Copyright © 2019 by Diplomat Pharmacy Inc. Diplomat is a registered trademark of Diplomat Pharmacy Inc. All rights reserved. Jacque , Diplomat Patient Third Quarter 2019 Operating Results November 12 , 2019 Exhibit 99.2

Disclaimers 2 NON - GAAP INFORMATION We define Adjusted EBITDA as net income (loss) before interest expense, income taxes, depreciation and amortization, share - based compensation, change in fair value of contingent consideration and other merger and acquisition - related expenses, restructuring and impairment charges, and certain other items that we do not consider indicative of our ongoing operating performance (which are itemized in the reconciliation to net income (loss) that can be found in the Appendix to this presentation ) . Adjusted EBITDA is not in accordance with, or an alternative to, accounting principles generally accepted in the United States (“GAAP”) . In addition, this non - GAAP measure is not based on any comprehensive set of accounting rules or principles . You should be aware that in the future we may incur expenses that are the same as or similar to some of the adjustments in the presentation, and we do not infer that our future results will be unaffected by unusual or non - recurring items . We consider Adjusted EBITDA to be a supplemental measures of our operating performance . We present Adjusted EBITDA because it is used by our Board of Directors and management to evaluate our operating performance . Adjusted EBITDA is also used as a factor in determining incentive compensation, for budgetary planning and forecasting overall financial and operational expectations, for identifying underlying trends, and for evaluating the effectiveness of our business strategies . Further, we believe it assist s us, as well as investors, in comparing performance from period - to - period on a consistent basis . Other companies in our industry may calculate Adjusted EBITDA differently than we do and these calculations may not be comparable to our Adjusted EBITDA . A reconciliation of Adjusted EBITDA, a non - GAAP measure, to net income ( loss) as prepared in accordance with GAAP can be found in the Appendix to this presentation . INDUSTRY AND MARKET DATA Certain information in this presentation concerning our industry and the markets in which we operate is derived from publicly available information released by third - party sources, including independent industry and research organizations, and management estimates . Management estimates are derived from publicly available information released by independent industry and research analysts and other third - party sources, as well as data from our internal research, and are based on assumptions made by us upon reviewing such data and our knowledge of such industry and markets, which we believe to be reasonable . We believe the data from these third - party sources is reliable . In addition, projections, assumptions, and estimates of the future performance of the industry in which we operate and our future performance are necessarily subject to uncertainty and risk due to a variety of factors, as discussed in Diplomat’s reports filed with the Securities and Exchange Commission . These and other factors could cause results to differ materially from those expressed in the estimates made by these third - party sources . FORWARD - LOOKING STATEMENT S This presentation contains forward - looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 . Forward - looking statements give current expectations or forecasts of future events or our future financial or operating performance, and may include Diplomat’s expectations regarding revenues, net (loss) income, Adjusted EBITDA, loss per share, the strategic alternatives review process and potential transactions that may be identified and explored as a result of such review process, the expected benefits and performance of business and growth strategies, impact of operational improvement initiatives and results of operational and capital expenditures . The forward - looking statements contained in this presentation are based on management’s good - faith belief and reasonable judgment based on current information . These statements are qualified by important risks and uncertainties, many of which are beyond our control, that could cause our actual results to differ materially from those forecasted or indicated by such forward - looking statements . These risks and uncertainties include : our ability to adapt to changes or trends within the specialty pharmacy industry ; a significant increase in competition from a variety of companies in the health care industry ; significant and increasing pricing pressure from third party payors, resulting in continuing margin compression and adversely impacting contract profitability and driving our exit of certain pharmacy provider networks ; our ability to continue as a going concern ; maintaining compliance with our amended credit facility covenants ; maintaining access to our revolving line of credit ; failure to execute our plans to obtain waivers of, or mitigate potential lack of, compliance with our credit facility covenants and resulting effect of any liquidity issues ; increased financing and other costs ; failure to effectively differentiate our products and services in the PBM market place ; possibility of client losses and/or the failure to win new business ; declining gross margins in the PBM industry ; shifts in pharmacy mix toward lower margin drugs ; the ability to identify and consummate strategic alternatives that yield additional value for shareholders ; the timing, benefits and outcome of the Company’s strategic alternatives review process, including the determination of whether or not to pursue or consummate any strategic alternative ; the structure, terms and specific risks and uncertainties associated with any potential strategic transaction ; potential disruptions in our business and the stock price as a result of our exploration, review and pursuit of strategic alternatives or the public announcement thereof and any decision or transaction resulting from such review, including potential disruptions with respect to our employees, vendors, clients and customers ; supply disruption of any of the specialty drugs we dispense ; potential for contracting at reduced rates to win new business or secure renewal business ; the dependence on key employees and effective succession planning and managing recent turnover among key employees ; potential disruption to our workforce and operations due to cost savings and restructuring initiatives ; disruption in our operations as we implement a new operating system within our Specialty segment ; maintaining existing patients ; the amount of direct and indirect remuneration fees, as well as the timing of assessing such fees and the methodology used to calculate such fees ; the outcome of material legal proceedings ; our relationships with wholesalers and key pharmaceutical manufacturers ; our ability to drive volume through a refreshed marketing strategy in traditional specialty pharmacy ; our capability to penetrate the fragmented infusion market ; the success of our strategy in the PBM industry ; our inability to remediate present material weaknesses, and to identify and remediate future material weaknesses, in our disclosure controls and procedures and internal control over financial reporting, which could impair our ability to produce accurate and timely financial statements ; the effect of any future impairments to our goodwill or other intangible assets on our net (loss) income and loss per share, and the underlying reasons for such impairment ; investments in new business strategies and initiatives, including with respect to data and analytics capabilities, could disrupt our ongoing business and present risks not originally contemplated ; tax matters and imposition of new taxes ; and the additional factors set forth in “Risk Factors” in Diplomat’s most recent Annual Report on Form 10 - K and in subsequent reports filed with or furnished to the Securities and Exchange Commission . Except as may be required by any applicable laws, Diplomat assumes no obligation to publicly update such forward - looking statements, which are made as of the date hereof or the earlier date specified herein, whether as a result of new information, future developments, or otherwise .

