- MCRB Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

PRE 14A Filing

Seres Therapeutics (MCRB) PRE 14APreliminary proxy

Filed: 3 Mar 25, 4:08pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

☒ | Preliminary Proxy Statement |

|

|

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

|

☐ | Definitive Proxy Statement |

|

|

☐ | Definitive Additional Materials |

|

|

☐ | Soliciting Material under § 240.14a-12 |

SERES THERAPEUTICS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check all boxes that apply)

☒ | No fee required. |

| |

☐ | Fee paid previously with preliminary materials. |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

Seres Therapeutics, Inc. |

|

| ||||

PROXY STATEMENT | ||||||

Annual Meeting of Stockholders April 10, 2025 8:00 a.m. Eastern Time | ||||||

PRELIMINARY PROXY MATERIALS

SUBJECT TO COMPLETION, DATED MARCH 3, 2025

SERES THERAPEUTICS, INC.

101 CAMBRIDGEPARK DRIVE

CAMBRIDGE, MASSACHUSETTS 02140

[ ], 2025

To Our Stockholders:

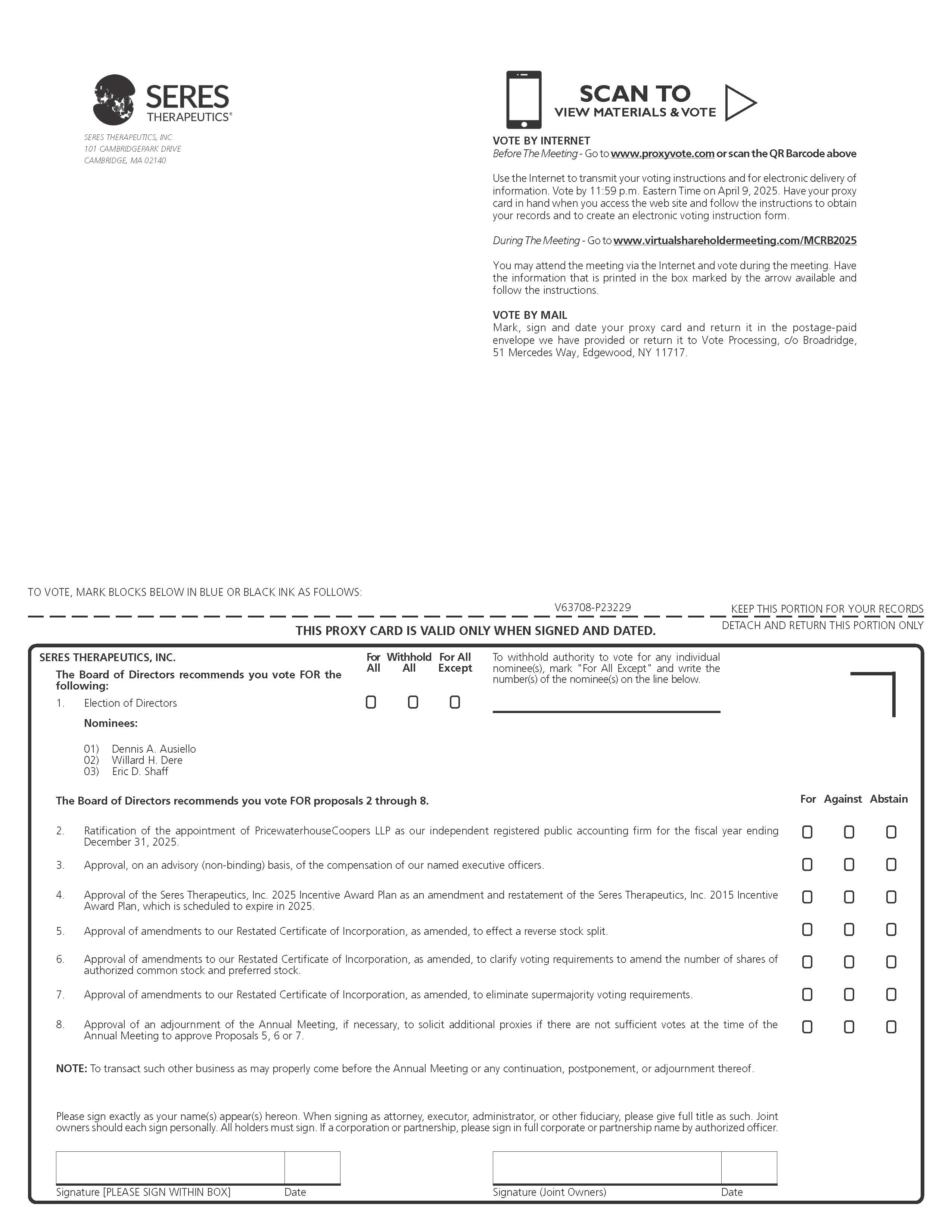

You are cordially invited to attend the 2025 Annual Meeting of Stockholders of Seres Therapeutics, Inc. at 8:00 a.m. Eastern time, on Thursday, April 10, 2025 (the “Annual Meeting”). The Annual Meeting will be held online. You will be able to attend the Annual Meeting online and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/MCRB2025.

The Notice of Meeting and Proxy Statement on the following pages describe the matters to be presented at the Annual Meeting. Please see the section called “Who Can Attend the 2025 Annual Meeting of Stockholders?” on page 3 of the proxy statement for more information about how to attend the meeting online.

Whether or not you attend the Annual Meeting webcast, it is important that your shares be represented and voted at the Annual Meeting. Therefore, I urge you to promptly vote and submit your proxy via the Internet or by signing, dating and returning the enclosed proxy card in the enclosed envelope, which requires no postage if mailed in the United States. Instructions regarding how you can vote are contained on the proxy card. You may also vote online during the Annual Meeting. Instructions on how to vote during the meeting will be available at www.virtualshareholdermeeting.com/MCRB2025.

Thank you for your support.

Sincerely,

Eric D. Shaff

President and Chief Executive Officer

Compensation and Talent Committee Interlocks and Insider Participation | 66 |

|

|

67 | |

|

|

68 | |

|

|

69 | |

|

|

70 | |

|

|

71 | |

|

|

88 | |

|

|

90 | |

|

|

91 | |

|

|

92 | |

|

|

94 |

Notice of Annual Meeting of Stockholders

To Be Held Thursday, April 10, 2025

SERES THERAPEUTICS, INC.

101 CAMBRIDGEPARK DRIVE

CAMBRIDGE, MASSACHUSETTS 02140

The Annual Meeting of Stockholders (the “Annual Meeting”) of Seres Therapeutics, Inc., a Delaware corporation (the “Company”), will be held at 8:00 a.m. Eastern time on Thursday, April 10, 2025. The Annual Meeting will be a completely virtual meeting, which will be conducted via live webcast. You will be able to attend the Annual Meeting online and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/MCRB2025 and entering your 16-digit control number included on your proxy card or on the instructions that accompanied your proxy materials. The Annual Meeting will be held for the following purposes:

Holders of record of our Common Stock as of the close of business on February 13, 2025 are entitled to notice of and to vote at the Annual Meeting, or any continuation, postponement or adjournment of the Annual Meeting. To participate in the Annual Meeting, including to vote via the Internet, you will need the 16-digit control number included on your proxy card or on the instructions that accompanied your proxy materials. A complete list of stockholders entitled to vote at the Annual Meeting will be open to the examination of any stockholder for a purpose germane to the meeting by sending an email to info@serestherapeutics.com, stating the purpose of the request and providing proof of ownership of our Common Stock for a period of ten days ending on the day before the Annual Meeting. The Annual Meeting may be continued or adjourned from time to time without notice other than by announcement at the Annual Meeting.

It is important that your shares be represented regardless of the number of shares you may hold. Whether or not you plan to attend the Annual Meeting webcast, we urge you to vote your shares via the Internet, as described in the enclosed materials. If you have received a printed copy of your proxy card by mail, you may alternatively sign, date and mail the proxy card in the enclosed return envelope. Promptly voting your shares will ensure the presence of a quorum at the Annual Meeting and will save us the expense of further solicitation. Submitting your proxy now will not prevent you from voting your shares at the Annual Meeting if you desire to do so, as your proxy is revocable at your option.

By Order of the Board of Directors

Thomas J. DesRosier

Secretary

Cambridge, Massachusetts

[ ], 2025

Proxy Statement

SERES THERAPEUTICS, INC.

