Exhibit 99.1 Investor Presentation Third Quarter Fiscal Year 2019

KIMBALL ELECTRONICS (Nasdaq: KE) // Safe Harbor Statement Certain statements contained within this presentation may be considered forward-looking under the Private Securities Litigation Reform Act of 1995 and are subject to risks and uncertainties including, but not limited to, successful integration of acquisitions and new operations, global economic conditions, geopolitical environment, significant reductions in volumes and order patterns from key contract customers, loss of key customers or suppliers, financial stability of key customers and suppliers, availability or cost of raw materials, impact related to tariffs and other trade barriers, and increased competitive pricing pressures reflecting excess industry capacities. Additional cautionary statements regarding other risk factors that could have an effect on the future performance of Kimball Electronics, Inc. (the “Company”) are contained in the Company’s Annual Report on Form 10-K for the fiscal year ended June 30, 2018 and other filings with the Securities and Exchange Commission (the “SEC”). This presentation contains non-GAAP financial measures. A non-GAAP financial measure is a numerical measure of a company’s financial performance that excludes or includes amounts so as to be different than the most directly comparable measure calculated and presented in accordance with Generally Accepted Accounting Principles (GAAP) in the United States in the statement of income, statement of comprehensive income, balance sheet, statement of cash flows, or statement of equity of the company. The non-GAAP financial measures contained herein include Adjusted Operating Income/Margin, Adjusted Net Income/Margin, Adjusted EBITDA/Margin, Tangible Book Value, Tangible Book Value per Share, Adjusted Earnings Per Share, and Return on Invested Capital (ROIC), which have been adjusted for spin-off expenses, proceeds from a lawsuit settlement, a bargain purchase gain, and adjustments to provision for income taxes related to the U.S. Tax Cuts and Jobs Act (“Tax Reform”) enacted in December 2017. Management believes it is useful for investors to understand how its core operations performed without the effects of incremental costs related to the spin-off, lawsuit proceeds, the bargain purchase gain, and adjustments to provision for income taxes related to Tax Reform. Excluding these amounts allows investors to meaningfully trend, analyze, and benchmark the performance of the Company’s core operations. Many of the Company’s internal performance measures that management uses to make certain operating decisions use these and other non-GAAP measures to enable meaningful trending of core operating metrics.

KIMBALL ELECTRONICS (Nasdaq: KE) // Who We Are Global contract manufacturer Headquarters: of electronic components used in… Jasper, Indiana Automotive, Industrial, Medical & Public Safety Industries Established in 1961 Focused on non-commodity products and components that require … Nasdaq: KE complexity, quality, reliability, and durability Market Cap*: $398 M TTM Revenue: $1.1 B 6,000+ employees in 9 countries** FYE: June 30 *As of May 17, 2019 KIMBALL ELECTRONICS ** Including acquisition of GES, closed October 1, 2018 3

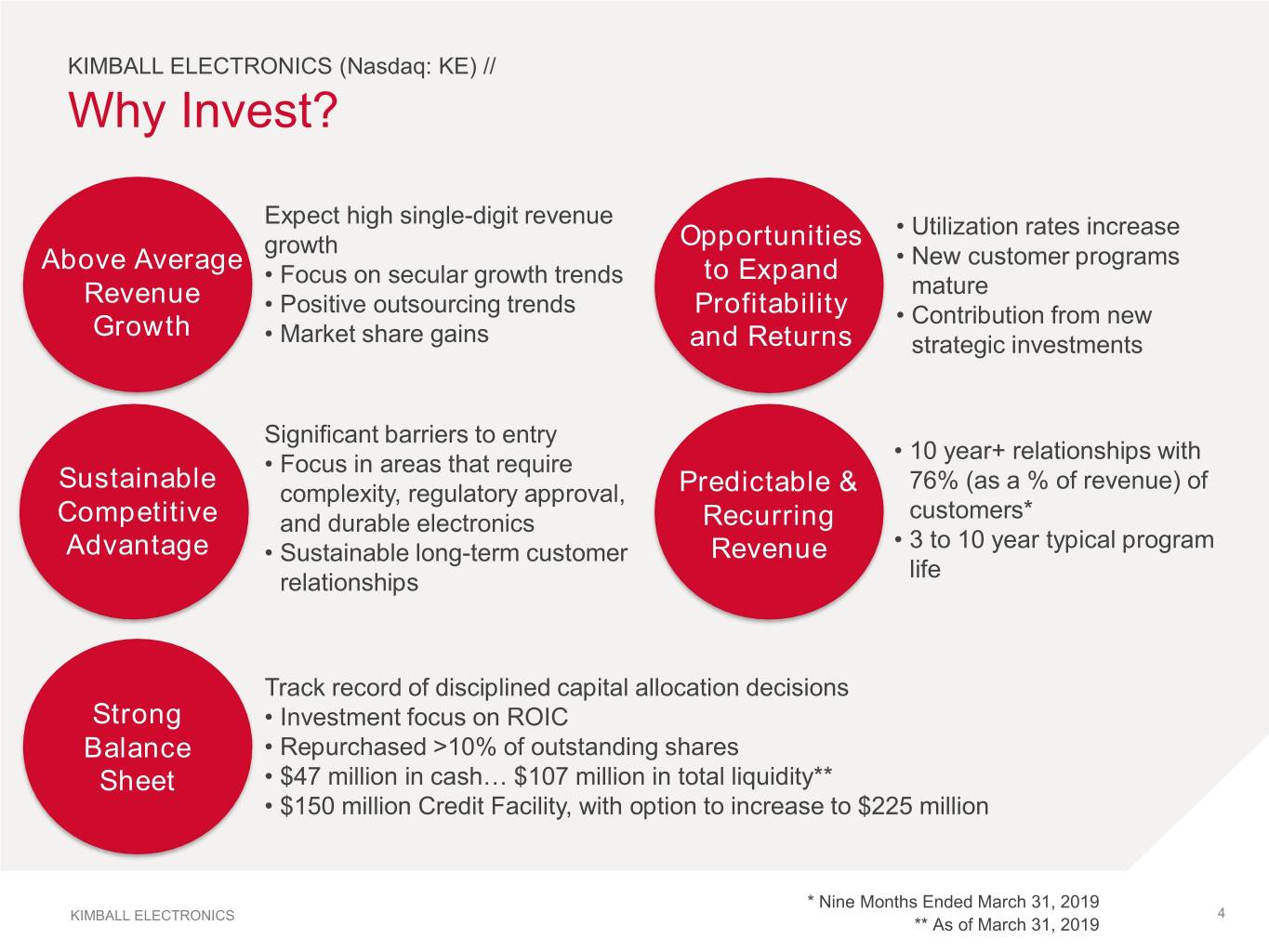

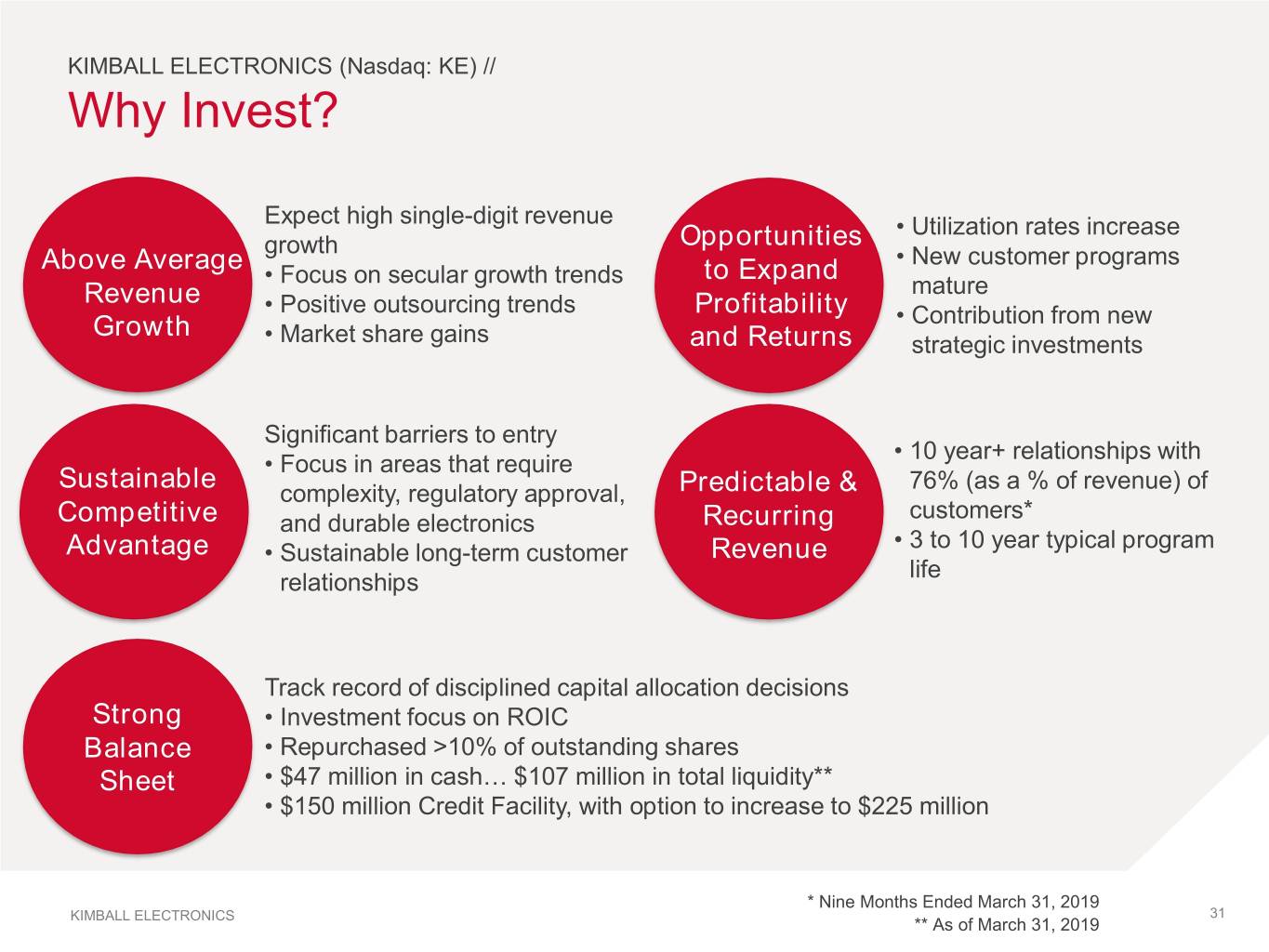

KIMBALL ELECTRONICS (Nasdaq: KE) // Why Invest? Expect high single-digit revenue • Utilization rates increase growth Opportunities Above Average to Expand • New customer programs • Focus on secular growth trends mature Revenue • Positive outsourcing trends Profitability Growth • Contribution from new • Market share gains and Returns strategic investments Significant barriers to entry • 10 year+ relationships with • Focus in areas that require Sustainable 76% (as a % of revenue) of complexity, regulatory approval, Predictable & customers* Competitive and durable electronics Recurring • 3 to 10 year typical program Advantage • Sustainable long-term customer Revenue life relationships Track record of disciplined capital allocation decisions Strong • Investment focus on ROIC Balance • Repurchased >10% of outstanding shares Sheet • $47 million in cash… $107 million in total liquidity** • $150 million Credit Facility, with option to increase to $225 million * Nine Months Ended March 31, 2019 KIMBALL ELECTRONICS 4 ** As of March 31, 2019

KIMBALL ELECTRONICS (Nasdaq: KE) // What We Do PUBLIC SAFETY 6%* INDUSTRIAL 20%* • Thermal Imaging • Climate Controls • Fire Detection • Automation Controls • Defense • LED Lighting • Security • Operator Interface $1.1B OTHER 1%* FY 2018 NET SALES AUTOMOTIVE 44%* MEDICAL 29%* • Electronic Power Steering • Sleep Therapy and Respiratory Care • Anti-Lock Brakes • Patient Care and Monitoring • Occupant Safety • In Vitro Diagnostics • Telematics • Drug Delivery Contract Manufacturer of non-commodity products and components that require complexity, quality, reliability, and durability KIMBALL ELECTRONICS *As a % of FY2018 total revenue; Unaudited 5

KIMBALL ELECTRONICS (Nasdaq: KE) // Our Value Proposition/Competitive Moat Global consistency - Single instance of SAP supports manufacturing operations globally. Standard lean six sigma practices shared across all facilities. Deep domain expertise - Experienced body of knowledge required for high quality, high reliability, highly complex, and durable electronics. Regulatory compliance & industry certifications - FDA, ISO, UL, CSA, RoHS, WEEE, HALT, HASS, IPC, J-STD Global Footprint – Support global OEMs in all areas of the world. More easily allows programs to be single sourced. 58 year history – Track record for quality and cost innovation. KIMBALL ELECTRONICS 6

KIMBALL ELECTRONICS (Nasdaq: KE) // Global Footprint Poznan, Poland Indianapolis, IN San Jose, CA Chiba, Japan Timisoara, Romania Nanjing, China Jasper, IN Tampa, FL Suzhou, China Reynosa, Mexico Trivandrum, India Ho Chi Minh City, Vietnam Laem Chabang, Thailand 1.3 million square feet of owned manufacturing space KIMBALL ELECTRONICS 7

