UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K/A

Amended

Current Report

Pursuant to Section 13 or 15(d) of the

Securities Act of 1934

September 22, 2014

(Date of Original Report)

November 12, 2014

(Date of First Amendment)

December 9, 2014

(Date of Second Amendment)

AMERICATOWNE Inc.

(EXACT NAME OF REGISTRANT AS SPECIFIED IN CHARTER)

Delaware

(STATE OR OTHER JURISDICTION OF INCORPORATION OR ORGANIZATION)

000-55206

(COMMISSION FILE NO.)

46-5488722

(IRS EMPLOYEE IDENTIFICATION NO.)

353 E. Six Forks Road, Suite 270, Raleigh, North Carolina 27609(ADDRESS OF PRINCIPAL EXECUTIVE OFFICES)

(888) 406 2713

(ISSUER TELEPHONE NUMBER)

(FORMER NAME OR FORMER ADDRESS, IF CHANGED SINCE LAST REPORT)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

ITEM 1.01 ENTRY INTO A MATERIAL DEFINITIVE AGREMENT.

As set forth in its recent filings with the United States Securities and Exchange Commission (the "SEC"), on June 18, 2014, the Company's sole shareholder, officer and director, Richard Chiang, entered into an agreement to sell an aggregate of 10,000,000 shares of the Company's common stock to Yilaime Corporation, a Nevada corporation ("Yilaime"). Effective upon the closing date of the Share Purchase Agreement, June 26, 2014, Richard Chiang executed the agreement and owned no shares of the Company's stock. This transaction resulted in Yilaime retaining rights, title and interest to all issued and outstanding shares of common stock in the Company.

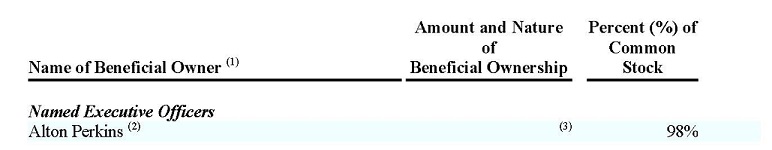

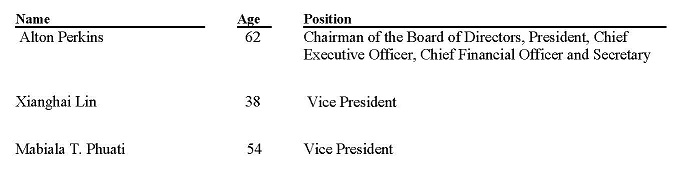

Yilaime proceeded to appoint its sole shareholder, Alton Perkins, as Chairman of the Board of Directors. Immediately following the election of Mr. Perkins to the Company's Board of Directors, Mr. Perkins, acting as the sole Director of the Company, accepted the resignation of Richard Chiang as the Company's President, Chief Executive Officer, Chief Financial Officer, Secretary and Chairman of the Board of Directors. The Board of Directors proceeded to appoint Mr. Perkins as President, Chief Executive Officer, Chief Financial Officer and Secretary. The Board of Directors further appointed Xianghai Lin and Mabiala T. Phuati as Vice Presidents of the Company with duties and obligations to be set forth by the Board of Directors at a later date. The biographical information for these officers were previously disclosed by the Company on its June 26, 2014 Form 8-K, which is incorporated herein by reference.

Following a series of additional filings, all of which are incorporated herein by reference, the Company entered into a Contribution Agreement with Yilaime on August 11, 2014 (the "Contribution Agreement"). Pursuant to the terms of the Contribution Agreement, in consideration for the issuance of 3,000,000 shares of common stock in the Company to Yilaime, Yilaime agreed to contribute to the operations of the Company certain assets previously acquired by Yilaime through an Intellectual Property Assignment Agreement between Mr. Perkins, as Assignee, and Yilaime, as Assignor (attached as Exhibit A to the Assignment Agreement). The intent of the parties in executing and performing under the Contribution Agreement was to effectuate the tax-free transfer of assets into the Company pursuant to Section 351 of the United States Tax Code.

On August 28, 2014, the Company entered into an Exporter Services Agreement with Bamyline Services, LLC, a North Carolina limited liability company doing business in Wake Forest, North Carolina ("Bamyline"). A copy of the executed Exporter Services Agreement is attached hereto as an exhibit under Item 9.01. Under the terms of the Exporter Services Agreement, during the two-year term of the agreement, in consideration for a one-time service fee of $52,000 and a transaction fee of 5% paid to the Company, Bamyline is granted access to and benefits derived from the Company's proprietary AmericaTowne Platform, Sample and Test Market Program, and if applicable, Accepted Market Program (described below).The general scope of the Exporter Services Agreement is discussed in more detail, below, in subsection (A).

On August 28, 2014, the Company entered into a Licensing, Lease and Use Agreement (the/a "Licensing Agreement") with Grandeur on Demand, LLC, a North Carolina limited liability company doing business in Knightdale, North Carolina ("Grandeur"), and another Licensing Agreement with Landmark Motors Corporation, a North Carolina corporation doing business in Raleigh, North Carolina ("Landmark") on August 29, 2014. A copy of the Grandeur and Landmark Licensing Agreements is attached hereto as an exhibit under Item 9.01. Under the terms of each Licensing Agreement, during the fifteen-year term of the agreement, in consideration for the payment of the Licensing Fee, Source and Use Schedule and Royalty Fee (all defined under Section 4 of the Licensing Agreement), Grandeur and Landmark are granted licenses to use the Company's intellectual property rights, trade secrets, products and ideas, trade and service marks such as AmericaTowne and AmericaStreet, and other confidential and proprietary services (collectively referred to herein as the "Licensed Methods").

In addition to licensing the use of the Licensed Methods, the Company has granted to Grandeur and Landmark a lease right to operate its business at an "Authorized Location," which is defined under Section 2 of the Agreement, for the consideration set forth in Section 3 of the Agreement. No authorized location has yet been determined under the Exporter Services Agreements identified in this Form 8-K. The general scope of the Exporter Services Agreement is discussed in more detail, below, in subsection (B).

On October 8, 2014, the Company entered into a Stock Exchange Agreement with Yilaime Corporation of NC, a North Carolina corporation ("Yilaime NC") (the "Stock Exchange Agreement"). A copy of the Stock Exchange Agreement was disclosed in a Form 8-K filing on October 8, 2014, and is attached hereto as an exhibit under Item 9.01. Although executed on October 8, 2014, the Stock Exchange Agreement is effective as of October 13, 2014 in order to allow for sufficient time to process the exchange of stock. The stock has since been exchanged. Pursuant to the terms of the Stock Exchange Agreement, in consideration for the issuance of 3,616,059 shares of common stock in the Company to Yilaime NC, Yilaime NC conveyed 10,848,178 shares of its restricted common stock. The intent of the parties in executing and performing under the Stock Exchange Agreement is to effectuate tax-free reorganization under Section 368 of the Internal Revenue Code of 1986.

On October 27, 2014, the Company entered into a Service Provider Agreement with Yilaime (the "Service Agreement"). A copy of the Service Agreement was disclosed in a Form 8-K filing on October 27, 2014, and is attached hereto as an exhibit under Item 9.01. Pursuant to the terms of the Service Agreement, the Company and Yilaime have agreed to an exclusivity relationship over the next five years with Yilaime retaining an option right on five more years. In consideration of the mutual compensation set forth in the Service Agreement, Yilaime has agreed to provide on an exclusive basis "Export Funding and Support Services" and "Occupancy Services," as these terms are defined therein. Yilaime has also agreed to a covenant not to compete, an agreement not to circumvent, confidentiality and mutual indemnification and hold harmless.

