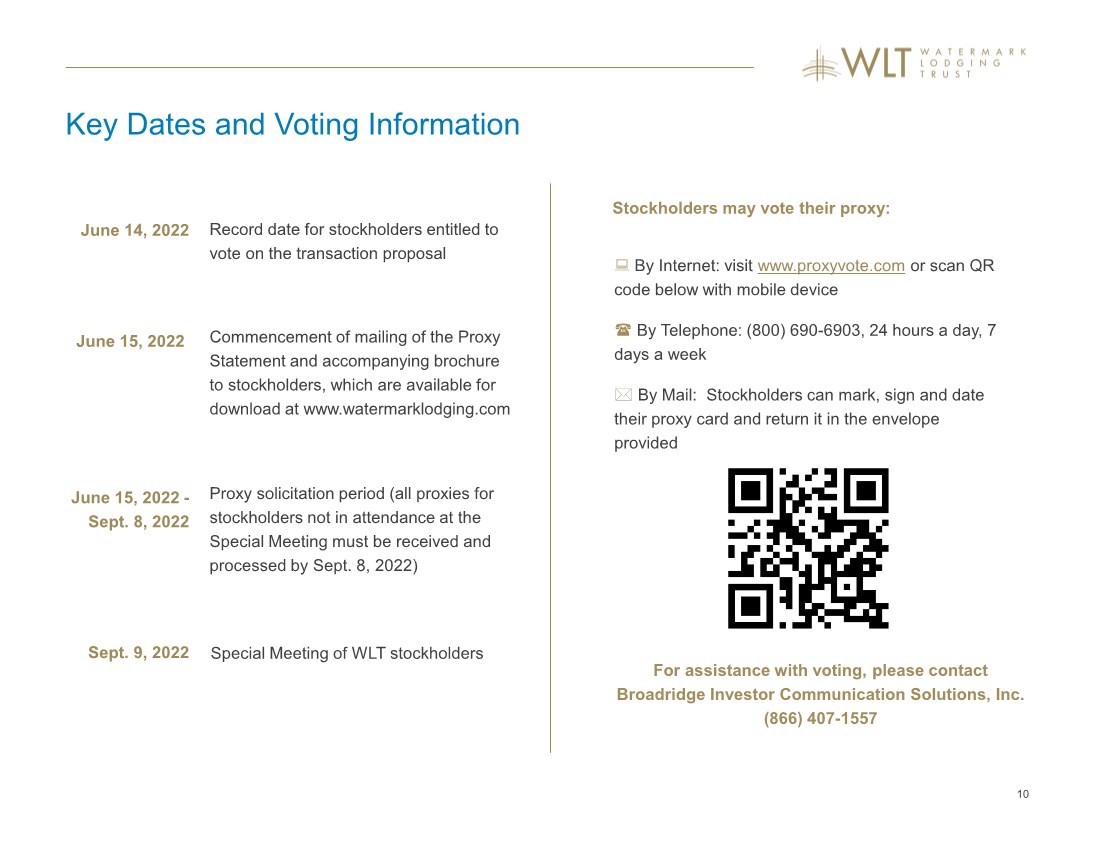

| 12 This communication relates to the proposed merger transaction involving the Company. In connection with the proposed transaction, the Company has filed relevant materials with the Securities and Exchange Commission, including a proxy statement on Schedule 14A filed on June 15, 2022 (the “Proxy Statement”). This communication is not a substitute for the Proxy Statement or for any other document that the Company may file with the SEC and send to the Company’s stockholders in connection with the proposed transaction. INVESTORS AND SECURITY HOLDERS OF THE COMPANY ARE URGED TO READ THE PROXY STATEMENT AND OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders are able to obtain free copies of the Proxy Statement and other documents filed by the Company with the SEC through the website maintained by the SEC at www.sec.gov. Copies of the documents filed by the Company with the SEC will be available free of charge on the Company’s website at www.watermarklodging.com, or by contacting the Company’s Investor Relations Department at (855) WLT REIT (958-7348). Additional Information and Where to Find It Participants in the Solicitation The Company and its directors and executive officers may be considered participants in the solicitation of proxies with respect to the proposed transaction under the rules of the SEC. Information about the directors and executive officers of the Company is set forth in its Annual Report on Form 10-K/A for the year ended December 31, 2021, which was filed with the SEC on April 27, 2022, and subsequent documents filed with the SEC. Additional information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will also be included in the Proxy Statement and other relevant materials filed with the SEC. Investors should read the Proxy Statement carefully before making any voting or investment decisions. The forward-looking statements contained in this communication, including statements regarding the proposed transaction and the timing and benefits of such transaction, are subject to various risks and uncertainties. Although the Company believes the expectations reflected in any forward-looking statements contained herein are based on reasonable assumptions, there can be no assurance that such expectations will be achieved. Forward-looking statements, which are based on certain assumptions and describe future plans, strategies and expectations of the Company, are generally identifiable by use of the words “believe,” “expect,” “intend,” “anticipate,” “estimate,” “project,” or other similar expressions. Such statements involve known and unknown risks, uncertainties, and other factors that may cause the actual results of the Company to differ materially from future results, performance or achievements projected or contemplated in the forward-looking statements. Some of the factors that may affect outcomes and results include, but are not limited to: (i) risks associated with the Company’s ability to obtain the stockholder approval required to consummate the merger and the timing of the closing of the merger, including the risks that a condition to closing would not be satisfied within the expected timeframe or at all or that the closing of the merger will not occur, (ii) the outcome of any legal proceedings that may be instituted against the parties and others related to the Agreement and Plan of Merger relating to the proposed transaction, (iii) unanticipated difficulties or expenditures relating to the transaction, the response of business partners and competitors to the announcement of the transaction, and/or potential difficulties in employee retention as a result of the announcement and pendency of the transaction, (iv) the possible failure of the Company to maintain its qualification as a REIT, and (v) those additional risks and factors discussed in reports filed with the SEC by the Company from time to time, including those discussed under the heading “Risk Factors” in the Company's most recently filed Annual Report on Form 10-K/A, as updated by subsequent Quarterly Reports on Form 10-Q and other reports filed with the SEC. The Company undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Investors should not place undue reliance upon forward-looking statements. Forward Looking Statements |