- VKTX Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Viking Therapeutics (VKTX) DEF 14ADefinitive proxy

Filed: 5 Apr 24, 4:05pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No.)

Filed by the Registrant ☒ | Filed by a Party other than the Registrant ☐ |

Check the appropriate box:

VIKING THERAPEUTICS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

VIKING THERAPEUTICS, INC.

9920 Pacific Heights Blvd

Suite 350, San Diego, CA 92121

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

Tuesday, May 21, 2024

8:00 a.m. Pacific Time

https://web.lumiconnect.com/255403211 (password: viking2024)

Dear Stockholder:

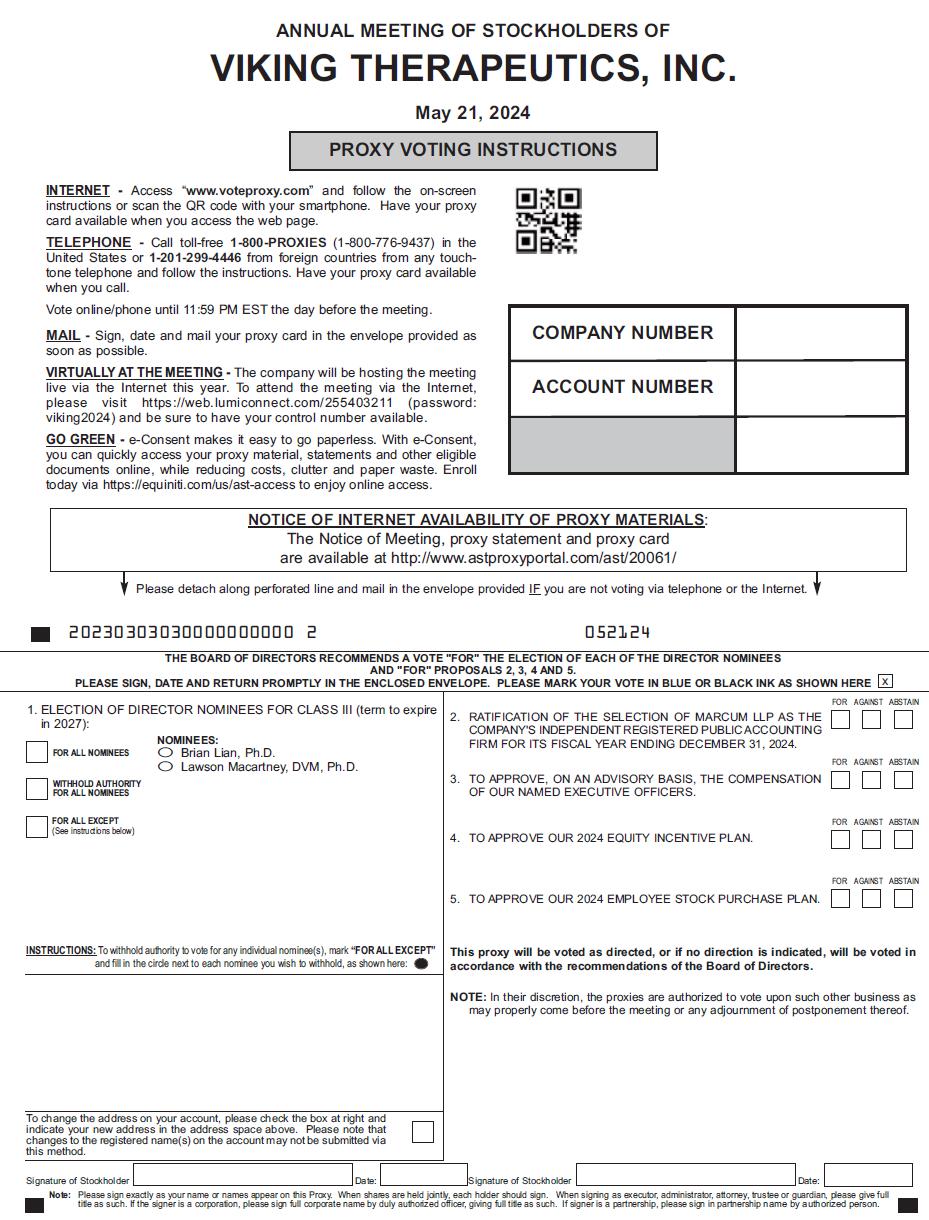

You are cordially invited to attend the Annual Meeting of Stockholders (the “Annual Meeting”) of Viking Therapeutics, Inc., a Delaware corporation (the “Company”), or any adjournment or postponement thereof. The Annual Meeting will be held virtually, via live webcast at https://web.lumiconnect.com/255403211 (password: viking2024), on Tuesday, May 21, 2024, at 8:00 a.m. Pacific Time for the following purposes:

These items of business are more fully described in the proxy statement accompanying this Notice of Internet Availability of Proxy Materials (the “Notice”).

The record date for the Annual Meeting is March 28, 2024 (the “Record Date”). Only stockholders of record at the close of business on the Record Date may vote at the Annual Meeting or any adjournment or postponement thereof. This Notice is being mailed to all stockholders of record entitled to vote at the Annual Meeting on or about April 5, 2024.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to be held virtually, via live webcast at: https://web.lumiconnect.com/255403211 (password: viking2024), on Tuesday, May 21, 2024, at 8:00 a.m. Pacific Time. The accompanying proxy statement and annual report to stockholders are available at http://astproxyportal.com/ast/20061/. |

By Order of the Board of Directors

/s/ Lawson Macartney, DVM, Ph.D.

Lawson Macartney, DVM, Ph.D.

Chairperson of the Board

San Diego, California

April 5, 2024

You are cordially invited to attend the Annual Meeting virtually. Whether or not you expect to attend the Annual Meeting, please complete, date, sign and return the enclosed proxy or submit your proxy through the internet or by telephone as promptly as possible in order to ensure your representation at the Annual Meeting. If you have requested physical materials to be mailed to you, then a return envelope (which is postage prepaid if mailed in the United States) is enclosed for your convenience if you choose to submit your proxy by mail. Even if you have voted by proxy, you may still vote electronically if you attend the Annual Meeting virtually. Please note, however, that if your shares are held of record by a broker, bank or other agent and you wish to vote electronically at the Annual Meeting, you must obtain a proxy issued in your name from that record holder.

VIKING THERAPEUTICS, INC.

9920 Pacific Heights Blvd

Suite 350, San Diego, CA 92121

PROXY STATEMENT

FOR THE 2024 Annual Meeting OF STOCKHOLDERS

TO BE HELD ON TUESDAY, MAY 21, 2024

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING

Why am I receiving these materials?

We have sent you these proxy materials because the Board of Directors (our “Board”) of Viking Therapeutics, Inc. (sometimes referred to as “we”, “us”, “Viking” or the “Company”) is soliciting your proxy to vote at the 2024 Annual Meeting of Stockholders, or any adjournment or postponement thereof (the “Annual Meeting”). You are invited to attend the Annual Meeting virtually and we request that you vote on the proposals described in this proxy statement.

Why did I receive a notice regarding the availability of proxy materials on the internet?

Pursuant to rules adopted by the Securities and Exchange Commission (the “SEC”), we have elected to provide access to our proxy materials over the internet. Accordingly, we are sending a Notice of Internet Availability of Proxy Materials (the “Notice”) to our stockholders of record. All stockholders will have the ability to access the proxy materials on the website referred to in the Notice or request to receive a printed set of the proxy materials. Instructions on how to access the proxy materials over the internet or to request a printed copy of the proxy materials (including a proxy card) may be found in the Notice.

We intend to mail the Notice on or about April 5, 2024 to all stockholders of record entitled to vote at the Annual Meeting.

When and where will the Annual Meeting be held?

The Annual Meeting will be held virtually, via live webcast at https://web.lumiconnect.com/255403211 (password: viking2024), on Tuesday, May 21, 2024, at 8:00 a.m. Pacific Time. Equiniti Trust Company, LLC (“EQ”) will host the virtual Annual Meeting and tabulate votes for the meeting.

How do I attend the Annual Meeting online?

