Michael Greiner Interim CEO January 13, 2025

Certain matters in this presentation, including expectations and planning assumptions, any comments about our expected performance, and any estimates, projections, or statements relating to our business plans, objectives, acquisitions and transformation initiatives, constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and are based upon current plans and management’s expectations and beliefs concerning future events impacting the Company. These statements are subject to risks and uncertainties that could cause our actual results to differ materially from those expressed or implied in such statements, including risks related to competition, market demand, cost savings and reductions, raw material, energy, and other input costs, supply chain disruptions (including availability of drugs used in our Acute Pain products), inflation, the regional conflicts between Russia and Ukraine and in the Middle East, our ability to successfully execute on or achieve the expected benefits of our transformation initiative, new or higher tariffs, trade restrictions or import taxes, potential threats to the solvency of commercial banks, economic conditions, currency exchange risks, human capital risks, cyber risks, intellectual property risks, and legislative and regulatory actions. There can be no assurance that these future events will occur as anticipated or that the Company’s results will be as estimated. Forward-looking statements speak only as of the date they were made, and we undertake no obligation to publicly update them. For a more complete listing and description of these and other factors that could cause the Company’s future results to differ materially from those expressed in any forward-looking statements, see the Company’s most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. This presentation includes financial measures that have not been calculated in accordance with accounting principles generally accepted in the U.S., or GAAP. The Company provides these non-GAAP financial measures as supplemental information to its GAAP financial measures. Management believes that such non-GAAP financial measures enhance investors’ understanding and analysis of the Company’s performance. As such, results and outlook have been adjusted to exclude certain items for relevant time periods as indicated in the non-GAAP reconciliations to the comparable GAAP financial measures included in this presentation and posted on our website (www.avanos.com/investors). These non-GAAP financial measures should not be considered in isolation or as a substitute for analysis of our results as reported under GAAP. FORWARD-LOOKING INFORMATION NON-GAAP FINANCIAL MEASURES DISCLAIMERS The information presented herein involves technologies and concepts in development that are not products and may never become products. For technology in development, the technologies or concepts are not being offered for sale and are not cleared or approved by the U.S. FDA or any other global regulator for commercial availability. This presentation contains trademarks, trade names and service marks which are the property of their respective owners. We do not intend our use or display of other parties' trademarks, trade names or service marks to imply, and such use or display should not be construed to imply, a relationship with, or endorsement or sponsorship of us by, these other parties.

TRIDENT*COOLIEF* TRIVISC* & GENVISC* Enteral Feeding ~$395M PM&R ~$290M Two Differentiated Device Portfolios: Enteral Feeding and Pain Management & Recovery (PM&R) Short-Term Feeding CORTRAK* 2 NEOMED* Pre-Surgical ON-Q* AMBIT* Post-Surgical GAME READY* Recovery MIC-KEY* Long-Term Feeding MARKET-LEADING BRANDS ~$685M Total Net Sales NICU Feeding & Care CORFLO* *Registered Trademark or Trademark of Avanos Medical, Inc., or its affiliates. © 2018 AVNS. All rights reserved.

Therapy/Trademark Market Size Market Growth Nasogastric Tube Placement & Short-Term Feeding (CORTRAK*/CORFLO*) Neonatal Feeding & Medication Delivery NEOMED*/ENFit® Enteral Feeding Portfolio Growth Outlook: At or Above Market † Market size is US-only $300M Initial Tube Placement & Long-Term Feeding (MIC-KEY*) $500M S h o r t- T e r m F e e d in g L o n g -T e r m F e e d in g $150M†N I C U F e e d in g 4-6% CAGR 4-6% CAGR 3-5% CAGR N I C U F e e d in g

