Exhibit 99.1

THIS IS NEITHER AN OFFER TO SELL NOR A SOLICITATION OF AN OFFER TO BUY THE SECURITIES DESCRIBED HEREIN . AN OFFERING IS MADE ONLY BY A PROSPECTUS . THIS LITERATURE MUST BE PRECEDED OR ACCOMPANIED BY A CURRENT PROSPECTUS . AS SUCH, A COPY OF THE CURRENT PROSPECTUS MUST BE MADE AVAILABLE TO YOU IN CONNECTION WITH THIS OFFERING . BEFORE YOU MAKE AN INVESTMENT IN THIS OFFERING, YOU SHOULD READ AND CAREFULLY REVIEW THE CURRENT PROSPECTUS IN ORDER TO UNDERSTAND FULLY ALL OF THE IMPLICATIONS INCLUDING THE RISKS, CHARGES AND EXPENSES OF AMERICAN REALTY CAPITAL GLOBAL TRUST II, INC . No offering is made except by a prospectus filed with the Department of Law of the State of New York . Neither the Attorney - General of the State of New York nor any other state or federal regulator has passed on or endorsed the merits of American Realty Capital Global Trust II, Inc . or confirmed the adequacy or accuracy of the prospectus . Any representation to the contrary is unlawful . All information contained in this material is qualified in its entirety by the terms of the current prospectus . The achievement of any goals is not guaranteed . * American Realty Capital Global Trust II, Inc . intends to elect and qualify to be taxed as a real estate investment trust (“REIT”) commencing with the taxable year ending December 31 , 2015 . A Public Non - Traded Real Estate Investment Trust* American Realty Capital Global Trust II, Inc. Publicly Registered Non - Traded Real Estate Investment Trust*

American Realty Capital Global Trust II, Inc. 2 IMPORTANT INFORMATION REGARDING THE OFFERING Risk Factors Investing in our common stock involves a high degree of risk . You should purchase these securities only if you can afford a complete loss of your investment . See the section entitled “Risk Factors” in the prospectus for a discussion of the risks which should be considered in connection with your investment in our common stock . Forward - Looking Statements This presentation may contain forward - looking statements . You can identify forward - looking statements by the use of forward looking terminology such as “believes,” “expects,” “may,” “will,” “would,” “could,” “should,” “seeks,” “intends,” “plans,” “projects,” “estimates,” “anticipates,” “predicts,” or “potential” or the negative of these words and phrases or similar words or phrases . Please review the end of this presentation and the fund’s prospectus for a more complete list of risk factors, as well as a discussion of forward - looking statements and other offering details.