Record Holders: Stockholders of record at the close of business on the Record Date (i.e., shares held in holder’s own name in the records of our transfer agent, EQ), may attend the virtual Annual Meeting by visiting https://web.lumiconnect.com/255403211 (password: viking2024) and entering the 11-digit control number included on the Notice on your proxy card (if you received a printed copy of the proxy materials), or on the instructions that accompanied your proxy materials. The password for the virtual Annual Meeting is viking2024. Stockholders of record who have misplaced their 11-digit control number, may contact EQ at (800) 973-5449.

Beneficial Owners: Beneficial owners at the close of business on the Record Date (i.e., shares held in “street name” through an intermediary, such as a bank, broker or other nominee), must register in advance to attend the virtual Annual Meeting. To register, beneficial owners must obtain a legal proxy from the bank, broker or other nominee that is the record holder of the shares and then submit the legal proxy, along with their respective name and email address, to EQ to receive an 11-digit control number. This control number can then be used to access the virtual Annual Meeting site provided above. Please note that any control number that was previously provided with proxy materials, likely a 16-digit number, will not provide access to the virtual Annual Meeting site. All requests for registration and submission of legal proxies should be labeled as “Legal Proxy” and must be received by EQ no later than 5:00 p.m. Pacific Time, on May 20, 2024. All requests should be submitted by email to proxy@equiniti.com, by facsimile to (718) 765-8730 or by mail to Equiniti Trust Company, LLC, Attn: Proxy Tabulation Department,55 Challenger Road, Ridgefield Park, NJ 07660. Obtaining a legal proxy may take several days and we advise you to

1

register as far in advance as possible. Once an 11-digit control number is obtained from EQ, please follow the steps set forth above for stockholders of record to attend the virtual Annual Meeting.

We recommend you access the Annual Meeting prior to the start time. Online check-in will begin at 7:30 a.m. Pacific Time. Please allow ample time for the check-in procedures. Technicians will be ready to assist with any technical difficulties prior to the start of the virtual Annual Meeting. Stockholders should call EQ at (800) 973-5449 with any questions regarding the virtual Annual Meeting. If you encounter any difficulty accessing the virtual Annual Meeting, please visit https://go.lumiglobal.com/faq for assistance.

The virtual Annual Meeting platform is fully supported across multiple browsers (Internet Explorer, Firefox, Chrome and Safari) and devices (desktops, laptops, tablets and cell phones) running the most updated version of applicable software and plugins. Stockholders should ensure that they have a strong internet connection wherever they intend to participate in the Annual Meeting. Stockholders should also give themselves ample time to log in and ensure that they can hear streaming audio prior to the start of the Annual Meeting.

Who can vote at the Annual Meeting?

Only stockholders of record at the close of business on the Record Date will be entitled to vote at the Annual Meeting. At the close of business on the Record Date, there were 110,217,994 shares of common stock outstanding and entitled to vote and no shares of preferred stock outstanding or entitled to vote. The holders of common stock will have one vote for each share of common stock they owned as of the close of business on the Record Date.

Stockholder of Record: Shares Registered in Your Name

If at the close of business on the Record Date, your shares of common stock were registered directly in your name with our transfer agent, EQ, then you are the stockholder of record for these shares. As a stockholder of record, you may vote either electronically at the Annual Meeting or by proxy. Whether or not you plan to attend the Annual Meeting, we urge you to vote by proxy over the telephone or internet as instructed below to ensure that your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker, Bank or Other Agent

If at the close of business on the Record Date, your shares of common stock were held, not in your name, but rather in an account at a brokerage firm, bank, dealer or other similar organization, then you are the beneficial owner of shares held in “street name” and the Notice is being forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your broker, bank or other agent regarding how to vote the shares in your account. Certain of these institutions offer the ability to direct your agent how to vote through the internet or by telephone. You are also invited to attend the Annual Meeting. However, because you are not the stockholder of record, you may not vote your shares electronically at the Annual Meeting unless you request and obtain a valid proxy issued in your name from the broker, bank or other agent considered the stockholder of record of the shares.

What am I voting on?

There are five matters scheduled for a vote at the Annual Meeting:

2

Will there be any other items of business on the agenda?

Aside from the election of the Class III directors, ratification of the selection of our independent registered public accounting firm, the advisory vote to approve the compensation of our named executive officers, the vote to approve our 2024 Equity Incentive Plan and the vote to approve our 2024 Employee Stock Purchase Plan, our Board knows of no matters to be presented at the Annual Meeting. If any other matter should be presented at the Annual Meeting upon which a vote properly may be taken, shares represented by all proxies received by our Board will be voted with respect thereto in accordance with the judgment of the persons named as attorneys-in-fact in the proxies.

What is our Board’s voting recommendation?

Our Board recommends that you vote your shares:

How do I vote?

With respect to the election of the director nominees (Proposal No. 1), you may either vote “For” a nominee or you may “Withhold” your vote for a nominee. For the ratification of our independent registered public accounting firm (Proposal No. 2), the approval of the compensation of our named executive officers (Proposal No. 3), the approval of our 2024 Equity Incentive Plan (Proposal No. 4) and the approval of our 2024 Employee Stock Purchase Plan (Proposal No. 5), you may vote “For” or “Against” or abstain from voting. The procedures for voting are described below, based upon your form of ownership.

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote electronically at the Annual Meeting by attending the Annual Meeting online and following the on-screen voting instructions.

If you do not wish to vote electronically or you will not be attending the Annual Meeting, you may vote by proxy. You may vote by proxy on the internet, vote by proxy over the telephone or vote by proxy using a proxy card that you may request. The procedures for voting by proxy are as follows:

3

If you vote by proxy, your vote must be received by 11:59 p.m. Eastern Time on May 20, 2024 to be counted.

We provide internet and telephone proxy voting with procedures designed to ensure the authenticity and correctness of your proxy vote instructions. However, please be aware that you must bear any costs associated with your internet and telephone access, such as usage charges from internet access providers and telephone companies.

Beneficial Owner: Shares Registered in the Name of Your Broker, Bank or Other Agent

If you are a beneficial owner of shares registered in the name of your broker, bank or other agent, you should have received a notice containing voting instructions from that organization rather than from us. To ensure that your vote is counted, follow the voting instructions in the notice. To vote electronically at the Annual Meeting, you must obtain a valid proxy from your broker, bank or other agent in whose name the shares are registered. Follow the instructions from your broker, bank or other agent included with these proxy materials, or contact your broker, bank or other agent to request a proxy card.

How many votes do I have?

On each matter to be voted upon, holders of common stock will have one vote for each share of common stock they owned as of the close of business on the Record Date for the Annual Meeting.

Will my vote be kept confidential?

Proxies, ballots and voting tabulations are handled on a confidential basis to protect your voting privacy. This information will not be disclosed, except as required by law.

Who is paying for this proxy solicitation?

We will bear the cost of soliciting proxies for the Annual Meeting. We will ask banks, brokerage houses, fiduciaries and custodians holding shares of our common stock in their names for others to send proxy materials to and obtain proxies from the beneficial owners of such shares, and we will reimburse them for their reasonable expenses in doing so. We and our directors, officers and regular employees may solicit proxies by mail, personally, by telephone or by other appropriate means. We may also decide to engage an outside proxy solicitor to assist us in these efforts. No additional compensation will be paid to directors, officers or other regular employees for such services.

What does it mean if I receive more than one Notice?

If you receive more than one Notice, your shares are registered in more than one name or are registered in different accounts. Please follow the voting instructions on each Notice to ensure that all of your shares are voted.

Can I change my vote after submitting my proxy?

Yes. You can revoke your proxy at any time before the final vote at the Annual Meeting. If you are a stockholder of record, you may revoke your proxy in any one of four ways:

4

If you are a beneficial owner of shares registered in the name of your broker, bank or other agent, you should follow the voting instructions from that organization, or contact that organization to determine how you may revoke your proxy.

Votes will be counted by the inspector of election appointed for the virtual Annual Meeting.

How are my shares voted if I give no specific instruction?

We must vote your shares as you have instructed. If there is a matter on which a stockholder of record has given no specific instruction but has authorized us generally to vote the shares, they will be voted as follows:

If other matters properly come before the Annual Meeting and you do not provide specific voting instructions, your shares will be voted at the discretion of the proxies.

If your shares are held in street name, see “What is a broker non-vote?” below regarding the ability of banks, brokers and other such holders of record to vote the uninstructed shares of their customers or other beneficial owners in their discretion and regarding broker non-votes.

What is a broker non-vote?

