- UBS Dashboard

- Financials

- Filings

- Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

F-4/A Filing

UBS (UBS) F-4/ARegistration of securities (foreign) (amended)

Filed: 9 Oct 14, 12:00am

As filed with the Securities and Exchange Commission on October 9, 2014

Registration No. 333-199011

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Pre-Effective Amendment No. 1 to

Form F-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

UBS Group AG

(Exact name of Registrant as specified in its charter)

| Switzerland | 6021 | Not Applicable | ||

(State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

Bahnhofstrasse 45, CH-8001 Zurich, Switzerland +41 44 234 11 11

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

677 Washington Boulevard, Stamford, CT 06901

Telephone: (203) 719-3000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

David Kelly UBS AG 677 Washington Boulevard Stamford, CT 06901 Telephone: +1 (203) 719-3000 | David Rockwell, Esq. Sullivan & Cromwell LLP 1 New Fetter Lane London EC4A 1AN United Kingdom Tel. No.: 011-44-20-7959-8900 | Prof. Dr. Rolf Watter Bär & Karrer AG Brandschenkestrasse 90 CH-8027 Zurich Switzerland Tel. No.: +41 58 261 50 00 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer) ¨

Exchange Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) x

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary offer to exchange/prospectus is not complete and may be changed. UBS Group AG may not complete the exchange offer and issue the securities referred to below until the registration statement filed with the Securities and Exchange Commission becomes effective. This preliminary offer to exchange/prospectus is not an offer to sell these securities and UBS Group AG is not soliciting an offer to buy these securities in any state or other jurisdiction where the offer or sale is not permitted.

| Preliminary Offer to Exchange/Prospectus | Subject to Completion Dated October 9, 2014 |

EXCHANGE OFFER BY UBS GROUP AG

FOR THE ORDINARY SHARES OF UBS AG

UBS AG (“UBS”) proposes to its shareholders to establish a new holding company, UBS Group AG (“UBS Group”). To implement this proposal, UBS Group, a wholly owned subsidiary of UBS, is conducting an exchange offer to acquire any and all issued ordinary shares of UBS (“UBS Shares”) in exchange for registered shares of UBS Group (“UBS Group Shares”).

Under the terms of the exchange offer, every UBS Share validly tendered in, and not withdrawn from, the exchange offer will be exchanged for one UBS Group Share. The exchange offer is comprised of separate offers (respectively, the “U.S. offer” and the “Swiss offer”, and collectively, the “exchange offer”). The U.S. offer is being made to all holders of UBS Shares located in the United States pursuant to this offer to exchange/prospectus and the related letter of transmittal and acceptance form. The Swiss offer is being made to all holders of UBS Shares, wherever located, in accordance with local laws, regulations and restrictions, pursuant to separate offer documentation.

If, in the exchange offer or within three months thereafter, UBS Group acquires more than 98% of the total UBS Shares in issue, we intend to initiate a statutory squeeze-out procedure under Swiss law (the “SESTA squeeze-out”). If, during the same period or at any time thereafter, UBS Group acquires between 90% and 98% of the total UBS Shares in issue, we expect to conduct a squeeze-out merger under Swiss law (the “squeeze-out merger” and, together with the SESTA squeeze-out, the “squeeze-out”). If the squeeze-out occurs, remaining holders of UBS Shares will receive one UBS Group Share for each UBS Share they hold.

The board of directors of UBS has determined that the exchange offer is in the best interests of UBS and all holders of UBS Shares, in their capacity as such, and recommends that holders of UBS Shares tender their UBS Shares pursuant to the exchange offer.

THE EXCHANGE OFFER AND WITHDRAWAL RIGHTS FOR TENDERS OF UBS SHARES HELD IN THE SIS SETTLEMENT SYSTEM OR IN CERTIFICATED FORM RECORDED ON THE SWISS SHARE REGISTER WILL EXPIRE AT 10:00 A.M. NEW YORK CITY TIME (4:00 P.M., SWISS TIME), ON NOVEMBER 11, 2014 (AS SUCH TIME AND DATE MAY BE EXTENDED, THE “SWISS TENDER DEADLINE”), UNLESS THE EXCHANGE OFFER IS EXTENDED.

THE EXCHANGE OFFER AND WITHDRAWAL RIGHTS FOR TENDERS OF UBS SHARES HELD IN DTC OR DIRECTLY WITH COMPUTERSHARE INC. WILL EXPIRE AT 5:00 P.M., NEW YORK CITY TIME, ON NOVEMBER 11, 2014 (AS SUCH TIME AND DATE MAY BE EXTENDED, THE “EXPIRATION DATE”), UNLESS THE EXCHANGE OFFER IS EXTENDED.

Completion of the exchange offer is subject to a number of conditions, including a 90% minimum acceptance condition requiring that UBS Shares that have been validly tendered and not withdrawn from the exchange offer (together with any UBS Shares tendered, or contributed, by UBS to UBS Group or already owned by UBS Group) represent at least 90% of all UBS Shares in issue at the expiration of the initial offer period. See “The Exchange Offer—Conditions to the Exchange Offer” beginning on page 57.

Based on the current number of issued UBS Shares, UBS Group will issue up to approximately 3,911,284,375 UBS Group Shares in the exchange offer and the squeeze-out, of which it has registered 1,060,000,000 UBS Group Shares pursuant to the registration statement of which this offer to exchange/prospectus forms a part.

UBS Group has applied for all of the UBS Group Shares to be listed and admitted to trading on the SIX Swiss Exchange AG (the “SIX Swiss Exchange”). UBS Group also intends to apply for listing of the UBS Group Shares on the New York Stock Exchange (the “NYSE”) under the symbol “UBS”. Admissions on the SIX Swiss Exchange and the NYSE are expected to be effective upon settlement of the shares validly tendered as of the expiration date.

See the “Risk Factors” section of this offer to exchange/prospectus beginning on page 33 for a discussion of important risk factors that you should consider before deciding whether or not to tender your UBS Shares into the U.S. offer.

Neither the U.S. Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of the securities to be issued in the transactions described in this offer to exchange/prospectus or passed upon the adequacy or accuracy of this offer to exchange/prospectus. Any representation to the contrary is a criminal offense.

The Dealer-Manager for the exchange offer in the United States is

UBS Securities LLC

The date of this offer to exchange/prospectus is October , 2014.

| ii | ||||

| iii | ||||

| v | ||||

| 1 | ||||

| 12 | ||||

| 33 | ||||

| 38 | ||||

| 39 | ||||

| 56 | ||||

| 68 | ||||

BOARD OF DIRECTORS, SENIOR MANAGEMENT AND CORPORATE GOVERNANCE | 78 | |||

| 101 | ||||

DESCRIPTION OF THE UBS GROUP SHARES AND ARTICLES OF ASSOCIATION | 104 | |||

COMPARISON OF RIGHTS OF HOLDERS OF UBS GROUP SECURITIES AND UBS SECURITIES | 113 | |||

| 114 | ||||

| 119 | ||||

| 121 | ||||

| 121 |

This offer to exchange/prospectus incorporates by reference important business and financial information about UBS that is contained in its filings with the SEC but which is not included in, or delivered with, this offer to exchange/prospectus. This information is available on the SEC’s website at www.sec.gov and from other sources. For more information about how to obtain copies of these documents, see the “Where You Can Find More Information” section of this offer to exchange/prospectus. UBS Group will also make copies of this information available to you without charge upon your written or oral request to Georgeson at +1 (888) 613-9817.In order to receive timely delivery of these documents, you must make such a request no later than five business days before the then-scheduled expiration date of the exchange offer. This deadline is currently 5:00 p.m., New York City time on November 4, 2014 because the expiration date of the exchange offer is currently 5:00 p.m., New York City time on November 11, 2014 but these dates will be different if the exchange offer is extended.

i

Pursuant to exemptive relief granted by the SEC from Rule 14e-5 under the U.S. Securities Exchange Act of 1934, as amended, and subject to certain enumerated conditions set forth in the exemptive relief letter, UBS, UBS’s subsidiaries and their respective affiliates and separately identifiable departments may conduct certain trading activities involving UBS Shares or derivatives related to such shares (including, without limitation, futures, forwards, options, swaps or similar instruments), both inside and outside the United States prior to and during the period in which the offer remains open for acceptance in the ordinary course of business. Additionally, these persons may engage in similar trading activities in UBS Group Shares once they are issued. In this section, we refer to the UBS Shares and UBS Group Shares collectively as the “relevant shares.” No such purchases or arrangements to purchase will be undertaken for the purpose of promoting or otherwise facilitating the exchange offer.

