Exhibit 99.1

2014 Full Year Update

NYSE: AVOL

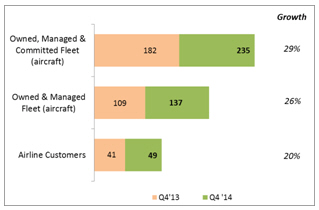

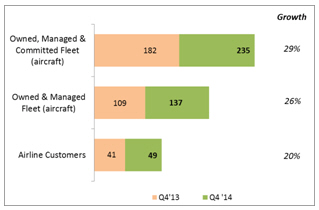

Dublin |20 January, 2015: Avolon (NYSE: AVOL), the international aircraft leasing company, today issues an update for the fourth quarter and full year 2014. Avolon concluded 2014 with a delivered (owned and managed) fleet of 137 aircraft and commitments for 98 aircraft for additional growth.

2014 Full YearHighlights

| | |

• Completed initial public offering and admitted to listing on the New York Stock Exchange in December 2014 under the symbol AVOL. • Owned and managed delivered fleet of 137 aircraft at the end of 2014 increased by 28 aircraft or 26% year-on-year. • Owned, managed and committed fleet increased by 53 aircraft year-on-year to 235 aircraft at the end of 2014. • Signed lease agreements for 46 aircraft during 2014. • Took delivery of 41 aircraft in 2014 including 5 aircraft owned by Avolon Capital Partners, a joint venture between Avolon and Wells Fargo, launched in 2013. • Added 8 new customers, increasing total customer base to 49 airlines. | |  |

| • | | Sold 9 aircraft in 2014 which brings total sales since inception to 27 aircraft. |

| • | | Owned fleet had an average age of 2.52 years and an average lease term remaining of 7.11 years at the end of 2014. |

| • | | Total commitments for 98 aircraft delivering 2015 to 2022 including B737 MAX, A320neo, A330neo and 787 Dreamliners. 2014 highlights include: |

| | • | | Signed purchase agreement to acquire 15 new A330neos from Airbus as a launch customer on the programme. |

| | • | | Signed purchase agreement to acquire 6 new 787 Dreamliners from Boeing. |

| • | | Raised additional debt financing commitments of US$2.3 billion. |

| • | | US$1.2 billion of available debt was undrawn at the end of 2014. |

2014 Fourth Quarter Highlights

| • | | Signed lease agreements for 11 aircraft. |

| • | | Took delivery of 8 aircraft. |

| • | | Sold 4 aircraft in the quarter. |

| • | | Raised additional debt financing commitments of US$0.3 billion. |

| • | | Signed purchase agreement with Airbus to acquire 15 new A330neos. |

About Avolon

Headquartered in Ireland, with offices in the United States, Dubai, Singapore and China, Avolon provides aircraft leasing and lease management services. Avolon has an owned, managed and committed fleet of 235 aircraft serving 49 customers in 27 countries as of December 2014. Avolon is listed on the New York Stock Exchange, under the ticker symbol AVOL.

Note regarding Forward-Looking Statements

This document includes forward-looking statements, beliefs or opinions, including statements with respect to Avolon’s business, financial condition, results of operations and plans. These forward-looking statements involve known and unknown risks and uncertainties, many of which are beyond our control and all of which are based on our management’s current beliefs and expectations about future events. Forward-looking statements are sometimes identified by the use of forward-looking terminology such as “believe,” “expects,” “may,” “will,” “could,” “should,” “shall,” “risk,” “intends,” “estimates,” “aims,” “plans,” “predicts,” “continues,” “assumes,” “positioned” or “anticipates” or the negative thereof, other variations thereon or comparable terminology or by discussions of strategy, plans, objectives, goals, future events or intentions. These forward-looking statements include all matters that are not historical facts. Forward-looking statements may and often do differ materially from actual results. No assurance can be given that such future results will be achieved.

These risks, uncertainties and assumptions include, but are not limited to, the following: general economic and financial conditions; the financial condition of our lessees; our ability to obtain additional capital to finance our growth and operations on attractive terms; decline in the value of our aircraft and market rates for leases; the loss of key personnel; lessee defaults and attempts to repossess aircraft; our ability to regularly sell aircraft; our ability to successfully re-lease our existing aircraft and lease new aircraft; our ability to negotiate and enter into profitable leases; periods of aircraft oversupply during which lease rates and aircraft values decline; changes in the appraised value of our aircraft; changes in interest rates; competition from other aircraft lessors; and the limited number of aircraft and engine manufacturers. Such forward-looking statements contained in this document speak only as of the date of this document. We expressly disclaim any obligation or undertaking to update these forward-looking statements contained in this document to reflect any change in our expectations or any change in events, conditions, or circumstances on which such statements are based unless required to do so by applicable law.

More detailed information about these and other factors is set forth in the prospectus filed pursuant to Rule 424(b)(4) on 15 December, 2014 as well as other reports filed by us with the U.S. Securities and Exchange Commission.

www.avolon.aero

For further information:

| | | | | | |

| Jonathan Neilan | | T: +353 1 663 3686 | | M: +353 86 231 4135 | | avolon@fticonsulting.com |

| Jennifer Peters | | T: +353 1 663 3684 | | M: +353 87 178 7021 | | avolon@fticonsulting.com |

Avolon | 2014 Full Year Update