UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant | ☒ | |

Filed by a Party other than the Registrant | ◻ | |

Check the appropriate box:

◻ | Preliminary Proxy Statement |

◻ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | Definitive Proxy Statement |

◻ | Definitive Additional Materials |

◻ | Soliciting Material Pursuant to §240.14a-12 |

Transocean Partners LLC |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

☒ | No fee required. |

◻ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| | |

| (2) | Aggregate number of securities to which transaction applies: |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| (4) | Proposed maximum aggregate value of transaction: |

| | |

| (5) | Total fee paid: |

| | |

◻ | Fee paid previously with preliminary materials. |

◻ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| | |

| (2) | Form, Schedule or Registration Statement No.: |

| | |

| (3) | Filing Party: |

| | |

| (4) | Date Filed: |

| | |

GLYN A. BARKER | Transocean Partners LLC |

Chairman of the Board of Directors | 40 George Street |

| London W1U 7DW |

| United Kingdom |

KATHLEEN S. MCALLISTER

President, Chief Executive Officer and Chief Financial Officer

March 17, 2016

Dear Unitholder:

You are cordially invited to attend Transocean Partners LLC’s Annual Meeting of unitholders (the “Annual Meeting”) to be held on Thursday, May 5, 2016, at 5:00 p.m., local time, at 40 George Street, 4th Floor, London W1U 7DW, United Kingdom.

Information regarding the matters to be voted upon at this year’s Annual Meeting is attached in the Notice of Annual Meeting of Unitholders and the proxy statement. Please consider the items presented and vote your units as promptly as possible.

Your vote is important to us. Therefore, please provide your proxy by following the instructions provided in the proxy statement and on the Notice of Internet Availability of Proxy Materials. Even if you plan to attend the Annual Meeting, we encourage you to vote your units prior to the meeting. Additional information about voting your units is included in the proxy statement.

Our Annual Report on Form 10-K for the year ended December 31, 2015 accompanies the proxy materials.

Thank you for your continued support of Transocean Partners LLC.

Sincerely,

Glyn A. Barker | Kathleen S. McAllister |

Chairman of the Board of Directors | President, Chief Executive Officer and Chief Financial Officer |

Transocean Partners LLC

40 George Street

London W1U 7DW

United Kingdom

Notice of Annual Meeting of Unitholders

To the Unitholders of

Transocean Partners LLC:

Our Annual Meeting of unitholders will be held on Thursday, May 5, 2016, at 5:00 p.m., local time, at 40 George Street, 4th Floor, London W1U 7DW, United Kingdom, to:

| 1. | | elect the director nominees named in the attached proxy statement, |

| 2. | | ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for fiscal year 2016, and |

| 3. | | transact any other business that properly comes before the meeting, or any adjournment thereof. |

The holders of our common units will be entitled to vote on all of the items at the Annual Meeting, and the holders of our subordinated units will be entitled to vote on the ratification of our auditors and any other business that properly comes before the meeting.

The Board of Directors recommends a vote “FOR” each of the director nominees and ratification of the appointment of the independent registered public accounting firm.

Information relating to the foregoing matters is set forth in the attached proxy statement. Our Board of Directors has fixed the close of business on March 10, 2016, as the record date for the Annual Meeting. All unitholders of record at the close of business on that date are entitled to notice of, and to be present and vote at, the Annual Meeting and at any adjournment thereof.

| Raoul F. Dias |

March 17, 2016 | Managing Counsel and Corporate Secretary |

Important Notice Regarding the Availability of Proxy Materials

for the Unitholder Meeting to be held on May 5, 2016:

This Proxy Statement for the Annual Meeting and the Annual Report on Form 10-K for the fiscal year ended December 31, 2015, are available at www.proxyvote.com

Transocean Partners LLC

40 George Street

London W1U 7DW

United Kingdom

PROXY STATEMENT

GENERAL

References in this proxy statement to “the Company,” “we,” “our,” “us” or like terms refer to Transocean Partners LLC, organized as a limited liability company under the laws of the Republic of the Marshall Islands, and its subsidiaries. References in this proxy statement to “Transocean” refer, depending on the context, to Transocean Ltd. (NYSE: RIG, SIX: RIGN) and/or to any one or more of its direct and indirect subsidiaries, other than us. References in this proxy statement to “Transocean Member” refer to Transocean Partners Holdings Limited, an indirect wholly-owned subsidiary of Transocean Ltd., and the owner of the Transocean Member interest. The Transocean Member interest is a non-economic interest in Transocean Partners that includes the right to appoint three members of our Board of Directors (the “Board”) as further described herein. References in this proxy statement to the “LLC Agreement” refer to our Second Amended and Restated Limited Liability Company Agreement dated as of July 29, 2014. References in this proxy statement to “units” or “Membership Interest” refer collectively to common units and subordinated units of the Company. References in this proxy statement to “unitholders” refer to members of the Company owning our common units and/or our subordinated units.

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING

Why am I receiving these materials?

These proxy materials are furnished to you in connection with the solicitation of proxies by the Board of the Company, for the annual meeting of our unitholders to be held on Thursday, May 5, 2016, at 5:00 p.m., local time, at 40 George Street, 4th Floor, London W1U 7DW, United Kingdom (the “Annual Meeting”). The proxies also may be voted at any adjournments or postponements of the Annual Meeting.

When will the proxy solicitation materials first be given to unitholders?

The Annual Report, together with the Notice of Annual Meeting and this Proxy Statement, will be first made available to unitholders on or about March 17, 2016.

Why did I receive a Notice of Internet Availability of Proxy Materials instead of a full set of proxy materials?

We are utilizing the Securities and Exchange Commission (the “SEC”) rule that allows us to furnish our proxy materials over the Internet rather than sending a full set of materials by mail. All unitholders receiving the Notice of Internet Availability of Proxy Materials will have the option of (1) accessing the proxy materials over the Internet and voting by Internet or by phone or (2) requesting a paper copy of the proxy materials by mail by following the instructions in the “Notice of Internet Availability of Proxy Materials” (the "Notice"). If you do not timely request paper copies of the proxy materials, you should access the proxy materials online. Instructions on how to access the proxy materials over the Internet or to request a paper copy may be found in the Notice and below. We believe electronic delivery will expedite your receipt of our proxy materials while lowering costs of delivery and reducing the environmental impact.

What is included in the proxy materials?

The proxy materials include this proxy statement for our Annual Meeting and our Annual Report on Form 10-K for the fiscal year ended December 31, 2015 (the “Annual Report”). If you receive a paper copy of these materials by mail, they also include a proxy card or voting instruction form.

I share an address with another unitholder, and we received only one paper copy of the proxy materials. How may I obtain an additional copy of the proxy materials?

The Company has adopted a procedure called “householding,” which the SEC has approved. Under this procedure, the Company is delivering a single copy of the Notice and, if applicable, this Proxy Statement and the Annual Report to multiple unitholders who share the same address unless the Company has received contrary instructions from one or more

of the unitholders. This procedure reduces the Company’s printing and mailing costs and the environmental impact. Unitholders who participate in householding will be able to access and receive separate proxy cards. Upon written or oral request, the Company will promptly deliver a separate copy of the Notice and, if applicable, this Proxy Statement and the Annual Report to any unitholder at a shared address to which the Company delivered a single copy of any of these documents.

To receive a separate copy of the Notice and, if applicable, this Proxy Statement or the Annual Report, unitholders may write or call the Company at the following address and telephone number:

Transocean Partners LLC

40 George Street

London W1U 7DW, United Kingdom

+44 20 3675 8410

Unitholders who hold units in “street name” (as described below) may contact their brokerage firm, bank, broker-dealer or other similar organization to request information about householding.

Who is entitled to vote at the Annual Meeting, and how many votes do they have?

With respect to Proposal Nos. 1 and 2, holders of record of our common units who owned common units as of the close of business on March 10, 2016 (the “Record Date”) may vote at the Annual Meeting. Each common unit has one vote. There were 41,015,787 common units outstanding and entitled to vote on the Record Date.

With respect to Proposal No. 2, holders of record of our subordinated units who owned subordinated units as of the close of business on the Record Date may vote at the Annual Meeting. Each subordinated unit has one vote. There were 27,586,207 subordinated units outstanding and entitled to vote on the Record Date. The subordinated units are not entitled to vote on Proposal No.1.

Who may attend the Annual Meeting?

All unitholders as of the Record Date may attend the Annual Meeting.

