UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22976

Cross Shore Discovery Fund

(Exact name of registrant as specified in charter)

Huntington Asset Services, Inc.

2960 N. Meridian Street, Suite 300

Indianapolis, IN 46208

(Address of principal executive offices) (Zip code)

Neil Kuttner, President and Principal Executive Officer

Cross Shore Discovery Fund

2960 N. Meridian Street, Suite 300

Indianapolis, Indiana 46208

(Name and address of agent for service)

With a copy to:

Leslie K. Klenk

Bernstein Shur

100 Middle Street

Portland, Maine 04101

Registrant’s telephone number, including area code: 317-917-7000

Date of fiscal year end: 3/31

Date of reporting period: 9/30/15

Item 1. Reports to Stockholders.

Cross Shore Discovery Fund

Semi-Annual Report

September 30, 2015

Cross Shore Capital Management, LLC

111 Great Neck Road

Suite 210

Great Neck, NY 11021

Investment Results (Unaudited)

Total Returns (For the period ended September 30, 2015)

| | | | |

| |

| | | Since Inception(1) | |

Cross Shore Discovery Fund | | | (1.5)% | |

S&P 500(R) Index(2) | | | (5.3)% | |

HFRI Equity Hedge Index(3) | | | (2.2)% | |

|

The returns shown do not reflect the deduction of taxes that a shareholder

would pay on Fund distributions or the redemption of Fund shares. | |

Performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. All performance figures are presented net of fees.

Investors should carefully consider the investment objectives, risks, charges and expenses of the Cross Shore Discovery Fund. This and other important information about the Fund is contained in the prospectus, which can be obtained at www.crossshorefunds.com or by calling (844) 300-7828. The prospectus should be read carefully before investing.

The Cross Shore Discovery Fund is distributed by Unified Financial Securities, Inc. (Member FINRA).

| (1) | | For the period from January 2, 2015 (inception date of the Fund) to September 30, 2015. |

| (2) | | The S&P 500 Index is a widely recognized unmanaged index of equity prices and is representative of a broader market and range of securities than is found in the Fund’s portfolio. The index returns do not reflect the deduction of expenses, which have been deducted from the Fund’s returns. The Index returns assume reinvestment of all distributions and does not reflect the deduction of taxes and fees. Individuals cannot invest directly in the Index. |

| (3) | | The HFRI Equity Hedge Index, an equally weighted performance index, consists of investment managers who maintain positions both long and short in primarily equity and equity derivative securities. HFRI data may include estimated returns and is subject to revision per HFRI policies and procedures. |

1

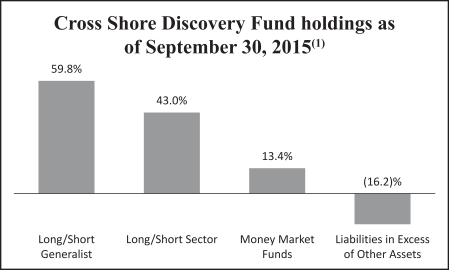

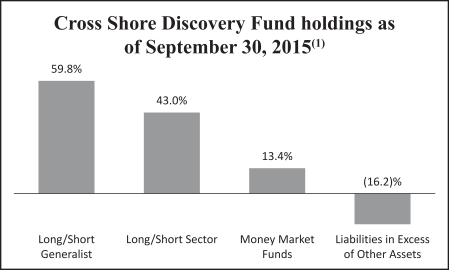

Fund Holdings (Unaudited)

| (1) | | As a percentage of net assets. |

Availability of Portfolio Schedule – (Unaudited)

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available at the SEC’s website at www.sec.gov. The Fund’s Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

2

This page is intentionally left blank.

Schedule of Investments (Unaudited)

September 30, 2015

| | | | |

| Portfolio Funds | | Strategy | | % of

Net Assets |

Long/Short Generalist: | | | | |

Sachem Head Offshore, Ltd., Common Series | | Generalist | | 5.0% |

Sachem Head Offshore, Ltd., Founders Series | | Generalist | | 4.9% |

| | | | |

Total Sachem Head Offshore, Ltd. | | | | 9.9% |

Lucerne Capital Offshore Fund, Ltd., Class A | | Generalist | | 9.4% |

Atika Offshore Fund, Ltd., Class A, Series 1 | | Generalist | | 5.8% |

Shellback Offshore Fund, Ltd., Class C, Series 2014-04 | | Generalist | | 4.6% |

Shellback Offshore Fund, Ltd., Class C, Series S | | Generalist | | 0.7% |

| | | | |

Total Shellback Offshore Fund, Ltd. | | | | 5.3% |

Bloom Tree Offshore Fund, Ltd., Class A-1, Series 2012-07 | | Generalist | | 4.3% |

Bloom Tree Offshore Fund, Ltd., Class A-5, Series 2015-09 | | Generalist | | 0.8% |

| | | | |

Total Bloom Tree Offshore Fund, Ltd. | | | | 5.1% |

Lomas Capital, Ltd., Class A, Series 15 | | Generalist | | 5.1% |

Tiger Legatus Offshore Fund, Ltd., Class A, Series 1 | | Generalist | | 4.6% |

Incline Global Offshore, Ltd., Class I | | Generalist | | 4.0% |

Marcato Encore International, Ltd., Class A, Series 1 | | Generalist | | 4.0% |

Rivulet Capital Offshore Fund, Ltd., Series 2 | | Generalist | | 4.0% |

Riverloft Offshore Fund, Ltd., Class B-1,0 Series 2014-08 | | Generalist | | 2.6% |

| | | | |

Total Generalist | | | | 59.8% |

Long/Short Sector: | | | | |

Long Pond Offshore, Ltd., Class A, Series 2010-11 | | Real Estate | | 5.5% |

Long Pond Offshore, Ltd., Class C, Series 2015-04 | | Real Estate | | 5.1% |

| | | | |

Total Long Pond Offshore, Ltd. | | | | 10.6% |

Suvretta Offshore Fund, Ltd., Class 1-C, Series 2015-01A | | Consumer, TMT | | 5.4% |

Suvretta Offshore Fund, Ltd., Class 1-B, Series 2015-04 | | Consumer, TMT | | 5.0% |

| | | | |

Total Suvretta Offshore Fund, Ltd. | | | | 10.4% |

Armistice Capital Offshore Fund, Ltd., Class A2, Series 2015-02 | | Healthcare, Consumer | | 4.8% |

Armistice Capital Offshore Fund, Ltd., Class A2, Series 2015-09 | | Healthcare, Consumer | | 0.6% |

| | | | |

Total Armistice Capital Offshore Fund, Ltd. | | | | 5.4% |

Light Street Xenon, Ltd., Class A, Series N | | TMT | | 5.1% |

Game Creek Offshore Fund, Ltd., Class 1 | | Consumer, TMT | | 4.2% |

Krensavage Offshore Fund, Ltd., Class A, Series 1 | | Healthcare | | 3.9% |

Whale Rock Flagship Fund, Ltd., Class A-1, Series 2015-04 | | TMT | | 3.4% |

| | | | |

Total Sector | | | | 43.0% |

| | | | |

Total Investments In Portfolio Funds | | | | 102.8% |

| | | | |

See accompanying notes which are an integral part of these financial statements.

