Check-Cap Ltd.

Check-Cap Building

29 Abba Hushi Avenue

P.O. Box 1271

Isfiya, 3009000

Israel

_____________________

PROXY STATEMENT

ANNUAL GENERAL MEETING OF SHAREHOLDERS

This Proxy Statement is being furnished in connection with the solicitation of proxies on behalf of the board of directors of Check-Cap Ltd. (“we,” “us,” “our,” “Check-Cap” or the “Company”) to be voted at an Annual General Meeting of Shareholders (the “Meeting”), and at any adjournment thereof, pursuant to the accompanying Notice of Annual General Meeting of Shareholders. The Meeting will be held on Monday, December 18, 2023 at 2:00 p.m. (Israel time) at the offices of Check-Cap’s Israeli legal counsel, FISCHER (FBC & Co.), located at 146 Menachem Begin Rd., Tel Aviv 6492103, Israel.

Purpose of the Annual General Meeting

At the Meeting, shareholders will be asked to consider and vote on the following proposals:

| 1. | to approve, pursuant to Section 320 of the Israeli Companies Law 5759-1999 (the “Companies Law”), the merger of Capstone Merger Ltd., an Israeli company (“Israeli Merger Sub”) and a wholly-owned subsidiary of Capstone Dental Pubco, Inc., a Delaware corporation (“New Parent”) with and into Check-Cap, with Check-Cap surviving and becoming a wholly-owned subsidiary of New Parent, including approval of: (x) the Business Combination Agreement, dated as of August 16, 2023, by and among New Parent, Keystone Dental Holdings, Inc., a Delaware corporation (“Keystone”), Check-Cap, U.S. Merger Sub (as defined below) and Israeli Merger Sub (the “Business Combination Agreement”), pursuant to which, Capstone Merger Sub Corp., a Delaware corporation (“U.S. Merger Sub”, and, together with Israeli Merger Sub, the “Merger Subs”), and wholly-owned subsidiary of New Parent, will merge (the “U.S. Merger”) with and into Keystone, with Keystone surviving as a wholly-owned subsidiary of New Parent, and Israeli Merger Sub will merge (the “Israeli Merger,” and collectively with the U.S. Merger and the other transactions described in the Business Combination Agreement, the “Business Combination”) with and into Check-Cap, with Check-Cap surviving (which we refer to for the periods at and after the effective time of the Israeli Merger as the “Israeli Surviving Company”), and each of U.S. Merger Sub and Israeli Merger Sub will cease to exist, and (y) all other transactions and arrangements to which Check-Cap is a party contemplated by the Business Combination Agreement, a copy of which was attached as Exhibit 99.1 to the Company’s Form 6-K furnished to the U.S. Securities and Exchange Commission (“SEC”) on August 17, 2023 (we refer to this proposal collectively as the “Business Combination Proposal”). If the Israeli Merger is completed, you will be entitled to receive one share of common stock, par value $0.01 per share, of New Parent (which we refer to as Parent Common Stock) in exchange for each ordinary share, par value NIS 48.00 per share, of Check-Cap (which we refer to as an Ordinary Share) that you hold as of immediately prior to the effective time of the Israeli Merger (as may be adjusted if Proposal 4 is approved at the Meeting and a reverse share split of the Company’s ordinary shares is implemented); |

| 2. | to ratify and approve the reappointment of Brightman Almagor Zohar & Co., Certified Public Accountants, a firm in the Deloitte Global Network, as our independent auditor for the year ending December 31, 2023 and for such additional period until our next annual general meeting of shareholders; |

| 3. | to approve and restate the Company’s Compensation Policy for Executive Officers and Directors; |

| 4. | to authorize our Board of Directors to determine to effect a reverse share split of the Company’s ordinary shares within a range of 1 for 2 to 1 for 5, the exact ratio to be determined by our Board of Directors, to be effective on a date to be determined by our Board of Directors and announced by the Company, and to approve the amendment of our Articles of Association to reflect any such reverse share split (if implemented); |

| 5. | to elect five directors as members of the Company’s board of directors (the “Check-Cap Board”) out of the following ten director nominees proposed for election at the Meeting, each to serve until our next annual general meeting of shareholders and until their respective successors are duly elected and qualified: Steven Hanley, Clara Ezed, Dr. Mary Jo Gorman, XiangQian (XQ) Lin, Yuval Yanai (collectively, the “Company Director Nominees”), Idan Ben Shitrit, Avital Shafran, Jordan Lipton, William Vozzolo and Lilian Malczewski (collectively, the “Shareholder Director Nominees” and together with the Company Director Nominees, the “Director Nominees”) (we refer to this proposal collectively as the “Director Election Proposal”); |

| 6. | to approve the cash remuneration to be paid to the Director Nominees who are elected to serve as directors at the Meeting under Proposal 5; and |

| 7. | to approve the Company’s entry into indemnification and exculpation agreements and to provide directors’ and officers’ liability insurance coverage to a Shareholder Director Nominee who is elected to serve at the Meeting under Proposal 5 (if any). |

In addition, at the Meeting, representatives of our management will be available to review and discuss with shareholders the Company’s financial statements for the year ended December 31, 2022.

We are not aware of any other matters that will come before the Meeting. If any other matters properly come before the Meeting, the persons designated as proxies intend to vote on such matters in accordance with the judgment and recommendation of the Check-Cap Board.

Recommendation of the Board of Directors

OUR BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR” THE APPROVAL OF THE BUSINESS COMBINATION PROPOSAL, “FOR” THE ELECTION OF EACH OF THE COMPANY DIRECTOR NOMINEES NOMINATED IN PROPOSAL 5, “AGAINST” THE ELECTION OF EACH OF THE SHAREHOLDER DIRECTOR NOMINEES NOMINATED IN PROPOSAL 5, AND “FOR” ALL OTHER PROPOSALS, OTHER THAN PROPOSAL 7 WITH RESPECT TO WHICH THE BOARD OF DIRECTORS IS NOT EXPRESSING AN OPINION.

Who Can Vote

You are entitled to notice of, and to vote in person or by proxy at, the Meeting, if you are a holder of record of our ordinary shares as of the close of business on November 10, 2023. You are also entitled to notice of the Meeting and to vote at the Meeting if you held ordinary shares through a bank, broker or other nominee that is one of our shareholders of record at the close of business on November 10, 2023, or which appeared in the participant listing of a securities depository on that date. See below “How You Can Vote.”

How You Can Vote

| • | Voting in Person. If you are a shareholder of record, i.e., your shares are registered directly in your name with our transfer agent, American Stock Transfer & Trust Company LLC, you may attend and vote in person at the Meeting. If you are a beneficial owner of shares registered in the name of your broker, bank, trustee or nominee (i.e., your shares are held in “street name”), you are also invited to attend the Meeting; however, to vote in person at the Meeting as a beneficial owner, you must first obtain a “legal proxy” from your broker, bank, trustee or nominee that holds your shares giving you the right to vote the shares at the Meeting. |

| • | Voting by mailing your Proxy. If you are a shareholder of record, these proxy materials are being sent directly to you by our transfer agent. You may submit your proxy by completing, signing and mailing the enclosed proxy card that was mailed to you in the enclosed, postage-paid envelope. If your ordinary shares are held in “street name,” these proxy materials are being forwarded to you by the broker, trustee or nominee or an agent hired by the broker, trustee or nominee. Please follow the voting instructions provided to you by your broker, trustee or nominee. Proxies must be received by our transfer agent or at our registered office in Israel no later than forty-eight (48) hours prior to the designated time for the Meeting. Proxies received by our transfer agent or at our registered office in Israel during the forty-eight (48) hours preceding the designated time for the Meeting will be presented to the Chairman of the Meeting and, at his discretion, may be voted as specified in the instructions included in such proxies. |

| • | Voting by Internet or mobile. If you are a shareholder of record, you can submit a proxy over the Internet by logging on to the website listed on the enclosed proxy card, entering your control number located on the enclosed proxy card and submitting a proxy by following the on-screen prompts. You may also access Internet voting via your smartphone or tablet by scanning the QR image that appears on your proxy card. If you hold shares in “street name,” you may vote those shares by accessing the Internet website address specified in the instructions provided by your broker, bank, trustee or nominee. Submitting an Internet or mobile proxy will not affect your right to vote at the Meeting should you decide to attend the Meeting. |

Change or Revocation of Proxy

If you are a shareholder of record, you may change your vote at any time prior to the exercise of authority granted in the proxy by delivering a written notice of revocation to our Chief Financial Officer, by granting a new proxy bearing a later date, or by voting again via the Internet or your smartphone or tablet, or by attending the Meeting and voting in person. Attendance at the Meeting will not cause your previously granted proxy to be revoked unless you specifically so request.