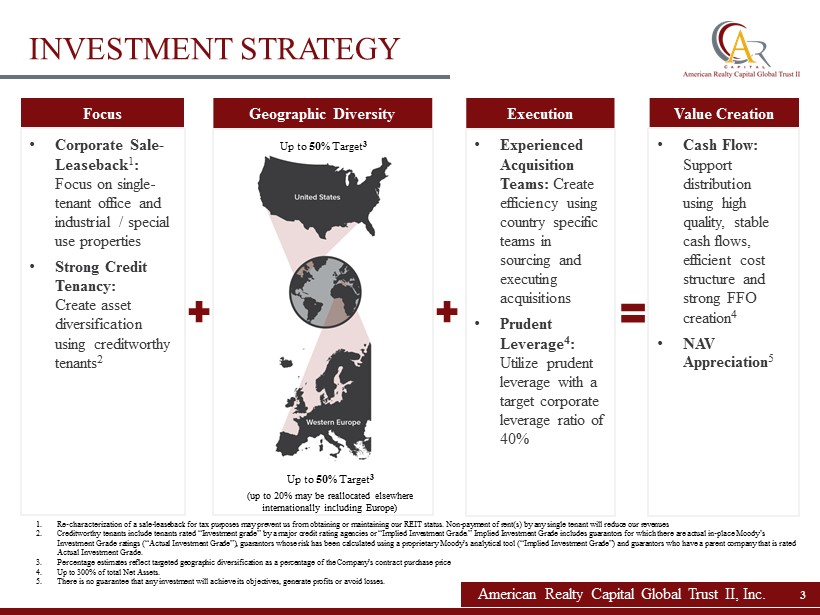

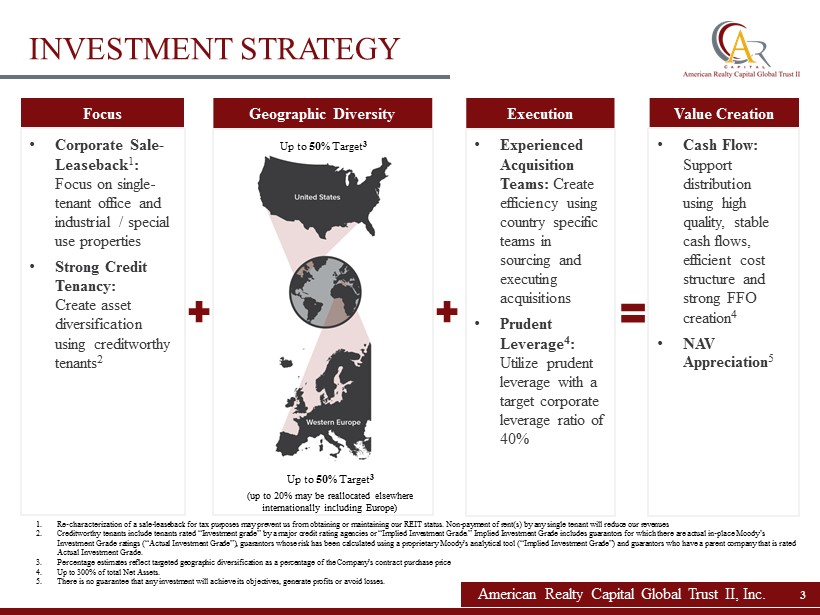

Focus Geographic Diversity Execution Value Creation • Corporate Sale - Leaseback 1 : Focus on single - tenant office and industrial / special use properties • Strong Credit Tenancy: Create asset diversification using creditworthy tenants 2 • Experienced Acquisition Teams: C reate efficiency using c ountry specific teams in sourcing and executing acquisitions • Prudent Leverage 4 : Utilize prudent leverage with a target corporate leverage ratio of 40% • Cash Flow: Support distribution using high quality, stable cash flows, efficient cost structure and strong FFO creation 4 • NAV Appreciation 5 1. Re - characterization of a sale - leaseback for tax purposes may prevent us from obtaining or maintaining our REIT status. Non - payme nt of rent(s) by any single tenant will reduce our revenues 2. Creditworthy tenants include tenants rated “Investment grade” by a major credit rating agencies or “Implied Investment Grade. ” I mplied Investment Grade includes guarantors for which there are actual in - place Moody’s Investment Grade ratings (“Actual Investment Grade”), guarantors whose risk has been calculated using a proprietary Moody’s a nal ytical tool (“Implied Investment Grade”) and guarantors who have a parent company that is rated Actual Investment Grade. 3. Percentage estimates reflect targeted geographic diversification as a percentage of the Company’s contract purchase price 4. Up to 300% of total Net Assets. 5. There is no guarantee that any investment will achieve its objectives, generate profits or avoid losses. American Realty Capital Global Trust II, Inc. 3 Up to 50 % Target 3 (up to 20% may be reallocated elsewhere internationally including Europe) INVESTMENT STRATEGY Up to 50 % Target 3

