Table of ContentsUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant☒ Filed by a Party other than the Registrant☐

Check the appropriate box:

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material Pursuant to §240.14a-12 |

NATIONAL COMMERCE CORPORATION

|

(Name of Registrant as Specified in its Charter) |

| |

| N/A |

| |

| (Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| | |

☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| | (5) | Total fee paid: |

☐ | Fee paid previously with preliminary materials. |

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

April 21, 2017

To Our Stockholders:

We are pleased to invite you to attend the 2017 Annual Meeting of Stockholders (the “Annual Meeting”) of National Commerce Corporation, to be held on Tuesday, May 23, 2017, at 9:30 a.m., Central Time, at our principal executive offices located at 813 Shades Creek Parkway, Suite 100, Birmingham, Alabama 35209. Details regarding the Annual Meeting and the business to be conducted are more fully described in the accompanying Notice of Annual Meeting of Stockholders and Proxy Statement.

Your vote is important. Whether or not you plan to attend the Annual Meeting, we encourage you to vote.Please review the instructions on each of your voting options described in the accompanying Notice of Annual Meeting of Stockholders and Proxy Statement.

On behalf of the directors and management of National Commerce Corporation, thank you for your support of and ownership in our company.

| | Sincerely, | |

| | | |

| |  | |

| | | |

| | John H. Holcomb, III | |

| | | Chairman and Chief Executive Officer | |

NATIONAL COMMERCE CORPORATION

813 Shades Creek Parkway, Suite 100

Birmingham, Alabama 35209

Notice of Annual Meeting of Stockholders

NOTICE IS HEREBY GIVEN that the 2017 Annual Meeting of Stockholders (the “Annual Meeting”) of National Commerce Corporation (the “Company”) will be held on Tuesday, May 23, 2017, at 9:30 a.m., Central Time, at the Company’s principal executive offices, located at 813 Shades Creek Parkway, Suite 100, Birmingham, Alabama 35209. Directions to attend the Annual Meeting can be found at https://www.proxydocs.com/NCOM. The Annual Meeting is being held for the following purposes:

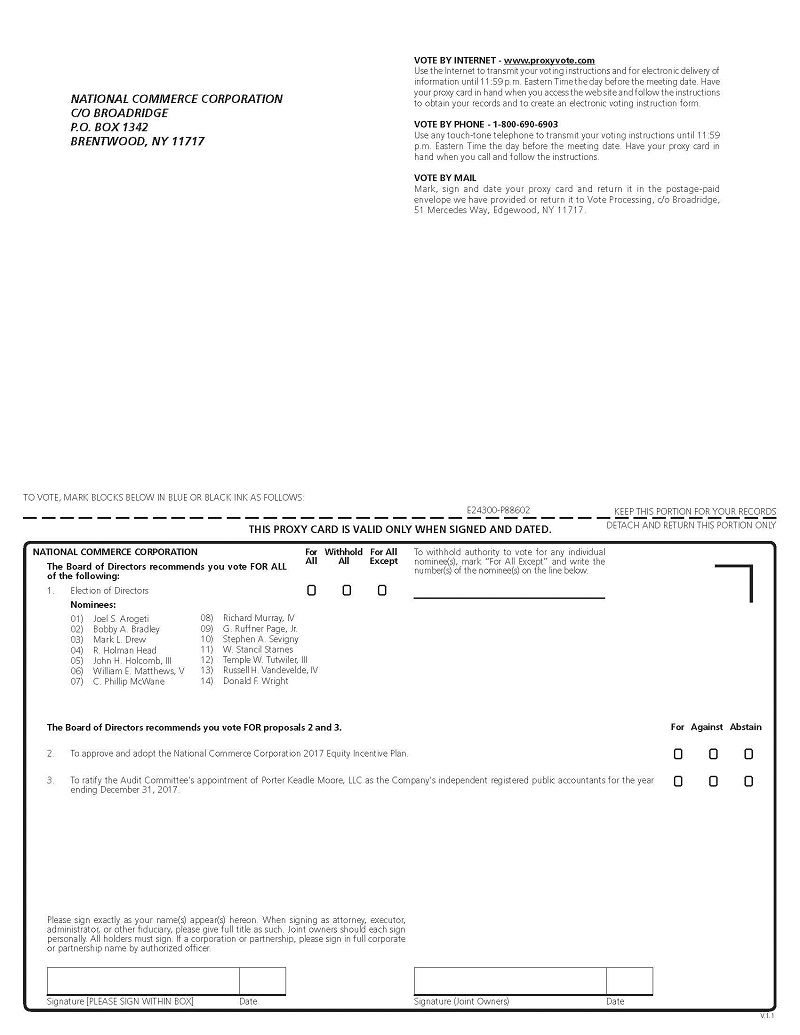

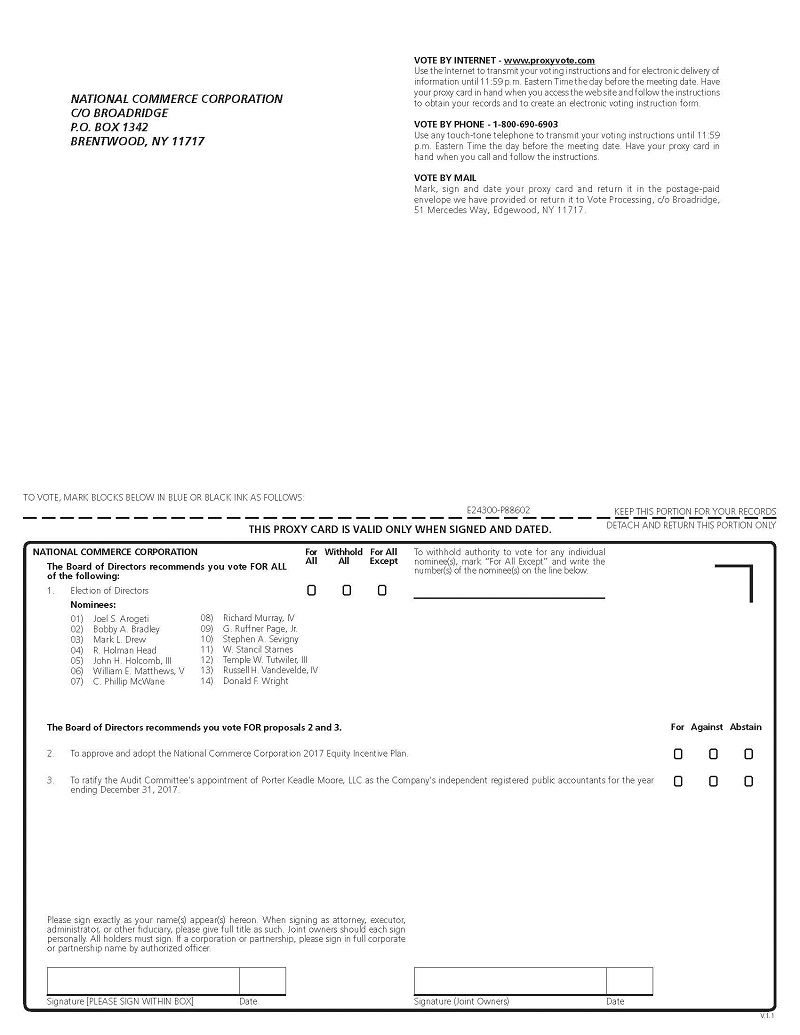

| | 1. | To elect fourteen (14) directors to serve on the Board of Directors of the Company until the 2018 annual meeting; |

| | 2. | To approve and adopt the National Commerce Corporation 2017 Equity Incentive Plan; |

| | 3. | To ratify the Audit Committee’s appointment of Porter Keadle Moore, LLC as the Company’s independent registered public accountants for the year ending December 31, 2017; and |

| | 4. | To transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof. |

The Board of Directors recommends that you vote FOR each of the nominees for director, FOR the approval of the National Commerce Corporation 2017 Equity Incentive Plan, and FOR the ratification of the appointment of Porter Keadle Moore, LLC as the Company’s independent registered public accountants.

The Board of Directors has established April 7, 2017 as the record date for the Annual Meeting. Only holders of record of the Company’s common stock at the close of business on the record date are entitled to notice of, and to vote at, the Annual Meeting and at any adjournments or postponements thereof.