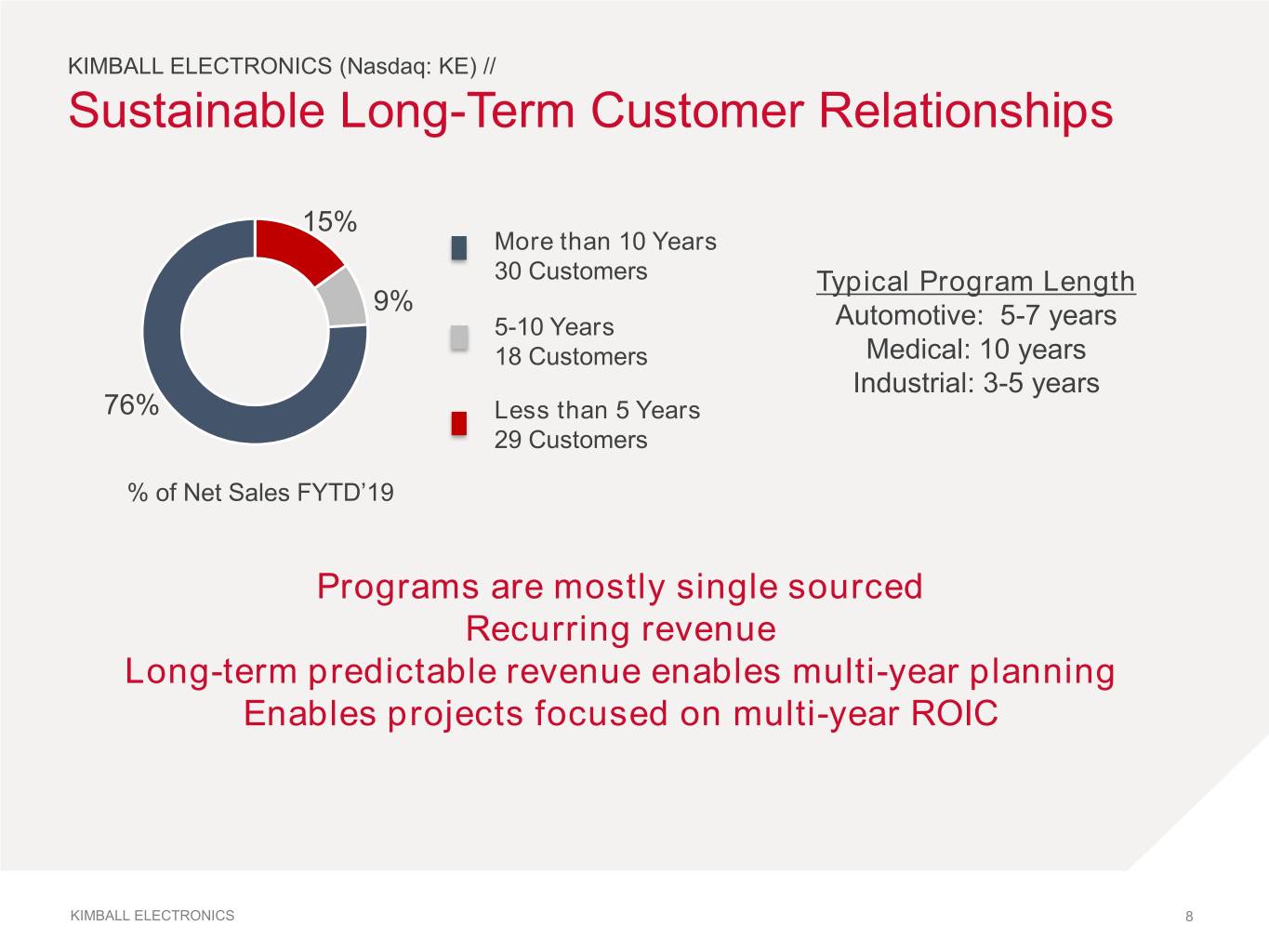

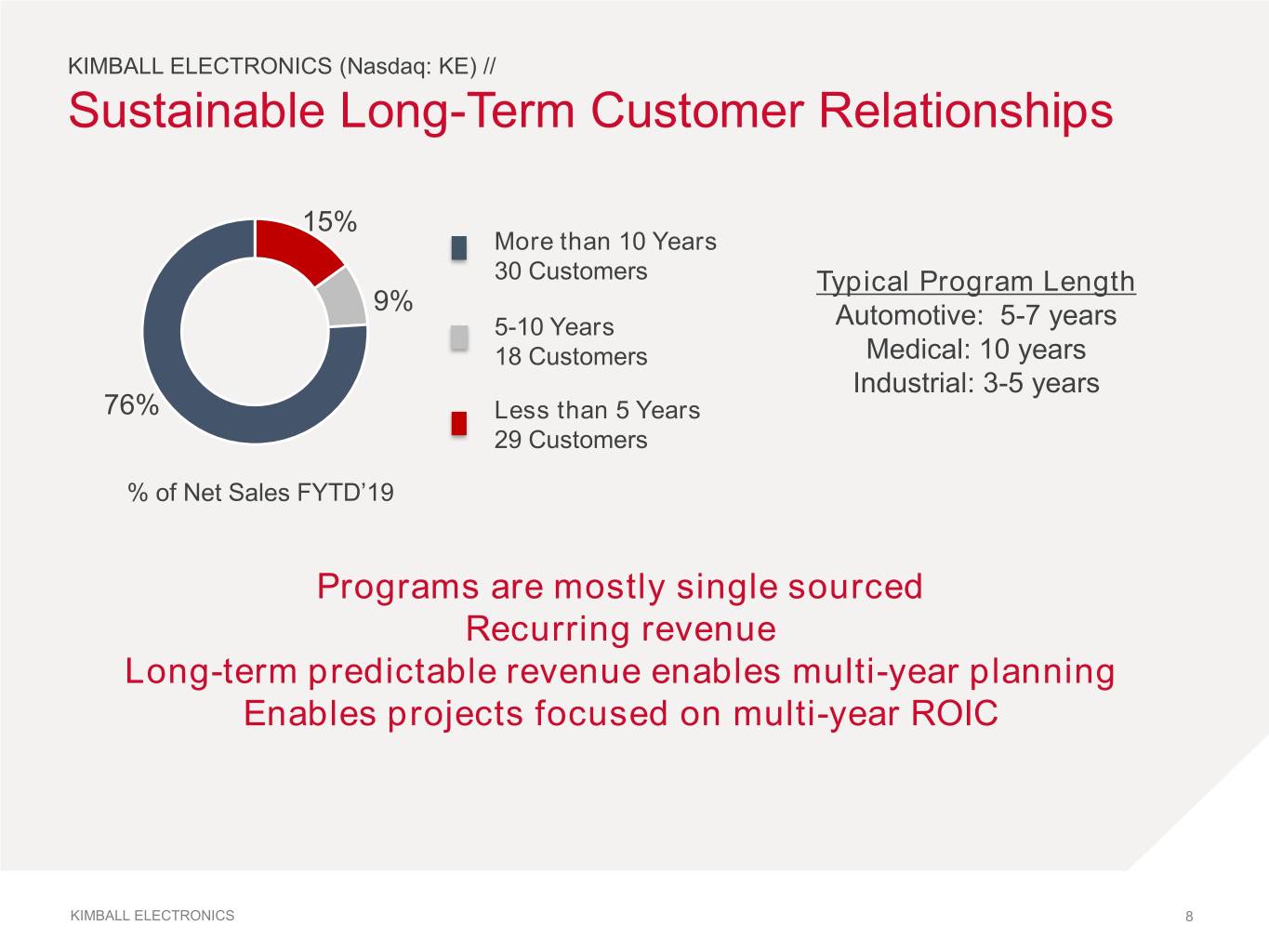

KIMBALL ELECTRONICS (Nasdaq: KE) // Sustainable Long-Term Customer Relationships 15% More than 10 Years 30 Customers Typical Program Length 9% 5-10 Years Automotive: 5-7 years 18 Customers Medical: 10 years Industrial: 3-5 years 76% Less than 5 Years 29 Customers % of Net Sales FYTD’19 Programs are mostly single sourced Recurring revenue Long-term predictable revenue enables multi-year planning Enables projects focused on multi-year ROIC KIMBALL ELECTRONICS 8

KIMBALL ELECTRONICS (Nasdaq: KE) // Sizable Addressable Market Total Market Size $471 Billion Industrial Market CAGR CAGR Medical $31 Verticals 2012-2017 2017-2022 Billion Automotive 5.9% 8.3% $19 Medical 5.1% 6.2% Billion Industrial 2.5% 5.9% Total Market 2.7% 7.5% Automotive $14 Billion Focused on Fast Growing Market Verticals Source: THE WORLDWIDE ELECTRONICS MANUFACTURING SERVICES MARKET – 2018 EDITION New Venture Research Corp. KIMBALL ELECTRONICS 9

KIMBALL ELECTRONICS (Nasdaq: KE) // Rapid Change for Traditional Manufacturing • Outsourcing is accelerating… – Faster time to market – Allocating resources to points of differentiation – Eco-system is becoming exponentially more complicated – Global worker shortage – Near sourcing •Disruption is coming… – Automation – 3D Printing – Artificial Intelligence – Augmented Reality Creates Multiple Opportunities for Kimball Electronics KIMBALL ELECTRONICS 10

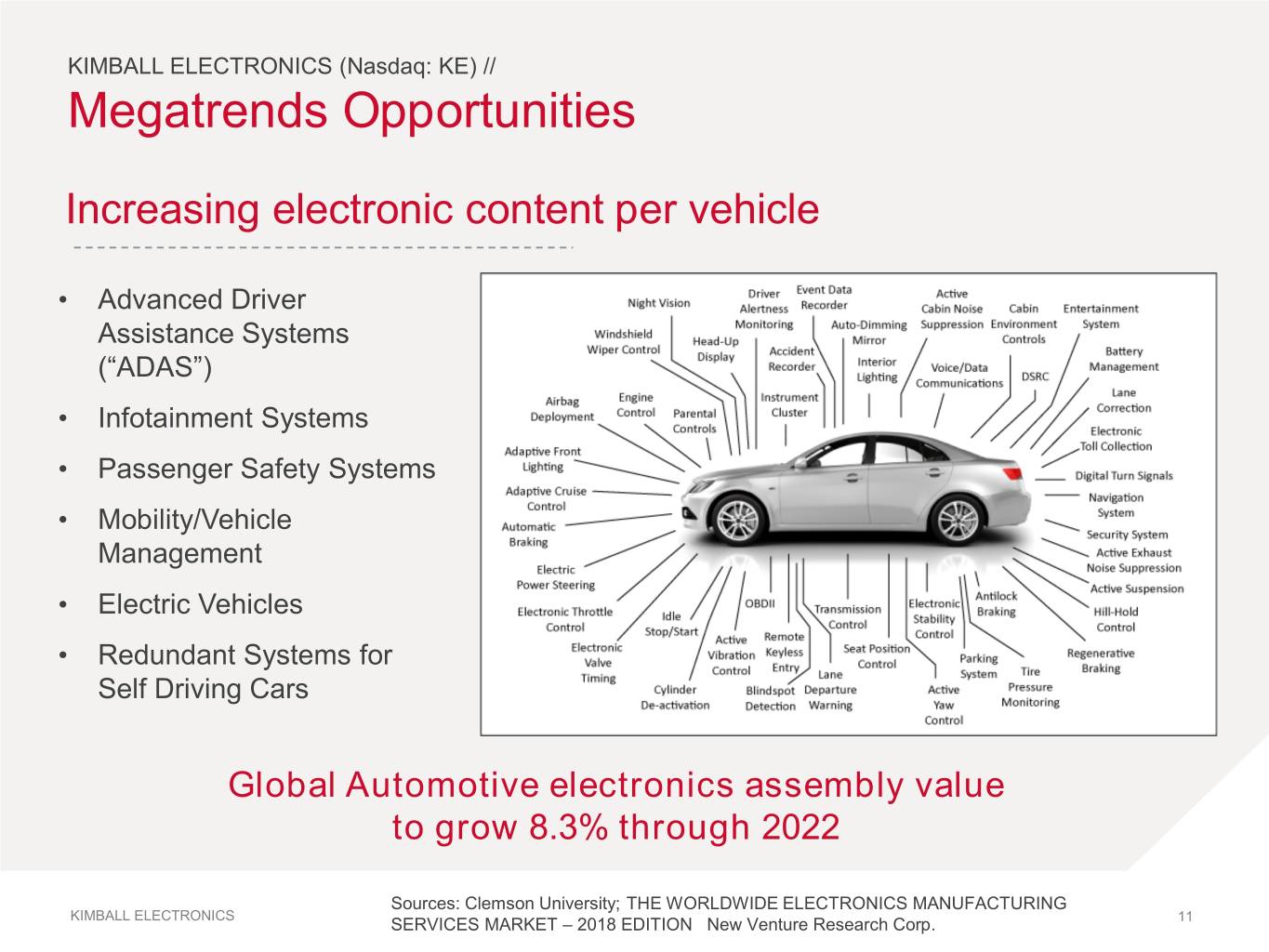

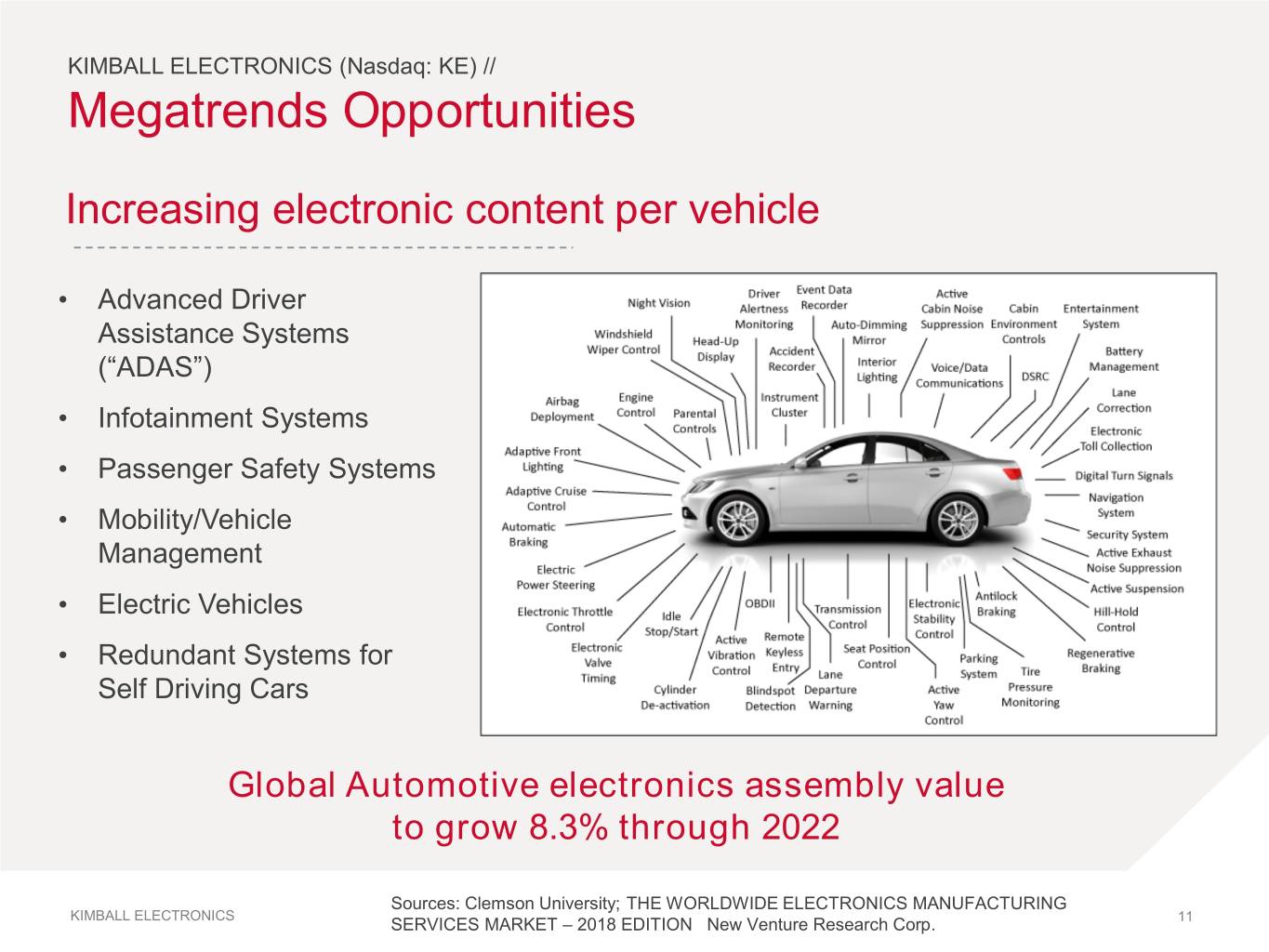

KIMBALL ELECTRONICS (Nasdaq: KE) // Megatrends Opportunities Increasing electronic content per vehicle • Advanced Driver Assistance Systems (“ADAS”) • Infotainment Systems • Passenger Safety Systems • Mobility/Vehicle Management • Electric Vehicles • Redundant Systems for Self Driving Cars Global Automotive electronics assembly value to grow 8.3% through 2022 Sources: Clemson University; THE WORLDWIDE ELECTRONICS MANUFACTURING KIMBALL ELECTRONICS SERVICES MARKET – 2018 EDITION New Venture Research Corp. 11