101 CAMBRIDGEPARK DRIVE

CAMBRIDGE, MASSACHUSETTS 02140

This proxy statement is furnished in connection with the solicitation by the Board of Directors of Seres Therapeutics, Inc., a Delaware corporation (the "Company") of proxies to be voted at our Annual Meeting of Stockholders to be held on Thursday, April 10, 2025 (the “Annual Meeting”), at 8:00 a.m. Eastern time, and at any continuation, postponement, or adjournment of the Annual Meeting. The Annual Meeting will be a completely virtual meeting, which will be conducted via live webcast. You will be able to attend the Annual Meeting online and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/MCRB2025 and entering the 16-digit control number included on your proxy card or on the instructions that accompanied your proxy materials. Holders of record of shares of our common stock (our “Common Stock”), as of the close of business on February 13, 2025 (the “Record Date”), will be entitled to notice of and to vote at the Annual Meeting and any continuation, postponement, or adjournment of the Annual Meeting. As of the Record Date, there were 174,107,525 shares of Common Stock outstanding and entitled to vote at the Annual Meeting. Each share of Common Stock is entitled to one vote on any matter presented to stockholders at the Annual Meeting.

This proxy statement and our Annual Report to Stockholders for the year ended December 31, 2024 (the “2024 Annual Report”) will be released on or about March 13, 2025 to our stockholders on the Record Date.

In this proxy statement, “Seres”, “Company”, “we”, “us”, and “our” refer to Seres Therapeutics, Inc.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON THURSDAY, APRIL 10, 2025

This Proxy Statement and our 2024 Annual Report to Stockholders are available at http://www.proxyvote.com/.

PROPOSALS

At the Annual Meeting, our stockholders will be asked:

Stockholders at an annual meeting will only be able to consider proposals or nominations specified in the Notice of Annual Meeting or brought before the meeting by or at the direction of our Board of Directors or by a stockholder of record on the

1

Record Date for the meeting who is entitled to vote at the meeting and who has delivered timely written notice in proper form to our Corporate Secretary of the stockholder’s intention to bring such business before the meeting. As of the date of this proxy statement, we know of no other business that will be presented at the Annual Meeting. If any other matter properly comes before the stockholders for a vote at the Annual Meeting, however, the proxy holders named on the Company’s proxy card will vote your shares in accordance with their best judgment.

RECOMMENDATIONS OF THE BOARD

Our Board of Directors (the “Board of Directors” or the “Board”) recommends that you vote your shares of Common Stock as indicated below. If you return a properly completed proxy card, or vote your shares by Internet, your shares will be voted on your behalf as you direct. If not otherwise specified, shares of Common Stock represented by proxies will be voted, and the Board of Directors recommends that you vote:

If any other matter properly comes before the stockholders for a vote at the Annual Meeting, the proxy holders named on the Company’s proxy card will vote your shares in accordance with their best judgment.

INFORMATION ABOUT THIS PROXY STATEMENT

Why you Received this Proxy Statement. You are viewing or have received these proxy materials because our Board is soliciting your proxy to vote your shares of Common Stock at the Annual Meeting. This proxy statement includes information that we are required to provide to you under the rules of the Securities and Exchange Commission (“SEC”) and that is designed to assist you in voting your shares. Instructions regarding how you can vote are contained on the proxy card included in the proxy materials.

Householding. The SEC’s rules permit us and banks, brokers, or other agents to deliver a single set of proxy materials to one address shared by two or more of our stockholders. This delivery method is referred to as “householding” and can result in significant cost savings. To take advantage of this opportunity, we and certain banks, brokers, or other agents have delivered only one set of proxy materials to multiple stockholders who share an address, unless we received contrary instructions from the impacted stockholders prior to the mailing date. We agree to deliver promptly, upon written or oral request, a separate copy of the proxy materials, as requested, to any stockholder at the shared address to which a single copy of those documents was delivered. If you prefer to receive separate copies of the proxy materials, contact Broadridge Financial Solutions, Inc. at 1-866-540-7095 or in writing at Broadridge, Householding Department, 51 Mercedes Way, Edgewood, New York 11717.

If you are currently a stockholder sharing an address with another stockholder and wish to receive only one copy of future proxy materials for your household, please contact Broadridge at the above phone number or address.

2

Questions and Answers about the 2025 Annual Meeting of Stockholders

Who is entitled to vote at the Annual Meeting?

The Record Date for the Annual Meeting is February 13, 2025. You are entitled to vote at the Annual Meeting only if you were a stockholder of record at the close of business on that date, or if you hold a valid proxy for the Annual Meeting. Each outstanding share of Common Stock is entitled to one vote for all matters before the Annual Meeting. At the close of business on the Record Date, there were 174,107,525 shares of Common Stock outstanding and entitled to vote at the Annual Meeting.

What is the difference between being a "Record Holder" and holding shares in "Street Name"?

A record holder holds shares in his or her name. Shares held in “street name” means shares that are held in the name of a bank or broker on a person’s behalf.

Am I entitled to vote if my shares are held in "Street Name"?

Yes. If your shares are held by a bank or a brokerage firm, you are considered the “beneficial owner” of those shares held in “street name.” If your shares are held in street name, these proxy materials are being provided to you by your bank or brokerage firm, along with a voting instruction card if you received printed copies of our proxy materials. As the beneficial owner, you have the right to direct your bank or brokerage firm how to vote your shares, and the bank or brokerage firm is required to vote your shares in accordance with your instructions. If your shares are held in “street name” and you would like to vote your shares online at the Annual Meeting, you should contact your bank or broker to obtain your 16-digit control number or otherwise vote through the bank or broker.

How many shares must be present to hold the Annual Meeting?

A quorum must be present at the Annual Meeting for any business to be conducted. The presence at the Annual Meeting, in person, or by remote communication, or represented by proxy, of the holders of a majority in voting power of the Common Stock issued and outstanding and entitled to vote on the Record Date will constitute a quorum.

Who can attend the 2025 Annual Meeting of Stockholders?

You may attend the Annual Meeting online only if you are a Seres stockholder who is entitled to vote at the Annual Meeting, or if you hold a valid proxy for the Annual Meeting. You may attend and participate in the Annual Meeting by visiting the following website: www.virtualshareholdermeeting.com/MCRB2025.

The meeting webcast will begin promptly at 8:00 a.m. Eastern Time. We encourage you to access the meeting prior to the start time. Online check-in will begin at 7:55 a.m. Eastern Time, and you should allow sufficient time for the check-in procedures.

To attend and participate in the Annual Meeting, you will need the 16-digit control number included on your proxy card or on the instructions that accompanied your proxy materials. If your bank or broker holds your shares in street name, you should contact your bank or broker to obtain your 16-digit control number or otherwise vote through the bank or broker. If you lose your 16-digit control number, you may join the Annual Meeting as a “Guest” but you will not be able to vote or ask questions.

What if during the check-in time or during the Annual Meeting I have technical difficulties or trouble accessing the virtual meeting website?

We will have technicians ready to assist you with any technical difficulties you may have accessing the virtual meeting website. If you encounter any difficulties accessing the virtual meeting website during the check-in or meeting time, please call the technical support number that will be posted on the Annual Meeting login page.

Why hold a virtual meeting?

We believe that hosting a virtual meeting is in the best interest of the Company and its stockholders and enables increased stockholder attendance and participation because stockholders can participate from any location around the world. Stockholders will have the same rights and opportunities to participate as they would have at an in-person meeting.

What if a quorum is not present at the Annual Meeting?

If a quorum is not present at the scheduled time of the Annual Meeting, (i) the Chairperson of the Annual Meeting, or a person designated by the Chairperson of the Annual Meeting or (ii) a majority in voting power of the stockholders entitled

3

to vote thereon, present in person, or by remote communication, if applicable, or represented by proxy, may adjourn the Annual Meeting until a quorum is present or represented.

What does it mean if I receive more than one set of proxy materials?

It means that your shares are held in more than one account at the transfer agent and/or with banks or brokers. Please vote all of your shares. To ensure that all of your shares are voted, for each set of proxy materials, please submit your proxy via the Internet, or, if you received printed copies of the proxy materials, by signing, dating and returning each enclosed proxy card in the enclosed envelope.

How do I vote?

Whether or not you expect to attend the Annual Meeting online, we urge you to vote your shares as promptly as possible to ensure your representation and the presence of a quorum at the Annual Meeting. If you submit your proxy, you may still decide to attend the Annual Meeting and vote your shares electronically. Your most recent proxy card or Internet proxy is the one that is counted.

