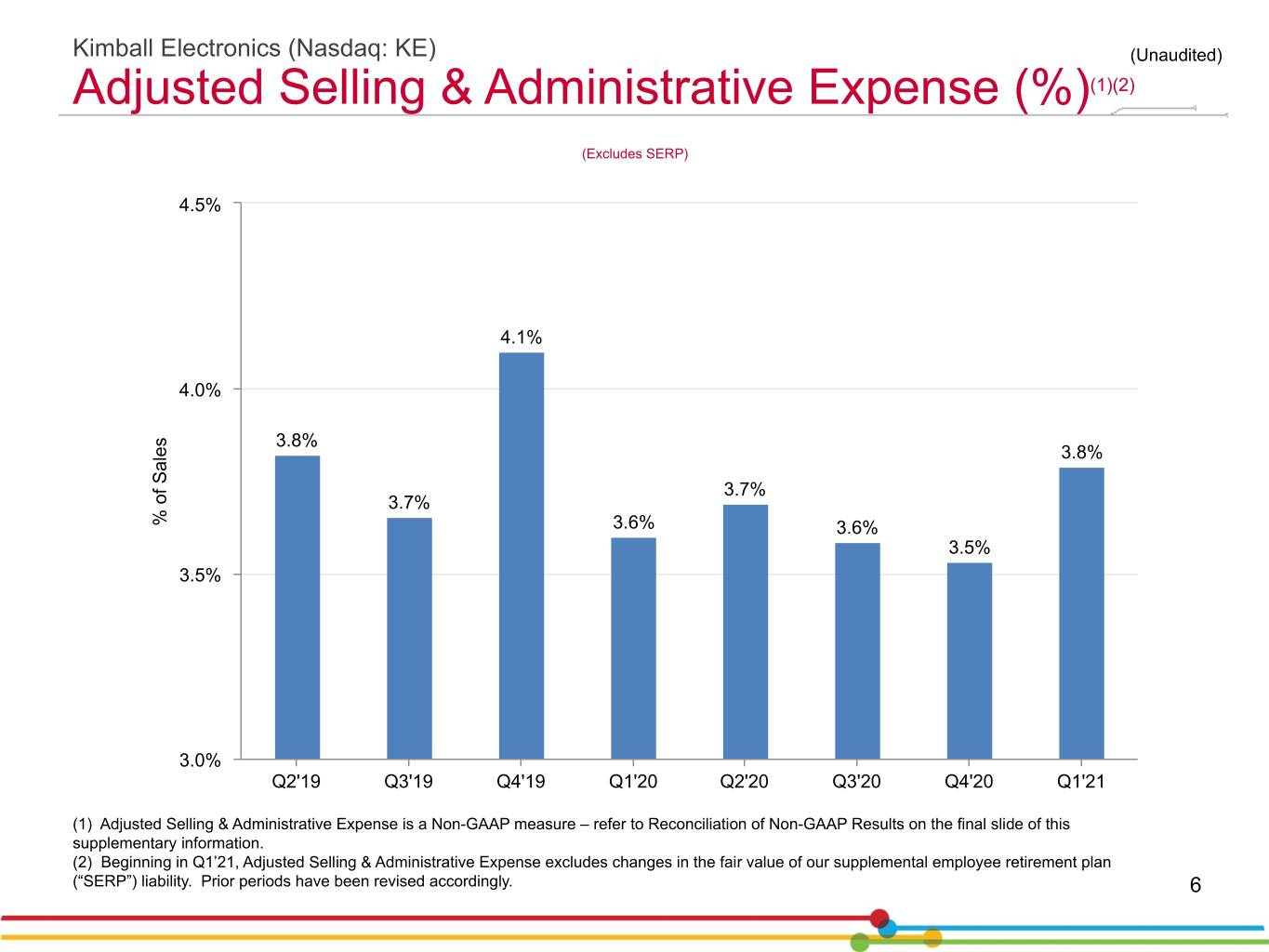

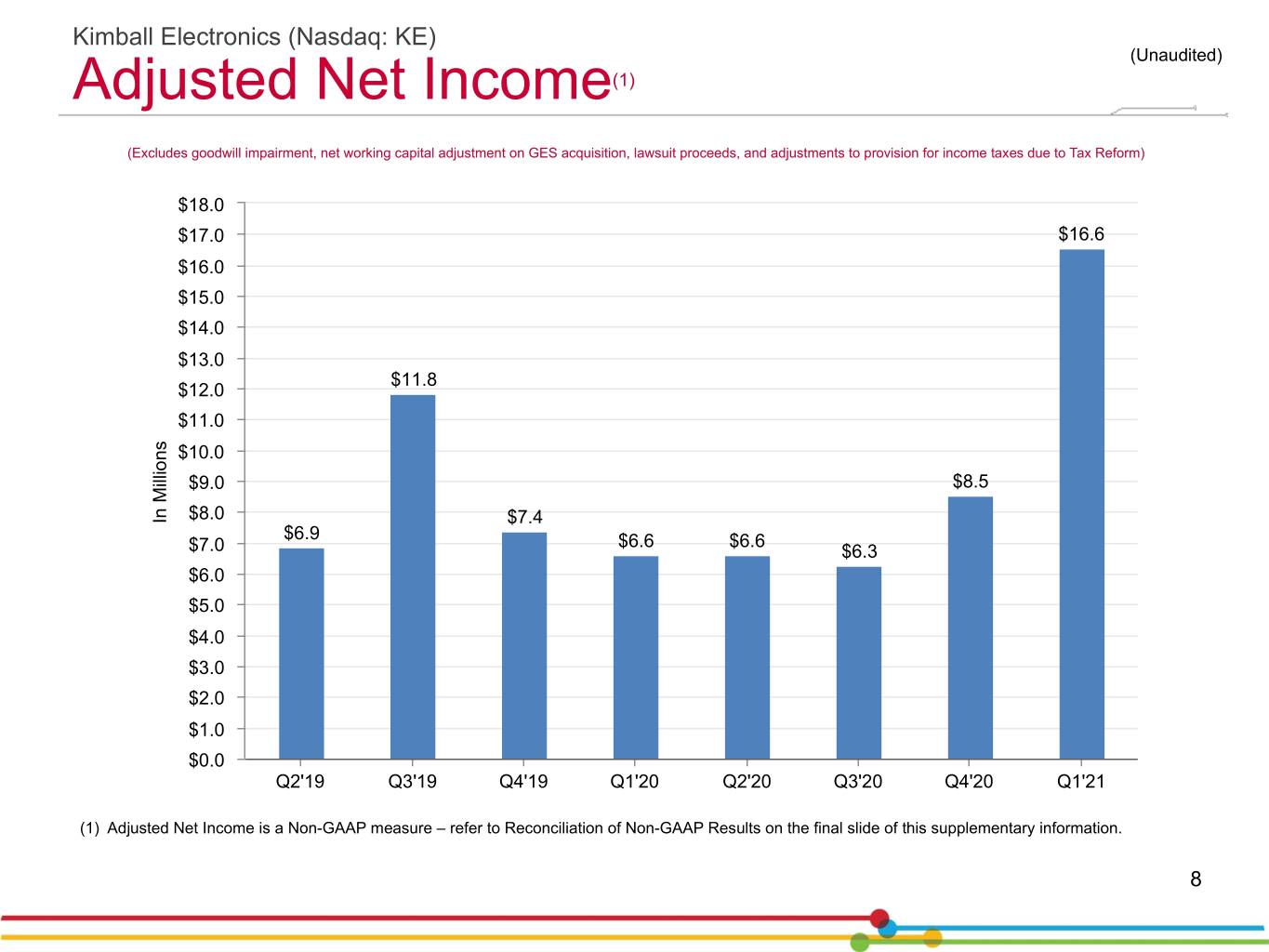

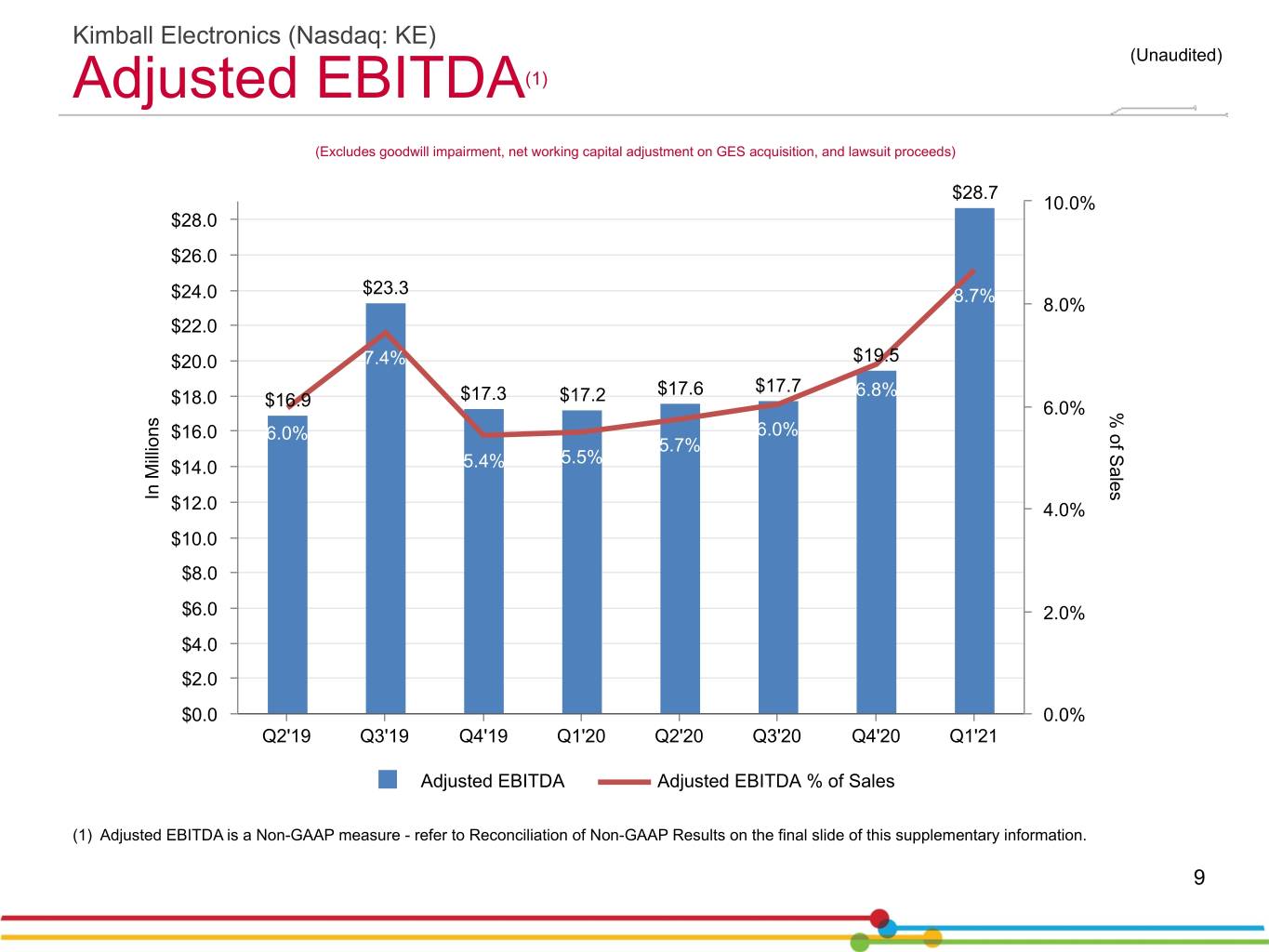

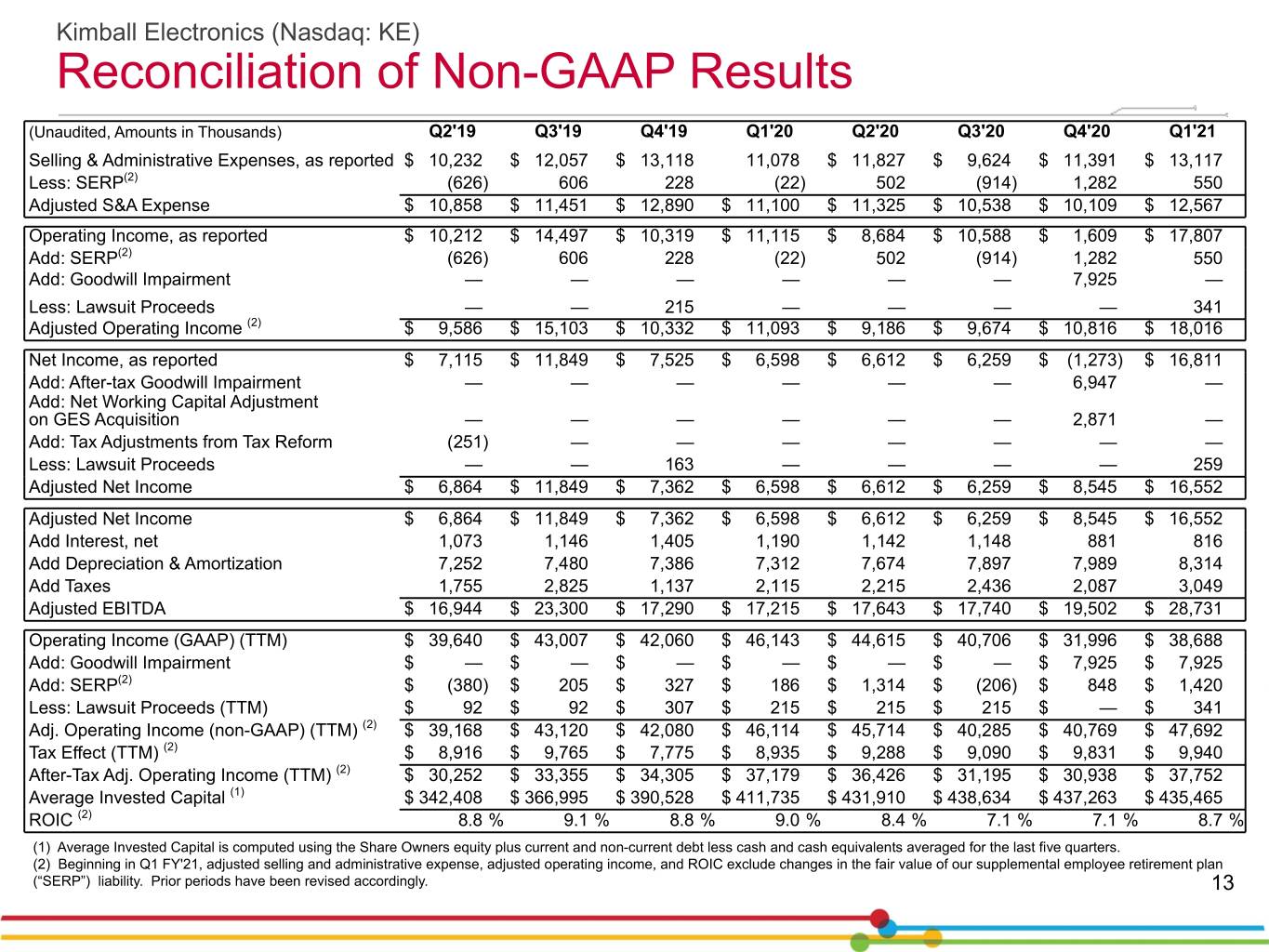

Kimball Electronics (Nasdaq: KE) Safe Harbor Statement Certain statements contained within this supplementary information and any statements made during our earnings conference call today may be considered forward-looking under the Private Securities Litigation Reform Act of 1995 and are subject to risks and uncertainties including, but not limited to, successful integration of acquisitions and new operations, adverse changes in global economic conditions, the geopolitical environment, global health emergencies including the COVID-19 pandemic, significant reductions in volumes and order patterns from key contract customers, loss of key customers or suppliers within specific industries, financial stability of key