CRC 2017 Analyst & Investor Day March 22, 2017 | Bakersfield, California

2 | 2017 CRC Analyst Day Forward Looking / Cautionary Statements This presentation contains forward-looking statements that involve risks and uncertainties that could materially affect our expected results of operations, liquidity, cash flows and business prospects. Such statements include those regarding our expectations as to our future: Actual results may differ from anticipated results, sometimes materially, and reported results should not be considered an indication of future performance. While we believe assumptions or bases underlying our expectations are reasonable and make them in good faith, they almost always vary from actual results, sometimes materially. We also believe third- party statements we cite are accurate but have not independently verified them and do not warrant their accuracy or completeness. Factors (but not necessarily all the factors) that could cause results to differ include: Words such as "anticipate," "believe," "continue," "could," "estimate," "expect," "goal," "intend," "likely," "may," "might," "plan," "potential," "project," "seek," "should," "target, "will" or "would" and similar words that reflect the prospective nature of events or outcomes typically identify forward-looking statements. Any forward-looking statement speaks only as of the date on which such statement is made and we undertake no obligation to correct or update any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by applicable law. See www.crc.com Investor Relations for important information about 3P reserves and other hydrocarbon resource quantities, finding and development costs, recycle ratio calculations, and drilling locations. • financial position, liquidity, cash flows and results of operations • business prospects • transactions and projects • operating costs • operations and operational results including production, hedging, capital investment and expected VCI • budgets and maintenance capital requirements • reserves • type curves • commodity price changes • debt limitations on our financial flexibility • insufficient cash flow to fund planned investment • inability to enter desirable transactions including asset sales and joint ventures • legislative or regulatory changes, including those related to drilling, completion, well stimulation, operation, maintenance or abandonment of wells or facilities, managing energy, water, land, greenhouse gases or other emissions, protection of health, safety and the environment, or transportation, marketing and sale of our products • unexpected geologic conditions • changes in business strategy • inability to replace reserves • insufficient capital, including as a result of lender restrictions, unavailability of capital markets or inability to attract potential investors • inability to enter efficient hedges • equipment, service or labor price inflation or unavailability • availability or timing of, or conditions imposed on, permits and approvals • lower-than-expected production, reserves or resources from development projects or acquisitions or higher-than-expected decline rates • disruptions due to accidents, mechanical failures, transportation constraints, natural disasters, labor difficulties, cyber attacks or other catastrophic events • factors discussed in “Risk Factors” in our Annual Report on Form 10-K available on our website at crc.com.

3 | 2017 CRC Analyst Day 2017 CRC Analyst & Investor Day Overview Todd Stevens – CRC Strategy and Investment Opportunity Bob Barnes – Operations Overview Shawn Kerns – Growth and Life of Field Plans Darren Williams – Exploration Francisco Leon – Portfolio Modeling Mark Smith – Strengthening the Balance Sheet

CRC STRATEGY & INVESTMENT OPPORTUNITY CRC 2017 Analyst & Investor Day Todd Stevens | President & CEO | March 22, 2017

5 | 2017 CRC Analyst Day Portfolio Built For Any Price Environment O il P ric e $ / B B L Gas Price $/MCF Bull Market Mid-cycle Bear Market Investor Topics of Discussion • No Peers; Modeling Multiple Drive Mechanisms • Balance Sheet • E&P Opportunity in California • Regulatory Environment Key Messages of the Day 1. World Class Assets • Undervalued • Significant Inventory • Resilient Model – Demonstrated Optionality 2. Focused on Value 3. Poised to Grow • Actionable Inventory • Growth on a Per Share Basis 4. Proven Track Record

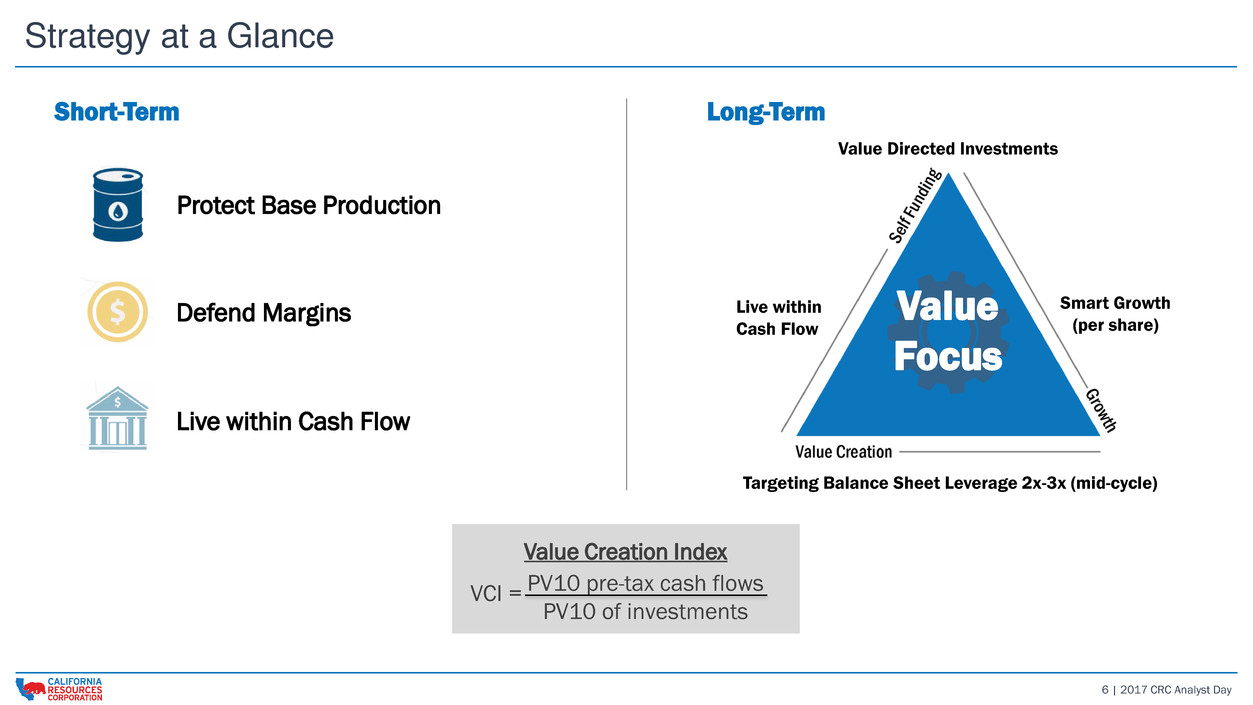

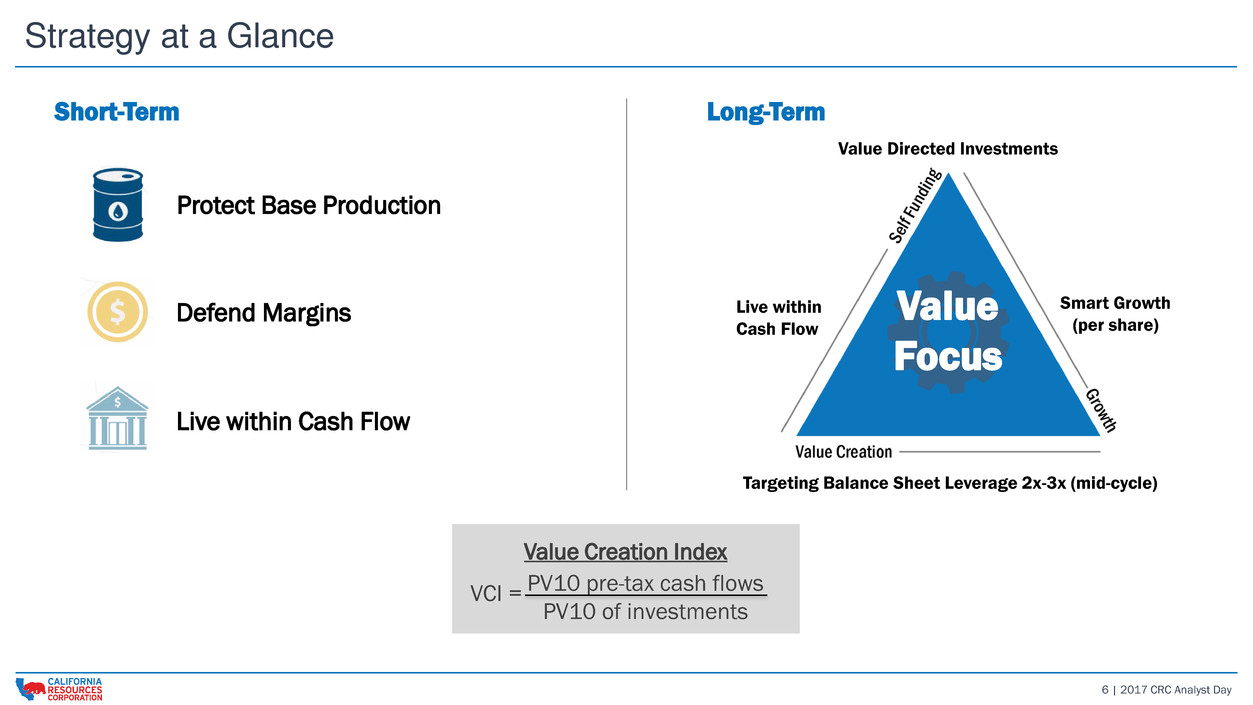

6 | 2017 CRC Analyst Day Strategy at a Glance Value Directed Investments Targeting Balance Sheet Leverage 2x-3x (mid-cycle) Value Focus Live within Cash Flow Smart Growth (per share) PV10 pre-tax cash flows PV10 of investments VCI = Value Creation Index Protect Base Production Defend Margins Live within Cash Flow Long-TermShort-Term

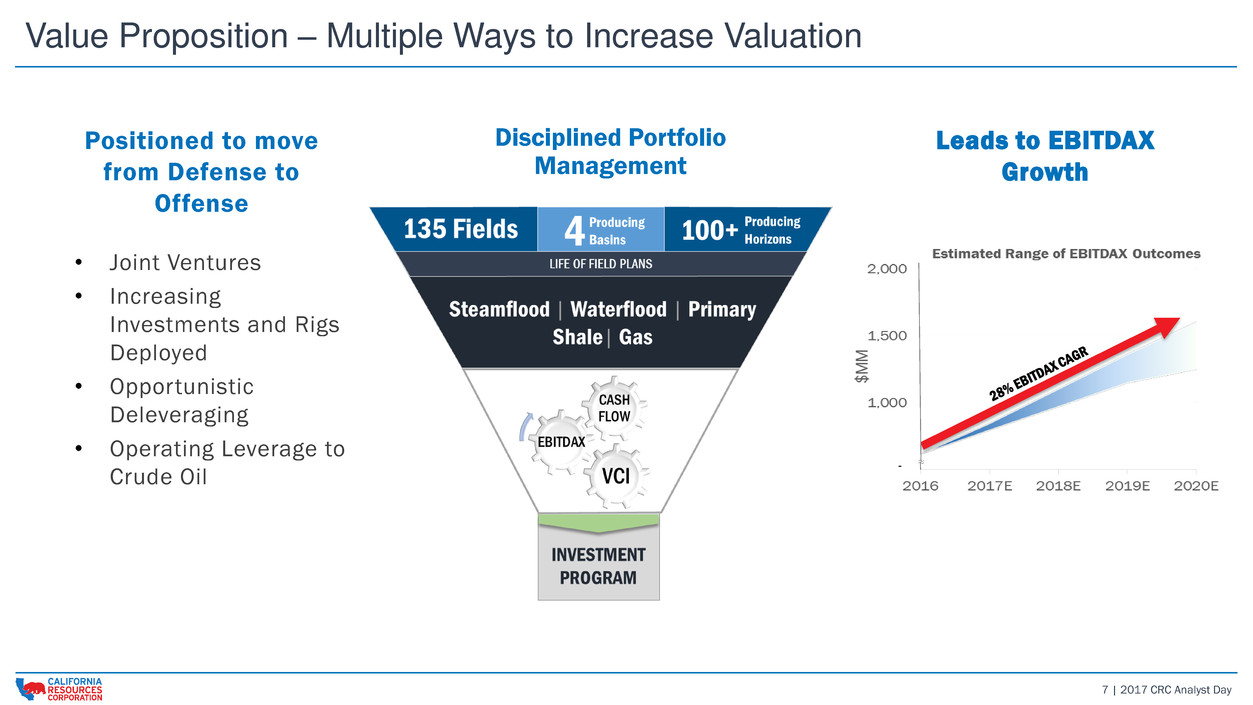

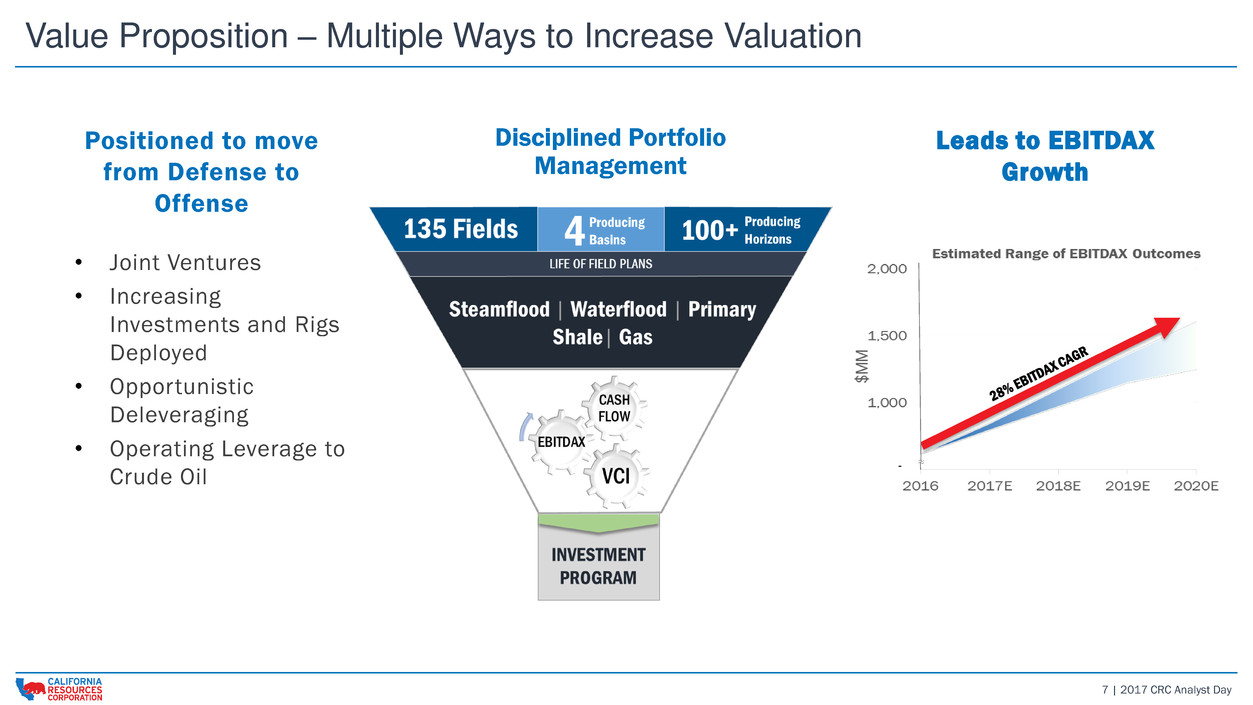

7 | 2017 CRC Analyst Day Value Proposition – Multiple Ways to Increase Valuation Disciplined Portfolio Management Leads to EBITDAX Growth Positioned to move from Defense to Offense • Joint Ventures • Increasing Investments and Rigs Deployed • Opportunistic Deleveraging • Operating Leverage to Crude Oil - ≈

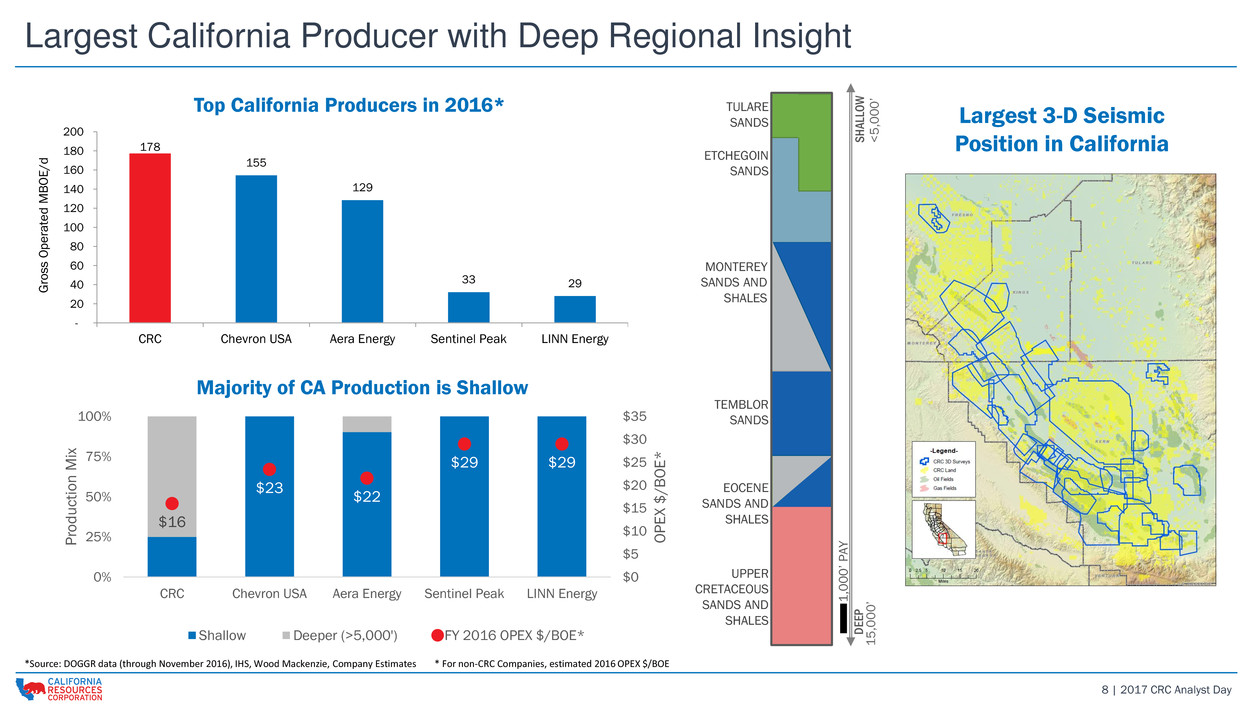

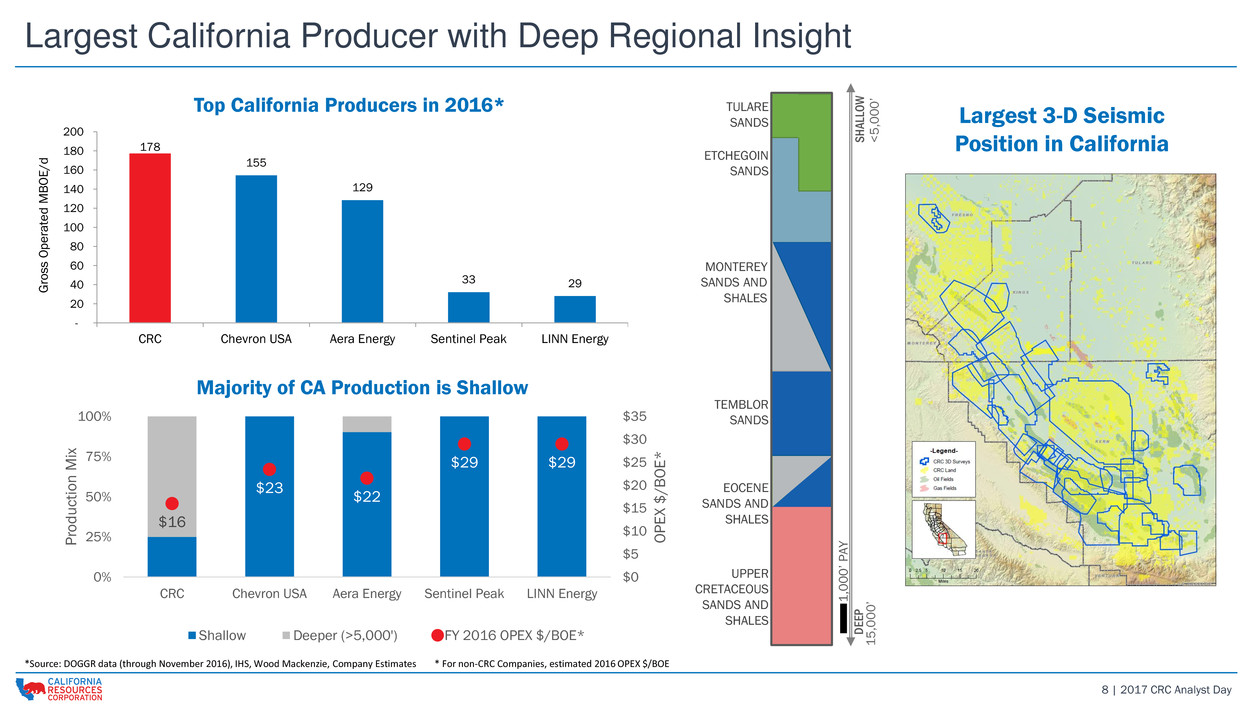

8 | 2017 CRC Analyst Day Largest California Producer with Deep Regional Insight Surface & Minerals3 178 155 129 33 29 - 20 40 60 80 100 120 140 160 180 200 CRC Chevron USA Aera Energy Sentinel Peak LINN Energy G ro ss O p e ra ted M B O E /d *Source: DOGGR data (through November 2016), IHS, Wood Mackenzie, Company Estimates * For non-CRC Companies, estimated 2016 OPEX $/BOE Largest 3-D Seismic Position in California $16 $23 $22 $29 $29 $0 $5 $10 $15 $20 $25 $30 $35 0% 25% 50% 75% 100% CRC Chevron USA Aera Energy Sentinel Peak LINN Energy OPEX $ /B OE * P roduc tion Mi x Shallow Deeper (>5,000') FY 2016 OPEX $/BOE* MONTEREY SANDS AND SHALES TEMBLOR SANDS EOCENE SANDS AND SHALES UPPER CRETACEOUS SANDS AND SHALES 1 ,0 0 0 ’ P A Y TULARE SANDS S HALLO W D EE P ETCHEGOIN SANDS < 5 ,0 0 0 ’ 1 5 ,0 0 0 ’ Top California Producers in 2016* Majority of CA Production is Shallow

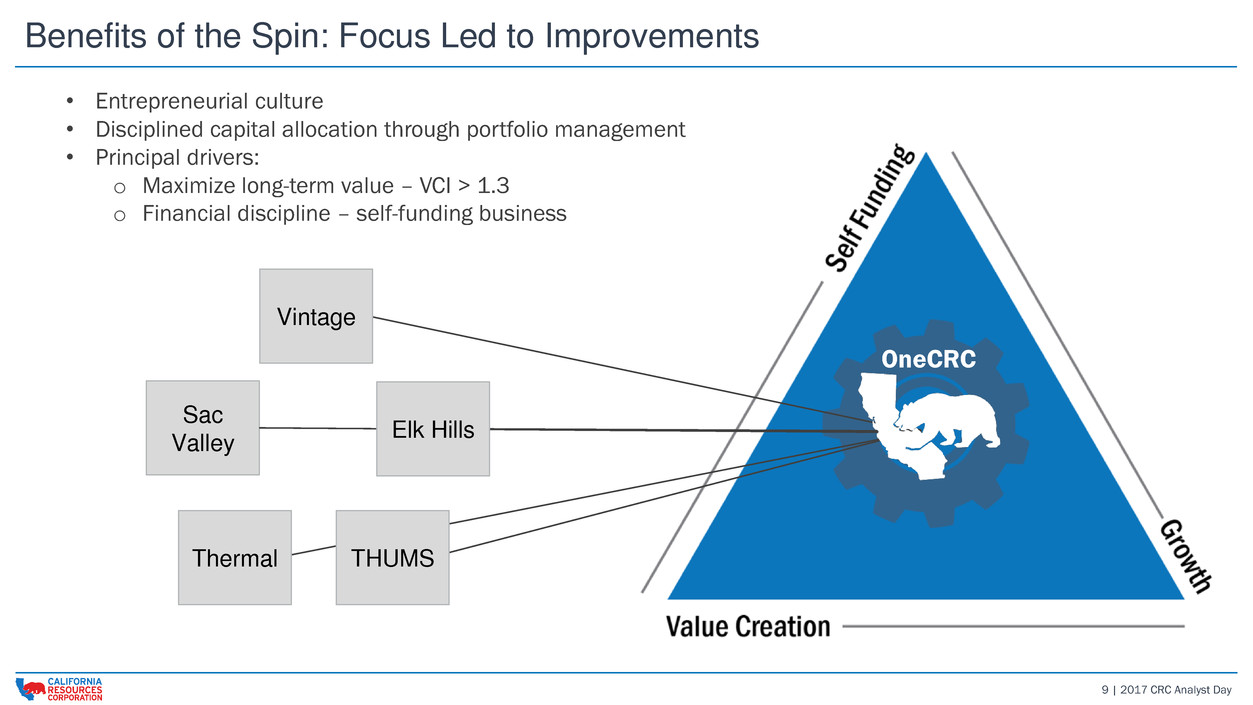

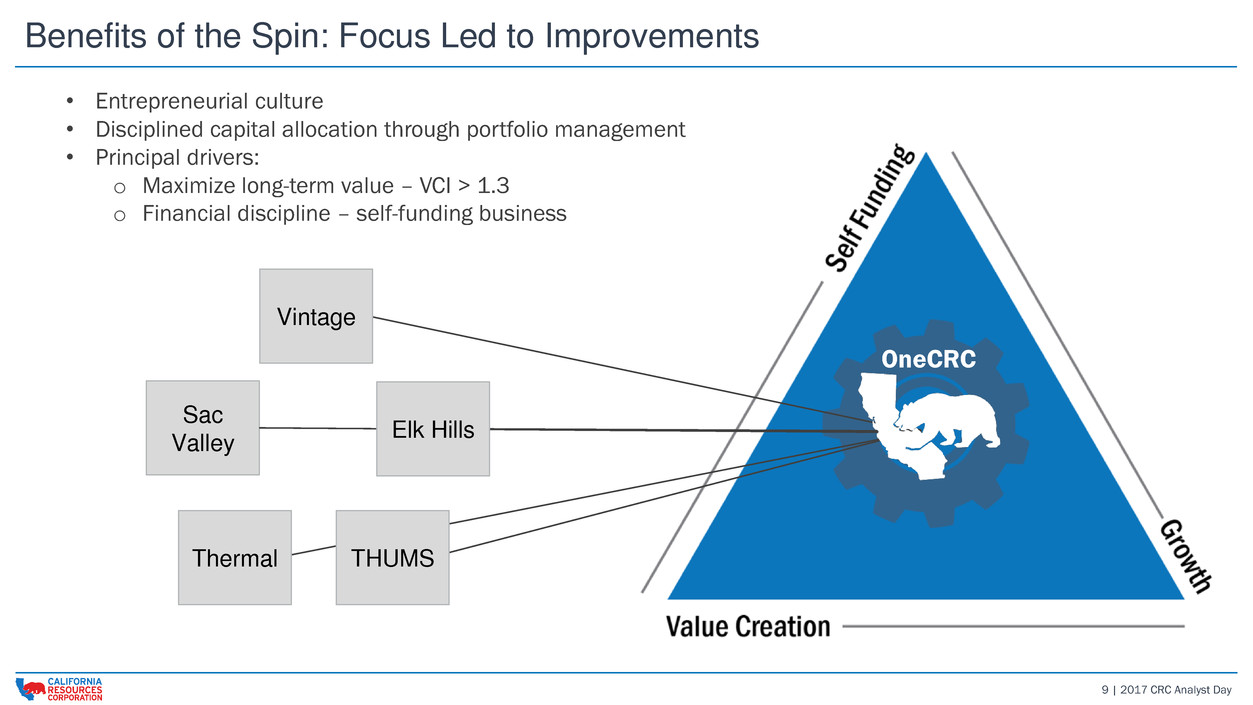

9 | 2017 CRC Analyst Day Benefits of the Spin: Focus Led to Improvements Sac Valley Elk Hills THUMS Vintage Thermal OneCRC • Entrepreneurial culture • Disciplined capital allocation through portfolio management • Principal drivers: o Maximize long-term value – VCI > 1.3 o Financial discipline – self-funding business

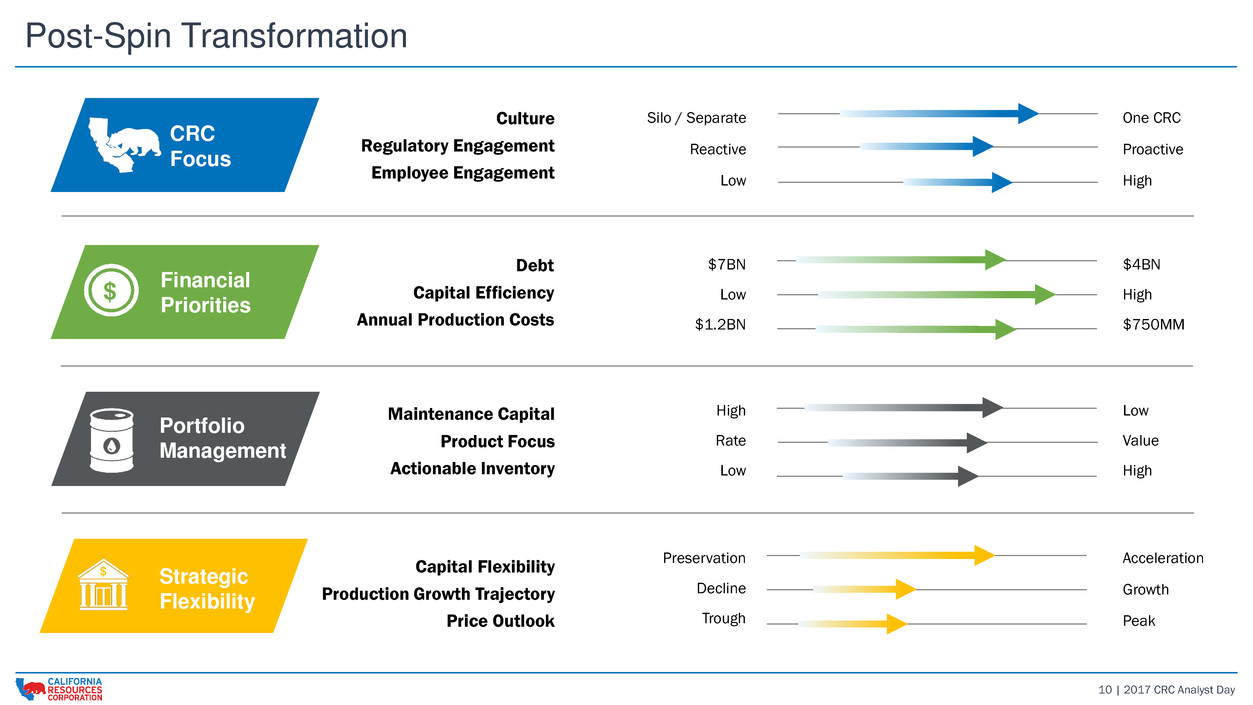

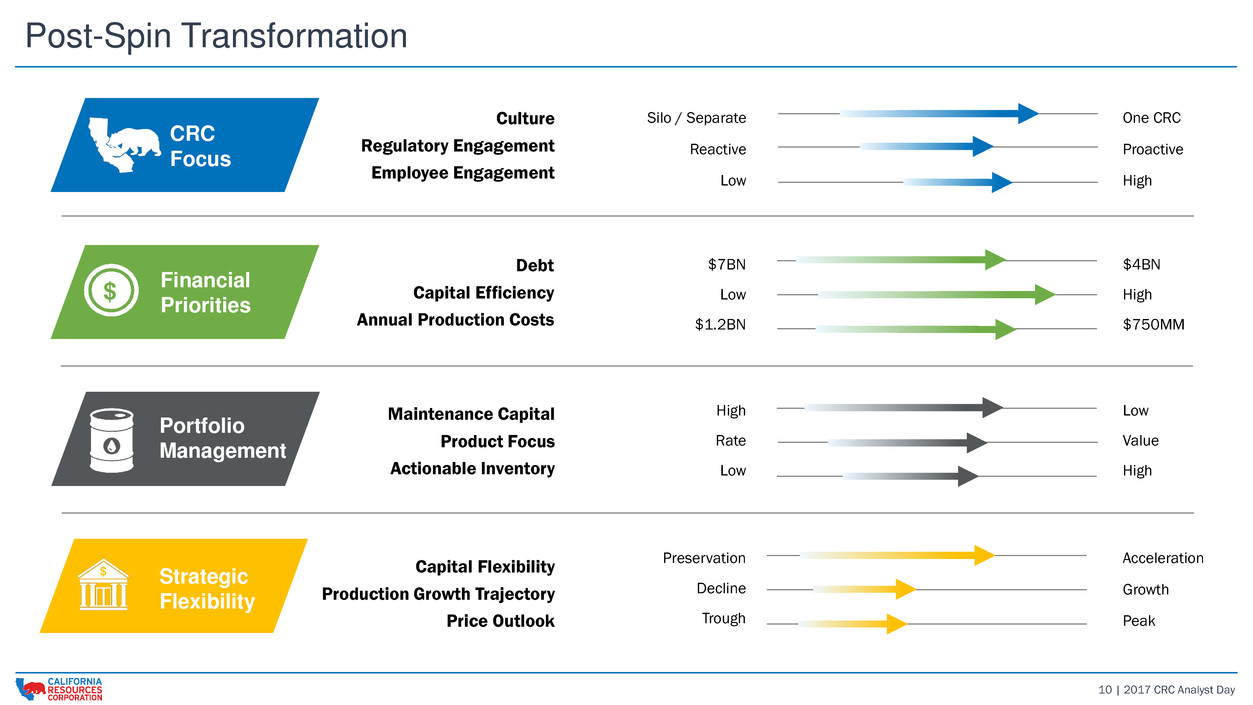

10 | 2017 CRC Analyst Day CRC Focus Post-Spin Transformation Culture Regulatory Engagement Employee Engagement Silo / Separate Reactive Low One CRC Proactive High Financial Priorities $ Debt Capital Efficiency Annual Production Costs $7BN Low $1.2BN $4BN High $750MM Portfolio Management Maintenance Capital Product Focus Actionable Inventory High Rate Low Low Value High Strategic Flexibility Capital Flexibility Production Growth Trajectory Price Outlook Preservation Decline Trough Acceleration Growth Peak $

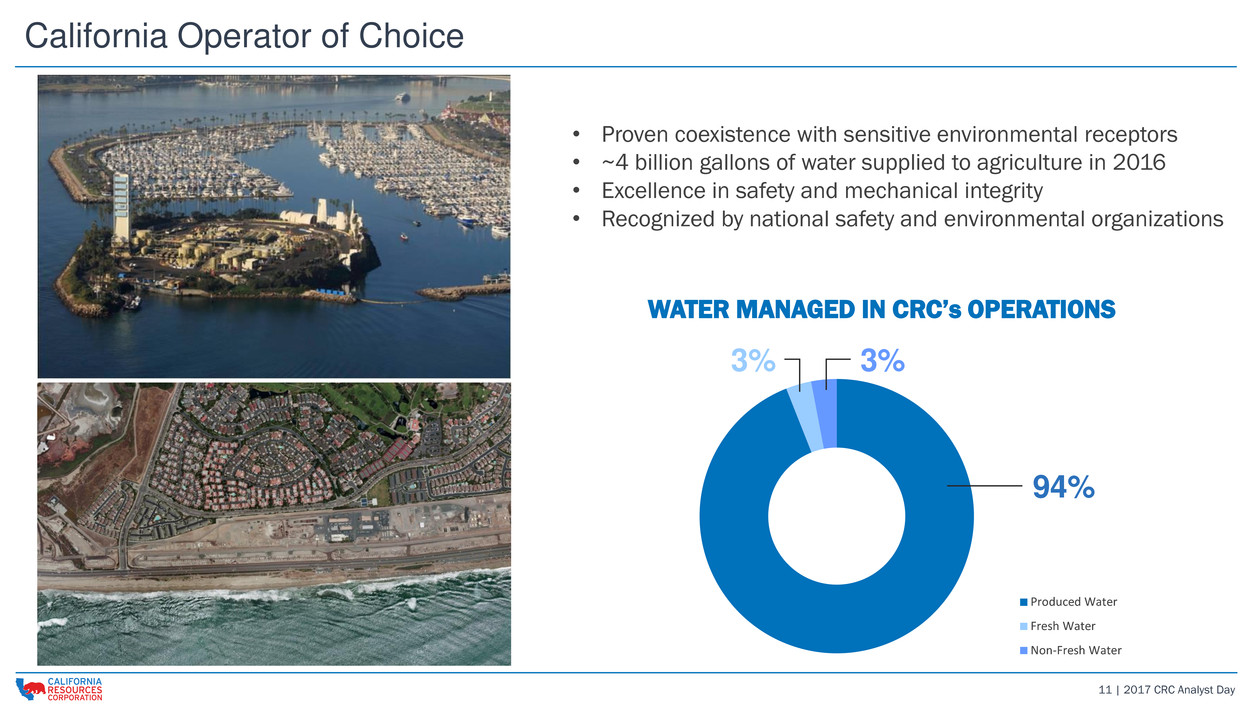

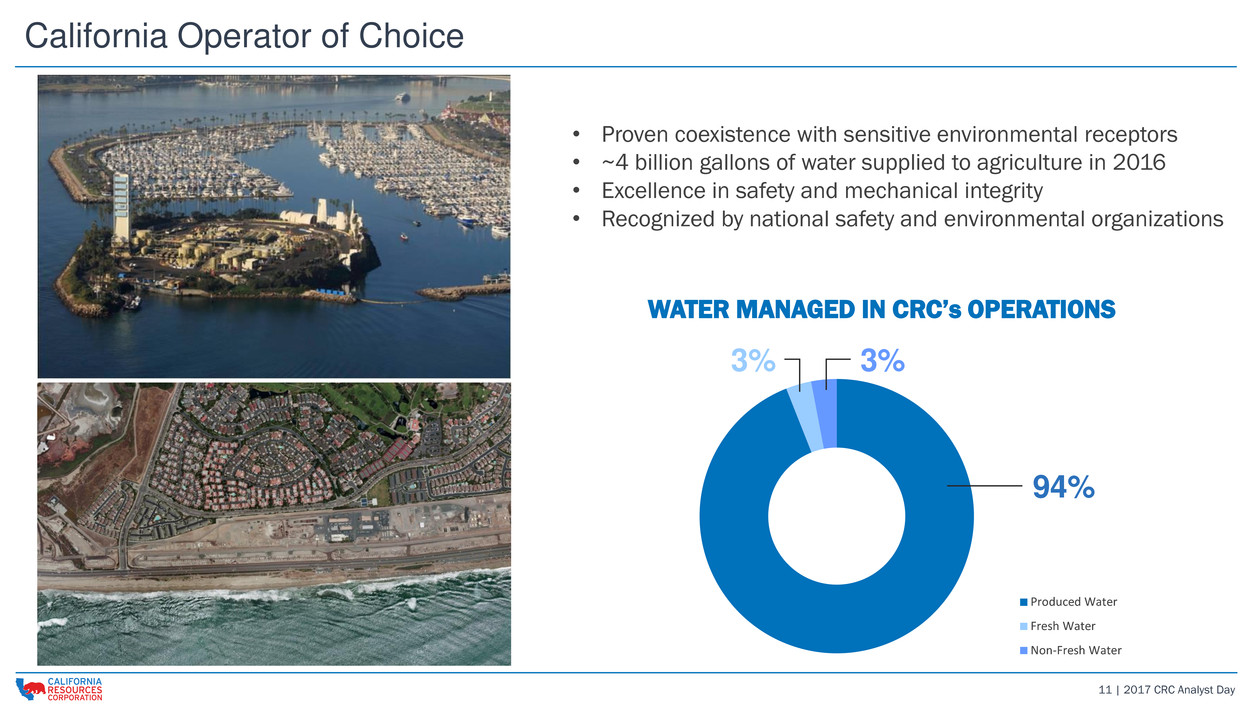

11 | 2017 CRC Analyst Day California Operator of Choice • Proven coexistence with sensitive environmental receptors • ~4 billion gallons of water supplied to agriculture in 2016 • Excellence in safety and mechanical integrity • Recognized by national safety and environmental organizations Produced Water Fresh Water Non-Fresh Water WATER MANAGED IN CRC’s OPERATIONS 3% 3% 94%

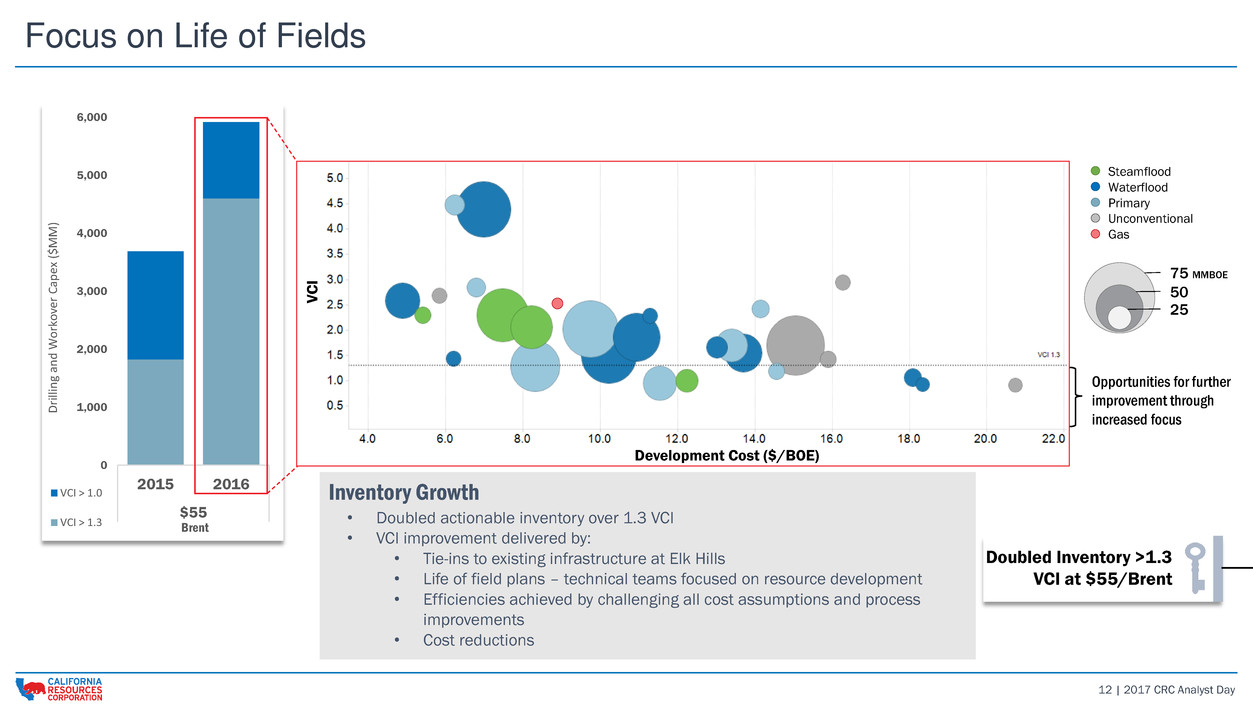

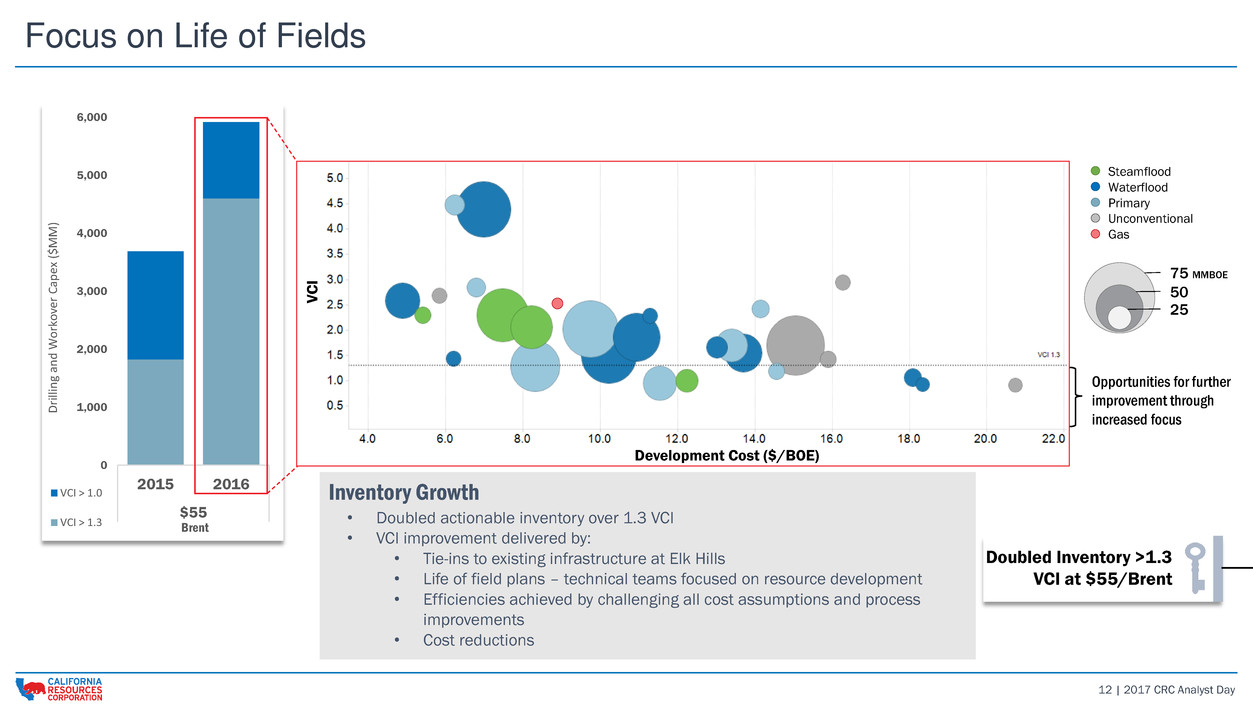

12 | 2017 CRC Analyst Day Steamflood Waterflood Primary Unconventional Gas Focus on Life of Fields 0 1,000 2,000 3,000 4,000 5,000 6,000 2015 2016 $55 Dril lin g an d W o rk o ve r Ca p ex ($MM ) VCI > 1.0 VCI > 1.3 Inventory Growth • Doubled actionable inventory over 1.3 VCI • VCI improvement delivered by: • Tie-ins to existing infrastructure at Elk Hills • Life of field plans – technical teams focused on resource development • Efficiencies achieved by challenging all cost assumptions and process improvements • Cost reductions Opportunities for further improvement through increased focus Brent 25 50 75 MMBOE Doubled Inventory >1.3 VCI at $55/Brent Development Cost ($/BOE) V C I

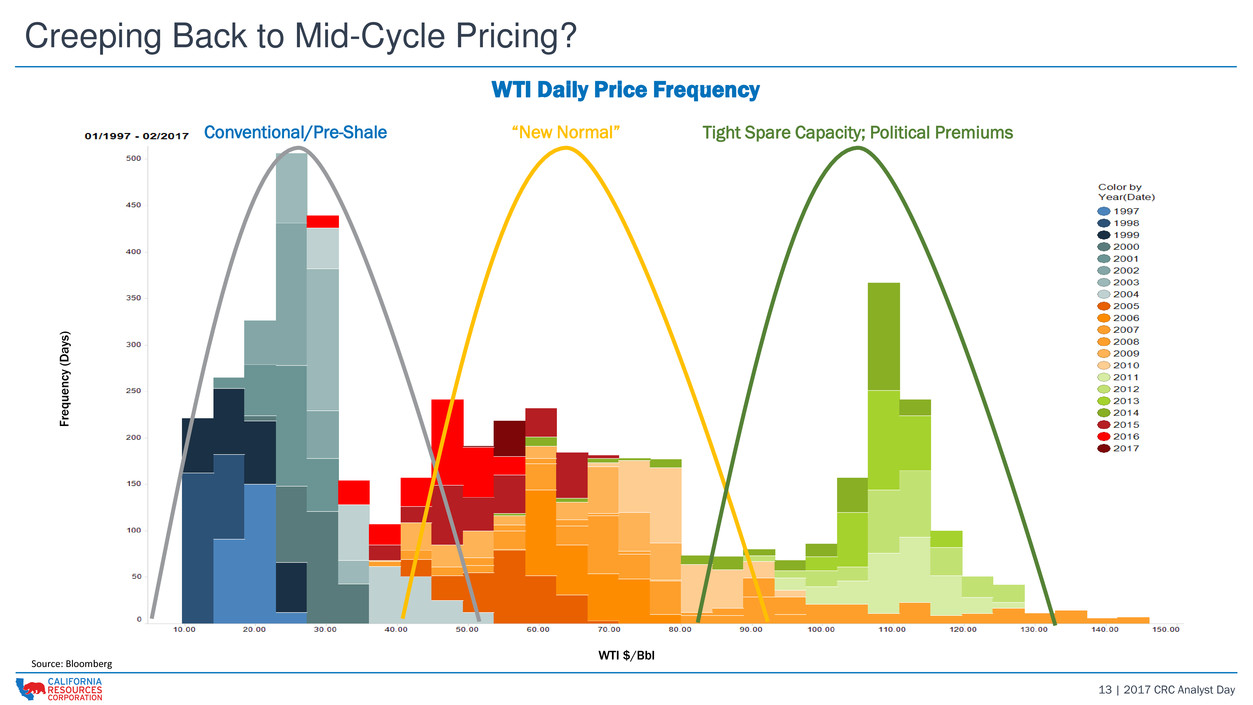

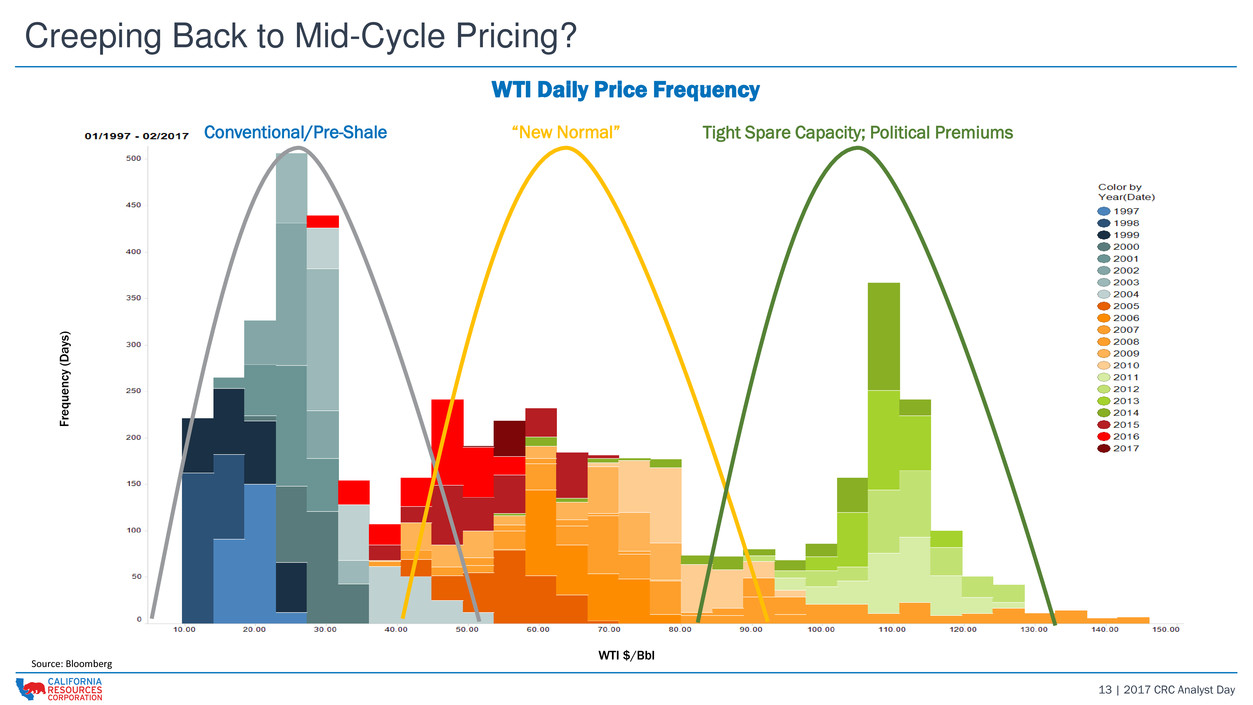

13 | 2017 CRC Analyst Day Creeping Back to Mid-Cycle Pricing? WTI Daily Price Frequency WTI $/Bbl F re qu e n cy ( D a ys ) Conventional/Pre-Shale “New Normal” Tight Spare Capacity; Political Premiums Source: Bloomberg

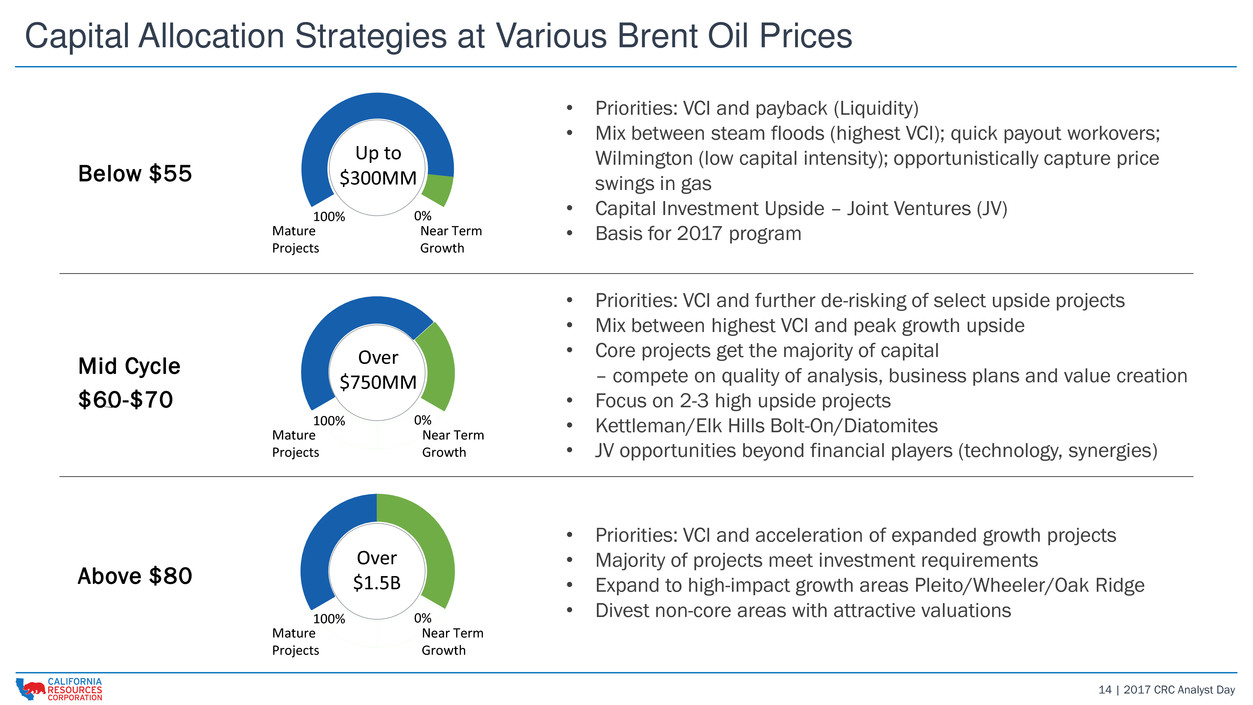

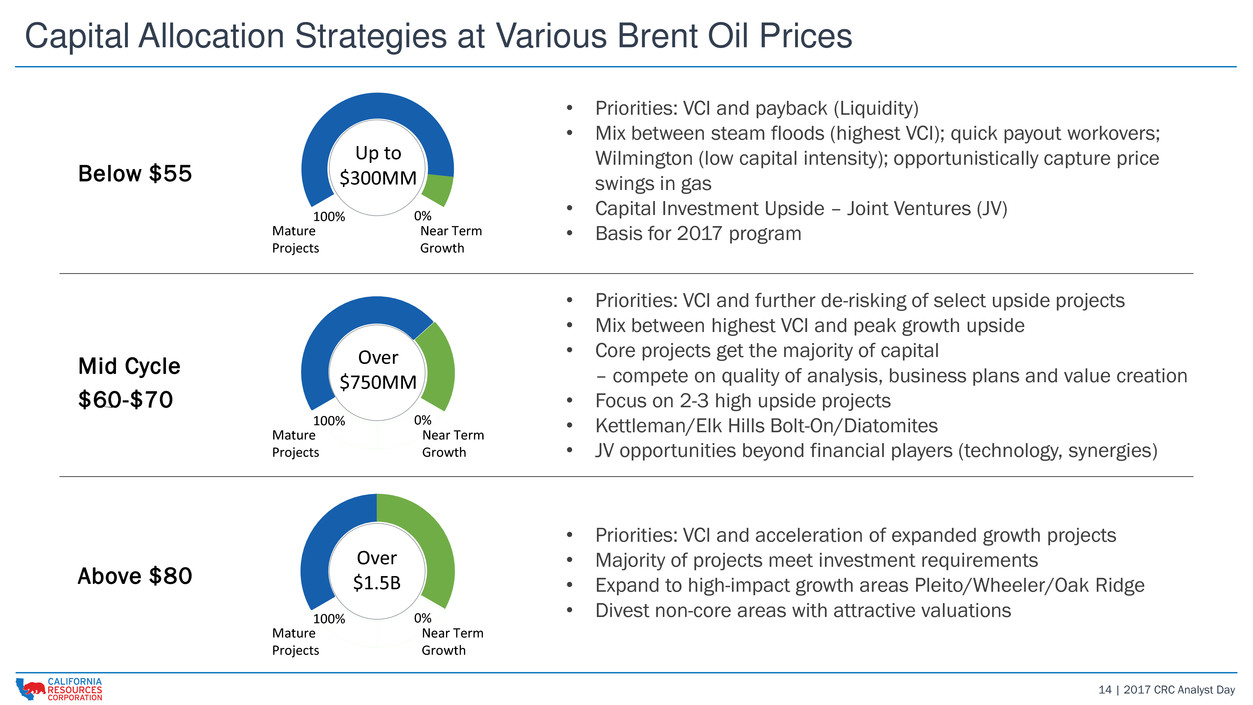

14 | 2017 CRC Analyst Day Mature Projects 100% 0% Near Term Growth Mature Projects 100% 0% Near Term Growth Capital Allocation Strategies at Various Brent Oil Prices Mid Cycle $60-$70 Above $80 • Priorities: VCI and payback (Liquidity) • Mix between steam floods (highest VCI); quick payout workovers; Wilmington (low capital intensity); opportunistically capture price swings in gas • Capital Investment Upside – Joint Ventures (JV) • Basis for 2017 program Up to $300MM Over $750MM Below $55 • Priorities: VCI and acceleration of expanded growth projects • Majority of projects meet investment requirements • Expand to high-impact growth areas Pleito/Wheeler/Oak Ridge • Divest non-core areas with attractive valuations • Priorities: VCI and further de-risking of select upside projects • Mix between highest VCI and peak growth upside • Core projects get the majority of capital – compete on quality of analysis, business plans and value creation • Focus on 2-3 high upside projects • Kettleman/Elk Hills Bolt-On/Diatomites • JV opportunities beyond financial players (technology, synergies) Mature Projects 100% 0% Near Term Growth Over $1.5B

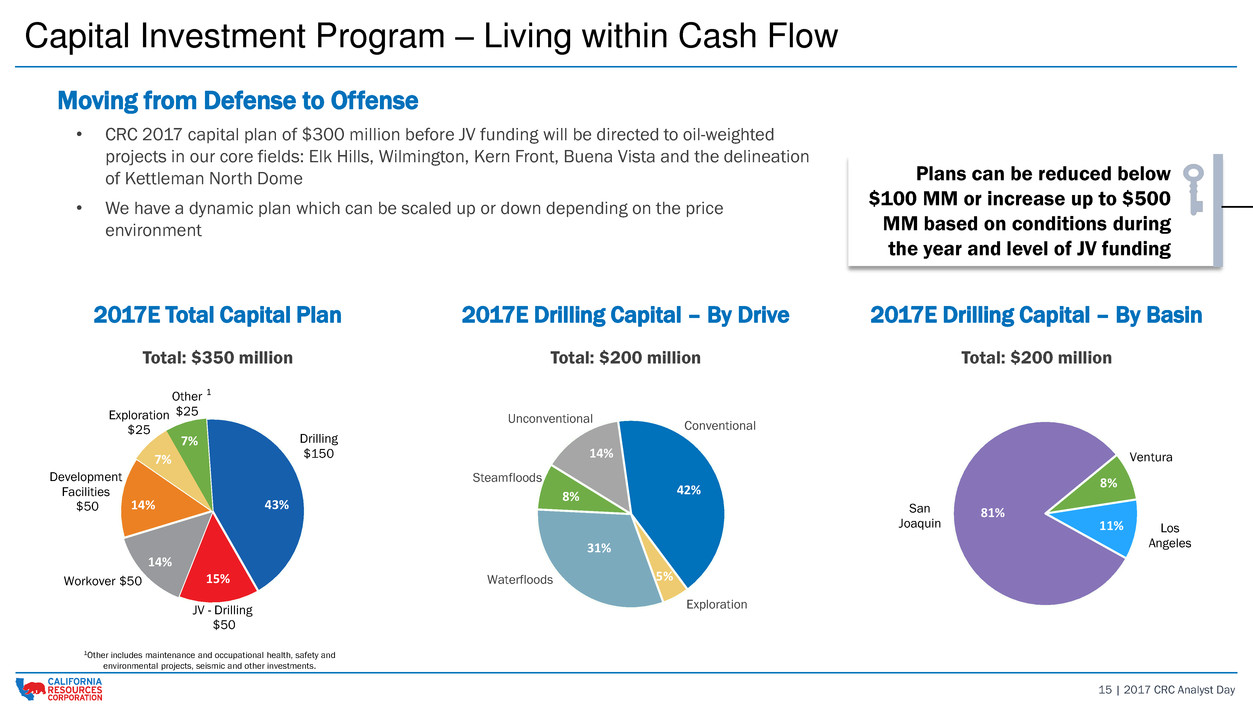

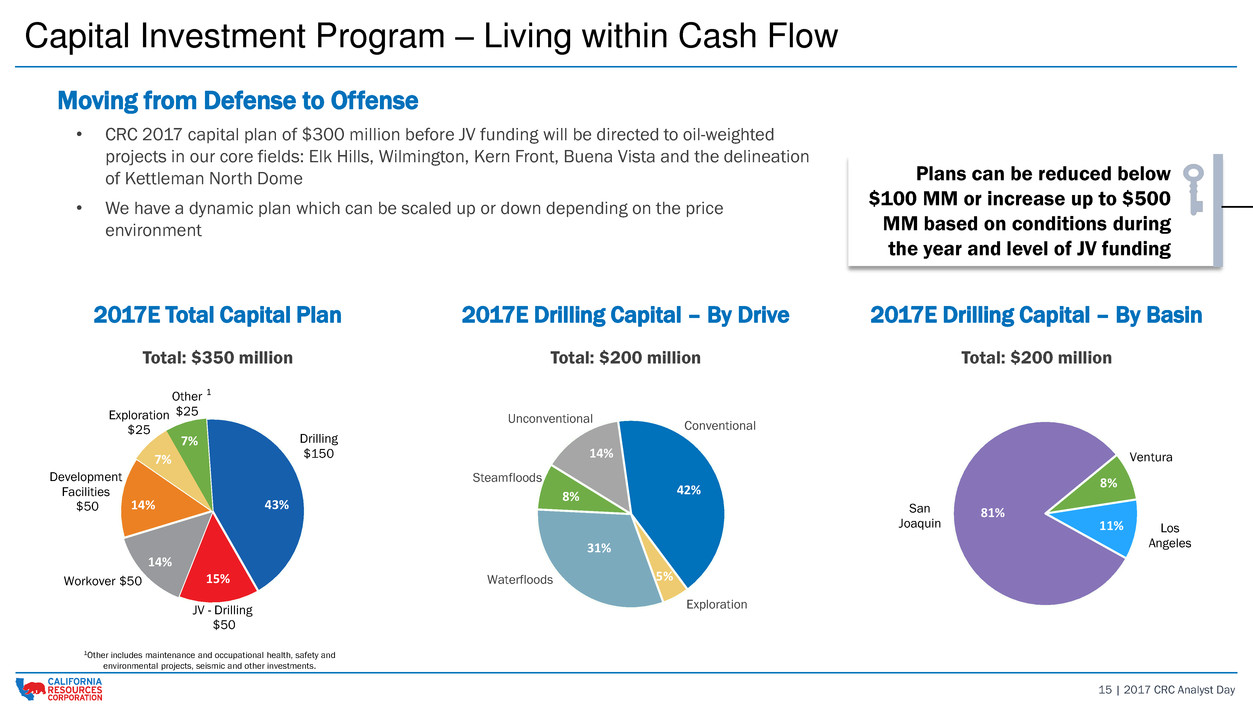

15 | 2017 CRC Analyst Day Drilling $150 JV - Drilling $50 Workover $50 Development Facilities $50 Exploration $25 Other $25 1 San Joaquin Ventura Los Angeles Moving from Defense to Offense • CRC 2017 capital plan of $300 million before JV funding will be directed to oil-weighted projects in our core fields: Elk Hills, Wilmington, Kern Front, Buena Vista and the delineation of Kettleman North Dome • We have a dynamic plan which can be scaled up or down depending on the price environment Capital Investment Program – Living within Cash Flow Total: $350 million 1Other includes maintenance and occupational health, safety and environmental projects, seismic and other investments. 2017E Total Capital Plan 2017E Drilling Capital – By Drive 2017E Drilling Capital – By Basin 43% 15% 14% 14% 7% 7% 8% 11% Conventional Exploration Waterfloods Steamfloods Unconventional 42% 5% 31% 8% 14% 81% Plans can be reduced below $100 MM or increase up to $500 MM based on conditions during the year and level of JV funding Total: $200 million Total: $200 million

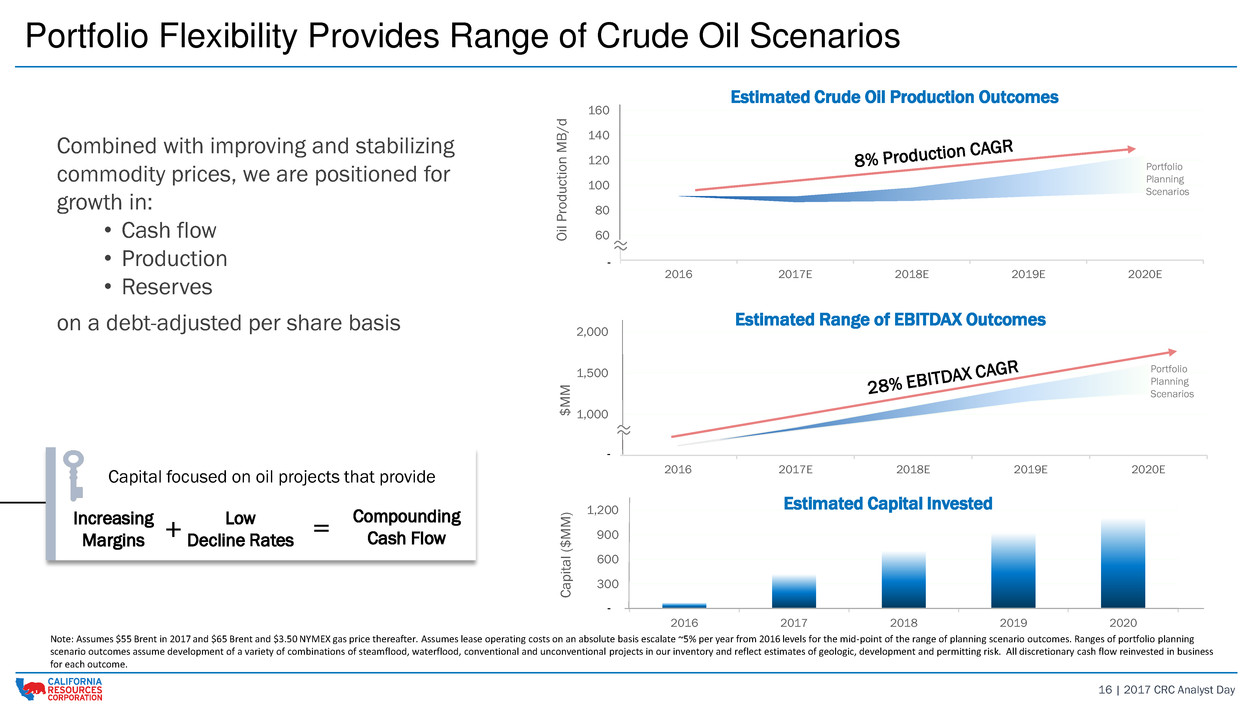

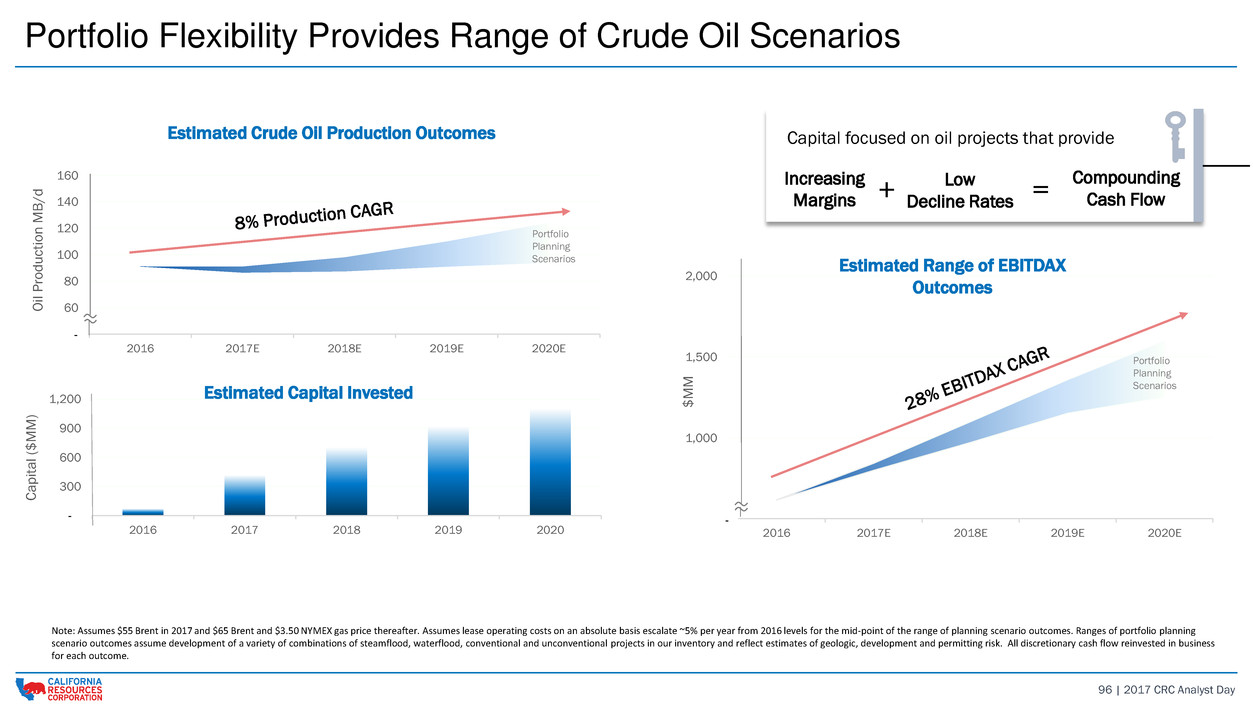

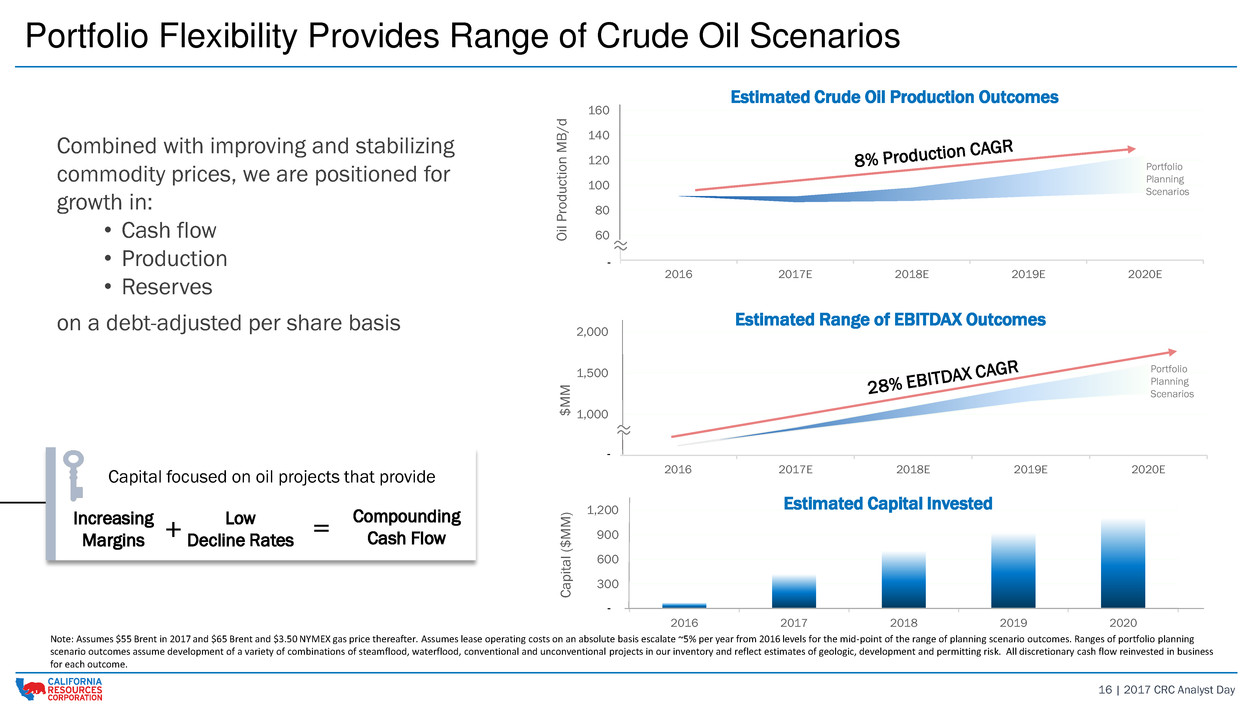

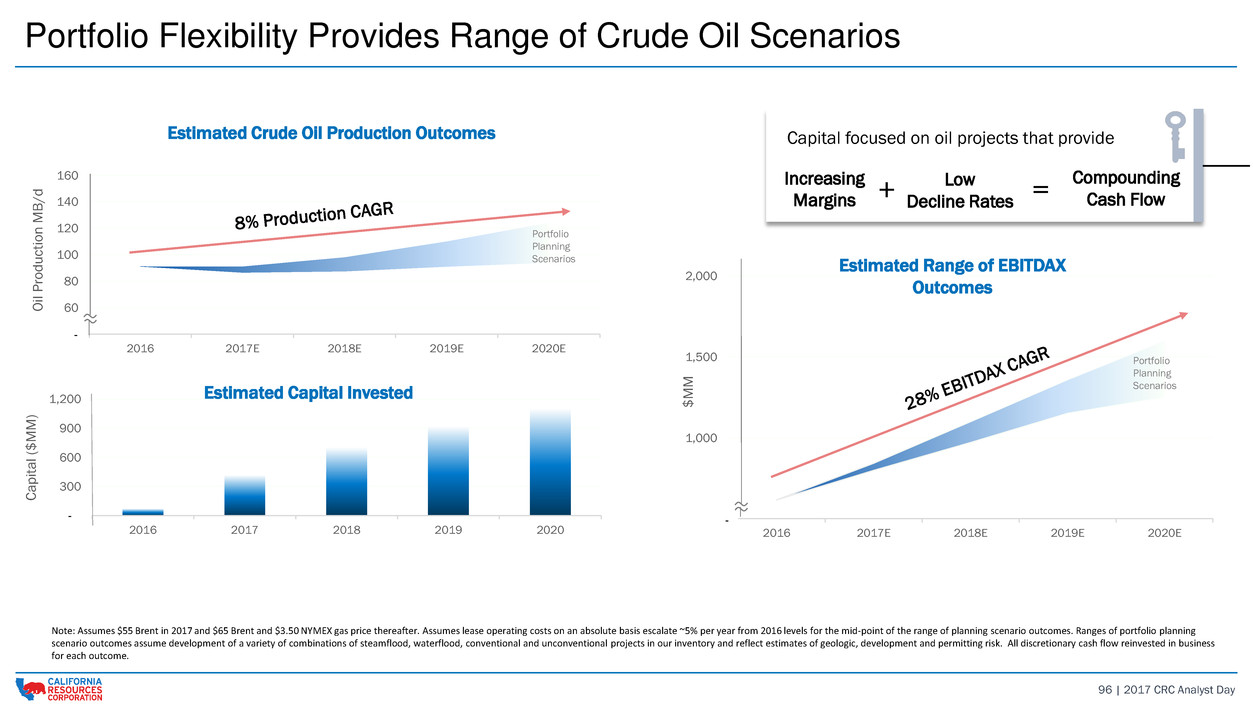

16 | 2017 CRC Analyst Day 40 60 80 100 120 140 160 2016 2017E 2018E 2019E 2020E Oi l P ro d uction M B /d 0 300 600 900 1,200 2016 2017 2018 2019 2020 Capi ta l ($ M M ) 500 1,000 1,500 2,000 2016 2017E 2018E 2019E 2020E $ M M Portfolio Flexibility Provides Range of Crude Oil Scenarios Note: Assumes $55 Brent in 2017 and $65 Brent and $3.50 NYMEX gas price thereafter. Assumes lease operating costs on an absolute basis escalate ~5% per year from 2016 levels for the mid-point of the range of planning scenario outcomes. Ranges of portfolio planning scenario outcomes assume development of a variety of combinations of steamflood, waterflood, conventional and unconventional projects in our inventory and reflect estimates of geologic, development and permitting risk. All discretionary cash flow reinvested in business for each outcome. Combined with improving and stabilizing commodity prices, we are positioned for growth in: • Cash flow • Production • Reserves on a debt-adjusted per share basis Portfolio Planning Scenarios Portfolio Planning Scenarios - ≈ ≈ Capital focused on oil projects that provide Increasing Margins Low Decline Rates Compounding Cash Flow+ = - - Estimated Crude Oil Production Outcomes Estimated Range of EBITDAX Outcomes Estimated Capital Invested

