As filed with the Securities and Exchange Commission on June 27, 2014

RegistrationNo. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Lamar Advertising REIT Company

(Exact name of registrant as specified in its charter)

| | | | |

| Delaware | | 6798 | | 47-0961620 |

(State or other jurisdiction of

incorporation or organization) | | (Primary Standard Industrial Classification Code) | | (I.R.S. Employer

Identification No.) |

5321 Corporate Boulevard

Baton Rouge, Louisiana 70808

(225) 926-1000

(Address, Including ZIP Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Sean E. Reilly

Chief Executive Officer

Lamar Advertising Company

5321 Corporate Boulevard

Baton Rouge, Louisiana 70808

(225) 926-1000

(Name, Address, Including ZIP Code and Telephone Number, Including Area Code, of Agent for Service)

with copies to:

| | |

Stacie S. Aarestad, Esq.

Edwards Wildman Palmer LLP

111 Huntington Avenue

Boston, Massachusetts 02199

(617) 239-0100 | | Gilbert G. Menna, Esq.

Suzanne D. Lecaroz, Esq.

Goodwin ProcterLLP

Exchange Place

Boston, Massachusetts 02109

(617)570-1000 |

Approximate date of commencement of proposed sale of the securities to the public: As soon as practicable after this registration statement becomes effective.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is apost-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, anon-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” inRule 12b-2 of the Exchange Act. (Check one):

| | | | | | |

| Large accelerated filer | | x | | Accelerated filer | | ¨ |

| | | |

| Non-accelerated filer | | ¨ | | Smaller reporting company | | ¨ |

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange ActRule 13e-4(i)(Cross-Border Issuer Tender Offer) ¨

Exchange ActRule 14d-1(d) (Cross BorderThird-Party Tender Offer) ¨

CALCULATION OF REGISTRATION FEE

| | | | | | | | |

|

Title of Each Class of Securities to be Registered | | Amount to be Registered(1) | | Proposed Maximum Offering Price per Unit | | Proposed Maximum

Aggregate Offering Price | | Amount of

Registration Fee |

Class A common stock, $0.001 par value | | 81,712,260 | | N/A | | $4,185,301,957(2)(3) | | $539,067(2) |

Class B common stock, $0.001 par value | | 14,610,365 | | N/A | | $748,342,896(2)(4) | | $96,387(2) |

Class A common stock, $0.001 par value, issuable upon conversion of the Class B common stock | | 14,610,365(5) | | N/A | | N/A | | N/A(6) |

|

|

| (1) | Includes the maximum number of shares of Class A common stock, $0.001 par value, and Class B common stock, $0.001 par value, of Lamar Advertising REIT Company, a Delaware corporation (referred to as “Lamar REIT,” which will be renamed “Lamar Advertising Company” following the merger described below), that may be issuable pursuant to the merger of Lamar Advertising Company, a Delaware corporation, or Lamar Advertising, with and into Lamar REIT, pursuant to the agreement and plan of merger between Lamar Advertising and Lamar REIT as described in the proxy statement/prospectus that forms a part of this Registration Statement, based on the number of shares of Class A common stock, $0.001 par value, and Class B common stock, $0.001 par value, of Lamar Advertising outstanding at the close of business on June 24, 2014 or that may be issuable pursuant to outstanding options or pursuant to our employee stock purchase plan prior to the date the merger is expected to be completed. Pursuant to the merger, each outstanding share of Lamar Advertising Class A common stock will be converted into the right to receive the same number of shares of Lamar REIT Class A common stock and each outstanding share of Lamar Advertising Class B common stock will be converted into the right to receive the same number of shares of Lamar REIT Class B common stock. |

| (2) | Estimated solely for purposes of calculating the registration fee pursuant to Rule 457(f) promulgated under the Securities Act of 1933, as amended. The proposed maximum aggregate offering price of Lamar REIT common stock was calculated in accordance with Rule 457(c). |

| (3) | Reflects $51.22, the average of the high and low prices per share of Lamar Advertising Class A common stock on the NASDAQ Global Select Market on June 20, 2014, multiplied by 81,712,260, the estimated maximum number of shares of Lamar REIT Class A common stock that may be issued upon the completion of the merger of Lamar Advertising. |

| (4) | Reflects $51.22, the average of the high and low prices per share of Lamar Advertising Class A common stock on the NASDAQ Global Select Market on June 20, 2014, multiplied by 14,610,365, the estimated maximum number of shares of Lamar REIT Class B common stock that may be issued upon the completion of the merger of Lamar Advertising. |

| (5) | Represents the maximum number of shares of Lamar REIT Class A common stock issuable upon conversion of Lamar REIT Class B common stock, which is convertible at the option of the holder on aone-for-one basis at any time. |

| (6) | Pursuant to Rule 457(i) under the Securities Act of 1933, there is no additional filing fee with respect to the shares of Class A Common Stock issuable upon conversion of the Class B Common Stock because no additional consideration will be received by us in connection with the conversion. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said section 8(a), may determine.

The information in this proxy statement/prospectus is not complete and may be changed. A registration statement relating to these securities has been filed with the Securities and Exchange Commission. Lamar Advertising REIT Company may not sell or exchange these securities until the Registration Statement is effective. This proxy statement/prospectus is not an offer to sell or exchange these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject To Completion, dated June 27, 2014

[ ], 2014

Dear Stockholder:

I am pleased to invite you to attend a special meeting of stockholders of Lamar Advertising Company, or Lamar Advertising, a Delaware corporation, which will be held on [ ], 2014 at [ ], local time, at the offices of Lamar Advertising Company, 5321 Corporate Boulevard, Baton Rouge, Louisiana 70808.

I am also pleased to report that the board of directors of Lamar Advertising has unanimously approved a plan to reorganize the business operations of Lamar Advertising to allow Lamar Advertising to be taxed as a real estate investment trust, or REIT, for U.S. federal income tax purposes. We refer to this reorganization plan as the REIT conversion.

The REIT conversion is being implemented through a series of steps including, among other things, the merger of Lamar Advertising into Lamar Advertising REIT Company, or Lamar REIT, a Delaware corporation and wholly owned subsidiary of Lamar Advertising, which was recently formed in connection with the REIT conversion. Effective at the time of the merger, Lamar REIT will be renamed “Lamar Advertising Company” and will hold, directly or indirectly through its subsidiaries, the assets currently held by Lamar Advertising and will conduct the existing businesses of Lamar Advertising and its subsidiaries. In the merger, you will receive a number of shares of Lamar REIT Class A common stock, Class B common stock and Series AA preferred stock equal to, and in exchange for, the number of shares of Lamar Advertising Class A common stock, Class B common stock and Series AA preferred stock you own. We anticipate that the shares of Lamar REIT Class A common stock will trade on the NASDAQ Global Select Market under the symbol “LAMR.”

We are requesting that our stockholders vote to adopt the Agreement and Plan of Merger dated [ ], 2014 by and between Lamar Advertising and Lamar REIT pursuant to which Lamar Advertising will merge with and into Lamar REIT. The affirmative vote of the holders of a majority of the outstanding shares of Lamar Advertising Class A common stock, Class B common stock and Series AA preferred stock entitled to vote, voting together as a single class, is required for the adoption of the merger agreement. After careful consideration, the board of directors has unanimously approved the REIT conversion, including the merger and other restructuring transactions, and recommends that all stockholders vote “FOR” the adoption of the merger agreement.

This proxy statement/prospectus is a prospectus of Lamar REIT as well as a proxy statement for Lamar Advertising and provides you with detailed information about the REIT conversion, the merger and the special meeting.We encourage you to read carefully this entire proxy statement/prospectus, including all its annexes, and we especially encourage you to read the section entitled “Risk Factors” beginning on page 24.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved the shares of Class A common stock and Class B common stock to be issued by Lamar REIT under this proxy statement/prospectus. Any representation to the contrary is a criminal offense.

This proxy statement/prospectus is dated [ ], 2014 and is being

first mailed to stockholders on or about [ ], 2014.