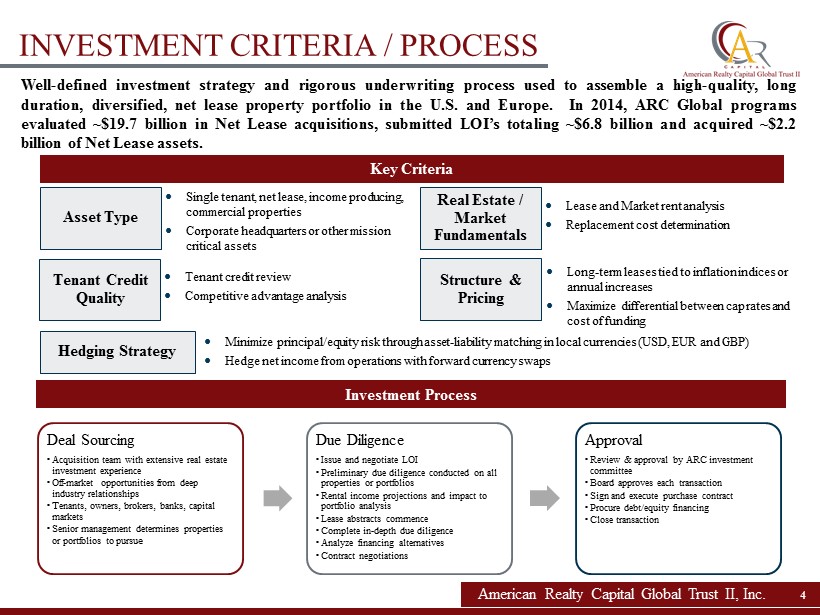

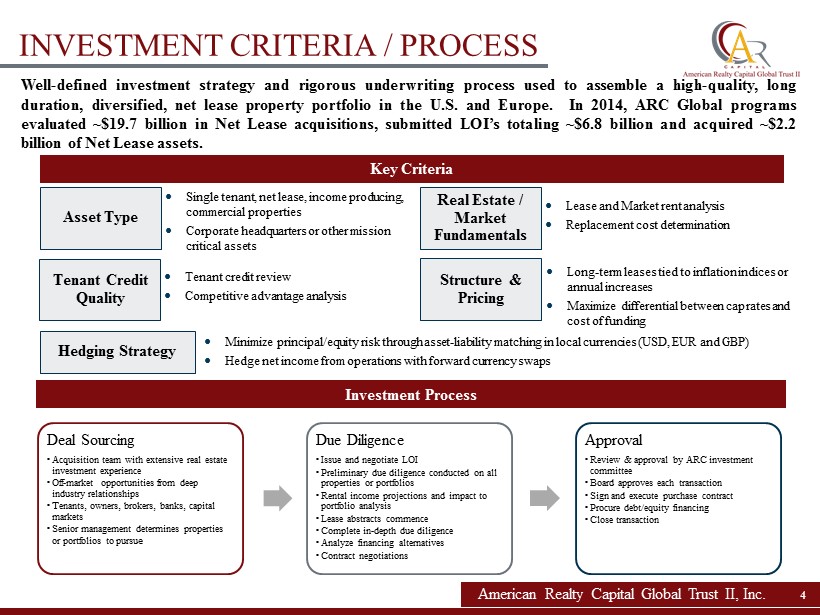

American Realty Capital Global Trust II, Inc. 4 Key Criteria Tenant Credit Quality Real Estate / Market Fundamentals Asset Type Tenant credit review Competitive advantage analysis Lease and Market rent analysis Replacement cost determination Structure & Pricing Single tenant, net lease, income producing, commercial properties Corporate headquarters or other mission critical assets Long - term leases tied to inflation indices or annual increases Maximize differential between cap rates and cost of funding Hedging Strategy Minimize principal/equity risk through asset - liability matching in local currencies (USD, EUR and GBP) Hedge net income from operations with forward currency swaps Investment Process Deal Sourcing • Acquisition team with extensive real estate investment experience • Off - market opportunities from deep industry relationships • Tenants, owners, brokers, banks, capital markets • Senior management determines properties or portfolios to pursu e Due Diligence • Issue and negotiate LOI • Preliminary due diligence conducted on all properties or portfolios • Rental income projections and impact to portfolio analysis • Lease abstracts commence • Complete in - depth due diligence • Analyze financing alternatives • Contract negotiations Approval • Review & approval by ARC investment committee • Board approves each transaction • Sign and execute purchase contract • Procure debt/equity financing • Close transaction INVESTMENT CRITERIA / PROCESS Well - defined investment strategy and rigorous underwriting process used to assemble a high - quality, long duration, diversified, net lease property portfolio in the U . S . and Europe . In 2014 , ARC Global programs evaluated ~ $ 19 . 7 billion in Net Lease acquisitions, submitted LOI’s totaling ~ $ 6 . 8 billion and acquired ~ $ 2 . 2 billion of Net Lease assets .

