CRC: VALUE-DRIVEN ANALYST & INVESTOR DAY O c t o b e r 3 , 2 0 1 8 | N e w Y o r k C i t y , N e w Y o r k

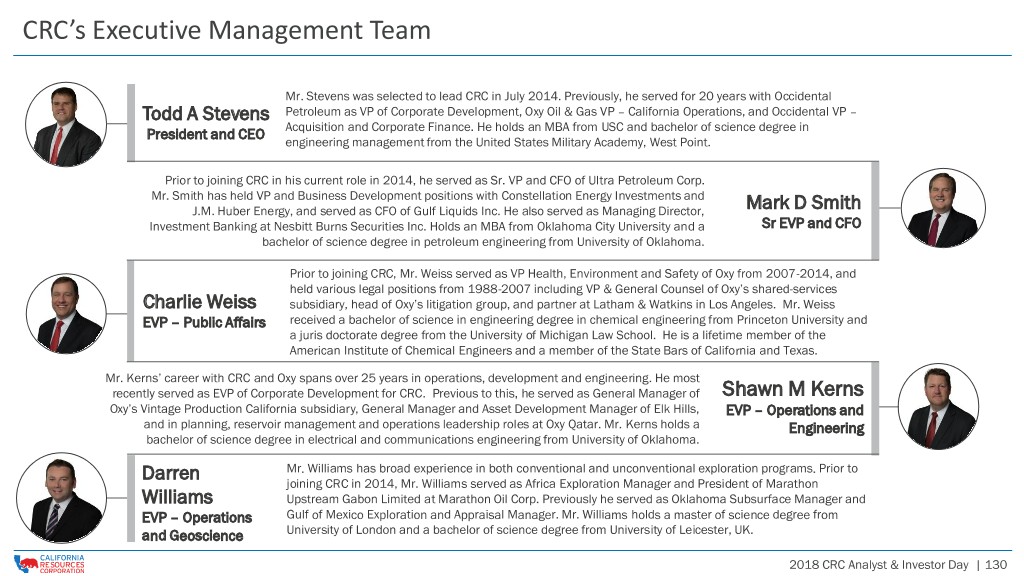

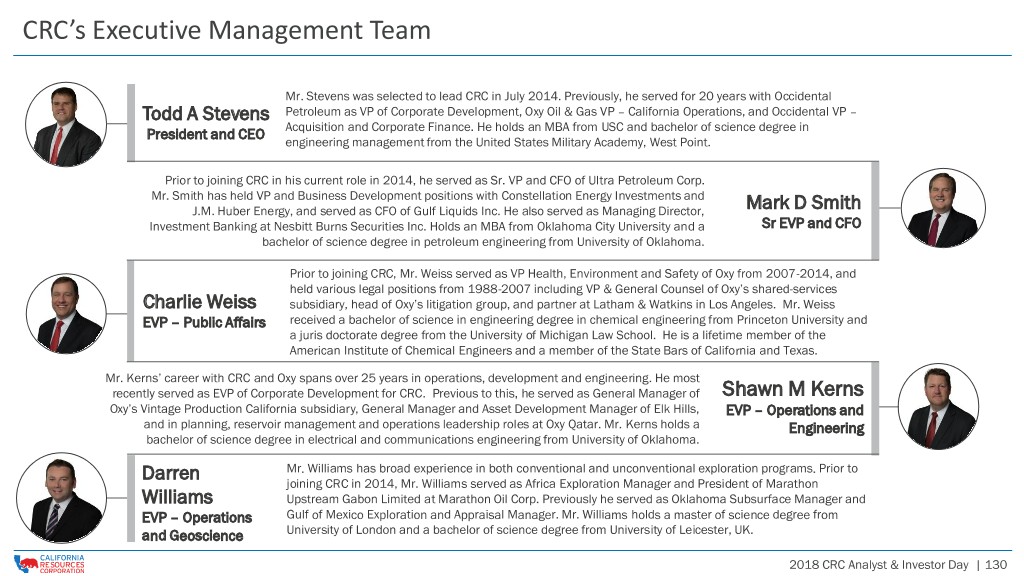

Agenda Strategic Overview Value Driven Exploration & Development Todd Stevens, President and CEO Darren Williams, EVP Operations and Geoscience Operating in California Strengthening the Balance Sheet Charlie Weiss, EVP Public Affairs Mark Smith, Sr. EVP and CFO Conventional Delivers Strong Value CRC Investment Proposition Francisco Leon, EVP Corporate Development & Strategic Planning Todd Stevens, President and CEO Driving Operational Excellence Shawn Kerns, EVP Operations and Engineering 2018 CRC Analyst & Investor Day | 2

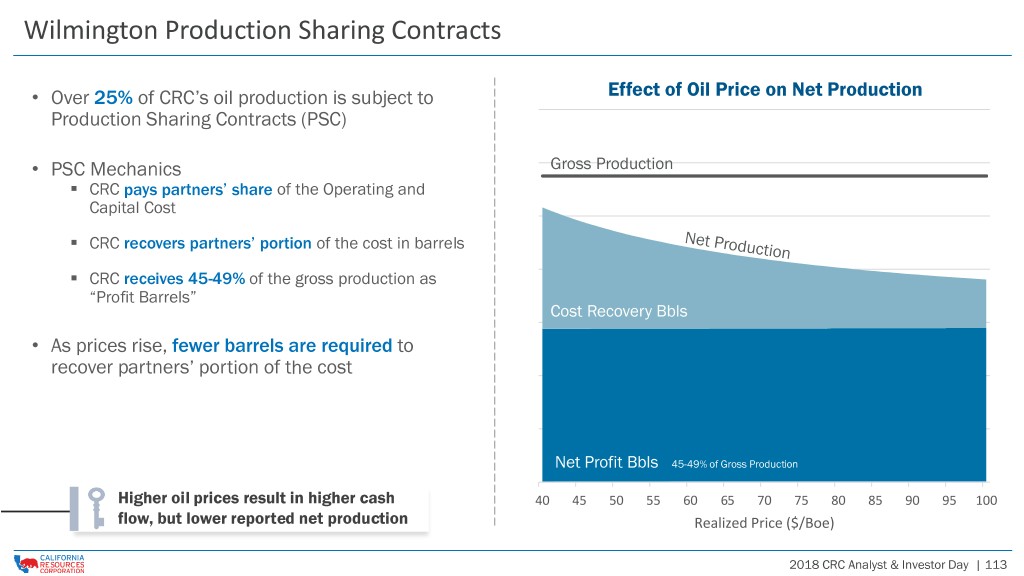

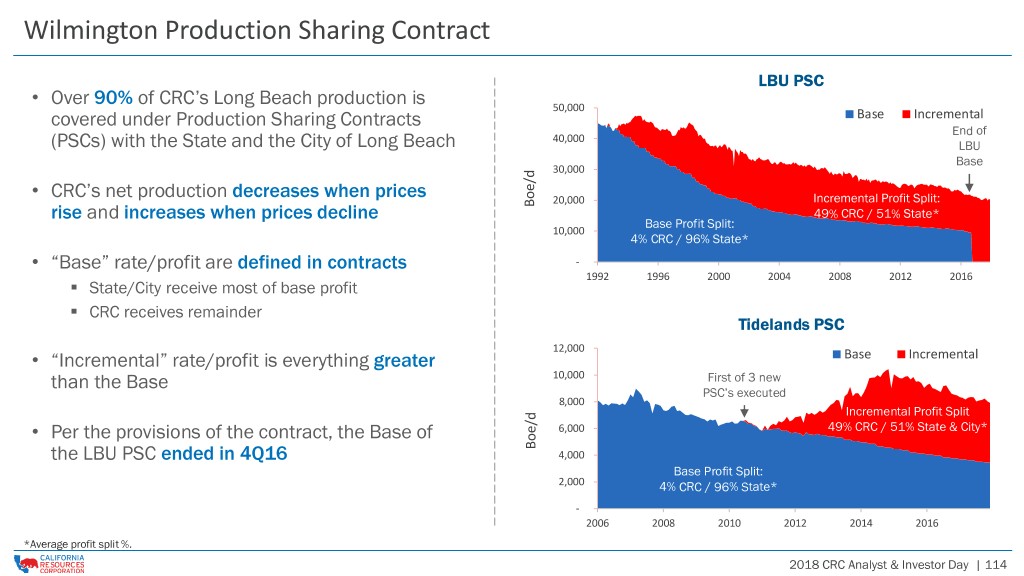

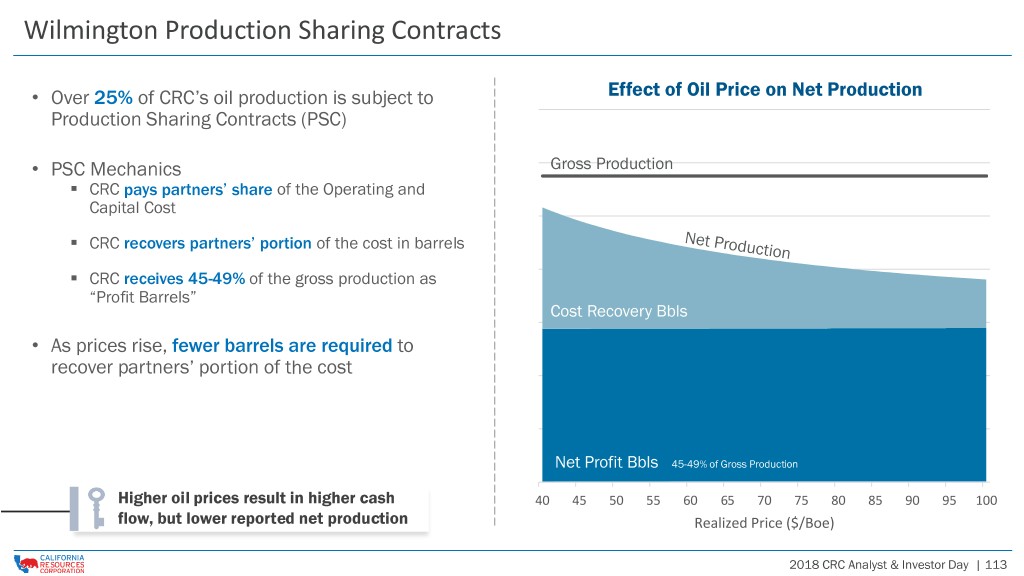

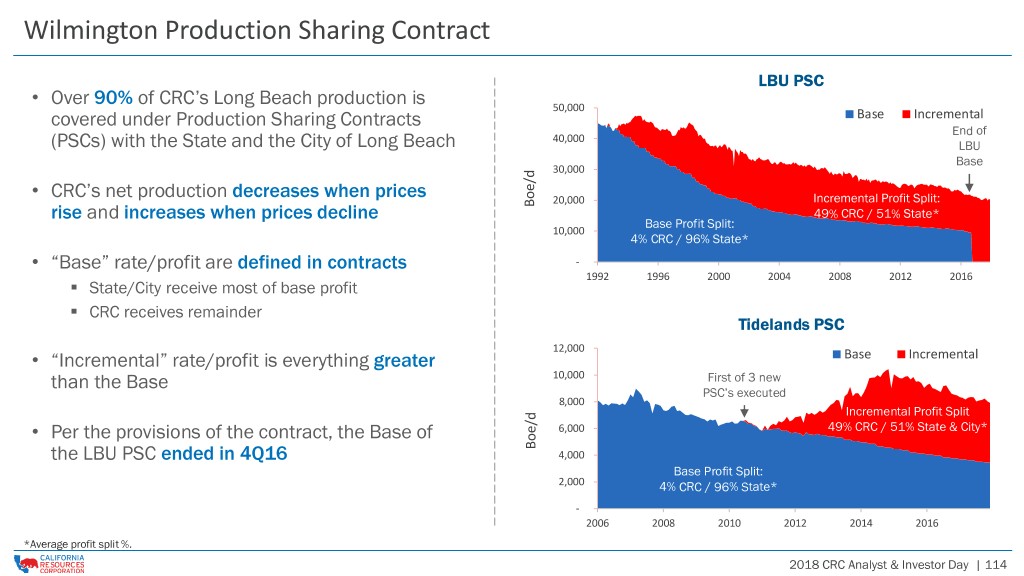

Forward Looking / Cautionary Statements – Certain Terms This presentation contains forward-looking statements that involve risks and uncertainties that could materially affect our expected results of operations, liquidity, cash flows and business prospects. Such statements include those regarding our expectations as to our future: • financial position, liquidity, cash flows and results of operations • operations and operational results including production, hedging and capital investment • business prospects • budgets and maintenance capital requirements • transactions and projects • reserves • operating costs • type curves • Value Creation Index (VCI) metrics, which are based on certain estimates including • expected synergies from acquisitions and joint ventures future production rates, costs and commodity prices Actual results may differ from anticipated results, sometimes materially, and reported results should not be considered an indication of future performance. While we believe assumptions or bases underlying our expectations are reasonable and make them in good faith, they almost always vary from actual results, sometimes materially. We also believe third-party statements we cite are accurate but have not independently verified them and do not warrant their accuracy or completeness. Factors (but not necessarily all the factors) that could cause results to differ include: • commodity price changes • changes in business strategy • debt limitations on our financial flexibility • PSC effects on production and unit production costs • insufficient cash flow to fund planned investments, debt repurchases or changes to our • effect of stock price on costs associated with incentive compensation capital plan • insufficient capital, including as a result of lender restrictions, unavailability of capital • inability to enter desirable transactions, including acquisitions, asset sales and joint markets or inability to attract potential investors ventures • effects of hedging transactions • legislative or regulatory changes, including those related to drilling, completion, well • equipment, service or labor price inflation or unavailability stimulation, operation, maintenance or abandonment of wells or facilities, managing • availability or timing of, or conditions imposed on, permits and approvals energy, water, land, greenhouse gases or other emissions, protection of health, safety • lower-than-expected production, reserves or resources from development projects, joint and the environment, or transportation, marketing and sale of our products ventures or acquisitions, or higher-than-expected decline rates • joint ventures and acquisitions and our ability to achieve expected synergies • disruptions due to accidents, mechanical failures, transportation or storage constraints, • the recoverability of resources and unexpected geologic conditions natural disasters, labor difficulties, cyber attacks or other catastrophic events • incorrect estimates of reserves and related future cash flows and the inability to replace • factors discussed in “Risk Factors” in our Annual Report on Form 10-K available on our reserves website at crc.com. Words such as "anticipate," "believe," "continue," "could," "estimate," "expect," "goal," "intend," "likely," "may," "might," "plan," "potential," "project," "seek," "should," "target, "will" or "would" and similar words that reflect the prospective nature of events or outcomes typically identify forward-looking statements. Any forward-looking statement speaks only as of the date on which such statement is made and we undertake no obligation to correct or update any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by applicable law. See the Investor Relations page at www.crc.com for important information about 3P reserves and other hydrocarbon resource quantities, organic finding and development (F&D) costs, organic recycle ratio calculations, original hydrocarbons in place, Value Creation Index (VCI), drilling locations and reconciliations of non-GAAP measures to the closest GAAP equivalent. 2018 CRC Analyst & Investor Day | 3

CRC OVERVIEW VIDEO See the Investor Relations page at www.crc.com to access this video.

Five Main Takeaways 1. CRC is well-positioned to prosper in the mid-cycle environment as California’s premier operator 2. Conventional delivers strong & differentiated value 3. The application of capital and technology will allow CRC to grow its core and growth areas, improve efficiencies and deliver increased margins 4. CRC has a robust opportunity set and significant remaining inventory potential 5. Continued financial strengthening in 2019 with a portion of discretionary cash flow dedicated to debt reduction

The VCI Difference Delivers Real Value Delivering Smart Growth and Real Value • Value-directed investments Value • Disciplined capital allocation Focus • Enhanced returns over full-cycle time frame • Prioritization of projects and drives alignment of team Value Creation Index • Ahead of competitive landscape shifting PV10 pre-tax cash flows to value VCI = PV10 of investments 2018 CRC Analyst & Investor Day | 6

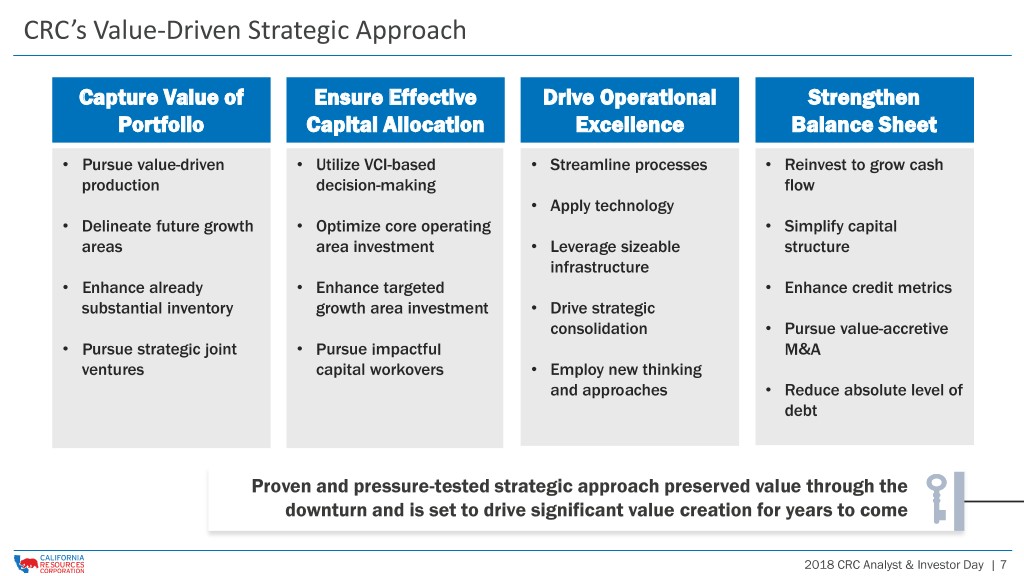

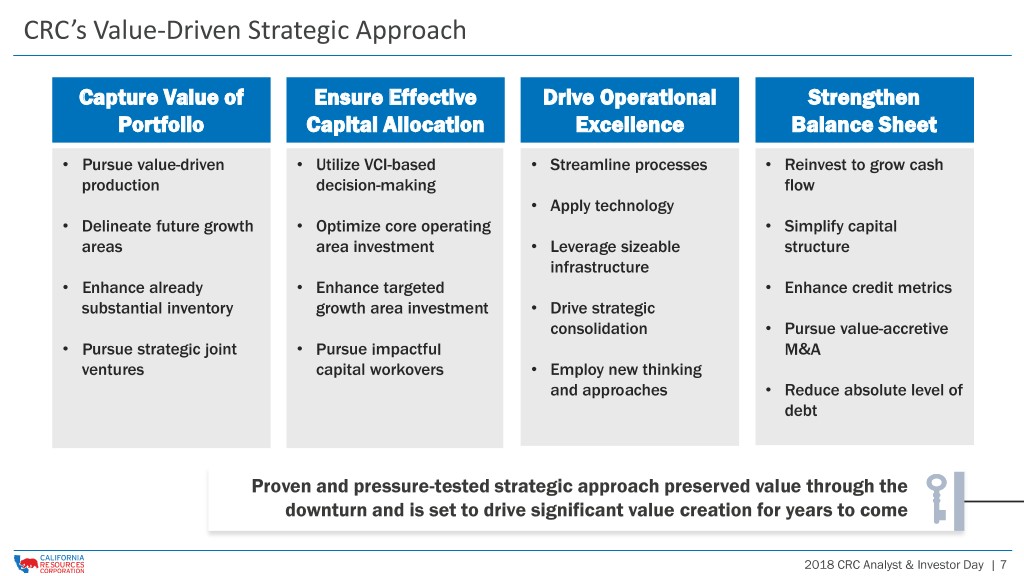

CRC’s Value-Driven Strategic Approach Capture Value of Ensure Effective Drive Operational Strengthen Portfolio Capital Allocation Excellence Balance Sheet • Pursue value-driven • Utilize VCI-based • Streamline processes • Reinvest to grow cash production decision-making flow • Apply technology • Delineate future growth • Optimize core operating • Simplify capital areas area investment • Leverage sizeable structure infrastructure • Enhance already • Enhance targeted • Enhance credit metrics substantial inventory growth area investment • Drive strategic consolidation • Pursue value-accretive • Pursue strategic joint • Pursue impactful M&A ventures capital workovers • Employ new thinking and approaches • Reduce absolute level of debt Proven and pressure-tested strategic approach preserved value through the downturn and is set to drive significant value creation for years to come 2018 CRC Analyst & Investor Day | 7

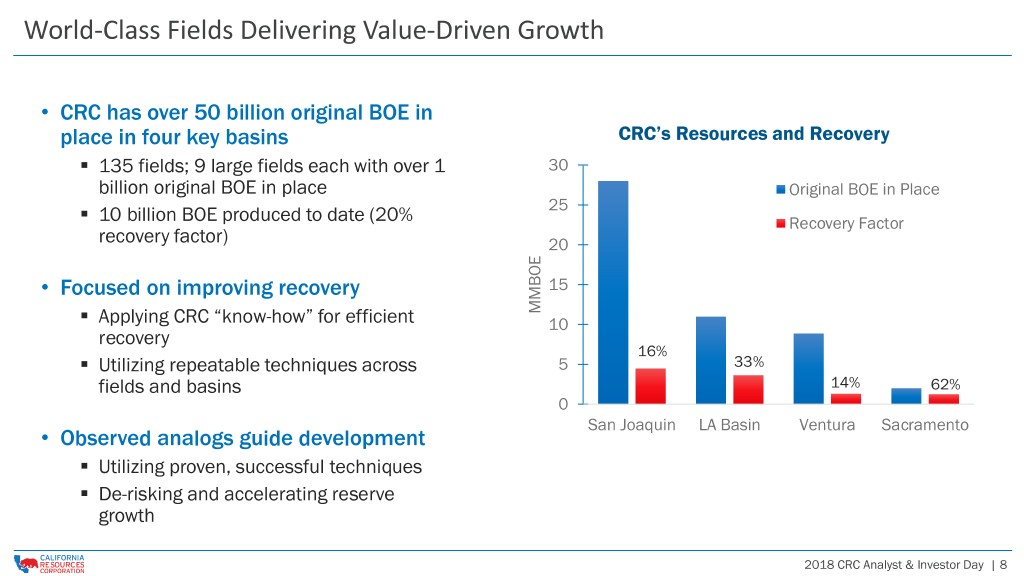

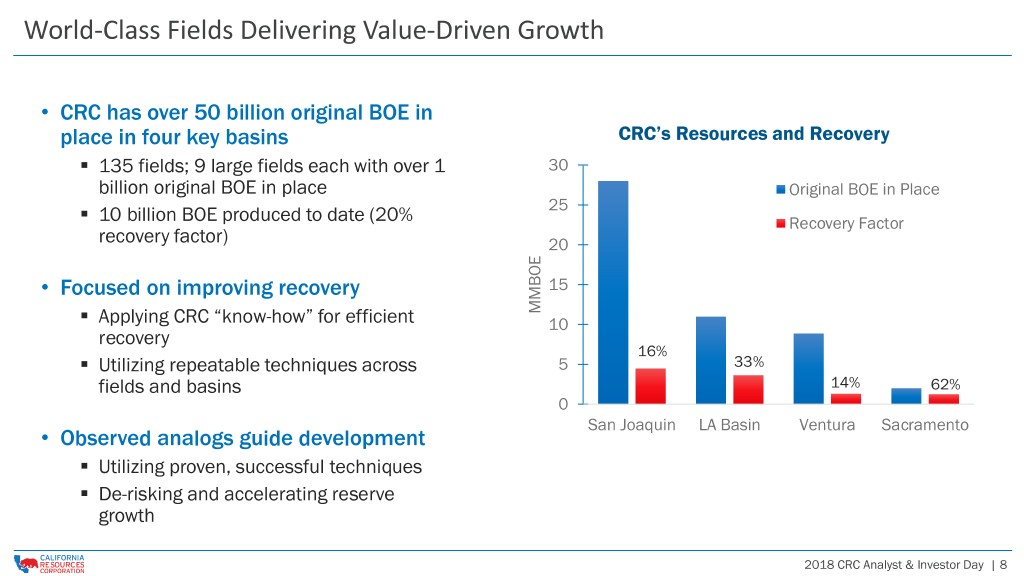

World-Class Fields Delivering Value-Driven Growth • CRC has over 50 billion original BOE in place in four key basins CRC’s Resources and Recovery ▪ 135 fields; 9 large fields each with over 1 30 billion original BOE in place Original BOE in Place ▪ 25 10 billion BOE produced to date (20% Recovery Factor recovery factor) 20 • Focused on improving recovery 15 ▪ MMBOE Applying CRC “know-how” for efficient 10 recovery 16% ▪ Utilizing repeatable techniques across 5 33% fields and basins 14% 62% 0 San Joaquin LA Basin Ventura Sacramento • Observed analogs guide development ▪ Utilizing proven, successful techniques ▪ De-risking and accelerating reserve growth 2018 CRC Analyst & Investor Day | 8

CRC’s Value-Driven Asset Playbook Delivers Results Through the Cycle 1. Optimize and extend current assets through comprehensive life of field plans 2. Apply operating expertise and technical knowledge to step out 3. Leverage infrastructure and apply technology to improve margins 4. Value-driven approach and disciplined capital allocation to manage portfolio 5. Grow resource potential via exploration, acquisition or partnership 6. Maximize value and cash flow 2018 CRC Analyst & Investor Day | 9

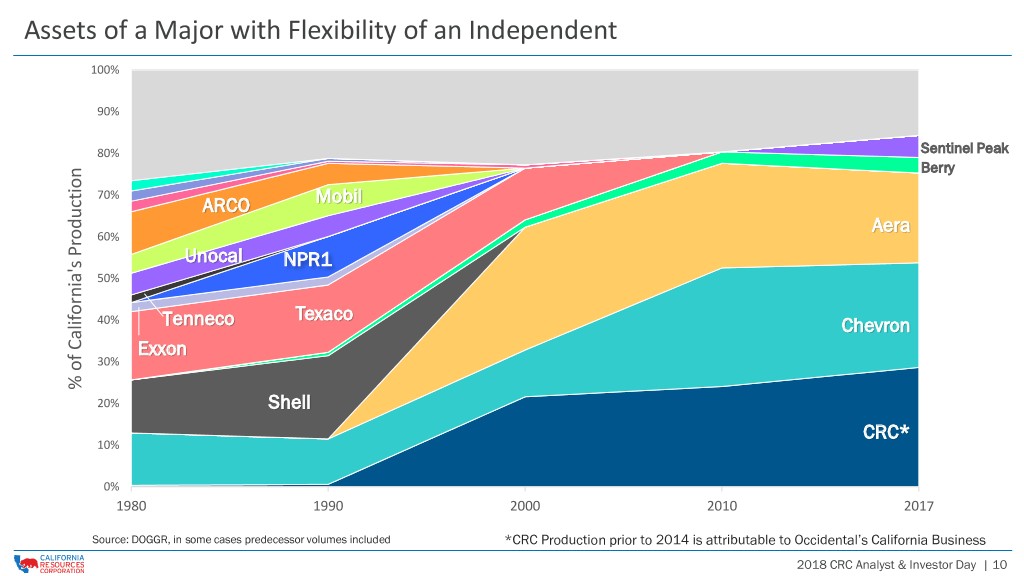

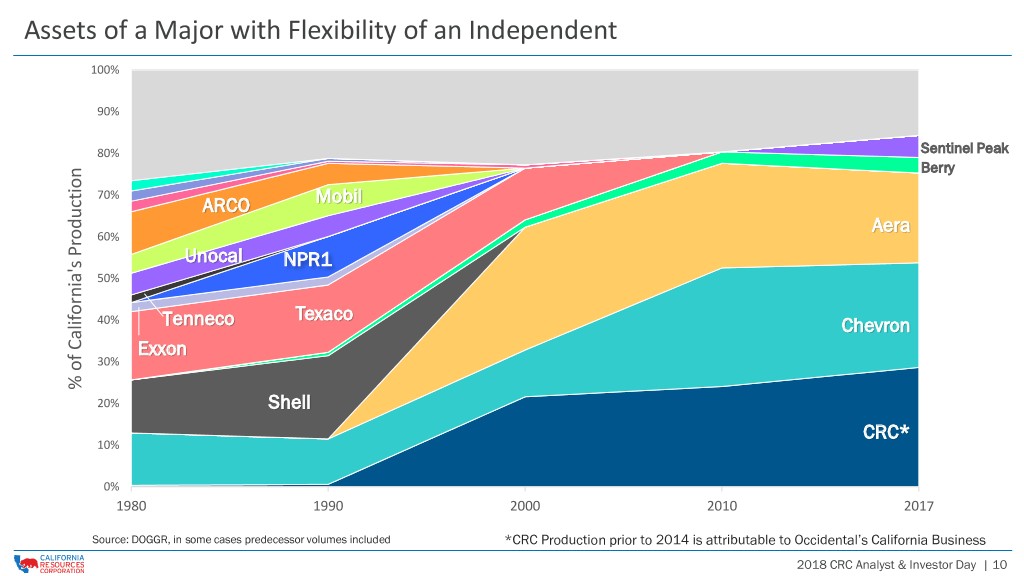

Assets of a Major with Flexibility of an Independent 100% 90% 80% Sentinel Peak Berry 70% ARCO Mobil Aera 60% Unocal NPR1 50% Texaco 40% Tenneco Chevron Exxon 30% % of California's Production California's of % 20% Shell CRC* 10% 0% 1980 1990 2000 2010 2017 Source: DOGGR, in some cases predecessor volumes included *CRC Production prior to 2014 is attributable to Occidental’s California Business 2018 CRC Analyst & Investor Day | 10

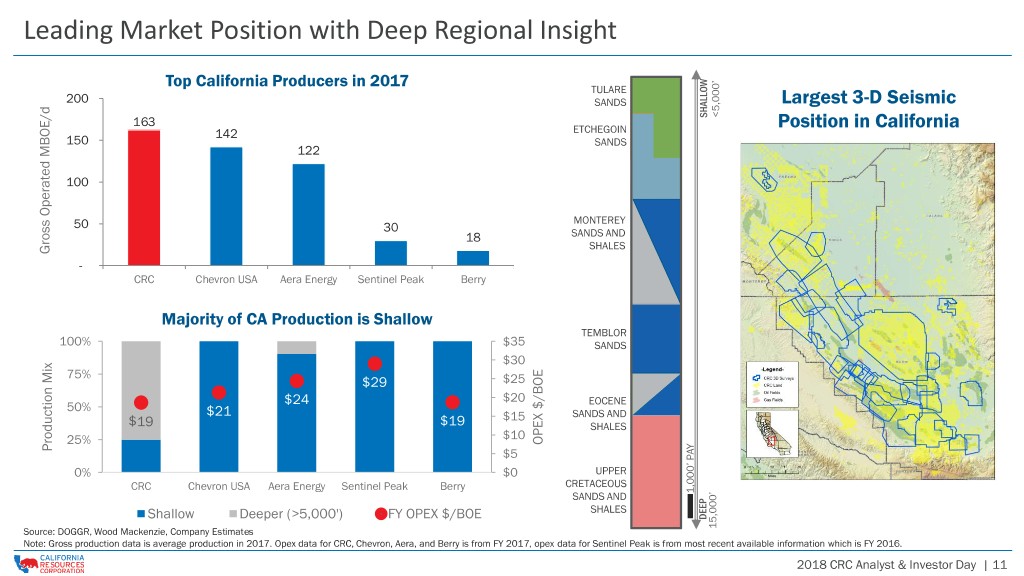

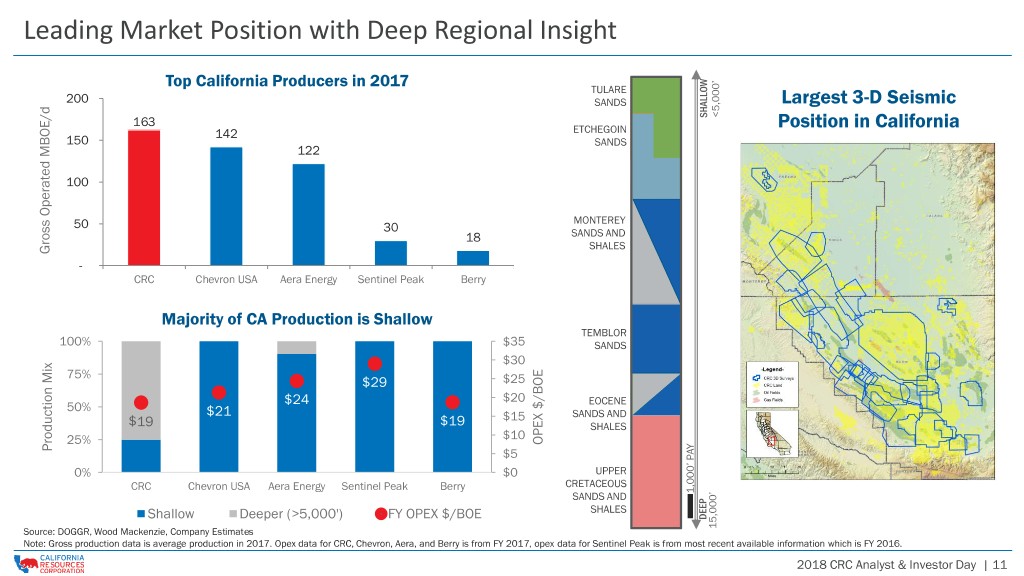

Leading Market Position with Deep Regional Insight Top California Producers in 2017 TULARE 200 SANDS 000’ Largest 3-D Seismic <5, 163 SHALLOW Position in California 142 ETCHEGOIN 150 SANDS 122 100 MONTEREY 50 30 18 SANDS AND SHALES Gross Operated GrossOperated MBOE/d - CRC Chevron USA Aera Energy Sentinel Peak Berry Majority of CA Production is Shallow TEMBLOR 100% $35 SANDS $30 75% $29 $25 $24 $20 EOCENE 50% $21 $15 SANDS AND $19 $19 SHALES $10 25% OPEX $/BOE Production Production Mix $5 PAY 0% $0 UPPER CRC Chevron USA Aera Energy Sentinel Peak Berry CRETACEOUS SANDS AND 1,000’ SHALES 000’ Shallow Deeper (>5,000') FY OPEX $/BOE DEEP Source: DOGGR, Wood Mackenzie, Company Estimates 15, Note: Gross production data is average production in 2017. Opex data for CRC, Chevron, Aera, and Berry is from FY 2017, opex data for Sentinel Peak is from most recent available information which is FY 2016. 2018 CRC Analyst & Investor Day | 11

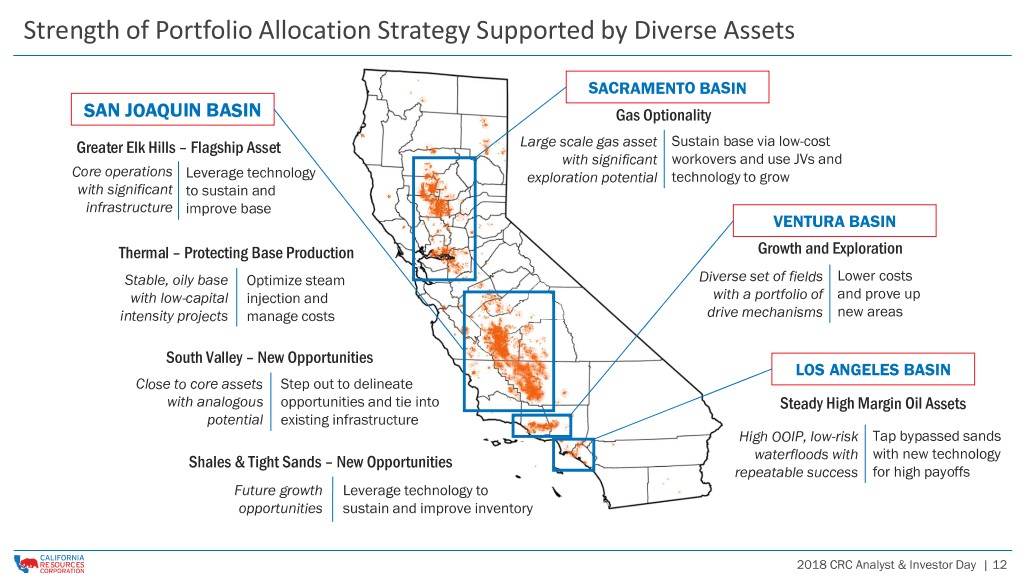

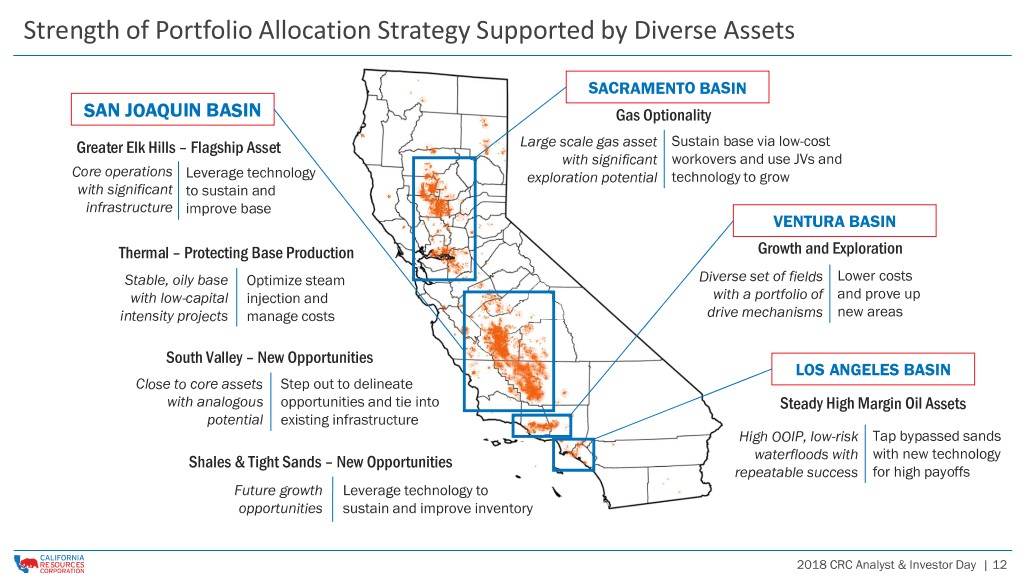

Strength of Portfolio Allocation Strategy Supported by Diverse Assets SACRAMENTO BASIN SAN JOAQUIN BASIN Gas Optionality Greater Elk Hills – Flagship Asset Large scale gas asset Sustain base via low-cost with significant workovers and use JVs and Core operations Leverage technology exploration potential technology to grow with significant to sustain and infrastructure improve base VENTURA BASIN Thermal – Protecting Base Production Growth and Exploration Stable, oily base Optimize steam Diverse set of fields Lower costs with low-capital injection and with a portfolio of and prove up intensity projects manage costs drive mechanisms new areas South Valley – New Opportunities LOS ANGELES BASIN Close to core assets Step out to delineate with analogous opportunities and tie into Steady High Margin Oil Assets potential existing infrastructure High OOIP, low-risk Tap bypassed sands Shales & Tight Sands – New Opportunities waterfloods with with new technology repeatable success for high payoffs Future growth Leverage technology to opportunities sustain and improve inventory 2018 CRC Analyst & Investor Day | 12

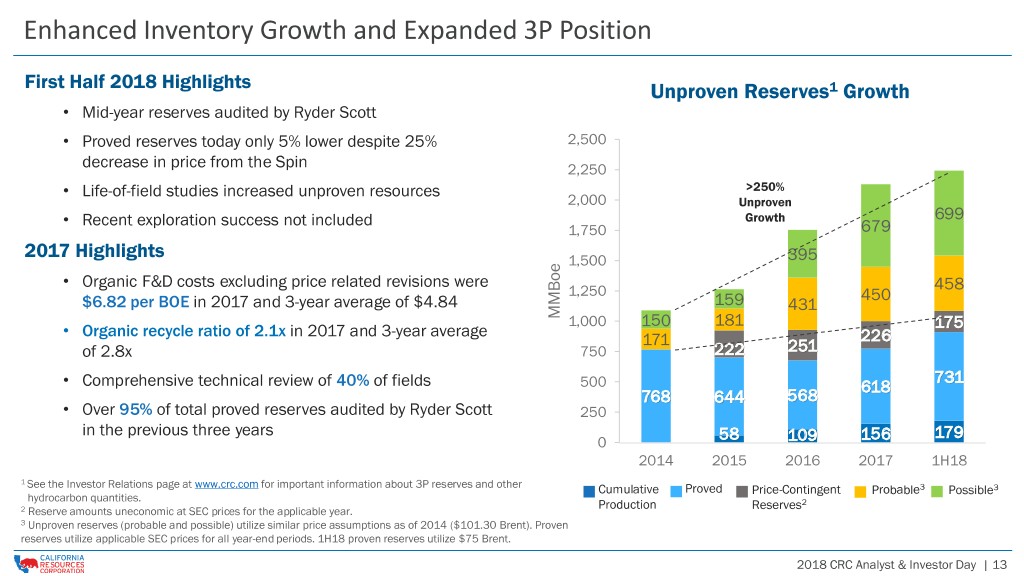

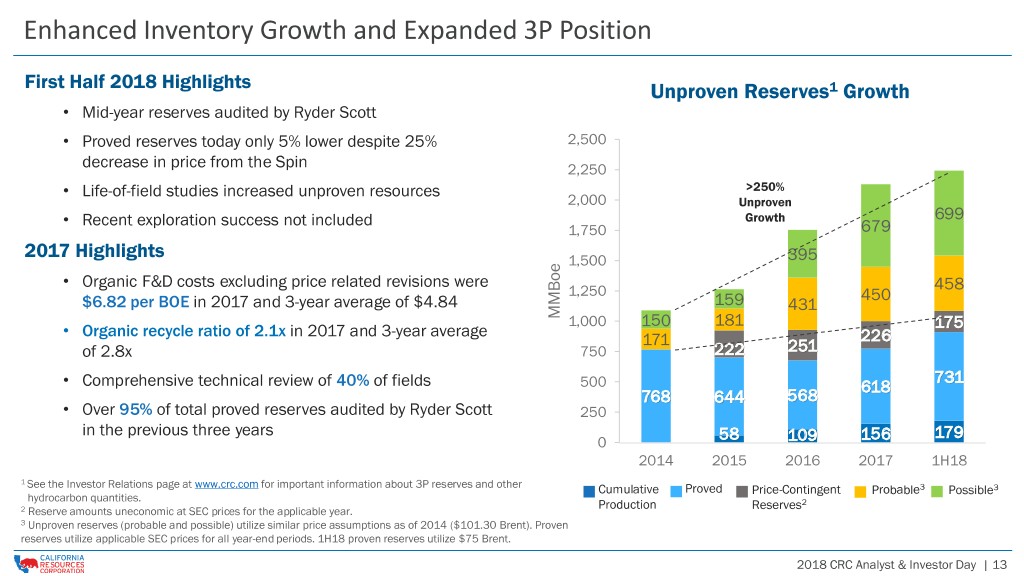

Enhanced Inventory Growth and Expanded 3P Position First Half 2018 Highlights Unproven Reserves1 Growth • Mid-year reserves audited by Ryder Scott • Proved reserves today only 5% lower despite 25% 2,500 decrease in price from the Spin 2,250 • Life-of-field studies increased unproven resources >250% 2,000 Unproven • Recent exploration success not included Growth 699 1,750 679 2017 Highlights 1,500 395 • Organic F&D costs excluding price related revisions were 458 1,250 450 $6.82 per BOE in 2017 and 3-year average of $4.84 159 431 MMBoe 1,000 150 181 175 Organic recycle ratio of 2.1x in 2017 and 3-year average • 171 226 of 2.8x 750 222 251 731 • Comprehensive technical review of 40% of fields 500 618 768 644 568 • Over 95% of total proved reserves audited by Ryder Scott 250 in the previous three years 156 179 0 58 109 2014 2015 2016 2017 1H18 1 See the Investor Relations page at www.crc.com for important information about 3P reserves and other Cumulative Proved Price-Contingent Probable3 Possible3 hydrocarbon quantities. Production Reserves2 2 Reserve amounts uneconomic at SEC prices for the applicable year. 3 Unproven reserves (probable and possible) utilize similar price assumptions as of 2014 ($101.30 Brent). Proven reserves utilize applicable SEC prices for all year-end periods. 1H18 proven reserves utilize $75 Brent. 2018 CRC Analyst & Investor Day | 13

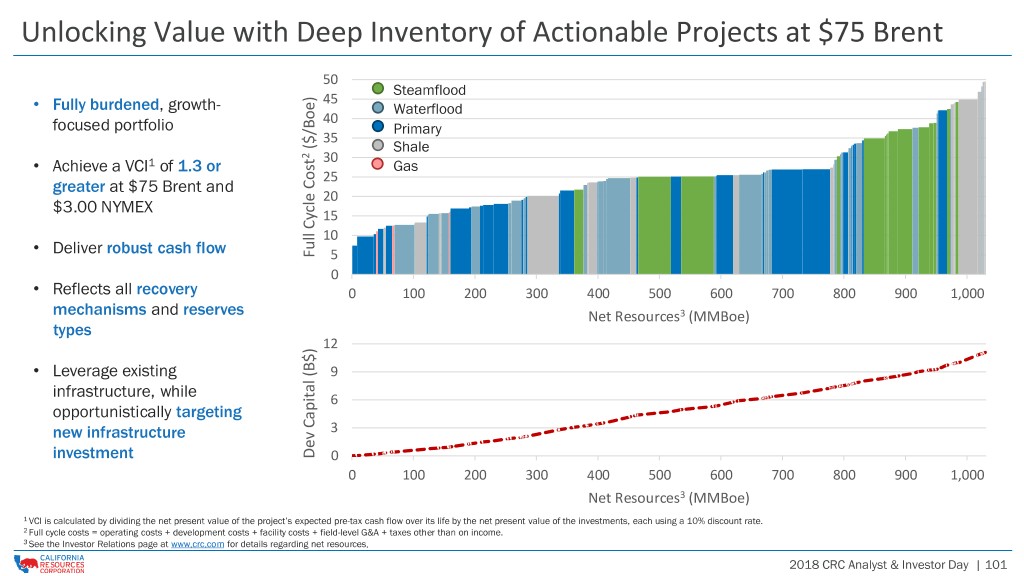

Unlocking Value with a Deep Inventory of Actionable Projects at $75 Brent 50 Steamflood 45 • Fully burdened, growth- Waterflood 40 focused portfolio Primary 35 ($/Boe) Shale 1 30 • Achieve a VCI of 1.3 or Gas 25 greater at $75 Brent and 20 $3.00 NYMEX 15 10 • Deliver robust cash flow Full Cycle Cost Cycle Full 5 0 • Reflects all recovery 0 100 200 300 400 500 600 700 800 900 1,000 mechanisms and reserves Net Resources2 (MMBoe) types 12 • Leverage existing 9 infrastructure, while 6 opportunistically targeting new infrastructure 3 investment (B$) Capital Dev 0 0 100 200 300 400 500 600 700 800 900 1,000 Net Resources2 (MMBoe) 1 Full cycle costs = operating costs + development costs + facility costs + field-level G&A + taxes other than on income. 2 See the Investor Relations page at www.crc.com for details regarding net resources. 2018 CRC Analyst & Investor Day | 14

