Exhibit 4.1

FIRST AMENDMENT TO CREDIT AGREEMENT

THIS FIRST AMENDMENT TO CREDIT AGREEMENT (this “Amendment”) is made and entered into as of March 18, 2009 by and among LUBY'S, INC., a Delaware corporation (the “Company”); each of the Lenders which is or may from time to time become a party to the Credit Agreement (as defined below) (individually, a “Lender” and, collectively, the “Lenders”), and WELLS FARGO BANK, NATIONAL ASSOCIATION, acting as administrative agent for the Lenders (in such capacity, together with its successors in such capacity, the “Administrative Agent”).

RECITALS

A. The Company, the Lenders and the Administrative Agent executed and delivered that certain Credit Agreement dated as of July 13, 2007. Said Credit Agreement, as amended, supplemented and restated, is herein called the “Credit Agreement”. Any capitalized term used in this Amendment and not otherwise defined shall have the meaning ascribed to it in the Credit Agreement.

B. The Company, the Lenders and the Administrative Agent desire to amend the Credit Agreement in certain respects.

NOW, THEREFORE, in consideration of the premises and the mutual agreements, representations and warranties herein set forth, and further good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Company, the Lenders and the Administrative Agent do hereby agree as follows:

SECTION 1. Amendments to Credit Agreement.

(a) The definition of “Applicable Rate” set forth in Section 1.01 of the Credit Agreement is hereby amended to read in its entirety as follows:

“Applicable Rate” means, for any day with respect to any ABR Loan or Eurodollar Loan or with respect to the commitment fees payable hereunder, as the case may be, the applicable rate per annum set forth below under the caption “ABR Spread”, “Eurodollar Spread” or “Commitment Fee Rate”, as the case may be, based upon the Total Leverage Ratio as of the most recent determination date:

| Total Leverage Ratio | ABR Spread | Eurodollar Spread | Commitment Fee Rate |

Category 1: greater than 2.50 | 0.75 | 2.50 | 0.45 |

Category 2: greater than 1.25 but less than or equal to 2.50 | 0.50 | 2.25 | 0.40 |

Category 3: greater than 0.50 but less than or equal to 1.25 | 0.25 | 2.00 | 0.35 |

Category 4: less than or equal to 0.50 | 0.00 | 1.75 | 0.30 |

For purposes of the foregoing, (i) the Total Leverage Ratio shall be determined as of the end of each fiscal quarter of the Borrower’s fiscal year based upon the Borrower’s consolidated financial statements delivered pursuant to Sections 5.01(a) or (b) and (ii) each change in the Applicable Rate resulting from a change in the Total Leverage Ratio shall be effective during the period commencing on and including the date of delivery to the Administrative Agent of such consolidated financial statements indicating such change and ending on the date immediately preceding the effective date of the next such change; but the Total Leverage Ratio shall be deemed to be in Category 1 at the request of the Required Lenders if the Borrower fails to timely deliver the consolidated financial statements required to be delivered by it pursuant to Sections 5.01(a) or (b), during the period from the deadline for delivery thereof until such consolidated financial statements are received.

(b) The definition of “Commitment” set forth in Section 1.01 of the Credit Agreement is hereby amended to read in its entirety as follows:

“Commitment” means, with respect to each Lender, the commitment, if any, of such Lender to make Loans and to acquire participations in Letters of Credit hereunder, expressed as an amount representing the maximum aggregate amount of such Lender’s Revolving Exposure hereunder, as such commitment may be (a) reduced or increased from time to time pursuant to Section 2.07 and (b) reduced or increased from time to time pursuant to assignments by or to such Lender pursuant to Section 9.04. The amount of each Lender’s Commitment as of March 18, 2009 is set forth on Schedule 2.01. The aggregate amount of the Lenders’ Commitments as of March 18, 2009 is $30,000,000.

(c) The definition of “Interest Coverage Ratio” set forth in Section 1.01 of the Credit Agreement is hereby amended to read in its entirety as follows:

“Interest Coverage Ratio” means, as of the last day of any fiscal quarter of the Borrower, the ratio of (a) EBITDA for the four fiscal quarters ending on such date to (b) the sum of (i) Interest Expense for such four fiscal quarter period plus (ii) Phantom Amortization for the applicable quarter, determined in each case on a consolidated basis for Borrower and its Subsidiaries.

(d) A new definition of “Maximum Capex Amount” is hereby added to Section 1.01 of the Credit Agreement, such new definition to read in its entirety as follows:

“Maximum Capex Amount” means, for each fiscal year, the greater of (i) $20,000,000, or (ii) an amount equal to one hundred percent (100%) of the Borrower's EBITDA for the immediately preceding fiscal year; plus any unused availability for Capital Expenditures from the immediately preceding fiscal year (but not from any earlier year).

