UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14C

(Rule 14c-101)

(Date of Original Filing: July 31, 2017)

(Date of First Amendment: September 27, 2017)

(Date of Second Amendment: November 27, 2017)

SCHEDULE 14C INFORMATION

Information Statement Pursuant to Section 14(c) of the

Securities Exchange Act of 1934

Check the appropriate box:

| ☒ | Preliminary Information Statement | | | |

| | | | | | | |

| ☐ | Definitive Information Statement | | | |

| | | | | | | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)(2)) |

| AmericaTowne, Inc. |

| (Name of Registrant as Specified in Its Charter) |

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required | | | |

| | | | | | |

| ☐ | Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11 |

| | | | | | |

| (1) | Title of each class of securities to which transaction applies: _____________________ |

| | | | | | |

| (2) | Aggregate number of securities to which transaction applies: _____________________ |

| | | | | | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): _____________________ |

| | | | | | |

| (4) | Proposed maximum aggregate value of transaction: _____________________ |

| | | | | | |

| (5) | Total fee paid: _____________________ | |

| | | | | | |

| ☐ | Fee paid previously with preliminary materials. | |

| | | | | | |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | | | | |

| (1) | Amount Previously Paid: _____________________ |

| | | | | | |

| (2) | Form, Schedule or Registration Statement No.: _____________________ |

| | | | | | |

| (3) | Filing Party: _____________________ | |

| | | | | | |

| (4) | Date Filed: _____________________ | |

AMERICATOWNE, INC.

4700 Homewood Court, Suite 100

Raleigh, North Carolina 27609

(888) 406-2713

NOTICE OF ACTION BY

WRITTEN CONSENT OF MAJORITY SHAREHOLDERS

WE ARE NOT ASKING YOU FOR A PROXY

AND YOU ARE REQUESTED NOT TO SEND US A PROXY

THIS IS NOT A NOTICE OF A MEETING OF SHAREHOLDERS AND NO SHAREHOLDERS’

MEETING WILL BE HELD TO CONSIDER ANY MATTER DESCRIBED HEREIN.

Attention Shareholders:

We are furnishing this notice and the accompanying information statement (the “Information Statement”) to the holders of shares of common stock, par value $0.0001 per share (“Common Stock”), of AmericaTowne, Inc., a Delaware corporation (the “Company”) pursuant to Section 14 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and Regulation 14C and Schedule 14C thereunder, in connection with the approval of the action described below (the “Actions”) taken by written consent of the holders of a majority of the issued and outstanding shares of Common Stock:

| | 1. | The Company’s execution of its Certificate of Amendment of Certificate of Incorporation, amending the Company’s Certificate of Incorporation, as amended (the “Articles”) increasing its shares of common stock to 200,000,000 shares at par value of $0.0001 (the “Share Increase”); |

| | | |

| | 2. | The Company’s execution of its Certificate of Amendment to Certificate of Incorporation to effectuate a one-to-four stock split of the Company’s issued and outstanding common stock (the “Stock Split,” together with the Share Increase, the “Share Amendments”); and |

| | 3. | Following the Share Amendments, effectuating a merger whereby the Company and ATI Modular Technology Corp. (“ATI Modular”), the Company’s subsidiary, merge into one operating entity, with ATI Modular being the surviving entity as outlined in the Agreement and Plan of Merger executed on June 29, 2017 (“Plan of Merger”). |

The purpose of this Information Statement is to notify our shareholders that on June 19, 2017, June 29, 2017, and July 5, 2017, the owners of approximately 85.99% of our issued and outstanding shares of Common Stock voted for the Actions in lieu of a meeting, as allowed for under our Articles and Bylaws of the Company, as amended (the “Bylaws”). In accordance with Rule 14c-2 promulgated under the Exchange Act, the Actions will become effective no sooner than 20 days after we mail this notice and the accompanying Information Statement to our shareholders.

The written consent that we received constitutes the only shareholder approval required for the Actions under Delaware law and, as a result, no further action by any other shareholder is required to approve the Actions and we have not and will not be soliciting your approval of the Actions.

This notice and the accompanying Information Statement are being mailed to our shareholders on or about December __, 2017. This notice and the accompanying Information Statement shall constitute notice to you of the action by written consent in accordance with Rule 14c-2 promulgated under the Exchange Act.

| | By Order of the Board of Directors, /s/ Alton Perkins Chairman of the Board Dated: November 27, 2017 |

TABLE OF CONTENTS

AMERICATOWNE, INC.

4700 Homewood Court, Suite 100

Raleigh, North Carolina 27609

(888) 406-2713

__________________________________

INFORMATION STATEMENT

Action by Written Consent of Majority of Shareholders

__________________________________

GENERAL

This Information Statement is being furnished to the holders of shares of common stock, par value $0.0001 per share (“Common Stock” or the “Company’s Common Stock”) of AmericaTowne, Inc. in connection with the action by written consent of the holders of a majority of our issued and outstanding shares of Common Stock taken without a meeting to approve the Actions, as defined above and as described in this Information Statement. In this Information Statement, all references to “the Company,” “we,” “us” or “our” refer to AmericaTowne, Inc. We are mailing this Information Statement to our shareholders of record on or about December __, 2017.

Pursuant to Rule 14c-2 promulgated by the Securities and Exchange Commission (the “SEC”) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), the Actions will not become effective until 20 calendar days following the date on which this Information Statement is first mailed to our shareholders.

The Company is paying the entire cost of furnishing this Information Statement. We will request brokerage houses, nominees, custodians, fiduciaries and other like parties to forward this Information Statement to the beneficial owners of the Company’s Common Stock held of record by them and will reimburse such persons for their reasonable charges and expenses in connection therewith.

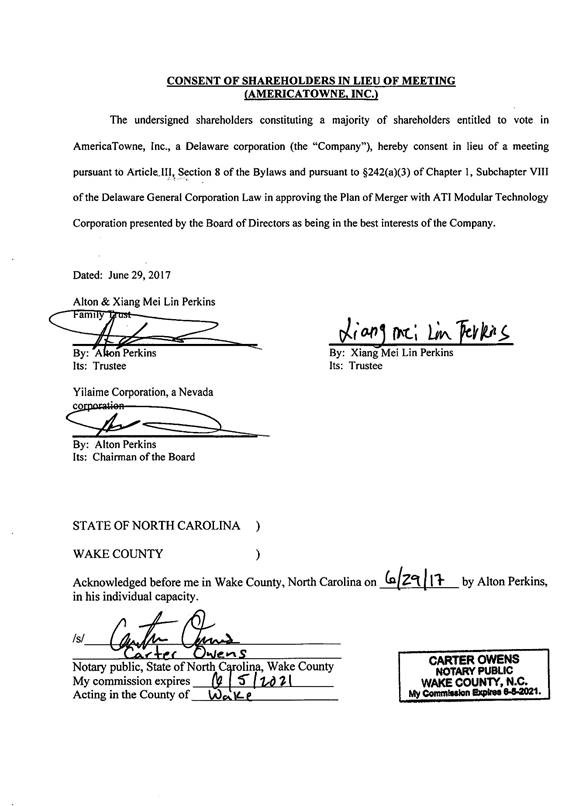

Action by Majority Shareholders

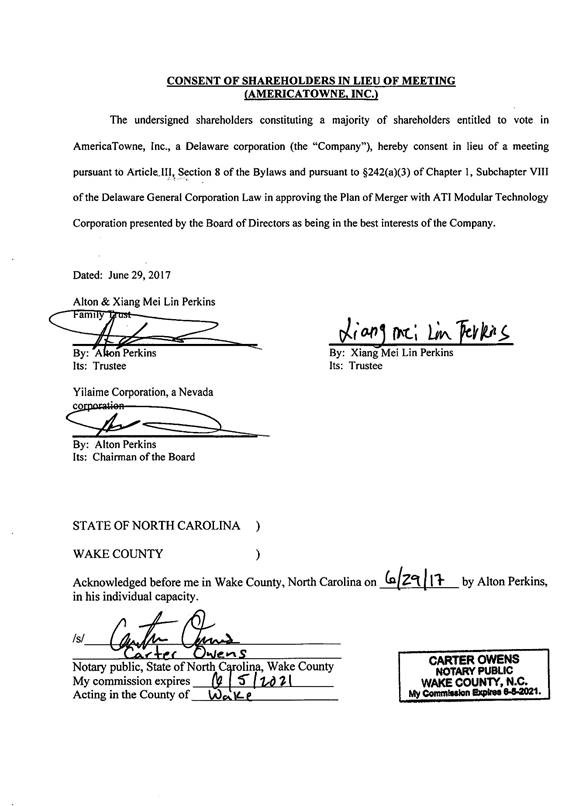

A majority of the Company’s shareholders that collectively own approximately 85.61% of the Company’s issued and outstanding common stock, specifically Yilaime Corporation, which own 13,756,216 shares, or 37.14%, of the Company’s issued and outstanding common stock, and the Alton & Xiang Mei Lin Perkins Family Trust, which

owns 17,948,939 shares, or 48.46% of the Company’s issued and outstanding common stock (collectively the “Majority Shareholders”) have consented to the following actions recommended by the Board of Directors (the “Actions”):