Whether or not you plan to attend the Annual Meeting, we urge you to review these materials carefully, which are available at www.proxyvote.com, and to vote by one of the following means.

| | ● | By Internet: Go to the website www.proxyvote.com and follow the instructions. You will need the control number included on the enclosed proxy card in order to vote by Internet. |

| | ● | By Telephone: From a touch-tone telephone, dial toll-free 1-800-690-6903 and follow the recorded instructions. You will need the control number included on the enclosed proxy card in order to vote by telephone. |

| | ● | By Mail:If you choose to vote by using the enclosed proxy card, please mark your selections on the proxy card, date and sign your name exactly as it appears on the proxy card and mail the proxy card in the enclosed pre-paid envelope. Mailed proxy cards must be received no later than May 22, 2017 in order to be counted for the Annual Meeting. |

| | By Order of the Board of Directors, | |

| | | |

| |  | |

| | John H. Holcomb, III | |

| | Chairman and Chief Executive Officer | |

Birmingham, Alabama

April 21, 2017

TABLE OF CONTENTS

NATIONAL COMMERCE CORPORATION

PROXY STATEMENT FOR THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD TUESDAY, MAY 23, 2017

This Proxy Statement, along with the accompanying Notice of Annual Meeting of Stockholders, contains information about the 2017 Annual Meeting of Stockholders (the “Annual Meeting”) of National Commerce Corporation, including any adjournments or postponements of the Annual Meeting. We are holding the Annual Meeting at 9:30 a.m., Central Time, on Tuesday, May 23, 2017, at our principal executive offices located at 813 Shades Creek Parkway, Suite 100, Birmingham, Alabama 35209.

In this Proxy Statement, unless the context suggests otherwise, references to “the Company,” “we,” “us” and “our” refer to National Commerce Corporation, a Delaware corporation, and, as appropriate, our subsidiaries, including National Bank of Commerce, which we may refer to as “the Bank,” CBI Holding Company, LLC, which operates through its wholly owned subsidiary, Corporate Billing, LLC (“Corporate Billing”), and National Commerce Risk Management, Inc.

This Proxy Statement relates to the solicitation of proxies by our Board of Directors for use at the Annual Meeting.

On or about April 21, 2017, we began mailing this Proxy Statement and the accompanying Notice of Annual Meeting of Stockholders to all stockholders entitled to vote at the Annual Meeting.

We encourage all of our stockholders to vote at the Annual Meeting, and we hope that the information contained in this document will help you decide how to vote at the Annual Meeting.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON MAY 23, 2017

This Proxy Statement and our 2016 Annual Report to Stockholders are available for viewing, downloading and printing atwww.proxyvote.com.

Additionally, you can find a copy of our Annual Report on Form 10-K for the fiscal year ended December 31, 2016, which includes our financial statements, on the website of the Securities and Exchange Commission (the “SEC”), at http://www.sec.gov, or by following the “Learn More – Investor Relations” link on our website at https://www.nationalbankofcommerce.com and proceeding to the “SEC Filings” heading. You may also obtain a printed copy of our Annual Report on Form 10-K, including our financial statements, free of charge by sending a written request to: National Commerce Corporation, 813 Shades Creek Parkway, Suite 100, Birmingham, Alabama 35209, Attention: Corporate Secretary. Exhibits will be provided upon written request and payment of an appropriate processing fee.

EXPLANATORY NOTE

We are an “emerging growth company” under applicable federal securities laws and therefore are permitted to take advantage of certain reduced public company reporting requirements. As an emerging growth company, we provide in this Proxy Statement the scaled disclosure permitted under the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”), including the compensation disclosures required of a “smaller reporting company,” as that term is defined in Rule 12b-2 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). In addition, as an emerging growth company, we are not required to conduct votes seeking approval, on an advisory basis, of the compensation of our named executive officers or the frequency with which such votes must be conducted. We will remain an “emerging growth company” until the earliest of (i) the last day of the fiscal year in which we have total annual gross revenues of $1 billion or more; (ii) December 31, 2019; (iii) the date on which we have issued more than $1 billion in nonconvertible debt during the previous three years; or (iv) the date on which we are deemed to be a large accelerated filer under the rules of the SEC, which means that the market value of our common stock that is held by non-affiliates exceeds $700 million as of the prior June 30th.

IMPORTANT INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

Why is the Company soliciting my proxy?

The Board of Directors of National Commerce Corporation (the “Board”) is soliciting your proxy to vote at the 2017 Annual Meeting of Stockholders to be held at our corporate headquarters, located at 813 Shades Creek Parkway, Suite 100, Birmingham, Alabama 35209, on Tuesday, May 23, 2017, at 9:30 a.m., Central Time, and any adjournments of the meeting, which we refer to as the “Annual Meeting.” This Proxy Statement, along with the accompanying Notice of Annual Meeting of Stockholders, summarizes the purposes of the Annual Meeting and the information you need to know to vote at the Annual Meeting.

Why am I receiving these materials?

Our Board is providing these proxy materials to you in connection with the Annual Meeting, which will take place on May 23, 2017. Stockholders are invited to attend the Annual Meeting and are requested to vote on the proposals described in this Proxy Statement.

What is included in these materials?

These proxy materials include:

| | ● | our Proxy Statement for the Annual Meeting; |

| | ● | our 2016 Annual Report to Stockholders, which contains our Annual Report on Form 10-K, including our audited consolidated financial statements; and |

What information is contained in these materials?

The information included in this Proxy Statement relates to the proposals to be voted on at the Annual Meeting, the voting process, the compensation of certain of our executive officers and directors and certain other required information.

What proposals will be voted on at the Annual Meeting?

There are three proposals scheduled to be voted on at the Annual Meeting:

| | ● | the election of fourteen (14) directors to serve on the Board until the Annual Meeting of Stockholders in 2018 (Proposal 1); |

| | ● | the approval and adoption of the National Commerce Corporation 2017 Equity Incentive Plan (the “2017 Equity Incentive Plan”) (Proposal 2); and |

| | ● | the ratification of the Audit Committee’s appointment of Porter Keadle Moore, LLC as the Company’s independent registered public accounting firm for 2017 (Proposal 3). |

What is the Board’s voting recommendation?

The Board recommends that you vote your shares “FOR” each of the nominees to the Board, “FOR” the approval of the 2017 Equity Incentive Plan and “FOR” the ratification of the Audit Committee’s appointment of Porter Keadle Moore, LLC as the Company’s independent registered public accounting firm. Unless instructed to the contrary, shares represented by proxies at the Annual Meeting will be voted in accordance with the Board recommendations described above.

What shares that I own can be voted?

All shares that you owned as of the close of business on April 7, 2017 (the “Record Date”) may be voted. The holders of our common stock do not have cumulative voting rights with respect to the matters to be acted on at the Annual Meeting. Consequently, as to each proposal to come before the Annual Meeting, you may cast only one vote per share of common stock that you held on the Record Date. These include shares that are held directly in your name as the stockholder of record or held for you as the beneficial owner through a stockbroker, bank or other nominee. On the Record Date, the Company had approximately 12,948,778 shares of common stock issued and outstanding.

What is the difference between holding shares as a stockholder of record and as a beneficial owner?

Many stockholders of the Company hold their shares through a stockbroker, bank or other nominee rather than directly in their own name. As summarized below, there are some differences between shares held of record and those owned beneficially.

Stockholder of Record

If your shares are registered directly in your name with the Company’s transfer agent, Broadridge Corporate Issuer Solutions, Inc., then you are considered the stockholder of record with respect to those shares, and these proxy materials are being sent directly to you. As the stockholder of record, you have the right to grant your voting proxy directly to the persons named as proxy holders, John H. Holcomb, III, the Company’s Chairman and Chief Executive Officer, and Richard Murray, IV, the Company’s President and Chief Operating Officer, or to vote in person at the Annual Meeting. You may vote by completing and mailing your proxy card, or by internet or telephone, as described below under the heading “How can I vote my shares without attending the Annual Meeting?”

Beneficial Owner

If your shares are held in a stock brokerage account or by a bank or other nominee, then you are considered the beneficial owner of shares held in “street name,” and these proxy materials are being forwarded to you by your broker or nominee who is considered, with respect to those shares, the stockholder of record. As the beneficial owner, you are invited to attend the Annual Meeting. You also have the right to direct your broker on how to vote these shares. Your broker or nominee should have enclosed a voting instruction card for you to direct your broker or nominee how to vote your shares. You may also vote by Internet or by telephone, as described below under “How can I vote my shares without attending the Annual Meeting?” However, shares held in “street name” may be voted in person by you only if you obtain a signed proxy from the record holder (broker, bank or other nominee) giving you the right to vote the shares.

How can I vote my shares in person at the Annual Meeting?