Among other things, UBS Group, UBS, UBS’s subsidiaries and their respective separately identifiable departments, as the case may be, intend (1) to make a market in the relevant shares by purchasing and selling the relevant shares for their own account or to facilitate customer transactions; (2) to make a market, from time to time, in derivatives (such as options, warrants, convertible securities and other instruments) relating to relevant shares for their own account and the accounts of their customers; (3) to engage in trades in relevant shares for their own account and the accounts of their customers for the purpose of hedging their positions established in connection with the derivatives market making described above; (4) to engage in unsolicited brokerage transactions in relevant shares with their customers; (5) to trade in relevant shares and derivatives on relevant shares as part of their investment management activities for the accounts of their customers; and (6) to trade in relevant shares in connection with employee incentive plans.

These activities may occur on the SIX Swiss Exchange, BATS Chi-X Europe, Scoach, in the over-the-counter market in Switzerland or elsewhere outside the United States of America. In addition, when and to the extent permitted by applicable law, UBS’s affiliated U.S. broker-dealers, UBS Securities LLC and UBS Financial Services, Inc., may engage in unsolicited brokerage transactions in relevant shares, and UBS’s investment management business groups may trade in relevant shares and derivatives on relevant shares, in the United States of America.

UBS and its affiliates are not obliged to make a market in or otherwise purchase relevant shares or derivatives on relevant shares and any such market making or other purchases may be discontinued at any time. These activities could have the effect of preventing or retarding a decline in the market price of the relevant shares.

In accordance with the requirements of Rule 14e-5 under the Exchange Act and with the exemptive relief granted by the SEC, where such purchases, or arrangements to purchase, take place outside the United States, they must comply with applicable Swiss law and rules or applicable relief that may be issued by the Swiss Takeover Board. With respect to purchases of UBS Shares and derivatives related to such shares outside the exchange offer made in reliance on the exemptive relief granted by the SEC, UBS will disclose promptly in the United States information regarding such purchases, to the extent such information is made public in Switzerland pursuant to the Swiss tender offer rules.

Between May 6, 2014, the date of the first public announcement of the exchange offer, and the date of this offer to exchange/prospectus, UBS, UBS’s subsidiaries and their respective affiliates and separately identifiable departments have, in the ordinary course of business and not for the purpose of promoting or otherwise facilitating the exchange offer, purchased and entered into arrangements to purchase the relevant shares, as permitted by the exemptive relief letter granted by the SEC.

ii

Cautionary statement regardingforward-looking statements

This offer to exchange/prospectus and the documents incorporated by reference herein contain forward-looking statements that involve risks and uncertainties, in particular those described in “Risk Factors” in this offer to exchange/prospectus, and “Risk Factors” in the UBS 2013 Annual Report on Form 20-F incorporated by reference herein (the “UBS 2013 Form20-F”) and in the UBS Report on Form 6-K filed with the SEC on September 29, 2014 relating to certain updated information regarding the Group, which is incorporated by reference herein. These statements may generally, but not always, be identified by the use of words such as “anticipate,” “believe,” “expect,” “guidance,” “intend,” “outlook,” “plan,” “target” and similar expressions to identify forward-looking statements. All statements other than statements of historical facts, including, among others, statements regarding expected take-up of the exchange offer; plans for UBS and for UBS Group following completion of the exchange offer; management’s outlook for the Group’s (as defined herein) financial performance and statements relating to the anticipated effect of transactions and strategic initiatives on the Group’s business and future development are forward-looking statements. You should not place undue reliance on such forward-looking statements. By their nature, forward-looking statements involve risks and uncertainties because they reflect current expectations and assumptions as to future events and circumstances that may not prove accurate. Actual results and events could differ materially from those anticipated in the forward-looking statements for many reasons, including (1) the degree to which we are successful in executing our announced strategic plans, including our efficiency initiatives and the planned further reduction in Basel III risk-weighted assets (RWA) and leverage ratio denominator; (2) developments in the markets in which the Group operates or to which it is exposed, including movements in securities prices or liquidity, credit spreads, currency exchange rates and interest rates and the effect of economic conditions and market developments on the financial position or creditworthiness of our clients and counterparties; (3) changes in the availability of capital and funding, including any changes in UBS’s credit spreads and ratings, or arising from requirements for bail-in debt or loss-absorbing capital; (4) changes in or the implementation of financial legislation and regulation in Switzerland, the U.S., the U.K. and other financial centers that may impose more stringent capital (including leverage ratio), liquidity and funding requirements, incremental tax requirements, additional levies, limitations on permitted activities, constraints on remuneration or other measures; (5) uncertainty as to when and to what degree the Swiss Financial Market Supervisory Authority (“FINMA”) will approve reductions to the incremental RWA resulting from the supplemental operational risk-capital analysis mutually agreed to by UBS and FINMA, or will approve a limited reduction of capital requirements due to measures to reduce resolvability risk; (6) the degree to which UBS is successful in executing the announced creation of a new Swiss banking subsidiary, a holding company for the Group (including this offer to exchange UBS Shares for UBS Group Shares), a U.S. intermediate holding company, changes in the operating model of UBS Limited and other changes which we may make in our legal entity structure and operating model, including the possible consequences of such changes, and the potential need to make other changes to the legal structure or booking model of the Group in response to legal and regulatory requirements, including capital requirements, resolvability requirements and the pending Swiss parliamentary proposals and proposals in other countries for mandatory structural reform of banks; (7) changes in the Group’s competitive position, including whether differences in regulatory capital and other requirements among the major financial centers will adversely affect its ability to compete in certain lines of business; (8) the liability to which UBS and its subsidiaries may be exposed, or possible constraints or sanctions that regulatory authorities might impose on them, due to litigation, contractual claims and regulatory investigations; (9) the effects on our cross-border banking business of tax or regulatory developments and of possible changes in our policies and practices relating to this business; (10) the Group’s ability to retain and attract the employees necessary to generate revenues and to manage, support and control its

iii

Cautionary statement regardingforward-looking statements

businesses, which may be affected by competitive factors including differences in compensation practices; (11) changes in accounting or tax standards or policies, and determinations or interpretations affecting the recognition of gain or loss, the valuation of goodwill, the recognition of deferred tax assets and other matters; (12) limitations on the effectiveness of internal processes for risk management, risk control, measurement and modeling, and of financial models generally; (13) whether UBS and its subsidiaries will be successful in keeping pace with competitors in updating its technology, particularly in trading businesses; (14) the occurrence of operational failures, such as fraud, unauthorized trading and systems failures; and (15) the effect that these or other factors or unanticipated events may have on the Group’s reputation and the additional consequences that this may have on its business and performance. The Group’s business and financial performance could be affected by other factors identified in the risks described under “Risk Factors” in this offer to exchange/prospectus and in past and future filings and reports filed with the SEC. Although UBS Group believes that, as of the date of this offer to exchange/prospectus, the expectations reflected in the forward-looking statements are reasonable, UBS Group cannot assure you that the Group’s future results, level of activity, performance or achievements will meet these expectations. Moreover, neither UBS Group nor any other person assumes responsibility for the accuracy and completeness of the forward-looking statements. After the date of this offer to exchange/prospectus, unless UBS Group is required by law to update these forward-looking statements, UBS Group will not necessarily update any of these forward-looking statements to conform them either to actual results or to changes in expectations.

iv

CERTAIN DEFINITIONS

As used in this offer to exchange/prospectus, the terms “we”, “us”, “our” and “Group” refer to UBS and its consolidated subsidiaries up to the time of the first capital increase of UBS Group in connection with the initial settlement of the exchange offer and to UBS Group and its consolidated subsidiaries after such capital increase.