Stockholders of Record. If you are a stockholder of record, you may vote:

Internet voting facilities for stockholders of record will be available 24 hours a day and will close at 11:59 p.m. Eastern Time on April 9, 2025 (other than the voting that occurs during the Annual Meeting). To participate in the Annual Meeting, including to vote via the Internet, you will need the 16-digit control number included on your proxy card or on the instructions that accompanied your proxy materials.

Beneficial Owners of Shares Held in “Street Name.” If your shares are held in street name through a bank or broker, you will receive instructions on how to vote from the bank or broker. You must follow their instructions in order for your shares to be voted. Internet voting also may be offered to stockholders owning shares through certain banks and brokers. If your shares are not registered in your own name and you would like to vote your shares online at the Annual Meeting, you should contact your bank or broker to obtain your 16-digit control number or otherwise vote through the bank or broker.

If you lose your 16-digit control number, you may join the Annual Meeting as a “Guest” but you will not be able to vote or ask questions. You will need to obtain your own Internet access if you choose to attend the Annual Meeting online and/or vote over the Internet.

Can I change my vote after I submit my proxy?

Yes.

If you are a registered stockholder, you may revoke your proxy and change your vote:

Your most recent proxy card or Internet proxy is the one that is counted. Your attendance at the Annual Meeting by itself will not revoke your proxy unless you give written notice of revocation to the Secretary before your proxy is voted or you vote online during the Annual Meeting.

If your shares are held in street name, you may change or revoke your voting instructions by following the specific directions provided to you by your bank or broker, or you may vote online during the Annual Meeting by obtaining your 16-digit control number or otherwise voting through the bank or broker.

4

Will there be a question and answer session during the Annual Meeting?

As part of the Annual Meeting, we will hold a live Q&A session, during which we intend to answer appropriate questions submitted by stockholders during the meeting that are pertinent to the Company and the meeting matters. The Company will endeavor to answer as many questions submitted by stockholders as time permits. Only stockholders that have accessed the Annual Meeting as a stockholder (rather than a “Guest”) by following the procedures outlined above in “Who Can Attend the 2025 Annual Meeting of Stockholders?” will be permitted to submit questions during the Annual Meeting. Each stockholder is limited to no more than two questions. Questions should be succinct and only cover a single topic. We will not address questions that are, among other things:

Additional information regarding the Q&A session will be available in the “Rules of Conduct” available on the Annual Meeting webpage for stockholders that have accessed the Annual Meeting as a stockholder (rather than a “Guest”) by following the procedures outlined above in “Who Can Attend the 2025 Annual Meeting of Stockholders?”.

Who will count the votes?

A representative of Broadridge Financial Solutions, Inc., our inspector of election, will tabulate and certify the votes.

What if I do not specify how my shares are to be voted?

If you submit a proxy but do not indicate any voting instructions, the persons named as proxies will vote in accordance with the recommendations of our Board of Directors. Our Board of Directors’ recommendations are indicated on page 2 of this proxy statement, as well as with the description of each proposal in this proxy statement.

Will any other business be conducted at the Annual Meeting?

We know of no other business that will be presented at the Annual Meeting. If any other matter properly comes before the stockholders for a vote at the Annual Meeting, however, the proxy holders named on the Company’s proxy card will vote your shares in accordance with their best judgment.

How many votes are required for the approval of the proposals to be voted upon and how will abstentions and broker non-votes be treated?

Proposal | Votes required | Effect of Votes Withheld / Abstentions and Broker Non-Votes |

Proposal 1: Election of Directors | The plurality of the votes cast. This means that the three nominees receiving the highest number of affirmative “FOR” votes will be elected as Class I Directors. | Votes withheld and broker non-votes will have no effect. |

Proposal 2: Ratification of Appointment of Independent Registered Public Accounting Firm | The affirmative vote of the holders of a majority of the votes cast affirmatively or negatively. | Abstentions and broker non-votes will have no effect. We do not expect any broker non-votes on this Proposal. |

Proposal 3: Approval, on an Advisory (Non- Binding) Basis, of the Compensation of Our Named Executive Officers | The affirmative vote of the holders of a majority of the votes cast affirmatively or negatively. | Abstentions and broker non-votes will have no effect. |

Proposal 4: Approval of the Seres Therapeutics, Inc. 2025 Incentive Award Plan | The affirmative vote of the holders of a majority of the votes cast affirmatively or negatively. | Abstentions and broker non-votes will have no effect. |

Proposal 5: Approval of amendments to our Certificate of Incorporation to effect a reverse stock split | The affirmative vote of the holders of a majority of the votes cast for and against. | Abstentions and broker non-votes will have no effect. We do not expect any broker non-votes on this Proposal. |

Proposal 6: Approval of amendments to our Certificate of Incorporation to clarify voting requirements to amend the number of shares of authorized Common Stock and preferred stock | The affirmative vote of the holders of a majority of the outstanding stock of the Company entitled to vote on the Proposal. | Abstentions and broker non-votes will have the same effect as votes against this Proposal. We do not expect any broker non-votes on this Proposal. |

Proposal 7: Approval of amendments to our Certificate of Incorporation to eliminate supermajority voting requirements | The affirmative vote of the holders of at least two-thirds in voting power of the outstanding shares of | Abstentions and broker non-votes will have the same effect as votes against this Proposal. |

5

Proposal | Votes required | Effect of Votes Withheld / Abstentions and Broker Non-Votes |

| capital stock of the Company entitled to vote on the Proposal. |

|

Proposal 8: Approval of an adjournment of the Annual Meeting, if necessary, to solicit additional proxies if there are not sufficient votes at the time of the Annual Meeting to approve Proposals 5, 6, or 7 | The affirmative vote of the holders of a majority of the votes cast affirmatively or negatively. | Abstentions and broker non-votes will have no effect. We do not expect any broker non-votes on this Proposal. |

What is an abstention and how will votes withheld and abstentions be treated?

A “vote withheld,” in the case of the proposal regarding the election of directors, or an “abstention,” with respect to the other proposals, represents a stockholder’s affirmative choice to decline to vote on a proposal. Votes withheld and abstentions are counted as present and entitled to vote for purposes of determining a quorum. Votes withheld have no effect on the election of directors (Proposal 1). Abstentions will have the same effect as a vote against the approval of amendments to our Certificate of Incorporation to clarify voting requirements to amend the number of authorized shares of Common Stock and preferred stock (Proposal 6) and the approval of amendments to our Certificate of Incorporation to eliminate supermajority voting requirements (Proposal 7). Abstentions have no effect on the other proposals (Proposals 2, 3, 4, 5, and 8).

What are broker non-votes and do they count for determining a quorum?

Generally, broker non-votes occur when shares held by a broker in “street name” for a beneficial owner are not voted with respect to a particular proposal because the broker (1) has not received voting instructions from the beneficial owner and (2) lacks discretionary voting power to vote those shares.

Broker non-votes count for purposes of determining whether a quorum is present.

A broker is entitled to vote shares held for a beneficial owner on routine matters without instructions from the beneficial owner of those shares. We believe that Proposals 2, 5, 6 and 8 are routine matters. On the other hand, absent instructions from the beneficial owner of such shares, a broker is not entitled to vote shares held for a beneficial owner on non-routine matters. We believe that Proposals 1, 3, 4, and 7 are non-routine matters. Those items for which your broker cannot vote result in broker non-votes if you do not provide your broker with voting instructions on such items.

Where can I find the voting results of the 2025 Annual Meeting of Stockholders?

We plan to announce preliminary voting results at the Annual Meeting and we will report the final results in a Current Report on Form 8-K, which we intend to file with the SEC after the Annual Meeting.

6

Proposals to be Voted On

PROPOSAL 1

Election of Directors

At the Annual Meeting, three (3) Class I Directors are to be elected to hold office until the Annual Meeting of Stockholders to be held in 2028 and until such director’s successor is elected and qualified.

We currently have nine (9) directors on our Board, including three (3) current Class I Directors. Our current Class I Directors are Dennis A. Ausiello, M.D., who has served on our Board since April 2015, Willard H. Dere, M.D., who has served on our Board since July 2017, and Eric D. Shaff, who has served on our Board since January 2019. The Board has nominated each of Dennis A. Ausiello, M.D., Willard H. Dere, M.D., and Eric D. Shaff for election as Class I Directors at the Annual Meeting.

