Use these links to rapidly review the document

TABLE OF CONTENTS

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantý Filed by a Party other than the Registranto

| | |

| Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material under §240.14a-12

|

Diplomat Pharmacy, Inc.

(Name of registrant as specified in its charter)

(Name of person(s) filing proxy statement, if other than the registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| ý | | No fee required |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

|

(1) |

|

Title of each class of securities to which the transaction applies: |

|

|

|

|

|

(2) |

|

Aggregate number of securities to which the transaction applies: |

|

|

|

|

|

(3) |

|

Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|

|

|

|

|

(4) |

|

Proposed maximum aggregate value of the transaction: |

|

|

|

|

|

(5) |

|

Total fee paid: |

|

|

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid: |

|

|

|

|

|

(2) |

|

Form, Schedule or Registration Statement No.: |

|

|

|

|

|

(3) |

|

Filing Party: |

|

|

|

|

|

(4) |

|

Date Filed: |

|

|

|

Table of Contents

LETTER TO OUR SHAREHOLDERS

April 25, 2017

To our Shareholders:

We cordially invite you to attend our 2017 annual meeting of shareholders, which will be held on Thursday, June 8, 2017, at 1:00 p.m. Eastern Time, at our corporate headquarters, 4100 S. Saginaw St., Flint, Michigan. The business to be conducted at the annual meeting is set forth in the attached Notice of 2017 Annual Meeting of Shareholders and Proxy Statement.

Over the course of 2016, we grew our revenue by 31 percent, including acquisitions. And while Diplomat faced some challenges, they presented a chance to take a more strategic approach as we realigned the structure of our organization. As always, we remain focused on providing exceptional care and services to each of our patients and partners.

This is a year for us to get back to the basics—keeping our patients and partners at the center of everything we do and harnessing our entrepreneurial spirit. I am proud to be surrounded by a team that innovates, analyzes, and executes new and exciting solutions to help our patients thrive. As we make progress in each of the areas I have identified here, know we do so to support our patients. My dad has long said, "Take good care of patients and the rest falls into place."

For us, being a good steward of your investment means taking the best care of those who need us by growing in new ways and expanding our services.

It is an honor and privilege to spend 2017 doing just that.

In health,

Philip R. Hagerman

Chairman of the Board and

Chief Executive Officer

Corporate Headquarters

4100 S. Saginaw Street

Flint, MI 48507

(888) 720-4450

Table of Contents

DIPLOMAT PHARMACY, INC.

NOTICE OF 2017 ANNUAL MEETING OF SHAREHOLDERS

Our 2017 annual meeting of shareholders will be held on Thursday, June 8, 2017 at 1:00 p.m. Eastern Time, at our corporate headquarters at 4100 S. Saginaw St., Flint, Michigan to conduct the following items of business:

- •

- To elect two Class III directors named in the accompanying proxy statement, each to serve for a three-year term or until his or her successor has been duly elected and qualified.

- •

- To ratify the appointment of BDO USA, LLP as our independent registered public accounting firm for the year ending December 31, 2017.

- •

- To approve (on an advisory basis) the compensation of our named executive officers.

- •

- To transact any other business that may properly come before the meeting or any postponement or adjournment of the meeting.

Only holders of our common stock at the close of business on April 17, 2017, the record date, are entitled to receive this notice and to attend and vote at the annual meeting.

We have elected to furnish proxy materials to you primarily through the Internet, which expedites your receipt of materials, lowers our expenses, and conserves natural resources. On or about April 28, 2017, we intend to mail to our shareholders of record a notice containing instructions on how to access our 2017 proxy statement and 2016 annual report through the Internet and how to vote through the Internet. The notice also will include instructions on how to receive such materials, at no charge, by paper delivery (along with a proxy card) or by e-mail. Beneficial owners will receive a similar notice from their broker, bank, or other nominee. Please do not mail in the notice, as it is not intended to serve as a voting instrument. Notwithstanding anything to the contrary, we may send certain shareholders of record a full set of proxy materials by paper delivery instead of the notice or in addition to sending the notice.

You can elect to receive future proxy materials by e-mail at no charge instead of receiving these materials by paper delivery by voting using the Internet and, when prompted, indicating you agree to receive or access shareholder communications electronically in future years.

Your vote is important. Whether or not you plan to attend the meeting, we urge you to vote promptly and save us the expense of additional solicitation. If you attend the annual meeting, you may revoke your proxy in accordance with the procedures set forth in the proxy statement and vote in person.

| | |

| | | By Order of the Board of Directors |

|

|

Christina Flint

General Counsel and Secretary |

Flint, Michigan

April 25, 2017 |

|

|

Table of Contents

PROXY SUMMARY

This proxy summary highlights information contained elsewhere in this proxy statement. This summary does not contain all of the information that you should consider and therefore you should read the entire proxy statement before voting. For more complete information regarding the 2016 performance of Diplomat Pharmacy, Inc. (the "Company"), review the Company's annual report on Form 10-K for the year ended December 31, 2016.

Your vote is important. Whether or not you plan to attend the annual meeting, we urge you to vote promptly to save us the expense of additional solicitation. Please carefully review the proxy materials for the 2017 annual meeting and follow the instructions below to cast your vote on all of the proposals.

Proposals, Board Recommendations, and Required Vote |

| | | | | | |

| | | Board | | |

Proposal

|

| Recommendation

|

| Required Vote

|

| No. 1 - | | Election of Directors (page 6) | | FOR each nominee | | Plurality |

| No. 2 - | | Ratification of Independent Registered Public Accounting Firm (page 47) | | FOR | | Majority of the votes cast that are entitled to vote |

| No. 3 - | | Advisory Vote to Approve Named Executive Officer Compensation (page 48) | | FOR | | Majority of the votes cast that are entitled to vote |

Voting Methods in Advance of Annual Meeting |

Even if you plan to attend the 2017 annual meeting in person, please vote right away using one of the following voting methods (see page 3 for additional details).Make sure to have your proxy card or voting instruction card in hand and follow the instructions.

- •

- Use the Internet. Visit the website listed on your notice card, proxy card, voting instruction card, or e-mail notification.

- •

- Call by Telephone. Call the telephone number on your notice card, proxy card or voting instruction card.

- •

- Send by Mail. Sign, date and return your proxy card or voting instruction card in the enclosed envelope.

Attend and Vote at Annual Meeting |

| | |

| Date: | | Thursday, June 8, 2017 |

| Time: | | 1:00 p.m. Eastern Time |

| Location: | | Corporate Headquarters, 4100 S. Saginaw St., Flint, Michigan 48507 |

Shareholders of record and beneficial owners (if in possession of a proxy from your broker, bank or other nominee) as of April 17, 2017 may attend and vote at the annual meeting.

i

Table of Contents

The Board currently consists of seven directors serving staggered terms. Two Class III directors are to be elected at the annual meeting to hold office until the 2020 annual meeting of shareholders. The Board has nominated one current Class III director, Dr. Regina Benjamin, and nominated another Class III candidate, Mr. Jeff Park, each for three-year terms. The following table provides summary information about such director nominees.

| | | | | | | | | | | | |

| | | | | Director

|

| | | Primary

|

| Committee

|

| Current Public

Company |

Name

|

| Age

|

| Since

|

| Independent

|

| Occupation

|

| Memberships

|

| Boards

|

| Dr. Regina Benjamin | | 60 | | 2017 | | Yes | | NOLA.com/Times

Picayune Endowed Chair

in Public Health

Sciences, Xavier

University of Louisiana | | None | | None |

| Mr. Jeff Park | | 45 | | 2017 | | Yes | | Former Chief Operations

Officer, OptumRx | | None | | None |

We believe that our directors as a group have an appropriate mix of qualifications, attributes, skills, and experience.

See "Proposal No. 1—Election of Directors—Specific Qualifications, Attributes, Skills, and Experience to be Represented on the Board" and "—Director Background and Qualifications" beginning on page 8 for further discussion of these key qualifications that we consider important for service on our Board and additional information on each of our directors.

