Table of Contents

As filed with the Securities and Exchange Commission on September 19, 2014

Registration No. 333-196742

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

to

FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Crown Castle REIT Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 6798 | 76-0470458 | ||

(State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

1220 Augusta Drive

Suite 600

Houston, Texas 77057

(713) 570-3000

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Jay A. Brown

Chief Financial Officer

Crown Castle International Corp.

1220 Augusta Drive, Suite 600

Houston, Texas 77057

(713) 570-3000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies To:

Stephen L. Burns Johnny G. Skumpija Cravath, Swaine & Moore LLP Worldwide Plaza 825 Eighth Avenue New York, New York 10019 (212) 474-1000 | E. Blake Hawk General Counsel Crown Castle International Corp. 1220 Augusta Drive, Suite 600 Houston, Texas 77057 (713) 570-3000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer) ¨

Exchange Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) ¨

Table of Contents

CALCULATION OF REGISTRATION FEE

| ||||||||

Title of each class of securities to be registered | Amount to be registered | Proposed maximum offering price per unit | Proposed maximum aggregate offering price | Amount of registration fee | ||||

Common stock, par value $0.01 per share | 203,564(1) | N/A | $6,390,457.28(4) | $823.09(7) | ||||

Common stock, par value $0.01 per share | 347,062,076(2) | N/A | $24,830,752,363.04(5) | $3,198,200.91(7)(8) | ||||

4.50% Mandatory Convertible Preferred Stock, Series A, par value $0.01 per share | 9,775,000(3) | N/A | $997,147,750.00(6) | $128,432.64(7)(8) | ||||

| ||||||||

| ||||||||

| (1) | Represents the number of additional shares of common stock, par value $0.01 per share (“CCR common stock”), of Crown Castle REIT Inc., a Delaware corporation (“CCR”, which, effective at the time of the merger described below, will be renamed “Crown Castle International Corp.”), issuable pursuant to the merger of Crown Castle International Corp., a Delaware corporation (“Crown Castle”), with and into CCR, pursuant to the Agreement and Plan of Merger between Crown Castle and CCR as described in the proxy statement/prospectus that forms a part of this Registration Statement (the “merger agreement”), based on the collective number of shares of common stock, par value $0.01 per share, of Crown Castle (“Crown Castle common stock”) issued, or that became issuable, on or after June 13, 2014. Pursuant to the merger agreement, each outstanding share of Crown Castle common stock will be converted into one share of CCR common stock. |

| (2) | Represents the maximum number of shares of CCR common stock that may be issuable pursuant to the merger of Crown Castle with and into CCR, pursuant to the merger agreement, based on the number of shares of Crown Castle common stock (i) outstanding (other than shares owned by Crown Castle or CCR) as of the close of business on June 12, 2014, (ii) that are or may become issuable prior to the date the merger is expected to be completed upon the settlement of restricted stock units and restricted stock awards outstanding as of the close of business on June 12, 2014, and (iii) that are issuable upon conversion of the 4.50% Mandatory Convertible Preferred Stock, Series A, par value $0.01 per share, of CCR (“CCR Convertible Preferred Stock”). Pursuant to the merger agreement, each outstanding share of Crown Castle common stock will be converted into one share of CCR common stock. The number of shares of CCR common stock to be registered in accordance with clause (iii) above represents the maximum number of shares of CCR common stock into which 9,775,000 shares of CCR Convertible Preferred Stock can be converted, which, as of the close of business on June 12, 2014, is 1.3576 shares of CCR common stock per share of the CCR Convertible Preferred Stock, or a maximum total of 13,270,540 shares of CCR common stock. Pursuant to Rule 416, the number of shares of CCR common stock registered includes an indeterminate number of additional shares of CCR common stock that may be issued from time to time upon conversion of the CCR Convertible Preferred Stock as a result of the anti-dilution provisions thereof. |

| (3) | Represents the maximum number of shares of CCR Convertible Preferred Stock that may be issuable pursuant to the merger agreement, based on the number of shares of 4.50% Mandatory Convertible Preferred Stock, Series A, par value $0.01 per share, of Crown Castle (the “Crown Castle Convertible Preferred Stock”), outstanding as of the close of business on June 12, 2014. Pursuant to the merger agreement, each outstanding share of Crown Castle Convertible Preferred Stock will be converted into one share of CCR Convertible Preferred Stock. |

| (4) | Pursuant to Rules 457(c) and 457(f)(1) under the Securities Act of 1933, as amended (the “Securities Act”), and solely for purposes of calculating this registration fee, the proposed maximum aggregate offering price is equal to the market value of shares of Crown Castle common stock (the securities to be cancelled pursuant to the merger agreement) in accordance with Rule 457(c) under the Securities Act, calculated as follows: the product of (i) $78.53, the average of the high and low prices per share of Crown Castle common stock on September 15, 2014, as reported on the New York Stock Exchange (“NYSE”), and (ii) 81,376 shares of Crown Castle common stock issued, or that became issuable, on or after June 13, 2014. Pursuant to Rule 457(i), there is no additional filing fee payable with respect to the shares of CCR common stock issuable upon conversion of the CCR Convertible Preferred Stock because no additional consideration will be received in connection with the exercise of the conversion privilege. |

| (5) | Pursuant to Rules 457(c) and 457(f)(1) under the Securities Act and solely for purposes of calculating this registration fee, the proposed maximum aggregate offering price is equal to the market value of shares of Crown Castle common stock (the securities to be cancelled pursuant to the merger agreement) in accordance with Rule 457(c) under the Securities Act, calculated as follows: the product of (i) $74.39, the average of the high and low prices per share of Crown Castle common stock on June 12, 2014, as reported on the NYSE, and (ii) 333,791,536, the number of shares of Crown Castle common stock (A) outstanding (other than shares owned by Crown Castle or CCR) as of the close of business on June 12, 2014 and (B) that are or may become issuable prior to the date the merger is expected to be completed upon the settlement of restricted stock units and restricted stock awards outstanding as of the close of business on June 12, 2014. Pursuant to Rule 457(i), there is no additional filing fee payable with respect to the shares of CCR common stock issuable upon conversion of the CCR Convertible Preferred Stock because no additional consideration will be received in connection with the exercise of the conversion privilege. |

| (6) | Pursuant to Rules 457(c) and 457(f)(1) under the Securities Act, and solely for purposes of calculating this registration fee, the proposed maximum aggregate offering price is equal to the market value of shares of Crown Castle Convertible Preferred Stock (the securities to be cancelled pursuant to the merger agreement) in accordance with Rule 457(c) under the Securities Act, calculated as follows: the product of (i) $102.01, the average of the high and low prices per share of Crown Castle Convertible Preferred Stock on June 12, 2014, as reported on the NYSE, and (ii) 9,775,000, the number of shares of Crown Castle Convertible Preferred Stock outstanding (other than shares owned by Crown Castle or CCR) as of the close of business on June 12, 2014. |

| (7) | Reflects the product of (i) 0.0001288 and (ii) the proposed maximum aggregate offering price. |

| (8) | Previously paid by CCR in connection with the initial filing of this Registration Statement on June 13, 2014. |

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(A) OF THE SECURITIES ACT OF 1933 OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE SECURITIES AND EXCHANGE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(A), MAY DETERMINE.

Table of Contents

The information in this proxy statement/prospectus is not complete and may be changed. A registration statement relating to these securities has been filed with the Securities and Exchange Commission. Crown Castle REIT Inc. may not sell or exchange these securities until the registration statement is effective. This proxy statement/prospectus is not an offer to sell or exchange these securities and it is not soliciting an offer to buy these securities in any state where the offer, sale or exchange is not permitted.

