Exhibit 99.1

September 2016 Acquisition of American Realty Capital Global Trust II

Additional Information About the Proposed Transaction and Where to Find It This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval . In connection with the proposed transaction, Global Net Lease, Inc . (“GNL”) and American Realty Capital Global Trust II, Inc . (“Global II”) intend to file relevant materials with the Securities and Exchange Commission (the "SEC"), including a joint proxy statement/prospectus on Form S - 4 . BOTH GNL AND GLOBAL II STOCKHOLDERS ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS THERETO) AND OTHER RELEVANT DOCUMENTS FILED WITH THE SEC IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION . Investors may obtain free copies of the proxy statement/prospectus and other relevant documents filed by GNL and Global II with the SEC (if and when they become available) through the website maintained by the SEC at www . sec . gov . Copies of the documents filed by GNL and Global II with the SEC are also available free of charge on GNL’s website at www . globalnetlease . com and copies of the documents filed by Global II with the SEC are available free of charge on Global II’s website at www . arcglobal 2 . com . GNL and Global II and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from both companies’ stockholders in respect of the proposed transaction . Information regarding GNL’s directors and executive officers can be found in GNL’s definitive proxy statement filed with the SEC on April 29 , 2016 . Information regarding Global II's directors and executive officers can be found in the Global II's definitive proxy statement filed with the SEC on April 29 , 2016 . Additional information regarding the interests of such potential participants will be included in the joint proxy statement and other relevant documents filed with the SEC in connection with the proposed transaction if and when they become available . These documents are available free of charge on the SEC’s website and from GNL and Global II, as applicable using the sources indicated above . 2

GNL Acquires ARC Global Trust II 3 x Best - in - Class Portfolio: GNL acquires a $620 million (1) high - quality net lease portfolio, creating a pro forma Company with $3.3 billion of enterprise value (2) . Increases portfolio size by 16 properties and 4.2 million square feet, for a combined total of 345 properties and 23.0 million square feet, bringing U.S. / European portfolio mix to parity x Scale Benefits: Enhances size, scale and portfolio diversification by the merger of two strategically aligned portfolios x Accretive Transaction: Transaction expected to be accretive to AFFO in the first year post - acquisition x Future Growth : Expected to enhance diversification and increase access to capital markets due to strong balance sheet, positioning GNL well for future growth x Cost Savings and Synergies: Immediately realizable management fee cost savings and G&A synergies of $5.7 million The merger of Global Net Lease, Inc. (NYSE: GNL, or the "Company ") and American Realty Capital Global Trust II, Inc. ("Global II ") enhances our standing as a premier, global single - tenant net lease REIT Sagemcom - Rueil Malmaison , FR Deutsche Bank – Kirchberg , LUX Harper Collins – Glasgow, UK __________________________ 1. Based on contract purchase price at the exchange rate at the date of purchase, excluding acquisition related costs. 2. Pro forma enterprise value prior to asset sales contemplated by the Company, calculated based on GNL closing price of $8.63 on 8/5/2016; inclusive of net debt as of 6/30/2016 and share count as of 7/31/2016.

Transaction Overview 4 Deal Summary Board Composition & Leadership "Go - Shop" / Breakup Fee ▪ GNL has entered into a definitive agreement to acquire Global II, subject to approval by the stockholders of each of GNL and Global II , which will advance our commitment to becoming the premier single - tenant, global net lease REIT ▪ 100% stock transaction , resulting in a $ 3.3 (1) billion combined pro forma enterprise value through the acquisition of a $ 620 million (2) net lease portfolio ▪ Fixed exchange ratio , with each common share of Global II, and each of Global II's operating partnership units, receiving 2.27 shares of GNL at closing • Implied value per Global II share of $19.59 based on GNL closing price of $8.63 on August 5, 2016 ▪ Pro Forma Ownership (3) : 86% GNL / 14% Global II ▪ 45 - day go - shop period for Global II • $1.2 million break - up fee payable to GNL plus expenses not to exceed $5.0 million ▪ Post go - shop period break - up fee increases to $6.0 million payable to GNL ▪ Global II to appoint one director to GNL's board, increasing to four the total number of independent directors ▪ No social or integration issues arising from the combination of companies Expected Closing ▪ Transaction expected to close in Q4 2016, subject to certain closing conditions, including stockholder approval by each of the stockholders of GNL and Global II __________________________ 1. Pro forma enterprise value prior to asset sales contemplated by the Company, calculated based on GNL closing price of $8.63 o n 8 /5/2016; inclusive of net debt as of 6/30/2016 and share count as of 7/31/2016. 2. Based on contract purchase price at the exchange rate at the date of purchase, excluding acquisition related costs. 3. Based on share count as of 7/31/2016 and exchange ratio of 2.27.

Transaction Benefits x Larger size improves potential for index inclusion and securing investment grade ratings x Company would be better positioned to pursue larger transactions x Proposed asset recycling plan enhances capital efficiency through targeted dispositions and selective reinvestment 5 Increased Scale Alignment of Advisor Realized Synergies Immediate Returns Best - in - Class Portfolio Metrics x Creates broader diversification x Maintains best - in - class investment grade tenancy, with a long average remaining lease term x Attractive embedded rent growth from acquisition, with 4.8% (1) in contractual rent increases at Global II assets over the first 2 years, resulting in a $0.01/share increase to AFFO of the combined entity x Expected $5.7 million of annual savings, comprised of $1.6 million in contractual management fee savings and $4.1 million in G&A savings (2) in the first year post - acquisition x Reduces total fees and expense reimbursements to advisor currently paid by the two companies by $3.6 million (2) in the first year post - acquisition x Eliminates perceived conflicts for management between GNL and Global II The acquisition of Global II advances GNL’s strategy to become the premier global single - tenant net lease REIT x Expected to be accretive to AFFO for shareholders in the first year post - acquisition x Improves dividend coverage for GNL and Global II shareholders x Achieves objective of a balanced European and U.S. portfolio exposure __________________________ 1. Embedded rent growth not adjusted for free rent; calculated based on Q3 2016 annualized cash rental income and LTM Q3 2018E c ash rental income. 2. Includes $2.0 million of expense reimbursements to the Advisor.

