New Hope for Serious Infections Corporate Presentation January 2020 © Cidara Therapeutics 2020

Forward-Looking Statements Because such statements are subject to risks and observed attributes, represent an improvement These slides and the uncertainties, actual results may differ materially from those over existing therapies or will also be observed in expressed or implied by such forward-looking statements. human use; and whether our Cloudbreak platform accompanying oral Such statements include, but are not limited to, statements can be expanded to identify product candidates to presentation contain regarding Cidara’s pipeline and whether any of its product treat or prevent other viral diseases, such as RSV, candidates may be developed to address unmet medical HIV, or other viruses. This presentation also forward-looking needs; the effectiveness, safety, long-acting nature of contains estimates and other statistical data made rezafungin; the potential for rezafungin to treat and/or prevent by independent parties and by Cidara relating to statements within the infections; the ability of Cidara to achieve all milestones from market size and growth and other data about its collaboration partner for rezafungin, Mundipharama, and Cidara's industry. These data involve a number of meaning of the Private receive related payments; whether the top line results of the assumptions and limitations, and you are cautioned STRIVE Part B clinical trial will be supported in the full not to give undue weight to such estimates. Securities Litigation analysis of the STRIVE Part B clinical data, and whether the Projections, assumptions and estimates of the success of the STRIVE Part B clinical trial or the post-hoc future performance of the markets in which Cidara Reform Act of 1995. analysis of the STRIVE Part A and Part B data indicates a operates are necessarily subject to a high degree successful outcome in the Phase 3 ReSTORE clinical trial, of uncertainty and risk. Risks that contribute to the including whether or not rezafungin will meet the primary uncertain nature ofinclude: Cidara's estimated use endpoints in the ReSTORE trial; and, whether Cidara will be of proceeds from the Rights Offering; Cidara’s the able to successfully develop and commercialize rezafungin, forward-looking statements ability to obtain as well as the potential market size for rezafungin, ability of additional financing; the success and timing of rezafungin to capture market share from existing therapies, Cidara’s preclinical studies, clinical trials and other and the advantages of rezafungin in other settings of care. research and development activities; receipt of Certain statements regarding our Cloudbreak platform are necessary regulatory approvals for development also forward-looking including statements regarding whether and commercialization, as well as changes to our Cloudbreak platform can identify product candidates with applicable regulatory laws in the United States and intrinsic antimicrobial activity and immune engagement that foreign countries; changes in Cidara’s plans to will increase efficacy or represent an improvement over develop and commercialize its product candidates; Cidara’s ability to obtain and maintain intellectual These slides and the accompanying oral existing anti-infective agents; whether Cloudbreak candidates, property protection for its product candidates; and presentation are not intended to and do not including CD377, will achieve the major attributes believed to the loss of key scientific or management personnel. constitute an offer to sell or the solicitation of be needed in flu such as broad spectrum, superior resistance an offer to subscribe for or buy or an invitation profile, protection for high-risk populations, expanded efficacy These and other risks and uncertainties are to purchase or subscribe for any securities in window, long duration of action and rapid onset of activity, or described more fully in Cidara’s Form 10-Q as any jurisdiction, nor shall there be any sale, flexible administration; whether results observed with most recently filed with the United States Securities issuance or transfer of securities in any Cloudbreak influenza candidates, including CD377, in-vitro or and Exchange Commission (SEC), under the jurisdiction in contravention of applicable law. in animal studies, including, potency and broad coverage, heading “Risk Factors.” All forward-looking No offer of securities shall be made except by activity against resistant strains, activity in immune statements contained in this presentation speak means of a prospectus meeting the compromised patients, extending the treatment window, only as of the date on which they were made. requirements of Section 10 of the Securities extended half-life and long duration of action, improved viral Cidara undertakes no obligation to update such Act of 1933, as amended. clearance in the lungs, improved reduction in inflammatory statements to reflect events that occur or cytokines, and a robust safety profile, or other circumstances that exist after the date on which they were made. 2