Preliminary Proxy Materials—Subject To Completion, dated September 19, 2014

[ ], 2014

To the holders of our common stock and, for informational purposes only, to the holders of our 4.50% Mandatory Convertible Preferred Stock:

I am pleased to invite you to attend a special meeting of stockholders of Crown Castle International Corp., a Delaware corporation, or Crown Castle, which will be held on [ ], 2014 at [ ], local time, at 1220 Augusta Drive, Suite 600, Houston, Texas 77057.

In September 2013, Crown Castle announced that it was commencing the steps necessary to qualify as a real estate investment trust, or REIT, for the taxable year beginning January 1, 2014. Prior to commencing its operations as a REIT, Crown Castle completed the steps necessary in order to operate in compliance with the REIT rules. We refer to the completion of these steps and the commencement of Crown Castle’s operations as a REIT as the REIT conversion. Effective January 1, 2014, Crown Castle began operating as a REIT for U.S. federal income tax purposes.

Although the REIT rules do not require the completion of the merger described below, we intend to complete the merger to facilitate our continued compliance with the REIT rules by ensuring the effective adoption of certain charter provisions that implement REIT-related ownership limitations and transfer restrictions related to our capital stock, subject to approval by the holders of Crown Castle common stock. In the merger, Crown Castle will merge with and into Crown Castle REIT Inc., a Delaware corporation, or CCR, and wholly owned subsidiary of Crown Castle, which was recently formed for the purpose of the merger. Effective at the time of the merger, CCR will be renamed “Crown Castle International Corp.” and will succeed to the assets, continue the business and assume the obligations of Crown Castle. In the merger, holders of Crown Castle common stock will receive a number of shares of CCR common stock equal to, and in exchange for, the number of shares of Crown Castle common stock such holders own. The holders of Crown Castle Convertible Preferred Stock will receive a number of shares of CCR Convertible Preferred Stock equal to, and in exchange for, the number of shares of Crown Castle Convertible Preferred Stock such holders own. We expect that, immediately following the completion of the merger, shares of CCR common stock will trade on the New York Stock Exchange under the symbol “CCI” and that shares of CCR Convertible Preferred Stock will trade on the New York Stock Exchange under the symbol “CCI-PRA”.

The affirmative vote of the holders of a majority of the outstanding shares of common stock entitled to vote thereon is required for the adoption of the agreement and plan of merger, or the merger agreement. The holders of our Convertible Preferred Stock do not have the right to vote on the proposal to adopt the merger agreement and this proxy statement/prospectus is being mailed to such holders for informational purposes only. After careful consideration, on August 7, 2014, the board of directors, on a unanimous basis, approved and declared to be advisable the merger agreement, and hereby recommends that all holders of Crown Castle common stock entitled to vote thereon vote “FOR” the adoption of the merger agreement.

This proxy statement/prospectus is a prospectus of CCR as well as a proxy statement for Crown Castle and provides you with detailed information about the REIT conversion, the merger and the special meeting.We encourage you to carefully read this entire proxy statement/prospectus, including all its annexes and the documents referred to as incorporated by reference into this proxy statement/prospectus, and we especially encourage you to read the section entitled “Risk Factors” beginning on page 17.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities to be issued by CCR under this proxy statement/prospectus or passed upon the adequacy or accuracy of this proxy statement/prospectus. Any representation to the contrary is a criminal offense.

This proxy statement/prospectus is dated [ ], 2014 and is being first mailed to stockholders on or about [ ], 2014.

Sincerely,

J. Landis Martin

Chairman of the Board

Table of Contents

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

[ ], [ ], 2014

[ ]

1220 Augusta Drive, Suite 600

Houston, Texas 77057

NOTICE IS HEREBY GIVEN that a special meeting of stockholders of Crown Castle International Corp., a Delaware corporation, or Crown Castle, will be held on [ ], 2014 at [ ], local time, at 1220 Augusta Drive, Suite 600, Houston, Texas 77057, for the following purposes:

| 1. | to consider and vote upon a proposal to adopt the Agreement and Plan of Merger dated September 19, 2014 (as it may be amended from time to time), or the merger agreement, between Crown Castle and Crown Castle REIT Inc., a newly formed wholly owned subsidiary of Crown Castle, which is being implemented in connection with Crown Castle’s conversion to a real estate investment trust, or REIT; and |

| 2. | to consider and vote upon a proposal to approve the adjournment of the special meeting, if necessary, to solicit additional proxies if there are not sufficient votes at the time of the special meeting to approve the proposal to adopt the merger agreement. |

On August 7, 2014, the board of directors of Crown Castle approved and declared to be advisable the merger agreement, and hereby recommends that you vote “FOR” the proposals that are described in more detail in this proxy statement/prospectus.

Crown Castle reserves the right to cancel or defer the merger, even if the holders of Crown Castle common stock vote to adopt the merger agreement and the other conditions to the completion of the merger are satisfied or waived, if the board of directors of Crown Castle determines that the merger is no longer in the best interests of Crown Castle and its stockholders.

If you are a holder of record of Crown Castle common stock as of the close of business on [ ], 2014, the record date, you are entitled to notice of, and to vote those shares by proxy or at, the special meeting and at any adjournment or postponement of the special meeting. During the ten-day period before the special meeting, Crown Castle will keep a list of holders of Crown Castle common stock entitled to vote at the special meeting or any adjournment or postponement thereof available for inspection during normal business hours at Crown Castle’s offices in Houston, Texas, for any purpose germane to the special meeting. The list of holders of Crown Castle common stock will also be provided and kept at the location of the special meeting for the duration of the special meeting, and may be inspected by any holder of Crown Castle common stock who is present.

The holders of record of Crown Castle’s Convertible Preferred Stock as of the record date are entitled to notice of the special meeting, but are not entitled to vote on the proposals at the special meeting and this proxy statement/prospectus is being mailed to such holders for informational purposes only.

Your vote is important.Whether or not you, as a holder of Crown Castle common stock, plan to attend the special meeting in person, please complete, sign, date and promptly return the enclosed proxy card in the enclosed envelope. You may also authorize a proxy to vote your shares by telephone or over the Internet as described in your proxy card. Holders of Crown Castle common stock who return proxy cards by mail or submit a proxy by telephone or over the Internet prior to the special meeting may nevertheless attend the special meeting, revoke their proxies and vote their shares at the special meeting.

We encourage you to read the attached proxy statement/prospectus carefully. If you have any questions or need assistance voting your shares, please call our proxy solicitor, Georgeson Inc., toll-free at (888) 658-3624.

| By Order of the Board of Directors, |

Donald J. Reid |

| Corporate Secretary |

Houston, Texas

[ ], 2014

Table of Contents

ADDITIONAL INFORMATION

This proxy statement/prospectus incorporates important business and financial information about Crown Castle International Corp. from other documents that are not included in or delivered with this proxy statement/prospectus. This information is available to you without charge upon your request. You can obtain the documents incorporated by reference into this proxy statement/prospectus by requesting them in writing or by telephone from Crown Castle, or Georgeson Inc., Crown Castle’s proxy solicitor, at the following addresses and telephone numbers, as applicable:

Crown Castle International Corp. 1220 Augusta Drive Suite 600 Houston, Texas 77057 (713) 570-3000 Attn: Investor Relations | Georgeson Inc. 480 Washington Boulevard 26th Floor Jersey City, NJ 07310 (888) 658-3624 |

Crown Castle’s filings with the Securities and Exchange Commission, or SEC, are also available through the investor relations section of Crown Castle’s website at http://investor.crowncastle.com. Except for documents incorporated by reference into this proxy statement/prospectus, no information in, or that can be accessed through, Crown Castle’s website is incorporated by reference into this proxy statement/prospectus, and no such information should be considered a part of this proxy statement/prospectus.

