UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

(Mark One) | | | | | | | | | | | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2024

or | | | | | | | | | | | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from __________ to __________

Commission File Number: 001-36904 GoDaddy Inc.

(Exact name of registrant as specified in its charter) | | | | | | | | | | | | | | |

| Delaware | | | | 46-5769934 |

| (State or other jurisdiction of incorporation or organization) | | | | (I.R.S. Employer Identification Number) |

| | | | |

100 S. Mill Ave, Suite 1600

Tempe, Arizona 85281

(Address of principal executive offices, including zip code)

(480) 505-8800

(Registrant's telephone number, including area code) Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Class A Common Stock, par value $0.001 per share | | GDDY | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes x No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Exchange Act. | | | | | | | | | | | | | | |

| Large accelerated filer | x | | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | | Smaller reporting company | ☐ |

| | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. x

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No x

As of June 30, 2024, the aggregate market value of the registrant's Class A common stock held by non-affiliates, based upon the closing sales price for the registrant's Class A common stock as reported by the New York Stock Exchange, was approximately $19.7 billion. For the purpose of calculating the aggregate market value of shares held by non-affiliates, we have assumed that all outstanding shares are held by non-affiliates, except for shares beneficially owned by each of our executive officers and directors.

As of February 14, 2025, there were 141,355,906 shares of GoDaddy Inc.'s Class A common stock, $0.001 par value per share, outstanding. DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant's Definitive Proxy Statement relating to the Annual Meeting of Stockholders are incorporated by reference into Part III of this Annual Report on Form 10-K where indicated. Such Definitive Proxy Statement will be filed with the Securities and Exchange Commission within 120 days after the end of the registrant's fiscal year ended December 31, 2024.

GoDaddy Inc.

Annual Report on Form 10-K

Year Ended December 31, 2024

NOTE ABOUT FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (Annual Report), including the sections titled "Business," "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations," contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the Securities Act), and Section 21E of the Securities Exchange Act of 1934, as amended (the Exchange Act), involving substantial risks and uncertainties. The words "believe," "may," "will," "potentially," "plan," "could," "should," "predict," "ongoing," "estimate," "continue," "anticipate," "intend," "project," "expect," "seek," or the negative of these words, or terms or similar expressions conveying uncertainty of future events or outcomes, or that concern our expectations, strategy, plans or intentions, are intended to identify forward-looking statements. Forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those projected, anticipated, or expected. When considering forward-looking statements, you should keep in mind the risk factors and other cautionary statements discussed under the heading "Risk Factors" in Part I, Item 1A, and in our publicly available filings and press releases. These statements include, among other things, those regarding:

•our ability to continue to increase sales to new and existing customers;

•our ability to develop new solutions and bring them to market in a timely manner;

•our ability to timely and effectively scale and adapt our existing solutions;

•our ability to deploy new and evolving technologies, such as artificial intelligence, generative artificial intelligence, agentic artificial intelligence, machine learning, and similar tools (collectively, AI) in our offerings;

•our dependence on establishing and maintaining a strong brand;

•the occurrence of service interruptions and security or privacy incidents and related remediation efforts and fines;

•system failures or capacity constraints;

•the rate of growth of, and anticipated trends and challenges in, our business and in the market for our products;

•our future financial performance, including our expectations regarding our revenue, cost of revenue, operating expenses, including changes in technology and development, marketing and advertising, general and administrative and customer care expenses, and our ability to maintain future profitability;

•our ability to maintain our high customer retention rates and grow the level of our customers' lifetime spend;

•our ability to provide high quality customer care;

•the effects of increased competition in our markets and our ability to compete effectively;

•our ability to grow internationally;

•the impact of fluctuations in foreign currency exchange rates on our business and our ability to effectively manage the exposure to such fluctuations;

•our ability to effectively manage our growth and associated investments, including the migration of applications and services to the public cloud;

•our ability to integrate acquisitions, our entry into new lines of business and our ability to achieve expected results from our integrations and new lines of business;

•our ability to complete desired or proposed divestitures;

•our ability to maintain our relationships with our partners;

•adverse consequences of our level of indebtedness and our ability to repay our debt;

•our ability to maintain, protect and enhance our intellectual property;

•our ability to maintain or improve our market share;

•sufficiency of cash and cash equivalents to meet our needs for at least the next 12 months;

•beliefs and objectives for future operations;

•our ability to stay in compliance with laws, rules and regulations currently applicable to, or which may become applicable to, our business both in the United States (U.S.) and internationally;

•economic and industry trends or trend analysis;

NOTE ABOUT FORWARD-LOOKING STATEMENTS (continued)

•our ability to attract and retain qualified employees and key personnel;

•anticipated income tax rates, tax estimates and tax standards;

•our future taxable income and ability to realize our deferred tax assets;

•interest rate changes;

•the future trading prices of our Class A common stock;

•our expectations regarding the outcome of any regulatory investigation or litigation;

•the amount and timing of future repurchases of our Class A common stock under any share repurchase program; and

•the potential impact of shareholder activism on our business and operations.

as well as other statements regarding our future operations, financial condition, growth prospects and business strategies.

We operate in very competitive and rapidly changing environments, and new risks emerge from time-to-time. It is not possible for us to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties and assumptions, the forward-looking events discussed in this Annual Report may not occur, and actual results could differ materially and adversely from those implied in our forward-looking statements.

You should not rely upon forward-looking statements as predictions of future events. Although we believe the expectations reflected in our forward-looking statements are reasonable, we cannot guarantee the future results, levels of activity, performance or events and circumstances described in the forward-looking statements will be achieved or occur. Neither we, nor any other person, assume responsibility for the accuracy and completeness of the forward-looking statements. We undertake no obligation to publicly update any forward-looking statements for any reason after the date of this Annual Report to conform such statements to actual results or to changes in our expectations, except as required by law. Given these risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements. Investors and others should note that we use our Investor Relations website (https://investors.godaddy.net) as a means of disclosing material financial information. Accordingly, investors should monitor our Investor Relations website, in addition to following press releases, Securities and Exchange Commission filings, public conference calls and webcasts.

Unless expressly indicated or the context suggests otherwise, references to "GoDaddy," "company," "we," "us" and "our" refer to GoDaddy Inc. and its consolidated subsidiaries, including Desert Newco, LLC and its subsidiaries (Desert Newco).

Part I.

Item 1. Business

Overview

GoDaddy is a global leader serving a large market of entrepreneurs, developing and delivering easy-to-use solutions as a one-stop shop provider, alongside personalized guidance. We serve small businesses, individuals, organizations, developers, designers and domain investors. Our vision is to radically shift the global economy toward life-fulfilling entrepreneurial ventures. Our mission is to empower entrepreneurs everywhere, making opportunity more inclusive for all. We are passionate about our mission and honored that entrepreneurs trust their ideas with us. Our 20.5 million customers are passionate and determined to transform their ideas into something meaningful. Our ability to evolve and build products to meet our customers' needs uniquely positions us to help our customers navigate their journey as small business owners.

