| | | FREE WRITING PROSPECTUS |

| | | FILED PURSUANT TO RULE 433 |

| | | REGISTRATION FILE NO.: 333-177891-08 |

| | | |

Free Writing Prospectus

Structural and Collateral Term Sheet

$1,425,796,349

(Approximate Aggregate Cut-off Date Balance of Mortgage Pool)

$1,242,225,000

(Approximate Aggregate Principal Balance of Offered Certificates)

WFRBS Commercial Mortgage Trust 2014-C21

as Issuing Entity

RBS Commercial Funding Inc.

as Depositor

Wells Fargo Bank, National Association

The Royal Bank of Scotland

Liberty Island Group I LLC

C-III Commercial Mortgage LLC

Basis Real Estate Capital II, LLC

NCB, FSB

as Sponsors and Mortgage Loan Sellers

Commercial Mortgage Pass-Through Certificates

Series 2014-C21

July 11, 2014

| RBS | | |

Co-Lead Manager and

Co-Bookrunner | | Co-Lead Manager and Co-Bookrunner |

Co-Manager |

STATEMENT REGARDING THIS FREE WRITING PROSPECTUS

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (‘‘SEC’’) (SEC File No. 333-177891) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the depositor, any underwriter, or any dealer participating in the offering will arrange to send you the prospectus after filing if you request it by calling toll free 1-866-884-2071 (8 a.m. – 5 p.m. EST) or by emailing rbscmbs@rbs.com.

Nothing in this document constitutes an offer to sell or a solicitation to buy securities in any jurisdiction where such offer, solicitation or sale is not permitted. The information contained herein is preliminary as of the date hereof, supersedes any such information previously delivered to you and will be superseded by any information subsequently delivered and ultimately by the final prospectus relating to the securities. These materials are subject to change, completion, supplement or amendment from time to time.

STATEMENT REGARDING ASSUMPTIONS AS TO SECURITIES, PRICING ESTIMATES AND OTHER INFORMATION

The attached information contains certain tables and other statistical analyses (the “Computational Materials”) which have been prepared in reliance upon information furnished by the Mortgage Loan Sellers. Numerous assumptions were used in preparing the Computational Materials, which may or may not be reflected herein. As such, no assurance can be given as to the Computational Materials’ accuracy, appropriateness or completeness in any particular context; or as to whether the Computational Materials and/or the assumptions upon which they are based reflect present market conditions or future market performance. The Computational Materials should not be construed as either projections or predictions or as legal, tax, financial or accounting advice. You should consult your own counsel, accountant and other advisors as to the legal, tax, business, financial and related aspects of a purchase of these securities. Any weighted average lives, yields and principal payment periods shown in the Computational Materials are based on prepayment and/or loss assumptions, and changes in such prepayment and/or loss assumptions may dramatically affect such weighted average lives, yields and principal payment periods. In addition, it is possible that prepayments or losses on the underlying assets will occur at rates higher or lower than the rates shown in the attached Computational Materials. The specific characteristics of the securities may differ from those shown in the Computational Materials due to differences between the final underlying assets and the preliminary underlying assets used in preparing the Computational Materials. The principal amount and designation of any security described in the Computational Materials are subject to change prior to issuance. None of RBS Securities Inc. (“RBSSI”), Wells Fargo Securities, LLC (“WFS”), Deutsche Bank Securities Inc. or any of their respective affiliates make any representation or warranty as to the actual rate or timing of payments or losses on any of the underlying assets or the payments or yield on the securities. The information in this presentation is based upon management forecasts and reflects prevailing conditions and management’s views as of this date, all of which are subject to change. In preparing this presentation, we have relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources or which was provided to us by or on behalf of the Mortgage Loan Sellers or which was otherwise reviewed by us.

This free writing prospectus contains certain forward-looking statements. If and when included in this free writing prospectus, the words “expects”, “intends”, “anticipates”, “estimates” and analogous expressions and all statements that are not historical facts, including statements about our beliefs or expectations, are intended to identify forward-looking statements. Any forward-looking statements are made subject to risks and uncertainties which could cause actual results to differ materially from those stated. Those risks and uncertainties include, among other things, declines in general economic and business conditions, increased competition, changes in demographics, changes in political and social conditions, regulatory initiatives and changes in customer preferences, many of which are beyond our control and the control of any other person or entity related to this offering. The forward-looking statements made in this free writing prospectus are made as of the date stated on the cover. We have no obligation to update or revise any forward-looking statement.

RBS is a trade name for the investment banking business of RBSSI. Securities, syndicated loan arranging, financial advisory and other investment banking activities are performed by RBSSI and their securities affiliates. Lending, derivatives and other commercial banking activities are performed by The Royal Bank of Scotland plc and their banking affiliates. RBSSI is a member of SIPC, FINRA and the NYSE.

Wells Fargo Securities is the trade name for the capital markets and investment banking services of Wells Fargo & Company and its subsidiaries, including Wells Fargo Securities, LLC, a member of FINRA, NYSE, NFA and SIPC, Wells Fargo Institutional Securities, LLC, a member of FINRA and SIPC, Wells Fargo Prime Services, LLC, a member of FINRA, NFA and SIPC and Wells Fargo Bank, N.A.

IRS CIRCULAR 230 NOTICE

THIS TERM SHEET IS NOT INTENDED OR WRITTEN TO BE USED, AND CANNOT BE USED, FOR THE PURPOSE OF AVOIDING U.S. FEDERAL, STATE OR LOCAL TAX PENALTIES. THIS TERM SHEET IS WRITTEN AND PROVIDED BY THE DEPOSITOR IN CONNECTION WITH THE PROMOTION OR MARKETING BY THE DEPOSITOR AND THE CO-LEAD BOOKRUNNING MANAGERS OF THE TRANSACTION OR MATTERS ADDRESSED HEREIN. INVESTORS SHOULD SEEK ADVICE BASED ON THEIR PARTICULAR CIRCUMSTANCES FROM AN INDEPENDENT TAX ADVISOR.

IMPORTANT NOTICE REGARDING THE OFFERED CERTIFICATES

The offered certificates referred to in these materials and the asset pool backing them are subject to modification or revision (including the possibility that one or more classes of certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a “when, as and if issued” basis. Prospective investors should understand that, when considering the purchase of the offered certificates, a contract of sale will come into being no sooner than the date on which the relevant class of certificates has been priced and the underwriters have confirmed the allocation of certificates to be made to investors; any “indications of interest” expressed by any prospective investor, and any “soft circles” generated by the underwriters, will not create binding contractual obligations for such prospective investors, on the one hand, or the underwriters, the depositor or any of their respective agents or affiliates, on the other hand.

As a result of the foregoing, a prospective investor may commit to purchase certificates that have characteristics that may change, and each prospective investor is advised that all or a portion of the certificates referred to in these materials may be issued that differ from the characteristics described in these materials. The underwriters’ obligation to sell certificates to any prospective investor is conditioned on the certificates and the transaction having the characteristics described in these materials. If the underwriters determine that a condition is not satisfied in any material respect, such prospective investor will be notified, and neither the depositor nor the underwriters will have any obligation to such prospective investor to deliver any portion of the offered certificates which such prospective investor has committed to purchase, and there will be no liability between the underwriters, the depositor or any of their respective agents or affiliates, on the one hand, and such prospective investor, on the other hand, as a consequence of the non-delivery.

Each prospective investor has requested that the underwriters provide to such prospective investor information in connection with such prospective investor’s consideration of the purchase of the certificates described in these materials. These materials are being provided to each prospective investor for informative purposes only in response to such prospective investor’s specific request. The underwriters described in these materials may from time to time perform investment banking services for, or solicit investment banking business from, any company named in these materials. The underwriters and/or their affiliates or respective employees may from time to time have a long or short position in any security or contract discussed in these materials.

The information contained herein supersedes any previous such information delivered to any prospective investor and will be superseded by information delivered to such prospective investor prior to the time of sale.

IMPORTANT NOTICE RELATING TO AUTOMATICALLY-GENERATED EMAIL DISCLAIMERS

Any legends, disclaimers or other notices that may appear at the bottom of, or attached to, any email communication to which this free writing prospectus is attached relating to (1) these materials not constituting an offer (or a solicitation of an offer), (2) no representation that these materials are accurate or complete and may not be updated or (3) these materials possibly being confidential, are not applicable to these materials and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of these materials having been sent via Bloomberg or another system.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| WFRBS Commercial Mortgage Trust 2014-C21 | Characteristics of the Mortgage Pool |

| | | Class | Expected Ratings (DBRS/Moody’s/Morningstar)(1) | | Approximate Initial Certificate Principal Balance or Notional Amount(2) | | Approx. Initial Credit Support(3) | | Pass-Through Rate Description | | Weighted

Average Life (Years)(4) | | Expected Principal Window(4) | | Certificate Principal to Value Ratio(5) | | Certificate Principal U/W NOI Debt Yield(6) |

| | | | Offered Certificates | | | | | | | | | | |

| | | A-1 | AAA(sf)/Aaa(sf)/AAA | | $66,230,000 | | | 30.000% | | (7) | | 2.67 | | 09/14 - 06/19 | | 34.6% | | 17.2% |

| | | A-2 | AAA(sf)/Aaa(sf)/AAA | | $109,149,000 | | | 30.000% | | (7) | | 4.87 | | 06/19 - 07/19 | | 34.6% | | 17.2% |

| | | A-3 | AAA(sf)/Aaa(sf)/AAA | | $48,253,000 | | | 30.000% | | (7) | | 6.83 | | 04/21 - 08/21 | | 34.6% | | 17.2% |

| | | A-4 | AAA(sf)/Aaa(sf)/AAA | | $330,000,000 | | | 30.000% | | (7) | | 9.80 | | 01/24 - 06/24 | | 34.6% | | 17.2% |

| | | A-5 | AAA(sf)/Aaa(sf)/AAA | | $345,689,000 | | | 30.000% | | (7) | | 9.91 | | 06/24 - 07/24 | | 34.6% | | 17.2% |

| | | A-SB | AAA(sf)/Aaa(sf)/AAA | | $98,736,000 | | | 30.000% | | (7) | | 7.23 | | 07/19 - 01/24 | | 34.6% | | 17.2% |

| | | A-S(8) | AAA(sf)/Aaa(sf)/AAA | | $92,677,000 | | | 23.500% | | (7) | | 9.93 | | 07/24 - 07/24 | | 37.8% | | 15.8% |

| | | B(8) | AA(low)(sf)/Aa3(sf)/AA- | | $98,023,000 | | | 16.625% | | (7) | | 9.93 | | 07/24 - 07/24 | | 41.2% | | 14.5% |

| | | C(8) | A(low)(sf)/A3(sf)/A- | | $53,468,000 | | | 12.875% | | (7) | | 9.93 | | 07/24 - 07/24 | | 43.1% | | 13.9% |

| | | PEX(8) | A(low)(sf)/A1(sf)/A- | | $244,168,000 | | | 12.875% | | (7) | | 9.93 | | 07/24 - 07/24 | | 43.1% | | 13.9% |

| | | X-A | AAA(sf)/Aaa(sf)/AAA | | $1,090,734,000 | (9) | | N/A | | Variable(10) | | N/A | | N/A | | N/A | | N/A |

| | | X-B | AAA(sf)/NR/AAA | | $235,256,000 | (11) | | N/A | | Variable(12) | | N/A | | N/A | | N/A | | N/A |

| | | | Non-Offered Certificates | | | | | | | | | | | | | | | |

| | | X-C | AAA(sf)/NR/AAA | | $19,605,000 | (13) | | N/A | | Variable(14) | | N/A | | N/A | | N/A | | N/A |

| | | X-D | AAA(sf)/NR/AAA | | $80,201,349 | (15) | | N/A | | Variable(16) | | N/A | | N/A | | N/A | | N/A |

| | | D | BBB(low)(sf)/NR/BBB- | | $83,765,000 | | | 7.000% | | (7) | | 9.93 | | 07/24 - 07/24 | | 46.0% | | 13.0% |

| | | E | BB(sf)/NR/BB | | $19,605,000 | | | 5.625% | | (7) | | 9.99 | | 07/24 - 08/24 | | 46.6% | | 12.8% |

| | | F | B(sf)/NR/B | | $26,733,000 | | | 3.750% | | (7) | | 10.01 | | 08/24 - 08/24 | | 47.6% | | 12.5% |

| | | G | NR/NR/NR | | $53,468,349 | | | 0.000% | | (7) | | 10.01 | | 08/24 - 08/24 | | 49.4% | | 12.1% |

Notes: |

| (1) | The expected ratings presented are those of DBRS, Inc. (“DBRS”), Moody’s Investors Service, Inc. (“Moody’s”), and Morningstar Credit Ratings, LLC (“Morningstar”) which the depositor hired to rate the rated offered certificates. One or more other nationally recognized statistical rating organizations, as defined in Section 3(a)(62) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), that were not hired by the depositor may use information they receive pursuant to Rule 17g-5 under the Securities Exchange Act or otherwise to rate or provide market reports and/or published commentary related to the offered certificates. We cannot assure you as to what ratings a non-hired nationally recognized statistical rating organization would assign or that its reports will not express differing, possibly negative, views of the mortgage loans and/or the offered certificates. See “Risk Factors—Risks Related to the Offered Certificates—Nationally Recognized Statistical Rating Organizations May Assign Different Ratings to the Certificates; Ratings of the Certificates Reflect Only the Views of the Applicable Rating Agencies as of the Dates Such Ratings Were Issued; Ratings May Affect ERISA Eligibility; Ratings May Be Downgraded” in the free writing prospectus, dated July 11, 2014 (the “Free Writing Prospectus”). |

| | |

| (2) | The principal balances and notional amounts set forth in the table are approximate. The actual initial principal balances and notional amounts may be larger or smaller depending on the aggregate cut-off date principal balance of the mortgage loans definitively included in the pool of mortgage loans, which aggregate cut-off date principal balance may be as much as 5% larger or smaller than the amount presented in the Free Writing Prospectus. |

| | |

| (3) | The approximate initial credit support with respect to the Class A-1, A-2, A-3, A-4, A-5 and A-SB Certificates represents the approximate credit enhancement for the Class A-1, A-2, A-3, A-4, A-5 and A-SB Certificates in the aggregate. The approximate initial credit support with respect to each of the Class C Certificates and Class PEX Certificates is equal to the approximate initial credit support of the Class C regular interest. |

| | |

| (4) | Weighted Average Lives and Expected Principal Windows are calculated based on an assumed prepayment rate of 0% CPR and the “Structuring Assumptions” described on Annex D to the Free Writing Prospectus. |

