Exhibit (e)(28)

Excerpts from Diplomat Pharmacy Inc.’s Definitive Proxy Statement on Schedule 14A filed with the Securities and Exchange Commission on April 24, 2019.

Non-employee directors of the Board receive a mix of cash and share-based compensation. The compensation mix is intended to encourage non-employee directors to continue Board service, further align the interests of the Board and shareholders, and attract new non-employee directors with outstanding qualifications. Directors who are employees or officers of the Company do not receive any additional compensation for Board service during such time.

2018 Compensation Program

In September 2018, the Board revised the non-employee director compensation program, effective October 1, 2018. The Compensation Committee, with the assistance of its compensation consultant, reviewed market data and other relevant information, including as related to the executive compensation peer group further described herein. As a result of this review, the Board determined that the equity component of director compensation and cash compensation for serving as a chair or member of a Board committee trailed behind market practice among the Company’s peers. Accordingly, the non-employee director compensation program was revised as illustrated below.

| | Effective

October 1, 2018 | | Effective Prior to

October 1, 2018 | |

Annual cash retainer: | | | | | |

Board | | $ | 80,000 | | $ | 75,000 | |

Additional annual cash retainer: | | | | | |

Lead Director | | $ | 30,000 | | $ | 30,000 | |

Audit Committee-Chair | | $ | 20,000 | | $ | 15,000 | |

Compensation Committee-Chair | | $ | 15,000 | | $ | 10,000 | |

Nominating and Corporate Governance Committee-Chair | | $ | 15,000 | | $ | 10,000 | |

Audit Committee-Member | | $ | 10,000 | | $ | — | |

Compensation Committee-Member | | $ | 7,500 | | $ | — | |

Nominating and Corporate Governance Committee-Member | | $ | 7,500 | | $ | — | |

Special Committee-Member (as applicable) | | $ | 15,000-20,000 | | $ | — | |

Annual grant of restricted stock (grant date fair value): | | | | | |

Board | | $ | 150,000 | | $ | 85,000 | |

Special one-time grant of restricted stock (grant date fair value): | | | | | |

Lead Director | | $ | 75,000 | | $ | 75,000 | |

In addition, in January of 2018 the Board approved an annual cash retainer of $75,000 in the event of an independent Chair of the Board. As a result of the appointment of Mr. Griffin as Chairman and CEO, the chair was no longer an independent director and accordingly, after Mr. Griffin’s appointment no such retainer was paid during 2018. As of October 1, 2018 the cash retainer for service as Chair of the Board was removed from the non-employee director compensation program.

The Company reimburses expenses associated with attendance at Board meetings for all directors. Although the revised non-employee director compensation program provides for additional compensation for service on special committees, no such compensation was paid to any director in 2018.

Annual Cash Retainer - Board. In connection with the changes to the non-employee director compensation program effective October 1, 2018, the increase in annual cash retainer was made as of the effective date of such changes and provided for a pro rata payment of such annual cash retainer to each eligible director.

Restricted Stock - Board. Each non-employee director will be paid the annual grant of restricted stock as of the earlier of (i) June 1 and (ii) the date of the annual meeting of shareholders. Notwithstanding the foregoing, (i) the initial restricted stock grant for a new non-employee director appointed other than at the annual meeting of shareholders shall be made as of the date of initial appointment and (ii) any restricted stock grant made as a result of changes to the non-employee director compensation program

1

shall be made as of the effective date of such changes, each of the foregoing having a pro rata grant date fair value as determined by the Board or the Compensation Committee.

The restricted stock vests in full on the first anniversary of the grant date or earlier upon a change of control of the Company, subject to the director’s continued service to the Company through such vesting date. Except as set forth in the prior sentence, the restricted stock will be forfeited in the event of termination of service prior to the vesting date. During the restricted period, the restricted stock entitles the participant to all of the rights of a shareholder, including the right to vote the shares and the right to receive any dividends thereon. Prior to the end of the restricted period, restricted stock generally may not be sold, assigned, pledged, or otherwise disposed of or hypothecated by participants.

Restricted Stock — Lead Director. In connection with Mr. Wolin’s initial appointment as Lead Director of the Board in 2017, he received a special one-time grant of restricted stock. The restricted stock vested 50% on the first anniversary of the initial appointment and 50% on the second anniversary.

2018 Director Compensation Table

The table below sets forth the compensation of each non-employee director in 2018 (excluding Mr. Hagerman and Mr. Park, whose compensation is covered in the Summary Compensation Table for 2018 due to their service as Chief Executive Officer during the transitional periods discussed herein). The Company does not provide any perquisites to directors.

Name | | Fees Earned or

Paid in Cash

($) | | Restricted

Stock

($)(1) | | Total

($) | |

Regina Benjamin | | 80,511 | | 128,263 | | 208,744 | |

David Dreyer | | 102,917 | | 128,263 | | 231,180 | |

Kenneth O. Klepper | | 88,723 | | 128,263 | | 216,986 | |

Shawn C. Tomasello | | 78,508 | | 128,263 | | 206,771 | |

Benjamin Wolin | | 129,895 | | 128,263 | | 258,158 | |

Total | | 480,554 | | 641,315 | | 1,121,869 | |

(1) Reflects restricted stock awards granted on June 1, 2018 and October 1, 2018 under the 2014 Omnibus Incentive Plan. The amounts reported represent the grant date fair value of a restricted stock award, which is the closing trading price of a share of common stock on the grant date multiplied by the number of shares subject to the award. The Company does not pay in cash the value of fractional shares.

As of December 31, 2018, the restricted stock outstanding held by non-employee directors was as follows: Dr. Benjamin 5,929 shares; Mr. Dreyer, 5,929 shares; Mr. Klepper, 5,929 shares; Ms. Tomasello, 5,929 shares; and Mr. Wolin, 8,488 shares.

COMPENSATION DISCUSSION AND ANALYSIS

This section of the proxy statement explains the philosophy, objectives, process, and components of our 2018 compensation program for our named executive officers. Our named executive officers for 2018 (with titles as of December 31, 2018) were: Mr. Griffin, Chief Executive Officer; Mr. Park, Former Interim Chief Executive Officer; Mr. Hagerman, Former Chief Executive Officer; Mr. Kavthekar, Chief Financial Officer; Mr. Saban, President; and Mr. Rice, Executive Vice President of Operations.

Executive Summary

Executive Transitions

In 2018, the Company transitioned the Chief Executive Officer role from the Company’s founder and long-time Chairman and Chief Executive Officer, Phil Hagerman, to our current Chairman and Chief Executive Officer, Brian Griffin. On January 4, 2018, the Company’s founder, Phil Hagerman, announced his retirement as Chairman and Chief Executive Officer, and the Board

2

appointed one of its independent members, Jeff Park, to serve as interim Chief Executive Officer. Upon the Company’s May 10, 2018 announcement of the appointment of Brian Griffin as Chief Executive Officer, to be effective on Mr. Griffin’s June 4, 2018 start date, Mr. Park stepped down as interim Chief Executive Officer and remained on the Board as an independent director. Mr. Kavthekar was appointed interim Chief Executive Officer for the brief transitional period prior to Mr. Griffin’s start date (and his compensation was not impacted). The compensation arrangements of Mr. Park and Mr. Griffin were individually negotiated based on the unique circumstances arising from Chief Executive Officer transitions experienced by the Company in 2018. As such, they were outside the Compensation Committee’s regular process for setting executive compensation, which is described in greater detail elsewhere in this section.

Compensation of Brian Griffin and Griffin Offer Letter. Effective June 4, 2018, the Board appointed Mr. Griffin to serve as Chairman of the Board and the Company’s Chief Executive Officer. In order to induce Mr. Griffin to leave his prior employer and accept the Chief Executive Officer role, the Company negotiated a compensation program for Mr. Griffin in light of Mr. Griffin’s then-current cash compensation and significant outstanding equity with his prior employer. Pursuant to the terms of an offer letter between the Company and Mr. Griffin, dated May 9, 2018, Mr. Griffin’s 2018 compensation consisted of: (1) a base salary of $1,200,000 (pro rata for 2018), which will be reviewed annually and may be adjusted by the Board at its discretion; (2) a target cash bonus of 125% of his annual base salary (pro rata for 2018), with the potential to earn between 50% to 200% of his target bonus based upon the Company’s performance relative to revenue (40%) and Adjusted EBITDA (60%) goals for 2018; (3) the Make Whole Inducement Award of $4,500,000, composed of 70% PSUs (to be earned or forfeited based upon the Company’s performance relative to revenue (40%) and Adjusted EBITDA (60%) goals for 2018 and with the potential to earn between 100% to 400% of each component), 15% time-based options and 15% RSUs, each vesting in equal installments over three years; and (4) the Sign-on Inducement Award of (a) PSUs with a target value of $7,500,000 (to be earned or forfeited based upon the Company’s performance relative to revenue (40%) and Adjusted EBITDA (60%) goals for 2018 and 2019, on a combined basis, and with the potential to earn between 100% to 400% of each component) vesting in 2020 upon completion of the Company’s 2019 audit; and (b) RSUs with a value of $2,500,000, which had a one-year vesting period subject to acceleration based on achievement of the specified share price requirement (and that vested on July 10, 2018).