4

Schedule of Investments (continued) (Unaudited)

September 30, 2015

| | | | | | | | | | | | | | |

| Cost(1) | | | Fair Value | | | Initial Acquisition Date | | Redemption

Frequency(2) | | Next Available Redemption Date | |

| | | | | | | | | | | | | | |

| $ | 1,500,000 | | | $ | 1,445,407 | | | 4/1/2015 | | Quarterly | | | 12/31/2015 | (3) |

| | 1,316,735 | | | | 1,412,467 | | | 1/2/2015 | | Quarterly | | | 12/31/2015 | (3) |

| | | | | | | | |

| | 2,816,735 | | | | 2,857,874 | | | | | | | | | |

| | 3,000,000 | | | | 2,681,749 | | | 4/1/2015 | | Quarterly | | | 12/31/2015 | (4) |

| | 1,457,098 | | | | 1,647,874 | | | 1/2/2015 | | Quarterly | | | 12/31/2015 | (5) |

| | 1,309,607 | | | | 1,329,789 | | | 1/2/2015 | | Quarterly | | | 12/31/2015 | |

| | 200,000 | | | | 197,102 | | | 9/1/2015 | | Quarterly | | | 12/31/2015 | |

| | | | | | | | |

| | 1,509,607 | | | | 1,526,891 | | | | | | | | | |

| | 1,165,168 | | | | 1,229,729 | | | 1/2/2015 | | Quarterly | | | 12/31/2015 | |

| | 250,000 | | | | 239,122 | | | 9/1/2015 | | Quarterly | | | 12/31/2015 | |

| | | | | | | | |

| | 1,415,168 | | | | 1,468,851 | | | | | | | | | |

| | 1,438,724 | | | | 1,463,113 | | | 1/2/2015 | | Quarterly | | | 12/31/2015 | |

| | 1,290,149 | | | | 1,311,898 | | | 1/2/2015 | | Quarterly | | | 12/31/2015 | |

| | 1,250,000 | | | | 1,156,142 | | | 6/1/2015 | | Quarterly | | | 12/31/2015 | (5)(6) |

| | 1,250,000 | | | | 1,143,495 | | | 7/1/2015 | | Quarterly | | | 12/31/2015 | (3) |

| | 1,250,000 | | | | 1,143,757 | | | 6/1/2015 | | Quarterly | | | 12/31/2015 | (3) |

| | 880,240 | | | | 745,219 | | | 1/2/2015 | | Quarterly | | | 12/31/2015 | (3) |

| | | | | | | | |

| $ | 17,557,721 | | | $ | 17,146,863 | | | | | | | | | |

| | | | | | | | | | | | |

| | 1,552,612 | | | | 1,575,494 | | | 1/2/2015 | | Quarterly | | | 12/31/2015 | |

| | 1,500,000 | | | | 1,458,102 | | | 4/1/2015 | | Quarterly | | | 12/31/2015 | (5) |

| | | | | | | | |

| | 3,052,612 | | | | 3,033,596 | | | | | | | | | |

| | 1,495,566 | | | | 1,558,048 | | | 1/2/2015 | | Quarterly | | | 12/31/2015 | |

| | 1,500,000 | | | | 1,423,531 | | | 4/1/2015 | | Quarterly | | | 12/31/2015 | (7) |

| | | | | | | | |

| | 2,995,566 | | | | 2,981,579 | | | | | | | | | |

| | 1,367,892 | | | | 1,359,220 | | | 1/2/2015 | | Quarterly | | | 12/31/2015 | |

| | 200,000 | | | | 177,560 | | | 9/1/2015 | | Quarterly | | | 12/31/2015 | |

| | | | | | | | |

| | 1,567,892 | | | | 1,536,780 | | | | | | | | | |

| | 1,456,937 | | | | 1,467,285 | | | 1/2/2015 | | Quarterly | | | 12/31/2015 | |

| | 1,194,735 | | | | 1,188,624 | | | 1/2/2015 | | Quarterly | | | 12/31/2015 | |

| | 1,250,000 | | | | 1,109,654 | | | 7/1/2015 | | Quarterly | | | 12/31/2015 | (5) |

| | 1,000,000 | | | | 969,688 | | | 4/1/2015 | | Quarterly | | | 12/31/2015 | (8) |

| | | | | | | | |

| $ | 12,517,742 | | | $ | 12,287,206 | | | | | | | | | |

| | | | | | | | | | |

| $ | 30,075,463 | | | $ | 29,434,069 | | | | | | | | | |

| | | | | | | | |

See accompanying notes which are an integral part of these financial statements.

5

Schedule of Investments (Unaudited) (continued)

September 30, 2015

| | | | | | | | | | | | |

| Portfolio Funds | | Shares | | % of Net Assets | | Cost | | | Fair Value | |

| | | | | | | | | | | | |

Money Market Funds: | | | | | | | | | | | | |

Fidelity Institutional Money Market Portfolio, Institutional Class, 0.17%(9) | | 3,846,979 | | 13.4% | | $ | 3,846,979 | | | $ | 3,846,979 | |

| | | | | | | | | | | | |

Total Investments | | | | 116.2% | | $ | 33,922,442 | | | $ | 33,281,048 | |

| | | | | | | | | | | | |

Liabilities in Excess of Other Assets | | | | (16.2)% | | | | | | $ | (4,635,593 | ) |

| | | | | | | | | | | | |

Net Assets | | | | 100.0% | | $ | 33,922,442 | | | $ | 28,645,455 | |

| | | | | | | | | | | | |

| (1) | | There were no unfunded capital commitments as of September 30, 2015. |

| (2) | | Certain redemptions may be subject to various restrictions and limitations such as redemption penalties on investments liquidated within a certain period subsequent to investment (e.g. a soft lock-up), investor-level gates and/or Portfolio Fund-level gates. Redemption notice periods range from 30 to 65 days. |

| (3) | | Subject to 25% investor level quarterly gate. |

| (4) | | Subject to 2% soft lock during the first year of investment. |

| (5) | | Subject to 3% soft lock during the first year of investment. |

| (6) | | Subject to 50% investor level quarterly gate. |

| (7) | | Subject to 3% soft lock during the first two years of investment. |

| (8) | | Subject to 4% soft lock during the first year of investment. |

| (9) | | Rate disclosed is the seven day yield as of September 30, 2015. |

| TMT | | – Technology, Media and Telecom |

See accompanying notes which are an integral part of these financial statements.