| | ☐ | Action No. 1: On June 19, 2017, the Majority Shareholders consented to the Company’s execution of the Certificate of Amendment of Certificate of Incorporation, amending its Articles by increasing its total shares of authorized common stock from 100,000,000 shares at par value of $0.0001 to 200,000,000 shares at par value of $0.0001 (the “Share Increase”); |

| | | |

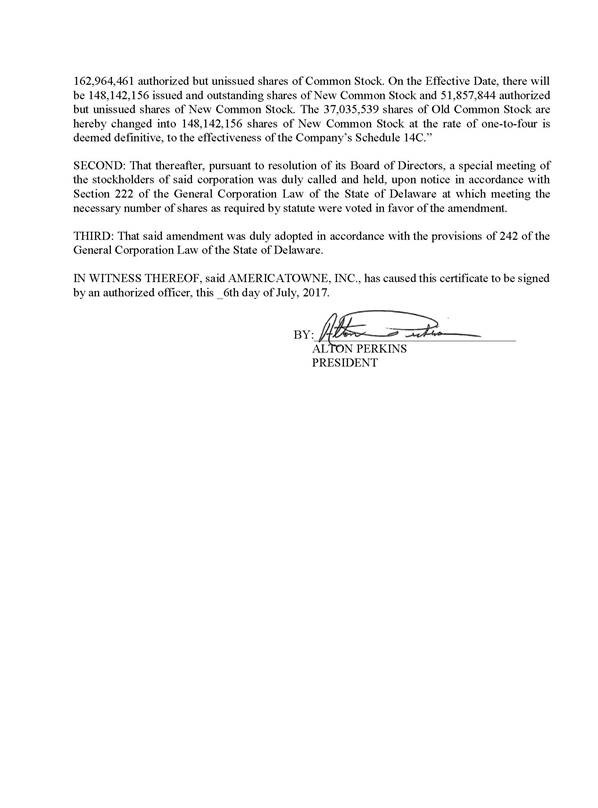

| | ☐ | Action No. 2: On July 5, 2017, following the amendment outlined in Action 1, the Majority Shareholders consented to the Company effectuating a one-to-four stock split of the Company’s common stock via an additional amendment to the Company’s articles (the “Stock Split,” together with the Share Increase referred to as the “Share Amendments”); and |

| | | |

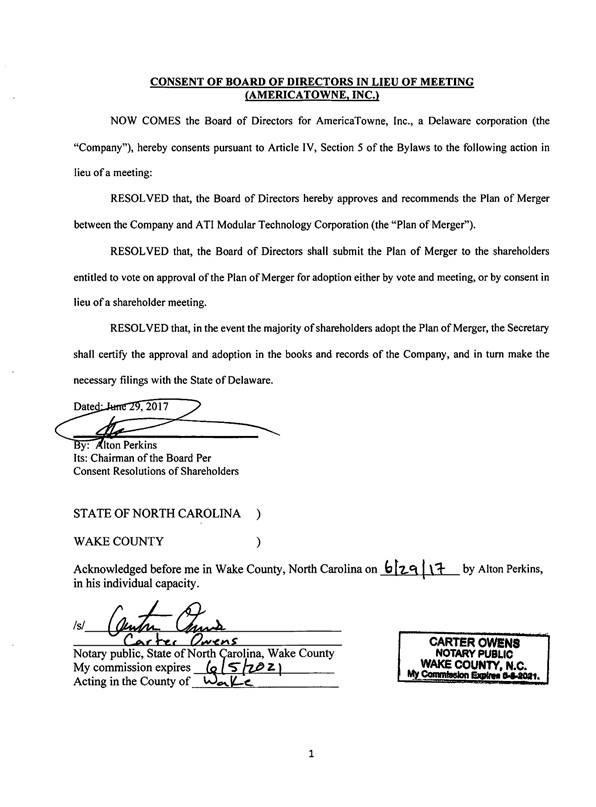

| | ☐ | Action No. 3: On June 29, 2017, the Majority Shareholders consented to the Company’s merger into ATI Modular Technology Corp. (“ATI Modular”), a subsidiary of the Company, with ATI Modular surviving the merger, as outlined in the Agreement and Plan of Merger (“Plan of Merger”). |

Alton Perkins is the natural person who controls both of the Majority Shareholders. Mr. Perkins is the trustee of the Alton & Xiang Mei Lin Perkins Family Trust, which is the majority shareholder of Yilaime Corporation. He is also the President, Chief Executive Officer, and Chairman of the Board, of AmericaTowne. The Board of Directors unanimously recommended the Actions described above. The Consents of the Board of Directors are attached hereto. The Actions detailed above will become effective twenty days after the filing of this Information Statement. As of the close of business on July 5, 2017, we had 37,035,539 shares of Common Stock outstanding of the Company. Each share of outstanding Common Stock is entitled to one vote. Because the Majority Shareholders already consented to the Actions described herein, your consent is not required and is not being solicited in connection with the approval of the aforementioned Actions.

INFORMATION REQUIRED BY ITEM 14 OF SCHEDULE 14A

Special Note Regarding Forward-Looking Statements

Information included or incorporated by reference in this Information Statement on Schedule 14C contains forward-looking statements. All forward-looking statements are inherently uncertain as they are based on current expectations and assumptions concerning future events or future performance of the Company and/or AmericaTowne. Readers are cautioned not to place undue reliance on these forward-looking statements, which are only predictions and speak only as of the date hereof. Forward-looking statements may contain the words “believes,” “project,” “expects,” “anticipates,” “estimates,” “forecasts,” “intends,” “strategy,” “plan,” “may,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions, and are subject to numerous known and unknown risks and uncertainties. Additionally, statements relating to implementation of business strategy, future financial performance, acquisition strategies, capital raising transactions, performance of contractual obligations, and similar statements may contain forward-looking statements. In evaluating such statements, shareholders should carefully review various risks and uncertainties identified in this Report. These risks and uncertainties could cause the Company’s actual results to differ materially from those indicated in the forward-looking statements. The Company disclaims any obligation to update or publicly announce revisions to any forward-looking statements to reflect future events or developments.

Although forward-looking statements in this Schedule 14C reflect the good faith judgment of our management, such statements can only be based on facts and factors currently known by the Company. Consequently, forward-looking statements are inherently subject to risks and uncertainties, and actual results and outcomes may differ materially from the results and outcomes discussed in or anticipated by the forward-looking statements. Factors that could cause or contribute to such differences in results and outcomes include, without limitation, those specifically addressed under the heading “Risk Factors Related to Our Business” below, as well as those discussed elsewhere in this Schedule 14C. Readers are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of this Information Statement. The Company and AmericaTowne file reports with the Securities and Exchange Commission (“SEC”). You can read and copy any materials the Company and AmericaTowne file with the SEC at the SEC’s Public Reference Room, 100 F. Street, NE, Washington, D.C. 20549. You can obtain additional information about the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains an Internet site (www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC, including us.

We disclaim any obligation to revise or update any forward-looking statements in order to reflect any event or circumstance that may arise after the date of this Information Sheet on Schedule 14C, accept as required by law. Readers are urged to carefully review and consider the various disclosures made throughout the entirety of this Schedule 14C, as well as our other public filings, which attempt to advise interested parties of the risks and factors that may affect our business, financial condition, results of operations and prospects.

PRO FORMA

| AMERICATOWNE Holdings, Inc. |

| Pro Forma Balance Sheets |

| | | | | | | | | | | |

| | | Historical | | Pro Forma |

| | | September 30, 2017 | | September 30, 2017 | | | | | | |

| | | ATI Modular Technology Corp. | | AmericaTowne Inc. | | Adjustment | | Notes | | Combined |

| ASSETS | | | | | | | | | | |

| Current Assets | | | | | | | | | | |

| Cash and cash equivalents | $ | 167,554 | $ | 893,743 | | | | | $ | 1,061,297 |

| Notes receivable - related parties | | - | | 15,000 | | | | | | 15,000 |

| Accounts receivable, net | | - | | 657,872 | | | | | | 657,872 |

| Accounts receivable, net - related parties | | 1,096,384 | | 1,074,236 | | (172,173) | | (A) | | 1,998,447 |

| Other receivables | | - | | 7,903 | | | | | | 7,903 |

| Other receivables - related parties | | 95,504 | | 161,673 | | | | | | 257,177 |

| Prepayment-current | | - | | 146,717 | | | | | | 146,717 |

| Total Current Assets | | 1,359,442 | | 2,957,144 | | | | | | 4,144,413 |

| | | | | | | | | | | |

| Prepayment-non current | | - | | 7,035 | | | | | | 7,035 |

| Property, plant and equipment, net | | 3,679 | | 18,473 | | | | | | 22,152 |

| Goodwill | | - | | 215,331 | | | | | | 215,331 |

| Investments | | - | | 178,859 | | (175,000) | | (B) | | 3,859 |

| Total Assets | $ | 1,363,121 | $ | 3,376,843 | | | | | $ | 4,392,791 |

| | | | | | | | | | | |

| LIABILITIES AND SHAREHOLDERS' EQUITY | | | | | | | | | | |

| Current Liabilities | | | | | | | | | | |

| Accounts payable and accrued expenses | $ | 27,412 | $ | 377,500 | | (181,235) | | (A) | $ | 223,677 |