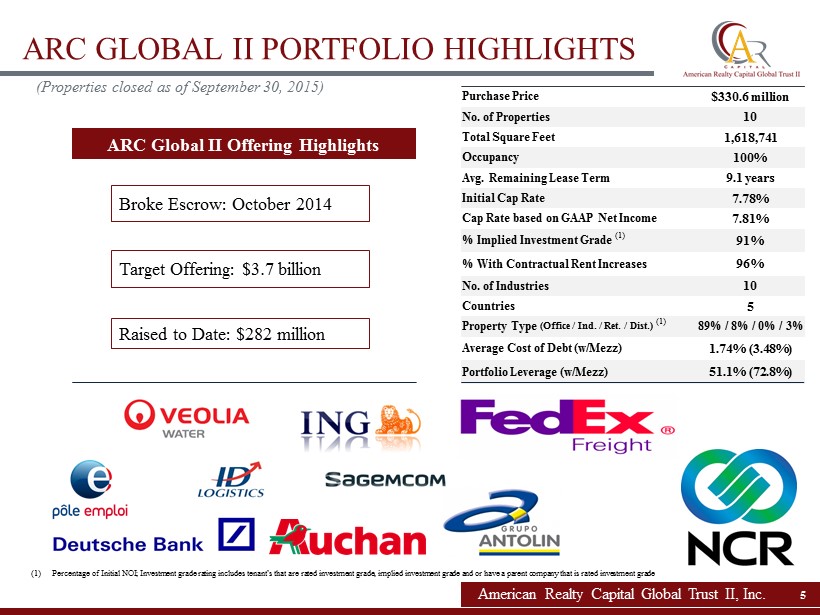

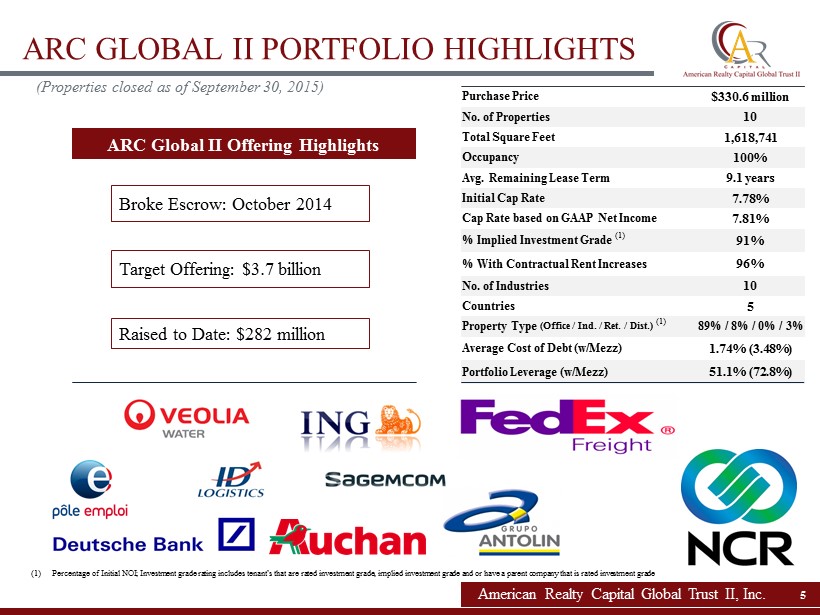

(1) Percentage of Initial NOI; Investment grade rating includes tenant’s that are rated investment grade, implied investment grade and or have a parent comp any that is rated investment grade ARC GLOBAL II PORTFOLIO HIGHLIGHTS Broke Escrow: October 2014 Target Offering: $3.7 billion Raised to Date: $282 million ARC Global II Offering Highlights (Properties closed as of September 30, 2015) American Realty Capital Global Trust II, Inc. 5 Purchase Price $330.6 million No. of Properties 10 Total Square Feet 1,618,741 Occupancy 100% Avg. Remaining Lease Term 9.1 years Initial Cap Rate 7.78% Cap Rate based on GAAP Net Income 7.81% % Implied Investment Grade (1) 91% % With Contractual Rent Increases 96% No. of Industries 10 Countries 5 Property Type (Office / Ind. / Ret. / Dist.) (1) 89% / 8% / 0% / 3% Average Cost of Debt (w/Mezz) 1.74% (3.48%) Portfolio Leverage (w/Mezz) 51.1% (72.8%)