6

Statement of Assets and Liabilities

September 30, 2015 (Unaudited)

| | | | |

Assets | | | | |

Cash | | $ | 3,529,691 | |

Investments in Portfolio Funds and Money Market Funds, at fair value (cost $33,922,442) | | | 33,281,048 | |

Deferred offering costs | | | 20,213 | |

Prepaid expenses | | | 11,889 | |

Total assets | | | 36,842,841 | |

Liabilities | | | | |

Subscriptions received in advance | | | 4,285,643 | |

Payable for redemption of shares | | | 3,750,000 | |

Payable to Adviser | | | 86,977 | |

Payable for audit fees | | | 51,774 | |

Payable for Chief Compliance Officer (“CCO”) fees | | | 5,083 | |

Payable for administration fees | | | 3,125 | |

Payable for fund accounting fees | | | 2,083 | |

Payable for custody fees | | | 2,652 | |

Other accrued expenses | | | 10,049 | |

Total liabilities | | | 8,197,386 | |

Net Assets | | $ | 28,645,455 | |

Net Assets Consist Of | | | | |

Paid-in capital | | $ | 29,714,643 | |

Accumulated net investment loss | | | (427,794 | ) |

Accumulated net realized gain/(loss) from investment transactions | | | – | |

Net unrealized appreciation / (depreciation) on investments | | | (641,394 | ) |

| | | $ | 28,645,455 | |

Net Asset Value Per Share | | | | |

Institutional Shares (based on 290,860 shares outstanding; 500,000 shares authorized) | | $ | 98.48 | (1) |

| (1) | | The net asset value per share does not recalculate due to rounding of net assets and/or shares outstanding. |

7

See accompanying notes which are an integral part of these financial statements.

Statement of Operations

For the six months ended September 30, 2015 (Unaudited)

| | | | |

Investment Income | | | | |

Dividend income | | $ | 51 | |

Expenses | | | | |

Adviser | | | 286,534 | |

Administration | | | 18,750 | |

Fund accounting | | | 12,500 | |

CCO | | | 15,500 | |

Transfer agent | | | 10,000 | |

Legal | | | 16,000 | |

Registration | | | 10,866 | |

Custodian | | | 6,866 | |

Audit | | | 38,524 | |

Trustee | | | 10,068 | |

Insurance | | | 4,841 | |

Printing | | | 8,960 | |

Amortization of offering cost | | | 39,130 | |

Miscellaneous | | | 10,360 | |

Total expenses | | | 488,899 | |

Expenses waived and reimbursed by Adviser | | | (120,498 | ) |

Net expenses | | | 368,401 | |

Net investment loss | | | (368,350 | ) |

Realized and Unrealized Gain from Investments in Portfolio Funds | | | | |

Net realized gain/(loss) on sale of investments in Portfolio Funds | | | – | |

Net change in unrealized appreciation/(depreciation) from investments in Portfolio Funds | | | (1,280,786 | ) |

Net decrease in net assets resulting from operations | | $ | (1,649,136 | ) |

8

See accompanying notes which are an integral part of these financial statements.

Statements of Changes in Net Assets

| | | | | | | | |

| | | For The Six Months Ended

September 30, 2015

(Unaudited) | | | For The Period Ended

March 31, 2015 (1) | |

Increase In Net Assets Resulting From Operations | | | | | | | | |

Net investment loss | | $ | (368,350 | ) | | $ | (88,917 | ) |

Net realized gain/(loss) on sale of investments in Portfolio Funds | | | – | | | | – | |

Net change in unrealized appreciation/(depreciation) from investments in Portfolio Funds | | | (1,280,786 | ) | | | 639,392 | |

Net increase/(decrease) in net assets resulting from operations | | | (1,649,136 | ) | | | 550,475 | |

Capital Share Transactions | | | | | | | | |

Proceeds from issuance of shares | | | 17,751,000 | | | | 167,654 | |

Proceeds from subscriptions-in-kind | | | – | | | | 15,575,462 | |

Payments for redemption of shares | | | (3,750,000 | ) | | | – | |

Net increase in net assets resulting from capital share transactions | | | 14,001,000 | | | | 15,743,116 | |

Net increase in net assets | | | 12,351,864 | | | | 16,293,591 | |

Net assets at beginning of period | | | 16,293,591 | | | | – | |

Net assets at end of period | | $ | 28,645,455 | | | $ | 16,293,591 | |

Accumulated net investment loss | | $ | (427,794 | ) | | $ | (59,444 | ) |

Share Transactions | | | | | | | | |

Shares issued | | | 171,514 | | | | 157,425 | |

Shares redeemed | | | (38,079 | ) | | | – | |

Net increase in share transactions | | | 133,435 | | | | 157,425 | |

| (1) | | For the period from January 2, 2015 (inception date of the Fund) to March 31, 2015. |

9

See accompanying notes which are an integral part of these financial statements.

Financial Highlights

| | | | | | | | |

| | | For The Six Months Ended

September 30, 2015

(Unaudited) | | | For The Period

January 30, 2015

to March 31, 2015(1) | |

Per Share Operating Performance | | | | | | | | |

Net asset value, beginning of period | | | $103.50 | | | | $98.99 | |

| | |

Investment operations: | | | | | | | | |

| | |

Net investment loss | | | (1.27 | ) | | | (0.38 | )(2) |

| | |

Net unrealized gains/(losses) from investments in Portfolio Funds | | | (3.75 | ) | | | 4.89 | |

| | | | | | | | |

| | |

Net change in net assets resulting from operations | | | (5.02 | ) | | | 4.51 | |

| | | | | | | | |

| | |

Net asset value, end of period | | | $98.48 | | | | $103.50 | |

| | | | | | | | |

| | |

Total return(3) | | | (4.85 | )%(4) | | | 4.56 | %(4) |

| | |

Net assets, end of period | | | $28,645,455 | | | | $16,293,591 | |

| | | | | | | | |

Ratios To Average Net Assets(5) | | | | | | | | |

Expenses after waiver and reimbursement | | | 2.25 | %(6) | | | 2.25 | %(6) |

| | |

Expenses before waiver and reimbursement | | | 2.99 | %(6) | | | 5.11 | %(6) |

| | |

Net investment income after waiver and reimbursement | | | (2.25 | )%(6) | | | (2.25 | )%(6) |

| | |

Net investment income before waiver and reimbursement | | | (2.99 | )%(6) | | | (5.11 | )%(6) |

| | |

Portfolio turnover rate | | | 0.00 | %(4) | | | 0.00 | %(4) |

| (1) | | The period of the financial highlights are from the date of effectiveness of the Fund’s registration statement under the Investment Company Act of 1940, as amended, and the Securities Act of 1933, as amended, through March 31, 2015. |

| (2) | | Calculated based on the average shares outstanding during the period, January 30, 2015 to March 31, 2015. |

| (3) | | Total return in the above table represents the rate an investor would have earned or lost on an investment in the Fund, assuming reinvestment of dividends, if any. |

| (5) | | The ratios do not reflect the Fund’s proportionate share of income and expenses of the underlying Portfolio Funds. |

10

See accompanying notes which are an integral part of these financial statements.