LAMAR ADVERTISING COMPANY

5321 Corporate Boulevard

Baton Rouge, Louisiana 70808

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS OF

LAMAR ADVERTISING COMPANY

TO BE HELD ON [ ], 2014

NOTICE IS HEREBY GIVEN that a special meeting of stockholders of Lamar Advertising Company, a Delaware corporation, will be held on [ ], 2014 at [ ], local time, at the offices of Lamar Advertising Company, 5321 Corporate Boulevard, Baton Rouge, Louisiana 70808, for the following purposes:

| (1) | To consider and vote upon a proposal to adopt the Agreement and Plan of Merger dated [ ], 2014 between Lamar Advertising Company and Lamar Advertising REIT Company, a newly formed wholly owned subsidiary of Lamar Advertising, which is part of the reorganization through which Lamar Advertising intends to qualify as a real estate investment trust, or REIT, for U.S. federal income tax purposes; and |

| (2) | To consider and vote upon a proposal to permit Lamar Advertising’s board of directors to adjourn the special meeting, if necessary, for further solicitation of proxies if there are not sufficient votes at the originally scheduled time of the special meeting to approve the foregoing proposal. |

The board of directors of Lamar Advertising has unanimously approved the REIT conversion, including the merger and other restructuring transactions, and recommends that you vote “FOR” the proposals that are described in more detail in this proxy statement/prospectus.

Lamar Advertising reserves the right to cancel or defer the merger or the REIT conversion even if stockholders of Lamar Advertising vote to adopt the merger agreement and the other conditions to the completion of the merger are satisfied or waived, if the board of directors of Lamar Advertising determines that the merger or the REIT conversion are no longer in the best interests of Lamar Advertising and its stockholders.

If you own shares of Lamar Advertising Class A common stock, Class B common stock or Series AA preferred stock as of the close of business on [ ], 2014, you are entitled to notice of, and to vote those shares by proxy or at the special meeting and at any adjournment or postponement of the special meeting. During theten-day period before the special meeting, Lamar Advertising will keep a list of stockholders entitled to vote at the special meeting available for inspection during normal business hours at Lamar Advertising’s offices in Baton Rouge, Louisiana, for any purpose germane to the special meeting. The list of stockholders will also be provided and kept at the location of the special meeting for the duration of the special meeting, and may be inspected by any stockholder who is present.

Your vote is important.Whether or not you plan to attend the special meeting in person, please complete, sign, date and promptly return the enclosed proxy card and return it in the enclosed envelope. Stockholders who return proxy cards by mail prior to the special meeting may nevertheless attend the special meeting, revoke their proxies and vote their shares at the special meeting.

We encourage you to read the attached proxy statement/prospectus carefully. If you have any questions or need assistance voting your shares, please call our proxy solicitor, [ ],toll-free at [ ].

By order of the board of directors,

James R. McIlwain

Secretary

Baton Rouge, Louisiana [ ], 2014

ADDITIONAL INFORMATION

Lamar Advertising Company, or Lamar Advertising, files annual, quarterly and current reports, proxy statements and other information with the Securities and Exchange Commission, or SEC. Lamar Advertising’s SEC filings are available to the public over the Internet at the SEC’s website at http://www.sec.gov. Please note that the SEC’s website is included in this proxy statement/prospectus and any applicable prospectus supplement as an inactive textual reference only. The information contained on the SEC’s website is not incorporated by reference into this proxy statement/prospectus and should not be considered to be part of this proxy statement/prospectus, except as described in the following paragraph. You may also read and copy any document we file with the SEC at its public reference facility at 100 F Street, NE, Washington, D.C. 20549. Please call the SEC at1-800-SEC-0330 for further information on the operation of the public reference facility.

We “incorporate by reference” into this proxy statement/prospectus, which means that we can disclose important information to you by referring you specifically to those documents. The information incorporated by reference is an important part of this proxy statement/prospectus. Certain information that we subsequently file with the SEC will automatically update and supersede information in this prospectus and in our other filings with the SEC. We incorporate by reference the documents listed below, which we have already filed with the SEC, and any future filings we make with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended, or Exchange Act, between the date of this proxy statement/prospectus and the date of the special meeting, except that we are not incorporating any information included in a Current Report on Form8-K that has been or will be furnished (and not filed) with the SEC, unless such information is expressly incorporated herein by reference to a furnished Current Report on Form8-K or other furnished document:

| | • | | our Annual Report on Form10-K for the year ended December 31, 2013 filed with the SEC on February 27, 2014; |

| | • | | our Quarterly Report on Form10-Q for the quarter ended March 31, 2014 filed with the SEC on May 7, 2014; |

| | • | | the information in our Definitive Proxy Statement on Schedule 14A filed with the SEC on April 25, 2014 that is deemed “filed” with the SEC under the Exchange Act; |

| | • | | our Current Reports on Form8-K filed with the SEC on January 8, 2014, January 15, 2014, February 7, 2014, March 21, 2014, March 24, 2014, April 22, 2014, April 23, 2014, May 22, 2014 and May 23, 2014; and |

| | • | | the description of our Class A common stock contained in our Registration Statement on Form8-A filed with the SEC on June 7, 1996 under the Exchange Act, and any subsequent amendments and reports filed to update such description. |

You may request a copy of these filings at no cost, by writing or calling us at the following address: 5321 Corporate Boulevard, Baton Rouge, LA 70808, Tel:(225) 926-1000, Attention: Keith Istre, Chief Financial Officer. If you would like to request documents from us, please do so by [ ], 2014.

Lamar Advertising REIT Company, or Lamar REIT, has filed a registration statement on FormS-4 to register with the SEC the Lamar REIT Class A common stock and Lamar REIT Class B common stock that Lamar Advertising stockholders will receive in connection with the merger if the merger is approved and completed. This proxy statement/prospectus is part of the registration statement of Lamar REIT on FormS-4 and is a prospectus of Lamar REIT and a proxy statement of Lamar Advertising for its special meeting.

Upon completion of the merger, Lamar REIT will be required to file annual, quarterly and special reports, proxy statements and other information with the SEC.

You should only rely on the information in, or incorporated by reference into, this proxy statement/prospectus. No one has been authorized to provide you with different information. You should not assume that the information contained in this proxy statement/prospectus is accurate as of any date other than the date on the front page. We are not making an offer to exchange or sell (or soliciting any offer to buy) any securities, or soliciting any proxy, in any state where it is unlawful to do so.

TABLE OF CONTENTS

QUESTIONS AND ANSWERS ABOUT THE REIT CONVERSION AND THE MERGER

What follows are questions that you, as a stockholder of Lamar Advertising Company, or Lamar Advertising, may have regarding the REIT conversion, the merger and the special meeting of stockholders, or the special meeting, and the answers to those questions. You are urged to carefully read this proxy statement/prospectus and the other documents referred to in this proxy statement/prospectus in their entirety because the information in this section may not provide all of the information that might be important to you with respect to the REIT conversion and the merger or the special meeting. Additional important information is contained in the annexes to, and the documents incorporated by reference into, this proxy statement/prospectus.

The information contained in this proxy statement/prospectus, unless otherwise indicated, assumes the REIT conversion and all the transactions related to the REIT conversion, including the merger, will occur. When used in this proxy statement/prospectus, unless otherwise specifically stated or the context otherwise requires, all references to “Company,” “Lamar Advertising,” “we,” “our” and “us” refer to Lamar Advertising and its subsidiaries with respect to the period prior to the merger, and Lamar REIT and its subsidiaries with respect to the period after the merger.

| Q. | What is the purpose of the special meeting? |

| A. | At the special meeting, our stockholders will vote on the following matters: |

| | • | | Proposal 1: To consider and vote upon a proposal to adopt the Agreement and Plan of Merger dated [ ], 2014 between Lamar Advertising Company and Lamar Advertising REIT Company, a newly formed wholly owned subsidiary of Lamar Advertising, which is part of the reorganization through which Lamar Advertising intends to qualify as a real estate investment trust, or REIT, for U.S. federal income tax purposes. |

| | • | | Proposal 2: To consider and vote upon a proposal to permit Lamar Advertising’s board of directors to adjourn the special meeting, if necessary, for further solicitation of proxies if there are not sufficient votes at the originally scheduled time of the special meeting to approve the foregoing proposal. |

| Q. | What are we planning to do? |

| A. | The board of directors has unanimously approved a plan to restructure our business operations to allow Lamar Advertising to be taxed as a REIT. We refer to this plan, including the related restructuring transactions, as the REIT conversion. The board of directors has determined that the REIT conversion would be in the best interests of Lamar Advertising and its stockholders. The REIT conversion includes the following key elements: |

| | • | | a restructuring of our business operations to facilitate the election to be taxed as a REIT which was completed during the course of 2013 and the early part of 2014; |

| | • | | the distribution of our earnings and profits, accumulated through 2013, which distribution is expected to be made as part of the payment of regular quarterly distributions in 2014 rather than through the payment of aone-time special distribution; |

| | • | | the payment of regular quarterly distributions to holders of our common stock, the amount of which will be determined, and is subject to adjustment, by the board of directors and the declaration of which commenced in the second quarter of 2014; and |

| | • | | the consummation of the merger of Lamar Advertising with and into Lamar REIT in order to effectively adopt the amended and restated certificate of incorporation of Lamar REIT that will contain provisions intended to facilitate our compliance with certain REIT rules relating to share ownership. |

As announced on April 23, 2014, we received a private letter ruling from the U.S. Internal Revenue Service, or the IRS, regarding certain matters relevant to our qualification as a REIT.