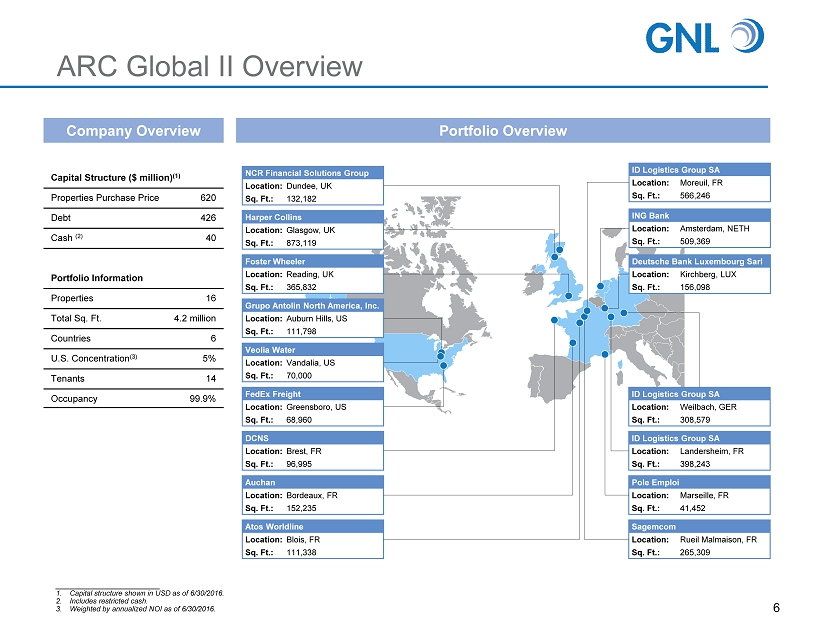

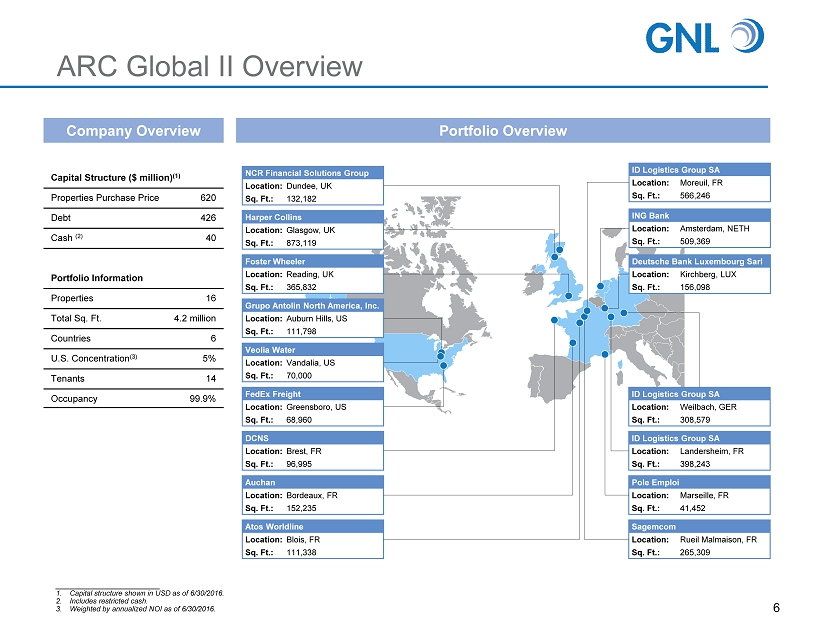

ARC Global II Overview 6 Company Overview Portfolio Overview Pole Emploi Location: Marseille, FR Sq. Ft.: 41,452 Auchan Location: Bordeaux, FR Sq. Ft.: 152,235 Veolia Water Location: Vandalia, US Sq. Ft.: 70,000 Sagemcom Location: Rueil Malmaison, FR Sq. Ft.: 265,309 NCR Financial Solutions Group Location: Dundee, UK Sq. Ft.: 132,182 FedEx Freight Location: Greensboro, US Sq. Ft.: 68,960 Deutsche Bank Luxembourg Sarl Location: Kirchberg, LUX Sq. Ft.: 156,098 Grupo Antolin North America, Inc. Location: Auburn Hills, US Sq. Ft.: 111,798 ING Bank Location: Amsterdam, NETH Sq. Ft.: 509,369 Atos Worldline Location: Blois, FR Sq. Ft.: 111,338 Foster Wheeler Location: Reading, UK Sq. Ft.: 365,832 ID Logistics Group SA Location: Weilbach, GER Sq. Ft.: 308,579 ID Logistics Group SA Location: Landersheim, FR Sq. Ft.: 398,243 ID Logistics Group SA Location: Moreuil, FR Sq. Ft.: 566,246 Harper Collins Location: Glasgow, UK Sq. Ft.: 873,119 DCNS Location: Brest, FR Sq. Ft.: 96,995 __________________________ 1. Capital structure shown in USD as of 6/30/2016. 2. Includes r estricted cash. 3. Weighted by annualized NOI as of 6/30/2016. Capital Structure ($ million) (1) Properties Purchase Price 620 Debt 426 Cash (2) 40 Portfolio Information Properties 16 Total Sq. Ft. 4.2 million Countries 6 U.S. Concentration (3) 5% Tenants 14 Occupancy 99.9%

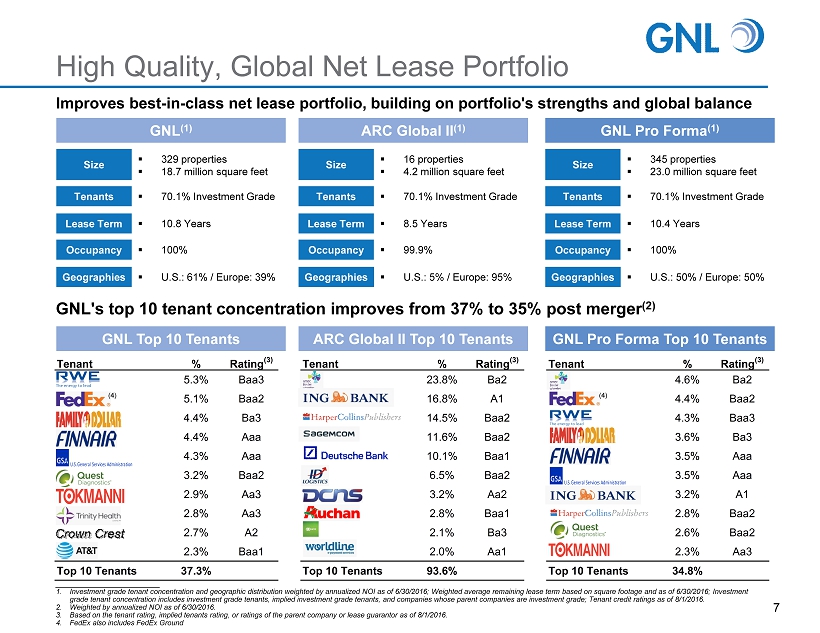

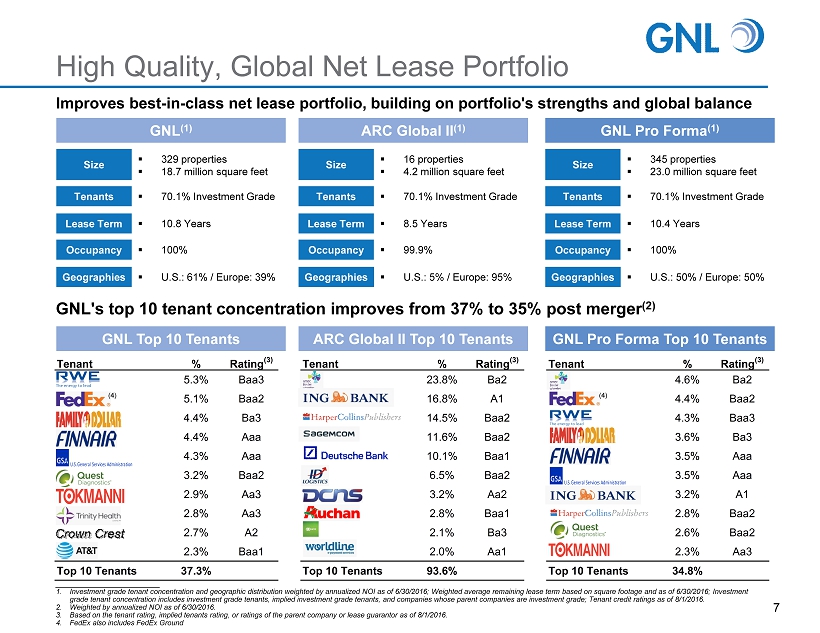

Tenant % Rating (3) Tenant % Rating (3) Tenant % Rating (3) 5.3% Baa3 23.8% Ba2 4.6% Ba2 5.1% Baa2 16.8% A1 4.4% Baa2 4.4% Ba3 14.5% Baa2 4.3% Baa3 4.4% Aaa 11.6% Baa2 3.6% Ba3 4.3% Aaa 10.1% Baa1 3.5% Aaa 3.2% Baa2 6.5% Baa2 3.5% Aaa 2.9% Aa3 3.2% Aa2 3.2% A1 2.8% Aa3 2.8% Baa1 2.8% Baa2 2.7% A2 2.1% Ba3 2.6% Baa2 2.3% Baa1 2.0% Aa1 2.3% Aa3 Top 10 Tenants 37.3% Top 10 Tenants 93.6% Top 10 Tenants 34.8% High Quality, Global Net Lease Portfolio 7 GNL's top 10 tenant concentration improves from 37% to 35% post merger (2) GNL Top 10 Tenants ARC Global II Top 10 Tenants GNL Pro Forma Top 10 Tenants __________________________ 1. Investment grade tenant concentration and geographic distribution weighted by annualized NOI as of 6/30/2016; Weighted averag e r emaining lease term based on square footage and as of 6/30/2016; Investment grade tenant concentration includes investment grade tenants, implied investment grade tenants, and companies whose parent companies are investment grade; Tenant credit ratings as of 8/1/2016. 2. Weighted by annualized NOI as of 6/30/2016. 3. Based on the tenant rating, implied tenants rating, or ratings of the parent company or lease guarantor as of 8/1/2016. 4. FedEx also includes FedEx Ground Improves best - in - class net lease portfolio, building on portfolio's strengths and global balance GNL (1) ARC Global II (1) GNL Pro Forma (1) Size Tenants Lease Term Occupancy ▪ 329 properties ▪ 18.7 million square feet ▪ 16 properties ▪ 4.2 million square feet ▪ 345 properties ▪ 23.0 million square feet Size Tenants Lease Term Occupancy Size Tenants Lease Term Occupancy ▪ 70.1% Investment Grade ▪ 70.1% Investment Grade ▪ 70.1% Investment Grade ▪ 10.8 Years ▪ 8.5 Years ▪ 10.4 Years ▪ 100% ▪ 99.9% ▪ 100% Geographies Geographies Geographies ▪ U.S.: 61% / Europe: 39% ▪ U.S.: 5% / Europe: 95% ▪ U.S.: 50% / Europe: 50% (4) (4)

