Exhibit 10.1

Execution Version

PURCHASE AND SALE AGREEMENT

dated as of May 4, 2017,

but effective as of May 1, 2017

by and among

SHELL PIPELINE COMPANY LP,

SHELL GOM PIPELINE COMPANY LLC,

SHELL CHEMICAL LP,

SHELL MIDSTREAM PARTNERS, L.P.,

SHELL MIDSTREAM OPERATING LLC,

PECTEN MIDSTREAM LLC,

And

SAND DOLLAR PIPELINE LLC

TABLE OF CONTENTS

ARTICLE I DEFINITIONS 2

Section 1.1 Definitions 2

Section 1.2 Construction 11

ARTICLE II PURCHASE AND SALE AND CLOSING 11

Section 2.1 Purchase and Sale 11

Section 2.2 Consideration 11

Section 2.3 Closing 11

Section 2.4 Custody Transfer 15

Section 2.5 Proceeds From and Costs of Operations 15

Section 2.6 Assumption of Obligations Relating to the Assets 15

ARTICLE III REPRESENTATIONS AND WARRANTIES OF THE SELLERS 16

Section 3.1 Organization 16

Section 3.2 Authority and Approval 16

Section 3.3 No Conflict; Consents 17

Section 3.4 Title to the Assets 17

Section 3.5 Litigation; Laws and Regulations 19

Section 3.6 No Adverse Changes 20

Section 3.7 Taxes 20

Section 3.8 Environmental Matters 20

Section 3.9 Licenses; Permits 21

Section 3.10 Material Contracts 23

Section 3.11 Insurance 24

Section 3.12 Brokerage Arrangements 25

Section 3.13 Books and Records 25

Section 3.14 Regulatory Matters 25

Section 3.15 Management Projections and Budget 25

Section 3.16 Disclaimer of Warranties 25

ARTICLE IV REPRESENTATIONS AND WARRANTIES OF THE PURCHASERS 26

Section 4.1 Organization and Existence 26

Section 4.2 Authority and Approval 26

Section 4.3 No Conflict; Consents 27

Section 4.4 Brokerage Arrangements 27

Section 4.5 Litigation 28

ARTICLE V ADDITIONAL AGREEMENTS, COVENANTS, RIGHTS AND OBLIGATIONS 28

Section 5.1 Operation of the Assets 28

Section 5.2 Conversion of Convent RG Pipeline 30

Section 5.3 Non-conveyed Interests 30

Section 5.4 NBR Line Lease Termination 31

Section 5.5 Joint Tariff- Pecten and SPLC 32

ARTICLE VI TAX MATTERS 32

Section 6.1 Liability for Taxes 32

Section 6.2 Cooperation 33

Section 6.3 Transfer Taxes 33

Section 6.4 Allocation of Consideration 33

Section 6.5 Conflict 33

ARTICLE VII CONDITIONS TO CLOSING 34

Section 7.1 Conditions to the Obligations of the Purchasers 34

Section 7.2 Conditions to the Obligations of the Sellers 35

ARTICLE VIII INDEMNIFICATION 36

Section 8.1 Indemnification of SHLX and the Purchasers 36

Section 8.2 Indemnification of the Sellers 36

Section 8.3 Survival 36

Section 8.4 Indemnification Procedures 37

Section 8.5 Direct Claim 38

Section 8.6 Limitations on Indemnification 38

Section 8.7 Sole Remedy 39

ARTICLE IX MISCELLANEOUS 40

Section 9.1 Acknowledgements 40

Section 9.2 Cooperation; Further Assurances 40

Section 9.3 Expenses 40

Section 9.4 Notices 40

Section 9.5 Arbitration 41

Section 9.6 Governing Law 42

Section 9.7 Public Statements 42

Section 9.8 Entire Agreement; Amendments and Waivers 43

Section 9.9 Conflicting Provisions 43

Section 9.10 Binding Effect and Assignment 43

Section 9.11 Severability 43

Section 9.12 Interpretation 44

Section 9.13 Headings and Disclosure Letter 44

Section 9.14 Multiple Counterparts 44

Section 9.15 Action by SHLX 44

EXHIBITS

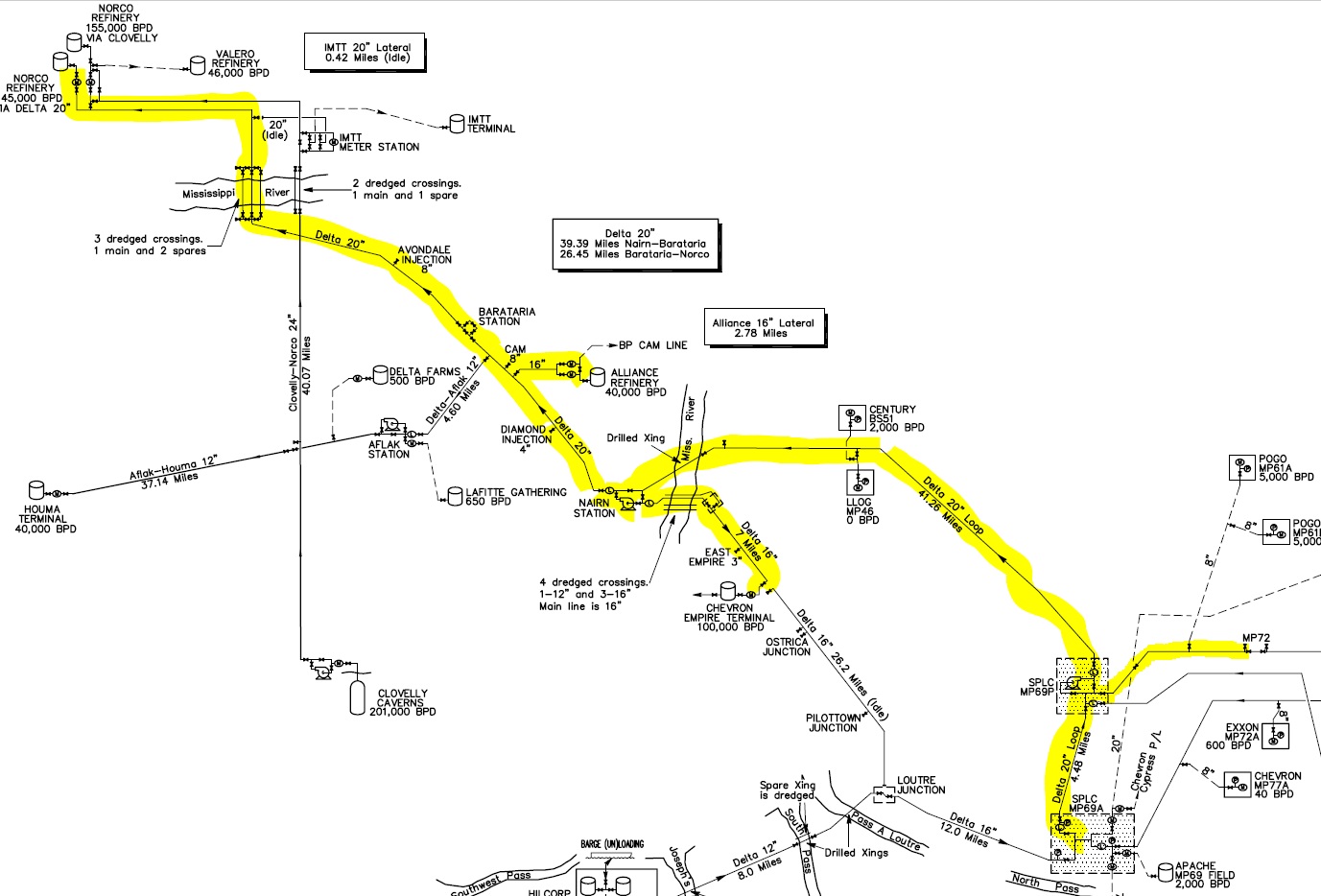

Exhibit A Delta Pipeline System

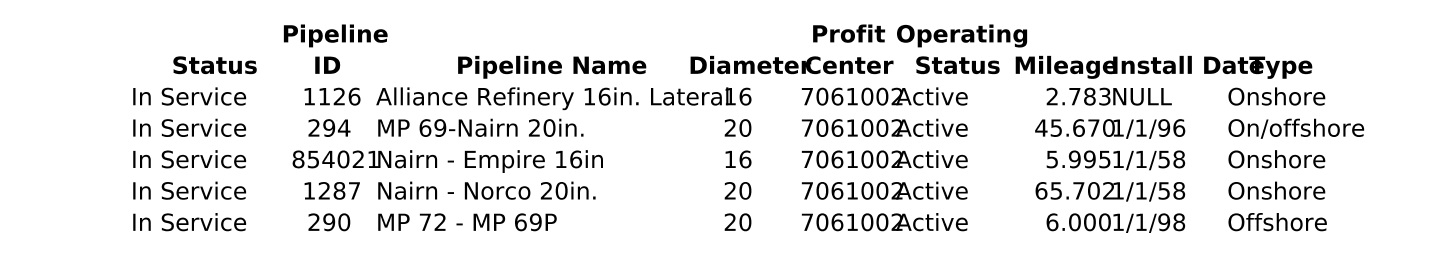

Exhibit B Na Kika Pipeline System

Exhibit C NBR Line

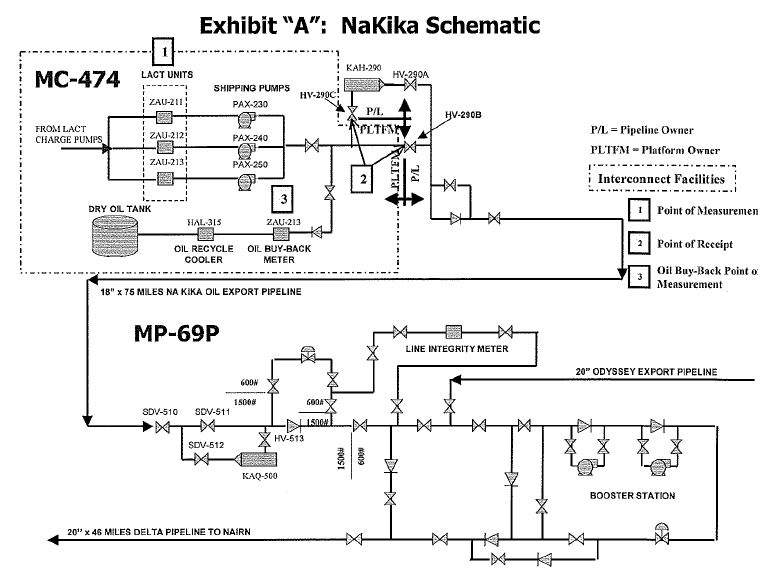

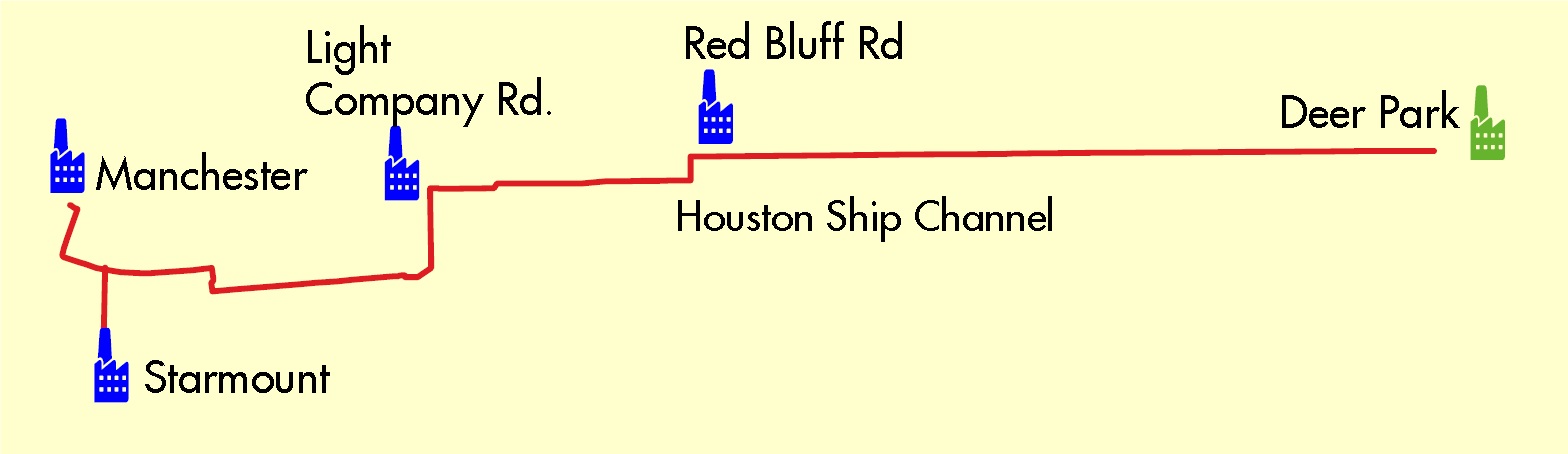

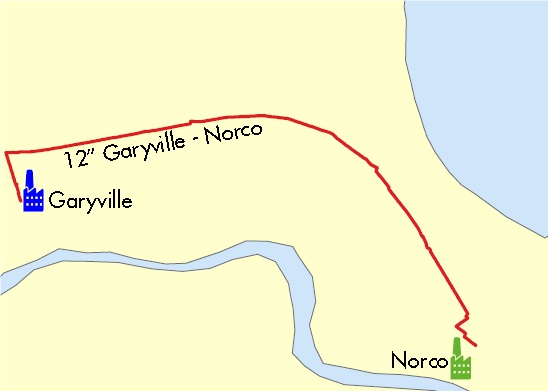

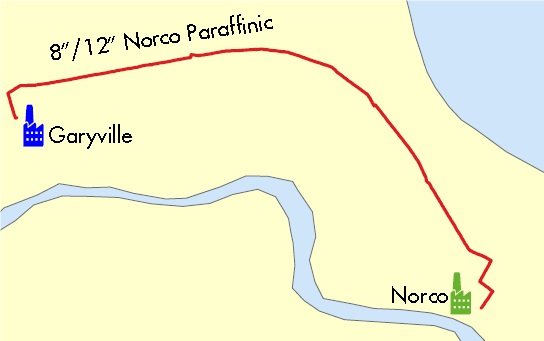

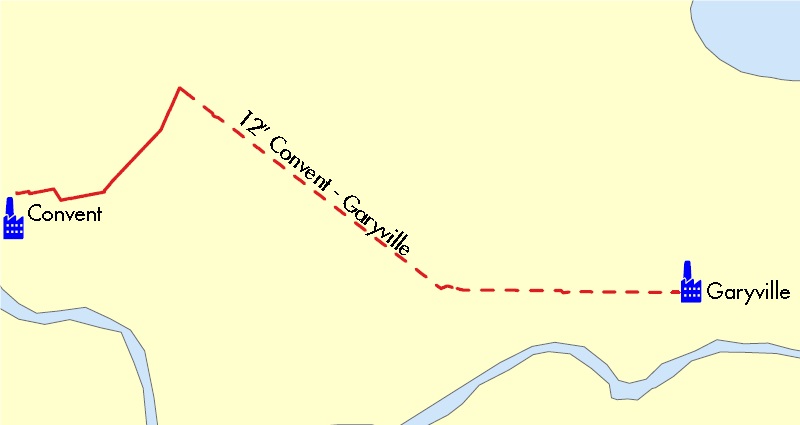

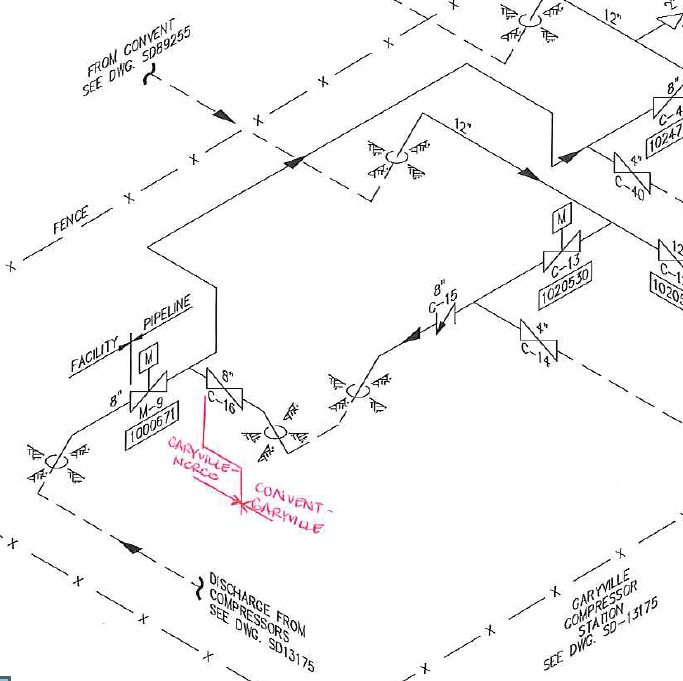

Exhibit D RG Pipelines

PURCHASE AND SALE AGREEMENT

This Purchase and Sale Agreement (this “Agreement”) is made as of May 4, 2017, but effective as of May 1, 2017, by and among Shell Pipeline Company LP, a Delaware limited partnership (“SPLC”), Shell GOM Pipeline Company LLC, a Delaware limited liability company (“GOM”), Shell Chemical LP, a Delaware limited partnership (“Shell Chemical”), Shell Midstream Partners, L.P., a Delaware limited partnership (“SHLX”), Shell Midstream Operating LLC, a Delaware limited liability company that is wholly owned by SHLX (“Operating”), Pecten Midstream LLC, a Delaware limited liability company that is wholly owned by Operating (“Pecten”), and Sand Dollar Pipeline LLC, a Delaware limited liability company that is wholly owned by Operating (“Sand Dollar”).