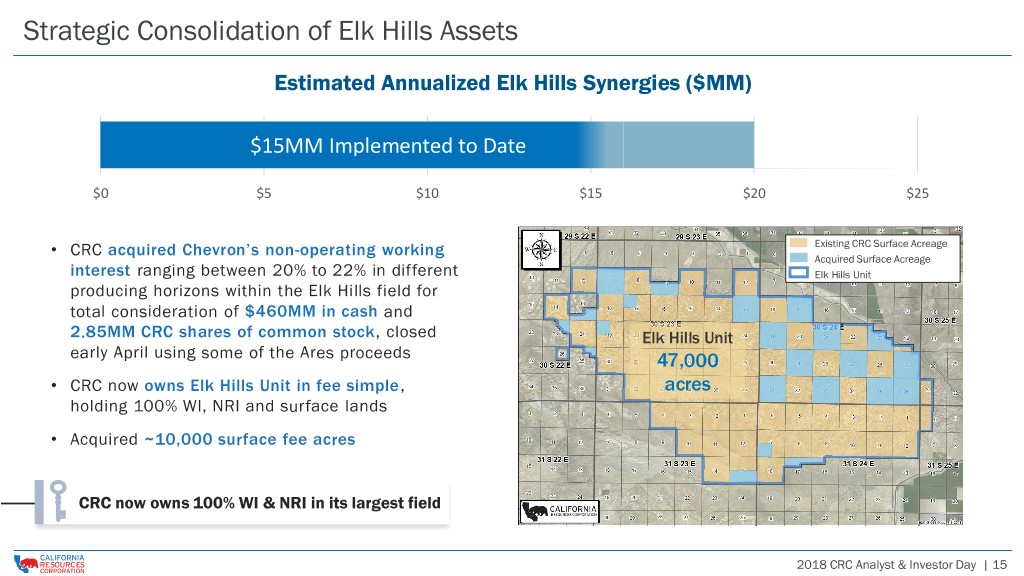

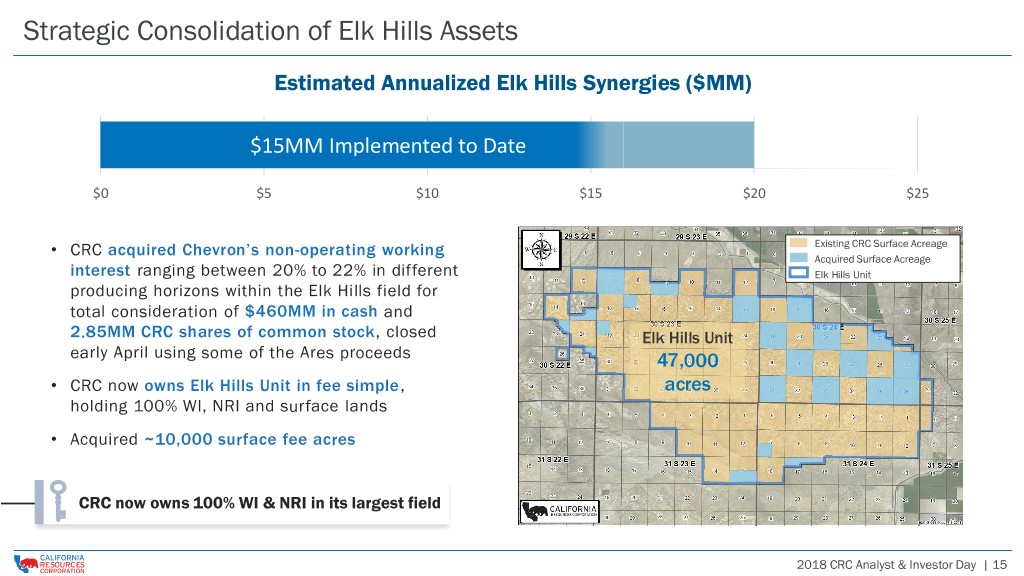

Strategic Consolidation of Elk Hills Assets Estimated Annualized Elk Hills Synergies ($MM) $15MM Implemented to Date $0 $5 $10 $15 $20 $25 • CRC acquired Chevron’s non-operating working Existing CRC Surface Acreage Acquired Surface Acreage interest ranging between 20% to 22% in different Elk Hills Unit producing horizons within the Elk Hills field for total consideration of $460MM in cash and 2.85MM CRC shares of common stock, closed Elk Hills Unit early April using some of the Ares proceeds 47,000 • CRC now owns Elk Hills Unit in fee simple, acres holding 100% WI, NRI and surface lands • Acquired ~10,000 surface fee acres CRC now owns 100% WI & NRI in its largest field 2018 CRC Analyst & Investor Day | 15

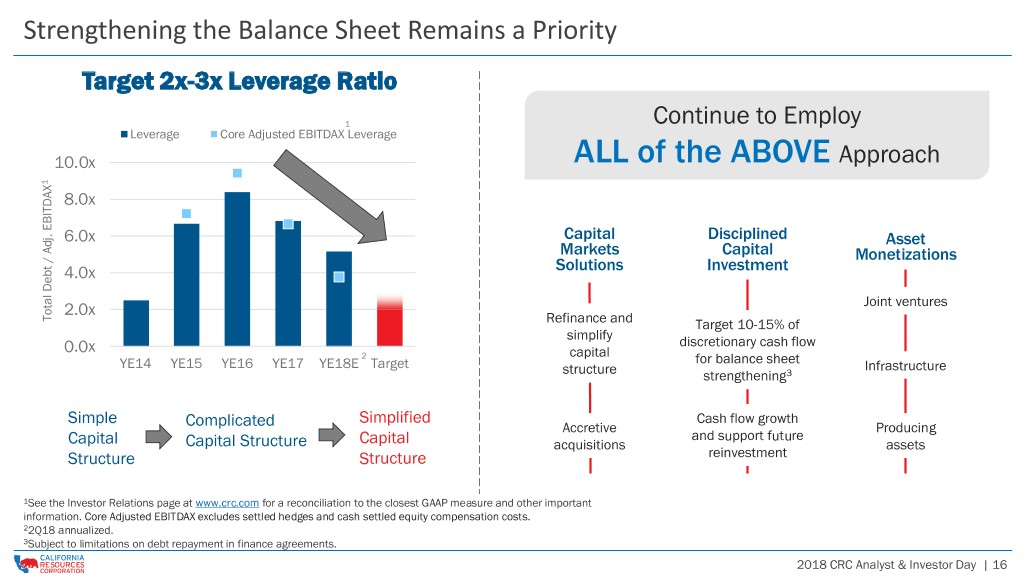

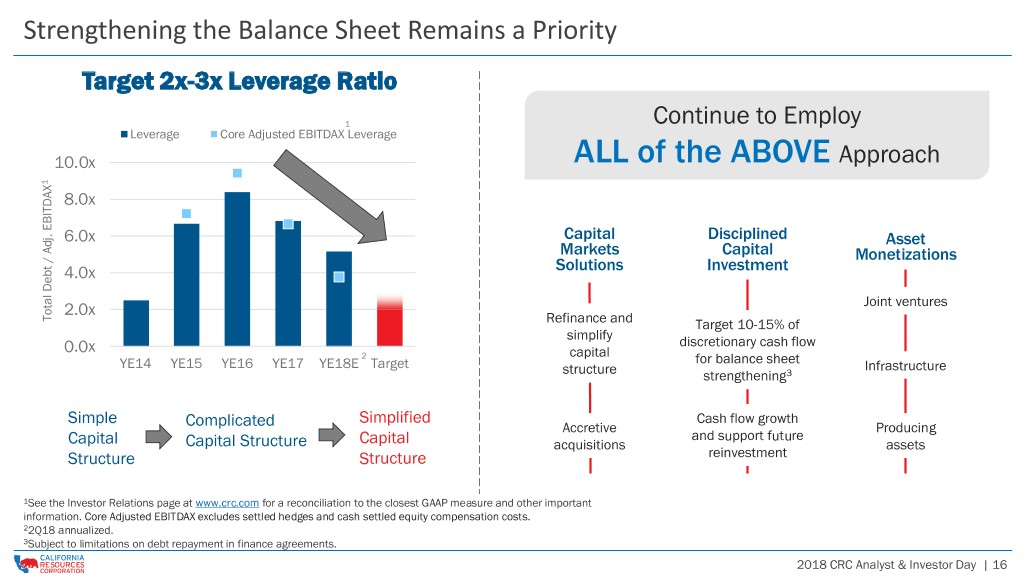

Strengthening the Balance Sheet Remains a Priority Target 2x-3x Leverage Ratio 1 Continue to Employ Leverage Core Adjusted EBITDAX Leverage 10.0x ALL of the ABOVE Approach 1 8.0x 6.0x Capital Disciplined Asset Markets Capital Monetizations 4.0x Solutions Investment 2.0x Joint ventures Total Debt / Adj. EBITDAX / Debt Adj. Total Refinance and Target 10-15% of simplify 0.0x discretionary cash flow 2 capital YE14 YE15 YE16 YE17 YE18E Target for balance sheet Infrastructure structure strengthening3 Simple Simplified Cash flow growth Complicated Accretive Producing and support future Capital Capital Structure Capital acquisitions assets Structure Structure reinvestment 1See the Investor Relations page at www.crc.com for a reconciliation to the closest GAAP measure and other important information. Core Adjusted EBITDAX excludes settled hedges and cash settled equity compensation costs. 22Q18 annualized. 3Subject to limitations on debt repayment in finance agreements. 2018 CRC Analyst & Investor Day | 16

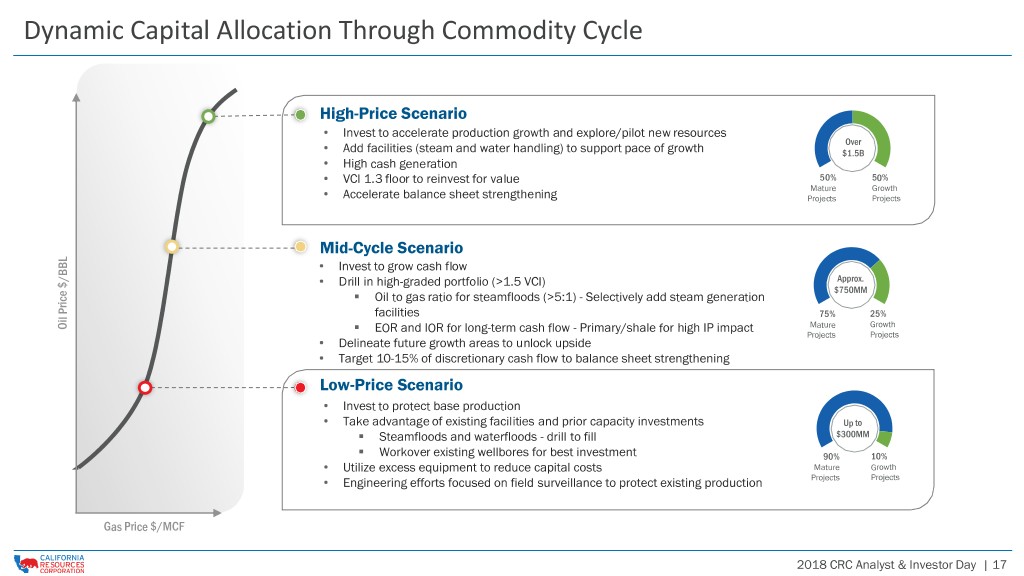

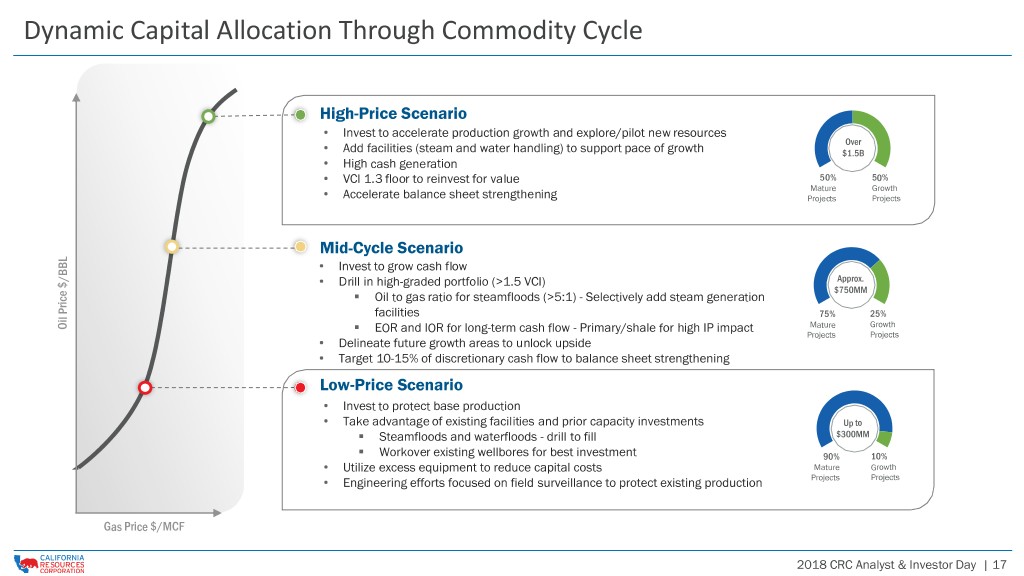

Dynamic Capital Allocation Through Commodity Cycle High-Price Scenario • Invest to accelerate production growth and explore/pilot new resources Over • Add facilities (steam and water handling) to support pace of growth $1.5B • High cash generation • VCI 1.3 floor to reinvest for value 50% 50% Mature Growth • Accelerate balance sheet strengthening Projects Projects Mid-Cycle Scenario • Invest to grow cash flow • Drill in high-graded portfolio (>1.5 VCI) Approx. $750MM ▪ Oil to gas ratio for steamfloods (>5:1) - Selectively add steam generation facilities 75% 25% ▪ Mature Growth Oil$/BBL Price EOR and IOR for long-term cash flow - Primary/shale for high IP impact Projects Projects • Delineate future growth areas to unlock upside • Target 10-15% of discretionary cash flow to balance sheet strengthening Low-Price Scenario • Invest to protect base production • Take advantage of existing facilities and prior capacity investments Up to ▪ Steamfloods and waterfloods - drill to fill $300MM ▪ Workover existing wellbores for best investment 90% 10% • Utilize excess equipment to reduce capital costs Mature Growth • Engineering efforts focused on field surveillance to protect existing production Projects Projects Gas Price $/MCF 2018 CRC Analyst & Investor Day | 17

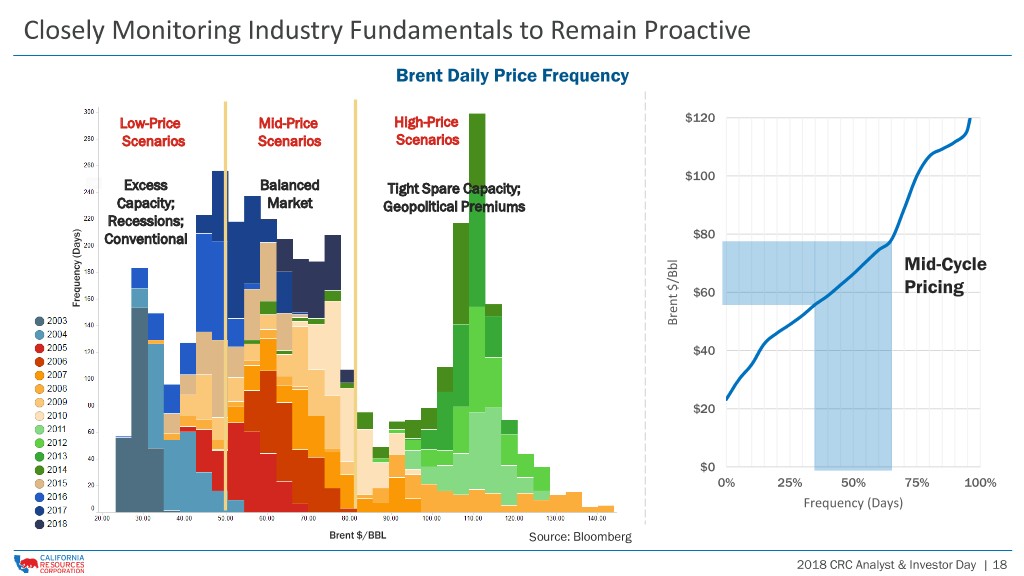

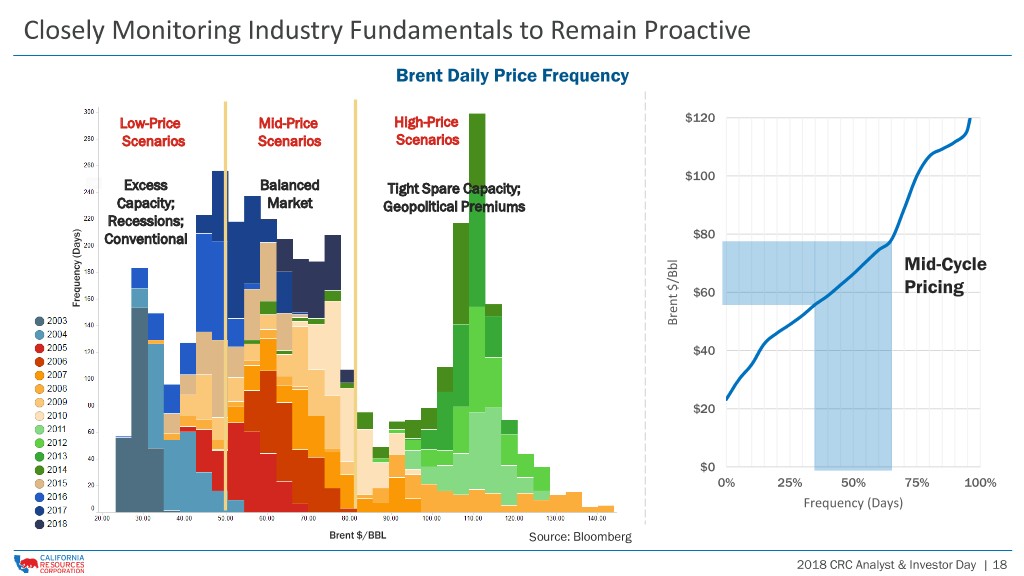

Closely Monitoring Industry Fundamentals to Remain Proactive Brent Daily Price Frequency Low-Price Mid-Price High-Price $120 Scenarios Scenarios Scenarios $100 Excess Balanced Tight Spare Capacity; Capacity; Market Geopolitical Premiums Recessions; Conventional $80 Mid-Cycle $60 Pricing Frequency (Days) Frequency Brent Brent $/Bbl $40 $20 $0 0% 25% 50% 75% 100% Frequency (Days) Brent $/BBL Source: Bloomberg 2018 CRC Analyst & Investor Day | 18

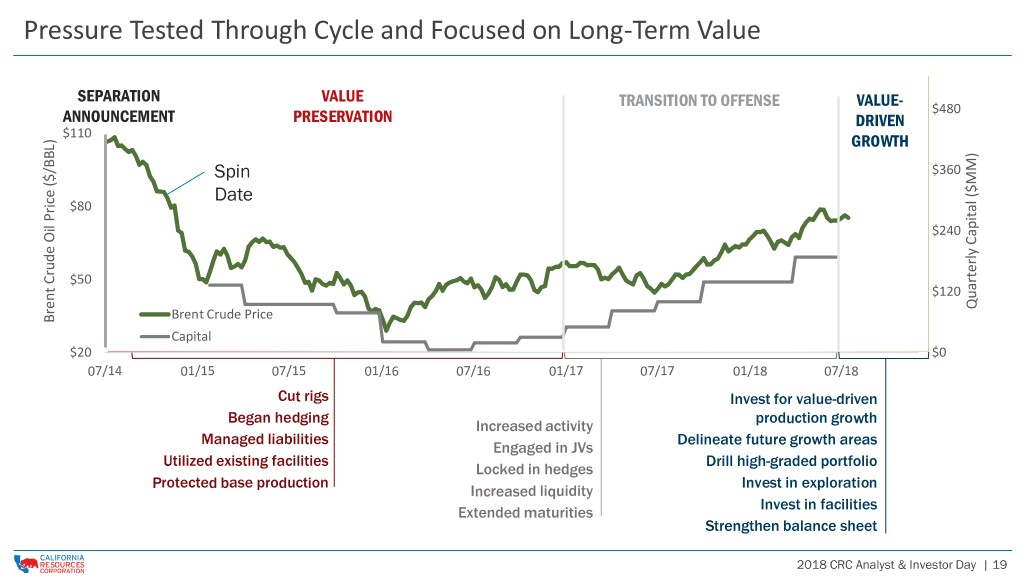

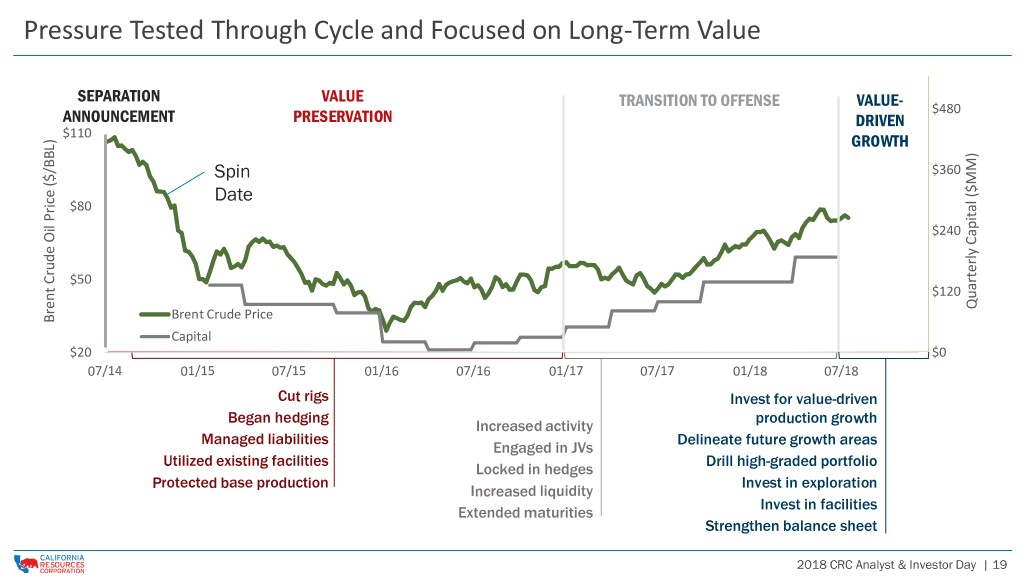

Pressure Tested Through Cycle and Focused on Long-Term Value SEPARATION VALUE TRANSITION TO OFFENSE VALUE- $480 ANNOUNCEMENT PRESERVATION DRIVEN $110 GROWTH Spin $360 Date $80 $240 $50 $120 Brent Crude Price ($MM) Capital Quarterly Brent Crude Oil Price ($/BBL) Price Oil Crude Brent Capital $20 $0 07/14 01/15 07/15 01/16 07/16 01/17 07/17 01/18 07/18 Cut rigs Invest for value-driven Began hedging production growth Increased activity Managed liabilities Delineate future growth areas Engaged in JVs Utilized existing facilities Drill high-graded portfolio Locked in hedges Protected base production Invest in exploration Increased liquidity Invest in facilities Extended maturities Strengthen balance sheet 2018 CRC Analyst & Investor Day | 19

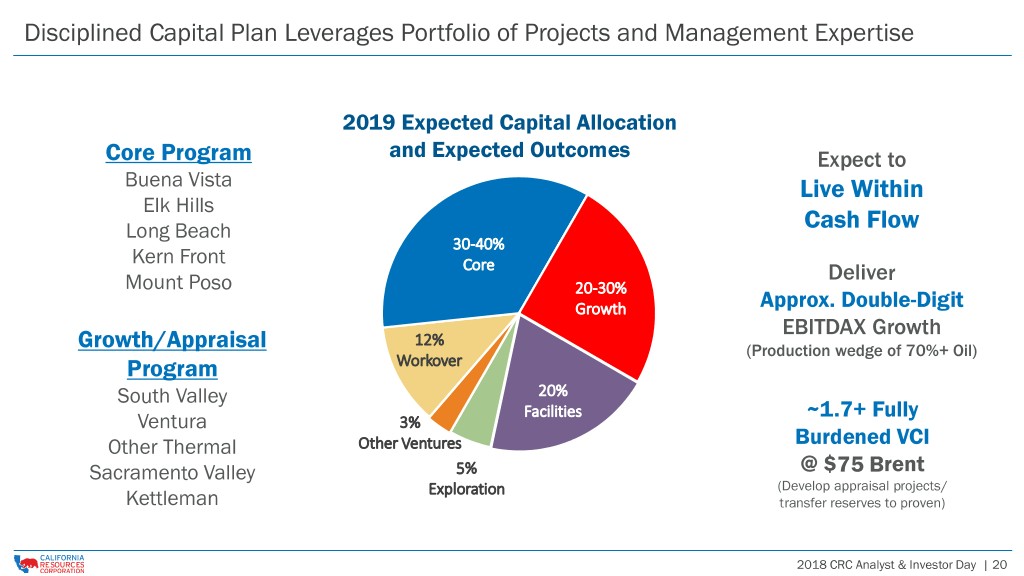

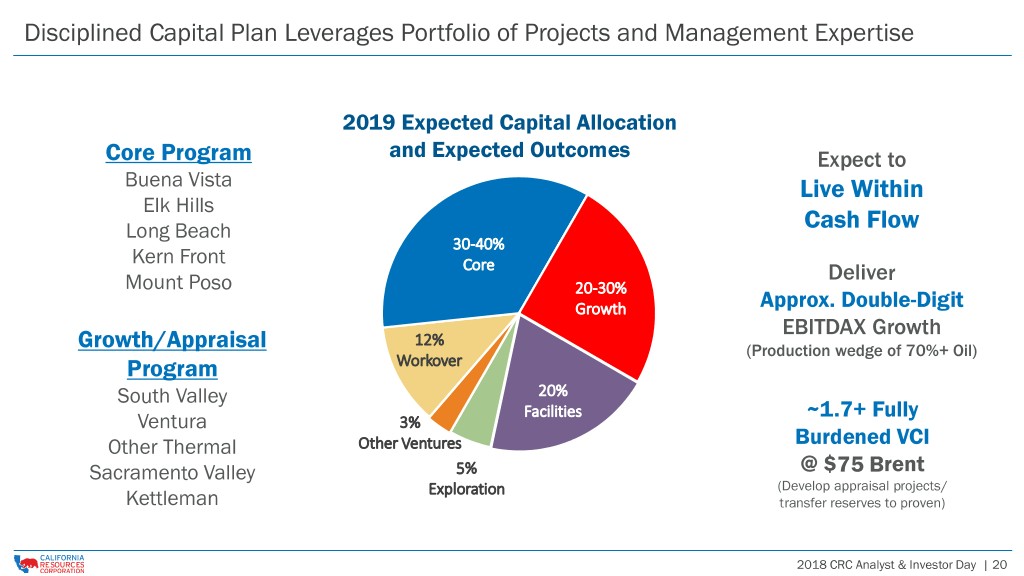

Disciplined Capital Plan Leverages Portfolio of Projects and Management Expertise 2019 Expected Capital Allocation Core Program and Expected Outcomes Expect to Buena Vista Live Within Elk Hills Long Beach Cash Flow 30-40% Kern Front Core Deliver Mount Poso 20-30% Growth Approx. Double-Digit EBITDAX Growth 12% Growth/Appraisal (Production wedge of 70%+ Oil) Program Workover South Valley 20% Facilities ~1.7+ Fully Ventura 3% Other Thermal Other Ventures Burdened VCI Sacramento Valley 5% @ $75 Brent Exploration (Develop appraisal projects/ Kettleman transfer reserves to proven) 2018 CRC Analyst & Investor Day | 20

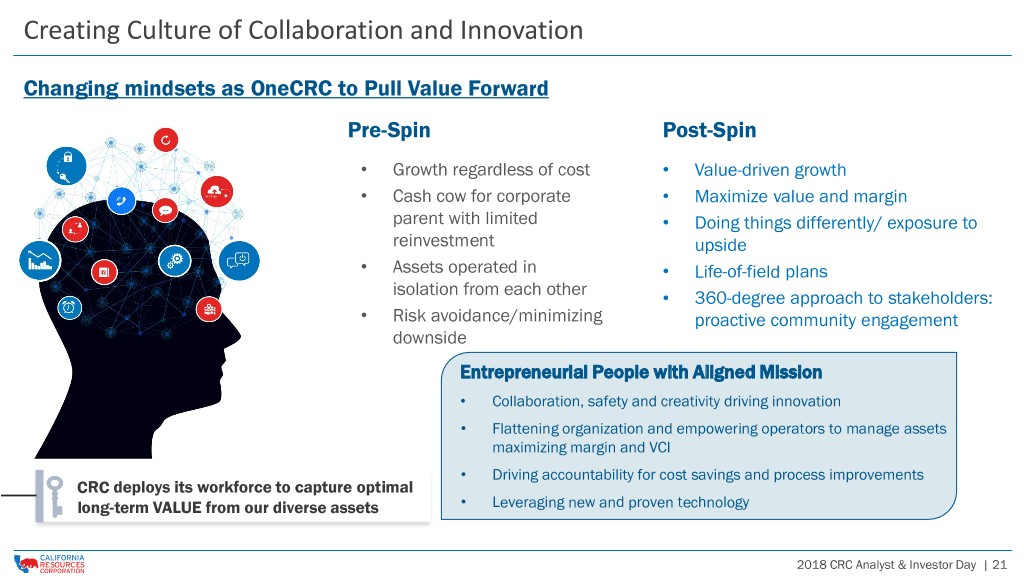

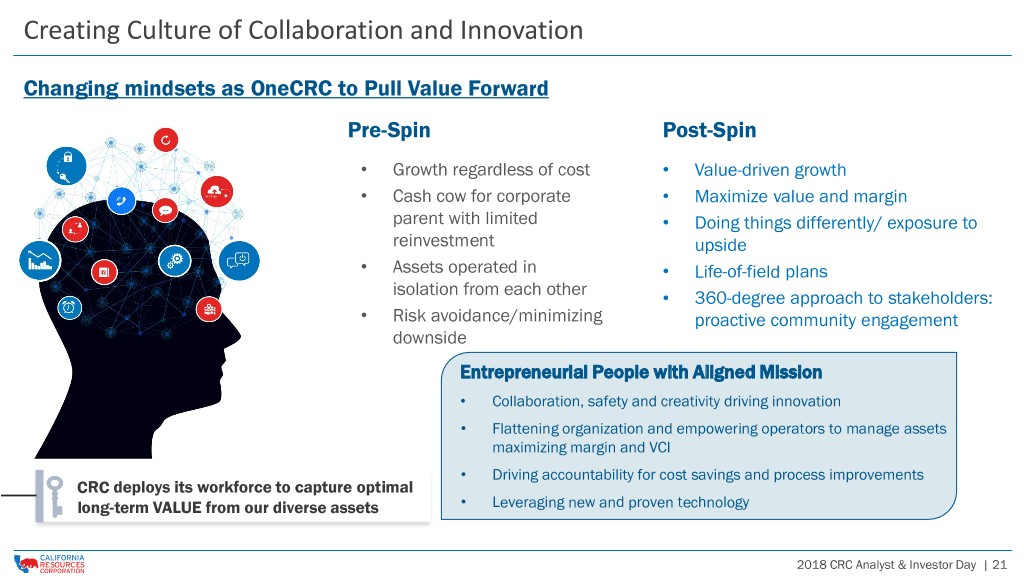

Creating Culture of Collaboration and Innovation Changing mindsets as OneCRC to Pull Value Forward Pre-Spin Post-Spin • Growth regardless of cost • Value-driven growth • Cash cow for corporate • Maximize value and margin parent with limited • Doing things differently/ exposure to reinvestment upside • Assets operated in • Life-of-field plans isolation from each other • 360-degree approach to stakeholders: • Risk avoidance/minimizing proactive community engagement downside Entrepreneurial People with Aligned Mission • Collaboration, safety and creativity driving innovation • Flattening organization and empowering operators to manage assets maximizing margin and VCI • Driving accountability for cost savings and process improvements CRC deploys its workforce to capture optimal long-term VALUE from our diverse assets • Leveraging new and proven technology 2018 CRC Analyst & Investor Day | 21

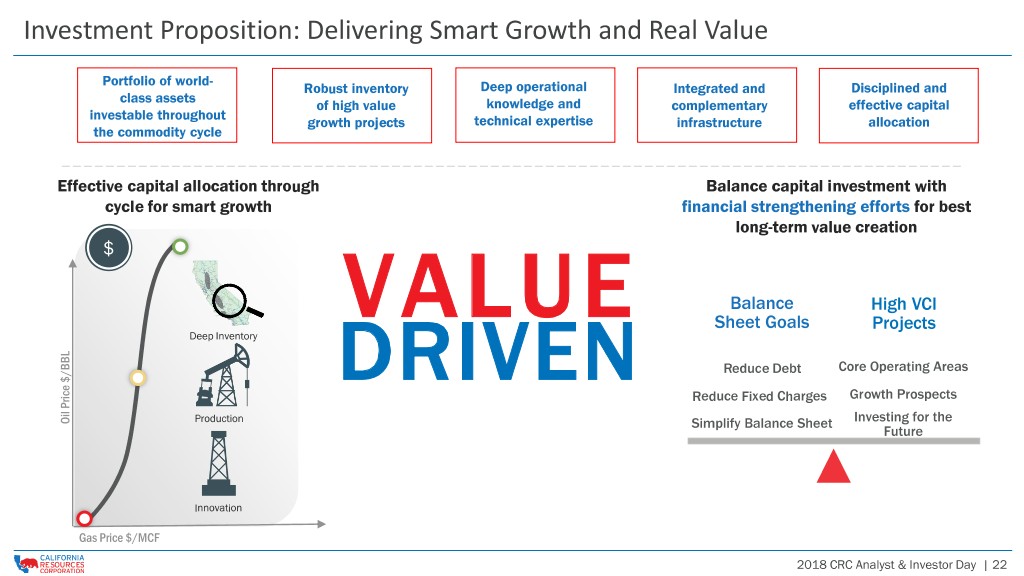

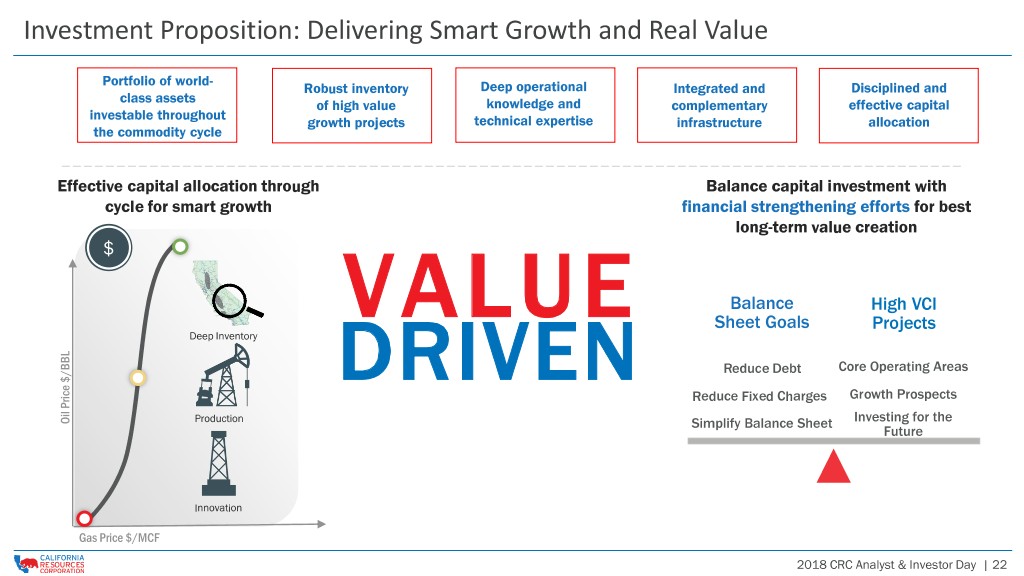

Investment Proposition: Delivering Smart Growth and Real Value Portfolio of world- Robust inventory Deep operational Integrated and Disciplined and class assets of high value knowledge and complementary effective capital investable throughout growth projects technical expertise infrastructure allocation the commodity cycle Effective capital allocation through Balance capital investment with cycle for smart growth financial strengthening efforts for best long-term value creation $ Balance High VCI VALUE Sheet Goals Projects Deep Inventory DRIVEN Reduce Debt Core Operating Areas Reduce Fixed Charges Growth Prospects Production Investing for the Oil$/BBL Price Simplify Balance Sheet Future Innovation Gas Price $/MCF 2018 CRC Analyst & Investor Day | 22

OPERATING IN CALIFORNIA Charlie Weiss, EVP Public Affairs

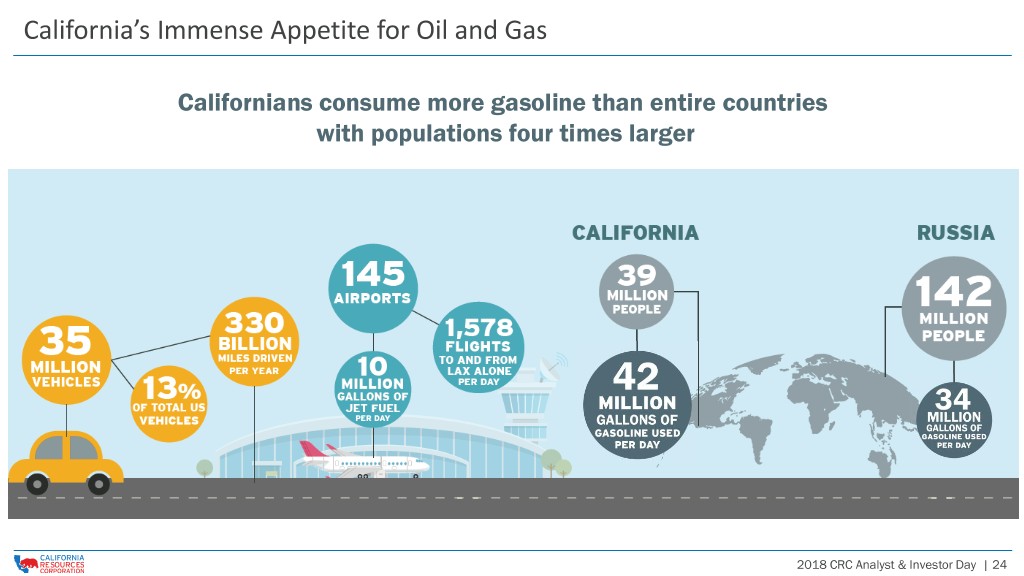

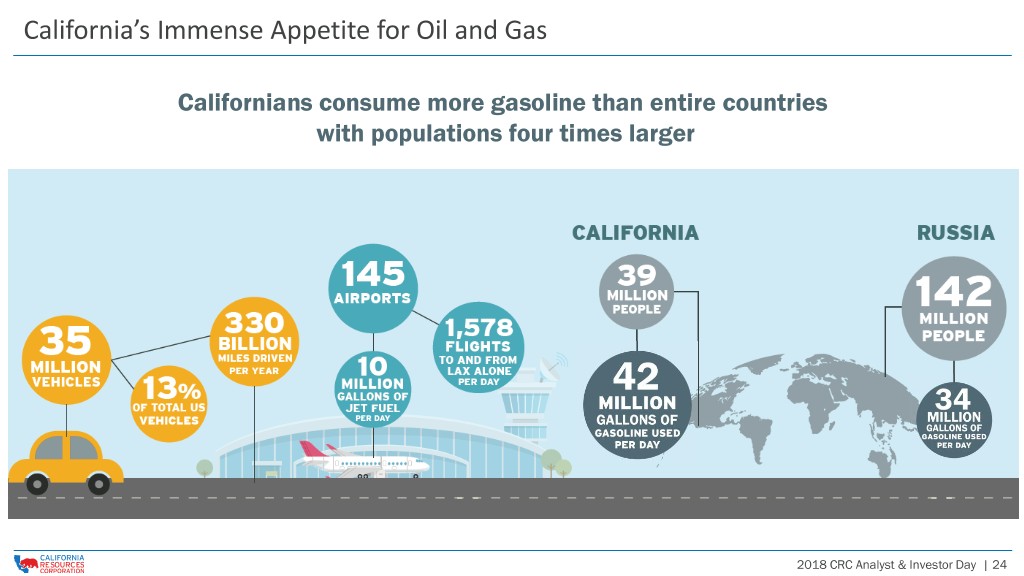

California’s Immense Appetite for Oil and Gas Californians consume more gasoline than entire countries with populations four times larger 2018 CRC Analyst & Investor Day | 24

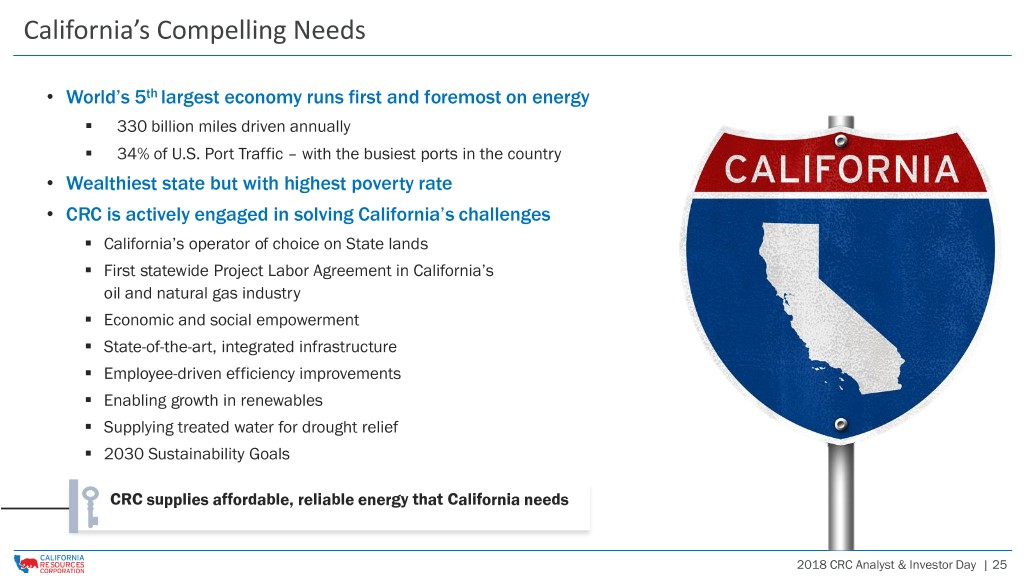

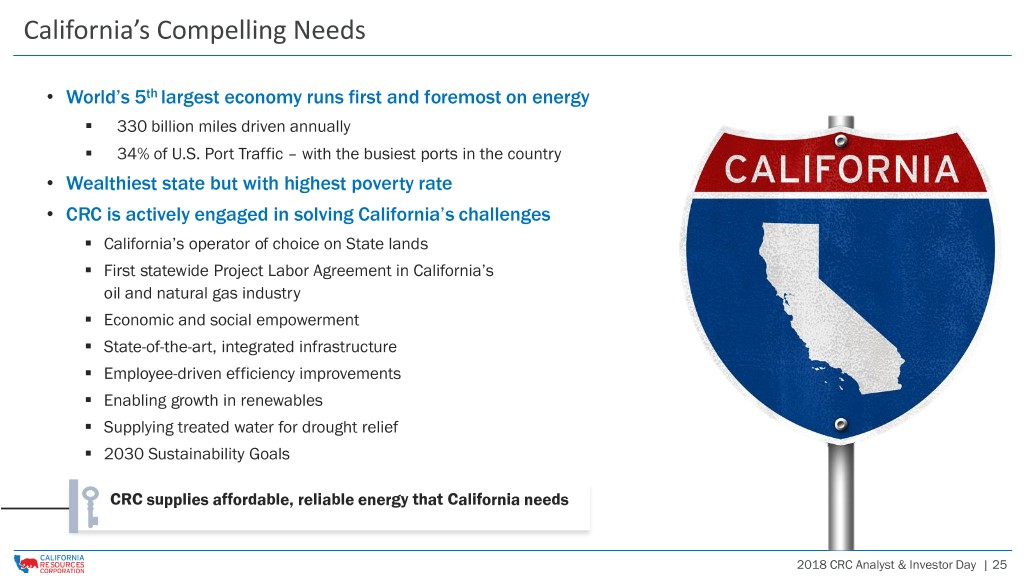

California’s Compelling Needs • World’s 5th largest economy runs first and foremost on energy ▪ 330 billion miles driven annually ▪ 34% of U.S. Port Traffic – with the busiest ports in the country • Wealthiest state but with highest poverty rate • CRC is actively engaged in solving California’s challenges ▪ California’s operator of choice on State lands ▪ First statewide Project Labor Agreement in California’s oil and natural gas industry ▪ Economic and social empowerment ▪ State-of-the-art, integrated infrastructure ▪ Employee-driven efficiency improvements ▪ Enabling growth in renewables ▪ Supplying treated water for drought relief ▪ 2030 Sustainability Goals CRC supplies affordable, reliable energy that California needs 2018 CRC Analyst & Investor Day | 25

California’s Growing Dependence on Imported Energy 800,000 Oil Product Consumption “Because as long as [California's] cars are 700,000 moving... [we] are burning up gasoline that is 600,000 being shipped from Iraq, from Russia, from Venezuela and all sorts of other places... so 500,000 Imported Oil whatever we don't do from here, we’re just 400,000 going to get from somewhere else.” MBBL 300,000 — California Gov. Jerry Brown, February 6, 2015 200,000 Native California Oil Production 100,000 • Imported production does not apply California’s - safety, labor and environmental standards • Local production enhances energy security and mitigates greenhouse gas emissions while Production Consumption boosting California’s economy and supporting Source: EIA thousands of local jobs California oil imports from foreign countries and other states hit record levels in 2017 2018 CRC Analyst & Investor Day | 26

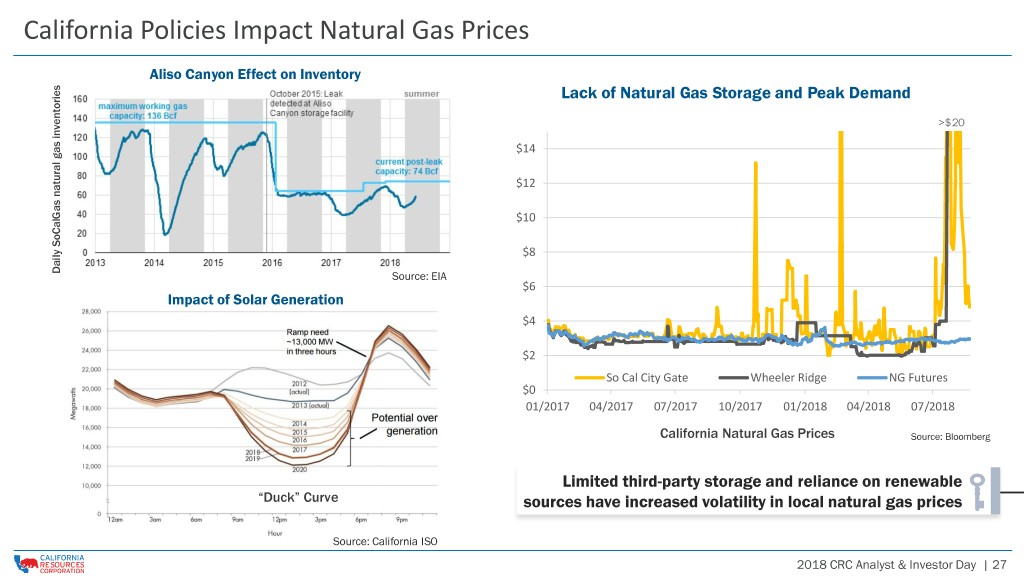

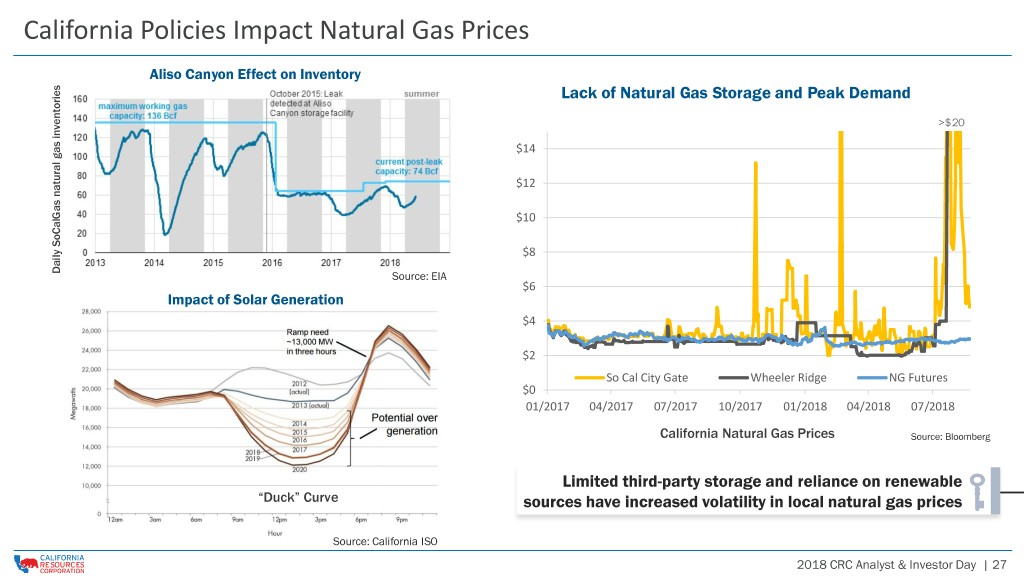

California Policies Impact Natural Gas Prices Aliso Canyon Effect on Inventory Lack of Natural Gas Storage and Peak Demand >$20 $14 $12 $10 $8 Daily SoCalGas SoCalGas natural Daily inventories gas Source: EIA $6 Impact of Solar Generation $4 $2 So Cal City Gate Wheeler Ridge NG Futures $0 01/2017 04/2017 07/2017 10/2017 01/2018 04/2018 07/2018 California Natural Gas Prices Source: Bloomberg Limited third-party storage and reliance on renewable “Duck” Curve sources have increased volatility in local natural gas prices Source: California ISO 2018 CRC Analyst & Investor Day | 27

Powering California’s Economic Engine 2014-2017 Economic Contributions • $828 million in California state, local and payroll taxes CRC’s operations in Long Beach have generated more than • $591 million $4.7 billion in revenues for the in revenues to the State Lands Commission city and state since 2003 • $719 million to 20,000 mineral and surface owners 2018 CRC Analyst & Investor Day | 28

Increasing Energy Literacy • California’s ambitious goals and vibrant future require: ▪ Energy equality for disadvantaged communities ▪ Resilience through diverse mix of affordable traditional and renewable energy ▪ Responsible local energy production to supplant imports ▪ Predictable permitting for infrastructure and economic growth ▪ Sustained industrial jobs supporting working families • Outreach examples ▪ CRC’s Powering California program ▪ Sustainability Report and infographics ▪ STEM education and job training programs • CRC coalition partners ▪ Workforce ▪ Organized labor ▪ Diverse communities ▪ Non-profit organizations ▪ Business and agricultural groups 2018 CRC Analyst & Investor Day | 29

CRC’s Regulatory Strategy Advances California’s Leading Standards Growing Permit Inventory CRC’S CONSISTENT REGULATORY STRATEGY (Permitted drilling rig days at end of period) ✓ Reflect Californians’ values 1200 ✓ Solicit community input 1000 ✓ Advance community interests ✓ Build strategic alliances 800 ✓ Educate and inform policy makers ✓ Sustain 90-day permit inventory per rig line 600 ✓ Fulfill California’s high standards ✓ Help achieve the state’s long-term goals 400 ✓ Contribute to vibrant future for all Californians 200 0 YE16 YE17 1Q18 2Q18 3Q18E Seasoned operator with proven local expertise 2018 CRC Analyst & Investor Day | 30

REGULATORY VIDEO See the Investor Relations page at www.crc.com to access this video.

