2018 Annual Meeting of Shareholders 10:00 A.M. | May 9th, 2018 The Lake Ontario Conference and Events Center Oswego, New York

Welcoming Remarks Chris R. Burritt Chairman of the Board

Agenda – 2018 Annual Meeting of Shareholders Introduction of Directors, Management and Guests Conduct of the Meeting Notice and proxy Report of Inspector of Elections Meeting Proposals Call for Vote Management Presentation and Q & A to Follow Results of Shareholder Vote Meeting Adjourned

Board of Directors Director Since David A. Ayoub 2012 William A. Barclay 2011 Chris R. Burritt, Chairman 1986 John P. Funiciello 2011 Adam C. Gagas 2014 George P. Joyce 2000 Melanie Littlejohn 2016 Thomas W. Schneider, President & CEO 2001 John F. Sharkey, III 2014 Lloyd “Buddy” Stemple 2005

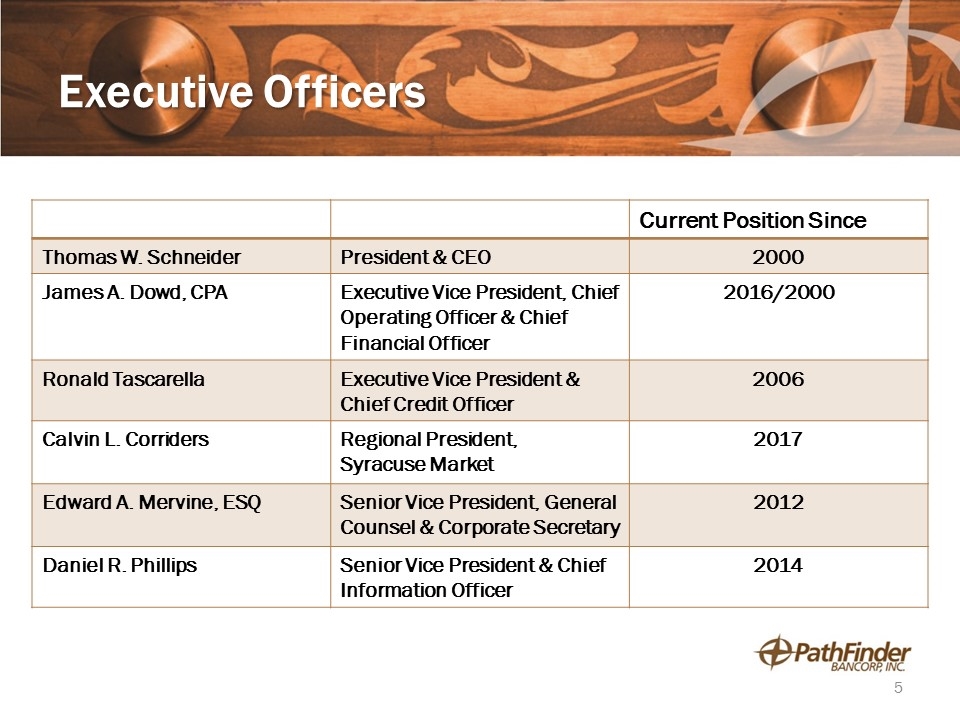

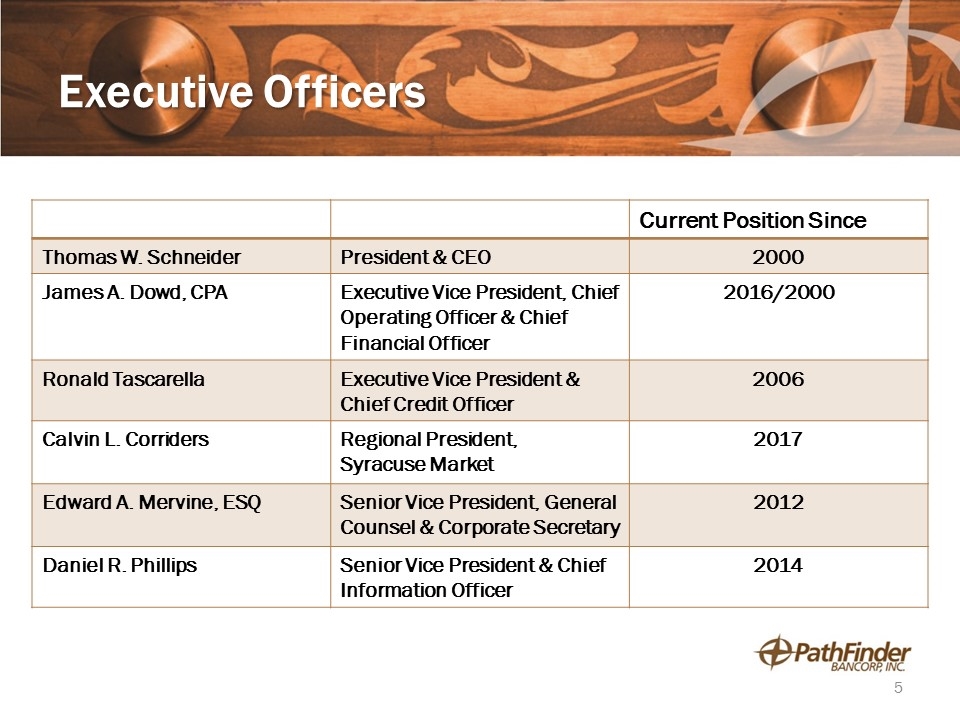

Executive Officers Current Position Since Thomas W. Schneider President & CEO 2000 James A. Dowd, CPA Executive Vice President, Chief Operating Officer & Chief Financial Officer 2016/2000 Ronald Tascarella Executive Vice President & Chief Credit Officer 2006 Calvin L. Corriders Regional President, Syracuse Market 2017 Edward A. Mervine, ESQ Senior Vice President, General Counsel & Corporate Secretary 2012 Daniel R. Phillips Senior Vice President & Chief Information Officer 2014

Independent Registered Public Accounting Firm Jamie L. Keiser Bonadio & Company, LLP

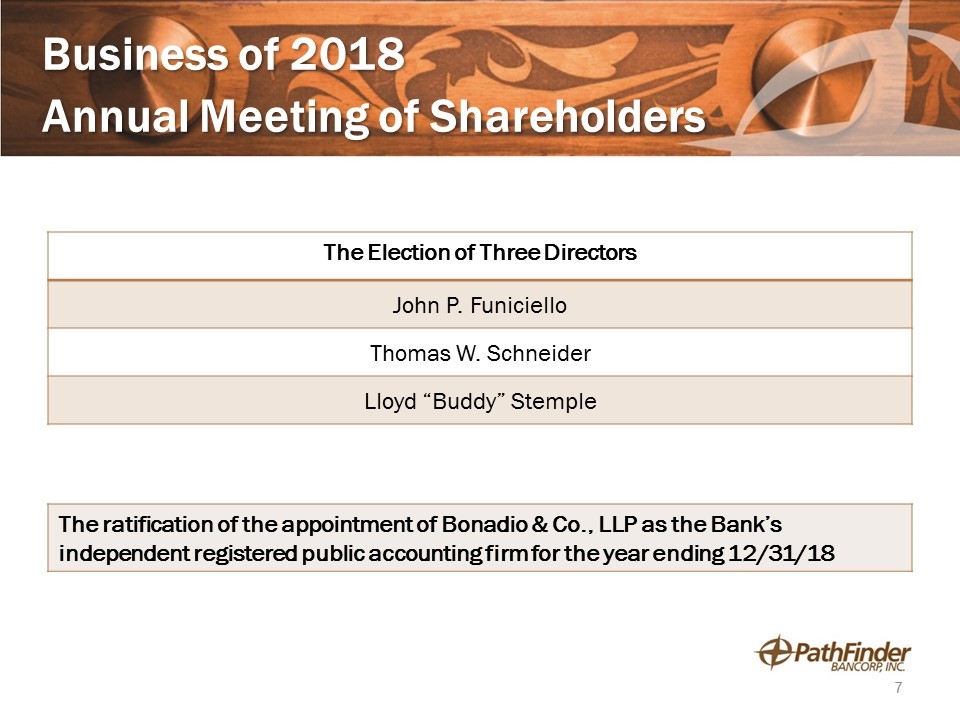

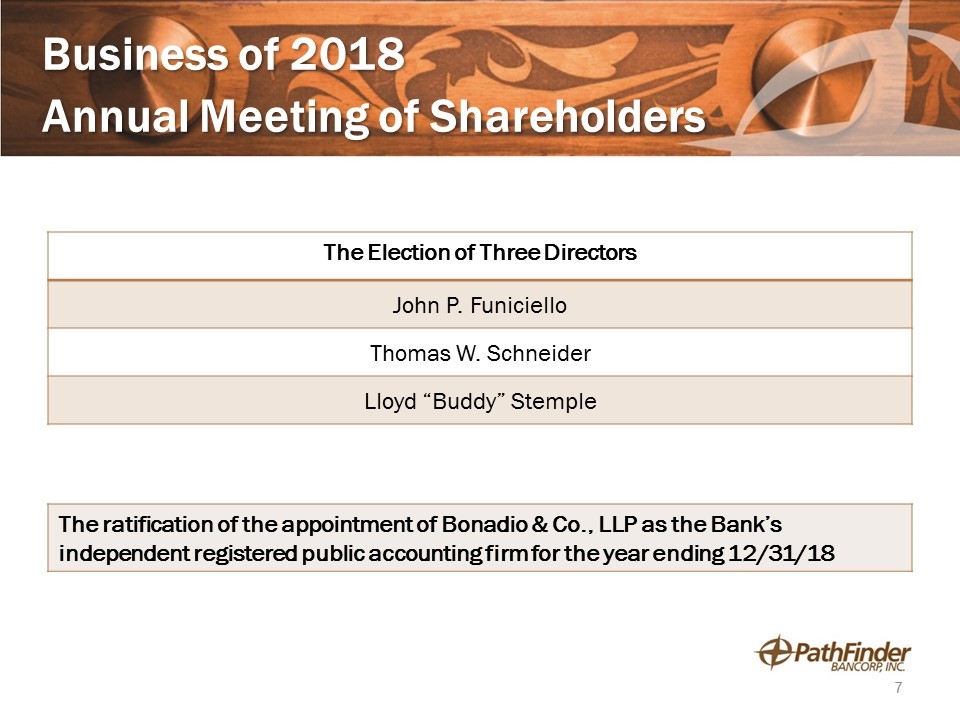

Business of 2018 Annual Meeting of Shareholders The Election of Three Directors John P. Funiciello Thomas W. Schneider Lloyd “Buddy” Stemple The ratification of the appointment of Bonadio & Co., LLP as the Bank’s independent registered public accounting firm for the year ending 12/31/18