Shares held directly in your name as the stockholder of record may be voted in person at the Annual Meeting. If you choose to vote your shares in person at the Annual Meeting, please bring proof of your identity and proof of your ownership of the Company’s common stock on the Record Date, such as a proxy card or the voting instruction card provided by your broker, bank or other nominee. Even if you plan to attend the Annual Meeting, the Company recommends that you vote your shares in advance as described below so that your vote will be counted if you later decide not to attend the Annual Meeting.

How can I vote my shares without attending the Annual Meeting?

Whether you hold your shares directly as the stockholder of record or beneficially in “street name,” you may direct your vote by proxy without attending the Annual Meeting. You can vote by proxy by one of the following means:

| | ● | By Internet: Go to the website www.proxyvote.com and follow the instructions. You will need the control number included on the enclosed proxy card in order to vote by Internet. |

| | ● | By Telephone:From a touch-tone telephone, dial toll-free 1-800-690-6903 and follow the recorded instructions. You will need the control number included on the enclosed proxy card in order to vote by telephone. |

| | ● | By Mail:If you choose to vote by mail, please mark your selections on the proxy card, date and sign your name exactly as it appears on the proxy card and mail the proxy card in the enclosed pre-paid envelope. Mailed proxy cards must be received no later than May 22, 2017 in order to be counted for the Annual Meeting. |

Please follow the instructions set forth above in order to vote your shares at the Annual Meeting. We urge you to review the proxy materials carefully before you vote.

Can I revoke my proxy or change my vote?

You may revoke your proxy or change your voting instructions prior to the vote at the Annual Meeting. You may enter a new vote by using the Internet or the telephone or by mailing a new proxy card or new voting instruction card bearing a later date (which will automatically revoke your earlier voting instructions), which must be received by 11:59 p.m., Central Time, on May 22, 2017. You may also enter a new vote by attending the Annual Meeting and voting in person. Your attendance at the Annual Meeting in person will not cause your previously granted proxy to be revoked unless you specifically so request.

How are votes counted?

In the election of directors (Proposal 1), your vote may be cast “FOR” or “AGAINST” one or more of the nominees, or you may “ABSTAIN” from voting with respect to one or more of the nominees. Shares voting “ABSTAIN” have no effect on the election of directors.

For the approval of the 2017 Equity Incentive Plan and the ratification of Porter Keadle Moore, LLC as the Company’s independent registered public accounting firm (Proposals 2 and 3), your vote may be cast “FOR” or “AGAINST” the proposal, or you may “ABSTAIN” from voting on the proposal. Shares voting “ABSTAIN” have no effect on the outcome of the proposal.

If you sign your proxy card or broker voting instruction card with no further instructions, your shares will be voted as described below in “Abstentions and Broker Non-Votes.”

What is the effect of abstentions and brokernon-votes?

Any shares represented by proxies that are marked to “ABSTAIN” from voting on a proposal will be counted as present in determining whether we have a quorum. Abstentions and, if applicable, broker non-votes will not be counted as votes “FOR” or “AGAINST” a director nominee or a particular proposal.

If your shares are held in street name and you do not instruct your broker on how to vote your shares, then your broker, in its discretion, may either leave your shares unvoted or vote your shares on routine matters.

Proposal 1 (election of directors) and Proposal 2 (approval of the 2017 Equity Incentive Plan) are not considered routine matters, and without your instruction, your broker cannot vote your shares. Because brokers do not have discretionary authority to vote on this proposal, broker non-votes will not be considered in determining the outcome of Proposals 1 and 2 and, therefore, will have no effect on the outcome of the vote for Proposals 1 and 2. Only Proposal 3 (ratifying the appointment of our independent registered public accounting firm) is considered a routine matter. If your broker returns a proxy card but does not vote your shares on Proposal 1 or Proposal 2, this results in a “broker non-vote.” Broker non-votes will be counted as present for the purpose of determining a quorum.

What is the voting requirement to approve each of the proposals?

Proposal 1, Election of Directors: Under our plurality voting standard, the directors elected to serve on the Board will be the fourteen (14) nominees receiving the highest number of votes cast in the election. Abstentions and broker non-votes will not count as votes “FOR” or “AGAINST” a nominee’s election and thus will have no effect in determining whether a director nominee is elected.

Proposal 2, Approval of2017 Equity Incentive Plan: The approval of the adoption of the 2017 Equity Incentive Plan requires the affirmative vote of the holders of a majority of the votes cast affirmatively or negatively on the proposal. Abstentions will have no effect on the outcome of Proposal 2. The approval of Proposal 2 is not a routine proposal on which a broker or other nominee is generally empowered to vote in the absence of voting instructions from the beneficial owner, so it is possible that broker non-votes could result from this proposal.

Proposal 3, Ratification of Appointment of Independent Registered Public Accounting Firm: The ratification of the appointment of Porter Keadle Moore, LLC as our independent registered public accountants for 2017 requires the affirmative vote of the holders of a majority of the votes cast affirmatively or negatively on the proposal. Abstentions will have no effect on the outcome of Proposal 3. The approval of Proposal 3 is a routine proposal on which a broker or other nominee is generally empowered to vote in the absence of voting instructions from the beneficial owner, so broker non-votes are unlikely to result from this proposal.

What does it mean if I receive more than one set of proxy materials?

It means that your shares are registered in different names or are in more than one account. For each set of proxy materials that you receive, please submit your vote for the control number that has been assigned to you in such materials.

Where can I find the voting results of the Annual Meeting?

We will announce preliminary voting results at the Annual Meeting and publish preliminary results, or final results if available, in a Current Report on Form 8-K within four business days after the Annual Meeting. If final results are unavailable at the time at which we file the Form 8-K, then we will file an amended report on Form 8-K to disclose the final voting results within four business days after the final voting results are known.

What happens if additional proposals are presented at the Annual Meeting?

Other than the three proposals described in this Proxy Statement, we do not expect any matters to be presented for a vote at the Annual Meeting. If you grant a proxy, the persons named as proxy holders, John H. Holcomb, III, our Chief Executive Officer and Chairman of the Board, and Richard Murray, IV, our President and Chief Operating Officer, will have the discretion to vote your shares on any additional matters properly presented for a vote at the Annual Meeting. If for any unforeseen reason, one or more of the Company’s nominees is not available as a candidate for director, then the persons named as proxy holders will vote your proxy for such other candidate or candidates as may be nominated by the Board.

What is the quorum requirement for the Annual Meeting?

The quorum requirement for holding the Annual Meeting and transacting business is a majority of the voting power of the outstanding shares entitled to be voted at the meeting. The shares may be present in person or represented by proxy at the Annual Meeting. Both abstentions and broker non-votes are counted as present for the purpose of determining the presence of a quorum. Broker non-votes, however, are not counted as shares present and entitled to be voted with respect to the particular matter on which the broker has expressly not voted. Thus, broker non-votes will not affect the outcome of any of the matters being voted on at the Annual Meeting.

Who will count the vote?

We will appoint one or more Inspectors of Election who will determine the number of shares outstanding, the voting power of each, the number of shares represented at the Annual Meeting, the existence of a quorum and whether or not the proxies and ballots are valid and effective. The Inspectors of Election will determine, and retain for a reasonable period, a record of the disposition of any challenges and questions arising in connection with the right to vote, and will count all votes and ballots cast for and against and any abstentions or broker non-votes with respect to all proposals and will determine the results of each vote.

Is my vote confidential?

Proxy instructions, ballots and voting tabulations that identify individual stockholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed either within the Company or to third parties except (1) as necessary to meet applicable legal requirements, (2) to allow for the tabulation and certification of the votes and (3) to facilitate a successful proxy solicitation by the Board. Additionally, any written comments that you provide on a proxy card or through other means will be forwarded to management.

Who will bear the cost of soliciting proxies for the Annual Meeting?

The Company will pay the entire cost of soliciting proxies for the Annual Meeting, including the distribution of the proxy materials. We will also reimburse brokers or nominees for the expenses that they incur for forwarding the proxy materials to their customers. The original solicitation of proxies by mail may be supplemented by solicitation by telephone and other means by our directors, officers and employees. We will reimburse them for their expenses, but no additional compensation will be paid to these individuals for any such services.

May I propose actions for consideration at next year’s annual meeting of stockholders or nominate individuals to serve as directors?

You may submit proposals, including director nominations, for consideration at future annual stockholder meetings.

