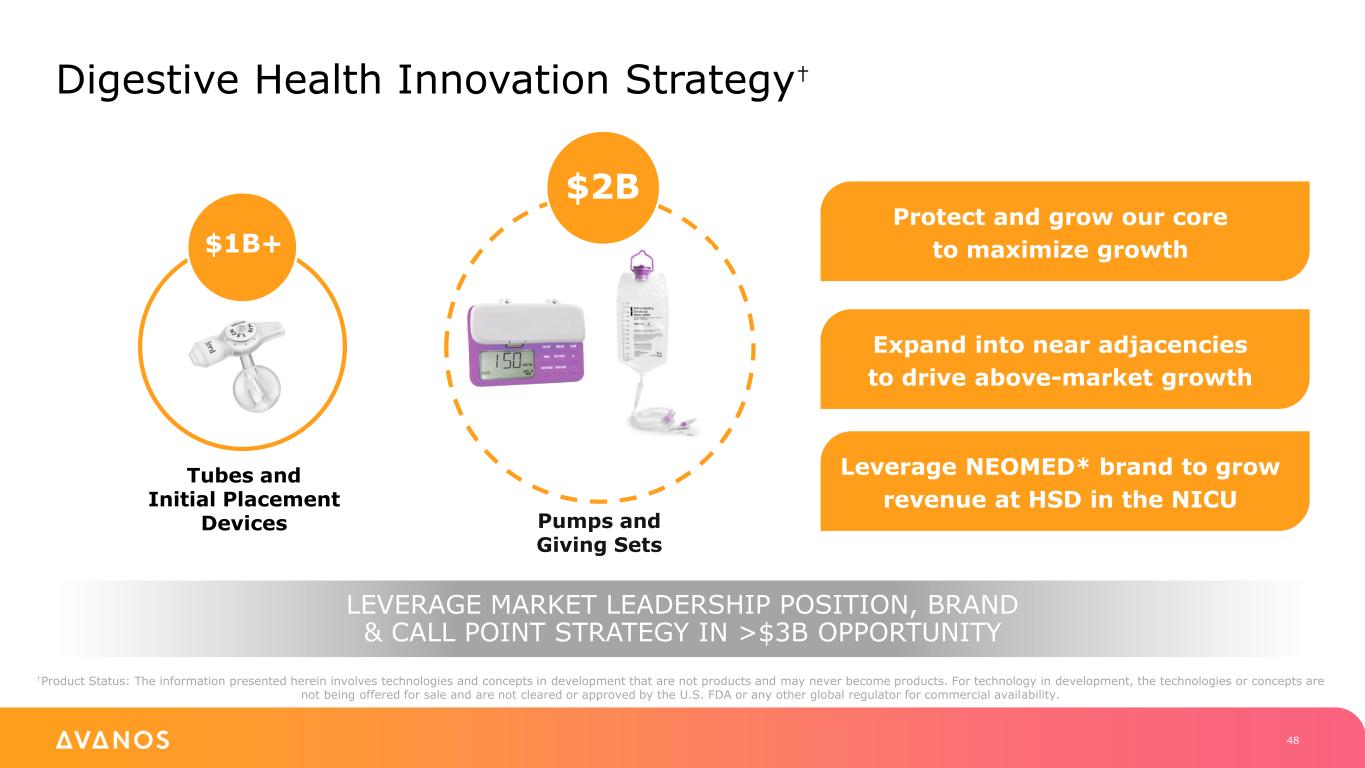

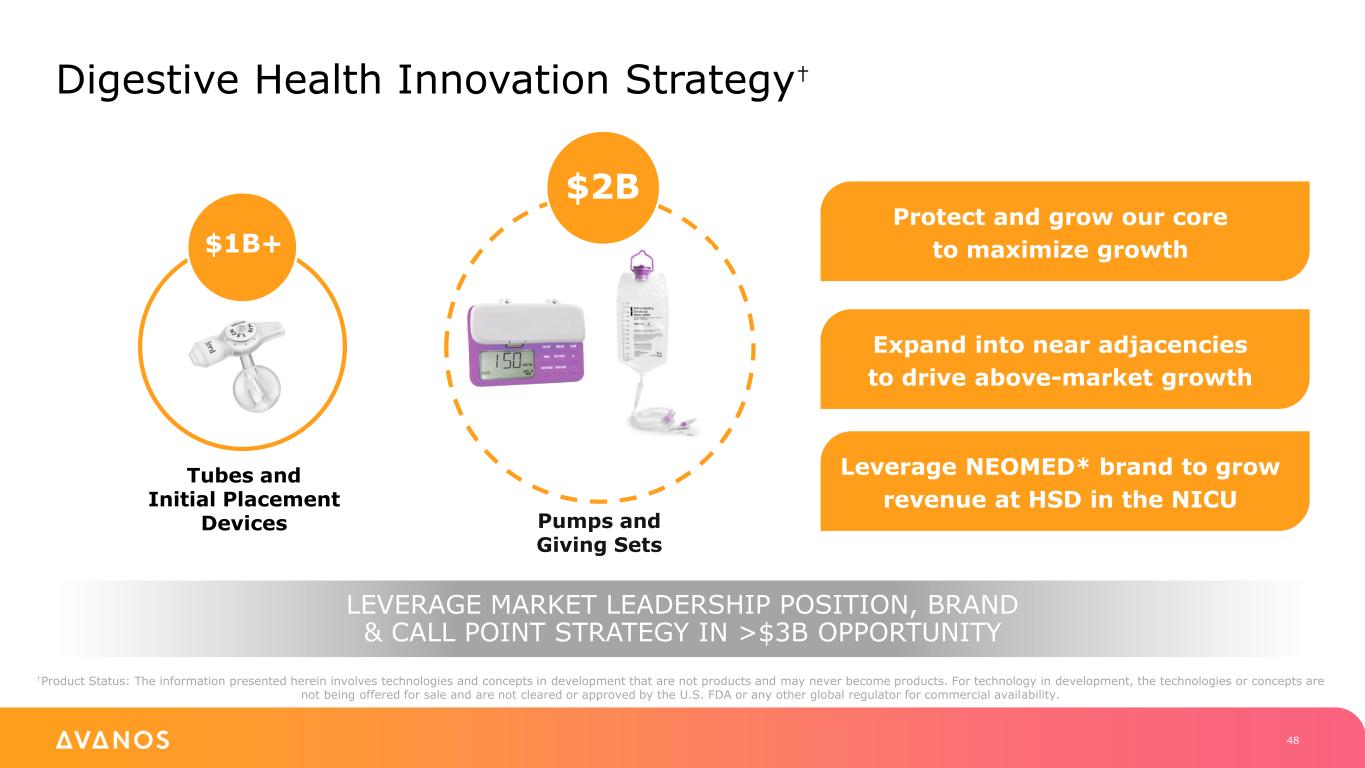

Digestive Health Innovation Strategy† Pumps and Giving Sets Protect and grow our core to maximize growth Expand into near adjacencies to drive above-market growth Leverage NEOMED* brand to grow revenue at HSD in the NICU 48 $2B Tubes and Initial Placement Devices $1B+ LEVERAGE MARKET LEADERSHIP POSITION, BRAND & CALL POINT STRATEGY IN >$3B OPPORTUNITY †Product Status: The information presented herein involves technologies and concepts in development that are not products and may never become products. For technology in development, the technologies or concepts are not being offered for sale and are not cleared or approved by the U.S. FDA or any other global regulator for commercial availability.

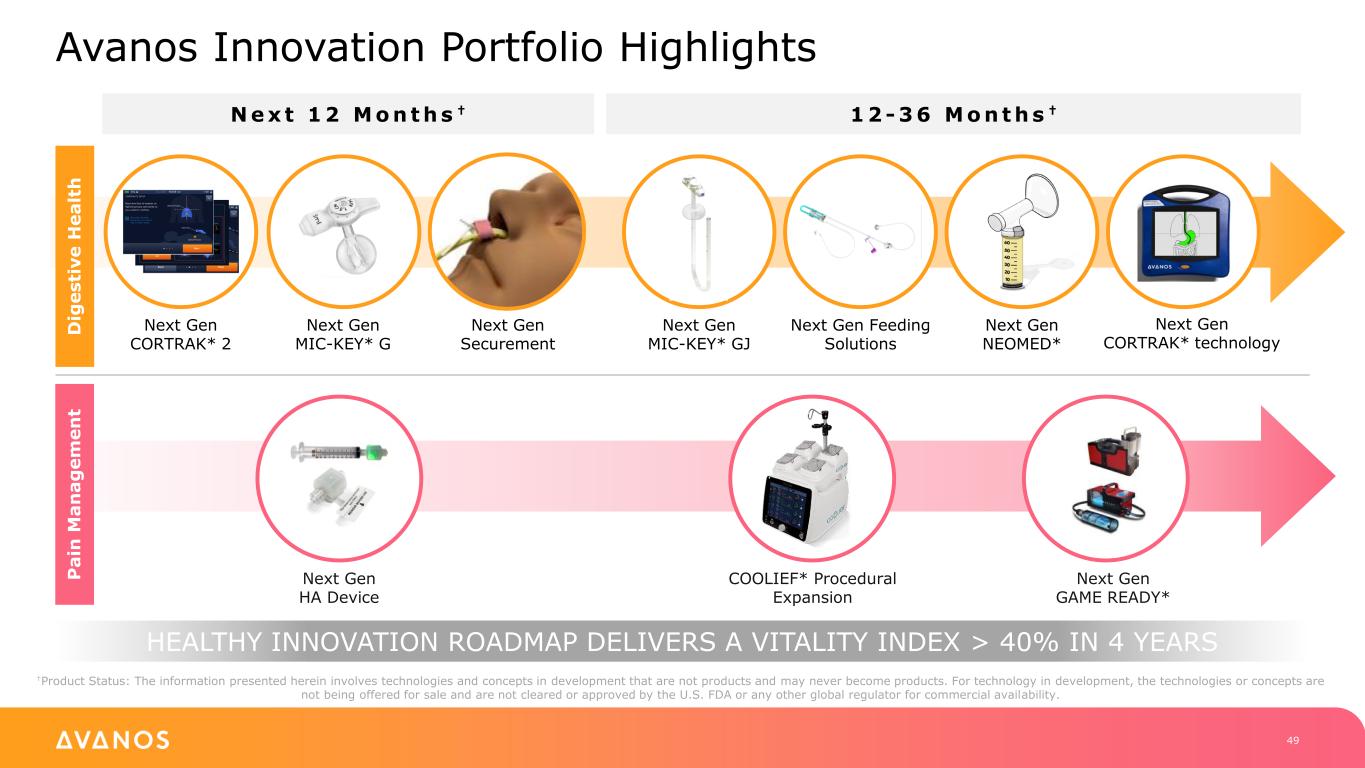

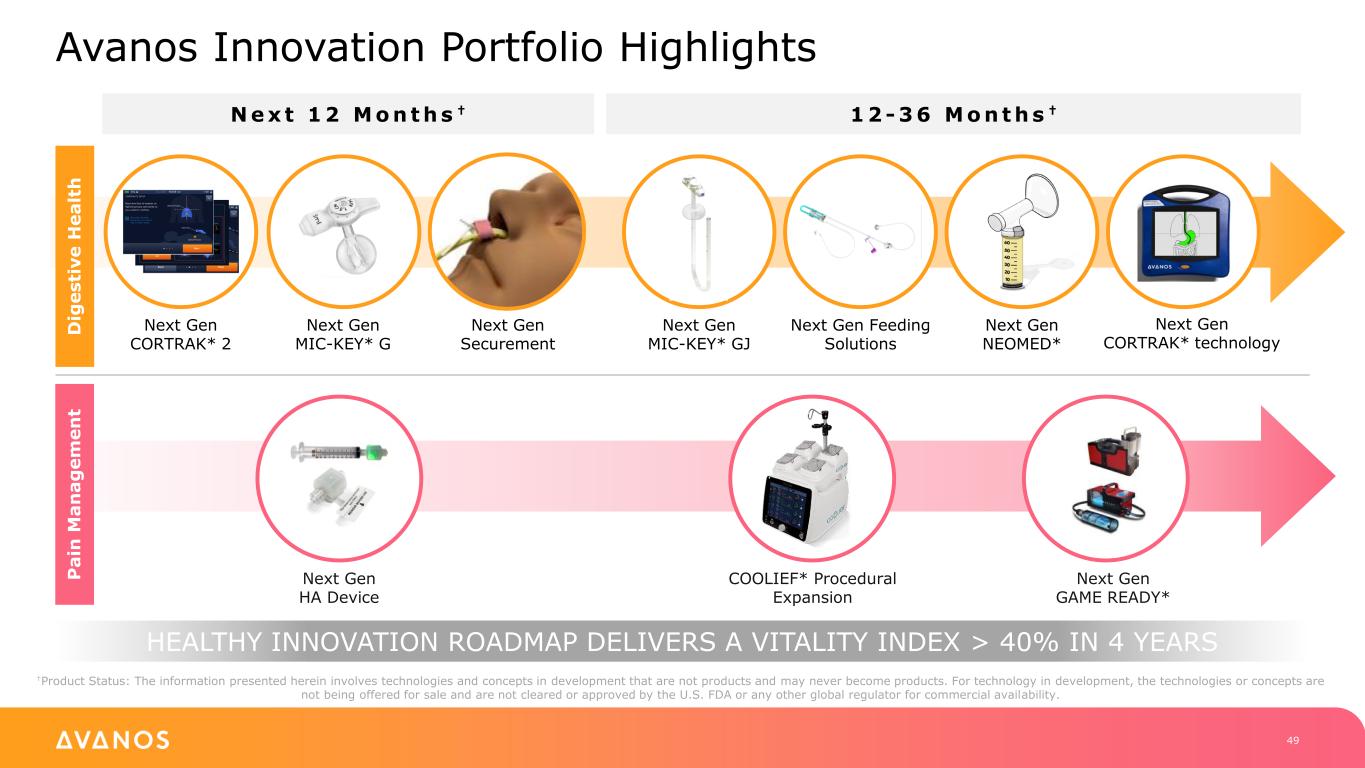

Avanos Innovation Portfolio Highlights 49 Concept Feasibility Development Validation Commercialization D ig e s ti v e H e a lt h Exploration N e x t 1 2 M o n t h s † 1 2 - 3 6 M o n t h s † Next Gen CORTRAK* 2 Next Gen HA Device COOLIEF* Procedural Expansion Next Gen GAME READY* Next Gen MIC-KEY* G Next Gen Feeding Solutions Next Gen NEOMED* Next Gen MIC-KEY* GJ Next Gen CORTRAK* technology P a in M a n a g e m e n t Next Gen Securement HEALTHY INNOVATION ROADMAP DELIVERS A VITALITY INDEX > 40% IN 4 YEARS †Product Status: The information presented herein involves technologies and concepts in development that are not products and may never become products. For technology in development, the technologies or concepts are not being offered for sale and are not cleared or approved by the U.S. FDA or any other global regulator for commercial availability.