Note: *Moody's implied rating - determined based on a company’s financial statements, long - run performance, industry, and country of b usiness. ** Reflects parent rating (1) Assumes FX rates at acquisition ARC GLOBAL II INVESTMENTS (Properties closed as of September 30, 2015) American Realty Capital Global Trust II, Inc. 6 ARC Global II Portfolio – Closed Tenant Location Rating Industry Property Type # of Props. Sq. Feet Purchase Price (1) Mortgage Rate Lease Term Remaining Closing Date ING Bank Amsterdam, NETH S&P: A Financial Services Office 1 509,369 $98,577,600 1.67% 9.8 6/30/2015 Sagemcom Rueil Malmaison, FR *Moody's: Baa2 Telecommunications Office 1 265,309 $74,500,800 1.65% 8.3 2/27/2015 Deutsche Bank Kirchberg, LUX **S&P: A Financial Services Office 1 156,098 $73,180,935 1.42% 8.2 5/18/2015 Auchan Bordeaux, FR S&P: A Food Retailer Industrial 1 152,235 $20,640,480 1.72% 7.9 12/29/2014 NCR Dundee, UK **S&P: BB+ Technology Office 1 132,182 $13,733,170 N/A 11.1 4/30/2015 Pole Emploi Marseille, FR Moody's: Aa1 Government Services Office 1 41,452 $13,091,186 1.72% 7.8 12/29/2014 FedEx Freight Greensboro, NC S&P: BBB Freight Distribution 1 68,960 $11,686,708 N/A 7.9 5/15/2015 Grupo Antolin Auburn Hills, MI **Moody’s: Baa3 Auto Manufacturer Office 1 111,798 $9,426,000 N/A 9.8 6/10/2015 Atos Worldline Blois, FR *Moody’s: Baa2 Technology Office 1 111,338 $8,801,445 1.85% 8.3 7/9/2015 Veolia Water Vandalia, OH **S&P: BBB Environmental Services Industrial 1 70,000 $6,995,939 N/A 10.3 2/26/2015 Totals: 10 1,618,741 $330,634,263 9.1

