Investor Relations

Tel. +41-44-234 41 00

Media Relations

Tel. +41-44-234 85 00

UBS Group AG and UBS AG, News Release, 16 April

2024

Page 1

16 April 2024

News Release

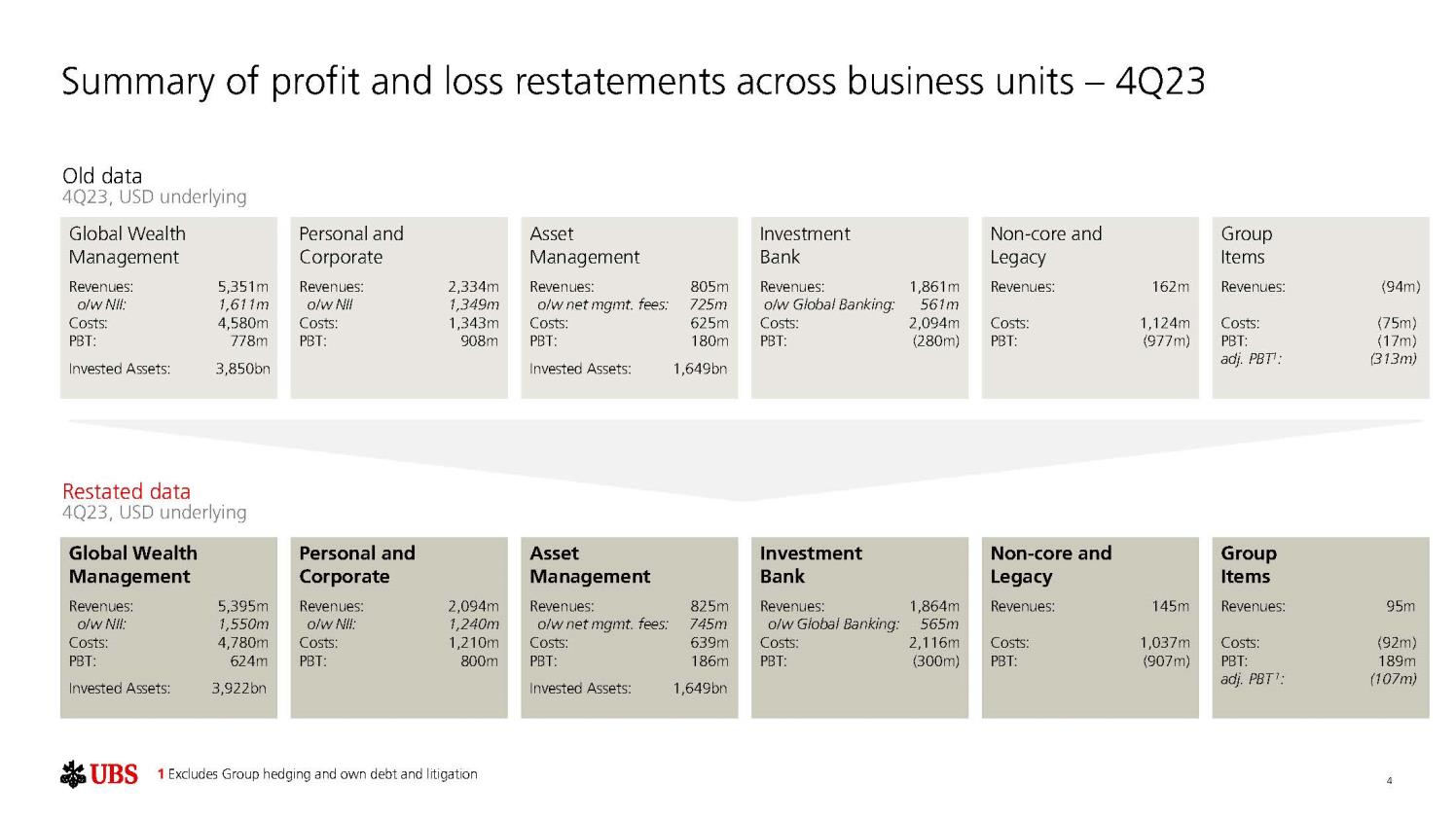

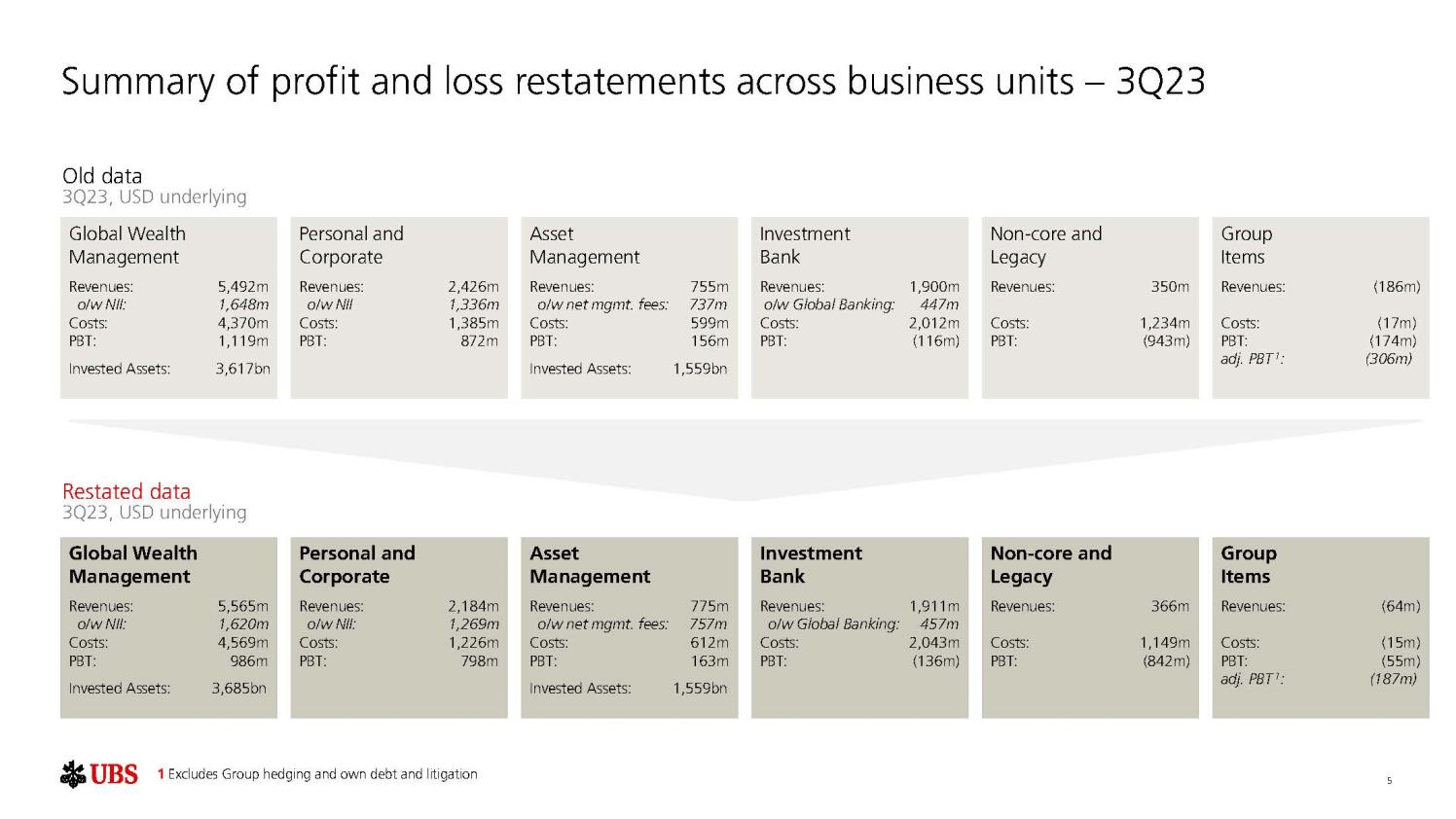