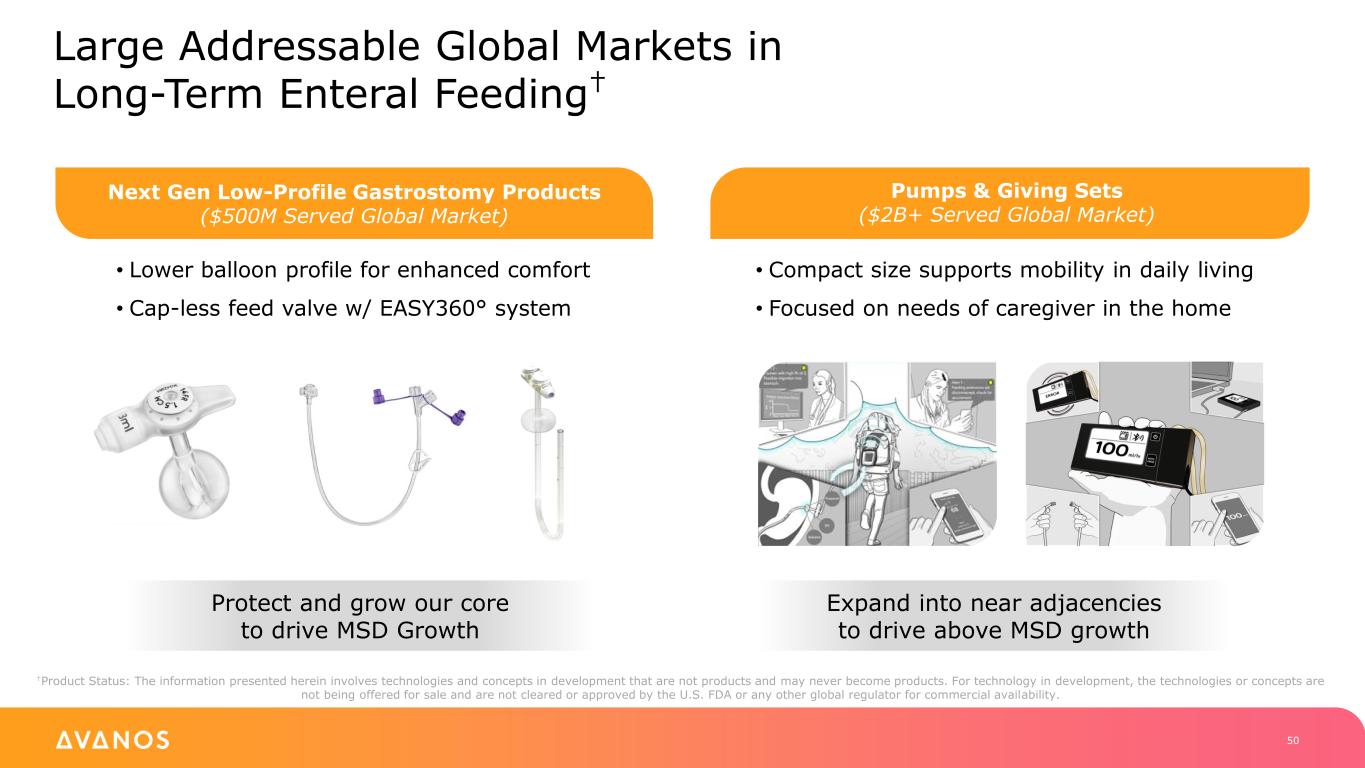

Large Addressable Global Markets in Long-Term Enteral Feeding† 50 • Compact size supports mobility in daily living • Focused on needs of caregiver in the home Pumps & Giving Sets ($2B+ Served Global Market) Expand into near adjacencies to drive above MSD growth Next Gen Low-Profile Gastrostomy Products ($500M Served Global Market) • Lower balloon profile for enhanced comfort • Cap-less feed valve w/ EASY360° system Protect and grow our core to drive MSD Growth †Product Status: The information presented herein involves technologies and concepts in development that are not products and may never become products. For technology in development, the technologies or concepts are not being offered for sale and are not cleared or approved by the U.S. FDA or any other global regulator for commercial availability.

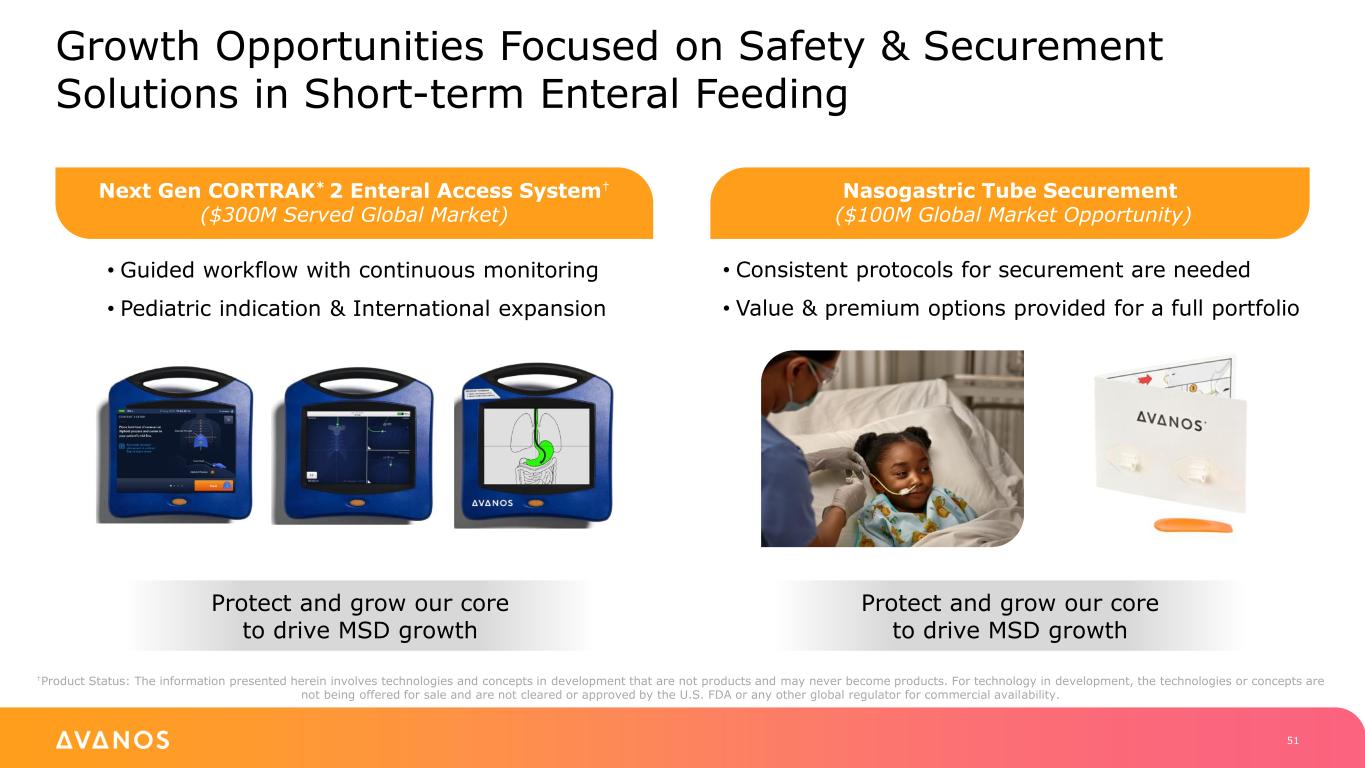

Growth Opportunities Focused on Safety & Securement Solutions in Short-term Enteral Feeding 51 Protect and grow our core to drive MSD growth Next Gen CORTRAK* 2 Enteral Access System† ($300M Served Global Market) • Guided workflow with continuous monitoring • Pediatric indication & International expansion Protect and grow our core to drive MSD growth Nasogastric Tube Securement ($100M Global Market Opportunity) • Consistent protocols for securement are needed • Value & premium options provided for a full portfolio †Product Status: The information presented herein involves technologies and concepts in development that are not products and may never become products. For technology in development, the technologies or concepts are not being offered for sale and are not cleared or approved by the U.S. FDA or any other global regulator for commercial availability.

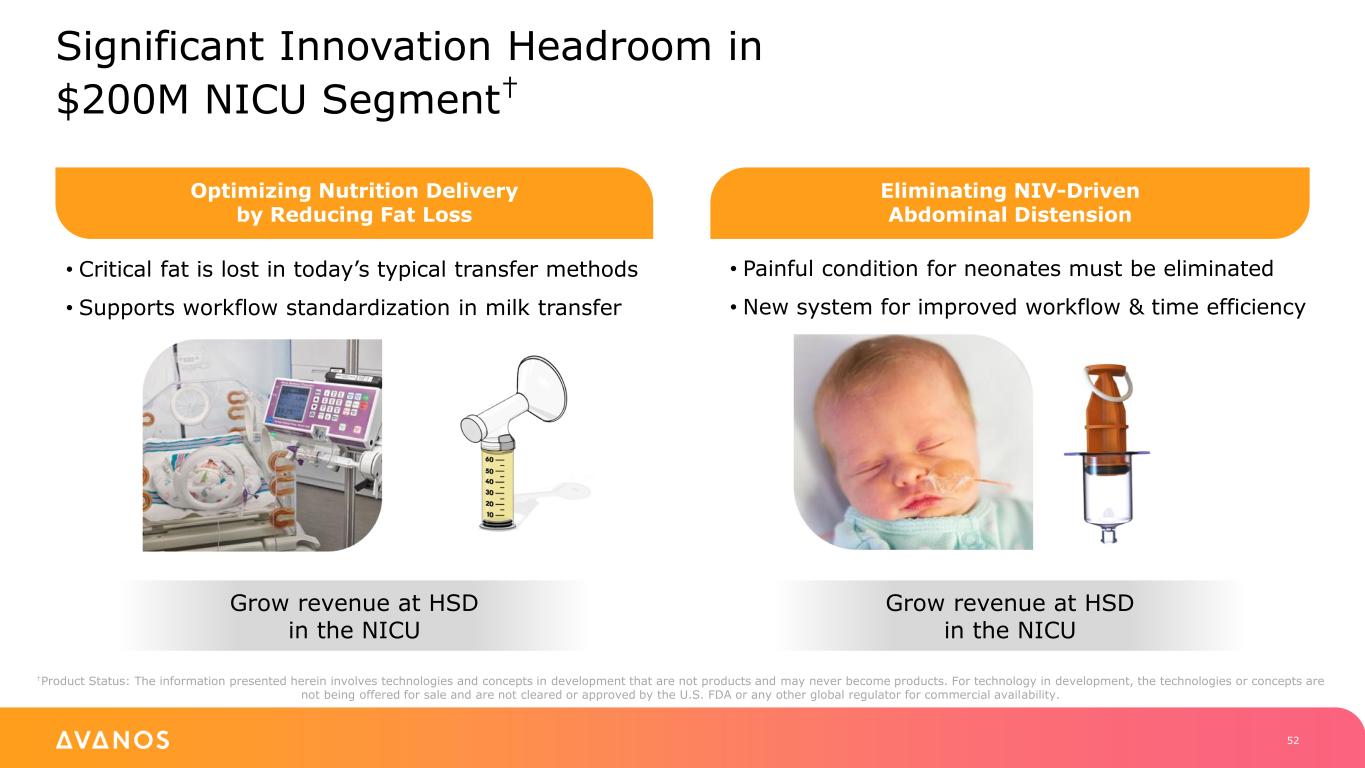

Significant Innovation Headroom in $200M NICU Segment† 52 • Painful condition for neonates must be eliminated • New system for improved workflow & time efficiency Eliminating NIV-Driven Abdominal Distension Grow revenue at HSD in the NICU • Critical fat is lost in today’s typical transfer methods • Supports workflow standardization in milk transfer Optimizing Nutrition Delivery by Reducing Fat Loss Grow revenue at HSD in the NICU †Product Status: The information presented herein involves technologies and concepts in development that are not products and may never become products. For technology in development, the technologies or concepts are not being offered for sale and are not cleared or approved by the U.S. FDA or any other global regulator for commercial availability.

Innovation Portfolio Summary† 53 • Transformed and optimized innovation approach • Supports DH above-market growth thesis • Upside to Pain growth via open innovation • New products accretive to 60% gross margin †Product Status: The information presented herein involves technologies and concepts in development that are not products and may never become products. For technology in development, the technologies or concepts are not being offered for sale and are not cleared or approved by the U.S. FDA or any other global regulator for commercial availability.

15-MINUTE BREAK 54

Supply Chain Optimization Sudhakar Varshney Senior Vice President, Global Supply Chain & Procurement

Transformation Priorities: 2023–2025 Strategic & Commercial Optimization 1 Transform the Product Portfolio 2 Additional Cost Management Initiatives to Enhance Operating Profitability 3 Continued Efficient Capital Allocation Strategies to Expand Return on Invested Capital 4 56 DELIVERING VALUE TO ALL STAKEHOLDERS

5 Nearshored Manufacturing Facilities in the US and Mexico Tijuana (MX) Nogales 1 (MX) Tucson (AZ) Nogales 2 (MX) Magdalena (MX) Percentage of space utilized shown next to product family • 450K square feet of internal manufacturing capability • Nogales 2: molding & extrusion • Magdalena: primary respiratory site • Global distribution through 3PL providers Pain Digestive Respiratory Open Pain Digestive Respiratory Open Pain Digestive Respiratory Open Pain Digestive Respiratory Open Pain Digestive Respiratory Open Percentage of space Pain Digestive Respiratory Open 57 Current Avanos Manufacturing Footprint