If your shares are held in “street name,” you may change your vote by submitting new voting instructions to your broker, bank, trustee or nominee or, if you have obtained a legal proxy from your broker, bank, trustee or nominee giving you the right to vote your shares, by attending the Meeting and voting in person.

Quorum

The presence, in person or by proxy, of two or more shareholders holding or representing, in the aggregate, at least twenty-five percent (25%) of our company’s voting rights will constitute a quorum at the Meeting. No business will be considered or determined at the Meeting unless the requisite quorum is present within half an hour from the time designated for the Meeting. If within half an hour from the time designated for the Meeting a quorum is not present, the Meeting will stand adjourned to the day, time and place as the Chairman of the Meeting shall determine. At least two shareholders present, in person or by proxy, will constitute a quorum at the adjourned meeting.

Abstentions and broker non-votes will be counted towards the quorum. Broker non-votes occur for a particular proposal when brokers that hold their customers’ shares in street name sign and submit proxies for such shares (in which case they are considered present for purposes of determining presence of a quorum at the Meeting) but do not have the discretionary authority to vote on such particular proposal. This occurs when brokers have not received any voting instructions from their customers, in which case the brokers, as the holders of record, are permitted to vote on “routine” matters, but not on non-routine matters. The proposals described in this Proxy Statement are non-routine matters except for Proposal 2 (relating to the appointment of Check-Cap’s independent registered public accounting firm); therefore, it is important that you vote your shares, either by proxy or in person at the Meeting.

Unsigned or unreturned proxies, including those not returned by banks, brokers, or other record holders, will not be counted for quorum or voting purposes.

Vote Required for Approval of the Proposals

Your vote is very important, regardless of the number of ordinary shares that you own. Each ordinary share entitles the holder to one vote.

Proposal 1 - the Business Combination Proposal: The affirmative vote of the holders of a majority of the ordinary shares represented at the Meeting, in person or by proxy, and entitled to vote and voting on the matter, is required to approve the Business Combination Proposal, excluding abstentions and broker non-votes and excluding any ordinary shares that are held by (a) New Parent, Keystone, Israeli Merger Sub or by any person holding directly or indirectly 25% or more of the voting power or the right to appoint 25% or more of the directors of New Parent, Keystone or Israeli Merger Sub, (b) a person or entity acting on behalf of New Parent, Keystone or Israeli Merger Sub or a person or entity described in clause (a) above, or (c) a family member of an individual contemplated by either of clause (a) or (b) above, or an entity controlled by New Parent, Keystone, Israeli Merger Sub or any of the foregoing (each, a “New Parent Affiliate”). Each shareholder voting on Proposal 1 is required to indicate on the proxy card or, if voting in person at the Meeting, inform us prior to voting on the matter at the Meeting, whether or not the shareholder is a New Parent Affiliate. Otherwise, the shareholder’s vote will not be counted for the purposes of the proposal.

Proposals 2, 3, 4, 6 and 7: The affirmative vote of the holders of a majority of the ordinary shares represented at the Meeting, in person or by proxy, and entitled to vote and voting on the matter, is required to approve each of Proposals 2, 3, 4, 6 and 7.

In addition to the foregoing majority requirement, the approval of Proposal 3 is also subject to the fulfillment of one of the following additional voting requirements (the “Special Majority”): (i) the shares voting in favor of the proposal (excluding abstentions) include at least a majority of the shares voted by shareholders who are not controlling shareholders and shareholders who do not have a personal interest in the proposal, or (ii) the total number of shares voted against the proposal by shareholders who are not controlling shareholders and shareholders who do not have a personal interest in the proposal does not exceed two-percent (2%) of our outstanding voting rights.

We are unaware of any shareholder that would be deemed to be a controlling shareholder of the Company (within the meaning of Israeli law) for purposes of the calculation of the Special Majority. A shareholder who signs and returns a proxy card will be deemed to be confirming that such shareholder, and any related party of such shareholder, is not a controlling shareholder for purposes of Proposal 3. If you believe that you, or a related party of yours, may be deemed to be a controlling shareholder and you wish to participate in the vote on Proposal 3, you should contact Ms. Mira Rosenzweig, our Chief Financial Officer (mira.rosenzweig@check-cap.com or +972-4-8303415).

Each shareholder voting on Proposal 3 is required to indicate on the proxy card or, if voting in person at the Meeting, inform us prior to voting on the matter at the Meeting, whether or not the shareholder has a personal interest in Proposal 3. Otherwise, the shareholder’s vote will not be counted for the purposes of the proposal. Under the Companies Law, a “personal interest” of a shareholder in an act or transaction of a company (i) includes a personal interest of (a) any spouse, sibling, parent, grandparent or descendant of the shareholder, any descendant, sibling or parent of a spouse of the shareholder and the spouse of any of the foregoing; and (b) a company with respect to which the shareholder (or any of the foregoing relatives of the shareholder) serves as a director or chief executive officer, owns at least 5% of the outstanding shares or voting rights or has the right to appoint one or more directors or the chief executive officer; and (ii) excludes a personal interest arising solely from the ownership of shares. Under the Companies Law, in the case of a person voting by proxy, “personal interest” includes the personal interest of either the proxy holder or the shareholder granting the proxy, whether or not the proxy holder has discretion how to vote.

Proposal 5 - the Director Election Proposal: Each Director Nominee shall be voted on separately. Five out of the ten Director Nominees shall be elected by the affirmative vote of the holders of the majority of the ordinary shares represented at the Meeting, in person or by proxy, entitled to vote and voting on the matter, by way of a plurality of votes cast (i.e., the five Director Nominees who receive an affirmative majority vote and who also receive the largest number of ”FOR” votes will be elected). If you mark a vote with respect to less than five Director Nominees in Proposal 5, your shares will only be voted FOR those Director Nominees you have so marked. If you vote for more than five Director Nominees, all of your votes on Proposal 5 will be invalid and will not be counted.

In tabulating the voting results for the proposal, shares that constitute broker non-votes and abstentions are not considered votes cast on the proposal, and will have no effect on the vote. Unsigned or unreturned proxies, including those not returned by banks, brokers, or other record holders, will not be counted for voting purposes. Therefore, it is important for a shareholder that holds ordinary shares through a bank or broker to instruct its bank or broker how to vote its shares if the shareholder wants its shares to count towards the vote tally for the proposal.

Cost of Soliciting Votes for the Meeting

We will bear the cost of soliciting proxies from our shareholders. Proxies will be solicited by mail and may also be solicited in person, by telephone or electronic communication, by our directors, officers and employees. We will reimburse brokerage houses and other custodians, nominees and fiduciaries for their expenses in accordance with the regulations of the SEC concerning the sending of proxies and proxy material to the beneficial owners of our shares. In addition, we have engaged Alliance Advisors, LLC, to assist in the solicitation of proxies and provide related advice and informational support, for services fees, plus customary disbursements, which are not expected to exceed $145,000 in total.

BENEFICIAL OWNERSHIP

OF ORDINARY SHARES BY CERTAIN BENEFICIAL OWNERS

The following table sets forth information with respect to the beneficial ownership of Check-Cap’s ordinary shares as of November 15, 2023, by (i) each person or entity known to Check-Cap to beneficially own more than 5% of Check-Cap’s outstanding ordinary shares; (ii) each of Check-Cap’s current executive officers and directors individually; and (iii) all of Check-Cap’s current executive officers and directors as a group.