Stockholder Proposals: In order for a proposal by a stockholder of the Company to be eligible to be included in the Company’s proxy statement for the 2018 annual meeting of stockholders pursuant to the proposal process mandated by SEC Rule 14a-8, the proposal must be received by the Company on or before December 22, 2017 and must comply with the informational and other requirements set forth in Regulation 14A under the Exchange Act. In order for a stockholder to raise a proposal from the floor during an annual meeting (outside of the proposal process mandated by SEC Rule 14a-8), the proposal must be submitted instead under the Company’s advance notice bylaw provision (Section 1.4(a) of the bylaws) and be received by the Company not more than 150 days and not less than 120 days before the first anniversary of the date of the preceding year’s annual meeting. Thus, in order for a proposal to be timely for next year’s meeting, the proposal, together with the information required under the applicable bylaw provision, must be received by the Company not earlier than December 24, 2017 or later than January 23, 2018.

Nomination of Director Candidates: The Company’s bylaws also permit stockholders to nominate directors at a meeting of stockholders. In order to make a director nomination at an annual meeting of stockholders, it is necessary that your nomination notice be received by the Company not more than 150 days or less than 120 days before the first anniversary of the date of the preceding year’s annual meeting. Thus, in order for any such nomination notice to be timely for next year’s annual meeting, it must be received by the Company not earlier than December 24, 2017 or later than January 23, 2018, together with the information required under the applicable bylaw provision.

Copy of Bylaw Provisions: You may contact our Corporate Secretary at our corporate headquarters for a copy of the relevant bylaw provisions regarding the requirements for making stockholder proposals and nominating director candidates. Additionally, a copy of the Company’s bylaws is available on our Investor Relations website, which may be accessed by clicking the “Learn More – Investor Relations” link on our website at https://www.nationalbankofcommerce.com and proceeding to the “Governance Documents” heading.

How do I obtain a separate set of proxy materials if I share an address with other stockholders?

To reduce expenses, in some cases, we are delivering one set of proxy materials to certain stockholders who share an address, unless otherwise requested by one or more of the stockholders. However, in such situations, a separate proxy card has been included with the proxy materials for each stockholder. If you have received only one set of proxy materials, you may request separate copies to be delivered promptly at no additional cost to you by calling us at (205) 313-8100 or by writing to us at National Commerce Corporation, 813 Shades Creek Parkway, Suite 100, Birmingham, Alabama 35209, Attn: Corporate Secretary.

If I share an address with other stockholders of the Company, how can we receive only one set of voting materials for future meetings?

You may request that we send you and the other stockholders who share an address with you only one set of proxy materials by calling us at (205) 313-8100 or by writing to us at: National Commerce Corporation, 813 Shades Creek Parkway, Suite 100, Birmingham, Alabama 35209, Attn: Corporate Secretary. You may make this request with respect to proxy materials provided both for this year’s Annual Meeting and for future meetings as well.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding the beneficial ownership of our common stock as of April 7, 2017, by:

(i) each of our directors and director nominees;

(ii) each of our named executive officers listed in the Summary Compensation Table herein;

(iii) all of our current directors and executive officers as a group; and

(iv) each stockholder known by us to beneficially own more than 5% of our common stock.

Beneficial ownership is determined in accordance with the rules of the SEC and includes voting or investment power with respect to the securities. Shares of common stock that may be acquired by an individual or group within 60 days of April 7, 2017 pursuant to derivative securities, such as options or restricted stock units, are deemed to be outstanding for the purpose of computing the percentage ownership of such individual or group, but are not deemed to be outstanding for the purpose of computing the percentage ownership of any other person shown in the table. Percentage of ownership is based on an aggregate of 12,948,778 shares of common stock outstanding as of April 7, 2017.

Except as indicated in the footnotes to this table, we believe that the stockholders named in this table have sole voting and investment power with respect to all shares of common stock shown to be beneficially owned by them, based on information provided to us by such stockholders. Unless otherwise indicated, the address for each director and executive officer is: c/o National Commerce Corporation, 813 Shades Creek Parkway, Suite 100, Birmingham, Alabama 35209.

Beneficial Owner | | Number of Shares of Common Stock Beneficially Owned | | | Percentage of CommonStock Beneficially Owned | |

Five Percent Stockholders | | | | | | | | |

Regions Bank (as trustee)(1) | | | 1,174,146 | | | | 9.1% | |

Charles Phillip McWane 2011 Grantor Retained Annuity Trust(2) | | | 865,746 | | | | 6.7% | |

| | | | | | | | | |

Directors and Executive Officers | | | | | | | | |

John H. Holcomb, III(3) | | | 91,333 | | | | * | |

Richard Murray, IV(4) | | | 108,898 | | | | * | |

William E. Matthews, V(5) | | | 49,355 | | | | * | |

Joel S. Arogeti(6) | | | 88,356 | | | | * | |

Bobby A. Bradley | | | 13,310 | | | | * | |

Mark L. Drew(7) | | | 26,619 | | | | * | |

R. Holman Head | | | 6,500 | | | | * | |

Jerry D. Kimbrough(8) | | | 94,326 | | | | * | |

C. Phillip McWane(9) | | | 1,331,101 | | | | 10.3% | |

G. Ruffner Page, Jr. (10) | | | 226,955 | | | | 1.8% | |

Stephen A. Sevigny, M.D.(11) | | | 52,366 | | | | * | |

W. Stancil Starnes | | | 66,551 | | | | * | |

Temple W. Tutwiler, III | | | 11,655 | | | | * | |

Russell H. Vandevelde, IV(12) | | | 122,663 | | | | * | |

Donald F. Wright(13) | | | 31,704 | | | | * | |

All Executive Officers and Directors as a Group (19 persons) | | | 2,542,346 | | | | 19.4% | |

| | |

* | Represents beneficial ownership of less than 1% of the shares of our outstanding common stock. |

| | |

(1) | Represents shares held by trusts for which Regions Bank serves as a fiduciary, as reported by Regions Bank and its parent company, Regions Financial Corporation, on a Schedule 13G/A filed jointly on February 10, 2017. None of the trusts for which Regions Bank serves as trustee holds five percent or more of our outstanding shares, except for the Charles Phillip McWane 2011 Grantor Retained Annuity Trust (the “McWane GRAT”), the beneficiary of which is Charles Phillip McWane, a director of the Company. The shares held by the McWane GRAT and by Mr. McWane individually are described further in notes (2) and (9) hereto. |

| | |

(2) | Consists of shares of our common stock held directly by the McWane GRAT. Our director C. Phillip McWane exercises sole voting power and shared dispositive power over the shares held by the McWane GRAT, as described further in note (9) below. |

(3) | Includes (a) 67,833 shares of our common stock held directly by Mr. Holcomb and (b) 23,500 shares of our common stock underlying options that are currently exercisable as of April 7, 2017. |

| | |

(4) | Includes (a) 61,560 shares of our common stock held jointly by Mr. Murray and his spouse, (b) 20,512 shares held in an individual retirement account for the benefit of Mr. Murray, (c) 3,326 shares of our common stock held by Mr. Murray’s dependent children over which Mr. Murray exercises voting control and (d) 23,500 shares of our common stock underlying options that are currently exercisable as of April 7, 2017. |

| | |

(5) | Includes (a) 23,288 shares of our common stock held in individual retirement accounts for the benefit of Mr. Matthews, (b) 2,567 shares of our common stock held jointly by Mr. Matthews and his spouse and (c) 23,500 shares of our common stock underlying options that are currently exercisable as of April 7, 2017. |

| | |

(6) | Includes (a) 70,964 shares of our common stock held directly by Mr. Arogeti, (b) 8,432 shares of our common stock held jointly by Mr. Arogeti and his spouse, (c) 5,376 shares held by Mr. Arogeti’s spouse, and (d) 3,584 shares held by Mr. Arogeti’s child, with respect to which Mr. Arogeti disclaims beneficial ownership. |

| | |

(7) | Includes (a) 16,637 shares of our common stock held directly by Mr. Drew and (b) 9,982 shares of our common stock held in individual retirement accounts for the benefit of Mr. Drew. |

| | |

(8) | Includes (a) 21,866 shares of our common stock held directly by Mr. Kimbrough, (b) 36,495 shares of our common stock held in an individual retirement account for the benefit of Mr. Kimbrough and (c) 35,965 shares of our common stock held by a limited liability company, a majority of the equity of which is owned by a trust for which Mr. Kimbrough’s spouse serves as trustee. Mr. Kimbrough is not standing for reelection at this year’s Annual Meeting. |

| | |

(9) | Includes (a) 465,355 shares of our common stock held directly by Mr. McWane and (b) 865,746 shares of our common stock held by the McWane GRAT, as to which Mr. McWane exercises sole voting power and shared dispositive power, as described in note (1) above. Pursuant to the terms of the McWane GRAT, Regions Bank, as trustee and acting through and on behalf of the McWane GRAT, has authority to select and dispose of assets held in the McWane GRAT, including the shares of our common stock held by the McWane GRAT, subject to the prior approval of Mr. McWane. Regions Bank is wholly owned by Regions Financial Corporation. |