If you would like to request any documents, please do so by [ ], 2014 in order to receive them before the special meeting.

For more information, see the section entitled “Where You Can Find More Information”.

i

Table of Contents

ABOUT THIS PROXY STATEMENT/PROSPECTUS

This proxy statement/prospectus constitutes a proxy statement of Crown Castle and has been mailed to you because you were a holder of Crown Castle common stock on the record date set by the board of directors of Crown Castle and were entitled to notice of a special meeting of Crown Castle stockholders or, for informational purposes only, because you were a holder of Crown Castle Convertible Preferred Stock on the record date. Only holders of Crown Castle common stock as of the record date are being asked to consider and vote at the special meeting upon the proposal to adopt the merger agreement and the proposal to approve the adjournment of the special meeting, if necessary, to solicit additional proxies if there are not sufficient votes at the time of the special meeting to approve the proposal to adopt the merger agreement. This proxy statement/prospectus also constitutes a prospectus of CCR, which is part of the registration statement on Form S-4 filed by CCR to register with the SEC the CCR common stock and the CCR Convertible Preferred Stock that holders of Crown Castle common stock and holders of Crown Castle Convertible Preferred Stock, respectively, will receive in connection with the merger if the merger agreement is adopted and the merger is completed. Accordingly, this proxy statement/prospectus is also being mailed for informational purposes only to holders of Crown Castle Convertible Preferred Stock.

You should rely only on the information contained in or incorporated by reference in this proxy statement/prospectus. We have not authorized anyone to provide you with additional or different information. We are not making an offer to exchange or sell (or soliciting any offer to buy) any securities, or soliciting any proxy, in any jurisdiction where it is unlawful to do so. You should assume that the information contained in this proxy statement/prospectus is accurate only as of the date on the front of this proxy statement/prospectus and that any information we have incorporated by reference is accurate only as of the date of the document incorporated by reference. Our business, financial condition, results of operations and prospects may have changed since these dates.

This proxy statement/prospectus does not contain all of the information set forth in the registration statement and the exhibits thereto. For further information with respect to CCR and the CCR common stock and the CCR Convertible Preferred Stock to be issued in connection with the merger, reference is made to the registration statement, including the exhibits thereto. See the section entitled “Where You Can Find More Information”.

When used in this proxy statement/prospectus, unless otherwise specifically stated or the context otherwise requires, the terms:

| • | “Company”, “Crown Castle”, “CCIC”, “we”, “our” and “us” refer to Crown Castle and its subsidiaries with respect to the period prior to the merger, and to CCR and its subsidiaries, including the taxable REIT subsidiaries, with respect to the period after the merger; |

| • | “stockholders” refers to the holders of Crown Castle capital stock with respect to the period prior to the merger, and to the holders of CCR capital stock with respect to the period after the merger; |

| • | “common stock” refers to Crown Castle common stock with respect to the period prior to the merger, and to CCR common stock with respect to the period after the merger; |

| • | “Convertible Preferred Stock” refers to 4.50% Mandatory Convertible Preferred Stock, Series A, par value $0.01 per share, of Crown Castle with respect to the period prior to the merger, and to 4.50% Mandatory Convertible Preferred Stock, Series A, par value $0.01 per share, of CCR with respect to the period after the merger; and |

| • | “CCUSA” and “in the U.S.” refer to our CCUSA segment and “CCAL” and “in Australia” refer to our CCAL segment. |

As used herein, the term “including” and any variation thereof, means “including without limitation”. The use of the word “or” herein is not exclusive.

ii

Table of Contents

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

The statements contained in, or incorporated by reference in, this proxy statement/prospectus include certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 with respect to the financial condition, results of operations, business strategies, operating efficiencies or synergies, competitive positions, growth opportunities for existing products, plans and objectives of management, markets for our stock and other matters that are based on management’s expectations as of the filing date of this proxy statement/prospectus with the SEC. Statements contained in, or incorporated by reference in, this proxy statement/prospectus that are not historical facts are hereby identified as “forward-looking statements” for the purpose of the safe harbor provided by Section 21E of the Securities Exchange Act of 1934, as amended, which we refer to as the Exchange Act, and Section 27A of the Securities Act of 1933, as amended, which we refer to as the Securities Act. In addition, words such as “estimate”, “anticipate”, “project”, “plan”, “intend”, “believe”, “expect”, “likely”, “predicted”, any variations of these words and similar expressions are intended to identify forward-looking statements. These forward-looking statements include plans, projections and estimates and are found at various places throughout this proxy statement/prospectus and the documents incorporated by reference herein. Such forward-looking statements include (1) expectations regarding anticipated growth in the wireless communication industry, carriers’ investments in their networks, new tenant additions, non-renewals of customer contracts, including the impact of Sprint decommissioning its iDEN network, customer consolidation or ownership changes, or demand for our wireless infrastructure, (2) availability and adequacy of cash flows and liquidity for, or plans regarding, future discretionary investments including capital expenditures, (3) potential benefits of our discretionary investments, (4) anticipated growth in our future revenues, margins, Adjusted EBITDA and operating cash flows, (5) expectations regarding our capital structure and the credit markets, our availability and cost of capital or our ability to service our debt and comply with debt covenants and the benefits of any future refinancings, (6) expectations for sustaining capital expenditures, (7) the potential advantages, benefits or impact of, or opportunities created by, our REIT status, (8) our intention to pursue certain steps and corporate actions in connection with our REIT conversion, including our future inclusion of REIT-related ownership limitations and transfer restrictions related to our capital stock, including pursuant to the transactions described in this proxy statement/prospectus and (9) our dividend policy, including the timing, amount or growth of any dividends.

These forward-looking statements should, therefore, be considered in light of various risks, uncertainties, assumptions and other important factors, including those set forth or incorporated by reference in this proxy statement/prospectus. Important factors that could cause actual results to differ materially from estimates or projections contained in the forward-looking statements include those factors described in the sections entitled “Risk Factors” beginning on page 17 of this proxy statement/prospectus and page 7 in our Annual Report on Form 10-K for the fiscal year ended December 31, 2013, as updated by annual, quarterly and other reports and documents we file with the SEC, and that are incorporated by reference herein. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those expected. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this proxy statement/prospectus or the date of the other documents incorporated by reference herein. Readers also should understand that it is not possible to predict or identify all such factors and that the risk factors as listed herein and in our filings incorporated by reference herein should not be considered a complete statement of all potential risks and uncertainties.

iii

Table of Contents

iv

Table of Contents

QUESTIONS AND ANSWERS ABOUT THE REIT CONVERSION AND THE MERGER

What follows are questions that you, as a stockholder of Crown Castle, may have regarding the REIT conversion, the merger and the special meeting of stockholders, which we refer to as the special meeting, and the answers to those questions. You are urged to carefully read this proxy statement/prospectus in its entirety because the information in this section may not provide all of the information that might be important to you with respect to the REIT conversion, the merger and the special meeting. Additional important information is contained in the annexes to, and the documents incorporated by reference into, this proxy statement/prospectus.

