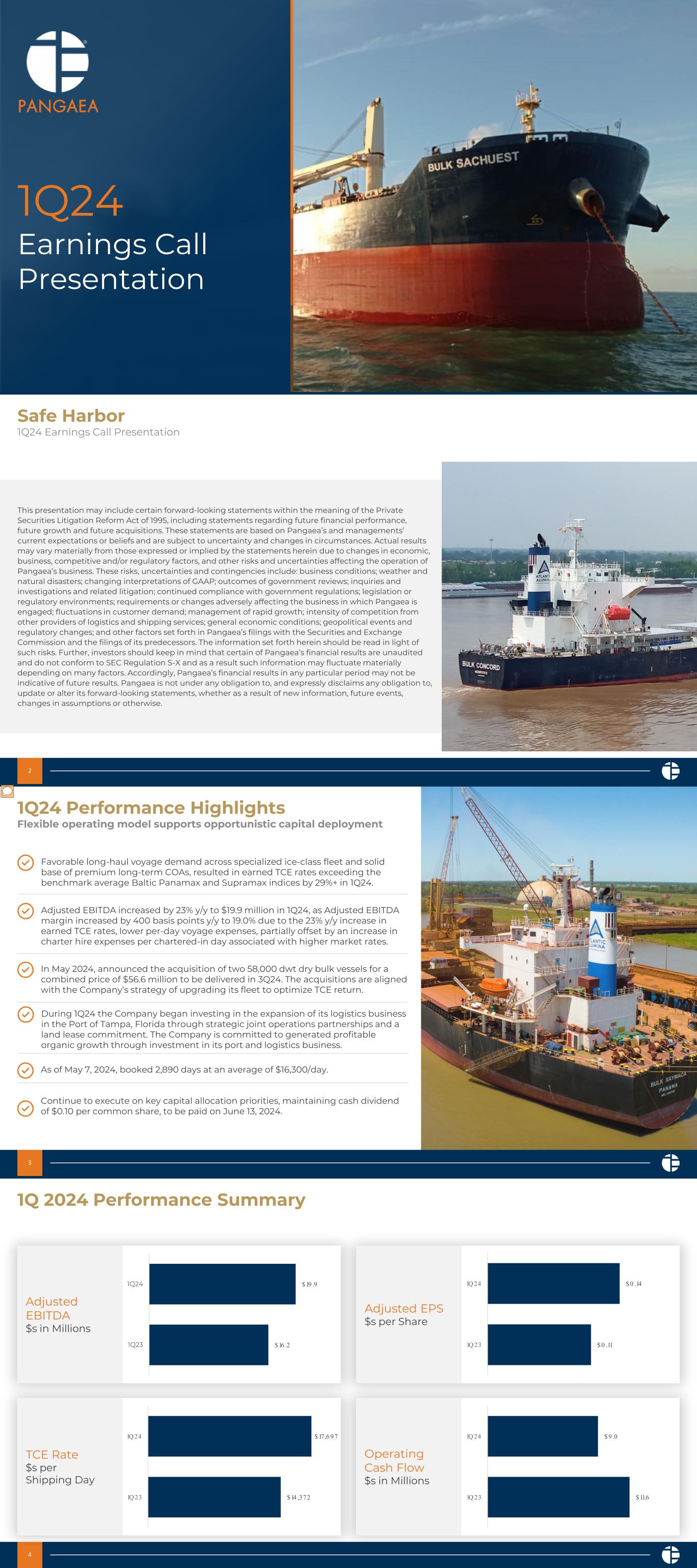

1Q24 Earnings Call Presentation 2 Safe Harbor 1Q24 Earnings Call Presentation This presentation may include certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding future financial performance, future growth and future acquisitions. These statements are based on Pangaea’s and managements’ current expectations or beliefs and are subject to uncertainty and changes in circumstances. Actual results may vary materially from those expressed or implied by the statements herein due to changes in economic, business, competitive and/or regulatory factors, and other risks and uncertainties affecting the operation of Pangaea’s business. These risks, uncertainties and contingencies include: business conditions; weather and natural disasters; changing interpretations of GAAP; outcomes of government reviews; inquiries and investigations and related litigation; continued compliance with government regulations; legislation or regulatory environments; requirements or changes adversely affecting the business in which Pangaea is engaged; fluctuations in customer demand; management of rapid growth; intensity of competition from other providers of logistics and shipping services; general economic conditions; geopolitical events and regulatory changes; and other factors set forth in Pangaea’s filings with the Securities and Exchange Commission and the filings of its predecessors. The information set forth herein should be read in light of such risks. Further, investors should keep in mind that certain of Pangaea’s financial results are unaudited and do not conform to SEC Regulation S-X and as a result such information may fluctuate materially depending on many factors. Accordingly, Pangaea’s financial results in any particular period may not be indicative of future results. Pangaea is not under any obligation to, and expressly disclaims any obligation to, update or alter its forward-looking statements, whether as a result of new information, future events, changes in assumptions or otherwise. 3 1Q24 Performance Highlights Flexible operating model supports opportunistic capital deployment Favorable long-haul voyage demand across specialized ice-class fleet and solid base of premium long-term COAs, resulted in earned TCE rates exceeding the benchmark average Baltic Panamax and Supramax indices by 29%+ in 1Q24. Adjusted EBITDA increased by 23% y/y to $19.9 million in 1Q24, as Adjusted EBITDA margin increased by 400 basis points y/y to 19.0% due to the 23% y/y increase in earned TCE rates, lower per-day voyage expenses, partially offset by an increase in charter hire expenses per chartered-in day associated with higher market rates. In May 2024, announced the acquisition of two 58,000 dwt dry bulk vessels for a combined price of $56.6 million to be delivered in 3Q24. The acquisitions are aligned with the Company’s strategy of upgrading its fleet to optimize TCE return. Continue to execute on key capital allocation priorities, maintaining cash dividend of $0.10 per common share, to be paid on June 13, 2024. As of May 7, 2024, booked 2,890 days at an average of $16,300/day. During 1Q24 the Company began investing in the expansion of its logistics business in the Port of Tampa, Florida through strategic joint operations partnerships and a land lease commitment. The Company is committed to generated profitable organic growth through investment in its port and logistics business. 4 1Q 2024 Performance Summary Adjusted EBITDA $s in Millions Adjusted EPS $s per Share TCE Rate $s per Shipping Day Operating Cash Flow $s in Millions $ 19 .9 $ 16 .2 1Q24 1Q23 $ 0 .14 $ 0 .11 1Q 24 1Q 23 $ 17,6 9 7 $ 14 ,372 1Q 24 1Q 23 $ 9 .0 $ 11.6 1Q 24 1Q 23

