UBS (UBS) 6-KCurrent report (foreign)

Filed: 22 Oct 19, 1:34pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

Date: October 22, 2019

UBS Group AG

Commission File Number: 1-36764

UBS AG

Commission File Number: 1-15060

(Registrants' Names)

Bahnhofstrasse 45, Zurich, Switzerland

Aeschenvorstadt 1, Basel, Switzerland

(Address of principal executive offices)

Indicate by check mark whether the registrants file or will file annual reports under cover of Form 20‑F or Form 40-F.

Form 20-F x Form 40-F o

This Form 6-K consists of the presentation materials related to the Third Quarter 2019 Results of UBS Group AG and UBS AG, and the related speaker notes, which appear immediately following this page.

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

Third quarter 2019 results

22 October 2019

Speeches by Sergio P. Ermotti, Group Chief Executive Officer, and Kirt Gardner, Group Chief Financial Officer

Including analyst Q&A session

Check against delivery.

Numbers for slides refer to the third quarter 2019 results presentation. Materials and a webcast replay are available at www.ubs.com/investors

Martin Osinga (Investor Relations)

Slide 1 – Important information

Good morning and welcome to our third quarter 2019 results presentation.

I would like to draw your attention to our slide regarding forward-looking statements at the end of this presentation. It refers to cautionary statements including in our discussion of risk factors in our latest annual report. Some of these factors may affect our future results and financial condition.

Now over to Sergio.

30

Sergio P. Ermotti

Thanks Martin. Good morning everyone, and thank-you for joining us.

Slide 2 – 3Q19 net profit of USD 1,049m

We had a solid third quarter. Even with mixed market conditions adding to the usual seasonality, we delivered over 1 billion in net profit.

As the investment environment evolves, we continue to position ourselves for future growth and clients continue to turn to UBS.

In Global Wealth Management, we had a good quarter. Our broad client relationships have driven net inflows of 16 billion and we now look after 2.5 trillion of their assets. This scale allows us to invest, drive innovation and provide choice to even better meet their changing needs.

In Personal and Corporate, strong net new business volumes growth this year is helping us mitigate interest rate headwinds.

Asset Management had a third consecutive quarter of YoY profit growth, or four on an adjusted basis, and saw strong NNM inflows this quarter.

The Investment Bank faced market conditions that were not favorable to our geographic footprint, business mix, and the strategic choices that we have made for the business, as well as tough comparisons with very strong results a year ago and in the previous quarter.

That said, we are not satisfied with the Investment Bank’s financial performance this quarter. In response to trends and developments in the industry and reflecting on our recent performance, we are implementing a number of actions to evolve our business model.

These actions will better position our IB to serve our clients, leverage investments we have made and capture important growth opportunities in the areas where we are strongest and returns are the most attractive.

These changes will also support our efficiency drive and help fund critical investments in both technology and talent.

Our goals remain unchanged. One, to deliver best in class services to our institutional and corporate clients for their evolving needs. And two, to support our corporate and wealth management clients across other business divisions.

Slide 3 – Market context

Similar to prior quarters, business and market conditions were challenging, with lingering questions over global GDP growth outlook and persisting geopolitical tensions.

Despite US markets hitting all-time highs in the summer, volatility, volumes and fee pools remained muted. Many of these challenges were especially visible in our traditional areas of strength – Asia and Europe – affecting our overall relative performance in the institutional space.

31

With low or negative rates looking increasingly permanent, we are taking actions to improve our profitability. We are optimizing our deposit base and, where appropriate, increasingly sharing the burden of negative rates with our clients.

Slide 4 – UBS global investor sentiment survey

Investors’ attitudes have not changed significantly. They are generally happy with their current asset allocations, remain evenly split on global economic outlook, and they are keeping high cash holdings.

That said, investors continue to look for opportunities to invest, opening doors for us to win them over with high quality service, a wide range of investment products, ability to protect their wealth, and meet their investment goals during these uncertain times.

To achieve this, we will keep fostering collaboration across the bank.

Slide 5 – Positioning for growth

As the world’s only truly global wealth manager, we are in a position of strength to meet clients’ changing needs.

They continue to demand greater value for money, a choice of public and private investments, and are looking for help in navigating the challenging markets.

Our Global Family Office is a very good example of how we meet these expectations by leveraging close collaboration between GWM and the IB. We are onboarding more clients under this model.

In the third quarter, our GFO clients were visibly more active in the markets than our other ultra-high net worth clients, especially in APAC. We also helped them carry out several significant transactions that required GWM’s relationships and the IB’s expertise to go hand-in-hand to succeed.

We are also working on closer collaboration between the IB and GWM in our US middle market offering and fostering cooperation between the IB and P&C in the corporate space in Switzerland.

We continue to deepen our partnership between GWM and Asset Management. In the US, we are announcing today that we will be bringing together our asset and portfolio management and execution resources. This will allow us to expand access to Asset Management solutions, drive net new money and mandate growth, and will come at a reduced cost to our clients.

An important part of our plan to grow efficiently is to increase our presence in attractive international markets through strategic partnerships.

Last quarter, we announced a deal in Japan with SuMi Trust and, as previously announced, we have signed a memorandum of understanding with Banco do Brasil to create a leading investment bank in South America. We'll give you an update on this latest by our fourth quarter results.

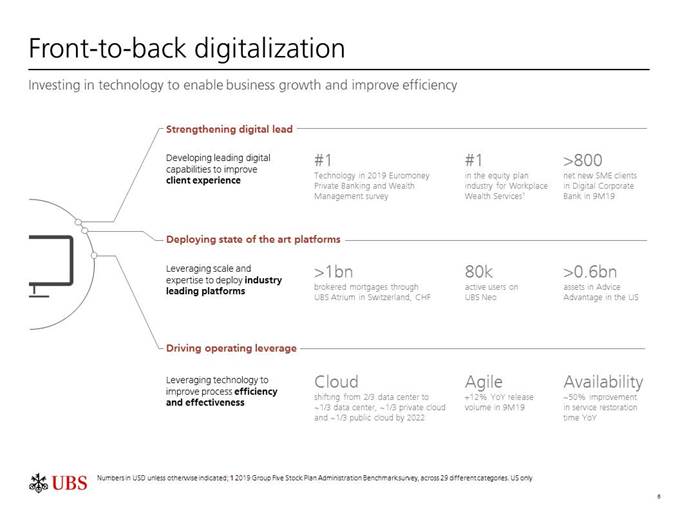

Slide 6 – Front-to-back digitalization

We keep investing in technology, which in this day and age is both an enabler of growth and a facilitator of efficiency and effectiveness.

32

You can see a few examples on the slide, but let me point to UBS Advice Advantage, our digital advice platform for wealth management clients in the US, which allows us to serve affluent clients in the US in a very effective way. It has been live for one and a half years, and we are encouraged by clients’ initial activity and the platform’s growth momentum.

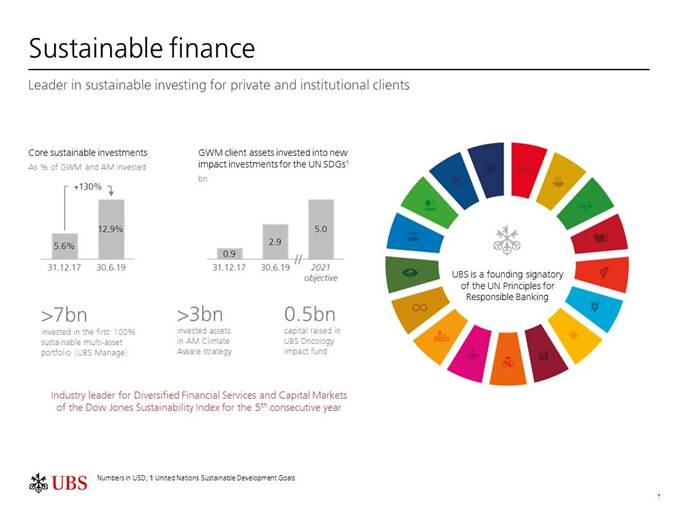

Slide 7 – Sustainable finance

Increased focus on sustainability principles when making investment decisions is one of the biggest and most important shifts in clients’ needs.

Our commitment to sustainable finance is aimed at delivering value to clients in an area they are becoming more and more passionate about.

Clients have allocated over 4 billion to our sustainable-oriented family of mandates within UBS Manage so far this year, making it the fastest-selling mandate product with over 7 billion in assets. These mandates also outperformed year-to-date.

For me, the fact that UBS was the industry leader of the Dow Jones Sustainability Index for the fifth year running is a great achievement.

But our ambitions do not stop here. Our goal is to strengthen our leading position by expanding and delivering to clients a pipeline of innovative, commercially attractive solutions in coming years.