You will need to bring proof of ownership of the units to enter the Annual Meeting. If you hold units directly in your name as a unitholder of record, you will need to bring the Notice or your proxy card. If you plan to attend the Annual Meeting, we ask that you vote your units by telephone, Internet or mail but keep your Notice or proxy card and bring it with you to the Annual Meeting.

If your units are registered or held in the name of your broker or bank or other nominee, your units are held in “street name.” Please note that if you hold your units in “street name,” you will need to bring proof of your ownership of the units as of the Record Date, such as a copy of a bank or brokerage statement, and check in at the registration desk at the Annual Meeting.

Please note that you also may be asked to present valid picture identification, such as a driver’s license or passport.

Because seating is limited, admission to the Annual Meeting will be on a first-come, first-served basis. For the safety of attendees, all boxes, handbags and briefcases are subject to inspection. Cameras (including cell phones with photographic capabilities), recording devices and other electronic devices are not permitted at the Annual Meeting.

What constitutes a quorum of unitholders?

We must have a quorum to conduct the Annual Meeting. Pursuant to our LLC Agreement, the holders of 33 1/3% of our outstanding common units and subordinated units represented in person or by proxy shall constitute a quorum at the Annual Meeting. As of the Record Date, there were 68,601,994 units outstanding; therefore, the presence of holders of 22,867,332 units is a quorum. Abstentions are counted for the purpose of determining the presence of a quorum. Broker non-votes (described below) will not be counted for the purpose of determining the presence of a quorum.

What is a proxy?

A proxy is another person that you authorize to vote on your behalf. We ask unitholders to instruct their proxies how to vote so that all units may be voted at the Annual Meeting even if the holders do not attend the Annual Meeting in person.

What is the voting requirement to approve each of the proposals?

| · | | Proposal No. 1—Election of Directors. A plurality of the votes of the common units present in person or represented by proxy at the Annual Meeting and entitled to vote is required to elect each director nominee, and |

| · | | Proposal No. 2—Ratification of Ernst & Young LLP. The affirmative vote of a majority of the common units and the subordinated units, voting together as a single class, present in person or represented by proxy at the Annual Meeting and entitled to vote is required to ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for fiscal year 2016. |

How are abstentions and broker non-votes treated?

An abstention occurs when a unitholder affirmatively chooses not to vote on a proposal. A broker non-vote occurs when a broker, bank, or other nominee who holds units for another person has not received voting instructions from the owner of the units and, under the rules of the New York Stock Exchange (the “NYSE”), does not have discretionary authority to vote on a matter. See “If my units are held in “street name” by my broker, bank or other nominee, will my broker, bank or other nominee vote my units for me?” below.

In tabulating the voting result for any particular proposal, units that constitute broker non-votes are not considered votes cast on that proposal. Thus, for purposes of Proposal No. 1 on the election of directors, abstentions and broker non-votes will not have any effect on the results of the votes and, for purposes of Proposal No. 2 on the ratification of Ernst & Young LLP, abstentions will have the same effect as a vote against the proposal.

If my units are held in “street name” by my broker, bank or other nominee, will my broker, bank or other nominee vote my units for me?

If your units are held by a broker, bank or other nominee, you will receive from that nominee a full meeting package including a voting instructions form to vote your units. Your broker, bank or other nominee may permit you to provide voting instructions by telephone or by Internet. Such nominees have the authority under NYSE rules to vote their clients’ unvoted units on certain routine matters. The matter covered by Proposal No. 2 (ratification of independent registered public accounting firm) is considered a routine matter under NYSE rules. Therefore, if you do not vote on this proposal, your broker, bank or other nominee may choose to vote for you or leave your units unvoted on that proposal.

NYSE rules, however, do not permit brokers, banks or other nominees to vote their clients’ unvoted units in the election of directors (Proposal No. 1). Therefore, if you do not vote on Proposal No. 1, your units will remain unvoted in the election of directors. We urge you to respond to your broker, bank or other nominee so that your units will be voted.

