UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22976

Cross Shore Discovery Fund

(Exact name of registrant as specified in charter)

| | | | |

| Huntington Asset Services, Inc. 2960 N. Meridian Street, Suite 300 | | Indianapolis, IN 46208 |

| (Address of principal executive offices) | | (Zip code) |

Neil Kuttner, President and Principal Executive Officer

Cross Shore Discovery Fund

2960 N. Meridian Street, Suite 300

Indianapolis, Indiana 46208

(Name and address of agent for service)

With a copy to:

Leslie K, Klenk

Bernstein Shur

100 Middle Street

Portland, Maine 04101

Registrant’s telephone number, including area code: 317-917-7000

Date of fiscal year end: 3/31

Date of reporting period: 3/31/15

| Item 1. | Reports to Stockholders. |

Cross Shore Discovery Fund

Annual Report

March 31, 2015

Cross Shore Capital Management, LLC

111 Great Neck Road

Suite 210

Great Neck, NY 11021

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE FOR THE PERIOD ENDED MARCH 31, 2015 (Unaudited)

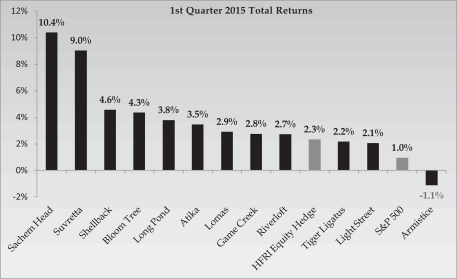

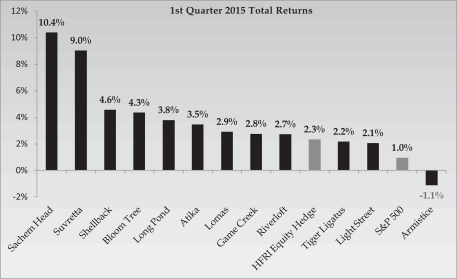

For the three months ended March 31, 2015, Cross Shore Discovery Fund (the “Fund”) returned 3.50% outperforming the HFRI Equity Hedge index(1) return of 2.34% as well as the S&P 500 Index®(2) return of 0.95%.

The Fund has a multi-manager portfolio of long/short equity funds that invests in both sector managers (those managers that specialize in a small number of industries) as well as generalists. For the first quarter of 2015 both sub-sets generated positive contribution to the Fund:

| | | | |

| | | Assets Under

Management

(“AUM”)%(3) | | Performance

Contribution

to Fund |

Sector Funds | | 44.2% | | 1.6% |

Generalist Funds | | 55.8% | | 2.6% |

Expenses | | — | | -0.7% |

| | | | |

| | 100.0% | | 3.5% |

| | | | |

On an individual manager level, we were pleased that 11 out of the Fund’s 12 underlying managers were positive for the quarter and that 9 out of the 12 beat the HFRI Equity Hedge Index.

1

The two largest contributors to first quarter performance were Sachem Head Offshore, Ltd. (“Sachem Head”) and Suvretta Offshore Fund, Ltd. (“Suvretta”):

Cross Shore Capital Management, LLC (the “Adviser”), the Fund’s investment adviser, allocates the Fund’s assets among a selected group of managers that direct the investment of such assets in securities and other financial instruments. The Fund accesses these managers by investing in private investment funds that predominately employ equity long/short strategies managed by these managers. The Adviser allocates Fund assets to private funds managed by sector managers.

Sachem Head

For the first quarter, Sachem Head earned 10.4% through a concentrated portfolio consisting of 14 long names and 3 shorts. The longs were up about 13%-14%, on a gross basis, in the first-quarter. Shorts were down about 1%. Profitable names on the long side included:

Healthcare – Actavis (ACT), Zoetis (ZTS) and Mylan (MYL)

Information Technology – CDK Global (CDK)

Basic Materials – Air Products & Chemicals (APD)

Consumer – Dollar General (DG)

Average net exposure was approximately 65%-70% net long. At March 31, 2015, firm AUM for Sachem Head was $2.9 billion.

Suvretta

Suvretta’s 9.0% return was due to positive returns in Healthcare, Consumer, Information Technology and Energy in the first-quarter. Specific positive contributors included:

Healthcare – Actavis (ACT), Allergan (AGN), Endo Health Solutions (ENDP), Medtronic (MDT) and Shire (ADR)

Consumer – Constellation Brands (STZ), Dollar Tree (DLTR) and Liberty Global (LBTYA)

Information Technology – CDK Global (CDK) and Facebook (FB)

Energy – Cheniere Energy (LNG) and Energy Transfer Equity (ETE)

Following the strong first-quarter results, Suvretta took profits on many of the positions listed above. At quarter-end there were 25 names in the long book and 14 shorts. Average gross exposure during the quarter was 165% (115% long and 45% short). Regarding cash flows, $60 million of net inflows were received in the first quarter. Another $60 million of cash flow came in for May 1st.

2

The one detractor from first quarter returns was Armistice Capital Offshore Fund, Ltd. (“Armistice”):

Armistice

It was a volatile quarter for Armistice with a large loss in January (-8.0%) followed by a rebound in February (+4.2%) and March (+3.1%). Overall Armistice ended up down 1.1% for the quarter.

January’s loss was due mainly to a large position in Leapfrog (LF), which pre-announced poor holiday earnings and lower cash balances than anticipated, costing Armistice 300 bps. Vanda Pharmaceuticals (VNDA), another large position was down 20% on news the company would not meet sales expectations. Armistice also lost money on Biotech sector short hedges, which also cost Armistic 300 bps in January.

Event-driven Healthcare names drove Armistice’s rebound in February and March. Positions include:

Healthcare – Ignyta (RXDX), Hyperion Therapeutics (HPTX) and Durect Corp (DRRX)

For the quarter Armistice’s net long exposure was 55% and the firm had AUM of $144 million.

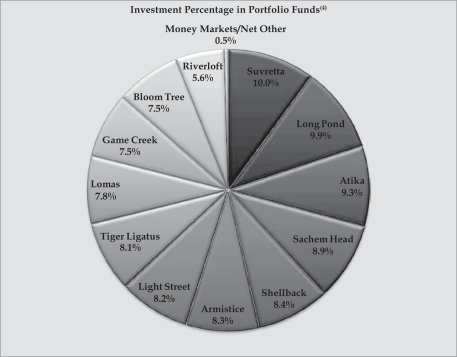

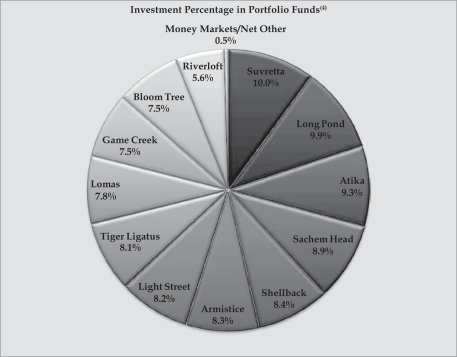

As of March 31, 2015, the Fund’s portfolio included private funds managed by 12 different managers (“Portfolio Funds”), with manager allocations ranging from 5.6% of total capital in Riverloft Offshore Fund, Ltd. to 10.0% of total capital in Suvretta.

3

Sincerely,

Cross Shore Capital Management LLC

(1) The HFRI Equity Hedge Index, an equally weighted performance index, consists of investment managers who maintain positions both long and short in primarily equity and equity derivative securities. HFRI data may include estimated returns and is subject to revision per HFRI policies and procedures.

(2) The S&P 500 Index is a widely recognized unmanaged index of equity prices and is representative of a broader market and range of securities than is found in the Fund’s portfolio. The index returns do not reflect the deduction of expenses, which have been deducted from the Fund’s returns. The Index returns assume reinvestment of all distributions and does not reflect the deduction of taxes and fees. Individuals cannot invest directly in the Index.

The views in the foregoing discussion were those of the Fund’s investment advisor as of the date set forth above and may not reflect its views on the date this Annual Report is first published or anytime thereafter. These views are intended to assist shareholders in understanding their investment in the Fund and do not constitute investment advice.

(3) As a percentage of total fair value in Portfolio Funds.

(4) As a percentage of net assets.

4

The performance information quoted above represents past performance and past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data, current to the most recent month end, may be obtained by calling the Fund at (844) 300-7828. Fee waivers and expense reimbursements have positively impacted Fund performance. An investor should consider the Fund’s investment objectives, risks, and charges and expenses carefully before investing. The Fund’s prospectus contains this and other important information. For information on the Fund’s expense ratio, please see the Financial Highlights Table found within the accompanying Annual Report.