RECITALS

WHEREAS, SPLC owns the Delta Assets (as defined in Section 1.1), and GOM owns the Na Kika Assets (as defined in Section 1.1);

WHEREAS, Shell Chemical owns the RGP Assets (as defined in Section 1.1), and SPLC owns the NBR Line Assets (as defined in Section 1.1);

WHEREAS, SPLC and GOM desire to sell to SHLX or to Pecten as its designee, and SHLX desires to accept and acquire or to cause Pecten to accept and acquire, SPLC’s and GOM’s respective interests in the Delta Assets and the Na Kika Assets;

WHEREAS, Shell Chemical and SPLC desire to sell to SHLX or to Sand Dollar as its designee, and SHLX desires to accept and acquire or to cause Sand Dollar to accept and acquire, Shell Chemical’s and SPLC’s respective interests in the RGP Assets and the NBR Line Assets;

WHEREAS, the Delta Assets, the Na Kika Assets, the RGP Assets, and the NBR Line Assets shall be collectively referred to herein as the “Assets”;

WHEREAS, the above referenced purchases and sales of the Assets shall be in accordance with the terms of this Agreement and shall collectively be referred to herein as the “Transaction”; and

WHEREAS, (a) the Conflicts Committee (the “Conflicts Committee”) of the Board of Directors (the “Board of Directors”) of Shell Midstream Partners GP LLC, the general partner of SHLX (the “General Partner”), has previously (i) received an opinion of Evercore Group L.L.C., the financial advisor to the Conflicts Committee (the “Financial Advisor”), that the consideration to be paid by SHLX pursuant to the Transaction is fair, from a financial point of view, to SHLX and its unitholders, other than the General Partner, Shell Midstream LP Holdings LLC and their respective Affiliates, and (ii) based on the belief of the members of the Conflicts Committee that the consummation of the Transaction on the terms and conditions set forth in this Agreement would not be adverse to the best interests of the Partnership Group (as defined in the First Amended and Restated Agreement of Limited Partnership of SHLX dated as of November 3, 2014 (the “Partnership Agreement”)), unanimously approved the Transaction, such approval constituting “Special Approval” for purposes of the Partnership Agreement, and unanimously recommended that the Board of Directors approve the Transaction and (b) subsequently, the Board of Directors has approved the Transaction.

NOW, THEREFORE, in consideration of the premises and the respective representations, warranties, covenants, agreements and conditions contained herein, the parties hereto agree as follows:

Article I

DEFINITIONS

The respective terms defined in this Section 1.1 shall, when used in this Agreement, have the respective meanings specified herein, with each such definition equally applicable to both singular and plural forms of the terms so defined:

“Affiliate,” means, with respect to any Person, any other Person that directly or indirectly Controls, is Controlled by or is under common Control with such Person; provided that such term when used (a) with respect to SPLC, GOM, or Shell Chemical, means any other Person that directly or indirectly Controls, is Controlled by or is under common Control with SPLC, GOM, or Shell Chemical, excluding SHLX, the General Partner, Operating and its subsidiaries and equity interests, and (b) with respect to SHLX, the term “Affiliate” shall mean only the General Partner, Operating and Operating’s subsidiaries (including Pecten and Sand Dollar) and equity interests. No Person shall be deemed an Affiliate of any Person solely by reason of the exercise or existence of rights, interests or remedies under this Agreement.