CALCULATION OF TOTAL ISSUED UBS SHARES

Unless otherwise stated, all references to total issued UBS Shares in this offer to exchange/prospectus are calculated based on the issued share capital of UBS as of the last practicable date prior to publication of this offer to exchange/prospectus, which consists of 3,844,376,615 UBS Shares. This number includes 91,115,480 UBS Shares held in treasury by UBS, the voting rights of which are suspended for as long as they are held in treasury. As of June 30, 2014, UBS had 3,844,030,621 issued UBS Shares, of which 91,236,602 were treasury shares.

CURRENCY AND EXCHANGE RATES

In this offer to exchange/prospectus, references to “U.S. dollar”, “USD” and “$” are to the lawful currency of the United States and references to “Swiss franc” or “CHF” are to the lawful currency of Switzerland.

The following tables set forth, for the periods indicated, information concerning the noon buying rate for the Swiss franc, expressed in U.S. dollar, or USD, per Swiss franc. The noon buying rate is the rate in New York for cable transfers in foreign currencies as certified for customs purposes by the Federal Reserve Bank of New York. Such rates are provided solely for your convenience and are not necessarily the rates used by UBS Group in the preparation of its financial statements. No representation is made that Swiss francs have been, could have been or could be converted into dollar amounts at the rates indicated below or at all. On October 3, 2014, the noon buying rate was CHF 1.00 per USD 1.0341.

| High | Low | Average Rate1 | Period End | |||||||||||||

Year ended December 31, | ||||||||||||||||

2009 | USD1.0016 | USD 0.8408 | USD 0.9260 | USD 0.9654 | ||||||||||||

2010 | USD1.0673 | USD 0.8610 | USD 0.9670 | USD 1.0673 | ||||||||||||

2011 | USD1.3706 | USD 1.0251 | USD 1.1398 | USD 1.0668 | ||||||||||||

2012 | USD1.1174 | USD 1.0043 | USD 1.0724 | USD 1.0923 | ||||||||||||

2013 | USD1.1292 | USD 1.0190 | USD 1.0826 | USD 1.1231 | ||||||||||||

Six months ended June 30, 2014 | USD1.1436 | USD 1.1101 | USD 1.1250 | USD 1.1280 | ||||||||||||

| 1 | The average of the noon buying rates on the last business day of each full month during the relevant period. |

| High | Low | |||||||

Monthly | ||||||||

April 2014 | USD 1.1431 | USD 1.1213 | ||||||

May 2014 | USD 1.1436 | USD 1.1133 | ||||||

June 2014 | USD 1.1276 | USD 1.1101 | ||||||

July 2014 | USD 1.1273 | USD 1.0994 | ||||||

August 2014 | USD 1.1079 | USD 1.0900 | ||||||

September 2014 | USD 1.0886 | USD 1.0467 | ||||||

October 2014 (to October 3, 2014) | USD 1.0491 | USD 1.0341 | ||||||

v

SOURCES OF THIRD-PARTY DATA

The information set out in and incorporated by reference into this offer to exchange/prospectus that has been sourced from third parties has been accurately reproduced and, as far as UBS Group is aware and has been able to ascertain from that published information, no facts have been omitted which would render the reproduced information inaccurate or misleading. Where third-party information has been used in this offer to exchange/prospectus, the source of such information has been identified.

SOURCES OF INFORMATION ABOUT UBS

All information contained in this offer to exchange/prospectus relating to UBS has been provided by UBS.

Information on or accessible through UBS’s corporate website,www.ubs.com does not form part of and is not incorporated into this offer to exchange/prospectus.

vi

Questions and answers about the exchange offer

The summary information in question and answer format set forth below highlights selected information about the exchange offer that is included elsewhere in this offer to exchange/prospectus. These questions and answers, as well as the following summary, do not, however, contain all of the information included in, or incorporated by reference into, this offer to exchange/prospectus and the related letter of transmittal and acceptance form, and this information is qualified in its entirety by the more detailed descriptions and explanations contained herein and therein. You should read and consider all such information carefully before deciding whether or not to tender your UBS Shares into the U.S. offer.

| Q. | What is UBS proposing to do? |

| A. | UBS proposes to its shareholders to establish a new holding company, UBS Group. To implement this proposal, UBS Group, a SwissAktiengesellschaft, is offering to acquire any and all issued UBS Shares in exchange for UBS Group Shares on a share-for-share basis. |

Under the terms of the exchange offer, every UBS Share validly tendered in, and not withdrawn from, the exchange offer will be exchanged for one UBS Group Share. The exchange offer is comprised of separate offers consisting of the U.S. offer and the Swiss offer. The U.S. offer is being made to all holders of UBS Shares located in the United States pursuant to this offer to exchange/prospectus and the related letter of transmittal and acceptance form. The Swiss offer is being made to all holders of UBS Shares, wherever located, in accordance with local laws, regulations and restrictions, pursuant to separate offer documentation, including, for holders of UBS Shares located in one or more member states of the European Economic Area (the “EEA”), one or more separate prospectuses.

The U.S. offer and the Swiss offer are being conducted simultaneously and, in all material respects, have the same terms and are subject to the same conditions.

| Q. | What is the purpose of the exchange offer? |

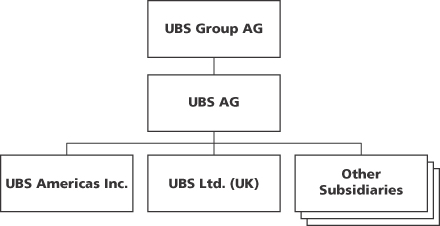

| A. | The purpose of the exchange offer is to establish a holding company for the Group. If the exchange offer is successful, UBS Group will become the new listed parent company of UBS, which is currently both the ultimate parent company and the primary operating entity of the Group. The exchange offer will not involve any change to our board of directors and senior management. |

The establishment of a group holding company is intended, along with other measures we have already announced, to substantially improve the resolvability of the Group in response to Swiss “too-big-to-fail” requirements and applicable requirements in other countries in which we operate.

We have already announced a series of measures to improve the resolvability of the Group, including the establishment of a new bank subsidiary in Switzerland, the implementation of a revised business and operating model for UBS Limited in the United Kingdom and the implementation of an intermediate holding company in the United States under the Dodd-Frank Wall Street Reform and Consumer Protection Act (“Dodd-Frank”). See “The Transaction—Plans for UBS After the Exchange Offer” beginning on page 49 for more information.

As a consequence of the announcements we have made regarding our legal structure, we believe that we are substantially enhancing the resolvability of the Group in response to evolving global regulatory requirements. We anticipate that the exchange offer coupled with the other measures already announced will allow the Group to qualify for a rebate on the progressive buffer capital requirements applicable to the Group as a systemically relevant Swiss bank under applicable Swiss “too-big-to-fail” requirements. This rebate would result in lower overall capital requirements for the Group.

