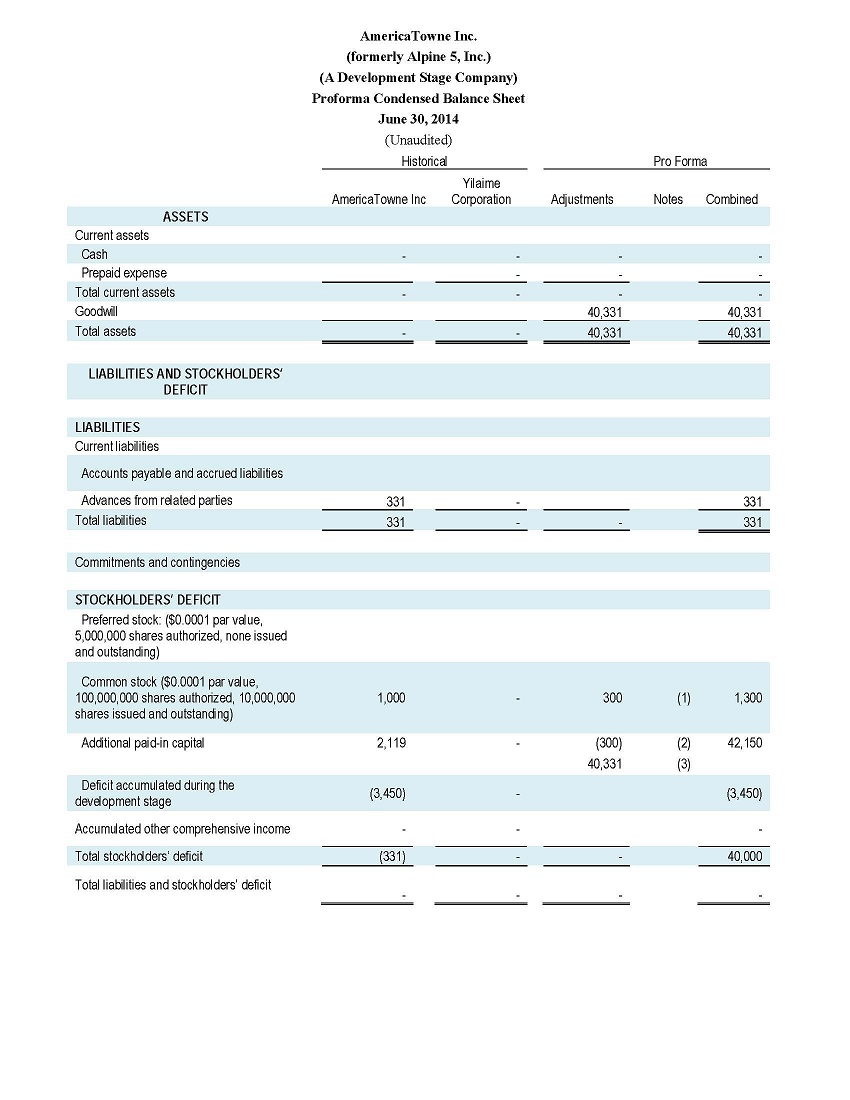

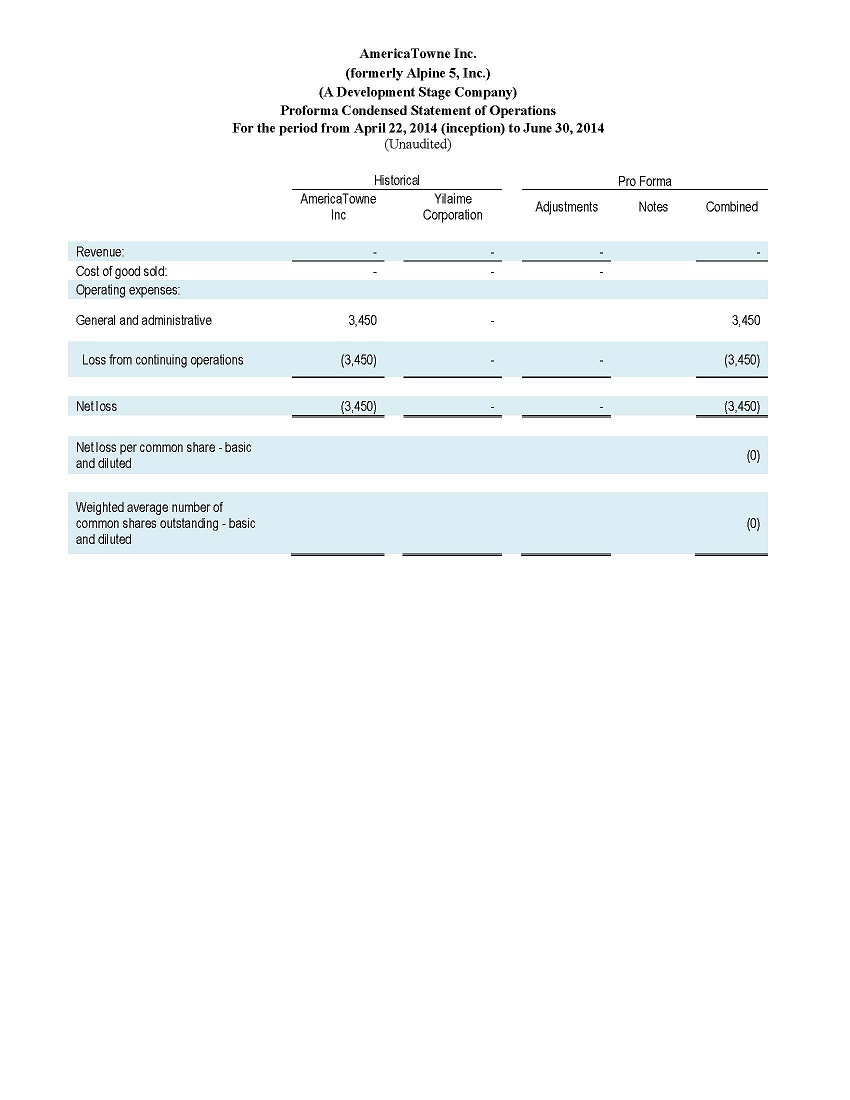

Unaudited Pro Forma Condensed Financial Statements

As of June 30, 2014 And For the period from April 22, 2014 (inception) to June 30, 2014

The accompanying unaudited pro forma condensed financial statements have been prepared to present the balance sheet and statement of operations of AmericaTowne Inc. (the "Company"), to indicate how the financial statements of the Company might have looked like as if the transactions related to the asset contributed had occurred as of the beginning of the period presented.

The unaudited pro forma condensed balance sheet has been prepared using the unaudited historical balance sheet of the Company and unaudited balance sheet of Yilaime Corporation related to the assets contributed as of June 30, 2014. The unaudited pro forma condensed statement of operations have been prepared using the unaudited historical statement of operations of the Company and unaudited statement of operations of Yilaime Corporation related to the assets contributed for the period from April 22, 2014 (inception) to June 30, 2014.

The pro forma condensed financial statements should be read in conjunction with historical financial statements of the Company. These pro forma condensed financial statements are presented for illustrative purposes only and are not intended to be indicative of actual financial position and results of operations had the contribution been in effect during the periods presented, or of financial condition or of operations that may be reported in the future.