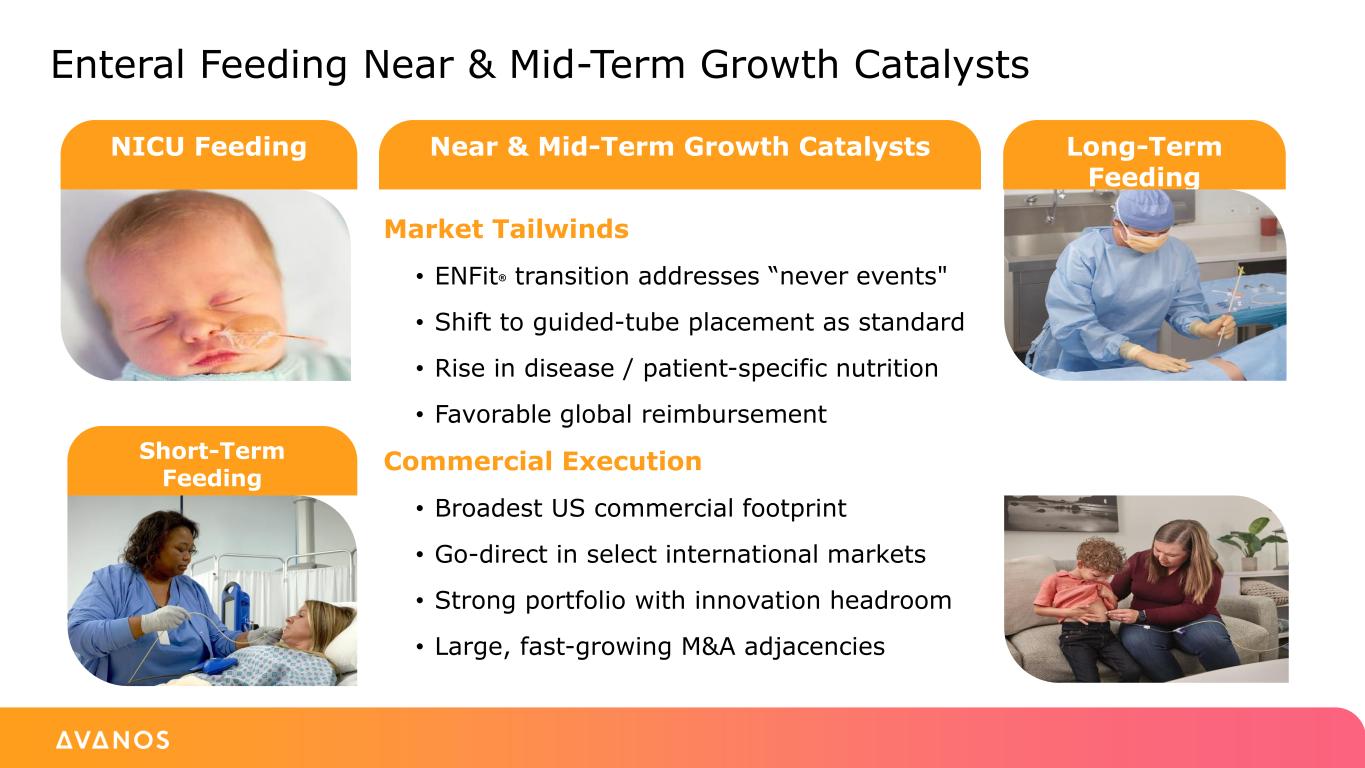

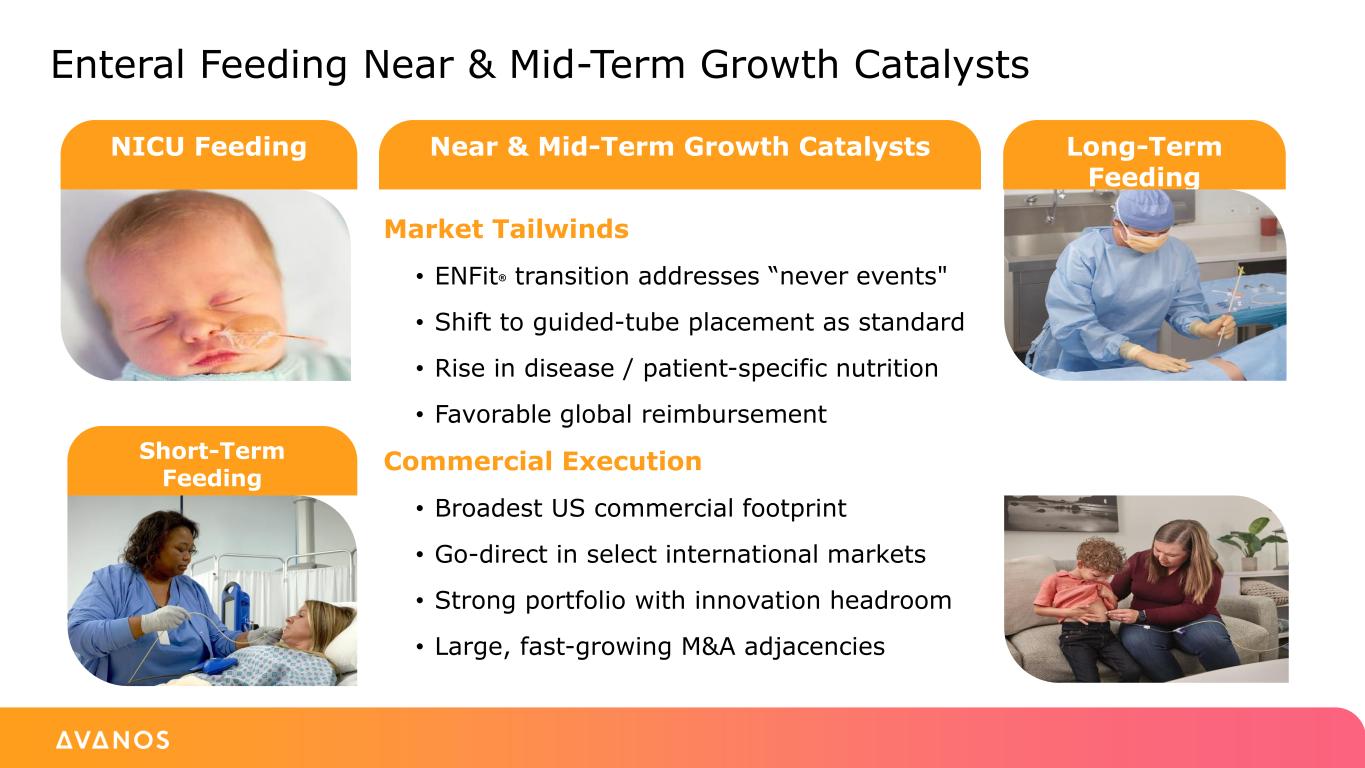

Near & Mid-Term Growth CatalystsNICU Feeding Enteral Feeding Near & Mid-Term Growth Catalysts Market Tailwinds • ENFit® transition addresses “never events" • Shift to guided-tube placement as standard • Rise in disease / patient-specific nutrition • Favorable global reimbursement Commercial Execution • Broadest US commercial footprint • Go-direct in select international markets • Strong portfolio with innovation headroom • Large, fast-growing M&A adjacencies Long-Term Feeding Short-Term Feeding

$1B+ $2B $4B Market Opportunity Expanded Market Potential Market Enteral Feeding Market Opportunity Market Expansion with Future Technology Available Market with Execution Existing Opportunity