Copyright © 2019 by Diplomat Pharmacy Inc. Diplomat is a registered trademark of Diplomat Pharmacy Inc. All rights reserved. Opening Remarks Brian Griffin, Chairman and CEO

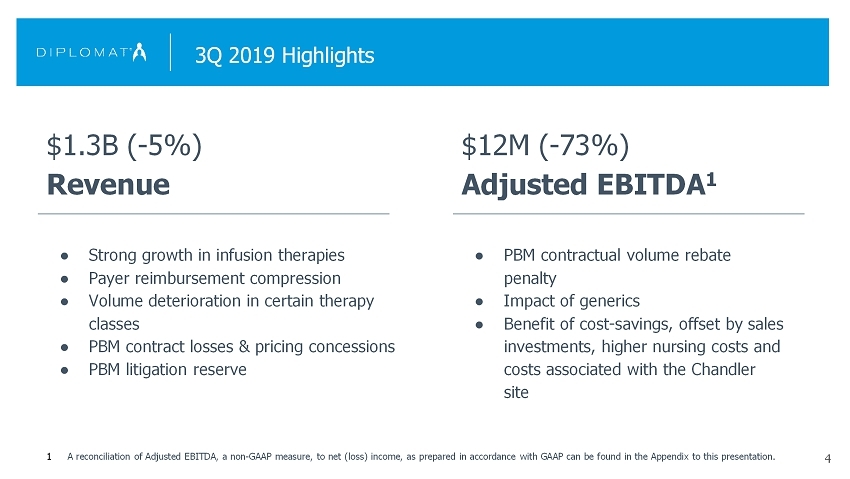

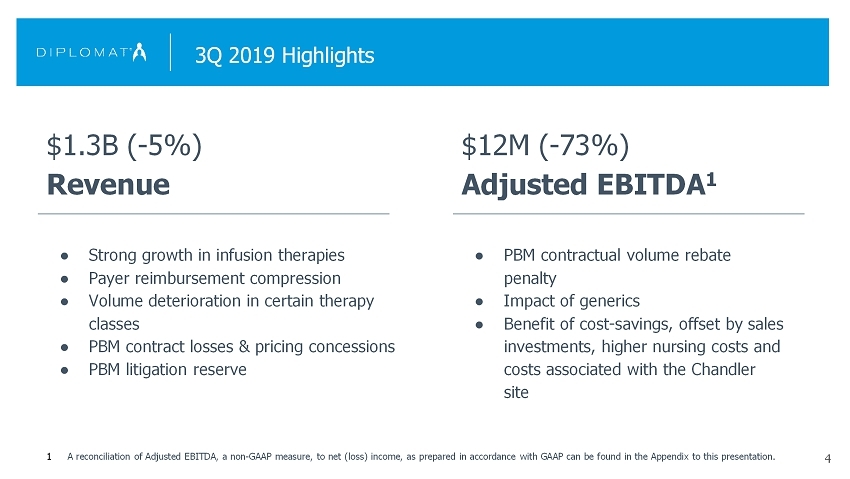

3Q 2019 Highlights $ 1.3 B ( - 5 %) Revenue $12M ( - 73%) Adjusted EBITDA 1 4 ● Strong growth in infusion therapies ● Payer reimbursement compression ● Volume deterioration in certain therapy classes ● PBM contract losses & pricing concession s ● PBM litigation reserve ● PBM contractual volume rebate penalty ● Impact of generics ● Benefit of cost - savings, offset by sales investments, higher nursing costs and costs associated with the Chandler site 1 A reconciliation of Adjusted EBITDA, a non - GAAP measure, to net ( loss) income, as prepared in accordance with GAAP can be found in the Appendix to this presentation.

Copyright © 2019 by Diplomat Pharmacy Inc. Diplomat is a registered trademark of Diplomat Pharmacy Inc. All rights reserved. Financial Results Dan Davison, CFO

