SECOND QUARTER 2019 EARNINGS CONFERENCE CALL PRESENTATION 1

SAFE HARBOR This presentation includes certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding future financial performance, future growth and future acquisitions. These statements are based on Pangaea’s and managements’ current expectations or beliefs and are subject to uncertainty and changes in circumstances. Actual results may vary materially from those expressed or implied by the statements herein due to changes in economic, business, competitive and/or regulatory factors, and other risks and uncertainties affecting the operation of Pangaea’s business. These risks, uncertainties and contingencies include: business conditions; weather and natural disasters; changing interpretations of GAAP; outcomes of government reviews; inquiries and investigations and related litigation; continued compliance with government regulations; legislation or regulatory environments; requirements or changes adversely affecting the business in which Pangaea is engaged; fluctuations in customer demand; management of rapid growth; intensity of competition from other providers of logistics and shipping services; general economic conditions; geopolitical events and regulatory changes; and other factors set forth in Pangaea’s filings with the Securities and Exchange Commission and the filings of its predecessors. The information set forth herein should be read in light of such risks. Further, investors should keep in mind that certain of Pangaea’s financial results are unaudited and do not conform to SEC Regulation S-X and as a result such information may fluctuate materially depending on many factors. Accordingly, Pangaea’s financial results in any particular period may not be indicative of future results. Pangaea is not under any obligation to, and expressly disclaims any obligation to, update or alter its forward-looking statements, whether as a result of new information, future events, changes in assumptions or otherwise. 2

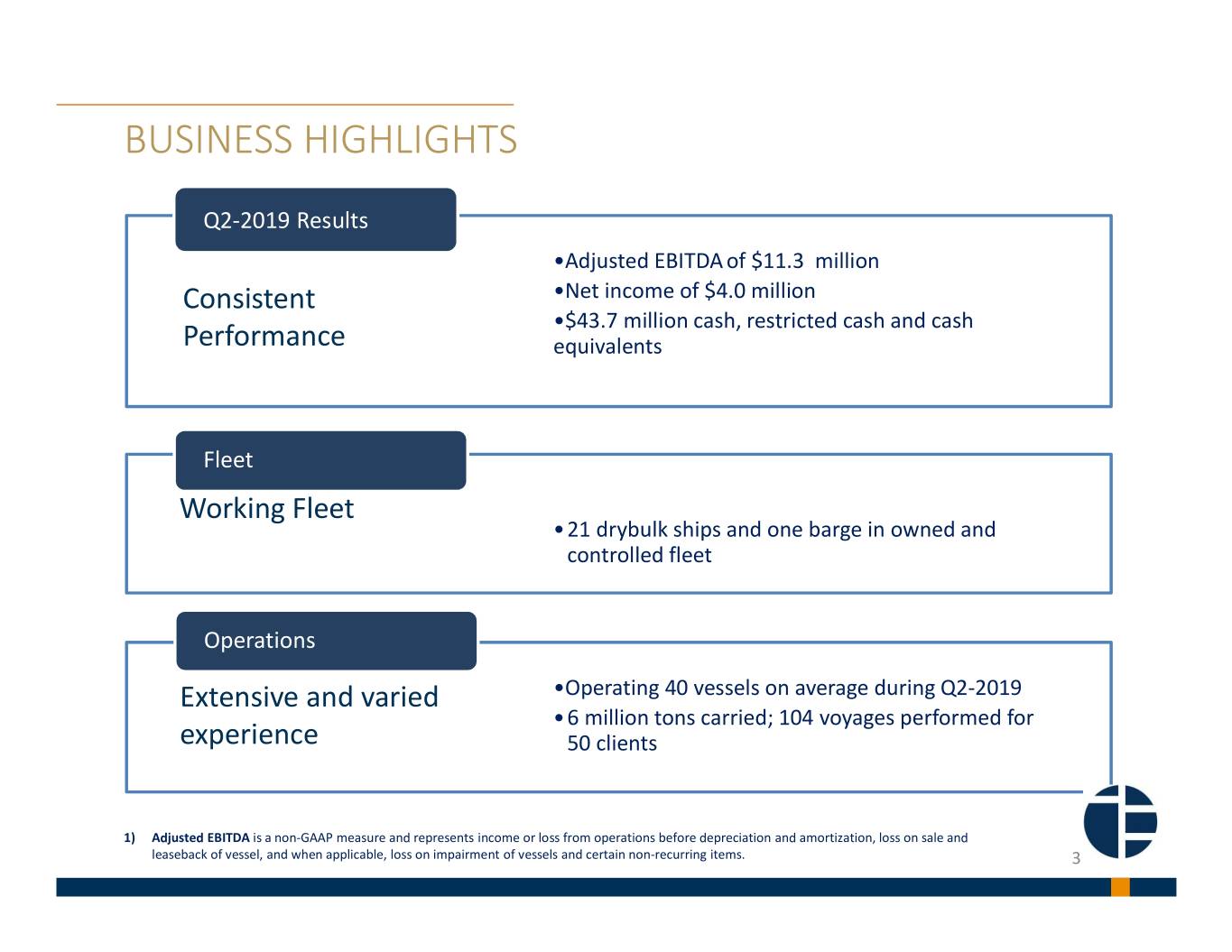

BUSINESS HIGHLIGHTS Q2-2019 Results •Adjusted EBITDA of $11.3 million Consistent •Net income of $4.0 million •$43.7 million cash, restricted cash and cash Performance equivalents Fleet Working Fleet •21 drybulk ships and one barge in owned and controlled fleet Operations Extensive and varied •Operating 40 vessels on average during Q2-2019 •6 million tons carried; 104 voyages performed for experience 50 clients 1) Adjusted EBITDA is a non-GAAP measure and represents income or loss from operations before depreciation and amortization, loss on sale and leaseback of vessel, and when applicable, loss on impairment of vessels and certain non-recurring items. 3