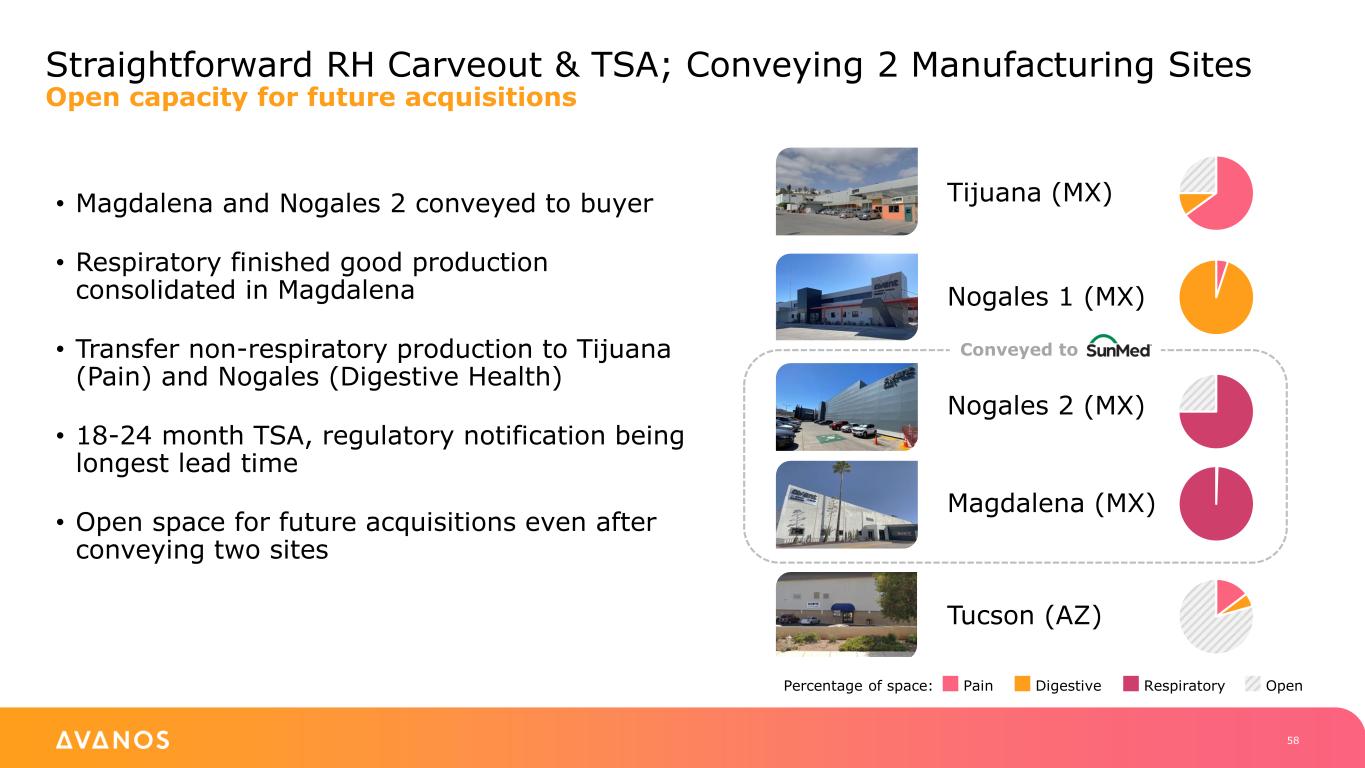

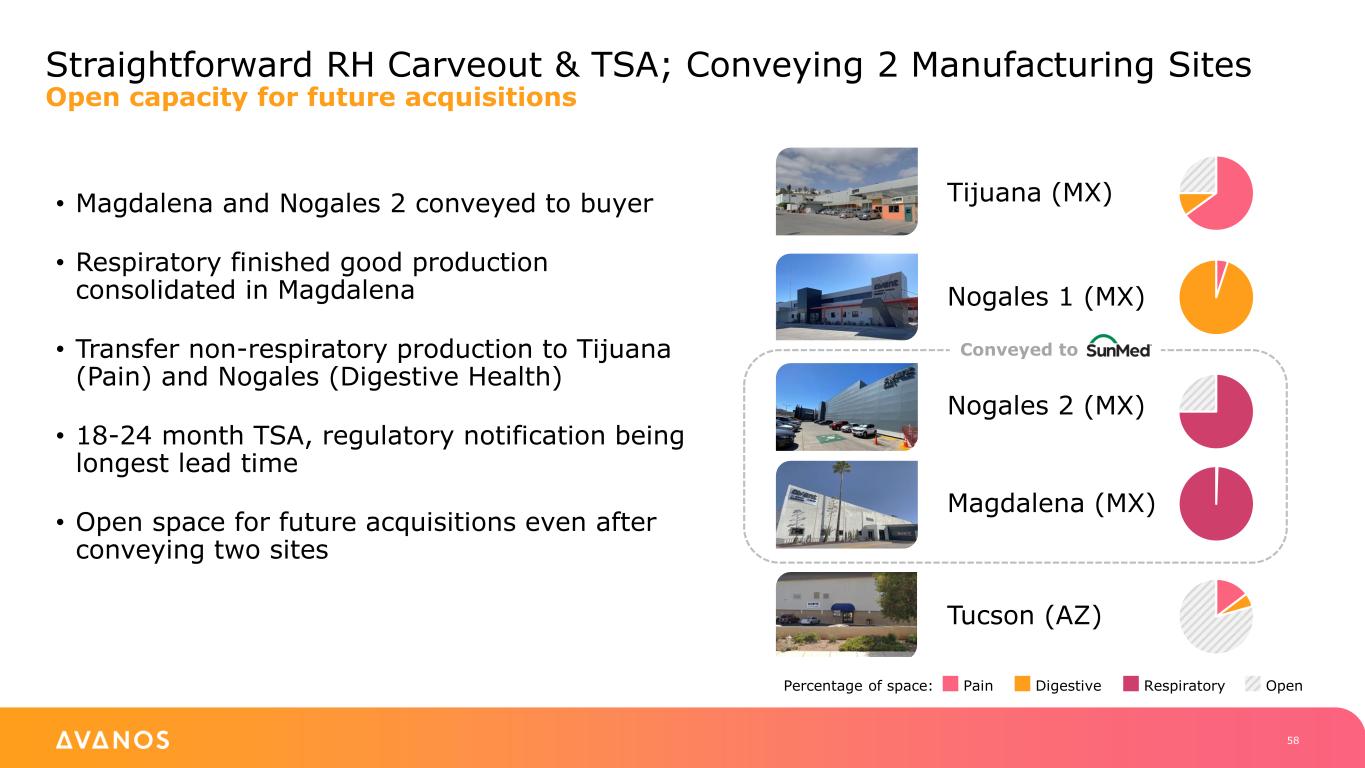

Straightforward RH Carveout & TSA; Conveying 2 Manufacturing Sites Open capacity for future acquisitions • Magdalena and Nogales 2 conveyed to buyer • Respiratory finished good production consolidated in Magdalena • Transfer non-respiratory production to Tijuana (Pain) and Nogales (Digestive Health) • 18-24 month TSA, regulatory notification being longest lead time • Open space for future acquisitions even after conveying two sites Tijuana (MX) Nogales 1 (MX) Nogales 2 (MX) Magdalena (MX) Tucson (AZ) Conveyed to 58 Percentage of space: Pain Digestive Respiratory Open

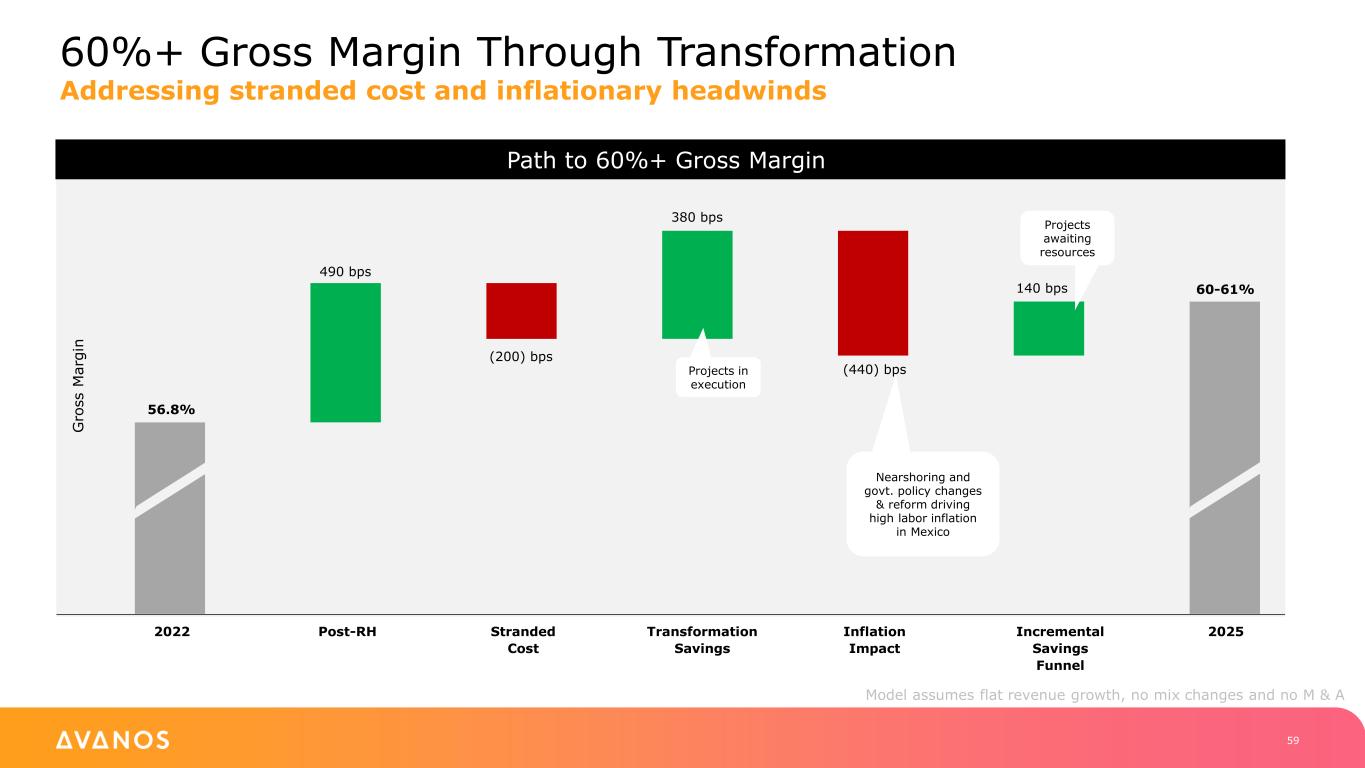

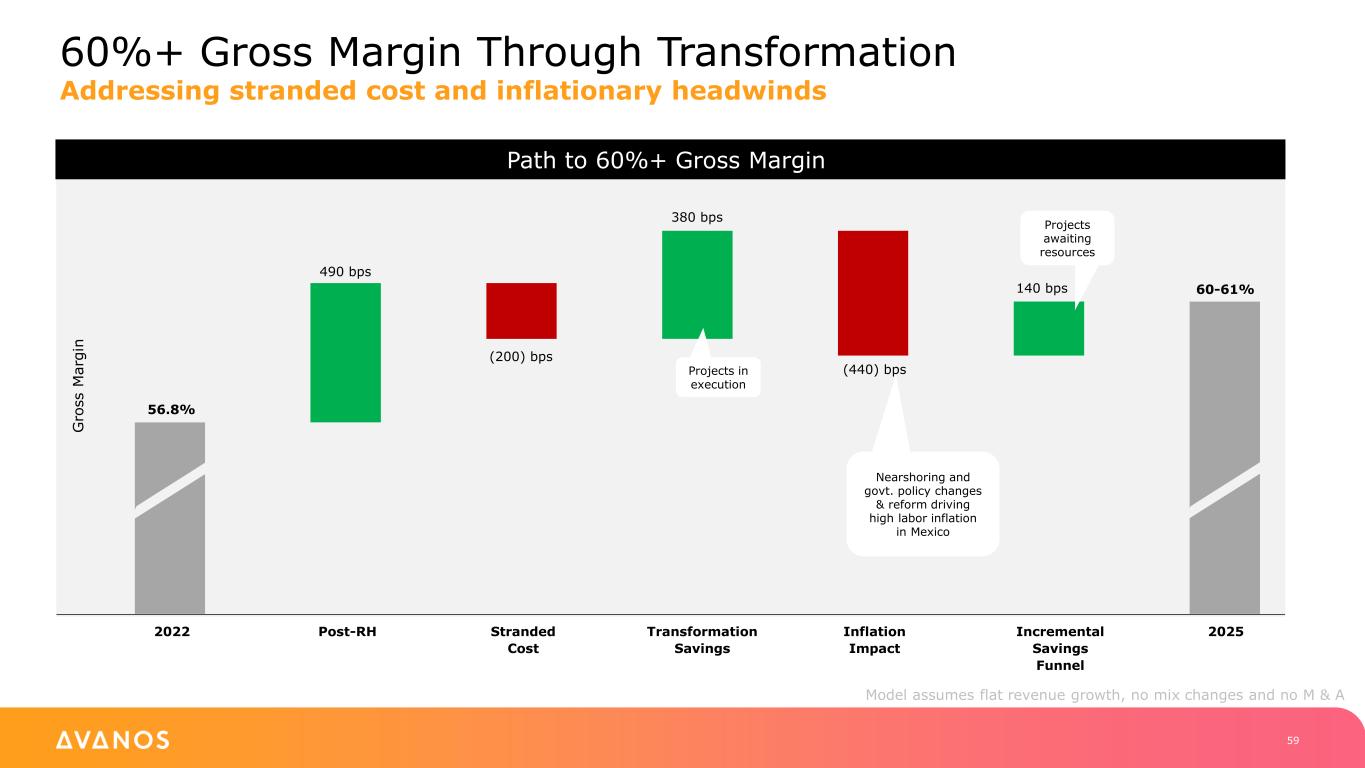

60%+ Gross Margin Through Transformation Addressing stranded cost and inflationary headwinds 2022 Post-RH Stranded Cost Transformation Savings Inflation Impact Incremental Savings Funnel 2025 Path to 60%+ Gross Margin 56.8% 60-61% 490 bps (200) bps (440) bps 380 bps 140 bps G ro s s M a rg in Projects awaiting resources Projects in execution Model assumes flat revenue growth, no mix changes and no M & A Nearshoring and govt. policy changes & reform driving high labor inflation in Mexico 59

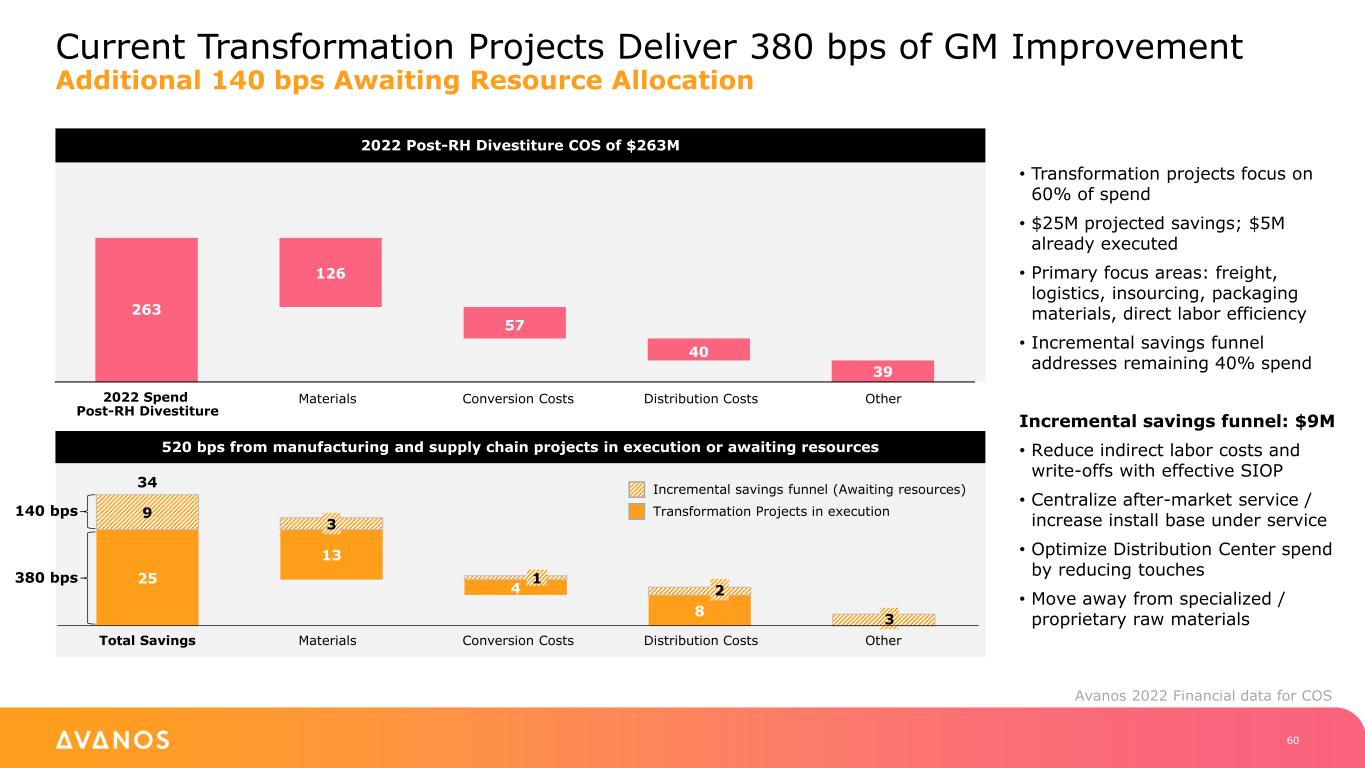

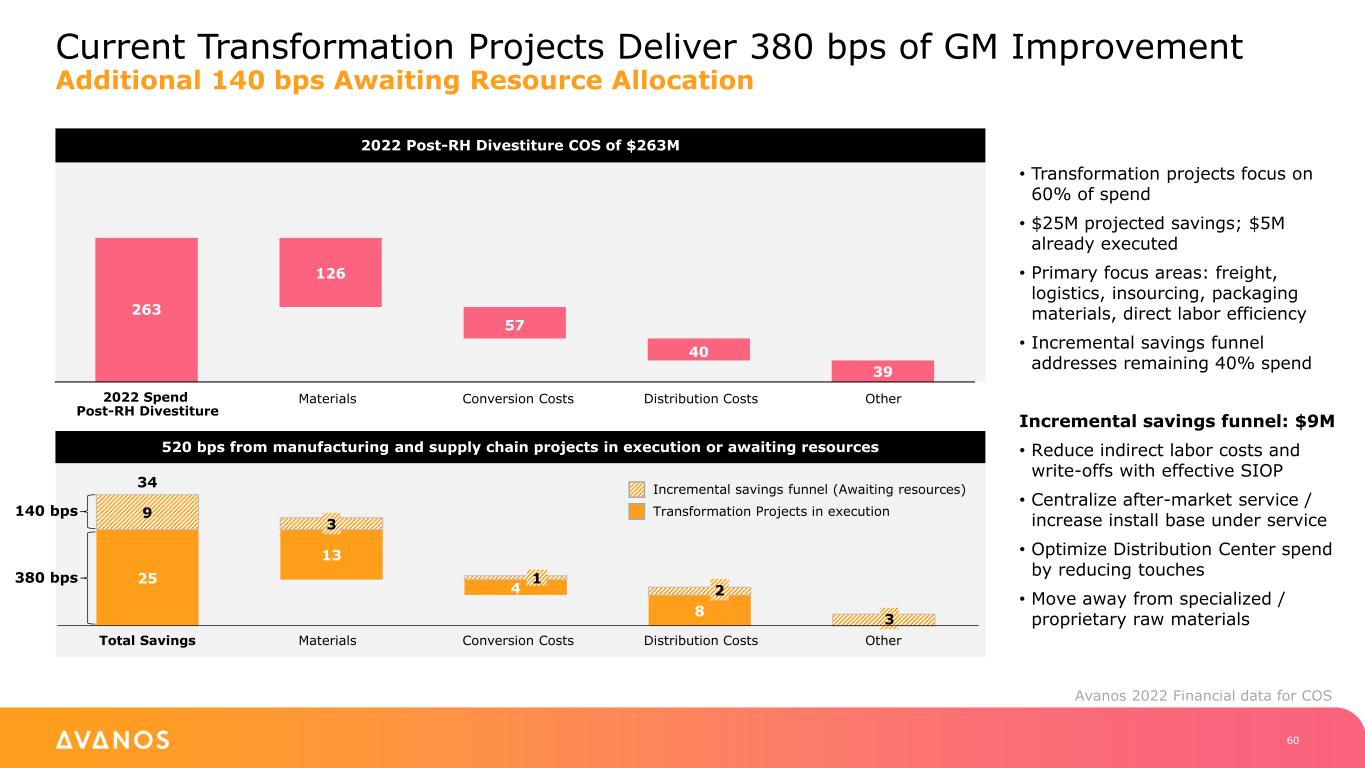

25 8 13 4 9 3 1 2 3 263 39 126 57 40 Current Transformation Projects Deliver 380 bps of GM Improvement Additional 140 bps Awaiting Resource Allocation • Transformation projects focus on 60% of spend • $25M projected savings; $5M already executed • Primary focus areas: freight, logistics, insourcing, packaging materials, direct labor efficiency • Incremental savings funnel addresses remaining 40% spend Incremental savings funnel: $9M • Reduce indirect labor costs and write-offs with effective SIOP • Centralize after-market service / increase install base under service • Optimize Distribution Center spend by reducing touches • Move away from specialized / proprietary raw materials 2022 Post-RH Divestiture COS of $263M Avanos 2022 Financial data for COS Materials Distribution CostsConversion Costs Other2022 Spend Post-RH Divestiture 520 bps from manufacturing and supply chain projects in execution or awaiting resources Conversion CostsTotal Savings Materials Distribution Costs Other 34 Transformation Projects in execution Incremental savings funnel (Awaiting resources) 140 bps 380 bps 60