KIMBALL ELECTRONICS (Nasdaq: KE) // Megatrends Opportunities Healthcare Growth Internet Connected Devices • Aging Population • Internet of Things • Increasing Access to Care • Smart Metering • Remote Patient Monitoring • Energy Efficient Lighting • Decreasing Device Size • Connected Drug Delivery Global Medical electronics assembly value to grow 6.2% through 2022 Global Industrial electronics assembly value to grow 5.9% through 2022 KIMBALL ELECTRONICS * THE WORLDWIDE ELECTRONICS MANUFACTURING SERVICES MARKET – 2018 EDITION New Venture Research Corp. 12

KIMBALL ELECTRONICS (Nasdaq: KE) // Creating Shareholder Value Target end markets with strong secular growth Make investments that enable greater strategic customer engagement and enhance return profile Leveraging existing assets & continuously improving efficiencies KIMBALL ELECTRONICS 13

KIMBALL ELECTRONICS (Nasdaq: KE) // Creating Shareholder Value (Unaudited) End Markets with Secular Growth - Automotive Kimball Automotive Growth 44% of Revenue* AUTOMOTIVE CAGR 2014-2018 3QFY19 TTM Growth • Electronic Power Steering • Anti-Lock Brakes 14% 2% • Occupant Safety • Telematics Market Growth Representative Customers CAGR 2012-2017** CAGR 2017-2022** 5.9% 8.3% 1 in 5 light vehicles have a Kimball Part *As a % of FY2018 total revenue KIMBALL ELECTRONICS ** THE WORLDWIDE ELECTRONICS MANUFACTURING SERVICES MARKET – 2018 EDITION New Venture Research Corp . 14

KIMBALL ELECTRONICS (Nasdaq: KE) // Creating Shareholder Value (Unaudited) End Markets with Secular Growth - Medical Kimball Medical Growth 29% of Revenue* CAGR 2014-2018 3QFY19 TTM Growth MEDICAL • Sleep Therapy and 11% 20% Respiratory Care • Patient Care and Monitoring • In Vitro Diagnostics • Drug Delivery Market Growth Representative Customers CAGR 2012-2017** CAGR 2017-2022** 5.1% 6.2% Medical Healthcare Healthcare *As a % of FY2018 total revenue KIMBALL ELECTRONICS ** THE WORLDWIDE ELECTRONICS MANUFACTURING SERVICES MARKET – 2018 EDITION New Venture Research Corp. 15

KIMBALL ELECTRONICS (Nasdaq: KE) // Creating Shareholder Value (Unaudited) End Markets with Secular Growth – Industrial 20% of Revenue* Kimball Industrial Growth INDUSTRIAL CAGR 2014-2018 3QFY19 TTM Growth • Climate Controls • Automation Controls • LED Lighting 3% 15% • Operator Interface Market Growth Representative Customers CAGR 2012-2017** CAGR 2017-2022** 2.5% 5.9% *As a % of FY2018 total revenue KIMBALL ELECTRONICS ** THE WORLDWIDE ELECTRONICS MANUFACTURING SERVICES MARKET – 2018 EDITION New Venture Research Corp. 16

KIMBALL ELECTRONICS (Nasdaq: KE) // Creating Shareholder Value Multifaceted Manufacturing Solutions Company Organic Growth Electronics Manufacturing Outsourced Manufacturing Services Services M&A Investments that Increase Customer Engagement Diversified Add manufacturing services for non-electronic Contract components Manufacturing Services Enhance profitability/return - Attractive margin and return profile Offer Turnkey Solutions & Package of Value Expand capabilities to manufacture, install, and service Automation, manufacturing systems Test & Measurement Greater strategic customer engagement – Engaged in the decision to build internally or contract, as well as the decision of “How to build it” Expanding Solution Set Solution Expanding Enhance profitability/return with businesses that include proprietary products, software, and services Leverage AT&M technologies across all market verticals – Create new revenue opportunities and improve manufacturing efficiencies/quality 17

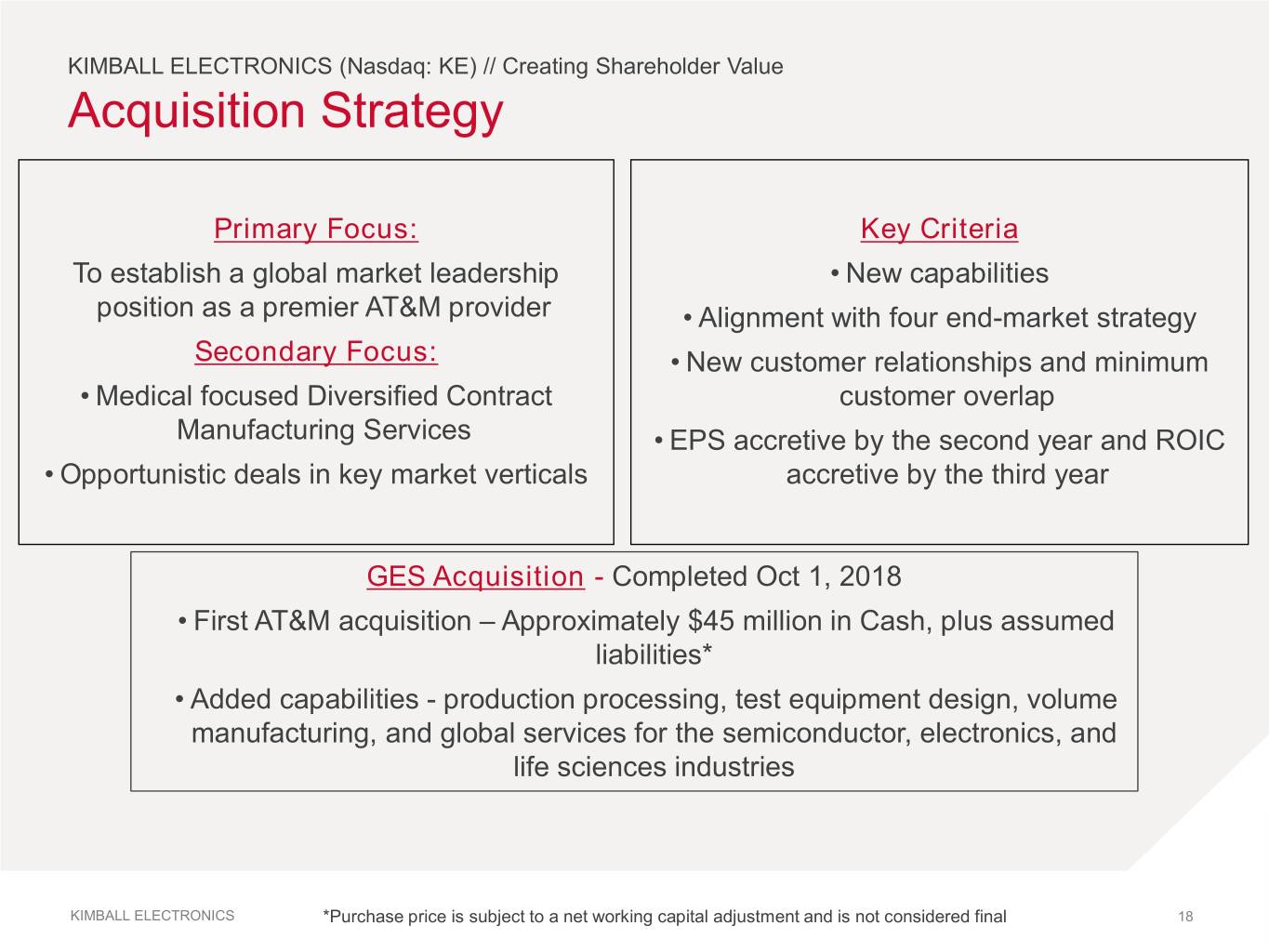

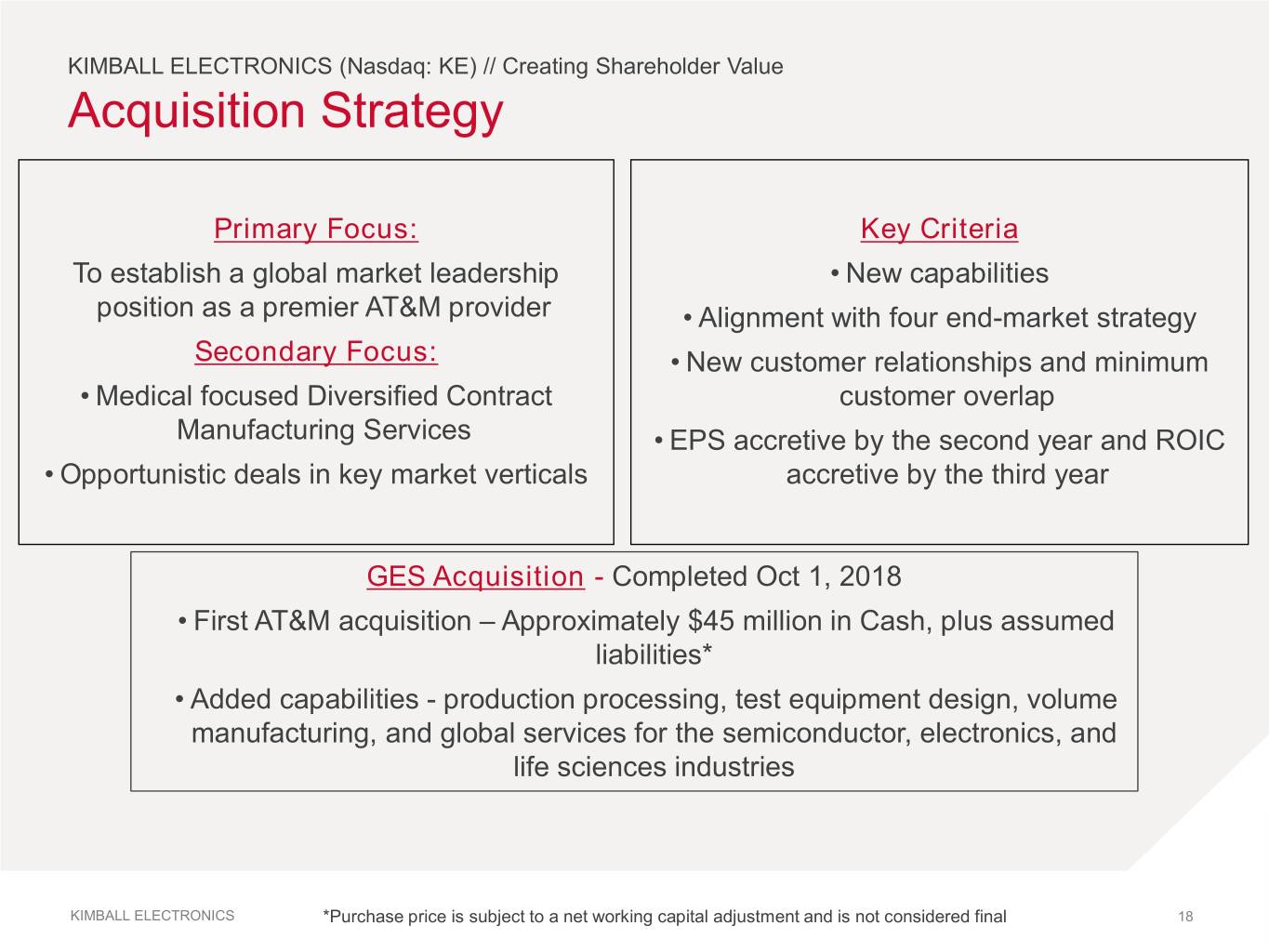

KIMBALL ELECTRONICS (Nasdaq: KE) // Creating Shareholder Value Acquisition Strategy Primary Focus: Key Criteria To establish a global market leadership • New capabilities position as a premier AT&M provider • Alignment with four end-market strategy Secondary Focus: • New customer relationships and minimum • Medical focused Diversified Contract customer overlap Manufacturing Services • EPS accretive by the second year and ROIC • Opportunistic deals in key market verticals accretive by the third year GES Acquisition - Completed Oct 1, 2018 • First AT&M acquisition – Approximately $45 million in Cash, plus assumed liabilities* • Added capabilities - production processing, test equipment design, volume manufacturing, and global services for the semiconductor, electronics, and life sciences industries KIMBALL ELECTRONICS *Purchase price is subject to a net working capital adjustment and is not considered final 18