As set forth in our Certificate of Incorporation, the Board of Directors is currently divided into three classes with staggered, three-year terms. At each annual meeting of stockholders, the successors to directors whose terms then expire will be elected to serve from the time of election and qualification until the third annual meeting following election. The members of the classes are divided as follows:

Our Certificate of Incorporation and Amended and Restated Bylaws ("Bylaws") provide that the authorized number of directors may be changed only by resolution of our Board of Directors. Any additional directorships resulting from an increase in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of the directors. The division of our Board of Directors into three classes with staggered three-year terms may delay or prevent a change of our management or a change in control of our Company. Currently, our directors may be removed only for cause by the affirmative vote of the holders of at least two-thirds of our outstanding voting stock entitled to vote in the election of directors. In Proposal 7, we are requesting stockholders to vote on the elimination of this supermajority voting requirement.

If you submit a proxy but do not indicate any voting instructions, the persons named as proxies will vote the shares of Common Stock represented thereby for the election as Class I Directors of the persons whose names and biographies appear below. All of the persons whose names and biographies appear below are currently serving as our directors. In the event any of the nominees should become unable to serve, or for good cause will not serve, as a director, it is intended that votes will be cast for a substitute nominee designated by our Board of Directors or our Board of Directors may elect to reduce its size. The Board of Directors has no reason to believe that the nominees named below will be unable to serve if elected. Each of the nominees has consented to being named in this proxy statement and to serve if elected.

VOTE REQUIRED

This Proposal requires the approval of a plurality of the votes cast. This means that the three nominees receiving the highest number of affirmative “FOR” votes will be elected as Class I Directors. Votes withheld and broker non-votes are not considered to be votes cast and, accordingly, will have no effect on the outcome of the vote on this Proposal.

RECOMMENDATION OF THE BOARD OF DIRECTORS

The Board of Directors unanimously recommends a vote “FOR” the election of the below Class I Director nominees.

7

DIRECTOR NOMINEES AND CONTINUING DIRECTORS

Name | Age | Served as a Director Since | Position with Seres | Class and Year Term Ending |

Director Nominees | ||||

Dennis A. Ausiello, M.D. | 79 | 2015 | Director | Class I (Subsequent Term Ending 2028 if elected at the Annual Meeting) |

Willard H. Dere, M.D. | 71 | 2017 | Director | Class I (Subsequent Term Ending 2028 if elected at the Annual Meeting) |

Eric D. Shaff | 49 | 2019 | President, Chief Executive | Class I (Subsequent Term Ending 2028 if elected at the Annual Meeting) |

Continuing Directors | ||||

Stephen A. Berenson | 64 | 2019 | Chairman of the Board of Directors | Class II (Term Ending 2026) |

Claire M. Fraser, Ph.D. | 69 | 2023 | Director | Class II (Term Ending 2026) |

Richard N. Kender | 69 | 2014 | Director | Class II (Term Ending 2026) |

Paul R. Biondi | 55 | 2020 | Director | Class III (Term Ending 2027) |

Kurt C. Graves | 57 | 2015 | Director | Class III (Term Ending 2027) |

Hans-Juergen Woerle, M.D., Ph.D. | 59 | 2025 | Director | Class III (Term Ending 2027) |

The principal occupations and business experience, for at least the past five years, of each Director (including the Class I Director nominees) are as follows:

DENNIS A. AUSIELLO, M.D. | Age 79 |

Dennis A. Ausiello, M.D., has served as a member of our Board of Directors since April 2015. Dr. Ausiello has served as the Jackson Distinguished Professor of Clinical Medicine at Harvard Medical School and Director, Emeritus of Harvard Medical School’s M.D./Ph.D. Program since 1996, Chair of Medicine, Emeritus, and Director of the Center for Assessment Technology and Continuous Health (CATCH) at Massachusetts General Hospital, which he co-founded, since 2012, and Physician-in-Chief Emeritus at Massachusetts General Hospital since 2013. From 1996 to April 2013, Dr. Ausiello served as the Chief of Medicine at Massachusetts General Hospital. Dr. Ausiello is a member of the Institute of Medicine of the National Academy of Sciences and a fellow of the American Academy of Arts and Sciences. Dr. Ausiello has served on the board of directors of Alnylam Pharmaceuticals since April 2012 and as Vice Chairman of the board of directors of Spexis AG, a clinical-stage biopharmaceutical company, since December 2021, and previously served on the board of directors of Pfizer Inc. from 2006 to 2020, where he currently serves on the advisory board since 2019. Dr. Ausiello also serves on the boards of directors of numerous privately held companies. Dr. Ausiello received a B.A. in Biochemistry from Harvard College and an M.D. from the University of Pennsylvania. We believe that Dr. Ausiello is qualified to serve on our Board of Directors because of his extensive experience as a physician and as a director of pharmaceutical companies.

WILLARD H. DERE, M.D. | Age 71 |

Willard H. Dere, M.D., has served as a member our Board of Directors since July 2017. Dr. Dere has served as Chief Advisor to the Chief Executive Officer and Chief Medical Officer of Angita Bio, a biotechnology company, since July 2022. Dr. Dere has also been Professor Emeritus, Department of Internal Medicine, at the University of Utah School of Medicine since July 2022. From November 2014 until June 2022, Dr. Dere held multiple roles at the University of Utah Health Sciences Center, including Associate Vice President for Research, Co-Director of the Utah Clinical and Translational Science Institute, and Co-Director of the Center for Genomic Medicine. Prior to his professorship, from 2003 until 2014, Dr. Dere worked at Amgen, where he was Senior Vice President and head of Global Development, and led development programs in multiple therapeutic areas. From 1989 to 2014, he worked at Eli Lilly and led multiple development programs, and also worked in clinical pharmacology, regulatory affairs and safety. Dr. Dere has served on the boards of directors of BioMarin Pharmaceutical, Inc. since 2016, Mersana Therapeutics, Inc. since 2018, and Metagenomi, Inc. since August 2021, and previously served on the boards of directors of Ocera Therapeutics and Radius Health. Dr. Dere received his B.A. in History and Zoology and M.D. from the University of California, Davis, completed his internal medicine residency training at the University of Utah, and his postdoctoral training in endocrinology and metabolism at the University of California, San Francisco. We believe Dr. Dere is qualified to serve on our Board of Directors due to his extensive academic experience and his knowledge of the biotechnology industry.

8

ERIC D. SHAFF | Age 49 |

Eric D. Shaff has served as our President and Chief Executive Officer and a member of our Board of Directors since January 2019. Previously, he served as our Chief Operating and Financial Officer and Executive Vice President from January 2018 until January 2019 and as our Chief Financial Officer from November 2014 until January 2019. From January 2012 to November 2014, Mr. Shaff was Vice President of Corporate Finance for Momenta Pharmaceuticals, or Momenta, a biotechnology company, where he helped manage Momenta’s accounting, finance, planning, and procurement functions, as well as contributing to Momenta’s investor relations efforts. Prior to Momenta, Mr. Shaff held a number of corporate development and finance positions with Genzyme Corporation, a biotechnology company, most recently as Vice President of Finance/Controller for the Personalized Genetic Health division. Mr. Shaff previously served on the board of directors of Sigilon Therapeutics, Inc. from 2017 to August 2023. Mr. Shaff received his B.A. from the University of Pennsylvania and his M.B.A. from Cornell University. We believe Mr. Shaff is qualified to serve on our Board of Directors because of his extensive business and finance experience and his knowledge of the biotechnology industry.

STEPHEN A. BERENSON | Age 64 |

Stephen A. Berenson has served as Chairman of our Board of Directors since December 2019 and as a member of our Board of Directors since August 2019. Mr. Berenson has been a Managing Partner at Flagship Pioneering, a life sciences innovation firm which conceives, creates, resources and develops first-in-category bioplatform companies, since June 2017. Prior to Flagship, Mr. Berenson spent 33 years in various roles as an investment banker at J.P. Morgan, most recently serving in the role of Vice Chairman of Investment Banking from 2005 to April 2017, where he focused on providing high-touch strategic advice and complex transaction execution to leading companies across all industries globally. He was co-founder of J.P. Morgan’s Global Strategic Advisory Council and co-founder of the firm’s Board Initiative. Mr. Berenson has served as chairman of the board of directors of Cellarity, a privately held pharmaceutical company, since July 2021, as chairman of SAIL Biomedicines, a privately held pharmaceutical company, since August 2024, and as a director of Inari, a privately held agricultural company, since January 2024. He previously served on the board of directors of Moderna, Inc., a pharmaceutical and biotechnology company, from October 2017 to August 2024. Mr. Berenson received an S.B. in Mathematics from the Massachusetts Institute of Technology. We believe that Mr. Berenson is qualified to serve on our Board of Directors because of his extensive experience working with rapidly-growing companies across various industries.