| Deferred revenues-current | | 1,004,387 | | 4,542 | | | | | | 1,008,929 |

| Notes payable | | - | | - | | | | | | - |

| Other payables | | - | | 560 | | | | | | 560 |

| Deposit from customers | | - | | 1,469 | | | | | | 1,469 |

| Due to related parties | | - | | 2,106 | | | | | | 2,106 |

| Income tax payable | | 7,246 | | 30,530 | | | | | | 37,776 |

| Total Current Liabilities | | 1,039,045 | | 416,707 | | | | | | 1,274,517 |

| Deferred revenues-non current | | - | | 50,576 | | | | | | 50,576 |

| Total Liabilities | | 1,039,045 | | 467,282 | | | | | | 1,325,093 |

| | | | | | | | | | | |

| Commitments & Contingencies | | | | | | | | | | |

| | | | | | | | | | | |

| Shareholders' Equity | | | | | | | | | | |

| Common stock, $0.001 par value; 500,000,000 shares authorized, | | | | | | | | |

| 198,323,882 shares issued and outstanding | | 126,741 | | 4,895 | | 66,688 | | (B) | | 198,324 |

| Common stock subscribed | | 1,000 | | 85 | | 3,415 | | (B) | | 4,500 |

| Additional paid-in capital | | 896,341 | | 5,265,627 | | (245,103) | | (B) | | 5,916,865 |

| Deferred compensation | | (375,000) | | (2,201,548) | | | | | | (2,576,548) |

| Receivable for issuance of stock | | (206,980) | | (90,223) | | | | | | (297,203) |

| Retained Earnings | | (118,026) | | (79,223) | | 9,061 | | (A) | | (188,188) |

| Noncontrolling interest | | - | | 9,949 | | | | | | 9,949 |

| Shareholders' Equity | | 324,076 | | 2,909,560 | | | | | | 3,067,698 |

| Total Liabilities and Shareholders' Equity | $ | 1,363,121 | $ | 3,376,843 | | | | | $ | 4,392,791 |

| | | | | | | | | | | |

| AMERICATOWNE Holdings, Inc. |

| |

| Pro Forma Statement of Operations |

| | | | | | | | | | | |

| | | Historical | | Pro Forma |

| | | For the Nine Months ended | | | | | | |

| | | September 30, 2017 | | September 30, 2017 | | | | | | |

| | | ATI Modular Technology Corp. | | AmericaTowne Inc. | | Adjustment | | Notes | | Combined |

| | | | | | | | | | | |

| Revenues | | | | | | | | | | | | | | | | | | | | |

| Sales | | $ | — | | | $ | 228,404 | | | | | | | | | | | $ | 228,404 | |

| Services-related parties | | | 375,000 | | | | 1,081,992 | | | | (375,000 | ) | | | (A) | | | | 1,081,992 | |

| | | | 375,000 | | | | 1,310,396 | | | | | | | | | | | | 1,310,396 | |

| Cost of Revenues-Related Parties | | | — | | | | 113,076 | | | | | | | | | | | | 113,076 | |

| Gross Profit | | | 375,000 | | | | 1,197,320 | | | | | | | | | | | | 1,197,320 | |

| | | | | | | | | | | | | | | | | | | | | |

| Operating Expenses | | | | | | | | | | | | | | | | | | | | |

| General and administrative | | | 223,212 | | | | 1,228,692 | | | | (375,000 | ) | | | (A) | | | | 1,067,843 | |

| | | | | | | | | | | | (9,061 | ) | | | (A) | | | | | |

| Professional fees | | | 103,476 | | | | 152,645 | | | | | | | | | | | | 256,121 | |

| Total operating expenses | | | 326,688 | | | | 1,381,337 | | | | | | | | | | | | 1,323,964 | |

| Income from operations | | | 48,312 | | | | (184,018 | ) | | | | | | | | | | | (126,644 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Other Expenses (Income) | | | — | | | | (229 | ) | | | | | | | | | | | (229 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Provision for income taxes | | | 7,247 | | | | — | | | | | | | | | | | | 7,247 | |

| Net Income (Loss) | | $ | 41,065 | | | $ | (183,789 | ) | | | | | | | | | | $ | (133,662 | ) |

| AMERICATOWNE Holdings, Inc. |

| |

| Pro Forma Balance Sheets |

| | | | | | | | | | | |

| | | Historical | | Pro Forma |

| | | For the Nine Months ended | | | | | | |

| | | September 30, 2017 | | September 30, 2017 | | | | | | |

| | | ATI Modular Technology Corp. | | AmericaTowne Inc. | | Adjustment | | Notes | | Combined |

| | | | | | | | | | | |

| ASSETS | | | | | | | | | | | | | | | | | | | | |

| Current Assets | | | | | | | | | | | | | | | | | | | | |

| Cash and cash equivalents | | $ | 94,266 | | | $ | 878,749 | | | | | | | | | | | $ | 973,015 | |

| Accounts receivable, net | | | — | | | | 610,715 | | | | | | | | | | | | 610,715 | |

| Accounts receivable, net - related parties | | | 458,755 | | | | 289,299 | | | | (60,088 | ) | | | (A) | | | | 687,966 | |

| Other receivables - related parties | | | 159,772 | | | | 99,797 | | | | | | | | | | | | 259,569 | |

| Prepayment-current | | | — | | | | 644 | | | | | | | | | | | | 644 | |

| Total Current Assets | | | 712,793 | | | | 1,879,204 | | | | | | | | | | | | 2,531,909 | |

| | | | | | | | | | | | | | | | | | | | | |

| Prepayment-non current | | | — | | | | 7,675 | | | | | | | | | | | | 7,675 | |

| Property, plant and equipment, net | | | 6,280 | | | | 19,581 | | | | | | | | | | | | 25,861 | |

| Goodwill | | | — | | | | 215,331 | | | | | | | | | | | | 215,331 | |

| Investments | | | — | | | | 178,859 | | | | (175,000 | ) | | | (B) | | | | 3,859 | |

| Total Assets | | $ | 719,073 | | | $ | 2,300,650 | | | | | | | | | | | $ | 2,784,636 | |

| | | | | | | | | | | | | | | | | | | | | |

| LIABILITIES AND SHAREHOLDERS' EQUITY | | | | | | | | | | | | | | | | | | | | |

| Current Liabilities | | | | | | | | | | | | | | | | | | | | |

| Accounts payable and accrued expenses | | $ | 209,699 | | | $ | 93,838 | | | | (63,250 | ) | | | (A) | | | $ | 240,287 | |

| Deferred revenues-current | | | 324,387 | | | | 4,542 | | | | | | | | | | | | 328,929 | |

| Other payables | | | — | | | | 5,016 | | | | | | | | | | | | 5,016 | |

| Due to related parties | | | — | | | | 42,839 | | | | | | | | | | | | 42,839 | |

| Income tax payable | | | — | | | | 32,198 | | | | | | | | | | | | 32,198 | |

| Total Current Liabilities | | | 534,086 | | | | 178,433 | | | | | | | | | | | | 649,269 | |

| Deferred revenues-non current | | | — | | | | 53,981 | | | | | | | | | | | | 53,981 | |

| Total Liabilities | | | 534,086 | | | | 232,414 | | | | | | | | | | | | 703,250 | |

| | | | | | | | | | | | | | | | | | | | | |

| Commitments & Contingencies | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Shareholders' Equity | | | | | | | | | | | | | | | | | | | | |

| Common stock, $0.001 par value; 500,000,000 shares authorized, | | | | | | | | | | | | | | | | | | | | |

| 110,433,767 shares issued and outstanding | | | 126,733 | | | | 2,697 | | | | (18,996 | ) | | | (B) | | | | 110,434 | |

| Common stock subscribed | | | 982 | | | | 90 | | | | 3,674 | | | | (B) | | | | 4,746 | |

| Additional paid-in capital | | | 833,363 | | | | 3,063,369 | | | | (159,677 | ) | | | (B) | | | | 3,737,055 | |

| Deferred compensation | | | (450,000 | ) | | | (1,000,842 | ) | | | | | | | | | | | (1,450,842 | ) |

| Receivable for issuance of stock | | | (167,000 | ) | | | (65,223 | ) | | | | | | | | | | | (232,223 | ) |

| Retained Earnings | | | (159,091 | ) | | | 83,249 | | | | 3,163 | | | | (A) | | | | (72,679 | ) |

| Noncontrolling interest | | | — | | | | (15,103 | ) | | | | | | | | | | | (15,103 | ) |

| Shareholders' Equity | | | 184,987 | | | | 2,068,237 | | | | | | | | | | | | 2,081,386 | |

| Total Liabilities and Shareholders' Equity | | $ | 719,073 | | | $ | 2,300,650 | | | | | | | | | | | $ | 2,784,636 | |

| AMERICATOWNE Holdings, Inc. |

| Pro Forma Statement of Operations |

| | | | | | | | | | | |

| | | Historical | | Pro Forma |

| | | For the Nine Months ended | | | | | | |

| | | September 30, 2017 | | September 30, 2017 | | | | | | |

| | | ATI Modular Technology Corp. | | AmericaTowne Inc. | | Adjustment | | Notes | | Combined |

| | | | | | | | | | | |

| Revenues | | | | | | | | | | | | | | | | | | | | |

| Sales | | $ | — | | | $ | 1,209,540 | | | | | | | | | | | $ | 1,209,540 | |

| Services-related parties | | | 375,000 | | | | 550,000 | | | | (375,000 | ) | | | (A) | | | | 550,000 | |