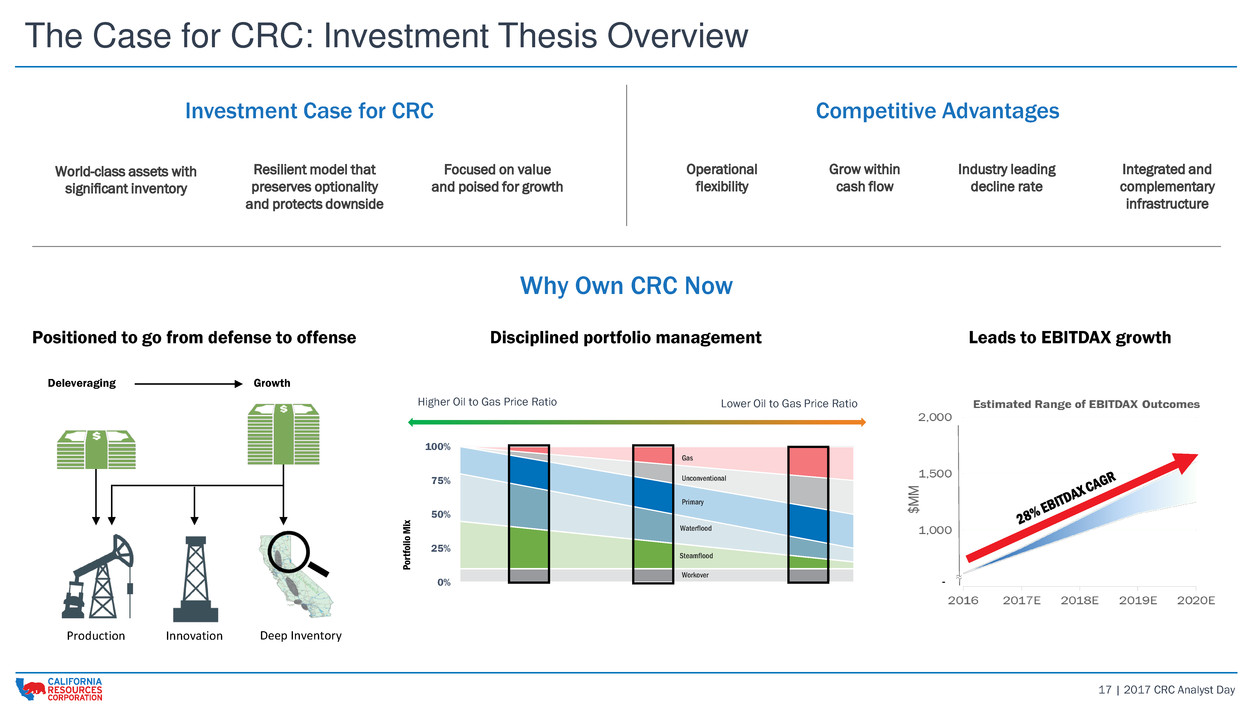

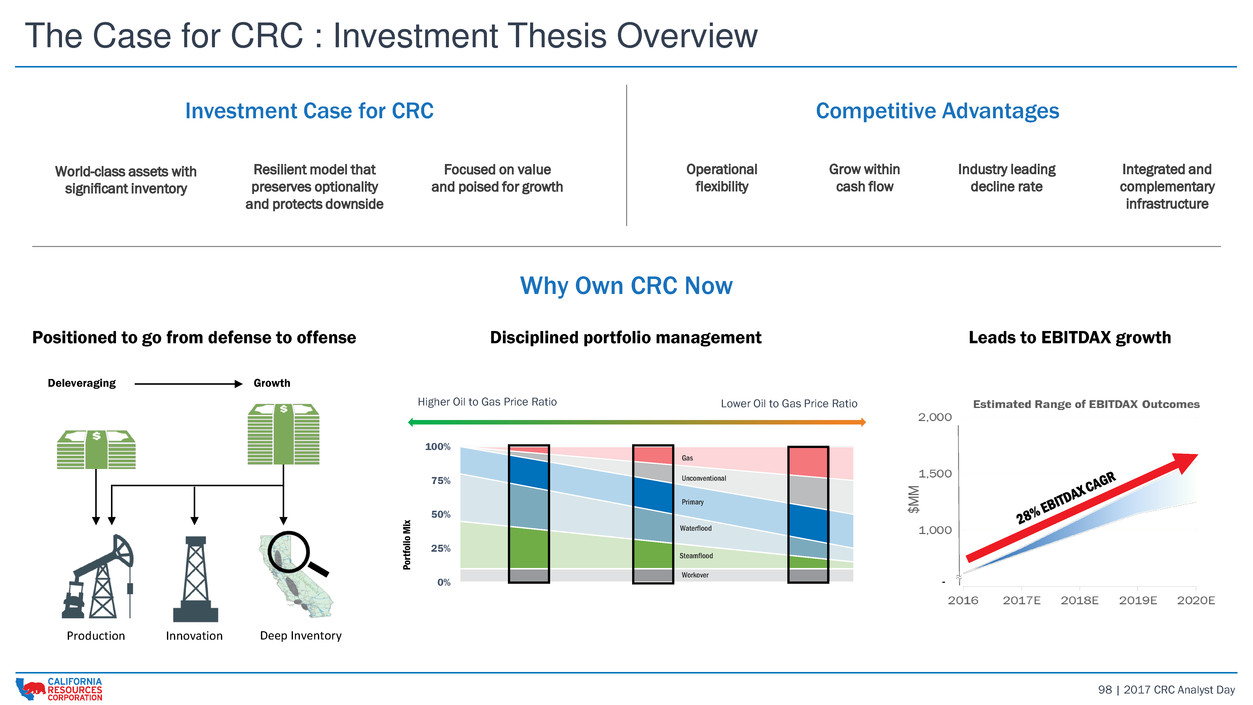

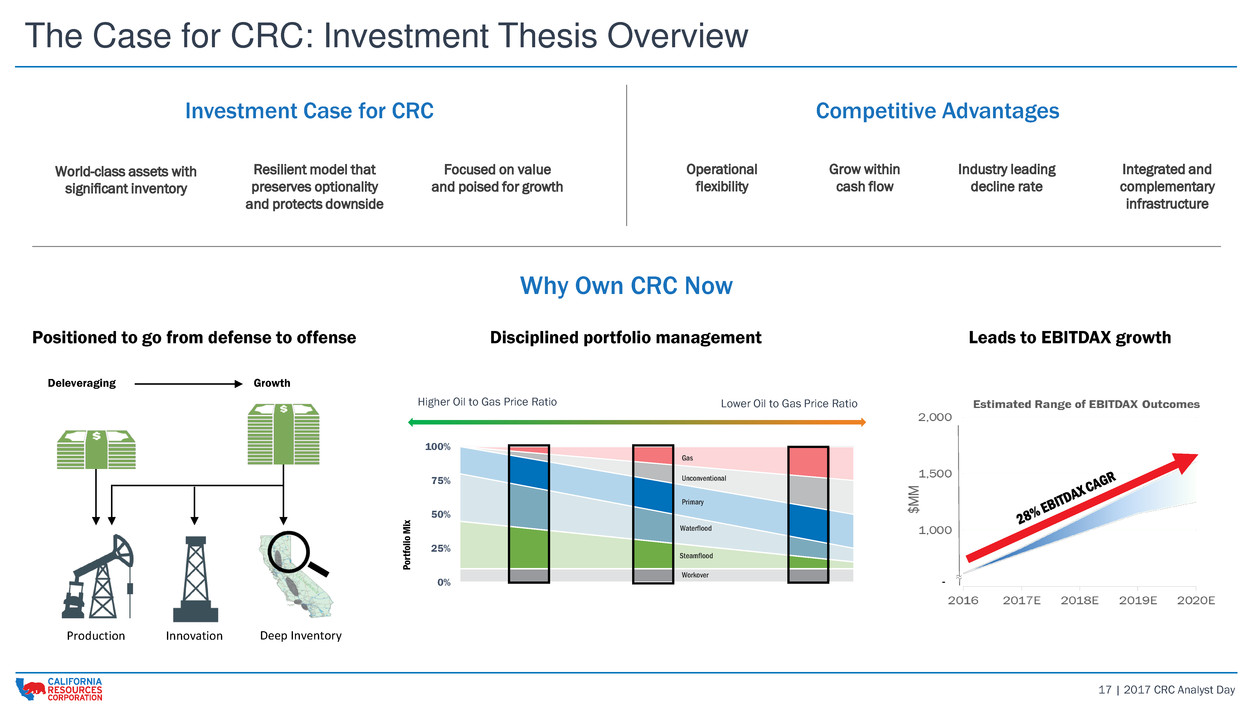

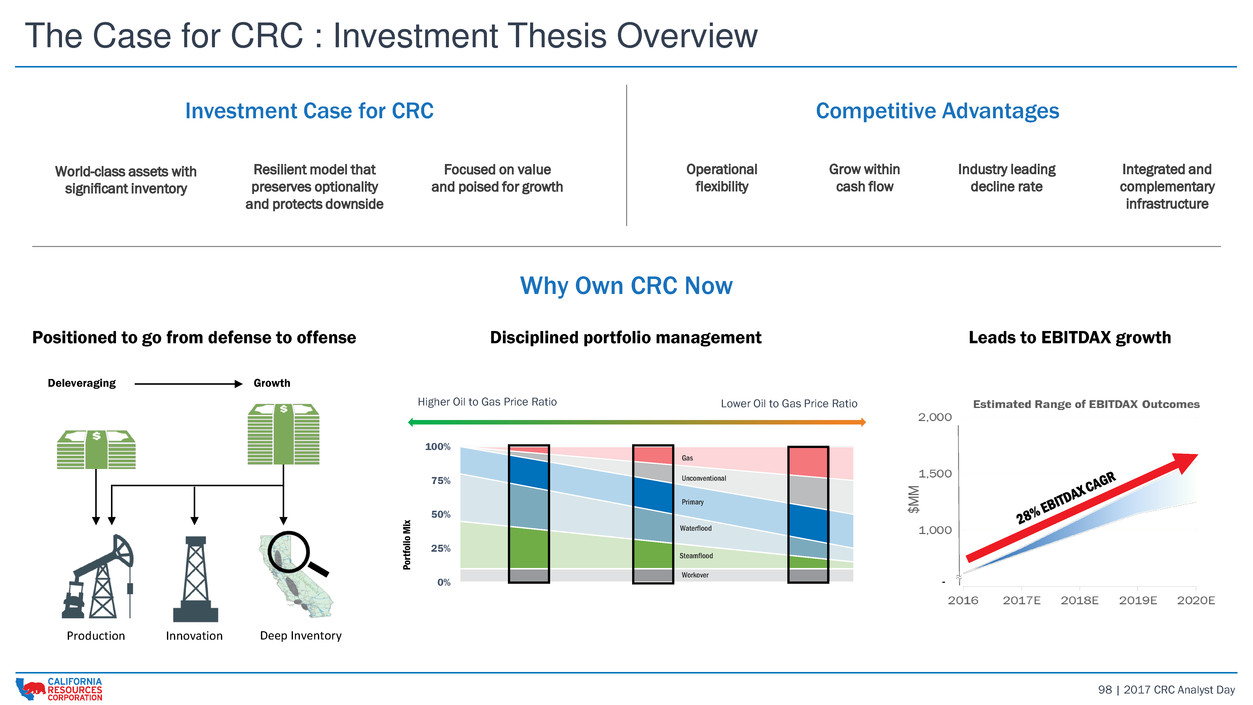

17 | 2017 CRC Analyst Day The Case for CRC: Investment Thesis Overview Operational flexibility Grow within cash flow Industry leading decline rate Integrated and complementary infrastructure 0% 25% 50% 75% 100% P or tf ol io M ix Higher Oil to Gas Price Ratio Lower Oil to Gas Price Ratio Gas Unconventional Primary Waterflood Steamflood Workover Deleveraging Growth Production Innovation Deep Inventory - ≈ Investment Case for CRC World-class assets with significant inventory Resilient model that preserves optionality and protects downside Focused on value and poised for growth Positioned to go from defense to offense Why Own CRC Now Competitive Advantages Disciplined portfolio management Leads to EBITDAX growth

OPERATIONS OVERVIEW CRC 2017 Analyst & Investor Day Bob Barnes | EVP Operations

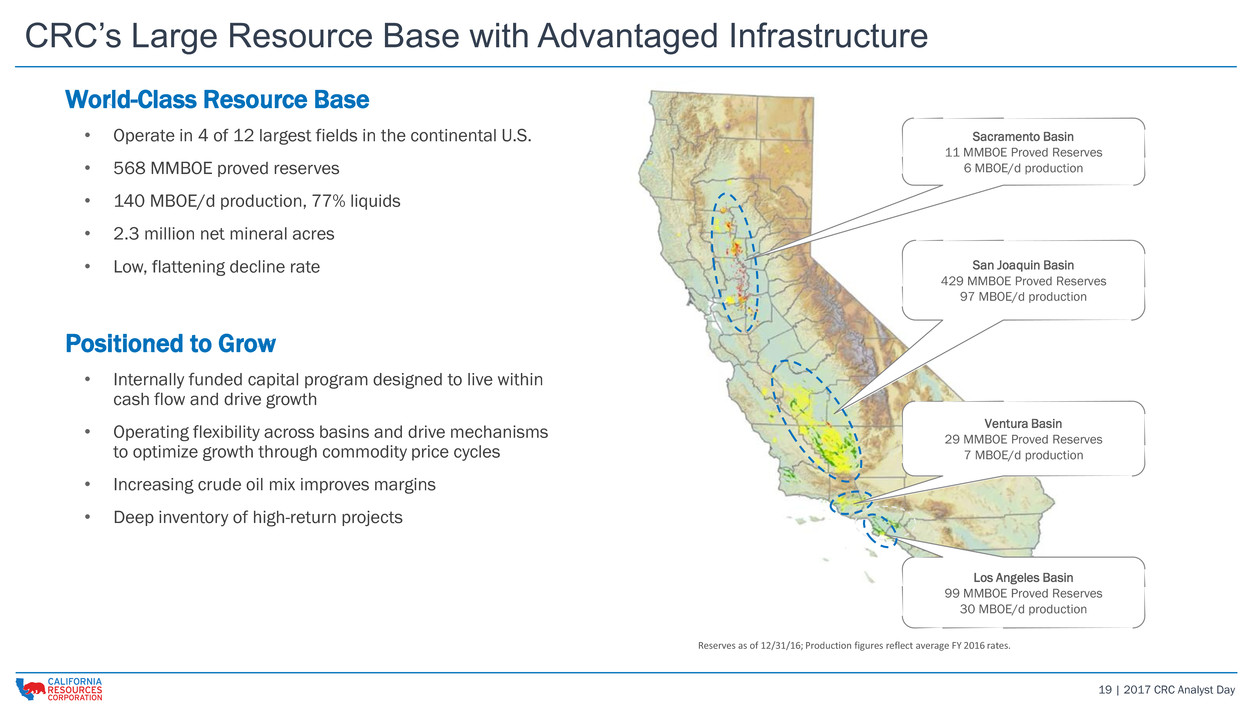

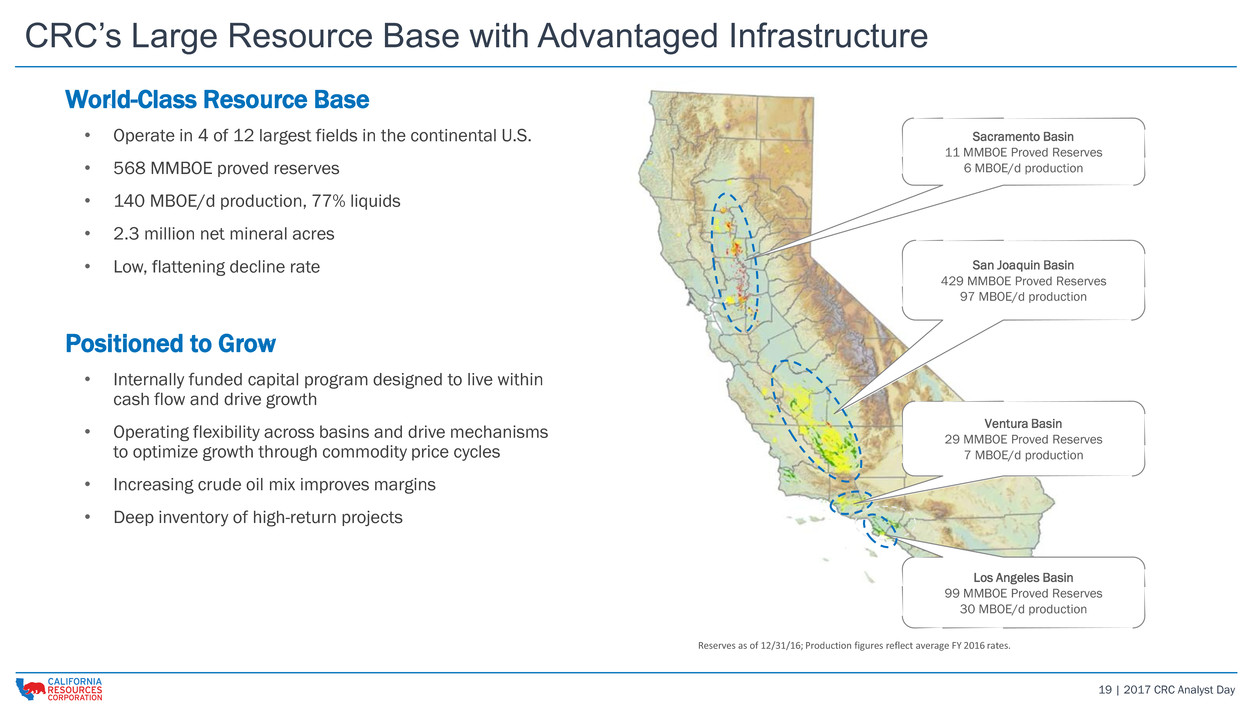

19 | 2017 CRC Analyst Day CRC’s Large Resource Base with Advantaged Infrastructure Sacramento Basin 11 MMBOE Proved Reserves 6 MBOE/d production San Joaquin Basin 429 MMBOE Proved Reserves 97 MBOE/d production Ventura Basin 29 MMBOE Proved Reserves 7 MBOE/d production World-Class Resource Base • Operate in 4 of 12 largest fields in the continental U.S. • 568 MMBOE proved reserves • 140 MBOE/d production, 77% liquids • 2.3 million net mineral acres • Low, flattening decline rate Positioned to Grow • Internally funded capital program designed to live within cash flow and drive growth • Operating flexibility across basins and drive mechanisms to optimize growth through commodity price cycles • Increasing crude oil mix improves margins • Deep inventory of high-return projects Reserves as of 12/31/16; Production figures reflect average FY 2016 rates. Los Angeles Basin 99 MMBOE Proved Reserves 30 MBOE/d production

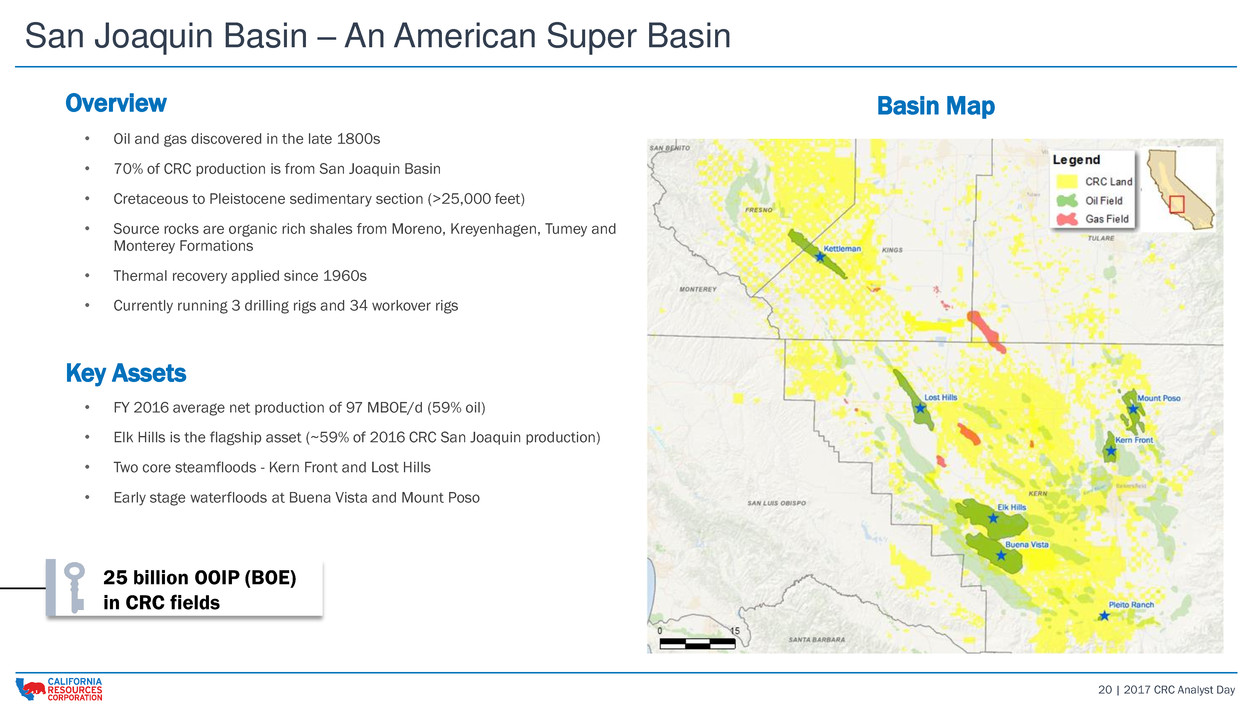

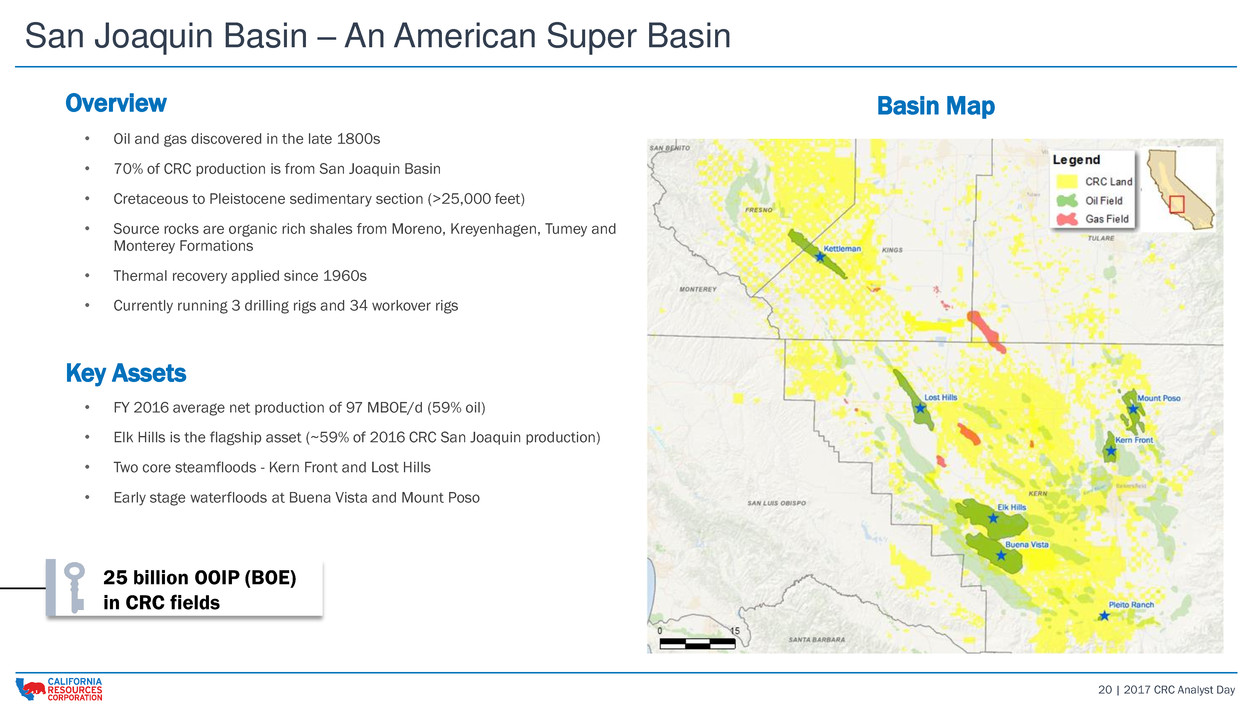

20 | 2017 CRC Analyst Day San Joaquin Basin – An American Super Basin Overview • Oil and gas discovered in the late 1800s • 70% of CRC production is from San Joaquin Basin • Cretaceous to Pleistocene sedimentary section (>25,000 feet) • Source rocks are organic rich shales from Moreno, Kreyenhagen, Tumey and Monterey Formations • Thermal recovery applied since 1960s • Currently running 3 drilling rigs and 34 workover rigs Key Assets • FY 2016 average net production of 97 MBOE/d (59% oil) • Elk Hills is the flagship asset (~59% of 2016 CRC San Joaquin production) • Two core steamfloods - Kern Front and Lost Hills • Early stage waterfloods at Buena Vista and Mount Poso 25 billion OOIP (BOE) in CRC fields Basin Map

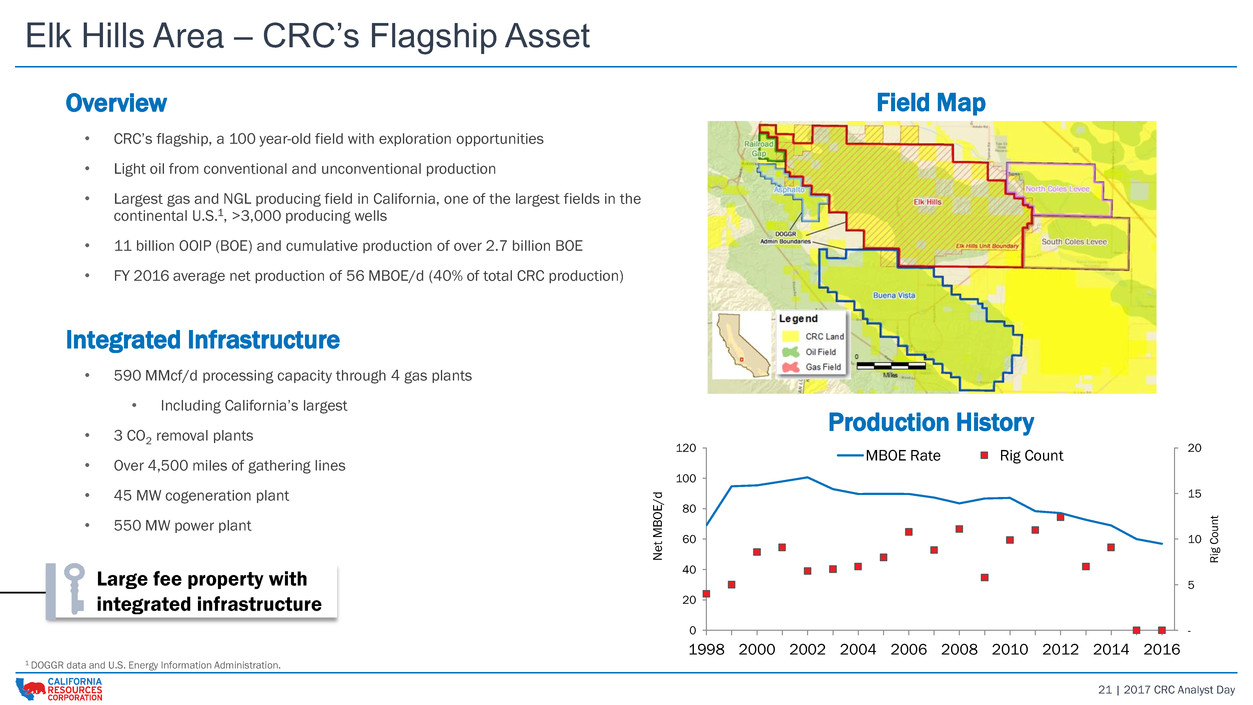

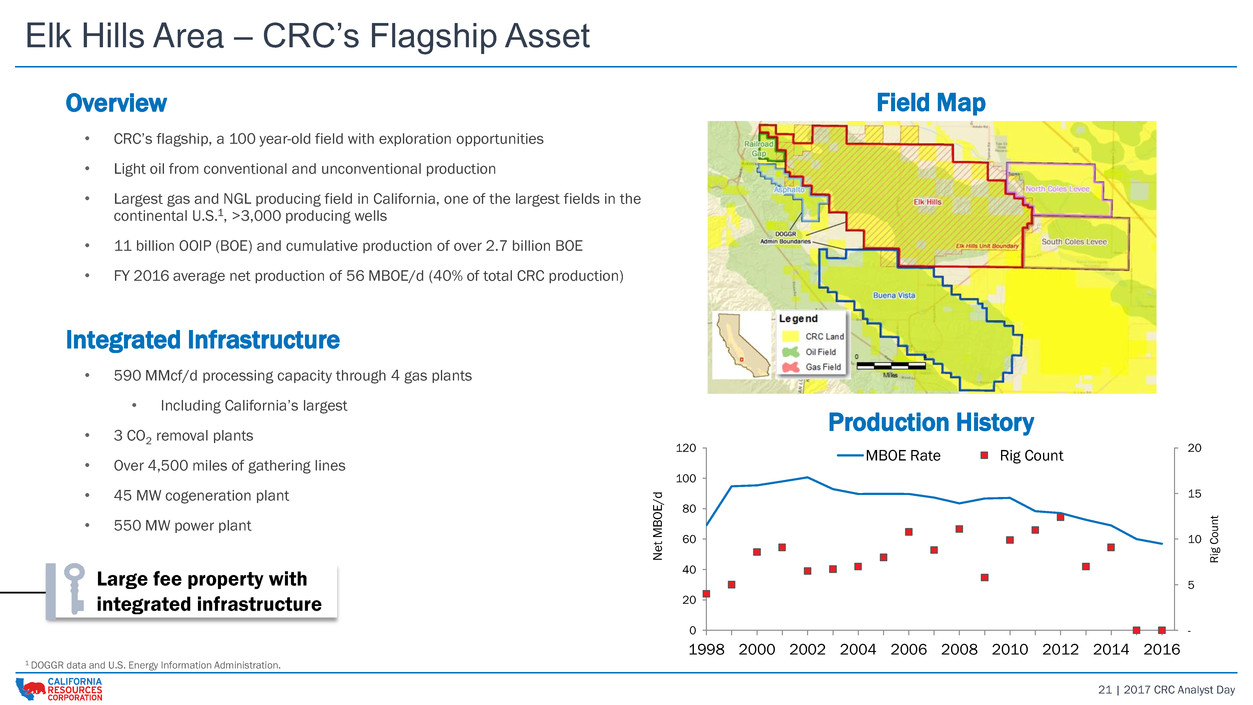

21 | 2017 CRC Analyst Day Elk Hills Area – CRC’s Flagship Asset Integrated Infrastructure • 590 MMcf/d processing capacity through 4 gas plants • Including California’s largest • 3 CO2 removal plants • Over 4,500 miles of gathering lines • 45 MW cogeneration plant • 550 MW power plant 1 DOGGR data and U.S. Energy Information Administration. - 5 10 15 20 0 20 40 60 80 100 120 1998 2000 2002 2004 2006 2008 2010 2012 2014 2016 Rig C o u n t N et M B O E /d MBOE Rate Rig Count Overview • CRC’s flagship, a 100 year-old field with exploration opportunities • Light oil from conventional and unconventional production • Largest gas and NGL producing field in California, one of the largest fields in the continental U.S.1, >3,000 producing wells • 11 billion OOIP (BOE) and cumulative production of over 2.7 billion BOE • FY 2016 average net production of 56 MBOE/d (40% of total CRC production) Field Map Production History Large fee property with integrated infrastructure

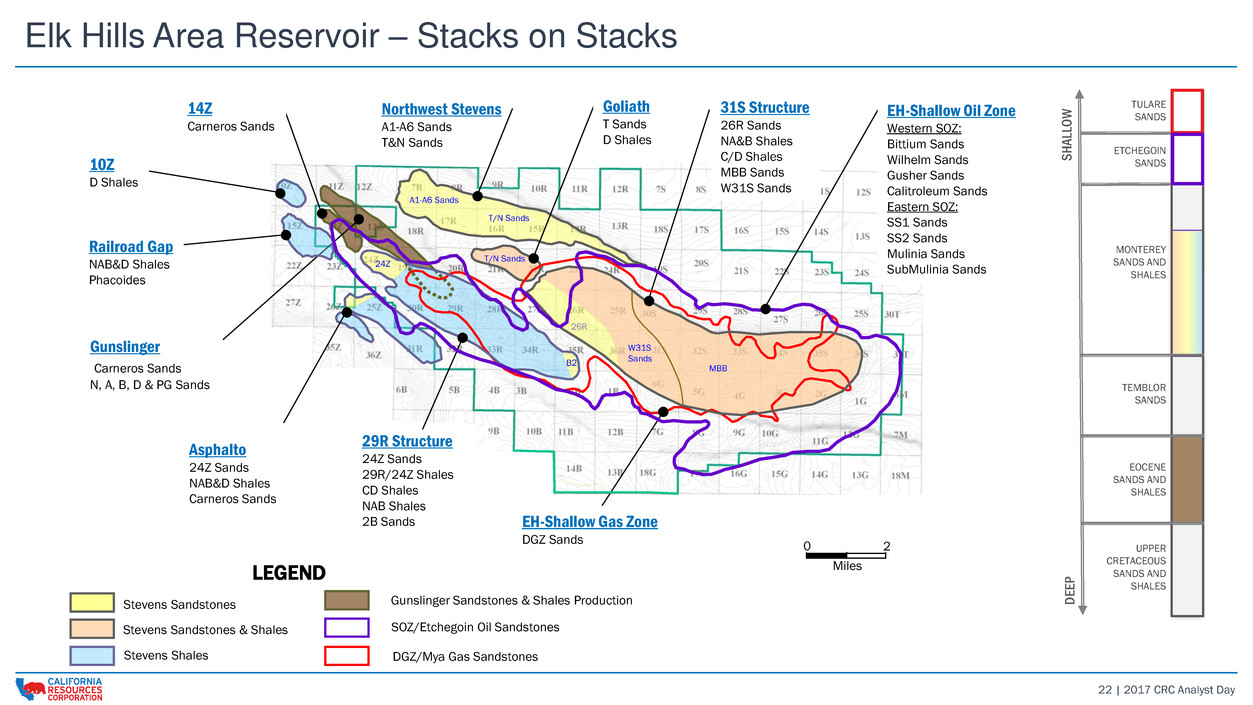

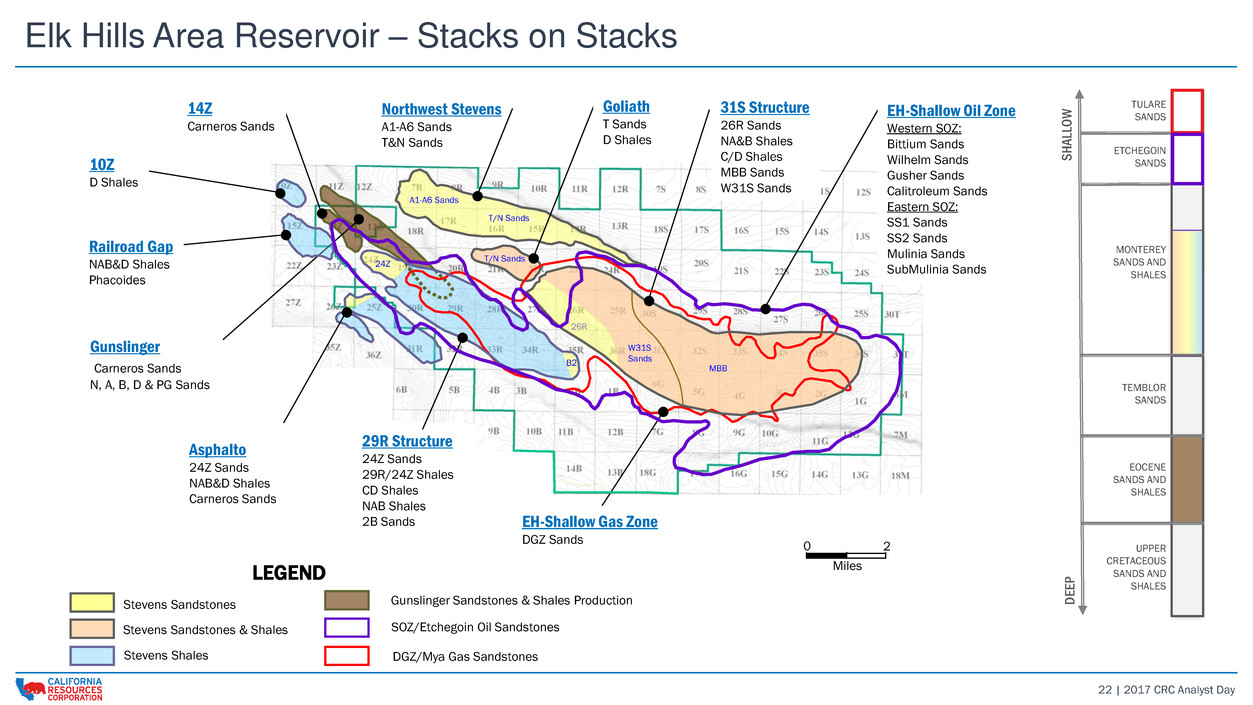

22 | 2017 CRC Analyst Day Elk Hills Area Reservoir – Stacks on Stacks TEMBLOR SANDS EOCENE SANDS AND SHALES UPPER CRETACEOUS SANDS AND SHALES MONTEREY SANDS AND SHALES TULARE SANDS SH A LL O W D EE P ETCHEGOIN SANDS LEGEND Stevens Sandstones Stevens Shales Stevens Sandstones & Shales Gunslinger Sandstones & Shales Production SOZ/Etchegoin Oil Sandstones DGZ/Mya Gas Sandstones 20 Miles A1-A6 Sands T/N Sands Goliath T Sands D Shales T/N Sands 14Z Carneros Sands Gunslinger Carneros Sands N, A, B, D & PG Sands W31S Sands 26R MBB 10Z D Shales Railroad Gap NAB&D Shales Phacoides Asphalto 24Z Sands NAB&D Shales Carneros Sands 29R Structure 24Z Sands 29R/24Z Shales CD Shales NAB Shales 2B Sands 24Z B2 EH-Shallow Gas Zone DGZ Sands Northwest Stevens A1-A6 Sands T&N Sands 31S Structure 26R Sands NA&B Shales C/D Shales MBB Sands W31S Sands EH-Shallow Oil Zone Western SOZ: Bittium Sands Wilhelm Sands Gusher Sands Calitroleum Sands Eastern SOZ: SS1 Sands SS2 Sands Mulinia Sands SubMulinia Sands

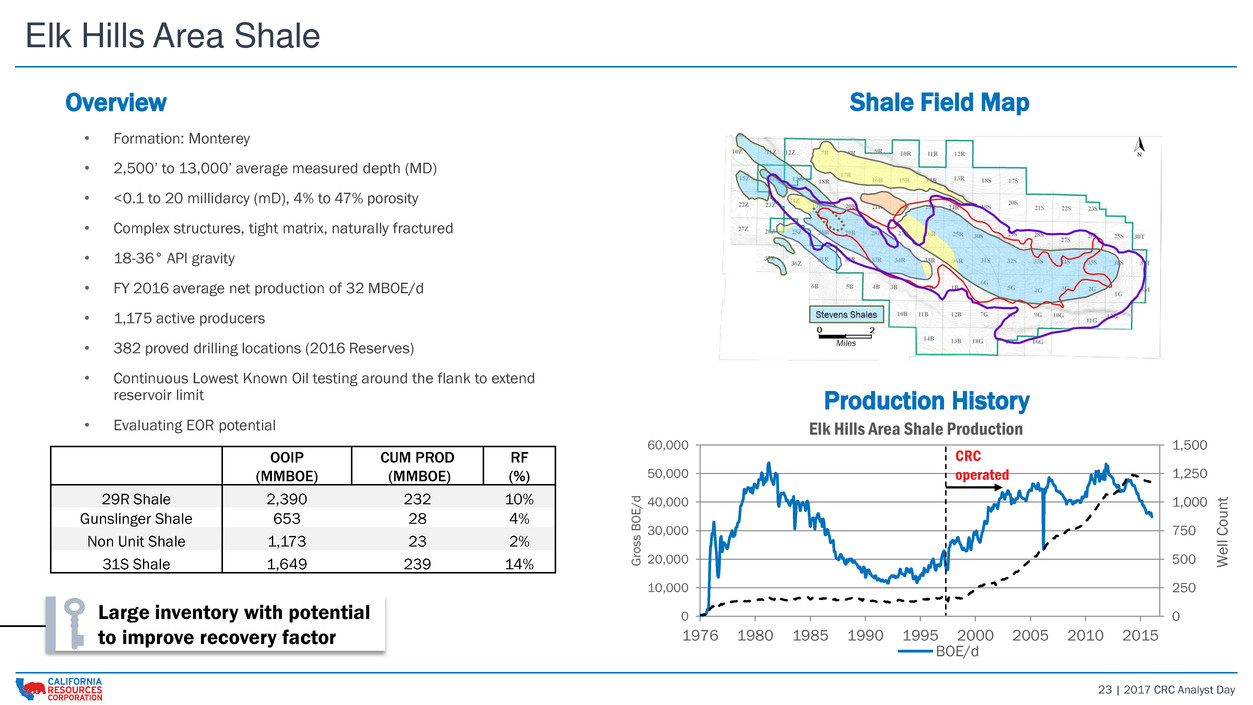

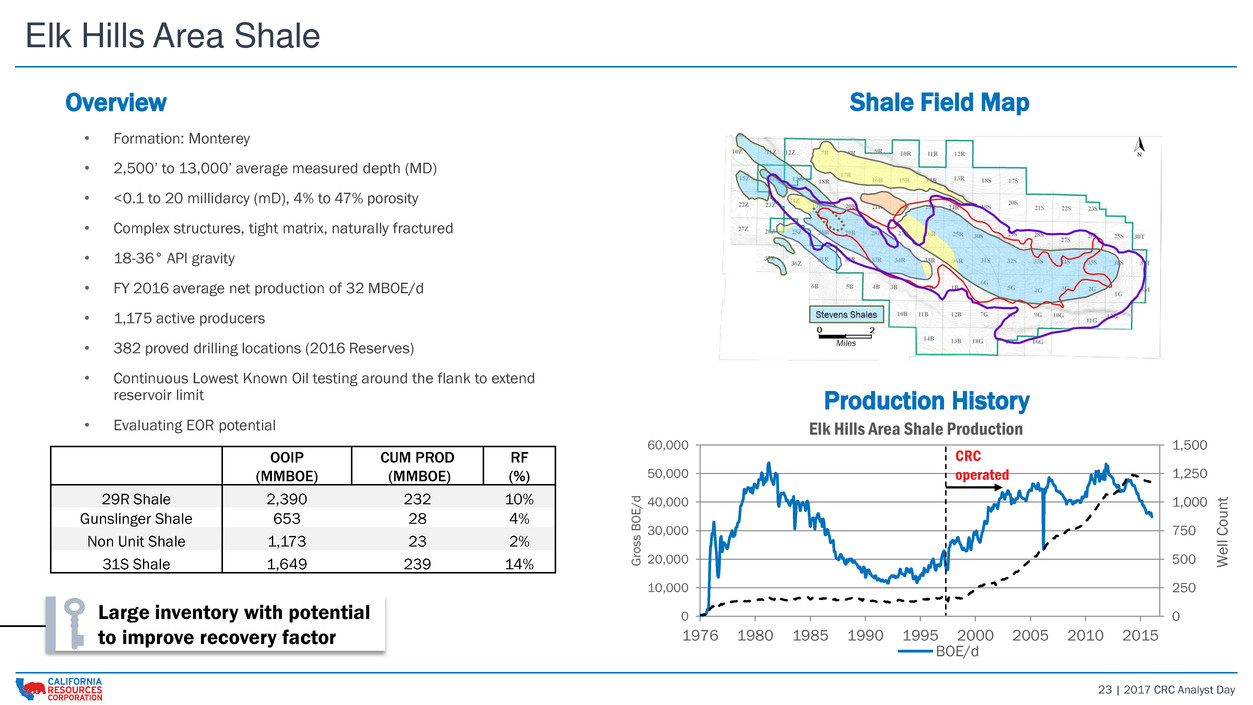

23 | 2017 CRC Analyst Day Elk Hills Area Shale Overview • Formation: Monterey • 2,500’ to 13,000’ average measured depth (MD) • <0.1 to 20 millidarcy (mD), 4% to 47% porosity • Complex structures, tight matrix, naturally fractured • 18-36° API gravity • FY 2016 average net production of 32 MBOE/d • 1,175 active producers • 382 proved drilling locations (2016 Reserves) • Continuous Lowest Known Oil testing around the flank to extend reservoir limit • Evaluating EOR potential WSOZ FIELD MAP OOIP (MMBOE) CUM PROD (MMBOE) RF (%) 29R Shale 2,390 232 10% Gunslinger Shale 653 28 4% Non Unit Shale 1,173 23 2% 31S Shale 1,649 239 14% 0 250 500 750 1,000 1,250 1,500 0 10,000 20,000 30,000 40,000 50,000 60,000 1976 1980 1985 1990 1995 2000 2005 2010 2015 W ell Cou n t G ro ss B O E /d Elk Hills Area Shale Production BOE/d CRC operated Shale Field Map Production History Large inventory with potential to improve recovery factor

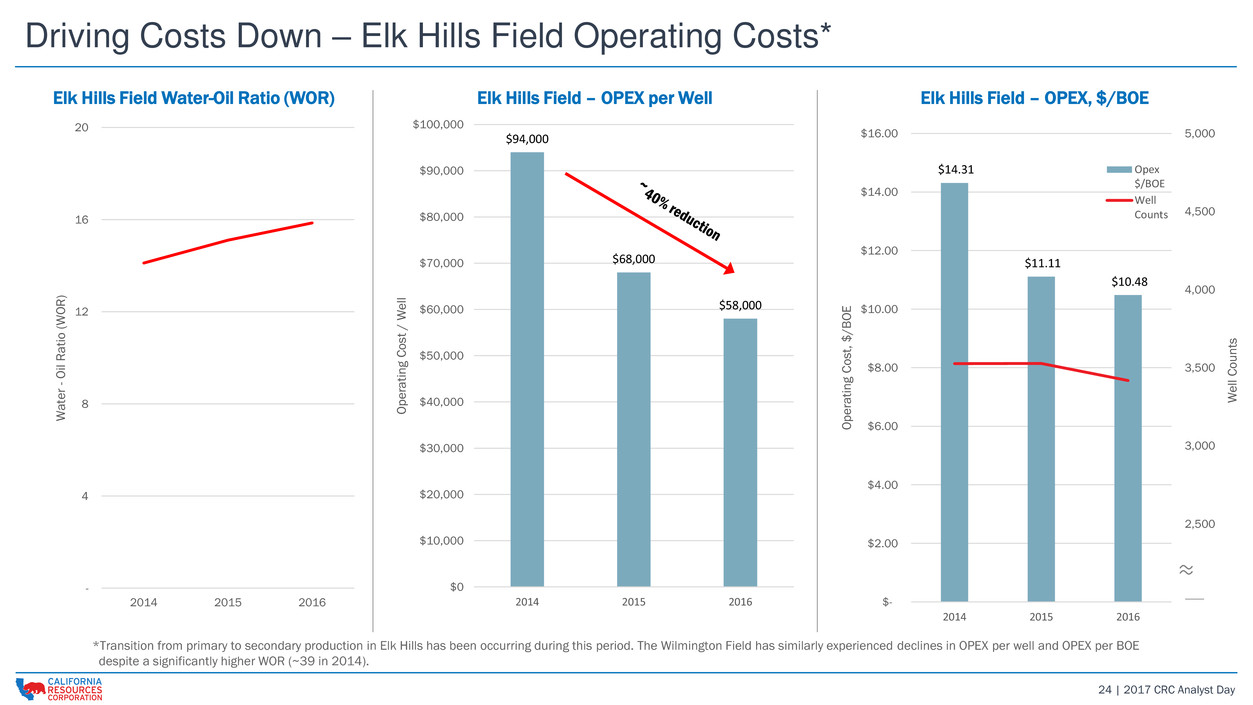

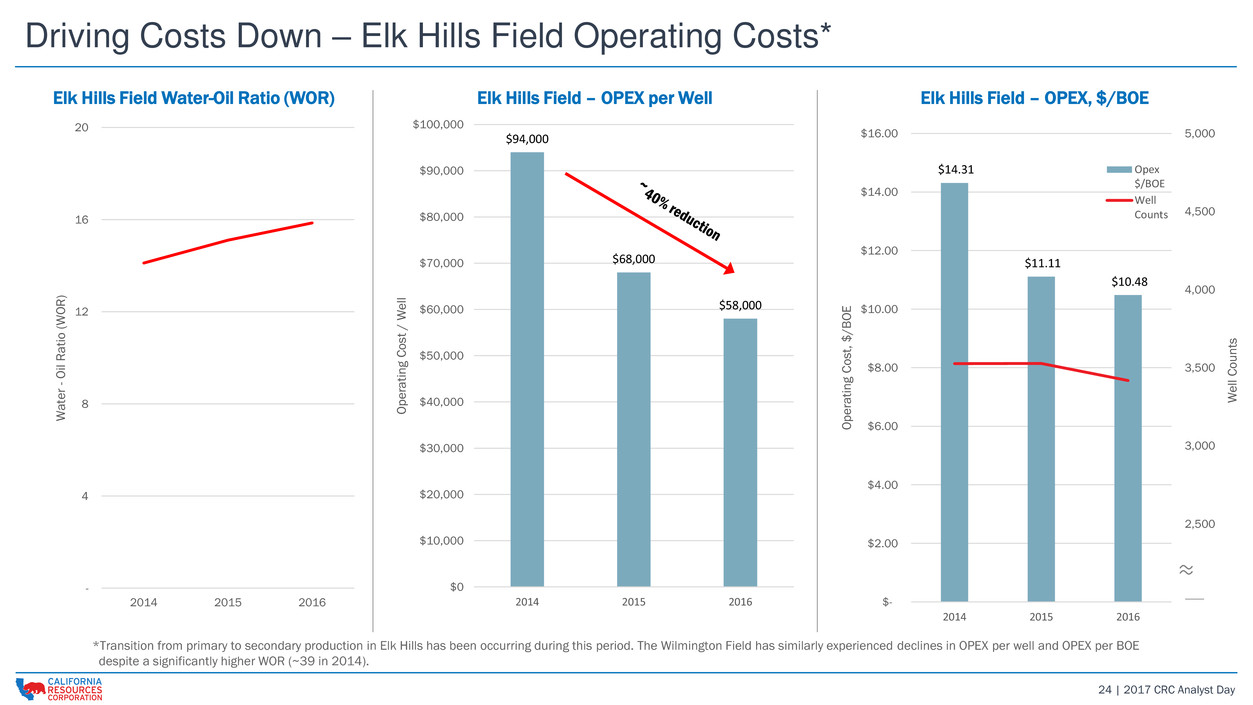

24 | 2017 CRC Analyst Day $14.31 $11.11 $10.48 2,000 2,500 3,000 3,500 4,000 4,500 5,000 $- $2.00 $4.00 $6.00 $8.00 $10.00 $12.00 $14.00 $16.00 2014 2015 2016 Well Count s O p e ra tin g Co st , $ /B O E Elk Hills Field – OPEX, $/BOE Opex $/BOE Well Counts ≈ Driving Costs Down – Elk Hills Field Operating Costs* - 4 8 12 16 20 2014 2015 2016 W a te r - O il Ra tio (W O R ) Elk Hills Field Water-Oil Ratio (WOR) $94,000 $68,000 $58,000 $0 $10,000 $20,000 $30,000 $40,000 $50,000 $60,000 $70,000 $80,000 $90,000 $100,000 2014 2015 2016 O p e ra tin g Co st / Wel l Elk Hills Field - OPEX per Well *Transition from primary to secondary production in Elk Hills has been occurring during this period. The Wilmington Field has similarly experienced declines in OPEX per well and OPEX per BOE despite a significantly higher WOR (~39 in 2014). Elk Hills Field Water-Oil Ratio (W R) Elk Hills Field – OPEX per Well Elk Hills Field – OPEX, $/BOE

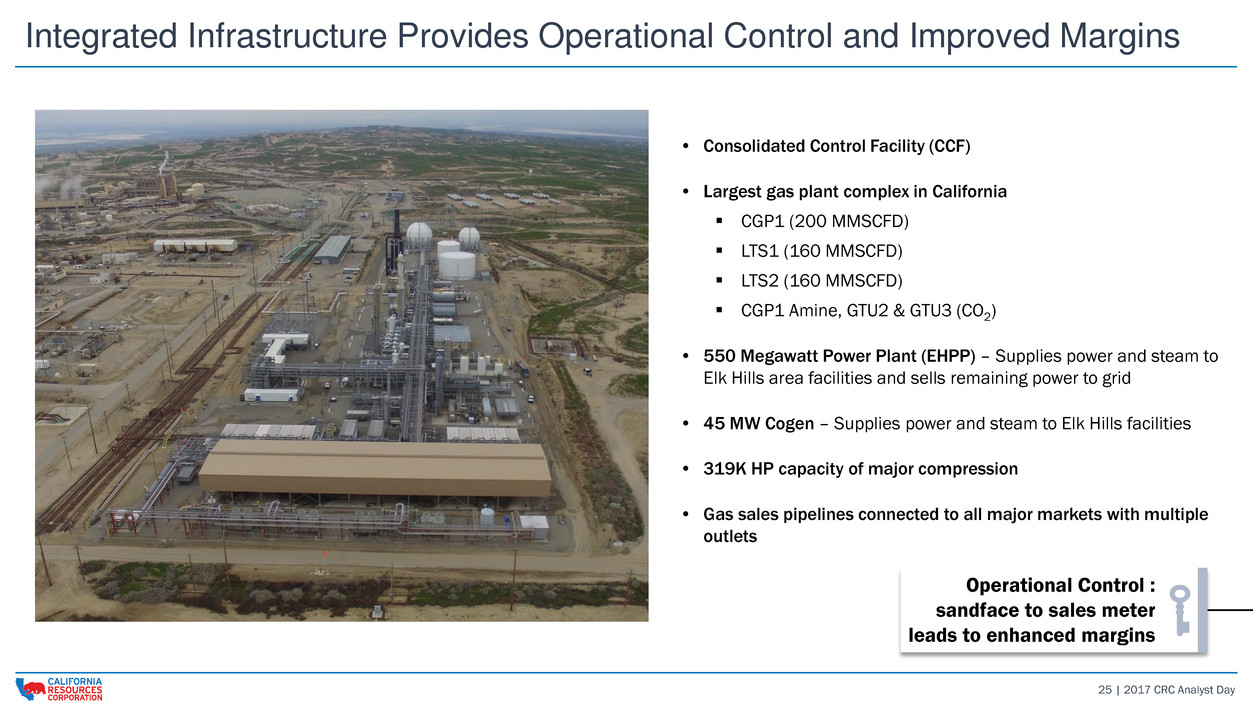

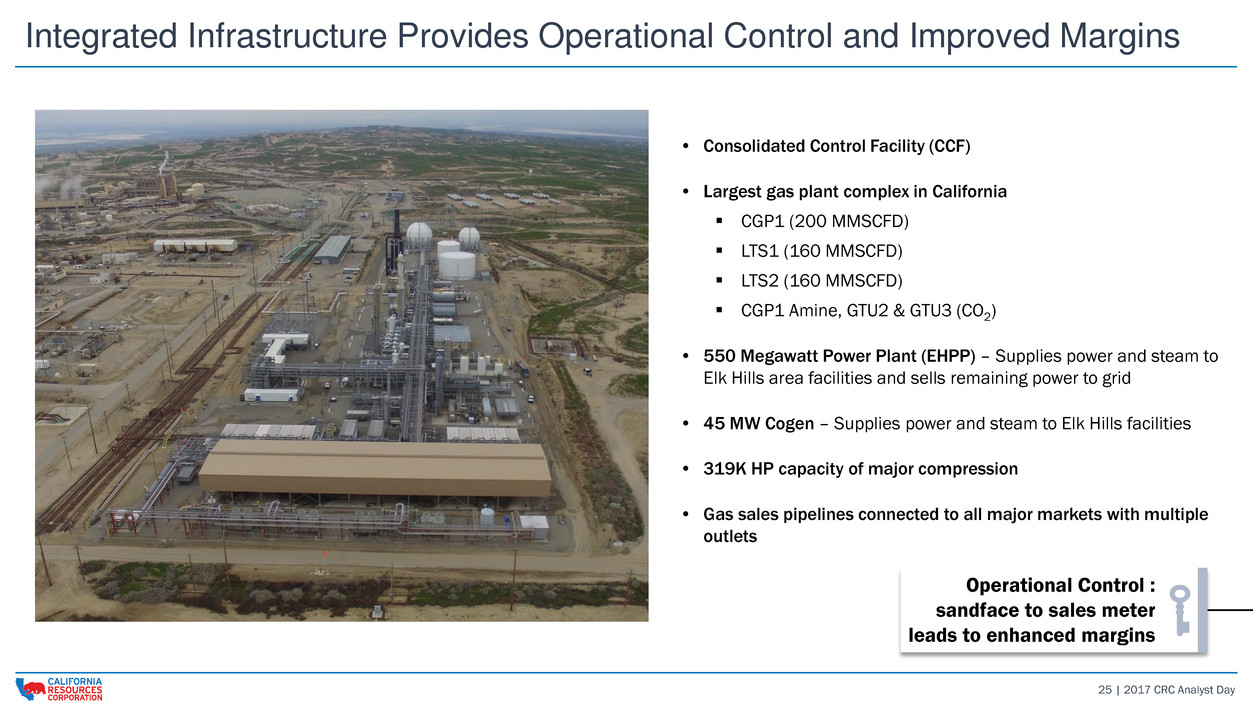

25 | 2017 CRC Analyst Day Integrated Infrastructure Provides Operational Control and Improved Margins • Consolidated Control Facility (CCF) • Largest gas plant complex in California CGP1 (200 MMSCFD) LTS1 (160 MMSCFD) LTS2 (160 MMSCFD) CGP1 Amine, GTU2 & GTU3 (CO2) • 550 Megawatt Power Plant (EHPP) – Supplies power and steam to Elk Hills area facilities and sells remaining power to grid • 45 MW Cogen – Supplies power and steam to Elk Hills facilities • 319K HP capacity of major compression • Gas sales pipelines connected to all major markets with multiple outlets Operational Control : sandface to sales meter leads to enhanced margins

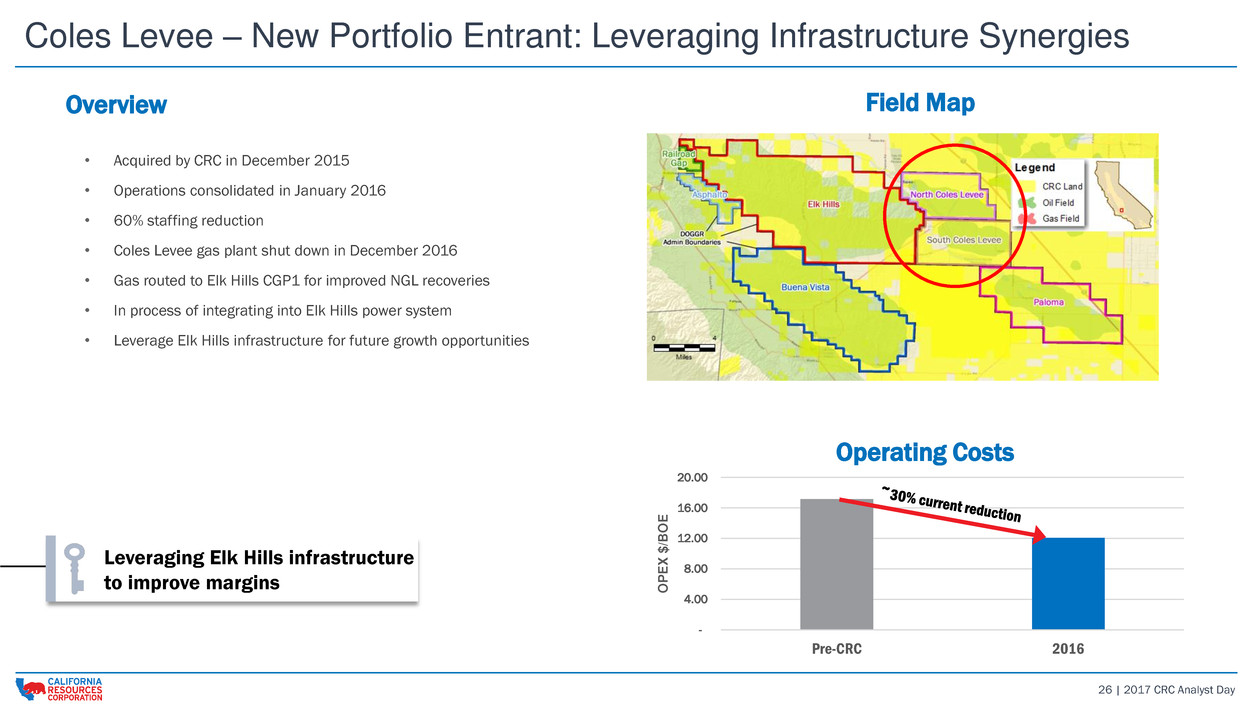

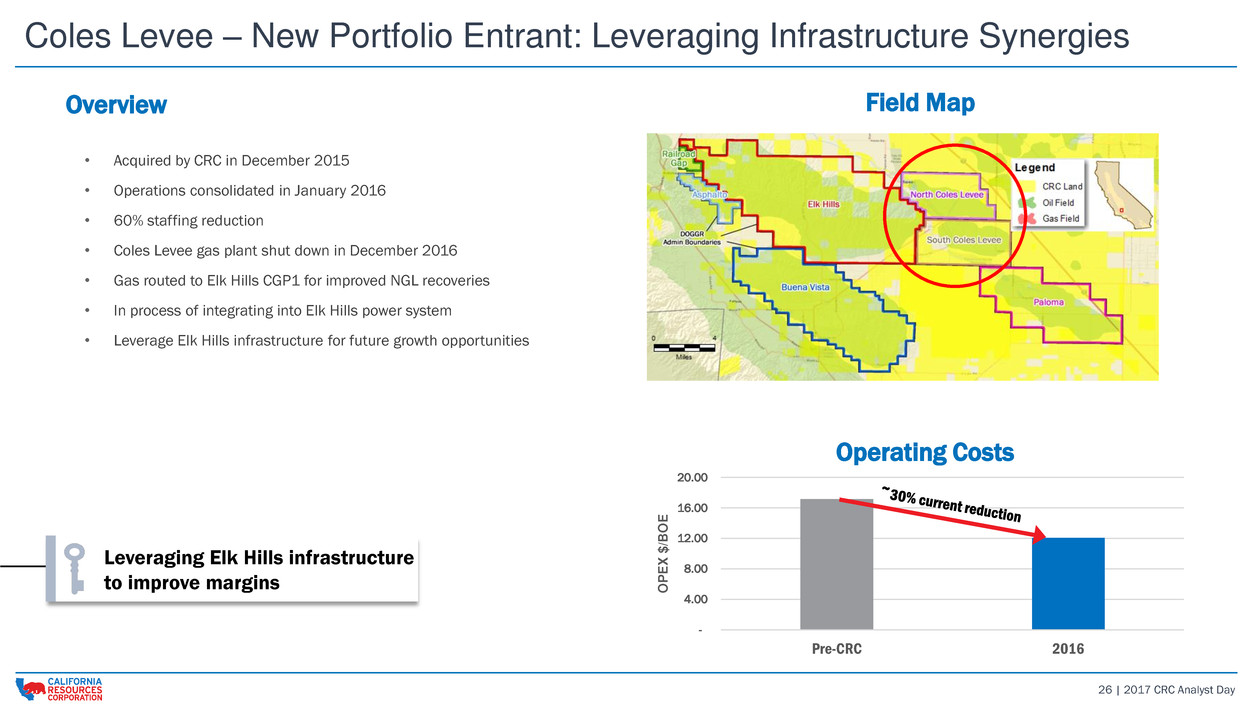

26 | 2017 CRC Analyst Day Coles Levee – New Portfolio Entrant: Leveraging Infrastructure Synergies - 4.00 8.00 12.00 16.00 20.00 Pre-CRC 2016 O P E X $ /B O E Overview • Acquired by CRC in December 2015 • Operations consolidated in January 2016 • 60% staffing reduction • Coles Levee gas plant shut down in December 2016 • Gas routed to Elk Hills CGP1 for improved NGL recoveries • In process of integrating into Elk Hills power system • Leverage Elk Hills infrastructure for future growth opportunities Field Map Operating Costs Leveraging Elk Hills infrastructure to improve margins

