Exhibit 10.7

Execution Version

SENIOR FIRST LIEN SECURED

CREDIT AGREEMENT

among

Empire Energy E&P, LLC

A Pennsylvania limited liability company

Empire Energy USA, LLC

A Delaware limited liability company

and

Empire Drilling and Field Services, LLC

A Delaware limited liability company

as Borrowers

and

Macquarie Bank Limited,

a bank incorporated under the laws of Australia,

as Lender

________________________________

Dated as of February 26, 2008

TABLE OF CONTENTS

| Article I DEFINITIONS | 2 |

| | | |

| Section 1.1. | Specific Defined Terms | 2 |

| | | |

| Section 1.2. | Other Capitalized Terms | 23 |

| | | |

| Section 1.3. | Exhibits and Schedules | 23 |

| | | |

| Section 1.4. | Amendment of Defined Instruments | 23 |

| | | |

| Section 1.5. | References and Titles | 23 |

| | | |

| Section 1.6. | Accounting Terms and Determinations | 24 |

| | | |

| Article II LOANS | 24 |

| | | |

| Section 2.1. | Maximum Commitments; Development Plan | 24 |

| | | |

| Section 2.2. | Cancellation of Commitments | 26 |

| | | |

| Section 2.3. | Advance Procedure | 26 |

| | | |

| Section 2.4. | Notes | 27 |

| | | |

| Section 2.5. | Interest Selection | 27 |

| | | |

| Section 2.6. | Interest Computation | 28 |

| | | |

| Section 2.7. | Repayment of Principal of and Interest: Net Operating Cash Flow | 28 |

