UBS (UBS) 6-KCurrent report (foreign)

Filed: 24 Jul 18, 7:03am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

Date: July 24, 2018

UBS Group AG

Commission File Number: 1-36764

UBS AG

Commission File Number: 1-15060

(Registrants' Names)

Bahnhofstrasse 45, Zurich, Switzerland and

Aeschenvorstadt 1, Basel, Switzerland

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20‑F or Form 40-F.

Form 20-F x Form 40-F o

This Form 6-K consists of the presentation materials related to the Second Quarter 2018 Results of UBS Group AG and UBS AG, and the related speaker notes, which appear immediately following this page.

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

Second quarter 2018 results

24 July 2018

Speeches by Sergio P. Ermotti, Group Chief Executive Officer and Kirt Gardner, Group Chief Financial Officer

Sergio P. Ermotti

Slide 1 – Cautionary statement regarding forward-looking statements

Thank you, Caroline.

Slide 2 – 2Q18 net profit +9% to CHF 1.3bn

Let me first touch briefly on our strong performance this quarter, and then I'll cover some highlights of the first half of the year and our plans for the future.

Q2 net profit increased 9% to nearly 1.3 billion francs with strong growth in Global Wealth Management and the Investment Bank. In Personal and Corporate, momentum was good, as profit increased. Reported profits in Asset Management were impacted by a business disposal in Q4 ‘17.

Kirt will cover the quarterly results in detail later.

Slide 3 – 1H18 net profit +15% to CHF 2.8bn

Strong performance in the 2Q contributed to a very good first half, with net profit up 15% to 2.8 billion.

Global Wealth Management's reported profit reached 2.2 billion, the highest in 10 years.

The Investment Bank was strong across the board, with 24% adjusted return on attributed equity.

Personal & Corporate maintained its good business momentum, despite interest rate headwinds.

In Asset Management, we saw a rebound in normalized profits and invested assets reached a decade high.

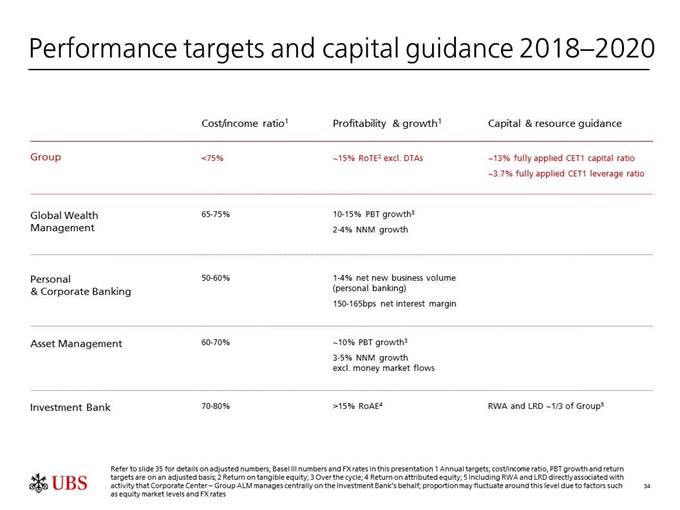

To conclude, we had two consecutive quarters of returns well above the 15% return on tangible, and we brought down our cost income ratio by 240 basis points.

37

Slide 4 – Generated 3bn in capital in 1H18

We have generated around 3 billion francs of CET1 capital in the first six months, the most in any first half since we began the implementation of Basel 3.

We added 1.1 billion to our capital base, while accruing for the 2018 dividend in line with our dividend policy.

In Q2, we also bought back 550 million worth of our shares, achieving the target we set for 2018. Any additional share repurchases this year will depend on business and capital development.

Slide 5 – Uniquely positioned with leading franchises

So now on our strengths and plans for the future.

As you know, UBS is the largest and the only truly global wealth manager, with a strong footprint and excellent growth dynamics in the world's most attractive markets. This is what makes UBS unique.

We can also rely on very strong and stable earnings from our Personal & Corporate business as part of our leading universal bank in Switzerland.

In Asset Management, we are focused both on areas with high growth potential and attractive margins

Similarly, our Investment Bank excels in the areas where it has chosen to compete and is a leader when it comes to resource efficiency and returns.