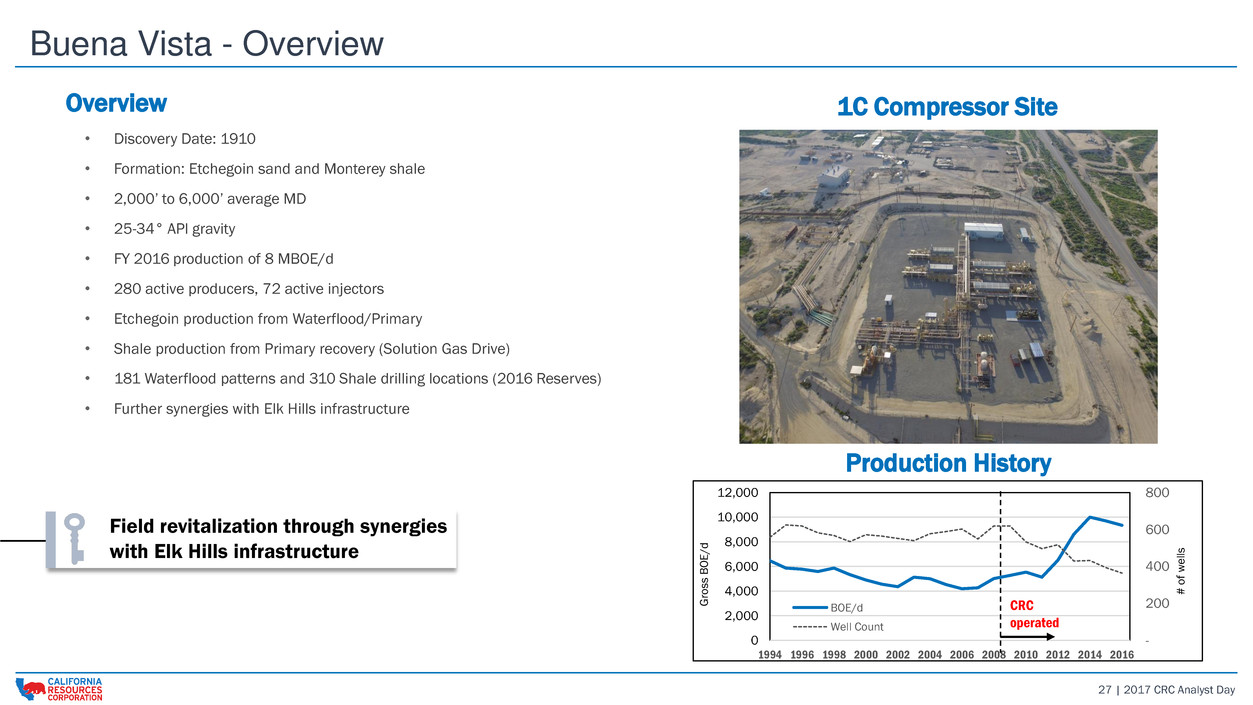

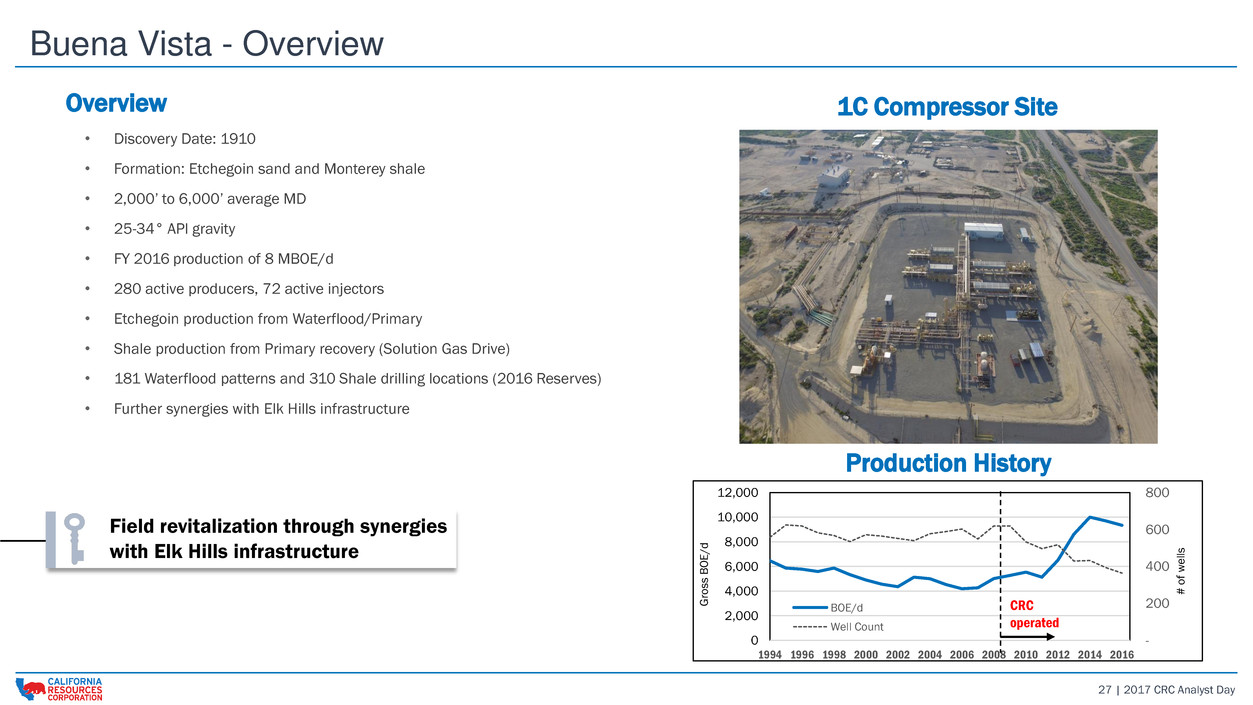

27 | 2017 CRC Analyst Day Buena Vista - Overview Overview • Discovery Date: 1910 • Formation: Etchegoin sand and Monterey shale • 2,000’ to 6,000’ average MD • 25-34° API gravity • FY 2016 production of 8 MBOE/d • 280 active producers, 72 active injectors • Etchegoin production from Waterflood/Primary • Shale production from Primary recovery (Solution Gas Drive) • 181 Waterflood patterns and 310 Shale drilling locations (2016 Reserves) • Further synergies with Elk Hills infrastructure Production History Field revitalization through synergies with Elk Hills infrastructure 1C Compressor Site - 200 400 600 800 0 2,000 4,000 6,000 8,000 10,000 12,000 1994 1996 1998 2000 2002 2004 2006 2008 2010 2012 2014 2016 BOE/d Well Count G ros s B O E/ d # o f wel ls CRC operated

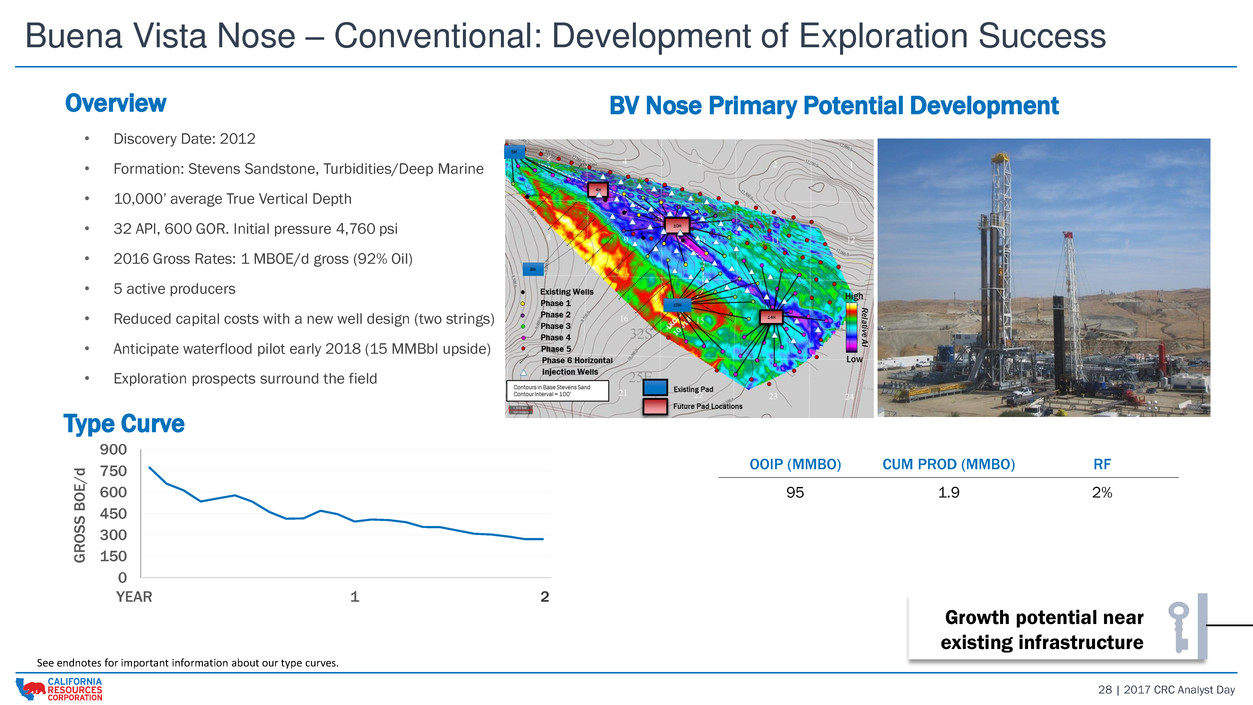

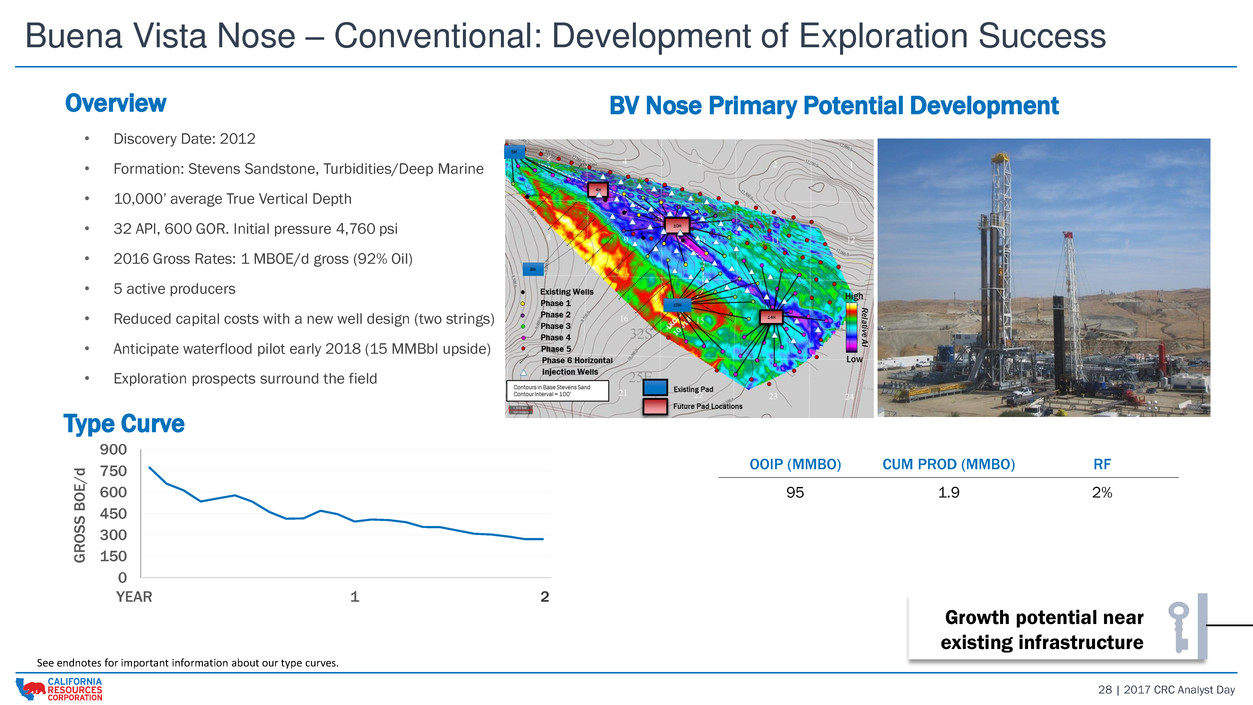

28 | 2017 CRC Analyst Day Buena Vista Nose – Conventional: Development of Exploration Success FIELDMAP Overview • Discovery Date: 2012 • Formation: Stevens Sandstone, Turbidities/Deep Marine • 10,000’ average True Vertical Depth • 32 API, 600 GOR. Initial pressure 4,760 psi • 2016 Gross Rates: 1 MBOE/d gross (92% Oil) • 5 active producers • Reduced capital costs with a new well design (two strings) • Anticipate waterflood pilot early 2018 (15 MMBbl upside) • Exploration prospects surround the field 0 150 300 450 600 750 900 0 1 G R O SS B O E / d YEAR BV Nose Primary Potential Development Type Curve Growth potential near existing infrastructure OOIP (MMBO) CUM PROD (MMBO) RF 95 1.9 2% 2 See endnotes for important information about our type curves.

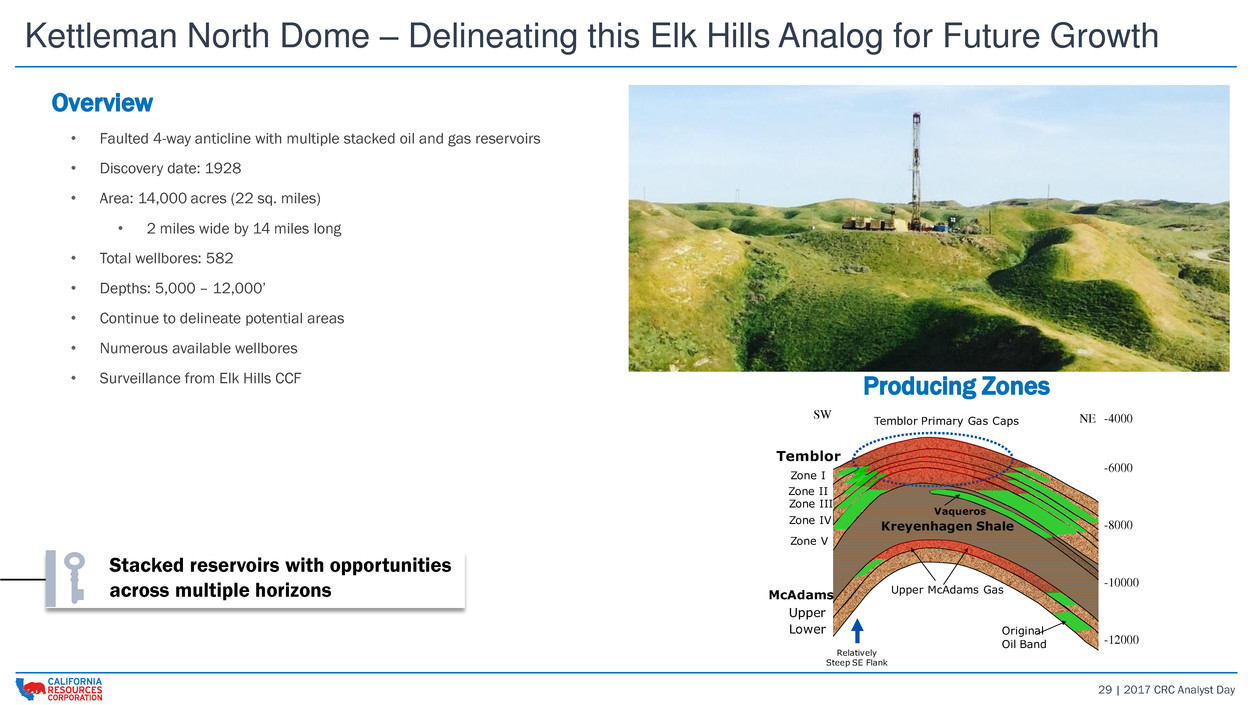

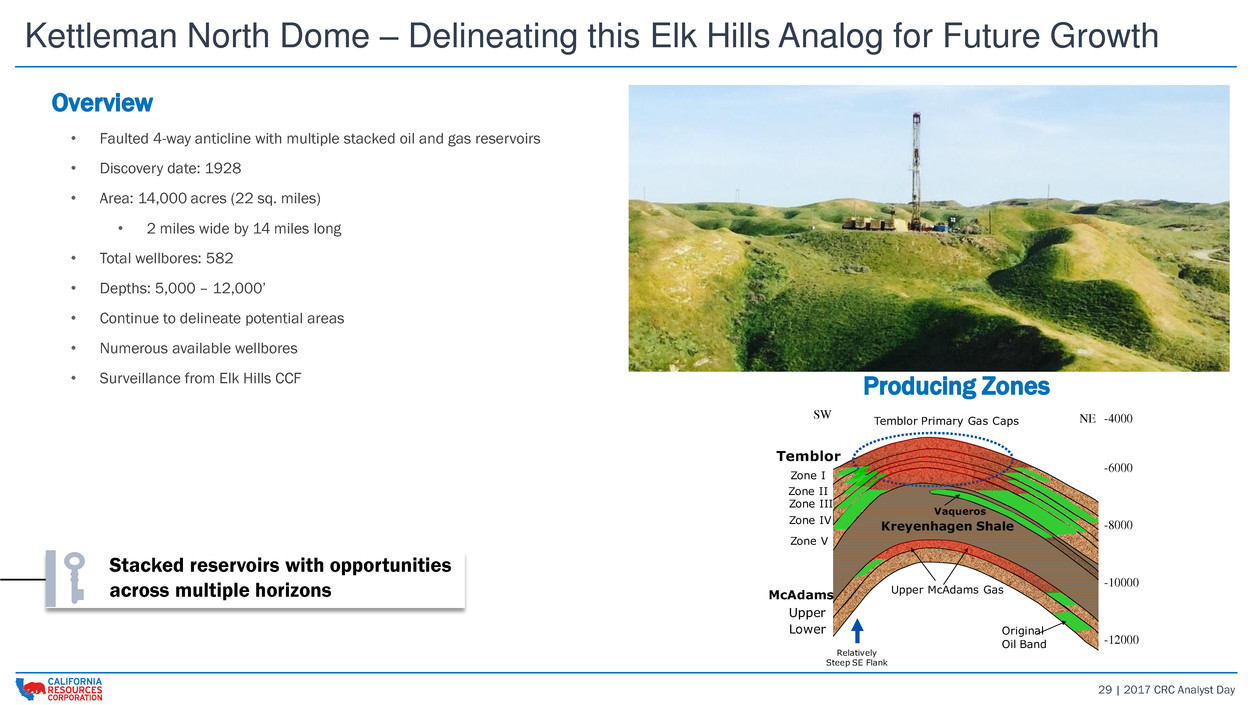

29 | 2017 CRC Analyst Day Kettleman North Dome – Delineating this Elk Hills Analog for Future Growth Overview • Faulted 4-way anticline with multiple stacked oil and gas reservoirs • Discovery date: 1928 • Area: 14,000 acres (22 sq. miles) • 2 miles wide by 14 miles long • Total wellbores: 582 • Depths: 5,000 – 12,000’ • Continue to delineate potential areas • Numerous available wellbores • Surveillance from Elk Hills CCF KETTLEMAN NORTH DOME MAP PRODUCTION HISTORY Relatively Steep SE Flank -4000 -6000 -8000 -10000 -12000 Temblor McAdams Upper Lower Zone I Zone II Zone III Zone IV Zone V SW NE Vaqueros Upper McAdams Gas Original Oil Band Temblor Primary Gas Caps Kreyenhagen Shale Producing Zones Stacked reservoirs with opportunities across multiple horizons

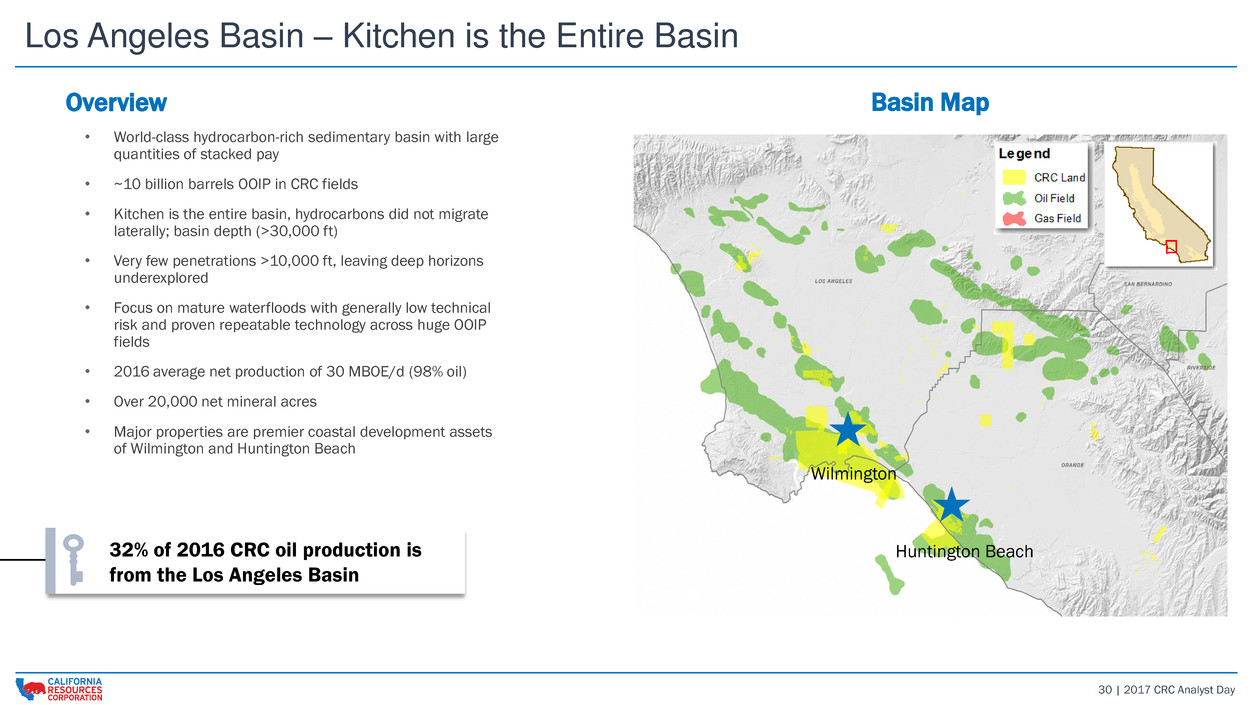

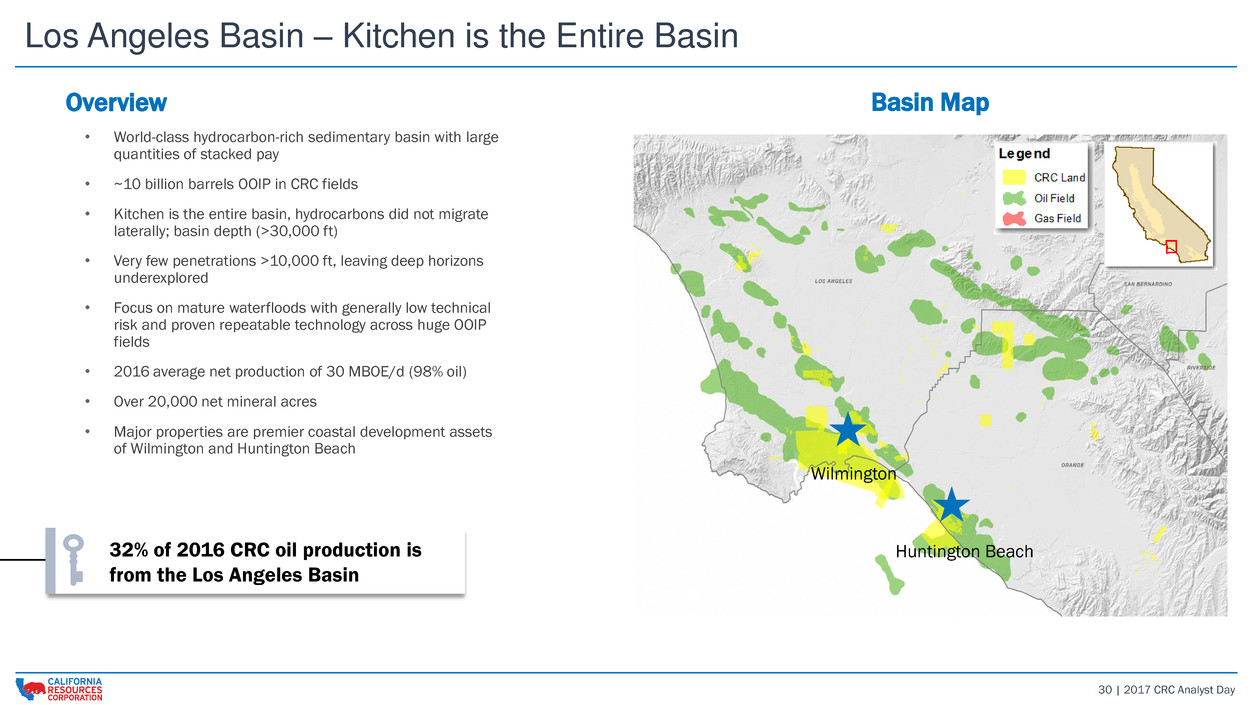

30 | 2017 CRC Analyst Day Los Angeles Basin – Kitchen is the Entire Basin Overview • World-class hydrocarbon-rich sedimentary basin with large quantities of stacked pay • ~10 billion barrels OOIP in CRC fields • Kitchen is the entire basin, hydrocarbons did not migrate laterally; basin depth (>30,000 ft) • Very few penetrations >10,000 ft, leaving deep horizons underexplored • Focus on mature waterfloods with generally low technical risk and proven repeatable technology across huge OOIP fields • 2016 average net production of 30 MBOE/d (98% oil) • Over 20,000 net mineral acres • Major properties are premier coastal development assets of Wilmington and Huntington Beach Wilmington Huntington Beach Basin Map 32% of 2016 CRC oil production is from the Los Angeles Basin

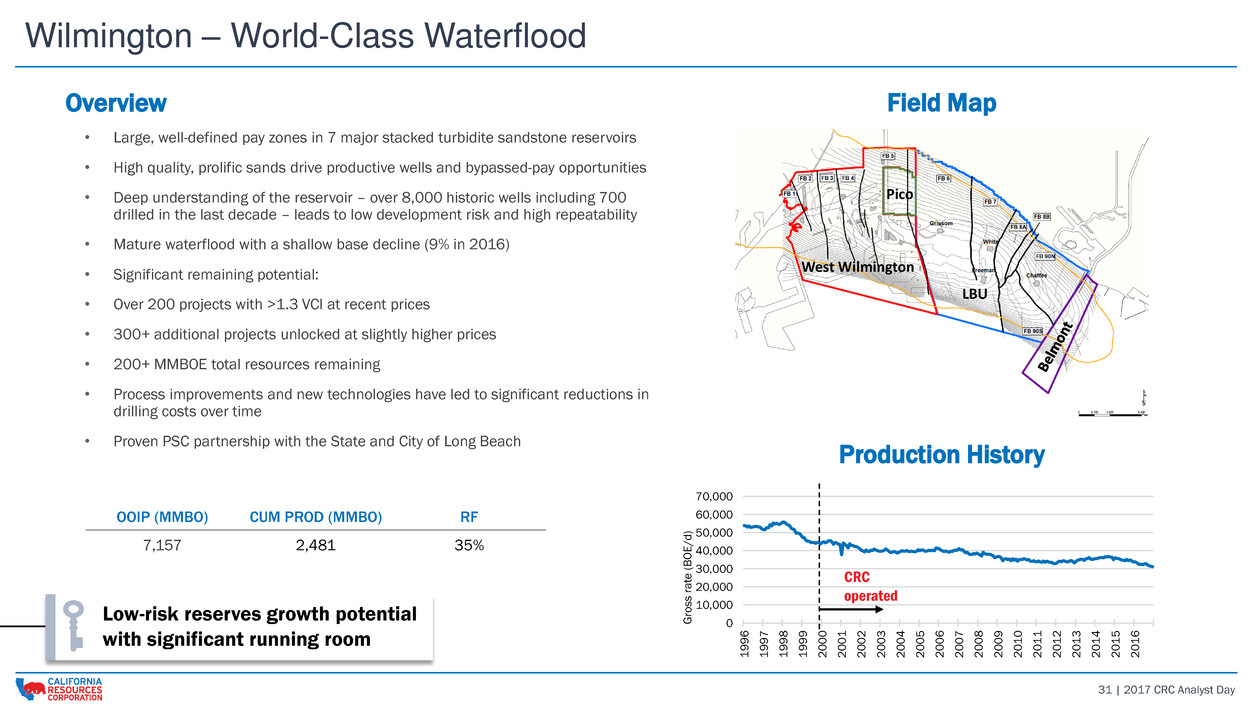

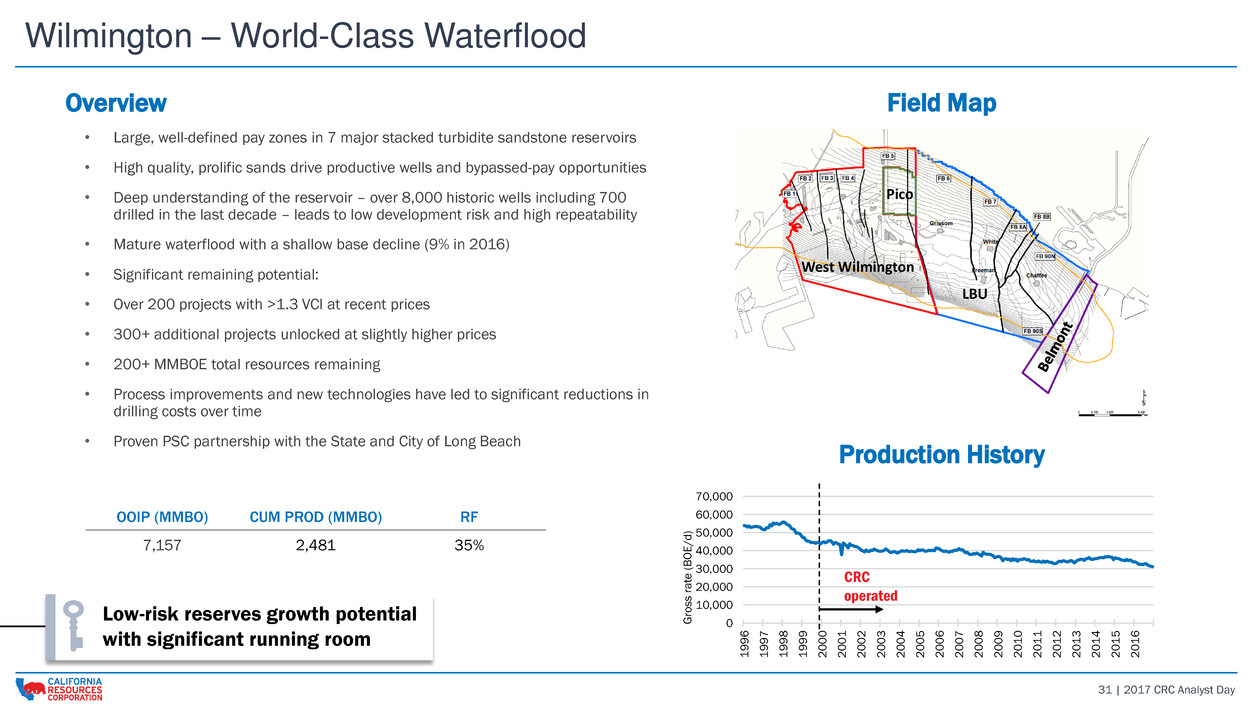

31 | 2017 CRC Analyst Day Wilmington –World-Class Waterflood Overview • Large, well-defined pay zones in 7 major stacked turbidite sandstone reservoirs • High quality, prolific sands drive productive wells and bypassed-pay opportunities • Deep understanding of the reservoir – over 8,000 historic wells including 700 drilled in the last decade – leads to low development risk and high repeatability • Mature waterflood with a shallow base decline (9% in 2016) • Significant remaining potential: • Over 200 projects with >1.3 VCI at recent prices • 300+ additional projects unlocked at slightly higher prices • 200+ MMBOE total resources remaining • Process improvements and new technologies have led to significant reductions in drilling costs over time • Proven PSC partnership with the State and City of Long Beach LBU West Wilmington Pico 0 10,000 20,000 30,000 40,000 50,000 60,000 70,000 1 9 9 6 1 9 9 7 1 9 9 8 1 9 9 9 2 0 0 0 2 0 0 1 2 0 0 2 2 0 0 3 2 0 0 4 2 0 0 5 2 0 0 6 2 0 0 7 2 0 0 8 2 0 0 9 2 0 1 0 2 0 1 1 2 0 1 2 2 0 1 3 2 0 1 4 2 0 1 5 2 0 1 6 G ros s ra te ( B O E/ d ) CRC operated Field Map Production History Low-risk reserves growth potential with significant running room OOIP (MMBO) CUM PROD (MMBO) RF 7,157 2,481 35%

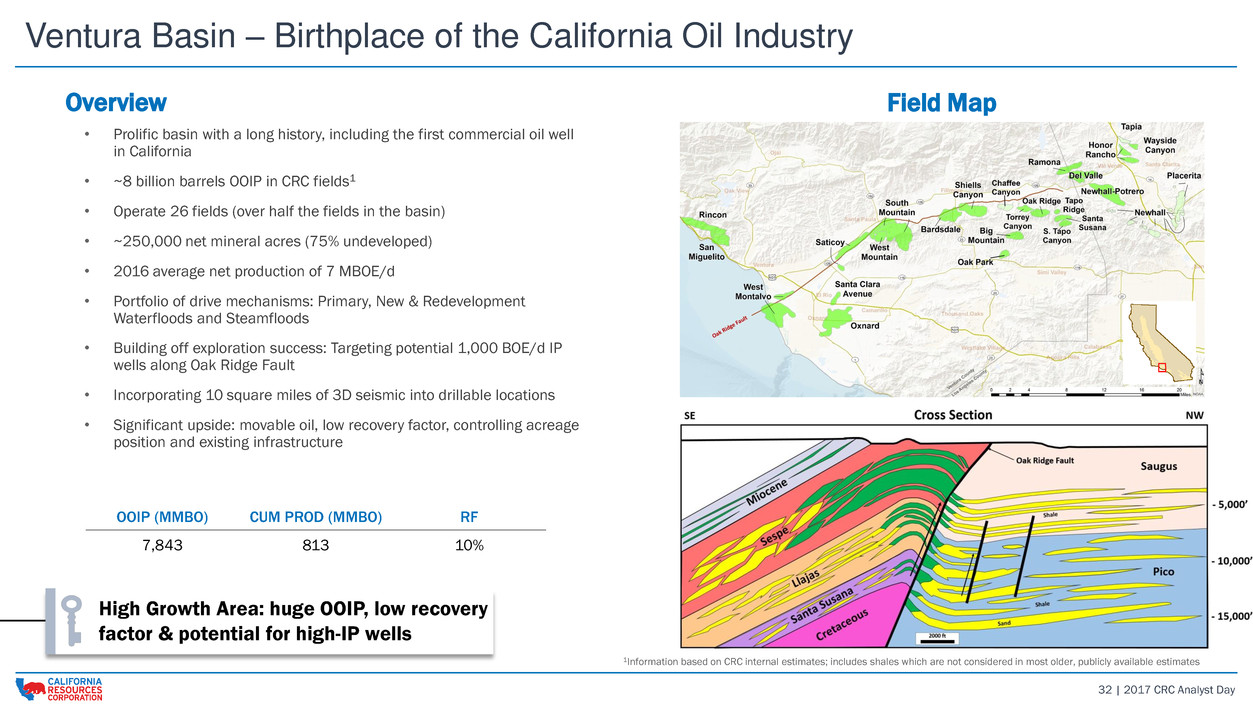

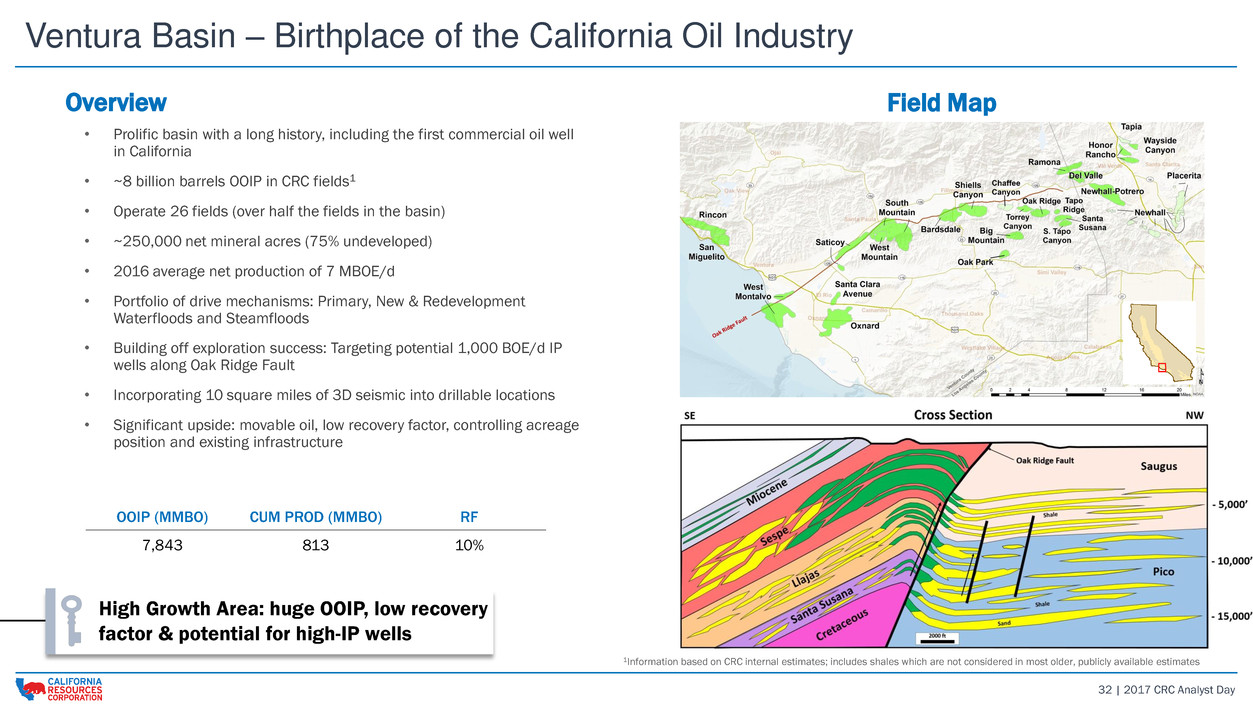

32 | 2017 CRC Analyst Day Ventura Basin – Birthplace of the California Oil Industry Overview • Prolific basin with a long history, including the first commercial oil well in California • ~8 billion barrels OOIP in CRC fields1 • Operate 26 fields (over half the fields in the basin) • ~250,000 net mineral acres (75% undeveloped) • 2016 average net production of 7 MBOE/d • Portfolio of drive mechanisms: Primary, New & Redevelopment Waterfloods and Steamfloods • Building off exploration success: Targeting potential 1,000 BOE/d IP wells along Oak Ridge Fault • Incorporating 10 square miles of 3D seismic into drillable locations • Significant upside: movable oil, low recovery factor, controlling acreage position and existing infrastructure High Growth Area: huge OOIP, low recovery factor & potential for high-IP wells Field Map OOIP (MMBO) CUM PROD (MMBO) RF 7,843 813 10% 1Information based on CRC internal estimates; includes shales which are not considered in most older, publicly available estimates

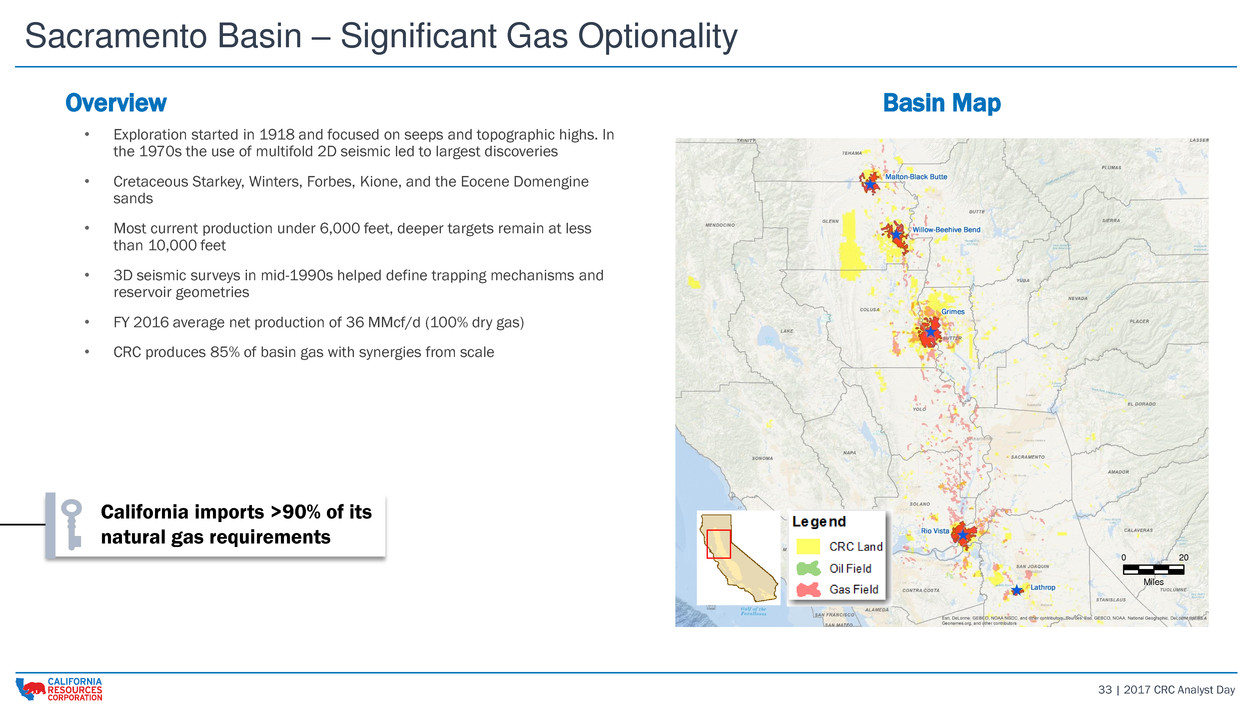

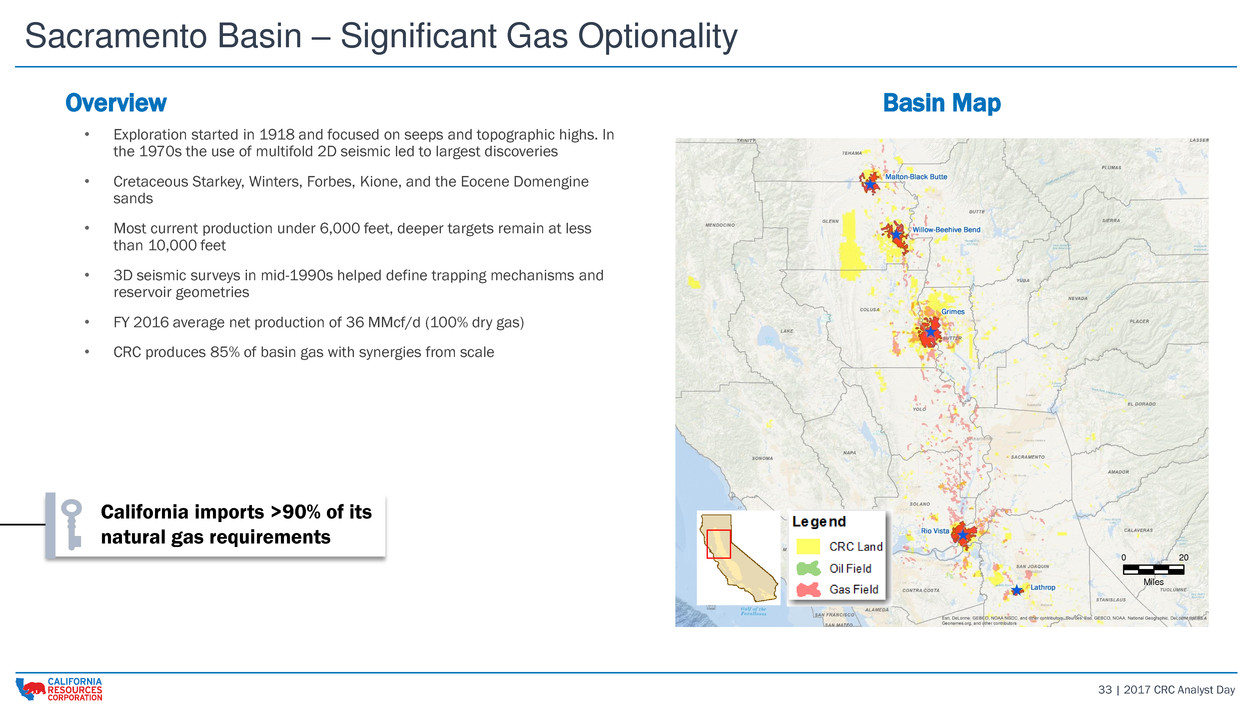

33 | 2017 CRC Analyst Day Sacramento Basin – Significant Gas Optionality Overview • Exploration started in 1918 and focused on seeps and topographic highs. In the 1970s the use of multifold 2D seismic led to largest discoveries • Cretaceous Starkey, Winters, Forbes, Kione, and the Eocene Domengine sands • Most current production under 6,000 feet, deeper targets remain at less than 10,000 feet • 3D seismic surveys in mid-1990s helped define trapping mechanisms and reservoir geometries • FY 2016 average net production of 36 MMcf/d (100% dry gas) • CRC produces 85% of basin gas with synergies from scale California imports >90% of its natural gas requirements Basin Map 0 20 Miles

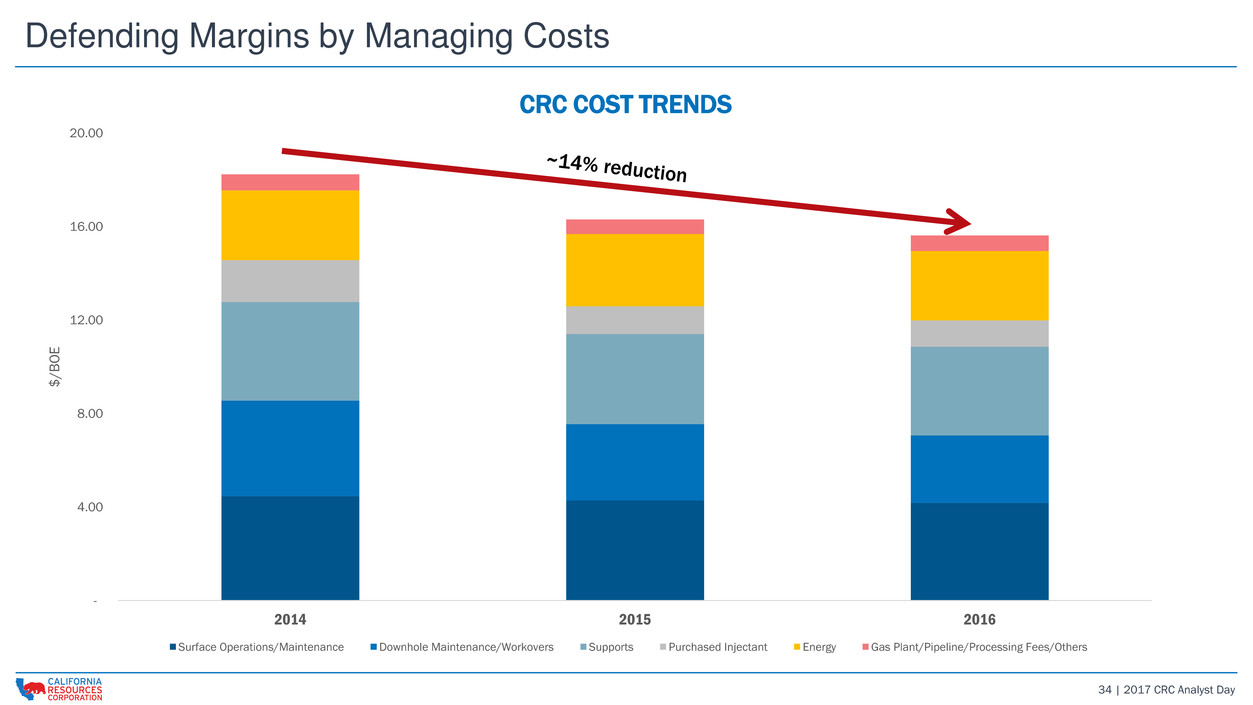

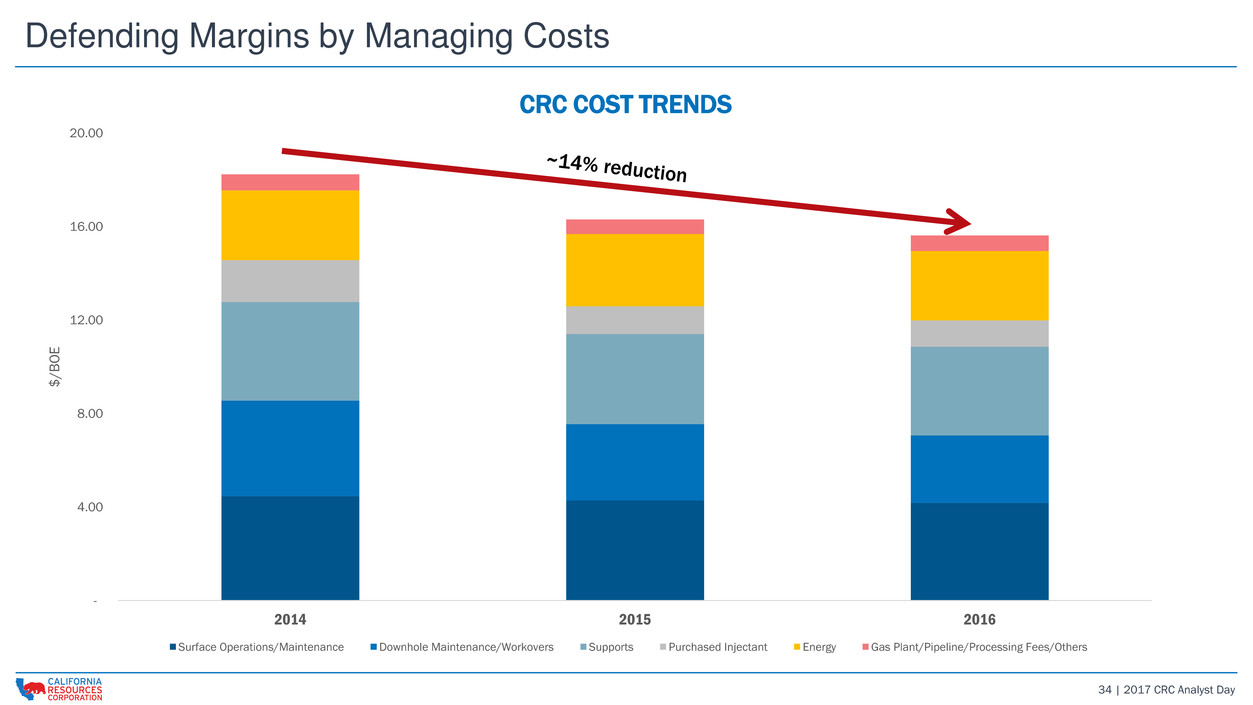

34 | 2017 CRC Analyst Day Defending Margins by Managing Costs - 4.00 8.00 12.00 16.00 20.00 2014 2015 2016 $ /B O E CRC COST TRENDS Surface Operations/Maintenance Downhole Maintenance/Workovers Supports Purchased Injectant Energy Gas Plant/Pipeline/Processing Fees/Others CRC COST TRENDS

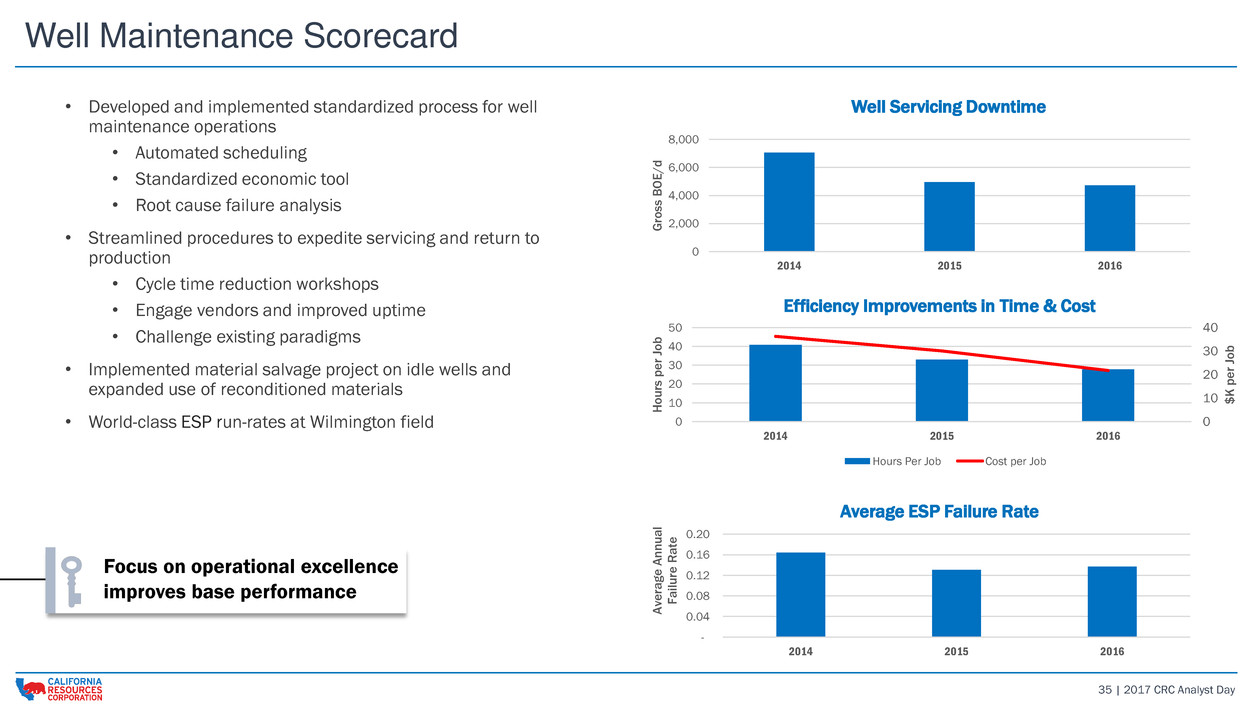

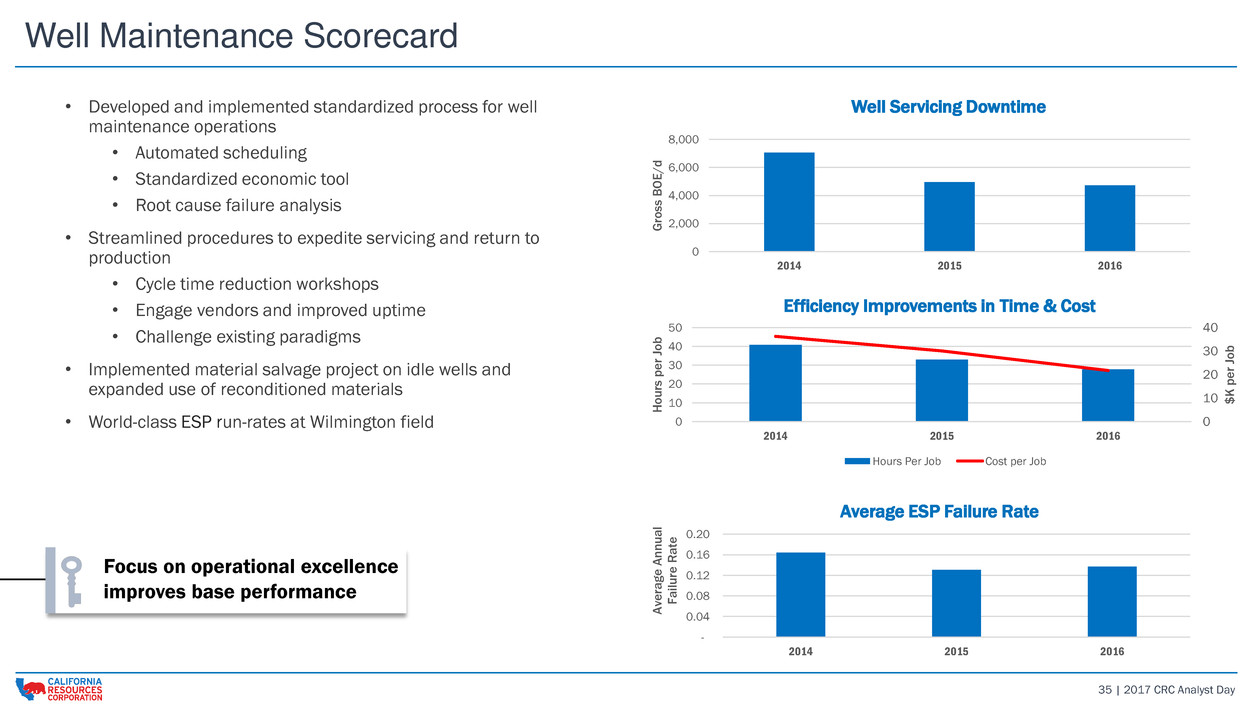

35 | 2017 CRC Analyst Day Well Maintenance Scorecard • Developed and implemented standardized process for well maintenance operations • Automated scheduling • Standardized economic tool • Root cause failure analysis • Streamlined procedures to expedite servicing and return to production • Cycle time reduction workshops • Engage vendors and improved uptime • Challenge existing paradigms • Implemented material salvage project on idle wells and expanded use of reconditioned materials • World-class ESP run-rates at Wilmington field 0 2,000 4,000 6,000 8,000 2014 2015 2016 G ro ss B O E / d Well Servicing Downtime 0 10 20 30 40 0 10 20 30 40 50 2014 2015 2016 $ K p e r Jo b Hou rs p e r Jo b Job Efficiency Hours Per Job Cost per Job - 0.04 0.08 0.12 0.16 0.20 2014 2015 2016 Av e rag e Annu a l Fa il u re R a te Average ESP Failure Rate Focus on operational excellence improves base performance Well Servicing Downtime Efficiency Improvements in Time & Cost Average ESP Failure Rate

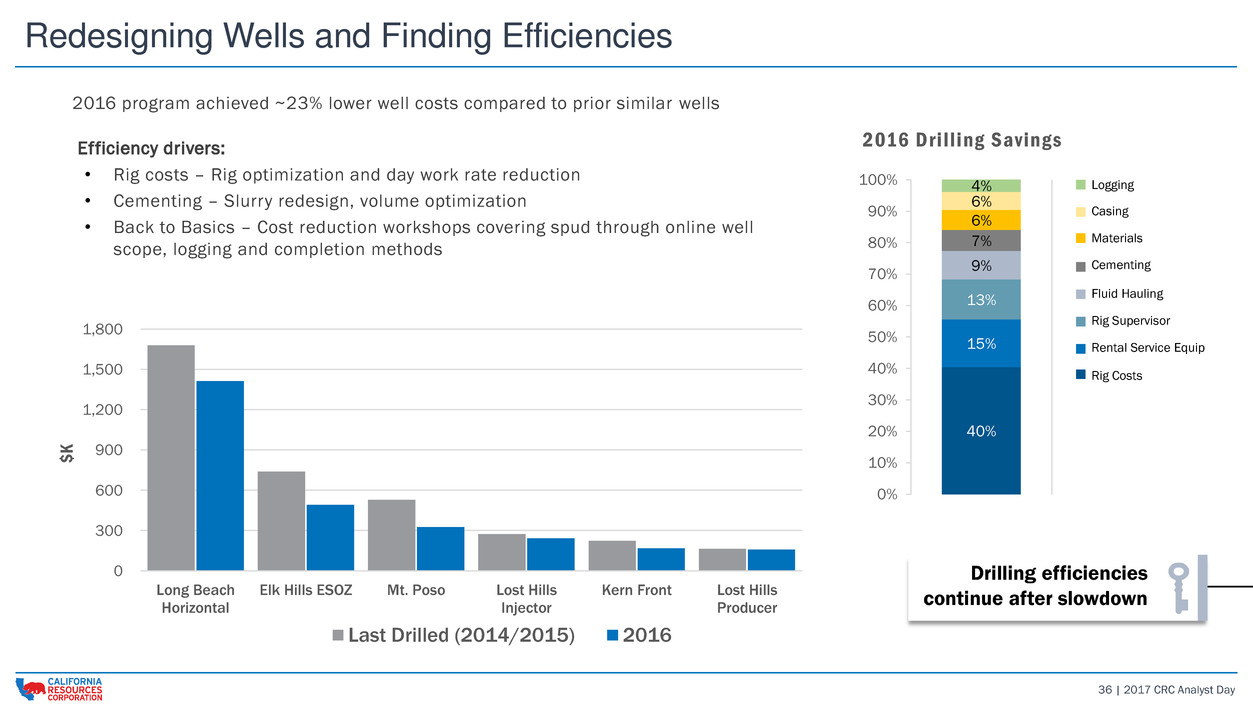

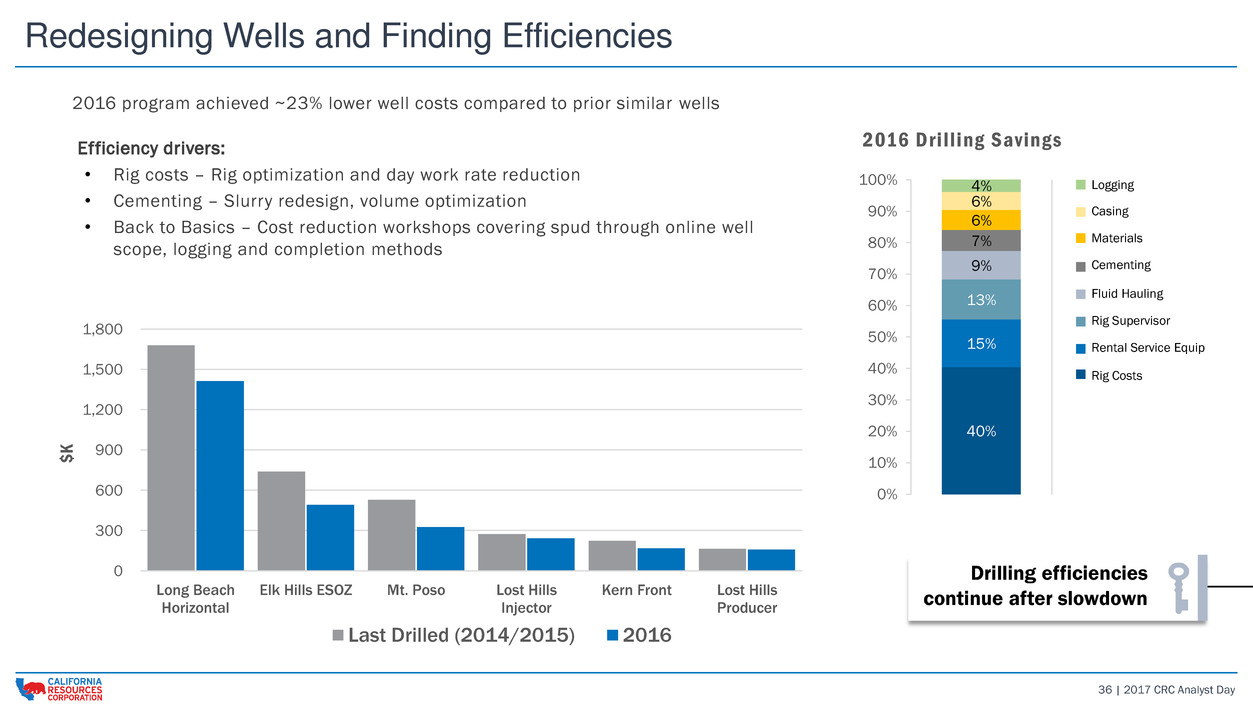

36 | 2017 CRC Analyst Day Redesigning Wells and Finding Efficiencies 2016 program achieved ~23% lower well costs compared to prior similar wells Efficiency drivers: • Rig costs – Rig optimization and day work rate reduction • Cementing – Slurry redesign, volume optimization • Back to Basics – Cost reduction workshops covering spud through online well scope, logging and completion methods Includes drilling, completion and hook-up costs 40% 15% 13% 9% 7% 6% 6% 4% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 2016 Dril l ing Savings 0 300 600 900 1,200 1,500 1,800 Long Beach Horizontal Elk Hills ESOZ Mt. Poso Lost Hills Injector Kern Front Lost Hills Producer $ K Last Drilled (2014/2015) 2016 Drilling efficiencies continue after slowdown Logging Casing Materials Cementing Fluid Hauling Rig Supervisor Rental Service Equip Rig Costs

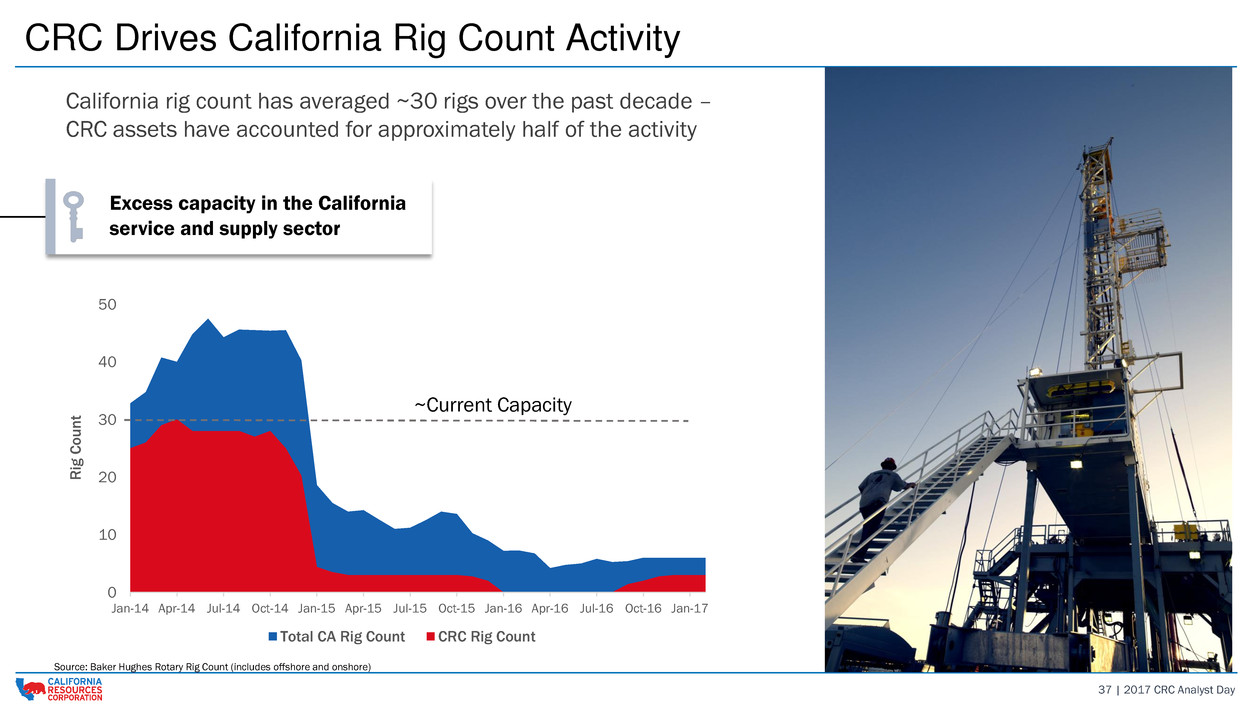

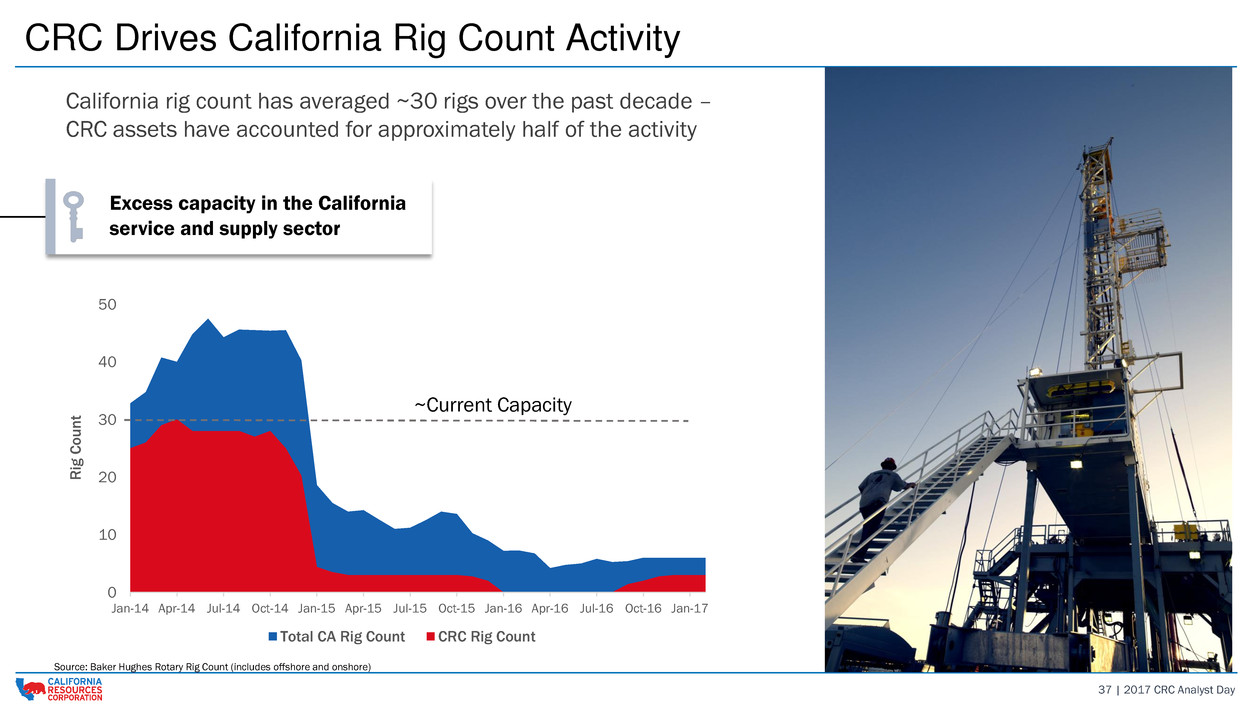

37 | 2017 CRC Analyst Day 0 10 20 30 40 50 Jan-14 Apr-14 Jul-14 Oct-14 Jan-15 Apr-15 Jul-15 Oct-15 Jan-16 Apr-16 Jul-16 Oct-16 Jan-17 R ig C o un t Total CA Rig Count CRC Rig Count CRC Drives California Rig Count Activity Source: Baker Hughes Rotary Rig Count (includes offshore and onshore) California rig count has averaged ~30 rigs over the past decade – CRC assets have accounted for approximately half of the activity Excess capacity in the California service and supply sector ~Current Capacity