CLAIRE M. FRASER, PH.D. | Age 69 |

Claire M. Fraser, Ph.D., has served as a member of our Board of Directors since January 2023. Dr. Fraser has been a faculty member at the University of Maryland School of Medicine in Baltimore, Maryland for the past 18 years and is the Founding Director of the Institute for Genome Sciences and Professor Emerita of Medicine and Microbiology and Immunology. From 1998 to 2007, she served as President and Director of The Institute for Genomic Research, a not-for-profit research organization engaged in human and microbial genomics studies. Dr. Fraser has served on the Board of Directors of Becton, Dickinson, and Company, a medical technology company, since 2006, and previously served as the Chair of the Board and a director of the American Association for the Advancement of Science. Dr. Fraser received her bachelor’s degree in Biology from Rensselaer Polytechnic Institute, her Ph.D. in Pharmacology from State University of New York-Buffalo and is an elected member of both the National Academy of Sciences and the National Academy of Medicine. We believe Dr. Fraser is qualified to serve on our Board of Directors due to her extensive academic experience and her knowledge of the microbiome industry.

RICHARD N. KENDER | Age 69 |

Richard N. Kender has served as a member of our Board of Directors since October 2014. From October 1978 to September 2013, Mr. Kender held positions in a variety of corporate areas at Merck & Co., Inc., or Merck, a pharmaceutical company, most recently serving as Senior Vice President of Business Development and Corporate Licensing. Mr. Kender has served on the boards of directors of Poxel S.A. since March 2015, Bicycle Therapeutics PLC since July 2019, Longeveron Inc. since May 2024 and Omega Therapeutics since June 2024. He previously served on the boards of directors of INC Research Holdings, Inc. (now known as Syneos Health) between December 2014 and August 2017, Abide Therapeutics, Inc., a privately held company, between December 2015 and May 2019, and ReViral Ltd., a privately held company, from November 2019 to June 2022. Mr. Kender received a B.S. in Accounting from Villanova University and an M.B.A. from Fairleigh Dickinson University. We believe Mr. Kender is qualified to serve on our Board of Directors because of his finance experience and knowledge of the biotechnology industry.

9

PAUL R. BIONDI | Age 55 |

Paul R. Biondi has served as a member of our Board of Directors since March 2020. Mr. Biondi is a Managing Partner and President of Pioneering Medicines at Flagship Pioneering, a life sciences innovation firm which conceives, creates, resources and develops first-in-category bioplatform companies, roles he has held since November 2019. Mr. Biondi joined Flagship Pioneering following a seventeen-year tenure at Bristol-Myers Squibb, or BMS, a pharmaceutical company, where he was most recently the Senior Vice President of Strategy and Business Development from October 2015 to November 2019. Prior to serving in the role of Senior Vice President of Strategy, from 2002 to 2015, Mr. Biondi held a series of other leadership roles within BMS’ Research and Development organization overseeing strategy, portfolio, and project management, as well as clinical and business operations. Mr. Biondi holds a bachelor’s degree from Dartmouth College and an M.B.A. from the J.L. Kellogg School of Management at Northwestern University. We believe that Mr. Biondi is qualified to serve on our Board of Directors because of his extensive experience in biopharmaceutical strategy and corporate development.

KURT C. GRAVES | Age 57 |

Kurt C. Graves has served as a member of our Board of Directors since November 2015. Mr. Graves has served as the Chairman, President and Chief Executive Officer of i20 Therapeutics, Inc., a biotechnology company, since August 2023, and as a director since August 2021. He previously served as the Executive Chairman of i20 Therapeutics’ board of directors from August 2021 to August 2023. Mr. Graves was previously the Chairman, President and Chief Executive Officer of Intarcia Therapeutics, Inc., a biotechnology company, from September 2010 to December 2020, and on its board of directors from August 2010 to December 2020. Previously, he served as Executive Vice President, Chief Commercial Officer and Head of Strategic Development at Vertex Pharmaceuticals Inc., or Vertex, from July 2007 to October 2009. Prior to joining Vertex, Mr. Graves held various senior leadership positions at Novartis Pharmaceuticals Corporation, or Novartis Corp., from 1999 to June 2007, including the Global General Medicines Business Unit Head and Global Chief Marketing Officer for the pharmaceuticals division of Novartis Corp. from September 2003 to June 2007. Prior to Novartis Corp., Mr. Graves held senior leadership positions at Merck and Astra-Merck where he led the U.S. Business Unit responsible for Prilosec, Nexium and Prilosec OTC over a 10-year period. He served as Chairman on the board of directors of Radius Health, Inc. from May 2011 to March 2020, and as a director on Achillion Pharmaceuticals, Inc., or Achillion, from June 2012 to January 2020, when Achillion was acquired. Mr. Graves received a B.S. in Biology from Hillsdale College. We believe Mr. Graves is qualified to serve as a member of our Board of Directors because of his extensive experience in the life sciences industry, membership on various boards of directors and his leadership and management experience.

Hans-Juergen Woerle, M.D., PH.D. | Age 59 |

Hans-Juergen Woerle, M.D., has served as a member of our Board of Directors since February 2025. Dr. Woerle has served as Chief Medical Officer and Chief Scientific Officer at Nestlé Health Science S.A. since November 2018, where he is responsible for global research and development strategy. Dr. Woerle served on the board of directors of Cerecin Inc., a clinical-stage biotechnology company, from June 2020 to September 2024. He currently serves on the board of directors of Enterome, SA, a clinical-stage biopharmaceutical company, since June 2020. Dr. Woerle is a board-certified physician and a specialist in internal medicine and endocrinology, holding an adjunct professorship at University of Ulm. Dr. Woerle earned his bachelors degree, masters degree and medical degree from Ludwig Maximilian University. We believe Dr. Woerle is qualified to serve on our Board of Directors because of his extensive experience as a physician and in clinical research and development.

10

PROPOSAL 2

Ratification of Appointment of Independent Registered Public Accounting Firm

The Audit Committee of the Board of Directors (the “Audit Committee”) has appointed PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2025. Our Board of Directors has directed that this appointment be submitted to our stockholders for ratification. Although ratification of our appointment of PricewaterhouseCoopers LLP is not required, we value the opinions of our stockholders and believe that stockholder ratification of our appointment is a good corporate governance practice.

PricewaterhouseCoopers LLP also served as our independent registered public accounting firm for the fiscal year ended December 31, 2024. Neither the accounting firm nor any of its members has any direct or indirect financial interest in or any connection with us in any capacity other than as our auditors, providing audit and non-audit related services. A representative of PricewaterhouseCoopers LLP is expected to attend the Annual Meeting and to have an opportunity to make a statement and be available to respond to appropriate questions from stockholders.

In the event that the appointment of PricewaterhouseCoopers LLP is not ratified by the stockholders, the Audit Committee will consider this fact when it appoints the independent auditors for the fiscal year ending December 31, 2026. Even if the appointment of PricewaterhouseCoopers LLP is ratified, the Audit Committee retains the discretion to appoint a different independent auditor at any time if it determines that such a change is in the interest of our Company.

VOTE REQUIRED

This Proposal requires the affirmative vote of the holders of a majority of the votes cast affirmatively or negatively. Abstentions and broker non-votes are not considered to be votes cast and, accordingly, will have no effect on the outcome of the vote on this Proposal. Because brokers have discretionary authority to vote on the ratification of the appointment of PricewaterhouseCoopers LLP, we do not expect any broker non-votes in connection with this Proposal.

RECOMMENDATION OF THE BOARD OF DIRECTORS

The Board of Directors unanimously recommends a vote “FOR” the Ratification of the Appointment of PricewaterhouseCoopers LLP as our Independent Registered Public Accounting Firm.

11

PROPOSAL 3

Approval, on an Advisory (Non-Binding) Basis, of the Compensation of Our Named Executive Officers

In accordance with the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”) and Rule 14a-21 under the Exchange Act, we request that our stockholders cast a non-binding, advisory vote to approve the compensation of our named executive officers identified in the section titled “Executive and Director Compensation” set forth below in this proxy statement. This Proposal, commonly known as a “say-on-pay” proposal, gives our stockholders the opportunity to express their views on our named executive officers’ compensation. This vote is not intended to address any specific item of compensation, but rather the overall compensation of our named executive officers and the philosophy, policies and practices described in this proxy statement.