All our businesses are critical to the success of our strategy, and each of them is a source of competitive advantage for the others.

Slide 6 – Diversified by business and by region

You've seen UBS delivering good profits in a variety of conditions in recent years. This speaks to the resilience and diversification of our earnings in difficult times and is also a result of our investments over the years. We continue to see significant potential in the world's largest and fastest growing markets.

The geographic and business diversity comes at a cost, which is structurally higher than many of our peers. Having said that, these costs are more than offset by the superior prospects and returns of our model.

Slide 7 – Delivering high quality revenue growth

Looking at revenues, we have added 2.2 billion to recurring income over the past 6 years, or 5% compounded, and today, almost 60% of revenues are recurring in nature. At the same time, we have refocused all our businesses on risk-adjusted returns and efficient use of resources. Transaction income also grew, despite margin pressure, risk-aversion and low volatility environment.

Because our business is capital light and also because of our risk discipline, credit losses have been minimal, which speaks to the quality of our credit book.

And finally, I'd like to highlight that UBS is one of the best rated large global banks.

38

Slide 8 – Substantial costs to fulfill regulatory requirements

Here are some examples of the costs associated with our global and diversified business model.

The 52 billion we have built in TLAC since 2012 has led to an increase in funding costs of around 700 million per annum.

In addition, the implementation of new regulations has also been costly. We are now spending over a billion and a half on regulatory matters every year. The inflow of new regulation has been well above anything we could have anticipated and some of the associated cost is more permanent in nature.

The latest example that will cost us over 100 million is Brexit.

Naturally, we continue to actively work to bring more efficiency to overall regulatory spend.

Slide 9 – Maximizing returns

Our philosophy in managing the trade-off between cost / income and capital efficiency on an absolute and relative basis is best reflected on this chart. Our model is very capital efficient, comes with a structurally higher cost / income ratio; however, generates superior overall returns.

Of course, we are working to improve on both fronts in order to move to the next efficient frontier.

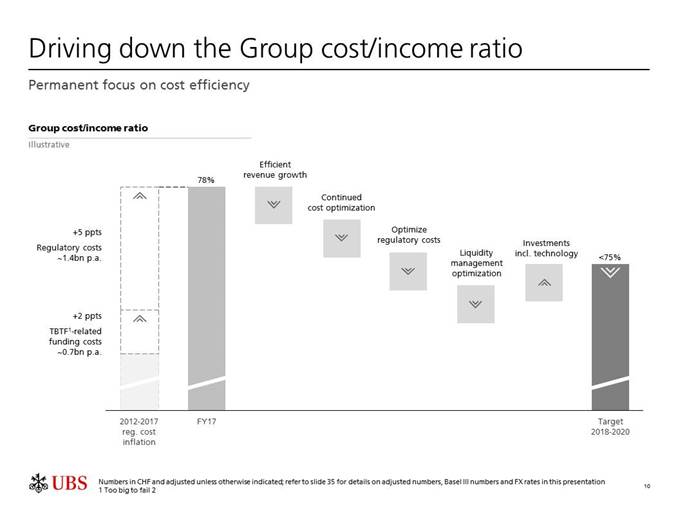

Slide 10 – Driving down the Group cost/income ratio

So how do we get there?

First and foremost, we need to keep growing the topline and here we have a range of strategic plans to add to the growth inherent to our business.

On costs, we have to focus on continuous improvement, as well as structural changes, including investing in technology, which will enable us to create sustainable efficiency.

We are taking some initial cost actions in the newly combined GWM as well as in Asset Management, which form part of our plans to improve efficiency and effectiveness.

We continue to reduce Corporate Center spend outside of tech and risk. Having said that, even within tech, we are doing some heavy lifting to insource staff to gain greater control and better efficiency.

39

Slide 11 – Global Wealth Management

As I mentioned in Q1, the creation of Global Wealth Management was a natural evolution of our business model. And it’s a story about growth. Having said that, of course, we are taking measures to optimize resource utilization in the new organization.

We already have an excellent position in terms of loans and mandate penetration. But we still have more scope to grow in both areas without compromising on risk or suitability standards.