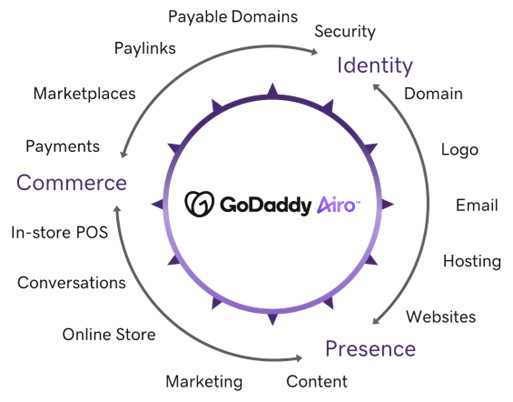

Our customers' journeys tend to be non-linear and each phase can be iterative in nature. We design our solutions to help across all aspects of our customers’ businesses and to assist them in improving and growing across what we call the "Entrepreneur's Wheel." The Entrepreneur's Wheel represents our customers' needs within three key focuses areas: Identity, Presence and Commerce.

Our customers often start with the most intimate of brand considerations, their Identity, which includes their company name, domain name, logo and email address. The domain name continues to be an important initial step for customers as they start and grow their business. We provide products to support their brand through our domain services that blend seamlessly into their connected social identities and online presence. In addition, with the help of GoDaddy Airo® (Airo), entrepreneurs can more easily establish their identity through AI-powered domain name searches and logo creation.

We also help our customers manage and grow their Presence while connecting with their customers through our expanded service offerings and access to relevant third-party products and platforms. We offer a suite of Presence-based solutions, most of which are enhanced by Airo, including website building and hosting, marketplace syndication, social media, search engine visibility, security, business products and email and other services.

Finally, we have built a suite of Commerce solutions that enable our customers to sell directly online, in-person and across multiple channels, such as marketplaces and social platforms, and to integrate dynamic information everywhere they engage with current and potential customers. These solutions include GoDaddy Payments, point-of-sale systems that unify transaction management for both in-person and online sales, and an inventory and order dashboard for easier management of our customers' businesses.

At GoDaddy, we believe our customers should have both great technology and great support at every point on the Entrepreneur's Wheel. With AI-powered experiences such as Airo and customer centric assistance such as our GoDaddy Guides, we can provide intelligent, proactive experiences within our GoDaddy solutions. For example, Airo can help small businesses build and grow with domain searches, logo and image creation, website and social media posts, ad design and email marketing campaigns. In addition, we help set our customers up for success with personalized guidance from our GoDaddy Guides via phone and digital experiences, thousands of daily conversations and our gathering of valuable feedback to enable us to continually evolve our products and solutions and respond to our customers' changing needs.

Our people and unique culture have been integral to our success. We live by the same principles that enable our customers' ideas to survive and thrive, including owning outcomes, building value, joining forces, working courageously and living passionately. We take pride in delivering successful outcomes based on data-driven decisions, which we believe is a key factor driving our financial performance.

Our Customers and Solutions

GoDaddy is built to serve the needs of customers by providing easy-to-use products on an integrated technology platform wrapped with personalized guidance.

Our Customers

We serve several customer populations: (i) Independents, (ii) WebPros, (iii) Domain Investors, and (iv) Domain Registrars, Third Party Registrars and Corporate Domain Portfolio owners. While these customer populations tend to utilize many of the same GoDaddy product offerings, there are meaningful differences in their journeys, what they value, their goals and how they communicate with their current and potential customers. We aim to establish and provide solutions that address these differences.

Our largest customer population, Independents, consists mostly of microbusinesses and non-commercial endeavors. Microbusiness owners have an entrepreneurial spirit, strong work ethic and, above all, passion for their ideas, yet their specific needs vary depending on the type of their idea and the phase of their journey. Independents range from individuals who have an initial business idea and those thinking about starting a business, to established ventures that need help attracting customers, growing their sales, processing payments, managing their online presence or expanding their operations. Most Independents have fewer than five employees, and most self-identify as having little to no technology or design skills. These customers need our help to create a unique and secure identity, especially with the more technical aspects of their online presence. Although our customers have differing degrees of resources and technical capabilities, they all share a desire to find tools to help them bring their ideas to life, enhance connections with their audience, sell their products and services and provide a seamless experience for both existing and new customers.

Our second largest customer population, WebPros, are website designers and developers who build websites on behalf of businesses and noncommercial organizations. We estimate that half of all global website builds occur through a third party, such as our WebPros, on a do-it-for-you basis. WebPros are often freelancers, moonlighters or teams within website design agencies that often have website design as one of multiple streams of income. WebPros generally have more technical acumen and look for tools that provide greater amounts of flexibility, such as the WordPress content management system (CMS). Although WebPros have a need for technical depth and flexibility, they also benefit from our simplicity and guidance as tools to increase their throughput and maximize the use of their time. We help our WebPros customers in a number of ways beyond our product suite and services, including providing tools to help them save time, make money and exceed client expectations. These client management applications aim to make it easier for WebPros to manage their clients' websites at any host, or on GoDaddy products such as Managed WordPress. Our solutions are built to assist WebPros in more easily managing their overall business with capabilities such as client billing, administrative access and shopping features, making it easier for them to buy and manage multiple products for their clients, as well as make use of enhanced technical support and discounts for reselling GoDaddy products. We support a variety of third-party control panels and content management tools favored by WebPros including cPanel, Plesk, Drupal, Joomla and more.

Our third largest customer population is Domain Investors. Domain Investors are individuals or organizations who manage a portfolio of registered domains for the purpose of selling via secondary markets. These investors bring a unique and valuable resource to our business in the form of liquidity and the ability to help our other populations (Independents and WebPros) successfully find a domain name they prefer.

We also serve Domain Registrars, Third Party Registrars and Corporate Domain Portfolio owners. Domain Registrars are organizations that have their own domain registration offerings, but who use our domain registration and management platform. These commercial arrangements provide for strategic relationships with many key platforms and enable further scale of our domain registration technology and insights. Third party registrars are served through GoDaddy Registry which provides wholesale generic top-level domains (gTLDs) and country-code top-level domains (ccTLDs) for registrars to sell to the end customer. These top-level domains (TLDs) provide alternatives to the .com domain that more closely represent the names of our customers' ideas, businesses and brands. For registry operators, we provide a fully managed registry platform, including managing the full registry technology and operating stack at scale, with approximately 180 TLDs including some of the largest brands in the world. We also serve corporate domain portfolio owners, which are organizations that maintain and manage a large portfolio of domain names, including general and international domains. These customers are looking for the most powerful, secure and intuitive technology to streamline their processes, unparalleled industry experience and expertise to navigate the complexities of managing a corporate portfolio, and a focused and dedicated team that can provide committed support with the highest levels of security, service and domain management.