Notes to Financial Statements (Unaudited)

September 30, 2015

1. Organization

Cross Shore Discovery Fund (the “Fund”) was organized on May 21, 2014 as a Delaware statutory trust. The Fund commenced operations on January 2, 2015. The Fund is registered under the Investment Company Act of 1940, as amended (the “1940 Act”) as a non-diversified closed-end management investment company and offers interests (“Shares”) registered under the 1940 Act and the Securities Act of 1933, as amended. The Fund’s initial registration under the 1940 Act and the Securities Act of 1933 became effective on January 30, 2015. The Fund operates as a “fund of hedge funds”. The Fund provides investors access to a variety of professionally managed private investment funds (“hedge funds”) that predominately employ equity long/short strategies (each a “Portfolio Fund”). The Portfolio Funds are not registered under the 1940 Act and are generally organized outside of the United States (“U.S.”). The Fund currently offers one class of shares (“Institutional Shares”).

Under the Fund’s organizational documents, its officers and Board of Trustees (“Board”) are indemnified against certain liabilities arising out of the performance of their duties to the Fund. In addition, in the normal course of business, the Fund may enter into contracts with vendors and others that provide for general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund. However, based on experience, the Fund expects that risk of loss to be remote.

2. Significant Accounting Policies

The Fund is an investment company and follows accounting and reporting guidance under Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946, “Financial Services-Investment Companies”. The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements. The policies are in conformity with generally accepted accounting principles in the United States of America (“GAAP”).

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the amounts of assets, liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses for the period. Actual results could differ from those estimates.

A. Portfolio Fund Transactions and Income Recognition

Investments in Portfolio Funds are recorded on a subscription effective date basis, which is generally the first day of the calendar month in which the investment is effective. Realized gains and losses are calculated on a specific identification method when redemptions are accepted by a Portfolio Fund which is generally on the last day of the calendar month. Interest income, if any, and expense are accrued each month. Dividends, less foreign tax withholding (if any), are recorded on the ex-dividend date.

B. Investment Valuation and Risks

The Fund will calculate the net asset value (“NAV”) of the Institutional Shares as of the close of business on the last business day of each calendar month and at such other times as the Board may determine, including in connection with the repurchase of Institutional Shares.

11

Notes to Financial Statements (Unaudited) (continued)

September 30, 2015

Because the Fund invests all or substantially all of its assets in Portfolio Funds, the NAV of the Institutional Shares will depend on the value of the Portfolio Funds. The NAV’s of Portfolio Funds are generally not available from pricing vendors, nor are they calculable independently by the Fund or by Cross Shore Capital Management, LLC, the Fund’s investment adviser (the “Adviser”).

Accordingly, the Board has approved procedures pursuant to which the Fund will value its investments in the Portfolio Funds at fair value (the “Valuation Procedures”). Under the Valuation Procedures, the Adviser is responsible for determining the fair value of each Portfolio Fund as of each date upon which Institutional Shares calculates its NAV (the “NAV Date”). The Valuation Procedures require the Adviser to consider all relevant information when assessing and determining the fair value of the Fund’s interest in each Portfolio Fund and to make all fair value determinations in good faith. All fair value determinations made by the Adviser are subject to the review and supervision of the Board through its Valuation Committee. The Board’s Valuation Committee will be responsible for ensuring that the valuation process utilized by the Adviser is fair to the Fund and consistent with applicable regulatory guidelines.

As a general matter, the fair value of the Fund’s interest in a Portfolio Fund will be the amount that the Fund could reasonably expect to receive from the Portfolio Fund if the Fund’s interest in the Portfolio Fund was redeemed as of the NAV Date. In accordance with the Valuation Procedures, the fair value of the Fund’s interest in a Portfolio Fund as of a NAV Date will ordinarily be the most recent NAV reported by a Portfolio Fund’s Investment Manager or third party administrator (“Portfolio Fund Management”). In the event that the last reported NAV of a Portfolio Fund is not as of the NAV Date, the Adviser may use other information that it believes should be taken into consideration in determining the Portfolio Fund’s fair value as of the NAV Date including benchmark or other triggers to determine any significant market movement that has occurred between the effective date of the most recent NAV reported by the Portfolio Fund and the NAV Date.

Because a Portfolio Fund is not registered under the 1940 Act and its governing documents typically do not impose significant investment restrictions, the Portfolio Fund may also, without limitation or prior notice to the Adviser, invest and trade in a broad range of securities, derivatives and other financial instruments (collectively, “Assets”). While, generally, each Portfolio Fund carries its investments at fair value, these investments are associated with a varying degree of off-balance sheet risks, including both market and credit risks. Market risk is the risk of potential adverse changes to the value of the Assets because of the changes in market conditions such as interest and currency rate movements and volatility of Asset values. Credit risk is the risk of the potential inability of counterparties to perform the terms of the contracts, which may be in excess of the amounts recorded in the Portfolio Funds’ respective balance sheets. In addition, the Portfolio Funds will engage in the short sale of securities. A short sale of a security not owned by a Portfolio Fund involves the sale of a security that is borrowed from a counterparty to complete the sale. The sale of a borrowed security may result in a loss if the price of the borrowed security increases after the sale. Purchasing securities to close out the short position can itself cause their market price to rise further, increasing losses. Furthermore, a short seller may be prematurely forced to close out a short position if a counterparty demands the return of borrowed securities. Losses on short sales are theoretically unlimited, although losses to the Fund are limited to its investment in a particular Portfolio Fund.

12

Notes to Financial Statements (Unaudited) (continued)

September 30, 2015

The Fund’s interests in Portfolio Funds are also illiquid and subject to substantial restrictions on transferability. The Fund may not be able to acquire initial or additional interests in a Portfolio Fund or withdraw all or a portion of its investment from a Portfolio Fund promptly after it has made a decision to do so because of limitations set forth in that fund’s governing documents.

