UBS (UBS) 6-KCurrent report (foreign)

Filed: 7 Mar 22, 1:01pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

Date: March 7, 2022

UBS Group AG

Commission File Number: 1-36764

UBS AG

Commission File Number: 1-15060

(Registrants' Names)

Bahnhofstrasse 45, Zurich, Switzerland and

Aeschenvorstadt 1, Basel, Switzerland

(Address of principal executive offices)

Indicate by check mark whether the registrants file or will file annual reports under cover of Form 20‑F or Form 40-F.

Form 20-F x Form 40-F o

A message from our Chairman and Group CEO

Hear what our Chairman, Axel A. Weber, and Group CEO, Ralph Hamers, have to say about driving the firm forward.

(Transcript from the video)

Axel Weber: 2021 was a good year that put every business model - including our own - to the test. UBS has passed that test. Today, our firm is healthy and has strong momentum. We've proven our resilience in the ongoing pandemic with a balance sheet for all seasons. We’re a world-leading global wealth manager and the leading bank in Switzerland.

Ralph Hamers: Last year pushes to new heights. We proved how strong our ecosystem of people and capabilities is. For example, we worked across the firm discovering and launching our purpose. And then updating our strategy and ambitions to align with that. We pioneered new, more personalized relevant on-time and seamless interacting with our clients. And we redefined how we as a financial firm, can operate by making our teams work more agile and our work policies more flexible. And these will help us continue to grow and capture new opportunities as we look to the future.

Axel Weber: I'm confident that we have everything it takes to further develop our firm from a position of strength and tackle future challenges. Today, UBS is one of the best capitalized banks globally with a strong reputation among clients, employees and investors. Thank you to everyone who has made our success possible.

Ralph Hamers: And Axel I have to include you in that as well. You'll be leaving us this year. And your contributions to UBS over the last 10 years are a big part of why we are so successful and why we are in such a strong position. Thank you very much. UBS has a lot to be proud of. And even more to look forward to.

(End transcript)

Statement on Russia’s invasion of Ukraine

We are shocked by the violence and tragedy caused by Russia’s invasion of Ukraine. Our hearts go out to those affected and who are suffering.

We are working to implement sanctions imposed by Switzerland, the US, the EU, the UK and others – all of which have announced unprecedented levels of sanctions against Russia and certain Russian entities and nationals. These events, together with counter-sanctions and other measures by Russia, will have ongoing effects on markets and the global economy.

Currently, to help victims of the war in Ukraine, UBS Optimus Foundation and our Community Impact teams are providing emergency relief to refugees through the International Rescue Committee and are matching the first USD 5 million of donations from employees and clients, creating a combined impact of USD 10 million.

Support the Ukraine Relief Fund > https://www.ubs.com/global/en/ubs-society/philanthropy/optimus-foundation/ukrainerelief.html

4

Table of content:

A purposeful year

Read more on page 6

Inspire

Read more on page 13

A purpose, that's our purpose

Reimagining the power of investing. Connecting people for a better world. It’s more than just a statement: it’s our why. Find out how the UBS purpose came to light. Read more on page 16

160 years of UBS

From humble beginnings to a global presence: take a trip down memory lane as the firm celebrates another milestone anniversary, and look ahead to what’s next. Read more on page 21

Looking back on the last ten years and looking ahead

Our Chairman Axel A. Weber on the firm’s development in 2021 and over the last decade. Read more on page23

We are

Read more on page 25

Connect

Read more on page 28

Transformation for the firm, transformational for clients

Agile isn’t a new concept for the wider world, or for UBS. Hear from Mike Dargan, chief digital and information officer, and Stefan Seiler, group head of human resources, who’re leading UBS’s agile transformation. Read more on page 32

Connecting Mount Fuji to the Matterhorn

Our partnership with Sumitomo Mitsui Trust Holdings (SuMi Trust) is the first between a global financial group and a domestic trust bank in Japan. Here’s how it came to life. Read more on page 38

A hybrid approach

While 2020 was the year a lot of the world stayed at home, 2021 was the year that many of us made tentative steps back into the world – and UBS offices – where circumstances allowed. Read more on page 40

To thrill fans and support the community

The opening of the UBS Arena is a big step in enhancing our brand in a key market. Here’s how we prepared to open the doors of UBS Arena – despite challenges that the pandemic put in the way. Read more on page 45

Video advice: personal & convenient

When the world went virtual, our meetings with clients did too. Take a look behind the scenes of how UBS offers video advice to clients in our Swiss home market. Read more on page 48

Which way? My way.

First launched in Switzerland, the UBS My Way portfolio management solution has since enjoyed strong success across key European and Asian markets. Now it’s coming to more locations around the globe. Read more on page 52

Empower

Read more on page 55

Sustainability at UBS

A conversation with Suni Harford, GEB sponsor for sustainability and Michael Baldinger, Chief Sustainability Officer. Read more on page 58

Let our differences make the difference

With colleagues and clients around the world, taking both cultural and business needs into account is key to operations and sustainable performance at UBS. Hear from Group Head Diversity, Equity and Inclusion (DE&I), Cicilia Wan. Read more on page 61

No silos, only solutions

In the Americas region, UBS is connecting a growing number of clients with private markets opportunities to creatively put their capital to work. Read more on page 64

A global community

We’re committed to supporting the communities in which we live and work. Find out how our Community Impact program operates in all regions to make connections where they matter most. Read more on page 67

The power of philanthropic partnerships: a look at the UBS Collectives

We’re dedicated to finding innovative ways to tackle some of the world’s most pressing social and environmental problems, and showing how the power of philanthropic partnerships will be critical in achieving systemic change. Read more on page 72

Legal disclaimer, Page 75

5

A purposeful year

2021 in numbers and milestones.

A look at the key figures and major events that took place at UBS last year.

6

2021 in numbers

Group results

USD billion

7.5

Net profit attributable to shareholders

(2020: 6.6 USD billion)

USD

2.06

Diluted earnings per share

(2020: 1.77)

Resources

USD trillion

1.1

Total assets

(2020: USD 1.1 trillion)

USD billion

60.7

Equity attributable to shareholders

(2020: USD 59.4 billion)

Profitability

%

17.5

Return on common equity tier 1 capital

(2020: 17.4%)

Percent

14.1

Return on tangible equity

(2020: 12.8%)

Sustainability

USD billion

251

of sustainability-focus and impact investments (78% increase)

Percent

23

of client-invested assets are SI assets and assets subject to ESG integration and to exclusions

7

Year in review

January

Changes to the UBS Board of Directors

The Board of Directors of UBS Group AG announced today that it will nominate Claudia Böckstiegel and Patrick Firmenich for election to the Board at the Annual General Meeting on 8 April 2021.

Read more: https://www.ubs.com/global/en/media/display-page-ndp/en-20210126-change-ubs-bod.html

UBS beats impact investment target and launches white paper on sustainable finance for The Davos Agenda

UBS, the world’s leading sustainable investment manager, today launched a white paper on sustainable finance trends in 2021, after the firm exceeded a key target more than a year ahead of schedule.

Read more: https://www.ubs.com/global/en/media/display-page-ndp/en-20210128-wef.html

February

UBS BB Investment Bank and Banco Patagonia announce a commercial agreement for investment banking services in Argentina

Today, UBS BB Investment Bank (“UBS BB”) and Banco Patagonia announced an agreement to provide clients in Argentina with enhanced access to leading investment banking services and international capital markets, in accordance with applicable regulatory requirements. The agreement combines UBS BB’s global and regional platform and experience with Banco Patagonia’s robust capabilities and strong relationships across Argentina.

