New Hope for Serious Infections Analyst – KOL Day Introduction November 14, 2019 © Cidara Therapeutics 2019

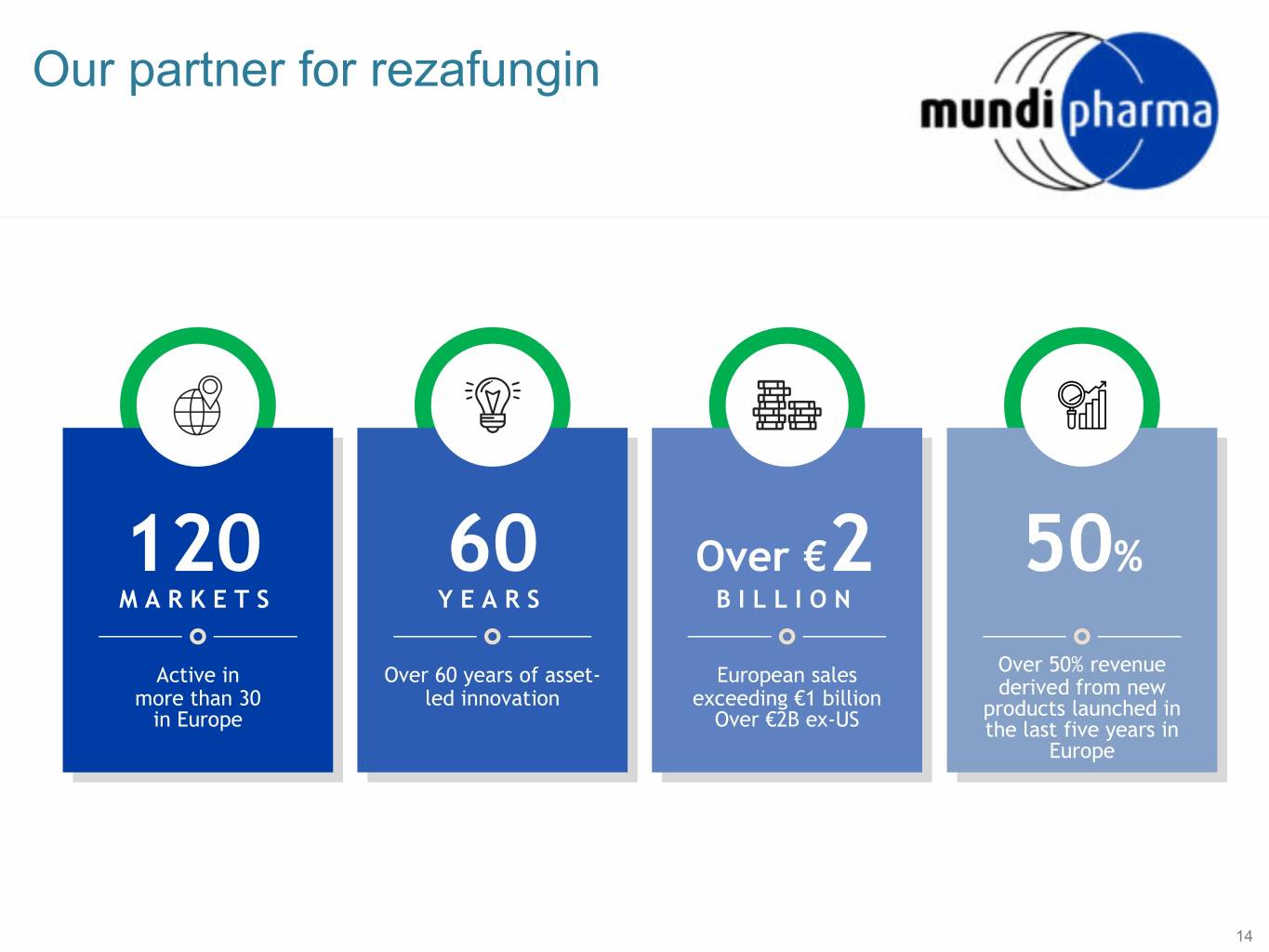

Forward-Looking Statements Because such statements are subject to risks and uncertainties, actual single dose protection, represent an improvement over These slides and the results may differ materially from those expressed or implied by such existing therapies or will also be observed in human use; and forward-looking statements. Such statements include, but are not limited whether our Cloudbreak platform can be expanded to identify accompanying to, statements regarding Cidara’s pipeline and whether any of its product product candidates to treat or prevent other viral diseases, candidates may be developed on time or to address unmet medical such as RSV, HIV, Dengue or Zika; statements about the oral presentation needs; statements regarding the development plan for rezafungin influenza market size; and statements about potential including, the potential for rezafungin to treat and/or prevent infections, revenue from a Cloudbreak AVC for influenza including, contain forward- the ultimate patient sizes for the rezafungin phase 3 clinical trials, and potential market share and product pricing. This presentation whether rezafungin may enable patients to be discharged early, provide also contains estimates and other statistical data made by looking statements a single drug paradigm for BMT patients or transform the standard of independent parties and by Cidara relating to market size care for BMT patients; statements about the superiority of the market and growth and other data about Cidara's industry. These within the meaning potential for antifungals compared to antibacterials, and the market data involve a number of assumptions and limitations, and opportunity for rezafungin in general, whether a non-inferiority approval you are cautioned not to give undue weight to such would enable rezafungin to achieve sales in the outpatient treatment and estimates. Projections, assumptions and estimates of the of the Private prophylaxis markets; statements about potential rezafungin revenue in future performance of the markets in which Cidara operates the US including, potential market share and pricing for rezafungin; are necessarily subject to a high degree of uncertainty and Securities Litigation statements about whether the top line results of the STRIVE Part B risk. Risks that contribute to the uncertain nature of the clinical trial will be supported in the full analysis of the STRIVE Part B forward-looking statements include: Cidara’s ability to obtain Reform Act of 1995. clinical data, and whether the success of the STRIVE Part B clinical trial additional financing; the success and timing of Cidara’s or the post-hoc analysis of the STRIVE Part A and Part B data indicates preclinical studies, clinical trials and other research and a successful outcome in the Phase 3 ReSTORE clinical trial, including development activities; receipt of necessary regulatory whether or not rezafungin will meet the primary endpoints in the approvals for development and commercialization, as well as ReSTORE trial; and statements regarding the ability of Cidara to achieve changes to applicable regulatory laws in the United States all milestones from its collaboration partner for rezafungin, and foreign countries; changes in Cidara’s plans to develop Mundipharama, and receive related payments. Certain statements and commercialize its product candidates; Cidara’s ability to regarding our Cloudbreak platform are also forward-looking including obtain and maintain intellectual property protection for its statements regarding whether our Cloudbreak platform can identify product candidates; and the loss of key scientific or product candidates with intrinsic antimicrobial activity and immune management personnel. These and other risks and engagement that will increase efficacy or represent an improvement over uncertainties are described more fully in Cidara’s Form 10-K existing anti-infective agents; whether Cloudbreak candidates will as most recently filed with the United States Securities and achieve the major attributes believed to be needed in flu such as broad Exchange Commission (SEC), under the heading “Risk spectrum, superior resistance profile, protection for high-risk populations, Factors.” All forward-looking statements contained in this expanded efficacy window, long duration of action and rapid onset of presentation speak only as of the date on which they were activity, or flexible administration; whether results observed with made. Cidara undertakes no obligation to update such Cloudbreak influenza candidates in-vitro or in animal studies, including, statements to reflect events that occur or circumstances that reduced resistance, potential expansion of treatment window, and exist after the date on which they were made. potential for 2

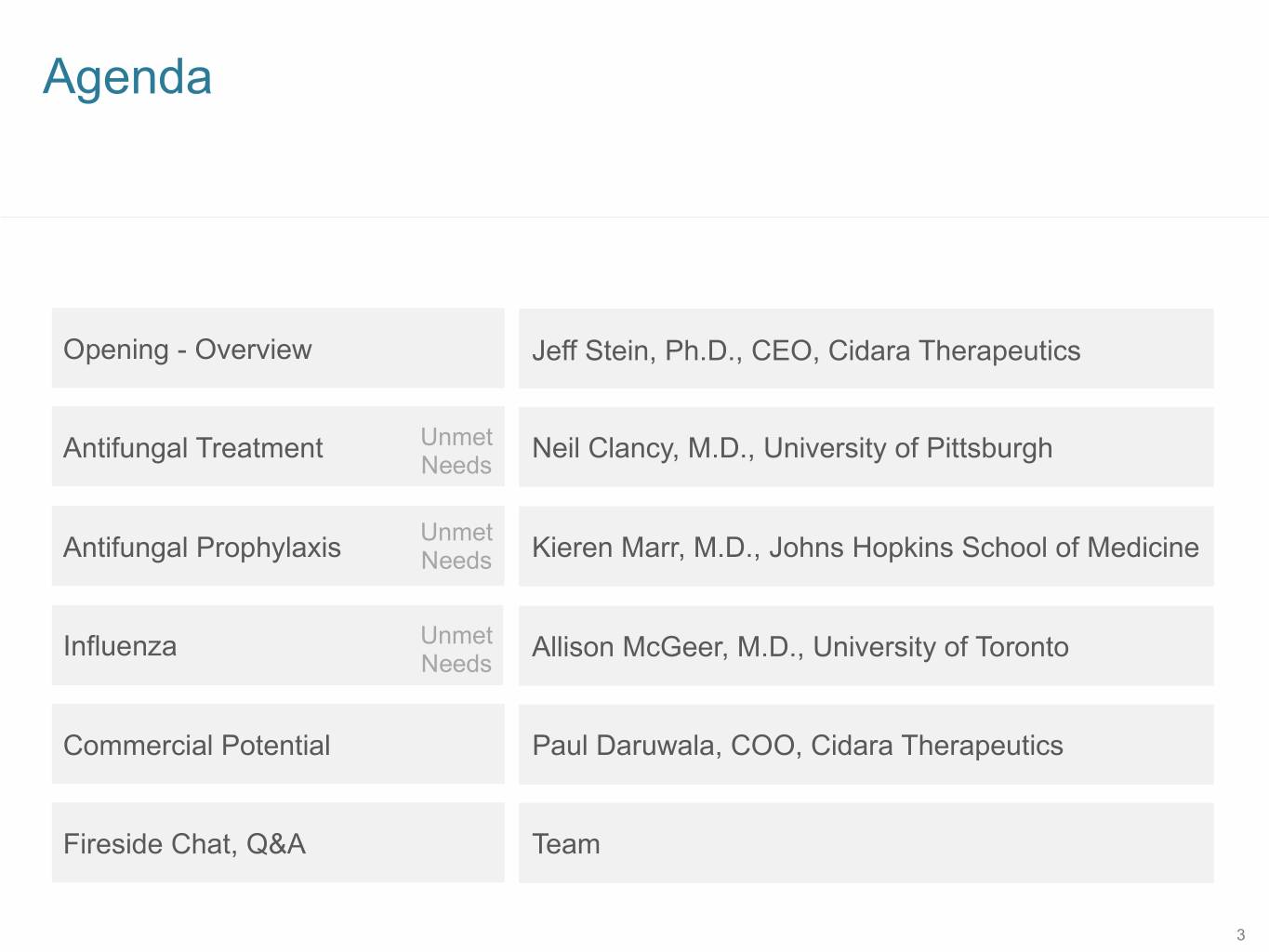

SB 12 Agenda Opening - Overview Jeff Stein, Ph.D., CEO, Cidara Therapeutics Antifungal Treatment Unmet Neil Clancy, M.D., University of Pittsburgh Needs Unmet Antifungal Prophylaxis Needs Kieren Marr, M.D., Johns Hopkins School of Medicine Influenza Unmet Allison McGeer, M.D., University of Toronto Needs Commercial Potential Paul Daruwala, COO, Cidara Therapeutics Fireside Chat, Q&A Team 3

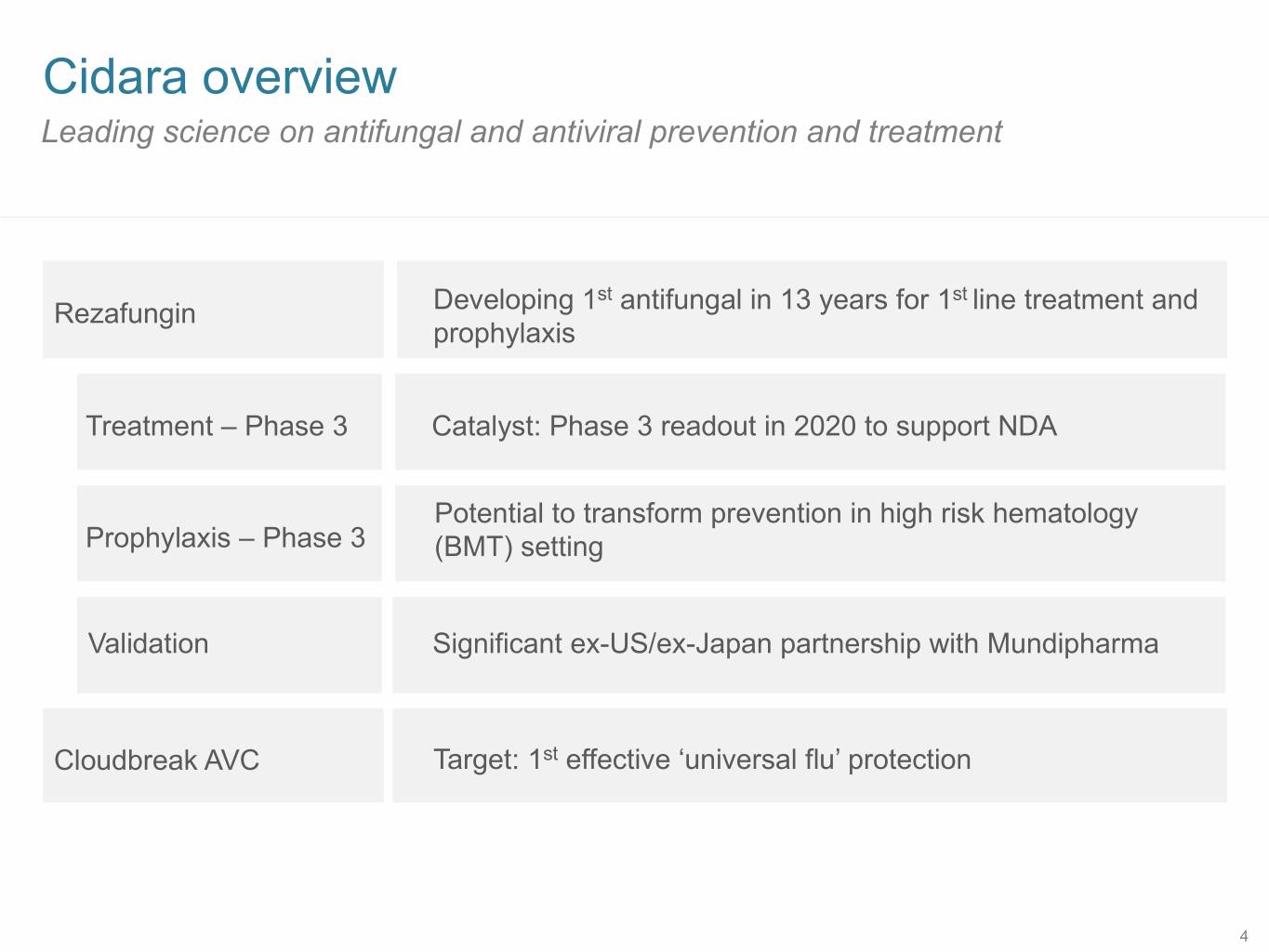

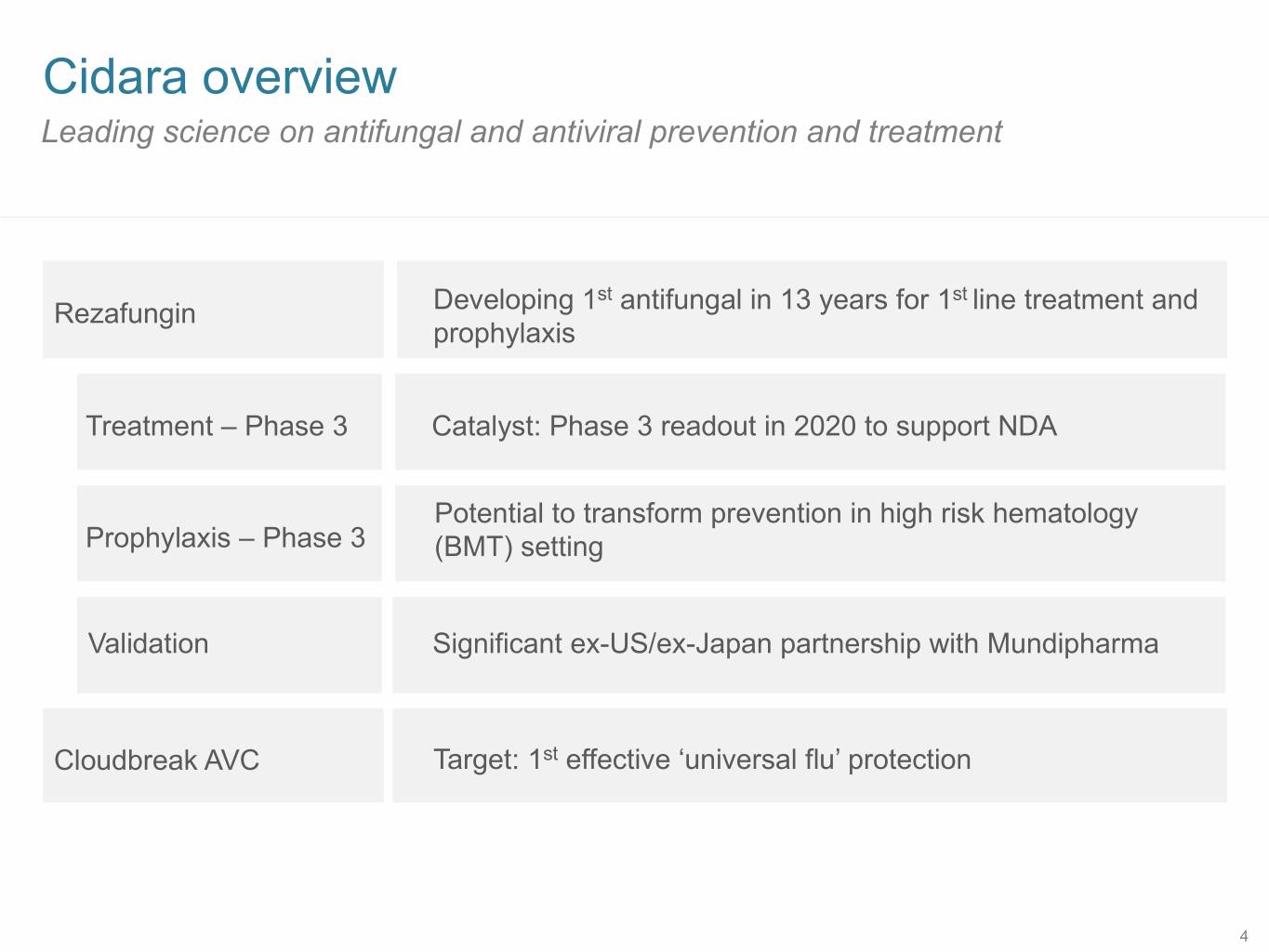

SB 12 Cidara overview Leading science on antifungal and antiviral prevention and treatment st st Rezafungin Developing 1 antifungal in 13 years for 1 line treatment and prophylaxis Treatment – Phase 3 Catalyst: Phase 3 readout in 2020 to support NDA Potential to transform prevention in high risk hematology Prophylaxis – Phase 3 (BMT) setting Validation Significant ex-US/ex-Japan partnership with Mundipharma Cloudbreak AVC Target: 1 st effective ‘universal flu’ protection 4

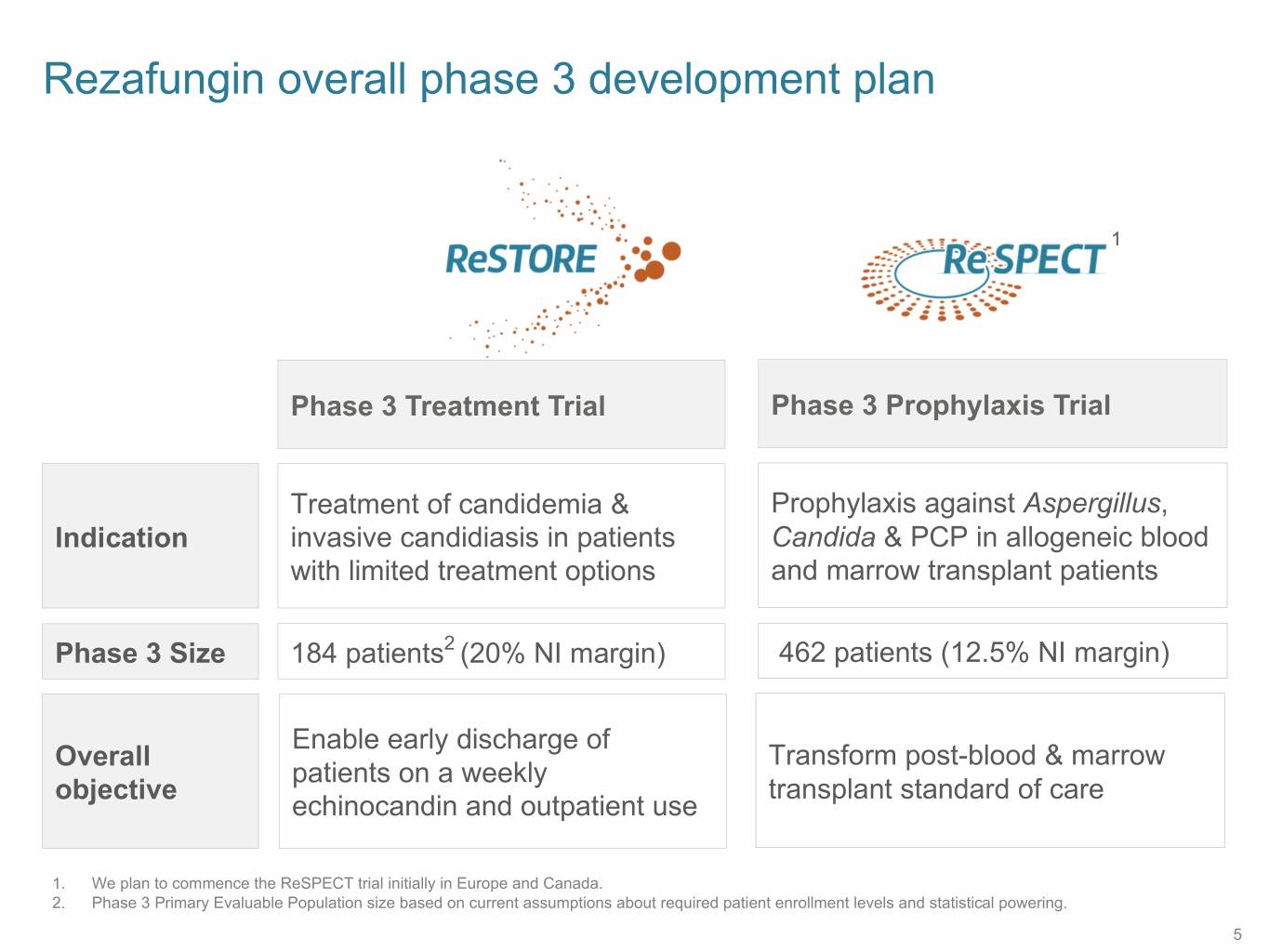

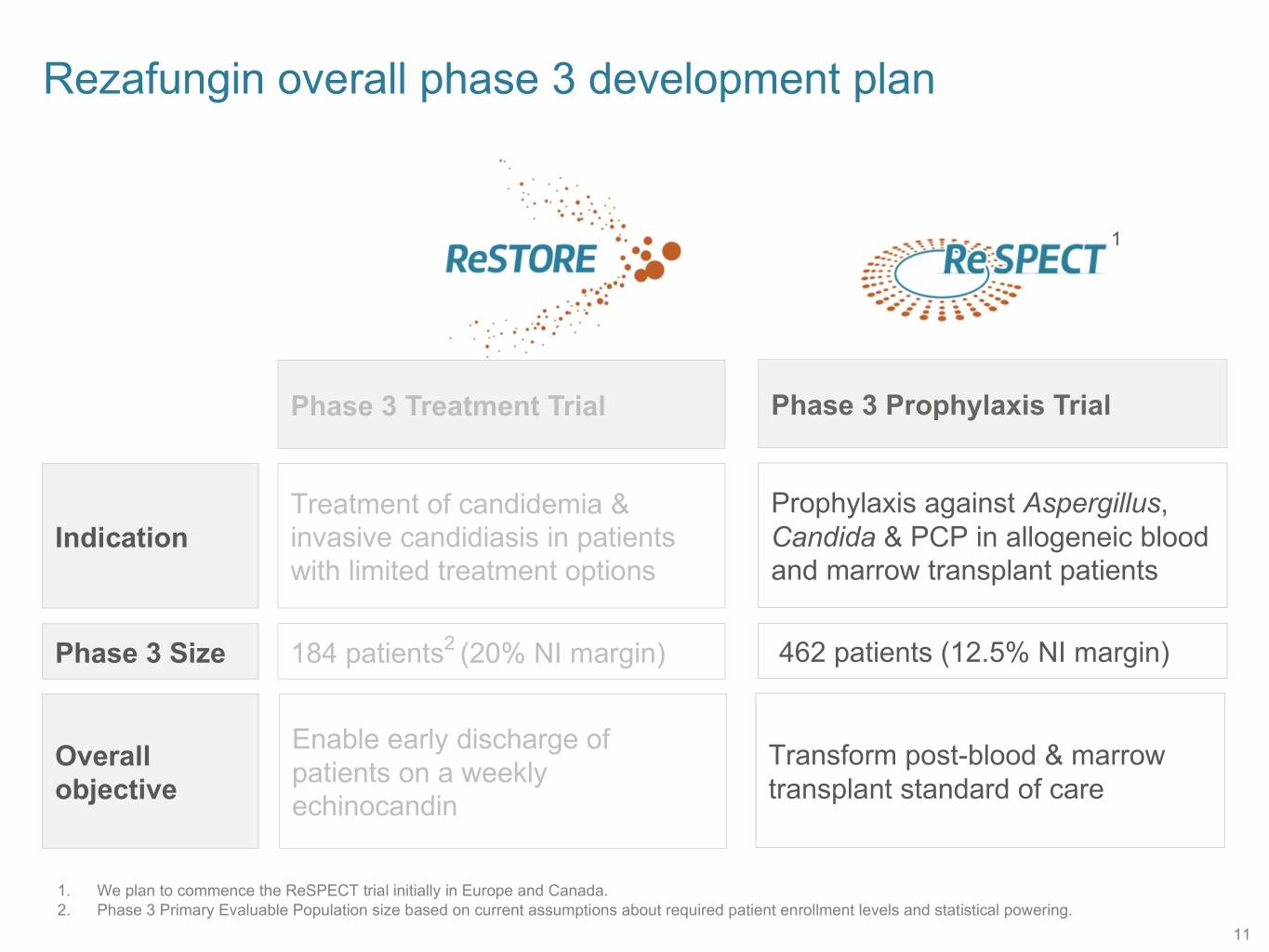

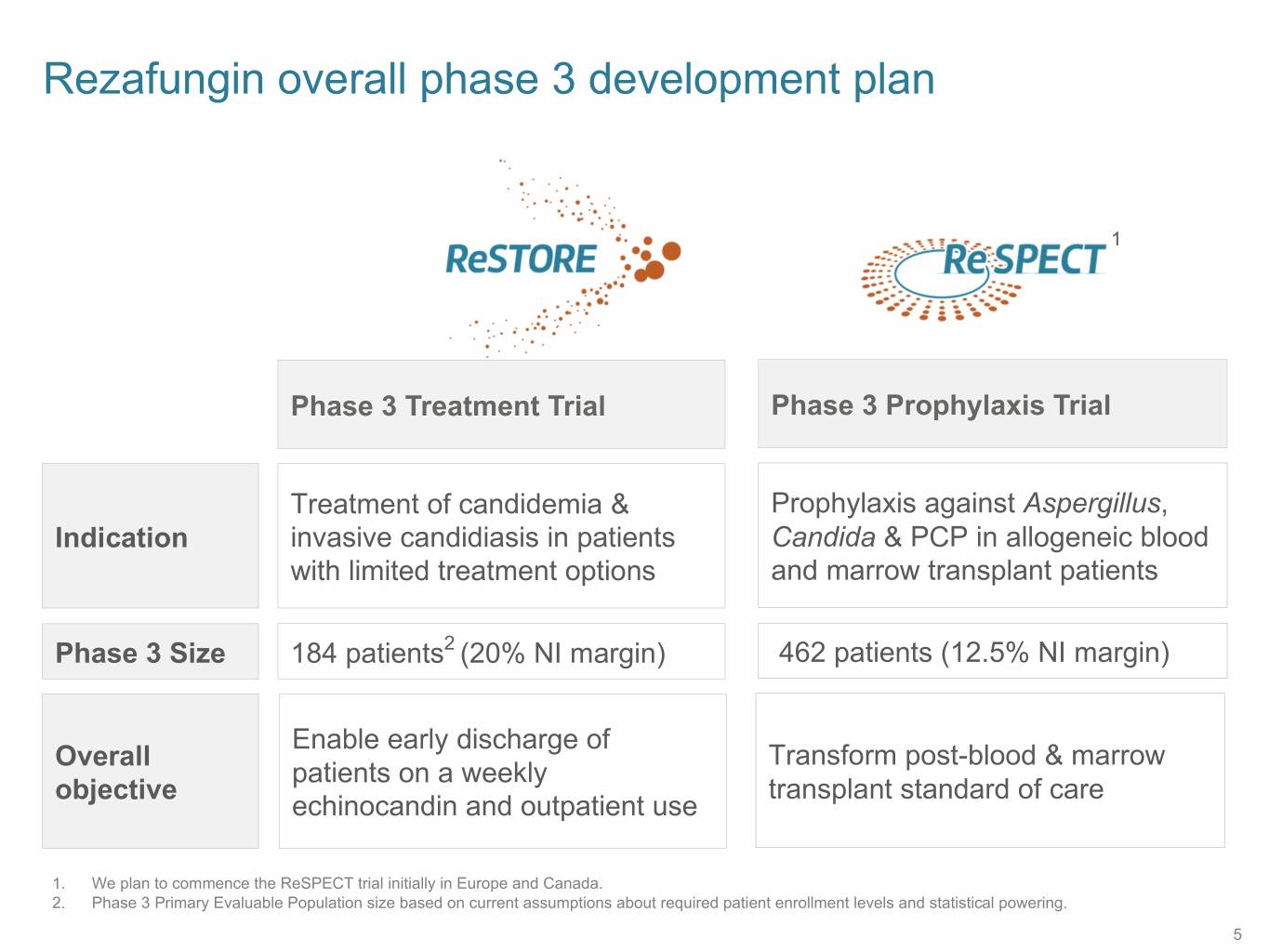

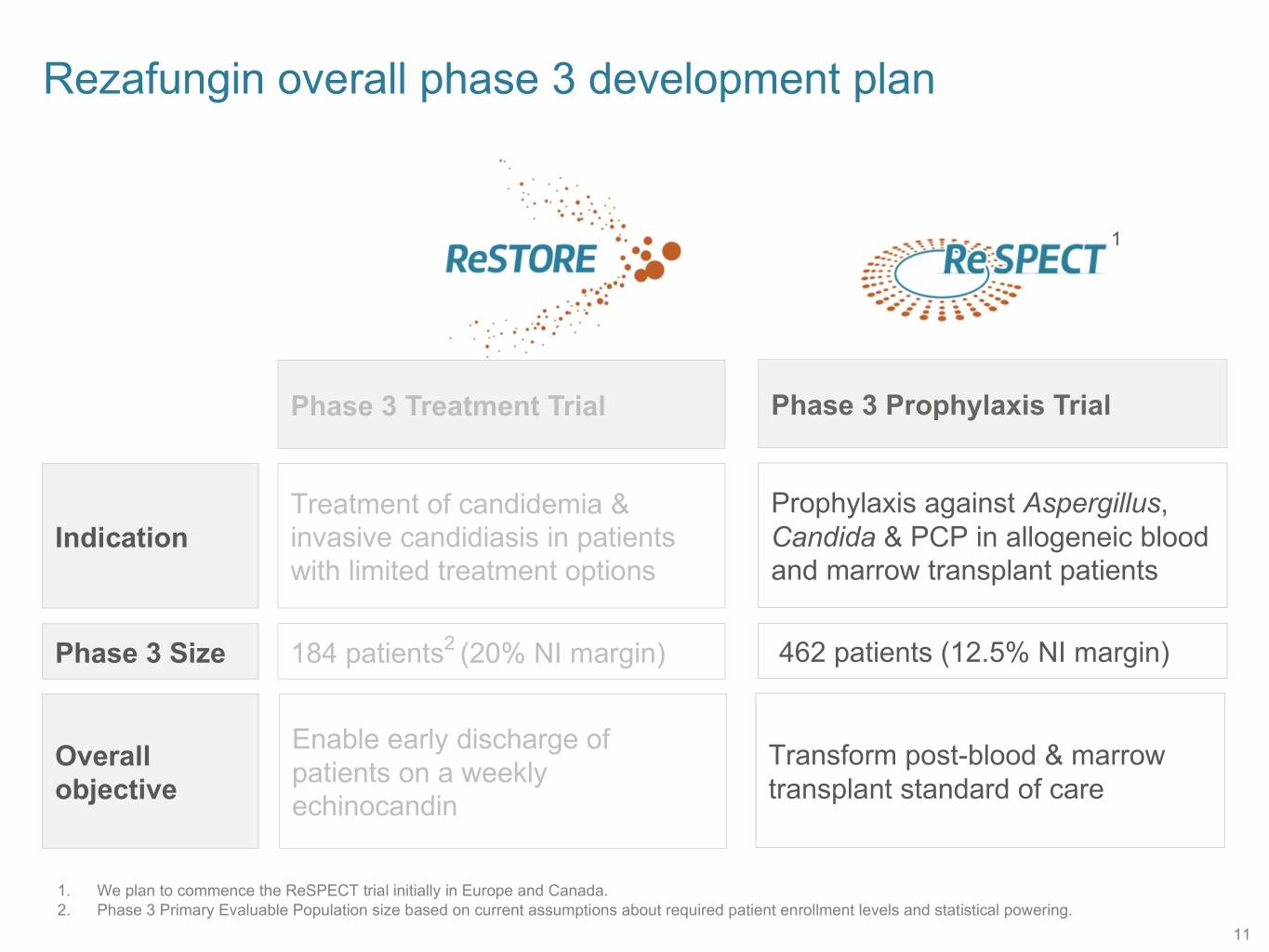

Rezafungin overall phase 3 development plan 1 Phase 3 Treatment Trial Phase 3 Prophylaxis Trial Treatment of candidemia & Prophylaxis against Aspergillus, Indication invasive candidiasis in patients Candida & PCP in allogeneic blood with limited treatment options and marrow transplant patients Phase 3 Size 184 patients2 (20% NI margin) 462 patients (12.5% NI margin) Enable early discharge of Overall Transform post-blood & marrow patients on a weekly objective transplant standard of care echinocandin and outpatient use 1. We plan to commence the ReSPECT trial initially in Europe and Canada. 2. Phase 3 Primary Evaluable Population size based on current assumptions about required patient enrollment levels and statistical powering. 5

STRIVE B Phase 2 data in candidemia & invasive candidiasis Corroborates STRIVE A results and supports ReSTORE Phase 3 6

P2 STRIVE Program: Candidemia & Invasive Candidiasis Not powered for inferential statistical analysis Mycological & EMA: Overall Response Mycological & N= 183 clinical (Mycological & clinical clinical response Mycological & response response) (IC only) clinical response Dose Optional dose FDA: All cause mortality Week 1 2 3 4 5 6 7 8 9 Rezafungin N= 122 1 5 8 15 22 28 35 42 45 49 56 59 Day Dose Optional dose Week 1 2 3 4 5 6 7 8 9 Caspofungin N= 61 1 5 8 15 22 28 35 42 45 49 56 59 Day Analysis Populations: § The Intent-to-treat (ITT) population: all randomized subjects § The Safety population: all subjects who received any amount of study drug § The Microbiological Intent-to-treat population (mITT): all subjects in safety population who had documented Candida infection 7

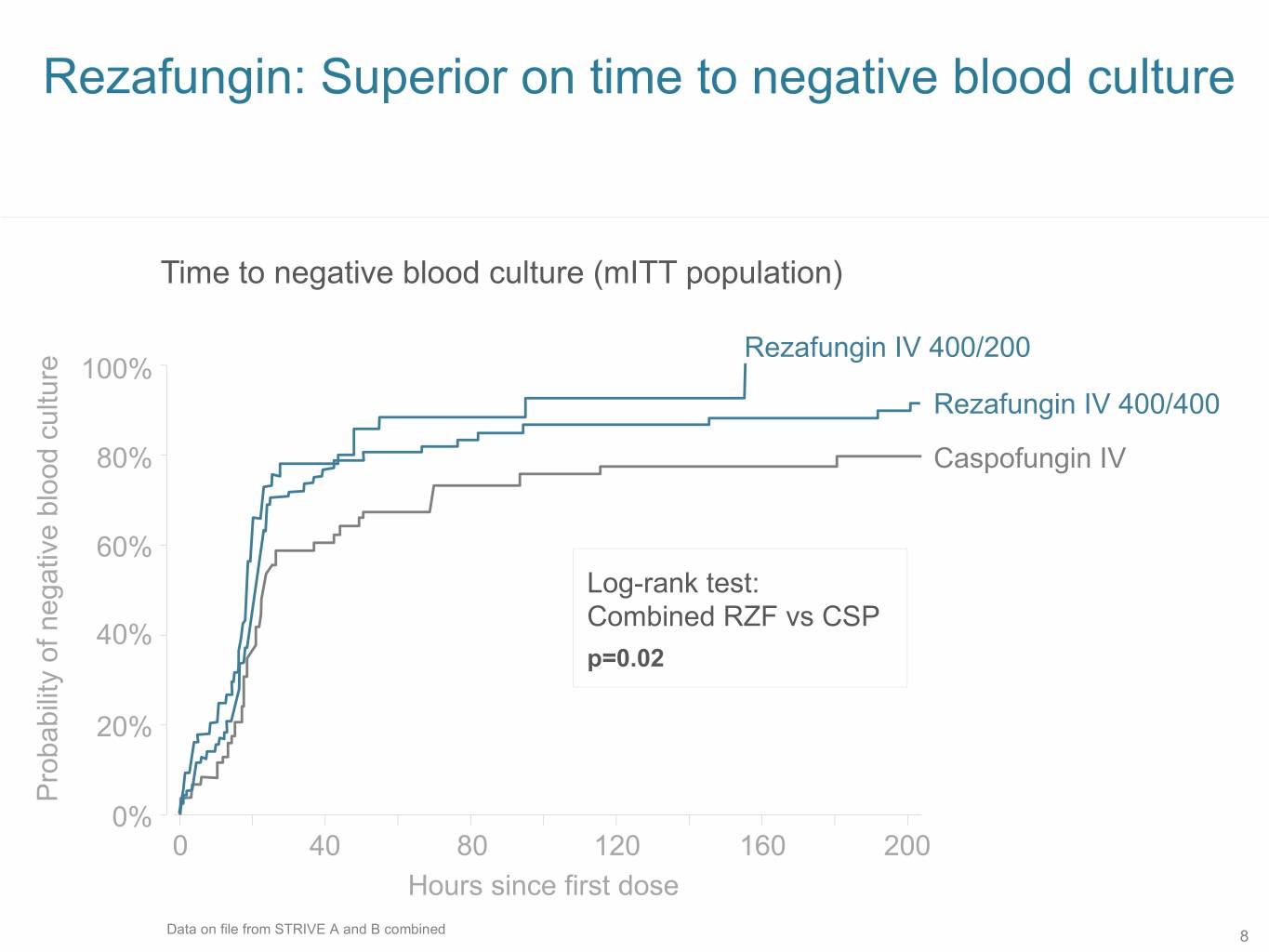

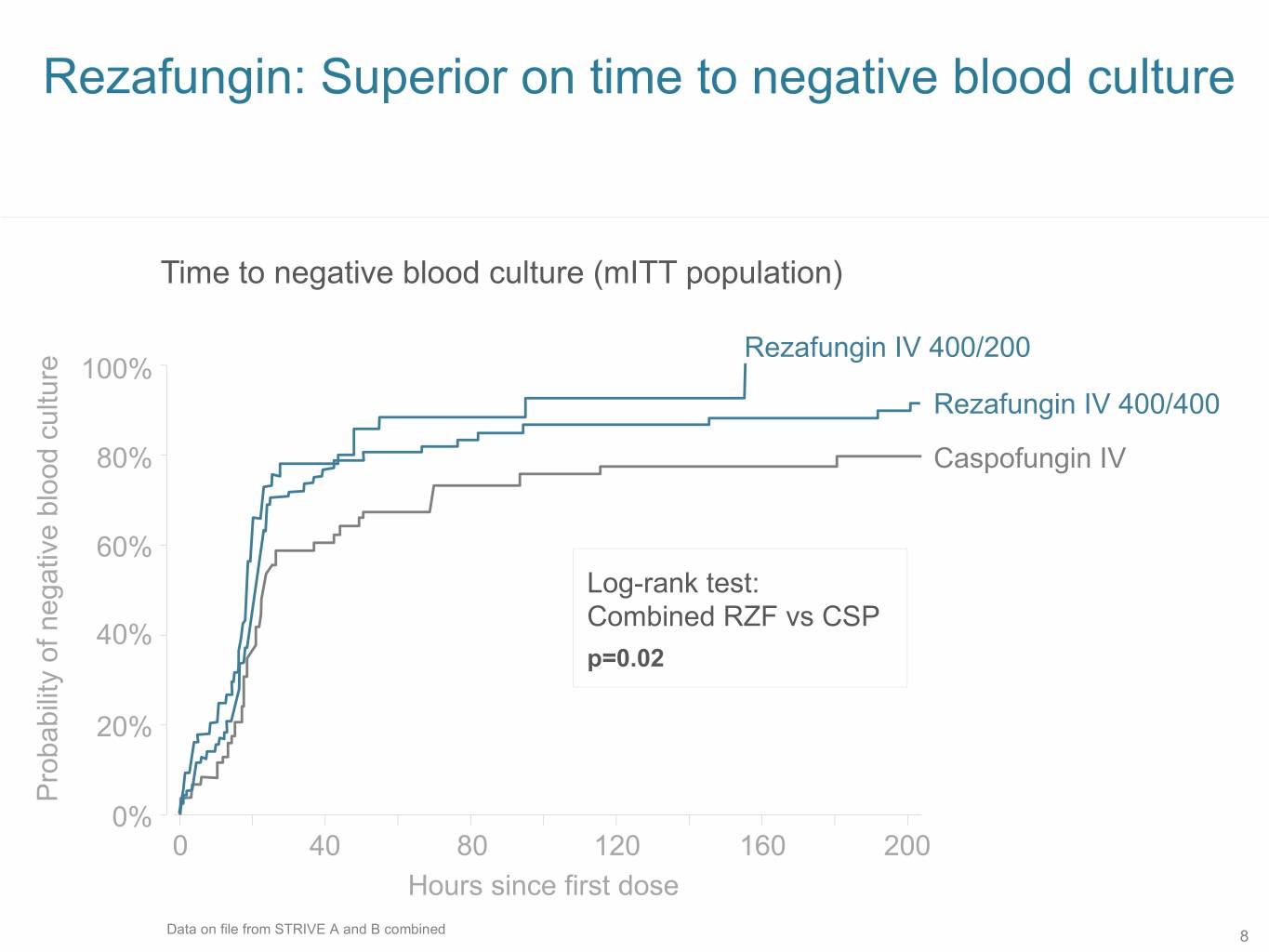

Rezafungin: Superior on time to negative blood culture Time to negative blood culture (mITT population) Rezafungin IV 400/200 100% Rezafungin IV 400/400 80% Caspofungin IV 60% Log-rank test: Combined RZF vs CSP 40% p=0.02 20% Probability of negative blood culture of blood negative Probability 0% 0 40 80 120 160 200 Hours since first dose Data on file from STRIVE A and B combined 8

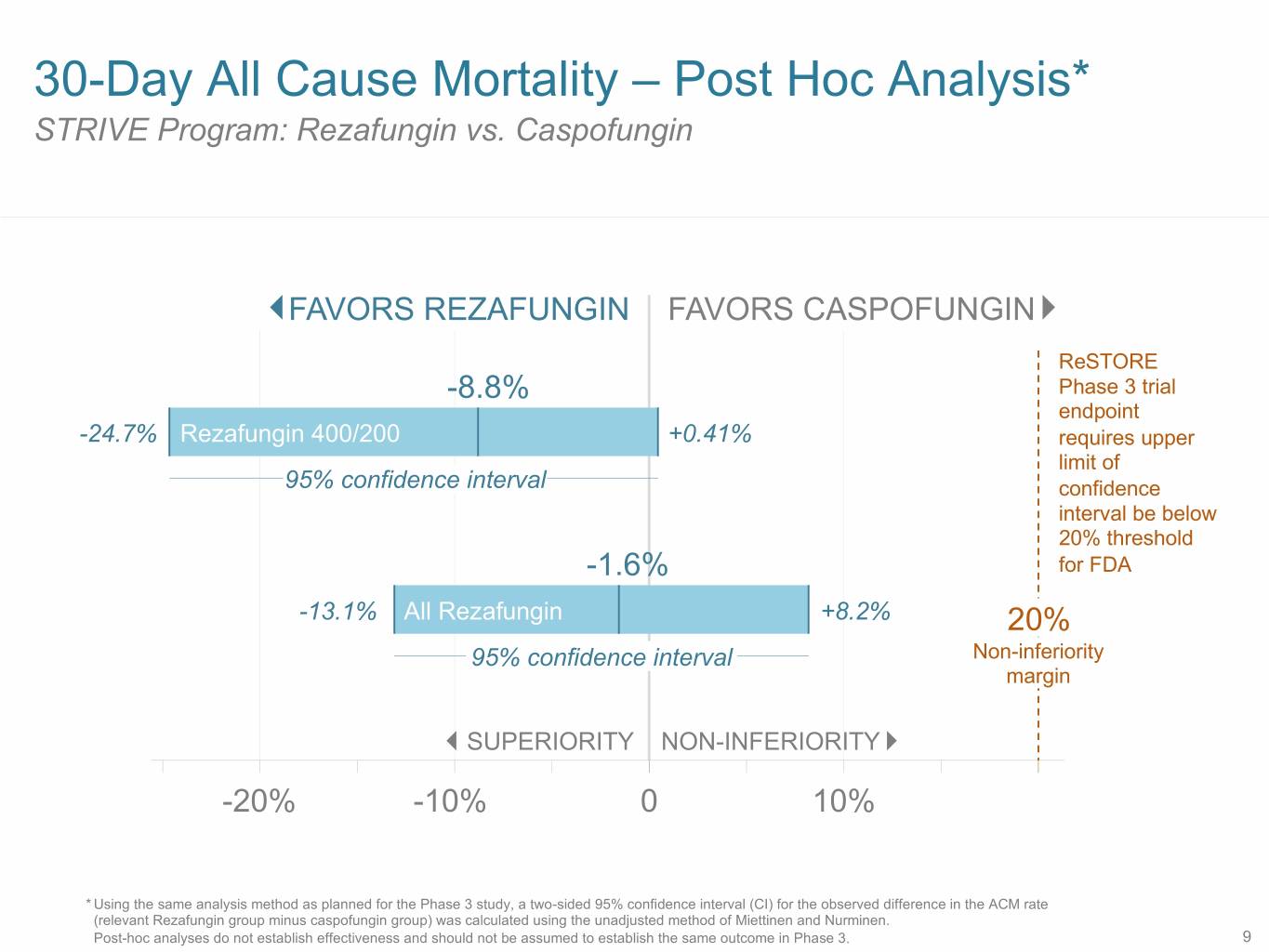

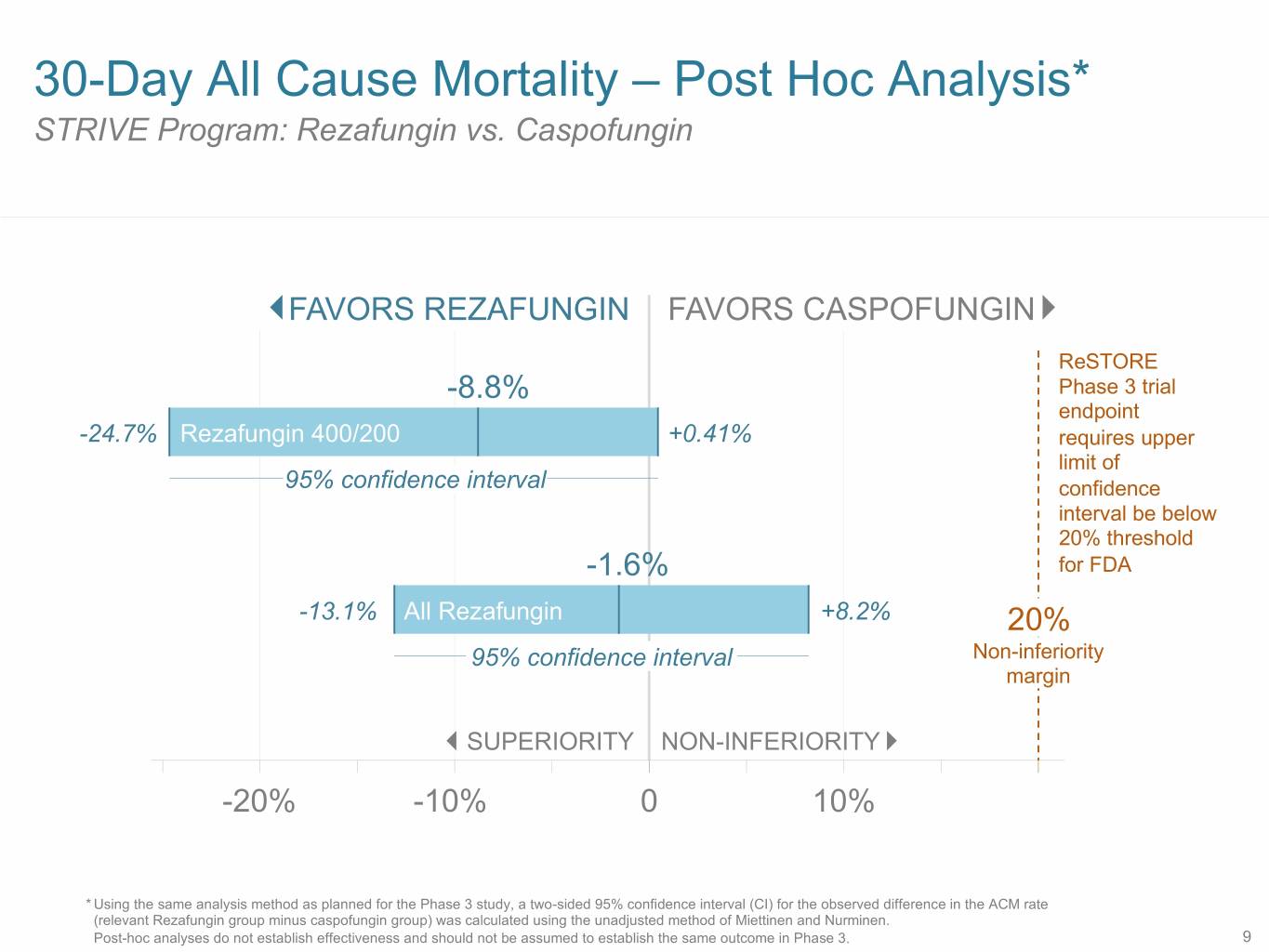

30-Day All Cause Mortality – Post Hoc Analysis* STRIVE Program: Rezafungin vs. Caspofungin FAVORS REZAFUNGIN FAVORS CASPOFUNGIN ReSTORE -8.8% Phase 3 trial endpoint -24.7% Rezafungin 400/200 +0.41% requires upper limit of 95% confidence interval confidence interval be below 20% threshold -1.6% for FDA -13.1% All Rezafungin +8.2% 20% 95% confidence interval Non-inferiority margin SUPERIORITY NON-INFERIORITY -20% -10% 0 10% * Using the same analysis method as planned for the Phase 3 study, a two-sided 95% confidence interval (CI) for the observed difference in the ACM rate (relevant Rezafungin group minus caspofungin group) was calculated using the unadjusted method of Miettinen and Nurminen. Post-hoc analyses do not establish effectiveness and should not be assumed to establish the same outcome in Phase 3. 9