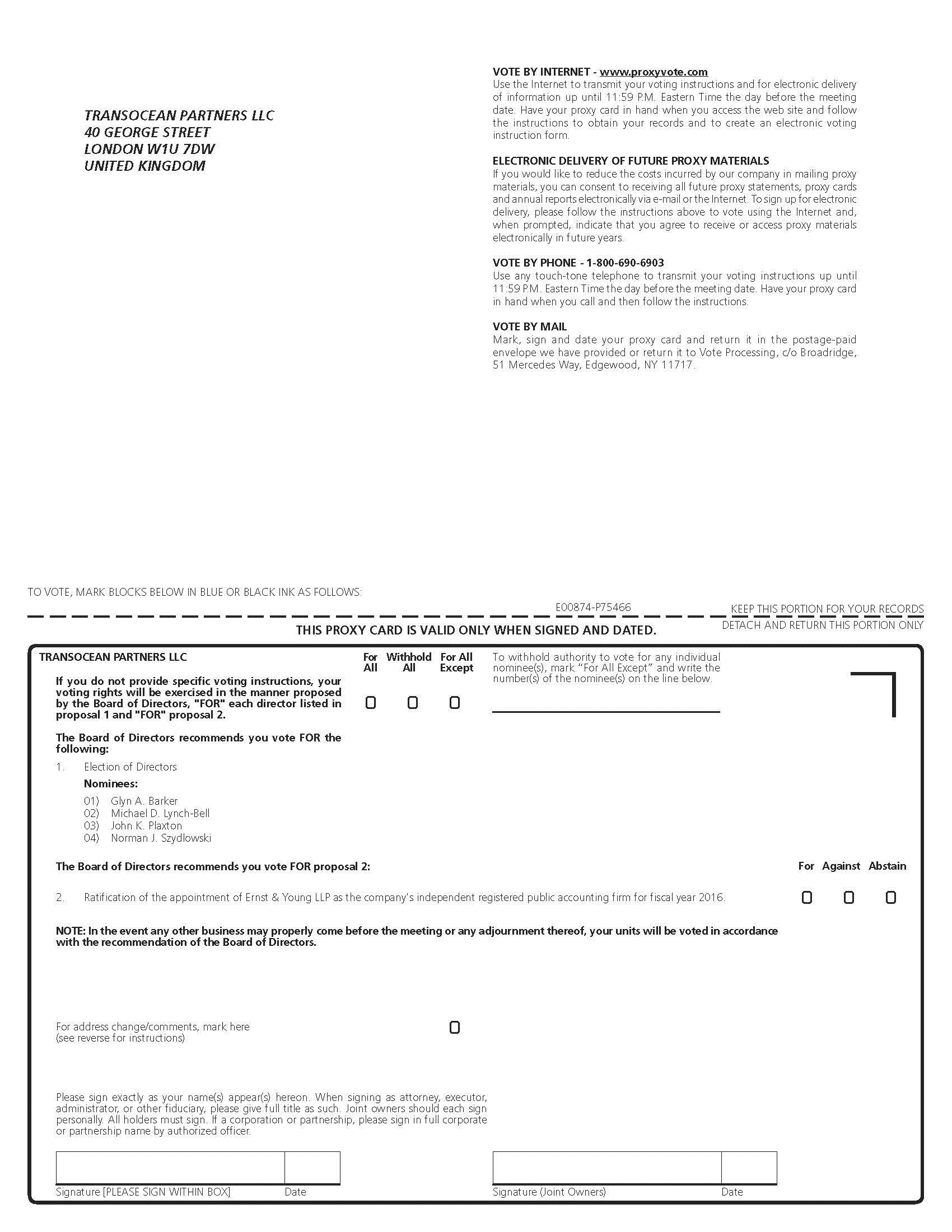

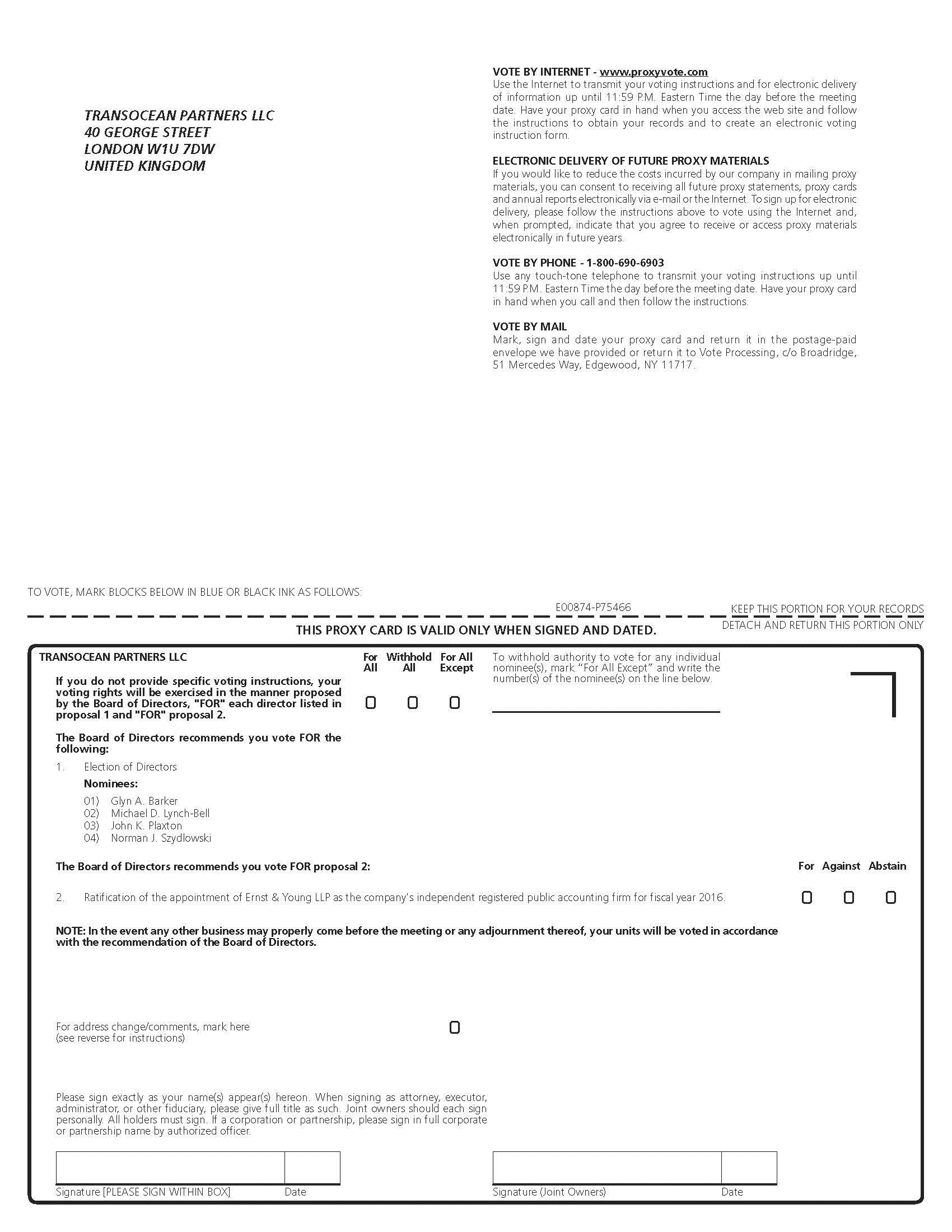

How do I vote if I am a unitholder of record?

You must be present, or represented by proxy, at the Annual Meeting in order to vote your units. Because many of our unitholders are unable to attend the Annual Meeting in person, you may vote your units in the following ways:

By Internet | To vote your units over the Internet, please visit the website listed on the Notice and follow the on-screen instructions. |

| |

By Telephone | To vote your units by telephone, please call the phone number listed on the proxy card, or on the website listed on the Notice, and follow the instructions. |

| |

By Mail | If you requested paper copies of the proxy materials by mail, or have a printed proxy card, you may vote your units by completing, signing and dating your proxy card and mailing it in the pre-addressed, postage-paid envelope. If you do not sign your proxy card, your votes cannot be counted. |

| |

In Person | To ensure your units are represented, we ask that you vote your units by telephone, Internet or mail, even if you plan to attend the Annual Meeting. |

If you plan to attend the Annual Meeting in person and need directions to the meeting site, please contact us at: info@deepwater.com.

How will my proxy vote my units?

Your units will be voted as you direct if you properly vote your units by proxy using the Internet or by telephone, or sign and return your proxy card or voting instructions form by mail. If you sign and return your proxy card or voting

instructions form, but do not specify how you want your units voted, then your units will be voted “FOR” the election of each director nominee and “FOR” the ratification of the appointment of our independent registered public accounting firm. Also, you will give your proxies authority to vote, using their discretion, on any other business that properly comes before the Annual Meeting, including to adjourn the Annual Meeting. If you do not return a validly signed proxy card, your units will not be voted at the Annual Meeting.

Can I vote by proxy even if I plan to attend the Annual Meeting in Person?

Yes. If you vote by proxy and decide to attend the Annual Meeting in person, you do not need to fill out a ballot at the Annual Meeting unless you want to change your vote.

Why might I receive more than one proxy card? Should I vote on each proxy card I receive?

First, you may have various accounts with us that are registered differently, perhaps in different names or with different social security or federal tax identification numbers. Second, you may also own units indirectly through your broker. Your broker will send you a voting instructions form for these units. You should vote on each proxy card or voting instructions form you receive in accordance with the instructions set forth in those documents.

How do I change my vote or revoke my proxy?

If you are a unitholder of record, you may change your vote or revoke your proxy at any time before the Annual Meeting by:

| · | | notifying Raoul F. Dias, Corporate Secretary, in writing at 40 George Street, London W1U 7DW, United Kingdom that you are changing your vote; |

| · | | providing subsequent Internet or telephone voting instructions; |

| · | | completing and sending in another proxy card with a later date; or |

| · | | attending the Annual Meeting and voting in person. |

If you hold your units through a broker, bank or other nominee, you should contact your broker, bank or other nominee for instructions on how to change your vote or revoke your proxy.

Who is soliciting my proxy, how is it being solicited, and who pays the cost?

The Company, on behalf of the Board, through its directors, officers and employees, is soliciting proxies. The Company will bear the cost of the solicitation of proxies. In addition to solicitation over the Internet and by mail, the Company will reimburse brokers, banks and other custodians, nominees and fiduciaries for reasonable expenses incurred in forwarding proxy materials to beneficial owners of our units and obtaining their proxies. Certain directors, officers and other employees of the Company, not specifically employed for this purpose, may solicit proxies, without additional remuneration, by personal interview, mail, telephone, facsimile or electronic mail.

Where may I obtain additional information about Transocean Partners LLC?

We refer you to our Annual Report for additional information about us. Our Annual Report is included with your proxy materials. You may receive additional copies of our Annual Report at no charge through the Investor Relations section of our website at: www.transoceanpartners.com. This proxy statement and our Annual Report are also available at: www.transoceanpartners.com.

MATTERS YOU ARE VOTING ON AT THE ANNUAL MEETING

Proposal No. 1: Election of Directors

The LLC Agreement provides that the Board must consist of seven members, three of whom are appointed by the Transocean Member, in its sole discretion (the "Appointed Directors"), and four of whom are elected by our common unitholders at the Annual Meeting (the “Elected Directors”).

The Board has nominated Glyn A. Barker, Michael D. Lynch-Bell, John K. Plaxton and Norman J. Szydlowski for election as directors at the Annual Meeting for a term ending at the next Annual Meeting of the Company. Each of the nominated directors has agreed to serve if elected. However, if one of them is unable to serve, your duly appointed proxy will vote for the election of another person nominated by the Board. The Transocean Member intends to appoint Kathleen S. McAllister and Mark L. Mey as Appointed Directors for a term beginning at the Annual Meeting and ending at the next annual meeting of unitholders. The Transocean Member does not intend to appoint Samuel J. Merksamer, currently an Appointed Director, for another term but, instead, expects to identify another individual to appoint after Mr. Merksamer completes his current term ending at the Annual Meeting. Notwithstanding the foregoing, each Elected Director and Appointed Director shall serve until his or her successor shall have been duly elected and qualified or until his or her earlier death, resignation or removal. Biographical information, including a discussion of specific experience, qualifications, attributes and skills, for each of the director nominees, as well as for the Appointed Directors and other information about them is presented beginning on page 6. The Board recommends a vote “FOR” each director nominee.

Proposal No. 2: Ratification of Ernst & Young LLP as Independent Registered Public Accounting Firm for fiscal year 2016

This proposal is to ratify our appointment of Ernst & Young LLP as our independent registered public accounting firm for fiscal year 2016. See Proposal No. 2 on page 9. The Board recommends a vote “FOR” this proposal.

Other Business Matters

The Board is not aware of any other business for the Annual Meeting. However, if any matters are properly presented for action, the unitholders present at the Annual Meeting may vote on such items. If you are represented by proxy, your proxy will vote your units using his or her discretion.