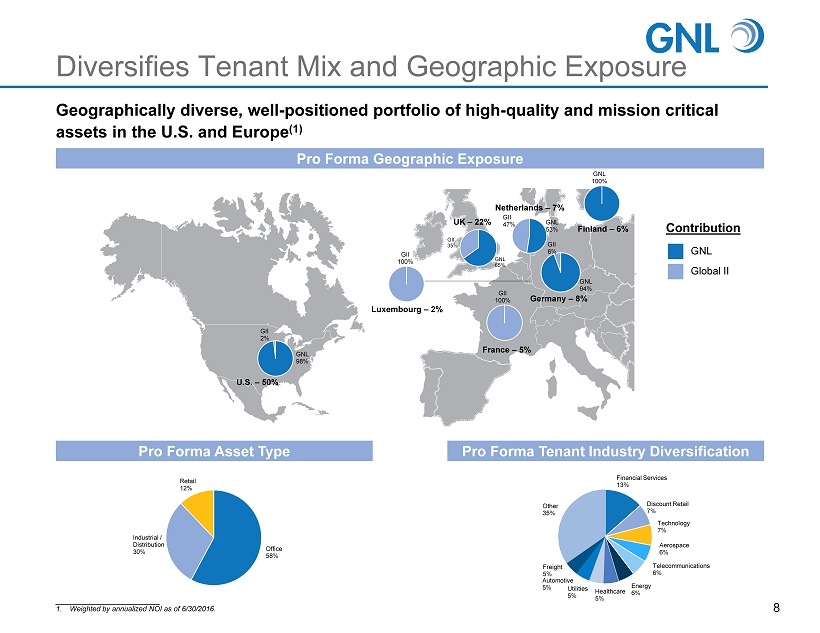

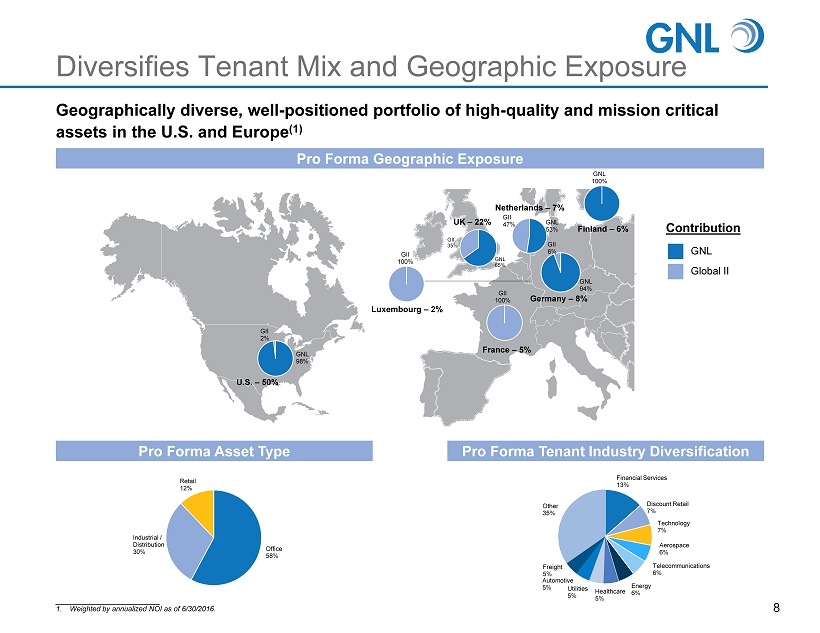

Geographically diverse, well - positioned portfolio of high - quality and mission critical assets in the U.S. and Europe (1) Diversifies Tenant Mix and Geographic Exposure 8 __________________________ 1. Weighted by annualized NOI as of 6/30/2016. Pro Forma Geographic Exposure Pro Forma Asset Type Pro Forma Tenant Industry Diversification GNL 100% GII 100% GII 100% UK – 22% Luxembourg – 2% Germany – 8% France – 5% Netherlands – 7% Finland – 6% U.S. – 50% Contribution GNL Global II GNL 98% GII 2% GNL 65% GII 35% GNL 94% GII 6% GNL 53% GII 47% Financial Services 13% Discount Retail 7% Technology 7% Aerospace 6% Telecommunications 6% Energy 6% Healthcare 5% Utilities 5% Automotive 5% Freight 5% Other 35% Office 58% Industrial / Distribution 30% Retail 12%