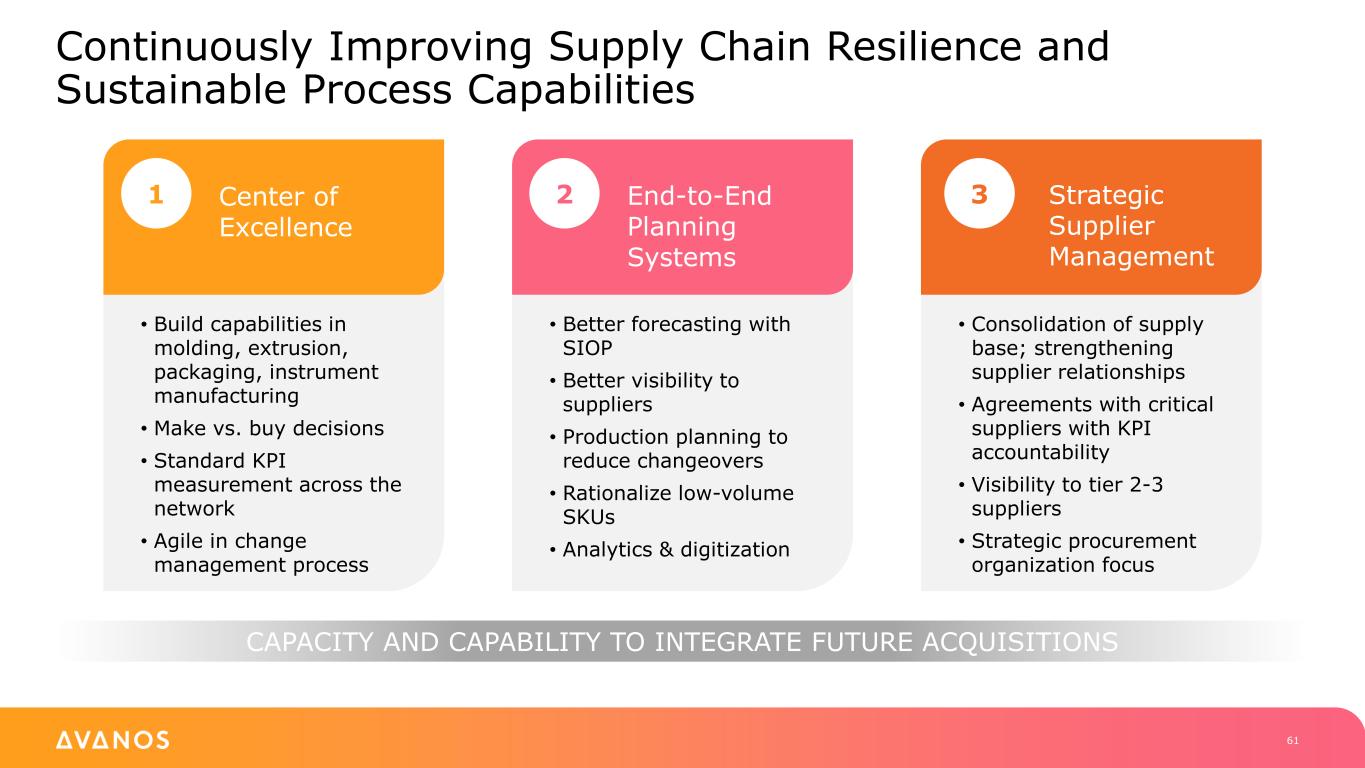

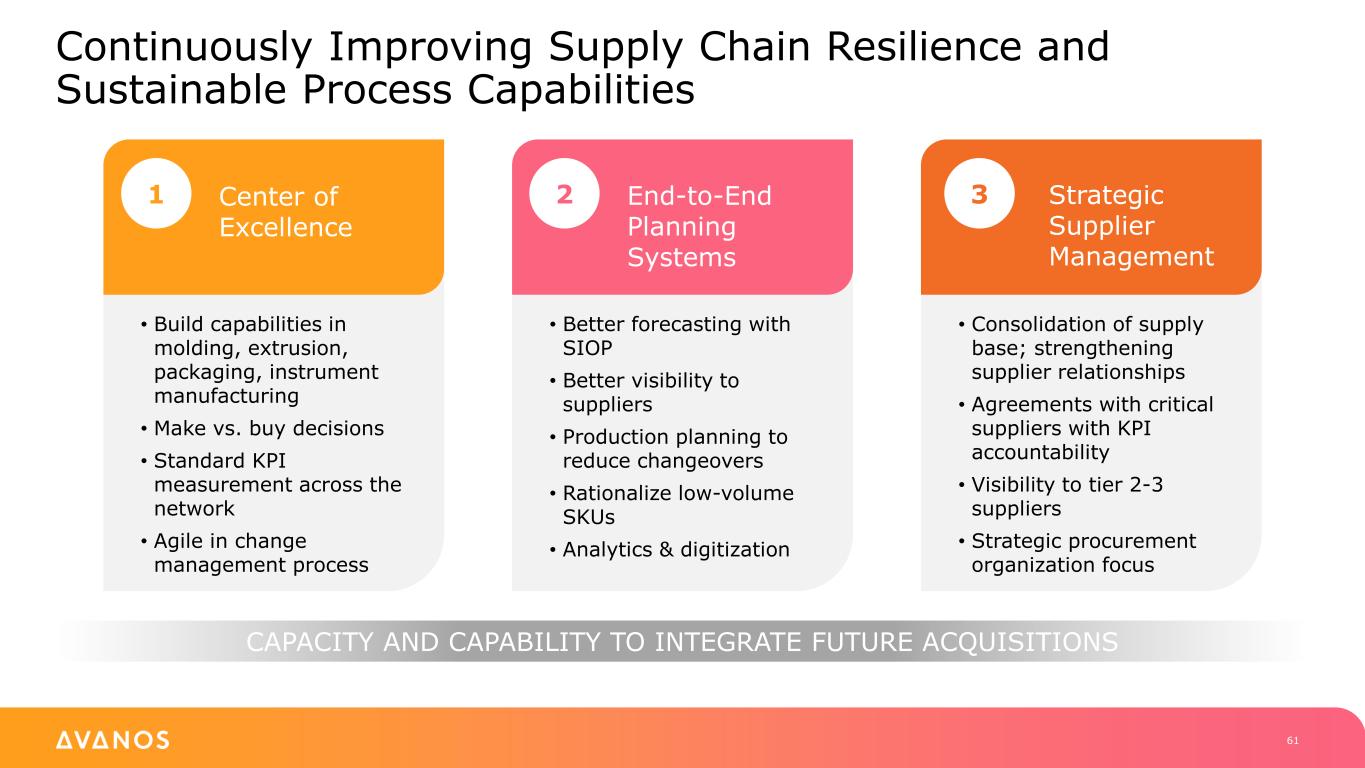

Continuously Improving Supply Chain Resilience and Sustainable Process Capabilities 61 • Build capabilities in molding, extrusion, packaging, instrument manufacturing • Make vs. buy decisions • Standard KPI measurement across the network • Agile in change management process 1 Center of Excellence • Better forecasting with SIOP • Better visibility to suppliers • Production planning to reduce changeovers • Rationalize low-volume SKUs • Analytics & digitization 2 End-to-End Planning Systems • Consolidation of supply base; strengthening supplier relationships • Agreements with critical suppliers with KPI accountability • Visibility to tier 2-3 suppliers • Strategic procurement organization focus 3 Strategic Supplier Management CAPACITY AND CAPABILITY TO INTEGRATE FUTURE ACQUISITIONS

Financial Optimization Michael Greiner Senior Vice President, Chief Financial Officer & Chief Transformation Officer

Transformation Priorities: 2023–2025 Strategic & Commercial Optimization 1 Transform the Product Portfolio 2 Additional Cost Management Initiatives to Enhance Operating Profitability 3 DELIVERING VALUE TO ALL STAKEHOLDERS 63 Continued Efficient Capital Allocation Strategies to Expand Return on Invested Capital 4

Our Path to 2025 and Beyond 2025 GOAL**2023 PRO FORMA* *Restated to exclude Respiratory Health business and include Diros acquisition. **Reflects net sales for 2025, on a constant currency basis. $750M ~$50M+ $675M Global Net Sales Core Growth Driven By: • Strategic & commercial optimization • Transforming the portfolio • New and expanded product introductions • Consistent international execution Upside Potential Growth Driven By: • M&A • International market opportunities 64

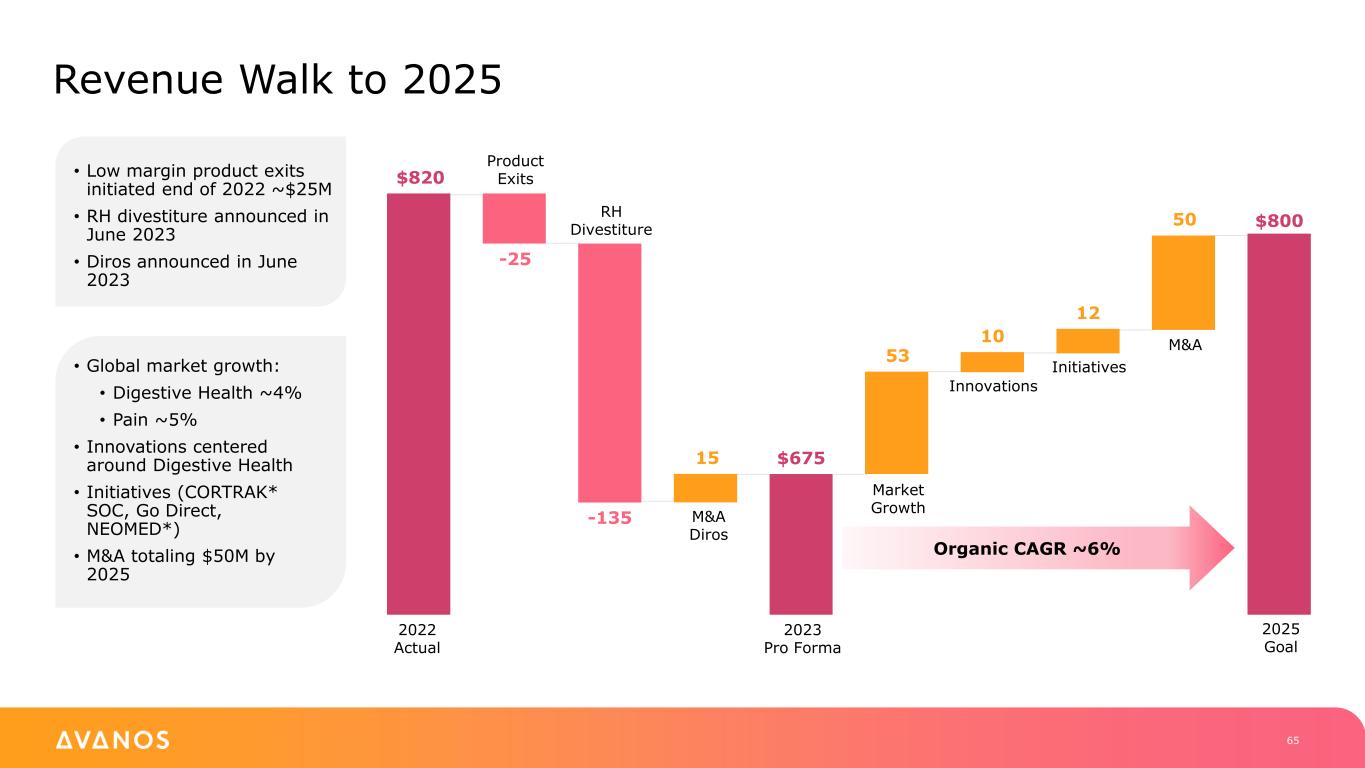

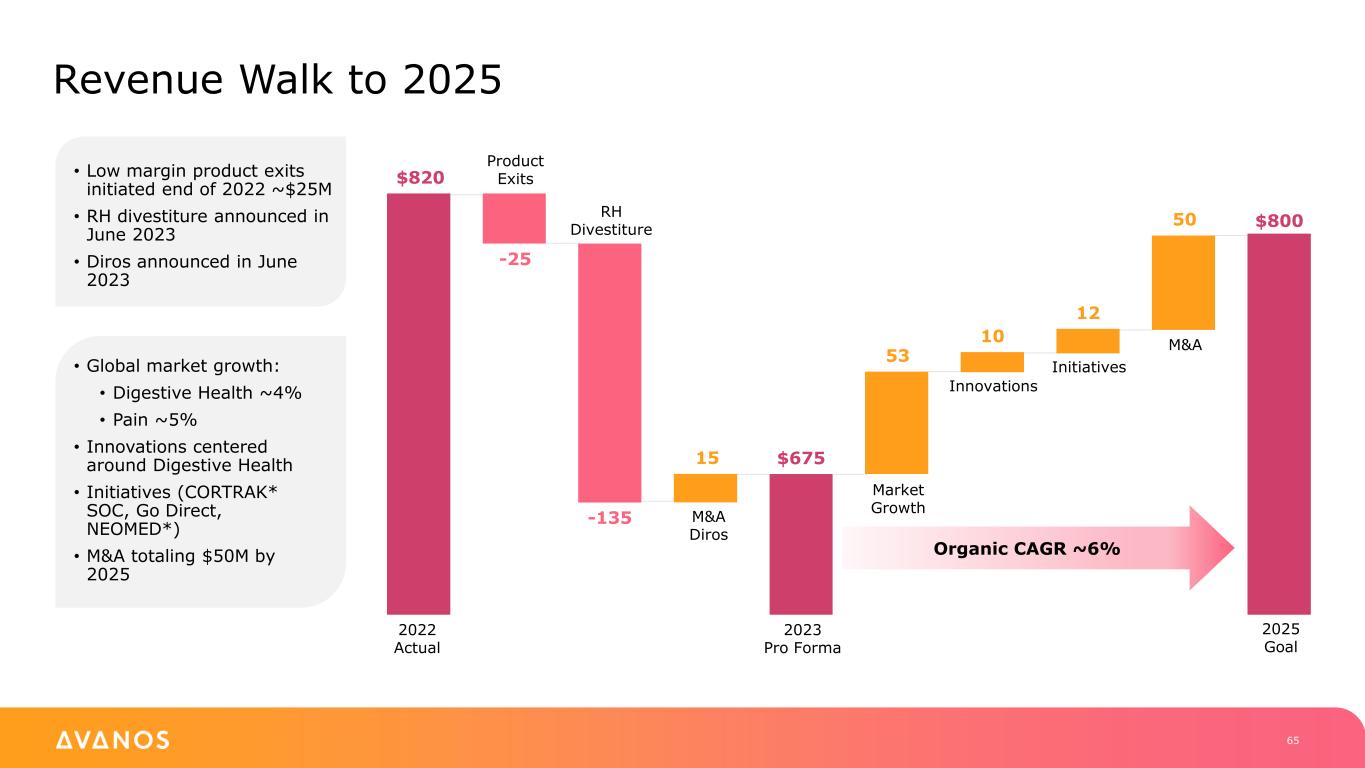

Revenue Walk to 2025 65 • Global market growth: • Digestive Health ~4% • Pain ~5% • Innovations centered around Digestive Health • Initiatives (CORTRAK* SOC, Go Direct, NEOMED*) • M&A totaling $50M by 2025 • Low margin product exits initiated end of 2022 ~$25M • RH divestiture announced in June 2023 • Diros announced in June 2023 2022 Actual Product Exits M&A Diros 2023 Pro Forma $820 -25 -135 RH Divestiture 15 $675 Organic CAGR ~6% Market Growth Innovations Initiatives M&A 2025 Goal 53 10 12 50 $800