Crown Castle has taken all of the required steps necessary for the REIT conversion and commenced operating as a REIT effective January 1, 2014. Although the REIT rules do not require the completion of the merger, we intend to complete the merger to facilitate our continued compliance with the REIT rules by ensuring the effective adoption of the charter provisions that implement REIT-related ownership limitations and transfer restrictions related to our capital stock, subject to approval by the holders of Crown Castle common stock.

| Q. | What will happen in the merger? |

| A. | Crown Castle will merge with and into CCR, a newly formed Delaware corporation that is wholly owned by Crown Castle. CCR will be the surviving entity in the merger and will succeed to the assets, continue the business and assume the obligations of Crown Castle. We refer to this transaction in this proxy statement/prospectus as the merger. Although the REIT rules do not require the completion of the merger, we intend to complete the merger, subject to approval by the holders of Crown Castle common stock, to facilitate our continued compliance with such rules, which, among other requirements, prohibit more than 50% of our capital stock from being owned by five or fewer individuals and require our capital stock to be beneficially owned by 100 or more persons, during certain periods of the taxable year. By merging Crown Castle with and into CCR, whose charter includes REIT-related provisions limiting the ownership and restricting the transfer of our capital stock, we will ensure the effective adoption of such provisions and facilitate our continued compliance with the REIT rules. |

As a consequence of the merger:

| • | the outstanding shares of common stock of Crown Castle, par value $0.01 per share, which we refer to as the Crown Castle common stock, will convert into the same number of shares of common stock of CCR, par value $0.01 per share, which we refer to as the CCR common stock; |

| • | the outstanding shares of Crown Castle’s 4.50% Mandatory Convertible Preferred Stock, Series A, par value $0.01 per share, which we refer to as the Crown Castle Convertible Preferred Stock, will convert into the same number of shares of CCR’s 4.50% Mandatory Convertible Preferred Stock of CCR, Series A, par value $0.01 per share, which we refer to as the CCR Convertible Preferred Stock; |

| • | the existing board of directors and executive officers of Crown Castle immediately prior to the merger will be the board of directors and executive officers, respectively, of CCR immediately following the merger, and each director and executive officer will continue his or her directorship or employment, as the case may be, with CCR under the same terms as his or her directorship or employment with Crown Castle; |

| • | effective at the time of the merger, CCR will be renamed “Crown Castle International Corp.” and will become the publicly traded New York Stock Exchange listed company that will succeed to the assets, continue the business and assume the obligations of Crown Castle; |

| • | the rights of the holders of CCR common stock will be governed by the amended and restated certificate of incorporation of CCR, which we refer to as the CCR Charter, and the amended and restated by-laws of CCR, which we refer to as the CCR By-Laws. The rights of holders of CCR Convertible Preferred Stock will be governed by the CCR Charter, the CCR By-Laws and Certificate of |

1

Table of Contents

Designations of 4.50% Mandatory Convertible Preferred Stock, Series A, of Crown Castle REIT Inc., which we refer to as the CCR Certificate of Designations. The CCR Charter is substantially similar to Crown Castle’s amended and restated certificate of incorporation, which we refer to as the Crown Castle Charter, except that the CCR Charter includes REIT-related ownership limitations and transfer restrictions related to CCR capital stock to facilitate our continued compliance with the REIT rules. These ownership limitations and transfer restrictions could have the effect of delaying, deferring or preventing a transaction or a change in control of us that might involve a premium price for our capital stock or otherwise be in the best interests of our stockholders. The CCR By-Laws and CCR Certificate of Designations are substantially similar to the amended and restated by-laws of Crown Castle, which we refer to as the Crown Castle By-Laws, and the Certificate of Designations of 4.50% Mandatory Convertible Preferred Stock, Series A, of Crown Castle International Corp., which we refer to as the Crown Castle Certificate of Designations, respectively; |

| • | there will be no change in the assets we hold or in the business we conduct; and |

| • | there will be no fundamental change to our discretionary capital allocation strategy or current operational strategy. |

We have attached to this proxy statement/prospectus a copy of the merger agreement as Annex A, a copy of the form of the CCR Charter as Annex B-1, a copy of the form of the CCR By-Laws as Annex B-2 and a copy of the form of the CCR Certificate of Designations as Annex B-3.

| Q. | When and where is the special meeting? |

| A. | The special meeting will be held on [ ], 2014 at [ ], local time, at 1220 Augusta Drive, Suite 600, Houston, Texas 77057. |

| Q. | Who can vote at the special meeting? |

| A. | If you are a holder of record of Crown Castle common stock at the close of business on [ ], 2014, you may vote the shares of common stock that you hold on the record date at the special meeting. On or about [ ], 2014, we will begin mailing this proxy statement/prospectus to all persons entitled to notice of the special meeting. |

The holders of record of Crown Castle Convertible Preferred Stock as of the record date are entitled to notice of the special meeting, but are not entitled to vote on the proposals at the special meeting and this proxy statement/prospectus is being mailed to such holders for informational purposes only.

| Q. | What will I be voting on at the special meeting? |

| A. | As a holder of Crown Castle common stock, you are entitled to, and requested to, vote on the proposal to adopt the merger agreement pursuant to which Crown Castle will be merged with and into CCR, a wholly owned subsidiary of Crown Castle, with CCR as the surviving entity. In addition, you are requested to vote on the proposal to approve the adjournment of the special meeting, if necessary, to solicit additional proxies if there are not sufficient votes at the time of the special meeting to approve the proposal to adopt the merger agreement. You are not being asked to vote on any element of the REIT conversion, which became effective for the taxable year beginning January 1, 2014 and was not conditioned upon stockholder approval of the merger. |

| Q. | Why is my vote important? |

| A. | If you, as a holder of Crown Castle common stock, do not submit a proxy or vote in person at the meeting, it will be more difficult for us to obtain the necessary quorum to hold the special meeting. In addition, your failure to submit a proxy or to vote in person will have the same effect as a vote against the adoption of the |

2

Table of Contents

| merger agreement. If you hold your shares through a broker, bank or other nominee, your broker, bank or other nominee will not be able to cast a vote on the adoption of the merger agreement without instructions from you. Failure to provide voting instructions to your broker, bank or other nominee will have the same effect as a vote against adoption of the merger agreement. |

| Q. | What constitutes a quorum for the special meeting? |

| A. | A majority of the voting power of the outstanding shares of common stock entitled to vote at the special meeting, represented in person or by proxy, constitutes a quorum for the meeting. |

| Q. | What vote is required? |

| A. | The affirmative vote of the holders of a majority of the outstanding shares of common stock entitled to vote thereon is required for the adoption of the merger agreement. The affirmative vote of the holders of a majority of the voting power of the shares of common stock present in person or represented by proxy at the meeting and entitled to vote thereon is required to approve the adjournment of the special meeting, if necessary, to solicit additional proxies if there are not sufficient votes at the time of the special meeting to approve the proposal to adopt the merger agreement. As of the close of business on the record date, there were [ ] shares of common stock outstanding and entitled to vote at the special meeting. Each share of outstanding common stock on the record date is entitled to one vote on each proposal submitted to you for consideration. |

| Q. | How do I vote without attending the special meeting? |

| A. | If you are a holder of common stock on the record date, you may cause your shares to be voted by completing, signing and promptly returning the proxy card in the self-addressed stamped envelope provided. You may also authorize a proxy to vote your shares by telephone or over the Internet as described in your proxy card. Authorizing a proxy by telephone or over the Internet or by mailing a proxy card will not limit your right to attend the special meeting and vote your shares in person. Those holders of Crown Castle common stock as of the record date who choose to submit a proxy by telephone or over the Internet must do so no later than 11:59 p.m., Eastern Time, on [ ], 2014. |

If your shares are held by a broker, bank or other nominee, please follow the voting instructions provided by your bank, broker or other nominee to ensure that your shares are represented at the special meeting.