Read more: https://www.ubs.com/global/en/media/display-page-ndp/en-20210209-bb-investment-bank-agreement.html

UBS Multibanking available to corporate clients throughout Switzerland

UBS Multibanking allows corporate clients to access third-party bank accounts worldwide in UBS E-Banking and, as a first in Switzerland, to make payments directly via a single platform. The solution features a consolidated liquidity overview across all banks and currencies. Following the successful pilot phase, the service will now gradually be made available to all clients throughout Switzerland.

Read more: https://www.ubs.com/global/en/media/display-page-ndp/en-20210201-multibanking.html

8

March

Our quest for zero

We’ve reached our 2020 environmental goals. So what’s next? We continue to aim for less of an environmental impact, and in some areas, even for zero.

Read more: https://www.ubs.com/global/en/sustainability-impact/net-zero.html

April

Launch of our purpose

Our purpose guides us in everything we do. We call on our global ecosystem for investing – where people and ideas are connected, opportunities are brought to life and where our thought leadership can be impactful.

Read more: https://www.ubs.com/global/en/our-firm/our-purpose.html

UBS moves to 9 Penang Road

UBS moves into its largest Asia Pacific office at 9 Penang Road (9PR). This move brings over 3000 colleagues in wealth management, investment bank and asset management together.

Read more: https://www.ubs.com/global/en/media/display-page-ndp/en-20210429-move-to-9-penang-road.html

May

UBS appoints Chief Sustainability Officer and establishes new Sustainability and Social Impact organization

UBS today announced two senior appointments within its new Sustainability and Impact organization, which will lead activities across the firm to drive its sustainability agenda and deliver on its Net Zero commitments. The new organization will report to Suni Harford, Group Executive Board sponsor for Sustainability and Impact and President of UBS Asset Management.

Read more: https://www.ubs.com/global/en/media/display-page-ndp/en-20210505-beyond-net-zero.html

UBS launches Future of Earth fund

UBS Global Wealth Management (GWM) has launched the Multi Manager Access II – Future of Earth fund, which will aim to generate a compelling return by investing in companies addressing environmental issues and related challenges.

Read more: https://www.ubs.com/global/en/media/display-page-ndp/en-20210527-future-of-earth.html

9

June

UBS AG prices inaugural Green bonds

UBS AG today announces the pricing of two senior preferred unsecured Green bonds. This includes a 500 million euro-denominated five-year bond (ISIN: XS2358287238) and a 250 million Swiss franc-denominated seven-year bond (ISIN: CH1120085670).

Read more: https://www.ubs.com/global/en/media/display-page-ndp/en-20210622-green-bonds.html

July

Otemachi One (OH-1) and Marunouchi Eiraku Building (Eiraku) offices open in Tokyo

After 23 years in Otemachi First Square, our colleagues in Tokyo have relocated to our new offices in Otemachi One (OH-1) and Marunouchi Eiraku Building (Eiraku). The Group Wealth Management team is co-located with the firm’s joint venture partner, Sumitomo Mitsui Trust, in Eiraku, while the rest of the employees have moved into OH-1.

August

Ground-Breaking Wealth Management Venture Launches in Japan

UBS SuMi TRUST Wealth Management Co., Ltd. announced that it launched operations in Tokyo, Osaka, and Nagoya today. The new company is the first in Japan to offer global securities and wealth management capabilities together with the custody, real estate, inheritance, and wealth transfer expertise of a Japanese trust banking group.

Read more: https://www.ubs.com/global/en/media/display-page-ndp/en-20210810-ground-breaking.html

October

UBS launches collective philanthropy initiative to help clients address critical global issues

Harnessing the power of collective philanthropy, UBS today announced the launch of UBS Collectives (“Collectives”), an innovative social-impact initiative that connects UBS’s philanthropic clients on issues that matter most to them. Led by UBS’s Philanthropy Services team, UBS Collectives will help clients combine their expertise and mobilize their capital to fund initiatives that address child protection, climate change, health, and education-related issues.

Read more: https://www.ubs.com/global/en/media/display-page-ndp/en-20211007-philanthropy.html

10

Launch of Agile@UBS

Moving to agile will help us deliver better outcomes for clients. Here's how we'll get there.

Read more: https://www.ubs.com/global/en/our-firm/what-we-do/technology/2021/think-agile-be-agile.html

UBS joins the Valuable 500

Our CEO and 499 of his peers have signed up to the Valuable 500 to make disability inclusion part of their business leadership agenda.

Read more: https://www.ubs.com/global/en/our-firm/our-culture/diversity-and-inclusion/ability.html

November

UBS Arena opens

UBS Arena celebrated its grand opening last week with the first New York Islanders home game and a jam-packed series of events.

Read more: https://www.ubs.com/global/en/wealth-management/our-approach/marketnews/article.1551303.html

Project Female Founder

Building on the success of the Female Founder Award as part of the Future of Finance Challenge, our project mission is to accelerate female and non-binary founders in their success through a holistic program of investor readiness training and a global ecosystem of support to build relationships and networks.

Read more: https://www.ubs.com/microsites/future-of-finance-challenge/en/project-female-founders.html

UBS celebrates its first Female Founder Award winner as part of the Future of Finance Challenge

For the first time since starting the Future of Finance Challenge in 2015, UBS has presented a Female Founder Award as part of its Future of Finance Challenge. Around one-third of the overall entries qualified for this award.

Read more: https://www.ubs.com/global/en/media/display-page-ndp/en-20211104-ubs-future-of-finance-challenge-winners.html

11

December

UBS Optimus Foundation becomes founding member of the newly launched Sustainable Development Goals Impact Finance Initiative

It’s important to know that the solutions we're investing in are actually making a difference. We know that the only way to do this is to engage in strategic philanthropy – philanthropy guided by six key principles.

Read more: https://www.ubs.com/global/en/ubs-society/philanthropy/optimus-foundation/how-we-work.html

12

Inspire

Rethinking the potential of people and capital, through connections and thought leadership.

Scroll down to explore our Inspire story

A message from our Chairman and Group CEO

(Transcript from the video)

Axel Weber: 2021 was a good year that put every business model - including our own - to the test. UBS has passed that test. Today, our firm is healthy and has strong momentum. We've proven our resilience in the ongoing pandemic with a balance sheet for all seasons. We’re a world-leading global wealth manager and the leading bank in Switzerland.

Ralph Hamers: Last year pushes to new heights. We proved how strong our ecosystem of people and capabilities is. For example, we worked across the firm discovering and launching our purpose. And then updating our strategy and ambitions to align with that. We pioneered new, more personalized relevant on-time and seamless interacting with our clients. And we redefined how we as a financial firm, can operate by making our teams work more agile and our work policies more flexible. And these will help us continue to grow and capture new opportunities as we look to the future.

Axel Weber: I'm confident that we have everything it takes to further develop our firm from a position of strength and tackle future challenges. Today, UBS is one of the best capitalized banks globally with a strong reputation among clients, employees and investors. Thank you to everyone who has made our success possible.

Ralph Hamers: And Axel I have to include you in that as well. You'll be leaving us this year. And your contributions to UBS over the last 10 years are a big part of why we are so successful and why we are in such a strong position. Thank you very much. UBS has a lot to be proud of. And even more to look forward to.

(End transcript)

Our Chairman looks back on the last ten years : https://www.ubs.com/global/en/our-firm/annual-review-2021/inspire/articles/looking-back.html

...learn about how we are inspired through our purpose...

Reimagining the power of investing.

Connecting people for a better world.

Learn more about our purpose : https://www.ubs.com/global/en/our-firm/annual-review-2021/inspire/articles/a-purpose-thats-our-purpose.html

13

...meet our boards...

Board of Directors

Responsible for the overall direction, supervision and control of the Group and its management, as well as for supervising compliance with applicable laws, rules and regulations.