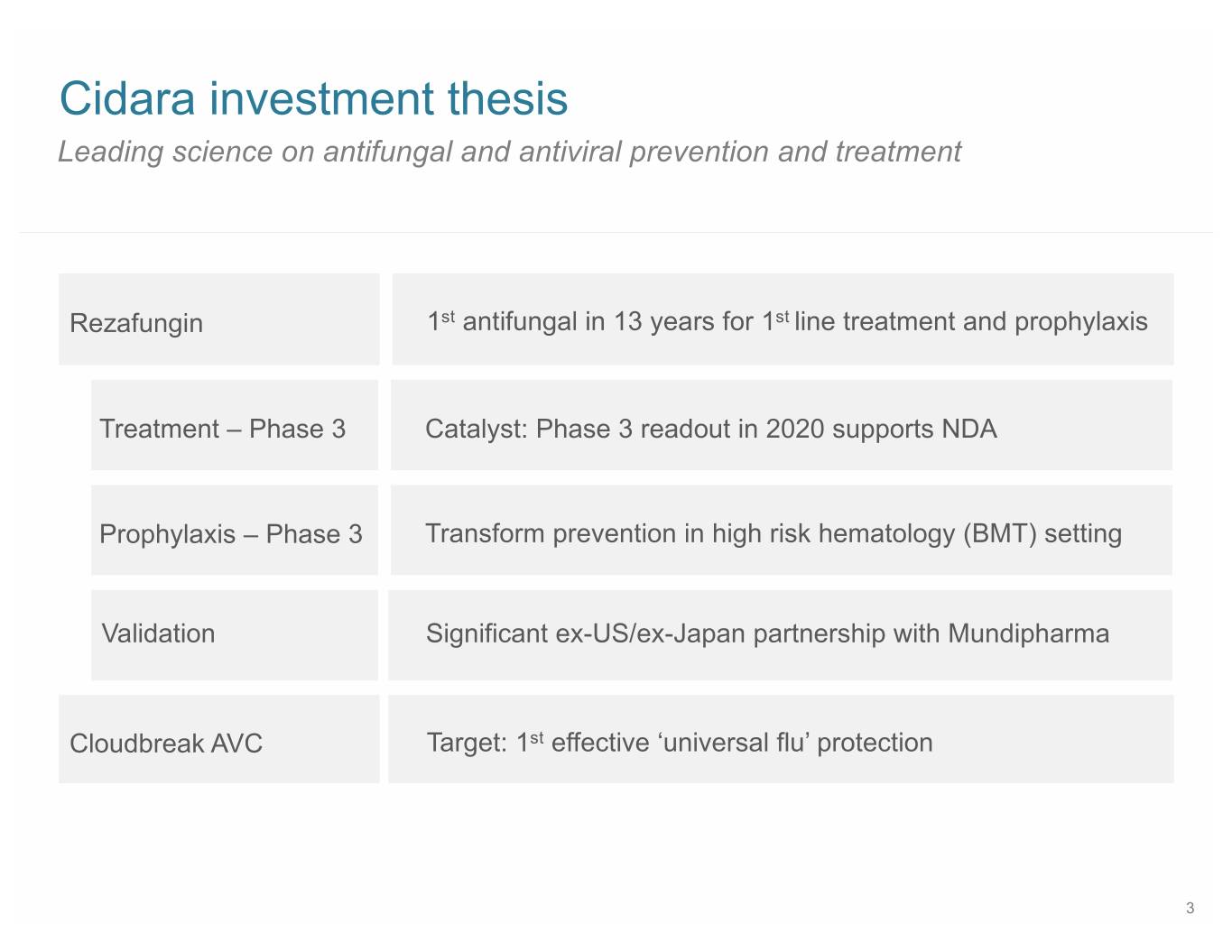

SB 12 Cidara investment thesis Leading science on antifungal and antiviral prevention and treatment Rezafungin 1st antifungal in 13 years for 1st line treatment and prophylaxis Treatment – Phase 3 Catalyst: Phase 3 readout in 2020 supports NDA Prophylaxis – Phase 3 Transform prevention in high risk hematology (BMT) setting Validation Significant ex-US/ex-Japan partnership with Mundipharma Cloudbreak AVC Target: 1 st effective ‘universal flu’ protection 3

Cidara’s pipeline targets fungal and viral infections Proposed IND- Indication Program Discov. in vitro in vivo enable Ph 1 Ph 2 Ph 3 REZAFUNGIN Candidemia & Treatment Invasive Candidiasis Blood & Marrow Prophylaxis Transplant Patients CLOUDBREAK Antiviral Fc Conjugates (AVCs) Prevention & Influenza Treatment Platform RSV, HIV, Expansion Other Viruses 4

Cidara’s pipeline targets multiple unmet medical needs Rezafungin Cloudbreak 5

Antifungals are historically big drugs globally Peak Annual Global Sales ($M) Diflucan 1000 Vfend 800 Noxafil 720 Cancidas 680 Ambisome 510 Mycamine 370 Source: IQVIA for all products in their respective peak sales year, other than Noxafil (2018 Merck Annual Report) and Diflucan (www.pharmaceuticalonline.com Feb 7, 2000) 6

Antifungal drug development has dwindled Number of New Antifungals 5 5 1 1980 1990 2000 2010 2019 amphotericin POLYENES lipid forms (3) itraconazole posaconazole AZOLES fluconazole voriconazole micafungin ECHINOCANDINS caspofungin anidulafungin 7