PROPOSAL NO. 1: ELECTION OF DIRECTORS

Nominees for Election to the Board of Directors

The Board believes that each director nominee possesses the experience, qualifications, attributes and skills, as described below, to enable such director nominee to make significant contributions to the Board, the Company and its unitholders. The information presented below sets forth each nominee’s, as well as each Appointed Director’s, specific experience, qualifications, attributes and skills that the Board considered in concluding that the nominee should serve as a director.

The information regarding the nominees presented below is as of March 10, 2016.

GLYN A. BARKER, age 62, has served as Chairman of the Board of Directors since July 2015 and as a director since July 2014. Mr. Barker served as Vice Chairman-U.K. of PricewaterhouseCoopers LLP (PwC) from 2008 to 2011. He was also responsible for PwC’s strategy and business development for the geographic areas of Europe, the Middle East, Africa and India. Mr. Barker joined PwC in 1975 and became an audit partner in 1987. He then established PwC’s private equity-focused Transactions Services business and led it globally. He joined the Management Board of PwC in the UK as Head of the Assurance Practice in 2002. In 2006, he became UK Managing Partner and served in that role until 2008. Mr. Barker is a non-executive director of Transocean Ltd. (NYSE: RIG) (since 2012), Interserve plc (LON: IRV) (since 2016), Berkeley Group Holdings plc (LON: BKG) (since 2012) and Aviva plc (LON: AV) (since 2012) and Chairman of Irwin Mitchell Holdings Ltd (since 2012). He is also Deputy Chairman of the English National Opera Company (since 2009). Mr. Barker received his Bachelor of Science degree in Economics & Accounting in 1975 from the University of Bristol and is a Chartered Accountant.

The Board has concluded that Mr. Barker should remain on the Board and recommends that he be elected to serve an additional term. The Board believes that Mr. Barker's experience and background in diverse industries, along with his extensive financial and accounting background, will enhance the Board's ability to assess and guide the Company's financial strategy.

MICHAEL D. LYNCH-BELL, age 62, has served as a director of the Company since October 2014. Mr. Lynch-Bell served as an audit partner of Ernst & Young LLP (EY) from 1985 to 1997 and as a transaction advisory services partner of EY from 1997 to 2012. He further served as a senior partner transaction advisory services, IPO services and mining & metals of EY from 2011 to 2012. Mr. Lynch-Bell led EY’s global oil & gas practice, founded EY’s UK IPO practice and founded, developed and led EY’s global oil & gas and mining transaction advisory practices. He also created EY’s oil & gas and mining & metals corporate finance teams. Mr. Lynch-Bell joined EY in 1974 and retired in 2012. Mr. Lynch-Bell is a non-executive director of GEM Diamonds Limited (LON: GEMD) (since 2015), KAZ Minerals PLC (LON: KAZ) (since 2013), Lenta Limited (LON: LNTA) (since 2013) and Seven Energy Limited (since 2013). He is also honorary treasurer and board member of Action Aid International (since 2011) and trustee of 21st Century Legacy (since 2012). Mr. Lynch-Bell previously served as a director of Equus Petroleum plc from 2013 to 2014. Mr. Lynch-Bell received his Bachelor of Arts degree in Economics and Accountancy in 1974 from the University of Sheffield and is a Chartered Accountant.

The Board has concluded that Mr. Lynch-Bell should remain on the Board and recommends that he be elected to serve an additional term. The Board believes that Mr. Lynch-Bell's extensive financial and accounting background, along with his experience in the energy industry, will enhance the Board's ability to assess and guide the Company's financial strategy and the understanding of the Company's industry.

JOHN K. PLAXTON, age 60, has served as a director of the Company since November 2014. Mr. Plaxton served as a Managing Director of the Investment Bank of Merrill Lynch from 1997 to 2008 and of the Capital Markets Group of Bank of America Merrill Lynch, the corporate and investment management division of Bank of America, from 2008 to 2013. He was head of UK Corporate Finance from 2003 to 2007 and served as Chairman of the Bank of America Merrill Lynch Commitment Committee for Europe, the Middle East and Africa from 2007 to 2013. Mr. Plaxton joined Merrill Lynch in 1982. He currently is a director of the Bank of America Merrill Lynch European Pension Fund (since 2000). Mr. Plaxton received his Master‘s degree in Business Administration in 1982 from the University of Chicago and his Bachelor of Science degree in Economics in 1976 from the London School of Economics. Mr. Plaxton is a Chartered Accountant.

The Board has concluded that Mr. Plaxton should remain on the Board and recommends that he be elected to serve an additional term. The Board believes that Mr. Plaxton's extensive financial background will enhance the Board's ability to assess and guide the Board in reviewing strategic decisions for the Company.

NORMAN J. SZYDLOWSKI, age 64, has served as a director of the Company since November 2014. Mr. Szydlowski served as president and chief executive officer of SemGroup Corporation (NYSE: SEMG) from November 2009 to April 2014. Mr. Szydlowski also served as chairman of the board of directors, president and chief executive officer of SemGroup’s wholly-owned subsidiary Rose Rock Midstream GP, LLC, the general partner of Rose Rock Midstream, LP (NYSE: RRMS). From January 2006 until January 2009, Mr. Szydlowski served as president and chief executive officer of Colonial Pipeline Company, an interstate common carrier of petroleum products. From 2004 to 2005, he served as senior consultant to the Iraqi Ministry of Oil in Baghdad on behalf of the U.S. Department of Defense, where he lead an advisory team in the rehabilitation, infrastructure security and development of the future state of the Iraqi oil sector. From 2002 until 2004, he served as vice president of refining for Chevron Corporation. He joined Chevron in 1981 and served in various capacities of increasing responsibility in sales, planning, supply chain management, refining and plant operations, transportation and construction engineering. Mr. Szydlowski is a director of 8point3 General Partner, LLC, the general partner of 8point3 Energy Partners LP (since 2015) (NASDAQ: CAFD), Novus Energy, LLC (since 2014), Rebellion Photonics, Inc. (since 2014), and JP Energy GP II LLC, the general partner of JP Energy Partners LP (since 2014) (NYSE: JPEP). He previously served as a director of NGL Energy Holdings, LLC, the general partner of NGL Energy Partners LP (NYSE: NGL) from 2011 to 2014. Mr. Szydlowski received his Master’s degree in Business Administration in 1976 from the Indiana University in Bloomington and his Bachelor’s degree in Mechanical Engineering in 1974 from the Kettering University in Flint, Michigan.

The Board has concluded that Mr. Szydlowski should remain on the Board and recommends that he be elected to serve an additional term. Mr. Szydlowski has significant experience in the energy industry, including master limited partnerships. This experience and the perspective it brings benefits the Board’s understanding of the Company's industry and its customers.

Recommendation of the Board of Directors

THE BOARD UNANIMOUSLY RECOMMENDS THAT UNITHOLDERS VOTE FOR THE ELECTION OF EACH OF THE DIRECTOR NOMINEES LISTED ABOVE.

Appointed Directors

The directors listed below are current members of the Board who have been appointed by the Transocean Member in accordance with the LLC Agreement and who are expected to be reappointed by the Transocean Member to serve on the Board for an additional term without being elected at the Annual Meeting.

The information regarding the directors presented below is as of March 10, 2016.

MARK L. MEY, age 52, has served as a director of the Company since June 2015. Mr. Mey is Executive Vice President and Chief Financial Officer of Transocean Ltd. He joined Transocean as the company’s CFO in May 2015. He previously served as Executive Vice President and Chief Financial Officer of Atwood Oceanics. Including his almost five years at Atwood, he has over 28 years of experience in the energy and financial services industries in both the United States and South Africa. Prior to Atwood, Mr. Mey was Senior Vice President and Chief Financial Officer and a Director of Scorpion Offshore Ltd. He also held positions of increasing responsibility during his 12 years with offshore driller Noble Corporation, including Vice President and Treasurer. Mr. Mey earned an Advanced Diploma in Accounting and a Bachelor of Commerce degree from the University of Port Elizabeth, South Africa. He is a Chartered Accountant and attended the Harvard Business School Executive Advanced Management Program.

The Board believes that Mr. Mey's expertise in finance, law and his industry experience enhance the Board’s ability to assess and guide the Company.

KATHLEEN S. MCALLISTER, age 51, has served as a director of the Company since July 2014 and as President & Chief Executive Officer of the Company since June 2014. Since February 2016, she has served as both President & Chief Executive Officer and Chief Financial Officer. From June 2014 to July 2014, Ms. McAllister also served as our Interim Chief Financial Officer. From December 2011 to June 2014, Ms. McAllister served as Vice President and Treasurer of Transocean Ltd. From March 2011 to December 2011, she served as Assistant Treasurer of Transocean Ltd. Ms. McAllister joined Transocean Ltd. in 2005 as Director of Tax Reporting and subsequently served as Finance Director for the Americas

Business Unit and the North America Division. Before joining Transocean Ltd., she served in various tax, treasury and finance roles at Helix Energy Solutions Group, Veritas DGC Inc. and Baker Hughes Inc. and began her career at Deloitte & Touche. Ms. McAllister received her Bachelor of Science degree in Accounting from the University of Houston in 1989.