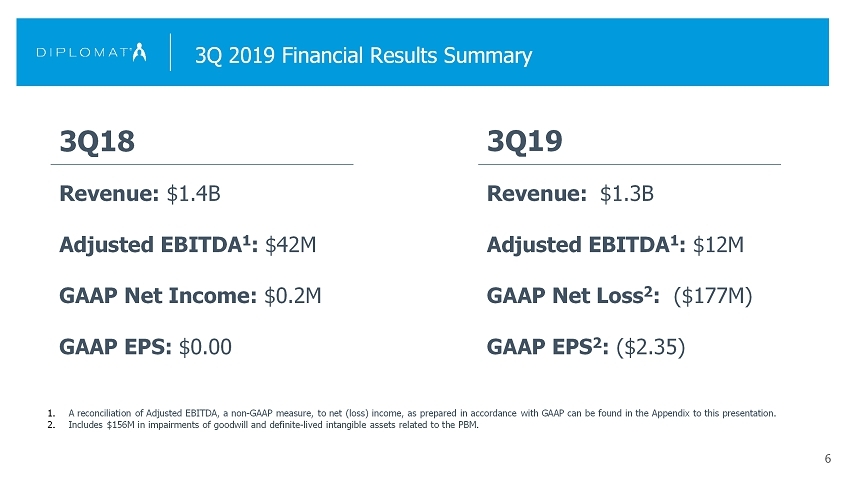

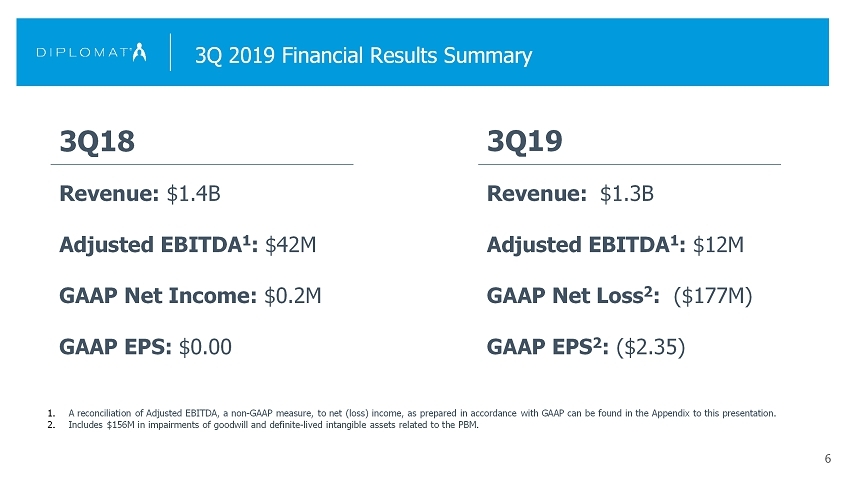

3Q 2019 Financial Results Summary 6 Revenue: $1.4B Adjusted EBITDA 1 : $42M GAAP Net Income : $0.2 M GAAP EPS: $0.00 Revenue: $ 1.3 B Adjusted EBITDA 1 : $ 12 M GAAP Net Loss 2 : ( $ 177 M) GAAP EPS 2 : ($ 2.35 ) 3Q18 3Q19 1. A reconciliation of Adjusted EBITDA, a non - GAAP measure, to net ( loss) income, as prepared in accordance with GAAP can be found in the Appendix to this presentation. 2. Includes $156M in impairments of goodwill and definite - lived intangible assets related to the PBM.