An investment in the Fund is speculative, involves significant risk and is not suitable for all investors. It is possible that you may lose some or all of your investment. For a complete description of the principal risks involved and eligibility criteria for investors, please refer to the Fund’s current prospectus. A shareholder does not have the right to require the Fund to redeem or repurchase its shares and may not have access to the money it invests for an indefinite period of time. Repurchases will be made at such times, and in such amounts, and on such terms as may be determined by Fund’s Board of Trustees. Shares are not, and are not expected to be, listed for trading on any securities exchange and, to the Fund’s knowledge, there is no, nor will there be, any secondary trading market for the shares. Shares are subject to substantial restrictions on transferability and resale and may not be transferred or resold except as permitted under the Fund’s Agreement and Declaration of Trust, as may be amended and restated from time to time. Because a shareholder may not be able to sell shares, you will not be able to reduce your investment exposure to the Fund on any market downturn.

5

Investment Results — (Unaudited)

Total Returns

(For the period ended March 31, 2015)

| | | | |

| |

| | | Since Inception(1) | |

Cross Shore Discovery Fund | | | 3.50% | |

S&P 500® Index(2) | | | 0.95% | |

HFRI Equity Hedge Index(3) | | | 2.34% | |

| |

| | | Expense Ratios

From Prospectus Dated

January 30, 2015(4) | |

Gross | | | 11.44% | |

With Applicable Waivers | | | 10.44% | |

|

Performance data quoted represents past performance. Past

performance does not guarantee future results. The

investment return and principal value of an investment will

fluctuate so that an investor's shares, when redeemed, may

be worth more or less than their original cost. Current

performance may be lower or higher than the performance

data quoted. All performance figures are presented net of

fees. | |

Investors should carefully consider the investment objectives, risks, charges and expenses of the Cross Shore Discovery Fund. This and other important information about the Fund is contained in the prospectus, which can be obtained at www.crossshorefunds.com or by calling (844) 300-7828. The prospectus should be read carefully before investing. The Cross Shore Discovery Fund is distributed by Unified Financial Securities, Inc. (Member FINRA).

| (1) | For the period from January 2, 2015 (inception date of the Fund) to March 31, 2015. |

| (2) | The S&P 500 Index is a widely recognized unmanaged index of equity prices and is representative of a broader market and range of securities than is found in the Fund's portfolio. The index returns do not reflect the deduction of expenses, which have been deducted from the Fund's returns. The Index returns assume reinvestment of all distributions and does not reflect the deduction of taxes and fees. Individuals cannot invest directly in the Index. |

| (3) | The HFRI Equity Hedge Index, an equally weighted performance index, consists of investment managers who maintain positions both long and short in primarily equity and equity derivative securities. HFRI data may include estimated returns and is subject to revision per HFRI policies and procedures. |

| (4) | The Adviser has contractually agreed to waive its management fee and/or reimburse expenses to limit the total annual fund operating expenses to 2.25% through July 31, 2016 (after fee waivers and/or expense reimbursements, and exclusive of taxes, interest, portfolio transaction expenses, acquired fund fees and expenses, dividend expenses on short sales and extraordinary expenses not incurred in the ordinary course of the Fund's business). |

6

Fund Holdings – (Unaudited)

| (1) | | As a percentage of net assets. |

Availability of Portfolio Schedule – (Unaudited)

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q will be available at the SEC’s website at www.sec.gov. The Fund’s Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

7

Schedule of Investments

March 31, 2015

| | | | | | | | | | | | | | |

| Portfolio Funds | | Strategy | |

% of

Net Assets | | | Cost(1) | | | Fair Value | |

Long/Short Generalist: | |

Atika Offshore Fund, Ltd. | | Generalist | | | 9.3 | % | | $ | 1,457,098 | | | $ | 1,509,050 | |

Sachem Head Offshore, Ltd. | | Generalist | | | 8.9 | % | | | 1,316,735 | | | | 1,454,038 | |

Shellback Offshore Fund, Ltd. | | Generalist | | | 8.4 | % | | | 1,309,607 | | | | 1,369,445 | |

Tiger Legatus Offshore Fund, Ltd. | | Generalist | | | 8.1 | % | | | 1,290,149 | | | | 1,318,392 | |

Lomas Capital, Ltd. | | Generalist | | | 7.8 | % | | | 1,238,724 | | | | 1,274,820 | |

Bloom Tree Offshore Fund, Ltd. | | Generalist | | | 7.5 | % | | | 1,165,168 | | | | 1,215,897 | |

Riverloft Offshore Fund, Ltd. | | Generalist | | | 5.6 | % | | | 880,240 | | | | 906,517 | |

| | | | | | |

Total Generalist | | | | | 55.6 | % | | $ | 8,657,721 | | | $ | 9,048,159 | |

Long/Short Sector: | |

Suvretta Offshore Fund, Ltd. | | Consumer, TMT | | | 10.0 | % | | | 1,495,566 | | | | 1,631,840 | |

Long Pond Offshore, Ltd. | | Real Estate | | | 9.9 | % | | | 1,552,611 | | | | 1,611,842 | |

Armistice Capital Offshore Fund, Ltd. | | Healthcare, Consumer | | | 8.3 | % | | | 1,367,892 | | | | 1,360,670 | |

Light Street Xenon, Ltd. | | TMT | | | 8.2 | % | | | 1,306,937 | | | | 1,334,616 | |

Game Creek Offshore Fund, Ltd. | | Consumer, TMT | | | 7.5 | % | | | 1,194,735 | | | | 1,227,727 | |

| | | | | | |

Total Sector | | | | | 43.9 | % | | $ | 6,917,741 | | | $ | 7,166,695 | |

| | | | | | |

Total Investments In Portfolio Funds | | | | | 99.5 | % | | $ | 15,575,462 | | | $ | 16,214,854 | |

| | | | | | |

| | | | |

| | | Shares | | % of

Net Assets | | | Cost | | | Fair Value | |

Money Market Funds: | |

Fidelity Institutional Money Market Portfolio – Institutional Class, 0.13%(6) | | 122,727 | | | 0.8 | % | | $ | 122,727 | | | $ | 122,727 | |

| | | |

Total Investments | | | | | 100.3 | % | | $ | 15,698,189 | | | $ | 16,337,581 | |

| | | | | | |

Liabilities in Excess of Other Assets | | | | | (0.3 | )% | | | | | | $ | (43,990 | ) |

| | | | | | |

Net Assets | | | | | 100.0 | % | | $ | 15,698,189 | | | $ | 16,293,591 | |

| | | | | | |

| (1) | | There were no unfunded capital commitments as of March 31, 2015. |

| (2) | | Certain redemptions may be subject to various restrictions and limitations such as lock-ups (ranging up to 1 year) with redemption penalties and gates. |

| (3) | | Subject to 3% soft lock during the first year of investment. |

| (4) | | Subject to 25% investor level quarterly gate. |

| (5) | | Subject to 4% soft lock during the first year of investment and 25% fund level quarterly gate. |

| (6) | | Rate disclosed is the seven day yield as of March 31, 2015. |

| TMT | | – Technology, Media and Telecom |

See accompanying notes which are an integral part of these financial statements.