As for the consideration under the Service Agreement, the Company and Yilaime have agreed to the following compensation schedule:

(a) For those services identified as "Export Funding and Support Services," the Company has agreed to pay Yilaime a fee equal to 1.0% of the gross value of all funds, insurance, loans and or guarantees charged and collected from those businesses participating or contracting with the Company;

(b) For those services identified as "Occupancy Services," the Company has agreed to pay Yilaime a fee equal to 10% of any and all licenses, leases, occupancy expenses, and association, sponsorship or exporting fees, and any revenues benefiting AmericaTowne procured through Yilaime's efforts. In addition, Yilaime has agreed to pay the Company an exclusive operations fee (the "Operations Fee"). Yilaime has acknowledged under the Service Agreement that it made a prior payment of the Operations Fee to the Company in the amount of $25,000 paid on September 23, 2014, and further acknowledged receipt of an invoice for the Operations Fee for the October 2014 to December 2014 quarter in the amount of $25,000 due by or before October 31, 2014.

The Company and Yilaime agreed that the next Operations Fee shall be invoiced in the amount of $25,000 on January 1, 2015 and due March 30, 2015, and then on the first day of the following third month during the term thereafter, i.e. every quarter, to be invoiced by AmericaTowne (hereinafter referred to as the "Quarterly Fee"). The Parties have agreed that the Quarterly Fee will be paid in four equal installments as follows after February 29, 2016: (a) $150,000 for the time period covering March 1, 2016 to February 28, 2017; (b) $200,000 for the time period covering March 1, 2017 to February 28, 2018; (c) $250,000 for the time period covering March 1, 2018 to February 28, 2019; and (d) $250,000 for the time period covering the remainder of the Term and, if applicable, the Option Term (as these terms are defined therein).

On October 28, 2014, the Company entered into the following two agreements: (a) Exporter Services Agreement with Nadia Emhirech and/or her assigns (the "Nadia Agreement"), and (b) Exporter Services Agreement with Janssen's Farms Incorporated, a North Carolina corporation (the "Janssen's Agreement"). A copy of the Nadia Agreement and the Janssen's Agreement were disclosed in a Form 8-K filing on October 28, 2014, and is attached hereto as an exhibit under Item 9.01.

Under the terms of the Nadia Agreement and the Janssen's Agreement, the Company is to earn the consideration set forth in each agreement in providing the customers access to the AmericaTowne Platform and in the customers' participation in the Sample and Test Market Program, and the Accepted Market Program provided that the Company concludes that the Sample and Test Market Program has resulted in market demand and target consumers for the customers' respective goods and services.

The Company has represented in the Nadia Agreement and the Janssen's Agreement that the AmericaTowne Platform consists or will consist of exhibition, showroom and display facilities, support office(s) and staff located in the United States and China, and the platform consists or will consist of a buyer's network, and online websites either directly owned by AmericaTowne or in a partnership with third-parties in order to support the exhibition center, showroom and network to market imported goods and services to consumers in China.

The consideration paid to the Company under the Nadia Agreement and the Janssen's Agreement differs slightly from similar customer agreement. More specifically, with respect to the Nadia Agreement, the Company has agreed to accept a promissory note from the customer in the amount of $36,000 in consideration of the Service Fee under Section 6 of the Nadia Agreement. The first payment under this note was made on October 18, 2014 (in advance of execution of the agreement) to be followed by twenty-three additional payments equal to $1,500 with no interest unless there is a default by the borrower. With respect to the Janssen's Agreement, the Company has agreed to accept $50,000 as the Service Fee under Section 6 of the Janssen's Agreement paid as follows: (a) $10,000 upon execution, (b) $20,000 paid in forty-five days after execution, and (c) $20,000 paid in ninety days after execution.

On November 6, 2014, the Company entered into the Exporter Services Agreement with World Empowerment Import and Export, LLC, a North Carolina limited liability company ("World Empowerment")(the "World Power Agreement"). A copy of the World Power Agreement was disclosed in a Form 8-K filing on November 11, 2014, and is attached hereto as an exhibit under Item 9.01.

Under the terms of the World Empowerment Agreement, the Company is to earn consideration set forth therein in providing World Empowerment access to the AmericaTowne Platform and in World Empowerment's participation in the Sample and Test Market Program, and the Accepted Market Program provided that AmericaTowne concludes that the Sample and Test Market Program has resulted in market demand and target consumers for the customers' respective goods and services.

AmericaTowne has represented in the World Empowerment Agreement that the AmericaTowne Platform consists or will consist of exhibition, showroom and display facilities, support office(s) and staff located in the United States and China, and the platform consists or will consist of a buyer's network, and online websites either directly owned by AmericaTowne or in a partnership with third-parties in order to support the exhibition center, showroom and network to market imported goods and services to consumers in China.

The consideration paid to the Company under the World Empowerment Agreement consists of a Service Fee and a Transaction Fee. The Service Fee paid to the Company equals $30,000 (payable over a term) for services provided by the Company in the AmericaTowne Platform, Sample and Test Market Program, and if applicable, Accepted Market Program. The Transaction Fee equals 5% for each transaction between World Empowerment and any end buyer facilitated by the Company.

(A) The Exporter Services Agreement

The AmericaTowne Platform consists or will consist of exhibition, showroom and display facilities, support office(s) and staff located in the United States and China, and the platform consists or will consist of a buyer's network, and online websites either directly owned by AmericaTowne or in a partnership with third-parties in order to support the exhibition center, showroom and network to market imported goods and services to consumers in China.

The AmericaTowne Platform works in conjunction with the Sample and Test Market Program. Under this program, the customer will be provided with access to and participation in a program whereby the Company will exercise its experience, expertise and training in assessing the customer's market acceptance and demand of the customer's products or services in China (and perhaps other locales depending on the Company's findings). The customer will work in conjunction with the Company is arranging for the delivery of the customer's samples or examples of products or services to the AmericaTowne Platform, and if deemed strategically beneficial by the Company, the customer may send specific videos, brochures and other promotional material to explain, show, and demonstrate the products or services features to the Chinese consumer and or wholesale customers. The customer agrees to be responsible for those costs associated with packaging, shipping and other reasonable and commercially acceptable costs in sending the samples to the AmericaTowne Platform, including where applicable, Value Added Tax (VAT) or custom costs.

Upon receipt of samples, brochures, and other promotional and marketing materials, the Company will be responsible for displaying the customer's goods and services on its online portal, and/or exhibition and showroom facilities in China, as well as marketing the customer's products through marketing channels. The Company, in conjunction with any representative of the customer, will exercise commercially reasonable discretion in determining how the customer's products and services are exhibited in the AmericaTowne Platform. The Company will use its best efforts to match the customer with an end buyer of its products or services. The customer agrees that there is no assurance that a demand for its product will exist or an end buyer will be found.