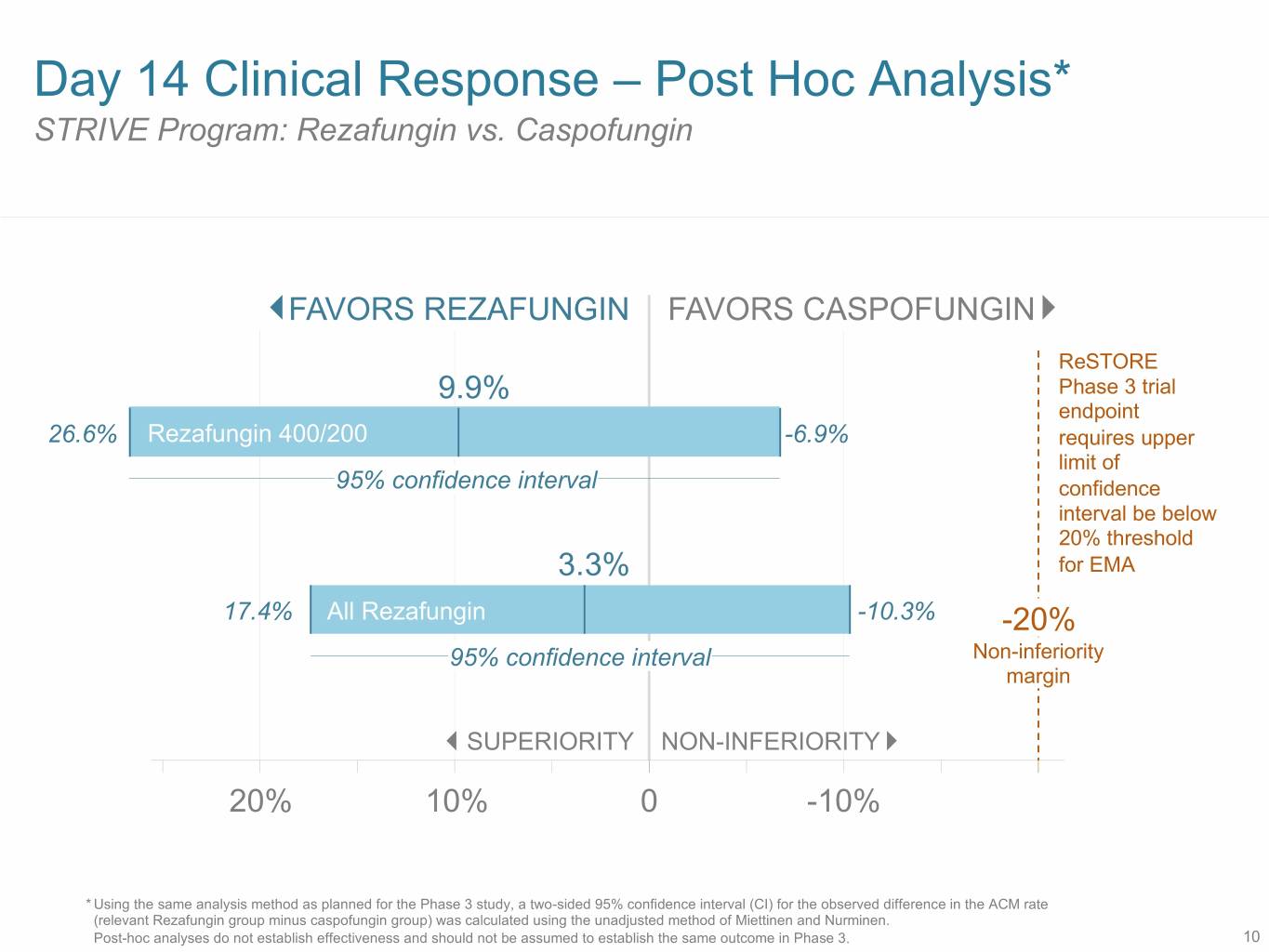

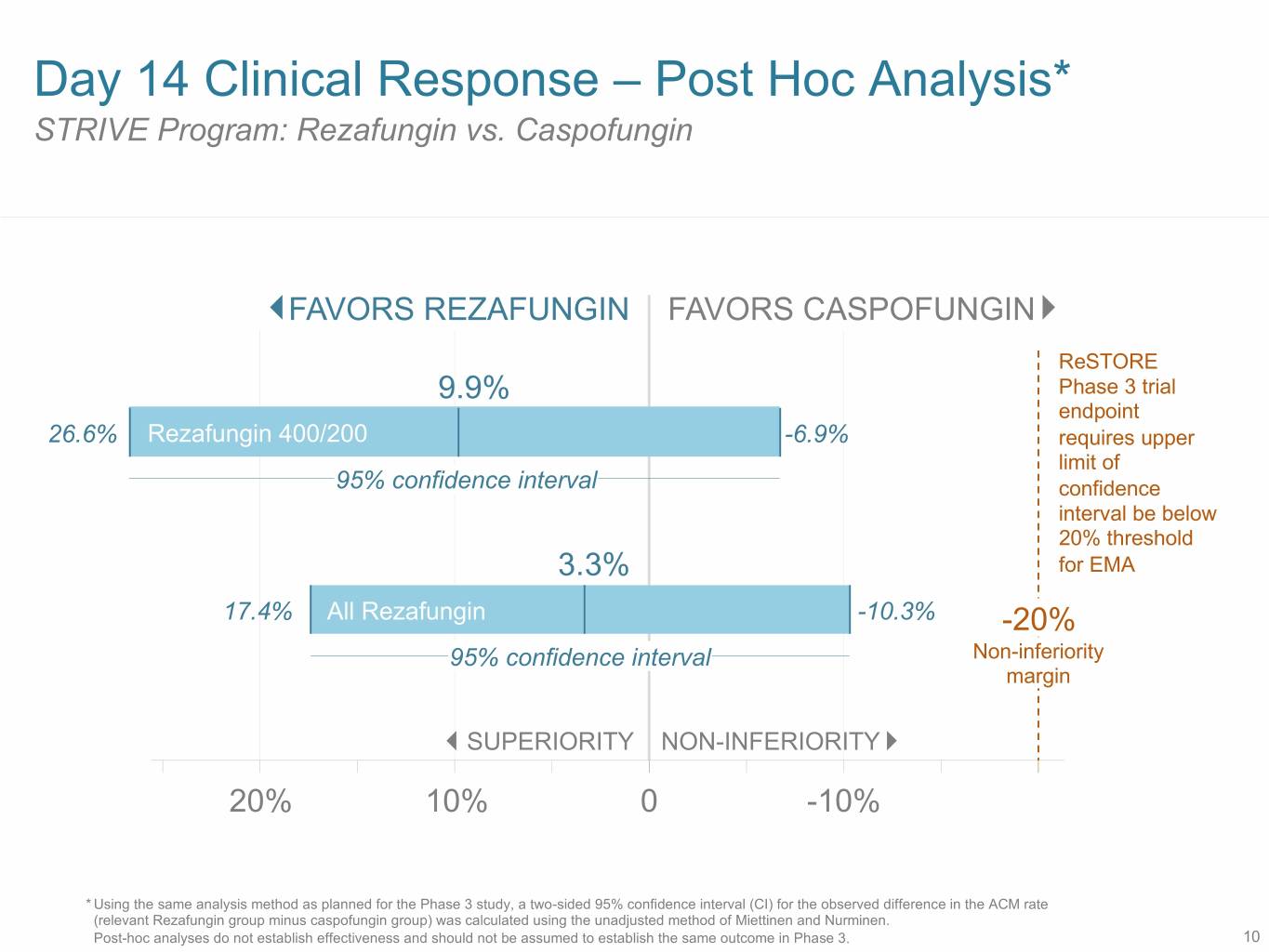

Day 14 Clinical Response – Post Hoc Analysis* STRIVE Program: Rezafungin vs. Caspofungin FAVORS REZAFUNGIN FAVORS CASPOFUNGIN ReSTORE 9.9% Phase 3 trial endpoint 26.6% Rezafungin 400/200 -6.9% requires upper limit of 95% confidence interval confidence interval be below 20% threshold 3.3% for EMA 17.4% All Rezafungin -10.3% -20% 95% confidence interval Non-inferiority margin SUPERIORITY NON-INFERIORITY 20% 10% 0 -10% * Using the same analysis method as planned for the Phase 3 study, a two-sided 95% confidence interval (CI) for the observed difference in the ACM rate (relevant Rezafungin group minus caspofungin group) was calculated using the unadjusted method of Miettinen and Nurminen. Post-hoc analyses do not establish effectiveness and should not be assumed to establish the same outcome in Phase 3. 10

Rezafungin overall phase 3 development plan 1 Phase 3 Treatment Trial Phase 3 Prophylaxis Trial Treatment of candidemia & Prophylaxis against Aspergillus, Indication invasive candidiasis in patients Candida & PCP in allogeneic blood with limited treatment options and marrow transplant patients Phase 3 Size 184 patients2 (20% NI margin) 462 patients (12.5% NI margin) Enable early discharge of Overall Transform post-blood & marrow patients on a weekly objective transplant standard of care echinocandin 1. We plan to commence the ReSPECT trial initially in Europe and Canada. 2. Phase 3 Primary Evaluable Population size based on current assumptions about required patient enrollment levels and statistical powering. 11

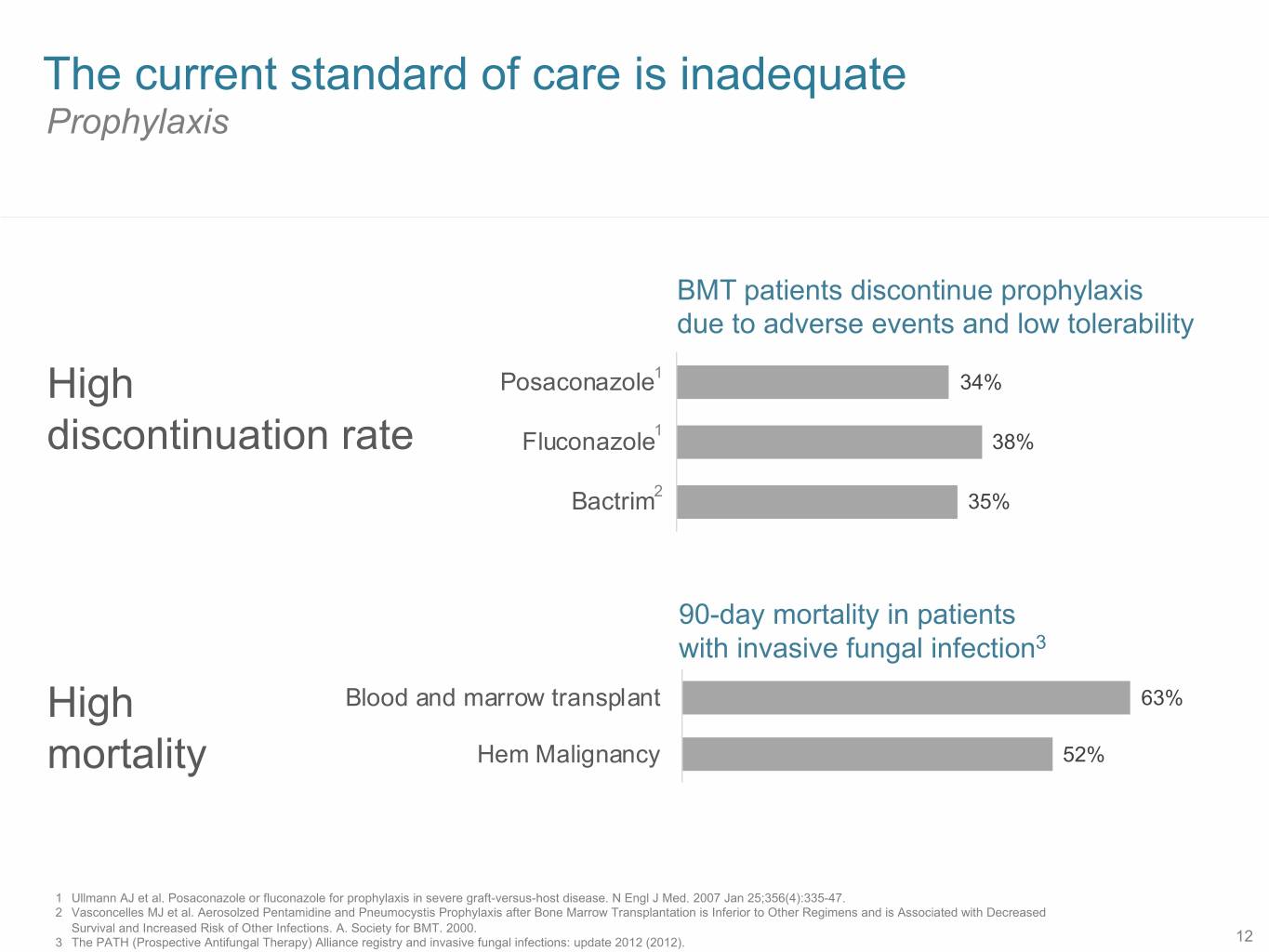

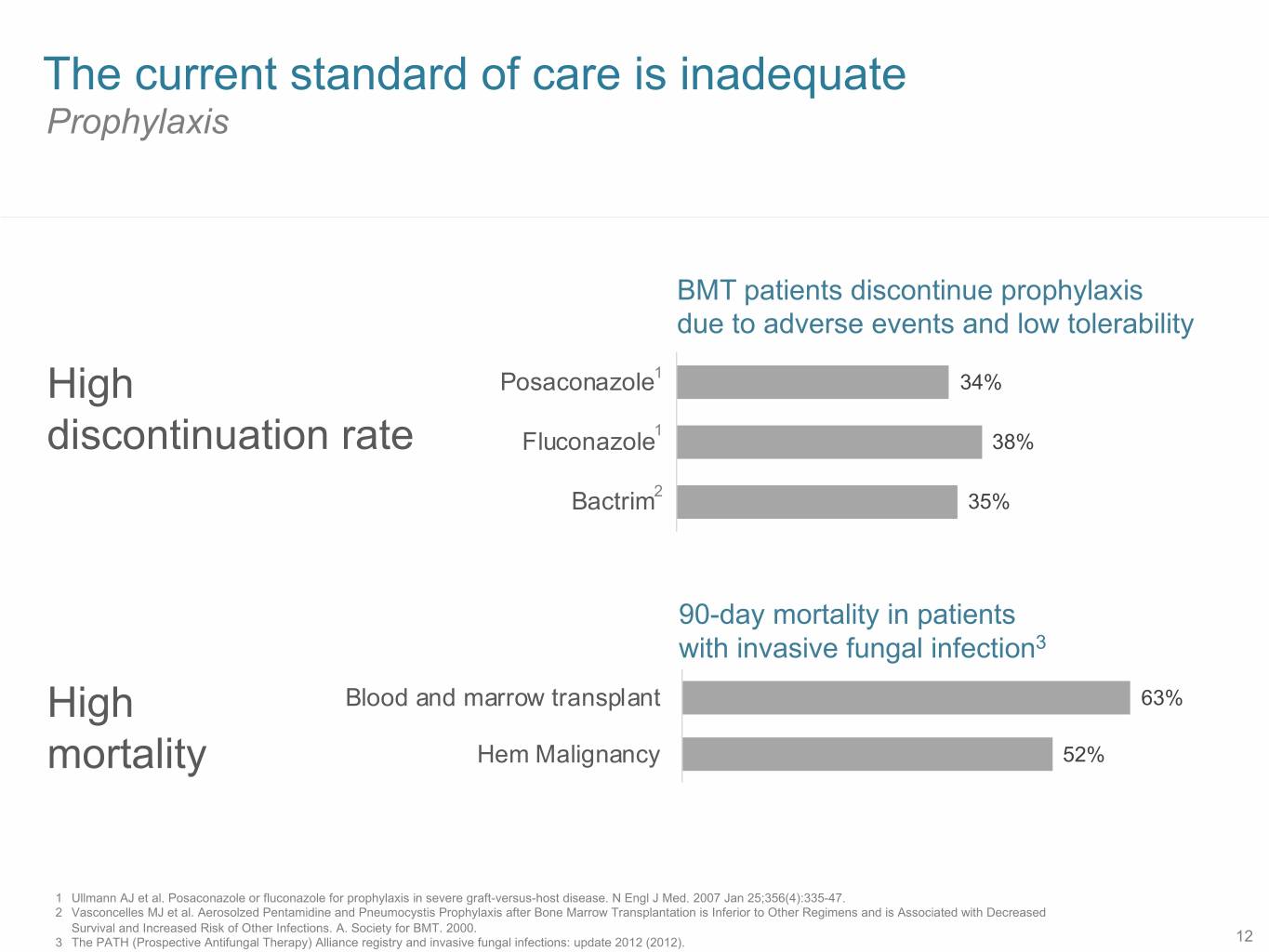

The current standard of care is inadequate Prophylaxis BMT patients discontinue prophylaxis due to adverse events and low tolerability High Posaconazole1 34% 1 discontinuation rate Fluconazole 38% 2 Bactrim 35% 90-day mortality in patients with invasive fungal infection3 High Blood and marrow transplant 63% mortality Hem Malignancy 52% 1 Ullmann AJ et al. Posaconazole or fluconazole for prophylaxis in severe graft-versus-host disease. N Engl J Med. 2007 Jan 25;356(4):335-47. 2 Vasconcelles MJ et al. Aerosolzed Pentamidine and Pneumocystis Prophylaxis after Bone Marrow Transplantation is Inferior to Other Regimens and is Associated with Decreased Survival and Increased Risk of Other Infections. A. Society for BMT. 2000. 3 The PATH (Prospective Antifungal Therapy) Alliance registry and invasive fungal infections: update 2012 (2012). 12

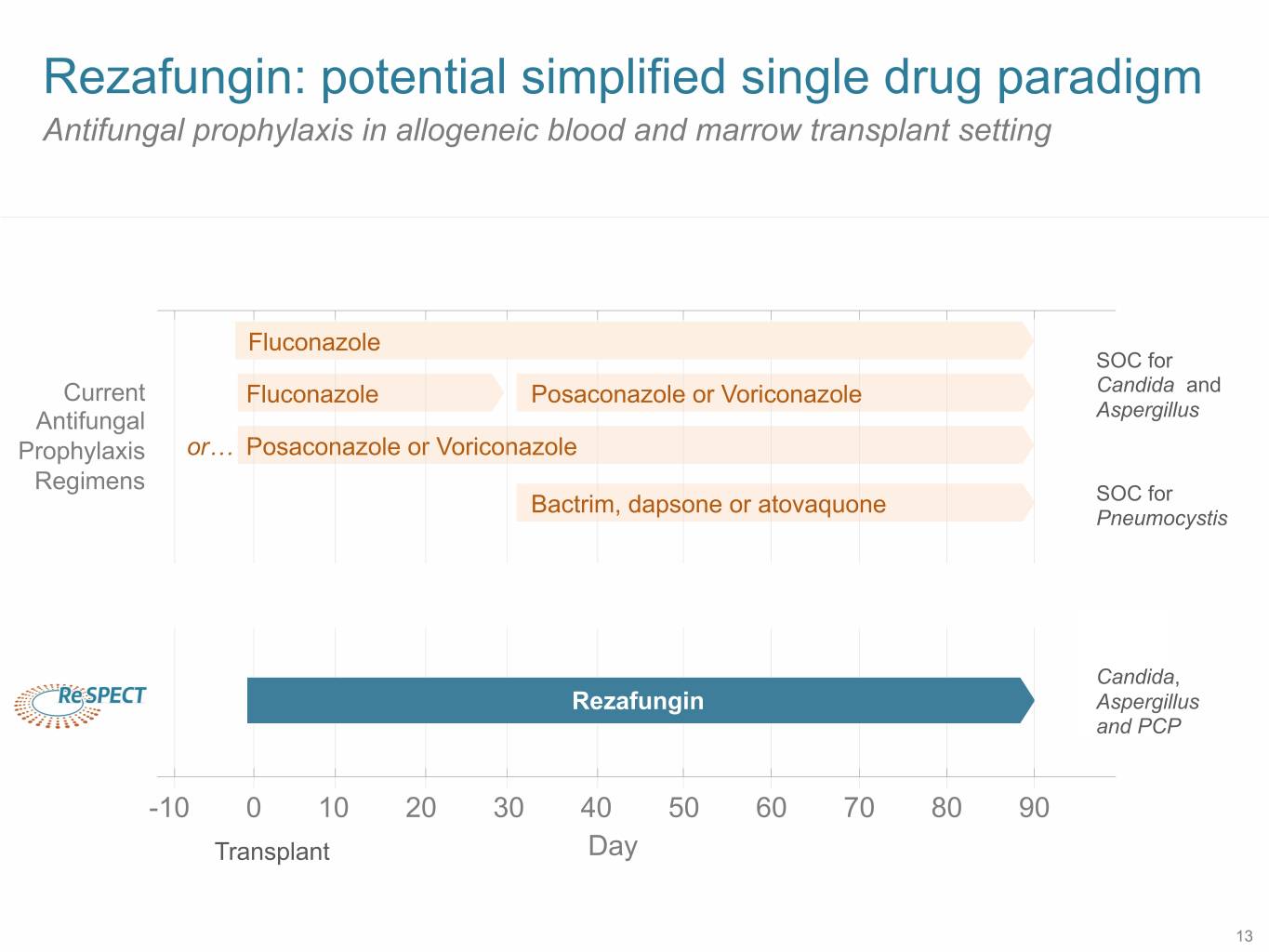

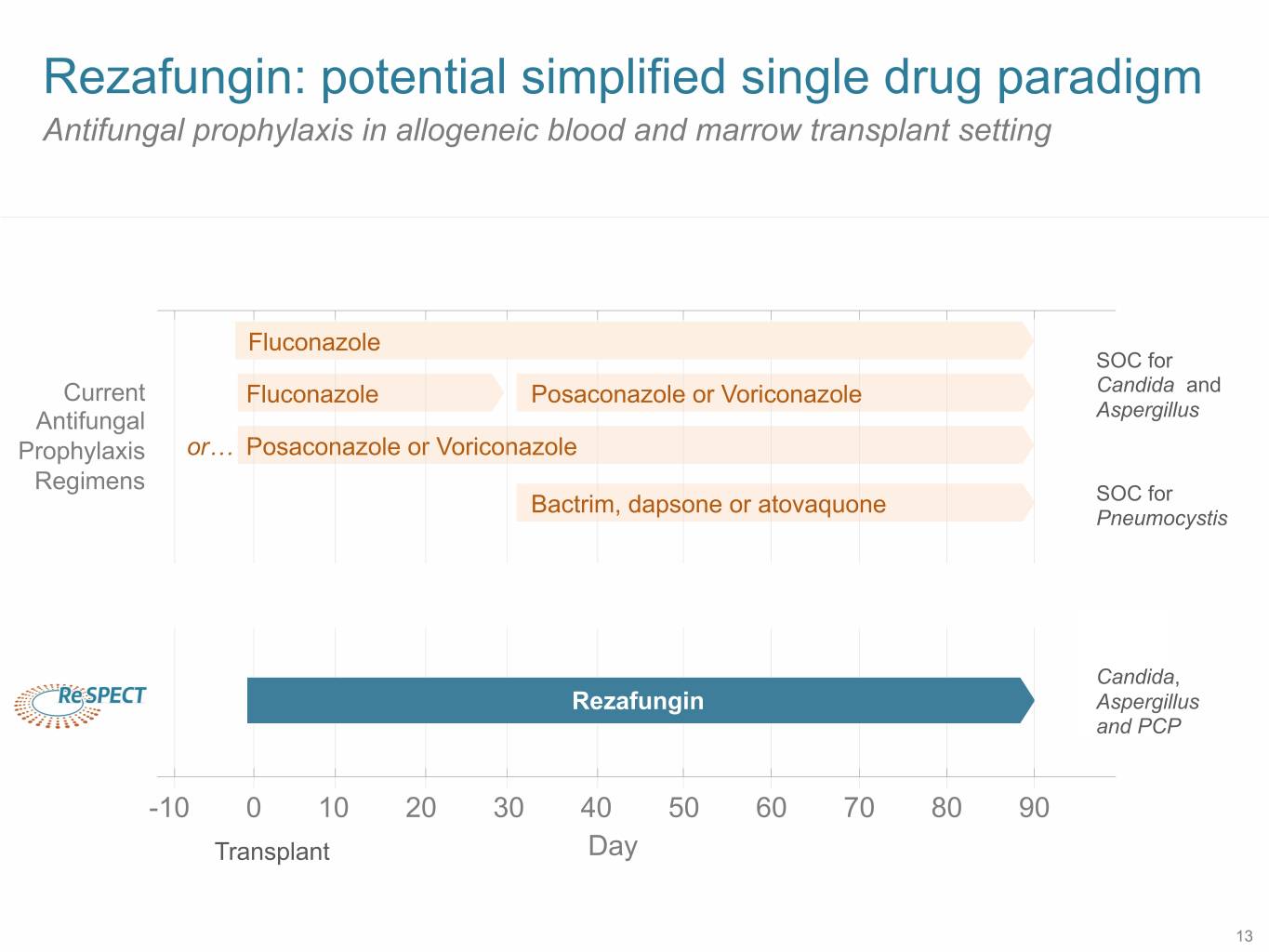

Rezafungin: potential simplified single drug paradigm Antifungal prophylaxis in allogeneic blood and marrow transplant setting Fluconazole SOC for Current Fluconazole Posaconazole or Voriconazole Candida and Antifungal Aspergillus Prophylaxis or… Posaconazole or Voriconazole Regimens Bactrim, dapsone or atovaquone SOC for Pneumocystis Candida, Rezafungin Aspergillus and PCP -10 0 10 20 30 40 50 60 70 80 90 Transplant Day 13

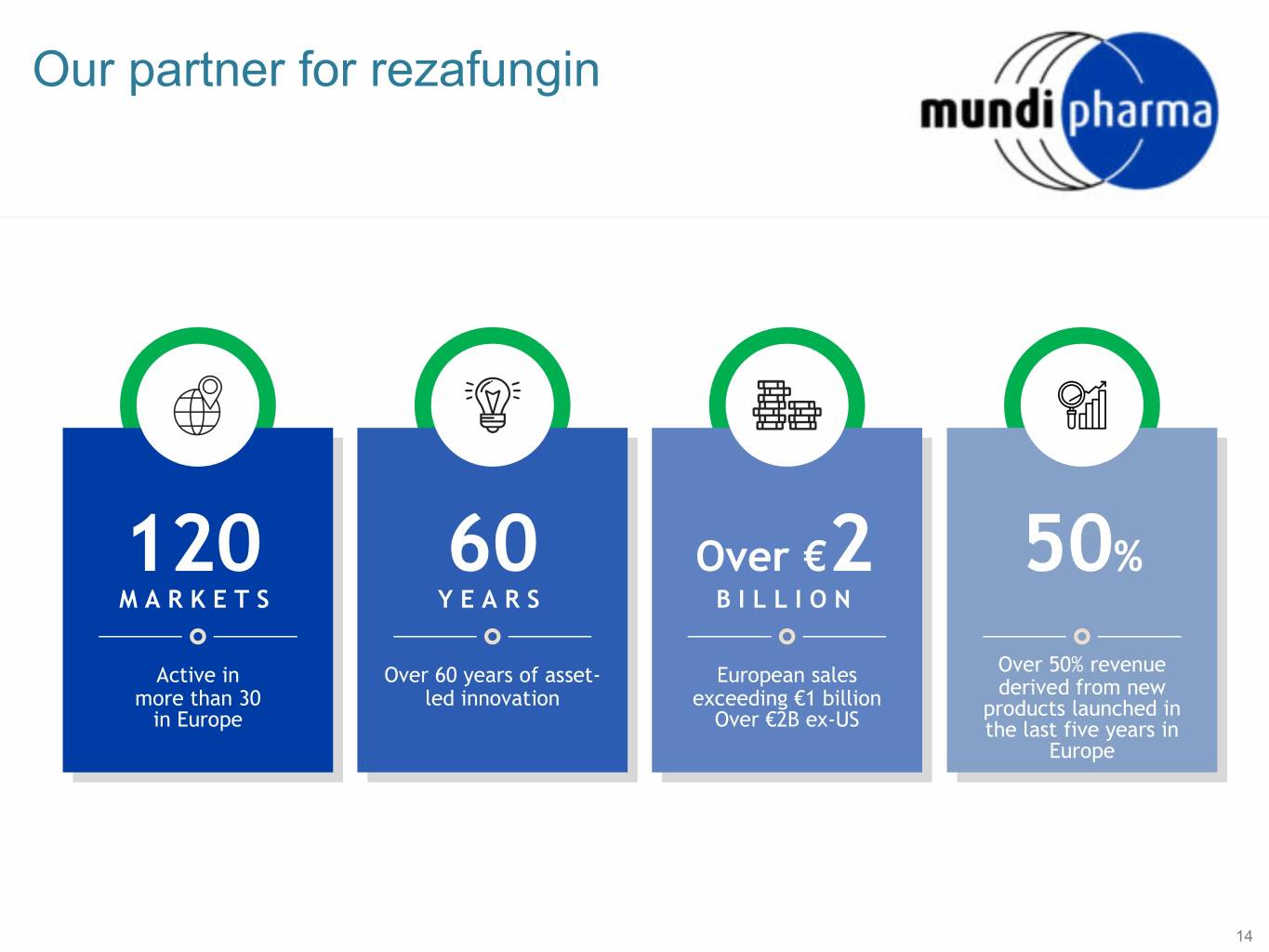

Our partner for rezafungin 120 60 Over €2 50% MARKETS YEARS BILLION Active in Over 60 years of asset- European sales Over 50% revenue derived from new more than 30 led innovation exceeding €1 billion products launched in in Europe Over €2B ex-US the last five years in Europe 14

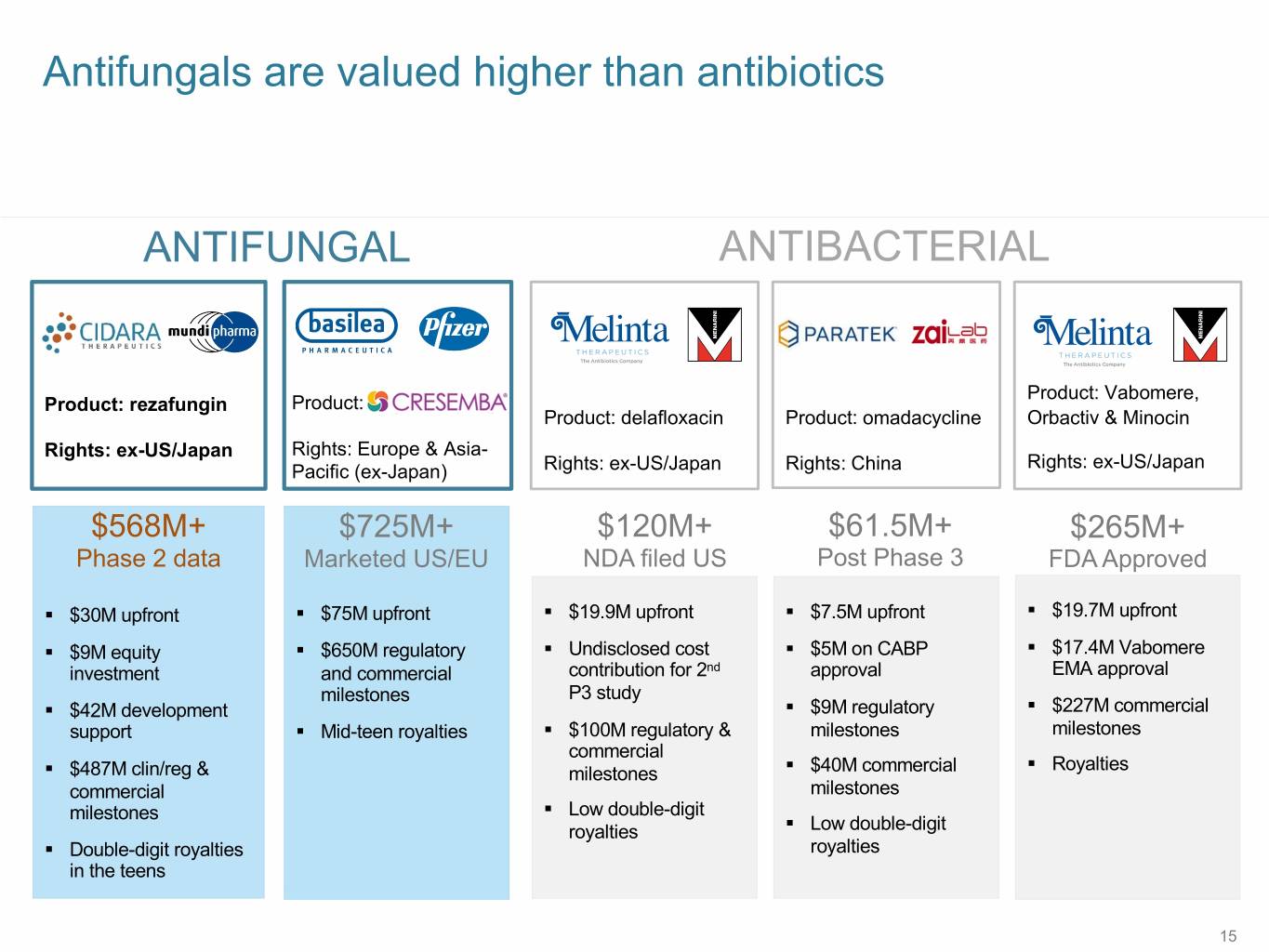

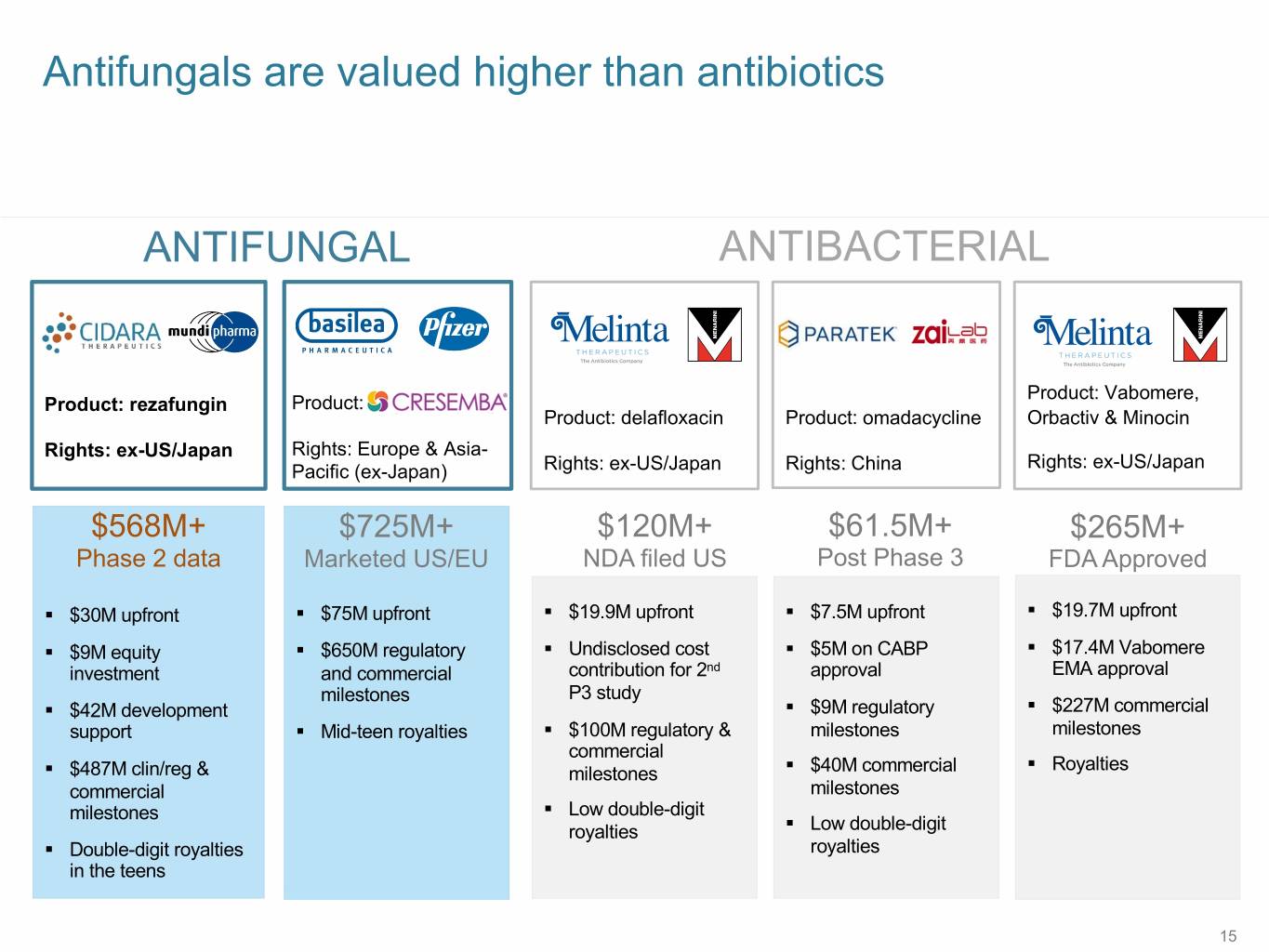

Antifungals are valued higher than antibiotics ANTIFUNGAL ANTIBACTERIAL Product: Vabomere, Product: rezafungin Product: Product: delafloxacin Product: omadacycline Orbactiv & Minocin Rights: ex-US/Japan Rights: Europe & Asia- Rights: ex-US/Japan Pacific (ex-Japan) Rights: ex-US/Japan Rights: China $568M+ $725M+ $120M+ $61.5M+ $265M+ Phase 2 data Marketed US/EU NDA filed US Post Phase 3 FDA Approved § $30M upfront § $75M upfront § $19.9M upfront § $7.5M upfront § $19.7M upfront § $9M equity § $650M regulatory § Undisclosed cost § $5M on CABP § $17.4M Vabomere investment and commercial contribution for 2nd approval EMA approval milestones P3 study § $42M development § $9M regulatory § $227M commercial support § Mid-teen royalties § $100M regulatory & milestones milestones commercial § Royalties § $487M clin/reg & milestones § $40M commercial commercial milestones milestones § Low double-digit royalties § Low double-digit § Double-digit royalties royalties in the teens 15

Cidara’s pipeline targets multiple unmet medical needs Rezafungin Cloudbreak 16

Cloudbreak antiviral conjugates (AVCs) for influenza: Potential single dose universal protection and treatment of seasonal and pandemic influenza 17

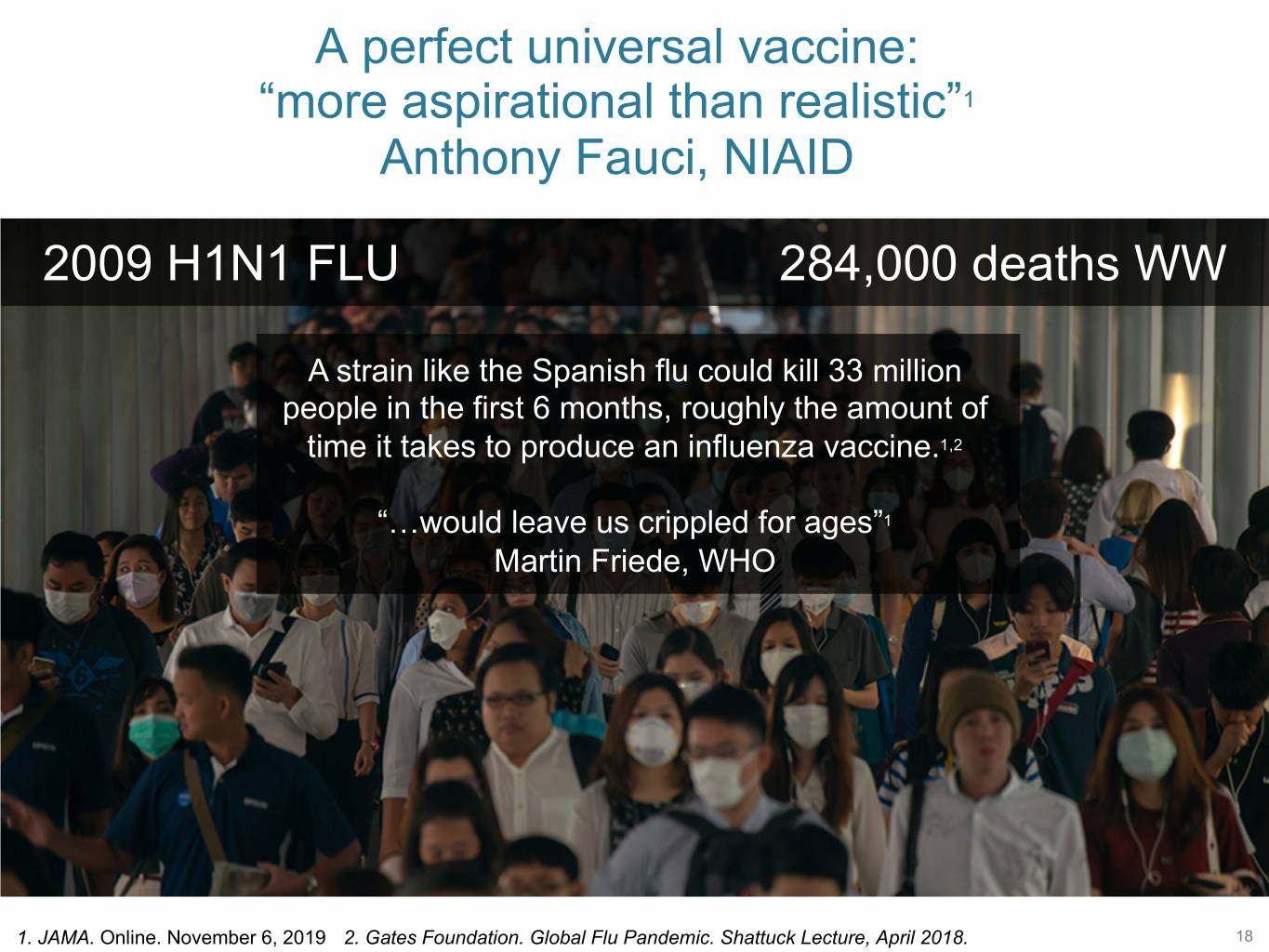

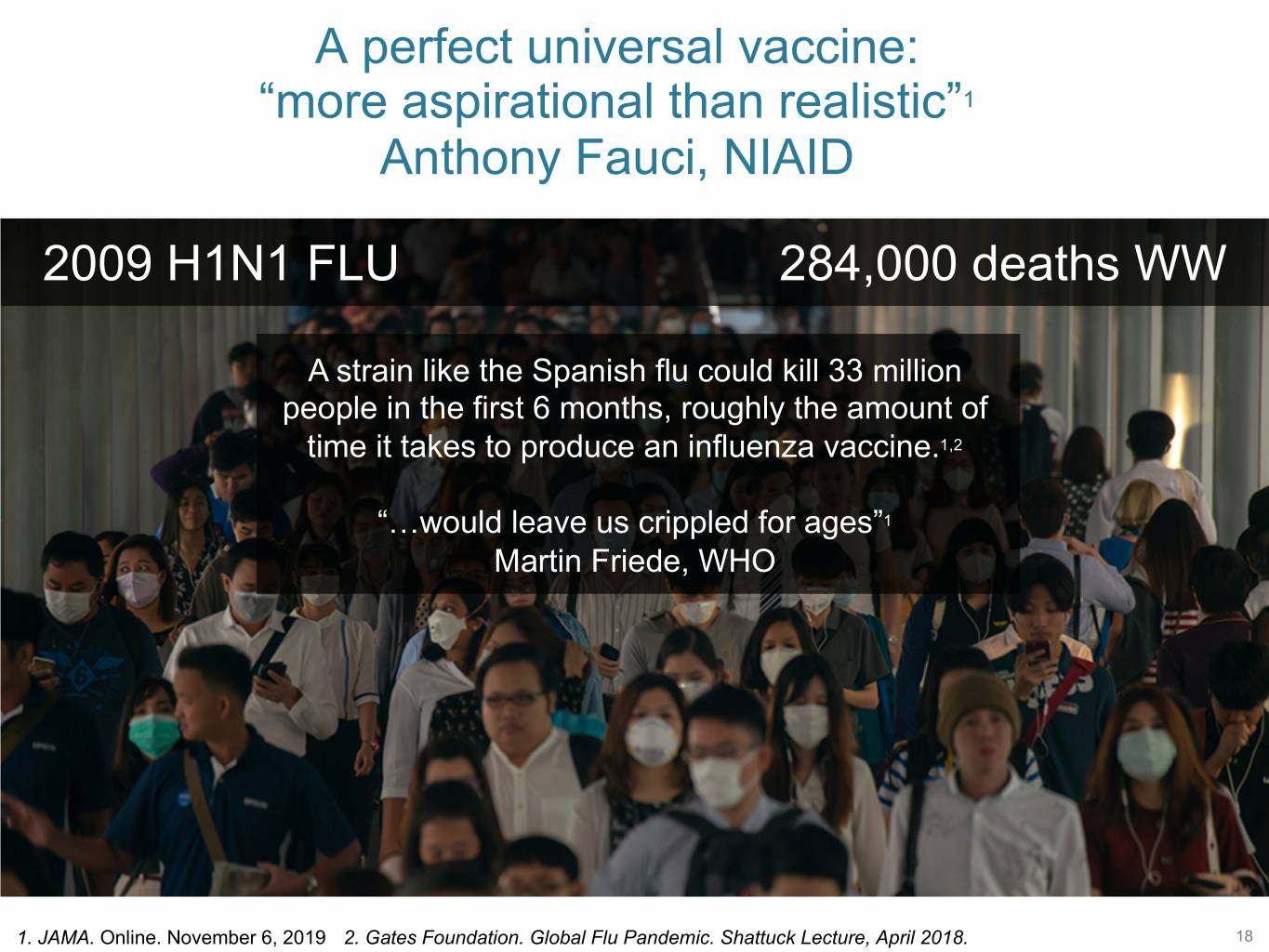

SB 17 A perfect universal vaccine: “more aspirational than realistic”1 Anthony Fauci, NIAID 2009 H1N1 FLU 284,000 deaths WW A strain like the Spanish flu could kill 33 million people in the first 6 months, roughly the amount of time it takes to produce an influenza vaccine.1,2 “…would leave us crippled for ages”1 Martin Friede, WHO 1. JAMA. Online. November 6, 2019 2. Gates Foundation. Global Flu Pandemic. Shattuck Lecture, April 2018. 18

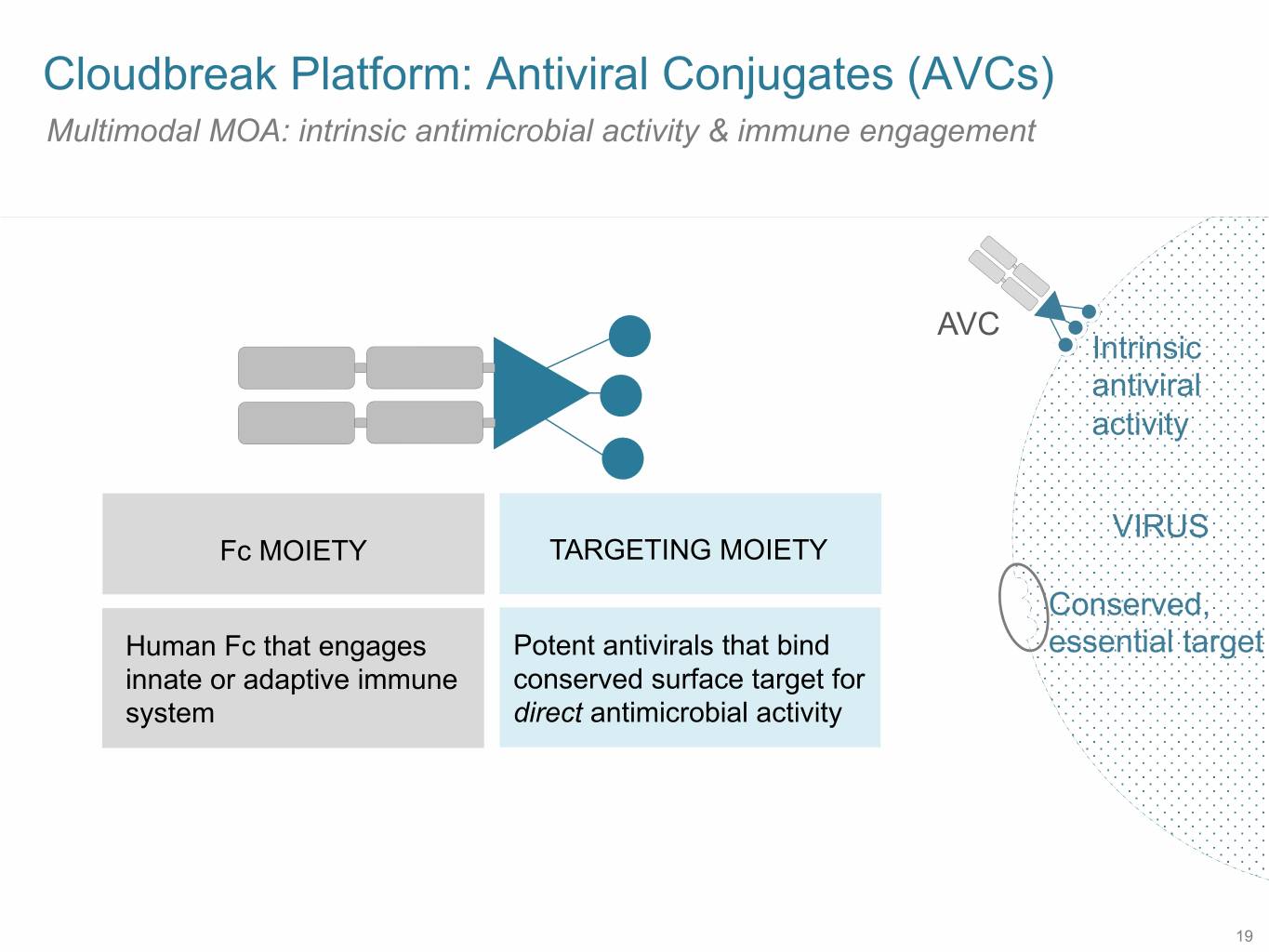

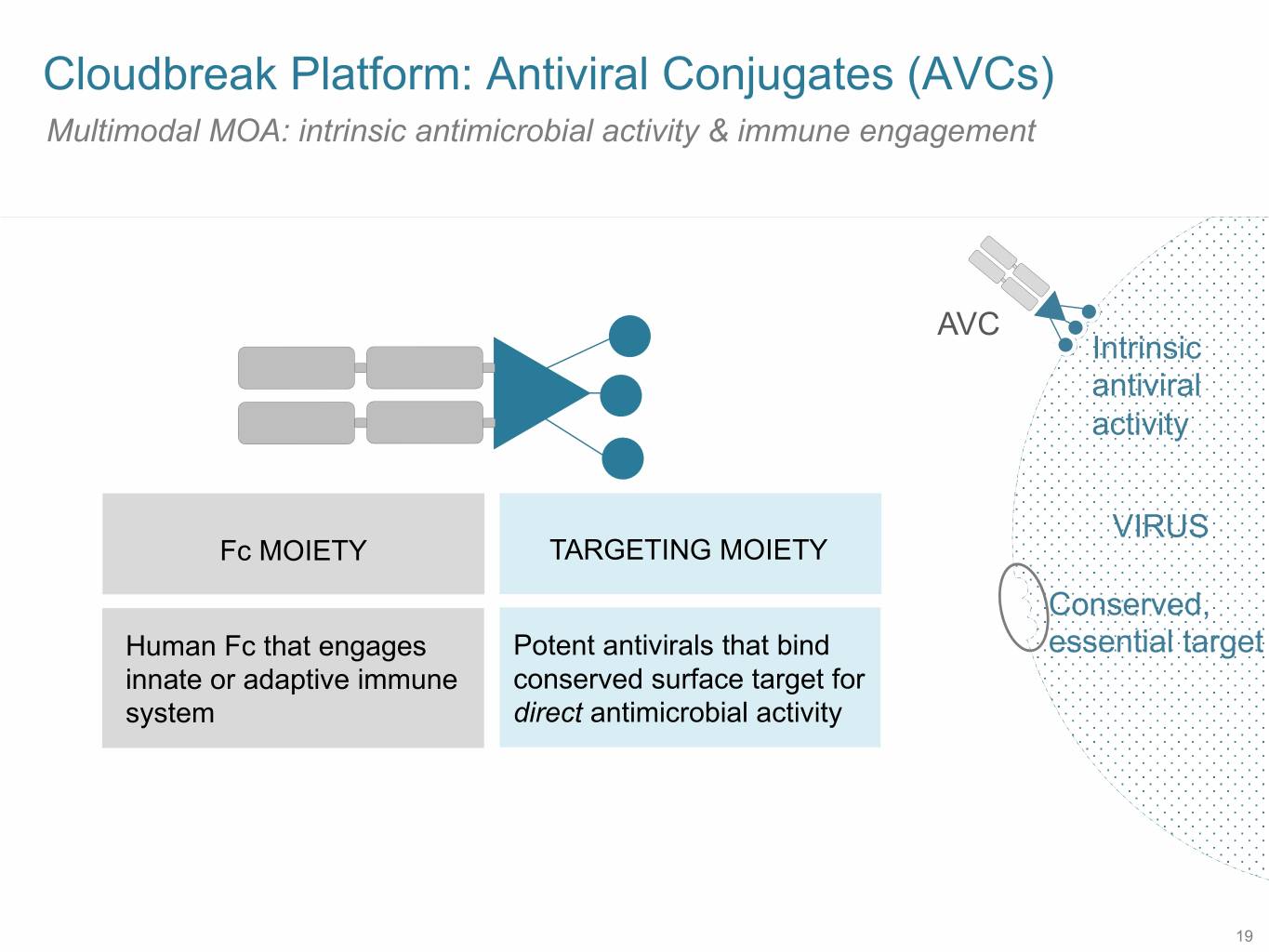

SB 9 Cloudbreak Platform: Antiviral Conjugates (AVCs) Multimodal MOA: intrinsic antimicrobial activity & immune engagement AVC Intrinsic antiviral activity VIRUS Fc MOIETY TARGETING MOIETY Conserved, Human Fc that engages Potent antivirals that bind essential target innate or adaptive immune conserved surface target for system direct antimicrobial activity 19

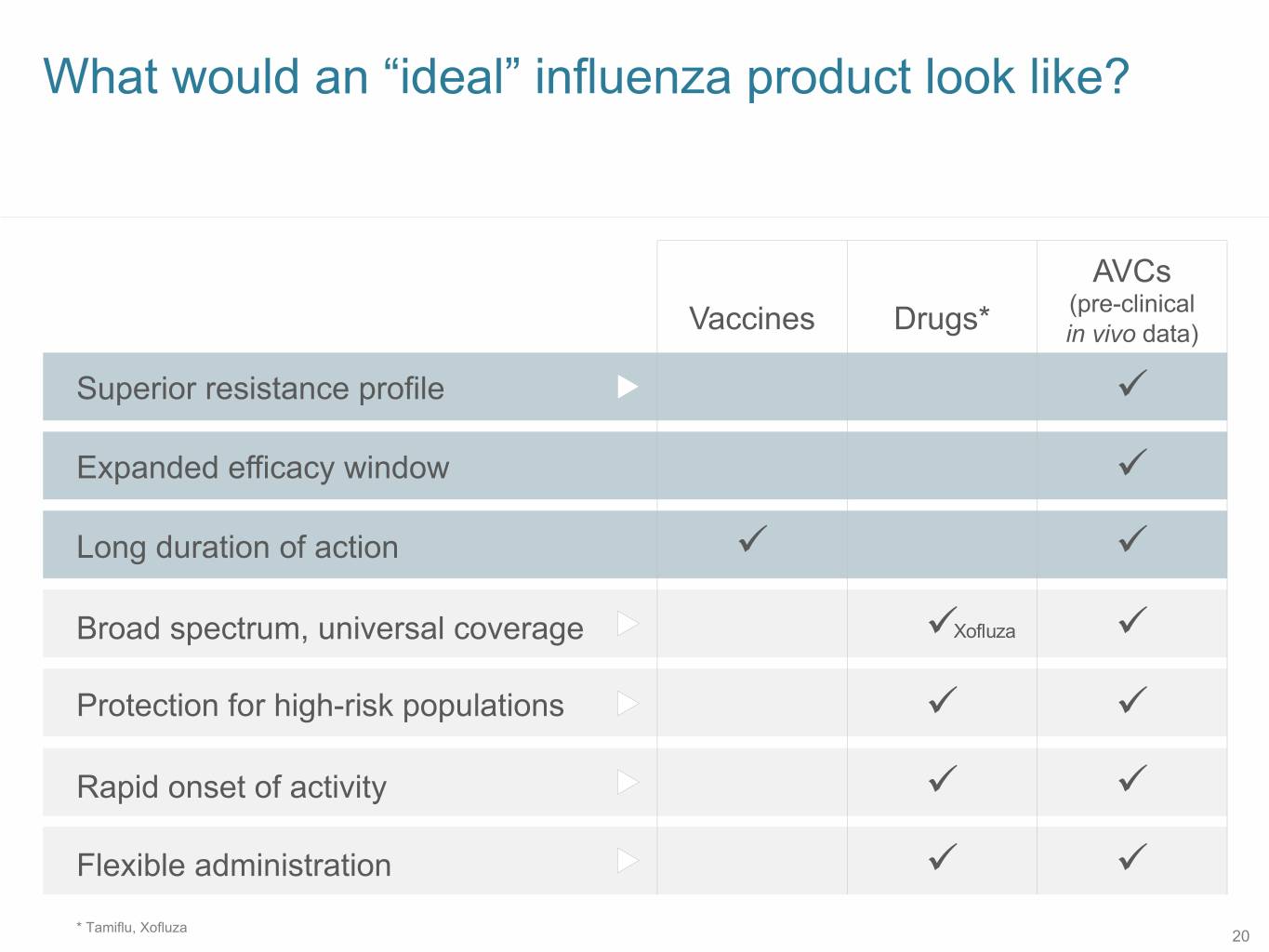

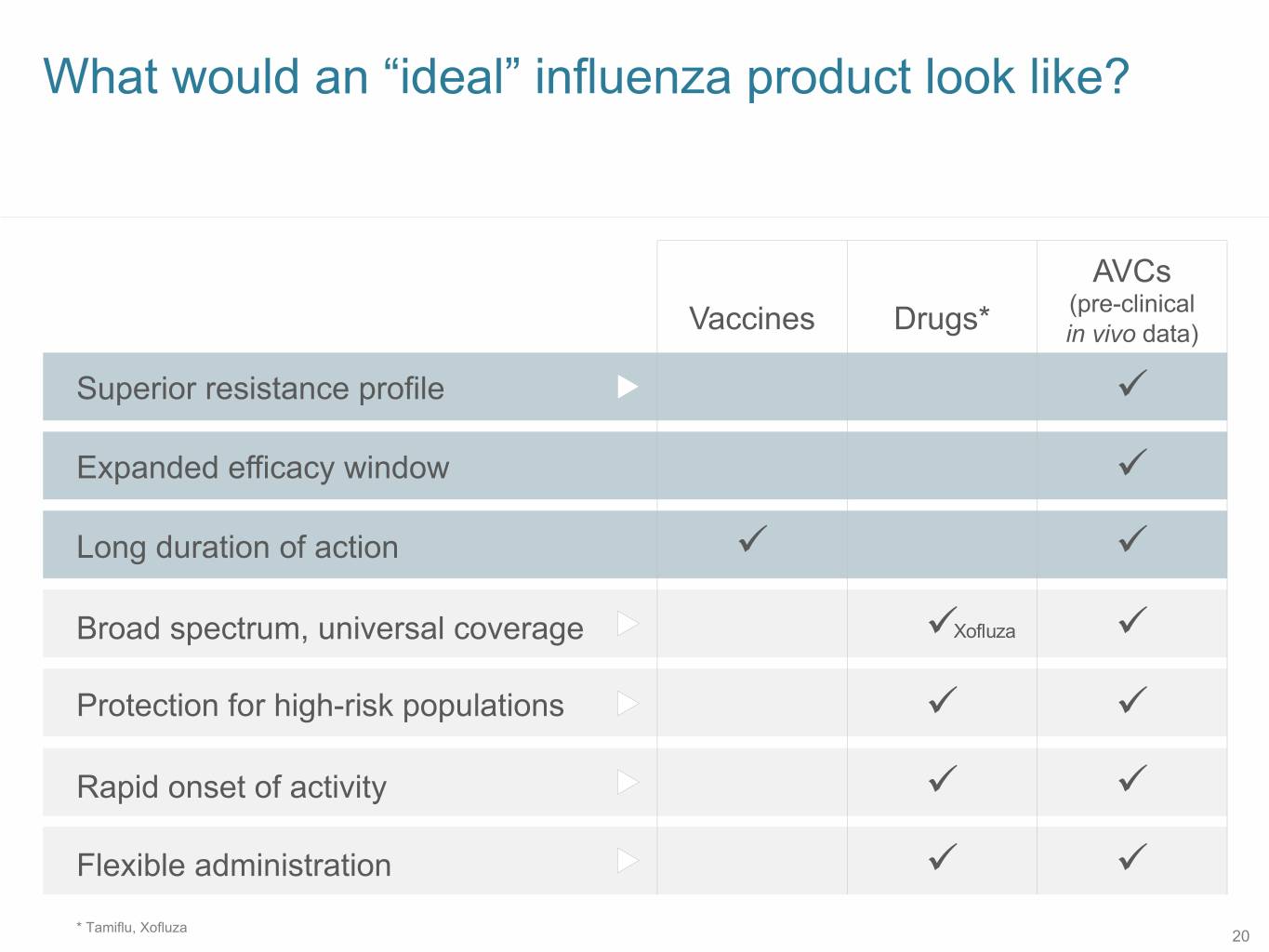

SB 12 What would an “ideal” influenza product look like? AVCs (pre-clinical Vaccines Drugs* in vivo data) Superior resistance profile ü Expanded efficacy window ü Long duration of action ü ü Broad spectrum, universal coverage üXofluza ü Protection for high-risk populations ü ü Rapid onset of activity ü ü Flexible administration ü ü * Tamiflu, Xofluza 20