| | | | 375,000 | | | | 1,759,540 | | | | | | | | | | | | 1,759,540 | |

| Cost of Revenues-Related Parties | | | | | | | 244,486 | | | | | | | | | | | | 244,486 | |

| Gross Profit | | | 375,000 | | | | 1,515,054 | | | | | | | | | | | | 1,515,054 | |

| | | | | | | | | | | | | | | | | | | | | |

| Operating Expenses | | | | | | | | | | | | | | | | | | | | |

| General and administrative | | | 319,140 | | | | 1,334,164 | | | | (375,000 | ) | | | (A) | | | | 1,275,141 | |

| | | | | | | | | | | | (3,163 | ) | | | (A) | | | | | |

| Professional fees | | | 65,922 | | | | 251,122 | | | | | | | | | | | | 317,044 | |

| Total operating expenses | | | 385,062 | | | | 1,585,286 | | | | | | | | | | | | 1,592,185 | |

| Income from operations | | | (10,062 | ) | | | (70,232 | ) | | | | | | | | | | | (77,131 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Other Expenses (Income) | | | (3,859 | ) | | | 1,419 | | | | | | | | | | | | (2,441 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Provision for income taxes | | | — | | | | (3,549 | ) | | | | | | | | | | | (3,549 | ) |

| Net Income (Loss) | | $ | (6,203 | ) | | $ | (68,101 | ) | | | | | | | | | | $ | (71,141 | ) |

Notes to Unaudited Pro Forma Combined Financial Information

Note 1 – Basis of Presentation

The unaudited pro forma combined balance sheets as of September 30, 2017 and December 31, 2016, and the unaudited pro forma combined statements of operations for the nine months ended September 30, 2017 and for year ended December 31, 2016, are based on the historical financial statements of the Company and AmericaTowne, Inc. after giving effect of the Agreement and Plan of Merger executed in June 29, 2017 and First Amendment to the Agreement and Plan of Merger dated July 14, 2017, and the assumptions, reclassifications and adjustments described in the accompanying notes to the unaudited pro forma condensed combined financial information.

The Company entered into Agreement and Plan of Merger with AmericaTowne, Inc. whereas the merger was accounted under US GAAP as a business combination under common control with the Company being the acquirer as both entities were owned by the same controlling shareholders. The pro forma combined financial information have been presented at historical costs and on a retroactive basis of the entities.

Note 2 – Adjustments

| (A) | To eliminate intercompany transactions. |

| (B) | Execution of the Company’s 50-to-1 reverse stock split, as well as AmericaTowne’s 1-to-4 stock split in accordance with Agreement and Plan of Merger. |

INFORMATION WITH RESPECT TO

ATI MODULAR TECHNOLOGY CORP.

(the “Acquiring Company”)

General Description of Business

ATI Modular Technology Corp. (“ATI Modular, “we,” “us,” or similar pronouns) is an operating company engaged in the development and the exporting of modular energy efficient technology and processes that allow government and private enterprises in China to use US-based methods for creating modular spaces, facilities, and properties. We are in the business of all aspects of modular construction, including but not limited to, (a) the furtherance of modular construction technology, education and development in developed and undeveloped countries, (b) acquisition and/or installation of construction equipment, materials, furnishings, adware, insulation, flooring, roofing, wiring, plumbing, heating and air conditioning, and landscaping, and (c) other businesses directly or tangentially related to these lines of services, including assisting businesses and entrepreneurs in securing naming, licensing or promotional rights, driving internet and media traffic, increasing visibility of product and name recognition, and other services. In China, the modular construction industry is new and in its very early stages. Though we expect other competitors to come forth, at this time, there are only three other competitors, and those competitors are based in China. None of the competitors are from the United States. We believe that it is recognized that United States modular technology is more advanced than our Chinese counterparts, and the technology is recognized as the gold standard. The construction industry in China, as a whole, has a mandate to immediately start developing modular technology with cities and provinces developing modular construction plans and targets to construct modular in both the public as well as private sectors. Most communities have milestones and are creating official policies on modular construction with the actual percentage of production mandated by particular target dates.

We have been sought out by three separate governments in China to assist their communities in developing their modular industry based upon United States’ technology. We have experience in the construction sector in China and the United States, and thus we believe we have the leverage in assembling experts in the modular industry to assist in delivery of goods, services, equipment, technology, and know-how all under the moniker of “Made in the USA.”

On June 21, 2016, AmericaTowne, the controlling shareholder of ATI Modular by virtue of its majority ownership of common stock in ATI Modular, entered into a Cooperative Agreement with the Shexian County Investment Promotion Bureau (the “Shexian County Bureau”) out of Shexian, China (hereinafter, the “AT/Shexian Cooperative Agreement”). The AT/Shexian Cooperative Agreement relates to the construction of an AmericaTowne location in advancing tourism in the Hanwang mountains.

Under the terms of the AT/Shexian Cooperative Agreement, AmericaTowne and the Shexian County Bureau have agreed to a strategic partnership wherein the Shexian County Bureau intends to invest local resources to AmericaTowne for construction of an AmericaTowne community. In consideration, AmericaTowne intends on investing funds towards the development of the AmericaTowne community. AmericaTowne will be obligated to bear any and all applicable taxes and the projected investment by AmericaTowne into the development of the AmericaTowne community is estimated to be $30,000,000. It is anticipated that the definitive agreement will set forth a detailed projection and proforma associated with the use of funds. There is no guarantee that AmericaTowne will be able to raise this capital in the event a definitive agreement is executed. Furthermore, AmericaTowne’s ability to raise the necessary capital and to perform obligations under any definitive agreement might be materially affected in the event ATI Modular is not able to perform any of its obligations under any future definitive agreement with the Shexian County Bureau.

On June 21, 2016, ATI Modular agreed to participate with the Shexian County Bureau in building local modular construction, researching technology and intelligent systems related thereto, and servicing the full lifecycle of modular construction in the locale through the execution of the Cooperative Agreement (the “ATI Modular/Shexian Cooperative Agreement”).

Pursuant to future negotiations and more definitive agreements, ATI Modular has agreed to purchase the requisite equipment and technology in performing under the ATI Modular/Shexian Cooperative Agreement. In consideration for the services provided by ATI Modular, the Shexian County Bureau has agreed to be responsible for providing factories and land, and other resources and manpower in developing the modular construction. ATI Modular has also agreed to exercise its best efforts in raising approximately $30,000,000 in furthering the parties’ collective interests under the ATI Modular/Shexian Cooperative Agreement. These funds would be allocated towards different operating costs than the funds necessary for AmericaTowne to perform under the AT/Shexian Cooperative Agreement. It is anticipated that the definitive agreement will set forth a detailed projection and proforma associated with the use of funds. ATI Modular and the Shexian County Bureau have agreed to continue to cooperate in good faith in executing and further agreements needed in furthering their respective objectives. However, notwithstanding this intent, ATI Modular’s ability to perform might be materially affected in the event AmericaTowne is not able to meet its obligations in furthering any future definitive agreement with the Shexian County Bureau.

On September 8, 2016, ATI Modular entered into the Investment and Cooperation Agreement for ATI Modular Green Building Manufacturing Project with the Jiangnan Industry Zone in Anhui Province (the “Jiangnan Agreement”). Under the Jiangnan Agreement, ATI Modular has agreed to manufacture and install modular buildings, and provide research into the development of green building module manufacturing. ATI Modular has agreed to provide appropriate technology and intelligent systems in providing modular building lifecycle services. The location of the planned project is the New Material Industry Park in the Jiangnan Industry Zone in Anhui Province. The parties have projected a cost of $30,000,000.

On December 28, 2016, ATI Modular entered into the American ATI Modular Technology Company Project Investment Agreement (the “Investment Agreement”), definitive agreement and supersedes the Jiangnan Cooperation Agreement of September 8, 2016. Under the Investment Agreement, the Administrative Committee of Jiangnan Industrial Concentration Zone of Anhui Province (hereinafter, “Jiangnan”) and ATI Modular have agreed to the construction of ATI Modular’s green, modular building and related technology under the project name “Modular Plant Production Base.”

The capitalization under the Investment Agreement is, in part, ATI Modular’s responsibility. However, ATI Modular and Jiangnan have agreed to certain provisions to mitigate against financing risks, including, but not limited to: (a) access upon request by ATI Modular to local bank loans in the Anhui Province and United States Exim Bank, (b) equity fund insertion up to $3,000,000 USD, and (c) contribution by Jiangnan up to $2,900,000 upon meeting conditions in the Investment Agreement.

On September 9, 2016, ATI Modular entered into the Investment and Cooperation Agreement for ATI Modular Green Building Manufacturing Project with the Yongan government in the Fujian province (the “Yongan Agreement”). Under the Yongan Agreement, similar to the Jiangnan Agreement, ATI Modular has agreed to manufacture and install modular buildings, and provide research into the development of green building module manufacturing. ATI Modular has agreed to provide appropriate technology and intelligent systems in providing modular building lifecycle services. The location of the planned project is Yongan city in the Fujian province, China. The parties have projected a cost of $30,000,000.