1

| A. | A REIT is a company that qualifies for special treatment for U.S. federal income tax purposes because, among other things, it derives most of its income from realestate-based sources and makes a special election under the Internal Revenue Code of 1986, as amended, or the Code. We intend to operate as a REIT that principally invests in, and derives most of its income from the rental of advertising space on outdoor advertising displays, or billboards, and logo signs owned and maintained by us. |

A corporation that qualifies as a REIT generally is not subject to U.S. federal income taxes on its income and gains that it distributes to its stockholders, reducing its corporate level income taxes and substantially eliminating the “double taxation” of corporate income.

Even if we qualify as a REIT, we will be required to pay U.S. federal income tax on earnings from all or a portion of ournon-REIT assets and operations, which consist primarily of design, production, and installation of advertising copy, which we refer to as our advertising services business, and the provision of transit advertising displays on bus shelters, benches and buses, which we refer to as our transit advertising business. In addition, our assets and operations in Canada and Puerto Rico will continue to be subject to taxation in the jurisdictions where those assets are held or those operations are conducted. We also may be subject to U.S. federal income and excise taxes in certain circumstances, as well as U.S. state and local andnon-U.S. income, franchise, property and other taxes.

Please see the section entitled “Material United States Federal Income Tax Considerations — Taxation of Lamar REIT as a REIT” beginning on page 106 for a more detailed description of the requirements for qualification as a REIT and the rules applicable to taxation of REITs and their stockholders.

| Q. | What will happen in the REIT conversion? |

| A. | The REIT conversion involves the following key elements: |

Merger. Lamar Advertising will merge with and into Lamar REIT, a newly formed, wholly owned subsidiary of Lamar Advertising, and Lamar REIT will be the surviving entity in the merger and will continue the business and assume the obligations of Lamar Advertising. We refer to this transaction in this proxy statement/prospectus as the merger. The merger will facilitate our compliance with REIT tax rules by ensuring the effective adoption by Lamar REIT of a certificate of incorporation that implements share ownership and transfer restrictions that are intended to facilitate compliance with certain REIT rules related to share ownership.

As a consequence of the merger:

| | • | | there will be no change in the assets we hold or in the businesses we conduct; |

| | • | | there will be no fundamental change to our current capital allocation strategy or current operational strategy; |

| | • | | the existing board of directors and executive management of Lamar Advertising immediately prior to the merger will be the board of directors and executive management, respectively, of Lamar REIT immediately following the merger; |

| | • | | the outstanding shares of capital stock of Lamar Advertising will be converted into the right to receive the same number and class of shares of capital stock of Lamar REIT; |

| | • | | effective at the time of the merger, Lamar REIT will be renamed “Lamar Advertising Company” and will become the publicly traded, NASDAQ Global Select Market, or NASDAQ, listed company that will continue to operate, directly or indirectly, all of our existing business; and |

| | • | | the rights of the stockholders of Lamar REIT will be governed by the amended and restated certificate of incorporation and amended and restated bylaws of Lamar REIT. The amended and restated certificate of Lamar REIT is substantially similar to Lamar Advertising’s restated certificate of incorporation with the principal difference being that it provides for restrictions on ownership and |

2

| | transfer of Lamar REIT stock that are intended to facilitate compliance with certain REIT rules related to share ownership. The bylaws of Lamar REIT are substantially similar to Lamar Advertising’s bylaws. |

We have attached a copy of the merger agreement asAnnex A, and a copy of the amended and restated certificate of incorporation and the amended and restated bylaws of Lamar REIT, asAnnexB-1 andAnnex B-2, respectively.

Other Restructuring Transactions. During the course of 2013 and the early part of 2014, we completed an internal corporate restructuring so that we would be in compliance with certain REIT qualification requirements for the 2014 taxable year. Following this restructuring, we now hold and operate certain of our assets that cannot be held and operated directly by a REIT through taxable REIT subsidiaries, or TRSs. A TRS is a subsidiary of a REIT that pays corporate taxes on its taxable income. The assets held in our TRSs primarily consist of our transit advertising business, advertising services business and our foreign operations in Canada and Puerto Rico.

Our TRS assets and operations will continue to be subject, as applicable, to U.S. federal and state corporate income taxes. Furthermore, our assets and operations outside the United States will continue to be subject to foreign taxes in the jurisdictions in which those assets and operations are located. Net income from our TRSs will either be retained by our TRSs and used to fund their operations, or distributed to us, where it will be reinvested by us in our business or be available for distribution to our stockholders.

Please see the section entitled “Material United States Federal Income Tax Considerations — Taxation of Lamar REIT as a REIT — Taxable REIT Subsidiaries” beginning on page 110 for a more detailed description of the requirements and limitations regarding the potential use of TRSs.

| Q. | What are our reasons for the REIT conversion and the merger? |

| A. | We are proposing the REIT conversion and the merger primarily for the following reasons: |

| | • | | To increase stockholder value. As a REIT, we believe we will be able to increase the value of Lamar REIT common stock by reducing corporate level taxes on most of our domestic income, primarily the income we receive from leasing advertising space on our billboards and logo signs, which in turn may increase the amount of future distributions to our stockholders; |

| | • | | To establish regular distributions to stockholders. We believe our stockholders will benefit from our establishment of regular cash distributions, resulting in ayield-oriented stock; |

| | • | | To expand our base of potential stockholders. By becoming a company that makes regular distributions to its stockholders, our stockholder base may expand to include investors attracted by yield, which may improve the liquidity of Lamar REIT common stock and provide a broader stockholder base; and |

| | • | | To comply with REIT qualification rules. The merger will facilitate our compliance with certain REIT rules by merging Lamar Advertising with and into Lamar REIT, the latter of which will adopt an amended and restated certificate of incorporation which implements share ownership and transfer restrictions necessary to facilitate our compliance with the REIT rules related to share ownership. |

To review the background of, and the reasons for, the REIT conversion and the merger in greater detail, and the related risks associated with the reorganization, see the sections entitled “Background of the REIT Conversion and Merger” beginning on page 41, “Reasons for the Merger and REIT Conversion” beginning on page 44 and “Risk Factors” beginning on page 24.