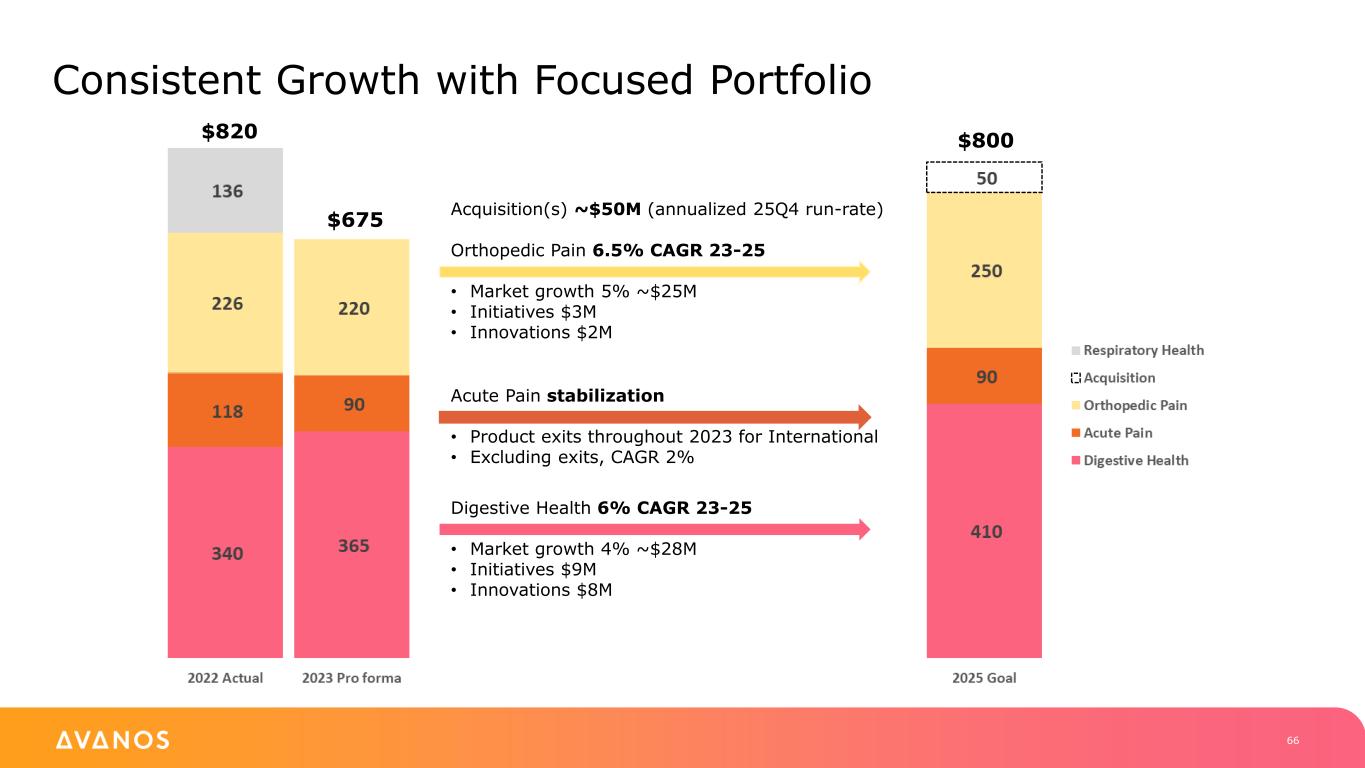

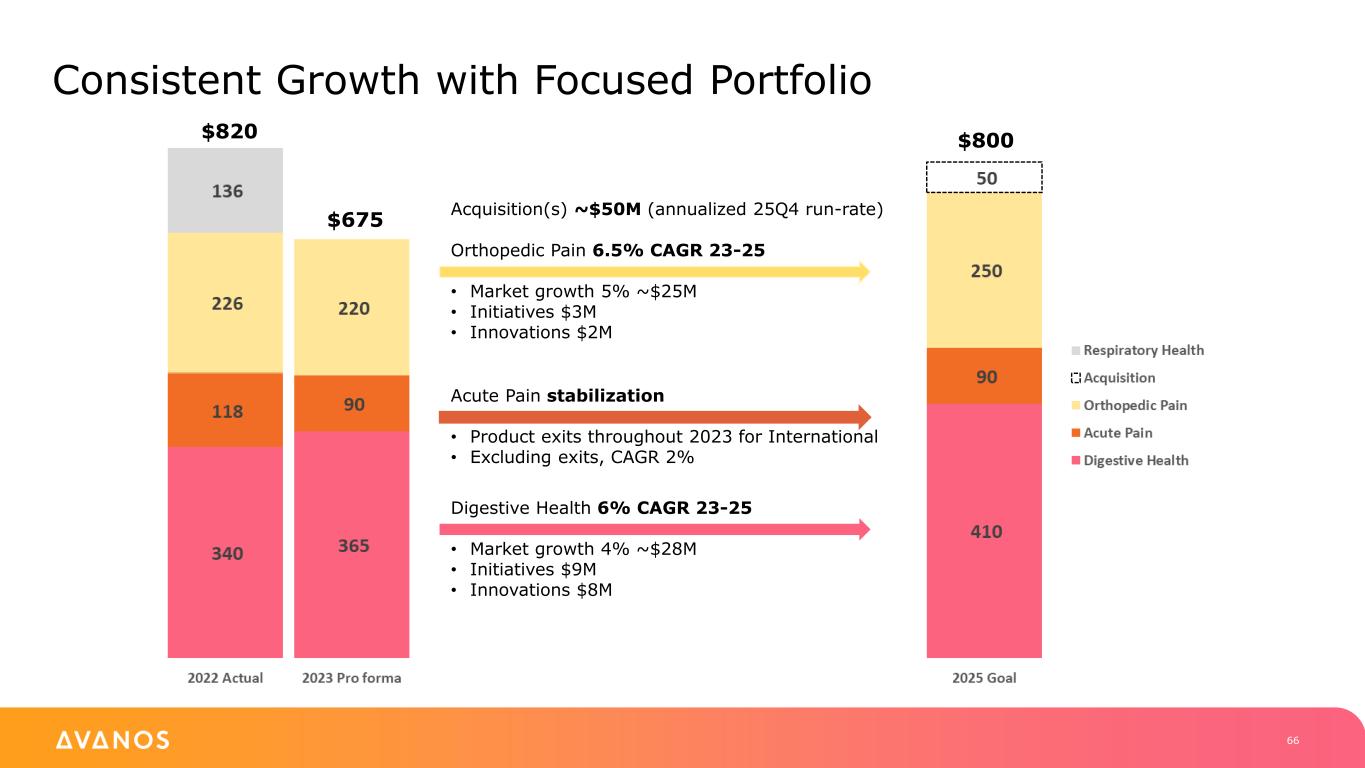

Consistent Growth with Focused Portfolio 66 $820 $675 $800 Digestive Health 6% CAGR 23-25 • Market growth 4% ~$28M • Initiatives $9M • Innovations $8M Acute Pain stabilization • Product exits throughout 2023 for International • Excluding exits, CAGR 2% Orthopedic Pain 6.5% CAGR 23-25 • Market growth 5% ~$25M • Initiatives $3M • Innovations $2M Acquisition(s) ~$50M (annualized 25Q4 run-rate)

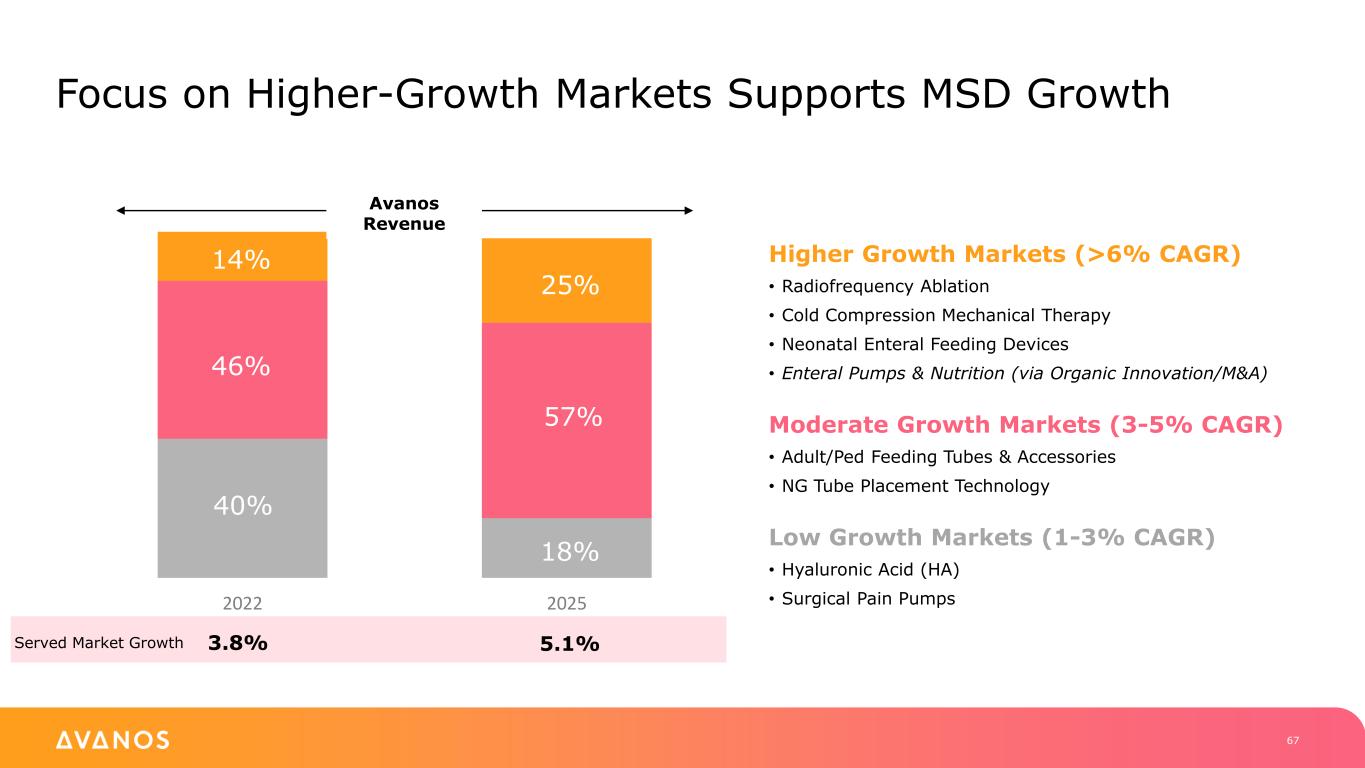

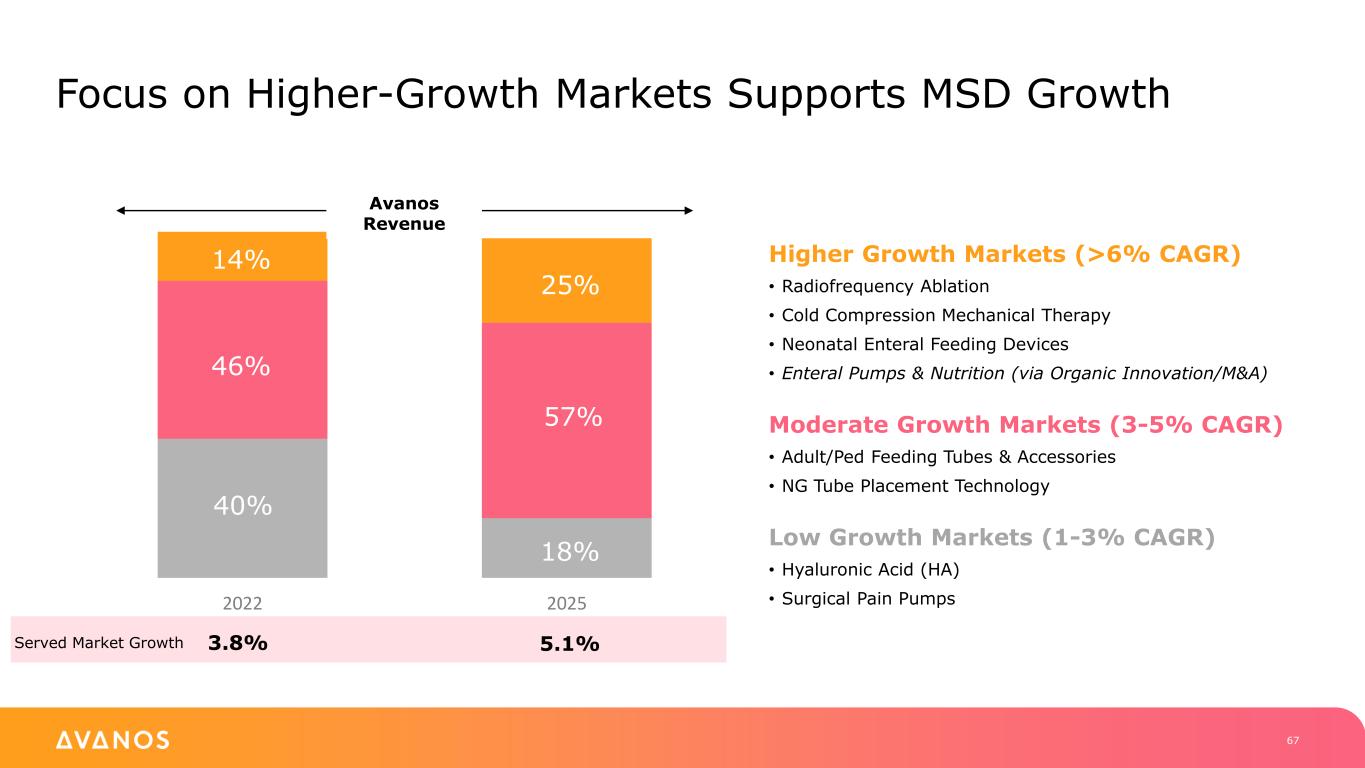

Focus on Higher-Growth Markets Supports MSD Growth 67 2022 2025 Higher Growth Markets (>6% CAGR) • Radiofrequency Ablation • Cold Compression Mechanical Therapy • Neonatal Enteral Feeding Devices • Enteral Pumps & Nutrition (via Organic Innovation/M&A) Moderate Growth Markets (3-5% CAGR) • Adult/Ped Feeding Tubes & Accessories • NG Tube Placement Technology Low Growth Markets (1-3% CAGR) • Hyaluronic Acid (HA) • Surgical Pain Pumps Served Market Growth Avanos Revenue 3.8% 5.1% 57% 18% 25% 40% 46% 14%