Compensation of Phil Hagerman. Effective January 4, 2018, Mr. Hagerman resigned as Chairman and Chief Executive Officer. Upon his resignation, Mr. Hagerman served as a consultant of the Company for six months and received $50,000 per month for his service as consultant. Mr. Hagerman continues to serve as a Director and received pro rata compensation under the non-employee director compensation program following the end of his consulting period.

Compensation of Jeff Park. Effective January 4, 2018, the Company appointed Mr. Park as its interim Chief Executive Officer. As compensation for his service, from January 2018 through February 2018 Mr. Park received a pro-rated base salary of $500,000 and continued to participate in the Company’s non-employee director program. In late February 2018, the Compensation Committee subsequently revised Mr. Park’s compensation arrangement and Mr. Park was granted 69,349 RSUs in lieu of any base salary or other cash compensation. Upon his resignation as interim Chief Executive Officer on May 11, 2018, 47,683 of these RSUs had vested and the remaining 21,666 RSUs were forfeited. Mr. Park continued to serve as a Director until his February 2019 resignation and received pro rata compensation under the non-employee director compensation program following the end of his service as interim Chief Executive Officer.

2018 Target Annual Compensation Determinations

Although the Compensation Committee and Board do not benchmark executive compensation in terms of targeting a specific percentage relative to peers, each does review market survey and peer group data to inform decision-making as appropriate in establishing the target annual compensation of executive officers. In March 2018, the Compensation Committee approved an industry peer group to use as an input to consider when assessing and determining pay levels for senior management (as detailed in the table below). The peer group is based on companies within the healthcare services industry, including suppliers, distributors and facilities managers, with revenues ranging between $2.2 billion to $12 billion.

Executive Compensation Peer Group — 2018 | |

| | |

DENTSPLY SIRONA Inc. | Intuitive Surgical, Inc. | Quest Diagnostics Incorporated |

| | |

Edwards Lifesciences Corporation | Laboratory Corporation of America Holdings | Steris Plhc |

| | |

Envision Healthcare Corporation | Magellan Health, Inc. | Triple-S Management Corporation |

3

Henry Schein, Inc. | MEDNAX, Inc. | Universal Health Services, Inc. |

| | |

Hill-Rom Holdings, Inc. | Owens & Minor, Inc. | Verian Medical Systems, Inc. |

| | |

Hologic, Inc. | Patterson Companies, Inc. | Zimmer Biomet Holdings, Inc. |

2018 Annual Target Compensation. The Board/Compensation Committee approved the 2018 base salary of Messrs. Kavthekar, Saban and Rice in March 2018, and Mr. Griffin in May 2018. The Board considered market survey and peer group data from Aon in making determinations for Messrs. Kavthekar, Rice, Saban and Griffin, along with the recommendations of Mr. Park, in his role as interim Chief Executive Officer at the time, with respect to Messrs. Kavthekar, Saban and Rice. The Board approved the 2018 annual target compensation for each of the named executive officers, noted above, as follows. Mr. Kavthekar’s base salary was increased from $400,000 to $450,000, his annual target bonus was increased from 50% to 65% of base salary, and his annual target equity award was increased from 100% to 222% of base salary. Mr. Saban’s base salary was increased from $450,000 to $500,000, his annual target bonus was increased from 60% to 75% of base salary, and his annual target equity award was increased from 100% to 360% of base salary. Mr. Rice’s base salary was increased from $320,000 to $340,000, his annual target bonus was increased from 40% to 45% of base salary, and his annual target equity award was increased from 60% to 100% of base salary.

Annual Bonus Plan. The 2018 bonus plan and 2018 annual equity award program were approved by the Board, upon the recommendation of the Compensation Committee, in March 2018.

Historically, the Company’s Chief Executive Officer did not participate in the Company’s annual bonus plan or receive equity awards, due to Mr. Hagerman’s significant equity ownership in Diplomat and the Company’s historical shareholder distributions prior to the Company’s initial public offering. The 2018 compensation arrangements of Mr. Park and Mr. Griffin were individually negotiated based on the unique circumstances arising from the Chief Executive Officer transitions in 2018. Following the executive transitions in 2018, the Board expects to include all executive officers in the Company’s annual bonus plan and equity award program in future periods.

The 2018 bonus plan for the other named executive officers and certain other eligible key employees generally memorialized the Company’s historical annual bonus plan and was generally consistent with the 2017 bonus plan, including the use of Adjusted EBITDA, revenue, and individual performance goals. However, in contrast to our historical practice, the 2018 bonus plan requires a minimum Adjusted EBITDA target to be satisfied for there to be a payout based on each revenue goal. In addition, the 2018 bonus plan provides participants with the potential to earn between 50% and 200% of their, respective, target bonus based on the performance goals for each component.

Annual Equity Award Program. In March 2018, for retention purposes and based on input from its compensation consultant, upon recommendation from the Compensation Committee, the Board approved changes to the Company’s annual equity award program. The 2018 annual equity award program added PSUs (which agreements along with the RSU and option agreements, respectively, contain “double-trigger” vesting upon a change in control) for named executive officers and changed the allocation of the target annual equity awards (based on grant date fair value) of named executive officers to consist of 50% PSUs; 25% RSUs and 25% time-based options. In addition, the PSU awards provide the named executive officers with the potential to earn between 50% and 200% respectively, of their target bonus based on the relative achievement of performance goals for Adjusted EBITDA. The Board also approved changes to provide for three-year pro rata vesting for all equity awards to named executive officers. The performance-based component of the 2018 annual equity award program for named executive officers was based upon the grant of PSUs, which is to be earned or forfeited based upon the Company’s performance relative to specified Adjusted EBITDA goals for the applicable year, excluding the effect of mergers and acquisitions transacted during the bonus plan year, if any. The earned PSUs, if any, vest in three annual installments, with the first installment vesting upon the date the Company files its Annual Report on Form 10-K or Audit Committee confirmation of the satisfaction of the applicable performance goals, and the remaining two installments vesting annually on such date thereafter. The options and RSUs vest in three annual installments, with the first installment vesting upon the first anniversary of the grant date.

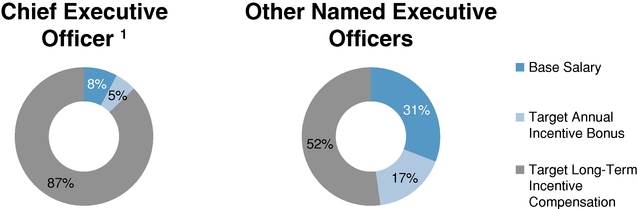

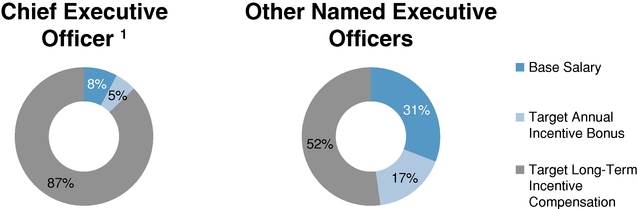

Components of Target Annual Compensation. The following graphs set forth the various components of target annual compensation approved for the Chief Executive Officer and the other named executive officers in 2018. For purposes of these calculations, base salary (i) includes car allowances and 401(k) contributions, and (ii) is based on base salaries effective on December 31, 2018.

4

(1) Information is reflected solely for Mr. Griffin. Percentages reflected above include significant performance awards in connection with Mr. Griffin’s hiring that may or may not be earned. Therefore, this chart may not be reflective of Mr. Griffin’s target annual compensation in future years.

2018 Pay-For-Performance

The establishment of performance metrics generally is focused on the Company and its management team as a collective unit, to foster teamwork and maximize the Company’s performance in particular on Adjusted EBITDA and revenue goals that would constitute exceptional achievement for the Company. We define Adjusted EBITDA as net income (loss) before interest expense, income taxes, depreciation and amortization, share-based compensation, restructuring and impairment charges, equity loss and impairment of non-consolidated entities, and certain other items that we do not consider indicative of our ongoing operating performance.

Chief Executive Officer Compensation

Chief Executive Officer Annual Bonus. Pursuant to the terms of the Griffin Offer Letter, Mr. Griffin was eligible for a target cash bonus of 125% of his annual base salary (pro rata for 2018). Mr. Griffin’s bonus was earned based upon performance relative to revenue and Adjusted EBITDA budget goals for 2018.

| | | | 2018 Performance Metric— | | % of Target | |

Performance | | Component | | Chief Executive Officer Annual Bonus | | Bonus | |

Component(1) | | % of Target Bonus | | Target | | Actual | | Earned | |

Adj. EBITDA | | 60 | | $ | 174,500,000 | | $ | 167,759,994 | | 68 | |

Revenue | | 40 | | $ | 5,800,000,000 | | $ | 5,492,524,048 | | 69 | |

(1) Achievement of the minimum, target and maximum performance measures results in a payment of 50%, 100%, and 200%, respectively, of the target bonus. There are linear changes between minimum, target, and maximum payouts for the Adjusted EBITDA and revenue components. The revenue component of the target bonus was only payable to the extent a minimum Adjusted EBITDA target was achieved ($164,000,000 at the minimum threshold).