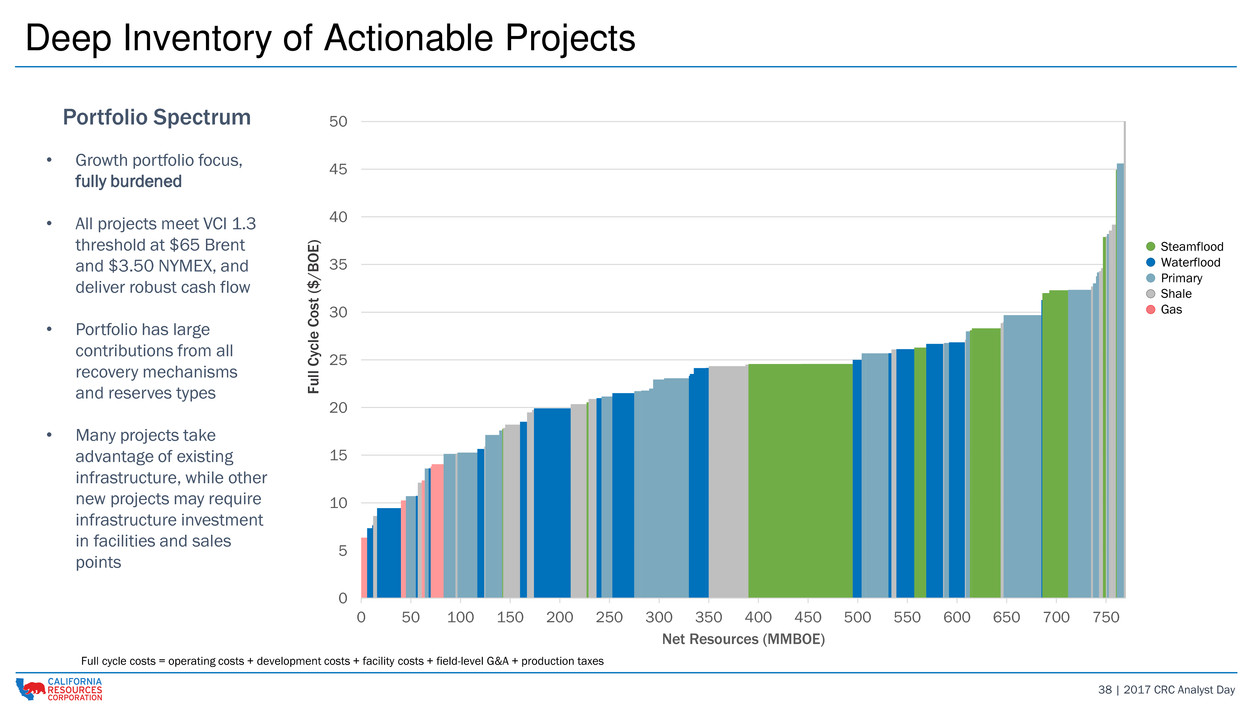

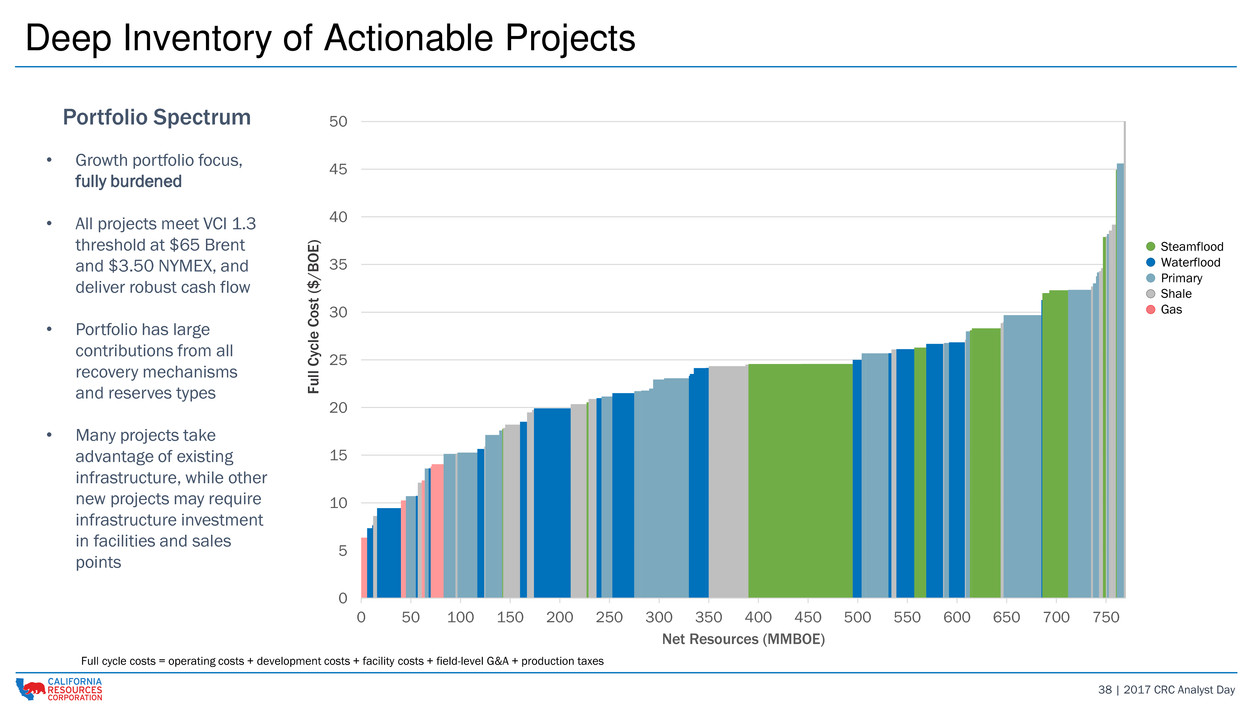

38 | 2017 CRC Analyst Day Deep Inventory of Actionable Projects Steamflood Waterflood Primary Shale Gas Portfolio Spectrum • Growth portfolio focus, fully burdened • All projects meet VCI 1.3 threshold at $65 Brent and $3.50 NYMEX, and deliver robust cash flow • Portfolio has large contributions from all recovery mechanisms and reserves types • Many projects take advantage of existing infrastructure, while other new projects may require infrastructure investment in facilities and sales points 0 5 10 15 20 25 30 35 40 45 50 0 50 100 150 200 250 300 350 400 450 500 550 600 650 700 750 Net Resources (MMBOE) Fu ll Cy cl e Cos t ($ / B O E ) Full cycle costs = operating costs + development costs + facility costs + field-level G&A + production taxes

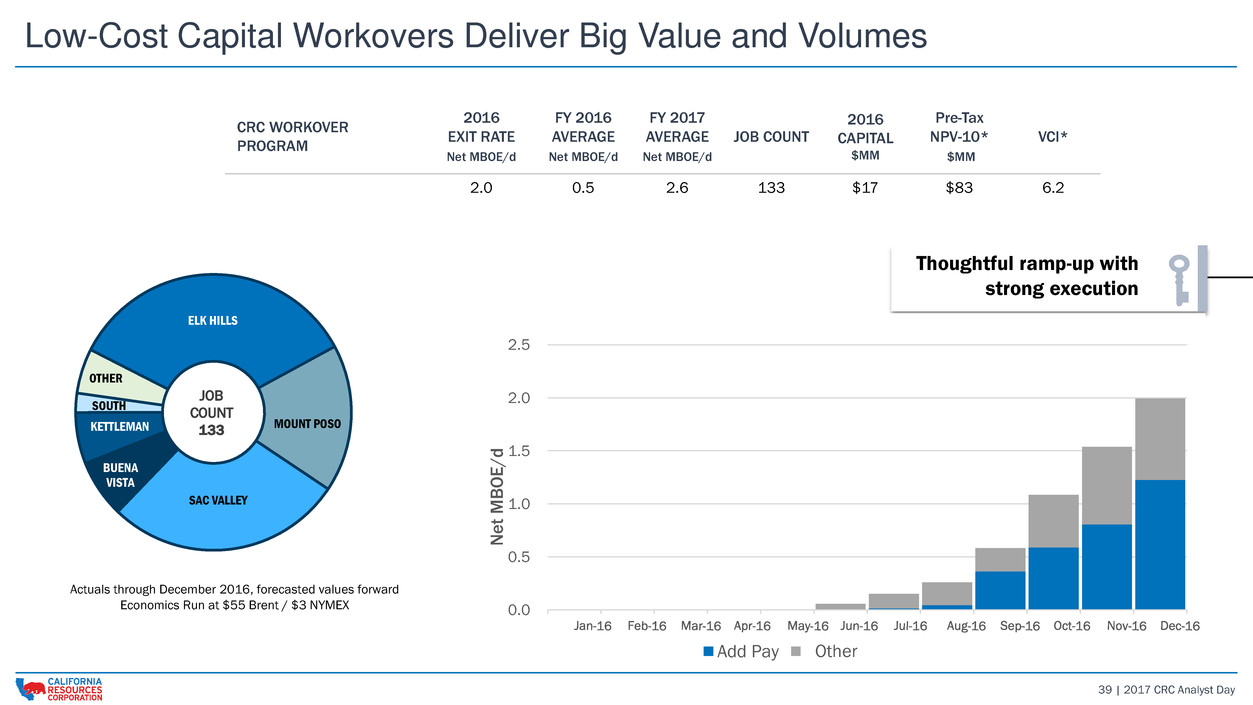

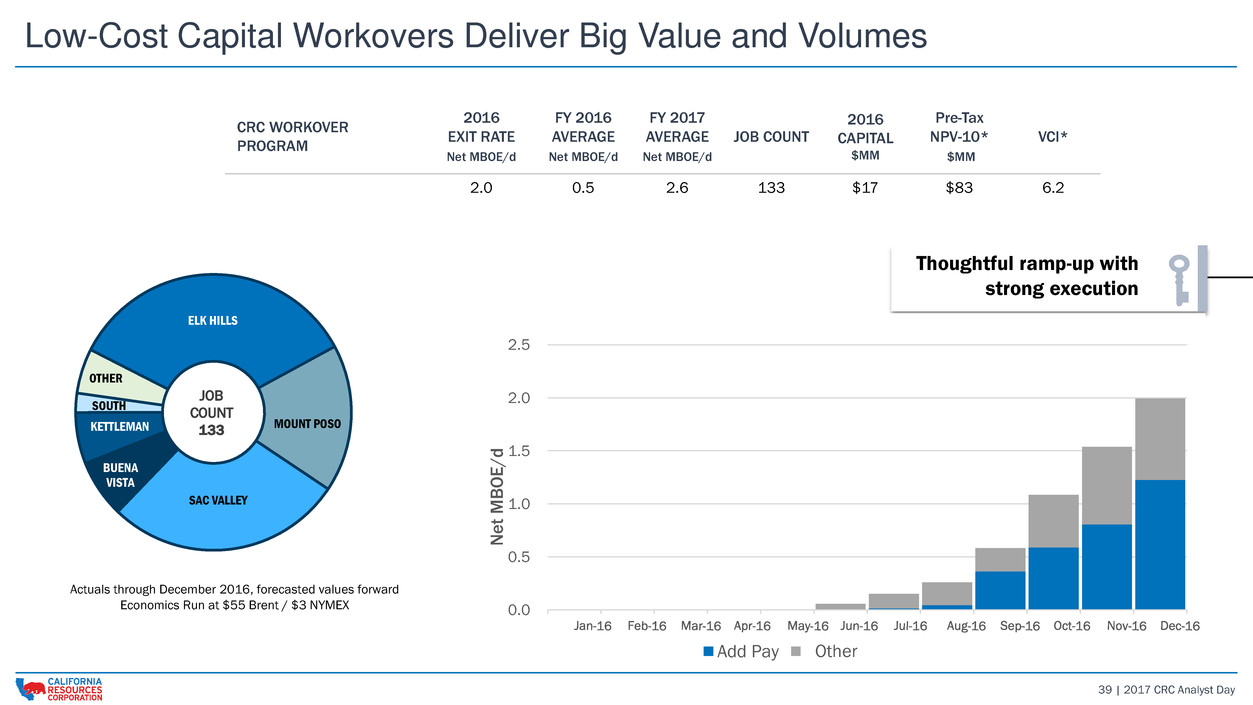

39 | 2017 CRC Analyst Day Low-Cost Capital Workovers Deliver Big Value and Volumes Actuals through December 2016, forecasted values forward Economics Run at $55 Brent / $3 NYMEX 0.0 0.5 1.0 1.5 2.0 2.5 N e t MBOE/ d Add Pay Return to production Tie In Convert to InjOther Thoughtful ramp-up with strong execution CRC WORKOVER PROGRAM 2016 EXIT RATE Net MBOE/d FY 2016 AVERAGE Net MBOE/d FY 2017 AVERAGE Net MBOE/d JOB COUNT 2016 CAPITAL $MM Pre-Tax NPV-10* $MM VCI* 2.0 0.5 2.6 133 $17 $83 6.2 ELK HILLS MOUNT POSO SAC VALLEY BUENA VISTA KETTLEMAN SOUTH OTHER JOB COUNT 133

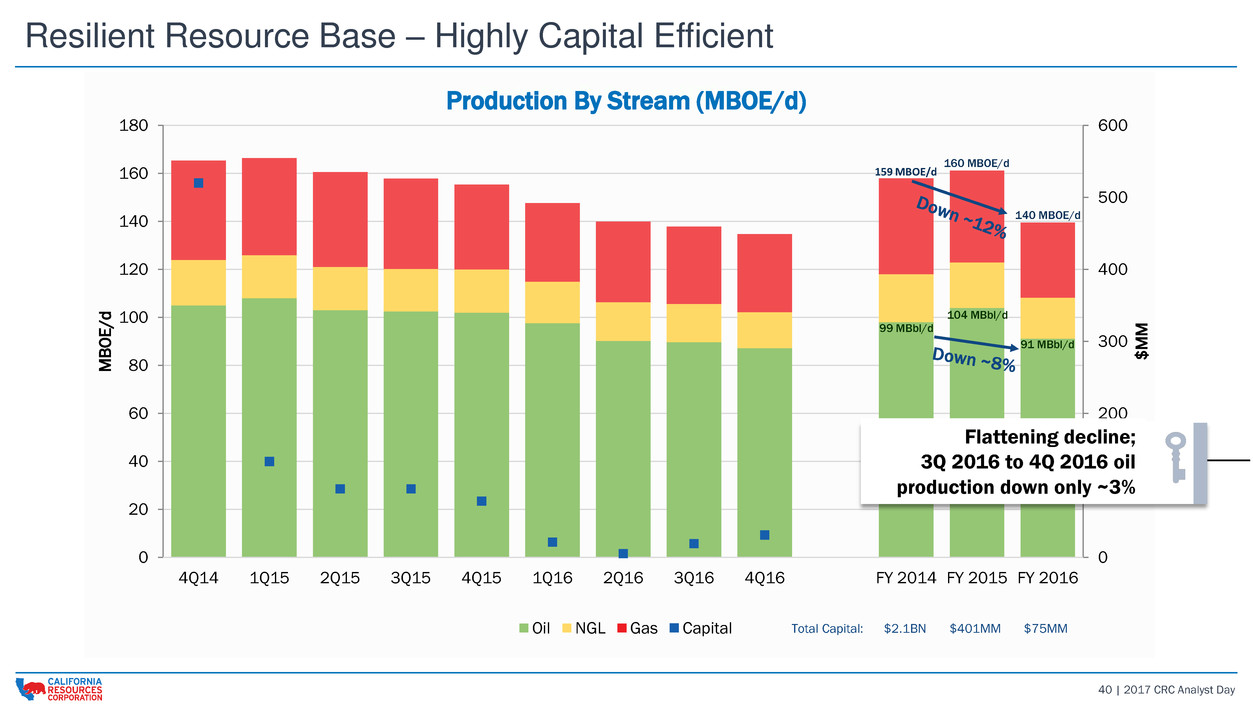

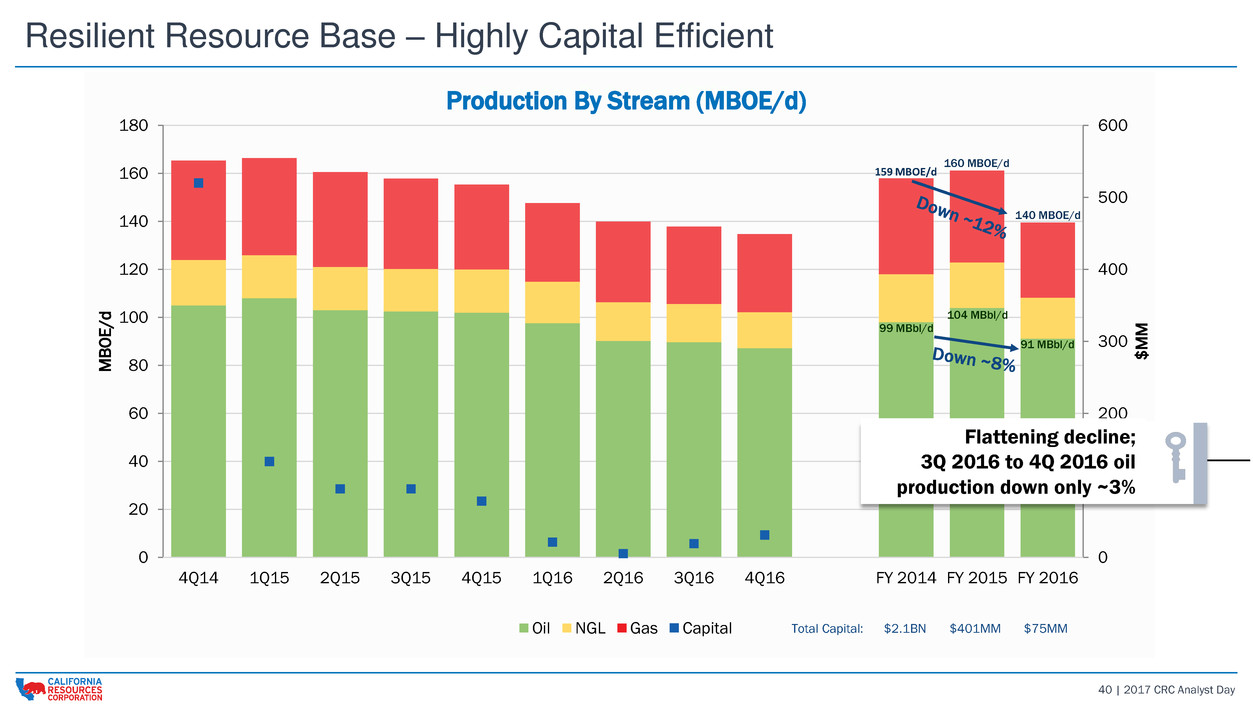

40 | 2017 CRC Analyst Day Resilient Resource Base – Highly Capital Efficient 0 100 200 300 400 500 600 0 20 40 60 80 100 120 140 160 180 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 FY 2014 FY 2015 FY 2016 $ M M M B O E /d Production By Stream (MBOE/d) Oil NGL Gas Capital 159 MBOE/d 160 MBOE/d 99 MBbl/d 104 MBbl/d 140 MBOE/d 91 MBbl/d $2.1BN $401MM $75MMTotal Capital: Production By Stream (MBOE/d) Flattening decline; 3Q 2016 to 4Q 2016 oil production down only ~3%

GROWTH AND LIFE OF FIELD PLANS CRC 2017 Analyst & Investor Day Shawn Kerns | EVP Corporate Development

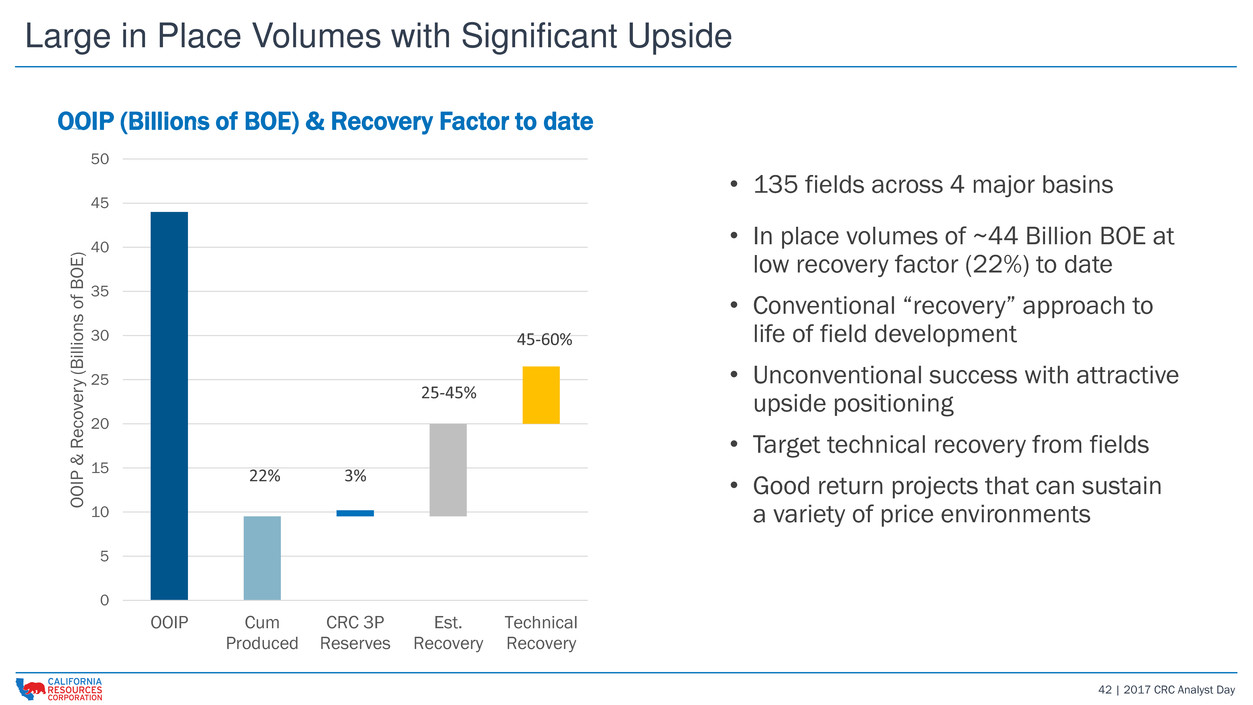

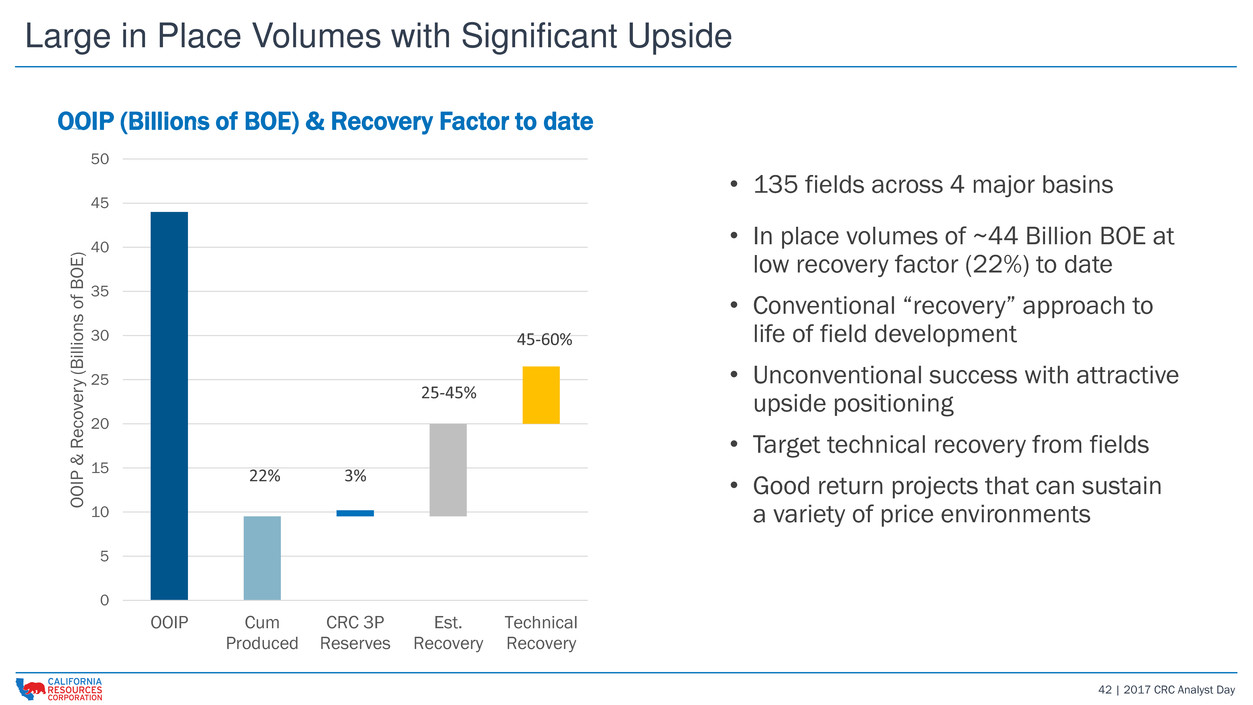

42 | 2017 CRC Analyst Day Large in Place Volumes with Significant Upside • 135 fields across 4 major basins • In place volumes of ~44 Billion BOE at low recovery factor (22%) to date • Conventional “recovery” approach to life of field development • Unconventional success with attractive upside positioning • Target technical recovery from fields • Good return projects that can sustain a variety of price environments 0 5 10 15 20 25 30 35 40 45 50 OOIP Cum Produced CRC 3P Reserves Est. Recovery Technical Recovery OOIP & R e co ve ry (Bil lio n s of BOE ) OOIP & Recovery 22% 25-45% 45-60% OOIP (Billions of BOE) & Recovery Factor to date 3%

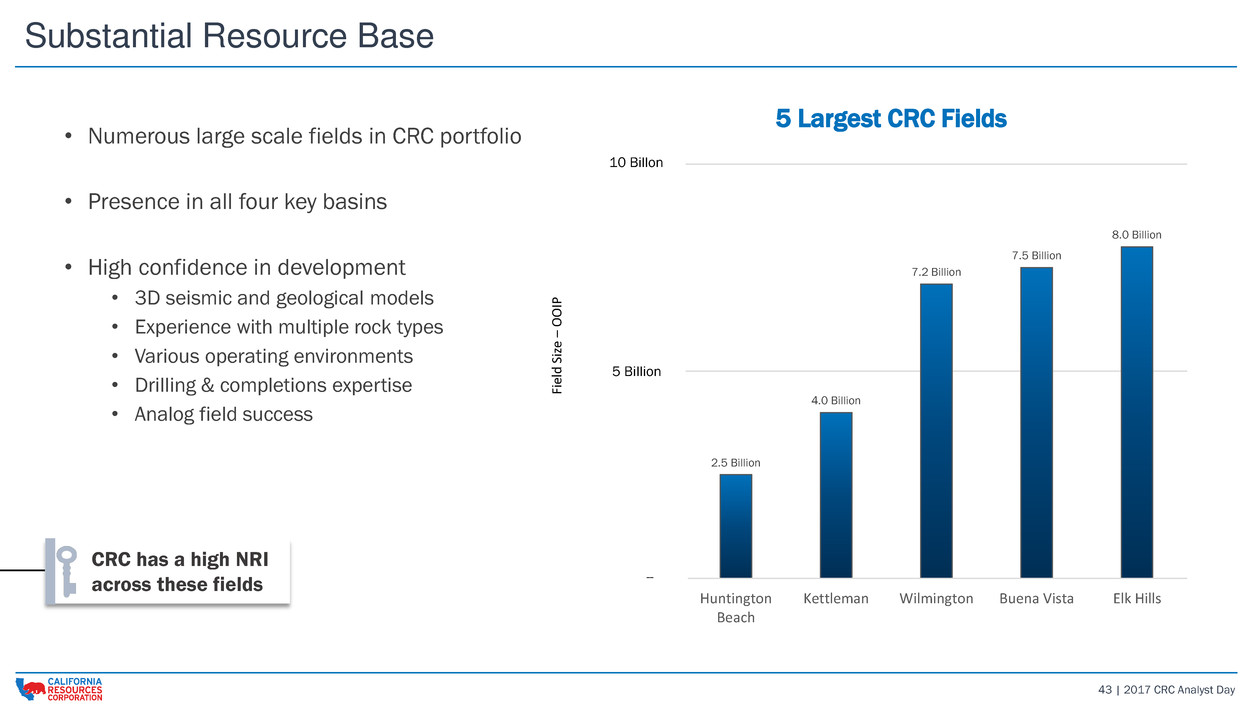

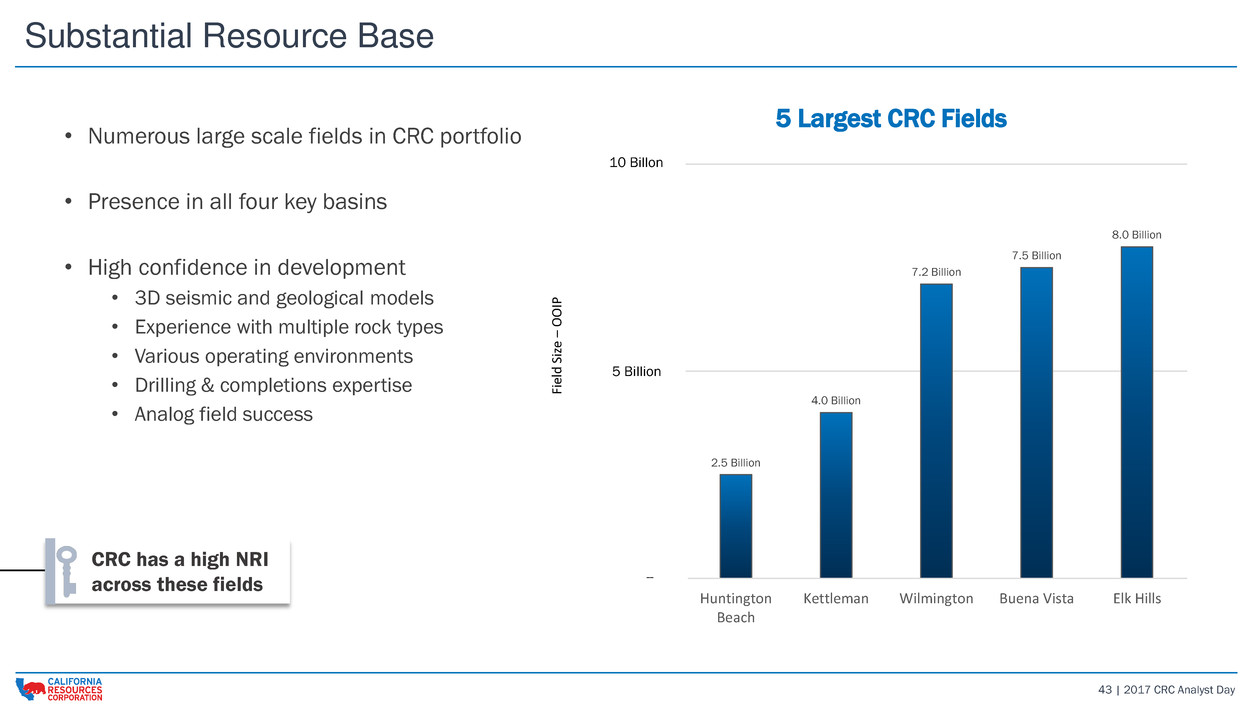

43 | 2017 CRC Analyst Day Substantial Resource Base • Numerous large scale fields in CRC portfolio • Presence in all four key basins • High confidence in development • 3D seismic and geological models • Experience with multiple rock types • Various operating environments • Drilling & completions expertise • Analog field success 5 Largest CRC Fields 2.5 Billion 4.0 Billion 7.2 Billion 7.5 Billion 8.0 Billion 0 5 10 Huntington Beach Kettleman Wilmington Buena Vista Elk Hills Fi el d S iz e – OOI P 10 Billon 5 Billion -- CRC has a high NRI across these fields

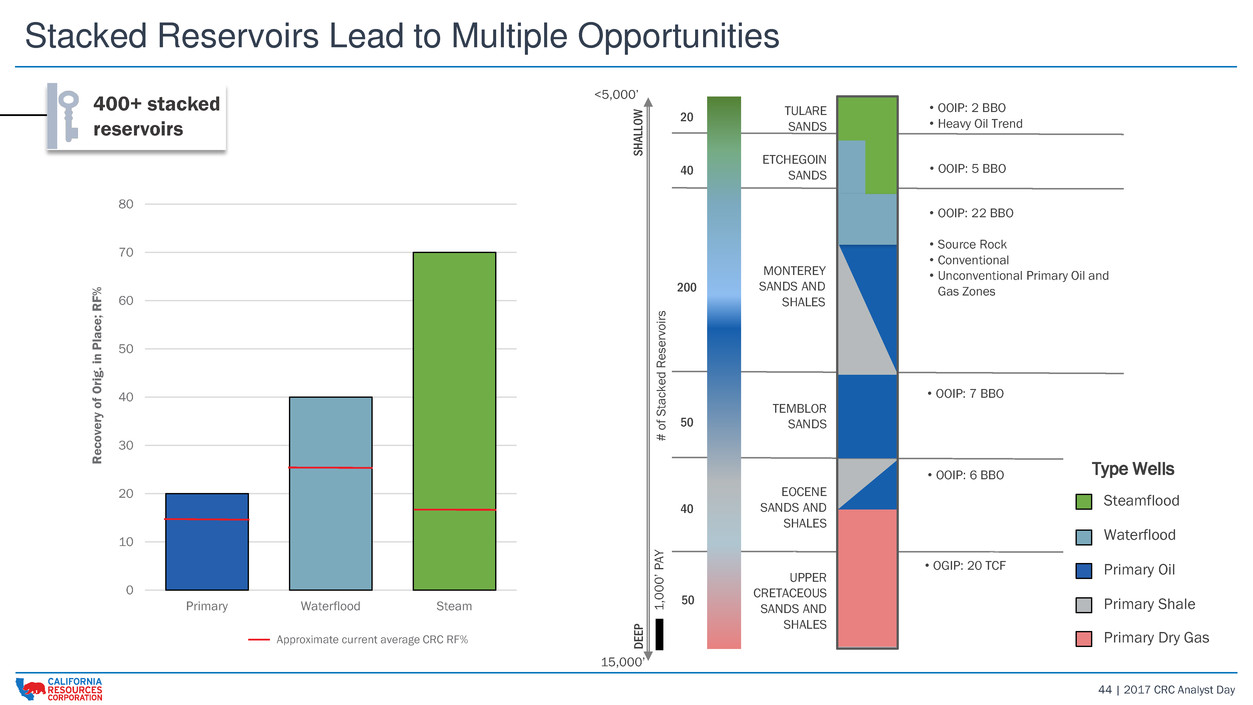

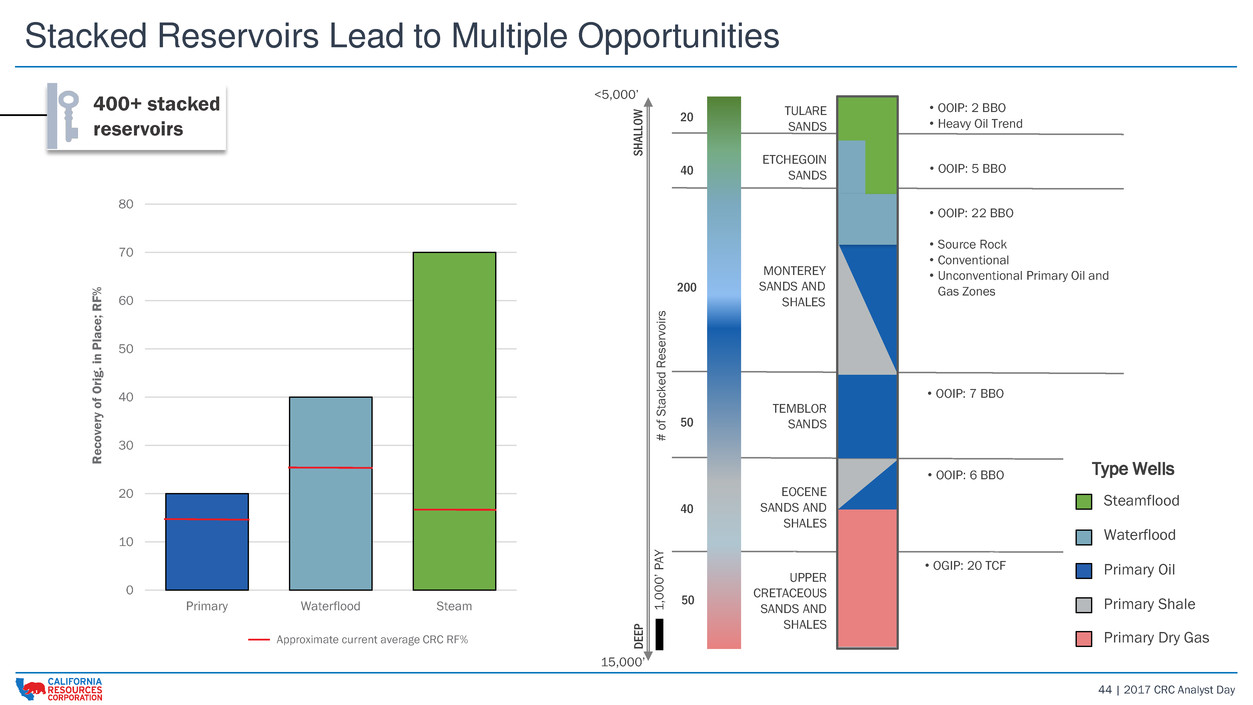

44 | 2017 CRC Analyst Day Stacked Reservoirs Lead to Multiple Opportunities Primary Oil Primary Shale Primary Dry Gas Steamflood Waterflood Type Wells MONTEREY SANDS AND SHALES TEMBLOR SANDS EOCENE SANDS AND SHALES UPPER CRETACEOUS SANDS AND SHALES 1 ,0 0 0 ’ P A Y TULARE SANDS 20 40 200 50 40 50 S HALLO W D EE P • OOIP: 2 BBO • Heavy Oil Trend • OOIP: 5 BBO • OOIP: 22 BBO • Source Rock • Conventional • Unconventional Primary Oil and Gas Zones • OOIP: 7 BBO • OOIP: 6 BBO • OGIP: 20 TCF ETCHEGOIN SANDS <5,000’ 15,000’ # of S ta ck ed Re se rv oi rs 400+ stacked reservoirs 0 10 20 30 40 50 60 70 80 Primary Waterflood Steam R e c o ve ry o f Ori g . in Pla c e ; R F % Approximate current average CRC RF%

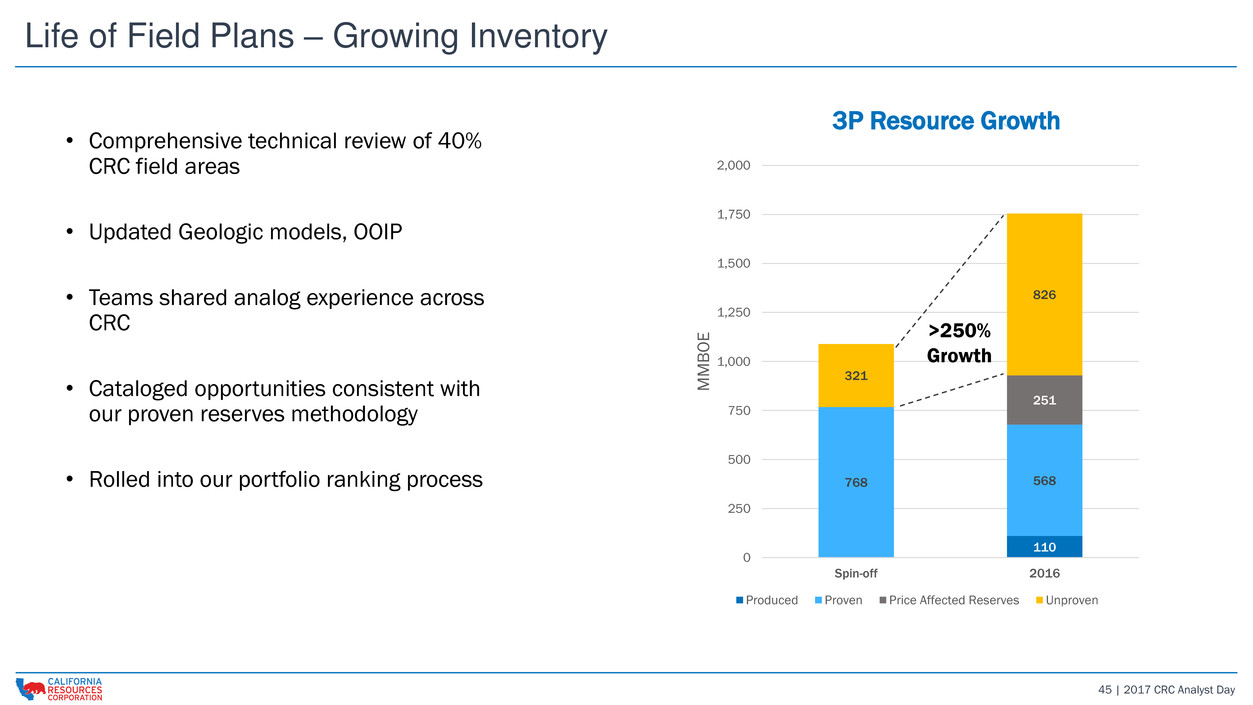

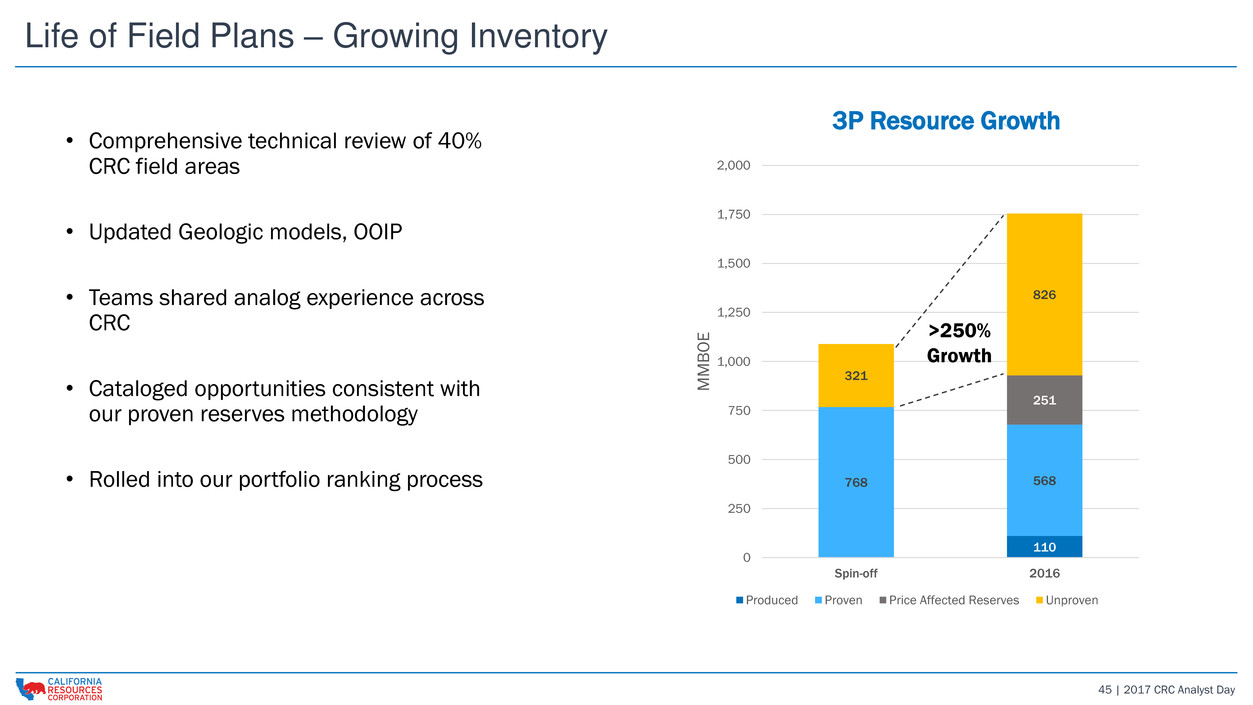

45 | 2017 CRC Analyst Day Life of Field Plans – Growing Inventory • Comprehensive technical review of 40% CRC field areas • Updated Geologic models, OOIP • Teams shared analog experience across CRC • Cataloged opportunities consistent with our proven reserves methodology • Rolled into our portfolio ranking process Base Production Additional Recovery New Pools 3P Resource Growth 110 768 568 251 321 826 0 250 500 750 1,000 1,250 1,500 1,750 2,000 Spin-off 2016 MMBO E Produced Proven Price Affected Reserves Unproven >250% Growth

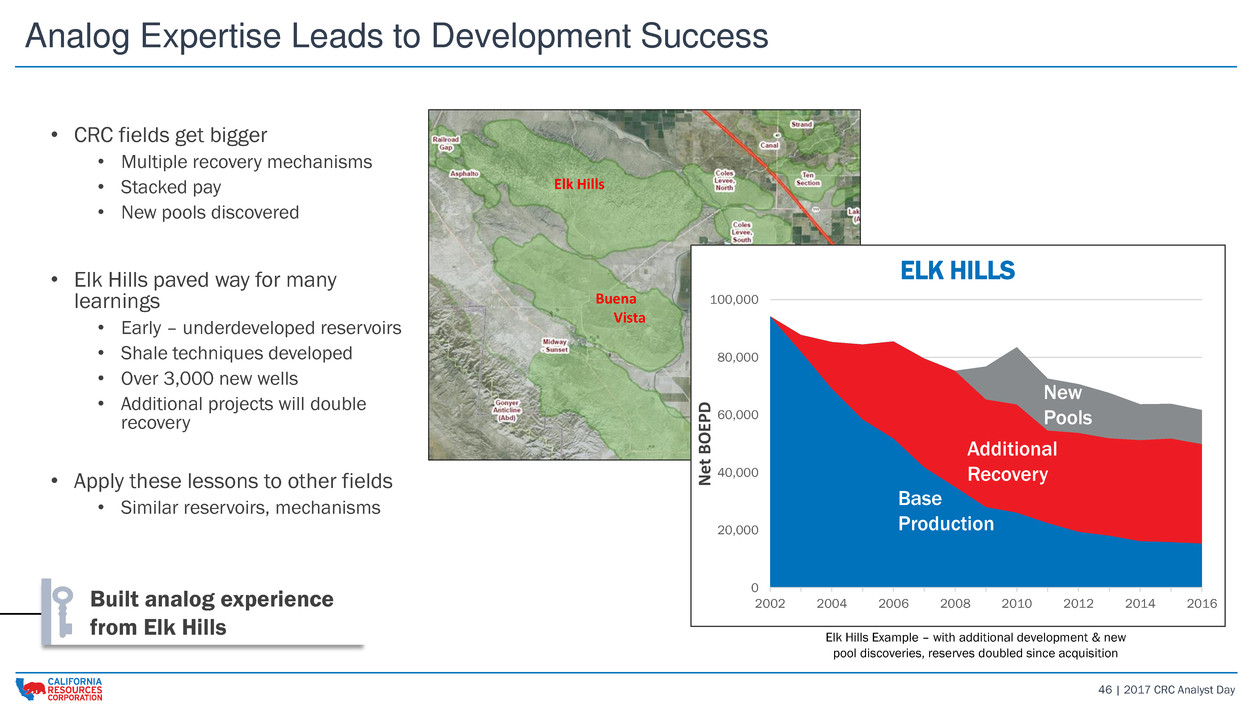

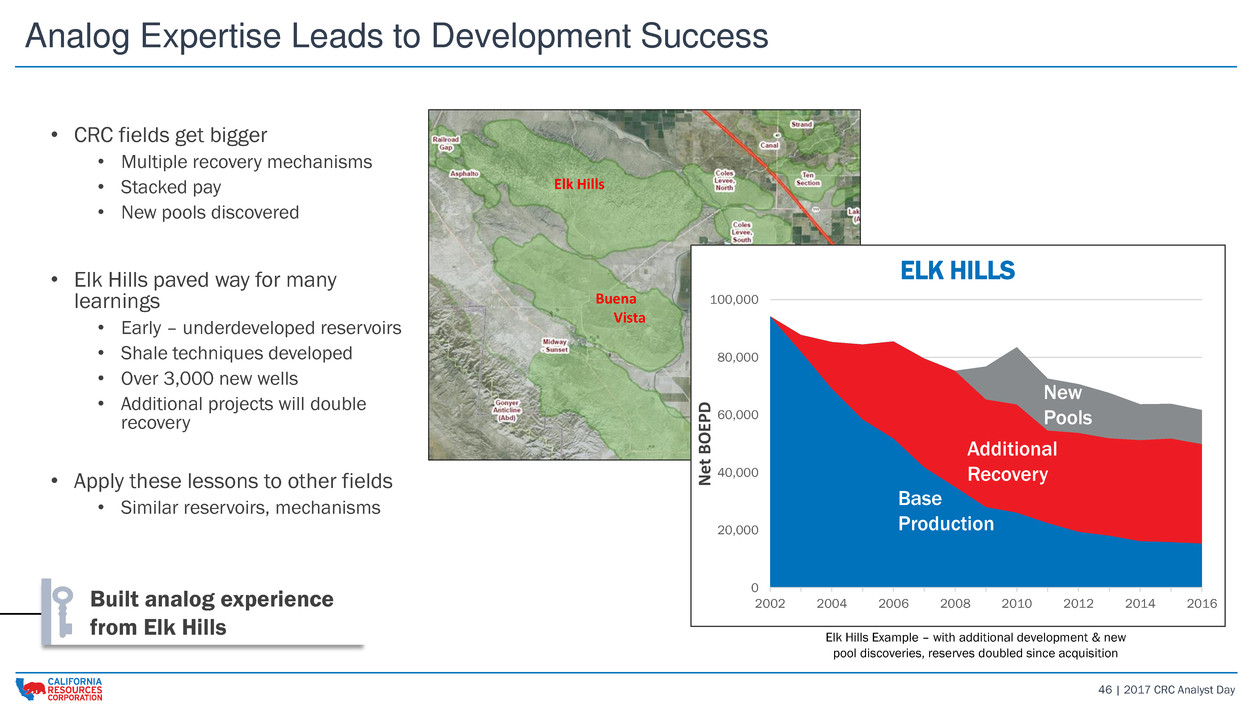

46 | 2017 CRC Analyst Day Built analog experience from Elk Hillsf 0 20,000 40,000 60,000 80,000 100,000 2002 2004 2006 2008 2010 2012 2014 2016 N et B OE P D ELK HILLS Analog Expertise Leads to Development Success Elk Hills Example – with additional development & new pool discoveries, reserves doubled since acquisition New Pools ELK HILLS Base Production Additional Recovery • CRC fields get bigger • Multiple recovery mechanisms • Stacked pay • New pools discovered • Elk Hills paved way for many learnings • Early – underdeveloped reservoirs • Shale techniques developed • Over 3,000 new wells • Additional projects will double recovery • Apply these lessons to other fields • Similar reservoirs, mechanisms Buena Vista Elk Hills

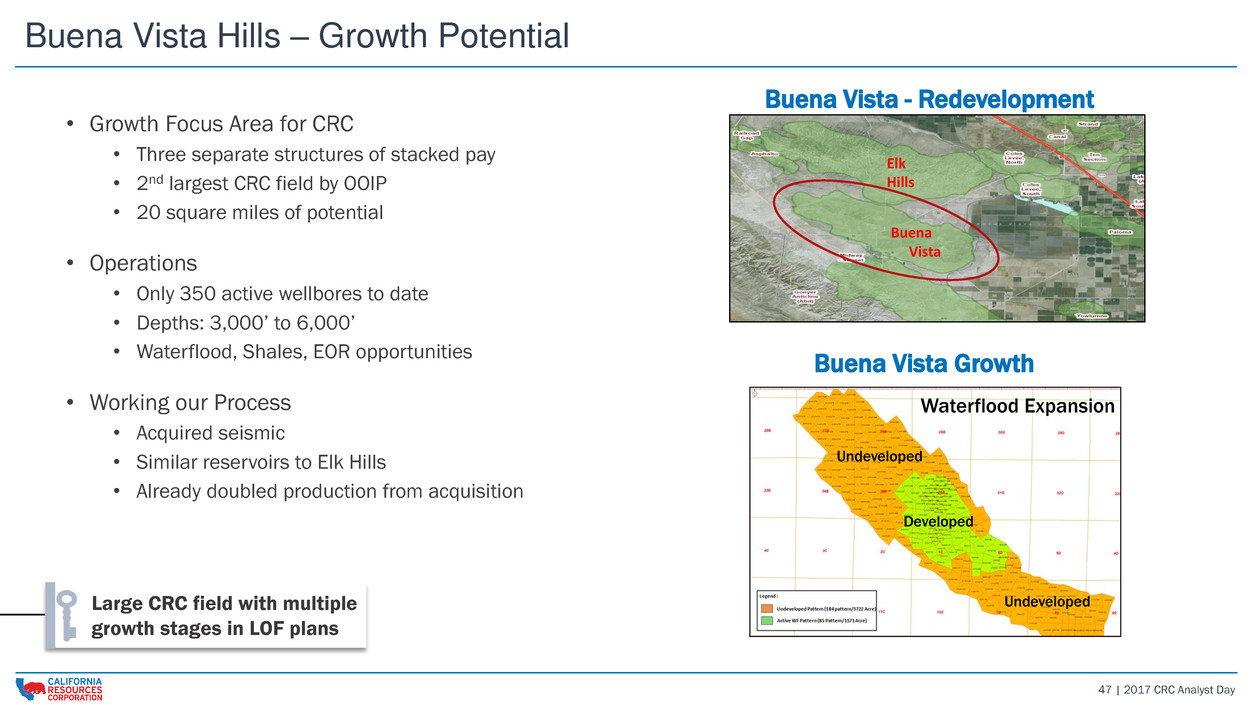

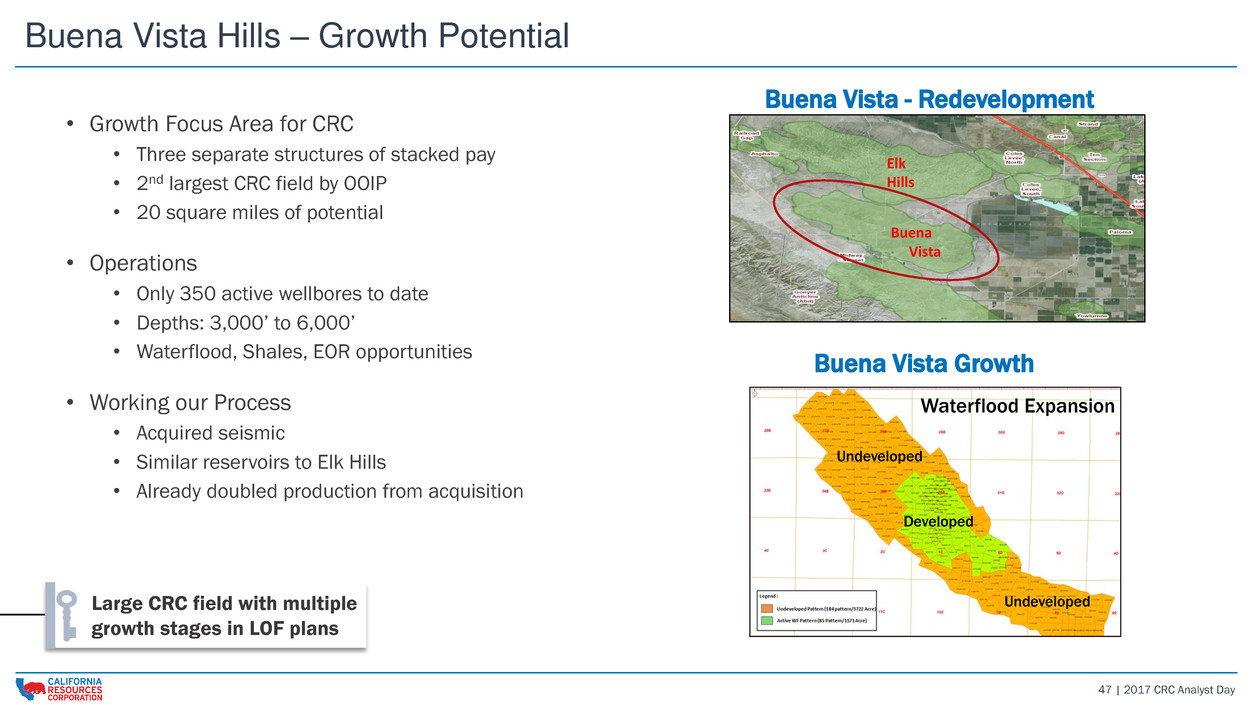

47 | 2017 CRC Analyst Day Buena Vista Hills – Growth Potential • Growth Focus Area for CRC • Three separate structures of stacked pay • 2nd largest CRC field by OOIP • 20 square miles of potential • Operations • Only 350 active wellbores to date • Depths: 3,000’ to 6,000’ • Waterflood, Shales, EOR opportunities • Working our Process • Acquired seismic • Similar reservoirs to Elk Hills • Already doubled production from acquisition Buena Vista - Redevelopment Buena Vista Growth Buena Vista Elk Hills Undeveloped Undeveloped Developed Waterflood Expansion Large CRC field with multiple growth stages in LOF plans

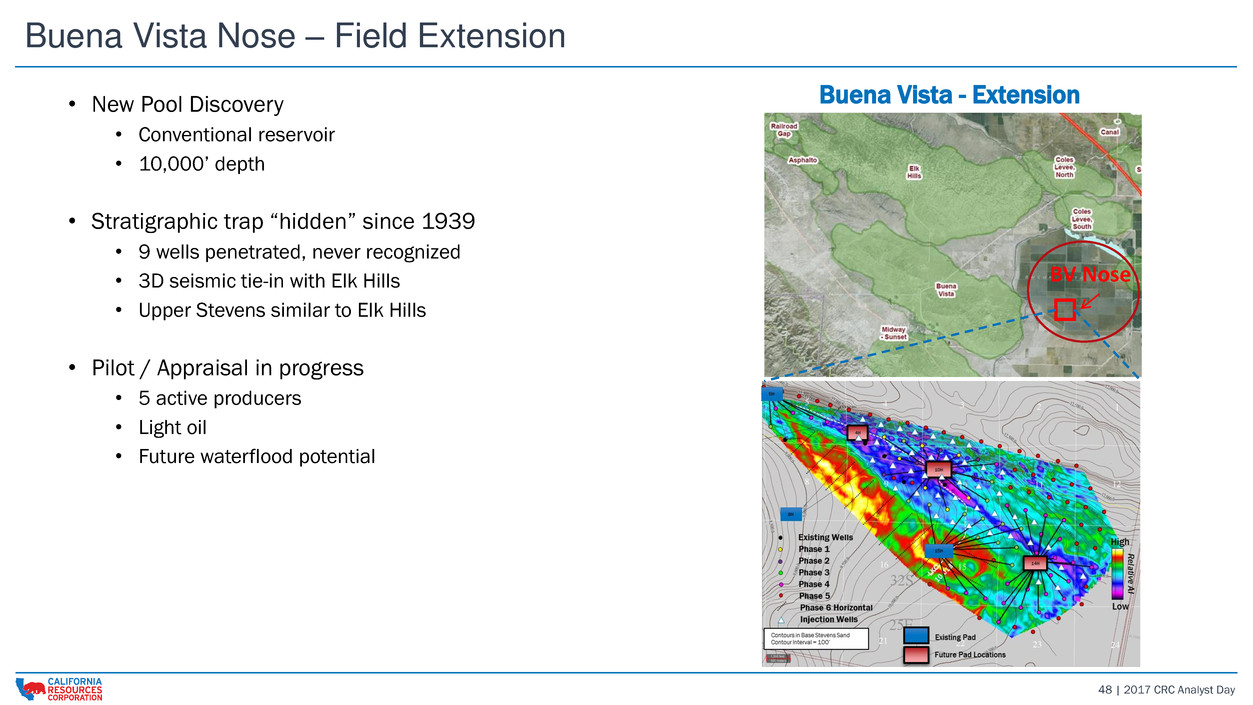

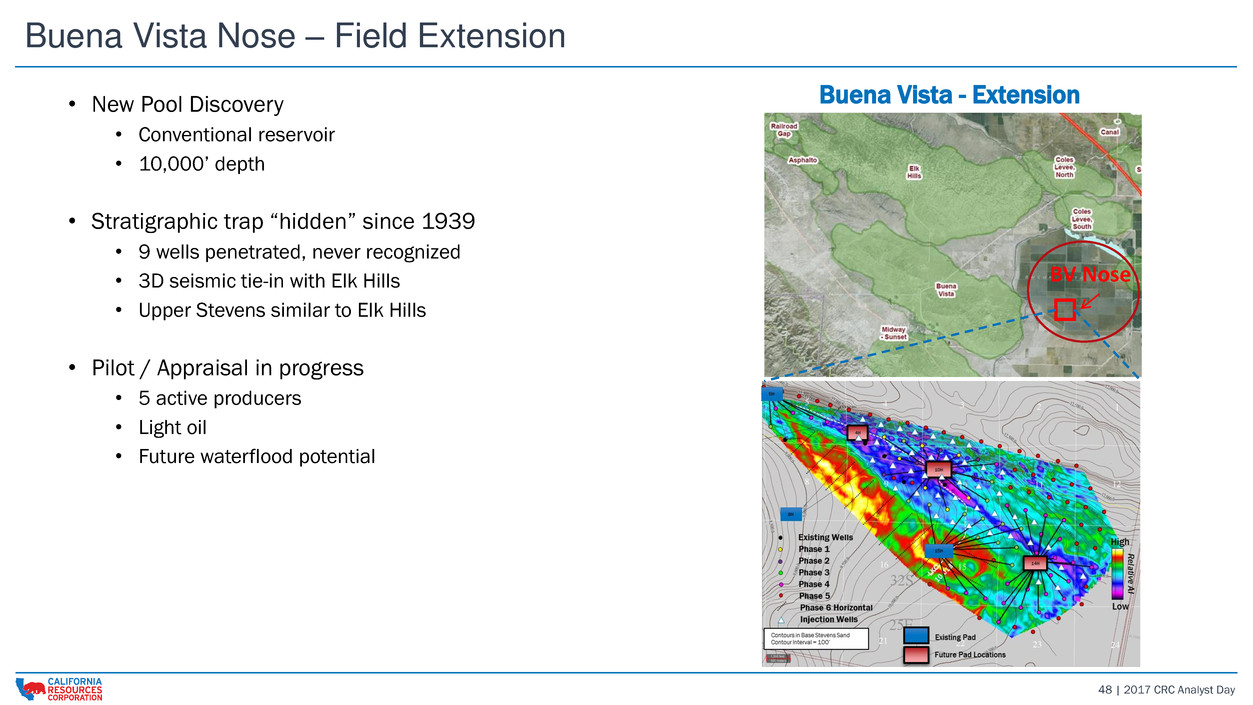

48 | 2017 CRC Analyst Day Buena Vista Nose – Field Extension FIELDMAP Buena Vista - Extension BV Nose • New Pool Discovery • Conventional reservoir • 10,000’ depth • Stratigraphic trap “hidden” since 1939 • 9 wells penetrated, never recognized • 3D seismic tie-in with Elk Hills • Upper Stevens similar to Elk Hills • Pilot / Appraisal in progress • 5 active producers • Light oil • Future waterflood potential

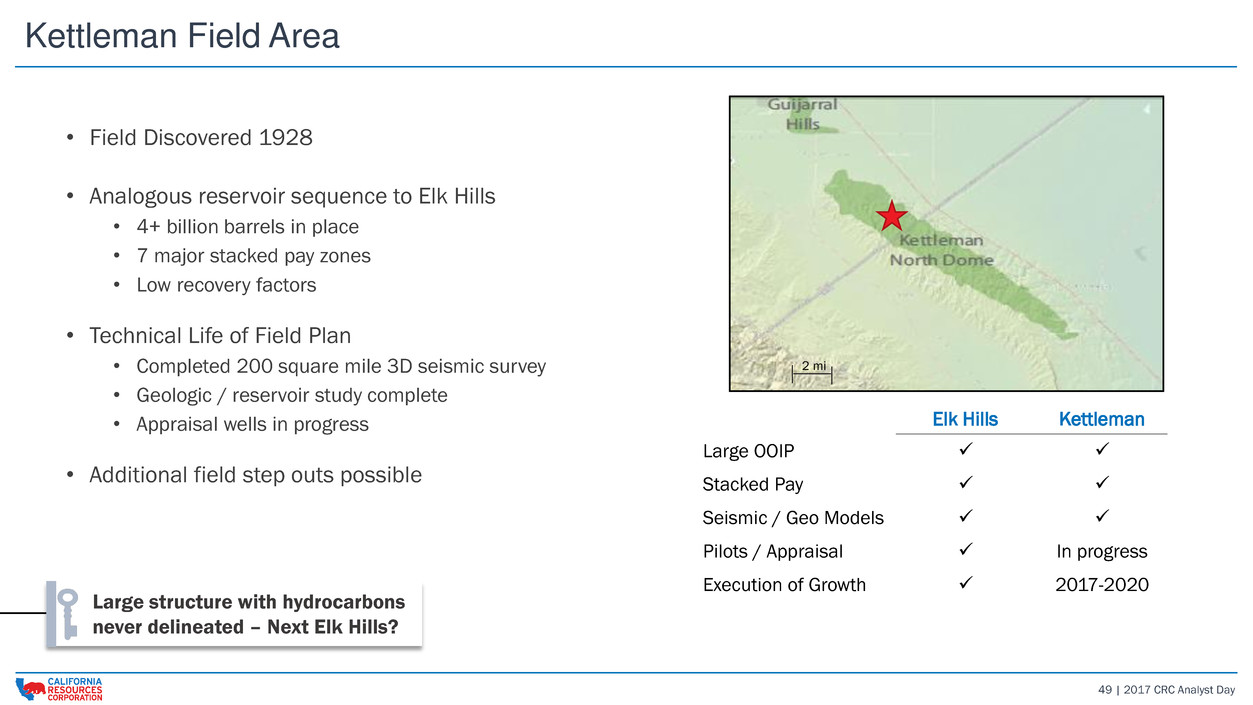

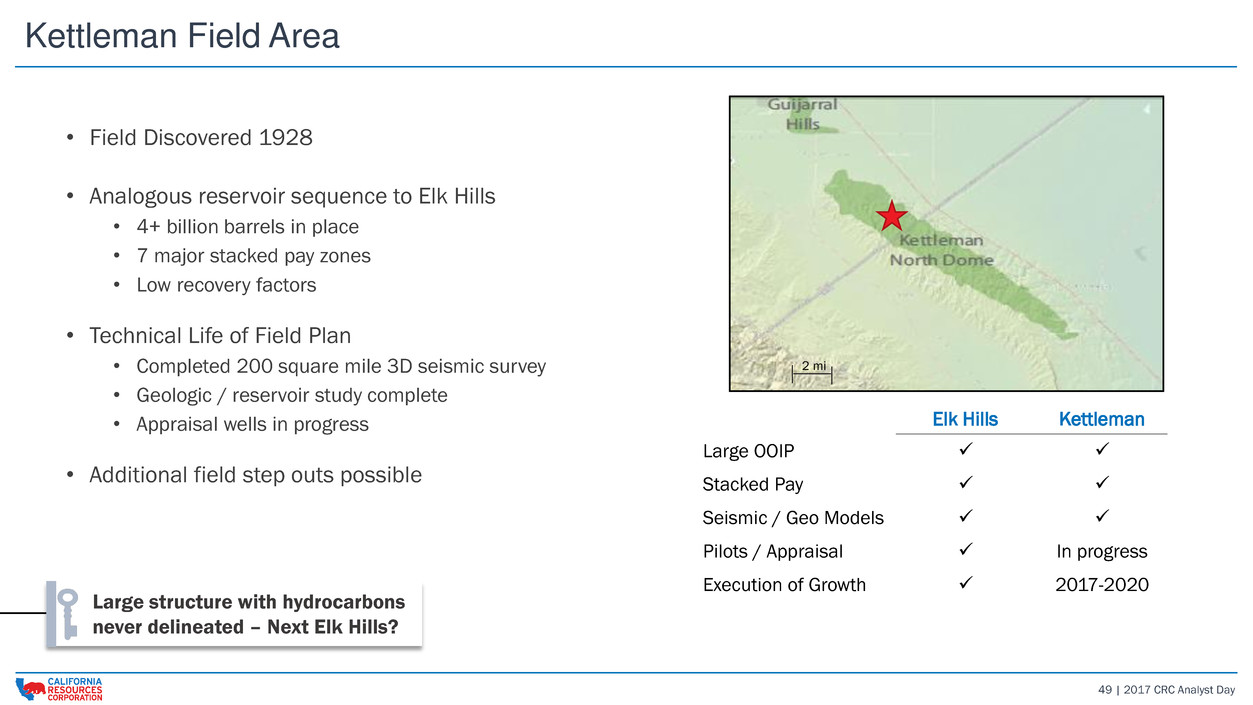

49 | 2017 CRC Analyst Day Kettleman Field Area • Field Discovered 1928 • Analogous reservoir sequence to Elk Hills • 4+ billion barrels in place • 7 major stacked pay zones • Low recovery factors • Technical Life of Field Plan • Completed 200 square mile 3D seismic survey • Geologic / reservoir study complete • Appraisal wells in progress • Additional field step outs possible Elk Hills Kettleman Large OOIP Stacked Pay Seismic / Geo Models Pilots / Appraisal In progress Execution of Growth 2017-2020 2 mi Large structure with hydrocarbons never delineated – Next Elk Hills?