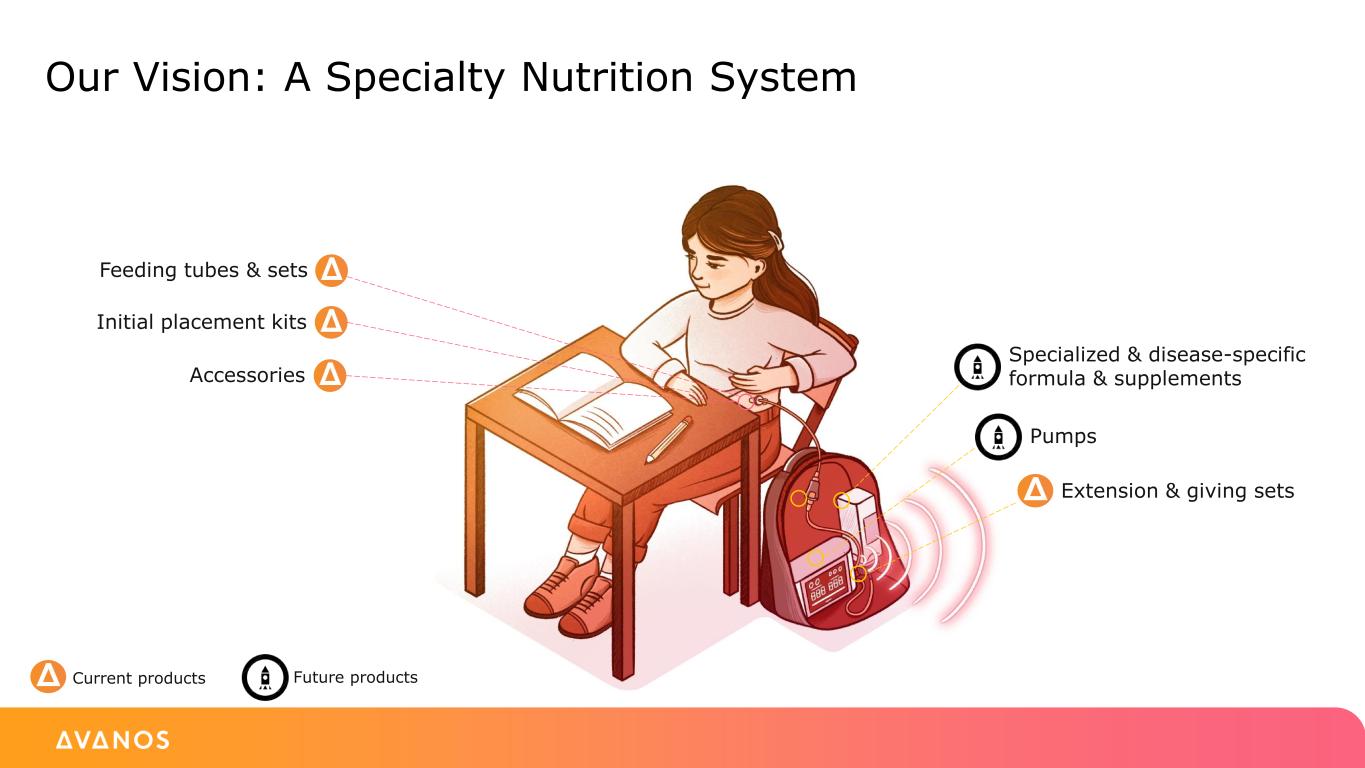

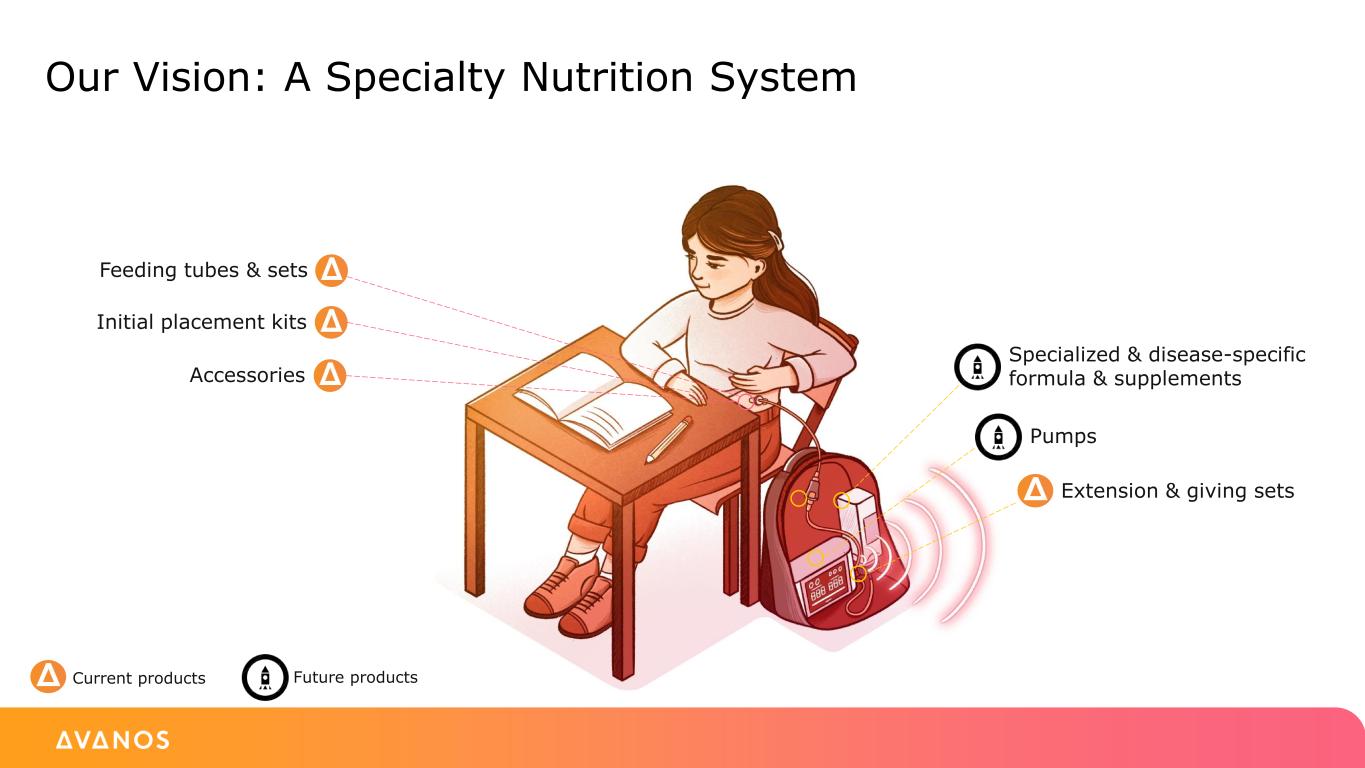

Our Vision: A Specialty Nutrition System Feeding tubes & sets Initial placement kits Accessories Pumps Specialized & disease-specific formula & supplements Extension & giving sets Current products Future products

Our Vision: Providing a Comprehensive Nutrition System for Newborns Milk collection bottles Breast pumps, accessories & lipid-saving technology Milk tracking & analysis system NG and percutaneous feeding tubes Gastric venting for CPAP belly Intelligent feeding Tube placement & confirmation Enteral syringes & syringe pump Specialty nutrition & fortifier Current products Future products

Meet Carson!* *Individual experiences may vary, please consult with your physician.

Radiofrequency Ablation (RFA) Solutions (ESENTEC*, Trident*, COOLIEF*) Hyaluronic Acid (Trivisc*/Genvisc*) PM&R Portfolio Growth Outlook: At Market Except HA † Market size is US-only $380M Catheter-Based Peripheral Nerve Block (ON-Q*/ambIT*) Cold & Compression (GAME READY*) $300M $320M † P r e - S u r g ic a l P o s t- S u r g ic a l & R e c o v e r y $460M † 1% CAGR 4-6% CAGR 0-2% CAGR 4-6% CAGR Therapy/Trademark Market Size Market Growth