The percentage of beneficial ownership of Check-Cap’s ordinary shares is based on 5,850,364 ordinary shares, NIS 48.00 par value per share outstanding as of November 15, 2023. Beneficial ownership is determined in accordance with the rules of the SEC and generally includes voting power or investment power with respect to securities. All ordinary shares subject to options currently exercisable or exercisable into ordinary shares within 60 days of November 15, 2023, and underlying RSUs that shall vest within 60 days of November 15, 2023, are deemed to be outstanding and beneficially owned by the shareholder holding such options or RSUs for the purpose of computing the number of shares beneficially owned by such shareholder. Such shares are also deemed outstanding for purposes of computing the percentage ownership of the person holding the option or RSU. They are not, however, deemed to be outstanding and beneficially owned for the purpose of computing the percentage ownership of any other shareholder.

This table is based upon publicly available information and information supplied by officers and directors and is believed to be accurate. Except as indicated in footnotes to this table, Check-Cap believes that the shareholders named in this table have sole voting and investment power with respect to all shares shown to be beneficially owned by them, based on information available to Check-Cap or provided to Check-Cap by such shareholders. Unless otherwise noted below, each shareholder’s address is: c/o 29 Abba Hushi Avenue, P.O. Box 1271, Isfiya, 3009000, Mount Carmel, Israel.

| | | Ordinary Shares

Beneficially Owned | |

| | | Number | | | Percent | |

| 5% or Greater Shareholders | | | | | | |

| Vijay Ramanathan (1) | | | 360,000 | | | | 6.1 | %* |

| Symetryx Corporation (2) | | | 300,864 | | | | 5.1 | %* |

| Directors and Executive Officers | | | | | | | | |

| Alex Ovadia (3) | | | 25,452 | | | | ** |

|

| Mira Rosenzweig (4) | | | 4,854 | | | | ** |

|

| Boaz Shpigelman (5) | | | 5,783 | | | | ** |

|

| Steven Hanley (6) | | | 7,075 | | | | ** |

|

| Clara Ezed (7) | | | 7,031 | | | | ** |

|

| Mary Jo Gorman (8) | | | 7,069 | | | | ** |

|

| XiangQian (XQ) Lin (9) | | | 7,972 | | | | * |

|

| Yuval Yanai (10) | | | 7,075 | | | | ** |

|

| All directors and executive officers as a group (8 persons) (11) | | | |

| | | 1.2 | % |

| * | Following the consummation of the Business Combination, the shareholder will own less than 1% of New Parent’s outstanding Common Stock.

|

| ** | Represents beneficial ownership of less than 1% of Check-Cap’s outstanding ordinary shares. |

| (1) | Based solely upon, and qualified in its entirety with reference to, Schedule 13G filed with the SEC on September 22, 2023. The address of the reporting person is 20 Adelaide St E, Suite 1105, Toronto, ON M5C 2T6, Canada.

|

| (2) | Based solely upon, and qualified in its entirety with reference to, Schedule 13D filed with the SEC on September 29, 2023, as amended on October 30, 2023 and November 14, 2023. The address of the reporting person is 2828 Bathurst Street, Suite 400, Toronto, Canada M6B3A7.

|

| (3) | Includes (i) 752 outstanding ordinary shares, and (ii) 24,700 ordinary shares subject to options currently exercisable or options and/or RSUs that will become exercisable or vested within 60 days of the date of this table.

|

| (4) | Includes (i) 797 outstanding ordinary shares, and (ii) 4,057 ordinary shares subject to options currently exercisable or options and/or RSUs that will become exercisable or vested within 60 days of the date of this table.

|

| (5) | Includes (i) 1,228 outstanding ordinary shares, and (ii) 4,555 ordinary shares subject to options currently exercisable or options and/or RSUs that will become exercisable or vested within 60 days of the date of this table.

|

| (6) | Includes (i) 255 outstanding ordinary shares, and (ii) 6,820 ordinary shares subject to options currently exercisable or options and/or RSUs that will become exercisable or vested within 60 days of the date of this table.

|

| (7) | Includes (i) 211 outstanding ordinary shares, and (ii) 6,820 ordinary shares subject to options currently exercisable or options and/or RSUs that will become exercisable or vested within 60 days of the date of this table.

|

| (8) | Includes (i) 249 outstanding ordinary shares, and (ii) 6,820 ordinary shares subject to options currently exercisable or options and/or RSUs that will become exercisable or vested within 60 days of the date of this table.

|

| (9) | Includes (i) 950 outstanding ordinary shares, and (ii) 7,022 ordinary shares subject to options currently exercisable or options and/or RSUs that will become exercisable or vested within 60 days of the date of this table.

|

| (10) | Includes (i) 255 outstanding ordinary shares, and (ii) 6,820 ordinary shares subject to options currently exercisable or options and/or RSUs that will become exercisable or vested within 60 days of the date of this table.

|

| (11) | See footnotes (3)-(10). |

As of November 15, 2023, based upon information provided to us by Check-Cap’s transfer agent in the United States and other information reasonably available to Check-Cap, Check-Cap had 51 holders of record of Check-Cap’s ordinary shares in the United States. Such holders of record held, as of that date, 99.89% of Check-Cap’s outstanding ordinary shares. The number of record holders is not representative of the number of beneficial holders of Check-Cap’s ordinary shares, as 99.83% of Check-Cap’s outstanding ordinary shares are recorded in the name of Cede & Co. as nominee for the Depository Trust Company, in whose name all shares held in “street name” are held in the United States.

None of Check-Cap’s shareholders have voting rights different from the voting rights of other shareholders. To the best of Check-Cap’s knowledge, Check-Cap’s ordinary shares are not owned or controlled, directly or indirectly, by another corporation or by any government. Check-Cap is not aware of any arrangement that may, at a subsequent date, result in a change of control of Check-Cap.

To Check-Cap’s knowledge, other than as disclosed in the table above, Check-Cap’s other filings with the SEC and this Proxy Statement, there has been no significant change in the percentage ownership held by any major shareholder since January 1, 2020.

Board Diversity Matrix

The table below provides certain information with respect to the diversity of our Board of Directors as of the date hereof.

| Country of Principal Executive Offices | Israel |

| Foreign Private Issuer: | Yes |

| Disclosure Prohibited Under Home Country Law | No |

| Total Number of Directors | 5 |

| | Female | Male | Non-Binary | Did Not Disclose Gender |

| Part I: Gender Identity | | | | |

| Directors | 2 | 2 | - | 1 |

| Part II: Demographic Background |

| Underrepresented Individual in Home Country Jurisdiction | 1 |

| LGBTQ+ | - |

| Did Not Disclose Demographic Background | 3 |

Executive Officer Compensation

For information regarding the compensation incurred by us in relation to our five most highly compensated office holders (within the meaning of the Companies Law) for the year ended December 31, 2022, see “Item 6B. Directors, Senior Management and Employees — Compensation of Directors and Executive Officers” of our annual report on Form 20-F for the year ended December 31, 2022, filed with the SEC on March 31, 2023.

If you have questions about this Proxy Statement or the Meeting, please contact Alliance Advisors, LLC, our proxy solicitor:

Alliance Advisors, LLC

1-833-970-2875

1-973-604-4443 (International)

CHEK@allianceadvisors.com

TABLE OF CONTENTS

Page Number

The following questions and answers are intended to briefly address some commonly asked questions regarding the Business Combination, the Business Combination Agreement, the shares of New Parent Common Stock to be issued pursuant to the Business Combination and the Meeting. These questions and answers may not address all questions that may be important to you as a shareholder of Check-Cap. Please refer to the exhibits to this Proxy Statement and the documents referred to in the accompanying prospectus filed by New Parent with the SEC as part of a registration statement on Form S-4 on November 13, 2023 in connection with the transactions contemplated under the Business Combination Agreement (the “New Parent Prospectus”), a copy of which is attached to this proxy statement as Annex A, which you should read carefully and in their entirety.

Q: Why am I receiving this Proxy Statement?