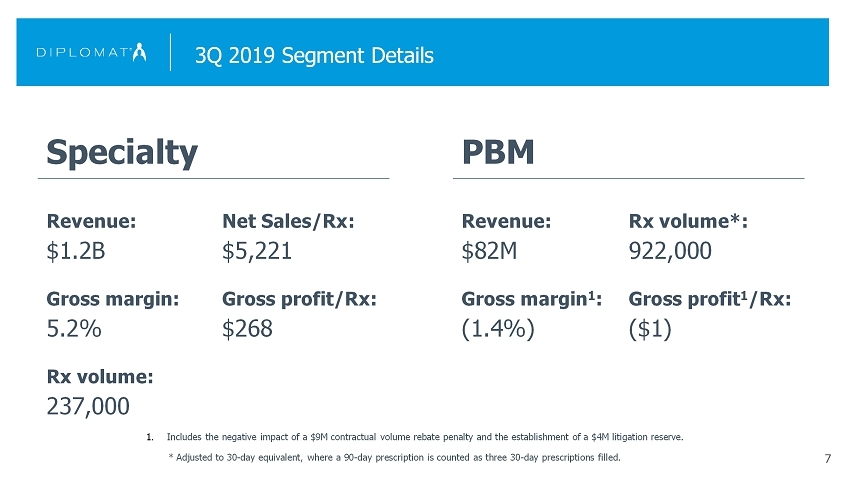

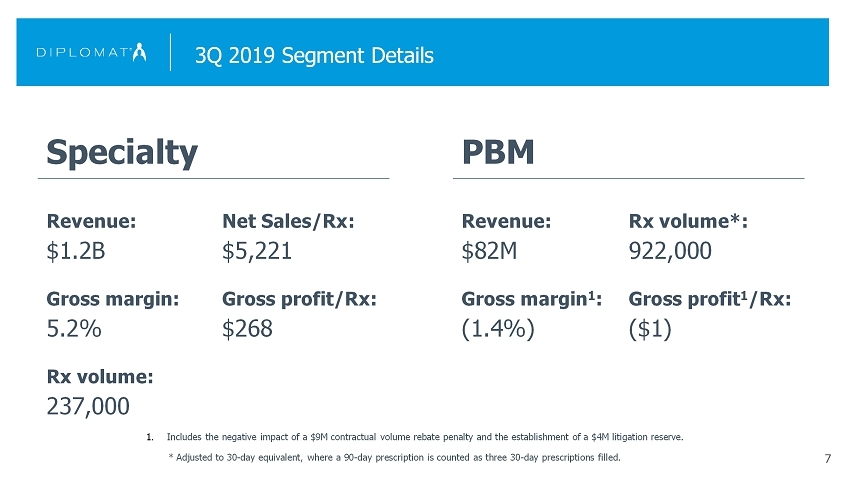

3 Q 2019 Segment Details 7 Specialty PBM Revenue: $ 1.2 B Gross margin: 5.2 % Rx volume: 237,000 Net Sales/Rx: $ 5,221 Gross profit/Rx: $ 268 Revenue: $82 M Gross margin 1 : (1.4%) Rx volume*: 922,000 Gross profit 1 /Rx: ($1) * Adjusted to 30 - day equivalent, where a 90 - day prescription is counted as three 30 - day prescriptions filled. 1. Includes the negative impact of a $9M contractual volume rebate penalty and the establishment of a $4M litigation reserve.