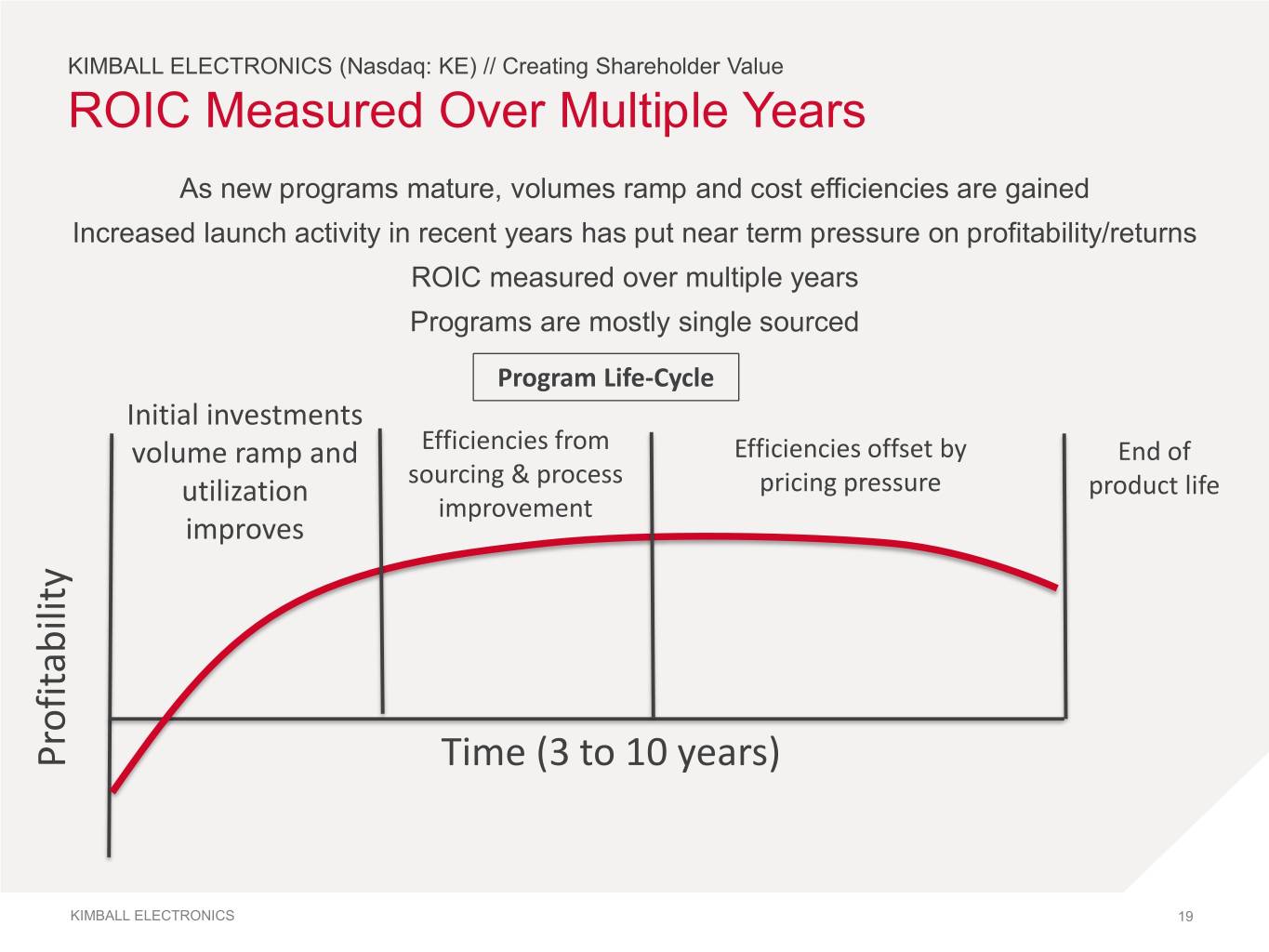

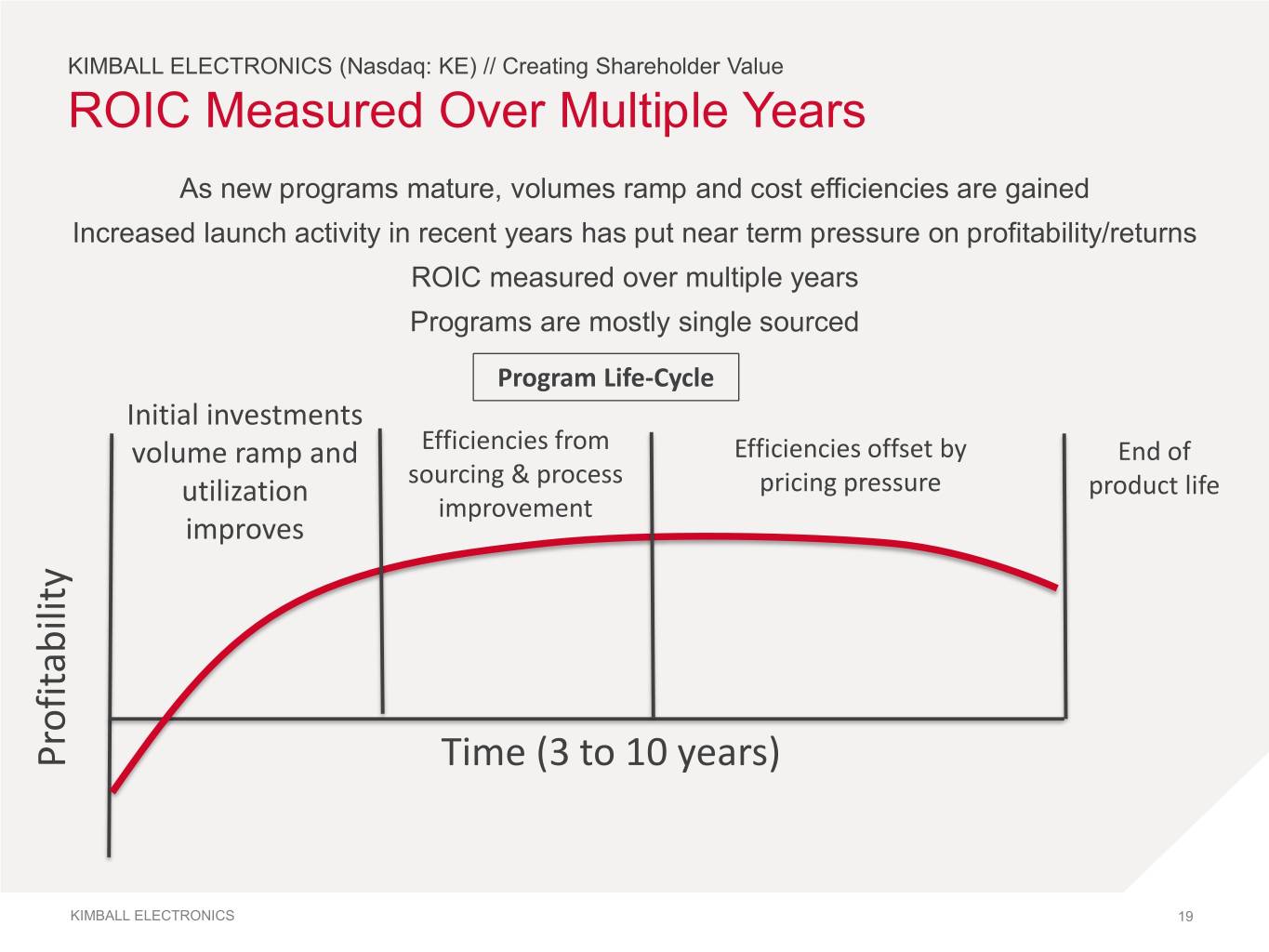

KIMBALL ELECTRONICS (Nasdaq: KE) // Creating Shareholder Value ROIC Measured Over Multiple Years As new programs mature, volumes ramp and cost efficiencies are gained Increased launch activity in recent years has put near term pressure on profitability/returns ROIC measured over multiple years Programs are mostly single sourced Program Life-Cycle Initial investments volume ramp and Efficiencies from Efficiencies offset by End of sourcing & process utilization pricing pressure product life improvement improves Profitability Time (3 to 10 years) KIMBALL ELECTRONICS 19

KIMBALL ELECTRONICS (Nasdaq: KE) // Financial Review Revenue Growth, Margin Expansion, and Strong Financial Profile KIMBALL ELECTRONICS 20

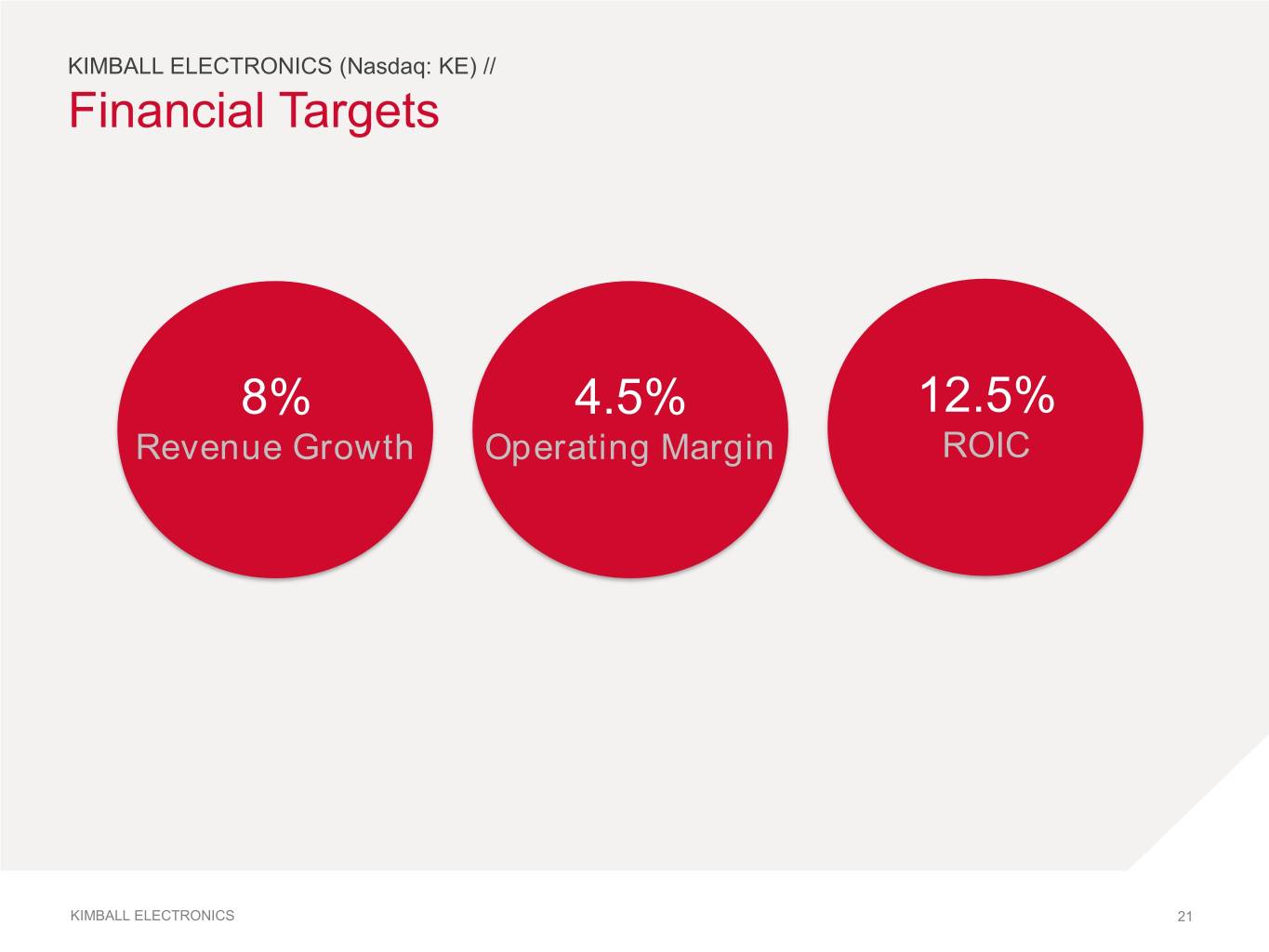

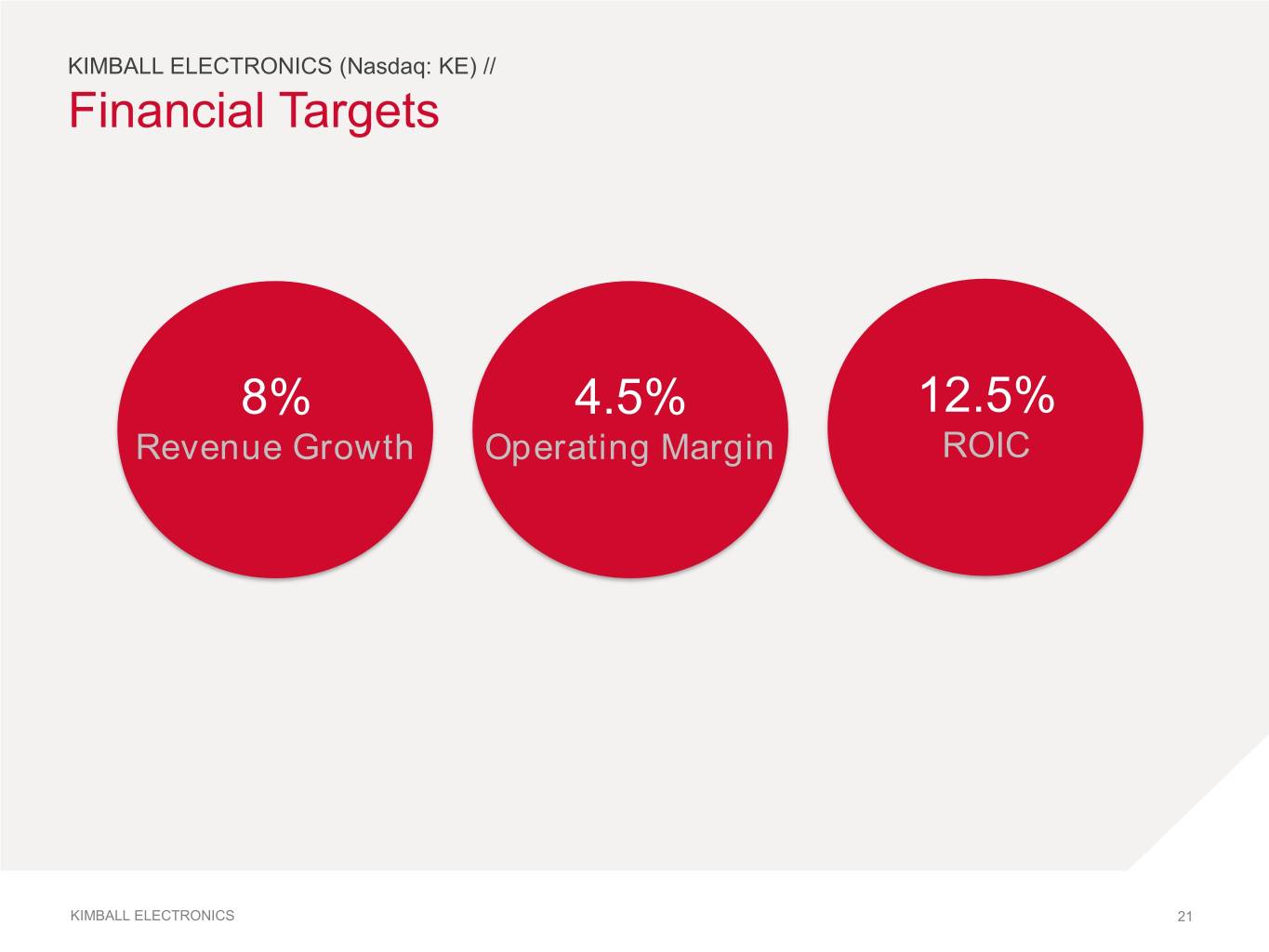

KIMBALL ELECTRONICS (Nasdaq: KE) // Financial Targets 8% 4.5% 12.5% Revenue Growth Operating Margin ROIC KIMBALL ELECTRONICS 21