1

Questions and answers about the exchange offer

| Q. | Does UBS support the exchange offer? |

| A. | Yes. The UBS board of directors unanimously reached the conclusion, on the basis of the considerations stated in this offer to exchange/prospectus, that the exchange offer is in the best interests of UBS and all holders of UBS Shares, in their capacity as such. Accordingly, the UBS board of directors unanimously recommends its acceptance. |

Information about the recommendation of the UBS board of directors is set forth under “The Transaction—Reasons for the UBS Board of Directors’ Approval and Recommendation of the Exchange Offer” on page 51.

| Q. | What are UBS Group’s plans following the exchange offer? |

| A. | If, in the exchange offer or within three months thereafter, UBS Group acquires more than 98% of the total UBS Shares in issue, we intend to initiate the SESTA squeeze-out, a statutory squeeze-out procedure under Swiss law. If, during the same period or at any time thereafter, UBS Group acquires between 90% and 98% of the total UBS Shares in issue, we expect to conduct the squeeze-out merger under Swiss law. For more information on the details and mechanics of the squeeze-out transactions, see “The Transaction—Plans for UBS After the Exchange Offer—Squeeze-out” beginning on page 49. If the squeeze-out occurs, we currently intend that remaining holders of UBS Shares subject thereto will receive one UBS Group Share for each UBS Share they hold. You should note however that UBS Group Shares will be delivered in the squeeze-out much later than in the exchange offer. |

We expect to initiate the delisting of the UBS Shares from the SIX Swiss Exchange and the NYSE as soon as practicable after consummation of the exchange offer. For reasons of Swiss law, we anticipate that the delisting from the SIX Swiss Exchange will occur at or around the time of implementation of the squeeze-out.

As a result of the improvement of the resolvability of UBS and its subsidiaries, and the resulting eligibility for a capital rebate under the Swiss “too-big-to-fail” law, UBS Group expects to propose (if the exchange offer is successful and the squeeze-out is completed) to the UBS Group shareholders that they approve the distribution of a supplementary capital return of at least CHF 0.25 per UBS Group Share. Any such proposal will be subject to approval of UBS Group shareholders at a general meeting. See “The Transaction—Financial Statements and Dividend Policy” on page 53 for more information on our dividend policy after completion of the exchange offer.

Furthermore, we have already announced a series of additional measures to improve the resolvability of the Group:

| • | We intend to establish a bank subsidiary in Switzerland in a phased approach starting in mid-2015. The scope of this future subsidiary’s business will include the Retail & Corporate business division and the Swiss-booked business within the Wealth Management business division. |

| • | In the United Kingdom, and in consultation with the UK and Swiss regulators, we have implemented the first stages of a revised business and operating model for UBS Limited in the second quarter of 2014. This will result in UBS Limited bearing and retaining a greater degree of the risk and reward of its business activities. We have increased the capitalization of UBS Limited accordingly. |

| • | In the United States, we will implement new rules for foreign banks promulgated by the Board of Governors of the Federal Reserve System (the “Federal Reserve Board”) under Sections 165 and 166 of Dodd-Frank that will require an intermediate holding company to own all of its operations other than U.S. branches of UBS by July 1, 2016. As a result, we will designate an intermediate holding company to hold all U.S. subsidiaries of UBS. |

2

Questions and answers about the exchange offer

We may consider further changes to the legal structure of the Group in response to regulatory requirements in Switzerland or in other countries in which we operate, including to further improve the resolvability of the Group, to respond to Swiss and other capital requirements (including seeking potential reduction in the progressive buffer capital requirements applied to the Group as a systemically relevant bank in Switzerland) and to respond to other regulatory requirements regarding our legal structure. Such changes may include the transfer of operating subsidiaries of UBS to become direct subsidiaries of UBS Group by purchase, dividend or other means, transfer of shared service and support functions to one or more service companies and adjustments to the booking entity or location of products and services. These structural changes are being discussed on an ongoing basis with the Swiss Financial Market Supervisory Authority (“FINMA”) and other regulatory authorities and remain subject to a number of uncertainties that may affect their feasibility, scope or timing.

| Q. | What are the conditions to the exchange offer? |

| A. | The completion of the exchange offer is subject to a number of conditions, including that: |

| (1) | UBS Shares that have been validly tendered and not withdrawn from the exchange offer, together with any UBS Shares tendered, or contributed, by UBS to UBS Group or already owned by UBS Group, represent at least 90% of all UBS Shares in issue at the expiration of the initial offer period (we refer to this condition as the “minimum acceptance condition”); |

| (2) | The SIX Swiss Exchange has approved the listing and admission to trading of the UBS Group Shares and the NYSE has approved the listing of the UBS Group Shares, subject to notice of issuance; |

| (3) | To the extent required, the competent authorities, including, without limitation, FINMA, the Board of Governors of the Federal Reserve System (the “Federal Reserve Board”), the Office of the Comptroller of the Currency (the “OCC”), the Federal Deposit Insurance Corporation (the “FDIC”), the U.K. Prudential Regulatory Authority (the “PRA”) and the U.K. Financial Conduct Authority (the “FCA”), as well as the competent regulatory authorities in the Cayman Islands, Singapore, Hong Kong, Australia, France, Germany, Jersey and Luxembourg, shall have granted all approvals, clearances or declarations of no objection required for the exchange offer and the function of UBS Group as holding company of the Group and all applicable waiting periods shall have expired or been waived; |

| (4) | No court or governmental authority shall have issued a decision or an order preventing, prohibiting or declaring illegal the consummation of the exchange offer; and |

| (5) | The U.S. registration statement relating to the UBS Group Shares has become effective in accordance with the provisions of the Securities Act, no stop order suspending the effectiveness of this registration statement has been issued by the SEC and no proceedings for that purpose have been initiated or threatened by the SEC and not concluded or withdrawn. |

The conditions specified in clauses (2), (3) (with respect to required approvals, clearances and declarations of no objection from FINMA, the Federal Reserve Board, the OCC, the FDIC, the PRA and the FCA only), (4) and (5) above may not be waived. Subject to the requirements of Swiss tender offer regulations and U.S. federal securities laws, UBS Group reserves the right, at any time, and from time to time, to waive any of the other conditions to the exchange offer in any respect, including to reduce the minimum acceptance condition, in accordance with the procedures outlined under “The Exchange Offer—Extensions, Termination and Amendments” beginning on page 57. UBS intends to tender or cause to tender in the exchange offer substantially all treasury shares held as of the close of the initial offer period towards satisfaction of the minimum acceptance condition. As of October 8, 2014, UBS had 3,844,376,615 issued UBS Shares, of which 91,115,480 were treasury shares.

3

Questions and answers about the exchange offer

| Q. | What will happen if the minimum acceptance condition is reduced? |

| A. | If UBS Group reduces the minimum acceptance condition, each holder who has validly tendered his or her UBS Shares into the U.S. offer will have the right to withdraw the UBS Shares he or she has already tendered for so long as required by applicable U.S. federal securities laws and Swiss tender offer rules, including any extension of the withdrawal rights required by such laws. |

Unless otherwise provided by applicable law, the exchange offer will be open for acceptances for at least five U.S. business days after any reduction in the minimum acceptance condition, which period may include the subsequent offer period.

UBS Group does not intend to reduce the minimum acceptance condition below two-thirds of the total UBS Shares in issue. Acquiring at least two-thirds of the UBS Shares in issue would ensure UBS Group’s control over not only the management of UBS but also important corporate actions requiring a vote of two-thirds of the shares represented at a shareholder meeting, the highest majority requirement under both Swiss law and UBS’s articles of association. Under Swiss corporate law, a vote of two-thirds of the shares represented at a shareholders meeting is required, for example, to approve an increase in authorized or contingent capital or the creation of reserve capital in accordance with Swiss banking law, or an increase in share capital against contribution in kind for the purpose of acquisition and the granting of special rights.

| Q. | What will happen if UBS Group reduces the minimum acceptance condition and is unable to conduct, or conduct promptly, the squeeze-out? |

| A. | The purpose of the exchange offer and the squeeze-out is to enable UBS Group to acquire all of the issued UBS Shares. |

If UBS Group reduces the minimum acceptance condition and does not attain the relevant threshold to initiate a squeeze-out at the expiration of the subsequent offer period, it reserves the right to use any legally permitted method to acquire additional UBS Shares, or the totality of the remaining UBS Shares in issue, by way of purchases or subsequent exchange or tender offers or to engage in one or more corporate restructuring transactions, such as a merger, demerger, liquidation, transfer of assets or conversion of UBS into another form or corporate entity, or to change the UBS articles of association to alter the corporate or capital structure in a manner beneficial to UBS Group and UBS Group’s shareholders. You should note that whether we will implement any post-closing transactions or restructuring measures (and the form thereof) will depend on the number of UBS Shares which are acquired by UBS Group after completion of the exchange offer and the means available to achieve the objective of enabling UBS Group to acquire all of the UBS Shares in issue. The Swiss Takeover Board has exempted us from the “best price” requirement under the Swiss tender offer rules that would otherwise apply during the offer period and six months thereafter to allow us to engage in cash purchases during that period. However, our ability to purchase UBS Shares for cash during that period will be limited to purchases on exchange, on multi-lateral trading facilities or in the traditional OTC markets, in each case at prevailing market prices on the SIX Swiss Exchange at the time of the transactions. After completion of the exchange offer, such prices may be depressed as a result of low level of liquidity, among other factors. It is possible that we may not be able to take post-closing steps promptly after completion of the exchange offer, that such steps are delayed or that such steps cannot take place at all.