Ratification of Independent Registered Public Accounting Firm |

At the 2017 annual meeting, shareholders are being asked to ratify the appointment of BDO USA, LLP ("BDO") as the Company's independent registered public accounting firm for 2017.

The following table sets forth the fees the Company was billed for audit and other services provided by BDO in 2016 and 2015. All of such services were approved in conformity with the pre-approval policies and procedures of the Audit Committee, and the Audit Committee, based on its reviews and discussions with

ii

Table of Contents

management and BDO, determined that the provision of these services was compatible with maintaining BDO's independence.

| | | | | | | |

| | 2016

($) | | 2015

($) | |

|---|

Audit Fees | | | 882,120 | | | 557,040 | |

Audit-Related Fees | | | 15,321 | | | — | |

Tax Fees | | | 332,410 | | | 212,110 | |

| | | | | | | | |

Total Fees | | | 1,229,851 | | | 769,150 | |

Corporate Governance Highlights |

The Company is committed to good corporate governance appropriate to the Company and its shareholders. In 2017, we made significant changes to our corporate governance structure.

Lead Director. In February 2017, the Board established the role of an independent Lead Director and our independent Board members appointed Mr. Benjamin Wolin, a member of the Nominating and Corporate Governance Committee and the Audit Committee, to serve as the independent Lead Director for a term of at least one year. In his capacity as Lead Director, Mr. Wolin is empowered to:

- •

- Facilitate communication across Board committees and among the Chairman, the Board as a whole, and Board committees;

- •

- Serve as a liaison between the Chairman and the independent directors;

- •

- Act as a sounding board and advisor to the CEO along with other directors;

- •

- Preside at meetings of the Board if the Chairman is not present;

- •

- Preside at executive sessions of the independent directors and coordinate feedback and follow-up with the Chairman as appropriate;

- •

- Call meetings of the independent directors, establish the agenda of such meetings with the input of other directors, and preside over such meetings;

- •

- Be available to meet with key shareholders of the Company as appropriate;

- •

- Approve the Board meeting agenda, schedules, and materials in order to support Board deliberations; and

- •

- Facilitate as appropriate the responsibilities of the Board, the Board committees, and senior management.

In addition, the Company has increased the overall independence of the Board and its committees. Following the retirement of Mr. Gary Kadlec, our former President, and the resignation of Mr. Sean Whelan, our former Chief Financial Officer, each of whom served on the Board during 2016, the Nominating and Corporate Governance Committee engaged a third party search firm to assist the Board in identifying Board candidates consistent with the qualification criteria set forth in the Company's Corporate Governance Guidelines. This process led to the Board's appointment of Dr. Benjamin in April 2017 and the nomination of Mr. Park as Class III directors (each of whom will stand for election at the 2017 annual meeting). As a result:

- •

- Assuming election of the Class III nominees, the number of independent directors will increase from four of seven directors to six of seven directors.

- •

- Following our transition from controlled company status, only independent directors have served on Board committees since March 2016.

iii

Table of Contents

- •

- The Company will benefit from the unique perspectives, experience and qualification of its additional independent Board members.

These measures supplement the Company's other governance practices, highlights of which include:

- •

- Annual Board and Committee performance evaluations;

- •

- Appropriately tailored governance policies, including anti-hedging and pledging policies and a clawback policy for the annual bonus plan;

- •

- Shareholder engagement, as appropriate; and

- •

- An engaged Board — On average, each director attended over 85% of the meetings of the Board and the committees of which he or she was a member.

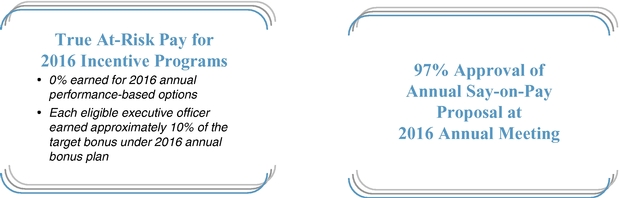

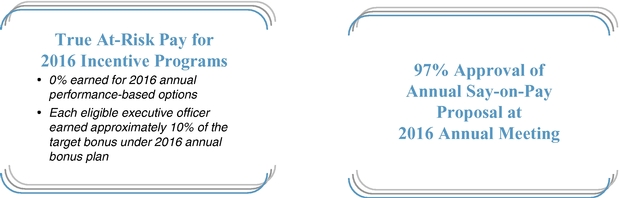

Executive Compensation Highlights |

See "Compensation Discussion and Analysis—Executive Summary" beginning on page 21 for a summary of key compensation matters for fiscal 2016.

Executive Transitions in 2016.

The Company experienced significant executive transition in 2016, which materially impacted the named executive officer compensation program in 2016. Effective November 1, 2016, the Board appointed Mr. Paul Urick to serve as the Company's President. Mr. Urick, who had previously served as a Senior Vice President of the Company, was promoted in connection with the retirement of Mr. Kadlec. Mr. Kadlec, a current board member whose term will expire at the 2017 annual meeting, resigned as President on November 1, 2016 and retired as an employee effective December 31, 2016. In addition, our former Chief Financial Officer and Board member, Mr. Whelan, resigned from both positions effective December 31, 2016.

In December 2016, the Board determined that Mr. Gary Rice, in connection with his recent promotion to Executive Vice President of Operations, became a named executive officer of the Company and that Dr. Atheer Kaddis was no longer a named executive officer due to a change in his role and responsibilities. Mr. Rice is a named executive officer for 2016, although his annual cash compensation was determined by

iv

Table of Contents

management and not the Compensation Committee. Dr. Kaddis did not qualify as a named executive officer at 2016 year end.

For a more detailed discussion of these executive transitions and their effect on named executive officer compensation, see "Compensation Discussion and Analysis—Executive Summary" beginning on page 21.

Fiscal 2016 Target Annual Compensation Determinations.

- •

- The 2016 target annual compensation of named executive officers were adjusted in March 2016 by the Board. The base salaries of Mr. Urick and Mr. Rice were further adjusted in 2016 in connection with their promotions.

- •

- The 2016 bonus plan was approved by the Board in March 2016. Consistent with the prior year, the Board included all named executive officers except Mr. Philip Hagerman, our Chief Executive Officer, in the Company's annual bonus plan. The 2016 bonus plan for named executive officers and certain other eligible key employees did not materially change from the 2015 bonus plan and was based on specified Adjusted EBITDA and revenue performance goals, in each case exclusive of the effect of mergers and acquisitions transacted during the bonus plan year, and individual performance goals for 2016.

- •

- The 2016 equity award program of annual grants was approved in March 2016. All named executive officers participated in such equity award program and were granted options to purchase a number of shares of common stock of the Company, to be earned or forfeited based upon the Company's performance relative to the specified Adjusted EBITDA and revenue goals for 2016.

See "Compensation Discussion and Analysis—2016 Target Annual Compensation Determinations—2016 Compensation Determinations" for further description of how the components of target annual compensation are determined.

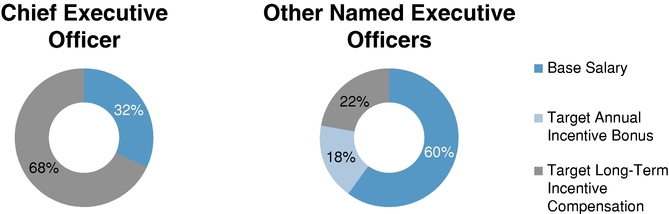

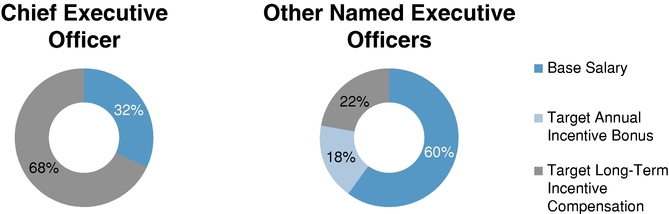

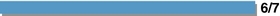

Components of Target Annual Compensation. The following graphs set forth the various components of target annual compensation approved for the Chief Executive Officer and the other named executive officers in 2016. For purposes of these calculations, base salary (i) includes car allowances and 401(k) contributions, (ii) is based on base salaries effective on December 31, 2016, and (iii) excludes special equity awards issued in connection with promotions.