“Agreement” has the meaning ascribed to such term in the preamble.

“Applicable Law” means any law (including common law) or administrative rule or regulation or any judicial, administrative or arbitration order, award, judgment, writ, injunction or decree applicable to any Seller or Purchaser, or the Assets.

“Applicable Production” has the meaning ascribed to such term in Section 5.5.

“Assets” has the meaning ascribed to such term in the recitals.

“Assignment Agreements” means: (i) the bill of sale and assignment agreement among SPLC, GOM, and Pecten, dated as of the Closing Date, conveying SPLC and GOM’s respective interests in the Delta Assets and Na Kika Assets, except for the Delta Rights-of-Way and Leases and the Na Kika Rights-of-Way (the “Delta/Na Kika Bill of Sale and Assignment”); (ii) subject to Section 5.3, the assignments of rights-of-way and leases among SPLC, GOM, and Pecten, dated as of the Closing Date, conveying SPLC and GOM’s respective interests in the Delta Rights-of-Way and Leases and the Na Kika Rights-of-Way (the “Delta/Na Kika Assignments of Rights-of-Way and Leases”); (iii) the bill of sale and assignment agreement among SPLC, Shell Chemical, and Sand Dollar, dated as of the Closing Date, conveying Shell Chemical and SPLC’s respective interests in the RGP Assets and NBR Line Assets, except for the RGP Rights-of-Way and the NBR Line Rights-of-Way (the “RGP Bill of Sale and Assignment”); and (iv) subject to Section 5.3, the assignments of rights-of-way among SPLC, Shell Chemical, and Sand Dollar dated as of the Closing Date and conveying Shell Chemical and SPLC’s respective interests in the RGP Rights-of-Way and the NBR Line Rights-of-Way (the “RGP Assignments of Rights-of-Way”), each in a form to be mutually agreed upon by the applicable parties.

“Board of Directors” has the meaning ascribed to such term in the recitals.

“Business Day” means any day except a Saturday, a Sunday and any day in which in Houston, Texas, United States shall be a legal holiday or a day on which banking institutions are authorized or required by law or other government action to close.

“Ceiling Amount” has the meaning ascribed to such term in Section 8.6(a).

“CERCLA” means the Comprehensive Environmental Response, Compensation, and Liability Act.

“Closing” has the meaning ascribed to such term in Section 2.3.

“Closing Date” means the date on which the Closing occurs.

“Code” means the Internal Revenue Code of 1986, as amended.

“Conflicts Committee” has the meaning ascribed to such term in the recitals.

“Connection Agreements” (each a “Connection Agreement”) means: (i) the connection agreement to be executed by Sand Dollar and Shell Chemical, to be effective at the Effective Time, with respect to each connection between a RG Pipeline and another Shell Chemical asset that is not part of the Assets, and (ii) the connection agreement to be executed by Pecten and SPLC, to be effective at the Effective Time, with respect to each connection between the Delta Pipeline and another SPLC asset that is not part of the Assets, each in a form to be mutually agreed upon by the applicable parties.

“Consideration” means Six Hundred Thirty Million United States Dollars ($630,000,000).

“Control” and its derivatives mean the possession, directly or indirectly, of the power to direct or cause the direction of the management and policies of a Person, whether through ownership of voting securities, by contract or otherwise.

“Convent Refinery” means the Shell refinery in Convent, Louisiana.

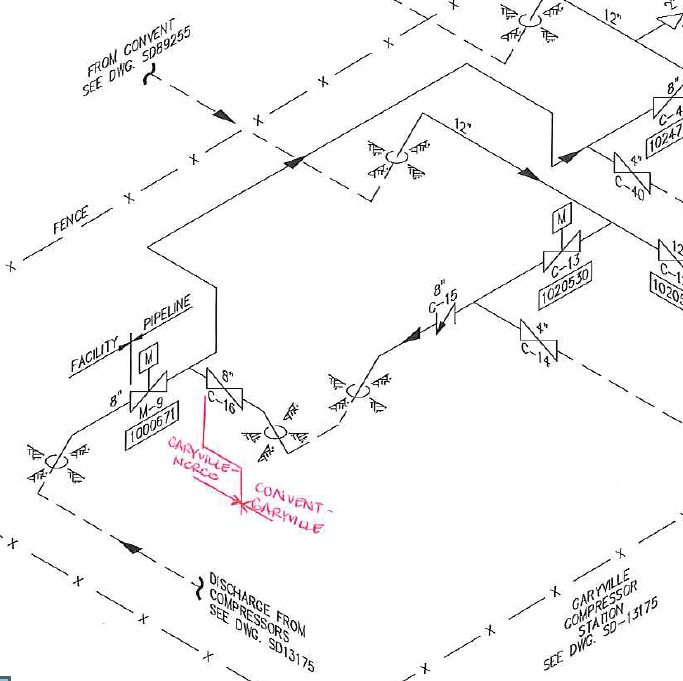

“Convent RG Pipeline” means the RG Pipeline that extends from an interconnection with the Convent Refinery to Sorrento and Garyville in Louisiana and which system is more particularly described on Exhibit D-5.

“Crude Oil Inventory” has the meaning ascribed to such term in Section 2.4(a).

“Damages” means any losses, damages, liabilities, claims, demands, causes of action, judgments, settlements, fines, penalties, costs and expenses (including court costs and reasonable attorneys’ and expert’s fees) of any and every kind or character, known or unknown, fixed or contingent.

“Deductible Amount” has the meaning ascribed to such term in Section 8.6(a).

“Delaware LLC Act” means the Delaware Limited Liability Company Act, as amended.

“Delta Assets” means: (i) the Delta Pipeline System; (ii) the Delta Contracts; (iii) the Delta Rights-of-Way and Leases; (iv) the books and records of SPLC and its Affiliates to the extent relating to the Delta Pipeline System and required for the operation or management thereof; and (v) rights, benefits, claims, causes of action, and choses in action relating to the Delta Pipeline System, in each case effective and/or owned or held by SPLC as of the Closing Date.

“Delta Contracts” means those contracts, agreements, and permits set forth on Section 1.1 of the Disclosure Letter under the heading “Delta.”

“Delta Pipeline System” means the crude oil trunk line system commonly known as the “Delta Pipeline,” which is comprised of approximately 126 miles of pipeline in the eastern Gulf of Mexico that connects various offshore production facilities, an offshore transportation platform more commonly known as MP-69P, and a station more commonly known as MP-69A, and is more particularly described on Exhibit A attached hereto and made a part hereof, and any additions or modifications made thereto prior to the Closing, together with any and all pipe, tanks, pumps, motors, valves, fittings, miscellaneous equipment, personal property, improvements, fixtures, structures, facilities, and buildings associated therewith.

“Delta Rights-of-Way and Leases” means those rights-of-way, easements, servitudes, leases, and similar rights set forth on Section 1.1 of the Disclosure Letter under the heading “Delta.”

“Direct Claim” has the meaning ascribed to such term in Section 8.5.

“Disclosure Letter” has the meaning ascribed to such term in Article III.

“Dispute” has the meaning ascribed to such term in Section 9.5(a).

“Effective Time” means 12:01 a.m., Central Standard Time, on May 1, 2017.

“Environmental Laws” means, without limitation, the following laws, in effect, and as interpreted and enforced, as of the Closing Date: (a) the Resource Conservation and Recovery Act; (b) the Clean Air Act; (c) CERCLA; (d) the Federal Water Pollution Control Act; (e) the Safe Drinking Water Act; (f) the Toxic Substances Control Act; (g) the Emergency Planning and Community Right-to-Know Act; (h) the National Environmental Policy Act; (i) the Pollution Prevention Act of 1990; (j) the Oil Pollution Act of 1990; (k) the Hazardous Materials Transportation Act; (l) the Federal Insecticide, Fungicide and Rodenticide Act; (m) all laws, statutes, rules, regulations, orders, judgments, decrees promulgated or issued with respect to the foregoing Environmental Laws by Governmental Authorities; and (n) any other federal, state or local statutes, laws, common laws, ordinances, rules, regulations, orders, codes, decisions, injunctions or decrees that regulate or otherwise pertain to the protection of the environment, including the management, control, discharge, emission, exposure, treatment, containment, handling, removal, use, generation, permitting, migration, storage, release, transportation, disposal, remediation, manufacture, processing or distribution of Hazardous Materials that are or may present a threat to human health or the environment.

“FERC” means the United States Federal Energy Regulatory Commission.

“Financial Advisor” has the meaning ascribed to such term in the recitals.

“GAAP” means generally accepted accounting principles in the United States of America.

“General Partner” has the meaning ascribed to such term in the recitals.

“GOM” has the meaning ascribed to such term in the preamble.

“GOM Closing Certificate” has the meaning ascribed to such term in Section 7.1(a).

“GOM Permits” has the meaning ascribed to such term in Section 3.9.

“Governmental Authority” means any federal, state, municipal or other government, governmental court, department, commission, board, bureau, agency or instrumentality, whether foreign or domestic.

“Hazardous Materials” means (a) any substance, whether solid, liquid or gaseous, that (i) is listed, defined or regulated as a “hazardous material,” “hazardous waste,” “solid waste,” “hazardous substance,” “toxic substance,” “pollutant” or “contaminant,” or words of similar meaning or import found in any applicable Environmental Law or (ii) is or contains asbestos, polychlorinated biphenyls, radon, urea formaldehyde foam insulation, explosives, or radioactive materials; (b) any petroleum, petroleum hydrocarbons, petroleum substances, petroleum or petrochemical products, refined petroleum products, natural gas, crude oil and any components, fractions, or derivatives thereof, any oil or gas exploration or production waste, and any natural gas, synthetic gas and any mixtures thereof; (c) naturally occurring radioactive material, radioactive material, waste and pollutants, radiation, radionuclides and their progeny, or nuclear waste including used nuclear fuel; or (d) any substance, whether solid, liquid or gaseous, that causes or poses a threat to cause contamination or nuisance on any properties, or any adjacent property or a hazard to the environment or to the health or safety of persons on or about any properties.

“HSR Act” means the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended.