Our Solutions and Experiences

We designed and developed an extensive set of easy-to-use technology solutions and seamless experiences to enable our customers' journeys along the Entrepreneur's Wheel across multiple platforms and online marketplaces. We understand that no matter what our customers' needs are, or what stage of their idea they are focusing on, our customers want a "one-stop-shop" solution. We offer our customers products and services to meet them at every stage of their journey.

Our domain name registration products enable us to engage customers at a common starting place for establishing an exclusive, uniquely branded identity and are often an on-ramp for our other products. Domains are a part of our Core Platform business, and we believe our Applications and Commerce products are a natural adjacency to our domain registration products. Applications and Commerce products, including our proprietary website building and commerce products as well as our productivity solutions, significantly improve our value proposition to customers, thereby improving our financial performance, growth opportunities and customer retention.

In addition, we have built customer experiences that provide our solutions in a seamless one-stop-shop environment. Airo helps small businesses establish an online presence and grow through AI-powered tools that assist customers with domain searches, logo and image creation, website and social media posts, ad design and email marketing campaigns. And, our GoDaddy Guides are readily available and provide care to customers who have different levels of technical sophistication.

We manage and report our business in the following two segments:

•Applications and Commerce (A&C), which primarily consists of sales of products containing proprietary software, notably our website building products, as well as our proprietary commerce solutions and third-party email and productivity solutions and sales of certain products when they are included in bundled offerings of our proprietary software products.

•Core Platform (Core), which primarily consists of sales of domain registrations and renewals, aftermarket domain sales, domain protection, website hosting products and website security products when not included in bundled offerings of our proprietary software products as well as sales of products not containing a software component.

Applications and Commerce

Bringing an idea to life online, establishing and maintaining a presence and continuing to grow requires the right tools and products. Website building solutions, e-commerce tools, digital marketing capabilities and other GoDaddy solutions are designed to help our customers start, grow and scale their presence and ultimately their businesses. Our customers come to

GoDaddy to build a professional website, attract customers, sell their products and services and accept payments online and in person by engaging with our easy-to-use tools, managed in one place.

Applications Products

Our primary applications products include:

Websites + Marketing. Websites + Marketing is an easy-to-use, do-it-yourself, mobile-optimized online tool that enables our customers to build effective websites and e-commerce enabled online stores with minimal technical skill. We offer a variety of plans, with pricing dependent on business and marketing features. With each of these plans, customers gain access to industry-targeted professional design templates, which can be further customized using our editor by adding intent-driven sections, photos, videos or text. Our design templates cover a wide range of categories with professionally written content for small businesses, organizations, families, weddings and other ideas. We design our websites and tools to work seamlessly on mobile devices, with a focus on performance, to enable websites to appear in search engine rankings.

Managed WordPress and Managed WooCommerce Stores. Managed WordPress is our streamlined, optimized website building experience that allows our customers to easily build and manage a faster WordPress site that offers more flexibility and power than our Websites + Marketing solution. With our Managed WordPress site, we manage the administrative tasks for our customers, allowing them to spend more time on building or growing their business. We offer a variety of plans, with pricing based on various features. Our Managed WordPress sites are built with automatic, regular backups and core updates, enhanced security, integrated Secure Sockets Layer (SSL), one-click migration tools, pre-installed extensions, plugins and themes, business email and backups and a staging site. We also offer Managed WooCommerce Stores, giving our customers the freedom to sell anything, anywhere online, from physical products to digital downloads, services and subscriptions.

Digital Marketing. We offer a range of marketing tools and services designed to help businesses acquire and engage customers and create content. These capabilities are available in an integrated offering with our website and commerce tools, or as a stand-alone offering for customers using other website content-management systems. The tools are designed for busy customers who may lack experience with online marketing, focusing on ease of use, mobile experience and delivering business results. For example, Airo, an AI-powered experience, allows our customers to quickly create a powerful marketing campaign, including recommended, customized social media posts, better site traffic with the Airo SEO wizard, a step-by-step guide to optimizing each website page with suggested keywords and descriptions that can lead to better traffic results, and a Customer Insights dashboard that provides insights on site traffic, sales and orders and digital marketing. Our mobile application, GoDaddy Studio, helps our customers to grow their brands by easily creating impactful visual content for almost any online platform. Search Engine Optimization helps our customers get their websites found on major search sites using a simple step-by-step wizard with targeted recommendations on which search phrases are most likely to drive traffic to a customer's site. Business listings capabilities bring business information to where customers are looking, including Meta and Google My Business. Email marketing lets customers build targeted campaigns, either from scratch or using website or commerce content. Social Media Marketing helps customers create ads and boost brand awareness through a complete "do-it-for-me" service for managing engagement on the most popular social networks. This service combines dedicated teams of branding experts – photographers, writers, designers, marketers – with proprietary technology to manage activity on Meta, X and Yelp, among others, to help our customers acquire new customers and build stronger relationships with their existing customers.

Commerce

We aim to lead the small business commerce market by enabling GoDaddy customers of all sizes, from those just starting out to established businesses looking to scale and grow, to sell everywhere their customers shop. We design our commerce products to help our customers sell online, in person and on leading marketplaces, while being able to manage their sales from one place. In addition to robust commerce capabilities, we offer the lowest card transaction fees in the industry when compared to similar plans from other leading providers, which allows our customers to keep more of what they make.

Our primary commerce products and services include:

Online Store. Our Websites + Marketing product includes online store capabilities, which allows our customers to transact business directly on their websites. Online store capability is easy to use and offers powerful commerce features with templates for websites that are optimized for mobile shopping, integrations with GoDaddy Payments and our Smart Terminal Point-of-Sale (POS) system, inventory and product catalog management, and growth tools for marketing. It also allows customers to sell on marketplaces such as Amazon, Etsy, eBay, Walmart and Google and social media platforms such as Facebook and Instagram, with all channels managed from our centralized dashboard. As part of the GoDaddy Commerce ecosystem, Managed

WooCommerce Stores, our WordPress-based online store solutions, provide our customers with everything they need to sell online, in person, and across popular marketplaces and social media platforms from one built-in experience. Similar to our Websites + Marketing product, Managed WooCommerce Stores include our centralized dashboard, allow for marketplace selling and are integrated with GoDaddy Payments and our Smart Terminal POS system.

Point-of-Sale (POS) Systems. We offer a line of smart POS terminals for businesses with in-store operations, including our flagship countertop, Smart Terminal, and our compact Smart Terminal Flex. Our Smart Terminal devices are modern, dual screen all-in-one POS systems that allow our customers to manage in-store inventory and product catalogs and accept payments. In addition, the Smart Terminal line seamlessly integrates with both our Websites + Marketing Online Store and Managed WooCommerce Stores to unify in-person and online sales so businesses can offer “Buy online pick up in-store” experiences to their customers. The Smart Terminal line also offers access to third-party applications that meet merchants' needs that we do not address directly.