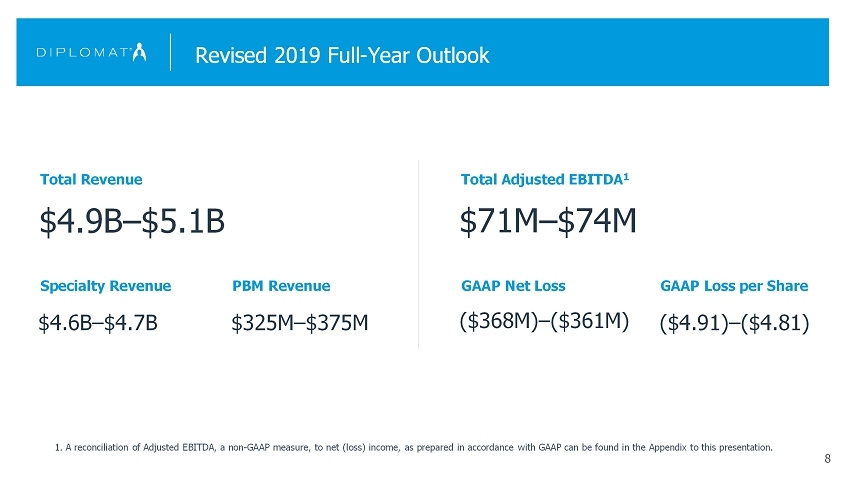

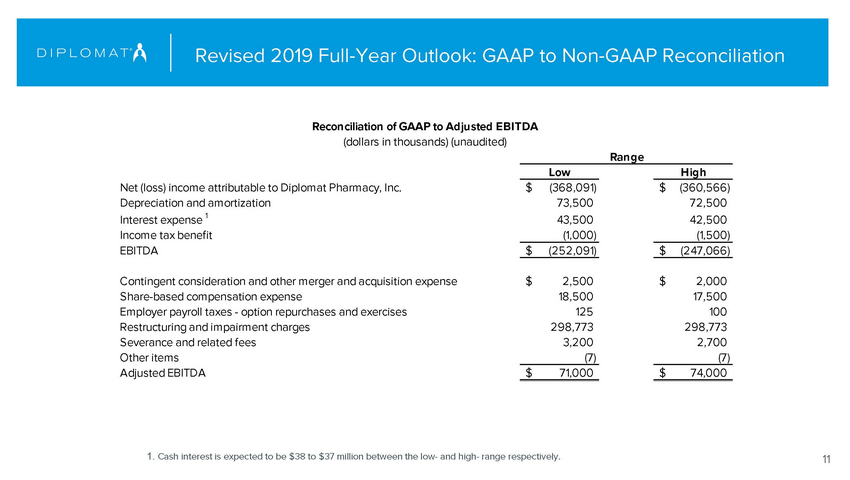

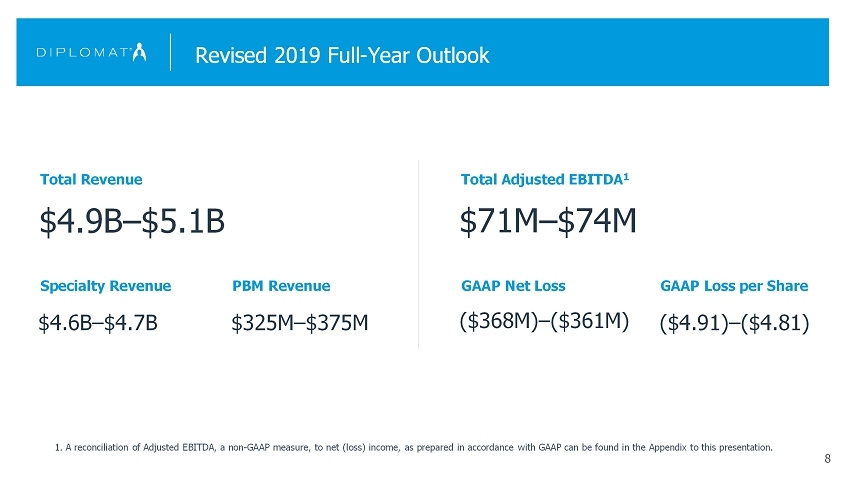

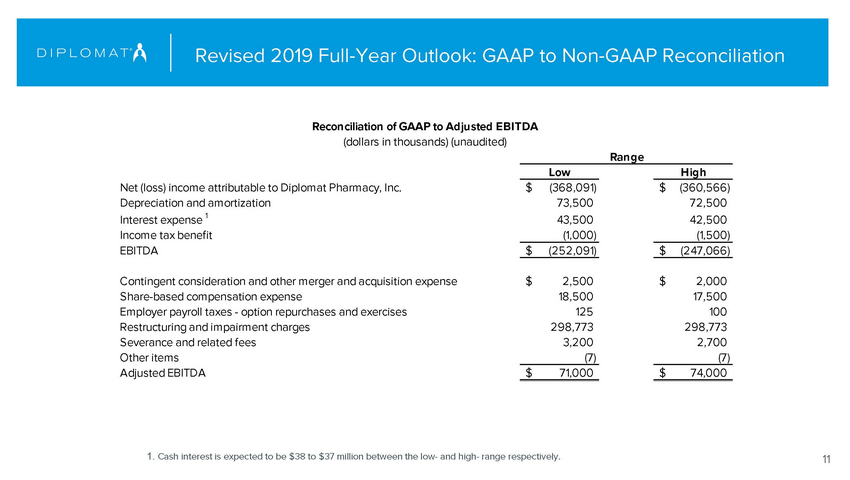

Revised 2019 Full - Year Outlook 8 1. A reconciliation of Adjusted EBITDA, a non - GAAP measure, to net ( loss) income, as prepared in accordance with GAAP can be found in the Appendix to this presentation. $4.6B – $4.7B $ 325 M – $ 375 M $4.9B – $5.1B Specialty Revenue PBM Revenue Total Revenue Total Adjusted EBITDA 1 $71M – $74M ($368 M ) – ($36 1 M) ($ 4.91 ) – ($ 4.81 ) GAAP Net Loss GAAP Loss per Share

Copyright © 2019 by Diplomat Pharmacy Inc. Diplomat is a registered trademark of Diplomat Pharmacy Inc. All rights reserved. Appendix Supplemental Financial Information