A: Check-Cap is soliciting proxies for an Annual General Meeting of Shareholders of the Company, which we refer to as the Meeting, which will be held at the offices of Check-Cap’s Israeli legal counsel, FISCHER (FBC & Co.), located at 146 Menachem Begin Rd., Tel Aviv 6492103, Israel. You are receiving this Proxy Statement because you owned ordinary shares of the Company, par value NIS 48.00 per share, which we refer to as Ordinary Shares, on November 10, 2023, which is the record date for the Meeting, and such ownership entitles you to vote at the Meeting. By use of a proxy, you can vote your shares whether or not you attend the Meeting. This Proxy Statement describes the matters on which we would like you to vote: (i) the approval of the Business Combination Proposal; (ii) the ratification and approval of the reappointment of Brightman Almagor Zohar & Co., Certified Public Accountants, a firm in the Deloitte Global Network, for the year ending December 31, 2023 and for such additional period until our next annual general meeting of shareholders; (iii) the approval and restatement of the Company’s Compensation Policy for Executive Officers and Directors; (iv) the authorization of our Board of Directors to determine to effect a reverse share split of the Company’s ordinary shares within a range of 1 for 2 to 1 for 5, the exact ratio to be determined by the Board of Directors, to be effective on a date to be determined by our Board of Directors and announced by the Company, and to approve the amendment of our Articles of Association to reflect any such reverse share split (if implemented), (v) the election of five directors as members of the Check-Cap Board under the Director Election Proposal, (vi) the approval of the cash remuneration to be paid to the Director Nominees who are elected to serve as directors at the Meeting; and (vii) the approval of the Company’s entry into indemnification and exculpation agreements and to provide directors’ and officers’ liability insurance coverage to any Shareholder Director Nominee who is elected to serve at the Meeting, and provides information on these matters so that you can make an informed decision. This Proxy Statement also references various disclosures that appear in the New Parent Prospectus and that do not appear (or that appear more briefly) in this Proxy Statement. It is important that you carefully review the New Parent Prospectus, which contains, among other important matters, information concerning New Parent, Keystone, Keystone’s business, the Merger, the Business Combination Agreement and your prospective rights as a shareholder of New Parent following the Merger.

Q: What am I being asked to vote on?

A: You are being asked to vote on the approval of (i) the Business Combination Proposal; (ii) the ratification and approval of the reappointment of Brightman Almagor Zohar & Co., Certified Public Accountants, a firm in the Deloitte Global Network, for the year ending December 31, 2023 and for such additional period until our next annual general meeting of shareholders; (iii) the approval and restatement of the Company’s Compensation Policy for Executive Officers and Directors; (iv) the approval of a reverse share split of the Company’s ordinary shares within a range of 1 for 2 to 1 for 5, the exact ratio to be determined by further action of the Board of Directors and announced by the Company, and to amend our Articles of Association accordingly; (v) the election of five directors as members of the Check-Cap Board under the Director Election Proposal; (vi) the approval of the cash remuneration to be paid to the Director Nominees who are elected to serve as directors at the Meeting; and (vii) the approval of the Company’s entry into indemnification and exculpation agreements and to provide directors’ and officers’ liability insurance coverage to any Shareholder Director Nominee who is elected to serve at the Meeting.

Q: Who is Keystone?

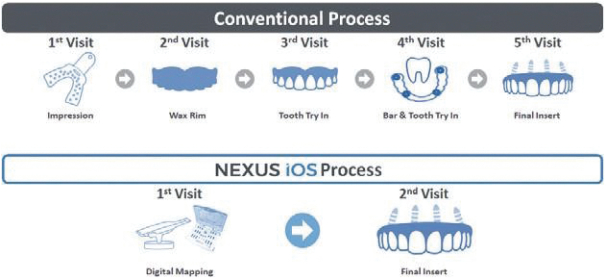

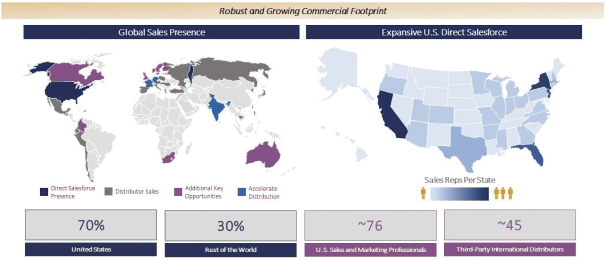

A: Following the date of the closing of the Business Combination (the “Closing”), the sole business and operations of New Parent will be the business and operations of Keystone Dental, Inc. (which we refer to as Keystone Dental), a wholly-owned subsidiary of Keystone, and its subsidiaries, and New Parent will continue to run and operate such business and operations. Keystone is a global commercial stage medical technology company focused on providing end-to-end solutions for dental practitioners and tooth replacement procedures. Its comprehensive portfolio of tooth replacement solutions is comprised of implants, prosthetic solutions, biomaterial solutions and digital dentistry capabilities. Keystone develops and offers technologies it believes are effective and advanced technologies for dental practitioners, dental laboratories and patients at an attractive price, driving significant value to both practitioners and patients. Keystone believes its products offer strong value proposition for dental practitioners through its innovative products with high quality manufacturing and design at various pricing options. Keystone has premium and high touch customer service with an experienced direct sales force and third-party distributors, simplifying a complex procedure through the digitalization of workflow for multiple clinical indications. Based on Keystone’s estimates, it believes its digital capabilities for dental practices have the potential to reduce the number of office visits and decrease patient chair time per procedure. Keystone’s various brands, including Genesis, Prima, Paltop, Molaris, Dyna, Osteon and Nexus iOS, are widely known amongst dental practitioners. For more information, see the section entitled “Information about Keystone– Keystone Business” in the New Parent Prospectus.

Q: What are the approval requirements at the Meeting?

A: All holders of record of Check-Cap ordinary shares as of the close of business on November 10, 2023, the record date for the Meeting, will be entitled to vote at the Meeting. Each holder of Check-Cap ordinary shares will be entitled to cast one vote on each matter properly brought before the Meeting for each Check-Cap ordinary share that such holder owned of record as of the record date.

Proposal 1 - the Business Combination Proposal: The approval of the Business Combination Proposal requires the affirmative vote of the holders of a majority of the Check-Cap ordinary shares present, in person or by proxy, and entitled to vote and voting on the matter at the Meeting, excluding abstentions and broker non-votes (and other invalid votes) and excluding any Check-Cap ordinary shares that are held by (a) New Parent, Keystone, Israeli Merger Sub or by any person holding directly or indirectly 25% or more of the voting power or the right to appoint 25% or more of the directors of New Parent, Keystone or Israeli Merger Sub, (b) a person or entity acting on behalf of New Parent, Keystone or Israeli Merger Sub or a person or entity described in clause (a) above, or (c) a family member of an individual contemplated by either of clause (a) or (b) above, or an entity controlled by New Parent, Keystone, Israeli Merger Sub or any of the foregoing. Each shareholder voting on Proposal 1 is required to indicate on the proxy card or, if voting in person at the Meeting, inform us prior to voting on the matter at the Meeting, whether or not the shareholder is a New Parent Affiliate. Otherwise, the shareholder’s vote will not be counted for the purposes of the proposal.

Proposals 2, 3, 4, 6 and 7: The approval of each of Proposals 2, 3, 4, 6 and 7 requires the affirmative vote of the holders of a majority of the ordinary shares represented at the Meeting, in person or by proxy, and entitled to vote and voting on the matter.

In addition to the foregoing majority requirement, the approval of Proposal 3 is also subject to the fulfillment of the Special Majority (see above “Vote Required for Approval of the Proposals”). Each shareholder voting on Proposal 3 is required to indicate on the proxy card or, if voting in person at the Meeting, inform us prior to voting on the matter at the Meeting, whether or not the shareholder has a personal interest in Proposal 3. Otherwise, the shareholder’s vote will not be counted for the purposes of the proposal.

Proposal 5 - the Director Election Proposal: Each Director Nominee shall be voted on separately. Five out of the ten Director Nominees shall be elected by the affirmative vote of the holders of the majority of the ordinary shares represented at the Meeting, in person or by proxy, entitled to vote and voting on the matter, by way of a plurality of votes cast (i.e., the five Director Nominees who receive an affirmative majority vote and who also receive the largest number of ”FOR” votes will be elected). If you mark a vote with respect to less than five Director Nominees in Proposal 5, your shares will only be voted FOR those Director Nominees you have so marked. If you vote for more than five Director Nominees, all of your votes on Proposal 5 will be invalid and will not be counted.

Q: Is consummation of the Business Combination contingent upon any future approval by the holders of New Parent Common Stock?