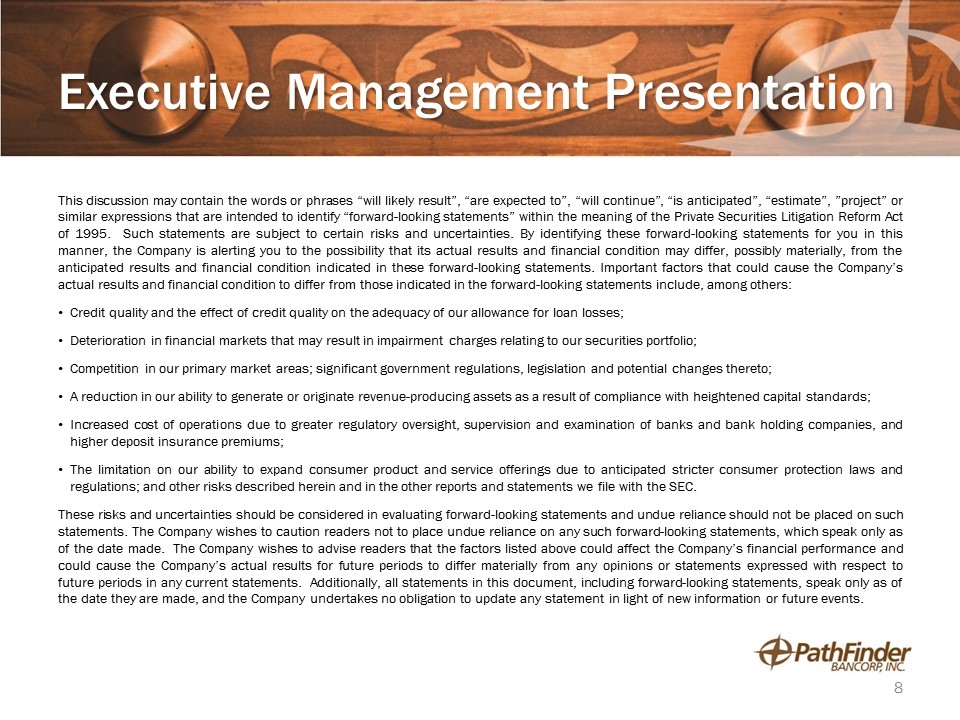

Executive Management Presentation This discussion may contain the words or phrases “will likely result”, “are expected to”, “will continue”, “is anticipated”, “estimate”, ”project” or similar expressions that are intended to identify “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements are subject to certain risks and uncertainties. By identifying these forward-looking statements for you in this manner, the Company is alerting you to the possibility that its actual results and financial condition may differ, possibly materially, from the anticipated results and financial condition indicated in these forward-looking statements. Important factors that could cause the Company’s actual results and financial condition to differ from those indicated in the forward-looking statements include, among others: Credit quality and the effect of credit quality on the adequacy of our allowance for loan losses; Deterioration in financial markets that may result in impairment charges relating to our securities portfolio; Competition in our primary market areas; significant government regulations, legislation and potential changes thereto; A reduction in our ability to generate or originate revenue-producing assets as a result of compliance with heightened capital standards; Increased cost of operations due to greater regulatory oversight, supervision and examination of banks and bank holding companies, and higher deposit insurance premiums; The limitation on our ability to expand consumer product and service offerings due to anticipated stricter consumer protection laws and regulations; and other risks described herein and in the other reports and statements we file with the SEC. These risks and uncertainties should be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements. The Company wishes to caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. The Company wishes to advise readers that the factors listed above could affect the Company’s financial performance and could cause the Company’s actual results for future periods to differ materially from any opinions or statements expressed with respect to future periods in any current statements. Additionally, all statements in this document, including forward-looking statements, speak only as of the date they are made, and the Company undertakes no obligation to update any statement in light of new information or future events.

Executive Management Presentation Thomas W. Schneider, President and Chief Executive Officer James A. Dowd, CPA, Executive Vice President, Chief Operating Officer & Chief Financial Officer Ronald Tascarella, Executive Vice President and Chief Credit Officer

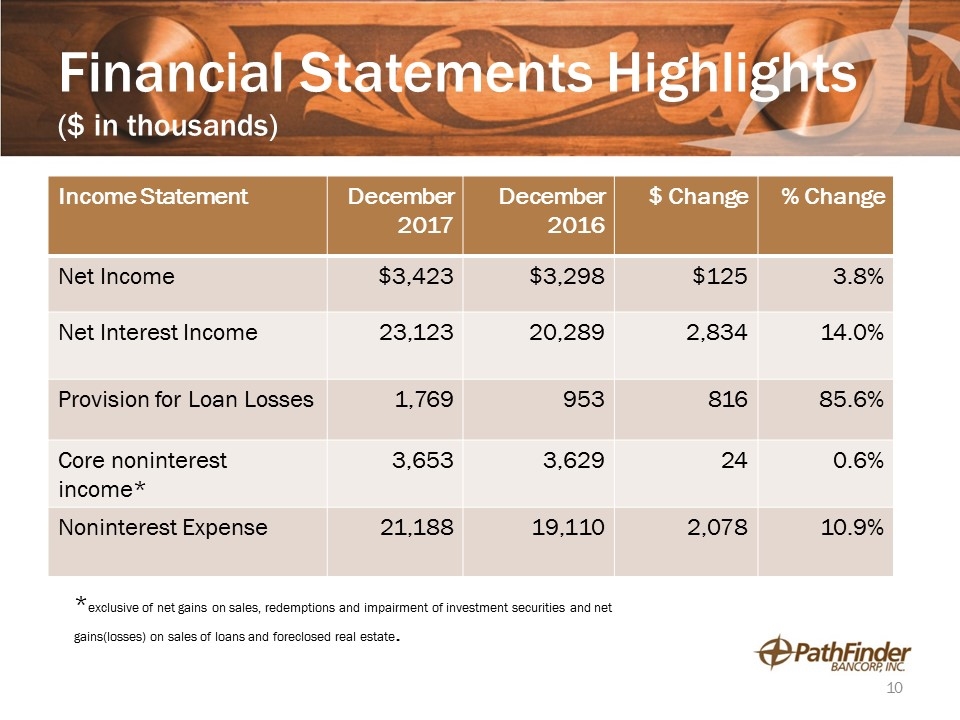

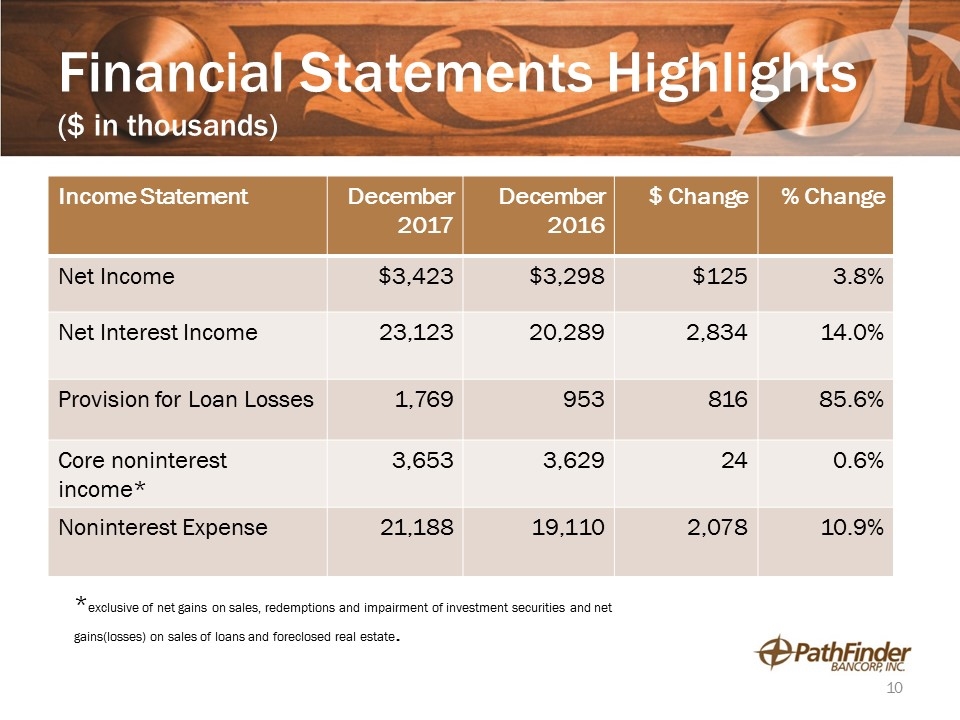

Financial Statements Highlights ($ in thousands) Income Statement December 2017 December 2016 $ Change % Change Net Income $3,423 $3,298 $125 3.8% Net Interest Income 23,123 20,289 2,834 14.0% Provision for Loan Losses 1,769 953 816 85.6% Core noninterest income* 3,653 3,629 24 0.6% Noninterest Expense 21,188 19,110 2,078 10.9% *exclusive of net gains on sales, redemptions and impairment of investment securities and net gains(losses) on sales of loans and foreclosed real estate.

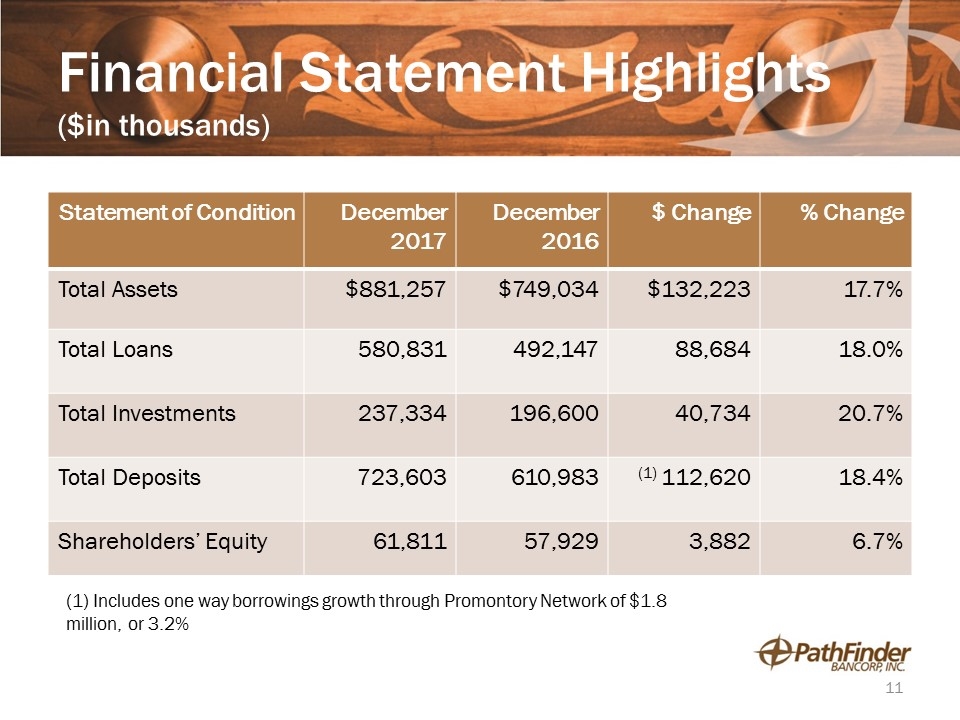

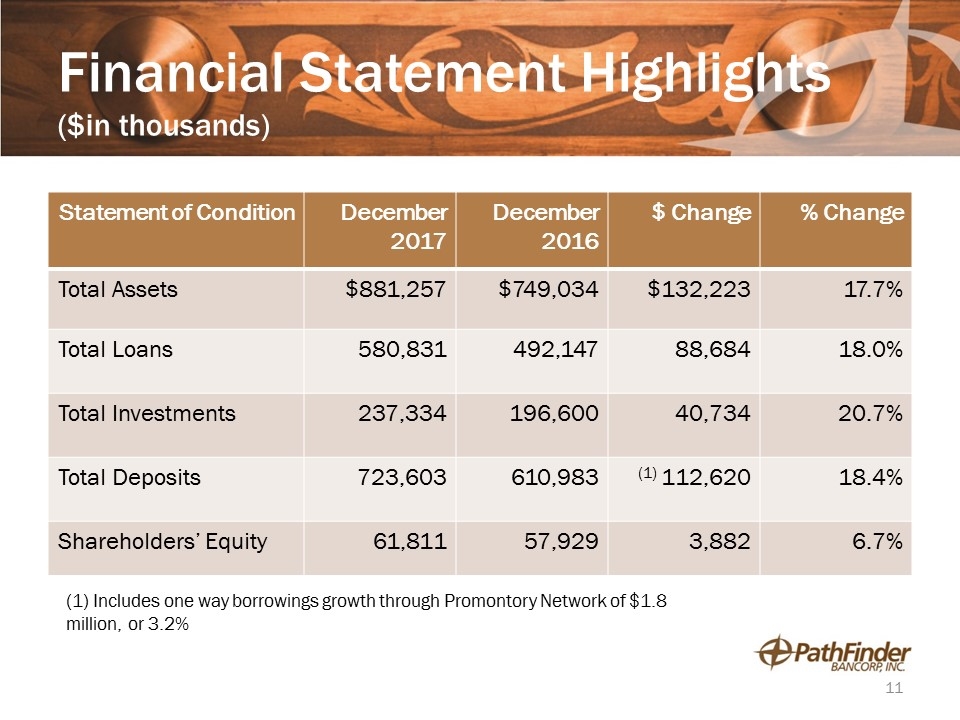

Financial Statement Highlights ($in thousands) Statement of Condition December 2017 December 2016 $ Change % Change Total Assets $881,257 $749,034 $132,223 17.7% Total Loans 580,831 492,147 88,684 18.0% Total Investments 237,334 196,600 40,734 20.7% Total Deposits 723,603 610,983 (1) 112,620 18.4% Shareholders’ Equity 61,811 57,929 3,882 6.7% (1) Includes one way borrowings growth through Promontory Network of $1.8 million, or 3.2%