| | | |

| Section 2.8. | Time and Place of Payments | 29 |

| | | |

| Section 2.9. | Borrowers Sub-Account | 29 |

| | | |

| Section 2.10. | Optional Prepayment of the Term Loan | 30 |

| | | |

| Section 2.11. | Mandatory Prepayment of the Term Loan | 31 |

| | | |

| Section 2.12. | Revenues Remaining in the Borrowers Sub-Account | 31 |

| | | |

| Section 2.13. | Taxes | 31 |

| | | |

| Section 2.14. | Fees | 34 |

| | | |

| Section 2.15. | LIBOR Breakage Costs | 34 |

| | | |

| Section 2.16. | Borrowing Base | 34 |

| | | |

| Section 2.17. | Conversion to Revolver | 35 |

| | | |

| Article III SECURITY | 36 |

| | | |

| Section 3.1. | Grant of Security Interests | 36 |

| | | |

| Section 3.2. | Pledged Interests | 37 |

| | | |

| Section 3.3. | Equipment | 37 |

| | | |

| Section 3.4. | Subordination Agreements | 37 |

| | | |

| Article IV REPRESENTATIONS AND WARRANTIES | 37 |

| | | |

| Section 4.1. | Formation and Existence | 37 |

| Section 4.2. | Executive Offices | 38 |

| | | |

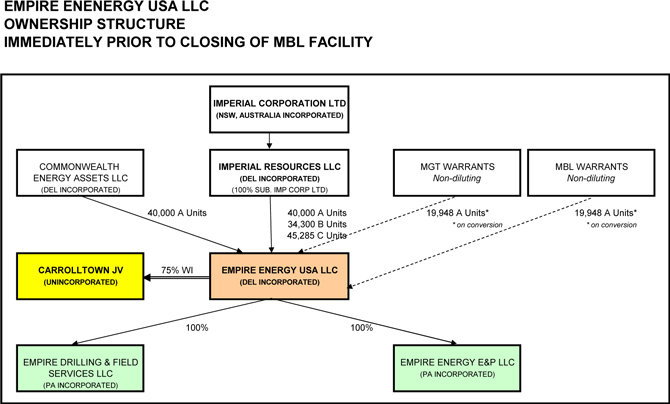

| Section 4.3. | Capitalization; Ownership; Subsidiaries | 38 |

| | | |

| Section 4.4. | Authorization; Non-Contravention | 38 |

| | | |

| Section 4.5. | Solvency | 38 |

| | | |

| Section 4.6. | Omissions and Misstatements | 39 |

| | | |

| Section 4.7. | Joint Venture | 39 |

| | | |

| Section 4.8. | Commissions; Expenses | 39 |

| | | |

| Section 4.9. | Tax Returns | 39 |

| | | |

| Section 4.10. | Litigation; Governmental Proceedings | 40 |

| | | |

| Section 4.11. | Ownership of Collateral; Interests | 40 |

| | | |

| Section 4.12. | Indebtedness | 40 |

| | | |

| Section 4.13. | Trademarks, Etc | 40 |

| | | |

| Section 4.14. | Other Leases | 41 |

| | | |

| Section 4.15. | Investments | 41 |

| | | |

| Section 4.16. | Environmental Matters | 41 |

| | | |

| Section 4.17. | Operating Permits and Licenses | 42 |

| | | |

| Section 4.18. | Maintenance of Properties | 43 |

| | | |

| Section 4.19. | USA PATRIOT Act Representation | 43 |

| | | |

| Section 4.20. | Contingent Liabilities | 43 |

| | | |

| Section 4.21. | Restrictions on Equipment | 43 |

| | | |

| Section 4.22. | Unpaid Bills | 44 |

| | | |

| Section 4.23. | Taxpayer Identification | 44 |

| | | |

| Section 4.24. | Investment Company | 44 |

| | | |

| Section 4.25. | Borrower Not a Public Company | 44 |

| | | |

| Section 4.26. | Other Agreements | 44 |

| | | |

| Section 4.27. | Basic Documents | 44 |

| | | |

| Section 4.28. | Farmout Agreements and Subject Contracts, Etc | 44 |

| | | |

| Section 4.29. | Operating Agreements | 45 |

| | | |

| Section 4.30. | No Unusual Agreements | 45 |

| | | |

| Section 4.31. | Suspense of Proceeds | 45 |

| | | |

| Section 4.32. | Employee Plans | 45 |

| | | |

| Section 4.33. | Use of Proceeds | 46 |

| | | |

| Section 4.34. | Borrowers’ Interests in the Properties | 46 |

| | | |

| Section 4.35. | Insurance | 46 |

| Section 4.36. | No Material Adverse Effect | 46 |

| | | |

| Section 4.37. | No Other Interest in the Properties | 46 |

| | | |

| Section 4.38. | Conduct of Business Since Formation | 46 |

| | | |

| Section 4.39. | Restriction on Liens | 46 |

| | | |

| Section 4.40. | Hedging Agreements | 47 |

| | | |

| Section 4.41. | Marketing of Production | 47 |

| | | |

| Section 4.42. | Deposit Accounts | 47 |

| | | |

| Section 4.43. | Labor Matters | 47 |

| | | |

| Section 4.44. | Vendor Liens | 47 |

| | | |

| Section 4.45. | Eligible Contract Participant | 47 |

| | | |

| Section 4.46. | Character of Pledged Interests | 47 |

| | | |

| Section 4.47. | Choice of Law | 47 |

| | | |

| Section 4.48. | No Default | 48 |

| | | |

| Section 4.49. | Financial Statements | 48 |

| | | |

| Section 4.50. | Priority | 48 |

| | | |

| Section 4.51. | Terms and Conditions | 48 |

| | | |

| Article V FINANCIAL STATEMENTS AND INFORMATION; CERTAIN NOTICES TO LENDER | 48 |

| | | |

| Section 5.1. | Property Operating Statement | 48 |

| | | |

| Section 5.2. | Annual Reports | 49 |

| | | |

| Section 5.3. | Quarterly Financial Reports | 49 |

| | | |

| Section 5.4. | Certificate of Financial Officer; Compliance | 49 |

| | | |

| Section 5.5. | Default Notices | 50 |

| | | |

| Section 5.6. | Reserve Reports | 51 |

| | | |

| Section 5.7. | Other Information | 52 |

| | | |

| Section 5.8. | Daily Field Reports | 53 |

| | | |

| Section 5.9. | [Reserved] | 53 |

| | | |

| Section 5.10. | Monthly Field Activity Reports | 53 |

| | | |

| Section 5.11. | AFEs | 53 |

| | | |

| Section 5.12. | Test Results; Core Analyses; Surveys and Logs | 53 |

| | | |

| Section 5.13. | Advance Notice of Operations | 54 |

| | | |

| Section 5.14. | Reports Made to a Governmental Authority | 54 |

| | | |

| Section 5.15. | Charter Documents | 54 |

| | | |

| Section 5.16. | Information to Imperial Corporation | 54 |

| Section 5.17. | Certificate of Authorized Officer; Hedging Agreements | 54 |

| | | |

| Section 5.18. | Certificate of Insurer; Insurance Coverage | 54 |

| | | |

| Section 5.19. | Updated Development Plan | 54 |

| | | |

| Article VI AFFIRMATIVE COVENANTS | 55 |

| | | |

| Section 6.1. | Preservation of Existence | 55 |

| | | |

| Section 6.2. | Compliance with Law | 55 |

| | | |

| Section 6.3. | Environmental Matters | 57 |

| | | |

| Section 6.4. | Records | 57 |

| | | |

| Section 6.5. | Litigation | 57 |

| | | |

| Section 6.6. | Damage to Collateral | 58 |