Reflecting Californians’ Values • Institutional Shareholder Services ▪ Highest environmental rating (1 of 10) ▪ High social rating (2 of 10) • Humanitarian Company of the Year ▪ American Red Cross, LA Region • Kern County named February 5 “CRC Day” ▪ 20 years of service and investment at Elk Hills • CRC and its workforce consistently give back to the community 2018 CRC Analyst & Investor Day | 32

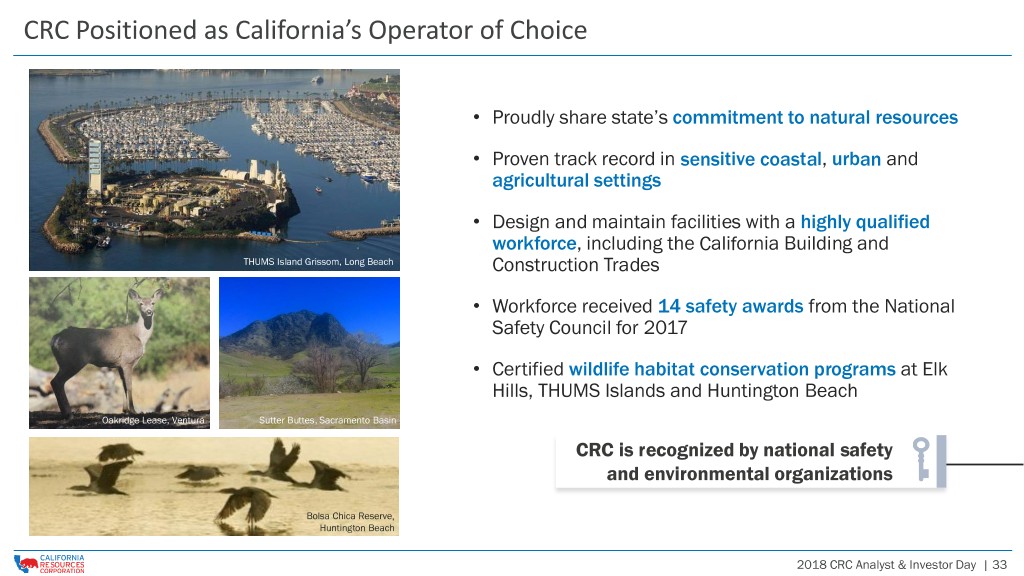

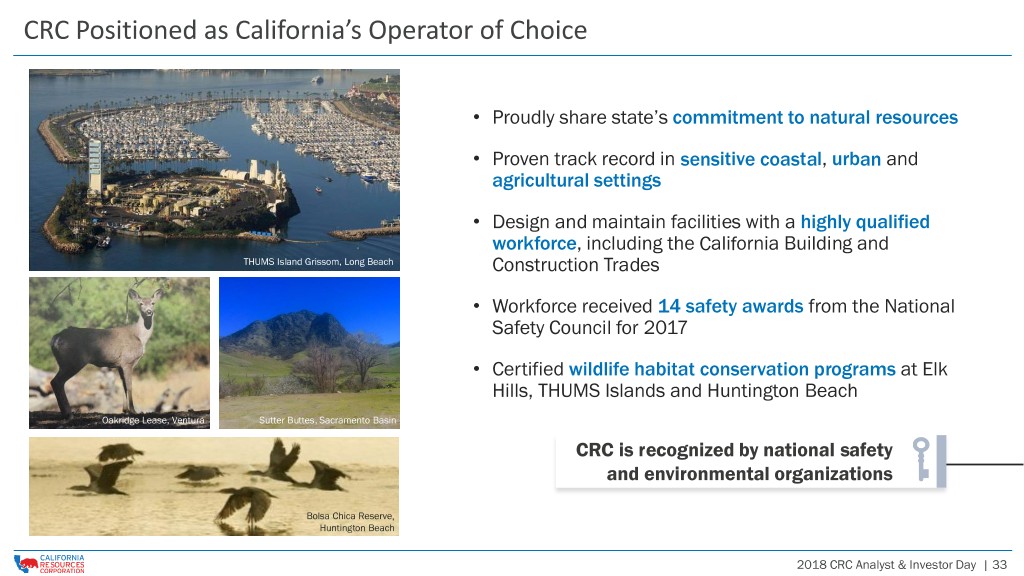

CRC Positioned as California’s Operator of Choice • Proudly share state’s commitment to natural resources • Proven track record in sensitive coastal, urban and agricultural settings • Design and maintain facilities with a highly qualified workforce, including the California Building and THUMS Island Grissom, Long Beach Construction Trades • Workforce received 14 safety awards from the National Safety Council for 2017 • Certified wildlife habitat conservation programs at Elk Hills, THUMS Islands and Huntington Beach Oakridge Lease, Ventura Sutter Buttes, Sacramento Basin CRC is recognized by national safety and environmental organizations Bolsa Chica Reserve, Huntington Beach 2018 CRC Analyst & Investor Day | 33

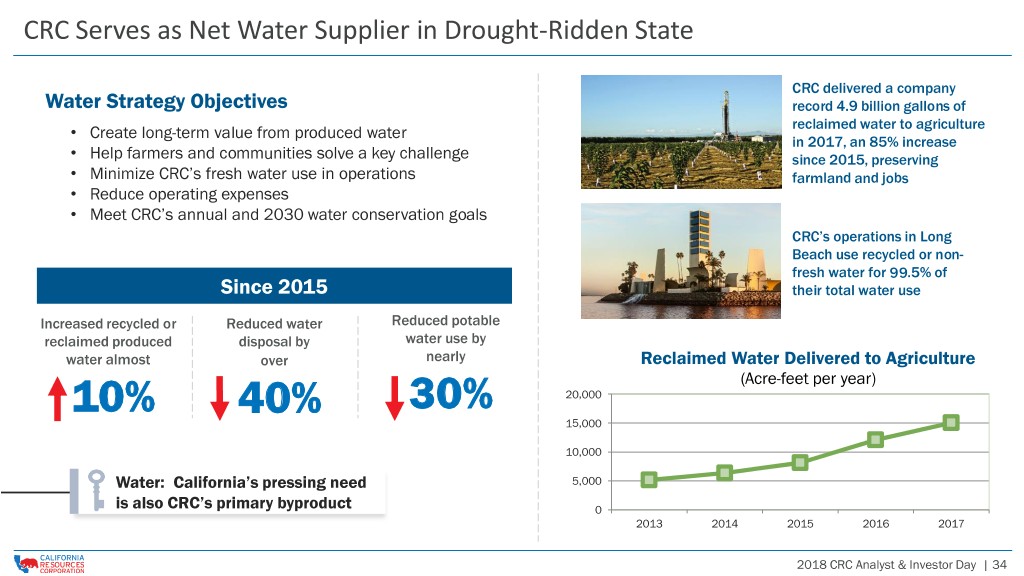

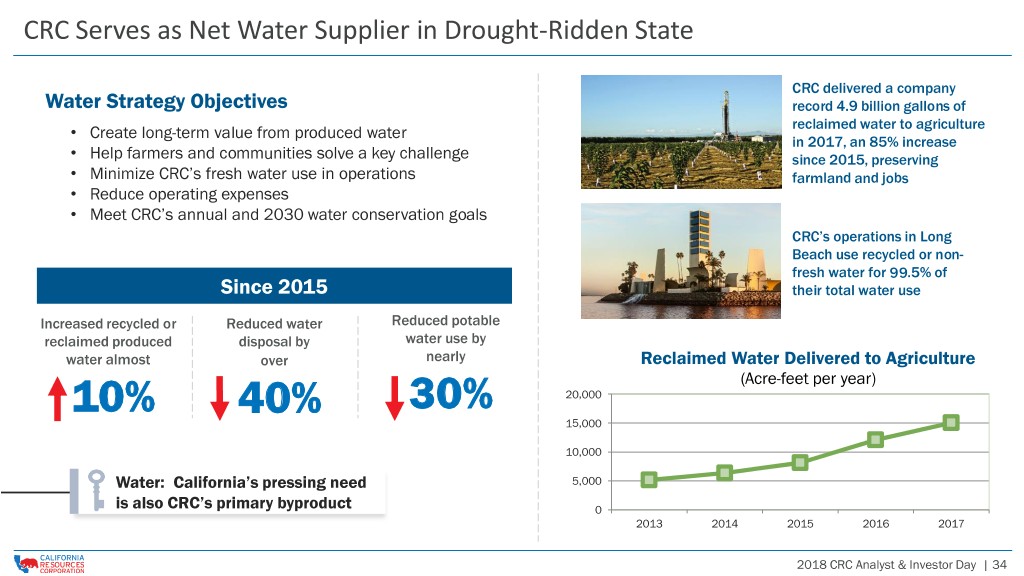

CRC Serves as Net Water Supplier in Drought-Ridden State CRC delivered a company Water Strategy Objectives record 4.9 billion gallons of reclaimed water to agriculture • Create long-term value from produced water in 2017, an 85% increase • Help farmers and communities solve a key challenge since 2015, preserving • Minimize CRC’s fresh water use in operations farmland and jobs • Reduce operating expenses • Meet CRC’s annual and 2030 water conservation goals CRC’s operations in Long Beach use recycled or non- fresh water for 99.5% of Since 2015 their total water use Increased recycled or Reduced water Reduced potable reclaimed produced disposal by water use by water almost over nearly Reclaimed Water Delivered to Agriculture (Acre-feet per year) 10% 40% 30% 20,000 15,000 10,000 Water: California’s pressing need 5,000 is also CRC’s primary byproduct 0 2013 2014 2015 2016 2017 2018 CRC Analyst & Investor Day | 34

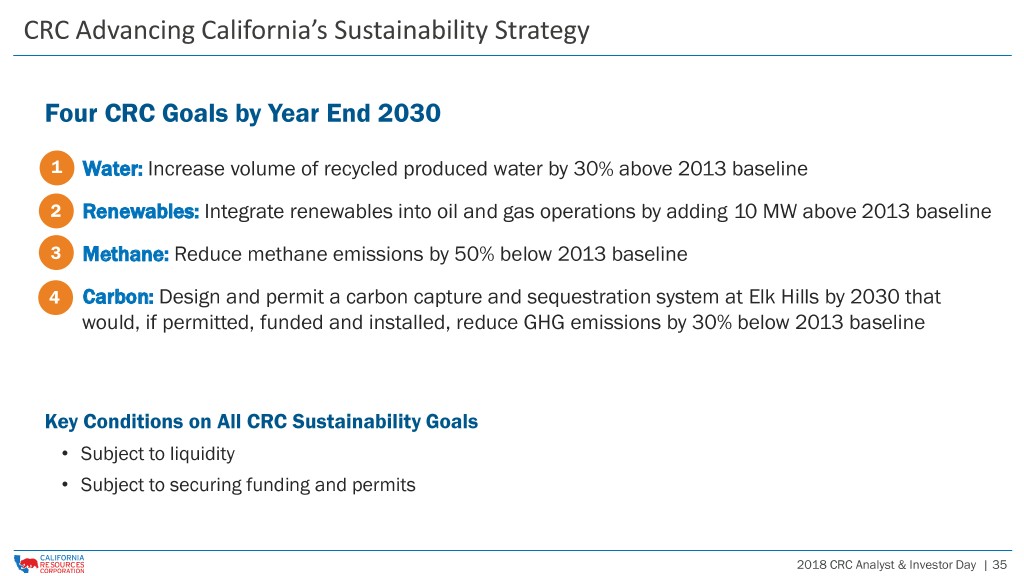

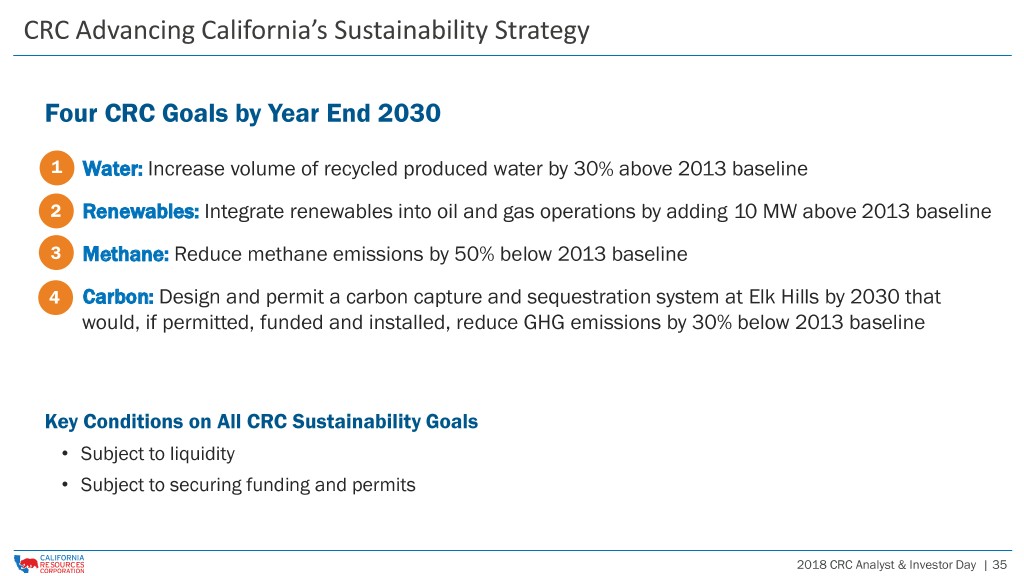

CRC Advancing California’s Sustainability Strategy Four CRC Goals by Year End 2030 1 Water: Increase volume of recycled produced water by 30% above 2013 baseline 2 Renewables: Integrate renewables into oil and gas operations by adding 10 MW above 2013 baseline 3 Methane: Reduce methane emissions by 50% below 2013 baseline 4 Carbon: Design and permit a carbon capture and sequestration system at Elk Hills by 2030 that would, if permitted, funded and installed, reduce GHG emissions by 30% below 2013 baseline Key Conditions on All CRC Sustainability Goals • Subject to liquidity • Subject to securing funding and permits 2018 CRC Analyst & Investor Day | 35

CONVENTIONAL DELIVERS STRONG RETURNS Francisco Leon, EVP Corporate Development & Strategic Planning

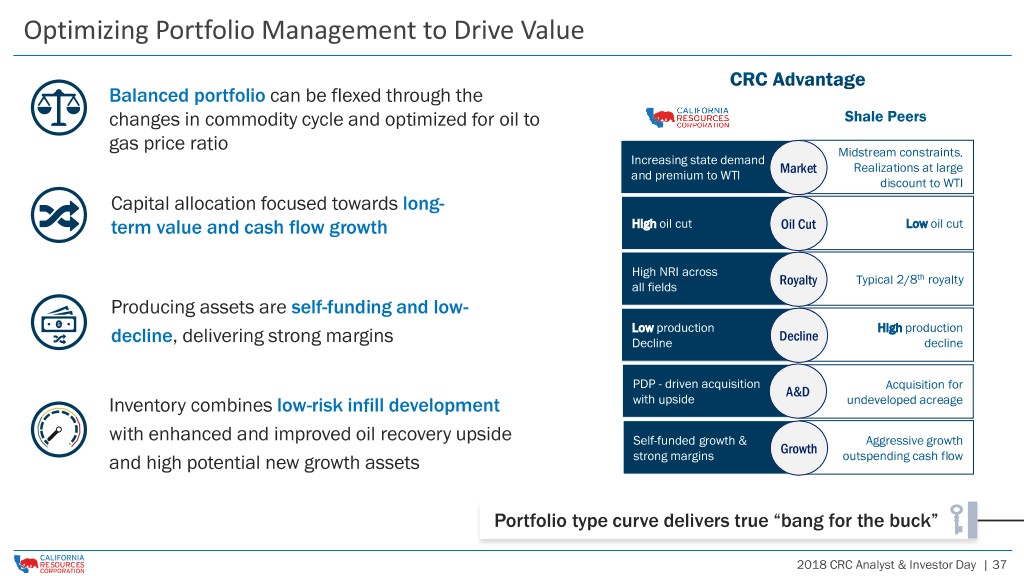

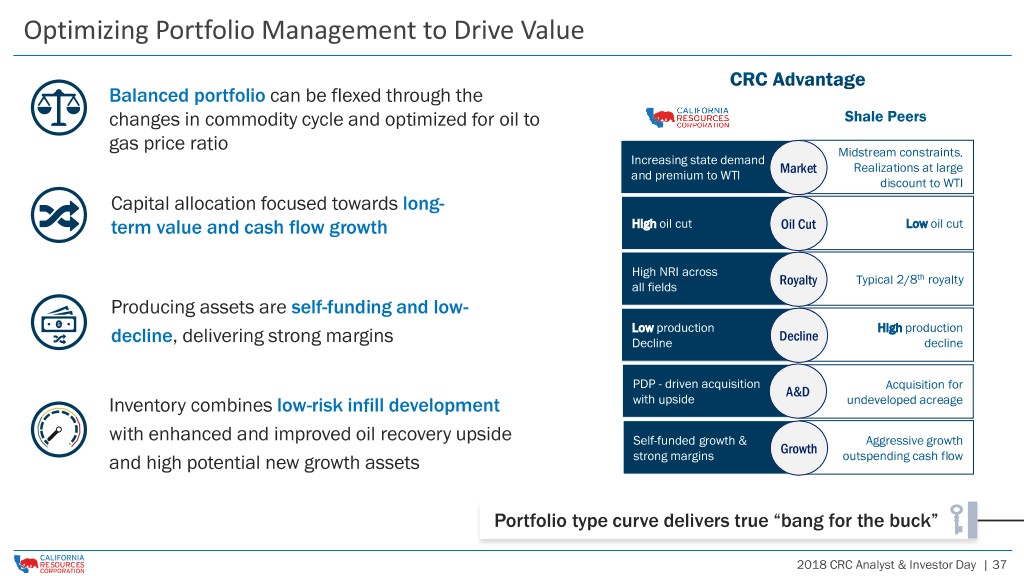

Optimizing Portfolio Management to Drive Value Balanced portfolio can be flexed through the changes in commodity cycle and optimized for oil to Shale Peers gas price ratio Midstream constraints. Increasing state demand Realizations at large and premium to WTI Market discount to WTI Capital allocation focused towards long- term value and cash flow growth High oil cut Oil Cut Low oil cut High NRI across Royalty Typical 2/8th royalty all fields Producing assets are self-funding and low- $ Low production High production decline, delivering strong margins Decline Decline decline 1.0x 1.0x PDP - driven acquisition Acquisition for A&D Inventory combines low-risk infill development with upside undeveloped acreage with enhanced and improved oil recovery upside Self-funded growth & Aggressive growth Growth and high potential new growth assets strong margins outspending cash flow Portfolio type curve delivers true “bang for the buck” 2018 CRC Analyst & Investor Day | 37

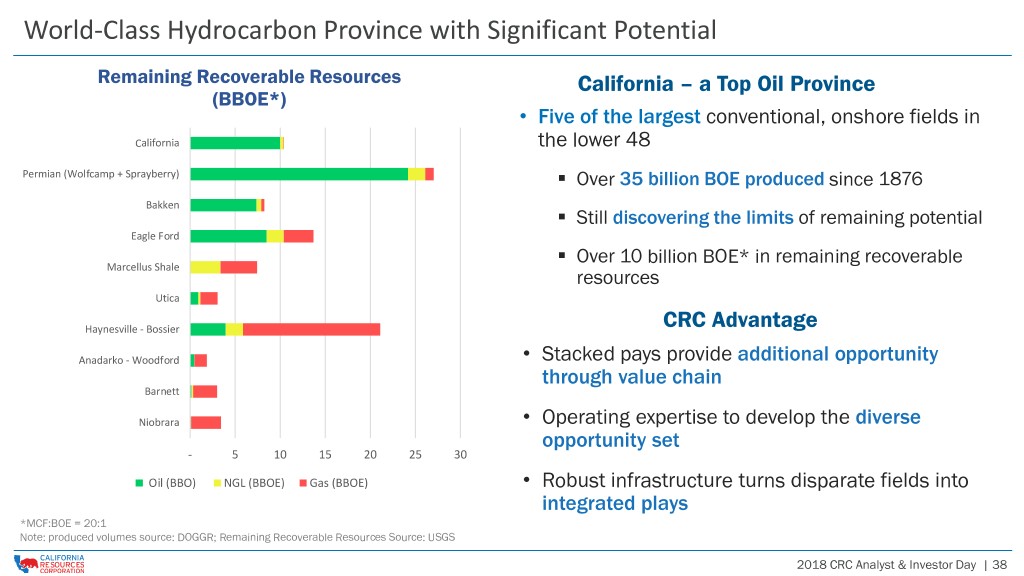

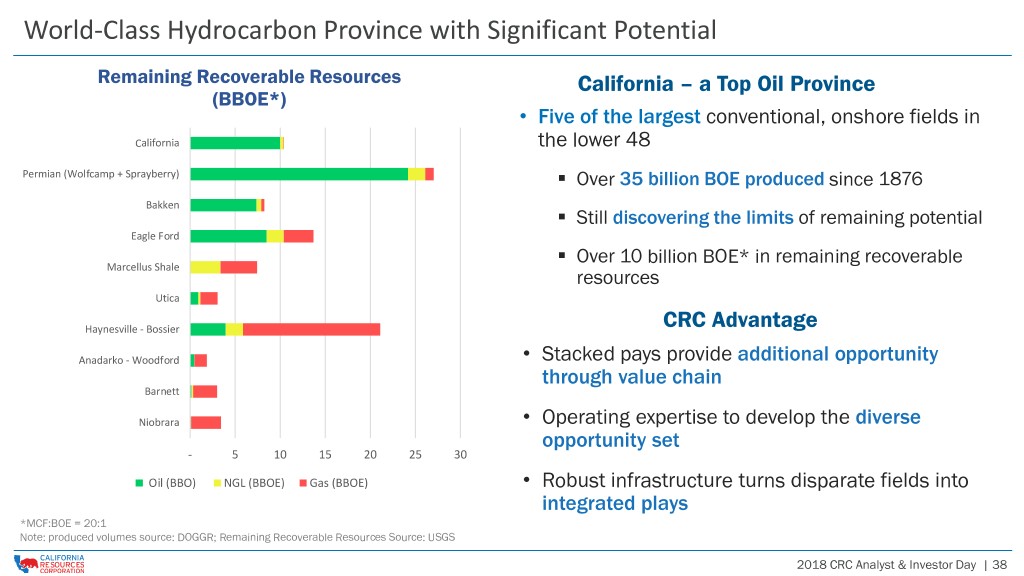

World-Class Hydrocarbon Province with Significant Potential Remaining Recoverable Resources California – a Top Oil Province (BBOE*) • Five of the largest conventional, onshore fields in California the lower 48 Permian (Wolfcamp + Sprayberry) ▪ Over 35 billion BOE produced since 1876 Bakken ▪ Still discovering the limits of remaining potential Eagle Ford ▪ Over 10 billion BOE* in remaining recoverable Marcellus Shale resources Utica Haynesville - Bossier CRC Advantage Anadarko - Woodford • Stacked pays provide additional opportunity through value chain Barnett Niobrara • Operating expertise to develop the diverse opportunity set - 5 10 15 20 25 30 Oil (BBO) NGL (BBOE) Gas (BBOE) • Robust infrastructure turns disparate fields into integrated plays *MCF:BOE = 20:1 Note: produced volumes source: DOGGR; Remaining Recoverable Resources Source: USGS 2018 CRC Analyst & Investor Day | 38

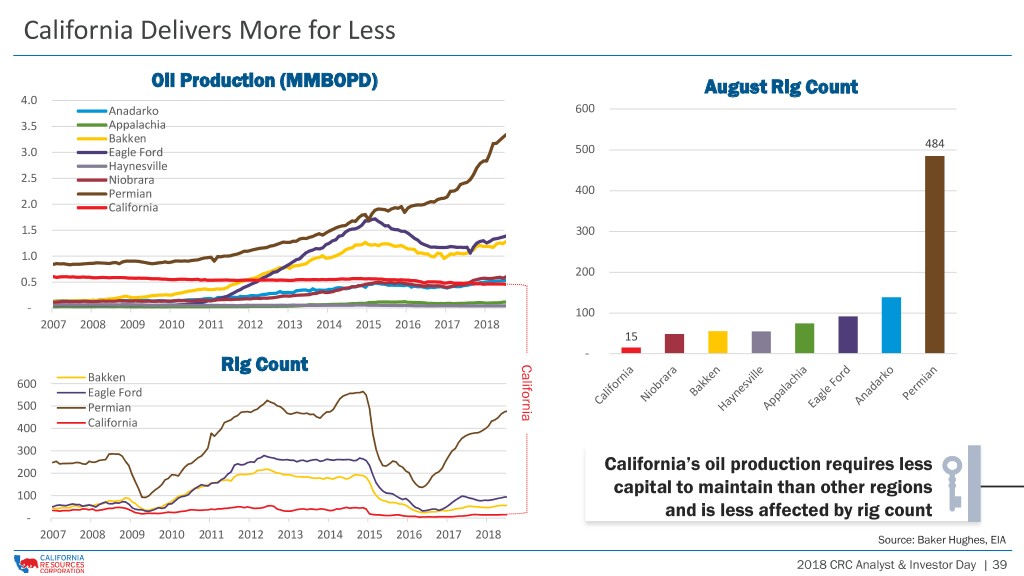

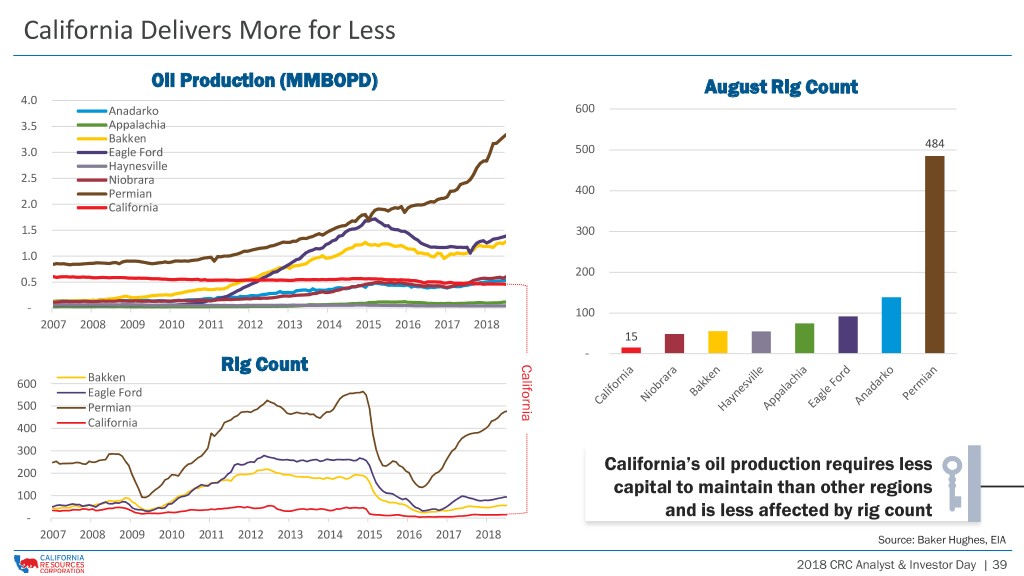

California Delivers More for Less Oil Production (MMBOPD) August Rig Count 4.0 Anadarko 600 3.5 Appalachia Bakken 484 3.0 Eagle Ford 500 Haynesville 2.5 Niobrara Permian 400 2.0 California 1.5 300 1.0 200 0.5 - 100 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 15 - Rig Count California 600 Bakken Eagle Ford 500 Permian 400 California 300 California’s oil production requires less 200 100 capital to maintain than other regions - and is less affected by rig count 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 Source: Baker Hughes, EIA 2018 CRC Analyst & Investor Day | 39

$85 $80 California Imports Waterborne With 100% CRC Brent Realization in 2Q18 $75 Brent based pricing + CRC’s unconstrained market access provide meaningful pricing uplift $70 $85 $65 $80 $60 $75 $ / Bbl / $ $70 $55 $65 $50 $60 $ / Bbl / $ $45 $55 $50 $40 Jan-17 Mar-17 $45May-17 Jul-17 Sep-17 Nov-17 Jan-18 Mar-18 May-18 Jul-18 $40 Jan-17 Mar-17 May-17 Jul-17 Sep-17 Nov-17 Jan-18 Mar-18 May-18 Jul-18 ICE Brent Crude Oil Futures (Front Month) NYMEX Light Sweet Crude Oil (WTI) Futures Electronic (Front Monthly) Argus WTI Midland month 1 - HoustonICE Brent close Crude Oil Futures (Front Month) Argus BakkenNYMEX Clearbrook Light Sweet Crude month Oil (WTI) 1 - FuturesHouston Electronic close (Front Monthly) Argus Niobrara Cushing month 1Argus - Houston WTI Midland close month 1 - Houston close Argus Bakken Clearbrook month 1 - Houston close Argus Niobrara Cushing month 1 - Houston close Source: Bloomberg / Argus as of 8/22/18 2018 CRC Analyst & Investor Day | 40

California’s Refineries Ready for IMO Reduced Sulfur Standards Refinery Capacity 12 10 Nelson Complexity Index 8 15 8 6 MMBOPD 4 YOY Crude Demand Growth 6/17-6/18 2 10% 8% PADD 5 - 6% PADD 4 PADD4 PADD1 PADD2 PADD 3 PADD 5 California 4% PADD 1 Increasing Complexity* Source: EIA PADD 2 2% California’s highly complex refineries are well prepared to Growth Demand Crude % PADD 3 0% address the IMO 2020 requirements 0 5 10 15 20 25 30 Crude Demand Growth in Thousand BOPD *Estimates using area EIA data as of 1/1/2018 Source: EIA 2018 CRC Analyst & Investor Day | 41

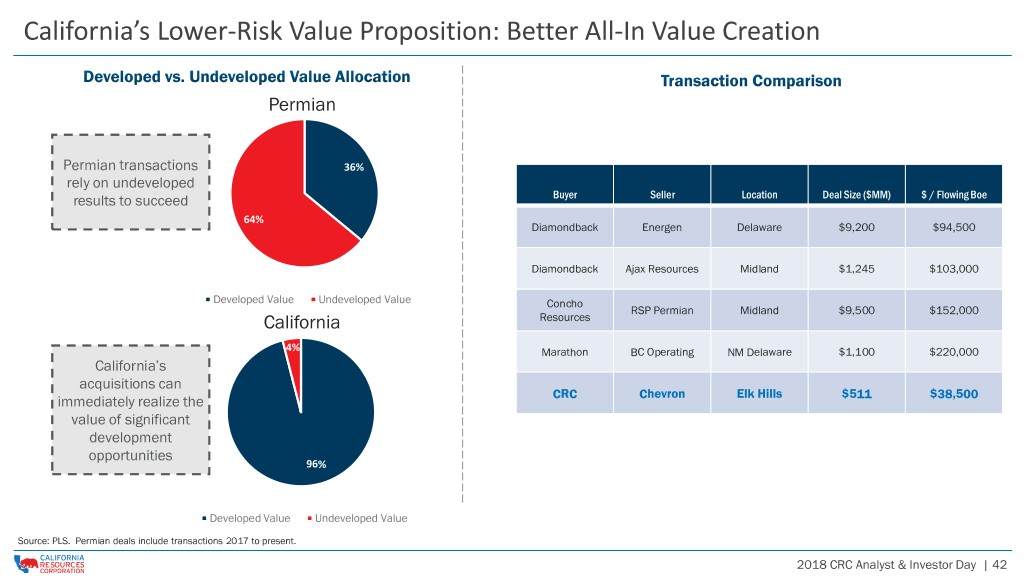

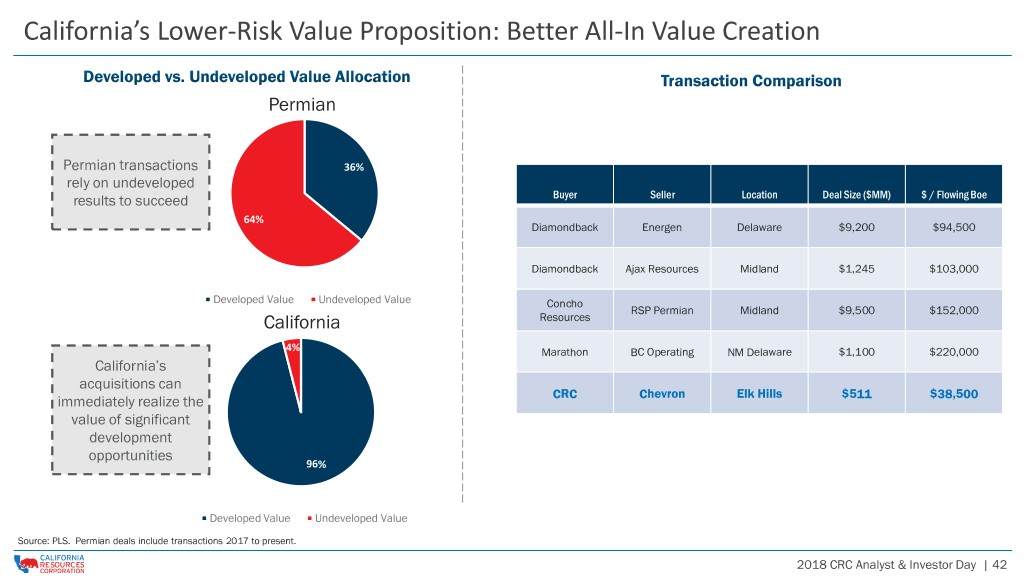

California’s Lower-Risk Value Proposition: Better All-In Value Creation Permian Permian transactions 36% rely on undeveloped results to succeed Buyer Seller Location Deal Size ($MM) $ / Flowing Boe 64% Diamondback Energen Delaware $9,200 $94,500 Diamondback Ajax Resources Midland $1,245 $103,000 Developed Value Undeveloped Value Concho RSP Permian Midland $9,500 $152,000 California Resources 4% Marathon BC Operating NM Delaware $1,100 $220,000 California’s acquisitions can CRC Chevron Elk Hills $511 $38,500 immediately realize the value of significant development opportunities 96% Developed Value Undeveloped Value Source: PLS. Permian deals include transactions 2017 to present. 2018 CRC Analyst & Investor Day | 42

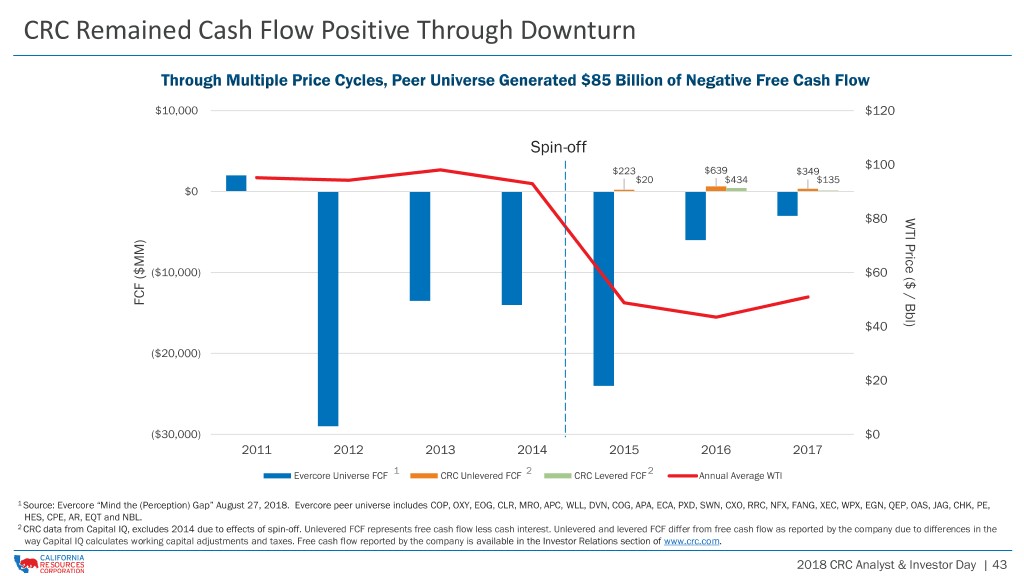

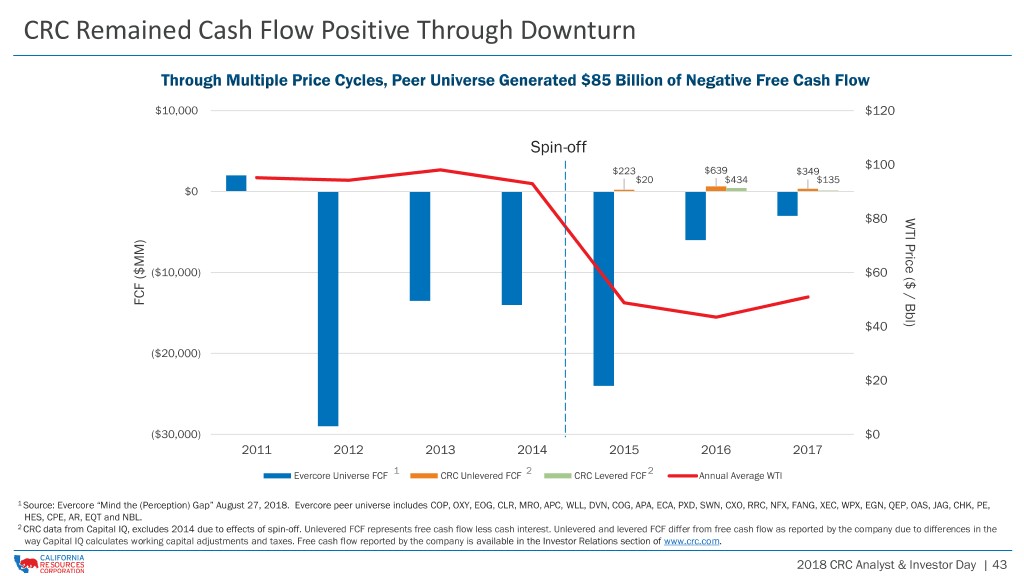

CRC Remained Cash Flow Positive Through Downturn Spin-off 1 2 2 1 Source: Evercore “Mind the (Perception) Gap” August 27, 2018. Evercore peer universe includes COP, OXY, EOG, CLR, MRO, APC, WLL, DVN, COG, APA, ECA, PXD, SWN, CXO, RRC, NFX, FANG, XEC, WPX, EGN, QEP, OAS, JAG, CHK, PE, HES, CPE, AR, EQT and NBL. 2 CRC data from Capital IQ, excludes 2014 due to effects of spin-off. Unlevered FCF represents free cash flow less cash interest. Unlevered and levered FCF differ from free cash flow as reported by the company due to differences in the way Capital IQ calculates working capital adjustments and taxes. Free cash flow reported by the company is available in the Investor Relations section of www.crc.com. 2018 CRC Analyst & Investor Day | 43

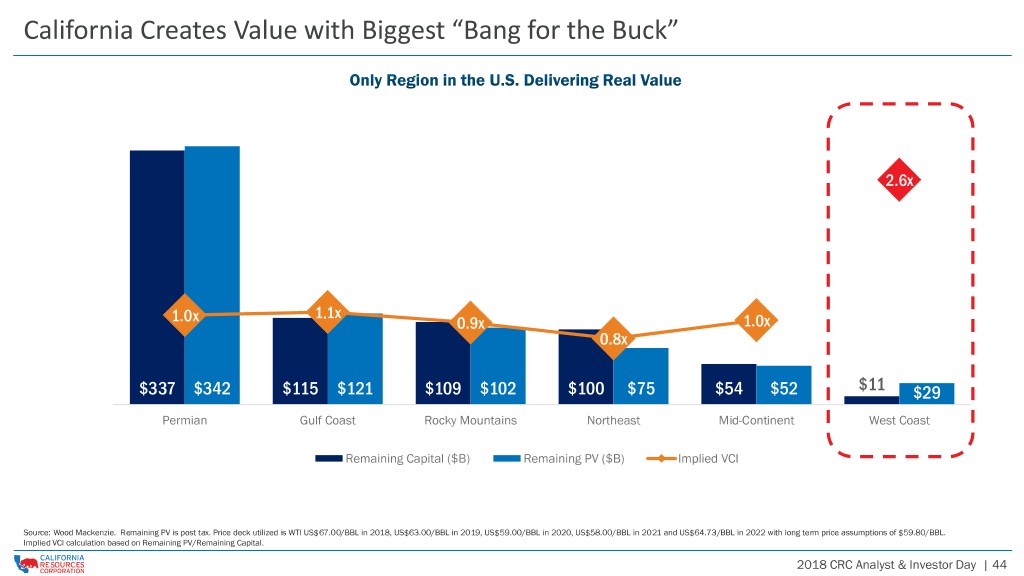

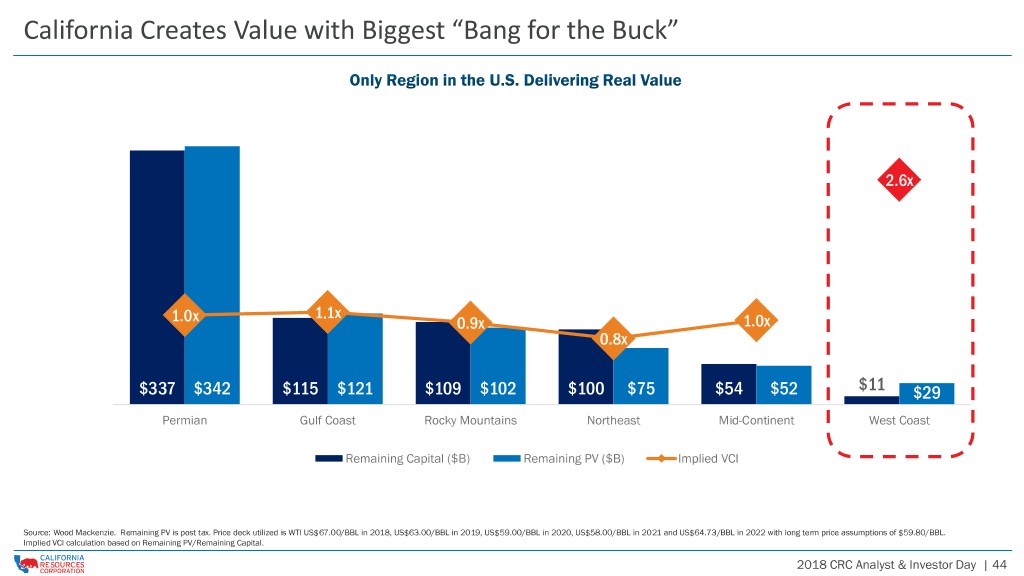

California Creates Value with Biggest “Bang for the Buck” $350,000 3.0x $300,000 2.6x 2.5x $250,000 2.0x $200,000 1.5x $150,000 1.0x 1.1x 1.0x $100,000 0.9x 1.0x 0.8x $50,000 0.5x $337 $342 $115 $121 $109 $102 $100 $75 $54 $52 $11 $29 $0 0.0x Permian Gulf Coast Rocky Mountains Northeast Mid-Continent West Coast Remaining Capital ($B) Remaining PV ($B) Implied VCI Source: Wood Mackenzie. Remaining PV is post tax. Price deck utilized is WTI US$67.00/BBL in 2018, US$63.00/BBL in 2019, US$59.00/BBL in 2020, US$58.00/BBL in 2021 and US$64.73/BBL in 2022 with long term price assumptions of $59.80/BBL. Implied VCI calculation based on Remaining PV/Remaining Capital. 2018 CRC Analyst & Investor Day | 44