| | |

(10) | Includes (a) 24,424 shares of our common stock held directly by Mr. Page, (b) 23,500 shares of our common stock underlying options that are currently exercisable as of April 7, 2017 and (c) 179,031 shares of our common stock held by the G. Ruffner Page, Jr. Grantor Retained Annuity Trust (the “Page GRAT”), as to which Mr. Page exercises sole voting power and shared dispositive power. Pursuant to the terms of the Page GRAT, Regions Bank, as trustee and acting through and on behalf of the Page GRAT, has authority to select and dispose of assets held in the Page GRAT, including the shares of our common stock held by the Page GRAT, subject to the prior approval of Mr. Page. Regions Bank is wholly owned by Regions Financial Corporation. |

| | |

(11) | Includes (a) 35,928 shares of our common stock held by Dr. Sevigny as tenants by the entirety with his spouse, (b) 7,273 shares of our common stock held directly by Dr. Sevigny and (c) 9,165 shares of our common stock underlying options that are currently exercisable as of April 7, 2017. |

| | |

| (12) | Includes (a) 98,233 shares of our common stock held directly by Mr. Vandevelde, (b) 19,980 shares of our common stock held in individual retirement accounts for the benefit of Mr. Vandevelde, (c) 1,250 shares of our common stock held in an individual retirement account for the benefit of Mr. Vandevelde’s spouse and (d) 3,200 shares of our common stock held by Mr. Vandevelde as custodian for his four minor children. |

| | |

| (13) | Includes (a) 30,746 shares of our common stock that are beneficially owned by Mr. Wright through a revocable trust, with respect to which Mr. Wright serves as a co-trustee with his spouse, and (b) 958 shares of our common stock held directly by Mr. Wright. |

MANAGEMENT AND CORPORATE GOVERNANCE

Our Board of Directors

Our certificate of incorporation and bylaws provide that our Board will consist of up to 15 directors, with the precise number of directors being determined by our Board from time to time. We currently have 15 directors, although one director, Jerry D. Kimbrough, will not stand for reelection at the Annual Meeting. Our directors are elected for a one-year term and hold office until their successors are duly elected and qualified, or until their earlier death, resignation or removal.

Information about the Director Nominees

Set forth below are the biographies of each of the nominees for director, including their names, ages, offices in the Company, if any, principal occupations or employment for at least the past five years, the length of their tenure as directors, and the names of other public companies in which such persons hold or have held directorships during the past five years. Additionally, information about the specific experience, qualifications, attributes or skills that led to our Board’s conclusion at the time of the filing of this Proxy Statement that each person listed below should serve as a director is set forth below. Each of the nominees currently serves as a director of the Company, and Messrs. Holcomb, Murray and Matthews also currently serve as executive officers of the Company. The stock ownership of each director and nominee for director is set forth in the table entitled “Security Ownership of Certain Beneficial Owners and Management.”

Name | Age | Position(s) with the Company |

John H. Holcomb, III(4)(5) | 65 | Chairman of the Board and Chief Executive Officer |

Richard Murray, IV(4)(5) | 54 | President, Chief Operating Officer and Director |

William E. Matthews, V(4)(5) | 52 | Vice Chairman of the Board and Chief Financial Officer |

Joel S. Arogeti(5) | 60 | Director |

Bobby A. Bradley(1) | 67 | Director |

Mark L. Drew(1) | 55 | Director |

R. Holman Head(1)(2)(5) | 61 | Director |

C. Phillip McWane(4) | 59 | Director |

G. Ruffner Page, Jr. (2)(3)(4)(5) | 57 | Director |

Stephen A. Sevigny, M.D.(1)(5) | 49 | Director |

W. Stancil Starnes(2)(3)(5) | 68 | Director |

Temple W. Tutwiler, III(1)(3)(5) | 63 | Director |

Russell H. Vandevelde, IV(2) (5) | 50 | Director |

Donald F. Wright(5) | 74 | Director |

| (1) | Member of our Audit Committee |

| (2) | Member of our Compensation Committee |

(3) | Member of our Nominating and Corporate Governance Committee |

(4) | Member of our Executive Committee |

(5) | Member of our Risk Committee |

John H. Holcomb, III has served on our Board since 2010. Mr. Holcomb has served as our Chief Executive Officer and as Chairman of our Board and of the board of directors of the Bank since October 2010. From October 2010 until June 2012, Mr. Holcomb also served as Chief Executive Officer of the Bank. On March 21, 2017, the Company announced that Mr. Holcomb will transition into an Executive Chairman role with the Bank effective May 31, 2017, and, assuming that he is elected as a director by the stockholders of the Company at the Annual Meeting, will serve as Executive Chairman of the board of directors of the Company. Mr. Holcomb previously served as Chairman of the board of directors and Chief Executive Officer of Alabama National Bancorporation from 1996 until it was acquired in 2008, and then as Vice Chairman of RBC Bank (USA) until June 2009. Our Board believes that Mr. Holcomb’s nearly 40 years of commercial banking experience focused on the markets in which we currently operate, and his service in senior executive positions with us since 2010, provide him with extensive knowledge of our operations and allow him to contribute critical insights to our Board.

Richard Murray, IV has served on our Board since 2010. Mr. Murray has served as our President and Chief Operating Officer since October 2010 and as President and Chief Executive Officer ofthe Bank since June 2012. On March 21, 2017, the Company announced that Mr. Murray will become the Company’s Chief Executive Officer, effective May 31, 2017. From October 2010 until June 2012, Mr. Murray served as President and Chief Operating Officer ofthe Bank. Mr. Murray previously served as President and Chief Operating Officer of Alabama National Bancorporation from 2000 until it was acquired in 2008, and then as Regional President (Alabama and Florida) of RBC Bank (USA) from February 2008 until July 2009. Our Board believes that Mr. Murray’s nearly 30 years of commercial banking experience in the markets in which we currently operate and his service in senior executive positions with us since 2010 provide him with extensive knowledge of our operations and allow him to contribute valuable insight and experience to our Board.

William E. Matthews, V has served on our Board since 2010. Mr. Matthews has served as Vice Chairman of our Board and of the board of directors of the Bank since June 2012 and as the Company’s and the Bank’s Chief Financial Officer since November 2011. He served as Executive Vice President of the Company and the Bank from November 2011 until June 2012. Mr. Matthews previously served as Executive Vice President and Chief Financial Officer of Alabama National Bancorporation from 1998 until it was acquired in 2008, and then as Chief Financial Officer of RBC Bank (USA) until March 2009. From March 2009 until October 2011, Mr. Matthews was a partner at New Capital Partners, a private equity firm based in Birmingham, Alabama. Our Board believes that Mr. Matthews’ nearly 25 years of involvement in the banking and finance industries and extensive experience as a chief financial officer of various banks contributes valuable experience to our Board.

Joel S. Arogeti has served on our Board since January 2017. Mr. Arogeti is an attorney with more than 33 years of experience in the practice of business and estate planning law, and he has prior experience practicing as a staff attorney with the Securities and Exchange Commission. He is a shareholder in the Atlanta law firm of Kitchens Kelley Gaynes, P.C., where he serves as its Chief Executive Officer and President. He served on the board of directors of Private Bancshares, Inc. (“PBI”), including as chair of the audit committee thereof, before joining our Board in connection with our acquisition of PBI. He is a member of the State Bar of Georgia, Atlanta Bar Association, American Bar Association and the Atlanta Estate Planning Council. Our Board believes that Mr. Arogeti’s extensive contacts in the Atlanta community, as well as his widely recognized leadership strengths, skills and professional experience, give him a wide range of knowledge on topics important to our business and operations and will allow him to contribute important insight to our Board.

Bobby A. Bradley has served on our Board since 2010. Ms. Bradley currently serves as Managing Partner of Lewis Properties, LLC, a real estate investment company, Managing Partner of Anderson Investments, LLC, a technology business investment company, and Managing Partner of Genesis II, a family business designed to support various philanthropic and investment efforts. Ms. Bradley previously served as Chief Executive Officer of Computer Systems Technology, Inc. from 1989 until 2003, and then as Group Manager of Science Applications International Corporation (SAIC) until 2004. Ms. Bradley also served on the board of directors of Alabama National Bancorporation from 2005 until it was acquired in 2008. Our Board believes that Ms. Bradley’s skills and professional experience in a variety of operational and leadership roles give her a wide range of knowledge on topics important to our business and operations and allow her to contribute important insight to our Board.