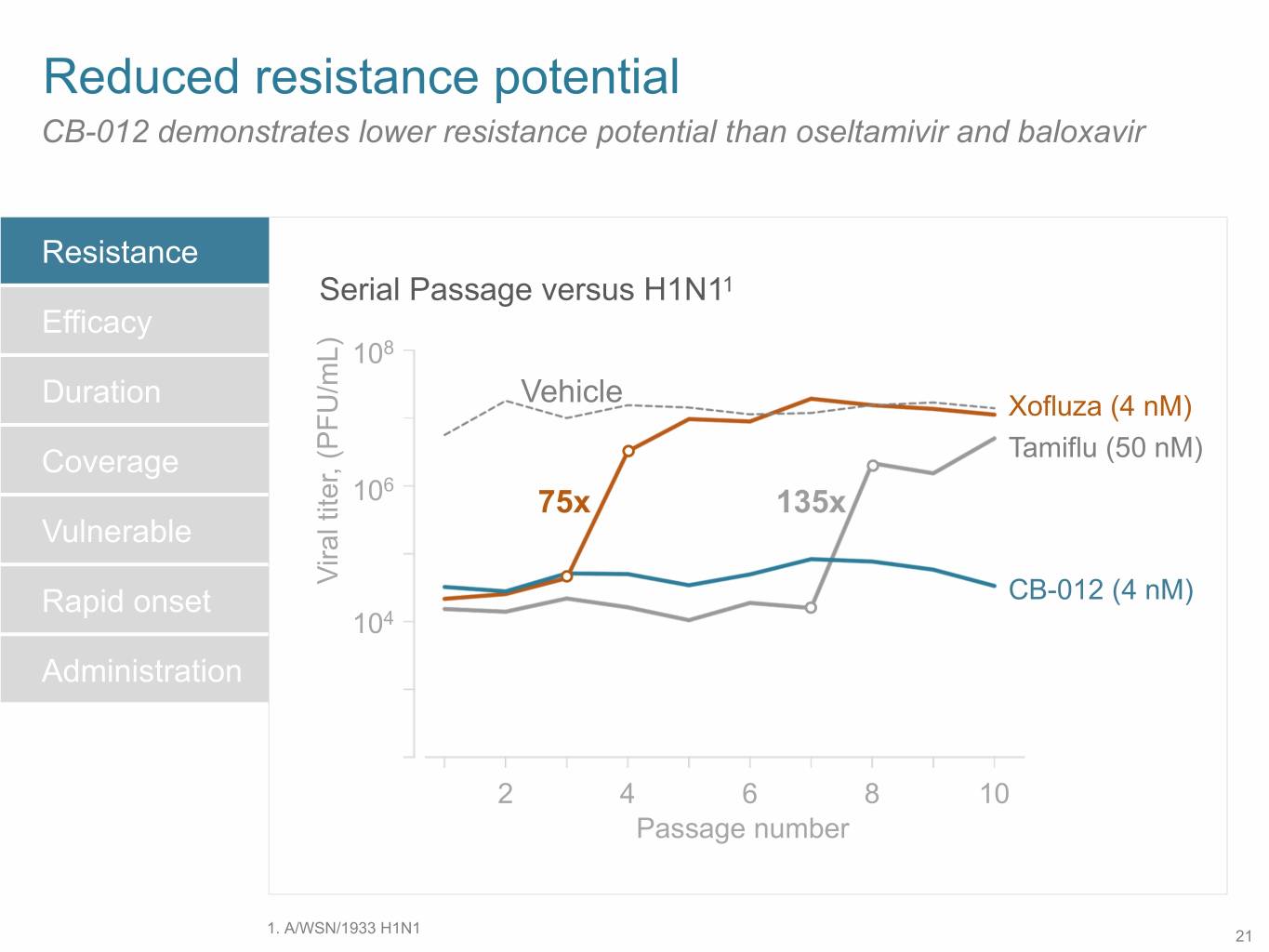

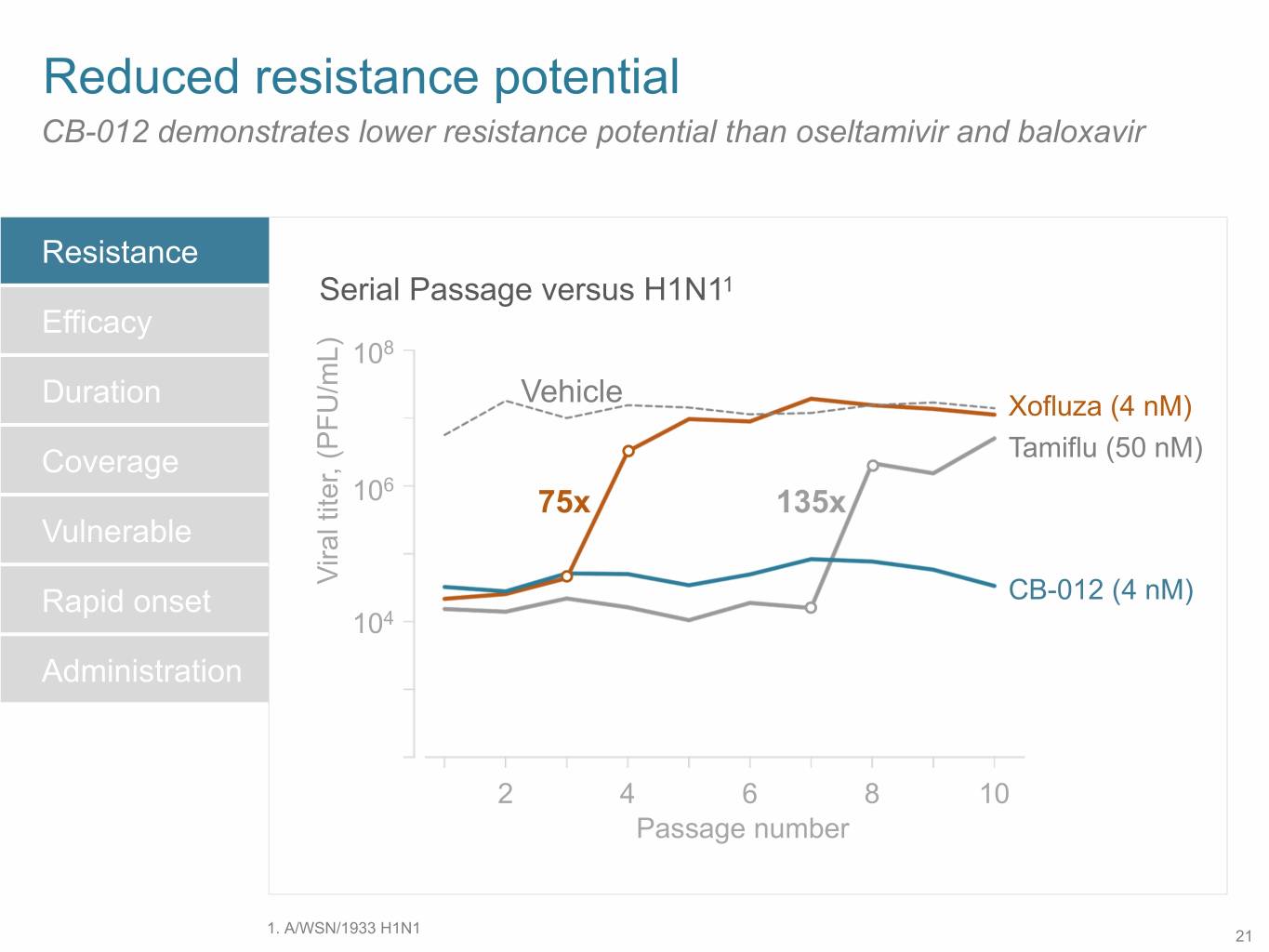

SB 14 Reduced resistance potential CB-012 demonstrates lower resistance potential than oseltamivir and baloxavir Resistance Serial Passage versus H1N11 Efficacy 108 Duration Vehicle Xofluza (4 nM) Coverage Tamiflu (50 nM) 6 10 75x 135x Vulnerable Viral titer, (PFU/mL) Rapid onset CB-012 (4 nM) 104 Administration 2 4 6 8 10 Passage number 1. A/WSN/1933 H1N1 21

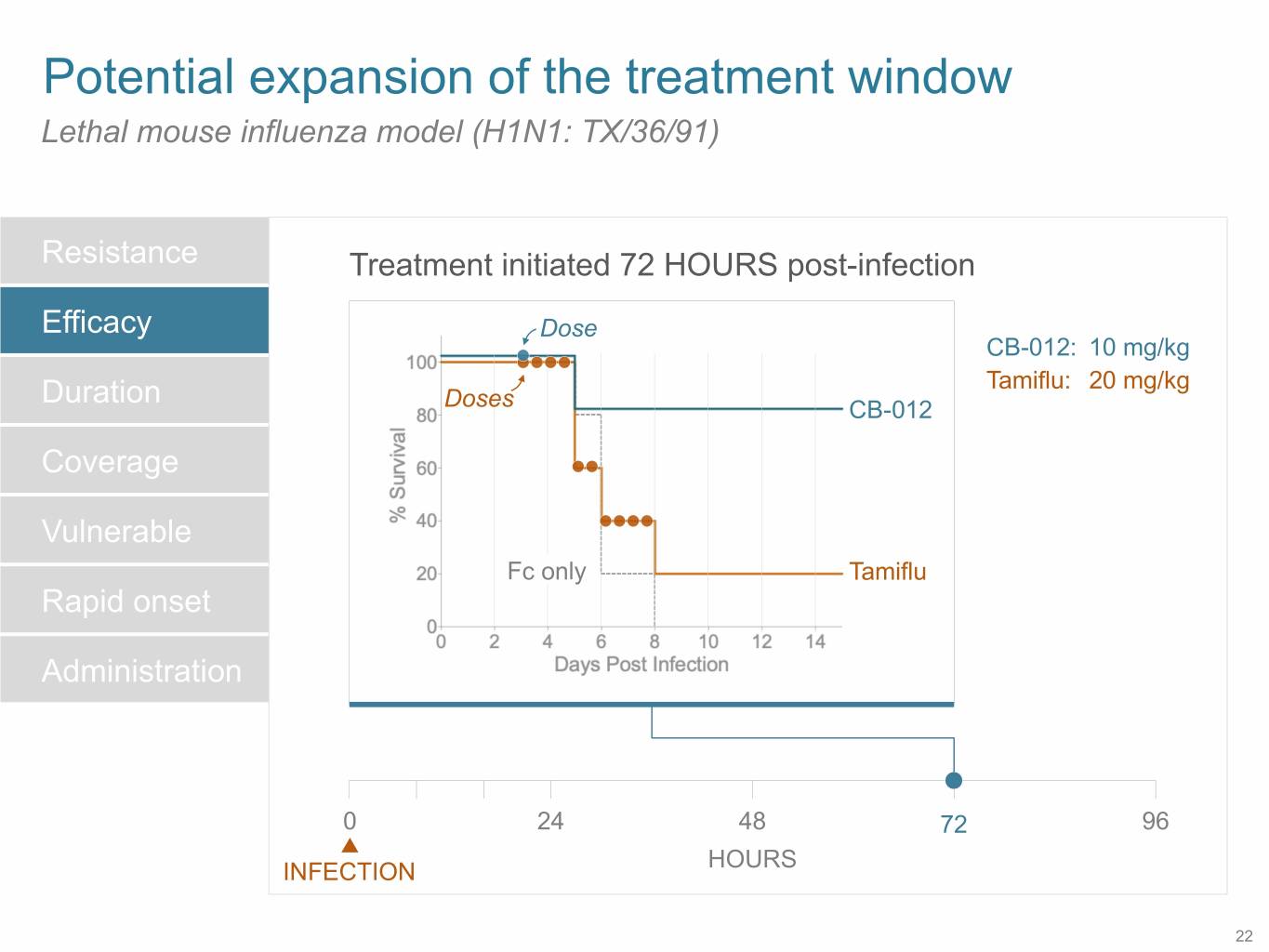

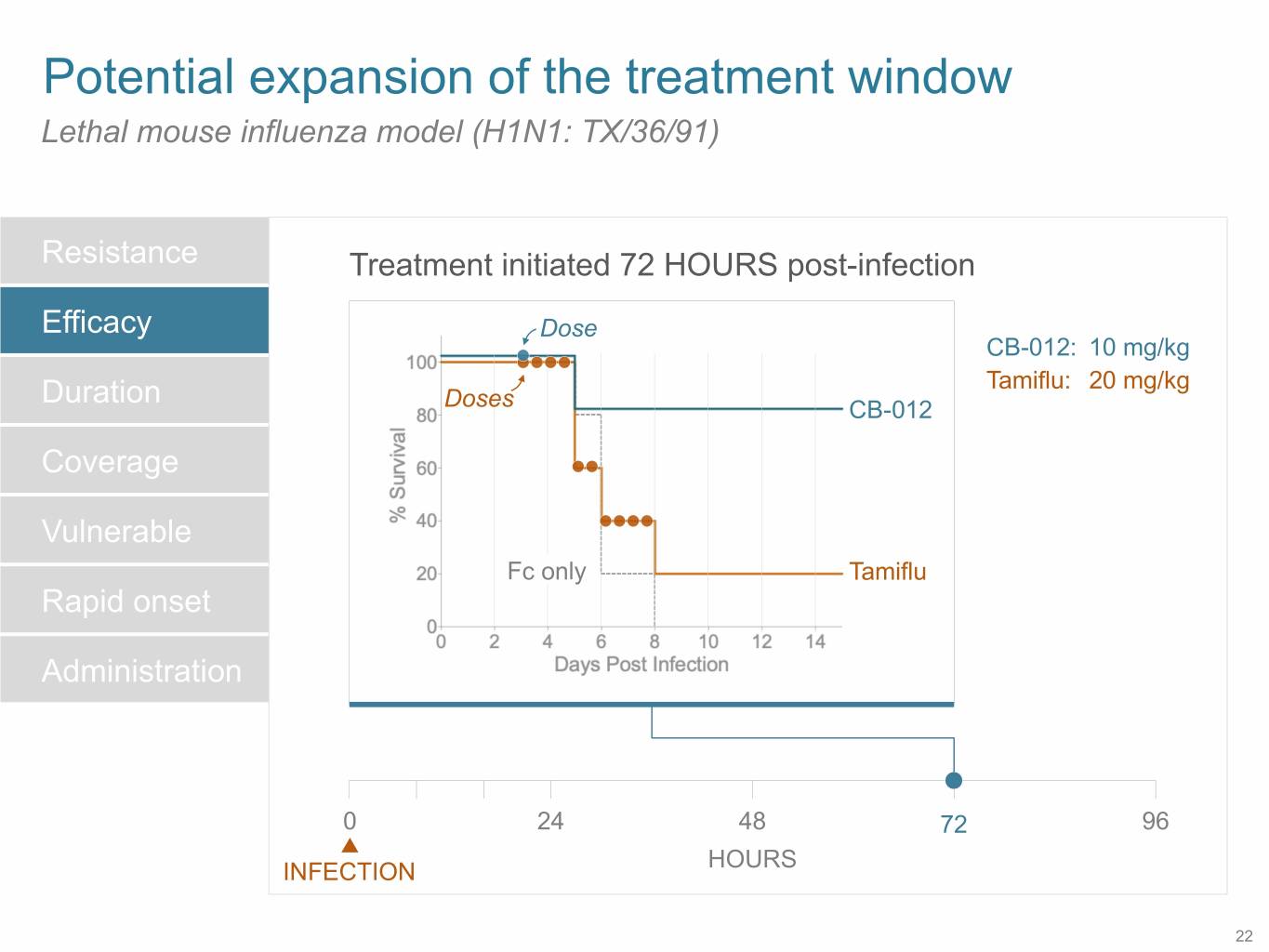

SB 14 Potential expansion of the treatment window Lethal mouse influenza model (H1N1: TX/36/91) Resistance Treatment initiated 72 HOURS post-infection Efficacy Dose CB-012: 10 mg/kg Duration Tamiflu: 20 mg/kg Doses CB-012 Coverage Vulnerable Fc only Tamiflu Rapid onset Administration 0 24 48 72 96 HOURS INFECTION 22

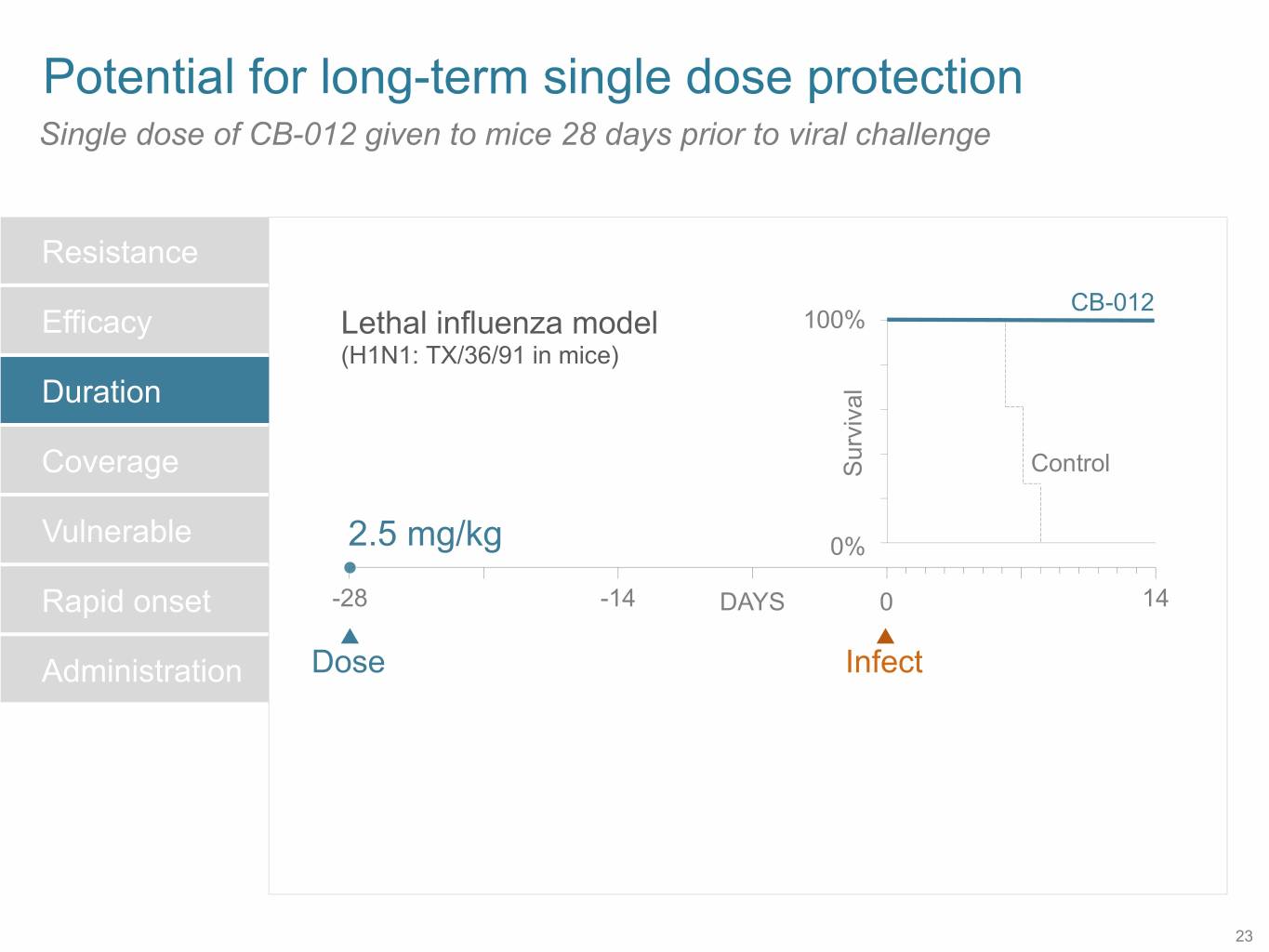

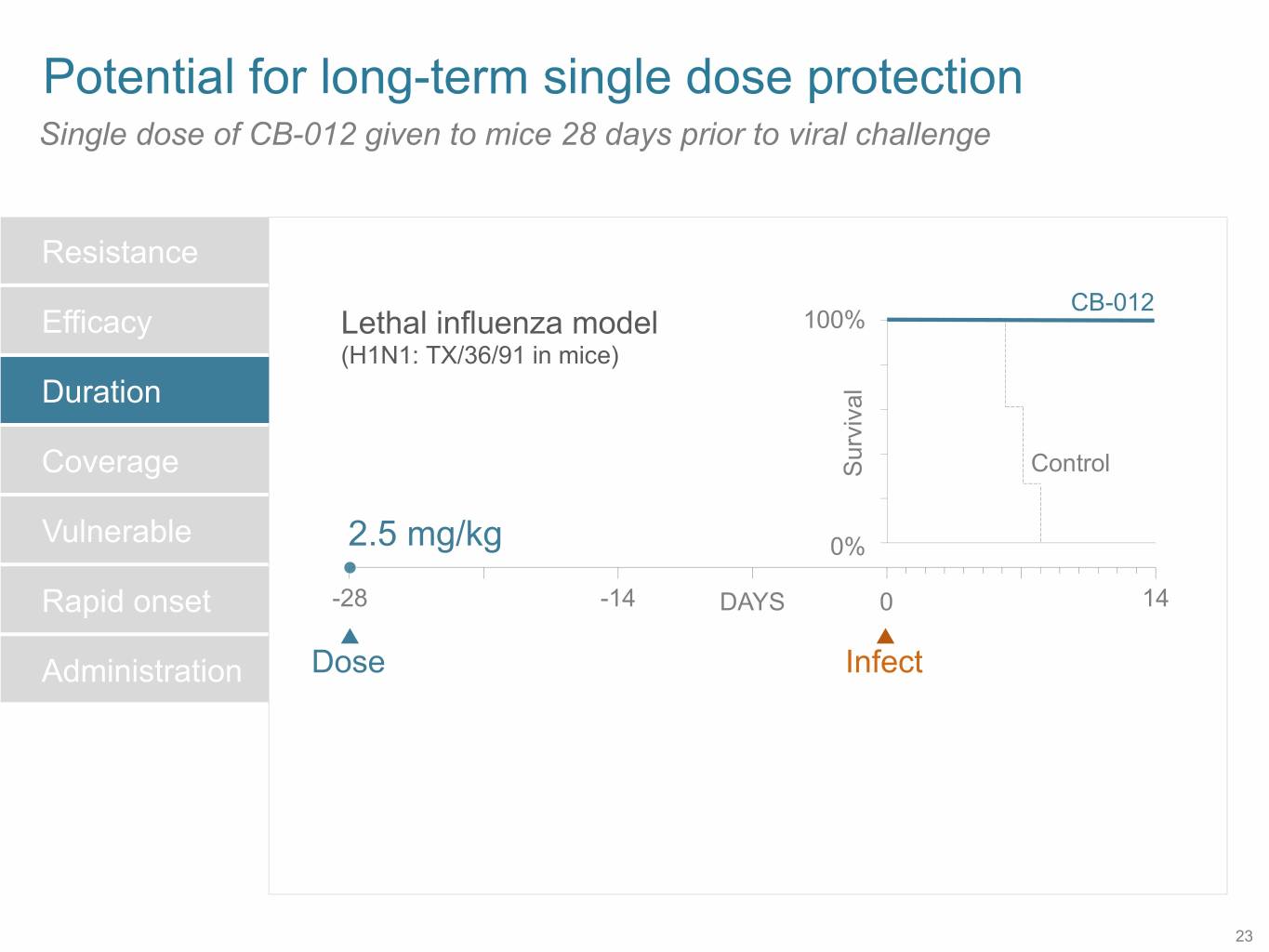

SB 14 Potential for long-term single dose protection Single dose of CB-012 given to mice 28 days prior to viral challenge Resistance CB-012 Efficacy Lethal influenza model 100% (H1N1: TX/36/91 in mice) Duration Control Coverage Survival Vulnerable 2.5 mg/kg 0% Rapid onset -28 -14 DAYS 0 14 Administration Dose Infect 23

Cloudbreak platform: potential applications beyond influenza INFLUENZA RSV HIV DENGUE ZIKA 24

SB 12 Agenda Opening - Overview Jeff Stein, PhD, CEO, Cidara Therapeutics Antifungal Treatment Unmet Neil Clancy, M.D., University of Pittsburgh Needs Unmet Antifungal Prophylaxis Needs Kieren Marr, M.D., Johns Hopkins School of Medicine Influenza Unmet Allison McGeer, M.D., University of Toronto Needs Commercial Potential Paul Daruwala, COO, Cidara Therapeutics Fireside Chat, Q&A Team 25

SB 12 Agenda Opening - Overview Jeff Stein, PhD, CEO, Cidara Therapeutics Antifungal Treatment Unmet Neil Clancy, M.D., University of Pittsburgh Needs Unmet Antifungal Prophylaxis Needs Kieren Marr, M.D., Johns Hopkins School of Medicine Influenza Unmet Allison McGeer, M.D., University of Toronto Needs Commercial Potential Paul Daruwala, COO, Cidara Therapeutics Fireside Chat, Q&A Team 26

Unmet needs in treatment of invasive fungal disease Cornelius J. (Neil) Clancy, M.D. University of Pittsburgh Pittsburgh, PA Cidara Analyst Day NYC, NY 14 November 2019

Fungal infections at UPMC-PUH

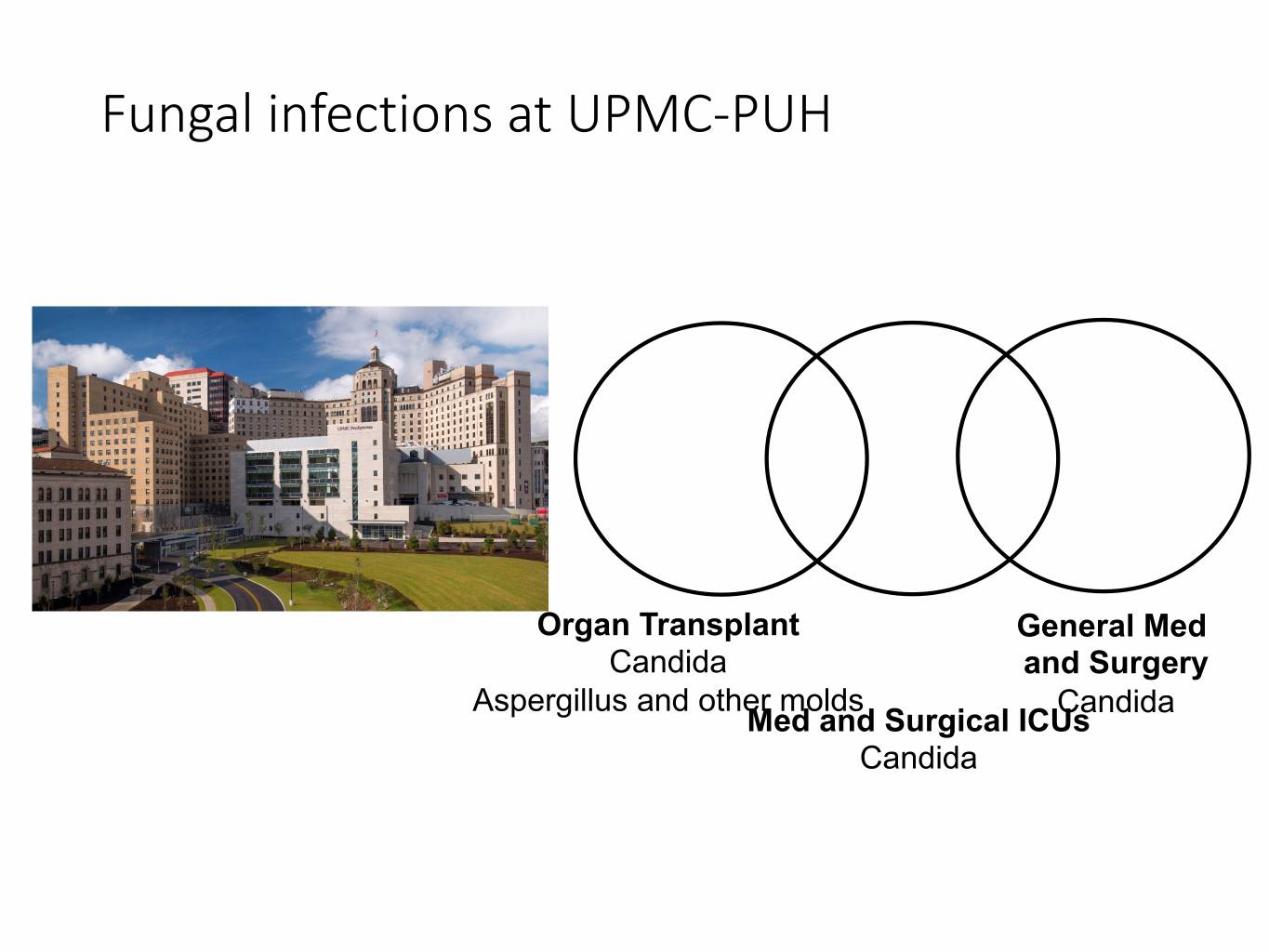

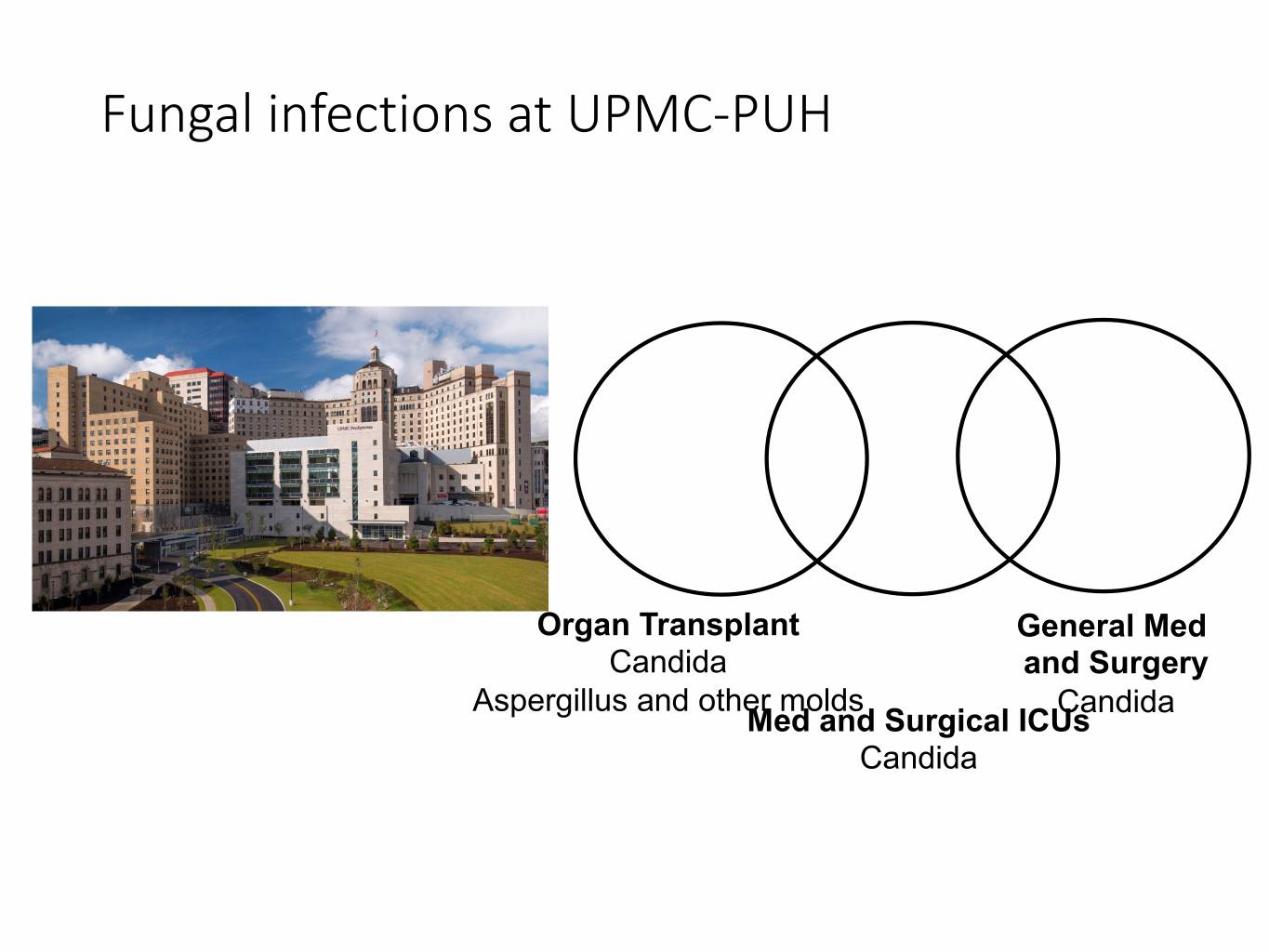

Fungal infections at UPMC-PUH Organ Transplant General Med Candida and Surgery Aspergillus and other molds Candida Med and Surgical ICUs Candida

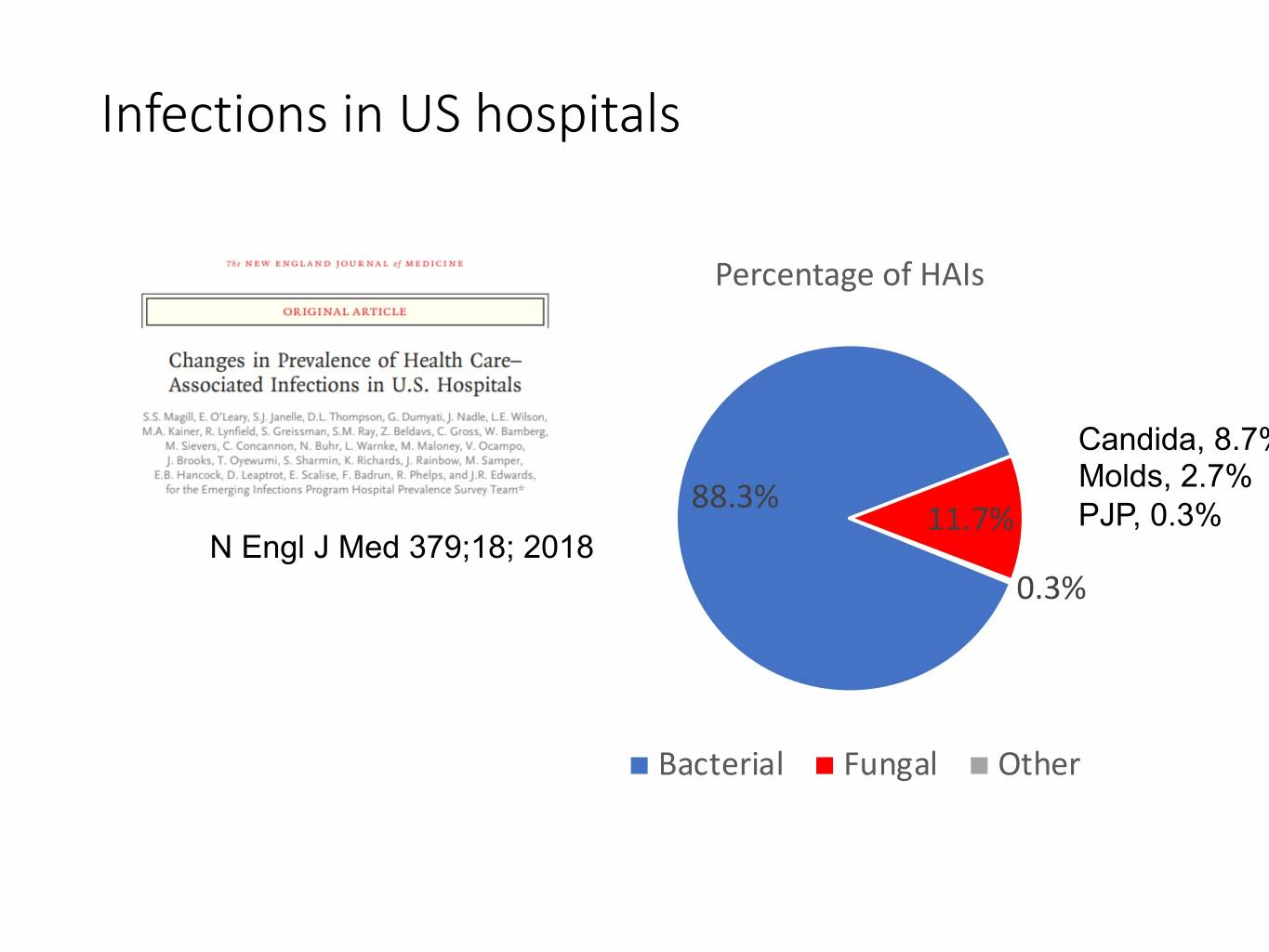

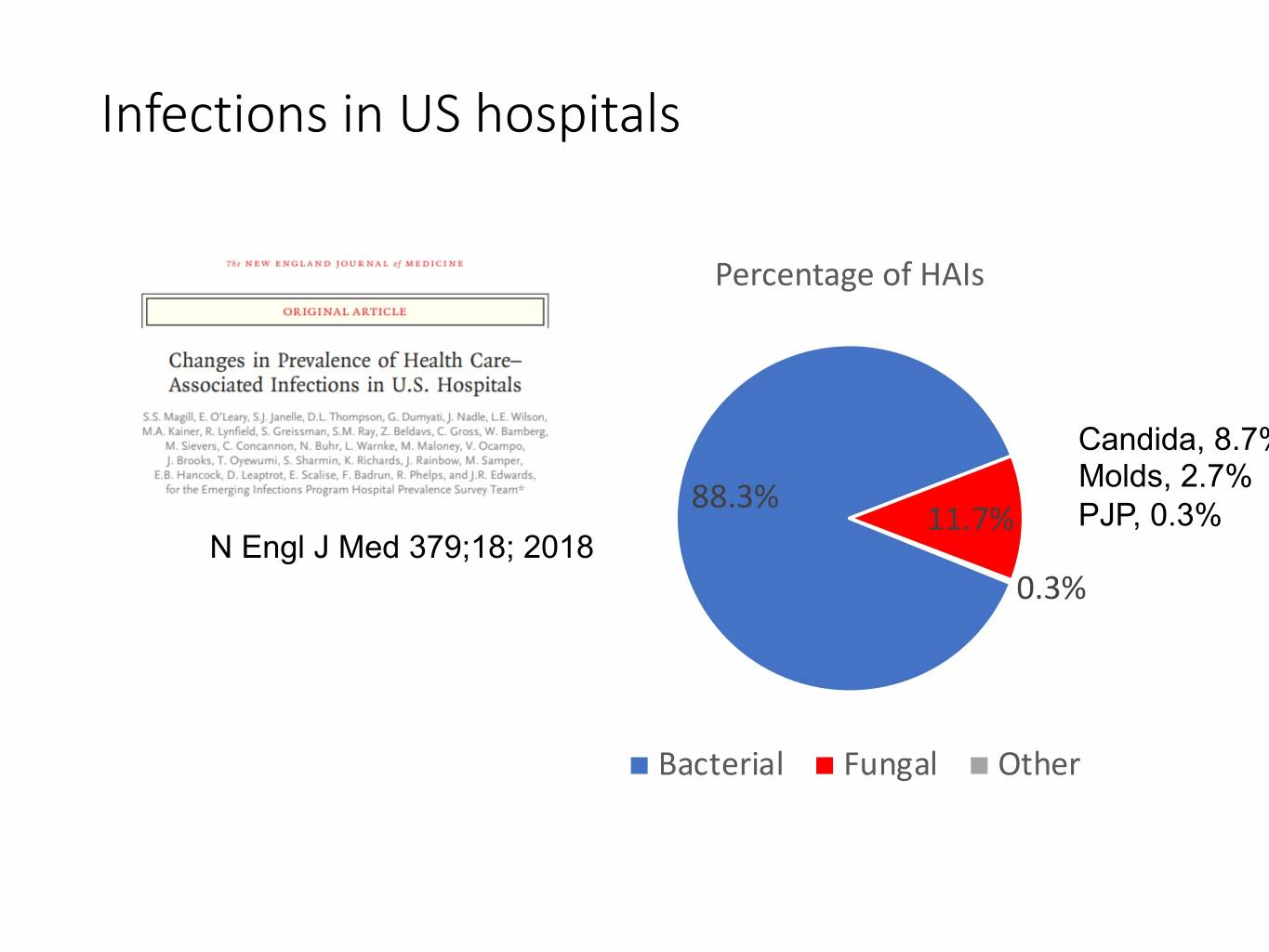

Infections in US hospitals Percentage of HAIs Candida, 8.7% Molds, 2.7% 88.3% 11.7% PJP, 0.3% N Engl J Med 379;18; 2018 0.3% Bacterial Fungal Other

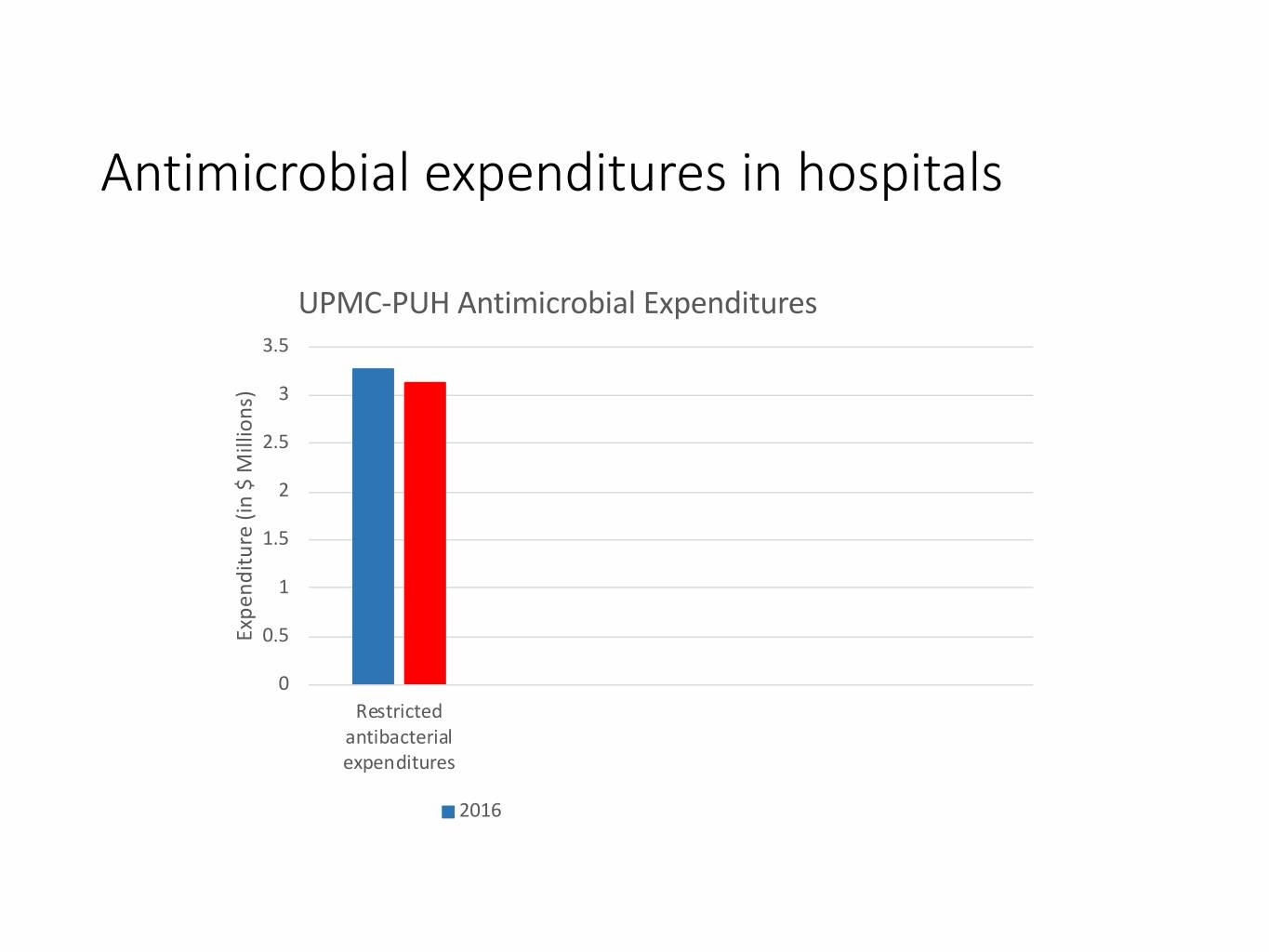

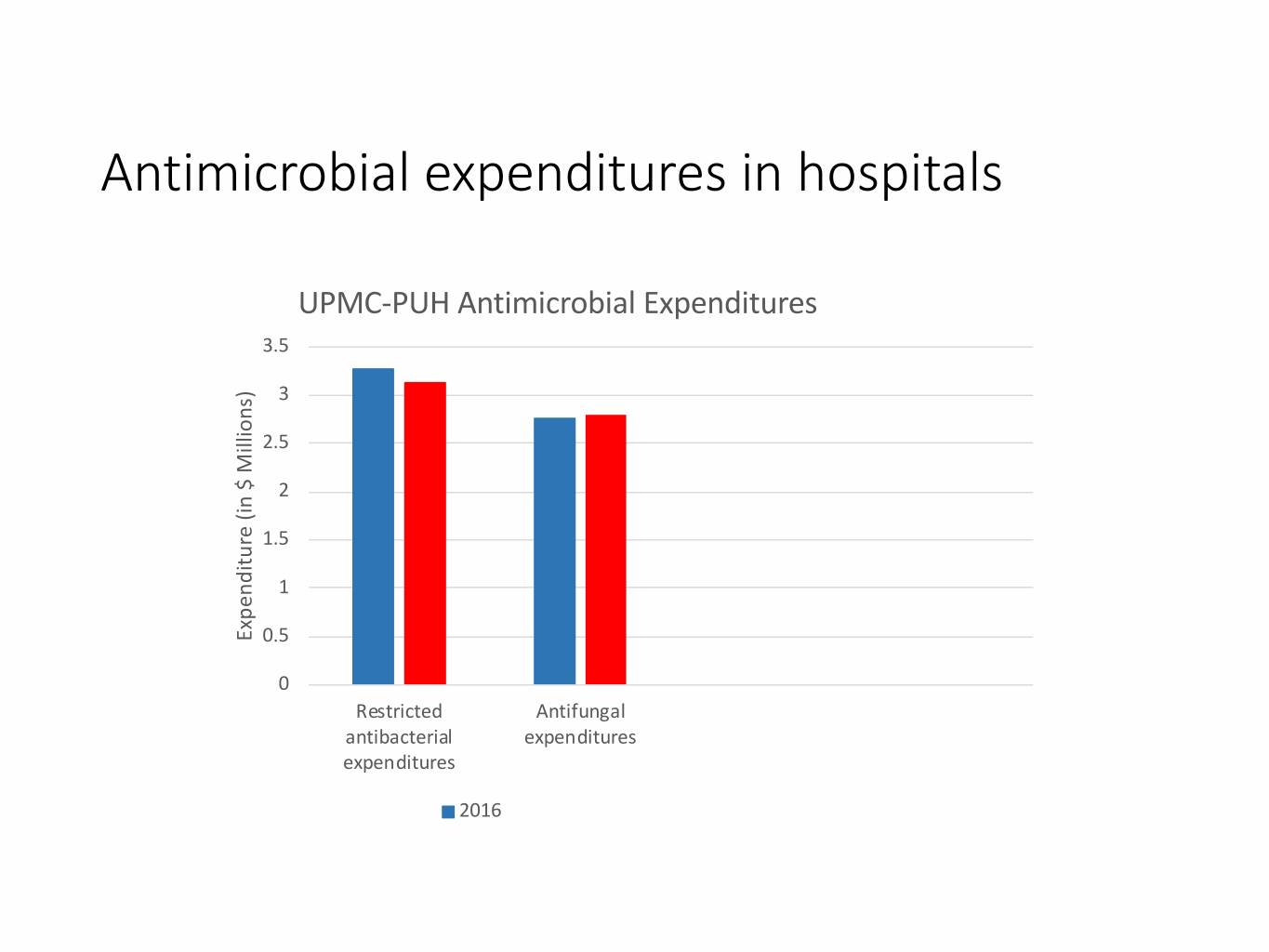

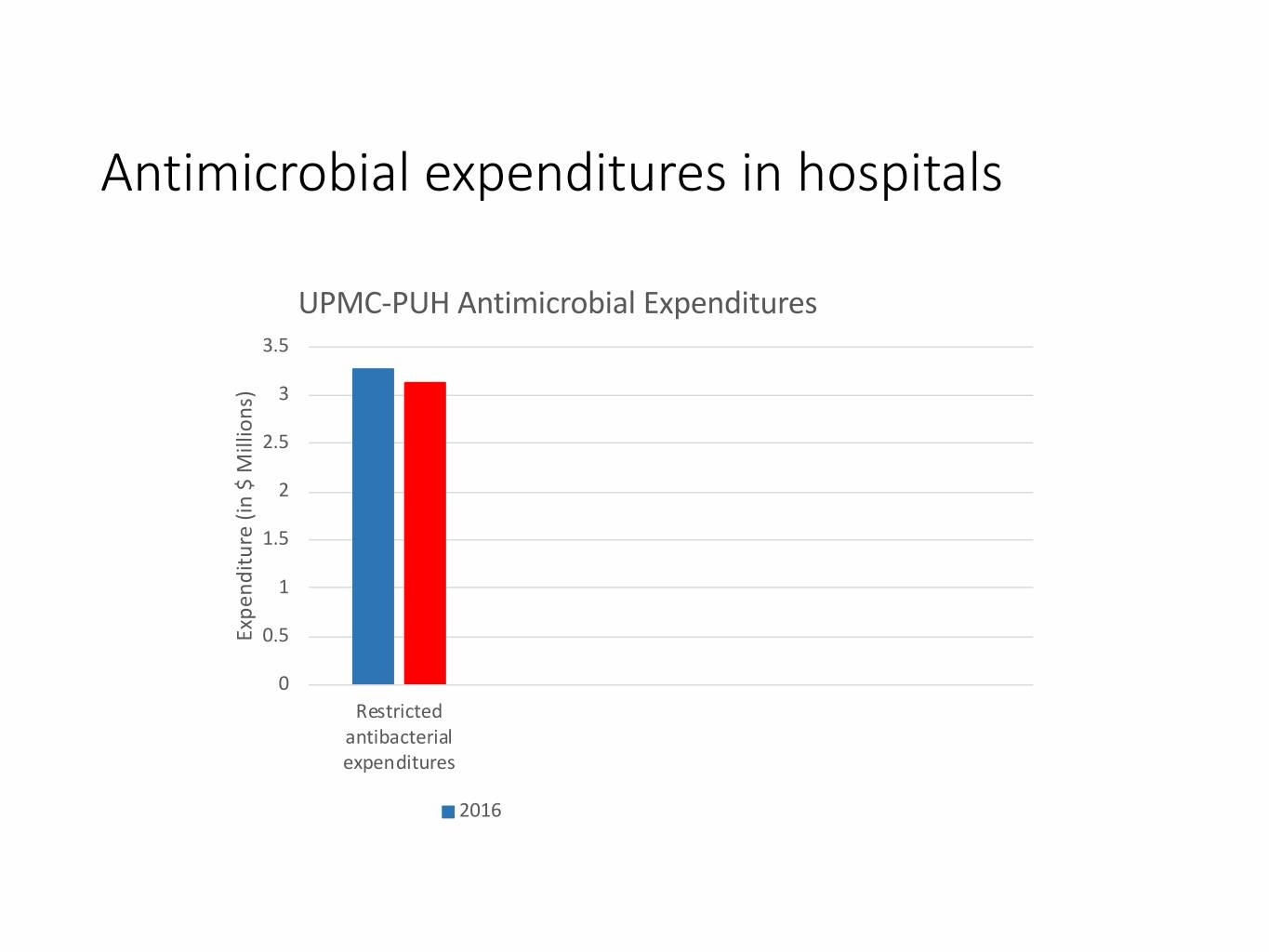

Antimicrobial expenditures in hospitals UPMC-PUH Antimicrobial Expenditures 3.5 3 2.5 2 1.5 1 Expenditure (in $ Millions) $ (in Expenditure 0.5 0 Restricted antibacterial expenditures 2016

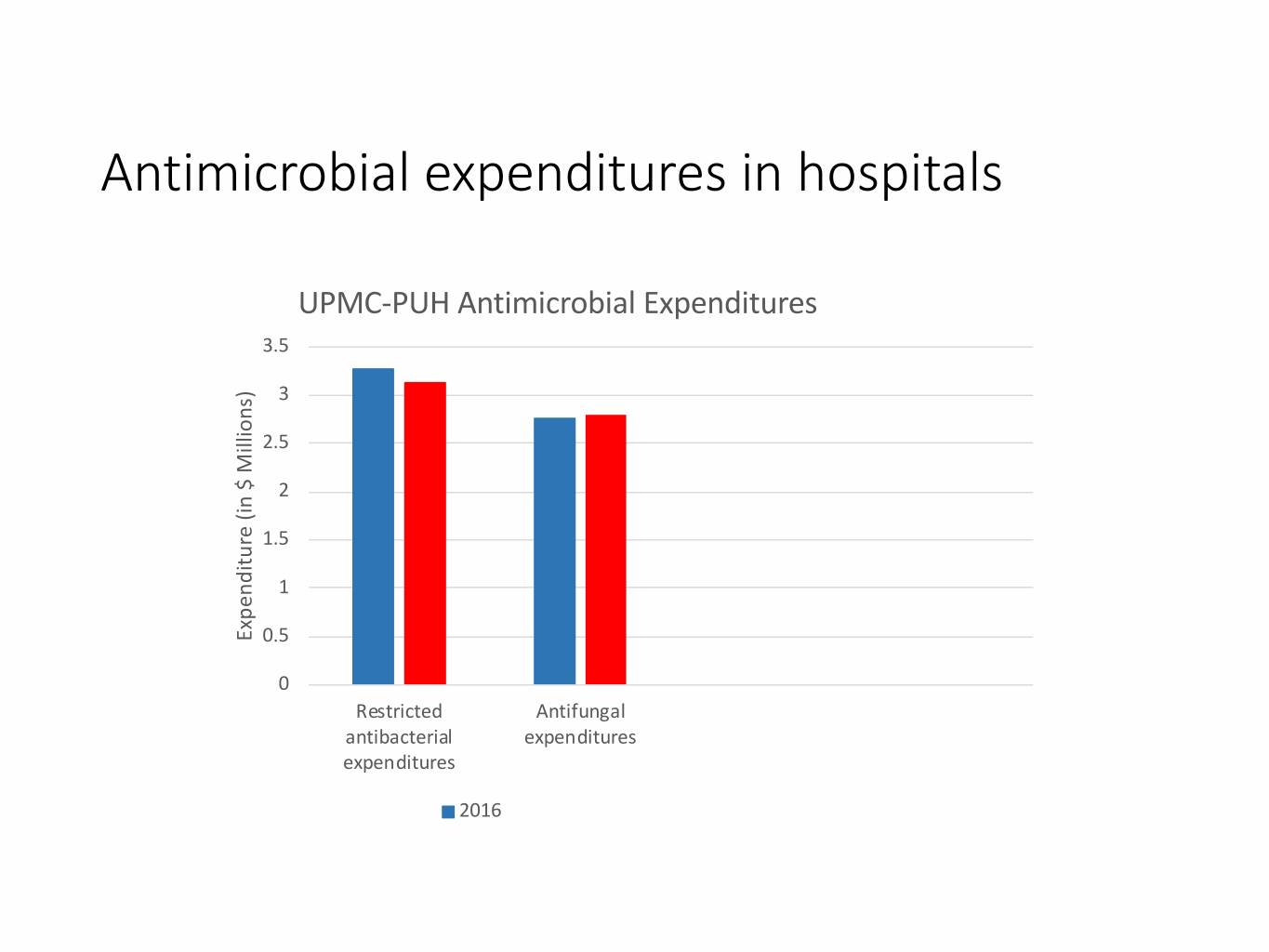

Antimicrobial expenditures in hospitals UPMC-PUH Antimicrobial Expenditures 3.5 3 2.5 2 1.5 1 Expenditure (in $ Millions) $ (in Expenditure 0.5 0 Restricted Antifungal antibacterial expenditures expenditures 2016

Why do hospitals spend so much on antifungals?