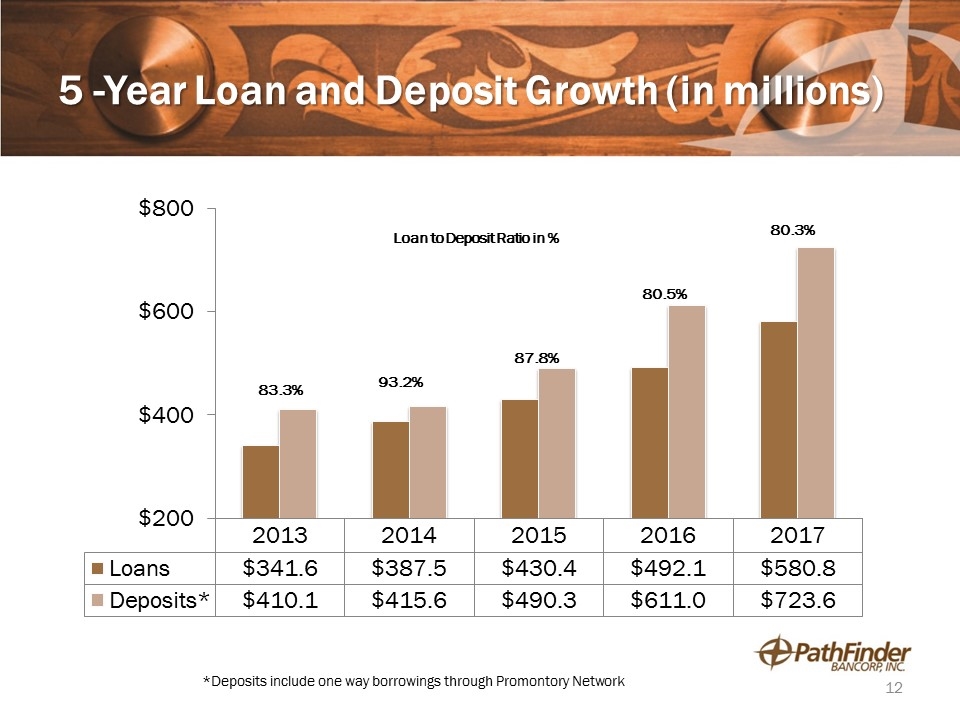

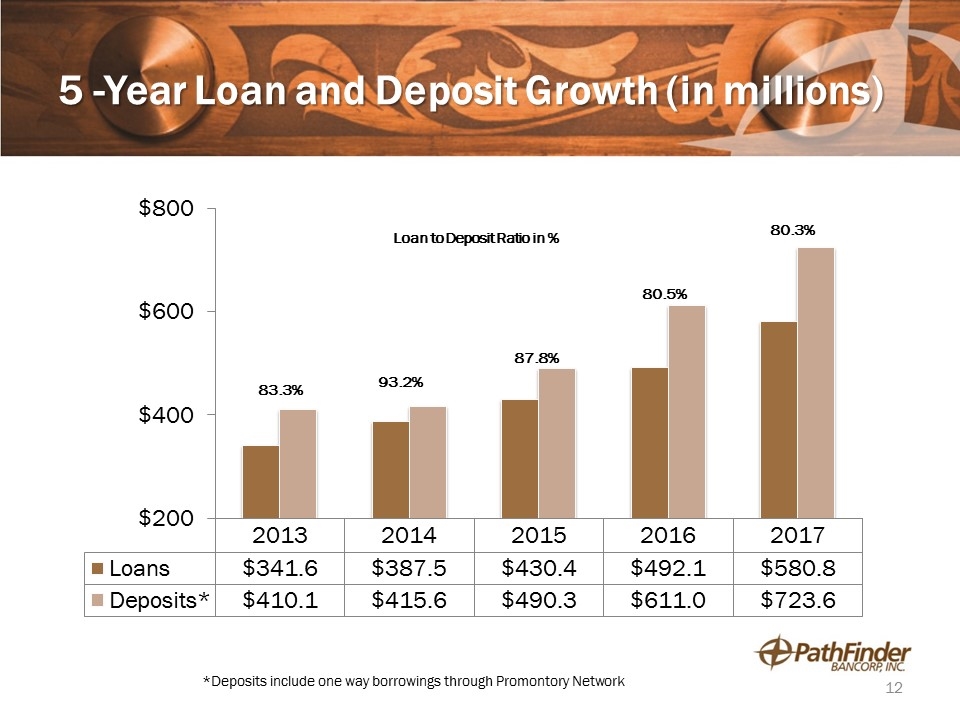

5 -Year Loan and Deposit Growth (in millions) *Deposits include one way borrowings through Promontory Network