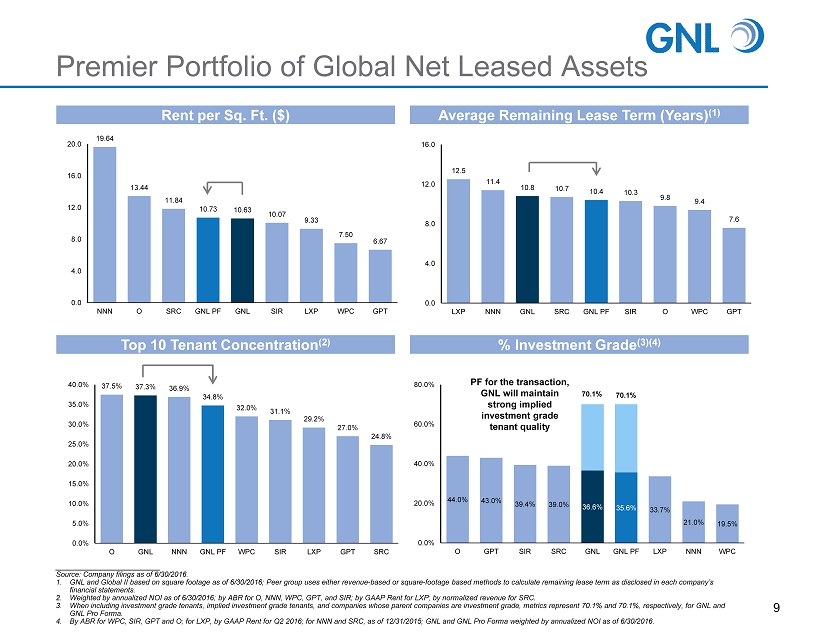

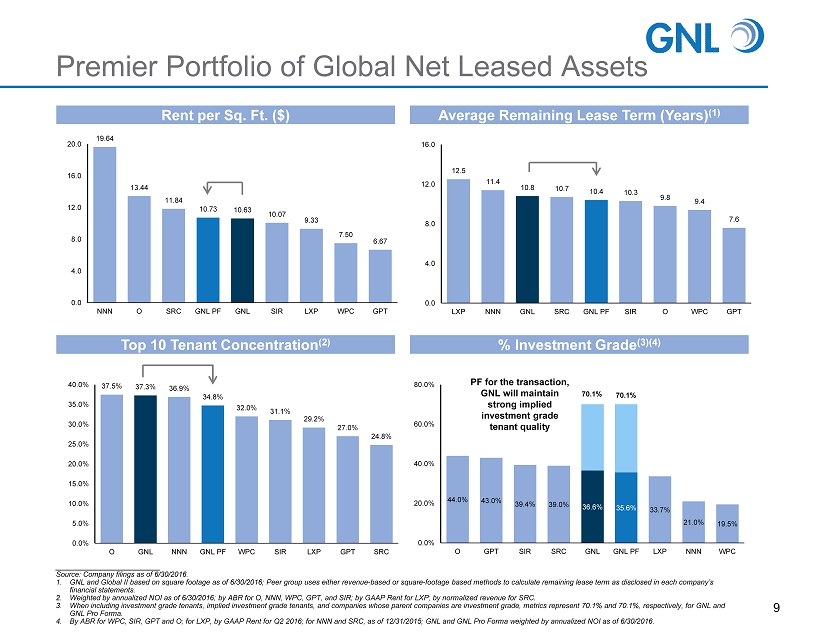

12.5 11.4 10.8 10.7 10.4 10.3 9.8 9.4 7.6 0.0 4.0 8.0 12.0 16.0 LXP NNN GNL SRC GNL PF SIR O WPC GPT 19.64 13.44 11.84 10.73 10.63 10.07 9.33 7.50 6.67 0.0 4.0 8.0 12.0 16.0 20.0 NNN O SRC GNL PF GNL SIR LXP WPC GPT Premier Portfolio of Global Net Leased Assets 9 Rent per Sq. Ft. ($) Average Remaining Lease Term (Years) ( 1) % Investment Grade (3)(4) Top 10 Tenant Concentration (2) __________________________ Source: Company filings as of 6/30/2016 . 1. GNL and Global II based on square footage as of 6/30/2016; Peer group uses either revenue - based or square - footage based methods to calculate remaining lease term as disclosed in each company’s financial statements. 2. Weighted by annualized NOI as of 6/30/2016; by ABR for O, NNN, WPC, GPT, and SIR; by GAAP Rent for LXP; by normalized revenue for SRC. 3. When including investment grade tenants, implied investment grade tenants, and companies whose parent companies are investmen t g rade, metrics represent 70.1% and 70.1%, respectively, for GNL and GNL Pro Forma. 4. By ABR for WPC, SIR, GPT and O; for LXP, by GAAP Rent for Q2 2016; for NNN and SRC, as of 12/31/2015; GNL and GNL Pro Forma weighted by annualized NOI as of 6/30/2016. PF for the transaction, GNL will maintain strong implied investment grade tenant quality 37.5% 37.3% 36.9% 34.8% 32.0% 31.1% 29.2% 27.0% 24.8% 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% 35.0% 40.0% O GNL NNN GNL PF WPC SIR LXP GPT SRC 44.0% 43.0% 39.4% 39.0% 36.6% 35.6% 33.7% 21.0% 19.5% 0.0% 20.0% 40.0% 60.0% 80.0% O GPT SIR SRC GNL GNL PF LXP NNN WPC 70.1% 70.1%

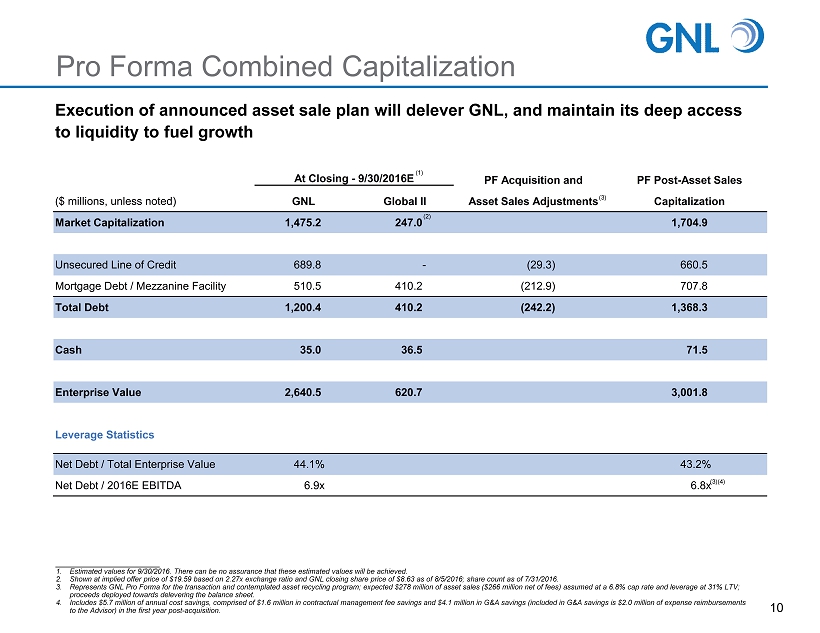

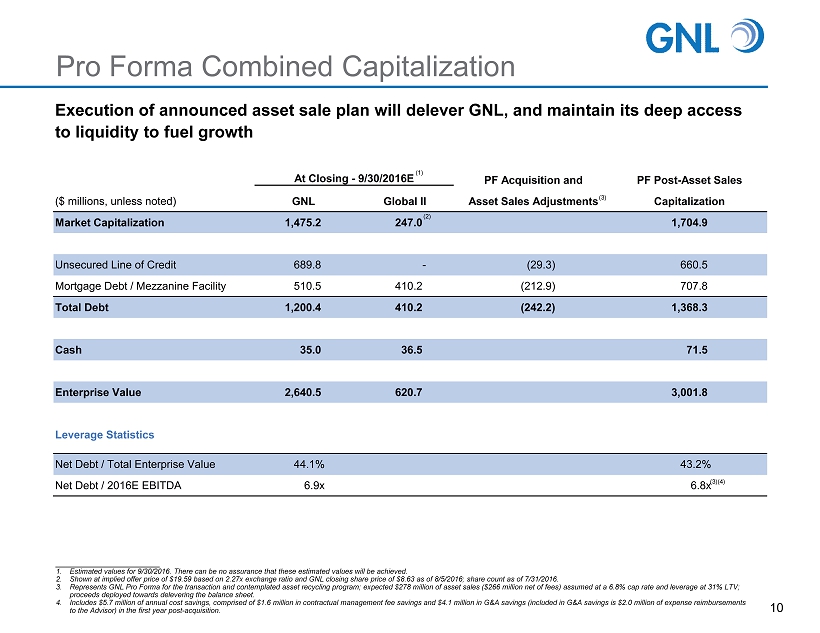

At Closing - 9/30/2016E PF Acquisition and PF Post-Asset Sales ($ millions, unless noted) GNL Global II Asset Sales Adjustments Capitalization Market Capitalization 1,475.2 247.0 1,704.9 Unsecured Line of Credit 689.8 - (29.3) 660.5 Mortgage Debt / Mezzanine Facility 510.5 410.2 (212.9) 707.8 Total Debt 1,200.4 410.2 (242.2) 1,368.3 Cash 35.0 36.5 71.5 Enterprise Value 2,640.5 620.7 3,001.8 Leverage Statistics Net Debt / Total Enterprise Value 44.1% 43.2% Net Debt / 2016E EBITDA 6.9x 6.8x Pro Forma Combined Capitalization 10 Execution of announced asset sale plan will delever GNL, and maintain its deep access to liquidity to fuel growth __________________________ 1. Estimated values for 9/30/2016. There can be no assurance that these estimated values will be achieved. 2. Shown at implied offer price of $19.59 based on 2.27x exchange ratio and GNL closing share price of $8.63 as of 8/5/2016; sha re count as of 7/31/2016. 3. Represents GNL Pro Forma for the transaction and contemplated asset recycling program; expected $278 million of asset sales ($266 million net of fees) assumed at a 6.8% cap rate and leverage at 31% LTV; proceeds deployed towards delevering the balance sheet. 4. Includes $ 5.7 million of annual cost savings , comprised of $1.6 million in contractual management fee savings and $4.1 million in G&A savings (included in G&A savings is $2.0 million of expense reimbursements to the Advisor) in the first year post - acquisition. (1) (3) (2) (3)(4)