A: Following the execution of the Business Combination Agreement, Keystone obtained all approvals and consents of the holders of its capital stock necessary to effect the U.S. Merger, the Business Combination and the other transactions contemplated by the Business Combination Agreement. No further approvals by the holders of Keystone capital stock are required to consummate the Business Combination or the other transactions contemplated by the Business Combination Agreement other than those already obtained.

Q: Has the board of directors of each of Keystone and Check-Cap approved the Business Combination?

A: Yes. The board of directors of each Keystone and Check-Cap have approved the Business Combination and recommended that the stockholders of Keystone and the shareholders of Check-Cap, respectively, vote in favor of the Business Combination, vote to adopt the Business Combination Agreement and approve the Business Combination and related transactions. As noted above, Keystone has already obtained all approvals and consents of the holders of its capital stock necessary to effect the Business Combination and the other transactions contemplated by the Business Combination Agreement.

Q: Did the Check-Cap Board obtain a third-party valuation or fairness opinion in determining whether or not to proceed with the Business Combination?

A: Yes. In considering the Business Combination, the Check-Cap Board engaged Ladenburg Thalmann & Co. Inc. (which we refer to as Ladenburg) as its financial advisor. Ladenburg evaluated the fairness of the Business Combination, from a financial point of view, to the holders of Check-Cap ordinary shares, and provided a written opinion to the Check-Cap Board. The full text of the written opinion of Ladenburg is attached as Annex B to the New Parent Prospectus, and a summary of the opinion is set forth in “The Business Combination–Opinion of Check-Cap’s Financial Advisors—Fairness Opinion of Ladenburg” below.

In addition, the Check-Cap Board engaged Variance Economic Consulting Ltd. (which we refer to as Variance) as an additional financial advisor. Variance evaluated the fairness of the Exchange Ratio (as defined below), from a financial point of view, to the holders of Check-Cap ordinary shares, and provided a written opinion to the Check-Cap Board. The full text of the written opinion of Variance is attached as Annex C to the New Parent Prospectus, and a summary of the opinion is set forth in “The Business Combination—Opinion of Check-Cap’s Financial Advisors—Fairness Opinion of Variance” below.

Q: What are the conditions to the consummation of the Business Combination?

A: In addition to approval of the Business Combination by Check-Cap shareholders as described above, completion of the Business Combination is subject to the satisfaction of a number of other conditions, including (among others): authorization for listing of New Parent Common Stock on the Nasdaq Capital Market; the effectiveness of the Registration Statement of which the New Parent Prospectus forms a part; the accuracy of representations and warranties under the Business Combination Agreement (subject to certain materiality exceptions); the absence of a material adverse effect on Keystone or Check-Cap; Keystone’s and Check-Cap’s performance of their respective obligations under the Business Combination Agreement; the receipt of a “no-action” letter from the Israel Securities Authority (which we refer to as the ISA), which was obtained on November 6, 2023; the receipt of certain tax rulings from the Israel Tax Authority (which we refer to as the ITA); the termination of any stockholders agreements, voting agreements, registration rights agreements, co-sale agreements and any other similar contracts between Keystone and any holders of Keystone capital stock; the Registration Rights Agreement pursuant to which New Parent will provide certain Keystone stockholders certain registration rights with respect to the shares of New Parent Common Stock shall have been executed by the parties; New Parent shall have delivered an undertaking of New Parent, and Check-Cap shall have delivered a notice, in each case to be submitted to the Israel Innovation Authority; Check-Cap taken all actions necessary to terminate the employment of substantially all of the Check-Cap employees and terminate the consulting relationship with substantially all of the independent contractors of Check-Cap; and the Israeli District Court shall have approved a distribution by Check-Cap in the amount of $21.3 million (including an amount for the redemption of all of the redeemable Check-Cap warrants), subject to and following the Closing. In addition, under the Companies Law, a minimum of 50 days must elapse from the date of the filing of the merger proposal by both merging companies with the Israeli Companies Registrar before the Israeli Merger can become effective, and the Israeli Merger may not be effective until the expiration of 30 days from the date of the approval of the Israeli Merger by Check-Cap’s shareholders. The Business Combination Agreement provides that the consummation of the Israeli Merger and the consummation of the U.S. Merger will occur on the closing date; as such, the two mergers are conditioned upon each other. For more information, see “The Business Combination Agreement– Conditions to Closing” in the accompanying New Parent Prospectus.

Q: When is the Business Combination expected to be consummated?

A: Subject to the satisfaction or waiver of the closing conditions described under the section entitled “The Business Combination Agreement—Conditions to Closing” in the accompanying New Parent Prospectus, including the approval of the Business Combination by Check-Cap shareholders at the Meeting, Keystone and Check-Cap expect that the Business Combination will be consummated in January 2024. However, it is possible that factors outside the control of both companies could result in the Business Combination being consummated at a different time or not at all. In addition, under the Companies Law, a minimum of 50 days must elapse from the date of the filing of the merger proposal by both merging companies with the Israeli Companies Registrar before the Israeli Merger can become effective, and the Israeli Merger may not be effective until the expiration of 30 days from the date of the approval of the Israeli Merger by Check-Cap’s shareholders.

Q: What happens if the Business Combination is not consummated?

A: If the Business Combination is not approved by Check-Cap shareholders, or if the Business Combination is not consummated for any other reason, neither the Keystone equityholders nor the Check-Cap equityholders will receive shares of New Parent Common Stock in exchange for their Keystone or Check-Cap equity, as applicable. In addition, in certain instances of termination by Keystone or Check-Cap of the Business Combination Agreement such terminating party will be required to pay the other party a termination fee, in such amount and in accordance with the Business Combination Agreement. In addition, if the Business Combination is not approved by Check-Cap shareholders, or if the Business Combination is not consummated, Check-Cap will remain a public reporting company and Check-Cap shareholders will continue to hold equity in Check-Cap. For more information, see “The Business Combination Agreement—Termination” in the accompanying New Parent Prospectus.

Q: What will Check-Cap shareholders, optionholders, holders of RSUs and warrantholders receive in the Business Combination?

A: Upon consummation of the Israeli Merger, each holder of Check-Cap ordinary shares will receive one share of New Parent Common Stock in exchange for each Check-Cap ordinary share that is issued and outstanding immediately prior to the effective time of the Israeli Merger (as may be adjusted if Proposal 4 is approved at the Meeting and a reverse share split of the Company’s ordinary shares is implemented). Each option to purchase Check-Cap ordinary shares (whether vested or unvested) that is outstanding and unexercised immediately prior to the effective time of the Israeli Merger will automatically expire and cease to exist as of immediately prior to the effective time of the Israeli Merger without any assumption or conversion, and no consideration will be delivered in respect thereof. Each restricted stock unit award representing the right to receive a Check-Cap ordinary share under the Check-Cap stock plans (a “Check-Cap RSU”) that is outstanding and fully vested immediately prior to the effective time of the Israeli Merger but has not been settled in Check-Cap ordinary shares (“Check-Cap Vested RSU”) will be canceled and will automatically convert into and represent the right to receive from New Parent one share of New Parent Common Stock in exchange for each Check-Cap ordinary share underlying such Check-Cap Vested RSU.

Each Check-Cap RSU that is outstanding and unvested immediately prior to the effective time of the Israeli Merger will automatically expire and cease to exist as of immediately prior to the effective time of the Israeli Merger without any assumption or conversion, and no consideration will be delivered in respect thereof. Each of the certain warrants issued pursuant to the certain Check-Cap Credit Line Agreement dated as of August 20, 2014 (“Check-Cap CLA Warrant”) that is outstanding and unexercised immediately prior to the effective time of the Israeli Merger will automatically expire with no consideration delivered in respect thereof. Finally, certain warrants to purchase Check-Cap ordinary shares may be exercised by the holders thereof following the effective time of the Israeli Merger or, for a period of thirty days following the effective time of the Israeli Merger, redeemed at the election of the holders thereof for cash in an amount determined based on the Black-Scholes valuation model pursuant to the terms of such warrants (the warrants containing such redemption feature, the “Check-Cap Registered Direct Warrants and Check-Cap Placement Agent Warrants”). As the Check-Cap Registered Direct Warrants and Check-Cap Placement Agent Warrants are “out of the money” relative to the current per share valuation of Check-Cap, it is expected that they will be redeemed in full and the calculation of net cash (as determined in accordance with the Business Combination Agreement) includes a reduction for the aggregate cost of the expected redemptions of such Check-Cap Registered Direct Warrants and Check-Cap Placement Agent Warrants. If any Check-Cap Registered Direct Warrant or Check-Cap Placement Agent Warrant is not redeemed by the end of such thirty-day period, the warrantholder will have the right to receive, upon exercise of such warrant, that number of shares of New Parent Common Stock that could have been acquired if such warrant had been exercised for ordinary shares of Check-Cap prior to the effective time of the Israeli Merger (as may be adjusted if Proposal 4 is approved at the Meeting and a reverse share split of the Company’s ordinary shares is implemented), and an allocable portion of any distributions with respect to the sale of Check-Cap’s legacy assets, as further described herein. There can be no assurance that any such sale or distributions will occur.