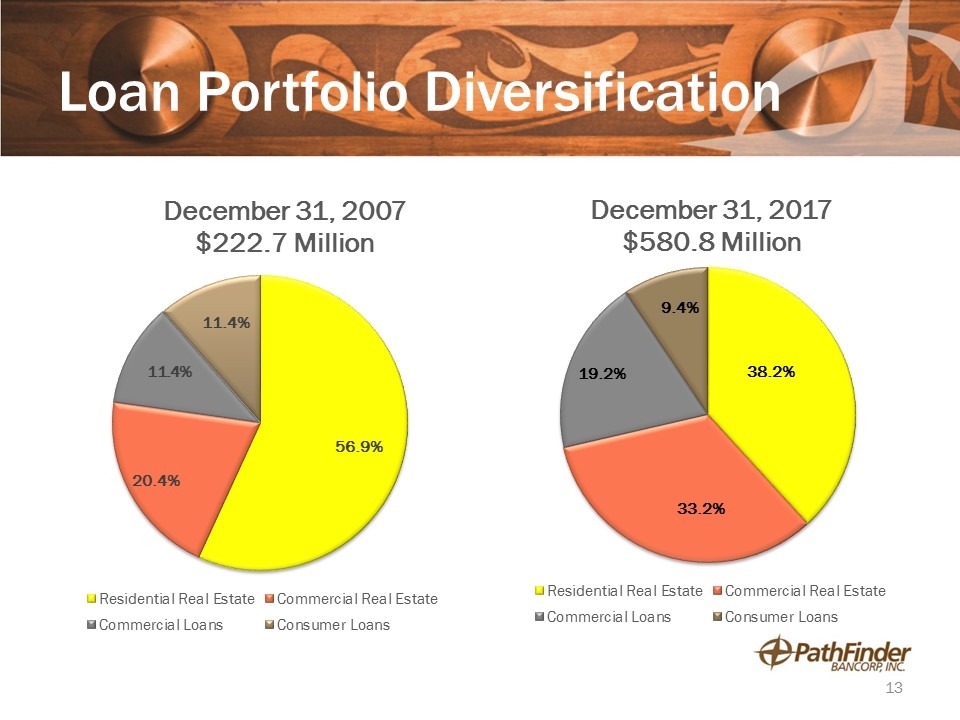

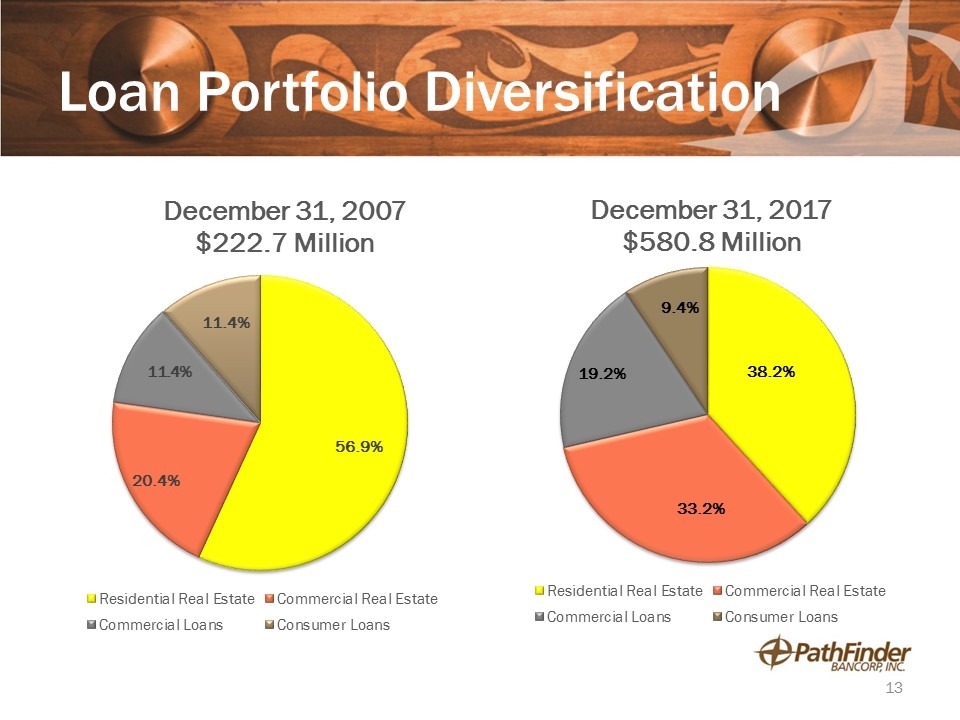

Loan Portfolio Diversification

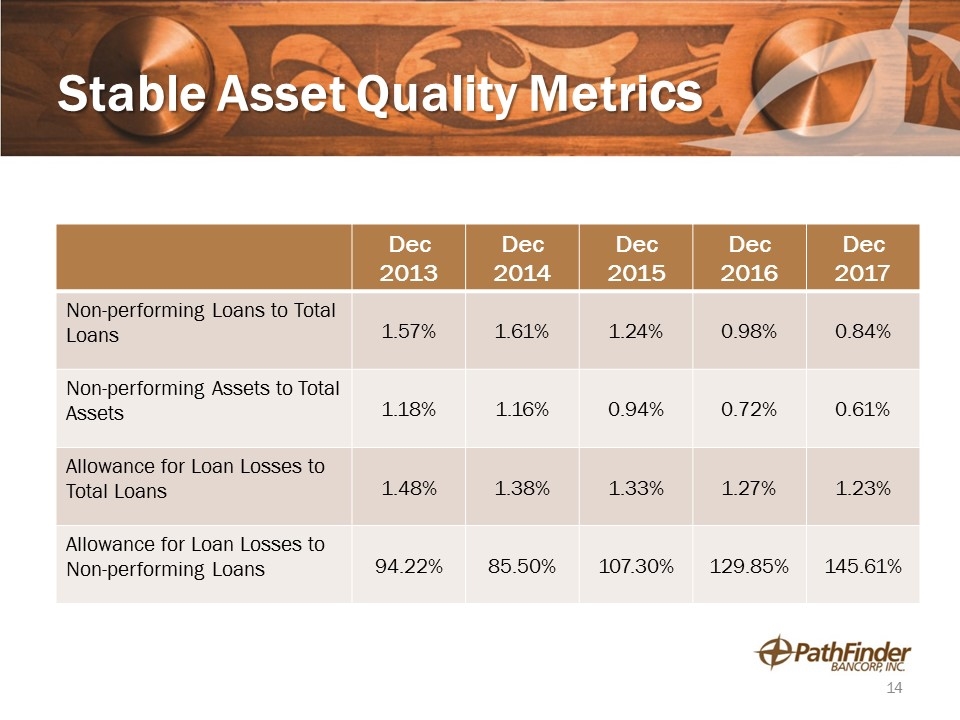

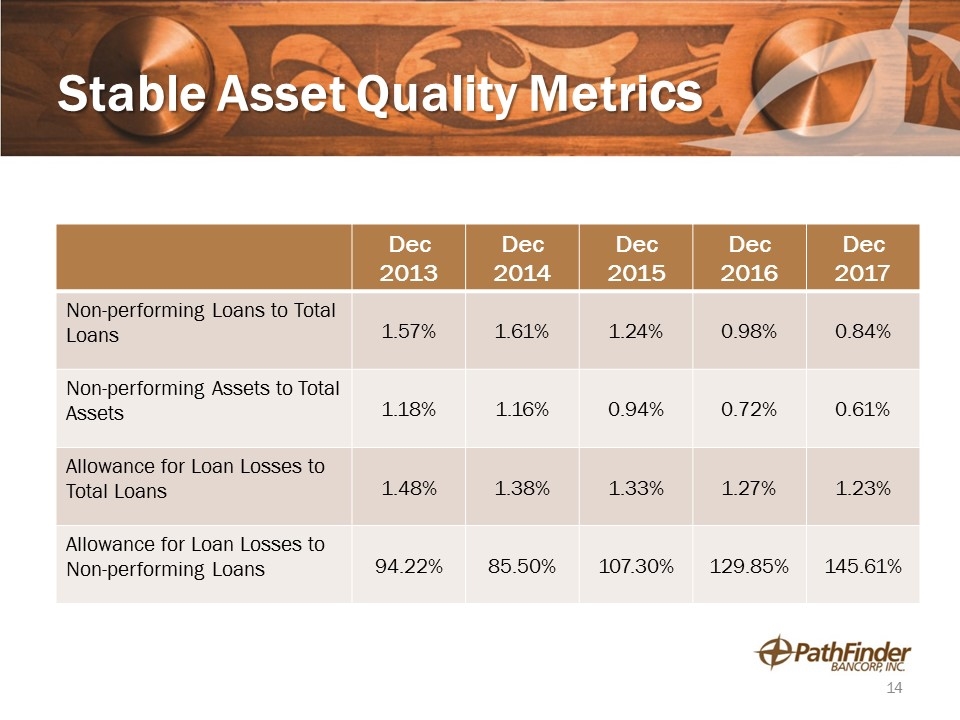

Stable Asset Quality Metrics Dec 2013 Dec 2014 Dec 2015 Dec 2016 Dec 2017 Non-performing Loans to Total Loans 1.57% 1.61% 1.24% 0.98% 0.84% Non-performing Assets to Total Assets 1.18% 1.16% 0.94% 0.72% 0.61% Allowance for Loan Losses to Total Loans 1.48% 1.38% 1.33% 1.27% 1.23% Allowance for Loan Losses to Non-performing Loans 94.22% 85.50% 107.30% 129.85% 145.61%

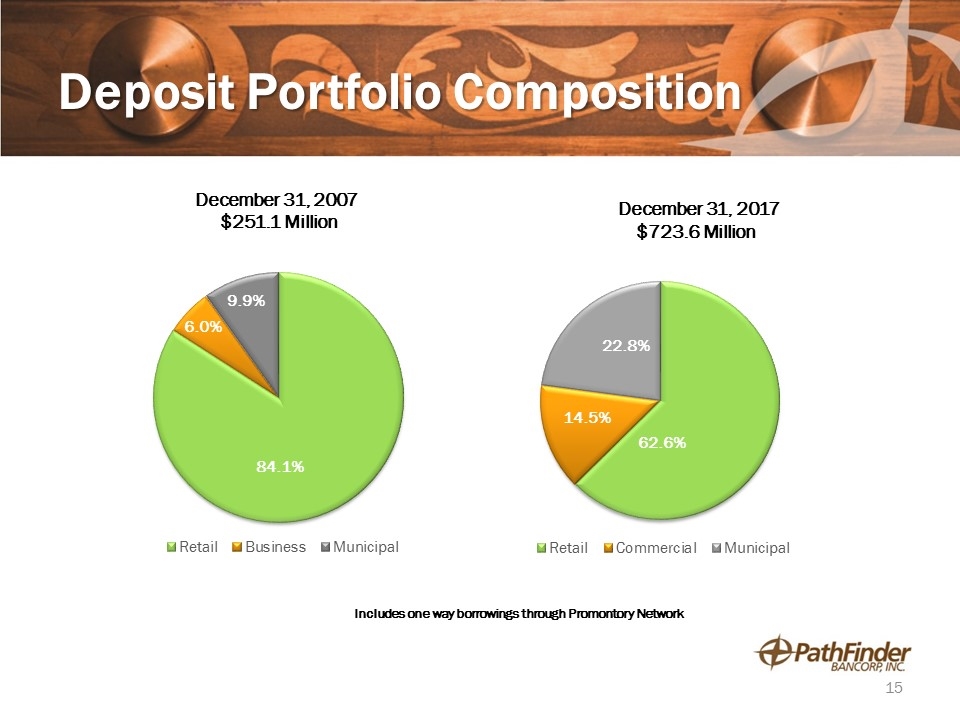

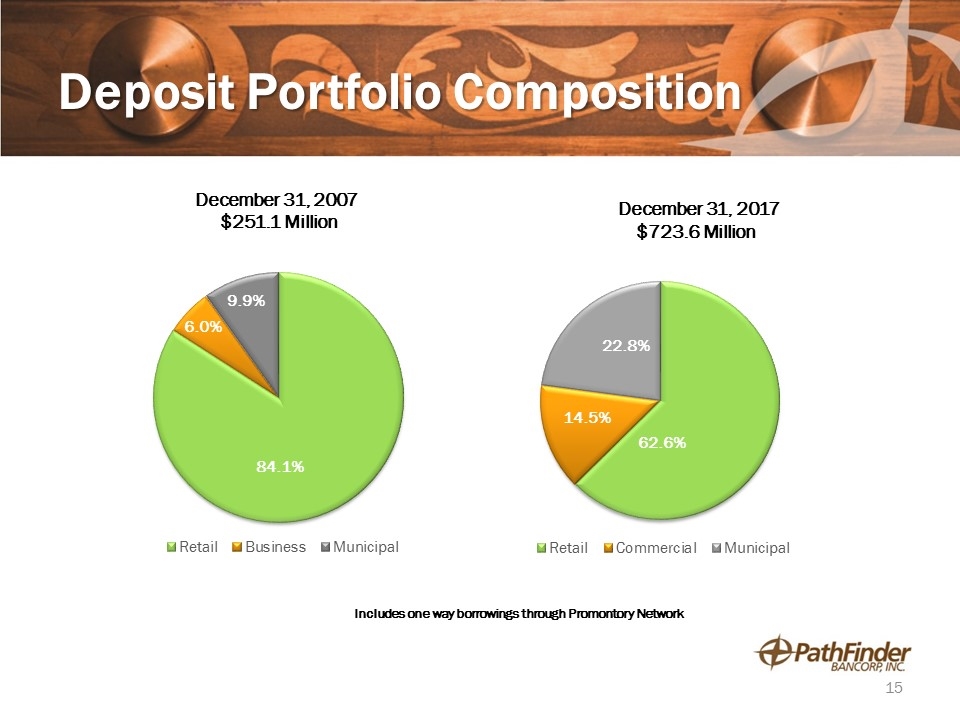

Deposit Portfolio Composition December 31, 2007 $251.1 Million December 31, 2017 $723.6 Million Includes one way borrowings through Promontory Network