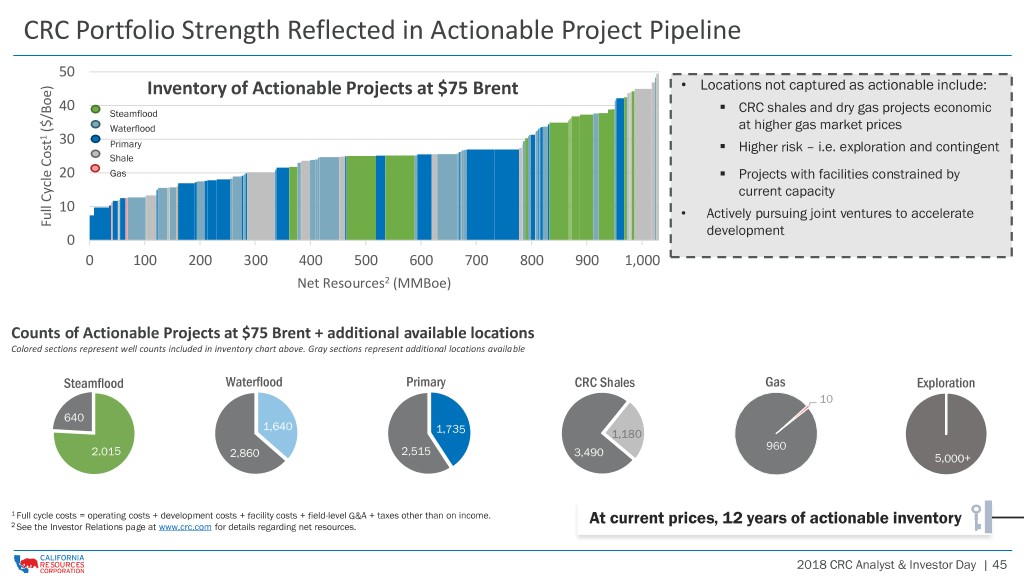

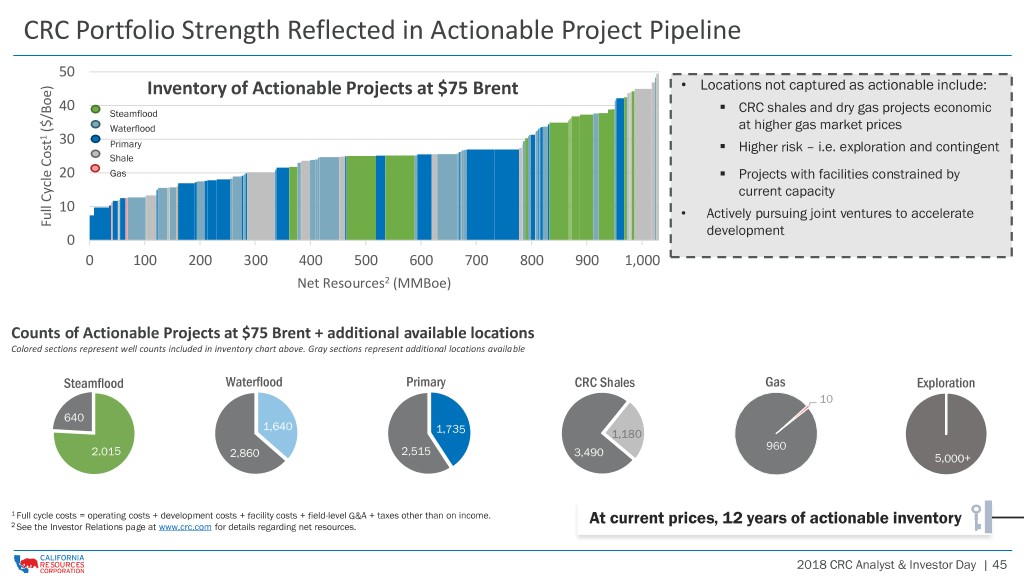

CRC Portfolio Strength Reflected in Actionable Project Pipeline 50 Inventory of Actionable Projects at $75 Brent • Locations not captured as actionable include: ▪ 40 Steamflood CRC shales and dry gas projects economic ($/Boe) Waterflood at higher gas market prices 1 30 Primary ▪ Higher risk – i.e. exploration and contingent Shale 20 Gas ▪ Projects with facilities constrained by current capacity 10 • Actively pursuing joint ventures to accelerate Full Cycle Cost Cycle Full development 0 0 100 200 300 400 500 600 700 800 900 1,000 Net Resources2 (MMBoe) Counts of Actionable Projects at $75 Brent + additional available locations Colored sections represent well counts included in inventory chart above. Gray sections represent additional locations available Steamflood Waterflood Primary CRC Shales Gas Exploration 10 640 1,640 1,735 1,180 2,015 2,515 960 2,860 3,490 5,000+ 1 Full cycle costs = operating costs + development costs + facility costs + field-level G&A + taxes other than on income. At current prices, 12 years of actionable inventory 2 See the Investor Relations page at www.crc.com for details regarding net resources. 2018 CRC Analyst & Investor Day | 45

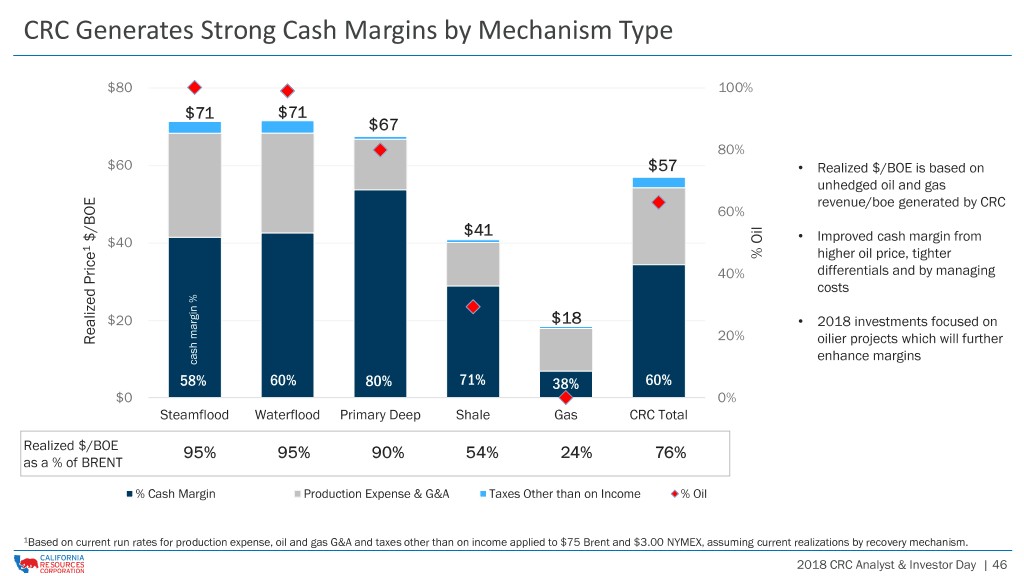

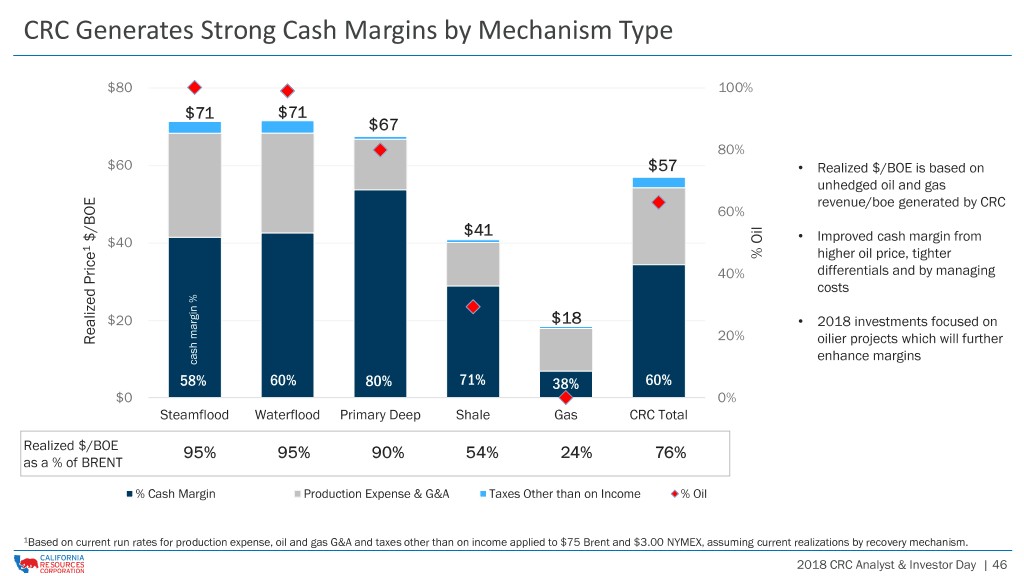

CRC Generates Strong Cash Margins by Mechanism Type $80 100% 80% $60 60% $40 % Oil % 40% $20 20% $0 0% 1Based on current run rates for production expense, oil and gas G&A and taxes other than on income applied to $75 Brent and $3.00 NYMEX, assuming current realizations by recovery mechanism. 2018 CRC Analyst & Investor Day | 46

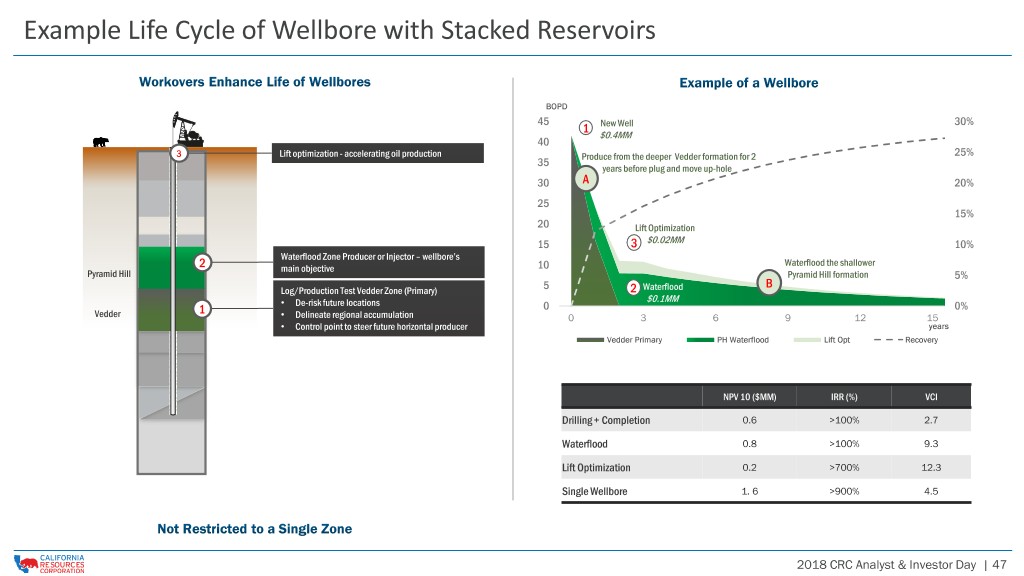

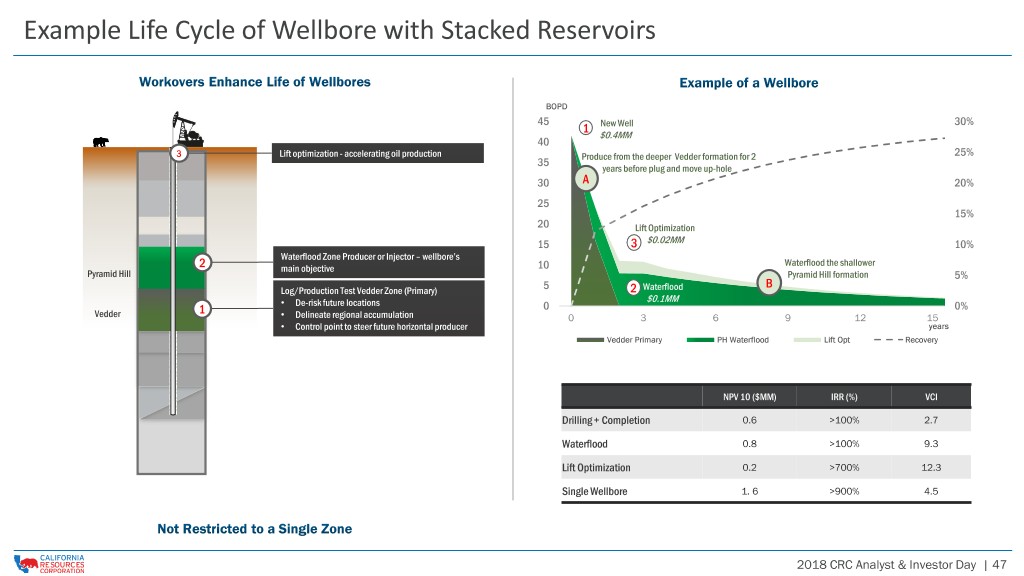

Example Life Cycle of Wellbore with Stacked Reservoirs 1 3 A 3 2 2 B 1 NPV 10 ($MM) IRR (%) VCI 2018 CRC Analyst & Investor Day | 47

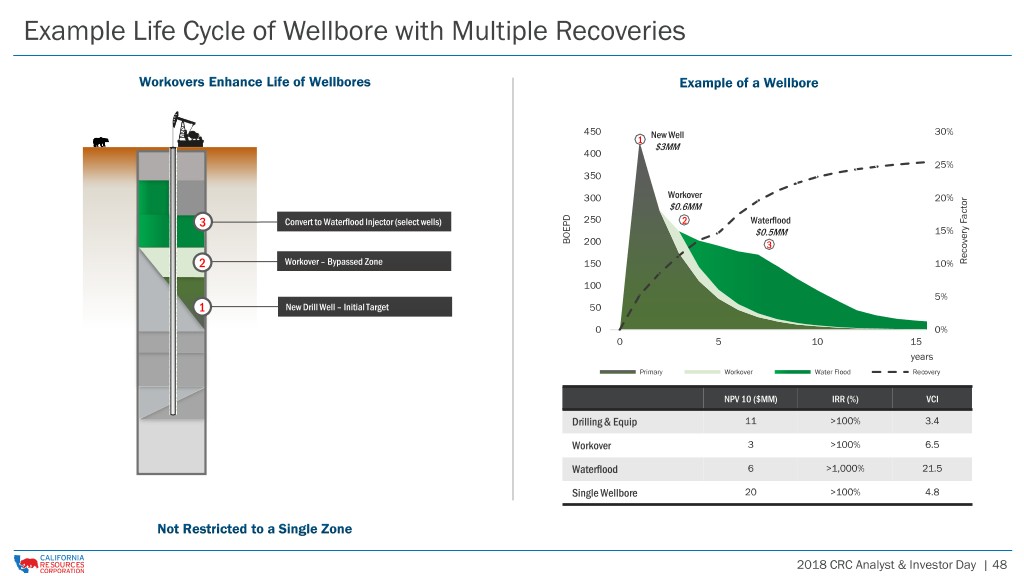

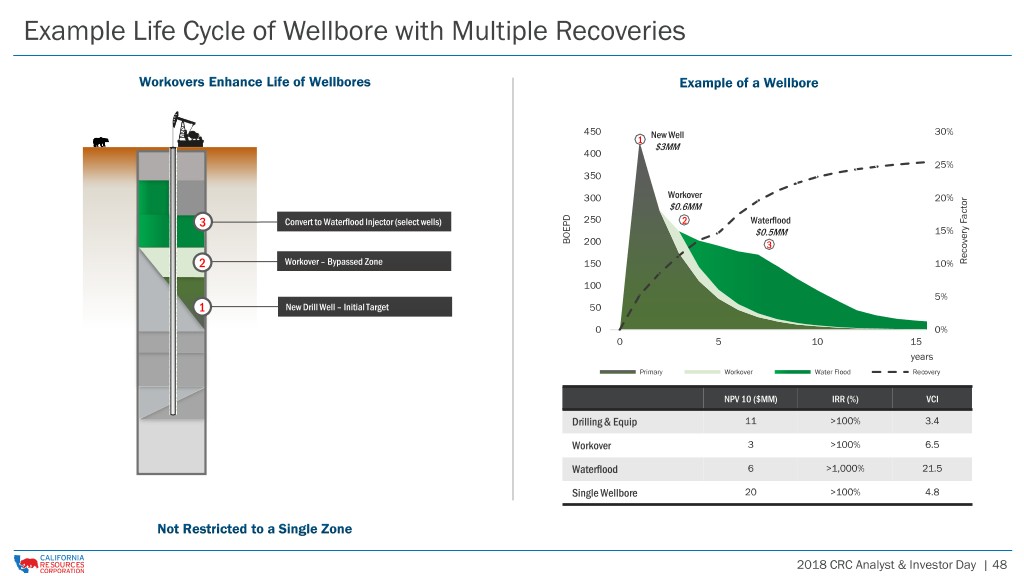

Example Life Cycle of Wellbore with Multiple Recoveries 450 30% 1 400 25% 350 300 20% 3 250 2 15% BOEPD 200 3 2 150 10% Recovery Factor 100 5% 1 50 0 0% 0 5 10 15 years Primary Workover Water Flood Recovery NPV 10 ($MM) IRR (%) VCI 2018 CRC Analyst & Investor Day | 48

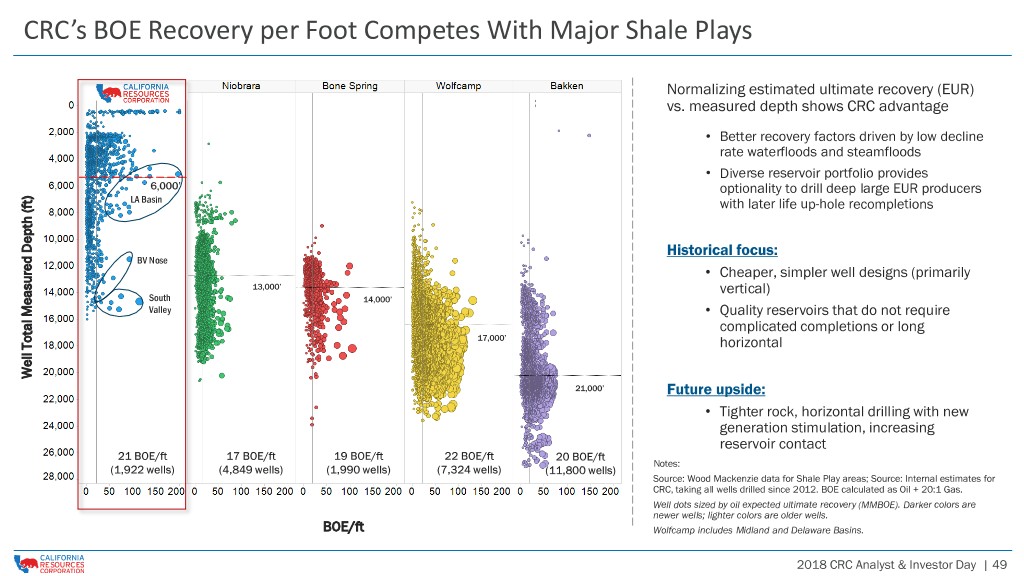

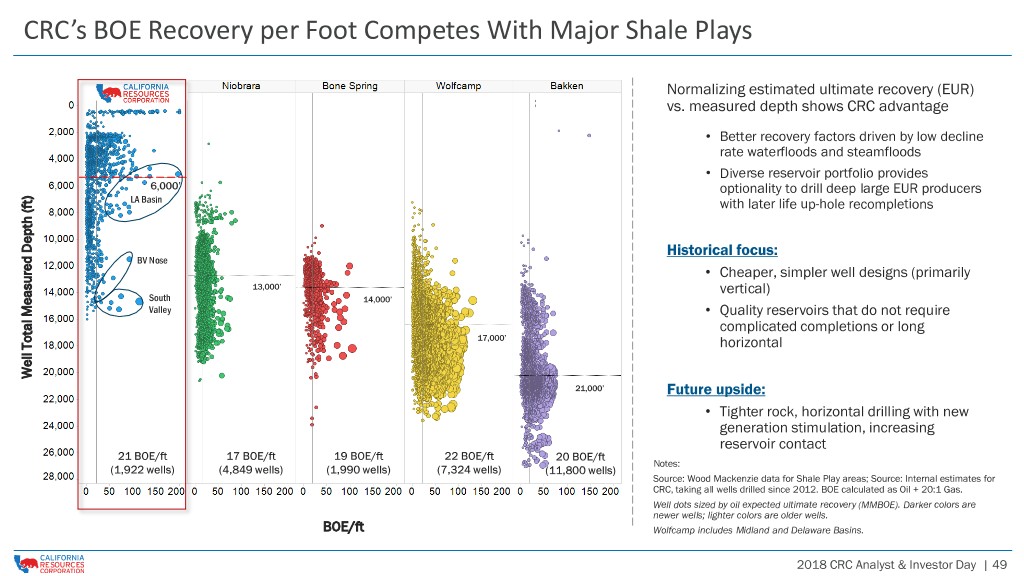

CRC’s BOE Recovery per Foot Competes With Major Shale Plays Normalizing estimated ultimate recovery (EUR) vs. measured depth shows CRC advantage • Better recovery factors driven by low decline rate waterfloods and steamfloods • Diverse reservoir portfolio provides 6,000’ optionality to drill deep large EUR producers LA Basin with later life up-hole recompletions Historical focus: BV Nose • Cheaper, simpler well designs (primarily 13,000’ vertical) South 14,000’ Valley • Quality reservoirs that do not require complicated completions or long 17,000’ horizontal Well TotalWellMeasuredDepth(ft) 21,000’ Future upside: • Tighter rock, horizontal drilling with new generation stimulation, increasing reservoir contact Notes: Source: Wood Mackenzie data for Shale Play areas; Source: Internal estimates for CRC, taking all wells drilled since 2012. BOE calculated as Oil + 20:1 Gas. Well dots sized by oil expected ultimate recovery (MMBOE). Darker colors are newer wells; lighter colors are older wells. BOE/ft Wolfcamp includes Midland and Delaware Basins. 2018 CRC Analyst & Investor Day | 49

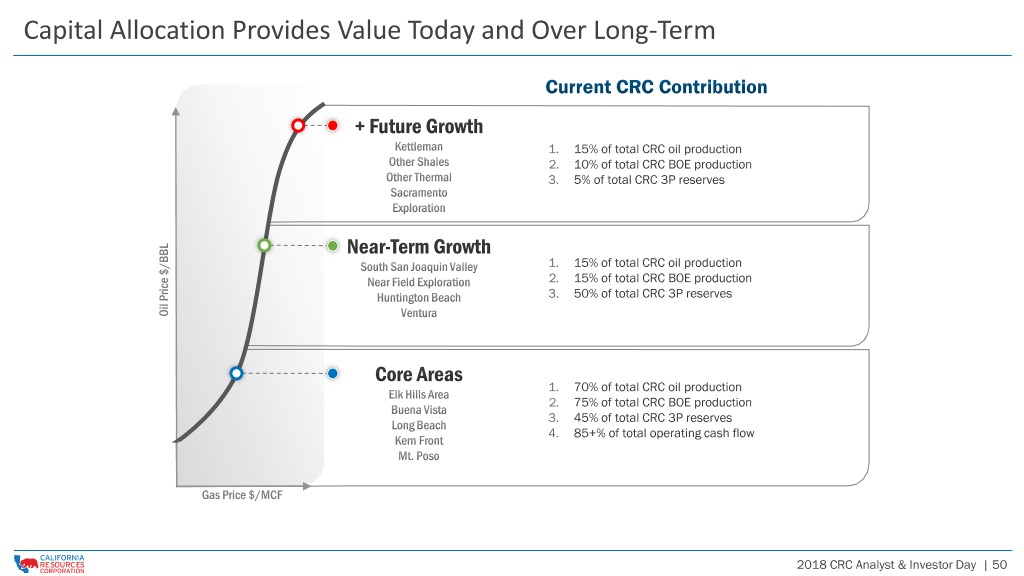

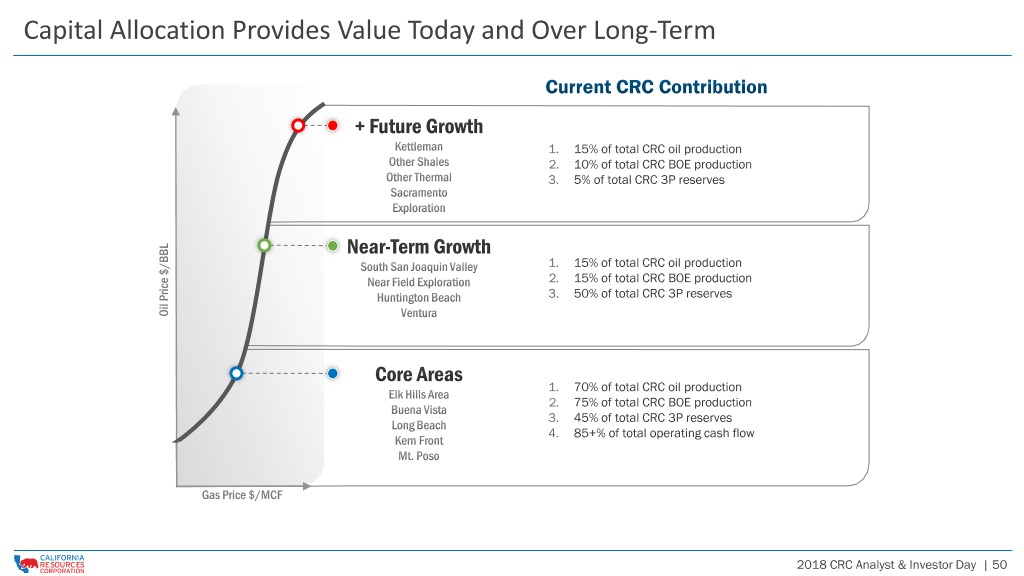

Capital Allocation Provides Value Today and Over Long-Term 1. 2. 3. 1. 2. 3. 1. 2. 3. 4. 2018 CRC Analyst & Investor Day | 50

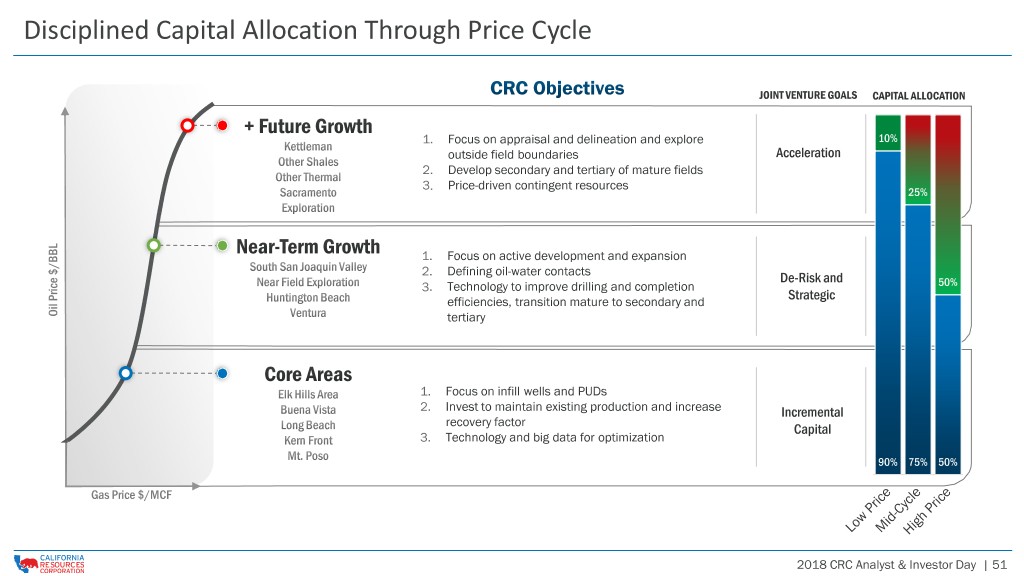

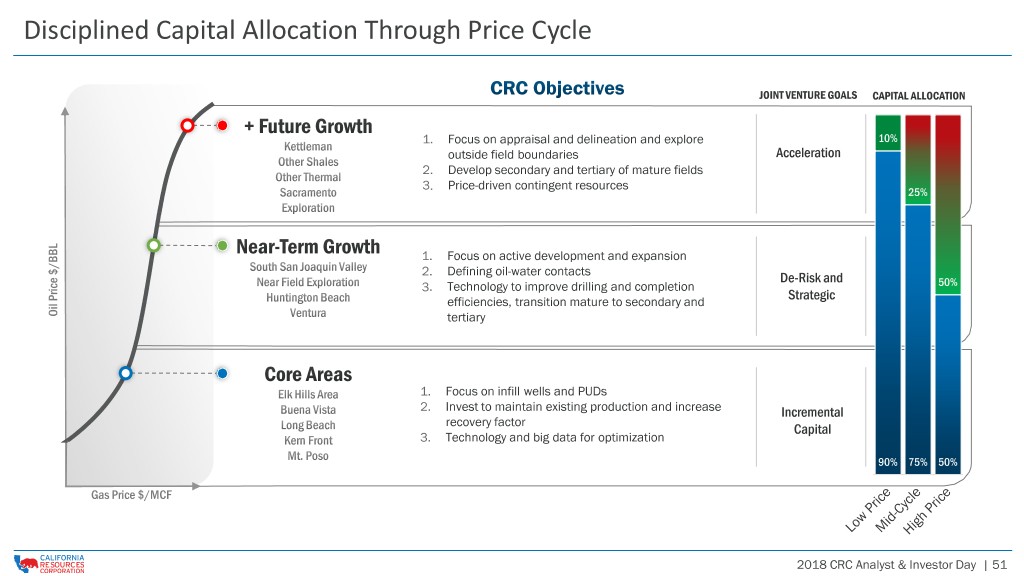

Disciplined Capital Allocation Through Price Cycle 1. 2. 3. 1. 2. 3. 1. 2. 3. 2018 CRC Analyst & Investor Day | 51

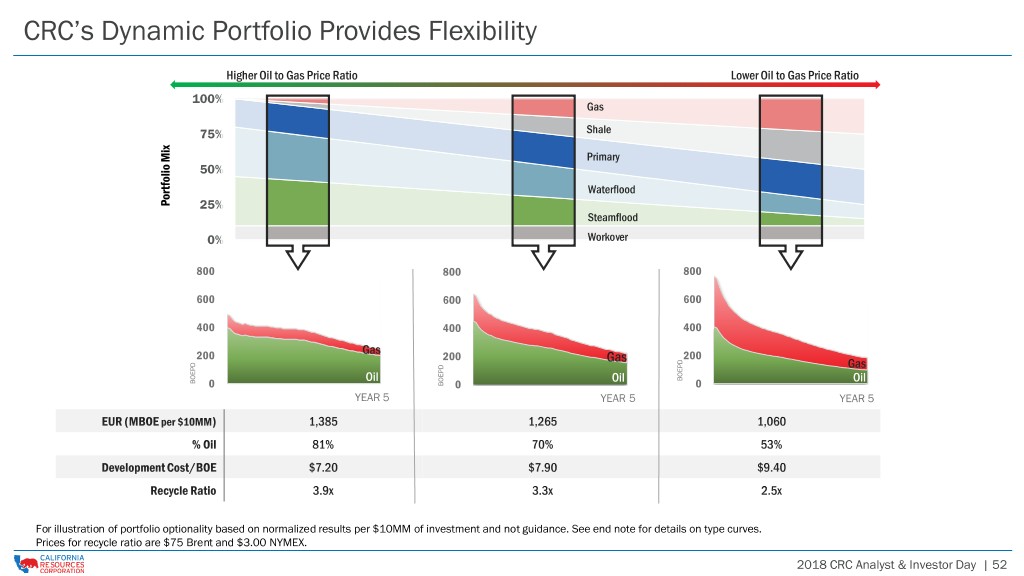

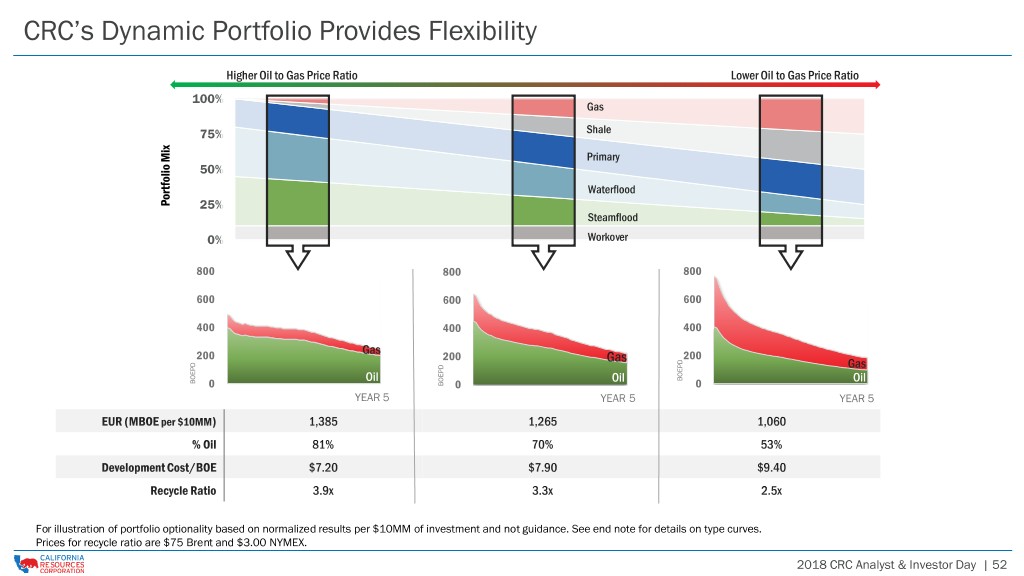

CRC’s Dynamic Portfolio Provides Flexibility 100% Gas 75% Shale Primary 50% Waterflood Portfolio Mix Portfolio 25% Steamflood 0% Workover 800 800 800 600 600 600 400 400 400 200 200 200 Oil BOEPD BOEPD Oil Oil 0 BOEPD 0 0 YEAR 5 YEAR 5 YEAR 5 For illustration of portfolio optionality based on normalized results per $10MM of investment and not guidance. See end note for details on type curves. Prices for recycle ratio are $75 Brent and $3.00 NYMEX. 2018 CRC Analyst & Investor Day | 52

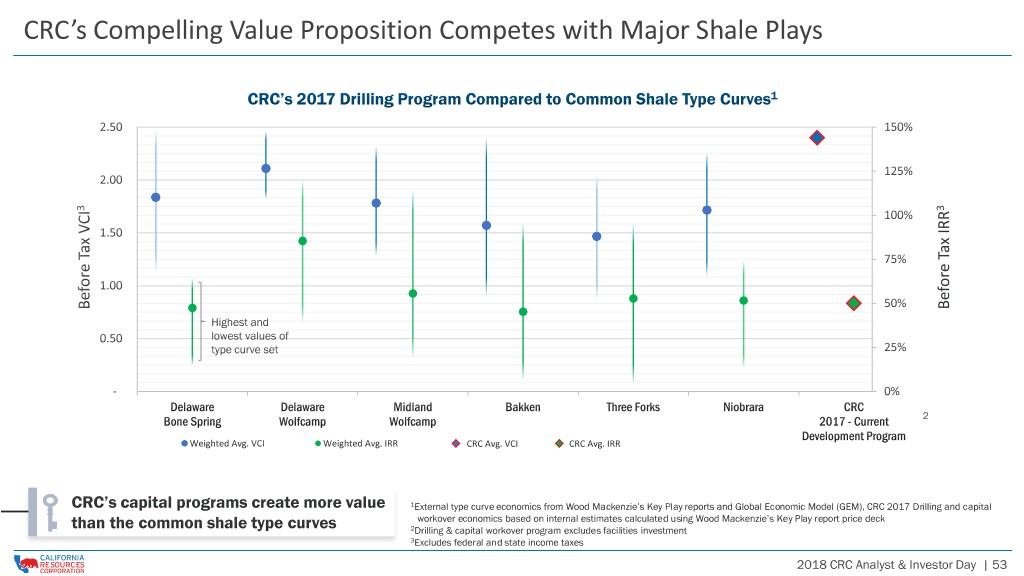

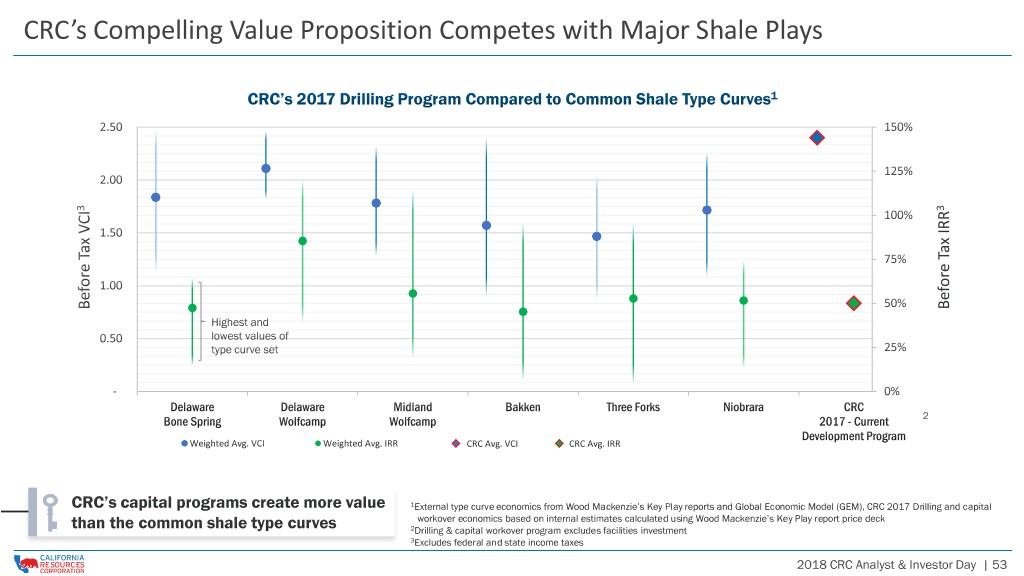

CRC’s Compelling Value Proposition Competes with Major Shale Plays 2 1External type curve economics from Wood Mackenzie’s Key Play reports and Global Economic Model (GEM), CRC 2017 Drilling and capital workover economics based on internal estimates calculated using Wood Mackenzie’s Key Play report price deck 2Drilling & capital workover program excludes facilities investment 3Excludes federal and state income taxes 2018 CRC Analyst & Investor Day | 53

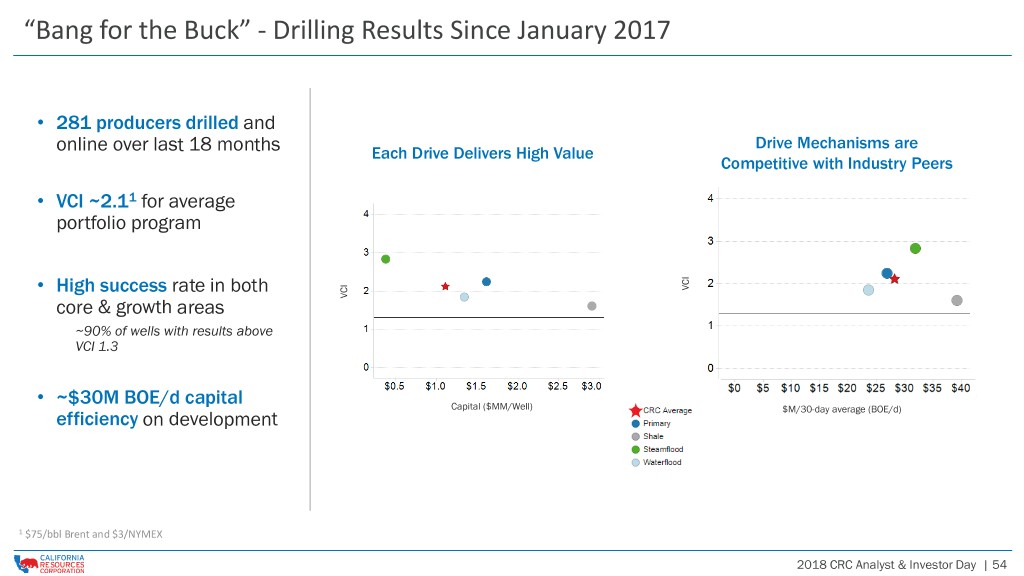

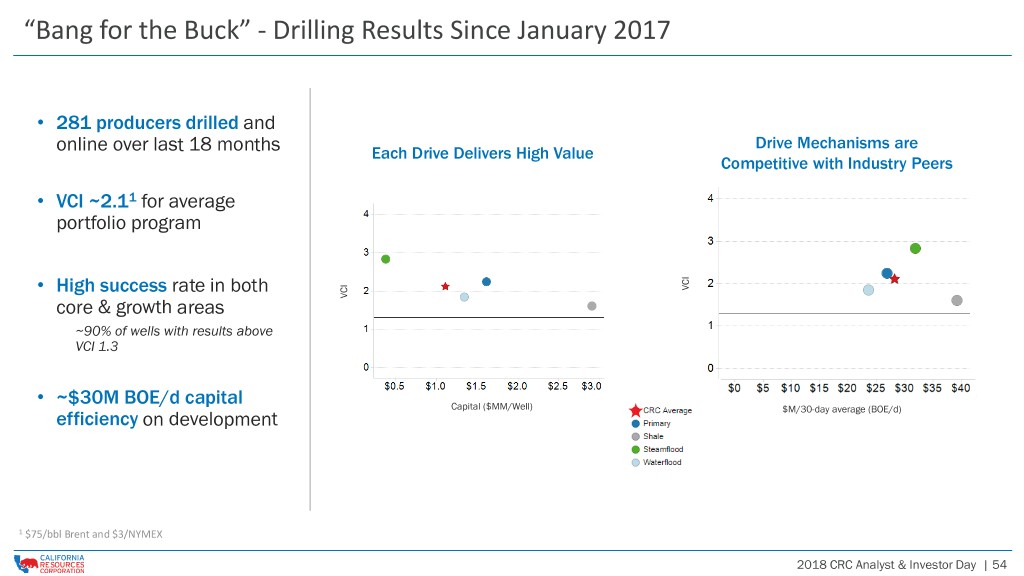

“Bang for the Buck” - Drilling Results Since January 2017 • 281 producers drilled and Drive Mechanisms are online over last 18 months Each Drive Delivers High Value Competitive with Industry Peers • VCI ~2.11 for average portfolio program • High success rate in both core & growth areas ~90% of wells with results above VCI 1.3 • ~$30M BOE/d capital efficiency on development 1 $75/bbl Brent and $3/NYMEX 2018 CRC Analyst & Investor Day | 54

Value-Driven CRC differentiated conventional assets compete favorably versus the shale model, delivering $ attractive VCI-based returns and compelling value to shareholders Our portfolio management approach to capital allocation is tailored for the asset base and cyclical nature of the commodity environment, providing for value-driven optionality and flexibility CRC assets deliver great value, which translates to both NPV growth and benefits to $ near-term financial performance Deep inventory of actionable projects that create significant running room to drive growth in the near and longer term 2018 CRC Analyst & Investor Day | 55

DRIVING OPERATIONAL EXCELLENCE Shawn Kerns, EVP Operations and Engineering

Unparalleled California Expertise Largest Operator in Extensive Field California Growth Areas Operations Experience Operate across Core Areas of observed field ~12,000 wells 135 fields behavior and Decades demonstrated shallow base decline rates CRC’s experienced team Elk Hills built this position Kern Front Mount Poso ~ 20,000 net identified Buena Vista proven and unproven drilling locations in 2017 Wilmington/ Huntington #1 in Sacramento Basin Beach 86% of basin production, 85% of basin mineral acreage Core Assets Provide #2 in San Joaquin Basin Operational Leverage 26% of basin production, 60% of basin mineral acreage Applying analog development #1 in Ventura Basin to adjacent fields 25% of basin production, 90% of basin mineral acreage #1 in Los Angeles Basin Midstream infrastructure 52% of basin production, 65% of basin mineral acreage provides low cost advantage Source: DOGGR 2018 CRC Analyst & Investor Day | 57

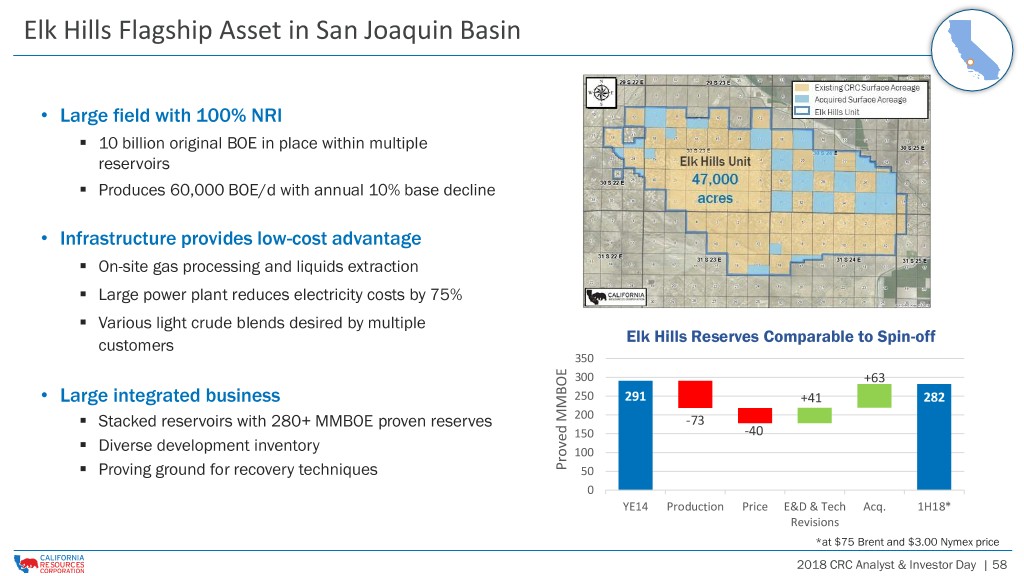

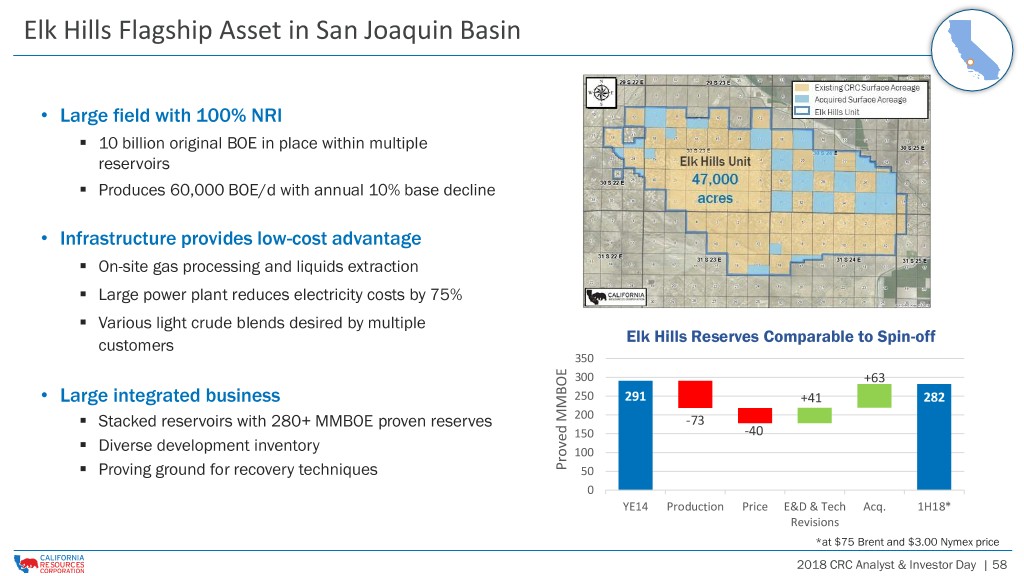

Elk Hills Flagship Asset in San Joaquin Basin • Large field with 100% NRI ▪ 10 billion original BOE in place within multiple reservoirs ▪ Produces 60,000 BOE/d with annual 10% base decline • Infrastructure provides low-cost advantage ▪ On-site gas processing and liquids extraction ▪ Large power plant reduces electricity costs by 75% ▪ Various light crude blends desired by multiple Elk Hills Reserves Comparable to Spin-off customers 350 300 +63 • Large integrated business 250 291 +41 282 ▪ Stacked reservoirs with 280+ MMBOE proven reserves 200 -73 ▪ 150 -40 Diverse development inventory 100 ▪ MMBOE Proved Proving ground for recovery techniques 50 0 YE14 Production Price E&D & Tech Acq. 1H18* Revisions *at $75 Brent and $3.00 Nymex price 2018 CRC Analyst & Investor Day | 58

ELK HILLS VIDEO See the Investor Relations page at www.crc.com to access this video.