Q: Do any of the directors or executive officers of Keystone or Check-Cap have any interests in the Business Combination that may be different from, or in addition to, those of Keystone’s stockholders of Check-Cap’s shareholders?

A: In considering the Business Combination, you should be aware that the directors and executive officers of Keystone and Check-Cap may have interests in the Business Combination that may be different from, or in addition to, those of Keystone’s stockholders and Check-Cap’s shareholders generally. The board of directors of each of Keystone and Check-Cap were aware of and considered these interests among other matters, in evaluating and approving the Business Combination Agreement and the Business Combination, and in recommending that the Keystone stockholders or Check-Cap shareholders (as applicable) vote to adopt the Business Combination Agreement and approve the Business Combination. These interests include post-Business Combination roles at New Parent, as following the closing of the Business Combination it is expected that Melker Nilsson will serve as Chief Executive Officer of New Parent and Amnon Tamir will serve as Chief Financial Officer of New Parent. It is also expected that Uri Geiger will serve as chairman of the board of directors of New Parent, each of Melker Nilsson, Erin Enright, Howard Zauberman, Shmuel Rubinstein, Stanley Stern and Sheryl Conley will serve as a member of, and Michael Tuckman will serve as an observer on, the board of directors of New Parent, and two of the current members of the Check-Cap Board will serve as members of the board of directors of New Parent. Messrs. Nilsson, Tamir and Stern will also each receive a one-time transaction bonus, and Messrs. Nilsson’s and Tamir’s respective annual base salaries and annual bonus targets will be increased. Finally, the Business Combination Agreement requires that the organizational documents of New Parent contain provisions no less favorable with respect to exculpation, indemnification, advancement or expense reimbursement than are set forth in the organizational documents of Keystone and Check-Cap, and the parties will purchase a “tail” directors’ and officers’ liability insurance policy that will provide coverage to Keystone’s and Check-Cap’s executive officers and directors with respect to matters occurring prior to the closing until the seventh anniversary of the closing. For more information, see “The Business Combination – Interests of Check-Cap’s Directors and Executive Officers in the Business Combination”.

Q: What are the material Israeli tax consequences to Keystone and Check-Cap securityholders of the Business Combination?

A: Generally, the exchange of Keystone securities and Check-Cap securities for the Business Combination consideration should be treated as a sale and subject to Israeli tax both for Israeli and non-Israeli resident securityholders. However, certain relief and/or exemptions may be available under Israeli law or under applicable tax treaties. In addition, Keystone and Check-Cap have filed applications for various tax rulings with the Israel Tax Authority relating to the consideration to be received in the Business Combination. Obtaining such tax rulings is a condition to the closing of the Business Combination; however, if one or more tax rulings is not received, the parties may determine to waive the condition and proceed to closing. In such an event, the relief sought under such rulings, which include tax exemptions or deferrals to Keystone and Check-Cap securityholders, will not have been obtained, and the Business Combination could be taxable to certain of such securityholders.

Tax matters are complicated, and the tax consequences of the Business Combination to Check-Cap securityholders and Keystone securityholders will depend on their particular situation. You are encouraged to consult your tax advisors regarding the specific tax consequences of the Business Combination applicable to you.

For more information, see “The Business Combination – Material Israeli Tax Consequences of the Business Combination” in the New Parent Prospectus.

Q: What are the material U.S. federal income tax consequences of the Israeli Merger to U.S. holders of Check-Cap ordinary shares?

A: The Business Combination should constitute an integrated transaction that qualifies as a tax-deferred exchange under Section 351(a) of the Code. Assuming such qualification, and subject to the application of the passive foreign investment company (“PFIC”) rules, U.S. holders (as defined in the New Parent Prospectus under the section entitled “The Business Combination – Material U.S. Federal Income Tax Considerations for Holders of Check-Cap Securities”) of Check-Cap ordinary shares should not recognize any gain or loss on such exchange.

For additional discussion of the U.S. federal income tax consequences of the Israeli Merger, including the PFIC rules, see the section entitled “The Business Combination – Material U.S. Federal Income Tax for Holders of Check-Cap Securities” in the New Parent Prospectus.

Q: Do I have appraisal rights if I object to the Business Combination?

A: Appraisal rights are not available to holders of Check-Cap ordinary shares in connection with the Business Combination and the transactions contemplated thereby. Keystone stockholders are entitled to statutory appraisal rights in connection with the Business Combination under Section 262 of the Delaware General Corporation Law (the “DGCL”). For more information about such rights, please see the provisions of Section 262 of the DGCL and the section entitled “Appraisal Rights” in the New Parent Prospectus.

Q: What will happen to Check-Cap’s ordinary shares following the Business Combination?

A: As a result of the Business Combination, Check-Cap will no longer be a publicly held company, and all shares of Check-Cap will be owned by New Parent. Following the consummation of the Business Combination, Check-Cap ordinary shares will be delisted from Nasdaq and deregistered under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and Check-Cap will no longer be required to file reports with the SEC in respect of Check-Cap ordinary shares.

Q: What equity stake will current Keystone stockholders and Check-Cap shareholders have in New Parent following the Business Combination?

A: Following the Closing, current Keystone equityholders will own approximately 85% of the issued and outstanding shares of Common Stock of New Parent on a fully diluted basis and current Check-Cap equityholders will own approximately 15% of the issued and outstanding shares of Common Stock of New Parent on a fully diluted basis. Entities affiliated with Accelmed Partners, L.P. (“Accelmed”), currently the principal stockholder of Keystone, will own approximately 60% of the issued and outstanding shares of New Parent Common Stock. These percentages are subject to a net cash adjustment, such that if Check-Cap’s net cash (as determined in accordance with the Business Combination Agreement) as of the close of business on the last business day prior to the anticipated closing date is $1.0 million lower or higher than the net cash target of $22.3 million, there will be a linear adjustment to Check-Cap’s equityholders’ ownership in New Parent. Following the Closing it is expected that Accelmed will own approximately 60% of the issued and outstanding shares of New Parent Common Stock. Accordingly, Accelmed will have substantial influence over the outcome of a corporate action requiring stockholder approval, including the election of directors, any approval of a merger, consolidation or sale of all or substantially all of New Parent’s assets or any other significant corporate transaction, even if the outcome sought by such stockholders is not in the interest of New Parent’s other stockholders. In addition, the significant concentration of stock ownership may adversely affect the value of New Parent Common Stock due to a resulting lack of liquidity of New Parent Common Stock or a perception among investors that conflicts of interest may exist or arise. For more information, see “Risk Factors – Risks Related to the Business Combination – Ownership of New Parent’s Common Stock will be highly concentrated after consummation of the Business Combination” in the New Parent Prospectus.

Q: Who will be the officers and directors of New Parent following the Closing?

A: The Business Combination Agreement provides that, immediately following the Closing, Melker Nilsson will serve as Chief Executive Officer of New Parent and Amnon Tamir will serve as Chief Financial Officer of New Parent. The board of directors of New Parent will be comprised of those individuals designated by Keystone, provided, however, that Check-Cap shall have the right to designate (x) one (1) initial director of New Parent if the New Parent board of directors as of immediately following the effective time of the U.S. Merger will have up to seven (7) members, and (y) two (2) initial directors of New Parent if the New Parent board of directors as of immediately following the effective time of the U.S. Merger will have more than seven (7) members. For more information, see “The Business Combination – Governance of New Parent Following the Business Combination” below.