Chief Executive Officer Performance-Based Inducement Awards. Pursuant to the terms of the Griffin Offer Letter, Mr. Griffin received two inducement equity awards upon becoming Chairman and Chief Executive Officer that have performance-based components: (1) the Make-Whole Inducement Award, which includes 70% of the total value in PSUs with a target value of $3,150,000; and (2) the Sign-On Inducement Award, which includes 75% of the total value in PSUs with a target value of $7,500,000.

5

Make-Whole Inducement Award — Performance-Based Restricted Stock Units.

The PSU component of Mr. Griffin’s Make-Whole Inducement Award is earned based upon the achievement of Adjusted EBITDA and revenue goals.

| | Component | | 2018 Performance Metric— | | % of Target | |

Performance | | % of Target | | Make-Whole Inducement Award | | Bonus | |

Component(1) | | Bonus | | Target | | Actual | | Earned | |

Adj. EBITDA | | 60 | | $ | 174,500,000 | | $ | 167,759,994 | | 0 | |

Revenue | | 40 | | $ | 5,800,000,000 | | $ | 5,492,524,048 | | 0 | |

(1) Achievement of the target, 200%, 300% and maximum performance measures results in a payment of 100%, 200%, 300% and 400%, respectively, of the target value of the PSUs. There are linear changes between target, 200%, 300% and maximum payouts for the Adjusted EBITDA and revenue components.

The target PSU award under Mr. Griffin’s Make-Whole Inducement Award was not achieved in 2018.

Sign-On Inducement Award — Performance-Based Restricted Stock Units.

Under the terms of the Griffin Offer Letter, the PSU portion of Mr. Griffin’s Sign-On Inducement Award will be earned, if at all, based upon the Company’s performance relative to revenue (40%) and Adjusted EBITDA (60%) budget goals for 2018 and 2019, on a combined basis. Mr. Griffin can earn between 374,625 PSUs up to a maximum of 1,498,500 PSUs. The number of PSUs earned, if any, by Mr. Griffin will be determined in 2020 upon completion of the Company’s 2019 audit and will be reflected in the Company’s 2020 Proxy Statement.

Other NEO Compensation

Named Executive Officers 2018 Annual Bonus Plan (other than CEO). The target bonus for named executive officers was based upon a specified percentage of the participant’s annual base salary. Bonuses were earned based upon the achievement of Adjusted EBITDA, revenue, and individual annual performance goals.

| | Component | | 2018 Performance Metric— | | % of Target | |

Performance | | % of Target | | Annual Bonus Plan | | Bonus | |

Component(1) | | Bonus | | Target | | Actual | | Earned | |

Adj. EBITDA | | 60 | | $ | 174,500,000 | | $ | 167,759,994 | | 68 | |

Revenue | | 30 | | $ | 5,800,000,000 | | $ | 5,492,524,048 | | 69 | |

Individual Performance | | 10 | | Varied | | Varied | | Varied | |

(1) For the Adjusted EBITDA and revenue components, achievement of the minimum, target and maximum performance measures results in a payment of 50%, 100%, and 200%, respectively, of the target bonus. There are linear changes between minimum, target, and maximum payouts for the Adjusted EBITDA and revenue components. For the achievement of the individual performance goals, payments range from 0% to 200% of the target bonus. The revenue component of the target bonus is only payable to the extent a minimum Adjusted EBITDA target is achieved ($164,000,000 at the minimum threshold).

2018 Equity Awards — Performance-Based Restricted Stock Unit Awards (PSUs). The target equity award for named executive officers is based upon a specified percentage of the participant’s annual base salary. The PSU component of the equity award program is earned based upon the achievement of Adjusted EBITDA goals.

6

| | 2018 Performance Metric— | | | |

| | Equity Award Plan | | % of Target Bonus | |

Performance Component(1) | | Target | | Actual | | Earned | |

Adj. EBITDA | | $ | 174,500,000 | | $ | 167,759,994 | | 68 | |

| | | | | | | | | |

(1) Achievement of the minimum, target and maximum performance measures results in a payment of 50%, 100%, and 200%, respectively, of the target bonus. There are linear changes between minimum, target, and maximum payouts.

2018 Other Equity

2018 Equity Awards — Restricted Stock Units and Options.

· In March 2018, as part of the annual equity program:

· Mr. Saban received an RSU award of 20,000 shares and an option award to purchase 47,539 shares of the Company’s common stock;

· Mr. Kavthekar received an RSU award of 11,100 shares and an option award to purchase 26,384 shares of the Company’s common stock; and

· Mr. Rice received an RSU award of 3,778 shares and an option award to purchase 8,980 shares of the Company’s common stock.

· In connection with Mr. Park’s service as interim Chief Executive Officer, Mr. Park was granted an RSU award of 69,349 shares in February 2018. In addition, Mr. Park received Restricted Stock grants of 3,654 shares and 2,275 shares June 1, 2018 and October 1, 2018, in connection with his service as a non-employee director.

· Mr. Hagerman received a restricted stock grant of 5,222 shares on October 1, 2018 in connection with his service as a non-employee director.

· In June 2018, as part of the Make-Whole Inducement Award, Mr. Griffin was granted: (i) RSUs of 33,716 shares, and (ii) an option award to purchase 81,351 shares of the Company’s common stock, and as part of the Sign-On Inducement Award, RSUs of 124,875 shares.

Executive Compensation and Related Governance Practices

What We Do | | What We Don’t Do |

á | | 100% independent Board committees | | â | | No significant perquisites |

| | | | | | |

á | | Stock ownership guidelines | | â | | No tax gross-ups |

| | | | | | |

á | | Pay for performance, including bonus and equity plan | | â | | No defined benefit, supplemental executive retirement, or nonqualified deferred compensation plans |

| | | | | | |

á | | Fixed caps on bonus and equity payouts | | â | | No repricing/replacement of underwater stock options |

| | | | | | |

á | | Oversight to confirm no undue risk in compensation programs | | â | | No hedging nor use of derivatives permitted |

| | | | | | |

á | | Equity awards for NEOs meaningfully focused more on performance-based | | â | | No pledging permitted |

| | | | | | |

á | | Annual say-on-pay shareholder vote | | | | |

| | | | | | |

á | | Double trigger equity awards (beginning in | | | | |

7

| | December 2016) vest only if terminated within one year of change in control | | | | |

| | | | | | |

á | | All of performance-based equity awards, and substantially all (or all for Mr. Griffin) of the bonus award, based on objective performance metrics | | | | |

| | | | | | |

á | | Compare and consider compensation against an appropriate peer group based on comparable industry and revenue | | | | |

Say-On-Pay Shareholder Vote for 2018 Annual Meeting of Shareholders

The Compensation Committee and the Board discussed the results of such shareholder vote in 2018. Over the past four years, over 97% of votes cast have voted in favor of our say-on-pay proposals. Given the high level of shareholder support, the Compensation Committee did not materially revise the Company’s compensation policies and decisions relating to the named executive officers as a result of such vote, other than Chief Executive Officer compensation determinations, which was driven by the unique circumstances arising from the Chief Executive Officer transitions experienced by the Company in 2018.

Compensation Philosophy, Program Objectives and Key Features

The Company’s named executive officer compensation program has been designed to reward, attract and retain management deemed essential to ensure our success. The program seeks to align compensation with our short- and long-term objectives, business strategy, financial performance, and Company values. In furtherance of such philosophy, the Company’s compensation objectives for the named executive officers are designed to:

· Reward executive officers who consistently perform above expectations and are proficient in their roles with higher base pay and/or total compensation opportunity compared to Company salary range guidelines;

· Link pay to performance to create incentives for the named executive officers to perform their duties at a high level, with 60% of the target bonus for named executive officers (other than the Chief Executive Officer) linked to Adjusted EBITDA goals, 30% linked to revenue goals, and 10% linked to individual goals (60% linked to Adjusted EBITDA goals and 40% linked to revenue goals for the Chief Executive Officer);

· Grant equity awards to align long-term interests with those of our shareholders, to reward long-term performance, and to assist retention;

· Include equity awards for new hires and employment agreements where appropriate to recruit and retain executive talent; and

· In exceptional circumstances, discretionary bonuses as appropriate to provide flexibility to reward executive officers for performance and to adjust to significant events during the year.

The following table sets forth how each component of 2018 compensation was intended to satisfy one or more of the Board’s compensation objectives.