3

| Q. | What will holders of Lamar Advertising common stock receive in connection with the completion of the merger? When will holders of Lamar Advertising common stock receive it? |

| A. | Lamar Advertising has two classes of common stock: Class A Common Stock, $0.001 par value per share, which we refer to as Class A common stock, and Class B Common Stock, $0.001 par value per share, which we refer to as Class B common stock. We refer to the Class A common stock and the Class B common stock collectively as our common stock. |

At the time of completion of the merger:

| | • | | each holder of Class A common stock will have the right to receive a number of shares of Lamar REIT Class A common stock equal to, and in exchange for, the number of shares of Class A common stock that the holder then owns; and |

| | • | | each holder of Class B common stock will have the right to receive a number of shares of Lamar REIT Class B common stock equal to, and in exchange for, the number of shares of Class B common stock that the holder then owns. |

As of [ ], 2014, we had [ ] shares of Class A common stock outstanding and [ ] shares of Class B common stock outstanding.

| Q. | Will the voting rights of the common stock remain the same following completion of the merger? |

| A. | Yes, the respective voting rights of the Class A common stock and the Class B common stock will be unchanged following completion of the merger. The respective powers, preferences, rights, qualifications, limitations and restrictions relating to the Lamar REIT Class A common stock and the Lamar REIT Class B common stock received in the merger will be identical to the respective powers, preferences, rights, qualifications, limitations and restrictions relating to the Class A common stock and the Class B common stock immediately prior to the merger. Therefore, holders of Class A common stock will be entitled to one (1) vote for each share of Lamar REIT Class A common stock held and holders of Class B common stock will be entitled to ten (10) votes for each share of Lamar REIT Class B common stock held. |

| Q. | What will holders of Lamar Advertising preferred stock receive in connection with the completion of the merger? When will holders of Lamar Advertising preferred stock receive it? |

| A. | Lamar Advertising has one class of preferred stock issued and outstanding: Series AA Preferred Stock, $0.001 par value per share, which we refer to as Series AA preferred stock. |

At the time of completion of the merger:

| | • | | each holder of Series AA preferred stock will have the right to receive a number of shares of Lamar REIT Series AA preferred stock equal to, and in exchange for, the number of shares of Series AA preferred stock that the holder then owns. |

The powers, preferences, rights, qualifications, limitations and restrictions relating to the Lamar REIT Series AA preferred stock received in the merger will be identical to the powers, preferences, rights, qualifications, limitations and restrictions relating to the Series AA preferred stock immediately prior to the merger.

As of [ ], 2014, Lamar Advertising had 5,719.49 shares of Series AA preferred stock outstanding, which were held by 3 holders of record. The aggregate outstanding preferred stock represents less than 0.01% of the outstanding capital stock of Lamar Advertising.

| Q. | What distributions will you receive? |

| A. | As a REIT, we will be required to distribute annually at least 90% of our REIT taxable income (determined without regard to the dividends paid deduction and by excluding net capital gain). Our REIT taxable income generally does not include income earned by our TRSs except to the extent the TRSs pay dividends to the |

4

| | REIT. We estimate that we had approximately $328 million in federal net operating loss carry forwards, or NOLs, as of January 1, 2014. To the extent we use these NOLs to offset our REIT taxable income, the required distributions to stockholders would be reduced. However, in this case, we may be subject to the alternative minimum tax. |

On May 21, 2014, the board of directors of Lamar Advertising declared a cash dividend of $0.83 per share of common stock, payable on June 30, 2014 to holders of record of Lamar Advertising Class A common stock and Class B common stock on June 1, 2014. We expect to continue to declare regular quarterly distributions to holders of Lamar REIT common stock on an ongoing basis, the amount of which will be determined, and is subject to adjustment, by the board of directors. Any such dividends will be paid on all shares of common stock outstanding at the time of such payment. The actual timing and amount of the distributions will be as determined and declared by the board of directors and will depend on, among other factors, our financial condition, earnings, debt covenants and other possible uses of such funds. See the section entitled “Dividend and Distribution Policy” beginning on page 53.

If you did not hold shares of common stock on June 1, 2014 or dispose of your shares of common stock before the record date for any subsequent quarterly distribution, you will not receive the first quarterly distribution or any other regular quarterly distribution. As discussed below, we do not expect to pay aone-time special distribution of ournon-REIT accumulated earnings and profits.

| Q. | When will we distribute ournon-REIT accumulated E&P? |

A REIT is not permitted to retain earnings and profits accumulated during years when the company or its predecessor was taxed as a regular “C” corporation. For Lamar REIT to elect REIT status for the taxable year that began on January 1, 2014, we must distribute to our stockholders on or before December 31, 2014 our previously undistributed accumulated earnings and profits attributable to the taxable periods ending prior to January 1, 2014, which we refer to as ournon-REIT accumulated earnings and profits, or E&P. We currently estimate that the aggregate amount of the distribution ofnon-REIT accumulated E&P will be approximately $40 million, and we expect to pay it solely with cash. We expect that the amounts declared and paid in connection with regular quarterly distributions, which commenced in the second quarter of 2014, will be in an amount sufficient to enable us to distribute ournon-REIT accumulated E&P no later than December 31, 2014. As a result, we do not expect to pay aone-time special distribution ofnon-REIT accumulated E&P.

Following completion of the merger and REIT conversion, holders of Lamar REIT Series AA preferred stock will continue to be entitled to preferential dividends in an annual aggregate amount of $364,904 before any dividends may be paid on Lamar REIT common stock.

If you dispose of your shares of common stock before the record date for any of the regular quarterly distributions in 2014, you will not receive any of the regular quarterly distributions, a portion of which will include a distribution of ournon-REIT accumulated E&P.

| Q. | Will the REIT conversion change our current operational strategy? |

| A. | We do not anticipate that the REIT conversion will change our current operational strategy. We expect to continue focusing on the following objectives: |

| | • | | Continuing to provide high quality national, regional and local rentals and services; |

| | • | | Continuing a centralized control and decentralized management structure; |

| | • | | Continuing to focus on internal growth, including improving pricing and occupancy statistics; |

| | • | | Continuing to pursue other outdoor advertising opportunities; and |

| | • | | Continuing to invest in profitable digital billboards. |

5

| Q. | Who will be the board of directors and management after the merger and REIT conversion is completed? |

| A. | The board of directors and executive management of Lamar Advertising immediately prior to the merger will be the board of directors and executive management, respectively, of Lamar REIT. |

| Q. | Do any of our directors and executive officers have any interests in the REIT conversion or the merger that are different from mine? |

| A. | No. Our directors and executive officers and their affiliates have equity interests in Lamar Advertising through the ownership of shares of Class A common stock, Class B common stock and Series AA preferred stock and/or options to purchase shares of Class A common stock and, to that extent, their interest in the REIT conversion and the merger is the same as that of the other holders of shares of Class A common stock, Class B common stock and Series AA preferred stock and options to purchase shares of Class A common stock. Ournon-employee directors also hold Class A common stock subject to restrictions. We do not anticipate that the REIT conversion or the merger will cause any vesting or acceleration of benefits. |

| Q. | When and where is the special meeting? |

| A. | The special meeting will be held on [ ], 2014 at [ ], local time, at the offices of Lamar Advertising Company, 5321 Corporate Boulevard, Baton Rouge, Louisiana 70808. |

| Q. | What will I be voting on at the special meeting? |

| A. | As a stockholder, you are entitled to, and requested to, vote on the proposal to adopt the merger agreement pursuant to which Lamar Advertising will be merged with and into Lamar REIT, a wholly owned subsidiary of Lamar Advertising, with Lamar REIT as the surviving entity. In addition, you are requested to vote on the proposal to adjourn the special meeting, if necessary, to solicit additional proxies in the event that there are not sufficient votes at the time of the special meeting to approve the proposal regarding the adoption of the merger agreement. You are not being asked to vote on any other element of the REIT conversion. |

| Q. | Who can vote on the merger? |

| A. | If you are a stockholder of record at the close of business on [ ], 2014, which we refer to as the record date, you may vote the Class A common stock, Class B common stock and Series AA preferred stock that you hold on the record date at the special meeting. On or about [ ], 2014, we will begin mailing this proxy statement/prospectus to persons entitled to vote at the special meeting. |

| Q. | Why is my vote important? |

| A. | If you do not submit a proxy or vote in person at the meeting, it will be more difficult for us to obtain the necessary quorum to hold the special meeting. In addition, your failure to submit a proxy or to vote in person will have the same effect as a vote against the adoption of the merger agreement. If you hold your shares through a broker, bank, or other nominee, your broker, bank, or other nominee will not be able to cast a vote on the adoption of the merger agreement without instructions from you. |

| Q. | What constitutes a quorum for the special meeting? |

| A. | The presence at the special meeting, in person or by proxy, of the holders ofone-third of the votes represented by Class A common stock, Class B common stock, and Series AA preferred stock issued and outstanding on the record date constitutes a quorum for the meeting. There must be a quorum for business to be conducted at the special meeting. Failure of a quorum to be represented at the special meeting will necessitate an adjournment or postponement and will subject us to additional expense. For the purposes of determining the presence of a quorum, abstentions will be included in determining the number of shares present and entitled to vote at the special meeting; however, because brokers, banks or other nominees are |