Accordingly, we ask our stockholders to vote “FOR” the following resolution at the Annual Meeting:

“RESOLVED, that the Company’s stockholders approve, by a non-binding advisory vote, the compensation of the named executive officers, as disclosed in the Company’s Proxy Statement for the 2025 Annual Meeting of Stockholders pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the compensation tables and narrative discussion.”

We believe that our compensation programs and policies for the year ended December 31, 2024 were an effective incentive for the achievement of our goals, aligned with stockholders’ interest and worthy of stockholder support. Additional details concerning how we structure our compensation programs to meet the objectives of our compensation program are provided in the section titled “Executive Compensation” set forth below in this proxy statement. In particular, we discuss how we design performance-based compensation programs and set compensation targets and other objectives to maintain a close correlation between Company and individual achievement.

This vote is merely advisory and will not be binding upon us, our Board of Directors or our Compensation and Talent Committee, nor will it create or imply any change in the duties of us, our Board of Directors or our Compensation and Talent Committee. The Compensation and Talent Committee will, however, take into account the outcome of the vote when considering future executive compensation decisions. At our 2024 Annual Meeting of Stockholders, approximately 65% of the votes cast on the “say-on-pay” proposal were voted “FOR” the proposal. The Board of Directors values constructive dialogue on executive compensation and other significant governance topics with our stockholders and encourages all stockholders to vote their shares on this important matter.

At our 2021 Annual Meeting of Stockholders held on June 16, 2021, our stockholders recommended, on an advisory basis, that the stockholder vote on the compensation of our named executive officers occur every year. In light of the foregoing recommendation, our board of directors determined to hold a “say-on-pay” advisory vote every year. Accordingly, our next advisory say-on-pay vote (following the non-binding advisory vote at this Annual Meeting) is expected to occur at the 2026 Annual Meeting of Stockholders.

VOTE REQUIRED

This Proposal requires the affirmative vote of the holders of a majority of the votes cast affirmatively or negatively. Abstentions and broker non-votes are not considered to be votes cast and, accordingly, will have no effect on the outcome of the vote on this Proposal.

RECOMMENDATION OF THE BOARD OF DIRECTORS

The Board of Directors unanimously recommends a vote “FOR” the approval, on an advisory (non-binding) basis, of the compensation of our named executive officers.

12

PROPOSAL 4

Approval of the Amendment and Restatement of the Seres Therapeutics, Inc. 2015 Incentive Award Plan, which is scheduled to expire in 2025

In this Proposal 4, we are requesting stockholders approve the Seres Therapeutics, Inc. 2025 Incentive Award Plan, or the 2025 Plan. The Board approved the 2025 Plan on March 3, 2025, subject to and effective upon stockholder approval of the 2025 Plan at the annual meeting. The 2025 Plan is an amendment and restatement of the Seres Therapeutics, Inc. 2015 Incentive Award Plan, or the 2015 Plan, which is scheduled to expire in 2025.

If approved by our stockholders, the 2025 Plan would, among other things, authorize the issuance of 48,960,690 shares of our common stock for awards under the 2025 Plan, which includes 39,365,690 shares previously authorized for issuance under the 2015 Plan plus an increase of 9,595,000 shares, and extend the term of the 2025 Plan to March 3, 2035, the tenth anniversary of the approval of the 2025 Plan by the Board.

The 2025 Plan is described in more detail below. If this Proposal is not approved by our stockholders, the 2025 Plan will not become effective, the 2015 Plan will continue as in effect immediately prior to the date the 2025 Plan was approved by the Board and we will continue to make grants under the 2015 Plan until the expiration of the 2015 Plan on June 25, 2025, after which we will not be able to continue making equity grants to our employees, directors and consultants.

We believe that the effective use of incentive compensation has been integral to our success in the past and is vital to our ability to achieve strong performance in the future. We also believe that grants of equity awards will help create long-term participation in the Company and, thereby, assist us in attracting, retaining, motivating and rewarding employees, directors and consultants. The use of long-term equity grants allows the administrator of the 2025 Plan to align the incentives of our employees, directors and consultants with the interests of our stockholders, linking compensation to our performance. The use of equity awards as compensation also allows us to conserve cash resources for other important purposes. Accordingly, the Board believes that approval of the 2025 Plan is in the best interests of the Company and the Board recommends that stockholders vote for approval of the 2025 Plan.

Material Amendments Included in the 2025 Plan

Increase in Share Reserve

The 2025 Plan will authorize the issuance of 48,960,690 shares of our common stock for awards under the 2025 Plan, which includes 39,365,690 shares previously authorized for issuance under the 2015 Plan, plus an increase of 9,595,000 shares. The increase to the share reserve also includes a corresponding increase in the number of shares that may be issued upon exercise of incentive stock options, within the meaning of Section 422 of the Internal Revenue Code of 1986, as amended, or the “Code.”

Remove Liberal Share Recycling Provisions

Shares tendered by a participant or withheld by the Company to satisfy the exercise price of an option or stock appreciation right or to satisfy tax withholding obligations, shares subject to a stock appreciation right that are not issued in connection with the stock settlement of the stock appreciation right and shares repurchased by the Company using proceeds from the exercise of an option will not be “added back” to the shares available for issuance under the 2025 Plan.

Increase Director Compensation Limit

The sum of any cash or other compensation and the value (determined as of the grant date in accordance with ASC 718, or any successor thereto), of awards granted to any non-employee director for services as a director pursuant to the 2025 Plan during any fiscal year may not exceed $750,000, or $1,000,000 in the first year an individual becomes a non-employee director, except in extraordinary circumstances.

Removal of Evergreen Provision

The 2025 Plan does not include the “evergreen” feature pursuant to which the shares available for issuance under the 2015 Plan were automatically replenished annually. Instead, the 2025 Plan authorizes a fixed number of shares so that, other than to reflect certain corporate transactions as provided in the 2025 Plan, stockholder approval is required for any increase to the number of shares that may be issued under the 2025 Plan.

13

No Repricing of Awards without Stockholder Approval

We may not reduce the exercise price of an option or stock appreciation right or cancel an option or stock appreciation right in exchange for cash, another award under the 2025 Plan or an option or stock appreciation right with an exercise price that is less than the exercise price of the original option or stock appreciation right, unless such action is approved by the stockholders or taken in connection with certain corporate transactions.

Extension of Expiration Date

Unless terminated earlier pursuant to its terms, the 2025 Plan will expire on March 3, 2035. After termination, the 2025 Plan will continue to govern outstanding awards.

Other Amendments Included in the 2025 Plan

Dividend Payments

The 2025 Plan clarifies our existing practice that no dividend or dividend equivalent will be paid to a holder of an outstanding award under the 2025 Plan unless and until the award to which such dividend or dividend equivalent relates vests.

Substitute Awards

The 2025 Plan implements the NASDAQ rule permitting shares available under certain plans acquired in acquisitions and mergers to be used for certain post-transaction grants without further stockholder approval.

Delegation of Authority

The Board may delegate any or all if its powers under the 2025 Plan to a committee of the Board or to Company officers, to the extent permitted by applicable law and subject to such restrictions set by the Board.

2025 Plan Contains Equity Compensation Best Practices

In addition to the amendments described above, the 2025 Plan contains a number of provisions that we believe reflect a broad range of compensation and governance best practices. These include:

Determination of Additional Shares under the 2025 Plan

14

The total number of shares reserved for issuance under the 2015 Plan equals the sum of (i) 2,200,000 shares, (ii) any shares that as of the effective date of the 2015 Plan were subject to awards under our 2012 Stock Incentive Plan (the “2012 Plan”), which are forfeited or lapse unexercised and which are not issued under the 2012 Plan; and (iii) an annual increase on the first day of each calendar year beginning January 1, 2016 and ending on and including January 1, 2025, equal to the lesser of (A) 4% of the aggregate number of shares outstanding on the final day of the immediately preceding calendar year and (B) such smaller number of shares as is determined by the Board.

Set forth below is the number of shares available for issuance pursuant to outstanding and future equity awards under the 2015 Plan and under all of our equity incentive plans (other than our 2015 Employee Stock Purchase Plan (the “2015 ESPP”)) on an aggregate basis, in each case, as of February 13, 2025. The closing price of our common stock on the Nasdaq Global Select Market on that date was $0.84 per share.