| | |

| (5) | The Certificate Principal to Value Ratio for each Class of Certificates (other than the Class A-1, A-2, A-3, A-4, A-5 and A-SB Certificates and other than the Exchangeable Certificates) is calculated by dividing the aggregate principal balance of such class of certificates and all classes of certificates (other than the Exchangeable Certificates and other than the Class X-A, X-B, X-C and X-D Certificates, which are notional amount certificates and will not have principal balances), if any, that are senior to such class by the aggregate appraised value of $2,884,596,243 (calculated as described in the Free Writing Prospectus) of the mortgaged properties securing the mortgage loans (excluding, with respect to the Queens Atrium, Montgomery Mall, and Oak Court Mall loan combinations, a pro rata portion of the related appraised value allocated to the related companion loan based on its cut-off date principal balance). The Certificate Principal to Value Ratios for each of the Class A-1, A-2, A-3, A-4, A-5 and A-SB Certificates are calculated by dividing the aggregate principal balance of the Class A-1, A-2, A-3, A-4, A-5 and A-SB Certificates by such aggregate appraised value (excluding, with respect to the Queens Atrium, Montgomery Mall, and Oak Court Mall loan combinations, a pro rata portion of the related appraised value allocated to the related companion loan based on its cut-off date principal balance). The Certificate Principal to Value Ratio for each of the Class A-S, B and C Certificates is calculated by dividing the aggregate principal balance of the Class A-S regular interest, the Class B regular interest or the Class C regular interest, as applicable, and all other classes of certificates (other than the Exchangeable Certificates) and the regular interests that are senior to such class, by such aggregate appraised value (excluding, with respect to the Queens Atrium, Montgomery Mall, and Oak Court Mall loan combinations, a pro rata portion of the related appraised value allocated to the related companion loan based on its cut-off date principal balance). The Certificate Principal to Value Ratio of the Class PEX Certificates is equal to the Certificate Principal to Value Ratio of the Class C Certificates. In any event, however, excess mortgaged property value associated with a mortgage loan will not be available to offset losses on any other mortgage loan (unless such mortgage loans are cross-collateralized and the cross-collateralization remains in effect). |

| | |

| (6) | The Certificate Principal U/W NOI Debt Yield for each Class of Certificates (other than the Class A-1, A-2, A-3, A-4, A-5 and A-SB Certificates and other than the Exchangeable Certificates) is calculated by dividing the underwritten net operating income (which excludes, with respect to Queens Atrium, Montgomery Mall, and Oak Court Mall loan combinations, a pro rata portion of the related underwritten net operating income allocated to the related companion loan based on its cut-off date principal balance) for the mortgage pool of $172,089,005 (calculated as described in the Free Writing Prospectus) by the aggregate principal balance of such class of certificates and all classes of certificates (other than the Class X-A, X-B, X-C and X-D Certificates, which are notional amount certificates and will not have principal balances, and other than the Exchangeable Certificates), if any, that are senior to such class of certificates. The Certificate Principal U/W NOI Debt Yield for each of the Class A-1, A-2, A-3, A-4, A-5 and A-SB Certificates is calculated by dividing such mortgage pool underwritten net operating income (which excludes, with respect to the Queens Atrium, Montgomery Mall, and Oak Court Mall loan combinations, a pro rata portion of the related underwritten net operating income allocated to the related companion loan based on its cut-off date principal balance) by the aggregate principal balance of the Class A-1, A-2, A-3, A-4, A-5 and A-SB Certificates. The Certificate Principal U/W NOI Debt Yield for each of the Class A-S, B and C Certificates is calculated by dividing the underwritten net operating income (which excludes, with respect to the Queens Atrium, Montgomery Mall, and Oak Court Mall loan combinations, a pro rata portion of the related underwritten net operating income allocated to the related companion loan based on its cut-off date principal balance) for the mortgage pool of approximately $172,089,005 (calculated as described in the Free Writing Prospectus) by the aggregate principal balance of the Class A-S regular interest, the Class B regular interest or the Class C regular interest, as applicable, and all other classes of certificates (other than the Exchangeable Certificates) and the regular interests that are senior to such class. The Certificate Principal U/W NOI Debt Yield of the Class PEX Certificates is equal to the Certificate Principal U/W NOI Debt Yield for the Class C Certificates. In any event, however, cash flow from each mortgaged property supports only the related mortgage loan and will not be available to support any other mortgage loan (unless such mortgage loans are cross-collateralized and the cross-collateralization remains in effect). |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| WFRBS Commercial Mortgage Trust 2014-C21 | Characteristics of the Mortgage Pool |

| (7) | The pass-through rates for the Class A-1, A-2, A-3, A-4, A-5, A-SB, D, E, F and G Certificates and the Class A-S, B and C regular interests, in each case, will be one of the following: (i) a fixed rate per annum, (ii) the WAC Rate (as defined in the Free Writing Prospectus) for the related distribution date, (iii) a variable rate per annum equal to the lesser of (a) a fixed rate and (b) the WAC Rate for the related distribution date or (iv) a variable rate per annum equal to the WAC Rate for the related distribution date minus a specified percentage. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. The Class PEX Certificates will not have a pass-through rate, but will be entitled to receive the sum of the interest distributable on the percentage interests of the Class A-S, B and C regular interests represented by the Class PEX Certificates. The pass-through rates on the Class A-S, B and C Certificates will at all times be the same as the pass-through rates of the Class A-S, B and C regular interests. |

| | |

| (8) | The Class A-S, B, C and PEX Certificates are “Exchangeable Certificates”. On the closing date, the upper-tier REMIC of the issuing entity will issue the Class A-S, B and C regular interests (each a “regular interest”) which will have outstanding principal balances on the closing date of $92,677,000, $98,023,000 and $53,468,000, respectively. The regular interests will be held in a grantor trust for the benefit of the holders of the Class A-S, B, C and PEX Certificates. The Class A-S, B, C and PEX Certificates will, at all times, represent undivided beneficial ownership interests in a grantor trust that will hold those regular interests. Each class of the Class A-S, B and C Certificates will, at all times, represent an undivided beneficial ownership interest in a percentage of the outstanding certificate principal balance of the regular interest with the same alphabetical class designation. The Class PEX Certificates will, at all times, represent an undivided beneficial ownership interest in the remaining percentages of the outstanding certificate principal balances of the Class A-S, B and C regular interests and which portions of those regular interests are referred to in this Term Sheet as the Class PEX Component A-S, Class PEX Component B and Class PEX Component C (collectively, the “Class PEX Components”). Following any exchange of Class A-S, B and C Certificates for Class PEX Certificates or any exchange of Class PEX Certificates for Class A-S, B and C Certificates as described in the Free Writing Prospectus, the percentage interest of the outstanding certificate principal balances of the Class A-S, B and C regular interest that is represented by the Class A-S, B, C and PEX Certificates will be increased or decreased accordingly. The initial certificate principal balance of each of the Class A-S, B and C Certificates shown in the table represents the maximum certificate principal balance of such class without giving effect to any exchange. The initial certificate principal balance of the Class PEX Certificates is equal to the aggregate of the initial certificate principal balance of the Class A-S, B and C Certificates and represents the maximum certificate principal balance of the Class PEX Certificates that could be issued in an exchange. The certificate principal balances of the Class A-S, B and C Certificates to be issued on the closing date will be reduced, in required proportions, by an amount equal to the certificate principal balance of the Class PEX Certificates issued on the closing date. Distributions and allocations of payments and losses with respect to the Exchangeable Certificates are described in this Term Sheet under “Allocations and Distributions on the Class A-S, B, C and PEX Certificates” and under “Description of the Offered Certificates—Distributions” in the Free Writing Prospectus. The maximum certificate principal balance of the Class PEX Certificates is set forth in the table but is not included in the certificate principal balance of the certificates set forth on the cover page of this Term Sheet or on the top of the cover page of the Free Writing Prospectus. |

| | |

| (9) | The Class X-A Certificates are notional amount certificates. The Notional Amount of the Class X-A Certificates will be equal to the aggregate principal balance of the Class A-1, A-2, A-3, A-4, A-5 and A-SB Certificates and the Class A-S regular interest outstanding from time to time. The Class X-A Certificates will not be entitled to distributions of principal. |

| | |

| (10) | The pass-through rate for the Class X-A Certificates for any distribution date will be a per annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the weighted average of the pass-through rates on the Class A-1, A-2, A-3, A-4, A-5 and A-SB Certificates and the Class A-S regular interest for the related distribution date, weighted on the basis of their respective aggregate principal balances outstanding immediately prior to that distribution date. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. |

| | |

| (11) | The Class X-B Certificates are notional amount certificates. The Notional Amount of the Class X-B Certificates will be equal to the aggregate principal balance of the Class B and C regular interests and the Class D Certificates outstanding from time to time. The Class X-B Certificates will not be entitled to distributions of principal. |

| | |

| (12) | The pass-through rate for the Class X B certificates for any distribution date will be a per annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the weighted average of the pass-through rates on the Class D certificates and the Class B and Class C regular interests for the related distribution date, weighted on the basis of their respective aggregate certificate principal balances outstanding immediately prior to that distribution date. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. |

| | |

| (13) | The Class X-C Certificates are notional amount certificates. The Notional Amount of the Class X-C Certificates will be equal to the principal balance of the Class E Certificates outstanding from time to time. The Class X-C Certificates will not be entitled to distributions of principal. |

| | |

| (14) | The pass-through rate for the Class X-C Certificate for any distribution date will be a per annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the pass-through rate on the Class E Certificates for the related distribution date. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. |

| | |

| (15) | The Class X-D Certificates are notional amount certificates. The Notional Amount of the Class X-D Certificates will be equal to the aggregate principal balance of the Class F and G Certificates outstanding from time to time. The Class X-D Certificates will not be entitled to distributions of principal. |

| | |

| (16) | The pass-through rate for the Class X-D Certificates for any distribution date will be a per annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the weighted average of the pass-through rates on the Class F and G Certificates for the related distribution date, weighted on the basis of their respective aggregate principal balances outstanding immediately prior to that distribution date. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| WFRBS Commercial Mortgage Trust 2014-C21 | Characteristics of the Mortgage Pool |

| II. | Transaction Highlights |

Mortgage Loan Sellers:

| Mortgage Loan Seller | | Number of Mortgage Loans | | | Number of Mortgaged Properties | | | Aggregate Cut-off Date Balance | | | % of Cut-off Date Pool Balance | |

| Wells Fargo Bank, National Association | | 40 | | | | 41 | | | | | $587,584,612 | | | | 41.2 | % | |

The Royal Bank of Scotland(1) | | 16 | | | | 34 | | | | | | 384,156,012 | | | | 26.9 | | |

| Liberty Island Group I LLC | | 14 | | | | 16 | | | | | | 189,621,552 | | | | 13.3 | | |

| C-III Commercial Mortgage LLC | | 27 | | | | 30 | | | | | | 126,954,763 | | | | 8.9 | | |

| Basis Real Estate Capital II, LLC | | 10 | | | | 10 | | | | | | 77,992,875 | | | | 5.5 | | |

| NCB, FSB | | 15 | | | | 15 | | | | | | 59,486,535 | | | | 4.2 | | |

| Total | | 122 | | | | 146 | | | | | $1,425,796,349 | | | | 100.0 | % | |

| | |

| (1) | The mortgage loan seller referred to herein as The Royal Bank of Scotland is comprised of two affiliated companies: The Royal Bank of Scotland plc and RBS Financial Products Inc. With respect to the mortgage loans being sold for the deposit into the trust by The Royal Bank of Scotland: (a) fourteen (14) mortgage loans, having an aggregate cut-off date principal balance of $357,917,998 and representing approximately 25.1% of the aggregate principal balance of the pool of mortgage loans as of the cut-off date, are being sold for deposit into the trust by The Royal Bank of Scotland plc and (b) two (2) mortgage loans, having an aggregate cut-off date principal balance of $26,238,014and representing approximately 1.8% of the aggregate principal balance of the pool of mortgage loans as of the cut-off date are being sold for deposit into the trust by RBS Financial Products Inc. |

Loan Pool:

| Cut-off Date Balance: | $1,425,796,349 |

| Number of Mortgage Loans: | 122 |

| Average Cut-off Date Balance per Mortgage Loan: | $11,686,855 |

| Number of Mortgaged Properties: | 146 |

Average Cut-off Date Balance per Mortgaged Property(1): | $9,765,728 |

| Weighted Average Mortgage Interest Rate: | 4.608% |

| Ten Largest Mortgage Loans as % of Cut-off Date Pool Balance: | 42.2% |

| Weighted Average Original Term to Maturity or ARD (months): | 114 |

| Weighted Average Remaining Term to Maturity or ARD (months): | 113 |

Weighted Average Original Amortization Term (months)(2): | 351 |

Weighted Average Remaining Amortization Term (months)(2): | 351 |

| Weighted Average Seasoning (months): | 1 |

| (1) | Information regarding mortgage loans secured by multiple properties is based on an allocation according to relative appraised values or the allocated loan amounts or property-specific release prices set forth in the related loan documents or such other allocation as the related mortgage loan seller deemed appropriate. |

| (2) | Excludes any mortgage loan that does not amortize. |

Credit Statistics:

Weighted Average U/W Net Cash Flow DSCR(1): | 1.98x |

Weighted Average U/W Net Operating Income Debt Yield Ratio(1): | 12.1% |

Weighted Average Cut-off Date Loan-to-Value Ratio(1): | 63.3% |

Weighted Average Balloon or ARD Loan-to-Value Ratio(1): | 55.2% |

% of Mortgage Loans with Additional Subordinate Debt(2): | 5.0% |

% of Mortgage Loans with Single Tenants(3): | 6.3% |

| (1) | With respect to the Queens Atrium, Montgomery Mall, and Oak Court Mall mortgage loans, loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan (unless otherwise stated) in total debt. The information for each mortgaged property that relates to a mortgage loan that is cross-collateralized with other mortgage loans is based upon the principal balance of that mortgage loan, except that the applicable loan-to-value ratio, debt service coverage ratio, or debt yield for each such mortgaged property is based upon the ratio or yield (as applicable) for the aggregate indebtedness evidenced by all loans in the group. On an individual basis, without regard to the cross-collateralization feature, any mortgaged property securing a mortgage loan that is part of a cross-collateralized group of mortgage loans may have a higher loan-to-value ratio, lower debt service coverage ratio and/or lower debt yield than is presented herein. The debt service coverage ratio and debt yield calculations for each residential cooperative mortgage loan is calculated using underwritten net cash flow for the related residential cooperative property, which is the projected net cash flow reflected in the most recent appraisal obtained by or otherwise in the possession of the related mortgage loan seller as of the cut-off date, and the loan-to value ratio information for each residential cooperative mortgage loan is based upon the appraised value of the residential cooperative property determined as if such residential cooperative property is operated as a residential cooperative.See Annex A to the Free Writing Prospectus. Debt service coverage ratio, debt yield and loan-to-value ratio information does not take into account any of subordinate debt (whether or not secured by the mortgaged property), that is allowed under the terms of any mortgage loan. |

| (2) | Nine (9) of the mortgage loans, each of which are secured by residential cooperative properties, currently have in place subordinate secured lines of credit to the related mortgage borrowers that permit future advances (such loans, collectively, the “Subordinate Coop LOCs”). The percentage figure expressed as “% of Mortgage loans with Additional Subordinate Debt” is determined as a percentage of cut-off date principal balance of the mortgage pool and does not take into account future subordinate debt (whether or not secured by the mortgaged property), if any, that may be permitted under the terms of any mortgage loan or the pooling and servicing agreement. See “Description of the Mortgage Pool—Subordinate and/or Other Financing” and “—Additional Debt Financing for Mortgage Loans Secured by Residential Cooperatives” in the Free Writing Prospectus. |

| (3) | Excludes mortgage loans that are secured by multiple single-tenant properties. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| WFRBS Commercial Mortgage Trust 2014-C21 | Characteristics of the Mortgage Pool |

Loan Structural Features:

Amortization: Based on the Cut-off Date Pool Balance, 81.5% of the mortgage pool (112 mortgage loans) have scheduled amortization, as follows:

45.8% (85 mortgage loans) require amortization during the entire loan term

35.6% (27 mortgage loans) provide for an interest-only period followed by an amortization and/or hyperamortization period

Interest-Only: Based on the Cut-off Date Pool Balance, 18.5% of the mortgage pool (10 mortgage loans) provides for interest-only payments during the entire loan term. The Weighted Average Cut-off Date Loan-to-Value Ratio and Weighted Average U/W Net Cash Flow DSCR for those mortgage loans is 58.9% and 3.19x, respectively.