2016 Actual Performance. The following tables present actual Adjusted EBITDA and revenue as calculated for purposes of the bonus plan and the equity award program, respectively, and provide the percentage of target bonus and percentage of equity awards earned for 2016. We define Adjusted EBITDA as net income (loss) before interest expense, income taxes, depreciation and amortization, share-based compensation, restructuring and impairment charges, equity loss and impairment of non-consolidated entities, and certain other items that we do not consider indicative of our ongoing operating performance. For purposes of the

v

Table of Contents

bonus plan and equity award program, Adjusted EBITDA and revenue exclude the effect of mergers and acquisitions transacted during the bonus plan year. Accordingly, Adjusted EBITDA and revenue as presented below and elsewhere in this proxy statement differ from the Company's reported Adjusted EBITDA and revenue in 2016.

| | | | | | | | |

| | | | 2016 Performance Metric –

|

| |

| | Component

|

| Annual Bonus Plan

|

| % of Target Bonus |

Component

|

| % of Target Bonus

|

| Target

|

| Actual

|

| Earned

|

Adjusted EBITDA | | 60 | | $123,000,000 | | $102,000,000 (1) | | 0 |

Revenue | | 30 | | $4,621,000,000 | | $4,131,000,000 (1) | | 0 |

Individual Performance | | 10 | | Varied | | Varied | | Varied |

| | | | | | | | |

| | | | 2016 Performance Metric –

|

| |

| | Component

|

| Equity Award Plan

|

| % of Target Award |

Component

|

| % of Target Award

|

| Target

|

| Actual(1)

|

| Earned

|

Adjusted EBITDA | | 70 | | $123,000,000 | | $102,000,000 | | 0 |

Revenue | | 30 | | $4,621,000,000 | | $4,131,000,000 | | 0 |

- (1)

- Subset of total Company financial results, as calculated for incentive plans.

For further discussion of our annual incentive bonus plan and our long-term incentive compensation, see "Compensation Discussion and Analysis—2016 Pay-for-Performance—2016 Annual Bonus Plan" and "—2016 Equity Awards – Performance-Based Stock Option Awards.

vi

Table of Contents

TABLE OF CONTENTS

| | |

About the Annual Meeting | | 1 |

Proposal No. 1—Election of Directors | | 6 |

Board of Directors | | 7 |

Specific Qualifications, Attributes, Skills, and Experience to be Represented on the Board | | 7 |

Director Background and Qualifications | | 8 |

Director Independence | | 11 |

Board Matters | | 12 |

The Board of Directors | | 12 |

Committees of the Board | | 14 |

Corporate Governance | | 17 |

Director Compensation | | 19 |

Shareholder Communication with the Board | | 20 |

Compensation Discussion and Analysis | | 21 |

Executive Summary | | 21 |

Compensation Philosophy, Program Objectives, and Key Features | | 25 |

2016 Compensation Determinations | | 26 |

Other Equity-Related Policies | | 28 |

Tax and Accounting Implications | | 29 |

Compensation Committee Report | | 30 |

Compensation Committee Interlocks and Insider Participation | | 30 |

Named Executive Officer Compensation Tables | | 31 |

Summary Compensation Table for 2016 | | 31 |

Grants of Plan-Based Awards in 2016 | | 33 |

Outstanding Equity Awards at December 31, 2016 | | 34 |

Option Exercises and Stock Vested in 2016 | | 35 |

Potential Payments Upon Termination or Change in Control | | 35 |

Certain Relationships and Related Person Transactions | | 41 |

Procedures for Related Person Transactions | | 41 |

Related Person Transactions Since January 1, 2016 | | 41 |

Security Ownership of Certain Beneficial Owners and Management | | 43 |

Audit Committee Report | | 45 |

Audit Committee Matters | | 46 |

Pre-Approval Policies and Procedures | | 46 |

BDO Fees | | 46 |

Proposal No. 2—Ratification of Appointment of Independent Registered Public Accounting Firm for 2017 | | 47 |

Proposal No. 3—Advisory Vote on Named Executive Officer Compensation | | 48 |

Additional Information | | 49 |

Equity Compensation Plans | | 49 |

Section 16(a) Beneficial Ownership Reporting Compliance | | 49 |

Availability of 2016 Annual Report to Shareholders | | 49 |

Requirements for Submission of Shareholder Proposals and Nominations for 2018 Annual Meeting | | 50 |

Solicitation by Board; Expenses | | 50 |

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to be Held on June 8, 2017 | | 50 |

Table of Contents

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

JUNE 8, 2017

ABOUT THE ANNUAL MEETING

Who is soliciting my vote? |

The Board of Directors (the "Board") of Diplomat Pharmacy, Inc. (the "Company," "Diplomat," "our," "us," or "we") is soliciting your proxy, as a holder of our common stock, for use at our 2017 annual meeting of shareholders and any adjournment or postponement of such meeting. The 2017 annual meeting will be held on Thursday, June 8, 2017, at 1:00 p.m. Eastern Time, at the Company's headquarters at 4100 S. Saginaw St., Flint, Michigan.

The notice of annual meeting, proxy statement, and form of proxy was first mailed to shareholders of record of our common stock on or about April 28, 2017.

What is the purpose of the annual meeting? |

At the annual meeting, you will be voting on:

- •

- The election of two Class III directors named in this proxy statement, each to serve for a three-year term or until his or her successor has been duly elected and qualified.

- •

- The ratification of the appointment of BDO USA, LLP ("BDO") as our independent registered public accounting firm for the year ending December 31, 2017.

- •

- The approval (on an advisory basis) of the compensation of our named executive officers.

The Board recommends a voteFOR each of the director nominees listed in this proxy statement,FOR the ratification of BDO's appointment, andFOR the approval of the compensation of our named executive officers. We are not aware of any other matters that will be brought before the shareholders for a vote at the annual meeting. If any other matter is properly brought before the meeting, your signed proxy card gives authority to your proxies to vote on such matter in their best judgment; proxy holders named in the proxy card will vote as the Board recommends or, if the Board gives no recommendation, in their own discretion.

During or immediately following the annual meeting, management will report on our performance and will respond to appropriate questions from shareholders. Representatives of BDO will be present at the annual meeting, will make a statement, if they desire to do so, and will answer appropriate questions from our shareholders.

You may vote if you owned shares of our common stock at the close of business on April 17, 2017, the record date, provided such shares are held directly in your name as the shareholder of record or are held for you as the beneficial owner through a broker, bank or other nominee. Each share of common stock is entitled to one vote on each matter properly brought before the meeting. As of April 17, 2017, we had 67,164,606 shares of common stock outstanding and entitled to vote.

1

Table of Contents

What is the difference between holding shares as a shareholder of record and a beneficial owner? |

Shareholders of Record. If your shares are registered directly in your name with the Company's transfer agent, Computershare, you are considered the shareholder of record with respect to those shares, and the applicable proxy materials are being sent directly to you by Broadridge Investor Communications Solutions ("Broadridge") on behalf of the Company. As the shareholder of record, you have the right to grant your voting proxy directly to the Company through a proxy card, through the Internet, or by telephone, or to vote in person at the annual meeting.

Beneficial Owners. Many of the Company's shareholders hold their shares through a broker, bank or other nominee rather than directly in their own names. If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares, and the applicable proxy materials are being forwarded to you by your broker, bank or nominee who is considered the shareholder of record with respect to those shares. As the beneficial owner, you have the right to direct your broker, bank or nominee on how to vote and are also invited to attend the annual meeting. Your broker, bank or nominee has enclosed voting instructions for you to use in directing the broker, bank, or nominee on how to vote your shares. Since you are not the shareholder of record, you may not vote these shares in person at the annual meeting unless you obtain a proxy from your broker, bank, or nominee and bring such proxy to the annual meeting.