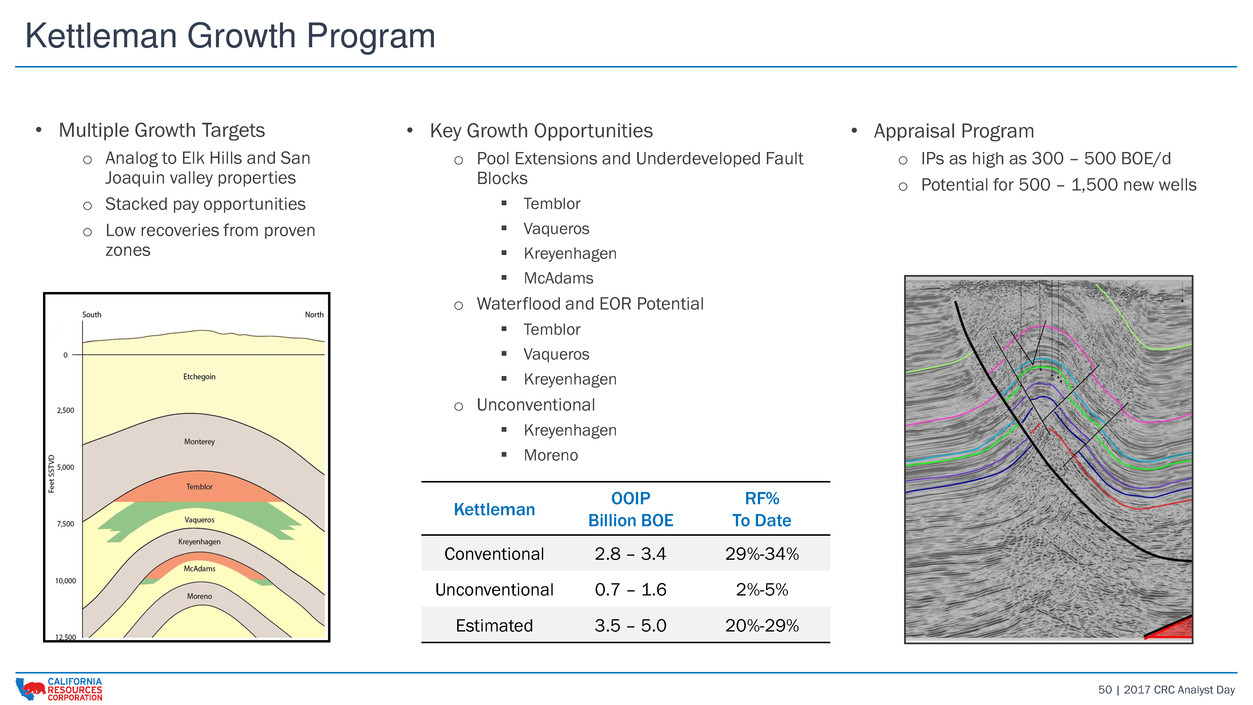

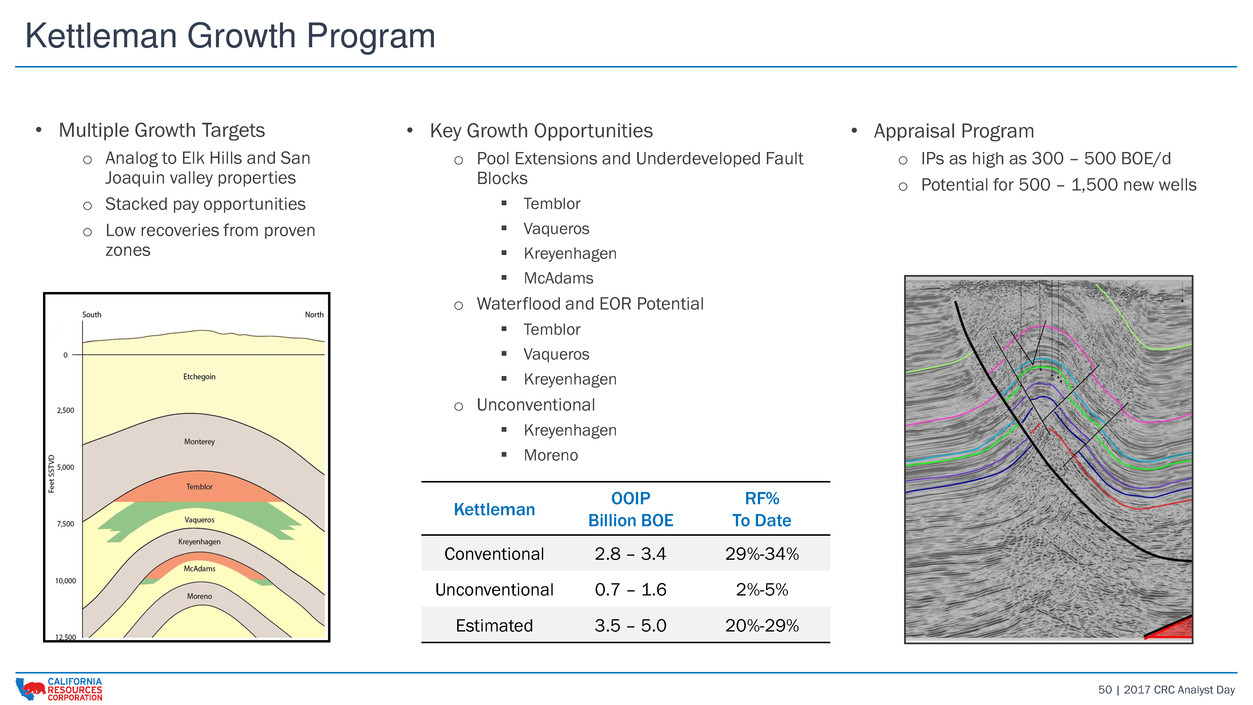

50 | 2017 CRC Analyst Day Kettleman Growth Program • Multiple Growth Targets o Analog to Elk Hills and San Joaquin valley properties o Stacked pay opportunities o Low recoveries from proven zones • Key Growth Opportunities o Pool Extensions and Underdeveloped Fault Blocks Temblor Vaqueros Kreyenhagen McAdams o Waterflood and EOR Potential Temblor Vaqueros Kreyenhagen o Unconventional Kreyenhagen Moreno • Appraisal Program o IPs as high as 300 – 500 BOE/d o Potential for 500 – 1,500 new wells Kettleman OOIP Billion BOE RF% To Date Conventional 2.8 – 3.4 29%-34% Unconventional 0.7 – 1.6 2%-5% Estimated 3.5 – 5.0 20%-29%

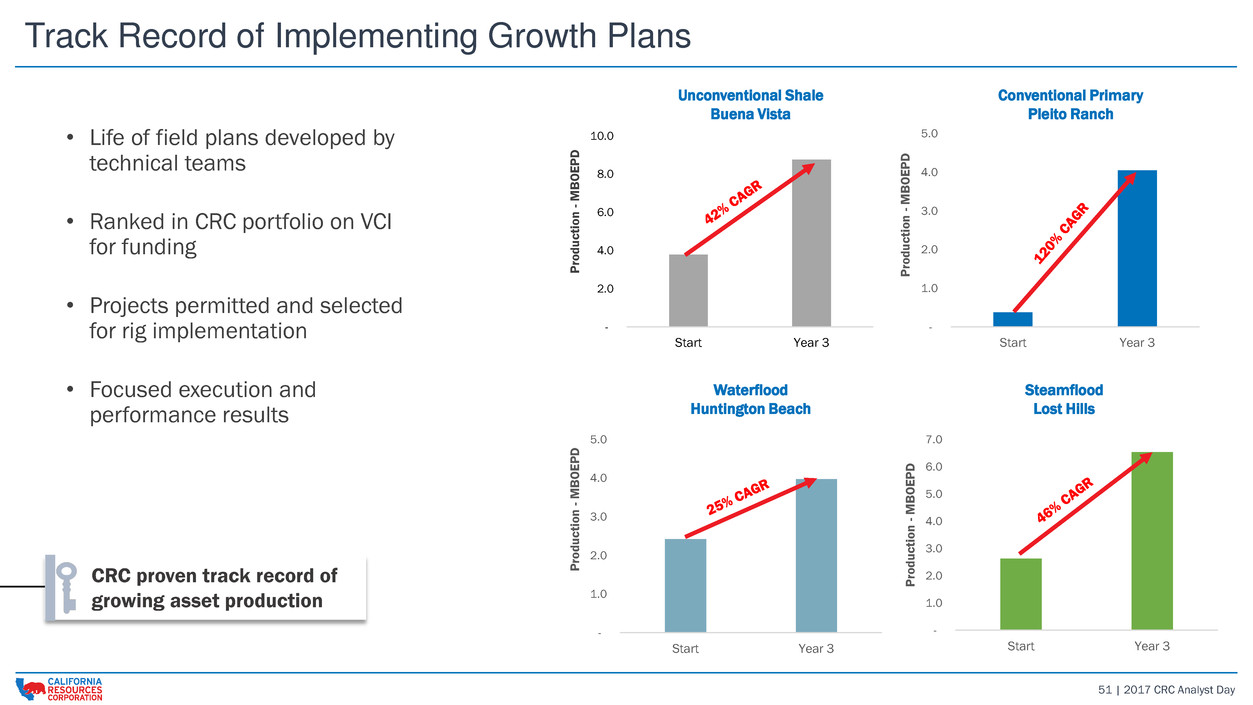

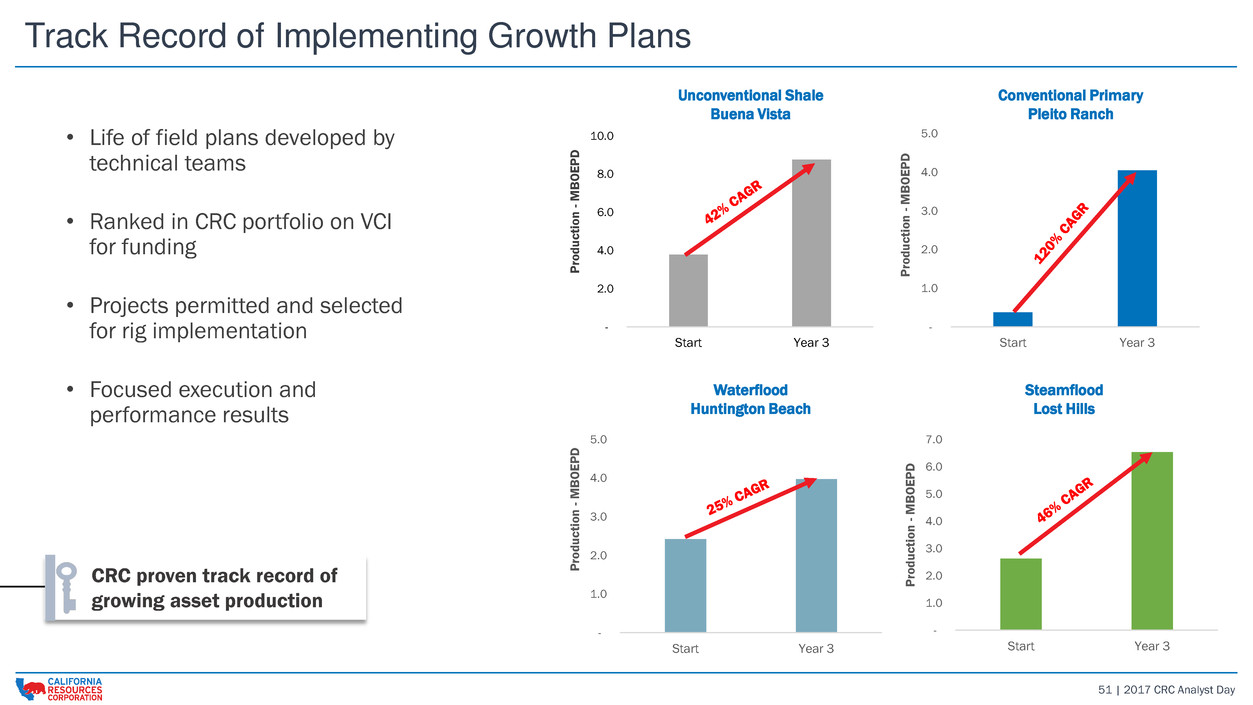

51 | 2017 CRC Analyst Day Track Record of Implementing Growth Plans - 1.0 2.0 3.0 4.0 5.0 6.0 7.0 Start Year 3 Pr o du c ti o n - M BO E P D Steamflood Lost Hills - 1.0 2.0 3.0 4.0 5.0 Start Year 3 Pr o du c ti o n - M BO E P D Waterflood Huntington Beach - 1.0 2.0 3.0 4.0 5.0 Start Year 3 Pr o du c ti o n - M BO E P D Conventional Primary Pleito - 2.0 4.0 6.0 8.0 10.0 Start Year 3 Pr o du c ti o n - M BO E P D Unconventional Shale Buena Vista • Life of field plans developed by technical teams • Ranked in CRC portfolio on VCI for funding • Projects permitted and selected for rig implementation • Focused execution and performance results Unconventional Shale Buena Vista Conventional Primary Pleito Ranch Waterflood Huntington Beach Steamflood Lost Hills CRC proven track record of growing asset production

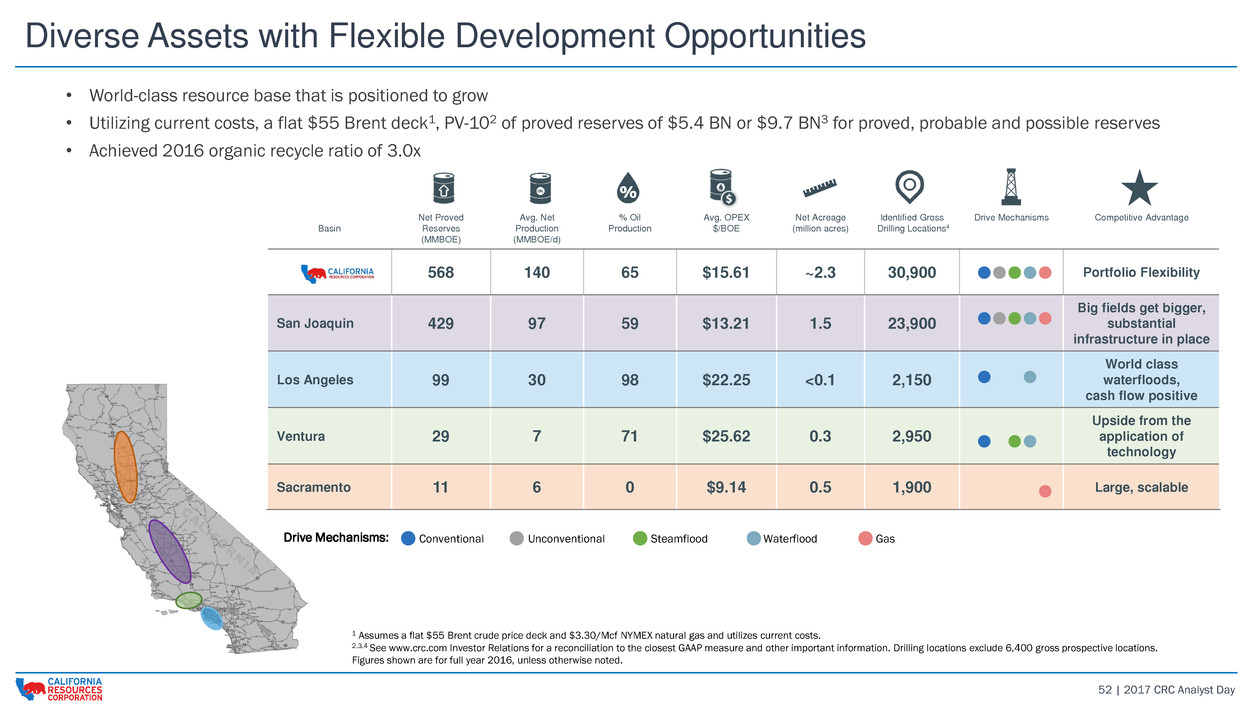

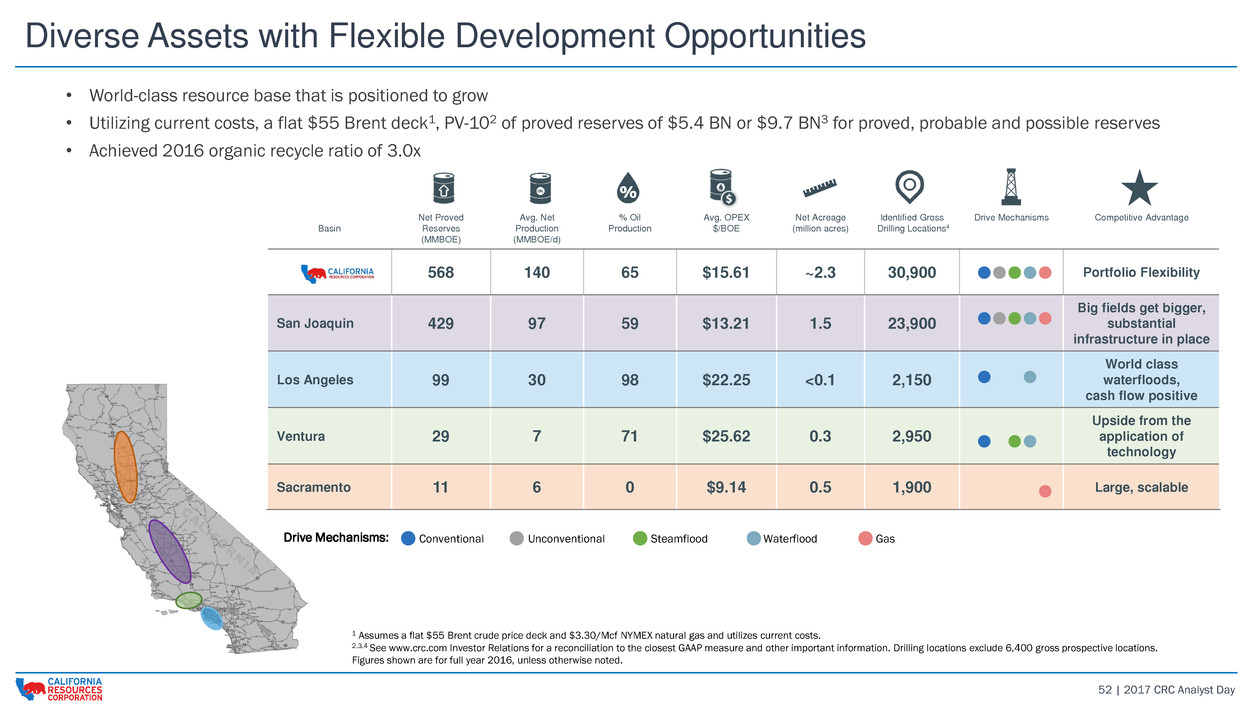

52 | 2017 CRC Analyst Day Diverse Assets with Flexible Development Opportunities Basin Net Proved Reserves (MMBOE) Avg. Net Production (MMBOE/d) % Oil Production Avg. OPEX $/BOE Net Acreage (million acres) Identified Gross Drilling Locations4 Drive Mechanisms Competitive Advantage 568 140 65 $15.61 ~2.3 30,900 Portfolio Flexibility San Joaquin 429 97 59 $13.21 1.5 23,900 Big fields get bigger, substantial infrastructure in place Los Angeles 99 30 98 $22.25 <0.1 2,150 World class waterfloods, cash flow positive Ventura 29 7 71 $25.62 0.3 2,950 Upside from the application of technology Sacramento 11 6 0 $9.14 0.5 1,900 Large, scalable • World-class resource base that is positioned to grow • Utilizing current costs, a flat $55 Brent deck1, PV-102 of proved reserves of $5.4 BN or $9.7 BN3 for proved, probable and possible reserves • Achieved 2016 organic recycle ratio of 3.0x Drive Mechanisms: Conventional Unconventional Steamflood Waterflood Gas 1 Assumes a flat $55 Brent crude price deck and $3.30/Mcf NYMEX natural gas and utilizes current costs. 2,3,4 See www.crc.com Investor Relations for a reconciliation to the closest GAAP measure and other important information. Drilling locations exclude 6,400 gross prospective locations. Figures shown are for full year 2016, unless otherwise noted.

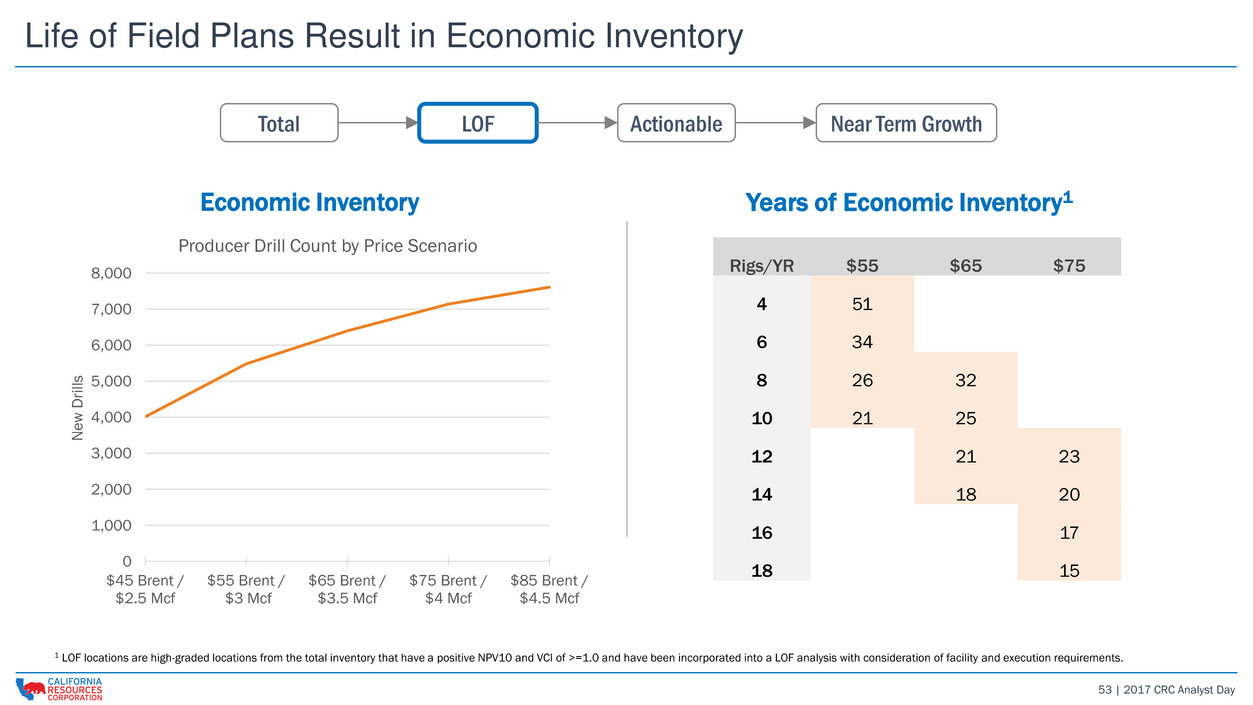

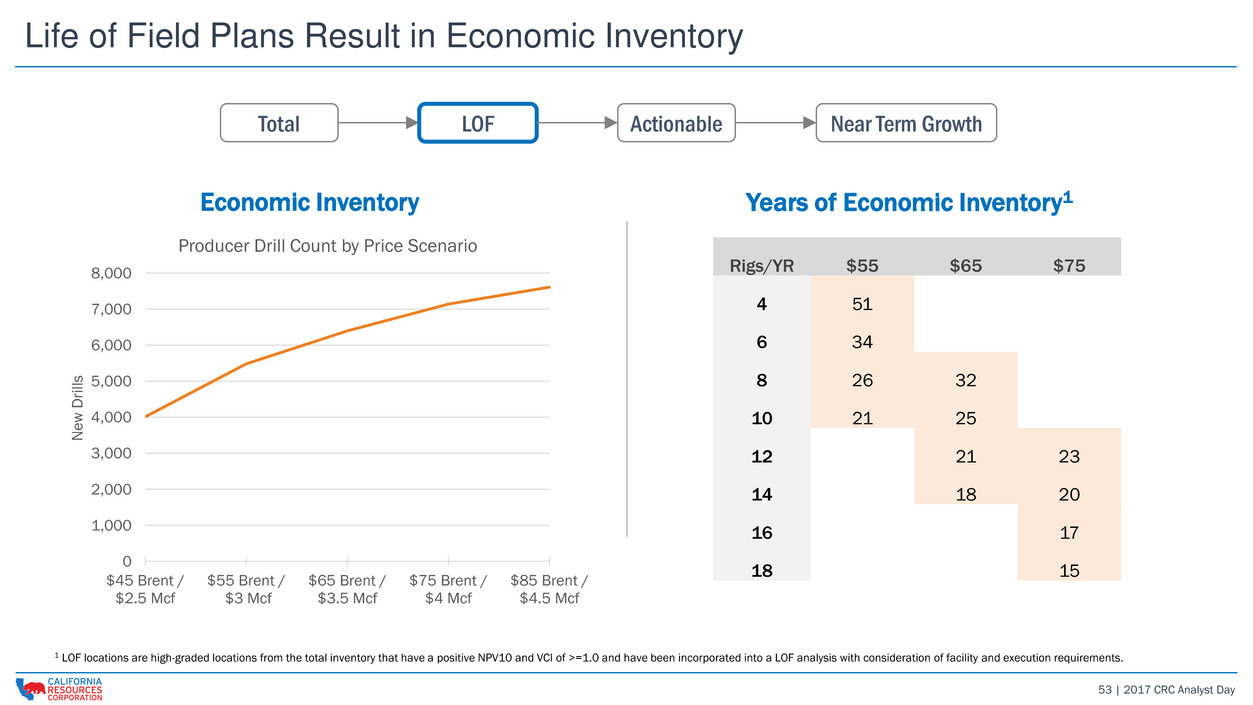

53 | 2017 CRC Analyst Day Life of Field Plans Result in Economic Inventory Economic Inventory Years of Economic Inventory1 1 LOF locations are high-graded locations from the total inventory that have a positive NPV10 and VCI of >=1.0 and have been incorporated into a LOF analysis with consideration of facility and execution requirements. 0 1,000 2,000 3,000 4,000 5,000 6,000 7,000 8,000 $45 Brent / $2.5 Mcf $55 Brent / $3 Mcf $65 Brent / $3.5 Mcf $75 Brent / $4 Mcf $85 Brent / $4.5 Mcf N e w D rill s Producer Drill Count by Price Scenario Total LOF Actionable Near Term Growth Rigs/YR $55 $65 $75 4 51 6 34 8 26 32 10 21 25 12 21 23 14 18 20 16 17 18 15

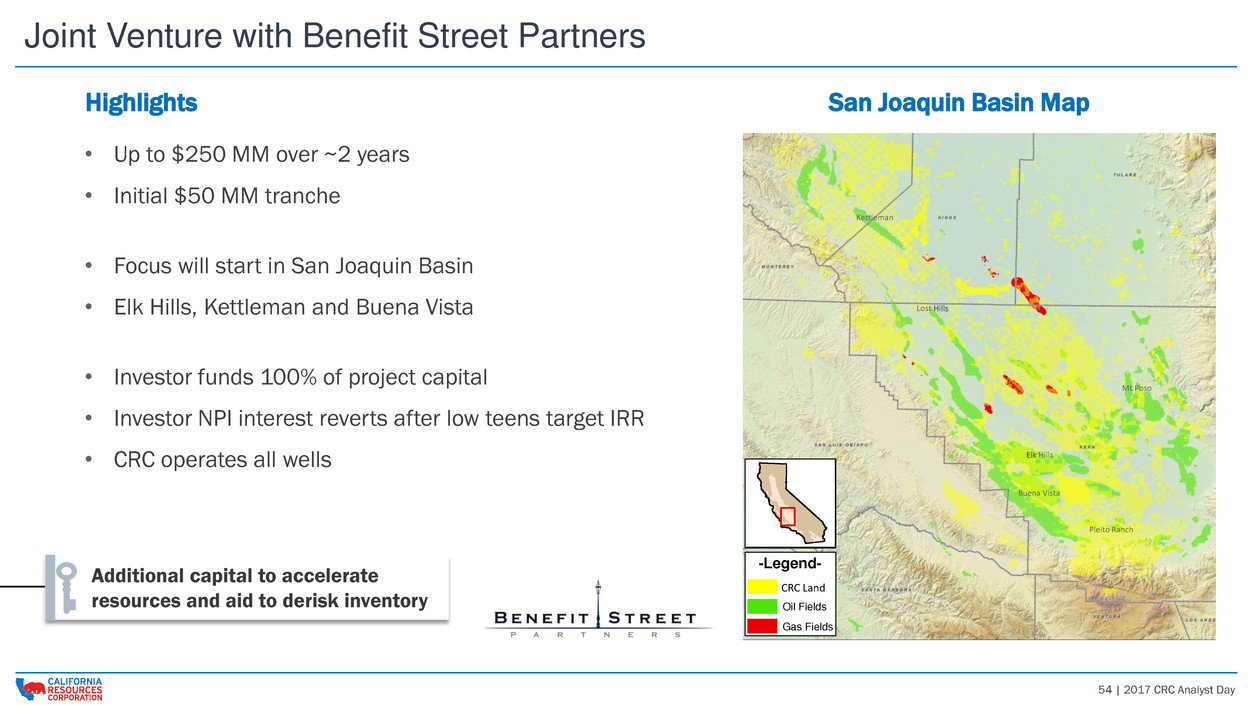

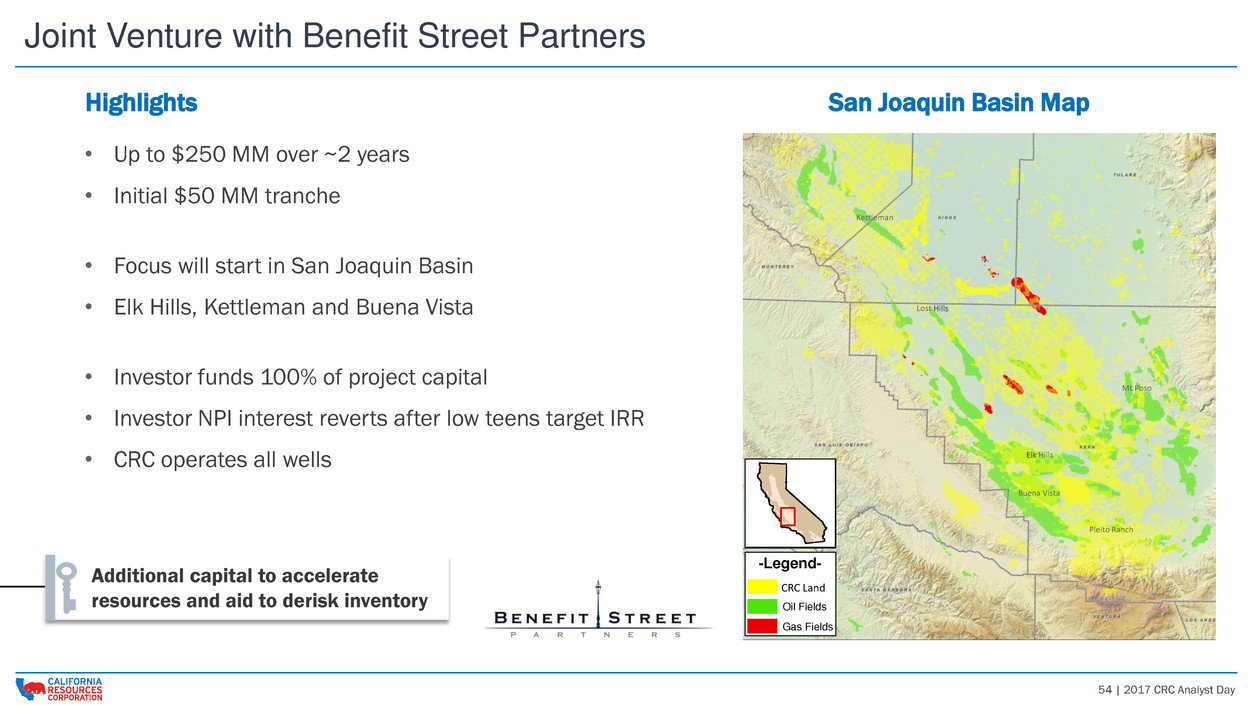

54 | 2017 CRC Analyst Day Joint Venture with Benefit Street Partners Kern Front -Legend- Oxy Land Oil Fields Gas Fields Buena Vista Pleito Ranch Elk Hills Kettleman Lost Hills Mt Poso CRC Land Highlights • Up to $250 MM over ~2 years • Initial $50 MM tranche • Focus will start in San Joaquin Basin • Elk Hills, Kettleman and Buena Vista • Investor funds 100% of project capital • Investor NPI interest reverts after low teens target IRR • CRC operates all wells San Joaquin Basin Map Additional capital to accelerate resources and aid to derisk inventory

EXPLORATION CRC 2017 Analyst & Investor Day Darren Williams | EVP Exploration

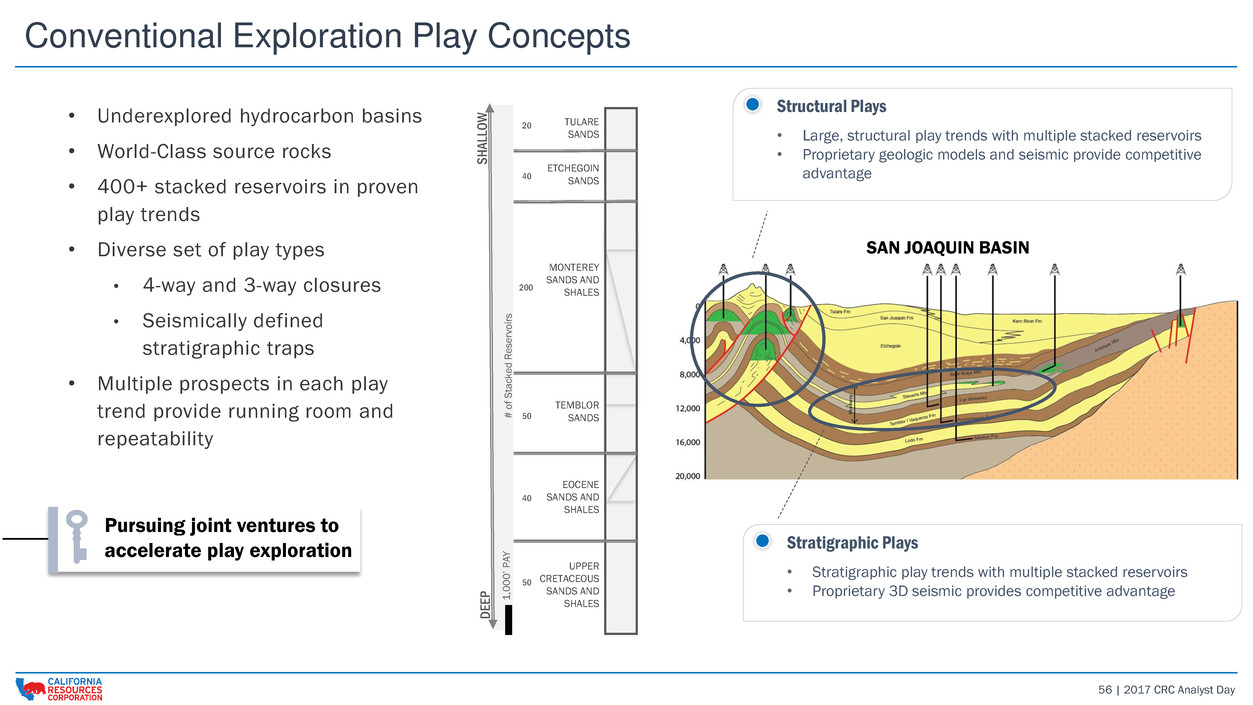

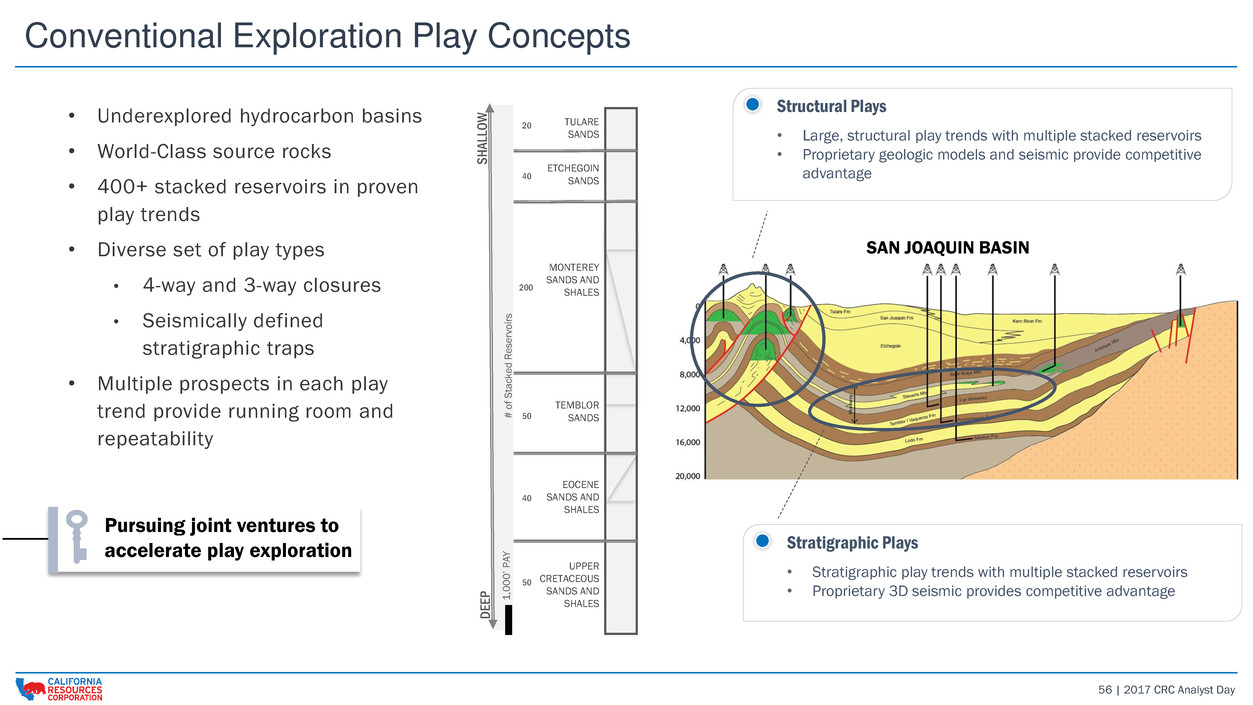

56 | 2017 CRC Analyst Day Conventional Exploration Play Concepts • Underexplored hydrocarbon basins • World-Class source rocks • 400+ stacked reservoirs in proven play trends • Diverse set of play types • 4-way and 3-way closures • Seismically defined stratigraphic traps • Multiple prospects in each play trend provide running room and repeatability SAN JOAQUIN BASIN Structural Plays • Large, structural play trends with multiple stacked reservoirs • Proprietary geologic models and seismic provide competitive advantage Stratigraphic Plays • Stratigraphic play trends with multiple stacked reservoirs • Proprietary 3D seismic provides competitive advantage TEMBLOR SANDS EOCENE SANDS AND SHALES UPPER CRETACEOUS SANDS AND SHALES MONTEREY SANDS AND SHALES 1 ,0 0 0 ’ P A Y TULARE SANDS 20 40 200 50 40 50 SH A LL O W D EE P ETCHEGOIN SANDS # of S ta ck ed Reser voi rs Pursuing joint ventures to accelerate play exploration

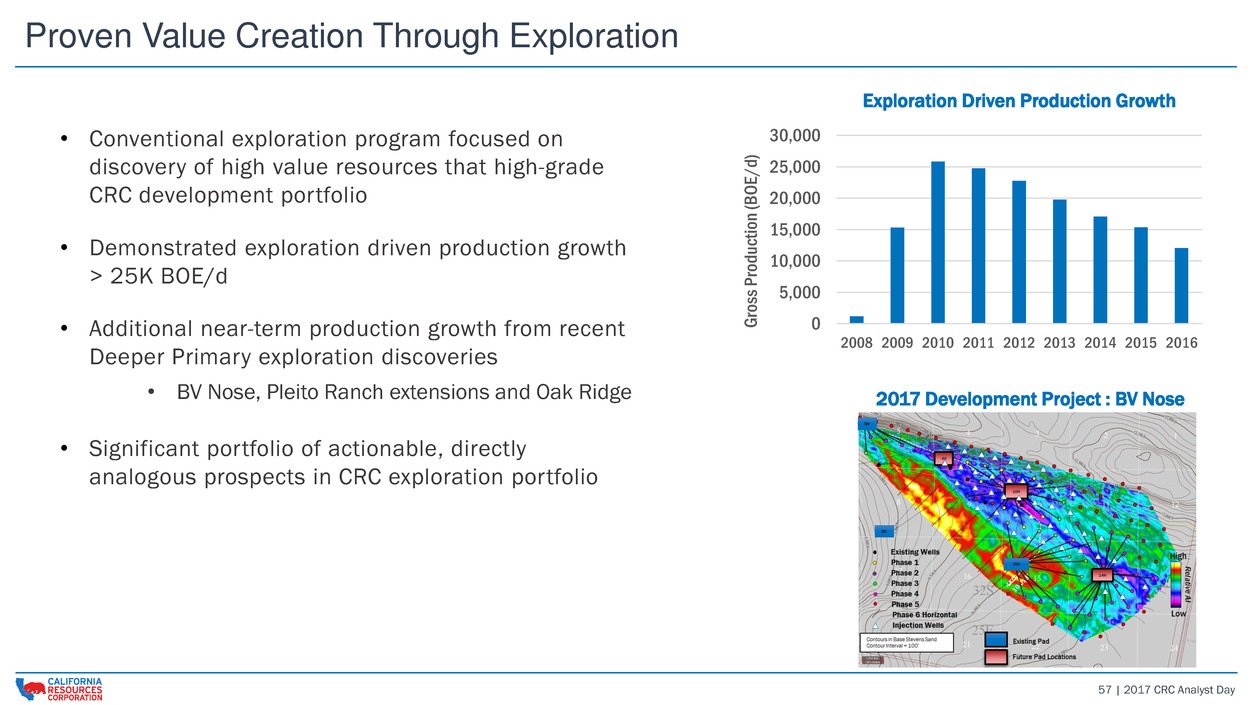

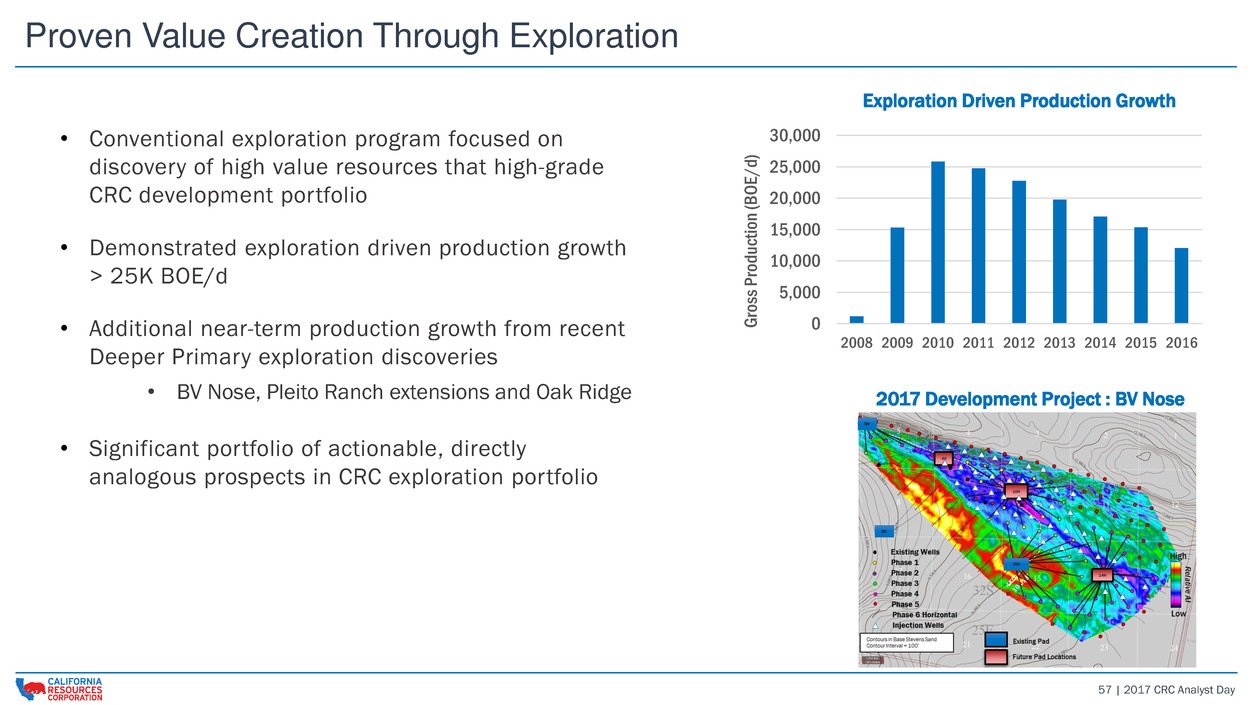

57 | 2017 CRC Analyst Day Proven Value Creation Through Exploration • Conventional exploration program focused on discovery of high value resources that high-grade CRC development portfolio • Demonstrated exploration driven production growth > 25K BOE/d • Additional near-term production growth from recent Deeper Primary exploration discoveries • BV Nose, Pleito Ranch extensions and Oak Ridge • Significant portfolio of actionable, directly analogous prospects in CRC exploration portfolio 2017 Development Project : BV Nose Exploration Driven Production Growth 0 5,000 10,000 15,000 20,000 25,000 30,000 2008 2009 2010 2011 2012 2013 2014 2015 2016 G ros s P ro d uc tio n (B OE / d )

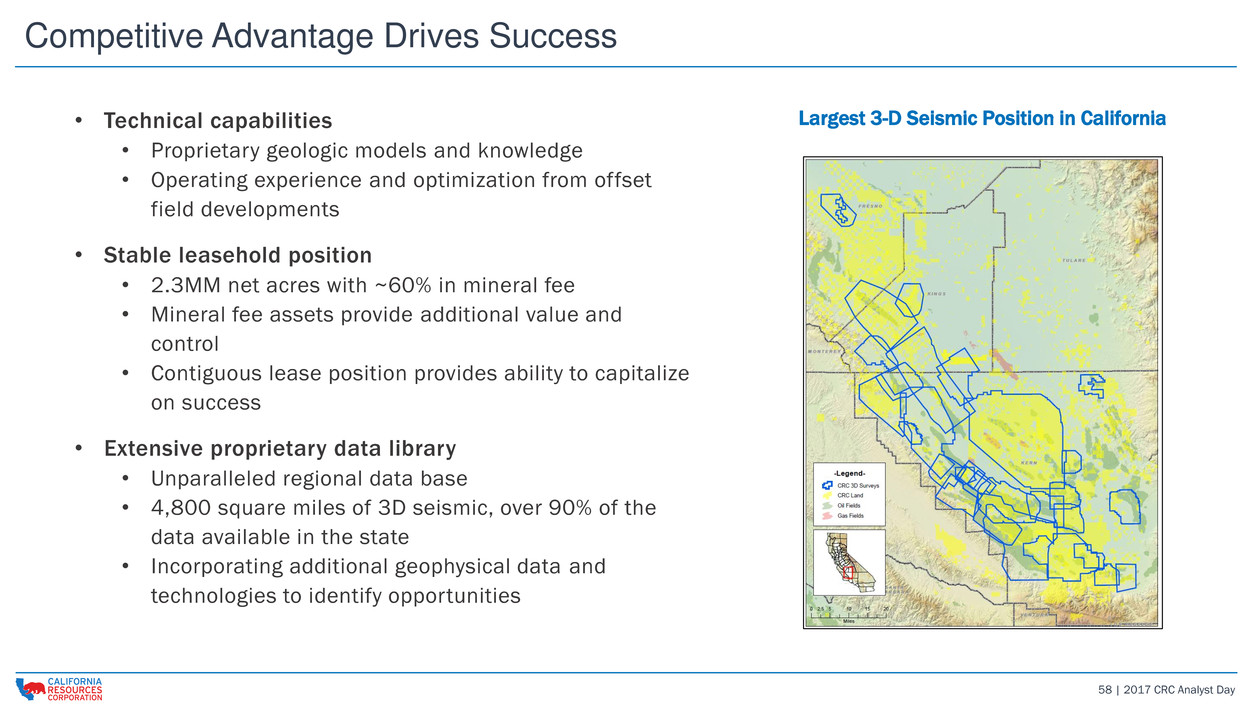

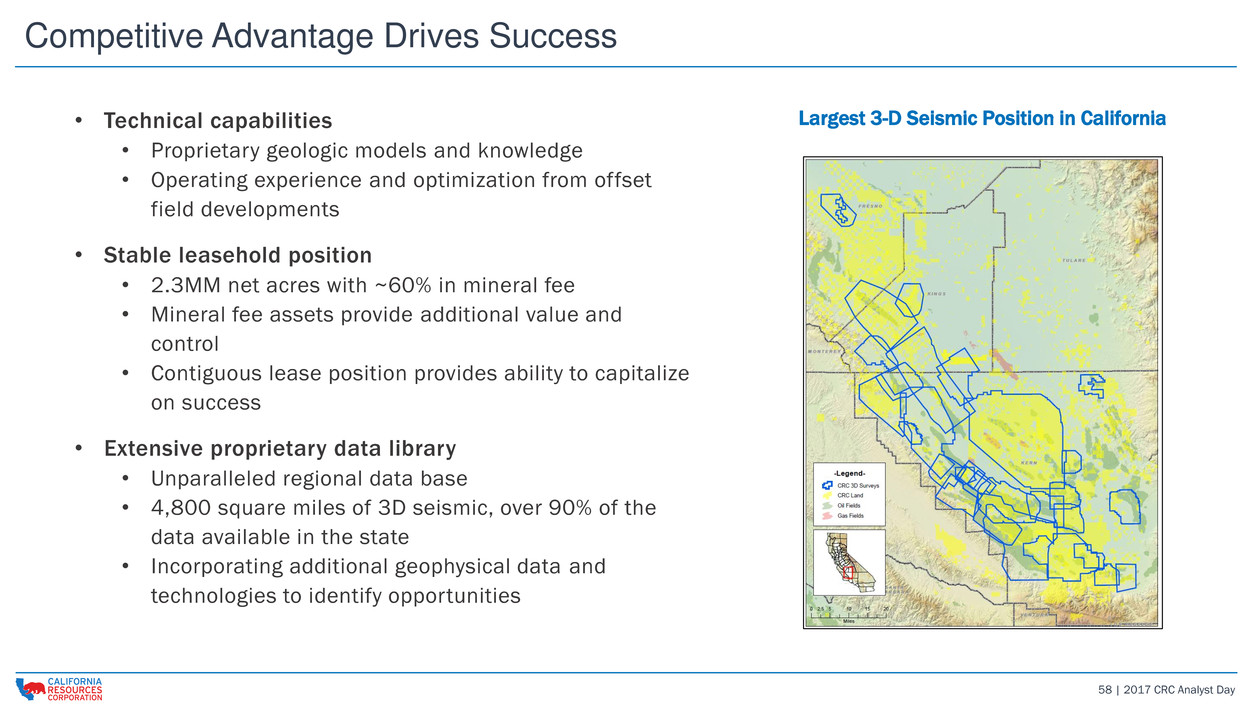

58 | 2017 CRC Analyst Day Competitive Advantage Drives Success Largest 3-D Seismic Position in California• Technical capabilities • Proprietary geologic models and knowledge • Operating experience and optimization from offset field developments • Stable leasehold position • 2.3MM net acres with ~60% in mineral fee • Mineral fee assets provide additional value and control • Contiguous lease position provides ability to capitalize on success • Extensive proprietary data library • Unparalleled regional data base • 4,800 square miles of 3D seismic, over 90% of the data available in the state • Incorporating additional geophysical data and technologies to identify opportunities

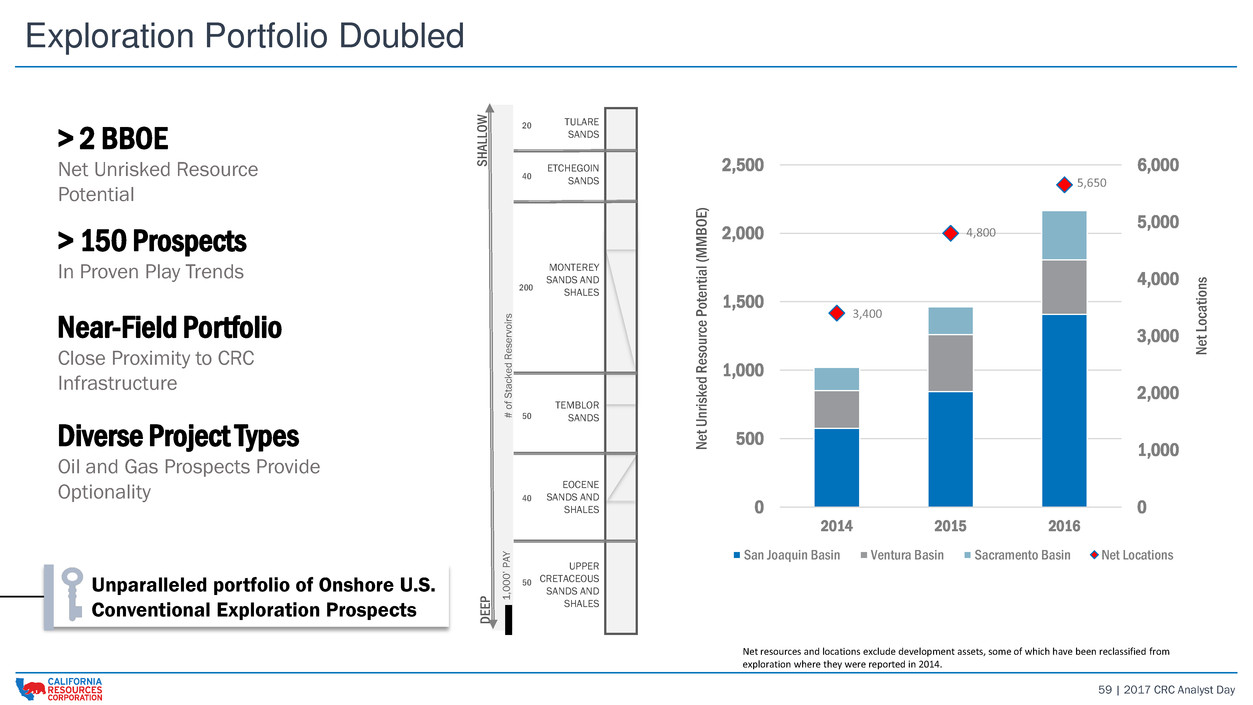

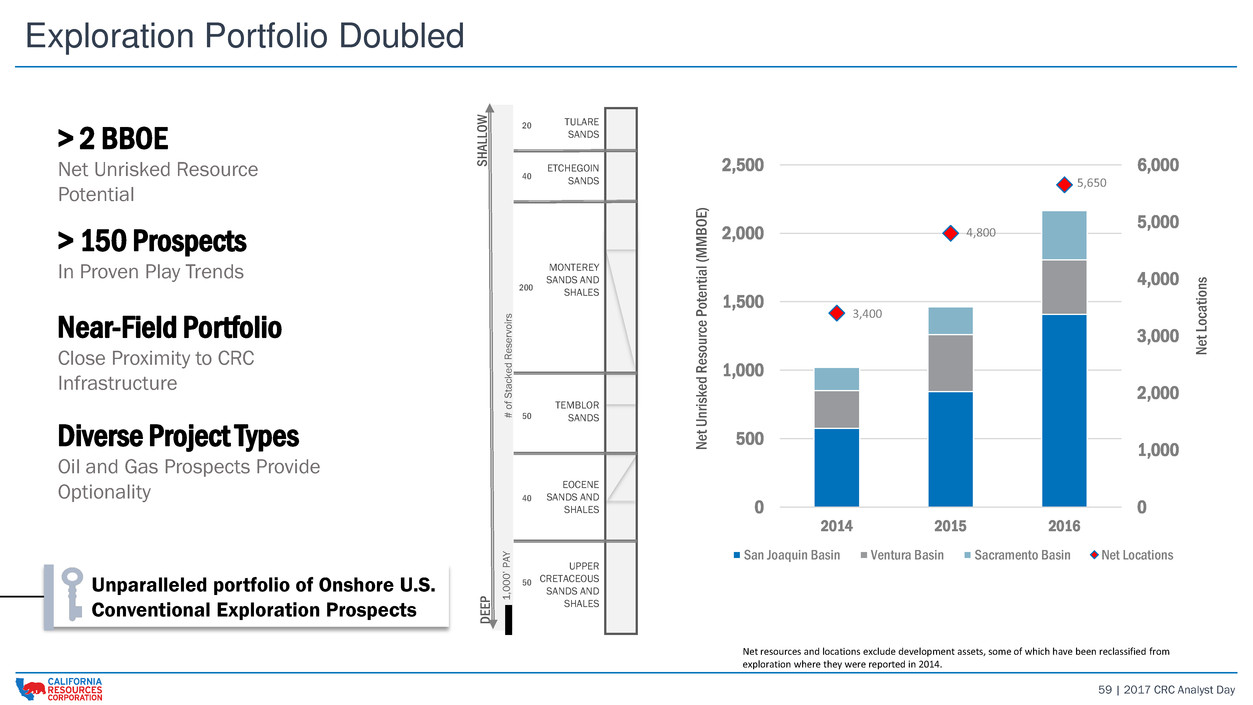

59 | 2017 CRC Analyst Day 3,400 4,800 5,650 0 1,000 2,000 3,000 4,000 5,000 6,000 0 500 1,000 1,500 2,000 2,500 2014 2015 2016 N et Loc at ion s N et U nr iske d R esou rce P ot ent ial (M M B O E) San Joaquin Basin Ventura Basin Sacramento Basin Net Locations Exploration Portfolio Doubled > 2 BBOE Net Unrisked Resource Potential Diverse Project Types Oil and Gas Prospects Provide Optionality Near-Field Portfolio Close Proximity to CRC Infrastructure > 150 Prospects In Proven Play Trends Net resources and locations exclude development assets, some of which have been reclassified from exploration where they were reported in 2014. Unparalleled portfolio of Onshore U.S. Conventional Exploration Prospects TEMBLOR SANDS EOCENE SANDS AND SHALES UPPER CRETACEOUS SANDS AND SHALES MONTEREY SANDS AND SHALES 1 ,0 0 0 ’ P A Y TULARE SANDS 20 40 200 50 40 50 SH A LL O W D EE P ETCHEGOIN SANDS # of S ta ck ed Reser voi rs

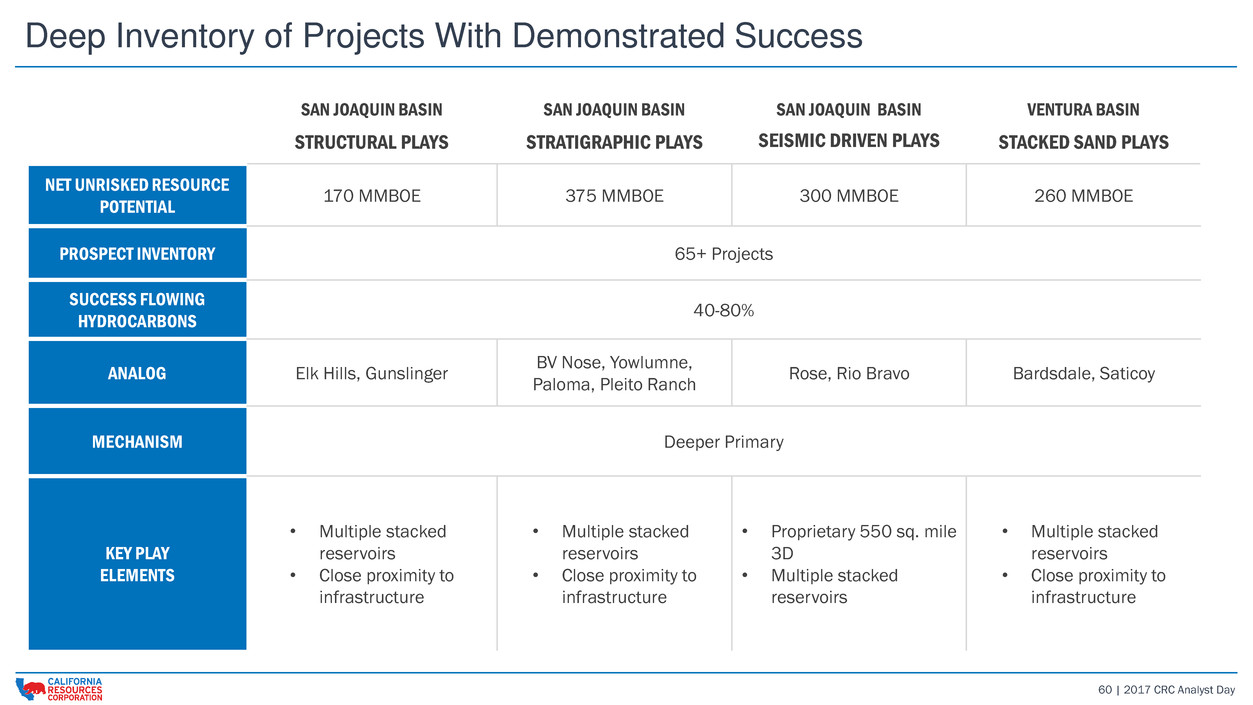

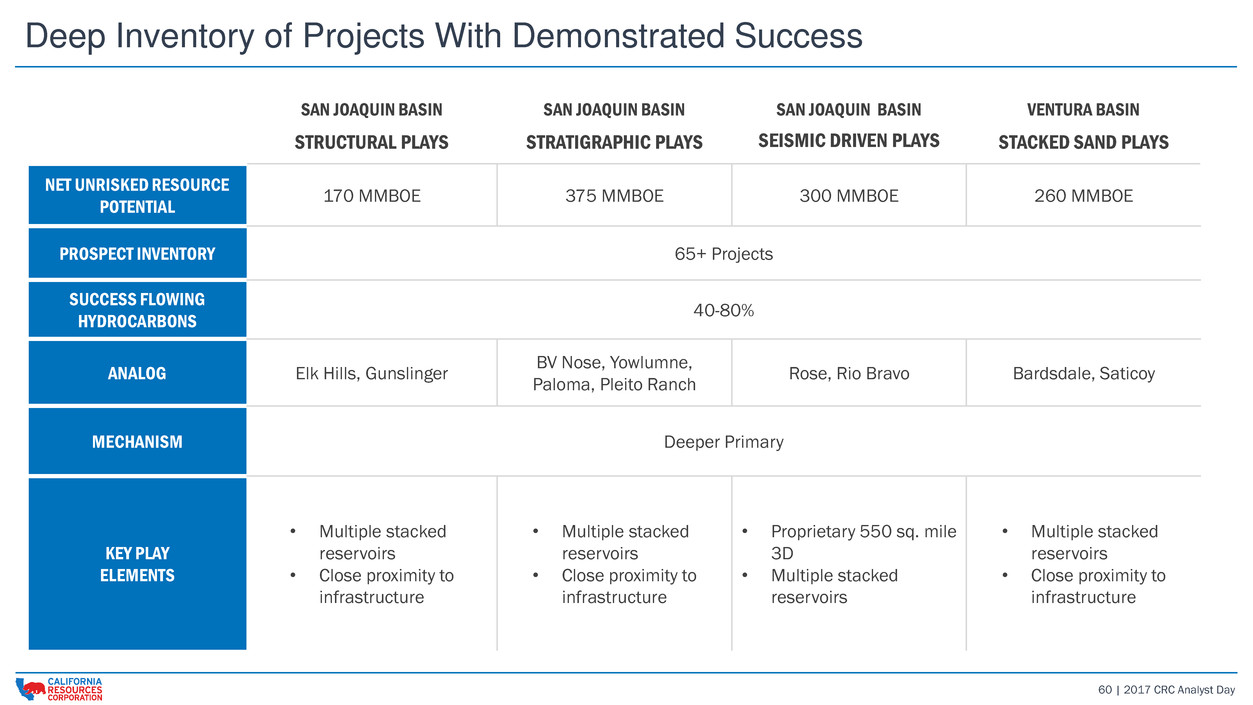

60 | 2017 CRC Analyst Day Deep Inventory of Projects With Demonstrated Success SAN JOAQUIN BASIN STRUCTURAL PLAYS SAN JOAQUIN BASIN STRATIGRAPHIC PLAYS SAN JOAQUIN BASIN SEISMIC DRIVEN PLAYS VENTURA BASIN STACKED SAND PLAYS NET UNRISKED RESOURCE POTENTIAL 170 MMBOE 375 MMBOE 300 MMBOE 260 MMBOE PROSPECT INVENTORY 65+ Projects SUCCESS FLOWING HYDROCARBONS 40-80% ANALOG Elk Hills, Gunslinger BV Nose, Yowlumne, Paloma, Pleito Ranch Rose, Rio Bravo Bardsdale, Saticoy MECHANISM Deeper Primary KEY PLAY ELEMENTS • Multiple stacked reservoirs • Close proximity to infrastructure • Multiple stacked reservoirs • Close proximity to infrastructure • Proprietary 550 sq. mile 3D • Multiple stacked reservoirs • Multiple stacked reservoirs • Close proximity to infrastructure

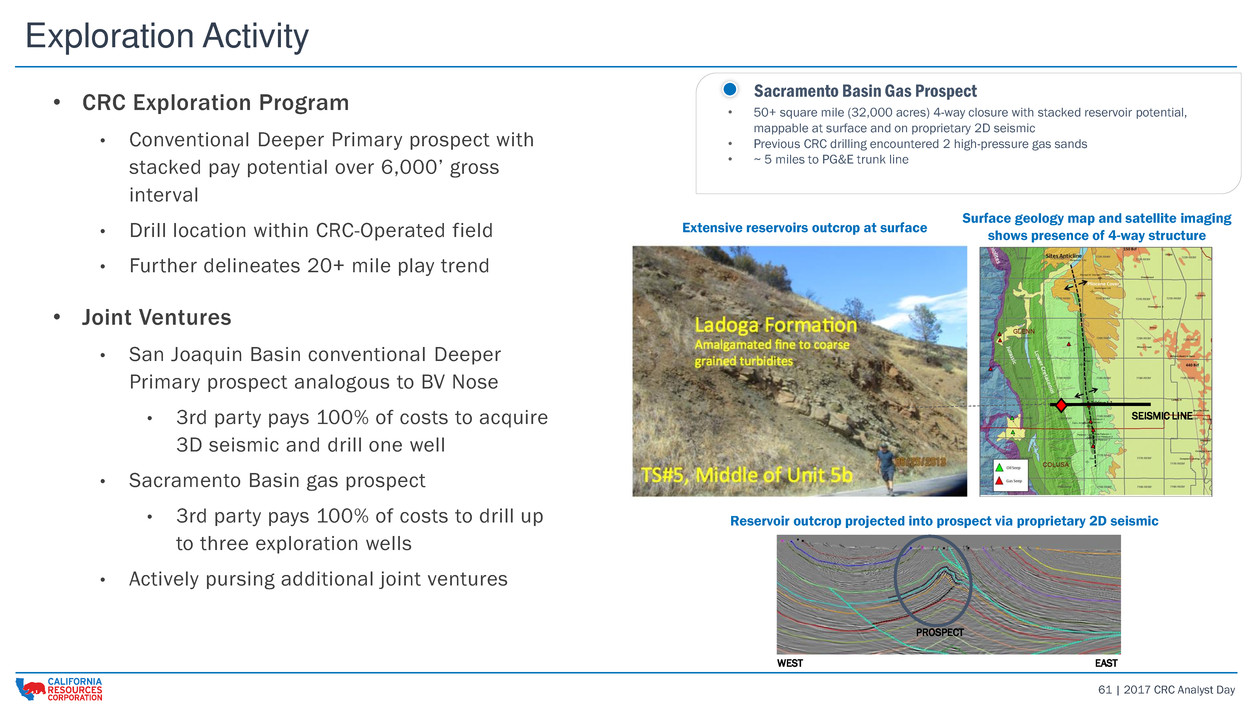

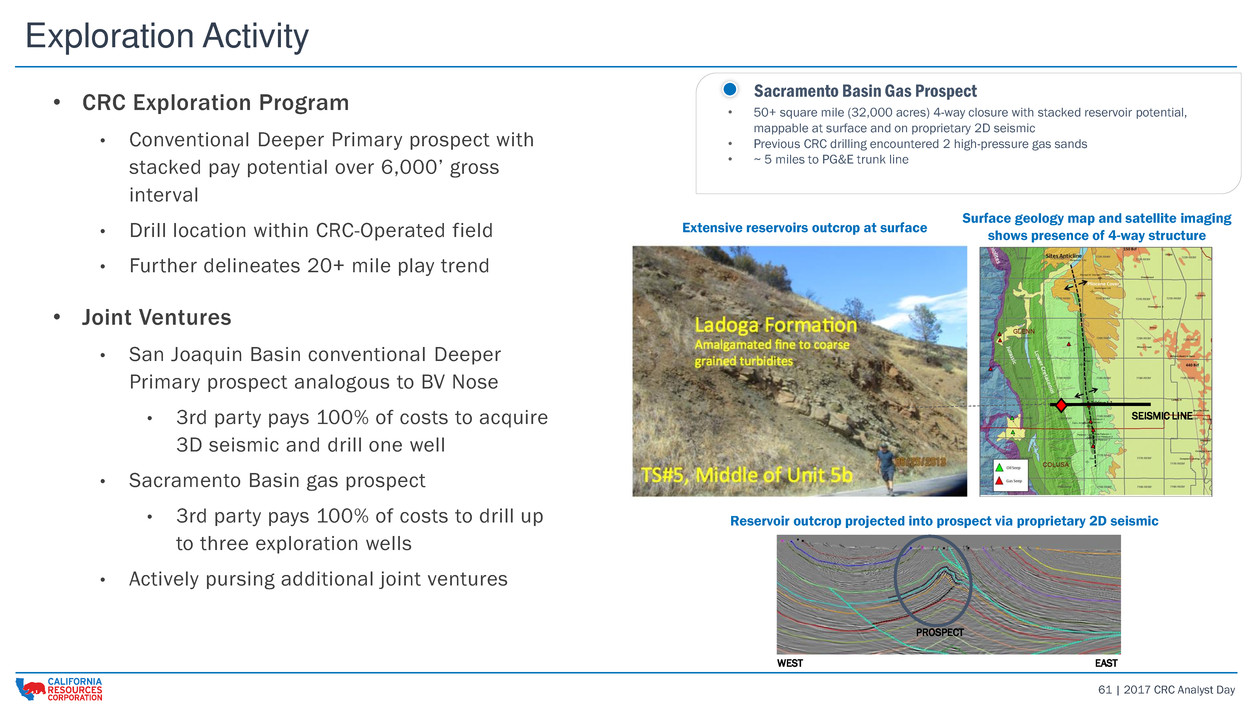

61 | 2017 CRC Analyst Day Exploration Activity Sacramento Basin Gas Prospect • 50+ square mile (32,000 acres) 4-way closure with stacked reservoir potential, mappable at surface and on proprietary 2D seismic • Previous CRC drilling encountered 2 high-pressure gas sands • ~ 5 miles to PG&E trunk line Extensive reservoirs outcrop at surface Reservoir outcrop projected into prospect via proprietary 2D seismic Surface geology map and satellite imaging shows presence of 4-way structure SEISMIC LINE PROSPECT WEST EAST • CRC Exploration Program • Conventional Deeper Primary prospect with stacked pay potential over 6,000’ gross interval • Drill location within CRC-Operated field • Further delineates 20+ mile play trend • Joint Ventures • San Joaquin Basin conventional Deeper Primary prospect analogous to BV Nose • 3rd party pays 100% of costs to acquire 3D seismic and drill one well • Sacramento Basin gas prospect • 3rd party pays 100% of costs to drill up to three exploration wells • Actively pursing additional joint ventures

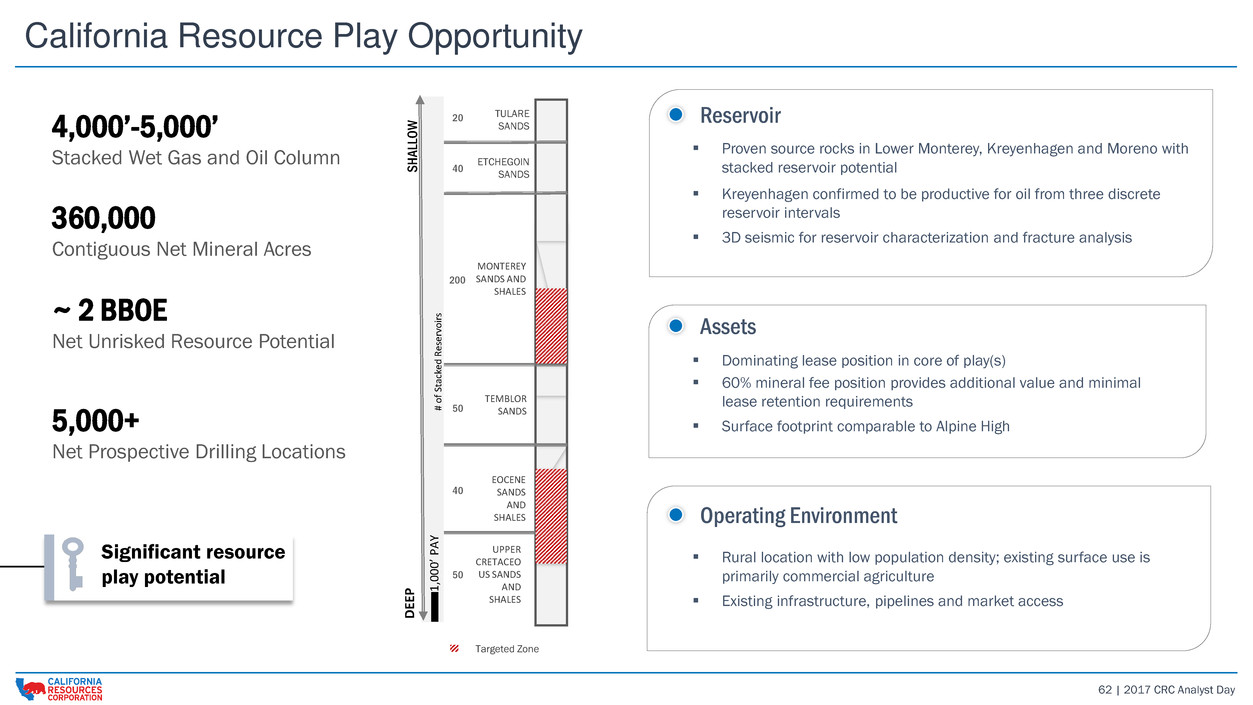

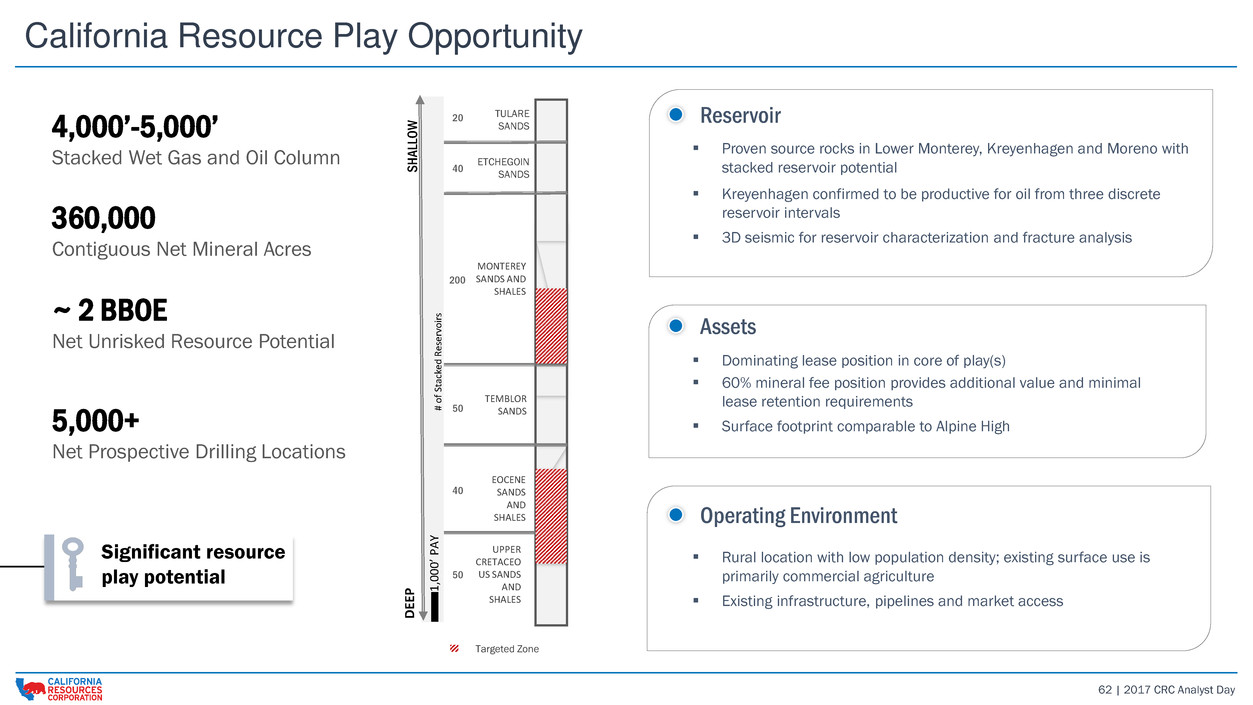

62 | 2017 CRC Analyst Day California Resource Play Opportunity ~ 2 BBOE Net Unrisked Resource Potential 4,000’-5,000’ Stacked Wet Gas and Oil Column 360,000 Contiguous Net Mineral Acres Dominating lease position in core of play(s) 60% mineral fee position provides additional value and minimal lease retention requirements Surface footprint comparable to Alpine High Assets Proven source rocks in Lower Monterey, Kreyenhagen and Moreno with stacked reservoir potential Kreyenhagen confirmed to be productive for oil from three discrete reservoir intervals 3D seismic for reservoir characterization and fracture analysis Reservoir Rural location with low population density; existing surface use is primarily commercial agriculture Existing infrastructure, pipelines and market access Operating Environment 5,000+ Net Prospective Drilling Locations Significant resource play potential TEMBLOR SANDS EOCENE SANDS AND SHALES UPPER CRETACEO US SANDS AND SHALES MONTEREY SANDS AND SHALES 1,000’ PA Y TULARE SANDS 20 40 200 50 40 50 SH A LL O W D EE P ETCHEGOIN SANDS # o f St ac ke d R es er vo ir s Targeted Zone