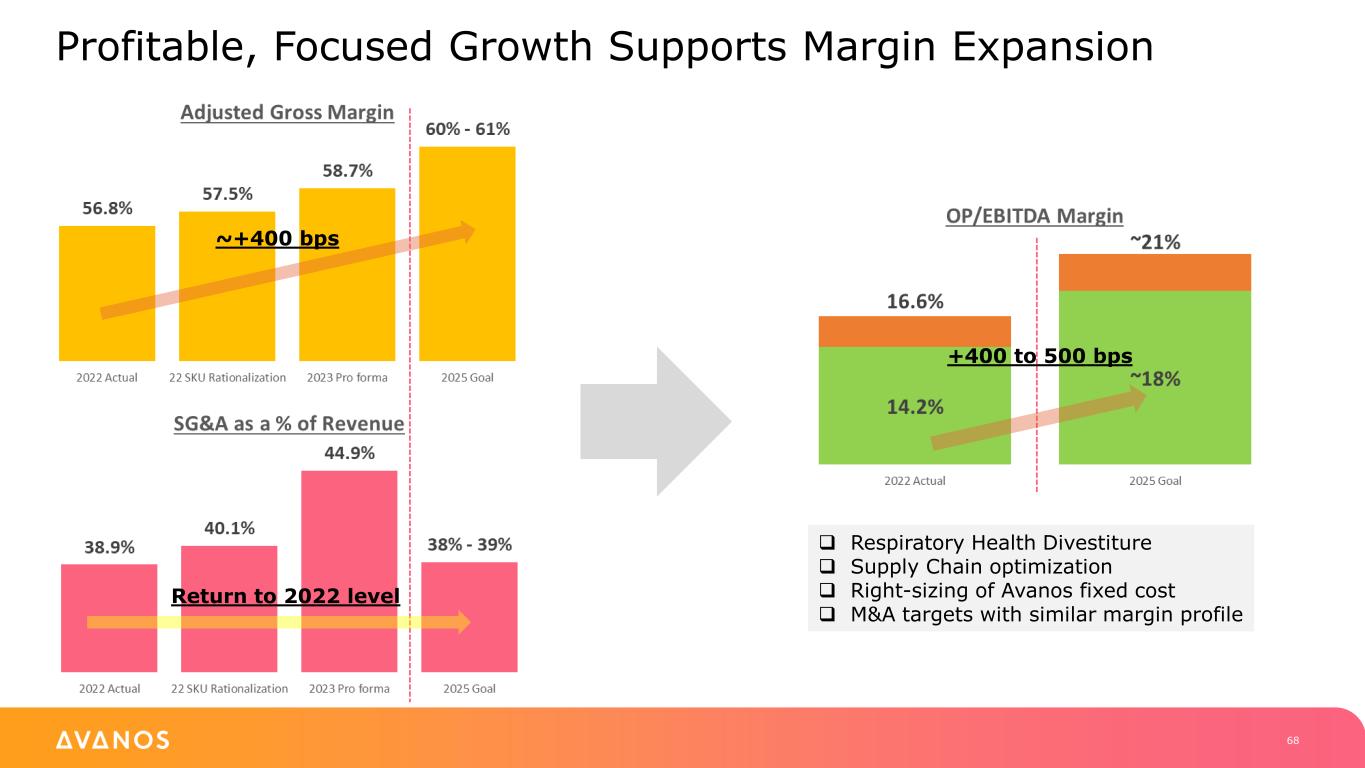

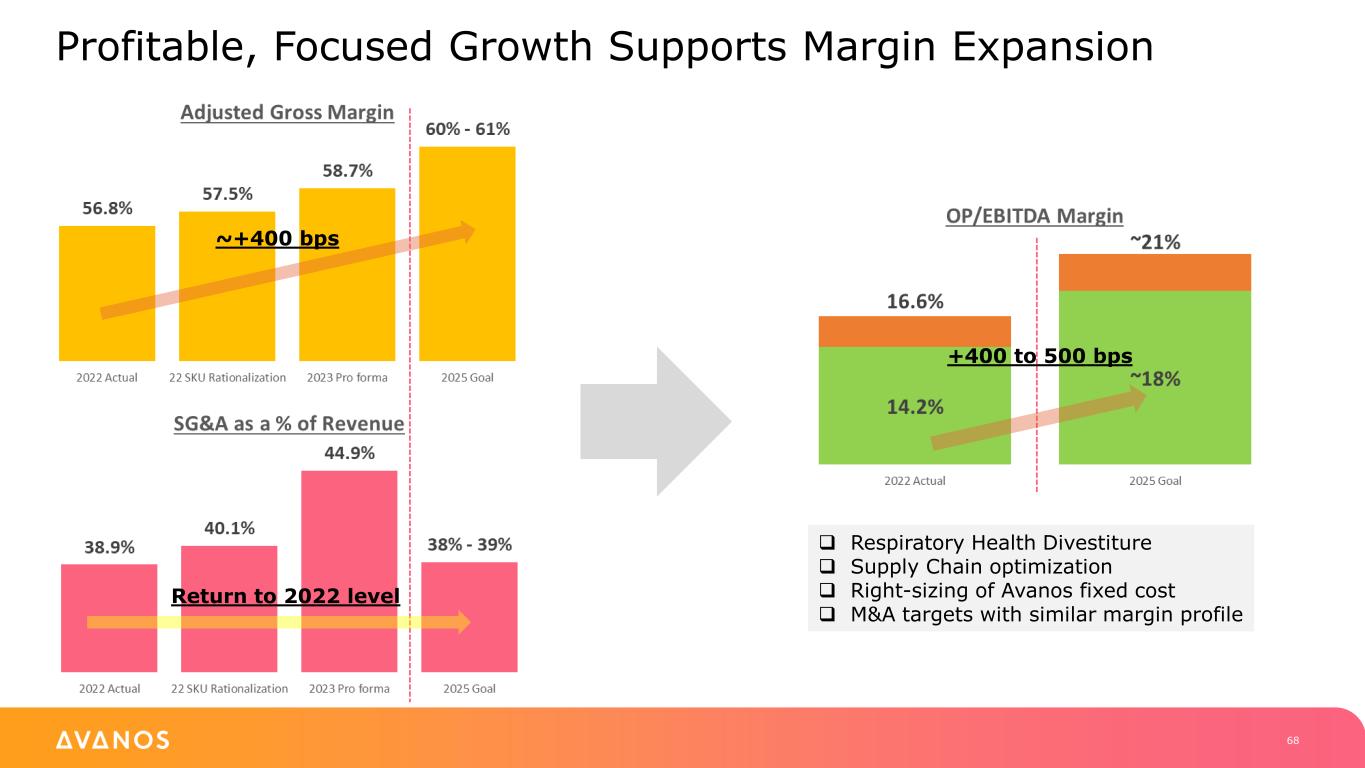

Profitable, Focused Growth Supports Margin Expansion 68 ~+400 bps ❑ Respiratory Health Divestiture ❑ Supply Chain optimization ❑ Right-sizing of Avanos fixed cost ❑ M&A targets with similar margin profile Return to 2022 level +400 to 500 bps

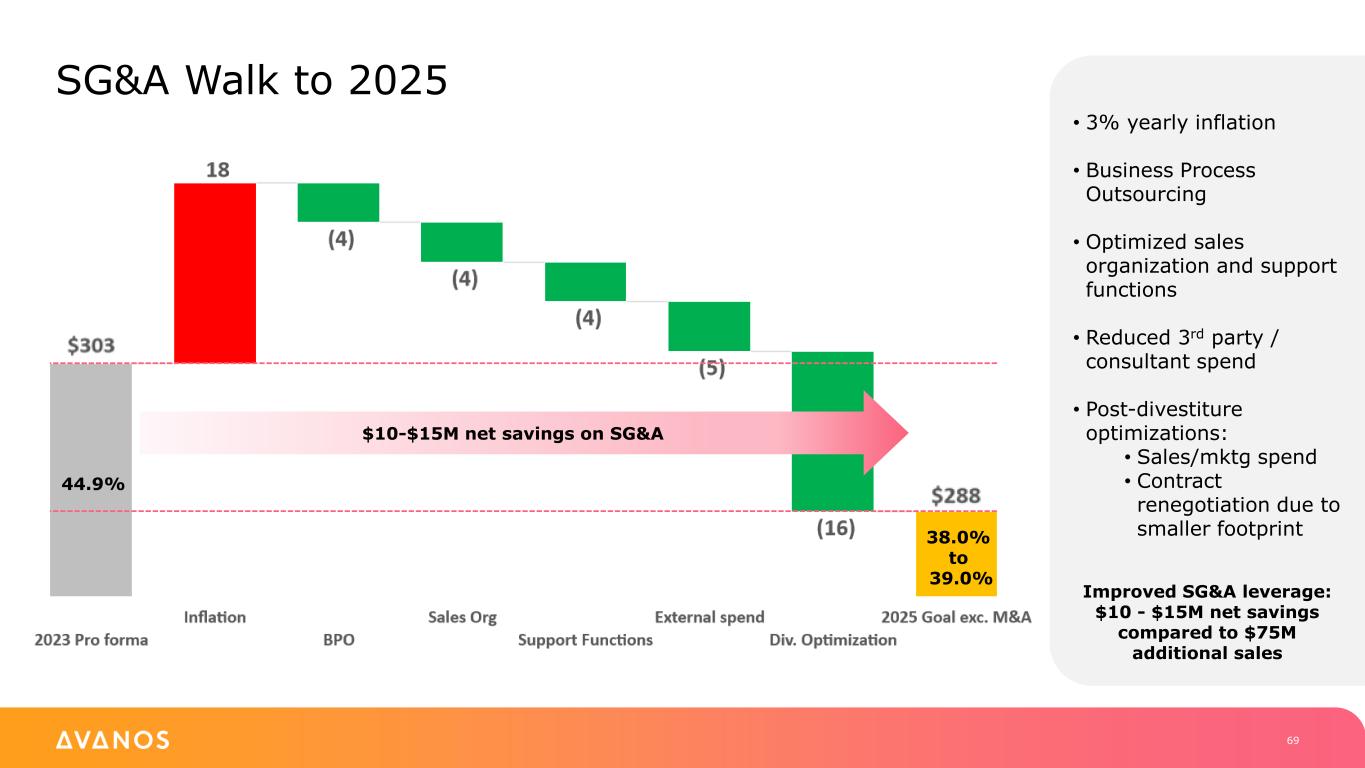

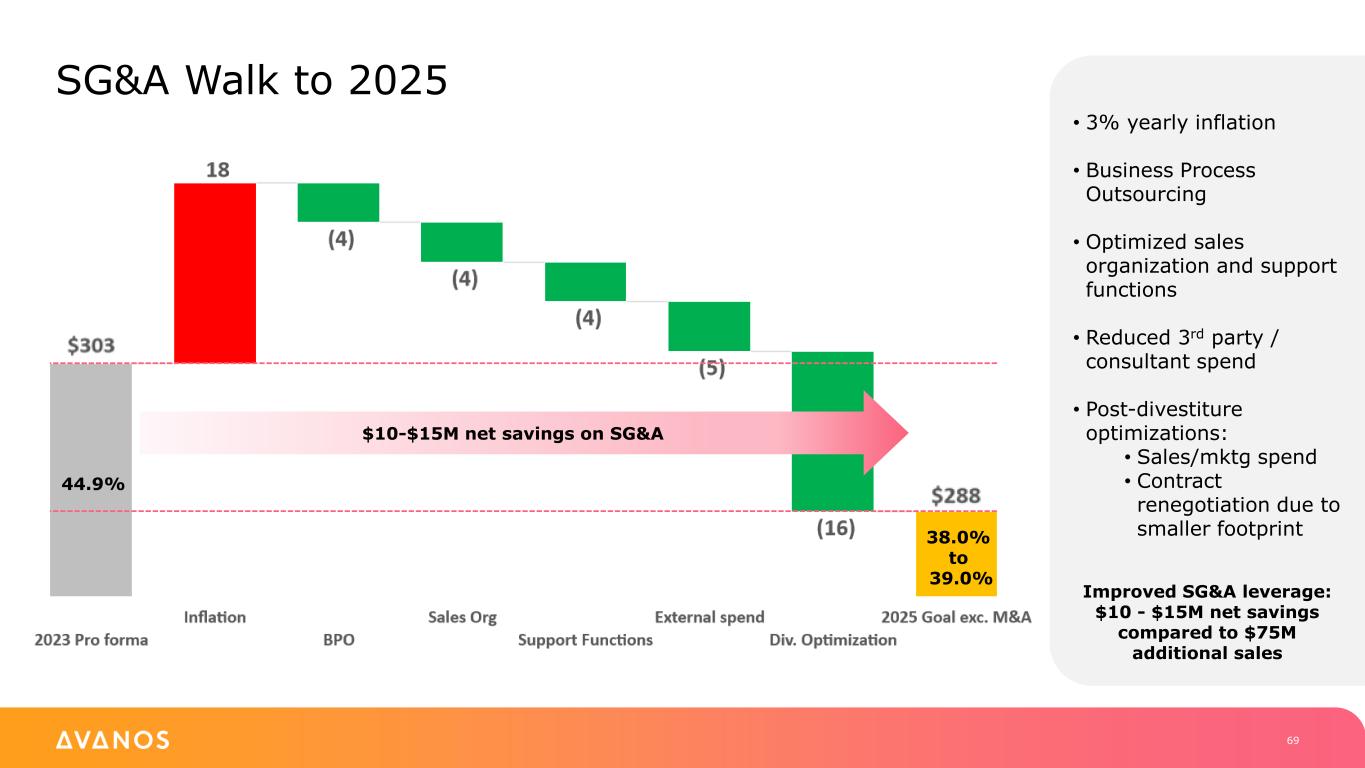

SG&A Walk to 2025 69 • 3% yearly inflation • Business Process Outsourcing • Optimized sales organization and support functions • Reduced 3rd party / consultant spend • Post-divestiture optimizations: • Sales/mktg spend • Contract renegotiation due to smaller footprint Improved SG&A leverage: $10 - $15M net savings compared to $75M additional sales 44.9% 38.0% to 39.0% $10-$15M net savings on SG&A