| | | |

| Section 6.7. | Solvency | 58 |

| | | |

| Section 6.8. | Insurance | 58 |

| | | |

| Section 6.9. | [Reserved] | 59 |

| | | |

| Section 6.10. | Delivery of Instruments | 59 |

| | | |

| Section 6.11. | Consultants | 59 |

| | | |

| Section 6.12. | Creditors | 60 |

| | | |

| Section 6.13. | Inspection | 60 |

| | | |

| Section 6.14. | Compliance Opinions and Reports | 60 |

| | | |

| Section 6.15. | Operators | 60 |

| | | |

| Section 6.16. | Purchasers of Hydrocarbons | 61 |

| | | |

| Section 6.17. | Access to Officers, Employees and Agents | 62 |

| | | |

| Section 6.18. | Use of Proceeds; Development of Properties | 62 |

| | | |

| Section 6.19. | Bonds | 62 |

| | | |

| Section 6.20. | Hedging Hydrocarbon Production | 62 |

| | | |

| Section 6.21. | Minimum Payments | 62 |

| | | |

| Section 6.22. | Title Opinions | 62 |

| | | |

| Section 6.23. | Continuing Enterprise | 63 |

| | | |

| Section 6.24. | Venue for Debtor Relief Proceedings | 63 |

| | | |

| Section 6.25. | Access to Seismic and Geophysical Data | 63 |

| | | |

| Section 6.26. | Financial Ratios | 63 |

| | | |

| Section 6.27. | Liens on Collateral | 63 |

| | | |

| Section 6.28. | Warrants | 63 |

| | | |

| Section 6.29. | Payment of Taxes | 64 |

| | | |

| Section 6.30. | Right of First Negotiation and Right of First Refusal | 64 |

| Section 6.31. | Post Closing Covenants | 64 |

| | | |

| Article VII NEGATIVE COVENANTS | 65 |

| | | |

| Section 7.1. | Debt | 65 |

| | | |

| Section 7.2. | Accounts | 66 |

| | | |

| Section 7.3. | Guaranties | 66 |

| | | |

| Section 7.4. | Ownership and Business Operations | 66 |

| | | |

| Section 7.5. | Liens and Encumbrances | 67 |

| | | |

| Section 7.6. | Investments | 68 |

| | | |

| Section 7.7. | Subsidiaries and Divestitures | 68 |

| | | |

| Section 7.8. | Compliance with Laws | 68 |

| | | |

| Section 7.9. | Dividends and Distributions | 68 |

| | | |

| Section 7.10. | Modifications | 69 |

| | | |

| Section 7.11. | Development Expenditures | 69 |

| | | |

| Section 7.12. | Quarterly Net Operating Cash Flow | 69 |

| | | |

| Section 7.13. | Quarterly Net Revenue Interest Production Levels | 69 |

| | | |

| Section 7.14. | Other | 69 |

| | | |

| Section 7.15. | Proceeds of Notes | 70 |

| | | |

| Section 7.16. | Limitation on Leases | 70 |

| | | |

| Section 7.17. | Nature of Business | 70 |

| | | |

| Section 7.18. | Deposit Accounts | 70 |

| | | |

| Section 7.19. | No Severance Agreements | 70 |

| | | |

| Section 7.20. | G&A Expenses | 71 |

| | | |

| Section 7.21. | Commodity Deliveries | 71 |

| | | |

| Section 7.22. | Disqualified Capital Stock | 71 |

| | | |

| Section 7.23. | Total Adjusted Present Value to Net Debt Ratio | 71 |

| | | |

| Section 7.24. | Affiliate Transactions | 71 |

| | | |

| Article VIII FURTHER RIGHTS OF LENDER | 71 |

| | | |

| Section 8.1. | Delivery of Additional Documents; Power of Attorney | 71 |

| | | |

| Section 8.2. | Payments by Lender | 72 |

| | | |

| Section 8.3. | Possession | 72 |

| | | |

| Section 8.4. | Indemnification from Borrowers | 72 |

| | | |

| Section 8.5. | Removal and Appointment of Operator | 74 |

| | | |

| Article IX CLOSING; CONDITIONS PRECEDENT TO CLOSING | 74 |

| Section 9.1. | Closing | 74 |

| | | |

| Section 9.2. | Conditions to Makin the Initial Loans | 74 |

| | | |

| Section 9.3. | Additional Conditions Precedent | 79 |

| | | |

| Article X EVENTS OF DEFAULT | 80 |

| | | |

| Section 10.1. | Events of Default | 80 |

| | | |

| Article XI REMEDIES OF LENDER | 83 |

| | | |

| Section 11.1. | Remedies | 83 |

| | | |

| Section 11.2. | Collateral | 84 |

| | | |

| Section 11.3. | Set-Off Rights | 84 |

| | | |

| Section 11.4. | Rights Under Operating Agreements | 84 |

| | | |

| Article XII MISCELLANEOUS | 84 |

| | | |

| Section 12.1. | Remedies Cumulative | 84 |

| | | |

| Section 12.2. | Assignment | 85 |

| | | |

| Section 12.3. | Notices | 85 |

| | | |

| Section 12.4. | Waivers; Amendments | 87 |

| | | |

| Section 12.5. | Confidentiality | 87 |

| | | |

| Section 12.6. | Final Agreement | 88 |

| | | |

| Section 12.7. | WAIVER OF JURY TRIAL, PUNITIVE DAMAGES, ETC | 88 |

| | | |

| Section 12.8. | GOVERNING LAW | 88 |

| | | |

| Section 12.9. | No Third-Party Beneficiaries | 89 |

| | | |

| Section 12.10. | Fees, Costs and Expenses | 89 |

| | | |

| Section 12.11. | Compliance with Law | 90 |

| | | |

| Section 12.12. | Power of Attorney; Etc | 90 |

| | | |

| Section 12.13. | Severability | 90 |

| | | |

| Section 12.14. | Captions; Headings | 90 |

| | | |

| Section 12.15. | Construction | 90 |

| | | |

| Section 12.16. | Additional Documents | 90 |

| | | |

| Section 12.17. | Counterpart Execution | 91 |

| | | |

| Section 12.18. | EXCULPATION PROVISIONS | 91 |

| | | |

| Section 12.19. | Joint and Several Liability; Authority | 91 |

| | | |

| Section 12.20. | NO OTHER AGREEMENTS; NO PAROL EVIDENCE | 93 |

| Exhibit A | Description of Properties; Interests |

| Exhibit B-1 | Form of Term Loan Note |

| Exhibit B-2 | Form of Revolving Loan Note |

| Exhibit C | Form of Advance Request |

| Exhibit D | Area of Mutual Interest |

| Exhibit E | Form of Deposit Account Control Agreement |

| Exhibit F | Form of Property Operating Statement |

| Exhibit G | Form of Subordination Agreement |

| Exhibit H | Form of Notice to Purchasers |

| Exhibit I | Aged Payables and Other Liabilities |