Hard Lockboxes: Based on the Cut-off Date Pool Balance, 43.5% of the mortgage pool (22 mortgage loans) have hard lockboxes in place.

Reserves: The mortgage loans require amounts to be escrowed monthly as follows (excluding any mortgage loans with springing provisions):

| | | | | |

| | Real Estate Taxes: | | |

| | Insurance Premiums: | | |

| | Capital Replacements: | | |

| | TI/LC: | | |

| | (1) | The percentage of the Cut-off Date Balance for loans with TI/LC reserves is based on the aggregate principal balance allocable to office, retail, industrial, and other properties. | |

Call Protection/Defeasance: Based on the Cut-off Date Pool Balance, the mortgage pool has the following call protection and defeasance features:

86.3% of the mortgage pool (94 mortgage loans) feature a lockout period, then defeasance only until an open period

4.2% of the mortgage pool (15 mortgage loans) feature no lockout period, but the greater of a prepayment premium or yield maintenance, then prepayment premium until an open period

5.4% of the mortgage pool (11 mortgage loans) feature a lockout period, then the greater of a prepayment premium or yield maintenance until an open period

3.3% of the mortgage pool (1 mortgage loans) feature no lockout period, then the greater of a prepayment premium or yield maintenance until an open period

0.8% of the mortgage pool (1 mortgage loans) feature a lockout period, then defeasance or the greater of a prepayment premium or yield maintenance until an open period

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| WFRBS Commercial Mortgage Trust 2014-C21 | Characteristics of the Mortgage Pool |

| III. | Issue Characteristics | | |

| | | | |

| | Securities Offered: | | $1,242,225,000 approximate monthly pay, multi-class, commercial mortgage REMIC pass-through certificates consisting of twelve classes (Classes A-1, A-2, A-3, A-4, A-5, A-SB, A-S, B, C, PEX, X-A and X-B), which are offered pursuant to a registration statement filed with the SEC. |

| | | | |

| | Mortgage Loan Sellers: | | Wells Fargo Bank, National Association (“WFB”); The Royal Bank of Scotland (“RBS”); Liberty Island Group I LLC (“LIG I”); Basis Real Estate Capital II, LLC (“Basis”), C-III Commercial Mortgage LLC (“CIIICM”) and NCB, FSB |

| | | | |

| | Co-lead Bookrunning

Managers: | | RBS Securities Inc. and Wells Fargo Securities, LLC |

| | | | |

| | Co-Managers: | | Citigroup Global Markets Inc. |

| | | | |

| | Rating Agencies: | | DBRS, Inc., Moody’s Investors Service, Inc., and Morningstar Credit Ratings, LLC |

| | | | |

| | Master Servicers: | | Wells Fargo Bank, National Association and NCB, FSB |

| | | | |

| | Special Servicers: | | CWCapital Asset Management, LLC and NCB, FSB |

| | | | |

| | Certificate Administrator: | | Wells Fargo Bank, National Association |

| | | | |

| | Trustee: | | Wilmington Trust, National Associatation |

| | | | |

| | Trust Advisor: | | Trimont Real Estate Advisors, Inc. |

| | | | |

| | Initial Majority

Subordinate

Certificateholder: | | An affiliate of Seer Capital Management, LP |

| | | | |

| | Cut-off Date: | | The Cut-off Date with respect to each mortgage loan is the due date for the monthly debt service payment that is due in August 2014 (or, in the case of any mortgage loan that has its first due date in September 2014, the date that would have been its due date in August 2014 under the terms of that mortgage loan if a monthly debt service payment were scheduled to be due in that month). |

| | | | |

| | Expected Closing Date: | | On or about August 12, 2014. |

| | | | |

| | Determination Dates: | | The eleventh day of each month (or if that day is not a business day, the next succeeding business day), commencing in September 2014. |

| | | | |

| | Distribution Dates: | | The fourth business day following the Determination Date in each month, commencing in September 2014. |

| | | | |

| | Rated Final Distribution

Date: | | The Distribution Date in August 2047. |

| | | | |

| | Interest Accrual Period: | | With respect to any Distribution Date, the calendar month preceding the month in which such Distribution Date occurs. |

| | | | |

| | Day Count: | | The Offered Certificates will accrue interest on a 30/360 basis. |

| | | | |

| | Minimum Denominations: | | $10,000 for each Class of Offered Certificates (other than the Class X-A and Class X-B Certificates) and $1,000,000 for the Class X-A and Class X-B Certificates. Investments may also be made in any whole dollar denomination in excess of the applicable minimum denomination. |

| | | | |

| | Clean-up Call: | | 1% |

| | | | |

| | Delivery: | | DTC, Euroclear and Clearstream Banking |

| | | | |

| | ERISA/SMMEA Status: | | Each Class of Offered Certificates is expected to be eligible for exemptive relief under ERISA. No Class of Offered Certificates will be SMMEA eligible. |

| | | | |

| | Risk Factors: | | THE CERTIFICATES INVOLVE CERTAIN RISKS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. SEE THE “RISK FACTORS” SECTION OF THE FREE WRITING PROSPECTUS. |

| | | | |

| | Bond Analytics

Information: | | The Certificate Administrator will be authorized to make distribution date settlements, CREFC® reports and certain supplemental reports (other than confidential information) available to certain financial modeling and data provision services, including Bloomberg Financial Markets L.P., Trepp LLC, Intex Solutions, Inc., Markit Group Limited, Interactive Data Corp., BlackRock Financial Management, Inc. and CMBS.com, Inc. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| WFRBS Commercial Mortgage Trust 2014-C21 | Characteristics of the Mortgage Pool |

| IV. | Characteristics of the Mortgage Pool(1) |

| | |

| A. | Ten Largest Mortgage Loans |

Mortgage Loan Seller | | Mortgage Loan Name | | City | | State | | Number of

Mortgage Loans /

Mortgaged

Properties | | | Mortgage Loan

Cut-off Date

Balance ($) | | | % of Cut-

off Date

Pool

Balance

(%) | | Property Type | | Number of

SF, Rooms

or Units | | | Cut-off Date

Balance Per

Unit of

Measure($) | | | Cut-off Date

LTV Ratio

(%) | | | Balloon or

ARD LTV

Ratio (%) | | | U/W NCF

DSCR (x) | | | U/W NOI

Debt Yield

(%) |

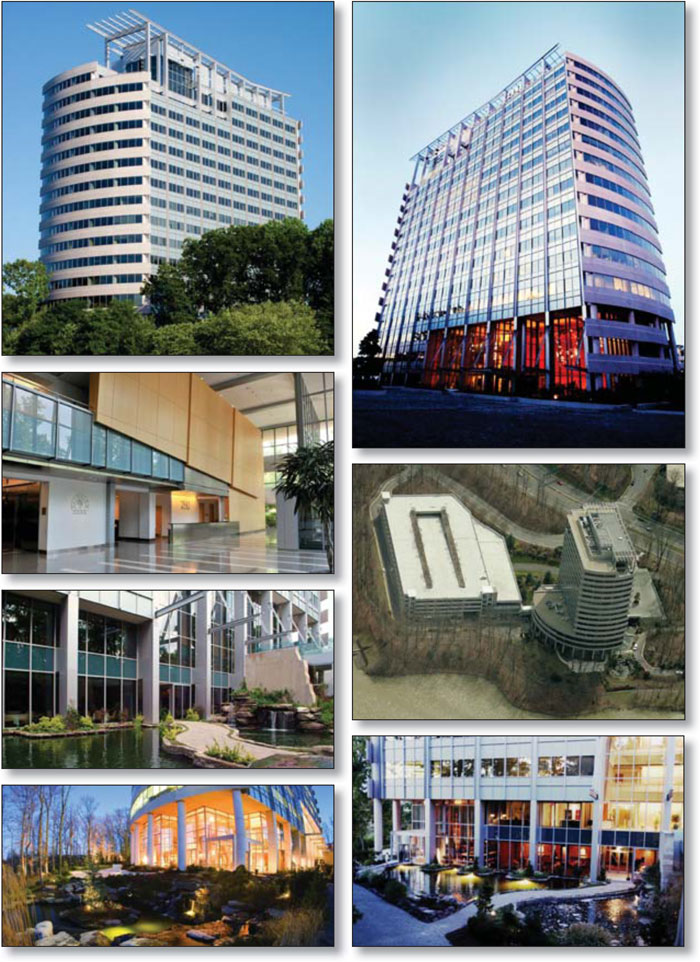

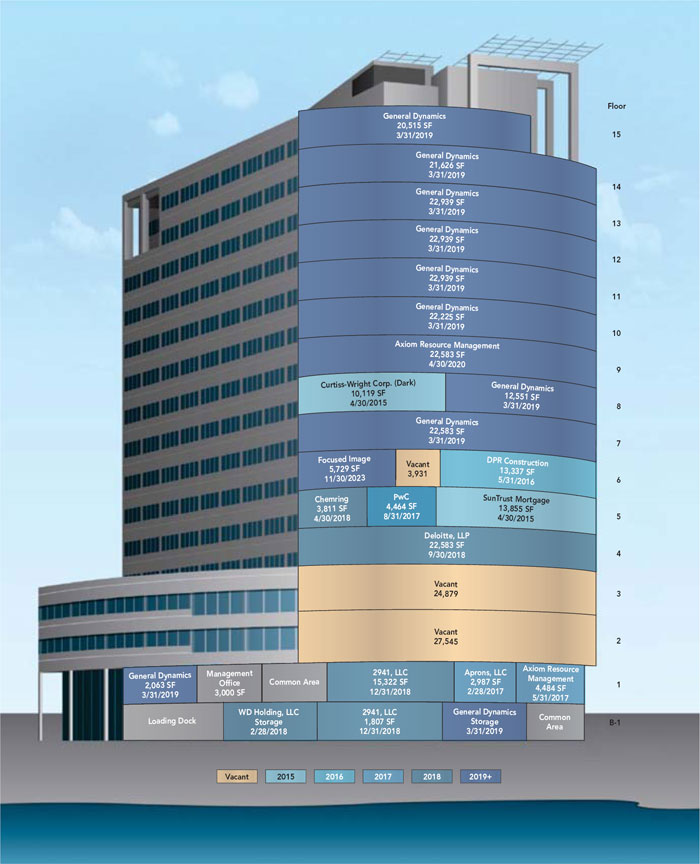

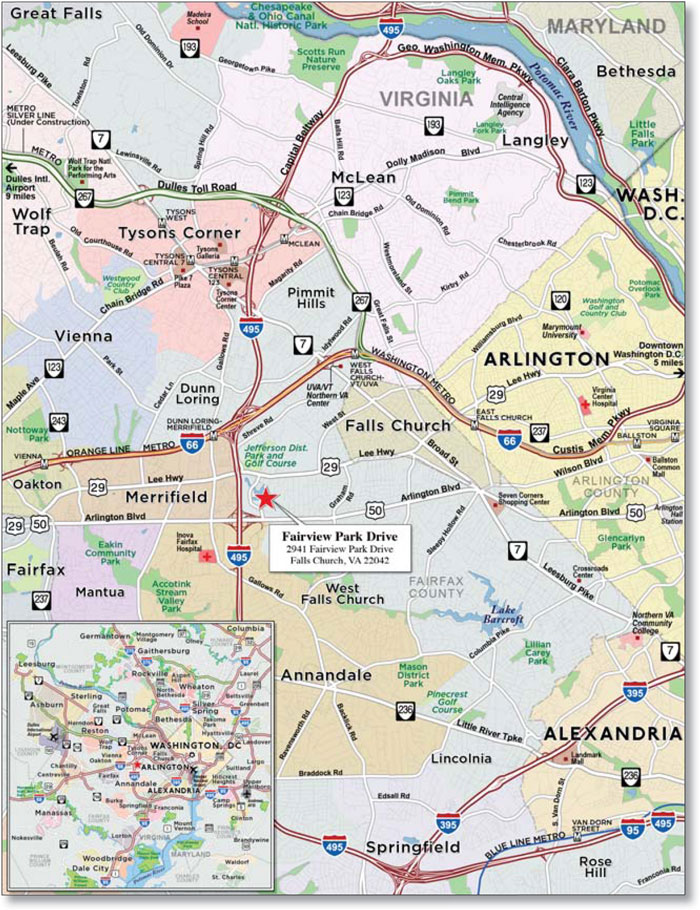

| RBS | | Fairview Park Drive | | Falls Church | | VA | | 1 / 1 | | | | $90,000,000 | | | 6.3 | % | | Office | | 360,864 | | | $249 | | | 66.7 | % | | | 66.7 | % | | | 1.91 | x | | | 8.7 | % |