“Indebtedness for Borrowed Money” means, with respect to any Person, without duplication, (a) all obligations of such Person for borrowed money or with respect to deposits or advances of any kind, (b) all obligations of such Person evidenced by bonds, debentures, notes or similar instruments, (c) all obligations of such Person under conditional sale or other title retention agreements relating to property acquired by such Person, (d) all obligations of such Person in respect of the deferred purchase price of property or services or any other similar obligation upon which interest charges are customarily paid (excluding trade accounts payable incurred in the ordinary course of business), (e) all Indebtedness for Borrowed Money of others secured by (or for which the holder of such Indebtedness for Borrowed Money has an existing right, contingent or otherwise, to be secured by) any encumbrance on property owned or acquired

by such Person, whether or not the Indebtedness for Borrowed Money secured thereby has been assumed, (f) all assurances by such Person of Indebtedness for Borrowed Money of others, (g) all capital lease obligations of such Person, (h) all obligations, contingent or otherwise, of such Person as an account party in respect of letters of credit and letters of guaranty and (i) all obligations, contingent or otherwise, of such Person in respect of bankers’ acceptances.

“Interstate Commerce Act” means the version of the Interstate Commerce Act under which FERC regulates oil pipelines, 49 U.S.C. app. §§ 1, et seq. (1988), and the regulations promulgated by the FERC thereunder.

“Knowledge,” as used in this Agreement with respect to a party hereof, means the actual knowledge of that party’s designated personnel after due inquiry. The designated personnel for SPLC, GOM, Shell Chemical, and SHLX are set forth on Appendix A.

“Lien” means any mortgage, deed of trust, lien, security interest, pledge, conditional sales contract, charge or encumbrance.

“LPSC” has the meaning ascribed to such term in Section 3.14.

“Material Contract” has the meaning ascribed to such term in Section 3.10(a).

“Minimum Claim Amount” has the meaning ascribed to such term in Section 8.6(a).

“Na Kika Assets” means (i) the Na Kika Pipeline System; (ii) the Na Kika Contracts; (iii) the Na Kika Rights-of-Way; (iv) the books and records of GOM and its Affiliates to the extent relating to the Na Kika Pipeline System and required for the operation or management thereof; and (v) rights, benefits, claims, causes of action, and choses in action relating to the Na Kika Pipeline System, in each case effective and/or owned or held by GOM as of the Closing Date.

“Na Kika Contracts” means those contracts, agreements, and permits set forth on Section 1.1 of the Disclosure Letter under the heading “Na Kika.”

“Na Kika Pipeline System” means the offshore crude oil pipeline system commonly known as the “Na Kika Pipeline,” which is comprised of approximately 74 miles of pipeline in the eastern Gulf of Mexico and is more particularly described on Exhibit B attached hereto and made a part hereof, and any additions or modifications made thereto prior to the Closing, together with any and all pipe, pumps, motors, valves, fittings, miscellaneous equipment, personal property, improvements, fixtures, and structures associated therewith.

“Na Kika Rights-of-Way” means those rights-of-way, easements, servitudes, and similar rights set forth on Section 1.1 of the Disclosure Letter under the heading “Na Kika.”

“NBR Line” means the approximately 16-mile segment of a pipeline that extends between Sorrento and Garyville, Louisiana, leased by SPLC to Shell Chemical under the NBR Line Lease, and more particularly described on Exhibit C attached hereto and made a part hereof and any additions or modifications made thereto prior to the Closing, together with any and all pipe, motors, valves, fittings, miscellaneous equipment, personal property, improvements, fixtures, structures, facilities, and buildings associated therewith.

“NBR Line Assets” means: (i) the NBR Line; (ii) the NBR Line Contracts; (iii) the NBR Line Rights-of-Way; (iv) the books and records of SPLC and its Affiliates to the extent relating to the NBR Line and required for the operation or management thereof; and (v) rights, benefits, claims, causes of action, and choses in action relating to the NBR Line, in each case effective and/or owned or held by SPLC as of the Closing Date.

“NBR Line Contracts” means those contracts, agreements, and permits set forth on Section 1.1 of the Disclosure Letter under the heading “NBR Line.”

“NBR Line Lease” means that certain Lease of Shell Pipeline 12” Products Line Segment dated effective January 1, 2013, as may have been amended and extended, between SPLC and Shell Chemical for the NBR Line.

“NBR Line Rights-of-Way” means those rights-of-way, easements, servitudes, and similar rights set forth on Section 1.1 of the Disclosure Letter under the heading “NBR Line.”

“Non-Assigned Asset” has the meaning ascribed to such term in Section 5.3.

“Notice” has the meaning ascribed to such term in Section 9.4.

“OCSLA” has the meaning ascribed to such term in Section 3.14.

“Omnibus Agreement” means that certain Omnibus Agreement among SPLC, SHLX, the General Partner, Operating and Shell Oil Company, dated as of November 3, 2014.

“Operating” has the meaning ascribed to such term in the preamble.

“Option Agreement” means an option agreement to be executed by Sand Dollar, Operating, and Shell Chemical, at the Closing to be effective at the Effective Time, in which Sand Dollar will grant Shell Chemical both a purchase option and a right of first refusal as to all or a portion of the RG Pipeline Assets and/or the NBR Line Assets, and in which Operating will grant Shell Chemical a right of first refusal as to the membership interests of Sand Dollar, in a form to be mutually agreed upon among Sand Dollar, Operating, and Shell Chemical.

“Partnership Agreement” has the meaning ascribed to such term in the recitals.

“Pecten” has the meaning ascribed to such term in the preamble.

“Pecten Operating Agreement” means the Operating and Administrative Management Agreement dated effective October 1, 2015 by and between SPLC and Pecten.

“Permitted Liens” means all: (a) mechanics’, materialmen’s, repairmen’s, employees’ contractors’ operators’, carriers’, workmen’s or other like Liens or charges arising by operation of law, in the ordinary course of business or incident to the construction or improvement of any of the Assets, in each case, for amounts not yet delinquent (including any amounts being withheld as provided by law); (b) Liens arising under original purchase price conditional sales contracts and equipment leases with third parties entered into in the ordinary course of business; (c) immaterial defects and irregularities in title, encumbrances, exceptions and other matters that, singularly or in the aggregate, will not materially interfere with the ownership, use, value, operation or maintenance of the Assets to which they pertain or the Sellers’ ability to perform their respective obligations hereunder with respect thereto; (d) Liens for Taxes that are not yet due and payable; (e) pipeline, utility and similar easements and other rights in respect of surface operations; (f) Liens supporting surety bonds, performance bonds and similar obligations issued in connection with the Assets; and (g) all rights to consent, by required notices to, filings with, or other actions by Governmental Authorities or third parties in connection with the sale or conveyance of easements, rights-of-way, licenses, facilities or interests therein if they are customarily obtained subsequent to the sale or conveyance.

“Person” means an individual or entity, including any partnership, corporation, association, trust, limited liability company, joint venture, unincorporated organization or other entity.

“Purchasers” (individually, a “Purchaser”) has the meaning ascribed to such term in Section 2.1.

“RGP Assets” means: (i) the RG Pipelines; (ii) the RGP Contracts; (iii) the RGP Rights-of-Way; (iv) the books and records of Shell Chemical and its Affiliates to the extent relating to the RG Pipelines and required for the operation or management thereof; and (v) rights, benefits, claims, causes of action, and relating to the RG Pipelines, in each case effective and/or owned or held by Shell Chemical as of the Closing Date.

“RGP Contracts” means those contracts, agreements, and permits set forth on Section 1.1 of the Disclosure Letter under the heading “RG Pipelines.”

“RGP Connections” has the meaning ascribed to such term in Section 5.2.

“RG Inventory” has the meaning ascribed to such term in Section 2.4(b).

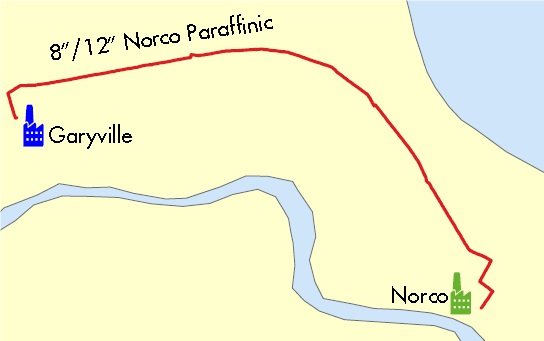

“RG Pipelines” (each, an “RG Pipeline”) means the five (5) refinery gas pipelines that transport off gases from various refinery and other process units and extend to delivery points at Shell Chemical’s Deer Park Chemical Plant or the Norco Chemical Plant, which systems are more particularly described on Exhibit D attached hereto and made a part hereof and any additions or modifications made thereto prior to the Closing, together with any and all pipe, motors, valves, fittings, miscellaneous equipment, personal property, improvements, fixtures, structures, facilities, and buildings associated therewith, but specifically excluding any pumps, compressors, and associated equipment owned by Shell Chemical, as may be further described in the Connection Agreements.

“RGP Rights-of-Way” means those rights-of-way, easements, servitudes, and similar rights set forth on Section 1.1 of the Disclosure Letter under the heading “RG Pipelines.”

“Rules” has the meaning ascribed to such term in Section 9.5(a).

“Sand Dollar” has the meaning ascribed to such term in the preamble.

“Sand Dollar Operating Agreement” means an Operating and Administrative Management Agreement, to be executed between Sand Dollar and SPLC, to be effective as of the Effective Time, in which SPLC will provide certain services to Sand Dollar relating to the RGP Assets and NBR Line Assets, in a form to be agreed upon between Sand Dollar and SPLC.

“Securities Act” means the Securities Act of 1933, as amended, and the rules and regulations promulgated thereunder.

“Seller Material Adverse Effect” means a material adverse effect on or a material adverse change in (a) the value or operation of the Assets, taken as a whole, other than any effect or change (i) that impacts the offshore or onshore crude oil or refinery gas transportation generally (including any change in the prices of crude oil, refinery gas, or other hydrocarbon products, industry margins or any regulatory changes or changes in Applicable Law or GAAP), (ii) in United States or global political or economic conditions or financial markets in general, or (iii) resulting from the announcement of the transactions contemplated by this Agreement and the taking of any actions contemplated by this Agreement , provided, that in the case of clauses (i) and (ii), the impact on the Assets is not materially disproportionate to the impact on similarly situated assets in the offshore or onshore crude oil or refinery gas transportation, as applicable, or (b) the ability of any of the Sellers to perform its respective obligations under this Agreement and/or the other Transaction Documents to which a Seller is a party or to consummate the transactions contemplated hereby or thereby.

“Seller Indemnified Parties” has the meaning ascribed to such term in Section 8.2.