Group ExecutiveBoard

Across business regions, divisions, and functions: meet our most senior leaders.

Find out more about our corporate governance: https://www.ubs.com/global/en/our-firm/annual-review-2021/inspire/we-are.html

...where and how we operate...

4 divisions

The best wealth manager(1) with scale in the world’s largest and fastest growing wealth markets.

A large-scale investment manager

The leading universal

bank in Switzerland

A focused investment bank

4 regions

30% of employees in the Americas

29% of employees in Switzerland

21% of employees in Asia Pacific

20% of employees in Europe, Middle East and Africa

Find out more about who we are: https://www.ubs.com/global/en/our-firm/annual-review-2021/inspire/we-are.html

(1) Euromoney Awards for Excellence 2021: World, Best Bank for Wealth Management

14

...a trip down memory lane...

160 years of UBS

From humble beginnings to a global presence

Read the full article: https://www.ubs.com/global/en/our-firm/annual-review-2021/inspire/articles/160-years-of-ubs.html

How we connect and empower.

15

A purpose that’s our purpose

Reimagining the power of investing. Connecting people for a better world. It’s more than just a statement: it’s our why. Find out how the UBS purpose came to light.

07 Mar 2022 7 min read

Key highlights

1. Finding the UBS purpose took months of asking the right questions to the right people, to define a statement that really reflected who we are and what we do as a firm.

2. Our purpose is at the heart of everything we do, and every decision we make.

3. The two parts of the statement work together and individually to connect people, ideas, and opportunities.

At UBS, we’re reimagining the power of people and capital, to create a better world for all of us – a world that’s fair, sustainable and gives everyone the opportunity to thrive. A key part of this is making connections: connecting people with other people, with ideas that deliver results to drive progress and innovation, and with opportunities that change people’s lives and help to forge a fairer society.

But setting our purpose by getting to the bottom of why UBS exists as a firm today, and what our ambitions for the future are, was no small job. It took months of asking a lot of questions to a lot of people, of listening to their answers and of reflecting on the feedback. Only then could we come up with a purpose statement that reflects who we are and represents our aspirations.

Matthias Schacke, Head Talent and Recruiting, and Hasmita Mistry, Head Brand Strategy, told us more about the journey to becoming a purpose-driven organization.

All about purpose (and why an organization like UBS needs one)

“Our purpose is a north star,” explained Matthias. “It stands for why we do what we do. It guides us in deploying our strategic priorities, and it helps us to decide where to grow and which opportunities to capture. Our purpose helps us and our clients to develop the future of UBS.”

Having this direction sets out a clear path in front of us, as well as setting the firm apart from the crowd.

16

The demands of our employees, our clients, investors and society are changing and evolving. What matters to them more and more is that a company shares their values, is authentic, and focused on the value they provide on what matters most, now and in the future.

Whereas Connecting is about enabling real and relevant connectivity with our clients from across the organization, Reimagining is about being forward thinking. The two parts of the UBS purpose statement work meaningfully as individual sentences, but equally together, showing powerful opportunities and unlocking the full potential of the organization.

“It’s more than a statement, and certainly not a marketing slogan,” added Hasmita. “A purpose-led organization uses its purpose statement as a roadmap to keep it on the right path.”

“It’s more than a statement, and certainly not a marketing slogan.”

A purpose holds us as individuals and as an organization accountable, authentic and reflective on our strengths and direction. But the only way for it to truly have an impact, and to achieve our vision to convene THE global ecosystem for investing – where thought leadership is impactful, people and ideas are connected, and opportunities are brought to life – is for everyone to embrace and live it, every day.

“Our purpose has to be present in each employee’s day-to-day work and be translated through into every decision we make, and across our entire chain and business practices,” said Hasmita. “Our clients, our investors and all of our stakeholders should feel the value in what they experience, and the difference our purpose makes to enhance the way our business runs and on timely decisions being made should be clear, too.“

17

From foundation to implementation

“Finding our purpose was a journey of discovery. It’s not something that we created or pulled out of thin air. Every company has a reason for being, but it’s not always clearly identified, or articulated. And that’s what UBS had to do: find that reason, articulate it, and make it front and center, so we could tell employees, clients and the world why we do what we do, and ultimately, why it matters,” said Hasmita.

With only one shot to get it right, we dug deep making sure to look at all angles – from what we’re good at, to what our firm’s value and role is towards all our stakeholders, clients and in society.

“A core team, together with more than 3,000 employees we called a ‘discovery squad’, who represented the diversity of UBS’s people, explored, listened and answered some of the fundamental questions,” explained Matthias. “We involved all employees throughout the journey, including members of the Group Executive Board and the Board of Directors, as well as thought leaders and clients. Themes including client centricity, our culture and three keys were frontrunners in discussions, and it became clear what was important to everyone.”

With the statement in place, thoughts turned to implementation and showing how the words work in practice. Becoming a purpose-led organization is a multi-year journey that will build confidence, empowerment and competence around our purpose – and success will come through taking people both inside and outside of the firm on the journey.

‘’Our purpose implementation program is keeping up the momentum over the coming years, with the goal of empowering our employees in a purpose-driven organization to drive our client promise, focus on the strategic imperatives and strengthen our culture,’’ said Matthias. “Ultimately, our purpose should be deeply embedded in our culture and leadership behaviors, making sure we create powerful business results from new products and services, deliver on the client experience and ensuring that UBS is globally recognized as one of the most attractive employers.’’

To help us fully embed our purpose, we have more than 600 purpose champions. They are viewed as role models and ambassadors showing the value of what happens when we talk, live and breathe purpose right across our firm. And, they help us roll out purpose-driven initiatives within the business and spot opportunities for growth.

The importance of shared values

“Shared values, as well as giving people space to connect in their own way with their purpose and the firms purpose, are important when it comes to linking the two,” said Hasmita. “Being authentic as a firm and as an individual is key to making sure this happens, and we need to help people connect to their individual purpose in areas where it might still be unclear to bring the best out of the workforce and client base.”

18

Looking to the future, we’ll roll out leadership training, learning resources and support with personal purpose journeys to help people link their individual purpose to the UBS purpose. We’ll also look to identify processes and business models in which we can (and should) embed our purpose, with the goal of making more purpose-based decisions.

In time, and thanks to the efforts during the creation of the purpose statement, our purpose will become so obvious and such a part of who we are that there won’t be an option to hide from it.

“It needs to be everywhere, but it doesn’t always have to be an explicit statement which people see,” said Matthias. “Over time, our purpose should come out naturally in the conversations we have with colleagues and clients.”

“Ultimately, our purpose should be deeply embedded in our culture and leadership behaviors, making sure we create powerful business results from new products and services, the client experience and that UBS is globally recognized as one of the most attractive employers.”

Here’s how having THE global ecosystem for investing fits in with clients’ lives – wherever they are, whatever their goals.

(Transcript from the video)

Having the global ecosystem for investing

To keep up with the ever-changing needs of our clients, we’re collaborating seamlessly across the firm to create value for them.

Our client's needs and expectations are changing at pace.

We need to adjust and fit into their lives, not the other way around.

By leveraging the scale and strong network effects that ourbusiness offers,

UBS is uniquely positioned to be the orchestrator of a global ecosystem for investing where thought leadership is impactful, people and ideas are connected and opportunities are brought to life.

Our ecosystem is a powerful gateway providing seamless access to the breadth of our solutions, complementary products and services from our network of curated partners. And a community of like minded participants and contributors that create a unique marketplace.

Utilizing our leading content, advice capabilities and personalized solutions, we not only attract prospective clients but also become more appealing to external partners.