Generally, the fair value of the Fund’s investments in a Portfolio Fund represents the Fund’s proportionate share of that Portfolio Fund’s net assets as reported by applicable Portfolio Fund Management. All valuations were determined by the Adviser consistent with the Fund’s Valuation Procedures and are net of management and incentive fees pursuant to the Portfolio Funds’ applicable agreements. The fair value represents the amount the Fund expects to receive, gross of redemption fees or penalties, at September 30, 2015, if it were to liquidate its investments in the Portfolio Funds. Because of the inherent uncertainly of valuation, the value of investments in the Portfolio Funds held by the Fund may differ significantly from the values that would have been used had a ready market existed, and differences could be material.

Pursuant to the Valuation Procedures, the Adviser may conclude in certain circumstances that, after considering information reasonably available at the time the valuation is made and that the Adviser believes to be reliable, the balance provided by a Portfolio Fund Management does not represent the fair value of the Fund’s interest in the Portfolio Fund. In addition, in the absence of specific transaction activity in the interests of a particular Portfolio Fund, the Adviser could consider whether it was appropriate, in light of all relevant circumstances, to value such a position at the Portfolio Fund’s net assets as reported at the time of valuation, or whether to adjust such value to reflect a premium or discount to the reported net assets. Any such decision is made in good faith and is subject to the review and supervision of the Board.

In determining fair values as of September 30, 2015, the Adviser has, as a practical expedient, estimated fair value of each Portfolio Fund using the NAV (or its equivalent) provided by the Portfolio Fund Management of each Portfolio Fund as of that date.

Investments in money market mutual funds are generally priced at the ending NAV provided by the service agent of the funds. Accordingly, money market mutual funds with a fair value of $3,846,979 have been categorized as Level 1 in the fair value hierarchy.

The valuation techniques described maximize the use of observable inputs and minimize the use of unobservable inputs in determining fair value. The inputs used for valuing the Fund’s investments are summarized in the three broad levels listed below:

| | • | | Level 1 – Unadjusted quoted prices in active markets for identical investments and/or registered investment companies where the value per share is determined and published and is the basis for current transactions for identical assets or liabilities at the valuation date. |

| | • | | Level 2 – Quoted prices in markets that are not active or financial instruments for which all significant inputs are observable, either directly or indirectly. |

| | • | | Level 3 – Inputs, broadly referred to as the assumptions that market participants use to make valuation decisions, are unobservable and reflect the Adviser’s best estimate of what market participants would use in pricing the financial instrument at the measurement date. |

13

Notes to Financial Statements (Unaudited) (continued)

September 30, 2015

Changes in valuation techniques may result in transfers in or out of an assigned level with the disclosure hierarchy. The Fund recognizes transfer between fair value hierarchy levels at the reporting period end. The inputs or methodology used for valuing investments is not necessarily an indication of the risk associated with investing in those investments.

In May 2015, the FASB issued Accounting Standards Update (“ASU”) No. 2015-07 (“ASU 2015-07”), Fair Value Measurement (Topic 820), Disclosures for Investments in Certain Entities That Calculate Net Asset Value per Share (or its Equivalent). ASU 2015-07 removes the requirement to categorize within the fair value hierarchy all investments for which fair value is measured using the NAV per share practical expedient. As permitted, the Fund has elected to early adopt ASU 2015-07 for its September 30, 2015 financial statements. Accordingly, Portfolio Funds with a fair value of $29,434,069 have not been categorized in the fair value hierarchy.

3. Investment Strategies

The Fund seeks to invest at least 80% of its total assets in Portfolio Funds that predominantly employ equity long/short strategies. Generally, the equity long/short strategies employed by the Portfolio Funds involve taking long and short positions in the equity securities (or the equivalent thereof) of U.S. and foreign issuers. These long and short positions are created by purchasing and selling short specific equity securities or groups of equity securities.

Investment managers of the Portfolio Funds (the “Investment Managers”) may utilize a variety of investment approaches and techniques to implement their long/short equity strategies. Investment Managers, for example, may construct long and short portions based upon: (1) a mispricing of equity securities relative to each other or relative to historic norms (Relative Value Approach); (2) the effect of events on different equity securities (Event Driven Approach); (3) perceived valuations of equity securities (e.g., whether an issuer is overvalued or undervalued) (Fundamental Long/Short Approach); and/or (4) the effect of economic and political changes on the prices of equity securities (Directional Trading Approach) (collectively, “Long/Short Equity Techniques”). The Investment Managers may utilize a variety of investment styles (e.g. growth/value, small cap/large cap) and focus on specific sectors, regions (e.g. U.S., emerging markets, global) and asset classes (e.g. common stocks, preferred stocks and convertible securities) to implement their long/short equity strategies.

While it is anticipated that the Portfolio Funds will primarily invest in publicly traded U.S. and foreign common stocks, Portfolio Funds may also use other equity securities such as preferred stock, convertible securities and warrants (“Equity Securities”) to implement their equity long/short strategies. A Portfolio Fund may also invest in fixed income securities such as corporate debt obligations, government securities, municipal securities, financial institution obligations, mortgage-related securities, asset-backed securities and zero-coupon securities issued by U.S. issuers and similar securities issued by foreign issuers (collectively, “Fixed Income Securities”) on an opportunistic basis. For example, a Portfolio Fund may take a long or short position in the Fixed Income Securities of one or more specific issuers or groups of Fixed Income Securities to the extent that the Investment Manager believes that such securities constitute a better investment opportunity than corresponding Equities Securities over a given period of time. A Portfolio Fund may also take long or short positions in Fixed Income Securities as a hedge against the equity or fixed income exposure in its portfolio. It is expected that an Investment Manager may apply

14

Notes to Financial Statements (Unaudited) (continued)

September 30, 2015

techniques similar to the Long/Short Equity Techniques to implement long/short positions in Fixed Income Securities.

While a Portfolio Fund generally implements its long/short strategies by investing directly or selling short Equity and Fixed Income Securities, a Portfolio Fund may use derivatives, typically, options on Equity or Fixed Income indices (each an “Index”), futures on Indices and total return swaps involving one or a basket of Equity or Fixed Income Securities, to create synthetic exposure to these Indices/securities for the purposes of increasing portfolio profitability or for hedging against certain long/short strategy risks.

4. Investment Advisory Fee and Other Transactions with Affiliates

A. Investment Advisory Fees

The Adviser serves as the Fund’s investment adviser. The Adviser receives an annual fee of 1.75% payable monthly based on the Fund’s month-end net assets.