Component | | Primary Purpose(s) | | Key Features |

Base Salary | | · Retains and attracts employees in a competitive market · Preserves an employee’s commitment in the event of downturns in the specialty pharmacy industry and/or equity markets | | · Determinations are based on the Board’s collective view of market salaries for executive officers in similar positions with similar responsibilities, and the individual’s experience, current performance, responsibilities, anticipated individual growth, internal pay equity, and other subjective factors |

8

Annual Incentive Cash Bonus | | · Motivates and rewards achievement of annual performance-based measures · Retains and attracts employees for short term | | · The bonus target for each employee is set forth as a percentage of base salary · Earned based upon the achievement of Adjusted EBITDA and revenue (each exclusive of the effect of mergers and acquisitions transacted during the bonus plan year) at target amounts, along with the opportunity to earn bonus for individual annual performance goals independent of overall Company results |

| | | | |

Equity Awards | | · Provides incentive for employees to focus on long-term fundamentals and thereby create long-term shareholder value · Assist in maintaining a stable, continuous management team in a competitive market · Provide alignment with shareholders; increased value when stock price improves · Performance-Based: Motivate and reward achievement of annual performance measures · Time-Based: Assists in retaining key executive officers over longer-term period, particularly where change in strategy may affect achievement of performance-based awards · New Hires: Time-based equity awards to attract and incentivize new talent | | · Performance-Based: Awarded to named executive officers and earned or forfeited based upon the achievement of targeted Adjusted EBITDA (and revenue for Chief Executive Officer) · Time-Based: Vesting over a several year period from grant date |

2018 Compensation Determinations

Base Salary

Changes in base salary have generally been effective in March or April each year. The following table sets forth the base salaries of the named executive officers in 2017 and 2018:

Name | | Jan 2017 to Dec 2017

($) | | Jan 2018 to Dec 2018

($) | |

Brian Griffin(1) | | — | | 1,200,000 | |

Jeff Park(2) | | — | | — | |

Philip R. Hagerman(3) | | 550,000 | | — | |

Atul Kavthekar(4) | | 400,000 | | 450,000 | |

Joel Saban(5) | | 450,000 | | 500,000 | |

Gary Rice(6) | | 320,000 | | 340,000 | |

9

(1) Reflects base salary as of June 4, 2018 upon appointment as Chairman and Chief Executive Officer.

(2) In connection with Mr. Park’s service as interim Chief Executive Officer he received a grant of RSUs of 69,349 shares, and from January 2018 through February 2018 he received a pro-rated base salary of $500,000.

(3) Reflects actual base salary amount as set by the Board. Mr. Hagerman voluntarily diverted a portion of his salary payments to the Company’s social responsibility budget in order to support the Company’s involvement with certain community groups and charities in 2017. Mr. Hagerman resigned as Chairman and Chief Executive Officer on January 4, 2018.

(4) 2017 column reflects base salary as of May 1, 2017 upon appointment as Chief Financial Officer. 2018 column reflects base salary as of March 27, 2018 upon adjustment by Board for market and retention reasons. Mr. Kavthekar’s base salary was $400,000 from January 2018 to March 2018.

(5) 2017 column reflects base salary as of August 7, 2017 upon appointment as President. 2018 column reflects base salary as of March 27, 2018 upon adjustment by Board for market and retention reasons. Mr. Saban’s base salary was $450,000 from January 2018 to March 2018.

(6) 2017 column reflects base salary as of July 1, 2017 upon adjustment by Board for market and retention reasons. Mr. Rice’s base salary was $280,000 from January 2017 to July 2017. 2018 column reflects base salary as of March 27, 2018 upon adjustment by Board for market and retention reasons. Mr. Rice’s base salary was $320,000 from January 2018 to March 2018.

Establishing Chief Executive Officer’s Performance Goals for 2018 Annual Bonus and Equity Inducement Awards

As previously discussed, Mr. Griffin’s employment arrangement was individually negotiated based on the unique circumstances arising from the Chief Executive Officer transitions experienced by the Company in 2018.

2018 Performance Goals — Annual Bonus

Mr. Griffin’s 2018 target performance goals for his 2018 cash bonus award were established pursuant to the Griffin Offer Letter. There are linear increases between the minimum, target, and maximum goals for the 2018 annual bonus.

| | Minimum | | Target | | Maximum | |

Component | | 2018 Target

($) | | Increase

over 2017

Actual

(%) | | 2018 Target

($) | | Increase

over 2017

Actual

(%) | | 2018 Target

($) | | Increase

over 2017

Actual

(%) | |

Adj. EBITDA | | 164,000,000 | | 61 | | 174,500,000 | | 71 | | 180,000,000 | | 77 | |

Revenue | | 5,300,000,000 | | 18 | | 5,800,000,000 | | 29 | | 5,900,000,000 | | 32 | |

Target Bonus. Pursuant to the terms of the Griffin Offer Letter, Mr. Griffin was eligible for a target cash bonus of 125% of his annual base salary (pro rata for 2018), based upon performance relative to revenue and Adjusted EBITDA budget goals for 2018.

Performance Components. Adjusted EBITDA and revenue goals represented 60% and 40%, respectively, of the target bonus. See “— 2018 Performance Goals — Annual Bonus” for specific Adjusted EBITDA and revenue goals.

2018 Performance Goals — Make-Whole Inducement Award

Mr. Griffin’s 2018 target performance goals for the performance-related components of his make-whole inducement award were established pursuant to the Griffin Offer Letter. There are linear increases between the target (100%), 200%, 300% and maximum (400%) goals for the 2018 annual bonus.

10

| | Target | | 200% | | 300% | | Maximum | |

Component | | 2018 Target | | Increase

over

2017

Actual

(%) | | 2018 Target | | Increase

over

2017

Actual

(%) | | 2018 Target | | Increase

over

2017

Actual

(%) | | 2018 Target | | Increase

over

2017

Actual

(%) | |

Adjusted EBITDA | | $ | 174,500,000 | | 71 | | $ | 180,000,000 | | 77 | | $ | 195,000,000 | | 92 | | $ | 210,000,000 | | 106 | |

Revenue | | $ | 5,800,000,000 | | 29 | | $ | 5,900,000,000 | | 32 | | $ | 6,000,000,000 | | 34 | | $ | 6,100,000,000 | | 36 | |

2018 Performance Goals — Sign-On Inducement Award. See “Executive Summary—2018-Pay-For-Performance—Chief Executive Officer Inducement Awards—Sign-On Inducement Award—Performance-Based Restricted Stock Units.” above for information regarding the performance goals associated with this award.

2018 Annual Bonus - Earned. The following table sets forth information regarding the percentage of the bonus target that may be earned based on the achievement of the minimum, target, and maximum performance goals, and the actual percentage of bonus target earned. No amount is earned below minimum performance. See “Executive Summary—2018 Pay-For-Performance—Chief Executive Officer Annual Bonus” for the Company’s actual performance with respect to each performance metric.

| | Payout Opportunity Based on Component

Performance

(Expressed as a % of Bonus Target) | | Earned Bonus

(Expressed as a %

of | |

Component | | Minimum | | Target | | Maximum | | Bonus Target) | |

Adj. EBITDA | | 30 | | 60 | | 120 | | 68 | |

Revenue | | 20 | | 40 | | 80 | | 69 | |

2018 Annual Bonus. The following table sets forth summary information regarding the 2018 target bonus and bonus actually earned in 2018 for Mr. Griffin.

| | 2018 Bonus Plan Target(1) | | Bonus Plan Earned | |

Name | | % of Base Salary | | $ | | $ | |

Brian Griffin | | 125 | | 875,000 | | 599,875 | |

(1) Mr. Griffin’s target bonus and earned bonus amounts stated are prorated based on amounts earned during 2018, multiplied by a bonus target percentage of 125%. Mr. Griffin was appointed Chairman and Chief Executive Officer on June 4, 2018.

Equity Inducement Awards

Upon appointment as Chairman and Chief Executive Officer, Mr. Griffin received two inducement equity awards that have performance-based components: (1) the Make-Whole Inducement Award, which includes 70% of the total value in PSUs with a target value of $3,150,000; and (2) the Sign-On Inducement Award, which includes 75% of the total value in PSUs with a target value of $7,500,000. Mr. Griffin’s target grants are based on the value determined by the Board divided by the fair value (closing price on the date of the Griffin Offer Letter for RSUs and PSUs and the fair value on the grant date for the options).

Performance Components. Adjusted EBITDA and revenue performance goals represented 60% and 40%, respectively, of the target grant award. See “—2018 Performance Goals—Make-Whole Inducement Award” for specific Adjusted EBITDA and revenue goals.

2018-Make-Whole Inducement Award-Performance-Based Restricted Stock Units Earned. The following table sets forth information regarding the percentage of the target that may be earned based on the achievement of the target, 200%, 300%, and maximum performance goals, and the actual percentage of target earned. No award is earned below target performance. See

11

“Executive Summary-2018 Pay-For-Performance—Chief Executive Officer Inducement Award” for the Company’s actual performance with respect to each performance metric.

| | Make-Whole Inducement Award Opportunity Based on

Component Performance (Expressed as a % of

Bonus Target) | | Earned Equity | |

| | | | | | | | Maximum | | (Expressed as | |

Component | | Target | | 200% | | 300% | | (400%) | | a % of Target) | |

Adjusted EBITDA | | 60 | | 120 | | 180 | | 240 | | 0 | |

Revenue | | 40 | | 80 | | 120 | | 160 | | 0 | |

The following table sets forth summary information regarding the 2018 target equity incentive award and retention-based awards received by Mr. Griffin.

| | Total

Equity

Award(1) | | PSUs Target Award | | Retention Based Awards | |

Name | | % of Base

Salary | | Grant

Date

Fair

Value

($) | | PSUs

Target

(#) | | PSUs

Earned

(#)(2) | | RSUs

(#) | | Grant

Date

Fair

Value

($) | | Options

(#) | | Grant

Date

Fair

Value

($) | |

Brian Griffin | | 1,138 | | 8,984,194 | | 531,968 | | 0 | | 158,591 | | 3,852,176 | | 81,351 | | 823,191 | |

(1) Amounts included in percentage of Total Equity Award Target include value of PSUs, RSUs and options.