customers and suppliers, availability or cost of raw materials and components, the ability of the supply chain to react successfully to significant increases in demand for certain medical components, impact related to tariffs and other trade barriers, increased competitive pricing pressures, foreign exchange fluctuations, changes in the regulatory environment, or similar unforeseen events. Additional cautionary statements regarding other risk factors that could have an effect on the future performance of Kimball Electronics, Inc. (the “Company”) are contained in the Company’s Annual Report on Form 10-K for the fiscal year ended June 30, 2020, our earnings release, and other filings with the Securities and Exchange Commission (the “SEC”). This supplementary information contains non-GAAP financial measures. A non-GAAP financial measure is a numerical measure of a company’s financial performance that excludes or includes amounts so as to be different than the most directly comparable measure calculated and presented in accordance with Generally Accepted Accounting Principles (GAAP) in the United States in the statement of income, statement of comprehensive income, balance sheet, statement of cash flows, or statement of Share Owners' equity of the Company. The non-GAAP financial measures contained herein include Adjusted Selling & Administrative Expenses, Adjusted Operating Income, Adjusted Net Income, Adjusted EBITDA, and Return on Invested Capital (ROIC), which have been adjusted for changes in the fair value of the supplemental employee retirement plan (“SERP”), goodwill impairment, expense related to a net working capital adjustment after the measurement period of the GES acquisition, proceeds from lawsuit settlements, and adjustments to provision for income