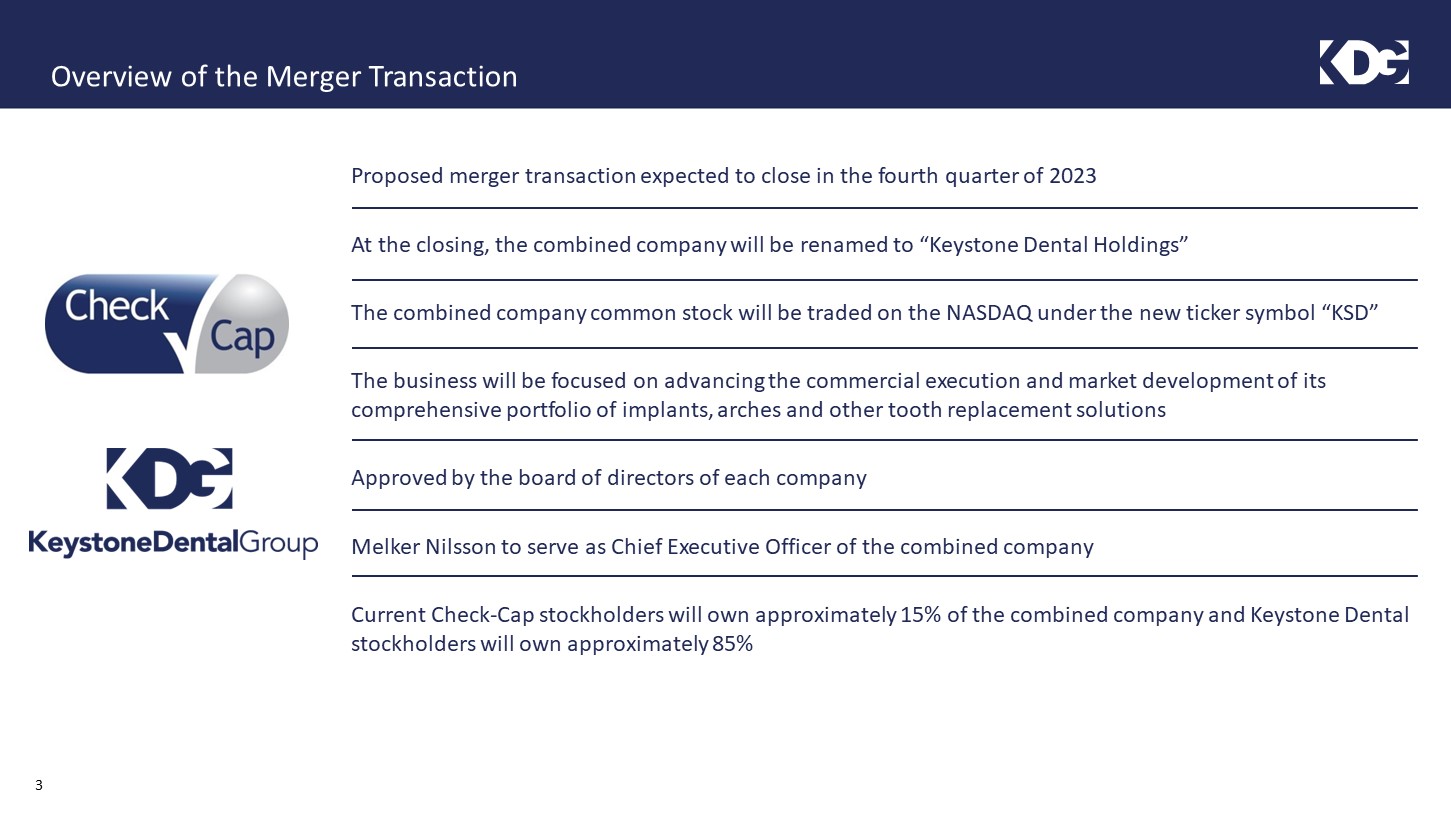

Forward Looking Statements Certain statements in this Presentation may constitute “forward-looking statements”. Forward-looking statements include, but are not limited to, statements regarding expectations, hopes, beliefs, intentions or strategies of Check-Cap Ltd. (“Check-Cap”) and/or Keystone Dental Holdings, Inc. (“Keystone”) regarding the future including, without limitation, statements regarding: Keystone’s technology and the benefits of tooth replacement solutions; the market opportunity for Keystone’s product portfolio; expectations and assumptions related to amounts of cash to be contributed by Check-Cap at the closing of the proposed business combination between Keystone and Check-Cap (the Proposed Transaction); and the expected effects of the Proposed Transaction. In addition, any statements that refer to projections, forecasts, or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “anticipate,” “believe,” continue,” “ could,” “estimate,” “ expect,” “ intend,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “ should,” “ strive,” “would,” “aim,” “target,” “commit,” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that statement is not forward looking. Forward-looking statements are based on current expectations and assumptions that, while considered reasonable are inherently uncertain. New risks and uncertainties may emerge from time to time, and it is not possible to predict all risks and uncertainties. Factors that may cause actual results to differ materially from current expectations include, but are not limited to, various factors beyond management’s control including general economic conditions; the outcome of any legal proceedings that may be instituted against Keystone or Check-Cap following the announcement of the Proposed Transaction; the inability to complete the Proposed Transaction, including due to the inability to concurrently close the business combination or due to failure to obtain approval of the shareholders of Check-Cap; delays in obtaining, adverse conditions contained in, or the inability to obtain necessary regulatory approvals, or delays in completing regulatory reviews, required to complete the Proposed Transaction; the risk that the Proposed Transaction disrupts current plans and operations as a result of the announcement and consummation of the Proposed Transaction; the inability to recognize the anticipated benefits of the Proposed Transaction, which may be affected by, among other things, competition, the ability of the combined company to grow and manage growth, maintain relationships with customers and suppliers and retain key employees; costs related to the Proposed Transaction; the possibility that the combined company may be adversely affected by other economic, business, and/or competitive factors; other risks and uncertainties indicated from time to time in the prospectus on Form S-4 which is expected to be filed by a newly formed wholly owned subsidiary of Keystone (“Keystone Parent”) with the SEC and other risks, uncertainties and factors set forth under “Risk Factors” therein as well as in the sections entitled “Risk Factors,” in Check-Cap’s Report on Form 6-K furnished to the SEC on August 4, 2023, and its other filings with the SEC, as well as factors associated with companies, such as Keystone and Check-Cap, that operate in the life science industry. Nothing in this Presentation should be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved or that any of the contemplated results of such forward-looking statements will be achieved. You should not place undue reliance on forward-looking statements in this Presentation, which speak only as of the date they are made and are qualified in their entirety by reference to the cautionary statements herein. Neither Check-Cap nor Keystone undertakes or accepts any duty to release publicly any updates or revisions to any forward-looking statements to reflect any change in their expectations or in the events, conditions or circumstances on which any such statement is based. This Presentation does not purport to summarize all of the conditions, risks and other attributes of an investment in Keystone, Check-Cap or the combined company. 2