Why do hospitals spend so much on antifungals? 1. Patients often receive antifungal prophylaxis and treatment for weeks to months • Organ transplant recipients at UPMC receive 1-4 months of prophylaxis • Invasive aspergillosis and other mold infections are usually treated “for a minimum of 6-12 weeks” IDSA Practice Guidelines for the Diagnosis and Management of Aspergillosis, 2016 • Changing epidemiology of Candida infections related to opioid and injection drug epidemics 6-12 week treatments for endocarditis and other complications

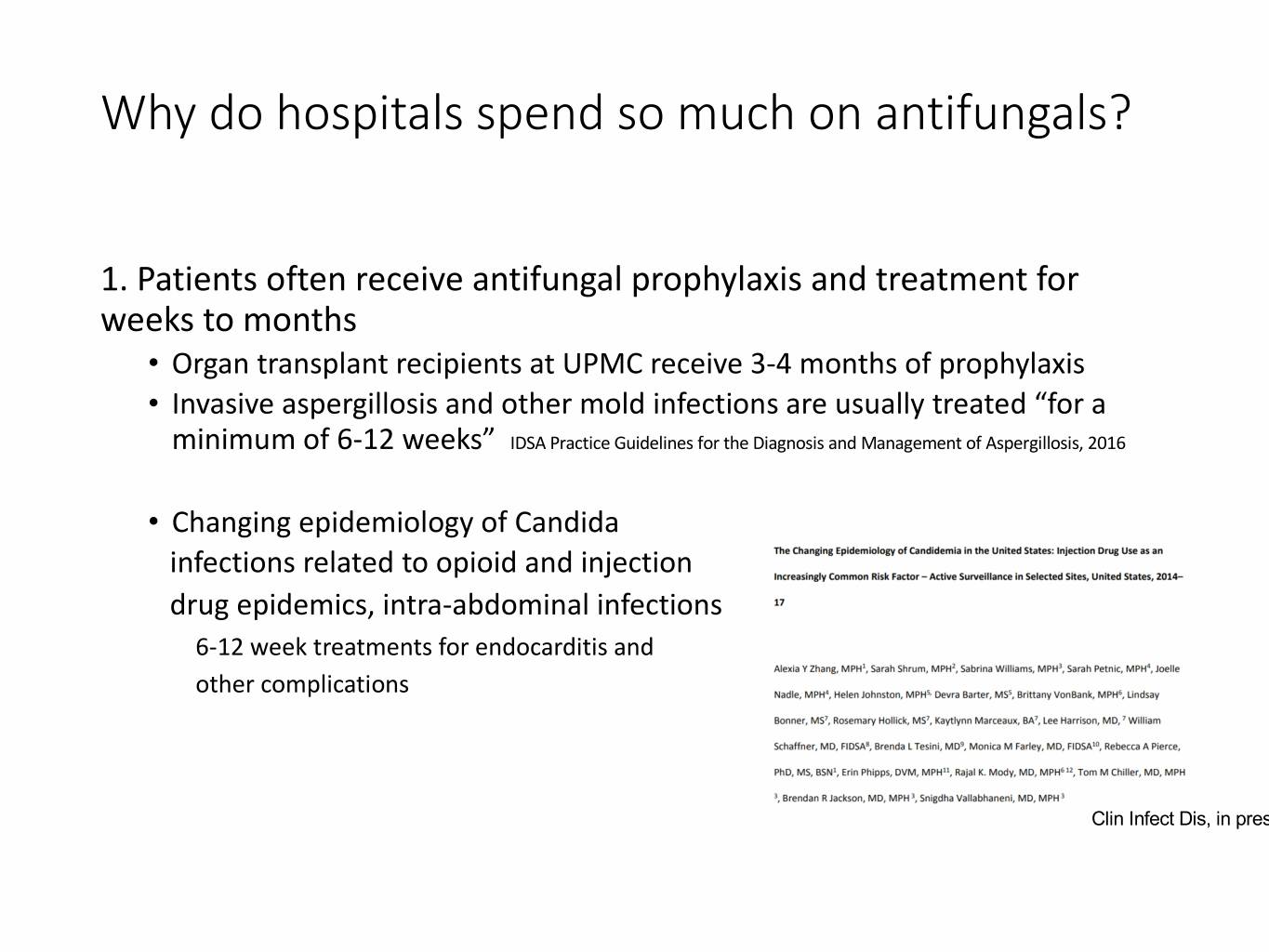

Why do hospitals spend so much on antifungals? 1. Patients often receive antifungal prophylaxis and treatment for weeks to months • Organ transplant recipients at UPMC receive 3-4 months of prophylaxis • Invasive aspergillosis and other mold infections are usually treated “for a minimum of 6-12 weeks” IDSA Practice Guidelines for the Diagnosis and Management of Aspergillosis, 2016 • Changing epidemiology of Candida infections related to opioid and injection drug epidemics, intra-abdominal infections 6-12 week treatments for endocarditis and other complications Clin Infect Dis, in press

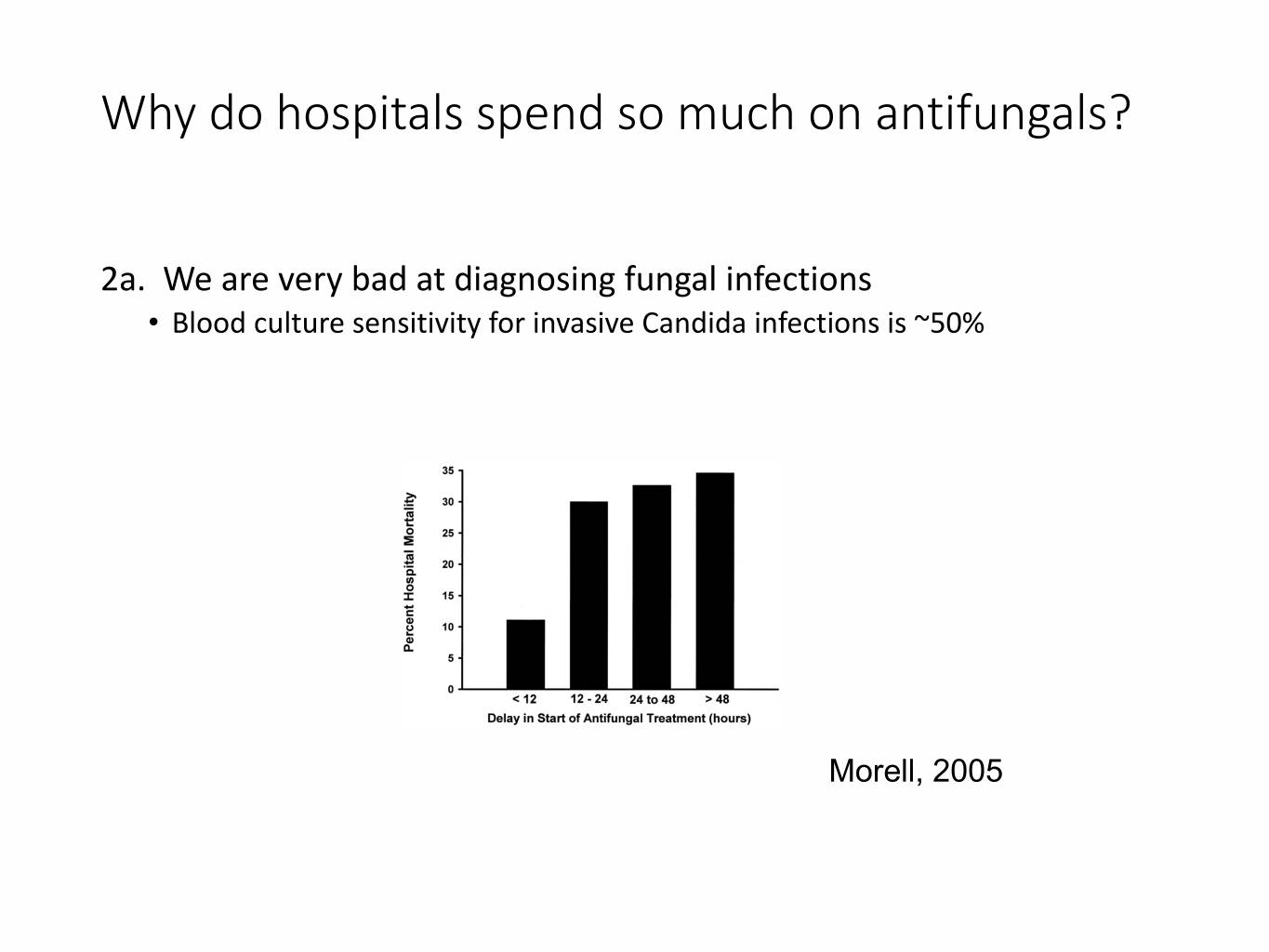

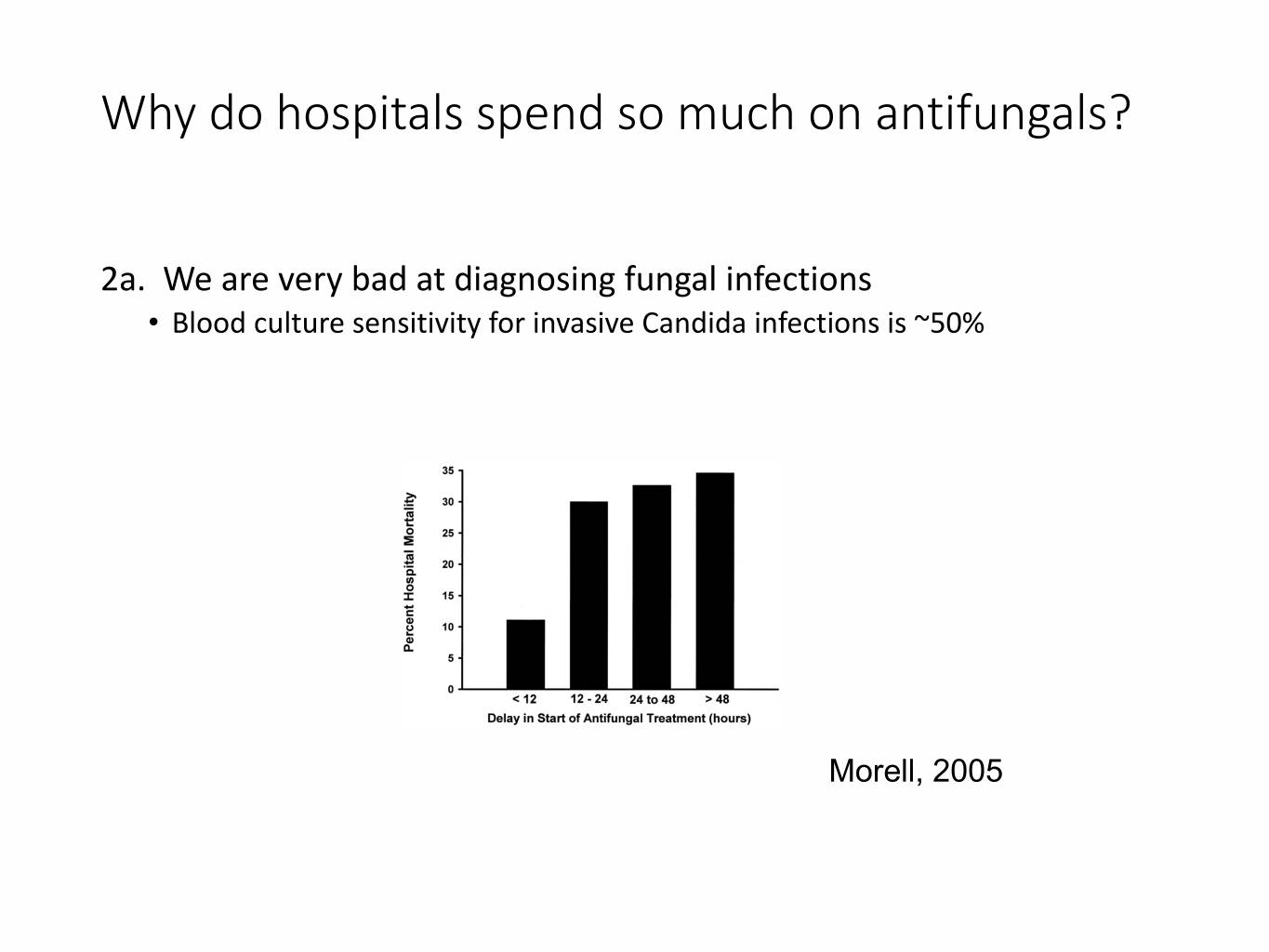

Why do hospitals spend so much on antifungals? 2a. We are very bad at diagnosing fungal infections • Blood culture sensitivity for invasive Candida infections is ~50% Morell, 2005

Why do hospitals spend so much on antifungals? 2b. Empiric and pre-emptive treatment are common • Empiric, pre-emptive and prophylactic antifungal use dwarfs treatment of documented infections Many hospitalized patients are at-risk for fungal infections • It’s not just cancer patients and transplant recipients! • Candida is the 3rd most common pathogen in US ICUs • 50% of invasive Candida infections occur in patients who do not have “classic” immunosuppression • Risk factors for candidiasis are present in the majority of hospitalized patients • Aspergillus complicates 15% of severe influenza in European ICUs • are very bad at diagnosing fungal infections • Blood culture sensitivity for invasive Candida infections is ~50%

Why do hospitals spend so much on antifungals? 2b. Empiric and pre-emptive treatment are common • Empiric, pre-emptive and prophylactic antifungal use exceeds treatment of documented infections 3. Many hospitalized patients are at-risk for fungal infections • It’s not just cancer patients and transplant recipients! • Candida is the 3rd most common pathogen in US ICUs • 50% of invasive Candida infections occur in patients who do not have “classic” immunosuppression • Risk factors for candidiasis are present in the majority of hospitalized patients • Aspergillus complicates 15% of severe influenza in European ICUs • are very bad at diagnosing fungal infections • Blood culture sensitivity for invasive Candida infections is ~50%

What are unmet needs in treatment of invasive fungal disease?

What are unmet needs in treatment of invasive fungal disease? • We need better drugs! • Mortality rates (12 m) • Stem cell transplant • 75% molds • 67% Candida • Organ transplant • 40% molds • 33% Candida bad at diagnosing fungal infections • Blood culture sensitivity for invasive Candida infections is ~50%

Echinocandins are agents of choice in treatment of invasive candidiasis • Mortality rate (30 d) is still 27% 41

Echinocandins are agents of choice in treatment of invasive candidiasis • Mortality rate (30 d) is still 27% WHY? 42

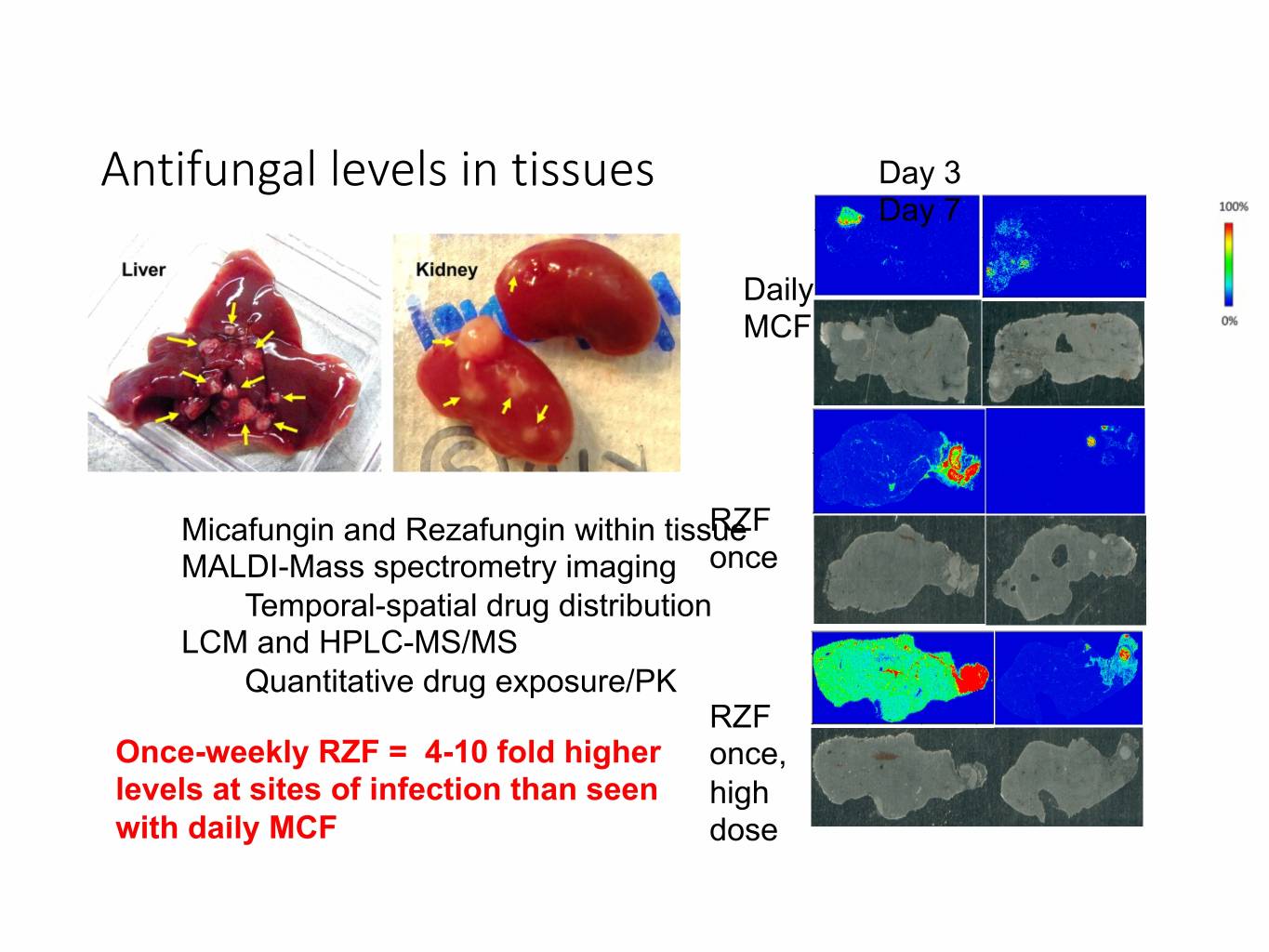

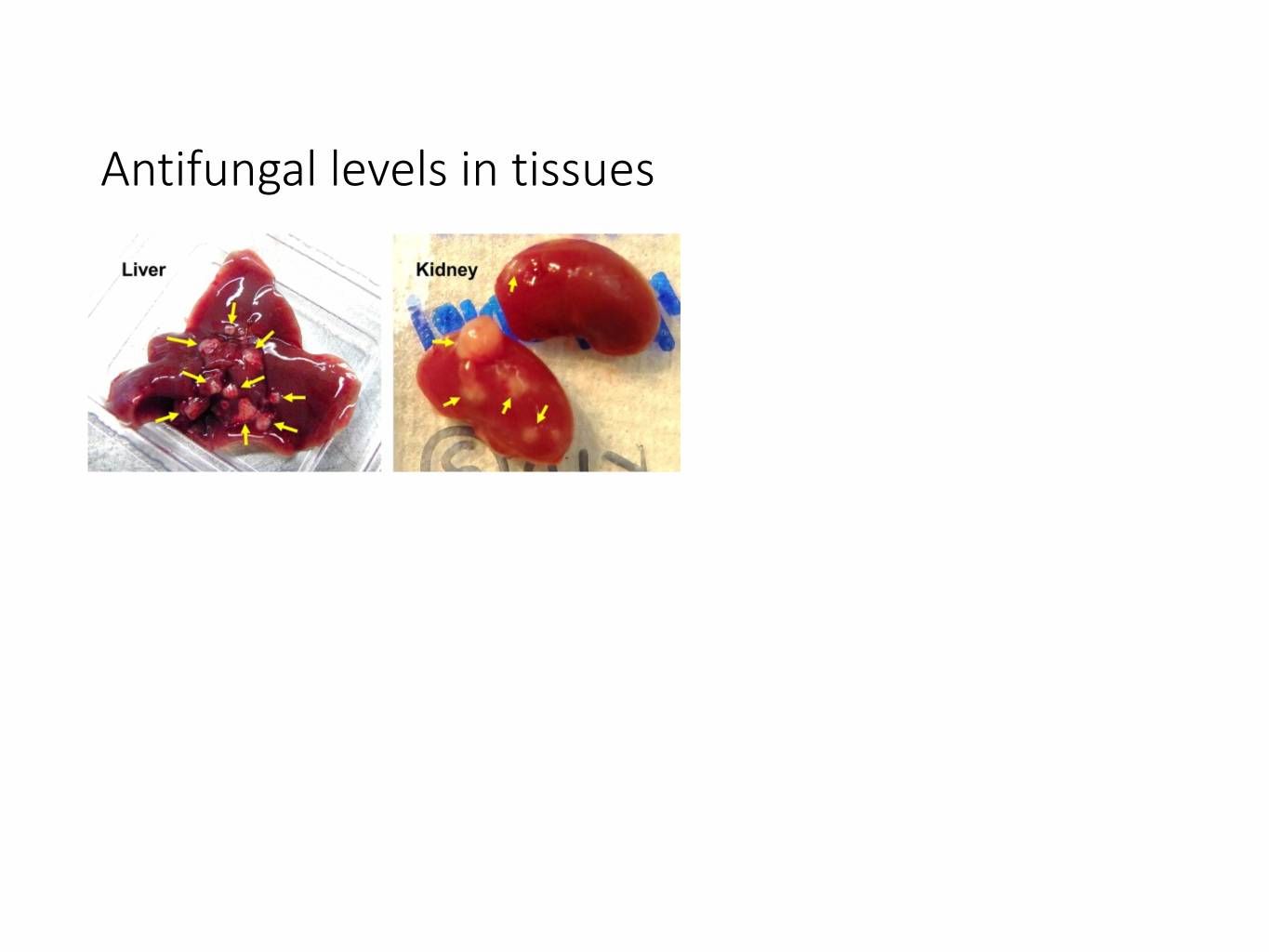

Antifungal levels in tissues

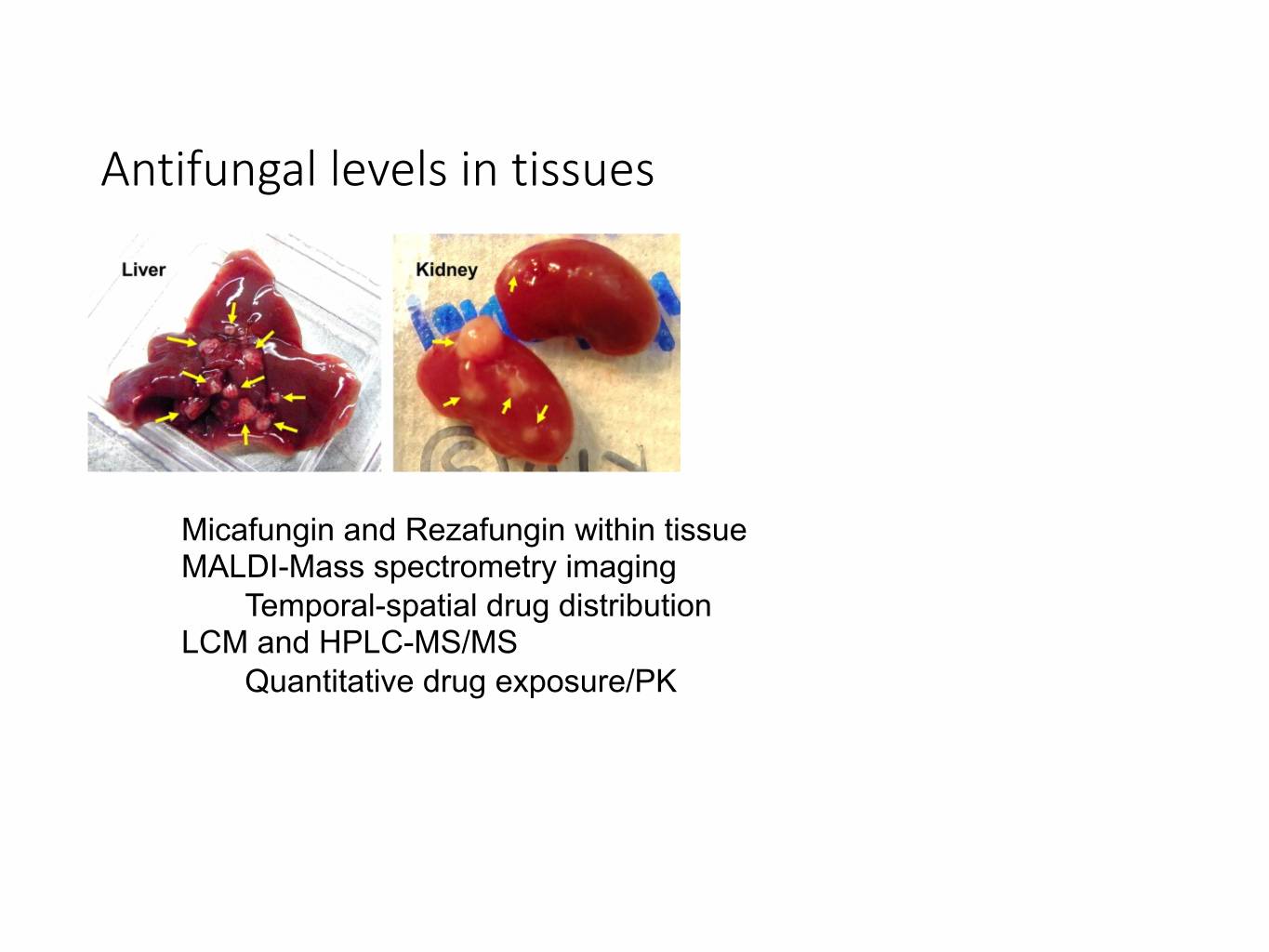

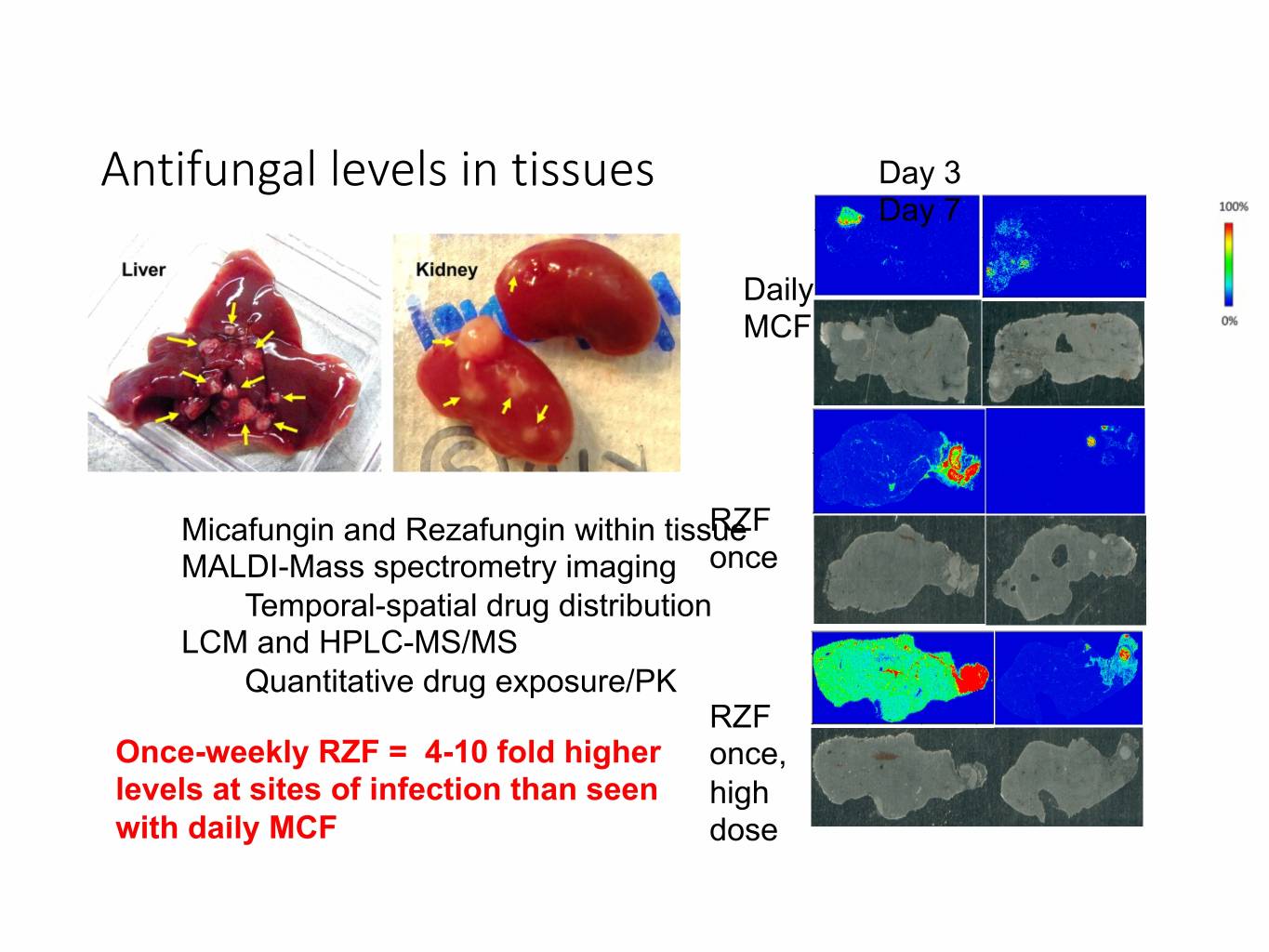

Antifungal levels in tissues Micafungin and Rezafungin within tissue MALDI-Mass spectrometry imaging Temporal-spatial drug distribution LCM and HPLC-MS/MS Quantitative drug exposure/PK

Antifungal levels in tissues Day 3 Day 7 Daily MCF Micafungin and Rezafungin within tissueRZF MALDI-Mass spectrometry imaging once Temporal-spatial drug distribution LCM and HPLC-MS/MS Quantitative drug exposure/PK RZF Once-weekly RZF = 4-10 fold higher once, levels at sites of infection than seen high with daily MCF dose

What does Rezafungin offer? • Superior penetration and drug levels at tissue sites of infection, compared to current standard of care • Once-weekly dosing, excellent safety and drug-drug interaction profiles • Changing epidemiology of Candida

What does Rezafungin offer? • Presents opportunities for new treatment paradigms • Organ transplant • Below the diaphragm transplant • Prophylaxis • Definitive treatment of candidiasis • Above the diaphragm transplants • Alternative to azoles • Azole intolerance in 20-40%

What does Rezafungin offer? • Presents opportunities for new treatment paradigms • ICUs, Pre-emptive, empiric treatment • Need: Time to sort things out • Once-weekly dosing allows you several days to make definitive diagnoses, while not tying up an intravenous line

What does Rezafungin offer? • Presents opportunities for new treatment paradigms • Definitive treatment • Inpatient need: Effectiveness, safety and convenience • Post-discharge need: Effective and convenient dosing strategies in outpatient setting • May be able to administer a terminal dose prior to discharge, eliminating need for outpatient treatment • Weekly intravenous therapy in-home or at infusion center • Injection drug users: May eliminate need for long-term hospitalizations

SB 12 Agenda Opening - Overview Jeff Stein, PhD, CEO, Cidara Therapeutics Antifungal Treatment Unmet Neil Clancy, M.D., University of Pittsburgh Needs Unmet Antifungal Prophylaxis Needs Kieren Marr, M.D., Johns Hopkins School of Medicine Influenza Unmet Allison McGeer, M.D., University of Toronto Needs Commercial Potential Paul Daruwala, COO, Cidara Therapeutics Fireside Chat, Q&A Team 50

Unmet Needs in Heme - BMT Kieren Marr MD, MBA Professor and Vice Chair of Medicine for Innovation in Healthcare Implementation Director, Transplant and Oncology Infectious Diseases 51 51

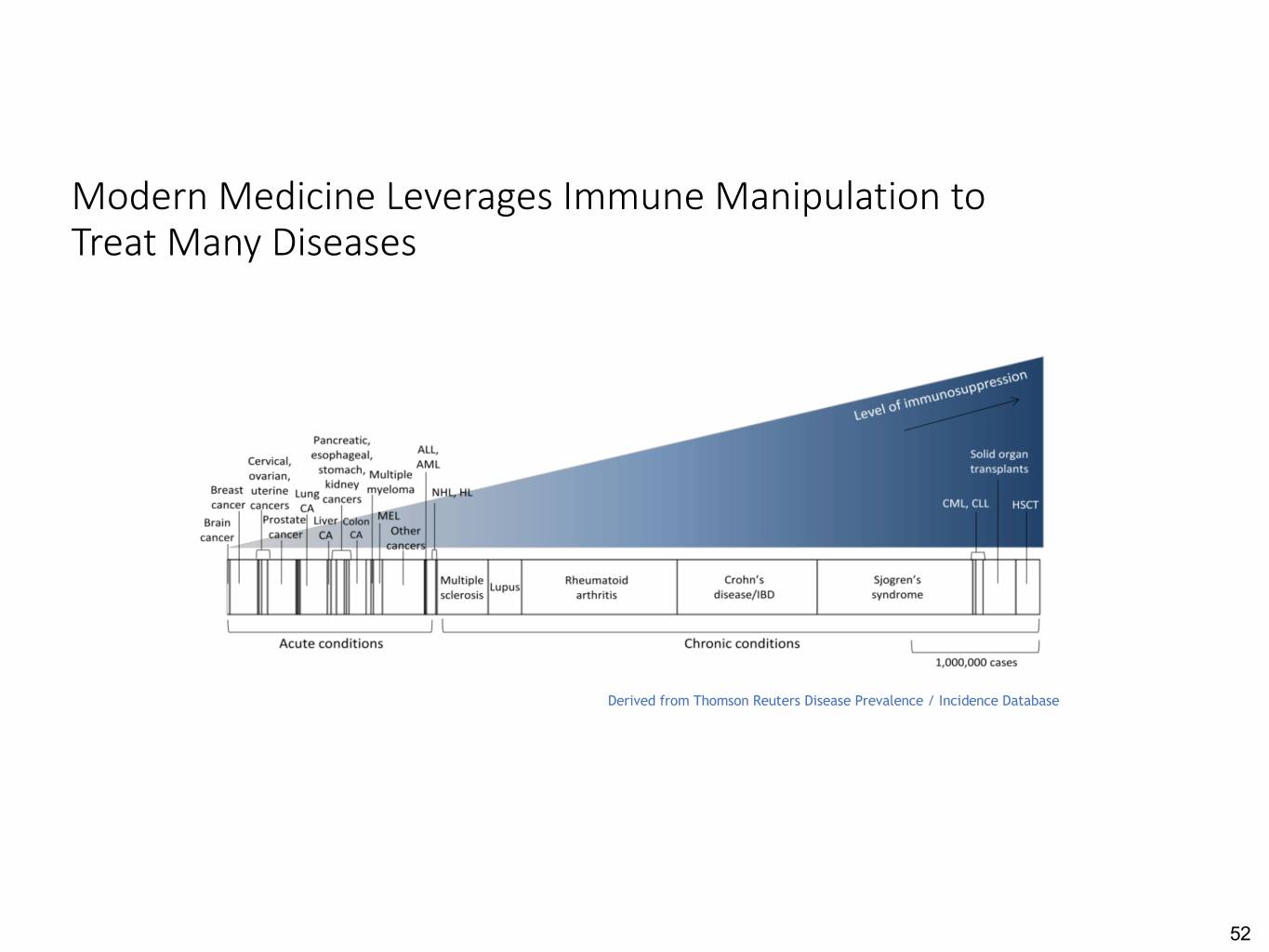

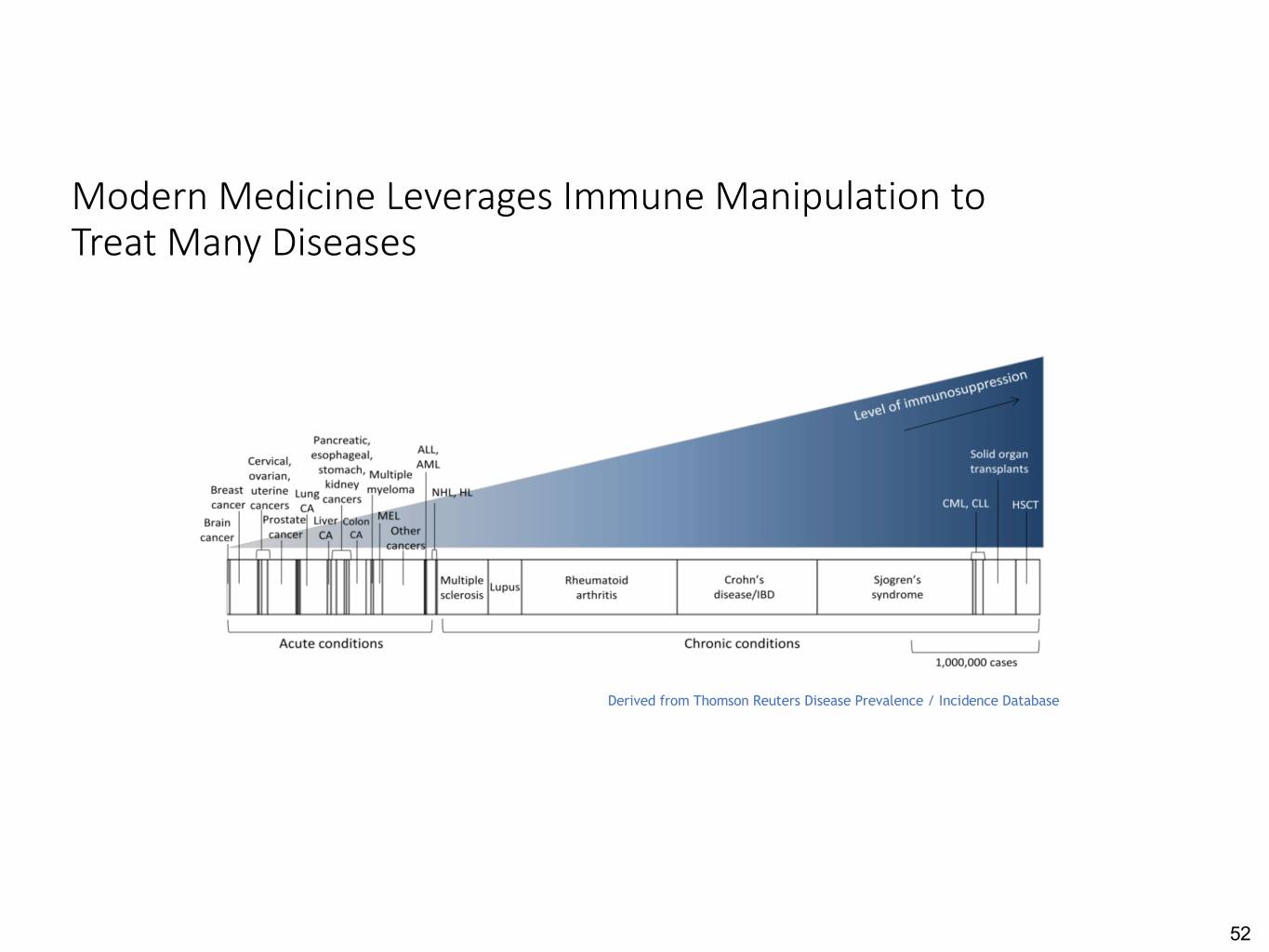

Modern Medicine Leverages Immune Manipulation to Treat Many Diseases Derived from Thomson Reuters Disease Prevalence / Incidence Database 52

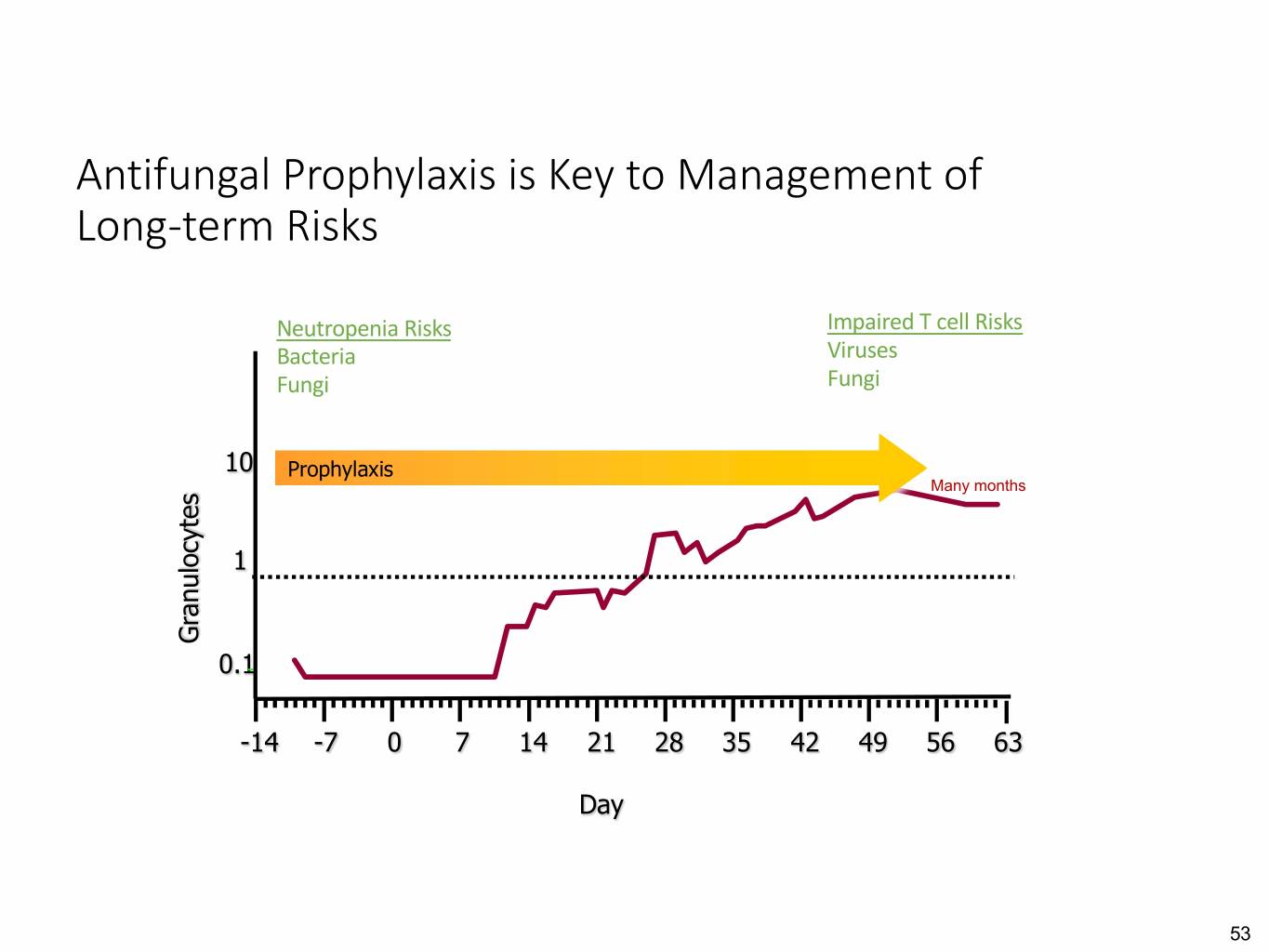

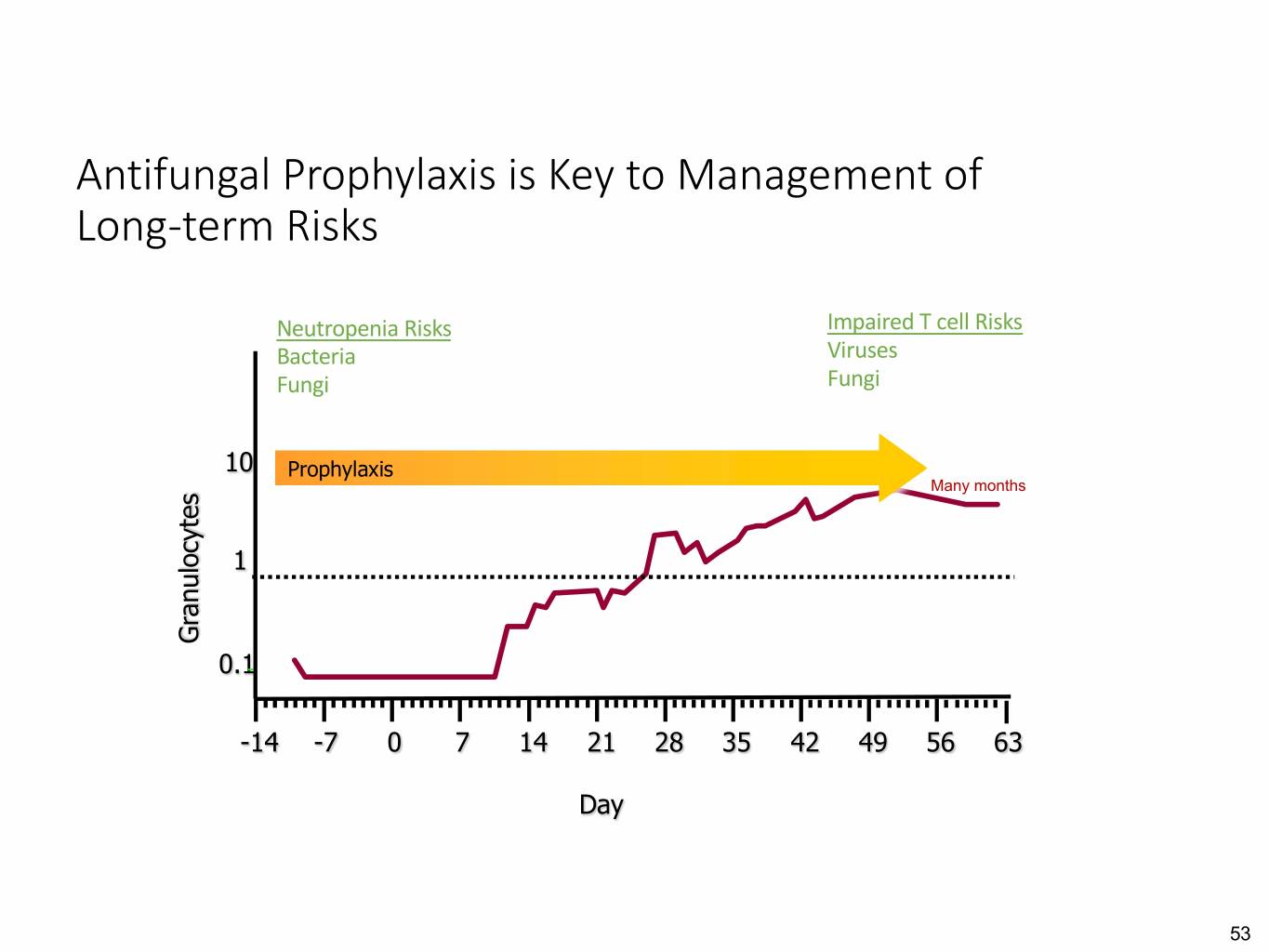

Antifungal Prophylaxis is Key to Management of Long-term Risks Neutropenia Risks Impaired T cell Risks Bacteria Viruses Fungi Fungi 10 Prophylaxis Many months 1 Granulocytes 0.1 -14 -7 0 7 14 21 28 35 42 49 56 63 Day 53

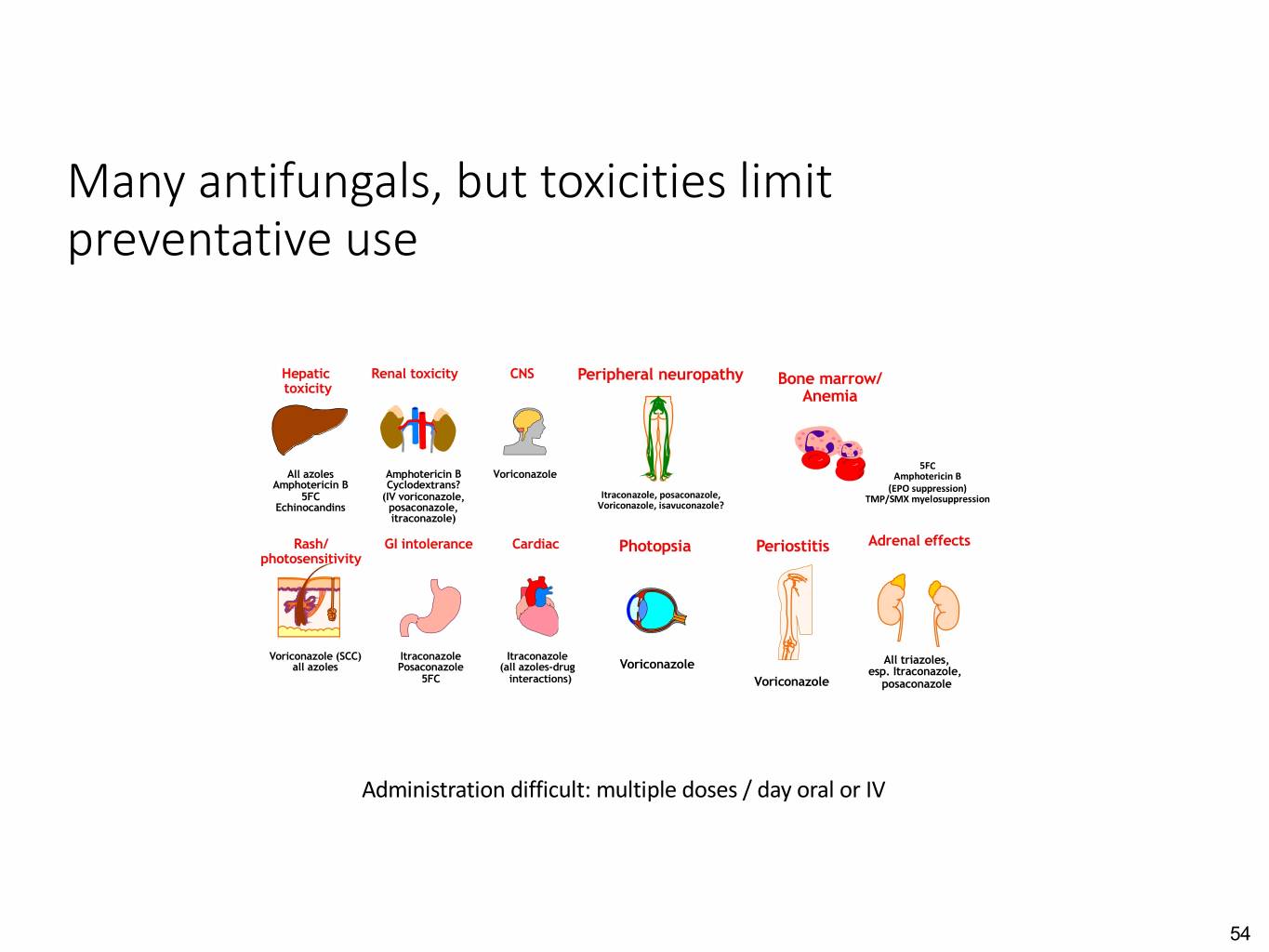

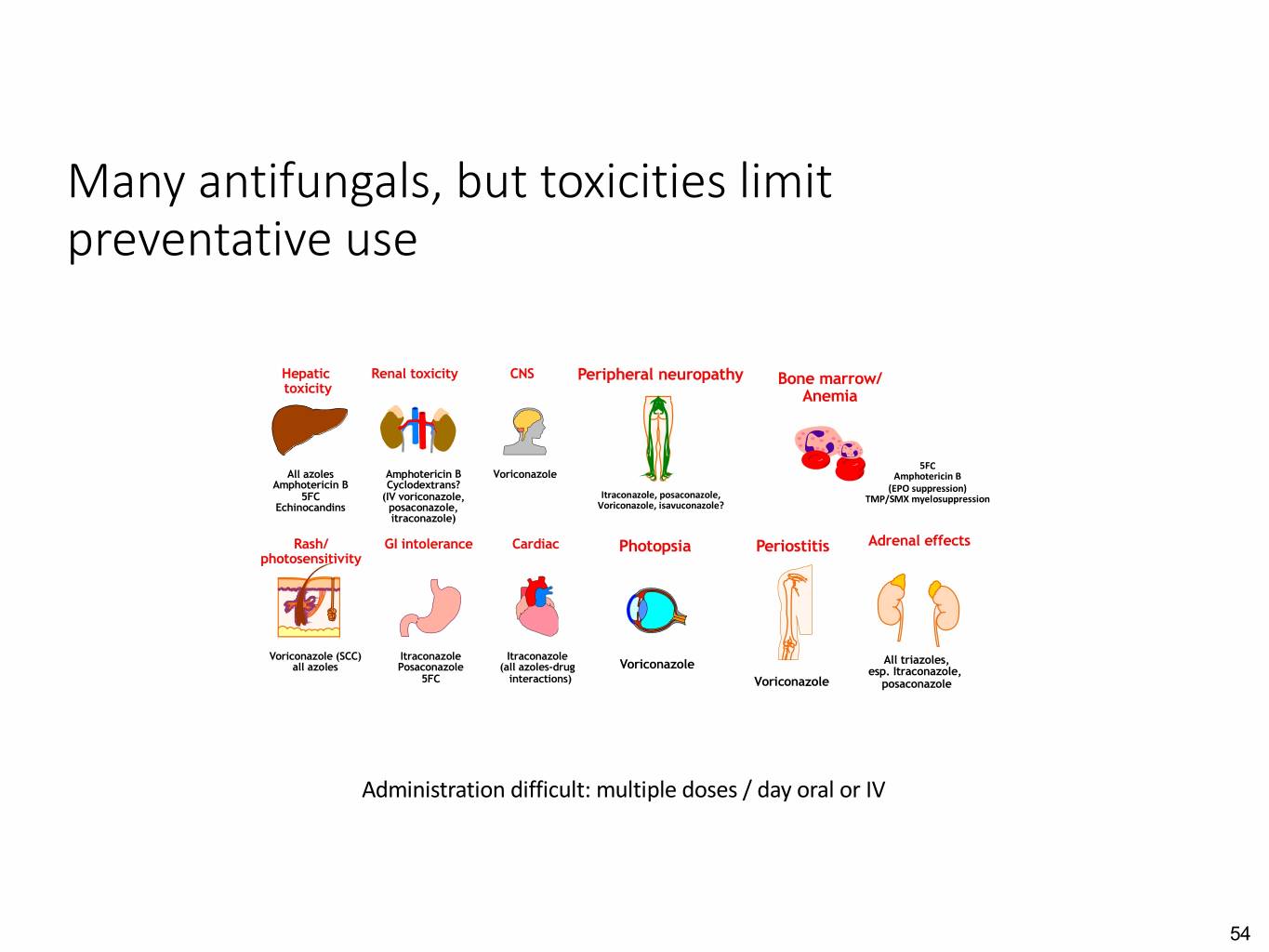

Many antifungals, but toxicities limitPeripheral neuropathy Periostitis preventative use Voriconazole Peripheral neuropathy Periostitis Hepatic Renal toxicity CNS Peripheral neuropathy PeriostitisBone marrow/ Adrenal effects toxicity Anemia 5FC All azoles Amphotericin B Voriconazole AmphotericinVoriconazole B Amphotericin B Cyclodextrans? (EPO suppression) 5FC (IV voriconazole, Itraconazole, posaconazole, TMP/SMX myelosuppression Echinocandins posaconazole, Voriconazole, isavuconazole? Voriconazole5FC All triazoles, itraconazole) Amphotericin B esp. Itraconazole, (EPO suppression) posaconazole Rash/ GI intolerance CardiacPeripheralPhotopsia neuropathy BonePeriostitis marrow/ Adrenal effects photosensitivity Anemia Bone marrow/ Adrenal effects Anemia Voriconazole (SCC) Itraconazole Itraconazole Voriconazole 5FC All triazoles, all azoles Posaconazole (all azoles-drug Amphotericin B esp. Itraconazole, 5FC interactions) (EPOVoriconazole suppression) posaconazole 5FC All triazoles, Amphotericin B esp. Itraconazole, (EPO suppression) posaconazole Lewis RE. Mayo Clinic Reviews 2011;86:805-17. Bone marrow/Infusion Adrenal effects Anemiareactions Administration difficult: multiple doses / day oral or IV 5FCAmphotericin B All triazoles, AmphotericinEchinocandins B esp. Itraconazole, (EPO suppression) posaconazole 54