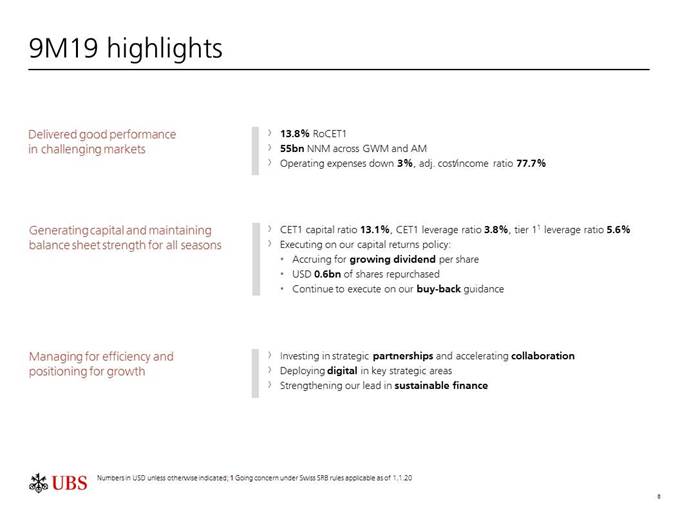

Slide 8 – 9M19 highlights

Looking back at the first nine months of the year, we had a good performance considering the environment we've been operating in. Our return on CET1 capital was 13.8% and we decreased our costs by 3%, while still investing for growth.

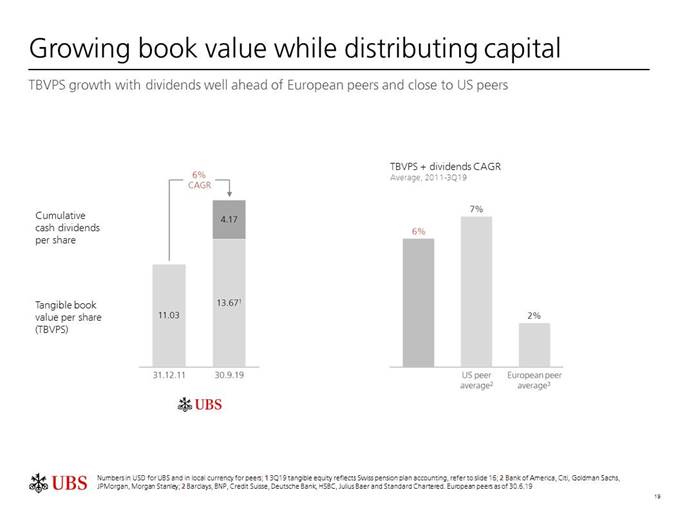

Our balance sheet strength for all seasons supports our ability to invest, generate shareholder returns and also navigate whatever uncertainties the world will throw at us. We have accrued for a growing cash dividend and bought back 600 million worth of shares.

For the remainder of this year, we intend to continue to execute on our capital returns plans as previously communicated.

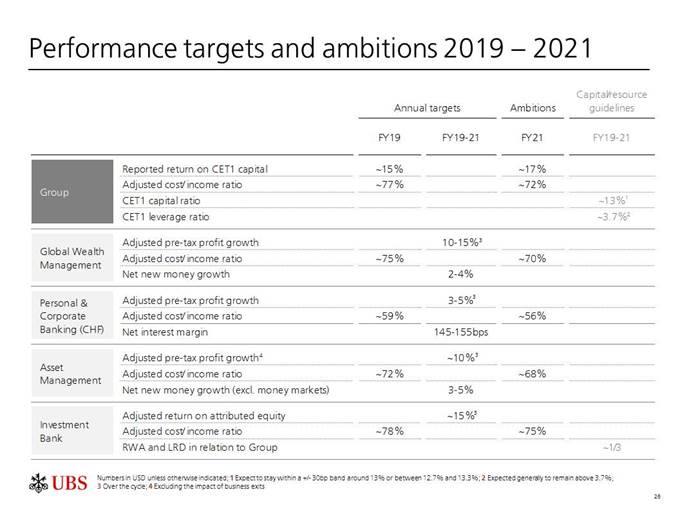

Lastly, as we finalize our rolling 3-year plan, we will provide an update on our targets in January, with our full-year results.

Our immediate focus is to execute on our strategy in the fourth quarter, leveraging our outstanding franchise to create value for clients and our shareholders.

Now I’ll turn over the call to Kirt to discuss this quarter in greater detail. Thank-you.

33

Kirt Gardner

Thank you, Sergio. Good morning everyone.

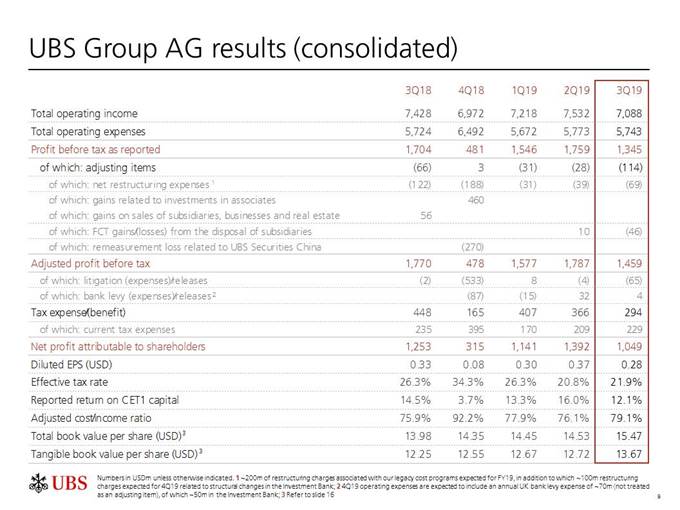

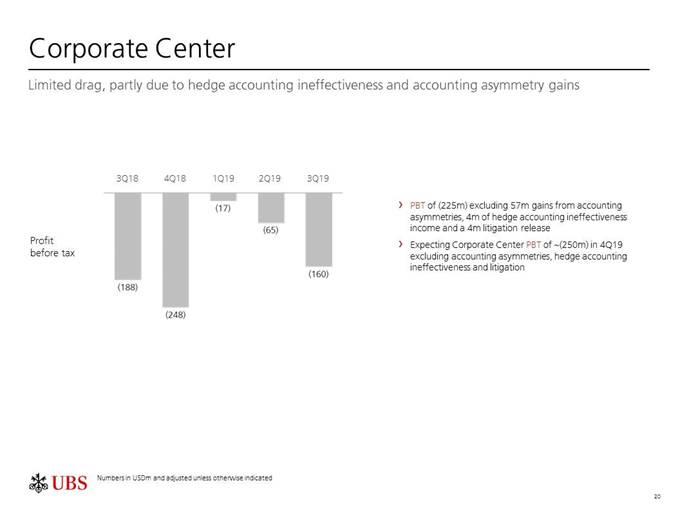

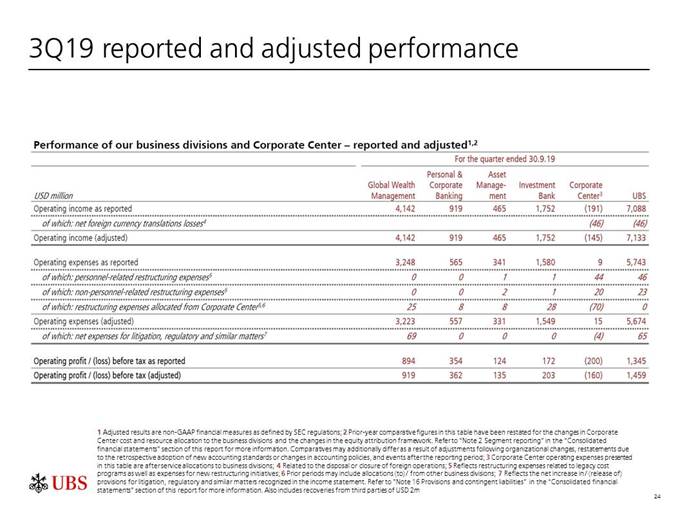

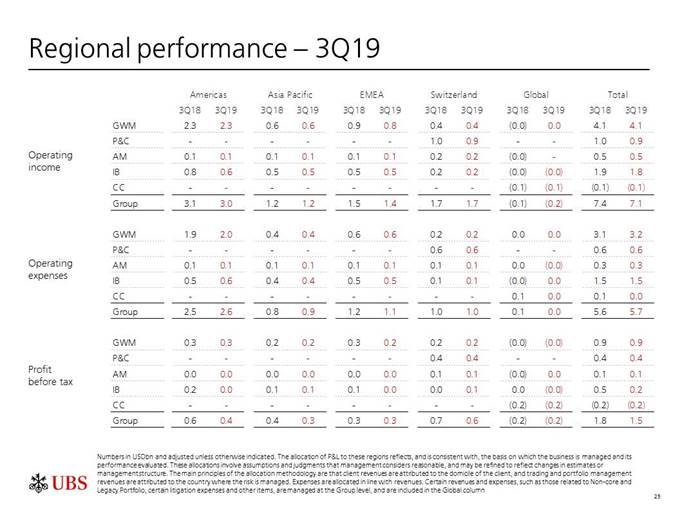

Slide 9 – UBS Group AG results (consolidated)

As usual, my comments will compare year-on-year quarters and reference adjusted results in US dollars unless otherwise stated.

We adjusted for foreign currency translation losses on sales of 46 million and restructuring expenses of 69 million. Year-to-date, restructuring expenses were 139 million, and we still anticipate around 200 million for legacy programs for the full year 2019. In addition, we expect the IB reorganization that Sergio just mentioned to lead to around 100 million of restructuring expenses in the fourth quarter.

