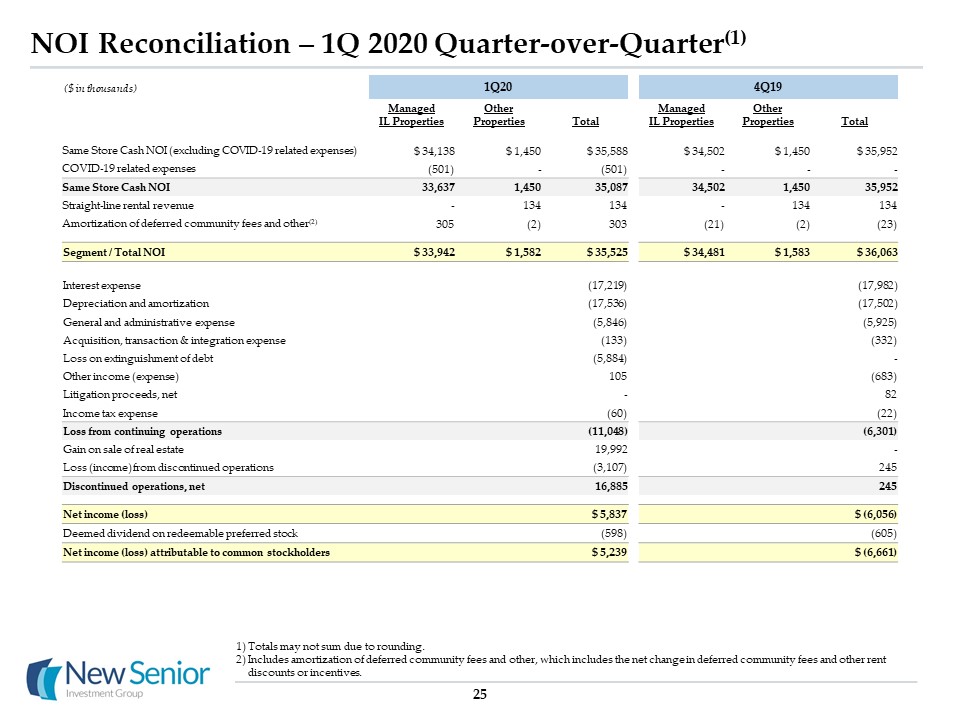

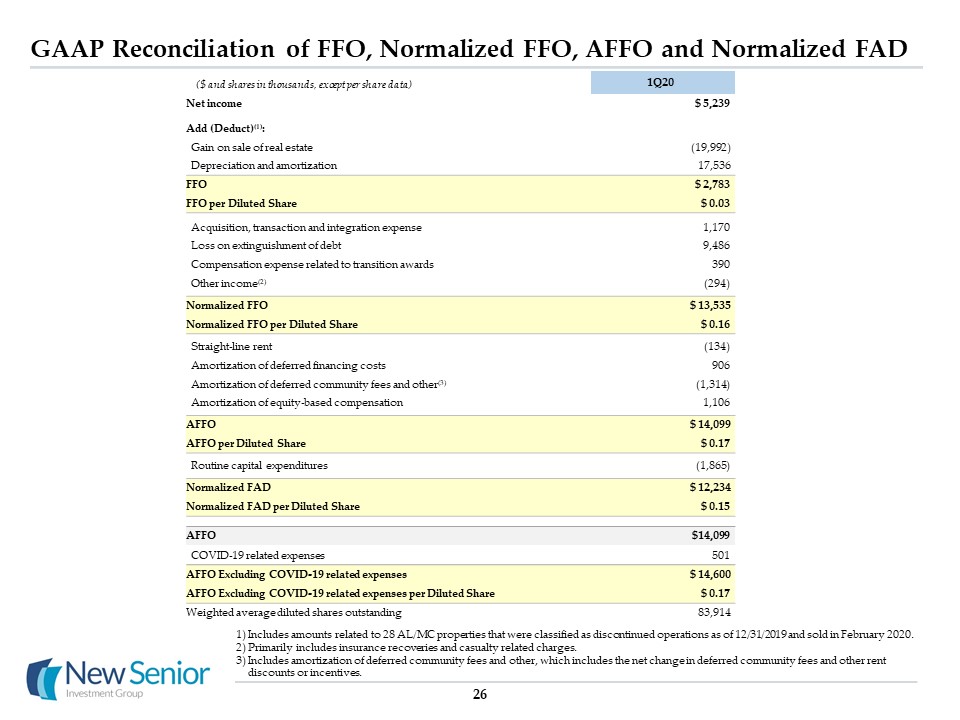

NOI Reconciliation – 1Q 2020 Year-over-Year(1) ($ in thousands) 24 Totals may not sum due to rounding.Includes amortization of deferred community fees and other, which includes the net change in deferred community fees and other rent discounts or incentives. 1Q20 1Q19 Managed IL Properties Other Properties Total Managed IL Properties Other Properties Total Same Store Cash NOI (excluding COVID-19 related expenses) $ 34,138 $ 1,450 $ 35,588 $ 33,646 $ 1,411 $ 35,057 COVID-19 related expenses (501) - (501) - - - Same Store Cash NOI 33,637 1,450 35,087 33,646 1,411 35,057 Non-Same Store Cash NOI - - - - (249) (249) Straight-line rental revenue - 134 134 - 206 206 Amortization of deferred community fees and other(2) 305 (2) 303 (620) (2) (622) Segment / Total NOI $ 33,942 $ 1,582 $ 35,525 $ 33,026 $ 1,366 $ 34,392 Interest expense (17,219) (19,850) Depreciation and amortization (17,536) (16,994) General and administrative expense (5,846) (4,978) Acquisition, transaction & integration expense (133) (492) Loss on extinguishment of debt (5,884) - Other income (expense) 105 (1,315) Income tax expense (60) (36) Loss from continuing operations (11,048) (9,273) Gain on sale of real estate 19,992 - Loss from discontinued operations (3,107) (1,920) Discontinued operations, net 16,885 (1,920) Net income (loss) $ 5,837 $ (11,193) Deemed dividend on redeemable preferred stock (598) (598) Net income (loss) attributable to common stockholders $ 5,239 $ (11,791)