Under rules that govern banks, brokers and others who have record ownership of company stock held in brokerage accounts for their clients who beneficially own the shares, these banks, brokers and other such holders who do not receive voting instructions from their clients have the discretion to vote uninstructed shares on certain matters (“discretionary matters”) but do not have discretion to vote uninstructed shares as to certain other matters (“non-discretionary matters”). Only the ratification of our independent registered public accounting firm is considered a discretionary matter at the Annual Meeting under these rules. A broker may return a proxy card on behalf of a beneficial owner from whom the broker has not received voting instructions that casts a vote with regard to discretionary matters but expressly states that the broker is not voting as to non-discretionary matters. The broker’s inability to vote with respect to the non-discretionary matters for which the broker has not received voting instructions from the beneficial owner is referred to as a “broker non-vote”.

5

What are the voting requirements that apply to the proposals discussed in this proxy statement?

Proposals | Vote Required | Discretionary Voting Allowed? |

1. Election of Directors | Plurality | No |

2. Ratification of Independent Registered Public Accounting Firm | Majority Cast | Yes |

3. Advisory Vote to Approve the Compensation of our Named Executive Officers | Majority Cast | No |

4. Vote to Approve the 2024 Equity Incentive Plan | Majority Cast | No |

5. Vote to Approve the 2024 Employee Stock Purchase Plan | Majority Cast | No |

A “plurality”, with regard to the election of directors, means the nominee receiving the most “For” votes will be elected to our Board. A “majority cast”, with regard to the ratification of our independent registered public accounting firm and the advisory vote to approve the compensation of our named executive officers, means the number of votes cast “For” the proposal must exceed the number of votes cast “Against” the proposal.

“Discretionary voting” occurs when a bank, broker, or other holder of record does not receive voting instructions from the beneficial owner and votes those shares at its discretion on any proposal as to which the rules permit such bank, broker or other holder of record to vote. As noted above, when banks, brokers and other holders of record are not permitted under the rules to vote the beneficial owner’s shares, the affected shares are referred to as “broker non-votes”.

Accordingly:

The votes on Proposal No. 3 are advisory and non-binding; however, as provided by law, our Board and the Compensation Committee of our Board (the “Compensation Committee”) will review the results of the votes and,

6

consistent with our record of stockholder engagement, will consider the results in making future decisions concerning executive compensation to approve the compensation of our named executive officers.

What is the effect of abstentions and broker non-votes?

Abstentions: Under Delaware law (under which we are incorporated), withheld votes and abstentions are counted as shares present and entitled to vote at the Annual Meeting, but they are not counted as shares cast. Our amended and restated bylaws (our “Bylaws”) generally provide that stockholder actions are approved if the votes cast for an action exceed the votes cast opposing the action. Therefore, withheld votes and abstentions will have no effect on Proposal No. 1 (Election of Directors), Proposal No. 2 (Ratification of Independent Registered Public Accounting Firm), Proposal No. 3 (Advisory Vote to Approve the Compensation of Our Named Executive Officers), Proposal No. 4 (Approval of 2024 Equity Incentive Plan) or Proposal No. 5 (Approval of Employee Stock Purchase Plan).

Broker Non-Votes: As a result of a change in the rules related to discretionary voting and broker non-votes, banks, brokers and other such record holders are no longer permitted to vote the uninstructed shares of their customers on a discretionary basis in the election of directors or on named executive officer compensation matters. Because broker non-votes are not considered under Delaware law to be entitled to vote at the Annual Meeting, they will have no effect on the outcome of the vote on Proposal No. 1 (Election of Directors), Proposal No. 3 (Advisory Vote to Approve the Compensation of Our Named Executive Officers), Proposal No. 4 (Vote to Approve the 2024 Equity Incentive Plan), or Proposal No. 5 (Vote to Approve the 2024 Employee Stock Purchase Plan). As a result, if you hold your shares in street name and you do not instruct your bank, broker or other such holder how to vote your shares with respect to Proposals No. 1, 3, 4 or 5, no votes will be cast on your behalf on such proposal. Therefore, it is critical that you indicate your vote on these proposals if you want your vote to be counted. The proposal to ratify the selection of Marcum LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024 should be considered a discretionary matter. Therefore, your bank, broker or other such holder will be able to vote on this proposal even if it does not receive instructions from you, so long as it holds your shares in its name.

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if the holders of at least a majority of our outstanding shares of common stock are present virtually at the Annual Meeting or represented by proxy. At the close of business on the Record Date, there were 110,217,994 shares of common stock outstanding. Thus, a total of 110,217,994 shares are entitled to vote at the Annual Meeting and the holders of 55,108,998 shares of common stock representing at least 55,108,998 votes must be represented at the Annual Meeting or by proxy to have a quorum.

Your shares will be counted towards the quorum requirement only if you submit a valid proxy (or if one is submitted on your behalf by your broker, bank or other agent) or if you vote electronically at the Annual Meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, the chairperson of the Annual Meeting or a majority of the shares present at the Annual Meeting may adjourn the Annual Meeting to another date.

Who will count the votes?

The votes will be counted, tabulated and certified by EQ, the transfer agent and registrar for our common stock.

Do our officers and directors have an interest in any of the matters to be acted upon at the Annual Meeting?

Dr. Lian and Dr. Macartney each have an interest in Proposal No. 1 (Election of Directors), as each nominee is currently a member of our Board. Members of our Board and our executive officers do not have any interest in Proposal No. 2 (Ratification of Independent Registered Public Accounting Firm). Dr. Lian, our President and Chief Executive Officer, Ms. Mancini, our Chief Operating Officer and Mr. Zante, our Chief Financial Officer, each have an interest in Proposal No. 3 (Approval of the Compensation of the Named Executive Officers), as his or her compensation is subject to this vote. Each of our executive officers and directors has an interest in Proposal No. 4

7

(Approval of our 2024 Equity Incentive Plan), as all of our executive officers and directors will be eligible to receive awards under this plan. Each of our executive officers has an interest in Proposal No. 5 (Approval of our 2024 Employee Stock Purchase Plan), as all of our executive officers are eligible to participate in this plan.

How can I find out the results of the voting at the Annual Meeting?

Voting results are expected to be announced at the Annual Meeting and will also be disclosed in a Current Report on Form 8-K (the “Form 8-K”) that we will file with the SEC within four business days of the date of the Annual Meeting. In the event the results disclosed in our Form 8-K are preliminary, we will subsequently amend the Form 8-K to report the final voting results within four business days of the date that such results are known.

Why did I receive a Notice in the mail regarding the internet availability of proxy materials instead of a full set of proxy materials?

Pursuant to rules adopted by the SEC, we provide stockholders access to our proxy materials via the internet. On or about April 5, 2024, we are sending a Notice to our stockholders of record and beneficial owners. All stockholders will have the ability to access the proxy materials on a website referred to in the Notice. Stockholders may request to receive a full set of printed proxy materials by mail. Instructions on how to access the proxy materials on the internet or request a printed copy may be found in the Notice.

When are stockholder proposals due for next year’s annual meeting of stockholders?

Stockholders may submit proposals on matters appropriate for stockholder action at the 2025 annual meeting of our stockholders (“2025 Annual Meeting of Stockholders”) consistent with Rule 14a-8 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). To be considered for inclusion in proxy materials for our 2025 Annual Meeting of Stockholders, a stockholder proposal must be submitted in writing no later than December 6, 2024 to our Corporate Secretary, c/o Viking Therapeutics, Inc., 9920 Pacific Heights Blvd, Suite 350, San Diego, CA 92121. If you wish to submit a proposal that is not to be included in the proxy materials for our 2025 Annual Meeting of Stockholders, your proposal generally must be submitted in writing to the same address no earlier than January 21, 2015, but no later than February 20, 2025. However, if the date of the 2025 Annual Meeting of Stockholders is convened more than 30 days before, or delayed by more than 30 days after, May 21, 2025, to be considered for inclusion in proxy materials for our 2025 Annual Meeting of Stockholders, a stockholder proposal must be submitted in writing to our Corporate Secretary, c/o Viking Therapeutics, Inc., 9920 Pacific Heights Blvd, Suite 350, San Diego, CA 92121 a reasonable time before we begin to print and send our proxy materials for the 2025 Annual Meeting of Stockholders. If the date of the 2025 Annual Meeting of Stockholders is convened more than 30 days before, or delayed by more than 30 days after, May 21, 2024 and you wish to submit a proposal that is not to be included in the proxy materials for our 2025 Annual Meeting of Stockholders, your proposal generally must be submitted in writing to the same address not earlier than the close of business on the 120th day prior to the date of the 2025 Annual Meeting of Stockholders, and no later than the close of business on the later of (1) the 90th day before the date of the 2025 Annual Meeting of Stockholders, or (2) the 10th day following the day on which we first publicly announce (by press release or a filing with the SEC) the date of the 2025 Annual Meeting of Stockholders. Please review our Bylaws, which contain additional requirements regarding advance notice of stockholder proposals. You may view our Bylaws by visiting the SEC’s internet website at www.sec.gov.