The Adviser has contractually agreed to waive its management fee and/or reimburse expenses to the extent necessary to ensure that the total annual Fund operating expenses attributable to the Institutional Shares will not exceed 2.25% (after fee waivers and/or expense reimbursements, and exclusive of taxes, interest, portfolio transaction expenses, acquired fund fees and expenses and extraordinary expenses not incurred in the ordinary course of the Fund’s business). The arrangements will continue until November 30, 2016 and can only be terminated prior to that day with approval from the Board. The Adviser may recoup fees waived and expenses reimbursed within three years of the year in which such waivers and reimbursements were made if such recoupment does not cause current expenses within the fiscal year to exceed the expense limit in effect at the time the expense were paid/waived.

The Amount subject to repayment by the Fund subject to the limitations noted above, at September 30, 2015 is as follows:

| | | | |

| Recoverable through March 31, | | Amount | |

2018 | | $ | 175,584 | |

2019 | | $ | 120,498 | |

B. Administration, Accounting, Compliance Services and Transfer Agent Fees

Pursuant to an agreement between the Fund and Citco Mutual Fund Services, Inc. (“Administrator”), the Administrator provides administration, fund accounting and compliance services to the Fund and supplies certain officers to the Fund including a Principal Financial Officer, a Chief Compliance Officer, and an Anti-Money Laundering Officer. The Fund pays the Administrator a basis point fee, subject to fee minimums, for both administrative and fund accounting services, a fixed fee for compliance services and certain out of pocket expenses. The Administrator has retained Huntington Asset Services, Inc. (“Huntington”) to serve as the Fund’s sub-administrator. Huntington is compensated by the Administrator for the sub-administrative services provided to the Fund.

Pursuant to a Transfer Agency Services Agreement with the Fund, Huntington provides transfer agency services to the Fund and is compensated for the provision of these services.

15

Notes to Financial Statements (Unaudited) (continued)

September 30, 2015

C. Distribution

Unified Financial Securities, Inc. (the “Distributor”) acts as principal underwriter and distributor of the Fund’s shares of beneficial interest on a best effort basis, subject to various conditions. The Distributor may retain additional broker-dealers and other financial intermediates (each a “Selling Agent”) to assist in the distribution of shares and shares are available for purchase through these Selling Agents or directly through the Distributor. Generally, shares are only offered to investors that are U.S. persons for U.S. federal income tax purposes.

D. Custodian Fees

The Huntington National Bank, N.A. (the “Custodian”), is custodian of the Fund’s investments and may maintain Fund assets with U.S. and foreign sub custodians, subject to policies and procedures approved by the Board. The Fund and the Custodian have entered into an agreement with Citco Bank (Canada) (“Citco”) to perform certain sub-custodian services to the Fund. Fees and expenses of the Custodian and Citco are paid by the Fund.

E. General

Certain officers of the Fund are officers, directors and/or trustees of the above companies. Independent trustees are paid a $10,000 annual retainer, payable in quarterly installments, for their services to the Fund. Interested trustees and officers of the Trust are not paid for services directly by the Fund. For the six months ended September 30, 2015, $10,000 was paid to the independent trustees and is included in the trustee line item of the Statement of Operations.

5. Organization and Offering Costs

The Fund bears all expenses incurred in its business and operations. The Adviser advanced some of the Fund’s organization and initial offering costs and may be subsequently reimbursed by the Fund. Reimbursements to the Adviser of organizational and offering costs are subject to the expense limitation agreement described in Note 4.

Costs of $75,669 incurred in connection with the offering and initial registration of the Fund have been deferred and are being amortized on a straight-line basis over the first twelve months after commencement of operations.

6. Capital Share Transactions

Shares of the Fund will be traded for purchase only through the Distributor, or a Selling Agent as of the first business day of each month. To provide a limited degree of liquidity to shareholders, the Fund may from time to time offer to repurchase shares pursuant to written repurchase offers, but is not obligated to do so.

Subscriptions received in advance on the Statement of Assets and Liabilities represents shareholder subscriptions received during the month of September that will be issued on the first business day of the following month.

Repurchase offers will be made at such times and on such terms as may be determined by the Board in its sole discretion and generally will be offers to repurchase an aggregate specified dollar

16

Notes to Financial Statements (Unaudited) (continued)

September 30, 2015

amount of outstanding shares or a specific number of shares. Any such offer will be made only on terms that the Board determines to be fair to the Fund and to all shareholders or persons holdings shares acquired from shareholders. When the Board determines that the Fund will repurchase shares or portions thereof, notice will be provided to each shareholder describing the terms thereof, and containing information a shareholder should consider in deciding whether and how to participate in such repurchase opportunity. The Board convenes quarterly to consider whether or not to authorize a tender offer. The Board expects that repurchase offers, if authorized, will be made no more frequently than on a quarterly basis and will typically have a valuation date as of March 31, June 30, September 30 or December 31 (or, if any such date is not a Business Day, on the last Business Day of such calendar quarter).

7. Distributions

The Fund declares and pays dividends on investment income, if any, annually. The Fund also makes distributions of net capital gains, if any, annually.

8. Federal Income Taxes

It is the policy of the Fund to qualify or continue to qualify as a regulated investment company by complying with the provisions available to certain investment companies, as defined in applicable sections of the Internal Revenue Code, and to make distributions of net investment income and net realized capital gains sufficient to relieve it from all, or substantially all, federal income taxes.

The following information is provided on a tax basis as of September 30, 2015:

| | | | |

Gross unrealized appreciation | | $ | – | |

Gross unrealized depreciation | | | (1,288,007 | ) |

Net unrealized appreciation / (depreciation) | | $ | (1,288,007 | ) |

As of September 30, 2015, the aggregate cost of investment entities for federal tax purposes was $34,569,055. The difference between the book-basis unrealized appreciation/(depreciation) is attributable primarily to the realization for tax purposes of unrealized gain/(losses) on investments in passive foreign investment companies.

As of March 31, 2015, the Fund’s most recent fiscal year end, the components of accumulated earnings (deficit) on a tax basis were as follows:

| | | | |

Undistributed ordinary income | | $ | 587,169 | |

Undistributed long-term capital gains | | | – | |

Accumulated capital and other losses | | | – | |

Unrealized appreciation / (depreciation) | | | (7,221 | ) |

Total | | $ | 579,948 | |

Under current tax law, capital losses and specified ordinary losses realized after October 31st and non-specified ordinary losses incurred after December 31st (ordinary losses collectively known as “qualified late year ordinary loss”) may be deferred and treated as occurring on the first business day of the following fiscal year.

17

Notes to Financial Statements (Unaudited) (concluded)

September 30, 2015

Management of the Fund has reviewed tax positions taken in tax years that remain subject to examination by all major tax jurisdictions, including federal (ie, all open tax periods since inception). Management believes there is no tax liability resulting from unrecognized tax benefits related to uncertain tax positions taken.