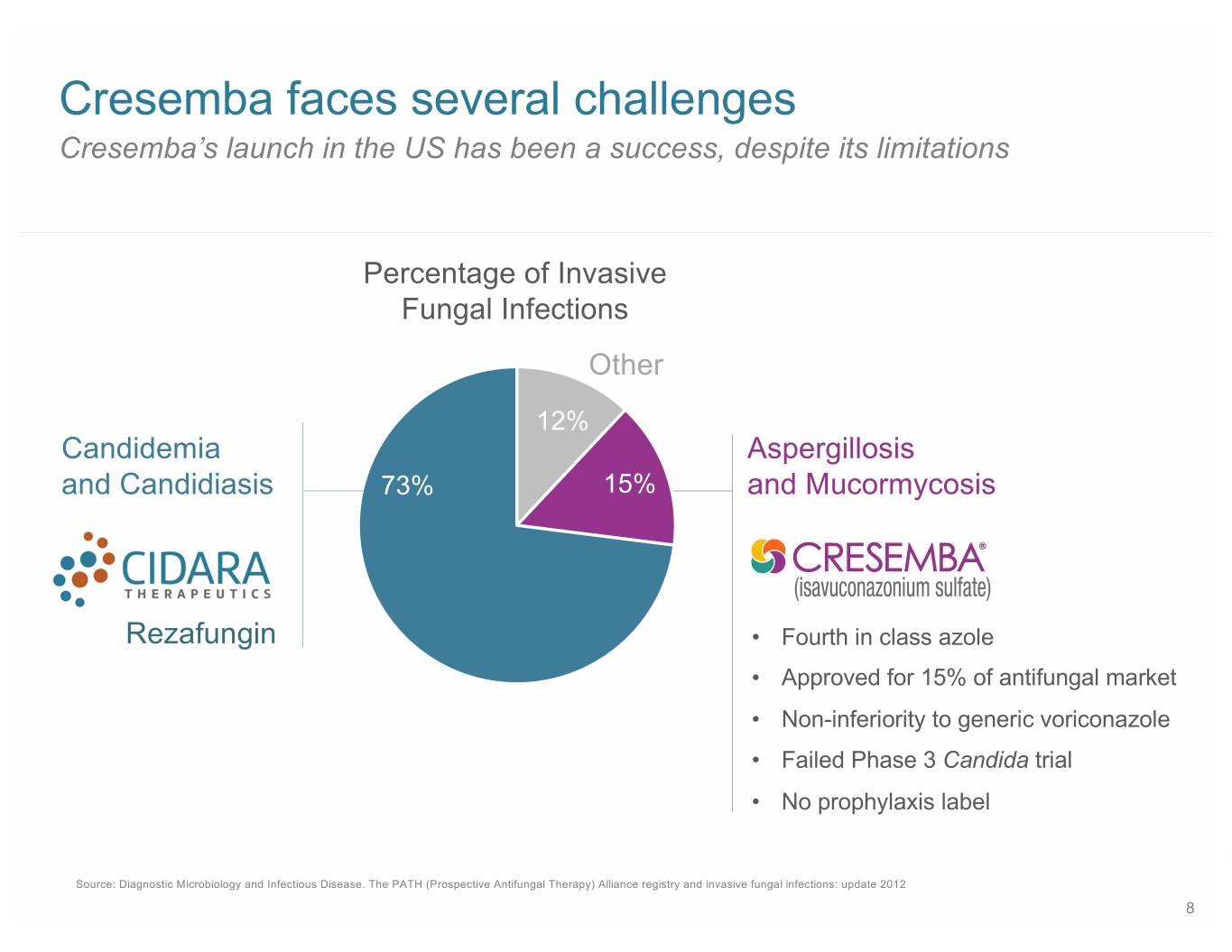

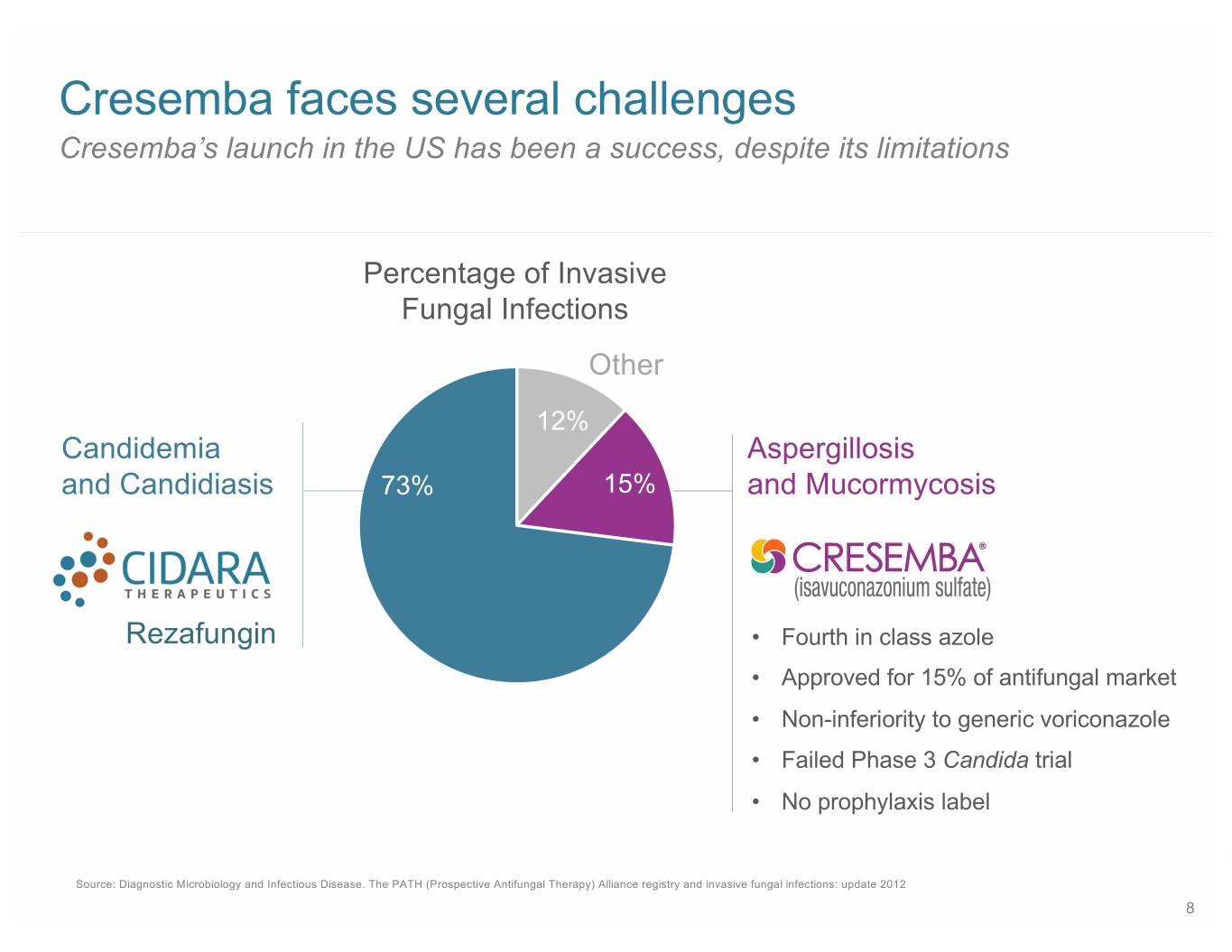

SB 15 Cresemba faces several challenges Cresemba’s launch in the US has been a success, despite its limitations Percentage of Invasive Fungal Infections Other 12% Candidemia Aspergillosis and Candidiasis 73% 15% and Mucormycosis Rezafungin • Fourth in class azole • Approved for 15% of antifungal market • Non-inferiority to generic voriconazole • Failed Phase 3 Candida trial • No prophylaxis label Source: Diagnostic Microbiology and Infectious Disease. The PATH (Prospective Antifungal Therapy) Alliance registry and invasive fungal infections: update 2012 8