2 and 10 Year Treasury Curve

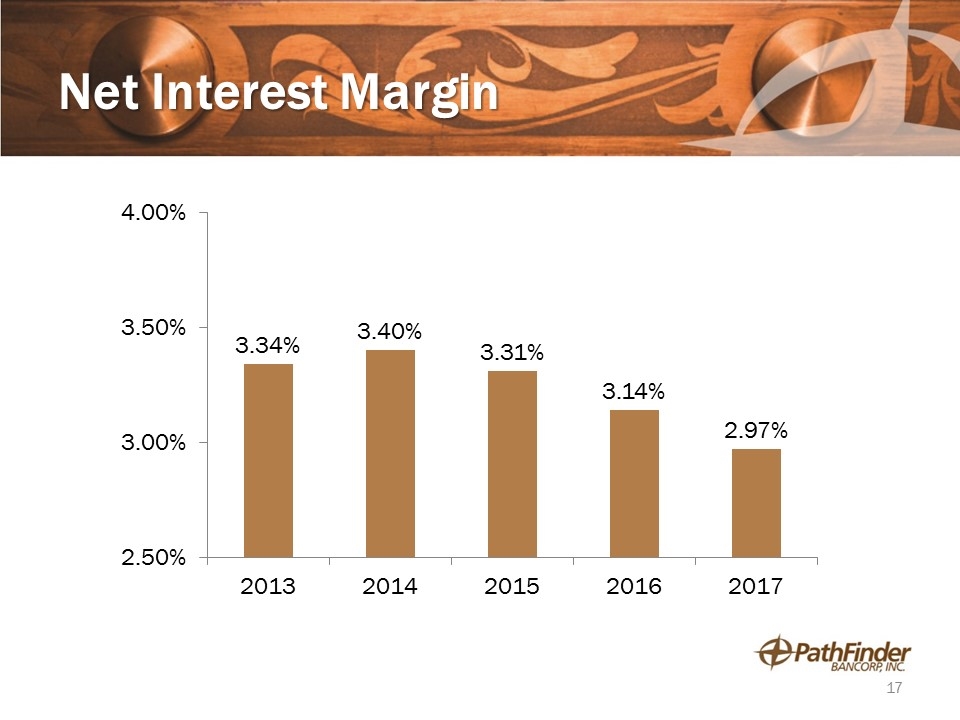

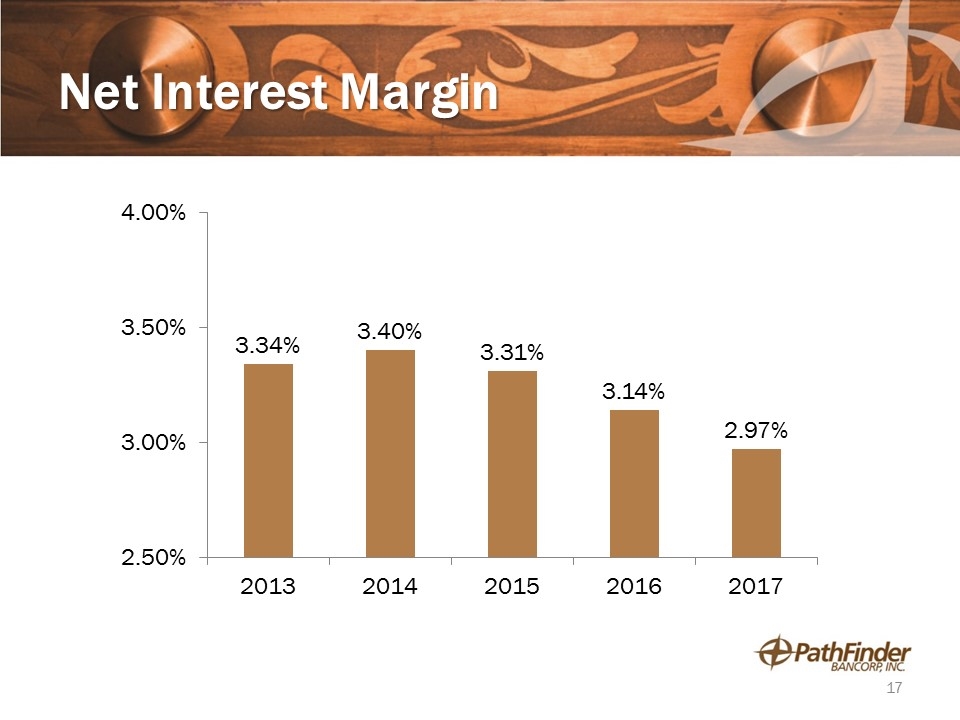

Net Interest Margin

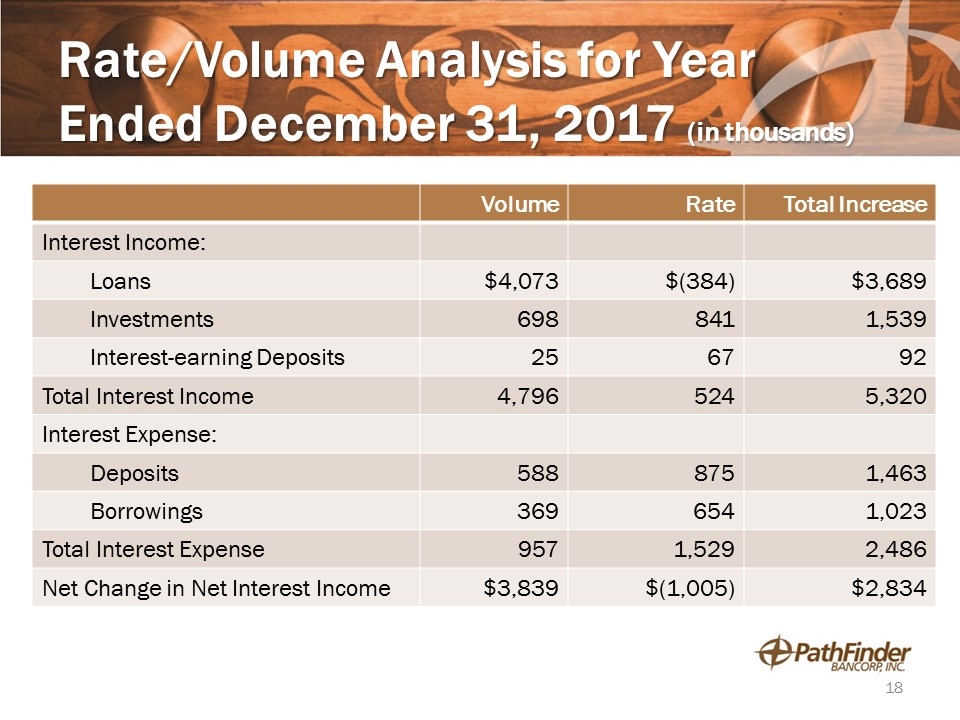

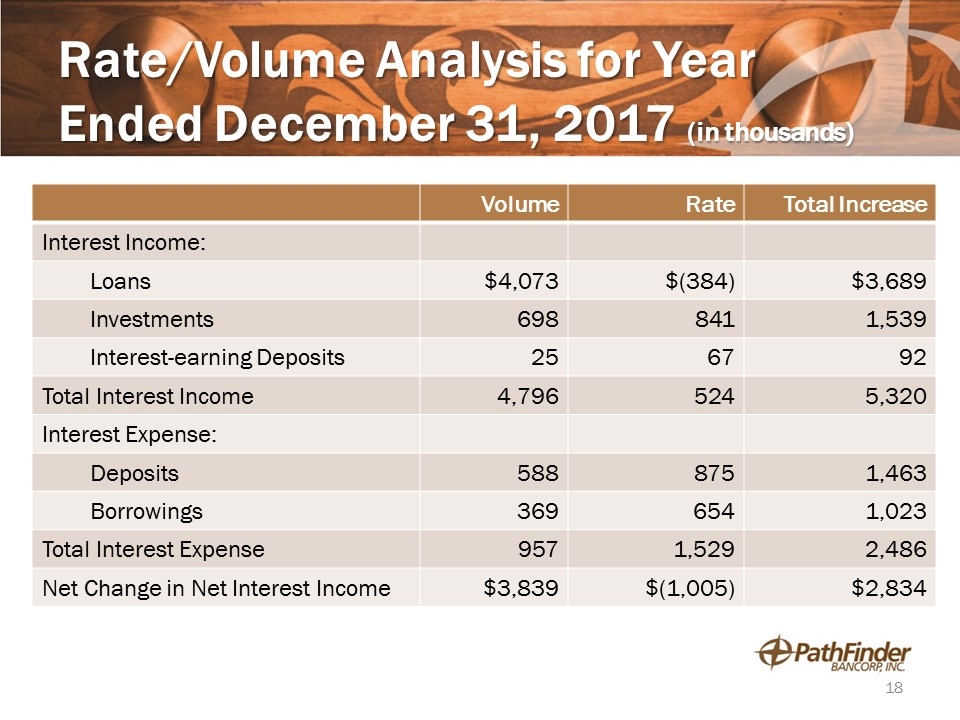

Rate/Volume Analysis for Year Ended December 31, 2017 (in thousands) Volume Rate Total Increase Interest Income: Loans $4,073 $(384) $3,689 Investments 698 841 1,539 Interest-earning Deposits 25 67 92 Total Interest Income 4,796 524 5,320 Interest Expense: Deposits 588 875 1,463 Borrowings 369 654 1,023 Total Interest Expense 957 1,529 2,486 Net Change in Net Interest Income $3,839 $(1,005) $2,834