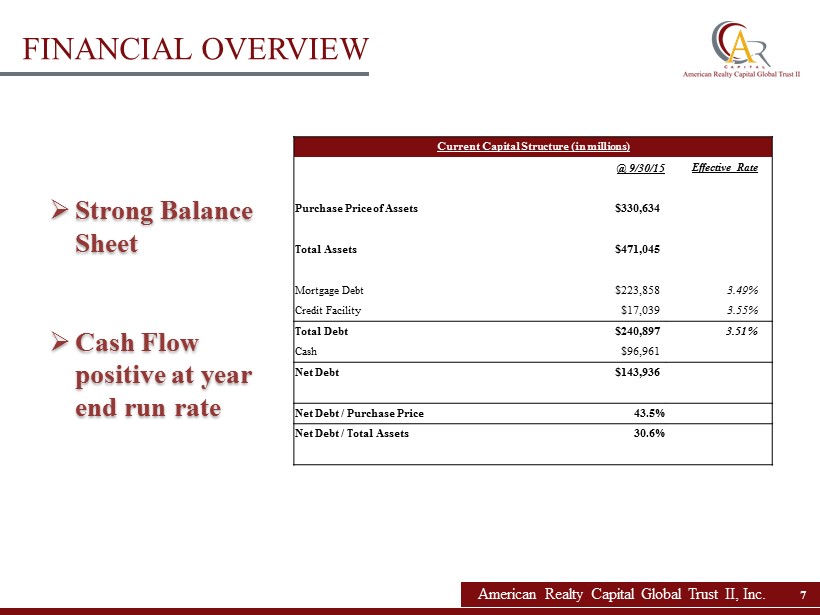

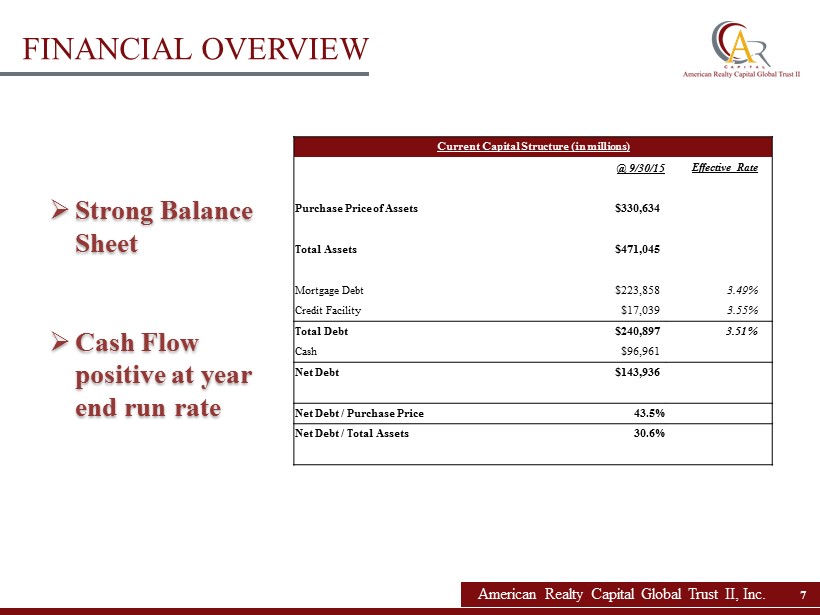

FINANCIAL OVERVIEW American Realty Capital Global Trust II, Inc. 7 » Strong Balance Sheet » Cash Flow positive at year end run rate Current Capital Structure (in millions) @ 9/30/15 Effective Rate Purchase Price of Assets $330,634 Total Assets $471,045 Mortgage Debt $223,858 3.49% Credit Facility $17,039 3.55% Total Debt $240,897 3.51% Cash $96,961 Net Debt $143,936 Net Debt / Purchase Price 43.5% Net Debt / Total Assets 30.6%

KEY INITIATIVES American Realty Capital Global Trust II, Inc. 8 » Complete remaining 2015 acquisitions: » Foster Wheeler – Reading, UK » Office building leased to international engineering company, totaling 365,842 SF ( COMPLETED) » ID Logistics – Weilbach, GER » Warehouse leased to international contract logistics company, totaling 305,587 SF ( COMPLETED) » ID Logistics – Landershein / Moreuil, FR » Two warehouses leased to international contract logistics company , totaling 964,149 SF » Harper Collins – Glasgow, UK » Distribution and office headquarters property leased to international book publisher totaling 873,119 SF » DCNS – Brest, FR » Office building leased to French naval defense company, totaling 98,824 SF » Negotiate out of agreements in connection with 2016 pipeline – no expected exposure to loss of deposits

ARC Moor Park ARC Global II Board of Directors William Kahane Exec. Chairman Stanley R. Perla Independent Bob Burns Independent Lee Elman Independent ARC Management Team / Investment Committee Scott Bowman CEO Tim Salvemini* CFO Shared Services Support Operations Investor Relations Accounting Legal Due Diligence IT Marketing Human Resources Financing Asset Management Moor Park Management Team / Investment Committee Jagdeep Kapoor CIO Shameel Kahn CEO Gary Wilder Executive Chairman Acquisitions Team Legal Asset Management Finance / Operations United States Lucas O’Connor Jr . Analyst Jason Slear Executive Vice President Brian Mansouri Vice President Audrey Ellis Vice President Europe Michael Glaser United Kingdom Javier Paz Valibuena Germany Greg Smith Nordics Diego Voss Benelux Jamal Dutheil France Akomea Poku - Kankam Senior Vice President & Counsel Ken Miles Transaction Counsel Jacqui Shimmin London David Layton Head of Asset Management Max Garelick Asset Management Analyst Paul Bergagna Vice President Karen Masey Assistant Property Manager Shaun Riley Fund Controller Paschal Ferreira Chief Accounting Officer Leah Kusayeva Finance Manager Kyle Gray Jr . Analyst Samir Mody Property Manager Marc Sabo Operations Controller Graydon Butler COO Sven Utermueller Investment Controller BOARD OF DIRECTORS AND TEAM American Realty Capital Global Trust II, Inc. American Realty Capital Global Trust II, Inc. 9 *December 1, 2015 start date