Excluding litigation, we expect an uptick in adjusted costs of around 200 million sequentially in the fourth quarter, which is broadly in line with 2018, reflecting normal seasonality, including the UK bank levy, as well as build-up of regulatory-related expenses. Excluding the bank levy, we expect the vast majority to be reflected in GWM.

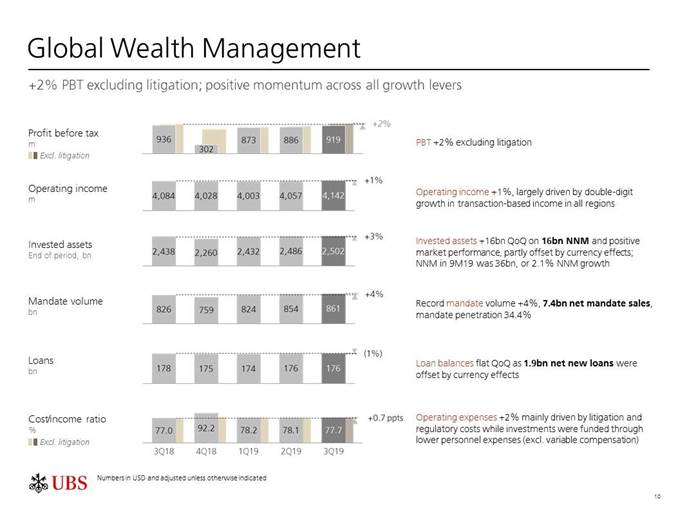

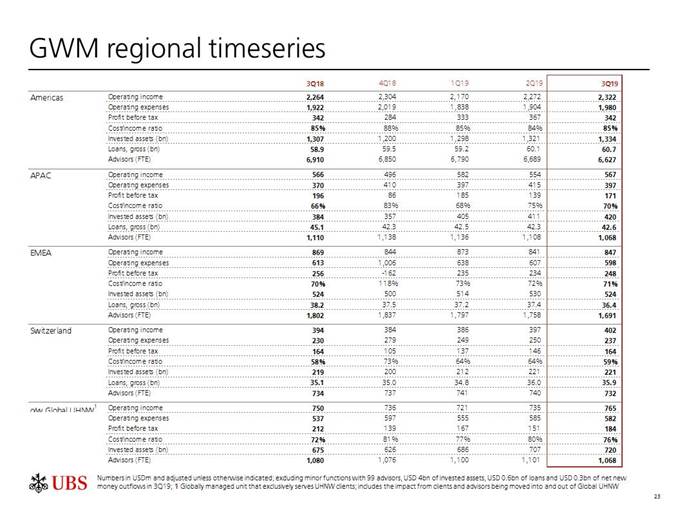

Slide 10 – Global Wealth Management

Moving to our businesses. Global Wealth Management delivered good results. PBT was down 2%, or up 2% excluding litigation. We saw healthy volumes across our key growth levers: net new money, mandate sales, and net new loans.

For the quarter, operating income increased by 1% on higher transaction-based income, offsetting lower recurring fees and net interest income. I’ll cover revenues in more detail in a moment.

Costs increased by 2%, driven by higher litigation expenses and strategic investments in the business, partly offset by our savings initiatives.

As part of our cost management and in response to the environment this year, we have been very disciplined on the hiring front, resulting in a reduction in personnel expenses excluding FA and variable compensation, while still funding strategic priorities.

We’re continuing to invest in strengthening our controls, including our AML programs in particular, which will persist into the fourth quarter. These costs were spread across all business divisions, but primarily GWM and the IB.

Mandate penetration was stable at 34.4%, with strong net sales offsetting the increase in total invested assets. On the lending side, we had 2 billion net new loans, but loan balances were unchanged due to the offsetting currency effects.

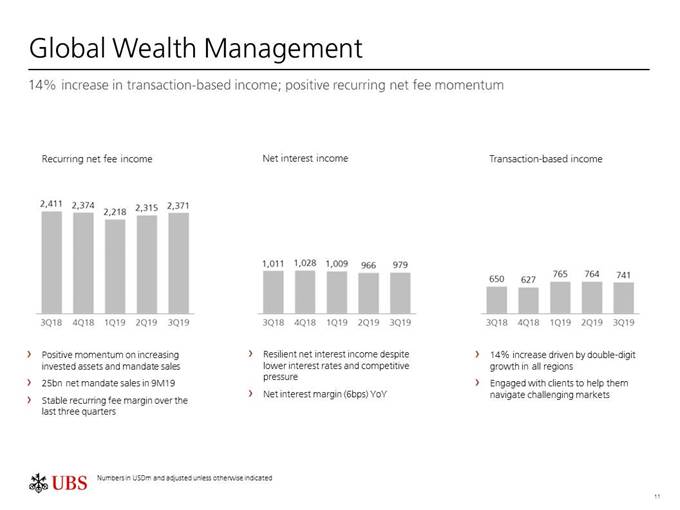

Slide 11 – Global Wealth Management

Back to revenues. Recurring fees were up 2% sequentially and down 2% year-on-year. Year-over-year, fees were impacted by margin pressure from client preferences for mandates with lower fees, which we already noted last quarter, along with a higher concentration in ultra-high net worth. Recurring margins have been stable over the last three quarters, and fees increased quarter-on-quarter due to strong mandate sales and record invested assets.

34

Net interest income was down 3%, driven by lower revenues from both deposits and loans, partly offset by higher investment of equity income following our switch to US dollars. While net interest income was slightly up sequentially, persistent negative rates, along with additional expected Fed rate moves, pose net interest income headwinds. A 25 basis point cut by the Fed would reduce NII by around 60 million a year, excluding any volume changes or pricing actions.

Transaction-based income increased by 14%, partly reflecting a weak 3Q18, but also supported by our focus on helping clients to manage their investments in this particularly complex and challenging environment. For example, our advisors and product teams have been working together to provide alternatives to traditional investments, allowing clients to diversify and enhance yield in a suitable way. Just to call out a couple of examples, we’ve attracted around 2 billion year-to-date into private real estate products. And we’ve had half a billion of inflows in Q3 into our systematic allocation strategy, which tactically shifts between equities and bonds.

Other income increased by about 40 million, primarily due to the repositioning of the liquidity portfolio in the Americas and a gain on legacy securities positions.

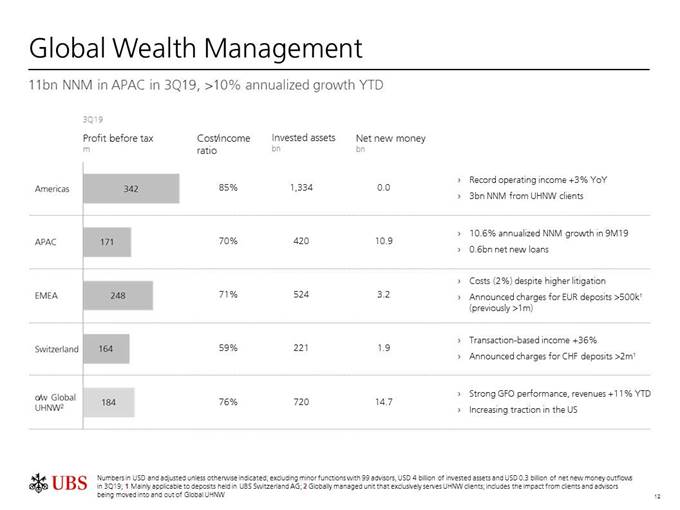

Slide 12 – Global Wealth Management

Moving to the regional view. In the Americas, income increased to a record 2.3 billion, driven by higher transaction income. This however was more than offset by higher expenses, which increased largely due to litigation provisions and the investments in our controls I just mentioned. Excluding litigation, PBT is up 5% year-on-year, comparing favorably to our US competitors. Our advisors continued to be the most productive in our peer group, with invested assets and revenue per advisor increasing to another record level. Loans also rose to a record level. Net new money was flat as 3 billion inflows from ultra-high net worth offset outflows elsewhere.

Outside the Americas, mandate penetration rose to record levels in each region and we had positive net new lending, although offset by currency effects. We had double-digit increases in transaction-based revenues year-on-year in each of the regions and decent performance versus the seasonally stronger second quarter. In the fourth quarter, we are reducing the threshold for charging for euro deposits to 500 thousand and introducing charging for Swiss franc balances above 2 million. But we are of course working with clients to provide alternatives; for example, by investing in mandates, offering deposits with other UBS Group entities, or moving to other products.

In our Global Family Office, we had strong year-to-date performance, with revenues up 11%.

In terms of net new money, we had 16 billion inflows globally and it was positive or flat in all regions. Asia was a major contributor, helped by a large single inflow, contributing to year-to-date annualized growth of 11% in the region. Year-to-date net new money globally has been solid at a growth rate of just above 2%, and particularly strong in Global Ultra, with 32 billion of net inflows or an annualized growth rate of around 7%.