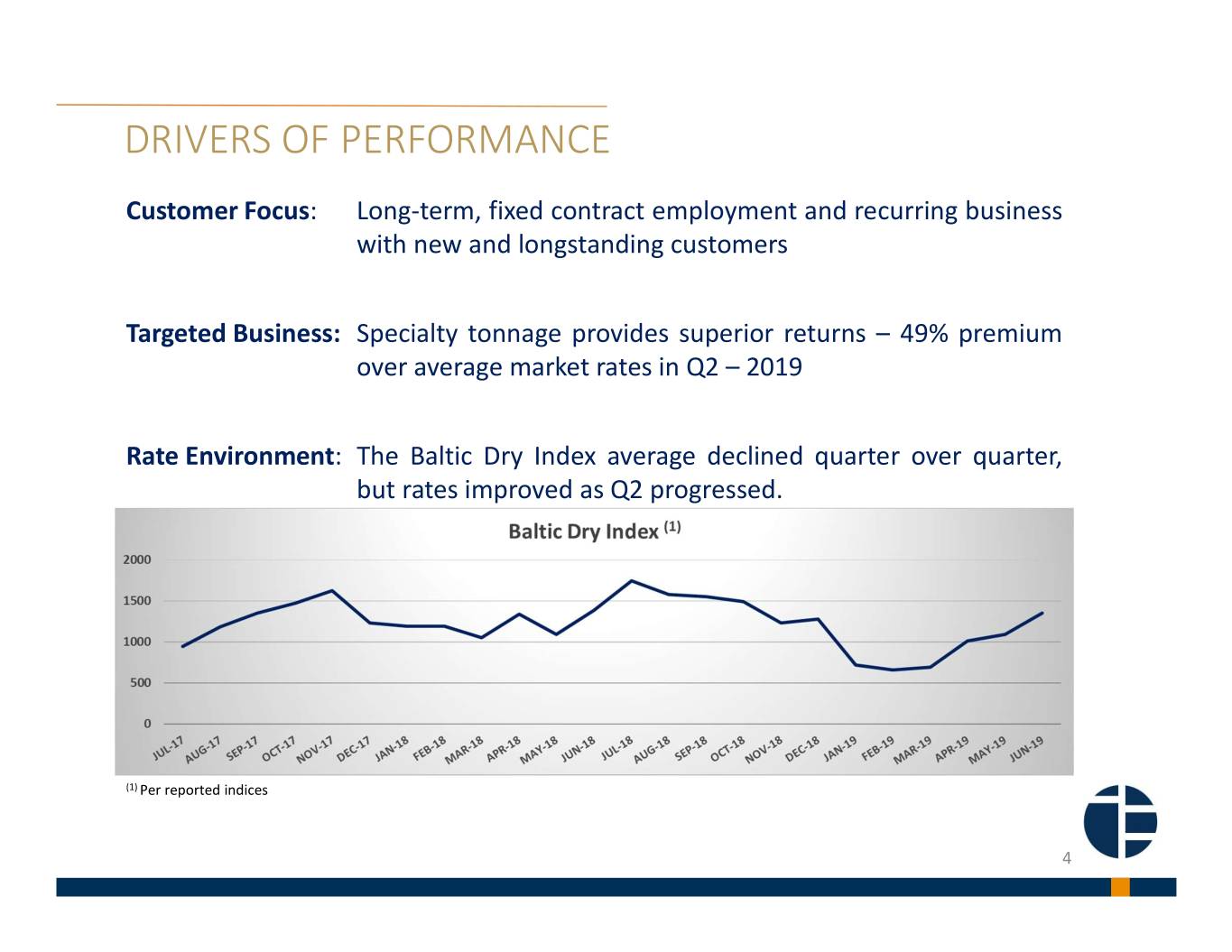

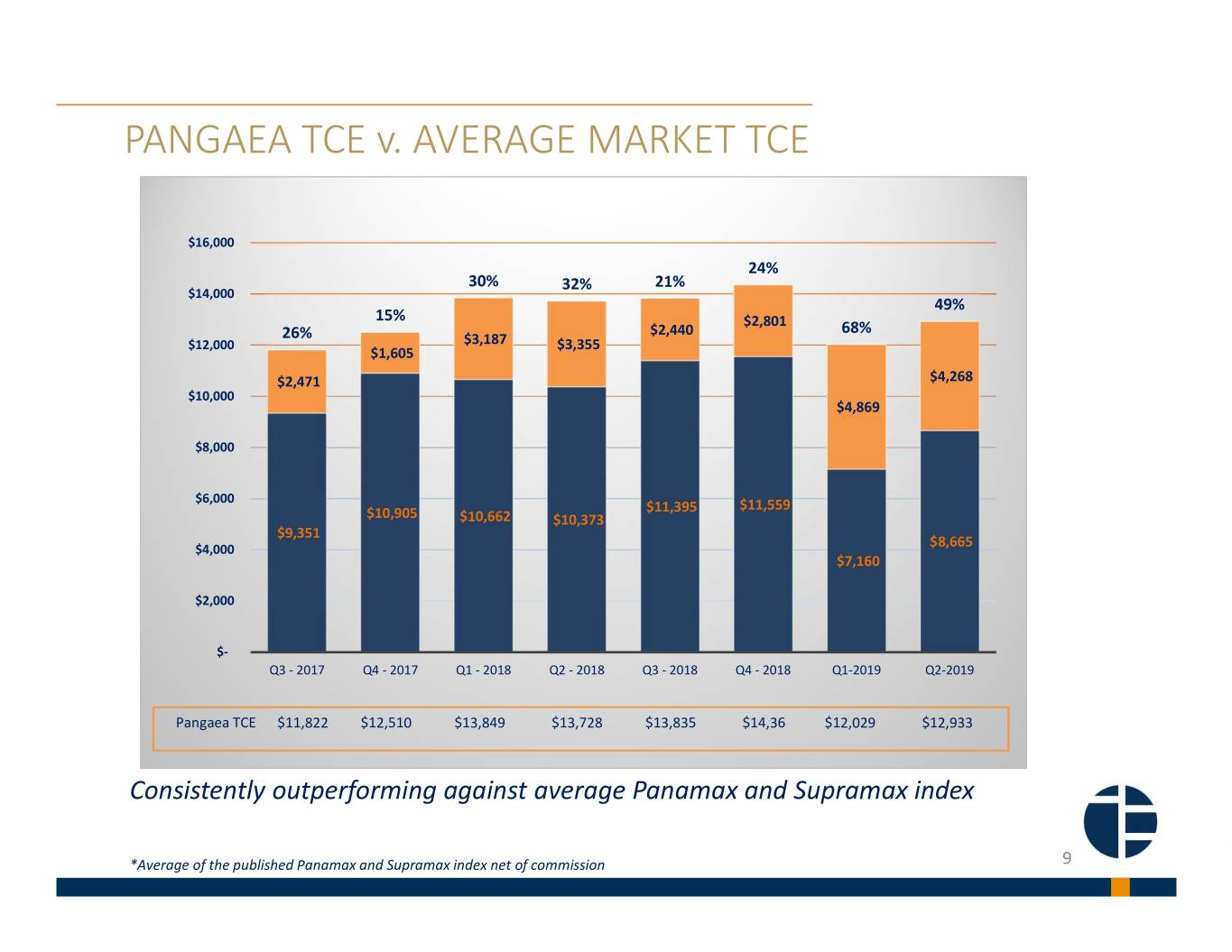

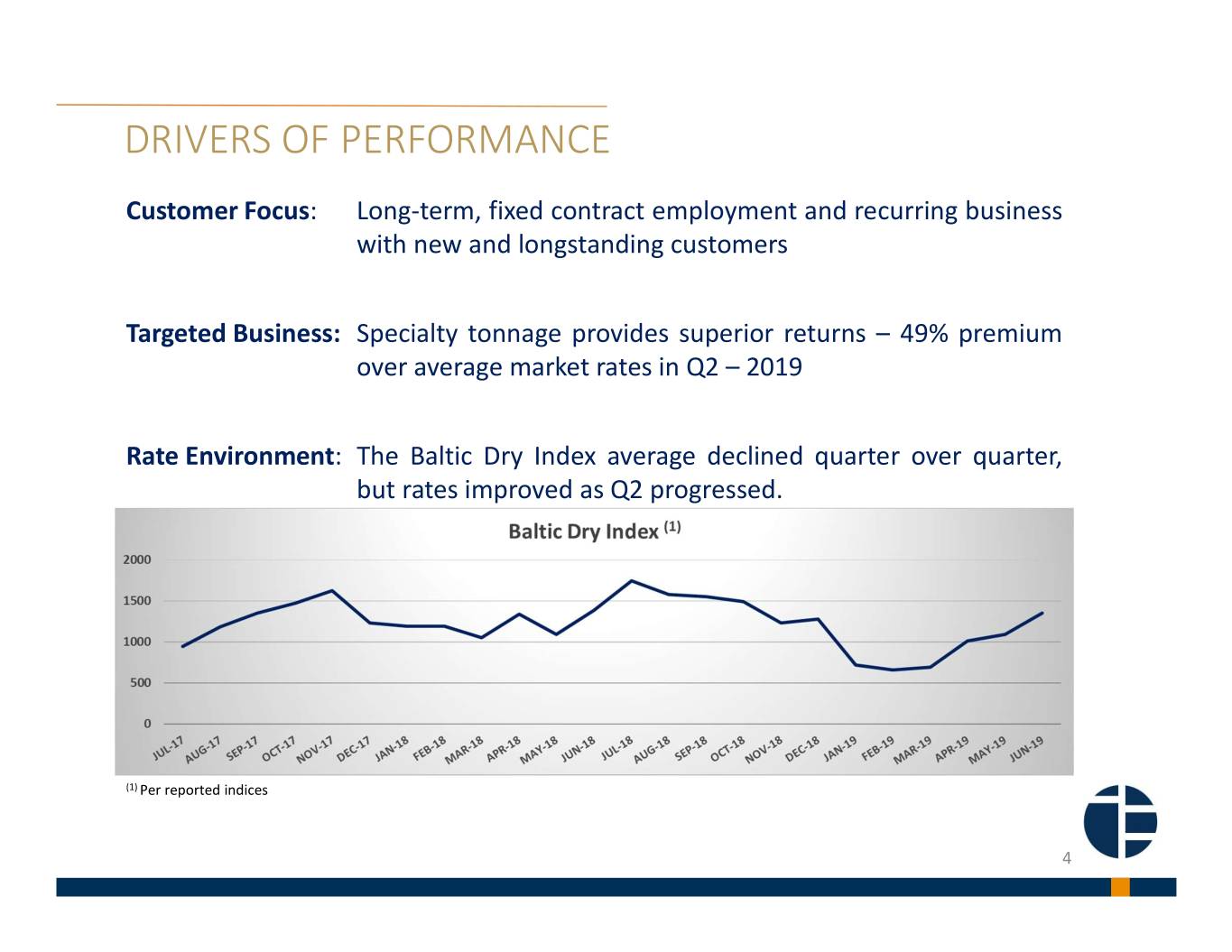

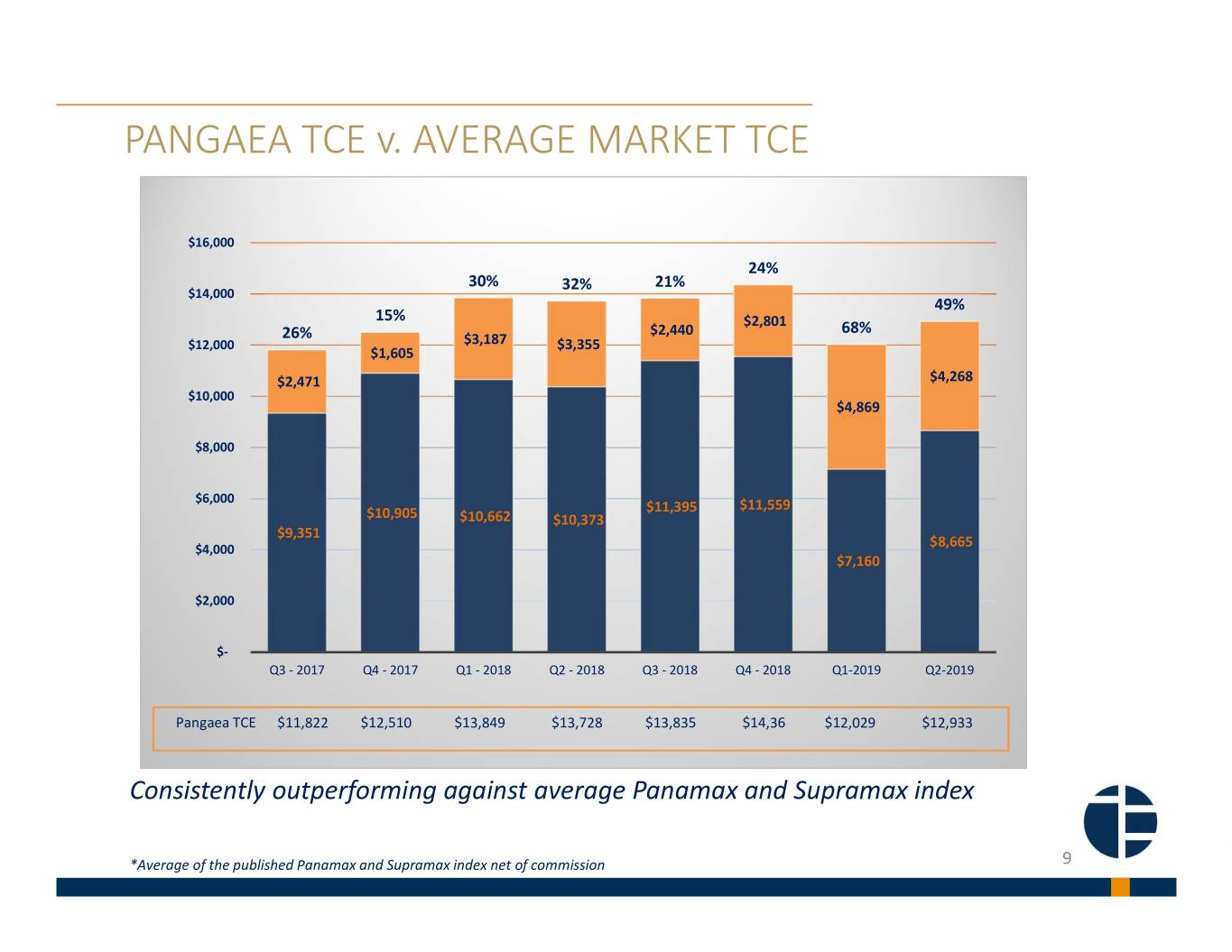

DRIVERS OF PERFORMANCE Customer Focus: Long-term, fixed contract employment and recurring business with new and longstanding customers Targeted Business: Specialty tonnage provides superior returns – 49% premium over average market rates in Q2 – 2019 Rate Environment: The Baltic Dry Index average declined quarter over quarter, but rates improved as Q2 progressed. (1) Per reported indices 4

FINANCIAL HIGHLIGHTS • Net income attributable to Pangaea Logistics Solutions Ltd. approximately $4.0 million for three months ended June 30, 2019 as compared to approximately $5.8 million for the same period of 2018. • Earnings per share were $0.09 as compared to $0.13 for the three months ended June 30, 2018. • Pangaea's TCE rates were $12,933 for the three months ended June 30, 2019 while the market average for the second quarter of 2019 was approximately $8,665, giving the Company an overall average premium over market rates of approximately $4,268 or 49%. The Company's long-term COAs, cargo focus, and specialized fleet give rise to this premium. • At the end of the quarter, Pangaea had $43.7 million in cash, restricted cash and cash equivalents. • Initiated and paid quarterly cash dividend of $0.035 per common share 5