In addition to our Smart Terminal line of POS systems, we offer payment acceptance solutions that allow our customers to accept payments their way while seamlessly interacting with their customers wherever they may be. For example, we include Payable Domains, a default payments system that is designed to create a frictionless, out-of-the-box experience for our customers. Our Card Reader and Tap-to-Pay on the GoDaddy Mobile App (iPhone and Android) allow customers to accept payments and sell on the go. Our Virtual Terminal allows customers to accept payments from their smartphone, tablet or computer with Internet connection with no hardware needed. Our customers also have the ability to accept online payments without needing to create a website through our Online Pay Links. Customers can brand and personalize these shareable pay links with their domain, giving them another opportunity to build their brand. Pay links can be sent through text or email or shared on social media sites. We also provide merchants with QR code-based payments, allowing their customers to scan and pay through the GoDaddy Mobile App.

GoDaddy Payments. As a "payment facilitator," GoDaddy Payments enables our customers in both the U.S. and Canada to accept all major forms of payment, including Visa, MasterCard, American Express, Discover, and contactless payments including Apple Pay and Google Pay, with no long-term contracts or monthly minimums. This service enables our customers to start accepting payments in minutes with a simple setup and get paid, in many cases, as early as the next business day, all with the lowest fees in the industry when compared to similar plans from other leading providers. In addition, GoDaddy Payments is built-in as a payments acceptance method in all our U.S. and Canada commerce products for easy enablement.

Email and Productivity Solutions

Our customers want to spend their time on what matters most to them, selling their products and services or helping their customers do the same. We provide them with productivity tools such as domain-specific email, telephony and online storage to help run their ventures. We offer a variety of products designed to make the business of business easier for our customers. The products we offer include those developed in-house as well as third-party applications which we distribute and support, such as Microsoft 365.

Our primary email and productivity solutions products include:

Email Accounts. We offer a range of email service plans with a multi-feature web interface that connects to our customers' domains. The pricing of these plans depends on the customer's desire for additional features, including HIPAA- compliant email, advanced email security, archiving, and additional business applications such as Microsoft Teams. All our email accounts are ad-free and we offer added security functionality designed to protect from spam, viruses and other forms of online fraud, such as phishing.

Microsoft 365. We offer fully-supported Microsoft 365 accounts that are easy to set up and use with our customers' domains. We offer Microsoft 365 through multiple plans, ranging from email with calendar and contacts connected to a full suite of productivity tools, including file sharing and full desktop versions of Microsoft productivity applications, such as Outlook, Word, Excel and PowerPoint. For customers wanting to protect their email data, we provide an email backup service, and for customers needing to comply with regulatory requirements, we provide email add-on services such as HIPAA-enabled email, encryption services (in partnership with ProofPoint), archiving services (in partnership with Barracuda) and advanced e-mail security. Our customers can also make use of Microsoft Copilot through chat enabled features, or can purchase Microsoft 365 Copilot as an integrated solution for Microsoft Office apps. We help make Microsoft 365 and Microsoft 365 Copilot installation easy, allowing customers to be up and running in minutes, including "do-it-for-me" migration services to move customers' existing email data to Microsoft 365 accounts.

In 2024, 2023 and 2022, we derived approximately 36%, 34% and 31% of our total revenue, respectively, from sales of our A&C products.

Core Platform

Domains

Every great idea needs a great name and GoDaddy is the leading global domain naming service. Staking a claim on an identity with a domain name is an integral part of establishing a concept and presence online. When inspiration strikes, we provide our customers with the broadest selection of domains and high-quality search, discovery and recommendation tools to help them find the right name for their idea. Securing a domain is a key component to creating a complete identity and our domain products often serve as the starting point in our customer relationships. We are a global leader in domain name registration, with approximately 81 million domains under management as of December 31, 2024. Based on information reported in VeriSign's most recent Domain Name Industry Brief, this represented approximately 22% of the approximately 362 million domain names registered worldwide as of December 31, 2024. As of December 31, 2024, approximately 93% of our customers purchased a domain from us. In addition, GoDaddy Registry provides a high-performance back-end registry technology platform with a portfolio of TLDs including .biz, .co, .nyc, and .us.

Our primary domains product offerings include:

Primary Registrations. Using our website or mobile application, we offer customers the ability to search for and register available domain names with the applicable registry. Our inventory for primary registrations is defined by the number of TLDs we offer. As of December 31, 2024, 458 different generic TLDs, such as .com, .net and .biz, and 58 different country code TLDs, such as .co, .ca, .in and .jp., were available for purchase through GoDaddy. Since 2013, hundreds of new gTLDs were launched through ICANN's "new gTLD program" initiated in 2012 (the Expansion Program), making it easier for companies and individuals to find and register new, easy-to-remember domain names tailored to their ideas, industry or interests. ccTLDs are important to our international expansion efforts as we found international customers often prefer the ccTLD for the country or geographic market in which they operate. Our primary registration offering relies heavily on our search, discovery and recommendation tools which enable our customers to find a domain name that matches their business needs and goals. We also sell domain registrations through relationships with third-party resellers and we provide back-end registry services supporting approximately 180 TLDs.

Aftermarket. We operate a large domain aftermarket platform, which processes aftermarket, or secondary, domain name sales and we maintain a portfolio of more than 1.0 million domain names. We designed our aftermarket platform to enable the seamless purchase and sale of previously registered domain names through an online auction, an offer and counter offer transaction, a "buy now" transaction and automation and lease to own options for our customers. In addition, we allow our customers to "List for Sale" names under their registration, and we provide functionality for the entire registrar network to list expiring domains from their platforms and "List for Sale" functionality to registrar partners allowing their currently registered customers to list domain names within GoDaddy's aftermarket. These various channels provide a diverse inventory available to meet the demand from our customers. In addition, our GoDaddy Investor mobile application helps investors watch and bid on domains at auction and stay on top of their current bids from their mobile devices. We operate a cross-registrar network that automates transaction execution across registrars, thereby reducing the time required to complete a transaction.

Registry. GoDaddy Registry is a world-leading provider of domain name registry services. GoDaddy Registry operates or provides back-end registry services to approximately 180 registry TLDs including ccTLDs, such as .us, .tv and .co, city TLDs such as .nyc and .sydney, gTLDs such as .club, .health and .design, and branded TLDs such as .chase and .godaddy. Our integrated registry solutions provide policy and operational support, and domain marketing, sales and strategic planning.

Domain Name Add-ons. Domain name add-ons are features that are offered for purchase concurrently with domain name registrations and have low costs associated with their delivery. For example, in addition to privacy features included at no cost with every domain registered with GoDaddy, we offer more advanced full domain and ultimate domain protection products exclusively focused on protecting our customers' domains against bad actors and online risks, as well as domain ownership products, to prevent the accidental loss of a domain name.

Hosting and Security

For more technically sophisticated WebPros and other customers, we provide high-performance, flexible hosting and security products that can be used with a variety of open source design tools, including WordPress. We design these solutions to be easy to use, effective, reliable, flexible and provide great value. We offer a variety of hosting and security products enabling our customers to create and manage their identity, or in the case of WebPros, the identities of their end-customers.