2015 Plan

Shares subject to outstanding options (1) | 25,804,493 |

Shares subject to outstanding restricted stock units (“RSUs”) (2) | 1,611,150 |

Shares subject to outstanding performance-based RSUs (“PSUs”) | 0 |

Shares available for issuance pursuant to future awards | 2,999,294 |

Combined Plans (3)

Shares subject to outstanding options (4) | 26,551,776 |

Shares subject to outstanding restricted stock units (“RSUs”) (5) | 1,628,579 |

Shares subject to outstanding performance-based RSUs (“PSUs”) | 0 |

Shares available for issuance pursuant to future awards | 4,710,792 |

(1) As of February 13, 2025, options outstanding under the 2015 Plan had a weighted average per share exercise price of $4.36 and a weighted average remaining term of 7.98 years.

(2) As of February 13, 2025, the weighted average remaining vesting term for RSUs under the 2015 Plan was 0.9 years.

(3) Includes the 2015 Plan, the 20212 Plan and the Seres Therapeutics, Inc. 2022 Employment Inducement Award Plan (the “2022 Inducement Award Plan”). Pursuant to Rule Nasdaq Listing Rule 5635(c)(4), awards under the 2022 Inducement Award Plan generally may only be granted to an individual who is commencing employment with the Company or who is being rehired following a bona fide interruption of employment by the Company as an inducement material to the individual’s entering into employment with the Company.

(4) As of February 13, 2025, options outstanding under the 2015 Plan, the 2012 Plan and the 2022 Inducement Award Plan had a combined weighted average per share exercise price of $4.27 and a weighted average remaining term of 8.01 years.

(5) As of February 13, 2025, the combined weighted average remaining vesting term for RSUs under 2015 Plan, the 2012 Plan and the 2022 Inducement Award Plan was 2.01 years.

If this Proposal 4 is approved, the 2025 Plan will authorize the issuance of 48,960,690 shares of our common stock for awards under the 2025 Plan, which includes 39,365,690 shares previously authorized for issuance under the 2015 Plan, plus an increase of 9,595,000 shares.

In determining to adopt the 2025 Plan, the Board reviewed an analysis prepared by Alpine-Rewards, an independent compensation consultant. Specifically, the Board considered that:

The Board also considered our broader equity grant objectives and practices and believes that the 2025 Plan is necessary to permit the Company to continue using equity incentive awards to achieve the Company’s general performance, retention and incentive goals. Equity awards are intended to motivate high levels of performance and align the interests of our directors, employees and consultants with those of our stockholders by giving directors, employees and consultants the perspective of an owner with an equity stake in the Company and providing a means of recognizing their contributions to the success of the Company. Specifically, the Board considered, among other things, that the market for high caliber, experienced talent in our industry and in our geographic location is extremely competitive. Our ability to grant equity

15

awards is critical to our ability to be competitive and to attract, retain and motivate the talent we need to best position our Company for success.

In consideration of these factors, and our belief that the ability to continue granting equity compensation is vital to our attracting and retaining employees and facilitating long-term stockholder value creation, including by retaining and incentivizing our executives and other employees, we believe that the 2025 Plan and the size of the share reserve under the 2025 Plan are reasonable, appropriate and in the best interests of the Company at this time.

Summary of the 2025 Plan

This section summarizes certain principal features of the 2025 Plan. The summary is qualified in its entirety by reference to the complete text of the 2025 Plan, which is attached to this proxy statement as Appendix A.

Eligibility and Administration

Our employees, consultants and directors, and employees and consultants of our subsidiaries, are eligible to receive awards under the 2025 Plan. As of February 13, 2025, approximately 103 employees and 8 non-employee directors were eligible to receive awards under the 2025 Plan. The 2025 Plan is administered by our Compensation and Talent Committee, although the Board may exercise any powers and responsibilities assigned to the Compensation and Talent Committee at any time. The Board may also delegate its duties and responsibilities to one or more other committees of our directors and/or to officers of the Company, subject to the limitations imposed under the 2025 Plan, Section 16 of the Exchange Act, stock exchange rules and other applicable laws. The actual administrator of the 2025 Plan is referred to as the “plan administrator” in this Proposal. The plan administrator has the authority to take all actions and make all determinations under the 2025 Plan, to interpret the 2025 Plan and award agreements and to adopt, amend and repeal rules for the administration of the 2025 Plan as it deems advisable. The plan administrator also has the authority to determine which eligible service providers receive awards, grant awards and set the terms and conditions of all awards under the 2025 Plan, including any vesting and vesting acceleration provisions, subject to the conditions and limitations in the 2025 Plan.

Shares Available for Awards

If the 2025 Plan is approved, the number of shares reserved for issuance under the 2025 Plan will be equal to the sum of (i) 48,960,690 shares; and (ii) any shares that are subject to awards under the 2012 Plan which are forfeited or lapse unexercised and which are not issued under the 2012 Plan. As of February 13, 2025, there were 5,400 shares subject to awards outstanding under the 2012 Plan. No more than 48,966,090 shares may be issued under the 2025 Plan upon the exercise of incentive stock options. Shares issued under the 2025 Plan may be authorized but unissued shares, shares purchased on the open market or treasury shares.

If an award under the 2025 Plan or the 2012 Plan, expires, lapses or is terminated, exchanged for cash, surrendered, repurchased, canceled without having been fully exercised or forfeited, any unused shares subject to the award will, as applicable, become or again be available for new grants under the 2025 Plan. However, the 2025 Plan does not allow the share pool to be replenished with shares that (i) are used to satisfy the exercise or purchase price of an award; (ii) are used to satisfy tax withholding obligations arising from an award; (iii) are subject to a stock appreciation right but are not issued in connection with the stock settlement of the stock appreciation right; or (iv) the Company purchases on the open market with cash proceeds from the exercise of options.

Director Compensation Limit

The sum of any cash or other compensation and the value (determined as of the grant date in accordance with ASC 718, or any successor thereto), of awards granted to any non-employee director for services as a director pursuant to the 2025 Plan during any fiscal year may not exceed $750,000, increased to $1,000,000 in the first year an individual becomes a non-employee director. The plan administrator may, however, make exceptions to such limit on director compensation in extraordinary circumstances, subject to the limitations in our 2025 Plan.

Awards

The 2025 Plan provides for the grant of options, including incentive stock options, or ISOs, and nonqualified options, or NSOs, stock appreciation rights, or SARs, restricted stock, dividend equivalents, restricted stock units, or RSUs, and other stock or cash based awards. Certain awards under the 2025 Plan may constitute or provide for payment of “nonqualified

16

deferred compensation” under Section 409A of the Code. All awards under the 2025 Plan are set forth in award agreements, which detail the terms and conditions of awards, including any applicable vesting and payment terms and post-termination exercise limitations. A brief description of each award type follows

Performance Criteria

The plan administrator may select performance criteria for an award to establish performance goals for a performance period. Performance criteria under the 2025 Plan may include, but are not limited to, the following: net earnings or losses (either before or after one or more of interest, taxes, depreciation, amortization, and non-cash equity-based compensation expense); gross or net sales or revenue or sales or revenue growth; net income (either before or after taxes) or adjusted net income; profits (including but not limited to gross profits, net profits, profit growth, net operation profit or economic profit), profit return ratios or operating margin; budget or operating earnings (either before or after taxes or before or after allocation of corporate overhead and bonus); cash flow (including operating cash flow and free cash flow or cash flow return on capital); return on assets; return on capital or invested capital; cost of capital; return on stockholders’ equity; total stockholder return; return on sales; costs, reductions in costs and cost control measures; expenses; working capital; earnings or loss per share; adjusted earnings or loss per share; price per share or dividends per share (or appreciation in or maintenance of such price or dividends); regulatory achievements or compliance; implementation, completion or attainment of objectives relating to research, development, regulatory, commercial, or strategic milestones or developments; market share; economic value or economic value added models; division, group or corporate financial goals; customer satisfaction/growth; customer service; employee satisfaction; recruitment and maintenance of personnel; human resources management; supervision of litigation and other legal matters; strategic partnerships and transactions; financial ratios (including those measuring liquidity, activity, profitability or leverage); debt levels or reductions; sales-related goals; financing and other capital raising transactions; cash on hand; acquisition activity; investment sourcing activity; and marketing initiatives, any of which may be measured in absolute terms or as compared to any incremental increase or decrease, peer group results, or market performance indicators or indices.