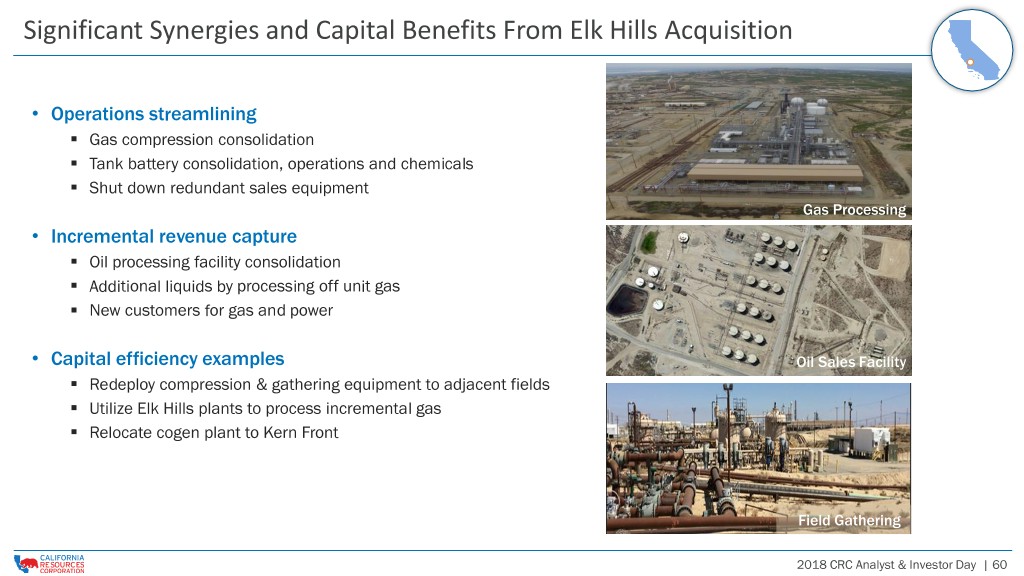

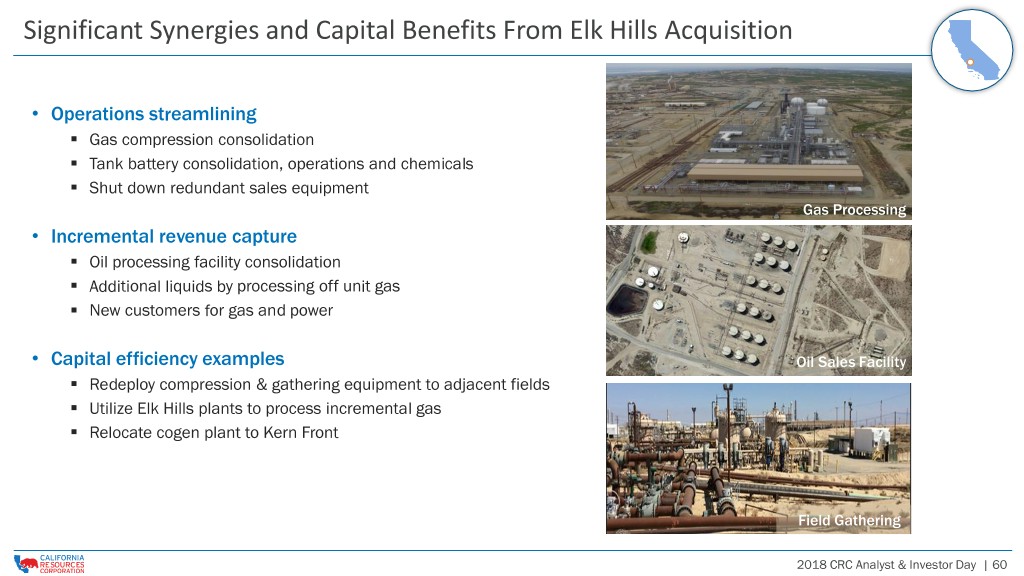

Significant Synergies and Capital Benefits From Elk Hills Acquisition • Operations streamlining ▪ Gas compression consolidation ▪ Tank battery consolidation, operations and chemicals ▪ Shut down redundant sales equipment Gas Processing • Incremental revenue capture ▪ Oil processing facility consolidation ▪ Additional liquids by processing off unit gas ▪ New customers for gas and power • Capital efficiency examples Oil Sales Facility ▪ Redeploy compression & gathering equipment to adjacent fields ▪ Utilize Elk Hills plants to process incremental gas ▪ Relocate cogen plant to Kern Front Field Gathering 2018 CRC Analyst & Investor Day | 60

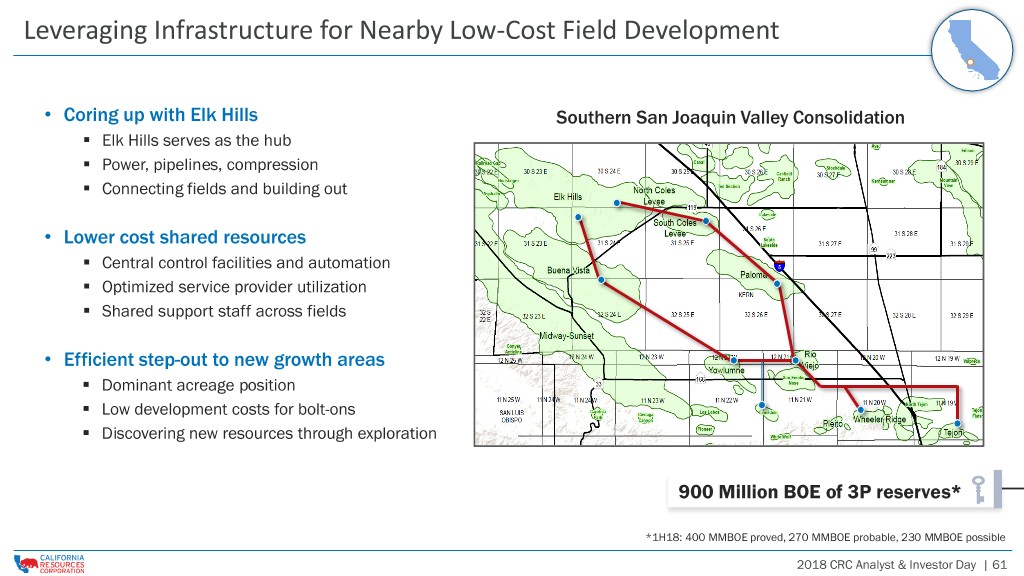

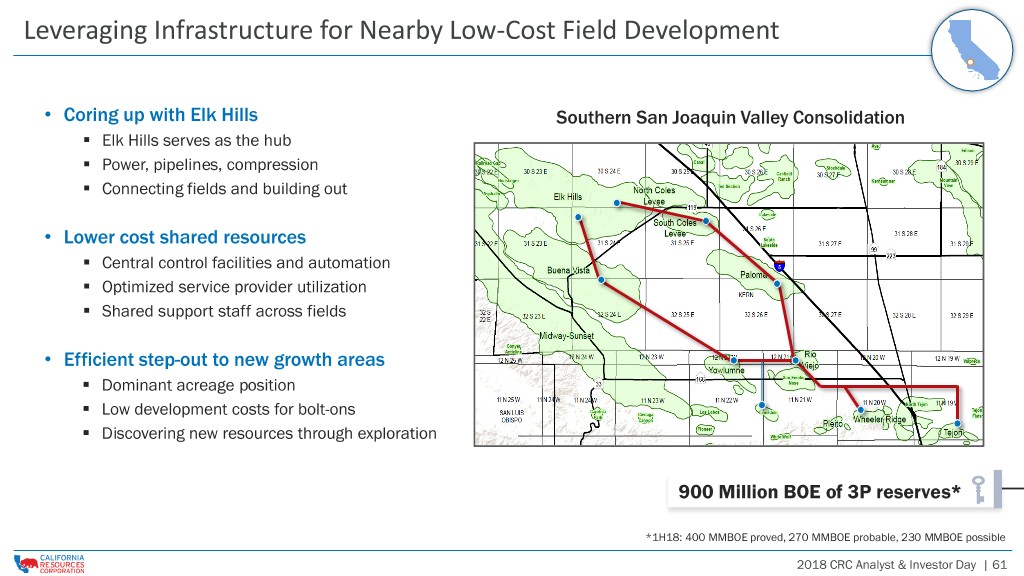

Leveraging Infrastructure for Nearby Low-Cost Field Development • Coring up with Elk Hills Southern San Joaquin Valley Consolidation ▪ Elk Hills serves as the hub ▪ Power, pipelines, compression ▪ Connecting fields and building out • Lower cost shared resources ▪ Central control facilities and automation ▪ Optimized service provider utilization ▪ Shared support staff across fields • Efficient step-out to new growth areas ▪ Dominant acreage position ▪ Low development costs for bolt-ons ▪ Discovering new resources through exploration 900 Million BOE of 3P reserves* *1H18: 400 MMBOE proved, 270 MMBOE probable, 230 MMBOE possible 2018 CRC Analyst & Investor Day | 61

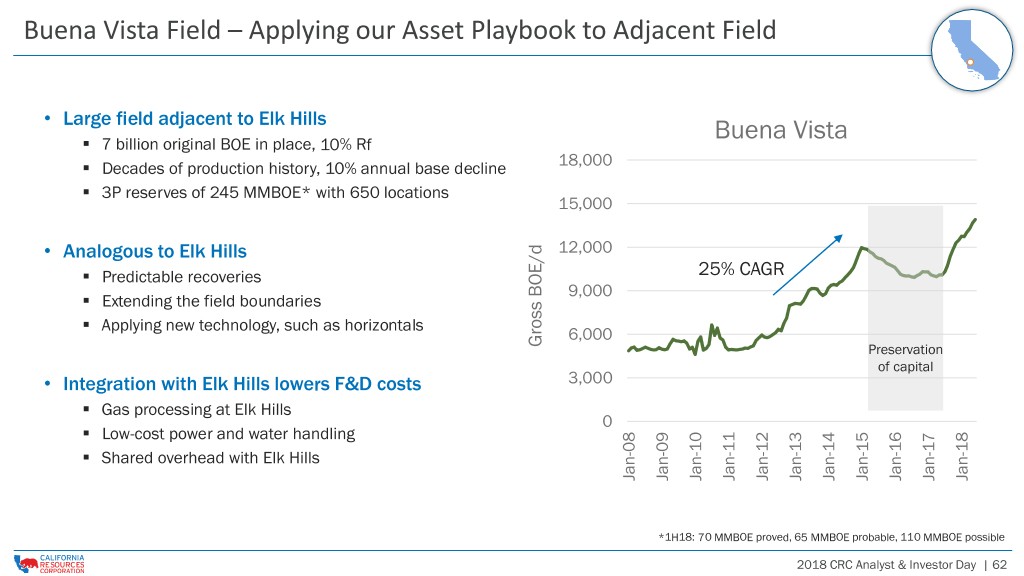

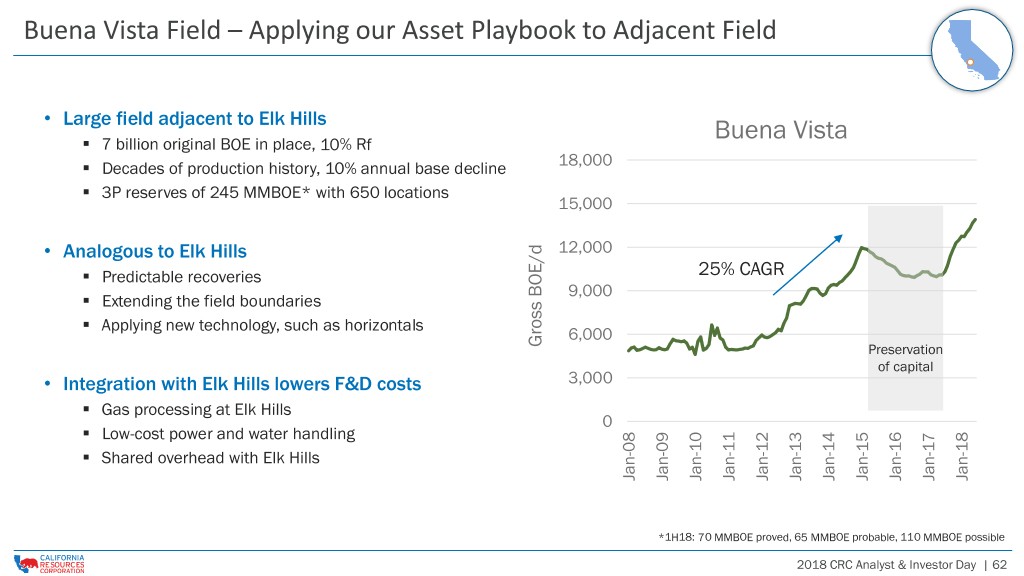

Buena Vista Field – Applying our Asset Playbook to Adjacent Field • Large field adjacent to Elk Hills Buena Vista ▪ 7 billion original BOE in place, 10% Rf ▪ Decades of production history, 10% annual base decline 18,000 ▪ 3P reserves of 245 MMBOE* with 650 locations 15,000 • Analogous to Elk Hills 12,000 ▪ Predictable recoveries 25% CAGR 9,000 ▪ Extending the field boundaries ▪ Applying new technology, such as horizontals 6,000 Gross BOE/d Gross Preservation of capital • Integration with Elk Hills lowers F&D costs 3,000 ▪ Gas processing at Elk Hills 0 ▪ Low-cost power and water handling ▪ Shared overhead with Elk Hills Jan-08 Jan-09 Jan-10 Jan-11 Jan-12 Jan-13 Jan-14 Jan-15 Jan-16 Jan-17 Jan-18 *1H18: 70 MMBOE proved, 65 MMBOE probable, 110 MMBOE possible 2018 CRC Analyst & Investor Day | 62

LOS ANGELES BASIN VIDEO See the Investor Relations page at www.crc.com to access this video.

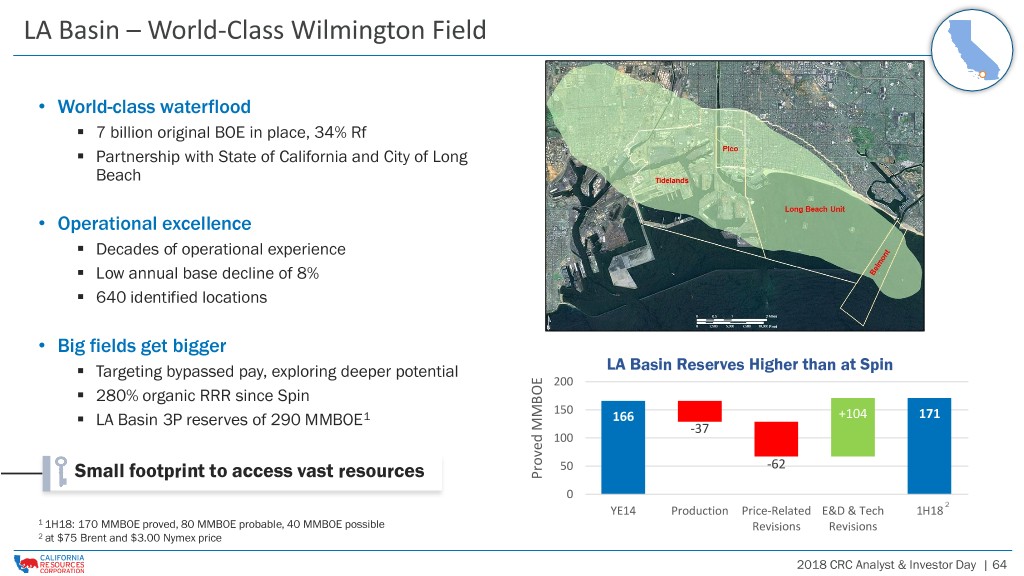

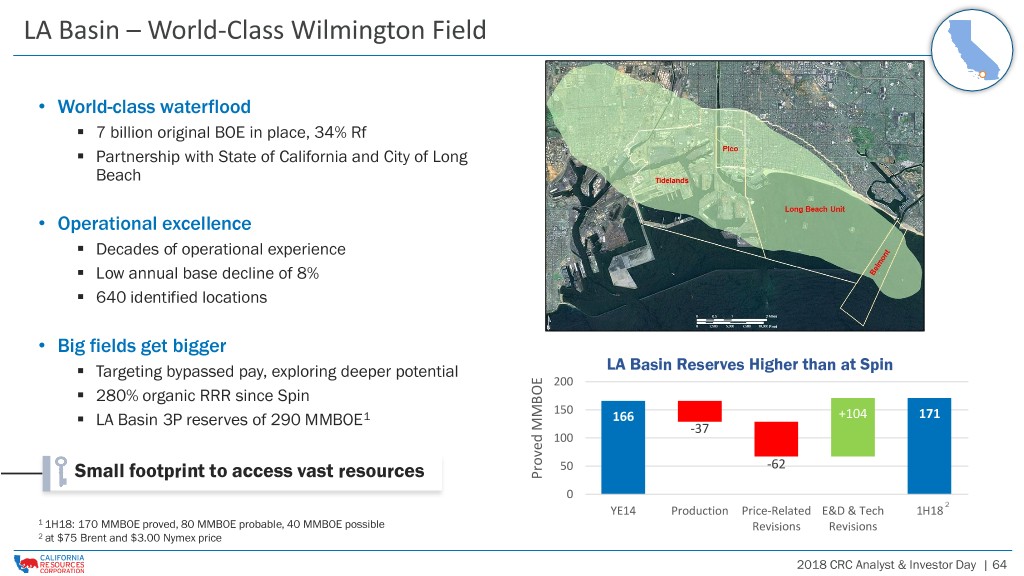

LA Basin – World-Class Wilmington Field • World-class waterflood ▪ 7 billion original BOE in place, 34% Rf ▪ Partnership with State of California and City of Long Beach • Operational excellence ▪ Decades of operational experience ▪ Low annual base decline of 8% ▪ 640 identified locations • Big fields get bigger ▪ Targeting bypassed pay, exploring deeper potential LA Basin Reserves Higher than at Spin 200 ▪ 280% organic RRR since Spin 150 ▪ LA Basin 3P reserves of 290 MMBOE1 166 +104 171 -37 100 50 -62 Small footprint to access vast resources MMBOE Proved 0 2 YE14 Production Price-Related E&D & Tech 1H18 1 1H18: 170 MMBOE proved, 80 MMBOE probable, 40 MMBOE possible Revisions Revisions 2 at $75 Brent and $3.00 Nymex price 2018 CRC Analyst & Investor Day | 64

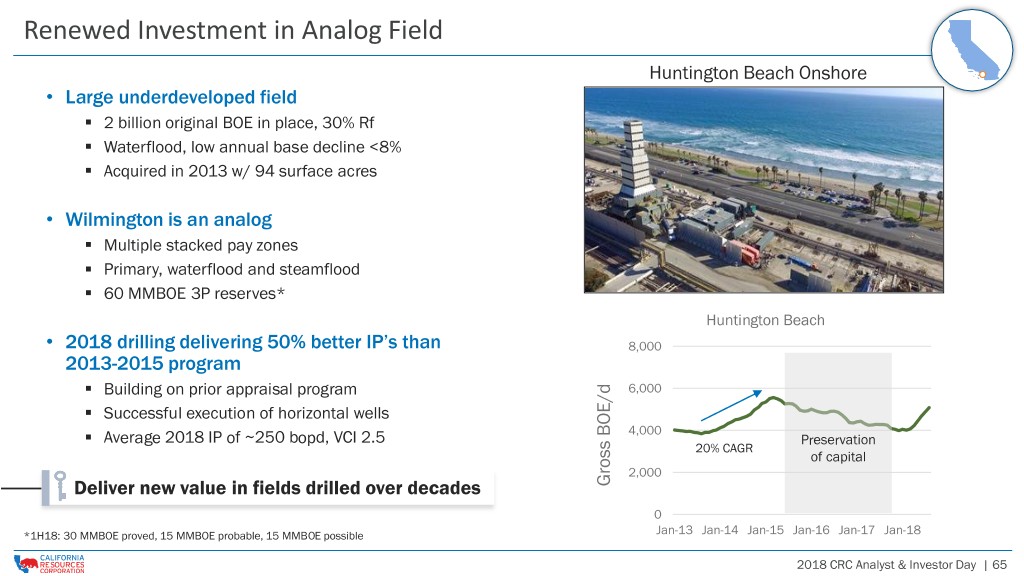

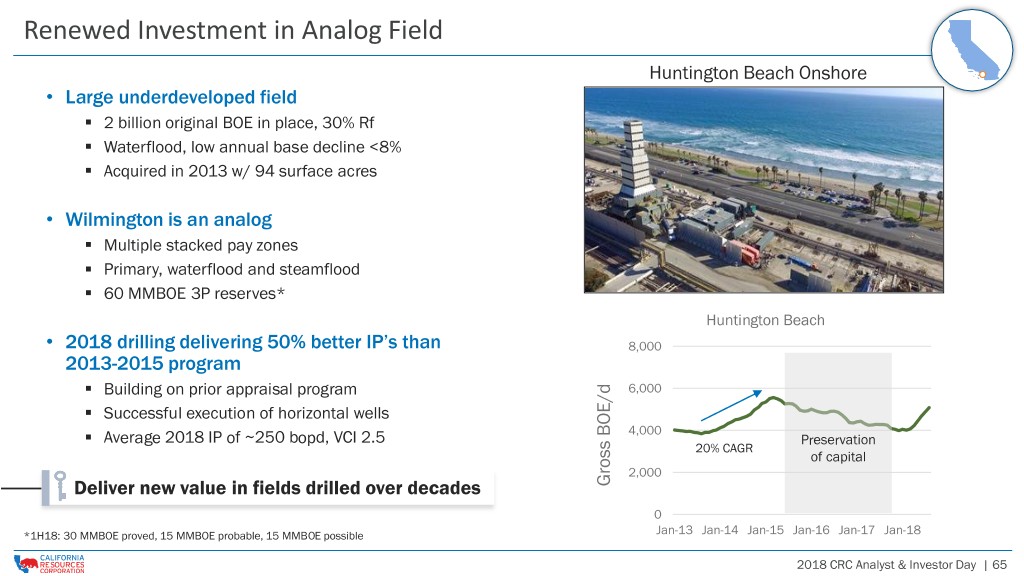

Renewed Investment in Analog Field Huntington Beach Onshore • Large underdeveloped field ▪ 2 billion original BOE in place, 30% Rf ▪ Waterflood, low annual base decline <8% ▪ Acquired in 2013 w/ 94 surface acres • Wilmington is an analog ▪ Multiple stacked pay zones ▪ Primary, waterflood and steamflood ▪ 60 MMBOE 3P reserves* Huntington Beach • 2018 drilling delivering 50% better IP’s than 8,000 2013-2015 program ▪ Building on prior appraisal program 6,000 ▪ Successful execution of horizontal wells ▪ 4,000 Average 2018 IP of ~250 bopd, VCI 2.5 Preservation 20% CAGR of capital 2,000 Deliver new value in fields drilled over decades BOE/d Gross 0 *1H18: 30 MMBOE proved, 15 MMBOE probable, 15 MMBOE possible Jan-13 Jan-14 Jan-15 Jan-16 Jan-17 Jan-18 2018 CRC Analyst & Investor Day | 65

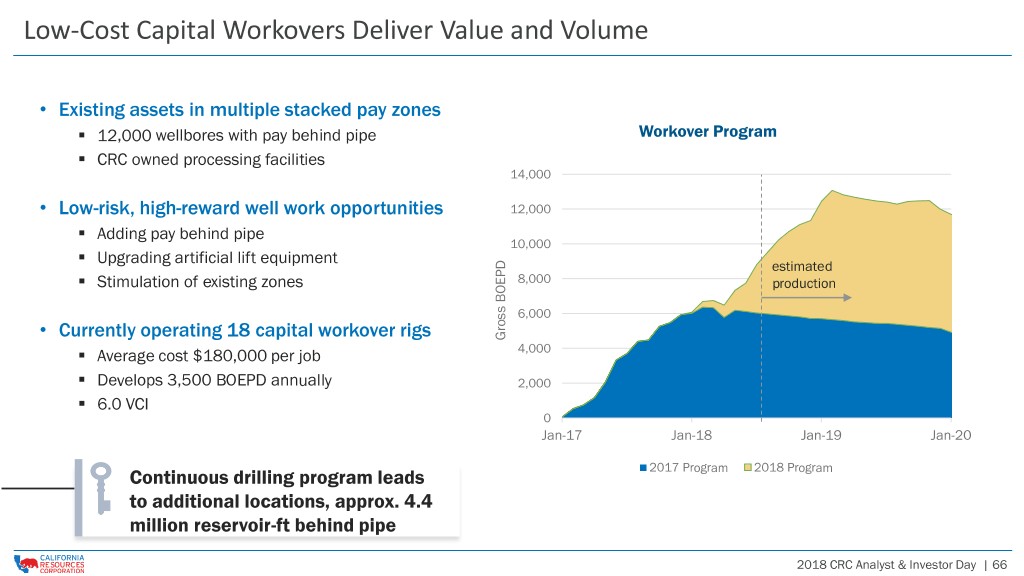

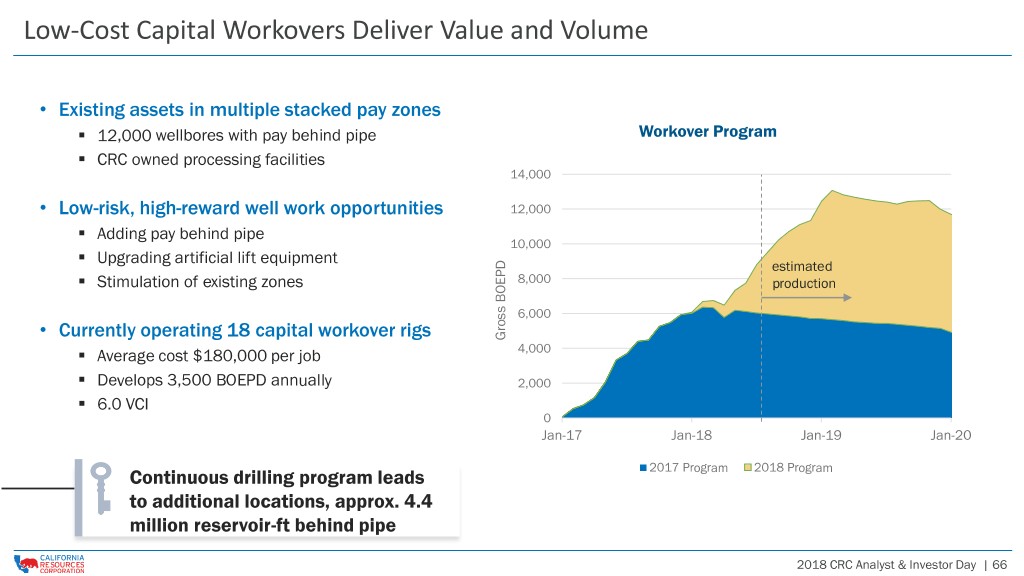

Low-Cost Capital Workovers Deliver Value and Volume • Existing assets in multiple stacked pay zones ▪ 12,000 wellbores with pay behind pipe Workover Program ▪ CRC owned processing facilities 14,000 • Low-risk, high-reward well work opportunities 12,000 ▪ Adding pay behind pipe 10,000 ▪ Upgrading artificial lift equipment estimated ▪ Stimulation of existing zones 8,000 production 6,000 Currently operating 18 capital workover rigs • Gross BOEPD ▪ Average cost $180,000 per job 4,000 ▪ Develops 3,500 BOEPD annually 2,000 ▪ 6.0 VCI 0 Jan-17 Jan-18 Jan-19 Jan-20 2017 Program 2018 Program Continuous drilling program leads to additional locations, approx. 4.4 million reservoir-ft behind pipe 2018 CRC Analyst & Investor Day | 66

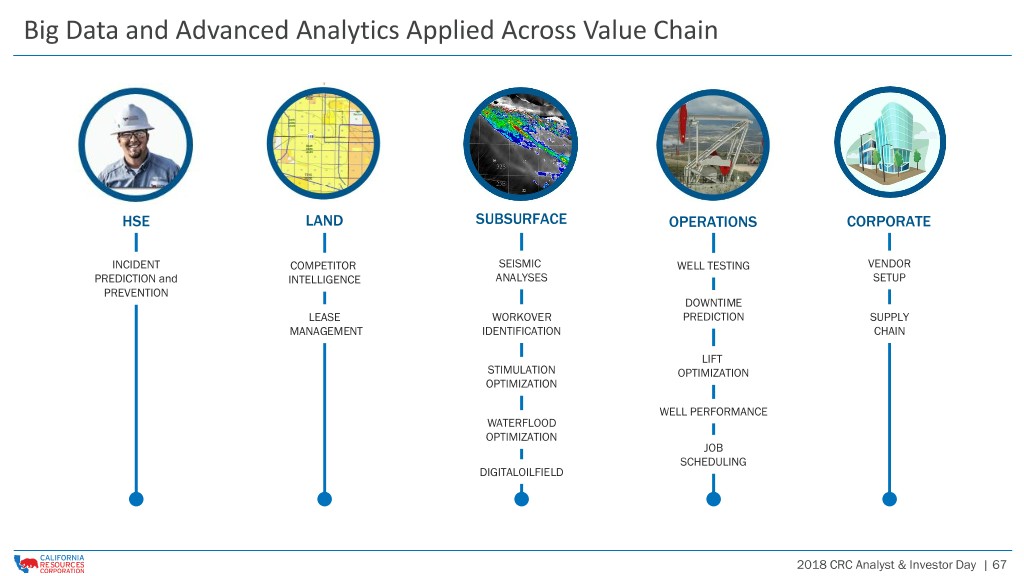

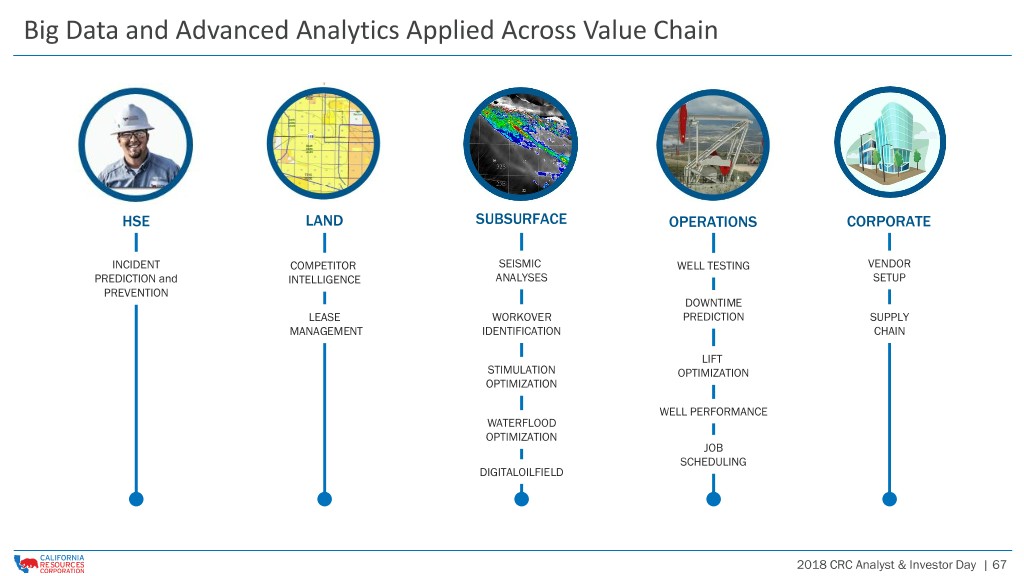

Big Data and Advanced Analytics Applied Across Value Chain HSE LAND SUBSURFACE OPERATIONS CORPORATE INCIDENT COMPETITOR SEISMIC WELL TESTING VENDOR PREDICTION and INTELLIGENCE ANALYSES SETUP PREVENTION DOWNTIME LEASE WORKOVER PREDICTION SUPPLY MANAGEMENT IDENTIFICATION CHAIN LIFT STIMULATION OPTIMIZATION OPTIMIZATION WELL PERFORMANCE WATERFLOOD OPTIMIZATION JOB SCHEDULING DIGITALOILFIELD 2018 CRC Analyst & Investor Day | 67

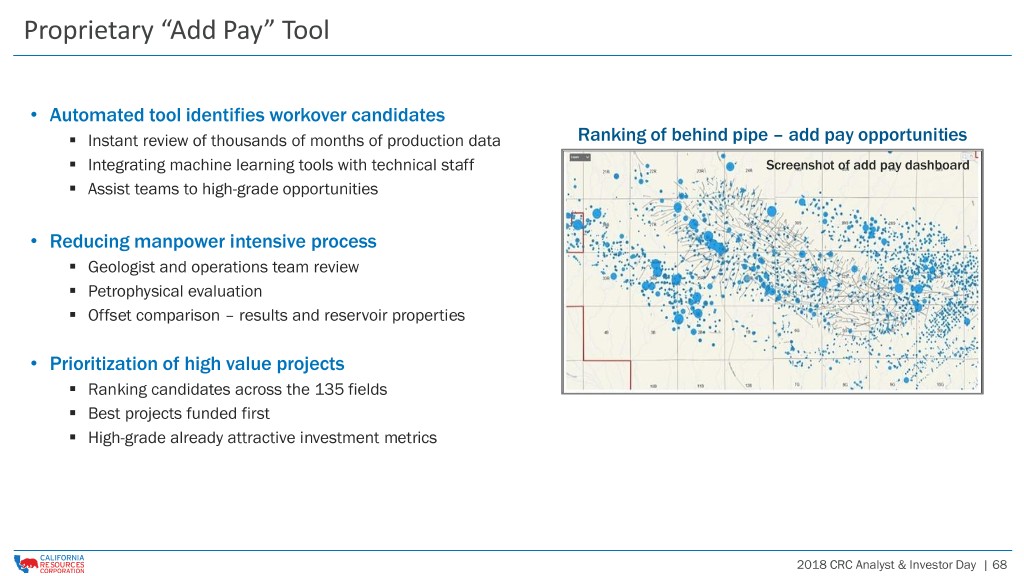

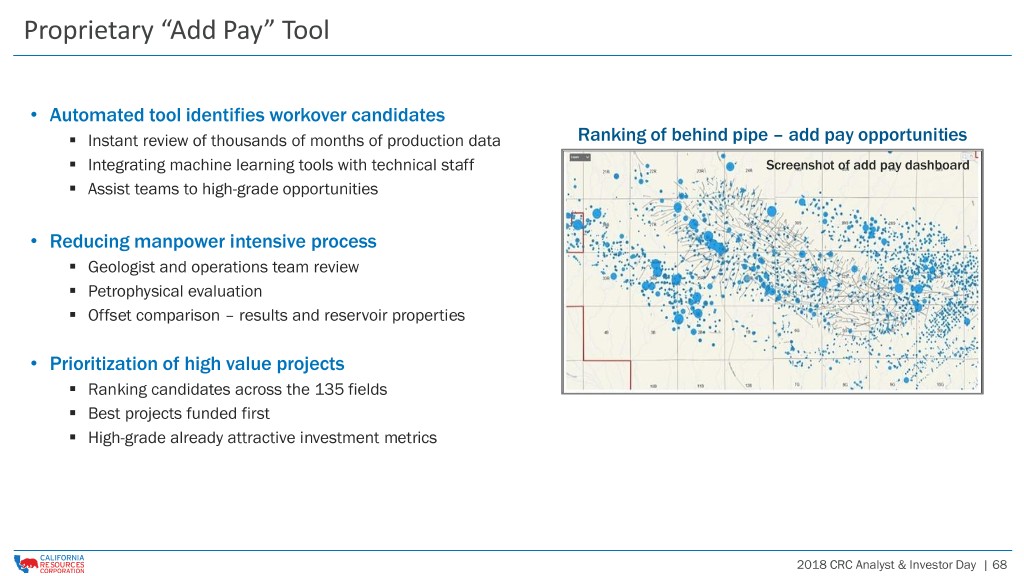

Proprietary “Add Pay” Tool • Automated tool identifies workover candidates ▪ Instant review of thousands of months of production data Ranking of behind pipe – add pay opportunities ▪ Integrating machine learning tools with technical staff Screenshot of add pay dashboard ▪ Assist teams to high-grade opportunities • Reducing manpower intensive process ▪ Geologist and operations team review ▪ Petrophysical evaluation ▪ Offset comparison – results and reservoir properties • Prioritization of high value projects ▪ Ranking candidates across the 135 fields ▪ Best projects funded first ▪ High-grade already attractive investment metrics 2018 CRC Analyst & Investor Day | 68

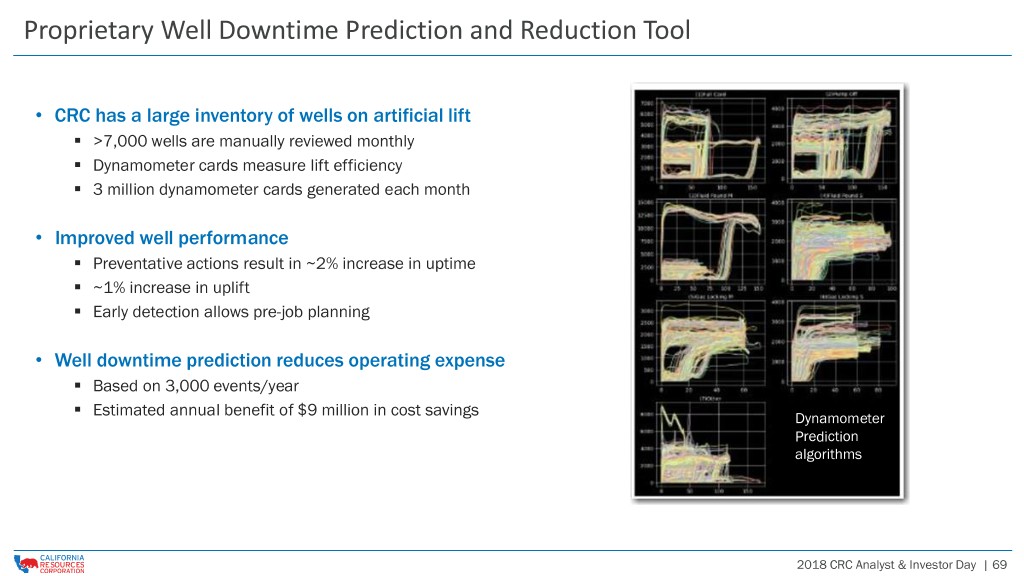

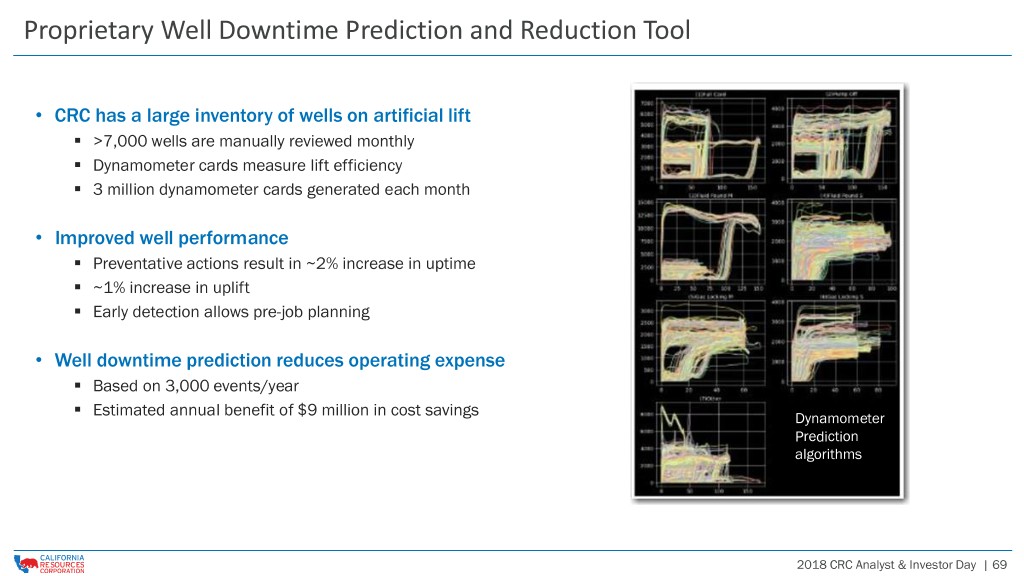

Proprietary Well Downtime Prediction and Reduction Tool • CRC has a large inventory of wells on artificial lift ▪ >7,000 wells are manually reviewed monthly ▪ Dynamometer cards measure lift efficiency ▪ 3 million dynamometer cards generated each month • Improved well performance ▪ Preventative actions result in ~2% increase in uptime ▪ ~1% increase in uplift ▪ Early detection allows pre-job planning • Well downtime prediction reduces operating expense ▪ Based on 3,000 events/year ▪ Estimated annual benefit of $9 million in cost savings Dynamometer Prediction algorithms 2018 CRC Analyst & Investor Day | 69

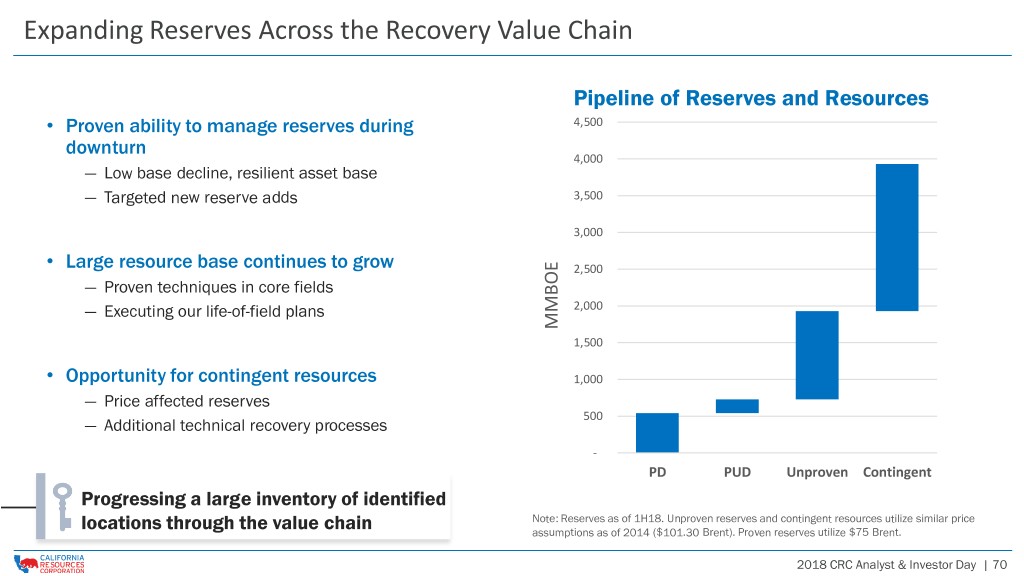

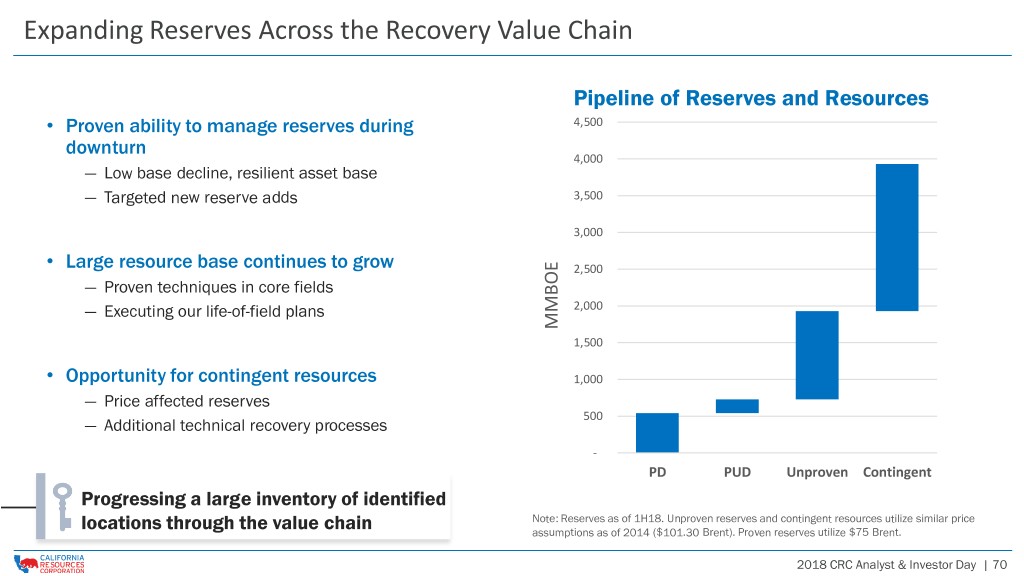

Expanding Reserves Across the Recovery Value Chain Pipeline of Reserves and Resources • Proven ability to manage reserves during 4,500 downturn 4,000 ― Low base decline, resilient asset base ― Targeted new reserve adds 3,500 3,000 • Large resource base continues to grow 2,500 ― Proven techniques in core fields ― Executing our life-of-field plans 2,000 MMBOE 1,500 • Opportunity for contingent resources 1,000 ― Price affected reserves 500 ― Additional technical recovery processes - PD PUD Unproven Contingent Progressing a large inventory of identified Note: Reserves as of 1H18. Unproven reserves and contingent resources utilize similar price locations through the value chain assumptions as of 2014 ($101.30 Brent). Proven reserves utilize $75 Brent. 2018 CRC Analyst & Investor Day | 70