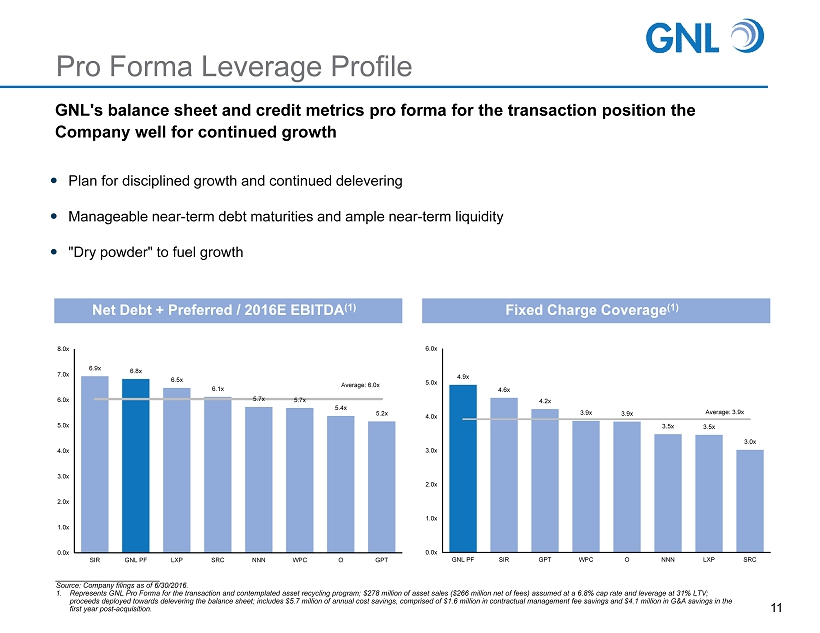

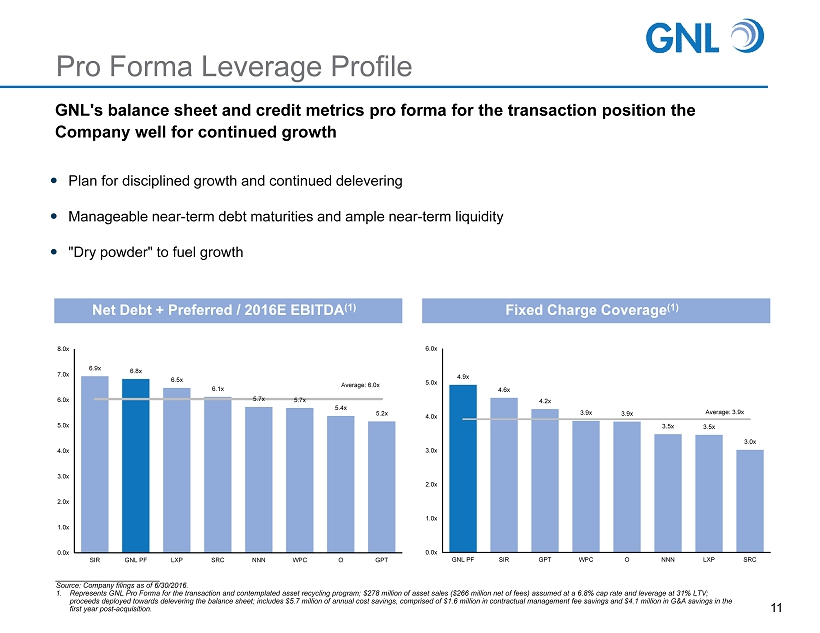

Pro Forma Leverage Profile Plan for disciplined growth and continued delevering Manageable near - term debt maturities and ample near - term liquidity "Dry powder" to fuel growth GNL's balance sheet and credit metrics pro forma for the transaction position the Company well for continued growth Fixed Charge Coverage (1) Net Debt + Preferred / 2016E EBITDA (1) 11 __________________________ Source: Company filings as of 6/30/2016 . 1. Represents GNL Pro Forma for the transaction and contemplated asset recycling program; $ 278 million of asset sales ($ 266 million net of fees) assumed at a 6.8% cap rate and leverage at 31% LTV; proceeds deployed towards delevering the balance sheet; includes $5.7 million of annual cost savings, comprised of $1.6 million in contractual management fee savings and $4.1 million in G&A sav ings in the first year post - acquisition. 6.9x 6.8x 6.5x 6.1x 5.7x 5.7x 5.4x 5.2x 0.0x 1.0x 2.0x 3.0x 4.0x 5.0x 6.0x 7.0x 8.0x SIR GNL PF LXP SRC NNN WPC O GPT Average: 6.0x 4.9x 4.6x 4.2x 3.9x 3.9x 3.5x 3.5x 3.0x 0.0x 1.0x 2.0x 3.0x 4.0x 5.0x 6.0x GNL PF SIR GPT WPC O NNN LXP SRC Average: 3.9x