35

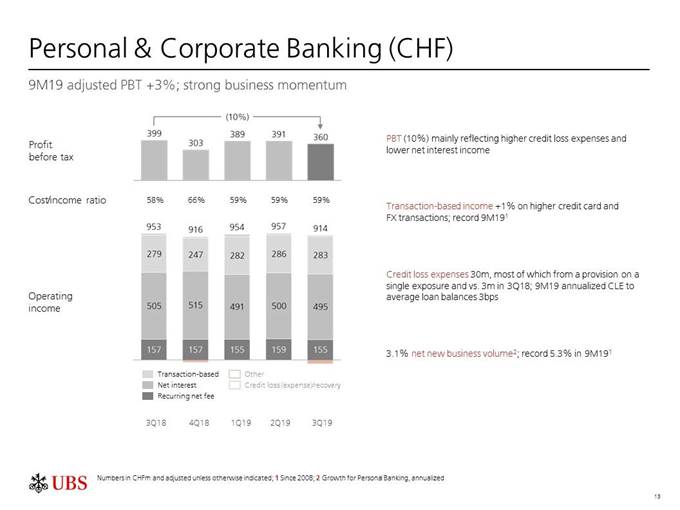

Slide 13 – Personal & Corporate Banking (CHF)

Performance in P&C has been strong year-to-date, with PBT up 3%. Third quarter PBT was down 10% to 360 million Swiss francs, mainly driven by higher credit loss expenses and lower net interest income.

The CLE this quarter was predominantly due to a provision on a single exposure. Year-to-date credit losses have only been 3 basis points annualized on P&C's 130 billion franc loan book.

NII was down 2%, driven by a 4 basis-point reduction in net interest margin to 150 basis points, partly offset by higher loan balances.

Recurring fees were stable. Transaction revenues rose on increased credit card and foreign exchange transactions, and reached a record level year-to-date.

Business momentum remains very strong, with 3.1% annualized net new business volume growth in Personal Banking for the quarter and a record 5.3% year-to-date.

Costs were flat and the cost-to-income ratio was 59%.

During the fourth quarter, we expect to realign our client coverage between GWM and P&C. This will result in a one-time shift and referral fee of around 70 million paid by P&C to GWM.

Slide 14 – Asset Management

Asset Management had another good quarter. PBT was up 6% to 135 million dollars.

Operating income was up 2%, driven by a 3% increase in net management fees, reflecting higher average invested assets.

Costs were broadly flat, driving 2% of operating leverage and improving the cost-to-income ratio to 71%.

Invested assets were up 3% during the quarter to the highest dollar level for at least the last decade and a half, driven primarily by net inflows of 33 billion. Year-to-date net new money was broad-based across asset classes and channels, and has come in at higher margins in aggregate than our average book of business margins.

During the quarter, UBS was ranked #1 in Broadridge's inaugural ranking of 60 global asset managers operating onshore in China, confirming UBS as the leading foreign fund manager in China.

Slide 15 – Investment Bank

Our IB return on attributed equity was 6.6% as income decreased and costs rose from a lower base in the prior-year quarter. Market conditions and broader macroeconomic trends did not favor our Investment Bank's business and geographic mix. Compared with our peers, we have heavier weighting to EMEA and APAC versus the US. Our capital-light strategy also means we have a smaller footprint than some of our peers in Rates, Credit and DCM.

36

After outperforming in the second quarter, CCS revenues were down 19% year-on-year in the third quarter, with decreases across most products. Geographically, we underperformed in the Americas, where the fee pool was up slightly, while we outperformed in EMEA, where the fee pool declined.

Our Equities revenues were down 7%. Derivatives was the main driver, partly reflecting our strong performance in 3Q18, but also our weighting towards APAC and specifically in structured derivatives versus peers, where market conditions were tougher. Our Cash business held up well with revenue broadly flat, and we believe we’ve gained market share in the US and in APAC.

FRC performed well, considering the low volatility and volumes in FX, where we delivered an increase on a strong 3Q18 performance, and e-FX rose in the Bloomberg Spot rankings during this year. Lower Credit revenues more than offset broad-based increases in our Rates business.

IB costs were up 6%, reflecting a net release of a litigation expenses in 3Q18, as well as higher tech and regulatory-related expenses including the investment in controls I referenced earlier.

To be clear, and as Sergio already said, we aren’t satisfied with our year-to-date financial performance. The reorganization that he referenced will realign our business to better serve our clients, and we expect to deliver around 90 million of net cost savings.

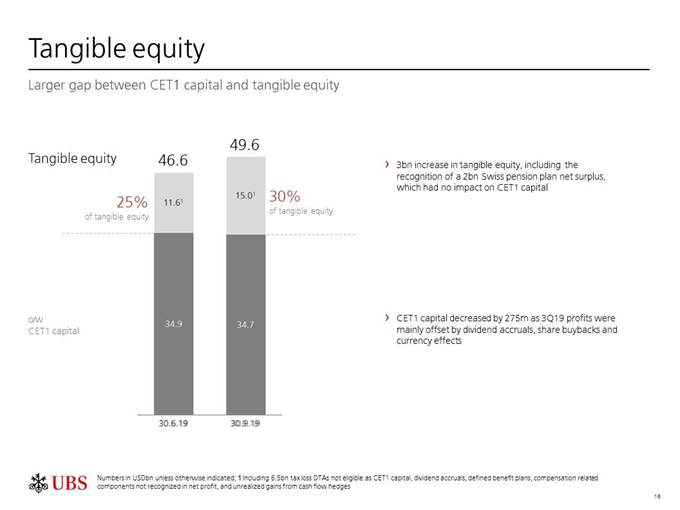

Slide 16 – Tangible equity

In the third quarter, tangible equity rose by 3 billion, while CET1 capital was relatively flat at 35 billion.

The increase in tangible equity primarily was driven by the recognition of a 2 billion net surplus in our Swiss pension plan. The recognition had no impact on CET1 capital.

Prior to this quarter, and going back a few years, the surplus wasn’t reflected in tangible equity due to an accounting requirement that effectively caps the recognition of the surplus. The large decreases in the discount rate we saw during the third quarter reduced the pension surplus, but also removed the effect of this cap, triggering the recognition of the 2 billion net surplus in our equity.

As a consequence, the CET1 deduction items included in our tangible equity increased from 25 to 30%, compared with peers deducting only around 6% on average. Our deduction items notably include 6.5 billion DTAs, along with around 2 billion each in dividend accruals, compensation items, and unrealized gains from cash flow hedges, as well as our pension surplus from this quarter. None of these components provide usable capital to our businesses, nor do they contribute to our regulatory capital requirements, which dictate our ability to return capital to shareholders.

This all further reinforces why measuring our returns based on CET1 capital makes sense.

Slide 17 – UBS at a glance

We navigated a challenging quarter to deliver over 1 billion in net profits and 12.1% return on CET1 capital.

We remain focused on executing our strategy, while optimizing costs and capital.

With that, we'll take questions.

37

Analyst Q&A (CEO and CFO)

Benjamin Goy, Deutsche Bank

Yes, hi good morning, two questions please. First, on your net interest income in GWM, it was better than guidance and looking at how rates moved, probably better than expected, so just wondering, what helped you in Q3 and you gave the guidance for rate cuts to be expected, any positive mitigation in Q4 as well after the September rate cut?

And then secondly, on the investment bank costs, so is it fair to assume the 90 million you target on cost savings is mainly personnel expenses, and that the non-personnel expenses are likely to continue to go up due to investments? Thank you.

Kirt Gardner

Yes, Benjamin, thank you for your two questions. In terms of net interest income, if you look at the year-on-year, we saw 6 basis points overall erosion in our net interest margin, and that’s as a consequence of course of the lower interest rates but as well as the price competition that we're seeing in the market. Now, we continue to see that price competition, particularly for loans in the US, and internationally. Nevertheless, you did see that our net interest income quarter on quarter was more stable, and really there was a slight deterioration in product results, but our treasury-related results held up a little bit better. You shouldn’t read into that any indication of the future trend, as I highlighted in my comments. We still expect the persistent negative and low interest rates, along with further expected reductions in the FED will pose net interest income headwinds. And I highlighted that a 25 basis point move implies around 60 million of full-year reduction, absent any changes to our balances or our pricing on a full-year basis.

In terms of the IB costs, you are correct, the 90 million reduction really is 100% personnel costs. You know, in fact the gross reductions are greater than that, and we are planning to continue to invest in technology in our investment bank, particularly in our electronic platforms, just given how critical digital and electronic is in our investment bank’s performance and in that industry going forward. In addition to that, I did highlight that there are some regulatory, increased regulatory cost headwinds that we expect to see in that business in the fourth quarter.

Benjamin Goy, Deutsche Bank

Ok, thank you.

Kirt Gardner

Along of course, with the typical UK bank levy.

Benjamin Goy, Deutsche Bank

Yes, perfect. And then maybe a small follow-up. Given the investments, is it too early to see a leverage out of these investments so to say to reduce platform costs over time?

Kirt Gardner

Yes, I am not sure your question around reducing platform costs. I mean, I think as we indicated, the realignment of the business is importantly to adjust our organization so we can better serve our clients. So there is certainly a revenue component of this, and we do believe it will allow us to better allocate both our capital as well as our cost resources into the market segments, the business and product segments where we can best perform. But then in addition to that, there’s an efficiency element that we highlighted with the 90 million net reductions.