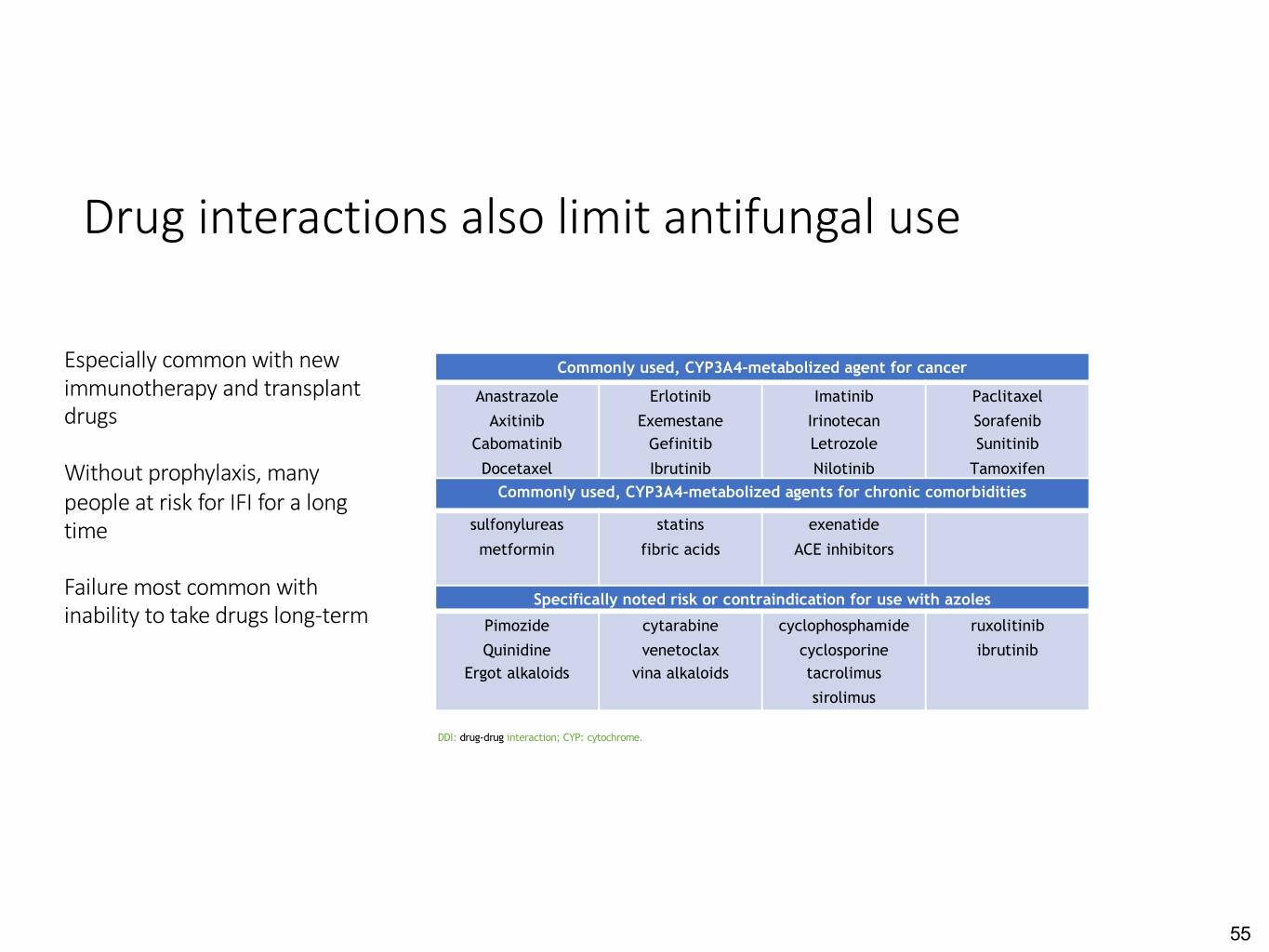

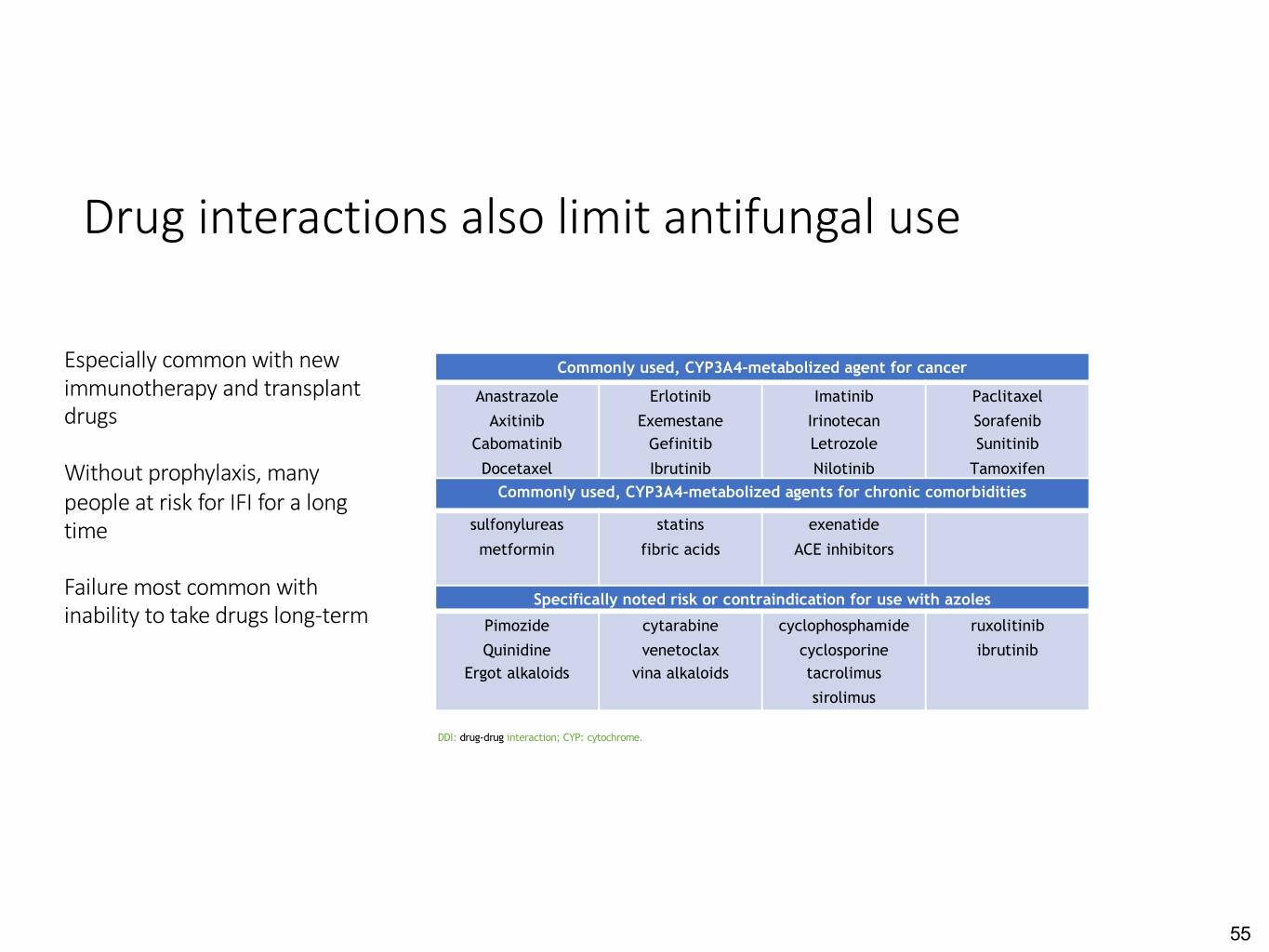

Drug interactions also limit antifungal use Especially common with new Commonly used, CYP3A4-metabolized agent for cancer immunotherapy and transplant Anastrazole Erlotinib Imatinib Paclitaxel drugs Axitinib Exemestane Irinotecan Sorafenib Cabomatinib Gefinitib Letrozole Sunitinib Without prophylaxis, many Docetaxel Ibrutinib Nilotinib Tamoxifen people at risk for IFI for a long Commonly used, CYP3A4-metabolized agents for chronic comorbidities time sulfonylureas statins exenatide metformin fibric acids ACE inhibitors Failure most common with Specifically noted risk or contraindication for use with azoles inability to take drugs long-term Pimozide cytarabine cyclophosphamide ruxolitinib Quinidine venetoclax cyclosporine ibrutinib Ergot alkaloids vina alkaloids tacrolimus sirolimus DDI: drug-drug interaction; CYP: cytochrome. 55

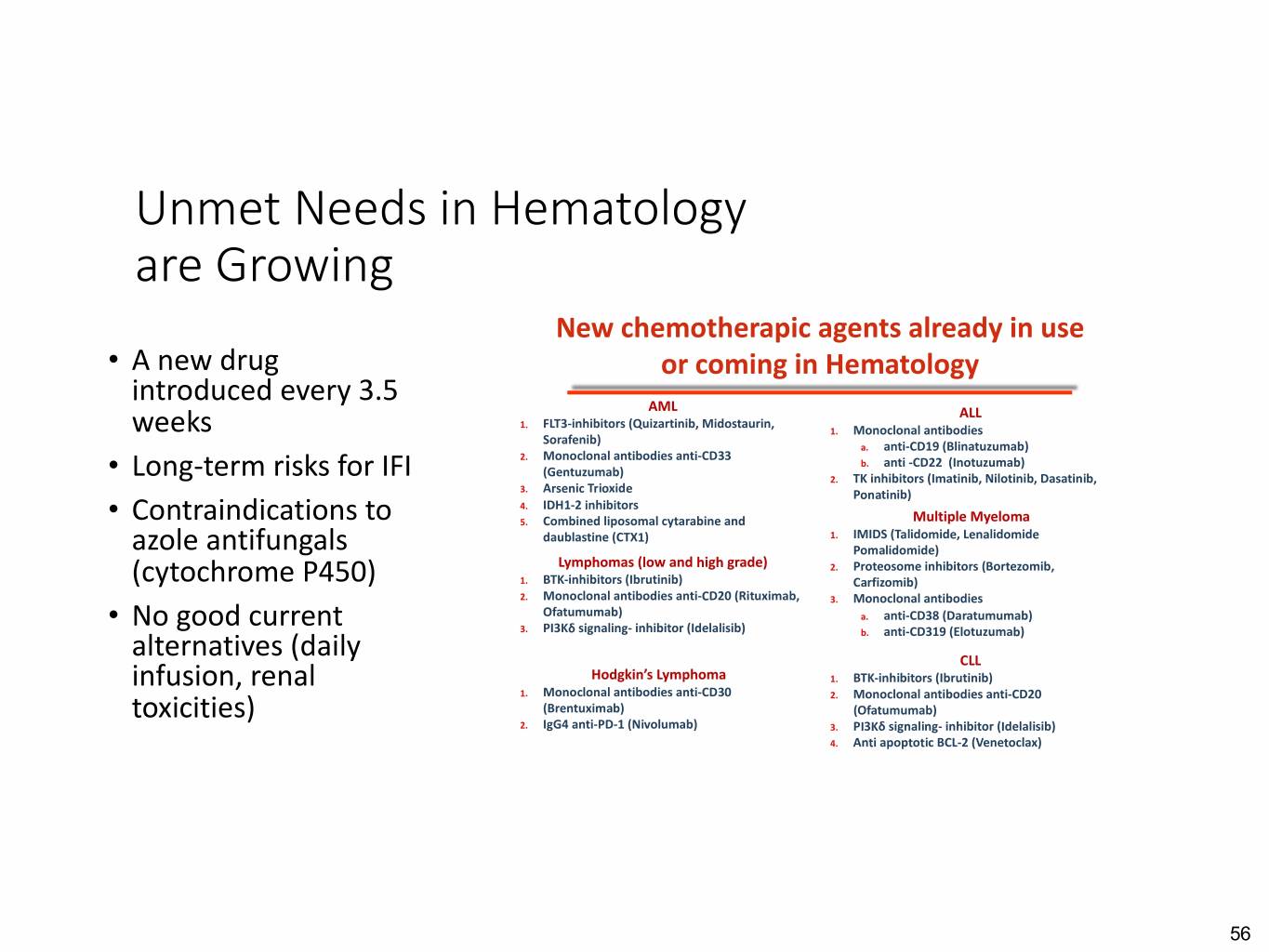

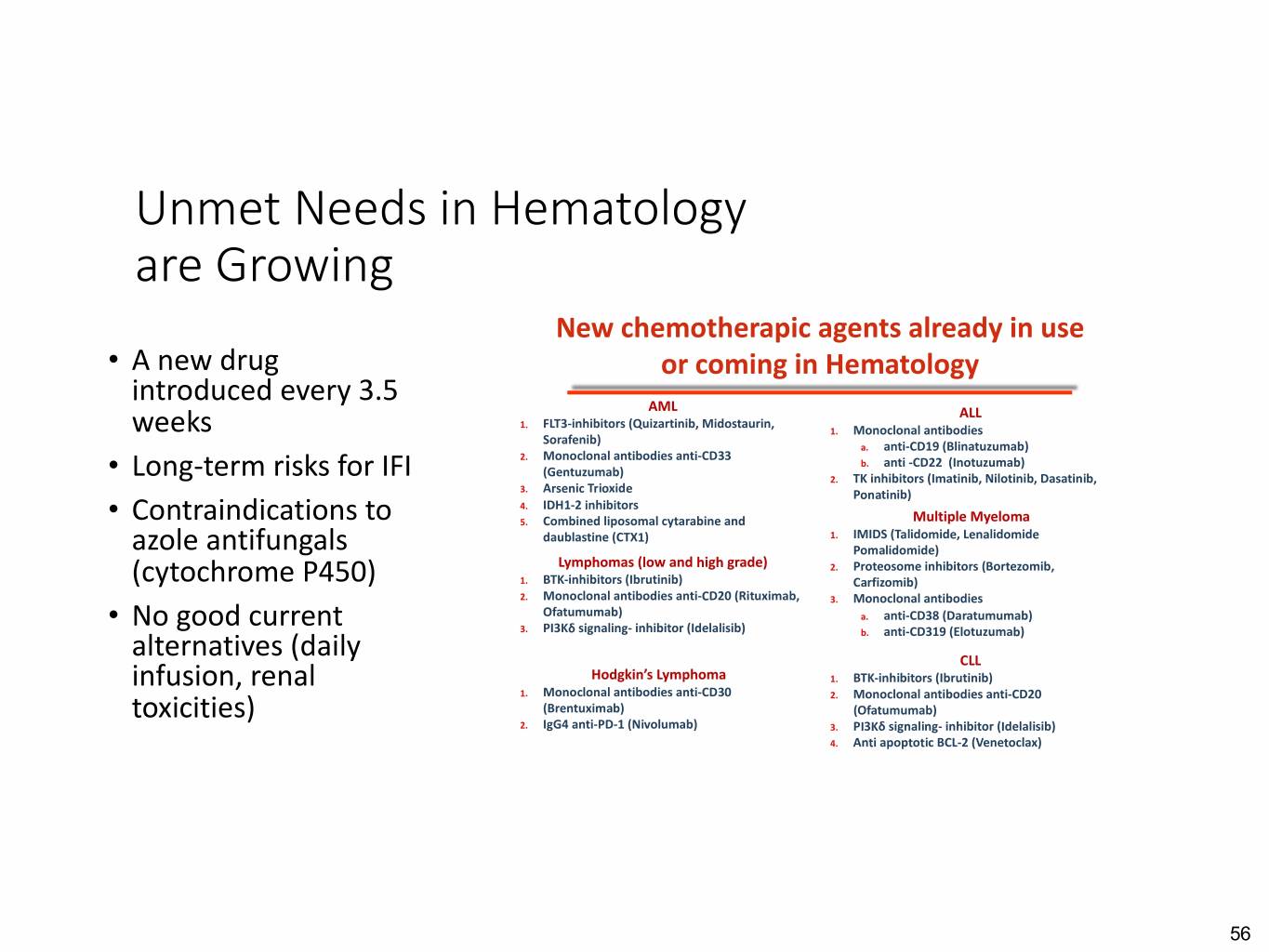

Unmet Needs in Hematology are Growing New chemotherapic agents already in use • A new drug or coming in Hematology introduced every 3.5 AML ALL 1. FLT3-inhibitors (Quizartinib, Midostaurin, weeks 1. Monoclonal antibodies Sorafenib) a. anti-CD19 (Blinatuzumab) 2. Monoclonal antibodies anti-CD33 b. anti -CD22 (Inotuzumab) (Gentuzumab) • Long-term risks for IFI 2. TK inhibitors (Imatinib, Nilotinib, Dasatinib, 3. Arsenic Trioxide Ponatinib) 4. IDH1-2 inhibitors • Contraindications to 5. Combined liposomal cytarabine and Multiple Myeloma daublastine (CTX1) 1. IMIDS (Talidomide, Lenalidomide azole antifungals Pomalidomide) Lymphomas (low and high grade) 2. Proteosome inhibitors (Bortezomib, (cytochrome P450) 1. BTK-inhibitors (Ibrutinib) Carfizomib) 2. Monoclonal antibodies anti-CD20 (Rituximab, 3. Monoclonal antibodies • No good current Ofatumumab) a. anti-CD38 (Daratumumab) 3. PI3Kδ signaling- inhibitor (Idelalisib) b. anti-CD319 (Elotuzumab) alternatives (daily CLL infusion, renal Hodgkin’s Lymphoma 1. BTK-inhibitors (Ibrutinib) 1. Monoclonal antibodies anti-CD30 2. Monoclonal antibodies anti-CD20 toxicities) (Brentuximab) (Ofatumumab) 2. IgG4 anti-PD-1 (Nivolumab) 3. PI3Kδ signaling- inhibitor (Idelalisib) 4. Anti apoptotic BCL-2 (Venetoclax) 56

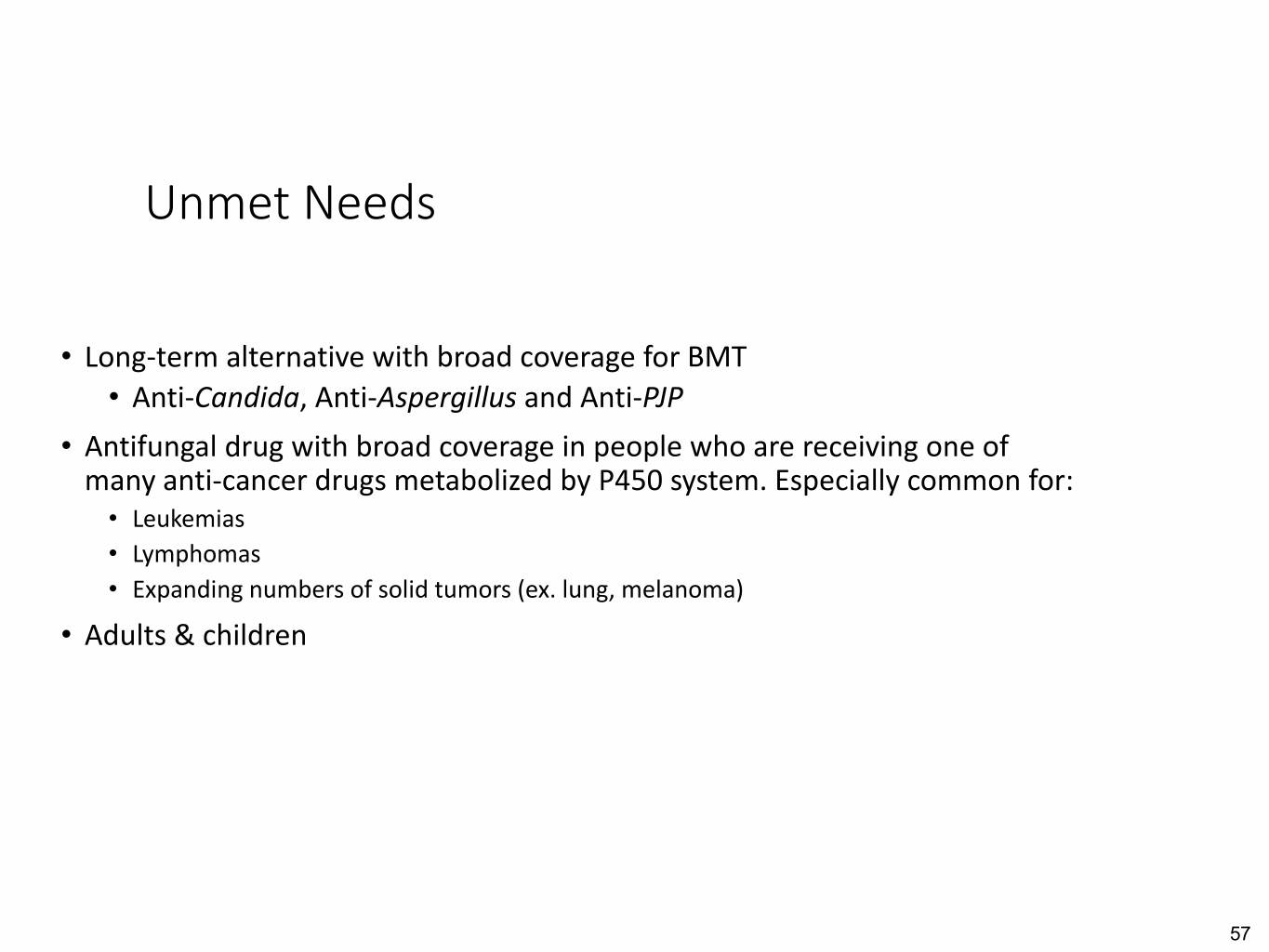

Unmet Needs • Long-term alternative with broad coverage for BMT • Anti-Candida, Anti-Aspergillus and Anti-PJP • Antifungal drug with broad coverage in people who are receiving one of many anti-cancer drugs metabolized by P450 system. Especially common for: • Leukemias • Lymphomas • Expanding numbers of solid tumors (ex. lung, melanoma) • Adults & children 57

Rezafungin One-drug Antifungal Prophylaxis • Once – weekly infusion • No liver cytochrome P450 interactions • Preclinical, clinical activity against Candida spp. (most common during neutropenia) • Preclinical activity against Aspergillus & Pneumocystis (most common during impaired T cell responses) • A once – weekly, one – drug prophylaxis 58

SB 12 Agenda Opening - Overview Jeff Stein, PhD, CEO, Cidara Therapeutics Antifungal Treatment Unmet Neil Clancy, M.D., University of Pittsburgh Needs Unmet Antifungal Prophylaxis Needs Kieren Marr, M.D., Johns Hopkins School of Medicine Influenza Unmet Allison McGeer, M.D., University of Toronto Needs Commercial Potential Paul Daruwala, COO, Cidara Therapeutics Fireside Chat, Q&A Team 59

Gaps in the prevention of influenza Allison McGeer, MSc, MD, FRCPC, FAMMI, FSHEA Sinai Health System University of Toronto 60

61

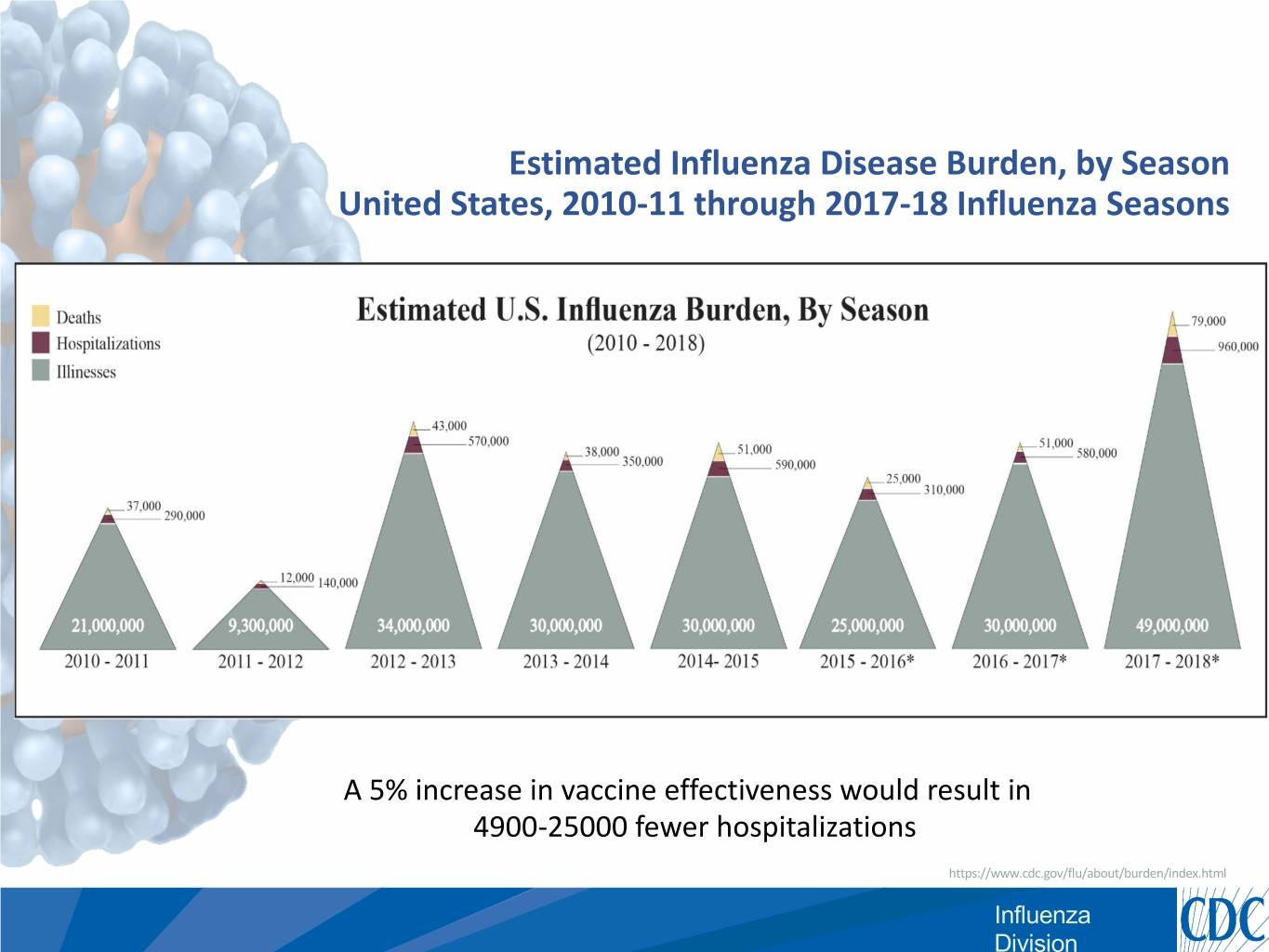

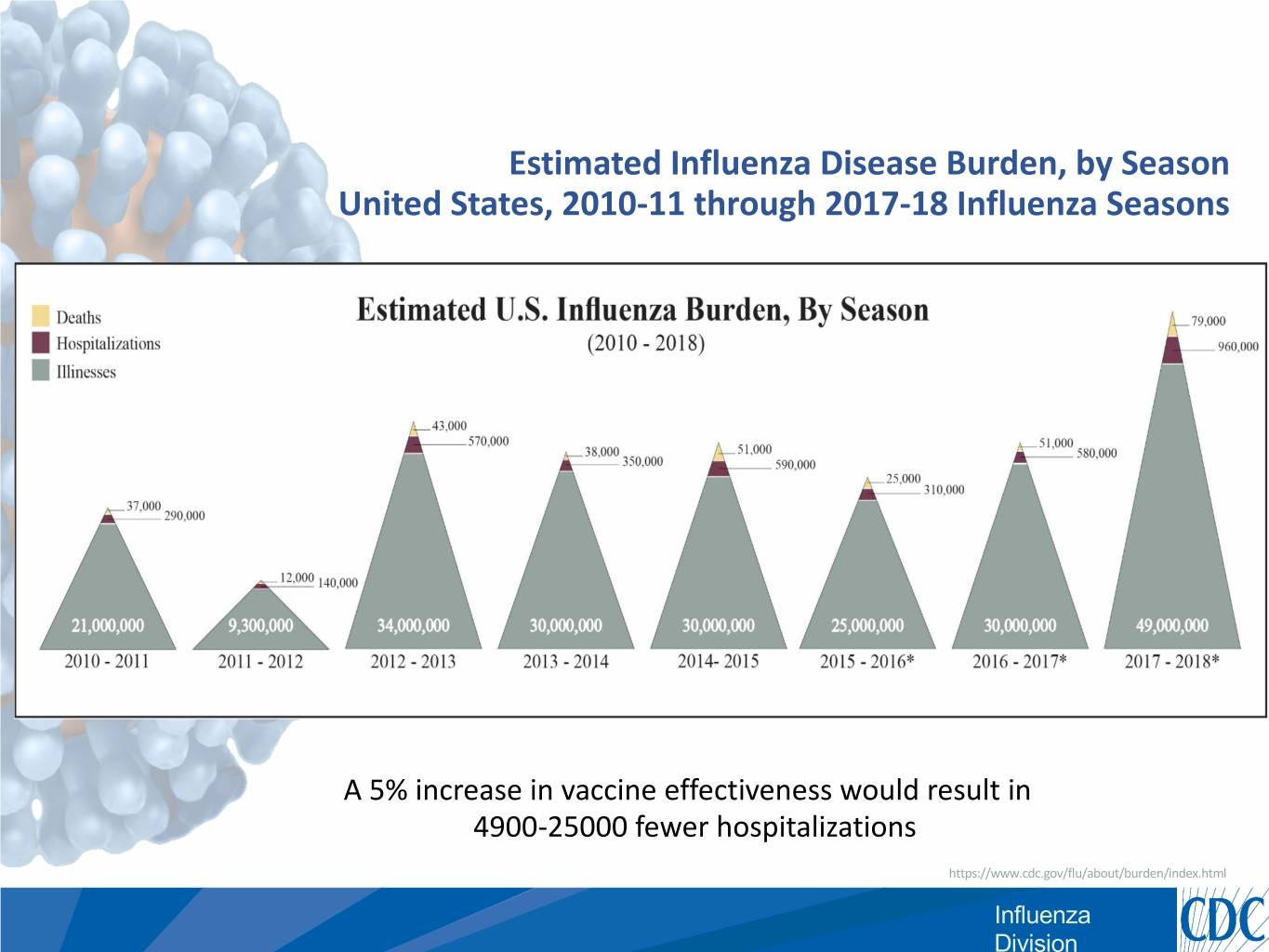

Estimated Influenza Disease Burden, by Season United States, 2010-11 through 2017-18 Influenza Seasons A 5% increase in vaccine effectiveness would result in 4900-25000 fewer hospitalizations https://www.cdc.gov/flu/about/burden/index.html Influenza Division

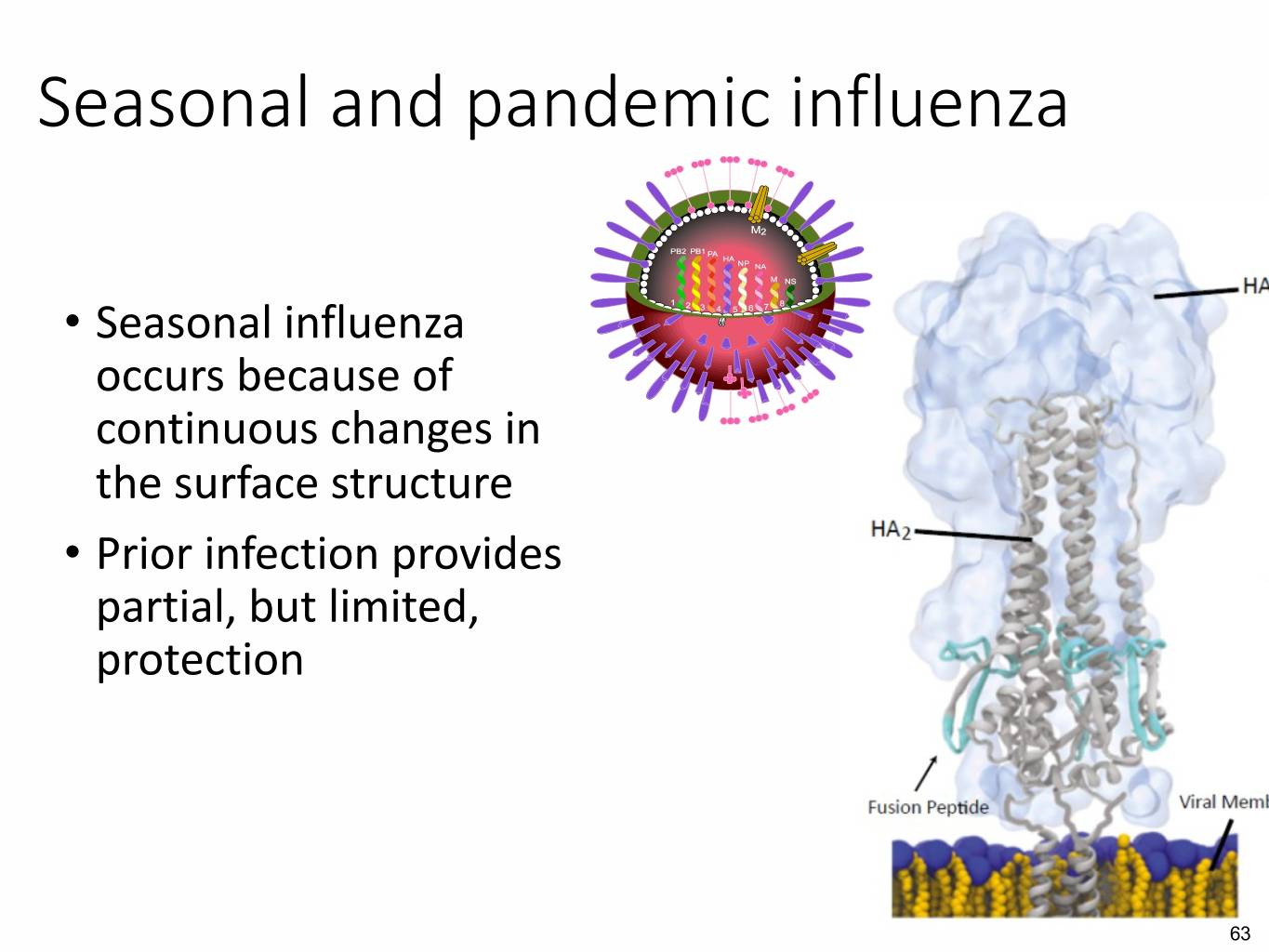

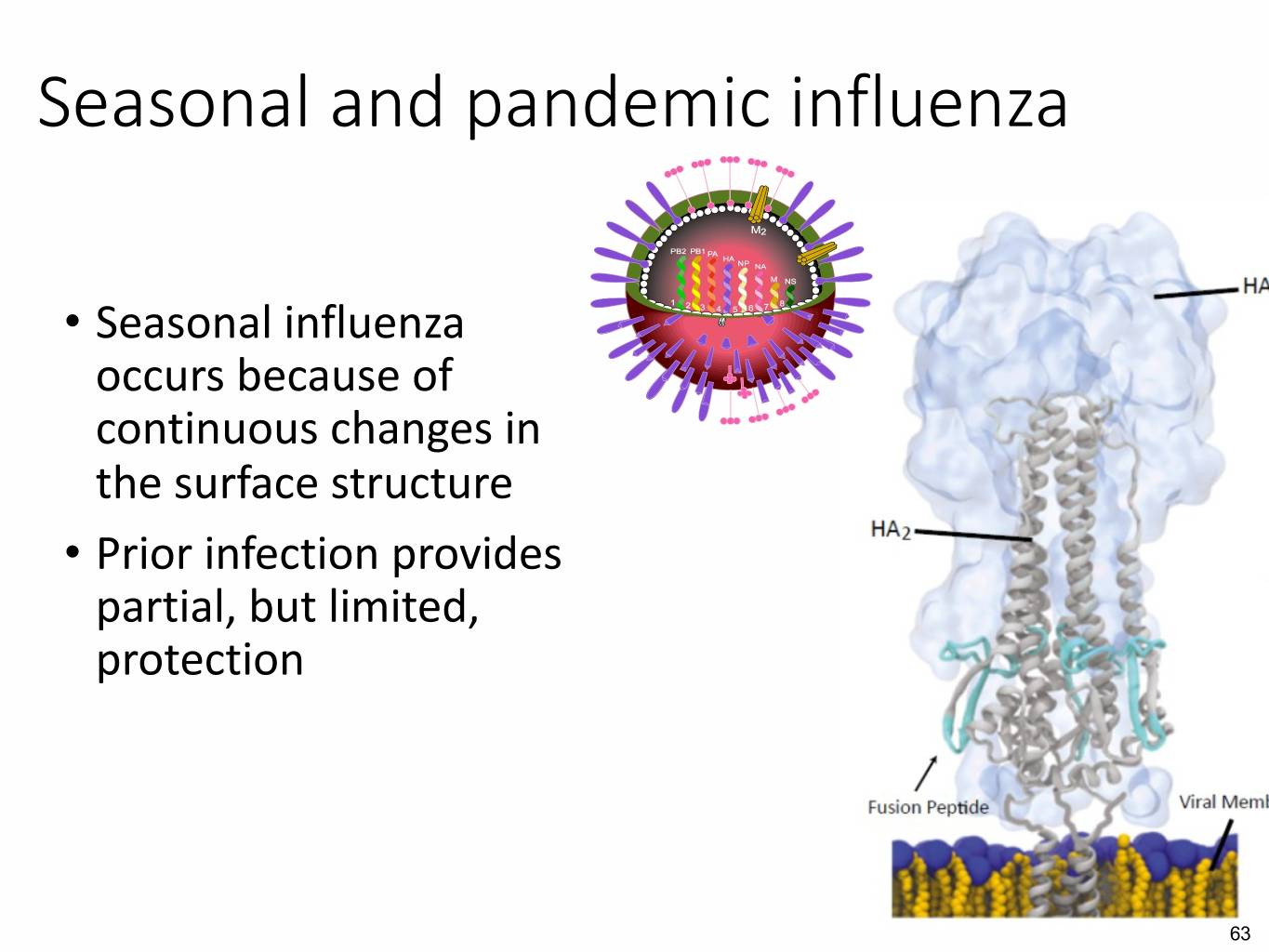

Seasonal and pandemic influenza • Seasonal influenza occurs because of continuous changes in the surface structure • Prior infection provides partial, but limited, protection 63

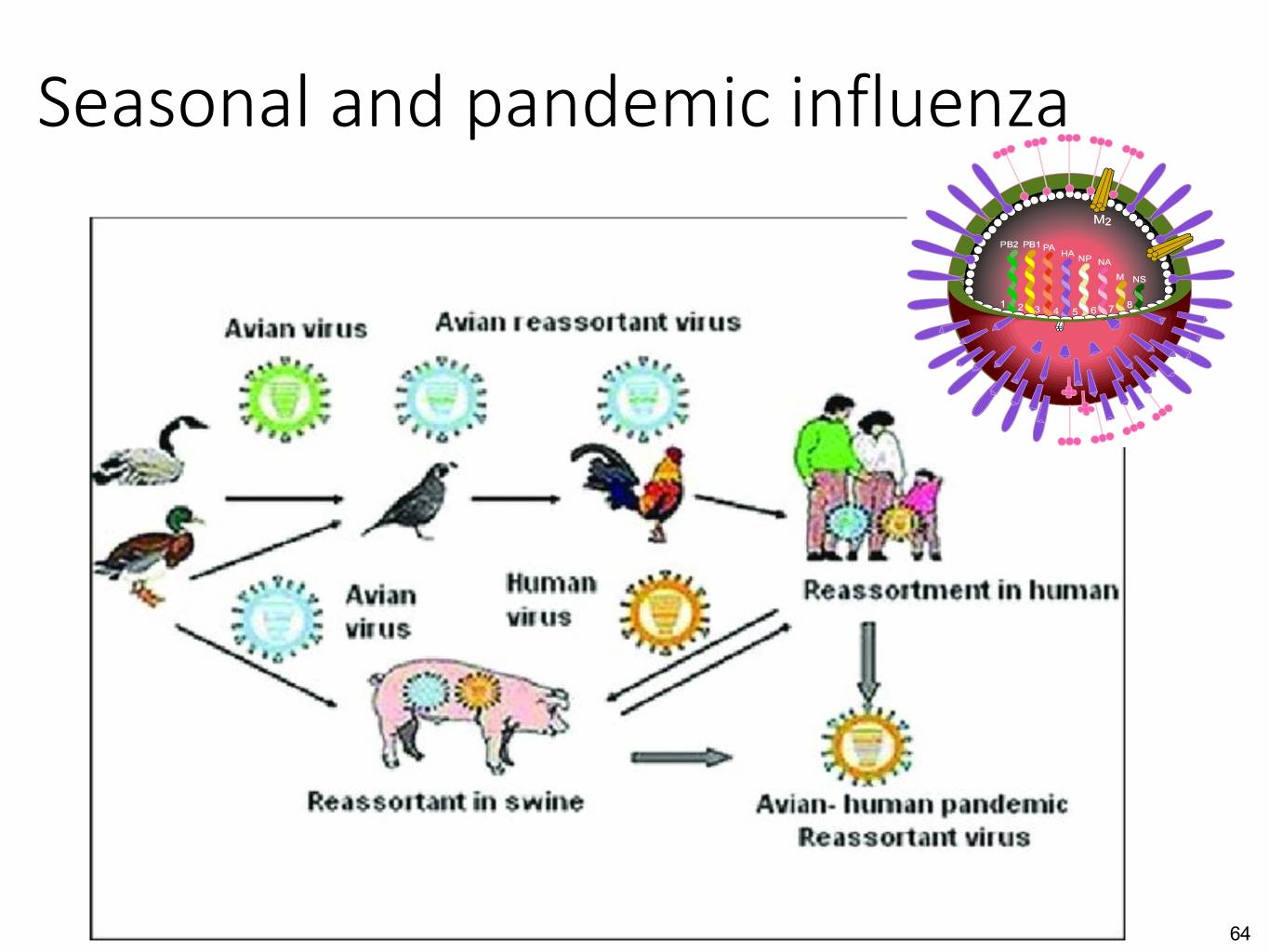

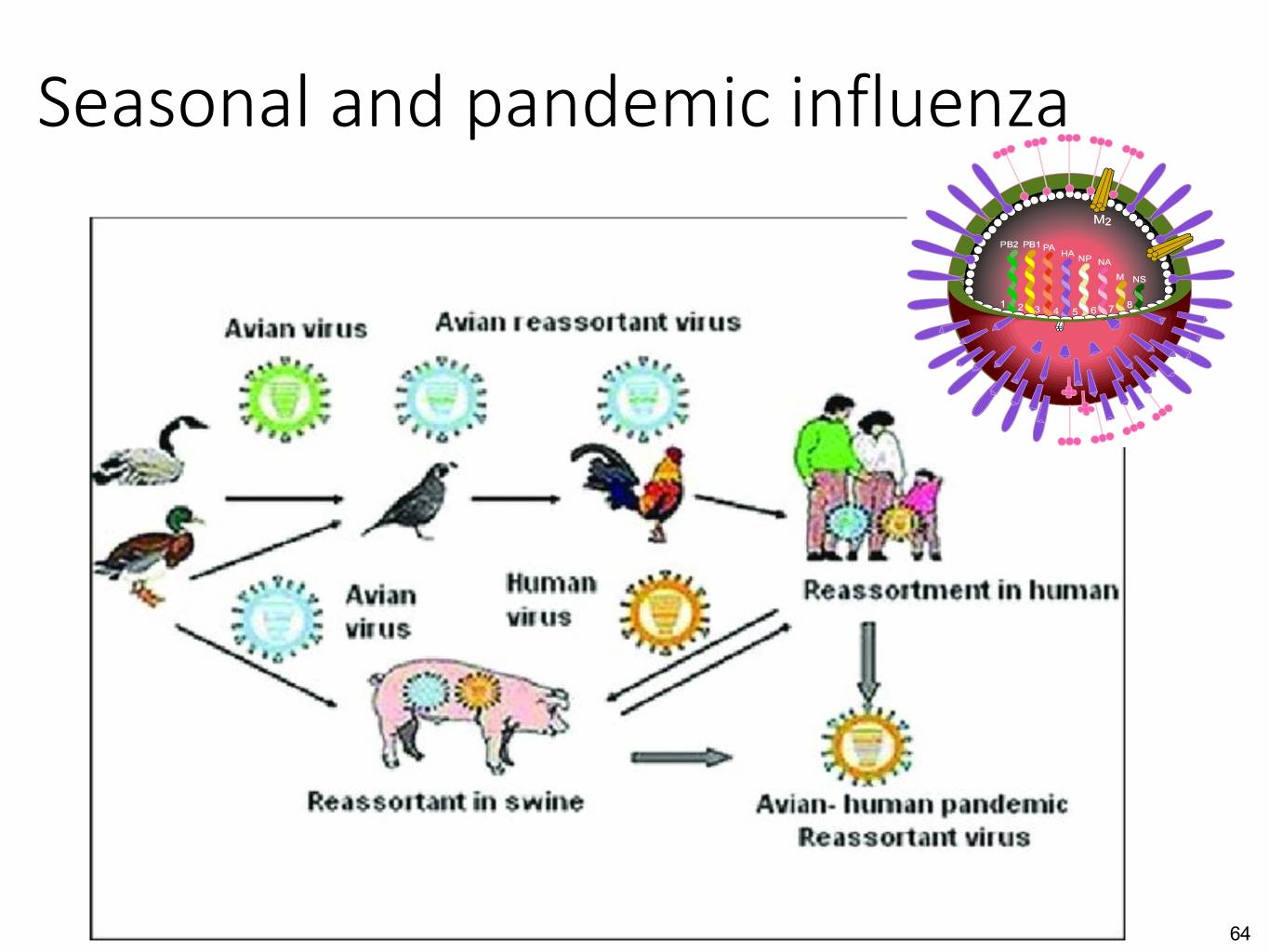

Seasonal and pandemic influenza 64

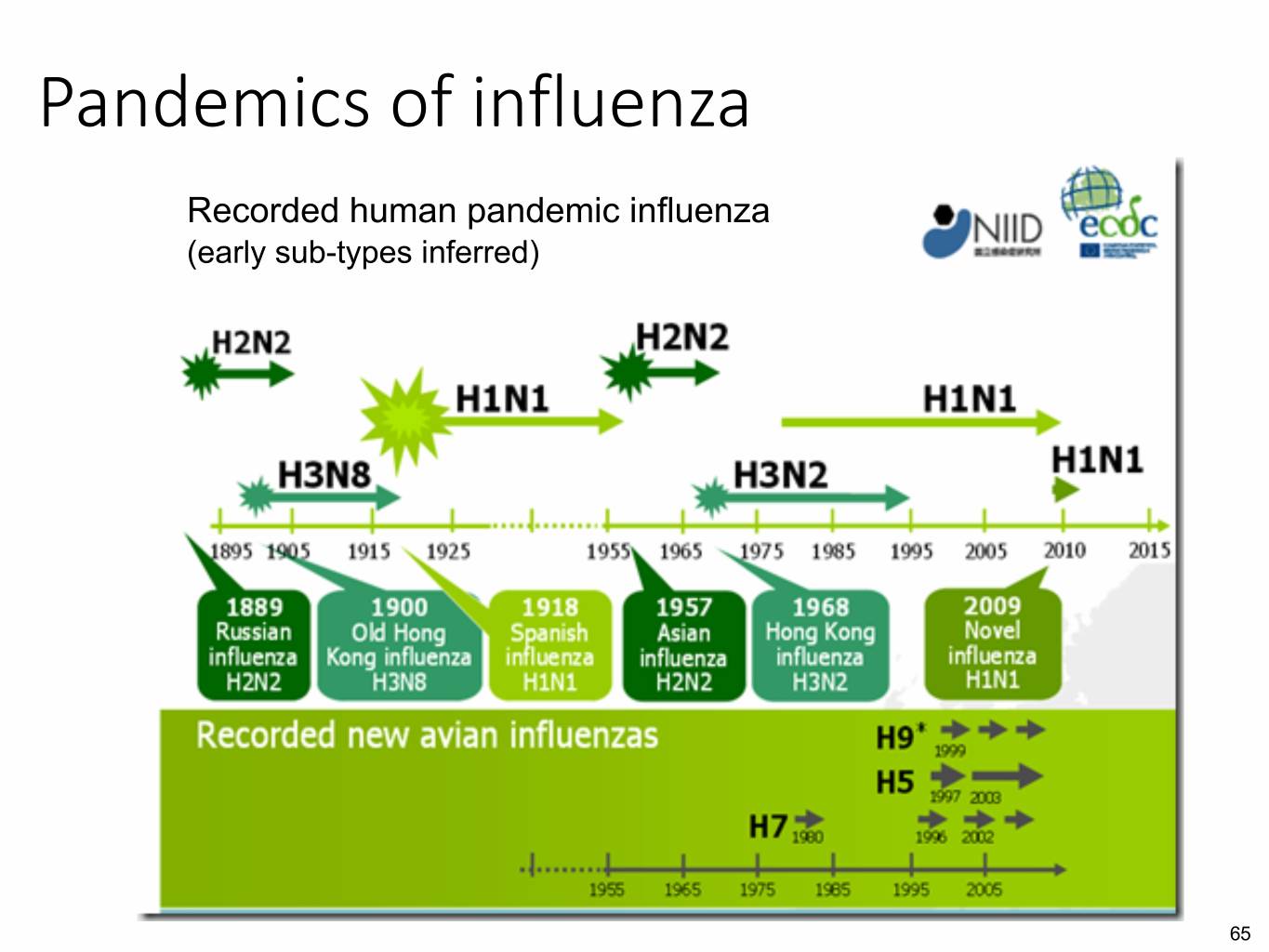

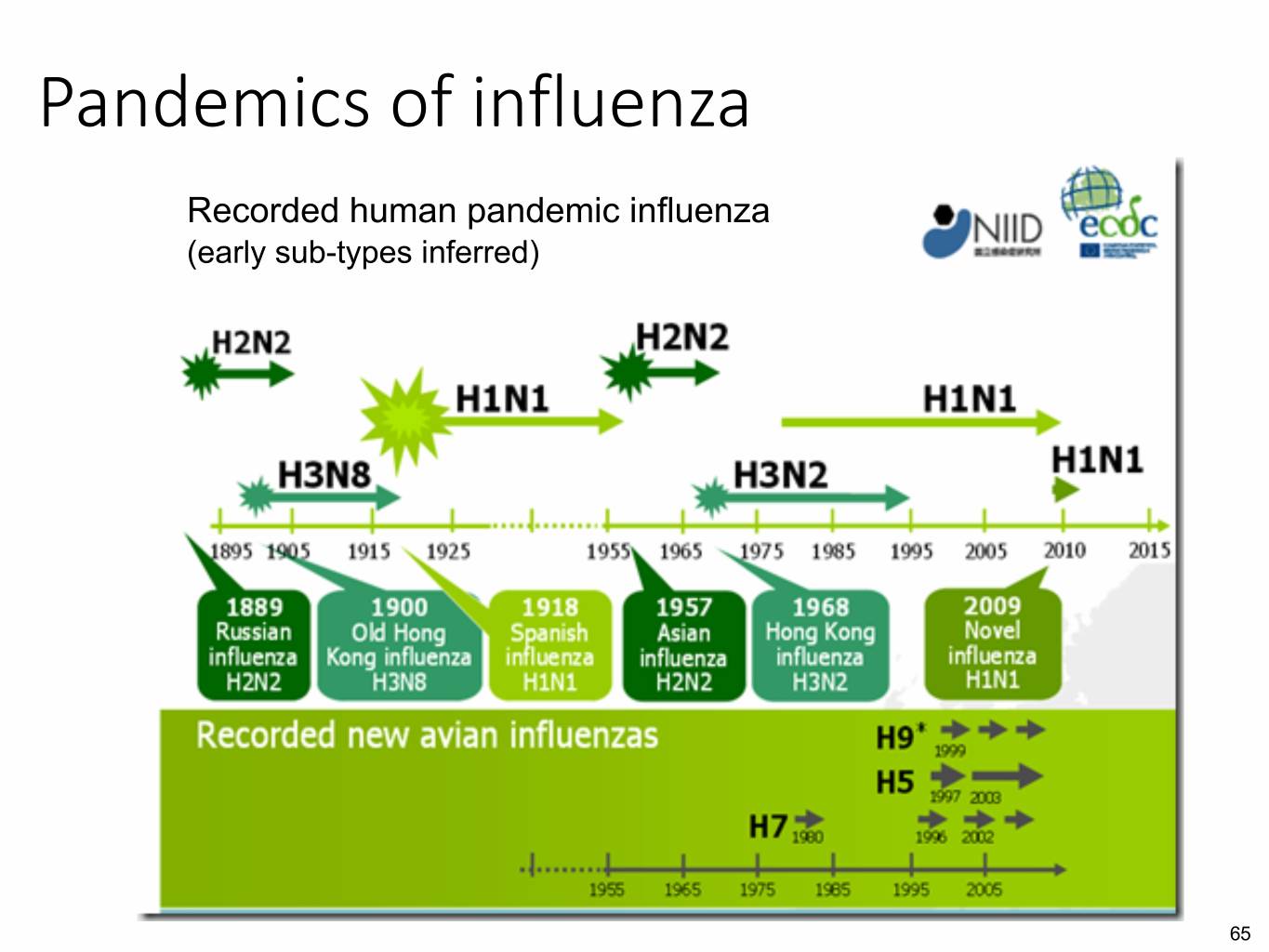

Pandemics of influenza Recorded human pandemic influenza (early sub-types inferred) 65