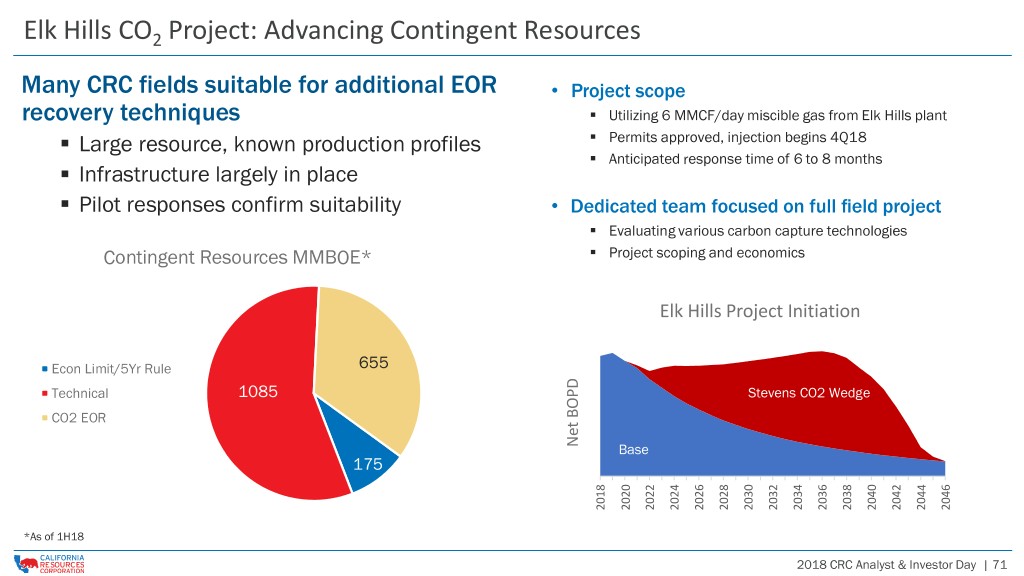

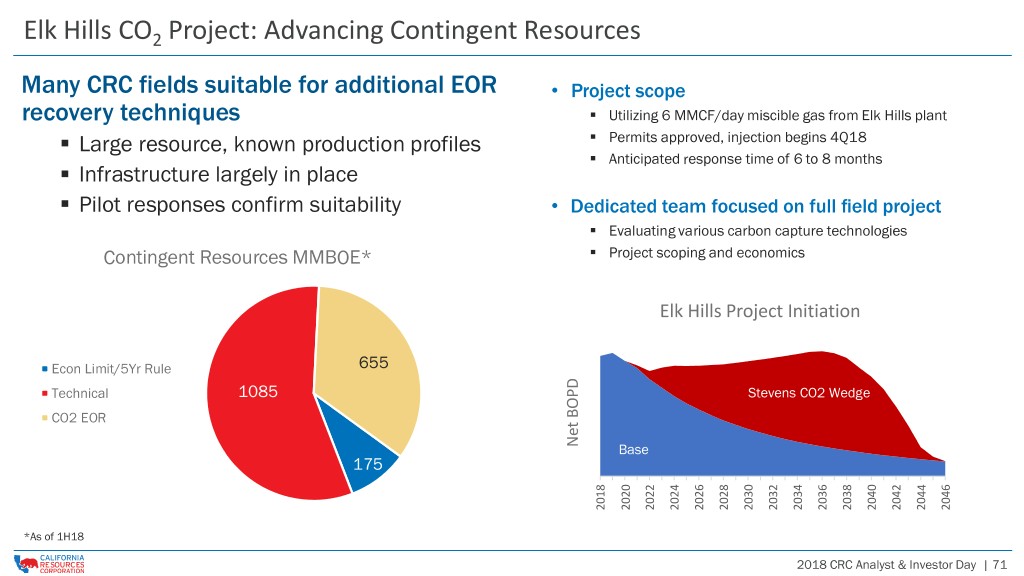

Elk Hills CO2 Project: Advancing Contingent Resources Many CRC fields suitable for additional EOR • Project scope recovery techniques ▪ Utilizing 6 MMCF/day miscible gas from Elk Hills plant ▪ ▪ Large resource, known production profiles Permits approved, injection begins 4Q18 ▪ Anticipated response time of 6 to 8 months ▪ Infrastructure largely in place ▪ Pilot responses confirm suitability • Dedicated team focused on full field project ▪ Evaluating various carbon capture technologies ▪ Contingent Resources MMBOE* Project scoping and economics Elk Hills Project Initiation Econ Limit/5Yr Rule 655 Technical 1085 Stevens CO2 Wedge CO2 EOR Net BOPD Net Base 175 2018 2020 2022 2024 2026 2028 2030 2032 2034 2036 2038 2040 2042 2044 2046 *As of 1H18 2018 CRC Analyst & Investor Day | 71

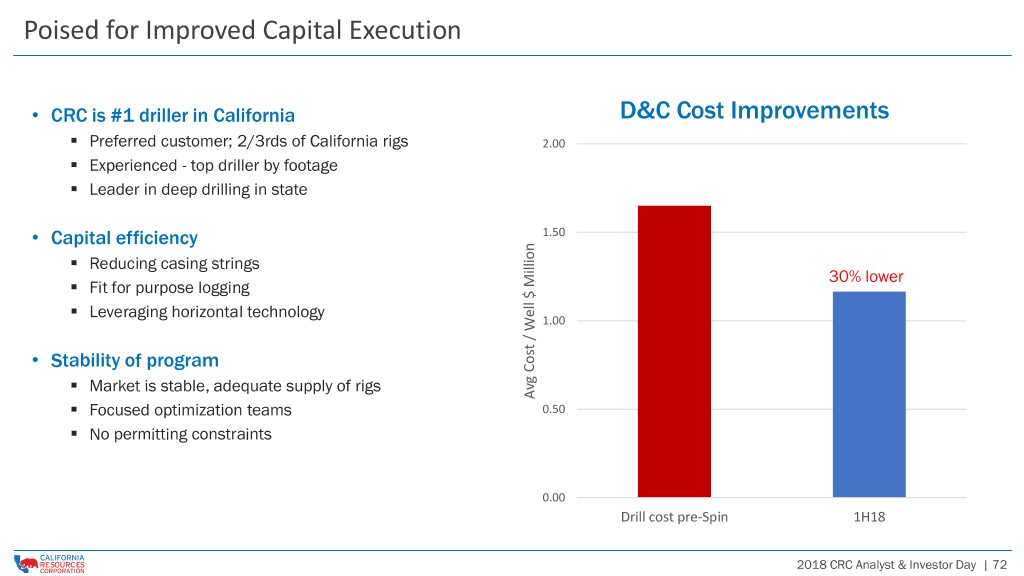

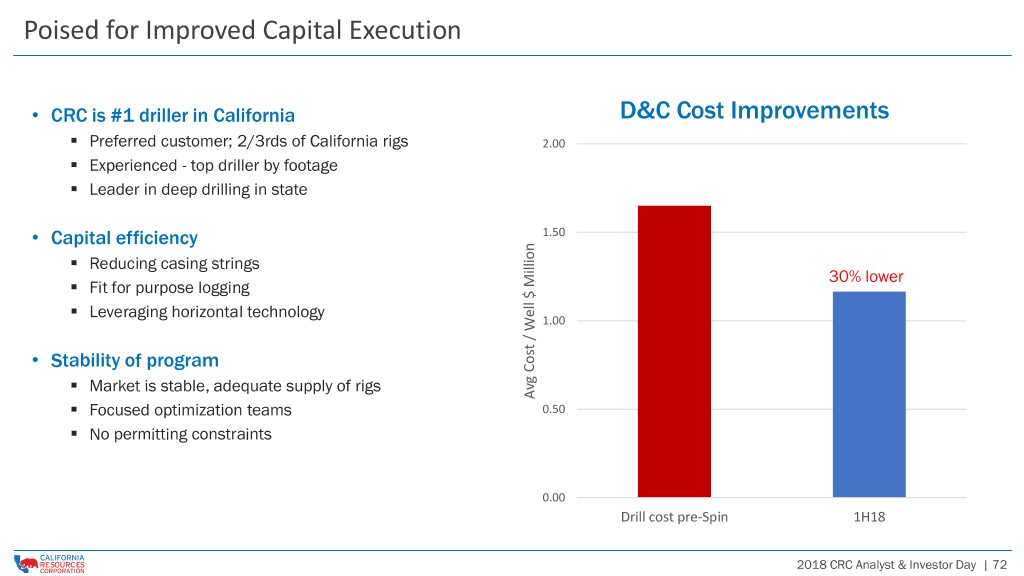

Poised for Improved Capital Execution • CRC is #1 driller in California D&C Cost Improvements ▪ Preferred customer; 2/3rds of California rigs 2.00 ▪ Experienced - top driller by footage ▪ Leader in deep drilling in state • Capital efficiency 1.50 ▪ Reducing casing strings 30% lower ▪ Fit for purpose logging ▪ Leveraging horizontal technology 1.00 • Stability of program ▪ Market is stable, adequate supply of rigs Avg Cost / Well $ Million $ Well /Cost Avg ▪ Focused optimization teams 0.50 ▪ No permitting constraints 0.00 Drill cost pre-Spin 1H18 2018 CRC Analyst & Investor Day | 72

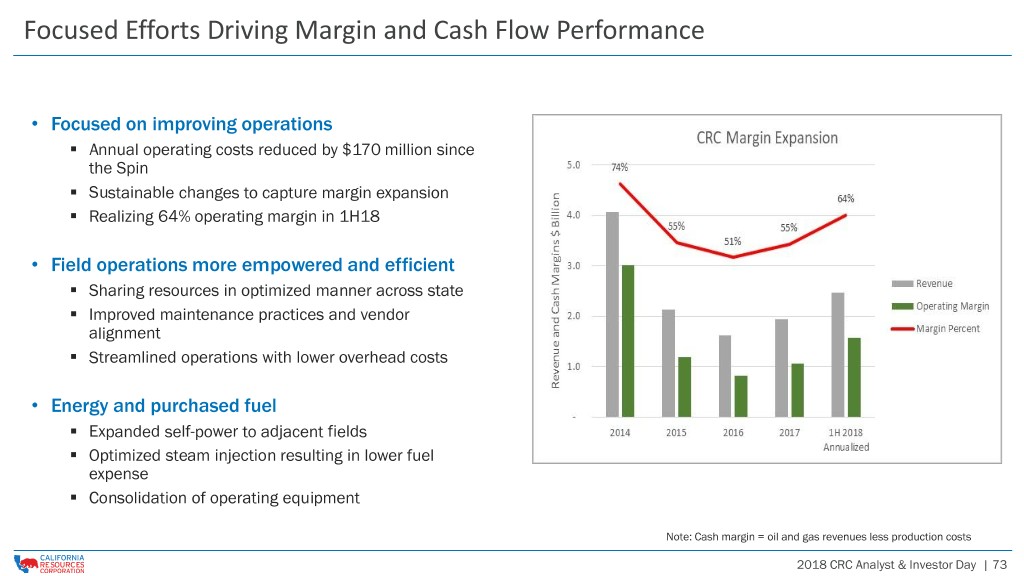

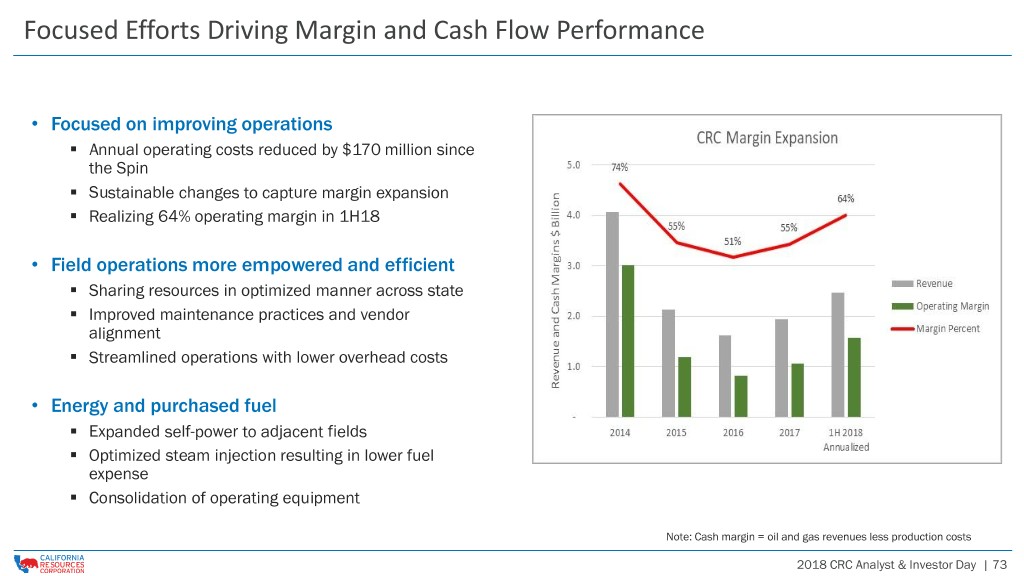

Focused Efforts Driving Margin and Cash Flow Performance • Focused on improving operations ▪ Annual operating costs reduced by $170 million since the Spin ▪ Sustainable changes to capture margin expansion ▪ Realizing 64% operating margin in 1H18 • Field operations more empowered and efficient ▪ Sharing resources in optimized manner across state ▪ Improved maintenance practices and vendor alignment ▪ Streamlined operations with lower overhead costs • Energy and purchased fuel ▪ Expanded self-power to adjacent fields ▪ Optimized steam injection resulting in lower fuel expense ▪ Consolidation of operating equipment Note: Cash margin = oil and gas revenues less production costs 2018 CRC Analyst & Investor Day | 73

Driving Operational Excellence - Key Takeaways • Coring up positions with large resources in place • Driving operational efficiencies and applying new technology • Capturing reserve growth opportunities across the recovery value chain • Utilizing experience from analog fields to drive value creation 2018 CRC Analyst & Investor Day | 74

VALUE-DRIVEN GROWTH Darren Williams, EVP Operations and Geoscience

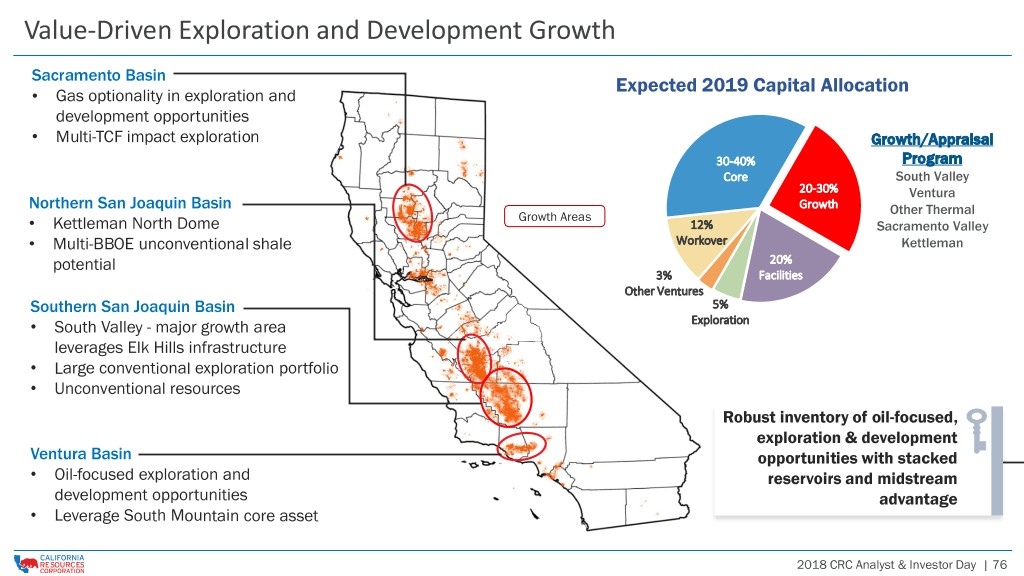

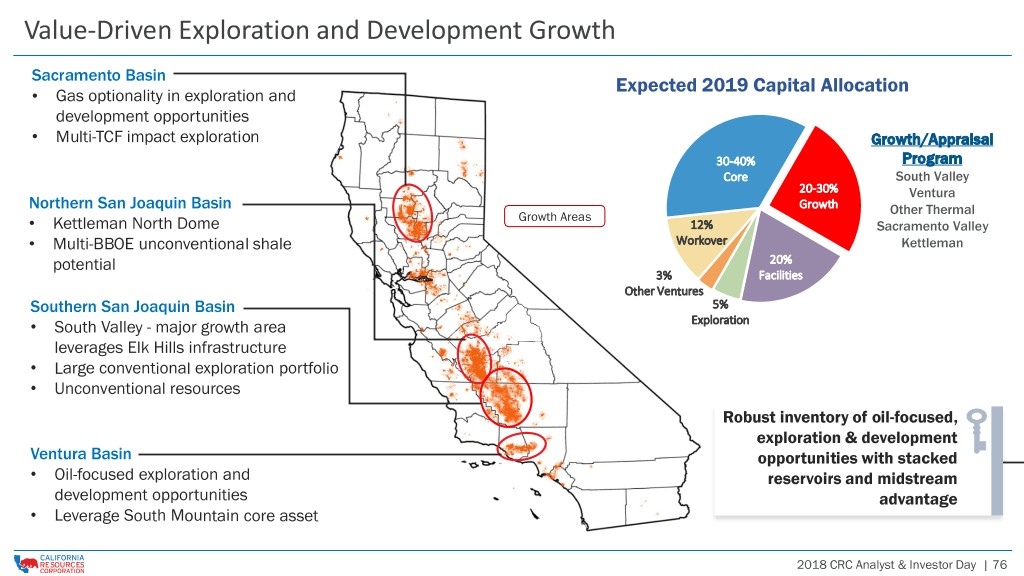

Value-Driven Exploration and Development Growth Sacramento Basin Expected 2019 Capital Allocation • Gas optionality in exploration and development opportunities • Multi-TCF impact exploration Growth/Appraisal 30-40% Program Core South Valley 20-30% Ventura Northern San Joaquin Basin Growth Other Thermal Growth Areas • Kettleman North Dome 12% Sacramento Valley • Multi-BBOE unconventional shale Workover Kettleman potential 20% 3% Facilities Other Ventures Southern San Joaquin Basin 5% • South Valley - major growth area Exploration leverages Elk Hills infrastructure • Large conventional exploration portfolio • Unconventional resources Robust inventory of oil-focused, exploration & development Ventura Basin opportunities with stacked • Oil-focused exploration and reservoirs and midstream development opportunities advantage • Leverage South Mountain core asset 2018 CRC Analyst & Investor Day | 76

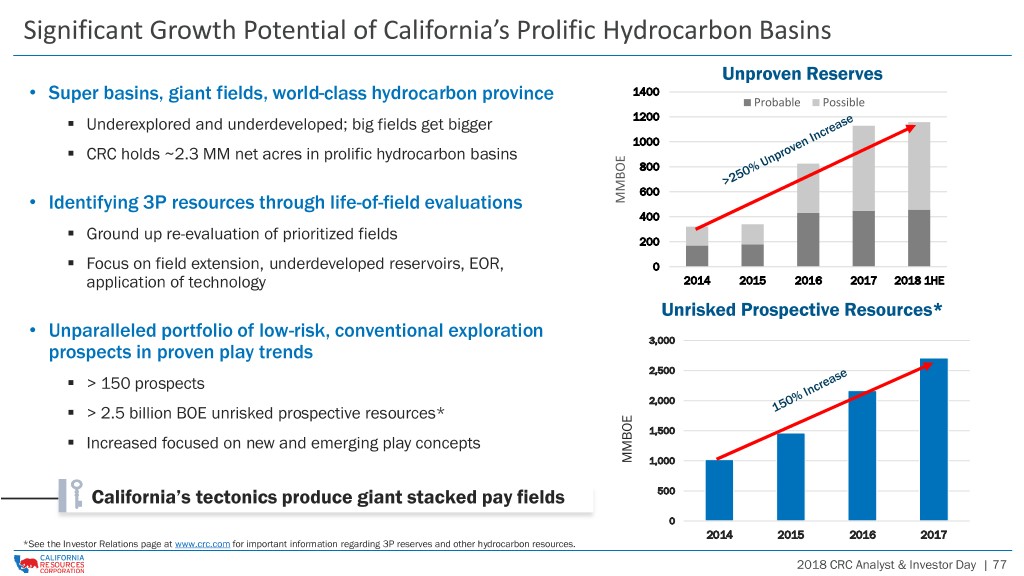

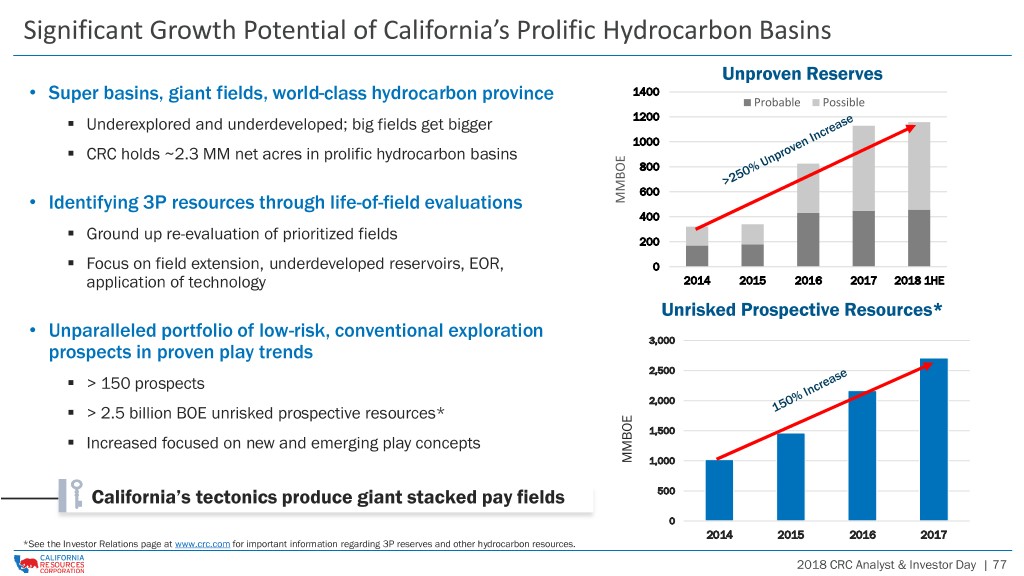

Significant Growth Potential of California’s Prolific Hydrocarbon Basins Unproven Reserves Super basins, giant fields, world-class hydrocarbon province 1400 • Probable Possible ▪ Underexplored and underdeveloped; big fields get bigger 1200 1000 ▪ CRC holds ~2.3 MM net acres in prolific hydrocarbon basins 800 600 • Identifying 3P resources through life-of-field evaluations MMBOE 400 ▪ Ground up re-evaluation of prioritized fields 200 ▪ Focus on field extension, underdeveloped reservoirs, EOR, 0 application of technology 2014 2015 2016 2017 2018 1HE Unrisked Prospective Resources* Unparalleled portfolio of low-risk, conventional exploration • 3,000 prospects in proven play trends 2,500 ▪ > 150 prospects 2,000 ▪ > 2.5 billion BOE unrisked prospective resources* 1,500 ▪ Increased focused on new and emerging play concepts MMBOE 1,000 California’s tectonics produce giant stacked pay fields 500 0 2014 2015 2016 2017 *See the Investor Relations page at www.crc.com for important information regarding 3P reserves and other hydrocarbon resources. 2018 CRC Analyst & Investor Day | 77

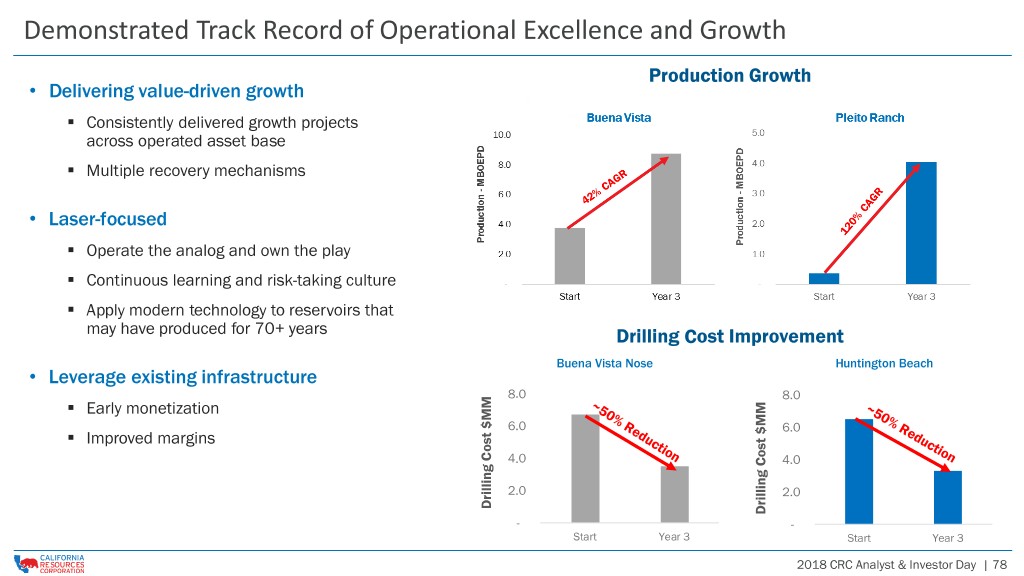

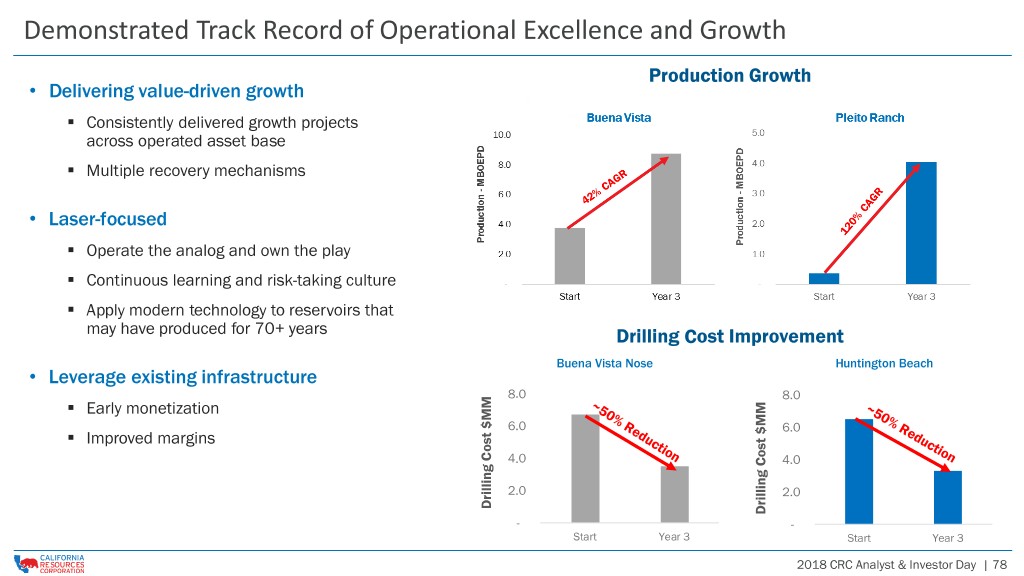

Demonstrated Track Record of Operational Excellence and Growth Production Growth • Delivering value-driven growth ▪ Consistently delivered growth projects across operated asset base ▪ Multiple recovery mechanisms • Laser-focused ▪ Operate the analog and own the play ▪ Continuous learning and risk-taking culture ▪ Apply modern technology to reservoirs that may have produced for 70+ years Drilling Cost Improvement Buena Vista Nose Huntington Beach • Leverage existing infrastructure 8.0 8.0 ▪ Early monetization 6.0 6.0 ▪ Improved margins 4.0 4.0 2.0 2.0 Drilling Cost $MM Drilling Cost $MM - - Start Year 3 Start Year 3 2018 CRC Analyst & Investor Day | 78

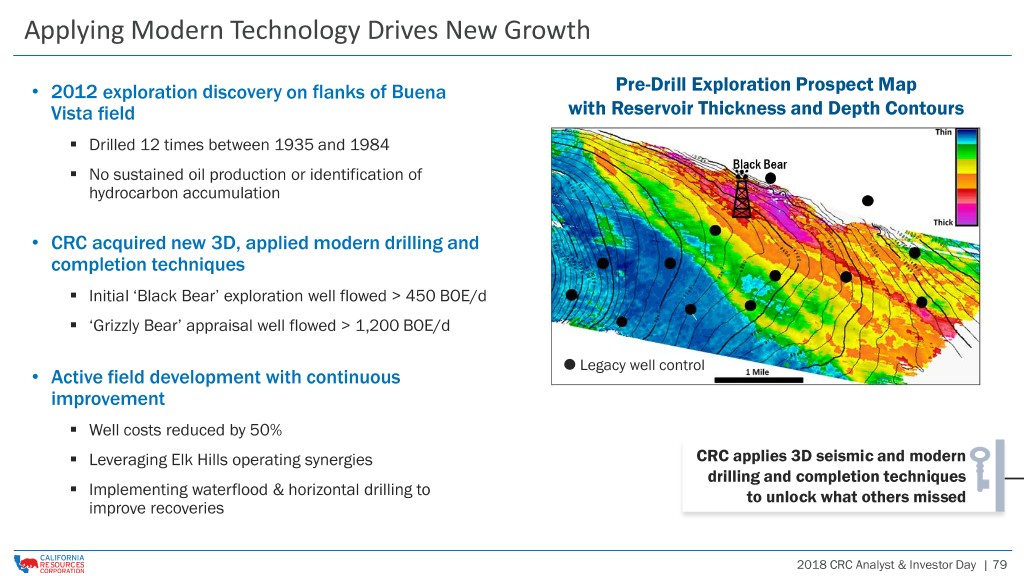

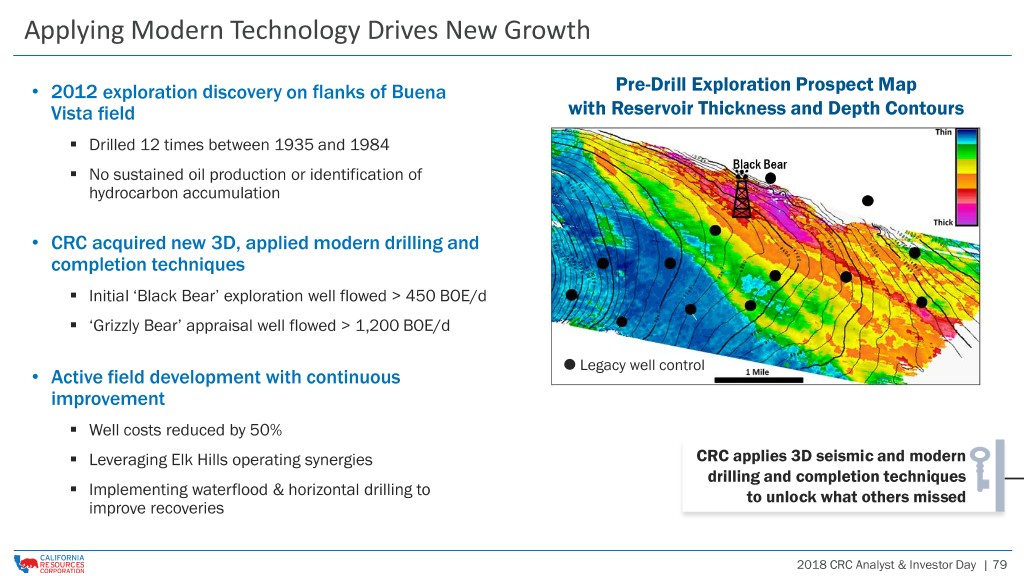

Applying Modern Technology Drives New Growth • 2012 exploration discovery on flanks of Buena Pre-Drill Exploration Prospect Map Vista field with Reservoir Thickness and Depth Contours ▪ Drilled 12 times between 1935 and 1984 ▪ No sustained oil production or identification of hydrocarbon accumulation • CRC acquired new 3D, applied modern drilling and completion techniques ▪ Initial ‘Black Bear’ exploration well flowed > 450 BOE/d ▪ ‘Grizzly Bear’ appraisal well flowed > 1,200 BOE/d Legacy well control • Active field development with continuous improvement ▪ Well costs reduced by 50% ▪ Leveraging Elk Hills operating synergies CRC applies 3D seismic and modern ▪ drilling and completion techniques Implementing waterflood & horizontal drilling to to unlock what others missed improve recoveries 2018 CRC Analyst & Investor Day | 79

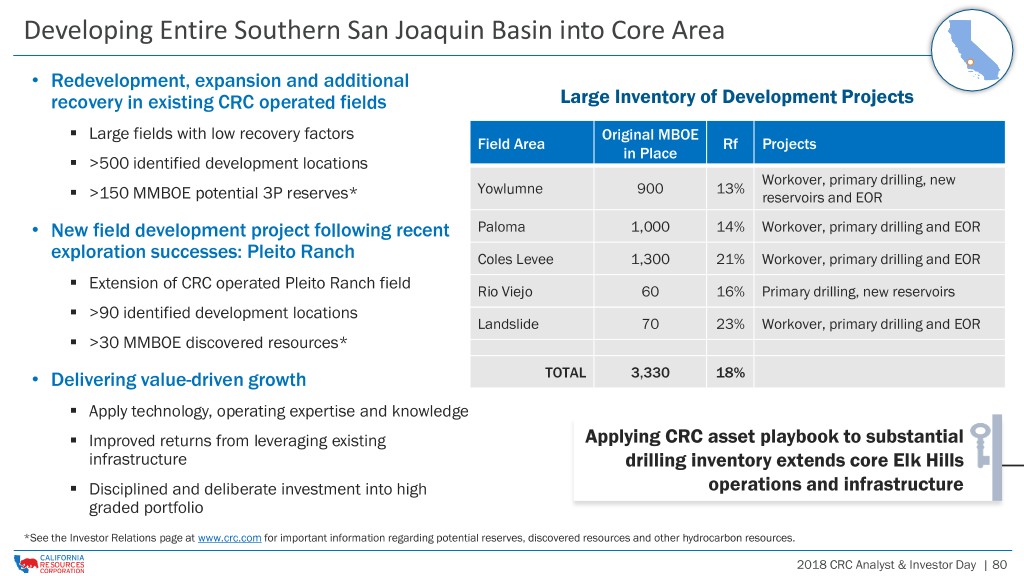

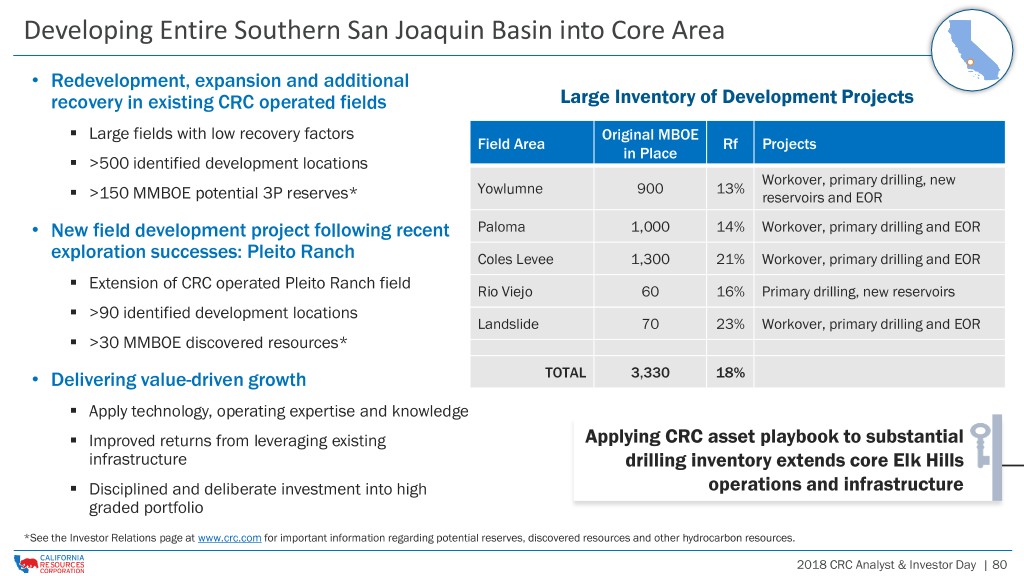

Developing Entire Southern San Joaquin Basin into Core Area • Redevelopment, expansion and additional recovery in existing CRC operated fields Large Inventory of Development Projects ▪ Large fields with low recovery factors Original MBOE Field Area Rf Projects in Place ▪ >500 identified development locations Workover, primary drilling, new ▪ Yowlumne 900 13% >150 MMBOE potential 3P reserves* reservoirs and EOR • New field development project following recent Paloma 1,000 14% Workover, primary drilling and EOR exploration successes: Pleito Ranch Coles Levee 1,300 21% Workover, primary drilling and EOR ▪ Extension of CRC operated Pleito Ranch field Rio Viejo 60 16% Primary drilling, new reservoirs ▪ >90 identified development locations Landslide 70 23% Workover, primary drilling and EOR ▪ >30 MMBOE discovered resources* • Delivering value-driven growth TOTAL 3,330 18% ▪ Apply technology, operating expertise and knowledge ▪ Improved returns from leveraging existing Applying CRC asset playbook to substantial infrastructure drilling inventory extends core Elk Hills ▪ Disciplined and deliberate investment into high operations and infrastructure graded portfolio *See the Investor Relations page at www.crc.com for important information regarding potential reserves, discovered resources and other hydrocarbon resources. 2018 CRC Analyst & Investor Day | 80

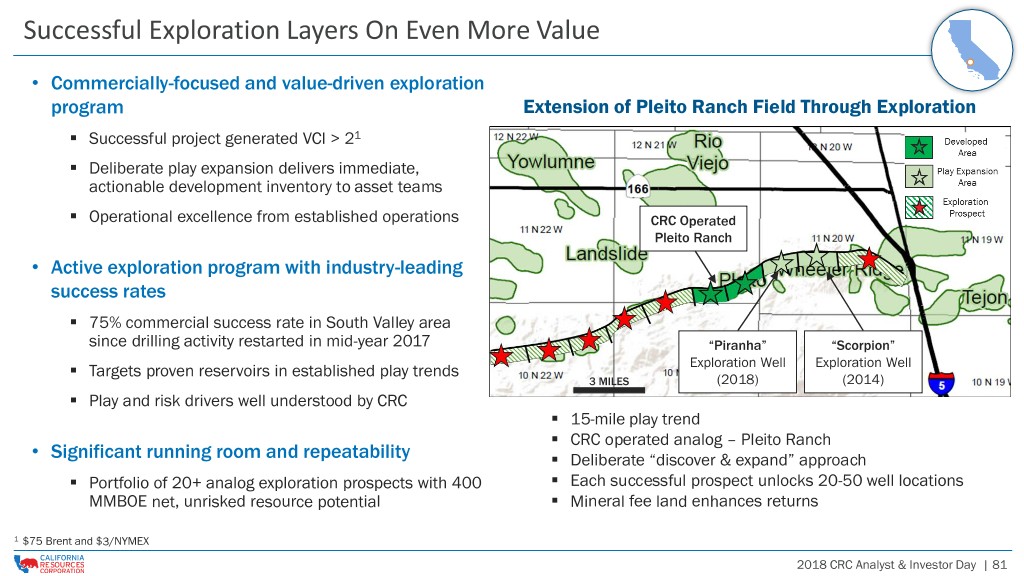

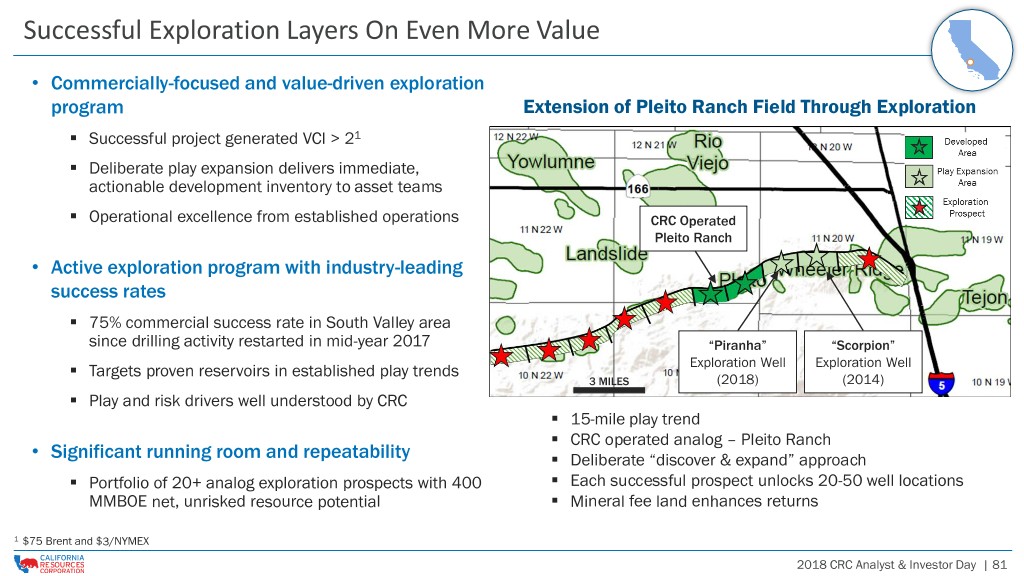

Successful Exploration Layers On Even More Value • Commercially-focused and value-driven exploration program Extension of Pleito Ranch Field Through Exploration ▪ Successful project generated VCI > 21 ▪ Deliberate play expansion delivers immediate, actionable development inventory to asset teams ▪ Operational excellence from established operations CRC Operated Pleito Ranch • Active exploration program with industry-leading success rates ▪ 75% commercial success rate in South Valley area since drilling activity restarted in mid-year 2017 “Piranha” “Scorpion” ▪ Targets proven reservoirs in established play trends Exploration Well Exploration Well 3 MILES (2018) (2014) ▪ Play and risk drivers well understood by CRC ▪ 15-mile play trend ▪ CRC operated analog – Pleito Ranch • Significant running room and repeatability ▪ Deliberate “discover & expand” approach ▪ ▪ Portfolio of 20+ analog exploration prospects with 400 Each successful prospect unlocks 20-50 well locations MMBOE net, unrisked resource potential ▪ Mineral fee land enhances returns 1 $75 Brent and $3/NYMEX 2018 CRC Analyst & Investor Day | 81

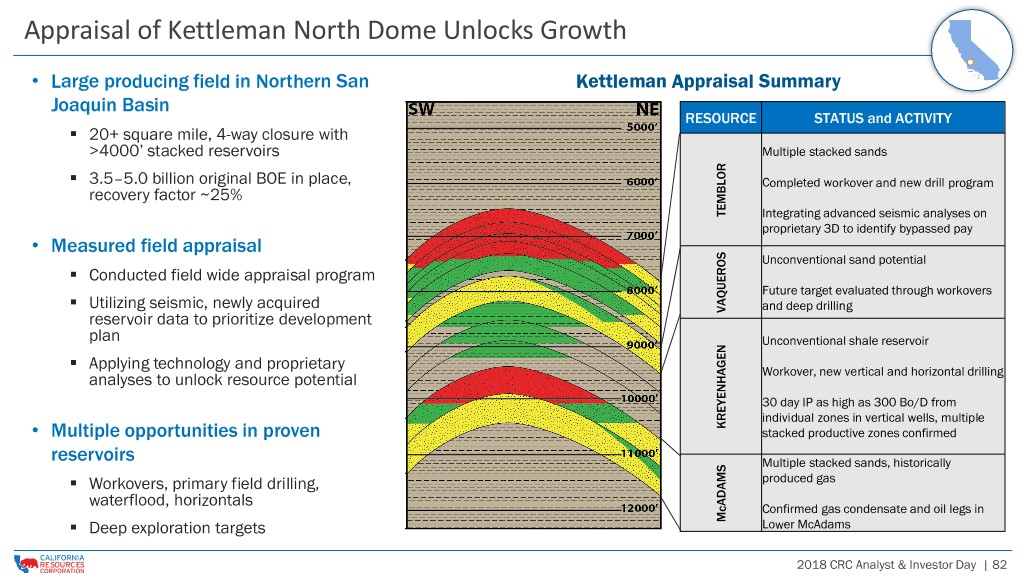

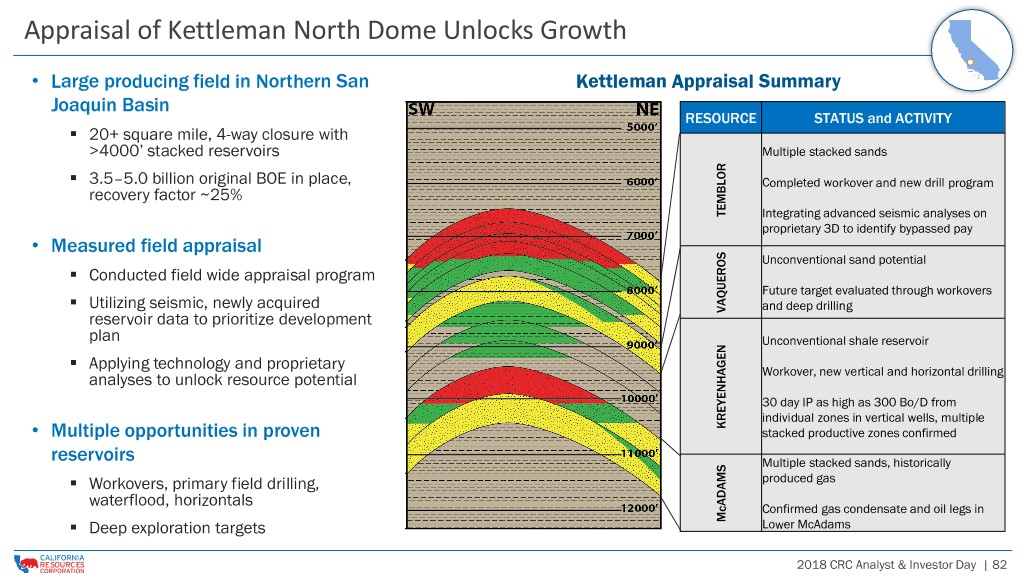

Appraisal of Kettleman North Dome Unlocks Growth • Large producing field in Northern San Kettleman Appraisal Summary Joaquin Basin RESOURCE STATUS and ACTIVITY ▪ 20+ square mile, 4-way closure with >4000’ stacked reservoirs Multiple stacked sands ▪ 3.5–5.0 billion original BOE in place, Completed workover and new drill program recovery factor ~25% TEMBLOR Integrating advanced seismic analyses on proprietary 3D to identify bypassed pay • Measured field appraisal Unconventional sand potential ▪ Conducted field wide appraisal program ▪ Future target evaluated through workovers Utilizing seismic, newly acquired and deep drilling reservoir data to prioritize development VAQUEROS plan Unconventional shale reservoir ▪ Applying technology and proprietary analyses to unlock resource potential Workover, new vertical and horizontal drilling 30 day IP as high as 300 Bo/D from individual zones in vertical wells, multiple • Multiple opportunities in proven KREYENHAGEN stacked productive zones confirmed reservoirs Multiple stacked sands, historically ▪ Workovers, primary field drilling, produced gas waterflood, horizontals Confirmed gas condensate and oil legs in ▪ Deep exploration targets McADAMS Lower McAdams 2018 CRC Analyst & Investor Day | 82

VENTURA VIDEO See the Investor Relations page at www.crc.com to access this video.