For information regarding nominations for director candidates, including a summary of the requirements and applicable deadlines for such nominations, please see “Corporate Governance and Board Matters-Consideration of Director Nominees-Security Holder Nominations” beginning on page 21 of this proxy statement.

8

EXECUTIVE OFFICERS

Our executive officers are elected by, and serve at the discretion of, our Board. Our executive officers, their ages as of April 5, 2024, and their respective positions and biographies are listed below:

Name | Age | Position(s) |

Brian Lian, Ph.D. | 58 | President and Chief Executive Officer, Director |

Marianne Mancini | 59 | Chief Operating Officer |

Greg Zante | 53 | Chief Financial Officer |

Brian Lian, Ph.D. has served as our President and Chief Executive Officer and as a Director since our inception in September 2012. Dr. Lian has over 15 years of experience in the biotechnology and financial services industries. Prior to joining us, he was a Managing Director and Senior Research Analyst at SunTrust Robinson Humphrey, an investment bank, from 2012 to 2013. At SunTrust Robinson Humphrey, he was responsible for coverage of small and mid-cap biotechnology companies with an emphasis on companies in the diabetes, oncology, infectious disease and neurology spaces. Prior to SunTrust Robinson Humphrey, he was Managing Director and Senior Research Analyst at Global Hunter Securities, an investment bank, from 2011 to 2012. Prior to Global Hunter Securities, he was Senior Healthcare Analyst at The Agave Group, LLC, a registered investment advisor, from 2008 to 2011. Prior to The Agave Group, he was an Executive Director and Senior Biotechnology Analyst at CIBC World Markets, an investment bank, from 2006 to 2008. Prior to CIBC, he was a research scientist in small molecule drug discovery at Amgen, a biotechnology company. Prior to Amgen, he was a research scientist at Microcide Pharmaceuticals, a biotechnology company. Dr. Lian has served as a member of the board of directors of Seelos Therapeutics, Inc. since January 2019. Dr. Lian holds a MBA in accounting and finance from Indiana University, an MS and Ph.D. in organic chemistry from The University of Michigan, and a BA in chemistry from Whitman College. We believe that Dr. Lian’s experience in the biotechnology industry, as well as his extensive investment banking and other experience in the financial services industry, provide him with the qualifications and skills to serve as a member of our Board and bring relevant strategic and operational guidance to our Board.

Marianne Mancini has served as our Chief Operating Officer since January 2021. Prior to Ms. Mancini’s appointment as our Chief Operating Officer, Ms. Mancini served as our Senior Vice President of Clinical Operations from March 2018 to January 2021, and as our Vice President of Clinical Operations from May 2015 to March 2018. Ms. Mancini has over 30 years of experience in the pharmaceutical and biotechnology industries, focusing on the management and oversight of clinical trials from early stage to late-stage drug development. Prior to joining us, Ms. Mancini was Senior Director of Clinical Operations at Ambit Biosciences Corporation, a company focused primarily on the development of oncology therapies for the treatment of Acute Myeloid Leukemia (AML), from August 2013 to May 2015. Previously, Ms. Mancini was the Senior Director of Clinical Operations at Aires Pharmaceuticals, Inc., a company focused on developing therapies for pulmonary vascular disorders, from March 2011 to October 2012. At Arena Pharmaceuticals, Inc., she served as Senior Director of Project Management and Clinical Operations and was also the Project Team Leader for the company’s lead obesity compound, BELVIQ®, from November 2006 to March 2011. Ms. Mancini held management positions at Baxter BioSciences, a division of Baxter Healthcare Corporation, where she was the Global Director of Clinical Operations overseeing the company’s global clinical trials involving coagulation disorders, biosurgery, and critical care, from January 1999 to August 2006. She also previously held positions at Genentech from September 1996 to January 1999, Procter & Gamble Pharmaceuticals, Inc. from August 1991 to August 1996, and Phoenix International Life Sciences from April 1990 to July 1991. Ms. Mancini holds a MA in Bioethics from Loyola Marymount University, a MBA from the University of Phoenix, and a BS in Nutritional Sciences from McGill University.

Greg Zante has served as our Chief Financial Officer since January 2021. Prior to Mr. Zante’s appointment as our Chief Financial Officer, Mr. Zante served as our Senior Vice President of Finance from August 2019 to January 2021, and as our Vice President, Finance & Operations from December 2016 to July 2019. Mr. Zante

9

possesses nearly 25 years of financial management experience at public and private companies in the biotechnology and accounting industries. Prior to joining us, Mr. Zante was Chief Financial Officer at Dance Biopharm, Inc., a diabetes-focused biopharmaceutical company, from 2013 to 2016, where he managed the company’s private financing strategy and positioned it for initial public offering activities. Mr. Zante has also previously held senior positions at several biopharmaceutical companies, including Sangamo Therapeutics, Inc. from 2003 to 2013, Calyx Therapeutics Inc. from 2001 to 2003 and Matrix Pharmaceuticals, Inc. from 2000 to 2001. He is a certified public accountant in the State of California and previously served as a senior staff accountant at Ernst & Young. He holds a BA in Business-Economics from the University of California, Los Angeles.

There are no family relationships between or among any of our executive officers or our directors.

10

BOARD OF DIRECTORS

Our business and affairs are managed under the direction of our Board, which currently consists of six members. The primary responsibilities of our Board are to provide oversight, strategic guidance, counseling and direction to our management.

In accordance with our Charter and our Bylaws, our Board is divided into three classes with staggered three-year terms. Only one class of directors will be elected at each annual meeting of our stockholders, with the other classes continuing for the remainder of their respective three-year terms. Our directors are divided among the three classes as follows:

At each annual meeting of stockholders, the successors to the directors whose term will then expire will be elected to serve from the time of election and qualification until the third annual meeting following election. In addition, the authorized number of directors may be changed only by resolution of our Board. Any additional directorships resulting from an increase in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of the directors. This classification of our Board may have the effect of delaying or preventing a change of our management or a change in control.

The names of our current directors, their ages as of April 5, 2024, director class and biographies are listed below. There are no family relationships between or among any of our directors.

Name | Age | Director Class | Position(s) |

Matthew W. Foehr | 51 | Class I | Director |

Charles A. Rowland, Jr. | 65 | Class I | Director |

J. Matthew Singleton | 71 | Class II | Director |

S. Kathy Rouan, Ph.D. | 61 | Class II | Director |

Lawson Macartney, DVM, Ph.D. | 66 | Class III | Chairperson of our Board |

Brian Lian, Ph.D.(1) | 58 | Class III | President and Chief Executive Officer, Director |

_________________

(1) Please see “Executive Officers” on page 9 of this proxy statement for Dr. Lian’s biography.

Matthew W. Foehr has served as a member of our Board since May 2014. He has also served as the President and Chief Executive Officer and a member of the board of directors of OmniAb, Inc. since March 2022. From February 2015 to November 2022, Mr. Foehr served as President and Chief Operating Officer of Ligand Pharmaceuticals Incorporated (“Ligand”), and previously served as Executive Vice President and Chief Operating Officer of Ligand from April 2011 to February 2015. From February 2015 to May 2020, he served on the board of directors of Ritter Pharmaceuticals, Inc. (now named Qualigen Therapeutics, Inc.) and served on its audit committee and as Chair of its compensation committee. Mr. Foehr has over 25 years of experience in the pharmaceutical industry, having managed global operations, technology development and research and development programs. From March 2010 to April 2011, he was Vice President and Head of Consumer Dermatology R&D, as well as Acting Chief Scientific Officer of Dermatology, in the Stiefel division of GSK. Following GSK’s $3.6 billion acquisition of Stiefel Laboratories, Inc., a pharmaceutical company, in 2009, Mr. Foehr led the R&D integration of Stiefel into GSK. At Stiefel Laboratories, Inc., Mr. Foehr served as Senior Vice President of Global R&D Operations, Senior Vice President of Product Development & Support, and Vice President of Global Supply Chain Technical Services from January 2007 to March 2010. Prior to Stiefel, Mr. Foehr held various executive roles at Connetics Corporation, a pharmaceutical company, including Senior Vice President of Technical Operations and

11

Vice President of Manufacturing. Early in his career, Mr. Foehr managed manufacturing activities and worked in process sciences at both LXR Biotechnology Inc. and Berlex Biosciences. He received his BS in Biology from Santa Clara University. We believe that Mr. Foehr’s past service in executive management roles for companies in the pharmaceutical industry and related experience provide him with the qualifications and skills to serve as a member of our Board.