(e) The definition of "Permitted Investments" set forth in Section 1.01 of the Credit Agreement is hereby amended by (i) deleting clause (f) in its entirety and replacing it as set forth below, and (ii) by adding a new clause (g) as follows:

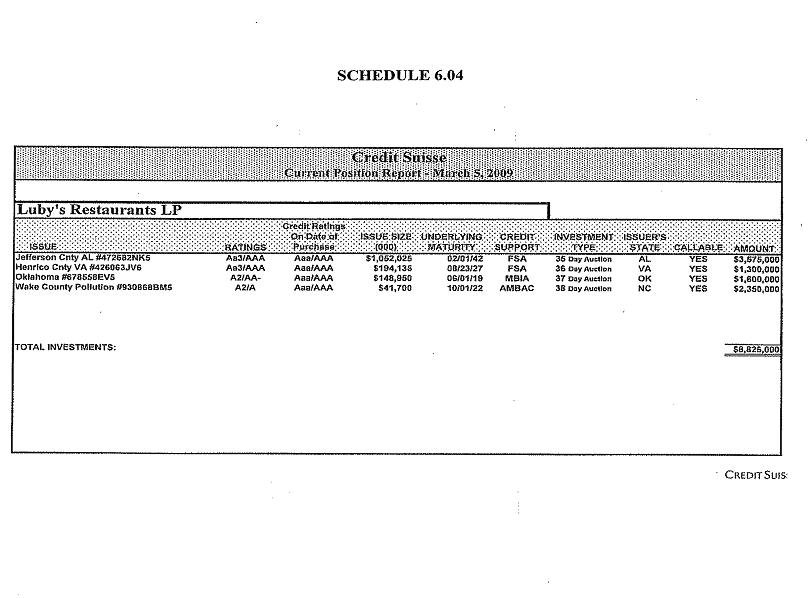

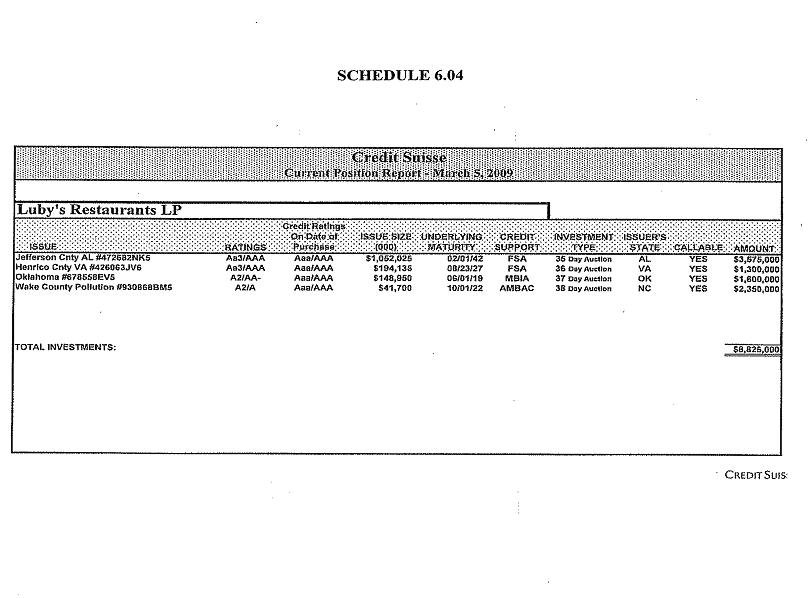

(f) the auction rate securities (debt instruments, tax-exempt, with a long-term maturity for which the interest rate is reset through a "dutch auction" process with interest on such instrument being paid at the end of each such auction period) set forth in Schedule 6.04; and

(g) expenditures made in compliance with Section 6.13 hereof.

(f) A new definition of “Phantom Amortization” is hereby added to Section 1.01 of the Credit Agreement, such new definition to read in its entirety as follows:

“Phantom Amortization” means, for any fiscal quarter, an amount equal to the outstanding principal balance of the Loans as of the close of business on the last day of such fiscal quarter divided by five (5).

(g) Section 2.11(a) of the Credit Agreement is hereby amended to read in its entirety as follows:

(a) The Loans comprising each ABR Borrowing shall bear interest at the lesser of (i) the greater of (x) three and one half percent (3-1/2%) or (y) the sum of the Alternate Base Rate plus the Applicable Rate or (ii) the Ceiling Rate.