This self reinforcing dynamic strengthens our value proposition, accelerates growth and allows us to reinvest in our core capabilities.

Our private credit funds business is just one example of the power of our ecosystem and how we collaborate seamlessly across the firm to create value for our clients.

19

We develop bespoke financing solutions for entrepreneurs with very specific and often complex financing needs.

We make this possible by matching them to wealth management clients and institutional investors with an appetite for alternative asset classes.

This makes UBS increasingly relevant for entrepreneurs.

They want to raise capital from a wide range of sources beyond public capital

markets. This is all part of living and breathing our purpose.

It's how we're re-imagining the power of investing and connecting people for a better world.

(End transcript)

20

160 years of UBS

From humble beginnings to a global presence: take a trip down memory lane as the firm celebrates another milestone anniversary, and look ahead to what’s next.

07 Mar 2022 5 min read

Key highlights

1. This year marks 160 years of UBS. From the foundation of our three keys to success to today’s forward-looking strategy: we’ve achieved a lot.

2. Everything we do and have today is built on the history and tradition, and the solid foundations, that our predecessor Groups set.

3. Our three keys to success continue to be a crucial part of our strategy and purpose going forward.

Today’s UBS is the result of the 1998 merger of two leading Swiss banks: Swiss Bank Corporation (SBC) and Union Bank of Switzerland. When the two banks merged, they brought with them a long history, enhanced by many other predecessor companies, that’s well rooted in the second half of the nineteenth century. Everything we do is built on that history and tradition, and the solid foundations that these predecessor Groups set. Along the way, various other firms, including US-based PaineWebber, have joined the Group. As one, they have overcome challenging times in the early- to mid-1900s, to focus on global expansion in the second half of the twentieth century.

A shift in business and culture

Today, our three keys are embedded into the firm at every level. Our Pillars (what we’re built on), Principles (what we stand for) and Behaviors (how we do it) are the foundation of our strong and inclusive culture. Among other things, these three areas incorporate a focus on simplification and efficiency, client centricity, and innovation.

“In 1938, SBC introduced the three keys as its symbol. It was firmly embedded in UBS’s logo in 1998.”

The concept is one that’s taken years to form. In 1938, SBC introduced the three keys as its symbol. It was firmly embedded in UBS’s logo in 1998, and, in 2011, that connection was made stronger with the launch of the three keys to success program. The foundation of the program formed the strategy, identity and culture of the firm as we know it now. And the launch of the Group Franchise Awards program to foster collaboration across the Group has even given employees the opportunity to submit – and be rewarded for – ideas to improve processes since 2016.

21

We also further advanced the execution of the firm’s first strategic transformation, completing it in 2014, and setting out on the path to develop the firm many are familiar with now.

With a well-founded culture, attention turned to amendments to the legal structure of the firm, to comply with the too big to fail requirements in 2014.

Then, moving from the legal structures to the structure of our buildings, there’s been a lot of developments since 2012. The official opening in Beijing of UBS (China) Limited in 2013 further enhanced the firm’s presence in the market, and we continued to take root in China, with a new branch in Shanghai, a new Business Solution Center in Wuxi, and UBS Business University in Shanghai all opening in 2016. And we also opened our new Singapore office at 9 Penang Road in 2021.

Closer to the Swiss home market, UBS’s new, and sustainably designed, London headquarters opened its doors to employees at 5 Broadgate in the same year, and, 101 years after it first opened, the Group headquarters at Bahnhofstrasse 45, Zurich, reopened in 2018 after three years of renovation work.

Going forward with purpose

In 2013, UBS further committed to maximizing efforts of investing according to sustainable and responsible criteria through a dedicated industry-leading platform. The subsequent launch of UBS and Society to combine and help to shape all activities and capabilities in sustainable investing and philanthropy, as well as UBS’s interaction with the communities, demonstrated our commitment. In 2021, we cemented this commitment to sustainability by establishing the Group Sustainability and Impact organization. As we are advancing toward 2030, the designated deadline to reach the 17 United Nations Sustainable Development Goals (the SDGs), our aim is to continue to be the financial provider of choice for clients who wish to mobilize capital toward the achievement of the SDGs and the orderly transition to a low-carbon economy.

“UBS was the first major global financial institution to make sustainable investments the preferred solution.»

The new division Global Wealth Management started off working as an integrated business and creating new opportunities for revenue growth and improving the ability to execute existing opportunities in 2018 and, in line with sustainable efforts, UBS was the first major global financial institution to make sustainable investments the preferred solution.

When we marked 150 years, we outlined a goal to focus on clients, offering them stability and dependability. The COVID-19 crisis demonstrated how years of sustainable thinking and acting delivered value for the firm and for clients by, for example, allowing strengthened support for business owners during the crisis and facilitating a seamless transition from the workplace to remote working, thanks to previous technology investments.

Looking ahead, the UBS purpose, which was launched in 2021, will help the firm build on these successes, by aligning all that we do with the purpose statement:

Reimagining the power of investing.

Connecting people for a better world.

22

Looking back on the last ten years and looking ahead

Our Chairman Axel A. Weber on the firm’s development in 2021 and over the last decade.

01 Mar 2022 4 min read

When elected to the Board of Directors and upon becoming Chairman in 2012, we outlined our path: ‘UBS was an icon of the Swiss economy. And the bank has to get back there.’

I’m proud that we are well on the way. UBS is again the leading bank in Switzerland. And it has become one of the world’s leading global wealth managers over the past ten years.

Rather than being just a financial services provider, we are seen and respected as a trusted advisor. A leader in sustainable finance. A great place to work for more than 70,000 employees in over 50 countries. And we’ve shown that we can generate attractive returns for our shareholders across different market environments.

The last few years have been like none before. The Russian invasion of Ukraine marks a historic turning point with far-reaching economic and geopolitical consequences. We are witnessing a human tragedy and additional geopolitical uncertainty – the consequences of which cannot be predicted at this point. Furthermore, the pandemic gripped the whole world and presented challenges for every aspect of society: politics, healthcare systems and the economy.

The past two years put every business model – including ours – to the test. And UBS has passed that test.

The firm is healthy and has strong momentum. We’ve proven our resiliency with a balance sheet for all seasons. Our divisions and regions are successfully meeting the many and varied needs of our clients, and the way our business areas complement each other is getting better all the time. Our strategy is focused on sustainable performance.

“The firm is healthy and has strong momentum. We’ve proven our resiliency in the ongoing crisis with a balance sheet for all seasons.”

That said, the pandemic has changed the economy, and the way we interact with each other. Technology and digitalization are becoming even more important and at UBS, we have made it a priority to turn technology from an enabler into a differentiator for our business.

23

Looking ahead, climate change is another – if not the – major challenge for our society. It can be tackled successfully only if there is global agreement, not only on the problem but also on the solutions. Sustainability has been a priority for UBS for many years. In 2021, we were once again recognized for our industry leadership in the Environmental dimension of the Dow Jones Sustainability Index. As a founding signatory of the Net Zero Asset Managers Initiative, we also announced our commitment to align USD 235 billion of assets under management to net zero by 2030. This is one of the largest absolute commitments of any member firm.

And looking beyond our own organization, I’m convinced that we have a huge opportunity to build the green capital market of the future – an important step toward solving our and future generations’ challenges.

“I’m convinced that we today have a huge opportunity to build the green capital market of the future.”

If we can get both the public and private sectors behind this agenda, a green capital market could have a market capitalization of USD 100 trillion globally. But harmonized standards and open markets are needed, so there’s still a lot of work to be done.

I look back in gratitude, not just on 2021, but on the last ten years. The whole team at UBS has done a great job in stabilizing and re-focusing the firm. We’ve gone from addressing legacy and remediation to implementing a successful strategy, focused on a unique and well-diversified business model that’s built on a strong culture.