Any delay in acquiring or failure to acquire full ownership of UBS could adversely impact some of the anticipated benefits of the exchange offer and the liquidity and market value of the UBS Group Shares. The existence of minority shareholders in UBS may make it more cumbersome or delay, among other things, UBS Group’s ability to implement changes to the legal structure of the Group

4

Questions and answers about the exchange offer

and interfere with its day-to-day business operations and its corporate governance. In addition, any holders of UBS Shares who do not tender their UBS Shares in the exchange offer will have a non-controlling interest and, as such, a pro rata claim upon dividends or other distributions of UBS if any were to be paid by UBS. For more information, see “Risk Factors—Risk Relating to the Exchange Offer—If UBS Group fails to acquire full ownership of UBS on a timely basis, we may be unable to fully realize the anticipated benefits of the exchange offer. Additionally, the liquidity and market value of the UBS Group Shares may be adversely affected.”

If we are not able to initiate a squeeze-out and decide not to, or are not able to, implement any post-closing transactions or restructuring measures, minority shareholders will remain shareholders of UBS rather than UBS Group and are likely to suffer a number of adverse consequences. Among other things, the market for UBS Shares is expected to be significantly less liquid following completion of the exchange offer, the UBS Shares may be delisted from the NYSE and the SIX Swiss Exchange and be excluded from the Swiss Market Index (the “SMI”) and the Swiss Performance Index (the “SPI”), UBS may change its dividend policy in a way that is materially adverse to minority shareholders and the UBS Shares may cease to be margin securities, all of which may significantly depress the value of UBS Shares held by minority shareholders. See “Risk Factors—Risks to UBS Shareholders Who Do Not Tender their UBS Shares in the Exchange Offer” for a description of the risks affecting minority shareholders.

| Q. | What will I receive if the U.S. offer is completed? |

| A. | If the U.S. offer is completed, you will receive one UBS Group Share for each UBS Share you validly tender into, and do not withdraw from, the U.S. offer. |

| Q. | How much time do I have to decide whether to tender? |

| A. | If you hold UBS Shares in the securities settlement system (the “SIS Settlement System”) operated by SIX SIS AG, Baslerstrasse 100, 4600 Olten, Switzerland (“SIS”), or in certificated form recorded in the Swiss share register, you may tender your UBS Shares into the U.S. offer at any time prior to 10:00 a.m. New York City time (4:00 p.m., Swiss time), on November 11, 2014, which is the Swiss tender deadline in accordance with prevailing market practice in Switzerland but will change if the initial offer period (the “initial offer period”) of the exchange offer is extended. If you hold UBS Shares in DTC or directly with Computershare Inc. (“Computershare”), you may tender your UBS Shares into the U.S. offer at any time prior to 5:00 p.m., New York City time, on November 11, 2014, which is the expiration date of the initial offer period but will change if the initial offer period is extended. |

In either case, if you hold UBS Shares through a broker, you should be aware that you may have to act prior to the applicable deadline in order to enable your broker to validly tender your UBS Shares. You should follow your broker’s instructions in this regard. For more information on the time involved in tendering your UBS Shares in the exchange offer, see “The Exchange Offer—Procedure for Tendering” section of this offer to exchange/prospectus.

| Q. | Can the exchange offer be extended? |

| A. | Yes. Subject to applicable U.S. rules and regulations, UBS Group may voluntarily extend or may be compelled to extend the initial offer period. If UBS Group determines to extend the initial offer period of the U.S. offer, it will make an announcement of such extension no later than 9:00 a.m., New York City time, on the next business day by issuing a press release on the Dow Jones News Service and posting a notice onwww.ubs.com/investors. Such announcement will also be filed with the SEC no later than 9:00 a.m., New York City time on that same day. Separately, subject to applicable Swiss rules and regulations, UBS Group will publish an amendment to the Swiss offer |

5

Questions and answers about the exchange offer

documentation in the electronic media and submit such amendment to the Swiss Takeover Board. Swiss rules and regulations require an amendment to be published no later than 7:30 a.m., Swiss time, on the last trading day of the initial offer period. Any extension of the initial offer period in excess of 40 Swiss trading days requires the prior clearance of the Swiss Takeover Board. The information onwww.ubs.com is not a part of this offer to exchange/prospectus and is not incorporated by reference herein. |

| Q. | Can there be a subsequent acceptance period after the expiration of the initial offer period? |

| A. | Yes. If all the conditions of the exchange offer have been met or have been waived by the end of the initial offer period and UBS Group has not acquired 100% of the total UBS Shares in issue, a subsequent offer period of eleven Swiss business days will be provided. The subsequent offer period is expected to begin upon the announcement of the definitive results of the initial offer period. |

| Q. | How do I validly tender my UBS Shares into the exchange offer? |

| A. | The steps you must take to validly tender into the exchange offer will depend on whether you hold your UBS Shares through a broker, dealer, commercial bank, trust company or other nominee, in certificated form or in uncertificated form registered directly in your name in the share register maintained by UBS’s transfer agent, Computershare. |

If you hold UBS Shares through the DTC system or directly with Computershare, you should follow the applicable steps described below:

| • | If you hold your UBS Shares in the DTC system through a custody account with a custodian bank or broker, you should instruct your broker, dealer, commercial bank, trust company or other entity through which you hold your shares to arrange for the DTC participant holding your shares in its DTC account to tender your shares in the U.S. offer to the U.S. exchange agent by means of delivery through the DTC book-entry confirmation facility (the Automated Tender Offer Program or “ATOP”) of your shares to the DTC account of the U.S. exchange agent, together with an agent’s message acknowledging that the tendering participant has received and agrees to be bound by the terms of the offer, prior to the expiration date of the offer. All tenders of UBS Shares through the DTC book-entry confirmation facilities must be received by the U.S. exchange agent before the expiration date of the offer. |

| • | If you hold UBS Shares in the form of one or more share certificates registered with Computershare, you may tender your UBS Shares by delivering to the U.S. exchange agent a properly completed and duly executed letter of transmittal, with all applicable signature guarantees from an eligible guarantor institution together with the certificate(s) representing your UBS Shares specified on the face of the letter of transmittal, and any other required documents, prior to the expiration date of the offer. You should note that UBS Group will not issue UBS Group Shares in the form of physical share certificates. As a result, any UBS Group Shares issuable in exchange of UBS Shares tendered in accordance with these procedures will be delivered in uncertificated form in direct registration with Computershare. |

| • | If you hold your UBS Shares in uncertificated form in direct registration with Computershare, you may tender your UBS Shares by delivering to the U.S. exchange agent a properly completed and duly executed letter of transmittal, with all applicable signature guarantees from an eligible guarantor institution and any other required documents, prior to the expiration date of the offer. |