| Exhibit J | Approved Purchasers |

| Exhibit K | Terms and Conditions of Investment Business of MBL |

| Exhibit L | Conversion to Revolving Loans |

| Exhibit M | Form of Intercreditor and Subordination Agreement |

| | |

| Exhibit N | Form of Warrant Agreement |

| | |

| Annex A | Lean Documents |

| Schedule 2.1 | Development Plan |

| Schedule 2.3(b) | Approved Authorizations for Expenditure (“AFEs”) |

| Schedule 2.3(d) | Authorized Signatories an Advance Requests |

| Schedule 2.5(a) | Selection Notice |

| Schedule 2.8(a) | Project Account |

| Schedule 4.3 | Ownership of Equity Interests in Borrowers |

| Schedule 4.7 | Joint Ventures and Partnerships |

| Schedule 4.10 | Litigation |

| Schedule 4.11 | Wells |

| Schedule 4.12 | Indebtedness |

| Schedule 4.16 | Environmental Matters |

| Schedule 4.20 | Contingent Liabilities |

| Schedule 4.22 | Unpaid Bills |

| Schedule 4.26 | Other Agreements |

| Schedule 4.28 | Farmout Agreements and Subject Contracts |

| Schedule 4.29 | Operators/Operating Agreements |

| Schedule 4.31 | Suspense of Proceeds |

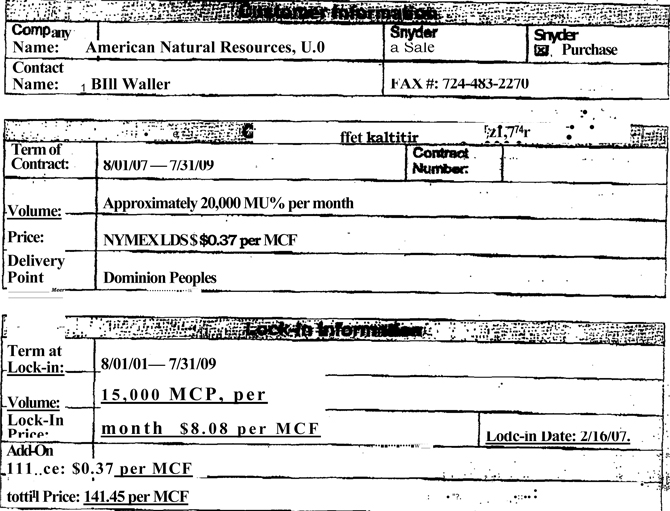

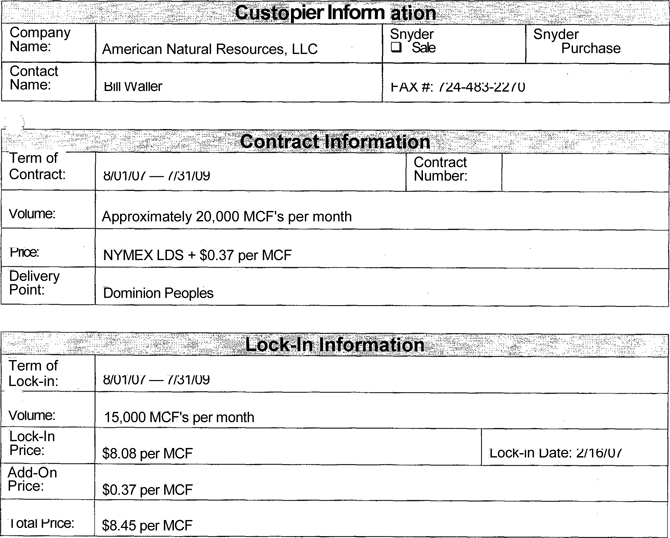

| Schedule 4.40 | Hedging Agreements |

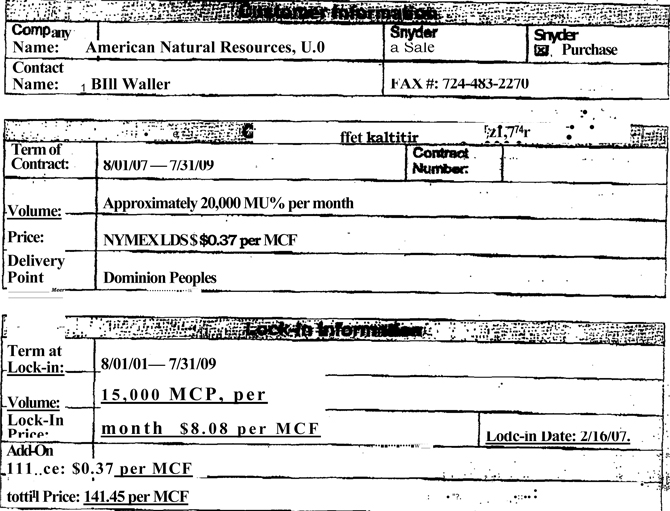

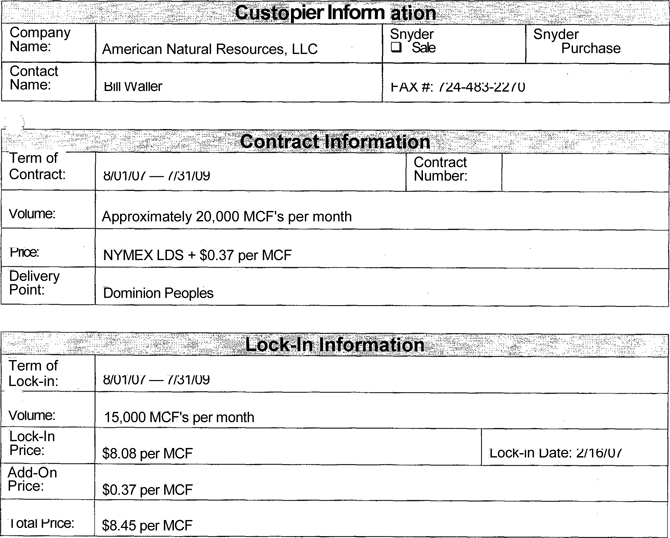

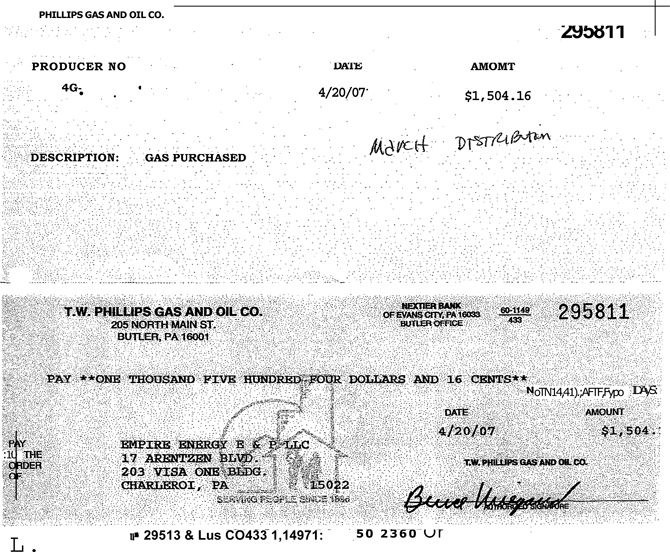

| Schedule 4.41 | Marketing Contracts |

| Schedule 4.42 | Deposit Accounts |

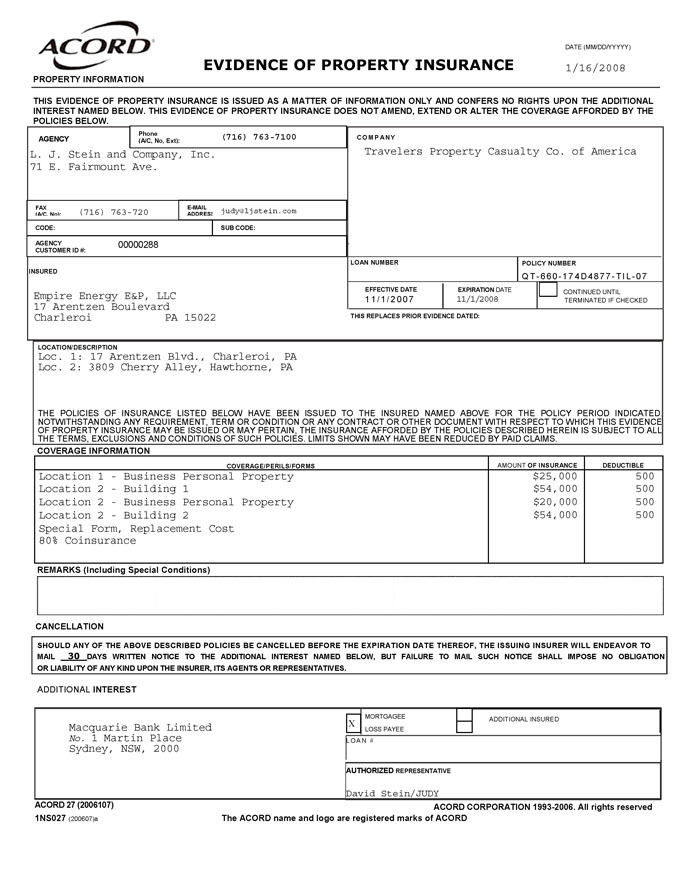

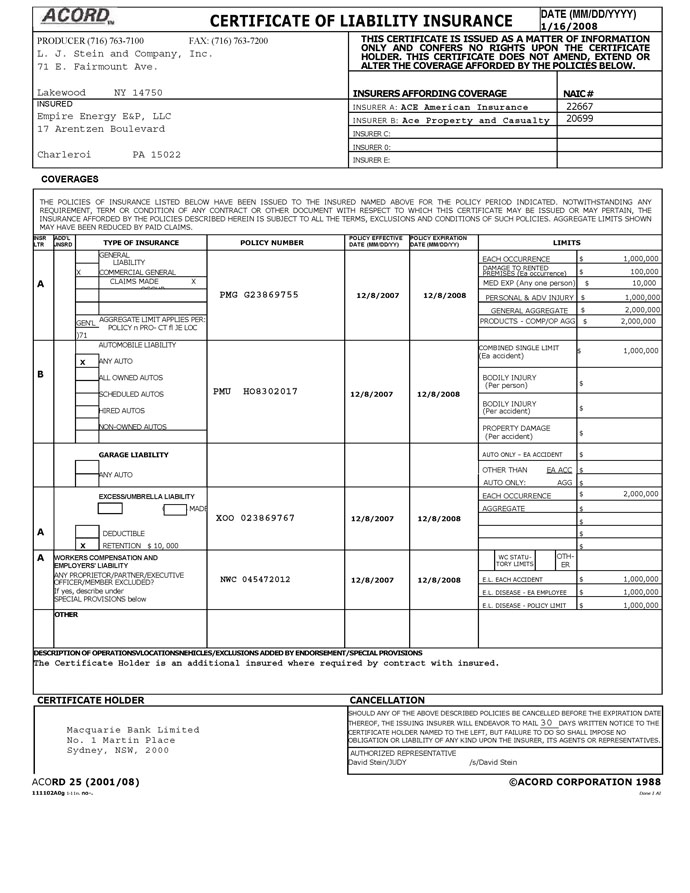

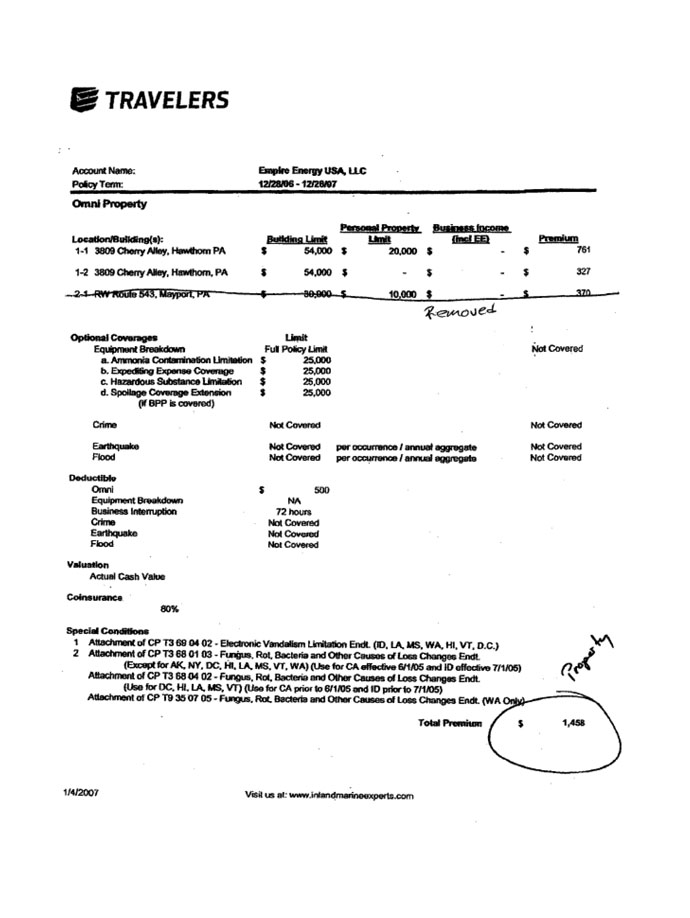

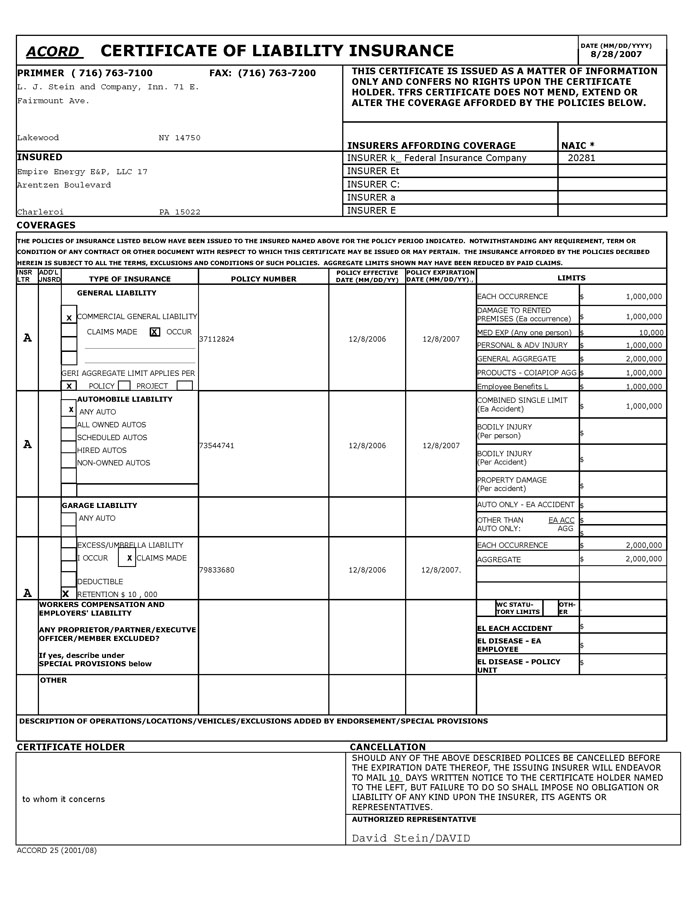

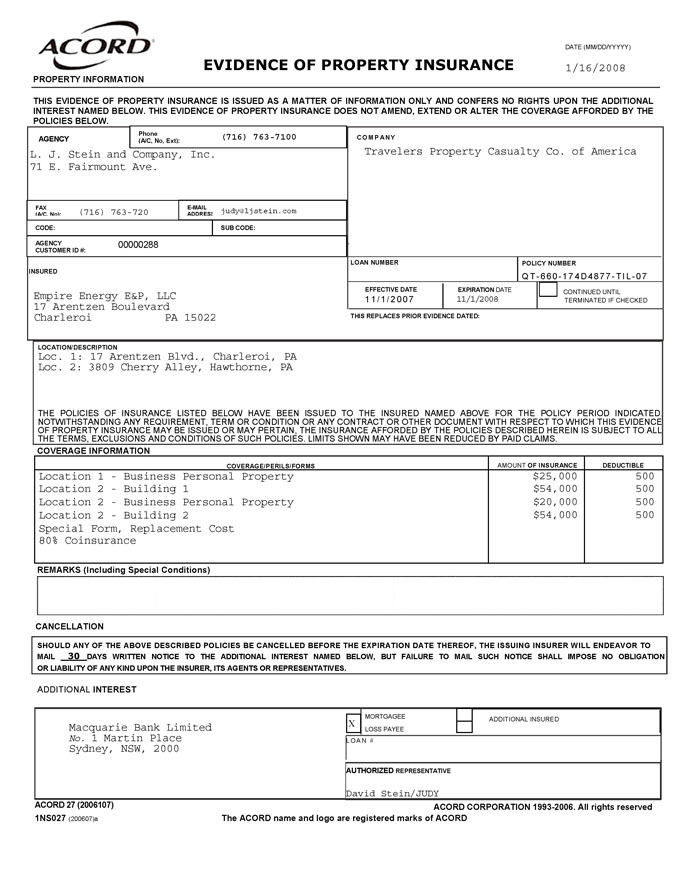

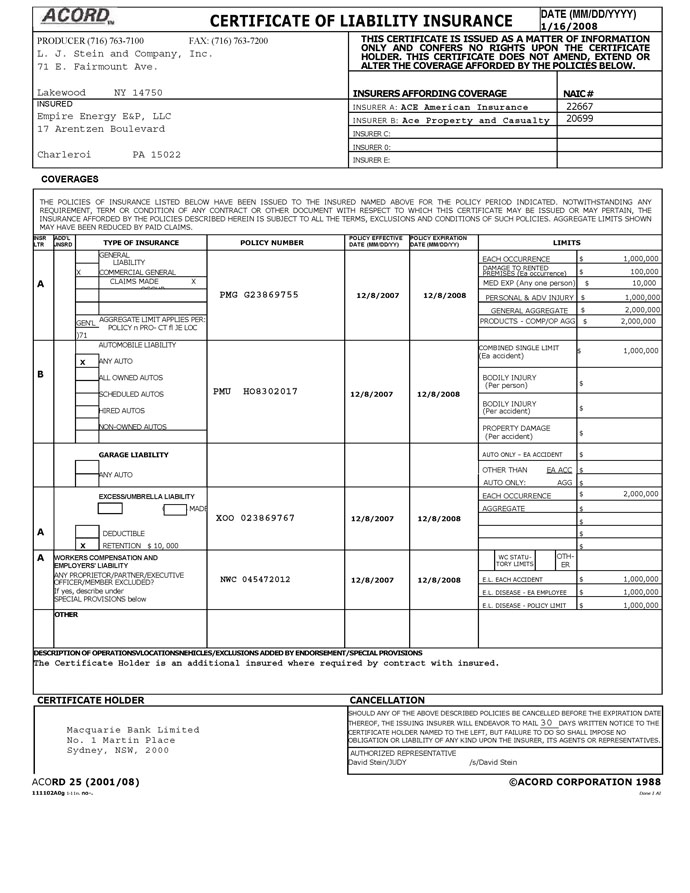

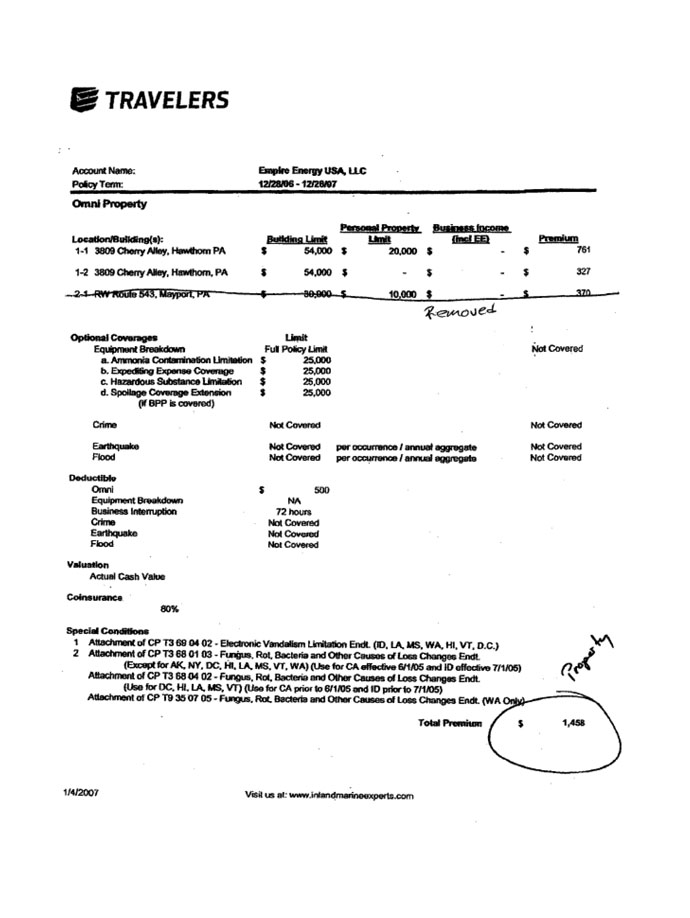

| Schedule 6.8 | Insurance |

| Schedule 6.19 | Bonds and Qualifications |

| Schedule 6.31 | Post-Closing Assignment of Additional Leases |

| Schedule 7.1(b) | Authorized Capital Leases |

| Schedule 7.5 | Liens and Encumbrances |

| Schedule 7.12 | Minimum Quarterly Net Operating Cash Flow |

| Schedule 7.13 | Minimum Quarterly Production Levels (Borrowers’ NRI production) |

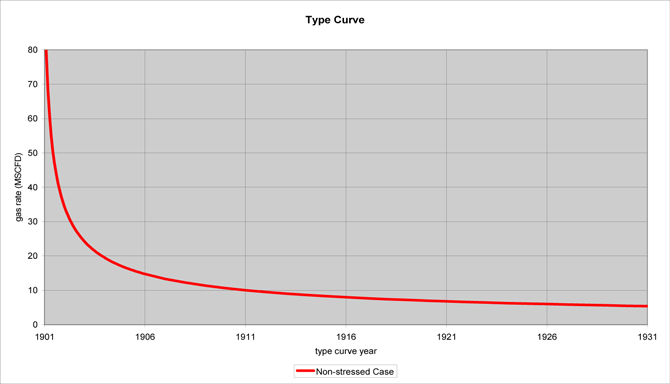

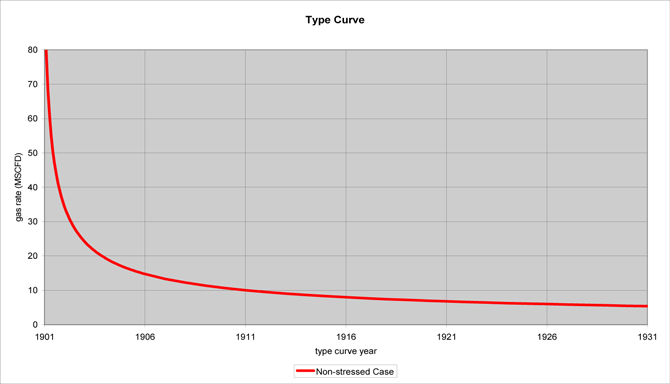

| Schedule 7.13(a) | Type Curves Used in Establishing Production and Revenue Covenants |

SENIOR FIRST LIEN SECURED CREDIT AGREEMENT

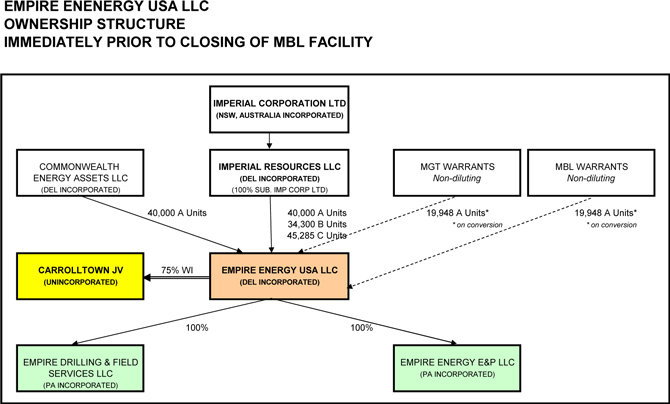

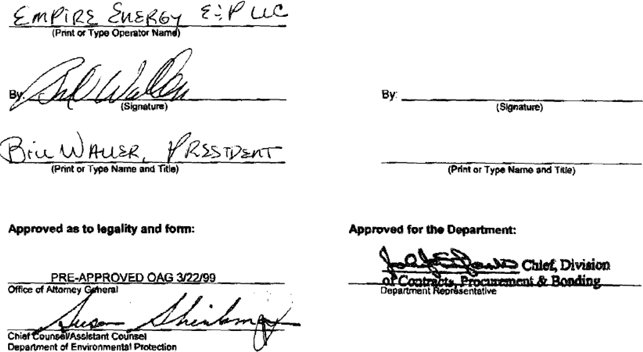

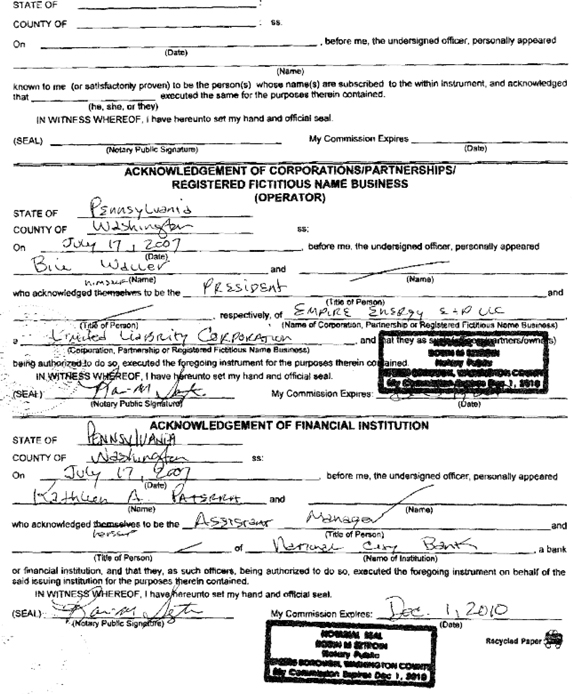

This Senior First Lien Secured Credit Agreement (this “Agreement”) is dated as of 26 February, 2008, among Empire Energy E&P, LLC, a Pennsylvania limited liability company, Empire Energy, USA, LLC, a Delaware limited liability company and Empire Drilling and Field, Services, LLC, a Delaware limited liability company, (each is referred to as a “Borrower” and collectively as “Borrowers”), and Macquarie Bank Limited, a bank incorporated under the laws of Australia, with offices at Level 15, 1 Martin Place, Sydney, New South Wales, 2000 Australia (“MBL” or “Lender”).

Background:

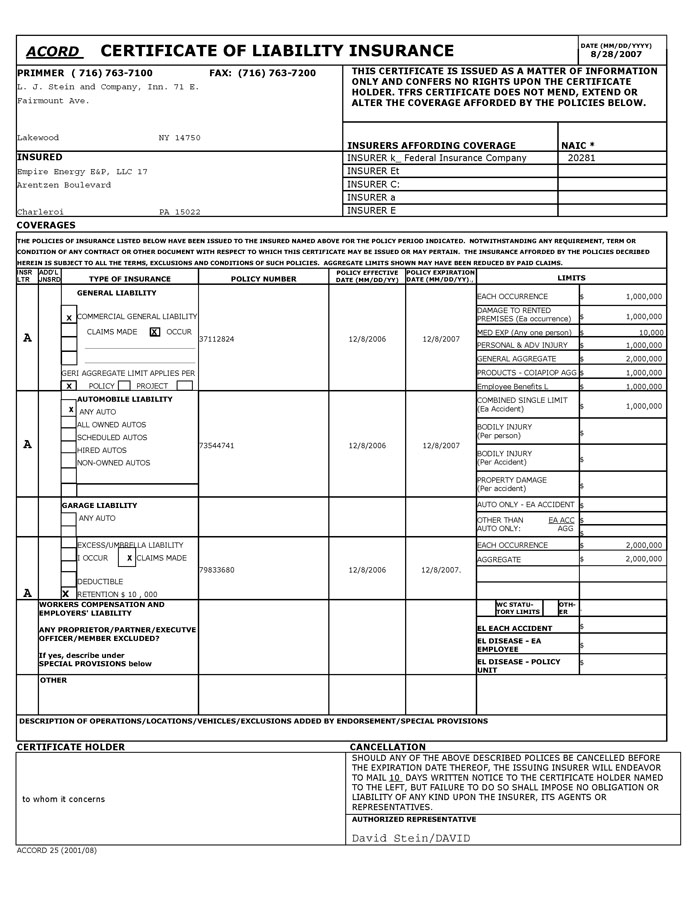

A. Empire Energy E&P, LLC and S&T Bank (“Old Lender”) are parties to the Line of Credit Loan Agreement dated December 8, 2006 (“Old Loan Agreement”) pursuant to which (i) a revolving line of credit loan was made (“Old Revolving Loans”) which was evidenced by a Line of Credit Note dated December 8, 2006 (“Old Revolving Lean Note”) and (ii) a term loan was made (“Old Term Loan”) which was evidenced by a Note dated December 8, 2006 (“Old Term Loan Note”).

B. Borrowers, Old Lender and Lender have agreed that, pursuant to the Assignment of Notes and Liens dated the date hereof, Lender will purchase, among the other rights and documents, the Old Loan Agreement, the Old Revolving Lean Note, the Old Term Loan Note, the Old Revolving Loans and the Old Term Loan (“Assignment”).

C. Borrowers and Lender have agreed that, immediately following the Assignment, (i) the Old Loan Agreement be amended and restated in its entirety by this Agreement, (ii) the Old Revolving Loan Note be replaced by the Revolving Loan Note, (iii) the Old Tent Loan Note be replaced by the Term Loan Note, (iv) the Old Revolving Loans be replaced by the Revolving Loans hereunder, as increased or decreased under this Agreement and (v) the Old Term Loan be replaced by the Term Loan in such amounts as set forth in the Advance Requests in accordance with this Agreement.

D. Borrowers and Lender also agree that the mortgages, security agreements and other documents granting liens and security interests to secure the Old Term Loan and the Old Revolving Loans are assigned to Lender under the Assignment and secure the Loans under this Agreement under the terms of this Agreement and under the terms of such documents, as amended.

E. Borrowers and Lender and the other parties hereto desire to enter into this Agreement to set forth the terms and conditions pursuant to which Lender will make available to Borrowers additional senior secured term loans on a non-revolving Basis and additional revolving loans for the purposes set forth in this Agreement.

In connection with Lender making available to Borrowers the financial accommodations described in this Agreement, Borrowers have granted and will affirm the continuing grant to Lender of a first-priority mortgage Lien and a first-priority perfected security interest in all of the real and personal property of Borrowers and subject only to the Permitted Encumbrances (defined below).

