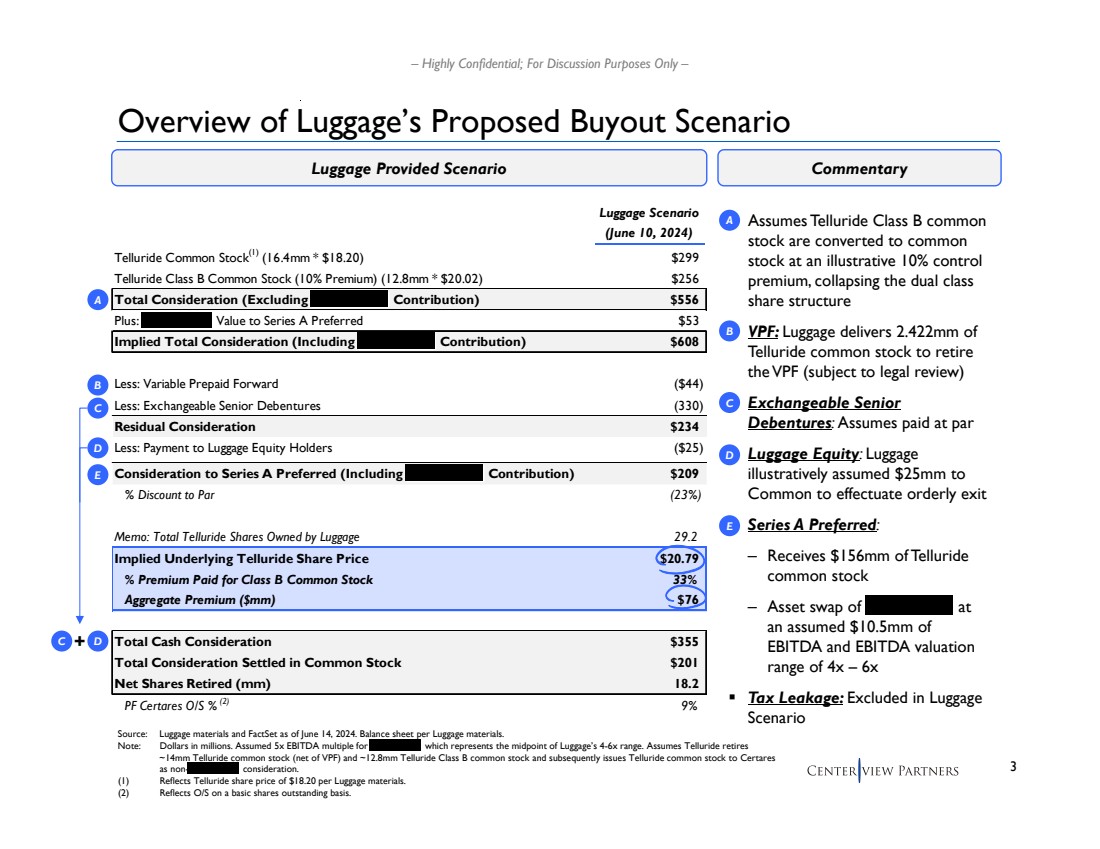

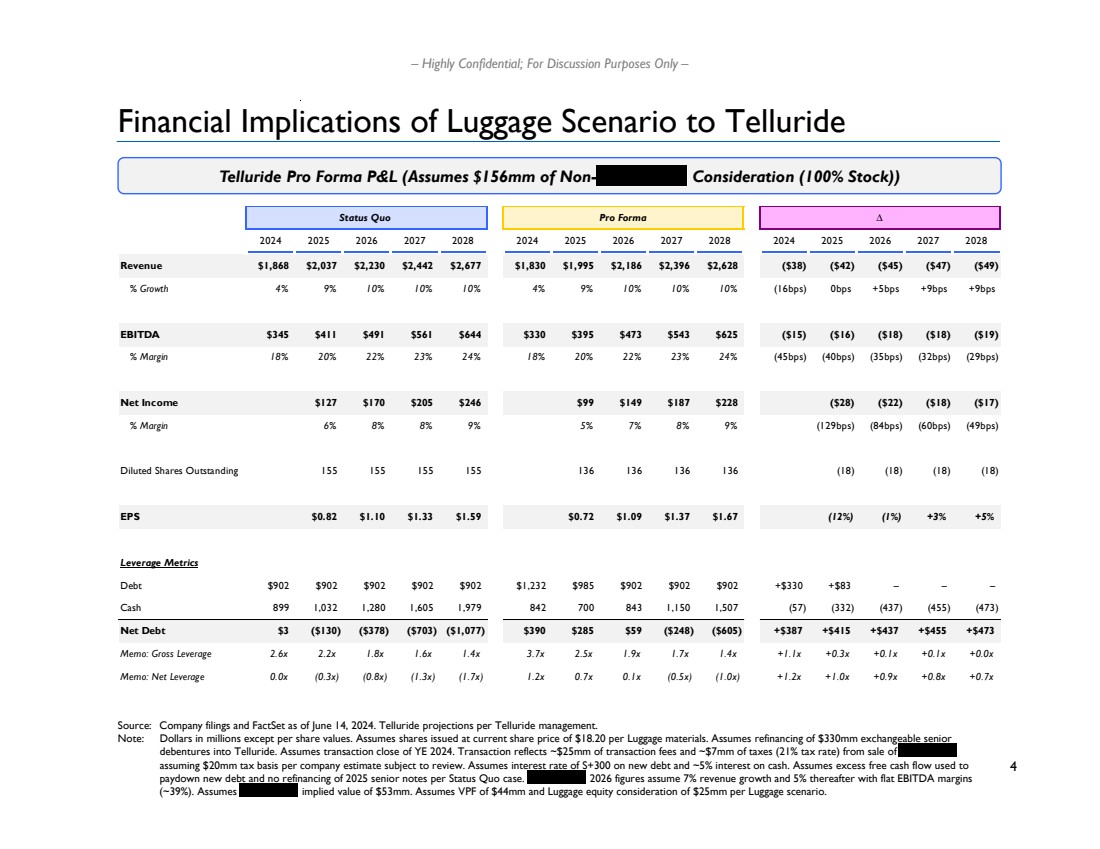

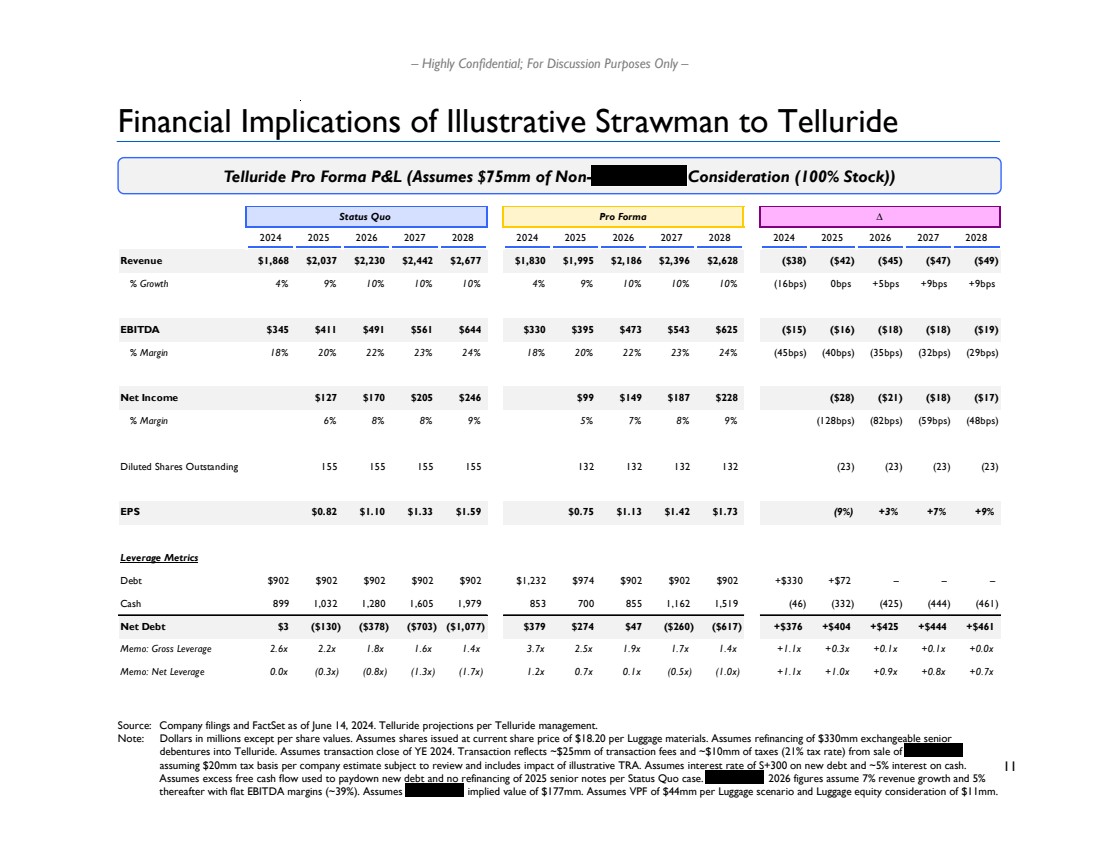

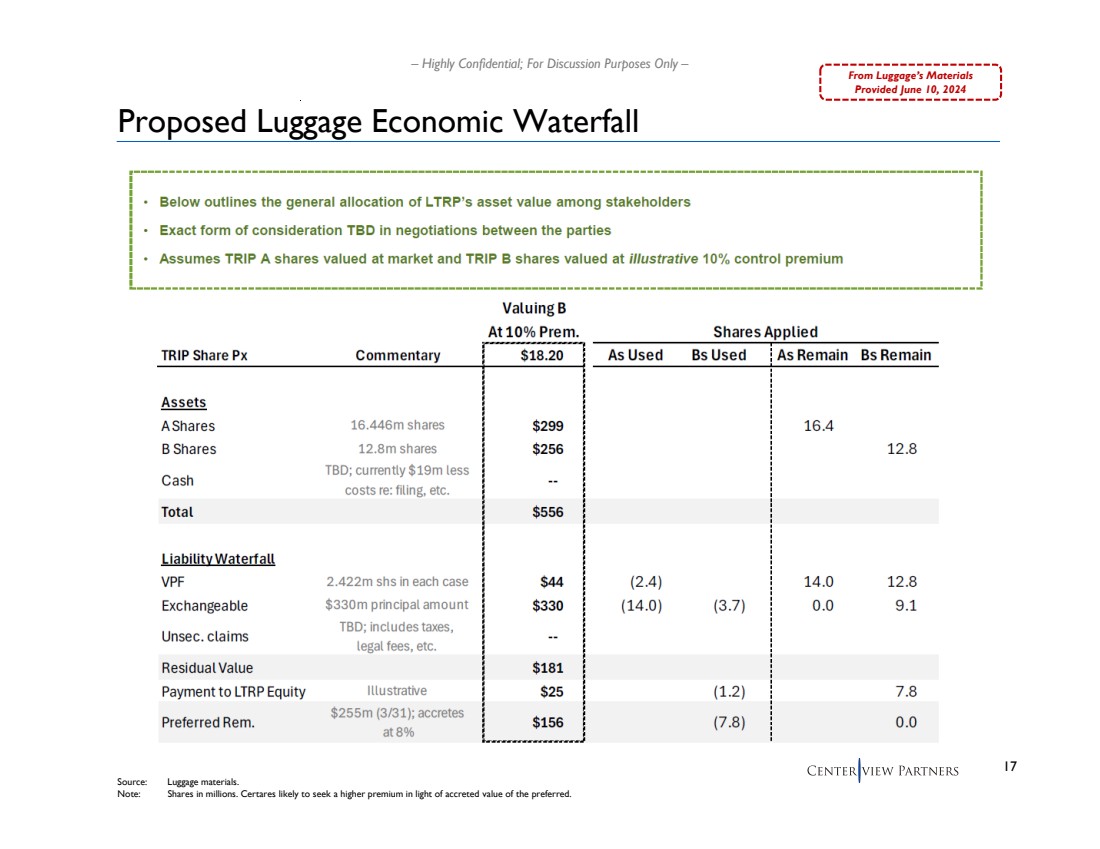

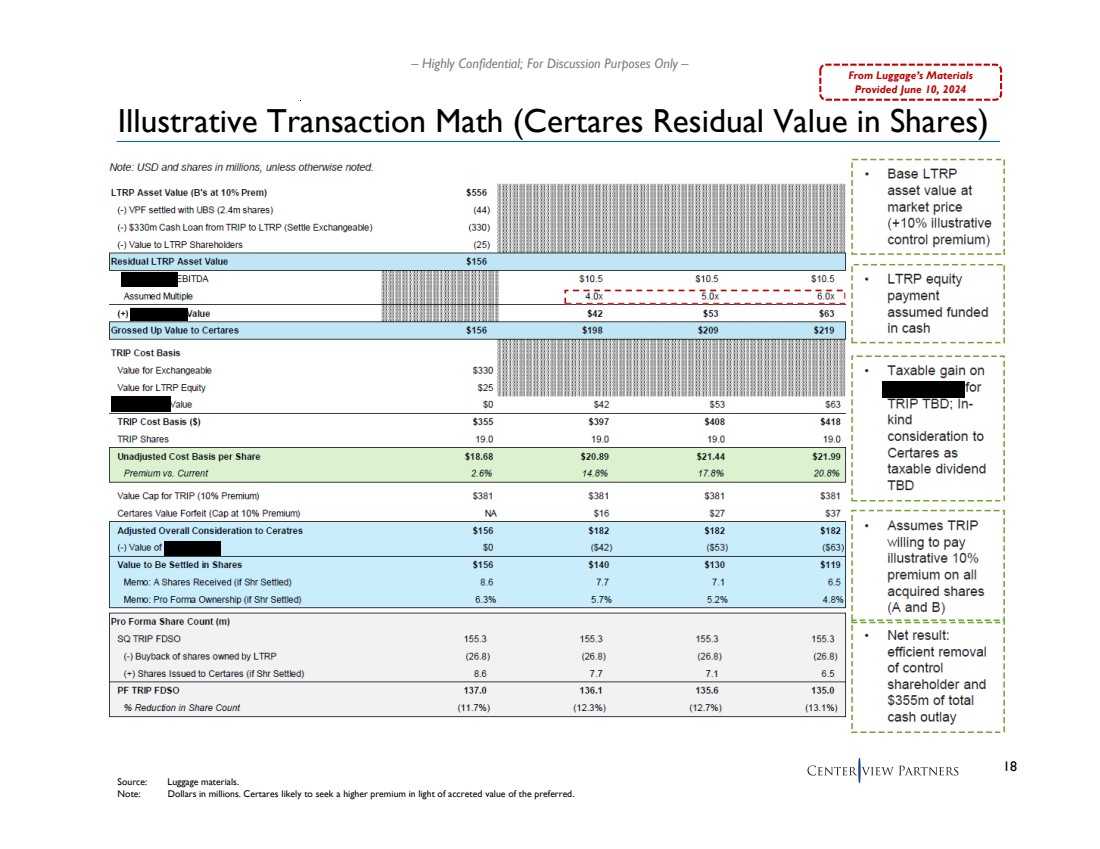

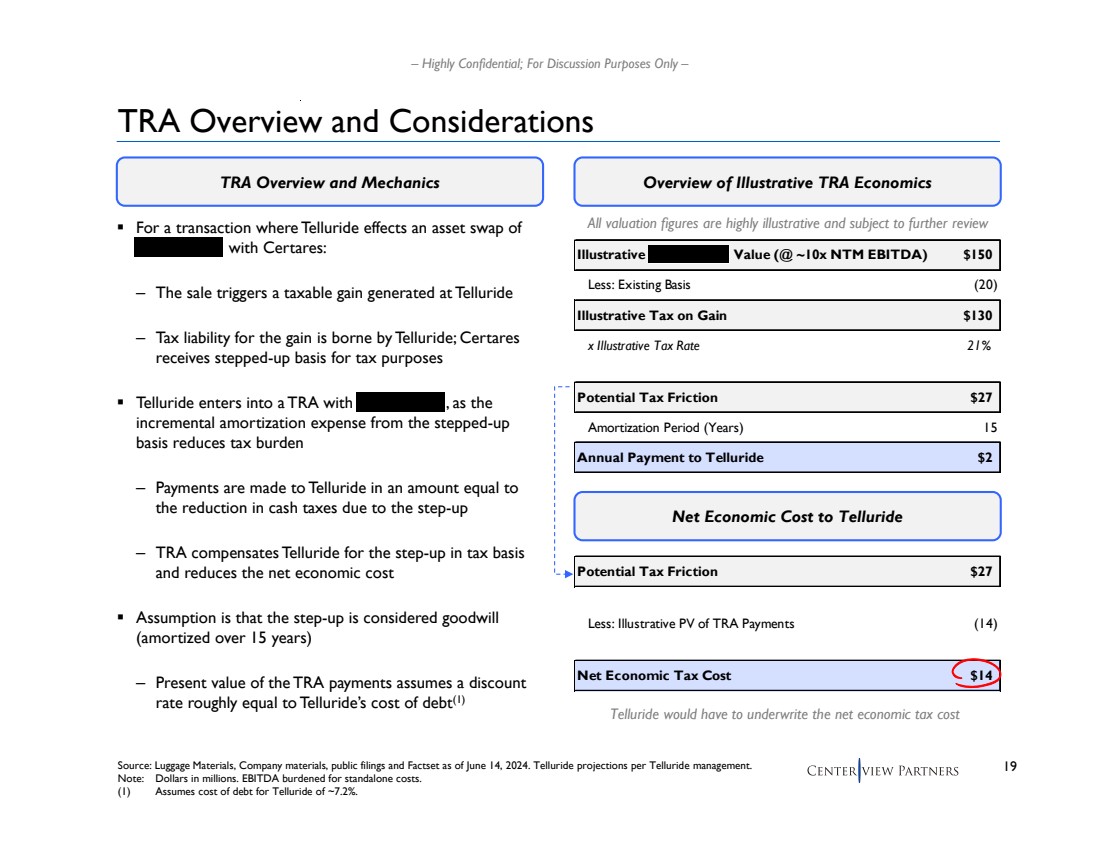

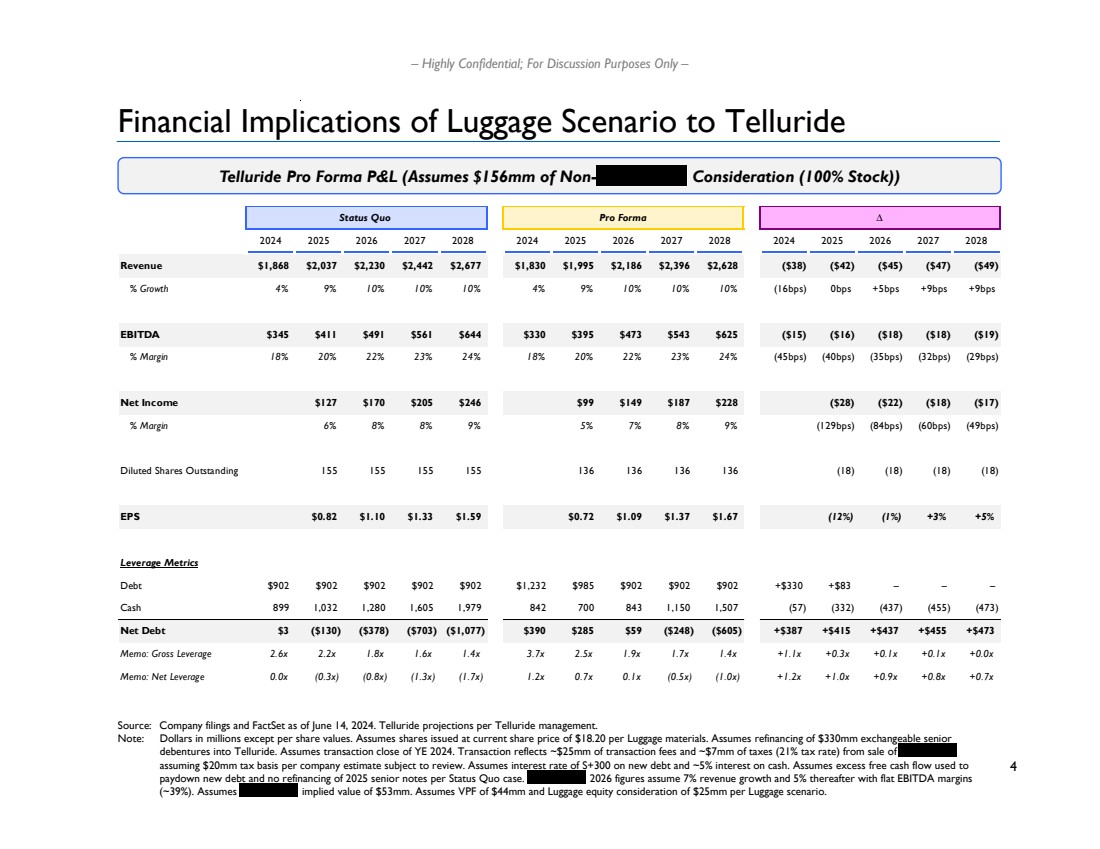

| 4 – Highly Confidential; For Discussion Purposes Only – Financial Implications of Luggage Scenario to Telluride Source: Company filings and