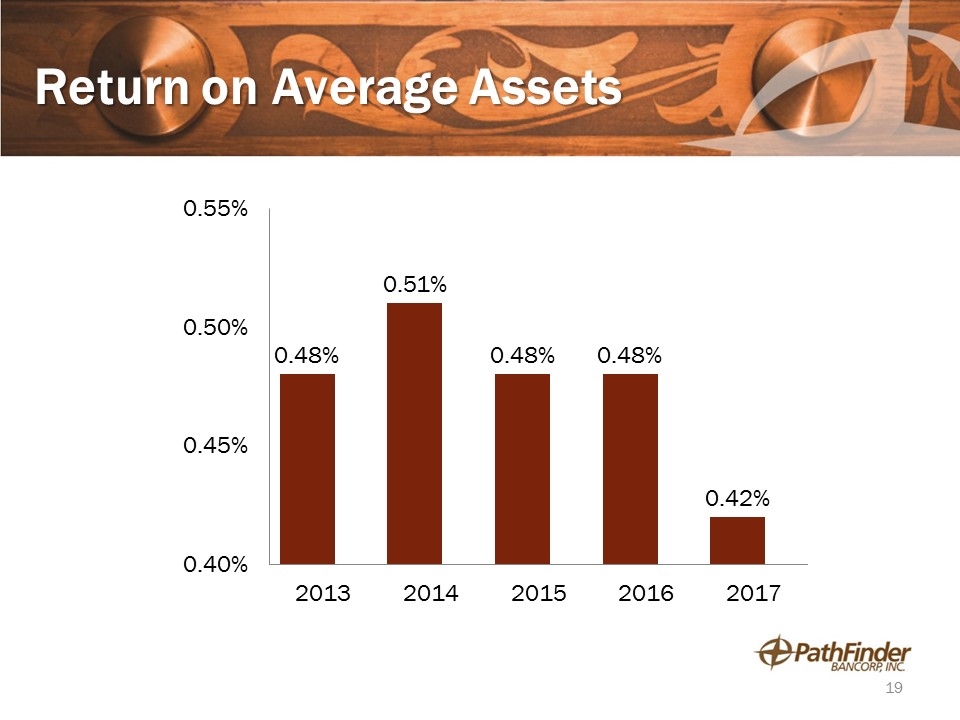

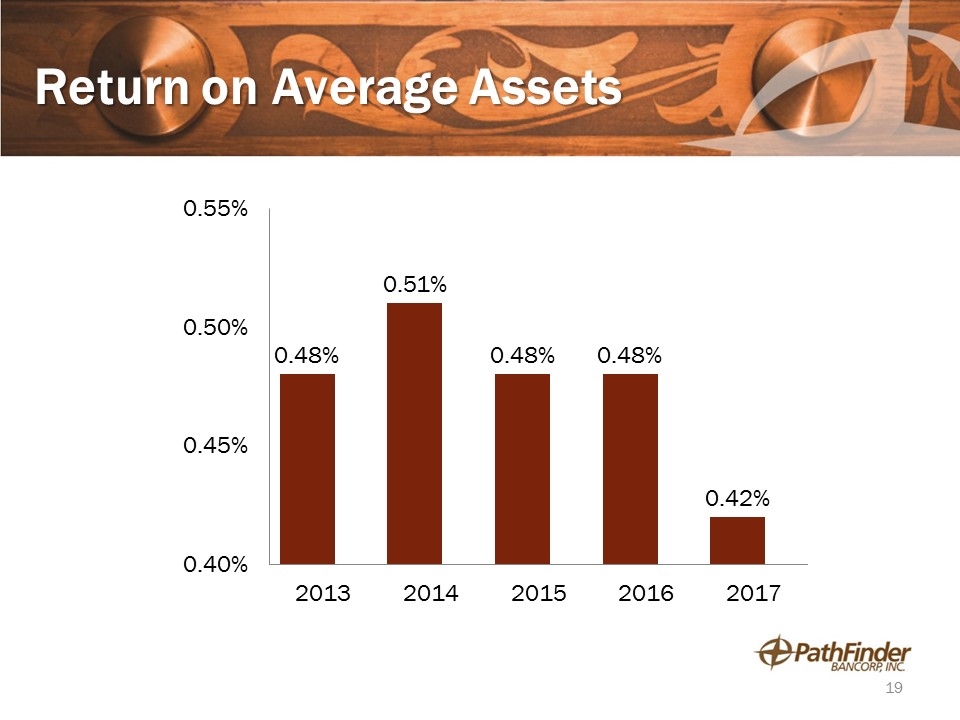

Return on Average Assets

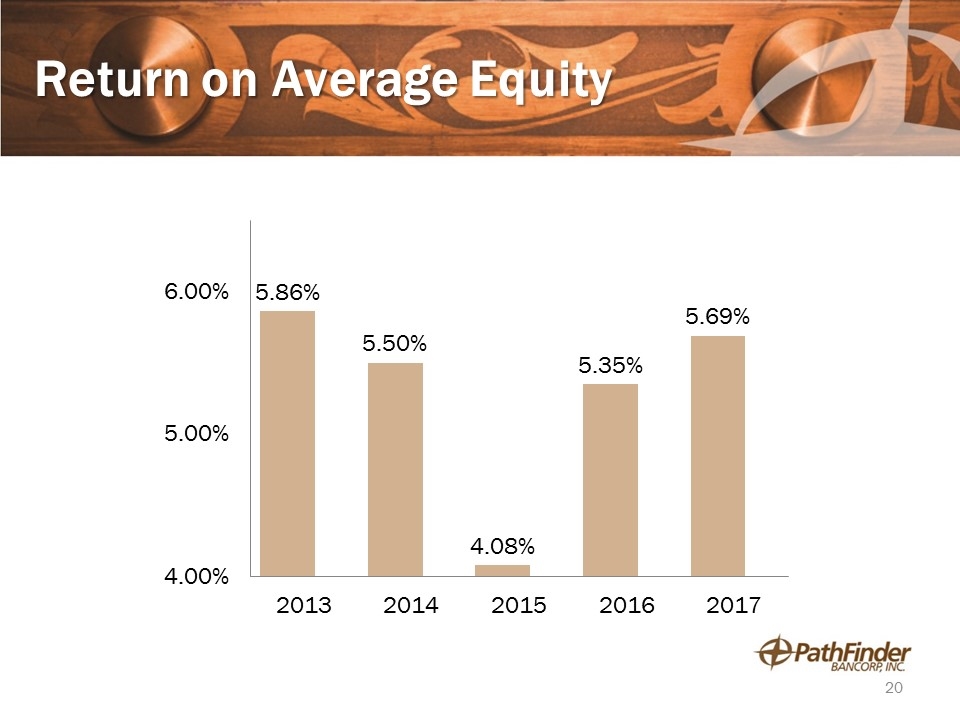

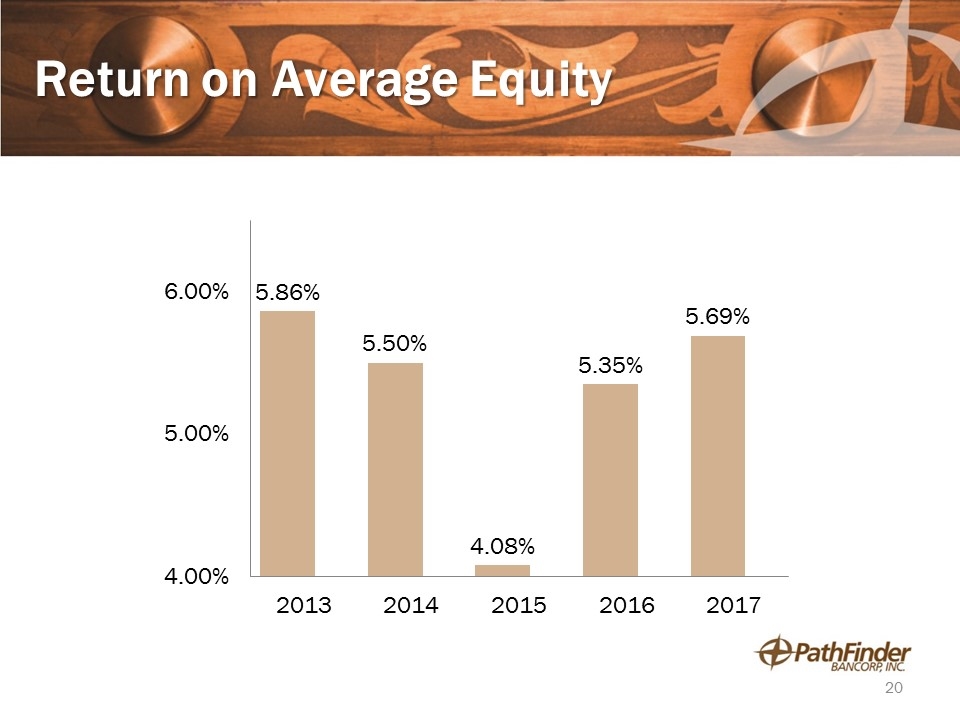

Return on Average Equity

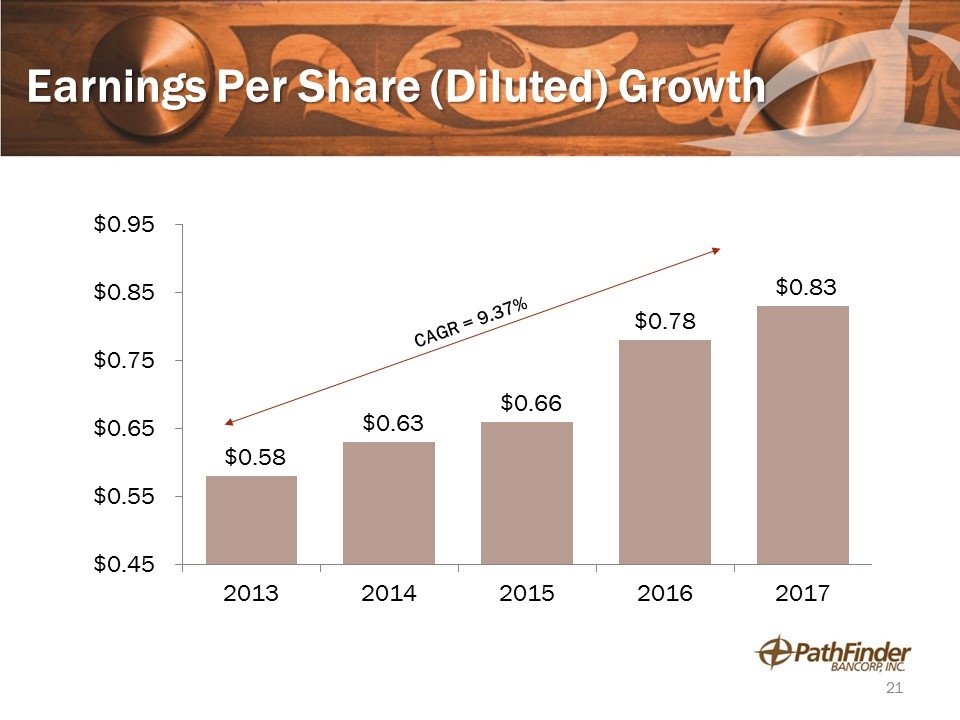

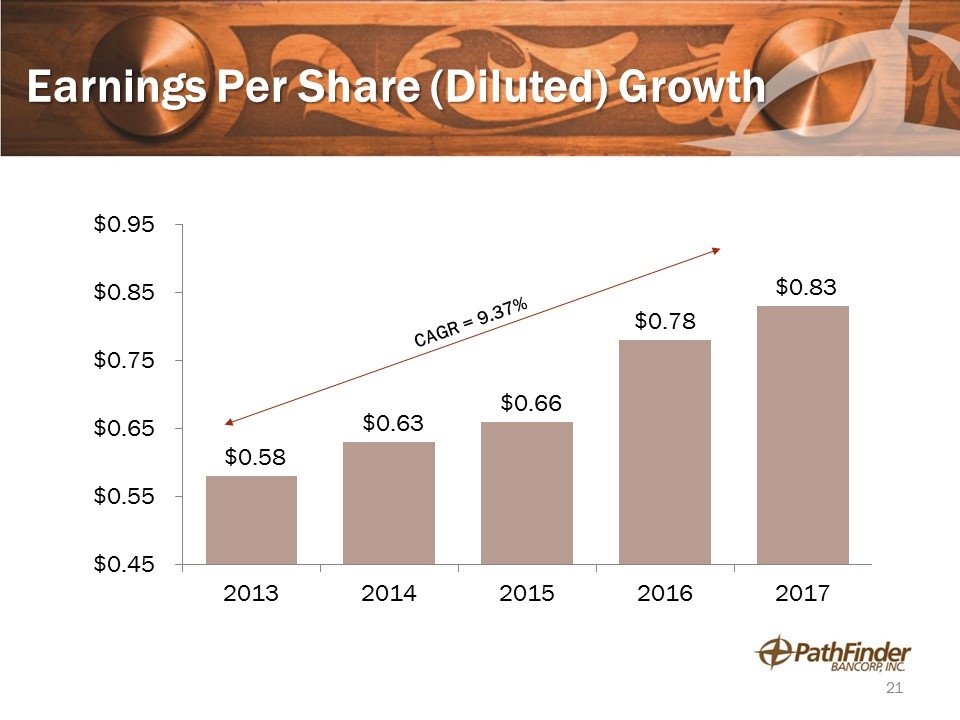

Earnings Per Share (Diluted) Growth

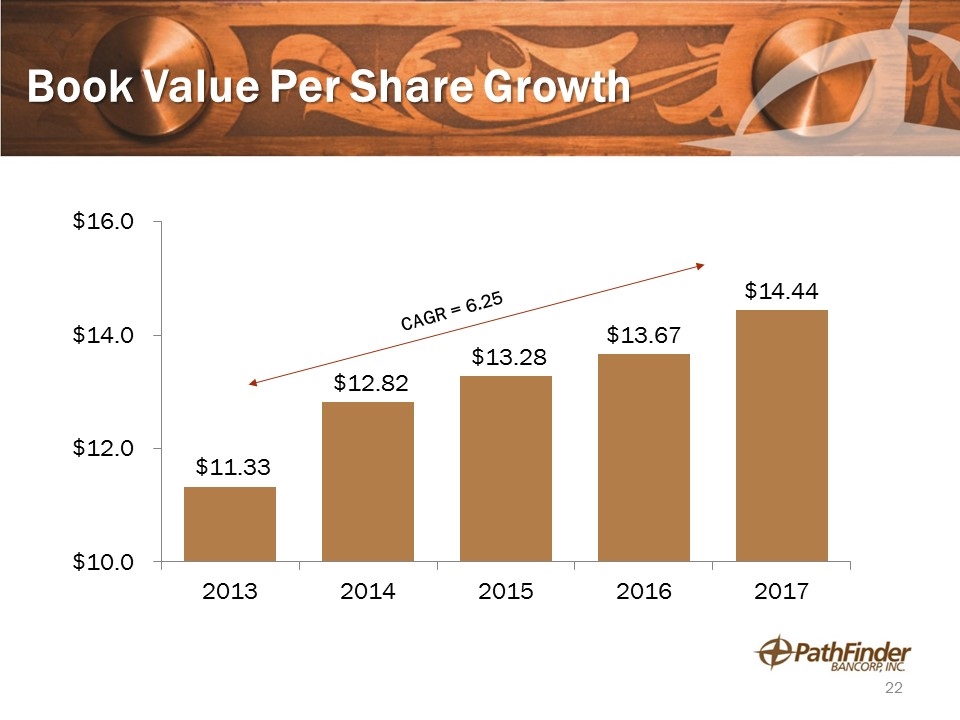