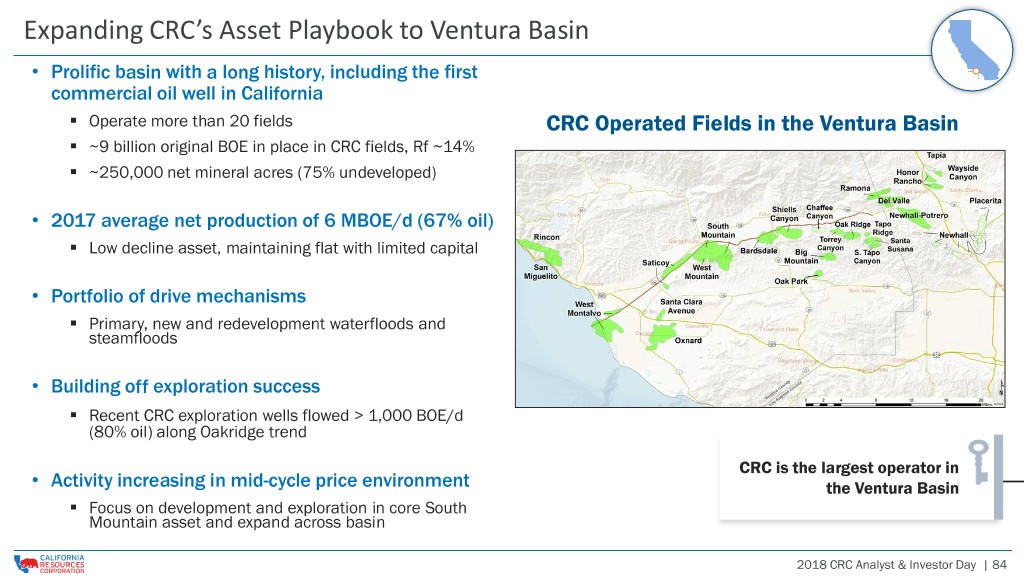

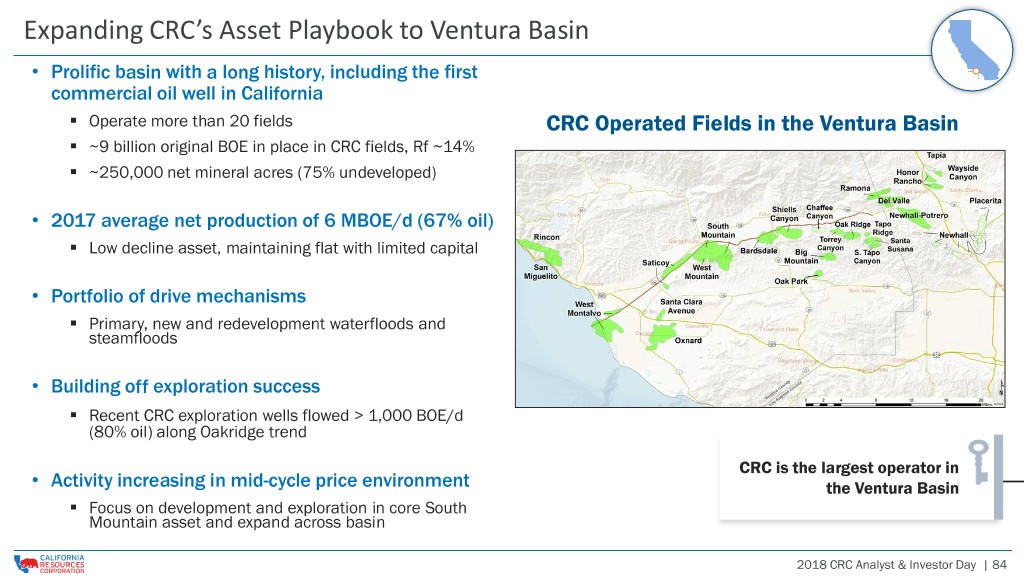

Expanding CRC’s Asset Playbook to Ventura Basin • Prolific basin with a long history, including the first commercial oil well in California ▪ Operate more than 20 fields CRC Operated Fields in the Ventura Basin ▪ ~9 billion original BOE in place in CRC fields, Rf ~14% ▪ ~250,000 net mineral acres (75% undeveloped) • 2017 average net production of 6 MBOE/d (67% oil) ▪ Low decline asset, maintaining flat with limited capital • Portfolio of drive mechanisms ▪ Primary, new and redevelopment waterfloods and steamfloods • Building off exploration success ▪ Recent CRC exploration wells flowed > 1,000 BOE/d (80% oil) along Oakridge trend CRC is the largest operator in • Activity increasing in mid-cycle price environment the Ventura Basin ▪ Focus on development and exploration in core South Mountain asset and expand across basin 2018 CRC Analyst & Investor Day | 84

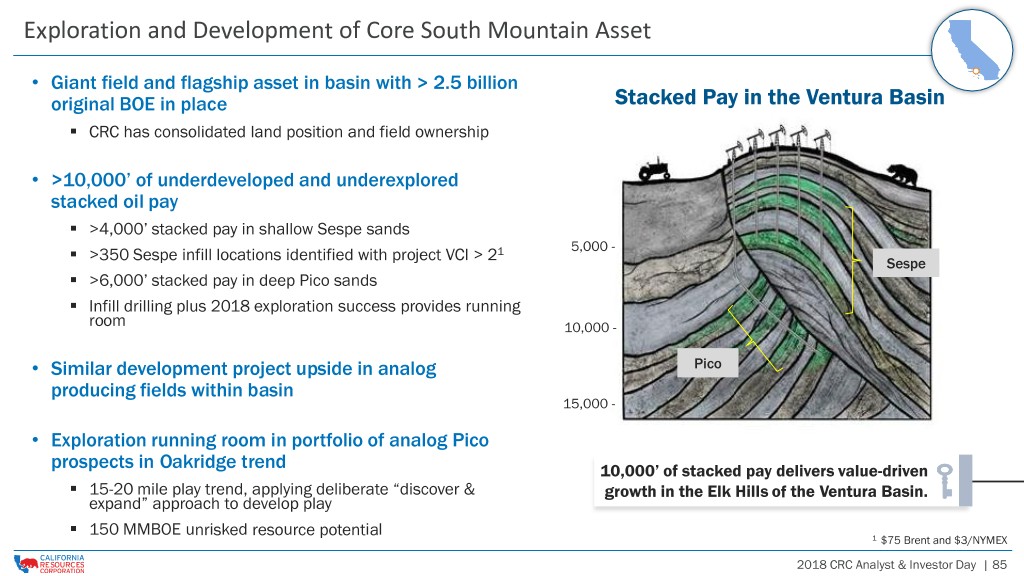

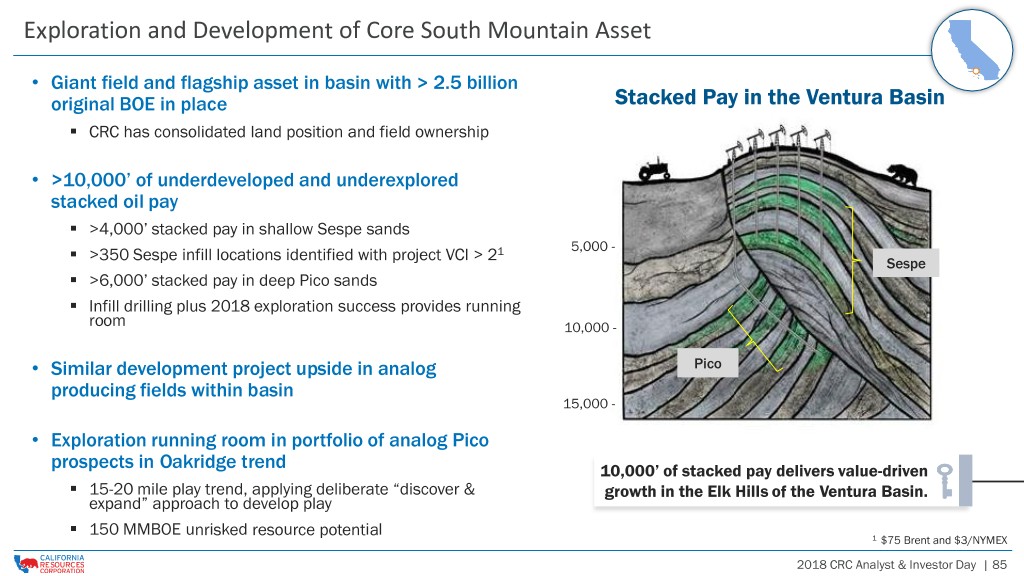

Exploration and Development of Core South Mountain Asset • Giant field and flagship asset in basin with > 2.5 billion original BOE in place Stacked Pay in the Ventura Basin ▪ CRC has consolidated land position and field ownership • >10,000’ of underdeveloped and underexplored stacked oil pay ▪ >4,000’ stacked pay in shallow Sespe sands ▪ >350 Sespe infill locations identified with project VCI > 21 5,000 - Sespe ▪ >6,000’ stacked pay in deep Pico sands ▪ Infill drilling plus 2018 exploration success provides running room 10,000 - • Similar development project upside in analog Pico producing fields within basin 15,000 - • Exploration running room in portfolio of analog Pico prospects in Oakridge trend 10,000’ of stacked pay delivers value-driven ▪ 15-20 mile play trend, applying deliberate “discover & growth in the Elk Hills of the Ventura Basin. expand” approach to develop play ▪ 150 MMBOE unrisked resource potential 1 $75 Brent and $3/NYMEX 2018 CRC Analyst & Investor Day | 85

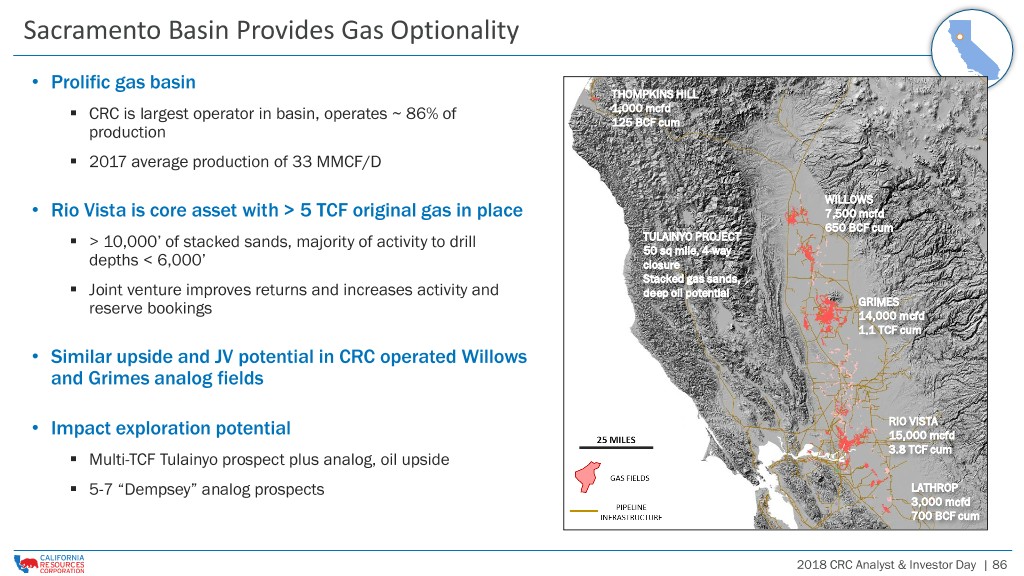

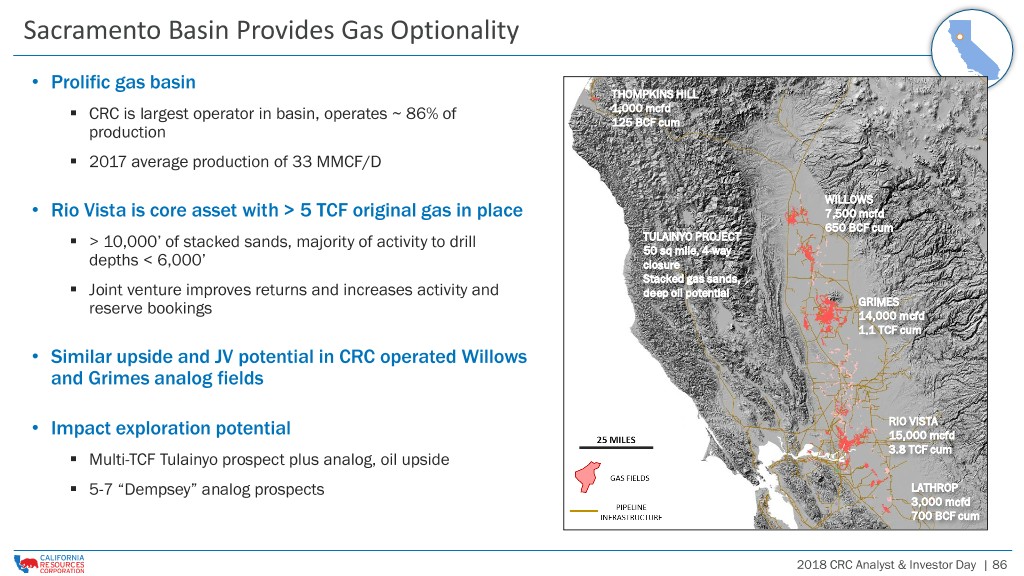

Sacramento Basin Provides Gas Optionality • Prolific gas basin THOMPKINS HILL ▪ CRC is largest operator in basin, operates ~ 86% of 1,000 mcfd 125 BCF cum production ▪ 2017 average production of 33 MMCF/D WILLOWS • Rio Vista is core asset with > 5 TCF original gas in place 7,500 mcfd 650 BCF cum ▪ > 10,000’ of stacked sands, majority of activity to drill TULAINYO PROJECT 50 sq mile, 4-way depths < 6,000’ closure ▪ Stacked gas sands, Joint venture improves returns and increases activity and deep oil potential GRIMES reserve bookings 14,000 mcfd 1.1 TCF cum • Similar upside and JV potential in CRC operated Willows and Grimes analog fields RIO VISTA • Impact exploration potential 15,000 mcfd 3.8 TCF cum ▪ Multi-TCF Tulainyo prospect plus analog, oil upside ▪ 5-7 “Dempsey” analog prospects LATHROP 3,000 mcfd 700 BCF cum 2018 CRC Analyst & Investor Day | 86

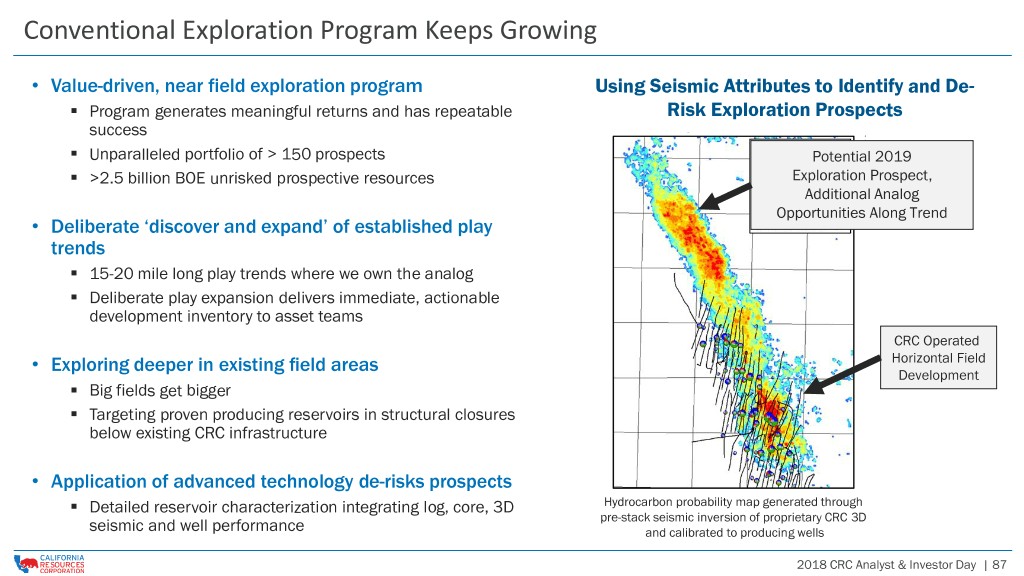

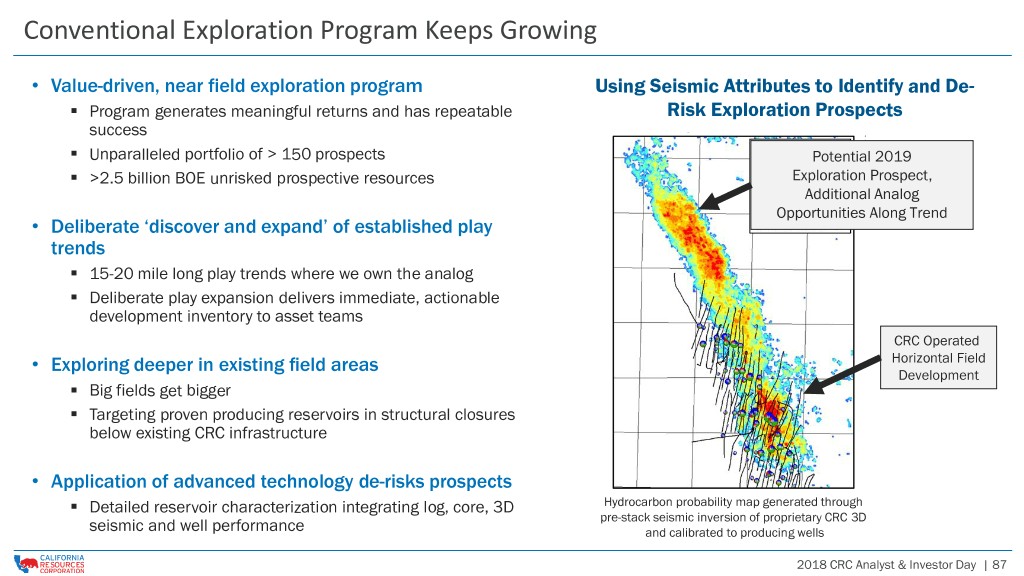

Conventional Exploration Program Keeps Growing • Value-driven, near field exploration program Using Seismic Attributes to Identify and De- ▪ Program generates meaningful returns and has repeatable Risk Exploration Prospects success ▪ Unparalleled portfolio of > 150 prospects Potential 2019 ▪ >2.5 billion BOE unrisked prospective resources Exploration Prospect, Additional Analog Opportunities Along Trend • Deliberate ‘discover and expand’ of established play trends ▪ 15-20 mile long play trends where we own the analog ▪ Deliberate play expansion delivers immediate, actionable development inventory to asset teams CRC Operated • Exploring deeper in existing field areas Horizontal Field Development ▪ Big fields get bigger ▪ Targeting proven producing reservoirs in structural closures below existing CRC infrastructure • Application of advanced technology de-risks prospects ▪ Detailed reservoir characterization integrating log, core, 3D Hydrocarbon probability map generated through pre-stack seismic inversion of proprietary CRC 3D seismic and well performance and calibrated to producing wells 2018 CRC Analyst & Investor Day | 87

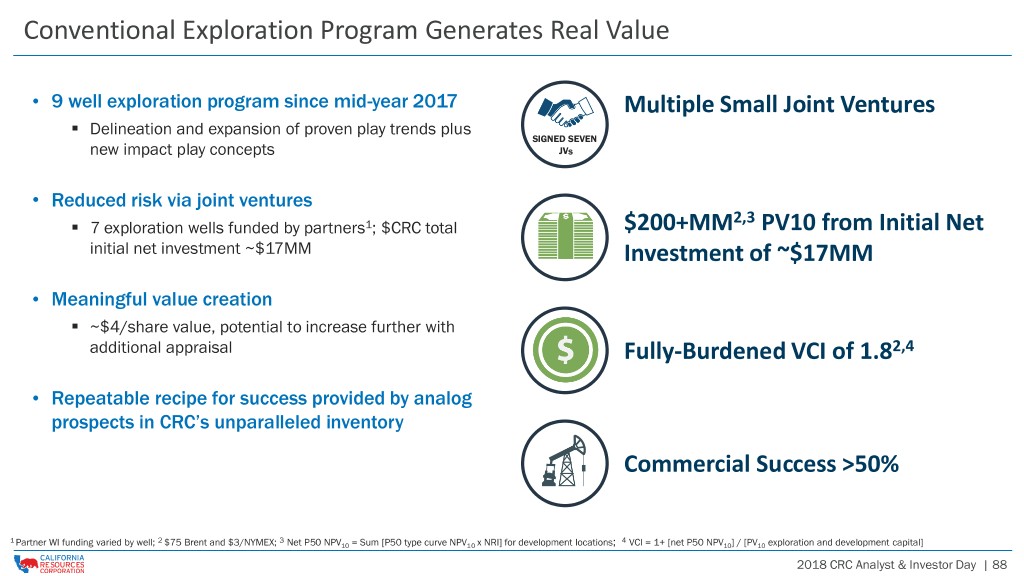

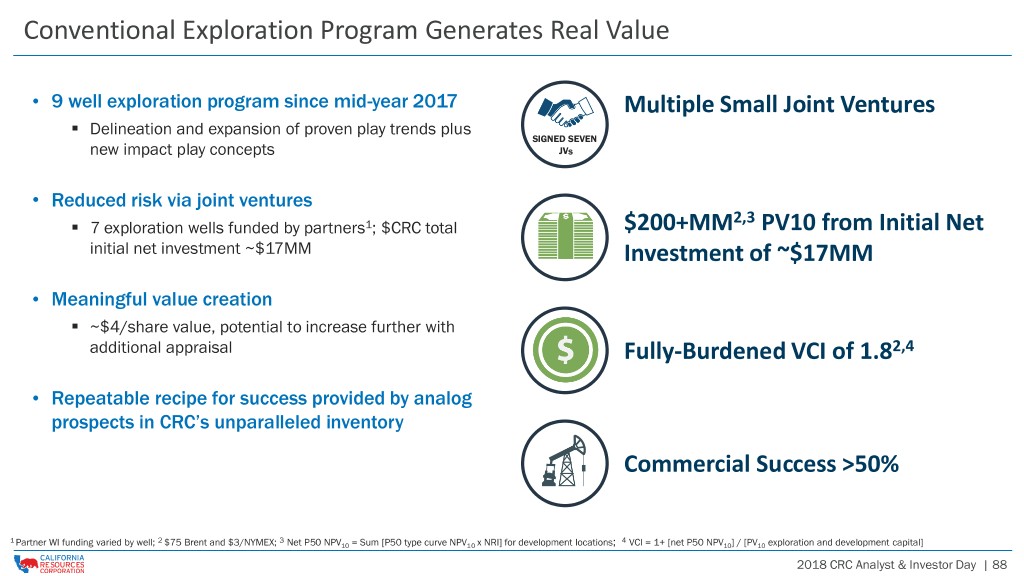

Conventional Exploration Program Generates Real Value • 9 well exploration program since mid-year 2017 Multiple Small Joint Ventures ▪ Delineation and expansion of proven play trends plus SIGNED SEVEN new impact play concepts JVs • Reduced risk via joint ventures 2,3 ▪ 7 exploration wells funded by partners1; $CRC total $200+MM PV10 from Initial Net initial net investment ~$17MM Investment of ~$17MM • Meaningful value creation ▪ ~$4/share value, potential to increase further with additional appraisal Fully-Burdened VCI of 1.82,4 • Repeatable recipe for success provided by analog prospects in CRC’s unparalleled inventory Commercial Success >50% 1 2 3 4 Partner WI funding varied by well; $75 Brent and $3/NYMEX; Net P50 NPV10 = Sum [P50 type curve NPV10 x NRI] for development locations; VCI = 1+ [net P50 NPV10] / [PV10 exploration and development capital] 2018 CRC Analyst & Investor Day | 88

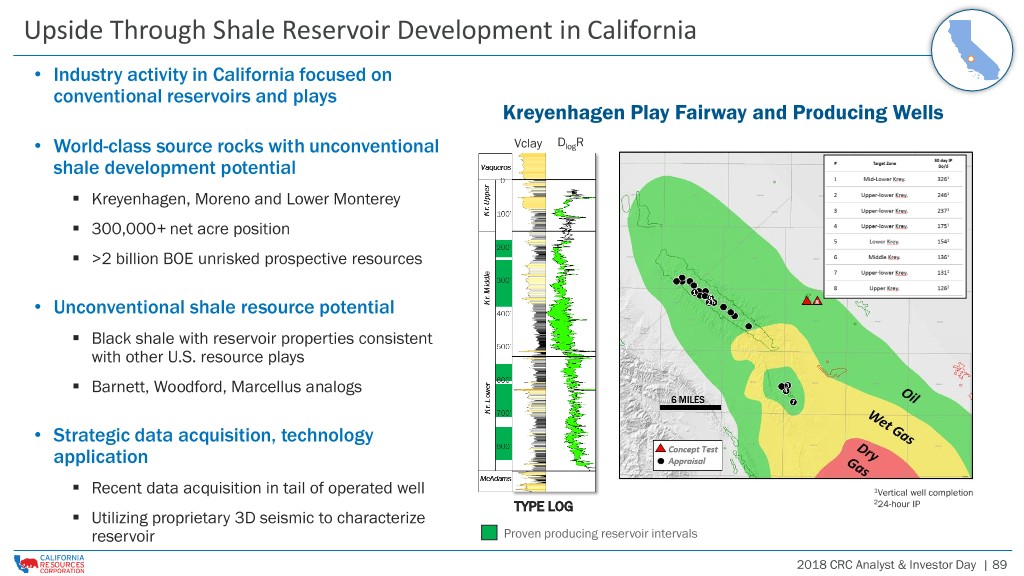

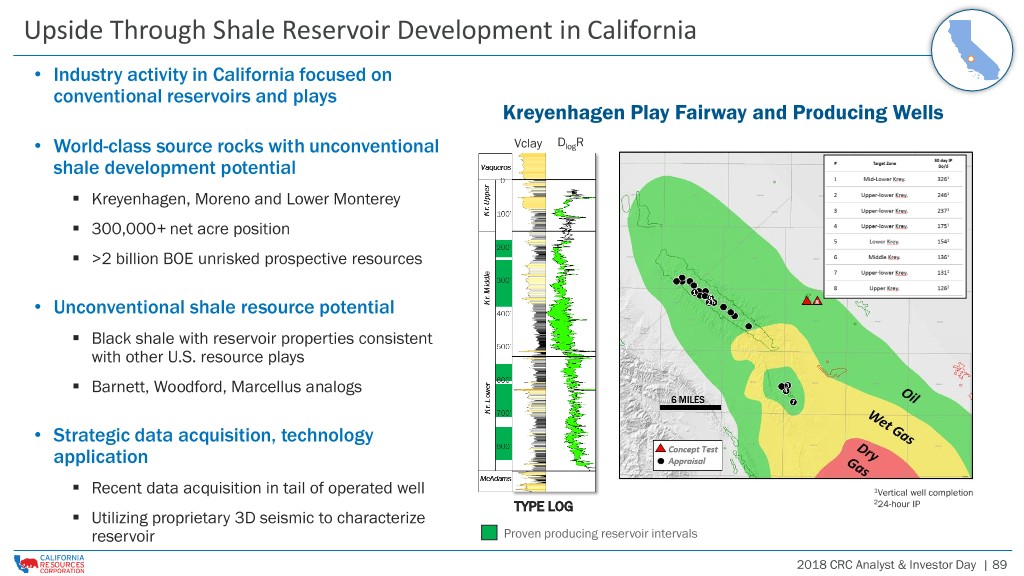

Upside Through Shale Reservoir Development in California • Industry activity in California focused on conventional reservoirs and plays Kreyenhagen Play Fairway and Producing Wells D R • World-class source rocks with unconventional Vclay log shale development potential ▪ Kreyenhagen, Moreno and Lower Monterey ▪ 300,000+ net acre position ▪ >2 billion BOE unrisked prospective resources • Unconventional shale resource potential ▪ Black shale with reservoir properties consistent with other U.S. resource plays ▪ Barnett, Woodford, Marcellus analogs • Strategic data acquisition, technology application ▪ Recent data acquisition in tail of operated well 1Vertical well completion TYPE LOG 224-hour IP ▪ Utilizing proprietary 3D seismic to characterize reservoir Proven producing reservoir intervals 2018 CRC Analyst & Investor Day | 89

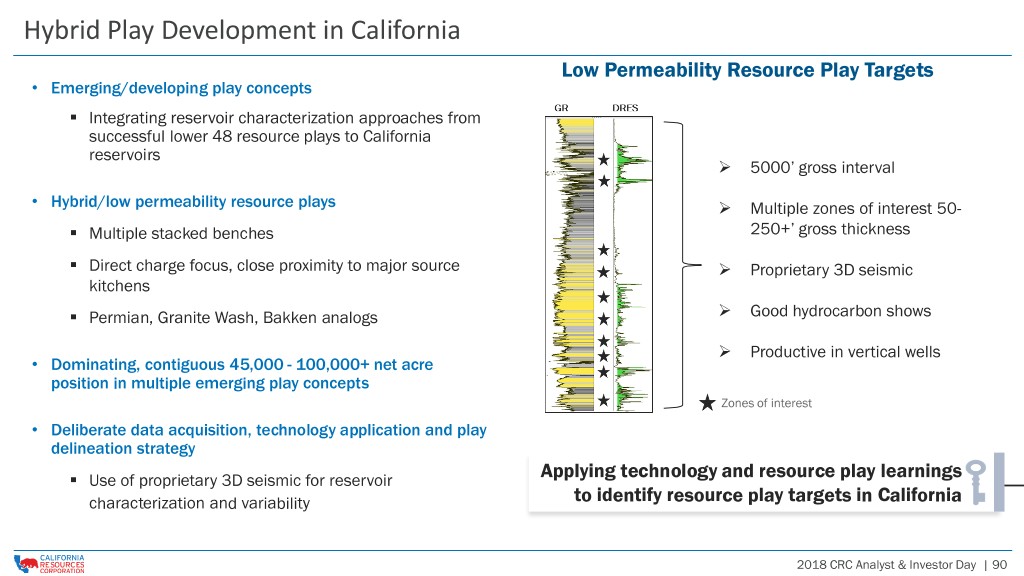

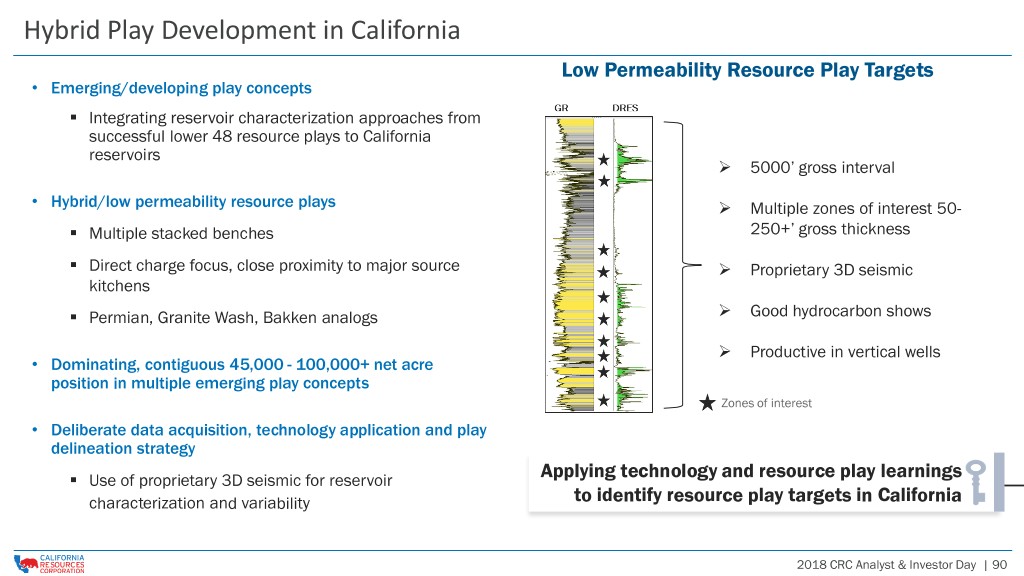

Hybrid Play Development in California Low Permeability Resource Play Targets • Emerging/developing play concepts ▪ Integrating reservoir characterization approaches from successful lower 48 resource plays to California reservoirs ➢ 5000’ gross interval • Hybrid/low permeability resource plays ➢ Multiple zones of interest 50- ▪ Multiple stacked benches 250+’ gross thickness ▪ Direct charge focus, close proximity to major source ➢ Proprietary 3D seismic kitchens ➢ ▪ Permian, Granite Wash, Bakken analogs Good hydrocarbon shows ➢ Productive in vertical wells • Dominating, contiguous 45,000 - 100,000+ net acre position in multiple emerging play concepts Zones of interest • Deliberate data acquisition, technology application and play delineation strategy ▪ Use of proprietary 3D seismic for reservoir Applying technology and resource play learnings characterization and variability to identify resource play targets in California 2018 CRC Analyst & Investor Day | 90

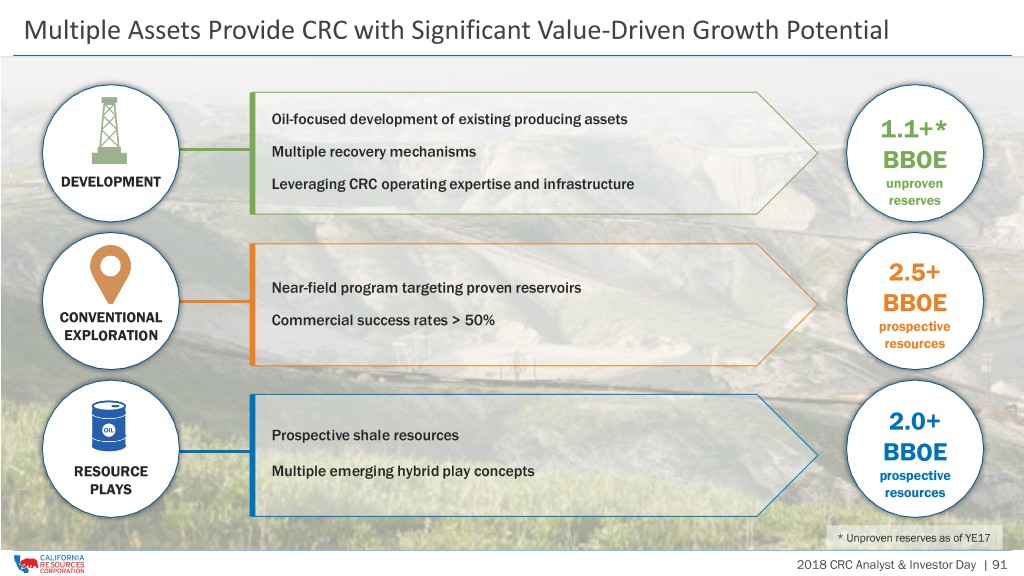

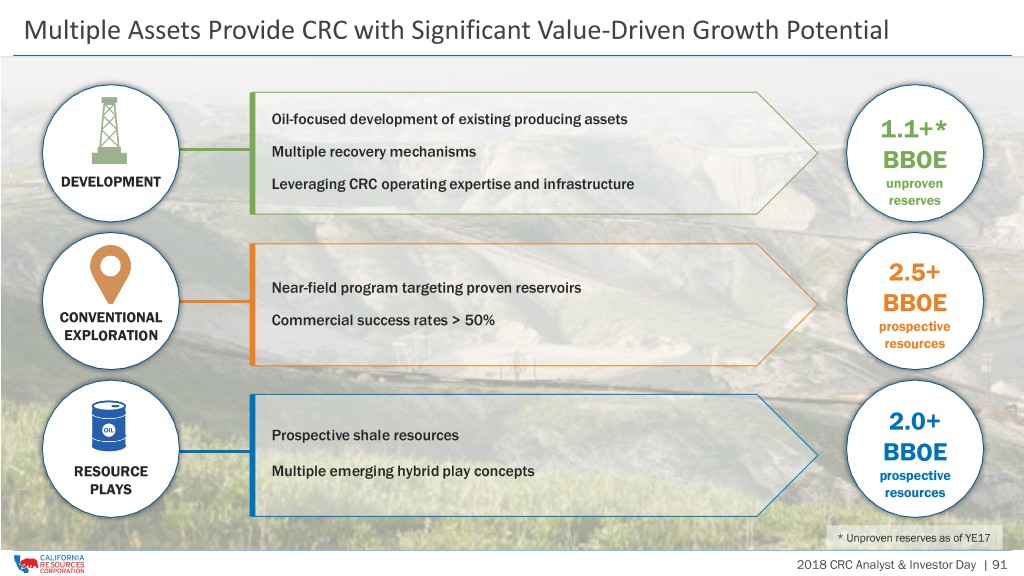

Multiple Assets Provide CRC with Significant Value-Driven Growth Potential Oil-focused development of existing producing assets 1.1+* Multiple recovery mechanisms BBOE DEVELOPMENT Leveraging CRC operating expertise and infrastructure unproven reserves 2.5+ Near-field program targeting proven reservoirs BBOE CONVENTIONAL Commercial success rates > 50% prospective EXPLORATION resources 2.0+ Prospective shale resources BBOE RESOURCE Multiple emerging hybrid play concepts prospective PLAYS resources * Unproven reserves as of YE17 2018 CRC Analyst & Investor Day | 91

CONTINUED FINANCIAL STRENGTHENING INTO 2019 Mark Smith, Sr. EVP & CFO

Strengthening and Simplifying the Balance Sheet Remains a Priority Remain committed to debt reduction with a goal of: ▪ Returning to a simplified balance sheet ▪ Targeting a near investment grade balance sheet ▪ 2x-3x target leverage ratio Continue on path of debt reduction to increase flexibility and remain healthy through the cycle 10.0x 9.0x 1 8.0x Current Target 7.0x Revolving Credit Facility Revolving Credit Facility 6.0x 5.0x 1L 2017 TL Senior Unsecured Notes 4.0x 1L 2016 TL 3.0x Total Debt 2.0x 2L Notes Total Total Debt / Adj. EBITDAX 1.0x 0.0x Senior Unsecured Notes YE16 YE17 YE18E 2 Target Total Debt 1 Leverage Core Adjusted EBITDAX Leverage 1See the Investor Relations page at www.crc.com for a reconciliation to the closest GAAP measure and other important information. Core Adjusted EBITDAX excludes settled hedges and cash settled equity compensation costs. 22Q18 annualized. 2018 CRC Analyst & Investor Day | 93

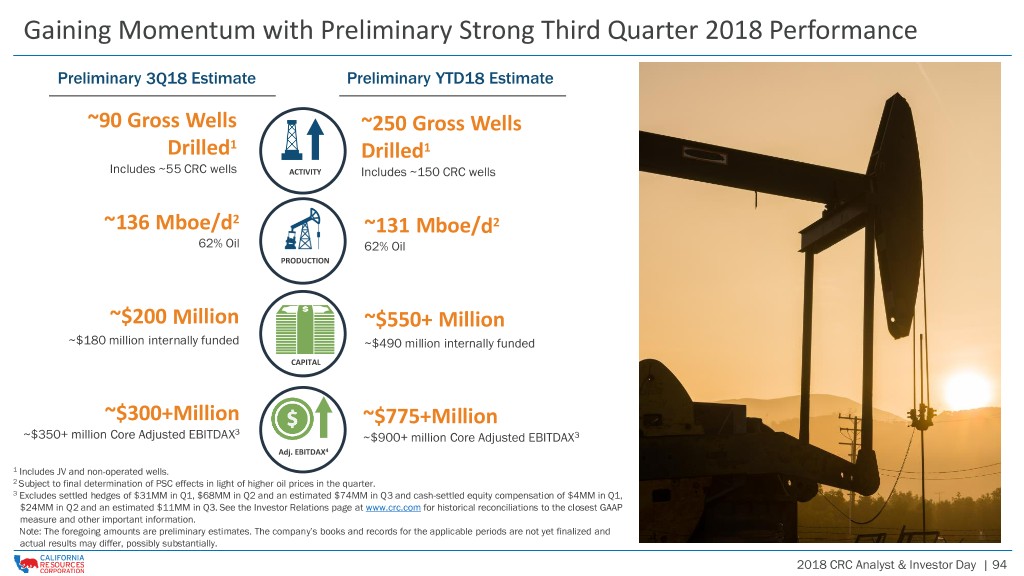

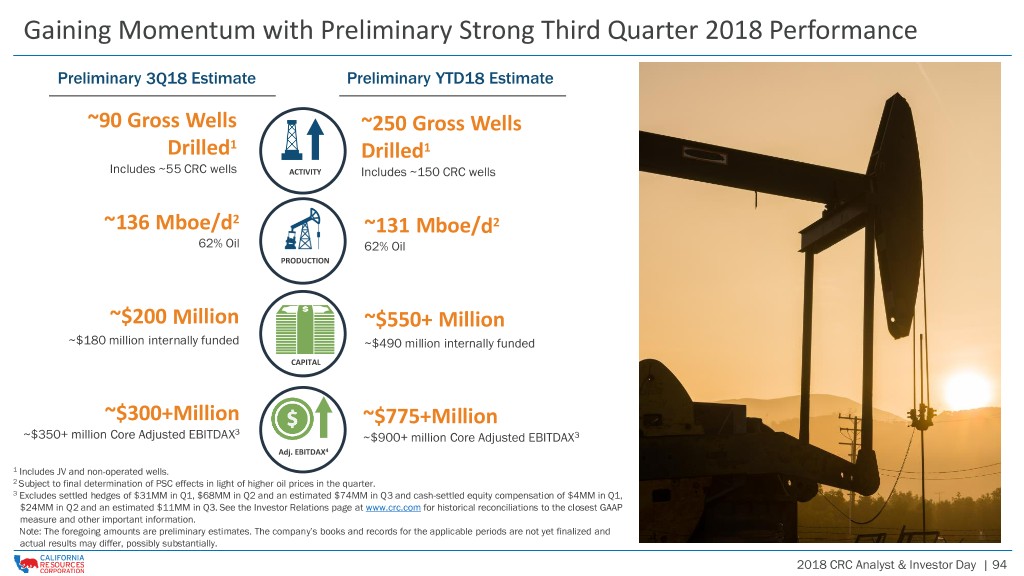

Gaining Momentum with Preliminary Strong Third Quarter 2018 Performance Preliminary 3Q18 Estimate Preliminary YTD18 Estimate ~90 Gross Wells ~250 Gross Wells Drilled1 Drilled1 Includes ~55 CRC wells ACTIVITY Includes ~150 CRC wells ~136 Mboe/d2 ~131 Mboe/d2 62% Oil 62% Oil PRODUCTION ~$200 Million ~$550+ Million ~$180 million internally funded ~$490 million internally funded CAPITAL ~$300+Million ~$775+Million ~$350+ million Core Adjusted EBITDAX3 ~$900+ million Core Adjusted EBITDAX3 Adj. EBITDAX4 1 Includes JV and non-operated wells. 2 Subject to final determination of PSC effects in light of higher oil prices in the quarter. 3 Excludes settled hedges of $31MM in Q1, $68MM in Q2 and an estimated $74MM in Q3 and cash-settled equity compensation of $4MM in Q1, $24MM in Q2 and an estimated $11MM in Q3. See the Investor Relations page at www.crc.com for historical reconciliations to the closest GAAP measure and other important information. Note: The foregoing amounts are preliminary estimates. The company’s books and records for the applicable periods are not yet finalized and actual results may differ, possibly substantially. 2018 CRC Analyst & Investor Day | 94

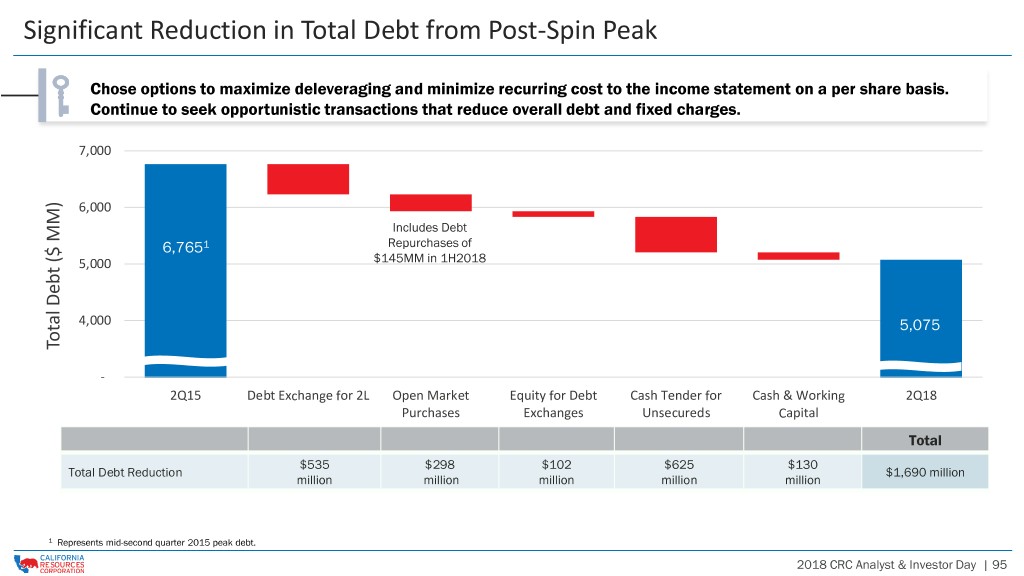

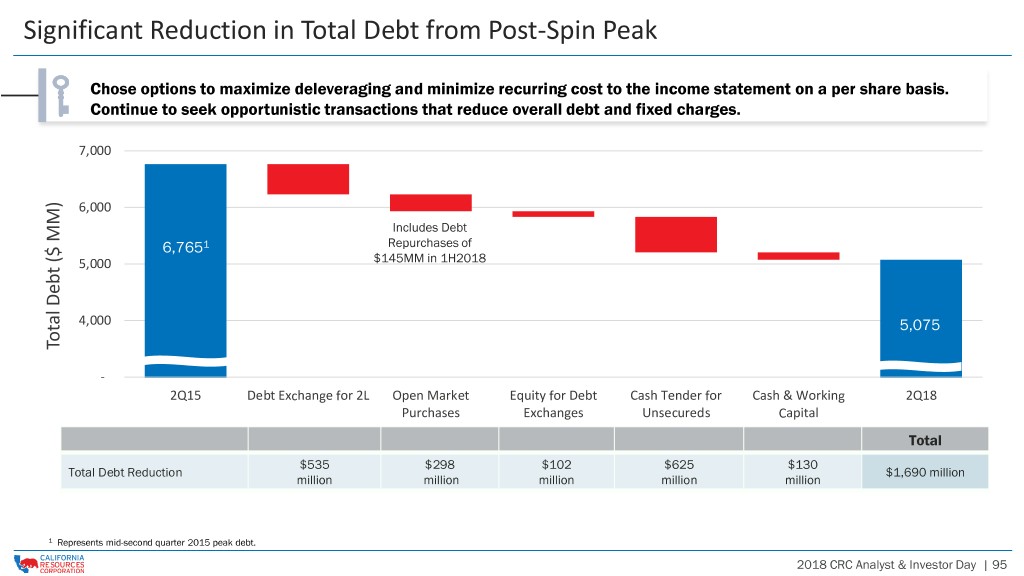

Significant Reduction in Total Debt from Post-Spin Peak Chose options to maximize deleveraging and minimize recurring cost to the income statement on a per share basis. Continue to seek opportunistic transactions that reduce overall debt and fixed charges. 7,000 6,000 Includes Debt 6,7651 Repurchases of 5,000 $145MM in 1H2018 4,000 5,075 Total Debt ($ MM) ($ Debt Total 3,000- 2Q15 Debt Exchange for 2L Open Market Equity for Debt Cash Tender for Cash & Working 2Q18 Purchases Exchanges Unsecureds Capital Total $535 $298 $102 $625 $130 Total Debt Reduction $1,690 million million million million million million 1 Represents mid-second quarter 2015 peak debt. 2018 CRC Analyst & Investor Day | 95