(2) Does not reflect the number of PSUs from the Sign-On Inducement Award earned, if any. The amount earned by Mr. Griffin, if any, will be determined in 2020 upon completion of the Company’s 2019 audit and will be reflected in the Company’s 2020 Proxy Statement.

Establishing Company Performance Goals for 2018 Annual Bonus Plan and PSUs (Non-CEO)

The 2018 target performance goals for all named executive officers other than the chief executive officer were established in March 2018, which represented the Compensation Committee’s reasonable judgment of what would be an exceptional outcome for the Company for 2018 after taking into account the significant impact of the acquisitions made by the Company in 2017. There are linear increases between the minimum, target, and maximum goals for the 2018 bonus plan and equity awards.

| | Minimum | | Target | | Maximum | |

Component | | 2018 Goal

($) | | Increase

over 2017

Actual

(%) | | 2018 Goal

($) | | Increase

over 2017

Actual

(%) | | 2018 Goal

($) | | Increase

over 2017

Actual

(%) | |

Adj. EBITDA | | 164,000,000 | | 61 | | 174,500,000 | | 71 | | 180,000,000 | | 77 | |

Revenue(1) | | 5,300,000,000 | | 18 | | 5,800,000,000 | | 29 | | 5,900,000,000 | | 32 | |

(1) Revenue is a component for the Annual Bonus Plan only.

12

Annual Incentive Cash Bonus (2018 Annual Bonus Plan)

The 2018 bonus plan for named executive officers and certain other eligible key employees generally continued the Company’s 2017 annual bonus plan, with continuation of provisions to address, among other things, pro rata bonuses, rights upon termination of employment, and the Company’s right to clawback such bonus upon specified events.

Target Bonuses of Named Executive Officers. Under the 2018 bonus plan, a participant’s bonus target is set forth as a percentage of base salary. The Board increased the 2018 bonus targets as a percentage of base salary of each of Messrs. Kavthekar, Saban and Rice as a result of management recommendations, in consultation with the Compensation Committee, based on input from the compensation consultant, comparative information acquired through industry surveys, as well as judgments regarding the appropriate levels of base, incentive, and total compensation for named executive officers in light of the Company’s characteristics and market position.

Performance Components. Adjusted EBITDA, revenue and individual performance goals represented 60%, 30%, and 10%, respectively, of the target bonus. See “—Establishing Company Performance Goals for 2018 Annual Bonus Plan and Performance-Based RSUs” for specific Adjusted EBITDA and revenue goals.

Individual Performance Component. The individual performance component is discretionary and takes into account a number of subjective factors evaluating the performance of such named executive officer.

2018-Earned. The following table sets forth information regarding the percentage of the bonus target that may be earned based on the achievement of the minimum, target, and maximum performance goals, and the actual percentage of bonus target earned. No amount is earned below minimum performance. See “Executive Summary—2018 Pay-For-Performance” for the Company’s actual performance with respect to each performance metric.

| | Payout Opportunity Based on

Component Performance

(Expressed as a % of Bonus Target) | | Earned Bonus

(Expressed as a %

of | |

Component | | Minimum | | Target | | Maximum | | Bonus Target) | |

Adj. EBITDA | | 30 | | 60 | | 120 | | 68 | |

Revenue | | 15 | | 30 | | 60 | | 69 | |

Individual | | 0 | | 10 | | 20 | | Varied | |

The following table sets forth summary information regarding the 2017 target bonus, 2018 target bonus, and bonus earned in 2018 for our named executive officers.

| | 2017 Bonus Plan | | 2018 Bonus Plan Target(1) | | | |

Name | | Target as % of

Base

Salary | | % of Base

Salary | | $ | | Bonus Plan

Earned

$ | |

Atul Kavthekar | | 50 | | 65 | | 292,500 | | 180,274 | |

Joel Saban | | 60 | | 75 | | 375,000 | | 307,500 | (2) |

Gary Rice | | 40 | | 45 | | 153,000 | | 109,597 | |

(1) The target and earned bonus was based on the base salary in effect as of December 31, 2018.

(2) Represents the amount agreed to be paid to Mr. Saban under the terms of the Saban Separation Agreement (as defined herein).

Equity Incentive Program

In March 2018, upon recommendation of the Compensation Committee, the Board approved PSUs, RSUs and options to be granted to our named executive officers under the 2014 Omnibus Incentive Plan.

13

PSUs and Time-Vested Options and RSUs.

Target Grants to Named Executive Officers. A participant’s target grant was based on the value determined by the Board divided by the grant date fair value of each equity award (the Company’s closing stock price for RSUs and PSUs) on the grant date.

Performance Components. The Adjusted EBITDA goal represented 100% of the target grant award. See “—Establishing Company Performance Goals for 2018 Annual Bonus Plan and PSUs” for specific Adjusted EBITDA goals.

2018-Earned. The following table sets forth information regarding the percentage of the target that may be earned based on the achievement of the minimum, target, and maximum performance goals, and the actual percentage of target earned. No award is earned below minimum performance. See “Executive Summary-2018 Pay-For-Performance” for the Company’s actual performance.

| | Equity Award Opportunity Based on

Component Performance

(Expressed as a % of Bonus Target) | | Earned Equity

(Expressed as a %

of | |

Component | | Minimum | | Target | | Maximum | | Target) | |

Adj. EBITDA | | 50 | | 100 | | 200 | | 68 | |

The following table sets forth summary information regarding the 2018 target equity incentive award and retention-based awards earned for our named executive officers participating in such programs.

| | Total

Equity

Award(1) | | PSUs Target Award | | Retention Based

Awards | |

Name | | % of

Base

Salary | | Grant

Date

Fair

Value

($) | | PSUs

Target

(#) | | PSUs

Earned

(#) | | RSUs

(#) | | Grant

Date

Fair

Value

($) | | Options

(#) | | Grant

Date

Fair

Value

($) | |

Atul Kavthekar | | 222 | | 455,544 | | 22,200 | | 15,118 | (2) | 11,100 | (2) | 227,772 | | 26,384 | (2) | 223,261 | |

Joel Saban | | 360 | | 820,200 | | 40,000 | | 27,240 | (3) | 20,000 | (4) | 410,400 | | 47,539 | (5) | 402,275 | |

Gary Rice | | 100 | | 155,049 | | 7,556 | | 5,146 | | 3,778 | | 77,525 | | 8,980 | | 75,989 | |

(1) Amounts included in percentage of Total Equity Award Target include value of PSUs, RSUs and options.

(2) One-third of this amount vested prior to Mr. Kavthekar’s resignation. The remaining two-thirds was forfeited upon Mr. Kavthekar’s resignation.

(3) Represents the amount agreed to be paid to Mr. Saban under the terms of the Saban Separation Agreement. Per the terms of the Saban Separation Agreement two-thirds of this amount vested upon filing the Company’s 2018 Form 10-K, and the remaining one-third was forfeited.

(4) 13,333 shares of this award vested upon Mr. Saban’s resignation. The remaining 6,667 shares were forfeited upon Mr. Saban’s resignation.

(5) This award was forfeited upon Mr. Saban’s resignation.

14

Other Equity-Related Policies

Timing and Pricing of Share-Based Grants

With respect to annual equity awards, the Compensation Committee and the Board do not coordinate the timing of share-based grants with the release of material non-public information. Promotion and new hire equity grants are generally made quarterly following the release of the company’s quarterly and full-year earnings.

In accordance with the 2014 Omnibus Incentive Plan, the exercise price of each option is the closing price for the Company’s common stock on the date approved by the Compensation Committee or the Board to be the grant date (which date is not earlier than the date the Compensation Committee or the Board approved such grant).

Policy on Pledging and Hedging Company Securities

In addition to the restrictions set forth in SEC regulations, the Company’s Insider Trading Policy prohibits the hedging and, since March 2018, the pledging of Company securities. In particular, the policy prohibits directors, executive officers and other employees, with respect to the Company’s securities, from engaging in short sales, trading in puts, calls, options or other derivative securities. In addition, the policy prohibits pledging of Company securities or holding Company securities in a margin account.