UBS publishes updated time series with restated segment financial

information reflecting previously announced changes with no impact on

Group results

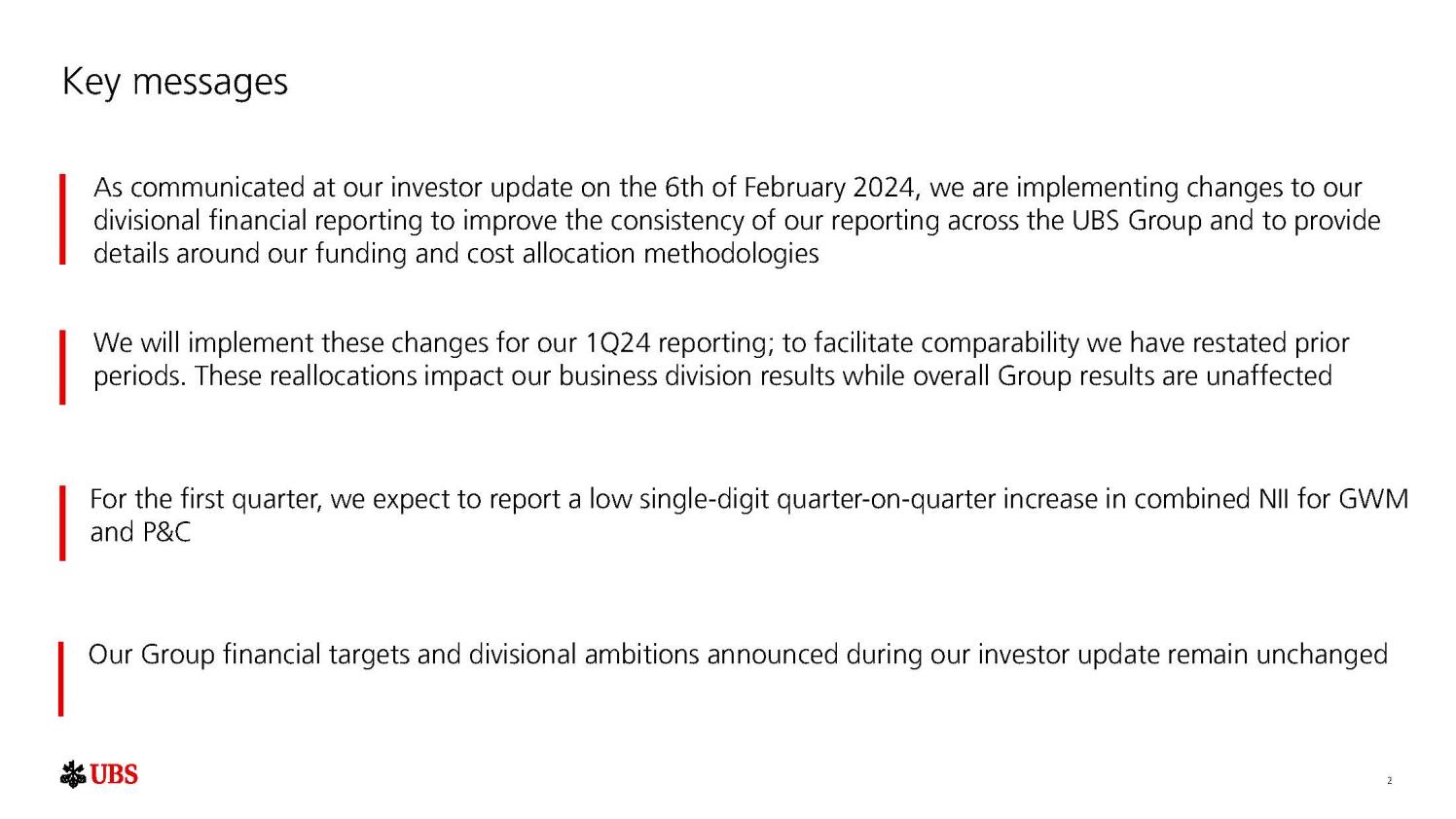

Zurich, 16 April 2024 – UBS today has published

restated historical segment-level financial data reflecting

the

changes to the Group’s segment financial reporting announced

on 6 February 2024. These changes

improve

the consistency of reporting across the Group and provide details around funding

and cost allocation

methodologies. The changes include:

-

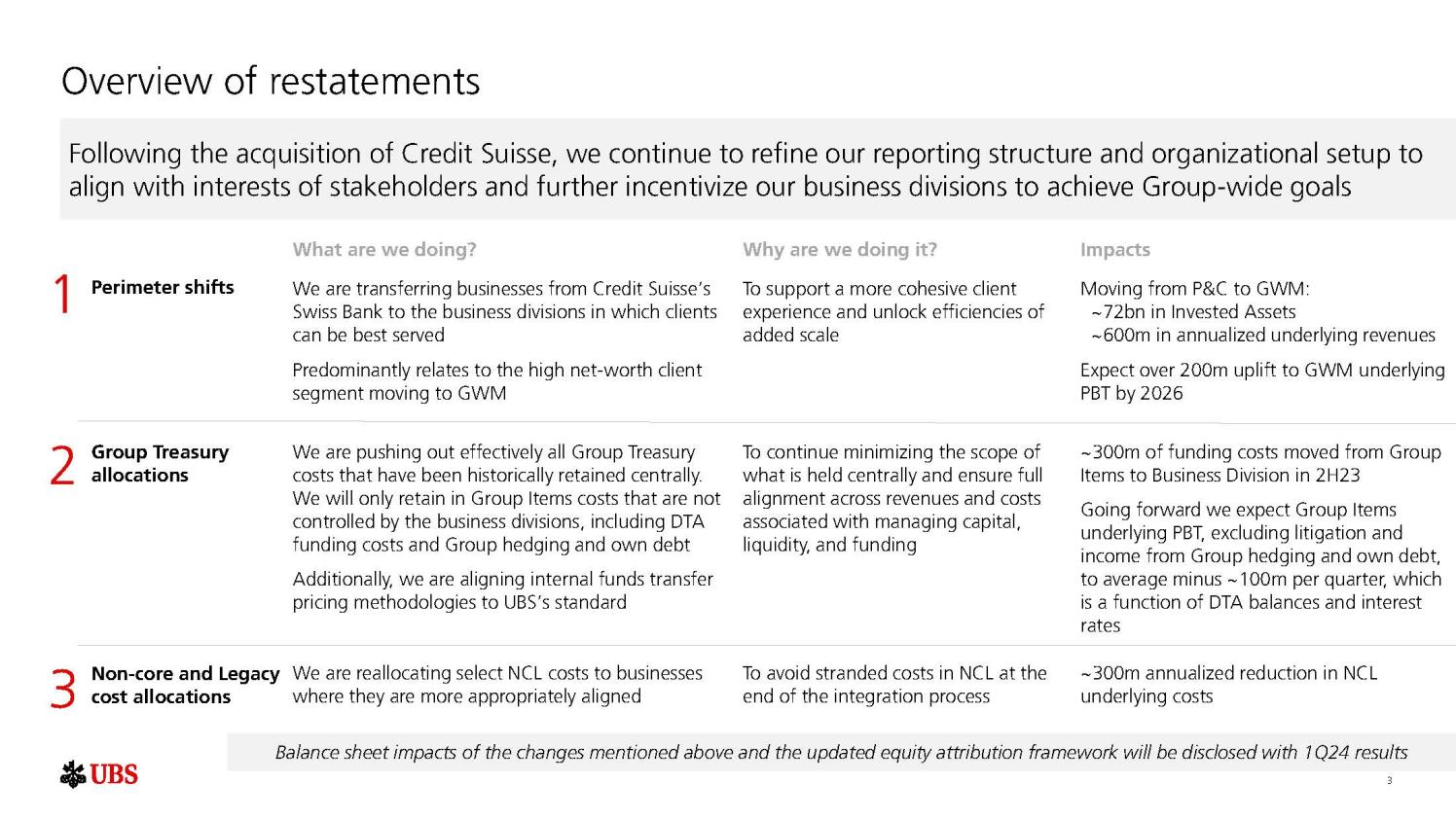

Client segment shifts: The transfer of the

Credit Suisse Swiss Bank high net worth client

segment

representing USD 72 billion in invested assets and annualized

underlying revenues of around USD 600

million from Personal & Corporate Banking to Global

Wealth Management, along with other smaller

transfers of businesses previously constituting Credit Suisse’s

Swiss Bank. The realignment supports a

more cohesive client experience and unlocks efficiencies

of added scale. We expect the transferred high

net worth segment to contribute more than USD 200

million annually to Global Wealth Management

PBT by 2026.

-

Group Treasury

allocations: A transfer of effectively all Group Treasury costs to the business divisions

that were historically retained centrally. We will only retain in Group Items costs that are not controlled

by the business divisions, including Group hedging

and own debt as well as DTA funding costs. Further

changes relate to the alignment of internal funds

transfer pricing methodologies to

UBS’s standard.

These changes result in lower net interest income (NII)

in the business divisions, with an offset in Group

Items. For the first quarter, we expect to report a low single-digit quarter-on-quarter increase in

combined NII for Global Wealth Management and

Personal & Corporate Banking. Going forward,

we

expect PBT reported in Group Items, excluding the P&L

from Group hedging and own debt, to average

around minus USD 100 million per quarter.

-

Non-core and Legacy cost allocations: A reallocation of

around USD 300 million annually in select costs

from Non-core and Legacy into the core business divisions where they are more appropriately

aligned

and to avoid stranded costs at the end of

the integration process.

These changes have no impact on the

Group’s financial performance and will be reflected in the

first quarter

results published on 7 May 2024.

The time series of financial information for

UBS and its business divisions can be found

at

https://www.ubs.com/global/en/investor-relations/financial-information/timeseries.html

including restated

financial information for 2023 to aid comparability

along with an accompanying presentation. The numbers

contained in these updated time series are unaudited.