Post-full implementation of FATCA and automatic exchange of information, we have a unique opportunity to expand our global offering to ultra-wealthy and Global Family Office clients, regardless of their domicile. For example, we are working on new avenues to link international clients into the Americas, and better serving US persons anywhere in the world. We are also working to fuel more growth in our GFO business by extending and scaling this highly successful joint venture between Global Wealth Management and the Investment Bank.

The key regional drivers of growth – Americas and APAC – remain intact and progress here continues to be excellent. We see onshore China as a critical long-term driver of growth and we're investing to capitalize on our strong position in the region.

And of course, technology remains an important part of the strategy. We are piloting and perfecting different client approaches. Technology will also help us to drive costs lower.

Slide 12 – Targeting 10% PBT growth in Asset Management

Many of you will be all too familiar with the pressures facing the asset management industry today.

Our Asset Management business has undergone a fundamental transformation over the past few years. We have refocused on areas of strength and worked to build our investment capabilities and target future growth areas.

As you can see on the slide, the business has six strategic priorities, of which five are focused both on high growth and attractive margin areas of the industry.

And complementing these initiatives, we're improving efficiency and operational excellence.

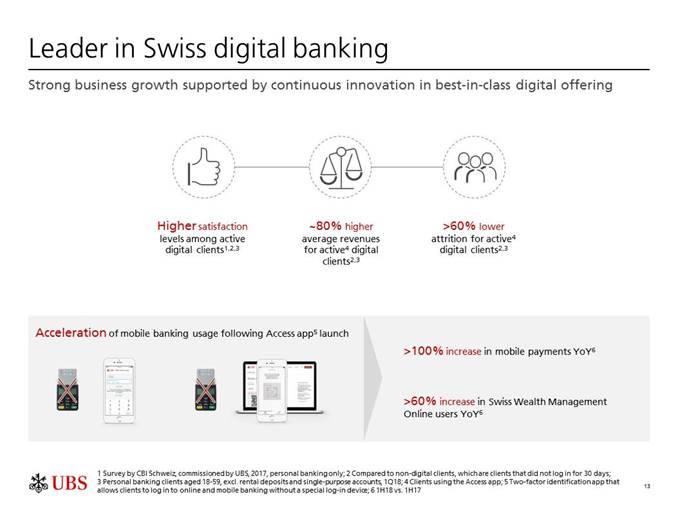

Slide 13 – Leader in Swiss digital banking

We are regularly asked to provide examples and quantify the benefits of technology investments. Here are some examples.

In Switzerland, we are running a multi-year program to digitize the bank covering front-to-back processes and improving the client experience. So far, we are very happy with our progress and clients' response. Our digital clients are more satisfied, have a more attractive revenue profile, and lower attrition rates. Digital penetration and service usage are also growing rapidly across both the personal bank and our Swiss wealth management client base, which is key for cost efficient growth. All this will help us to sustain our leadership position in Switzerland.

40

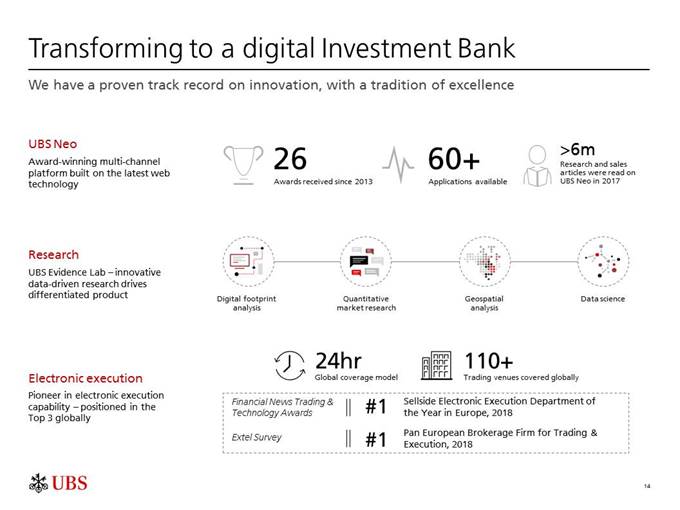

Slide 14 – Transforming to a digital Investment Bank

The investment bank broke new ground with its transformation to a client-focused and capital-efficient model and the results over the last few years speak for themselves.