Clawbacks

Both our annual bonus plan and equity incentive program are subject to a clawback provision included therein. Specifically for the annual bonus plan, if the Company’s financial statements are the subject of a restatement due to error or misconduct, to the extent permitted by governing law, the Company is authorized to seek reimbursement of excess incentive cash compensation paid under the bonus plan to participants for the relevant performance periods; however, the Company’s clawback right extends only to any bonuses earned for the three completed fiscal years prior to the date the Company determines such restatement is required. In addition, the Company’s PSU awards will be subject to forfeiture and/or recovery under any compensation recovery policy that the Company may adopt from time to time, which recovery right extends to the proceeds realized by the applicable participant due to sale or other transfer of such stock.

Tax and Accounting Implications

Deductibility of Executive Compensation

Section 162(m) of the Internal Revenue Code (the “Code”) generally places a $1 million limit on the amount of compensation a company can deduct in any one year for certain executive officers. While the Compensation Committee considers the deductibility of awards as one factor in determining executive compensation, the Compensation Committee also looks at other factors in making its decisions and retains the flexibility to award compensation that it determines to be consistent with the goals of our executive compensation program even if the awards are not deductible for tax purposes.

The exemption from Section 162(m)’s deduction limit for performance-based compensation has been repealed, effective for taxable years beginning after December 31, 2017, such that compensation paid to our covered executive officers in excess of $1 million will not be deductible unless it qualifies for transition relief applicable to certain arrangements in place as of November 2, 2017.

Despite the Compensation Committee’s efforts to structure the executive team performance-based equity awards in a manner intended to be exempt from Section 162(m) and therefore not subject to its deduction limits, because of ambiguities and uncertainties as to the application and interpretation of Section 162(m) and the regulations issued thereunder, including the uncertain scope of the transition relief under the legislation repealing Section 162(m)’s exemption from the deduction limit, no assurance can be given that compensation intended to satisfy the requirements for exemption from Section 162(m) in fact will. Further, the Compensation Committee reserves the right to modify compensation that was initially intended to be exempt from Section 162(m) if it determines that such modifications are consistent with our business needs.

Nonqualified Deferred Compensation

Section 409A of the Code provides that amounts deferred under nonqualified deferred compensation arrangements will, upon becoming vested, be included in an employee’s income as well as be subject to penalties and interest, unless certain requirements are complied with. We do not offer any nonqualified deferred compensation plans to any of our executive officers. The

15

Company’s 2014 Omnibus Incentive Plan and other compensation arrangements for executive officers are intended to comply with or be exempt from the requirements of Section 409A.

Change in Control Payments

If a company makes “parachute payments” to an employee, Section 280G of the Code disallows the company’s tax deduction for the portion of the parachute payments constituting “excess parachute payments,” and Section 4999 of the Code subjects the employee to an additional 20% excise tax on the excess parachute payments. For this purpose, parachute payments generally are defined as payments to specified persons that are contingent upon a change in control in an amount equal to or greater than three times the person’s base amount (the five-year average Form W-2 compensation). The excess parachute payments, which are nondeductible and subject to an additional 20% excise tax, equal the amount of the parachute payments in excess of one times the person’s base amount. The Company does not pay tax gross-ups with respect to such excise tax.

Mr. Griffin has, and Messrs. Saban and Kavthekar had, employment arrangements with the Company that entitle, or entitled, each to payments upon the termination of his respective employment, including following a change of control that may qualify as “excess parachute payments.” The Company’s 2007 Option Plan and 2014 Omnibus Incentive Plan may entitle participants to payments in connection with a change in control that may result in excess parachute payments.

Other

We do not provide any named executive officer with a tax gross-up or other reimbursement payment for any tax liability that he may owe as a result of the application of Sections 4999 or 409A of the Code.

COMPENSATION COMMITTEE REPORT

The Compensation Committee has reviewed and discussed the Compensation Discussion and Analysis (“CD&A”) in this proxy statement with management, including Messrs. Griffin and Kavthekar. Based on such review and discussion, the Compensation Committee recommended, and the Board authorized, the inclusion of the CD&A in the Company’s Annual Report on Form 10-K for the year ended December 31, 2018 and the proxy statement for the 2019 annual meeting.

| The Compensation Committee |

| |

| David Dreyer, Chair |

| Regina Benjamin |

| Shawn Tomasello |

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

In 2018, none of our executive officers served on the compensation committee or board of directors of another entity whose executive officer(s) served on the Compensation Committee or our Board of Directors.

16

NAMED EXECUTIVE OFFICER COMPENSATION TABLES

Summary Compensation Table for 2018

The table below summarizes the total compensation paid or earned by the named executive officers in 2018, 2017, and 2016.

Name and

Principal

Position | | Year | | Salary

($) | | Bonus

($)(1) | | Stock

Awards

($)(2) | | Option

Awards

($)(3) | | Non-Equity

Incentive

Plan

Compensation

($)(1) | | All Other

Compensation

($)(4) | | Total

($) | |

Brian Griffin | | 2018 | | 669,231 | | — | | 7,674,037 | | 823,191 | | 599,875 | | 5,550 | | 9,771,884 | |

Chief Executive Officer | | | | | | | | | | | | | | | | | |

Jeff Park | | 2018 | | 120,701 | | — | | 1,237,845 | (5) | — | | — | | 3,330 | | 1,786,958 | |

Former Interim Chief Executive Officer | | | | | | | | | | | | | | | | | |

Philip R. Hagerman (6) | | 2018 | | 359,098 | | — | | 99,322 | | — | | — | | 1,216 | | 421,692 | |

Former Chief Executive | | 2017 | | 352,469 | | — | | 110,003 | | 990,002 | | — | | 20,200 | | 1,472,674 | |

Officer | | 2016 | | 388,461 | | — | | — | | 1,102,897 | | — | | 20,220 | | 1,511,578 | |

Atul Kavthekar | | 2018 | | 436,538 | | — | | 683,316 | | 223,261 | | 180,274 | | 18,834 | | 1,542,223 | |

Former Chief Financial Officer Treasurer and Former Interim Chief Executive Officer | | 2017 | | 261,538 | | 122,667 | | — | | 1,186,000 | | — | | 13,059 | | 1,583,264 | |

Joel Saban Former President | | 2018 | | 486,538 | | — | | 1,231,200 | | 402,275 | | — | | 328,120 | | 2,448,133 | |

| 2017 | | 173,077 | | 103,500 | | — | | 1,241,800 | | — | | 5,085 | | 1,523,462 | |

Gary Rice | | 2018 | | 336,154 | | 15,300 | | 232,574 | | 75,989 | | 94,297 | | 17,838 | | 772,133 | |

Executive Vice President of Operations | | 2017 | | 300,000 | | 117,760 | | 67,200 | | 100,802 | | — | | 15,802 | | 601,564 | |

| 2016 | | 231,346 | | 7,728 | | — | | 508,926 | | — | | 16,505 | | 764,505 | |

17

(1) Amounts reflected in the “Bonus” column for 2017 represent a discretionary bonus amount (inclusive of the portion related to individual performance measures) and, in 2018 and 2016, the discretionary portion of such person’s cash bonus earned under the 2018 and 2016 bonus plans (i.e., the portion related to individual performance measures). Amounts reflected in the “Non-Equity Incentive Plan Compensation” column represent the Company performance-based portion of such person’s cash bonus earned under the 2018, 2017 and 2016 bonus plans for Messrs. Kavthekar and Rice, and the Griffin Offer Letter for Mr. Griffin. Mr. Hagerman did not participate in the bonus plan in any of the years reflected above. None of our current named executive officers earned any Company performance-based portion of such person’s cash bonus in 2017 or 2016. Payments of bonuses for 2018 were made in March 2019.

(2) Represents the grant date fair value (excluding the effect of estimated forfeitures) of all RSUs, PSUs (PSU amounts reflected at target (100%)) and RSAs, based on the closing price of the Company’s common stock on the grant date. In the event Messrs. Griffin, Kavthekar, Saban and Rice had received the maximum payouts under their 2018 stock awards, the grant date fair values would have been: $19,139,621 for Mr. Griffin; $1,138,860 for Mr. Kavthekar; $2,052,000 for Mr. Saban and $387,623 for Mr. Rice.

(3) Represents the grant date fair value (excluding the effect of estimated forfeitures) calculated in accordance with Accounting Standards Codification Topic 718. The Company uses the Black-Scholes-Merton option pricing model to determine the grant date fair value of options (both performance-based and time-vested option grants), including assumptions which are specified in Note 12 to the Company’s audited financial statements included in the Annual Report on Form 10-K for the year ended December 31, 2018. For Messrs. Saban and Kavthekar the amounts reflected for 2017 represent special new hire option grants ($1,241,800) and ($1,186,000), respectively. For Mr. Griffin the amount reflected for 2018 represents the grant of a Make-Whole Inducement option award ($823,121) in connection with Mr. Griffin’s appointment as Chairman and CEO.

(4) For 2018, includes: 401(k) matching contributions by the Company ($9,214 for Mr. Kavthekar, $11,000 for Mr. Saban, $8,218 for Mr. Rice and $846 Mr. Hagerman); car allowances ($5,550 for Mr. Griffin, $9,620 for Mr. Kavthekar, $9,620 for Mr. Saban $9,620 for Mr. Rice, $3,330 for Mr. Park and $370 for Mr. Hagerman) and a cash payment of $307,500 for Mr. Saban in accordance with the Saban Separation Agreement.