“Sellers” (individually, a “Seller”) has the meaning ascribed to such term in Section 2.1.

“Shell Chemical” has the meaning ascribed to such term in the preamble.

“Shell Chemical Closing Certificate” has the meaning ascribed to such term in Section 7.1(a).

“Shell Chemical Permits” has the meaning ascribed to such term in Section 3.9.

“SHLX” has the meaning ascribed to such term in the preamble.

“SHLX Closing Certificate” has the meaning ascribed to such term in Section 7.2(a).

“SHLX Indemnified Parties” has the meaning ascribed to such term in Section 8.1.

“SHLX Material Adverse Effect” means a material adverse effect on or a material adverse change in the ability of any of the Purchasers to perform its respective obligations under this Agreement and the other Transaction Documents or to consummate the transactions contemplated hereby or thereby.

“SPLC” has the meaning ascribed to such term in the preamble.

“SPLC Closing Certificate” has the meaning ascribed to such term in Section 7.1(a).

“SPLC Permits” has the meaning ascribed to such term in Section 3.9.

“Tax” means any and all U.S. federal, state, local or foreign net income, gross income, gross receipts, sales, use, ad valorem, transfer, franchise, capital stock, profits, margin, license, license fee, environmental, customs duty, unclaimed property or escheat payments, alternative fuels, mercantile, lease, service, withholding, payroll, employment, unemployment, social security, disability, excise, severance, registration, stamp, occupation, premium, property (real or personal), windfall profits, fuel, value added, alternative or add on minimum, estimated or other similar taxes, duties, levies, customs, tariffs, imposts or assessments (including public utility commission property tax assessments) imposed by any Governmental Authority, together with any interest, penalties or additions thereto payable to any Governmental Authority in respect thereof or any liability for the payment of any amounts of any of the foregoing types as a result of being a member of an affiliated, consolidated, combined or unitary group, or being a party to any agreement or arrangement whereby liability for payment of such amounts was determined or taken into account with reference to the liability of any other Person.

“Tax Return” means any return, declaration, report, statement, election, claim for refund or other written document, together with all attachments, amendments and supplements thereto, filed with or provided to, or required to be filed with or provided to, a Governmental Authority in respect of Taxes.

“Taxing Authority” means, with respect to any Tax, the Governmental Authority that imposes such Tax, and the agency (if any) charged with the collection of such Tax for such entity or subdivision, including any governmental or quasi-governmental entity or agency that imposes, or is charged with collecting, social security or similar charges or premiums.

“Transaction” has the meaning ascribed to such term in the recitals.

“Transaction Documents” means this Agreement, the Assignment Agreements, the Transportation Services Agreements, the Connection Agreements, the Option Agreement, the Sand Dollar Operating Agreement, the amendment to the Pecten Operating Agreement, any certificates delivered by any of the parties at the Closing and any other documents of conveyance or other related documents contemplated to be entered into in connection with this Agreement and the transactions contemplated hereby with respect to which any of the Sellers or Purchasers are parties.

“Transfer Tax” has the meaning ascribed to such term in Section 6.3.

“Transportation Services Agreement” means a transportation services agreement to be executed by Sand Dollar and Shell Chemical, to be effective at the Effective Time, with respect to a RG Pipeline, in a form to be mutually agreed upon between Sand Dollar and Shell Chemical.

“Tribunal” has the meaning ascribed to such term in Section 9.5(b).

In constructing this Agreement: (a) the word “includes” and its derivatives means “includes, without limitation” and corresponding derivative expressions; (b) the currency amounts referred to herein, unless otherwise specified, are in United States dollars; (c) whenever this Agreement refers to a number of days, such number shall refer to calendar days unless Business Days are specified; (d) unless otherwise specified, all references in this Agreement to “Article,” “Section,” “Disclosure Letter,” “Exhibit,” “preamble” or “recitals” shall be references to an Article, Section, Disclosure

Letter, Exhibit, preamble or recitals hereto; (e) whenever the context requires, the words used in this Agreement shall include the masculine, feminine and neuter and singular and the plural; and (f) the terms “herein,” “hereby,” “hereunder,” “hereof,” “hereinafter,” “hereto” and other equivalent words refer to this Agreement in its entirety and not solely to the particular portion of the Agreement in which such word is used.

ARTICLE II

PURCHASE AND SALE AND CLOSING

| |

| Section 2.1 | Purchase and Sale. |

Upon the terms and subject to the conditions set forth in this Agreement (including but not limited to Section 5.3) and in the Transaction Documents, at the Closing, SPLC, GOM, and Shell Chemical (collectively, the “Sellers” and individually, a “Seller”)) shall each sell, transfer, assign, and convey their respective interests in the Assets to SHLX or to Pecten or Sand Dollar, as the case may be, each as designees of SHLX (collectively, with SHLX, the “Purchasers” and individually, a “Purchaser”), free and clear of all Liens (other than restrictions under applicable federal and state securities laws and other than Permitted Liens), and the Purchasers shall accept and acquire their respective interests in the Assets from the Sellers, as described in the recitals.

| |

| Section 2.2 | Consideration. |

The aggregate amount of cash consideration for the Assets to be paid by SHLX to the Sellers shall be the Consideration.

(a) The closing of the Transaction (the “Closing”) shall take place as provided in this Section 2.3, but if the Closing occurs, the Transaction, including the transfer of the Assets, of the risk of loss and reward relating to the Assets, shall be effective as of the Effective Time. The Closing will be held at the offices of SPLC at 910 Louisiana Street, Houston, Texas 77002 on May 10, 2017, commencing at 9:00 a.m., Houston time, or such other place, date and time or means (including by electronic means), as may be mutually agreed upon by the parties hereto.

(b) At the Closing, SHLX or its designee shall deliver, or cause to be delivered, the following:

| |

| (i) | to SPLC or its designee(s), on behalf of the Sellers, the Consideration by wire transfer in immediately available funds to an account of SPLC or such designee(s) to be designated by SPLC, which designation shall be made not less than two (2) business days prior to the Closing; |

| |

| (ii) | to the Sellers, a certificate of good standing of recent date of each of SHLX, Pecten, and Sand Dollar; and |

| |

| (iii) | to the Sellers, the SHLX Closing Certificate. |

(c) At the Closing, Operating or its designee shall deliver, or cause to be delivered, the following:

| |

| (i) | to Shell Chemical, a duly executed counterpart of the Option Agreement. |

(d) At the Closing, Pecten or its designee shall deliver, or cause to be delivered, the following:

| |

| (i) | to SPLC, a duly executed counterpart of the Connection Agreements for each connection of a Delta Asset to an SPLC asset that is not part of the Assets; |

| |

| (ii) | to SPLC and GOM, a duly executed counterpart of the Delta/Na Kika Bill of Sale and Assignment; |

| |

| (iii) | to SPLC and GOM, a duly executed counterpart of the Delta/Na Kika Assignments of Rights-of-Way and Leases, one for each county or parish in which the underlying real property is located; and |

| |

| (iv) | to SPLC, a duly executed counterpart of an amendment to the Pecten Operating Agreement, expanding the scope of SPLC’s services to Pecten to include services for the Delta Assets and the Na Kika Assets. |

(e) At the Closing, Sand Dollar or its designee shall deliver, or cause to be delivered, the following:

| |

| (i) | to Shell Chemical and SPLC, a duly executed counterpart of the RGP Bill of Sale and Assignment; |

| |

| (ii) | to Shell Chemical and SPLC, a duly executed counterpart of the RGP Assignments of Rights-of-Way, one for each county or parish in which the underlying real property is located; |

| |

| (iii) | to SPLC, a duly executed counterpart of the Sand Dollar Operating Agreement; |

| |

| (iv) | to Shell Chemical, a duly executed counterpart of a Transportation Services Agreement for each of the five (5) RG Pipelines; |

| |

| (v) | to Shell Chemical, a duly executed counterpart of the Connection Agreements for each connection of a RG Pipeline to a Shell Chemical asset that is not part of the Assets; and |

| |

| (vi) | to Shell Chemical, a duly executed counterpart of the Option Agreement. |

(f) At the Closing, SPLC or its designee shall deliver, or cause to be delivered, to SHLX or its designee, the following:

| |

| (i) | a duly executed counterpart of the Connection Agreements for each connection of a Delta Asset to an SPLC asset that is not part of the Assets; |

| |

| (ii) | a duly executed counterpart of the Delta/Na Kika Bill of Sale and Assignment; |

| |

| (iii) | a duly executed counterpart of the Delta/Na Kika Assignments of Rights-of-Way and Leases, one for each county or parish in which the underlying real property is located; |

| |

| (iv) | a duly executed counterpart of an amendment to the Pecten Operating Agreement, expanding the scope of SPLC’s services to Pecten to include services for the Delta Assets and the Na Kika Assets; |

| |

| (v) | a duly executed counterpart of the RGP Bill of Sale and Assignment; |

| |

| (vi) | a duly executed counterpart of the RGP Assignments of Rights-of-Way, one for each county or parish in which the underlying real property is located; |

| |

| (vii) | a duly executed counterpart of the Sand Dollar Operating Agreement; |

| |

| (viii) | a certificate of good standing of recent date for SPLC; |

| |

| (ix) | a foreign qualification certificate of recent date for SPLC; |

| |

| (x) | a certification of non-foreign status in accordance with U.S. Treasury Regulation Section 1.1445-2(b)(2); and |

| |

| (xi) | the SPLC Closing Certificate, duly executed by SPLC. |

(g) At the Closing, GOM or its designee shall deliver, or cause to be delivered, to SHLX or its designee, the following:

| |

| (i) | a duly executed counterpart of the Delta/Na Kika Bill of Sale and Assignment; |

| |

| (ii) | a duly executed counterpart of the Delta/Na Kika Assignments of Rights-of-Way and Leases, one for each county or parish in which the underlying real property is located; |

| |

| (iii) | a certificate of good standing of recent date for GOM; |

| |

| (iv) | a foreign qualification certificate of recent date for GOM; |

| |

| (v) | a certification of non-foreign status in accordance with U.S. Treasury Regulation Section 1.1445-2(b)(2); and |

| |

| (vi) | the GOM Closing Certificate, duly executed by GOM. |

(h) At the Closing, Shell Chemical or its designee shall deliver, or cause to be delivered, to SHLX or its designee, the following:

| |

| (i) | a duly executed counterpart of the RGP Bill of Sale and Assignment; |

| |

| (ii) | a duly executed counterpart of the RGP Assignments of Rights-of-Way, one for each county or parish in which the underlying real property is located; |

| |

| (iii) | a duly executed counterpart of a Transportation Services Agreement for each of the RG Pipelines; |

| |

| (iv) | a duly executed counterpart of the Connection Agreements for each connection of a RG Pipeline to a Shell Chemical asset; |

| |

| (v) | a duly executed counterpart of the Option Agreement; |

| |

| (vi) | a certificate of good standing of recent date for Shell Chemical; |

| |

| (vii) | a foreign qualification certificate of recent date for Shell Chemical; |

| |

| (viii) | a certification of non-foreign status in accordance with U.S. Treasury Regulation Section 1.1445-2(b)(2); and |

| |

| (ix) | the Shell Chemical Closing Certificate, duly executed by Shell Chemical. |

(i) Unless otherwise agreed by the parties hereto and subject to Section 5.3, SHLX or its designee shall record any assignments of rights-of-way, and leases if applicable, in the real property records of the county or parish in which the underlying real property is located, at SHLX’s cost. To the extent that any right-of-way or lease to be assigned hereunder covers assets other than the Assets, the applicable assignment document will note that such right-of-way or lease is being partially assigned only as to the applicable Assets.