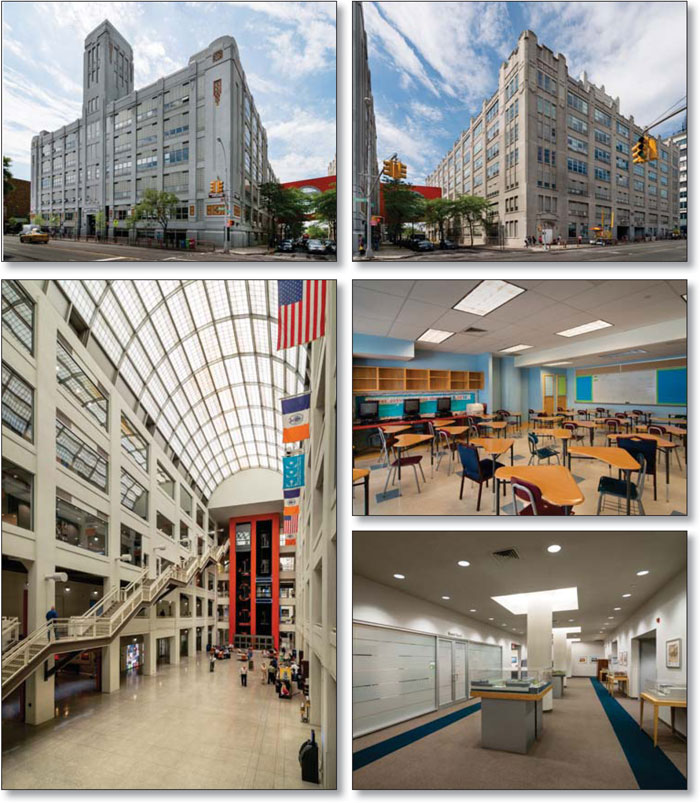

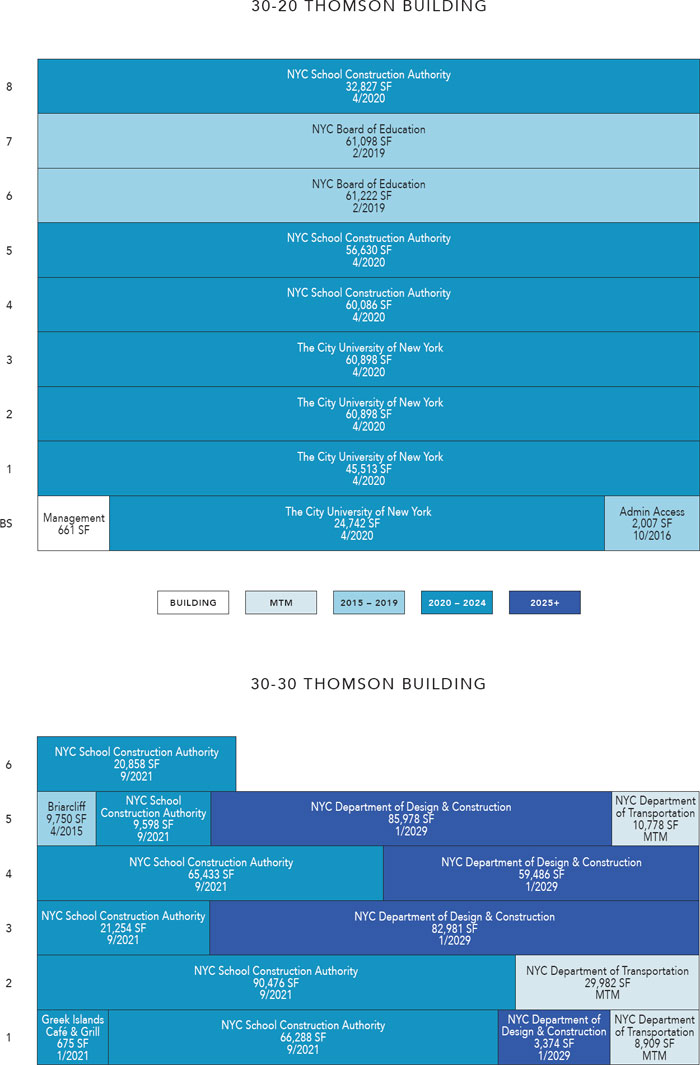

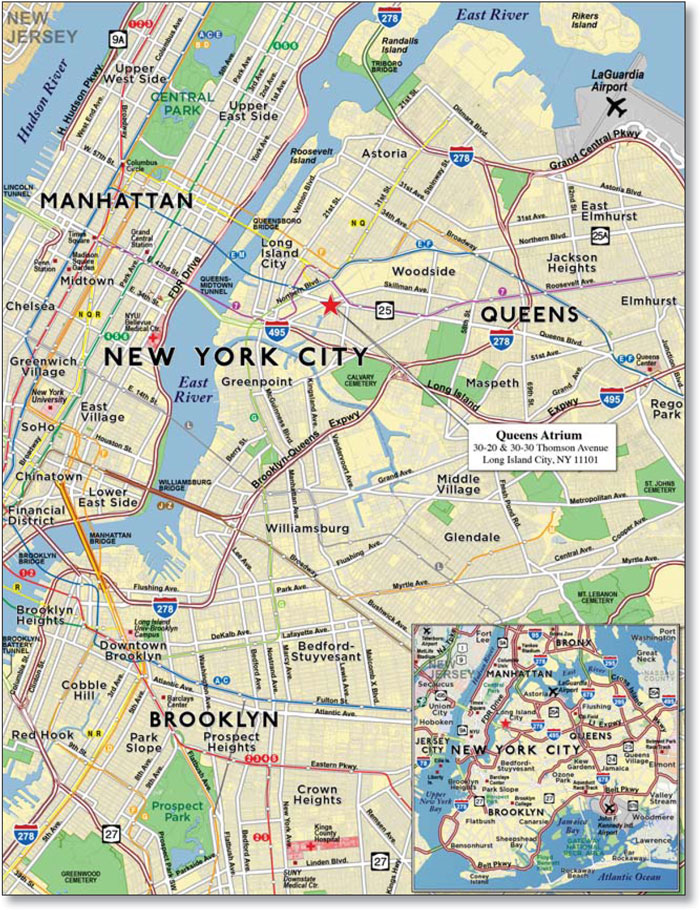

| WFB | | Queens Atrium | | Long Island City | | NY | | 1 / 1 | | | | 90,000,000 | | | 6.3 | | | Office | | 1,032,402 | | | 174 | | | 69.2 | | | | 63.2 | | | | 1.41 | | | | 9.2 | |

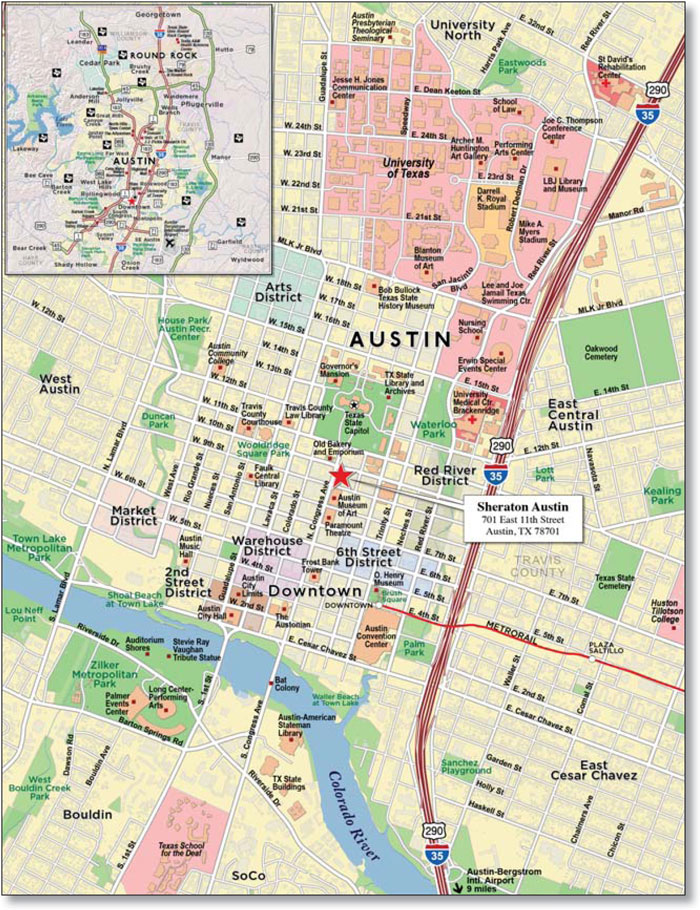

| WFB | | Sheraton Austin | | Austin | | TX | | 1 / 1 | | | | 67,000,000 | | | 4.7 | | | Hospitality | | 365 | | | 183,562 | | | 61.8 | | | | 61.8 | | | | 3.03 | | | | 13.6 | |

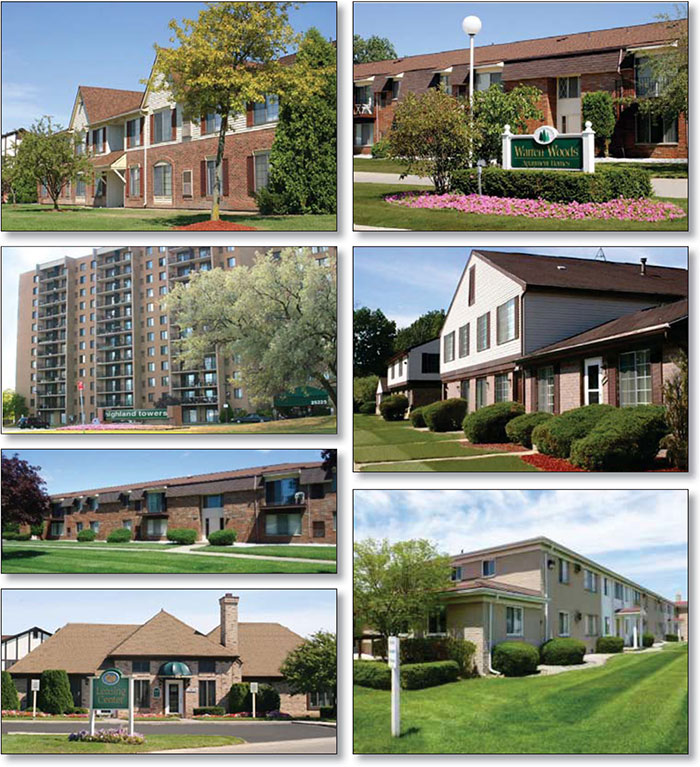

| RBS | | Highland Portfolio | | Various | | MI | | 1 / 6 | | | | 62,400,000 | | | 4.4 | | | Multifamily | | 1,873 | | | 33,316 | | | 72.1 | | | | 65.1 | | | | 1.20 | | | | 8.4 | |

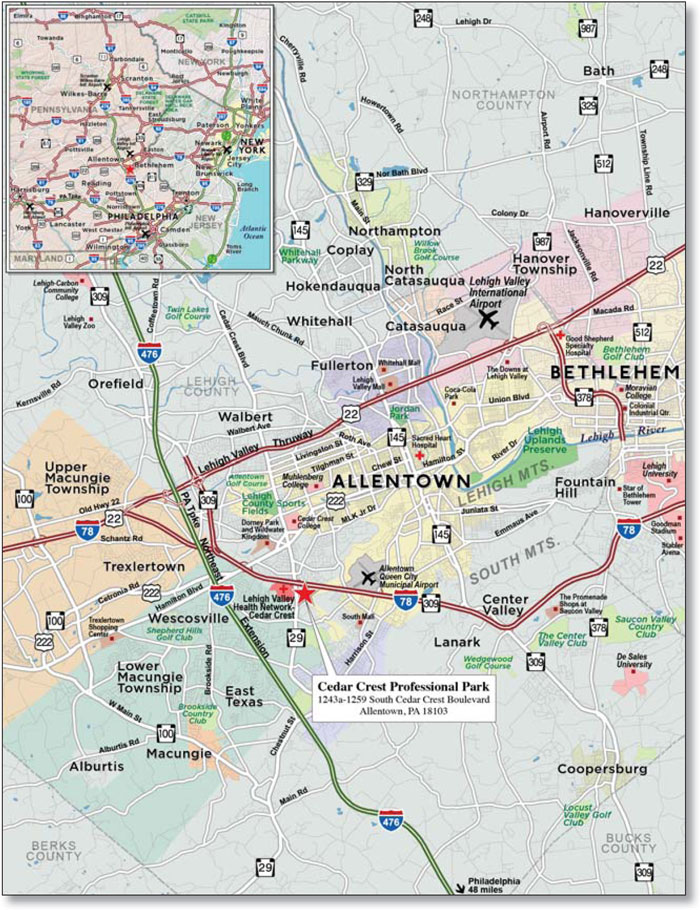

| WFB | | Cedar Crest Professional Park | | Allentown | | PA | | 1 / 1 | | | | 59,929,763 | | | 4.2 | | | Office | | 700,815 | | | 86 | | | 64.4 | | | | 52.3 | | | | 1.47 | | | | 10.5 | |