Why did I receive a Notice in the mail regarding Internet availability of proxy materials? |

The Company has elected to furnish proxy materials to you primarily through the Internet, which expedites the receipt of materials, lowers our expenses, and conserves natural resources. If you received the Notice containing instructions on how to access this proxy statement and the 2016 annual report through the Internet, please do not mail in the Notice, as it is not intended to serve as a voting instrument.

How can I access the Company's proxy and other reports filed with the United States Securities and Exchange Commission ("SEC")? |

The Company's website,www.diplomat.is, under the Investors — Financial Information — SEC Filings tab, provides free access to the Company's reports with the SEC as soon as reasonably practicable after the Company electronically files such reports with, or furnishes such reports to, the SEC, including proxy materials, Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to these reports. Further, you can view these documents on a website maintained by the SEC atwww.sec.gov.

As noted above, most shareholders will receive a Notice with instructions on how to view the proxy materials through the Internet (atwww.proxyvote.com). The Notice includes a control number that must be entered at the website in order to view the proxy materials. The Notice also describes how to receive the proxy materials by paper delivery or e-mail. You can elect to receive future proxy materials by e-mail at no charge by voting using the Internet and, when prompted, indicating you agree to receive or access shareholder communications electronically in future years. If you would like to receive additional paper copies without charge, please send a written request to the Company's executive office: Diplomat Pharmacy, Inc., Attention: General Counsel, 4100 S. Saginaw St., Flint, MI 48507.

The references to the website addresses of the Company and the SEC in this proxy statement are not intended to function as a hyperlink and, except as specified herein, the information contained on such websites is not part of this proxy statement.

2

Table of Contents

May I vote my shares in person at the annual meeting? |

Even if you plan to be present at the meeting, we encourage you to vote your shares prior to the meeting.

Shareholders of Record. If you are a shareholder of record and attend the annual meeting, you may deliver your completed proxy card or vote by ballot.

Beneficial Owners. If you hold your common shares through a bank, broker, or other nominee and want to vote such shares in person at the annual meeting, you must obtain a proxy from your broker, bank or other nominee giving you the power to vote such shares.

Can I vote my shares without attending the annual meeting? |

By Mail. If you received your annual meeting materials by paper delivery, you may vote by completing, signing, and returning the enclosed proxy card or voting instruction card. Please do not mail in the Notice, as it is not intended to serve as a voting instrument.

By Telephone. You may vote by telephone as indicated on your enclosed proxy card or voting instruction card.

Through the Internet. You may vote through the Internet as instructed on your Notice, proxy card, voting instruction card, or e-mail notification. In order to vote through the Internet, you must enter the control number that was provided on your Notice, proxy card, voting instruction card, or e-mail notification. If you do not have any of these materials and are ashareholder of record, you may contact Diplomat at Diplomat Pharmacy, Inc., Attention: General Counsel, 4100 S. Saginaw St., Flint, Michigan, 48507 to request a proxy card (which will include your control number) to be mailed to your address on record or an e-mail with your control number to be sent to your e-mail address on record. If you do not have any of these materials and are abeneficial owner, you must contact your broker, bank, or other nominee to obtain your control number.

Shareholders of Record. You may change your vote at any time before the proxy is exercised by voting in person at the annual meeting or by filing with our Secretary either a notice revoking the proxy or a properly signed proxy, in each case bearing a later date. Your attendance at the annual meeting in person will not cause your previously granted proxy to be revoked unless you vote at the meeting.

Beneficial Owners. If you hold your shares through a bank, broker, or other nominee, you should contact such person prior to the time such voting instructions are exercised.

What does it mean if I receive more than one Notice, proxy card, voting instruction card, or e-mail notification? |

If you receive more than one Notice, proxy card, voting instruction card, or e-mail notification, it means that you have multiple accounts with banks, brokers, other nominees, and/or our transfer agent. Please vote each document that you receive. We recommend that you contact your nominee and/or our transfer agent, as appropriate, to consolidate as many accounts as possible under the same name and address. Our transfer agent is Computershare Trust Company, 480 Washington Blvd., 29th Floor, Jersey City, NJ 07310; Telephone: (201) 680-5258.

3

Table of Contents

What if I do not vote for some of the items listed on my proxy card or voting instruction card? |

Shareholders of Record. If you indicate a choice with respect to any matter to be acted upon on your proxy card, the shares will be voted in accordance with your instructions. Proxy cards that are signed and returned, but do not contain voting instructions with respect to certain matters, will be voted in accordance with the recommendations of the Board on such matters.

Beneficial Owners. If you indicate a choice with respect to any matter to be acted upon on your voting instruction card, the shares will be voted in accordance with your instructions. If you do not indicate a choice or return the voting instruction card, the bank, broker, or other nominee will determine if it has the discretionary authority to vote on each matter. Under applicable law and New York Stock Exchange ("NYSE") rules and regulations, a bank, broker, or nominee has the discretion to vote on routine matters, including the ratification of the appointment of an independent registered public accounting firm. For all other matters at the 2017 annual meeting, the Company believes that your broker and certain banks and nominees will be unable to vote on your behalf if you do not instruct them how to vote your shares. If you do not provide voting instructions, your shares may be considered "broker non-votes" with regard to the non-routine proposals because the broker and certain other nominees will not have the discretionary authority to vote thereon. Therefore, it is very important for you to vote your shares for each proposal.

How many shares must be present to hold the meeting? |

In order for us to conduct the annual meeting, a majority of our outstanding shares entitled to vote as of April 17, 2017 must be present in person or by proxy at the meeting. This is known as a quorum. Abstentions and broker non-votes will be considered present for purposes of determining a quorum.

What vote is required to approve each item of business? |

Proposal No. 1—Election of Directors. The two nominees receiving the highest number of "for" votes at the meeting will be elected as Class III directors. This number is called a plurality. Withheld votes and broker non-votes will have no effect on the outcome of the vote.

Proposal No. 2—Ratification of Appointment of BDO. The affirmative vote of holders of a majority of shares cast and entitled to vote, present in person or by proxy, is required for ratification of the appointment of BDO as our independent registered public accounting firm for the year ending December 31, 2017. Abstentions will have the same effect as votes against the matter.

Proposal No. 3—Advisory Approval of the Compensation of Our Named Executive Officers. The affirmative vote of holders of a majority of shares cast and entitled to vote, present in person or by proxy, is required for the approval of the compensation of our named executive officers. Abstentions will have the same effect as votes against the matter. Broker non-votes will have no effect on the outcome of the vote.

Other Matters. If any other matter is properly submitted to the shareholders at the annual meeting, its adoption generally will require the affirmative vote of holders of a majority of shares cast and entitled to vote, present in person or by proxy. The Board does not propose to conduct any business at the annual meeting other than as stated above.

Is a registered list of shareholders available? |

The names of shareholders of record entitled to vote at the annual meeting will be available to shareholders entitled to vote at the meeting on Thursday, June 8, 2017 for any purpose reasonably relevant to the meeting.

4

Table of Contents

Who will count the votes and where can I find the voting results? |

Broadridge will tabulate the voting results. We intend to announce the preliminary voting results at the annual meeting and, in accordance with rules of the SEC, we intend to publish the final results in a current report on Form 8-K within four business days of the annual meeting.

