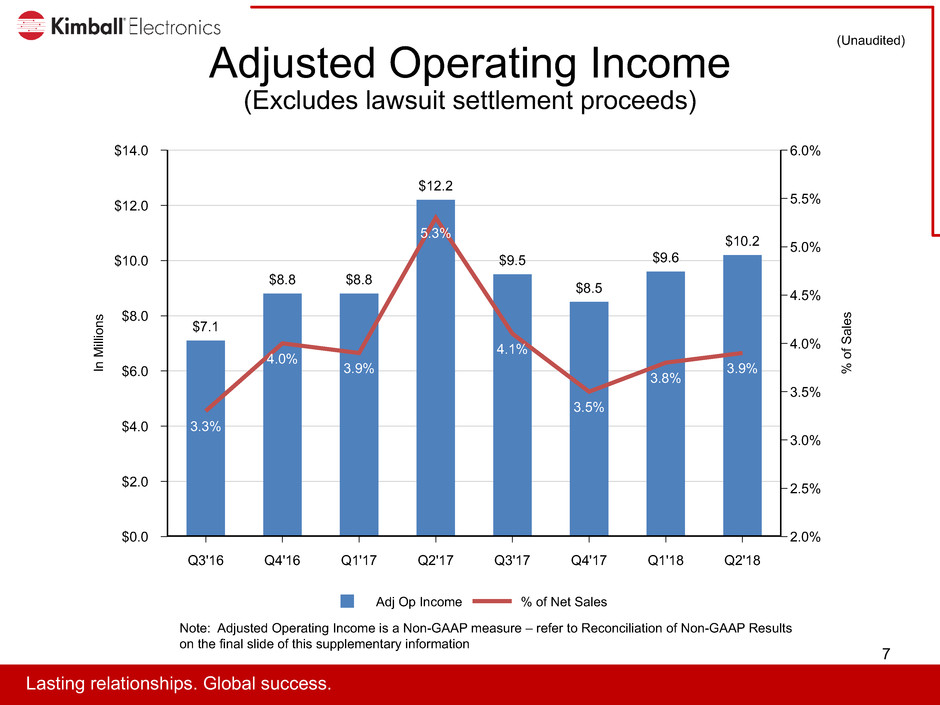

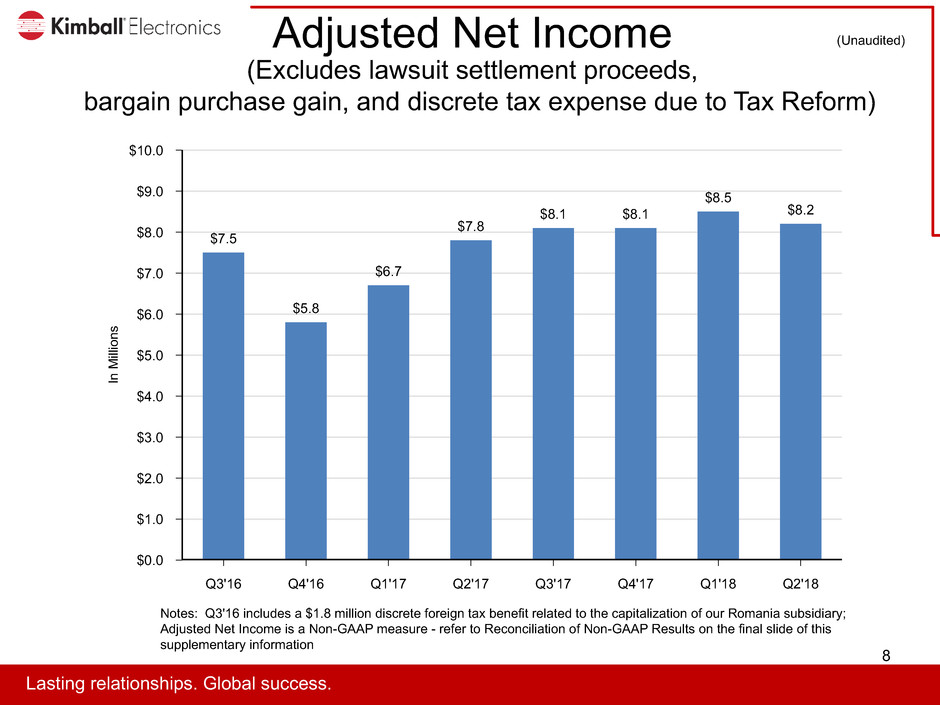

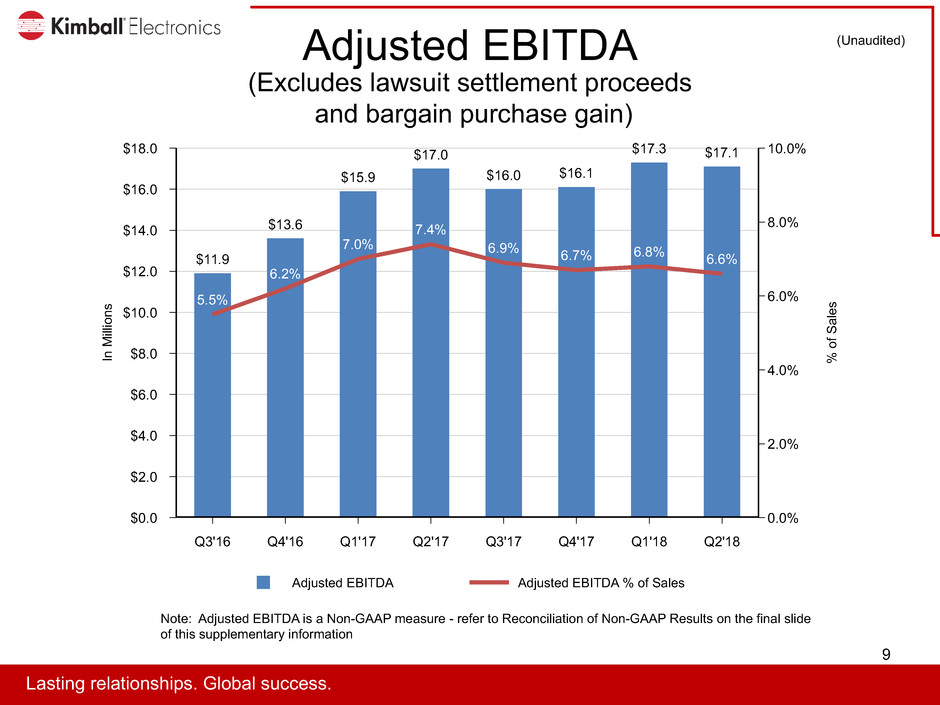

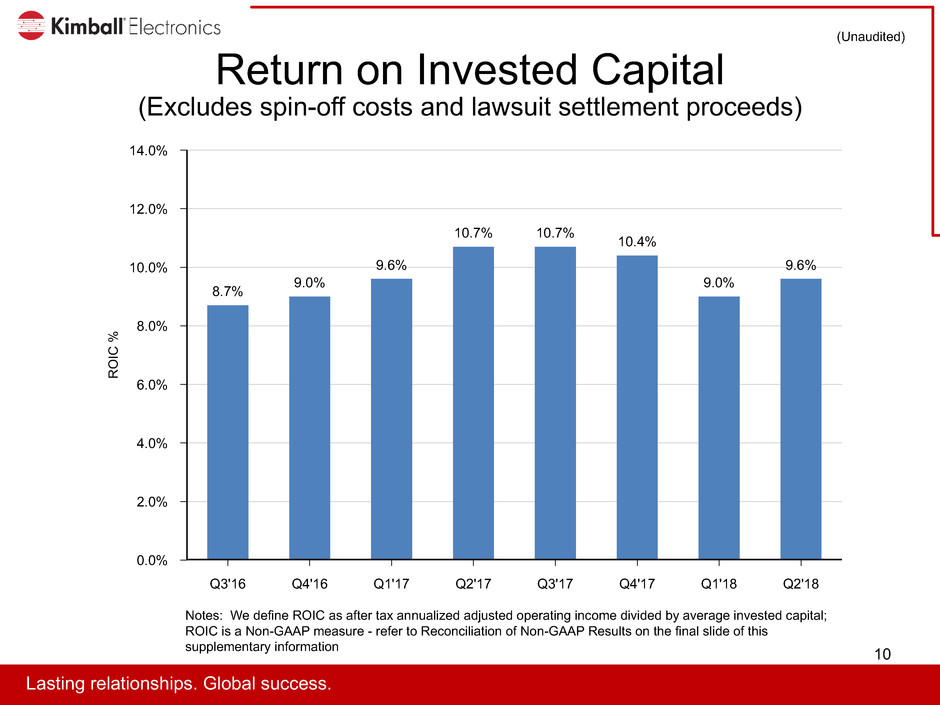

Lasting relationships. Global success.Lasting relationships. Global success. Safe Harbor Statement Certain statements contained within this supplementary information and any statements made during our earnings conference call today may be considered forward-looking under the Private Securities Litigation Reform Act of 1995 and are subject to risks and uncertainties including, but not limited to, successful integration of acquisitions and new operations, global economic conditions, geopolitical environment, significant reductions in volumes and order patterns from key contract customers, loss of key customers or suppliers, financial stability of key customers and