Our primary hosting and security products include:

Shared Website Hosting. The term "shared hosting" refers to the housing of multiple websites on the same server. Shared hosting is our most popular hosting product. We operate, maintain and support shared website hosting in our owned and operated data centers and our leased co-located data centers using either Linux or Windows operating systems. We currently offer several tiers of website hosting plans to suit the needs and resources of our customers, a majority of which use industry standard cPanel or Parallels Plesk control panels. We also bundle our hosting plans with a variety of applications and products such as web analytics and SSL certificates. WordPress is the most used CMS on our shared hosting platform.

Virtual Private Servers. Our broad range of virtual private server (VPS) offerings allow our customers to select the server configuration best suited for their applications, requirements and growth. Our VPS solutions provide our customers with a single virtual machine which runs multiple other virtual machines for other customers. Our VPS is designed for customers who need greater control, more advanced technical capabilities and higher performance than offered by our shared hosting plans. Our customers can tailor their VPS plans based on a range of performance, storage, bandwidth and operating system needs.

Security. Our security product portfolio is a comprehensive suite of tools designed to help our customers secure their online presence. The portfolio includes (i) SSL certificates to help ensure information is secure between browsers and servers through encryption; (ii) the use of a content delivery network to improve a website's performance; (iii) a proprietary web application firewall to help keep customers' websites safe from hackers; (iv) managed security with malware scanning and site cleanups; and (v) a skilled team of security professionals working to secure our services or to provide support in the event of a disruption to our solutions.

In 2024, 2023 and 2022, we derived approximately 64%, 66% and 69% of our total revenue, respectively, from sales of our Core Platform products.

Experiences

GoDaddy Airo®

Airo is an intelligent experience that can help proactively build and grow our customers' businesses with the power of AI. Airo operates across the GoDaddy ecosystem and is built to activate intelligent, proactive experiences within other GoDaddy solutions. Airo aims to help our customers by anticipating their needs and providing solutions through informed interactions across the GoDaddy suite of products and services, small business industry expertise, knowledge queries and best practices. Airo can help our customers build their identity with domain searching, personalized logos, email inboxes and email templates. It also aims to help our customers grow their business with proactive email and text messages, proposed product descriptions and social media posts, conversational UI landing pages and auto-generated product catalogs.

GoDaddy Guides

Our GoDaddy Guides consist of approximately 5,900 specialists worldwide who are readily available to provide care to and build strong relationships with our customers throughout their lifetime. Our customers deeply value expertise and know-how that is individualized and unique to their ventures and our Guides are trained and supported to provide the high-quality, responsive and personalized guidance that our customers need. In addition, our GoDaddy Guides market our brand through their recommendations of our solutions to specifically meet the needs of our customers to support their growth.

Our Opportunity and Advantages

Our Opportunity—Empowering Entrepreneurs

Our mission is to empower entrepreneurs everywhere, making opportunity more inclusive for all. Our customers represent a large and diverse market that we believe is fundamentally underserved by other companies. According to the U.S.

Small Business Administration's Office of Advocacy, 99.9% of all firms in the U.S. are small businesses, of which there were approximately 34.8 million, based on the Census Bureau's 2021 Statistics of U.S. Businesses. These small businesses are estimated to represent approximately 43.5% of total U.S. gross domestic product (GDP). We believe a significant market exists for our products and services, and we believe our addressable market extends beyond small businesses and includes individuals and organizations, such as universities, community organizations, charities and hobbyists.

Our customers are consumers themselves, which makes them keenly aware of the need to have an impactful online presence. While our customers' needs change depending on where they are in their journey, the most common customer needs we serve include:

•Identity. Our customers want to develop an identity by finding a name that distinctly identifies their business, hobby or passion. We believe their identity includes not just a simple, mobile-enabled website, but the ability to get found across various search engines, social media platforms and vertical marketplaces. And while our customers' online identities start with creating and managing these points of presence, their identities are amplified through content generation and the ability to engage and transact online with their customers and audience.

•Presence. Presence represents the need of our customers to present themselves to their customers, which they do through an ever-expanding set of options across social media, marketing channels, email, marketplaces and through their website. Being able to seamlessly create and post content quickly is imperative. What it means for our customers to be online continues to evolve. Today, having an effective online presence often means having a combination of: (i) a secure and content-rich website viewable from any device; (ii) a presence on multiple social media channels (e.g., Meta, TikTok, Snapchat, X and WeChat); (iii) getting found by search engines (e.g., Google); and (iv) establishing a presence on: (a) an increasing number of horizontal marketplaces (e.g., Yelp and Eventbrite); (b) vertical marketplaces (e.g., Zillow, OpenTable and HomeAdvisor); and (c) e-commerce platforms (e.g., Amazon, eBay and Etsy).

•Commerce. Commerce recognizes that our customers need commerce to work seamlessly for them both offline and online. Our customers' customer expectations are set by how they engage with enterprise-grade experiences, which means they expect to be able to buy online and pick up in the store in a matter of minutes. A customer in the store expects to be recognized online seamlessly, while a customer online expects to transition to a store experience seamlessly. For service commerce entrepreneurs, their customers expect to find products and services online, engage through online messaging, book appointments digitally and complete transactions in-person.

•Interacting with customers as they grow their business. Our customers need to effectively communicate with existing customers and potential customers across a communication landscape that is fragmented in both form and function. This landscape includes (i) branded email communication, originating with domain registration and email creation through an email client; (ii) online marketing in a variety of content types and channels; (iii) online commerce with reservation and scheduling, product catalogs and e-commerce and payment processing capabilities, including in-person point-of-sale payment processing; (iv) messaging capabilities across SMS, Facebook Messenger, WhatsApp and other platforms; (v) email marketing for audience engagement; and (vi) telephony, for inbound and outbound voice communication. Surrounding these channels and tactics, our customers also need easy-to-use tools to run their businesses.

•Technology that is easy-to-use, reliable, secure, efficient, performance enhancing and evolves with their needs. Our customers vary significantly, but they remain the same in their need for an integrated platform and set of tools that enable their domain, website, marketing and commerce solutions to easily work together as their ideas grow and become more complex. Our customers expect reliable products and want to be confident that their digital presence is secure, even when customized. Our customers work on their ideas whenever and however they can and need solutions fitting their lifestyle and schedule. Our products and services provide a platform that can meet the range of needs, demands and levels of sophistication of our customers, from those that may not be technologically savvy to more sophisticated customers such as WebPros. In addition to our standalone products, Airo helps small businesses establish their online presence and grow through AI-powered tools that assist with domain searches, logo and image creation, website and social media posts, ad design and email marketing campaigns.