5

Table of Contents

PROPOSAL NO. 1—ELECTION OF DIRECTORS

The Board currently consists of seven directors serving staggered terms. The Board has nominated current Class III director Dr. Benjamin and nominated Mr. Park, each to serve as Class III directors for three-year terms. Dr. Benjamin initially was appointed to the Board in April 2017, filling the vacancy of Mr. Whelan, our former Chief Financial Officer, who resigned from the Board and his executive position on December 31, 2016. The Board nominated Mr. Park to fill the vacancy of Mr. Kadlec, our former President, who, to allow for a more independent Board, determined not to stand for re-election at the 2017 annual meeting. As discussed below, the Board has affirmatively concluded that each of Dr. Benjamin and Mr. Park is independent under the applicable rules of the NYSE. In 2016, the Nominating and Corporate Governance Committee engaged a professional third-party search firm to identify independent Board nominees, consistent with the Company's criteria for Board membership, and such engagement resulted in the foregoing appointment and nominations.

The two directors to be elected at the 2017 annual meeting will hold office until the 2020 annual meeting of shareholders (Class III directors). Each director will serve until a successor is duly elected and qualified or until such director's earlier resignation, retirement or death. The remaining directors are Class I directors (terms expire in 2018) or Class II directors (terms expire in 2019).

Each nominee has consented to be listed in this proxy statement and agreed to serve as a director if elected by the shareholders. If any nominee becomes unable or unwilling to serve between the date of this proxy statement and the annual meeting, the Board may designate a new nominee and the persons named as proxies in the attached proxy card will vote for that substitute nominee. Alternatively, the Board may reduce the size of the Board.

The Board recommends that you vote FOR the election of each of the Class III director nominees.

6

Table of Contents

The directors and director nominees of the Company are set forth below. Mr. Hagerman is also the Chief Executive Officer of the Company and serves at the pleasure of the Board in such capacity.

| | | | | | |

Name

|

| Age

|

| Title

|

| Class—Term

Ending

|

| Regina Benjamin | | 60 | | Director | | Class III—2017 |

| Gary Kadlec | | 68 | | Director | | Class III—2017* |

| Jeff Park | | 45 | | Nominee | | Class III Nominee* |

| David Dreyer | | 60 | | Director | | Class I—2018 |

| Philip R. Hagerman | | 64 | | Chief Executive Officer, Chairman of the Board of Directors | | Class I—2018 |

| Shawn C. Tomasello | | 58 | | Director | | Class I—2018 |

| Kenneth O. Klepper | | 63 | | Director | | Class II—2019 |

| Benjamin Wolin | | 42 | | Lead Director | | Class II—2019 |

*Mr. Park has been nominated to replace Mr. Kadlec, who determined not to stand for re-election at the 2017 annual meeting.

Specific Qualifications, Attributes, Skills and Experience to be Represented on the Board |

The Nominating and Corporate Governance Committee is responsible for reviewing and assessing with the Board the appropriate skills, experience, and background sought of Board members in the context of our business and the then-current membership on the Board. The Nominating and Corporate Governance Committee and the Board review and assess the continued relevance of and emphasis on these factors generally and in connection with candidate searches to determine if they are effective in helping to satisfy the Board's goal of creating and sustaining a Board that can appropriately support and oversee the Company's activities.

The Board believes that the directors have an appropriate balance of knowledge, experience, attributes, skills, and expertise as a group to ensure that the Board appropriately fulfills its oversight responsibilities and acts in the best interests of the Company's shareholders. Although specific qualifications for Board membership may vary from time to time, desired qualities include (A) the highest ethical character, integrity, and shared values with the Company, (B) loyalty to the Company and concern for its success and welfare, (C) sound business judgment, and (D) sufficient commitment and availability to effectively carry out a director's duties. Listed below are additional key skills and experience that we consider important for our directors to have in light of our current business and structure. Thereafter, the biographies of the directors and nominees set forth their business experience during at least the past five years, as well as the specific experience, qualifications, attributes, and skills that led to the Nominating and Corporate Governance Committee's conclusion that each current director (except Mr. Kadlec) should continue to serve on the Board and that such Class III nominee should serve on the Board if elected at the 2017 annual meeting.

| | |

| · | | Senior Leadership Experience. |

|

|

|

|

|

Directors who have served in senior leadership positions can provide experience and perspective in analyzing, shaping, and overseeing the execution of important operational, organizational, and policy issues at a senior level. |

· |

|

Public Company Board Experience. |

|

|

|

7

Table of Contents

| | |

| | | Directors who have served on other public company boards can offer advice and insights with regard to the dynamics and operation of a board of directors, the relations of a board to the chief executive officer and other management personnel, the importance of particular agenda and oversight matters, and oversight of a changing mix of strategic, operational, governance and compliance-related matters. |

· |

|

Business Development and Mergers and Acquisitions Experience. |

|

|

|

|

|

Directors who have a background in business development and in mergers and acquisitions transactions can provide insight into developing and implementing strategies for growing our business, which may include mergers and acquisitions. Useful experience in mergers and acquisitions includes an understanding of the importance of "fit" with the Company's culture and strategy, the valuation of transactions, and management's plans for integration with existing operations. |

· |

|

Financial and Accounting Expertise. |

|

|

|

|

|

Knowledge of the financial markets, corporate finance, accounting regulations, and accounting and financial reporting processes can assist our directors in understanding, advising, and overseeing our capital structure, financing and investing activities, financial reporting, and internal control of such activities. The Company also strives to have a number of directors who qualify as financial experts under SEC rules. |

· |

|

Industry Expertise. |

|

|

|

|

|

We are a specialty pharmacy operating at the center of the healthcare continuum for the treatment of complex and chronic diseases. Education or experience in the healthcare, specialty pharmacy, pharmaceutical, and biotechnology industries is useful in understanding the patients, payors, pharmaceutical partners, hospitals, and healthcare systems with whom we interact, the various procedures that we develop, regulatory requirements, our sales efforts, and the markets in which we compete. |

Director Background and Qualifications |

Regina Benjamin, MD, is Former United States Surgeon General and a practicing family physician. In July 2009, Dr. Benjamin was appointed as the 18th United States Surgeon General and served a four-year term. During such period, Dr. Benjamin served as the Chair of the National Prevention, Health Promotion, and Public Health Council, which consists of 17 cabinet-level Federal agencies that released the first ever National Prevention Strategy, a roadmap for health. In addition, since September 2013, Dr. Benjamin has served as the NOLA.com/Times Picayune Endowed Chair in Public Health Sciences at Xavier University of Louisiana. Dr. Benjamin is the founder and CEO of BayouClinic, Inc., a Federally Qualified Health Center Look-Alike clinic in Alabama which Dr. Benjamin founded in 1990. From December 2013 through July 2015, Dr. Benjamin served on the board of directors of Alere Inc. (NYSE:ALR), a healthcare diagnostics company, where she served on the nominating and corporate governance committee. Dr. Benjamin also currently serves on boards of directors of Kaiser Foundation Hospitals and Health Plan since 2015. She was the associate dean for Rural Health at the University of South Alabama College of Medicine and served as the chair of the Federation of State Medical Boards of the United States from 2002 to 2003. In 2002, Dr. Benjamin became the first African-American female president of a state medical society in the United States when she assumed leadership of the Medical Association State of Alabama, a position she held until 2003. She also served as chair of the AMA Council on Ethical and Judicial Affairs from 2003 until 2009 and

8

Table of Contents

as president of the American Medical Association Education and Research Foundation from 1997 until 1998. Dr. Benjamin was the first physician under the age of 40 and the first African-American woman to be elected to the American Medical Association Board of Trustees in 1995. In 1992, she was chosen as a Kellogg National Fellow and in 1998 she was chosen as a Rockefeller Next Generation Leader. Dr. Benjamin is a member of the Institute of Medicine and a fellow of the American Academy of Family Physicians.

Dr. Benjamin has approximately 30 years of experience as a practicing family physician and has served in leadership roles at the highest levels of the US government and in the healthcare field. Dr. Benjamin also has significant financial experience, having served on the finance committee of several healthcare, educational and charitable organizations and on the audit committee of the Robert Wood Johnson Foundation. In particular, Dr. Benjamin's experience as the United States Surgeon General is a unique and valuable qualification which provides the Board with insight into governmental practice, policy making and regulation. In addition, her leadership positions with several healthcare industry associations and medical groups, as well as her practical experience as a family physician bring the Board valuable perspectives with respect to key partners of the Company, including patients, physicians, pharmaceuticals, health plans, and regulatory agencies.