suppliers, availability or cost of raw materials, and increased competitive pricing pressures reflecting excess industry capacities. Additional cautionary statements regarding other risk factors that could have an effect on the future performance of Kimball Electronics, Inc. (the “Company”) are contained in the Company’s Annual Report on Form 10-K for the fiscal year ended June 30, 2017, our earnings release, and other filings with the Securities and Exchange Commission (the “SEC”). This supplementary information contains non-GAAP financial measures. A non-GAAP financial measure is a numerical measure of a company’s financial performance that excludes or includes amounts so as to be different than the most directly comparable measure calculated and presented in accordance with Generally Accepted Accounting Principles (GAAP) in the United States in the statement of income, statement of comprehensive income, balance sheet, statement of cash flows, or statement of equity of the company. The non-GAAP financial measures contained herein include Adjusted Operating Income, Adjusted Net Income, Adjusted EBITDA, and Return on Invested Capital (ROIC), which have been adjusted for spin-off expenses, proceeds from a lawsuit settlement, a bargain purchase gain, and discrete tax expense related to Tax Reform. Management believes it is useful for investors to understand how its core operations performed without the effects of incremental costs related to the spin-off, the lawsuit proceeds, the bargain purchase gain, and discrete tax expense related to Tax Reform. Excluding these amounts allows investors to meaningfully trend, analyze, and benchmark the performance of the Company’s