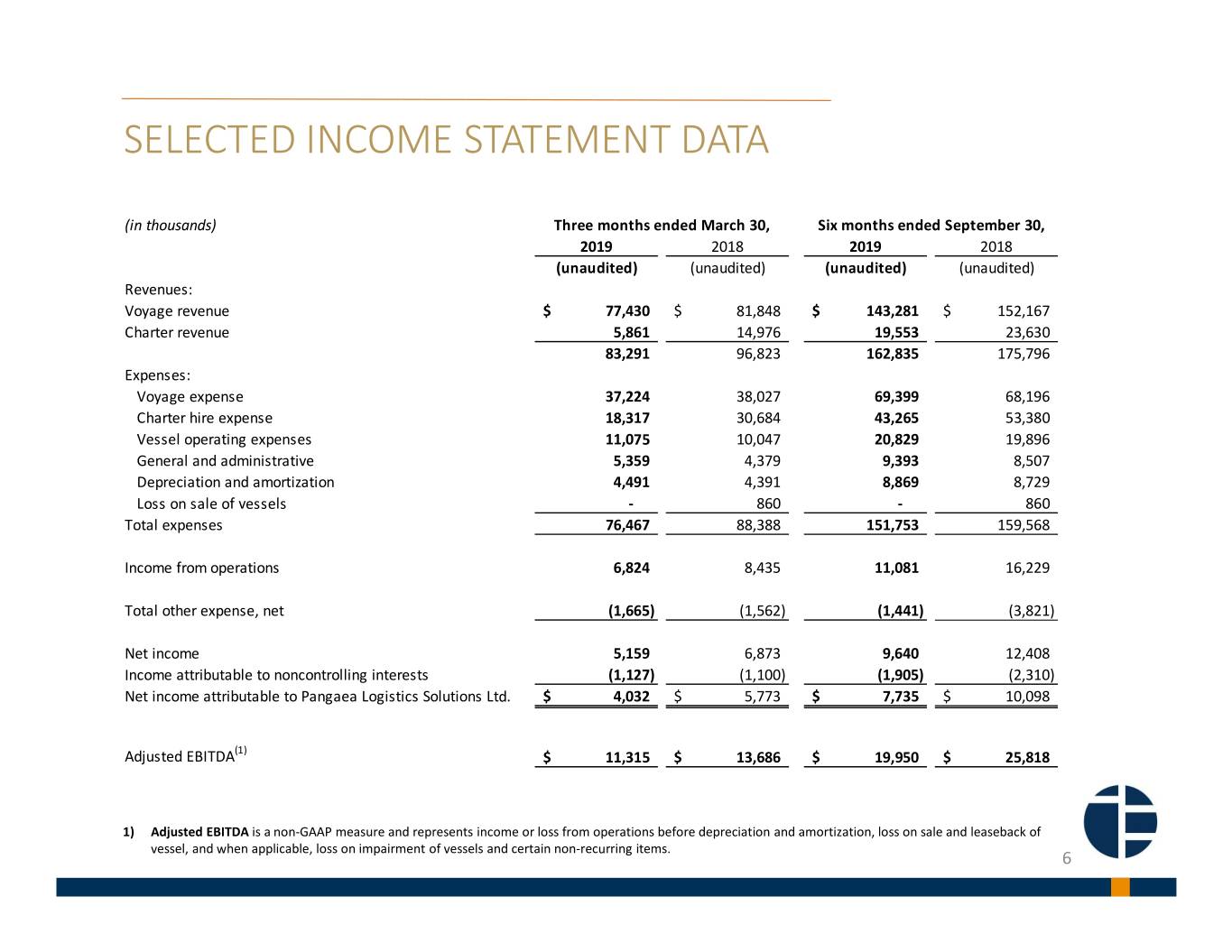

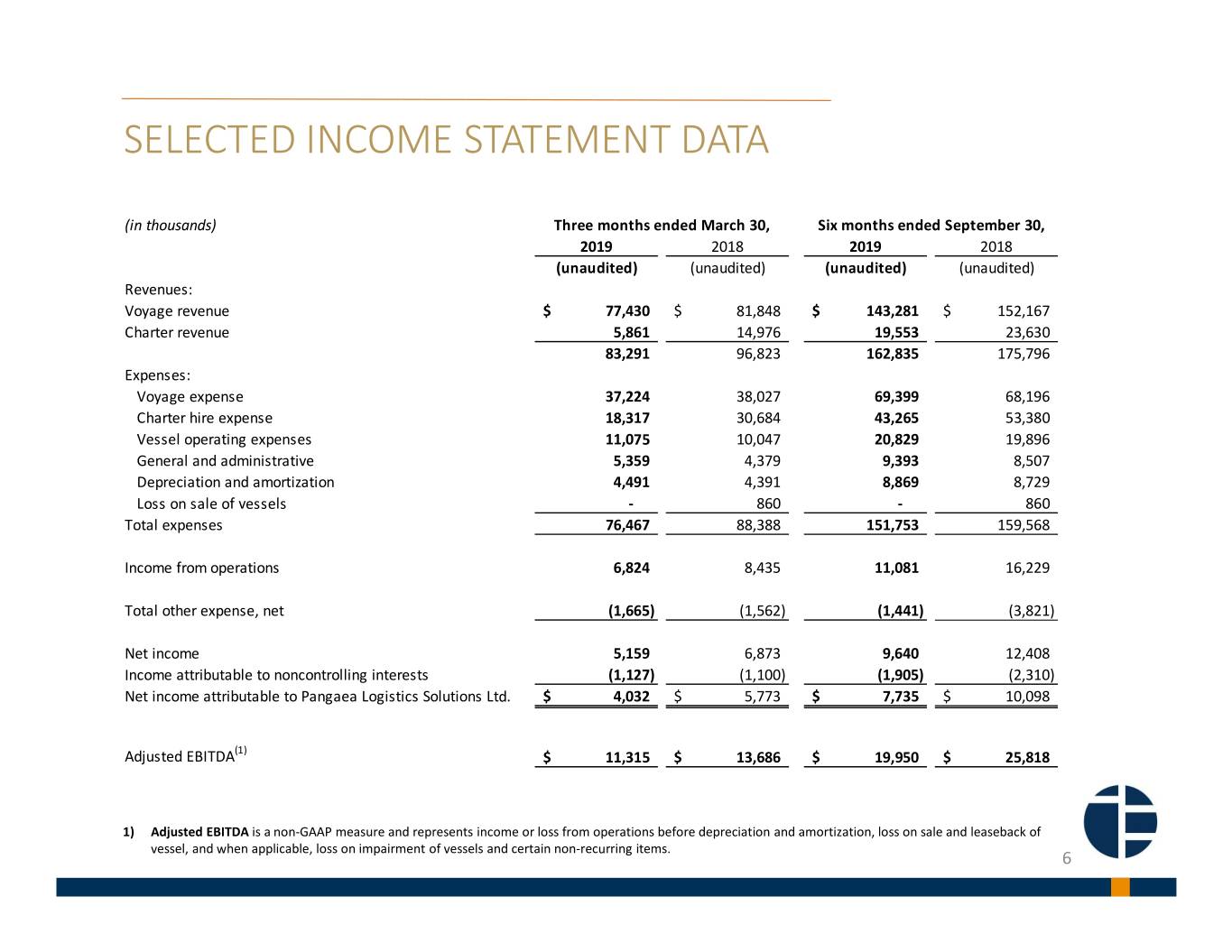

SELECTED INCOME STATEMENT DATA (in thousands) Three months ended March 30, Six months ended September 30, 2019 2018 2019 2018 (unaudited) (unaudited) (unaudited) (unaudited) Revenues: Voyage revenue $ 77,430 $ 81,848 $ 143,281 $ 152,167 Charter revenue 5,861 14,976 19,553 23,630 83,291 96,823 162,835 175,796 Expenses: Voyage expense 37,224 38,027 69,399 68,196 Charter hire expense 18,317 30,684 43,265 53,380 Vessel operating expenses 11,075 10,047 20,829 19,896 General and administrative 5,359 4,379 9,393 8,507 Depreciation and amortization 4,491 4,391 8,869 8,729 Loss on sale of vessels - 860 - 860 Total expenses 76,467 88,388 151,753 159,568 Income from operations 6,824 8,435 11,081 16,229 Total other expense, net (1,665) (1,562) (1,441) (3,821) Net income 5,159 6,873 9,640 12,408 Income attributable to noncontrolling interests (1,127) (1,100) (1,905) (2,310) Net income attributable to Pangaea Logistics Solutions Ltd. $ 4,032 $ 5,773 $ 7,735 $ 10,098 Adjusted EBITDA(1) $ 11,315 $ 13,686 $ 19,950 $ 25,818 1) Adjusted EBITDA is a non-GAAP measure and represents income or loss from operations before depreciation and amortization, loss on sale and leaseback of vessel, and when applicable, loss on impairment of vessels and certain non-recurring items. 6