Jeff Park was the Chief Operating Officer of OptumRx, a $75 billion entity resulting from the merger of Catamaran Corporation (NASDAQ: CTRX), a major Pharmacy Benefits Management (PBM) services provider, and OptumRx, UnitedHealth Group's (NYSE: UNH) free-standing pharmacy care services business from July 2015 until July 2016. Immediately prior to the merger, Mr. Park served as Catamaran's Executive Vice President, Operations since March 2014 and previously served as its Chief Financial Officer beginning in 2006. Prior to his service as Chief Financial Officer, Mr. Park was a member of Catamaran's board of directors and was a Senior Vice President of Covington Capital Corporation, a private equity venture capital firm he joined in 1998. Prior to his experience with Covington, Mr. Park worked for IBM in several areas of their Global Services Organization and is a former audit manager with Deloitte Canada.

Mr. Park has substantial experience in the PBM industry, a field significant to our business. He has also had key managerial, financial and operational responsibilities during his 11 years in the health care industry, including significant roles in building through acquisitions and organic growth. In addition, Mr. Park has extensive financial and accounting expertise from his experience serving as a chief financial officer through a transition from a small Canadian listed public company to a Fortune 500 Nasdaq listed public company and as an audit manager at Deloitte Canada. Mr. Park also has experience in corporate governance, having served on ten Covington portfolio company boards as well as public company board experience. Our Board believes that Mr. Park will bring valuable insights into the PBM industry, as well as financial, operational, and mergers and acquisition expertise to our Board.

David Dreyer, CPA, has been a director since September 2014. Mr. Dreyer served as Chief Financial Officer for BIOLASE, Inc. (NASDAQ:BIOL), a medical device company that develops, manufactures, and markets innovative lasers in dentistry and medicine as well as other digital equipment, from March 2015 to January 2017. From October 2010 to March 2015, Mr. Dreyer served as Chief Financial Officer, Chief Operating Officer and Secretary of Patient Safety Technologies, which develops, markets and sells healthcare products relating to surgical safety, and is a former public reporting company (OTC: PSTX) and a subsidiary of Stryker Corporation (NYSE: SYK) since March 2014. Previously, Mr. Dreyer was Chief Financial Officer of Alphastaff Group, Inc., a human resource outsourcing company, from August 2009 to September 2010. From September 2004 to August 2009, Mr. Dreyer served as Chief Financial Officer and Chief Accounting Officer of AMN Healthcare Services, Inc. (NYSE: AHS), which provided healthcare staffing for physicians, travel nurses, and allied travel. From 1997 through 2004, Mr. Dreyer served as Chief Financial Officer and Chief Accounting Officer of Sicor, Inc. (formerly Nasdaq: SCRI), a manufacturer of complex pharmaceuticals with operations in the United States and internationally, which was acquired by Teva Pharmaceutical Limited in January 2004. Prior to joining Sicor, Mr. Dreyer served in related senior financial management positions within the pharmaceutical industry, working for Elan Corporation plc, Athena Neurosciences and Syntex Corporation. Mr. Dreyer is a certified public accountant in California. Mr. Dreyer has been a director of

9

Table of Contents

InfuSystem Holdings, Inc. (NYSE: INFU), a provider of infusion pumps and related services, since April 2008, and currently serves as chairman of its Compensation Committee and is a member of its Audit, and Nominating and Governance Committees.

Mr. Dreyer has approximately 30 years of accounting, financial, compliance, and operating experience and expertise in the healthcare field and has extensive senior leadership skills from his executive management positions. Mr. Dreyer also has public company board and executive experience, from which he has expertise in finance, financial reporting, accounting, corporate governance, compensation, risk management, and healthcare matters. His long tenure as a certified public accountant and expertise in accounting and financial reporting matters, including in executive positions for public companies, led our Board to determine that Mr. Dreyer is a financial expert in accordance with SEC rules.

Philip R. Hagerman, RPh, has served as our Chief Executive Officer, a director, and the Chairman of the Board of Directors since 1991. Mr. Hagerman co-founded the Company with his father in 1975.

Mr. Hagerman has led the Company as its principal executive officer, Chairman of the Board of Directors, and a director for approximately 25 years. He has a unique perspective and understanding of our business, culture, and history, having led the Company through many economic cycles and operational initiatives. His day-to-day leadership of the Company gives him critical insights into our operations, strategy, and competition, and he facilitates the Board's ability to perform its oversight function. Throughout his career at the Company, he has demonstrated strong entrepreneurial skills, as well as regulatory, marketing, strategic, merger and acquisition, capital market, and operational expertise. Mr. Hagerman also possesses in-depth knowledge of, and key relationships in, the specialty pharmacy industry on a national basis.

Kenneth O. Klepper has been a director since December 2014. He currently serves as Co-Founder, Chairman, and Chief Executive Officer of ReactiveCore, LLC, an enterprise AIOS (Artificial Intelligence Operating System) technology start-up company, an entity he co-founded in March 2015. He previously served as President and Chief Operating Officer of Medco Health Solutions, Inc. (NYSE: MHS), a supplier of pharmacy benefit management, mail order, and specialty pharmacy services, from March 2006 until the April 2012 acquisition of Medco by Express Scripts, Inc. He joined Medco in June 2003 and served as Executive Vice President, Chief Operating Officer from June 2003 through March 2006. Previously, Mr. Klepper was employed by WellChoice, Inc. (NYSE: WC), a health insurance company and parent of Empire Blue Cross Blue Shield of New York, where he held the positions of Senior Vice President, Process Champion from March 1995 to August 1999 and Senior Vice President for Systems, Technology and Infrastructure from August 1999 to April 2003. From 1991 to 1995, Mr. Klepper served in management roles at CIGNA Health Care. Mr. Klepper is a former member of the Defense Business Board and the Chief of Naval Operations Executive Panel, where he has served five CNOs. He also serves on the Board of Directors at the United States Naval Institute.

Mr. Klepper has extensive operating, compliance, technology, financial and accounting experience, and expertise from his various executive management positions. In particular, his services as an executive for over 20 years in the healthcare industry, including six years as a leading executive for a provider of specialty pharmaceutical services, provides him critical industry insight and related operations, strategic, marketing, acquisition, and senior leadership expertise. Mr. Klepper has over 17 years of experience in serving in executive roles for public companies, from which he has expertise in finance, financial reporting, accounting, corporate governance, compensation, risk management, and healthcare matters. Mr. Klepper's extensive expertise in finance, financial reporting, and accounting with public companies led our Board to determine that Mr. Klepper is a financial expert in accordance with SEC rules.

Shawn C. Tomasello has been a director since October 2015. Since December 2015, Ms. Tomasello has served as the Chief Commercial Officer of Kite Pharma, Inc. (Nasdaq: KITE), a clinical-stage biopharmaceutical company engaged in the development of cancer immunotherapy products. Prior to joining Kite Pharma, Ms. Tomasello served as the Chief Commercial Officer of Pharmacyclics Inc. (Nasdaq: PCYC), a pharmaceutical manufacturer acquired by Abbvie, Inc. in 2015, a position she held from August

10

Table of Contents

2014 to July 2015. From April 2005 to August 2014, Ms. Tomasello was employed at Celgene Corporation (Nasdaq: CELG), initially as the Vice President, Sales and Training, and then as President of the Americas, Hematology and Oncology, where she was responsible for all aspects of the commercial organization encompassing multiple brands spanning 11 indications. Prior to joining Celgene Corporation, Ms. Tomasello was with Genentech, Inc. (formerly NYSE: DNA) from 1989 through 2005. Her last position at Genentech was National Director, Hematology Franchise (Rituxan®) from early 2003 to April 2005.