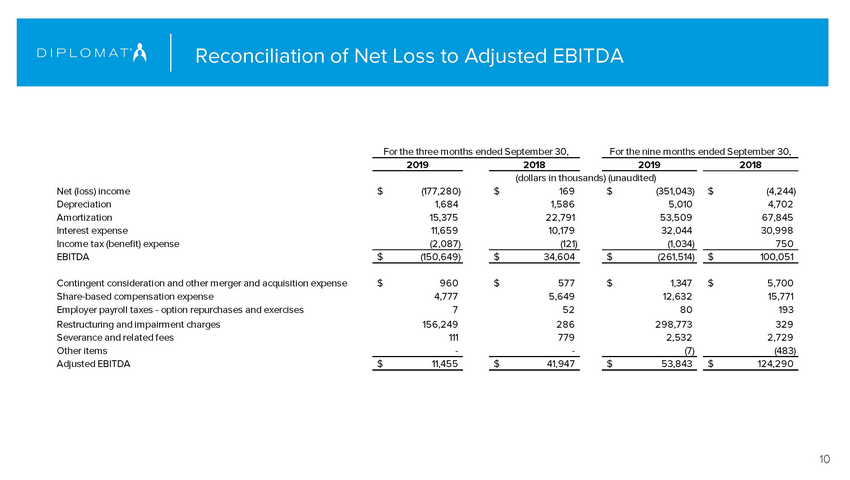

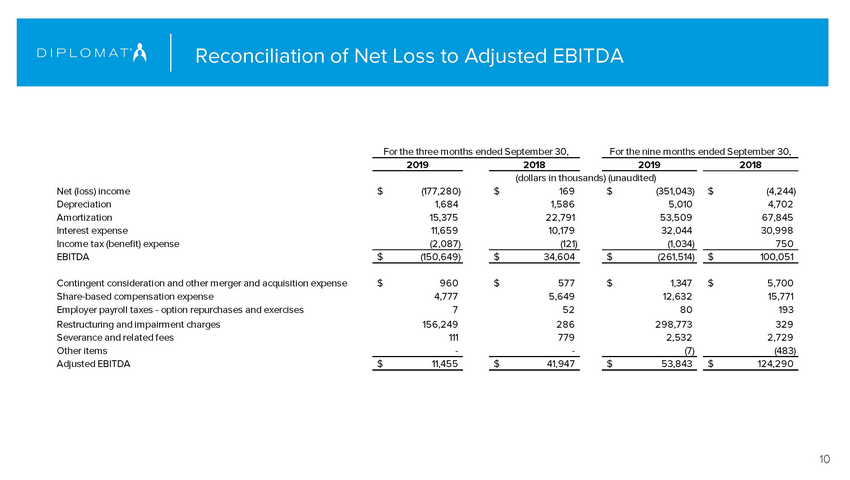

10 Reconciliation of Net Loss to Adjusted EBITDA 2019 2018 2019 2018 Net (loss) income (177,280)$ 169$ (351,043)$ (4,244)$ Depreciation 1,684 1,586 5,010 4,702 Amortization 15,375 22,791 53,509 67,845 Interest expense 11,659 10,179 32,044 30,998 Income tax (benefit) expense (2,087) (121) (1,034) 750 EBITDA (150,649)$ 34,604$ (261,514)$ 100,051$ Contingent consideration and other merger and acquisition expense960$ 577$ 1,347$ 5,700$ Share-based compensation expense 4,777 5,649 12,632 15,771 Employer payroll taxes - option repurchases and exercises 7 52 80 193 Restructuring and impairment charges 156,249 286 298,773 329 Severance and related fees 111 779 2,532 2,729 Other items - - (7) (483) Adjusted EBITDA 11,456$ 41,947$ 53,842$ 124,290$ For the three months ended September 30,For the nine months ended September 30, (dollars in thousands) (unaudited)