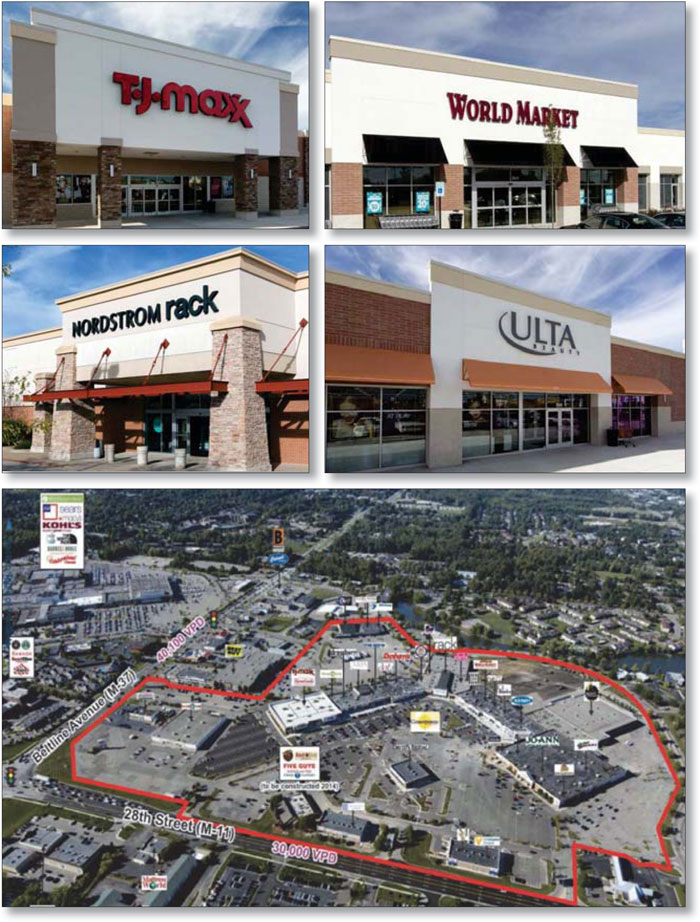

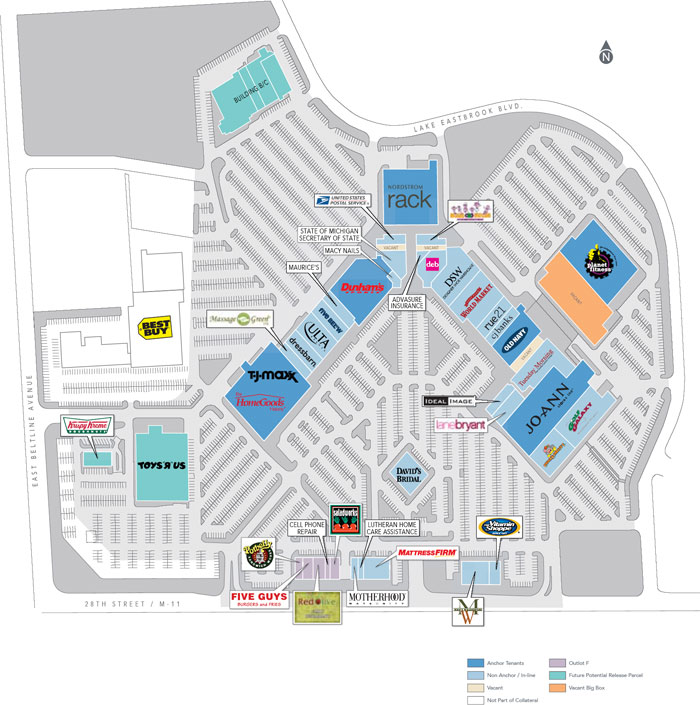

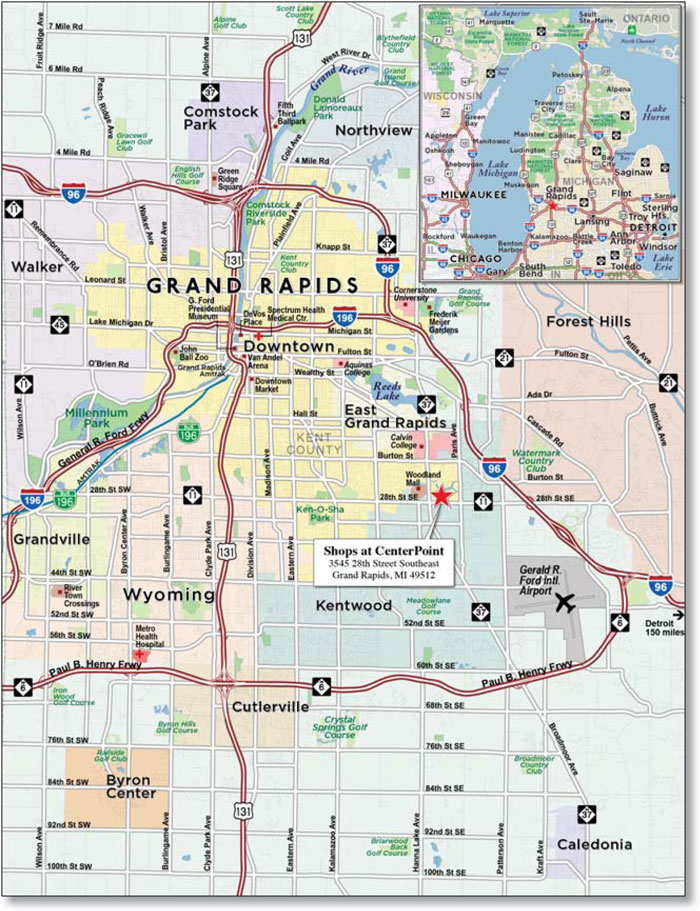

| WFB | | Shops at CenterPoint | | Grand Rapids | | MI | | 1 / 1 | | | | 54,000,000 | | | 3.8 | | | Retail | | 461,196 | | | 117 | | | 73.4 | | | | 67.1 | | | | 1.44 | | | | 9.3 | |

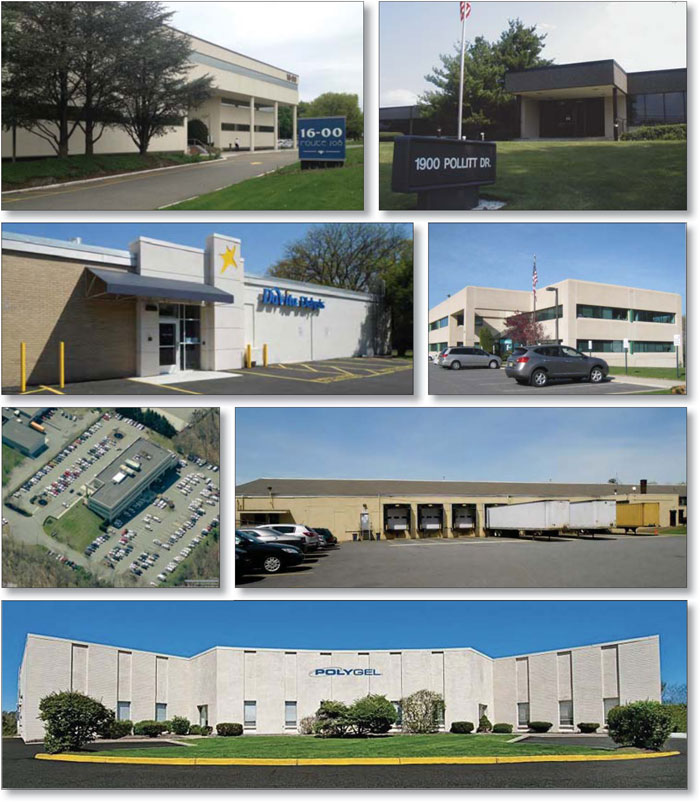

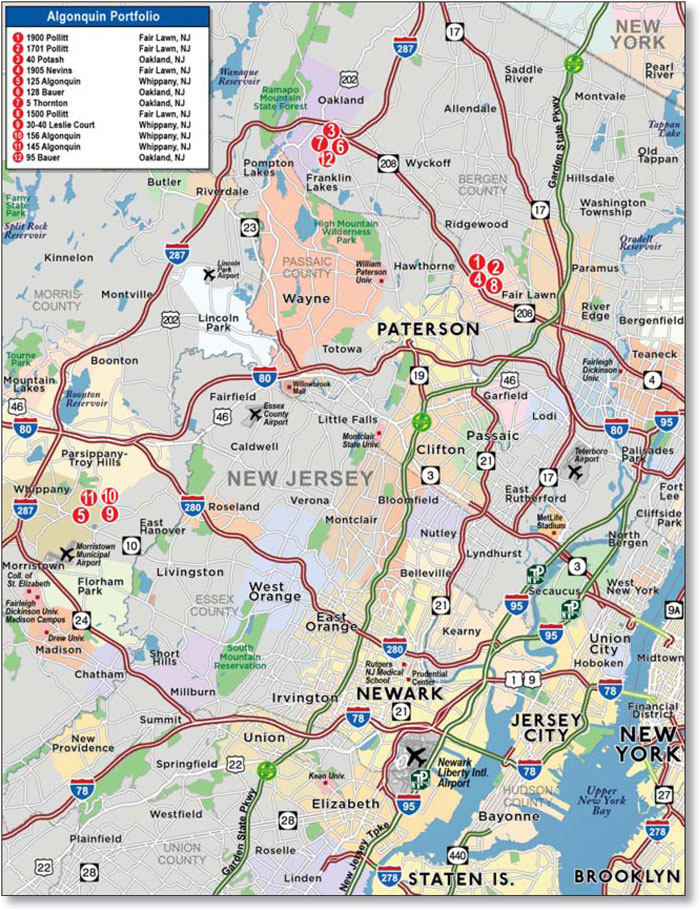

| RBS | | Algonquin Portfolio | | Various | | NJ | | 1 / 12 | | | | 49,500,000 | | | 3.5 | | | Various | | 750,823 | | | 66 | | | 59.7 | | | | 52.5 | | | | 1.39 | | | | 9.4 | |

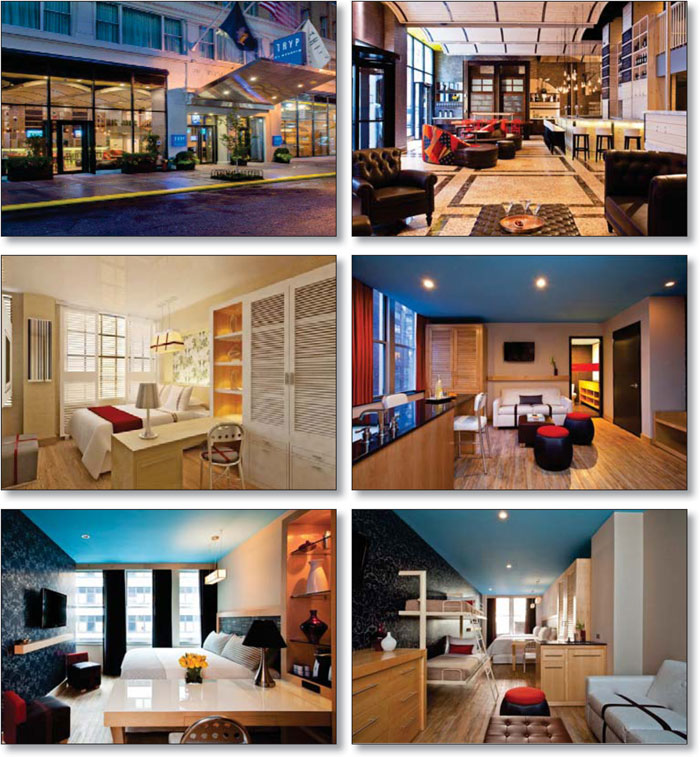

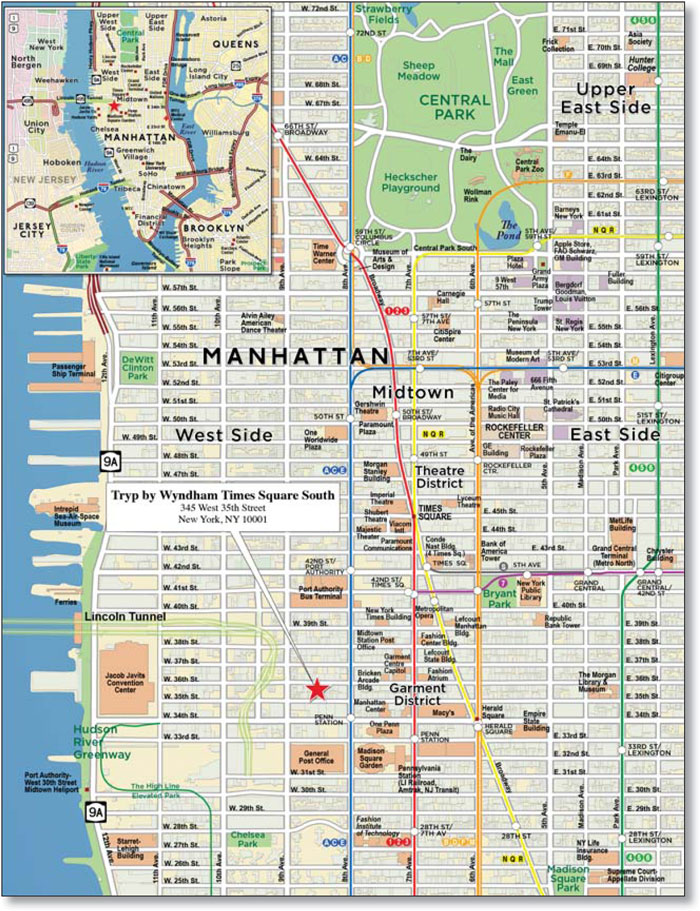

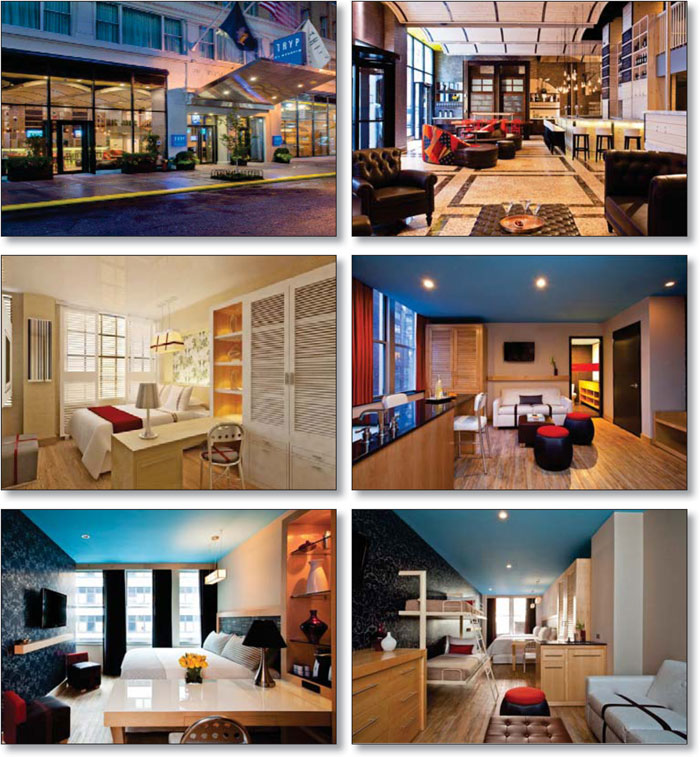

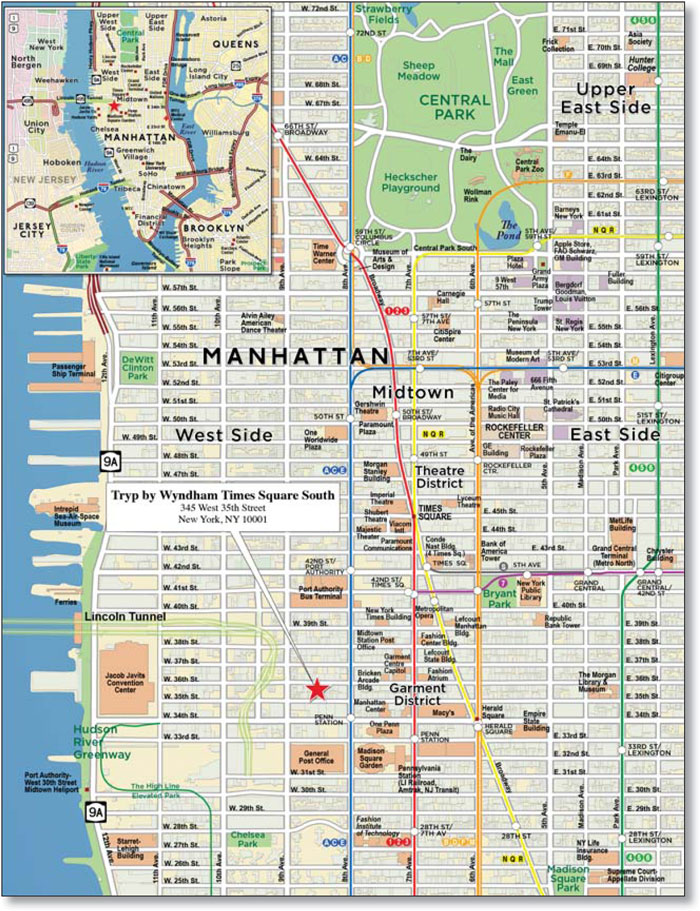

| WFB | | Tryp by Wyndham Times Square South | | New York | | NY | | 1 / 1 | | | | 46,879,457 | | | 3.3 | | | Hospitality | | 173 | | | 270,980 | | | 53.8 | | | | 43.4 | | | | 1.67 | | | | 11.4 | |