Today, UBS is once again leading the charge, with our transformation into a digital investment bank. Over the last two years, we've invested in our electronic FX platform to enable faster and more competitive pricing. Since we launched the new technology in Q3 ‘17, we have seen a steady increase in volumes. The year-to-date revenues were up 27% above the previous year's and we have gained market share. Our Equities electronic platform is also growing dynamically, with revenues up nearly 40% in the first six months. UBS's position in this area is well recognized by clients and by industry surveys.

We have also invested in technology to support our research franchise. Evidence Lab is a key differentiator and allows our analysts to produce smarter and eye-opening research for our clients. We are using big data to bring a different and complementary take on traditional ways of valuing a company. Last year, we had over 6 million downloads of research and sales notes from our Neo platform.

Slide 15 – Unlocking our full potential

So all in all, we have had a very good first half of the year, which is a continuation of the trends we saw over the last few years. We are well positioned to capture growth across all our businesses and regions where we operate. We will continue to invest in a focused way in technology to drive an even better client experience and to help us achieve sustainable efficiencies. All this will allow us to continue to grow our profitability and deliver our capital return targets.

Slide 16 – Save the date – Investor Update, October 25, 2018

I realize that fifteen minutes, half an hour is not enough to tell you about all the progress at UBS and our future plans. That's why we are planning to hold an Investor Update in London on October 25th. So I look forward to seeing you there, and with that, I'll hand over to Kirt, who will take you through the quarterly results.

41

Kirt Gardner

Thank you, Sergio. Good morning everyone.

Slide 17 – UBS Group AG results (consolidated)

As usual, my comments will compare year-on-year quarters and reference adjusted results unless otherwise stated.

This quarter, we have adjusted for restructuring expenses of 114 million and 15 million of foreign currency translation losses.

Taxes for the quarter include a reversal of the provision of 13 million we took last quarter for BEAT, as following a continuing assessment of the new law's application, we no longer expect a material impact this year or for the foreseeable future. I would also note that we are currently reviewing our DTA remeasurement process and expect to make any adjustments in the fourth quarter this year.

Slide 18 – Global Wealth Management

Global Wealth Management had another very good quarter, with ten-year record performances in net interest income and recurring net fee income, strong invested asset growth and record lending volume and mandate penetration. We delivered 18% PBT growth on a reported basis, or 7% on an adjusted basis, despite lower client activity.

On the efficiency side, our reported cost-to-income ratio improved by 280 basis points, or 50 on an adjusted basis.

At the same time, we have absorbed material increases in incremental investment and regulatory-related spend. This year, we have been investing in technology, building out our product suite in the US, and hiring advisors in APAC, resulting in over 175 million in incremental expenses compared with the first half '17. In addition to this, we spent an incremental 90 million for regulatory developments.

As Sergio mentioned, we have also implemented a number of initial efficiency measures in the quarter, which we expect to result in a reduction of over 100 million by year-end, compared with the first half annualized.

Slide 19 – Global Wealth Management

Operating income increased by 5%, with 83% of our revenues recurring in Q2. Net interest income and recurring net fee income were up 9% combined, benefitting from growth in invested assets, mandate penetration, deposit margins and loans.

Conversely, transaction-based income declined on muted client activity in both the Americas and Asia, as uncertainty weighs on client sentiment, compared with a more buoyant mood in the prior year.

42

Slide 20 – Global Wealth Management

Looking at net interest income in more detail, we saw 10% growth overall, driven by both deposits and loans.

Higher deposit net interest margin drove the larger share of the increase, as we have benefitted from US dollar rate rises outside of the US, as well as having maintained our deposit beta at relatively low levels through the retiering exercise we undertook in the US towards the end of last year. It's likely that our deposit beta will increase with future rate rises, reducing the benefit we'd expect to realize in the US.

We've grown loans in all regions over the past year, and most notably in APAC, which was the largest contributor to the 11% increase in total lending balances. We're also expanding our product suite in the Americas in jumbo mortgages and more tailored and specialized lending.

Partly offsetting these positive product results, we were impacted by the roll-off of interest rate hedges at the end of last year and higher funding costs.