SELECTED BALANCE SHEET & CASH FLOW DATA (in thousands) June 30, 2019 December 31, 2018 (unaudited) Current Assets Cash and cash equivalents $ 41,161 $ 53,615 Accounts receivable, net 15,996 28,482 Other current assets 35,941 31,410 Total current assets 93,098 113,506 Restricted Cash 2,500 2,500 Fixed assets, including finance lease right of use assets, net 301,097 281,356 Investment in newbuildings in-process 7,657 - Right of Use Asset 54,864 56,113 Total assets $ 459,216 $ 453,475 Current liabilities Accounts payable, accrued expenses and other current liabilities $ 31,169 $ 31,898 Related party debt 1,186 2,878 Current portion of long-term debt and finance lease liabilities 21,585 25,493 Other current liabilities 10,679 18,781 Total current liabilities 64,619 79,049 Secured long-term debt and capital lease obligations, net 156,903 141,059 Total Pangaea Logistics Solutions Ltd. equity 168,777 161,688 Non-controlling interests 68,917 71,679 Total stockholders' equity 237,694 233,367 Total liabilities and shareholders' equity $ 459,216 $ 453,475 Cash flow data June 30, 2019 June 30, 2018 (unaudited) (unaudited) Net cash provided by operations $ 19,584 $ 20,806 Net cash used in investing activities $ (33,495) $ (2,846) Net cash provided by (used in) financing activities $ 1,457 $ (4,072) The amounts in the table below have been calculated based on unrounded numbers. Accordingly, certain amounts may not sum due to the effect of rounding. 7