Mark L. Drew has served on our Board since January 2017. Mr. Drew serves as Executive Vice President and General Counsel of Protective Life Corporation, a $76 billion asset subsidiary of The Dai-ichi Life Insurance Company, Limited. Prior to his employment with Protective Life, Mr. Drew was the Managing Shareholder of Maynard, Cooper & Gale, P.C., a full-service law firm in Birmingham, Alabama. As a corporate lawyer, Mr. Drew served as counsel to private and public companies, including banking, insurance and other financial institutions, at both the board and transactional level. Our Board believes that Mr. Drew’s extensive contacts in the Birmingham community, as well as his widely recognized leadership strengths, skills and professional experience, give him a wide range of knowledge on topics important to our business and operations and will allow him to contribute important insight to our Board.

R. Holman Head has served on our Board since 2013. Mr. Head currently serves as President and Chief Operating Officer of O’Neal Industries, the largest family-owned group of metals service centers in the United States. In this role, Mr. Head, among other duties, serves on the audit committee of O’Neal Industries and oversees the financial reporting function of the company, including the principal financial officer thereof. Mr. Head has been employed by O’Neal Industries in various positions since 1980. Mr. Head is also a partner and officer of Sigma Investments, a private investment company. Mr. Head’s extensive experience as a senior executive officer of a corporation adds valuable expertise and insight to our Board.

C. Phillip McWane has served on our Board since 2010. Mr. McWane has served as Chairman of McWane, Inc., a company involved in the manufacture of pipes, valves, water fittings, fire extinguishers and propane tanks and in various technology industries, since 1999. Mr. McWane has been employed by McWane, Inc. in various positions since 1980. Mr. McWane also served on the board of directors of Alabama National Bancorporation from 1995 until it was acquired in 2008. Mr. McWane’s more than 16 years of experience as a senior executive of a corporation adds valuable expertise and insight to our Board.

G. Ruffner Page, Jr. has served on our Board since 2010 and currently serves as its lead independent director. Mr. Page has served as President of McWane, Inc., a company involved in the manufacture of pipes, valves, water fittings, fire extinguishers and propane tanks and in various technology industries, since 1999. Mr. Page previously served as Executive Vice President of National Bank of Commerce, a subsidiary of Alabama National Bancorporation, from 1989 until 1994, after which time he accepted employment at McWane, Inc. Mr. Page also served on the board of directors of Alabama National Bancorporation from 1995 until it was acquired in 2008. Mr. Page’s experience as a senior banking executive and as a senior executive of McWane, Inc. gives him a wide range of knowledge on topics important to the banking business and allows him to contribute valuable insight to our Board.

Stephen A. Sevigny, M.D. has served on our Board since 2015. Dr. Sevigny has more than 16 years of experience as a practicing physician and is currently a partner at Radiology Associates of Daytona Beach, Florida. He is also an officer and owner of several real estate investment ventures. Dr. Sevigny served as a member of the board of directors of Reunion Bank of Florida (“Reunion”) from April 2012 until we acquired Reunion in October 2015, after which time he joined our Board. Our Board believes that Dr. Sevigny’s experience as an active real estate investor and as a director of Reunion give him unique insight into the business climate in east central Florida and allow him to bring a valuable perspective to our Board.

W. Stancil Starnes has served on our Board since 2010. Mr. Starnes currently serves as Chairman of the board of directors and as President and Chief Executive Officer of ProAssurance Corporation, a public holding company for property and casualty insurance companies focused on professional liability insurance. Mr. Starnes practiced law at the law firm of Starnes & Atchison LLP in Birmingham, Alabama from 1975 until October 2006, most recently serving as the senior and managing partner. Mr. Starnes then served as President of Corporate Planning and Administration for Brasfield & Gorrie, Inc., a commercial construction firm based in Birmingham, Alabama, until May 2007, when he joined ProAssurance Corporation. Mr. Starnes currently serves as a director of Infinity Property and Casualty Corporation, a public insurance holding company based in Birmingham, Alabama, where he serves on the audit, compensation and executive committees. He also served on the board of directors of Alabama National Bancorporation from 1995 until it was acquired in 2008. Our Board believes that Mr. Starnes has gained valuable insight into the operation and governance of companies through his more than 30 years of legal experience and his management experience with various companies, including public companies, which allows him to contribute valuable experience and insight to our Board.

Temple W. Tutwiler, III has served on our Board since 2013. Mr. Tutwiler serves as President of Shades Creek Real-Estate & Investment Co., as a general partner in Tutwiler Properties, Ltd., and as an officer of or partner in several other family-controlled entities. Mr. Tutwiler has more than 30 years of experience managing and developing real estate in central Alabama and managing stock and bond portfolios. Mr. Tutwiler also served on the board of directors of First American Bank, Alabama National Bancorporation’s largest subsidiary bank, from 1995 until 2008. Our Board believes that Mr. Tutwiler’s skills and professional experience in a variety of operational and leadership roles in the real estate and banking industries give him a wide range of knowledge on topics important to our business and operations, allowing him to contribute valuable experience and insight to our Board.

Russell H. Vandevelde, IV has served on our Board since 2006 (when the Company was known as Americus Financial Services, Inc.). Mr. Vandevelde currently serves as Chief Executive Officer and is a founding member of Executive Benefits Specialists, LLC, a company specializing in the design, implementation, and administration of benefit plans for financial institutions, with a concentration in community banks. Mr. Vandevelde served as Chairman of our Board from approximately May 2009 until October 2010. Our Board believes that Mr. Vandevelde’s 18 years as a consultant to financial institutions, as well as his experience as a director on our Board, add valuable expertise and insight to our Board.

Donald F. Wright has served on our Board since 2014. Mr. Wright has more than 40 years of experience as a lawyer and is currently a senior partner in the law firm of Wright, Fulford, Moorhead & Brown, P.A. in Altamonte Springs, Florida. Mr. Wright served as a member of the board of directors of United Group Banking Company of Florida, Inc. (“United”) from February 2010 until December 2014, at which time he joined our Board following our acquisition of United. Our Board believes that Mr. Wright’s extensive experience as a practicing attorney, during which period he has advised a number of companies on a variety of issues, provides a unique and valuable perspective to our Board.

With the exception of Messrs. Wright, Sevigny and Arogeti, none of the directors was selected pursuant to any arrangement or understanding, other than with our directors and executive officers acting within their capacities as such. Under the terms of the Company’s merger agreements with United, Reunion and PBI, Mr. Wright (a former United director), Dr. Sevigny (a former Reunion director), and Mr. Arogeti (a former PBI director) will be nominated for election at the first two annual meetings of stockholders following the effective date of the respective mergers (December 15, 2014 for United, October 31, 2015 for Reunion, and January 1, 2017 for PBI), unless they are disqualified from service as directors based on the occurrence of certain specified events. Except for the relationship between Mr. Head and Mr. Page as brothers-in-law, there are no family relationships between our directors and executive officers. None of our directors or executive officers serves as a director of any company that has a class of securities registered under, or that is subject to the periodic reporting requirements of, the Exchange Act, or any investment company registered under the Investment Company Act of 1940, other than Mr. Starnes, who serves as Chairman and Chief Executive Officer of ProAssurance Corporation and as a director of Infinity Property and Casualty Corporation, each of which has a class of securities registered under, and is subject to the periodic reporting requirements of, the Exchange Act.None of our directors or executive officers has been involved in any legal proceedings during the past 10 years that are material to an evaluation of the ability or integrity of such person. In addition, none of our directors, executive officers or 5% stockholders or any associate of any of the foregoing has been involved in any legal proceedings in which such person has or had a material interest adverse to the Company or any of our subsidiaries. The principal occupation and employment during the past five years of each of our directors was carried on, in each case except as specifically identified above, with a corporation or organization that is not a parent, subsidiary or other affiliate of the Company. Jerry D. Kimbrough is currently a director but is not standing for reelection.

Information about Executive Officers Who Are Not Also Directors

John R. Bragg, 55, has served as Executive Vice President – Bank Operations of the Company and the Bank since October 2010. Mr. Bragg previously served as Senior Vice President of National Bank of Commerce beginning in 1992 and then as Executive Vice President of Alabama National Bancorporation until it was acquired in 2008. Mr. Bragg served as Senior Vice President – Bank Operations of RBC Bank (USA) from February 2008 until June 2009.

M. Davis Goodson, Jr., 45, has served as Executive Vice President and Senior Lender of the Bank since May 2011. Mr. Goodson previously served as Senior Vice President and Senior Lender of the Bank from October 2010 until April 2011. Mr. Goodson served in various commercial loan officer and commercial banking manager positions beginning in May 1994, including as Commercial Banking Manager of RBC Bank (USA) from July 2006 until June 2009.