Slide 21 – Global Wealth Management

We've seen a 9% increase in recurring net fee income, primarily as we have grown mandate products by almost 100 billion in the past 12 months, partly offset by the diminishing impact on recurring income from cross-border outflows in prior periods.

Slide 22 – Global Wealth Management

Moving to the regional view, Americas PBT increased by 16% on double-digit recurring fee income growth and strong net interest income. Invested assets, loans, and managed account assets all increased.

The cost/income ratio decreased one percentage point from the prior year. Costs increased only 3%, mainly on investments that we’ve made to further expand the product shelf and to deploy technology for our FAs and clients. Total FA compensation was flat year-on-year, as higher grid-based compensation was mostly offset by the reduction in compensation commitments to FAs, as our focus on retention and productivity over recruitment is paying off. Our FA productivity remains unrivalled.

In APAC, our revenues rose by 10% on strong net interest income and recurring net fee income growth, which offset weak transaction activity as mentioned earlier. Costs were up 13%, reflecting an uptick in investments, including a 9% increase in advisors and our investments in China, both of which will take some time to bear fruit. We also had an increase in expense for litigation and regulatory matters.

Our ultra-high net worth business demonstrated strong PBT growth of 30%, on double-digit growth across all regions, higher invested assets, and increases in all revenue lines.

After a very strong first quarter, this quarter’s net new money was atypical. Outside the Americas, net new money was around six billion, as we had lower net inflows from ultra-high net worth clients, and very little net new lending. In the Americas, there were 4.6 billion of tax-related outflows, and we also had a 4.4 billion, low margin outflow from a corporate employee share program. That said, the underlying story is encouraging, as, excluding these items, US same store net new money was more than three times last year’s amount. We continue to target 2 to 4% growth in Global Wealth Management.

43

Slide 23 – Personal & Corporate Banking

PBT in our Personal and Corporate business was 378 million Swiss francs, almost unchanged from the previous year, despite the material ongoing net interest income drag, as well as increased investment in technology.

Recurring net fees rose on higher volumes of bundled products and investment funds. Transaction-based income increased on FX and referral fees. Net interest income decreased by 16 million from the prior year, as increased deposit revenue was more than offset by lower banking book revenues and higher funding costs.

As mentioned before, we initiated a multi-year investment program to digitize our Swiss universal bank, where we've spent about 70 million year-to-date. We expect both revenue and cost benefits to begin to accrue in 2019.

Net new business volume growth was strong at 3.9%, with increases in both client assets and loans.

Slide 24 – Asset Management

PBT for Asset Management was 126 million, down 7 million. Normalized for the sale of our fund administration business in Q4, profits were up 1%.

Invested assets reached a decade high on strong net new money over the last 12 months, favorable markets and improved investment performance. Furthermore, net new run-rate fees were the highest since 2Q15, led by a strong contribution from our wholesale business, which is one of our six strategic priorities.

Performance fees were lower in both alternatives and equities. This was partly driven by the implementation of IFRS 15, which delays crystallization of a large proportion of our performance fees in Active Equities until the fourth quarter, as our investment performance held up well.

We have taken cost actions in the business in the second quarter to generate personnel cost savings of around 25 million by year-end. We booked restructuring charges of 13 million in Q2 as a result, which we adjusted for.

44

Slide 25 – Investment Bank

Our IB delivered another excellent quarter, with 44% PBT growth, a 23% return on attributed equity, and very strong operating leverage.

On a regional basis, we had particularly strong performances in the Americas and Asia Pacific.

Within ICS, Equities increased 17% on higher revenues across all regions and products, with stronger client flows in Financing Services and Derivatives. If we include corporate equity derivatives to be more comparable with peers, Equities rose 11%.

FRC had a strong quarter with revenues up 72% to over 500 million, partly due to the recognition of around 100 million, mainly related to previously deferred day-1 profits. Excluding this, FRC revenues were up by more than a third, with increases in all regions and all products.

Corporate Client Solutions had a more subdued quarter, mainly as equity capital markets revenues were lower.

Costs were up just 4%, mostly on higher IT investments and regulatory expenses. We reduced our cost-to-income ratio by 6 percentage points, demonstrating ongoing cost control.

We achieved these strong results while reducing our RWA sequentially, mainly due to a 9 billion reduction in market risk RWA on risk management actions taken during the quarter.