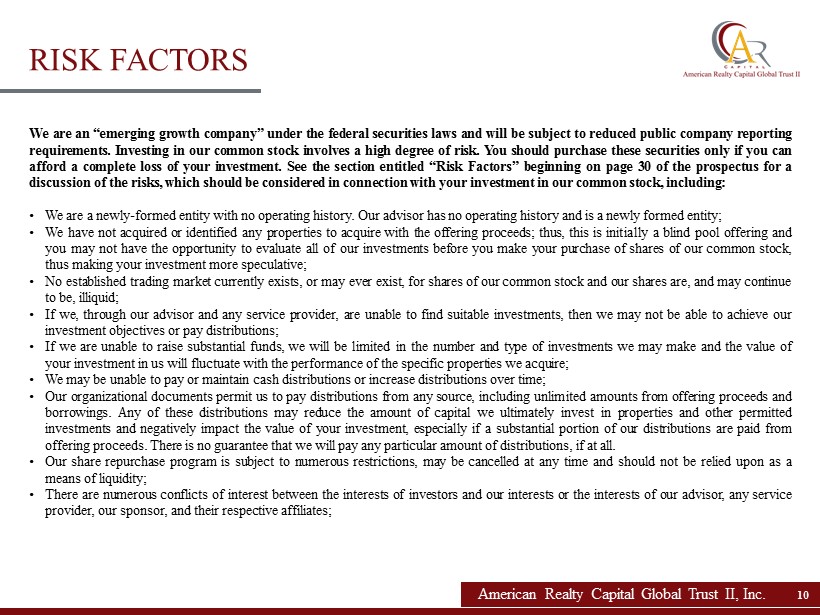

American Realty Capital Global Trust II, Inc. 10 RISK FACTORS We are an “emerging growth company” under the federal securities laws and will be subject to reduced public company reporting requirements . Investing in our common stock involves a high degree of risk . You should purchase these securities only if you can afford a complete loss of your investment . See the section entitled “Risk Factors” beginning on page 30 of the prospectus for a discussion of the risks, which should be considered in connection with your investment in our common stock, including : • We are a newly - formed entity with no operating history . Our advisor has no operating history and is a newly formed entity ; • We have not acquired or identified any properties to acquire with the offering proceeds ; thus, this is initially a blind pool offering and you may not have the opportunity to evaluate all of our investments before you make your purchase of shares of our common stock, thus making your investment more speculative ; • No established trading market currently exists, or may ever exist, for shares of our common stock and our shares are, and may continue to be, illiquid ; • If we, through our advisor and any service provider, are unable to find suitable investments, then we may not be able to achieve our investment objectives or pay distributions ; • If we are unable to raise substantial funds, we will be limited in the number and type of investments we may make and the value of your investment in us will fluctuate with the performance of the specific properties we acquire ; • We may be unable to pay or maintain cash distributions or increase distributions over time ; • Our organizational documents permit us to pay distributions from any source, including unlimited amounts from offering proceeds and borrowings . Any of these distributions may reduce the amount of capital we ultimately invest in properties and other permitted investments and negatively impact the value of your investment, especially if a substantial portion of our distributions are paid from offering proceeds . There is no guarantee that we will pay any particular amount of distributions, if at all . • Our share repurchase program is subject to numerous restrictions, may be cancelled at any time and should not be relied upon as a means of liquidity ; • There are numerous conflicts of interest between the interests of investors and our interests or the interests of our advisor, any service provider, our sponsor, and their respective affiliates ;