The Sample and Test Market Program allows the customer an opportunity to (i) test the demand and market for its products and service by exhibiting it products or service in the AmericaTowne Platform, and (ii) receive follow-on orders for its products or services, if a demand and buyers exist, without expending normal costs for exporting. The customer has one year from the effective date under the Exporter Services Agreement to participate in the Sample and Test Market Program. Afterwards, provided no transaction has occurred in the AmericaTowne Platform, the customer agrees to pay a fee equal to 25% of the original Service Fee (in the case of Bamyline, it would equal $13,000) within thirty days to extend the customer's participation, To the extent this fee is not paid, the customer's participation and membership in the Sample and Test Program terminates. In the event of termination, the Company and customer agree that the balance of the Exporter Services Agreement would remain in full force and effect.

Provided that the Company concludes that the Sample and Test Market Program has resulted in market demand and target consumers for the customer's goods and services, the Company will notify the customer within a commercially reasonable time of its opinions, conclusions and recommendations, and in turn, provide services associated with its Accepted Market Program. Under this program, the Company will advise the customer in the negotiation of price, and terms and conditions of sale of its goods and/or services. The Company will assist the customer in all phases of the exporting process, including but not limited to, labeling and preparation for exporting, customs inspection and clearance, shipping, warehousing, and payment. The Company, if deemed necessary, will propose the form and substance of purchase orders to be presented to the target buyer setting forth, amongst other things, terms and conditions of sale, costs, and payment to the customer (or its assignee or designee) with the Company being responsible for currency exchange into United States dollars,

Under the Accepted Market Program, the Company anticipates advising the customer of the various components of the selling price including, but not limited to, normal product costs, shipping costs, other related expenses, and customs and VAT. The customer will make the final determination of its sale price offered to the buyer. The Company will advise the customer on available incentives and accommodations as a result of the Company operating out of a Bonded Port Zone in China, such as, but not limited to, making the determination that the buyer assumes VAT and customs costs by including such costs in the price of the product or service, and reduced warehousing and logistics product costs in China. From time to time state and federal agencies will have marketing and promotional programs to assist small businesses in exporting their products and services. The Company will work with the customer where warranted, to take advantage of the various funding, grants and promotional opportunities available.

In certain cases, special certification will be required from the appropriate authorities in China, prior to export of the customer's goods and/or services in conjunction with a buyer's purchase order. In such a case, the Company will assist the customer in securing the proper certification. The customer will be responsible for all costs of such certification. Prior to any such certification action, the Company will advise the customer, and the customer will have the sole discretion to determine if a certification is to be obtained, and understand if such certification is obtained, The customer, or its assignee or designee, is ultimately responsible for the costs of certification.

(B) The Licensing, Lease and Use Agreement

The general intent behind the Licensing Agreement is for the Company to license its intellectual property to the customer and a right to lease a future physical location to conduct its business in China for the consideration stated therein. The Licensing Agreement incorporates as exhibits the approved licensed intellectual property to be used by the customer at the Authorized Location, the proposed site for the Authorized Location (which in the case of Landmark is yet to be determined), the consideration to be paid by the customer associated with the Authorized Location, a preliminary financing budget, and a source and use schedule.

For the consideration set forth in the Licensing Agreement, the Company grants to the customer a license and lease right to operate one business unit on the proposed, anticipated and intended location in China (defined as the "Authorized Location"), The granting of this right by the Company does not constitute a representation, warranty, or guarantee by the Company that the customer's business can be successfully operated at the Authorized Location. The consideration paid by the customer associated with the Authorized Location is in addition to any other payment obligations of the customer set forth in the Licensing Agreement, or where applicable, the Exporter Services Agreement discussed in subsection (A), above.

Provided the customer is in full compliance with all provisions of the Licensing Agreement, any and all other agreements between the Company and the customer (i.e. the Exporter Services Agreement, if applicable), and has provided the agreed upon written notice, the customer has the option to renew the business operations at the Authorized Location for successive periods of ten years upon the payment to the Company of a renewal fee in an amount $25,000, and the execution of any standard business operation's agreement used by the Company at the time of the written notice.

Provided the customer is in full compliance with all of its payment and performance obligations under the Licensing Agreement, and any other agreements related to its performance hereunder, and any and all applicable laws and regulations, the Company agrees that it will not operate, or permit any other entity or person to operate any similar or like business as the customer within the AmericaTowne location in which the Authorized Location is situated. The Company has acknowledged that the Authorized Location is currently not ready for occupancy. The customer acknowledges and agrees that the consideration paid under the Licensing Agreement is for, in part, site development and construction services, expenses, fees and costs incurred by the Company in building the Authorized Location exclusively for the benefit of the customer, subject to the terms and conditions of the Licensing Agreement.

The parties agree that the occupancy by the customer post-construction shall be considered a leasehold interest with the Company being the lessor and the customer as the lessee. The parties agree to execute a lease agreement consistent with the terms of Section 3 of the Licensing Agreement within thirty days of the Company securing all applicable permits, licenses and necessary authorization from the proper regulatory agency approving the construction of the specific AmericaTowne site in which the Authorized Location is to be situated. Unless otherwise negotiated, the parties agree that the term of the lease shall coincide with the balance of the "Term" under the Licensing Agreement, as defined under Section 1 of the Licensing Agreement. For example, to the extent the Company provides notification to the customer that the AmericaTowne site has been approved for construction and there is a balance of fourteen years left on the Licensing Agreement at the time of the notification, the customer agrees that the term under the corresponding lease shall be fourteen years.

Unless otherwise negotiated, the lease price shall be the average square meter of leased space for businesses at the location to be determined as stated by published and/or stated lease rates at the specific location at the time the customer provides notice to the Company. The lease shall contain such terms and provisions as are reasonably acceptable to the Company and, at the Company's sole option, shall be subleased to third-parties provided that the subtenant acknowledges in writing that its obligations under the Licensing Agreement are equally primary to the customer (i.e. a sublease versus an assignment of lease), and that the Company may be entitled to adequate collateral to secure payment and performance by the subtenant and the customer, jointly and severally.

The Company shall provide the customer with a budget and funding plan for the Authorized Location, and the customer's business start-up, based on the Company's experience and expertise in conducting business within the particular locale (the "Financing Budget"). The parties agree that the approval of the Financing Budget does not guarantee success of actually securing the necessary financing or in the overall success of the business. The parties agree to the preliminary Financing Budget, and will agree to an updated Financing Budget within sixty days prior to construction of the Authorized Location. Upon agreement of all terms and conditions of an updated Financing Budget, the parties shall mutually execute a "Final Financing Budget," which can be amended or modified only by a writing signed by the parties. The parties acknowledge that the Final Financing Budget might alter or modify their respective rights, duties and obligations, and if so, such modification will be memorialized in writing signed by the parties. Absent a writing, the Licensing Agreement is to be interpreted, as a whole, consistent with the Final Financing Budget and the alterations or modifications caused by the Final Financing Budget.

The Company agrees to provide to the customer plans and specifications for the AmericaTowne location in which the Authorized Location shall be constructed within a commercially reasonable period of time. The plans and specifications will reflect the Company's requirements, recommendation and suggestions for dimensions, exterior design, interior design and layout, decor, building materials, equipment, fixtures, furniture, and signs, which shall all be designed after business facilities typically found in the United States of America. Promptly after being provided with the plans and specifications, the customer shall submit any requested changes and/or comments to the plans and specifications, and the Company reserves the right to accept or reject such recommendations in order to (i) ensure continuity of appearance within the AmericaTowne site, (ii) ensure capacity for the type, size, scope and adequacy of any machinery and equipment utilized by the Licensee, and (iii) ensure that the recommendation is within the Final Financing Budget.