(j) If any of the Delta Contracts, Delta Rights-of-Way and Leases, Na Kika Contracts, Na Kika Rights-of-Way, NBR Line Contracts, NBR Line Rights-of-Way, RGP Contracts, or RGP Rights-of-Way are held by an Affiliate of any of the Sellers, then the applicable Seller shall cause its Affiliate to execute an assignment of such Asset to the applicable Purchaser at Closing, subject to Applicable Law and subject to any consents or approvals required to be

obtained from a third party or Governmental Authority. If any such required consents or approvals are not obtained by Closing, then the provisions of Section 5.3 shall apply.

(k) The parties hereto agree to deliver such other certificates, instruments of conveyance and documents as may be reasonably requested by another party hereto not less than two (2) Business Days prior to the Closing Date to carry out the intent and purposes of this Agreement.

| |

| Section 2.4 | Custody Transfer. |

(a) As of the Effective Time, custody of the crude oil held in the Delta Assets and in the Na Kika Assets (the “Crude Oil Inventory”) will be transferred to SHLX or Pecten as its designee, and SHLX, or Pecten as applicable, shall become responsible to each shipper or customer with an interest in the Crude Oil Inventory.

(b) As of the Effective Time, custody of the refinery gas held in the RGP Assets and NBR Assets (the “RG Inventory”) will be transferred to SHLX or Sand Dollar as its designee, and SHLX, or Sand Dollar as applicable, shall become responsible to Shell Chemical for its interest in the RG Inventory.

(c) From and after the Effective Time, the Purchasers and Sellers waive all claims and audit rights as to the Crude Oil Inventory and RG Inventory and the volumes, measurement, and quality thereof.

| |

| Section 2.5 | Proceeds From and Costs of Operations. |

(a) All proceeds attributable to the operation, ownership, use or maintenance of or otherwise relating to the Assets prior to the Effective Time shall be the property of the respective Sellers and to the extent received by any Purchaser or its Affiliates, Purchaser shall promptly and fully disclose, account for and transmit same to the applicable Seller. All proceeds attributable to the operation, ownership, use, or maintenance of or otherwise relating to the Assets on and after the Effective Time shall be the property of the applicable Purchaser and to the extent received by a Seller or its Affiliates, such Seller shall promptly and fully disclose, account for and transmit same to the applicable Purchaser.

(b) Subject to the indemnification provisions herein, Sellers shall be responsible for all costs and expenses with respect to the ownership, operation, use and maintenance of their respective Assets prior to the Effective Time. Subject to the indemnification provisions herein, Purchasers shall be responsible for all such costs and expenses with respect to the ownership, operation, use and maintenance of their respective Assets on and after the Effective Time.

| |

| Section 2.6 | Assumption of Obligations Relating to the Assets. |

From and after the Effective Time, but subject to Sellers’ indemnification obligations herein, Purchasers shall perform all obligations of Sellers to the extent relating to the Assets and arising or incurred after the Effective Time (whether such obligations are to a grantor, a Governmental Authority or any other Person), including, but not limited to, any obligations arising or incurred after the Effective Time with respect to the abandonment or removal (as the case may be) of any existing facilities, any pipeline, appurtenant or associated equipment or other personal property located on and included in the Assets.

ARTICLE III

REPRESENTATIONS AND WARRANTIES OF THE SELLERS

The Sellers each hereby represent and warrant, as applicable and only as to their respective interest in the Assets, to the Purchasers that, except as disclosed in the disclosure letter delivered to the Purchasers on the date of this Agreement (“Disclosure Letter”) (it being understood that any information set forth on any section of the Disclosure Letter shall be deemed to apply to and qualify all sections or subsections of this Agreement to the extent that it is reasonably apparent on its face that such information is relevant to such other sections or subsections):

(a) SPLC is a limited partnership duly formed, validly existing and in good standing under the laws of the State of Delaware and has all requisite limited partnership power and authority to own, operate and lease its properties and assets and to carry on its business as now conducted.

(b) GOM is a limited liability company duly formed, validly existing and in good standing under the laws of the State of Delaware and has all requisite limited liability company power and authority to own, operate and lease its properties and assets and to carry on its business as now conducted.

(c) Shell Chemical is a limited partnership duly formed, validly existing and in good standing under the laws of the State of Delaware and has all requisite limited partnership power and authority to own, operate and lease its properties and assets and to carry on its business as now conducted.

| |

| Section 3.2 | Authority and Approval. |

(a) Such Seller has full limited partnership power and authority or full limited liability company power and authority, as applicable, to execute and deliver this Agreement, to consummate the transactions contemplated hereby and to perform all of the obligations hereof to be performed by it. The execution and delivery of this Agreement and the other Transaction Documents to which such Seller is a party, the consummation of the transactions contemplated hereby and thereby and the performance of all of the obligations hereof and thereof to be performed by such Seller have been duly authorized and approved by all requisite limited partnership or limited liability company action, as applicable, of such Seller.

(b) This Agreement has been duly executed and delivered by each of such Seller and constitutes the valid and legally binding obligation of such Seller, enforceable against such Seller in accordance with its terms, and, upon the execution of all of the other Transaction Documents to which any of the Sellers is a party, such other Transaction Documents will be duly executed and delivered by such Seller and constitute the valid and legally binding obligations of the such Seller, as applicable, enforceable against such Seller, as applicable, in accordance with their terms, except as such enforcement may be limited by applicable bankruptcy, insolvency, reorganization, moratorium, fraudulent conveyance or other similar laws affecting the enforcement of creditors’ rights and remedies generally and by general principles of equity (whether applied in a proceeding at law or in equity).

| |

| Section 3.3 | No Conflict; Consents. |

Except as set forth on Section 3.3 of the Disclosure Letter:

(a) The execution, delivery and performance of this Agreement and the other Transaction Documents to which any of the Sellers is a party by the Sellers, as applicable, does not, and the fulfillment and compliance with the terms and conditions hereof and thereof and the consummation of the transactions contemplated hereby and thereby will not, (i) violate, conflict with, result in any breach of, or require the consent of any Person under, any of the terms, conditions or provisions of the organizational documents of any of the Sellers; (ii) conflict with or violate any provision of any law or administrative rule or regulation or any judicial, administrative or arbitration order, award, judgment, writ, injunction or decree applicable to any of the Sellers or the Assets; (iii) conflict with, result in a breach of, constitute a default under (whether with notice or the lapse of time or both), or accelerate or permit the acceleration of the performance required by, or require any consent, authorization or approval under, or result in the suspension, termination or cancellation of, or in a right of suspension, termination or cancellation of, any indenture, mortgage, agreement, contract, commitment, right of way, license, concession, permit, lease, refinery gas supply contract to which Shell Chemical is a party that constitutes a source of supply of refinery gas to Shell Chemical that is shipped on any of the RG Pipelines, joint venture or other instrument to which any Seller is a party or by which any of them are bound or to which any of the Assets are subject; or (iv) result in the creation of any Lien (other than Permitted Liens) on any of the Assets under any such indenture, mortgage, agreement, contract, commitment, right of way, license, concession, permit, lease, joint venture or other instrument, except in the case of clauses (ii), (iii) and (iv) for those items which, individually or in the aggregate, would not reasonably be expected to have a Seller Material Adverse Effect or result in any material liability or obligation of the Purchasers (other than any liability or obligation hereunder); and

(b) No consent, approval, license, permit, order or authorization of any Governmental Authority or other Person is required to be obtained or made by or with respect to the Sellers with respect to the Assets in connection with the execution, delivery and performance of this Agreement and the other Transaction Documents to which any of the Sellers is a party or the consummation of the transactions contemplated hereby or thereby, except (i) as have been waived or obtained or with respect to which the time for asserting such right has expired or (ii) for those which individually or in the aggregate would not reasonably be expected to have a Seller Material Adverse Effect (including such consents, approvals, licenses, permits, orders or authorizations that are not customarily obtained prior to the Closing and are reasonably expected to be obtained in the ordinary course of business following the Closing).

| |

| Section 3.4 | Title to the Assets. |

(a) Except as set forth on Section 3.4 of the Disclosure Letter, SPLC represents and warrants that:

| |

| (i) | the Delta Assets and the NBR Line Assets are (x) in good operating condition and repair (normal wear and tear excepted), (y) free from any material defects (other than Permitted Liens) and (z) suitable for the purposes for which they are currently used; |

| |

| (ii) | none of the Delta Assets or the NBR Line Assets is in need of maintenance or repairs except for ordinary, routine maintenance and except for regularly scheduled overhauls from time to time; |

| |

| (iii) | SPLC or its Affiliate has valid, binding, and enforceable rights-of-way necessary or required for the ownership and operation of the Delta Assets and the NBR Line Assets in the same manner that they were used, owned, and operated immediately prior to the Effective Time, free and clear of any Liens (other than Permitted Liens); and |

| |

| (iv) | As of the date hereof, SPLC or its Affiliate has good and valid title to the Delta Assets and the NBR Line Assets, free and clear of any Liens (other than Permitted Liens), by, through or under SPLC, but not otherwise, excepting Liens that are discharged by SPLC at Closing. |