ATI Modular has agreed to grant the Yongan government audit, access, supervision, inspection and other rights. The Yongan government has agreed to coordinate any and all necessary services in securing benefits associated with ATI Modular being a foreign investment enterprise, including but not limited to, providing the site for the manufacturing facility, tax relief, access to financing and a “Project Headquarter” for ATI Modular, which is defined in the Yongan Agreement. The Yongan Agreement is not a definitive agreement; rather, it is a memorialization of the parties’ future intent as to the subject matter therein. ATI Modular’s business plans and objectives could be impaired in the event the parties do not reach a definitive agreement. . ATI Modular is responsible for financing and providing any necessary facilities inside any factory plant. There is no guarantee that ATI Modular can secure such financing or develop the necessary facilities.

On June 27, 2016, we entered into a Sales and Support Services Agreement with Yilaime Corporation, a Nevada corporation (“Yilaime”). Yilaime is controlled by Mr. Perkins, who is our sole director and officer. Yilaime holds the majority of issued and outstanding shares of common stock in AmericaTowne, Inc. (“ATI”), a Delaware corporation and fully-reporting company with the United States Securities and Exchange Commission (the “SEC”). Under the Services Agreement, Yilaime will provide ATI Modular with marketing, sales and support services in ATI Modular’s pursuit of ATI Modular business in China in consideration of a commission equal to 10% of the gross amount of monies procured for ATI Modular through Yilaime’s services. In consideration of the right to receive this commission, Yilaime has agreed to pay ATI Modular a quarterly fee of $250,000 starting on July 1, 2016. The Services Agreement is set to expire on June 10, 2020, absent early termination for breach thereof by either party. Yilaime retains an option to extend the term under its sole discretion until June 10, 2025 by providing written notice to ATI Modular by March 10, 2019. Yilaime has agreed to be ATI Modular’s exclusive independent contractor in providing the services in the Services Agreement, and has agreed to a non-compete and non-circumvent agreement. Yilaime is obligated to provide support services only in a manner that is deemed commercially acceptable by Yilaime and Yilaime has the sole right to determine the means, manner and method by which services will be provided and at the time and location of its choosing. Furthermore, as the control person of Yilaime, Mr. Perkins might make decisions he deems are in the best interests of Yilaime, which might be to the detriment of the goals and objectives of ATI Modular.

On June 28, 2016, we entered into a Modular Construction & Technology Services Agreement (the “Modular Services Agreement”) with AmericaTowne Inc. (“ATI”), a Delaware corporation and fully-reporting company with the SEC. The impetus behind the Modular Services Agreement was ATI Modular’s Cooperative Agreement with the Shexian County Government, China. Under the Cooperative Agreement, ATI and the Shexian County Bureau have agreed to a partnership in furthering the development of an AmericaTowne community in the Hanwang mountains, Shexian, China. In addition, ATI, at the invitation of the Xiamen Longyan City Chamber of Commerce, Xiamen/Longyan China and the Xiamen City Growth Planning Agency plan to pursue the development of an AmericaTowne Community and an International School in Longyan County China.

Under the Modular Services Agreement, ATI Modular shall provide the research, development, training and modular technology in a manner deemed commercially acceptable by ATI based on its commercially reasonable requirements, plans and specifications, which shall be agreed upon in advance of any substantial and material construction. ATI will pay ATI Modular a quarterly fee of $125,000 per quarter. The initial fee under the Modular Services Agreement with AmericaTowne was recorded as a related-party receivable upon its execution. The Services Agreement is set to expire on June 10, 2020, absent early termination for breach thereof by either party. ATI retains an option to extend the term under its sole discretion until June 10, 2025 by providing written notice to ATI Modular by March 10, 2019. Yilaime has agreed to be ATI Modular’s exclusive independent contractor in providing the services in the Services Agreement, and has agreed to a non-compete and non-circumvent agreement.

On June 29, 2016, we entered into an IC-DISC Service Provider Agreement with AXP Holding Corporation, a Nevada corporation (“AXP Holding”) and related party to ATI Modular through Mr. Perkins control of AXP Holding. AXP Holding is an Interest Charge - Domestic International Sales Corporation, or “IC-DISC”. AXP IC-DISC tax-exempt status was authorized and approved by the United States Department of the Treasury, Internal Revenue Service. As an IC-DISC, AXP Holding may, under certain conditions, act as a sister corporation to entities and provide services to assist a company in obtaining lower tax rates on export income. In addition to the export tax savings provided by AXP, AXP can provide an additional array of services including promoting ATI Modular’s export activities, purchasing receivables from ATI Modular at a discount through a factoring relationship, and providing ATI Modular with working capital loans.

The term under the IC-DISC Service Provider Agreement is set to expire on December 6, 2019, absent early termination for breach thereof by either party. AXP retains the right to extend the term, exercising its sole discretion, to December 6, 2024 by providing written notice to ATI Modular by November 6, 2019. AXP has agreed to a non-compete and non-circumvent in providing the services under the IC-DISC Service Provider Agreement. ATI Modular has agreed to pay AXP a commission fee up to the greater of 50% of ATI Modular’s export net income or 4% of ATI Modular’s export gross receipts. ATI Modular will determine the exact amount and the method of payment of the commission fee. The commission fee shall be paid at the option of ATI Modular periodically throughout the year, but no later than December 31 on annual basis. If there is no commission fee due to no export sales, ATI Modular will pay AXP an export service fee of $50,000. The export service fee, if any, is due on or before December 31 on an annual basis.

In addition, for referring businesses from ATI Modular’s “Export Platform” or “Community,” AXP agrees to pay ATI Modular 25% of each “Sales Export Service Fee” charged and received as an “IC-DISC Commission” from each Exporter or Licensee resulting from participating in the Export Platform or Community. This fee is called a “Group Export Consulting Fee” in the IC-DISC Service Provider Agreement, and is due no later than fifteen business days after receipt from the Exporter or Licensee, but no later than December 31 on an annual basis. For illustrative purposes, if AXP receives and or charges an Exporter 50% of its net export sales as a commission, and that value is $100,000, AXP would owe ATI Modular 25%, or $25,000. Furthermore, during the term, ATI Modular shall pay AXP a flat fee of $5,000 per transaction for purchasing receivables from ATI Modular, plus an interest rate for such factoring at the prime rate plus one-percent.

ATI Modular is in the early stages of its operations, and many of its plans and objectives are aspirational in nature, and thus might never come to fruition. At this time, ATI Modular plans to retain engineering and architectural firms based in the United States who have extensive experience in developing modular structures in the United States, China and other foreign locations based on market demand, which has not been thoroughly researched to date. ATI Modular has been focused on obtaining quotes, negotiating formal engagements and researching all aspects of the modular construction industry. While the infrastructure is still in the developmental stage, ATI Modular is confident that it has the experience, or access to those with experience, in the modular construction field.

ATI Modular plans on engaging in onsite placement and delivery of modular structures. Mr. Perkins has extensive experience in operating business in China. One of the reasons that Mr. Perkins was sought out and invited to participate in developing the modular industry in China is that he was the co-chairman of a construction company in China - Yilaime Foreign Partnership in Henghsui China. His experience with Yilaime Foreign Partnership allows ATI Modular to call on local companies in China as well as modular companies and experts in the United States to help provide on-site services. Yilaime Foreign Partnership is not a related party to ATI Modular, ATI, Yilaime or AXP.

In addition, ATI Modular recently joined the Modular Building Institute in Charlottesville, Virginia. In September of 2016, Mr. Perkins attended the Institute’s annual exposition in order to line up available suppliers, and experts in the modular construction field.

We intend on offering support services in all phases of modular construction. Our approach will be to focus on exporting United States based technology, services and equipment, and general “know-how.” Exporters in our related company, AmericaTowne, are experienced in the modular field and we plan on allowing those experienced exporters to participate in various levels of our program.

ATI Modular currently does not have a principal supplier of raw materials. ATI Modular has identified potential sources of raw materials in the United States through its membership in the Modular Building Institute. One of our primary challenges will be pricing the source of raw materials and delivery to China. We are also looking to potential raw material sources in China.

To operate within China, ATI Modular requires approval of government officials in China. In both cases where ATI Modular has signed Cooperative or Definitive Agreements (and in the case of the Shexian Agreement), and at the invitation of the local government, we have the approval to register and conduct business.

As with any business plan that is aspirational in nature, there is no assurance ATI Modular will be able to accomplish all of its objectives or that it will be able to meet financing needs to accomplish said objectives. ATI Modular is a “shell company,” as defined under Rule 12b-2 of the Exchange Act. Our CIK number is 0001697426, and we have selected December 31 as our fiscal year.

Description of Property

We are currently evaluating a physical location for our operations in China along with a manufacturing facility. Our principal executive offices are located at 4700 Homewood Court, Suite 100 in Raleigh, North Carolina. We are registered as a foreign business entity in the State of North Carolina. We lease the office space from Yilaime Corporation, a Nevada corporation doing business in North Carolina for $2,500 per month. Yilaime is a related party to ATI Modular.

Legal Proceedings

There are not presently any material pending legal proceedings to which ATI Modular is a party or as to which any of its property is subject, and no such proceedings are known to ATI Modular to be threatened or contemplated against it.

Market Price of and Dividends on the Registrants Common Equity and Related Stockholder Matters.