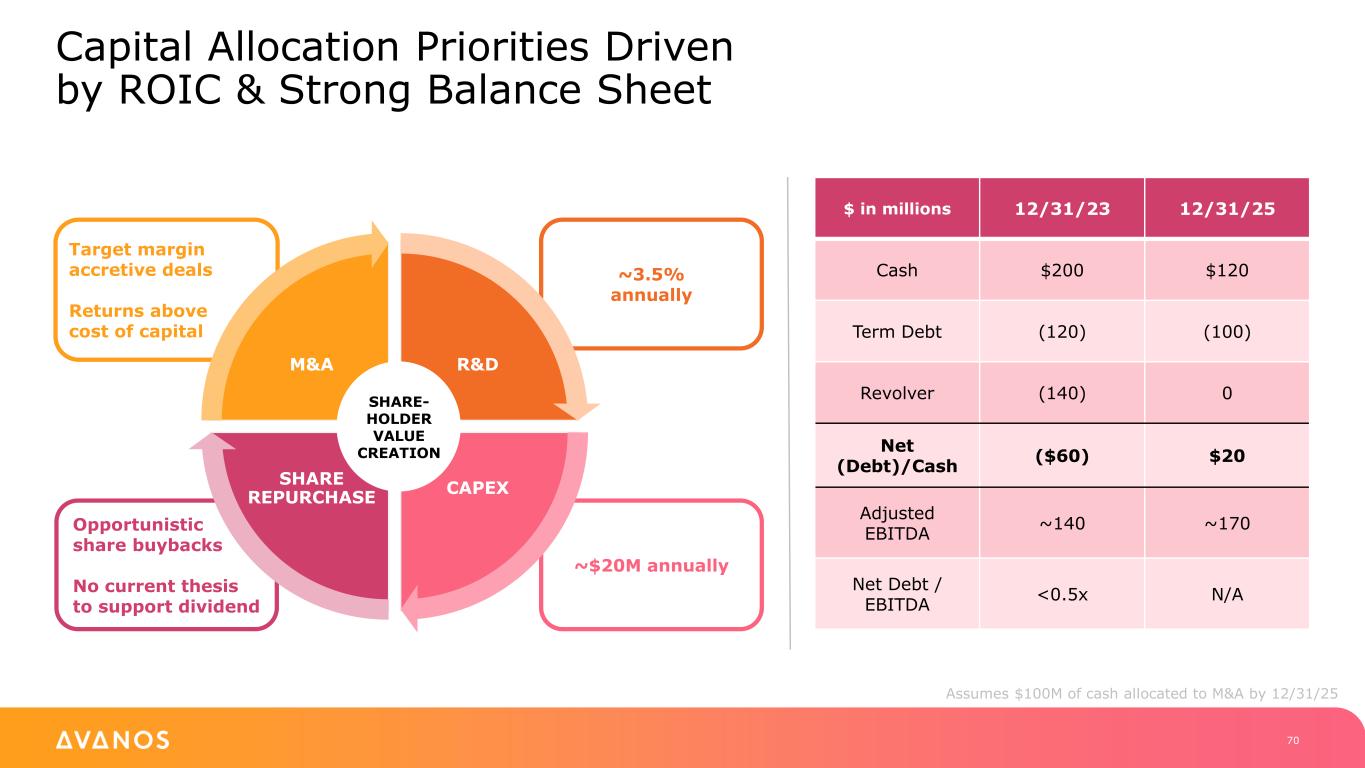

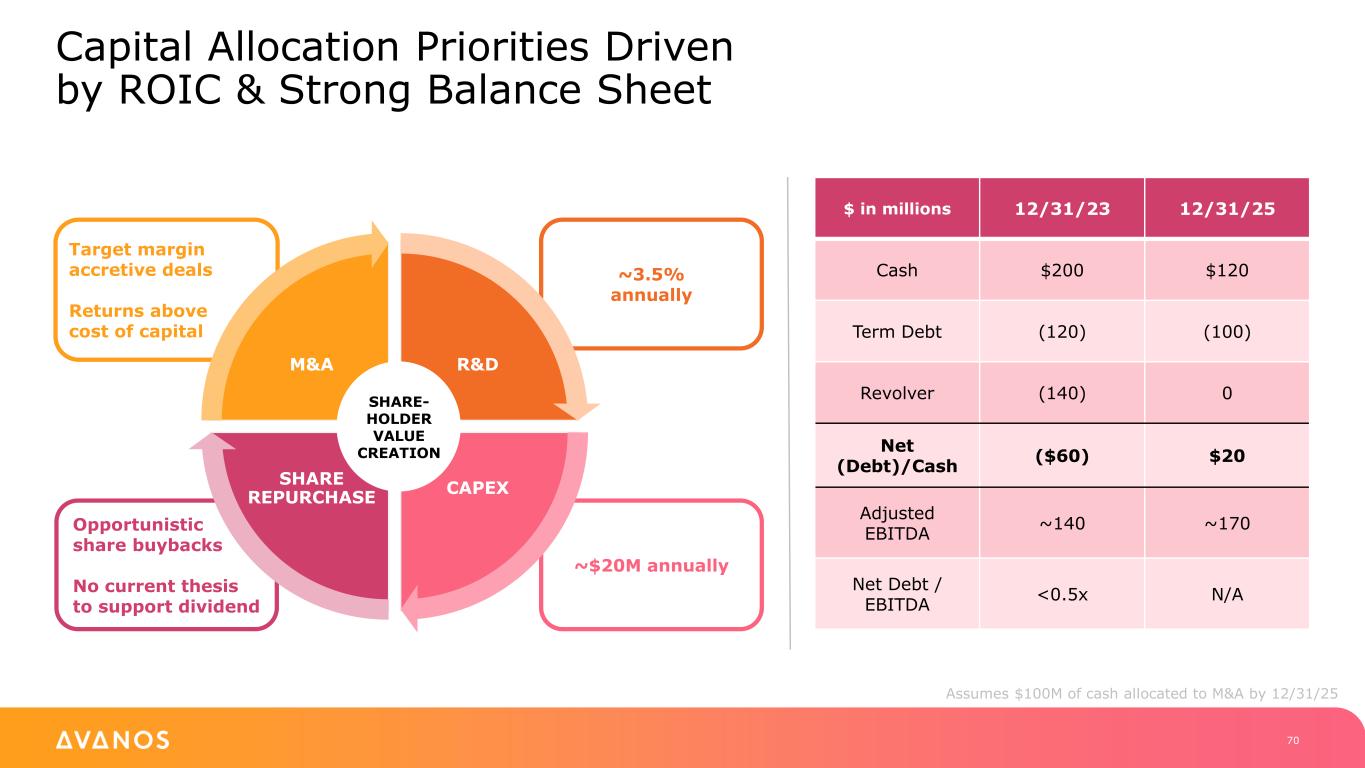

~3.5% annually Target margin accretive deals Returns above cost of capital ~$20M annually Opportunistic share buybacks No current thesis to support dividend R&D CAPEX SHARE REPURCHASE M&A SHARE- HOLDER VALUE CREATION Capital Allocation Priorities Driven by ROIC & Strong Balance Sheet 70 $ in millions 12/31/23 12/31/25 Cash $200 $120 Term Debt (120) (100) Revolver (140) 0 Net (Debt)/Cash ($60) $20 Adjusted EBITDA ~140 ~170 Net Debt / EBITDA <0.5x N/A Assumes $100M of cash allocated to M&A by 12/31/25

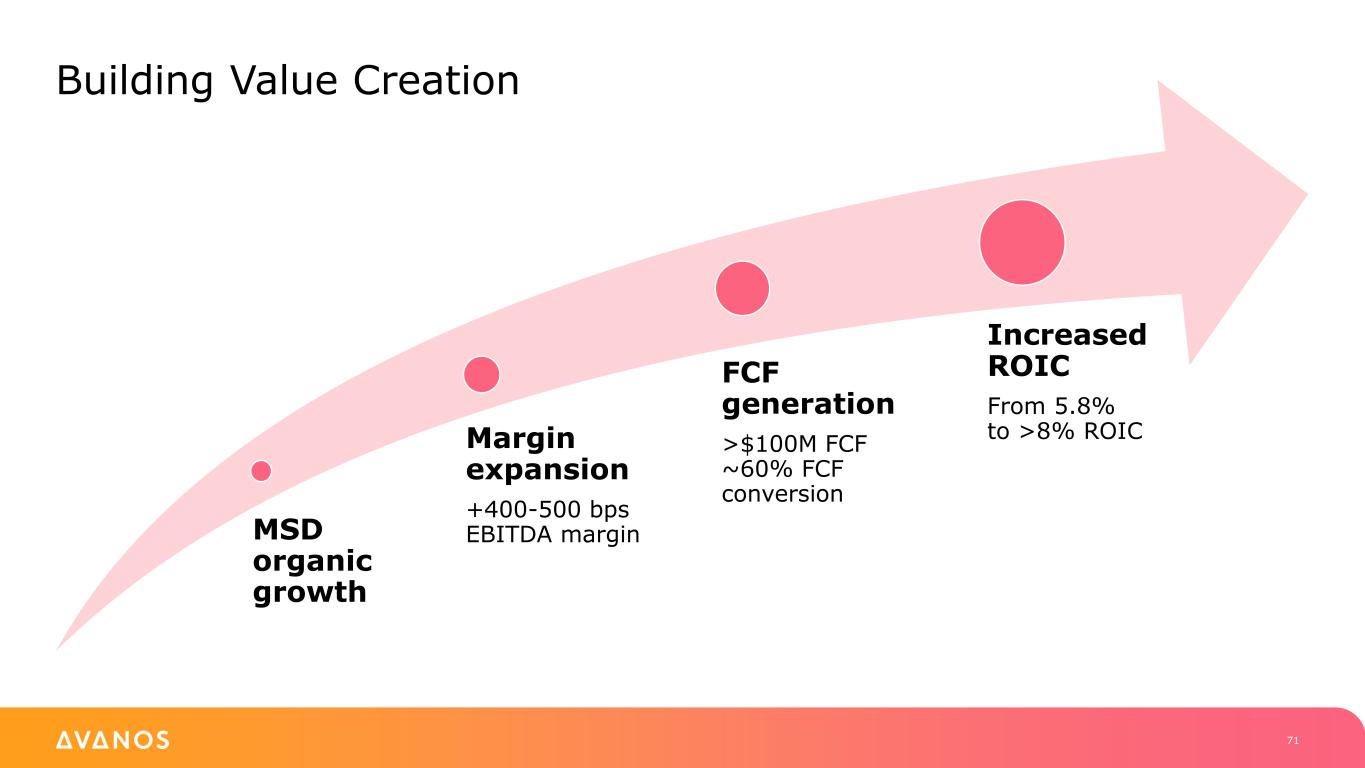

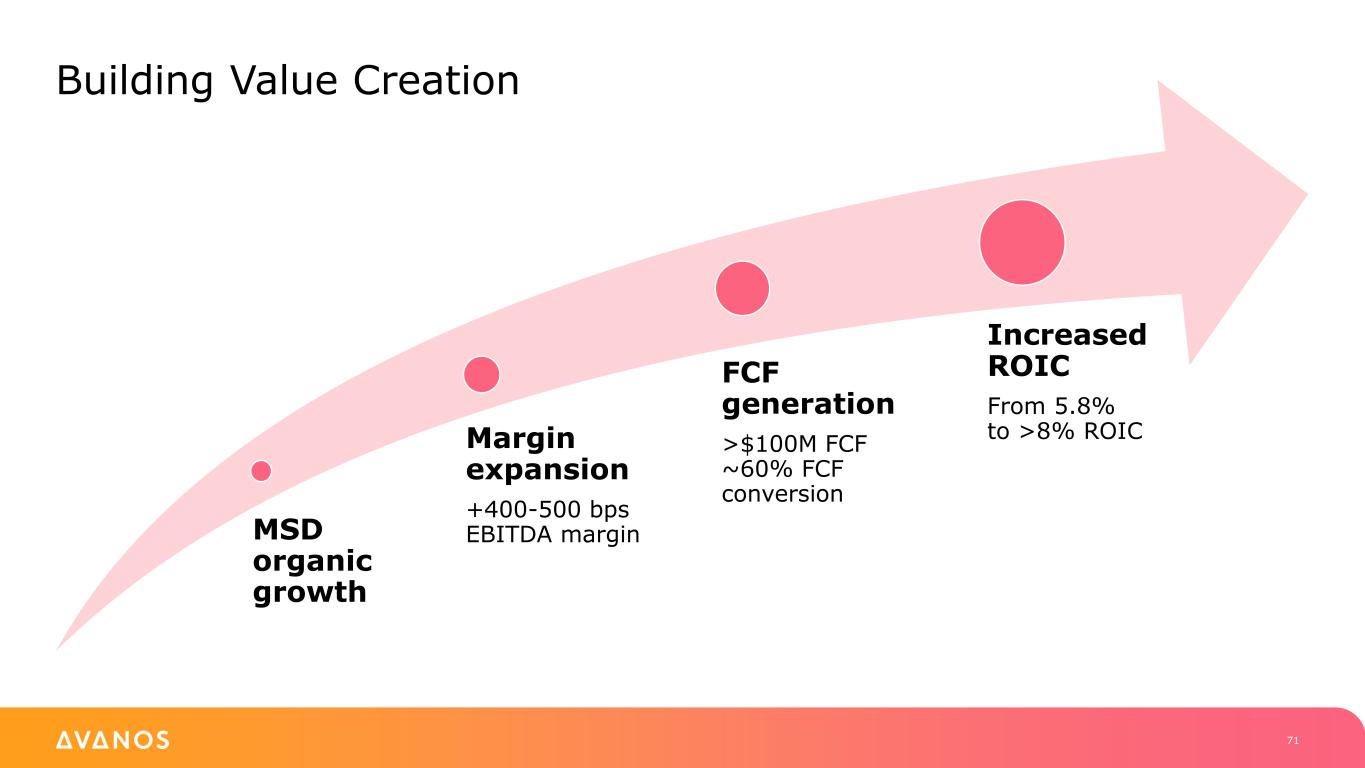

MSD organic growth Margin expansion +400-500 bps EBITDA margin FCF generation >$100M FCF ~60% FCF conversion Increased ROIC From 5.8% to >8% ROIC Building Value Creation 71