Note the pro forma adjustments contained in the pro forma condensed financial statements relate to the assumptions of all prior and existing liabilities of the Company upon consummation of the contribution.

Notes to Unaudited Pro Forma Condensed Financial Statements

Note 1 - Basis of Presentation

The Company entered into a Contribution Agreement with the Yilaime Corporation ("Yilaime"). Pursuant to the terms of the Contribution Agreement, Yilaime transferred to the Company certain intangible assets. In return, the Company issued 3,000,000 shares of the Company's common stock to Yilaime (such transaction is hereinafter referred to as the "Contribution").

The unaudited pro forma financial information provides the effect to the contribution of the intangible assets from Yilaime. Per the terms of the Contribution Agreement, the Company was delivered with certain historical and existing assets of Yilaime. The assets were recorded at book value based on the accounting principles generally accepted in the United States of America.

Note 2 -Adjustments

(1) Per the Contribution Agreement, the Company issued 3,000,000 shares of common stock ($300 at par value of $0.0001) to Yilaime for the assets delivered.

(2) Because the fair value of the assets delivered to the Company on the date of contribution was zero, to offset the value recorded at common stock, $300 negative additional paid-in capital was recorded.

(3) Per the Share Purchase Agreement on June 26, 2014, Yilaime acquired 100% of the Company's share at the cost of $40,000. To apply push-down accounting, the Company booked goodwill to make the total net value equal to purchase cost.