Charles A. Rowland, Jr., MBA, has served as a member of our Board since July 2017. He has served as a member of the board of directors and chair of the audit committee of Generation Bio Co. since July 2018 and as a member of the board of directors and chair of the compensation committee of Nabriva Therapeutics, AG since January 2015. He previously served as a member of the board of directors and chair of the audit and compensation committees of Orchard Therapeutics plc from June 2018 to January 2024, when Orchard Therapeutics plc was acquired by Kyowa Kirin Co., Ltd. From March 2015 to June 2022, Mr. Rowland served as a member of the board of directors and chair of the audit committee of Blueprint Medicines Corporation. From April 2016 to February 2017, he served as president and chief executive officer of Aurinia Pharmaceuticals Inc., and as a member of the board of directors of Aurinia from July 2014 to February 2017. Mr. Rowland previously served as vice president and chief financial officer of ViroPharma Incorporated, an international biopharmaceutical company, from October 2008 until it was acquired by Shire plc in January 2014. Prior to joining ViroPharma, from 2006 to 2008, Mr. Rowland served as executive vice president and chief financial officer, as well as the interim co-chief executive officer, for Endo Pharmaceuticals Inc., a specialty pharmaceutical company with a primary focus in pain management. Mr. Rowland previously held positions of increasing responsibility at Biovail Pharmaceuticals, Inc., Breakaway Technologies, Inc., Pharmacia Corporation, Novartis AG and Bristol-Myers Squibb Co., each a biopharmaceutical company. Mr. Rowland’s past board services include Psioxus Therapeutics from August 2017 to October 2019, Vitae Pharmaceuticals, Inc. from September 2014 to September 2016, BIND Therapeutics, Inc. from May 2014 to July 2016 and Idenix Pharmaceuticals, Inc. from June 2013 to August 2014. Rowland received a B.S. in Accounting from Saint Joseph’s University and an M.B.A. with a finance concentration from Rutgers University. We believe that Mr. Rowland’s financial and business expertise in the life sciences industry provide him with the qualifications and skills to serve as a member of our Board.

J. Matthew Singleton has served as a member of our Board since May 2014. In October 2011, Mr. Singleton retired from his position as Executive Vice President and Chief Financial Officer of CitationAir (formerly CitationShares LLC), a privately held jet services company wholly-owned by Textron Inc., a public industrial conglomerate. He had served in this position since 2000. Mr. Singleton has extensive financial, accounting and transactional experience, including through his role as Managing Director, Executive Vice President and Chief Administrative Officer of CIBC World Markets, an investment banking company, for 20 years, from 1974 to 1994, at Arthur Andersen & Co., a public accounting firm, including as Partner-in-Charge of the Metro New York Audit and Business Advisory Practice, and as a Practice Fellow at the Financial Accounting Standards Board, a private organization responsible for establishing financial accounting reporting standards. From 2003 until 2014, Mr. Singleton served as a director of Cubist Pharmaceuticals Inc., and as Audit Committee Chair beginning in 2004. Mr. Singleton previously served as an independent director of Salomon Reinvestment Company Inc., a privately held investment services company. Mr. Singleton received an AB in Economics from Princeton University and his MBA from New York University with a focus in Accounting. We believe that Mr. Singleton’s financial, accounting and business expertise provide him with the qualifications and skills to serve as a member of our Board, and are of particular importance as we continue to finance our operations.

S. Kathy Rouan, Ph.D. has served as a member of our Board since July 2019. Dr. Rouan is an experienced drug developer and leader with over 30 years of pharmaceutical industry experience. She was appointed Senior Vice President and Head of Projects, Clinical Platforms and Sciences (PCPS) at GlaxoSmithKline plc (GSK) in May 2016, following a 27-year career in a range of discovery and development roles. The PCPS organization within GSK encompasses the Global Clinical Operations, Statistics and Programming, Clinical Pharmacology, GCP Quality, Third Party Resourcing and Project Management functions and includes approximately 1,800 staff in 20 countries. Dr. Rouan was the Head of Research & Development for Stiefel, a dermatology focused subsidiary of GSK, from 2013 to 2016. Dr. Rouan joined GSK in 1989 with a background in Pharmaceutical Sciences focusing on formulation development of protein pharmaceuticals. In 1993, she moved into Project Leadership and Management becoming Vice President and Head of Metabolism and Pulmonary Project Management in 1999. Dr. Rouan continued to lead projects in a number of therapeutic areas, including cardiovascular, immunoinflammation and gastroenterology therapy areas. In 2007, she led the development, submission and approval of Arzerra

12

(ofatumumab) in refractory chronic lymphocytic leukemia in addition to leading its development in other oncology and autoimmune indications. In 2012, Dr. Rouan became Head of Biopharmaceutical Development responsible for the delivery of GSK’s portfolio of biopharmaceutical medicines. Currently, Dr. Rouan is serving as a non-executive Board member at Code Biotherapeutics, Inc. She previously served on the board of directors of Navidea Pharmaceuticals, Inc. from 2018 to 2021. Dr. Rouan earned a Ph.D. in Pharmaceutical Sciences from the University of Rhode Island, while conducting her research at Pfizer’s Immunoinflammation Research group in Groton, Connecticut. She holds a B.Pharm., First Class Honours, from the University of London. We believe that Dr. Rouan’s extensive drug development and leadership experience in the pharmaceutical industry provide her with the qualifications and skills to serve as a member on our Board.

Lawson Macartney, DVM, Ph.D., has served as the Chairperson of our Board since May 2015 and as a member of our Board since May 2014. From January 2017 to June 2017, Dr. Macartney served as Chief Executive Officer of Scout Bio Inc., a gene therapy company developing therapies for companion animals. Dr. Macartney serves on the Board of Dechra PLC, an international animal health pharmaceutical company based in the United Kingdom, and on the Supervisory Board of the Netherlands Translational Research Centre, a preclinical biopharmaceutical company based in The Netherlands. He served as President, Chief Executive Officer and a member of the board of directors of Ambrx Inc., a biopharmaceutical company, from February 2013 to June 2015. Prior to Ambrx, Dr. Macartney served at Shire AG, a specialty biopharmaceutical company, as Senior Vice President of the Emerging Business Unit from 2011 to 2013, where he was responsible for discovery initiatives through Phase 3 development of Shire’s Specialty Pharmaceutical portfolio. Prior to joining Shire AG, he served at GSK, a pharmaceutical company, from 1999 to 2011, serving as Senior Vice President of Global Product Strategy and Project/Portfolio Management from 2007 to 2011, as Senior Vice President, Cardiovascular and Metabolic Medicine Development Center from 2004 to 2007, and as Vice President, Global Head of Cardiovascular, Metabolic and Urology Therapeutic Areas from 1999 to 2004. Prior to joining GSK, Dr. Macartney was employed at Astra Pharmaceuticals from 1998 to 1999 in leadership roles in operations, marketing and sales, and served as Executive Director, Commercial Operations at AstraMerck, Inc., a pharmaceutical company, from 1996 to 1998. Dr. Macartney received his Ph.D. from Glasgow University in Scotland in 1982, where he was a Royal Society Research Fellow, and his B.V.M.S. (equivalent to a D.V.M.) in 1979 from Glasgow University Veterinary School. He is also trained in diagnostic pathology and is a Fellow of the Royal College of Pathologists. We believe that Dr. Macartney’s extensive experience in leadership positions at numerous pharmaceutical companies qualifies him to serve on our Board.