Yet, the events of the past two years show that we live in uncertain times. The pandemic, the Russian invasion and geopolitical tensions globally, but also other challenges such as digitization, climate change, and the normalization of monetary policy will require UBS to respond nimbly and flexibly.

I’m confident that we have everything it takes to further develop our firm from a position of strength. Today, UBS is one of the best capitalized banks globally, with a strong reputation among clients, employees and investors. And I am confident that we will maintain this position in the future.

24

We are

The best wealth manager(1) with scale in the world’s largest and fastest growing wealth markets. The leading universal bank in Switzerland. A large-scale investment manager. A focused investment bank. That’s UBS. Drawing on our 160-year heritage and through our businesses, which all have a competitive edge in their areas of expertise, we provide financial advice and solutions to our global client base. To serve our clients best, we also aspire to attract, develop and retain a diverse range of highly talented employees, and to provide a supportive and inclusive workplace where everyone can unlock their full potential.

The best wealth manager(1) with scale in the world’s largest and fastest growing wealth markets.

We help our clients pursue what matters most to them. Individuals around the world look to us to provide them with the advice, expertise and solutions to preserve and grow their wealth – today, tomorrow and for generations to come.

>3.3

trillion US dollars in invested assets as of 31 December 2021

7

times winner of the Euromoney Awards for Excellence World’s Best Bank for Wealth Management in a decade

A focused investment bank

We’re focused on a client-centric offering that helps us provide value, and on being a leader in the areas we choose to compete in. We connect people to ideas and solutions through industry expertise and differentiated insights, products and services.

Top 3

in Institutional Investor’s Global Equity Research for the sixth consecutive year

A large-scale investment manager

With investment capabilities and investment styles across all major traditional and alternative asset classes, we are committed to sustainable outcomes, without compromise, with the aim of driving long-term performance and positive impact beyond returns.

1.2

trillion US dollars in invested assets as of 31 December 2021

The leading universal bank in Switzerland

UBS is Switzerland’s leading universal bank. And Switzerland is the only country where we’re active in retail banking, corporate and institutional banking, wealth management, asset management and investment banking.

~ 30%

of Swiss households are UBS clients

2.6

million clients in Region Switzerland

(1) Euromoney Awards for Excellence 2021: World, Best Bank for Wealth Management

25

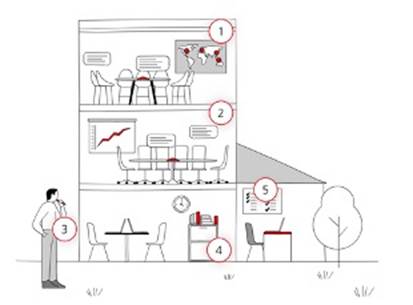

Corporate governance

1) Board of Directors

The BoD of UBS Group AG, led by the Chairman, consists of between 6 and 12 members, as per our Articles of Association. Shareholders elect each member of the BoD individually. The BoD of UBS Group AG has five permanent committees: the Audit Committee, the Compensation Committee, the Corporate Culture and Responsibility Committee, the Governance and Nominating Committee, and the Risk Committee. They assist the BoD in the performance of its responsibilities.

In 2021, the BoD met 22 times, next to numerous committee meetings. The average duration of the meetings was 130 minutes. 12 BoD meetings were attended by the GEB.

BoD geographic diversity in 2021

42% Switzerland

17% US or Canada

17% Europe

25% Asia

2) Group Executive Board

All members of the GEB, with the exception of the Group CEO, are proposed by the Group CEO. The appointments are approved by the BoD. In 2021, the GEB held 66 meetings.

GEB geographic diversity in 2021

33% US or Canada

33% Europe

25% Switzerland

8% Asia

3) Shareholders

The general meeting of shareholders is the supreme corporate body of UBS. It must be held within six months of the close of each financial year. In 2021, physical attendance at our general meetings was not possible, due to COVID-19-related restrictions, and voting rights could only be exercised through the independent proxy. The same setup is planned for our annual general meeting on 6 April 2022.

4) Group Internal Audit

Group Internal Audit is an independent voice to safeguard and strengthen UBS. It supports the Board of Directors in discharging its governance responsibilities by taking a dynamic approach to audit, issue assurance and risk assessment.

5) Group External audit

External auditors perform financial statement audits and audits of internal controls over financial reporting, and regulatory audits. While safeguarding their independence, the external auditors also coordinate their work with Group Internal Audit.

26

Our boards

The functions of Chairman of the Board of Directors (the BoD) and Group Chief Executive Officer (Group CEO) are assigned to two different people, ensuring a separation of power. The BoD delegates the management of the business to the Group Executive Board (the GEB).

Read more on Board of Directors: https://www.ubs.com/global/en/our-firm/governance/ubs-group-ag/board-of-directors.html

Read more on Group Exectutive Board: https://www.ubs.com/global/en/our-firm/governance/ubs-group-ag/group-executive-board.html

27

Connect

Joining the dots to drive change for a better world.

Scroll down to explore our Connect story

Which way? My way.

By combining the very best of our digital capabilities with over 160 years of wealth management expertise and insights, we’ve moved investing into the twenty-first century.

USD 1 billion in assets reached just six months after launch

USD 3 billion in assets reached in under a year

more than 4,500 clients used solution by 31 December 2021

over 1,700 portfolio adjustments made by clients

Read the full article: https://www.ubs.com/global/en/our-firm/annual-review-2021/connect/articles/which-way-my-way.html

...this and other great achievements done while we were...

Hybrid working

“Being forced to work from home certainly opened our minds to alternative ways of working.“

“There’s definitely a balance to be struck between flexibility and retaining some structure.“

“I had to learn to trust my team in a way that I didn’t have to consider before.“

“During the first lockdown we started having a team huddle every morning and have kept it post return to office to make sure no one feels left out wherever they’re working.“

Read the full article to find out why not every good piece of work has to be done in an office: https://www.ubs.com/global/en/our-firm/annual-review-2021/connect/articles/a-hybrid-approach.html

...with a focus on clients, as always...

28

Remote Sales & Advice

When the world went virtual, our meetings with clients did too.

How it works?

1

Call us or arrange a call-back to set up an appointment.

2

We confirm the appointment by phone and answer any initial questions

3

You will receive a Zoom link to the consultation via email.

Read the full article to see how we deal with remote advice: https://www.ubs.com/global/en/our-firm/annual-review-2021/connect/articles/video-advice-personal-convenient.html

...using technology as an enabler...

Transformation for the firm, transformational for clients

“Increasingly, agile will be an essential tool to deliver on our client promise of a personalized, relevant, on-time and seamless experience.”

Mike Dargan

Chief digital and information officer

“For employees, agile means moving away from traditional forms of governance, to create a more flexible, more productive firm.”

Stefan Seiler

Group head of human resources

Read the full article to learn about our agile ways of working: https://www.ubs.com/global/en/our-firm/annual-review-2021/connect/articles/transformation-for-the-firm-and-for-clients.html

...for us, business also happens in entertainment venues...

29

UBS Arena

To thrill fans and support the community

Was designed and built in accordance with the strictest environmental, sustainability and energy standards.

Ten thousand jobs were created during construction, with plans in place for 30 percent of permanent jobs to go to residents of its surrounding neighborhoods.

Thirty percent of construction funds were earmarked for state-certified minority and female-owned businesses.

30

Read the full article to learn how we prepared to open the doors of UBS Arena – despite challenges that the pandemic put in the way: https://www.ubs.com/global/en/our-firm/annual-review-2021/connect/articles/to-thrill-fans-and-support-the-community.html

...partnerships are a big part of what we do...