38

Benjamin Goy, Deutsche Bank

Ok, understood, thank you.

Stefan Stalmann, Autonomous Research

Good morning, gentlemen, thanks for taking my questions. I have two, please. The first one regards the investment bank. We have had quite a bit of a spike in credit and counter-party risk-weighted assets during the quarter, about 6 billion. Would you say that was a, let’s say, seasonal spike that will drop back and normalize, or is that a more permanent elevated level of activity and then capital consumption?

And the second question is more, I guess a strategic question regarding GWM, you have obviously made a high-profile hire to co-head the business, Mr Khan. Could you talk a little bit about what objectives he is going to follow and what he is asked to do differently from what has been done before in GWM? That would be helpful, thank you very much.

Kirt Gardner

Yes, thank you for the two questions. In terms of the IB, first just to clarify, quarter on quarter RWA is up 3 billion, and year on year up just 1 billion – and year on year that’s despite the fact that we’ve actually absorbed a fair bit of regulatory-related increases. Now you shouldn’t read anything in terms of what we saw quarter on quarter. It’s just normal business activity during the quarter. And also I would highlight that our LRD was actually flat quarter on quarter and 16 billion down year on year. So that’s reflective of the fact that there was just less inventory at work, just given the lower volumes and activity levels that we saw this quarter versus third quarter last year.

Stefan Stalmann, Autonomous Research

I was actually referring to the credit and counter-party risk component only, which was up 6 billion.

Kirt Gardner

Yes, that was just really reflective of, during the quarter, activity that we saw across our CCS franchise, and it should be indicative of forward opportunities that we have for future deals in the pipeline.

Stefan Stalmann, Autonomous Research

Ok, great.

Sergio Ermotti

Stefan, on your second question. Well, first of all, it is Iqbal’s priority to help the execution of our current plans, and that’s really first priority, we need to keep momentum on the execution, and we have a well-defined set of initiatives that we need to just execute. The second is that I asked him to basically look in the first 60 days to make his own assessment of our franchise, and together with Tom Naratil to come back to me early in December with ideas on how to, you know, refocus or explore different opportunities. So you know, I will give him a little bit of time to go into the organization, get to know people, and of course like, you know, I expect, every person being appointed to any new role in the organization, to bring some things different, a new approach, and I am sure Iqbal will bring his expertise to that.

Stefan Stalmann, Autonomous Research

Great, thank you very much.

39

Kian Abouhossein, JP Morgan

Yes, thanks for taking my questions. The first one is just coming back to the issue of transaction-based income in wealth management. You clearly state that it’s up in all regions on a year-on-year basis, also when you talk about double-digit growth by the way, and you also clearly see a relative good performance quarter on quarter. Just trying to understand that when I look at stock markets, in particular in Hong Kong and Europe, and look at the data relative to what you illustrated in your revenues, which is very good – just to understand, what’s driving that? And in that context, should we not look at exchange volume data to get a feeling of what’s going on and if there’s any other measures that you would suggest, if you could maybe highlight that in that context?

And then the second question is regarding more US wealth management business, in terms of hiring process, where we are, how we should think about that as employee numbers are going down – and in that context, the competition in the US, which is clearly heating up, with some of the peers becoming very aggressive in pricing, as well as some of the banks entering so to say.

Kirt Gardner

Yes, Kian, thank you for the question. First to put the transaction revenue and the quarter into context, it is on a comparative basis off of quite a low 3Q18 and we also, you might recall, had a low 4Q18 where our transaction margin was only 11 basis points. So what you’ve seen this year is a 1 basis point uptick, but also I think it’s reflective of the fact that we have been very focused on working with our clients to find appropriate investment opportunities given the low yield environment, and given the very, very challenging macroeconomic outlook. You reference equity and brokerage and stock exchange volumes, that’s really generally not a good proxy for us in terms of transaction revenue – when we have a good transaction revenue quarter, usually it’s much more concentrated in structured products. So volatility can help, although we didn’t have a lot of volatility this quarter, as well as positioning in funds and mandates. There was quite a bit of activity and positioning in funds that we felt were appropriate for clients. I referenced a couple. The 2 billion inflows in the real estate fund. And also our systemic dynamic fund that I mentioned, with half a billion inflows.

In terms of wealth management hiring, you’ve seen overall we’ve had had a reduction in our FAs, and we are very focused and Tom consistently talks about our focus on our productivity, not number of FAs. And we still believe there is substantial upside in terms of continued improvement in productivity. Nevertheless, we have been very focused in our hiring, and very selective. We focus much more on ultra-high net worth FAs, FAs with a higher concentration of ultra-high net worth consistent with our strategy to increase penetration of that segment in the US, and you saw that result. We had 3 billion of ultra-high net worth inflows during the quarter, although that was offset by some outflows from some smaller clients. We have a decent pipeline going forward, and that’s going to continue to be our focus. And yes indeed, there is quite intense competition, and clearly you see JP Morgan step up their game and the regionals are competing quite a bit, but we still feel comfortable with our franchise and our strategy going forward.

Kian Abouhossein, JP Morgan

Ok, thank you.

40

Jeremy Sigee, Exane

Morning, thank you, a question on targets and a question on capital, please. So firstly on targets, you said that you plan to give us an update with the full-year results. And I just wondered what sort of shape of communication we should expect, whether you would, obviously the 2019 targets will have been gone by that point – so is this about updating 2021 or rolling over to 2022, and should we expect any sort of tweaks to business strategy, or is it just a kind of numbers communication? So that’s my first question.

And then secondly, just on capital, you’re proceeding quite strongly with the buy-back, you’ve obviously done another 300 million in 3Q like 2Q, so I wondered do you expect to reach the billion that you’re targeting, well, technically up to a billion. Do you think you will reach the full billion and have you reached decisions on dividend growth policy in relation to that preference for buy-backs? Thank you.

Sergio Ermotti

Well, thank you. Let me take the questions on what we expect in January. I think in January you will get an update, as I mentioned in my remarks, on how we execute the current strategy, and outlining where we stand in the 19, how we executed in 19, and based on that we will also update on if we have new initiatives, or if we believe that some of the initiatives that we have in the pipeline may need to be slowed down or even not considered for the future, considering market changes. And the second topic, we will also highlight, you know, our expectations for the profitability and the targets for 2020, but also rolling over what you saw in 2021 into 21 and 22. So, I mean pretty much in line with what you saw a year ago.

And in terms of our share buy-back, I think as I mentioned in my remarks again, we are accruing for a cash dividend in line with our policy, and our intention is to continue to execute on what we mentioned in the past, so buy-back up to 1 billion for the year.

Jeremy Sigee, Exane

And, excuse me, the dividend policy is the mid-single digit growth, that’s the current stated policy?

Sergio Ermotti

Exactly.

Jeremy Sigee, Exane

Ok, thank you.

Jernej Omahen, Goldman Sachs

Good morning from my side as well. I have two questions. The first one is on page 12, where you highlight that you reduced the hurdle for negative interest rates on your euro deposits with your customers. And I was wondering, what type of a financial impact do you expect from this move? And I guess it’s correct to say that it should already materialize the next quarter. Secondly, just on the side it says that this applies to deposits held in UBS Switzerland. And I was wondering whether, what that means, that if you have euros in Singapore, you still get zero, or whether that’s something different.

And the second question I wanted to ask: so there is a hundred million restructuring charge that you have earmarked for the investment bank, I think the charge is low compared to the cost base in the investment bank. And I was wondering, whether there is a particular area within the IB that you are targeting with this charge – thank you.

41

Kirt Gardner

Yes, just regarding the negative rates overall, I think first, Jernej, you might recall back in 2017 we first introduced charging on euro cash deposits, and that was really driven mostly to address the fact that we had a large euro deposit overhang versus our lending book. And at that point we saw quite significant outflow, and actually we saw net new money outflows, so now we lowered the charging floor from a million to half a million – and the focus as well is also to deal with the fact that we have a large overhang. Now when we already communicated that to our clients, and as part of that communication we offered alternatives for them to ship their deposits into other products, other investments, or other legal entities where we actually needed the funding, which is why the shift out of UBS Switzerland for us is accretive to the group overall. We’ve actually already seen the reaction, and in general we think that we’re going to see more shifts into products rather than clients opting to pay the pricing – and the same dynamic for Swiss francs where we introduced pricing for the first time on deposits above 2 million.

In terms of the restructuring charge, the restructuring really just aligns with the organizational changes we made when we talked about realigning the global bank around five segments and three product segments, including the introduction of private markets and then internationally where we’ve converged our equity and our fixed income business around platform, around structuring and around financing. And the overall restructuring and the reductions are going to be broad base across the group at fairly senior levels.

Jernej Omahen, Goldman Sachs

Thanks a lot, can I just ask as a follow-up, what is the negative rate? So if I had, if somebody has 10 million euros of deposits in UBS Switzerland, what would you charge them?

Kirt Gardner

Well, we haven’t announced specifically what we will charge them, but generally it’s in line with the current negative rates that you see for euros and for Swiss francs.

Jernej Omahen, Goldman Sachs

Thank you very much.