(b) Except as set forth on Section 3.4 of the Disclosure Letter, GOM represents and warrants that:

| |

| (i) | the Na Kika Assets are (x) in good operating condition and repair (normal wear and tear excepted), (y) free from any material defects (other than Permitted Liens) and (z) suitable for the purposes for which they are currently used; |

| |

| (ii) | none of the Na Kika Assets is in need of maintenance or repairs except for ordinary, routine maintenance and except for regularly scheduled overhauls from time to time; |

| |

| (iii) | GOM or its Affiliate has valid, binding, and enforceable rights-of-way necessary or required for the ownership and operation of the Na Kika Assets in the same manner that they were used, owned, and operated immediately prior to the Effective Time, free and clear of any Liens (other than Permitted Liens); and |

| |

| (iv) | As of the date hereof, GOM or its Affiliate has good and valid title to the Na Kika Assets, free and clear of any Liens (other than Permitted Liens) by, through or under GOM, but not otherwise, excepting Liens that are discharged by GOM at Closing. |

(c) Except as set forth on Section 3.4 of the Disclosure Letter, Shell Chemical represents and warrants that:

| |

| (i) | the RGP Assets are (x) in good operating condition and repair (normal wear and tear excepted), (y) free from any material defects (other than Permitted Liens) and (z) suitable for the purposes for which they are currently used; |

| |

| (ii) | none of the RGP Assets is in need of maintenance or repairs except for ordinary, routine maintenance and except for regularly scheduled overhauls from time to time; |

| |

| (iii) | Shell Chemical or its Affiliate has valid, binding, and enforceable rights-of-way necessary or required for the ownership and operation of the RGP Assets in the same manner that they were used, owned, and operated immediately prior to the Effective Time, free and clear of any Liens (other than Permitted Liens); and |

| |

| (iv) | As of the date hereof, Shell Chemical or its Affiliate has good and valid title to the RGP Assets, free and clear of any Liens (other than Permitted Liens) by, through or under Shell Chemical, but not otherwise, excepting Liens that are discharged by Shell Chemical at Closing. |

| |

| Section 3.5 | Litigation; Laws and Regulations. |

Except as set forth on Section 3.5 of the Disclosure Letter:

(a) There are no (i) civil, criminal or administrative actions, suits, claims, hearings, arbitrations or proceedings pending, or to SPLC’s Knowledge threatened, affecting the Delta Assets or SPLC’s ownership or operation thereof; (ii) judgments, orders, decrees or injunctions of any Governmental Authority, whether at law or in equity, against SPLC pertaining to the Delta Assets or to SPLC’s ownership or operation thereof; or (iii) pending or, to SPLC’s Knowledge, threatened investigations by any Governmental Authority against SPLC pertaining to the Delta Assets or to SPLC’s ownership or operation thereof, except in each case, for those items that would not, individually or in the aggregate with all matters that are subject to this Section 3.5(a), 3.5(b), 3.5(c) or 3.5(d), reasonably be expected to have a Seller Material Adverse Effect;

(b) There are no (i) civil, criminal or administrative actions, suits, claims, hearings, arbitrations or proceedings pending, or to GOM’s Knowledge threatened, affecting the Na Kika Assets or GOM’s ownership or SPLC’s operation thereof; (ii) judgments, orders, decrees or injunctions of any Governmental Authority, whether at law or in equity, against GOM pertaining to the Na Kika Assets or to GOM’s ownership or SPLC’s operation thereof; or (iii) pending or, to GOM’s Knowledge, threatened investigations by any Governmental Authority against GOM pertaining to the Na Kika Assets or to GOM’s ownership or SPLC’s operation thereof, except in each case, for those items that would not, individually or in the aggregate with all matters that are subject to this Section 3.5(b), 3.5(a), 3.5(c) or 3.5(d), reasonably be expected to have a Seller Material Adverse Effect;

(c) There are no (i) civil, criminal or administrative actions, suits, claims, hearings, arbitrations or proceedings pending, or to Shell Chemical’s Knowledge threatened, affecting the RGP Assets or Shell Chemical’s ownership or SPLC’s operation thereof; (ii) judgments, orders, decrees or injunctions of any Governmental Authority, whether at law or in equity, against Shell Chemical pertaining to the RGP Assets or to Shell Chemical’s ownership or SPLC’s operation thereof; or (iii) pending or, to Shell Chemical’s Knowledge, threatened investigations by any Governmental Authority against Shell Chemical pertaining to the RGP Assets or to Shell Chemical’s ownership or SPLC’s operation thereof, except in each case, for those items that would not, individually or in the aggregate with all matters that are subject to this Section 3.5(c), 3.5(a), 3.5(b) or 3.5(d), reasonably be expected to have a Seller Material Adverse Effect; and

(d) There are no (i) civil, criminal or administrative actions, suits, claims, hearings, arbitrations or proceedings pending, or to SPLC’s Knowledge threatened, affecting the NBR Line Assets or SPLC’s ownership or operation thereof; (ii) judgments, orders, decrees or injunctions of any Governmental Authority, whether at law or in equity, against SPLC pertaining to the NBR Line Assets or to SPLC’s ownership or operation thereof; or (iii) pending or, to SPLC’s Knowledge, threatened investigations by any Governmental Authority against SPLC pertaining to the NBR Line Assets or to SPLC’s ownership or operation thereof, except in each case, for those items that would not, individually or in the aggregate with all matters that are subject to this Section 3.5(d), 3.5(a), 3.5(b) or 3.5(c), reasonably be expected to have a Seller Material Adverse Effect.

| |

| Section 3.6 | No Adverse Changes. |

Except as set forth on Section 3.6 of the Disclosure Letter, since December 31, 2016:

(a) there has not been a Seller Material Adverse Effect; and

(b) there has not been any damage, destruction or loss to any material portion of the Assets, whether or not covered by insurance, in excess of One Million Dollars ($1,000,000).

(a) Except as would not reasonably be expected to have a Seller Material Adverse Effect, (i) all Tax Returns required to be filed by or with respect to the Assets or the operations thereof have been filed on a timely basis (taking into account all extensions of due dates); (ii) all Taxes owed by the Sellers, or any of their Affiliates with respect to the Assets or the operations of thereof, as applicable, which are or have become due, have been timely paid; (iii) there are no Liens on any of the Assets that arose in connection with any failure (or alleged failure) to pay any Tax on the Assets other than Permitted Liens; and (iv) there is no pending action, proceeding or investigation for assessment or collection of Taxes and no Tax assessment, deficiency or adjustment has been asserted or proposed with respect to the Assets, or the operations thereof.

| |

| Section 3.8 | Environmental Matters. |

Except as disclosed in Section 3.8 of the Disclosure Letter, or as would not reasonably be expected, individually or in the aggregate, to have a Seller Material Adverse Effect:

(a) The Assets and the operation thereof are in compliance with applicable Environmental Laws, which compliance includes the possession and maintenance of, and compliance with, all material permits required under all Environmental Laws;

(b) no circumstances exist with respect to the Assets or the operation thereof that give rise to an obligation by any of the Sellers or their respective operators to investigate or remediate the presence, on-site or offsite, of Hazardous Materials under any applicable Environmental Laws;

(c) None of the Sellers have received any written communication from a Governmental Authority as to the Assets that remains unresolved alleging that it may be in violation of any Environmental Law or any Permit issued pursuant to Environmental Law;

(d) none of the Sellers or the Assets are subject to any pending or, to the Knowledge of each of the Sellers, threatened, claim, action, suit, investigation, inquiry or proceeding under any Environmental Law (including designation as a potentially responsible party under CERCLA or any similar local or state law);

(e) all notices, permits, permit exemptions, licenses or similar authorizations, if any, required to be obtained or filed by each of the Sellers under any Environmental Law in connection with their respective interests in the Assets have been duly obtained or filed, are valid and currently in effect, and the Assets and the operation thereof are in compliance with such authorizations;

(f) since January 1, 2014, there has been no release of any Hazardous Material into the environment by the Delta Assets, or, to the Knowledge of SPLC, by a third party except in compliance with applicable Environmental Law;

(g) since January 1, 2014, there has been no release of any Hazardous Material into the environment by the Na Kika Assets, or, to the Knowledge of GOM, by a third party except in compliance with applicable Environmental Law;

(h) since January 1, 2014, there has been no release of any Hazardous Material into the environment by the RGP Assets, or, to the Knowledge of Shell Chemical, by a third party except in compliance with applicable Environmental Law; and

(i) since January 1, 2014, there has been no release of any Hazardous Material into the environment by the NBR Line Assets, or, to the Knowledge of SPLC, by a third party except in compliance with applicable Environmental Law.

| |

| Section 3.9 | Licenses; Permits. |

Except as set forth in Section 3.9 of the Disclosure Letter:

(a) SPLC or its Affiliate has all licenses, permits and authorizations issued or granted or waived by Governmental Authorities that are necessary for the conduct of its business as now being conducted as to the Delta Assets and NBR Line Assets (collectively, “SPLC Permits”), except, in each case, for such items for which the failure to obtain or have waived would not, individually or in the aggregate with any other failure pursuant to this Section 3.9(a), 3.9(f) or 3.9(k), result in a Seller Material Adverse Effect;

(b) All SPLC Permits are validly held by SPLC or its Affiliate and are in full force and effect, except as would not, individually or in the aggregate with any other SPLC Permits, GOM Permits or Shell Chemical Permits that in accordance with this Section 3.9(b), 3.9(g) or 3.9(l) are not validly held or in full force and effect, reasonably be expected to have a Seller Material Adverse Effect;

(c) SPLC has complied with all terms and conditions of the SPLC Permits, except as would not, individually or in the aggregate with any other SPLC Permits, GOM Permits or Shell Chemical Permits that in accordance with this Section 3.9(c), 3.9(h) or 3.9(m) the terms of which have not been complied with, reasonably be expected to have a Seller Material Adverse Effect;

(d) There is no outstanding written notice nor, to SPLC’s Knowledge, any other notice of revocation, cancellation or termination of any SPLC Permit, except, in each case, as would not, individually or in the aggregate with any other SPLC Permits, GOM Permits or Shell Chemical Permits that in accordance with this Section 3.9(d), 3.9(i) or 3.9(n) are the subject of any such notice of revocation, cancellation or termination, reasonably be expected to have a Seller Material Adverse Effect;

(e) No proceeding is pending or, to SPLC’s Knowledge, threatened with respect to any alleged failure by SPLC to have any material SPLC Permit necessary for the operation of any of the Delta Assets or the NBR Line Assets;

(f) GOM, its operator, or its Affiliate has all licenses, permits and authorizations issued or granted or waived by Governmental Authorities that are necessary for the conduct of its business as now being conducted as to the Na Kika Assets (collectively, “GOM Permits”), except, in each case, for such items for which the failure to obtain or have waived would not, individually or in the aggregate with any other failure pursuant to this Section 3.9(f), 3.9(a) or 3.9(k), result in a Seller Material Adverse Effect;