Connecting Mount Fuji to the Matterhorn

This joint venture is the first between a global financial group and a domestic trust bank in Japan.

Read the full article to see how we’re continuing to expand and make strategic moves: https://www.ubs.com/global/en/our-firm/annual-review-2021/connect/articles/mount-fuji-to-matterhorn.html

How we empower and inspire.

31

Transformation for the firm, transformational for clients

Agile isn’t a new concept for the wider world, or for UBS. Hear from Mike Dargan, chief digital and information officer, and Stefan Seiler, group head of human resources, who’re leading UBS’s agile transformation.

07 Mar 2022 7 min read

Key highlights

1. Agile isn’t a new concept – but it will certainly become more prominent in the future.

2. Change is a constant in the banking industry, and UBS is setting the pace to keep up with the ever-changing environment.

3. Being an agile organization means working across teams, divisions, and regions to deliver a more streamlined client experience across the firm.

In the banking industry, change has been a constant and, today, the pace of that change is more rapid than ever. Across all sectors, established incumbents are being challenged by disruptors who promise clients and employees something new and better.

“At UBS, we believe the key to navigating this turning point and succeeding in the future is agile working,” said Mike. “Increasingly, agile will be an essential tool to deliver on our client promise of a personalized, relevant, on-time and seamless experience. We’ve already seen examples of how it’s helping us stay ahead of the game.”

“At UBS, we believe the key to navigating this turning point and succeeding in the future is agile working.”

“Agile@UBS enables flexible, multi-disciplinary teams working across the firm to deliver greater business and client value, and to fulfill our purpose,” explained Stefan. “It does this by removing friction and dependencies, creating small, empowered teams, with clear ownership, and common objectives, and delivering incremental business value faster.”

32

Already well on the way

Many employees already work in agile pods (small, multi-disciplinary teams) across UBS, forming a solid foundation of an agile mindset, skills, practices, and knowledge. These pods are complemented by larger agile crews to ensure alignment and consistency, and further by agile chapters to encourage best-practice sharing. The success of this approach in many areas of the firm showed that this flexible method can improve our way of working, to the benefit of employees and clients. To have a unified, agile way of working across the whole firm, which takes the best elements from our existing agile practices, we opened up Agile@UBS to more employees.

“By doing so, we want to respond quicker to our clients’ ever-changing expectations,” said Mike. “We also aim to optimize for the challenges and opportunities of the digital age, and benefit from a step change in performance – in speed of delivery, client satisfaction, employee engagement, and efficiency.”

Going forward, Agile@UBS will continue to transform the way the firm operates, offer learning and growth opportunities for all our people, and help make UBS a top digital place to work.

“We have experience in agile ways of working – we’ve operated successful agile models for many years. We’re building on the best of those to craft a unified model that will make our business better now and for the future,” explained Stefan.

Driving us forward

At times, agile has been incorrectly characterized as being unstructured. But, in reality, it’s a well-defined way of working that allows teams to speed up innovation and lower risk – all while providing faster and better outcomes for clients. To develop our model, we’ve relied on two areas of expertise in particular: technology and people.

“Change at this level requires an overhaul across key parts of the organization, including IT, HR, and operations. But, arguably most importantly, it requires a mindset change across the board,” said Stefan. “For employees, agile means moving away from traditional forms of governance, to create a more flexible, more productive firm.”

“Agile working will allow us to create tailor-made products more quickly, as well as a data-centric, omni-channel and self-service experience – this is what will enable us to make tech a differentiator for our firm, and that will guarantee we provide clients with the best possible service.”

“Even those who aren’t yet working in official Agile@UBS pods will be encouraged to learn agile ways of working that they can adopt to make us all more productive, more streamlined, and able to deliver our best. In our Agile Academy within UBS University, our employees can develop the right skills,” he continued.

And, when the process works well internally, the results are clear externally. To give an example of the success of agile to date, it’s been instrumental in reducing testing time and, as a result, increasing the speed of transactions on trading platforms. It’s a clear opportunity for greater operational efficiency and reduction in time-to-market; and that’s something that benefits everyone.

33

“Agile working will allow us to create tailor-made products more quickly, as well as a data-centric, omni-channel and self-service experience – this is what will enable us to make tech a differentiator for our firm, and that will guarantee we provide clients with the best possible service,” added Mike.

Delivering our purpose

To reimagine the power of investing and connect people for a better world, we need to become an even more responsive business, with teams that have our clients and our products at the center of all they do. When we work in an agile way, we reimagine the way we work, the way we connect with each other – our colleagues, clients and partners – and the way we deliver value.

With Agile@UBS, we’ll align the whole firm to make sure everyone approaches operations with the same client focus. We know the power of investing, and Agile@UBS will unleash that power, helping us live up to our purpose while, at the same time, delivering on our strategy.

Agile in action: a team in the spotlight

As Mike and Stefan explained: being agile isn’t an entirely new concept for the wider world, nor for our firm. The Client Needs Stream “Plan My Wealth” (or agile ‘stream’), is one of many teams working in an agile mode. Stream product lead Christine Deilmann explains what this means for them.

“We started the transformation with a fundamental review of our organization based on client needs,” Christine explained. “We created pods (multi-disciplinary teams), crews (pods working together to create a broader overview) and streams (crews working together for a common purpose) to bring all necessary people and skills together in one team.”

“When we selected the pod leads, the decision was made jointly by the business and the tech side, to make sure both parts are well represented,” added Roland Brandes, Stream tech lead of “Plan My Wealth”. “The UBS Wealth Way tool, for example, is one of the key developments. And that involves software developers, business experts, designers and data experts, to name only a few.”

“Key for me in this agile transformation was not only the change of working methodology in the teams, but much more to move into an agile mindset in the collaboration together with the whole organization,” he added. “As a Stream tech lead, it was also extremely important and challenging to continuously deliver changes and business value, while keeping the production stable with high availability for our clients and client advisory also during the transformation phase.”

34

Having agile coaches is essential. They keep the focus on the right things and make sure everyone in the boat is rowing at the same pace. The key to success for agile is sharing information transparently, establishing continuous improvement and feedback loops, and focusing on what really matters which involves having the courage to reprioritize relentlessly if needed. But it’s not an overnight transition.

“It takes time to become fully agile!” Christine said. “But, by putting the work in at the beginning to truly learn the best methods, in the long-term, the benefits will be enormous.”

Think agile. Be agile.

(Transcript from the video)

Transcript: Think agile. Be agile.

35

Learn more about where we’re headed as we set off on our exciting journey to implement one Agile@UBS model across our firm.

When the world around us is rapidly changing, standing still is not a choice.

Clients expect us to be ahead of changes, to lead the way.

That's why we no longer go the traditional way.

Instead, we become a truly agile organization.

Think agile. Be agile. Reimagining the way we work, the way we connect people and the way we deliver value.

Reimagination requires courage to challenge our preconceptions to innovate, to learn, to establish a new mindset.

It's a journey worth taking because being a more responsive business means better outcomes for our clients and our teams.

Unlocking tomorrow means unlocking the full potential of UBS.

From now on it's autonomy at all levels, but with alignment. How do we do that?

Well, that's the best part.

At UBS it's no more them and us, only we. We have a clear vision, but instead of telling people what to do to achieve this vision, we must trust our teams to direct us and empower them to decide because they know best what our clients need now and in the future.

Moving forward, we will align on one consistent Agile@UBS approach with an agile mindset that applies across the firm.

For some teams this will also mean a change of set up.

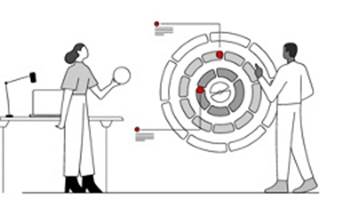

Let's talk Pods, Crews and Chapters.