Goal: Simplification of the Balance Sheet Capitalization ($MM) Recent Highlights 6/30/2018 • Received 8th Amendment to repurchase $300 million in 2L notes and 1st Lien 2014 Revolving Credit Facility (RCF) $ 277 senior notes at any discount 1st Lien 2017 Term Loan 1,300 nd 1st Lien 2016 Term Loan 1,000 • Repurchased face value of $97 MM of 2 Lien Notes and $50 MM of 2nd Lien Notes 2,153 senior notes in 1H18 for $119 MM in cash Senior Unsecured Notes 345 • Purchased LIBOR interest caps which cap a notional $1.3B of floating Total Debt 5,075 rate debt at one-month LIBOR of 2.75% through May, 2021 1 Less cash (19) • Recent S&P upgrade on 2L notes to B- from CCC+ Total Net Debt 5,056 Mezzanine Equity 735 2 Equity (645) Debt Maturities ($MM) Total Net Capitalization $ 5,146 $4,000 Total Debt / Total Net Capitalization 99% 2nd Lien Notes 3 2014 RCF Total Debt / LTM Adjusted EBITDAX 5.1x $3,000 LTM Adjusted EBITDAX3 / LTM Interest Expense 2.8x Unsecured Notes PV-104 / Total Debt 1.0x 2016 Term Loan Total Debt / Proved Reserves5 ($/Boe) $7.44 $2,000 2017 Term Loan Total Debt / Proved Developed Reserves5 ($/Boe) $10.42 Total Debt / 2Q18 Production ($/Boepd) $37,873 $1,000 1 Excludes $23MM of restricted cash. 2 Includes $144 million of noncontrolling interest equity for BSP and Ares. 3 LTM Adjusted EBITDAX includes a +$85 million adjustment as a result of the Elk Hills transaction. 4 PV-10 includes an estimate of the Elk Hills reserves acquired at SEC 2017 pricing. See the Investor $0 Relations page at www.crc.com for details on this calculation. 2018 2019 2020 2021 2022 2023 2024 5 Reserves include an estimate of the Elk Hills reserves acquired at SEC 2017 pricing. 2018 CRC Analyst & Investor Day | 96

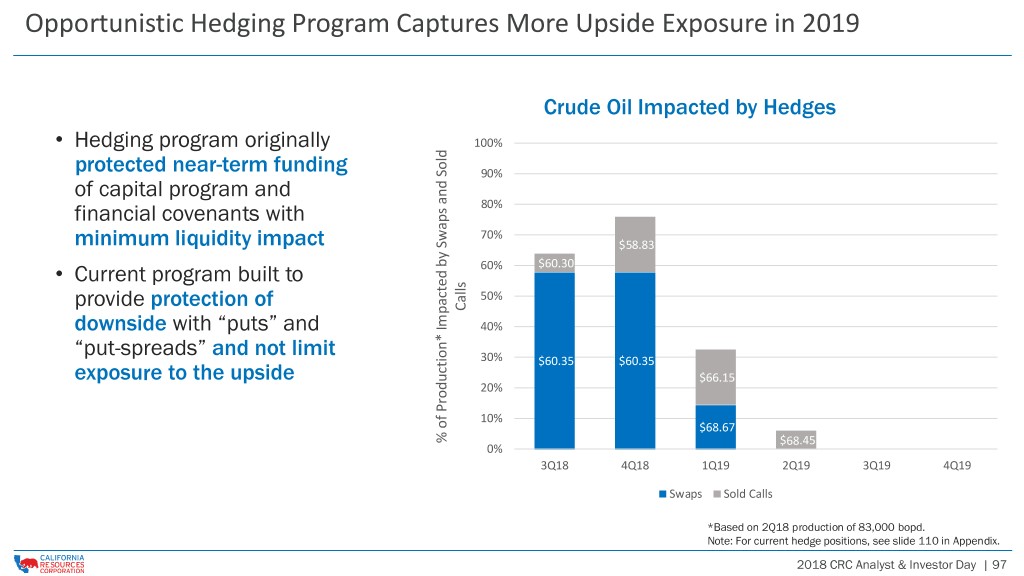

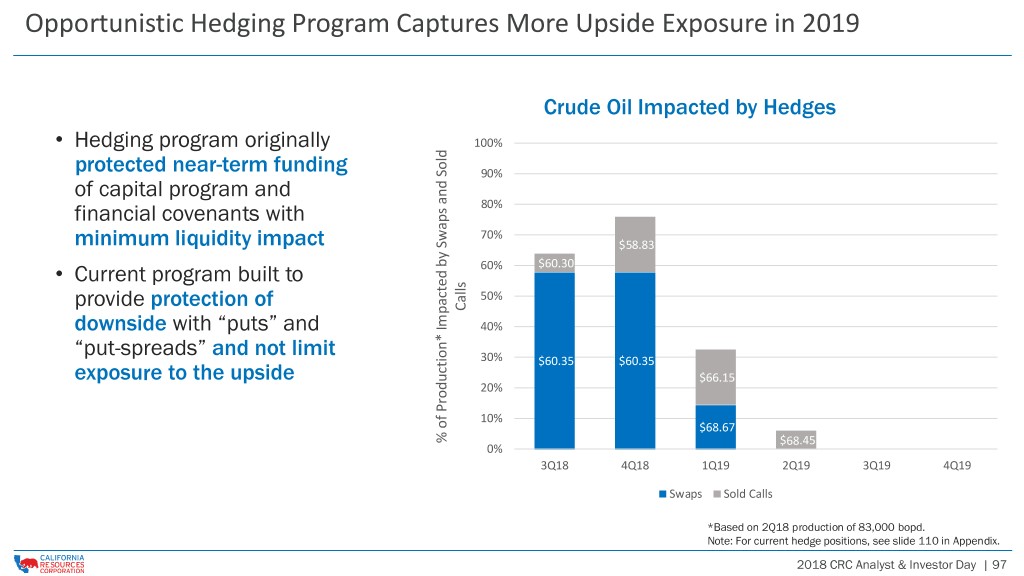

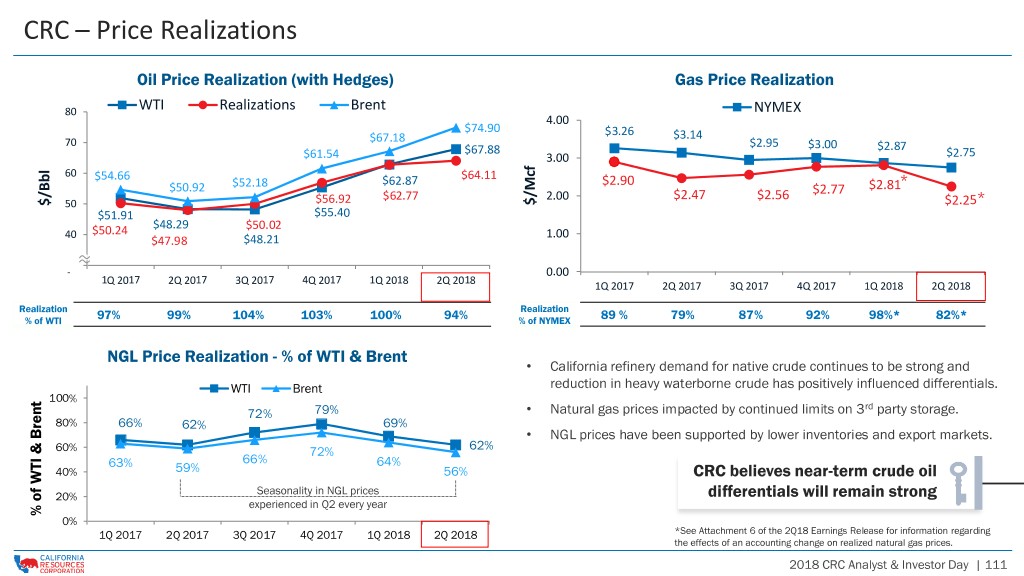

Opportunistic Hedging Program Captures More Upside Exposure in 2019 Crude Oil Impacted by Hedges • Hedging program originally 100% protected near-term funding 90% of capital program and financial covenants with 80% 70% minimum liquidity impact $58.83 • Current program built to 60% $60.30 provide protection of 50% Calls downside with “puts” and 40% “put-spreads” and not limit 30% $60.35 $60.35 exposure to the upside $66.15 20% 10% $68.67 % of Production* Impacted by Swaps and Sold Sold and Swaps by Impacted Production* of % $68.45 0% 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 Swaps Sold Calls *Based on 2Q18 production of 83,000 bopd. Note: For current hedge positions, see slide 110 in Appendix. 2018 CRC Analyst & Investor Day | 97

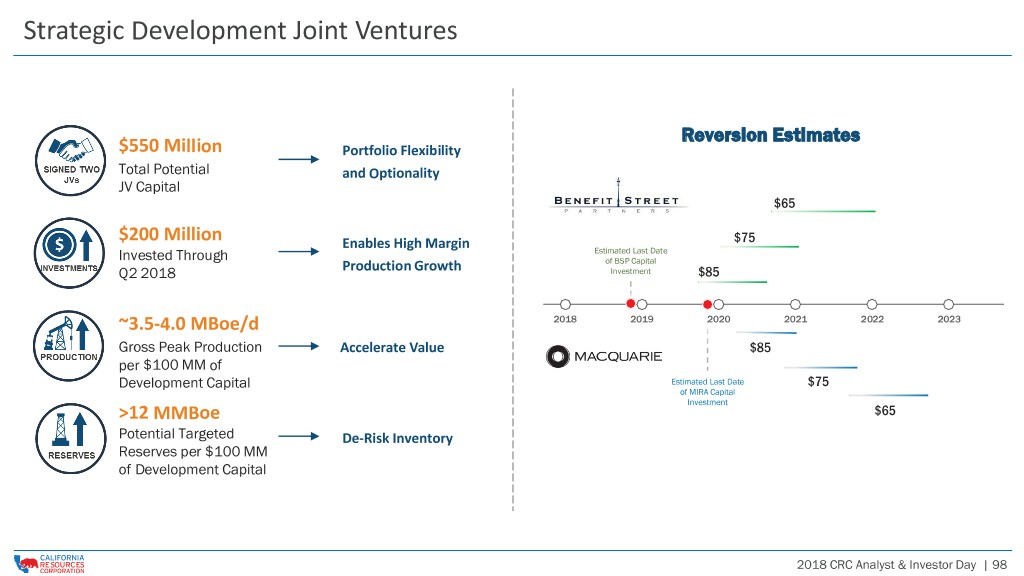

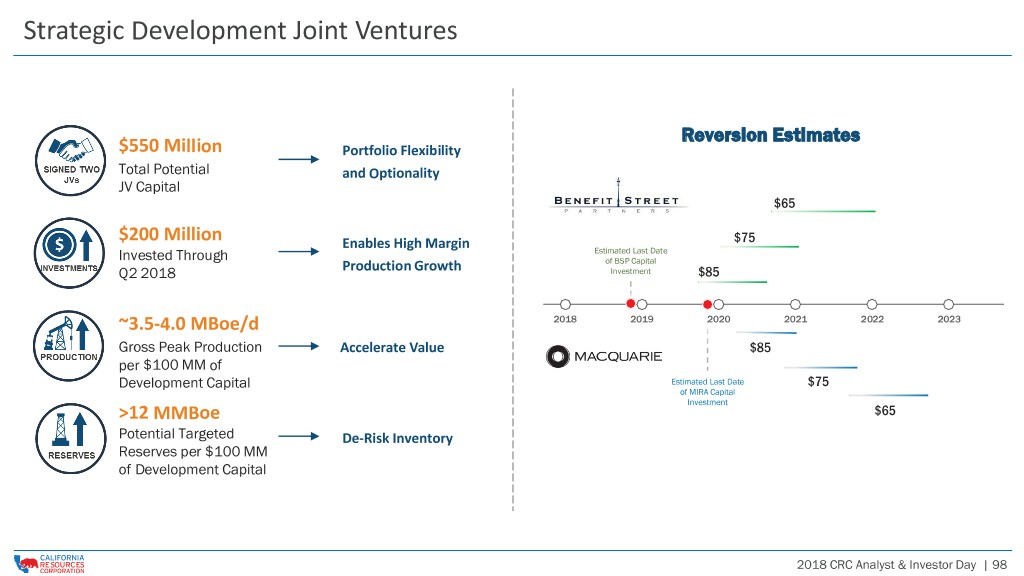

Strategic Development Joint Ventures Reversion Estimates $550 Million Portfolio Flexibility Total Potential and Optionality JV Capital $65 $200 Million $75 Enables High Margin Estimated Last Date Invested Through of BSP Capital Q2 2018 Production Growth Investment $85 ~3.5-4.0 MBoe/d 2018 2019 2020 2021 2022 2023 Gross Peak Production Accelerate Value $85 per $100 MM of Development Capital Estimated Last Date $75 of MIRA Capital Investment >12 MMBoe $65 Potential Targeted De-Risk Inventory Reserves per $100 MM of Development Capital 2018 CRC Analyst & Investor Day | 98

Summary of Mid-Year 2018 Reserves Changes 96% 731 MMBOE <$10/BOE 15 Year Half-Year Proven Organic Proved Reserves 1 Reserves Replacement Up 18% from YE 2017 F&D Cost R/P (excl. price-related revisions – unaudited) CRC Reserves Changes (Net MMBOE) YE 17 YE 18 Price July 1P RRR3 Reserve YE 2017 1H 2018 Acq & Proved Gross Gross Related Changes2 2018 (Excl Category Balance Production Div R/P Well Well Revision Balance Price) Count Count PD 440 40 (23) 25 46 528 9,695 10,097 PUD 178 10 0 (2) 18 203 1,691 1,546 Proved4 618 50 (23) 23 64 731 96% 15 11,386 11,643 1 Organic F&D including the effect of the Elk Hills acquisition. 2 Includes transfers, revisions, exploration and development and improved recovery. 58 MMBOE “Technical” proven reserves in contingent replacement due to economics and/or 5-year rule limitations. 3 RRR refers to organic reserves replacement ratio. 4 Proved reserves at $75 Brent / $3 Nymex. 2018 CRC Analyst & Investor Day | 99

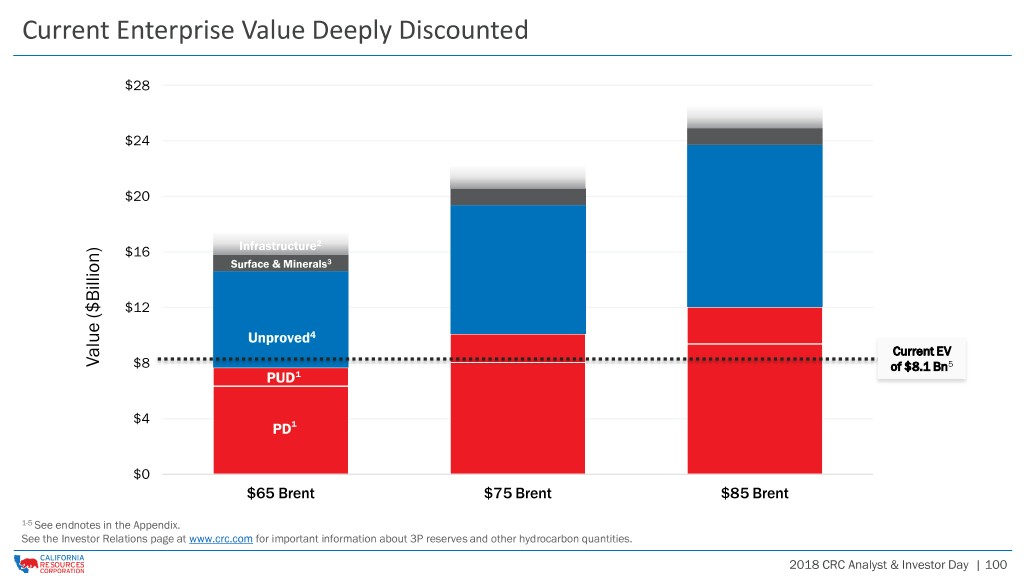

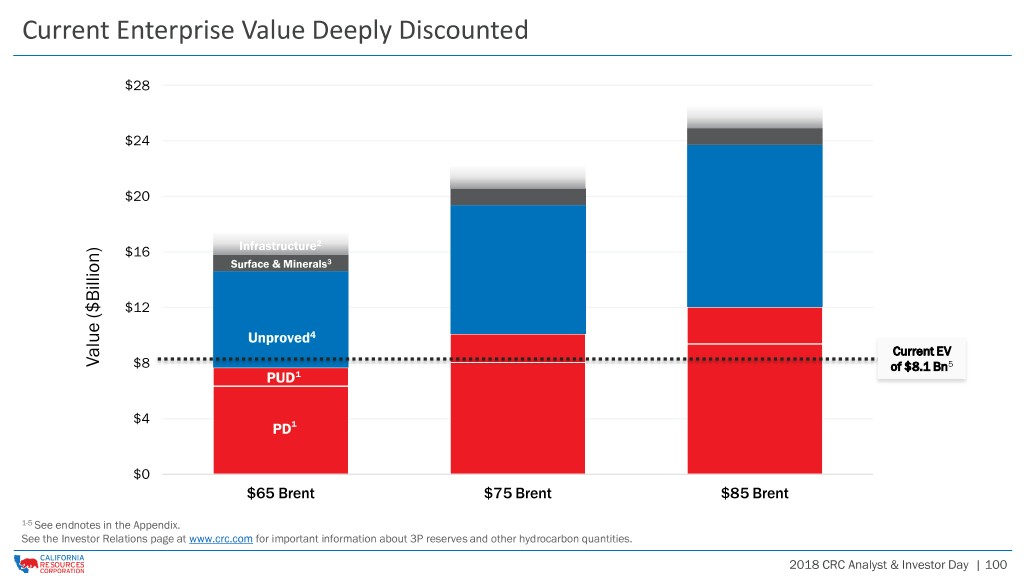

Current Enterprise Value Deeply Discounted $28 $24 $20 2 $16 Infrastructure Surface & Minerals3 $12 Unproved4 Current EV Value ($Billion) Value $8 of $8.1 Bn5 PUD1 $4 PD1 $0 $65 Brent $75 Brent $85 Brent 1-5 See endnotes in the Appendix. See the Investor Relations page at www.crc.com for important information about 3P reserves and other hydrocarbon quantities. 2018 CRC Analyst & Investor Day | 100

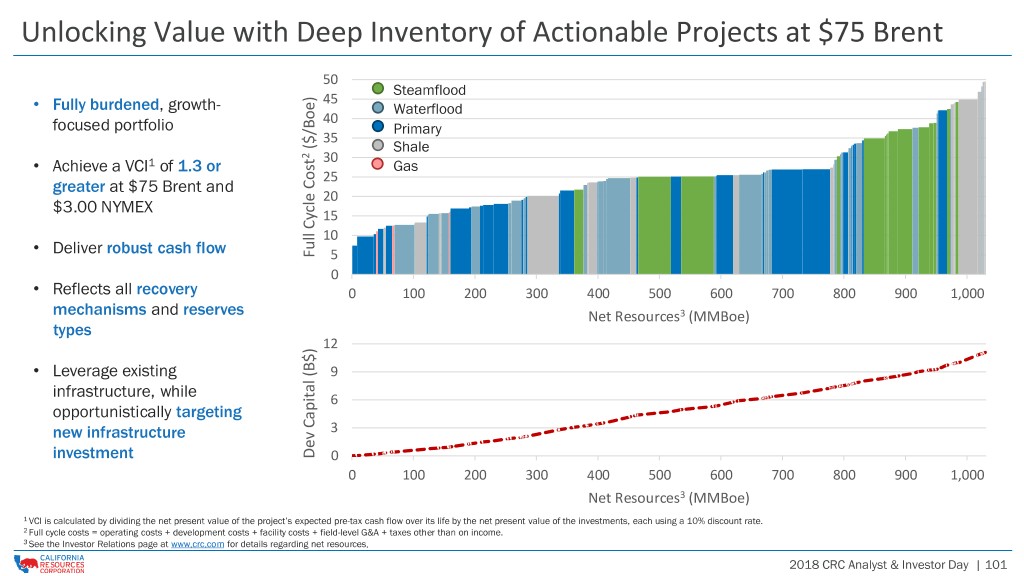

Unlocking Value with Deep Inventory of Actionable Projects at $75 Brent 50 Steamflood 45 • Fully burdened, growth- Waterflood 40 focused portfolio Primary 35 ($/Boe) Shale 2 30 • Achieve a VCI1 of 1.3 or Gas 25 greater at $75 Brent and 20 $3.00 NYMEX 15 10 • Deliver robust cash flow Full Cycle Cost Cycle Full 5 0 • Reflects all recovery 0 100 200 300 400 500 600 700 800 900 1,000 mechanisms and reserves Net Resources3 (MMBoe) types 12 • Leverage existing 9 infrastructure, while 6 opportunistically targeting new infrastructure 3 investment (B$) Capital Dev 0 0 100 200 300 400 500 600 700 800 900 1,000 Net Resources3 (MMBoe) 1 VCI is calculated by dividing the net present value of the project’s expected pre-tax cash flow over its life by the net present value of the investments, each using a 10% discount rate. 2 Full cycle costs = operating costs + development costs + facility costs + field-level G&A + taxes other than on income. 3 See the Investor Relations page at www.crc.com for details regarding net resources. 2018 CRC Analyst & Investor Day | 101

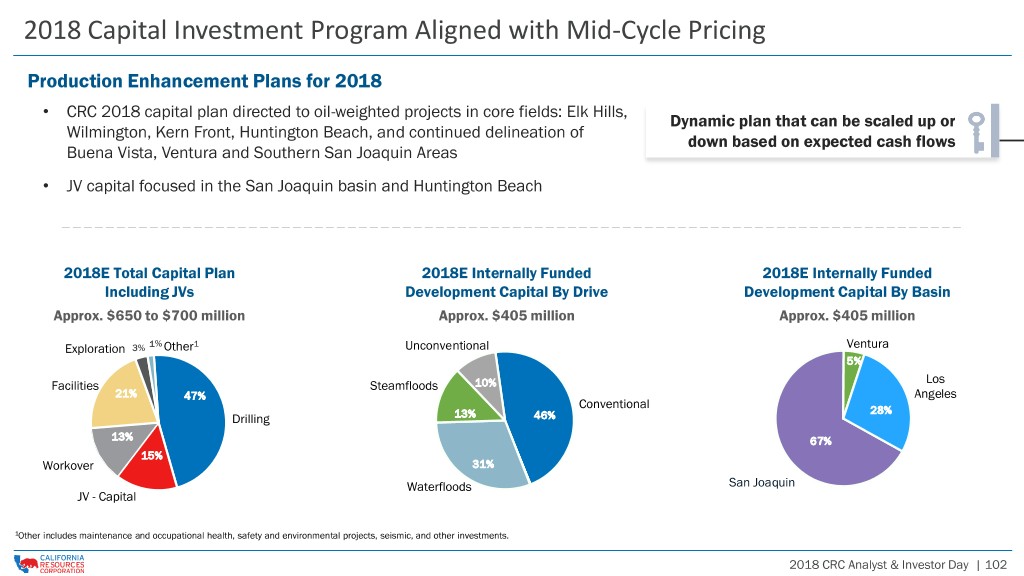

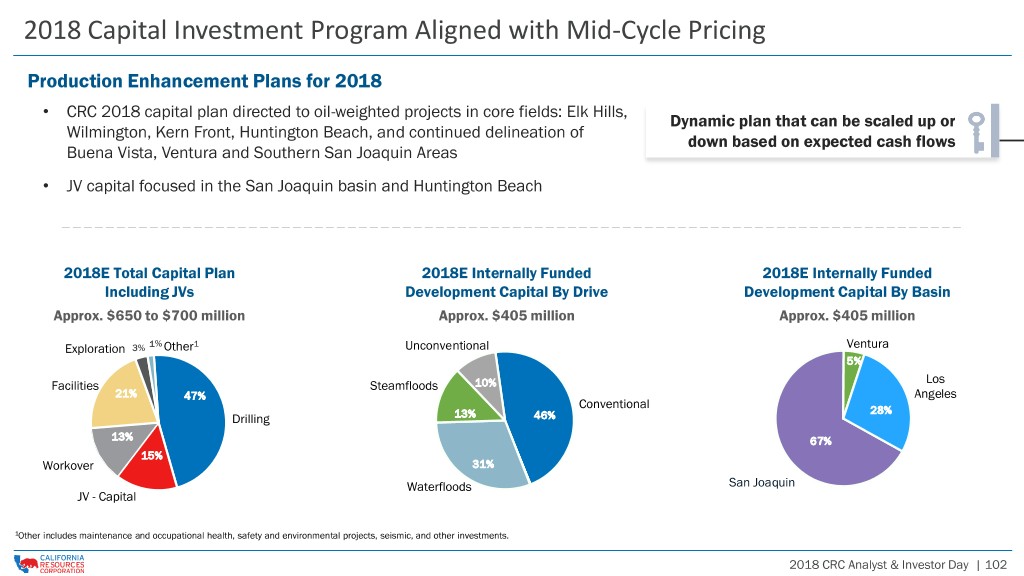

2018 Capital Investment Program Aligned with Mid-Cycle Pricing Production Enhancement Plans for 2018 • CRC 2018 capital plan directed to oil-weighted projects in core fields: Elk Hills, Dynamic plan that can be scaled up or Wilmington, Kern Front, Huntington Beach, and continued delineation of down based on expected cash flows Buena Vista, Ventura and Southern San Joaquin Areas • JV capital focused in the San Joaquin basin and Huntington Beach 2018E Total Capital Plan 2018E Internally Funded 2018E Internally Funded Including JVs Development Capital By Drive Development Capital By Basin Approx. $650 to $700 million Approx. $405 million Approx. $405 million Exploration 3% 1% Other1 Unconventional Ventura 5% Los Facilities Steamfloods 10% 21% 47% Angeles Conventional 28% Drilling 13% 46% 13% 67% 15% Workover 31% Waterfloods San Joaquin JV - Capital 1Other includes maintenance and occupational health, safety and environmental projects, seismic, and other investments. 2018 CRC Analyst & Investor Day | 102

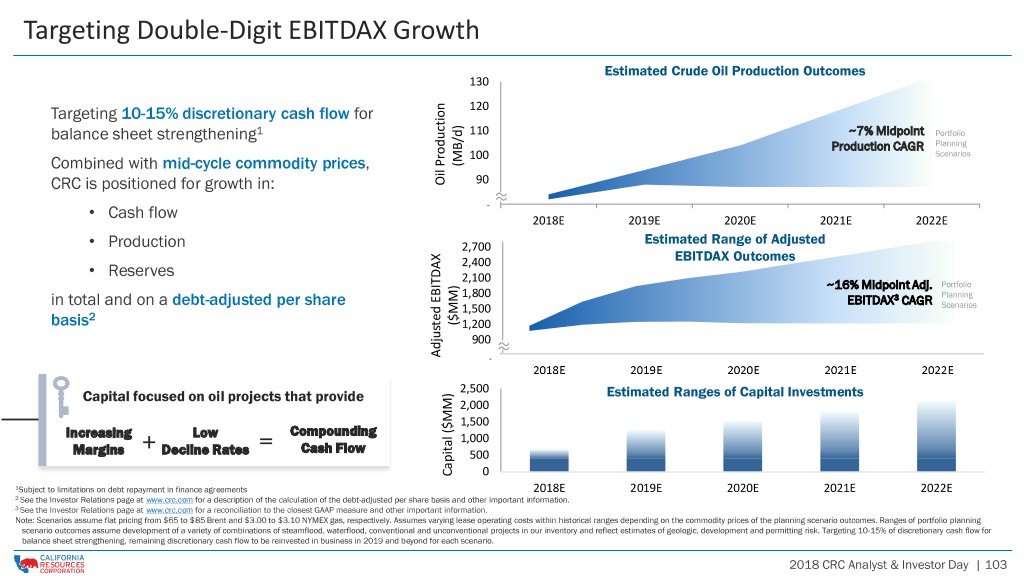

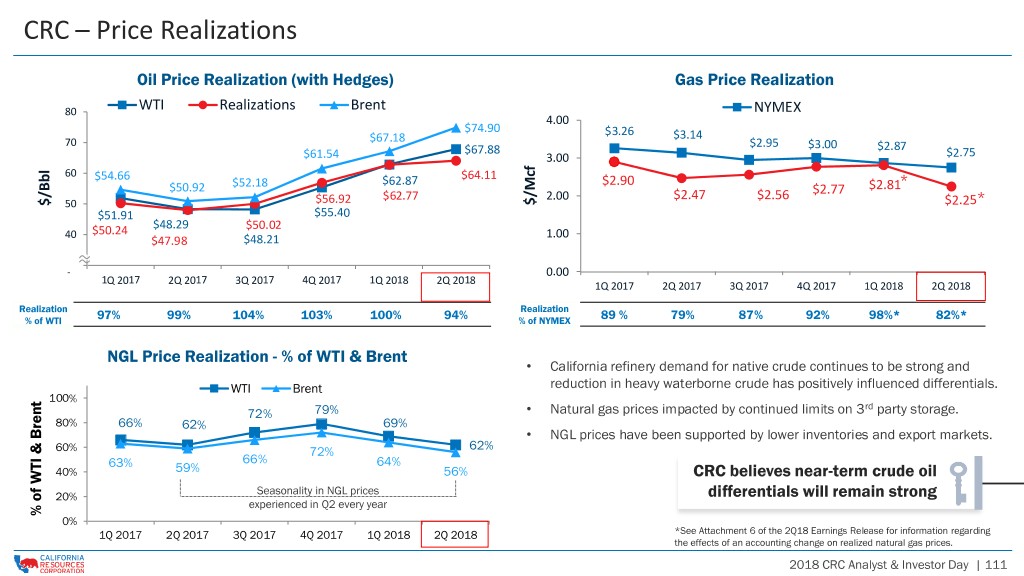

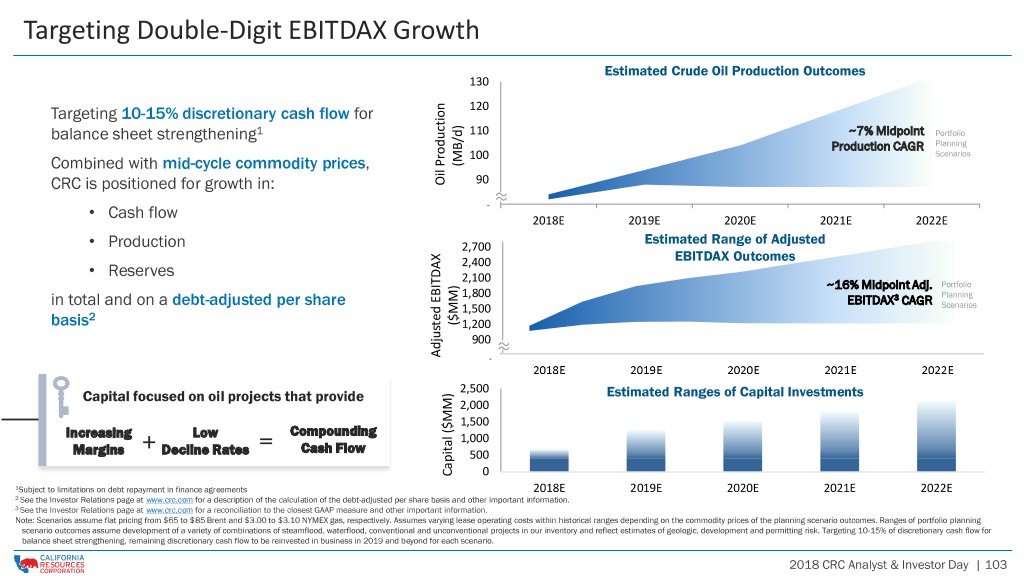

Targeting Double-Digit EBITDAX Growth Estimated Crude Oil Production Outcomes 130 Targeting 10-15% discretionary cash flow for 120 balance sheet strengthening1 110 ~7% Midpoint Portfolio Production CAGR Planning 100 Scenarios Combined with mid-cycle commodity prices, (MB/d) Oil Production Oil 90 CRC is positioned for growth in: ≈ Cash flow 80- • 2018E 2019E 2020E 2021E 2022E Estimated Range of Adjusted • Production 2,700 2,400 EBITDAX Outcomes • Reserves 2,100 ~16% Midpoint Adj. Portfolio 1,800 Planning in total and on a debt-adjusted per share EBITDAX3 CAGR 1,500 Scenarios 2 basis ($MM) 1,200 900 AdjustedEBITDAX ≈ 600- Capital focused on oil projects that provide 2,500 Estimated Ranges of Capital Investments 2,000 1,500 Compounding Increasing Low 1,000 = Cash Flow Margins + Decline Rates 500 Capital($MM) 0 1Subject to limitations on debt repayment in finance agreements 2018E 2019E 2020E 2021E 2022E 2 See the Investor Relations page at www.crc.com for a description of the calculation of the debt-adjusted per share basis and other important information. 3 See the Investor Relations page at www.crc.com for a reconciliation to the closest GAAP measure and other important information. Note: Scenarios assume flat pricing from $65 to $85 Brent and $3.00 to $3.10 NYMEX gas, respectively. Assumes varying lease operating costs within historical ranges depending on the commodity prices of the planning scenario outcomes. Ranges of portfolio planning scenario outcomes assume development of a variety of combinations of steamflood, waterflood, conventional and unconventional projects in our inventory and reflect estimates of geologic, development and permitting risk. Targeting 10-15% of discretionary cash flow for balance sheet strengthening, remaining discretionary cash flow to be reinvested in business in 2019 and beyond for each scenario. 2018 CRC Analyst & Investor Day | 103

Continuous Efforts Provide Pathway to Reasonable Leverage Estimated Leverage Ratios 10.0x 1 8.0x 6.0x 4.0x Total Debt/Adj. EBITDAX Debt/Adj. Total 2.0x 0.0x 2 2016 2017 2018E 2019E 2020E 2021E 2022E $65 $75 $85 Core Adj. EBITDAX1 Leverage 1See the Investor Relations page at www.crc.com for a reconciliation to the closest GAAP measure and other important information. Core Adjusted EBITDAX excludes settled hedges and cash settled equity compensation costs. 22Q18 annualized. Note: Targeting 10-15% of discretionary cash flow for balance sheet strengthening, remaining discretionary cash flow to be reinvested in business in 2019 and beyond for each scenario. 2018 CRC Analyst & Investor Day | 104

All of the Above Approach to Simplify Balance Sheet Reduce Debt Through Cash Flow Reduce Reduce Outstanding Fixed Debt Charges Capital Simplify Asset Market Balance Monetizations Solutions Sheet Extend Capital Maturities Structure EBITDAX Growth 2018 CRC Analyst & Investor Day | 105

Five Main Takeaways 1. CRC is well-positioned to prosper in the mid-cycle environment as California’s premier operator 2. Conventional delivers strong & differentiated value 3. The application of capital and technology will allow CRC to grow its core and growth areas, improve efficiencies and deliver increased margins 4. CRC has a robust opportunity set and significant remaining inventory potential 5. Continued financial strengthening in 2019 with a portion of discretionary cash flow dedicated to debt reduction

Investment Proposition: Delivering Smart Growth and Real Value Portfolio of world- Robust inventory Deep operational Integrated and Disciplined and class assets of high value knowledge and complementary effective capital investable throughout growth projects technical expertise infrastructure allocation the commodity cycle Effective capital allocation through Balance capital investment with cycle for smart growth financial strengthening efforts for best long-term value creation $ Balance High VCI VALUE Sheet Goals Projects Deep Inventory DRIVEN Reduce Debt Core Operating Areas Reduce Fixed Charges Growth Prospects Production Investing for the Oil$/BBL Price Simplify Balance Sheet Future Innovation Gas Price $/MCF 2018 CRC Analyst & Investor Day | 107

APPENDIX

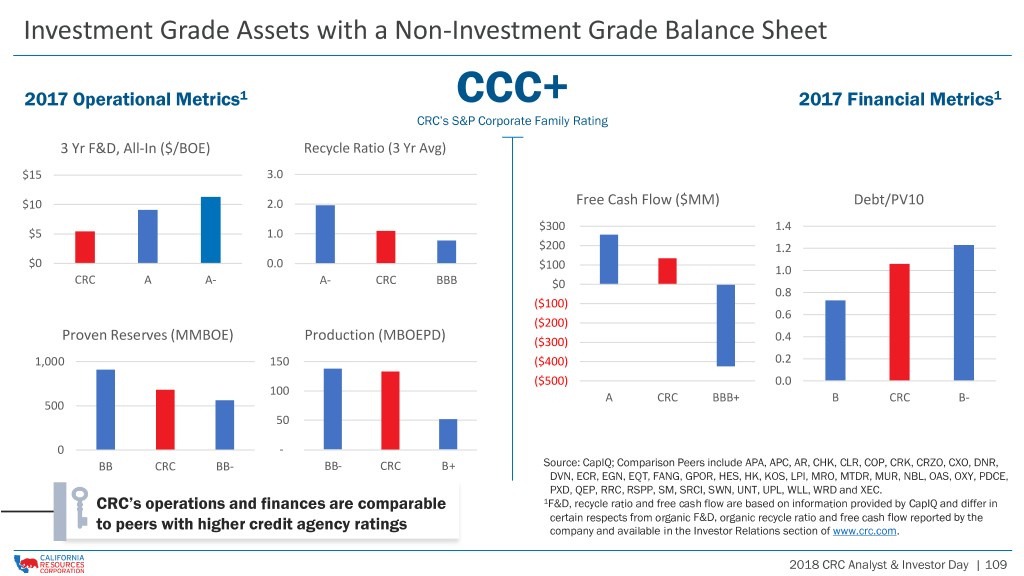

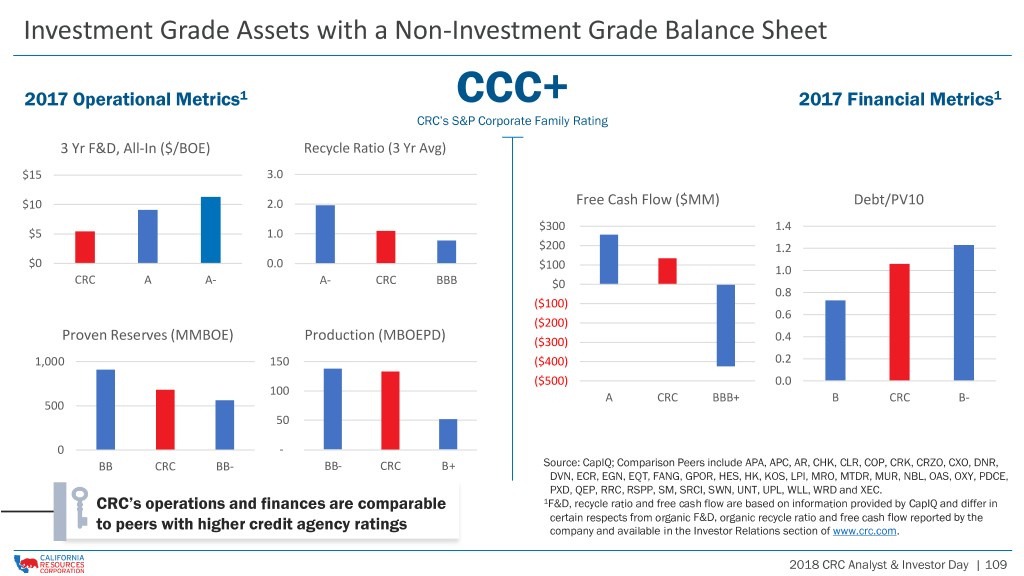

Investment Grade Assets with a Non-Investment Grade Balance Sheet 2017 Operational Metrics1 CCC+ 2017 Financial Metrics1 CRC’s S&P Corporate Family Rating 3 Yr F&D, All-In ($/BOE) Recycle Ratio (3 Yr Avg) $15 3.0 $10 2.0 Free Cash Flow ($MM) Debt/PV10 $300 1.4 $5 1.0 $200 1.2 $0 0.0 $100 1.0 CRC A A- A- CRC BBB $0 0.8 ($100) 0.6 ($200) Proven Reserves (MMBOE) Production (MBOEPD) ($300) 0.4 1,000 150 ($400) 0.2 ($500) 0.0 100 A CRC BBB+ B CRC B- 500 50 0 - BB CRC BB- BB- CRC B+ Source: CapIQ; Comparison Peers include APA, APC, AR, CHK, CLR, COP, CRK, CRZO, CXO, DNR, DVN, ECR, EGN, EQT, FANG, GPOR, HES, HK, KOS, LPI, MRO, MTDR, MUR, NBL, OAS, OXY, PDCE, PXD, QEP, RRC, RSPP, SM, SRCI, SWN, UNT, UPL, WLL, WRD and XEC. CRC’s operations and finances are comparable 1F&D, recycle ratio and free cash flow are based on information provided by CapIQ and differ in certain respects from organic F&D, organic recycle ratio and free cash flow reported by the to peers with higher credit agency ratings company and available in the Investor Relations section of www.crc.com. 2018 CRC Analyst & Investor Day | 109

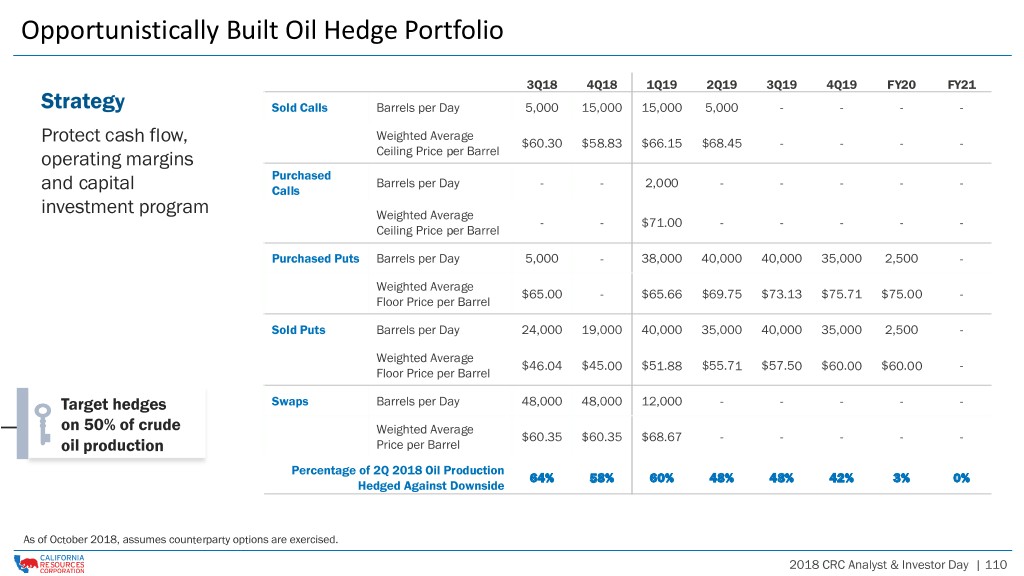

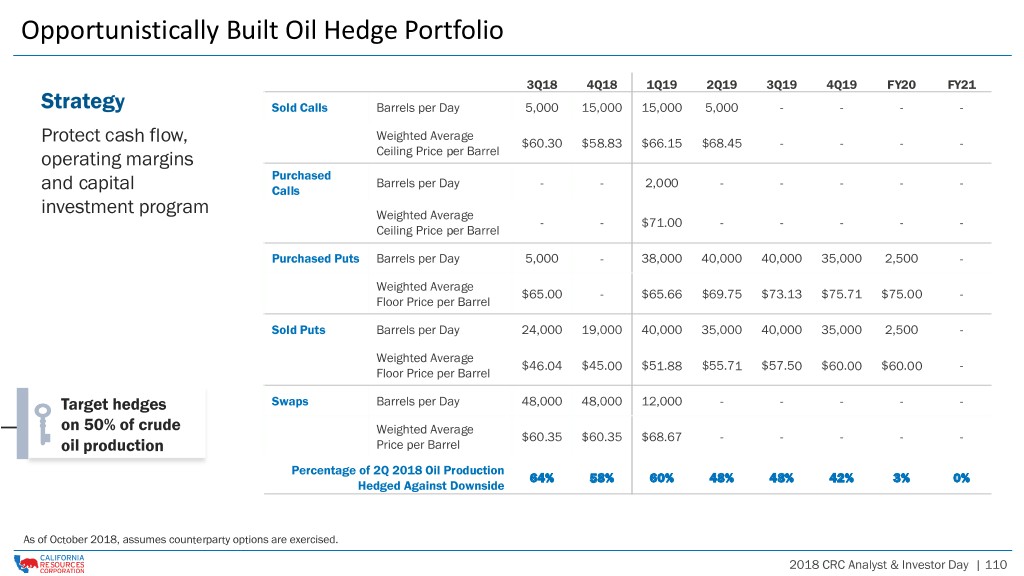

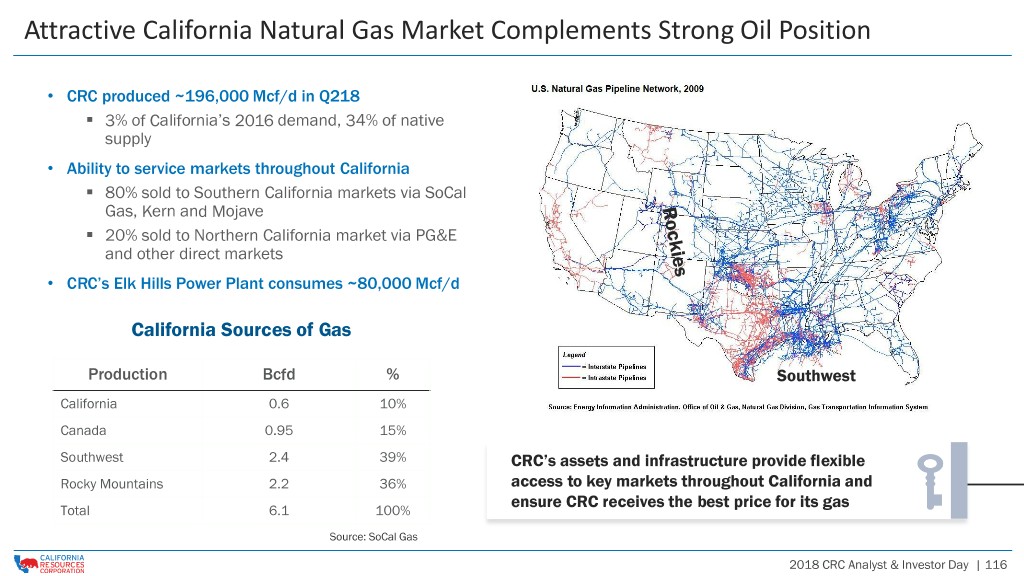

Opportunistically Built Oil Hedge Portfolio 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 FY20 FY21 Strategy Sold Calls Barrels per Day 5,000 15,000 15,000 5,000 - - - - Weighted Average Protect cash flow, $60.30 $58.83 $66.15 $68.45 - - - - operating margins Ceiling Price per Barrel Purchased Barrels per Day - - 2,000 - - - - - and capital Calls investment program Weighted Average - - $71.00 - - - - - Ceiling Price per Barrel Purchased Puts Barrels per Day 5,000 - 38,000 40,000 40,000 35,000 2,500 - Weighted Average $65.00 - $65.66 $69.75 $73.13 $75.71 $75.00 - Floor Price per Barrel Sold Puts Barrels per Day 24,000 19,000 40,000 35,000 40,000 35,000 2,500 - Weighted Average $46.04 $45.00 $51.88 $55.71 $57.50 $60.00 $60.00 - Floor Price per Barrel Target hedges Swaps Barrels per Day 48,000 48,000 12,000 - - - - - on 50% of crude Weighted Average $60.35 $60.35 $68.67 - - - - - oil production Price per Barrel Percentage of 2Q 2018 Oil Production 64% 58% 60% 48% 48% 42% 3% 0% Hedged Against Downside As of October 2018, assumes counterparty options are exercised. 2018 CRC Analyst & Investor Day | 110