Jon Peace, Credit Suisse

Hi, good morning. So my first question is about net new money in the Americas. It’s been flat or negative for about 6 quarters now. And I just wondered, what is going on there, and it’s quite a drag on your group net new money goal, and when do you think that might sort of normalize upwards a little bit?

And then my second question is on the litigation in France. Is there any change to your expectation that we probably won’t get any developments here until the end of next year? Thank you.

Kirt Gardner

Jon, yes, in terms of net new money, I think, first and most importantly, and you know of course we constantly remind all of you that the focus really should be on invested asset growth rather than net new money – because as you know, net new money can include a lot of different components that can be either high quality or low quality, and in general we see more of our growth in invested assets driven by market moves and dividend retention than we do net new money. So with that, if you look at our invested asset performance in the US, it’s completely in line with our US competitors. I think there was a chart that we showed last quarter, where over the last two years our net new money growth has been very much in line with our US competitors. So that would suggest the dynamic where it’s relevant, net new money has been, and performance has been very consistent across our peer group. Having said that, we did have net neutral, net new money for the quarter, we had 3 billion of inflows from our ultra clients, which is our strategic target, and our intention is to going forward to begin to show some growth in net new money in the US.

42

And the second question? (Sergio Ermotti: It was on regulation. Expectation on regulation implementation).

Yes, so broadly, if you look at the continued regulatory and compliance investments that we’re making, we’re making those across the group, I highlighted the fact that we continue to spend a fair bit to up our game in AML. And that is just as the regulators continue to up that bar, and as the leading global wealth manager it is appropriate for us to do that. In addition to that, if you look in other areas where we’re spending money, we need to onboard the ECB as a consequence of the BREXIT and the establishment of our SE entity in Frankfurt. We’re also spending a fair bit of money to address LIBOR migration, benchmark migration, which is an industry challenge more broadly. So there’s still a number of requirements that we have where we are investing to address regulatory as well as up our game on the compliance side.

Jon Peace, Credit Suisse

Thank you, and specifically with regards to the French tax case, we shouldn’t expect any material updates on that until the end of next year? Or has your timetable evolved a little bit?

Sergio Ermotti

The next update is going to be on November 4th. There is a, you know it is not sure, but most likely we’re going to find out the date of the appeal trial.

Jon Peace, Credit Suisse

Ok, thank you.

Andrew Stimpson, Bank of America Merrill Lynch

Morning everyone. First question on the IB please. The IB has made a return on, or ROAE, of 9.4% in the first nine months of this year, and today you've announced some cost cuts to try and fix that. But the 90 million of annual savings, it seems quite small, given the headwinds that you’ve got there, I think on my numbers at least it looks like it might add 70 basis points or so to returns. So, still leaves you pretty big gaps. So just wondering how, given that that’s the level of restructuring now, how that division will get back towards its target of being above 15%. Is there any heavy lifting to come from the denominator there? I think Kirt you mentioned very quickly there something about on the balance sheet, from a smaller balance sheet maybe? I don’t know if I misinterpreted that. Or whether the plan is just reliant upon improved revenues in the IB.

And then secondly, Kirt, you spoke about discipline on costs, and the advisor numbers in GWM, but the costs that we actually see in GWM haven’t been dropping year on year. So even though the advisor numbers are down about 460 year on year, so what is the driver there? Is it that you are needing to pay up to retain the other advisors that you’ve got, as the competition has increased. I guess for all of us, when we look at our models, we tend to think that as advisor numbers are going up or down, that would be one of the main drivers on cost. So was just wondering if that relationship should reestablish itself in the future? Thank you.

43

Kirt Gardner

Yes, Andy, thank you for your two questions. Just in terms of the IB, you heard my previous response. The changes that we’re making are not just cost. But very importantly, they are realigning our overall organizational model. It’s an evolution in our organizational model, and really kind of the first change that we made since Accelerate . It also recognizes just the general change in trend, so we do believe that with the resources that we will continue to have in the investment bank, we will be able to continue to better focus them on opportunities of growth, and that’s both capital as well as our human capital. And with that, we would anticipate in addition to some of the efficiency improvement, that that should improve our ability to achieve our target return levels. In addition to that, importantly we continue to accelerate the IB and how it supports GWM. Sergio referenced a couple of areas, the acceleration of GFO, which for us is a major growth area, along with the combining and the integration of our platforms, which is now part of the overall savings that we mentioned, both in the US and internationally, and that should help to contribute cost as well as revenue for both businesses. There’s no intention to shrink the footprint at all. We’re still targeting the 1/3 of the group’s capital. So you did hear me, you did hear me incorrectly there. And we believe that is still the right minimum capital for the investment bank to be relevant.

In terms of discipline and personnel costs, what I would point out for wealth management is that actually, if you look year on year, there are about 850 reductions overall on headcount, and that includes middle office of course, as well as some FAs, and along with that actually there’s been quite a substantial reduction overall in our personnel expenses. In fact, personnel expenses are down year on year, as we’ve taken those saves and we partially reinvested them in the hires that we’re making in China, the hires we’re making in the US, for the bill of our GFO and our ultra-high net program, but still delivering some net savings. Now overall costs are up, because on top of that you do see the litigation costs year on year, and you also in addition to that see the increased investments we’re making in technology as well as compliance.

Andrew Stimpson, Bank of America Merrill Lynch

Ok great, and just to follow up on the IB, when you say you’d be better focused, the capital and human capital will be better focused – is that just you redirecting that capital into higher returning areas, or is that more the velocity of the balance sheet?

Kirt Gardner

You know, I think it’s some of both. I mean, as you know, the way that we’ve oriented our investment bank, it’s capital-light and it’s capital-efficient and very highly capital-productive, and so we do think that the reorganization… A good example, we’ve moved our global banking, our CCS business into a focus around five industry segments globally – so that will allow us to be much more efficient in how we deploy our capital globally across geographies. And we’ve moved away from really a geographic structure.

In addition to that, converging our markets platforms so that we can better leverage the technology investment we have in execution platforms will also allow us to generate better return on that investment capital.

Andrew Stimpson, Bank of America Merrill Lynch

Ok, thank you very much.

44

Magdalena Stoklosa, Morgan Stanley

Thank you very much, I’ve got two questions. One is on the pricing in the US, and another one is on the operating leverage. So really in the US, we’re seeing very different kind of price moves in the market. We have seen discount brokers moving to zero commissions, you are kind of suggesting slightly lower fees on select accounts. On the page 5, I assume to kind of drive the net new money and mandate sales as well. But I am curious more, kind of philosophically, when you see kind of, how do you see the overall pricing evolution, particularly as you kind of target very different layers, kind of higher layers in the private bank, but also how do you think about the value of advice in the US market, in particular, going forward.

And my second question is really about your operating leverage – and when you think about 2020 in particular, what are the levers to pull on the operational side that you see. Because of course we have, you have communicated the savings you are seeing from the IB restructuring, and you have also been talking about the regulatory and conduct cost inflation, but do you see any of that abating into next year? Thank you.

Kirt Gardner

Yes, thank you, Magdalena. In terms of pricing overall, of course we saw the move by the electronic brokers, by Schwab, to eliminate their brokerage fees. And just to put that into context, brokerage income is a very small percentage of our overall operating income. And in addition to that, we already over a year ago waived our commission fees on our work place wealth solutions, which is our equity investment, our employee equity investment platform, which is a part of our business that most directly competes against Schwab. And if we think about our pricing more broadly, if we look at in particular of course our advisory pricing, which is the most important pricing component of our US business, there are many other dimensions where we add value, including planning, trust advice, helping with philanthropy solutions, thinking about the next generations, that holistic advice is recognized by our clients first of all, as having a cost component, but having a much greater value component than just execution and transaction. We still feel pretty secure in those margins and our pricing integrity overall in the US.

On the operating leverage side, I think what we’ve guided before is, we are looking to maintain our total direct costs excluding variable compensation flat going forward, and in maintaining that flat we are generating substantial cost saves to fund the additional investments that we have in compliance that we highlighted, mitigating some of the regulatory issues that we need to address, in addition to investing in the business. And we feel that that flat trajectory is appropriate for us, given what we want to accomplish in the franchise. So therefore the operating leverage will come from what we generate on the alpha side, as well as any beta help we can get in this environment, which is a bit more fleeting, we would admit. So clearly we 're going to have to track and watch how the market evolves as we get into 2020.

Magdalena Stoklosa, Morgan Stanley

Thank you.

45

Andrew Lim, Société Générale

Hi, good morning, thanks for taking my questions. First of all, can I tackle the GWM net margin. Obviously, the markets to some extent are working in your favor. S&P near record highs, the markets are doing well, but your net margin is still declining, 14 basis points now versus 16 for the third quarter last year. I know you don’t have a target. But is there a lower level here which you would say to yourselves, this is intolerable, we can’t face single-digit basis points on the net margin, and we have to do something about it. And what to your mind are the key strategic initiatives that you will undertake to try and defend that in the near term? Or are you just hoping on the market beta to try and rescue the situation?

And then the second question really drivels down a bit more on the NII side – so for now of course there are some changes on the deposit charges. If we look forward to what the forward rates are pricing in, to what extent do these changes on the deposit charges offset the net interest margin compression, from the rate decreases. I am just trying to get more of an absolute sense of how this should play out in the coming quarters. Thank you.