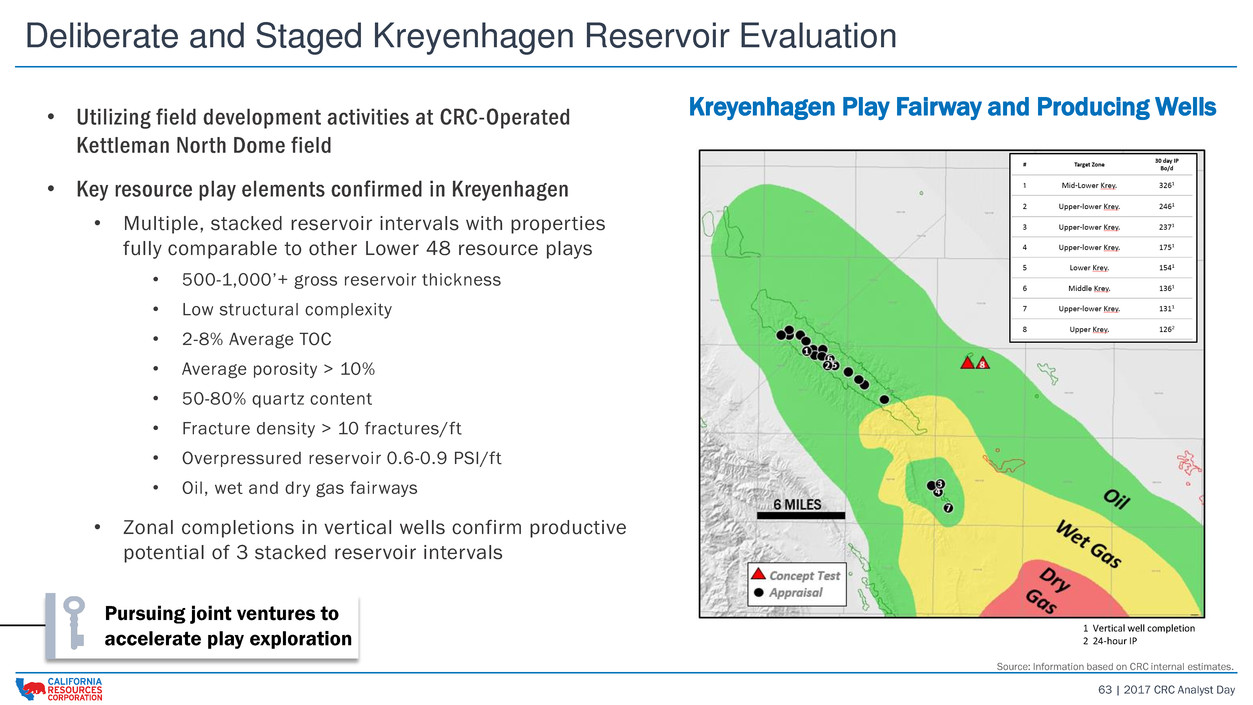

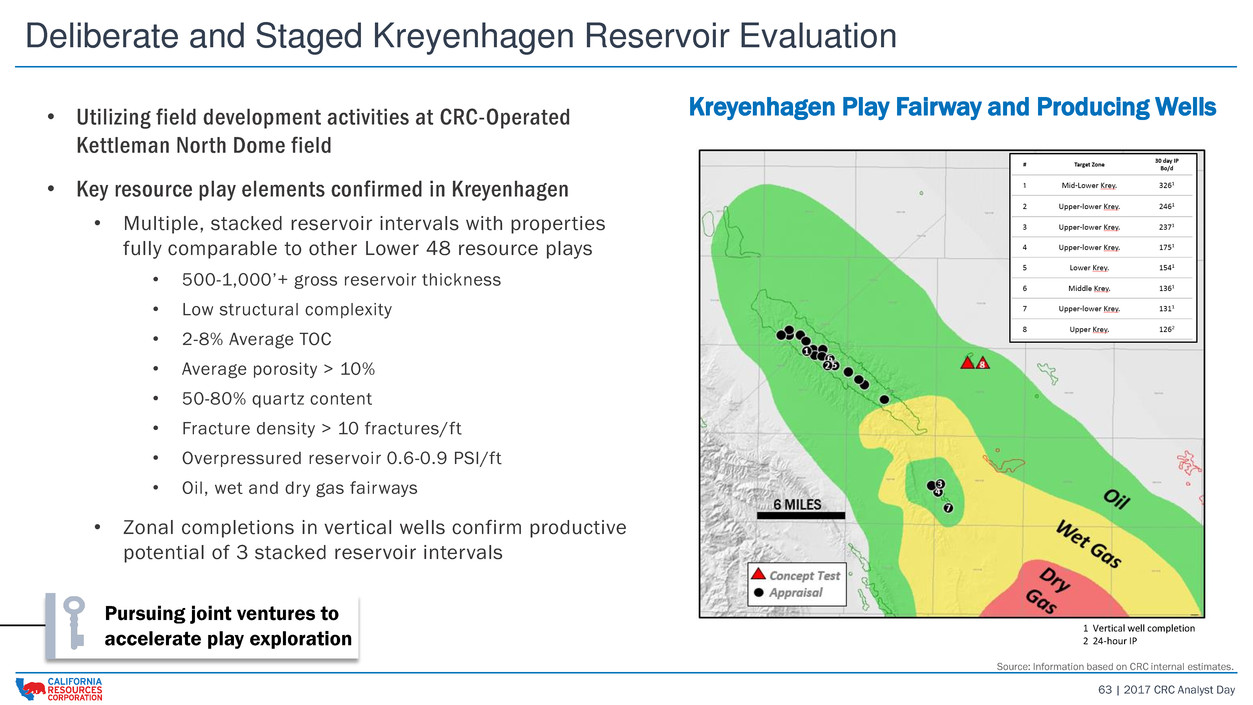

63 | 2017 CRC Analyst Day Deliberate and Staged Kreyenhagen Reservoir Evaluation • Utilizing field development activities at CRC-Operated Kettleman North Dome field • Key resource play elements confirmed in Kreyenhagen • Multiple, stacked reservoir intervals with properties fully comparable to other Lower 48 resource plays • 500-1,000’+ gross reservoir thickness • Low structural complexity • 2-8% Average TOC • Average porosity > 10% • 50-80% quartz content • Fracture density > 10 fractures/ft • Overpressured reservoir 0.6-0.9 PSI/ft • Oil, wet and dry gas fairways • Zonal completions in vertical wells confirm productive potential of 3 stacked reservoir intervals Kreyenhagen Play Fairway and Producing Wells Source: Information based on CRC internal estimates. 1 Vertical well completion 2 24-hour IP Pursuing joint ventures to accelerate play exploration

64 | 2017 CRC Analyst Day Material Growth Opportunity Geoscientist collecting magnetic susceptibility data near active seeps in the Monterey formation • Underexplored, world-class hydrocarbon province • Proven value creation and organic growth through exploration success • Unparalleled portfolio of onshore U.S. conventional exploration assets • Significant prospective shale resources with reservoir properties comparable to U.S. resource plays • Actively pursuing exploration joint ventures

PORTFOLIO MODELING CRC 2017 Analyst & Investor Day Francisco Leon | VP Portfolio Management & Strategic Planning

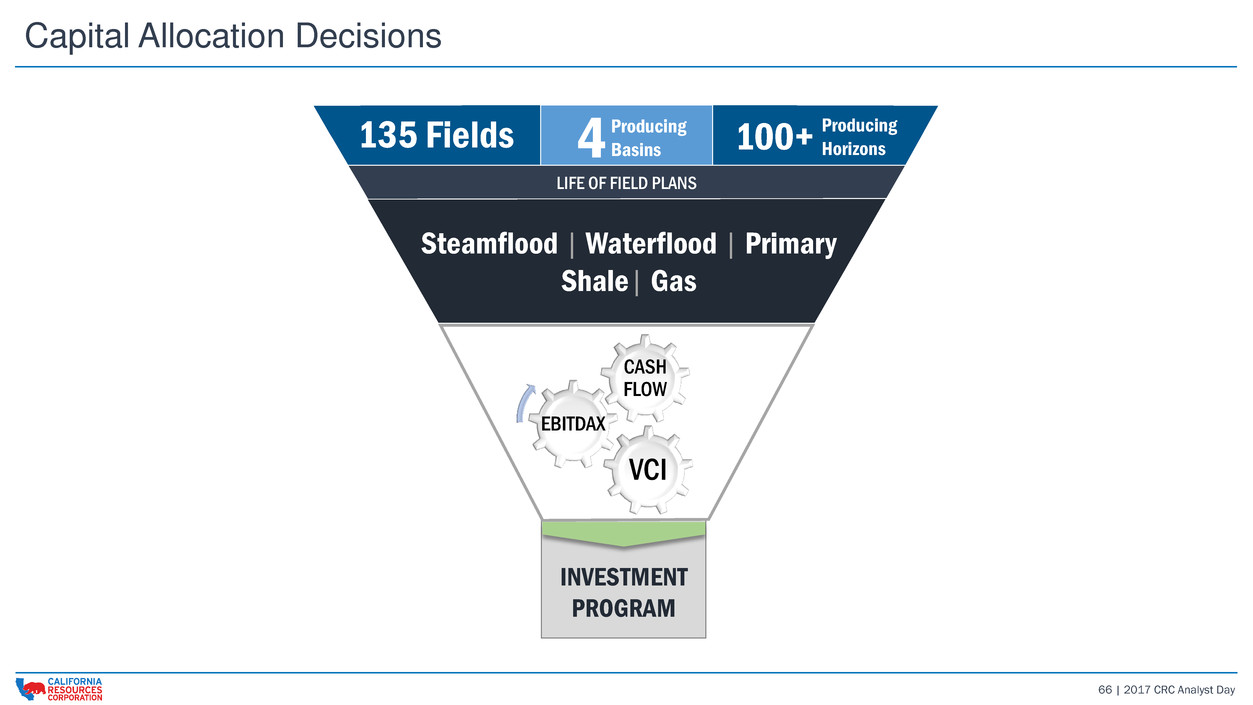

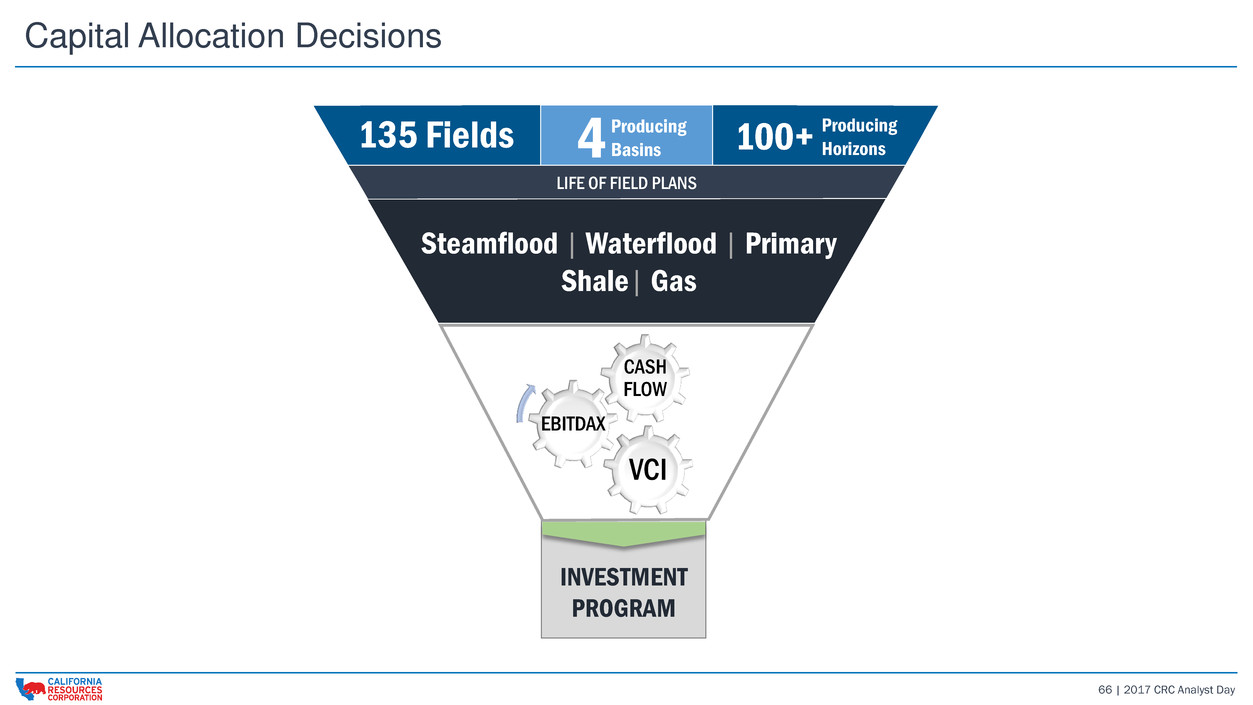

66 | 2017 CRC Analyst Day Capital Allocation Decisions INVESTMENT PROGRAM Steamflood | Waterflood | Primary Shale| Gas 100+ Producing Horizons4 Producing Basins135 Fields LIFE OF FIELD PLANS VCI EBITDAX CASH FLOW

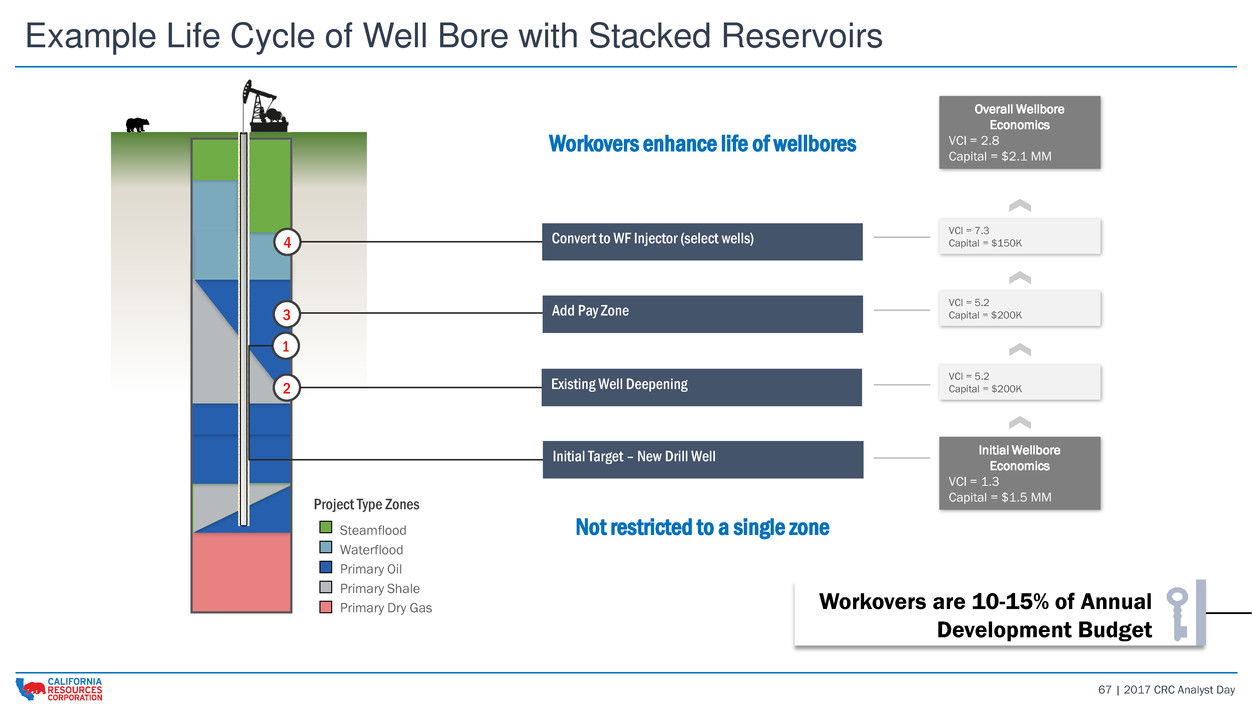

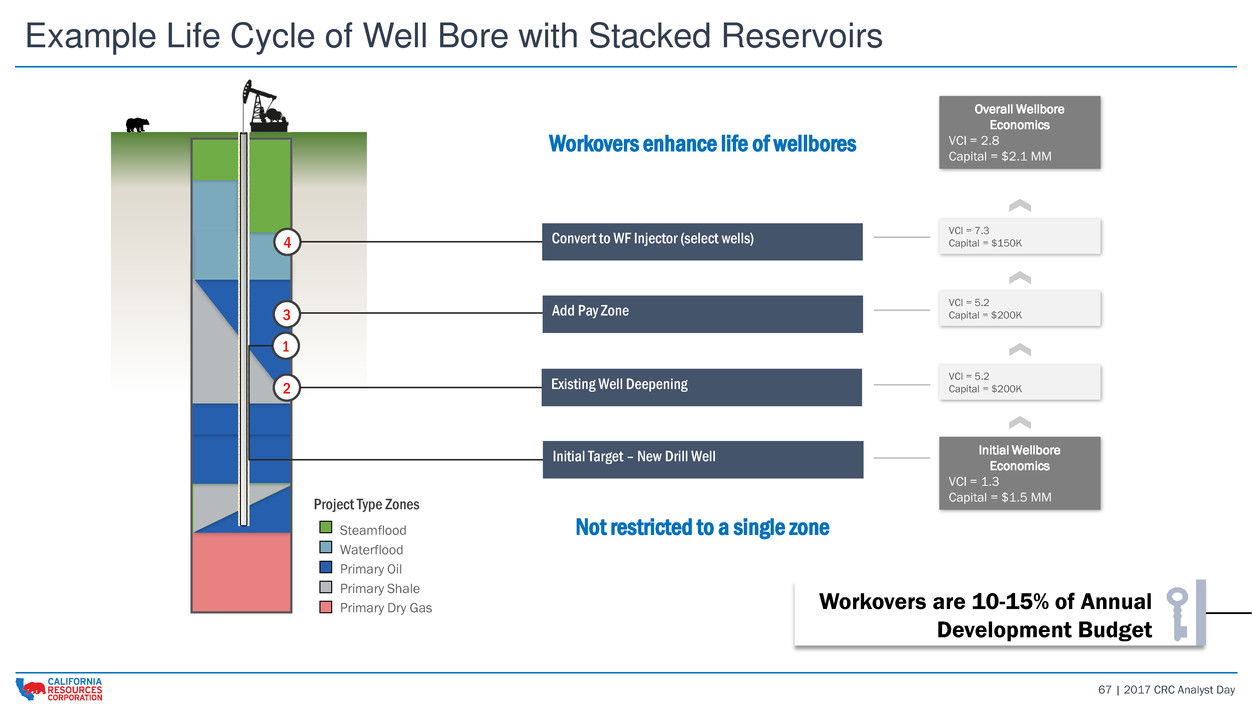

67 | 2017 CRC Analyst Day 1 Initial Wellbore Economics VCI = 1.3 Capital = $1.5 MM Primary Oil Primary Shale Primary Dry Gas Steamflood Waterflood Project Type Zones 2 VCI = 5.2 Capital = $200K 3 VCI = 5.2 Capital = $200K 4 VCI = 7.3 Capital = $150K Overall Wellbore Economics VCI = 2.8 Capital = $2.1 MM Workovers enhance life of wellbores Not restricted to a single zone Example Life Cycle of Well Bore with Stacked Reservoirs Workovers are 10-15% of Annual Development Budget Initial Target – New Drill Well Existing Well Deepening Add Pay Zone Convert to WF Injector (select wells)

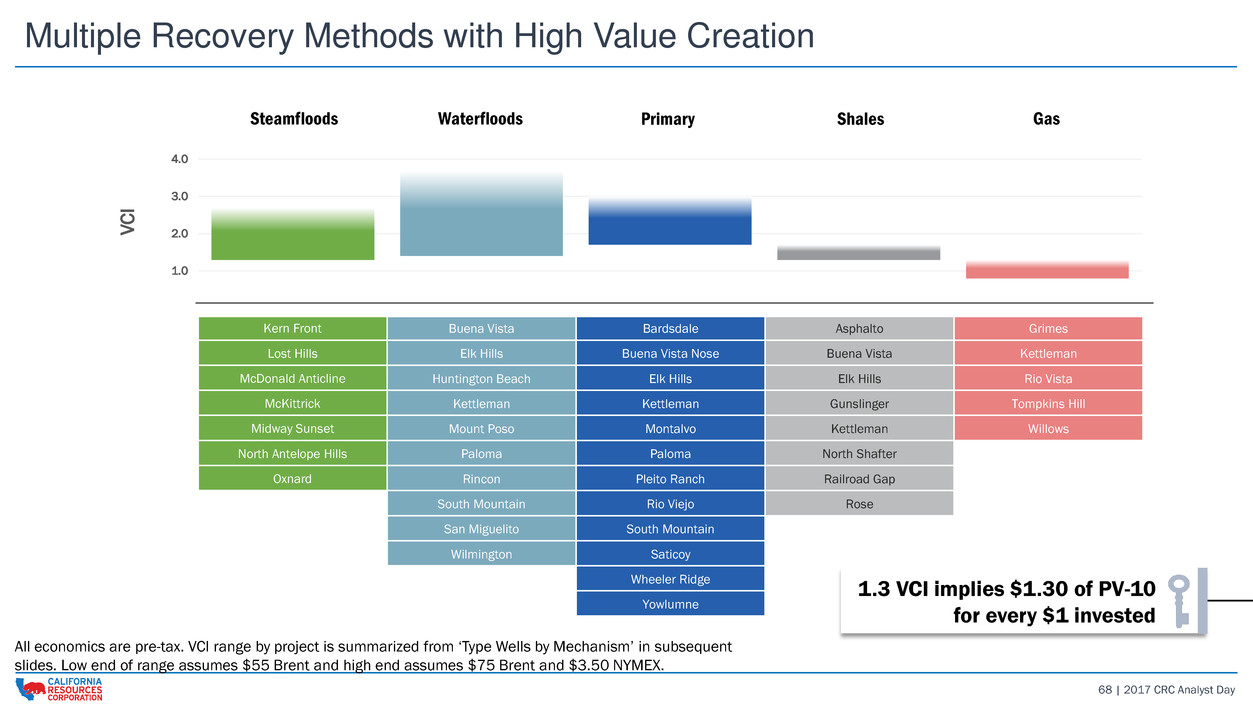

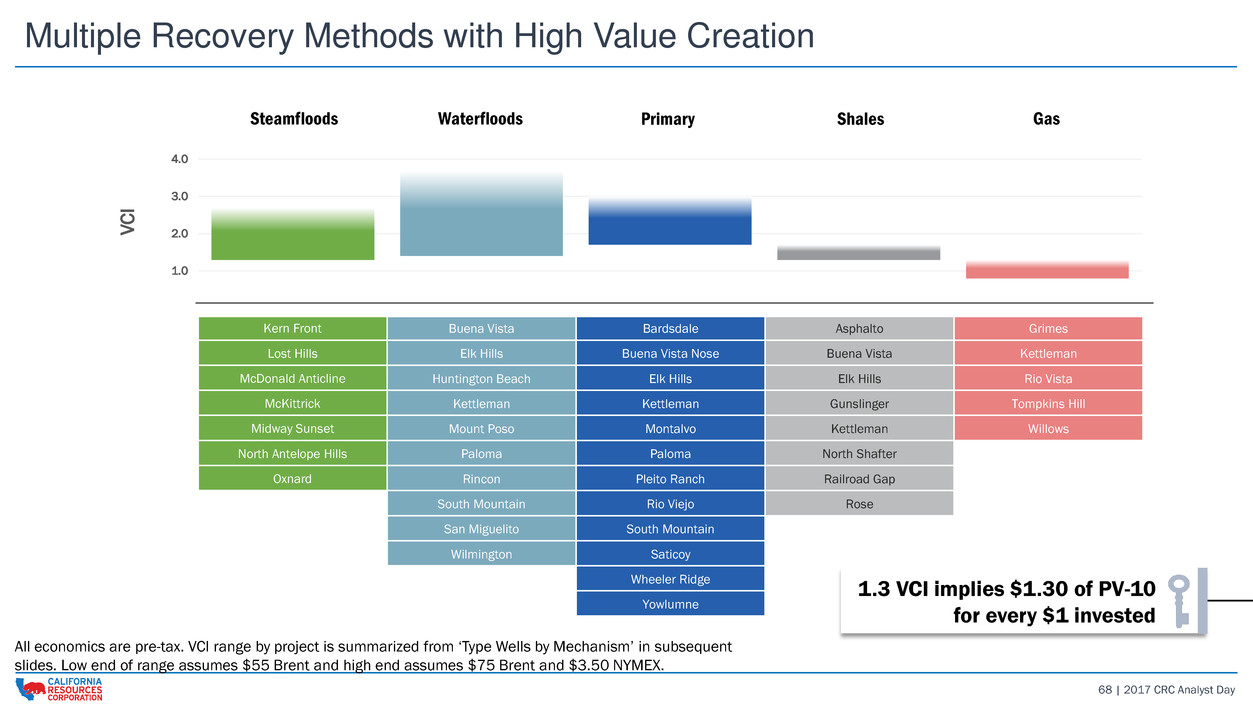

68 | 2017 CRC Analyst Day 0.0 1.0 2.0 3.0 4.0 V C I Kern Front Buena Vista Bardsdale Asphalto Grimes Lost Hills Elk Hills Buena Vista Nose Buena Vista Kettleman McDonald Anticline Huntington Beach Elk Hills Elk Hills Rio Vista McKittrick Kettleman Kettleman Gunslinger Tompkins Hill Midway Sunset Mount Poso Montalvo Kettleman Willows North Antelope Hills Paloma Paloma North Shafter Oxnard Rincon Pleito Ranch Railroad Gap South Mountain Rio Viejo Rose San Miguelito South Mountain Wilmington Saticoy Wheeler Ridge Yowlumne Steamfloods PrimaryWaterfloods Shales Gas All economics are pre-tax. VCI range by project is summarized from ‘Type Wells by Mechanism’ in subsequent slides. Low end of range assumes $55 Brent and high end assumes $75 Brent and $3.50 NYMEX. Multiple Recovery Methods with High Value Creation 1.3 VCI implies $1.30 of PV-10 for every $1 invested

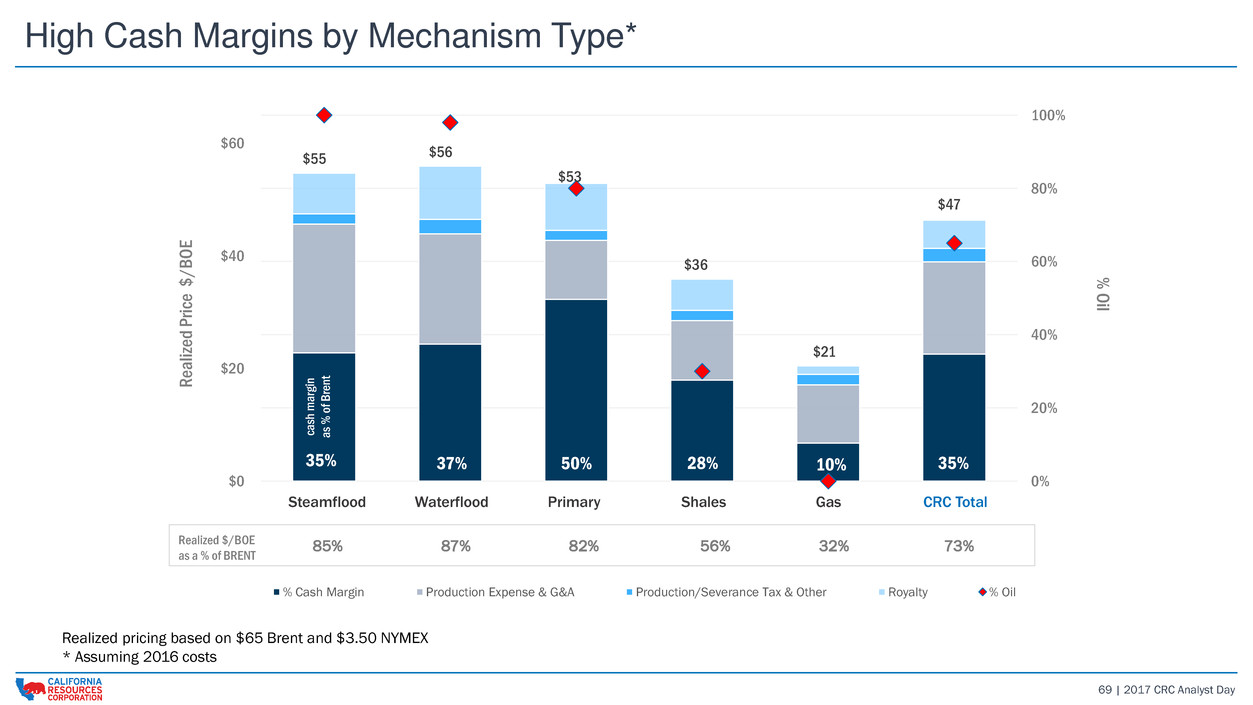

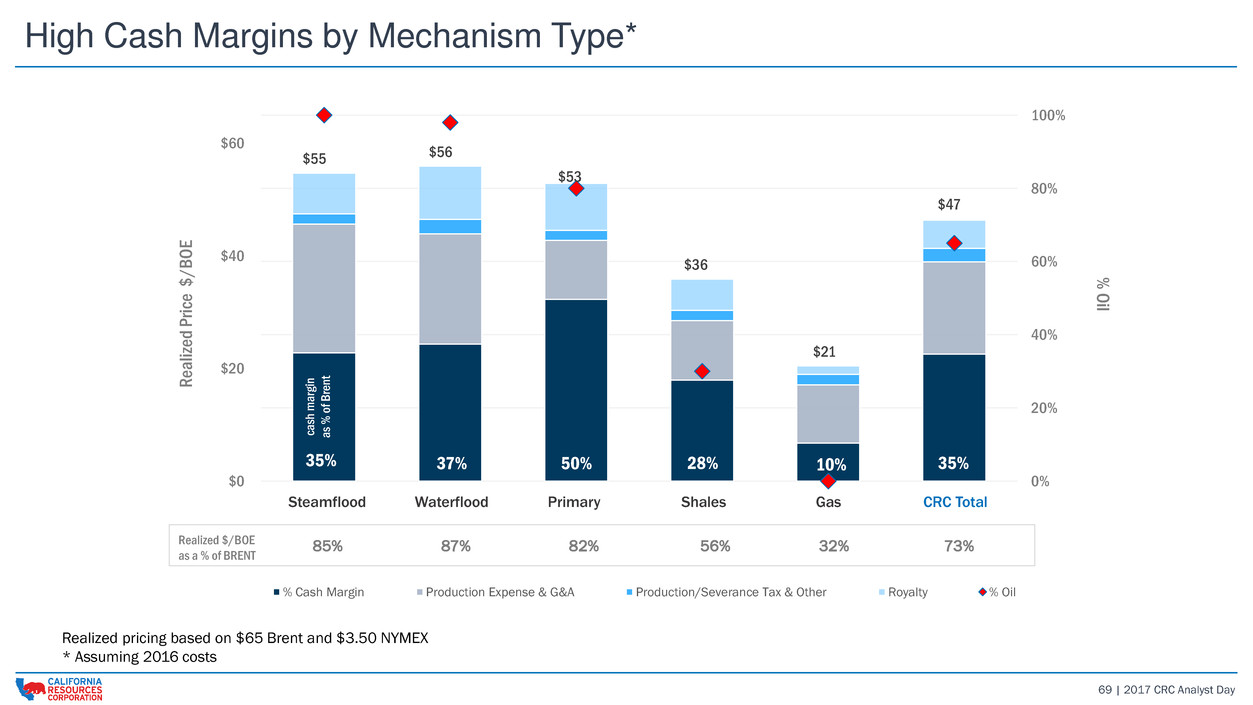

69 | 2017 CRC Analyst Day Realized pricing based on $65 Brent and $3.50 NYMEX * Assuming 2016 costs High Cash Margins by Mechanism Type* 85% 87% 82% 56% 32% 73%Realized $/BOE as a % of BRENT $55 $56 $53 $36 $21 $47 35% 37% 50% 28% 10% 35% 0% 20% 40% 60% 80% 100% $0 $20 $40 $60 % O il R ea lize d P rice $ / B OE % Cash Margin Production Expense & G&A Production/Severance Tax & Other Royalty % Oil ca sh ma rgi n as % o f Br en t Steamflood Waterflood Primary Shales Gas CRC Total

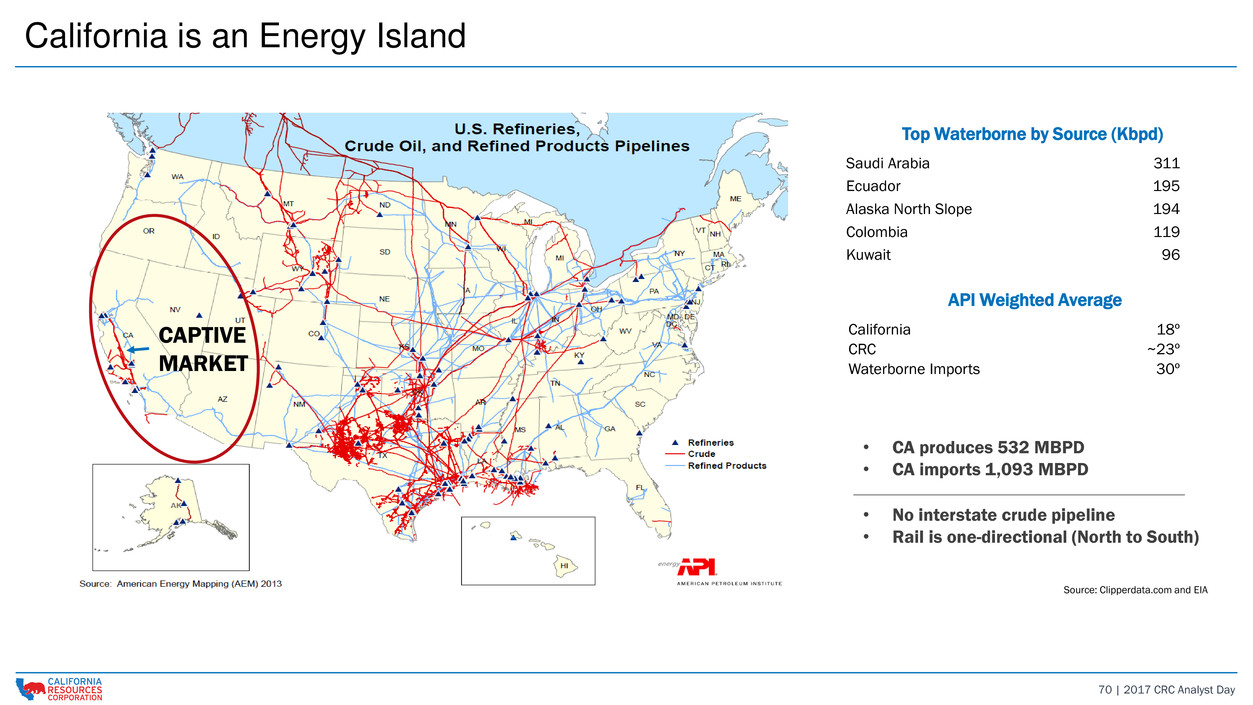

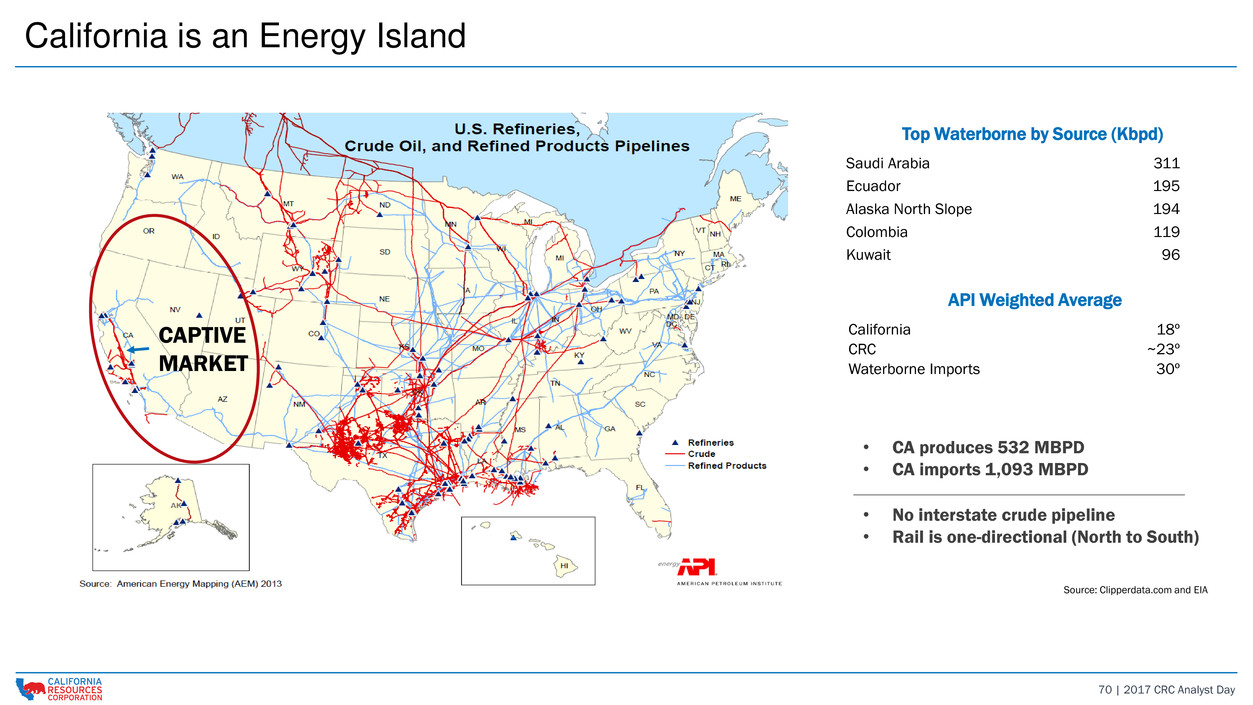

70 | 2017 CRC Analyst Day California is an Energy Island • CA produces 532 MBPD • CA imports 1,093 MBPD • No interstate crude pipeline • Rail is one-directional (North to South) CAPTIVE MARKET Saudi Arabia 311 Ecuador 195 Alaska North Slope 194 Colombia 119 Kuwait 96 California 18º CRC ~23º Waterborne Imports 30º Source: Clipperdata.com and EIA API Weighted Average Top Waterborne by Source (Kbpd)

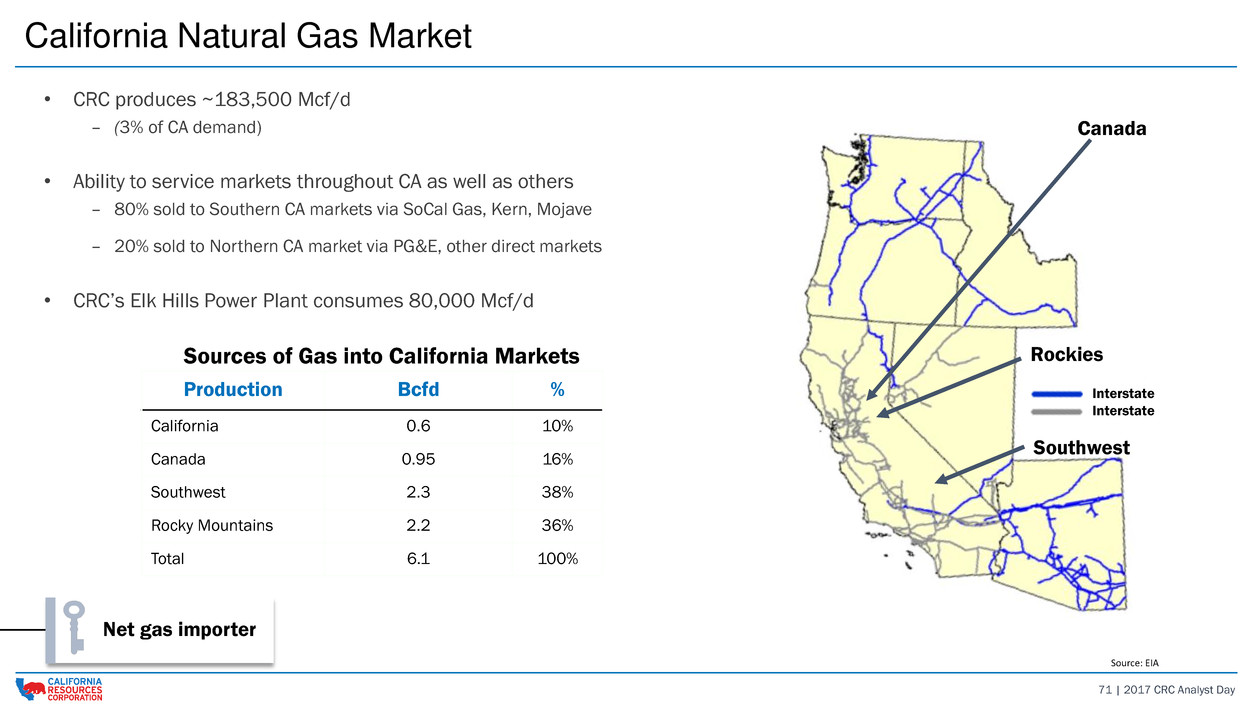

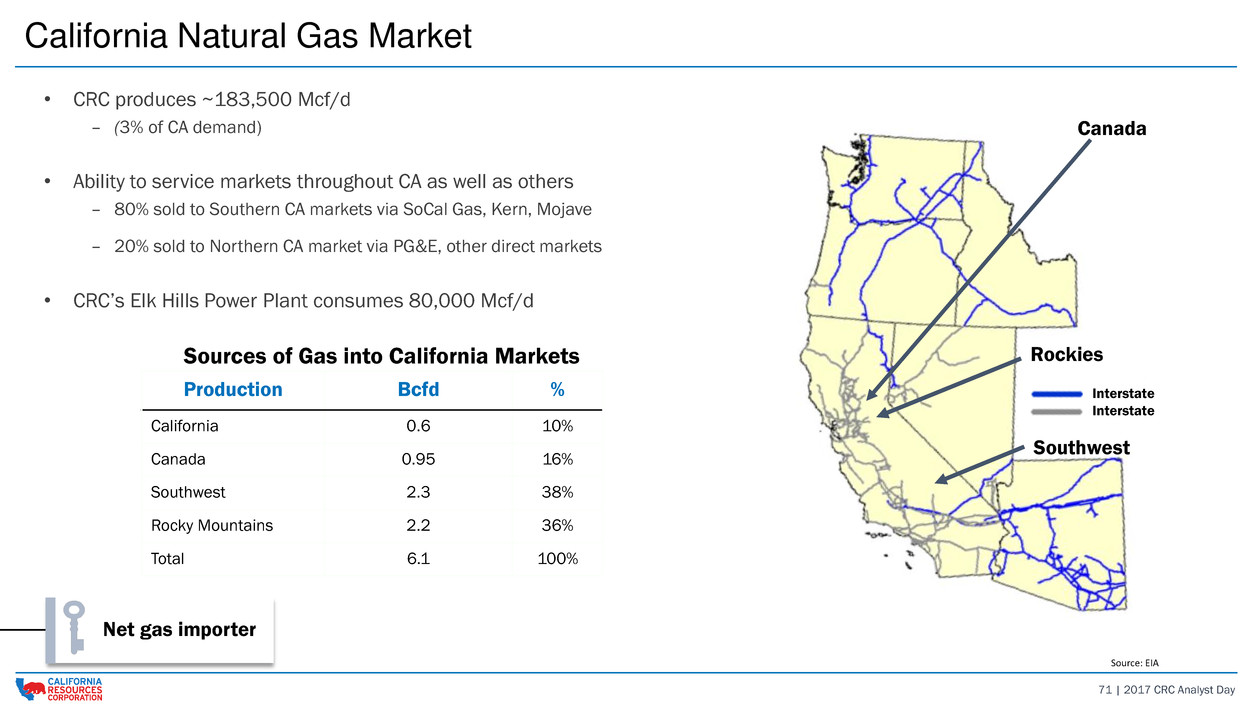

71 | 2017 CRC Analyst Day California Natural Gas Market • CRC produces ~183,500 Mcf/d – (3% of CA demand) • Ability to service markets throughout CA as well as others – 80% sold to Southern CA markets via SoCal Gas, Kern, Mojave – 20% sold to Northern CA market via PG&E, other direct markets • CRC’s Elk Hills Power Plant consumes 80,000 Mcf/d Source: EIA Rockies Canada Production Bcfd % California 0.6 10% Canada 0.95 16% Southwest 2.3 38% Rocky Mountains 2.2 36% Total 6.1 100% Sources of Gas into California Markets Net gas importer Interstate Interstate Southwest

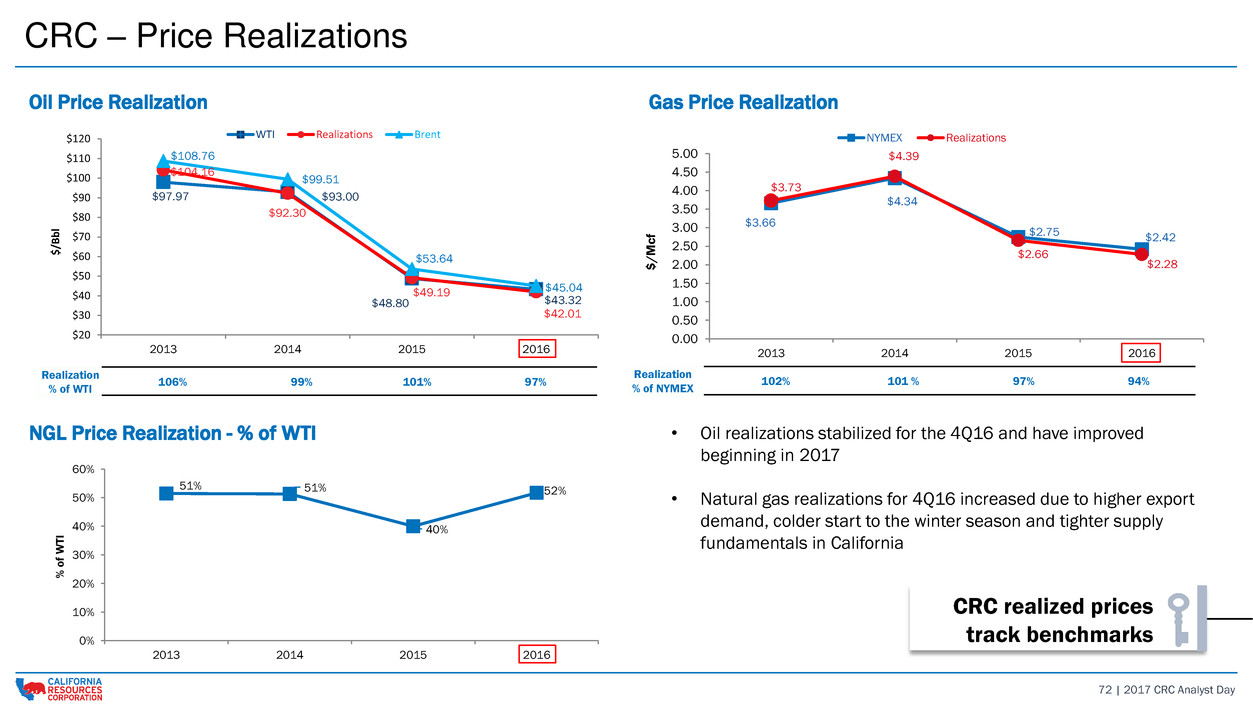

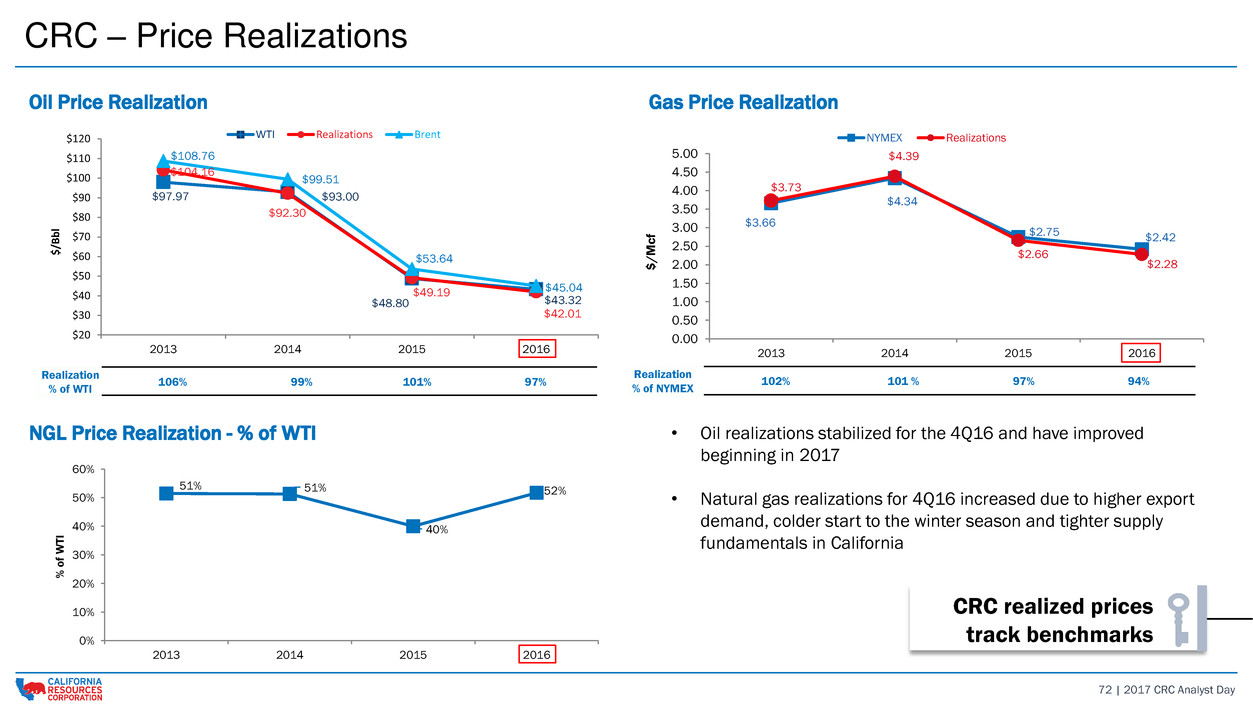

72 | 2017 CRC Analyst Day $3.66 $4.34 $2.75 $2.42 $3.73 $4.39 $2.66 $2.28 0.00 0.50 1.00 1.50 2.00 2.50 3.00 3.50 4.00 4.50 5.00 2013 2014 2015 2016 $ / M c f NYMEX Realizations CRC – Price Realizations 51% 51% 40% 52% 0% 10% 20% 30% 40% 50% 60% 2013 2014 2015 2016 % of W T I $97.97 $93.00 $48.80 $43.32 $104.16 $92.30 $49.19 $42.01 $108.76 $99.51 $53.64 $45.04 $20 $30 $40 $50 $60 $70 $80 $90 $100 $110 $120 2013 2014 2015 2016 $ /B b l WTI Realizations Brent Realization % of WTI 106% 99% 101% 97% Realization % of NYMEX 102% 101 % 97% 94% Oil Price Realization Gas Price Realization NGL Price Realization - % of WTI CRC realized prices track benchmarks • Oil realizations stabilized for the 4Q16 and have improved beginning in 2017 • Natural gas realizations for 4Q16 increased due to higher export demand, colder start to the winter season and tighter supply fundamentals in California

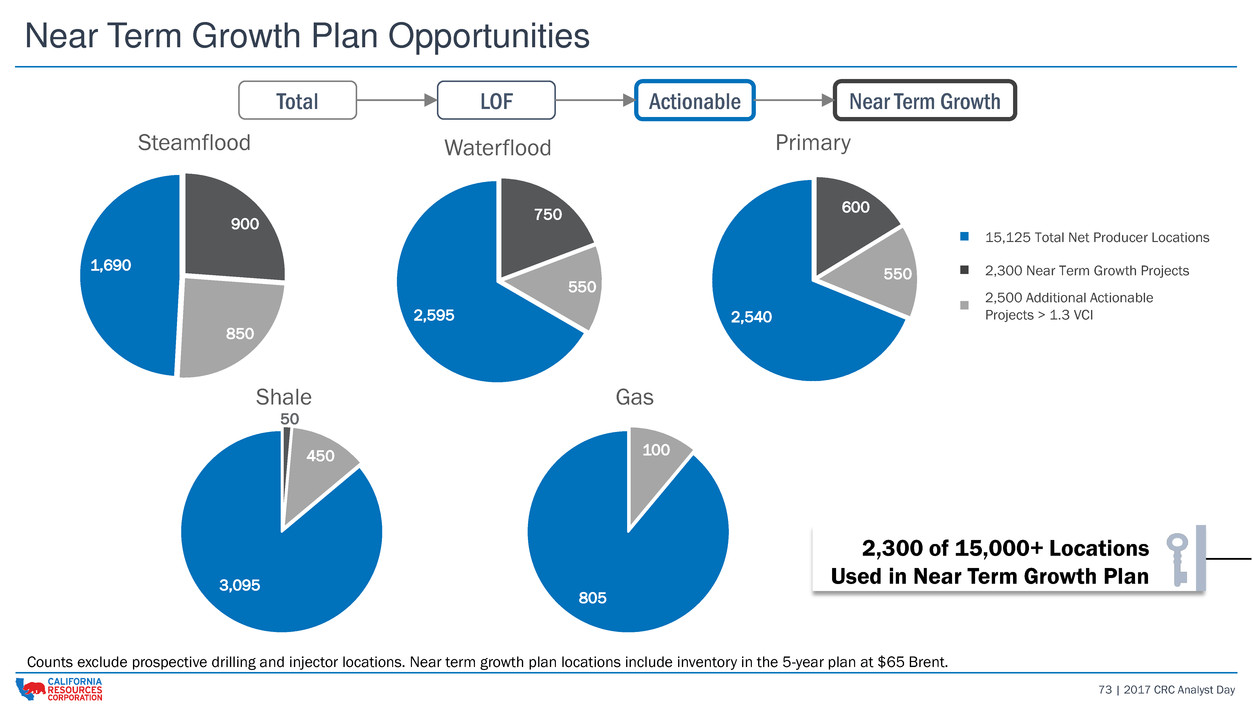

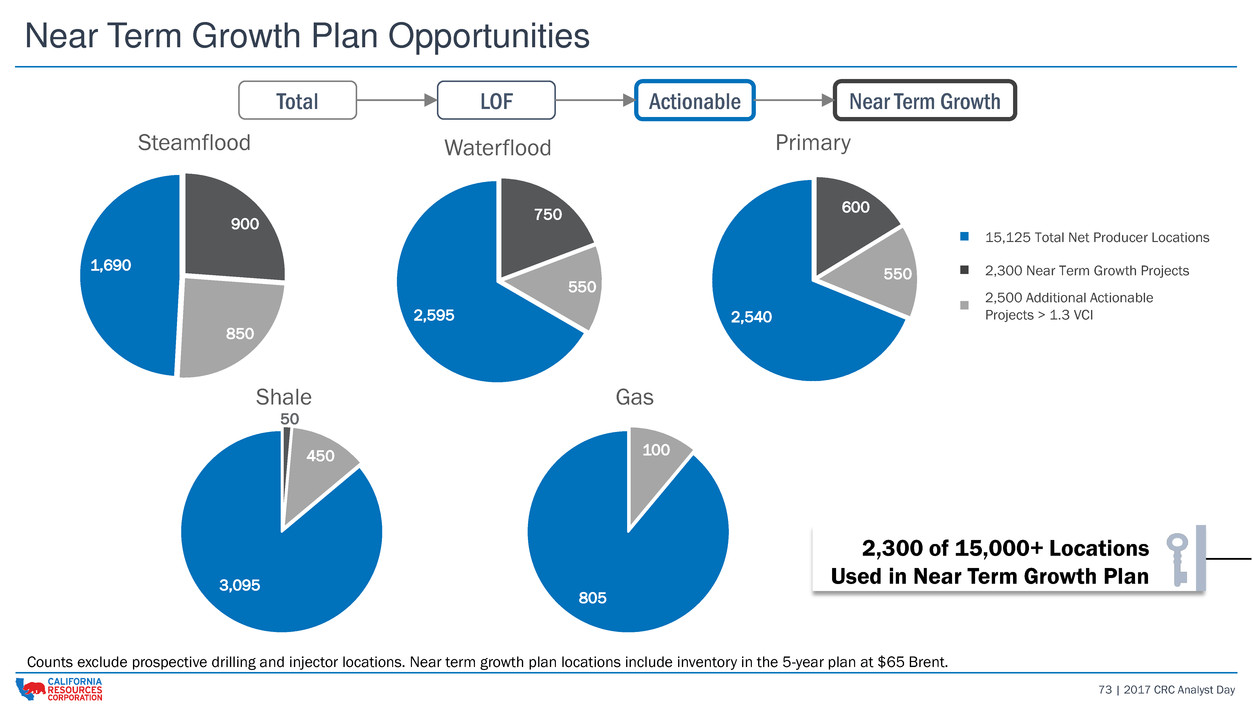

73 | 2017 CRC Analyst Day Near Term Growth Plan Opportunities Counts exclude prospective drilling and injector locations. Near term growth plan locations include inventory in the 5-year plan at $65 Brent. 2,300 of 15,000+ Locations Used in Near Term Growth Plan 15,125 Total Net Producer Locations 2,300 Near Term Growth Projects 2,500 Additional Actionable Projects > 1.3 VCI 900 850 1,690 Steamflood 750 550 2,595 Waterflood 600 550 2,540 Primary 50 450 3,095 Shale 100 805 Gas Total LOF Actionable Near Term Growth

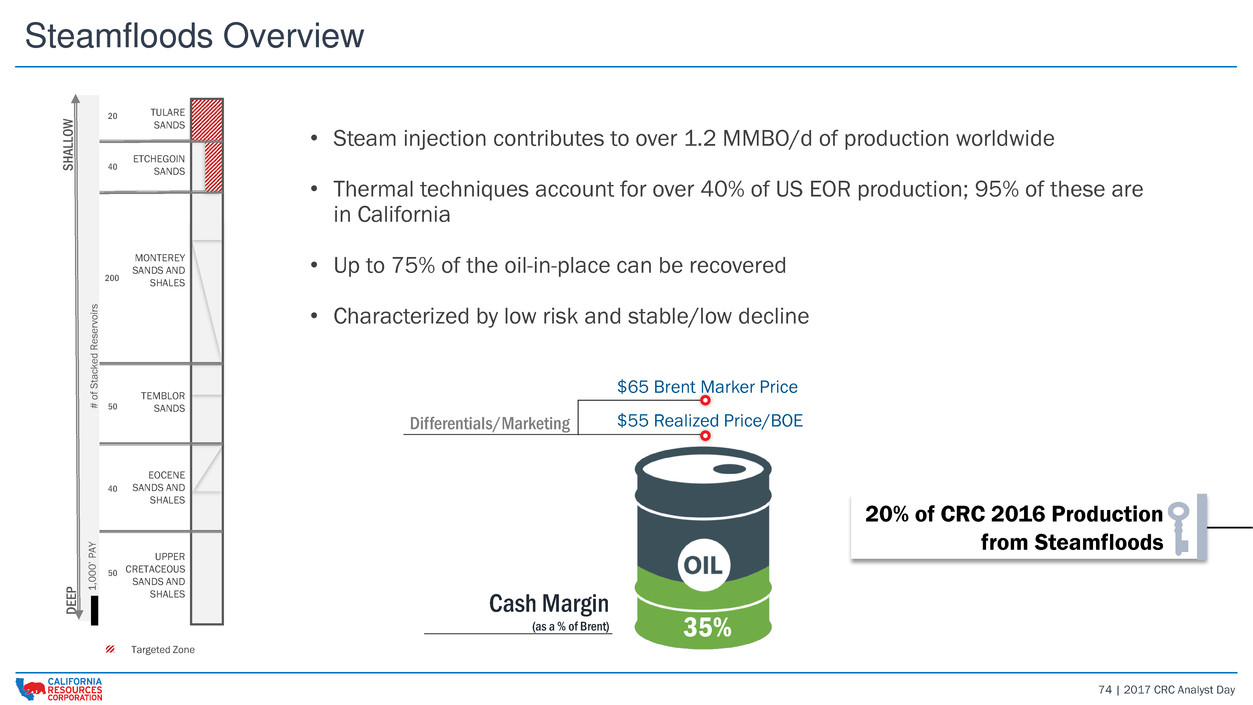

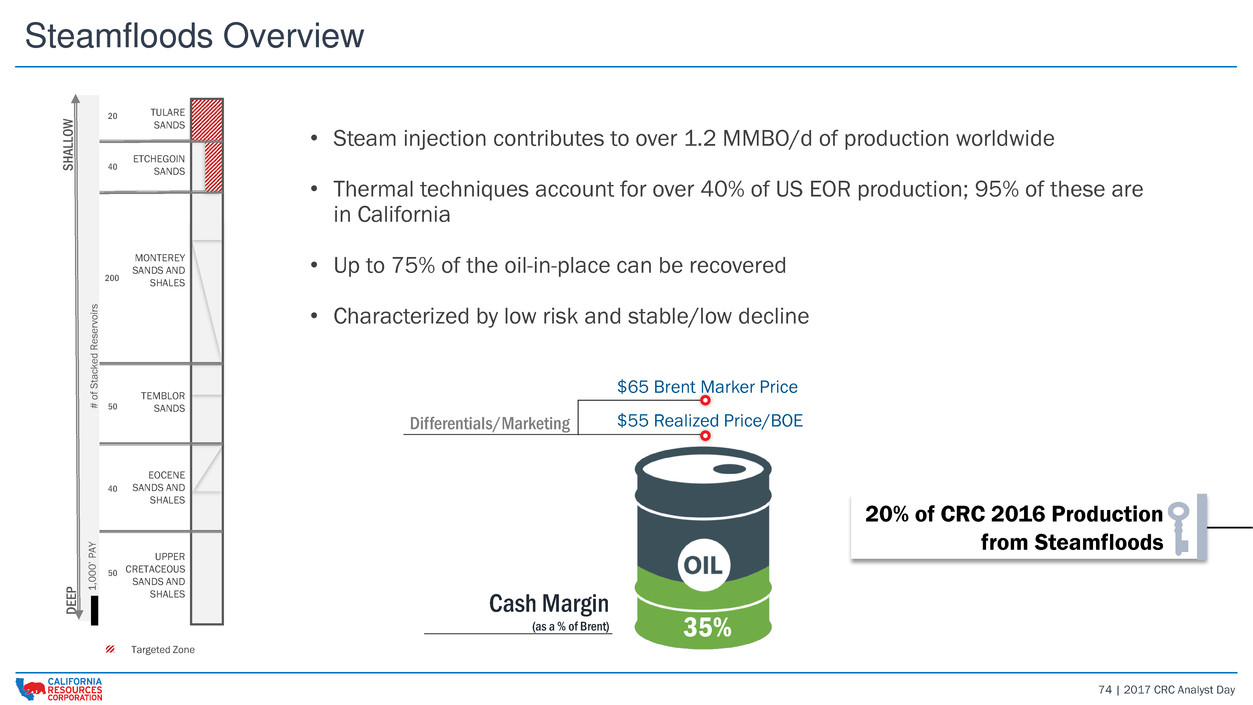

74 | 2017 CRC Analyst Day • Steam injection contributes to over 1.2 MMBO/d of production worldwide • Thermal techniques account for over 40% of US EOR production; 95% of these are in California • Up to 75% of the oil-in-place can be recovered • Characterized by low risk and stable/low decline TEMBLOR SANDS EOCENE SANDS AND SHALES UPPER CRETACEOUS SANDS AND SHALES MONTEREY SANDS AND SHALES 1 ,0 0 0 ’ P A Y TULARE SANDS 20 40 200 50 40 50 SH A LL O W D EE P ETCHEGOIN SANDS # of S ta ck ed Reser voi rs Targeted Zone Steamfloods Overview $65 Brent Marker Price $55 Realized Price/BOEDifferentials/Marketing Cash Margin (as a % of Brent) 20% of CRC 2016 Production from Steamfloods 35%

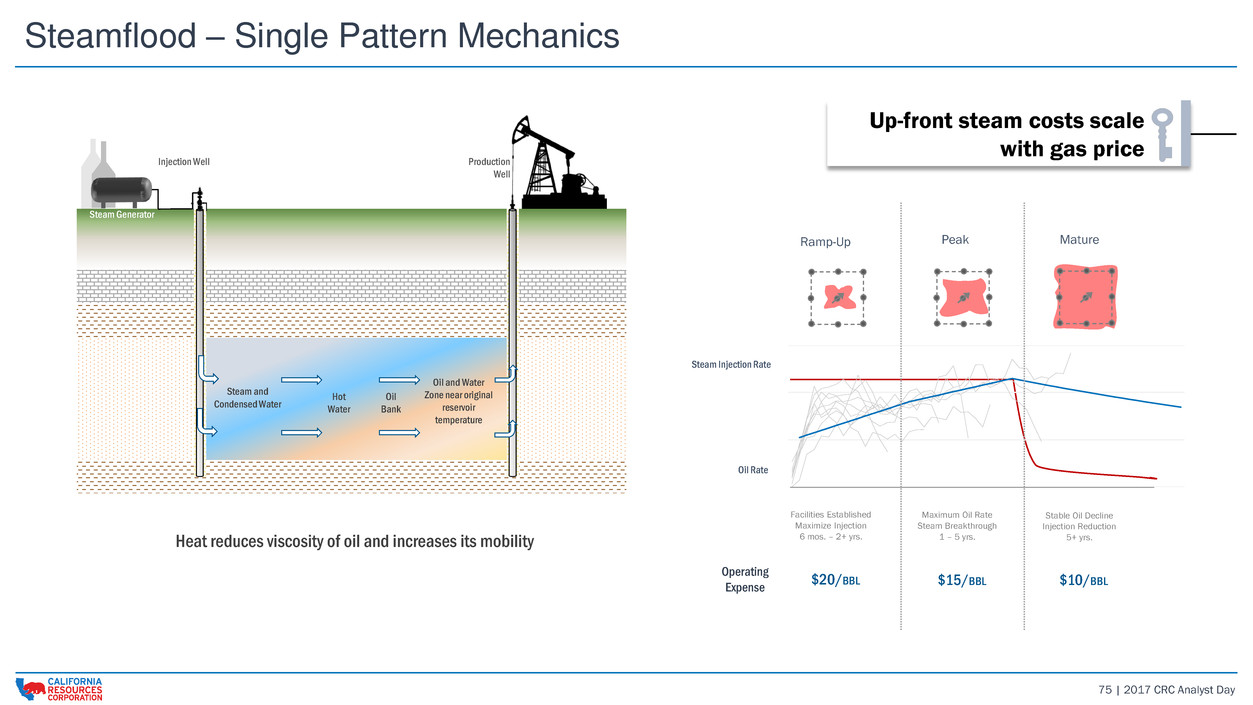

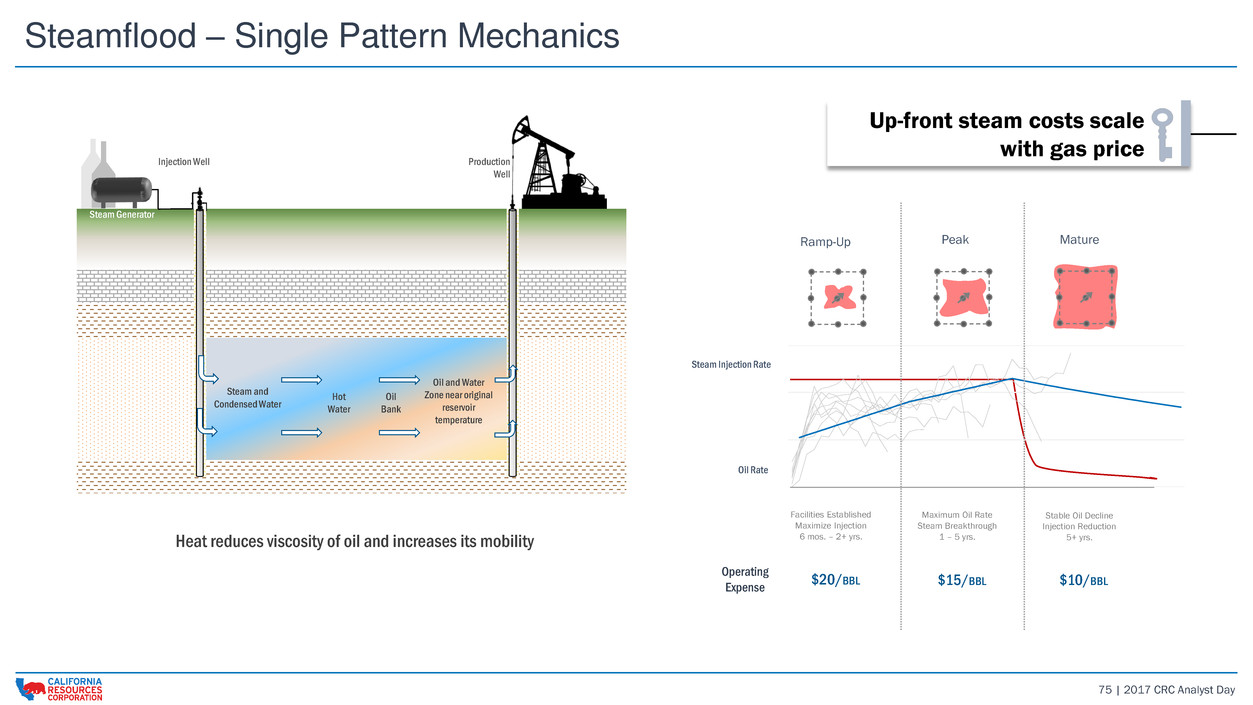

75 | 2017 CRC Analyst Day Heat reduces viscosity of oil and increases its mobility Steam and Condensed Water Hot Water Oil Bank Oil and Water Zone near original reservoir temperature Steam Generator Injection Well Production Well Steamflood – Single Pattern Mechanics Ramp-Up Peak Mature Facilities Established Maximize Injection 6 mos. – 2+ yrs. Maximum Oil Rate Steam Breakthrough 1 – 5 yrs. Stable Oil Decline Injection Reduction 5+ yrs. Steam Injection Rate Oil Rate $20/BBL $15/BBL $10/BBL Operating Expense Up-front steam costs scale with gas price