6

Questions and answers about the exchange offer

If you hold UBS Shares in the SIS Settlement System or in physical form recorded in the Swiss share register, you should follow the applicable steps described below:

| • | If you hold your shares in the SIS Settlement System through brokers or custodian banks who are SIS participants (whether or not you are registered as a shareholder in UBS’s share register), you will be informed of the procedure for accepting the exchange offer by your broker or custodian bank, and have to act in accordance with such instructions. All tenders of UBS Shares through the SIS Settlement System must be received by the Swiss exchange agent before the Swiss tender deadline. |

| • | If you hold your shares in the form of physical share certificates (Heimverwahrer) and are recorded in the Swiss share register, you will be informed of the procedures for accepting the exchange offer by UBS Shareholder Services directly, and will have to tender your UBS Shares by delivering to your custodian bank (if you have one) or to UBS Shareholder Services (if you do not have a custodian bank) a duly completed acceptance form, together with the certificate(s) representing your UBS Shares specified on the acceptance form, and any other required documents, in accordance with such instructions. All tenders of such shares must be received by the Swiss exchange agent prior to the Swiss tender deadline. You should note that UBS Group will not issue UBS Group Shares in the form of physical share certificates. As a result, any UBS Group Shares issuable in exchange of UBS Shares tendered in accordance with these procedures will be delivered in book-entry form in the SIS Settlement System to an account with the relevant custodian bank (and SIS participant) or otherwise to an omnibus account maintained by UBS. |

If you hold UBS Shares which, when tendered, are recorded in the share register of UBS as registered shares (with voting rights or without voting rights, as the case may be) and are accepted for exchange in the exchange offer, you will generally be similarly recorded in the share register of UBS Group (with voting rights, if so registered). Tendering fiduciaries and nominees that currently have a nominee agreement with UBS will generally be registered on UBS Group’s share register to the same extent as they are currently registered on UBS’s share register. You will be deemed to have given the necessary authorizations to this effect. For more information on the share register of the UBS Group and on how registration with voting rights will be effected, see “Description of the UBS Group Shares and Articles of Association – Share Register” beginning on page 105 below.

For more information on the procedure for tendering, the time and expense of tendering, the timing of the exchange offer, extensions of the exchange offer and your rights to withdraw your UBS Shares from the exchange offer, see “The Exchange Offer” beginning on page 56 below.

| Q. | Can I withdraw UBS Shares that I have tendered in the U.S. offer? |

| A. | Yes. You may withdraw any UBS Shares that you hold in the SIS Settlement System or in physical form recorded in the Swiss share register and tendered in the U.S. offer at any time prior to the Swiss tender deadline, and you may withdraw any UBS Shares that you hold through DTC or directly with Computershare and tendered in the U.S. offer at any time prior to the expiration date of the initial offer period. UBS Shares tendered during the subsequent offer period, if any, may not be withdrawn unless withdrawal rights are mandatorily provided by law or regulation applicable to the exchange offer. |

| Q. | How do I withdraw previously tendered UBS Shares? |

| A. | If you have tendered your UBS Shares by means of the DTC book-entry confirmation facility (ATOP), you may withdraw your tender by instructing your broker, dealer, commercial bank, trust company or other entity to cause the DTC participant through which your UBS Shares were |

7

Questions and answers about the exchange offer

tendered to deliver a notice of withdrawal to the U.S. exchange agent by means of an agent’s message transmitted through the DTC book-entry confirmation facility (ATOP) prior to the expiration date of the initial offer period. |

If you have tendered your UBS Shares by means of physical delivery of a letter of transmittal (together with, in the case of UBS Shares held in the form of one or more share certificates, the certificate(s) representing your UBS Shares), you may withdraw your tender by delivering to the U.S. exchange agent a properly completed and duly executed notice of withdrawal prior to the expiration date of the initial offer period.

If you have tendered your UBS Shares through a bank, broker or other custodian institution in the SIS Settlement System, you should contact the institution through which you have tendered your UBS Shares to learn about its procedures to withdraw UBS Shares validly tendered. You should contact your bank, broker or other custodian institution sufficiently in advance of the Swiss tender deadline to allow your previously tendered UBS Shares to be validly withdrawn.

If you have tendered your UBS Shares in the form of share certificates recorded on the Swiss share register by means of delivery to your custodian bank (if you have one) or to UBS Shareholder Services (if you do not have a custodian bank) of an acceptance form and delivery of your physical certificates, you may withdraw your tender by delivering to UBS Shareholder Services a properly completed and duly executed notice of withdrawal prior to the Swiss tender deadline. If you have tendered your UBS Shares through your custodian bank, you should contact your custodian bank sufficiently in advance of the Swiss tender deadline to allow your previously tendered UBS Shares to be validly withdrawn.

| Q. | Can I participate in the Swiss offer? |

| A. | You may participate in the Swiss offer. However, you should note that the Swiss offer is being made pursuant to the Swiss tender offer rules and will not be subject to the requirements of the U.S. federal securities law as they relate to tender offers and may not be subject to the anti-fraud provisions of the U.S. federal securities laws. The separate prospectus that UBS Group intends to publish for holders located in certain EEA Member States will not be available to holders of UBS Shares located in the United States. |

| Q. | Will tendered UBS Shares be subject to proration? |

| A. | No. Subject to the terms and conditions of the exchange offer, UBS Group will acquire any and all UBS Shares validly tendered into, and not withdrawn from, the exchange offer. |

| Q. | Can I tender less than all the UBS Shares that I own into the exchange offer? |

| A. | Yes. You may elect to tender all or a portion of the UBS Shares that you own into the exchange offer. |

| Q. | Will I have to pay any fees or commissions for tendering my UBS Shares in the exchange offer? |

| A. | If your UBS Shares are tendered into the exchange offer by your broker, dealer, commercial bank, trust company or other nominee, you will be responsible for any fees or commissions they may charge you in connection with such tender. |

You will also be responsible for all governmental charges and taxes payable in connection with tendering your UBS Shares.

8

Questions and answers about the exchange offer

| Q. | How and where will the outcome of the exchange offer be announced? |

| A. | UBS Group currently expects to announce the provisional interim results of the exchange offer (via electronic media) on November 12, 2014 before 7:30 a.m., Swiss time and to announce the definitive interim results of the exchange offer (via electronic and print media) on November 17, 2014 (but in no event later than the fourth Swiss business day after the expiration date of the initial offer period) before 7:30 a.m., Swiss time. UBS Group expects to announce the provisional final results of the exchange offer (via electronic media) on December 2, 2014 before 7:30 a.m., Swiss time and to announce the definitive final results of the exchange offer (via electronic and print media) on December 5, 2014 before 7:30 a.m., Swiss time. These dates will change if the initial offer period is extended. |

| Q. | When will I receive my UBS Group Shares? |

| A. | UBS Shares tendered during the initial offer period are expected to be settled within six Swiss business days after the expiration date of the initial offer period. Settlement of UBS Shares validly tendered during the initial offer period is currently expected to take place on November 19, 2014. Any UBS Shares tendered after the expiration of the initial offer period but before the end of the subsequent offer period are expected to be settled within six Swiss trading days following the end of the subsequent offer period. Settlement of these shares is currently expected to take place on December 9, 2014. These dates will change if the initial offer period or the subsequent offer period is extended. |

| Q. | Will UBS’s senior management participate in the exchange offer? |

| A. | Each director and each member of senior management of UBS who owns UBS shares has confirmed that he or she currently intends to validly tender in the exchange offer all UBS Shares that such person holds as of the date of this offer to exchange/prospectus. |

| Q. | If I decide not to tender, how will the exchange offer affect my UBS Shares? |

| A. | If the exchange offer is successful and we attain the required level of acceptance to initiate the squeeze-out, completion of the squeeze-out will likely take a number of months (between four to six months for the SESTA squeeze-out and between two to three months for the squeeze-out merger). In the meantime, the market for UBS Shares will be significantly less liquid, and the value of any UBS Shares you retain may be lower or fluctuate more widely following completion of the exchange offer than before completion of the exchange offer. |