6

| | not entitled to vote on the proposal to adopt the merger agreement absent specific instructions from the beneficial owner (as more fully described below), shares held by brokers, banks, or other nominees for which instructions have not been provided will not be included in the number of shares present and entitled to vote at the special meeting for the purposes of establishing a quorum. |

| A. | The affirmative vote of the holders of a majority of the outstanding shares of Class A common stock, Class B common stock and Series AA preferred stock, voting together as a single class, is required for the adoption of the merger agreement. The affirmative vote of a majority of the shares of Class A common stock, Class B common stock and Series AA preferred stock, voting together as a single class, that are present or represented by proxy at the special meeting is required to approve the adjournment proposal. Each share of outstanding Class A common stock and Series AA preferred stock is entitled to one vote, and each share of outstanding Class B common stock is entitled to ten votes, on each proposal submitted for consideration. As of the close of business on the record date, there were [ ] shares of Class A common stock, [ ] shares of Class B common stock and [ ] shares of Series AA preferred stock, outstanding and entitled to vote at the special meeting. |

| Q. | Have any stockholders already agreed to approve the merger? |

| A. | No. There are no agreements between us and any stockholder in which a stockholder has agreed to vote in favor of adoption of the merger agreement. We expect, however, that members of the Reilly family, including Kevin P. Reilly, Jr., the Company’s Chairman and President, and Sean E. Reilly, the Company’s Chief Executive Officer, and their affiliates will vote the shares that they beneficially own in favor of adoption of the merger agreement. As of March 31, 2014, they owned in the aggregate approximately 16% of the Company’s outstanding common stock, assuming the conversion of all Class B common stock to Class A common stock. As of that date, their combined holdings represented 65% of the voting power of Lamar Advertising’s outstanding capital stock. |

| Q. | How does the board of directors recommend I vote on the proposals? |

| A. | The board of directors of Lamar Advertising believes that the REIT conversion, including the merger, is advisable and in the best interests of the Company and its stockholders. The board of directors of Lamar Advertising recommends that you vote “FOR” both proposals: |

| | • | | Proposal 1: To consider and vote upon a proposal to adopt the Agreement and Plan of Merger dated [ ], 2014 between Lamar Advertising Company and Lamar Advertising REIT Company, a newly formed wholly owned subsidiary of Lamar Advertising, which is part of the reorganization through which Lamar Advertising intends to qualify as a real estate investment trust, or REIT, for U.S. federal income tax purposes. |

| | • | | Proposal 2: To consider and vote upon a proposal to permit Lamar Advertising’s board of directors to adjourn the special meeting, if necessary, for further solicitation of proxies if there are not sufficient votes at the originally scheduled time of the special meeting to approve the foregoing proposal. |

| Q. | When is the merger expected to be completed and the REIT election expected to be made? |

| A. | We expect to complete the merger following the special meeting of stockholders, receipt of stockholder approval of the adoption of the merger agreement and the satisfaction or waiver of the other conditions to the merger. We expect to convert to REIT status effective January 1, 2014. However, we reserve the right to cancel or defer the merger or the REIT conversion even if stockholders of Lamar Advertising vote to adopt the merger agreement and other conditions to the completion of the merger are satisfied or waived, if the board of directors determines that the merger or the REIT conversion is no longer in the best interests of Lamar Advertising and its stockholders. Additionally, even if the merger is effected, the board of directors |

7

| | of Lamar Advertising may decide not to elect REIT status, or to delay such election, if it determines in its sole discretion that it is not in the best interests of Lamar Advertising and its stockholders. See the section entitled “Terms of the Merger” beginning on page 45 for a more detailed description of the merger. |

| Q. | Are there risks associated with the REIT conversion and the merger that I should consider in deciding how to vote? |

| A. | Yes. There are a number of risks relating to the REIT conversion and the merger, including the following: |

| | • | | If we fail to qualify as a REIT or fail to remain qualified as a REIT, we would be taxed as a regular “C” corporation and may owe substantial amounts of U.S. federal and state income taxes, interest and penalties, and may have reduced funds available for distribution to our stockholders; |

| | • | | There is no assurance that our cash flows from operations will be sufficient for us to fund required distributions; |

| | • | | Compliance with REIT requirements may hinder our ability to make certain attractive investments and to that extent limit our opportunities; |

| | • | | There will be restrictions on ownership of Lamar REIT common stock; and |

| | • | | Our current management has no experience operating a REIT and we cannot assure you that our management will be able to manage successfully our business as a REIT. |

To review the risks associated with the REIT conversion and the merger, see the sections entitled “Reasons for the Merger and REIT Conversion” beginning on page 44 and “Risk Factors” beginning on page 24.

| Q. | Will REIT qualification requirements restrict any of our business activities or limit our financial flexibility? |

| A. | As summarized in the section entitled “Material United States Federal Income Tax Considerations” beginning on page 104, to qualify as a REIT, we must continually satisfy various qualification tests imposed under the Code, concerning, among other things, the sources of our income, the nature and diversification of our assets, the diversity of our share ownership and the amounts we distribute to our stockholders. In particular, the REIT qualification requirements could restrict our business activities and financial flexibility because: |

| | • | | we may be required to liquidate or otherwise forego attractive investments to satisfy the asset and income tests or to qualify under certain statutory relief provisions; and |

| | • | | to meet annual distribution requirements, we may be required to distribute amounts that may otherwise be used for our operations, including amounts that may otherwise be invested in future acquisitions, capital expenditures or repayment of debt and it is possible that we might be required to borrow funds, sell assets or raise equity to fund these distributions, even if thethen-prevailing market conditions are not favorable for these borrowings, sales or offerings. |

To review in greater detail the risks associated with our status as a REIT, see the section entitled “Risk Factors — Risks Related to the REIT Conversion and REIT Qualification” beginning on page 24.

In reaching its determination regarding a possible REIT conversion, the board of directors considered these REIT qualification requirements and other potential disadvantages regarding a potential REIT conversion, which are more fully described in the sections entitled “Background of the REIT Conversion and Merger” beginning on page 41 and “Reasons for the Merger and REIT Conversion” beginning on page 44.

8

| Q. | Will I have to pay U.S. federal income taxes as a result of the REIT conversion? |

| A. | You will not recognize gain or loss for U.S. federal income tax purposes as a result of the exchange of your shares of common stock and Series AA preferred stock of Lamar Advertising for shares of common stock and Series AA preferred stock of Lamar REIT in the merger. However, if you are anon-United States person who owns or has owned more than 5% of the outstanding common stock of Lamar Advertising, it may be necessary for you to comply with reporting and other requirements of the Treasury regulations in order to achieve nonrecognition of gain on the exchange of your Lamar Advertising common stock for Lamar REIT common stock in the merger. |

The distribution ofnon-REIT accumulated E&P will result in the recognition of ordinary dividend income by you, which may qualify as qualified dividend income that is potentially eligible for reduced maximum rates of taxation depending on your circumstances. However, other ordinary dividends paid by Lamar REIT generally will not be treated as qualified dividend income.

The U.S. federal income tax treatment of holders of Lamar Advertising common stock and Lamar REIT common stock depends in some instances on determinations of fact and interpretations of complex provisions of U.S. federal income tax laws for which no clear precedent or authority may be available. In addition, the tax consequences of holding Lamar Advertising common stock or Lamar REIT common stock to any particular stockholder will depend on that stockholder’s particular tax circumstances. We urge you to consult your tax advisor, particularly if you are anon-United States person, regarding the specific tax consequences, including the U.S. federal, state and local tax consequences and foreign tax consequences to you in light of your particular investment in, or the tax circumstances of acquiring, holding, exchanging, selling or otherwise disposing of, Lamar Advertising common stock or Lamar REIT common stock.