Prior to June 27, 2016, ATI Modular was incorporated as Global Recycle Energy, Inc. On June 27, 2016, ATI Modular amended its Articles of Incorporation with the State of Nevada to change the name of ATI Modular to ATI Modular Technology Corporation. On June 12, 2017, FINRA approved the name change to ATI Modular Technology Corp and symbol change to ATMO. ATI Modular is subject to Alternative Reporting Standards. The range of high and low bid information for ATI Modular’s common shares for each full quarterly period within the two most recent fiscal years, and any subsequent interim period for which financial statements are included, or as required under Article 3 of Regulation S-X, is as follows:

| | 10/1/15-12/31/15 | 1/1/16-3/31/16 | 4/1/16-6/30/16 | 7/1/16-9/30/16 | 10/1/16-12/31/16 | 1/1/17-3/31/17 | 4/1/17-6/30/17 | 7/1/17-9/30/17 |

| High | 0.14 | 0.44 | 0.4 | 9.74 | 8.95 | 9.39 | 8.25 | 74.99 |

| Low | 0.09 | 0.1 | 0.15 | 0.4 | 7.5 | 5.25 | 0.35 | 0.25 |

As the most recent practicable date, there are approximately 181 record holders of our common stock with an aggregate of 126,740,708 shares issued and outstanding. ATI Modular has not paid any cash dividends to date and does not anticipate or contemplate paying dividends in the foreseeable future. It is the present intention of management to utilize all available funds for the development of ATI Modular’s business. We have no securities authorized for issuance under any Equity Compensation Plans.

ATI Modular’s shares are traded on the OTC Markets on OTC:Pink. ATI Modular is currently listed by FINRA as a Caveat Emptor security and public interest concern with the OTC. The potential reasons for this categorization are set forth at http://www.otcmarkets.com/stock/ATMO/quote, even though no specific reason has been stated by OTC.

Financial Statements

ATI Modular Technology Corp

Balance Sheets

| | | September 30 | | December 31 |

| | | 2017 | | 2016 |

| | | (Unaudited) | | |

| Assets | | | | | | | | |

| Current assets | | | | | | | | |

| Cash and cash equivalents | | $ | 167,554 | | | $ | 94,266 | |

| Accounts receivable, net - related parties | | | 1,096,384 | | | | 458,755 | |

| Other receivables - related parties | | | 95,504 | | | | 159,772 | |

| Total Current Assets | | | 1,359,442 | | | | 712,793 | |

| | | | | | | | | |

| Office Equipment Furniture & Fixtures | | | 3,679 | | | | 6,280 | |

| | | | | | | | | |

| Total Assets | | $ | 1,363,121 | | | $ | 719,073 | |

| | | | | | | | | |

| Liabilities and Stockholders' Equity | | | | | | | | |

| | | | | | | | | |

| Current Liabilities | | | | | | | | |

| Accounts payable and accrued expenses | | $ | 27,412 | | | $ | 209,699 | |

| Deposit from customers | | | — | | | | — | |

| Deferred Revenue | | | 1,004,387 | | | | 324,387 | |

| Income tax payable | | | 7,246 | | | | — | |

| Total Current Liabilities | | | 1,039,045 | | | | 534,086 | |

| | | | | | | | | |

| Total Liabilities | | | 1,039,045 | | | | 534,086 | |

| | | | | | | | | |

| Commitments and Contingencies | | | | | | | | |

| | | | | | | | | |

| Stockholders' Equity | | | | | | | | |

| Common stock, $0.001 par value, 500,000,000 shares authorized; | | | | | | | | |

| 126,740,708 and 126,733,337 shares issued and outstanding | | | 126,741 | | | | 126,733 | |

| Common stock subscribed | | | 1,000 | | | | 982 | |

| Additional paid in capital | | | 896,341 | | | | 833,363 | |

| Deferred compensation | | | (375,000 | ) | | | (450,000 | ) |

| Receivable for issuance of stock | | | (206,980 | ) | | | (167,000 | ) |

| Retained Earnings | | | (118,026 | ) | | | (159,091 | ) |

| Total stockholders' equity | | | 324,076 | | | | 184,987 | |

| Total liabilities and stockholders' equity | | $ | 1,363,121 | | | $ | 719,073 | |

| | | | | | | | |

| See Notes to Financial Statements |

| ATI Modular Technology Corp |

| Statements of Operations |

| (Unaudited) |

| | | For the three months ended | | For the nine months ended |

| | | September 30 | | September 30 |

| | | 2017 | | 2016 | | 2017 | | 2016 |

| | | | | | | | | |

| Revenues - related parties | | $ | 125,000 | | | $ | 125,000 | | | $ | 375,000 | | | $ | 250,000 | |

| Cost of revenues - related parties | | | — | | | | — | | | | — | | | | — | |

| Gross profit | | | 125,000 | | | | 125,000 | | | | 375,000 | | | | 250,000 | |

| | | | | | | | | | | | | | | | | |

| Operating expenses | | | | | | | | | | | | | | | | |

| General and administrative | | | 122,284 | | | | 90,227 | | | | 326,688 | | | | 118,129 | |

| | | | | | | | | | | | | | | | | |

| Net income (loss) from operation | | | 2,716 | | | | 34,773 | | | | 48,312 | | | | 131,871 | |

| | | | | | | | | | | | | | | | | |

| Other Income | | | — | | | | — | | | | — | | | | 3,859 | |

| | | | | | | | | | | | | | | | | |

| Net income (loss) from operation before taxes | | | 2,716 | | | | 34,773 | | | | 48,312 | | | | 135,730 | |

| | | | | | | | | | | | | | | | | |

| Provision for income taxes | | | 408 | | | | 6,245 | | | | 7,247 | | | | 6,245 | |

| | | | | | | | | | | | | | | | | |

| Net income (loss) | | $ | 2,308 | | | $ | 28,528 | | | $ | 41,065 | | | $ | 129,485 | |

| | | | | | | | | | | | | | | | | |

| Earnings (Loss) per common share-basic and diluted | | $ | 0.00 | | | $ | 0.00 | | | $ | 0.00 | | | $ | 0.00 | |

| | | | | | | | | | | | | | | | | |

| Weighted average number of common shares outstanding basic and diluted | | | 126,740,708 | | | | 116,460,383 | | | | 126,739,881 | | | | 116,204,874 | |

| | | | | | | | | | | | | | | | | |

See Notes to Financial Statements

| ATI Modular Technology Corp |

| Statements of Cash Flows |

| (Unaudited) |

| | | | | |

| | | For the Nine Months Ended |

| | | September 30 |

| | | 2017 | | 2016 |

| | | | | |

| Operating Activities | | | | | | | | |

| Net income (loss) of the period | | $ | 41,065 | | | $ | 129,485 | |

| Adjustments to reconcile net loss from operations | | | | | | | | |

| Bad debt expense | | | 49,655 | | | | 15,927 | |

| Depreciation | | | 3,462 | | | | 208 | |

| Shares issued for services | | | — | | | | — | |

| Amortization on deferred compensation | | | 75,000 | | | | — | |

| Changes in Operating Assets and Liabilities | | | | | | | | |

| Accounts receivable | | | (687,284 | ) | | | (316,892 | ) |

| Other receivables | | | 64,269 | | | | — | |

| Advances to officers | | | — | | | | (130,311 | ) |

| Accounts payable and accrued expenses | | | (182,286 | ) | | | 3,699 | |

| Due to related parties | | | — | | | | 8,509 | |

| Deposit from customers | | | — | | | | — | |

| Income tax payable | | | | | | | 6,245 | |

| Deferred revenue | | | 680,000 | | | | 250,000 | |

| Income tax payable | | | 7,246 | | | | — | |

| Net cash provided by (used in) operating activities | | | 51,127 | | | | (50,148 | ) |

| | | | | | | | | |

| Investing Activities | | | | | | | | |

| Purchase of fixed assets | | | (861 | ) | | | (4,156 | ) |

| Net cash used in investing activities | | | (861 | ) | | | (4,156 | ) |

| | | | | | | | | |

| Financing Activities | | | | | | | | |

| Proceeds from issuance of stock | | | 23,022 | | | | 140,118 | |

| Net cash provided by financing activities | | | 23,022 | | | | 140,118 | |

| | | | | | | | | |

| Net increase (decrease) in cash and equivalents | | | 73,288 | | | | 85,814 | |

| | | | | | | | | |

| Cash and equivalents at beginning of the period | | | 94,266 | | | | — | |

| Cash and equivalents at end of the period | | $ | 167,554 | | | $ | 85,814 | |

| | | | | | | | | |

| Supplemental cash flow information: | | | | | | | | |

| Interest paid | | $ | — | | | $ | — | |

| Income taxes paid | | $ | — | | | $ | — | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

See Notes to Financial Statements

ATI Modular Technology Corp.

Notes to Financial Statements

(Unaudited)

NOTE 1. ORGANIZATION AND DESCRIPTION OF BUSINESS

ATI Modular Technology Corp., defined above and herein as the “Company” formerly Global Recycle Energy, Inc., was incorporated under the laws of the State of Nevada on March 7, 2008. The Company is engaged in the development and the exporting of modular energy efficient technology and processes that allow government and private enterprises in China to use US-based methods for creating modular spaces, facilities, and properties. As with any business plan that is aspirational in nature, there is no assurance we will be able to accomplish all our objective or that we will be able to meet our financing needs to accomplish our objectives.