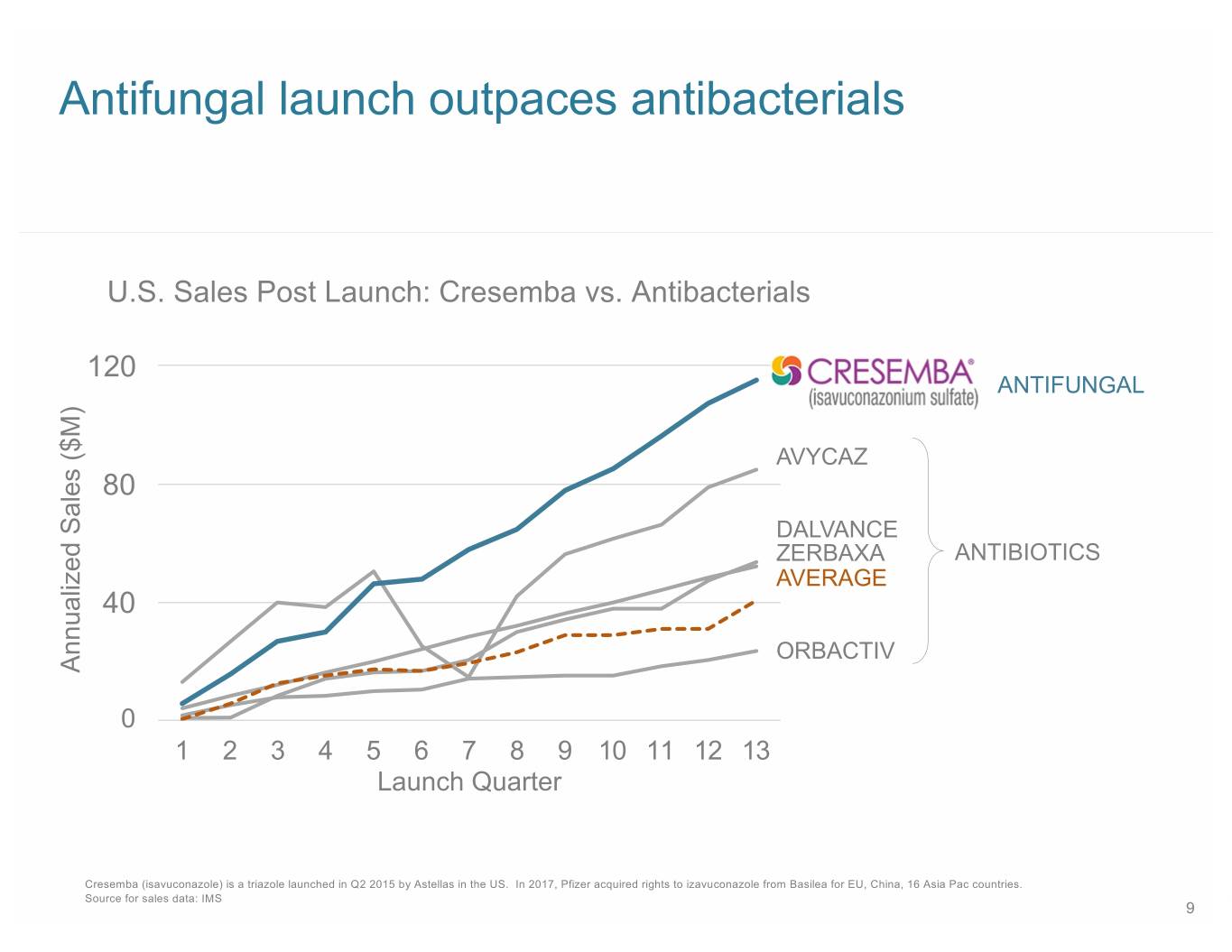

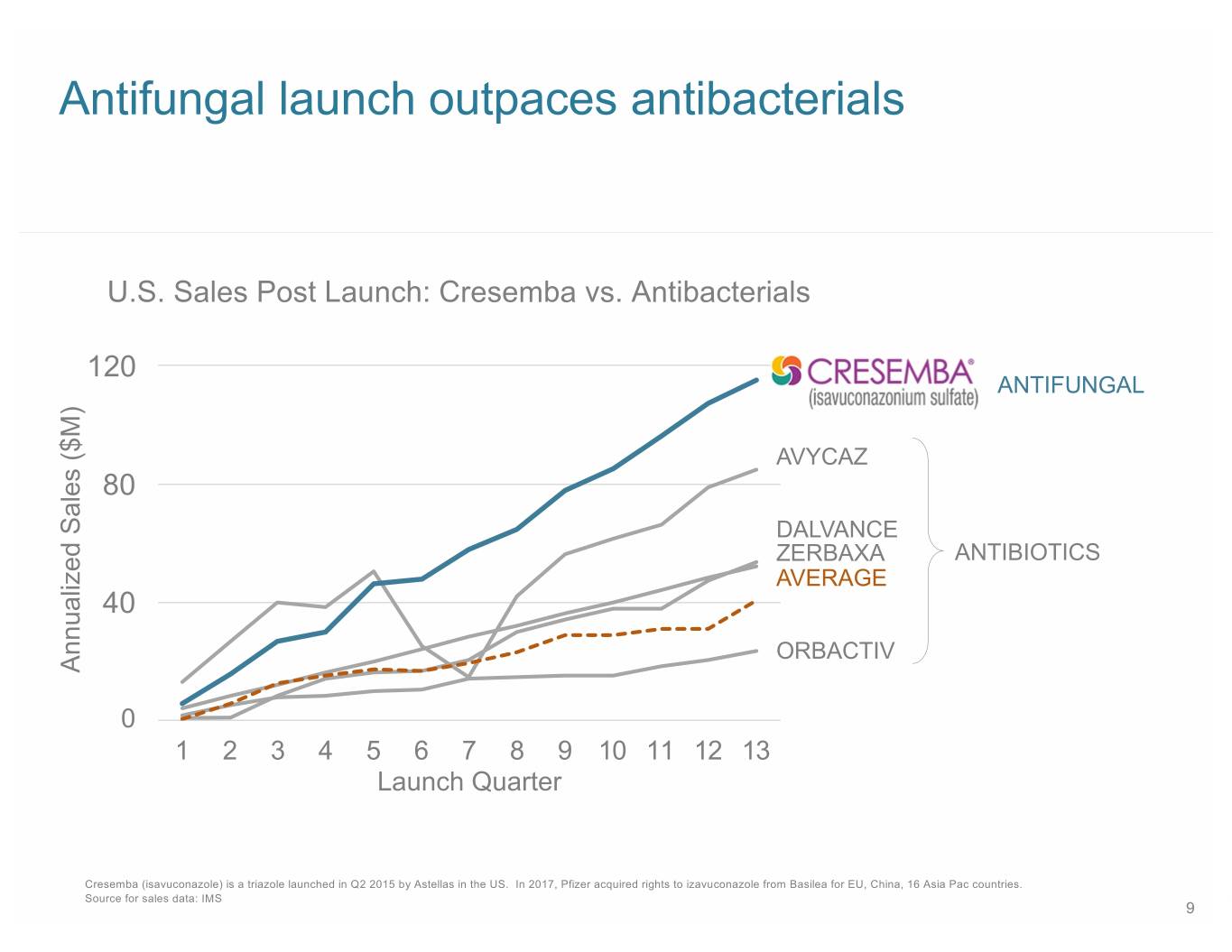

Antifungal launch outpaces antibacterials U.S. Sales Post Launch: Cresemba vs. Antibacterials 12030 ANTIFUNGAL AVYCAZ 8020 DALVANCE ZERBAXA ANTIBIOTICS AVERAGE 4010 ORBACTIV Annualized Sales ($M) 0 1 2 3 4 5 6 7 8 9 10 11 12 13 Launch Quarter Cresemba (isavuconazole) is a triazole launched in Q2 2015 by Astellas in the US. In 2017, Pfizer acquired rights to izavuconazole from Basilea for EU, China, 16 Asia Pac countries. Source for sales data: IMS 9