Agreements:

In consideration of the terms, covenants, provisions and conditions set forth in this Agreement, Borrowers and Lender agree as follows:

Article I

DEFINITIONS

Section 1.1. Specific Defined Terms. As used herein, the following terms shall have the following meanings and, as the context requires, the singular shall include the plural:

“Acceptable Bank” means:

(a) a bank or financial institution which has a rating for its long-term unsecured and non credit-enhanced debt obligations of A-1 or higher by Standard & Poor’s Rating Services or F-1 or higher by Fitch Ratings Ltd or P-1 or higher by Moody’s Investor Services Limited or a comparable rating from an internationally recognized credit rating agency; or

(b) any other bank or financial institution approved by Lender.

“Accounting Standards” means generally accepted accounting principles, standards and practices applying IFRS or GAAP, consistently applied, as applicable.

“Adjusted PV Ratio” means, as of any date, the ratio of (a) the Total Adjusted Present Value to (b) aggregate Net Debt of the Borrowers.

“Advance” means an advance of funds under the Revolving Loan or the Term Loan, as applicable, by Lender at the Contract Rate pursuant to Article 11 of this Agreement.

“Advance Request” means a request for an Advance under the Revolving Loan or the Term Loan in substantially the form of Exhibit C hereto.

“AFE” means an authorization for expenditure representing an estimate of work to be performed. AFEs shall not include COPAS overhead or other similar expenses related to Borrowers’ overhead expense.

“Affiliate” means as to any Person (a) any other Person who directly or indirectly controls, is under common control with, or is controlled by such Person, (b) any director or officer of such Person or of any Person referred to in clause (a) above, or (c) if any Person in clause (a) above is an individual, any member of the immediate family (including parents, spouse and children) of such individual and any trust whose principal beneficiary is such individual or one or more members of such immediate family and any Person who is controlled by any such member or trust. As used in this definition, “control” (including, with its correlative meanings, “controlled by” and “under common control with”) means possession, directly or indirectly, of power to direct or cause the direction of management or policies (whether through ownership of Equity Interests, by contract or otherwise); provided that, in any event, (i) any Person who owns directly or indirectly ten percent (10%) or more of the Equity Interests having ordinary voting power for the election of directors or other governing body of a corporation or ten percent (10%) or more of the Equity Interests of any other Person (other than as a limited partner (or member in a limited liability company in the nature of a limited partner) of such other Person) will be deemed to control such corporation or other Person, and (ii) any Subsidiary of any Borrower shall be deemed to be an Affiliate of such Borrower.

“Agreement” has the meaning assigned to that term in the introductory paragraph hereof, and includes any amendment, modification, supplement or restatement.

“Applicable Percentage” means ninety percent (90%); provided that, if an Event of Default exists, the term “Applicable Percentage” will mean one hundred percent (100%).

“Applicable Margin” means, for LIBOR Loans and Prime Rate Loans, 2.50% per annum for Revolving Loans and 4.00% per annum for Term Loans.

“Area of Mutual Interest” or “AMI” means the areas specified en Exhibit D.

“AUDS” means the lawful currency of the Commonwealth of Australia.

“Authorized Officer” has the meaning assigned to that term in Section 5.1(a).

“Availability Termination Date” means, unless extended in writing by Lender,

(a) for Revolving Loans, 26 February, 2013,

(b) for Tranche A-1 Term Loans, 26 August, 20] 0,

(c) for Tranche A-2 Tern, Loans, 26 August, 2008,

(d) for Tranche B Term Loans, the date that is six (6) months following the first date on which the Tranche B Test is satisfied, and

(e) for Tranche C Term Loans 26 November, 2012.

“Bankruptcy Code” means Title 11 of the United States Code as amended from time to time,

“Base Rate Lean” has the meaning assigned to that term in Section 2.5(a).

“Basic Documents” means Leases, Operating Agreements, Hydrocarbon purchase, sales, exchange, processing, gathering, treatment, compression and transportation agreements; farmout or farm-in agreements; unitization agreements; joint venture, exploration, limited or general partnership, dry hole, bottom hole, acreage contribution, purchase and acquisition agreements; area of mutual interest agreements; salt water disposal agreements, servicing contracts; easement and/or pooling agreements; surface leases, permits, licenses, rights-of-way, servitudes or other interests appertaining to the Properties and all other executory contracts and agreements relating to the Properties.

“Borrower” and “Borrowers” have the meaning assigned to those terms in the first paragraph hereof.

“Borrower Sub-Account” is defined in Section 2.9(a).

“Borrowing Base” is defined in Section 2.16(a).

“Business Day” means (a) any day other than a day on which commercial banks are authorized or required to close in New York, New York and (b) if such day relates to a borrowing or continuation of, a payment or prepayment of principal of or interest on, or a conversion of or into, or the Interest Period for, a Loan or a notice by Borrower with respect to any such borrowing or continuation, payment, prepayment, conversion or Interest Period, any day which is also a day on which dealings in Dollar deposits are carried out in the London interbank market.

“Capital Leases” means, in respect of any Person, all leases which shall have been, or should have been, in accordance with Accounting Standards, recorded as capital leases on the balance sheet of the Person liable (whether contingent or otherwise) for the payment of rent thereunder.

“Cash Equivalents” means at any time:

(a) certificates of deposit maturing within one (1) year after the relevant date of calculation and issued by an Acceptable Bank;

(b) any investment in marketable debt obligations issued or guaranteed by the government of the United States of America, or by an instrumentality or agency of any of them having an equivalent credit rating, maturing within one (1) year after the relevant date of calculation and not convertible or exchangeable to any other security;

(c) commercial paper not convertible or exchangeable to any other security:

(i) for which a recognized trading market exists;

(ii) issued by an issuer incorporated in the United States of America,

(iii) which matures within one (1) year after the relevant date of calculation; and

(iv) which has a credit rating of either A-1 or higher by Standard & Poor’s Rating Services or F-1 or higher by Fitch Ratings Ltd or P-1 or higher by Moody’s Investor Services Limited, or, if no rating is available in respect of the commercial paper, the issuer of which has, in respect of its long-term unsecured and non-credit enhanced debt obligations, an equivalent rating;

(d) any Investment in money market funds which:

(i) have a credit rating of either A-1 or higher by Standard & Poor’s Rating Services or F-1 or higher by Fitch Ratings Ltd or P-1 or higher by Moody’s Investor Services Limited,

(ii) which invest substantially all their assets in securities of the types described in paragraphs (a) to (d) above, and

(iii) can be converted into cash on not more than thirty (30) days notice.

“Cash Position” means the sum of cash and Cash Equivalents plus accounts receivable within two (2) months minus accounts payable within two (2) months.

“CERCLA” means the Comprehensive Environmental Response, Compensation and Liability Act of 1980, as amended.

“Change of Control” means the occurrence of any event pursuant to which:

(a) any Person (either alone or jointly with any other Person) acquires control of any Borrower or Guarantor (other than Imperial Corporation) becomes a Subsidiary of any Person, or any Person or group of Persons acting in concert to gain direct or indirect control of any Borrower or Guarantor(other than Imperial Corporation), in each case, in a transaction not approved by the Continuing Directors; for purposes of this subsection, control means:

(i) the power (whether by way of ownership of shares, proxy, contract, agency or otherwise) to:

(A) cast, or control the casting of, more than thirty-five percent (35%) of the maximum number of votes that might be cast at a general meeting of any Borrower or Guarantor (other than Imperial Corporation); or

(B) appoint or remove all, or the majority, of the directors or other equivalent officers of any Borrower or Guarantor (other than Imperial Corporation); or

(C) give directions with respect to the operating and financial policies of any Borrower or Guarantor (other than Imperial Corporation) with which the directors or other equivalent officers of any Borrower or Guarantor (other than Imperial Corporation) are obliged to comply;

(ii) the holding beneficially of more than thirty-five percent (35%) of the issued share capital of any Borrower or Guarantor ((other than Imperial Corporation) excluding any Part of that issued share capital that carries no right to participate beyond a specified amount in a distribution of either profits or capital); and

(iii) “acting in concert” means, a group of Persons who, pursuant to an agreement or understanding (whether formal or informal), actively co-operate, through the acquisition of shares directly or indirectly in any Borrower or Guarantor (other than Imperial Corporation) by any of them, either directly or indirectly, to obtain or consolidate control of any Borrower or Guarantor (other than Imperial Corporation);

(b) a majority of the members of the board of directors of any Borrower or Guarantor (other than Imperial Corporation) do not constitute Continuing Directors;

(c) the management of a Borrower is, in the reasonable opinion of Lender, materially diminished as a result of the failure of either of Bruce McLeod or William Waller to devote sufficient professional efforts to the management of a Borrower and the development of the Properties, unless, within thirty (30) days after the termination, cessation or dimunition of such individual’s participation in the management of a Borrower, such officer or director is replaced with an individual reasonably acceptable to Lender; or

(d) a Borrower issues securities subject to registration that is acceptable to Lender with the Securities and Exchange Commission or equivalent securities law regulator in the applicable jurisdiction.

“Charter Documents” means, as applicable for any Person that is not an individual, the articles or certificate of incorporation or formation, company agreement, certificate of limited partnership, regulations, bylaws, partnership or limited partnership agreement, and all similar documents related to the formation and governance of that Person, together with all amendments to any of them.

“Closing” means the date of execution by Borrowers and other applicable parties and the delivery to Lender of the Loan Documents (as hereinafter defined) and all other documents contemplated by this Agreement and necessary to satisfy the conditions described inArticle IX.

“Closing Date” has the meaning assigned to that term inSection 9.1.

“Collateral” means the Properties, all Personal Property and the Pledged Interests.

“Commitment” means the Revolving Loan Commitment and the Term Loan Commitment.

“Continuing Directors” means (a) any member of the board of directors who was a director (or comparable manager) of a Borrower an the Closing Date, and (b) any individual who becomes a member of the board of directors after the Closing Date if such individual was recommended, appointed or nominated for election to the board of directors by a majority of the continuing directors, but excluding any such individual originally proposed for election in Opposition to the board of directors in office at the Closing Date in an actual or threatened election contest relating to the election of the directors (or comparable managers) of a Borrower and whose initial assumption of office resulted from such contest or the settlement thereof.

“Contract Rate” means a rate per annum equal to the LIBOR plus the Applicable Margin for the LIBOR, or the Prime Rate Plus the Applicable Margin for the Prime Rate, as selected by Borrowers in a Selection Notice or in accordance withSection 2.5.

“CODAS” means the Accounting Procedures for Joint Operations Recommended by the Council of Petroleum Accountants Societies, then in effect, with respect to onshore or offshore operations, as applicable, and as applied to properties located in the same geographical area with the Leases.

“Crude Oil” means all crude oil, condensate and other liquid hydrocarbon substances.

“Current Assets” means on any date of determination, the consolidated current assets that would, in accordance with the Accounting Standards be classified as of that date as current assets, plus any unconditionally committed but undrawn availability under the Borrowing Base, less any non-cash amount required to be included in current assets as the result of the application of the Accounting Standards for the avoidance of any doubt, Current Assets shall exclude noncash commodity and interest rate hedges assets and liabilities,

“Current Liabilities” means on any date of determination, the consolidated obligations that would, in accordance with the Accounting Standards, be classified as of that date as current liabilities, excluding (a) non-cash obligations under the Accounting Standards; for the avoidance of any doubt, Current Liabilities shall exclude non-cash commodity and interest rate hedges assets and liabilities, and (b) shall exclude the current portion of long-term Debt, including the Debt hereunder.

“Current Ratio” means, as of any date, the ratio of (1) Empire USA’s Consolidated Current Assets to (ii) Empire USA’s Consolidated Current Liabilities on that date.