8

Schedule of Investments (continued)

March 31, 2015

| | | | | | | | | | | | | | | | | | | | | | | | |

| Level 1 | | | Level 2 | | | Level 3 | | | Initial

Acquisition

Date | | | Redemption

Frequency(2) | | Next

Available

Redemption

Date | | | Fair Value

For Next

Available

Redemption

Date | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| $ | – | | | $ | 1,509,050 | | | $ | – | | | | 1/2/2015 | | | Quarterly | | | 6/30/2015 | (3) | | $ | 1,509,050 | |

| | – | | | | 363,509 | | | | 1,090,529 | | | | 1/2/2015 | | | Quarterly | | | 6/30/2015 | (4) | | | 363,509 | |

| | – | | | | 1,369,445 | | | | – | | | | 1/2/2015 | | | Quarterly | | | 6/30/2015 | | | | 1,369,445 | |

| | – | | | | 1,318,392 | | | | – | | | | 1/2/2015 | | | Quarterly | | | 6/30/2015 | (3) | | | 1,318,392 | |

| | – | | | | 1,274,820 | | | | – | | | | 1/2/2015 | | | Quarterly | | | 6/30/2015 | (5) | | | 1,274,820 | |

| | – | | | | 1,215,897 | | | | – | | | | 1/2/2015 | | | Quarterly | | | 6/30/2015 | | | | 1,215,897 | |

| | – | | | | 226,629 | | | | 679,888 | | | | 1/2/2015 | | | Quarterly | | | 6/30/2015 | (4) | | | 226,629 | |

| | | | | | | | | | | | | | | | |

| $ | – | | | $ | 7,277,742 | | | $ | 1,770,417 | | | | | | | | | | | | | $ | 7,277,742 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | – | | | | 1,631,840 | | | | – | | | | 1/2/2015 | | | Quarterly | | | 6/30/2015 | | | | 1,631,840 | |

| | – | | | | 1,611,842 | | | | – | | | | 1/2/2015 | | | Quarterly | | | 6/30/2015 | | | | 1,611,842 | |

| | – | | | | 1,360,670 | | | | – | | | | 1/2/2015 | | | Quarterly | | | 6/30/2015 | | | | 1,360,670 | |

| | – | | | | 1,334,616 | | | | – | | | | 1/2/2015 | | | Quarterly | | | 6/30/2015 | | | | 1,334,616 | |

| | – | | | | 1,227,727 | | | | – | | | | 1/2/2015 | | | Quarterly | | | 6/30/2015 | | | | 1,227,727 | |

| | | | | | | | | | | | | | | | |

| $ | – | | | $ | 7,166,695 | | | $ | – | | | | | | | | | | | | | $ | 7,166,695 | |

| | |

| $ | — | | | $ | 14,444,437 | | | $ | 1,770,417 | | | | | | | | | | | | | $ | 14,444,437 | |

| | |

See accompanying notes which are an integral part of these financial statements.

9

Statement of Assets and Liabilities

March 31, 2015

| | | | |

Assets | | | | |

Cash | | $ | 14,025,667 | |

Investments at fair value (cost $15,698,189) | | | 16,337,581 | |

Advanced subscriptions in Portfolio Funds | | | 2,000,000 | |

Deferred offering costs | | | 48,979 | |

Prepaid expenses | | | 8,491 | |

Total assets | | | 32,420,718 | |

Liabilities | | | | |

Subscriptions received in advance | | | 16,000,000 | |

Payable to Adviser | | | 35,834 | |

Payable for audit fees | | | 71,500 | |

Payable for Chief Compliance Officer (“CCO”) fees | | | 5,667 | |

Payable for custody fees | | | 1,117 | |

Payable for fund accounting fees | | | 4,167 | |

Payable for administration fees | | | 3,125 | |

Other accrued expenses | | | 5,717 | |

Total liabilities | | | 16,127,127 | |

Net Assets | | $ | 16,293,591 | |

Net Assets Consist Of: | | | | |

Paid-in capital | | $ | 15,713,643 | |

Accumulated net investment loss | | | (59,444 | ) |

Accumulated net realized gain/(loss) from investment transactions | | | – | |

Net unrealized appreciation/(depreciation) on investments | | | 639,392 | |

| | | $ | 16,293,591 | |

Net Asset Value Per Share | | | | |

Institutional Shares (based on 157,425 shares outstanding; 500,000 shares authorized) | | $ | 103.50 | |

10

See accompanying notes which are an integral part of these financial statements.

Statement of Operations

For the period from January 2, 2015 (inception date of the Fund) to March 31, 2015

| | | | |

Investment Income | | | | |

Dividend income | | $ | 19 | |

Expenses | | | | |

Adviser | | | 69,173 | |

Administration | | | 9,375 | |

Fund accounting | | | 6,250 | |

CCO | | | 7,750 | |

Transfer agent | | | 5,000 | |

Legal | | | 8,000 | |

Registration | | | 3,070 | |

Custodian | | | 1,358 | |

Audit | | | 71,500 | |

Trustee | | | 5,000 | |

Insurance | | | 2,241 | |

Printing | | | 2,000 | |

Amortization of offering cost | | | 16,326 | |

Organization costs | | | 51,477 | |

Miscellaneous | | | 6,000 | |

Total expenses | | | 264,520 | |

Expenses waived and reimbursed by Adviser | | | (175,584 | ) |

Net expenses | | | 88,936 | |

Net investment loss | | | (88,917 | ) |

Realized and Unrealized Gain from Investments in Portfolio Funds | | | | |

Net realized gain/(loss) on sale of investments in Portfolio Funds | | $ | – | |

Net change in unrealized appreciation/(depreciation) from investments in Portfolio Funds | | | 639,392 | |

Net increase in net assets resulting from operations | | $ | 550,475 | |

11

See accompanying notes which are an integral part of these financial statements.

Statement of Cash Flows

For the period from January 2, 2015 (inception date of the Fund) to March 31, 2015

| | | | |

Increase/(Decrease) in Cash | | | | |

Cash flows from operating activities: | | | | |

Net increase in net assets resulting from operations | | $ | 550,475 | |

Adjustments to reconcile net increase in net assets from operations to net cash used in operating activities: | | | | |

Purchase of short-term securities, net | | | (122,727 | ) |

Subscriptions to Portfolio Funds made in advance | | | (2,000,000 | ) |

Increase in deferred offering costs and prepaid expenses | | | (57,470 | ) |

Increase in payable to Adviser | | | 35,834 | |

Increase in accrued expenses and expenses payable | | | 91,293 | |

Change in unrealized appreciation on investments | | | (639,392 | ) |

Net cash used in operating activities | | | (2,141,987 | ) |

Cash flows from financing activities: | | | | |

Proceeds from shares sold | | | 167,654 | |

Subscriptions received in advance | | | 16,000,000 | |

Net cash provided from financing activities | | | 16,167,654 | |

Net change in cash | | $ | 14,025,667 | |

Cash balance at beginning of period | | $ | – | |

Cash balance at end of period | | $ | 14,025,667 | |

Supplemental disclosure of cash flow information:

Non cash activities include purchases in-kind of $15,575,462.

Statement of Changes in Net Assets

For the period from January 2, 2015 (inception date of the Fund) to March 31, 2015

| | | | |

Increase In Net Assets Resulting From Operations | | | | |

Net investment loss | | $ | (88,917 | ) |

Net realized gain/(loss) on sale of investments in Portfolio Funds | | | – | |

Net change in unrealized appreciation/(depreciation) from investments in Portfolio Funds | | | 639,392 | |

Net increase in net assets resulting from operations | | | 550,475 | |

Capital Share Transactions | | | | |

Proceeds from issuance of shares | | | 167,654 | |

Proceeds from subscriptions-in-kind | | | 15,575,462 | |

Payments for redemption of shares | | | – | |

Net increase in net assets resulting from capital share transactions | | | 15,743,116 | |

Net increase in net assets | | | 16,293,591 | |

Net assets at beginning of period | | | – | |

Net assets at end of period | | $ | 16,293,591 | |

Accumulated net investment loss | | $ | (59,444 | ) |

Share Transactions | | | | |

Shares issued | | | 157,425 | |

Shares redeemed | | | – | |

Net increase in share transactions | | | 157,425 | |

12

See accompanying notes which are an integral part of these financial statements.

Financial Highlights

| | | | |

| | | For The Period

January 30, 2015 to

March 31, 2015(1) | |

Per Share Operating Performance | | | | |

Net asset value, beginning of period | | | $98.99 | |

| | | | |

| |

Investment operations: | | | | |

| |

Net investment loss | | | (0.38 | )(2) |

| |

Net unrealized gains/(losses) from investments in Portfolio Funds | | | 4.89 | |

| | | | |

| |

Net change in net assets resulting from operations | | | 4.51 | |

| | | | |

| |

Net asset value, end of period | | | $103.50 | |

| | | | |

| |

Total return(3) | | | 4.56 | %(4) |

| |

Net assets, end of period: | | | $16,293,591 | |

| | | | |

Ratios To Average Net Assets(5) | | | | |

Expenses after waiver and reimbursement | | | 2.25 | %(6) |

| |

Expenses before waiver and reimbursement | | | 5.11 | %(6) |

| |

Net investment income after waiver and reimbursement | | | (2.25 | %)(6) |

| |

Net investment income before waiver and reimbursement | | | (5.11 | %)(6) |

| |

Portfolio turnover rate | | | 0.00 | %(4) |

| (1) | | The period of the financial highlights are from the date of effectiveness of the Fund’s registration statement under the Investment Company Act of 1940, as amended, and the Securities Act of 1933, as amended, through March 31, 2015. |

| (2) | | Calculated based on the average shares outstanding during the period, January 30, 2015 to March 31, 2015. |

| (3) | | Total return in the above table represents the rate an investor would have earned or lost on an investment in the Fund, assuming reinvestment of dividends, if any. |

| (5) | | The ratios do not reflect the Fund’s proportionate share of income and expenses of the underlying Portfolio Funds. |

13

See accompanying notes which are an integral part of these financial statements.