Slide 26 – Corporate Center

We’ve made progress in our Corporate Center this quarter.

Consistent with our objective, Services’ total costs were down 2%, excluding both technology, where we committed to invest, and risk control, where higher expenses were related to regulatory requirements. As a reminder, over 95% of the 2 billion from Services was allocated to the divisions this quarter.

The factors we highlighted last quarter continue to impact Group ALM. While there was an improvement in structural risk management quarter-on-quarter, Libor-OIS and FX basis spreads remain adverse. We are progressing actions to improve our Group ALM results going forward.

Non-core and Legacy Portfolio posted a small loss of 17 million, including an additional litigation provision of 76 million and valuation gains on our auction rate securities portfolio.

Slide 27 – Workforce management

As part of our overall focus on efficiency and effectiveness, we have been insourcing jobs from third-party vendors to our Business Solutions Centers in recent quarters, primarily in technology. Overall, we reduced our total workforce by nearly a thousand since September last year.

45

Slide 28 – Capital and leverage ratios

Our capital position remains strong, with our CET1 ratios comfortably above the 2020 requirements, and TLAC of over 81 billion.

To wrap up, we had a very good second quarter, contributing to a strong first half of 2018, and we are on track to deliver our financial targets.

With that, Sergio and I will open it up for questions.

46

Cautionary statement regarding forward-looking statements: This document contains statements that constitute “forward-looking statements,” including but not limited to management’s outlook for UBS’s financial performance and statements relating to the anticipated effect of transactions and strategic initiatives on UBS’s business and future development. While these forward-looking statements represent UBS’s judgments and expectations concerning the matters described, a number of risks, uncertainties and other important factors could cause actual developments and results to differ materially from UBS’s expectations. These factors include, but are not limited to: (i) the degree to which UBS is successful in the ongoing execution of its strategic plans, including its cost reduction and efficiency initiatives and its ability to manage its levels of risk-weighted assets (RWA), including to counteract regulatory-driven increases, leverage ratio denominator, liquidity coverage ratio and other financial resources, and the degree to which UBS is successful in implementing changes to its businesses to meet changing market, regulatory and other conditions; (ii) continuing low or negative interest rate environment, developments in the macroeconomic climate and in the markets in which UBS operates or to which it is exposed, including movements in securities prices or liquidity, credit spreads, and currency exchange rates, and the effects of economic conditions, market developments, and geopolitical tensions on the financial position or creditworthiness of UBS’s clients and counterparties as well as on client sentiment and levels of activity; (iii) changes in the availability of capital and funding, including any changes in UBS’s credit spreads and ratings, as well as availability and cost of funding to meet requirements for debt eligible for total loss-absorbing capacity (TLAC); (iv) changes in or the implementation of financial legislation and regulation in Switzerland, the US, the UK and other financial centers that have imposed, or resulted in, or may do so in the future, more stringent or entity-specific capital, TLAC, leverage ratio, liquidity and funding requirements, incremental tax requirements, additional levies, limitations on permitted activities, constraints on remuneration, constraints on transfers of capital and liquidity and sharing of operational costs across the Group or other measures, and the effect these will or would have on UBS’s business activities; (v) the degree to which UBS is successful in implementing further changes to its legal structure to improve its resolvability and meet related regulatory requirements and the potential need to make further changes to the legal structure or booking model of UBS Group in response to legal and regulatory requirements, to proposals in Switzerland and other jurisdictions for mandatory structural reform of banks or systemically important institutions or to other external developments, and the extent to which such changes will have the intended effects; (vi) uncertainty as to the extent to which the Swiss Financial Market Supervisory Authority (FINMA) will confirm limited reductions of gone concern requirements due to measures to reduce resolvability risk; (vii) the uncertainty arising from the timing and nature of the UK exit from the EU and the potential need to make changes in UBS’s legal structure and operations as a result of it; (viii) changes in UBS’s competitive position, including whether differences in regulatory capital and other requirements among the major financial centers will adversely affect UBS’s ability to compete in certain lines of business; (ix) changes in the standards of conduct applicable to our businesses that may result from new regulation or new enforcement of existing standards, including recently enacted and proposed measures to impose new and enhanced duties when interacting with customers and in the execution and handling of customer transactions; (x) the liability to which UBS may be exposed, or possible constraints or sanctions that regulatory authorities might impose on UBS, due to litigation, contractual claims and regulatory investigations, including the potential for disqualification from certain businesses or loss of licenses or privileges as a result of regulatory or other governmental sanctions, as well as the effect that litigation, regulatory and similar matters have on the operational risk component of our RWA; (xi) the effects on UBS’s cross-border banking business of tax or regulatory developments and of possible changes in UBS’s policies and practices relating to this business; (xii) UBS’s ability to retain and attract the employees necessary to generate revenues and to manage, support and control its businesses, which may be affected by competitive factors including differences in compensation practices; (xiii) changes in accounting or tax standards or policies, and determinations or interpretations affecting the recognition of gain or loss, the valuation of goodwill, the recognition of deferred tax assets and other matters, including from changes to US taxation under the Tax Cuts and Jobs Act; (xiv) UBS’s ability to implement new technologies and business methods, including digital services and technologies and ability to successfully compete with both existing and new financial service providers, some of which may not be regulated to the same extent; (xv) limitations on the effectiveness of UBS’s internal processes for risk management, risk control, measurement and modeling, and of financial models generally; (xvi) the occurrence of operational failures, such as fraud, misconduct, unauthorized trading, financial crime, cyberattacks, and systems failures; (xvii) restrictions on the ability of UBS Group AG to make payments or distributions, including due to restrictions on the ability of its subsidiaries to make loans or distributions, directly or indirectly, or, in the case of financial difficulties, due to the exercise by FINMA or the regulators of UBS’s operations in other countries of their broad statutory powers in relation to protective measures, restructuring and liquidation proceedings; (xviii) the degree to which changes in regulation, capital or legal structure, financial results or other factors may affect UBS’s ability to maintain its stated capital return objective; and (xix) the effect that these or other factors or unanticipated events may have on our reputation and the additional consequences that this may have on our business and performance. The sequence in which the factors above are presented is not indicative of their likelihood of occurrence or the potential magnitude of their consequences. Our business and financial performance could be affected by other factors identified in our past and future filings and reports, including those filed with the SEC. More detailed information about those factors is set forth in documents furnished by UBS and filings made by UBS with the SEC, including UBS’s Annual Report on Form 20-F for the year ended 31 December 2017. UBS is not under any obligation to (and expressly disclaims any obligation to) update or alter its forward-looking statements, whether as a result of new information, future events, or otherwise.