The Company agrees that it shall be solely responsible for construction, and in securing the proper licenses, permits, and certificates required for all construction of the Authorized Location, and for building the Authorized Location in accordance with the highest building standards consistent with the intent of the AmericaTowne concept. The Company further agrees that it will be responsible for equipping and finishing the Authorized Location in a commercially reasonable period of time and in a manner consistent with securing occupancy for the customer.

The rights granted to the customer under the Licensing Agreement, and more specifically, rights related to the Authorized Location cannot be transferred to any other location without the prior written approval of the Company. If the customer has operated its business for less than twelve months from the "Effective Date" and requests relocation to an alternative AmericaTowne site, the customer must set forth its reasons for requesting the relocation in writing to the Company, and its requested relocation plan, along with a proposed timeline of relocation. The Company reserves the right to approve the relocation. To the extent the Company agrees to the relocation, the customer agrees that the relocation does not alter, impair or modify its duties and obligations under the Licensing Agreement, unless otherwise set forth in an amended agreement in the same form and substance as the Licensing Agreement. The customer agrees to pay the Company a nonrefundable design and set up fee for the preparation of a design for the Licensee's new location based on current market conditions at the time of the request for and implementation of the relocation.

ITEM 2.01 COMPLETION OF DISPOSITION OR ACQUISITION OF ASSETS.

As described above under Item 1.01, the Company acquired assets from Yilaime in consideration of 3,000,000 shares of common stock in the Company pursuant to Section 351 of the United States Tax Code. It is this acquisition, amongst other disclosures herein, and the Form 10-Q reported on October 31, 2014, that the Company relies on in coming to the reasoned opinion that it is now an operational entity, as addressed in Item 5.06 herein.

As a result of the acquisition and conveyance of assets, the Company acquired all rights, title and interest in and to AmericaTowne and AmericaStreet images, signatures, business plans, studies, analyses, likenesses and goodwill appurtenant thereto. The Company acquired certain rights of publicity in the trademark and registration of AmericaTowne, and the name, image, likeness, signature and other elements of AmericaTowne persona and identity. The Company acquired all rights, title and interest in any derivative or joint development programs using the intellectual property contributed under the Contribution Agreement, plus all historical contacts, business relationships, business expectancies, references and any other actual or perceived business interests in China. Using these assets, the Company proceeded to procure the above-referenced Exporter Services Agreement, and Licensing, Lease and Use Agreements identified above, and set forth in Item 9.01. In addition, the Company has secured a Letter of Interest from the US Ex-Im Bank, which is likewise set forth in Item 9.01.

Pursuant to Item 2.01(f) of Form 8-K, the Company provides below the information that would be required if it was filing a general form for registration of securities on Form 10 under the Securities Exchange Act of 1934, as amended (the "Exchange Act"), such as a discussion related to the business as a going concern, risk factors, financial information, security ownership of certain beneficial owners, and directors and executive officers. However, for the sake of avoiding redundancy and clarity to the reader, Items typically discussed in Sections 3, 5 and 9 of a Form 10 under the Act are not set forth in this section but are rather set forth in Section 3, 5 and 9 of this Form 8-K.

Item 1. BUSINESS

Company Information

Organization

AmericaTowne Inc. ("AmericaTowne," the Company," or "we" or "us") was incorporated in the State of Delaware on April 22, 2014, as ALPINE 5 Inc. From inception through the filing of this Form 8-K, in which the Company asserts that it is an operational entity, the Company was in the developmental stage and conducted virtually no business operations, other than organizational activities and preparation of a registration statement on Form 10 (the "Registration Statement"). The Form 10 was filed on May 8, 2014 and as amended on June 13, 2014, went effective following a review by the U.S. Securities and Exchange Commission (the "SEC"). On June 18, 2014, the SEC informed the Company the SEC staff had no further comments.

Subsequently, on June 18, 2014, our sole officer and director, Richard Chiang, entered into a Share Purchase Agreement (the "SPA") pursuant to sell an aggregate of 10,000,000 shares of his shares of the Company's common stock to Yilaime at a purchase price of $40,000. Effective upon the closing date of the SPA, June 26, 2014, Richard Chiang executed the agreement and owned no shares of the Company's stock and Yilaime was the sole majority stockholder of the Company. In aggregate, these shares represented 100% of the Company's issued and outstanding common stock.

Additionally, on June 26, 2014, following the execution of the SPA, Yilaime elected Alton Perkins as a Director of the Company and as Chairman of the Company's Board of Directors. Immediately following the election of Mr. Perkins to the Company's Board of Directors, Mr. Perkins, accepted the resignation of Richard Chiang as the Company's President, Chief Executive Officer, Chief Financial Officer, Secretary and Chairman of the Board of Directors. These resignations were in connection with the consummation of the SPA with Yilaime, and were not the result of any disagreement with Company on any matter relating to Company's operations, policies or practices. Mr. Xianghai Lin, and Mr. Mabiala T. Phuati were appointed Vice Presidents.

On June 27, 2014, the Company filed a Certificate of Amendment to its Articles of Incorporation with the State of Delaware changing the name of the Company to "AmericaTowne, Inc." The Company did not authorize additional shares of common or preferred stock in the Certificate of Amendment or alter, amend or modify any rights of shareholders, directors or officers.

As noted above, pursuant to the assets purchased by the Company from Yilaime, under the Contribution Agreement, the Company plans on creating a 50-plus acre plot consisting of small businesses, hotel, villas, senior care facilities, a theme park and performing arts center - all located on specific acreage in China depicting the American lifestyle and the American experience.

As a preface to the subsequent disclosures herein, the Company represents that certain statements in this filing are not historical facts, but rather "forward-looking statements." These forward-looking statements are subject to risks and uncertainties that are beyond our control.

Although management believes that the assumptions underlying the forward looking statements included in this filing are reasonable, they do not guarantee our future performance, and actual results could differ from those contemplated by these forward looking statements. The assumptions used for purposes of the forward-looking statements specified in the following information represent estimates of future events and are subject to uncertainty as to possible changes in economic, legislative, industry, and other circumstances. As a result, the identification and interpretation of data and other information and their use in developing and selecting assumptions from and among reasonable alternatives require the exercise of judgment.

To the extent that the assumed events do not occur, the outcome may vary substantially from anticipated or projected results, and, accordingly, no opinion is expressed on the achievability of those forward-looking statements. In the light of these risks and uncertainties, there can be no assurance that the results and events contemplated by the forward-looking statements contained in this filing will in fact transpire. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of their dates. We do not undertake any obligation to update or revise any forward-looking statements.

Factors that might cause or contribute to such differences include, but are not limited to, those discussed in "Risk Factors" contained in this report. As a result of these factors, we cannot assure you that the forward-looking statements in this prospectus will prove to be accurate. Except as required by law, we expressly disclaim any obligation to update publicly any forward-looking statements for any reason after the date of this report, to conform these statements to actual results, or to changes in our expectations. You should, however, review the factors and risks we describe in the reports we will file from time to time with the United States Securities and Exchange Commission (the "SEC") after the date of this report.

AmericaTowne's is to be a world class, globally respected and profitable company providing value to our customers, the environment and the lives of the people we service.