Notes to Financial Statements

March 31, 2015

1. ORGANIZATION

Cross Shore Discovery Fund (the “Fund”) was organized on May 21, 2014 as a Delaware statutory trust. The Fund commenced operations on January 2, 2015. The Fund’s registration statement under the Investment Company Act of 1940, as amended, and the Securities Act of 1933, as amended, became effective on January 30, 2015. Pursuant to this registration statement, the Fund is a non-diversified, closed-end management investment company, operates as a “fund of hedge funds” and provides investors access to a variety of professionally managed private investment funds (“hedge funds”) that predominately employ equity long/short strategies (each a “Portfolio Fund”). The Portfolio Funds are not registered under the 1940 Act and are generally organized outside of the United States (“U.S”). The Fund currently offers one class of shares (“Institutional Shares”).

The Fund’s investment objective is to seek rates of return over a full market cycle that exceed the average rate of return of the HFRI Equity Hedge Index with capital draw downs and overall volatility less than the broad U.S. equity market indices. A capital drawdown is a period during which the Fund’s net asset value (the “NAV”) is below its most recent, highest NAV. The HFRI Equity Hedge Index, an equally weight performance index, consists of investment managers who maintain positions both long and short in primarily equity and equity derivative securities.

Under the Fund’s organizational documents, its officers and Board of Trustees (“Board”) are indemnified against certain liabilities arising out of the performance of their duties to the Fund. In addition, in the normal course of business, the Fund may enter into contracts with vendors and others that provide for general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund. However, based on experience, the Fund expects that risk of loss to be remote.

2. SIGNIFICANT ACCOUNTING POLICIES

The Fund is an investment company and follows accounting and reporting guidance under Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946, “Financial Services-Investment Companies”. The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements. The policies are in conformity with generally accepted accounting principles in the United States of America (“GAAP”).

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the amounts of assets, liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses for the period. Actual results could differ from those estimates.

A. Portfolio Fund Transactions and Income Recognition

Security transactions are accounted for on the first business day of each calendar month. Realized gains and losses are calculated using the identified cost basis and are reflected on the Statement of Operations. Interest income, if any, and expense are accrued each month. Dividends, less foreign tax withholding (if any), are recorded on the ex-dividend date. Interest and dividend income, if any, are included on the Statement of Operations.

14

Notes to Financial Statements (continued)

March 31, 2015

Investments in underlying Portfolio Funds paid in advance on the Statement of Assets and Liabilities represent subscriptions paid by the Fund to underlying Portfolio Funds with an effective date of April 1, 2015. Cash presented on the Statement of Assets and Liabilities represents deposits held at banks in U.S. Dollars that were received during March 2015 for subscriptions to shareholders effective April 1, 2015.

B. Investment Valuation and Risks

The Fund will calculate the NAV of the Institutional Shares as of the close of business on the last business day of each calendar month and at such other times as the Board may determine, including in connection with the repurchase of Institutional Shares.

Because the Fund invests all or substantially all of its assets in Portfolio Funds, the NAV of the Institutional Shares will depend on the value of each Portfolio Fund. The NAV’s of Portfolio Funds are generally not available from pricing vendors, nor are they calculable independently by the Fund or by Cross Shore Capital Management, LLC, the Fund’s investment adviser (the “Adviser”).

The Fund has the ability to liquidate its investments in Portfolio Funds periodically ranging from monthly to quarterly, and may be subject to gate provisions or other provisions in accordance with the Portfolio Funds’ respective agreements. The Fund received securities in exchange for subscriptions of capital shares. There were no other purchases or proceeds from sales of Portfolio Funds’ by the Fund for the period ended March 31, 2015. For the period ended March 31, 2015, the fair value of securities received for subscriptions was $15,575,462.

While it is anticipated that the Portfolio Funds will primarily invest in publicly traded U.S. and foreign common stocks, Portfolio Funds may also use other equity securities such as preferred stock, convertible securities and warrants (collectively, “Equity Securities”) to implement their equity long/short strategies. A Portfolio Fund may also invest in fixed income securities such as corporate debt obligations, government securities, municipal securities, financial institution obligations, mortgage-related securities, asset-backed securities and zero-coupon securities issued by U.S. issuers and similar securities issued by foreign issuers (collectively, “Fixed Income Securities”) on an opportunistic basis. While a Portfolio Fund generally implements its long/short strategies by investing directly or selling short Equity and Fixed Income Securities, a Portfolio Fund may use derivatives, typically, options on Equity or Fixed Income indices (each an “Index”), futures on Indices and total return swaps involving one or a basket of Equity or Fixed Income Securities, to create synthetic exposure to these Indices/securities for the purposes of increasing portfolio profitability or hedging against certain long/short strategy risks, including short selling risk. Because a Portfolio Fund is not registered under the 1940 Act and its governing documents typically do not impose significant investment restrictions, the Portfolio Fund may also, without limitation or prior notice to the Adviser, invest and trade in a broad range of securities, derivatives and other financial instruments including but not limited to those described above. While, generally, each Portfolio Fund carries its investments at fair value, these investments are associated with a varying degree of off-balance sheet risks, including both market and credit risks. Market risk is the risk of potential adverse changes to the value of the financial instruments and their derivatives because of the changes in market conditions such as interest and currency rate movements and volatility in commodity or security prices. Credit risk is the risk of the potential inability of counterparties to perform the terms of the contracts, which may be in excess of the amounts recorded in the

15

Notes to Financial Statements (continued)

March 31, 2015

Portfolio Funds’ respective balance sheets. In addition, several of the Portfolio Funds’ sell securities not yet purchased, whereby a liability is created to repurchase the security at prevailing prices. Such Portfolio Funds’ ultimate obligations to satisfy the sales of securities sold, not yet purchased may exceed the amount recognized on their respective balance sheets. However, due to the nature of the Fund’s shareholder interest in these Portfolio Fund’s, the Fund’s risk with respect to such transactions is limited to its capital balance in each Portfolio Fund.

The Fund’s interests in Portfolio Funds are also illiquid and subject to substantial restrictions on transferability. The Fund may not be able to acquire initial or additional interests in a Portfolio Fund or withdraw all or a portion of its investment from a Portfolio Fund promptly after it has made a decision to do so because of limitations set forth in that fund’s governing documents.

The fair value of the Fund’s investments in Portfolio Funds represents the Fund’s proportionate share of its net assets of the Portfolio Fund’s as reported by management of those entities. All valuations utilize financial information supplied by management of each Portfolio Fund and are net of management and incentive fees pursuant to the Portfolio Funds’ applicable agreements. The fair value represents the amount the Fund expects to receive, gross of redemption fees or penalties, at March 31, 2015, if it were to liquidate its investments in the Portfolio Funds. Because of the inherent uncertainly of valuation, the value of investments in the Portfolio Funds held by the Fund may differ significantly from the values that would have been used had a ready market existed, and differences could be material. The resulting net change in unrealized appreciation or depreciation is reflected in the statement of operations.

The Adviser may conclude in certain circumstances that, after considering information reasonably available at the time the valuation is made and that the Adviser believes to be reliable, the balance provided by a Portfolio Fund’s management does not represent the fair value of the Fund’s interest in the Portfolio Fund. In addition, in the absence of specific transaction activity in the interests of a particular Portfolio Fund, the Adviser could consider whether it was appropriate, in light of all relevant circumstances, to value such a position at the Portfolio Fund’s net assets as reported at the time of valuation, or whether to adjust such value to reflect a premium or discount to the reported net assets. Any such decision is made in good faith and is subject to the review and supervision of the Adviser. In determining fair values, the Adviser has, as a practical expedient, estimated fair value of each Portfolio Fund using the NAV (or its equivalent) as of the reporting measurement date.