The Company is an operating company engaged in the development and the exporting of modular energy efficient and smart technology and processes that allow government and private enterprises in China and elsewhere to use US-based methods for creating modular spaces, facilities, and properties. The Company is in the business of all aspects of modular and smart construction, including but not limited to, (a) the furtherance of modular and smart construction technology, education, development and production in developed and undeveloped countries, (b) acquisition and/or installation of construction equipment, materials, furnishings, hardware, insulation, flooring, roofing, wiring, plumbing, heating and air conditioning, and landscaping, and (c) other businesses directly or tangentially related to these lines of services, including assisting businesses and entrepreneurs in securing naming, licensing or promotional rights, driving internet and media traffic, increasing visibility of product and name recognition, and other services.

Our principal executive offices are located at 4700 Homewood Court, Suite 100 in Raleigh, North Carolina. We are registered as a foreign business entity in the State of North Carolina. We lease the office space from Yilaime Corporation, a Nevada corporation doing business in North Carolina, and a related party to the Company, as set forth below. Our physical location for our operations in China along with a manufacturing facility is Anhui Province Jiangnan Industrial Concentration Zone New Energy Industry Park A1, A2, A5 Plant Chizhou City, Anhui Province, China. The Company has registering its wholly owned subsidiary Anhui Ao De Xin Modular Building Technology Co. Ltd. in Jiangnan Industry Zone, Chizhou, China.

The Company entered an Investment and Cooperation Agreement with the Jiangnan Industry Zone in Anhui Province, China dated September 8, 2016 (the “Jiangnan Cooperation Agreement”). On December 28, 2016, the Company entered the definitive agreement, American ATI Modular Technology Company Project Investment Agreement (the “Investment Agreement”) with the Administrative Committee, Jiangnan Industry Zone in Anhui Province. The Investment Agreement superseded the Jiangnan Cooperation Agreement. Under the Investment Agreement, the Administrative Committee of Jiangnan Industrial Concentration Zone of Anhui Province (hereinafter, “Jiangnan”) and the Company have agreed to the construction of the Company’s green, modular building and related technology under the project name “Modular Plant Production Base.”

Under the Investment Agreement, the Company has agreed to manufacture and install modular buildings, and provide research into the development of green building module manufacturing using US based technology. The Company has agreed to provide appropriate technology and intelligent systems in providing modular building lifecycle services. In addition, to modular and smart technology, the Company and Jiangnan has agreed to establish: 1) a modular development institute research and training center; 2) an entrepreneurial incubator; 3) an engineering technology research center; 4) an industrial design center; 5) a post-doctoral workstations and engineering laboratories; and 6) an international student intern summer work program. Where possible the Company’s aim is to increase US exports by using American based technology, equipment and services. (Strategy).

The Company presented to Anhui Project to United States Ex-Im Bank, which provided a Letter of Interest in providing support for the Project. Additionally, pursuant to its agreement with Chizhou government, Chizhou preliminarily agreed to provide support for EX-IM funding either by a guarantee or local bank support. Although no loan application has been submitted management is under the impression that subject to meeting Ex-Im Bank’s standard underwriting requirements, there is a possibility of loans, and other funding including working capital and insurance. Going forward, we plan on working with Ex-Im to seek insurance and funding for the Chizhou operations. There is no assurance that funding and or insurance will be obtained.

The Company entered the Modular Services Agreement with AmericaTowne, a related party and the majority and controlling shareholder of the Company, to support AmericaTowne’s obligations under the Shexian Agreement in designing, installing and manufacturing American modular technology for use in all government and private buildings throughout Shexian County, and elsewhere in China. The terms and conditions of the Modular Services Agreement with AmericaTowne and the Shexian Agreement are set forth above.

Also, the Company has entered the Yongan and Shexian Agreements to pursue the development of business opportunities involving modular technology and investments, and business development. While we plan to have robust operations in the United States and international locations, we expect the bulk of our operations and revenue will come from China.

China's economy and its government impact our revenues and operations. While the Company has an agreement in place with the government of Jiangnan as well as the approval by government officials in Shexian and Yongan China to operate facilities there is no assurance that we will operate the facilities successfully. Additionally, the Company will need government approval in other locations in China to operate other aspects of our business plan. There is no assurance that we will be successful in obtaining approvals from government entities in other locations to operate other aspects of our business plan. Finally, Mr. Perkins, as a control person of each entity – AmericaTowne and the Company, might elect to forego certain obligations of AmericaTowne under other Corporative Agreements currently in place or not enter more definitive agreements with Governments in China and elsewhere, which in turn, could impact the Company’s ability to meet its business plan set forth herein.

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

These financial statements have been prepared in accordance with generally accepted accounting principles in the United States of America ("U.S. GAAP”).

Interim Financial Statements

These interim unaudited financial statements have been prepared in accordance with accounting principles generally accepted in the United States for interim financial information. They do not include all the information and footnotes required by generally accepted accounting principles for complete financial statements. Therefore, these financial statements should be read in conjunction with the Company's audited financial statements and notes thereto contained in its report on Form 10-K for the transition period ended December 31, 2016.

The financial statements included herein are unaudited; however, they contain all normal recurring accruals and adjustments that, in the opinion of management, are necessary to present fairly the Company's financial position at September 30, 2017, and the results of its operations and cash flows for the nine months ended September 30, 2017. The results of operations for the period ended September 30, 2017 are not necessarily indicative of the results to be expected for future quarters or the full year.

Accounting Method

The Company's financial statements are prepared using the accrual method of accounting. The Company has elected a fiscal year ending on December 31.

Use of Estimates

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. In the opinion of management, all adjustments necessary in order to make the financial statements not misleading have been included. Actual results could differ from those estimates.

Financial Instruments

The carrying amount reported in the balance sheet for cash, accounts receivable, accounts payable, accrued expenses, interest payable and short-term notes payable approximate fair value because of the immediate or short term maturity of these financial instruments.

Cash Equivalents

The Company considers all highly liquid investments with maturity of three months or less when purchased to be cash equivalents.

Accounts Receivable

Accounts' receivable are stated at the amount management expects to collect from outstanding balances. Management provides for probable uncollected amounts through a charge to earnings and a credit to an allowance for bad debts based on its assessment of the current status of individual accounts. Balances that are still outstanding after management has used reasonable collection efforts are written off through a charge to the allowance for bad debts and a credit to accounts receivable.

Our bad debt policy is determined by the Company's periodic review of each account receivable for reasonable assurance of collection. Factors considered are the customer's financial condition, past payment history if any, any conversations with the customer about the customer's financial conditions and any other extenuating circumstances. Based upon the above factors the Company makes a determination whether the receivable are reasonable.

Concentration of Credit Risk

Financial instruments that potentially subject the Company to a significant concentration of credit risk consist primarily of cash and cash equivalents. The Company maintains deposits in federally insured financial institutions in excess of federally insured limits. However, management believes the Company is not exposed to significant credit risk due to the financial position of the depository institutions in which those deposits are held.

Property, Plant, and Equipment

Property, plant and equipment are initially recognized recorded at cost. Gains or losses on disposals are reflected as gain or loss in the period of disposal. The cost of improvements that extend the life of plant and equipment are capitalized. These capitalized costs may include structural improvements, equipment and fixtures. All ordinary repairs and maintenance costs are expensed as incurred.

Depreciation for financial reporting purposes is provided using the straight-line method over the estimated useful lives of the assets:

For the nine months ended September 30, 2017 and 2016 depreciation expense is $3,462 and $208, respectively

Income Taxes

Income taxes are provided in accordance with Statement of Financial Accounting Standards ASC 740 Accounting for Income Taxes. A deferred tax asset or liability is recorded for all temporary differences between financial and tax reporting and net operating loss carry forwards. Deferred tax expense (benefit) results from the net change during the year of deferred tax assets and liabilities. Deferred tax assets are reduced by a valuation allowance when, in the opinion of management, it is more likely than not that some portion of all the deferred tax assets will be realized. Deferred tax assets and liabilities are adjusted for the effects of changes in tax laws and rates on the date of enactment.

The Company was established under the laws of the State of Nevada and is subject to U.S. federal income tax and Nevada state income tax, if any. Deferred income tax assets and liabilities are computed for differences between the financial statement and tax bases of assets and liabilities that will result in future taxable or deductible amounts and are based on enacted tax laws and rates applicable to the periods in which the differences are expected to affect taxable income. Valuation allowances are established when necessary to reduce deferred income tax assets to the amount expected to be realized.

Earnings per Share

In February 1997, the FASB issued ASC 260, "Earnings per Share", which specifies the computation, presentation and disclosure requirements for earnings (loss) per share for entities with publicly held common stock. ASC 260 supersedes the provisions of APB No. 15, and requires the presentation of basic earnings (loss) per share and diluted earnings (loss) per share. The Company has adopted the provisions of ASC 260 effective (inception).

Basic earnings or net loss per share amounts are computed by dividing the net income or loss by the weighted average number of common shares outstanding. Diluted earnings per share are the same as basic earnings per share due to the lack of dilutive items in the Company.

At September 30, 2017 and December 31, 2016, no potentially dilutive shares were outstanding.

Impact of New Accounting Standards

The Company does not expect the adoption of recently issued accounting pronouncements to have a significant impact on the Company's results of operations, financial position, or cash flow.