“Debt” means, for any Person, the sum of the following (without duplication): (a) all obligations of such Person for borrowed money or evidenced by bonds, bankers’ acceptances, debentures, notes or other similar instruments; (b) all obligations of such Person (whether contingent or otherwise) in respect of letters of credit, surety or other bonds and similar instruments; (c) all accounts payable and all accrued expenses, liabilities or other obligations of such Person to pay the deferred purchase price of property or services; (d) all obligations under Capital Leases; (e) all obligations under Synthetic Leases; (f) all Debt (as defined in the other clauses of this definition) of others secured by a Lien on any property of such Person, whether or not such Debt is assumed by such Person; (g) all Debt (as defined in the other clauses of this definition) of others guarantee(‘ by such Person or in which such Person otherwise assures a creditor against loss of the Debt (howsoever such assurance shall be made) to the extent of the lesser of the amount of such Debt and the maximum stated amount of such guarantee or assurance against loss; (h) all obligations or undertakings of such Person to maintain or cause to be maintained the financial Position or covenants of others or to purchase the Debt or property of others; (i) obligations to deliver commodities, goods or services, including, without limitation, Hydrocarbons, in consideration of one or more advance payments, other than Natural Gas balancing arrangements in the ordinary course of business; (j) obligations to pay for goods or services whether or not such goods or services are actually received or utilized by such Person; (k) any Debt of a partnership for which such Person is liable either by agreement, by operation of law or by a Governmental Requirement but only to the extent of such liability; (l) Disqualified Capital Stock; and (m) the undischarged Balance of any production payment created by such Person or for the creation of which such Person directly or indirectly received payment. The Debt of any Person shall include all obligations of such Person of the character described above to the extent such Person remains legally liable in respect thereof notwithstanding that any such obligation is not included as a liability of such Person under the Accounting Standards.

“Debtor Relief Laws” means the Bankruptcy Code and all other applicable liquidation, conservatorship, bankruptcy, insolvency, rearrangement, moratorium, reorganization, fraudulent transfer or conveyance, or similar debtor relief laws affecting the rights of creditors generally from time to time in effect.

“Default” means the occurrence of any event which, with the lapse of time or the giving of notice or both will become an Event of Default hereunder. A Default is “continuing” if it has not been remedied or waived.

“Default Rate” has the meaning assigned to that term inSection 2.6(a)

“Defensible Title” means with respect to each Property, title that (a) entitles the Person to receive (free and clear of all royalties appearing or not appearing of record, all overriding royalties, and all net profits interests or other burdens on or measured by production of Hydrocarbons) not less than the Net Revenue Interest set forth onExhibit A (or in such other certificate or writing provided to Lender representing the interests in the Properties, including, without limitation, any Mortgage) in all Hydrocarbons produced, saved and marketed from the Property for the productive life of the Property, free and clear of any Lien, other than the Permitted Encumbrances and any Liens, which are in favor of Lender and its Affiliates or are permitted hereunder; and (b) obligates such Person to bear costs and expenses relating to the maintenance, development and Operation of such Property in an amount not greater than the Working Interest set forth onExhibit A for the productive life of such Property or (c) with respect to any Royalty Interests or other real property interests owned or acquired by any Borrower and not included in the Net Revenue Interest or Working Interest described inclauses (a) or(b) above, net profits interests and/or production interests and any rights which any Borrower acquires to receive revenues from production, good and indefeasible title to such interests, subject only to any Liens in favor of Lender, and free and clear of all other Liens.

“Deposit Account Control Agreement” means a Deposit Account Control Agreement among Borrowers, Lender and the depository bank(s) identified in Schedule 2.8(a), substantially in the form ofExhibit E.

“Development Plan” means the comprehensive plan or plan in effect from time to time with respect to development projects for the Properties, approved by Lender, and any other expenditure items which have been approved by Lender, in its sole discretion, including the initial Development Plan attached hereto as Schedule 2.1. A Development Plan shall provide for, but not be limited to the location, timing and estimated costs of Wells to be drilled or recompleted as well as names of key personnel required to undertake those operations and their associated responsibilities. The Development Plan may be amended, modified or replaced by Borrowers from time to time with the written approval of Lender in its sole and absolute discretion.

“Disqualified Capital Stock” means any Equity Interest that, by its terms (or by the terms of any security into which it is convertible or for which it is exchangeable) or upon the happening of any event, matures or is mandatorily redeemable for any consideration other than other Equity Interests (which would not constitute Disqualified Capital Stock), pursuant to a sinking fund obligation or otherwise, or is convertible into or exchangeable for Debt or redeemable for any consideration other than other Equity Interests (which would not constitute Disqualified Capital Stock) at the option of the holder thereof, in whole or in part, on or prior to the date that is one (1) year after the earlier of (a) the Maturity Date and (b) the date on which there are no Advances or other Obligations hereunder outstanding and all commitments (conditional or otherwise) of Lender to make additional Advances are terminated.

“EBITDA” means for Empire USA for any period (a) net income, in accordance with the Accounting Standards for such period plus (b) to the extent deducted in determining net income for such period, interest expense, income, withholding, franchise or similar taxes and non-cash depreciation and amortization expense for such period, plus (c) any non-cash charges for such period, minus (d) all non-cash income added to net income for such period. EBITDA shall be calculated without including non-cash mark-to-market adjustments arising from the application of the Accounting Standards.

“Empire Drilling” means Empire Drilling and Field Services, LLC.

“Empire E&P” means Empire E&P, LLC.

“Empire USA” means Empire Energy USA, LLC,

“Employee Plan” means an employee pension benefit plan covered by Title IV of ERISA.

“Engineers” means an independent petroleum engineering firm selected by Empire USA and approved by Lender in writing from time to time.

“Environmental and Safety Regulations” means all applicable federal, state or local laws, ordinances, codes, rules, orders and regulations with respect to any environmental, pollution, toxic or hazardous waste or health and safety law, including, without limitation, those promulgated by the United States Environmental Protection Agency, the Federal Energy Regulatory Commission, the Department of Energy, the Occupational Safety and Health Administration, the Department of the Interior, or any other Governmental Authority or any of their predecessor or successor agencies.

“Environmental Laws” shall mean any and all Governmental Requirements and Environmental and Safety Regulations pertaining to health or the environment in effect in any and all jurisdictions in which any Borrower is conducting or at any time has conducted business, or where any Property of any Borrower is located, including without limitation, the OPA, CERCLA, RCRA, the Safe Drinking Water Act, as amended, the Toxic Substances Control Act, as amended, the Superfund Amendments and Reauthorization Act of 1986, as amended, the Hazardous Materials Transportation Act, as amended, and other environmental conservation or protection laws. The term “oil” shall have the meaning specified in OPA, the terms “hazardous substance” and “release” (or “threatened release”) have the meanings specified in CERCLA, and the terms “solid waste” and “disposal” (or “disposed”) have the meanings specified in RCRA; provided, however, that (a) in the event either OPA, CERCLA or RCRA is amended so as to broaden the meaning of any term defined thereby, such broader meaning shall apply subsequent to the effective date of such amendment and (b) to the extent the laws of the state in which any Property of any Borrower is located establish a meaning for “oil,” “hazardous substance,” “release,” “solid waste” or “disposal” which is broader than that specified in either OPA, CERCLA or RCRA, such broader meaning shall apply to those issues covered by the applicable state laws.

“Equipment” has the meaning assigned to that term in the UCC and includes all surface or subsurface machinery, goods, equipment, fixtures, inventory, facilities, supplies or other personal or moveable property of whatsoever kind or nature (excluding property rented by any Borrower or taken to the premises for temporary uses) now owned or hereafter acquired by any Borrower which are now or hereafter located an or under any of the Lands attributable to the Properties which are used for the production, gathering, treatment, processing, storage or transportation of Hydrocarbons and whether or not attributable to the Properties (together with all accessions, additions and attachments to any thereof), including, without limitation, all Wells, casing, tubing, tubular goods, rods, pumping units and engines, Christmas trees, platforms, derricks, separators, compressors, gun Barrels, flow lines, water injection lines, tanks, gas systems (for gathering, treating and compression), pipelines (including gathering lines, laterals and trunklines), chemicals, solutions, water systems (for treating, disposal and injection), power plants, poles, lines, transformers, starters and controllers, machine shops, tools, storage yards and equipment stored therein, telegraph, telephone and other communication systems, loading docks, loading racks, shipping facilities, platforms, well equipment, wellhead valves, meters, motors, pumps, tankage, regulators, furniture, fixtures, automotive equipment, forklifts, storage and handling equipment, together with all additions and accessions thereto, all replacements and all accessories and parts therefor, all manuals, blueprints, documentation and processes, warranties and records in connection therewith including, without limitation, any and, to the extent permitted, all seismic data, geological data, geophysical data and interpretation of any of the foregoing, all rights against suppliers, warrantors, manufacturers, sellers or others in connection therewith, and together with all substitutes for any of the foregoing.

“Equity Interests” means shares of capital stock, partnership interests, membership interests in a limited liability company, beneficial interests in a trust or other equity ownership interests in a Person, and any warrants, options or other rights entitling the holder thereof to purchase or acquire any such Equity Interest.

“ERISA” means the Employee Retirement Income Security Act of 1974, as amended, and related rules and regulations.

“Event of Default” has the meaning assigned to that term inSection 10.1.

“Facility Fee” is defined inSection 2.14(d).

“Federal Reserve Board” has the meaning assigned to that term inSection 4.33.

“Financial Report” means, in relation to an entity, the following financial statements and information in relation to the entity, prepared for its financial quarter, financial half year or financial year, as applicable:

(a) a balance sheet;

(b) an income statement;

(c) a cash flow statement; and

(d) a change in equity statement.

“First Reserve Read Effective Date” means December 31, 2007.

“G&A Cap” means Fifty Thousand Dollars ($50,000.00) per calendar month (in this definition, the “subject month”);provided that, if Borrowers’ aggregate actual G&A Expenses during the applicable calendar year is less than an amount equal to $50,000.00multiplied by the number of complete calendar months that have preceded the subject month in such calendar year (the difference being referred to in this definition as the ‘‘surplus”), then the G&A Cap for the subject month will be increased by an amount equal to the surplus;provided further that the Borrower shall not be allowed to request the return of such surplus to the extent the return of such amount would have the effect of reducing the amount of cash available in the Borrower Sub-Account to pay the amounts described in clauses (a), (b), (d), (e) and (f) of the definition of Net Operating Cash Flow. Borrowers may propose, an each anniversary of the Closing Date, a modification to the G&A Cap subject to the review and written approval of Lender, such approval not be unreasonably withheld alter taking into consideration all relevant circumstances as determined by Lender, including but not limited to coverage ratios and Net Operating Cash Flow forecasts.

“G&A Expenses” means the general and administrative expenses of Borrower, including capitalized general and administrative expenses, calculated in accordance with the Accounting Standards (excluding all non-cash charges and performance-based compensation pursuant to a plan approved by Lender in writing).

“GAAP” means generally accepted accounting principles recognized as such by the Financial Accounting Standards Board (or generally recognized successor) consistently applied and maintained throughout the period indicated and consistent with applicable laws, except for changes mandated by the Financial Accounting Standards Board or any similar accounting authority of comparable standing. If any change in any accounting principle or practice is required by the Financial Accounting Standards Board (or generally recognized successor) in order for such principle or practice to continue as a generally accepted principle or practice, all financial reports or statements required hereunder or in connection herewith may be prepared in connection with such change, but all calculations and determinations to be made hereunder may be made in accordance with such change only if Borrower and Lender agree to do so. Whenever any accounting term is used herein which is not otherwise defined, it shall be interpreted in accordance with GAAP or IFRS, as applicable.

“Governmental Authority” means the government of the United States of America, any other nation, or any political subdivision thereof, whether state, local or tribal, and any agency, authority, instrumentality, regulatory body, court, central bank or other entity exercising executive, legislative, judicial, taxing, regulatory or administrative powers, jurisdiction or functions of or pertaining to government over any Borrower, any Affiliate of any Borrower, any of their Properties, the Properties, or Lender or any of their Affiliates.

“Governmental Requirements” means with respect to any Person, any law, statute, code, ordinance, order, determination, rule, regulation, judgment, decree, injunction, franchise, permit, certificate, license, authorization or other directive or requirement, whether now or hereinafter in effect, including, without limitation, Environmental Laws, energy regulations and occupational, safety and health standards or controls, of any Governmental Authority applicable to such Person.