Kirt Gardner

Yes, so, Andrew, first of all, if you look at our net margin dynamic, as you pointed out, we were at 16 basis points last year during the third quarter – second quarter actually we were at 14 basis points – we did have a basis point recovery in third quarter, now what’s driving that on a year-on-year basis? There are a couple of dynamics. I refer to the fact that we saw a drop in recurring fee margin in the first quarter. And that’s really stabilized though year-to-date. And the drop was driven by the fact that clients moved into lower risk under contract products, and also lower-price under contract products. In addition to that it’s the segment mix into ultra-high net worth. And then on top of that, it’s also within the mandates, it’s overall risk levels. And we do expect going forward to see continued stability overall in our recurring margin. Now the net interest income margin is also down one basis point year on year, and that’s partly offset by one basis point increase in transaction margin. Now, overall we still have good confidence that we’re going to maintain stability and even show some improvement if we get some help with the market environment in terms of the net margin, and what’s going to drive that. Banking product penetration is critical and we have not had a good year-to-date lending performance, but we are still very focused on growing our loans. Mandate penetration, where we have seen some improvement, and that’s a continued area where as we increase our penetration we will see an uptick in margins. And then on top of that, it’s continuing to manage our overall discount levels.

Now in terms of net interest income, on your question, your forward question around pricing, I am not exactly sure what you’re getting at, but essentially if you look at the industry, you know betas are somewhere around 50%, so what that’s going to suggest is: rates come down. There’s 50% of that that we can pass on to clients, and 50% that’s going to hit us. And if we look at that 60 million reference, that takes into account our current product and pricing structure as well as our betas.

Andrew Lim, Société Générale

I guess I am trying to ask more specifically. You know, given the changes that you‘ve announced on the charges for client deposits – are you still expecting your net interest income, or your net interest margin rather, to decline on the GWM side, given where forward rates are?

46

Kirt Gardner

Yes, so if you look at charging, of course the charging applies specifically to euro deposits and Swiss franc deposits – and if you look at that, if you put that into context within GWM, we actually implemented charging more because of the capital burden we have with excess euro cash. We don’t have a large euro loan book. So when we implemented that charging back in 2017, what it did is, we saw outflows – so clients took the cash elsewhere. Now the charging that, the updated charging bringing down the floor to 500,000, first of all, if you think that the industry’s catching up, we’re seeing other competitors that are introducing charging, so there’s going to be probably fewer places that clients can take their cash, but again, overall it’s not just a play to increase net interest income, it still remains a capital play and managing our LRD where we have excess, and we don’t have lending volume to be able to absorb that. And it’s a simple picture with the Swiss franc side. Our P&C business is a completely different dynamic.

Andrew Lim, Société Générale

Hi, just one more follow-up question. Would you expect deposit outflows because of this change in the charging structure? I think you referenced some net new money outflows the last time you did this back in 2017. Would we expect the same this time round? Especially as you seem to be on the front foot in terms of charging for deposits.

Sergio Ermotti

You know, we don’t really see a lot of this happening, as Kirt just mentioned before. You know, you have to wonder if someone is willing to pay for getting net new money right now, maybe you have one-off situations, but structurally speaking we see the industry facing the same kind of dilemma, and therefore for the more wealthy clients I think it’s, we try to find tactical solutions to avoid that, but you know, I think it’s clear that over time, as the pain grows, it is going to be an inevitable trade-off between profitability and capital consumption and net new money, as we always said. What we will not do, we will not pass negative rates to the affluent and retail segments.

Andrew Lim, Société Générale

That’s great, thank you very much.

Andrew Coombs, Citigroup

Good morning, one question on investment banking revenues. Let me use just one follow-up as well on the Swiss franc deposit charge. On the investment banking revenue mix by region, you cited that the impact was unfavourable for you in part due to your regional mix, and you cited the Dealogic fee pools for Asia and for Europe, but if I look at slide 25 which gives the regional breakdown, the decline year-on-year in your investment banking revenues appears to be more due to your US business rather than Asia and Europe, so could you just elaborate on what was driving the weakness there in your US investment banking revenues?

And then my second question, coming back to this point about the Swiss franc deposits passed through from November on customers with more than 2 million Swiss francs, what proportion of your deposit base do you expect to be captured by that? Thank you.

47

Kirt Gardner

Yes, Andrew, if you look at our investment bank, you know first to the comment that on a relative basis if you look at our overall concentration of revenue and activity compared to US and European peers, we are much more weighted to Europe and Asia Pacific. Now having said that, of course, the US fee pool is far larger than the Europe and the Asia Pacific fee pool. And in addition to that, if you look at the performance during the third quarter, you saw that the Europe fee pool was down a fair bit, the Asia fee pool was down a little bit less but still negative. Now year-to-date, we’ve actually held our share and increased our share in EMEA, so across those regions we’ve performed on a relative basis well. Where we have not performed well is in the US. In the US we were down more than the fee pool. So the fee pool was up slightly, 1% if you look at Dealogic. We were down considerably, substantially. So we did underperform in the US, in the largest fee pool that had the best performance during the quarter itself, and that really explains our CCS performance overall. Now we’re taking actions to address that. We’ve done some hiring year- to-date. And also some of the organizational changes that I mentioned are really looking to stabilize and improve our position in the US market.

On your second question in terms of relative balances, we haven’t really indicated the distribution of our balance by account size. You know, I just would mention that as you would expect we do have a relatively large concentration of Swiss franc deposits with clients with more than 2 million in deposits.

Andrew Coombs, Citigroup

Thank you.

(01:04:33)

Anke Reingen, Royal Bank of Canada

Thank you very much for taking my questions. The first one is just coming back on the investment bank and your January update of the targets. So with Q3 results, the update you announced, the 90 million cost savings, would that already capture the potential update on the investment bank, or assuming everything else stays, or the environment, stays the same, there is no update with respect to the structural changes or more cost savings for the investment bank that we could expect in January?

And then secondly, you talked a lot about the potential for cooperation revenues, and cross-selling. I always had the impression that UBS was more ahead than its peers, and I just wonder is there any indication you can give us and how much it contributes now or where you think you are on the potential to benefit from the cooperation within the group? Thank you very much.

48

Kirt Gardner

Yes, in terms of your first question, I think as we’ve said several times, the changes that we’ve made in our investment bank, which are meant to address both revenue opportunities as well as some efficiency, are what we’ve done to-date, and we think it does position us to be in a much better shape to be able to achieve our targets going forward, and there’s nothing else we should anticipate that we’re going to announce around the investment bank.

On the collaboration side, indeed collaboration is a really core part, critical and core part of our overall group model, and we do have substantial collaboration that takes place across all of our business divisions. Sergio mentioned the upshift in the referrals that take place from P&C and to global wealth management. We talked about the GFO, which is a joint venture between the GWM and also the IB where we see a significant uptick. When we transfer a client into that segment construct. We talked about what we’re doing with asset management and GWM. So for us it’s not really recognizing the fact that we don’t collaborate now. It’s actually recognizing that we think we have further upside, that even though we already we believe are one of the better groups in terms of level of collaboration, we still think that there’s substantial incremental opportunity for us to focus on accelerating and increasing the level of collaboration across our businesses.

Anke Reingen, Royal Bank of Canada

Thank you very much.

49

Amit Goel, Barclays

Hi, thank you. So two questions, one more a follow-up to a previous question. Just on the GWM net interest income, I am just curious, you mentioned that quarter on quarter there had been slightly lower product revenues and slightly higher contributions from treasury. Just curious if you can quantify the change in treasury contribution quarter on quarter. So that’s the first question.

And the second question just relates to the cost guidance that you gave at the half year. Curious if you still expect to see H2 costs greater than H1 on an underlying basis?

Kirt Gardner

Yes, on your first question, as I highlighted, we did have slightly better quarter on quarter group treasury revenue, there are really no specifics I can provide. There typically is a little bit of volatility in our group treasury revenue for the business divisions, and you kind of saw that quarter on quarter – this time in our favor.

In terms of cost guidance, the cost guidance we provided previously stands, we do expect overall an uptick in costs. The second half versus the first half.

Amit Goel, Barclays

Ok, thank you.

Adam Terelak, Mediobanca

Yes good morning, sorry to flog a dead horse, but I want to come back to GWM and NII. You’ve given the guidance on the short-end move of the curve, the 25 basis points to 60 million, but I’m more intrigued about the kind of mid and long end point of the curve, what the shift down in the euro swaps means for your deposit revenues on a multi-quarter basis and how much headwind could come through, as I suppose, hedges roll off into lower rates.

And then secondly is on the positive side, if you could just quantify the benefit that is going to come through from the uptiering threshold at the SNB, and where we should expect that in net interest income. GWM versus P&C. Thank you.