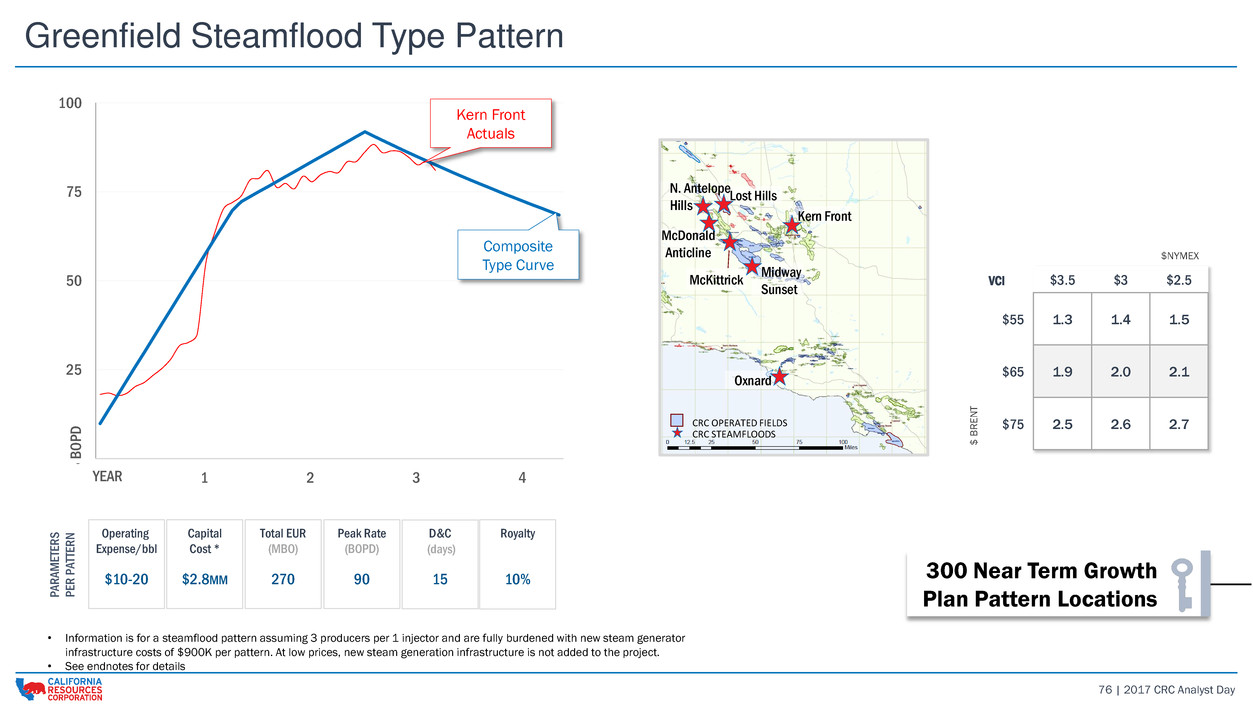

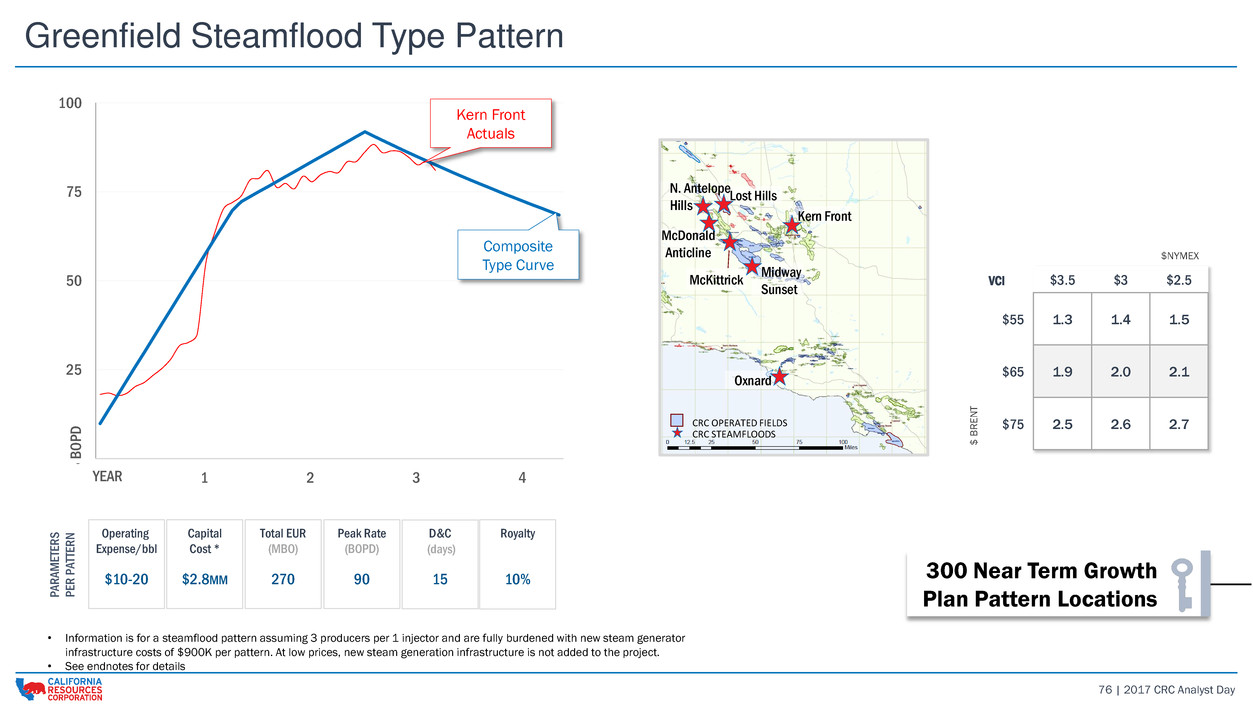

76 | 2017 CRC Analyst Day 0 25 50 75 100 0 1 2 3 4 B O P D YEAR • Information is for a steamflood pattern assuming 3 producers per 1 injector and are fully burdened with new steam generator infrastructure costs of $900K per pattern. At low prices, new steam generation infrastructure is not added to the project. • See endnotes for details PARAM ET ERS PER PAT TER N Operating Expense/bbl $10-20 Capital Cost * $2.8MM Total EUR (MBO) 270 Peak Rate (BOPD) 90 D&C (days) 15 Royalty 10% Greenfield Steamflood Type Pattern Composite Type Curve Kern Front Actuals CRC OPERATED FIELDS Oxnard Midway Sunset McKittrick McDonald Anticline Kern Front Lost Hills N. Antelope Hills CRC STEAMFLOODS 300 Near Term Growth Plan Pattern Locations $NYMEX VCI $3.5 $3 $2.5 $55 1.3 1.4 1.5 $65 1.9 2.0 2.1 $ B R E N T $75 2.5 2.6 2.7

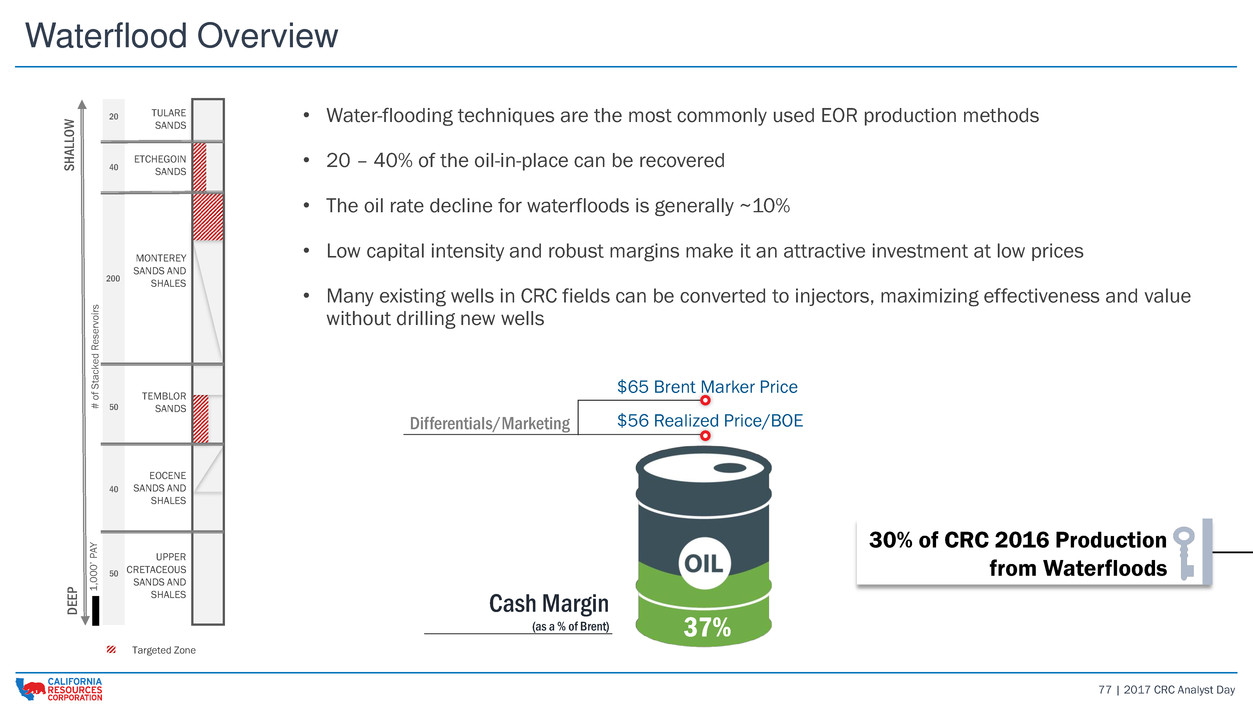

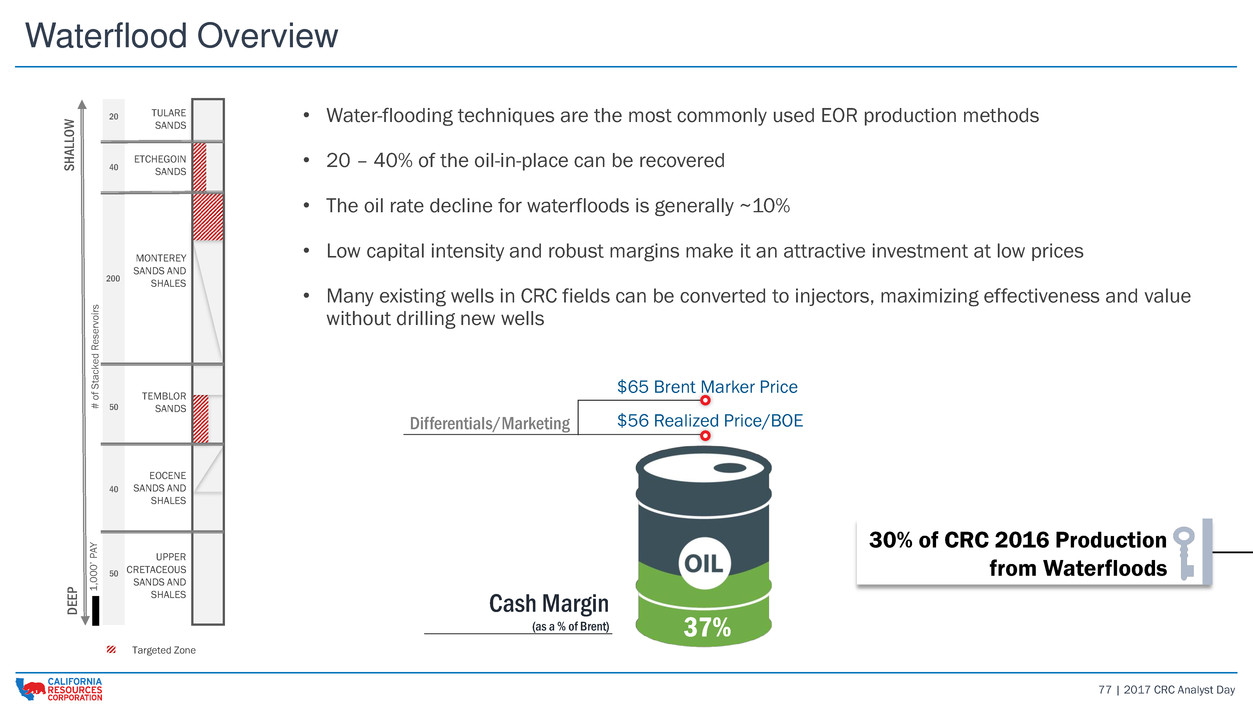

77 | 2017 CRC Analyst Day • Water-flooding techniques are the most commonly used EOR production methods • 20 – 40% of the oil-in-place can be recovered • The oil rate decline for waterfloods is generally ~10% • Low capital intensity and robust margins make it an attractive investment at low prices • Many existing wells in CRC fields can be converted to injectors, maximizing effectiveness and value without drilling new wells TEMBLOR SANDS EOCENE SANDS AND SHALES UPPER CRETACEOUS SANDS AND SHALES MONTEREY SANDS AND SHALES 1 ,0 0 0 ’ P A Y TULARE SANDS 20 40 200 50 40 50 SH A LL O W D EE P ETCHEGOIN SANDS # of S ta ck ed Reser voi rs Targeted Zone Waterflood Overview $65 Brent Marker Price $56 Realized Price/BOEDifferentials/Marketing Cash Margin (as a % of Brent) 37% 30% of CRC 2016 Production from Waterfloods

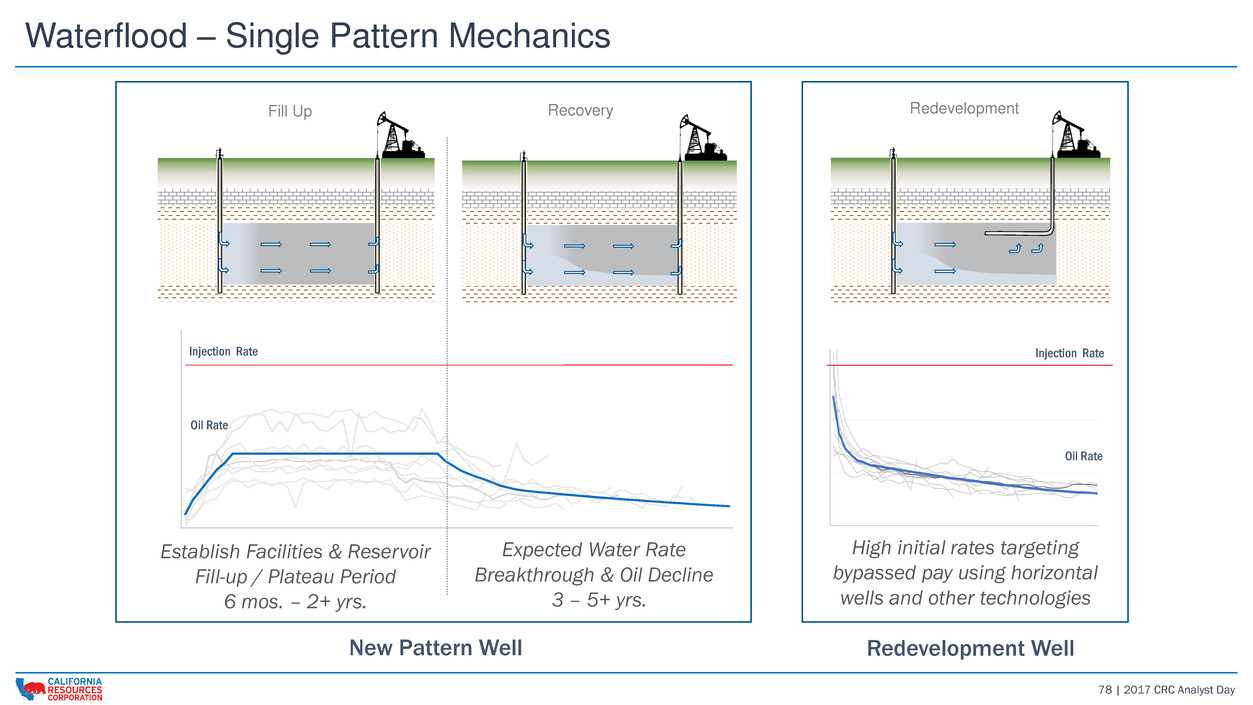

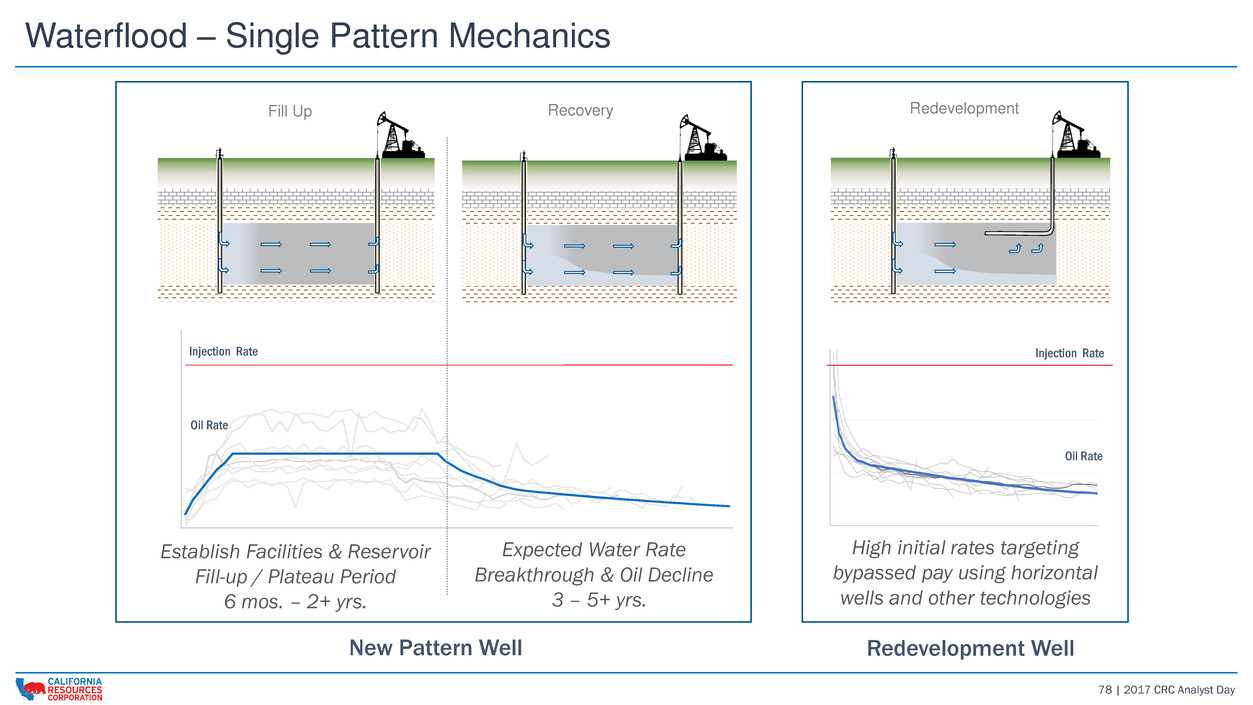

78 | 2017 CRC Analyst Day Fill Up Recovery Redevelopment Establish Facilities & Reservoir Fill-up / Plateau Period 6 mos. – 2+ yrs. Expected Water Rate Breakthrough & Oil Decline 3 – 5+ yrs. High initial rates targeting bypassed pay using horizontal wells and other technologies Injection Rate Oil Rate Waterflood – Single Pattern Mechanics New Pattern Well Redevelopment Well Injection Rate Oil Rate

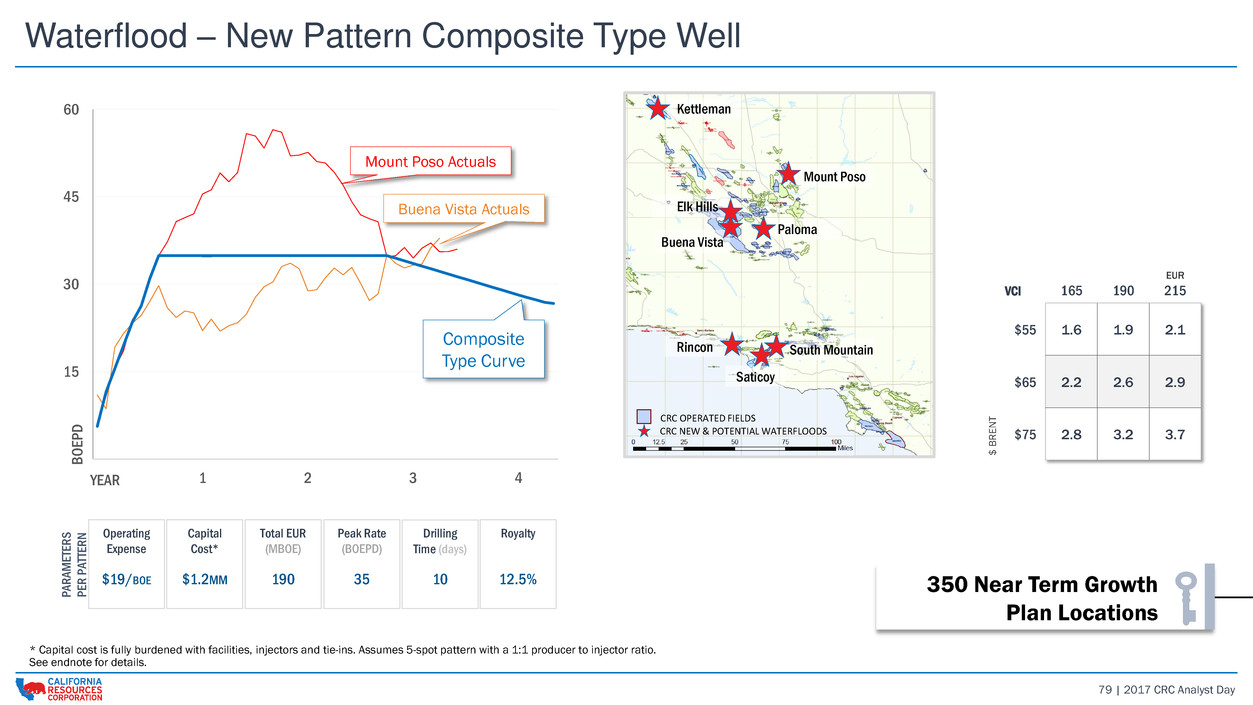

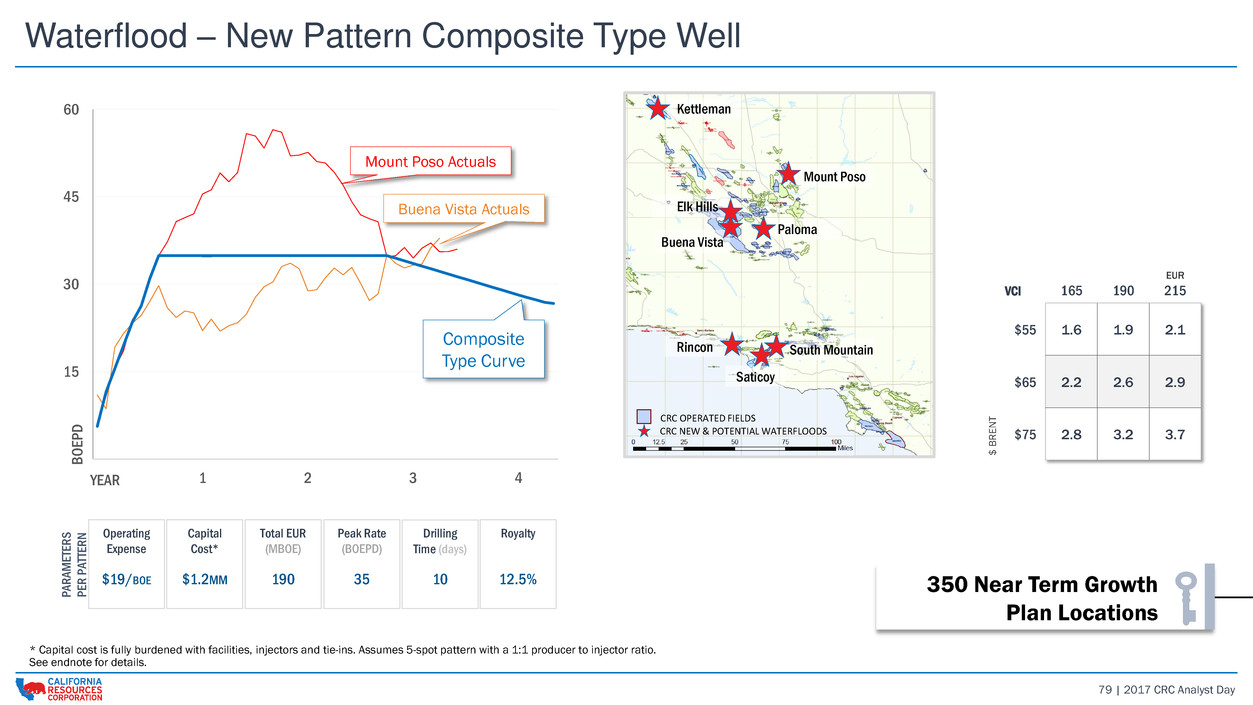

79 | 2017 CRC Analyst Day 0 15 30 45 60 0 1 2 3 4 B O EP D YEAR * Capital cost is fully burdened with facilities, injectors and tie-ins. Assumes 5-spot pattern with a 1:1 producer to injector ratio. VCI 165 190 EUR 215 $55 1.6 1.9 2.1 $65 2.2 2.6 2.9 $ B R E N T $75 2.8 3.2 3.7 Waterflood – New Pattern Composite Type Well Composite Type Curve Mount Poso Actuals Buena Vista Actuals CRC OPERATED FIELDS Rincon Saticoy South Mountain Paloma Mount Poso Kettleman Buena Vista Elk Hills CRC NEW & POTENTIAL WATERFLOODS See endnote for details. 350 Near Term Growth Plan Locations PARAM ET ERS PER PAT TER N Operating Expense $19/BOE Capital Cost* $1.2MM Total EUR (MBOE) 190 Peak Rate (BOEPD) 35 Drilling Time (days) 10 Royalty 12.5%

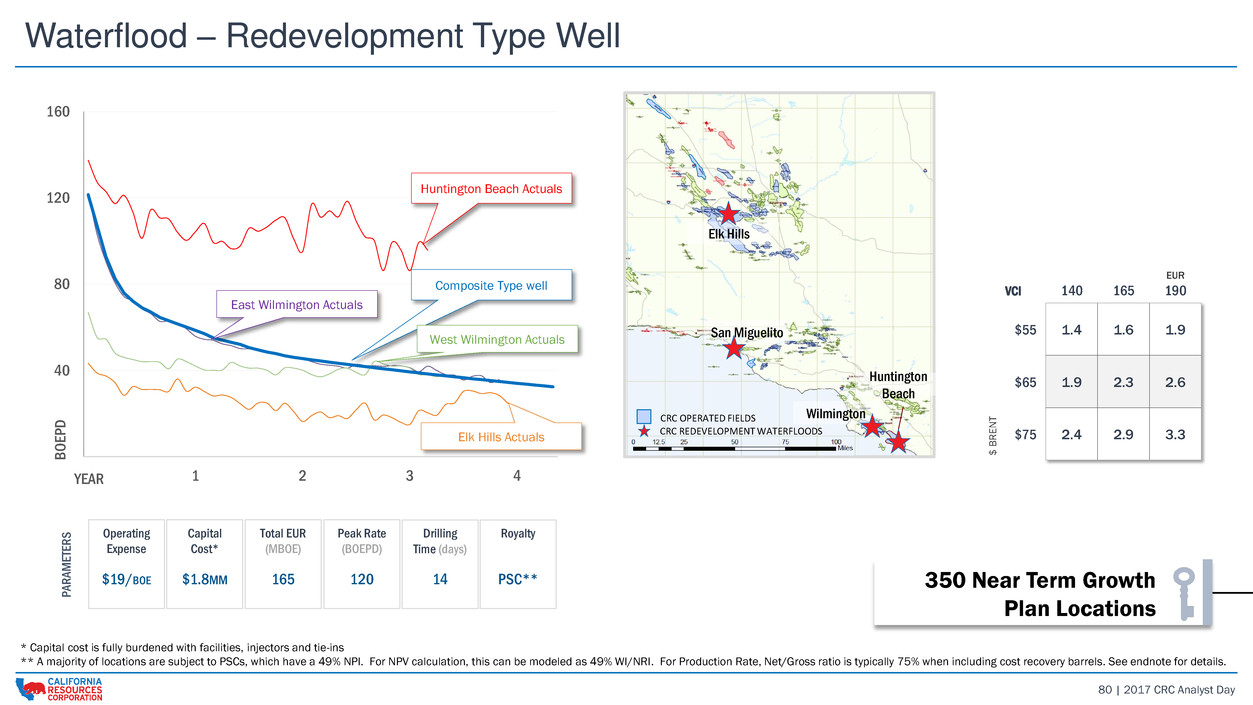

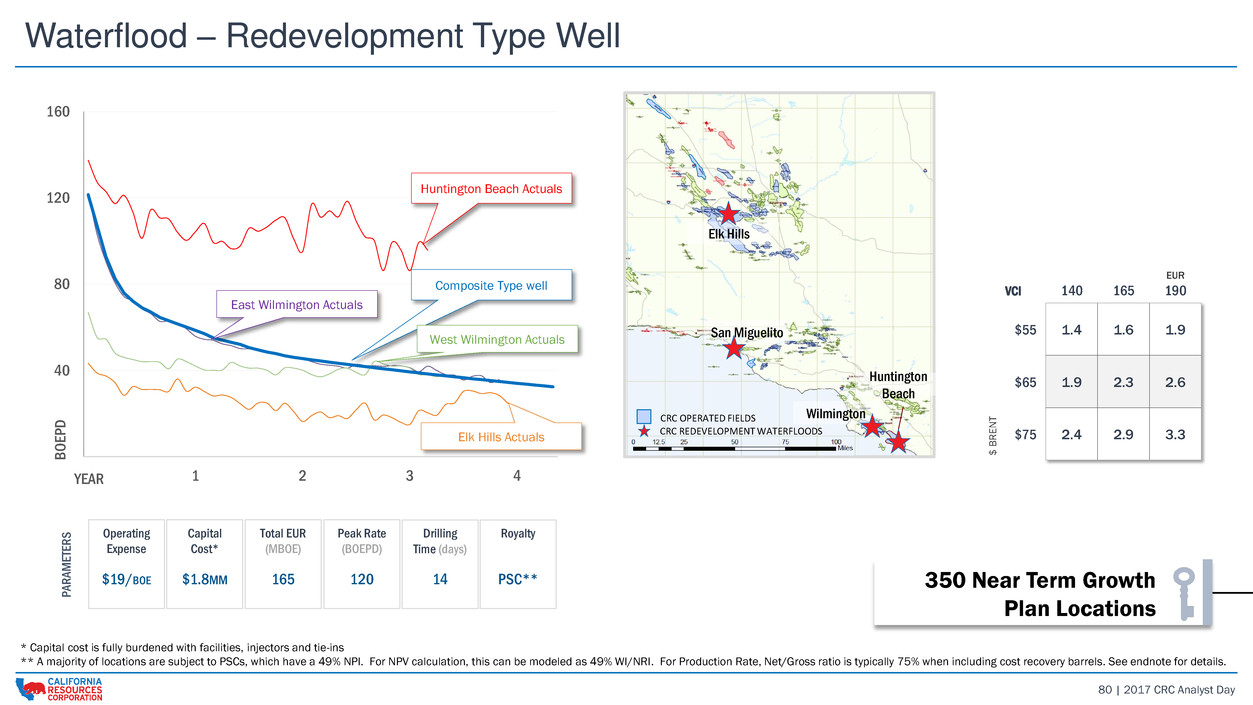

80 | 2017 CRC Analyst Day 0 40 80 120 160 0 1 2 3 4 B O EP D YEAR * Capital cost is fully burdened with facilities, injectors and tie-ins ** A majority of locations are subject to PSCs, which have a 49% NPI. For NPV calculation, this can be modeled as 49% WI/NRI. For Production Rate, Net/Gross ratio is typically 75% when including cost recovery barrels. See endnote for details. PARAM ET ER S Operating Expense $19/BOE Capital Cost* $1.8MM Total EUR (MBOE) 165 Peak Rate (BOEPD) 120 Drilling Time (days) 14 Royalty PSC** VCI 140 165 EUR 190 $55 1.4 1.6 1.9 $65 1.9 2.3 2.6 $ B R E N T $75 2.4 2.9 3.3 Waterflood – Redevelopment Type Well Huntington Beach Actuals Elk Hills Actuals Composite Type well West Wilmington Actuals East Wilmington Actuals CRC OPERATED FIELDS San Miguelito Elk Hills Wilmington Huntington Beach CRC REDEVELOPMENT WATERFLOODS 350 Near Term Growth Plan Locations

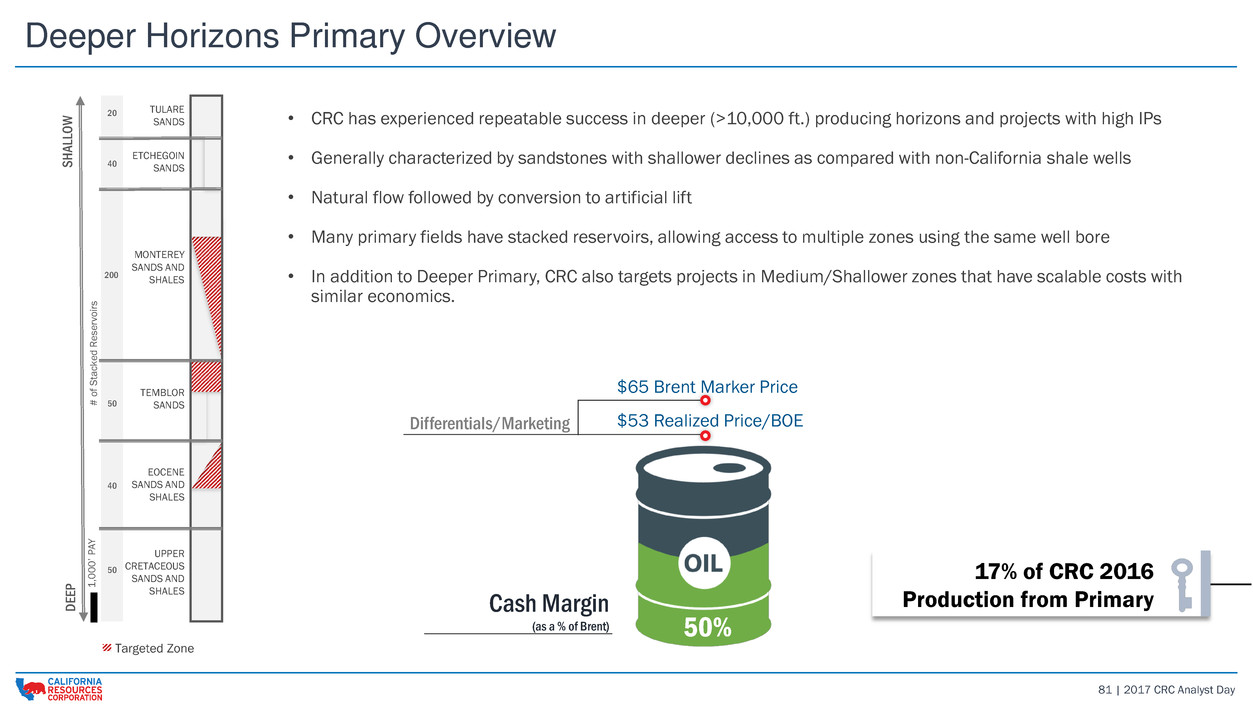

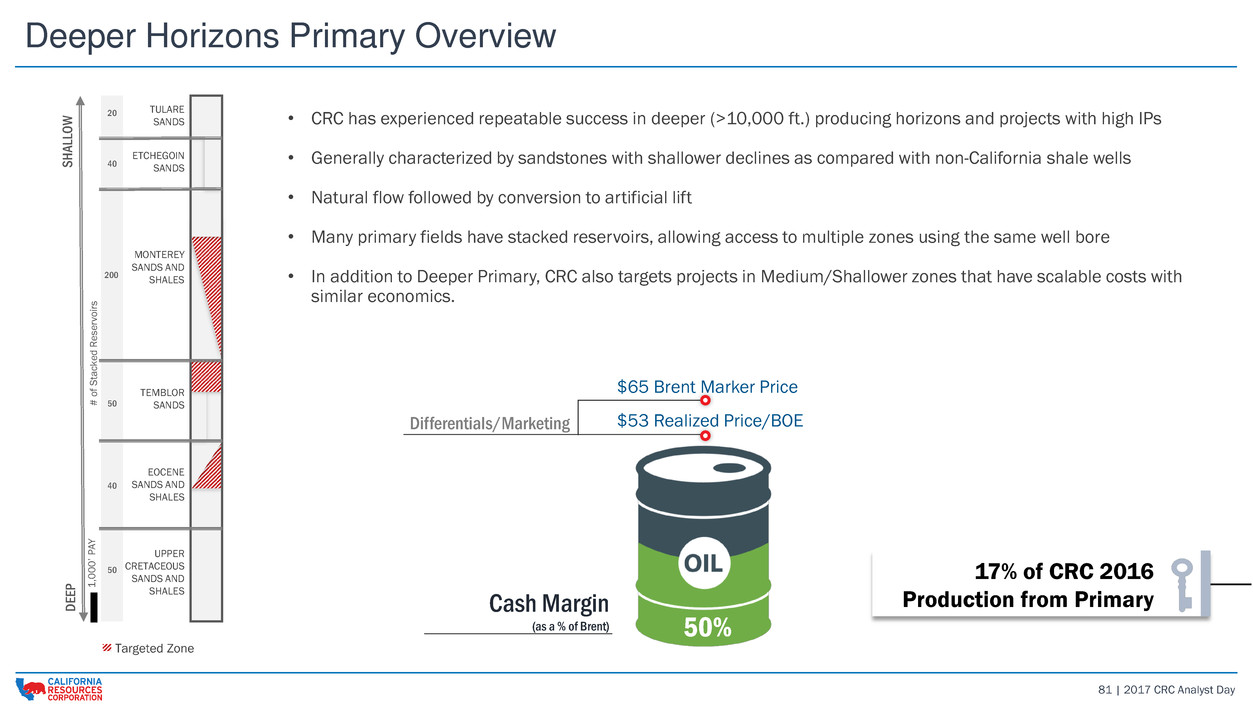

81 | 2017 CRC Analyst Day • CRC has experienced repeatable success in deeper (>10,000 ft.) producing horizons and projects with high IPs • Generally characterized by sandstones with shallower declines as compared with non-California shale wells • Natural flow followed by conversion to artificial lift • Many primary fields have stacked reservoirs, allowing access to multiple zones using the same well bore • In addition to Deeper Primary, CRC also targets projects in Medium/Shallower zones that have scalable costs with similar economics. TEMBLOR SANDS EOCENE SANDS AND SHALES UPPER CRETACEOUS SANDS AND SHALES MONTEREY SANDS AND SHALES 1 ,0 0 0 ’ P A Y TULARE SANDS 20 40 200 50 40 50 SH A LL O W D EE P ETCHEGOIN SANDS # of S ta ck ed Reser voi rs Targeted Zone Deeper Horizons Primary Overview $65 Brent Marker Price $53 Realized Price/BOEDifferentials/Marketing Cash Margin (as a % of Brent) 50% 17% of CRC 2016 Production from Primary

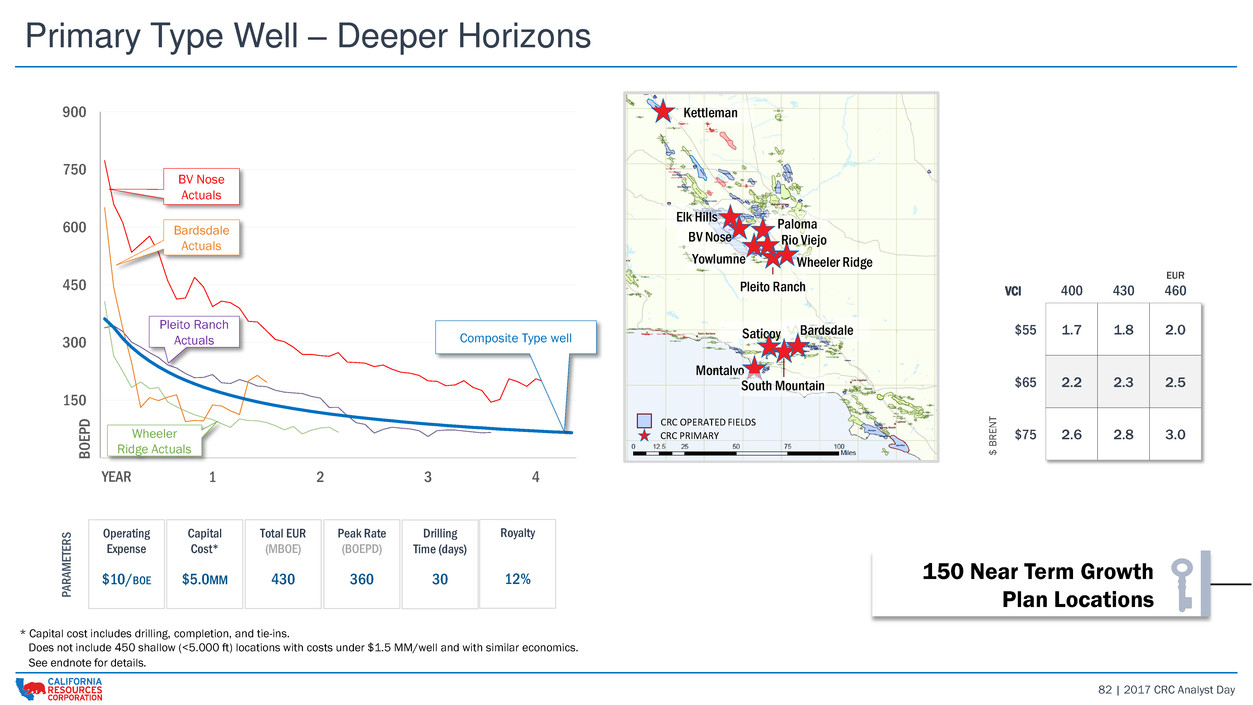

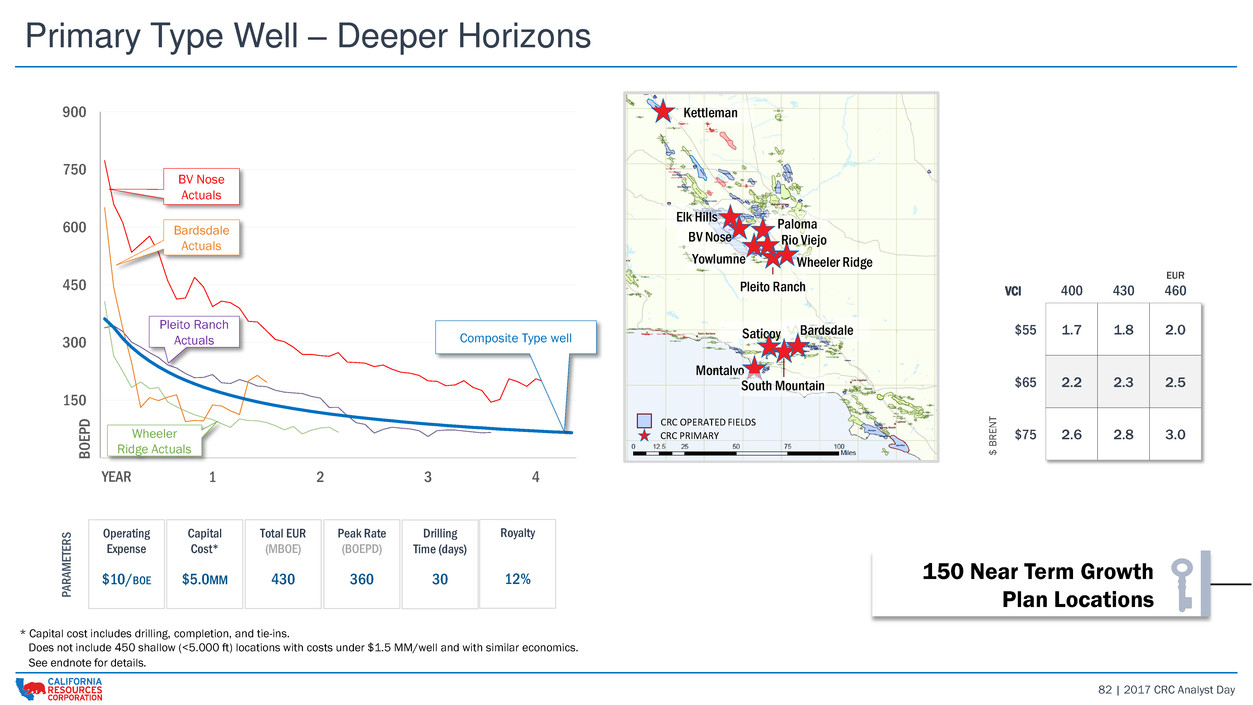

82 | 2017 CRC Analyst Day PARAM ET ER S Operating Expense $10/BOE Capital Cost* $5.0MM Total EUR (MBOE) 430 Peak Rate (BOEPD) 360 Drilling Time (days) 30 Royalty 12% * Capital cost includes drilling, completion, and tie-ins. Does not include 450 shallow (<5.000 ft) locations with costs under $1.5 MM/well and with similar economics. Primary Type Well – Deeper Horizons VCI 400 430 EUR 460 $55 1.7 1.8 2.0 $65 2.2 2.3 2.5 $ B R E N T $75 2.6 2.8 3.0 0 150 300 450 600 750 900 0 1 2 3 4 B O EP D YEAR Composite Type well Wheeler Ridge Actuals Bardsdale Actuals Pleito Ranch Actuals BV Nose Actuals CRC OPERATED FIELDS Montalvo Kettleman Saticoy Bardsdale South Mountain Elk Hills BV Nose Yowlumne Pleito Ranch Wheeler Ridge Paloma Rio Viejo CRC PRIMARY See endnote for details. 150 Near Term Growth Plan Locations

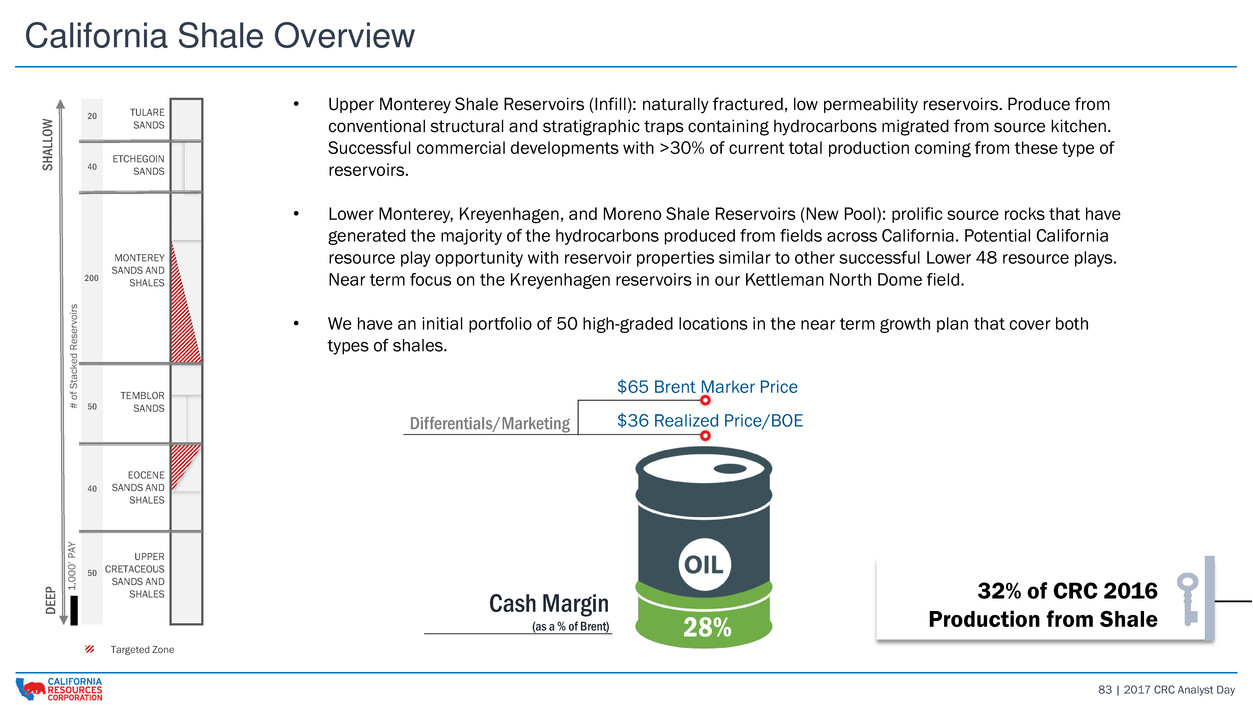

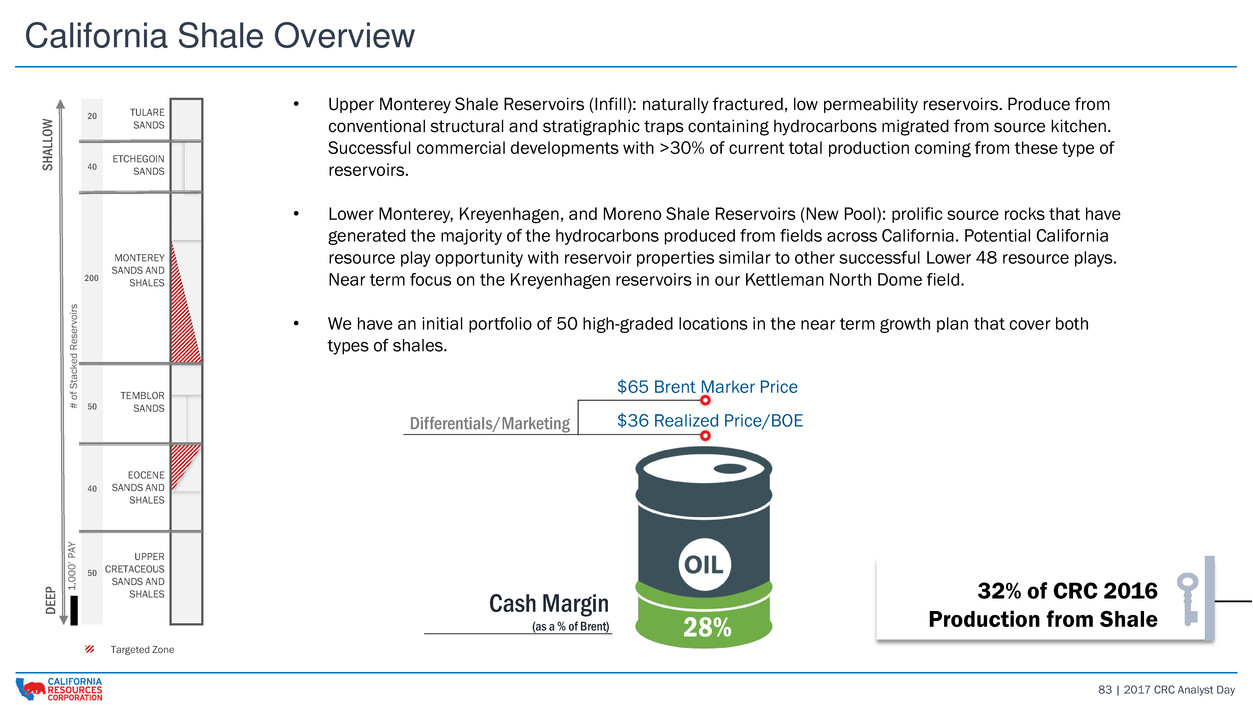

83 | 2017 CRC Analyst Day TEMBLOR SANDS EOCENE SANDS AND SHALES UPPER CRETACEOUS SANDS AND SHALES MONTEREY SANDS AND SHALES 1 ,0 0 0 ’ P A Y TULARE SANDS 20 40 200 50 40 50 SH A LL O W D EE P ETCHEGOIN SANDS # of S ta ck ed Reser voi rs Targeted Zone • Upper Monterey Shale Reservoirs (Infill): naturally fractured, low permeability reservoirs. Produce from conventional structural and stratigraphic traps containing hydrocarbons migrated from source kitchen. Successful commercial developments with >30% of current total production coming from these type of reservoirs. • Lower Monterey, Kreyenhagen, and Moreno Shale Reservoirs (New Pool): prolific source rocks that have generated the majority of the hydrocarbons produced from fields across California. Potential California resource play opportunity with reservoir properties similar to other successful Lower 48 resource plays. Near term focus on the Kreyenhagen reservoirs in our Kettleman North Dome field. • We have an initial portfolio of 50 high-graded locations in the near term growth plan that cover both types of shales. California Shale Overview $65 Brent Marker Price $36 Realized Price/BOEDifferentials/Marketing Cash Margin (as a % of Brent) 28% 32% of CRC 2016 Production from Shale

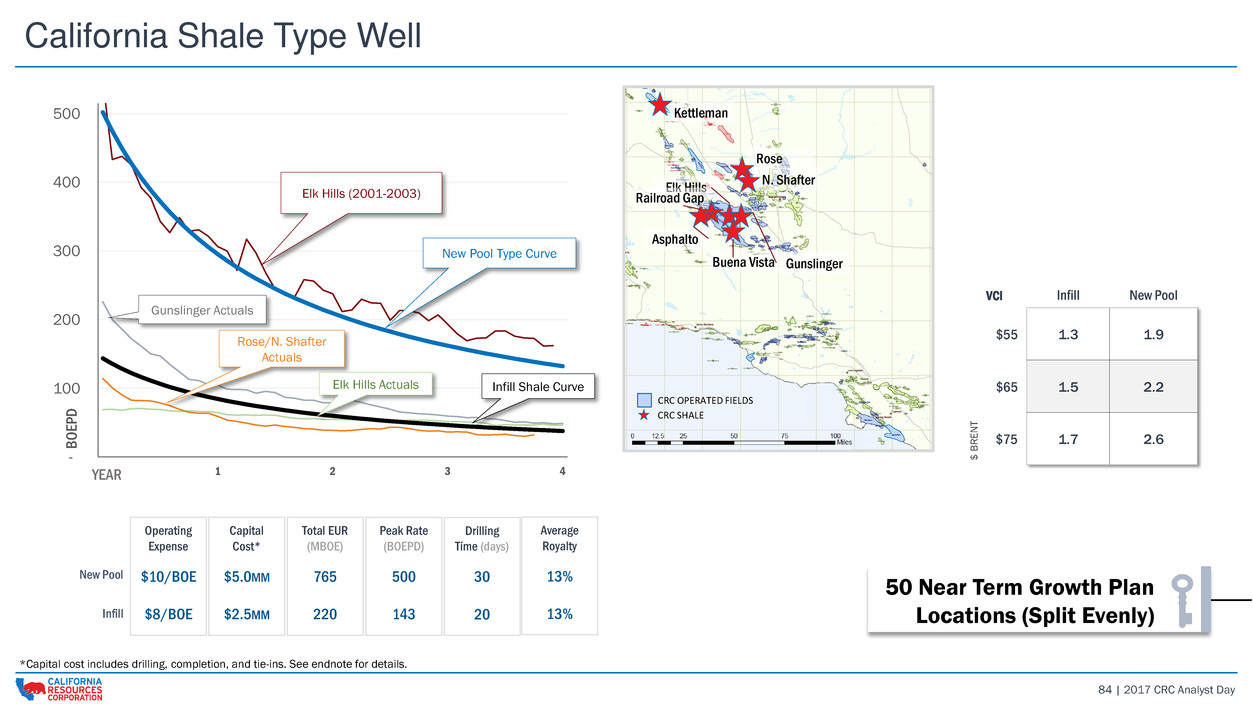

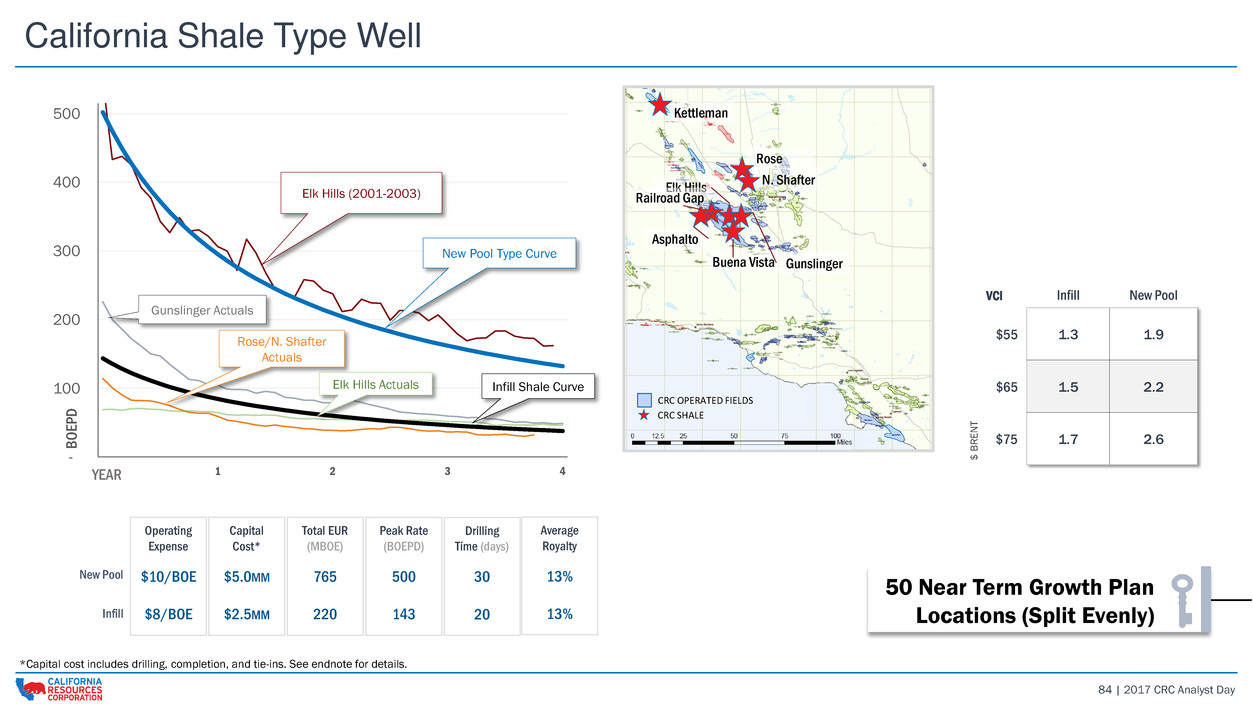

84 | 2017 CRC Analyst Day California Shale Type Well Asphalto Elk Hills Buena Vista Kettleman Rose N. Shafter Gunslinger Railroad Gap CRC SHALE - 100 200 300 400 500 0 1 2 3 4 B O EP D New Pool Type Curve Infill Shale Curve YEAR Gunslinger Actuals Rose/N. Shafter Actuals Elk Hills Actuals Elk Hills (2001-2003) VCI Infill New Pool $55 1.3 1.9 $65 1.5 2.2 $ B R E N T $75 1.7 2.6 *Capital cost includes drilling, completion, and tie-ins. See endnote for details. New Pool Operating Expense $10/BOE $8/BOE Capital Cost* $5.0MM $2.5MM Total EUR (MBOE) 765 220 Peak Rate (BOEPD) 500 143 Drilling Time (days) 30 20 Average Royalty 13% 13%Infill 50 Near Term Growth Plan Locations (Split Evenly) CRC OPERATED FIELDS

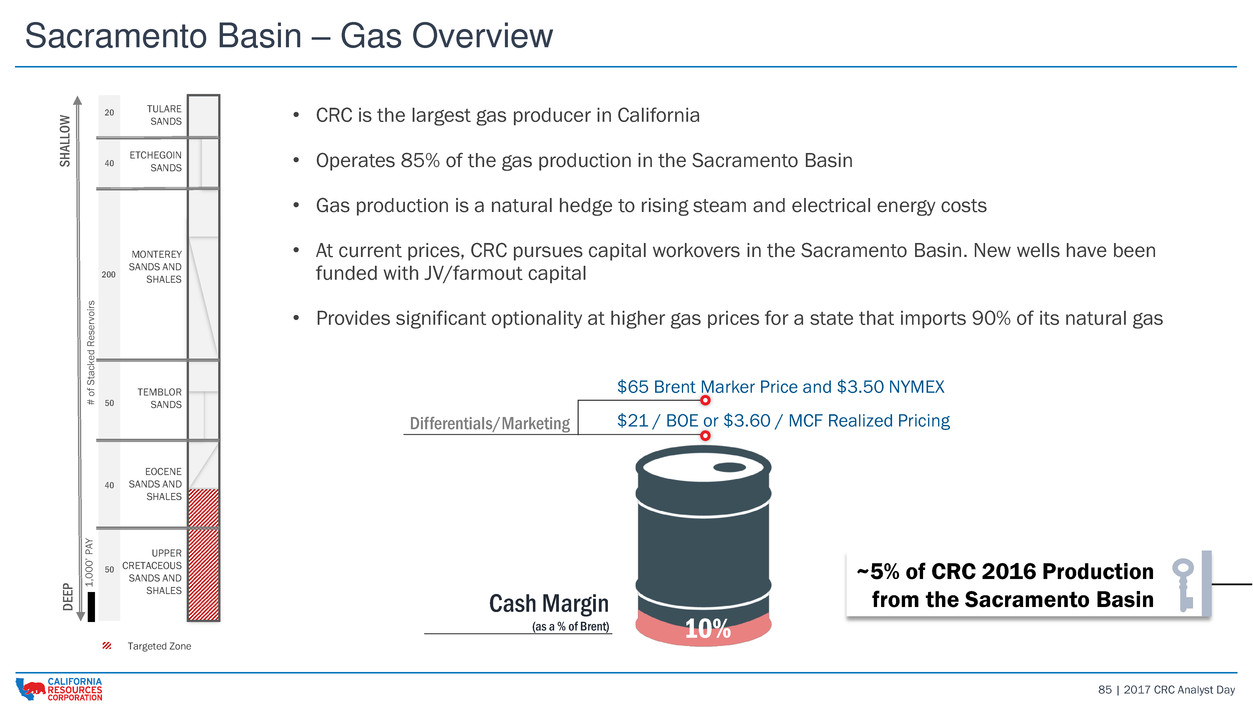

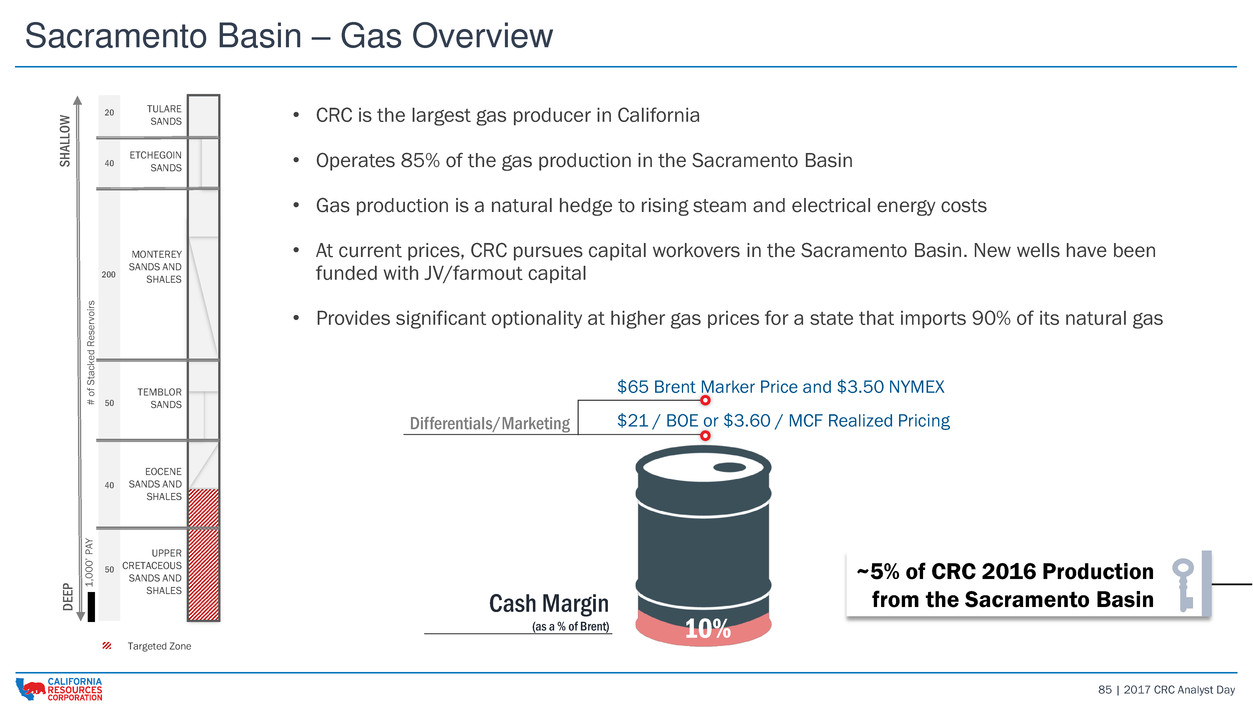

85 | 2017 CRC Analyst Day • CRC is the largest gas producer in California • Operates 85% of the gas production in the Sacramento Basin • Gas production is a natural hedge to rising steam and electrical energy costs • At current prices, CRC pursues capital workovers in the Sacramento Basin. New wells have been funded with JV/farmout capital • Provides significant optionality at higher gas prices for a state that imports 90% of its natural gas Sacramento Basin – Gas Overview TEMBLOR SANDS EOCENE SANDS AND SHALES UPPER CRETACEOUS SANDS AND SHALES MONTEREY SANDS AND SHALES 1 ,0 0 0 ’ P A Y TULARE SANDS 20 40 200 50 40 50 SH A LL O W D EE P ETCHEGOIN SANDS # of S ta ck ed Reser voi rs Targeted Zone $65 Brent Marker Price and $3.50 NYMEX $21 / BOE or $3.60 / MCF Realized PricingDifferentials/Marketing Cash Margin (as a % of Brent) 10% ~5% of CRC 2016 Production from the Sacramento Basin

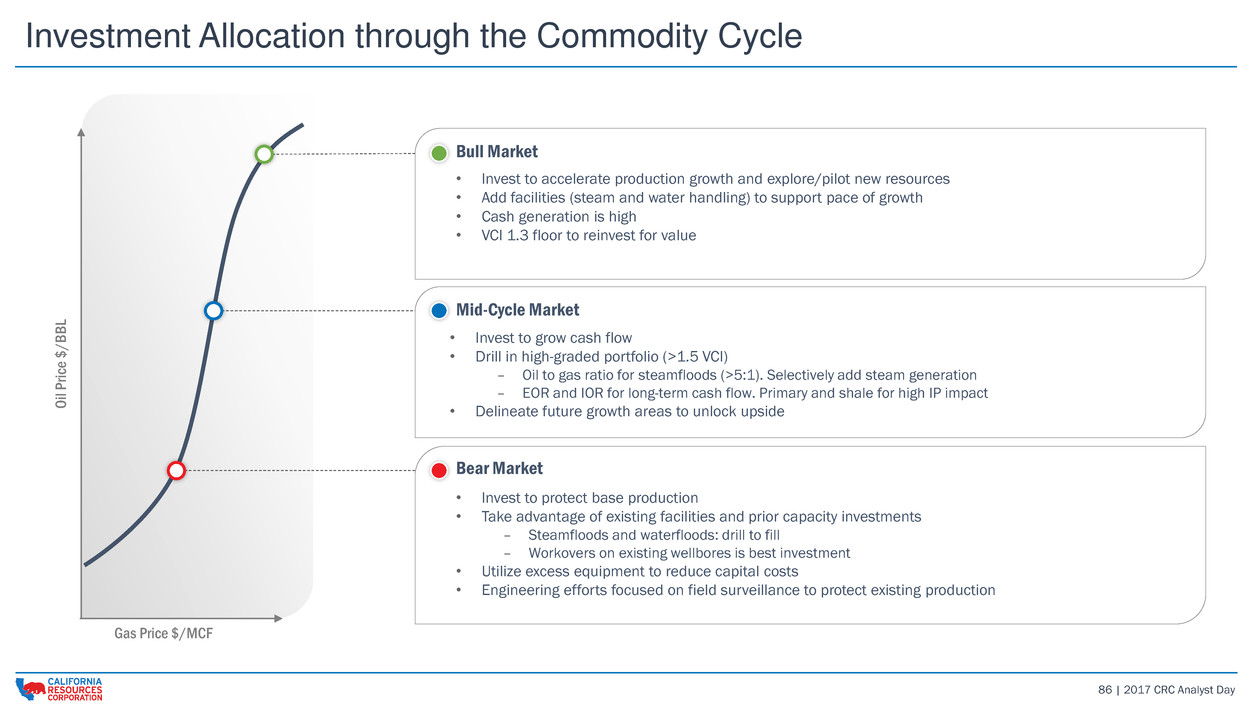

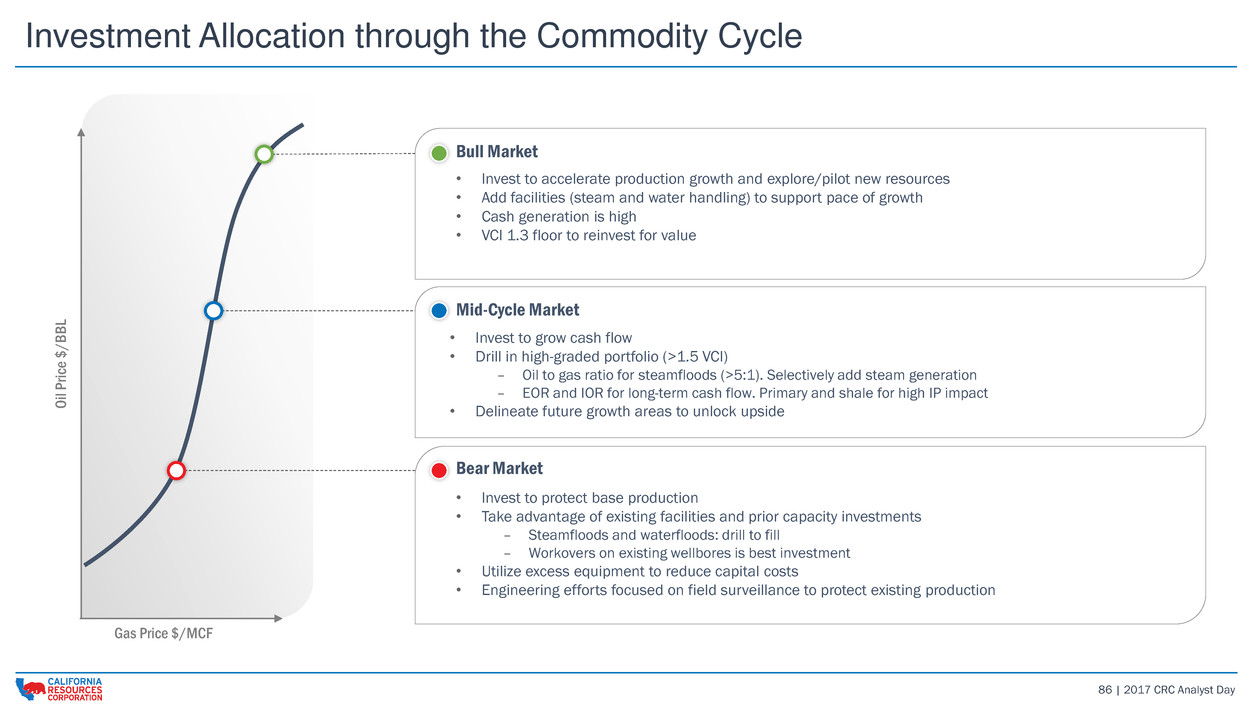

86 | 2017 CRC Analyst Day Investment Allocation through the Commodity Cycle O il P ric e $ / B B L Gas Price $/MCF • Invest to protect base production • Take advantage of existing facilities and prior capacity investments – Steamfloods and waterfloods: drill to fill – Workovers on existing wellbores is best investment • Utilize excess equipment to reduce capital costs • Engineering efforts focused on field surveillance to protect existing production • Invest to accelerate production growth and explore/pilot new resources • Add facilities (steam and water handling) to support pace of growth • Cash generation is high • VCI 1.3 floor to reinvest for value Bull Market Mid-Cycle Market Bear Market • Invest to grow cash flow • Drill in high-graded portfolio (>1.5 VCI) – Oil to gas ratio for steamfloods (>5:1). Selectively add steam generation – EOR and IOR for long-term cash flow. Primary and shale for high IP impact • Delineate future growth areas to unlock upside