•Connecting with a real person when they need help. Depending on their journey, a customer may seek guidance on setting up a website, launching new features or trying a new product or service and they need that guidance on their time. Our customers need real people who are readily available and can provide care to customers at all levels of technical sophistication. In addition to guiding our customers along their journey, we also provide support by handling the most difficult and arduous tasks for them through a collection of managed service offerings, and

customers who utilize Airo-enabled solutions get access to personalized support for website content, logos, ready-to-use social media posts and more.

•Affordable solutions. Our customers often have limited financial resources and may be unable to make large, upfront investments in the latest technology. Our customers need affordable solutions that deliver impactful results to level the playing field with the tools that allow them to appear and act as bigger ventures. We aim to provide affordable products and services for our customers at every level to support their businesses.

Serving our customers’ needs creates deep relationships, where we are viewed as not just a solution provider, but also a guide and partner to their journey on the Entrepreneur's Wheel. This makes for a favorable business and economic model, aligning the interests of GoDaddy and our customers.

Our stable and durable business model is driven by strong brand recognition, efficient customer acquisition, high customer retention rates, increasing lifetime spend of our customers and our ability to attract high intent customers. In 2024, we generated $4,573 million of revenue, up 7.5% from $4,254 million in 2023, and we generated $5,039 million in total bookings, up 9.5% from $4,603 million in 2023. We believe the breadth and depth of our product offerings, seamless ease-of-use in a one-stop shop and the high-quality, personalized guidance and responsiveness from GoDaddy Guides continues to build strong customer relationships leading to our high customer retention rates. For the year ended December 31, 2024, our customer retention rate was approximately 84%, a slight reduction from the approximate 85% in each of the four years prior, due to divestitures, migrations and the end of life of certain products as part of our efforts to streamline brands outside the GoDaddy platform. For the year ended December 31, 2024, retention for customers within the GoDaddy platform, which represents the vast majority of our customers, was approximately 87%. The retention rate for our customers who had been with us for over three years as of December 31, 2024 was approximately 90%. Greater than 89% of our total revenue was generated by customers who were also customers in the prior year. In addition, in 2024, we had over 1.8 million customers who each spent more than $500 a year on our product offerings.

Our Advantages

Our customers serve many roles in their business; they simultaneously run marketing, accounting, service delivery operations, customer service, people operations and many other tasks. Time is their most valuable resource and complexity is their hindrance; our customers want an impactful online presence, but may not have the time and skills to make that happen. Our goal is to be a trusted partner to these entrepreneurs, bringing together the technology, ease of use and guidance necessary to bring their ideas to life online. We believe the following strengths provide us with competitive advantages in serving these needs:

Global Brand Awareness. Our global brand benefits from high awareness as a leading domain name provider, with approximately 81 million domains under management as of December 31, 2024. Based on information reported in VeriSign's most recent Domain Name Industry Brief, this represented approximately 22% of the approximately 362 million domain names registered worldwide as of December 31, 2024. Our global presence gives us the ability to leverage our brand — a competitive advantage when customers search for products and solutions. We have 20.5 million paying customers and a customer retention rate of approximately 84% for the year ended December 31, 2024. We market and sell to customers in over 200 markets around the world and in 2024, 49% of our customer base and approximately a third of our revenue was derived from our international presence.

Seamlessly Intuitive Experiences. Our customers often self-identify as non-technical and inexperienced in areas such as marketing, content creation and customer management. Because they may lack the expertise to take full advantage of powerful tools, customers may be overwhelmed as they attempt to build and maintain their business. Our solutions aim to simplify this complexity with seamlessly intuitive experiences.

For example, with Managed WordPress, we help reduce the complexity of launching and managing WordPress sites so our customers can stay focused on growing their business, not managing complex WordPress hosting tasks. We provide this on a fully managed platform that delivers fast performance and AI-powered site creation. With Websites + Marketing, our proprietary CMS, we incorporate seamlessly intuitive experiences by uniting marketing, content, commerce and customer management tools into a single experience.

Additionally, with Airo, an experience that can help proactively build and grow our customers' businesses with AI, we aim to reduce complexities for our customers through an experience that can anticipate their needs and provide solutions through informed interactions, small business industry expertise, knowledge queries and best practices. Airo can help our customers build their identity with domain searching, personalized logos, email inboxes and email templates and aims to help our customers grow

their business with proactive email and text messages, proposed product descriptions and social media posts, conversational UI landing pages and auto-generated product catalogs.

We also seek to leverage data and insights to personalize the products and experiences of our customers as well as tailor our solutions and marketing efforts to each of our customer groups. The automation and content creation abilities inherent in these tools elevate the discoverability of and engagement with our products, creating a true one-stop-shop experience. This further enhances our customers' capacity to market their products, sell online, manage their businesses and grow, all in a seamless, low-friction manner. We constantly seek to improve our website, marketing programs and customer care to intelligently respond to each stage of our customers' lifecycles and identify their specific product needs based on experimentation. This allows us to interact more frequently with our customers and understand what products work well for them. We intend to continue investing in our technology and data platforms to harness the power of generative AI to further enable our personalization efforts and make our products even more intuitive for our customers.

Personalized Guidance. Our customers deeply value expertise and know-how, which has been part of the GoDaddy DNA since our founding. Our customers' needs are highly individualized and unique to their ventures, which we believe makes operating a guidance experience – at scale – a competitive advantage.

In recent years, we extended this competency into several new interfaces and subject matters. These interfaces allow us to take learnings and insights gained from customer interactions to build and grow our product and service offerings and drive more thoughtful engagements for our customers. For example, within our Websites + Marketing platform, we are now creating customized action plans for our customers as they seek to market their businesses in a number of different channels based on the type of their venture and their geography. We have also significantly increased the training and engagement content available to our customers, through a number of different content forums and across platforms like YouTube and Instagram. In addition, customers who utilizeAiro-enabled solutions get access to personalized support for website content, logos, ready-to-use social media posts and more.

GoDaddy Venture Forward Research Initiative. Established in 2018, GoDaddy's Venture Forward research initiative quantifies the impact that more than 20 million online businesses (measured by a unique domain and an active website) have on their economies. Most of these businesses employ fewer than ten people, categorizing each as a microbusiness. While these microbusinesses may be small, their impact on economies is outsized even though they are often too informal or too new to show up in traditional government statistics. Venture Forward’s data helps those studying, reporting on or advocating for entrepreneurs understand developing themes and insights into microbusiness/digital entrepreneurship. The data also helps us better understand our customers' mindsets, the requirements and challenges they face from start-up through more substantial developments, their aspirations as well as their current circumstances. We can also tailor topics covered by our survey to reflect current events, providing real time updates that can inform on key insights and themes from the populations surveyed. We update this information quarterly and share it to download for free.

Operations

Human Capital

Our people embody the same grit and determination as our customers. Our world-class engineers, designers, marketers and GoDaddy Guides share a passion for technology and its ability to change our customers' lives. We live by the same principles that enable our customers' ideas to survive and thrive, including owning outcomes, building value, joining forces, working courageously and living passionately. Our relentless pursuit of building value and doing right for our customers has been a crucial ingredient of our growth.