As noted above, pursuant to the rights granted to the Company under its Contribution Agreement, the Company is in the process of planning and developing the AmericaTowne and AmericaStreet concept. The concept allows American style communities to be built in China. It is anticipated that the AmericaTowne community will be planned on 50-plus acres consisting of small businesses, hotel, villas, senior care facilities, a theme park and performing arts center - all located on specific acreage in China depicting the American lifestyle and the American experience.

Through AmericaTowne, the Company's goal is to provide unique one-of-a-kind communities for people in China to go spend their leisure time all fashioned after the American way, business, and lifestyle. In short, the focus of AmericaTowne is to bring "a slice of Americana to China."

The Company plans to develop communities and conduct business operations within China using "Made in America" goods and services within five core areas: 1) small business operations (including 50 United States based businesses that will be either franchises, joint venture partners or individual operators); 2) a hotel with the development, construction, management and ownership through the Company or an entity under the control of the Company; 3) approximately 50 villas with the construction, management, leasing, timeshare and sales through the Company or an entity under the control of the Company; 4) a theme park and performing arts center with the development, construction, management, ownership and operations through the Company or an entity under the control of the Company; and 5) senior care facilities with the development, construction, management, ownership and operations through the Company or an entity under the control of the Company. All components of AmericaTowne are expected to be similar in style, decor and business operations typically found in the United States.

AmericaTowne is targeted at the middle to upper income consumer in China. The Company believes that this type of consumer in China desires goods and services from the United States, but also the experiences of American culture and lifestyle. The Company believes that by providing this target consumer with unique "Made in America" experiences, it will meet its business model's needs and growth strategy. In addition, the business model offers United States based small businesses a complete ecosystem for their businesses. For those businesses that would not typically seek to export because of various reasons, AmericaTowne will strive to offer those businesses a complete support system that will allow them to market their products and services in China.

The revenue streams from the Company's business operations align themselves with the five core business components set forth above, and provides eight potential revenue streams, if not more, as follows: 1) licenses and or franchise fees for businesses that set-up shop and operate within AmericaTowne as well as businesses that desire to export their goods and services to China through AmericaTowne; 2) franchise, joint venture and partnership arrangements with United States based businesses residing in and operating within AmericaTowne; 3) revenue from villa sales, rentals, timeshare and leasing; 4) hotel, leasing and or operational revenues and sales; 5) theme park and performing art center operations, sales and or leasing; 6) senior care facilities, operations and or sales; 7) export sales, marketing and license fees; and 8) franchise and license fees for United States support locations.

Mr. Perkins, the creator of the AmericaTowne concept, has extensive experience in business in China involving operations, construction, marketing, consumer behavior, finance and exporting. Mr. Perkins has experience as a co-chairman of a Foreign Invested Partnership in China that focused on real estate development and laid much of the foundation for the concepts behind AmericaTowne. The Company intends on continuing to use the management systems and services provided by Yilaime. The Company intends on evaluating and assessing potential management service agreements with Yilaime whereby Yilaime would provide valuable services to the Company in effectuating and facilitating the business model associated with AmericaTowne.

The Company is engaged in confidential negotiations with local government officials in China to secure a location that will serve as the initial AmericaTowne complex. The Company will promptly file a Form 8-K upon execution of a materially definitive agreement. It is anticipated that the location will be within a 100 miles of a Tier I city that the Company believes has the right economic and consumer base to support the AmericaTowne concept. Any location selected requires the cooperation of the local government and approval of the local and provincial planning and zoning boards. Though the Company has submitted plans, it does not yet have all required approvals from the applicable boards.

(b) The Company's Business Strategy

The Company's primary business strategy is to develop a position as a leader in supplying quality "Made in the USA" goods and services to middle, upper middle, and upper income consumers in China. The Company seeks to create market share in the rapidly growing middle and upper income population demographic with a focus on tourism, exports, and senior care. The Company believes China's economy is robust. People in China are prospering making more money and are looking for more places to go to enjoy leisure and tourism. Today and in the foreseeable future, in China, the Company believes the demand for leisure activities is outstripping the supply.

As set forth above, the Company's objective is to provide unique one-of-a-kind communities for people in China to spend their leisure time. The Company's current planning committee is concentrating its efforts on securing land between 50 and 165 acres, and to chart out land up to 50 unique American small businesses, a 5-star hotel, 50 villas, a theme park, performing arts center, and a senior care facility all fashioned after the American way, business, and lifestyle. The aforementioned businesses will bring a slice of America to China. The Company believes the communities will offer authentic goods, products and services that are "Made in the USA." The company is in the process of identifying United States based businesses looking to locate their operations and conduct business in AmericaTowne, and to take advantage of the key Chinese demographic.

We believe that AmericaTowne will help China counter its tourist deficit, satisfy China's increasing need to import United States based goods and meet the growing demand for senior living facilities (all of which are discussed in more detail below). As a dual and added value, the Company believes AmericaTowne will provide export opportunities and jobs in China and America. Furthermore, AmericaTowne supports America's national initiative to improve the balance of trade by exporting goods and services carrying the "Made in the USA" tag.

(i) Tourism

AmericaTowne meets the challenge of helping China reduce its tourist deficit by keeping more Chinese citizens at home to enjoy a slice of America. In short, instead of an economy based upon manufacturing and exporting products to other countries, the Company believes that China's focus has now changed to internal domestic consumption. The Company believes that China's government is ramping up the demand for its citizens to buy and use consumer products. At the same time, the Chinese government is emphasizing stability and improving its citizen's quality of life.

The Company believes leisure and tourism are cornerstones of China's long-term plans. Additionally, the Company believes that the demand by Chinese consumers for "Made in America" goods and services are high. Most important, the Company believes that the target Chinese consumer is sophisticated and focused on goods and services, but also the experiences that those goods and services bring. The Company believes that providing an AmericaTowne community with support services model after the American lifestyle will provide those experiences.

(ii) Exporting

The Company believes that over the next ten years, global spending on consumer goods is expected to increase by $4.8 trillion, from $7.3 trillion in 2010 to $12.1 trillion in 2020. According to Forbes' Major Trends In China: The Next 10 Years, China will account for 36 percent of global growth in consumer spending during this period (http://www.forbes.com/sites/jackperkowski/2012/11/27/major-trends-in-china-the-next-10-years/). In 2013, United States exports to China reached $120 billion, according to the US-China Business Council, making it the third-largest export market for United States goods behind Canada and Mexico, our neighbors and NAFTA partners. United States exports to China have grown faster than exports to any other major United States trading partner.

From 2004 to 2013, United States' exports to China increased 255%. That rate is greater than growth to any of the other top ten United States' export markets, including its two largest trading partners, Canada (59% growth) and Mexico (108% growth). With its large population, rapidly growing middle class, and long list of infrastructure goals, China will continue to be a major export market for United States goods and services. (US-China Business Council, US Exports to China 2013 www.uschina.org/reports/us-exports/national-2013.

(iii) Senior Care

A component of the Company's business is designed to take advantage of market conditions by constructing, developing and operating either through partnership or independently senior care facilities in China. "There is no stronger brand in the world than 'Made in America,' according to USA Export-Import Bank Chairman and President Fred P. Hochberg. We want to build on this and provide a slice of Americana in the fastest growing economy in the world.

As stated by the Chairman and President of the United States Export-Import Bank - Fred P. Hochberg, "There is no stronger brand in the World that 'Made in America'". See "Export-Import Bank Report to Congress: Aggressive, Unregulated Financing from Foreign Competitors is Costing U.S. Jobs" dated June 25, 2014 attached hereto at Item 9.01. The Company intends on building on this brand and provides a "slice of Americana" in the fastest growing economy in the World.