core operations. Many of the Company’s internal performance measures that management uses to make certain operating decisions use these and other non-GAAP measures to enable meaningful trending of core operating metrics. 2

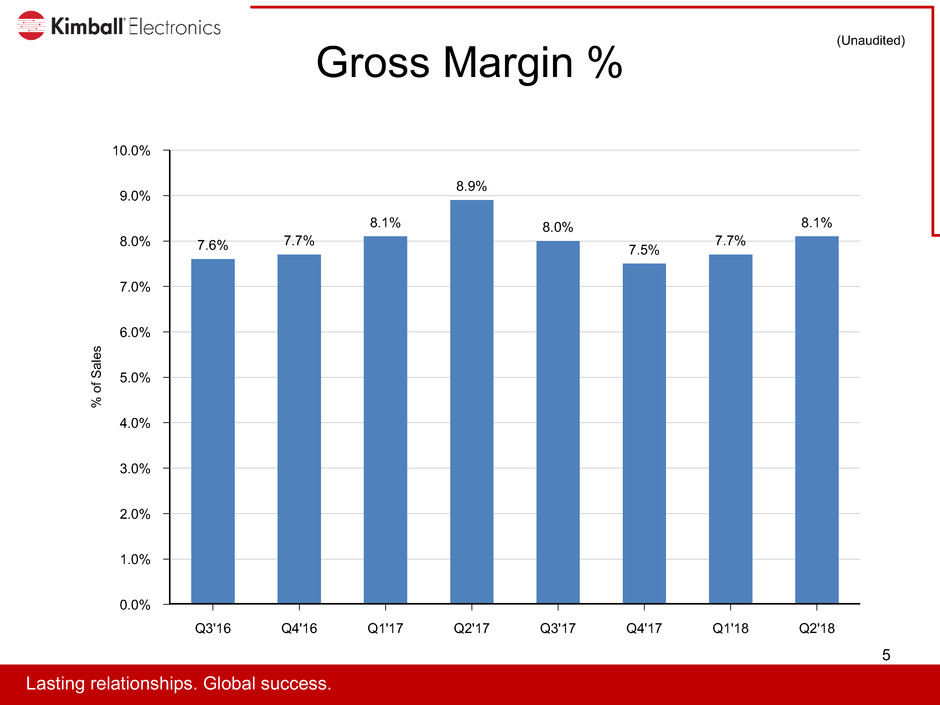

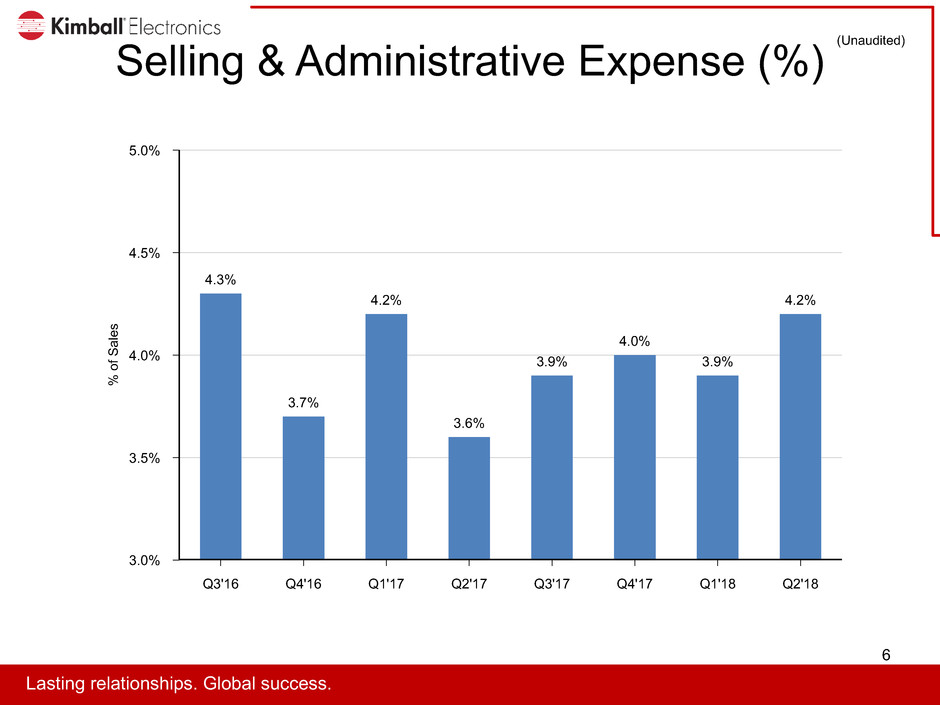

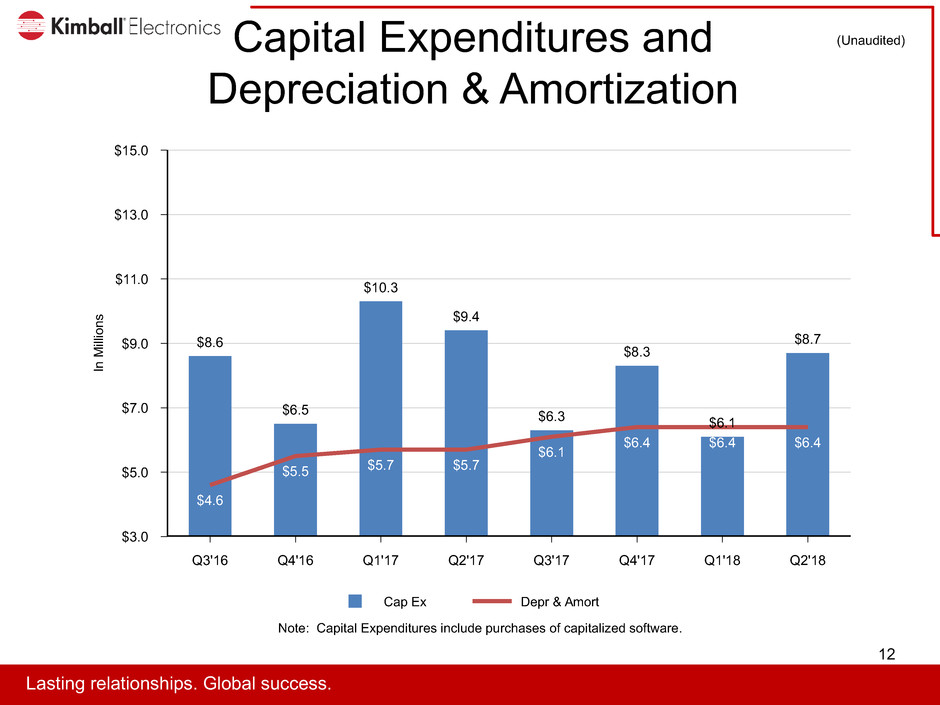

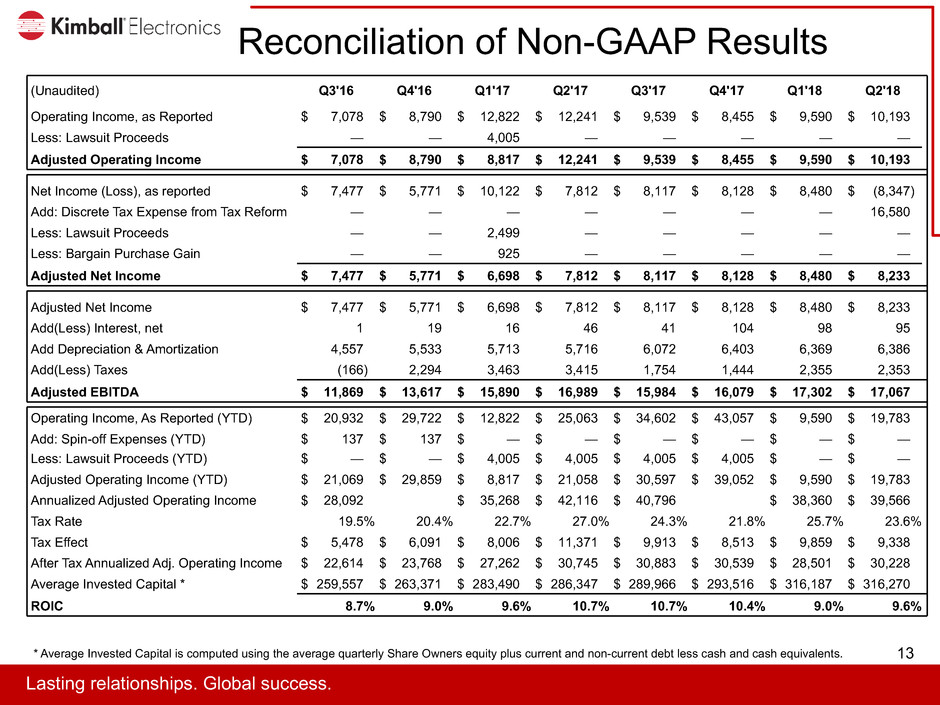

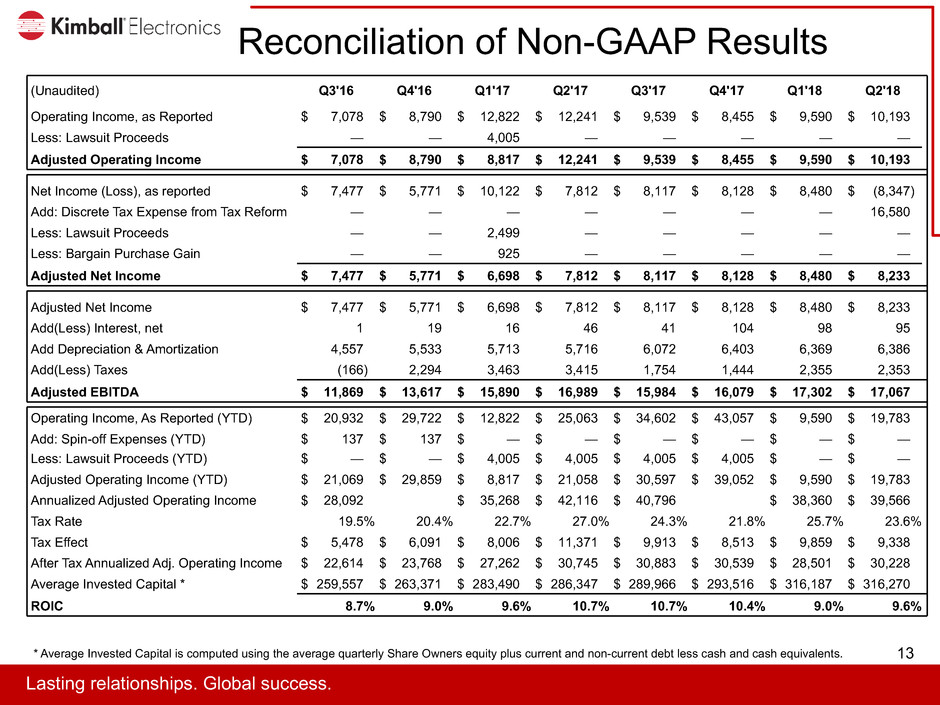

Lasting relationships. Global success.Lasting relationships. Global success. Reconciliation of Non-GAAP Results (Unaudited) Q3'16 Q4'16 Q1'17 Q2'17 Q3'17 Q4'17 Q1'18 Q2'18 Operating Income, as Reported $ 7,078 $ 8,790 $ 12,822 $ 12,241 $ 9,539 $ 8,455 $ 9,590 $ 10,193 Less: Lawsuit Proceeds — — 4,005 — — — — — Adjusted Operating Income $ 7,078 $ 8,790 $ 8,817 $ 12,241 $ 9,539 $ 8,455 $ 9,590 $ 10,193 Net