(h) Section 2.11(b) of the Credit Agreement is hereby amended to read in its entirety as follows:

(b) The Loans comprising each Eurodollar Borrowing shall bear interest at the lesser of (i) the greater of (x) three and one half percent (3-1/2%) or (y) the sum of the Adjusted LIBO Rate for the Interest Period in effect for such Borrowing plus the Applicable Rate or (ii) the Ceiling Rate.

(i) Section 5.12 of the Credit Agreement is hereby amended to read in its entirety as follows:

SECTION 5.12 Financial Covenants. The Borrower will have and maintain:

(a) Total Leverage Ratio – a Total Leverage Ratio of not greater than 2.75 to 1.00 at all times.

(b) Interest Coverage Ratio – an Interest Coverage Ratio of not less than 2.00 to 1.00 as of the end of each fiscal quarter.

(j) Section 6.13 of the Credit Agreement is hereby amended to read in its entirety as follows:

SECTION 6.13 Capital Expenditures. The Borrower will not, and will not permit any other Loan Party to, make a Capital Expenditure if, after giving effect to such Capital Expenditure, (x) any Event of Default is then existing or would arise as a result of the applicable Capital Expenditure or (y) such Capital Expenditure, when added with all other Capital Expenditures in such fiscal year, would exceed the applicable Maximum Capex Amount. Acquisitions permitted under the terms and provisions of Section 6.14 hereof shall not be treated as Capital Expenditures for purposes of this Section.

(k) Schedule 2.01 of the Credit Agreement is hereby amended to be identical to Schedule 2.01 attached hereto.

(l) A new Schedule 6.04 is hereby added to the Credit Agreement, such new Schedule to be identical to Schedule 6.04 attached hereto.

(m) Exhibit B of the Credit Agreement is hereby amended to be identical to Exhibit B attached hereto.

SECTION 2. Amendment Fee. As a condition precedent to the effectiveness of this Amendment, the Borrower shall pay to each Lender an amendment fee in the amount of $7,500.

SECTION 3. Ratification. Except as expressly amended by this Amendment, the Credit Agreement and the other Loan Documents shall remain in full force and effect. None of the rights, title and interests existing and to exist under the Credit Agreement are hereby released, diminished or impaired, and the Company hereby reaffirms all covenants, representations and warranties in the Credit Agreement.

SECTION 4. Expenses. The Company shall pay to the Administrative Agent all reasonable fees and expenses of its legal counsel incurred in connection with the execution of this Amendment.

SECTION 5. Certifications. The Company hereby certifies that (a) no material adverse change in the assets, liabilities, financial condition, business or affairs of the Company has occurred and (b) subject to the waiver set forth herein, no Default or Event of Default has occurred and is continuing or will occur as a result of this Amendment.

SECTION 6. Miscellaneous. This Amendment (a) shall be binding upon and inure to the benefit of the Company, the Lenders and the Administrative Agent and their respective successors, assigns, receivers and trustees; (b) may be modified or amended only by a writing signed by the required parties; (c) shall be governed by and construed in accordance with the laws of the State of Texas and the United States of America; (d) may be executed in several counterparts by the parties hereto on separate counterparts, and each counterpart, when so executed and delivered, shall constitute an original agreement, and all such separate counterparts shall constitute but one and the same agreement and (e) together with the other Loan Documents, embodies the entire agreement and understanding between the parties with respect to the subject matter hereof and supersedes all prior agreements, consents and understandings relating to such subject matter. The headings herein shall be accorded no significance in interpreting this Amendment.

NOTICE PURSUANT TO TEX. BUS. & COMM. CODE §26.02

THE CREDIT AGREEMENT, AS AMENDED BY THIS AMENDMENT, AND ALL OTHER LOAN DOCUMENTS EXECUTED BY ANY OF THE PARTIES PRIOR HERETO OR SUBSTANTIALLY CONCURRENTLY HEREWITH CONSTITUTE A WRITTEN LOAN AGREEMENT WHICH REPRESENTS THE FINAL AGREEMENT BETWEEN THE PARTIES AND MAY NOT BE CONTRADICTED BY EVIDENCE OF PRIOR, CONTEMPORANEOUS OR SUBSEQUENT ORAL AGREEMENTS OF THE PARTIES. THERE ARE NO UNWRITTEN ORAL AGREEMENTS BETWEEN THE PARTIES.