Q: What is the reverse share split and why is it necessary?

A: In connection with merger transactions like the Business Combination, Nasdaq rules requires New Parent to comply with the initial listing standards of the applicable Nasdaq market to continue to be listed on such market following the Business Combination. The Nasdaq Capital Market’s initial listing standards require a company to have, among other things, a $4.00 per share minimum bid price. Because Check-Cap’s current price per share is less than $4.00, a reverse share split may be necessary to meet the minimum bid listing requirement.

Q: Who can help answer any other questions I have?

A: If you have additional questions about the proposals for the Meeting or need additional copies of this Proxy Statement, please contact Alex Ovadia, the Chief Executive Officer of Check-Cap, at alex.ovadia@check-cap.com.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This Proxy Statement, including information set forth or incorporated by reference in this document, contains statements that constitute forward-looking information statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include statements regarding whether shares of New Parent Common Stock will be listed for trading on Nasdaq, whether the agenda item at the Meeting will be approved, and assumptions and results related to financial results, forecasts, clinical trials, and regulatory authorizations. Words such as “will,” “expect,” “anticipate,” “plan,” “believe,” “design,” “may,” “future,” “estimate,” “predict,” “objective,” “goal,” or variations thereof and variations of such words and similar expressions are intended to identify such forward-looking statements. Forward-looking statements are based on Check-Cap’s current knowledge and its present beliefs and expectations regarding possible future events and are subject to risks, uncertainties, and assumptions. Actual results and the timing of events could differ materially from those anticipated in these forward-looking statements as a result of several factors including, but not limited to, the expected timing and likelihood of completion of the proposed Business Combination, the occurrence of any event, change, or other circumstance that could result in the termination of the Business Combination Agreement, receipt and timing of any required governmental or regulatory approvals relating to the registration and listing of New Parent’s Common Stock or otherwise relating to the Business Combination, the anticipated amount needed to finance New Parent’s future operations, unexpected results of clinical trials, delays or denial in regulatory approval process, or additional competition in the market.

In light of the significant uncertainties inherent in the forward-looking statements contained herein, readers should not place undue reliance on forward-looking statements. We cannot guarantee any future results, including with respect to the Business Combination. The statements made in this Proxy Statement represent our views as of the date of this Proxy Statement, and it should not be assumed that the statements made herein remain accurate as of any future date. Moreover, we assume no obligation to update forward-looking statements or update the reasons that actual results could differ materially from those anticipated in forward-looking statements, except as otherwise required by law.

RISK FACTORS

In addition to the other information included in this Proxy Statement, including the matters addressed under the caption titled “Cautionary Statement Regarding Forward-Looking Statements”, you should consider carefully the risk factors set forth in the accompanying New Parent Prospectus in determining how to vote at the Meeting.

THE BUSINESS COMBINATION

(Item 1 on the Proxy Card)

The description in this Proxy Statement of the Business Combination and the other transactions contemplated by the Business Combination Agreement is subject to, and is qualified in its entirety by reference to, the Business Combination Agreement, which is the legal document governing the Business Combination. A copy of the Business Combination Agreement is attached as Annex A to the New Parent Prospectus. We also furnished a copy of the Business Combination Agreement as Exhibit 99.1 to the Report of Foreign Private Issuer on Form 6-K that we furnished to the SEC on August 17, 2023, and we urge that you read it carefully in its entirety.

The Parties

New Parent was formed solely for the purpose of effectuating the Business Combination. Upon the closing of the Business Combination, New Parent will become the parent entity of both Keystone and Check-Cap. New Parent was incorporated as a Delaware corporation on July 31, 2023. New Parent has no material assets and does not operate any business. To date, New Parent has not conducted any activities other than those incidental to its formation, the execution of the Business Combination Agreement and the preparation of applicable filings under U.S. securities laws and regulatory filings made in connection with the Business Combination.

The principal executive offices of New Parent are located at 154 Middlesex Turnpike, Burlington, Massachusetts 01803.

Keystone was incorporated in the State of Delaware in 2008. Keystone is a global commercial stage medical technology company focused on providing end-to-end solutions for dental practitioners and tooth replacement procedures. Its comprehensive portfolio of tooth replacement solutions is comprised of implants, prosthetic solutions, biomaterial solutions and digital dentistry capabilities. Keystone develops and offers advanced technologies for dental practitioners, dental laboratories and patients at an attractive price, driving significant value to both practitioners and patients. Keystone believes its products offer strong value proposition for dental practitioners through its innovative products with high quality manufacturing and design at various pricing options. Keystone has premium and high touch customer service with an experienced direct sales force and third-party distributors, simplifying a complex procedure through the digitalization of workflow for multiple clinical indications. Based on Keystone’s estimates, it believes its digital capabilities for dental practices have the potential to reduce the number of office visits and decrease patient chair time per procedure. Keystone’s various brands, including Genesis, Prima, Paltop, Molaris, Dyna, and Nexus iOS, are widely known amongst dental practitioners.

The principal executive offices of Keystone are located at 154 Middlesex Turnpike, Burlington, Massachusetts 01803.

Check-Cap was formed under the laws of the State of Israel in 2009. Check-Cap is a clinical stage medical diagnostics company aiming to redefine colorectal cancer (CRC) screening through the introduction of C-Scan®, a screening test designed to detect polyps before they may transform into cancer to enable early intervention and cancer prevention. Check-Cap has generated significant losses to date, and it expects to continue to generate losses as it continues to explore strategic alternatives focused on maximizing stockholder value.

The principal executive offices of Check-Cap are located at 29 Abba Hushi Avenue, Isfiya, 3009000, Israel.

U.S. Merger Sub is a wholly-owned subsidiary of New Parent formed solely for the purpose of effectuating the Business Combination. U.S. Merger Sub was incorporated as a Delaware corporation on July 31, 2023. U.S. Merger Sub has no material assets and does not operate any business. To date, U.S. Merger Sub has not conducted any activities other than those incidental to its formation and the execution of the Business Combination Agreement. After the consummation of the Business Combination, it will cease to exist.

The principal executive offices of U.S. Merger Sub are located at 154 Middlesex Turnpike, Burlington, Massachusetts 01803.

Israeli Merger Sub is a wholly-owned subsidiary of New Parent formed solely for the purpose of effectuating the Business Combination. Israeli Merger Sub was organized as a company under the laws of the State of Israel on July 30, 2023. Israeli Merger Sub has no material assets and does not operate any business. To date, Israeli Merger Sub has not conducted any activities other than those incidental to its formation and the execution of the Business Combination Agreement. After the consummation of the Business Combination, it will cease to exist.

The mailing address of Israeli Merger Sub’s registered office is 98 Yigal Alon Street, Tel Aviv 67891, Israel.

In accordance with the Business Combination Agreement, U.S. Merger Sub will merge with and into Keystone pursuant to the U.S. Merger, with Keystone surviving as a wholly-owned subsidiary of New Parent, and Israeli Merger Sub will merge with and into Check-Cap pursuant to the Israeli Merger, with Check-Cap surviving as a wholly-owned subsidiary of New Parent. Check-Cap, as a wholly owned subsidiary of New Parent, will maintain a registered office in the State of Israel. The U.S. Merger will become effective upon the filing of a certificate of merger with the Secretary of State of the State of Delaware executed in accordance with, and in such form as is required by, the relevant provisions of the DGCL, and the Israeli Merger will become effective upon the issuance by the Israeli Companies Registrar of the Certificate of Merger for the Israeli Merger in accordance with Section 323(5) of the Companies Law.

Background of the Business Combination

Overview

Check-Cap is a clinical stage medical diagnostics company engaged in the development of C-Scan®, a screening test to detect polyps before they may transform into colorectal cancer (CRC). Check-Cap’s Board and executive management regularly review Check-Cap’s operating and strategic plans, both near-term and long-term, in an effort to enhance shareholder value. This review has included consideration of equity financings and strategic transactions, and engaging in discussions with potential strategic partners and investors.