| Q. | Can I attend the special meeting and vote my shares in person? |

| A. | Yes. All stockholders are invited to attend the special meeting. Holders of record of Crown Castle common stock at the close of business on the record date are invited to attend and vote at the special meeting. If your shares are held by a broker, bank or other nominee, then you are not the holder of record. Therefore, to vote at the special meeting, you must bring the appropriate documentation from your broker, bank or other nominee confirming your beneficial ownership of the shares. |

| Q. | If my shares are held in “street name” by my broker, bank or other nominee, will my broker, bank or other nominee vote my shares for me without my instruction? |

| A. | No. If your shares are held in “street name” by your broker, bank or other nominee, you should follow the directions provided by your broker, bank or other nominee. Your broker, bank or other nominee will vote your sharesonly if you provide instructions on how you would like your shares to be voted. Failure to provide voting instructions to your broker, bank or other nominee will have the same effect as a vote against adoption of the merger agreement. |

3

Table of Contents

| Q. | Can I change my vote after I have mailed my signed proxy card? |

| A. | Yes. You can change your vote at any time before your proxy is voted at the special meeting. To revoke your proxy, you must either (1) timely notify the secretary of Crown Castle in writing, (2) timely mail a new proxy card dated after the date of the proxy you wish to revoke, (3) timely submit a later dated proxy, by telephone or over the Internet by following the instructions on your proxy card or (4) attend the special meeting and vote your shares in person. Merely attending the special meeting will not constitute revocation of your proxy. If your shares are held through a broker, bank or other nominee, you should contact your broker, bank or other nominee to change your vote. |

| Q. | Who will be the board of directors and executive officers after the merger? |

| A. | The existing board of directors and executive officers of Crown Castle immediately prior to the merger will be the board of directors and executive officers, respectively, of CCR immediately following the merger, and each director and executive officer will continue his or her directorship or employment, as the case may be, with CCR under the same terms as his or her directorship or employment with Crown Castle. |

| Q. | Do any of our directors and executive officers have any interests in the merger that are different from mine? |

| A. | No. Our directors and executive officers own shares of our common stock, restricted stock awards and restricted stock units and, to that extent, their interest in the merger is the same as that of the other holders of shares of our common stock, restricted stock awards and restricted stock units. |

| Q. | Will I have to pay U.S. federal income taxes as a result of the merger? |

| A. | No. You will not recognize gain or loss for U.S. federal income tax purposes as a result of the exchange of shares of Crown Castle common stock for shares of CCR common stock or shares of Crown Castle Convertible Preferred Stock for CCR Convertible Preferred Stock in the merger. However, if we are not a “domestically controlled qualified investment entity” within the meaning of the Internal Revenue Code of 1986, as amended, or the Code, and you are a non-U.S. person who owns or has owned more than 5% of the outstanding Crown Castle common stock or Crown Castle Convertible Preferred Stock, it may be necessary for you to comply with reporting and other requirements of the Treasury regulations in order to achieve nonrecognition of gain on the exchange of Crown Castle common stock for CCR common stock or the exchange of Crown Castle Convertible Preferred Stock for CCR Convertible Preferred Stock in the merger. |

The U.S. federal income tax treatment of holders of Crown Castle common stock, CCR common stock, Crown Castle Convertible Preferred Stock and CCR Convertible Preferred Stock depends in some instances on determinations of fact and interpretations of complex provisions of U.S. federal income tax law for which no clear precedent or authority may be available. In addition, the tax consequences to any particular holder of Crown Castle common stock, CCR common stock, Crown Castle Convertible Preferred Stock or CCR Convertible Preferred Stock will depend on that holder’s particular tax circumstances. We urge you to consult your tax advisor, particularly if you are a non-U.S. person, regarding the specific tax consequences, including the federal, state, local and foreign tax consequences, to you in light of your particular investment in, or the tax circumstances of acquiring, holding, exchanging or otherwise disposing of, Crown Castle common stock, CCR common stock, Crown Castle Convertible Preferred Stock or CCR Convertible Preferred Stock.

| Q. | Am I entitled to appraisal rights? |

| A. | No. Under Delaware law, you are not entitled to any statutory appraisal rights in connection with the merger. |

4

Table of Contents

| Q. | How does the board of directors recommend I vote on the merger proposal? |

| A. | The board of directors of Crown Castle believes that the merger is advisable and in the best interests of Crown Castle and its stockholders.The board of directors unanimously recommends that you vote “FOR” the adoption of the merger agreement. |

| Q. | When is the merger expected to be completed? |

| A. | We expect to complete the merger no later than [ ]. However, we reserve the right to cancel or defer the merger, even if the holders of Crown Castle common stock vote to adopt the merger agreement and the other conditions to the completion of the merger are satisfied or waived, if the board of directors determines that the merger is no longer in the best interests of Crown Castle and its stockholders. |

| Q. | When was the REIT conversion effective? |

| A. | We commenced operating as a REIT for U.S. federal income tax purposes, effective January 1, 2014. You are not being asked to vote on the REIT conversion and the REIT conversion was not contingent upon stockholder approval of the merger. |

| Q. | What actions were necessary for Crown Castle to elect REIT status? |

| A. | In September 2013, Crown Castle announced that it was commencing the steps necessary to qualify as a REIT for the taxable year beginning January 1, 2014. Prior to commencing its operations as a REIT, Crown Castle completed the steps necessary in order to operate in compliance with the REIT rules. We refer to the completion of these steps and the commencement of Crown Castle’s operations as a REIT as the REIT conversion. |

In connection with the REIT conversion, our small cell operations are currently conducted through one or more taxable REIT subsidiaries, which we refer to as TRSs. Additionally, we have included our tower operations in Australia and certain other assets and operations in TRSs. A TRS is a subsidiary of a REIT that is treated as a corporation for U.S. federal income tax purposes and may be subject to regular U.S. corporate taxes on its taxable income. Please see the section entitled “Material United States Federal Income Tax Considerations—Taxation as a REIT—Effect of Subsidiary Entities—Taxable REIT Subsidiaries” beginning on page 117 for a more detailed description of the requirements and limitations regarding our use of TRSs.

Effective January 1, 2014, Crown Castle commenced operations as a REIT for U.S. federal income tax purposes. You are not being asked to vote on the REIT conversion. You are being asked to vote on the merger agreement described below.

| Q. | What is a REIT? |

| A. | A REIT is a company that qualifies for special treatment for U.S. federal income tax purposes because, among other things, it derives most of its income from real estate-based sources and makes a special election under the Code. Crown Castle is operating as a REIT that principally invests in, and derives most of its income from the ownership, operation and leasing of, shared wireless infrastructure. |

A corporation that qualifies as a REIT will generally be entitled to a deduction for dividends that it pays and therefore will not be subject to U.S. federal income tax to the extent of such deductions.

We continue to pay U.S. federal income tax on earnings from certain assets or operations held through TRSs, which currently include our small cell business, our tower operations in Australia and certain other assets and operations. Our foreign assets and operations (including our tower operations in Puerto Rico and Australia) most likely will be subject to foreign income taxes in the jurisdictions in which such assets and operations are located, regardless of whether they are included in a TRS or not.