The valuation techniques described maximize the use of observable inputs and minimize the use of unobservable inputs in determining fair value. The inputs used for valuing the Fund’s investments are summarized in the three broad levels listed below:

| | • | | Level 1 – Unadjusted quoted prices in active markets that are accessible at the measurement date for identical, unrestricted financial instruments. |

| | • | | Level 2 – Quoted prices in markets that are not active or financial instruments for which all significant inputs are observable, either directly or indirectly. In addition, under FASB ASU No. 2009-12, Investments in Certain Entities that Calculate Net Asset Value per Share (or Its Equivalent) (ASU 2009-12), interests in financial instruments for which net asset value (NAV) is used as a practical expedient to approximate fair value are classified as Level 2 if the instruments are redeemable at the balance sheet date or in the near term. The Fund |

16

Notes to Financial Statements (continued)

March 31, 2015

| | views its Level 2 investments as the portions of financial instruments valued at NAV with liquidity within three months or less, unless a portion of the Fund’s investment is in an illiquid side pocket. |

| | • | | Level 3 – Inputs, broadly referred to as the assumptions that market participants use to make valuation decisions, are unobservable and reflect the Adviser’s best estimate of what market participants would use in pricing the financial instrument at the measurement date. Consideration is given to the risk inherent in the valuation technique and/or the risk inherent in the valuation technique and/or the risk inherent in the inputs to the model. The types of financial instruments carried at Level 3 fair value generally include certain private investments and certain derivatives. In addition, under ASU 2009-12, interests in financial instruments for which NAV is used as a practical expedient to approximate fair value are classified as Level 3 assets if the interests are not redeemable in the near term. The Fund views its Level 3 investments as the portions of financial instruments valued at NAV with liquidity of greater than three months as well as instruments in which a portion of the Fund’s investment is in an illiquid side pocket. |

Changes in valuation techniques may result in transfers in or out of an assigned level with the disclosure hierarchy. The Fund recognizes transfer between fair value hierarchy levels at the reporting period end. The inputs or methodology used for valuing investments is not necessarily an indication of the risk associated with investing in those investments.

The following is a summary of the inputs used to value the Fund’s investments as of March 31, 2015 based on the three levels defined previously:

| | | | | | | | | | | | | | | | |

| Investments | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Investments In Portfolio Funds | | $ | – | | | $ | 14,444,437 | | | $ | 1,770,417 | | | $ | 16,214,854 | |

Investments in Money Market Funds | | | 122,727 | | | | – | | | | – | | | | 122,727 | |

Total | | $ | 122,727 | | | $ | 14,444,437 | | | $ | 1,770,417 | | | $ | 16,337,581 | |

There were no transfers between levels 1 and 2 for the period ended March 31, 2015.

For the period ended March 31, 2015, the below is a Level 3 reconciliation of investments in Portfolio Funds’ as defined above:

| | | | |

| | | Level 3 | |

Balance as of January 2, 2015 | | $ | – | |

Received from subscription-in-kind | | | 1,735,985 | |

Sales of Portfolio Funds | | | – | |

Transfer in to Level 3 | | | – | |

Transfer out of Level 3 | | | (88,253 | ) |

Net realized gain/(loss) | | | – | |

Net change in unrealized appreciation/(depreciation) | | | 122,685 | |

Balance as of March 31, 2015 | | $ | 1,770,417 | |

Transfer out of Level 3 reflects the expiration of a lock up provision on Portfolio Funds.

The total change in unrealized appreciation/(depreciation) attributable to Level 3 assets still held at March 31, 2015 was $122,685.

17

Notes to Financial Statements (continued)

March 31, 2015

C. Fund Expenses

The Fund bears all expenses incurred in its business, subject to the expense limitation agreement (see Note 3.A. Investment Advisory Fees). Expenses are recorded monthly on the accrual basis.

3. INVESTMENT ADVISORY FEE AND OTHER TRANSACTIONS WITH AFFILIATES

A. Investment Advisory Fees

The Adviser serves as the Fund’s investment adviser. The Adviser receives an annual fee of 1.75% payable monthly based on the Fund’s month-end net assets.

The Adviser has contractually agreed to waive its management fee and/or reimburse expenses to the extent necessary to ensure that the total annual Fund operating expenses attributable to the Institutional Shares will not exceed 2.25% (after fee waivers and/or expense reimbursements, and exclusive of taxes, interest, portfolio transaction expenses, acquired fund fees and expenses and extraordinary expenses not incurred in the ordinary course of the Fund’s business). The arrangements will continue until July 31, 2016 and can only be terminated prior to that day with approval from the Board. The Adviser may recoup fees waived and expenses reimbursed within three years of the year in which such waivers and reimbursements were made if such recoupment does not cause current expenses within the fiscal year to exceed the expense limit in effect at the time the expense were paid/waived. As of March 31, 2015, $175,584 in expenses were waived or reimbursed, none of which has been recouped, by the Adviser and are subject to repayment by the Fund subject to the limitations noted above.

B. Administration, Accounting, Compliance Services and Transfer Agent Fees

Pursuant to an agreement between the Fund and Citco Mutual Fund Services, Inc. (“Administrator”), the Administrator provides administration, fund accounting and compliance services to the Fund and supplies certain officers to the Fund including a Principal Financial Officer, a Chief Compliance Officer, and an Anti-Money Laundering Officer. The Fund pays the Administrator a basis point fee, subject to fee minimums, for both administrative and fund accounting services, a fixed fee for compliance services and certain out of pocket expenses. The Administrator has retained Huntington Asset Services, Inc. (“Huntington”) to serve as the Fund’s sub-administrator. Huntington is compensated by the Administrator for the sub-administrative services provided to the Fund.

Pursuant to a Transfer Agency Services Agreement with the Fund, Huntington provides transfer agency services to the Fund and is compensated for the provision of these services.

C. Distribution

Unified Financial Securities, Inc. (the “Distributor”) acts as principal underwriter and distributor of the Fund’s shares of beneficial interest on a best effort basis, subject to various conditions. The Distributor may retain additional broker-dealers and other financial intermediates (each a “Selling Agent”) to assist in the distribution of shares and shares are available for purchase through these Selling Agents or directly through the Distributor. Generally, shares are only offered to investors that are U.S. persons for U.S. federal income tax purposes.

18

Notes to Financial Statements (continued)

March 31, 2015

D. Custodian Fees

The Huntington National Bank, N.A (the “Custodian”), is custodian of the Fund’s investments and may maintain Fund assets with U.S. and foreign subcustodians, subject to policies and procedures approved by the Board. The Fund and the Custodian have entered into an agreement with Citco Bank (Canada) (“Citco”) to perform certain sub-custodian services to the Fund. Fees and expenses of the Custodian and Citco are paid by the Fund.

E. General

Certain officers of the Fund are officers, directors and/or trustees of the above companies. Independent trustees are paid a $10,000 annual retainer, payable in quarterly installments, for their services to the Funds. Interested trustees and officers of the Trust are not paid for services directly by the Fund. For the period ended March 31, 2015, $5,000 was paid to the independent trustees and is included in the trustee line item of the Statement of Operations.

4. ORGANIZATION AND OFFERING COSTS

The Fund bears all expenses incurred in its business and operations. The Adviser advanced the Fund’s organization and initial offering costs and may be subsequently reimbursed by the Fund. Reimbursements to the Adviser of organizational and offering costs are subject to the expense limitation agreement described in Note 3.

Costs of $65,305 incurred in connection with the offering and initial registration of the Fund has been deferred and is being amortized on a straight-line basis over the first twelve months after commencement of operations.

5. CAPITAL SHARE TRANSACTIONS

Shares of each of the Funds will be traded for purchase only through the Distributor, or a Selling Agent as of the first business day of each month. To provide a limited degree of liquidity to shareholders, the Fund may from time to time offer to repurchase shares pursuant to written repurchase offers, but is not obligated to do so.

Subscriptions received in advance on the Statement of Assets and Liabilities represents shareholder subscriptions received during the month of March that will be issued on the first business day of the following month.

Repurchase offers will be made at such times and on such terms as may be determined by the Board in its sole discretion and generally will be offers to repurchase an aggregate specified dollar amount of outstanding shares or a specific number of shares. Any such offer will be made only on terms that the Board determines to be fair to the Fund and to all shareholders or persons holdings shares acquired from shareholders. When the Board determines that the Fund will repurchase shares or portions thereof, notice will be provided to each shareholder describing the terms thereof, and containing information shareholder should consider in deciding whether and how to participate in such repurchase opportunity. The Board convenes quarterly to consider whether or not to authorize a tender offer. The Board expects that repurchase offers, if authorized, will be made no more frequently than on a quarterly basis and will typically have a valuation date as of March 31, June 30, September 30 or December 31 (or, if any such date is not a Business Day, on the last Business Day of such calendar quarter).