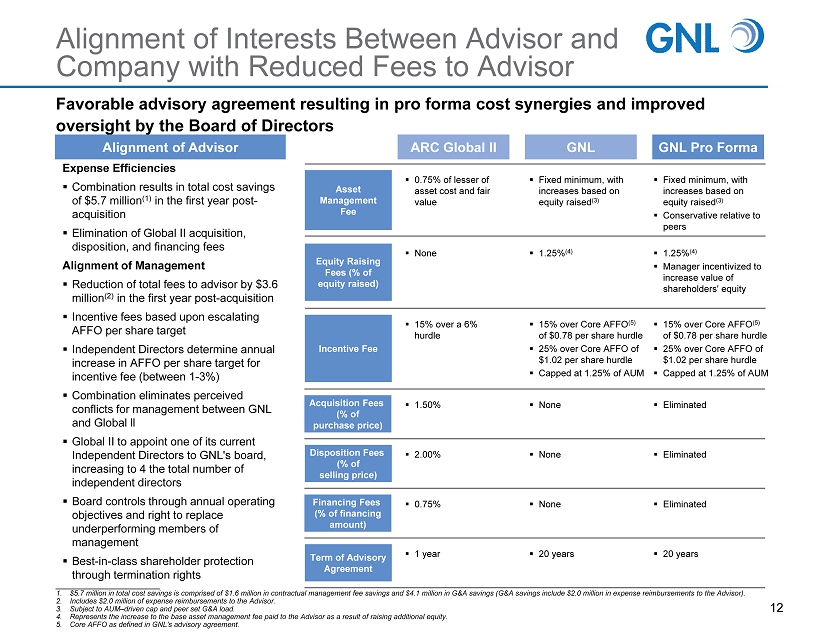

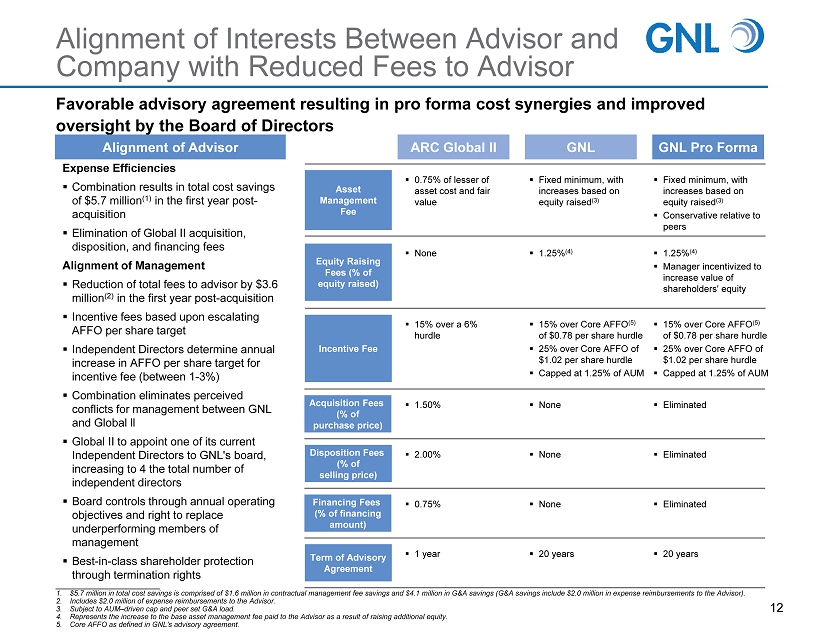

Alignment of Interests Between Advisor and Company with Reduced Fees to Advisor 12 Favorable advisory agreement resulting in pro forma cost synergies and improved oversight by the Board of Directors ARC Global II GNL GNL Pro Forma Asset Management Fee ▪ 0.75% of lesser of asset cost and fair value Equity Raising Fees (% of equity raised) Incentive Fee Acquisition Fees (% of purchase price) Disposition Fees (% of selling price) Financing Fees (% of financing amount ) ▪ Fixed minimum, with increases based on equity raised (3) ▪ Fixed minimum, with increases based on equity raised (3) ▪ Conservative relative to peers ▪ None ▪ None ▪ None ▪ None ▪ 1.25% (4) ▪ Manager incentivized to increase value of shareholders' equity ▪ 1.50% ▪ 2.00% ▪ 0.75% ▪ Eliminated ▪ Eliminated ▪ Eliminated ▪ 15% over a 6% hurdle ▪ 15% over Core AFFO (5) of $0.78 per share hurdle ▪ 25% over Core AFFO of $1.02 per share hurdle ▪ Capped at 1.25% of AUM ▪ 1.25% (4) Alignment of Advisor Expense Efficiencies ▪ Combination results in total cost savings of $5.7 million (1) in the first year post - acquisition ▪ Elimination of Global II acquisition, disposition, and financing fees Alignment of Management ▪ Reduction of total fees to advisor by $ 3.6 million (2) in the first year post - acquisition ▪ Incentive fees based upon escalating AFFO per share target ▪ Independent Directors determine annual increase in AFFO per share target for incentive fee (between 1 - 3 %) ▪ Combination eliminates perceived conflicts for management between GNL and Global ll ▪ Global II to appoint one of its current Independent Directors to GNL's board, increasing to 4 the total number of independent directors ▪ Board controls through annual operating objectives and right to replace underperforming members of management ▪ Best - in - class shareholder protection through termination rights __________________________ 1. $5.7 million in total cost savings is comprised of $1.6 million in contractual management fee savings and $4.1 million in G&A sa vings (G&A savings include $2.0 million in expense reimbursements to the Advisor). 2. Includes $2.0 million of expense reimbursements to the Advisor. 3. Subject to AUM – driven cap and peer set G&A load. 4. Represents the increase to the base asset management fee paid to the Advisor as a result of raising additional equity. 5. Core AFFO as defined in GNL's advisory agreement. Term of Advisory Agreement ▪ 20 years ▪ 1 year ▪ 20 years ▪ 15% over Core AFFO (5) of $0.78 per share hurdle ▪ 25% over Core AFFO of $1.02 per share hurdle ▪ Capped at 1.25% of AUM

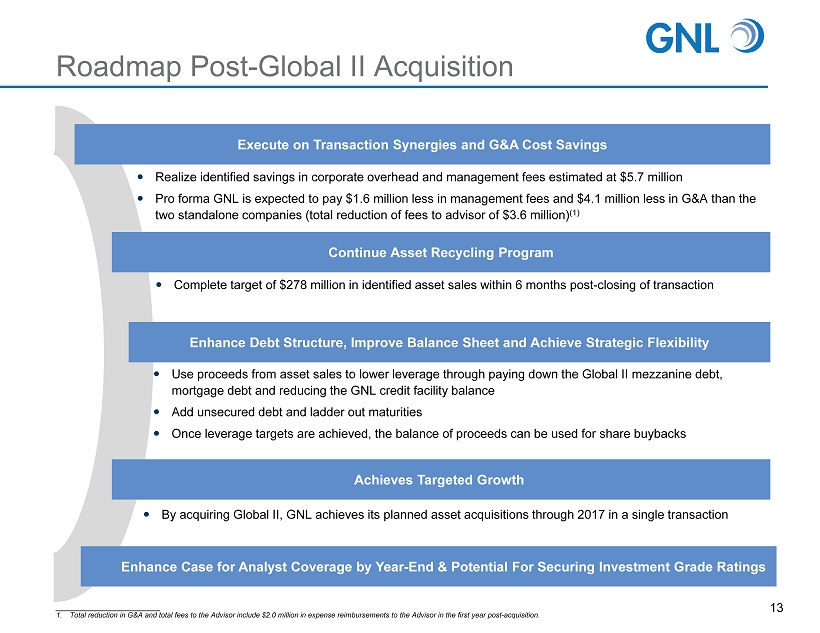

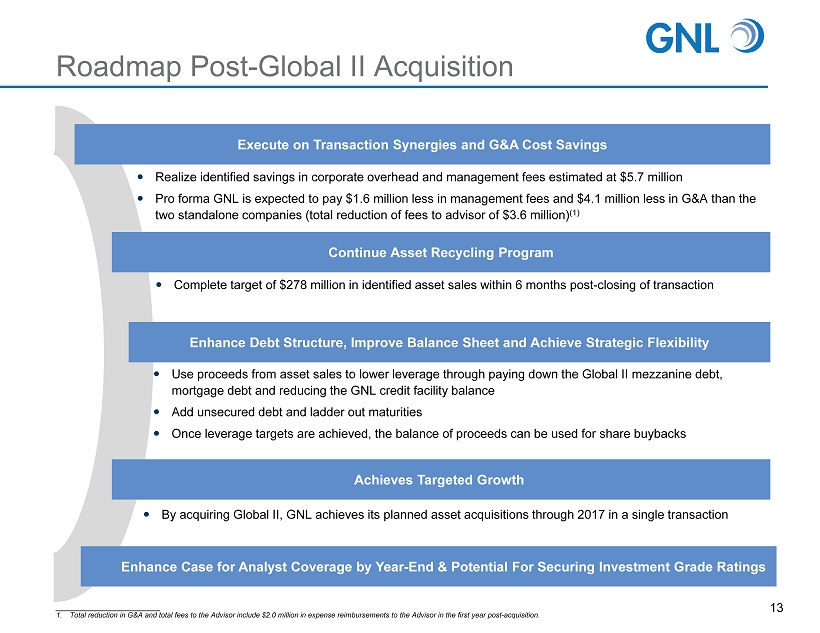

Roadmap Post - Global II Acquisition 13 Execute on Transaction Synergies and G&A Cost Savings Continue Asset Recycling Program Enhance Case for Analyst Coverage by Year - End & Potential For Securing Investment Grade Ratings Achieves Targeted Growth Enhance Debt Structure, Improve Balance Sheet and Achieve Strategic Flexibility Realize identified savings in corporate overhead and management fees estimated at $5.7 million Pro forma GNL is expected to pay $1.6 million less in management fees and $4.1 million less in G&A than the two standalone companies (total reduction of fees to advisor of $3.6 million) (1) Complete target of $ 278 million in identified asset sales within 6 months post - closing of transaction Use proceeds from asset sales to lower leverage through paying down the Global II mezzanine debt, mortgage debt and reducing the GNL credit facility balance Add unsecured debt and ladder out maturities Once leverage targets are achieved, the balance of proceeds can be used for share buybacks By acquiring Global II, GNL achieves its planned asset acquisitions through 2017 in a single transaction __________________________ 1. Total reduction in G&A and total fees to the Advisor include $2.0 million in expense reimbursements to the Advisor in the fir st year post - acquisition.

Forward Looking Statements Certain statements made in this presentation are “forward - looking statements” (as defined in Section 21 E of the Exchange Act), which reflect the expectations of Global Net Lease, Inc . (“GNL”) and American Realty Capital Global Trust II, Inc . (“Global II”) regarding future events . The forward - looking statements involve a number of risks, uncertainties and other factors that could cause actual results to differ materially from those contained in the forward - looking statements . Such forward - looking statements include, but are not limited to, whether and when the transactions contemplated by the Agreement and Plan of Merger (the “Merger Agreement”) between GNL and Global II, among others, will be consummated, the new combined company’s plans, market and other expectations, objectives, intentions, as well as any expectations or projections with respect to the combined company, including regarding future dividends and market valuations, and other statements that are not historical facts . The following additional factors, among others, could cause actual results to differ from those set forth in the forward - looking statements : the approval by GNL's and Global II’s stockholders of the transactions contemplated in the Merger Agreement ; market volatility ; unexpected costs or unexpected liabilities that may arise from the transaction, whether or not consummated ; continuation or deterioration of current market conditions ; future regulatory or legislative actions that could adversely affect the companies ; and the business plans of the tenants of the respective parties . Additional factors that may affect future results are contained in the Company’s and Global II’s filings with the SEC, including ( i ) the Annual Report on Form 10 - K for the year ended December 31 , 2015 filed on February 29 , 2016 , the Quarterly Reports on Form 10 - Q for the quarters ended March 31 , 2016 and June 30 , 2016 , filed on May 6 , 2016 and August 8 , 2016 , respectively, and in future periodic reports filed by the Company under the Securities Exchange Act of 1934 , as amended, which are available at the SEC’s website at www . sec . gov . The Company and Global II disclaim any obligation to update and revise statements contained in these materials based on new information or otherwise . 14