The Board believes that it is important for the Company's Chief Executive Officer to serve on the Board. The Chief Executive Officer provides a link between the Board and senior management, and the Board believes that this perspective is important in making decisions for the Company.

Family Relationships

There are no family relationships between any of our executive officers or director nominees or Appointed Directors.

PROPOSAL NO. 2: RATIFICATION OF ERNST & YOUNG LLP

AS INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

FOR FISCAL YEAR 2016

General

Management is responsible for our internal controls and the financial reporting process. Our independent registered public accounting firm, Ernst & Young LLP, is responsible for performing independent audits of our Consolidated Financial Statements and issuing an opinion on the conformity of those audited financial statements with United States generally accepted accounting principles ("US GAAP"). The Audit Committee monitors our financial reporting process and reports to the Board on its findings.

The Audit Committee has appointed Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2016. Ernst & Young LLP has been our independent auditor since 2014. A member of Ernst & Young LLP will be present at the Annual Meeting and will have the opportunity to make a statement, if he or she desires to do so, and will be available to answer appropriate questions. If the unitholders fail to ratify Ernst & Young LLP as the independent registered public accounting firm, the Audit Committee will reconsider its selection.

In connection with our initial public offering and the formation of our Audit Committee, we adopted a policy for pre-approving the services and associated fees of our independent registered public accounting firm. Under this policy, the Audit Committee pre-approves all auditing services, review and attest engagements and permitted non-audit services to be performed by our independent registered public accounting firm. The policy requires advance approval by the Audit Committee of all audit and non-audit work; provided that the Chairman of the Audit Committee may grant pre-approvals of audit or non-audit work so long as such pre-approvals are presented to the full Audit Committee at its next scheduled meeting. Unless the specific service has been previously pre-approved with respect to the 12-month period following the advance approval, the Audit Committee must approve a service before the independent registered public accounting firm is engaged to perform the service. Requests for services that have received this pre-approval are subject to specified fee or budget restrictions, as well as internal management controls.

Audit Fees for Ernst & Young LLP and its affiliates for each of the fiscal years 2015 and 2014 and Audit-Related Fees, Tax Fees and All Other Fees for services rendered in 2015 and 2014 are as follows:

| | 2015 | | 2014(1) | |

Audit Fees(2) | | $ | 922,118 | | $ | 734,000 | |

Audit-Related Fees(3) | | $ | 16,500 | | | __ | |

Tax Fees(4) | | | __ | | | __ | |

All Other Fees(4) | | | __ | | | __ | |

Total | | $ | 938,618 | | $ | 734,000 | |

| (1) | | The audit fees include those associated with our annual audit for the year ended December 31, 2014, and the review of our quarterly report on Form 10-Q for the three and nine months ended September 30, 2014. For the period prior to completion of our initial public offering on August 5, 2014, audit fees and audit-related fees were included as part of the aggregate fees billed to and paid by Transocean Ltd. |

| (2) | | The audit fees include those associated with our annual audit, reviews of our quarterly reports on Form 10-Q, statutory audits of our subsidiaries, services associated with documents filed with the SEC and audit consultations. |

| (3) | | The audit-related fees include services in connection with the issuance of consents relating to the Form S-8 and Form S-3 filed by the Company on February 26, 2015 and August 6, 2015, respectively. |

| (4) | | In the periods presented, Ernst & Young LLP did not render services to us that would be categorized as tax services, or other services other than audit fees and audit-related fees. |

The Audit Committee has established procedures for engaging Ernst & Young LLP to perform services other than audit, review and attest services. In order to safeguard the independence of Ernst & Young LLP, for each engagement to perform such non-audit service, (a) management and Ernst & Young LLP must affirm to the Audit Committee that the proposed non-audit service is not prohibited by applicable laws, rules or regulations; (b) management must describe the reasons for hiring Ernst & Young LLP to perform the services; and (c) Ernst & Young LLP must affirm to the Audit

Committee that it is qualified to perform the services. The Audit Committee has delegated to its chairman its authority to pre-approve such services in limited circumstances, and any such pre-approvals are reported to the Audit Committee at its next regular meeting. All services provided by Ernst & Young LLP in 2015 were audit or audit-related and are permissible under applicable laws, rules and regulations and were pre-approved by the Audit Committee in accordance with its procedures. In 2015, the Audit Committee considered all services provided by Ernst & Young LLP in assessing its independence.

Recommendation of the Board of Directors

THE BOARD UNANIMOUSLY RECOMMENDS THAT UNITHOLDERS VOTE FOR THIS PROPOSAL NO. 2.

CORPORATE GOVERNANCE

Transocean indirectly controls a majority of the voting power of our outstanding Membership Interests. As a result, we are a “controlled company” under the NYSE corporate governance standards. As a controlled company, we are exempt from complying with certain corporate governance requirements, including:

| · | | that we have a compensation committee or nominating and corporate governance committee; |

| · | | that a majority of the Board consists of “independent directors,” as defined under the rules of the NYSE; |

| · | | that any corporate governance and nominating committee or compensation committee be composed entirely of independent directors with a written charter addressing the committee’s purpose and responsibilities; |

| · | | that we conduct an annual performance evaluation of the nominating and corporate governance committee and compensation committee; and |

| · | | that we assess the independence of consultants, legal counsel and other advisors selected by the compensation committee. |

Notwithstanding the above exemptions, the Board has established a compensation committee and a majority of our directors qualify as "independent" under NYSE rules. We are committed to upholding high standards of corporate governance and business conduct and believe that we have implemented good corporate governance practices. We regularly review and update our Code of Integrity and conduct mandatory online training for employees, officers and directors on our Code of Integrity and other relevant compliance topics.

The Board continually evaluates the Company’s and the Board’s governance practices and formally reviews all committee charters along with the Board’s governance principles at least annually. The Board further periodically receives updates regarding new developments in the corporate governance arena. Our governance principles and our committee charters also require, among other things, that the committees and the Board annually evaluate their own performance.

Our current governance documents may be found on our website at: www.transoceanpartners.com under “Investor Relations-Governance.” Among the information you can find there is the following:

| · | | Corporate Governance Guidelines; |

| · | | Audit Committee Charter; |

| · | | Compensation Committee Charter; and |

Information contained on our website is not part of this proxy statement. We will continue to monitor our governance practices in order to maintain our high standards.

Board Composition and Independence

The Board currently consists of seven members. In accordance with the LLC Agreement, the Board must consist of seven individuals, with four elected at the Annual Meeting and the remaining three appointed by the Transocean Member. The Board believes that there should be no more than two directors who are employees of the Company at any time.

The elected directors will serve for one-year terms. However, pursuant to the LLC Agreement, the Transocean Member can elect to classify the Board at any time. Upon such election, the four directors elected by the unitholders will be divided into three classes and the election of the elected directors would be on a staggered basis to serve for three-year terms, meaning that the members of only one class of elected directors will be elected each year.

If any Appointed Director is removed, resigns or is otherwise unable to serve as a member of the Board, or a vacancy otherwise exists, the Transocean Member will appoint an individual to fill the vacancy. If any Elected Director is removed, resigns or is unable to serve as a member of the Board, or a vacancy otherwise exists, a majority of the Elected Directors then serving will fill the vacancy by electing an individual who meets the criteria for service as an Elected Director and is elected by a majority of the Elected Directors then serving. A director appointed or elected to fill such a vacancy shall be appointed or elected, as the case may be, for no longer than the unexpired term of his predecessor in office and notwithstanding the foregoing shall serve until his successor shall have been duly elected and qualified, or until his earlier

death, resignation or removal. In addition, the directors appointed by the Transocean Member will serve for terms determined by the Transocean Member. The directors appointed by the Transocean Member may designate a member of the Board to be the Chairman of the Board. Specific rights of the Transocean Member are designated in our LLC Agreement.

Under our LLC Agreement, common unitholders that own 50 percent or more of our common units have the ability to request that cumulative voting be in effect for the election of Elected Directors. Cumulative voting is an irrevocable election that allows for the unitholder to allocate its votes cumulatively, rather than proportionally. Therefore, as long as Transocean owns 50 percent or more of our common units, it will have the ability to request that cumulative voting be in effect for the election of Elected Directors, which would enable Transocean to elect one or more of the Elected Directors even after it owns less than 50 percent of our common units. As a result, if cumulative voting was in effect, Transocean would have the ability to appoint the majority of our Board as long as it retains at least 20 percent of our common units.