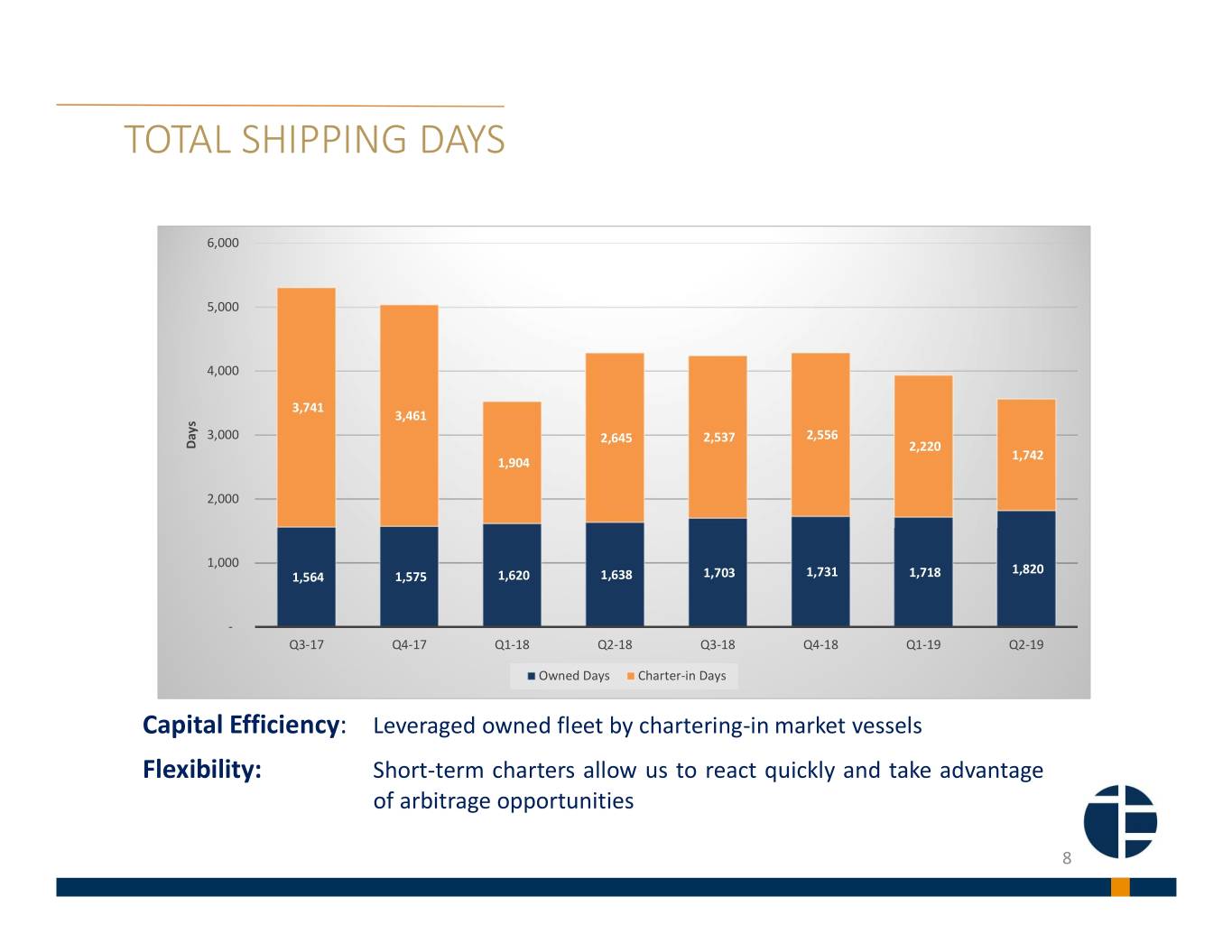

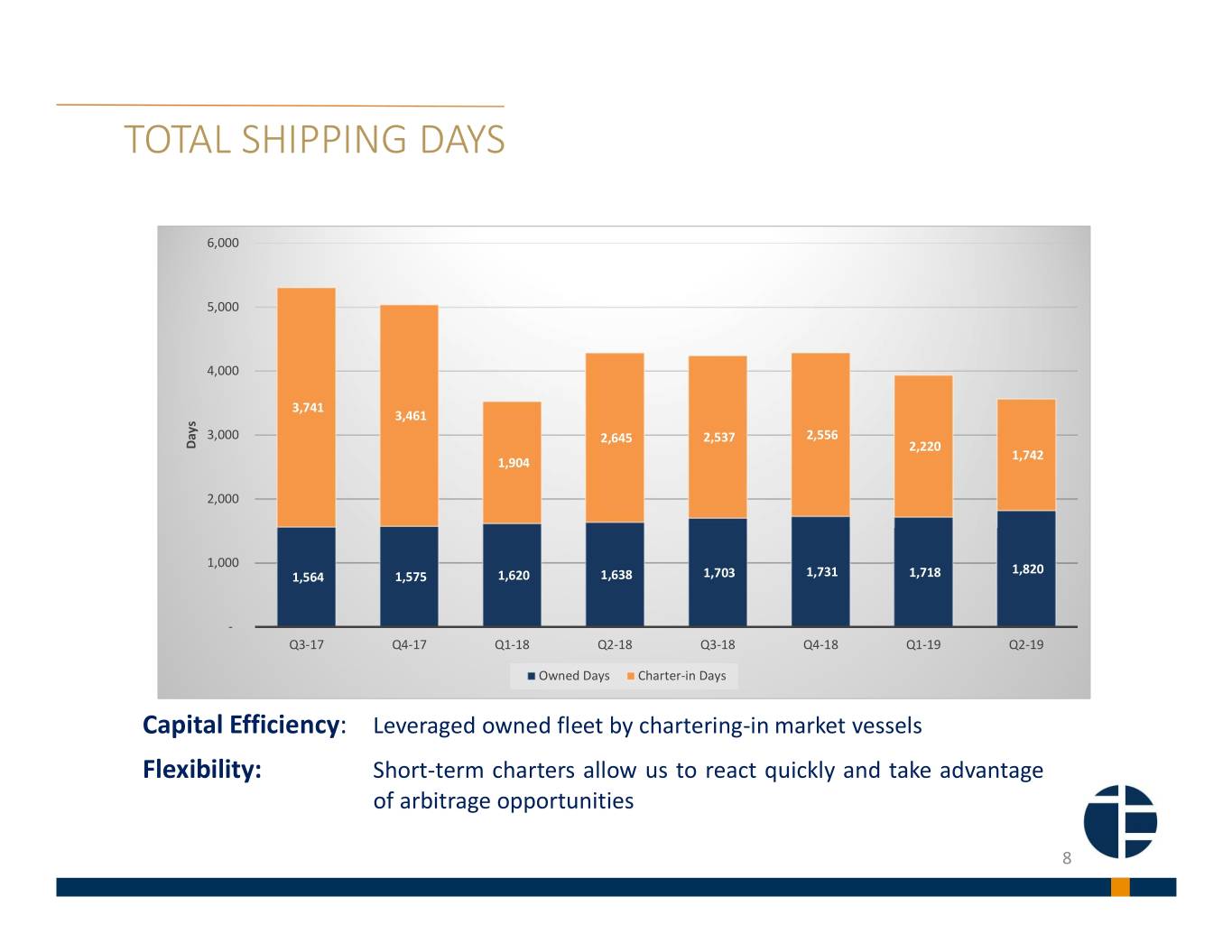

TOTAL SHIPPING DAYS 6,000 5,000 4,000 3,741 3,461 3,000 2,645 2,537 2,556 Days 2,220 1,742 1,904 2,000 1,000 1,820 1,564 1,575 1,620 1,638 1,703 1,731 1,718 - Q3-17 Q4-17 Q1-18 Q2-18 Q3-18 Q4-18 Q1-19 Q2-19 Owned Days Charter-in Days Capital Efficiency: Leveraged owned fleet by chartering-in market vessels Flexibility: Short-term charters allow us to react quickly and take advantage of arbitrage opportunities 8

PANGAEA TCE v. AVERAGE MARKET TCE $16,000 24% 30% 32% 21% $14,000 49% 15% $2,801 26% $2,440 68% $12,000 $3,187 $3,355 $1,605 $2,471 $4,268 $10,000 $4,869 $8,000 $6,000 $11,395 $11,559 $10,905 $10,662 $10,373 $9,351 $4,000 $8,665 $7,160 $2,000 $- Q3 - 2017 Q4 - 2017 Q1 - 2018 Q2 - 2018 Q3 - 2018 Q4 - 2018 Q1-2019 Q2-2019 Pangaea TCE $11,822 $12,510 $13,849 $13,728 $13,835 $14,36 $12,029 $12,933 Consistently outperforming against average Panamax and Supramax index *Average of the published Panamax and Supramax index net of commission 9

FINANCIAL PERFORMANCE Q3-2017 THROUGH Q2-2019 1) Adjusted EBITDA is a non-GAAP measure and represents income or loss from operations before depreciation and amortization, loss on sale and leaseback of vessels, and when applicable, loss on impairment of vessels and certain non-recurring items. 2) TCE is defined as total revenues less voyage expenses divided by the number of shipping days, which is consistent with industry standards. TCE rate is a common shipping industry performance measure used primarily to compare daily earnings generated by vessels on time charters with daily earnings generated by vessels on voyage charters, because charter hire rates for vessels on voyage charters are generally not expressed in per-day amounts while charter hire rates for vessels on time charters generally are expressed in per-day amounts. 10