Risk Factors All of our executive officers are also officers, managers and/or holders of a direct or indirect controlling interest in our Adv isor and other entities affiliated with AR Global Investments, LLC. As a result, our executive officers, our Advisor and its affiliates face conflict s o f interest, including significant conflicts created by our Advisor's compensation arrangements with us and other investment programs advised by AR Global Inves tme nts, LLC’s affiliates and conflicts in allocating time among these investment programs and us. These conflicts could result in unanticip ate d actions. Because investment opportunities that are suitable for us may also be suitable for other AR Global Investments, LLC advised i nve stment programs, our Advisor and its affiliates face conflicts of interest relating to the purchase of properties and other investments and such c onf licts may not be resolved in our favor, which could reduce the investment return to our stockholders. We may be unable to pay or maintain cash dividends or increase dividends over time. We are obligated to pay fees which may be substantial to our Advisor and its affiliates. We depend on tenants for our rental revenue and, accordingly, our rental revenue is dependent upon the success and economic v iab ility of our tenants. Increases in interest rates could increase the amount of our debt payments and limit our ability to pay dividends to our stoc kho lders. We may be unable to raise additional debt or equity financing on attractive terms or at all. Adverse changes in exchange rates may reduce the value of our properties located outside of the United States. We may not generate cash flows sufficient to pay dividends to our stockholders, as such, we may be forced to borrow at unfavo rab le rates or depend on our Advisor to waive reimbursement of certain expense and fees to fund our operations. There is no assurance that our Advi sor will waive reimbursement of expenses or fees. Any of these dividends may reduce the amount of capital we ultimately invest in properties and other permitted investments an d n egatively impact the value of our common stock. We are subject to risks associated with our international investments, including risks associated with compliance with and ch ang es in foreign laws, fluctuations in foreign currency exchange rates and inflation. We are subject to risks associated with any dislocations or liquidity disruptions that may exist or occur in the credit marke ts of the United States of America and Europe from time to time. We may fail to continue to qualify, as a real estate investment trust for U.S. federal income tax purposes, which would resul t i n higher taxes, may adversely affect operations, adversely affect our ability to pay dividends and reduce the market price of our common stock . We may be deemed to be an investment company under the Investment Company Act of 1940, as amended, and thus subject to regula tio n under the Investment Company Act. We may be exposed to risks due to a lack of tenant diversity, investment types and geographic diversity. The revenue derived from, and the market value of, properties located in the United Kingdom and continental Europe may declin e a s a result of the non binding referendum on June 23, 2016 in which a majority of voters voted to exit the European Union (the “ Brexit ” vote). Our ability to refinance or sell properties located in the United Kingdom and continental Europe may be impacted by the econo mic and political uncertainty following the Brexit vote. We may be exposed to changes in general economic, business and political conditions, including the possibility of intensified in ternational hostilities, acts of terrorism, and changes in conditions of United States of America or international lending, capital and financing mark ets , including as a result of the Brexit vote. The following are some of the risks and uncertainties, although not all risks and uncertainties, that could cause our actual res ults to differ materially from those presented in our forward - looking statements. See the section entitled “Item 1A. Risk Factors” in the Company’s Annual Repo rt on Form 10 - K filed with the U.S. Securities and Exchange Commission (the “SEC”) on February 29, 2016 and the section entitled “Item 1A. Risk Factors” in the Company’s Quarterly Reports on form 10 - Q filed with the SEC on May 6, 2016 and August 8, 2016 for a discussion of the risks which should be considered in connection with your investment. 15

Projections This presentation includes estimated projections of future operating results . These projections were not prepared in accordance with published guidelines of the SEC or the guidelines established by the American Institute of Certified Public Accountants for preparation and presentation of financial projections . This information is not fact and should not be relied upon as being necessarily indicative of future results ; the projections were prepared in good faith by management and are based on numerous assumptions that may prove to be wrong . Important factors that may affect actual results and cause the projections to not be achieved include, but are not limited to, risks and uncertainties relating to the company and other factors described in the “Risk Factors” section of GNL's Annual Report on Form 10 - K filed with the SEC on February 29 , 2016 , GNL's Quarterly Reports on Form 10 - Q filed for the quarters ended March 31 , 2016 and June 30 , 2016 filed on May 6 , 2016 and August 8 , 2016 , respectively, in the “Risk Factors” section of Global II's Annual Report on Form 10 - K filed with the SEC on March 22 , 2016 , Global II's Quarterly Reports on Form 10 - Q filed for the quarters ended March 31 , 2016 and June 30 , 2016 filed on May 16 , 2016 and August 15 , 2016 , respectively, in GNL's and Global II's future filings with the SEC . The projections also reflect assumptions as to certain business decisions that are subject to change . As a result, actual results may differ materially from those contained in the estimates . Accordingly, there can be no assurance that the estimates will be realized . This presentation also contains estimates and information concerning our industry, including market position, market size, and growth rates of the markets in which we participate, that are based on industry publications and reports . This information involves a number of assumptions and limitations, and you are cautioned not to give undue weight to these estimates . We have not independently verified the accuracy or completeness of the data contained in these industry publications and reports . The industry in which we operate is subject to a high degree of uncertainty and risk due to variety of factors, including those described in the “ Risk Factors” section of the Company’s Annual Report on Form 10 - K filed with the SEC on February 29 , 2016 , the Quarterly Reports on Form 10 - Q filed for the quarters ended March 31 , 2016 and June 30 , 2016 filed on May 6 , 2016 and August 8 , 2016 , respectively , and in future filings with the SEC . These and other factors could cause results to differ materially from those expressed in these publications and reports . 16

Definitions Funds from operations (“FFO”) Due to certain unique operating characteristics of real estate companies, as discussed below, the National Association of Real Estate Investment Trusts ("NAREIT"), an industry trade group, has promulgated a measure known as funds from operations ("FFO"), which we believe to be an appropriate supplemental measure to reflect the operating performance of a REIT . The use of FFO is recommended by the REIT industry as a supplemental performance measure . FFO is not equivalent to net income or loss as determined under accounting principles generally accepted in the United States ("GAAP") . We define FFO, a non - GAAP measure, consistent with the standards established by the White Paper on FFO approved by the Board of Governors of NAREIT, as revised in February 2004 (the "White Paper") . The White Paper defines FFO as net income or loss computed in accordance with GAAP, excluding gains or losses from sales of property but including asset impairment writedowns, plus depreciation and amortization, and after adjustments for unconsolidated partnerships and joint ventures . Adjustments for unconsolidated partnerships and joint ventures are calculated to reflect FFO . Our FFO calculation complies with NAREIT's definition . The historical accounting convention used for real estate assets requires straight - line depreciation of buildings and improvements, and straight - line amortization of intangibles, which implies that the value of a real estate asset diminishes predictably over time, especially if not adequately maintained or repaired and renovated as required by relevant circumstances or as requested or required by lessees for operational purposes in order to maintain the value disclosed . We believe that, because real estate values historically rise and fall with market conditions, including inflation, interest rates, the business cycle, unemployment and consumer spending, presentations of operating results for a REIT using historical accounting for depreciation and certain other items may be less informative . Historical accounting for real estate involves the use of GAAP . Any other method of accounting for real estate such as the fair value method cannot be construed to be any more accurate or relevant than the comparable methodologies of real estate valuation found in GAAP . Nevertheless, we believe that the use of FFO, which excludes the impact of real estate related depreciation and amortization, among other things, provides a more complete understanding of our performance to investors and to management, and when compared year over year, reflects the impact on our operations from trends in occupancy rates, rental rates, operating costs, general and administrative expenses, and interest costs, which may not be immediately apparent from net income . However, FFO, core funds from operations ("Core FFO") and adjusted funds from operations (“AFFO”), as described below, should not be construed to be more relevant or accurate than the current GAAP methodology in calculating net income or in its applicability in evaluating our operating performance . The method utilized to evaluate the value and performance of real estate under GAAP should be construed as a more relevant measure of operational performance and considered more prominently than the non - GAAP FFO, Core FFO and AFFO measures and the adjustments to GAAP in calculating FFO, Core FFO and AFFO . Other REITs may not define FFO in accordance with the current NAREIT definition (as we do) or may interpret the current NAREIT definition differently than we do and/or calculate Core FFO and/or AFFO differently than we do . Consequently, our presentation of FFO, Core FFO and AFFO may not be comparable to other similarly titled measures presented by other REITs . 17