| Q. | Am I entitled to dissenters’ rights as a holder of Lamar Advertising Class A common stock? |

| A. | No. Under Delaware law, you are not entitled to any dissenters’ rights of appraisal in connection with the REIT conversion or the merger. |

| Q. | Am I entitled to dissenters’ rights as a holder of Lamar Advertising Class B common stock or Lamar Advertising Series AA preferred stock? |

| A: | Yes. If you wish to exercise dissenters’ rights and receive the fair value of your Lamar Advertising Class B common stock or your Lamar Advertising Series AA preferred stock in cash as determined in a judicial proceeding instead of the merger consideration described in this proxy statement/prospectus, your shares must not be voted for approval of the merger proposal, and you must follow other procedures in accordance with applicable Delaware law. If you return a signed proxy without voting instructions, your proxy will be voted as recommended by the board of directors of Lamar Advertising and you may lose dissenters’ rights. If you return a signed proxy with instructions to vote “FOR” the merger agreement, your shares will be voted in favor of the merger agreement and you will lose dissenters’ rights. Thus, if you wish to dissent and you execute and return a proxy, you must specify that your shares are to be either voted “AGAINST” or “ABSTAIN” with respect to approval of the merger. For additional information on exercising dissenters’ rights, see “Terms of the Merger — Dissenters’ Rights for Holders of Lamar Advertising Class B common stock and Lamar Advertising Series AA preferred stock” included elsewhere in this proxy statement/prospectus. |

| Q. | How do I vote without attending the special meeting? |

| A. | You may vote by completing, signing and promptly returning the proxy card in theself-addressed stamped envelope provided. If you are a holder of Class A common stock, as described in your proxy card. |

9

| Q. | Can I attend the special meeting and vote my shares in person? |

| A. | Yes. All stockholders are invited to attend the special meeting. Stockholders of record at the close of business on the record date are invited to attend and vote at the special meeting. If your shares are held by a broker, bank or other nominee, then you are not the stockholder of record. Therefore, to vote at the special meeting, you must bring the appropriate documentation from your broker, bank or other nominee confirming your beneficial ownership of the shares. |

| Q. | If my shares are held in “street name” by my broker, bank or other nominee, will my broker, bank or other nominee vote my shares for me? |

| A. | No. If your shares are held in “street name” by your broker, bank or other nominee, you should follow the directions provided by your broker, bank or other nominee. Your broker, bank or other nominee will vote your shares only if you provide instructions on how you would like your shares to be voted. |

| Q. | What do I need to do now? |

| A. | You should carefully read and consider the information contained in this proxy statement/prospectus including its annexes. It contains important information about what the board of directors of Lamar Advertising considered in evaluating and approving the REIT conversion and the merger agreement. |

You should then complete and sign your proxy card and return it in the enclosed envelope as soon as possible so that your shares will be represented at the special meeting. If your shares are held through a broker, bank or other nominee, you should receive a separate voting instruction form with this proxy statement/prospectus.

| Q. | Can I change my vote after I have mailed my signed proxy card? |

| A. | Yes. You can change your vote at any time before your proxy is voted at the special meeting. To revoke your proxy, you must either (1) notify the secretary of Lamar Advertising in writing, (2) mail a new proxy card dated after the date of the proxy you wish to revoke, or (3) attend the special meeting and vote your shares in person. Merely attending the special meeting will not constitute revocation of your proxy. If your shares are held through a broker, bank, or other nominee, you should contact your broker, bank or other nominee to change your vote. |

| Q. | Should I send in my stock certificates now? |

| A. | No. If the merger is completed, your shares of Lamar Advertising common stock or Series AA preferred stock (whether certificated or uncertificated) will be converted into the right to receive the same number and class of shares of Lamar REIT common stock or Series AA preferred stock. Initially, the shares of Lamar REIT common stock and Lamar REIT Series AA preferred stock will not be represented by certificates, but rather will exist as entries on the record books of Lamar REIT’s transfer agent. |

If you hold certificated shares of Lamar Advertising Class A common stock, as soon as practicable following completion of the merger, an exchange agent, appointed by Lamar REIT, will send you a letter of transmittal explaining how to exchange your certificates, which represented shares of Lamar Advertising common stock, for certificates representing shares of Lamar REIT common stock.

If you hold uncertificated shares of Lamar Advertising Class A common stock, your shares will automatically be converted into uncertificated shares of Lamar REIT common stock. In addition, within a reasonable time following the issuance or transfer of shares of Lamar REIT common stock, Lamar REIT will send to each record holder of uncertificated shares a written notice containing the information set forth in the applicable legend affixed to certificated shares of Lamar REIT Class A common stock in accordance with Delaware law.

If you hold shares of Lamar Advertising Class B common stock or Series AA preferred stock, as soon as practicable following completion of the merger, Lamar REIT will send you a letter of transmittal explaining

10

how to exchange your certificates, which represented shares of Lamar Advertising Class B common stock or Series AA preferred stock, as applicable, for certificates representing shares of Lamar REIT Class B common stock or Series AA preferred stock.

| Q. | Will the Class A common stock of Lamar REIT be publicly traded? |

| A. | Yes. We will apply to list the new shares of Lamar REIT Class A common stock on NASDAQ upon completion of the merger. We expect that the Lamar REIT Class A common stock will trade under our current symbol “LAMR.” We will not complete the merger unless and until the shares of Lamar REIT Class A common stock are approved for listing on NASDAQ. Upon completion of the merger, Lamar REIT Class B common stock and Lamar REIT Series AA preferred stock will not be publicly traded and will continue to be held by members of the Reilly Family, including Kevin P. Reilly, Jr., our Chairman and President, and Sean E. Reilly, our Chief Executive Officer, and their affiliates and other related parties. Each share of Lamar REIT Class B common stock will be convertible at the option of its holder into one share of Lamar REIT Class A common stock at any time. |

| Q. | Will a proxy solicitor be used? |

| A. | Yes. We have engaged [ ] to assist in the solicitation of proxies for the meeting and estimate we will pay [ ] a fee of approximately $[ ]. We have also agreed to reimburse [ ] for reasonableout-of-pocket expenses and disbursements incurred in connection with the proxy solicitation and to indemnify [ ] against certain losses, costs and expenses. In addition, our directors, officers and employees may request the return of proxies by telephone or in person, but no additional compensation will be paid to them.] |

| Q. | Whom should I call with questions? |

| A. | You should call [ ], our proxy solicitor,toll-free at [ ] with any questions about the REIT conversion or merger, or to obtain additional copies of this proxy statement/prospectus or additional proxy cards. You also may also call Buster Kantrow, Director of Investor Relations, at (225) 926-1000. |