FactSet as of June 14, 2024. Telluride projections per Telluride management. Note: Dollars in millions except per share values. Assumes shares issued at current share price of $18.20 per Luggage materials. Assumes refinancing of $330mm exchangeable senior debentures into Telluride. Assumes transaction close of YE 2024. Transaction reflects ~$25mm of transaction fees and ~$7mm of taxes (21% tax rate) from sale of assuming $20mm tax basis per company estimate subject to review. Assumes interest rate of S+300 on new debt and ~5% interest on cash. Assumes excess free cash flow used to paydown new debt and no refinancing of 2025 senior notes per Status Quo case. 2026 figures assume 7% revenue growth and 5% thereafter with flat EBITDA margins (~39%). Assumes implied value of $53mm. Assumes VPF of $44mm and Luggage equity consideration of $25mm per Luggage scenario. Telluride Pro Forma P&L (Assumes $156mm of Non- Consideration (100% Stock)) Status Quo Pro Forma ∆ 2024 2025 2026 2027 2028 2024 2025 2026 2027 2028 2024 2025 2026 2027 2028 Revenue $1,868 $2,037 $2,230 $2,442 $2,677 $1,830 $1,995 $2,186 $2,396 $2,628 ($38) ($42) ($45) ($47) ($49) % Growth 4% 9% 10% 10% 10% 4% 9% 10% 10% 10% (16bps) 0bps +5bps +9bps +9bps EBITDA $345 $411 $491 $561 $644 $330 $395 $473 $543 $625 ($15) ($16) ($18) ($18) ($19) % Margin 