William R. Ireland, Jr., 60, has served as Executive Vice President – Chief Risk Management Officer of the Company and the Bank since October 2010. Mr. Ireland previously served as Director of Credit Review of RBC Bank (USA) from July 2008 until February 2010 and as Director, Risk Management and Strategic Initiatives of RBC Bank (USA) from February 2008 until July 2008. Mr. Ireland served as Executive Vice President, Chief Risk Management Officer, of Alabama National Bancorporation from 2004 until it was acquired in 2008.

James R. (“Skip”) Thompson, III, 57, has served as President and Chief Executive Officer of Corporate Billing since 2009. Mr. Thompson previously served as Chief Executive Officer of First American Bank, Alabama National Bancorporation’s largest subsidiary bank, from 1999 until 2008.

Market Presidents of the Bank

Our market presidents have extensive experience in the banking industry in the markets in which we currently operate. With the exception of Messrs. Powers, Sleaford and Crawford, these individuals have worked with our senior management team for many years and were previously employed in comparable roles at Alabama National Bancorporation. We believe that these market presidents are important to our success, as their banking experience within their markets, their involvement in their communities, and their relationships with customers make us more likely to succeed in our community banking model. Selected biographical information about our market presidents is set forth below. The Bank’s market presidents are not executive officers of the Company.

Robert B. Aland,Birmingham Market President. Mr. Aland has served as Birmingham Market President of the Bank since October 2010. Mr. Aland previously served as Birmingham Market President of RBC Bank (USA) from February 2008 until June 2009, and as Birmingham Market President of First American Bank, Alabama National Bancorporation’s largest subsidiary bank, from 2005 until February 2008. Mr. Aland is 54 years old and has been a banker for approximately 25 years.

P. Andrew Beindorf, Vero Beach Market President. Mr. Beindorf was the President and Chief Executive Officer of Alabama National Bancorporation’s Indian River National Bank in Vero Beach, Florida from 2001 until 2008, after which time he served as Market President for RBC Bank (USA) in the Vero Beach area from February 2008 through 2009. From 2010 until he rejoined us as Vero Beach Market President in 2014, Mr. Beindorf served as Executive Vice President and Regional President for CenterState Bank of Florida. Mr. Beindorf is 61 years old and has been a banker for approximately 38 years.

Eric L. Canada, Auburn-Opelika Market President. Mr. Canada served as Market President, including as Auburn-Opelika (Lee County) Market President, for AmSouth Bank before joining Alabama National Bancorporation’s First American Bank in 2001, where he again served the Auburn-Opelika area as Market President for First American Bank and, subsequently, for RBC Bank (USA) until 2009. He joined us as Auburn-Opelika Market President in October 2010. Mr. Canada is 57 years old and has been a banker for more than 31 years.

Charles B. Crawford, Jr.,Market President – Atlanta Region. Mr. Crawford served as President and Chief Executive Officer of PBI and Private Bank of Buckhead until we acquired PBI and Private Bank of Buckhead in January 2017. Mr. Crawford is 53 years old and has been a banker for more than 32 years.

David G. Powers, Market President – Central Florida. Mr. Powers served as President and Chief Executive Officer of United from 2010 until we acquired United on December 15, 2014 and as President and Chief Executive Officer of United Legacy Bank from 2010 until United Legacy Bank merged with and into the Bank on February 28, 2015. Mr. Powers is 60 years old and has more than 31 years of experience as a banker in the Orlando metropolitan area.

W. Evans Quinlivan, Huntsville Market President. Mr. Quinlivan served as Huntsville Market President for Alabama National Bancorporation’s First American Bank from 2000 until 2008, at which point he assumed the same role for RBC Bank (USA) until June 2009. He joined us as Huntsville Market President in October 2010. Mr. Quinlivan is 55 years old and has been a banker for approximately 31 years.

Robert M. Seaborn, Jr., Baldwin County Market President. Mr. Seaborn has more than 30 years of experience as a commercial banker. Prior to joining us in October 2010, Robert was President of Alabama National Bancorporation’s First Gulf Bank from 1996 until 2008 and subsequently served as Market President of the Gulf Coast Region for RBC Bank (USA) until July 2009. He is 58 years old.

Michael L. Sleaford,Market President – East Central Florida. Mr. Sleaford served as President and Chief Executive Officer of Reunion from 2008 until we acquired Reunion in October 2015. Mr. Sleaford is 55 years old and has been a banker for more than 21 years.

Director Independence

The listing standards of the Nasdaq Stock Market LLC (“Nasdaq”) generally require that listed companies have a majority of independent directors. Our Board has determined that all of our directors are “independent directors,” as defined in Nasdaq Marketplace Rule 5605(a)(2), except for Messrs. Holcomb, Murray and Matthews, who are our senior executive officers. In determining each director’s independence, our Board considered the services provided, any loan transactions between the Company or its subsidiaries and the director or the director’s family members or businesses with which our directors or their family members are associated, and other matters that our Board deemed pertinent.

Committees of the Board and Meetings

Meeting Attendance

Our Board conducts its business through meetings of the full Board and its committees. Under our Corporate Governance Guidelines, directors are expected to use their reasonable best efforts to attend all or substantially all Board meetings and meetings of the committees of the Board on which they serve, as well as annual meetings of stockholders. Last year, each of our thirteen directors who were serving at that time attended the annual meeting of stockholders. No director attended fewer than 75% of the aggregate of (i) the total number of meetings of the Board and (ii) the total number of meetings of committees of the Board for the period during which the director served on the Board or such committee in 2016.

Standing Committees

The Board has established five standing committees to assist it in carrying out its responsibilities: the Audit Committee, the Nominating and Corporate Governance Committee, the Compensation Committee, the Risk Committee and the Executive Committee. The Audit and Compensation Committees were established on July 17, 2014, the Nominating and Corporate Governance Committee on October 16, 2014, the Risk Committee on May 24, 2016 (as a joint committee with the risk committee of the Bank) and the Executive Committee on December 20, 2011. During 2016, our Board held eight meetings. Additionally, the Audit Committee met eight times, the Compensation Committee met two times, the Nominating and Corporate Governance Committee met four times, the Risk Committee met eight times (five times after becoming a joint committee of the Company and the Bank), and the Executive Committee did not meet. Except for the Executive Committee, whose scope of authority is prescribed in the resolutions pursuant to which it was created, each of the committees operates under its own written charter adopted by the Board. The respective committee charters may be accessed by following the “Learn More – Investor Relations” link on our website at https://www.nationalbankofcommerce.com and proceeding to the “Corporate Information” section under “Governance Documents.” In addition, special committees may be established under the direction of our Board when necessary to address specific issues. The membership and functions of each of the standing committees are described below.

Audit Committee

The Audit Committee is responsible for, among other things, the selection, engagement, retention, and compensation of our independent accountants, and the resolution of any disagreements with our independent accountants; the selection, engagement, retention, and compensation of our internal auditing firm; reviewing the audit plan of our independent accountants, the scope and results of their audit engagement, and the accompanying management letter, if any; reviewing the scope and results of our internal auditing; consulting with the independent accountants and management with regard to our accounting methods and principles and the adequacy of our internal financial controls; preparing any reports required of an audit committee under the rules of the SEC; reviewing major issues regarding financial statement presentations; reviewing and approving related party transactions; pre-approving all audit and permissible non-audit services provided by the independent accountants; reviewing the independence of our independent accountants; and reviewing the range of the independent accountants’ audit and non-audit fees.

The current members of our Audit Committee are Temple W. Tutwiler, III (Chairman), Bobby A. Bradley, Mark L. Drew, R. Holman Head and Stephen A. Sevigny, M.D. Our Board has determined that (i) each member of our Audit Committee is an “independent director,” as defined in Nasdaq Marketplace Rule 5605(a)(2), (ii) each member of our Audit Committee satisfies the heightened independence standards of Nasdaq Marketplace Rule 5605(c)(2)(A)(ii) and SEC Rule 10A-3, (iii) each member of our Audit Committee is financially literate under the rules and regulations of the Nasdaq Stock Market and the SEC, and (iv) Mr. Head meets the criteria specified under applicable SEC regulations for an “audit committee financial expert,” as defined in the SEC rules, and satisfies the financial sophistication requirements of the Nasdaq Stock Market. For more information about the members of the Audit Committee, including Mr. Head’s qualification as an audit committee financial expert, see the discussion under the heading “Management and Corporate Governance – Information about the Director Nominees” above.