11

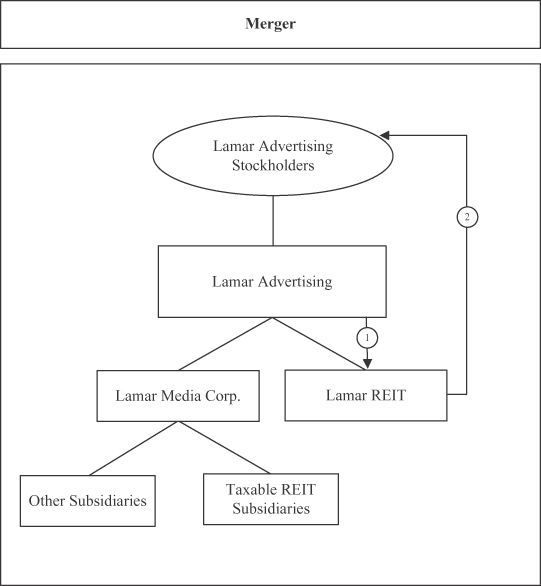

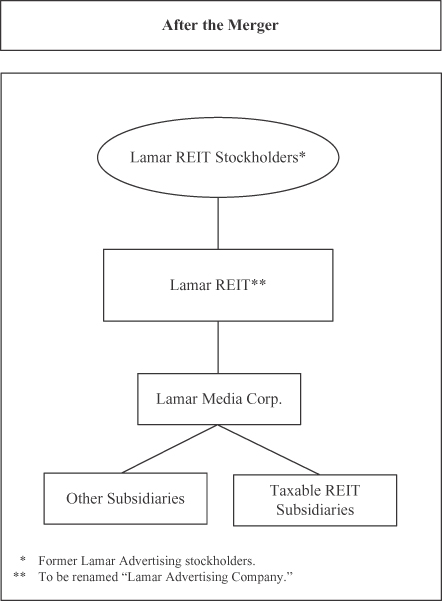

STRUCTURE OF THE TRANSACTION

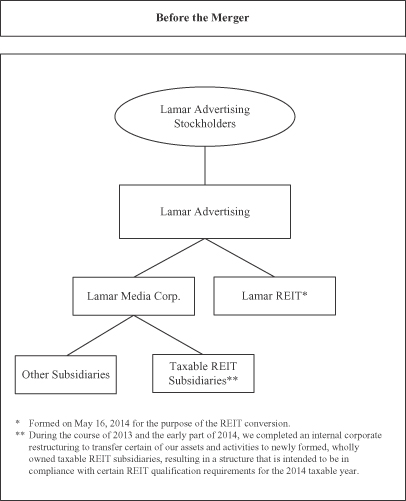

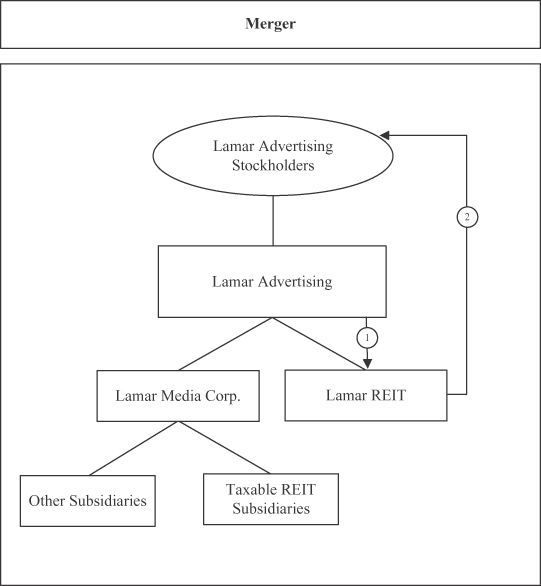

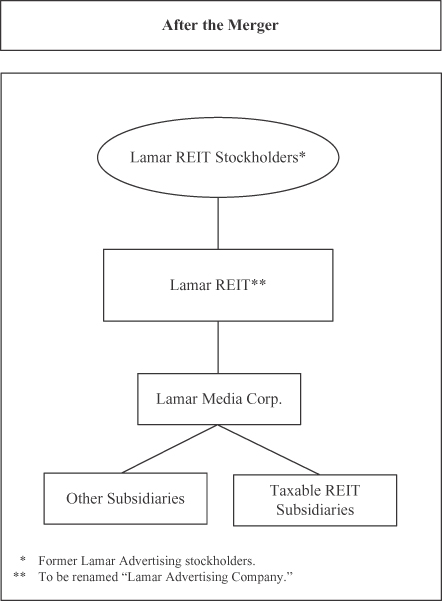

In order to help you better understand the merger and how it will affect Lamar Advertising, Lamar REIT and the subsidiaries of Lamar Advertising, the charts below illustrates, in simplified form, the following:

| | • | | Before the Merger: the organizational structure of Lamar Advertising, Lamar Media Corp. and Lamar REIT before the merger; |

| | • | | Merger: the steps involved in, and the effects of, the merger of Lamar Advertising with and into Lamar REIT and the exchange of shares of Lamar Advertising Class A common stock, Class B common stock and Series AA preferred stock for shares of Lamar REIT Class A common stock, Class B common stock and Series AA preferred stock; and |

| | • | | After the Merger: the organizational structure of Lamar REIT and its taxable REIT subsidiaries and other operating subsidiaries, immediately after the completion of the transactions. |

12

| 1. | Lamar Advertising merges with and into Lamar REIT. During the course of 2014, Lamar Advertising distributes its non-REIT accumulated E&P to its stockholders. |

| 2. | Each outstanding share of Lamar Advertising Class A common stock will be converted into the right to receive the same number of shares of Lamar REIT Class A common stock, each outstanding share of Lamar Advertising Class B common stock will be converted into the right to receive the same number of shares of Lamar REIT Class B common stock and each outstanding share of Lamar Advertising Series AA preferred stock will be converted into the right to receive the same number of Lamar REIT Series AA preferred stock. |

13

14

SUMMARY

This summary highlights selected information from this proxy statement/prospectus and may not contain all of the information that is important to you. You should carefully read this entire proxy statement/prospectus and the other documents to which this proxy statement/prospectus refers to fully understand the REIT conversion and the merger. In particular, you should read the annexes attached to this proxy statement/prospectus, including the merger agreement, which is attached as Annex A. You also should read the form of Amended and Restated Certificate of Incorporation of Lamar Advertising REIT Company, which we refer to as the Lamar REIT charter, attached as AnnexB-1, and the Amended and Restated Bylaws of Lamar Advertising REIT Company, which we refer to as the Lamar REIT bylaws, attached as AnnexB-2, because these documents will govern your rights as a stockholder of Lamar REIT following the merger. See the section entitled “Additional Information” in the front part of this proxy statement/prospectus. For a discussion of the risk factors that you should carefully consider, see the section entitled “Risk Factors” beginning on page 24. Most items in this summary include a page reference directing you to a more complete description of that item.

The information contained in this proxy statement/prospectus, unless otherwise indicated, assumes the REIT conversion and all the transactions related to the REIT conversion, including the merger, will occur. When used in this proxy statement/prospectus, unless otherwise specifically stated or the context otherwise requires, the terms “Company,” “Lamar Advertising,” “we,” “our” and “us” refer to Lamar Advertising Company and its subsidiaries with respect to the period prior to the merger, and Lamar REIT and its subsidiaries with respect to the period after the merger.

The Companies

Lamar Advertising Company

5321 Corporate Boulevard

Baton Rouge, Louisiana 70808

(225) 926-1000

Lamar Advertising is one of the largest outdoor advertising companies in the United States based on number of displays. We operate in a single operating and reporting segment, advertising. We rent advertising space on billboards, buses, shelters, benches and logo plates. As of March 31, 2014, we owned and operated approximately 145,000 billboard advertising displays in 44 states, Canada and Puerto Rico, approximately 120,000 logo advertising displays in 22 states and the province of Ontario, Canada, and operated over 40,000 transit advertising displays in 16 states, Canada and Puerto Rico. We offer our customers a fully integrated service, satisfying all aspects of their billboard display requirements from ad copy production to placement and maintenance.

We have operated under the Lamar name since our founding in 1902 and have been publicly traded on NASDAQ under the symbol “LAMR” since 1996. We completed a reorganization on July 20, 1999 that created our current holding company structure. At that time, the operating company (then called Lamar Advertising Company) was renamed Lamar Media Corp., and all of the operating company’s stockholders became stockholders of a new holding company. The new holding company then took the Lamar Advertising Company name, and Lamar Media Corp. became a wholly owned subsidiary of Lamar Advertising Company. Since inception, we have grown through acquisitions,long-term lease arrangements, development and construction of sites, and through mergers with and acquisitions of other advertising companies.

Lamar Advertising REIT Company

5321 Corporate Boulevard

Baton Rouge, Louisiana 70808

(225) 926-1000

15

Lamar Advertising REIT Company is a wholly owned subsidiary of Lamar Advertising and was incorporated in Delaware on May 16, 2014 to succeed to and continue the business of Lamar Advertising upon completion of the merger of Lamar Advertising with and into Lamar REIT. Effective at the time of the merger described below, Lamar REIT will be renamed “Lamar Advertising Company.” Prior to the merger, Lamar REIT will conduct no business other than that incident to the merger. Following the merger, Lamar REIT will directly or indirectly conduct all of the business currently conducted by Lamar Advertising. Upon completion of the merger, Lamar REIT will directly or indirectly hold all of Lamar Advertising’s assets.

General

The board of directors of Lamar Advertising has approved a plan to reorganize Lamar Advertising’s business operations to facilitate the qualification of Lamar REIT, as the successor of Lamar Advertising’s assets and business operations following the merger, as a REIT for U.S. federal income tax purposes. We refer to the merger, the related restructuring transactions and the election of REIT status by Lamar REIT in this proxy statement/prospectus as the REIT conversion. The merger and other restructuring transactions are designed to enable Lamar REIT, as the business successor of Lamar Advertising, to hold its assets and business operations in a manner that will enable us to elect to be treated as a REIT for U.S. federal income tax purposes. If Lamar REIT qualifies as a REIT, Lamar REIT generally will not be subject to U.S. federal corporate income taxes on that portion of its capital gain or ordinary income from its REIT operations that is distributed to its stockholders. This treatment would substantially eliminate the federal “double taxation” on earnings from REIT operations, or taxation once at the corporate level and again at the stockholder level, that generally results from investment in a regular “C” corporation. However, as explained more fully below, thenon-REIT operations of Lamar Advertising, which consist primarily of design, production and installation of advertising copy, which we refer to as our advertising services business, and the provision of transit advertising displays on bus shelters, benches and buses, which we refer to as our transit advertising business, and the operations of Lamar Advertising in Canada and Puerto Rico would continue to be subject, as applicable, to U.S. federal and state corporate income taxes and to foreign taxes in the jurisdictions in which those operations are located.