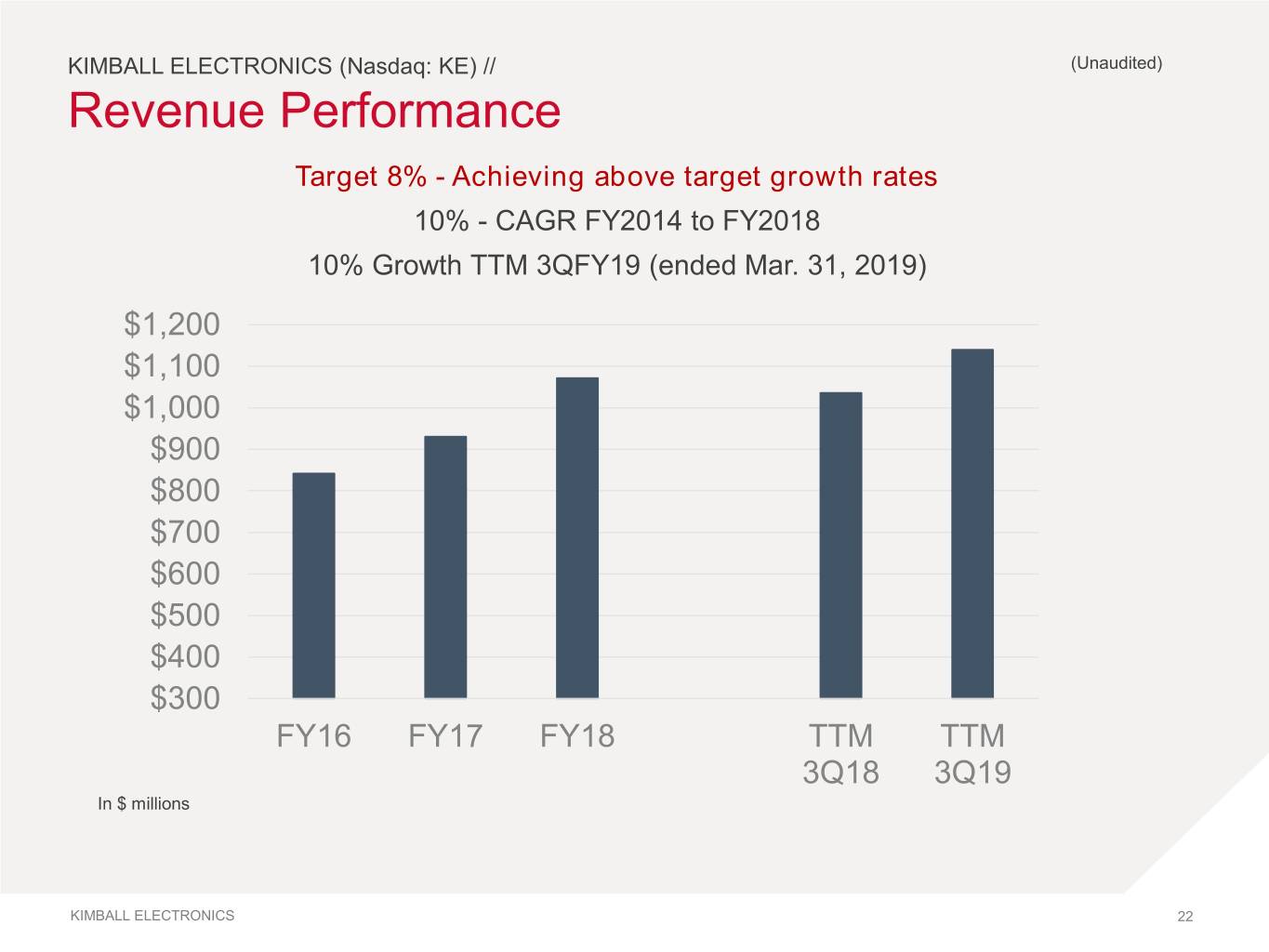

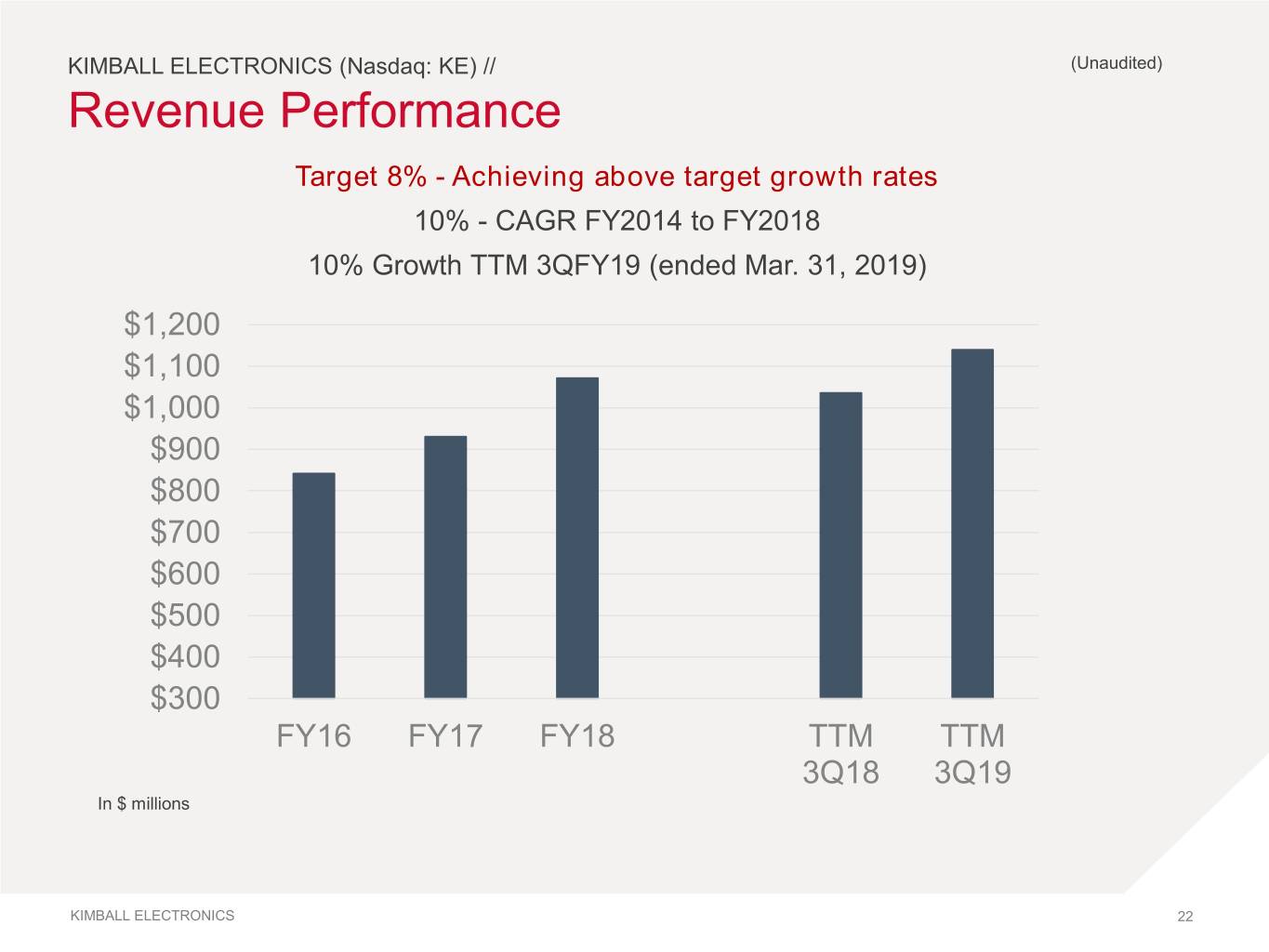

KIMBALL ELECTRONICS (Nasdaq: KE) // (Unaudited) Revenue Performance Target 8% - Achieving above target growth rates 10% - CAGR FY2014 to FY2018 10% Growth TTM 3QFY19 (ended Mar. 31, 2019) $1,200 $1,100 $1,000 $900 $800 $700 $600 $500 $400 $300 FY16 FY17 FY18 TTM TTM 3Q18 3Q19 In $ millions KIMBALL ELECTRONICS 22

KIMBALL ELECTRONICS (Nasdaq: KE) // (Unaudited) Revenue Mix by Vertical Market 100% 2% 2% 1% 1% 6% 5% 7% 7% 90% 20% 22% 80% 22% 22% 70% 60% 29% 32% 30% 28% 50% 40% 30% 44% 20% 39% 41% 40% 10% 0% FY16 FY17 FY18 Q3FY19 Automotive Medical Industrial Public Safety Other KIMBALL ELECTRONICS 23

KIMBALL ELECTRONICS (Nasdaq: KE) // Profitability Trends (Unaudited) Adjusted Operating Income/Margin* Target 4.5% Operating Margin Expect improvement from ramping utilization of greenfield plant in Romania and maturity of new programs $50 4.2% 3.9% 4.5% 3.8% 3.8% 3.5% 4.0% $40 3.5% 3.0% $30 2.5% 2.0% $20 1.5% $10 1.0% 0.5% $0 0.0% FY16 FY17 FY18 TTM 3Q18 TTM 3Q19 In $ millions *Adjusted Operating Income and Margin are Non-GAAP terms. A reconciliation is provided in the appendix of this presentation. Prior period amounts have been restated to reflect the retrospective adoption of new accounting guidance KIMBALL ELECTRONICS 24 on improving the presentation of net periodic pension cost and net periodic postretirement benefit cost.