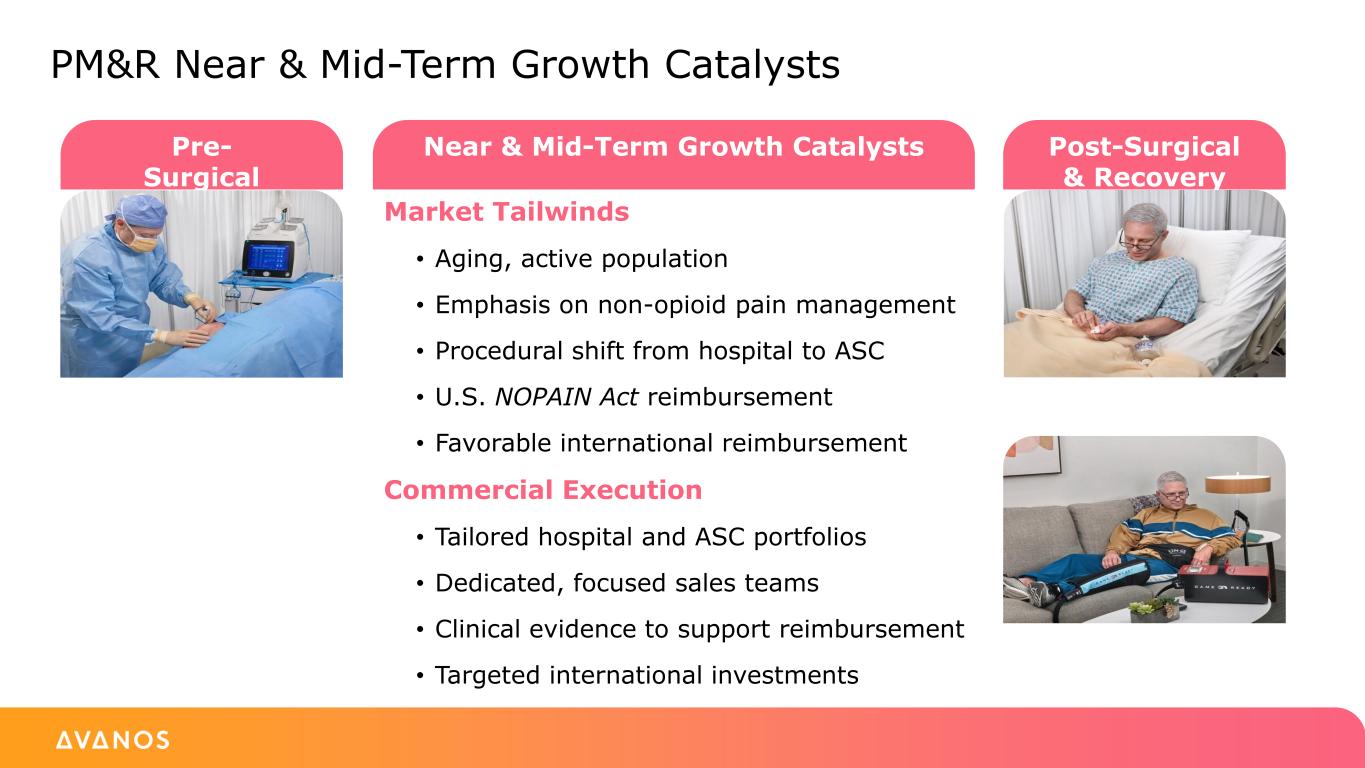

Pre- Surgical PM&R Near & Mid-Term Growth Catalysts Post-Surgical & Recovery Near & Mid-Term Growth Catalysts Market Tailwinds • Aging, active population • Emphasis on non-opioid pain management • Procedural shift from hospital to ASC • U.S. NOPAIN Act reimbursement • Favorable international reimbursement Commercial Execution • Tailored hospital and ASC portfolios • Dedicated, focused sales teams • Clinical evidence to support reimbursement • Targeted international investments

Existing Opportunity $1.5B Available Market with Execution $2.5B Market Expansion with Future Technology $10B Served Market Size Expanded Market Potential Market PM&R Market Opportunity

Avanos Transformation Priorities: 2023–2025 Strategic & Commercial Optimization 1 Transform the Product Portfolio 2 Additional Cost Management Initiatives to Enhance Operating Profitability 3 Continued Efficient Capital Allocation Strategies to Expand Return on Invested Capital 4 DELIVERING VALUE TO ALL STAKEHOLDERS

• Enteral Feeding • Restructured North America sales organization to optimize standard of care initiatives • Launched 3 new products enhancing portfolio • Implemented go-direct initiatives in select European markets • PM&R • Restructured sales organization to focus on ASC opportunities • Launched Trident* in US supported by direct sales force • Declines in HA and infusion pump category offset business recovery Avanos Transformation Progress: 2023-2024 1 2 Strategic & Commercial Optimization Transform the Product Portfolio • Exited low-margin and low-growth product categories • Completed Respiratory Health divestiture • Sold and/or discontinued diagnostic line of products and rationalized Needles, Kits & Trays SKUs • Exited international Surgical Pain • Completed two equity transactions for long-term portfolio expansion