13

CORPORATE GOVERNANCE AND BOARD MATTERS

This section describes key corporate governance guidelines and practices that we have adopted. Complete copies of the charters of the committees of our Board and our Code of Conduct and Ethics described below may be viewed on our internet website at http://ir.vikingtherapeutics.com/governance-highlights under “Committee Charters” and “Governance Documents”. Information contained on, or that can be accessed through, our website is not intended to be incorporated by reference into this proxy statement, and references to our website address in this proxy statement are inactive textual references only. Alternately, you can request a copy of any of these documents free of charge by writing to our Corporate Secretary, c/o Viking Therapeutics, Inc., 9920 Pacific Heights Blvd, Suite 350, San Diego, CA 92121.

Director Independence

Under the rules and listings standards (the “Nasdaq Rules”) of The Nasdaq Stock Market LLC (“Nasdaq”), a majority of the members of our Board must satisfy the Nasdaq criteria for “independence.” No director qualifies as independent under the Nasdaq Rules unless our Board affirmatively determines that the director does not have a relationship with us that would impair independence (directly or as a partner, stockholder or officer of an organization that has a relationship with us). Our Board has determined that Drs. Macartney and Rouan and Messrs. Foehr, Singleton and Rowland are independent directors as defined under the Nasdaq Rules. Dr. Lian is not independent under the Nasdaq Rules as a result of his position as our President and Chief Executive Officer.

Board Leadership Structure

Our Bylaws provide our Board with the discretion to combine or separate the positions of Chairperson of our Board and Chief Executive Officer. Dr. Macartney, who is an independent director, serves as Chairperson of our Board. As a general policy, our Board believes that separation of the positions of Chairperson of our Board and Chief Executive Officer reinforces the independence of our Board from management, creates an environment that encourages objective oversight of management’s performance and enhances the effectiveness of our Board as a whole. We believe that this separation of responsibilities will provide a balanced approach to managing our Board and overseeing the Company. However, our Board will continue to periodically review our leadership structure and may make such changes in the future as it deems appropriate.

Role of Board in Risk Oversight Process

Our Board is responsible for overseeing our overall risk management process. The responsibility for managing risk rests with executive management while the committees of our Board and our Board as a whole participate in the oversight process. Our Board’s risk oversight process builds upon management’s risk assessment and mitigation processes, which include reviews of long-term strategic and operational planning, executive development and evaluation, regulatory and legal compliance, and financial reporting and internal controls.

Meetings and Executive Sessions

Our Board meets on a regular basis throughout the year to review significant developments affecting us and to act upon matters requiring its approval. Our Board also holds special meetings as required from time to time when important matters arise requiring Board action between scheduled meetings. During fiscal year 2023, (i) our Board met four times and did not take any action by unanimous written consent, (ii) our audit committee of the Board (the “Audit Committee”) met four times and did not take any actions by unanimous written consent, (iii) our Compensation Committee met twice and took action by unanimous written consent once, and (iv) our nominating and corporate governance committee of the Board (the “Nominating and Corporate Governance Committee”) did not meet separately and did not take any actions by unanimous written consent. None of our directors attended fewer than 75% of the total number of meetings held by our Board and the committees (on which and for the period during which the director served) during fiscal year 2023.

As required under applicable Nasdaq listing standards, our independent directors periodically meet in an executive session at which only they are present.

14

Policy Regarding Board Member Attendance at Annual Meetings

It is the policy of our Board to invite directors and nominees for director to attend annual meetings of our stockholders. We expect any of them in attendance to be available to answer appropriate questions from our stockholders. We held one annual meeting of stockholders in fiscal year 2023, and Dr. Lian, Dr. Macartney, Mr. Foehr, Mr. Singleton and Dr. Rouan attended the meeting.

Information Regarding Committees of our Board

Our Board has established a standing Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee. The following table provides membership information as of the date hereof and meetings held in 2023 for each of these committees of our Board:

Name | Audit | Compensation | Nominating and Corporate Governance |

J. Matthew Singleton | X* | X |

|

S. Kathy Rouan, Ph.D. |

|

| X* |

Lawson Macartney, DVM, Ph.D. | X | X | X |

Brian Lian, Ph.D. |

|

|

|

Matthew W. Foehr |

|

|

|

Charles A. Rowland, Jr. | X | X* |

|

Total meetings in 2023 | 4 | 2 | 0 |

_________________

X Current Committee Member.

* Current Committee Chairperson.

Below is a description of each primary committee of our Board. Members serve on these committees until their resignation, disqualification or removal or until otherwise determined by our Board. Each of these committees has authority to engage legal counsel or other experts or consultants, as it deems appropriate to carry out its responsibilities. Our Board has determined that each member of each of these committees meets the applicable Nasdaq Rules and regulations regarding “independence” and that each member is free of any relationship that would impair his or her individual exercise of independent judgment with regard to us.

Audit Committee

We have a separately-designated standing Audit Committee established in accordance with Section 3(a)(58)(A) of the Exchange Act. Our Audit Committee is comprised of Messrs. Singleton and Rowland and Dr. Macartney, with Mr. Singleton serving as Chairperson of the committee. Each member of the Audit Committee must be independent as defined under the applicable Nasdaq Rules and SEC rules and financially literate under the Nasdaq Rules. Our Board has determined that each member of the Audit Committee is “independent” and “financially literate” under the Nasdaq Rules and the SEC rules and that Mr. Singleton is an “audit committee financial expert” under the rules of the SEC. The responsibilities of the Audit Committee are included in a written charter. The Audit Committee acts on behalf of our Board in fulfilling our Board’s oversight responsibilities with respect to our corporate accounting and financial reporting processes, the systems of internal control over financial reporting and audits of financial statements, and also assists our Board in its oversight of the quality and integrity of our financial statements and reports and the qualifications, independence and performance of our independent registered public accounting firm. For this purpose, the Audit Committee performs several functions. The Audit Committee’s responsibilities include:

15

The Audit Committee reviews, discusses and assesses its own performance and composition at least annually. The Audit Committee also periodically reviews and assesses the adequacy of its charter, including its roles and responsibilities as outlined in its charter, and recommends any proposed changes to our Board for its consideration and approval.

Typically, the Audit Committee meets at least quarterly and with greater frequency if necessary. Our Board has adopted a written charter of the Audit Committee that is available to stockholders on our internet website at http://ir.vikingtherapeutics.com/governance-highlights under “Committee Charters”.

16

Compensation Committee

Our Compensation Committee is comprised of Messrs. Rowland and Singleton and Dr. Macartney, with Mr. Rowland serving as Chairperson of the committee. Our Board has determined that each member of the Compensation Committee is “independent” under the Nasdaq Rules and SEC rules. Each of the members of the Compensation Committee is also a “non-employee director” as that term is defined under Rule 16b-3 of the Exchange Act and an “outside director” as that term is defined in Treasury Regulations Section 1.162-27(3). The Compensation Committee acts on behalf of our Board to fulfill our Board’s responsibilities in overseeing our compensation policies, plans and programs; and in reviewing and determining the compensation to be paid to our executive officers and non-employee directors. The responsibilities of the Compensation Committee include:

17

Our Board has adopted a written charter of the Compensation Committee that is available to stockholders on our internet website at http://ir.vikingtherapeutics.com/governance-highlights under “Committee Charters”. The Compensation Committee meets from time to time during the year. The agenda for each meeting is usually developed by the Chairperson of the Compensation Committee, in consultation with our Chief Executive Officer and other representatives of senior management and human resources as necessary. The Chief Executive Officer may not participate in or be present during any deliberations or determinations of the Compensation Committee regarding his compensation. Under its charter, the Compensation Committee may form, and delegate authority to, subcommittees as appropriate. The Compensation Committee reviews, discusses and assesses its own performance and composition at least annually. The Compensation Committee also periodically reviews and assesses the adequacy of its charter, including its roles and responsibilities as outlined in its charter, and recommends any proposed changes to our Board for its consideration and approval.

The Compensation Committee is authorized to retain the services of independent advisers to assist it in carrying out its responsibilities. Since June 2015, Aon, plc (“Aon”) has provided compensation consulting services to assist management and the Compensation Committee in assessing and determining competitive compensation packages. Aon is independent from us, was engaged directly by the Compensation Committee and has received compensation from us only for services provided to the Compensation Committee.