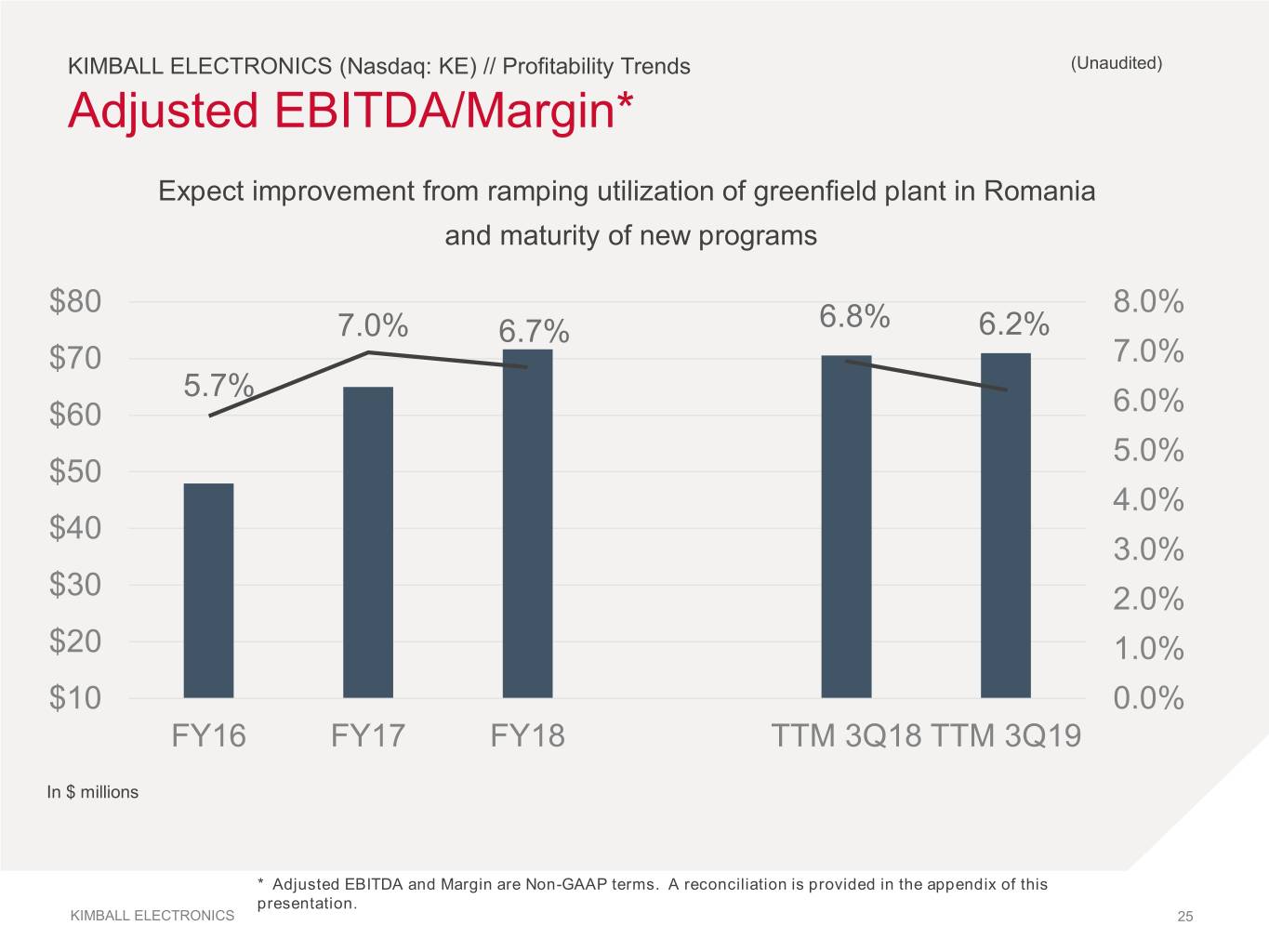

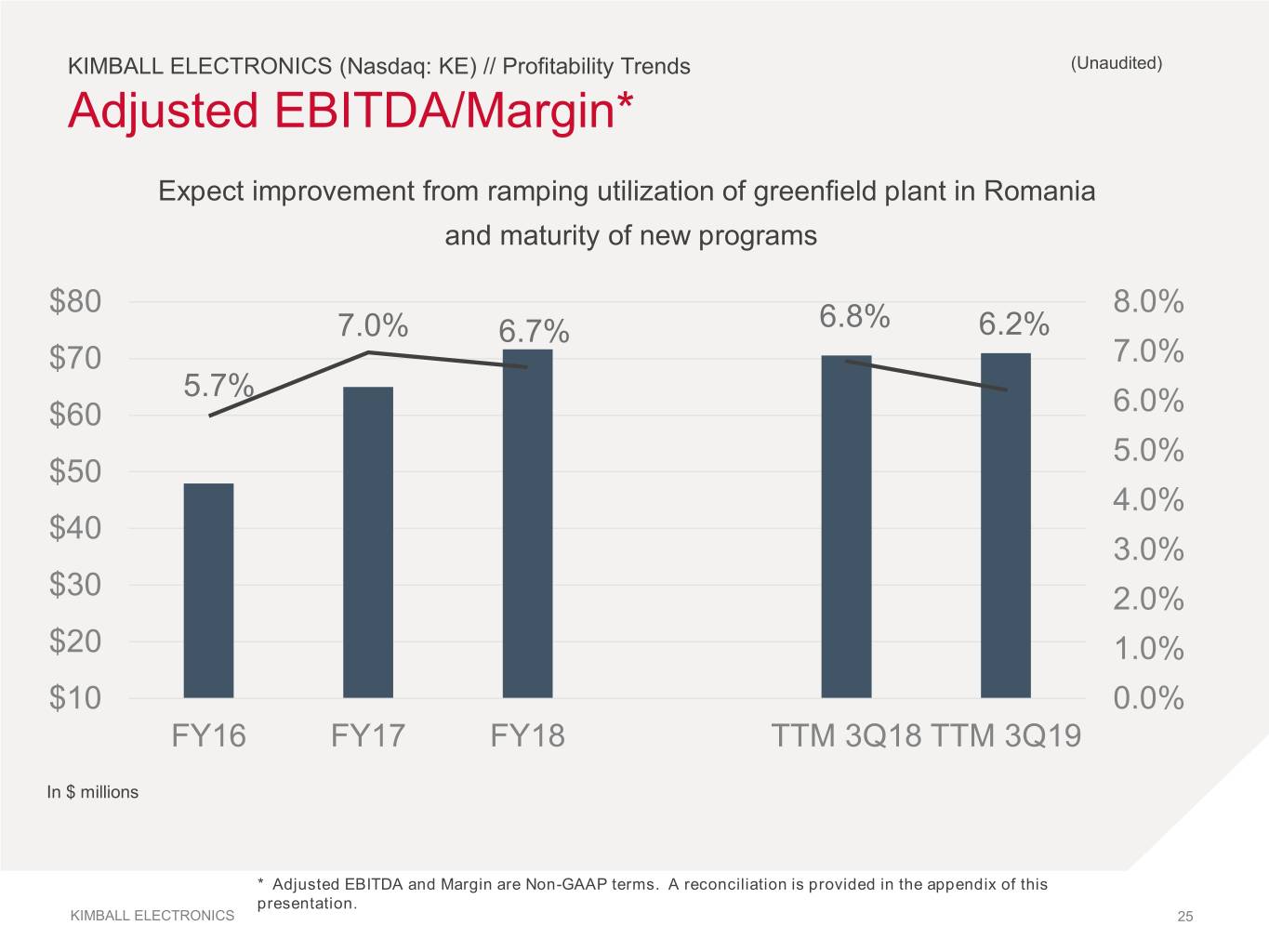

KIMBALL ELECTRONICS (Nasdaq: KE) // Profitability Trends (Unaudited) Adjusted EBITDA/Margin* Expect improvement from ramping utilization of greenfield plant in Romania and maturity of new programs $80 8.0% 7.0% 6.7% 6.8% 6.2% $70 7.0% 5.7% $60 6.0% 5.0% $50 4.0% $40 3.0% $30 2.0% $20 1.0% $10 0.0% FY16 FY17 FY18 TTM 3Q18 TTM 3Q19 In $ millions * Adjusted EBITDA and Margin are Non-GAAP terms. A reconciliation is provided in the appendix of this presentation. KIMBALL ELECTRONICS 25

KIMBALL ELECTRONICS (Nasdaq: KE) // (Unaudited) Capital Expenditures and D&A Significant capex spending to fuel multi-year organic growth and expansion in ROIC • DCMS • Romanian Plant FY2015 to FY2017 - $40 million+ investment in excess of D&A spent on Growth 14.0 12.0 10.0 8.0 6.0 4.0 2.0 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 In $ millions D&A Total Capex KIMBALL ELECTRONICS 26

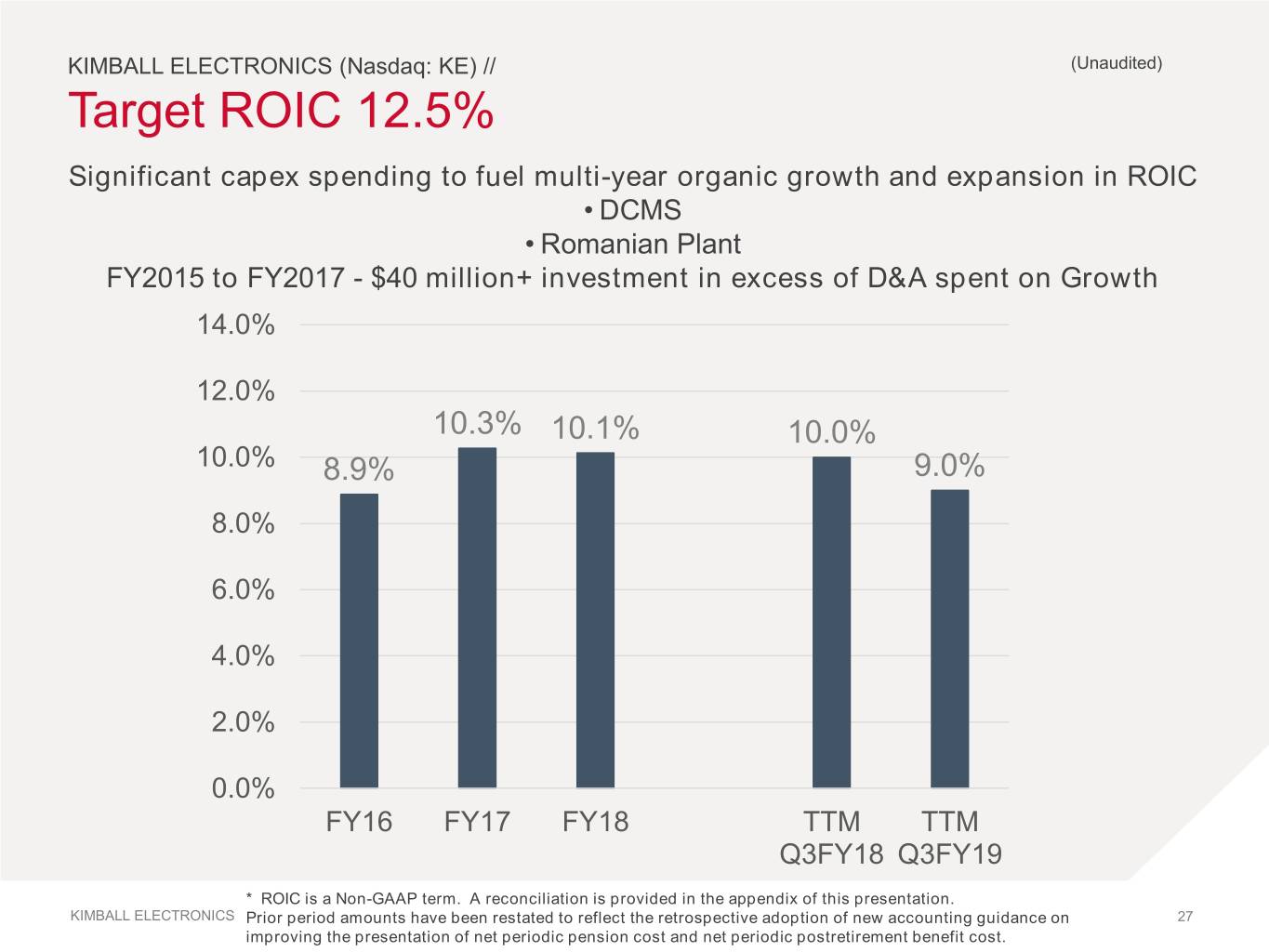

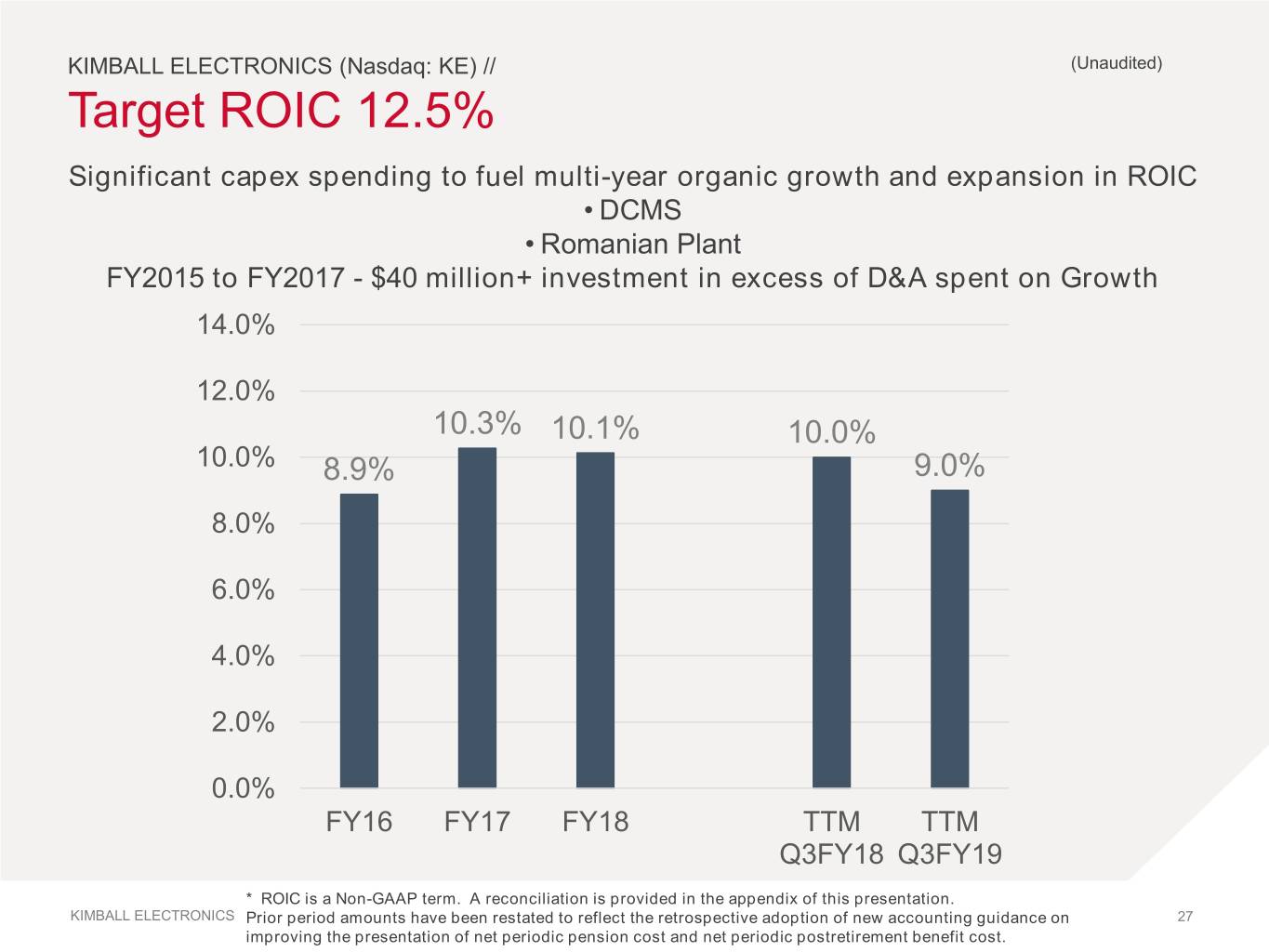

KIMBALL ELECTRONICS (Nasdaq: KE) // (Unaudited) Target ROIC 12.5% Significant capex spending to fuel multi-year organic growth and expansion in ROIC • DCMS • Romanian Plant FY2015 to FY2017 - $40 million+ investment in excess of D&A spent on Growth 14.0% 12.0% 10.3% 10.1% 10.0% 10.0% 8.9% 9.0% 8.0% 6.0% 4.0% 2.0% 0.0% FY16 FY17 FY18 TTM TTM Q3FY18 Q3FY19 * ROIC is a Non-GAAP term. A reconciliation is provided in the appendix of this presentation. KIMBALL ELECTRONICS Prior period amounts have been restated to reflect the retrospective adoption of new accounting guidance on 27 improving the presentation of net periodic pension cost and net periodic postretirement benefit cost.