taxes due to the U.S. Tax Cuts and Jobs Act (“Tax Reform”) enacted in December 2017. Management believes it is useful for investors to understand how its core operations performed without the effects of the SERP liability, the goodwill impairment, the expense related to the net working capital adjustment, the lawsuit proceeds, and adjustments to provision for income taxes due to Tax Reform. Excluding these amounts allows investors to meaningfully trend, analyze, and benchmark the performance of the Company’s core operations. Many of the Company’s internal performance measures that management uses to make certain operating decisions use these and other non-GAAP measures to enable meaningful trending of core operating metrics. 2

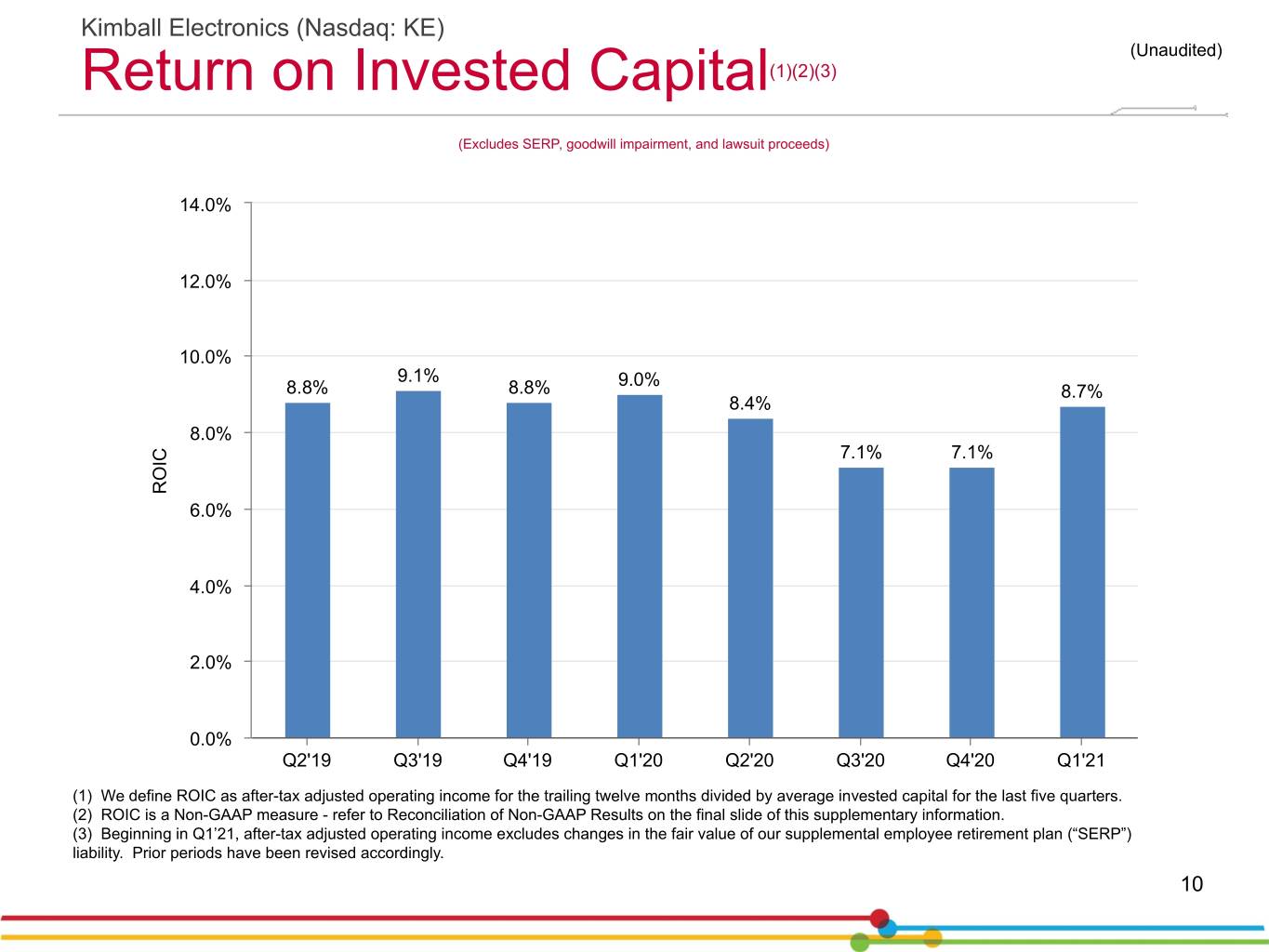

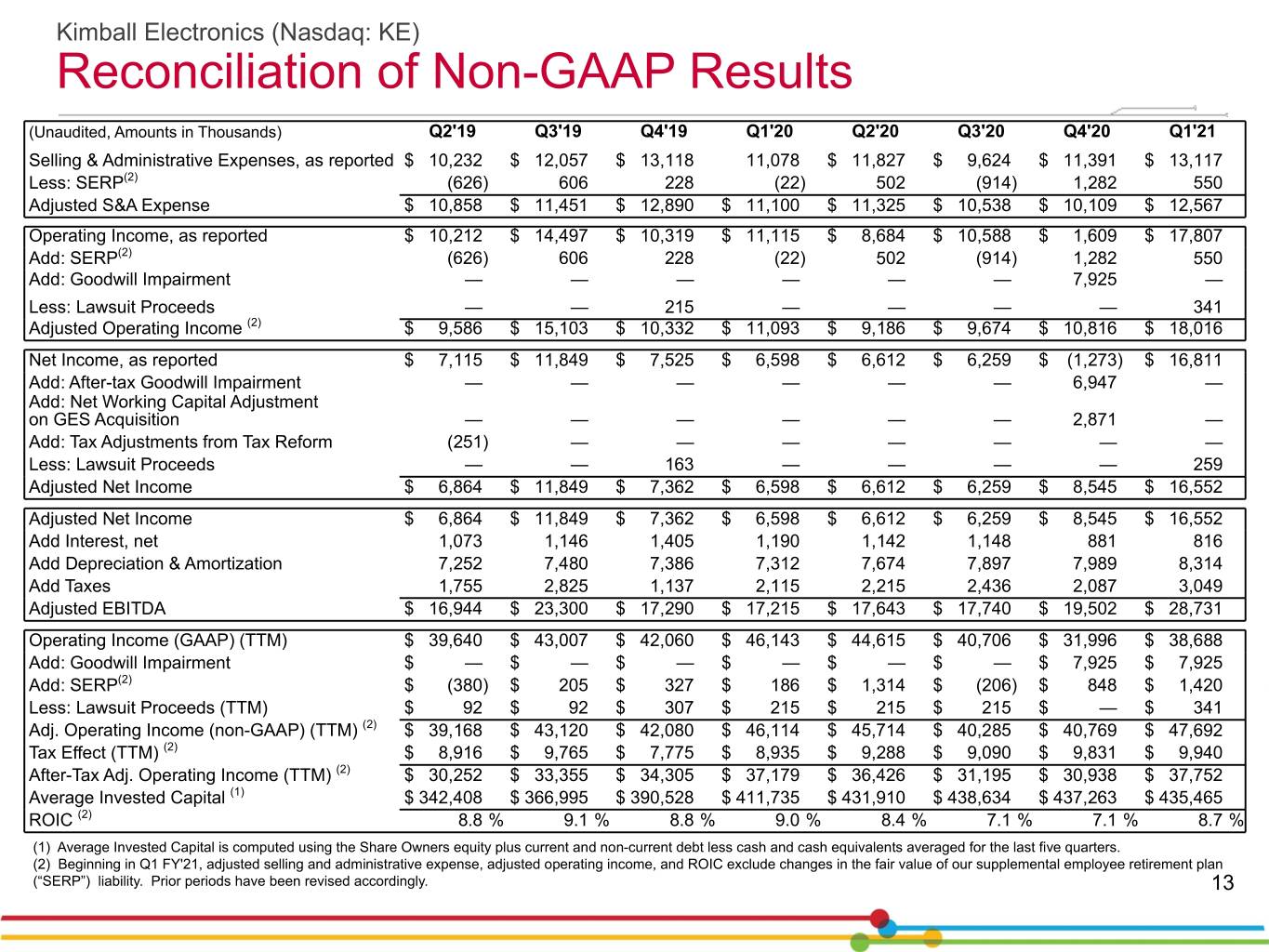