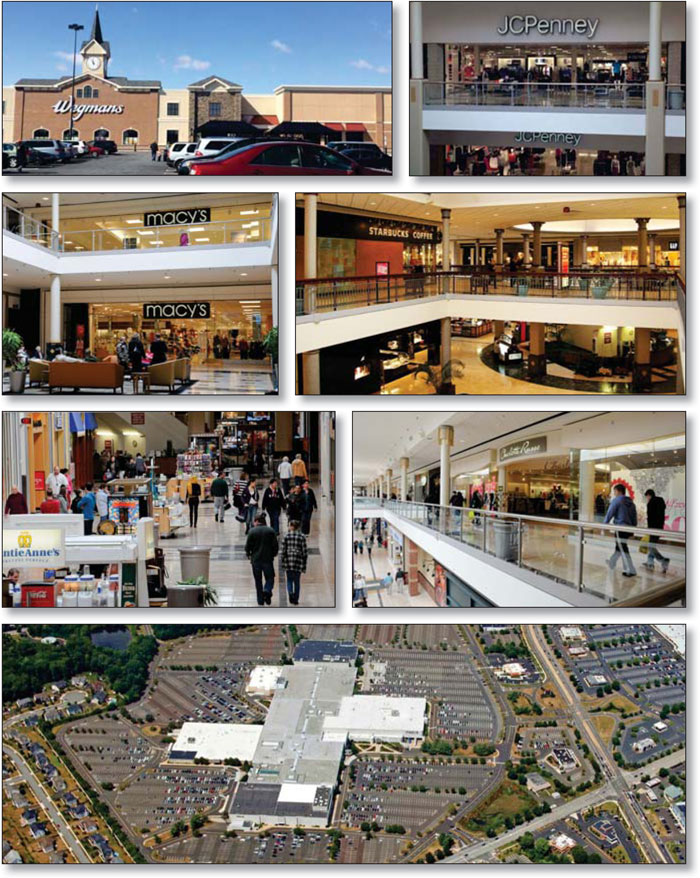

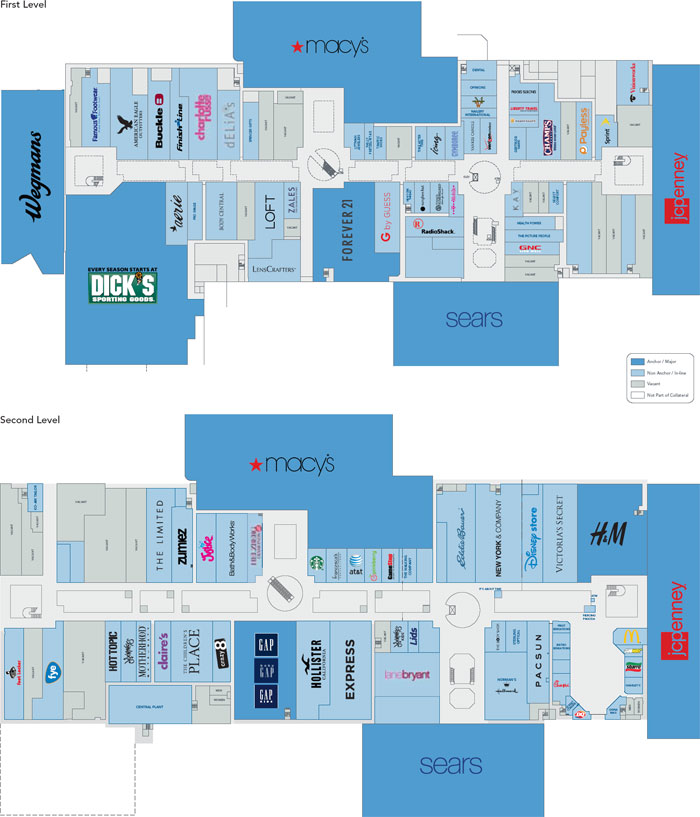

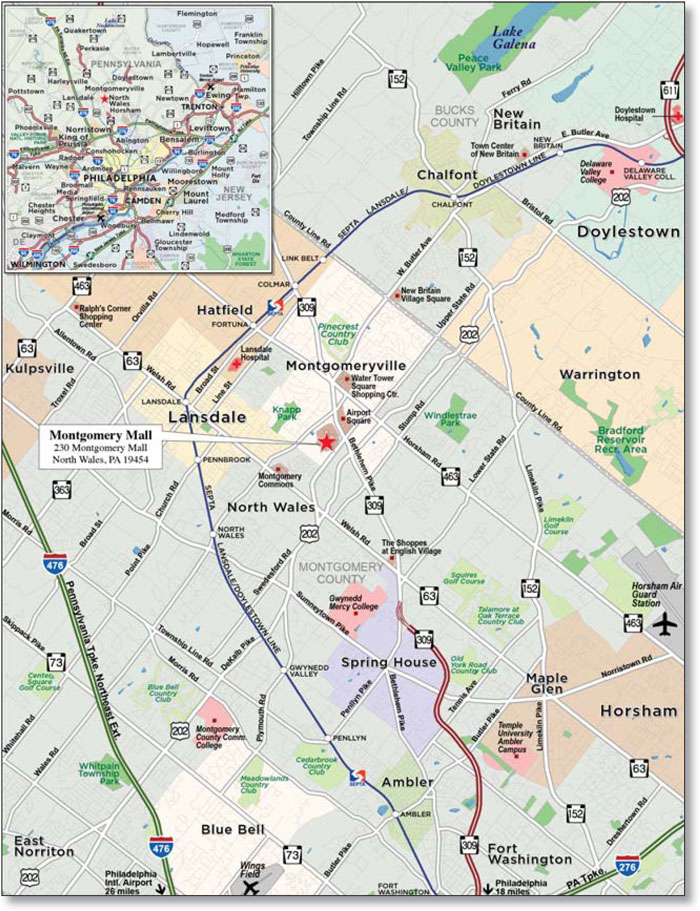

| RBS | | Montgomery Mall | | North Wales | | PA | | 1 / 1 | | | | 46,000,000 | | | 3.2 | | | Retail | | 1,109,341 | | | 90 | | | 51.3 | | | | 51.3 | | | | 3.06 | | | | 14.7 | |

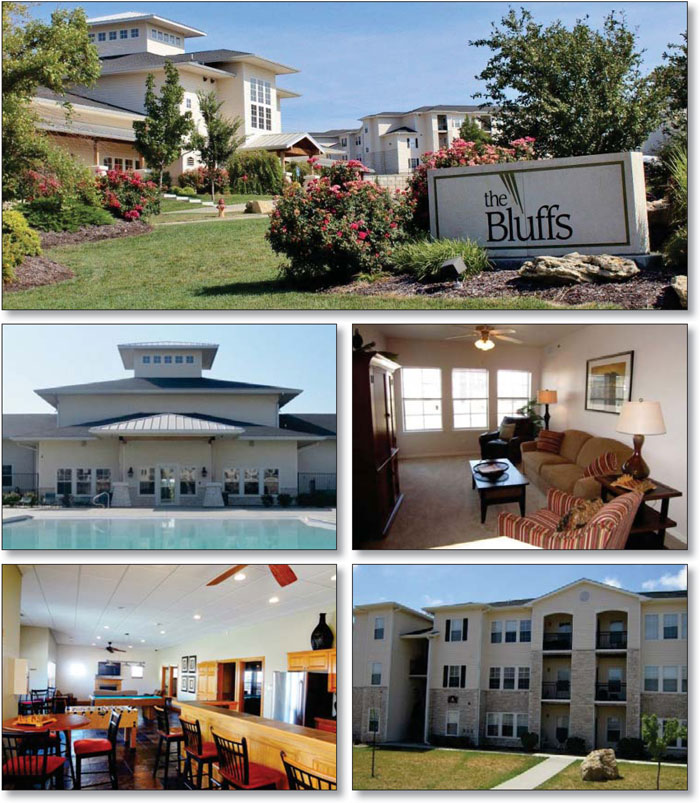

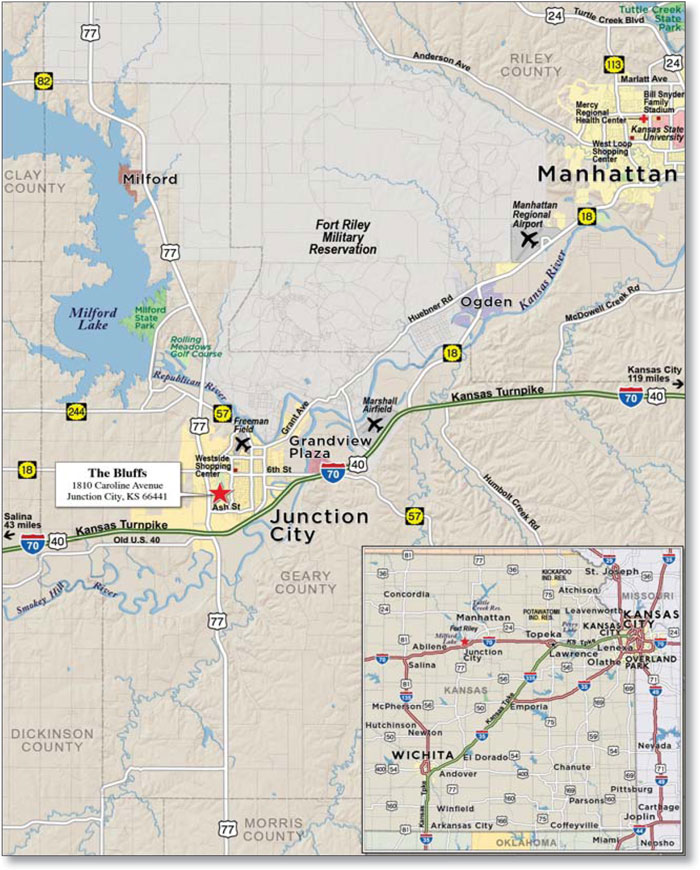

| WFB | | The Bluffs | | Junction City | | KS | | 1 / 1 | | | | 36,184,577 | | | 2.5 | | | Multifamily | | 602 | | | 60,107 | | | 74.9 | | | | 61.2 | | | | 1.35 | | | | 8.9 | |

| Top Three Total/Weighted Average | | 3 / 3 | | | | $247,000,000 | | | 17.3 | % | | | | | | | | | | 66.3 | % | | | 64.1 | % | | | 2.03 | x | | | 10.2 | % |

| Top Five Total/Weighted Average | | 5 / 10 | | | | $369,329,763 | | | 25.9 | % | | | | | | | | | | 67.0 | % | | | 62.4 | % | | | 1.80 | x | | | 10.0 | % |

| Top Ten Total/Weighted Average | | 10 / 26 | | | | $601,893,797 | | | 42.2 | % | | | | | | | | | | 65.2 | % | | | 59.6 | % | | | 1.79 | x | | | 10.3 | % |

| Non-Top Ten Total/Weighted Average | | 112 / 120 | | | | $823,902,552 | | | 57.8 | % | | | | | | | | | | 61.9 | % | | | 52.0 | % | | | 2.11 | x | | | 13.4 | % |

| (1) | With respect to the Queens Atrium, Montgomery Mall, and Oak Court Mall mortgage loans, Cut-off Date Balance per unit of measure, loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan (unless otherwise stated) in total debt. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| WFRBS Commercial Mortgage Trust 2014-C21 | Characteristics of the Mortgage Pool |

| B. | Summary of Pari Passu Split Loan Structures |

| Mortgage Loan Name | | Mortgage Loan

Seller | | Related Notes in

Loan Group

(Original Balance) | | Holder of Note | | Whether Note is

Lead Servicing for

the Entire Loan

Combination | | Current Master Servicer Under Related

Securitization PSA | | Current Special Servicer Under Related

Securitization PSA |

| Queens Atrium | | WFB | | $90,000,000 | | WFRBS 2014-C21 | | (1) | | Wells Fargo Bank, National Association | | CWCapital Asset Management, LLC |

| | Barclays | | $90,000,000 | | Barclays Bank PLC | | (1) | | TBD | | TBD |

| Montgomery Mall | | RBS | | $54,000,000 | | WFCM 2014-LC16 | | Y | | Wells Fargo Bank, National Association | | Rialto Capital Management, LLC |

| | RBS | | $46,000,000 | | WFRBS 2014-C21 | | N | | Wells Fargo Bank, National Association | | CWCapital Asset Management, LLC |

| Oak Court Mall | | RBS | | $24,000,000 | | WFRBS 2014-C21 | | Y | | Wells Fargo Bank, National Association | | CWCapital Asset Management, LLC |

| | RBS | | $16,000,000 | | WFCM 2014-LC16 | | N | | Wells Fargo Bank, National Association | | Rialto Capital Management, LLC |

| (1) | The Queens Atrium pari passu loan combination will be serviced under the WFRBS 2014-C21 pooling and servicing agreement until the securitization of the related pari passu companion loan, after which such loan combination will be serviced under the pooling and servicing agreement related to the securitization of the pari passu companion loan. The master servicer under the latter pooling and servicing agreement will be identified in a notice, report or statement to holders of the WFRBS 2014-C21 certificates after the securitization of the pari passu companion loan. |

| C. | Mortgage Loans with Additional Secured and Mezzanine Financing(1)(2) |

Loan

No. | | Mortgage Loan Seller | | Mortgage Loan Name | | Mortgage Loan Cut-off Date

Balance ($) | | | % of Cut-

off Date

Balance

(%) | | | Sub Debt

Cut-off Date

Balance ($) | | | Mezzanine

Debt Cut-off

Date Balance

($) | | | Total Debt

Interest

Rate (%) | | | Mortgage

Loan

U/W NCF

DSCR (x) | | | Total Debt

U/W NCF

DSCR (x) | | | Mortgage

Loan Cut-

off Date

U/W NOI

Debt Yield

(%) | | | Total Debt

Cut-off Date

U/W NOI

Debt Yield

(%) | | | Mortgage

Loan Cut-off

Date LTV

Ratio (%) | | | Total Debt

Cut-off

Date LTV

Ratio (%) |

| 13 | | Basis | | Oak Park Village Apartments | | $29,150,000 | | | 2.0 | % | | | $0 | | | $4,000,000 | | | 5.642 | % | | | 1.58 | x | | | 1.25 | x | | | 10.5 | % | | | 9.2 | % | | | 69.3 | %(3) | | | 80.1 | %(3) |

| 21 | | WFB | | Barrington Orthopedics Portfolio | | 15,859,221 | | | 1.1 | | | | 0 | | | 3,975,000 | | | 4.550 | (4) | | | 1.66 | | | | 1.37 | (4) | | | 10.8 | | | | 8.6 | | | | 59.6 | | | | 74.5 | |

| Total/Weighted Average | | $45,009,221 | | | 3.2 | % | | | $0 | | | $7,975,000 | | | 5.257 | % | | | 1.61 | x | | | 1.29 | x | | | 10.6 | % | | | 9.0 | % | | | 65.9 | % | | | 78.1 | % |

| (1) | In addition, nine (9) of the mortgage loans, each of which are secured by residential cooperative properties, currently have in place Subordinate Coop LOCs that permit future advances, but as to which there are no present outstanding balances, except for loan #121 214 West 17th Apartment Corp., which has a balance of $50,000 on its related Subordinate Coop LOC. See “Description of the Mortgage Pool—Subordinate and/or Other Financing” and “—Additional Debt Financing for Mortgage Loans Secured by Residential Cooperatives” in the Free Writing Prospectus. |

| (2) | Total Debt Interest Rate for any specified mortgage loan reflects the weighted average of the interest rates on the respective components of the total debt. |

| (3) | The Cut-off Date LTV Ratios were calculated net of the $3,500,000 holdback. |

| (4) | The mezzanine loan interest rate is variable. For calculations, 5.15% was the assumed mezzanine loan rate. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| WFRBS Commercial Mortgage Trust 2014-C21 | Characteristics of the Mortgage Pool |

| D. | Previous Securitization History(1) |

Loan

No. | | Mortgage

Loan Seller | | Mortgage Loan or Mortgaged Property Name | | City | | State | | Property Type | | Mortgage Loan or Mortgaged