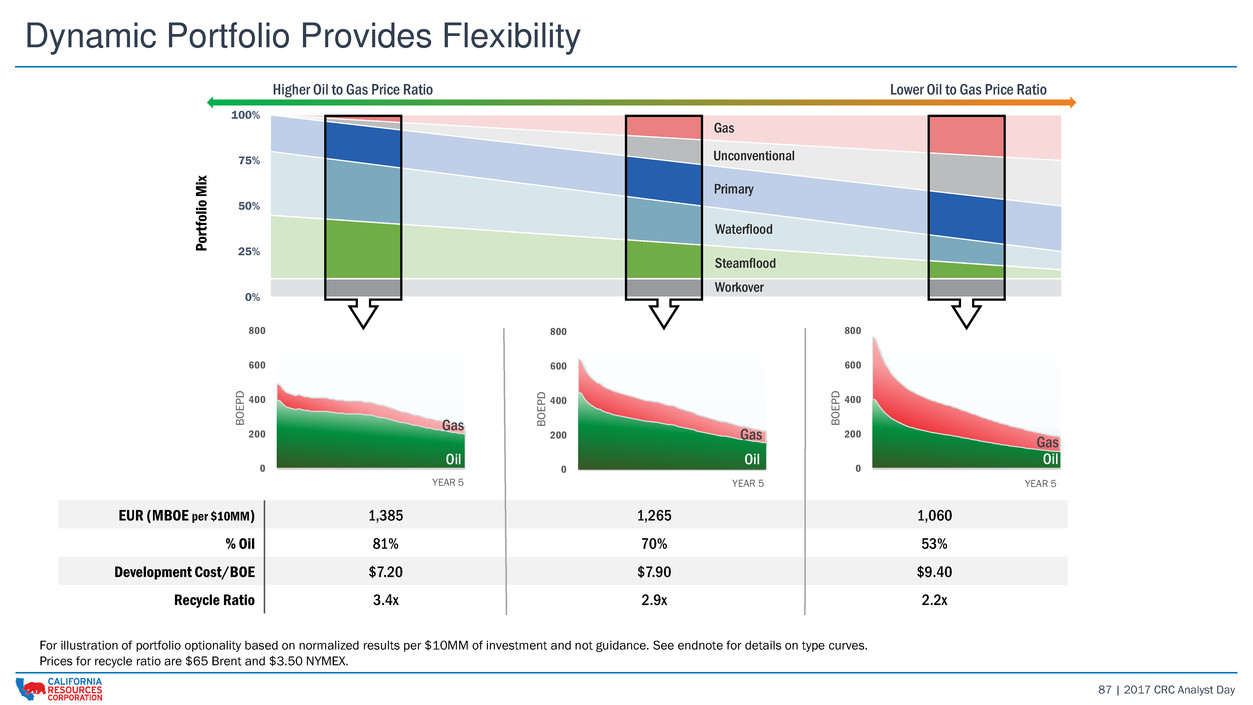

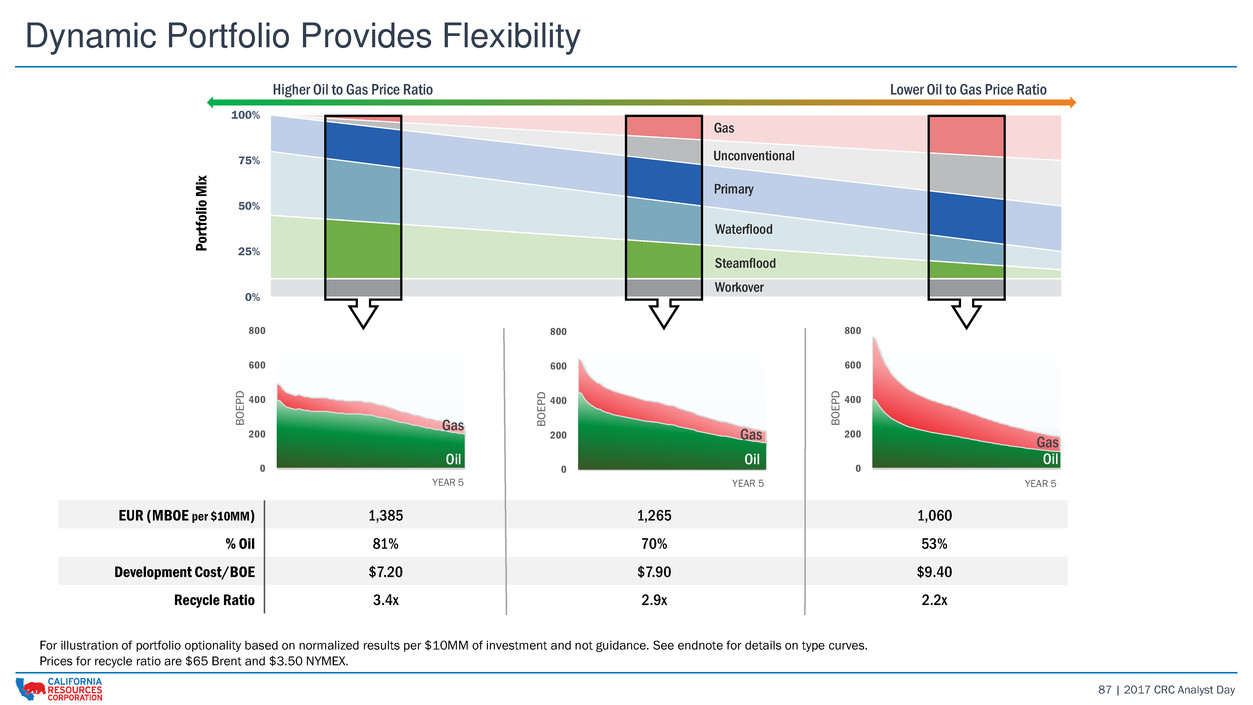

87 | 2017 CRC Analyst Day Dynamic Portfolio Provides Flexibility 0 200 400 600 800 B O EP D YEAR 5 0 200 400 600 800 B O EP D YEAR 5 Gas 0 200 400 600 800 B O EP D YEAR 5 0% 25% 50% 75% 100% Po rt fol io Mi x Higher Oil to Gas Price Ratio Lower Oil to Gas Price Ratio Gas Unconventional Primary Waterflood Steamflood Workover EUR (MBOE per $10MM) 1,385 1,265 1,060 % Oil 81% 70% 53% Development Cost/BOE $7.20 $7.90 $9.40 Recycle Ratio 3.4x 2.9x 2.2x For illustration of portfolio optionality based on normalized results per $10MM of investment and not guidance. See endnote for details on type curves. Prices for recycle ratio are $65 Brent and $3.50 NYMEX. Oil Gas Oil Oil Gas

STRENGTHENING THE BALANCE SHEET CRC 2017 Analyst & Investor Day Mark Smith | Sr. EVP & CFO

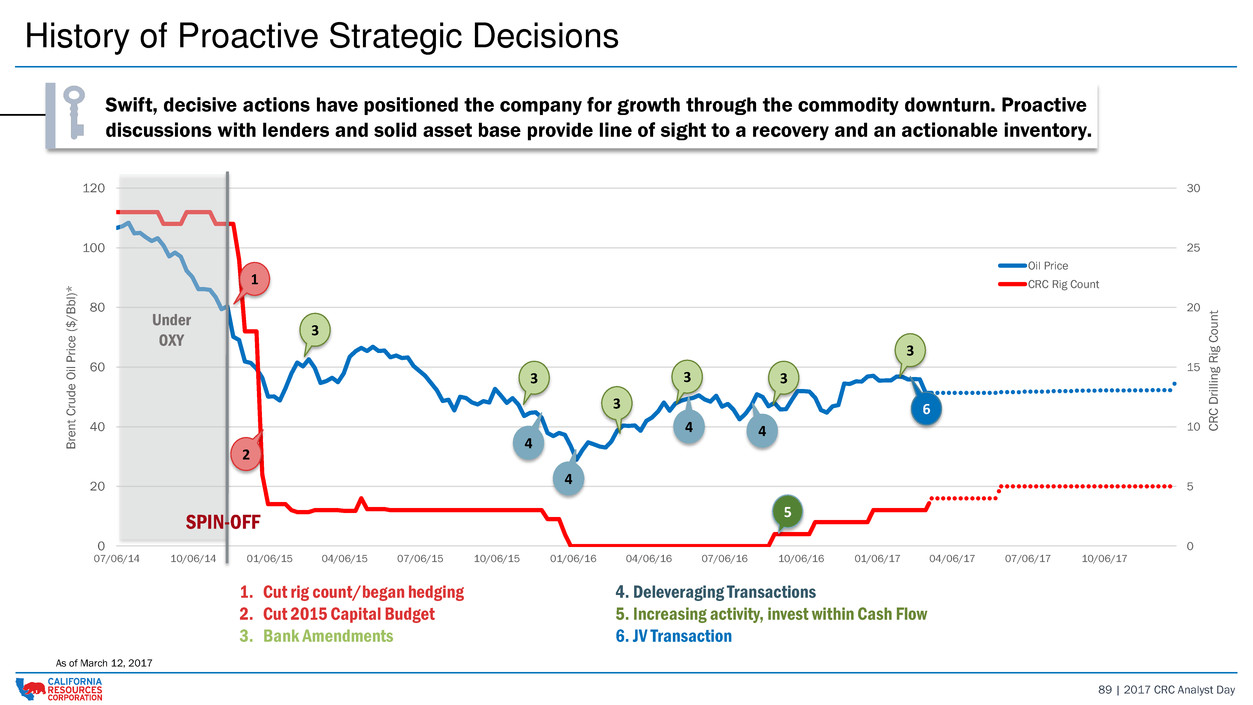

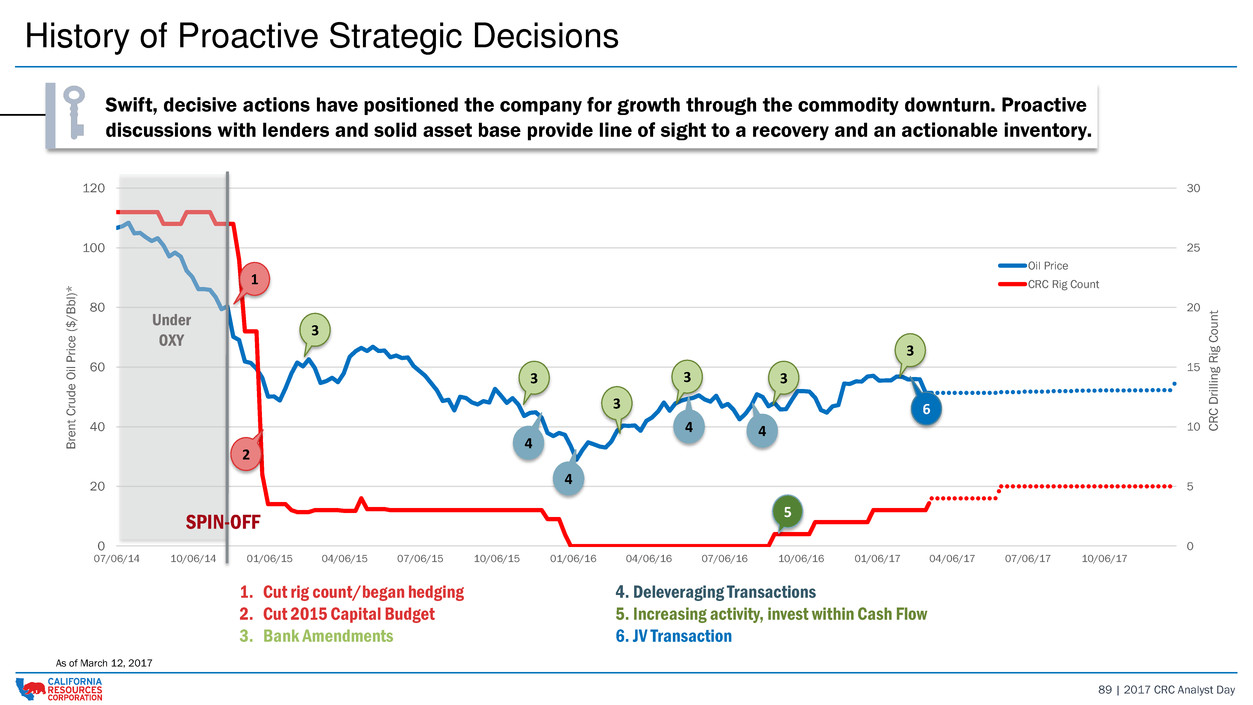

89 | 2017 CRC Analyst Day History of Proactive Strategic Decisions Swift, decisive actions have positioned the company for growth through the commodity downturn. Proactive discussions with lenders and solid asset base provide line of sight to a recovery and an actionable inventory. 0 5 10 15 20 25 30 0 20 40 60 80 100 120 07/06/14 10/06/14 01/06/15 04/06/15 07/06/15 10/06/15 01/06/16 04/06/16 07/06/16 10/06/16 01/06/17 04/06/17 07/06/17 10/06/17 CRC D rilling Ri g Coun t B rent C ru d e O il P ri ce ( $ /B b l) * Oil Price CRC Rig Count 1. Cut rig count/began hedging 4. Deleveraging Transactions 2. Cut 2015 Capital Budget 5. Increasing activity, invest within Cash Flow 3. Bank Amendments 6. JV Transaction 2 1 As of March 12, 2017 5 3 Under OXY 6 SPIN-OFF 3 3 33 3 4 44 4

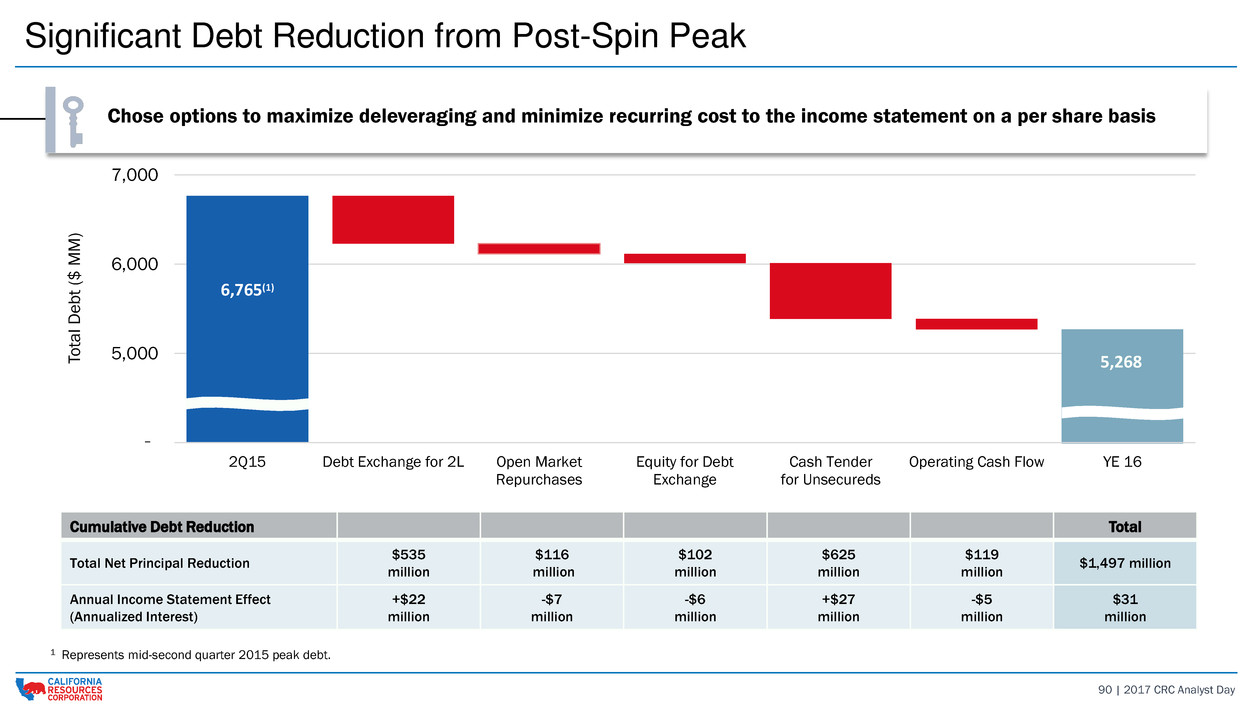

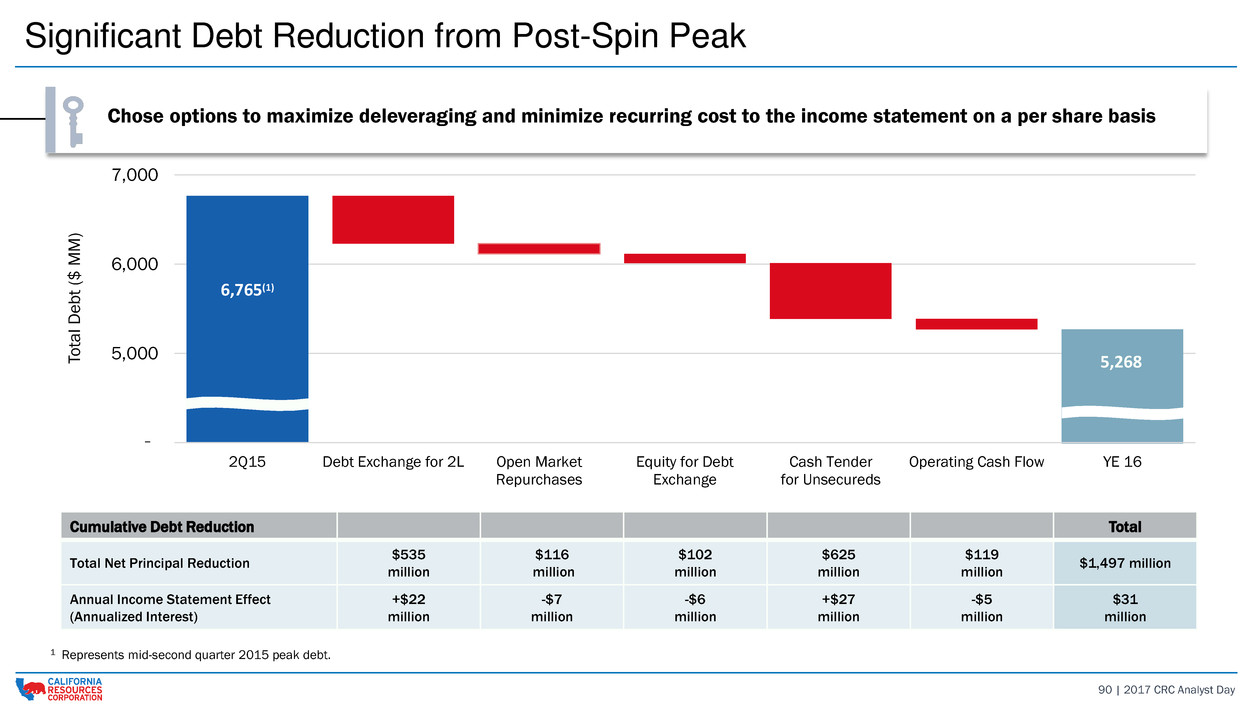

90 | 2017 CRC Analyst Day Significant Debt Reduction from Post-Spin Peak 6,765(1) 5,268 4,000 5,000 6,000 7,000 2Q15 Debt Exchange for 2L Open Market Repurchases Equity for Debt Exchange Cash Tender for Unsecureds Operating Cash Flow YE 16 To ta l D e b t ($ MM ) Cumulative Debt Reduction Total Total Net Principal Reduction $535 million $116 million $102 million $625 million $119 million $1,497 million Annual Income Statement Effect (Annualized Interest) +$22 million -$7 million -$6 million +$27 million -$5 million $31 million 1 Represents mid-second quarter 2015 peak debt. - Chose options to maximize deleveraging and minimize recurring cost to the income statement on a per share basis

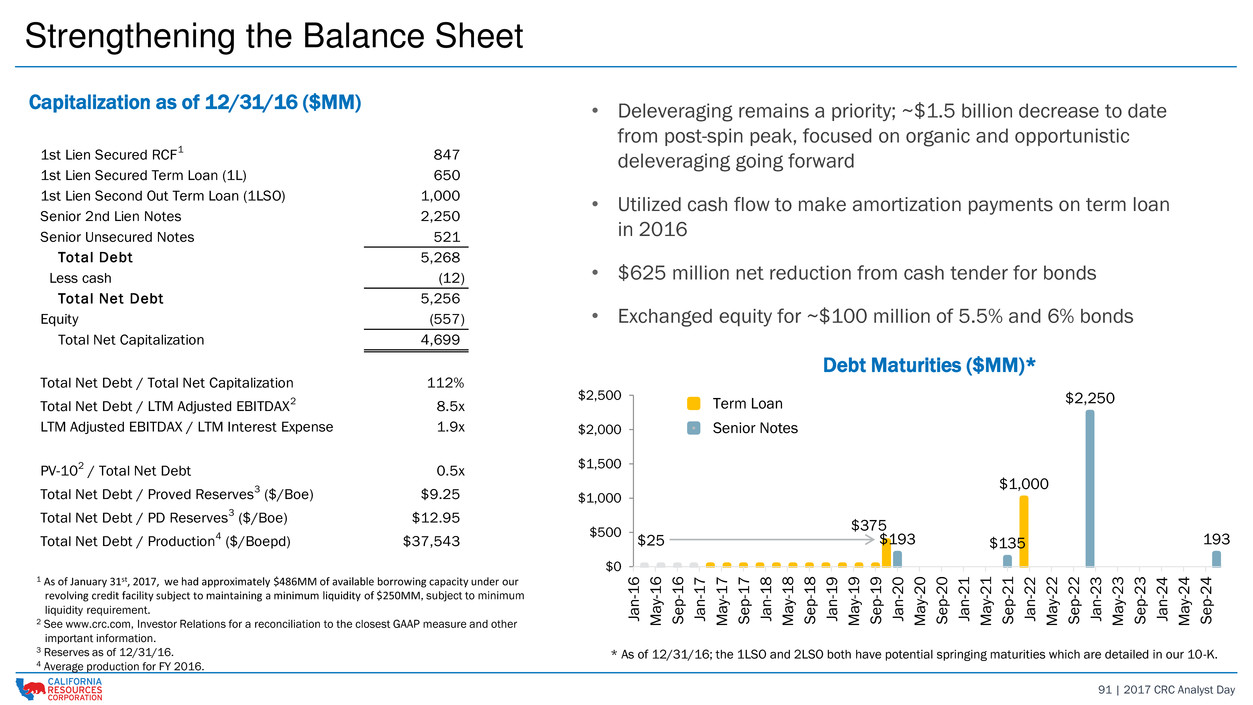

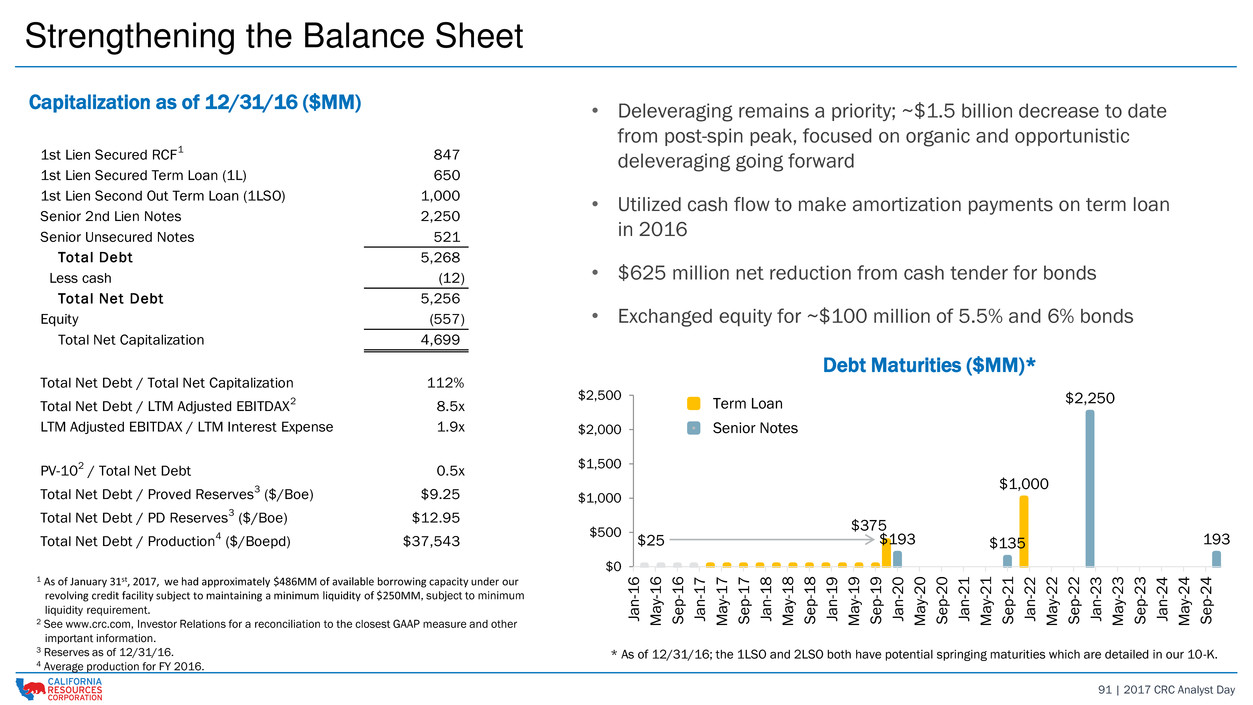

91 | 2017 CRC Analyst Day Strengthening the Balance Sheet $25 $375 $193 $135 $1,000 $2,250 193 $0 $500 $1,000 $1,500 $2,000 $2,500 Jan-1 6 Ma y- 1 6 Se p -1 6 Jan-1 7 Ma y- 1 7 Se p -1 7 Jan-1 8 Ma y- 1 8 Se p -1 8 Jan-1 9 Ma y- 1 9 Se p -1 9 Jan-2 0 Ma y- 2 0 Se p -2 0 Jan-2 1 Ma y- 2 1 Se p -2 1 Jan-2 2 Ma y- 2 2 Se p -2 2 Jan-2 3 Ma y- 2 3 Se p -2 3 Jan-2 4 Ma y- 2 4 Se p -2 4 Term Loan Senior Notes • Deleveraging remains a priority; ~$1.5 billion decrease to date from post-spin peak, focused on organic and opportunistic deleveraging going forward • Utilized cash flow to make amortization payments on term loan in 2016 • $625 million net reduction from cash tender for bonds • Exchanged equity for ~$100 million of 5.5% and 6% bonds 1 As of January 31st, 2017, we had approximately $486MM of available borrowing capacity under our revolving credit facility subject to maintaining a minimum liquidity of $250MM, subject to minimum liquidity requirement. 2 See www.crc.com, Investor Relations for a reconciliation to the closest GAAP measure and other important information. 3 Reserves as of 12/31/16. 4 Average production for FY 2016. 1st Lien Secured RCF1 847 1st Lien Secured Term Loan (1L) 650 1st Lien Second Out Term Loan (1LSO) 1,000 Senior 2nd Lien Notes 2,250 Senior Unsecured Notes 521 Total Debt 5,268 Less cash (12) Total Net Debt 5,256 Equity (557) Total Net Capitalization 4,699 Total Net Debt / Total Net Capitalization 112% Total Net Debt / LTM Adjusted EBITDAX2 8.5x LTM Adjusted EBITDAX / LTM Interest Expense 1.9x PV-102 / Total Net Debt 0.5x Total Net Debt / Prove Reserves3 ($/Boe) $9.25 Total Net Debt / PD Reserves3 ($/Boe) $12.95 Total Net Debt / Production4 ($/Boepd) $37,543 * As of 12/31/16; the 1LSO and 2LSO both have potential springing maturities which are detailed in our 10-K. Capitalization as of 12/31/16 ($MM) Debt Maturities ($MM)*

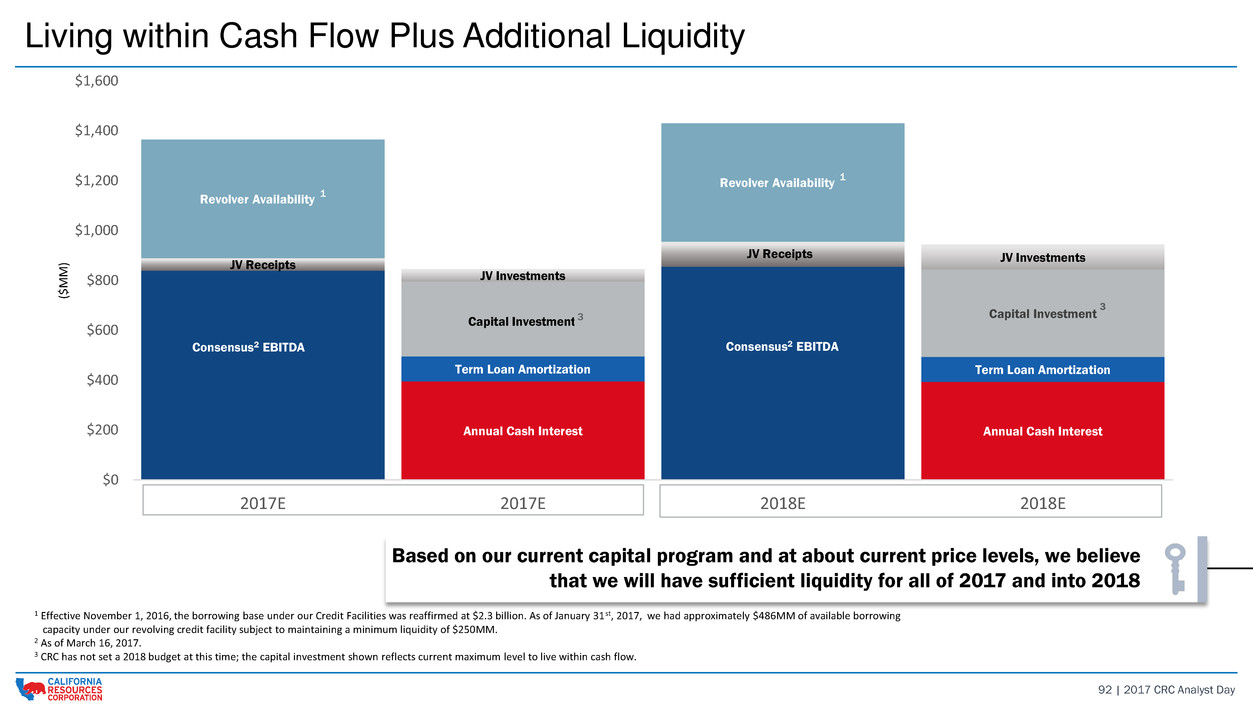

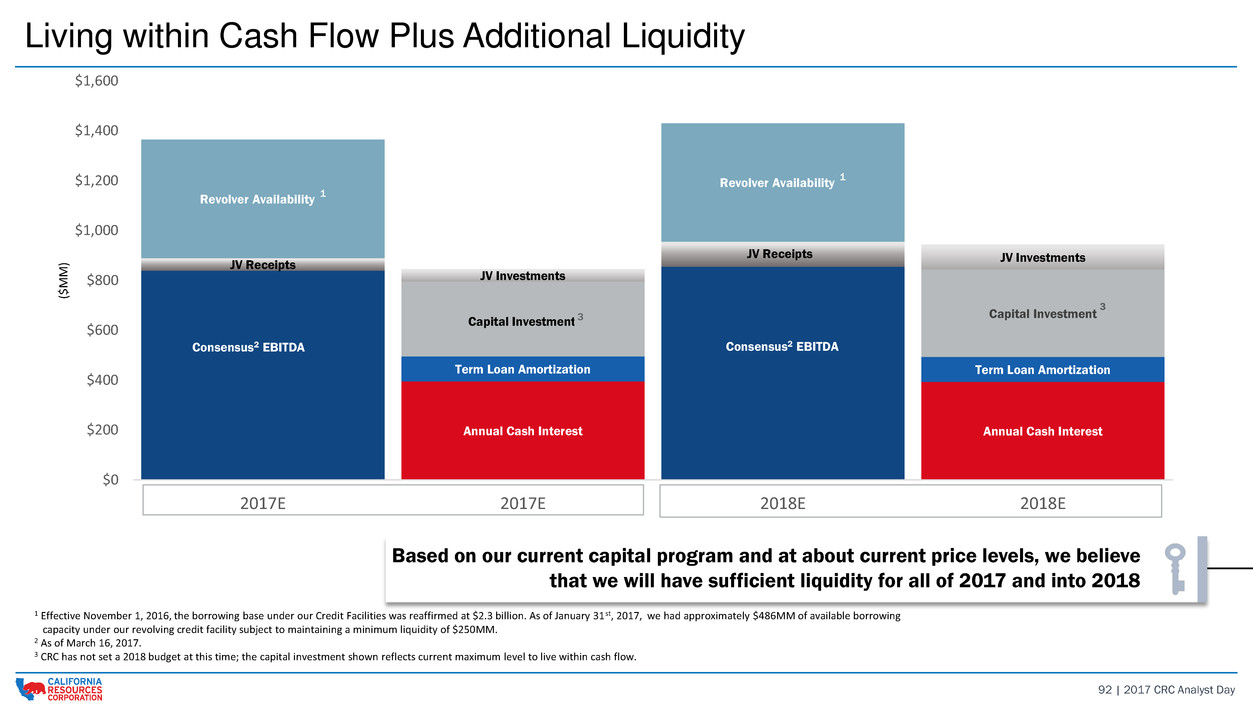

92 | 2017 CRC Analyst Day Living within Cash Flow Plus Additional Liquidity JV Receipts JV Receipts Revolver Availability 1 Revolver Availability 1 Annual Cash Interest Annual Cash Interest Term Loan Amortization Term Loan Amortization Capital Investment JV Investments JV Investments $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 $1,600 2017E 2017E 2018E 2018E ($MM ) 2 Capital Investment 1 Effective November 1, 2016, the borrowing base under our Credit Facilities was reaffirmed at $2.3 billion. As of January 31st, 2017, we had approximately $486MM of available borrowing capacity under our revolving credit facility subject to maintaining a minimum liquidity of $250MM. 2 As of March 16, 2017. 3 CRC has not set a 2018 budget at this time; the capital investment shown reflects current maximum level to live within cash flow. 1 3 Based on our current capital program and at about current price levels, we believe that we will have sufficient liquidity for all of 2017 and into 2018 3 Consensus2 EBITDA Consensus2 EBITDA 1

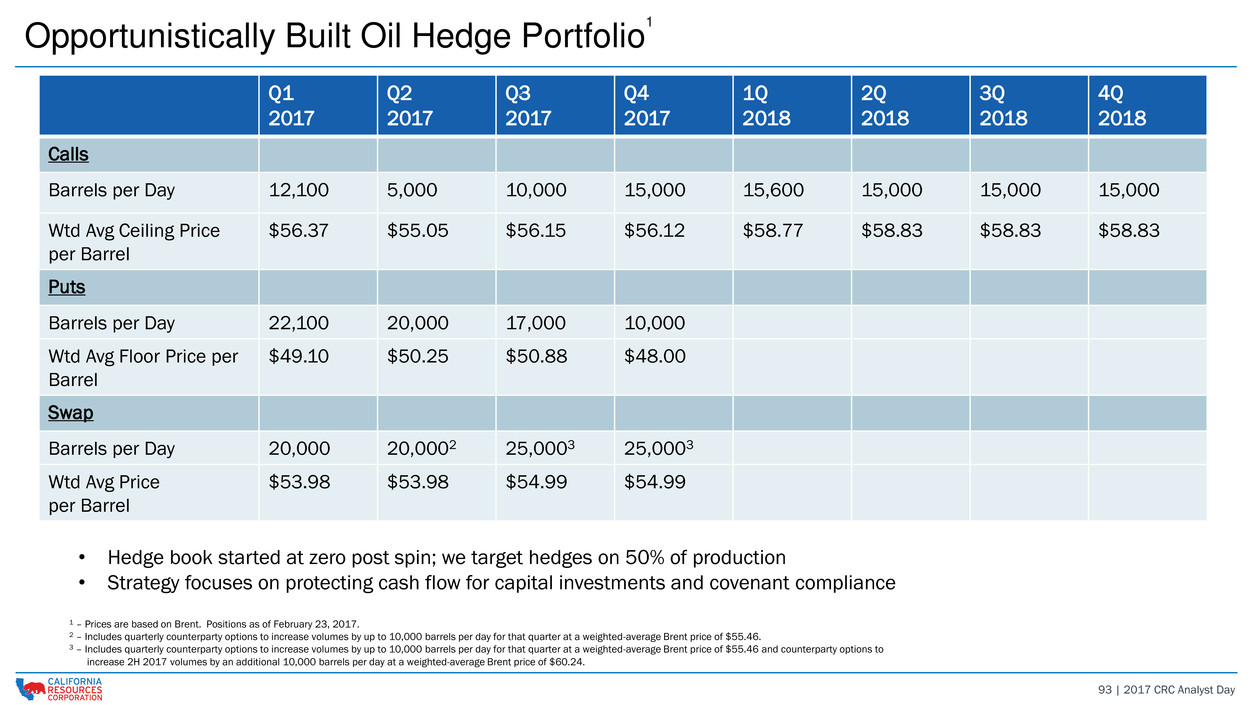

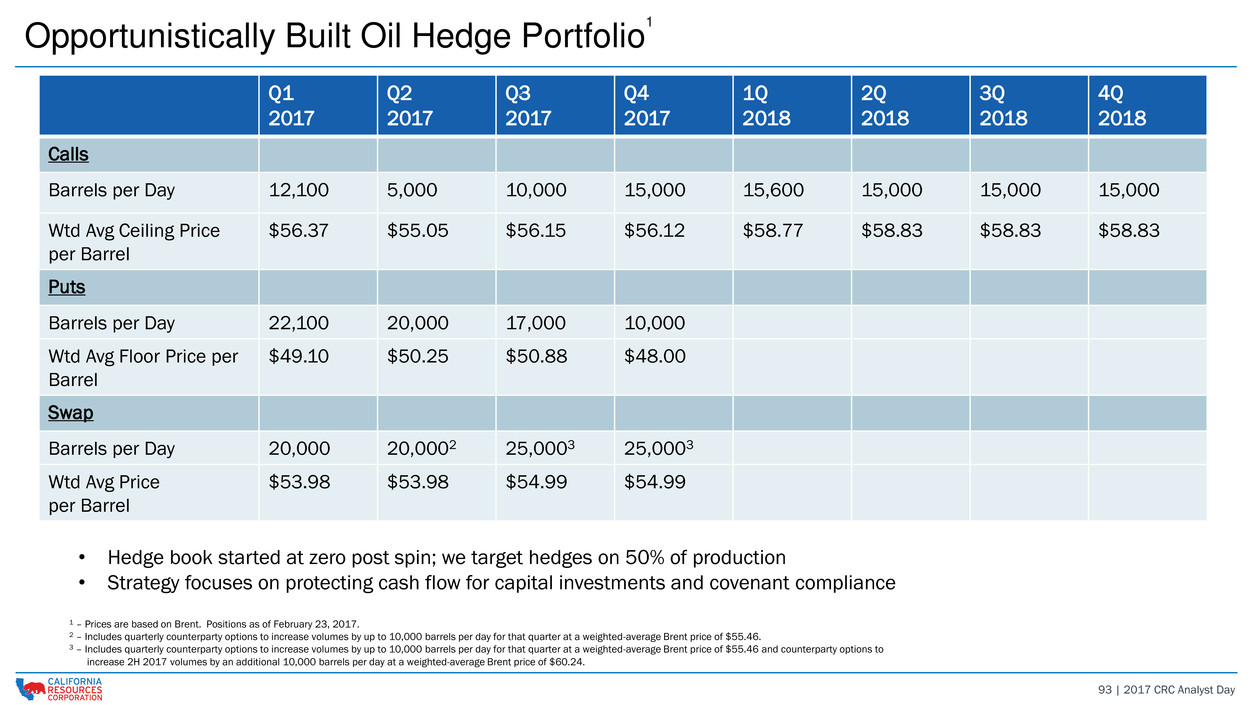

93 | 2017 CRC Analyst Day Opportunistically Built Oil Hedge Portfolio 1 • Hedge book started at zero post spin; we target hedges on 50% of production • Strategy focuses on protecting cash flow for capital investments and covenant compliance Q1 2017 Q2 2017 Q3 2017 Q4 2017 1Q 2018 2Q 2018 3Q 2018 4Q 2018 Calls Barrels per Day 12,100 5,000 10,000 15,000 15,600 15,000 15,000 15,000 Wtd Avg Ceiling Price per Barrel $56.37 $55.05 $56.15 $56.12 $58.77 $58.83 $58.83 $58.83 Puts Barrels per Day 22,100 20,000 17,000 10,000 Wtd Avg Floor Price per Barrel $49.10 $50.25 $50.88 $48.00 Swap Barrels per Day 20,000 20,0002 25,0003 25,0003 Wtd Avg Price per Barrel $53.98 $53.98 $54.99 $54.99 1 – Prices are based on Brent. Positions as of February 23, 2017. 2 – Includes quarterly counterparty options to increase volumes by up to 10,000 barrels per day for that quarter at a weighted-average Brent price of $55.46. 3 – Includes quarterly counterparty options to increase volumes by up to 10,000 barrels per day for that quarter at a weighted-average Brent price of $55.46 and counterparty options to increase 2H 2017 volumes by an additional 10,000 barrels per day at a weighted-average Brent price of $60.24.

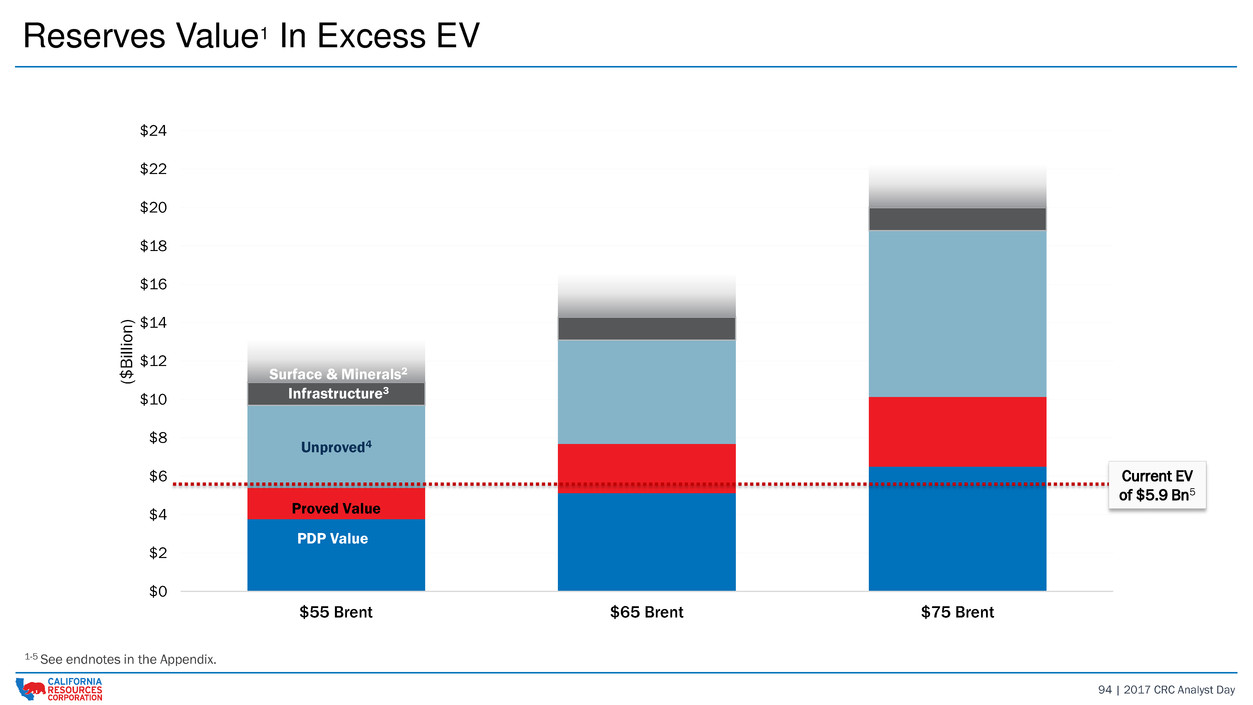

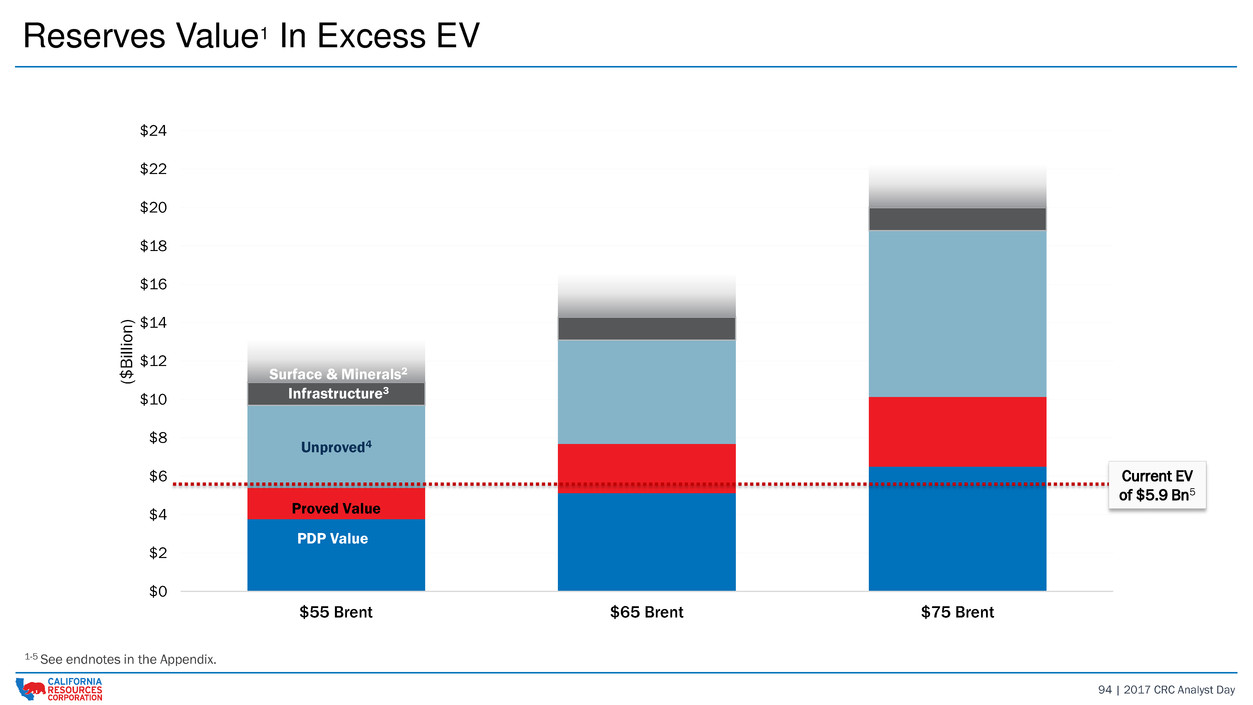

94 | 2017 CRC Analyst Day PDP Value Proved Value Unproved4 $0 $2 $4 $6 $8 $10 $12 $14 $16 $18 $20 $22 $24 $55 Brent $65 Brent $75 Brent ($B ill ion ) Reserves Value1 In Excess EV Current EV of $5.9 Bn5 Infrastructure3 Surface & Minerals2 1-5 See endnotes in the Appendix.

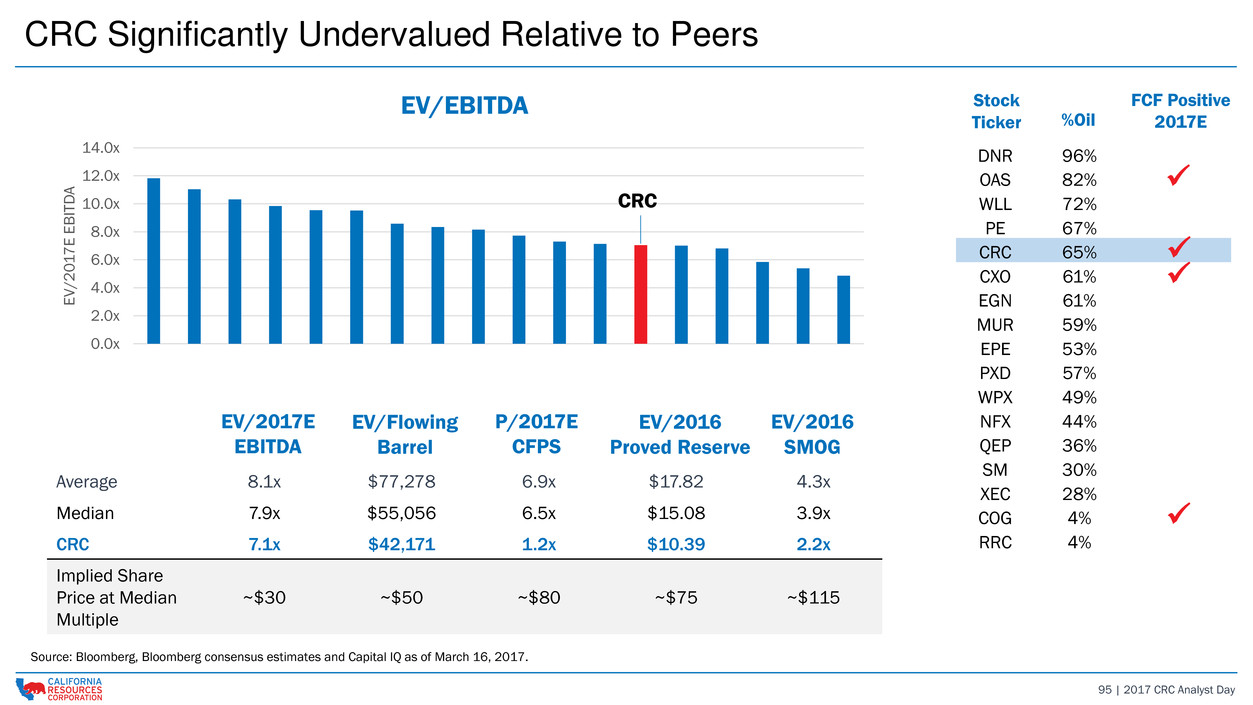

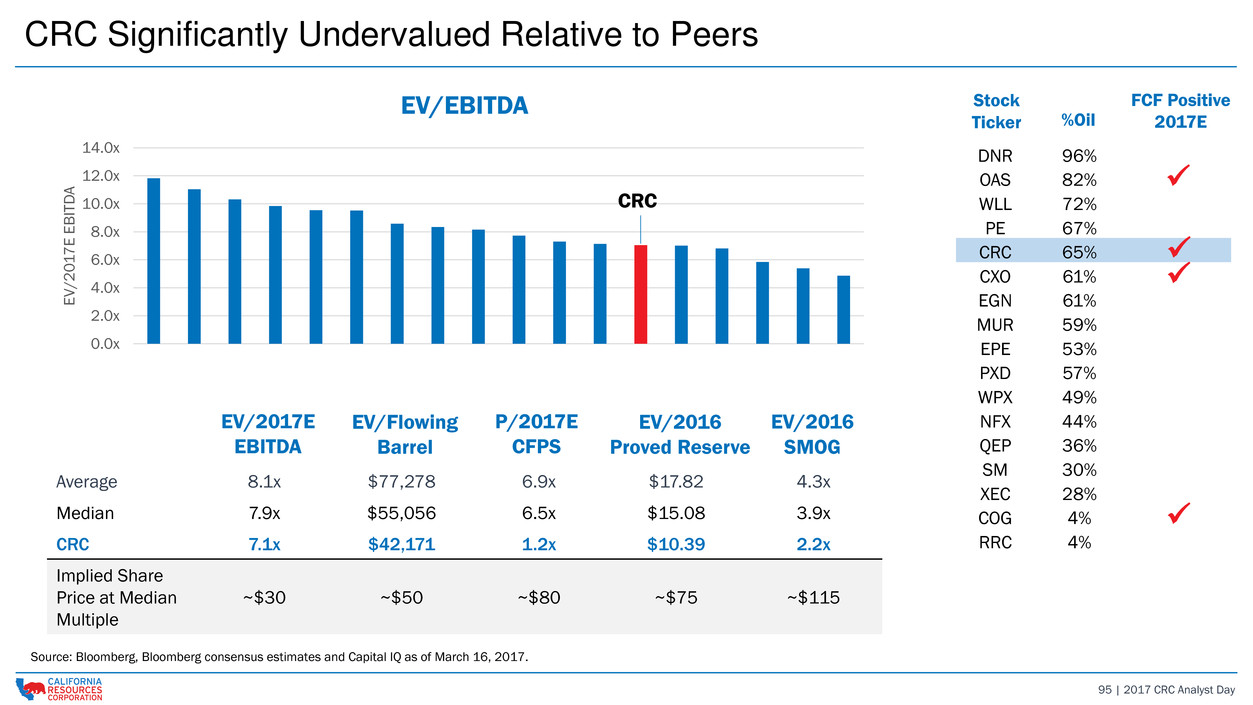

95 | 2017 CRC Analyst Day 0.0x 2.0x 4.0x 6.0x 8.0x 10.0x 12.0x 14.0x E V /2 0 1 7 E EBI T D A CRC Significantly Undervalued Relative to Peers Source: Bloomberg, Bloomberg consensus estimates and Capital IQ as of March 16, 2017. DNR 96% OAS 82% WLL 72% PE 67% CRC 65% CXO 61% EGN 61% MUR 59% EPE 53% PXD 57% WPX 49% NFX 44% QEP 36% SM 30% XEC 28% COG 4% RRC 4% Average 8.1x $77,278 6.9x $17.82 4.3x Median 7.9x $55,056 6.5x $15.08 3.9x CRC 7.1x $42,171 1.2x $10.39 2.2x Implied Share Price at Median Multiple ~$30 ~$50 ~$80 ~$75 ~$115 CRC %Oil Stock Ticker FCF Positive 2017E EV/2017E EBITDA EV/2016 SMOG EV/Flowing Barrel EV/2016 Proved Reserve P/2017E CFPS EV/EBITDA

96 | 2017 CRC Analyst Day 40 60 80 100 120 140 160 2016 2017E 2018E 2019E 2020E Oi l P ro d uction M B /d 0 300 600 900 1,200 2016 2017 2018 2019 2020 Capi ta l ($ M M ) 500 1,000 1,500 2,000 2016 2017E 2018E 2019E 2020E $ M M Portfolio Flexibility Provides Range of Crude Oil Scenarios Note: Assumes $55 Brent in 2017 and $65 Brent and $3.50 NYMEX gas price thereafter. Assumes lease operating costs on an absolute basis escalate ~5% per year from 2016 levels for the mid-point of the range of planning scenario outcomes. Ranges of portfolio planning scenario outcomes assume development of a variety of combinations of steamflood, waterflood, conventional and unconventional projects in our inventory and reflect estimates of geologic, development and permitting risk. All discretionary cash flow reinvested in business for each outcome. Portfolio Planning Scenarios Portfolio Planning Scenarios - ≈ - - Estimated Crude Oil Production Outcomes Estimated Range of EBITDAX Outcomes Estimated Capital Invested Capital focused on oil projects that provide Increasing Margins Low Decline Rates Compounding Cash Flow+ = ≈

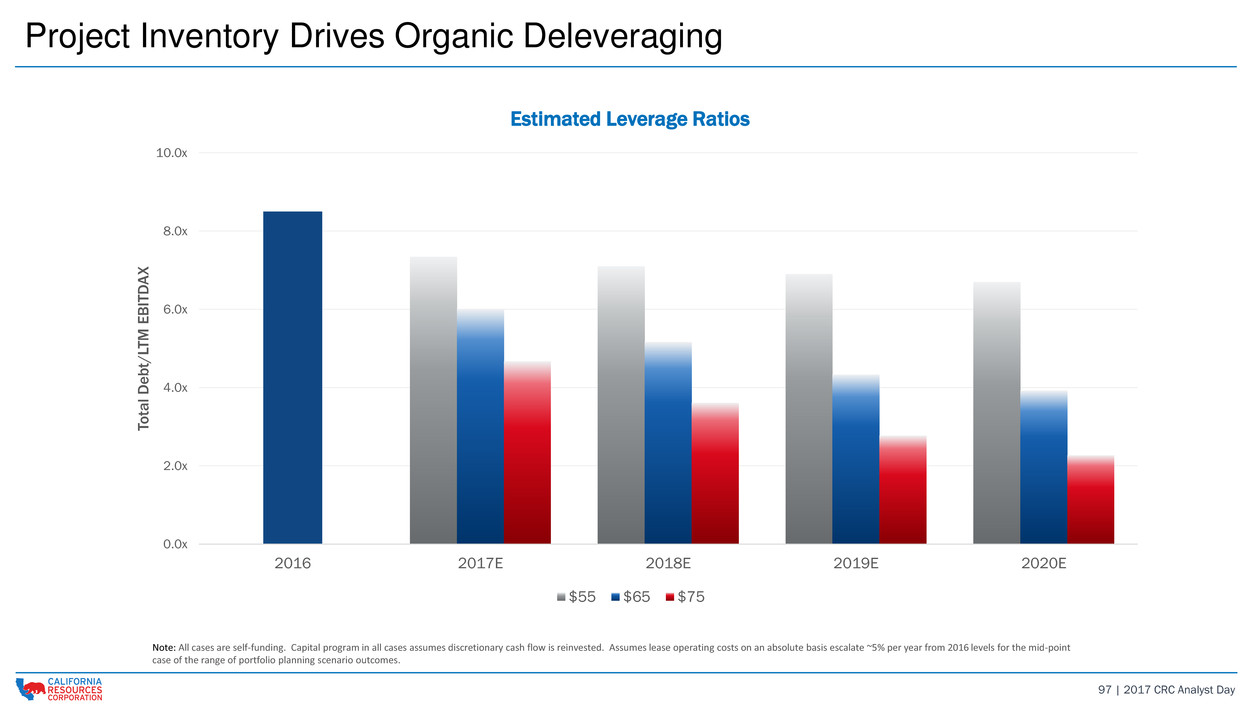

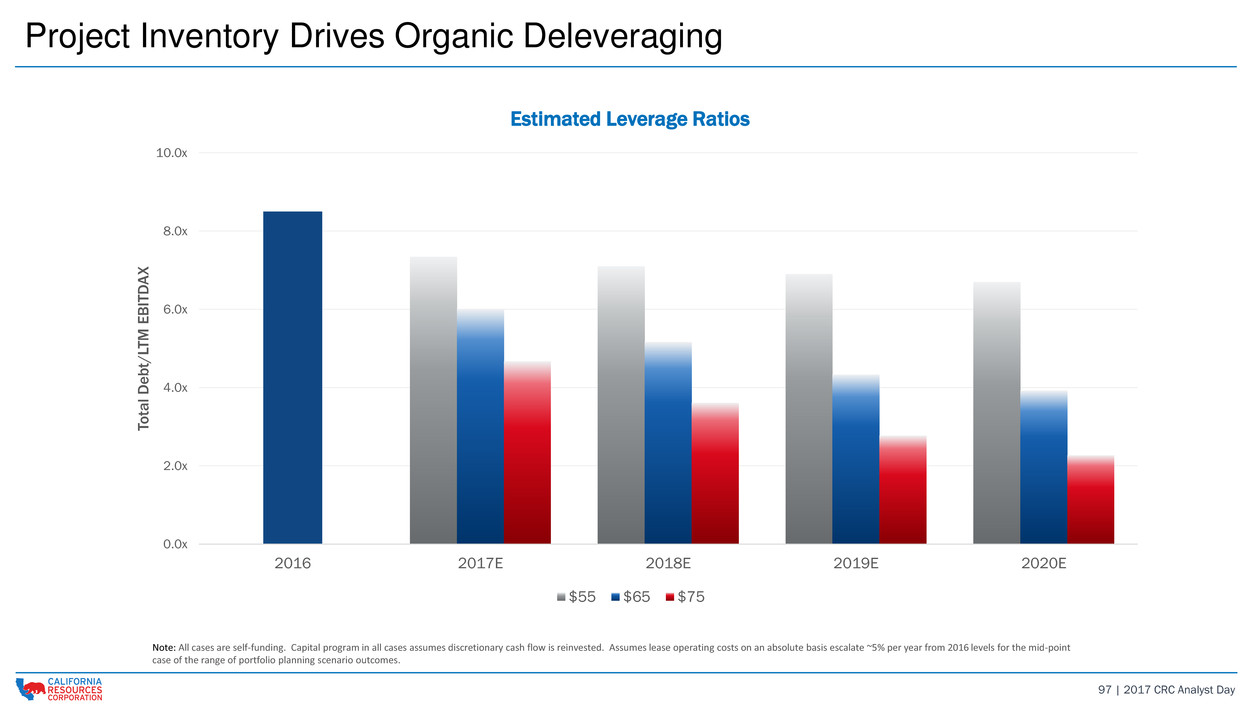

97 | 2017 CRC Analyst Day 0.0x 2.0x 4.0x 6.0x 8.0x 10.0x 2016 2017E 2018E 2019E 2020E Tota l D e bt/ LT M E B IT D A X $55 $65 $75 Project Inventory Drives Organic Deleveraging Note: All cases are self-funding. Capital program in all cases assumes discretionary cash flow is reinvested. Assumes lease operating costs on an absolute basis escalate ~5% per year from 2016 levels for the mid-point case of the range of portfolio planning scenario outcomes. Estimated Leverage Ratios

98 | 2017 CRC Analyst Day The Case for CRC : Investment Thesis Overview Operational flexibility Grow within cash flow Industry leading decline rate Integrated and complementary infrastructure 0% 25% 50% 75% 100% P or tf ol io M ix Higher Oil to Gas Price Ratio Lower Oil to Gas Price Ratio Gas Unconventional Primary Waterflood Steamflood Workover Deleveraging Growth Production Innovation Deep Inventory - ≈ Investment Case for CRC World-class assets with significant inventory Resilient model that preserves optionality and protects downside Focused on value and poised for growth Positioned to go from defense to offense Why Own CRC Now Competitive Advantages Disciplined portfolio management Leads to EBITDAX growth

APPENDIX

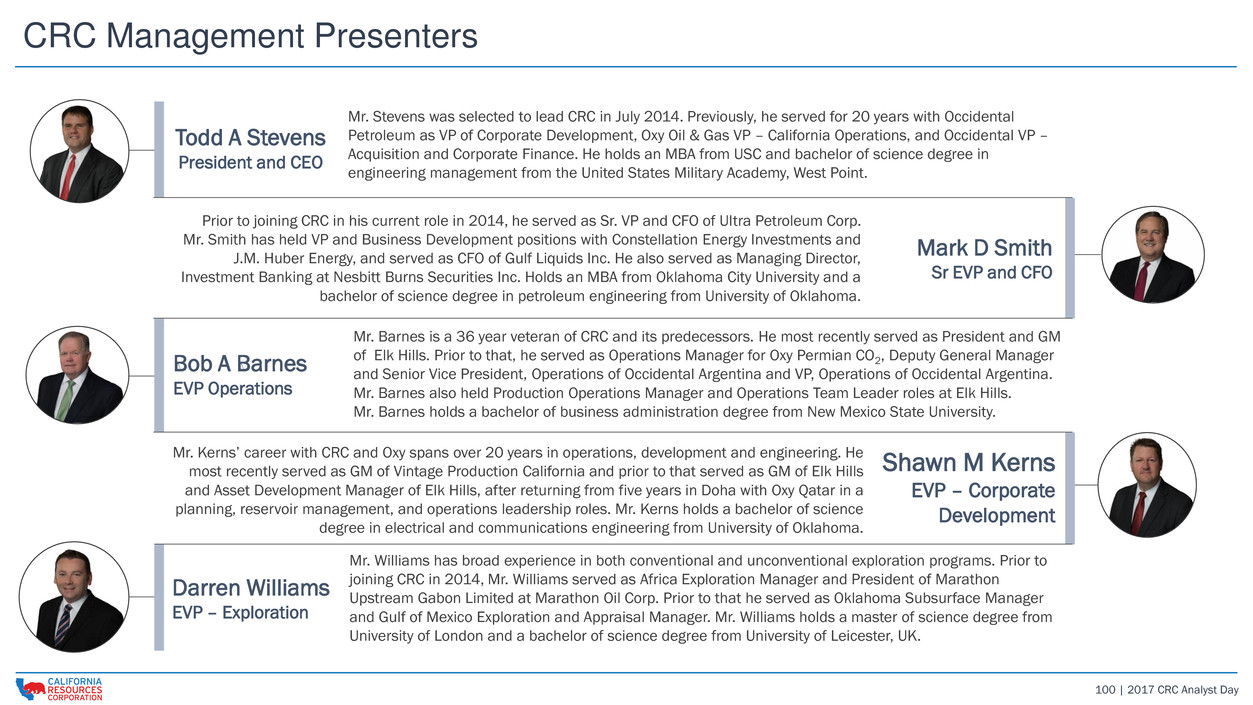

100 | 2017 CRC Analyst Day CRC Management Presenters Todd A Stevens President and CEO Mr. Stevens was selected to lead CRC in July 2014. Previously, he served for 20 years with Occidental Petroleum as VP of Corporate Development, Oxy Oil & Gas VP – California Operations, and Occidental VP – Acquisition and Corporate Finance. He holds an MBA from USC and bachelor of science degree in engineering management from the United States Military Academy, West Point. Prior to joining CRC in his current role in 2014, he served as Sr. VP and CFO of Ultra Petroleum Corp. Mr. Smith has held VP and Business Development positions with Constellation Energy Investments and J.M. Huber Energy, and served as CFO of Gulf Liquids Inc. He also served as Managing Director, Investment Banking at Nesbitt Burns Securities Inc. Holds an MBA from Oklahoma City University and a bachelor of science degree in petroleum engineering from University of Oklahoma. Mark D Smith Sr EVP and CFO Bob A Barnes EVP Operations Mr. Barnes is a 36 year veteran of CRC and its predecessors. He most recently served as President and GM of Elk Hills. Prior to that, he served as Operations Manager for Oxy Permian CO2, Deputy General Manager and Senior Vice President, Operations of Occidental Argentina and VP, Operations of Occidental Argentina. Mr. Barnes also held Production Operations Manager and Operations Team Leader roles at Elk Hills. Mr. Barnes holds a bachelor of business administration degree from New Mexico State University. Mr. Kerns’ career with CRC and Oxy spans over 20 years in operations, development and engineering. He most recently served as GM of Vintage Production California and prior to that served as GM of Elk Hills and Asset Development Manager of Elk Hills, after returning from five years in Doha with Oxy Qatar in a planning, reservoir management, and operations leadership roles. Mr. Kerns holds a bachelor of science degree in electrical and communications engineering from University of Oklahoma. Shawn M Kerns EVP – Corporate Development Darren Williams EVP – Exploration Mr. Williams has broad experience in both conventional and unconventional exploration programs. Prior to joining CRC in 2014, Mr. Williams served as Africa Exploration Manager and President of Marathon Upstream Gabon Limited at Marathon Oil Corp. Prior to that he served as Oklahoma Subsurface Manager and Gulf of Mexico Exploration and Appraisal Manager. Mr. Williams holds a master of science degree from University of London and a bachelor of science degree from University of Leicester, UK.

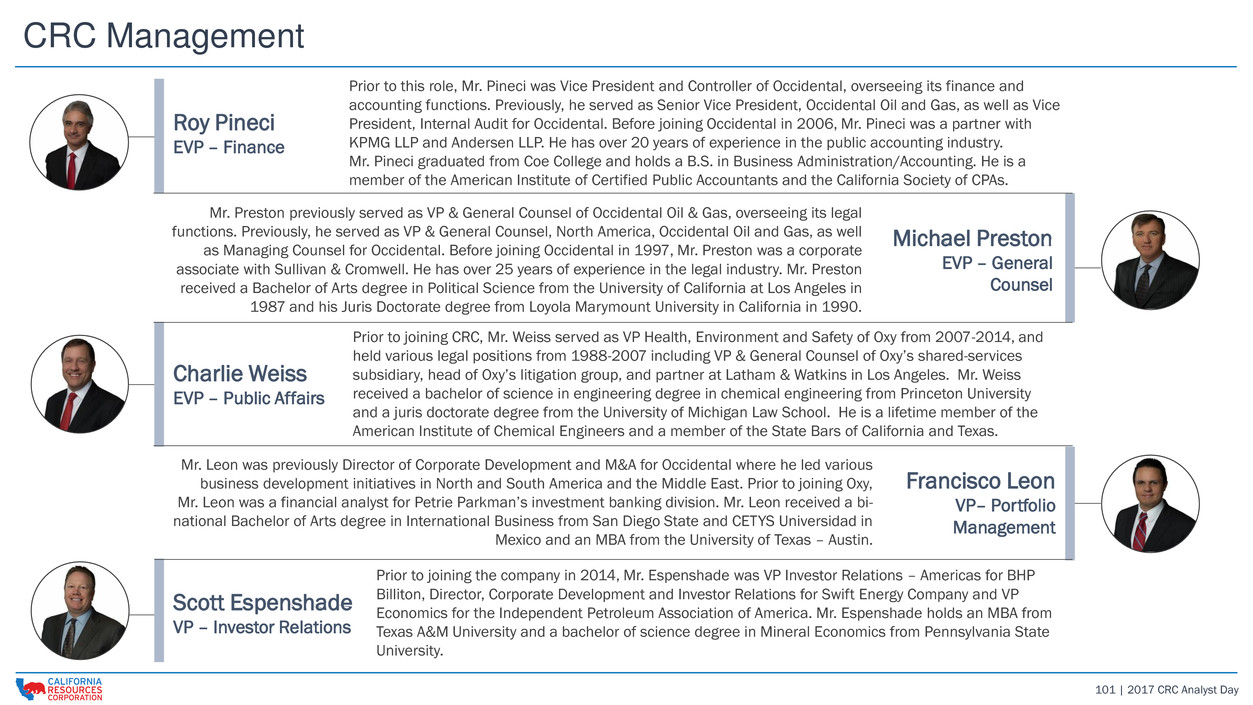

101 | 2017 CRC Analyst Day CRC Management Roy Pineci EVP – Finance Prior to this role, Mr. Pineci was Vice President and Controller of Occidental, overseeing its finance and accounting functions. Previously, he served as Senior Vice President, Occidental Oil and Gas, as well as Vice President, Internal Audit for Occidental. Before joining Occidental in 2006, Mr. Pineci was a partner with KPMG LLP and Andersen LLP. He has over 20 years of experience in the public accounting industry. Mr. Pineci graduated from Coe College and holds a B.S. in Business Administration/Accounting. He is a member of the American Institute of Certified Public Accountants and the California Society of CPAs. Mr. Preston previously served as VP & General Counsel of Occidental Oil & Gas, overseeing its legal functions. Previously, he served as VP & General Counsel, North America, Occidental Oil and Gas, as well as Managing Counsel for Occidental. Before joining Occidental in 1997, Mr. Preston was a corporate associate with Sullivan & Cromwell. He has over 25 years of experience in the legal industry. Mr. Preston received a Bachelor of Arts degree in Political Science from the University of California at Los Angeles in 1987 and his Juris Doctorate degree from Loyola Marymount University in California in 1990. Michael Preston EVP – General Counsel Charlie Weiss EVP – Public Affairs Prior to joining CRC, Mr. Weiss served as VP Health, Environment and Safety of Oxy from 2007-2014, and held various legal positions from 1988-2007 including VP & General Counsel of Oxy’s shared-services subsidiary, head of Oxy’s litigation group, and partner at Latham & Watkins in Los Angeles. Mr. Weiss received a bachelor of science in engineering degree in chemical engineering from Princeton University and a juris doctorate degree from the University of Michigan Law School. He is a lifetime member of the American Institute of Chemical Engineers and a member of the State Bars of California and Texas. Mr. Leon was previously Director of Corporate Development and M&A for Occidental where he led various business development initiatives in North and South America and the Middle East. Prior to joining Oxy, Mr. Leon was a financial analyst for Petrie Parkman’s investment banking division. Mr. Leon received a bi- national Bachelor of Arts degree in International Business from San Diego State and CETYS Universidad in Mexico and an MBA from the University of Texas – Austin. Francisco Leon VP– Portfolio Management Scott Espenshade VP – Investor Relations Prior to joining the company in 2014, Mr. Espenshade was VP Investor Relations – Americas for BHP Billiton, Director, Corporate Development and Investor Relations for Swift Energy Company and VP Economics for the Independent Petroleum Association of America. Mr. Espenshade holds an MBA from Texas A&M University and a bachelor of science degree in Mineral Economics from Pennsylvania State University.

102 | 2017 CRC Analyst Day End Notes 1 Current CRC estimate of reserves value as of December 31, 2016. Includes field-level operating expenses and G&A. Assumes $3.30/Mcf NYMEX. 2 Surface & Minerals reflect the estimated value of undeveloped surface and fee interests. 3Reflects the value of facilities and midstream assets at 50% of estimated replacement value. This discount is estimated to exceed the burden on reserves that would be incurred if assets were monetized. 4 Unproved inventory comprises risked probable and possible reserves and contingent and prospective resources. Contingent and prospective resources consist of volumes identified through life-of-field planning efforts to date. 5 Calculated using December 31, 2016 debt at par and market cap as of March 16, 2017. Type Curve Note: Each field-specific type well curve represents an average of the historical results of multiple projects over the prior four-year time period. Drive mechanism type curves are the weighted average of the field-specific curves related to the projects chosen for our near-term growth plan. Type curves represent management’s estimates of future results and are subject to project selection and other variables. Our type well curves are prepared for purposes of modeling overall results of our near-term growth program and are not useful for purpose of benchmarking any individual well/pattern performance. Actual results are expected to vary depending on which projects are specifically developed.