The Compensation Committee meets outside the presence of all of our executive officers, including the named executive officers, in order to consider appropriate compensation for our Chief Executive Officer. For all other named executive officers, the Compensation Committee meets outside the presence of all executive officers except for our Chief Executive Officer. The annual performance of our executive officers is considered by the Compensation Committee when making decisions on setting base salary, targets for and payments under our bonus plan and grants of equity incentive awards. When making decisions on executive officers, the Compensation Committee considers the importance of the position to us, the past salary history of such executive officer and the contributions we expect such executive officer to make to the success of our business going forward.

The specific determinations of the Compensation Committee with respect to executive compensation for fiscal year 2023 are described in greater detail in the “Executive Compensation” section of this proxy statement.

Nominating and Corporate Governance Committee

Our Nominating and Corporate Governance Committee is comprised of Dr. Rouan and Dr. Macartney, with Dr. Rouan serving as Chairperson of the committee. Our Board has determined that each member of the Nominating and Corporate Governance Committee is “independent” under the Nasdaq Rules and all applicable laws. The responsibilities of the Nominating and Corporate Governance Committee are included in its written charter. The Nominating and Corporate Governance Committee acts on behalf of our Board to fulfill our Board’s responsibilities in overseeing all aspects of our nominating and corporate governance functions. The responsibilities of the Nominating and Corporate Governance Committee include:

18

Our Board has adopted a written charter of the Nominating and Corporate Governance Committee that is available to stockholders on our internet website at http://ir.vikingtherapeutics.com/governance-highlightsunder “Committee Charters”. The Nominating and Corporate Governance Committee meets from time to time as it deems appropriate or necessary.

The Nominating and Corporate Governance Committee also periodically reviews, discusses and assesses the performance of our Board and the committees of our Board. In fulfilling this responsibility, the Nominating and Corporate Governance Committee seeks input from senior management, our Board and others. In assessing our Board, the Nominating and Corporate Governance Committee evaluates the overall composition of our Board, our Board’s contribution as a whole and its effectiveness in serving our best interests and the best interests of our stockholders. The Nominating and Corporate Governance Committee reviews, discusses and assesses its own performance and composition at least annually. The Nominating and Corporate Governance Committee also periodically reviews and assesses the adequacy of its charter, including its roles and responsibilities as outlined in its charter, and recommends any proposed changes to our Board for its consideration and approval.

Consideration of Director Nominees

Director Qualifications

There are no specific minimum qualifications that our Board requires to be met by a director nominee recommended for a position on our Board, nor are there any specific qualities or skills that are necessary for one or more members of our Board to possess, other than as are necessary to meet the requirements of the rules and regulations applicable to us. The Nominating and Corporate Governance Committee may consider a potential director candidate’s integrity, experience, judgment, commitment, skills, diversity, age, gender, race, background, place of residence, areas of expertise, experience serving as a board member or executive officer of other companies, relevant academic expertise and other factors relative to the overall composition of our Board and Board committees, including the following characteristics and factors:

19

The Nominating and Corporate Governance Committee retains the right to modify these criteria from time to time.

20

Security Holder Nominations

The Nominating and Corporate Governance Committee will consider director candidates recommended by our security holders. The Nominating and Corporate Governance Committee does not intend to alter the manner in which it evaluates candidates, including the criteria set forth above, based on whether a candidate is recommended by a security holder or not. Security holders who wish to recommend individuals for consideration by the Nominating and Corporate Governance Committee to become nominees for election to our Board at the 2025 Annual Meeting of Stockholders must do so by delivering a written recommendation to the Nominating and Corporate Governance Committee, c/o Viking Therapeutics, Inc., 9920 Pacific Heights Blvd, Suite 350, San Diego, CA 92121, no earlier than the close of business on January 21, 2025, but no later than February 20, 2025 unless the meeting date is more than 30 days before or after May 21, 2025, in which case the written recommendation must be received by our Corporate Secretary no later than the close of business not earlier than the close of business on the 120th day prior to the date of the 2025 Annual Meeting of Stockholders, and no later than the close of business on the later of (1) the 90th day before the date of the 2025 Annual Meeting of Stockholders, or (2) the 10th day following the day on which we first publicly announce (by press release or a filing with the SEC) the date of the 2025 Annual Meeting of Stockholders. Each written recommendation must set forth, among other information:

21

Director candidate nominations from security holders must include the written consent of each proposed nominee (1) consenting to be named as a nominee for election to our Board, (2) consenting to serve as a director, if elected, and (3) consenting to be interviewed by the Nominating and Corporate Governance Committee, if the Nominating and Corporate Governance Committee chooses to do so in its discretion. If a proposed director candidate is recommended by a security holder in accordance with the procedural requirements discussed above, our Corporate Secretary will provide the foregoing information to the Nominating and Corporate Governance Committee.

In addition, pursuant to Rule 14a-19 of the Exchange Act (“Rule 14a-19”), the SEC’s universal proxy rule, notices of a solicitation of proxies in support of director nominees other than our own nominees must be postmarked or electronically submitted no later than March 22, 2025, and each nomination must comply with the SEC regulations under Rule 14a-19, which requires, among other things, that such notice include a statement that such person intends to solicit the holders of shares representing at least 67% of the voting power of shares entitled to vote on the election of directors. If, however, the date of the 2024 Annual Meeting of Stockholders is more than 30 days before or after May 21, 2025, then the Rule 14a-19 deadline shall be the later of 60 calendar days prior to the date of the 2025 Annual Meeting of Stockholders or the 10th calendar day following the day on which we first make a public announcement of the date of the 2025 Annual Meeting of Stockholders. A nomination that does not comply with the requirements set forth in the Charter and Bylaws will not be considered for presentation at the Annual Meeting. We intend to file a proxy statement and white proxy card with the SEC in connection with our solicitation of proxies for our 2025 Annual Meeting of Stockholders.

Evaluating Nominees for Director

Our Nominating and Corporate Governance Committee will consider director candidates who are suggested by members of the committee, other members of our Board, members of management, advisors and our security holders who submit recommendations in accordance with the requirements set forth above. The Nominating and Corporate Governance Committee may, in the future, also retain a third-party search firm to identify candidates on terms and conditions acceptable to the Nominating and Corporate Governance Committee, but to date it has not paid a fee to any third party to assist in the process of identifying or evaluating director candidates. The Nominating and Corporate Governance Committee will evaluate all nominees for director under the same approach whether they are recommended by security holders or other sources.

The Nominating and Corporate Governance Committee will review candidates for director nominees in the context of the current composition of our Board and committees, our operating requirements and the long-term interests of our stockholders. In conducting this assessment, the Nominating and Corporate Governance Committee may consider the director nominee’s qualifications, diversity, age, skills and such other factors as it deems appropriate given the current needs of our Board, the committees and our company, to maintain a balance of knowledge, experience, diversity and capability. In the case of an incumbent director whose term of office is set to expire, the Nominating and Corporate Governance Committee may review such director’s overall service to our Board, the committees and our company during his or her term, including the number of meetings attended, level of participation, quality of performance and any other relationships and transactions that might impair such director’s independence. In the case of new director candidates, the Nominating and Corporate Governance Committee will also determine whether the nominee must be independent for Nasdaq and SEC purposes, which determination will be based upon applicable Nasdaq listing standards and applicable SEC rules and regulations. Although we do not have a formal diversity policy, when considering diversity in evaluating director nominees, the Nominating and Corporate Governance Committee will focus on whether the nominees can contribute varied perspectives, skills, experiences and expertise to our Board. The Nominating and Corporate Governance Committee will evaluate the proposed director’s candidacy, including proposed candidates recommended by security holders, and recommend whether our Board should nominate the proposed director candidate for election by our stockholders.

22

Board Diversity Matrix

The table below provides an enhanced disclosure regarding the diversity of the current members and nominees of our Board. Each of the categories listed in the below table has the meaning as it is used in Nasdaq Rule 5605(f).