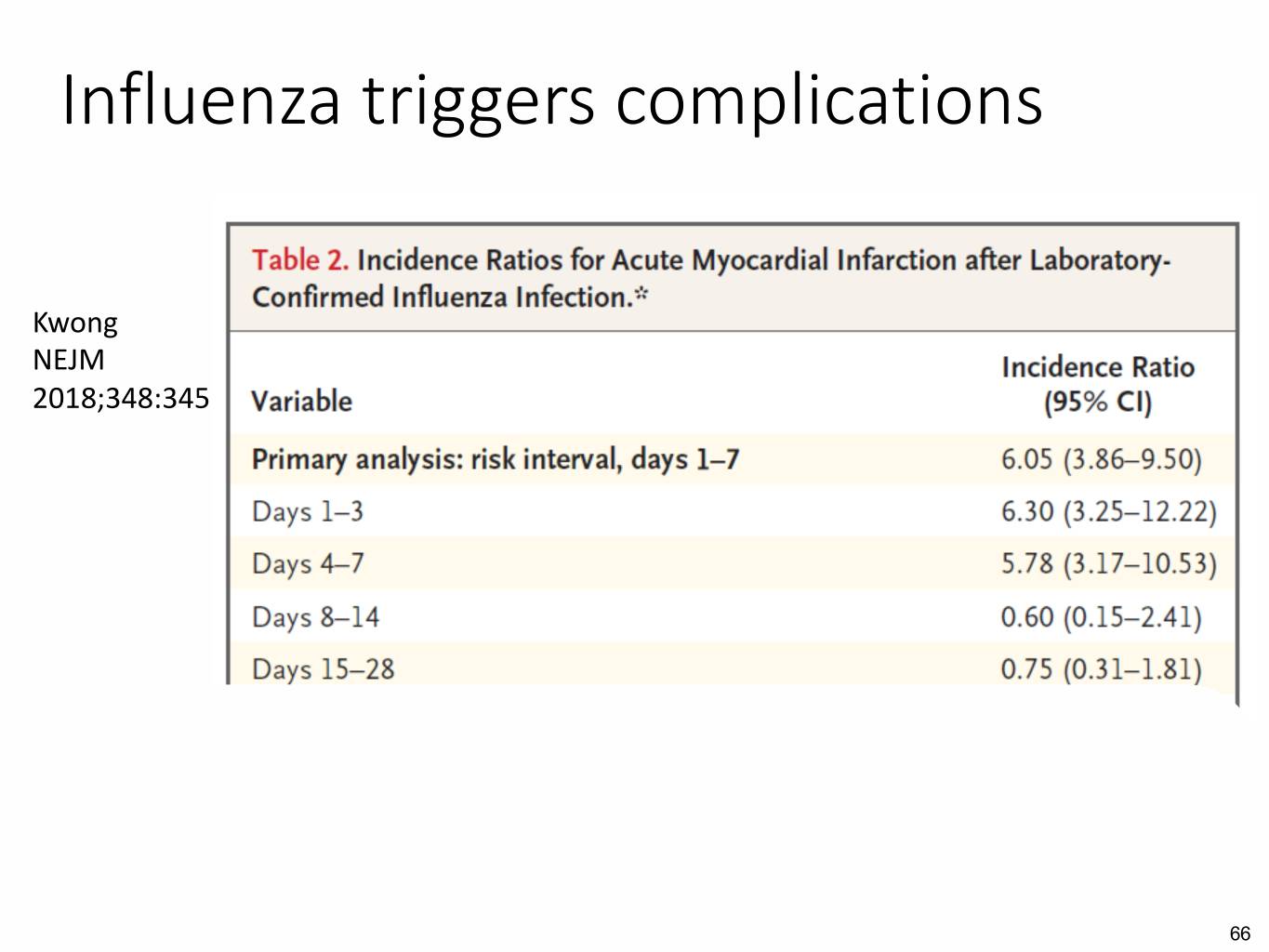

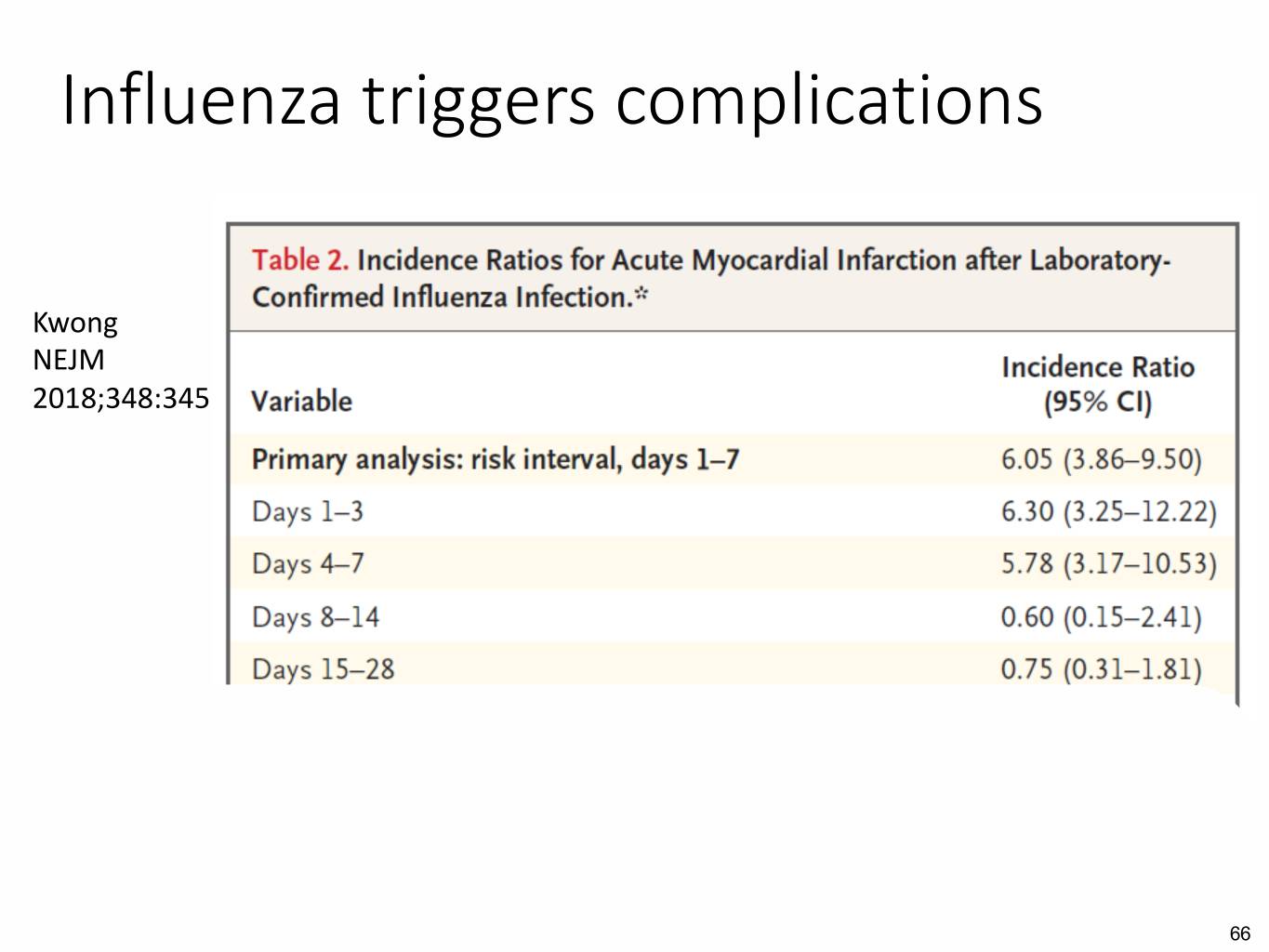

Influenza triggers complications Kwong NEJM 2018;348:345 66

Influenza treatment • Current: • Neuraminidase inhibitors • Baloxavir marboxil (cap-dependent endonuclease inhibitor) • New • Several molecules and monoclonal antibodies in phase 2 trials • Issues • Effectiveness • Cost • Delivery systems • Antibiotic resistance 67

Seasonal influenza prevention • Current: • Inactivated influenza vaccines: dose, adjuvant • Live attenuated vaccines • New • Broad spectrum vaccines (M-001 in phase 3 trial) • Issues • Vaccine efficacy 68

Pandemic influenza prevention • Current • Antivirals (?stockpiles) • New • Vaccines with shorter delay to production • Broad spectrum vaccines • Issues • Investing in prevention • How much shorter? • How broad spectrum? 69

SB 12 Agenda Opening - Overview Jeff Stein, PhD, CEO, Cidara Therapeutics Antifungal Treatment Unmet Neil Clancy, M.D., University of Pittsburgh Needs Unmet Antifungal Prophylaxis Needs Kieren Marr, M.D., Johns Hopkins School of Medicine Influenza Unmet Allison McGeer, M.D., University of Toronto Needs Commercial Potential Paul Daruwala, COO, Cidara Therapeutics Fireside Chat, Q&A Team 70

Commercial Outlook Rezafungin Cloudbreak - Influenza 71

Disclaimer Certain information about sample revenue on the following slides (e.g. slide #s 80-85 and 92-94) include projections and other forward-looking information based on our estimates and assumptions, including estimated patient populations, market share and pricing assumptions, which are made as of the date of this presentation. Actual results could differ materially from these projections and we do not assume any obligation to update such estimates and assumptions, except as may be required by law. You should not place undue reliance on these projections, or any other forward-looking information contained in this presentation. 72

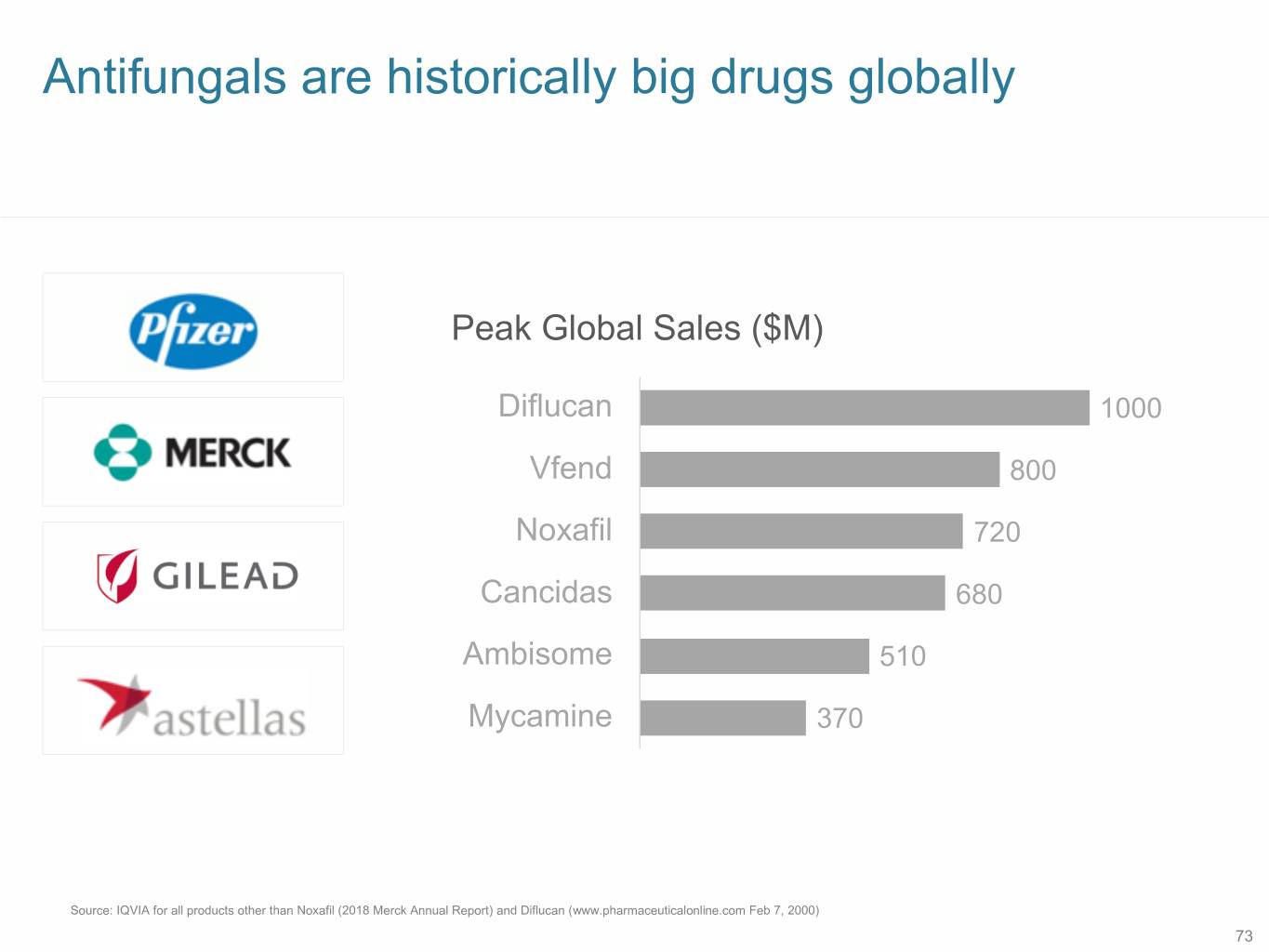

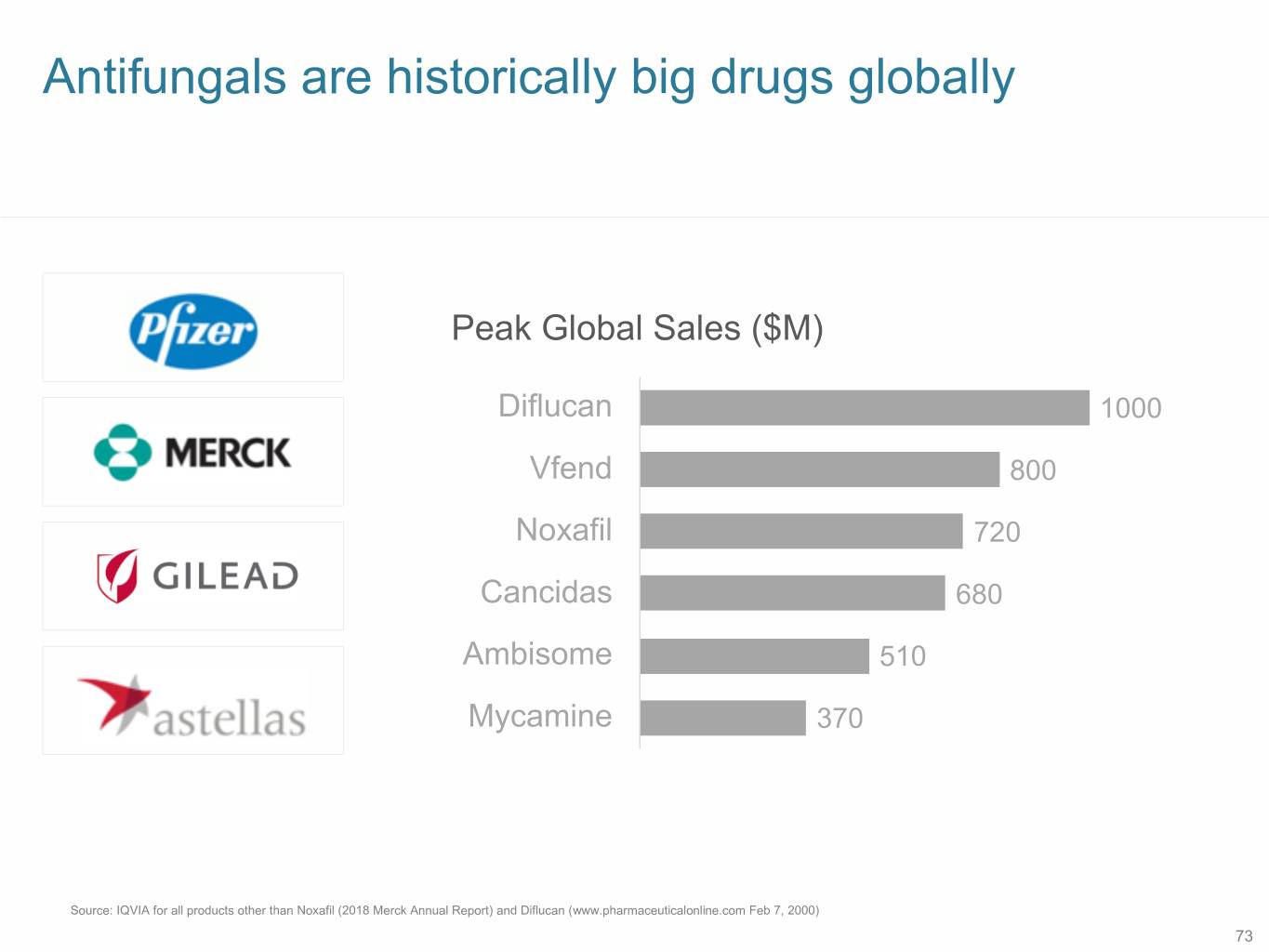

Antifungals are historically big drugs globally Peak Global Sales ($M) Diflucan 1000 Vfend 800 Noxafil 720 Cancidas 680 Ambisome 510 Mycamine 370 Source: IQVIA for all products other than Noxafil (2018 Merck Annual Report) and Diflucan (www.pharmaceuticalonline.com Feb 7, 2000) 73

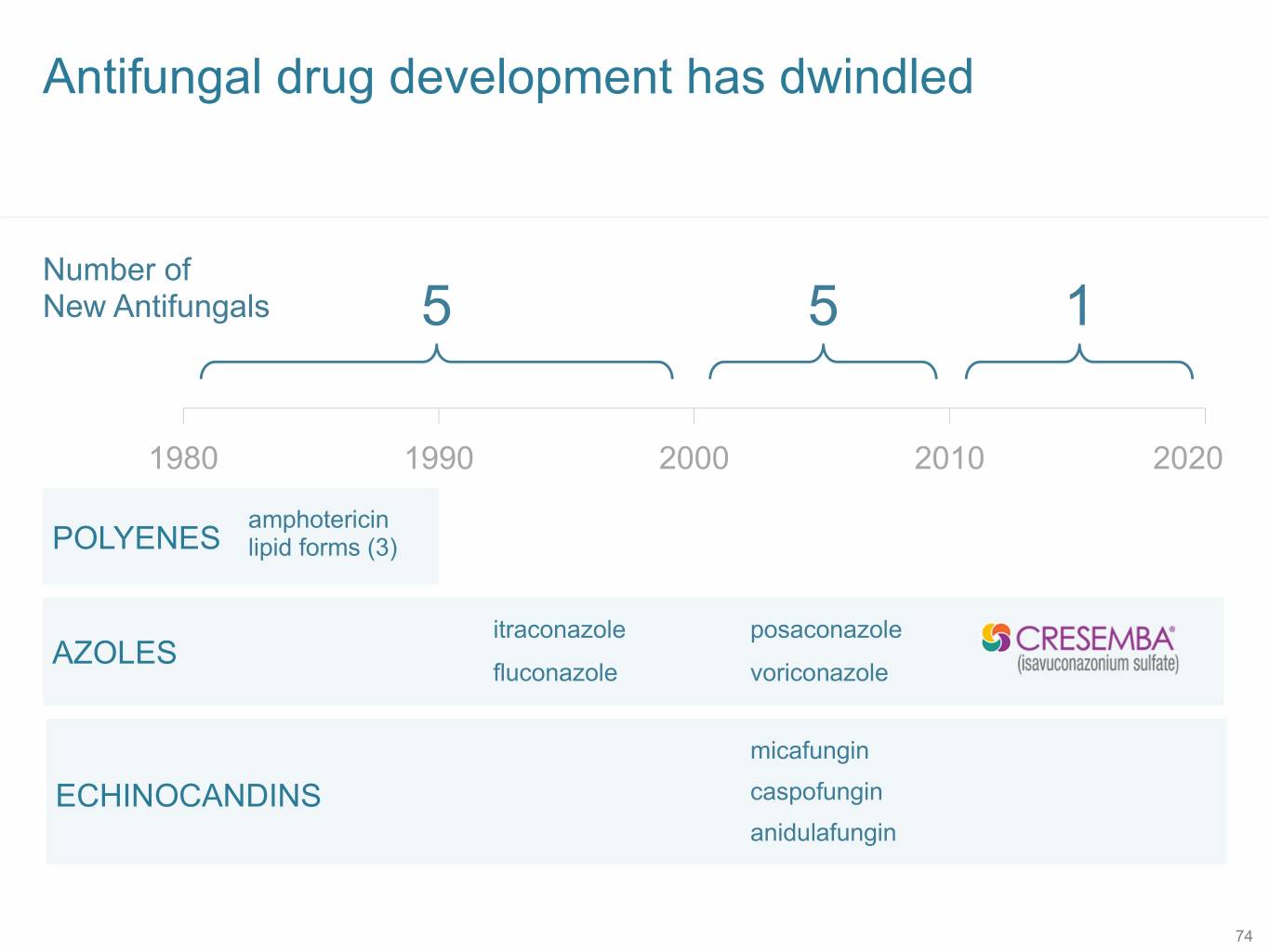

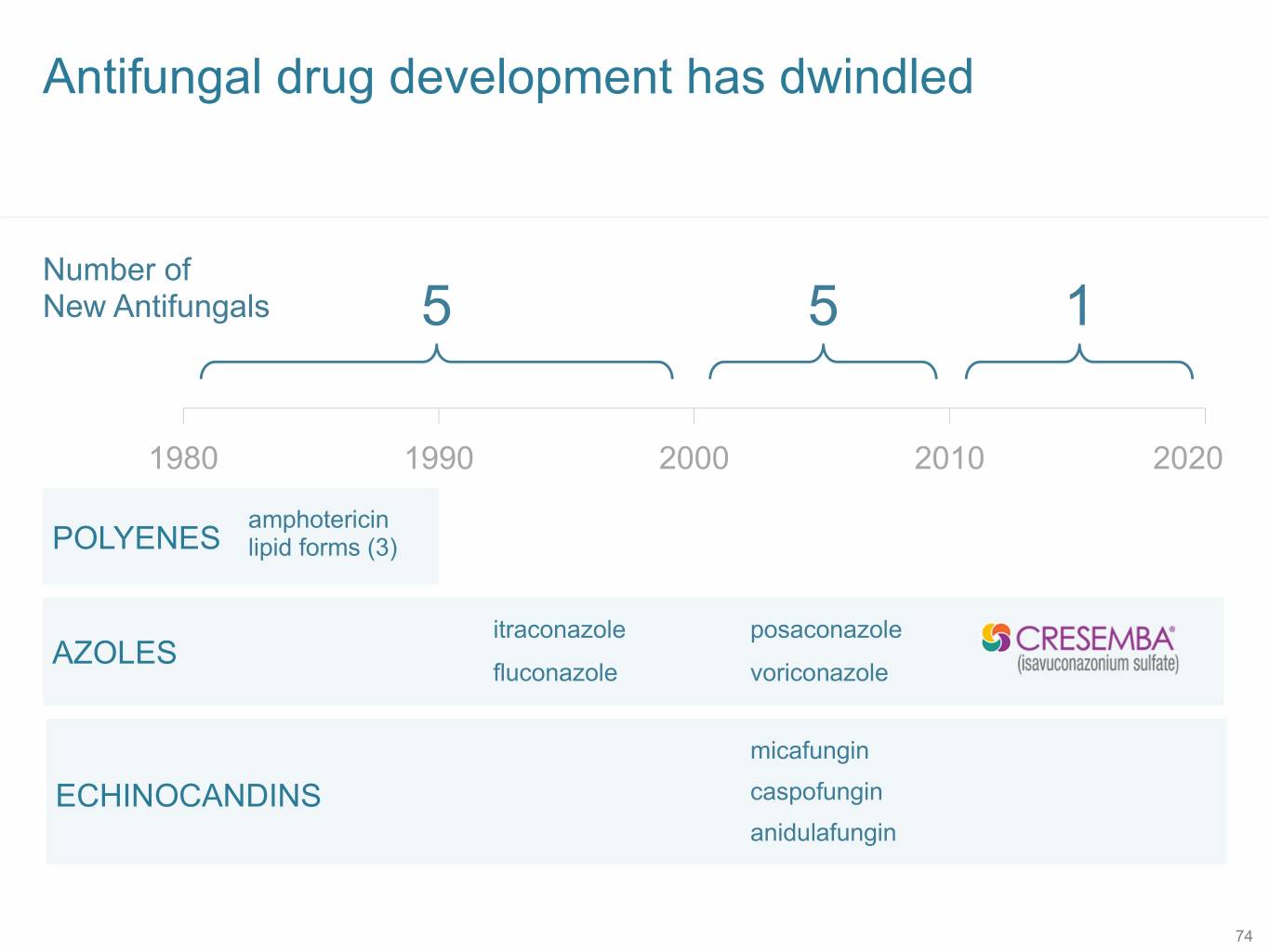

Antifungal drug development has dwindled Number of New Antifungals 5 5 1 1980 1990 2000 2010 2020 amphotericin POLYENES lipid forms (3) itraconazole posaconazole AZOLES fluconazole voriconazole micafungin ECHINOCANDINS caspofungin anidulafungin 74

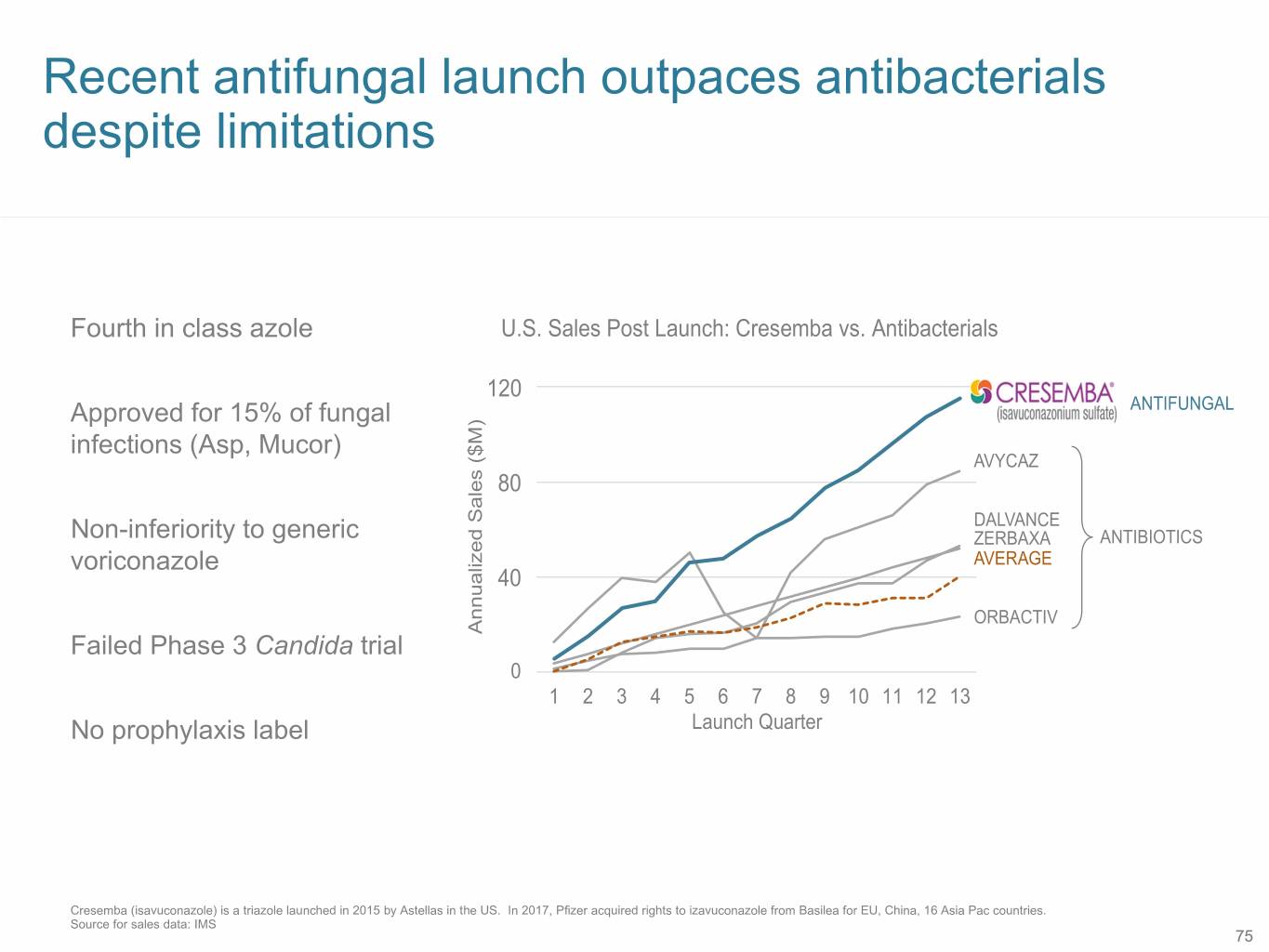

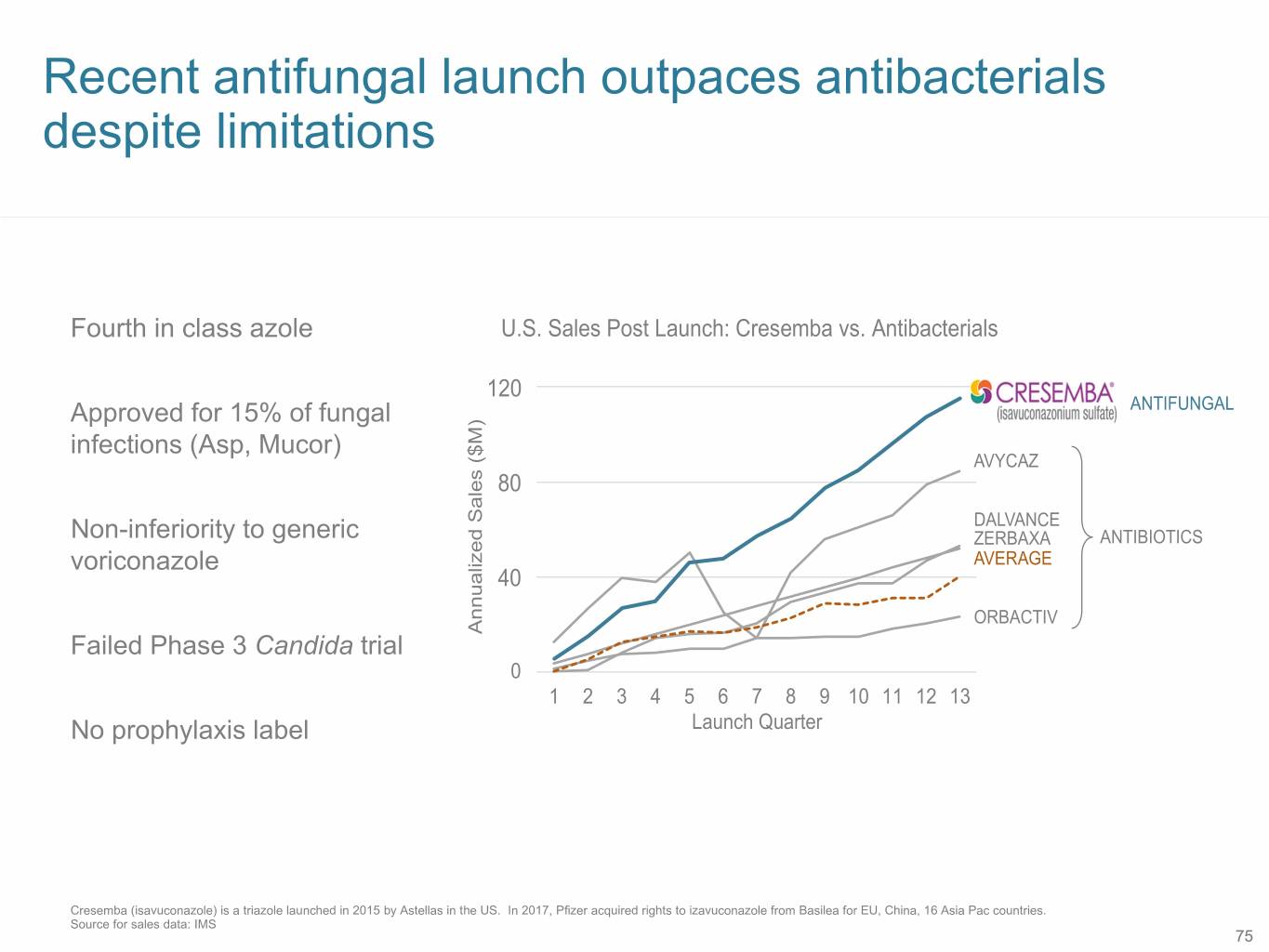

Recent antifungal launch outpaces antibacterials despite limitations Fourth in class azole U.S. Sales Post Launch: Cresemba vs. Antibacterials 12030 Approved for 15% of fungal ANTIFUNGAL infections (Asp, Mucor) AVYCAZ 8020 DALVANCE Non-inferiority to generic ZERBAXA ANTIBIOTICS voriconazole AVERAGE 4010 ORBACTIV Failed Phase 3 Candida trial ($M) Sales Annualized 0 1 2 3 4 5 6 7 8 9 10 11 12 13 No prophylaxis label Launch Quarter Cresemba (isavuconazole) is a triazole launched in 2015 by Astellas in the US. In 2017, Pfizer acquired rights to izavuconazole from Basilea for EU, China, 16 Asia Pac countries. Source for sales data: IMS 75

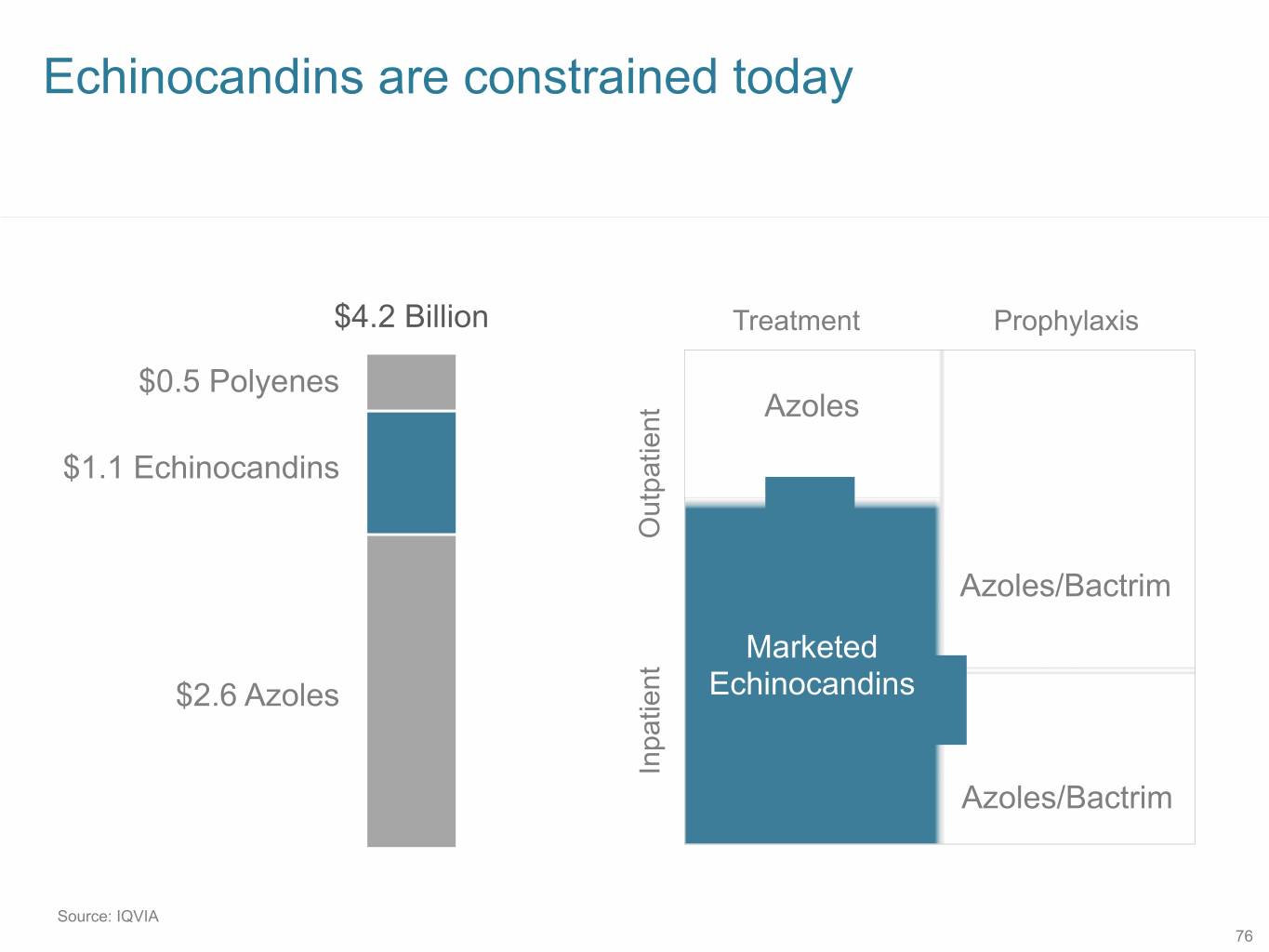

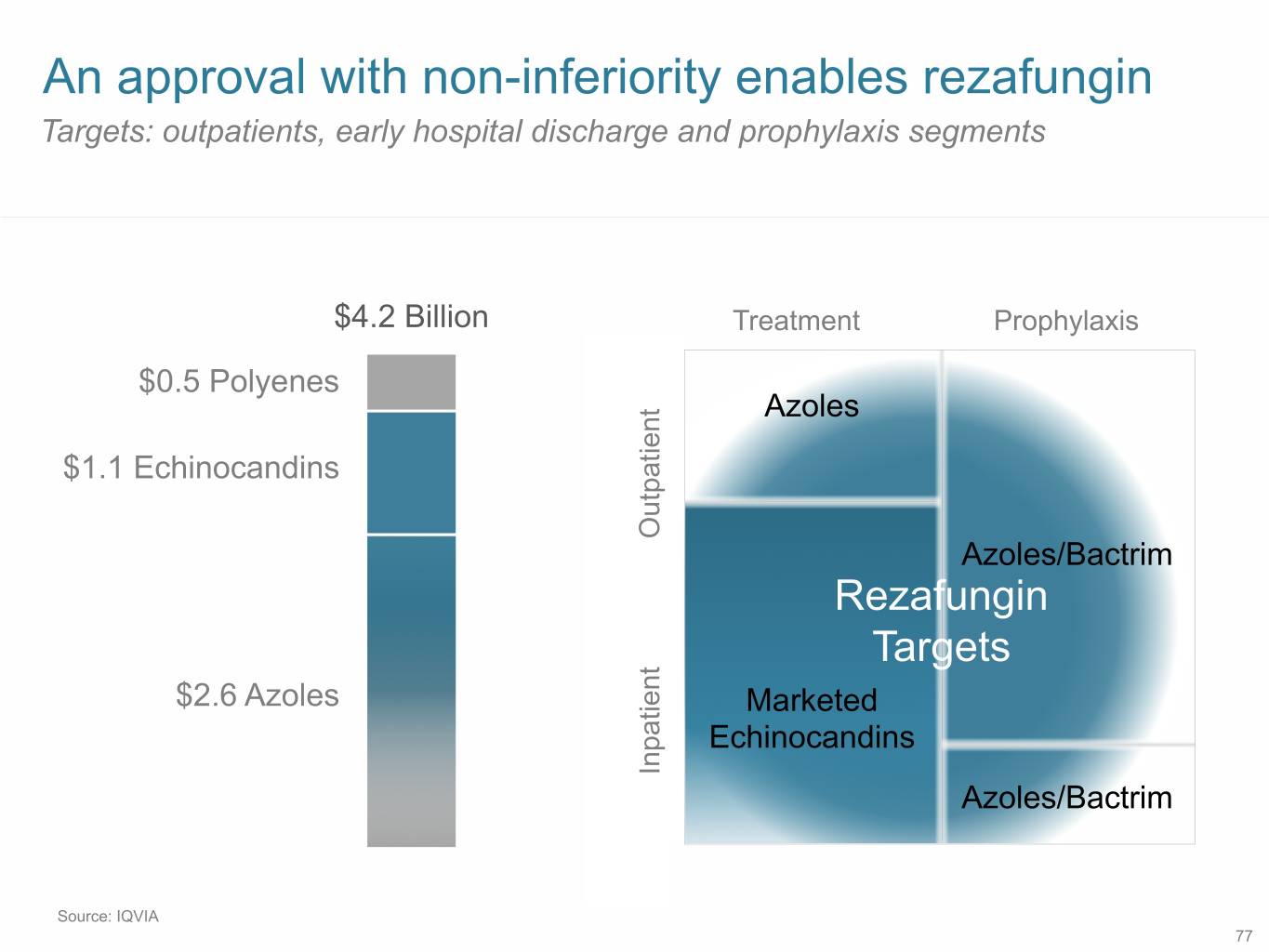

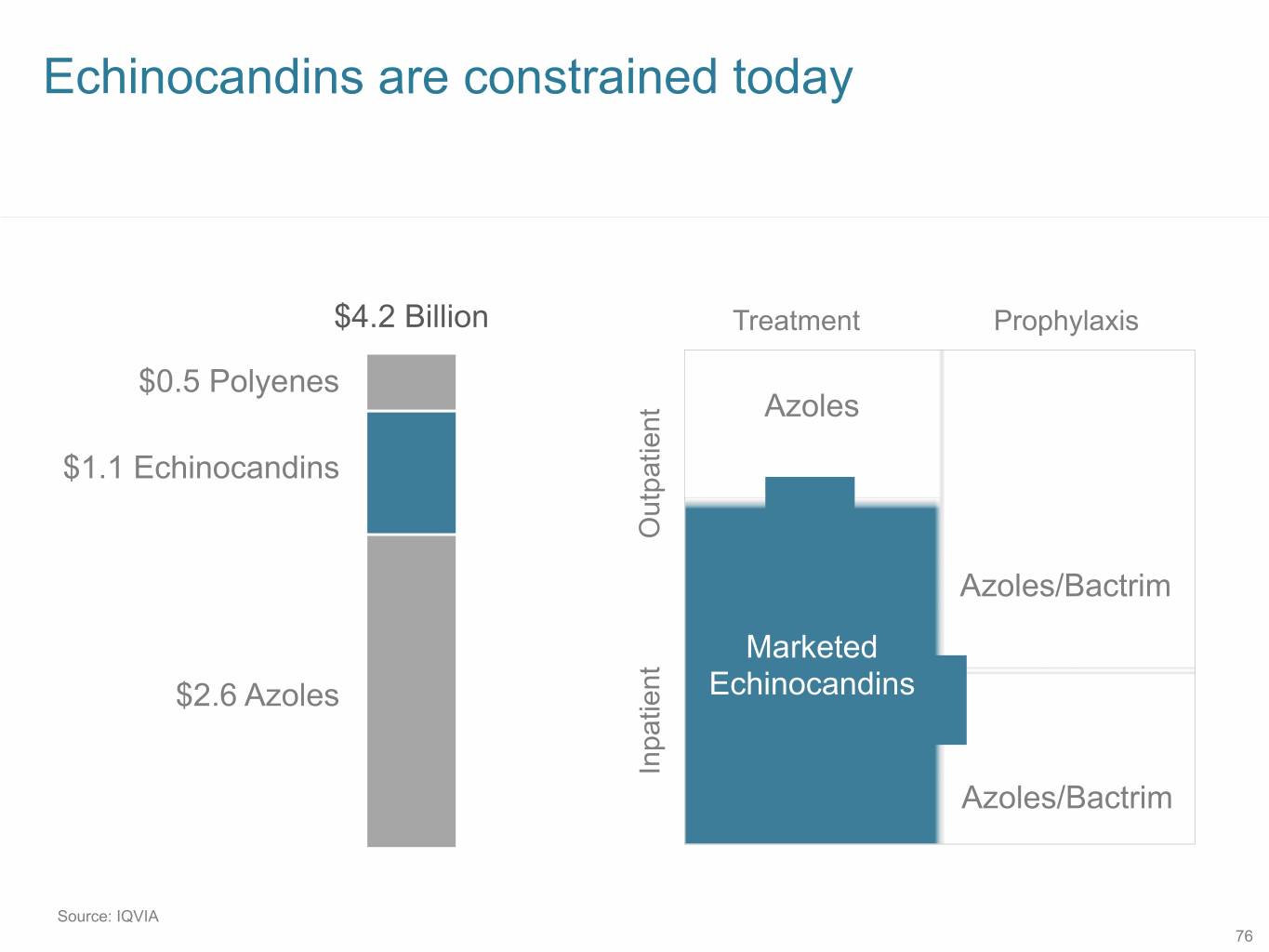

Echinocandins are constrained today $4.2 Billion Treatment Prophylaxis $0.5 Polyenes Azoles $1.1 Echinocandins Outpatient Azoles/Bactrim Marketed $2.6 Azoles Echinocandins Inpatient Azoles/Bactrim Source: IQVIA 76

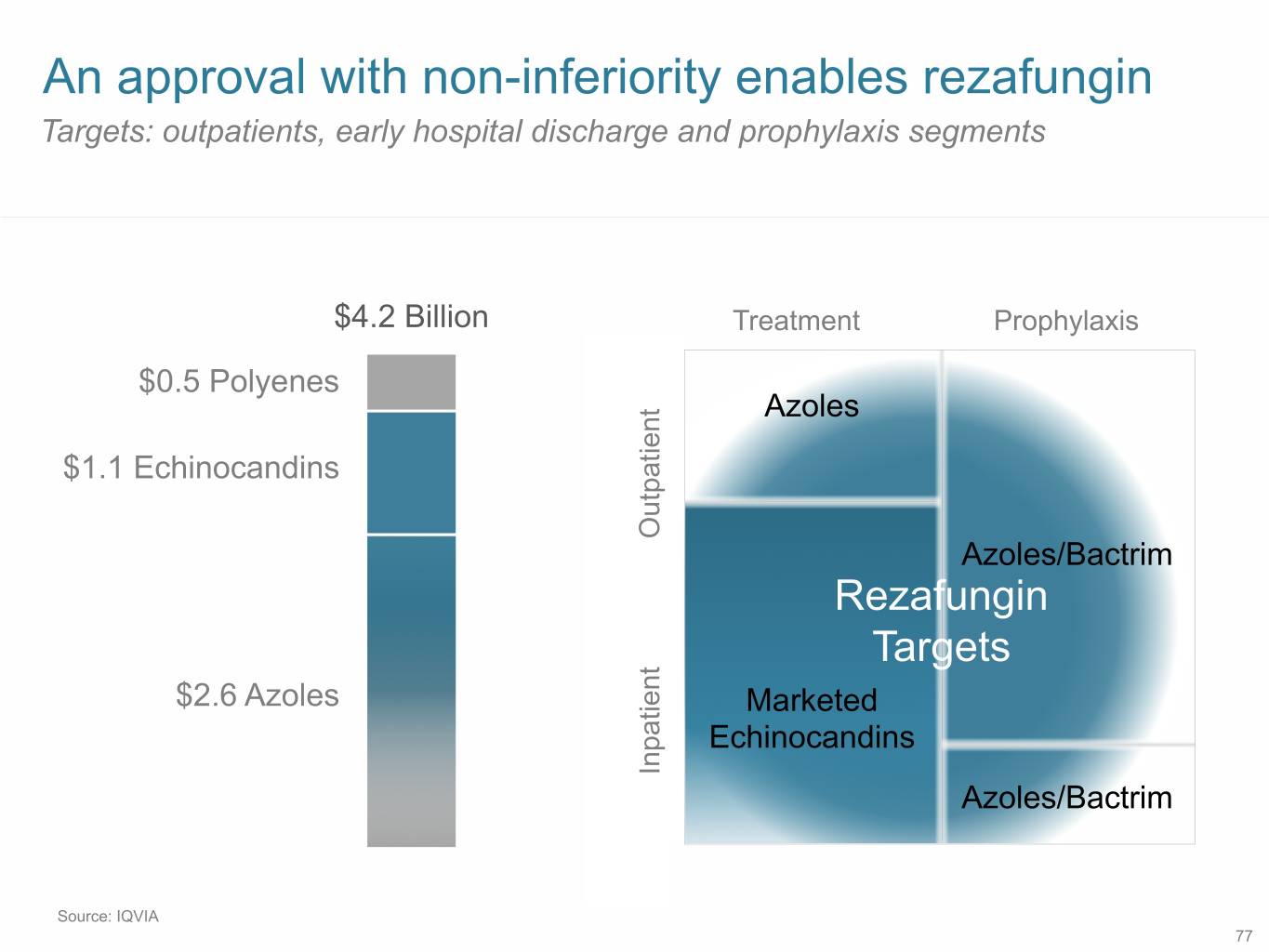

An approval with non-inferiority enables rezafungin Targets: outpatients, early hospital discharge and prophylaxis segments $4.2 Billion Treatment Prophylaxis $0.5 Polyenes Azoles $1.1 Echinocandins Outpatient Azoles/Bactrim Rezafungin Targets $2.6 Azoles Marketed Echinocandins Inpatient Azoles/Bactrim Source: IQVIA 77

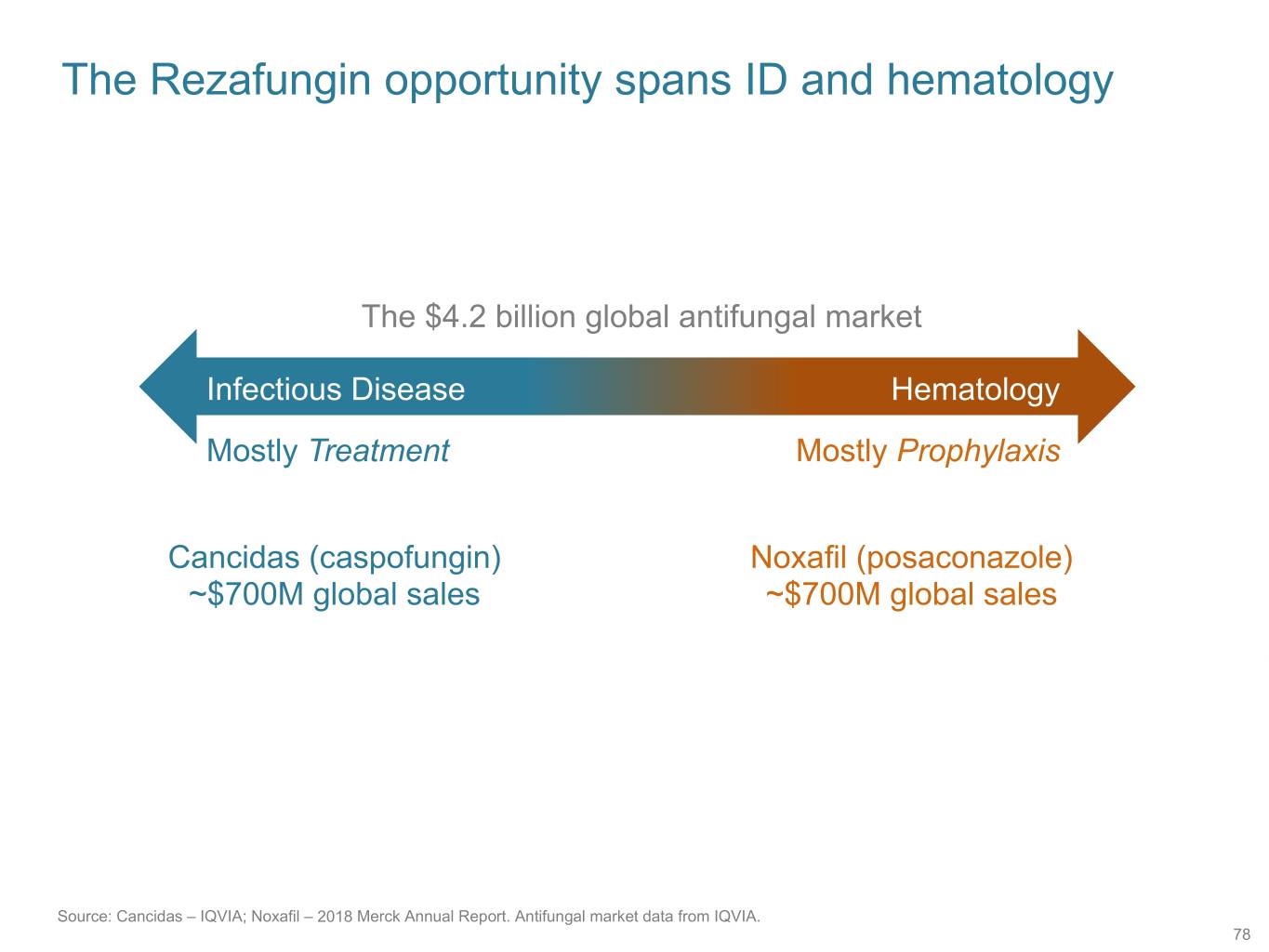

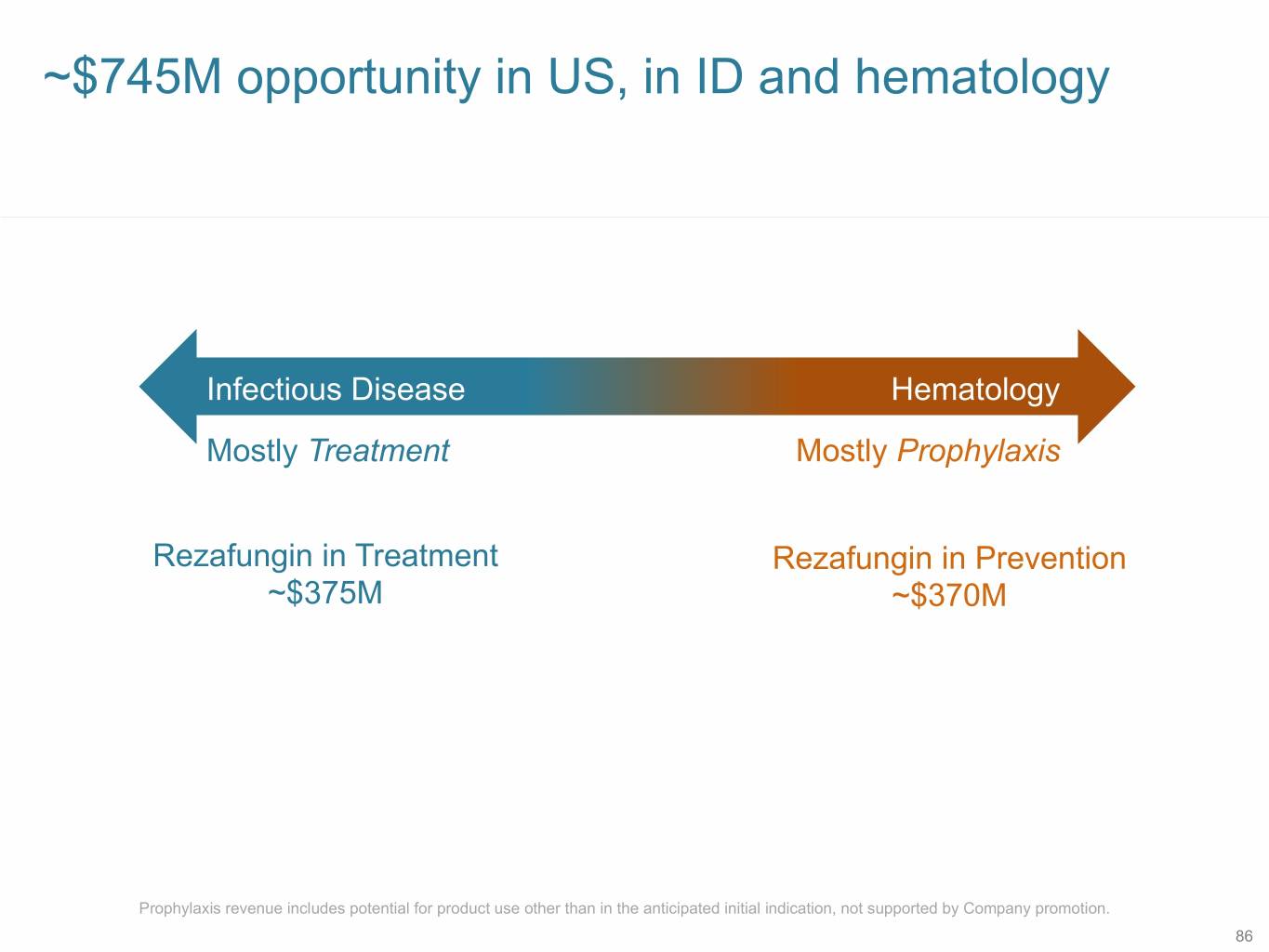

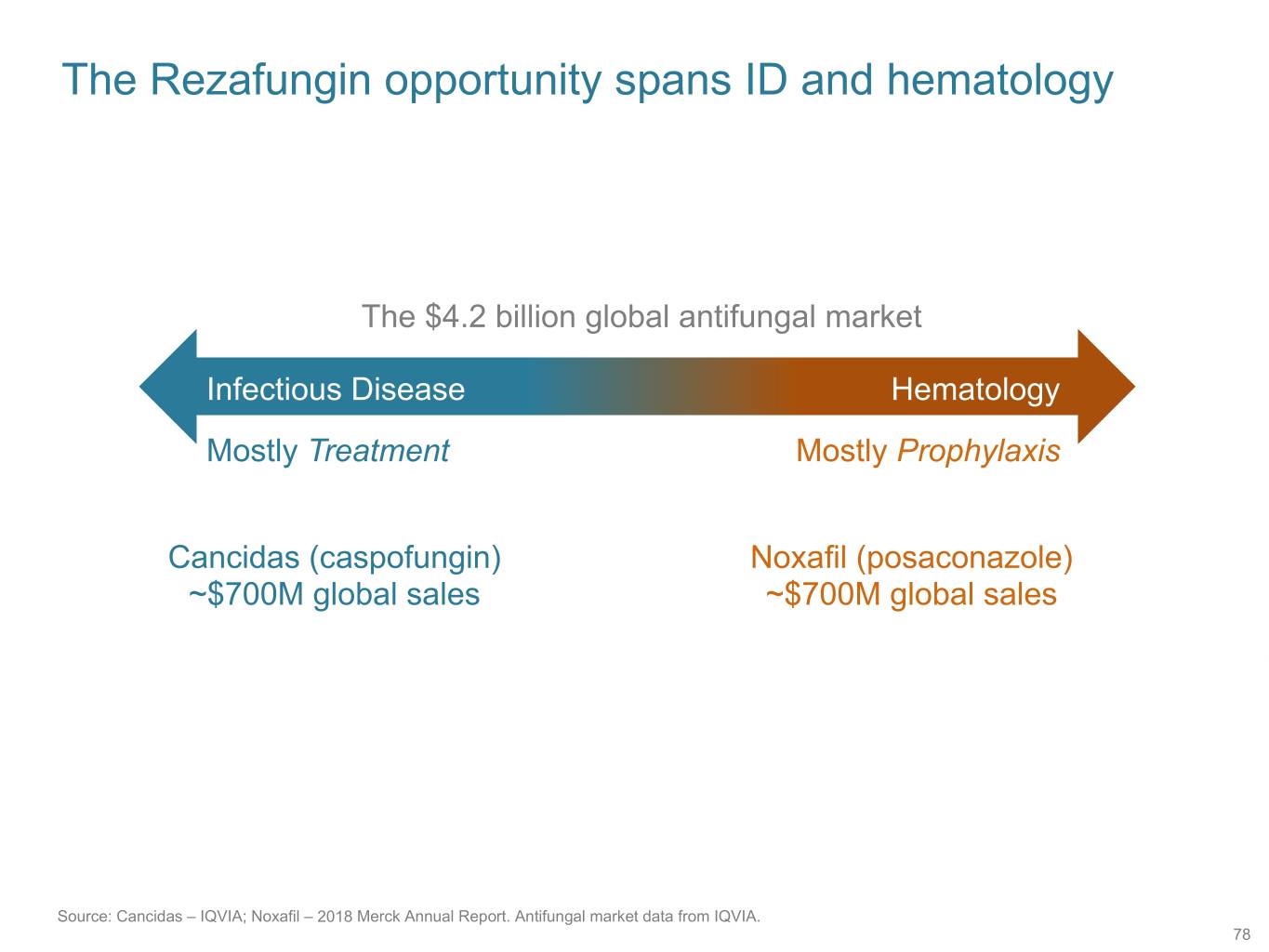

The Rezafungin opportunity spans ID and hematology The $4.2 billion global antifungal market Infectious Disease Hematology Mostly Treatment Mostly Prophylaxis Cancidas (caspofungin) Noxafil (posaconazole) ~$700M global sales ~$700M global sales Source: Cancidas – IQVIA; Noxafil – 2018 Merck Annual Report. Antifungal market data from IQVIA. 78