Although the Company is a “controlled company” and a majority of our directors are not required to be independent, the Company’s Corporate Governance Guidelines provide that at least a majority of the directors should meet the independence requirements of the NYSE. Additionally, the Corporate Governance Guidelines provide that a majority of the members of the Board must meet U.K. residency requirements as necessary under applicable tax rulings and regulations.

The Board has determined that all directors, except Ms. McAllister and Mr. Mey, are independent under the applicable rules of the NYSE, the Sarbanes-Oxley Act of 2002, as amended, and the rules and regulations promulgated by the SEC. In making its independence determinations, the Board reviewed (i) information regarding relevant relationships, arrangements or transactions between the Company and each director or parties affiliated with such director, (ii) Company records and (iii) publicly available information.

In making its independence determinations, the Board considered the fact that, while such relationships do not preclude independence under the NYSE rules or the Company’s guidelines, Messrs. Barker, Merksamer and Lynch-Bell are, or within the past three years have been, directors or officers of companies with which we conduct business in the ordinary course.

Since 2012, Mr. Barker has served as a non-executive director of Aviva plc, a company that provides insurance-related services to Transocean. Until 2015, Mr. Merksamer has served as a non-executive director of Talisman Energy, from which Transocean receives revenues for performing services. Both Mr. Barker and Mr. Merksamer serve as directors of Transocean Ltd. Until 2013, Mr. Lynch-Bell was a consultant of Ernst & Young LLP, the Company’s independent registered public accounting firm. Until 2012, Mr. Lynch-Bell was a partner of Ernst & Young LLP.

The Board believes that all transactions with these companies were on arm’s-length terms that were reasonable and competitive. Accordingly, the Board concluded that these relationships have no effect on the independence of these directors. Because of our and Transocean's extensive operations, transactions and director relationships, transactions of this nature are expected to take place in the ordinary course of business in the future.

In February 2016, American International Group, Inc. announced that Mr. Merksamer will be nominated as a non-executive director of American International Group, Inc. for election at its 2016 annual meeting of shareholders. American International Group, Inc. provides insurance-related services to Transocean.

Board Leadership Structure and Role in Risk Oversight

The Board is responsible for risk oversight of our activities with various aspects of risk oversight delegated to the Audit Committee. The Board periodically discusses with management our policies governing the process by which risk assessment and risk management is undertaken and our major risk exposures and the steps management has taken to monitor and control such exposures. The Audit Committee is responsible for discussing the Company’s policies and guidelines with respect to enterprise risk assessment and enterprise risk management, as well as major financial risk exposures. The Board believes that our current Board leadership structure takes into account the Board’s role in risk management oversight including the appropriate delegation of risk management oversight responsibilities to the Audit Committee.

The Board has chosen not to combine the positions of Chief Executive Officer and Chairman of the Board. The Board believes that this is currently the most appropriate structure for the Company because separating these positions allows our Chief Executive Officer to focus on our day-to-day business, while our Chairman of the Board presides over the Board as it provides advice to, and oversight of, management and the Company’s operations. The Board recognizes the time,

effort, and energy that the Chief Executive Officer is required to devote to her position and the additional commitment the position of Chairman of the Board requires. The Board believes that having separate positions and having another director serve as Chairman of the Board is the appropriate leadership structure for us at this time and demonstrates our commitment to good corporate governance.

Board Meetings

During 2015, the Board met six times. Each of our directors, other than Mr. Mey (who attended one of two meetings since he joined the Board in June 2015), and Mr. Merksamer (who attended four out of six meetings in 2015), attended at least 80% of the meetings during the year since he or she was elected or appointed as a director of the Company, including committees on which the director served. Pursuant to the Company's Corporate Governance Guidelines, the Board shall conduct no fewer than four regular meetings annually.

Executive Sessions

Our independent directors (i.e., all directors except for Ms. McAllister and Mr. Mey) met in executive session without management and our other non-independent director at each of the regularly scheduled Board meetings held in 2015. Our non-management directors (i.e., all directors except for Ms. McAllister) further met in executive session without management at each of the regularly scheduled Board meetings held in 2015. During 2016, our independent directors and our non-management directors are again scheduled to meet in executive session at each regularly scheduled Board meeting. The independent directors and the non-management directors generally designate the Chairman of the Board to act as the presiding director for executive sessions.

Policy on Attending the Annual Meeting

The Company’s directors are encouraged to attend our annual meetings of unitholders, but we do not currently have a policy relating to director attendance. At the 2015 annual meeting, all directors then serving on the Board were in attendance.

Restrictions on Pledging, Hedging and Margin Accounts

Pursuant to our Insider Trading Policy, employees, officers and directors of the Company are restricted from pledging, hedging or holding units in a margin account.

Committees of the Board of Directors

There are three standing committees of the Board: the Audit Committee, the Conflicts Committee and the Compensation Committee. In addition, the Board may from time to time form special committees to consider particular matters that arise. As described above, the Board does not have a Nominating and Corporate Governance Committee because it is a controlled company under NYSE rules. The Audit Committee and the Compensation Committee each have adopted a charter, copies of which we maintain on our website, www.transoceanpartners.com, along with a copy of our Corporate Governance Guidelines.

Audit Committee: The Audit Committee was formed in July 2014. The Audit Committee is responsible for the selection, retention and termination of our independent registered public accountants. The Audit Committee is directly responsible for the compensation and oversight of our independent registered public accountants. The Audit Committee further advises, as necessary, in the selection of the lead audit partner. The Audit Committee also monitors the integrity of our financial statements and the independence and performance of our auditors and their lead audit partner and reviews our financial reporting processes. The Audit Committee reviews and reports to the Board the scope and results of audits by our independent registered public accounting firm and our internal auditing staff and reviews the audit and other professional services rendered by the accounting firm. It also reviews with the accounting firm the adequacy of our system of internal controls. It reviews transactions between us and our directors and officers for disclosure in the proxy statement, our policies regarding those transactions and compliance with our business ethics and conflict of interest policies. The Audit Committee also is responsible for establishing, reviewing and overseeing internal processes for the receipt and treatment of complaints or allegations related to accounting, internal controls or audit matters. It also monitors the Company’s financial risk exposures and the steps taken to manage such risks.

The Board requires that all members of the Audit Committee be financially literate and that at least one member qualify as an “audit committee financial expert,” as defined by SEC rules. An “audit committee financial expert” is defined as a person who, based on his or her experience, possesses all of the following attributes:

| · | | an understanding of generally accepted accounting principles and financial statements; |

| · | | an ability to assess the general application of such principles in connection with the accounting for estimates, accruals, and reserves; |

| · | | experience preparing, auditing, analyzing or evaluating financial statements that present a breadth and level of complexity of accounting issues that are generally comparable to the breadth and level of complexity of issues that can reasonably be expected to be raised by our financial statements, or experience actively supervising one or more persons engaged in such activities; |

| · | | an understanding of internal controls and procedures for financial reporting; and |

| · | | an understanding of audit committee functions. |

The person must have acquired such attributes through one or more of the following:

| · | | education and experience as a principal financial officer, principal accounting officer, controller, public accountant or auditor or experience in one or more positions that involve the performance of similar functions; |

| · | | experience actively supervising a principal financial officer, principal accounting officer, controller, public accountant, auditor or person performing similar functions; |

| · | | experience overseeing or assessing the performance of companies or public accountants with respect to the preparation, auditing or evaluation of financial statements; or |

| · | | other relevant experience. |

The current members of the Audit Committee are Mr. Lynch-Bell, Chairman, and Messrs. Barker and Szydlowski. Mr. Lynch-Bell assumed the chairmanship in July 2015; Mr. Barker acted as Chairman from July 2014 to July 2015. The Board has reviewed the criteria set by the SEC and determined that each of the current members of the Audit Committee is “financially literate” and that Mr. Lynch-Bell qualifies as an “audit committee financial expert” as defined by the SEC. In addition, the Board has determined that Mr. Lynch-Bell qualifies under NYSE rules as having accounting or related financial management expertise. Mr. Lynch-Bell is a chartered accountant, was an audit partner of Ernst & Young LLP and also served as senior partner transaction advisory services, IPO services and mining & metals of Ernst & Young LLP from 2011 to 2012. NYSE rules restrict directors who have relationships with the Company that may interfere with their independence from management and the Company from serving on the Audit Committee. The Board has determined that all members of the Audit Committee qualify as independent directors under the applicable rules of the NYSE, the Sarbanes-Oxley Act of 2002, as amended, and the rules and regulations promulgated by the SEC. Messrs. Lynch-Bell and Barker currently serve on the audit committees of four public companies, including our Audit Committee. Pursuant to the NYSE rules and regulations, our Board has determined that their simultaneous service on the audit committees of four public companies does not impair their ability to effectively serve on our Audit Committee. The Audit Committee met five times during 2015.