Property Cut-off

Date Balance ($) | | % of Cut-off

Date Pool

Balance (%) | | Previous Securitization |

| 1 | | RBS | | Fairview Park Drive | | Falls Church | | VA | | Office | | $90,000,000 | | | 6.3 | % | | BSCMS 2004-PWR5 |

| 2 | | WFB | | Queens Atrium | | Long Island City | | NY | | Office | | 90,000,000 | | | 6.3 | | | BACM 2005-3 |

| 7 | | RBS | | Algonquin Portfolio | | Various | | NJ | | Various | | 49,500,000 | | | 3.5 | | | GMACC 2005-C1; BSCMS 2004-PWR5 |

| 9 | | RBS | | Montgomery Mall | | North Wales | | PA | | Retail | | 46,000,000 | | | 3.2 | | | LBUBS 2004-C7 |

| 11 | | LIG I | | Holiday Inn San Francisco Airport | | South San Francisco | | CA | | Hospitality | | 33,000,000 | | | 2.3 | | | CSMC 2006-C1 |

| 12 | | WFB | | White Road Plaza | | San Jose | | CA | | Retail | | 32,000,000 | | | 2.2 | | | GSMS 2004-GG2 |

| 17 | | CIIICM | | Rock Pointe East | | Spokane | | WA | | Office | | 21,750,000 | | | 1.5 | | | CD 2006-CD2 |

| 25 | | RBS | | Coastal Sunbelt | | Savage | | MD | | Industrial | | 14,500,000 | | | 1.0 | | | BSCMS 2007-PW17 |

| 27 | | CIIICM | | Kingsborough Estates MHC | | Raleigh | | NC | | Manufactured Housing Community | | 13,125,000 | | | 0.9 | | | GSMS 2011-GC3 |

| 29 | | NCB, FSB | | Warminster Heights Home Ownership Association, Inc. | | Warminster | | PA | | Multifamily | | 11,986,016 | | | 0.8 | | | CSFB 2005-C3 |

| 36 | | WFB | | Colonial Heritage MHC | | Doylestown | | PA | | Manufactured Housing Community | | 10,981,900 | | | 0.8 | | | WBCMT 2004-C11 |

| 42 | | RBS | | Quest Automotive Products | | Massillon | | OH | | Industrial | | 8,462,421 | | | 0.6 | | | JPMCC 2007-CB20 |

| 45 | | RBS | | Holiday Inn Express Superior | | Superior | | WI | | Hospitality | | 7,967,417 | | | 0.6 | | | LBUBS 2006-C6 |

| 50 | | CIIICM | | Bramblewood MHC | | McKinney | | TX | | Manufactured Housing Community | | 6,995,949 | | | 0.5 | | | LBUBS 2004-C6 |

| 51 | | RBS | | Residence Inn by Marriott, Colorado Springs, CO | | Colorado Springs | | CO | | Hospitality | | 6,800,000 | | | 0.5 | | | JPMCC 2006-LDP6 |

| 61 | | RBS | | Fairfield Inn & Suites Colorado Springs, CO | | Colorado Springs | | CO | | Hospitality | | 5,600,000 | | | 0.4 | | | MLMT 2006-C1 |

| 70 | | NCB, FSB | | Gateway Apartment Owners Corp. | | Yonkers | | NY | | Multifamily | | 4,811,970 | | | 0.3 | | | MSC 2005-IQ10 |

| 76 | | CIIICM | | All American Storage Bloomington South | | Bloomington | | IN | | Self Storage | | 4,194,651 | | | 0.3 | | | JPMCC 2005-LDP3 |

| 77 | | RBS | | Fairfield Inn & Suites, Olathe, KS | | Olathe | | KS | | Hospitality | | 4,080,000 | | | 0.3 | | | JPMCC 2006-LDP6 |

| 81 | | WFB | | Bay Area Self Storage - Bird | | San Jose | | CA | | Self Storage | | 3,900,000 | | | 0.3 | | | BSCMS 2004-PWR5 |

| 84 | | NCB, FSB | | 67th Road Housing Corporation | | Forest Hills | | NY | | Multifamily | | 3,585,775 | | | 0.3 | | | MSC 2005-IQ10 |

| 86 | | NCB, FSB | | 993 Fifth Avenue Corporation | | New York | | NY | | Multifamily | | 3,500,000 | | | 0.2 | | | CSFB 2005-C5 |

| 89 | | CIIICM | | All American Storage East | | Bloomington | | IN | | Self Storage | | 3,395,670 | | | 0.2 | | | JPMCC 2005-LDP3 |

| 90 | | Basis | | Shoppes of Fort Wright | | Fort Wright | | KY | | Retail | | 3,267,428 | | | 0.2 | | | JPMCC 2004-LN2 |

| 91 | | WFB | | Patriot Village | | Brandon | | FL | | Retail | | 3,200,000 | | | 0.2 | | | BSCMS 2003-PWR2 |

| 93 | | WFB | | University Center South | | Jacksonville | | FL | | Retail | | 3,142,626 | | | 0.2 | | | MLMT 2005-CIP1 |

| 95 | | CIIICM | | Shadow Wood MHP | | Champaign | | IL | | Manufactured Housing Community | | 2,954,777 | | | 0.2 | | | LBUBS 2004-C4 |

| 97 | | WFB | | Taxi Office Building | | Denver | | CO | | Office | | 2,846,768 | | | 0.2 | | | BSCMS 2004-PWR5 |

| 100 | | WFB | | Walgreens - Denver | | Denver | | CO | | Retail | | 2,728,180 | | | 0.2 | | | BSCMS 2004-PWR5 |

| 102 | | NCB, FSB | | 67-35 Yellowstone Blvd. Owners Corp. | | Forest Hills | | NY | | Multifamily | | 2,496,261 | | | 0.2 | | | MSC 2005-IQ9 |

| 104 | | NCB, FSB | | Palmbrook Gardens Tenants Corp. | | Yonkers | | NY | | Multifamily | | 2,490,381 | | | 0.2 | | | MSC 2005-IQ9 |

| 105 | | CIIICM | | Commercial Drive Plaza | | New Hartford | | NY | | Retail | | 2,397,521 | | | 0.2 | | | CSFB 2004-C3 |

| 106 | | CIIICM | | Stonegate MHP | | San Antonio | | TX | | Manufactured Housing Community | | 2,397,420 | | | 0.2 | | | LBUBS 2004-C7 |

| 107 | | NCB, FSB | | Harrison Commons, Ltd. | | Harrison | | NY | | Multifamily | | 2,246,645 | | | 0.2 | | | MSC 2005-IQ10 |

| 113 | | NCB, FSB | | Florence Court Corporation | | Brooklyn | | NY | | Multifamily | | 1,693,704 | | | 0.1 | | | MSC 2005-IQ9 |

| 118 | | NCB, FSB | | 320 W. 89th St. Owners Corp. | | New York | | NY | | Multifamily | | 1,494,181 | | | 0.1 | | | MSC 2005-IQ10 |

| 121 | | NCB, FSB | | 214 West 17th Apartment Corp. | | New York | | NY | | Multifamily | | 972,388 | | | 0.1 | | | MSC 2005-IQ9 |

| Total | | | | | | | | $510,465,049 | | | 35.8 | % | | |

(1) The table above represents the most recent securitization with respect to the mortgaged property securing the related mortgage loan, based on information provided by the related borrower or obtained through searches of a third-party database. While the above mortgage loans may have been securitized multiple times in prior transactions, mortgage loans are only listed in the above chart if the mortgage loan paid off a mortgage loan in another securitization. The information in the table above has not otherwise been confirmed by the mortgage loan sellers.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| WFRBS Commercial Mortgage Trust 2014-C21 | Characteristics of the Mortgage Pool |

E. Mortgage Loans with Scheduled Balloon Payments and Related Classes

Class A-2(1) |

Loan

No. | | Mortgage

Loan

Seller | | Mortgage Loan Name | | State | | Property Type | | Mortgage Loan

Cut-off Date

Balance ($) | | % of

Cut-off

Date

Pool

Balance

(%) | | Mortgage Loan

Balance at

Maturity ($) | | % of Class

A-2 Certificate

Principal

Balance

(%)(2) | | Units/SF

/Rooms | | Loan per

Unit/SF/

Room ($) | | U/W NCF

DSCR (x) | | U/W NOI Debt Yield (%) | | Cut-off

Date LTV Ratio (%) | | Balloon

LTV Ratio(%) | | Rem. IO

Period

(mos.) | | Rem.

Term to

Maturity

(mos.) |

| 3 | | WFB | | Sheraton Austin | | TX | | Hospitality | | $67,000,000 | | 4.7% | | $67,000,000 | | 61.4% | | 365 | | $183,562 | | 3.03x | | 13.6% | | 61.8% | | 61.8% | | 58 | | 58 |

| 16 | | LIG I | | Kane Distribution Center 6 | | PA | | Industrial | | 22,600,000 | | 1.6 | | 21,444,520 | | 19.6 | | 955,935 | | 24 | | 1.72 | | 11.2 | | 57.8 | | 54.8 | | 23 | | 59 |

| 52 | | Basis | | Fitch Apartments | | DC | | Multifamily | | 6,743,516 | | 0.5 | | 6,264,081 | | 5.7 | | 75 | | 89,914 | | 1.27 | | 8.9 | | 73.3 | | 68.1 | | 0 | | 59 |

| 76 | | CIIICM | | All American Storage Bloomington South | | IN | | Self Storage | | 4,194,651 | | 0.3 | | 3,824,642 | | 3.5 | | 55,534 | | 76 | | 1.57 | | 9.4 | | 72.3 | | 65.9 | | 0 | | 59 |

| 89 | | CIIICM | | All American Storage East | | IN | | Self Storage | | 3,395,670 | | 0.2 | | 3,096,139 | | 2.8 | | 50,784 | | 67 | | 1.54 | | 9.2 | | 74.5 | | 67.9 | | 0 | | 59 |

| 92 | | CIIICM | | All American Storage of Evansville | | IN | | Self Storage | | 3,195,925 | | 0.2 | | 2,914,013 | | 2.7 | | 57,135 | | 56 | | 1.51 | | 9.1 | | 74.3 | | 67.8 | | 0 | | 59 |

| 112 | | WFB | | World Park 9 | | OH | | Industrial | | 1,752,731 | | 0.1 | | 1,596,283 | | 1.5 | | 58,800 | | 30 | | 1.73 | | 12.4 | | 64.9 | | 59.1 | | 0 | | 59 |

| Total/Weighted Average | | | $108,882,493 | | 7.6% | | $106,139,678 | | 97.2% | | | | | | 2.48x | | 12.4% | | 62.9% | | 61.2% | | 40 | | 58 |

(1) The table above presents the mortgage loans whose balloon payments would be applied to pay down the principal balance of the Class A-2 Certificates, assuming a 0% CPR and applying the “Structuring Assumptions” described in the Free Writing Prospectus, including the assumptions that (i) none of the mortgage loans in the pool experience prepayments, defaults or losses; (ii) there are no extensions of maturity dates of any mortgage loans in the pool; and (iii) each mortgage loan in the pool is paid in full on its stated maturity date. Each class of Certificates, including the Class A-2 Certificates, evidences undivided ownership interests in the entire pool of mortgage loans. (2) Reflects the Mortgage Loan Balance at Maturity divided by the initial Class A-2 Certificate Principal Balance expressed as a percentage. |

Class A-3(1) |

Loan

No. | | Mortgage

Loan

Seller | | Mortgage Loan Name | | State | | Property Type | | Mortgage Loan

Cut-off Date

Balance ($) | | % of

Cut-off

Date

Pool

Balance

(%) | | Mortgage Loan

Balance at

Maturity ($) | | % of Class

A-3

Certificate

Principal

Balance

(%)(2) | | Units/SF

/Pads | | Loan per

Unit/SF/

Pads ($) | | U/W NCF

DSCR (x) | | U/W NOI Debt Yield (%) | | Cut-off Date LTV Ratio (%) | | Balloon

LTV Ratio (%) | | Rem. IO Period (mos.) | | Rem.

Term to Maturity (mos.) |

| 15 | | RBS | | Oak Court Mall | | TN | | Retail | | $23,884,983 | | 1.7% | | $21,132,804 | | 43.8% | | 240,197 | | $166 | | 1.81x | | 12.1% | | 65.3% | | 57.7% | | 0 | | 80 |

| 38 | | WFB | | Arrowhead Apartments | | OH | | Multifamily | | 9,987,623 | | 0.7 | | 8,719,616 | | 18.1 | | 360 | | 27,743 | | 1.96 | | 12.8 | | 48.8 | | 42.6 | | 0 | | 83 |

| 49 | | CIIICM | | Riverplace Athletic Club | | OR | | Retail | | 7,100,000 | | 0.5 | | 6,306,004 | | 13.1 | | 55,462 | | 128 | | 1.46 | | 10.7 | | 67.0 | | 59.5 | | 0 | | 84 |

| 79 | | WFB | | American Mini Storage I - Missouri City | | TX | | Self Storage | | 4,000,000 | | 0.3 | | 3,733,799 | | 7.7 | | 55,175 | | 73 | | 1.70 | | 10.5 | | 63.0 | | 58.8 | | 35 | | 83 |

| 87 | | WFB | | American Mini Storage II - Arlington | | TX | | Self Storage | | 3,500,000 | | 0.2 | | 3,264,988 | | 6.8 | | 85,175 | | 41 | | 1.72 | | 10.7 | | 63.6 | | 59.4 | | 35 | | 83 |

| 98 | | WFB | | American Mini Storage II - Colorado Springs | | CO | | Self Storage | | 2,800,000 | | 0.2 | | 2,611,991 | | 5.4 | | 109,460 | | 26 | | 1.83 | | 11.5 | | 65.9 | | 61.5 | | 35 | | 83 |

| 99 | | CIIICM | | Red Run MHC | | MI | | Manufactured Housing Community | | 2,797,087 | | 0.2 | | 2,483,783 | | 5.1 | | 122 | | 22,927 | | 1.75 | | 11.6 | | 69.9 | | 62.1 | | 0 | | 83 |

| Total/Weighted Average | | | $54,069,693 | | 3.8% | | $48,252,986 | | 100.0% | | | | | | 1.78x | | 11.8% | | 62.5% | | 55.8% | | 7 | | 82 |

(1) The table above presents the mortgage loans whose balloon payments would be applied to pay down the principal balance of the Class A-3 Certificates, assuming a 0% CPR and applying the “Structuring Assumptions” described in the Free Writing Prospectus, including the assumptions that (i) none of the mortgage loans in the pool experience prepayments, defaults or losses; (ii) there are no extensions of maturity dates of any mortgage loans in the pool; and (iii) each mortgage loan in the pool is paid in full on its stated maturity date. Each class of Certificates, including the Class A-3 Certificates, evidences undivided ownership interests in the entire pool of mortgage loans. (2) Reflects the Mortgage Loan Balance at Maturity divided by the initial Class A-3 Certificate Principal Balance expressed as a percentage. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| WFRBS Commercial Mortgage Trust 2014-C21 | Characteristics of the Mortgage Pool |