Certain Transactions

In connection with certain corporate transactions and events affecting our common stock, including a change in control, or change in any applicable laws or accounting principles, the plan administrator has broad discretion to take action under the 2025 Plan to prevent the dilution or enlargement of intended benefits, facilitate the transaction or event or give effect to the change in applicable laws or accounting principles. This includes canceling awards for cash or property,

17

accelerating the vesting of awards, providing for the assumption or substitution of awards by a successor entity, adjusting the number and type of shares subject to outstanding awards and/or with respect to which awards may be granted under the 2025 Plan and replacing or terminating awards under the 2025 Plan. Notwithstanding the foregoing, in the event awards are not assumed or substituted in connection with a change in control, such awards (other than awards that are regularly scheduled to vest based on performance-based vesting conditions) will become fully vested, exercisable and/or payable, as applicable, immediately prior to the consummation of the transaction and all forfeiture, repurchase and other restrictions will lapse. In addition, in the event of certain non-reciprocal transactions with our stockholders, the plan administrator will make equitable adjustments to the 2025 Plan and outstanding awards as it deems appropriate to reflect the transaction.

All share and per share amounts referenced in this Proposal are stated without giving effect to, and will be adjusted for, the reverse stock split proposed in Proposal 5 of this proxy statement, if this Proposal is approved.

Plan Amendment and Termination

Our Board may amend or terminate the 2025 Plan at any time; however, no amendment, other than an amendment that increases the number of shares available under the 2025 Plan, may materially and adversely affect an award outstanding under the 2025 Plan without the consent of the affected participant and stockholder approval will be obtained for any amendment to the extent necessary to comply with applicable laws. The 2025 Plan will remain in effect until March 3, 2035, the tenth anniversary of the date the Board approved the 2025 Plan, unless earlier terminated by the Board. No awards may be granted under the 2025 Plan after its termination.

No Repricings without Stockholder Approval

The plan administrator cannot, without the approval of our stockholders, reduce the exercise price of outstanding options or SARs, or cancel outstanding options or SARs, in exchange for cash, other awards under the 2025 Plan or options or SARs with an exercise price per share that is less than the exercise price per share of the original options or SARs.

Foreign Participants, Claw-Back Provisions, Transferability and Participant Payments

The plan administrator may modify awards granted to participants who are foreign nationals or employed outside the United States or establish subplans or procedures to address differences in laws, rules, regulations or customs of such foreign jurisdictions. All awards will be subject to the Company’s Policy for Recovery of Erroneously Awarded Compensation and any other clawback, recoupment, forfeiture or similar policies or provisions of the Company. Except as the plan administrator may determine or provide in an award agreement, awards under the 2025 Plan are generally non-transferrable, except by will or the laws of descent and distribution, or, subject to the plan administrator’s consent, pursuant to a domestic relations order, and are generally exercisable only by the participant. With regard to tax withholding obligations arising in connection with awards under the 2025 Plan, and exercise price obligations arising in connection with the exercise of options under the 2025 Plan, the plan administrator may, in its discretion, accept cash, wire transfer or check, shares of our common stock that meet specified conditions, a promissory note, a “market sell order,” such other consideration as the plan administrator deems suitable or any combination of the foregoing.

Interests of Certain Persons in the 2025 Plan

In considering the recommendation of the Board with respect to the approval of the 2025 Plan, stockholders should be aware that, as discussed above, non-employee directors and executive officers are eligible to receive awards under the 2025 Plan. The Board recognizes that approval of this Proposal may benefit our non-employee directors and executive officers and their successors.

Federal Income Tax Consequences

The following is a general summary as of this date of the federal income tax consequences to us and to U.S. participants for awards granted under the 2025 Plan. The federal tax laws may change and the tax consequences for any participant will depend upon his or her individual circumstances. Tax consequences for any particular individual may be different. This summary does not purport to be complete, and does not discuss state, local or non-U.S. tax consequences.

Non-Qualified Options. The grant of a non-qualified option under the 2025 Plan is not expected to result in any federal income tax consequences to the participant or to the Company. Generally, upon exercise of a non-qualified option,

18

the participant will realize ordinary income, and the Company will be entitled to a tax deduction, in an amount equal to the difference between the option exercise price and the fair market value of the shares at the time of exercise.

Incentive Stock Options. The grant or exercise of an ISO under the 2025 Plan is not expected to result in any federal income tax consequences to the participant or to the Company. However, the amount by which the fair market value of the shares at the time of exercise exceeds the option price will be an “item of adjustment” for participants for purposes of the alternative minimum tax, unless the shares are sold or otherwise disposed of in the same year the ISO is exercised. Gain realized by participants on the sale of shares underlying an ISO is taxable at capital gains rates, and no tax deduction is available to the Company, unless the participant disposes of the shares within (i) two years after the date of grant of the option or (ii) within one year of the date the shares were transferred to the participant. If the shares are sold or otherwise disposed of before the end of the one-year and two-year periods specified above, the difference between the option exercise price and the fair market value of the shares on the date of the option’s exercise (or the date of sale, if less) will be taxed at ordinary income rates, and the Company will be entitled to a deduction to the extent that the participant recognizes ordinary income.

Stock Appreciation Rights. The grant of a SAR under the 2025 Plan is not expected to result in any federal income tax consequences to either the participant or the Company. Generally, upon exercise of the SAR, the fair market value of the shares received, determined on the date of exercise of the SAR, or the amount of cash received in lieu of shares, will be treated as compensation taxable as ordinary income to the participant in the year of such exercise. The Company will be entitled to a deduction for compensation paid in the same amount which the participant realized as ordinary income.

Restricted Stock. A participant generally will not have taxable income on the grant of restricted stock under the 2025 Plan, nor will the Company then be entitled to a deduction, unless the participant makes a valid election under Section 83(b) of the Code. However, when restrictions on shares of restricted stock lapse, such that the shares are no longer subject to a substantial risk of forfeiture, the participant generally will recognize ordinary income, and the Company will be entitled to a corresponding deduction, for an amount equal to the difference between the fair market value of the shares on the date such restrictions lapse over the purchase price for the restricted stock.

Restricted Stock Units. A participant generally will not realize taxable income at the time of the grant of RSUs under the 2025 Plan, and the Company will not be entitled to a deduction at that time. When RSUs are settled, whether in cash or shares, the participant will have ordinary income, and the Company will be entitled to a corresponding deduction.

Stock Awards. If a participant receives a stock award under the 2025 Plan in lieu of a cash payment that would otherwise have been made, the participant generally will be taxed as if the cash payment has been received, and the Company will have a deduction in the same amount.

Dividend Equivalents. A participant generally will not realize taxable income at the time of the grant of dividend equivalents under the 2025 Plan, and the Company will not be entitled to a deduction at that time. When a dividend equivalent is paid, the participant will recognize ordinary income, and the Company will be entitled to a corresponding deduction.

Application of Section 409A of the Code. Section 409A of the Code imposes an additional 20% tax and interest on an individual receiving non-qualified deferred compensation under a plan that fails to satisfy certain requirements. For purposes of Section 409A, “non-qualified deferred compensation” includes equity-based incentive programs, including some options, SARs and RSU programs. Generally speaking, Section 409A does not apply to ISOs, non-discounted non-qualified options and SARs if no deferral is provided beyond exercise, or restricted stock.

The awards made pursuant to the 2025 Plan are expected to be designed in a manner intended to comply with the requirements of Section 409A to the extent the awards granted under the 2025 Plan are not exempt from Section 409A. However, if the 2025 Plan fails to comply with Section 409A in operation, a participant could be subject to the additional taxes and interest.

Limitations on the Company's Compensation Deduction. Section 162(m) of the Code limits the deduction certain employers may take for otherwise deductible compensation payable to certain current and former executive officers of the Company to the extent the compensation paid to such an officer for the year exceeds $1 million. Compensation deductions may also be limited by Section 280G of the Code.

New Plan Benefits

19

Other than with respect to awards that will be made automatically under our non-employee director compensation program as described in the footnote to the New Plan Benefits Table below, the benefits or amounts that may be received or allocated to participants under the 2025 Plan are subject to the discretion of the Compensation and Talent Committee or the Board and are not currently determinable. The following table sets forth the awards to be granted under our non-employee director compensation program irrespective of whether the 2025 Plan is approved by the stockholders.

New Plan Benefits | |||||

Seres Therapeutics, Inc. 2025 Incentive Award Plan | |||||