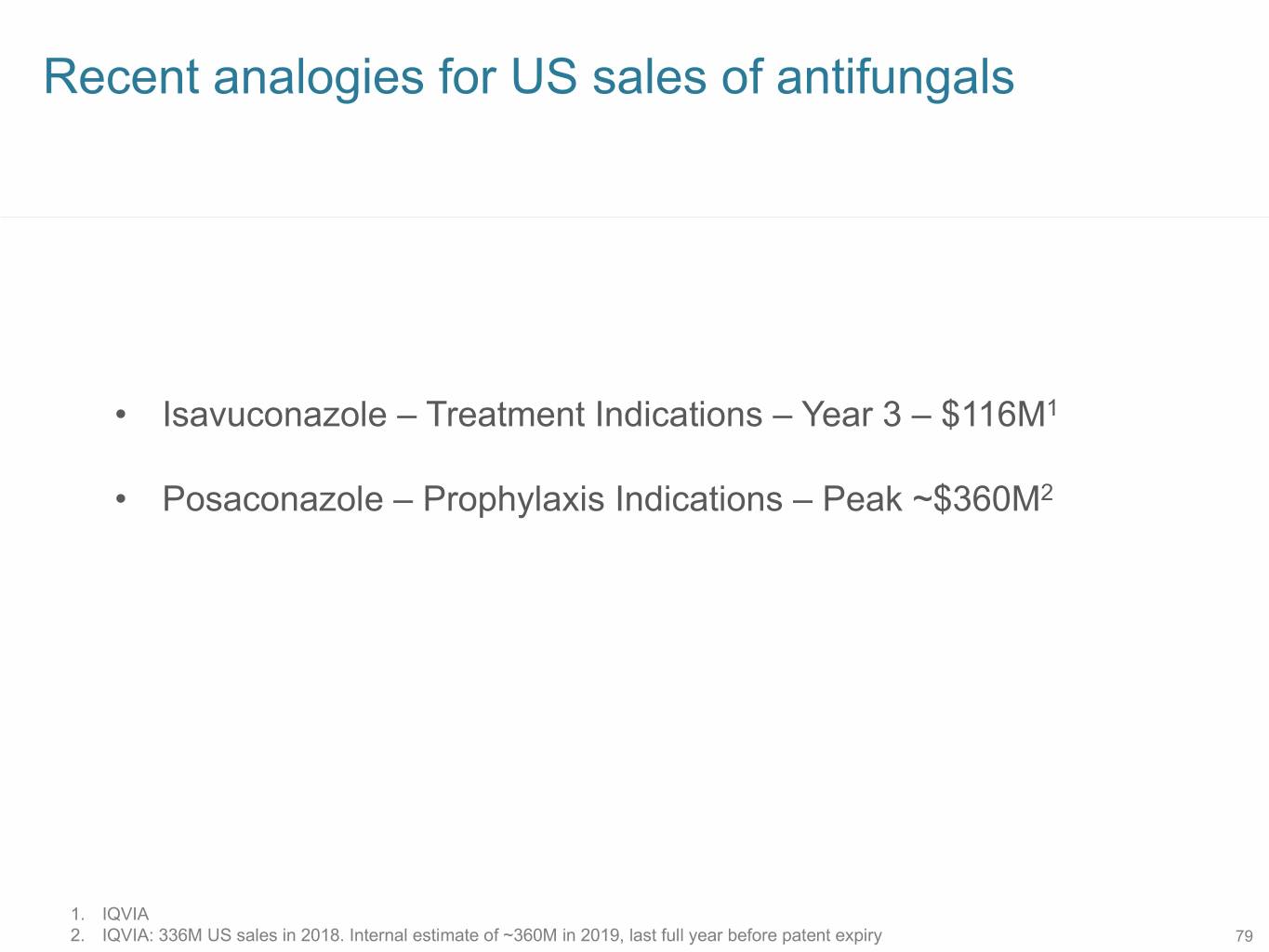

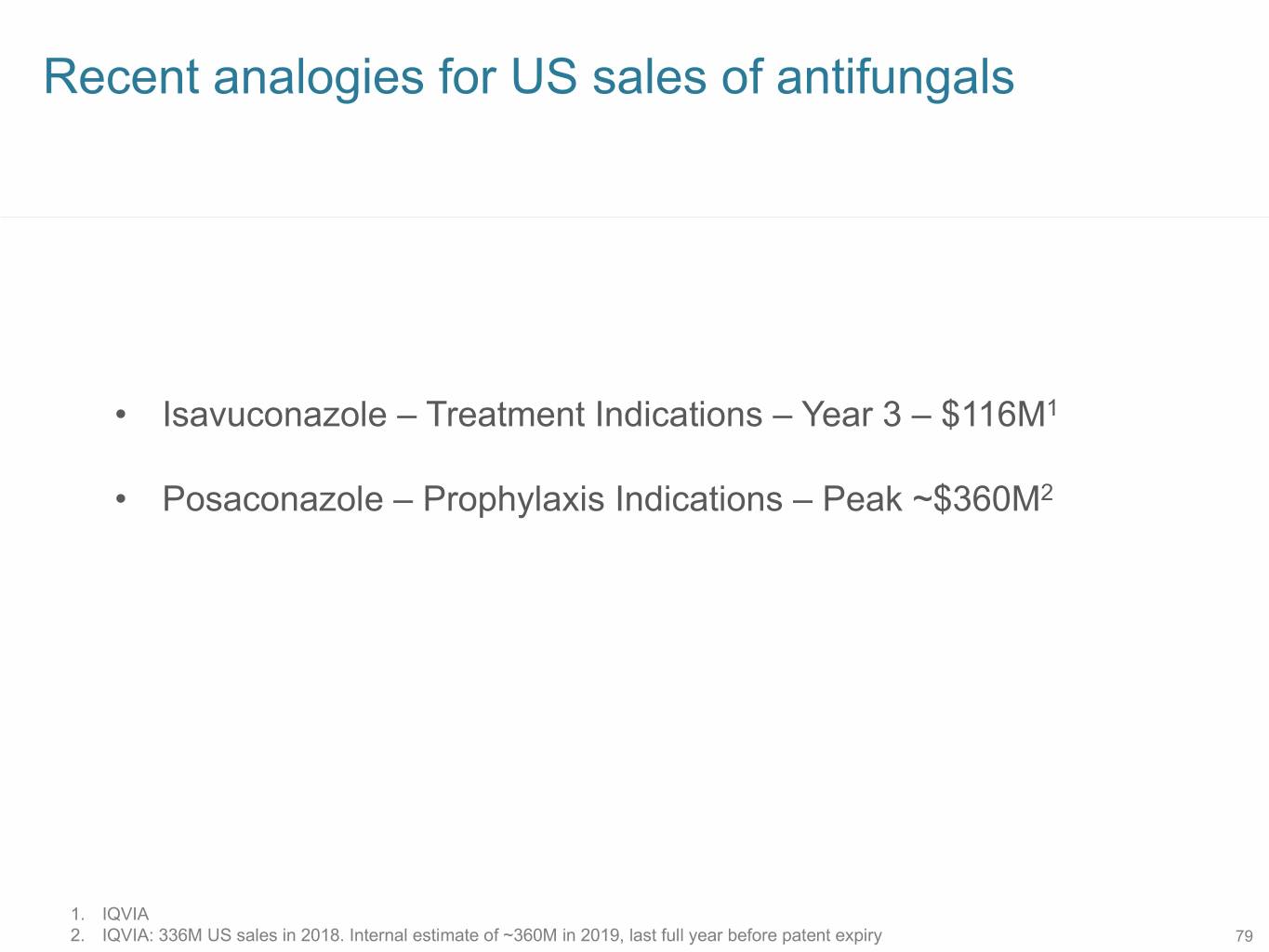

Recent analogies for US sales of antifungals • Isavuconazole – Treatment Indications – Year 3 – $116M1 • Posaconazole – Prophylaxis Indications – Peak ~$360M2 1. IQVIA 2. IQVIA: 336M US sales in 2018. Internal estimate of ~360M in 2019, last full year before patent expiry 79

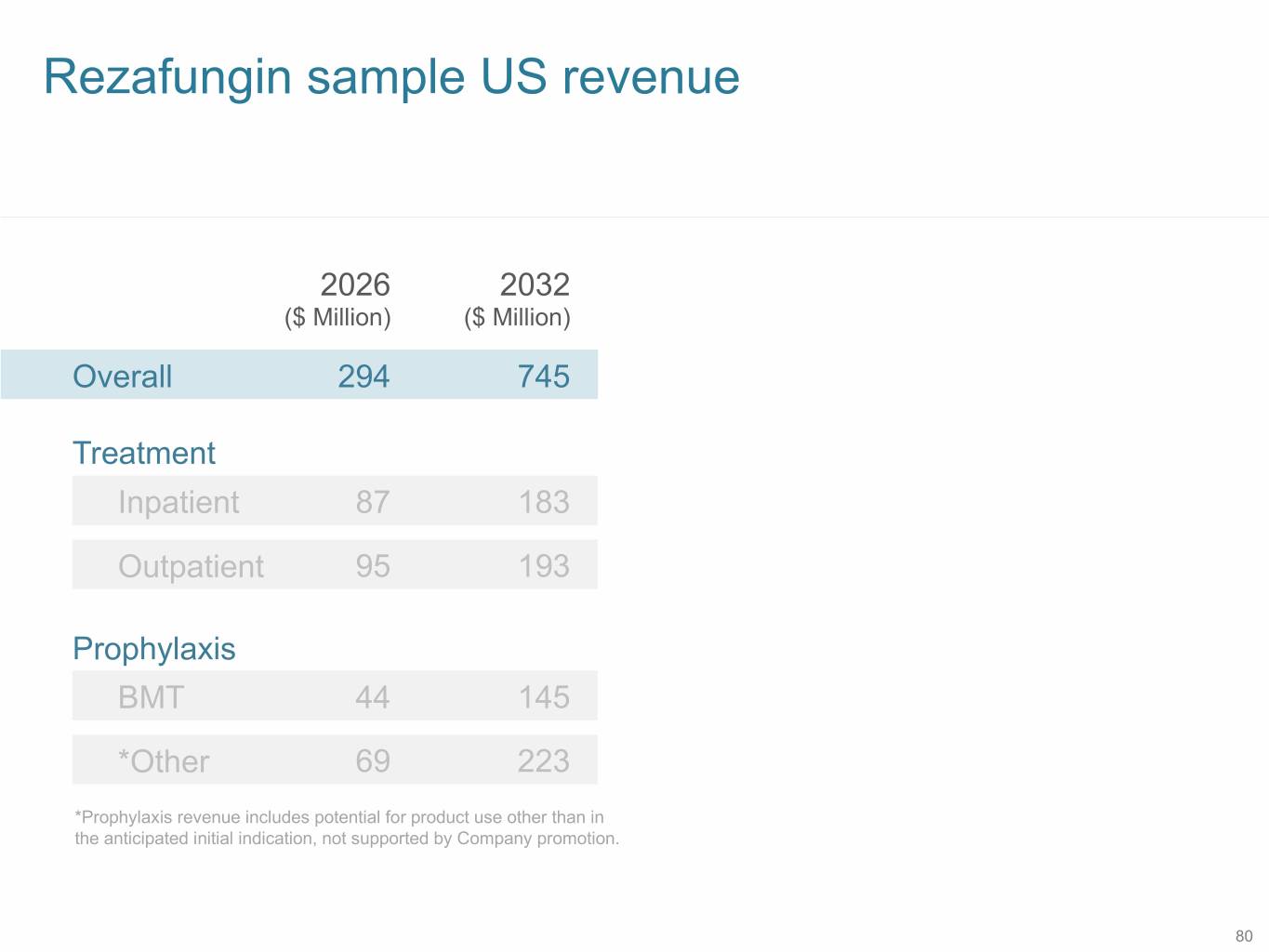

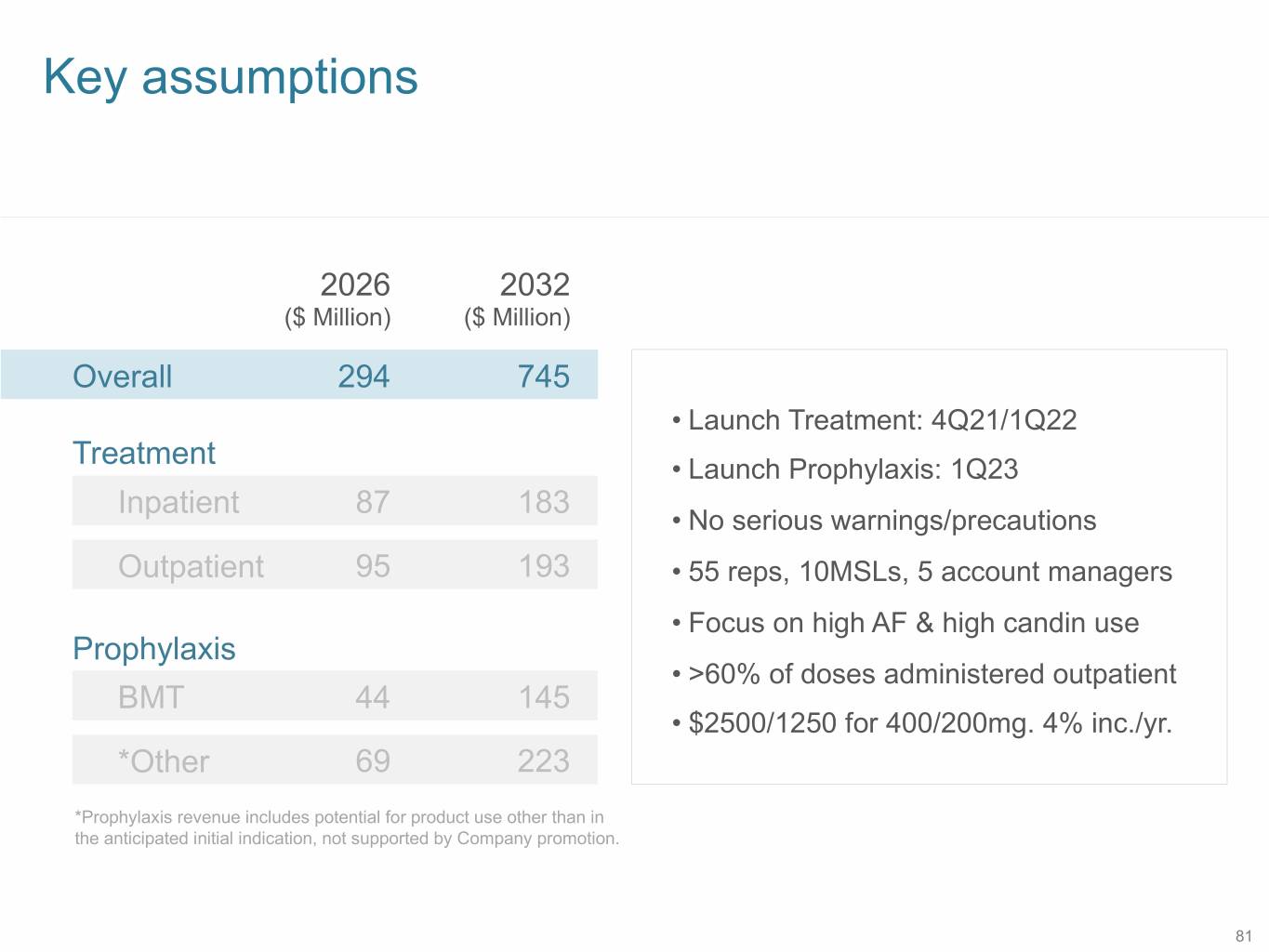

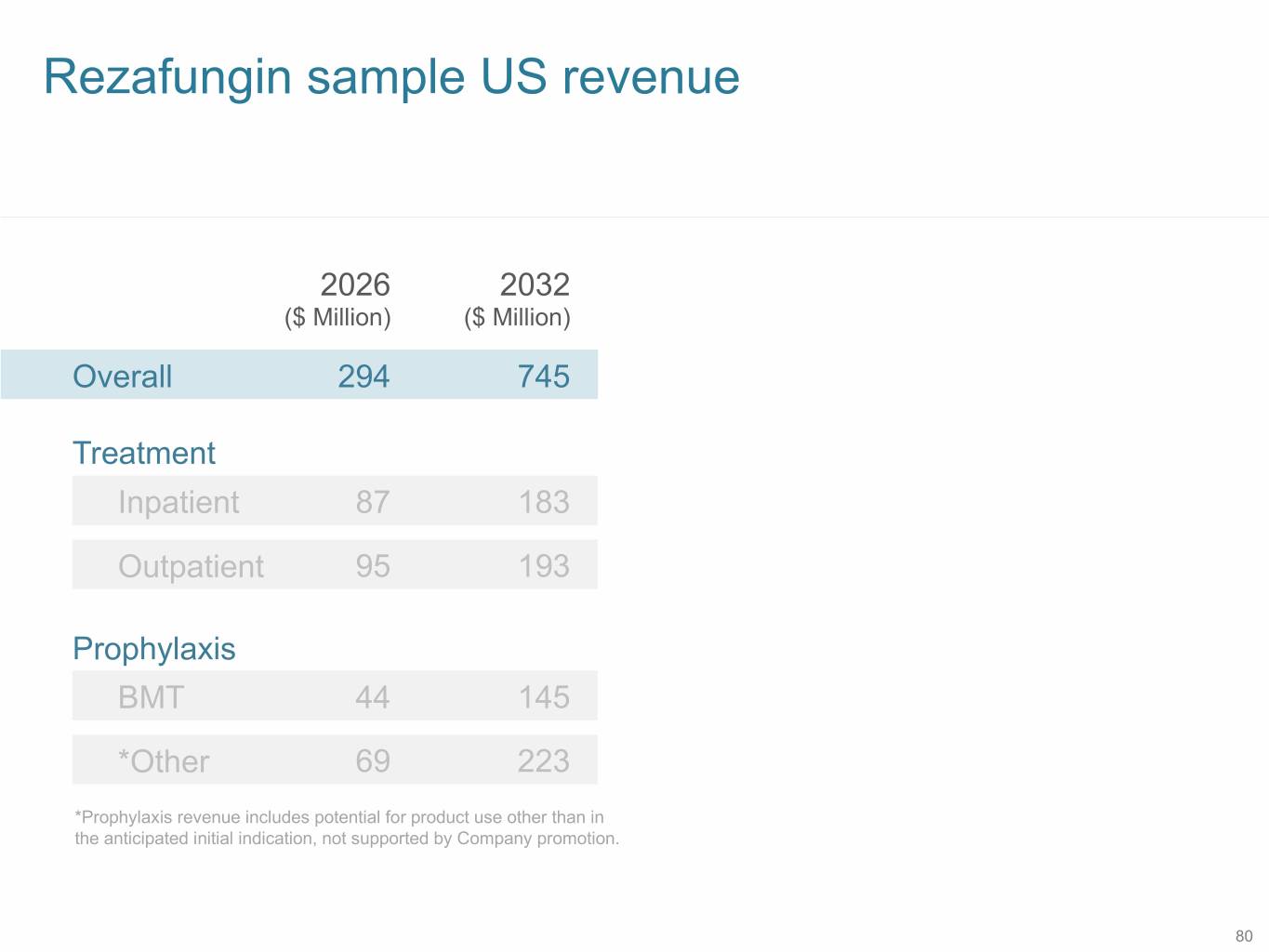

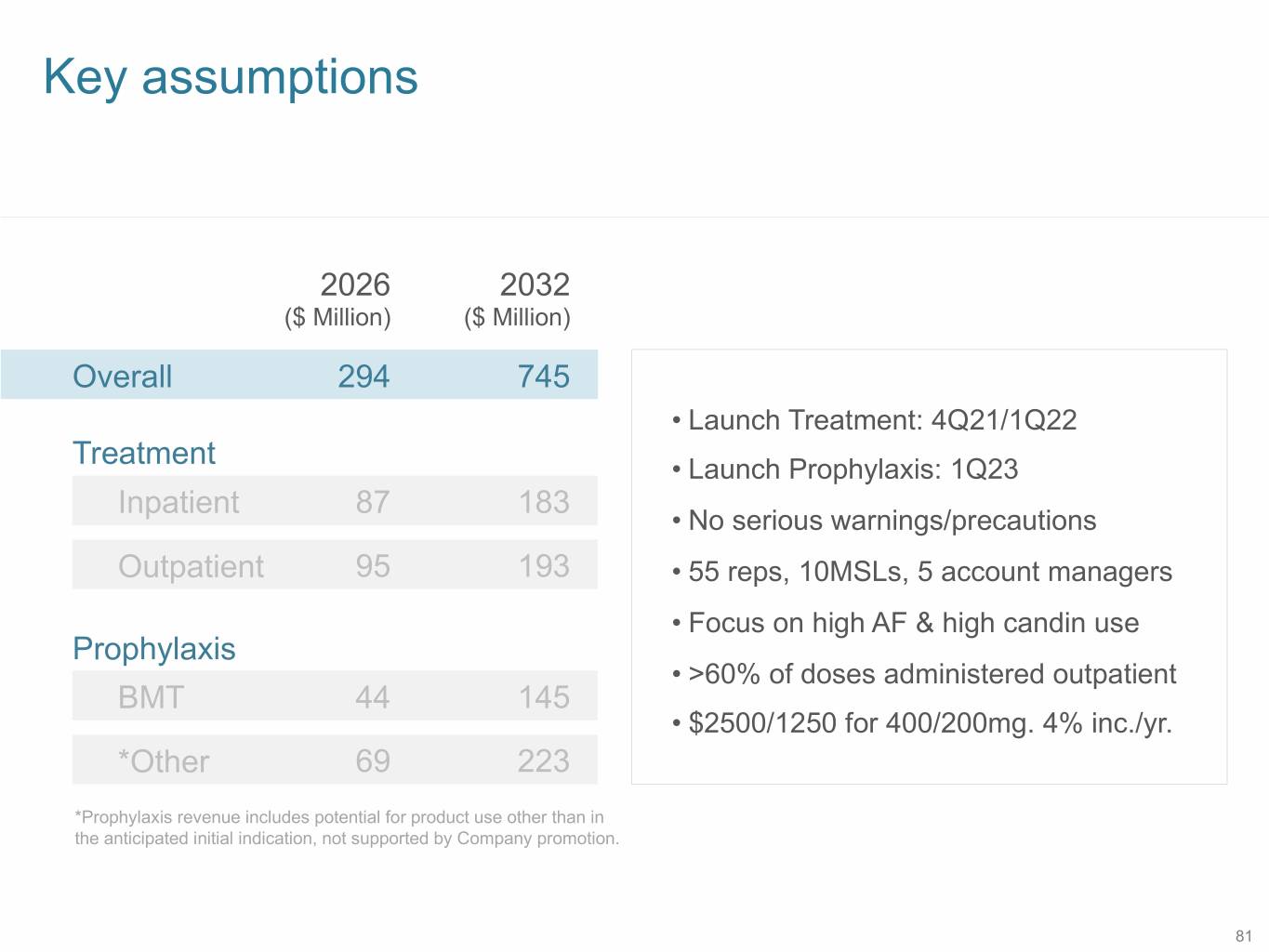

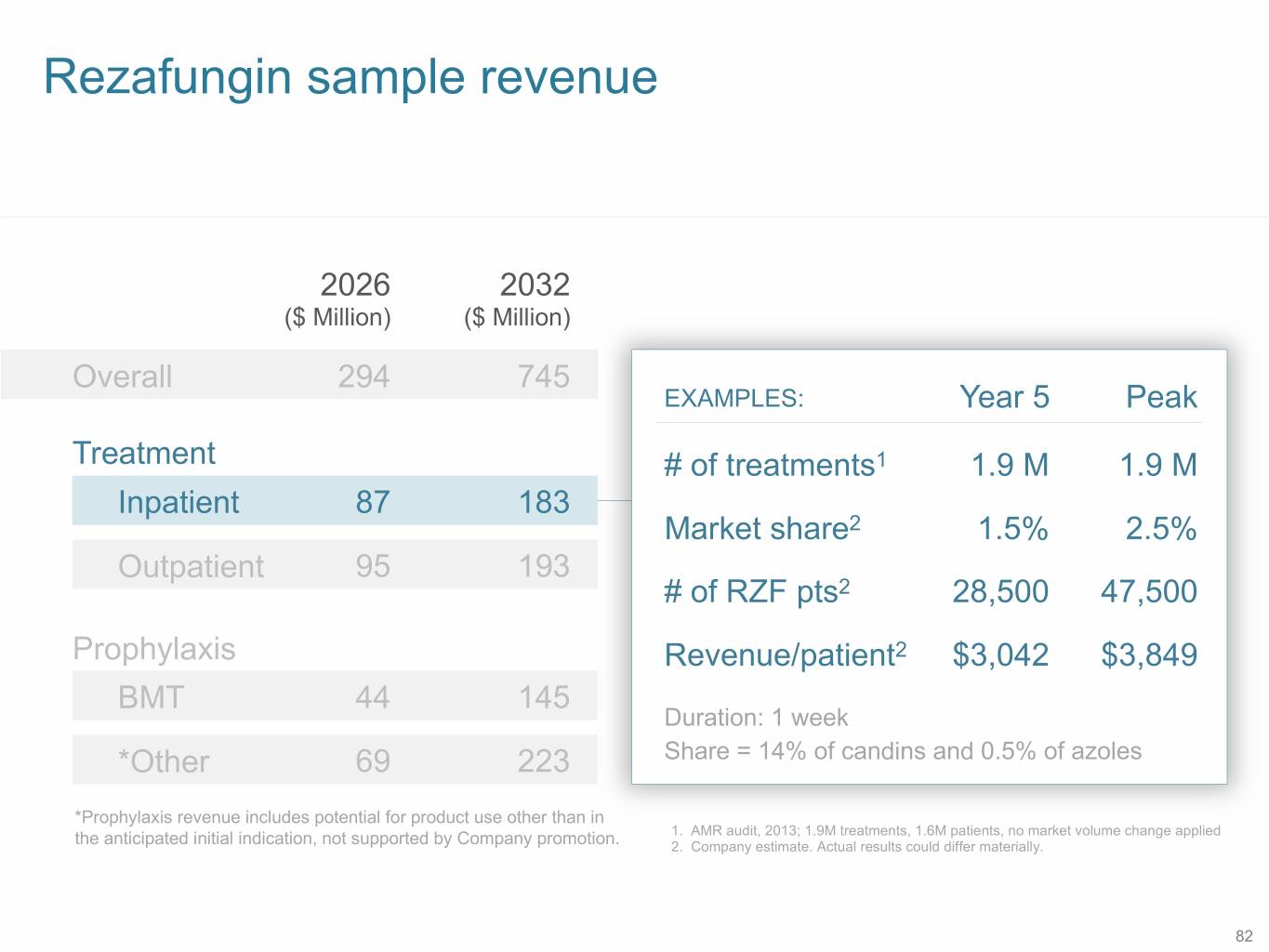

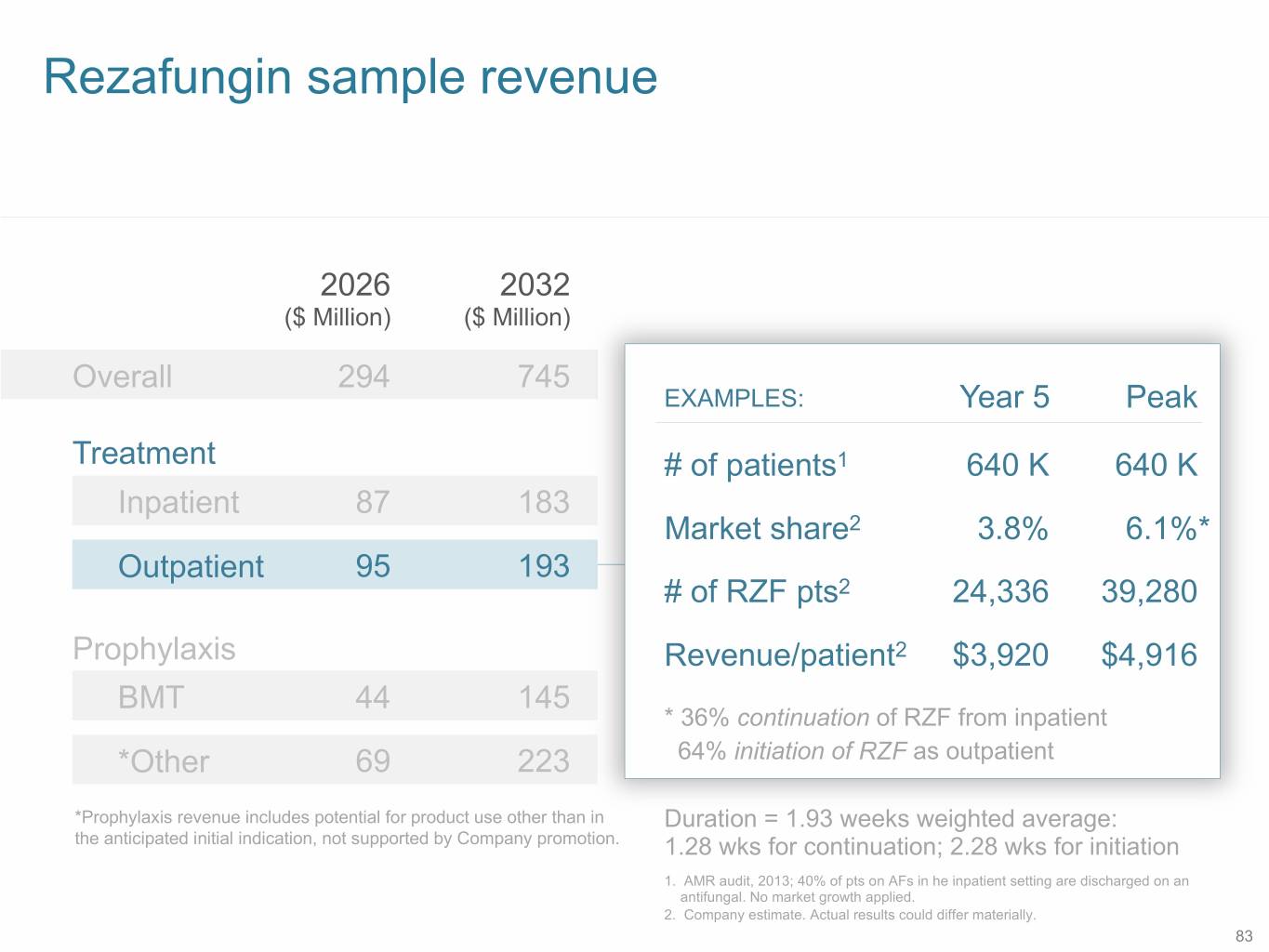

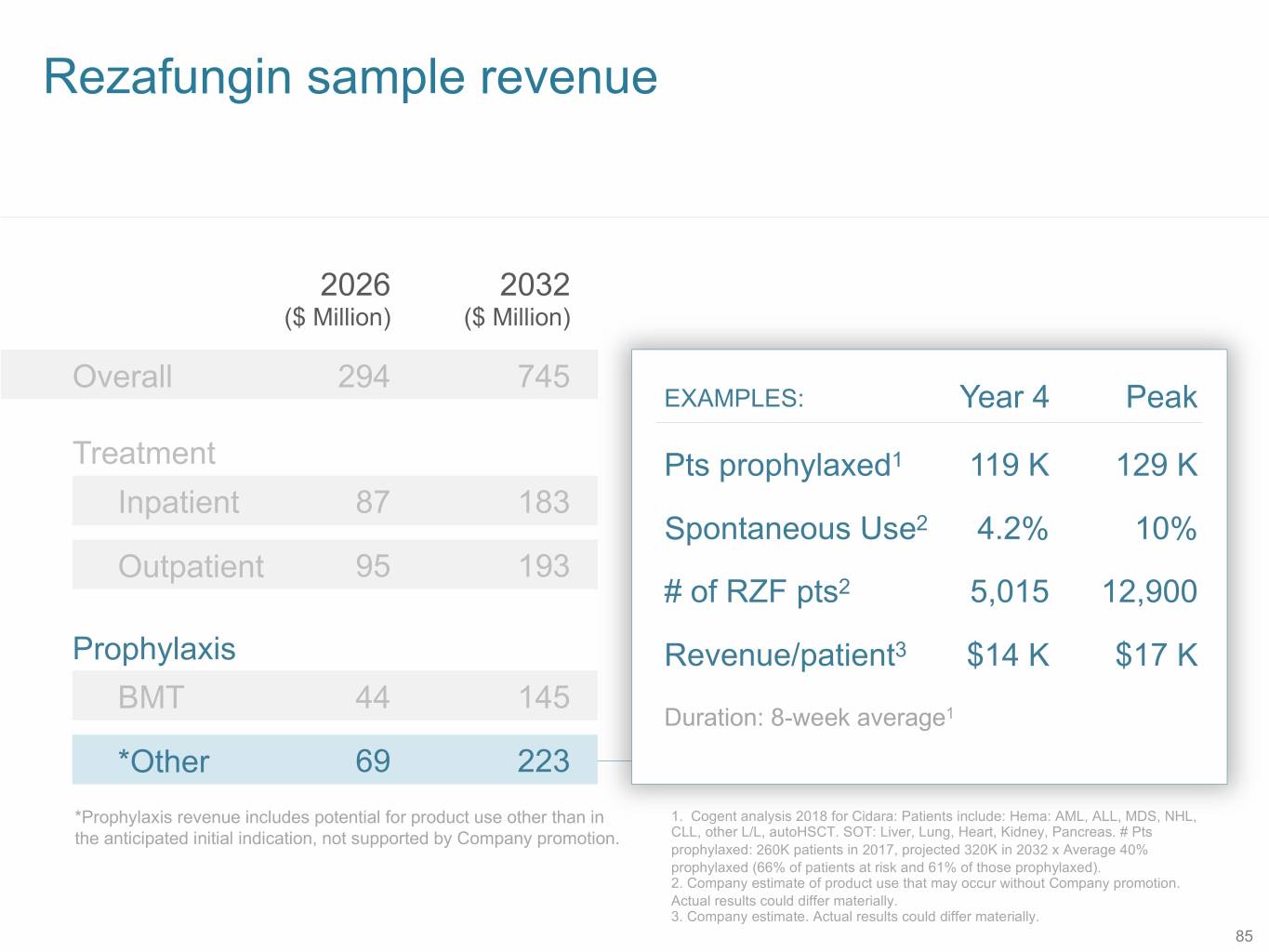

Rezafungin sample US revenue 2026 2032 ($ Million) ($ Million) Overall 294 745 Treatment Inpatient 87 183 Outpatient 95 193 Prophylaxis BMT 44 145 *Other 69 223 *Prophylaxis revenue includes potential for product use other than in the anticipated initial indication, not supported by Company promotion. 80

Key assumptions 2026 2032 ($ Million) ($ Million) Overall 294 745 • Launch Treatment: 4Q21/1Q22 Treatment • Launch Prophylaxis: 1Q23 Inpatient 87 183 • No serious warnings/precautions Outpatient 95 193 • 55 reps, 10MSLs, 5 account managers • Focus on high AF & high candin use Prophylaxis • >60% of doses administered outpatient BMT 44 145 • $2500/1250 for 400/200mg. 4% inc./yr. *Other 69 223 *Prophylaxis revenue includes potential for product use other than in the anticipated initial indication, not supported by Company promotion. 81

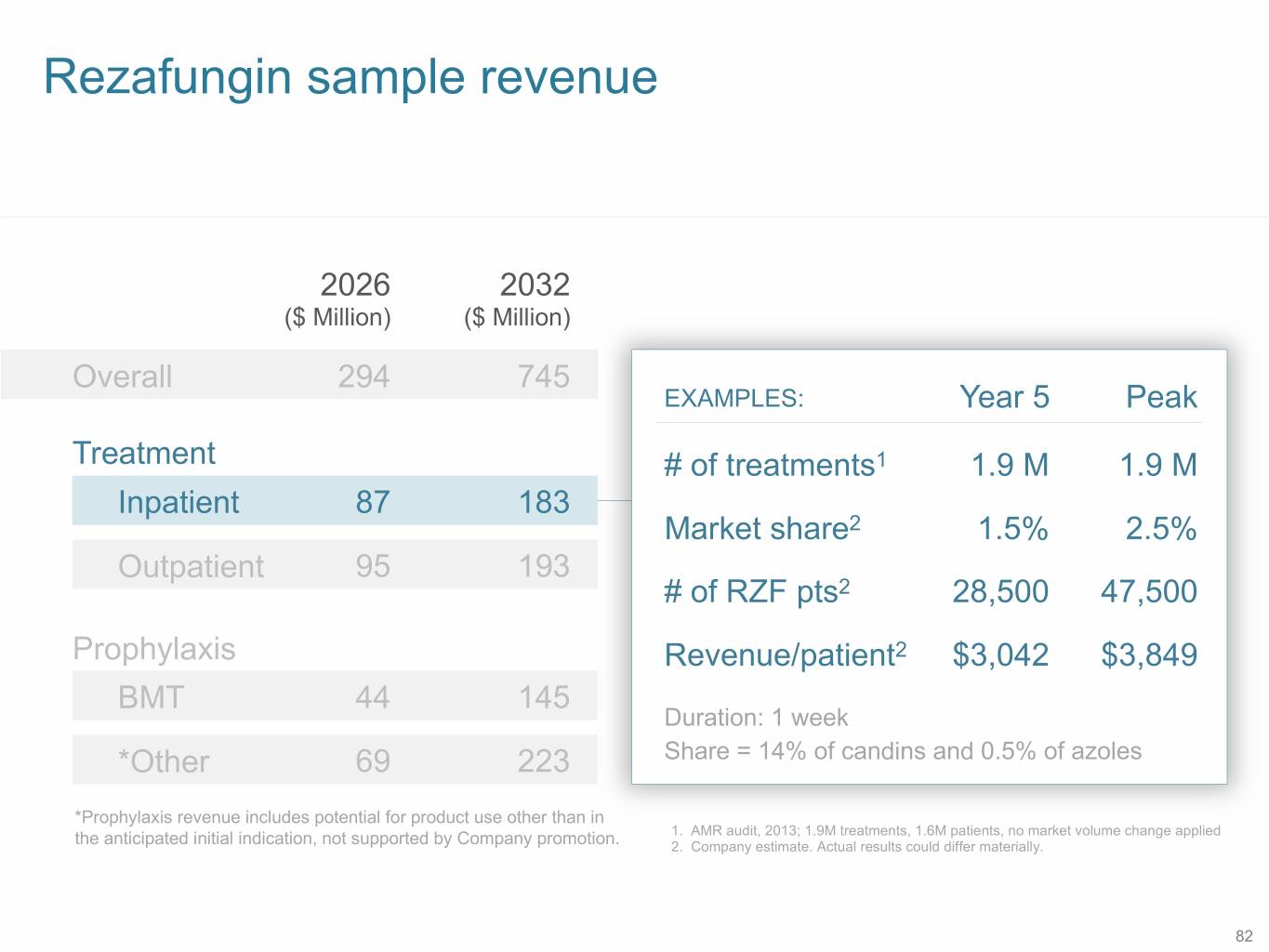

Rezafungin sample revenue 2026 2032 ($ Million) ($ Million) Overall 294 745 EXAMPLES: Year 5 Peak Treatment # of treatments1 1.9 M 1.9 M Inpatient 87 183 Market share2 1.5% 2.5% Outpatient 95 193 # of RZF pts2 28,500 47,500 Prophylaxis Revenue/patient2 $3,042 $3,849 BMT 44 145 Duration: 1 week *Other 69 223 Share = 14% of candins and 0.5% of azoles *Prophylaxis revenue includes potential for product use other than in 1. AMR audit, 2013; 1.9M treatments, 1.6M patients, no market volume change applied the anticipated initial indication, not supported by Company promotion. 2. Company estimate. Actual results could differ materially. 82

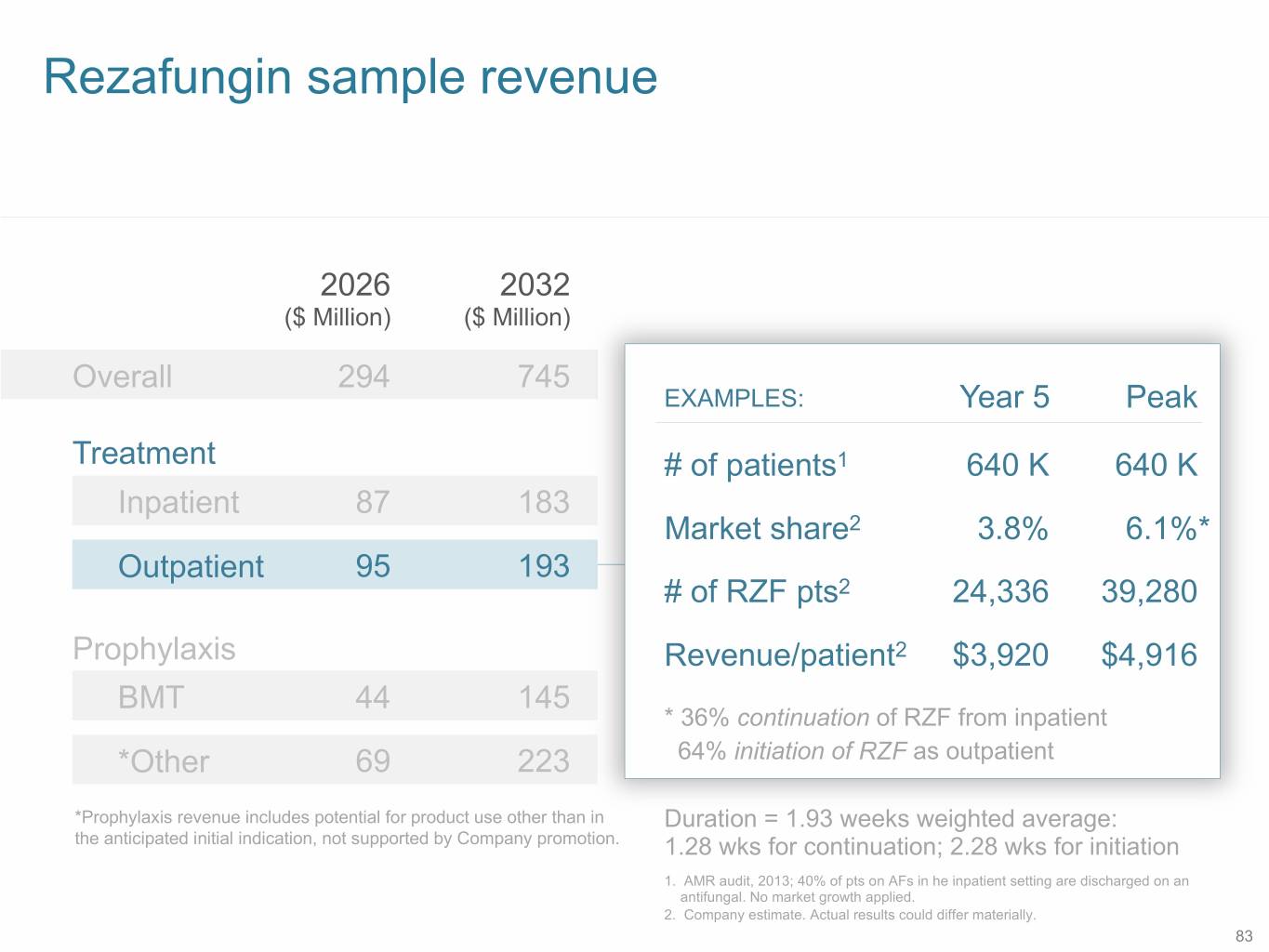

Rezafungin sample revenue 2026 2032 ($ Million) ($ Million) Overall 294 745 EXAMPLES: Year 5 Peak Treatment # of patients1 640 K 640 K Inpatient 87 183 Market share2 3.8% 6.1%* Outpatient 95 193 # of RZF pts2 24,336 39,280 Prophylaxis Revenue/patient2 $3,920 $4,916 BMT 44 145 * 36% continuation of RZF from inpatient *Other 69 223 64% initiation of RZF as outpatient *Prophylaxis revenue includes potential for product use other than in Duration = 1.93 weeks weighted average: the anticipated initial indication, not supported by Company promotion. 1.28 wks for continuation; 2.28 wks for initiation 1. AMR audit, 2013; 40% of pts on AFs in he inpatient setting are discharged on an antifungal. No market growth applied. 2. Company estimate. Actual results could differ materially. 83

Rezafungin sample revenue 2026 2032 ($ Million) ($ Million) Overall 294 745 EXAMPLES: Year 4 Peak Treatment AlloBMT patients1 9.7 K 10.7 K Inpatient 87 183 Market share2 21% 50% Outpatient 95 193 # of RZF pts2 2,054 5,391 Prophylaxis Revenue/patient2 $21 K $27 K BMT 44 145 Duration: 13 weeks *Other 69 223 *Prophylaxis revenue includes potential for product use other than in the anticipated initial indication, not supported by Company promotion. 1. # of alloBMT procedures projected from 8,780 in 2017, CIBMTR.org 2. Company estimate. Actual results could differ materially. 84

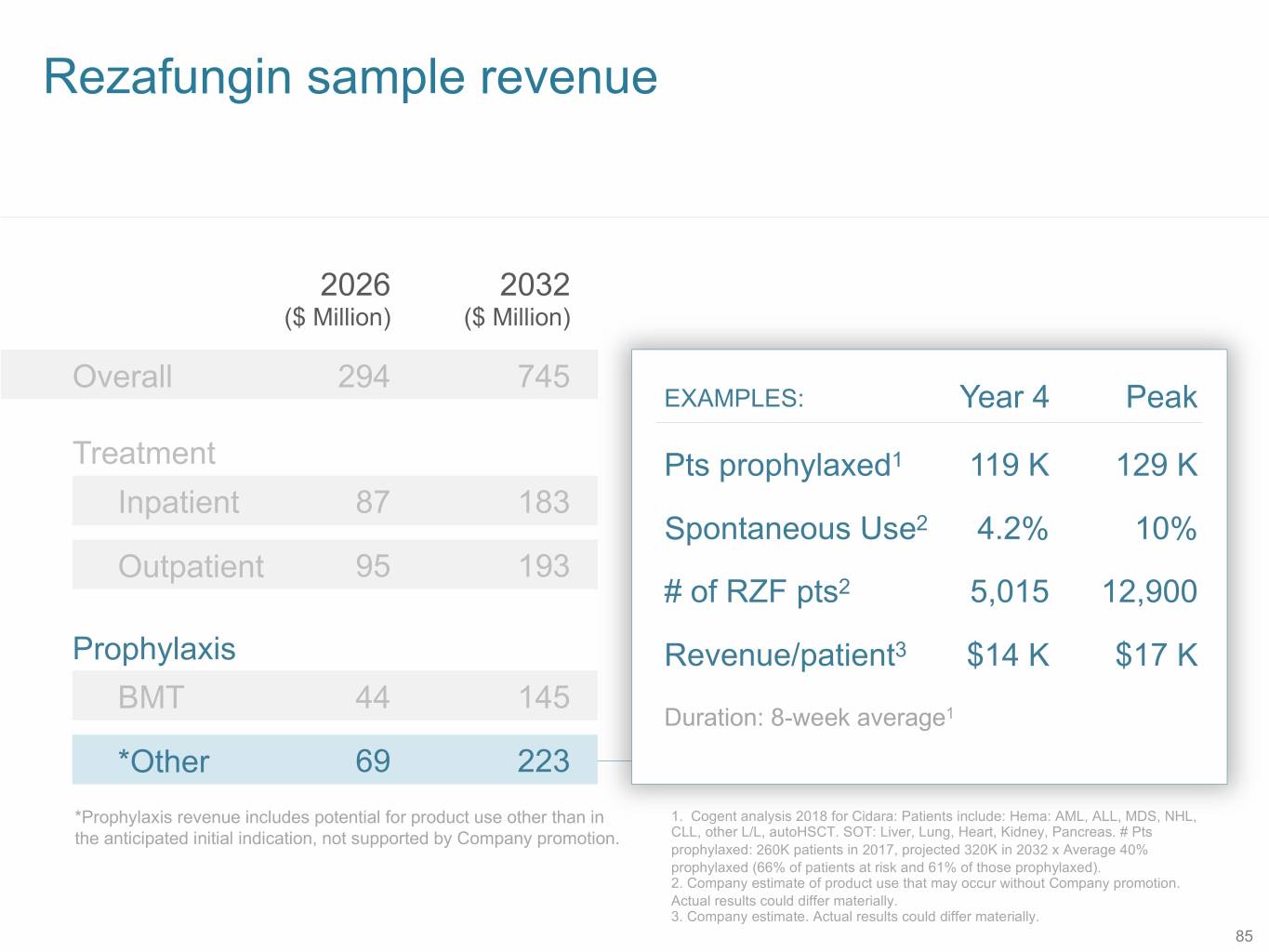

Rezafungin sample revenue 2026 2032 ($ Million) ($ Million) Overall 294 745 EXAMPLES: Year 4 Peak Treatment Pts prophylaxed1 119 K 129 K Inpatient 87 183 Spontaneous Use2 4.2% 10% Outpatient 95 193 # of RZF pts2 5,015 12,900 Prophylaxis Revenue/patient3 $14 K $17 K BMT 44 145 Duration: 8-week average1 *Other 69 223 *Prophylaxis revenue includes potential for product use other than in 1. Cogent analysis 2018 for Cidara: Patients include: Hema: AML, ALL, MDS, NHL, the anticipated initial indication, not supported by Company promotion. CLL, other L/L, autoHSCT. SOT: Liver, Lung, Heart, Kidney, Pancreas. # Pts prophylaxed: 260K patients in 2017, projected 320K in 2032 x Average 40% prophylaxed (66% of patients at risk and 61% of those prophylaxed). 2. Company estimate of product use that may occur without Company promotion. Actual results could differ materially. 3. Company estimate. Actual results could differ materially. 85

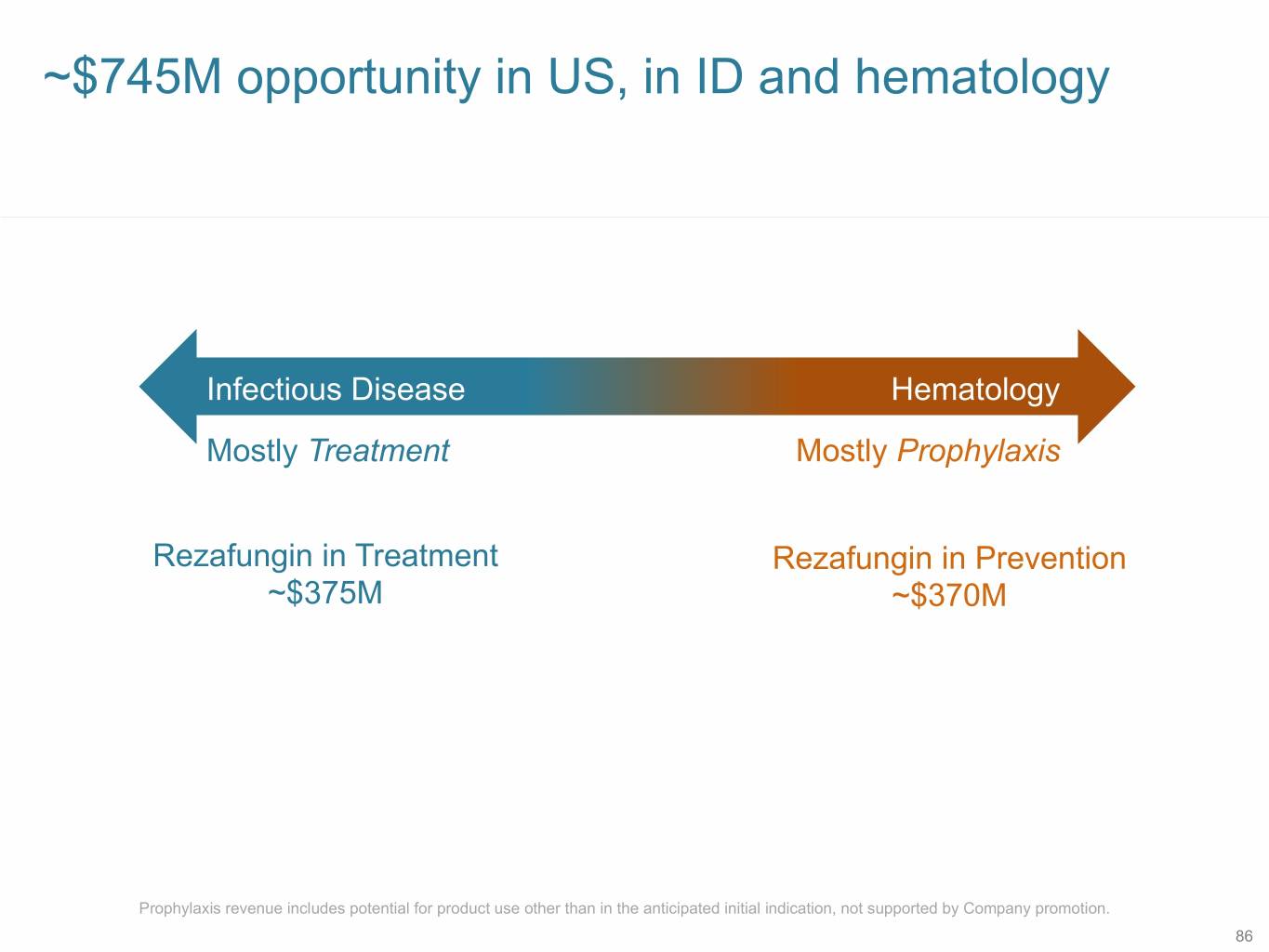

~$745M opportunity in US, in ID and hematology Infectious Disease Hematology Mostly Treatment Mostly Prophylaxis Rezafungin in Treatment Rezafungin in Prevention ~$375M ~$370M Prophylaxis revenue includes potential for product use other than in the anticipated initial indication, not supported by Company promotion. 86