Kirt Gardner

Yes, in terms of the curve, so the curve dynamics for us, they’re much more impactful for US dollars and Swiss francs where we structurally have a much higher volume of hedges just given the overall deposit composition that we have. There’s not an awful lot of longer term exposure that we have to euros, just because that is in order – it’s the third concentration of deposits, overall, but still, nevertheless if you do see a downshift in the longer end of the curve, if you see inverted curves it does have an impact on our replicating portfolios as we roll over our hedges, and it will have downward pressure overall on our net interest income. (Adam Terelak: Could you quantify that?) No. We certainly haven’t offered any guidance specifically on what happens to the euro curve, so there’s nothing. The only guidance is what I mentioned around the shorter term rates and the 25 basis points, you know otherwise right now there’s really no additional guidance that we want to provide on sensitivity to rates, except other than what you see in our quarterly report. As always, you see sensitivity towards various scenarios now, including a 100 basis point parallel shift. And that’s still in the report.

50

The second question around uptiering, I’m sorry (Sergio Ermotti: the benefit of uptiering of the SNB). The benefit of the uptiering of the SNB, that will be allocated to the business divisions that contribute in terms of their deposit mix to where that threshold is allocated – so it will be allocated across GWM and P&C going forward. And what we want to do is actually use that as a way to incent the businesses to get the right structure, the right type of deposits going forward.

Adam Terelak, Mediobanca

Thank you.

Nicholas Watts, Redburn

Thank you, good morning everyone. I had a question on the US wealth management business. The operating margin target, or the pretax margin target for that business, is 25%, that’s about 5% below where your two large peers are operating at the moment. Currently, that is sitting at about 15%, a level it’s been floating at over the last six quarters. I was just wondering whether that target of 25% is something you’re thinking about recalibrating, or whether you’re think it’s still achievable, particularly given where you two largest and closest peers are sitting. Thank you.

Kirt Gardner

Yes, Nicholas, thank you for the question. When we announced that last October, first of all it was a very different beta environment, including of course the US dollar rates and where they sit. Now in addition to that, you heard the actions that we associated with the improvement still stick, and the ones I mentioned before: It’s increasing mandate penetration, it’s increasing our lending and our banking products penetration overall, it’s continuing to improve the productivity of our FAs, and that’s still the path to improving our overall efficiency. As Sergio highlighted, any changes in targets will be announced as part of our fourth quarter earnings.

Nicholas Watts, Redburn

Thank you.

51

Cautionary statement regarding forward-looking statements: This document contains statements that constitute “forward-looking statements,” including but not limited to management’s outlook for UBS’s financial performance and statements relating to the anticipated effect of transactions and strategic initiatives on UBS’s business and future development. While these forward-looking statements represent UBS’s judgments and expectations concerning the matters described, a number of risks, uncertainties and other important factors could cause actual developments and results to differ materially from UBS’s expectations. These factors include, but are not limited to: (i) the degree to which UBS is successful in the ongoing execution of its strategic plans, including its cost reduction and efficiency initiatives and its ability to manage its levels of risk-weighted assets (RWA) and leverage ratio denominator (LRD), including to counteract regulatory-driven increases, liquidity coverage ratio and other financial resources, and the degree to which UBS is successful in implementing changes to its businesses to meet changing market, regulatory and other conditions; (ii) the continuing low or negative interest rate environment in Switzerland and other jurisdictions, developments in the macroeconomic climate and in the markets in which UBS operates or to which it is exposed, including movements in securities prices or liquidity, credit spreads, and currency exchange rates, and the effects of economic conditions, market developments, and geopolitical tensions on the financial position or creditworthiness of UBS’s clients and counterparties as well as on client sentiment and levels of activity; (iii) changes in the availability of capital and funding, including any changes in UBS’s credit spreads and ratings, as well as availability and cost of funding to meet requirements for debt eligible for total loss-absorbing capacity (TLAC); (iv) changes in or the implementation of financial legislation and regulation in Switzerland, the US, the UK, the European Union and other financial centers that have imposed, or resulted in, or may do so in the future, more stringent or entity-specific capital, TLAC, leverage ratio, liquidity and funding requirements, incremental tax requirements, additional levy, limitations on permitted activities, constraints on remuneration, constraints on transfers of capital and liquidity and sharing of operational costs across the Group or other measures, and the effect these will or would have on UBS’s business activities; (v) the degree to which UBS is successful in implementing further changes to its legal structure to improve its resolvability and meet related regulatory requirements and the potential need to make further changes to the legal structure or booking model of UBS Group in response to legal and regulatory requirements, proposals in Switzerland and other jurisdictions for mandatory structural reform of banks or systemically important institutions or to other external developments, and the extent to which such changes will have the intended effects; (vi) UBS’s ability to maintain and improve its systems and controls for the detection and prevention of money laundering and compliance with sanctions to meet evolving regulatory requirements and expectations, in particular in the US; (vii) the uncertainty arising from the timing and nature of the UK exit from the EU; (viii) changes in UBS’s competitive position, including whether differences in regulatory capital and other requirements among the major financial centers will adversely affect UBS’s ability to compete in certain lines of business; (ix) changes in the standards of conduct applicable to our businesses that may result from new regulation or new enforcement of existing standards, including recently enacted and proposed measures to impose new and enhanced duties when interacting with customers and in the execution and handling of customer transactions; (x) the liability to which UBS may be exposed, or possible constraints or sanctions that regulatory authorities might impose on UBS, due to litigation, contractual claims and regulatory investigations, including the potential for disqualification from certain businesses, potentially large fines or monetary penalties, or the loss of licenses or privileges as a result of regulatory or other governmental sanctions, as well as the effect that litigation, regulatory and similar matters have on the operational risk component of our RWA as well as the amount of capital available for return to shareholders; (xi) the effects on UBS’s cross-border banking business of tax or regulatory developments and of possible changes in UBS’s policies and practices relating to this business; (xii) UBS’s ability to retain and attract the employees necessary to generate revenues and to manage, support and control its businesses, which may be affected by competitive factors; (xiii) changes in accounting or tax standards or policies, and determinations or interpretations affecting the recognition of gain or loss, the valuation of goodwill, the recognition of deferred tax assets and other matters; (xiv) UBS’s ability to implement new technologies and business methods, including digital services and technologies and ability to successfully compete with both existing and new financial service providers, some of which may not be regulated to the same extent; (xv) limitations on the effectiveness of UBS’s internal processes for risk management, risk control, measurement and modeling, and of financial models generally; (xvi) the occurrence of operational failures, such as fraud, misconduct, unauthorized trading, financial crime, cyberattacks, and systems failures; (xvii) restrictions on the ability of UBS Group AG to make payments or distributions, including due to restrictions on the ability of its subsidiaries to make loans or distributions, directly or indirectly, or, in the case of financial difficulties, due to the exercise by FINMA or the regulators of UBS’s operations in other countries of their broad statutory powers in relation to protective measures, restructuring and liquidation proceedings; (xviii) the degree to which changes in regulation, capital or legal structure, financial results or other factors may affect UBS’s ability to maintain its stated capital return objective; and (xix) the effect that these or other factors or unanticipated events may have on our reputation and the additional consequences that this may have on our business and performance. The sequence in which the factors above are presented is not indicative of their likelihood of occurrence or the potential magnitude of their consequences. Our business and financial performance could be affected by other factors identified in our past and future filings and reports, including those filed with the SEC. More detailed information about those factors is set forth in documents furnished by UBS and filings made by UBS with the SEC, including UBS’s Annual Report on Form 20-F for the year ended 31 December 2018. UBS is not under any obligation to (and expressly disclaims any obligation to) update or alter its forward-looking statements, whether as a result of new information, future events, or otherwise.

52

Disclaimer: This document and the information contained herein are provided solely for information purposes, and are not to be construed as a solicitation of an offer to buy or sell any securities or other financial instruments in Switzerland, the United States or any other jurisdiction. No investment decision relating to securities of or relating to UBS Group AG, UBS AG or their affiliates should be made on the basis of this document. No representation or warranty is made or implied concerning, and UBS assumes no responsibility for, the accuracy, completeness, reliability or comparability of the information contained herein relating to third parties, which is based solely on publicly available information. UBS undertakes no obligation to update the information contained herein.

Non-GAAP Financial Measures: In addition to reporting results in accordance with International Financial Reporting Standards (IFRS), UBS reports adjusted results that exclude items that management believes are not representative of the underlying performance of its businesses. Such adjusted results are non-GAAP financial measures as defined by US Securities and Exchange Commission (SEC) regulations and may be Alternative Performance Measures as defined under the guidelines published the European Securities Market Authority (ESMA). Please refer to pages 7-9 of UBS's Quarterly Report for the third quarter of 2019 and to its most recent Annual Report for a reconciliation of adjusted performance measures to reported results under IFRS and for definitions of adjusted performance measures and other alternative performance measures.

© UBS 2019. The key symbol and UBS are among the registered and unregistered trademarks of UBS. All rights reserved.

53

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrants have duly caused this report to be signed on their behalf by the undersigned, thereunto duly authorized.

UBS Group AG

By: _/s/ David Kelly________________

Name: David Kelly

Title: Managing Director

By: _/s/ Ella Campi_____________ ____

Name: Ella Campi

Title: Executive Director

UBS AG

By: _/s/ David Kelly________________

Name: David Kelly

Title: Managing Director

By: _/s/ Ella Campi____________ ____

Name: Ella Campi

Title: Executive Director

Date: October 22, 2019