5

Table of Contents

| Q. | What are our reasons for the REIT conversion? |

| A. | We completed the REIT conversion primarily for the following anticipated benefits: |

| • | To increase long-term stockholder value: As a REIT, we believe we will be able to increase the long-term value of our common stock and benefit from a lower cost of capital compared to a regular C corporation as a result of increased cash flows and distributions; |

| • | To return capital to stockholders: We believe our stockholders will benefit from our establishment of regular cash distributions, resulting in a yield-oriented stock; and |

| • | To expand our base of potential stockholders: By becoming a company that makes regular distributions to its stockholders, our stockholder base may expand to include investors attracted by yield, which may improve the liquidity of our common stock and provide a broader stockholder base. |

To review the background of, and the reasons for, the REIT conversion in greater detail, and the related risks, see the sections entitled “Background of the REIT Conversion and the Merger” beginning on page 31, “Our Reasons for the REIT Conversion and the Merger” beginning on page 33 and “Risk Factors” beginning on page 17.

| Q. | What are our reasons for the merger? |

| A. | Although the REIT rules do not require the completion of the merger, we intend to complete the merger, subject to approval by the holders of Crown Castle common stock, to facilitate our continued compliance with such rules, which, among other requirements, prohibit more than 50% of our capital stock from being owned by five or fewer individuals and require our capital stock to be beneficially owned by 100 or more persons, during certain periods of the taxable year. By merging Crown Castle with and into CCR, whose charter includes REIT-related provisions limiting the ownership and restricting the transfer of our capital stock, we will ensure the effective adoption of such provisions and facilitate our continued compliance with the REIT rules. |

To review the background of, and the reasons for, the merger in greater detail, and the related risks, see the sections entitled “Background of the REIT Conversion and the Merger” beginning on page 31, “Our Reasons for the REIT Conversion and the Merger” beginning on page 33 and “Risk Factors” beginning on page 17.

| Q. | What will I receive in connection with the merger? When will I receive it? |

| A. | Shares of CCR common stock |

At the time of the completion of the merger, holders of Crown Castle common stock will receive a number of shares of CCR common stock equal to, and in exchange for, the number of shares of Crown Castle common stock that such holders then own.

Shares of CCR Convertible Preferred Stock

At the time of the completion of the merger, the holders of Crown Castle Convertible Preferred Stock will receive a number of shares of CCR Convertible Preferred Stock equal to, and in exchange for, the number of shares of Crown Castle Convertible Preferred Stock that such holders then own.

| Q. | Did the REIT conversion change Crown Castle’s current operational strategy? |

| A. | The REIT conversion did not change our current strategy of translating anticipated demand for wireless infrastructure into growth in our cash flows and long-term stockholder value. We measure “long-term stockholder value” as the combined growth in our per share results and dividends to common stockholders. The key elements of our strategy continue to be: |

| • | Organically grow the cash flows from our wireless infrastructure. We seek to maximize the site rental cash flows derived from our wireless infrastructure by co-locating additional tenants on our wireless |

6

Table of Contents

infrastructure through long-term contracts as our customers deploy and improve their wireless networks. We seek to maximize new tenant additions or modifications of existing installations, which we collectively refer to as new tenant additions, through our focus on customer service and deployment speed. Due to the relatively fixed nature of the costs to operate our wireless infrastructure (which tend to increase at approximately the rate of inflation), we expect increases in cash rental receipts from new tenant additions and the related subsequent impact from contracted escalations to result in growth in our operating cash flows. We believe there is considerable additional future demand for our existing wireless infrastructure based on its location and the anticipated growth in the wireless communications industry. Substantially all of our wireless infrastructure can accommodate additional tenancy, either as currently constructed or with appropriate modifications to the structure, which we expect to have high incremental returns. |

| • | Allocate capital efficiently. We seek to allocate our available capital, including the net cash provided by our operating activities, in a manner that will increase long-term stockholder value, such as through the payment of dividends to common stockholders. Our historical discretionary investments have included the following (in no particular order): |

| • | purchasing shares of our common stock from time to time; |

| • | acquiring or constructing wireless infrastructure; |

| • | acquiring land interests under towers; |

| • | making improvements and structural enhancements to our existing wireless infrastructure; or |

| • | purchasing, repaying or redeeming our debt. |

Our long-term strategy is based on our belief that additional demand for our wireless infrastructure will be created by the expected continued growth in the wireless communications industry, which is predominately driven by the demand for wireless data services by consumers. We believe that additional demand for wireless infrastructure will create future growth opportunities for us. We believe that such demand for our wireless infrastructure will continue, will result in organic growth of our cash flows due to new tenant additions on our existing wireless infrastructure and will create other growth opportunities for us, such as demand for new wireless infrastructure.

| Q. | What are some of the risks associated with the REIT conversion? |

| A. | The risks, uncertainties and assumptions associated with our REIT conversion include: |

| • | Future dividend payments to our stockholders will reduce the availability of our cash on hand available to fund future discretionary investments, and may result in a need to incur indebtedness or issue equity securities to fund growth opportunities. In such event, the then current economic, credit market or equity market conditions may impact the availability or cost of such financing, which could hinder our ability to grow our per share results of operations. |

| • | Qualifying and remaining qualified to be taxed as a REIT involves highly technical and complex provisions of the Code. Failure to remain qualified as a REIT would result in our inability to deduct dividends to stockholders when computing our taxable income, which would reduce our available cash. |

| • | Complying with REIT requirements, including the 90% distribution requirement, may limit our flexibility or cause us to forgo otherwise attractive opportunities, including certain discretionary investments and potential financing alternatives. |

| • | If we fail to pay scheduled dividends on the CCR Convertible Preferred Stock, in cash, common stock, or any combination of cash and common stock, we will be prohibited from paying dividends on our common stock, which may jeopardize our status as a REIT. |

7

Table of Contents

| • | We have limited experience operating as a REIT. Our failure to successfully operate as a REIT may adversely affect our financial condition, cash flow, the per share trading price of our common stock or our ability to satisfy debt service obligations. |

| • | REIT ownership limitations and transfer restrictions may prevent or restrict you from engaging in certain transfers of our capital stock. |

| • | We could fail to qualify for taxation as a REIT as a result of limitations on our ability to declare and pay dividends to stockholders as a result of restrictive covenants in our debt instruments and the terms of our Convertible Preferred Stock. |

The present U.S. federal income tax treatment of REITs is subject to change, possibly with retroactive effect, by legislative, judicial or administrative action at any time, and any such change might adversely affect our REIT status or benefits. To review the risks associated with the REIT conversion, see the sections entitled “Our Reasons for the REIT Conversion and the Merger” beginning on page 33 and “Risk Factors” beginning on page 17.

| Q. | What do I need to do now? |

| A. | You should carefully read and consider the information contained in this proxy statement/prospectus, including its annexes and the documents referred to as incorporated by reference into this proxy statement/prospectus. They contain important information about what the board of directors of Crown Castle considered in evaluating and approving the merger agreement and the transactions contemplated thereby, including the merger. |

You should then complete and sign your proxy card and return it in the enclosed envelope as soon as possible so that your shares will be represented at the special meeting, or submit your proxy by telephone or over the Internet in accordance with the instructions on your proxy card. If your shares are held through a broker, bank or other nominee, you should receive a separate voting instruction form with this proxy statement/prospectus.

| Q. | Should I send in my stock certificates now? |

| A. | No. After the merger is completed, holders of Crown Castle common stock will receive written instructions from the exchange agent on how to exchange their certificates representing shares of Crown Castle common stock for certificates representing shares of CCR common stock.Please do not send in your Crown Castle stock certificates with your proxy. |

| Q. | Where will my CCR common stock and CCR Convertible Preferred Stock be publicly traded? |

| A. | CCR will apply to list the new shares of CCR common stock and CCR Convertible Preferred Stock on the New York Stock Exchange, or the NYSE. We expect that, immediately following the completion of the merger, CCR common stock will trade under the symbol “CCI” and CCR Convertible Preferred Stock will trade under the symbol “CCI-PRA”. |

| Q. | Will a proxy solicitor be used? |

| A. | Yes. We have engaged Georgeson Inc. to assist in the solicitation of proxies for the special meeting and estimate we will pay Georgeson Inc. a fee of approximately $13,000. We have also agreed to reimburse Georgeson Inc. for certain costs and expenses incurred in connection with the proxy solicitation and to indemnify Georgeson Inc. against certain losses, claims, damages, costs, fees, expenses and liabilities. In addition, our officers and employees may request the return of proxies by telephone or in person, but no additional compensation will be paid to them. |

| Q. | Whom should I call with questions? |

| A. | You should call Georgeson Inc., our proxy solicitor, toll-free at (888) 658-3624 with any questions about the merger, or to obtain additional copies of this proxy statement/prospectus or additional proxy cards. |