Commercial Outlook Rezafungin Cloudbreak - Influenza 87

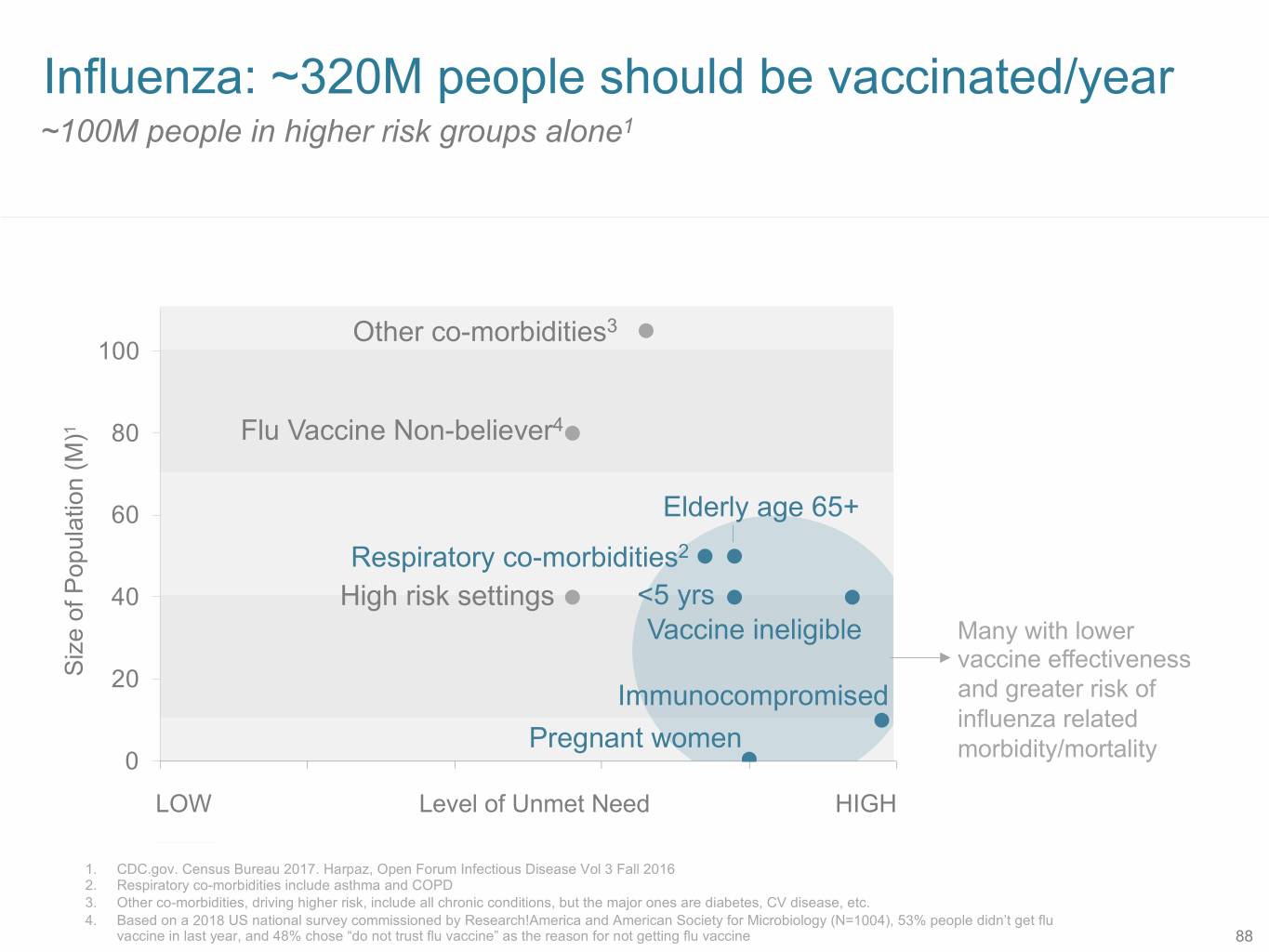

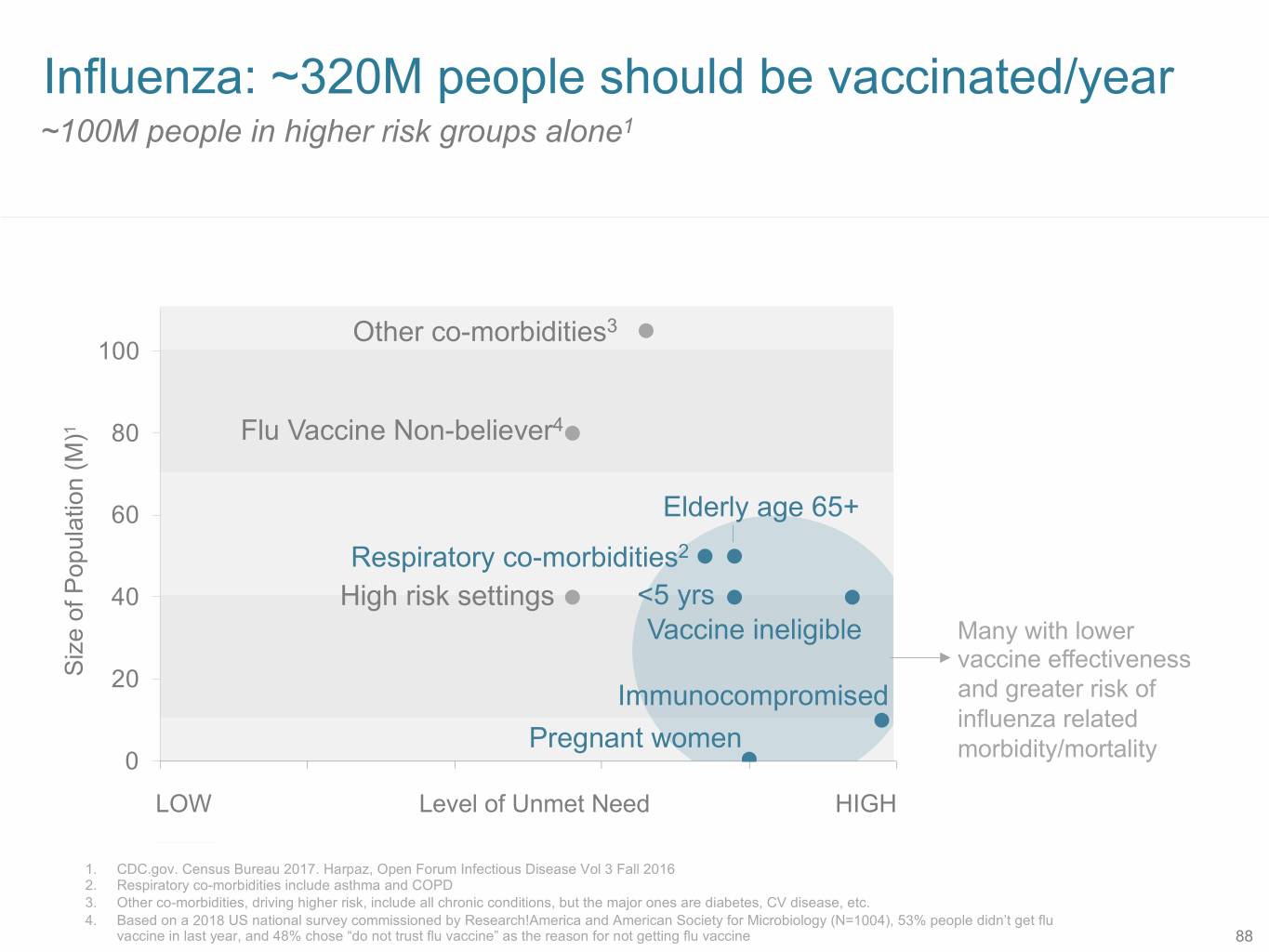

Influenza: ~320M people should be vaccinated/year ~100M people in higher risk groups alone1 Other co-morbidities3 100 1 80 Flu Vaccine Non-believer4 60 Elderly age 65+ Respiratory co-morbidities2 40 High risk settings <5 yrs Vaccine ineligible Many with lower vaccine effectiveness Size of Population (M) Population Sizeof 20 Immunocompromised and greater risk of influenza related Pregnant women 0 morbidity/mortality 0 1 2 3 4 5 LOW Level of Unmet Need HIGH DETAIL 1. CDC.gov. Census Bureau 2017. Harpaz, Open Forum Infectious Disease Vol 3 Fall 2016 2. Respiratory co-morbidities include asthma and COPD 3. Other co-morbidities, driving higher risk, include all chronic conditions, but the major ones are diabetes, CV disease, etc. 4. Based on a 2018 US national survey commissioned by Research!America and American Society for Microbiology (N=1004), 53% people didn’t get flu vaccine in last year, and 48% chose “do not trust flu vaccine” as the reason for not getting flu vaccine 88

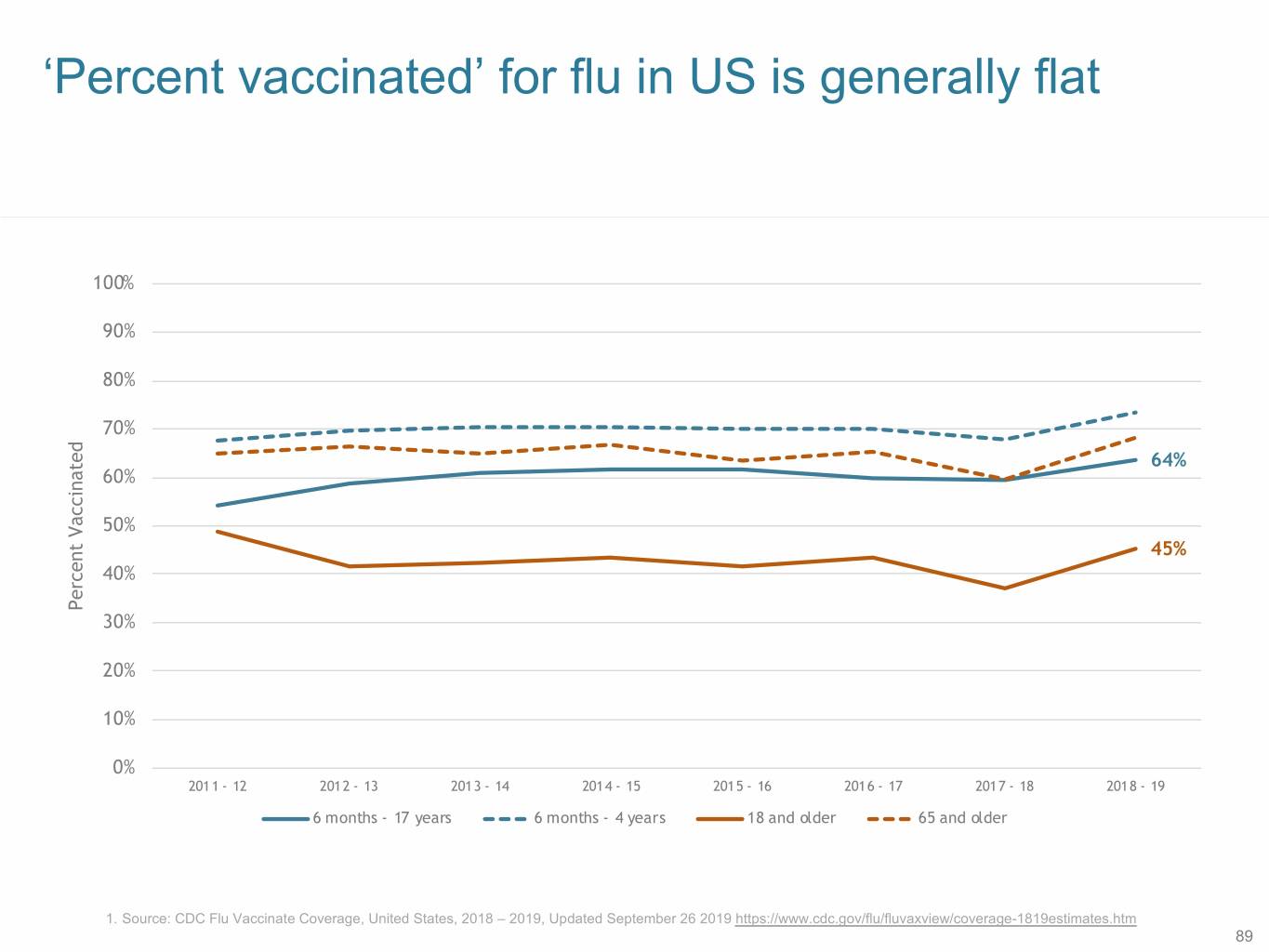

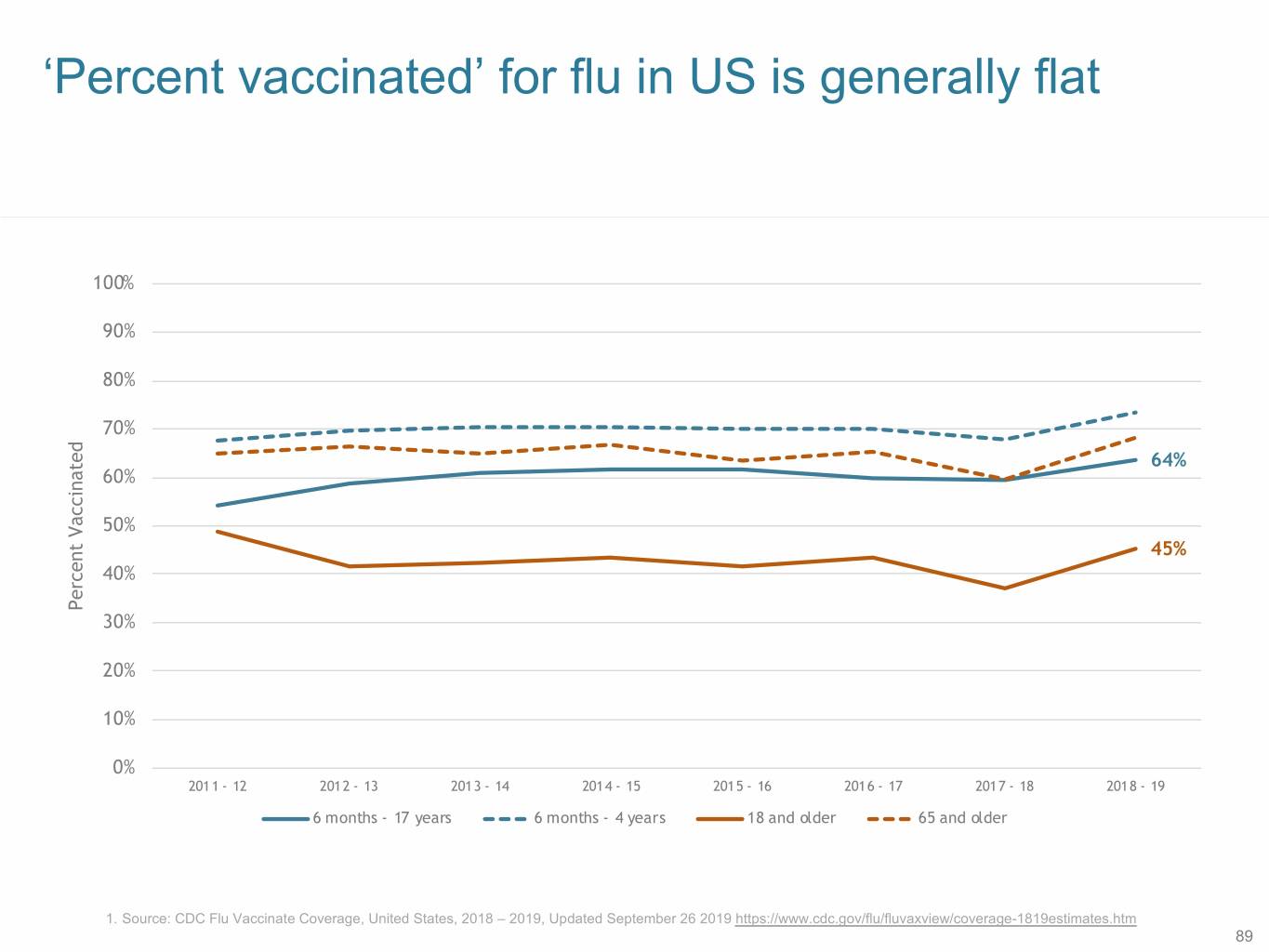

‘Percent vaccinated’ for flu in US is generally flat 100% 90% 80% 70% 64% 60% 50% 45% 40% Percent Vaccinated 30% 20% 10% 0% 2011 - 12 2012 - 13 2013 - 14 2014 - 15 2015 - 16 2016 - 17 2017 - 18 2018 - 19 6 months - 17 years 6 months - 4 years 18 and older 65 and older 1. Source: CDC Flu Vaccinate Coverage, United States, 2018 – 2019, Updated September 26 2019 https://www.cdc.gov/flu/fluvaxview/coverage-1819estimates.htm 89

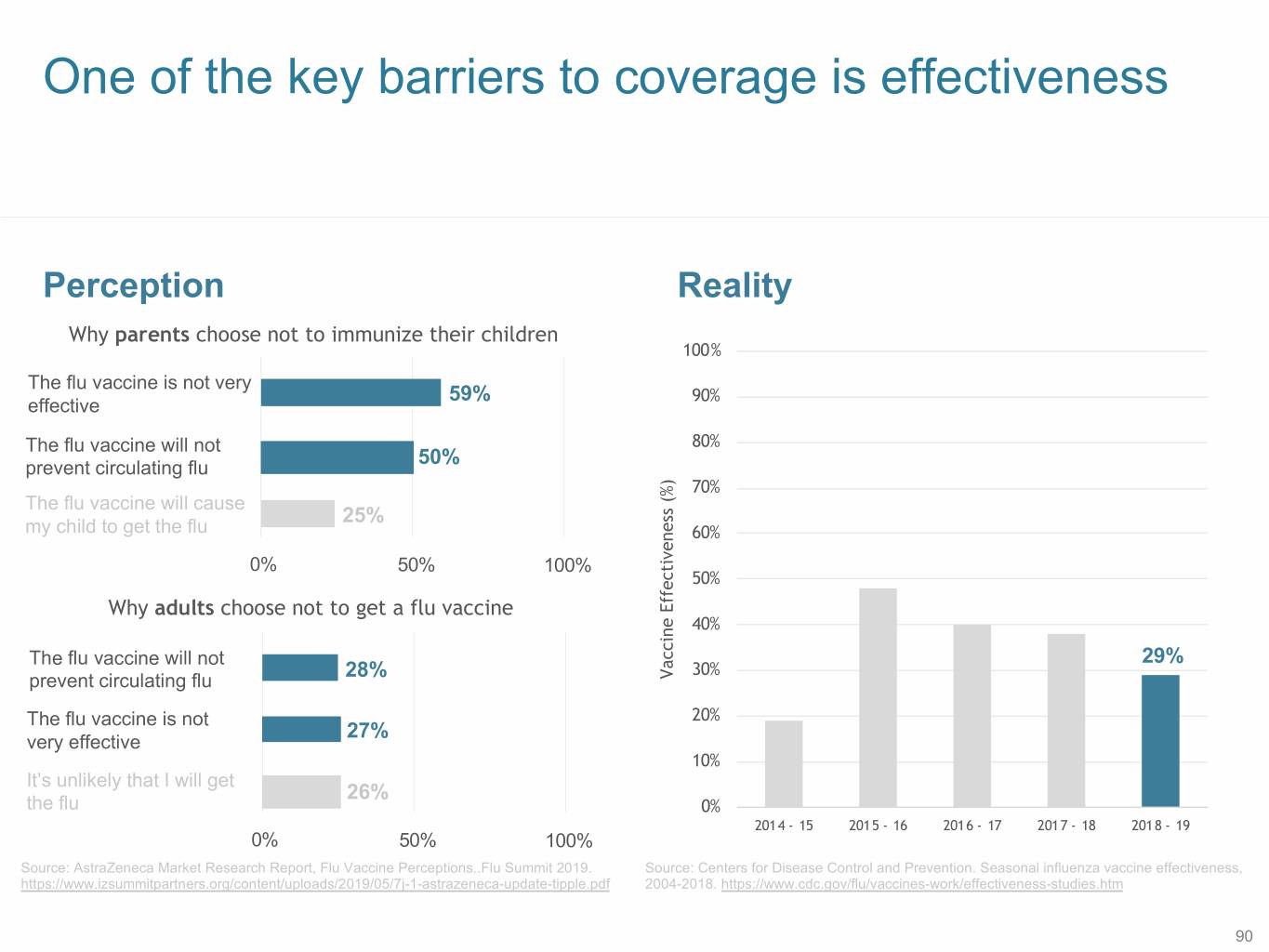

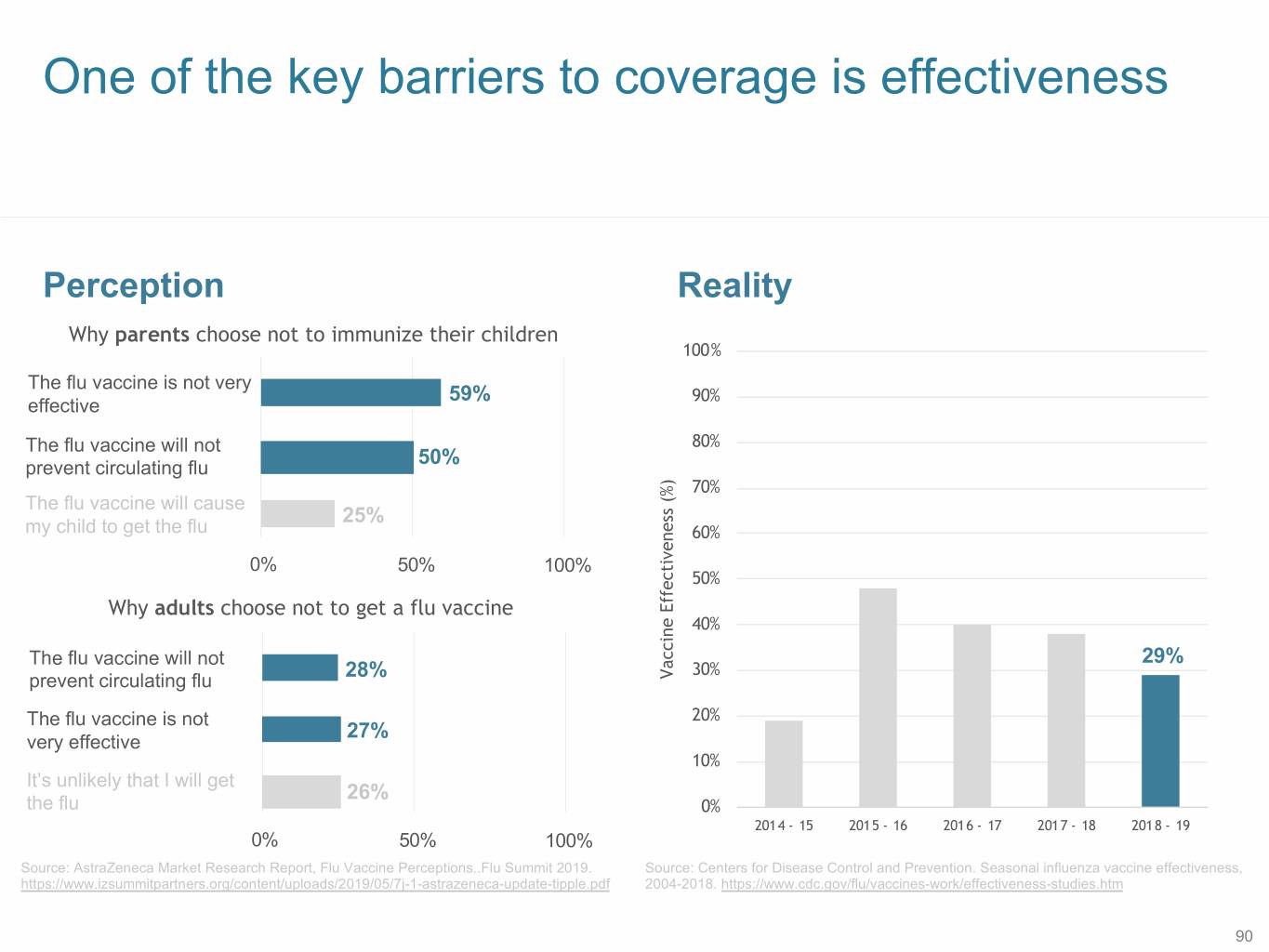

One of the key barriers to coverage is effectiveness Perception Reality Why parents choose not to immunize their children 100% The flu vaccine is not very 59% 90% effective The flu vaccine will not 80% 50% prevent circulating flu 70% The flu vaccine will cause 25% my child to get the flu 60% 0% 50% 100% 50% Why adults choose not to get a flu vaccine 40% The flu vaccine will not 29% 30% 28% Vaccine Effectiveness (%) prevent circulating flu The flu vaccine is not 20% 27% very effective 10% It’s unlikely that I will get 26% the flu 0% 2014 - 15 2015 - 16 2016 - 17 2017 - 18 2018 - 19 0% 50% 100% Source: AstraZeneca Market Research Report, Flu Vaccine Perceptions..Flu Summit 2019. Source: Centers for Disease Control and Prevention. Seasonal influenza vaccine effectiveness, https://www.izsummitpartners.org/content/uploads/2019/05/7j-1-astrazeneca-update-tipple.pdf 2004-2018. https://www.cdc.gov/flu/vaccines-work/effectiveness-studies.htm 90

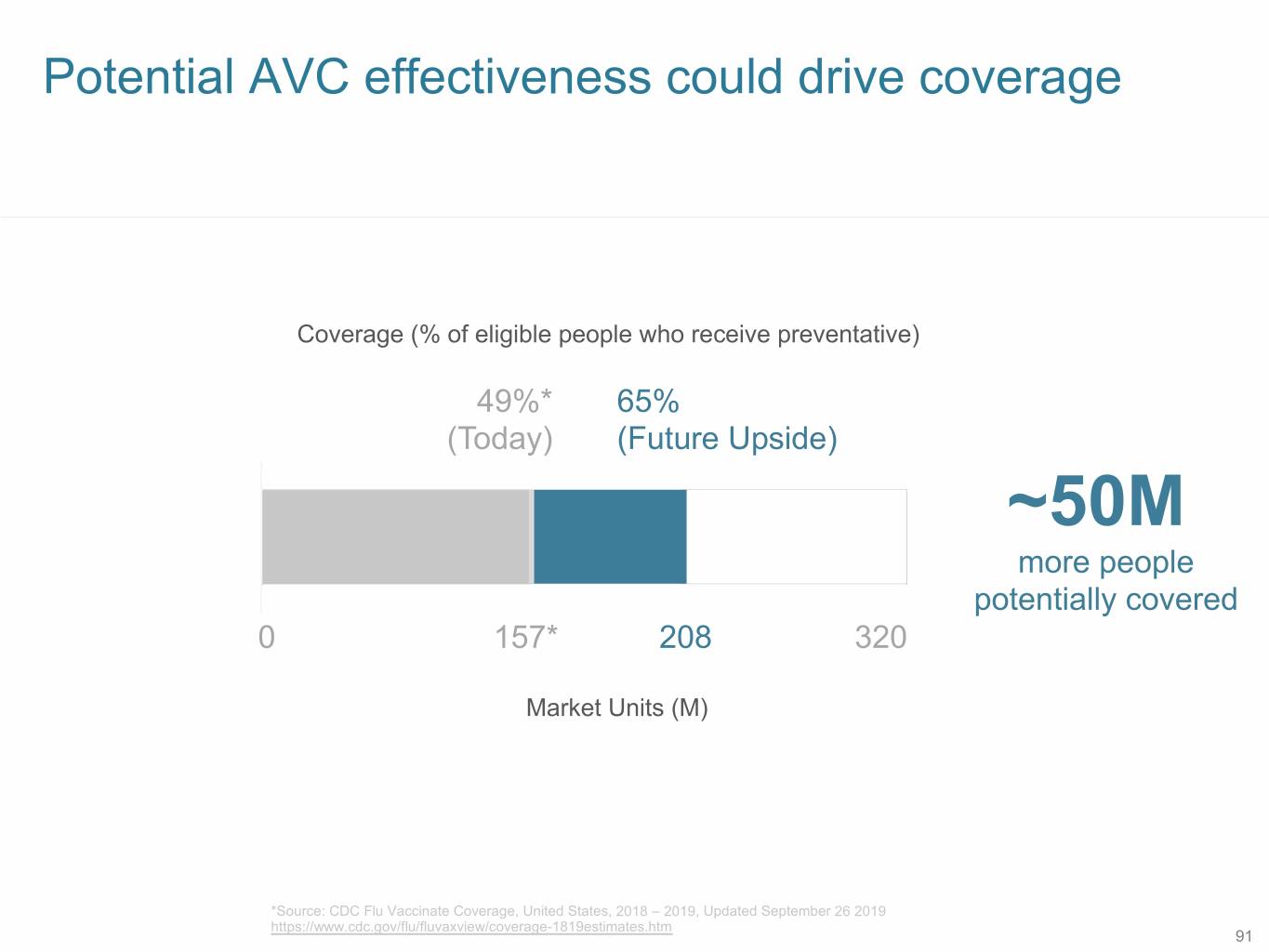

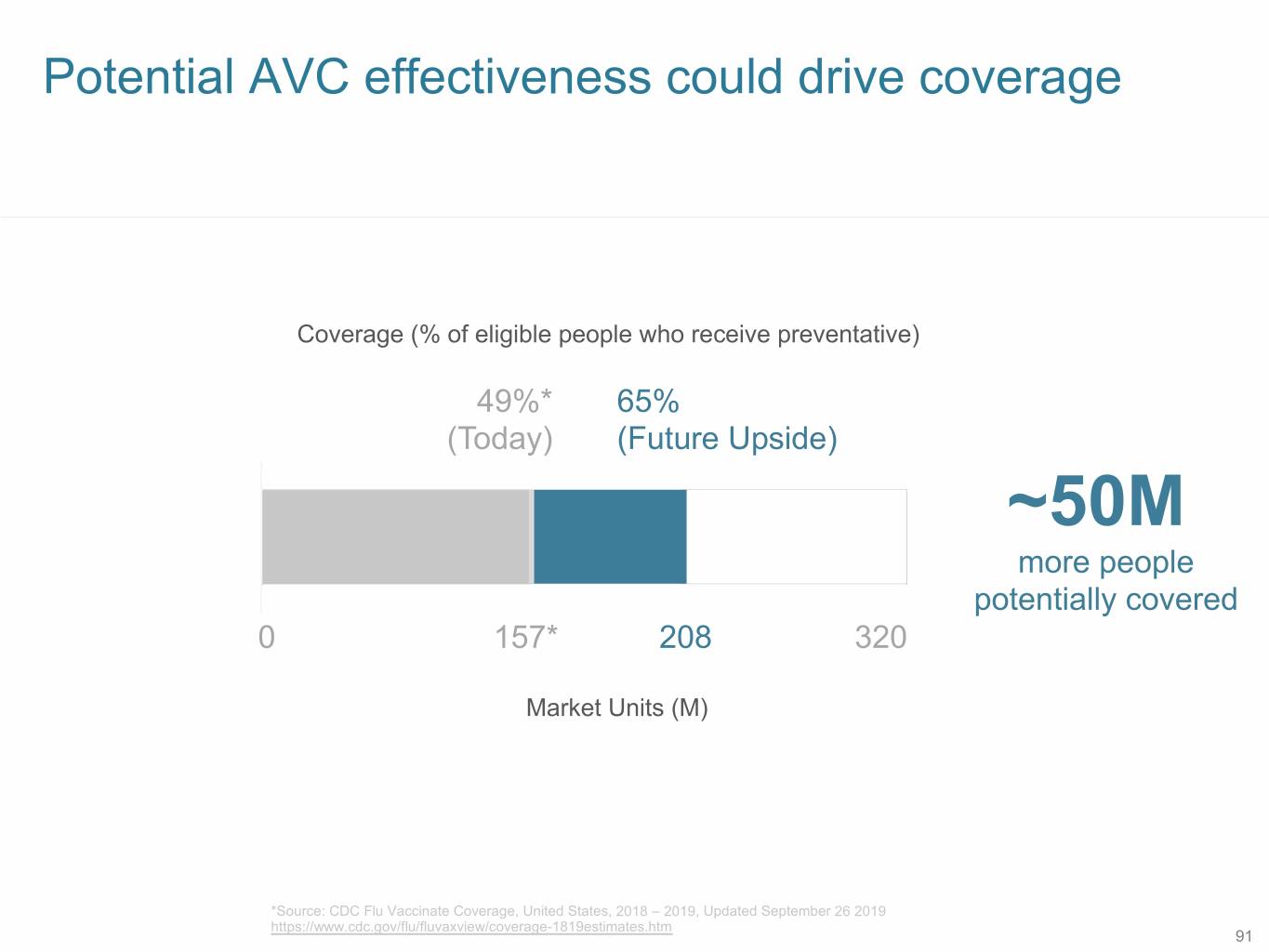

Potential AVC effectiveness could drive coverage Coverage (% of eligible people who receive preventative) 49%* 65% (Today) (Future Upside) ~50M more people potentially covered 0 157* 208 320 Market Units (M) *Source: CDC Flu Vaccinate Coverage, United States, 2018 – 2019, Updated September 26 2019 https://www.cdc.gov/flu/fluvaxview/coverage-1819estimates.htm 91

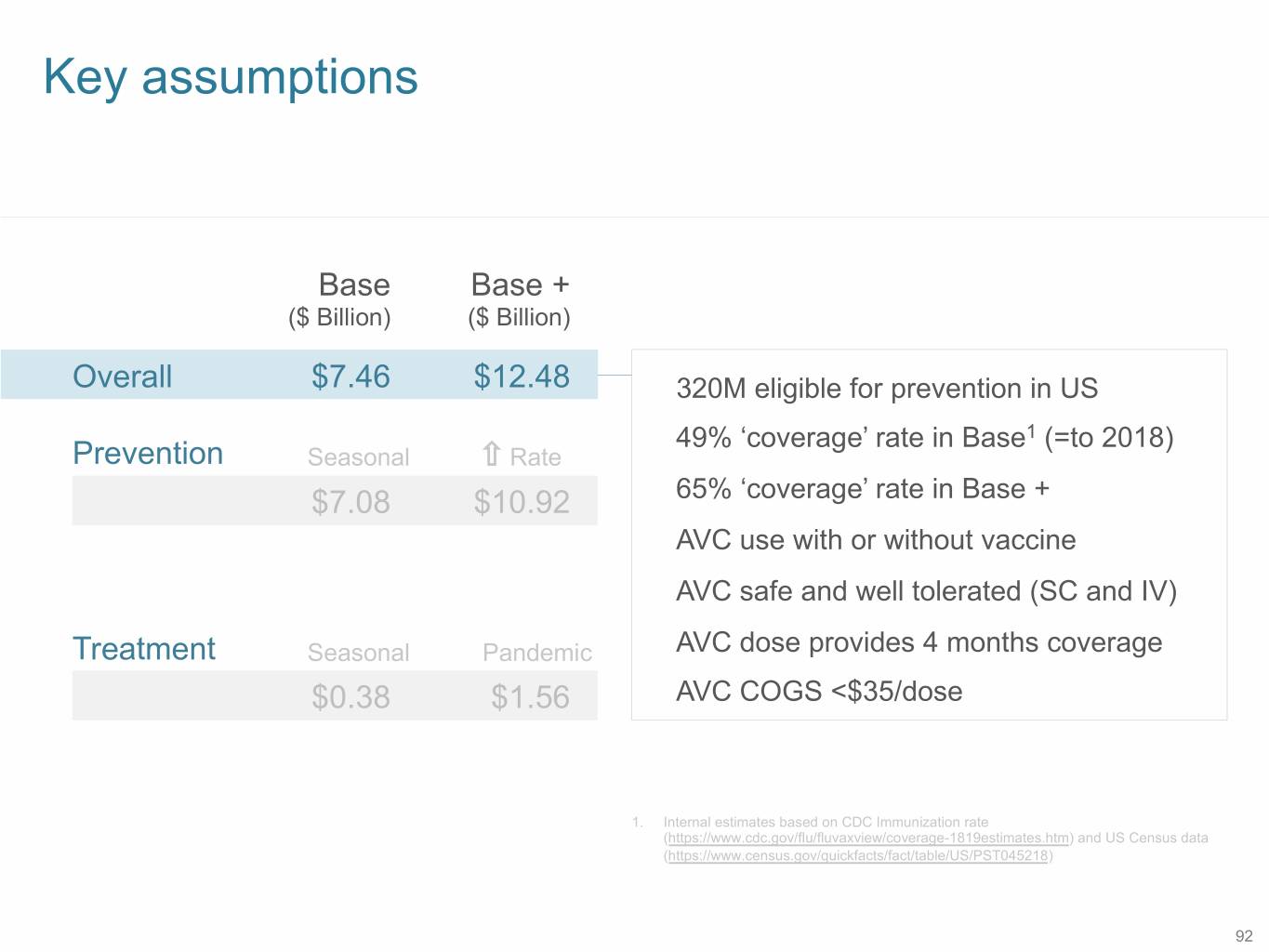

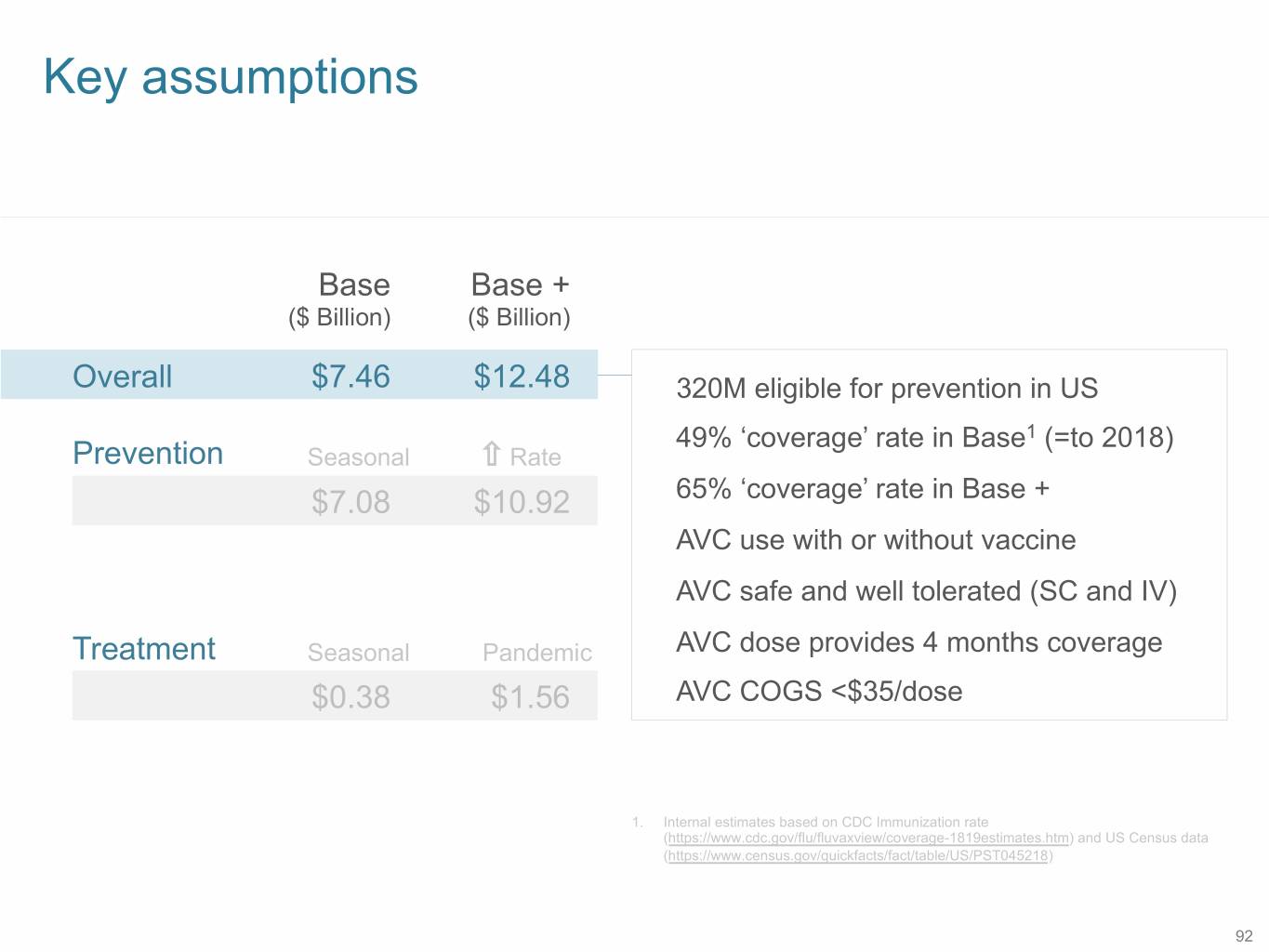

Key assumptions Base Base + ($ Billion) ($ Billion) Overall $7.46 $12.48 320M eligible for prevention in US 49% ‘coverage’ rate in Base1 (=to 2018) Prevention Seasonal Rate $7.08 $10.92 65% ‘coverage’ rate in Base + AVC use with or without vaccine AVC safe and well tolerated (SC and IV) Treatment Seasonal Pandemic AVC dose provides 4 months coverage $0.38 $1.56 AVC COGS <$35/dose 1. Internal estimates based on CDC Immunization rate (https://www.cdc.gov/flu/fluvaxview/coverage-1819estimates.htm) and US Census data (https://www.census.gov/quickfacts/fact/table/US/PST045218) 92

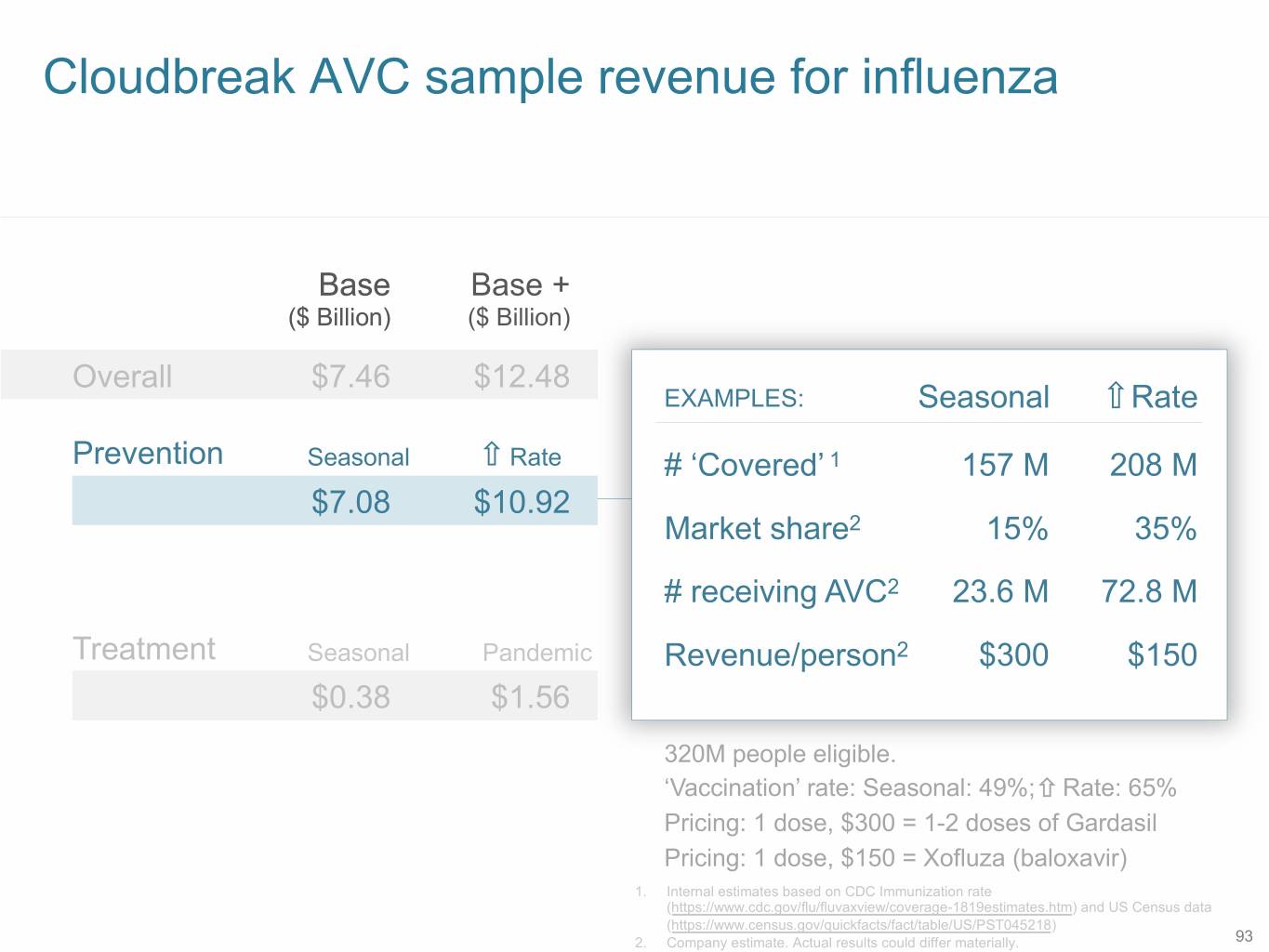

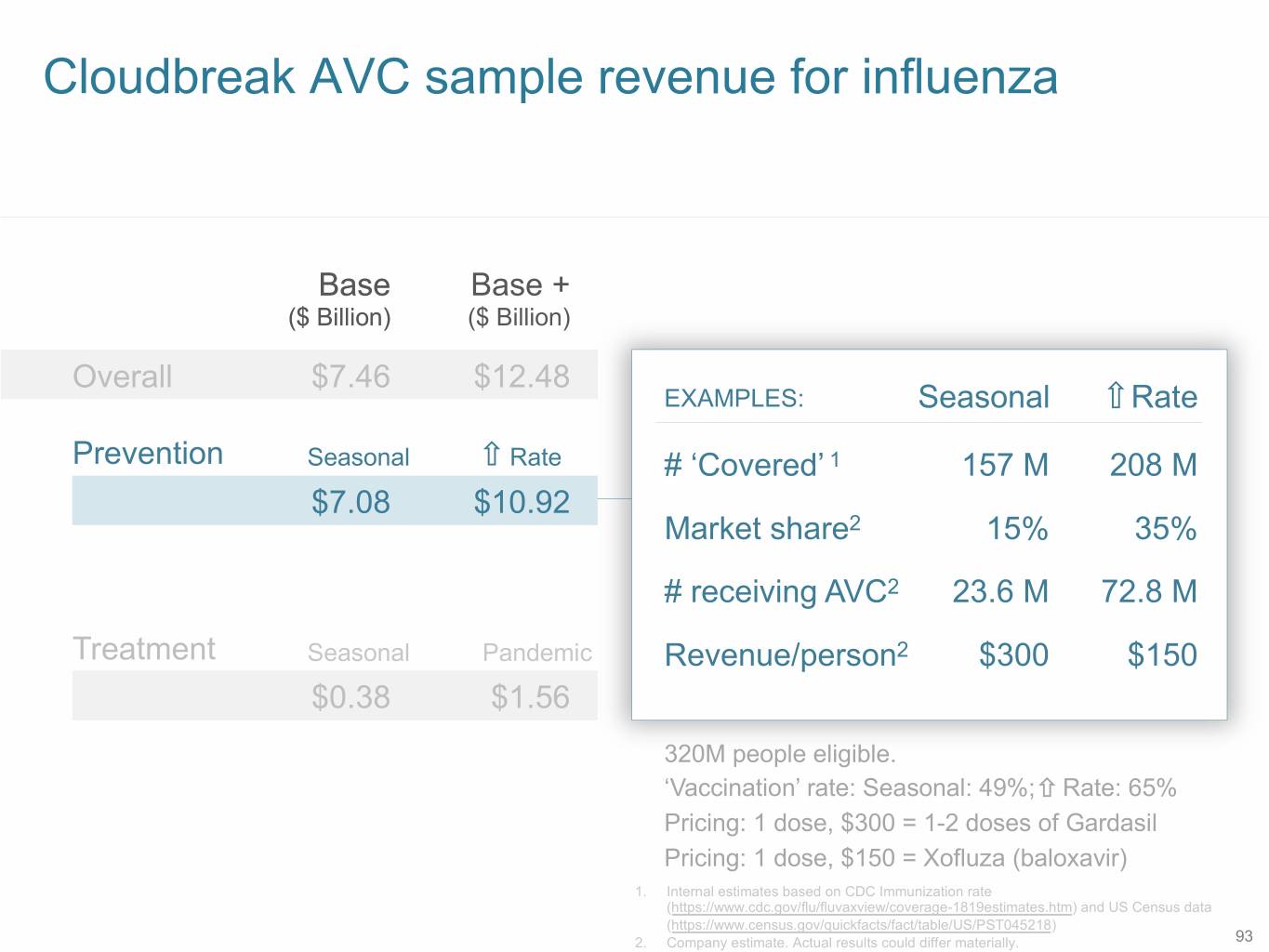

Cloudbreak AVC sample revenue for influenza Base Base + ($ Billion) ($ Billion) Overall $7.46 $12.48 EXAMPLES: Seasonal Rate Prevention Seasonal Rate # ‘Covered’ 1 157 M 208 M $7.08 $10.92 Market share2 15% 35% # receiving AVC2 23.6 M 72.8 M Treatment Seasonal Pandemic Revenue/person2 $300 $150 $0.38 $1.56 320M people eligible. ‘Vaccination’ rate: Seasonal: 49%; Rate: 65% Pricing: 1 dose, $300 = 1-2 doses of Gardasil Pricing: 1 dose, $150 = Xofluza (baloxavir) 1. Internal estimates based on CDC Immunization rate (https://www.cdc.gov/flu/fluvaxview/coverage-1819estimates.htm) and US Census data (https://www.census.gov/quickfacts/fact/table/US/PST045218) 2. Company estimate. Actual results could differ materially. 93

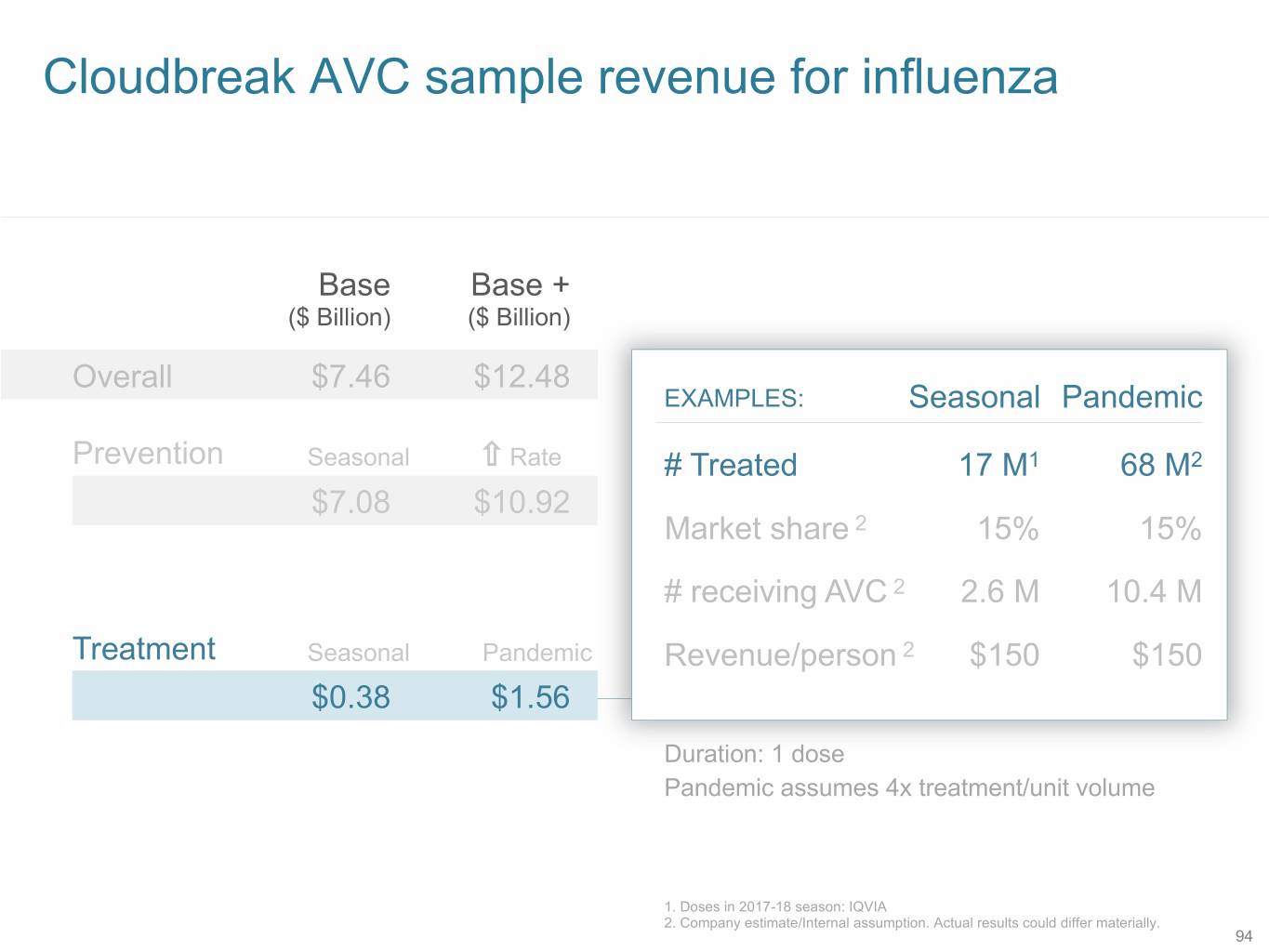

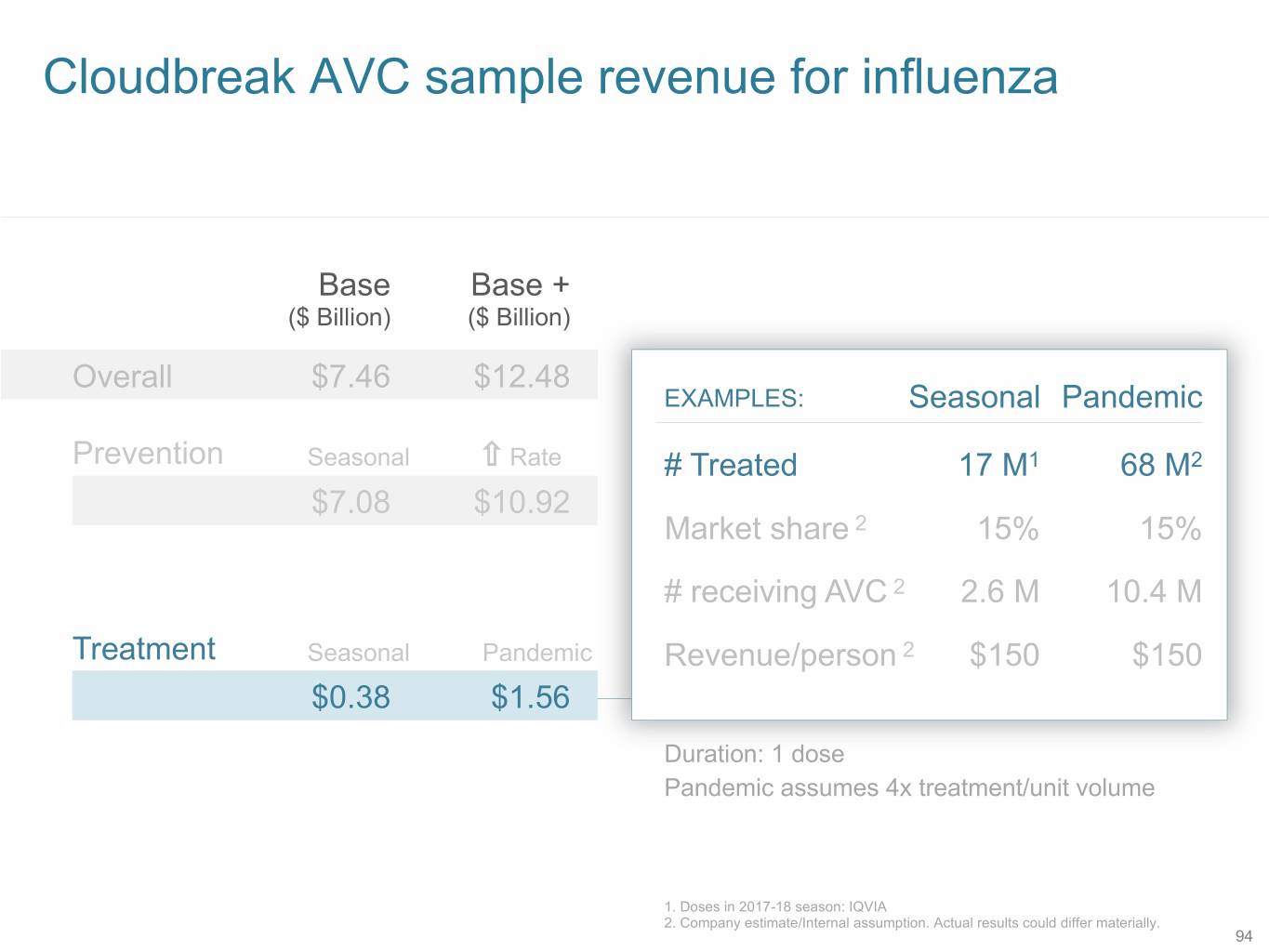

Cloudbreak AVC sample revenue for influenza Base Base + ($ Billion) ($ Billion) Overall $7.46 $12.48 EXAMPLES: Seasonal Pandemic Prevention Seasonal Rate # Treated 17 M1 68 M2 $7.08 $10.92 Market share 2 15% 15% # receiving AVC 2 2.6 M 10.4 M Treatment Seasonal Pandemic Revenue/person 2 $150 $150 $0.38 $1.56 Duration: 1 dose Pandemic assumes 4x treatment/unit volume 1. Doses in 2017-18 season: IQVIA 2. Company estimate/Internal assumption. Actual results could differ materially. 94

SB 12 Agenda Opening - Overview Jeff Stein, PhD, CEO, Cidara Therapeutics Antifungal Treatment Unmet Neil Clancy, M.D., University of Pittsburgh Needs Unmet Antifungal Prophylaxis Needs Kieren Marr, M.D., Johns Hopkins School of Medicine Influenza Unmet Allison McGeer, M.D., University of Toronto Needs Commercial Potential Paul Daruwala, COO, Cidara Therapeutics Fireside Chat, Q&A Team 95

New Hope for Serious Infections Analyst – KOL Day November 14, 2019 © Cidara Therapeutics 2019