Kimball Electronics (Nasdaq: KE) Reconciliation of Non-GAAP Results (Unaudited, Amounts in Thousands) Q2'19 Q3'19 Q4'19 Q1'20 Q2'20 Q3'20 Q4'20 Q1'21 Selling & Administrative Expenses, as reported $ 10,232 $ 12,057 $ 13,118 11,078 $ 11,827 $ 9,624 $ 11,391 $ 13,117 Less: SERP(2) (626) 606 228 (22) 502 (914) 1,282 550 Adjusted S&A Expense $ 10,858 $ 11,451 $ 12,890 $ 11,100 $ 11,325 $ 10,538 $ 10,109 $ 12,567 Operating Income, as reported $ 10,212 $ 14,497 $ 10,319 $ 11,115 $ 8,684 $ 10,588 $ 1,609 $ 17,807 Add: SERP(2) (626) 606 228 (22) 502 (914) 1,282 550 Add: Goodwill Impairment — — — — — — 7,925 — Less: Lawsuit Proceeds — — 215 — — — — 341 Adjusted Operating Income (2) $ 9,586 $ 15,103 $ 10,332 $ 11,093 $ 9,186 $ 9,674 $ 10,816 $ 18,016 Net Income, as reported $ 7,115 $ 11,849 $ 7,525 $ 6,598 $ 6,612 $ 6,259 $ (1,273) $ 16,811 Add: After-tax Goodwill Impairment — — — — — — 6,947 — Add: Net Working Capital Adjustment on GES Acquisition — — — — — — 