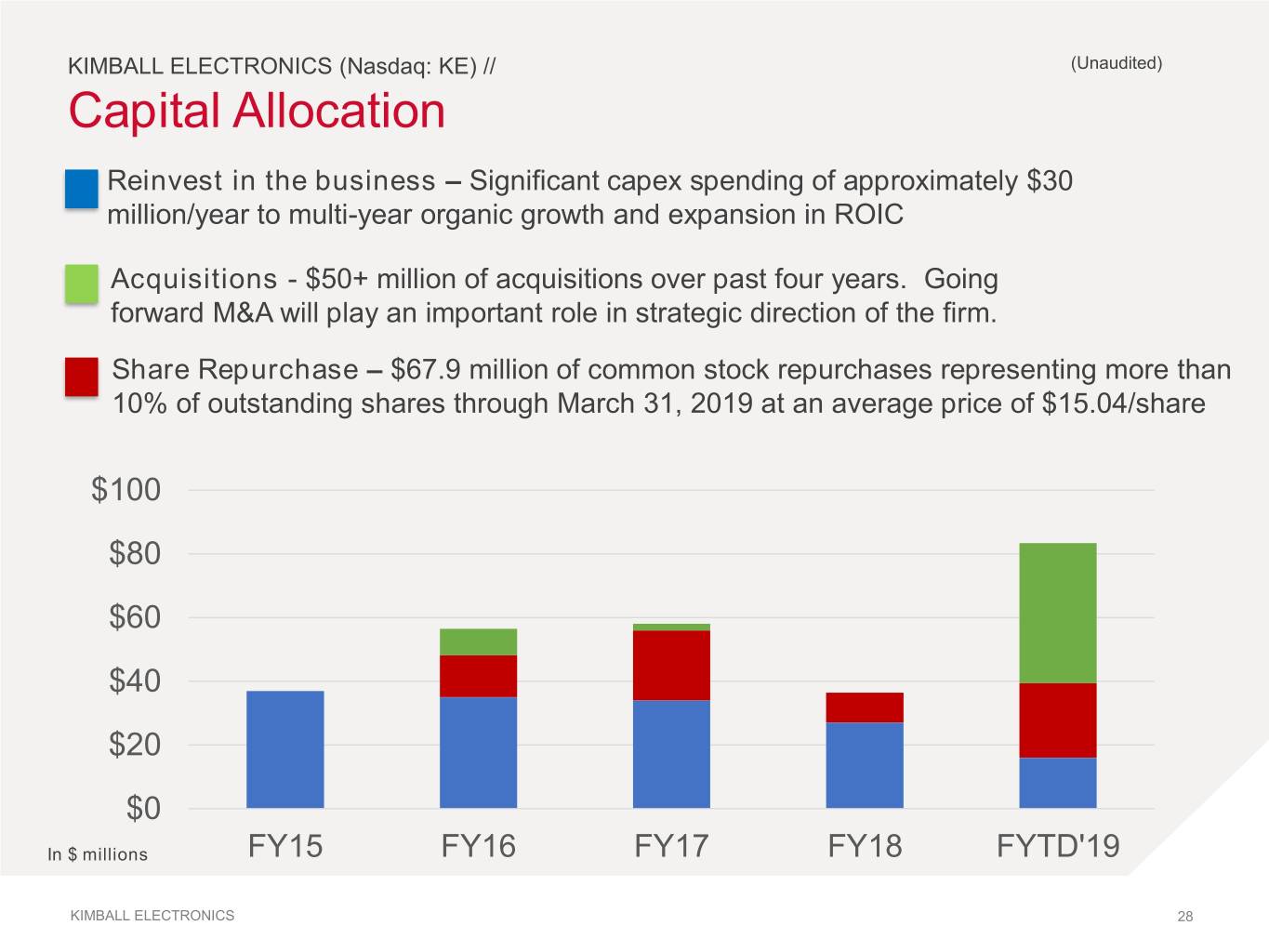

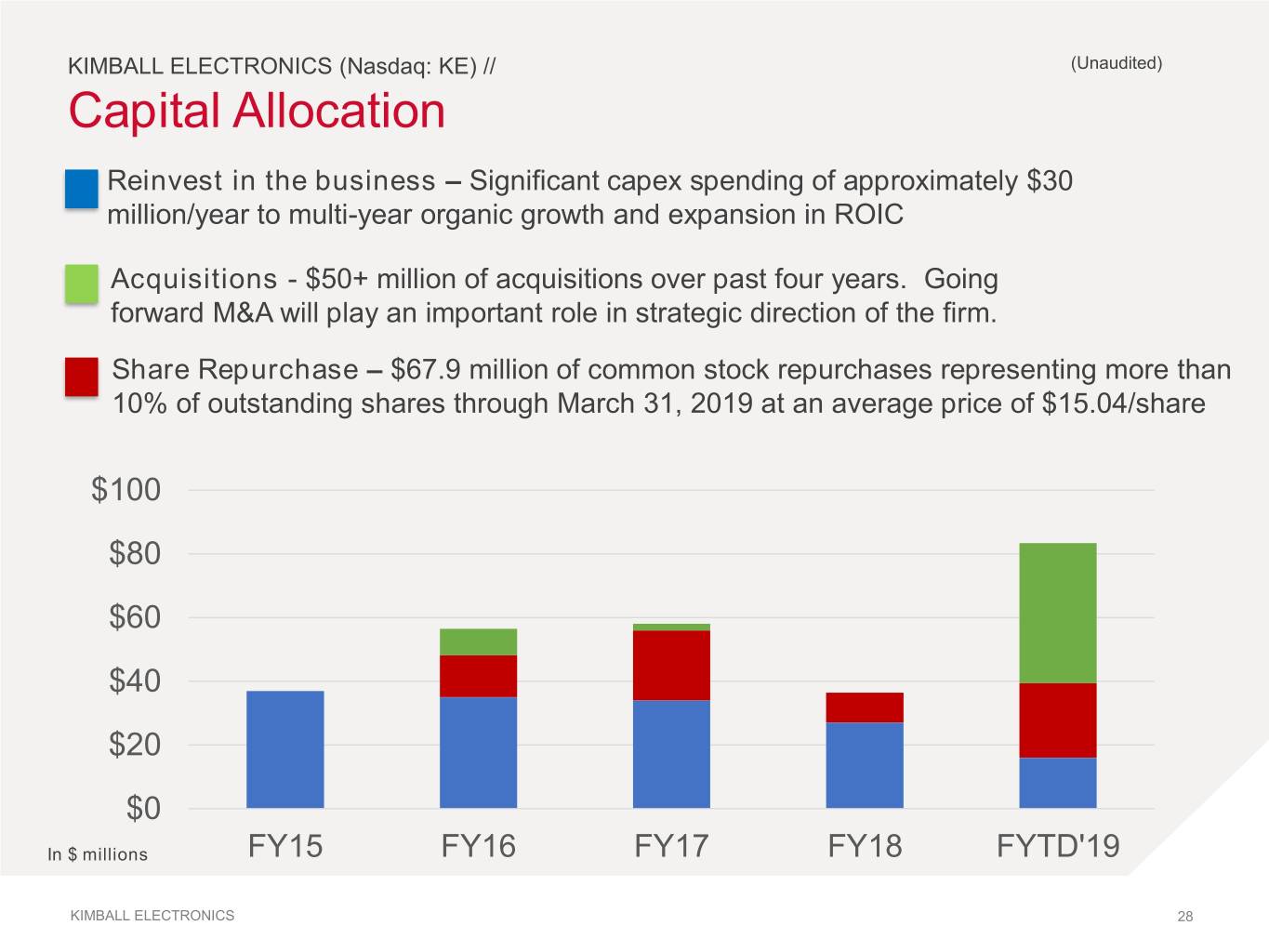

KIMBALL ELECTRONICS (Nasdaq: KE) // (Unaudited) Capital Allocation Reinvest in the business – Significant capex spending of approximately $30 million/year to multi-year organic growth and expansion in ROIC Acquisitions - $50+ million of acquisitions over past four years. Going forward M&A will play an important role in strategic direction of the firm. Share Repurchase – $67.9 million of common stock repurchases representing more than 10% of outstanding shares through March 31, 2019 at an average price of $15.04/share $100 $80 $60 $40 $20 $0 In $ millions FY15 FY16 FY17 FY18 FYTD'19 KIMBALL ELECTRONICS 28

KIMBALL ELECTRONICS (Nasdaq: KE) // (Unaudited) Strong Balance Sheet Ample Liquidity for Growth $47M in Cash* $107 million in total liquidity* $150M credit facility, with option to increase to $225 million 1.3 million square feet of owned manufacturing space Consistent Working Capital Management** DSO – 56 to 58 days Inventory Turns – 4x to 6x per year Cash Conversion Cycle – 62 to 75 days * As of Mar. 31, 2019 ** Range as reported for quarters ending Mar. 31 2018 and Mar. 31, 2019 KIMBALL ELECTRONICS 29

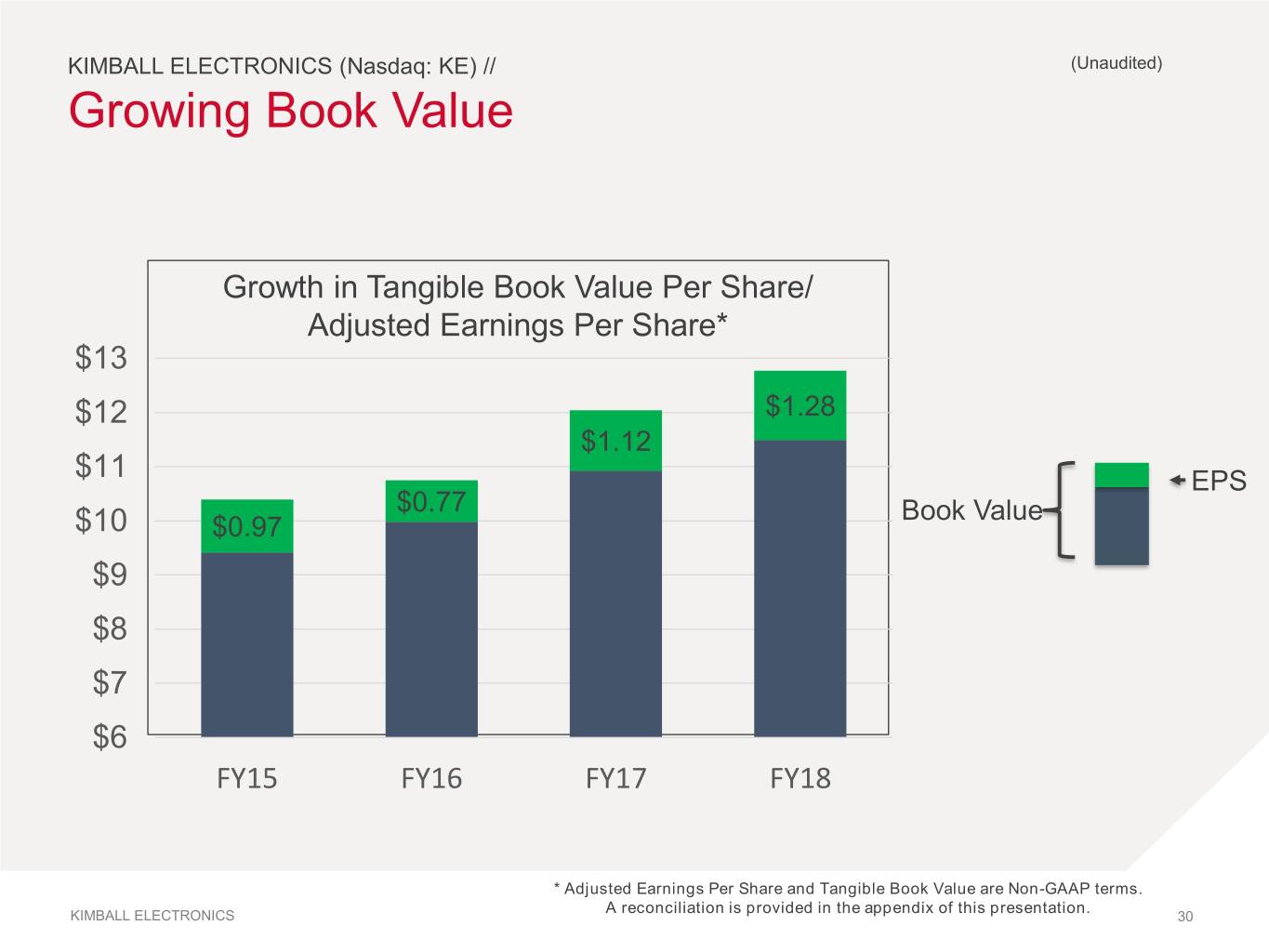

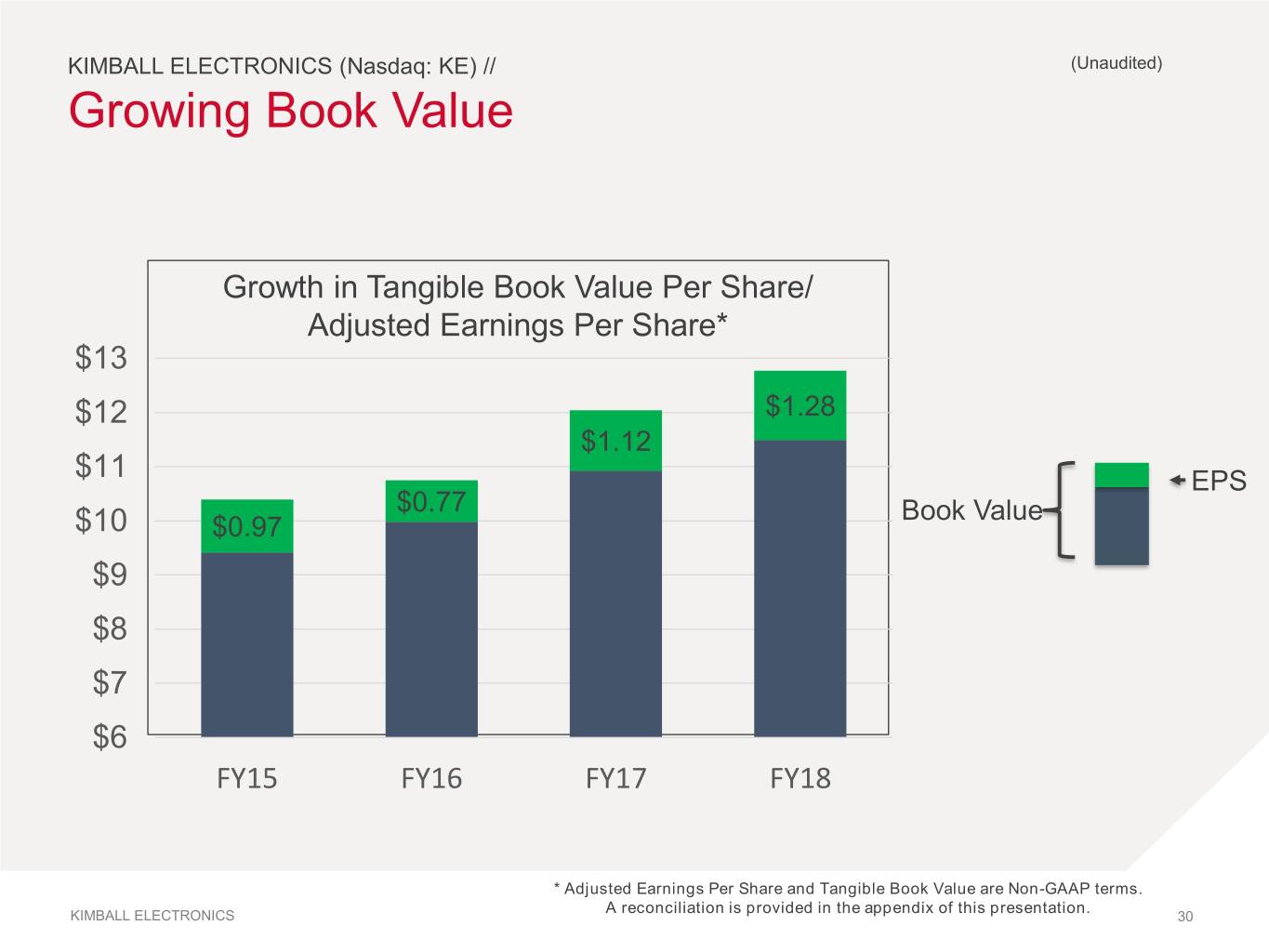

KIMBALL ELECTRONICS (Nasdaq: KE) // (Unaudited) Growing Book Value Growth in Tangible Book Value Per Share/ Adjusted Earnings Per Share* $13 $12 $1.28 $1.12 $11 EPS $0.77 Book Value $10 $0.97 $9 $8 $7 $6 FY15 FY16 FY17 FY18 * Adjusted Earnings Per Share and Tangible Book Value are Non-GAAP terms. A reconciliation is provided in the appendix of this presentation. KIMBALL ELECTRONICS 30