(5) Represents a grant of RSUs of 69,349 shares in connection with Mr. Park’s service as interim Chief Executive Officer from January 2018 to May 2018 (21,666 of which were forfeited upon his departure from this role) and grants of RSAs of 5,929 shares ($128,262) in connection with Mr. Park’s service as a member of the Board of Directors. The grants of Restricted Stock were forfeited upon Mr. Park’s resignation from the Board in February 2019.

(6) Mr. Hagerman resigned as Chief Executive Officer on January 4, 2018. The amount reflected in “Stock Awards” represents a grant of Restricted Stock of 5,222 shares ($99,322) in connection with Mr. Hagerman’s service as a member of the Board of Directors.

Narrative Discussion of Summary Compensation Table for 2018

Promotions and Transitions.

· For periods shown Mr. Hagerman served as Chairman and Chief Executive Officer of the Company until he resigned on January 4, 2018. The amount reflected in Salary for Mr. Hagerman for 2018 includes the payments for consulting services ($50,000/month) provided to the Company during the six months following Mr. Hagerman’s resignation and Mr. Hagerman’s annual cash compensation for service as a non-employee director.

· Mr. Park was appointed interim Chief Executive Officer on January 4, 2018 and resigned from his position on May 11, 2018. The amounts reflected in the Salary column reflect the pro-rated base salary of $500,000 he received from January 2018 through February 2018 and Mr. Park’s annual cash compensation for service as a non-employee director.

· Mr. Kavthekar was appointed Chief Financial Officer on May 1, 2017. He was appointed interim Chief Executive Officer on May 11, 2018 and resigned from this position on June 4, 2018. He did not receive any additional compensation for his service as interim Chief Executive Officer. Mr. Kavthekar resigned as the Company’s Chief Financial Officer in April 2019. Prior to Mr. Kavthekar’s resignation, 3,700 RSUs (with a grant date fair value of $75,924) and 5,039 PSUs (with a grant date fair value of $103,400) vested. All unvested Stock Awards and Option Awards were forfeited upon Mr. Kavthekar’s resignation.

· Mr. Saban was appointed president on August 7, 2017 and served in such position until his resignation on January 4, 2019. The amounts reflected in Stock Awards and Option Awards represent the 2018 target compensation amounts for Mr. Saban. Mr. Saban and the Company mutually agreed that Mr. Saban would resign from his position as President of the Company on January 4, 2019. In connection with Mr. Saban’s departure, Mr. Saban executed the Saban Separation Agreement and received a payment, as well as the acceleration of vesting of certain equity awards in connection therewith. In connection with the Saban Separation Agreement 13,333 RSUs (with a grant date fair value of $273,593)

18

and 18,180 PSUs (with a grant date fair value of $373,054) vested. All unvested Stock Awards and Option Awards were forfeited upon Mr. Saban’s resignation.

· Mr. Griffin was appointed Chief Executive Officer effective June 4, 2018. Mr. Griffin received inducement equity awards in June 2018 in connection with his appointment as Chief Executive Officer. In addition, pursuant to the Griffin Offer Letter, Mr. Griffin received a Sign-On Inducement Award with a value of $5,162,333 (reflected at target (100%) award amount) based on the Company’s performance relative to specified cumulative Adjusted EBITDA and revenue goals for the years ending December 31, 2018 and 2019. The grant date for the Sign-On Inducement Award is January 2019 when the 2019 performance measures became determinable. Accordingly, the Sign-On Inducement Award is not included in the summary compensation table. See “Compensation Discussion and Analysis — Executive Summary” for a description of Mr. Griffin’s 2018 target annual compensation.

Contractual Arrangements. In 2018, many of the compensation items reflected above were driven by considerations in the Griffin Offer Letter, Mr. Saban’s previous employment agreement and the Saban Separation Agreement. For a detailed discussion of these contracts, please see “Potential Payments Upon Termination or Change in Control.”

Mr. Hagerman. In 2016 and 2017, Mr. Hagerman voluntarily reduced or suspended his base salary for periods of time and directed such funds to the Company’s social responsibility budget. These amounts are not included in this table. Further, Mr. Hagerman did not participate in the annual bonus plan in 2016 and 2017 due to his significant equity ownership, in line with historical practice nor in 2018 due to his resignation from his position as Chief Executive Officer.

Base Salary. Base salary changes generally are effective in March or April each year.

Bonus and Incentive Plan Compensation. See “Compensation Discussion and Analysis—2018 Compensation Determinations” for information regarding Adjusted EBITDA, revenue, and discretionary components of the 2018 bonus plan and Chief Executive Officer 2018 annual bonus and amounts earned thereunder.

Equity Award Program. In March 2018, for retention purposes and based on input from its compensation consultant, upon recommendation from the Compensation Committee, the Board approved changes to the Company’s annual equity award program. The 2018 annual equity award program added PSUs (which agreements contain “double-trigger” vesting upon a change in control) for named executive officers, and changed the allocation of the annual equity awards of named executive officers to consist of 50% PSUs; 25% RSUs and 25% time-based options. The allocation of Mr. Griffin’s equity awards was specifically negotiated pursuant to the Griffin Offer Letter. The PSU awards provide the named executive officers with the potential to earn between 50% and 200% respectively, of their target bonus based on the relative achievement of performance goals for Adjusted EBITDA. Mr. Griffin can earn between 100% and 400% of his target bonus based on the relative achievement of performance goals for revenue and Adjusted EBITDA. The Equity Program also provides for three-year pro rata vesting for all equity awards. In 2018 each of Messrs. Griffin, Kavthekar, Saban and Rice were granted PSUs that vest pro rata over three years, with the first installment vesting upon the date the Company files its Annual Report on Form 10-K or Audit Committee confirmation of the satisfaction of the applicable performance goals, and the remaining two installments vesting annually on such date thereafter. For Mr. Griffin, the performance-based component of his Sign-On Inducement Award earned, if any, will vest entirely in 2020 upon the date the Company files its Annual Report on Form 10-K or Audit Committee confirmation of the satisfaction of the applicable performance goals.

2017 Equity Award Program

The 2017 annual equity award program consisted of RSUs and performance-based options. Under the 2017 annual equity award program the relative allocation between RSUs and performance-based options varied in accordance with the relative responsibility of the participants, with the mix more heavily weighted toward performance-based options for more senior employees, including the named executive officers (90% performance-based options in the case of Mr. Hagerman and 60% in the case of Mr. Rice). The performance-based component of the 2017 annual equity award program for named executive officers was based upon the grant of options to purchase a number of shares of common stock of the Company, which were to be earned or forfeited based upon the Company’s performance relative to specified Adjusted EBITDA and revenue goals for the applicable year, in each case excluding the effect of mergers and acquisitions transacted during the bonus plan year. The earned options, if any, vest in four annual installments, with the first installment vesting upon the date the Company files its Annual Report on Form 10-K or Audit Committee confirmation of the satisfaction of the applicable performance goals, and the remaining three installments vesting annually on such date thereafter. In addition, the RSUs granted to the named executive officers under the 2017 annual equity award program vest three years following the grant date. The RSUs granted to other participants under the 2017 annual equity award program vest in three annual installments, with the first installment vesting upon the first anniversary of the grant date.

19

Grants of Plan-Based Awards in 2018

The following table provides information about equity and non-equity awards granted to the named executive officers in 2018.

| | | | | | Estimated Possible Payouts

Under | | Estimated Possible Payouts

Under | | All Other

Stock

Awards:

Number

of | | All Other

Option

Awards: | | Exercise or | | Grant Date

Fair Value

of | |

| | | | | | Non-Equity Incentive Plan | | Equity Incentive Plan | | Shares | | Number of | | Base Price | | Stock and | |

| | | | | | Awards(1)(2) | | Awards(2) | | of Stock | | Securities | | of Option | | Option | |

Name | | Grant

Date | | Approval

Date | | Threshold

($) | | Target

($) | | Maximum

($) | | Threshold

(#) | | Target

(#) | | Maximum

(#) | | or

Units (#) | | Underlying

Options(#) | | Awards

($/Sh) | | Awards

($)(3) | |

Brian Griffin | | 6/4/18 | | 5/9/18 | | — | | — | | — | | — | | 157,343 | | 629,372 | | — | | — | | — | | 3,821,861 | |

| | 6/4/18 | | 5/9/18 | | — | | — | | — | | — | | — | | — | | 124,875 | | — | | — | | 3,033,214 | |

| | 6/4/18 | | 5/9/18 | | — | | — | | — | | — | | — | | — | | 33,716 | | — | | — | | 818,962 | |

| | 6/4/18 | | 5/9/18 | | — | | — | | — | | — | | — | | — | | — | | 81,351 | | 24.29 | | 823,191 | |

| | N/A | | N/A | | 437,500 | (4) | 875,000 | (4) | 1,750,000 | (4) | — | | — | | — | | — | | — | | — | | — | |

Jeff Park | | 2/26/18 | | | | — | | — | | — | | — | | — | | — | | 69,349 | (5) | — | | — | | 1,613,751 | |

| | 6/1/18 | | | | — | | — | | — | | — | | — | | — | | 3,654 | (6) | — | | — | | 84,992 | |

| | 10/1/18 | | | | — | | — | | — | | — | | — | | — | | 2,275 | (6) | — | | — | | 43,271 | |