If the exchange offer is successful but we are not able to initiate a squeeze-out and decide not to, or are not able to, implement any post-closing transactions or restructuring measures, you will remain a minority shareholder of UBS rather than UBS Group and are similarly likely to suffer a number of adverse consequences, including, among other things, reduced liquidity, potential delisting of the shares from the NYSE and the SIX Swiss Exchange, changes in dividend policy and the risk that your shares may no longer qualify as margin securities. See “Risk Factors—Risks to UBS Shareholders who Do Not Tender their UBS Shares in the Exchange Offer” beginning on page 36.

| Q. | Will I have appraisal rights in connection with the exchange offer? |

| A. | No. There are no appraisal or similar rights available to holders of UBS Shares in connection with the exchange offer. However, if we conduct a squeeze-out merger, under Swiss law, a minority shareholder subject to the squeeze-out merger could seek to claim, within two months of the |

9

Questions and answers about the exchange offer

publication of the squeeze-out merger, that the consideration offered is “inadequate” and petition a Swiss competent court to determine what is “adequate” consideration. We expect such proceeding to be unlikely given the share-for-share nature of the consideration we anticipate offering in a squeeze-out merger. |

| Q. | What are the tax consequences if I participate or do not participate in the exchange offer? |

| A. | For information on the Swiss and U.S. tax considerations relating to the exchange offer, see the “Material Tax Considerations” section of this offer to exchange/prospectus. You should consult your own tax advisor on the tax consequences to you of tendering your UBS Shares in the exchange offer. This offer to exchange/prospectus is being made available to holders of UBS Shares located in the United States. If you hold UBS Shares and are not located in the United States, you should consult the separate offer documentation. |

| Q. | If I tender my UBS Shares in the exchange offer, how will my rights as a holder of UBS Shares change? |

| A. | The rights of holders of UBS Shares are governed by Swiss law and by the articles of association of UBS. If your UBS Shares are acquired in the exchange offer, you will become a holder of UBS Group Shares. Your rights as a holder of UBS Group Shares will be governed by Swiss law and by the articles of association of UBS Group. The articles of association of UBS Group are in all material respects identical to the articles of association of UBS, subject to four differences: (i) company name; (ii) company domicile; (iii) company purpose (to reflect the function as holding company of UBS Group) and (iv) certain share capital provisions. For a discussion of these differences, see the “Comparison of Rights of Holders of UBS Group Securities and UBS Securities” section of this offer to exchange/prospectus. |

| Q. | What is the market value of my UBS Shares as of a recent date? |

| A. | On May 5, 2014, which was the last Swiss trading day preceding the date on which we announced our intention to establish a group holding company through a share exchange offer subject to regulatory approvals, the last reported sales price of a UBS Share on the SIX Swiss Exchange was CHF18.27 and the last reported sales price of a UBS Share on the NYSE was $20.84. On October 8, 2014, the last practicable date prior to publication of this offer to exchange/prospectus, the last reported sales price of a UBS Share on the SIX Swiss Exchange was CHF15.89 and the last reported sales price of a UBS Share on the NYSE was $16.84. Please obtain a recent quotation for your securities prior to deciding whether or not to tender. |

| Q. | Is UBS Group soliciting proxies? |

| A. | No proxies will be solicited to authorize or complete the exchange offer: |

| • | The capital increase required to issue and deliver UBS Group Shares to UBS shareholders who have tendered and not withdrawn their UBS Shares during the initial offer period will be approved by UBS, in its capacity as sole shareholder of UBS Group, and implemented by the UBS Group board of directors prior to the initial settlement date. |

| • | UBS Group Shares issuable to shareholders who have tendered and not withdrawn their UBS Shares during the subsequent offer period will be issued out of UBS Group’s authorized share capital that will be created at the time of the first capital increase referred to above and will only require, at the time of issuance, the approval of the UBS Group board of directors. |

10

Questions and answers about the exchange offer

If a squeeze-out merger occurs, proxies will be solicited under Swiss law to authorize or complete the squeeze-out merger at an extraordinary shareholders’ meeting of UBS. However, a majority of at least 90% of all UBS Shares and thus only the vote of UBS Group will be required to approve the squeeze-out merger.

In a squeeze-out, minority shareholders are expected to receive UBS Group shares, which will be issued out of UBS Group’s authorized share capital that will be created at the time of the first capital increase referred to above and will only require, at the time of issuance, the approval of the UBS Group board of directors.

| Q. | What percentage of UBS Group Shares will holders of UBS Shares own after the exchange offer? |

| A. | After completion of the exchange offer, former holders of UBS Shares will own 100% of UBS Group Shares. |

| Q. | Who can I call with questions? |

| A. | If you have more questions about the exchange offer, you should contact UBS Group’s U.S. information agent, Georgeson toll-free at +1 (888) 613-9817 or by email at UBSinfoagent@georgeson.com. |

11

This summary highlights selected information from this offer to exchange/prospectus. It does not contain all the information that is important to you. Before you decide whether or not to tender your UBS Shares, you should read carefully this entire offer to exchange/prospectus as well as the documents that are incorporated by reference into or filed as exhibits to the registration statement of which this offer to exchange/prospectus forms a part. See the “Where You Can Find More Information” section of this offer to exchange/prospectus beginning on page 119.

UBS GROUP (PAGE 114)

UBS Group was incorporated and registered in Switzerland on June 10, 2014 with corporate identification number CHE-395.345.924, as a stock corporation (Aktiengesellschaft) under the laws of Switzerland. UBS Group was entered into the Commercial Register of Canton Zurich on June 10, 2014 and has its registered domicile in Zurich.

Pursuant to article 2 of its Articles, the main business purpose of UBS Group is the acquisition, holding, administration and sale of direct and indirect participations in enterprises of any kind, in particular in the areas of banking, financial, advisory, trading and service activities in Switzerland and abroad. UBS Group may establish enterprises of any kind in Switzerland and abroad, hold equity interests in these companies, and conduct their management. UBS Group is authorized to acquire, mortgage and sell real estate and building rights in Switzerland and abroad. UBS Group may provide loans, guarantees and other types of financing and securities for group companies and borrow and invest capital on the money and capital markets.

As of the date of this offer to exchange/prospectus, UBS Group is a wholly owned subsidiary of UBS. UBS Group, which currently has a fully paid-up share capital of CHF 100,000 divided into 1,000,000 registered shares with a par value of CHF 0.10 each, has no operations other than in connection with the exchange offer and no material assets or liabilities.

UBS Group’s principal executive office is located at Bahnhofstrasse 45, CH-8001 Zurich, Switzerland, and the telephone number is +41 44 234 11 11.

Application has been made for admission of the UBS Group Shares to the SIX Swiss Exchange and application is expected to be made to the NYSE for the admission of the UBS Group Shares.

UBS (PAGE 115)

UBS is a stock corporation (Aktiengesellschaft) founded in accordance with Swiss law in 1978 for an indefinite period, and is entered in the Commercial Registers of the Cantons of Basel and Zurich under the name UBS AG. UBS has its registered domicile in Basel and Zurich.

Pursuant to its articles of association, the purpose of UBS is the operation of a bank. Its scope of operations extends to all types of banking, financial, advisory, trading and service activities in Switzerland and abroad. UBS may establish branches and representative offices as well as banks, finance companies and other enterprises of any kind in Switzerland and abroad, hold equity interests in these companies, and conduct their management. UBS is authorized to acquire, mortgage and sell real estate and building rights in Switzerland and abroad.

12

The operational structure of the Group comprises the Corporate Center and five business divisions: Wealth Management, Wealth Management Americas, Retail & Corporate, Global Asset Management, and the Investment Bank.

Wealth Management. Wealth Management provides comprehensive financial services to wealthy private clients around the world—except those served by Wealth Management Americas. Its clients benefit from the entire spectrum of the Group’s resources, ranging from investment management to estate planning and corporate finance advice, in addition to specific wealth management products and services.