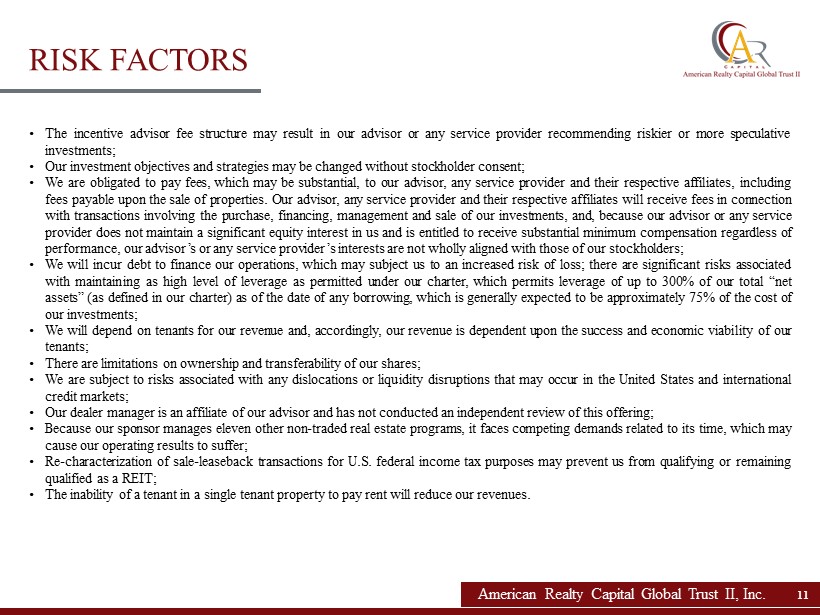

American Realty Capital Global Trust II, Inc. 11 RISK FACTORS • The incentive advisor fee structure may result in our advisor or any service provider recommending riskier or more speculative investments ; • Our investment objectives and strategies may be changed without stockholder consent ; • We are obligated to pay fees, which may be substantial, to our advisor, any service provider and their respective affiliates, including fees payable upon the sale of properties . Our advisor, any service provider and their respective affiliates will receive fees in connection with transactions involving the purchase, financing, management and sale of our investments, and, because our advisor or any service provider does not maintain a significant equity interest in us and is entitled to receive substantial minimum compensation regardless of performance, our advisor’s or any service provider’s interests are not wholly aligned with those of our stockholders ; • We will incur debt to finance our operations, which may subject us to an increased risk of loss ; there are significant risks associated with maintaining as high level of leverage as permitted under our charter, which permits leverage of up to 300 % of our total “net assets” (as defined in our charter) as of the date of any borrowing, which is generally expected to be approximately 75 % of the cost of our investments ; • We will depend on tenants for our revenue and, accordingly, our revenue is dependent upon the success and economic viability of our tenants ; • There are limitations on ownership and transferability of our shares ; • We are subject to risks associated with any dislocations or liquidity disruptions that may occur in the United States and international credit markets ; • Our dealer manager is an affiliate of our advisor and has not conducted an independent review of this offering ; • Because our sponsor manages eleven other non - traded real estate programs, it faces competing demands related to its time, which may cause our operating results to suffer ; • Re - characterization of sale - leaseback transactions for U . S . federal income tax purposes may prevent us from qualifying or remaining qualified as a REIT ; • The inability of a tenant in a single tenant property to pay rent will reduce our revenues .

American Realty Capital Global Trust II, Inc. 12 This presentation contains modified funds from operations (“MFFO”), a non - GAAP measure which the Investment Program Association (“IPA”) has recommended as a supplemental measure for publicly registered, non - listed REITs. We believe MFFO is reflective of the ongoing operating performance of publicly registered, non - listed REITs by adjusting for those costs that are more reflective of acquisitions and investment activity, along with other items the IPA believes are not indicative of the ongoing operating performance of a publicly registered, non - listed REIT, such as straight - lining of rents as required by GAAP. We believe that MFFO can provide, on a going - forward basis, an indication of the sustainability (that is, the capacity to continue to be maintained) of our operating performance after the period in which we are acquiring properties and once our portfolio is stabilized. MFFO is not equivalent to our net income or loss as determined under GAAP. Not all publicly registered, non - listed REITs calculate MFFO the same way. Accordingly, comparisons with other non - listed REITs may not be meaningful. Furthermore, MFFO is not indicative of cash flow available to fund cash needs and should not be considered as an alternative to net income (loss) or income (loss) from continuing operations as determined under GAAP as an indication of our performance, as an alternative to cash flows from operations, as an indication of our liquidity, or indicative of funds available to fund our cash needs including our ability to make distributions to our stockholders. MFFO should be reviewed in conjunction with other GAAP measurements and should not be construed to be more relevant or accurate than the current GAAP methodology. Please refer to our filings with the SEC, including our most recent Quarterly Report on Form 10 - Q, for a reconciliation of our calculation of MFFO to our net income or loss as determined under GAAP. MFFO DISCLOSURE

American Realty Capital Global Trust II, Inc. ARCGlobalTrust2.com ▪ For account information, including balances and the status of submitted paperwork, please call us at (844) 276 - 1077 ▪ Financial Advisors may view client accounts, statements and tax forms at www.dstvision.com ▪ Shareholders may access their accounts at www.americanrealtycap.com