19

Notes to Financial Statements (continued)

March 31, 2015

6. DISTRIBUTIONS

The Fund declares and pays dividends on investment income, if any, annually. The Fund also makes distributions of net capital gains, if any, annually.

7. FEDERAL INCOME TAXES

It is the policy of the Fund to qualify or continue to qualify as a regulated investment company by complying with the provisions available to certain investment companies, as defined in applicable sections of the Internal Revenue Code, and to make distributions of net investment income and net realized capital gains sufficient to relieve it from all, or substantially all, federal income taxes.

The following information is provided on a tax basis as of March 31, 2015:

| | | | |

Gross Appreciation | | $ | – | |

Gross Depreciation | | | (7,221 | ) |

Net Appreciation/(Depreciation) | | $ | (7,221 | ) |

As of the tax year ended March 31, 2015, the aggregate cost of investment entities for federal tax purposes was $16,222,075. The difference between the book-basis unrealized appreciation/(depreciation) is attributable primarily to the realization for tax purposes of unrealized gain/(losses) on investments in passive foreign investment companies.

As of the tax year ended March 31, 2015, the components of accumulated earnings (deficit) on a tax basis were as follows:

| | | | |

Undistributed ordinary income | | $ | 587,169 | |

Undistributed long-term capital gains | | | – | |

Accumulated capital and other losses | | | – | |

Unrealized appreciation/(depreciation) | | | (7,221 | ) |

Total | | $ | 579,948 | |

Under current tax law, capital losses and specified ordinary losses realized after October 31st and non-specified ordinary losses incurred after December 31st (ordinary losses collectively known as “qualified late year ordinary loss”) may be deferred and treated as occurring on the first business day of the following fiscal year.

As of March 31, 2015, for federal income tax purposes and the treatment of distributions payable, the Fund had no short-term or long-term capital loss carryforwards available to offset future gains, if any, to the extent provided by the Treasury regulations.

Management of the Fund has reviewed tax positions taken in tax years that remain subject to examination by all major tax jurisdictions, including federal (ie, all open tax periods since inception). Management believes there is no tax liability resulting from unrecognized tax benefits related to uncertain tax positions taken.

8. CONTROL PERSONS AND PRINCIPAL HOLDERS

A principal shareholder is any shareholder who owns of record or beneficially 5% or more of the outstanding shares of the Fund. A control person is a shareholder who owns beneficially or through

20

Notes to Financial Statements (continued)

March 31, 2015

controlled companies more than 25% of the voting securities of a company or acknowledges the existence of control. Shareholder owning voting securities in excess of 25% may determine the outcome of any matter affecting and voted on by shareholders of the Fund. As of March 31, 2015, Cross Shore QP Partners, LP owned 99% of the outstanding shares of the Fund.

9. SUBSEQUENT EVENTS

Management of the Fund has evaluated the need for disclosures and/or adjustments resulting from subsequent events through the date these financial statements were issued. Subsequent to the year end, the Fund made additional purchases of Portfolio Funds of approximately $9.0 million. Based upon this evaluation, management has determined there were no additional items requiring adjustment of the financial statements or additional disclosure.

10. RECENTLY ISSUED ACCOUNTING PRONOUNCEMENTS

In August 2014, the FASB issued Accounting Standards Update 2014-15 “Presentation of Financial Statements – Going Concern: Disclosure of Uncertainties about an Entity’s Ability to Continue as a Going Concern” which provides guidance about management’s responsibility to evaluate whether there is substantial doubt about an entity’s ability to continue as a going concern and to provide related footnote disclosures. The amendments are effective for annual periods ending after December 15, 2016, and for annual periods and interim periods thereafter, though early adoption is permitted. In management’s evaluation, there are no uncertainties about the Fund’s ability to continue as a going concern.

In May 2015, the FASB issued Accounting Standards Update 2015-07 “Fair Value Measurement (Topic 820): Disclosures for Investments in Certain Entities That Calculate Net Asset Value per Share (or its Equivalent)” which provide amendments to the fair value hierarchy table with respect to investments which are fair valued at their net asset value per share. The amendments are effective for fiscal years beginning after December 15, 2015, and interim periods within those fiscal years, though early adoption is permitted. Management’s currently evaluating what impact this will have on the Fund’s financial statements.

21

Report of Independent Registered Public Accounting Firm

The Board of Trustees and Shareholders of Cross Shore Discovery Fund

We have audited the accompanying statement of assets and liabilities of Cross Shore Discovery Fund (the “Fund”), including the schedule of investments, as of March 31, 2015, and the related statements of operations, cash flows and changes in net assets for the period January 2, 2015 (inception date of the Fund) through March 31, 2015 and the financial highlights for the period January 30, 2015 (date of effectiveness) through March 31, 2015. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. We were not engaged to perform an audit of the Fund’s internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements and financial highlights, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. Our procedures included confirmation of investments in portfolio funds as of March 31, 2015, by correspondence with management of the underlying portfolio funds or others. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Cross Shore Discovery Fund at March 31, 2015, the results of its operations and its cash flows and the changes in its net assets for the period January 2, 2015 (inception date of the Fund) through March 31, 2015 and the financial highlights for the period January 30, 2015 (date of effectiveness) through March 31, 2015 in conformity with U.S. generally accepted accounting principles.

New York, New York

May 29, 2015

22

Additional Federal Income Tax Information (Unaudited)

The Form 1099-DIV you will receive in January 2016 will show the tax status of all distributions paid to your account in calendar year 2015. Shareholders are advised to consult their own tax adviser with respect to the tax consequences of their investment in the Fund. As required by the Internal Revenue Code and/or regulations, shareholders must be notified regarding the status of qualified dividend income for individuals and the dividends received deduction for corporations.

Qualified Dividend Income. The Fund designates approximately 0% or up to the maximum amount of such dividends allowable pursuant to the Internal Revenue Code, as qualified dividend income eligible for the reduced tax rate of 15%.

Dividends Received Deduction. Corporate shareholders are generally entitled to take the dividends received deduction on the portion of the Fund’s dividend distribution that qualifies under tax law. For the Fund’s calendar year 2015 ordinary income dividends, 0% qualifies for the corporate dividends received deduction.

For the year ended March 31, 2015, the Fund designated $0 as long-term capital gain distributions.

23

Trustees and Officers – (Unaudited)

The Board of Trustees supervises the business activities of the Trust. Each Trustee serves as a trustee until termination of the Trust unless the Trustee dies, resigns, retires or is removed.

The following tables provide information regarding the Trustees and Officers.

The following table provides information regarding each of the Independent Trustees.

| | | | | | |

Name and year of Birth,

Positions (s) Held with

Company, Term of

Office and Length of

Time Served(1) | | Principal Occupation(s)

During Past Five Years | | Number of

Funds in

Complex

Overseen

by Trustee | | Other

Directorships

Held by Trustee

During the

Past 5 Years |

Independent Trustees: | | | | | | |

| | | |

David J. Gruber Born: 1963 Trustee; Lead Independent Trustee; Chairman/Member, Audit Committee; Member, Nominating and Valuation Committees Since 2014 | | President, DJG Financial Consulting LLC since 2007; Board Member and Treasurer, CASA of Delaware County (non-profit group of Court Appointed Special Advocates for children) from 2009-2010; Project Professional/Financial Consultant, Resources Global Professionals (Sarbanes-Oxley compliance provider) from 2004-2007; Chief Financial Officer/Personnel Director, Ohio Arts & Sports Facilities Commission from 2003-2004; Finance Director, Ohio Exposition Commission from 1996-2003; Assistant Director of Operations/Assistant Treasurer, Producers Livestock from 1993-1996; Senior Accountant, Holbrook, Manter, Nichols & Rogers from 1990-1993; Manager – Financial Reporting Department, Interstate Service Insurance Company from 1988-1990; Senior Accountant/Staff Accountant, Pricewaterhouse Cooper (Coopers & Lybrand) from 1985-1988. | | 1 | | Trustee, Fifth Third Funds from 2003-2012 |

| | | |

Thomas E. Niehaus Born: 1960 Trustee; Member, Audit Committee; Chairman and Member, Nominating and Valuation Committees Since 2014 | | Managing Director, Oakpoint Fund Services LLC since 2006; Chief Financial and Administrative Officer, Clarion Group (financial advisory firm) from 1997 to 2006; Controller/various positions, McDonald Investments (financial services firm) from 1990-1997; Auditor, Arthur Andersen & Co. from 1986-1990. | | 1 | | None |