According to China's National Bureau of Statistics, China has roughly 185,000,000 people over the age of 60. A 2007 study by the United Nations estimated that in 2005, there were 16 retired people in China for every 100 workers. The study projected that this ratio will reach 64 elderly for every 100 workers by 2025. Compare this to the United States, which currently has approximately 20 retirees for every 100 workers and is projected to have 33 retirees for every 100 workers by 2050. See also "Major Trends in China: The Next 10 Years" attached hereto.

See http://www.chinabusinessreview.com/senior-care-in-china-challenges-and-opportunities/; see also http://www.exim.gov/newsandevents/releases/2014/Export-Import-Bank-Report-to-Congress-Aggressive-Unregulated-Financing-from-Foreign-Competitors-is-Costing-US-Jobs.cfm and https://drive.google.com/viewerng/viewer?url=http://www.exim.gov/about/library/reports/competitivenessreports/upload/fact_sheet_competitiveness_report_24june2014.pdf&u=0

China's government funding only covers 1.6% of seniors in need of care, who cannot otherwise pay for their own care. The World Bank's standard for developed nations is 8% coverage. As Li Jianguo, vice chairman and general secretary of the Standing Committee of the National People's Congress stated last year, this translates to a need for an additional 3,400,000 hospital and nursing home beds dedicated to senior care over the next five years alone. Clearly, the need for senior care facilities is outstripping the supply.

According to China's National Bureau of Statistics, China has roughly 185 million people over the age of 60. A 2007 study by the United Nations estimated that in 2005, there were 16 retired people in China for every 100 workers. The study projected that this ratio will reach 64 elderly for every 100 workers by 2025. Compare this to the United States, which currently has approximately 20 retirees for every 100 workers and is projected to have 33 retirees for every 100 workers by 2050.

China's government funding only covers 1.6% of seniors in need of care, who cannot otherwise pay for their own care. The World Bank's standard for developed nations is 8 percent coverage. As Li Jianguo, vice chairman and general secretary of the Standing Committee of the National People's Congress, stated last year, this translates to a need for an additional 3.4 million hospital and nursing home beds dedicated to senior care over the next five years alone. Clearly, the need for senior care facilities is outstripping the supply.

(c) Gap in Small and Mid-Size Businesses

In June of 2013, the Commerce Department reported that exports hit a record high for one month of $191.1 billion-up 3.2% from June of 2012. As a result of imports falling, the United States trade deficit shrank 22.4% to its lowest monthly level since October 2009.Small and medium-sized companies account for 98% of United States' exporters, but represent less than one-third of the known export value of United States' goods' exports. In 2010, there were over 293,000 identified U.S. exporters - 269,269 of which were small or medium-sized.

The Company believes a market clearly exists; yet most small businesses do not have the resources including time, money and knowledge to enter the export market. A goal of AmericaTowne is to provide United States based small businesses with a support system that will allow them to flourish without undue worry of conducting business from afar. The Company believes that AmericaTowne provides some United States based businesses with a safety net, an entire team of businesses working together all focused on the same objective - to sell Americana to the Chinese consumer.

(d) Keys to Success

In order to meet its goals and objectives, and to achieve short-term and long-term success, the Company must develop significant cooperative agreements with key partners, including local governments in the United States and China, a business developer and United States based entrepreneurs and businesses. The Company must continue to develop and utilize cutting edge technology and commit to research and development of its brand and market presence.

It must dedicate financial resources and executive time towards establishing world-class marketing programs and procedures designed exclusively with the Chinese consumer in mind. As stated above, the Company must continue to be dedicated to building and operating AmericaTowne centers to meet the growing demand by citizens for more leisure and tourism opportunities.

As part of his ongoing market analysis, over the past five years, at the invitation of China city mayors and other government officials in China, our Chief Executive Officer, Mr. Perkins lived and worked in China, researching and studying consumer trends, and helping to develop import, tourist and leisure projects for the Chinese consumer. While in China, Mr. Perkins had the opportunity to work with local government officials, city mayors and Provincial Governments, and mid-size and large Chinese companies. The formation of the Company and the contribution of assets by Yilaime were the byproduct of Mr. Perkins' work dating back to 2009 and 2010 by the privately-held and Chinese-based Development Center Foreign Invested Partnership, which he owned and co-chaired. This early partnership did much of the work paving the way for much of the Company's current business plans.

As part of his market research efforts, Mr. Perkins visited the United States Ex-Im Bank in Washington, D.C., and attended a United States Ex-Im Bank National Conference to learn exporting rules and financing requirements. Additionally, the AmericaTowne concept was presented to the United States Ex-Im Bank, which provided a Letter of Interest for AmericaTowne (as set forth above and as attached hereto at Item 9.01) Mr. Perkins coordinated the initial draft of the business plan and proposed actions with a representative of the United States Small Business Administration with expertise in both exporting and finance, who in turn, reviewed the Company's business plan and provided suggestions and directions for implementing the plan. It is this level of involvement and dedication that is necessary to continue developing market awareness and success.

The Company must also continue to stick to its core principles of delivering superb and unique products and services at the lowest possible cost while still maintaining the highest quality - the quality accustomed to United States' goods and services. As an international operation operating on opposite ends of the World, the Company must maintain a strong dual-economic strategic plan and implement financial controls in the United States and China. Finally, the Company will need to aggressively pursue adequate funding to implement these keys to success and in the continued development of attractive programs in providing the Chinese consumer with the "Made in the USA" experience.

(e) Financial Objectives

The Company seeks to achieve commercial success in its initial AmericaTowne location. The Company seeks to validate its work through the success of its products and services. The Company's first revenues of $315,166 realized and earned through November of 2014, and a Letter of Interest from US Ex-Im Bank are an initial step towards this effort. The Company also seeks to develop a robust line of additional AmericaTowne products including licensing and franchising fees for additional project locations in the near future and to become financially sustainable.

(f) Sourcing and Fulfillment To complete the initial AmericaTowne, the Company expects a collaborative effort between small businesses owners in the United States looking for expansion opportunities in China. The Company through its relationship with Yilaime will contract with these businesses providing unique goods and services carrying the "Made in the USA" label. These select businesses will team with local counterparts to supply, source and operate the core businesses that are apart of AmericaTowne.

(g) Competition

Our competitive position within the tourism, export and senior care industry are affected by a number of factors. There are barriers to entry that make it difficult for entrants into the industry, including, but not limited to the socio-political environment in China.

In reviewing market conditions, the Company determined that although there is no known structure or operations existing within mainland China similar to AmericaTowne, the concept could be duplicated. The challenge for competitors whose business originates from China would be to identify and provide business owners and operators, as well as goods and services that would provide a unique American experience in one location, under one roof, and receive the support of the local government in providing "authentic American goods."

It has been Management's experience that at the local level mayors and other government officials have concerns about the authenticity of both the concept and the goods and services that would originate from America. Therefore, operators from America that provide goods and services especially from America's small businesses have a competitive advantage.

Builders and developers focusing on tourism and quality of life components are regionally based, and most focus on operations in what are called (based on demographics and other criteria) Tier 2, Tier 3 and Tier 4 Cities. Competitors that appear to be doing exceptionally well it seems have designed internal management, finance and control systems that work well in the United States and China.