47

Disclaimer: This document and the information contained herein are provided solely for information purposes, and are not to be construed as a solicitation of an offer to buy or sell any securities or other financial instruments in Switzerland, the United States or any other jurisdiction. No investment decision relating to securities of or relating to UBS Group AG, UBS AG or their affiliates should be made on the basis of this document. Refer to UBS's Annual Report on Form 20-F for the year ended 31 December 2017. No representation or warranty is made or implied concerning, and UBS assumes no responsibility for, the accuracy, completeness, reliability or comparability of the information contained herein relating to third parties, which is based solely on publicly available information. UBS undertakes no obligation to update the information contained herein.

Use of adjusted numbers

Adjusted results are a non-GAAP financial measure as defined by SEC regulations. Refer to pages 8-10 of the 2Q18 report which is available in the section "Quarterly reporting" at www.ubs.com/investors for an overview of adjusted numbers.

If applicable for a given adjusted KPI (i.e., adjusted return on tangible equity), adjustment items are calculated on an after-tax basis by applying an indicative tax rate.

Refer to page 17 of the 2Q18 report for more information..

© UBS 2018. The key symbol and UBS are among the registered and unregistered trademarks of UBS. All rights reserved.

48

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrants have duly caused this report to be signed on their behalf by the undersigned, thereunto duly authorized.

UBS Group AG

By: _/s/ David Kelly________________

Name: David Kelly

Title: Managing Director

By: _/s/ Ella Campi ________________

Name: Ella Campi

Title: Executive Director

UBS AG

By: _/s/ David Kelly________________

Name: David Kelly

Title: Managing Director

By: _/s/ Ella Campi ________________

Name: Ella Campi

Title: Executive Director

Date: July 24, 2018