8

Table of Contents

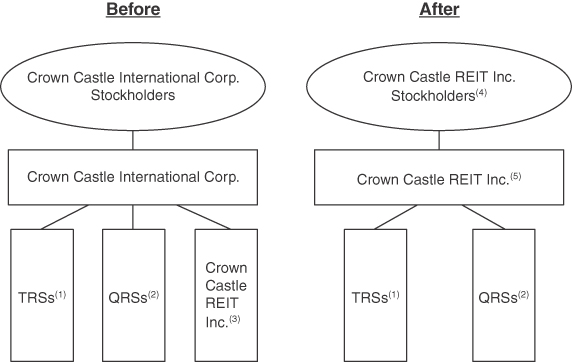

The following diagrams summarize the corporate structure of Crown Castle International Corp. before and after the merger.

| (1) | A “TRS” is a taxable REIT subsidiary that is treated as a corporation for U.S. federal income tax purposes and may be subject to regular U.S. corporate taxes on its taxable income. |

| (2) | A “QRS” is a qualified REIT subsidiary. |

| (3) | Recently formed for the purpose of effecting the merger. |

| (4) | Former stockholders of Crown Castle International Corp. |

| (5) | Effective at the time of the merger, Crown Castle REIT Inc. will be renamed “Crown Castle International Corp.” |

9

Table of Contents

This summary highlights selected information from this proxy statement/prospectus and may not contain all of the information that is important to you. You are urged to carefully read this entire proxy statement/prospectus and the other documents to which this proxy statement/prospectus refers to fully understand the REIT conversion and the merger. In particular, you should read the annexes attached to this proxy statement/prospectus, including the merger agreement, which is attached as Annex A. You also should read the form of CCR Charter, attached as Annex B-1, the form of CCR By-Laws, attached as Annex B-2, and the form of CCR Certificate of Designations, attached as Annex B-3, because these documents will govern your rights as a holder of CCR common stock or a holder of CCR Convertible Preferred Stock following the merger, as applicable. See the section entitled “Where You Can Find More Information” in this proxy statement/prospectus. For a discussion of the risk factors that you should carefully consider, see the section entitled “Risk Factors” beginning on page 17. Most items in this summary include a page reference directing you to a more complete description of that item.

Crown Castle has taken all of the required steps necessary for the REIT conversion and commenced operating as a REIT effective January 1, 2014.

The Companies

Crown Castle International Corp.

1220 Augusta Drive, Suite 600

Houston, Texas 77057

(713) 570-3000

Crown Castle owns, operates and leases shared wireless infrastructure, including: (1) towers and other structures, such as rooftops, which we collectively refer to as towers, and to a lesser extent, (2) distributed antenna systems, or DAS, a type of small cell network, or small cells, and (3) interests in land under third party towers in various forms, which we refer to as third party land interests. Unless the context otherwise suggests or requires, references herein to “wireless infrastructure” include towers, small cells and third party land interests. As of June 30, 2014, we owned, leased or managed approximately 40,000 towers in the United States, including Puerto Rico, which we collectively refer to as the U.S., and approximately 1,800 towers in Australia. As of June 30, 2014, we owned, including fee interests and perpetual easements, land and other property interests, including rooftops, which we collectively refer to as land, on which approximately one-third of our site rental gross margin is derived, and we leased, subleased, managed or licensed the land interests on which approximately two-thirds of our site rental gross margin is derived. Our customers include many of the world’s major wireless communication companies, including Sprint, AT&T, T-Mobile and Verizon Wireless in the U.S., and Telstra, Optus and a joint venture between Vodafone and Hutchison in Australia.

Our core business is providing access, including space or capacity, to our towers, and to a lesser extent, to our small cells and third party land interests, which we refer to as our site rental business, via long-term contracts in various forms, including license, sublease and lease agreements, which we collectively refer to as contracts. Our wireless infrastructure can accommodate multiple customers for antennas and other equipment necessary for the transmission of signals for wireless communication devices. We seek to increase our site rental revenues by adding more tenants on our wireless infrastructure, which we expect to result in significant incremental cash flows due to our relatively fixed operating costs. Site rental revenues represented approximately 83% of our consolidated net revenues for the six months ended June 30, 2014.

Our tower portfolios consist primarily of towers in various metropolitan areas. As of June 30, 2014, approximately 56% and 71% of our towers in the U.S. were located in the 50 and 100 largest U.S. basic trading areas, respectively, with a significant presence in each of the top 100 U.S. basic trading areas.

10

Table of Contents

As part of our effort to provide comprehensive wireless infrastructure solutions, we offer certain network services relating to our wireless infrastructure, consisting of customer equipment installation or subsequent augmentations, which we collectively refer to as installation services, and additional site development services relating to existing or new antenna installations on our wireless infrastructure.

Crown Castle REIT Inc.

1220 Augusta Drive, Suite 600

Houston, Texas 77057

(713) 570-3000

Crown Castle REIT Inc. is a wholly owned subsidiary of Crown Castle and was organized in Delaware on May 27, 2014. Effective at the time of the merger described below, CCR will be renamed “Crown Castle International Corp.” Prior to the merger, CCR will conduct no business other than that incident to the merger. Following the merger, CCR will succeed to the assets, continue the business and assume the obligations of Crown Castle.

General

In September 2013, Crown Castle announced that it was commencing the steps necessary to qualify as a REIT for the taxable year beginning January 1, 2014. Prior to commencing its operations as a REIT, Crown Castle completed the steps necessary in order to operate in compliance with the REIT rules. We refer to the completion of these steps and the commencement of Crown Castle’s operations as a REIT as the REIT conversion. Effective January 1, 2014, Crown Castle began operating as a REIT for U.S. federal income tax purposes.

Although the REIT rules do not require the completion of the merger, we intend to complete the merger, subject to approval by the holders of Crown Castle common stock, to facilitate our continued compliance with such rules, which, among other requirements, prohibit more than 50% of our capital stock from being owned by five or fewer individuals and require our capital stock to be beneficially owned by 100 or more persons, during certain periods of the taxable year. By merging Crown Castle with and into CCR, whose charter includes REIT-related provisions limiting the ownership and restricting the transfer of our capital stock, we will ensure the effective adoption of such provisions and facilitate our continued compliance with the REIT rules. Effective at the time of the merger, CCR will be renamed “Crown Castle International Corp.” and will succeed to the assets, continue the business and assume the obligations of Crown Castle. As a REIT, CCR will generally be entitled to a deduction for dividends that it pays and therefore will not be subject to U.S. federal corporate income tax on its net taxable income that is distributed to its stockholders. This treatment substantially eliminates the federal “double taxation”, or taxation once at the corporate level and again at the stockholder level, that generally results from investment in a regular C corporation. However, as explained more fully below, we continue to pay U.S. federal income tax on earnings from certain assets or operations held through TRSs, which currently include our small cell business, our tower operations in Australia and certain other assets and operations. Our foreign assets and operations (including our tower operations in Puerto Rico and Australia) most likely will be subject to foreign income taxes in the jurisdictions in which such assets and operations are located, regardless of whether they are included in a TRS or not.