Though Management is aware of "Disney" typed operations and ventures in China that focuses on themed leisure activities, AmericaTowne focus is on business operations in three specific areas and providing an experience unique to America. To date Management is not aware of similar businesses or concept operating within Mainland China.

In Management's opinion based upon its analysis, and research over three and a half year period direct competition and the intensity of that competition will depend upon the specific sector.

Management believes that competition from other businesses and communities in some specific sectors will be intense. For example, Management expects to receive stiff competition in the real estate sector specifically in developing villas. On the other hand, Management expects to receive moderate to little competition in developing its senior care and business communities.

The key competitors within the real estate sector as reflected in SEC filings consist of seven companies operating within China. However, there are considerably more developers operating within the industry. Of the competitors, we focused on two are listed on NASDAQ (China HGS Real Estate Inc. (HGSH) and China Housing & Land Development, Inc. (CHLN)) and two or listed on the New York Stock exchange (Xinyuan Real Estate Co., Ltd (XIN), and IFM Investments Limited (CTC)); the other three are listed on OTCB.

All have the advantage of being from China and may have better competitive balances because of this. All may receive various support and perceived benefits that are afforded to companies that are "home grown." Additionally, all appear to focus on regional and or Tier II, III and IV cities. On the other hand, AmericaTowne focuses on Tier I, II, and III cities were the competition for development could be both keen and at times restricted to a larger degree by the Central Government than smaller Tier locations. AmericaTowne will have to adapt to a system that its competitors have been operating all of their existence virtually. Additionally, most of the competition will not only have more experience but be better capitalized.

As we develop our business model further, we expect additional competitors to service and the competitive picture to become clearer.

(h) Tax Exempt Status for Certain Export Transactions

Because AmericaTowne will focus on providing "Made in the USA" goods and services to China, a portion of the Company's activities will involve not only involve development but also exporting. To take advantage of United States tax laws and incentives that support exporters, the Company has directed its legal counsel to assess the acquisition of Perkins-HSU Export Corporation ("Perkins-Hsu"), a Nevada corporation and an Interest Charge - Domestic International Sales Corporation ("IC-DISC") with tax-exempt status approved by the United States Department of the Treasury Internal Revenue Service.

In the event the Company acquires Perkins-Hsu or another IC-DISC entity, the Company would not need additional offices, employees, or tangible assets, nor would it be required to perform any invoicing or services. Additionally, as an IC-DISC, if warranted, the Company may achieve a significant reduction in taxes on the first $10,000,000 in revenues.

(i) Employees

As of November 11, 2014, the Company employed a total of three people. The Company considers its relationship with its employees to be stable, and anticipates growing its workforce.

(j) Facilities and Logistics

The Company is headquartered at 353 East Six Forks Road, Suite 270 in Raleigh, North Carolina 27609.

Item 1A. RISK FACTORS

An investment in our Common Stock is highly speculative in nature, involves a high degree of risk, and is suitable only for persons who can afford to risk the loss of the entire amount invested.. Before purchasing any of these securities, you should carefully consider the following factors relating to our business and prospects. If any of the following risks actually occurs, our business, financial condition or operating results could be materially adversely affected. In such case, the eventual trading price of our Common Stock could decline, and you may lose all or part of your investment.

Risks Related to our Business

We are a development stage company with no operating history, so it will be difficult for potential investors to judge our prospects for success.

We are a newly organized development stage corporation and have no operating history from which to evaluate our business and prospects. We have earned little to no revenue since inception. There can be no assurance that our future proposed operations will be implemented successfully or that we will ever have profits. If we are unable to sustain our operations, investors may lose their entire investment.

The company's auditor has substantial doubts as to the Company's ability to continue as a going concern.

Our auditor's report on our 2014 financial statements expresses an opinion that substantial doubt exists as to whether we can continue as an ongoing business. The lack of revenues from operations to date raises substantial doubt about our ability to continue as a going concern. The accompanying audited financial statements do not include any adjustments relating to the recoverability and classification of asset carrying amounts or the amount and classification of liabilities that might result from the outcome of this uncertainty.

Because the Company has been issued an opinion by its auditors that substantial doubt exists as to whether the company can continue as a going concern, it may be more difficult for the company to attract investors. The Company has generated little to no revenue since inception. Our future is dependent upon our ability to obtain financing and implement the Company's business plan. We will seek additional funds through private placements of our common stock. Our financial statements do not include any adjustments relating to the recoverability and classification of recorded assets, or the amounts of and classification of liabilities that might be necessary in the event we cannot continue in existence.

If we complete a financing through the sale of additional shares of our common stock in the future, then shareholders will experience dilution.

The most likely source of future financing presently available to us is through the sale of shares of our common stock. Any sale of common stock will result in dilution of equity ownership to existing shareholders. This means that, if we sell shares of our common stock, more shares will be outstanding and each existing shareholder will own a smaller percentage of the shares then outstanding. To raise additional capital we may have to issue additional shares, which may substantially dilute the interests of existing shareholders. Alternatively, we may have to borrow large sums, and assume debt obligations that require us to make substantial interest and capital payments.

We cannot guarantee we will be successful in generating revenue in the future or be successful in raising funds through the sale of shares to pay for the Company's business plan and expenditures. As of the date of this filing, we have earned little to no revenues. Failure to generate revenue or to raise funds could cause us to go out of business, which would result in the complete loss of your investment.

Because we do not have an audit committee, shareholders will have to rely on the directors, who are not independent, to perform these functions.

We do not have an audit or compensation committee comprised of independent directors. The board of directors as a whole performs these functions. The members of the Board of Directors are not independent. Thus, there is a potential conflict in that the board members are also engaged in management and participates in decisions concerning management compensation and audit issues that may affect management performance.

We have not developed independent corporate governance.

We do not presently have audit, compensation, or nominating committees. This lack of independent controls over our corporate affairs may result in conflicts of interest between our officers, directors and our stockholders. We presently have no policy to resolve such conflicts. As a result, our directors have the ability to, among other things, determine their own level of compensation. Until we comply with such corporate governance measures to form audit and other board committees in a manner consistent with rules of a national securities exchange, there is no assurance that we will not be subject to any conflicts of interest. As a result, potential investors may be reluctant to provide us with funds necessary to expand our operations.

The requirements of being a public company may strain our resources and distract our management, which could make it difficult to manage our business, particularly after we are no longer an "emerging growth company."

We are required to comply with various regulatory and reporting requirements, including those required by the SEC. Complying with these reporting and other regulatory requirements are time-consuming and expensive and could have a negative effect on our business, results of operations and financial condition.

As a public company, we are subject to the reporting requirements of the Exchange Act, and requirements of the Sarbanes-Oxley Act of 2002 ("SOX"). The cost of complying with these requirements may place a strain on our systems and resources. The Exchange Act requires that we file annual, quarterly and current reports with respect to our business and financial condition. SOX require that we maintain effective disclosure controls and procedures and internal controls over financial reporting. To maintain and improve the effectiveness of our disclosure controls and procedures, we must commit significant resources, may be required to hire additional staff and need to continue to provide effective management oversight. We will be implementing additional procedures and processes for the purpose of addressing the standards and requirements applicable to public companies. Sustaining our growth also will require us to commit additional management, operational and financial resources to identify new professionals to join the Company and to maintain appropriate operational and financial systems to adequately support expansion. These activities may divert management's attention from other business concerns, which could have a material adverse effect on our business, financial condition, results of operations and cash flows.