We are distributing this proxy statement/prospectus to you as a holder of Lamar Advertising Class A common stock, Class B common stock or Series AA preferred stock in connection with the solicitation of proxies by the board of directors for your approval of a proposal to adopt the merger agreement that will implement a part of the business reorganization through which Lamar Advertising intends to effect the REIT conversion. A copy of the merger agreement is attached to this proxy statement/prospectus asAnnex A.

The board of directors of Lamar Advertising reserves the right to cancel or defer the merger even if Lamar Advertising stockholders vote to adopt the merger agreement and the other conditions to the completion of the merger are satisfied or waived if it determines that the merger is no longer in the best interests of Lamar Advertising and its stockholders. Additionally, even if the merger is effected, the board of directors of Lamar Advertising may decide not to elect REIT status, or to delay such election, if it determines in its sole discretion that it is not in the best interests of Lamar Advertising and its stockholders.

We estimate thatone-time transaction costs incurred or to be incurred in connection with the REIT conversion, including the merger, will be approximately $5 million in the aggregate.

Board of Directors and Management of Lamar REIT

The board of directors and executive management of Lamar Advertising immediately prior to the merger will be the board of directors and executive management, respectively, of Lamar REIT immediately following the merger.

16

Interests of Directors and Executive Officers in the REIT Conversion and the Merger

Our directors and executive officers and their affiliates have equity interests in Lamar Advertising through the ownership of shares of Class A common stock, Class B common stock and Series AA preferred stock and/or options to purchase shares of Class A common stock, and, to that extent, their interest in the REIT conversion and the merger is the same as that of the other holders of shares of Class A common stock, Class B common stock and Series AA preferred stock and options to purchase shares of Class A common stock.

Regulatory Approvals (See page 48)

We are not aware of any federal, state, local or foreign regulatory requirements that must be complied with or approvals that must be obtained prior to completion of the merger pursuant to the merger agreement and the transactions contemplated thereby, other than compliance with applicable federal and state securities laws and the filing and acceptance of a certificate of merger as required under the Delaware General Corporation Law, which we refer to as the “DGCL.”

Comparison of Rights of Stockholders of Lamar Advertising and Lamar REIT (See page 99)

Your rights as a holder of common stock are currently governed by Delaware law, Lamar Advertising’s Restated Certificate of Incorporation, which we refer to as the Lamar Advertising charter, and the Amended and Restated Bylaws of Lamar Advertising, which we refer to as the Lamar Advertising bylaws. If the merger agreement is adopted and approved by Lamar Advertising’s stockholders and the merger is completed, you will become a stockholder of Lamar REIT and your rights as a stockholder of Lamar REIT will be governed by Delaware law, the Lamar REIT charter and the Lamar REIT bylaws. Some important differences exist between your rights as a holder of common stock and your rights as a holder of Lamar REIT common stock.

The major difference is that, to satisfy the share ownership requirements under the Code that are applicable to REITs, the Lamar REIT charter generally prohibits any person or entity from owning more than [ ]% of the outstanding shares of Lamar REIT common stock. The board of directors will establish a separate share ownership limitation for certain Lamar REIT stockholders and their affiliates that will generally allow them to own no more than [ ]% of the outstanding shares of Lamar REIT common stock and no more than [ ]% in value of the aggregate of the outstanding shares of all classes and series of Lamar REIT stock. For more detail regarding the differences between your rights as a holder of Lamar Advertising common stock and your rights as a holder of Lamar REIT common stock, see the sections entitled “Description of Lamar REIT Capital Stock” and “Comparison of Rights of Stockholders of Lamar Advertising and Lamar REIT.”

The forms of the Lamar REIT charter and the Lamar REIT bylaws are attached asAnnexB-1 andAnnexB-2, respectively.

Material United States Federal Income Tax Considerations of the Merger (See page 104)

Our tax counsel, Goodwin ProcterLLP is of the opinion that the merger will be treated for U.S. federal income tax purposes as a reorganization under Section 368(a)(1)(F) of the Code. Accordingly, we expect that for U.S. federal income tax purposes:

| | • | | no gain or loss will be recognized by Lamar Advertising or Lamar REIT as a result of the merger and Lamar REIT will be treated as a continuation of Lamar Advertising; |

| | • | | you will not recognize any gain or loss upon the conversion of your shares of Lamar Advertising common stock into Lamar REIT common stock; |

| | • | | the tax basis of the shares of Lamar REIT common stock that you receive pursuant to the merger in the aggregate will be the same as your adjusted tax basis in the shares of Lamar Advertising common stock being converted in the merger; and |

17

| | • | | the holding period of shares of Lamar REIT common stock that you receive pursuant to the merger will include your holding period with respect to the shares of Lamar Advertising common stock being converted in the merger, assuming that your Lamar Advertising common stock was held as a capital asset at the effective time of the merger. |

The U.S. federal income tax treatment of holders of Lamar Advertising common stock and Lamar REIT common stock depends in some instances on determinations of fact and interpretations of complex provisions of federal income tax law for which no clear precedent or authority may be available. In addition, the tax consequences of holding Lamar Advertising common stock or Lamar REIT common stock to any particular stockholder will depend on the stockholder’s particular tax circumstances. For example, in the case of anon-United States stockholder that owns or has owned in excess of 5% of Lamar Advertising common stock, it may be necessary for that person to comply with reporting requirements for him or her to achieve the nonrecognition of gain, carryover tax basis and tacked holding period described above. We urge you to consult your tax advisor, particularly if you are anon-United States person, regarding the specific tax consequences, including the U.S. federal, state and local tax consequences and foreign tax consequences, to you in light of your particular investment or tax circumstances of acquiring, holding, exchanging, selling or otherwise disposing of Lamar Advertising common stock or Lamar REIT common stock.

Qualification of Lamar REIT Following the REIT Conversion (See page 106)

We expect to qualify as a REIT for U.S. federal income tax purposes effective for our taxable year ending December 31, 2014. If we so qualify, we will be permitted to deduct distributions paid to our stockholders, allowing the income represented by such distributions to avoid taxation at the entity level and to be taxed, if at all, only at the stockholder level. Nevertheless, the income of our TRSs, which will hold our assets and operations that may not be held or engaged in directly by a REIT, will be subject, as applicable, to U.S. federal corporate income tax and to foreign income taxes where those operations are conducted. We will also be subject to a separate corporate income tax on any gains recognized during a specified period (generally, ten years) following the REIT conversion that are attributable to“built-in” gain with respect to the assets that we own on January 1, 2014.

Our ability to qualify as a REIT will depend upon our continuing compliance with various requirements starting on the effective date of our REIT conversion, which is expected to be January 1, 2014, including requirements related to the nature of our assets, the sources of our income, diversity of share ownership and the distributions to our stockholders. If we fail to qualify as a REIT, we will be subject to U.S. federal (and applicable state) income tax at regular corporate rates. Even if we qualify for taxation as a REIT, we will be subject to some U.S. federal, state and local and foreign taxes on our income and property. Given the complex nature of the REIT qualification requirements, the ongoing importance of factual determinations and the possibility of future changes in our circumstances and the laws applicable to REITs, we can provide no assurance that our actual operating results will satisfy the requirements for taxation as a REIT under the Code for any particular taxable year.

Our tax counsel, Goodwin ProcterLLP, will render an opinion to us to the effect that (i) commencing with our taxable year ending December 31, 2014 we have been organized in conformity with the requirements for qualification as a REIT and (ii) our prior and proposed organization, ownership and method of operation as represented by management have enabled and will enable us to satisfy the requirements for qualification and taxation as a REIT commencing with our taxable year ending December 31, 2014. This opinion will be based on representations made by us as to certain factual matters relating to our organization and our prior and intended or expected ownership and method of operation. Goodwin ProcterLLP will not verify those representations, and their opinion will assume that such representations and covenants are accurate and complete, that we have operated and will operate in accordance with such representations and that we will take no action inconsistent with our status as a REIT. Our tax counsel’s opinion also will be based in part on the private letter ruling we received from the IRS regarding certain federal income tax matters. This opinion will represent counsel’s legal

18