9. Control Persons and Principal Holders

A principal shareholder is any shareholder who owns of record, or beneficially, 5% or more of the outstanding shares of the Fund. A control person is a shareholder who owns beneficially, or through controlled companies, more than 25% of the voting securities of a company or acknowledges the existence of control. Shareholder owning voting securities in excess of 25% may determine the outcome of any matter affecting and voted on by shareholders of the Fund. As of September 30, 2015, Cross Shore QP Partners, LP owned 47% of the outstanding shares of the Fund.

10. Subsequent Events

Management of the Fund has evaluated the need for disclosures and/or adjustments resulting from subsequent events through the date these financial statements were issued. Subsequent to the period end, on November 13, 2015, Huntington Bancshares Inc. entered in an agreement to sell Huntington Asset Services, Inc. and Unified Financial Services, Inc. to Ultimus Fund Solutions, Inc. The sale is expected to close by the end of December 2015, subject to customary closing conditions. Management has determined that there were no additional items requiring additional disclosure.

11. Recently Issued Accounting Pronouncements

In August 2014, the FASB issued Accounting Standards Update 2014-15 “Presentation of Financial Statements – Going Concern: Disclosure of Uncertainties about an Entity’s Ability to Continue as a Going Concern” which provides guidance about management’s responsibility to evaluate whether there is substantial doubt about an entity’s ability to continue as a going concern and to provide related footnote disclosures. The amendments are effective for annual periods ending after December 15, 2016, and for annual periods and interim periods thereafter, though early adoption is permitted. In management’s evaluation, there are no uncertainties about the Fund’s ability to continue as a going concern.

18

CROSS SHORE DISCOVERY FUND

Privacy Policy

August 6, 2014

Cross Shore Discovery Fund (the “Trust”) adopts the following privacy policy in order to safeguard the personal information of its consumers and customers that are individuals in accordance with Securities and Exchange Commission Regulation S-P,17 CFR 284.30.

We collect only relevant information about the Trust’s shareholders that the law allows or requires us to have in order to conduct our business and properly service you. We collect financial and personal information about you (“Personal Information”) directly (e.g., information on account applications and other forms, such as your name, address, and social security number, and information provided to access account information or conduct account transactions online, such as password, account number, e-mail address, and alternate telephone number), and indirectly (e.g., information about your transactions with us, such as transaction amounts, account balance and account holdings).

The Trust does not disclose any non-public personal information about its shareholders or former shareholders other than for everyday business purposes such as to process a transaction, service an account, to respond to court orders and legal investigations or as otherwise permitted by law. Third parties that may receive this information include companies that provide transfer agency, technology and administrative services to the Trust, as well as the Trust’s investment adviser who is an affiliate of the Trust. If you maintain a retirement/educational custodial account directly with the Trust, we may also disclose your Personal Information to the custodian for that account for shareholder servicing purposes. We limit access to your Personal Information provided to unaffiliated third parties to information necessary to carry out their assigned responsibilities to the Trust. All shareholder records will be disposed of in accordance with applicable law.

The Trust maintains physical, electronic and procedural safeguards to protect Personal Information and requires its third parties service provides with access to such information to treat the Personal Information with the same high degree of confidentiality.

In the event that a shareholder holds shares of the Trust through a financial intermediary, including, but not limited to, a broker-dealer, bank, credit union or trust company, the privacy policy of the shareholders’ financial intermediary would govern how their non-public personal information would be shared with unaffiliated third parties.

19

PROXY VOTING

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities and information regarding how the Fund voted those proxies during the most recent twelve month period ended June 30, is available without charge upon request by (1) calling the Fund at (844) 300-7828 and (2) from Fund documents filed with the Securities and Exchange Commission (“SEC”) on the SEC’s website at www.sec.gov.

TRUSTEES

Neil Kuttner, Chairman

David J. Gruber

Thomas E. Niehaus

OFFICERS

Neil Kuttner, Chief Executive Officer and President

Bryan Haft, Principal Financial Officer and Treasurer

Steven Hoffman, Chief Compliance Officer, AML Officer

Carol J. Highsmith, Secretary

INVESTMENT ADVISER

Cross Shore Capital Management, LLC

111 Great Neck Road, Suite 210

Great Neck, NY 11021

DISTRIBUTOR

Unified Financial Securities, Inc.

2960 North Meridian Street, Suite 300

Indianapolis, IN 46208

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Ernst & Young LLP

5 Times Square

New York, NY 10036

LEGAL COUNSEL

Bernstein Shur

100 Middle Street P.O. Box 9729

Portland, ME 04104

CUSTODIAN

Huntington National Bank

41 S. High St.

Columbus, OH 43215

ADMINISTRATOR AND FUND ACCOUNTANT

Citco Mutual Fund Services, Inc.

One Columbus Center

10 West Broad Street, Suite 2475

Columbus, OH 43215

TRANSFER AGENT

Huntington Asset Services, Inc.

2960 North Meridian Street, Suite 300

Indianapolis, IN 46208

This report is intended only for the information of shareholders or those who have received the Fund’s prospectus which contains information about the Fund’s management fee and expenses. Please read the prospectus carefully before investing.

Distributed by Unified Financial Securities, Inc.

Member FINRA/SIPC

Item 2. Code of Ethics. NOT APPLICABLE- disclosed with annual report

Item 3. Audit Committee Financial Expert. NOT APPLICABLE- disclosed with annual report

Item 4. Principal Accountant Fees and Services. NOT APPLICABLE- disclosed with annual report

Item 5. Audit Committee of Listed Companies. NOT APPLICABLE – applies to listed companies only

Item 6. Schedule of Investments. Schedules filed with Item 1.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

I. STATEMENT OF POLICY

Proxy voting is an important right of shareholders and reasonable care and diligence must be undertaken to ensure that such rights are properly and timely exercised. When the Adviser has discretion to vote the proxies of its clients, it will vote those proxies in the best interest of its clients and in accordance with these policies and procedures.

Money market funds or their equivalent shall not be subject to these Proxy Voting Policies and Procedures.