IN WITNESS WHEREOF, the Company, the Lenders and the Administrative Agent have caused this Amendment to be signed by their respective duly authorized officers, effective as of the date first above written.

| | LUBY’S, INC., |

| a Delaware corporation |

| | | |

| By: | | /s/Christopher J. Pappas |

| | | Christopher J. Pappas, |

| | | President and Chief Executive Officer |

[signature page to First Amendment to Credit Agreement]

The undersigned Subsidiaries of the Borrower hereby join in this Amendment to evidence their consent to execution by Borrower of this Amendment, to confirm that each Loan Document now or previously executed by the undersigned applies and shall continue to apply to this Agreement, and to acknowledge that without such consent and confirmation, Lenders would not execute this Agreement.

| | LUBY’S HOLDINGS, INC., |

| a Delaware corporation, |

| LUBY’S LIMITED PARTNER, INC., |

| a Delaware corporation, |

| LUBCO, INC., |

| a Delaware corporation, |

| LUBY’S MANAGEMENT, INC., |

| a Delaware corporation, |

| LUBY’S BEVCO, INC., and |

| a Texas corporation |

| | | |

| | | |

| By: | | /s/Christopher J. Pappas |

| | | Christopher J. Pappas, |

| | | President and Chief Executive Officer |

| | LUBY’S RESTAURANTS LIMITED |

| PARTNERSHIP, a Texas limited partnership |

| | | | | | |

| By: | | Luby’s Management, Inc., |

| | | a Delaware corporation, |

| | | its general partner |

| | | | | | |

| | | | | | |

| | | By: | | | /s/Christopher J. Pappas |

| | | | | | Christopher J. Pappas, |

| | | | | | President and Chief Executive |

| | | | | | Officer |

[signature page to First Amendment to Credit Agreement]

| | WELLS FARGO BANK, NATIONAL ASSOCIATION, individually and as Administrative Agent |

| | | |

| | | |

| By: | | /s/Ben R. McCaslin |

| Name: | | Ben R. McCaslin |

| Title: | | Vice President |

[signature page to First Amendment to Credit Agreement]

| | AMEGY BANK, NATIONAL ASSOCIATION |

| | | |

| | | |

| By: | | /s/William B. Pyle |

| Name: | | William B. Pyle |

| Title: | | Senior Vice President |

SCHEDULE 2.01

| Revolving |

| Lender | Commitments |

| |

| Wells Fargo Bank, National Association | $15,000,000 |

| Amegy Bank, National Association | $15,000,000 |

COMPLIANCE CERTIFICATE

The undersigned hereby certifies that he or she is the __________________ of LUBY'S, INC., a Delaware corporation (the “Borrower”), and that as such he or she is authorized to execute this certificate on behalf of the Borrower pursuant to the Credit Agreement (the “Agreement”) dated as of July 13, 2007, by and among Borrower, WELLS FARGO BANK, NATIONAL ASSOCIATION, as Administrative Agent, and the lenders therein named; and that a review has been made under his or her supervision with a view to determining whether the Loan Parties have fulfilled all of their respective obligations under the Agreement, the Notes and the other Loan Documents; and further certifies, represents and warrants that to his or her knowledge (each capitalized term used herein having the same meaning given to it in the Agreement unless otherwise specified):

(a) The financial statements delivered to the Administrative Agent concurrently with this Compliance Certificate have been prepared in accordance with GAAP consistently followed throughout the period indicated and fairly present the financial condition and results of operations of the applicable Persons as at the end of, and for, the period indicated (subject, in the case of quarterly financial statements, to normal changes resulting from year-end adjustments and the absence of certain footnotes).

(b) As of the date hereof, [no Default or Event of Default] [a Default] has occurred and is continuing. [If a Default has occurred, specify the details thereof and any action taken or proposed to be taken with respect thereto.]

(c) The compliance with the provisions of Sections 5.12 and 6.13 as the effective date of the financial statements delivered to the Administrative Agent concurrently with this Compliance Certificate is as follows:

| | (i) | Section 5.12(a) – Total Leverage Ratio |

| | | |

| | Actual | Required |

| | | |

| | _____ to 1.00 | 2.75 to 1.00 |

| | | |

| | | |

| (ii) | Section 5.12(b) – Interest Coverage Ratio |

| | | |

| | Actual | Required |

| | | |

| | _____ to 1.00 | 2.00 to 1.00 |

EXHIBIT B

| | (iii) | Section 6.13 – Capital Expenditures |

| | | | |

| | Year to Date Actual | | Year to Date Permitted |

| | | | |

| | $_______________ | | $_______________ |

(d) There has been no change in GAAP or in the application thereof since the Effective Date which would reasonably be expected to affect the calculation of the financial covenants set forth in the Agreement or, if any such change has occurred, the effects of such change on the financial statements of the respective Loan Parties are specified on an attachment hereto.

(e) Since the date of the Agreement, no event has occurred which would be reasonably likely to have a Material Adverse Effect.

DATED as of _____________, 20___.

| | |

| [SIGNATURE OF AUTHORIZED OFFICER] | |

EXHIBIT B

13