Ms. Tomasello has considerable drug commercialization, operating, executive management, marketing, strategic, mergers and acquisitions, and compliance experience and expertise from her employment. In particular, Ms. Tomasello's service as an executive for over 18 years in the pharmaceutical manufacturing industry brings her critical industry insight into the opportunities and challenges of the Company generally as well as working with pharmaceutical manufacturers.

Benjamin Wolin has been a director since October 2015 and the independent Lead Director since February 2017. Mr. Wolin was the co-founder, Chief Executive Officer, and a member of the board of directors of Everyday Health, Inc. (NYSE: EVDY), a leading provider of digital health and wellness solutions, from January 2002 until its sale to a subsidiary of j2 Global, Inc. in December 2016. From September 1999 until December 2001, Mr. Wolin served as Vice President of Production and Technology for Beliefnet, Inc., an online provider of religious and spiritual information. Previously, Mr. Wolin served as Web Producer for Tribune Interactive, Inc., a multimedia corporation, and held several consulting positions with interactive companies.

Mr. Wolin has extensive technology, executive management, entrepreneurial, financial, and operating expertise from his former role as a founder, director, and principal executive of Everyday Health. His experience as the principal executive officer and a director of a company that completed an initial public offering provides him with unique insights into the dynamics of a growing company and the financial, accounting, governance and operational issues specific to public companies.

The Board recently undertook its annual review of director independence in accordance with the applicable rules of the NYSE. The independence rules include a series of objective tests, including that the director is not employed by us and has not engaged in various types of business dealings with us. In addition, the Board is required to make a subjective determination as to each independent director that no relationship exists which, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. The Board has adopted additional categorical standards regarding relationships that the Board does not consider material for purposes of determining a director's independence, as set forth in the Company's Corporate Governance Guidelines, which are available on the Investors – Corporate Governance section of our website atwww.diplomat.is. In making these determinations, the Nominating and Corporate Governance Committee and the Board reviewed and discussed information provided by the directors and us with regard to each director's business and personal activities as they may relate to us and our management.

The Board has affirmatively determined, after considering all of the relevant facts and circumstances, that Dr. Benjamin, Messrs. Park, Dreyer, Klepper and Wolin and Ms. Tomasello are independent directors under the applicable rules of the NYSE and our Corporate Governance Guidelines. Mr. Hagerman is employed by us and therefore is not an independent director.

All current members of the Audit Committee, Compensation Committee and the Nominating and Corporate Governance Committee are independent under NYSE rules. In addition, the Board has affirmatively determined that the current members of the Audit Committee and the Compensation Committee qualify as independent in accordance with the additional independence rules established by the SEC and the NYSE for such committees. Until March 2015, the Company was a "controlled company" under the corporate

11

Table of Contents

governance listing standards of the NYSE. Prior service of executive officers on our committees until March 2016 was in compliance with the phase-in rules of the NYSE and the SEC.

BOARD MATTERS

General

The Board has general oversight responsibility for our affairs and, in exercising its fiduciary duties, the Board represents and acts on behalf of the shareholders. Although the Board does not have responsibility for our day-to-day management, it stays regularly informed about our business and provides oversight and guidance to our management through periodic meetings and other communications. The Board provides critical oversight in, among other things, our strategic planning process, leadership development and succession planning, and risk management, as well as other functions carried out through the Board committees as described below.

Board Leadership

The Board is led by Mr. Hagerman, our Chief Executive Officer, a director, and the Chairman of the Board of Directors since he co-founded the Company with his father in 1975. The Board believes this structure permits a unified strategic vision for the Company that ensures appropriate alignment between the Board and management and provides clear leadership for the Company. The Board also believes that its independent directors provide significant independent leadership and direction. In order to augment and facilitate this leadership, in February 2017, the Board established the position of an independent Lead Director and made corresponding changes to the Corporate Governance Guidelines to further define this role. Our independent Board members appointed Mr. Wolin, a member of our Nominating and Corporate Governance Committee and our Audit Committee, to serve as our independent Lead Director for a term of at least one year. In his capacity as Lead Director, Mr. Wolin is empowered to:

- •

- Facilitate communication across Board committees and among the Chairman, the Board as a whole, and Board committees;

- •

- Serve as a liaison between the Chairman and the independent directors;

- •

- Act as a sounding board and advisor to the Chief Executive Officer along with other directors;

- •

- Preside at meetings of the Board if the Chairman is not present;

- •

- Preside at executive sessions of the independent directors and coordinate feedback and follow-up with the Chairman as appropriate;

- •

- Call meetings of the independent directors, establish the agenda of such meetings with the input of other directors, and preside over such meetings;

- •

- Be available to meet with major shareholders of the Company as appropriate;

- •

- Approve the Board meeting agenda, schedules, and materials in order to support Board deliberations; and

- •

- Facilitate as appropriate the responsibilities of the Board, the Board committees, and senior management.

In addition, independent directors comprise all of the members of the Board committees, which oversee critical matters of the Company such as the integrity of the Company's financial statements, the compensation of executive management, the nomination and/or appointment and evaluation of directors, and the development and implementation of the Company's corporate governance policies. The

12

Table of Contents

independent directors also meet regularly in executive session at Board and committee meetings, and have access to independent advisors as they deem appropriate.

Board Oversight of Risk Management

The Board oversees the Company's risk management primarily through the following:

- •

- Board's review and approval of management's annual business plan and budget, and review of management's long-term strategic and liquidity plans;

- •

- Board's review, on at least a quarterly basis, of business developments, strategic plans and implementation, liquidity, and financial results;

- •

- Board's oversight of succession planning;

- •

- Board's oversight of capital spending and financings, as well as mergers, acquisitions, and divestitures;

- •

- Audit Committee's oversight of the Company's significant financial risk exposures (including credit, liquidity and legal, regulatory, and other contingencies), accounting and financial reporting, disclosure control and internal control processes, the internal audit function, and the Company's legal, regulatory, and ethical compliance functions;

- •

- Nominating and Corporate Governance Committee's oversight of Board structure, the Company's governance policies, and the self-evaluation assessments conducted by the Board and committees;

- •

- Compensation Committee's review and approvals regarding executive officer compensation and its alignment with the Company's business and strategic plans, and the review of compensation plans generally and the related incentives, risks and risk mitigants, including anti-hedging and pledging policies, and a clawback policy for incentive programs; and

- •

- Board and committee executive sessions consisting solely of the independent directors.

Meetings

The Board and its committees meet throughout the year on a set schedule, and also hold special meetings and act by written consent from time to time as appropriate. The independent directors hold regularly scheduled executive sessions to meet without management present. In 2016, rotating directors led such sessions. In 2017, such sessions will be led by Mr. Wolin, the Lead Director. These executive sessions generally occur around regularly scheduled meetings of the Board and otherwise as appropriate.

All directors are expected to attend all meetings of the Board and of the Board committees on which they serve, as well as the annual meeting of shareholders. The Board met 9 times during 2016. In 2016, each director attended more than 75% of the aggregate of all meetings of the Board and the committees of which he or she was a member, with the exception of Mr. Klepper, who attended more than 70% of the aggregate of such meetings. Each director then in office attended our 2016 annual meeting of shareholders.

13

Table of Contents

The Board has delegated various responsibilities and authority to Board committees. Each committee has regularly scheduled meetings and reports on its activities to the full Board. Each committee operates under a written charter approved by the Board, which is reviewed annually by the respective committee and the Board. Each committee's charter is posted on the Investors – Corporate Governance section of our website atwww.diplomat.is. The table below sets forth the current membership for the three Board committees and the number of meetings held for each in 2016.

| | | | | | |

| | | | | | Nominating and |

Director

|

| Audit

|

| Compensation

|

| Corporate Governance

|

Regina Benjamin | | | | | | |

David Dreyer | | Chair | | Chair | | X |

Philip R. Hagerman | | | | | | |

Gary Kadlec(1) | | | | | | |

Kenneth O. Klepper | | X | | X | | Chair |

Shawn C. Tomasello(2) | | | | X | | |

Benjamin Wolin(2) | | X | | | | X |

Meetings | | 8 | | 3 | | 4 |

- (1)

- Mr. Kadlec, a former employee and current director until his term expires at the 2017 annual meeting, served on the Nominating and Corporate Governance Committee from its inception through March 2016.