We cannot predict or estimate the amount of additional costs we may incur as a result of becoming a public company or the timing of such costs.

We will be obligated to develop and maintain proper and effective internal controls over financial reporting.

We may not complete our analysis of our internal controls over financial reporting in a timely manner, or these internal controls may have one or more material weaknesses, which may adversely affect investor confidence in our company and, as a result, the value of our common stock.

Ensuring that we have adequate internal financial and accounting controls and procedures in place so that we can produce accurate financial statements on a timely basis is a costly and time-consuming effort that will need to be evaluated frequently. Section 404 of the Sarbanes-Oxley Act requires public companies to conduct an annual review and evaluation of their internal controls and attestations of the effectiveness of internal controls by independent auditors. We will be required to perform the annual review and evaluation of our internal controls no later than for the fiscal year ending December 31, 2014. However, we initially expect to qualify as a smaller reporting company and as an emerging growth company, and thus, we would be exempt from the auditors' attestation requirement until such time as we no longer qualify as a smaller reporting company and an emerging growth company. We would no longer qualify as a smaller reporting company if the market value of our public float exceeded $75 million as of the last day of our second fiscal quarter in any fiscal year following this offering. We would no longer qualify as an emerging growth company at such time as described in the risk factor immediately below.

We are in the early stages of the costly and challenging process of compiling the system and processing documentation necessary to evaluate our internal controls needed to comply with Section 404. During the evaluation and testing process, if we identify one or more material weaknesses in our internal control over financial reporting, we will be unable to assert that our internal controls are effective. If we are unable to assert that our internal control over financial reporting is effective, we could lose investor confidence in the accuracy and completeness of our financial reports, which would cause the price of our common stock to decline.

While we currently qualify as an "emerging growth company" under the JOBS Act, we will lose that status at the latest by the end of 2017, which will increase the costs and demands placed upon our management.

We will continue to be deemed an emerging growth company until the earliest of (i) the last day of the fiscal year during which we had total annual gross revenues of $1,000,000,000 (as indexed for inflation); (ii) the last day of the fiscal year following the fifth anniversary of the date of the first sale of common stock under a registration statement; (iii) the date on which we have, during the previous 3-year period, issued more than $1,000,000,000 in non-convertible debt; or (iv) the date on which we are deemed to be a "large accelerated filer," as defined by the SEC, which would generally occur upon our attaining a public float of at least $700 million. Once we lose emerging growth company status, we expect the costs and demands placed upon our management to increase, as we would have to comply with additional disclosure and accounting requirements, particularly if our public float should exceed $75 million on the last day of our second fiscal quarter in any fiscal year following this offering, which would disqualify us as a smaller reporting company.

We are an "emerging growth company" and we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies will make our common stock less attractive to investors.

The JOBS Act permits "emerging growth companies" like us to rely on some of the reduced disclosure requirements that are already available to smaller reporting companies, which are companies that have a public float of less than $75 million. As long as we qualify as an emerging growth company or a smaller reporting company, we would be permitted to omit the auditor's attestation on internal control over financial reporting that would otherwise be required by the Sarbanes-Oxley Act, as described above and are also exempt from the requirement to submit "say-on-pay", "say-on-pay frequency" and "say-on-parachute" votes to our stockholders and may avail ourselves of reduced executive compensation disclosure that is already available to smaller reporting companies.

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the exemption from complying with new or revised accounting standards provided in Section 7(a)(2)(B) of the Securities Act as long as we are an emerging growth company. An emerging growth company can therefore delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have elected to take advantage of the extended transition period for complying with new or revised accounting standards pursuant to Section 107(B). As a result, during such time that we delay the adoption of any new or revised accounting standards, our financial statements may not be comparable to other companies that comply with all public company accounting standards.

We will cease to be an emerging growth company at such time as described in the risk factor immediately above. Until such time, however, we cannot predict if investors will find our common stock less attractive because we may rely on these exemptions. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock and our stock price may be more volatile and could cause our stock price to decline.

We have not achieved profitable operations and continue to operate at a loss.

From incorporation to date, we have not achieved profitable operations and continue to operate at a loss. Our present business strategy is to improve cash flow by adding to our existing product line and expanding our sales and marketing efforts, including the addition of in-house sales personnel. There can be no assurance that we will ever be able to achieve profitable operations or that we will not require additional financing to fulfill our business plan.

The relative lack of public company experience of our management team may put us at a competitive disadvantage.

As a company with a class of securities registered under the Exchange Act, we are subject to reporting and other legal, accounting, corporate governance, and regulatory requirements imposed by the Exchange Act and rules and regulations promulgated under the Exchange Act. Our management team lacks significant public company experience, which could impair our ability to comply with these legal, accounting, and regulatory requirements. Such responsibilities include complying with Federal securities laws and making required disclosures on a timely basis. Our senior management may not be able to implement and effect programs and policies in an effective and timely manner that adequately responds to such increased legal and regulatory compliance and reporting requirements. Our failure to do so could lead to the imposition of fines and penalties and further result in the deterioration of our business.

Our profitability depends upon achieving success in our future operations through implementing our business plan, increasing sales, and expanding our customer and distribution bases, for which there can be no assurance given.

Profitability depends upon many factors, including the success of the Company's marketing program, the Company's ability to identify and obtain the rights to additional products to add to its existing product line, expansion of its distribution and customer base, maintenance or reduction of expense levels and the success of the Company's business activities. The Company anticipates that it will continue to incur operating losses in the future. The Company's ability to achieve profitable operations will also depend on its ability to develop and maintain an adequate marketing and distribution system.

There can be no assurance that the Company will be able to develop and maintain adequate marketing and distribution resources. If adequate funds are not available, the Company may be required to materially curtail or cease its operations.

If we are unable to successfully develop and market our products or if our products do not perform as expected, our business and financial condition will be adversely affected.

With the release of any new product, we will be subject to the risks generally associated with new product introductions and applications, including lack of market acceptance, delays in development and implementation, and failure of products to perform as expected. In order to introduce and market new products successfully with minimal disruption in customer purchasing patterns, we will need to manage the transition from existing products in the market. There can be no assurance that we will be successful in developing and marketing, on a timely basis, products that respond to advances by others, that our new products will adequately address the changing needs of the market, or that we will successfully manage product transitions. Further, failure to generate sufficient cash from operations or financing activities to develop or obtain improved products and technologies could have a material adverse effect on our results of operations and financial condition.

We are highly dependent on our executive officers and certain technical and operations employees.

Management anticipates that the Company's revenues will be derived almost exclusively from the sales of products and the operations of AmericaTowne. We depend heavily on our executive officers, including Alton Perkins, Xianghai Lin and Mabiala T. Phuati. As of the date of this filing, we do not have written employment agreements with these individuals. The loss of services of any of these personnel could impede the achievement of the Company's objectives. There can be no assurance that the Company will be able to attract and retain qualified executive or technical personnel on acceptable terms.

We intend to rely on third parties to construct AmericaTowne.

The Company has no construction capabilities and will seek to partner with and or hire a developer in China to develop the initial AmericaTowne location. While management has experience in identifying and selecting such joint venture partners in China, there is no guarantee that the partner and or developer selected to carry out the objectives of the AmericaTowne concept can do so successfully.