The following table provides information regarding the Trustee who is considered an “interested person” of the Trust, as that term is defined under the 1940 Act.

| | | | | | |

Name and year of Birth,

Positions (s) Held with

Company, Term of

Office and Length of

Time Served(2) | | Principal Occupation(s)

During Past Five Years | | Number of

Funds in

Complex

Overseen

by Trustee | | Other

Directorships

Held by Trustee

During the

Past 5 Years |

| | | |

Neil Kuttner Born: 1951 Trustee; Chief Executive Officer; President Since 2014 | | Managing Member, Adviser since 2002; Principal, Sanford Bernstein Co., Inc. (research and brokerage firm) from 1982-2001. | | 1 | | None |

| (1) | | Each Trustee serves until retirement, resignation or removal from the Board. Trustees may be removed in accordance with the Declaration of Trust with or without cause by written instrument signed by a majority of the Trustees or by vote of a majority of the shareholders, at a meeting holding at least two-thirds (2/3) of outstanding Institutional Shares. |

| (2) | | Mr. Kuttner is an Interested Trustee because of his affiliation with the Adviser. |

24

Principal Officers who are Not Trustees

The business address of each officer is 2960 N. Meridian Street, Suite 300, Indianapolis, Indiana 46208.

| | |

Name and year of Birth,

Positions (s) Held with

Company, Term of

Office and Length of

Time Served(1) | | Principal Occupation(s) During Past Five Years |

| |

Bryan Haft Born: 1965 Treasurer and Principal Financial Officer Since 2014 | | Senior Vice President of Operations, Citco Mutual Fund Services, Inc. since 2013; Employed in various positions with Citi Fund Services, LLC (most recently Senior Vice President of Relationship Management) from 1992-2013. |

| |

Carol Highsmith Born: 1964 Secretary Since 2014 | | Employed in various positions with Huntington Asset Services, Inc., the Trust’s administrator (currently Vice President of Legal Administration) since November of 1994. |

| |

Steven Hoffman Born: 1963 Chief Compliance Officer/Anti-Money Laundering Officer Since 2014 | | Senior Vice President of Operations, Citco Mutual Fund Services, Inc. since 2013; Chief Compliance Officer, Director of Human Resources, Meeder Investment Management, Inc. (financial services firm) and Chief Compliance Officer, Meeder Investment Management, Inc. (investment adviser) from 2011-2013; Chief Financial Officer, Sanese Services, Inc. (food services provider) from 2006-2009; Consultant, Beacon Hill Fund Services from 2009 to 2010; Divisional Chief Financial Officer, The BISYS Group, Inc. (“BISYS”) (financial services firm) and Financial and Operations Principal of BISYS’ affiliated introducing broker-dealers from 1995-2006. |

| (1) | | Each officer of the Fund serves for an indefinite term until the date his or her successor is elected and qualified, or until he or she sooner dies, retires, is removed or becomes disqualified. |

Other Information – (Unaudited)

The Fund’s Statement of Additional Information (“SAI”) includes additional information about the trustees and is available without charge, upon request. You may call toll-free at (844) 300-7828 to request a copy of the SAI or to make shareholder inquiries.

25

Investment Advisory Agreement Approval (Unaudited)

The Board of Trustees (the “Board”), including the Trustees who are not “interested persons” (as that terms is defined in Section 2(a)(19) of the Investment Company Act of 1940, as amended) (the “Independent Trustees”) voting separately, reviewed and approved the Investment Advisory Agreement between Cross Shore Management, LLC (the “Adviser”) and Cross Shore Discovery Fund, a Delaware statutory trust and registered closed-end fund under the Investment Company Act of 1940, as amended (the “Trust”), on behalf of its sole series of the same name (the “Fund”). The approval took place at an in-person meeting held on August 6, 2014 at which a majority of the Trustees, including a majority of the Independent Trustees, were present.

Prior to the meeting, the Board requested from, and received and reviewed a substantial amount of information provided by, the Adviser (the “Support Materials”). The Support Materials included, among other things, information regarding: (1) the Adviser’s organizational structure, management, personnel and proposed services to the Fund; (2) the fees to be paid by the Fund to the Adviser for services rendered under the Investment Advisory Agreement between the Adviser and the Trust (the “Advisory Agreement”), the Adviser’s projected profitability on services to be rendered to the Fund and related economies of scale; (3) the financial stability of the Adviser; and (4) the Adviser’s compliance program, including the Adviser’s Code of Ethics.

The Board also received a memorandum from counsel to the Fund and the Independent Trustees (“Counsel”) outlining the Board’s duties and legal standards applicable to the consideration and approval of advisory agreements. Counsel discussed with the Trustees the types of information and factors that should be considered by the Board in order to make an informed decision regarding the approval of the Advisory Agreement, including the following material factors: (i) the nature, extent, and quality of the services to be provided by the Adviser; (ii) the investment performance of the Adviser; (iii) the costs of the services to be provided and anticipated profits to be realized by the Adviser from the relationship with the Fund; (iv) the extent to which economies of scale would be realized if the Fund grows and whether advisory fee levels reflect those economies of scale for the benefit of the Fund’s investors; and (v) potential benefits to the Adviser from its relationship with the Fund (collectively, the “Factors”).

During the meeting and prior to approving Advisory Agreement, the Independent Trustees received a presentation from Mr. Neil Kuttner, a Managing Member of the Adviser and Trustee of the Trust, and discussed the services to be rendered by Adviser to the Fund. The Independent Trustees also convened with Counsel in executive session to discuss their obligations with respect to the approval of the Advisory Agreement and the Factors and the information provided by the Adviser applicable thereto.

In considering the Advisory Agreement and reaching its conclusion to approve the agreement, the Board reviewed and analyzed the Factors as set forth below. The Trustees did not identify any particular information that was most relevant to their consideration to approve the Advisory Agreement and each Trustee may have afforded different weight to the various Factors.

| 1. | The nature, extent, and quality of the services to be provided by Adviser. The Trustees considered the services to be rendered by the Adviser to the Fund as set forth in the Advisory Agreement, including without limitation: the provision of a complete investment management program for the Fund and related Board reporting, the voting of proxies relating to portfolio investments, and the fair valuation of the Fund’s portfolio investments, which will consist principally of interests in private investment companies, subject to |

26

| | oversight of the Trust’s Valuation Committee. The Trustees also considered the due diligence process utilized by the Adviser to identify and evaluate managers of the potential private investment companies in which the Fund will invest and the Adviser’s compliance policies and procedures including those dedicated to assuring that investments made are consistent with the Fund’s investment objectives and limitations. The Trustees also noted the Adviser’s anticipated efforts to promote the Fund and grow its assets, the high quality of its personnel based on education and experience and its commitment to maintain and enhance its resources and systems. The Trustees acknowledged the Adviser’s cooperation with the Board and counsel for the Fund and specifically discussed the significant efforts undertaken by Cross Shore to ensure its operations will be compliant with U.S. federal securities regulations applicable to a 1940 Act registered fund. The Trustees also noted that the Adviser had not experienced any issues under its compliance program during the past year and that neither the Adviser nor its affiliates were subject to any regulatory examinations, regulatory problems or litigation during the past year. The Trustees concluded that they were satisfied with the nature, extent, and quality of the services proposed to be provided by the Adviser pursuant to the Advisory Agreement. |

| 2. | Investment Performance of Adviser. The Trustees noted that while the Fund had not commenced operations and thus did not have investment performance information to review, the Trustees could consider the investment performance of the Adviser’s other fund of fund products. While recognizing that the other funds may not be subject to the same operations, expenses and restrictions as the Fund, the Trustees noted that the Adviser’s performance generally compared favorably with the HFRI Fund of Funds Index and the HFRI Equity Hedged Index for the periods since 2004 while deviations from the S&P 500 could generally be explained by the hedged nature of the investment portfolios. The Trustees concluded that they were satisfied with the Adviser’s performance. |

| 3. | The costs of the services to be provided and profits to be realized by the Adviser from its relationship with the Fund. The Trustees considered the financial condition of the Adviser based on its balance sheet as of May 31, 2014 and other related data including assets under management. The Trustees discussed the fact that the Adviser does not currently subscribe to errors and omission insurance and the reasons therefore. Mr. Kuttner agreed to further consider retaining errors and omission insurance on behalf of the Adviser to ensure sufficient coverage for potential liabilities under the Advisory Agreement. The Trustees reviewed the Adviser’s projected profitability on services to be rendered to the Fund over a twelve month period noting in particular that the Adviser would be waiving fees during the period in order to satisfy proposed contractual caps on Fund expenses and that the Adviser would be subsidizing the marketing and distribution of the Fund. The Trustees compared the management fee to be charged to the Fund to those paid by other fund of fund products managed by the Adviser noting that the Fund’s management fee is slightly lower than the fees paid by such other accounts. The Trustees compared the expected fees and expenses of the Fund (including the management fee) to certain other closed-end fund of funds that utilize alternative investment strategies. The Trustees noted that while the proposed management fee to be paid to the Adviser is higher than the average and median of the peer group, the projected net expense ratio of the Fund (excluding acquired fund fees) is equal to the peer group’s median. The Trustees considered the relatively high level of fees and expenses of the private investment companies in which the Fund expects to invest, noting that the higher expense may be attributed to the solid performance of these funds and related performance fees earned. The Trustees concluded that the Adviser’s projected |