KIMBALL ELECTRONICS (Nasdaq: KE) // Why Invest? Expect high single-digit revenue • Utilization rates increase growth Opportunities Above Average to Expand • New customer programs • Focus on secular growth trends mature Revenue • Positive outsourcing trends Profitability Growth • Contribution from new • Market share gains and Returns strategic investments Significant barriers to entry • 10 year+ relationships with • Focus in areas that require Sustainable 76% (as a % of revenue) of complexity, regulatory approval, Predictable & customers* Competitive and durable electronics Recurring • 3 to 10 year typical program Advantage • Sustainable long-term customer Revenue life relationships Track record of disciplined capital allocation decisions Strong • Investment focus on ROIC Balance • Repurchased >10% of outstanding shares Sheet • $47 million in cash… $107 million in total liquidity** • $150 million Credit Facility, with option to increase to $225 million * Nine Months Ended March 31, 2019 KIMBALL ELECTRONICS 31 ** As of March 31, 2019

QUESTIONS KIMBALL ELECTRONICS 32

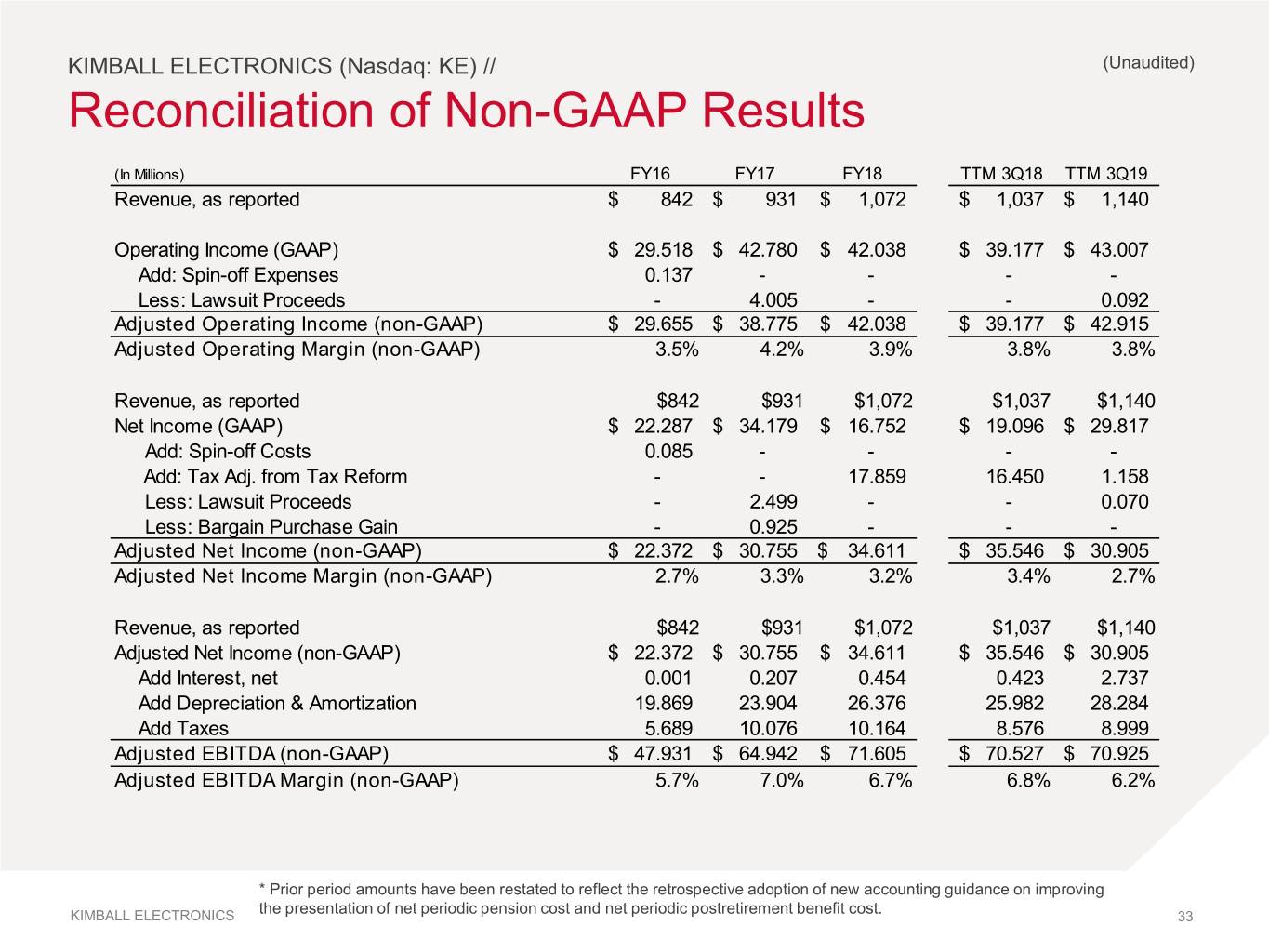

KIMBALL ELECTRONICS (Nasdaq: KE) // (Unaudited) Reconciliation of Non-GAAP Results (In Millions) FY16 FY17 FY18 TTM 3Q18 TTM 3Q19 Revenue, as reported $ 842 $ 931 $ 1,072 $ 1,037 $ 1,140 Operating Income (GAAP) $ 29.518 $ 42.780 $ 42.038 $ 39.177 $ 43.007 Add: Spin-off Expenses 0.137 - - - - Less: Lawsuit Proceeds - 4.005 - - 0.092 Adjusted Operating Income (non-GAAP) $ 29.655 $ 38.775 $ 42.038 $ 39.177 $ 42.915 Adjusted Operating Margin (non-GAAP) 3.5% 4.2% 3.9% 3.8% 3.8% Revenue, as reported $842 $931 $1,072 $1,037 $1,140 Net Income (GAAP) $ 22.287 $ 34.179 $ 16.752 $ 19.096 $ 29.817 Add: Spin-off Costs 0.085 - - - - Add: Tax Adj. from Tax Reform - - 17.859 16.450 1.158 Less: Lawsuit Proceeds - 2.499 - - 0.070 Less: Bargain Purchase Gain - 0.925 - - - Adjusted Net Income (non-GAAP) $ 22.372 $ 30.755 $ 34.611 $ 35.546 $ 30.905 Adjusted Net Income Margin (non-GAAP) 2.7% 3.3% 3.2% 3.4% 2.7% Revenue, as reported $842 $931 $1,072 $1,037 $1,140 Adjusted Net Income (non-GAAP) $ 22.372 $ 30.755 $ 34.611 $ 35.546 $ 30.905 Add Interest, net 0.001 0.207 0.454 0.423 2.737 Add Depreciation & Amortization 19.869 23.904 26.376 25.982 28.284 Add Taxes 5.689 10.076 10.164 8.576 8.999 Adjusted EBITDA (non-GAAP) $ 47.931 $ 64.942 $ 71.605 $ 70.527 $ 70.925 Adjusted EBITDA Margin (non-GAAP) 5.7% 7.0% 6.7% 6.8% 6.2% * Prior period amounts have been restated to reflect the retrospective adoption of new accounting guidance on improving the presentation of net periodic pension cost and net periodic postretirement benefit cost. KIMBALL ELECTRONICS 33

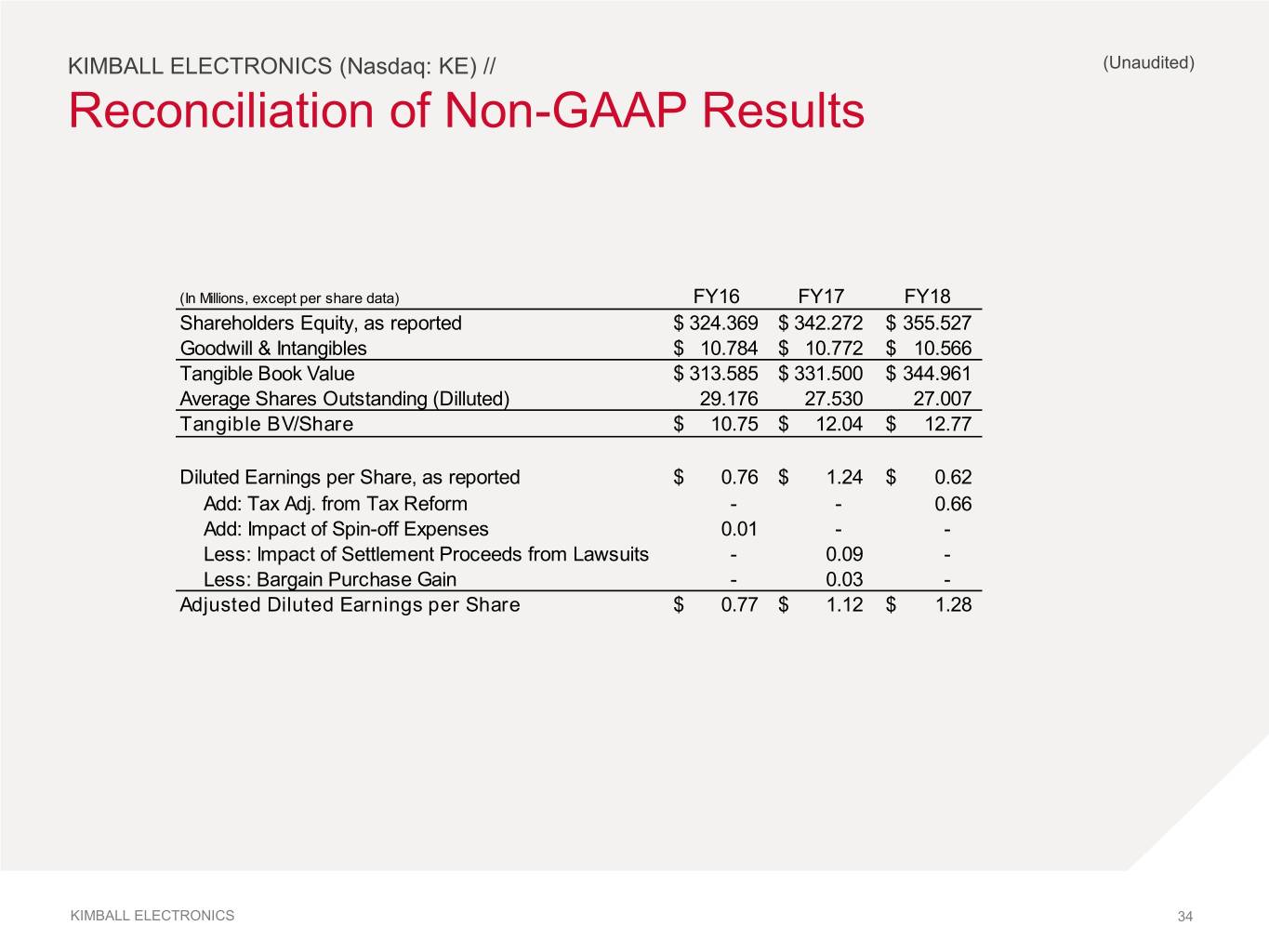

KIMBALL ELECTRONICS (Nasdaq: KE) // (Unaudited) Reconciliation of Non-GAAP Results (In Millions, except per share data) FY16 FY17 FY18 Shareholders Equity, as reported $ 324.369 $ 342.272 $ 355.527 Goodwill & Intangibles $ 10.784 $ 10.772 $ 10.566 Tangible Book Value $ 313.585 $ 331.500 $ 344.961 Average Shares Outstanding (Dilluted) 29.176 27.530 27.007 Tangible BV/Share $ 10.75 $ 12.04 $ 12.77 Diluted Earnings per Share, as reported $ 0.76 $ 1.24 $ 0.62 Add: Tax Adj. from Tax Reform - - 0.66 Add: Impact of Spin-off Expenses 0.01 - - Less: Impact of Settlement Proceeds from Lawsuits - 0.09 - Less: Bargain Purchase Gain - 0.03 - Adjusted Diluted Earnings per Share $ 0.77 $ 1.12 $ 1.28 KIMBALL ELECTRONICS 34

KIMBALL ELECTRONICS (Nasdaq: KE) // (Unaudited) Reconciliation of Non-GAAP Results (In Thousands) 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 Operating Income (GAAP) (TTM) $ 35,381 $ 40,671 $ 43,115 $ 42,780 $ 39,568 $ 37,515 $ 39,177 $ 42,038 $ 39,547 $ 39,640 $ 43,007 Less: Lawsuit Proceeds (TTM) $ 4,005 $ 4,005 $ 4,005 $ 4,005 $ - $ - $ - $ - $ 92 $ 92 $ 92 Adjusted Operating Income (non-GAAP) (TTM) $ 31,376 $ 36,666 $ 39,110 $ 38,775 $ 39,568 $ 37,515 $ 39,177 $ 42,038 $ 39,455 $ 39,548 $ 42,915 Tax Effect $6,232 $8,003 $9,845 $8,627 $8,723 $7,269 $7,642 $9,715 $9,152 $8,982 $9,718 After Tax Adj. Operating Income (TTM) $ 25,144 $ 28,663 $ 29,265 $ 30,148 $ 30,845 $ 30,246 $ 31,535 $ 32,323 $ 30,303 $ 30,566 $ 33,197 Average Invested Capital * $271,587 $277,291 $285,547 $293,516 $302,721 $308,339 $315,751 $319,074 $326,168 $342,408 $366,995 ROIC 9.3% 10.3% 10.2% 10.3% 10.2% 9.8% 10.0% 10.1% 9.3% 8.9% 9.0% * Average Invested Capital is computed using Share Owners’ equity plus current and non-current debt less cash and cash equivalents averaged for the last five quarters. Prior period amounts have been restated to reflect the retrospective KIMBALL ELECTRONICS adoption of new accounting guidance on improving the presentation of net periodic pension cost and net periodic 35 postretirement benefit cost.

KIMBALL ELECTRONICS (Nasdaq: KE) // (Unaudited) Reconciliation of Non-GAAP Results (In Thousands) FY16 FY17 FY18 TTM 3Q18 TTM 3Q19 Operating Income (GAAP) $ 29,518 $ 42,780 $ 42,038 $ 39,177 $ 43,007 Add: Spin-off Expenses $ 137 $ - $ - $ - $ - Less: Lawsuit Proceeds $ - $ 4,005 $ - $ - $ 92 Adjusted Operating Income (non-GAAP) $ 29,655 $ 38,775 $ 42,038 $ 39,177 $ 42,915 Tax Effect $ 6,267 $ 8,627 $ 9,715 $ 7,642 $ 9,718 After Tax Adj. Operating Income $ 23,388 $ 30,148 $ 32,323 $ 31,535 $ 33,197 Average Invested Capital * $ 263,371 $ 293,516 $ 319,074 $ 315,751 $ 366,995 ROIC 8.9% 10.3% 10.1% 10.0% 9.0% * Average Invested Capital is computed using Share Owners’ equity plus current and non-current debt less cash and cash equivalents averaged for the last five quarters. Prior period amounts have been restated to reflect the retrospective KIMBALL ELECTRONICS adoption of new accounting guidance on improving the presentation of net periodic pension cost and net periodic 36 postretirement benefit cost.