(g) All GOM Permits are validly held by GOM, its operator, or its Affiliate and are in full force and effect, except as would not, individually or in the aggregate with any other GOM Permits, SPLC Permits or Shell Chemical Permits that in accordance with this Section 3.9(g), 3.9(b) or 3.9(l) are not validly held or in full force and effect, reasonably be expected to have a Seller Material Adverse Effect;

(h) GOM or its operator has complied with all terms and conditions of the GOM Permits, except as would not, individually or in the aggregate with any other GOM Permits, SPLC Permits or Shell Chemical Permits that in accordance with this Section 3.9(h), 3.9(c) or 3.9(m) the terms of which have not been complied with, reasonably be expected to have a Seller Material Adverse Effect;

(i) There is no outstanding written notice nor, to GOM’s Knowledge, any other notice of revocation, cancellation or termination of any GOM Permit, except, in each case, as would not, individually or in the aggregate with any other GOM Permits, SPLC Permits or Shell Chemical Permits that in accordance with this Section 3.9(i), 3.9(d) or 3.9(n) are the subject of any such notice of revocation, cancellation or termination, reasonably be expected to have a Seller Material Adverse Effect;

(j) No proceeding is pending or, to GOM’s Knowledge, threatened with respect to any alleged failure by GOM to have any material GOM Permit necessary for the operation of any of the Na Kika Assets;

(k) Shell Chemical, its operator, or its Affiliate has all licenses, permits and authorizations issued or granted or waived by Governmental Authorities that are necessary for the conduct of its business as now being conducted as to the RGP Assets (collectively, “Shell Chemical Permits”), except, in each case, for such items for which the failure to obtain or have waived would not, individually or in the aggregate with any other failure pursuant to this Section 3.9(k), 3.9(a) or 3.9(f), result in a Seller Material Adverse Effect;

(l) All Shell Chemical Permits are validly held by Shell Chemical, its operator, or its Affiliate and are in full force and effect, except as would not, individually or in the aggregate with any other Shell Chemical Permits, SPLC Permits or GOM Permits that in accordance with this Section 3.9(l), 3.9(b) or 3.9(g) are not validly held or in full force and effect, reasonably be expected to have a Seller Material Adverse Effect;

(m) Shell Chemical or its operator has complied with all terms and conditions of the Shell Chemical Permits, except as would not, individually or in the aggregate with any other Shell Chemical Permits, SPLC Permits or GOM Permits that in accordance with this Section 3.9(m), 3.9(c) or 3.9(h) the terms of which have not been complied with, reasonably be expected to have a Seller Material Adverse Effect;

(n) There is no outstanding written notice nor, to Shell Chemical’s Knowledge, any other notice of revocation, cancellation or termination of any Shell Chemical Permit, except, in each case, as would not, individually or in the aggregate with any other Shell Chemical Permits, SPLC Permits or GOM Permits that in accordance with this Section 3.9(n), 3.9(d) or 3.9(i) are the subject of any such notice of revocation, cancellation or termination, reasonably be expected to have a Seller Material Adverse Effect; and

(o) No proceeding is pending or, to Shell Chemical’s Knowledge, threatened with respect to any alleged failure by Shell Chemical to have any material Shell Chemical Permit necessary for the operation of any of the RGP Assets.

| |

| Section 3.10 | Material Contracts. |

(a) Section 3.10(a) of the Disclosure Letter contains a true and complete listing (redacted as applicable to comply with regulatory requirements) of the following contracts and other agreements, as amended and in effect, to which, as of the date of this Agreement, any of the Assets are subject (each such contract or agreement, along with all amendments and supplements thereto, being referred to herein as a “Material Contract”):

| |

| (i) | contracts, agreements and instruments representing Indebtedness for Borrowed Money and all guarantees thereof; |

| |

| (ii) | price swaps, hedges, futures or similar instruments; |

| |

| (iii) | contracts containing any preferential rights to purchase or similar rights relating to any of the Assets; and |

| |

| (iv) | contracts or agreements which, individually, require or entitle any of the Sellers to make or receive payments aggregating at least Twenty-Five Million Dollars ($25,000,000) annually, provided that the calculation of the aggregate payments for any such agreement or contract |

shall not include payments attributable to any renewal periods or extensions for which any of the Sellers may exercise a renewal or extension option in its sole discretion.

(b) Subject to regulatory requirements of which SHLX has been informed, the Sellers have made available to SHLX a correct and complete copy of each Material Contract listed in Section 3.10(a) of the Disclosure Letter.

(c) Except as would not, individually or in the aggregate, reasonably be expected to result in a Seller Material Adverse Effect or as disclosed on Section 3.10(c) of the Disclosure Letter: (i) each Material Contract, each tariff or transportation contract for shipments on the Delta Pipeline System or Na Kika Pipeline System and each contract to which Shell Chemical is a party to acquire refinery gas from a supplier for shipment on any of the RG Pipelines is legal, valid and binding on and enforceable against the applicable Seller and in full force and effect; (ii) each Material Contract, each tariff or transportation contract for shipments on the Delta Pipeline System or Na Kika Pipeline System and each contract to which Shell Chemical is a party to acquire refinery gas from a supplier for shipment on any of the RG Pipelines will continue to be legal, valid, binding and enforceable, and in full force and effect on identical terms following the consummation of the transactions contemplated by this Agreement; (iii) each Seller represents that it is not in breach or default, and no event has occurred that with notice, lapse of time or a combination would constitute a breach or default by such Seller, or permit termination, modification or acceleration, under any Material Contract, any tariff or transportation contract for shipments on the Delta Pipeline System or Na Kika Pipeline System or any contract to which Shell Chemical is a party to acquire refinery gas from a supplier for shipment on any of the RG Pipelines; and (iv) to each Seller’s Knowledge, no other party to any Material Contract, any tariff or transportation contract for shipments on the Delta Pipeline System or Na Kika Pipeline System or any contract to which Shell Chemical is a party to acquire refinery gas from a supplier for shipment on any of the RG Pipelines is in breach or default, and no event has occurred which with notice, lapse of time or a combination would constitute a breach or default by such other party, or permit termination, modification or acceleration, under any Material Contract, any tariff or transportation contract for shipments on the Delta Pipeline System or Na Kika Pipeline System or any contract to which Shell Chemical is a party to acquire refinery gas from a supplier for shipment on any of the RG Pipelines (other than an expiration of any Material Contract, any tariff or transportation contract for shipments on the Delta Pipeline System or Na Kika Pipeline System or any contract to which Shell Chemical is a party to acquire refinery gas from a supplier for shipment on any of the RG Pipelines in accordance with its terms), nor has any other party repudiated any provision of any Material Contract, any tariff or transportation contract for shipments on the Delta Pipeline System or Na Kika Pipeline System or any contract to which Shell Chemical is a party to acquire refinery gas from a supplier for shipment on any of the RG Pipelines.

Section 3.11 of the Disclosure Letter sets forth a list of the material insurance policies that any of the Sellers holds with respect to the Assets whether any of the Sellers is the beneficiary. Such policies are in full force and effect, all premiums due and payable under such policies have been paid, and none of the Sellers has received written notice of any pending or threatened termination of, or indication of an intention not to renew, such policies.

| |

| Section 3.12 | Brokerage Arrangements. |

None of the Sellers or any of their respective Affiliates has entered (directly or indirectly) into any agreement with any Person that would obligate any of the SHLX, Operating, Pecten, Sand Dollar or any of their respective Affiliates, to pay any commission, brokerage or “finder’s fee” or other similar fee in connection with this Agreement or the other Transaction Documents or the Transactions contemplated hereby or thereby. For purposes of this Section 3.12, SHLX and its subsidiaries shall not constitute Affiliates of any of the Sellers or their respective Affiliates.

| |

| Section 3.13 | Books and Records. |

Accurate copies of all books and records maintained by, or made available to, any of the Sellers with respect the Assets have been made available for inspection to SHLX.

| |

| Section 3.14 | Regulatory Matters. |

Since January 1, 2016, SPLC has been subject to and has been in material compliance with the rules, regulations and orders of the LPSC applicable to the Delta Pipeline. SPLC has duly filed all forms and reports required to be filed by or with respect to the Delta Pipeline with the LPSC, and such forms and reports have been prepared in accordance with Applicable Law, except to the extent that any noncompliance, either individually or in the aggregate, would not reasonably be expected to have a Seller Material Adverse Effect.

Since January 1, 2016, the Na Kika Pipeline has not been subject to the jurisdiction of, or regulation by, the FERC under the Interstate Commerce Act and has been operated by SPLC in compliance with the nondiscriminatory open access transportation requirements under the Outer Continental Shelf Lands Act, 43 U.S.C. § 1331 et seq. (2017) (“OCSLA”).

Since 1996, the RG Pipelines and the NBR Line have not been subject to the jurisdiction of, or regulation by, the FERC under the Interstate Commerce Act and have been operated by SPLC in accordance with Applicable Law.

| |

| Section 3.15 | Management Projections and Budget. |

The projections and budgets regarding the Assets identified on Section 3.15 of the Disclosure Letter, which were provided to SHLX (including those provided to the Financial Advisor) by the Sellers and their Affiliates as part of SHLX’s review in connection with this Agreement, were prepared based upon assumptions that the Sellers’ respective management believe to be reasonable as of the date thereof and were consistent with the Sellers’ respective management’s reasonable expectations as of the time they were prepared.

| |

| Section 3.16 | Disclaimer of Warranties. |

Except as specifically set forth in this Agreement or the other Transaction Documents, (a) Sellers are selling and the Purchasers are acquiring the Assets on an “AS IS” and “WHERE IS” basis, without any representations and warranties concerning the Assets (express, implied or statutory), (b) the Sellers have not made and are not making any representation or warranty of title, fitness for a particular purpose, merchantability or otherwise with regard to the Assets, and Sellers hereby expressly disclaim any such representations or warranties (express, implied or statutory), (c) Purchasers are not relying on (and hereby disclaim any reliance on) any statement, promise or extra-contractual representation of Sellers or any agent or employee of any Seller and (d) Sellers have not and do not warrant any description, value, quality or condition of any of the Assets (including as to any of the pipelines, appurtenant or associated equipment or other real or personal property located on or included in the property constituting the Assets).

The above disclaimer shall appear in each of the Assignment Agreements.

ARTICLE IV

REPRESENTATIONS AND WARRANTIES OF THE PURCHASERS