As of December 31, 2024, we employed 5,518 people worldwide, made up of 2,131 in care and services (who comprise a portion of our GoDaddy Guides), 2,247 in technology and development, 367 in marketing and advertising and 773 in general and administrative functions. In addition, GoDaddy partners with various third-party providers and vendors to provide contracted care and support services to our customers; approximately 3,700 individuals are employed with or engaged by our external partners. These third-party providers are primarily located in international markets, most significantly in India, the Philippines, and Malaysia. A majority of our employees are based in the U.S. and Europe. None of our U.S. employees are represented by a labor union or are party to any collective bargaining agreement in connection with his, her or their employment with us. Certain of our employees in Germany are represented by employee works councils and some other internationally based employees are represented by worker representatives in accordance with local regulations.

At GoDaddy, we strive for a workplace culture where everyone has the opportunity to thrive. We support this goal by focusing on key human capital initiatives including:

•Compensation, Pay Parity and Benefits. We actively work to attract a diverse employee population and are committed to providing equitable opportunity in all aspects of employment. In line with this, our compensation programs and practices are designed to compensate our employees fairly based on the work that they perform. Our Compensation and Human Capital Committee aims to design compensation programs that align our pay for performance philosophy at each stage at which compensation decisions are made, including at hire, promotion and throughout the annual compensation cycle. Since 2015, we have published an annual diversity and pay parity report and, according to our analysis, we continue to compensate our male and female employees substantially the same for performing similar jobs across the company for all entities included in our analysis. In 2017, we began reporting on our pay practices across U.S.-based employee populations and reported each year that, according to our analysis of such data, we have paid employees of color and white employees substantially the same for performing similar jobs across the company. In addition to these pay practices, we continue to offer employees a range of comprehensive and competitive benefits and well being offerings that support our human-centered approach and that allow us to attract and retain top talent.

•Diversity, Equity, Inclusion and Belonging. At GoDaddy, we are committed to attracting, hiring, and retaining the best talent from around the world. We strive to foster a diverse, inclusive and equitable workplace where all employees have the opportunity to learn, grow, and succeed. Our employee resource groups (ERGs) play an important role in supporting these goals. ERGs are voluntary, employee-led groups open to all employees that focus on the common topics, identities, affinities, and interests that matter to our people. Aligning with our values of joining forces and respecting one another, our ERGs help employees connect with one another, feel a sense of belonging at GoDaddy, support one another’s professional development and come together. We also continuously work to have hiring, development, and retention practices that enable GoDaddy to be an employer of choice for top talent globally. To do so, we leverage the expertise of organizations like the Human Rights Campaign, PulseLearning and VMware Women’s Leadership Innovation Lab at Stanford University to understand best practices in these areas. As we work to make opportunity more inclusive for all, we remain committed to cultivating a workplace where our employees can thrive.

•Talent and Career Development. We commit to providing fulfilling career development opportunities for our employees. Through our learning and development initiatives, we aim to achieve three goals: (i) align employees to our company strategy and goals; (ii) connect employees through experiential learning; and (iii) grow employee skill sets for the future. We offer extensive learning opportunities to our employees spanning leadership, sales, service and technology and compliance training through e-learning, instructor-led content, video-based and blended platforms. We offer several leadership development opportunities including new manager onboarding, a leadership development program for managers and above, and a multi-month management program for our care and services managers. In addition, for our GoDaddy Guides, we offer continuing education and training programs that are immersive with environments, technology, and tools that enable active learning. We are also supporting our employees with the latest technologies to enhance and assist in productivity and learning, including AI solutions and software, such as our Guide Assist Bot, GABI, which supports our GoDaddy Guides as they provide care to our customers.

•Employee Engagement. We aim to create a working environment and culture in which our employees feel respected and supported to do their best work. To that end, we ensure that we are engaging, listening and responding to employee concerns through our annual anonymous employee engagement survey known as GoDaddy Voice. Approximately 84% of our employees participated in the survey in 2024. We monitor employee responses to identify areas of opportunity and set goals and expectations for improvement to ensure employees feel connected and engaged with GoDaddy's mission, our customers and their own teams. Following a comprehensive review, the key results, areas of progress and opportunity, and plans for improvement are shared with all employees.

•Community Engagement. Our social impact work, overseen by our Corporate Sustainability & ESG team, is an extension of our company vision and mission. Through our global volunteer and matching programs, we enable our employees to volunteer in their communities with paid time off, and we match employee donations to qualifying nonprofits of choice up to $1,500 per employee per year or country equivalent. In addition, our employees can earn funds for qualifying nonprofits they volunteer with through our volunteer rewards program.

Our Board and the Compensation and Human Capital Committee oversee our human capital management programs, practices and strategies. Additional information on these matters and their oversight can be found in our annual proxy statement.

Our most recently published pay parity practices and Company-wide gender and racial/ethnic representation are published in our annual sustainability report, which is available on our website along with our recent EEO-1 Report.

Technology and Infrastructure

Our products, customer experiences and business systems are enabled by our technology and infrastructure to provide scalability, security and flexibility. Technology and development expenses, including those expenses related to our technology platform, were $814 million, $840 million and $794 million in 2024, 2023 and 2022, respectively. The growth in our technology and development expenses has been driven primarily by our focus on enhancing customer experiences through the use of software-driven products. Additionally, we offer Domain Registry and Corporate Domains solutions to our customers. We built a scalable infrastructure platform allowing us to optimize for economies of scale and enable next-generation hosting architecture for our customers, while investing in faster, denser and more efficient data centers, improved network connectivity and improved resiliency, both domestically and internationally.

We aim to provide a reliable and secure global platform and infrastructure. Our investments in technology, including engineers, patents, online security, customer privacy, reliable infrastructure and data science capabilities, enable us to innovate and deliver personalized solutions to our customers. Our API-driven technology platform is built on state-of-the-art, open source technologies like OpenStack and other large-scale, distributed systems. Additionally, our platform allows our developers to create new and enhanced products or product features assembled from common building blocks leading to faster deployment cycles. We believe our products work well together and are more valuable and easier to use together than if our customers purchased them individually from other companies and tried to integrate them. As of December 31, 2024, we had 2,247 employees in technology and development and 368 issued patents in the U.S. and other countries covering various aspects of our product offerings. Additionally, as of December 31, 2024, we had 11 pending U.S. and international patent applications and intend to file additional patent applications in the future.

Physical Infrastructure and Management

Our physical technology infrastructure supports our products, experiences and business systems through servers located in data centers around the world. As a leading website hosting platform, we invest significantly in our peering architecture and underlying infrastructure management to handle significant Internet traffic at low bandwidth costs. We invest in the automation of common physical data center components like servers, load balancers, switches and storage, and we use open source solutions when possible to automate manual processes and thereby reduce the risk of human error and lower costs. Additionally, we leverage a common automated infrastructure based on OpenStack and Kernel-based Virtual Machine (KVM) to enable next-generation services. We continue to migrate many of our non-hosting products and internal systems to Amazon Web Services (AWS) and an optimized company owned cloud infrastructure. These and other efforts have reduced our managed physical footprint by approximately 80% over the last three years, and have accelerated our ability to provide speed and reliability in both our product and customer experiences. These efforts and our technology infrastructure footprint allow us to scale and provide our customers with valuable products at affordable prices.