Nominating and Corporate Governance Committee

Our Nominating and Corporate Governance Committee is responsible for, among other duties as may be directed by our Board, determining the qualifications, qualities, skills, and other expertise required to be a director; developing and recommending to our Board criteria to be considered in selecting nominees for director; identifying and screening individuals qualified to become directors; and making recommendations to our Board regarding changes in the size of the Board and the selection and approval of nominees for director to be submitted to a stockholder vote at annual meetings of stockholders. This committee is also charged with developing and overseeing Corporate Governance Guidelines; developing a process for an annual evaluation of our Board and its committees and overseeing such evaluations; reviewing our Board committee structure; monitoring communications from stockholders; and reviewing and making recommendations to our Board with respect to succession plans for our senior management.

The current members of our Nominating and Corporate Governance Committee are W. Stancil Starnes (Chairman), G. Ruffner Page, Jr., and Temple W. Tutwiler, III. Our Board has determined that each member of the Nominating and Corporate Governance committee is an “independent director,” as defined in Nasdaq Marketplace Rule 5605(a)(2).

Compensation Committee

Our Compensation Committee is responsible for, among other duties as may be directed by our Board, annually reviewing and approving the compensation of our chief executive officer, chief financial officer, chief operating officer and any other “executive officers” designated by our Board pursuant to Rule 3b-7 under the Exchange Act, as well as the corporate goals and objectives underlying such compensation; reviewing, administering and making grants under our employee benefit plans and incentive compensation plans; reviewing and approving the compensation information that we include in our proxy statements and annual report filings; reviewing any employment agreements and any severance arrangements or plans relating to our executive officers; determining stock ownership guidelines for our executive officers and directors and monitoring compliance therewith; reviewing and recommending director compensation; and engaging and consulting with outside compensation consultants, legal counsel, and other advisors as the committee deems necessary.

The Compensation Committee’s charter grants the Compensation Committee the authority, in its discretion, to delegate any of its responsibilities to subcommittees of the Compensation Committee. The Compensation Committee may confer with, and receive recommendations from, our executive management team regarding their compensation and the compensation of our other employees; however, no Executive Officer may be present during any voting or deliberations by the Compensation Committee on his or her compensation.

The current members of the Compensation Committee are G. Ruffner Page, Jr. (Chairman), R. Holman Head, W. Stancil Starnes, and Russell H. Vandevelde, IV. Our Board has determined that each member of the Compensation Committee satisfies the independence standards of Nasdaq Marketplace Rule 5605(d)(2)(A) for purposes of serving on a compensation committee, including being an “independent director,” as defined in Nasdaq Marketplace Rule 5605(a)(2).

Risk Committee

Our Risk Committee was established at the holding company level in May 2016 to serve jointly with the risk committee of the Bank. The Risk Committee is responsible for, among other things, reviewing reports from management with respect to risk-related activities, including credit risk, operational risk, interest rate risk, and compliance risk. In carrying out its responsibilities, the committee reviews the approval of all loan transactions exceeding a specified threshold; reviews and approves the Company’s credit policies and procedures; reviews and approves the Company’s plans and strategies concerning business continuity, information security, electronic payments and related matters; reviews reports on the Company’s interest rate risk management; and reviews any material litigation and risk management reports involving the Company. The Risk Committee is also responsible for overseeing management’s implementation and operation of the Company’s enterprise risk management program; developing and periodically reviewing with management an enterprise risk management policy for the Company; and assessing the performance of the Chief Risk Management Officer and reviewing and approving his or her compensation in light of such assessment.

The Risk Committee’s charter provides that the Risk Committee must consist of three or more directors who are deemed to be “independent directors,” as defined in Nasdaq Marketplace Rule 5605(a)(2), as well as the Chief Executive Officer, Chief Financial Officer and Chief Operating Officer of the Company. In addition, the chairperson of the Risk Committee must be an independent director. The current members of our Risk Committee are W. Stancil Starnes (Chairman), Joel S. Arogeti, R. Holman Head, John H. Holcomb, III, William E. Matthews, V, Richard Murray, IV, G. Ruffner Page, Jr., Temple W. Tutwiler, III, Russell H. Vandevelde, IV, and Donald F. Wright. Our Board has determined that Messrs. Starnes, Arogeti, Head, Page, Tutwiler, Vandevelde and Wright are “independent directors,” as defined in Nasdaq Marketplace Rule 5605(a)(2).

Executive Committee

The Executive Committee is authorized to exercise the authority of our Board between board meetings, subject to certain limitations. Although the Executive Committee generally has authority to exercise all powers and authority of the full Board in the management and direction of our business and affairs, the Executive Committee may not approve, adopt, or recommend to the stockholders any action or matter (other than the election or removal of directors) expressly required by law to be submitted to stockholders for approval, nor may it adopt, amend or repeal any of our bylaws. The Executive Committee does not have a charter. Current members of the Executive Committee include G. Ruffner Page, Jr. (Chairman), C. Phillip McWane, John H. Holcomb, III, Richard Murray, IV, and William E. Matthews, V.

Corporate Governance Guidelines

The Board has adopted Corporate Governance Guidelines to assist the Board and its committees in the exercise of their responsibilities. The Corporate Governance Guidelines set forth guiding principles and provide a flexible framework for the governance of the Company. The Corporate Governance Guidelines address, among other things, Board functions and responsibilities, management succession, Board membership and independence, Board meetings and committees, access to management, employees and outside advisors, director orientation and continuing education, and annual performance evaluations of the Board and its committees. The Nominating and Corporate Governance Committee regularly reviews and provides recommendations to the Board on the Corporate Governance Guidelines, and the full Board approves changes as it deems appropriate.

Board Leadership Structure

The Board oversees the business and affairs of the Company and monitors the performance of its management. Although the Board is not involved in the Company’s day-to-day operations, the directors keep themselves informed about the Company through meetings of the Board, reports from management and discussions with the Company’s executive officers. Directors also communicate with the Company’s outside advisors, as necessary.

The business of the Company is managed under the direction of the Board, the members of which are elected by our stockholders. The basic responsibility of the Board is to lead the Company by exercising its business judgment to act in what each director reasonably believes to be the best interests of the Company and its stockholders. Leadership is important to facilitate the Board acting effectively as a working group so that the Company and its performance may benefit.

The role of Chairman of the Board includes providing continuous feedback on the direction, performance and strategy of the Company, presiding as chairman of Board meetings, setting the Board’s agenda with management and leading the Board in anticipating and responding to opportunities and challenges faced by the Company. Mr. Holcomb currently serves as the Chairman of our Board and as our Chief Executive Officer. Our Board does not have a fixed policy regarding the combination of the roles of Chairman and Chief Executive Officer because the Board believes that it is in the best interests of our Company to have the flexibility to determine, from time to time, whether the positions should be held by the same person or by separate persons based on the leadership needs of our Board and the Company at any particular time. For the past several years, our Board has believed that having Mr. Holcomb serve in both roles is the most effective leadership structure for our Board and is in the best interests of the Company and our stockholders.

Since January 22, 2015, G. Ruffner Page, Jr. has served as our lead independent director. As lead independent director, Mr. Page presides over periodic meetings of our independent directors, serves as a liaison between our Chief Executive Officer and the independent directors and performs such additional duties as our Board may otherwise determine and delegate.

On March 21, 2017, the Company announced that Mr. Holcomb will transition into an Executive Chairman role with the Bank effective May 31, 2017, and, assuming that he is elected as a director by the stockholders of the Company at the Annual Meeting, will serve as Executive Chairman of the board of directors of the Company. Richard Murray, IV, the Company’s President and Chief Operating Officer, will become the Company’s Chief Executive Officer. Following this transition, the Board anticipates that the roles of Executive Chairman and Chief Executive Officer will remain separated for the foreseeable future and that the Board will continue to have a lead independent director. The Board believes that this structure will allow the Company to benefit from the experience and knowledge of Mr. Holcomb in his role as Executive Chairman and will be advantageous to independence, oversight and objectivity to have a separate lead independent director. The Board may reconsider this leadership structure from time to time based on then-current considerations.

Role of Our Board in Risk Oversight

Our Board, as a whole and through its committees, has responsibility for the oversight of risk management at the Company. In its risk oversight role, our Board has the responsibility to satisfy itself that the risk management processes designed and implemented by management are adequate and functioning as designed. The Board receives reports from management on financial, credit, liquidity, interest rate, capital, operational, legal compliance and reputation risks and the degree of exposure to those risks. The Board helps ensure that management is properly focused on risk by, among other things, reviewing and discussing the performance of senior management and business units of the Company.