In March 2023, Check-Cap announced that its most recent efficacy results from its calibration studies did not meet the goal in order to proceed to the powered portion of the U.S. pivotal study for C-Scan, its main product. In June 2023, after further review of additional data and interaction with the FDA on a revised pivotal study protocol together with consideration of the anticipated time and investment necessary to further develop the technology, Check-Cap’s Board determined to pursue strategic options. At such time, Check-Cap’s Board also approved a reduction in its workforce by approximately 90 percent, to reduce its cash burn. In light of these developments, Check-Cap discontinued the calibration studies and determined not to commence the powered portion of its U.S. pivotal study, and to concentrate its resources on its essential research activities and strategic alternatives.

Following the March 2023 announcement regarding the efficacy results from its calibration studies, Check-Cap’s Board commenced a review of strategic alternatives. As part of that review, Check-Cap’s Board considered and evaluated options for enhancing shareholder value. Recognizing that in light of the C-Scan calibration studies’ internal assessment, enhancing shareholder value as a stand-alone entity would be extremely challenging and uncertain, Check-Cap’s Board determined to explore various suitable alternatives, including but not limited to a business combination transaction.

Accordingly, during the second and third quarters of 2023, Check-Cap’s Board conducted a number of discussions with several potential targets concerning an acquisition of, combination with, or investment in, another company or technology, which, upon consummation, would provide Check-Cap with new, active operations. The Check-Cap Board also established a strategic transaction sub-committee comprised of four board members (Mr. Steven Hanley, the Check-Cap Board Chairman, as well as Ms. Clara Ezed, Dr. Mary Jo Gorman, and Mr. Yuval Yanai), which consulted with Check-Cap’s Chief Executive Officer and Chief Financial Officer when appropriate. As part of this initiative, Check-Cap’s Board also began working with Ladenburg as its primary financial advisor to assist the Check-Cap Board in, among other things, identifying and evaluating potential targets. Over the course of this process, Check-Cap’s Board, together with its financial advisor, contacted a total of 150 potential target companies for a proposed merger or acquisition, which were identified based on certain key characteristics that Check-Cap’s Board sought in a target company: (i) favorable technology in an investment-attractive space; (ii) management with strong records in initial public offerings and merger transactions; (iii) investors and/or strategic partners that have the experience and capability of developing products and bringing them to market; and (iv) the potential for achieving a significant return on investment for Check-Cap’s shareholders over the next two to three years based on multiple inflection points and with little remaining regulatory risk to limit the downside of the investment. In general, the potential target companies were private companies at various stages of development that operate in the medical device, pharma or biotechnology industries, similar to the industry in which Check-Cap had operated, and for which Check-Cap’ Board had the optimal experience for selection and evaluation.

The following chronology sets forth a summary of the material events leading up to the execution of the Business Combination Agreement with Keystone. In addition, throughout the chronology of developments described below, prior to and in between formal Check-Cap Board meetings, the Chairman of the Check-Cap Board, Mr. Hanley and the other members of the strategic transaction sub-committee, updated all of Check-Cap’s Board members on a frequent basis as to the nature and extent of such developments. During this time, Mr. Hanley and Mr. Yanai also continued to engage from time to time in preliminary discussions with third parties concerning potential transactions, although, ultimately, no such discussions advanced beyond preliminary stages. No alternative transaction was identified that was believed by the Check-Cap Board, based on the criteria identified above, to be as attractive to Check-Cap and its shareholders as the proposed transaction with Keystone.

Evaluation of Check-Cap’s Technology and Action Plan

In May 2022, Check-Cap initiated the first part of the U.S. pivotal study of C-Scan, which focused on device calibration and enhancement of C-Scan algorithms among the average risk U.S. population. In parallel, to support the calibration portion of the U.S. pivotal study, Check-Cap continued enrolling average risk patients in its study in Israel. Throughout the study, until March 2023, Check-Cap enrolled more than 300 average risk patients as part of its Israeli study, but only 17 average risk patients in the first part of its U.S. pivotal study. The slower than expected U.S. site recruitment pace was primarily due to state licensing requirements associated with the X-ray technology with a radioactive source within Check-Cap’s C-Scan capsule. While prior C-Scan trial performance was based on an enriched population (i.e., subjects with known polyps), the later calibration studies’ target was intended to optimize the C-Scan device for the average risk population prior to commencing the powered portion of the U.S. pivotal study, which aimed to demonstrate C-Scan performance in a statistically significant manner for average risk subjects. The initiation of the powered portion of the U.S. pivotal study was dependent upon successful completion of the Israeli calibration study, as well as the calibration portion of the U.S. pivotal study.

In March 2023, Check-Cap announced that its most recent efficacy results from its calibration studies did not meet the goal in order to proceed to the powered portion of the U.S. pivotal study. Though additional data was expected for additional subjects for C-Scan as well as the corresponding colonoscopy, the time to obtain this data was determined to be longer than expected in the original plan. Consequently, the Check-Cap Board requested that management prepare and present to the Check-Cap Board a plan of action intended to evaluate technology viability. In addition, the Check-Cap Board and management determined to review the most currently available data from past and committed subjects, and to consult with several medical experts to determine if updating algorithms or making other modifications to the study parameters could make the technology viable.

On March 13, 2023, the Check-Cap Board held a meeting in which the Chief Executive Officer of Check-Cap, Mr. Ovadia, advised the Check-Cap Board that following the Check-Cap Board’s request that management present an action plan, management had conducted internal discussions and assessments and prepared three proposed recommendations: (i) Plan A – C-Scan performance validation, to provide a possible path to quantitative validation of C-Scan performance; (ii) Plan B — pivots derived from C-Scan technology, to provide several options to expand Check-Cap’s product portfolio based on its existing intellectual property; and (iii) combined plan – an intermediate option combining aspects of both plans. Following discussion, the Check-Cap Board determined that the potential C-Scan technology pivots relating to other gastro-intestinal applications did not have sufficient clinical evidence to suggest that they were worthy of the necessary substantial investment. The product differentiation and patient and physician benefit were not sufficiently supported to determine that such option would be viable. Accordingly, both Plan B and the combined plan were determined to be too high a risk with insufficient data for investment. It was further determined that it would be appropriate to conduct additional analysis on the existing data and conduct a limited number of additional studies and to retrieve the additional colonoscopy data on past subjects to make a determination if such data would allow Check-Cap to achieve a new end point which would be acceptable to the FDA and still be commercially viable and cost effective. Plan A also involved the continuation of the C-Scan algorithm development relating to the post processing of the data with the goal of improving the results in a manner that would make the product viable. Based on the foregoing considerations, the Check-Cap Board determined to pursue Plan A.

On the same day, a call was held between several members of the Check-Cap Board and management and Ms. Janice Hogan of Hogan Lovells, Check-Cap’s regulatory advisor, to obtain feedback from Ms. Hogan on possible endpoints for C-Scan that could be acceptable to the FDA and their implications. During this call, Mr. Ovadia informed Ms. Hogan that following internal evaluation of results from calibration clinical studies to date, Check-Cap had concluded that C-Scan would likely not achieve the efficacy performance that was previously agreed with the FDA. Ms. Hogan discussed several possible options for Check-Cap to approach the FDA, but was uncertain if these approaches would be successful.

In addition to several internal discussions led by Dr. Mary Jo Gorman, on March 14, 2023, the Check-Cap Board held a meeting with Dr. Jeff Kreikemeier, a private U.S. gastroenterologist who was recruited as a consultant to Check-Cap, regarding the changes proposed to the U.S. pivotal study endpoints. Dr. Kreikemeier provided advice and feedback on the latest practices and the impact of detection of certain polyps sizes on the future use of C-Scan, as well as his understanding of the upcoming technology, including blood biopsies and new stool tests.

On March 15, 2023, Check-Cap’s Board held a meeting in which Dr. Aasma Shaukat and Dr. Seth Gross of New York University, Coordinating Principal Investigator (CPI) and Principal Investigator (PI) for the U.S. pivotal study, respectively, provided their input regarding Check-Cap’s potential plans, as presented to the Check-Cap Board at the meeting held on March 13, 2023. Dr. Shaukat and Dr. Gross commented primarily on the impact of proposed changes to the endpoints for the U.S. pivotal study that were being considered.