We are distributing this proxy statement/prospectus to the holders of common stock in connection with the solicitation of proxies by the board of directors for the approval of the proposal to adopt the merger agreement and the proposal to approve the adjournment of the special meeting, if necessary, to solicit additional proxies if there are not sufficient votes at the time of the special meeting to approve the proposal to adopt the merger

11

Table of Contents

agreement. This proxy statement/prospectus is also being distributed for informational purposes only, to the holders of Crown Castle Convertible Preferred Stock. A copy of the merger agreement is attached to this proxy statement/prospectus as Annex A.

Crown Castle’s board of directors reserves the right to cancel or defer the merger, even if holders of Crown Castle common stock vote to adopt the merger agreement and the other conditions to the completion of the merger are satisfied or waived, if it determines that the merger is no longer in the best interests of Crown Castle and its stockholders.

Board of Directors and Executive Officers of CCR

The existing board of directors and executive officers of Crown Castle immediately prior to the merger will be the board of directors and executive officers, respectively, of CCR immediately following the merger, and each director and executive officer will continue his or her directorship or employment, as the case may be, with CCR under the same terms as his or her directorship or employment with Crown Castle.

Interests of Directors and Executive Officers in the Merger

Our directors and executive officers own shares of our common stock, restricted stock awards and restricted stock units and, to that extent, their interest in the REIT conversion and the merger is the same as that of the other holders of shares of our common stock, restricted stock awards and restricted stock units.

Regulatory Approvals (See page 37)

We are not aware of any federal, state or local regulatory requirements that must be complied with or approvals that must be obtained prior to completion of the merger pursuant to the merger agreement and the transactions contemplated thereby, other than compliance with applicable federal and state securities laws, the filing of a certificate of merger as required under the Delaware General Corporation Law, or the DGCL, and various state governmental authorizations.

Comparison of Rights of Stockholders of Crown Castle and CCR (See page 111)

The rights of holders of Crown Castle common stock are currently governed by the DGCL, the Crown Castle Charter and the Crown Castle By-Laws. If the merger agreement is adopted by the holders of Crown Castle common stock and the merger is completed, holders of Crown Castle common stock will become holders of CCR common stock and the rights of holders of CCR common stock will be governed by the DGCL, the CCR Charter and the CCR By-Laws. As described below, some important differences exist between the rights of holders of Crown Castle common stock and the rights of holders of CCR common stock.

The rights of holders of Crown Castle Convertible Preferred Stock are currently governed by the DGCL, the Crown Castle Charter, the Crown Castle By-Laws and the Crown Castle Certificate of Designations. If the merger agreement is adopted by the holders of Crown Castle common stock and the merger is completed, holders of Crown Castle Convertible Preferred Stock will become holders of CCR Convertible Preferred Stock and the rights of the holders of Crown Castle Convertible Preferred Stock will be governed by the DGCL, the CCR Charter, the CCR By-Laws and the CCR Certificate of Designations. Some important differences exist between the rights of holders of Crown Castle Convertible Preferred Stock and the rights of holders of CCR Convertible Preferred Stock.

The major difference between your rights as a holder of Crown Castle common stock and your rights as a holder of CCR common stock or between your rights as a holder of Crown Castle Convertible Preferred Stock and your rights as a holder of CCR Convertible Preferred Stock is that, to facilitate continued compliance with the REIT rules, the CCR Charter generally prohibits any person (as defined in the CCR Charter) from beneficially or constructively owning, or being deemed to beneficially or constructively own by virtue of the

12

Table of Contents

attribution provisions of the Code, more than 9.8%, by value or number of shares, whichever is more restrictive, of the outstanding shares of CCR common stock, or 9.8% in aggregate value of the outstanding shares of all classes and series of our capital stock, including CCR common stock and any shares of the CCR Convertible Preferred Stock. In addition, the CCR Charter provides for certain other ownership limitations and transfer restrictions. These limitations and restrictions are subject to waiver or modification by the board of directors of CCR. For more detail regarding these differences, see the sections entitled “Description of CCR Capital Stock” and “Comparison of Rights of Stockholders of Crown Castle and CCR”.

The forms of the CCR Charter, CCR By-Laws and CCR Certificate of Designations are attached as Annex B-1, Annex B-2 and Annex B-3, respectively.

Material U.S. Federal Income Tax Consequences of the Merger (See page 113)

It is a condition to the closing of the merger that we receive an opinion from our special tax counsel, Cravath, Swaine & Moore LLP, to the effect that the merger will be treated for U.S. federal income tax purposes as a reorganization under Section 368(a)(1)(F) of the Code. Accordingly, we expect for U.S. federal income tax purposes that:

| • | no gain or loss will be recognized by Crown Castle or CCR as a result of the merger; |

| • | with respect to the conversion of shares of Crown Castle common stock into CCR common stock: |

| • | you will not recognize any gain or loss upon the conversion of your shares of Crown Castle common stock into CCR common stock; |

| • | the tax basis of the shares of CCR common stock that you receive pursuant to the merger in the aggregate will be the same as your adjusted tax basis in the shares of Crown Castle common stock being converted in the merger; and |

| • | the holding period of shares of CCR common stock that you receive pursuant to the merger will include your holding period with respect to the shares of Crown Castle common stock being converted in the merger, assuming that your Crown Castle common stock was held as a capital asset at the effective time of the merger. |

| • | With respect to the conversion of shares of Crown Castle Convertible Preferred Stock into CCR Convertible Preferred Stock: |

| • | you will not recognize any gain or loss upon the conversion of your shares of Crown Castle Convertible Preferred Stock into CCR Convertible Preferred Stock; |

| • | the tax basis of the shares of CCR Convertible Preferred Stock that you receive pursuant to the merger in the aggregate will be the same as your adjusted tax basis in the shares of Crown Castle Convertible Preferred Stock being converted in the merger; and |

| • | the holding period of shares of CCR Convertible Preferred Stock that you receive pursuant to the merger will include your holding period with respect to the shares of Crown Castle Convertible Preferred Stock being converted in the merger, assuming that your Crown Castle Convertible Preferred Stock was held as a capital asset at the effective time of the merger. |

The U.S. federal income tax treatment of holders of Crown Castle common stock, CCR common stock, Crown Castle Convertible Preferred Stock and CCR Convertible Preferred Stock depends in some instances on determinations of fact and interpretations of complex provisions of U.S. federal income tax law for which no clear precedent or authority may be available. In addition, the tax consequences to any particular holder of Crown Castle common stock, CCR common stock, Crown Castle Convertible Preferred Stock or CCR Convertible Preferred Stock will depend on that holder’s particular tax circumstances. For example, if we are not a

13

Table of Contents

“domestically controlled qualified investment entity” within the meaning of the Code, then in the case of a non-U.S. stockholder that owns or has owned in excess of 5% of outstanding Crown Castle common stock or Crown Castle Convertible Preferred Stock, it may be necessary for that person to comply with reporting requirements for him or her to achieve the nonrecognition of gain, carryover tax basis and tacked holding period described above. We urge you to consult your tax advisor, particularly if you are a non-U.S. person, regarding the specific tax consequences, including the federal, state, local and foreign tax consequences, to you in light of your particular investment in, or tax circumstances of acquiring, holding, exchanging or otherwise disposing of, Crown Castle common stock, CCR common stock, Crown Castle Convertible Preferred Stock or CCR Convertible Preferred Stock.

Qualification of CCR Following the REIT Conversion (See page 114)