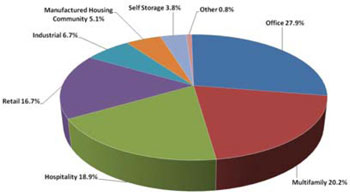

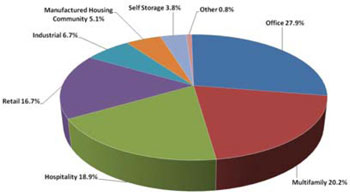

F. Property Type Distribution(1)

| Property Type | | Number of Mortgaged Properties | | Aggregate Cut-

off Date Balance

($) | | % of Cut-

off Date

Pool

Balance

(%) | | Weighted Average Cut-off

Date LTV Ratio (%) | | Weighted Average Balloon or ARD LTV Ratio (%) | | Weighted Average U/W NCF DSCR (x) | | Weighted Average U/W NOI Debt

Yield (%) | | Weighted Average U/W NCF Debt

Yield (%) | | Weighted Average Mortgage Rate (%) |

| Office | | 18 | | $397,129,491 | | 27.9% | | 66.1% | | 59.5% | | 1.62x | | 9.9% | | 8.9% | | 4.471% |

| Suburban | | 12 | | 174,390,507 | | 12.2 | | 65.1 | | 60.2 | | 1.72 | | 9.7 | | 8.9 | | 4.505 |

| CBD | | 4 | | 146,950,000 | | 10.3 | | 68.8 | | 62.7 | | 1.55 | | 9.6 | | 8.8 | | 4.393 |

| Medical | | 2 | | 75,788,984 | | 5.3 | | 63.4 | | 51.4 | | 1.51 | | 10.6 | | 9.2 | | 4.542 |

| Multifamily | | 39 | | 287,608,427 | | 20.2 | | 57.7 | | 49.9 | | 2.88 | | 16.5 | | 15.9 | | 4.667 |

| Garden | | 18 | | 165,721,892 | | 11.6 | | 67.0 | | 57.3 | | 1.62 | | 10.3 | | 9.6 | | 4.708 |

| Cooperative | | 15 | | 59,486,535 | | 4.2 | | 16.7 | | 13.5 | | 8.13 | | 42.2 | | 42.2 | | 4.250 |

| Low Rise | | 5 | | 56,368,290 | | 4.0 | | 72.1 | | 65.1 | | 1.20 | | 8.4 | | 7.7 | | 4.956 |

| Mid Rise | | 1 | | 6,031,710 | | 0.4 | | 72.1 | | 65.1 | | 1.20 | | 8.4 | | 7.7 | | 4.956 |

| Hospitality | | 19 | | 269,365,246 | | 18.9 | | 61.1 | | 51.3 | | 2.08 | | 13.1 | | 11.8 | | 4.601 |

| Full Service | | 4 | | 156,849,207 | | 11.0 | | 58.4 | | 51.3 | | 2.30 | | 13.1 | | 11.7 | | 4.374 |

| Limited Service | | 15 | | 112,516,039 | | 7.9 | | 64.8 | | 51.2 | | 1.77 | | 13.2 | | 11.8 | | 4.919 |

| Retail | | 19 | | 238,711,370 | | 16.7 | | 66.7 | | 60.1 | | 1.79 | | 10.9 | | 10.2 | | 4.653 |

| Anchored | | 5 | | 116,025,000 | | 8.1 | | 72.3 | | 65.5 | | 1.39 | | 9.2 | | 8.5 | | 4.557 |

| Regional Mall | | 2 | | 69,884,983 | | 4.9 | | 56.1 | | 53.5 | | 2.63 | | 13.8 | | 13.2 | | 4.634 |

| Single Tenant | | 3 | | 20,816,194 | | 1.5 | | 65.4 | | 55.2 | | 1.60 | | 10.9 | | 10.2 | | 4.934 |

| Unanchored | | 5 | | 18,351,453 | | 1.3 | | 67.3 | | 55.4 | | 1.57 | | 10.9 | | 10.0 | | 4.859 |

Shadow Anchored(2) | | 4 | | 13,633,739 | | 1.0 | | 73.7 | | 61.3 | | 1.50 | | 10.1 | | 9.5 | | 4.859 |

| Industrial | | 17 | | 95,128,084 | | 6.7 | | 61.6 | | 53.6 | | 1.49 | | 10.4 | | 9.4 | | 4.660 |

| Warehouse | | 7 | | 63,150,403 | | 4.4 | | 62.6 | | 54.3 | | 1.52 | | 10.6 | | 9.6 | | 4.668 |

| Flex | | 10 | | 31,977,681 | | 2.2 | | 59.6 | | 52.2 | | 1.43 | | 9.8 | | 8.8 | | 4.644 |

| Manufactured Housing Community | | 14 | | 73,029,038 | | 5.1 | | 69.9 | | 55.0 | | 1.47 | | 10.0 | | 9.8 | | 4.863 |

| Manufactured Housing Community | | 14 | | 73,029,038 | | 5.1 | | 69.9 | | 55.0 | | 1.47 | | 10.0 | | 9.8 | | 4.863 |

| Self Storage | | 19 | | 53,474,693 | | 3.8 | | 62.5 | | 53.9 | | 1.81 | | 11.1 | | 10.7 | | 4.698 |

| Self Storage | | 19 | | 53,474,693 | | 3.8 | | 62.5 | | 53.9 | | 1.81 | | 11.1 | | 10.7 | | 4.698 |

| Other | | 1 | | 11,350,000 | | 0.8 | | 59.7 | | 52.5 | | 1.39 | | 9.4 | | 8.6 | | 4.670 |

| Total/Weighted Average | | 146 | | $1,425,796,349 | | 100.0% | | 63.3% | | 55.2% | | 1.98x | | 12.1% | | 11.2% | | 4.608% |

| (1) | Because this table presents information relating to the mortgaged properties and not the mortgage loans, (a) the information for mortgage loans secured by more than one mortgaged property (other than through cross-collateralization with other mortgage loans) is based on allocated amounts (allocating the mortgage loan principal balance to each of those properties according to the relative appraised values of the mortgaged properties or the allocated loan amounts or property-specific release prices set forth in the related mortgage loan documents or such other allocation as the related mortgage loan seller deemed appropriate), and (b) the information for each mortgaged property that relates to a mortgage loan that is cross-collateralized with other mortgage loans is based upon the principal balance of that mortgage loan, except that the applicable loan-to-value ratio, debt service coverage ratio or debt yield for each such mortgaged property is based upon the ratio or yield (as applicable) for the aggregate indebtedness evidenced by all loans in the group. On an individual basis, without regard to the cross-collateralization feature, any mortgaged property securing a mortgage loan that is part of a cross-collateralized group of mortgage loans may have a higher loan-to-value ratio, lower debt service coverage ratio and/or lower debt yield than is presented herein. For mortgaged properties securing residential cooperative mortgage loans, the debt service coverage ratio or debt yield for each such mortgaged property is calculated using underwritten net cash flow for the related residential cooperative property, which is the projected net cash flow reflected in the most recent appraisal obtained by or otherwise in the possession of the related mortgage loan seller as of the cut-off date, and the loan-to-value ratio is calculated based upon the appraised value of the residential cooperative property determined as if such residential cooperative property is operated as a residential cooperative. Debt service coverage ratio, debt yield and loan-to-value ratio information takes no account of subordinate debt (whether or not secured by the mortgaged property), if any, that is allowed under the terms of any mortgage loan. With respect to the Queens Atrium, Montgomery Mall, and Oak Court Mall mortgage loans, loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan (unless otherwise stated) in total debt. |

| (2) | A mortgaged property is classified as shadow anchored if it is located in close proximity to an anchored retail property. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| WFRBS Commercial Mortgage Trust 2014-C21 | Characteristics of the Mortgage Pool |

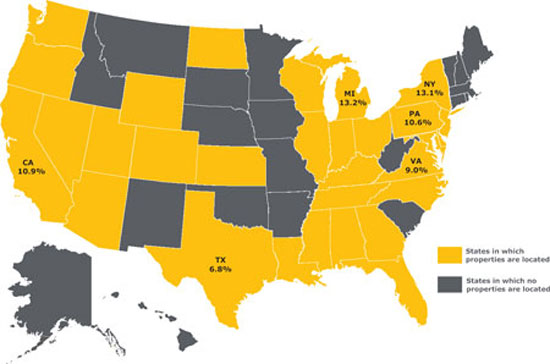

G. Geographic Distribution(1)(2)

| | Location(3) | Number of Mortgaged Properties | Aggregate Cut-off Date Balance ($) | % of

Cut-off

Date

Pool Balance | | Weighted

Average Cut-off

Date LTV Ratio

(%) | Weighted

Average

Balloon or

ARD LTV

Ratio (%) | Weighted

Average

U/W NCF

DSCR (x) | Weighted

Average

U/W NOI

Debt Yield

(%) | Weighted

Average

U/W NCF

Debt

Yield (%) | Weighted

Average

Mortgage

Rate (%) |

| | Michigan | 20 | $188,419,038 | | 13.2 | % | 69.9 | % | 61.5 | % | 1.45 | x | 10.0 | % | 9.2 | % | 4.778 | % |

| | New York | 17 | 186,777,497 | | 13.1 | | 51.8 | | 45.3 | | 3.39 | | 18.9 | | 18.2 | | 4.303 | |

| | California | 11 | 155,452,107 | | 10.9 | | 62.7 | | 53.0 | | 1.69 | | 11.5 | | 10.6 | | 4.688 | |

| | Northern | 7 | 109,980,821 | | 7.7 | | 61.2 | | 50.8 | | 1.77 | | 12.0 | | 11.1 | | 4.685 | |

| | Southern | 4 | 45,471,286 | | 3.2 | | 66.3 | | 58.4 | | 1.51 | | 10.1 | | 9.4 | | 4.695 | |

| | Pennsylvania | 5 | 151,497,680 | | 10.6 | | 56.3 | | 49.4 | | 2.27 | | 13.4 | | 12.5 | | 4.530 | |

| | Virginia | 4 | 127,967,122 | | 9.0 | | 64.2 | | 62.4 | | 1.91 | | 9.4 | | 8.9 | | 4.382 | |

| | Texas | 10 | 97,062,868 | | 6.8 | | 63.8 | | 60.0 | | 2.58 | | 12.8 | | 11.6 | | 4.219 | |

| | Other States(4) | 79 | 518,620,037 | | 36.4 | | 66.9 | | 56.2 | | 1.56 | | 10.7 | | 9.8 | | 4.784 | |

| | Total/Weighted Average | 146 | $1,425,796,349 | | 100.0 | % | 63.3 | % | 55.2 | % | 1.98 | x | 12.1 | % | 11.2 | % | 4.608 | % |

| (1) | The mortgaged properties are located in 30 states and the District of Columbia. |

| (2) | Because this table presents information relating to the mortgaged properties and not the mortgage loans, (a) the information for mortgage loans secured by more than one mortgaged property (other than through cross-collateralization with other mortgage loans) is based on allocated amounts (allocating the mortgage loan principal balance to each of those properties according to the relative appraised values of the mortgaged properties or the allocated loan amounts or property-specific release prices set forth in the related mortgage loan documents or such other allocation as the related mortgage loan seller deemed appropriate), and (b) the information for each mortgaged property that relates to a mortgage loan that is cross-collateralized with other mortgage loans is based upon the principal balance of that mortgage loan, except that the applicable loan-to-value ratio, debt service coverage ratio or debt yield for each such mortgaged property is based upon the ratio or yield (as applicable) for the aggregate indebtedness evidenced by all loans in the group. On an individual basis, without regard to the cross-collateralization feature, any mortgaged property securing a mortgage loan that is part of a cross-collateralized group of mortgage loans may have a higher loan-to-value ratio, lower debt service coverage ratio and/or lower debt yield than is presented herein. For mortgaged properties securing residential cooperative mortgage loans, the debt service coverage ratio or debt yield for each such mortgaged property is calculated using underwritten net cash flow for the related residential cooperative property, which is the projected net cash flow reflected in the most recent appraisal obtained by or otherwise in the possession of the related mortgage loan seller as of the cut-off date, and the loan-to-value ratio is calculated based upon the appraised value of the residential cooperative property determined as if such residential cooperative property is operated as a residential cooperative. Debt service coverage ratio, debt yield and loan-to-value ratio information takes no account of subordinate debt (whether or not secured by the mortgaged property), if any, that is allowed under the terms of any mortgage loan. With respect to the Queens Atrium, Montgomery Mall, and Oak Court Mall mortgage loans, loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan (unless otherwise stated) in total debt. |

| (3) | For purposes of determining whether a mortgaged property is in Northern California or Southern California, Northern California includes areas with zip codes above 93600 and Southern California includes areas with zip codes of 93600 and below. |

| (4) | Includes 24 other states and the District of Columbia. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| WFRBS Commercial Mortgage Trust 2014-C21 | Characteristics of the Mortgage Pool |

H. Characteristics of the Mortgage Pool(1)

| CUT-OFF DATE BALANCE |

Range of Cut-off Date Balances ($) | Number of Mortgage Loans | Aggregate Cut- off Date Balance ($) | | % of Cut-off Date Pool Balance |

| 847,754 - 1,000,000 | 2 | $1,820,142 | | 0.1% |

| 1,000,001 - 2,000,000 | 12 | 19,057,436 | | 1.3 |

| 2,000,001 - 3,000,000 | 16 | 41,273,226 | | 2.9 |

| 3,000,001 - 4,000,000 | 15 | 53,231,796 | | 3.7 |

| 4,000,001 - 5,000,000 | 12 | 54,755,863 | | 3.8 |

| 5,000,001 - 6,000,000 | 9 | 49,385,682 | | 3.5 |

| 6,000,001 - 7,000,000 | 7 | 46,998,318 | | 3.3 |

| 7,000,001 - 8,000,000 | 6 | 45,191,956 | | 3.2 |

| 8,000,001 - 9,000,000 | 4 | 33,852,584 | | 2.4 |

| 9,000,001 - 10,000,000 | 2 | 19,957,373 | | 1.4 |

| 10,000,001 - 15,000,000 | 15 | 184,684,873 | | 13.0 |

| 15,000,001 - 20,000,000 | 5 | 87,308,321 | | 6.1 |

| 20,000,001 - 30,000,000 | 5 | 121,384,983 | | 8.5 |

| 30,000,001 - 50,000,000 | 6 | 243,564,034 | | 17.1 |

| 50,000,001 - 70,000,000 | 4 | 243,329,763 | | 17.1 |

| 70,000,001 - 90,000,000 | 2 | 180,000,000 | | 12.6 |

| Total: | 122 | $1,425,796,349 | | 100.0% |

| Average: | $11,686,855 | | | |

| UNDERWRITTEN NOI DEBT SERVICE COVERAGE RATIO |

Range of U/W NOI DSCRs (x) | Number of Mortgage Loans | Aggregate Cut- off Date Balance ($) | | % of Cut-off Date Pool Balance |