II. PROXY VOTING PROCEDURES

All proxies received by the Adviser will be sent to the Compliance Officer. The Compliance Officer will:

| | • | | Keep a record of each proxy received; |

| | • | | Forward the proxy to the portfolio manager or other managing member who makes the voting decision in the firm |

| | • | | Determine which portfolios managed by the Adviser hold the security to which the proxy relates; |

| | • | | Provide the portfolio manager with a list of accounts that hold the security, together with the number of votes each account controls (reconciling any duplications), and the date by which the Adviser must vote the proxy in order to allow enough time for the completed proxy to be returned to the issuer prior to the vote taking place. |

| | • | | Absent material conflicts (see Section IV below), the portfolio manager will determine how the Adviser should vote the proxy. The portfolio manager will send its decision on how the Adviser will vote a proxy to the Compliance Officer. The Compliance Officer is responsible for completing the proxy and mailing the proxy in a timely and appropriate manner. |

| | • | | The Adviser may retain a third party to assist it in coordinating and voting proxies with respect to client securities. If so, the Compliance Officer will monitor the third party to assure that all proxies are being properly voted and appropriate records are being retained. |

III. VOTING GUIDELINES

In the absence of specific voting guidelines from the client, the Adviser will vote proxies in the best interests of each particular client, which may result in different voting results for proxies for the same issuer. The Adviser believes that voting proxies in accordance with the following guidelines is in the best interests of its clients.

| | • | | Generally, the Adviser will vote in favor of routine corporate housekeeping proposals, including election of directors (where no corporate governance issues are implicated), selection of auditors, and increases in or reclassification of common stock. |

| | • | | Generally, the Adviser will vote against proposals that make it more difficult to replace members of the issuer’s board of directors, including proposals to stagger the board, cause management to be overrepresented on the board, introduce cumulative voting, introduce unequal voting rights, and create supermajority voting. |

For other proposals, the Adviser shall determine whether a proposal is in the best interests of its clients and may take into account the following factors, among others:

| | • | | whether the proposal was recommended by management and the Adviser’s opinion of management; |

| | • | | whether the proposal acts to entrench existing management; and |

| | • | | whether the proposal fairly compensates management for past and future performance. |

IV. CONFLICTS OF INTEREST

1. The Compliance Officer will identify any conflicts that exist between the interests of the Adviser and its clients. This examination will include a review of the relationship of the Adviser and its affiliates with the issuer of each security and any of the issuer’s affiliates to determine if the issuer is a client of the Adviser or an affiliate of the Adviser or has some other relationship with the Adviser or a client of the Adviser.

2. If a material conflict exists, the Adviser will determine whether voting in accordance with the voting guidelines and factors described above is in the best interests of the client. The Adviser will also determine whether it is appropriate to disclose the conflict to the affected clients and, except in the case of clients that are subject to the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), give the clients the opportunity to vote their proxies themselves. In the case of ERISA clients, if the Investment Management Agreement reserves to the ERISA client the authority to vote proxies when the Adviser determines it has a material conflict that affects its best judgment as an ERISA fiduciary, the Adviser will give the ERISA client the opportunity to vote the proxies themselves. Absent the client reserving voting rights, the Adviser will vote the proxies solely in accordance with the policies outlined in Section III. “Voting Guidelines” above.

V. DISCLOSURE

1. The Adviser will disclose in its Form ADV Part II that clients may contact the Compliance Officer, via e-mail or telephone, in order to obtain information on how the Adviser voted such client’s proxies, and to request a copy of these policies and procedures. If a client requests this information, the Compliance Officer will prepare a written response to the client that lists, with respect to each voted proxy about which the client has inquired, (a) the name of the issuer; (b) the proposal voted upon, and (c) how the Adviser voted the client’s proxy.

2. A concise summary of this Proxy Voting Policy and Procedures will be included in the Adviser’s Form ADV Part II, and will be updated whenever these policies and procedures are updated.

VI. RECORDKEEPING

The Compliance Officer will maintain files relating to the Adviser’s proxy voting procedures in an easily accessible place. Records will be maintained and preserved for five years from the end of the fiscal year during which the last entry was made on a record, with records for the first two years kept in the offices of the Adviser. Records of the following will be included in the files:

| | • | | Copies of this proxy voting policy and procedures, and any amendments thereto. |

| | • | | A copy of each proxy statement that the Adviser receives, provided however that the Adviser may rely on obtaining a copy of proxy statements from the SEC’s EDGAR system for those proxy statements that are so available.1 |

| | • | | A record of each vote that the Adviser casts.2 |

| | • | | A copy of any document the Adviser created that was material to making a decision how to vote proxies, or that memorializes that decision. |

| | • | | A copy of each written client request for information on how the Adviser voted such client’s proxies, and a copy of any written response to any (written or oral) client request for information on how the Adviser voted its proxies. |

| 1 | The Adviser may choose instead to have a third party retain a copy of proxy statements (provided that the third party undertakes to provide a copy of the proxy statements promptly upon request). |

| 2 | The Adviser may also rely on a third party to retain a copy of the votes cast (provided that the third party undertakes to provide a copy of the record promptly upon request). |

Item 8. Portfolio Managers of Closed-End Investment Companies.

| (a) | NOT APPLICABLE- disclosed with annual report |

| (b) | As of this reporting period end there have been no changes to any of the Portfolio Managers since the registrant’s previous form N-CSR filing. |

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers. NOT APPLICABLE

Item 10. Submission of Matters to a Vote of Security Holders.

The guidelines applicable to shareholders desiring to submit recommendations for nominees to the Registrant’s board of trustees are contained in the statement of additional information of the Fund with respect to the Fund(s) for which this Form N-CSR is being filed.

Item 11. Controls and Procedures.

(a) Based on their evaluation of the registrant’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940, as amended (the “Act”)) as of a date within 90 days of the filing date of this report, the registrant’s principal executive officer and principal financial officer have concluded that such disclosure controls and procedures are reasonably designed and are operating effectively to ensure that material information relating to the registrant is made known to them by others within those entities, particularly during the period in which this report is being prepared, and that the information required in filings on Form N-CSR is recorded, processed, summarized, and reported on a timely basis.

(b) There were no changes in the registrant’s internal control over financial reporting (as defined in Rule 30a-3(d) under the Investment Company Act of 1940) that occurred during the second fiscal quarter of the period covered by this report that have materially affected, or are reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 12. Exhibits.

| | |

| (a) (1) | | NOT APPLICABLE- disclosed with annual report. |

| |

| (2) | | Certifications by the registrant’s principal executive officer and principal financial officer, pursuant to Section 302 of the Sarbanes- Oxley Act of 2002 and required by Rule 30a-2 under the Investment Company Act of 1940 are filed herewith. |

| |

| (3) | | Not Applicable |

| |

| (b) | | Certification pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 is filed herewith. |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

(Registrant) Cross Shore Discovery Fund

| | |

| By | | /s/ Neil Kuttner |

| | Neil Kuttner, President and Chief Executive Officer |

| |

| Date | | December 7, 2015 |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| | |

| By | | /s/ Neil Kuttner |

| | Neil Kuttner, President and Chief Executive Officer |

| |

| Date | | December 7, 2015 |

| | |

| By | | /s/ Bryan Haft |

| | Bryan Haft, Treasurer and Principal Financial Officer |

| |

| Date | | December 7, 2015 |