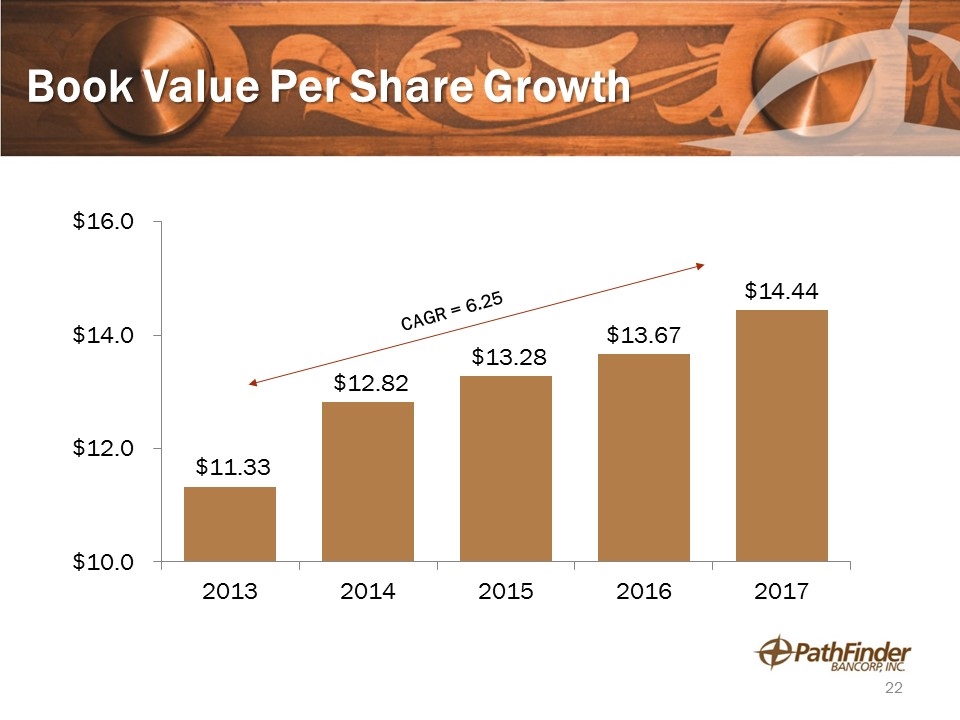

Book Value Per Share Growth

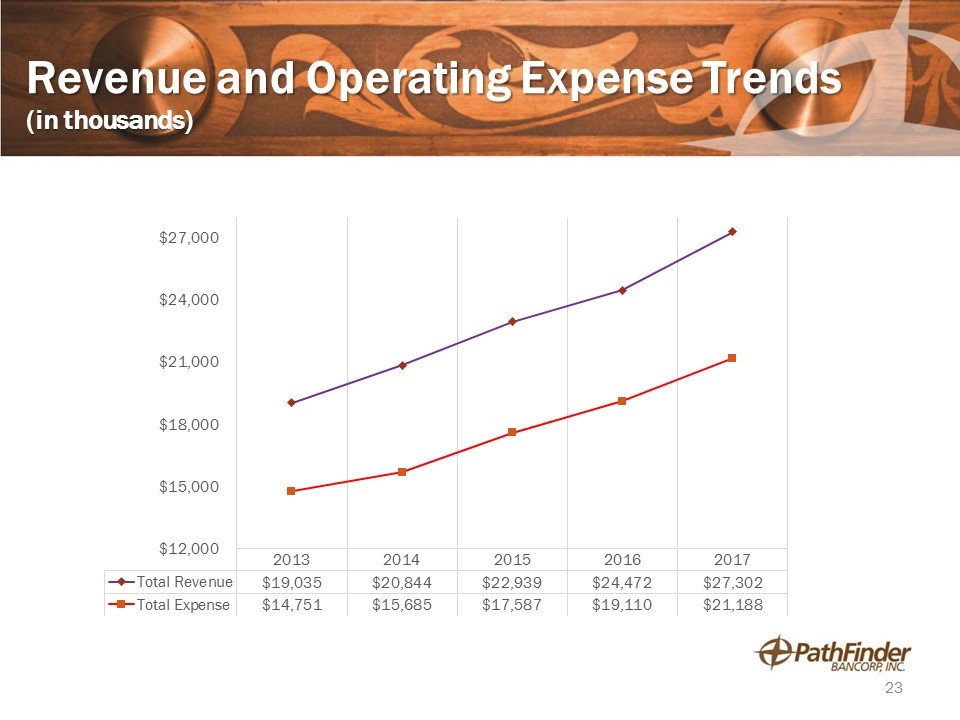

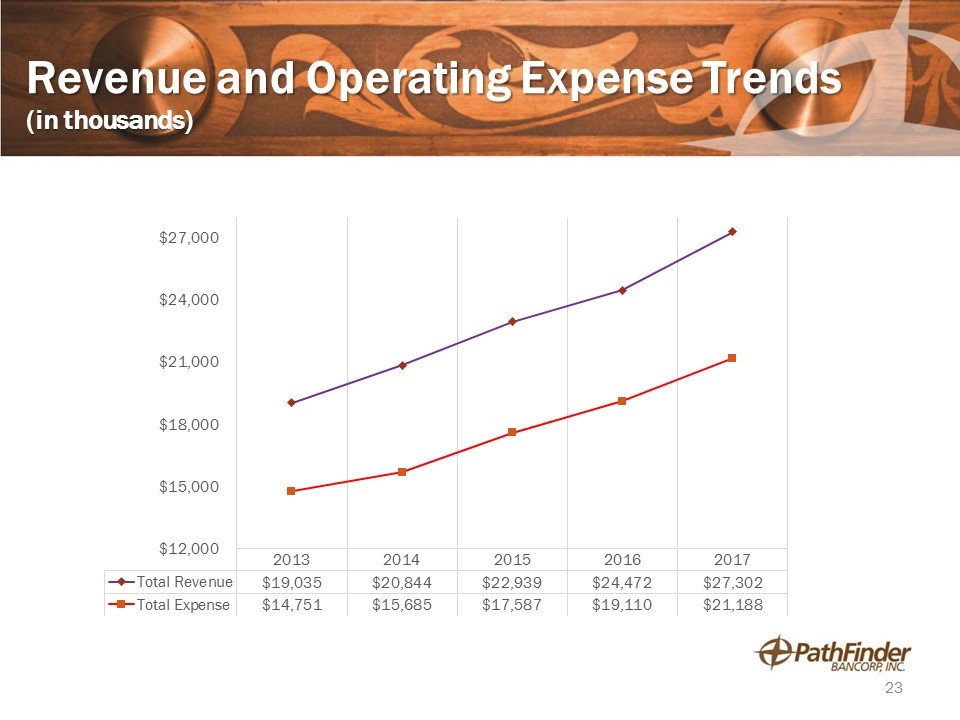

Revenue and Operating Expense Trends (in thousands)

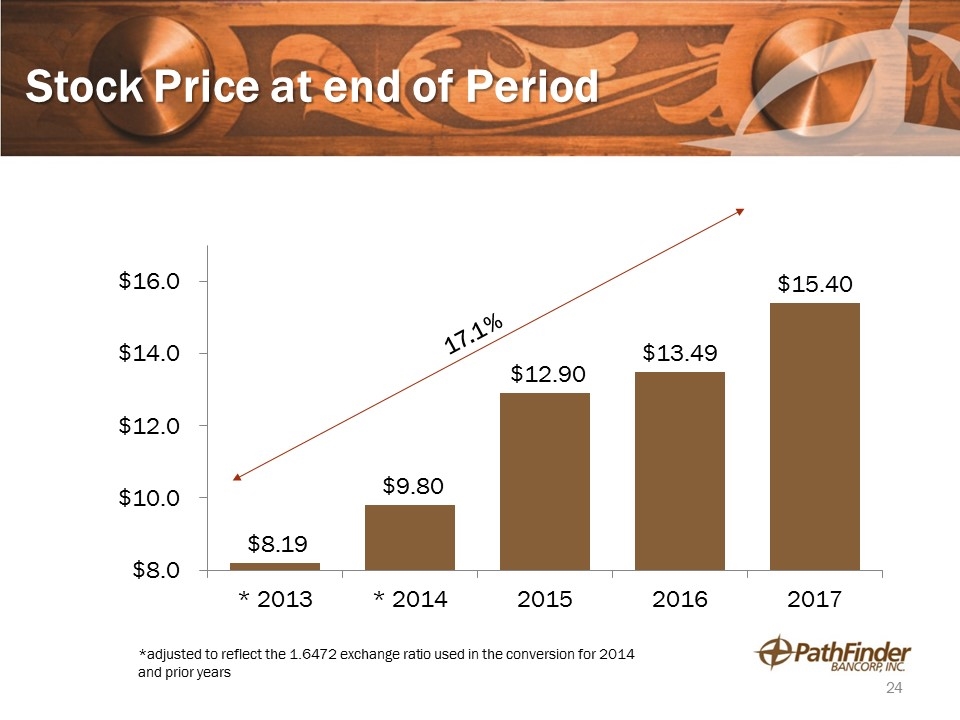

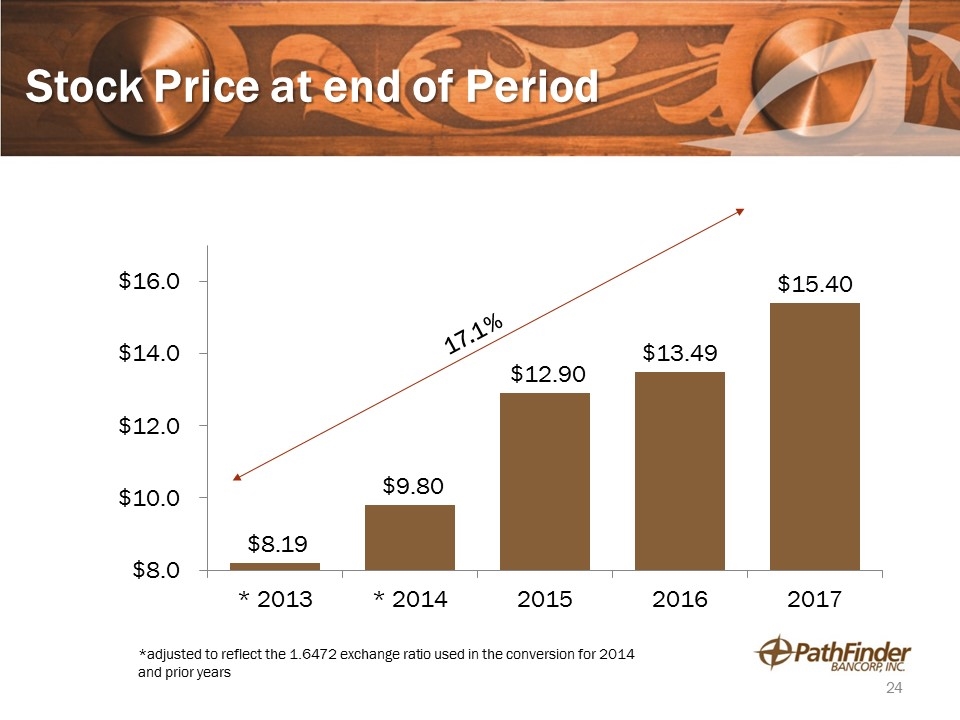

Stock Price at end of Period *adjusted to reflect the 1.6472 exchange ratio used in the conversion for 2014 and prior years 17.1%