Customer Experience and Business Systems

Our platforms provide our global customers easy-to-use products, by allowing us to experiment and quickly deploy improvements incorporating our data insights. Our investments in our platform capabilities include the following:

E-commerce Platform and Application Services. We invest in the architecture and capabilities of our e-commerce platform to create an ecosystem where we can rapidly scale up or down and integrate with third-party offerings. The platform broadens our distribution channels by being extensible and allowing resellers to easily sell our products. We seek to continuously launch new and relevant applications and streamline our existing offerings to provide the best user experience to our customers.

Data Platform. Our horizontal data platform helps us be a trusted source of data about our customers and their online ideas through accurate, meaningful and easily consumable data insights, which allows us to build best-in-class, personalized experiences for our customers. Our data platform is key to helping us deepen our customer and business insights, which enable innovation through instrumentation, experimentation and analysis.

Content and Marketing Platform. Our content and marketing platforms leverage the latest technology, operational and production models that enable us to deliver customer-centric digital experiences at an accelerated pace through multiple touchpoints and channels. Our content platform and content creation processes help us realize efficiencies and scalability, which

enhance our ability to drive new, high-quality products and customer experiences to market faster. We focus on driving advancements in experimentation, the speed and volume of content creation, localization and content self-service, while ensuring platform availability and performance. We also deliver new engagement marketing capabilities that improve business effectiveness and customer experiences.

Product Development

We continue to expand the ways we serve our customers to adjust to their changing needs from primarily domain name registration and hosting to a broader spectrum of offerings. Our primary website building products (Websites + Marketing, Managed WordPress), website security suite, email offerings (Microsoft 365), commerce products and domain aftermarket each represent significant need states that are complementary to our long-standing offerings and benefit from our strengths as a company in human-infused technology. Our key product development initiatives include:

Powering a Simple and Effortless Presence. We offer a range of solutions that help our customers publish their ideas online, including Websites + Marketing and Managed WordPress. These solutions combine mobile-optimized website builders with an integrated set of marketing and e-commerce tools, all of which is enhanced with AI. We continue to invest in Websites + Marketing and other tools, templates and technology to make building, maintaining and updating a professional looking mobile or desktop presence simple and easy. We harnessed the foundational expertise we cultivated with respect to AI to introduce multiple customer-facing capabilities in generative AI across our suite of products, including Airo to deliver personalized website content, logos, domains, ready-to-use social media posts, marketing calendars, email communications and more. The automation and content creation abilities inherent in these tools elevate the discoverability of and engagement with our products, creating a true one-stop-shop experience. This further enhances our customers' capacity to market their products, sell online, manage their businesses and grow, all in a seamless, low-friction manner.

Making the Business of Business Easy. Our business applications range from domain-specific email and email marketing to telephony services and payment tools to help our customers communicate with their customers and grow their ideas. For example, GoDaddy Conversations is a communications platform that helps small businesses support, engage and convert customers through email, text, online chat, social media, voice and video conversations. GoDaddy Conversations is also integrated with Google's Business Messages, allowing customers with Websites + Marketing plans to receive messages from their customers using Google Search and Google Maps. We intend to continue investing in the breadth of our product offerings to help our customers connect with their customers and run their ventures.

The Next Generation of Naming. We are a global leader in domain name registration, with approximately 81 million domains under management. We offer easy and efficient domain name search tools through our website and mobile application, including search using business descriptions, which enables GoDaddy to better understand intent and suggest a wide variety of creative domain and business name recommendations that suit a customer's needs. Customers can now also use Airo to generate unique domain name suggestions. In addition, through GoDaddy Registry, we operate or provide back-end registry services to approximately 180 TLDs. We also offer an expanded secondary market to help match buyers to sellers who already own domains. With GoDaddy Auctions, customers can find the perfect domain or invest in an inventory of domain listings and exclusive expired auctions, and they can even watch and bid on domains at auction and stay on top of current bids with our GoDaddy Investor mobile application. We continue to invest in search, discovery and recommendation tools and transfer protocols for both primary and secondary domains. In 2024 we started preparations for and work on an approach towards our participation in the next ICANN gTLD round. These efforts will continue throughout 2025. In addition, GoDaddy Registry now provides domain name blocking that is designed to help rights holders to take control of their online identity.

Partnering Up. Our flexible platform enables us to form strategic partnerships and quickly launch new products and offerings for our customers, including through partnerships such as Microsoft 365 for productivity solutions. Additionally, we have built a robust pipeline of future partnership opportunities to continue identifying value-added product and service offerings.

Harnessing the power of generative AI for our customers. We design our generative AI-powered tools and experiences to enhance our customers' discoverability of and engagement with the full suite of our product offerings and reduce the friction inherent in establishing their online presence and growing their businesses. With such tools, our customers can go from idea to domain to fully published website and content creation abilities in just minutes. In 2023, we introduced Airo, an AI-powered experience designed to build and help grow businesses online, implemented powerful generative AI tools into Websites + Marketing and brought AI-powered solutions to GoDaddy Pros with GoDaddy's AI Assistant in the Pro Hub. In 2024, we continued to build our AI-powered solutions and capabilities with the following:

•GoDaddy Airo: Continued to build Airo with increased investments in marketing initiatives to support a broader rollout to our customers, and now include Airo for customers that start with a website purchase. Airo also now provides advanced logos and imagery, as well as marketing tools to help our customers grow their businesses.

•Site Optimizer: Introduced our Site Optimizer tool, which can inspect any website and provide actionable recommendations to improve performance.

•Managed WordPress: Expanded AI generated content in Managed WordPress, including optimized and enhanced models to generate content for multiple pages of our customers' websites making it easier for customers to build and publish websites.

Helping customers sell anything anywhere. Our commerce solutions are designed to grow with our customers' businesses by enabling them to seamlessly sell both offline and online, from online marketplaces and social platforms, while easily managing their sales in one place. In 2024, we launched and upgraded the following commerce products and services:

•GoDaddy Payments Canada: Launched our first international market for GoDaddy Payments with the expansion into the Canadian market, offering Canadian merchants the lowest pricing compared to leading Canadian providers, and similar processing and payment acceptance solutions our U.S. merchants enjoy.

•Tap to Pay on GoDaddy App: Launched Tap-to-Pay capability in the GoDaddy Mobile App for Android phones, lowering the barrier for millions of small businesses to start accepting in-person, contactless payments in a seamless, low-friction sign-up experience.

•Smart Terminal Flex: Launched the new GoDaddy Smart Terminal Flex, a powerful and compact POS device in the GoDaddy Smart Terminal line that is powered by GoDaddy Payments.