Board Diversity Matrix (As of April 5, 2024) | ||||

Board Size: | ||||

Total Number of Directors | 6 | |||

| Male | Female | Non-Binary | Gender Undisclosed |

Part I: Gender Identity |

|

|

|

|

Number of directors based on gender identity | 4 | 1 | — | 1 |

Part II: Demographic Background |

|

|

|

|

African American or Black | — | — | — | — |

Alaskan Native or Native American | — | — | — | — |

Asian | — | — | — | — |

Hispanic or Latinx | — | — | — | — |

Native Hawaiian or Pacific Islander | — | — | — | — |

White | 4 | 1 | — | — |

Two or More Races or Ethnicities | — | — | — | — |

LGBTQ+ | — | |||

Did not Disclose Demographic Background |

|

|

| 1 |

Security holder Communications with our Board

Our Board has adopted a formal process by which security holders may communicate with our Board or any of its directors. Our Security holders wishing to communicate with our Board or an individual director may send a written communication to our Board or such director, c/o Viking Therapeutics, Inc., 9920 Pacific Heights Blvd, Suite 350, San Diego, CA 92121, Attn.: Corporate Secretary. Each communication must set forth:

Each communication will be reviewed by our Corporate Secretary to determine whether it is appropriate for presentation to our Board or the individual director. Examples of inappropriate communications include junk mail, spam, mass mailings, product complaints, product inquiries, new product suggestions, resumes, job inquiries, surveys, business solicitations and advertisements, as well as unduly hostile, threatening, illegal, unsuitable, frivolous, patently offensive or otherwise inappropriate material. These screening procedures have been approved by a majority of the independent members of our Board.

Communications determined by our Corporate Secretary to be appropriate for presentation to our Board or such director will be submitted to our Board or the individual director on a periodic basis. All communications directed to the Audit Committee in accordance with our “Open Door” Reporting and Non-Retaliation Policy Regarding Accounting and Auditing Matters (the “Open Door Policy”) that relate to questionable accounting, internal accounting controls or auditing matters involving the Company generally will be forwarded to a compliance officer designated by the Audit Committee to receive and review these communications and to the Chairperson of the Audit Committee, in accordance with the terms of the Open Door Policy. All communications directed to the Nominating and Corporate Governance Committee in accordance with our Code of Conduct and Ethics that relate to non-financial matters (including without limitation purported or suspected violations of any law or regulation, our Code

23

of Conduct and Ethics or other policies) will generally be forwarded to a compliance officer designated by the Nominating and Corporate Governance Committee to receive and review these communications and then promptly and directly forwarded by a compliance officer to the Nominating and Corporate Governance Committee or our Board, as appropriate, in accordance with the terms of the Code of Conduct and Ethics.

Code of Conduct and Ethics

Our Board has adopted a Code of Conduct and Ethics that applies to all of our employees, officers and directors, including our Chief Executive Officer and other employees. We have posted the Code of Conduct and Ethics on our website at http://ir.vikingtherapeutics.com/governance-highlights under “Governance Documents”. The Code of Conduct and Ethics can only be amended by the approval of the Audit Committee and any waiver to the Code of Conduct and Ethics for an executive officer or director may only be granted by our Audit Committee and must be timely disclosed as required by applicable law. We expect that any amendments to the Code of Conduct and Ethics, or any waivers of its requirements, will be disclosed on our website.

Hedging and Pledging Policies

As part of our insider trading policy, our executives and directors are prohibited from engaging in short sales of our securities and from engaging in hedging and monetization transactions involving our securities. Our insider trading policy does not restrict pledges of securities, but requires that pledges of securities be pre-cleared by an insider trading compliance officer.

Clawback Policy

Effective October 1, 2023, our Board adopted a restated compensation recovery (“clawback”) policy pursuant to the listing standards approved by Nasdaq implementing Rule 10D-1 under the Exchange Act. The clawback policy is administered by our Compensation Committee and applies to our current and former executive officers as defined in Rule 10D-1 (each an “Affected Officer”). Under the clawback policy, if we are required to prepare an accounting restatement to correct our material noncompliance with any financial reporting requirement under securities laws, including restatements that correct an error in previously issued financial statements that is material to the previously issued financial statements or that would result in a material misstatement if the error were corrected in the current period or left uncorrected in the current period (collectively, a “Restatement”), we are obligated to recover erroneously awarded incentive-based compensation received from us by any Affected Officers. Incentive-based compensation includes any compensation that is granted, earned or vested based in whole or in part on the attainment of a financial reporting measure. Erroneously awarded incentive-based compensation is the amount of incentive-based compensation received that exceeds the amount of incentive-based compensation that otherwise would have been received had it been determined based on an applicable Restatement.

24

EXECUTIVE COMPENSATION

How We Pay for Performance

Our executive officer compensation program is designed to reward achievement of the specific strategic goals that we believe will advance our business strategy and create long-term value for our stockholders. Consistent with our goal of attracting, motivating and retaining a high-caliber executive team, our executive officer compensation program is designed to pay for performance. We utilize compensation elements that meaningfully align our executives’ interests with those of our stockholders to incentivize long-term value creation. The Compensation Committee uses its discretion in determining the appropriate mix of fixed and variable compensation for each executive. As such, a significant portion of our Chief Executive Officer’s and other executive officers’ compensation is at-risk, performance-based compensation, in the form of long-term equity awards, and annual cash incentives that are only earned if we achieve multiple corporate goals. The balance between these components may change from year to year based on corporate strategy, company performance, market forces and company objectives, among other considerations.

Compensation Philosophy and Determination Process

In order to create value for our stockholders, it is critical to attract, motivate and retain key executive officer talent by providing competitive compensation packages. The market for talented individuals in the life sciences industry is highly competitive and is becoming more challenging for employers. Our Board believes our compensation program should align executive interests with the drivers of growth and stockholder returns, and support achievement of our key business mission, goals and objectives. Consequently, our Board believes the substantial majority of executive compensation should be at-risk, performance-based pay to facilitate the successful execution of our business strategy.

Use of Independent Compensation Consultant

The Compensation Committee utilizes Aon as its independent outside compensation consultant to assist with setting executive compensation. The Compensation Committee has sole authority to retain or replace such independent compensation consultants. The Compensation Committee believes that working with an independent compensation consultant furthers our objectives to recruit and retain qualified executives, align executive interests with those of our stockholders and ensure that executive compensation packages will appropriately motivate and reward ongoing achievement of business goals.

Aon provided the following services to the Compensation Committee with respect to our 2023 compensation matters:

The Compensation Committee annually assesses whether the work of Aon as a compensation consultant has raised any conflict of interest, taking into consideration the following factors: (i) the provision of other services, if any, to the Company by Aon; (ii) the amount of fees we paid to Aon; (iii) Aon’s policies and procedures that are designed to prevent conflicts of interest; (iv) any business or personal relationship of Aon or the individual compensation advisors employed by the firm with an executive officer of the Company; (v) any business or personal relationship of the individual compensation advisors with any member of the Compensation Committee; and (vi) any shares of our common stock owned by Aon or the individual compensation advisors employed by the firm. The Compensation Committee has determined, based on its analysis of the above factors, that the work of Aon and the individual compensation advisors employed by Aon as our compensation consultants have not created any conflict of interest.

25

The Compensation Committee also annually evaluates Aon’s independence and performance under the applicable listing standards of Nasdaq. In 2023, Aon did not provide any other services to us other than the consulting services to the Compensation Committee with respect to compensation matters.

Named Executive Officers

Our named executive officers for the year ended December 31, 2023 are:

Summary Compensation Table

The following table sets forth certain information with respect to the compensation paid to our named executive officers for the fiscal years ended December 31, 2023 and 2022:

Name and Principal Position | Year | Salary ($) | Non-Equity Incentive Plan Compensation(l) ($) | Stock Awards(2) ($) | Option Awards(3) ($) | All Other Compensation ($) | Total ($) |

Brian Lian, Ph.D. | 2023 | 615,000 | 372,100 | 7,937,803 | 3,703,158 | — | 12,628,061 |

Chief Executive Officer | 2022 | 611,800 | 353,315 | 3,041,865 | 1,404,311 | — | 5,411,291 |

Marianne Mancini | 2023 | 465,000 | 205,000 | 1,581,883 | 1,259,074 | — | 3,510,957 |

Chief Operating Officer | 2022 | 446,000 | 187,300 | 792,185 | 626,539 | — | 2,052,044 |

Greg Zante | 2023 | 455,000 | 200,000 | 1,581,883 | 1,259,074 | — | 3,495,957 |

Chief Financial Officer | 2022 | 425,000 | 178,500 | 675,065 | 432,096 | — | 1,710,661 |

____________

(1) The amounts in this column relate to amounts earned by our named executive officers pursuant to our bonus program described below under “2023 Bonuses”.