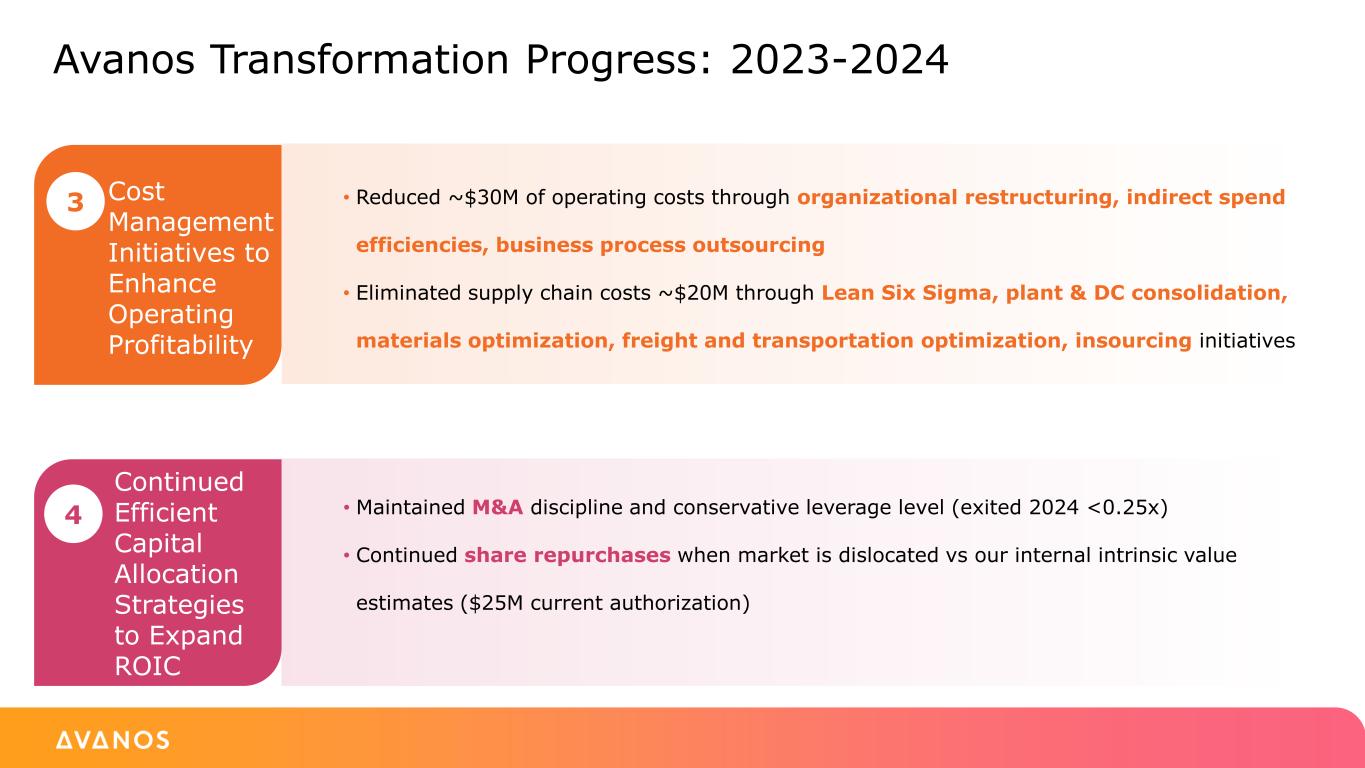

• Maintained M&A discipline and conservative leverage level (exited 2024 <0.25x) • Continued share repurchases when market is dislocated vs our internal intrinsic value estimates ($25M current authorization) Avanos Transformation Progress: 2023-2024 Transform the Product Portfolio 3 Cost Management Initiatives to Enhance Operating Profitability 4 Continued Efficient Capital Allocation Strategies to Expand ROIC • Reduced ~$30M of operating costs through organizational restructuring, indirect spend efficiencies, business process outsourcing • Eliminated supply chain costs ~$20M through Lean Six Sigma, plant & DC consolidation, materials optimization, freight and transportation optimization, insourcing initiatives

Reaffirming Our Q4 2024 Guidance • Net Sales: $175M to $180M • Adjusted Gross Margin: ~59% • Adjusted SG&A: ~40% • Adjusted EPS: $0.38 to $0.43

THANK YOU