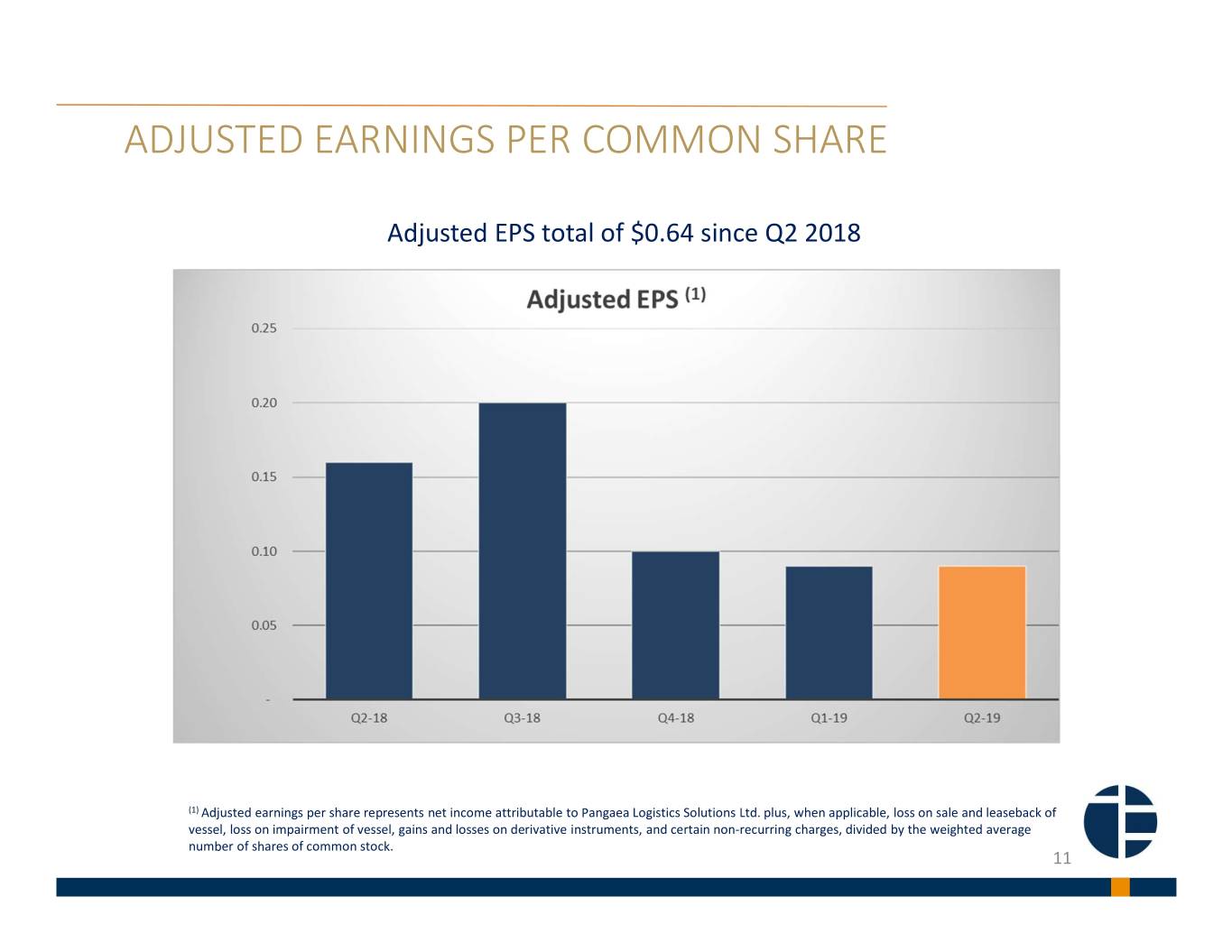

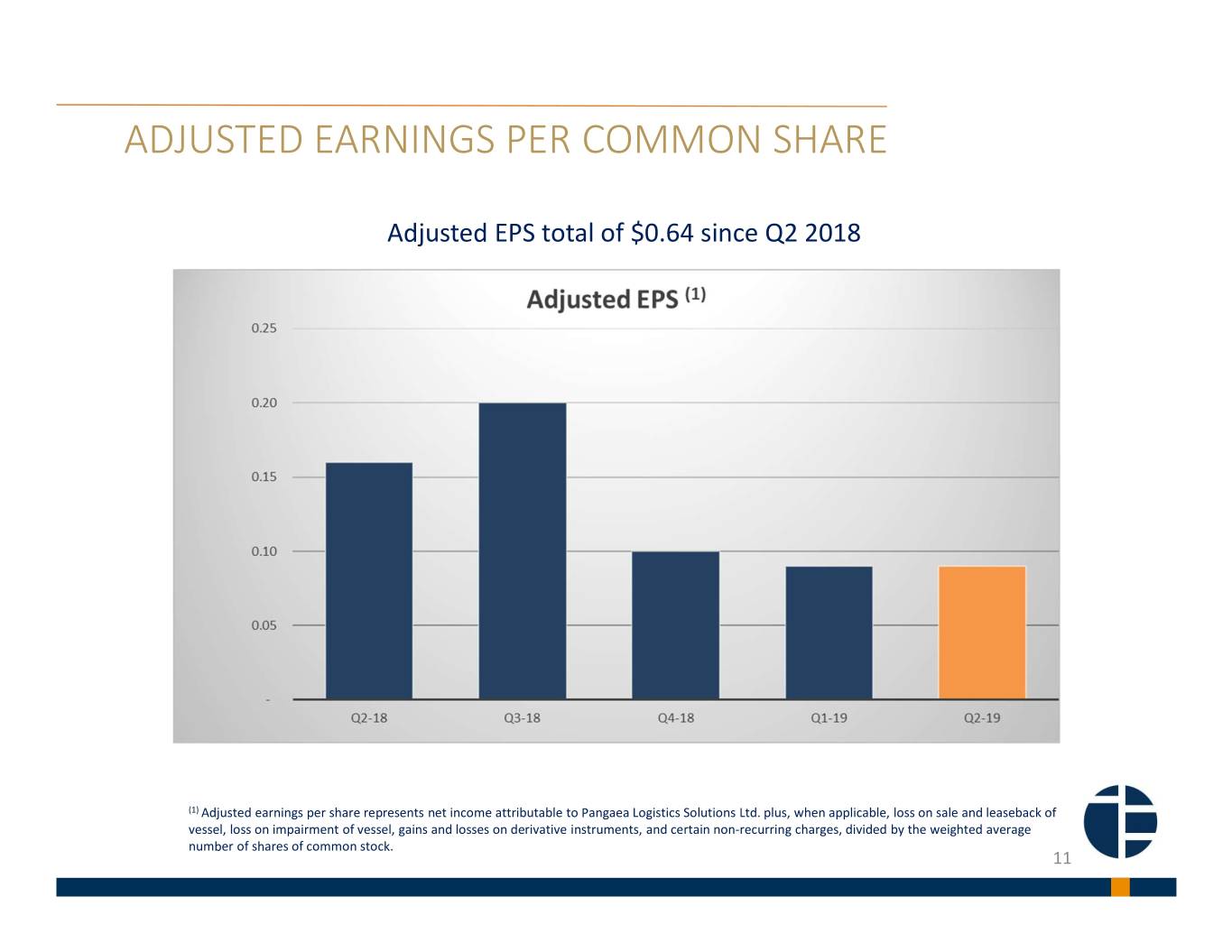

ADJUSTED EARNINGS PER COMMON SHARE Adjusted EPS total of $0.64 since Q2 2018 (1) Adjusted earnings per share represents net income attributable to Pangaea Logistics Solutions Ltd. plus, when applicable, loss on sale and leaseback of vessel, loss on impairment of vessel, gains and losses on derivative instruments, and certain non-recurring charges, divided by the weighted average number of shares of common stock. 11