Revenue Recognition

The Company's revenue recognition policies comply with FASB ASC Topic 605. The Company follows paragraph 605-10-S99-1 of the FASB Accounting Standards Codification for revenue recognition. The Company will recognize revenue when it is realized or realizable and earned. The Company considers revenue realized or realizable and earned when all the following criteria are met: (i) persuasive evidence of an arrangement exists,

(ii) the product has been shipped or the services have been rendered to the customer, (iii) the sales price is fixed or determinable, and (iv) collectability is reasonably assured.

The Company does not provide unconditional right of return, price protection or any other concessions to its customers.

There were no sales returns and allowances from inception to September 30, 2017.

NOTE 3. GOING CONCERN

The Company's financial statements are prepared using accounting principles generally accepted in the United States of America applicable to a going concern that contemplates the realization of assets and liquidation of liabilities in the normal course of business.

The Company is still in development stage and has not created sufficient revenue to cover any operating losses it may incur. Management's plans include the raising of capital through the equity markets to fund future operations, seeking additional acquisitions, and generating of revenue through our business. However, there can be no assurances the Company will be successful in its efforts to secure additional equity financing and obtaining sufficient revenue producing contracts. These factors raise substantial doubt about the Company's ability to continue as a going concern. The financial statements do not include any adjustments relating to the recoverability and classification of recorded asset amounts, or amounts and classification of liabilities that might result from this uncertainty.

NOTE 4. ACCOUNT RECEIVABLES – RELATED PARTIES

The nature of the accounts receivable for September 30, 2017 in the amount of $1,154,089 are for modular construction and technology services and utilization of anticipated modular construction technology by ATI pursuant to the Modular Construction & Technology Services Agreement between ATI and the Company dated June 28, 2016 (hereinafter, the “ATI Services Agreement”) and for the Sales and Support Services Agreement with Yilaime on June 27, 2016 (the “Yilaime Services Agreement”). On September 30, 2017, the Company's allowance for bad debt is $57,705 which provides a net receivable balance of $1,096,384.

Accounts receivable consist of the following:

| | | Sept 30

2017 | | Dec 31

2016 |

| | | | | |

| Accounts receivable related parties | | | 1,154,089 | | | | 482,900 | |

| Less: Allowance for doubtful accounts | | | (57,705 | ) | | | (24,145 | ) |

| Accounts receivable, net | | $ | 1,096,384 | | | $ | 458,755 | |

Bad debt expense was $49,655 and $15,927 for the nine months ended September 30, 2017 and 2016, respectively.

NOTE 5. DEFERRED REVENUE

The Company receives $250,000 quarterly fee from Yilaime for Sales and Support Services Agreement. In accordance with ASC 605-50-45, the Company defers and recognizes as a reduction to the future costs for quarterly fee. For the nine months September 30, 2017, $750,000 fee from exclusive agreement incurred; $1,004,387 is booked deferred revenue as current liability on September 30, 2017 and $70,000 went against cost charged by Yilaime.

NOTE 6. SHAREHOLDER'S EQUITY

The stockholders' equity section of the Company contains the following classes of capital stock as of September 30, 2017:

Common stock, $ 0.001 par value: 500,000,000 shares authorized; 126,740,708 shares issued and outstanding;

Preferred stock, none: 0 shares authorized; but not issued and outstanding.

NOTE 7. STOCK BASED COMPENSATION

The Company entered into an employment lock-up agreement on July 1, 2016 with Alton Perkins to serve as the Chairman of the Board, President, Chief Executive Officer, Chief Financial Officer and Secretary. The term of Mr. Perkins' agreement is five years with the Company retaining an option to extend in one-year periods. In consideration for Mr. Perkins' services, the Company has agreed to issue to his designee, the Alton & Xiang Mei Lin Perkins Family Trust, 10,000,000 shares of common stock. The Company may elect in the future to include money compensation to Mr. Perkins or his designee for his services provided there is sufficient cash flow.

For the nine months ended September 30, 2017, $75,000 of stock compensation was charged to operating expenses and $375,000 was recorded as deferred compensation on September 30, 2017.

NOTE 8. RELATED PARTIES TRANSACTIONS

The Company intends on relying on other businesses controlled by our sole director and officer, and beneficial owner of the majority shares of common stock in the Company – Alton Perkins, in implementing its business plan.

Mr. Perkins is the control person of Yilaime Corporation, AmericaTowne and AXP Holding Corporation. At this time, the purpose of the Company is to service the construction and related technology needs of AmericaTowne under AmericaTowne’s agreements with the Shexian County Investment Promotion Bureau in developing an AmericaTowne community in the Hanwang mountains in Shexian, China. The Company also intends on supporting these services in other AmericaTowne ventures at the invitation of the Xiamen Longyan City Chamber of Commerce, Xiamen/Longyan China and the Xiamen City Growth Planning Agency in developing an AmericaTowne Community and an International School in Longyan County China.

The related export services rendered to the Company in the implementation of its business plan cannot be provided by AmericaTowne or through the AmericaTowne relationship. In order to avoid conflicts of interest, Mr. Perkins is of the opinion that there must be a separate and distinct agreement between, in this case, the Company and AXP Holding Corporation. Furthermore, although other similar IC-DISC entities exist, the Company is able to obtain better terms and conditions from AXP Holding Corporation in light of Mr. Perkins’ control of AXP Holding Corporation.

AmericaTowne’s Board of Directors determined that operating and controlling a separate but related entity focused on the development and the exporting of modular energy efficient technology and processes for government and private enterprises in China would be more prudent from a risk mitigation and operational standpoint than providing these services under the AmericaTowne business plan. Furthermore, the intent of the Company is to expand its services and relationships to other similar endeavors in projects not related to AmericaTowne, thus the need to maintain and operate a separate entity.

Cooperative Agreement (Shexian County Government, China)

The Company’s majority and controlling shareholder – AmericaTowne, is a party under the Cooperative Agreement with the Shexian County Investment Promotion Bureau (the “Shexian Agreement”). Under the Shexian Agreement, AmericaTowne and the Shexian County Bureau have agreed to a partnership in furthering the development of an AmericaTowne community in the Hanwang mountains. Although not definitive at this time, the parties have agreed that, in consideration for AmericaTowne’s investment of approximately $30,000,000 into the development, plus any additional tax paid to the local government, where applicable, the Shexian County Bureau will dedicate local resources, including land (which AmericaTowne would be required to obtain rights through local bid invitation), and participation with AmericaTowne in an agreed upon equity split through a future definitive agreement.

The Company will be providing construction and technology services to AmericaTowne in facilitating AmericaTowne’s obligations under the Shexian Agreement. The Company’s ability to generate revenue under its agreement with AmericaTowne could be impaired in the event AmericaTowne is not able to meet its obligations under the Shexian Agreement. Furthermore, Mr. Perkins, as a control person of each entity, might elect to forego certain obligations of AmericaTowne under the Shexian Agreement or not enter into a more definitive agreement with the Shexian County Bureau, which in turn, could impact the Company’s ability to meet its business plan set forth herein.

Sales and Support Services Agreement (Yilaime Corporation)

On June 27, 2016, we entered into a Sales and Support Services Agreement with Yilaime Corporation, a Nevada corporation (“Yilaime”). Yilaime is controlled by Alton Perkins, who is our sole director and officer. Yilaime, and another related-party – Yilaime Corporation of NC, Inc. (“Yilaime NC”), are the holders of the majority of issued and outstanding shares of common stock in AmericaTowne, Inc. (“ATI”), a Delaware corporation and fully-reporting company with the United States Securities and Exchange Commission (the “SEC”). Mr. Perkins is also the Trustee of the Alton & Xiang Mei Lin Perkins Family Trust (“Perkins Trust”) and the AXP Nevada Asset Protection Trust 1 (“AXP”), which holds 5,100,367 and 120,000 shares, respectively, of the issued and outstanding common stock in ATI. Mr. Perkins is the beneficial owner of 20,674,484 shares of ATI, which equals 90.11% of issued and outstanding shares. Mr. Perkins is the beneficial owner of the majority and controlling interest in the Company through his direct holdings, and beneficial holdings through Yilaime, AXP and the Perkins Trust. ATI, Perkins Trust and Mr. Perkins beneficially own 110,117,593 shares, or 86%, of the Company’s common stock.

Under the Services Agreement, Yilaime will provide the Company with marketing, sales and support services in the Company’s pursuit of ATI Modular business in China in consideration of a commission equal to 10% of the gross amount of monies procured for the Company through Yilaime’s services. In consideration of the right to receive this commission, Yilaime has agreed to pay the Company a quarterly fee of $250,000 starting on July 1, 2016. The Services Agreement is set to expire on June 10, 2020, absent early termination for breach thereof by either party. Yilaime retains an option to extend the term under its sole discretion until June 10, 2025 by providing written notice to the Company by March 10, 2019. Yilaime has agreed to be the Company’s exclusive independent contractor in providing the services in the Services Agreement, and has agreed to a non-compete and non-circumvent agreement.

Yilaime is obligated to provide support services only in a manner that is deemed commercially acceptable by Yilaime and Yilaime has the sole right to determine the means, manner and method by which services will be provided and at the time and location of its choosing. Furthermore, as the control person of Yilaime, Mr. Perkins might make decisions he deems are in the best interests of Yilaime, which might be to the detriment of the goals and objectives of the Company.

Modular Construction & Technology Services Agreement (AmericaTowne)