Income (Loss), as reported $ 7,477 $ 5,771 $ 10,122 $ 7,812 $ 8,117 $ 8,128 $ 8,480 $ (8,347) Add: Discrete Tax Expense from Tax Reform — — — — — — — 16,580 Less: Lawsuit Proceeds — — 2,499 — — — — — Less: Bargain Purchase Gain — — 925 — — — — — Adjusted Net Income $ 7,477 $ 5,771 $ 6,698 $ 7,812 $ 8,117 $ 8,128 $ 8,480 $ 8,233 Adjusted Net Income $ 7,477 $ 5,771 $ 6,698 $ 7,812 $ 8,117 $ 8,128 $ 8,480 $ 8,233 Add(Less) Interest, net 1 19 16 46 41 104 98 95 Add Depreciation & Amortization 4,557 5,533 5,713 5,716 6,072 6,403 6,369 6,386 Add(Less) Taxes (166) 2,294 3,463 3,415 1,754 1,444 2,355 2,353 Adjusted EBITDA $ 11,869 $ 13,617 $ 15,890 $ 16,989 $ 15,984 $ 16,079 $ 17,302 $ 17,067 Operating Income, As Reported (YTD) $ 20,932 $ 29,722 $ 12,822 $ 25,063 $ 34,602 $ 43,057 $ 9,590 $ 19,783 Add: Spin-off Expenses (YTD) $ 137 $ 137 $ — $ — $ — $ — $ — $ — Less: Lawsuit Proceeds (YTD) $ — $ — $ 4,005 $ 4,005 $ 4,005 $ 4,005 $ — $ — Adjusted Operating Income (YTD) $ 21,069 $ 29,859 $ 8,817 $ 21,058 $ 30,597 $ 39,052 $ 9,590 $ 19,783 Annualized Adjusted Operating Income $ 28,092 $ 35,268 $ 42,116 $ 40,796 $ 38,360 $ 39,566 Tax Rate 19.5% 20.4% 22.7% 27.0% 24.3% 21.8% 25.7% 23.6% Tax Effect $ 5,478 $ 6,091 $ 8,006 $ 11,371 $ 9,913 $ 8,513 $ 9,859 $ 9,338 After Tax Annualized Adj. Operating Income $ 22,614 $ 23,768 $ 27,262 $ 30,745 $ 30,883 $ 30,539 $ 28,501 $ 30,228 Average Invested Capital * $ 259,557 $ 263,371 $ 283,490 $ 286,347 $ 289,966 $ 293,516 $ 316,187 $ 316,270 ROIC 8.7% 9.0% 9.6% 10.7% 10.7% 10.4% 9.0% 9.6% 13* Average Invested Capital is computed using the average quarterly Share Owners equity plus current and non-current debt less cash and cash equivalents.