27

| | profitability is reasonable, that its assets were sufficient to provide the services called for by the Advisory Agreement and that the Adviser’s assets, coupled with the retention of errors and omissions coverage would be sufficient to cover potential liabilities under the Advisory Agreement. |

| 4. | The extent to which economies of scale would be realized as the Fund grows and whether advisory fee levels reflect these economies of scale for the benefit of the Fund’s investors. The Trustees considered the Fund’s fee arrangements with Adviser and noted that the management fee would stay the same as asset levels increased, noting, however, that the shareholders of the Fund would benefit from the proposed cap on Fund expenses. The Trustees noted the Adviser’s representation that the firm would re-evaluate the advisory fee as assets in the Fund increase and that the Fund would benefit from economies of scale under the Trust’s agreements with service providers other than the Adviser. The Trustees also discussed the Fund’s projected asset levels and expectations for growth in relation to the proposed management fees. The Board determined that the Fund’s fee arrangements with the Adviser were fair and reasonable. |

| 5. | Other potential benefits to Cross Shore. The Board noted that the Adviser would benefit from its relationship with the Fund as the firm may gain introductions to fund managers through its work for the Fund that might fit the investment criteria of the Adviser’s other managed funds. Similarly, in marketing the Fund, the Adviser may discover opportunities which benefit the Adviser. The Trustees concluded that the anticipated benefits to be realized by Adviser from managing the Fund were acceptable. |

28

CROSS SHORE DISCOVERY FUND

Privacy Policy

August 6, 2014

Cross Shore Discovery Fund (the “Trust”) adopts the following privacy policy in order to safeguard the personal information of its consumers and customers that are individuals in accordance with Securities and Exchange Commission Regulation S-P,17 CFR 284.30.

We collect only relevant information about the Trust’s shareholders that the law allows or requires us to have in order to conduct our business and properly service you. We collect financial and personal information about you (“Personal Information”) directly (e.g., information on account applications and other forms, such as your name, address, and social security number, and information provided to access account information or conduct account transactions online, such as password, account number, e-mail address, and alternate telephone number), and indirectly (e.g., information about your transactions with us, such as transaction amounts, account balance and account holdings).

The Trust does not disclose any non-public personal information about its shareholders or former shareholders other than for everyday business purposes such as to process a transaction, service an account, to respond to court orders and legal investigations or as otherwise permitted by law. Third parties that may receive this information include companies that provide transfer agency, technology and administrative services to the Trust, as well as the Trust’s investment adviser who is an affiliate of the Trust. If you maintain a retirement/educational custodial account directly with the Trust, we may also disclose your Personal Information to the custodian for that account for shareholder servicing purposes. We limit access to your Personal Information provided to unaffiliated third parties to information necessary to carry out their assigned responsibilities to the Trust. All shareholder records will be disposed of in accordance with applicable law.

The Trust maintains physical, electronic and procedural safeguards to protect Personal Information and requires its third parties service provides with access to such information to treat the Personal Information with the same high degree of confidentiality.

In the event that a shareholder holds shares of the Trust through a financial intermediary, including, but not limited to, a broker-dealer, bank, credit union or trust company, the privacy policy of the shareholders’ financial intermediary would govern how their non-public personal information would be shared with unaffiliated third parties.

29

PROXY VOTING

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities and information regarding how the Fund voted those proxies is available without charge upon request by (1) calling the Fund at (844) 300-7828 and (2) from Fund documents filed with the Securities and Exchange Commission (“SEC”) on the SEC’s website at www.sec.gov.

TRUSTEES

Neil Kuttner, Chairman

David J. Gruber

Thomas E. Niehaus

OFFICERS

Neil Kuttner, Chief Executive Officer and President

Bryan Haft, Principal Financial Officer and Treasurer

Steven Hoffman, Chief Compliance Officer, AML Officer

Carol J. Highsmith, Secretary

INVESTMENT ADVISER

Cross Shore Capital Management, LLC

111 Great Neck Road, Suite 210

Great Neck, NY 11021

DISTRIBUTOR

Unified Financial Securities, Inc.

2960 North Meridian Street, Suite 300

Indianapolis, IN 46208

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Ernst & Young LLP

5 Times Square

New York, NY 10036

LEGAL COUNSEL

Bernstein Shur

100 Middle Street P.O. Box 9729

Portland, ME 04104

CUSTODIAN

Huntington National Bank

41 S. High St.

Columbus, OH 43215

ADMINISTRATOR AND FUND ACCOUNTANT

Citco Mutual Fund Services, Inc.

One Columbus Center

10 West Broad Street, Suite 2475

Columbus, OH 43215

TRANSFER AGENT

Huntington Asset Services, Inc.

2960 North Meridian Street, Suite 300

Indianapolis, IN 46208

This report is intended only for the information of shareholders or those who have received the Fund’s prospectus which contains information about the Fund’s management fee and expenses. Please read the prospectus carefully before investing.

Distributed by Unified Financial Securities, Inc.

Member FINRA/SIPC

As of the end of the period covered by this report, the registrant has adopted a code of ethics that applies to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party. Pursuant to Item 12(a)(1), a copy of registrant’s code of ethics is filed as an exhibit to this Form N-CSR. During the period covered by this report, the code of ethics has not been amended, and the registrant has not granted any waivers, including implicit waivers, from the provisions of the code of ethics.

| Item 3. | Audit Committee Financial Expert. |

a)(1) The registrant’s Board of Trustees has determined that the registrant has at least one audit committee financial expert serving on its audit committee.

(a)(2) The audit committee financial expert is David J. Gruber, who is “independent” for purposes of this Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services.

| | | | | | |

Registrant | | | | | |

Cross Shore Discovery Fund: | | FY 2015 | | $ | 55,000 | |

| | | | | | |

Registrant | | | | | |

Cross Shore Discovery Fund: | | FY 2015 | | $ | 0 | |

| | | | | | |

Registrant | | | | | |

Cross Shore Discovery Fund: | | FY 2015 | | $ | 11,750 | |

Nature of the fees: Preparation of the 1120 RIC and Excise review

| | | | | | |

Registrant | | | | | |

Cross Shore Discovery Fund: | | FY 2015 | | $ | 0 | |

(e) (1) Audit Committee’s Pre-Approval Policies

The Audit Committee Charter requires the Audit Committee to be responsible for the selection, retention or termination of auditors and, in connection therewith, to (i) evaluate the proposed fees and other compensation, if any, to be paid to the auditors, (ii) evaluate the independence of the auditors, (iii) pre-approve all audit services and, when appropriate, any non-audit services provided by the independent auditors to the Fund, (iv) pre-approve, when appropriate, any non-audit services provided by the independent auditors to the Fund’s investment adviser, or any entity controlling, controlled by, or under common control with the investment adviser and that provides ongoing services to the Fund if the engagement relates directly to the operations and financial reporting of the Fund, and (v) receive the auditors’ specific representations as to their independence;

| | (2) | Percentages of Services Approved by the Audit Committee |

| | | | |

Registrant | | | |

Audit-Related Fees: | | | 100 | % |

Tax Fees: | | | 100 | % |

All Other Fees: | | | 100 | % |

(f) During audit of registrant’s financial statements for the most recent fiscal year, less than 50 percent of the hours expended on the principal accountant’s engagement were attributed to work performed by persons other than the principal accountant’s full-time, permanent employees.