A pod is a multidisciplinary team aligned to a product. It's typically 5 to 10 people and has all the skills needed to deliver autonomously.

Each pod consists of different disciplines, such as data analysts, user experience designers, marketing experts or technology engineers.

A pod has a product owner who keeps the pod aligned on the objectives and key results.

Each pod has a clear purpose.

This is autonomy partnered with alignment.

This is key because our teams are no longer constrained by dependencies.

They go faster with quality.

They're agile.

But how can we ensure coordination between the pods?

That's where crews come in.

A crew is a collection of five to 10 pods aligned to services made of multiple products and value streams such

as digital channels or investment product journeys. Crews ensure that pods can work together at scale and they provide strategic vision.

36

A crew has a product manager and delivery manager who ensure effective alignment.

But how can we ensure that knowledge and good practices flow across pods and crews?

That's where chapters come in.

These are groups of people with similar roles, skills and interests, whether that be marketing, client journey or compliance. They come together to share knowledge and experience.

So an idea from one pod quickly spreads to the others.

There are many areas in the bank that can benefit from such an agile setup, and some already do. Becoming agile is a journey over time.

We need to all start adopting the mindset and for the specific model and practices we will start in the areas where we see the most benefit to reimagine the power of investing and connect people for a better world.

UBS becomes a more responsive business with teams that have the client and product at the center of all they do.

Join us on this exciting journey to make UBS a better place to work and a preferred partner for our clients.

Think agile. Be agile.

(End transcript)

37

Connecting Mount Fuji to the Matterhorn

Our partnership with Sumitomo Mitsui Trust Holdings (SuMi Trust) is the first between a global financial group and a domestic trust bank in Japan. Here’s how it came to life.

07 Mar 2022 4 min read

Key highlights

1. Our partnership with Sumitomo Mitsui Trust Holdings (SuMi Trust) is the first between a global financial group and a domestic trust bank in Japan.

2. This partnership enables UBS to deliver capabilities that we couldn’t cover alone in the country.

3. The venture is Japan's first-ever one-stop shop for the wealth management needs of high net worth and ultra high net worth individuals.

In Asia Pacific, the world’s fastest-growing market, we’re continuing to expand and make key strategic moves to engage in more business opportunities and to connect with a broader client base. As part of this effort, the operational side of the partnership between UBS Japan and Sumitomo Mitsui Trust Holdings (SuMi Trust) opened for business in 2021.

Building on our 50-year history in Japan, the partnership marries the Swiss insights, as well as the 160-year traditions and global capabilities of our firm, with the power, scale and knowledge of Japan’s premier trust banking group, which specializes in bringing inheritance, real estate and loans, as well as wealth transfer services to high net worth clients. Importantly, these are capabilities that UBS could not provide alone in the country.

The tie-up between the two will give high net worth clients in Japan an offering unmatched in scope and quality by any domestic or global peer. The country has an estimated USD 17 trillion of investible assets, much of which is not yet served by wealth advisors – so, as well as bringing with it many opportunities, this venture is also a substantial boost to our brand profile in an enormous, yet relatively untapped, market.

“With the addition of SuMi Trust's broad range of real estate, trust and loan services, we can now offer Japanese clients a portfolio of products and services equal to what UBS offers its clients today in Switzerland,” said Japan Country Head Zenji Nakamura.

“With the addition of SuMi Trust's broad range of real estate, trust and loan services, we can now offer Japanese clients a portfolio of products and services equal to what UBS offers its clients today in Switzerland.”

38

Taking opportunities where we see we can make a difference

Soon after the partnership was announced, the two groups established a consultation and event organizing company to identify prospective new clients, and also began introducing each other’s products to their respective client bases. They also worked hand-in-hand to create and introduce UBS SuMi TRUST Wealth Management, so that it could deliver a uniquely broad and relevant portfolio of benefits to wealthy clients across Japan.

The venture is Japan's first-ever one-stop shop for the wealth management needs of high net worth and ultra high net worth individuals. The partnership is certainly a significant event, and one of a number we've formed recently around the globe as we seek to offer our firm’s unique expertise in more markets. In 2020, for example, UBS Securities became the first foreign joint venture to gain market maker-status and access to China’s USD 12 trillion bond market. And a binding agreement for a UBS-controlled, jointly owned investment bank in Brazil, as well as a number of other key South American markets, aims to position UBS well to become the top bank with leading investment capabilities in another region where we see significant growth potential.

Setting the foundations for a prosperous future

Connecting people is at the heart of what we do. Every day, our global team of around 70,000 employees links people up with others, and to ideas and opportunities that make a real difference. Switzerland as a nation is highly regarded in Japan, seen as having a deep commitment to quality and attention to detail, as well as being a trustworthy country. And, as a firm with deep Swiss roots, we try to evoke those same qualities as we present ourselves in other overseas markets, too.

UBS SuMi TRUST Wealth Management is the first to bring Japan a full array of wealth management capabilities, on an equal scale with the world’s other private banking markets, in a truly holistic offering. As a key market for our firm, Japan offers huge opportunities, not only for wealth management, but also for our investment banking and asset management capabilities.

“This venture provides a substantial boost for our overall business in Japan, bringing new business opportunities and reputational benefits to the entire firm,” Zenji continued. “It also offers further testament to our long-term commitment to the Japanese market.”

39

There for the client, from wherever we work

While 2020 was the year a lot of the world stayed at home, 2021 was the year that many of us made tentative steps back into the world – and UBS offices – where circumstances allowed.

07 Mar 2022 10 min read

Key highlights

1. Our hybrid working model allows flexibility for employees and clients alike when it comes to in-person meetings and remote advice. Here’s how we’re meeting clients’ needs.

2. It’s a combination of the working from home model we employed when the pandemic hit and a tentative step back into office space.

3. The key part of this way of working is finding a balance between what works for the organization and the clients we serve.

The pandemic forced many people to drastically change their ways of working. For UBS, it meant being almost fully remote, with over 95% of employees enabled to work from home right at the start of the pandemic, including client advisors.

After seeing what was possible when working remotely, we’re now committed to offering employees the flexibility to work both at home and in the office, where job role and location allow. For clients, this hybrid working model builds on the success of Remote Sales & Advice that expanded rapidly at the start of the pandemic in the Swiss home market, and gives them a choice on how they interact with the firm, while offering first-class, top-quality advice, no matter where their advisor sits.

We’re focusing on fulfilling our client promise as an outcome of hybrid working by, among other things, looking at how we can hold efficient and effective virtual meetings, finding new ways to engage with new clients and build on trusted client relationships both virtually and in person, and creating pathways to more flexible work schedules. To succeed in implementing a hybrid working model long term, we need to operate with agility and care, while also taking factors like regulation, risk, and productivity into consideration.

Digital interactions offer different and even additional benefits to in-person meetings, encouraging more innovative thinking, and giving clients and employees more flexibility. But, while there’s certainly value to this side of the hybrid model, the importance of in-person interactions shouldn’t be underestimated, and will remain an important component of our relationships, both internally and with our clients.

40

David James, Head Global Banking UK, Malcolm Gordon, Head UK Institutional Client Coverage, and members of their teams told us how a well-balanced approach helps us meet the needs of both employees and the business, and further evolve into a more agile organization.

Keeping an open mind

Having both operated fully from the office pre pandemic, David and Malcolm’s teams were among the many that faced a shock to the system when the pandemic hit.

“My team has 40 people in it, mostly more senior employees, due to nature of our investment banking business,” David explained. “Being forced to work from home certainly opened our minds to alternative ways of working – there was a huge discussion about what the right thing to do was, for us and for our clients – once the necessity to work from home full time was gone.”