“Guarantor” means Imperial Corporation together with any other Person that has executed a Guaranty or assumed the Obligation of any Guarantor.

“Guaranty” includes (a) a deed of guarantee and indemnity between Imperial Corporation and Lender, in form and substance acceptable to Lender, whereby Imperial Corporation unconditionally agrees to guarantee the repayment of the Obligations and (b) any similar agreement or instrument executed by any other Guarantor.

“Hazardous Materials” means and include (1) all elements or compounds that are contained in the list of hazardous substances adopted by the United States Environmental Protection Agency and the list of toxic pollutants designated by the United States Congress or the Environmental Protection Agency or under any Hazardous Substance Laws (as hereinafter defined), and (ii) any “hazardous waste,” “hazardous substance,” “toxic substance,” “regulated substance,” “pollutant” or “contaminant” as defined under any Hazardous Substance Laws.

“Hazardous Substance Laws” means CERCLA, RCRA, the Federal Water Pollution Control Act, as amended, 33 U.S.C. 1251 et seq., the Toxic Substances Control Act, 15 U.S.C. 2601 et seq., the Hazardous Liquid Pipeline Safety Act of 1979, as amended, 40 U.S.C. 2001 et seq., the Federal Insecticide, Fungicide, and Rodenticide Act, 7 U.S.C. 136 et seq., the Federal Clean Air Act, 42 U.S.C, 7401 et seq., any so-called federal, state or local “superfund” or “superlien” statute, and any other applicable federal, state or local law, rule, regulation or ordinance related to the remediation, clean-up or reporting of environmental pollution or contamination or imposing liability (including strict liability) or standards of conduct concerning any Hazardous Materials.

“Hedging Agreement” means:

(a) The Swap Agreement and any and all other rate swap transactions, basis swaps, credit derivative transactions, forward rate transactions, commodity swaps, commodity options, forward commodity contracts. equity or equity index options, swaps or options, band or bond price or bond index swaps or options or forward band or forward bond price or forward bond index transactions, interest rate options, forward foreign exchange transactions, cap transactions, floor transactions, collar transactions, currency swap transactions, cross-currency rate swap transactions, currency options, Spot contracts or any other similar transactions or any combination of any of the foregoing (including any options to enter into any of the foregoing), whether or not any such transaction is governed by or subject to any Master Agreement (as defined in paragraph (b) below); and

(b) any and all transactions of any kind, and the related confirmations, which are subject to the terms and conditions of, or governed by, any form of master agreement published by the International Swaps and Derivates Association, Inc. or any International Foreign Exchange Master Agreement (any such master agreement, together with any related schedules, a “Master Agreement”), including any such obligations or liabilities under any Master Agreement.

“Highest Lawful Rate” means, with respect to Lender, the maximum nonusurious interest rate, if any, that at any time, or from time to time may be contracted for, taken, reserved, charged or received an the Loans or on other Obligations under laws applicable to such Lender which are presently in effect or, to the extent allowed by law, under such applicable laws which may hereafter be in effect and which allow a higher maximum nonusurious interest rate than applicable laws allow as of the date hereof.

“Hydrocarbons” means all Crude OH and Natural Gas.

“IFRS” means International Financial Reporting Standards as promulgated by the International Accounting Standards Board.

“Imperial Corporation” means Imperial Corporation Limited, an entity organized under the laws of New South Wales, Australia.

“Indemnified Party or Parties” has the meaning assigned to that term inSection 8.4(a).

“Intercreditor and Subordination Agreement” means an agreement substantially in the form of Exhibit M.

“Interest Coverage Ratio” means, as of any date, the ratio of (a) aggregate EBITDA of Borrowers and their Subsidiaries for the four (4) most recent fiscal quarters to (b) the aggregate interest expense of all Debt (including Debt under this Agreement) of Borrowers and their Subsidiaries for the same period.

“Interest Period” means, as to each Advance under the Loan, the period commencing an the date of the Loan and ending on the date that is thirty (30), sixty (60) or ninety (90) days thereafter (it being agreed that such interest period is equivalent to the one (I), two (2), or three (3) month periods shown an the Reuters “LIBO” page); provided that:

(a) any Interest Period that would otherwise end on a day that is not a Business Day shall be extended to the next succeeding Business Day unless such Business Day falls in another calendar month, in which case such Interest Period shall end on the next preceding Business Day;

(b) any Interest Period that begins on the last Business Day of a calendar month (or an a day for which there is no numerically corresponding day in the calendar month at the end of such Interest Period) shall end on the last Business Day of the calendar month at the end of such Interest Period; and

(c) no Interest Period applicable to any Loans shall extend beyond the Maturity Date for such Loans.

“Investment” means, for any Person: (a) the acquisition (whether for cash, property, services or securities or otherwise) of Equity Interests of any other Person or any agreement to make any such acquisition (including, without limitation, any “short sale” or any sale of any securities at a time when such securities are not owned by the Person entering into such short sale); (b) the making of any deposit (other than deposits in the Project Account, including the Borrower Sub-Account) with, or advance, loan or other extension of credit to, any other Person (including the purchase of property from another Person subject to an understanding or agreement, contingent or otherwise, to resell such property to such Person, but excluding any such advance, loan or extension of credit having a term not exceeding ninety (90) days representing the purchase price of inventory or supplies sold by such Person in the ordinary course of business); or (c) the entering into of any guarantee of, or other contingent obligation (including the deposit of any Equity Interests to be sold) with respect to, Debt or other liability of any other Person and (without duplication) any amount committed to be advanced, lent or extended to such Person.

“Lease” or “Leases” means, whether one or more, (a) those certain oil and gas leases, mineral estates, and all other mineral rights or interests set forth in the descriptions of the Properties attached asExhibit A hereto, and any other interests in the Leases or any other lease of real property, whether now owned or hereafter acquired by any Borrower, and any extension, renewals, corrections, modifications, elections or amendments (such as those relating to unitization) of any such Lease or Leases, or (b) other oil, gas and/or mineral leases or other interests pertaining to the Properties, whether now owned or later acquired, which may now and hereafter be made subject to the Lien of any of the Security Documents and any extension, renewals, corrections, modifications, elections or amendments (such as those relating to unitization) of any such lease or leases. The term shall include any permit, concession or similar grant by a Governmental Authority authorizing the development, exploration, extraction and sale of Hydrocarbons.

“Lender” has the meaning assigned to that term, in the first paragraph of this Agreement, and includes the initial Lender identified in this Agreement and its successors and one or more assignees to the extent any of them is a holder of a Note or any interest in a Note.

“Lender Participation Documents” means, collectively, (a) any assignment or participation and intercreditor agreement evidencing any transaction (each a “Lender Participation Transaction”) under which the initial Lender identified in this Agreement assigns to any other Person an interest in a Note and the rights of Lender under this Agreement and the other Loan Documents, (b) any Note issued by any Borrower to any other Person pursuant to any Lender Participation Transaction and (c) all other documents, agreements, instruments and writings at any time delivered in connection with a Lender Participation Transaction.

“LIBOR Breakage Costs” means all costs, expenses or losses incurred by Lender as the result of any prepayment of an Advance on a day prior to the day on which the applicable Interest Period ends (whether voluntary, mandatory, automatic, by reason of acceleration, or otherwise), including any loss or expense arising from the liquidation or reemployment of funds obtained by it to maintain the Loan or from fees payable to terminate the deposits from which such funds were obtained. Borrowers shall also pay any customary administrative fees charged by Lender in connection with the foregoing.

“LIBOR Loan” has the meaning assigned to that term inSection 2.5(a).

“LIBOR Market” means the London interbank offered interest rate market created by major London clearing banks for deposits in United States dollars (“USD”).

“LIBOR” means, in respect of an Interest Period and the Advance related thereto, the rate of interest established on the LIBOR Market as follows:

(a) if not less than two (2) rates are displayed cm Reuters page “LIBO” at or around 11:00 a.m. (London time) cm the second Business Day before the first day of the period for USD loans over the period which is closest to that period, the arithmetic mean (expressed as a rate per cent per annum and rounded up to five (5) decimal places) of not less than two (2) of those rates selected by Lender; or

(b) if less than two (2) rates for USD loans over that period are displayed an Reuters page “LIBO” at or around that time, the arithmetic mean (expressed as a rate per cent per annum and rounded up to five decimal places) of the offer rates quoted to Lender by not less than two (2) banks which ordinarily display rates an Reuters page “LIBO” on application by Lender for USD loans equal to that amount over the period equal to that period; or

(c) if Lender is unable to determine a rate under paragraph (a) or (b) because an insufficient number of ratesare displayed (in the case of paragraph (a)) or Lender is unable to obtain the necessary number of quotes (in the case of paragraph (b)), the rate (expressed as a rate per cent per annum and rounded up to five (5) decimal places) specified in good faith by Lender at or around that time having regard, to the extent possible, to the offer rates otherwise quoted to Lender for USD loans equal to that amount over the period equal to that period at or around that time.

“Lien” means any interest in property (real or personal) securing an obligation owed to, or a claim by, a Person other than the owner of the Property, whether such interest is based on the common law, statute or contract, and whether such obligation or Claim is fixed or contingent, and including but not limited to (a) the lien or security interest arising from a mortgage, encumbrance, pledge, security agreement, conditional sale or trust receipt or a lease, consignment or bailment for security purposes or (b) production payments and the like payable out of oil and gas properties and the Properties. The term “Lien” shall include easements, restrictions, servitudes, permits, conditions, covenants, exceptions or reservations. For the purposes of this Agreement, each Borrower shall be deemed to be the owner (to the extent of its interest therein) of any Property which it has acquired or holds subject to a conditional sale agreement, or leases under a financing lease or other arrangement pursuant to which title to the Property has been retained by or vested in some other Person in a transaction intended to create a financing.

“Loans” means the Tern Loans and the Revolving Loans.

“Loan Documents” means this Agreement, the Notes, the Security Documents, Lender Participation Documents, the Warrant Agreement, the Guaranty, the Swap Agreement or Hedging Agreement, as applicable, and all other agreements, certificates, documents, instruments and writings at any time delivered in connection herewith or therewith (exclusive of term sheets, commitment letters, correspondence and similar documents used in the negotiation hereof, except to the extent the same contain Information about any Borrower or its Affiliates, properties, business or prospects).

“Master Agreement” is defined in the definition of “Hedging Agreement”.

“Material Adverse Effect” means any effect, event or matter:

(a) which is materially adverse to:

(i) the business, assets, liabilities, ownership, board membership, management or condition (financial or otherwise) of any Borrower or of any Guarantor;

(ii) the ability of any Borrower or any Guarantor to perform any of its obligations (including payment of the Obligations) under any of the Loan Documents; or

(b) which results in any Security Document not providing to Lender security over, or security interest in, or lien on, the assets expressed to be secured under that Security Document.

“Maturity Date” means, for all Loans, 26, February, 2013.

“Maximum Term Loan Commitment” has the meaning assigned to that term inSection 2.1(b).

“MBL” has the meaning assigned to that term in the first paragraph of this Agreement.

“MMCF” and “MCF” means one million cubic feet and one thousand cubic feet, respectively.

“Mortgage” means a mortgage, deed of trust, assignment of production, security agreement and financing statement and act of mortgage and security agreement securing the Obligations, including but not limited to future advances executed by any Borrower and granting a first and Prior Lien to or for the benefit of Lender in the Properties described therein subject only to the Permitted Encumbrances, and otherwise in form and substance satisfactory to Lender, as the same may be modified, amended or supplemented pursuant to the terms of this Agreement.

“Natural Gas” means all natural gas, and any natural gas liquids and all products recovered in the processing of natural gas (other than condensate) including, without limitation, natural gasoline, casinghead gas, iso-butane, normal butane, propane and ethane (including such methane allowable in commercial ethane) produced from or attributable to the Properties.