Wealth Management Americas. Wealth Management Americas provides advice-based solutions and banking services through financial advisors who deliver a fully integrated set of products and services specifically designed to address the needs of ultra high net worth and high net worth individuals and families. It includes the domestic U.S. business, the domestic Canadian business and international business booked in the United States.

Retail & Corporate. Retail & Corporate maintains a leading position across retail, corporate and institutional client segments in Switzerland and constitutes a central building block of UBS Switzerland’s pre-eminent universal bank model. It provides comprehensive financial products and services embedded in a true multichannel experience, offering clients convenient access. It continues to enhance the range of life-cycle products and services offered to clients, while pursuing additional growth in advisory and execution services.

Global Asset Management. Global Asset Management is a large-scale asset manager with diversified businesses across investment capabilities, regions and distribution channels. It offers investment capabilities and styles across all major traditional and alternative asset classes including equities, fixed income, currencies, hedge funds, real estate, infrastructure and private equity that can also be combined into multi-asset strategies. The fund services unit provides professional services including fund set-up, accounting and reporting for both traditional investment funds and alternative funds.

Investment Bank. The Investment Bank provides corporate, institutional and wealth management clients with expert advice, innovative financial solutions, outstanding execution and comprehensive access to the world’s capital markets. It offers financial advisory and capital markets, research, equities, foreign exchange, precious metals and tailored fixed income services in rates and credit through its two business units, Corporate Client Solutions and Investor Client Services. The Investment Bank is an active participant in capital markets flow activities, including sales, trading and market-making across a range of securities.

Corporate Center. The Corporate Center comprises Corporate Center—Core Functions and Corporate Center—Non-core and Legacy Portfolio. Corporate Center—Core Functions provides Group-wide control functions including finance, risk control (including compliance) and legal. In addition, it provides all logistics and support functions, including operations, information technology, human resources, regulatory relations and strategic initiatives, communications and branding, corporate real estate and administrative services, physical security, information security, offshoring and treasury services such as funding, balance sheet and capital management. Corporate Center—Core Functions allocates most of its treasury income, operating expenses and personnel associated with the above-mentioned activities to the businesses. Corporate Center—Non-core and Legacy Portfolio comprises the non-core businesses and legacy positions previously part of the Investment Bank.

13

UBS’s principal executive office is located at Bahnhofstrasse 45, CH-8001 Zurich, Switzerland, and the telephone number is +41 44 234 11 11.

According to excerpts from the Commercial Register of the Canton of Zurich and the Commercial Register of the Canton of Basel, the share capital of UBS of CHF 384,200,206.90 is fully paid-up and divided into 3,842,002,069 ordinary shares with a par value of CHF 0.10 each. The UBS Shares are listed on the SIX Swiss Exchange and are included in the Swiss Market Index and the Swiss Performance Index (for information on the performance of the price of the UBS Shares on the SIX Swiss Exchange and the NYSE, see below). The UBS Shares are traded on the SIX Swiss Exchange under the symbol “UBSN” and on the NYSE under the symbol “UBS.” As of October 8, 2014, UBS had 3,844,376,615 issued UBS Shares, of which 91,115,480 were treasury shares.

Additional information about UBS and its subsidiaries is included in the documents incorporated by reference into this offer to exchange/prospectus. For more information about how to obtain copies of this information, see the “Where You Can Find More Information” section of this offer to exchange/prospectus.

RISK FACTORS (PAGE 33)

In considering whether or not to tender your UBS Shares in the exchange offer, you should carefully consider the information about the risks set forth under the “Risk Factors” section of this offer to exchange/prospectus beginning on page 33 and the other information included or incorporated by reference into this offer to exchange/prospectus.

PURPOSE OF THE EXCHANGE OFFER (PAGE 48)

The purpose of the exchange offer is to establish a holding company for the Group. If the exchange offer is successful, UBS Group will become the new listed parent company of UBS, which is currently both the ultimate parent company and the primary operating entity of the Group. The exchange offer will not involve any change to our board of directors and senior management.

The establishment of a group holding company is intended, along with other measures we have already announced, to substantially improve the resolvability of the Group in response to Swiss “too-big-to-fail” requirements and applicable requirements in other countries in which the Group operates.

Swiss “too-big-to-fail” requirements call for systemically important banks, including UBS and the Group, to put in place viable emergency plans to preserve the operation of systemically important functions despite a failure of the institution, to the extent that such activities are not sufficiently separated in advance, and to enable the recovery or resolution of the Group as a whole. The Swiss “too-big-to-fail” requirements provide for the possibility of a limited reduction in the progressive buffer capital requirement for systemically important institutions that adopt measures to reduce resolvability risk beyond what is legally required, including through alterations of legal structure.

We have already announced a series of measures to improve the resolvability of the Group, including the establishment of a new bank subsidiary in Switzerland, the implementation of a revised business and operating model for UBS Limited in the United Kingdom and the implementation of an intermediate holding company in the United States under Dodd-Frank. The new Swiss banking subsidiary is expected to contain the systemically important function of the Group in Switzerland and to reduce resolvability risk by eliminating the need to transfer functions to a bridge institution as part of a resolution. A group holding company is expected to facilitate the issue of debt that can be “bailed-in” in a resolution while

14

limiting the consequences of the bail-in on the operating entities of the group and the creditors of those entities. A debt bail-in is a procedure contemplated by the Swiss bank insolvency ordinance (and other similar laws and regulations in other countries) that permits the governmental authority exercising resolution powers to cause a write-down or conversion of debt into equity of the failing institution. The debt bail-in mechanism is intended to effectively recapitalize the institution to permit an orderly wind-down, disposition or continued operation of operating entities. We believe that these measures will substantially improve the overall resolvability of the Group. See “—Plans for UBS After the Exchange Offer” below.

As a consequence of the exchange offer and the other measures we have announced regarding our legal structure, we believe that we are substantially enhancing the resolvability of the Group in response to evolving global regulatory requirements. We anticipate that the exchange offer and the other measures already announced will allow the Group to qualify for a rebate on the progressive buffer capital requirements applicable to the Group as a systemically relevant Swiss bank under applicable Swiss “too-big-to-fail” requirements. FINMA has confirmed to us that the measures proposed are in principle suitable to warrant the granting of a rebate, but the amount of such rebate, will depend on the actual execution and implementation of these measures in Switzerland and elsewhere and therefore cannot be known at this time. Any such rebate would result in lower overall capital requirements for the Group.

REASONS FOR THE BOARD OF DIRECTORS’ APPROVAL AND RECOMMENDATION OF THE EXCHANGE OFFER (PAGE 51)

On September 28, 2014 the board of directors of UBS evaluated the terms of the exchange offer and other documentation and reached the conclusion that the exchange offer is in the best interests of UBS and all holders of UBS Shares, in their capacity as such. UBS’s board of directors recommended that holders tender their UBS Shares into the exchange offer in exchange for UBS Group Shares and has adopted the report pursuant to Swiss tender offer rules attached as Annex A to this offer to exchange/prospectus. The action of the UBS board of directors was taken by a unanimous vote of those members of the board present and voting.

For a discussion of the material factors considered by the board of directors of UBS in reaching its conclusions and the reasons why the board of directors determined that the exchange offer is in the best interests of UBS, see “The Transaction—Reasons for the Board of Directors’ Approval and Recommendation of the Exchange Offer.”

PLANS FOR UBS AFTER THE EXCHANGE OFFER (PAGE 49)

Squeeze-Out

If UBS Group acquires more than 98% of the total UBS Shares in issue in the exchange offer or within three months after expiration of the subsequent offer period, we intend to conduct the SESTA squeeze-out. This procedure involves the filing of a claim by us with the competent court in Switzerland, by which we will request the court to cancel the UBS Shares held by any remaining minority shareholders according to Swiss law. Upon the conclusion of the proceedings, which we expect to take between four and six months, minority UBS shareholders will lose their shareholder rights and will receive UBS Group Shares on a share-for-share basis.