18% 20% 22% 23% 24% 18% 20% 22% 23% 24% (45bps) (40bps) (35bps) (32bps) (29bps) Net Income $127 $170 $205 $246 $99 $149 $187 $228 ($28) ($22) ($18) ($17) % Margin 6% 8% 8% 9% 5% 7% 8% 9% (129bps) (84bps) (60bps) (49bps) Diluted Shares Outstanding 155 155 155 155 136 136 136 136 (18) (18) (18) (18) EPS $0.82 $1.10 $1.33 $1.59 $0.72 $1.09 $1.37 $1.67 (12%) (1%) +3% +5% Leverage Metrics Debt $902 $902 $902 $902 $902 $1,232 $985 $902 $902 $902 +$330 +$83 – – – Cash 899 1,032 1,280 1,605 1,979 842 700 843 1,150 1,507 (57) (332) (437) (455) (473) Net Debt $3 ($130) ($378) ($703) ($1,077) $390 $285 $59 ($248) ($605) +$387 +$415 +$437 +$455 +$473 Memo: Gross Leverage 2.6x 2.2x 1.8x 1.6x 1.4x 3.7x 2.5x 1.9x 1.7x 1.4x +1.1x +0.3x +0.1x +0.1x +0.0x Memo: Net Leverage 0.0x (0.3x) (0.8x) (1.3x) (1.7x) 1.2x 0.7x 0.1x (0.5x) (1.0x) +1.2x +1.0x +0.9x +0.8x +0.7x |