Revised 2019 Full - Year Outlook : GAAP to Non - GAAP Reconciliation 11 1. Cash interest is expected to be $38 to $37 million between the low - and high - range respectively. Low High Net (loss) income attributable to Diplomat Pharmacy, Inc. (368,091)$ (360,566)$ Depreciation and amortization 73,500 72,500 Interest expense 1 43,500 42,500 Income tax benefit (1,000) (1,500) EBITDA (252,091)$ (247,066)$ Contingent consideration and other merger and acquisition expense 2,500$ 2,000$ Share-based compensation expense 18,500 17,500 Employer payroll taxes - option repurchases and exercises 125 100 Restructuring and impairment charges 298,773 298,773 Severance and related fees 3,200 2,700 Other items (7) (7) Adjusted EBITDA 71,000$ 74,000$ Reconciliation of GAAP to Adjusted EBITDA (dollars in thousands) (unaudited) Range

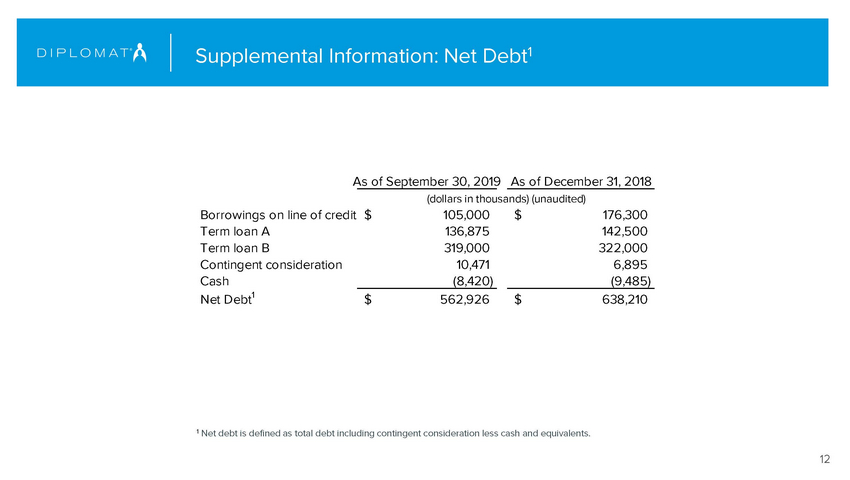

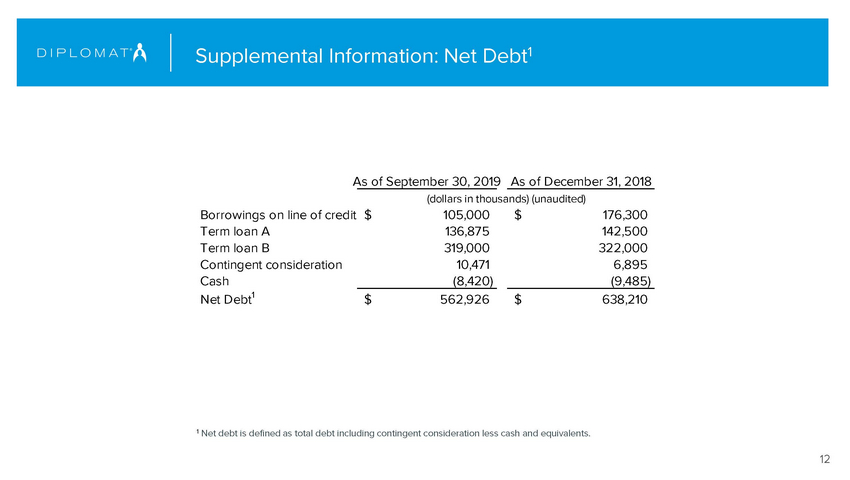

Supplemental Information: Net Debt 1 12 1 Net debt is defined as total debt including contingent consideration less cash and equivalents. As of September 30, 2019As of December 31, 2018 Borrowings on line of credit 105,000$ 176,300$ Term loan A 136,875 142,500 Term loan B 319,000 322,000 Contingent consideration 10,471 6,895 Cash (8,420) (9,485) Net Debt 1 562,926$ 638,210$ (dollars in thousands) (unaudited)