“Net Debt” means, as of any date, an amount equal to the sum of, without duplication, (a) the Total Committed Obligationsplus (b) the total amount of Empire USA’s other Debt classified as long-term Debt under the Accounting Standardsplus (c) any Cash Position deficit or minus Cash Position surplusplus (d) for purposes of calculating whether the Tranche B Test is satisfied, amounts that will become committed under Tranche B following the satisfaction of the Tranche B Test, without regard to whether such amounts have been funded.

“Net Operating Cash Flow” means, on a cash accounting basis, the Borrowers’ aggregate gross cash receipts from sales of Production Volumes and all other cash receipts from whatever source (including, without limitation, if applicable, cash payments received under any Hedging Agreement, but excluding any amounts received by any Borrower in connection with a Permitted Equity Transaction)minus the following expenses to be paid from this cash (a) lease operating expenses; (b) production taxes; (c) other state and federal taxes paid in cash (including taxes levied on the income of and paid by any Borrower), (d) cash payments made with respect to Hedging Agreements (if applicable); (e) amounts paid by Borrowers to acquire and/or maintain any bonds or letters of credit securing plugging and abandonment obligations with respect to the Properties as set forth in Schedule 6.19; (f) interest on the Loan to be paid to Lender pursuant to this Agreement during the relevant month; and (g) if no Event of Default exists, actual G&A Expenses up to the G&A Cap; provided that, for purposes of determining Borrowers’ compliance with Section 7.12 below, the amounts described in the preceding clause (f) will not be deducted when calculating Net Operating Cash Flow. For the avoidance of all doubt, Net Operating Cash Flow does not include cash receipts or disbursements attributable to third party Working Interest or third party Royalty Interest ownership, and net profits interests owned by third Parties that are not Affiliates of any Borrower.

“Net Revenue Interest” means, with respect to any Property, the decimal or percentage share of Hydrocarbons produced and saved from or allocable to such Property, after deduction of Royalty Interests and other burdens on or paid out of such production.

“Notes” means the Revolving Loan Note and the Term Loan Note as the same may be modified, restated or rearranged from time to time.

“Obligations” means and include all loans and advances (including the Loan), debts, liabilities, obligations, covenants, duties and amounts owing or to be owing by any Borrower or any Affiliate of any Borrower to Lender or any Affiliate of Lender of any kind or nature, present or future, whether or not evidenced by any note, guaranty, letter of credit or other instrument, arising directly or indirectly, under the Loan Documents (including but not limited to the Swap Agreement), and all renewals, extensions and/or rearrangements of any of the foregoing. The term includes, but is not limited to, all interest, reasonable charges, expenses, consultants’ and attorneys’ fees and any other sum chargeable to any Borrower under this Agreement, the Notes, the Security Documents, or any of the Loan Documents and all Related Costs.

“OPA” means the Oil Pollution Act of 1990, as amended.

“Operating Agreement” means (a) any joint operating agreements covering or relating to any one or more of the Properties and listed onSchedule 4.29 and (b) any subsequently executed joint operating agreement covering or relating to any one or more of the Properties that is approved in writing by Lender.

“Operator” means with respect to the Properties, operators (including any Borrower, as applicable), including contract operators, of the Properties, approved by Lender in writing pursuant toSection 6.15 andSection 8.5. The Operators for each of the Properties as of the date of execution of this Agreement are identified onSchedule 4.29.

“Other Taxes” has the meaning assigned such term inSection 2.13(b).

“Parent Company” means Imperial Corporation and Empire USA.

“Payment Date” means, prior to the repayment in full and final satisfaction of all Obligations (other than indemnity obligations and similar obligations that survive the termination of this Agreement), the twentieth (20th) day of each month, commencing cm February 20, 2008.

“Permitted Encumbrances” means (a) Liens for property taxes and assessments or governmental charges or levies, related to Borrower’s property, provided that payment thereof is not past due unless being contested in good faith by appropriate action promptly initiated and diligently concluded and for which appropriate reserves as may be required by the Accounting Standards have been made; (b) (i) Liens on cash and Cash Equivalents securing the performance of bids, tenders, trade or government contracts or leases (other than Capital Leases) or licenses or to secure statutory obligations, surety, performance or appeal bonds, letters of credit or other Liens of like general nature incurred in the ordinary course of business and not in connection with the borrowing of money or the acquisition of inventory or other property and (ii) Liens, other than any Liens imposed by ERISA, arising in the ordinary course of business or incidental to the ownership of Properties and assets (including Liens in connection with worker’s compensation, unemployment insurance and other like laws, carrier’s, mechanic’s, builder’s, suppliers’ materialmen’s, repairmen’s, vendors’, warehousemen’s, architects’ attorneys’ Liens, and Liens of operators and non-operators arising under Operating Agreements) for sums not pest due or being contested in good faith by appropriate action promptly initiated and diligently conducted, if such reserves as may be required by the Accounting Standards have been made; (c) survey exceptions, issues with regard to the merchantability of title, easements or reservations, or rights of others for rights-of-way, servitudes, Utilities and other similar purposes, or zoning or other restrictions as to the use of real properties, which could not reasonably be expected to have a Material Adverse Effect; (d) Liens permitted by Lender in writing; (e) Liens on Properties in respect of judgments or awards, the Debt with respect to which it is permitted hereunder; (f) Liens against specific Equipment securing Debt permitted hereunder; and (g) the specific exceptions and encumbrances affecting one or more of the Properties as described in the Mortgages, BUT ONLY INSOFAR as those exceptions and encumbrances are valid and subsisting and are enforceable against the particular Lease which is made subject to those exceptions and encumbrances.

“Permitted Equity Transaction” means the issuance of one or more classes of securities, including Debt or Equity Interests, by any Borrower for the purpose of raising additional equity, which securities may include such features regarding convertibility, rate of interest and other terms as determined by the Borrower; provided that, prior to the issuance of such securities, Borrowers shall cause the holder of such securities to execute and deliver to Lender an Intercreditor and Subordination Agreement, in the form of Exhibit M,

“Person” means an individual, corporation, partnership, limited liability company, joint venture, trust or unincorporated organization, joint stock company or other similar organization, Governmental Authority, a court, or any other legal entity, whether acting in an individual, fiduciary or other capacity.

“Personal Property” means all personal property of every kind, whether now owned or later acquired, including all goods (including Equipment), documents, accounts, chattel paper (whether tangible or electronic), money, deposit accounts, letters of credit and letter-of-credit rights (without regard to whether the letter of credit is evidenced by a writing), documents, securities and all other Investment property, supporting obligations, any other contract rights (including all rights in transportation agreements, processing agreements, delivery agreements and seismic agreements related to the Properties) or rights to the payment of money, insurance Claims and proceeds, all general intangibles (including all payment intangibles and rights to seismic and other geophysical data) and all permits, licenses, books and records related to the Properties or the business of each Borrower as it relates to the Properties in any way whatsoever,

“Pledge Agreement” means a pledge agreement in form and substance acceptable to Lender, granting a security interest in Equity Interests to Lender to secure the Obligations.

“Pledged Interests” has the meaning assigned such term inSection 3.2.

“Prime Rate” means, with respect to any period, the greater of (i) the prime rate of interest specified by the Wall Street Journal and (ii) the Federal Funds Rate plus 0.50% per annum, in each case changing from time to time as and when that rate changes. The Prime Rate is a reference rate and does not necessarily represent the lowest or best rate actually available.

“Production Volumes” means, with respect to the Properties or any portion thereof, the product of Borrowers’ Net Revenue Interest multiplied by gross Hydrocarbons produced from all Properties or any portion thereof, as applicable.

“Project Account” means the account identified inSection 2.8(a) or as otherwise specified in writing to any Borrower by Lender.

“Property” or “Properties” means, collectively the property of Borrowers, including without limitation, the Properties described onExhibit A, attached hereto as the same may be amended from time to time, and includes, without limitation, all Leases and all other real and personal property of each Borrower, whether now owned or later acquired and without regard to whether such property is related to any of the Leases, including but not limited to all Personal Property and all Basic Documents associated therewith. For the purposes of this Agreement, each Borrower will be deemed to be the owner of any Property which it has acquired or holds subject to a conditional sale agreement, or leases under a financing lease or other arrangement pursuant to which title to the Property has been retained by or vested in some other Person in a transaction intended to create a financing. “Properties” shall include all real property acquired by Borrower, directly or indirectly, from and alter the Closing Date, whether or not described onExhibit A hereto.

“Property Operating Statement” means a monthly statement substantially in the form ofExhibit F, to be prepared and delivered by Empire USA to Lender in accordance withSection 2.7(b).

“Proved Developed Non-Producing Present Value” or “PDNP Present Value” means the present value discounted at ten percent (10%) of future net revenues attributable to all PDNP Reserves from the Properties calculated based on a Reserve Report prepared in accordance withSection 5.6.

“Proved Developed Producing Present Value” or “PDP Present Value” means the present value discounted at ten percent (10%) of future net revenues attributable to all PDP Reserves from the Properties calculated based on a Reserve Report prepared in accordance withSection 5.6.

“Proved Reserves” has the meaning given that term in the definitions promulgated by the Society of Petroleum Evaluation Engineers and the World Petroleum Congress as in effect at the time in question; “Proved Developed Producing Reserves” or “PDP Reserves” means Proved Reserves which are categorized as both “Developed” and “Producing” in such definitions; “Proved Developed Non-Producing Reserves” or “PDNP Reserves” means Proved Reserves which are categorized as both “Developed” and “Non-Producing” in such definitions; and “Proved Undeveloped Reserves” or “PUD Reserves” means Proved Reserves which are categorized as “Undeveloped” in such definitions.

“Proved Undeveloped Present Value” or “PUD Present Value” means the present value discounted at ten percent (10%) of future net revenues attributable to all PUD Reserves from the Properties calculated based on a Reserve Report prepared in accordance withSection 5.6.

“Purchasers” means all Persons listed onExhibit J, including Operators or any other parties as selected by an Operator pursuant to the powers of the Operator under an Operating Agreement or pursuant to an applicable pooling Order or otherwise approved in writing by Lender, who purchase Hydrocarbons or distribute revenues allocable to the purchase of Hydrocarbons attributable or allocable to Empire USA’s Net Revenue Interest in the Properties.

“RCRA” means the Resource Conservation and Recovery Act of 1976, as amended.

“Recipient Parties” has the meaning assigned to such term inSection 2.9(c).

“Related Costs” means the reasonable fees and expenses of counsel for Lender and other consultants for Lender and Lender’s other out-of-pocket expenses incurred in connection with the due diligence, negotiation and preparation of documents relating to the Loans and execution, delivery and filing and/or recording of the Loan Documents together with any amendments, supplements or modifications thereto or administration or enforcement thereof.

“Release” means Hazardous Materials that are pumped, spilled, leaked, disposed of, emptied, discharged or otherwise released into the environment in violation of Governmental Requirements.

“Remedial Work” has the meaning assigned to that term inSection 6.3(a).

“Reserve Report” has the meaning assigned to that term inSection 5.6(a).

“Revolving Loans” is defined inSection 2.1(a)(i).

“Revolving Loan Commitment” has the meaning assigned such term inSection 2.1(a)(i).

“Revolving Loan Note” means the promissory note in the form ofExhibit B-2 that evidences the Revolving Loans.

“Revolving Loan Undrawn Commitment” means the difference between the Revolving Loan Commitment and the outstanding Revolving Loans.

“Royalty Interest” means an expense free interest retained by a mineral lessor in a Lease, an overriding royalty reserved by or conveyed to a Person or any other expense free right to receive production or revenues from a Property or Lease.

“Security Agreements” means, collectively, each Pledge Agreement, the Parent Companies Deed of Charge and any security agreement executed by any Borrower, as debtor, in favor of Lender, as secured party, in form and substance satisfactory to Lender in its sole discretion.