13 Selected Balance Sheet Data (in thousands,may not foot due to rounding) March 31, 2024 December 31, 2023 (unaudited) (audited) Current Assets Cash and cash equivalents 95,873$ 99,038$ Accounts receivable, net 41,998 47,892 Other current assets 57,686 44,897 Total current assets 195,557 191,826 Fixed assets, including finance lease right of use assets, net 498,907 504,659 Goodwill 3,105 3,105 Other Non-current Assets 5,736 5,590 Total assets 703,305$ 705,180$ Current liabilities Accounts payable, accrued expenses and other current liabilities 32,953$ 35,836$ Current portion long-term debt and finance lease liabilities 51,644 52,722 Other current liabilities 14,740 16,776 Total current liabilties 99,337 105,334 Secured long-term debt and finance lease liabilities, net 205,910 211,713 Other long-term liabilities 18,752 17,937 Total Pangaea Logistics Solutions Ltd. equity 332,004 323,886 Non-controlling interests 47,301 46,310 Total stockholders' equity 379,306 370,196 Total liabilities and stockholders' equity 703,305$ 705,180$ 14 Selected Income Statement Data (1) Ad just e d EBITDA re p re se n t s ne t inco m e (o r lo ss) , d e t e rm ine d in acco rd ance w ith U.S. GAAP, e xc lud ing in t e re s t e xp e nse , in t e re s t inco m e , inco m e t axe s , d e p re c ia t io n and am o rt iza t io n , lo ss o n im p a irm e nt , lo ss o n sa le and le a se b ack o f ve sse ls , sha re -b ase d co m p e nsa t io n , o the r no n-o p e ra t ing inco m e and / o r e xp e nse , and o the r no n-re curring it e m s, if any. (in thousands,may not foot due to rounding) 2024 2023 (audited) (audited) Revenues: Voyage revenue 87,291$ 107,950$ Charter revenue 15,031 5,749 Terminal & stevedore revenue 2,427 - Total revenue 104,749 113,699 Expenses: Voyage expense 37,115 56,815 Charter hire expense 27,143 22,591 Vessel operating expenses 12,669 13,607 Terminal Expenses 2,079 - General and administrative 7,278 5,692 Depreciation and amortization 7,436 7,327 Loss on sale of vessel - 1,172 Total expenses 93,720 107,203 Income from operations 11,028 6,496 Total other expense, net 1,638 (3,093) Net income 12,666 3,403 (Income) loss attributable to noncontrolling interests (991) 71 Net income attributable to Pangaea Logistics Solutions Ltd. 11,674$ 3,474$ Adjusted EBITDA (1) 19,947$ 16,238$ Three months ended March 31, 15 Reconciliation of Non-GAAP Measures 3/31/2024 3/31/2023 (unaudited) (unaudited) Net Transportation and Service Revenue Gross Profit 18,333,600$ 13,387,407$ Add: Vessel Depreciation and amortization 7,408,995 7,299,382 Net transportation and service revenue 25,742,595$ 20,686,789$ Adjusted EBITDA Net Income 12,665,634$ 3,402,912$ Interest expense, net 2,975,646 3,200,668 Income (loss) attributable to Non-controlling interest recorded as long-term liability interest expense 815,102 (144,736) Depreciation and amortization 7,436,473 7,326,860 EBITDA 23,892,855 13,785,704 Non-GAAP Adjustments: Loss on sale of vessels - 1,172,196 Share-based compensation 1,138,677 856,434 Unrealized (gain) loss on derivative instruments, net (5,084,339) 423,569 Adjusted EBITDA 19,947,193$ 16,237,903$ For the three months ended 16 Reconciliation of Non-GAAP Measures 3/31/2024 3/31/2023 (unaudited) (unaudited) Earnings Per Common Share Net income attributable to Pangaea Logistics Solutions Ltd. 11,674,176$ 3,474,267$ Weighted average number of common shares - basic 45,214,519 44,712,290 Weighted average number of common shares - diluted 45,914,772 45,116,719 Earnings per common share - basic 0.26$ 0.08$ Earnings per common share - diluted 0.25$ 0.08$ Adjusted EPS Net income attributable to Pangaea Logistics Solutions Ltd. 11,674,176$ 3,474,267$ Non-GAAP Add: Loss on sale of vessels - 1,172,196 Unrealized (gain) loss on derivative instruments, net (5,084,339) 423,569 Non-GAAP adjusted net income attributable to Pangaea Logistics Solutions Ltd. 6,589,837 5,070,032 Weighted average number of common shares - basic 45,214,519 44,712,290 Weighted average number of common shares - diluted 45,914,772 45,116,719 Adjusted EPS - basic 0.15$ 0.11$ Adjusted EPS - diluted 0.14$ 0.11$ For the three months ended