Definitions (cont’d) Funds from operations (“FFO”) (Cont’d) We consider FFO, Core FFO and AFFO useful indicators of our performance . Because FFO calculations exclude such factors as depreciation and amortization of real estate assets and gains or losses from sales of operating real estate assets (which can vary among owners of identical assets in similar conditions based on historical cost accounting and useful - life estimates), FFO facilitates comparisons of operating performance between periods and between other REITs in our peer group . Changes in the accounting and reporting promulgations under GAAP (for acquisition fees and expenses from a capitalization/depreciation model to an expensed - as - incurred model) that were put into effect in 2009 and other changes to GAAP accounting for real estate subsequent to the establishment of NAREIT's definition of FFO have prompted an increase in cash - settled expenses, specifically acquisition fees and expenses for all industries as items that are expensed under GAAP, that are typically accounted for as operating expenses . 18

Definitions (cont’d) Adjusted funds from operations (“AFFO”) We exclude certain income or expense items from AFFO that we consider more reflective of investing activities, other non - cash income and expense items and the income and expense effects of other activities that are not a fundamental attribute of our business plan . These items include unrealized gains and losses, which may not ultimately be realized, such as gains or losses on derivative instruments, gains and losses on foreign currency transactions, gains or losses on contingent valuation rights, gains and losses on investments and early extinguishment of debt . In addition, by excluding non - cash income and expense items such as amortization of above - market and below - market leases intangibles, amortization of deferred financing costs, straight - line rent and equity - based compensation from AFFO, we believe we provide useful information regarding income and expense items which have no cash impact and do not provide liquidity to the company or require capital resources of the company . By providing AFFO, we believe we are presenting useful information that assists investors and analysts to better assess the sustainability of our ongoing operating performance without the impacts of transactions that are not related to the ongoing profitability of our portfolio of properties . We also believe that AFFO is a recognized measure of sustainable operating performance by the REIT industry . Further, we believe AFFO is useful in comparing the sustainability of our operating performance with the sustainability of the operating performance of other real estate companies that are not making a significant number of acquisitions . Investors are cautioned that AFFO should only be used to assess the sustainability of our operating performance excluding these activities, as it excludes certain costs that have a negative effect on our operating performance during the periods in which these costs are incurred . In calculating AFFO, we exclude certain expenses, which under GAAP are characterized as operating expenses in determining operating net income . These expenses are paid in cash by us, and therefore such funds will not be available to distribute to investors . All paid and accrued merger, acquisition and transaction related fees and certain other expenses negatively impact our operating performance during the period in which expenses are incurred or properties are acquired will also have negative effects on returns to investors, the ability to fund dividends or distributions in the future, and cash flows generated by us, unless earnings from operations or net sales proceeds from the disposition of other properties are generated to cover the purchase price of the property and certain other expenses . AFFO that excludes such costs and expenses would only be comparable to companies that did not have such activities . Further, under GAAP, certain contemplated non - cash fair value and other non - cash adjustments are considered operating non - cash adjustments to net income in determining cash flow from operating activities . In addition, we view fair value adjustments as items which are unrealized and may not ultimately be realized . We view both gains and losses from fair value adjustments as items which are not reflective of ongoing operations and are therefore typically adjusted for when assessing operating performance . Excluding income and expense items detailed above from our calculation of AFFO provides information consistent with management's analysis of the operating performance of the properties . Additionally, fair value adjustments, which are based on the impact of current market fluctuations and underlying assessments of general market conditions, but can also result from operational factors such as rental and occupancy rates, may not be directly related or attributable to our current operating performance . By excluding such changes that may reflect anticipated and unrealized gains or losses, we believe AFFO provides useful supplemental information . As a result, we believe that the use of FFO, Core FFO and AFFO, together with the required GAAP presentations, provide a more complete understanding of our performance relative to our peers and a more informed and appropriate basis on which to make decisions involving operating, financing, and investing activities . . 19

Definitions (cont’d) Adjusted Earnings before Interest, Taxes, Depreciation and Amortization, Net Operating Income, Cash Net Operating Income and Adjusted Cash Net Operating Income . We believe that earnings before interest, taxes, depreciation and amortization adjusted for acquisition and transaction - related expenses, other non - cash items and including our pro - rata share from unconsolidated joint ventures ("Adjusted EBITDA") is an appropriate measure of our ability to incur and service debt . Adjusted EBITDA should not be considered as an alternative to cash flows from operating activities, as a measure of our liquidity or as an alternative to net income as an indicator of our operating activities . Other REITs may calculate Adjusted EBITDA differently and our calculation should not be compared to that of other REITs . Net operating income ("NOI") is a non - GAAP financial measure equal to net income (loss), the most directly comparable GAAP financial measure, less discontinued operations, interest, other income and income from preferred equity investments and investment securities, plus corporate general and administrative expense, acquisition and transaction - related expenses, depreciation and amortization, other non - cash expenses and interest expense . NOI is adjusted to include our pro rata share of NOI from unconsolidated joint ventures . We use NOI internally as a performance measure and believe NOI provides useful information to investors regarding our financial condition and results of operations because it reflects only those income and expense items that are incurred at the property level . Therefore, we believe NOI is a useful measure for evaluating the operating performance of our real estate assets and to make decisions about resource allocations . Further, we believe NOI is useful to investors as a performance measure because, when compared across periods, NOI reflects the impact on operations from trends in occupancy rates, rental rates, operating costs and acquisition activity on an unlevered basis, providing perspective not immediately apparent from net income . NOI excludes certain components from net income in order to provide results that are more closely related to a property's results of operations . For example, interest expense is not necessarily linked to the operating performance of a real estate asset and is often incurred at the corporate level as opposed to the property level . In addition, depreciation and amortization, because of historical cost accounting and useful life estimates, may distort operating performance at the property level . NOI presented by us may not be comparable to NOI reported by other REITs that define NOI differently . We believe that in order to facilitate a clear understanding of our operating results, NOI should be examined in conjunction with net income (loss) as presented in our consolidated financial statements . NOI should not be considered as an alternative to net income (loss) as an indication of our performance or to cash flows as a measure of our liquidity . Cash NOI is NOI presented on a cash basis, which is NOI after eliminating the effects of straight - lining of rent and the amortization of above and below market leases . Core AFFO Core AFFO is used to calculate incentive compensation pursuant to the GNL Advisory Agreement, which defines Core AFFO as ( i ) Net income adjusted for the following items (to the extent they are included in Net income) : (a) real estate related depreciation and amortization ; (b) Net income from unconsolidated partnerships and joint ventures ; (c) one - time costs that the Advisor deems to be non - recurring ; (d) non - cash equity compensation (other than any Restricted Share Payments) ; (e) other non - cash income and expense items ; (f) non - cash dividends related to the Class B units of the OP and certain non - cash interest expenses related to securities that are convertible to Common Stock ; (g) gains (or losses) from the sale of Investments ; (h) impairment losses on real estate ; ( i ) acquisition and transaction related costs ; (j) straight - line rent ; (k) amortization of above and below market leases assets and liabilities ; (l) amortization of deferred financing costs ; (m) accretion of discounts and amortization of premiums on debt investments ; (n) marked - to - market adjustments included in Net income ; (o) unrealized gains or losses resulting from consolidation from, or deconsolidation to, equity accounting, and (p) consolidated and unconsolidated partnerships and joint ventures . (ii) divided by the weighted average outstanding shares of Common Stock on a fully diluted basis for such period . 20