- (2)

- In March 2016, Mr. Wolin was appointed to the Nominating and Corporate Governance Committee and Ms. Tomasello was appointed to the Compensation Committee.

Sean Whelan, a former employee and director, served on the Compensation Committee from its inception through March 2016.

| | |

| | | |

AUDIT COMMITTEE

The Audit Committee's responsibilities include:• Providing general oversight of our financial reporting and internal control functions; • Reviewing our reports filed with or furnished to the SEC that include financial statements, results, or guidance; • Monitoring compliance with significant legal and regulatory requirements and other risks related to financial reporting and internal control; and • The appointment, retention, compensation, and oversight of the work of our independent registered public accounting firm, currently BDO, and oversight of our internal audit function. | | COMMITTEE AND

MEMBERS

David Dreyer, Chair

Kenneth Klepper

Benjamin Wolin

➢ All members are independent ➢ All members are financially literate under NYSE standards ➢ Two financial experts |

|

| | | |

14

Table of Contents

The Audit Committee may form and delegate authority to subcommittees as appropriate. The responsibilities and activities of the Audit Committee are described in greater detail in "Audit Committee Report" and "Audit Committee Matters," as well as in its charter.

The Board has determined that each Audit Committee member has sufficient knowledge in reading and understanding financial statements to serve on the Committee. The Board has further determined that two Audit Committee members, Messrs. Dreyer and Klepper, qualify as "audit committee financial experts" in accordance with SEC rules. The designation of an "audit committee financial expert" does not impose upon such persons any duties, obligations, or liabilities that are greater than those which are generally imposed on each of them as a member of the Audit Committee and the Board, and such designation does not affect the duties, obligations or liabilities of any other member of the Audit Committee or the Board.

| | |

| | | |

COMPENSATION COMMITTEE

The Compensation Committee's responsibilities include:• Administering the compensation programs for our executive officers and non-employee directors, including monitoring compensation trends, establishing the goals and policies of the compensation programs, and approving the compensation structure and amounts that may be earned thereunder; • Recommending or approving equity grants and otherwise administering share-based plans, as well as other benefit plans and policies, to the extent delegated by the Board; • Reviewing our compensation policies and practices for all employees, at least annually, regarding risk-taking incentives and risk management policies and practices; • Reviewing certain compensation disclosures and proposals in our proxy statement and other reports filed with or furnished to the SEC; and • The appointment, retention, compensation and oversight of the work of any compensation consultant it engages. | | COMMITTEE AND

MEMBERS

David Dreyer, Chair

Shawn Tomasello

Kenneth Klepper

➢ All members are independent |

|

| | | |

The Compensation Committee may form and delegate its authority to subcommittees as appropriate. See "Compensation Discussion and Analysis," "Compensation Committee Report," and the Committee's charter for additional information as to the responsibilities and activities of the Committee.

The Board has determined that Messrs. Dreyer, Klepper, and Ms. Tomasello qualify as "non-employee directors" as defined in Rule 16b-3 of the Securities Exchange Act of 1934, as amended ("Exchange Act"), and "outside directors" under Section 162(m) of the Internal Revenue Code of 1986, as amended (the "Code").

Role of Management. The Committee took significant direction from the recommendations of Mr. Hagerman given his role as Chief Executive Officer, Chairman of the Board, and a significant shareholder, with respect to the design and implementation of the Company's 2016 executive compensation program (except with respect to his own compensation). Mr. Hagerman consulted with certain members of management prior to making such recommendations. See "Compensation Discussion and Analysis – 2016 Target Annual Compensation Determinations" for further information.

15

Table of Contents

Role of Compensation Consultant. The Compensation Committee has the sole authority to engage outside advisors and establish the terms of such engagement, including compensatory fees. In connection with any such engagement, the Committee reviews the independence of such outside advisor, based on the factors specified by Nasdaq as well as any other factors it deems appropriate, and any conflicts of interest raised by the work of such outside advisor. The Compensation Committee utilized Willis Towers Watson as its compensation consultant with respect to the design and implementation of the 2016 executive compensation program, including as a source of market data related to executive promotions and potential new hires, and its non-employee director compensation program. Further, the Compensation Committee received an appropriate independence letter from Willis Towers Watson and confirmed there were no conflicts of interest. The Compensation Committee also re-engaged Willis Towers Watson as its compensation consultant for executive and director compensation matters in 2017.

| | |

| | | |

| NOMINATING AND CORPORATE GOVERNANCE COMMITTEE | | COMMITTEE AND

MEMBERS |

| | | |

| The Nominating and Corporate Governance Committee's responsibilities include: • Identifying individuals qualified to become Board members and recommending director nominees to the Board and/or filling any Board vacancies; • Reviewing the composition, organization, function, and performance of the Board and its committees; • Exercising general oversight over the corporate governance policy matters of the Company, including developing, recommending proposed changes to, and monitoring compliance with, the Corporate Governance Guidelines; and • Reviewing certain governance disclosures and proposals in the Company's proxy statement and other reports filed with or furnished to the SEC. | | Kenneth Klepper, Chair

David Dreyer

Benjamin Wolin

➢ All members are independent |

|

| | | |

The Nominating and Corporate Governance Committee may form and delegate its authority to subcommittees as appropriate. The responsibilities and activities of the Committee are described in greater detail in its charter and the Corporate Governance Guidelines.

The Nominating and Corporate Governance Committee reviews and makes recommendations to the Board, from time to time, regarding the appropriate skills and characteristics required of Board members in the context of the current make-up of the Board, the operations of the Company, and the long-term interests of shareholders. See "Proposal No. 1—Election of Directors—Specific Qualifications, Attributes, Skills and Experience to be Represented on the Board" and "Proposal No. 1—Election of Directors—Director Background and Qualifications."

The Nominating and Corporate Governance Committee will consider re-nominating incumbent directors who continue to satisfy the Committee's criteria for membership on the Board, continue to make important contributions to the Board, and consent to continue their service on the Board. In determining whether to recommend a director for re-election, the Nominating and Corporate Governance Committee also considers the director's past attendance at meetings, participation in and contributions to the activities of the Board and the Company, the results of Board self-evaluations, any potential or actual conflicts of interest, and

16

Table of Contents

other qualifications and characteristics. In connection with the selection and nomination process, the Nominating and Corporate Governance Committee also reviews the desired experience, mix of skills and other individual and aggregate qualities and attributes to assure appropriate Board composition, taking into account the current Board members, the specific needs of the Company and the Board, and the Board's ongoing self-evaluations. In accordance with the Corporate Governance Guidelines and as part of this process, the Nominating and Corporate Governance Committee evaluates diversity in the broad sense, recognizing the benefits of racial and gender diversity, but also considers the breadth of background, skills, and experiences that candidates may bring to the Board. If a vacancy on the Board occurs or the Board increases in size, the Committee will actively seek individuals that satisfy the Committee's criteria for membership on the Board.

In making director nominations or appointments, the Committee may rely on multiple sources for identifying and evaluating potential nominees, including referrals from our current directors and management. In 2017, the Committee engaged a professional third-party search firm to identify independent Board members that had qualifications, skills, and expertise consistent with its criteria for Board membership, and such engagement resulted in the appointment of Dr. Benjamin and the nomination of Mr. Park as Class III directors. The Company paid a customary fee for the director searches.

The Nominating and Corporate Governance Committee will consider recommendations of director nominees by shareholders so long as such recommendations are sent on a timely basis and are otherwise in accordance with our Amended and Restated By-Laws (as amended from time to time, the "By-Laws") and applicable law. The Committee will evaluate nominees recommended by shareholders against the same criteria that it uses to evaluate other nominees. We did not receive any director nominations by shareholders for the 2017 annual meeting.