Compensation Committee: The Compensation Committee was formed in November 2014. The purpose of the Compensation Committee is to assist the Board in (1) developing an appropriate compensation program for members of the Board, executives and other senior officers and (2) complying with the Board’s legal and regulatory requirements as to Board member, executive and senior officer compensation in order to facilitate the Company’s ability to attract, retain and motivate qualified individuals in a system that aligns compensation with the Company’s business performance. The authority and responsibilities of the Compensation Committee include, among others, the following:

| · | | annually review and approve the compensation paid to the Board and executive officers; |

| · | | select appropriate peer groups and market reference points against which the Board and executive officer compensation is compared; |

| · | | annually establish focus areas for our CEO, annually review the CEO’s performance in light of the focus areas and set the CEO’s compensation based on this evaluation, together with competitive data; |

| · | | administer our Incentive Compensation Plan, and any other compensation plans or arrangements providing for benefits primarily to members of the Board and to executive officers in accordance with goals and objectives established by the Board, the terms of the plans, and any applicable rules and regulations; |

| · | | consider and make recommendations to the Board, with guidance from an outside compensation consultant, concerning the existing Board and executive compensation programs and changes to such programs; |

| · | | consider, with guidance from an outside compensation consultant, and approve the terms of any contractual agreements and other similar arrangements that may be entered into with members of the Board and executive officers; provided, however, that the Compensation Committee shall not recommend and the Board shall not authorize ‘‘single-trigger’’ change of control agreements for any of our officers; |

| · | | assess the risks of the Company’s compensation arrangements applicable to members of the Board and the officers and other employees of the Company; and |

| · | | retain and approve the fees of legal, accounting or other advisors, including any compensation consultant, employed by the Committee to assist it in the evaluation of executive and director compensation. |

The Compensation Committee engaged Pay Governance as its independent compensation consultant. Pay Governance is also retained as independent consultant by the compensation committee of Transocean Ltd. Before engaging Pay Governance, the Compensation Committee assessed whether the work of Pay Governance for the compensation committee of Transocean Ltd. raised any conflict of interest, including a review of a number of independence factors, which included the factors set forth under Rule 10C-1 of the Securities Exchange Act of 1934, as amended, and the Compensation Committee concluded that no conflict of interest was raised that would prevent Pay Governance from independently representing the Compensation Committee.

The current members of the Compensation Committee are Mr. Lynch-Bell, Chairman (since November 2014), and Messrs. Merksamer (since November 2014) and Plaxton (since November 2014). Although the Company is a “controlled company” and our Compensation Committee is not required to comply with the additional independence requirements for compensation committee members under NYSE rules, the Board has determined that Mr. Lynch-Bell and Mr. Plaxton qualify as independent under these rules. The Compensation Committee met five times during 2015.

Conflicts Committee: The Conflicts Committee was formed in November 2014. The purpose of the Conflicts Committee is to assist the Board, at its discretion, with reviewing specific matters that the Board believes may involve conflicts of interest. The Conflicts Committee will determine if the resolution of the conflict of interest is fair and reasonable to us. The members of the Conflicts Committee may not be officers or employees of the Company or directors, officers or employees of the Transocean Member or its affiliates, and must meet the independence standards established by the SEC and the NYSE to serve on an audit committee of a board of directors and certain other requirements. In addition, the members of our Conflicts Committee may not own any interest in the Company or our subsidiaries, the Transocean Member or any affiliate of the Transocean Member other than Company common units and awards, if any, under our incentive compensation plan. Certain of our directors are currently and may be in the future outside directors of Transocean and may therefore meet the independence standards established by the NYSE, but any such directors nevertheless are not and would not be eligible to serve on the Conflicts Committee as a result of their relationship with Transocean. Any matters approved by the Conflicts Committee will be deemed to have been approved in good faith, approved by all of our members, and not a breach by our directors, the Transocean Member or its affiliates of any duties any of them may owe us or our unitholders.

The current members of the Conflicts Committee are Mr. Plaxton, Chairman (since November 2014), and Messrs. Lynch-Bell (since November 2014) and Szydlowski (since November 2014). The Board has determined that all members of the Conflicts Committee qualify as independent directors under the applicable rules of the NYSE, the Sarbanes-Oxley Act of 2002, as amended, and the rules and regulations promulgated by the SEC. The Conflicts Committee met two times during 2015.

Compensation Committee Interlocks and Insider Participation

No interlocking relationships exist between the members of our Compensation Committee and the board of directors or compensation committee of any other company.

PROCESS FOR NOMINATING DIRECTORS

The Board believes that the backgrounds and qualifications of the current director nominees and the Appointed Directors, considered as a group, provide a broad diversity of experience, knowledge and abilities that will allow the Board to fulfill its responsibilities. We discuss each nominee’s and each Appointed Director's specific experience, qualifications, attributes and skills in Director Nominees and Appointed Directors.

The Board does not have a specific policy regarding diversity in the selection of director nominees. However, the Board does consider diversity in the director nominee selection process. The Board has the goal of having the directors reflect the global diversity of the Company’s workforce, its clients and the cultures in which it operates.

As described above, the Board does not have a Nominating and Corporate Governance Committee because it is a controlled company under the NYSE rules. The full Board participates in the consideration of director nominees. The Board annually reviews the qualifications and backgrounds of the directors, as well as the overall composition of the Board. This review considers, among others, the following criteria, which are set forth in our Corporate Governance Guidelines:

| · | | breadth of business knowledge; |

| · | | whether the candidate has sufficient time and willingness to fulfill the substantial duties and responsibilities of a director; |

| · | | the number of other public company boards a candidate serves on; |

| · | | whether the candidate has demonstrated the high level of character and integrity expected by us; and |

| · | | whether the candidate will contribute to the overall diversity of Board in terms of management, operations and financial skills and experience and reflect the diversity of the Company’s workforce and operations. |

In light of the Board’s ability to nominate all Elected Directors, the Board has not adopted a formal policy with regard to the consideration of any director candidates recommended by other unitholders. However, if another unitholder were to recommend a director candidate, the Board would consider such candidate in the same manner as it reviews its own nominees. From time-to-time, the Board may retain third party search firms to assist the Board in identifying and evaluating potential nominees to serve on the Board.

UNITHOLDER COMMUNICATIONS

Any communications from our unitholders to the Board shall be directed to our Corporate Secretary, who will forward these communications, as appropriate, to the addressee depending on the facts and circumstances outlined in the communication. Communications that do not directly relate to the directors’ duties and responsibilities will be excluded from distribution by our Corporate Secretary. Such excluded items may include: “spam,” advertisements, mass mailings, form letters and e-mail campaigns that involve unduly large numbers of similar communications, solicitations for goods, services, employment or contributions, surveys and individual product inquiries or complaints. Additionally, communications that appear to be unduly hostile, intimidating, threatening, illegal or similarly inappropriate will be screened for omission. Any omitted or deleted communications will be made available to any director upon request. All other communications addressed to the Board that do directly relate to the Board’s duties and responsibilities will be forwarded to Mr. Barker and Ms. McAllister for their review. Any unitholder who wishes to communicate with the Board may submit such communication in writing to the Corporate Secretary, Transocean Partners LLC, 40 George Street, London W1U 7DW, United Kingdom.

TRANSACTIONS WITH RELATED PERSONS

As of the Record Date, the Transocean Member owned 21,254,310 common units and 27,586,207 subordinated units, representing a 71.2 percent limited liability company interest in us. The Transocean Member also owns the non-economic Transocean Member interest in us and all of our incentive distribution rights. In addition, the Transocean Member owns a 49 percent non-controlling interest in each of the companies that own and operate the drilling rigs in our initial fleet (together the “RigCos”). Transocean’s ability, as the sole owner of the Transocean Member, to control the appointment of three of the seven members of the Board and to approve certain significant actions we may take, and the Transocean Member’s common and subordinated unit ownership and its right to vote the subordinated units as a separate class on certain matters mean that Transocean will have the ability to exercise significant influence regarding our management.