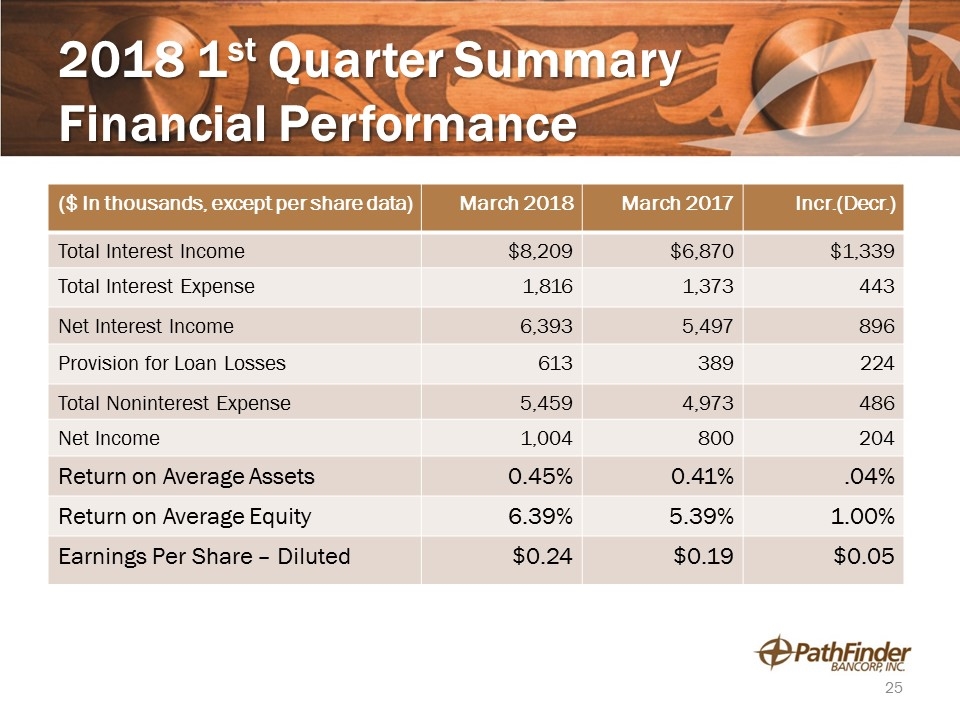

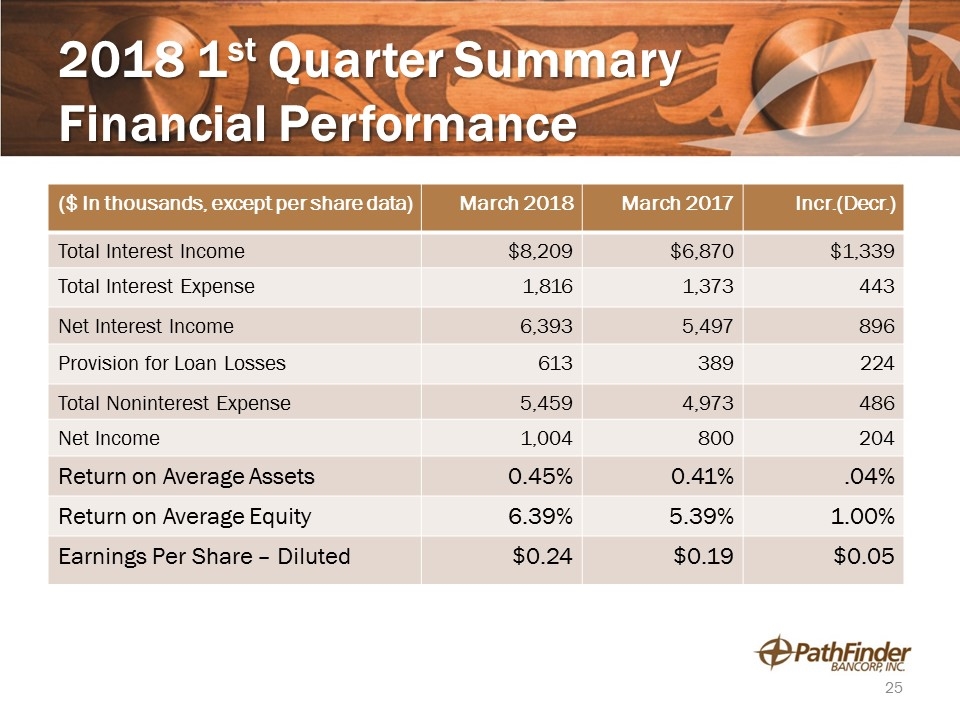

2018 1st Quarter Summary Financial Performance ($ In thousands, except per share data) March 2018 March 2017 Incr.(Decr.) Total Interest Income $8,209 $6,870 $1,339 Total Interest Expense 1,816 1,373 443 Net Interest Income 6,393 5,497 896 Provision for Loan Losses 613 389 224 Total Noninterest Expense 5,459 4,973 486 Net Income 1,004 800 204 Return on Average Assets 0.45% 0.41% .04% Return on Average Equity 6.39% 5.39% 1.00% Earnings Per Share – Diluted $0.24 $0.19 $0.05

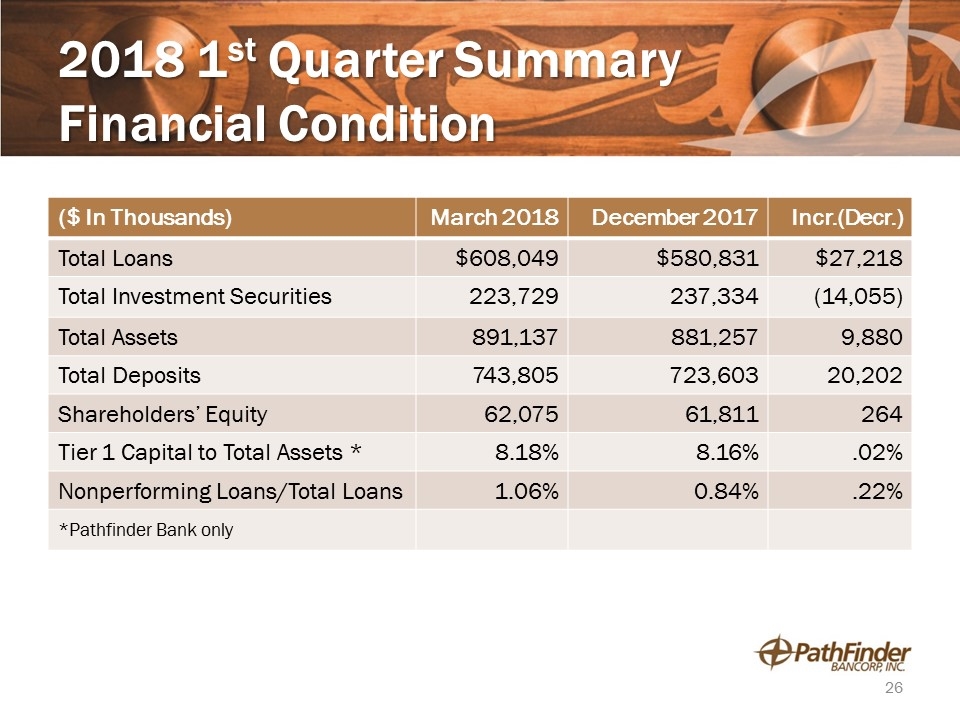

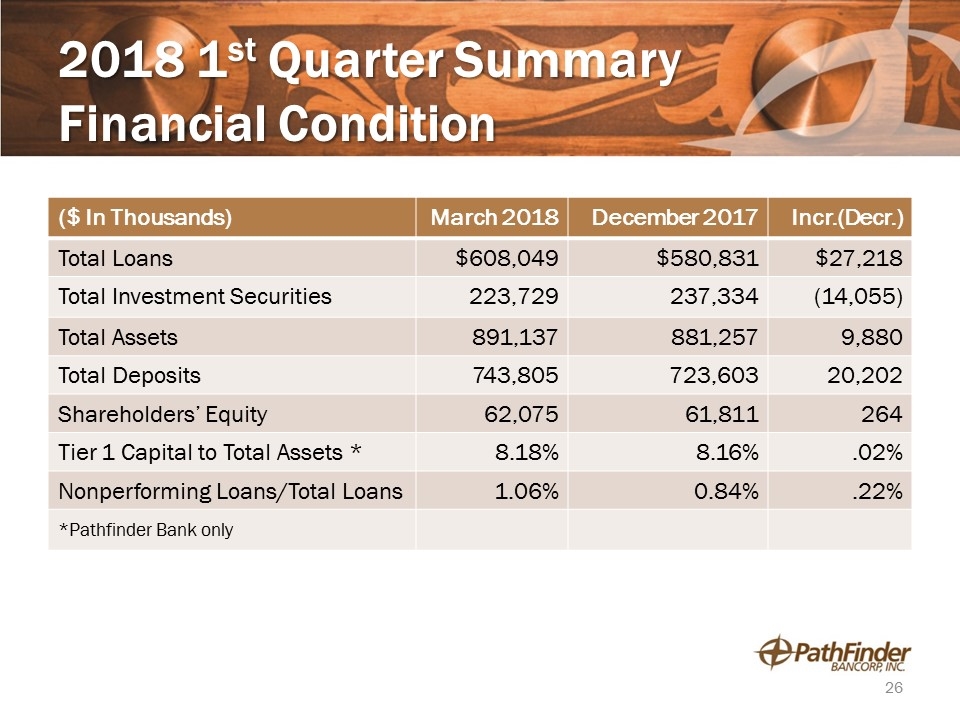

2018 1st Quarter Summary Financial Condition ($ In Thousands) March 2018 December 2017 Incr.(Decr.) Total Loans $608,049 $580,831 $27,218 Total Investment Securities 223,729 237,334 (14,055) Total Assets 891,137 881,257 9,880 Total Deposits 743,805 723,603 20,202 Shareholders’ Equity 62,075 61,811 264 Tier 1 Capital to Total Assets * 8.18% 8.16% .02% Nonperforming Loans/Total Loans 1.06% 0.84% .22% *Pathfinder Bank only

Executive Management Presentation Thomas W. Schneider, President & Chief Executive Officer

Local. Community. Trust PURPOSE VISION STRATEGY

Growth Strategy Organic Growth As a strategy to create return on capital vs. Aquisitive Growth

Positioned for Continued Growth Strong Competitive Market Position Plaza Office 291 State Route 104 East, Oswego Downtown Drive-Thru 34 East Bridge Street, Oswego Mexico Office 3361 Main Street, Mexico Fulton Office 5 West First Street South, Fulton Lacona Office 1897 Harwood Drive, Lacona Central Square Office 3025 East Avenue, Central Square Cicero Office 6194 State Route 31, Cicero Pike Block Office 109 West Fayette Street, Syracuse Main Office 214 West First Street, Oswego

Branch Growth Strategy 2017 – 2019 Branch Additions Utica Loan Production Office Route 31 Town of Clay Southwest Corrider – Syracuse Applying for Banking Development District

Positioned for Continued Growth Strong Competitive Market Position in Onondaga and Oswego Counties 6-30-17 Rank Institution (ST) Total Deposits ($000) Market Share (%) 1 Manufacturers and Traders Trust Company $3,112,538 25.95% 2 KeyBank National Association 2,312,490 19.28% 3 Bank of America, National Association 1,691,567 14.10% 4 JPMorgan Chase Bank, National Association 1,084,944 9.05% 5 Solvay Bank 780,611 6.51% 6 Pathfinder Bank 649,433 5.41% 7 NBT Bank, National Association 594,157 4.95% 8 Geddes Federal Savings and Loan Association 427,370 3.56% 9 Community Bank, National Association 328,220 2.74% 10 Citizens Bank, National Association 299,173 2.49% 11 Berkshire Bank 285,564 2.38% 12 Fulton Savings Bank 251,688 2.10% 13 Seneca Federal Savings and Loan Association 138,787 1.16% Source: FDIC Deposit Market Share Report at 6-30-17

Building to $1 Billion Expectations Regulatory Shareholders (owner) Corporate and Social Responsibility Opportunities Market Presence Valuation

Building to $1 Billion Capacity People Systems Infrastructure Succession – Career Pathing Building Leadership

Building to $1 Billion CAPITAL OUR PEOPLE

Brand/Image/Message Engagement - Alignment Business Government Academic Economic Inclusion – Diversity Live Your Message Local. Community. Trust. We strive to be the Local Bank our Community Trusts

Strategy Strategy Build Capacity Build Deposit Gathering Build People Build Systems Grow Business Deposits Treasury Management Business Deposit Specialist Location Capital Management

Questions and Discussion

Executive Management Presentation Ronald Tascarella, Executive Vice President and Chief Credit Officer

Voting Results Chris R. Burritt - Chairman Inspector of Elections Report – Edward Mervine

2018 Annual Meeting of Shareholders Meeting Adjourned Thank You for Attending 2018 Annual Meeting of Shareholders