Philip R. Hagerman | | 10/1/18 | | | | — | | — | | — | | — | | — | | — | | 5,222 | (6) | — | | — | | 99,322 | |

Atul Kavthekar | | 3/27/18 | | | | — | | — | | — | | 11,100 | (7) | 22,200 | (7) | 44,400 | (7) | — | | — | | — | | 455,544 | |

| 3/27/18 | | | | — | | — | | — | | — | | — | | — | | 11,100 | (8) | — | | — | | 227,772 | |

| | 3/27/18 | | | | — | | — | | — | | — | | — | | — | | | | 26,384 | (8) | 20.52 | | 223,261 | |

| | N/A | | | | 131,625 | | 263,250 | | 526,500 | | — | | — | | — | | — | | — | | — | | — | |

Joel Saban | | 3/27/18 | | | | — | | — | | — | | 20,000 | (9) | 40,000 | (9) | 80,000 | (9) | — | | — | | — | | 820,800 | |

| | 3/27/18 | | | | — | | — | | — | | — | | — | | — | | 20,000 | (10) | — | | — | | 410,400 | |

| | 3/27/18 | | | | — | | — | | — | | — | | — | | — | | — | | 47,539 | (11) | 20.52 | | 402,275 | |

| | N/A | | | | 168,750 | | 337,500 | | 675,000 | | — | | — | | — | | — | | — | | — | | — | |

Gary Rice | | 3/27/18 | | | | — | | — | | — | | 3,778 | (12) | 7,556 | (12) | 15,112 | (12) | — | | — | | — | | 155,049 | |

| | 3/27/18 | | | | — | | — | | — | | — | | — | | — | | 3,778 | (13) | — | | — | | 77,525 | |

| | 3/27/18 | | | | — | | — | | — | | — | | — | | — | | | | 8,980 | | 20.52 | | 75,989 | |

| | N/A | | | | 68,850 | | 137,700 | | 275,400 | | — | | — | | — | | — | | — | | — | | — | |

(1) Relates to possible cash payouts attributable to the Company performance-based components of the 2018 bonus plan, exclusive of the 10% discretionary component of the 2018 bonus plan. For Mr. Griffin this represents the possible cash payout attributable to his cash bonus as set forth in the Griffin Offer Letter.

20

(2) Threshold amounts with respect to both Non-Equity Incentive Plan Awards and Equity Incentive Plan Awards represent threshold achievement of the Adjusted EBITDA component and the revenue component, as applicable.

(3) Each option granted in 2018 had a grant date fair value as follows: March 27, $8.462 and June 4, $10.119. See Notes 2 and 3 to the Summary Compensation Table for information regarding the grant date fair value of options, PSUs and RSUs.

(4) Cash bonus opportunity amounts prorated from Mr. Griffin’s initial date of service, June 4, 2018.

(5) RSUs granted in connection with service as interim CEO: 9,166 RSUs vested on the grant date and 60,183 RSUs were to vest in five equal monthly installments on the fourth day of each month between March and July 2018. 21,666 shares were forfeited upon Mr. Park’s departure from his role as interim Chief Executive Officer, which amount is not reflected in this table.

(6) Granted in connection with service as a non-employee director pursuant to the Non-Employee Director Compensation Program, vests 100% on the first anniversary of the grant date. Mr. Park forfeited his awards upon his resignation from the Board in February 2019.

(7) Based on the achievement of certain performance conditions in 2018, Mr. Kavthekar earned 15,118 PSUs. One-third of this award vested on March 18, 2019, the date the Company filed its Annual Report on Form 10-K. The remaining two-thirds was forfeited upon Mr. Kavthekar’s resignation.

(8) One-third of this RSU award vested prior to Mr. Kavthekar’s termination, the remaining two-thirds was forfeited upon Mr. Kavthekar’s resignation.

(9) Based on the achievement of certain performance conditions in 2018, Mr. Saban earned 27,240 PSUs. Pursuant to the Saban Separation Agreement two-thirds of this award vested on March 18, 2019, the date the Company filed its Annual Report on Form 10-K, the remaining one-third was forfeited upon Mr. Saban’s resignation.

(10) Pursuant to the Saban Separation Agreement two-thirds of this RSU award vested on January 4, 2019, the remaining one-third was forfeited upon Mr. Saban’s resignation.

(11) This award was forfeited upon Mr. Saban’s resignation.

(12) Based on the achievement of certain performance conditions in 2018, Mr. Rice earned 5,146 PSUs. One-third of this award vested on March 18, 2019, the date the Company filed its Annual Report on Form 10-K. The remaining two-thirds vest annually on the anniversary of such confirmation date thereafter, subject to Mr. Rice’s continued employment with the Company.

(13) Consists of RSUs which vest in three equal increments on each of the first, second and third anniversary of the grant date.

Narrative Discussion of Grants of Plan-Based Awards in 2018 Table

Chief Executive Officer Annual Bonus. Pursuant to the Griffin Offer Letter, 60% and 40% of Mr. Griffin’s non-equity target cash bonus target bonus was based upon achievement of a 2018 Adjusted EBITDA performance measure and a 2018 revenue performance measure, respectively.

Chief Executive Officer Inducement Awards. Pursuant to the Griffin Offer Letter, Mr. Griffin received two performance-based equity awards. The PSU component of the Make-Whole Inducement Award target was based on achievement of a 2018 Adjusted EBITDA performance measure (60%) and 2018 revenue performance measure (40%), which is included in the table above. However, none of the PSUs were earned. The remaining components of the Make-Whole Inducement Award, consisting of the RSUs and stock options, vest in equal installments over three years; the PSUs would have vested on a similar pro-rata basis from the date earned.

The PSU component of the Sign-On Inducement Award target is based on the achievement 2018 and 2019 Adjusted EBITDA performance measures (60%) and 2018 and 2019 revenue performance measures (40%), on a combined basis, with a grant date of January 2019 when the 2019 measures became determinable. Accordingly, the Sign-On Inducement Award is not included in the table above. The PSU component is eligible to vest in 2020 upon the completion of the 2019 audit. The RSU component had a one-year vesting period, subject to acceleration based on the achievement of the specified share price requirement, the satisfaction of which resulted in vesting as of July 10, 2018.

21

Non-Equity Incentive Plan - 2018 Annual Bonus Plan. For each of Messrs. Kavthekar, Saban and Rice, 60%, 30%, and 10% of the non-equity incentive bonus target was based on achievement of a 2018 Adjusted EBITDA performance measure, a 2018 revenue performance measure, and a subjective individual performance, respectively. Only the amounts eligible to be earned under the objective performance components (Adjusted EBITDA and revenue) are included in this table.

Equity Incentive Plan - PSU Awards. For the participating named executive officers (which did not include Mr. Griffin), the equity incentive bonus target was based on achievement of a 2018 Adjusted EBITDA performance measure.

Outstanding Equity Awards at December 31, 2018

The following table sets forth certain information with respect to outstanding equity awards held by certain of our named executive officers on December 31, 2018. All options in the table granted prior to 2014 were made pursuant to the 2007 Option Plan, and all other equity awards set forth below were made pursuant to the 2014 Omnibus Incentive Plan, other than Mr. Griffin’s Inducement Awards.

| | Option Awards | | Stock Awards | |

Name | | Grant Date | | Number of

Securities

Underlying

Unexercised

Options

(#)

Exercisable | | Number of

Securities

Underlying

Unexercised

Options

(#)

Unexercisable | | Option

Exercise

Price

($) | | Option

Expiration

Date | | Number of

Shares or

Units of

Stock That

Have Not

Vested

(#) | | Market

Value of

Shares or

Units of

Stock

That

Have Not

Vested

($) | |

Brian Griffin | | 6/4/18 | (1)(2) | — | | — | | — | | — | | 33,716 | | 453,817 | |

| | 6/4/18 | (1)(2) | — | | 81,351 | | 24.29 | | 6/4/28 | | — | | — | |

Jeff Park | | 6/1/18 | (3) | — | | — | | — | | — | | 3,654 | | 49,183 | |

| | 10/1/18 | (3) | — | | — | | — | | — | | 2,275 | | 30,622 | |

Philip R. Hagerman | | 10/1/18 | (4) | — | | — | | — | | — | | 5,222 | | 70,288 | |

Atul Kavthekar | | 5/1/17 | (5) | 50,000 | | 150,000 | | 16.00 | | 5/1/27 | | — | | — | |

| | 3/27/18 | (2)(6) | — | | — | | — | | — | | 15,118 | | 203,488 | |

| | 3/27/18 | (2) | — | | — | | — | | — | | 11,100 | (9) | 149,406 | |