“Being forced to work from home certainly opened our minds to alternative ways of working.”

Another important aspect, he noted, was acknowledging that this was new for everyone; no employee or client knew how to operate in a hybrid model officially. And, as with everything, there would be a period of testing out options and making mistakes, but still recognizing that there’s definitely something here that could work – for both sides.

41

“When we were deciding how our work pattern would look on return to office in 2021, we got together as a team – when it was safe to do so – and just talked at a very human level, focusing on what works and what doesn’t, based on our experiences in the 2020 lockdown,” he explained. “Those meetings were really constructive: you could almost sense that, after each one, we were inching closer to something that actually works now and for the future. Everyone agreed that whatever we did, one hard requirement was to enhance the client experience of UBS.”

“I had to learn to trust my team in a way that I didn’t have to consider before.”

For Malcolm’s team, the issues – and dynamic – were different.

“We’re only five people, sitting within a broader client coverage unit, providing asset management services to clients. In some ways, having a smaller team makes it easier to make decisions, but, in others, it makes it harder, because everything and every person is more visible,” he said. “I had to learn to trust my team in a way that I didn’t have to consider before because, in a smaller, close-knit team in the office, having an overview of what people are working on simply by walking past or overhearing conversations is naturally easier than it is when you’re all at home. Not having that in the same way doesn’t mean things can grind to a halt, though, because their clients still need to be served and business has to continue.”

“One thing I would say without doubt, is that the joke of ‘Working from home? Enjoy your day off.’ is definitely no more!”

Hybrid working in practice

Like all good plans, the proof isn’t on paper, but rather in reality. For David and his team, this meant being particularly aligned with their time management.

“When we do go to the office, we try to all go in on the same days. We lean towards a Tuesday, Wednesday, Thursday pattern, with more flexibility on Monday and Friday,” he said. “But the big difference is evening work. Whereas, previously, we’d spend long hours at our desks in the office, often waiting around between emails and replies, now, I don’t see any reason why that work can’t be done in a more condensed way at home, after using the waiting around time to travel.”

The focus, as always, is on being available to talk to clients and address their questions at a time that works for them, either during the day or in the evening at a convenient timeslot for both.

42

“There’s definitely a balance to be struck between flexibility and retaining some structure,” agreed George Dracup from David’s team. “I do see the benefits of being in an office and do also see a keenness to get back some of the structure and team culture that comes with all being in the one place. But, I’m equally glad to still have some flexibility, particularly when it comes to managing sometimes-long hours more flexibly.”

“There’s definitely a balance to be struck between flexibility and retaining some structure.”

For Malcolm, keeping the team spirit up in split locations was top of the agenda.

“During the first lockdown, we started having a team huddle every morning and have kept it post return to office to make sure no one feels left out wherever they’re working and everyone can ask questions that they need to before everyone gets caught up with the day,” he explained. “Two of the team members actually joined during lockdown, so, as well as the huddle, we tried to meet in person when we could to welcome them into the team properly.”

One of them, was James Rogers.

“I started in July 2020 after accepting the job offer in March, of course, being fully remote at the beginning,” he said. “I’d done my fair share of networking at my old job, so I tried to replicate that virtually. The morning call, as a mix of a work and social touchpoint, was definitely helpful to get to know the team.”

“One thing that I think probably happened quicker virtually than it would have in the office, was learning about a wider variety of products at a faster pace in the very beginning, because people took the chance to have proper introduction calls instead of just a quick hello while passing in the office.”

“During the first lockdown, we started having a team huddle every morning and have kept it post return to office to make sure no one feels left out wherever they’re working.”

A change for teams and clients, too

“One of the biggest challenges in my case was making sure everyone felt comfortable with the return to office arrangements,” said Malcolm. “A couple of team members were more hesitant to come back as soon as it was announced that we could, so we delayed until everyone felt ready, so that we could start this new approach to working together.”

43

From dealing with comments on why other people aren’t in the office to expectations of availability: moving from everyone at home, to some, if not all, venturing back to the office took some getting used to. And, with timetables changed once again, the idea that everyone should be available during the same, ‘normal’ working hours was up for question when it came to everything from team calls to client events.

“In my opinion, communication, almost overcompensating in your communication about where you are and when you’re available that week to your team and clients, is key to keeping things run smoothly,” David added.

While in-team logistics and talking are certainly a big part of working in a hybrid model, it’s only half of the story. With people in the office less frequently, and, so, less available for face-to-face meetings, clients and prospects have also had to adapt.

“When it was clear that the situation wasn’t only going to last a few weeks, there was a frenzy of client activity,” said Malcolm. “Now, further down the line, while clients might be settling more into their own hybrid working habits and in-person meetings are possible in most cases, there’s still definitely a consistent increase in virtual meetings, with clients less inclined to travel to their/our office for the sake of one meeting.”

Some surprises along the way

Many parts of the pandemic have been unpredictable – not least the things we didn’t know we’d ever have to think about. In both teams, there were elements of surprise as they adapted to the new normal again and again.

“The first thing that surprised me was my lack of ability to predict what people will want to do when it comes to their work pattern!” David said with a laugh.

“I’m also surprised by the people who wanted and equally didn’t want to come back to the office…it’s not necessarily as easy to assume as you’d think, for example, based on what you know about someone,” said George in agreement.

“In seriousness, the fact that the hybrid model works so well is, to some extent, a pleasant surprise – and one I hope continues,” added David.

“I think the most important thing is two-way flexibility,” said Malcolm. “It’s about deciding what works best for you, but also works best for the business you’re delivering, and meeting in the middle.”

“My biggest surprise,” he added, “was the change is my dress sense. I was a suit and tie guy before, and now I’m a lot more casual, depending on the day. The general shift in dress code that many of us have seen due to working from home is a small point, but still significant in what it represents.”

44

To thrill fans and support the community

The opening of UBS Arena is a big step in enhancing our brand in a key market. Here’s how we prepared to open the doors of UBS Arena – despite challenges that the pandemic put in the way.

07 Mar 2022 5 min read

Key highlights

The opening of UBS Arena is a big step in enhancing our brand in a key market.

1. It was all about balance when promoting a live entertainment venue to bring people together in the future, during a pandemic that required us all to stay apart.

2. As well as being a top-class live entertainment and sports venue, the Arena is an investment into the Tri-state area, where we have deep roots as a firm.

Just over a year-and-a-half since we announced the exclusive 20-year naming rights agreement for the New York Metropolitan area’s most eagerly anticipated, cutting-edge live entertainment venue, and home of the New York Islanders ice hockey team, UBS Arena finally opened its doors on Saturday, 20 November 2021.

“This is a landmark day for our firm and our brand. New York City is home to our Americas headquarters, and the metropolitan region has more UBS clients and employees than any other US market,” said Tom Naratil, Co-President Global Wealth Management and President UBS Americas, on opening day. “We have deep roots in the Tri-state area and a fundamental commitment to revitalizing the economy and growing our presence in the US. This is an opportunity to demonstrate and accelerate that commitment, while having a positive and lasting impact on the surrounding community.”

“We have deep roots in the Tri-state area and a fundamental commitment to revitalizing the economy and growing our presence in the US. This is an opportunity to demonstrate and accelerate that commitment, while having a positive and lasting impact on the surrounding community.”

On top of the initial USD 1.5 billion private investment in the Arena and its surrounding campus, UBS Arena, which is located on the historic Belmont Park horse-racing grounds 20 miles east of our offices in Midtown Manhattan, is expected to generate close to USD 25 billion of economic activity over the full term of our naming rights agreement. A welcomed boost to the regional economy after a slowdown of economic activity due to the COVID-19 pandemic.