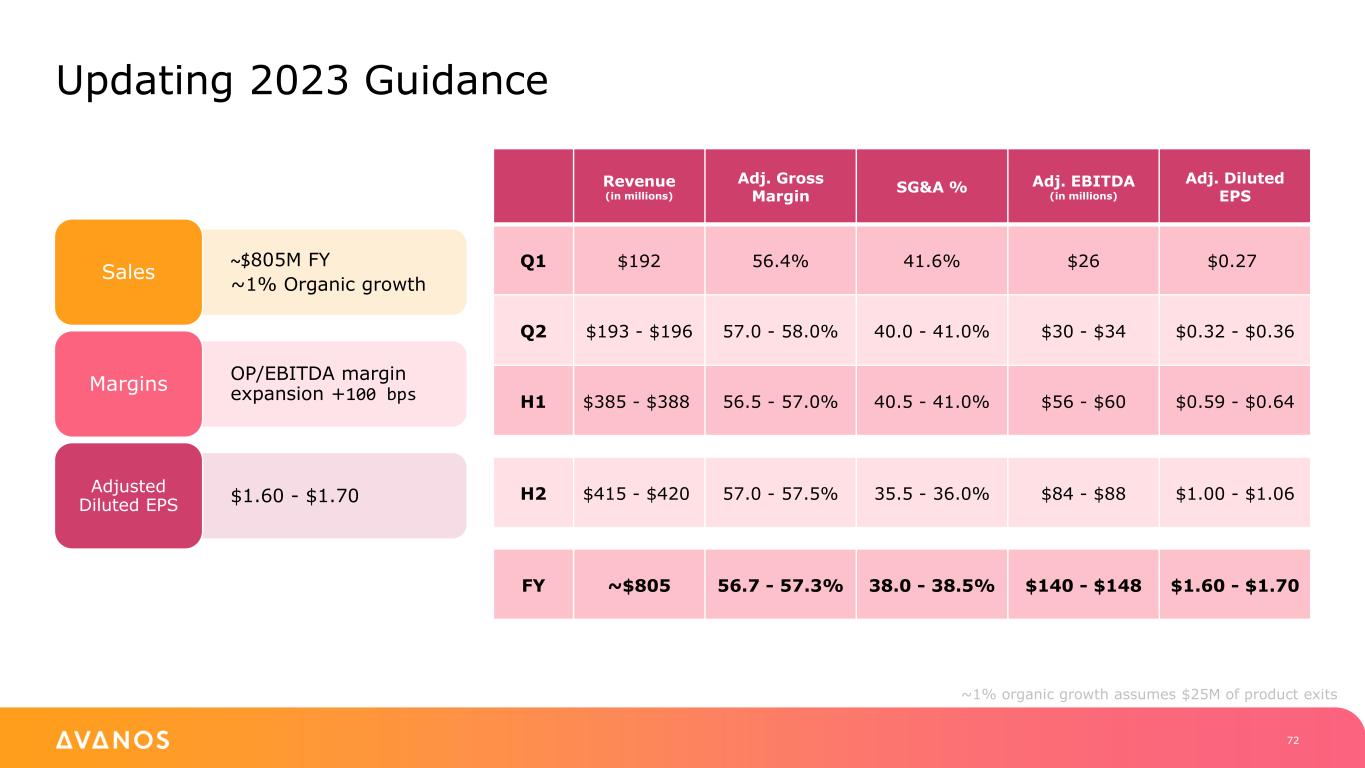

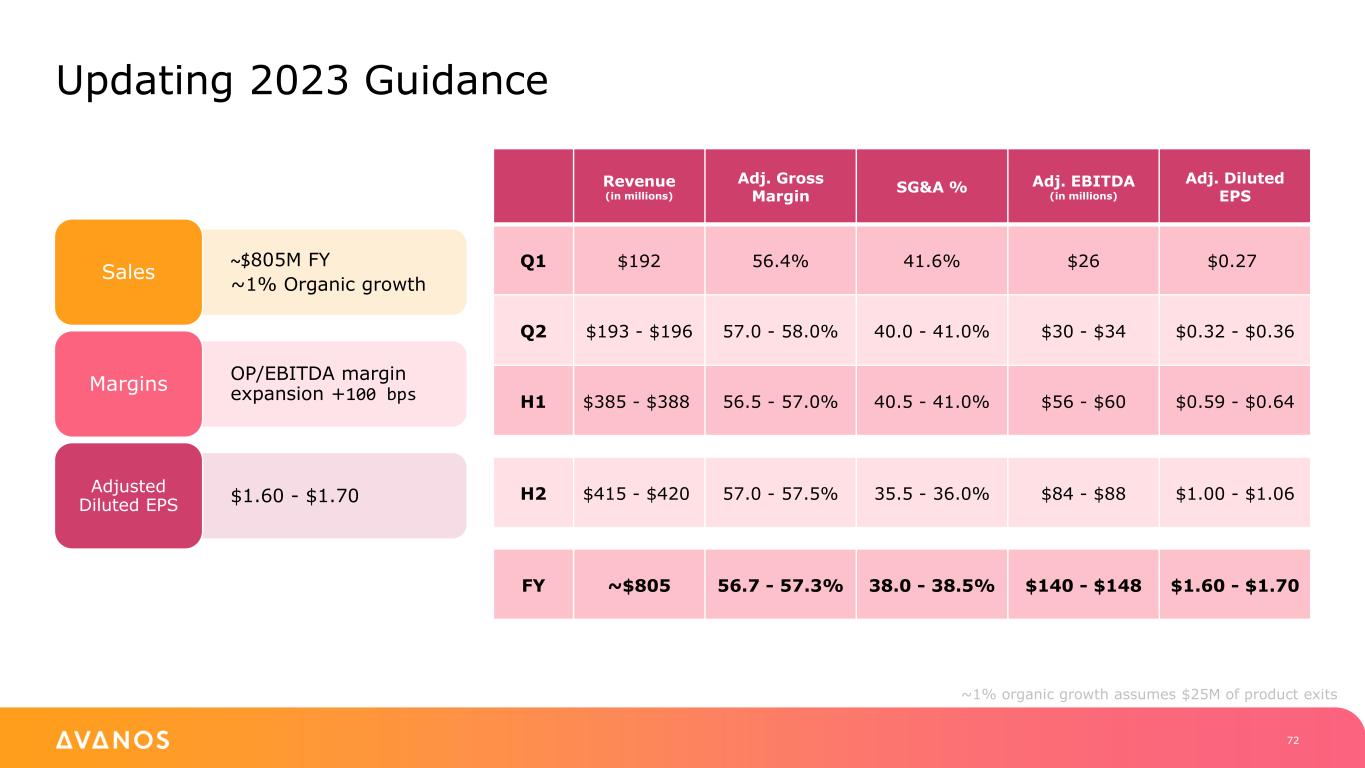

Updating 2023 Guidance 72 Revenue (in millions) Adj. Gross Margin SG&A % Adj. EBITDA (in millions) Adj. Diluted EPS Q1 $192 56.4% 41.6% $26 $0.27 Q2 $193 - $196 57.0 - 58.0% 40.0 - 41.0% $30 - $34 $0.32 - $0.36 H1 $385 - $388 56.5 - 57.0% 40.5 - 41.0% $56 - $60 $0.59 - $0.64 H2 $415 - $420 57.0 - 57.5% 35.5 - 36.0% $84 - $88 $1.00 - $1.06 FY ~$805 56.7 - 57.3% 38.0 - 38.5% $140 - $148 $1.60 - $1.70 ~$805M FY ~1% Organic growth Sales OP/EBITDA margin expansion +100 bps Margins $1.60 - $1.70 Adjusted Diluted EPS ~1% organic growth assumes $25M of product exits

Closing Remarks Joe Woody Chief Executive Officer

74 Avanos Investment Thesis Solid core categories with consistent organic growth Direct adjacencies to add growth and margin improvement Clearly defined set of transformation priorities already in motion Leverageable financial model to generate material free cash flow and high ROIC

Q&A

Innovation Showcase

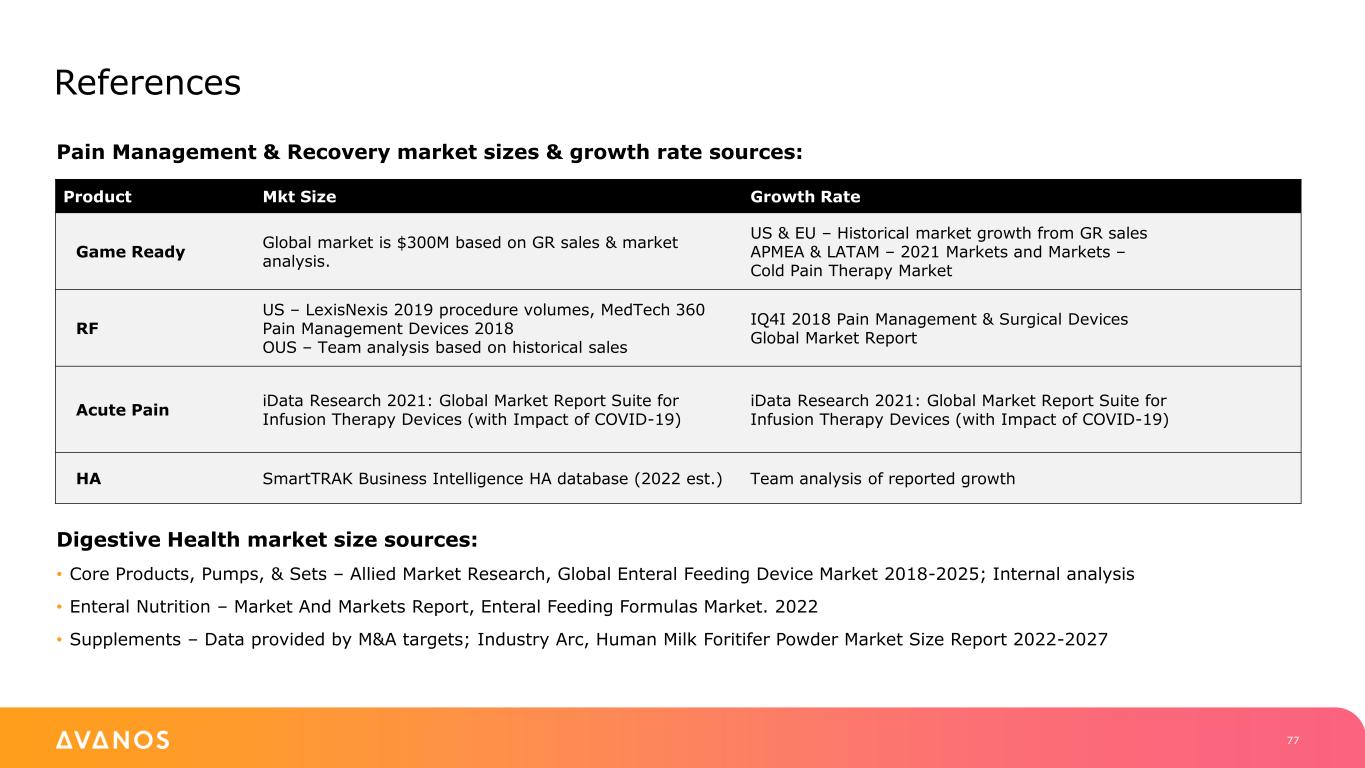

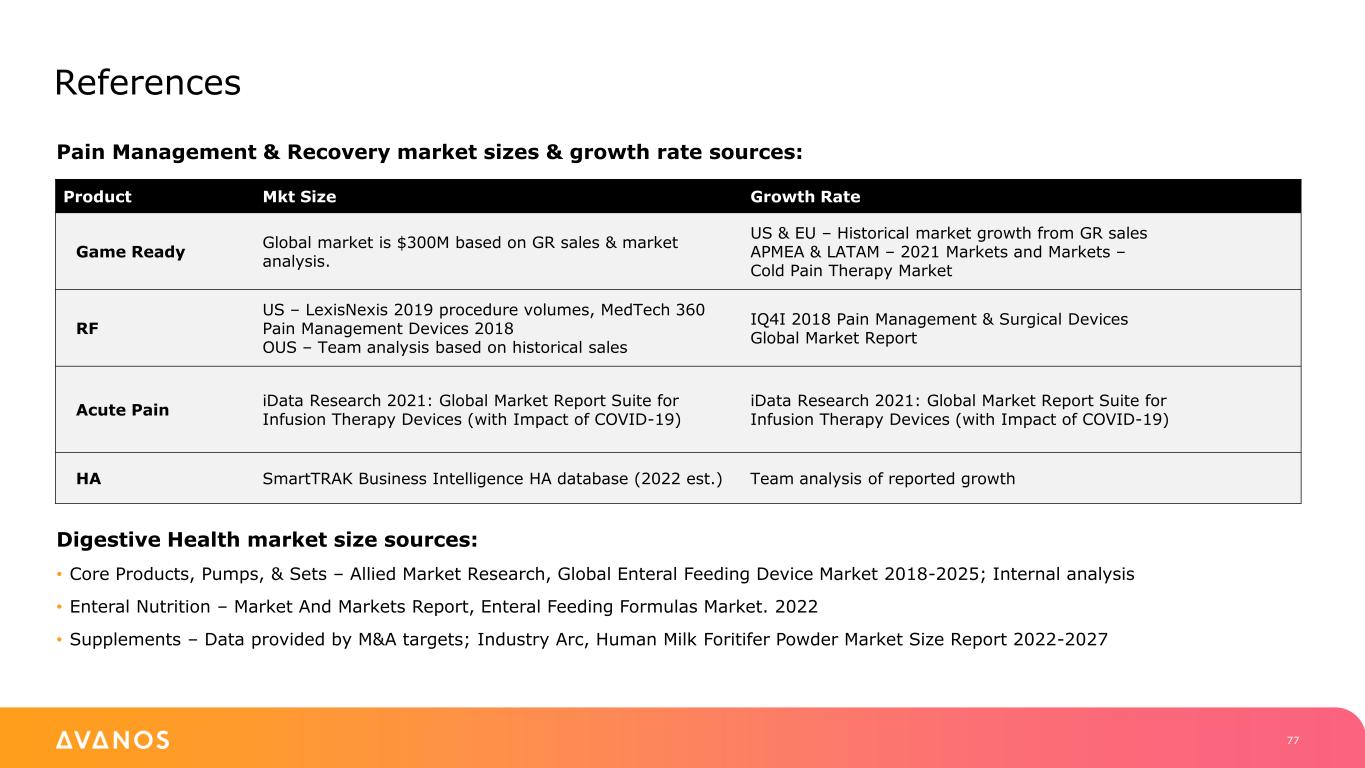

77 References Pain Management & Recovery market sizes & growth rate sources: Digestive Health market size sources: • Core Products, Pumps, & Sets – Allied Market Research, Global Enteral Feeding Device Market 2018-2025; Internal analysis • Enteral Nutrition – Market And Markets Report, Enteral Feeding Formulas Market. 2022 • Supplements – Data provided by M&A targets; Industry Arc, Human Milk Foritifer Powder Market Size Report 2022-2027 Product Mkt Size Growth Rate Game Ready Global market is $300M based on GR sales & market analysis. US & EU – Historical market growth from GR sales APMEA & LATAM – 2021 Markets and Markets – Cold Pain Therapy Market RF US – LexisNexis 2019 procedure volumes, MedTech 360 Pain Management Devices 2018 OUS – Team analysis based on historical sales IQ4I 2018 Pain Management & Surgical Devices Global Market Report Acute Pain iData Research 2021: Global Market Report Suite for Infusion Therapy Devices (with Impact of COVID-19) iData Research 2021: Global Market Report Suite for Infusion Therapy Devices (with Impact of COVID-19) HA SmartTRAK Business Intelligence HA database (2022 est.) Team analysis of reported growth

References (Digestive Health) 78 1. Slide 24 – Source: COPY-05911 approved on 4-1-2022. See mark 50-54 sec 2. Slide 25 – Source: 2021 Customer Satisfaction Survey 3. Slide 26 – Source: https://tubefed.com/newsletter/a-cancer-survivor-shares-his-mic-key-tube-story/

References (Pain Management & Recovery) 79 4. Slide 32 – Source: Computer Simulated Lesion Representation, Avanos Data on File 5. Slide 32 – Source: RF Tined Treatment Research KJT Group, March 20, 2023 KJT 6. Slide 34 – Source: GenVisc 850 Package Insert 7. Slide 34 – Source: Clinical Study Reference List • Davis T, et al. Reg Anesth Pain Med 2019;0:1–8. doi:10.1136/rapm-2018-100051Original“Twelve-month analgesia and rescue, by cooled radiofrequency ablation treatment of osteoarthritic knee pain: results from a prospective, multicenter, randomized, cross-over trial” 1Davis T, et al. Reg Anesth Pain Med 2019;0:1–8. doi:10.1136/rapm-2018-100051Original • Chenet al. BMC Musculoskeletal Disorders (2020) 21:363 • Leonardo Kapural, MD, PhD1, Nicholas Lee1, Kevin Neal, MD2, and Michael Burchell, MD2 “Long-Term Retrospective Assessment of Clinical Efficacy of Radiofrequency Ablation of the Knee Using a Cooled Radiofrequency System” Pain Physician 2019; 22:489-494 • ISSN 1533-3159 • Corey Hunter,MD et. Al. “Cooled Radiofrequency Ablation Treatment of the Genicular Nerves in the Treatment of Osteoarthritic Knee Pain:18-and24-Month Results” Printed by [Norgine Ltd - Uxbridge - GBR - 208.087.238.180 - /doi/epdf/10.1111/papr.12844] at [02/09/2020 • Jeffrey Lyman, M,D, et. al. “ARTICLECooled radiofrequency ablation of genicular nerves provides 24-Month durability in the management of osteoarthritic knee pain: Outcomes from a prospective, multicenter, randomized trial” Pain Practice. 2 022;0 0:1–11. 8. Slide 34 – Source: ON-Q* IFU 9. Slide 34 – Source: Clinical Study Reference List • E. P. Su, et. al. “A prospective, multi-center, randomised trial to evaluate the efficacy of a cryopneumatic device on total knee arthroplasty recovery” JBJS; VOL. 94-B, No. 11, NOVEMBER 2012 • John Hochberg, MD; “A Randomized Prospective Study to Assess the Efficacy of Two Cold-therapy Treatments Following Carpal Tunnel Release”; JOURNAL OF HAND THERAPY; July-September 20 • Sherwin S. W. Ho,MD, et. al.; “The Effects of Ice on Blood Flow and Bone Metabolism in Knees”; The American Journal of Sports Medicine, Vol. 22, NO.4 • https://doi.org/10.1016/j.otsr.2013.12.019 • Neurospine 2018;15(4):348-352. https://doi.org/10.14245/ns.1836070.035 • European Spine Journal (2019) 28:1257 – 1264. https://doi.org/10.1007/s00586-019-05886-6

References (Pain Management & Recovery) 80 10. Slide 37 – Source: Internal, Data on File (Customer Insights VOC) 11. Slide 38 – Source: COOLIEF* patient testimonials • COOLIEF* success stories: Real patients with real relief (mycoolief.com) 12. Slide 38 – Source: NICE Link, Japan Reimbursement Code Posted • https://www.nice.org.uk/guidance/indevelopment/gid-ipg10236 • Code: K697-3 Radio Frequency Ablation Therapy (Japan) 13. Slide 39 – Source: Pain Pump patient testimonials • mypainpump.com 14. Slide 40 – Source: Internal Physician Testimonials, Data on File (Game Ready Insights VOC) • Clinical Study Reference List: • Leegwater NC, Willems JH, Brohet R et al. Cryocompression therapy after elective arthroplasty of the hip. Hip Int 2012; 22: 527–33; • Song M, Sun X, Tian X et al. Compressive cryotherapy versus cryotherapy alone in patients undergoing knee surgery: a meta-analysis. Springerplus 2016; 5: 1–12; • Perna M, Su EP, Mayman DJ et al. A prospective, multi-center, randomised trial to evaluate the efficacy of a cryopneumatic device on total knee arthroplasty recovery. J Bone Joint Surg Br 2012; 94: 153–6; • Saito N, Horiuchi H, Kobayashi S et al. Continuous local cooling for pain relief following total hip arthroplasty. J Arthroplasty 2004; 19: 3334–337