2,871 — Add: Tax Adjustments from Tax Reform (251) — — — — — — — Less: Lawsuit Proceeds — — 163 — — — — 259 Adjusted Net Income $ 6,864 $ 11,849 $ 7,362 $ 6,598 $ 6,612 $ 6,259 $ 8,545 $ 16,552 Adjusted Net Income $ 6,864 $ 11,849 $ 7,362 $ 6,598 $ 6,612 $ 6,259 $ 8,545 $ 16,552 Add Interest, net 1,073 1,146 1,405 1,190 1,142 1,148 881 816 Add Depreciation & Amortization 7,252 7,480 7,386 7,312 7,674 7,897 7,989 8,314 Add Taxes 1,755 2,825 1,137 2,115 2,215 2,436 2,087 3,049 Adjusted EBITDA $ 16,944 $ 23,300 $ 17,290 $ 17,215 $ 17,643 $ 17,740 $ 19,502 $ 28,731 Operating Income (GAAP) (TTM) $ 39,640 $ 43,007 $ 42,060 $ 46,143 $ 44,615 $ 40,706 $ 31,996 $ 38,688 Add: Goodwill Impairment $ — $ — $ — $ — $ — $ — $ 7,925 $ 7,925 Add: SERP(2) $ (380) $ 205 $ 327 $ 186 $ 1,314 $ (206) $ 848 $ 1,420 Less: Lawsuit Proceeds (TTM) $ 92 $ 92 $ 307 $ 215 $ 215 $ 215 $ — $ 341 Adj. Operating Income (non-GAAP) (TTM) (2) $ 39,168 $ 43,120 $ 42,080 $ 46,114 $ 45,714 $ 40,285 $ 40,769 $ 47,692 Tax Effect (TTM) (2) $ 8,916 $ 9,765 $ 7,775 $ 8,935 $ 9,288 $ 9,090 $ 9,831 $ 9,940 After-Tax Adj. Operating Income (TTM) (2) $ 30,252 $ 33,355 $ 34,305 $ 37,179 $ 36,426 $ 31,195 $ 30,938 $ 37,752 Average Invested Capital (1) $ 342,408 $ 366,995 $ 390,528 $ 411,735 $ 431,910 $ 438,634 $ 437,263 $ 435,465 ROIC (2) 8.8 % 9.1 % 8.8 % 9.0 % 8.4 % 7.1 % 7.1 % 8.7 % (1) Average Invested Capital is computed using the Share Owners equity plus current and non-current debt less cash and cash equivalents averaged for the last five quarters. (2) Beginning in Q1 FY'21, adjusted selling and administrative expense, adjusted operating income, and ROIC exclude changes in the fair value of our supplemental employee retirement plan (“SERP”) liability. Prior periods have been revised accordingly. 13