We, and other parties, have entered into various agreements with Transocean in relation to our initial public offering on August 5, 2014. These agreements were not the result of arm’s-length negotiations and neither the agreements nor any of the transactions that they provide for, were effected on terms at least as favorable to the parties to these agreements as they could have obtained from unaffiliated third parties. All of the transaction expenses incurred in connection with these transactions were paid from the proceeds of the Company’s public offering.

Omnibus Agreement

On August 5, 2014, we entered into an omnibus agreement (the “Omnibus Agreement”) with Transocean. The following discussion describes certain provisions of the omnibus agreement.

Non-competition. Under the Omnibus Agreement, Transocean agreed, and will cause its controlled affiliates (other than us, our subsidiaries and any publicly held affiliates of Transocean) to agree, not to acquire, own, operate or contract for any drilling rig that was constructed in 2009 or later and is operating under a contract for five or more years. For purposes of determining the length of the contract for purposes of the omnibus agreement, the drilling contract is deemed to commence on the commencement date of the drilling contract or the date of execution of an extension related thereto and does not include any unexercised customer option to extend the term of such drilling contract. We refer to these drilling rigs, together with any related contracts and any associated assets, as “Five-Year Drilling Rigs” and to all other drilling rigs, together with any related contracts and any associated assets, as “Non-Five-Year Drilling Rigs.” The restrictions in this paragraph will not prevent Transocean (including us and our subsidiaries, except as set forth below) from:

| (1) acquiring, owning, operating or contracting for Non-Five-Year Drilling Rigs; |

| (2) acquiring, owning, operating or contracting one or more Five-Year Drilling Rigs if Transocean offers to sell the drilling rig to us for the greater of (x) acquisition price or (y) its fair market value (taking into account, among other things, the anticipated cash flows under the associated drilling contracts), plus in either case any additional taxes (including tax credits used and benefits foregone), flag administration, financing, debt premium prepayment or make-whole costs, consent fees, transaction costs, financial advisory, legal and other similar costs associated with the transfer to us at the time of the acquisition (which we refer to as “break-up costs”); |

| (3) constructing any drilling rig that, upon commencement of its drilling contract, will become a Five-Year Drilling Rig (and acquiring, owning, operating or contracting such rig that is constructed) if, either after the entry into such drilling contract or upon commencement of such drilling contract, Transocean offers to sell such Five-Year Drilling Rig to us (x) for the all-in construction price (if the offer was made after the entry into the drilling contract) or (y) for the greater of (1) the all-in construction price or (2) its fair market value (taking into account the anticipated cash flows under the associated drilling contracts), plus any break-up costs (if the offer was made upon commencement of the drilling contract); |

| (4) putting a Non-Five-Year Drilling Rig under contract for five or more years and acquiring, owning and operating such rig if, either before or after the time such rig becomes a Five-Year Drilling Rig, Transocean offers to sell the Non-Five-Year Drilling Rig to us for its fair market value (taking into account, among other things, the anticipated cash flows under the associated drilling contracts) plus any break-up costs (x) after the time it becomes a Five-Year Drilling Rig and (y) at each renewal or extension of that contract for a term of five years or longer; |

| (5) acquiring one or more Five-Year Drilling Rigs as part of the acquisition of a controlling interest in a business or package of assets and owning, operating or contracting for those drilling rigs; provided, however, that: |

| (a) if less than a majority of the value of the business (before taking into account any debt or other associated liabilities) or assets to be acquired is attributable to Five-Year Drilling Rigs, as determined in good faith by Transocean’s board of directors, Transocean may consummate the acquisition of the business or assets but must promptly thereafter offer to sell such Five-Year Drilling Rig(s) to us for the greater of (x) their acquisition price or (y) their fair market value (taking into account, among other things, the anticipated cash flows under the associated drilling contracts), plus any break-up costs; and |

| (b) if a majority or more of the value of the business (before taking into account any debt or other associated liabilities) or assets to be acquired is attributable to Five-Year Drilling Rigs, as determined in good faith by Transocean’s board of directors, Transocean must notify us of the proposed acquisition in writing in advance of acquiring such business or assets. We will, not later than the 10th calendar day following receipt of such notice, notify Transocean if we wish to acquire any Five-Year Drilling Rig forming part of that business or package of assets in cooperation and simultaneously with Transocean acquiring the Non-Five-Year Drilling Rigs forming part of that business or package of assets. If we do not notify Transocean of our intent to pursue the acquisition within 10 calendar days, Transocean may proceed with the acquisition but then must offer to sell Five-Year Drilling Rigs to us as provided in paragraph (a) above; |

| (6) acquiring a noncontrolling interest in any company, business or pool of assets; |

| (7) acquiring, owning, operating or contracting any Five-Year Drilling Rig if we do not fulfill our obligation to purchase such drilling rig in accordance with the terms of any existing or future agreement; |

| (8) acquiring, owning, operating or contracting a Five-Year Drilling Rig subject to the offers to us described in paragraphs (2), (3), (4) and (5)(a) above pending our determination whether to accept such offers and pending the closing of any offers we accept; |

| (9) providing rig management, operating or similar services relating to any drillship or other drilling rig, including pursuant to a transition services agreement, operating agreement, bareboat charter or other similar agreement; |

| (10) owning or operating a Five-Year Drilling Rig that Transocean owns and operates as of the closing of our public offering (including, for the avoidance of doubt, all drilling rigs under construction or contracted to be constructed that have or are contemplated to have a related drilling contract for five or more years) and that is not included in the fleet of drillships and other drilling rigs contributed to us in connection with the closing of our public offering; |

| (11) acquiring, owning, operating or contracting any Five-Year Drilling Rig if we have previously advised Transocean that we consent to such acquisition, operation or contract; or |

| (12) acquiring, owning, operating or contracting any Five-Year Drilling Rig in transactions with any other members of the Transocean group. |

If Transocean (other than us, our subsidiaries and any publicly held affiliates of Transocean) acquires, owns, operates or contracts for Five-Year Drilling Rigs pursuant to any of the exceptions described above, it may not subsequently enter into any new drilling contracts for such Five-Year Drilling Rigs without again complying with the provisions described above. The omnibus agreement does not prohibit Transocean Ltd. from forming a new publicly traded entity that will not be subject to the omnibus agreement and that may compete with us.

In addition, under the omnibus agreement we agreed, and will cause our subsidiaries to agree, not to acquire, own, operate or contract for any Non-Five-Year Drilling Rigs. The restrictions in this paragraph will not prevent us from:

| (1) acquiring, owning, operating or contracting any Five-Year Drilling Rig; |

| (2) acquiring, owning, operating or contracting one or more Non-Five-Year Drilling Rigs if we offer to sell such Non-Five-Year Drilling Rig to Transocean for the greater of (x) acquisition price or (y) its fair market value (taking into account the anticipated cash flows under the associated drilling contracts), plus any break-up costs; |

| (3) constructing any drilling rig that, upon commencement of its drilling contract, will become a Non-Five-Year Drilling Rig (and acquiring, owning, operating or contracting such rig once constructed) if, either after the entry into |

the drilling contract or upon commencement of the drilling contract, we offer to sell such Non-Five-Year Drilling Rig to Transocean (x) for the all-in construction price (if the offer was made after the entry into the drilling contract) or (y) for the greater of (1) the all-in construction price or (2) its fair market value, plus any break-up costs (if the offer was made upon commencement of such drilling contract); |

| (4) putting a Five-Year Drilling Rig under contract for less than five years and acquiring, owning and operating such rig if, either before or after the time such rig becomes a Non-Five-Year Rig, we offer to sell such Five-Year Drilling Rig to Transocean for its fair market value (taking into account the anticipated cash flows under the associated drilling contracts) plus any break-up costs (x) after the time it becomes a Non-Five-Year Drilling Rig and (y) at each renewal or extension of that contract (other than a renewal or extension with the existing customer for that rig) for less than five years; |

| (5) acquiring one or more Non-Five-Year Drilling Rigs as part of the acquisition of a controlling interest in a business or package of assets and owning, operating or contracting such Non-Five-Year Drilling Rig; provided, however, that: |

| (a) if less than a majority of the value of the business (before taking into account any debt or other associated liabilities) or assets acquired is attributable to Non-Five-Year Drilling Rigs, as determined in good faith by the conflicts committee of the Board, we may consummate the acquisition of the business or assets but must promptly thereafter offer to sell such Non-Five-Year Drilling Rig to Transocean for the greater of (x) their acquisition price or (y) their fair market value (taking into account, among other things, the anticipated cash flows under the associated drilling contracts), plus any break-up costs; and |