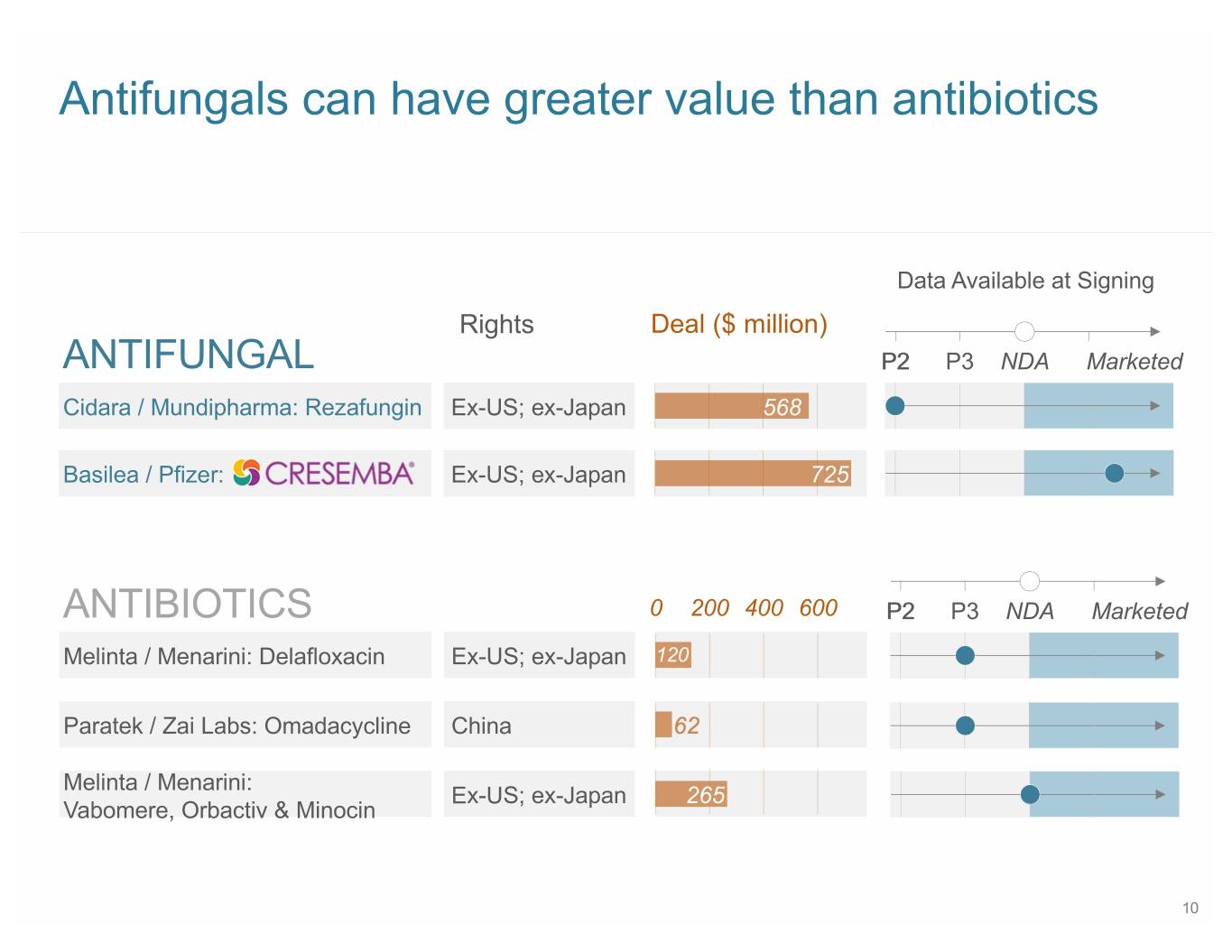

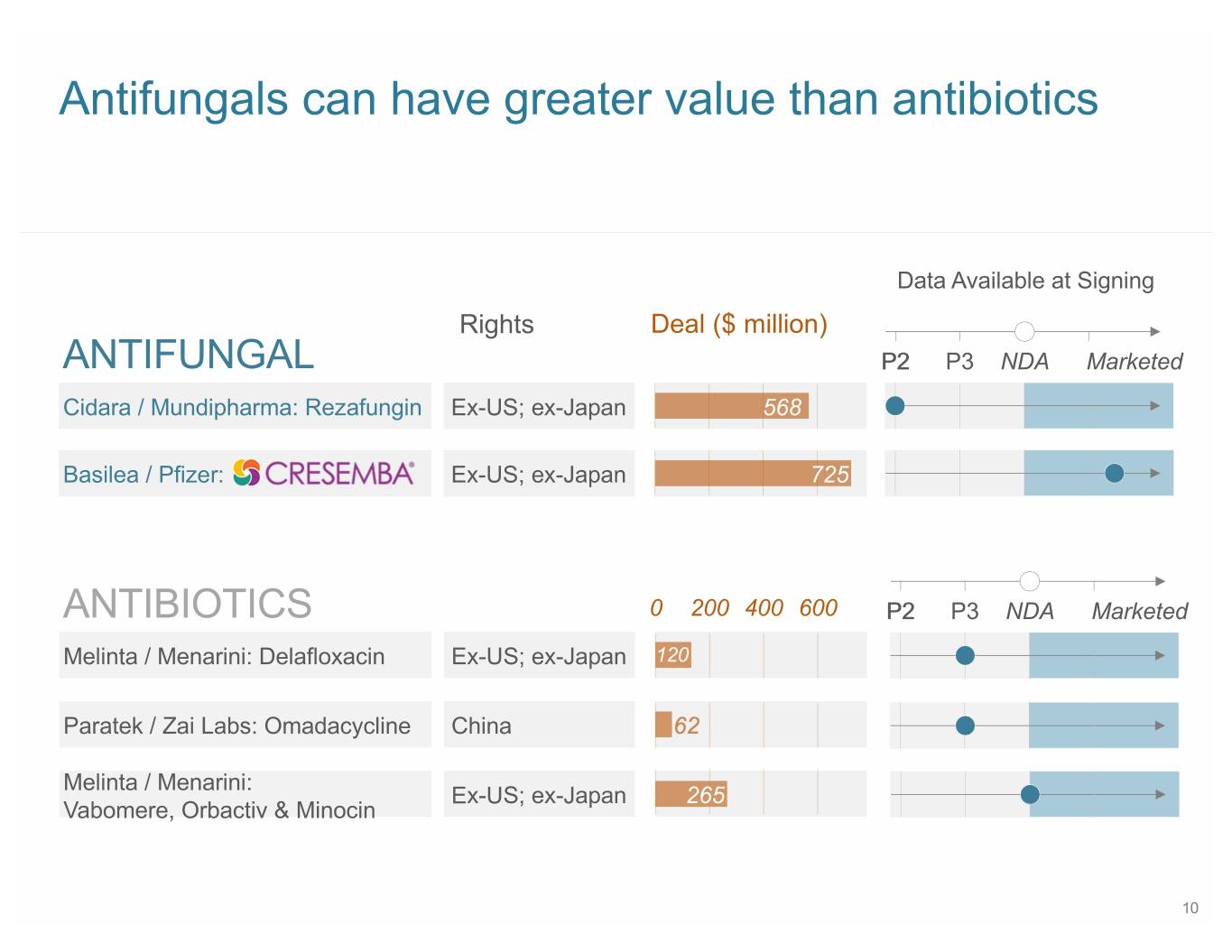

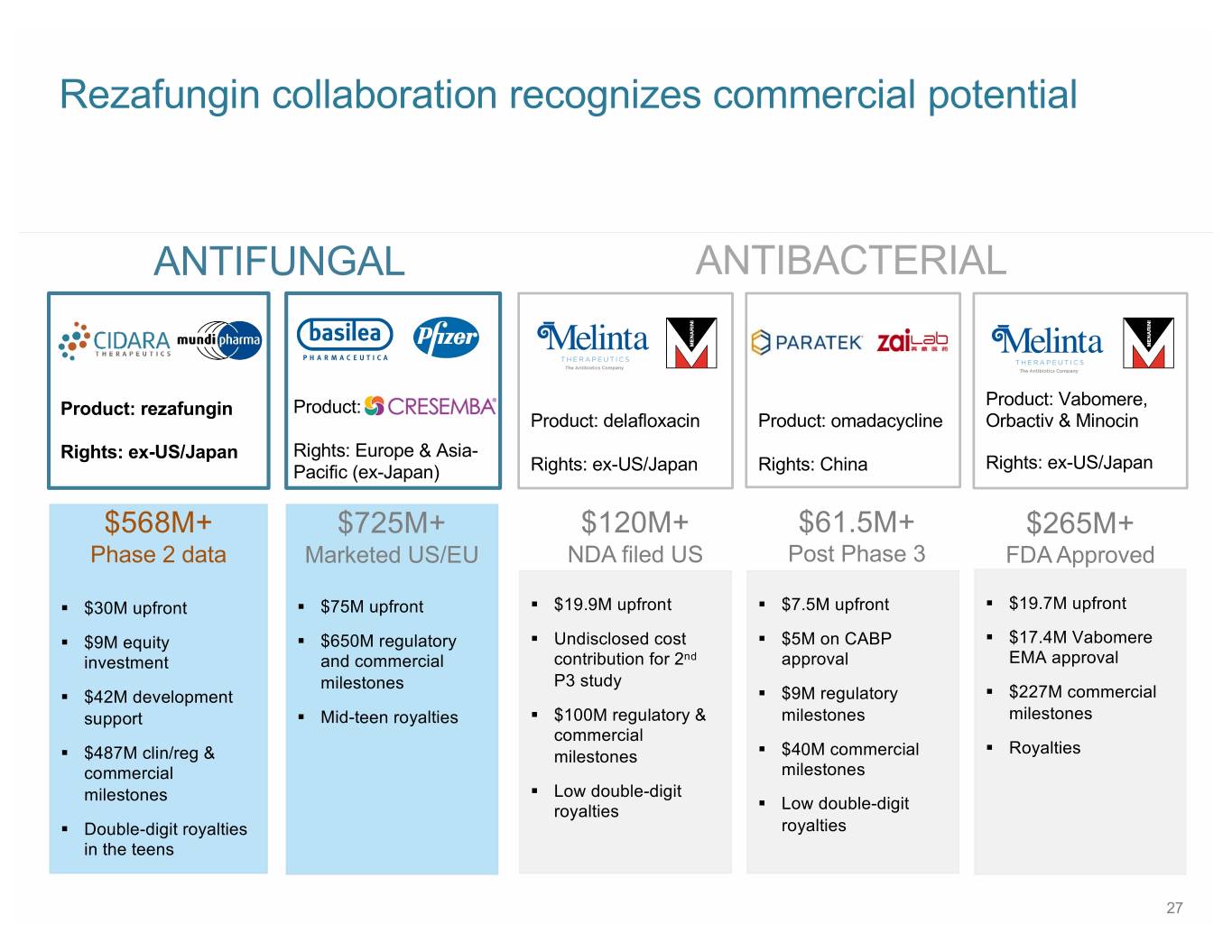

Antifungals can have greater value than antibiotics Data Available at Signing Rights Deal ($ million) ANTIFUNGAL P2 P3 NDA Marketed Cidara / Mundipharma: Rezafungin Ex-US; ex-Japan 568 Basilea / Pfizer: Ex-US; ex-Japan 725 ANTIBIOTICS 0 200 400 600 P2 P3 NDA Marketed Melinta / Menarini: Delafloxacin Ex-US; ex-Japan 120 Paratek / Zai Labs: Omadacycline China Melinta / Menarini: Ex-US; ex-Japan 265 Vabomere, Orbactiv & Minocin 10

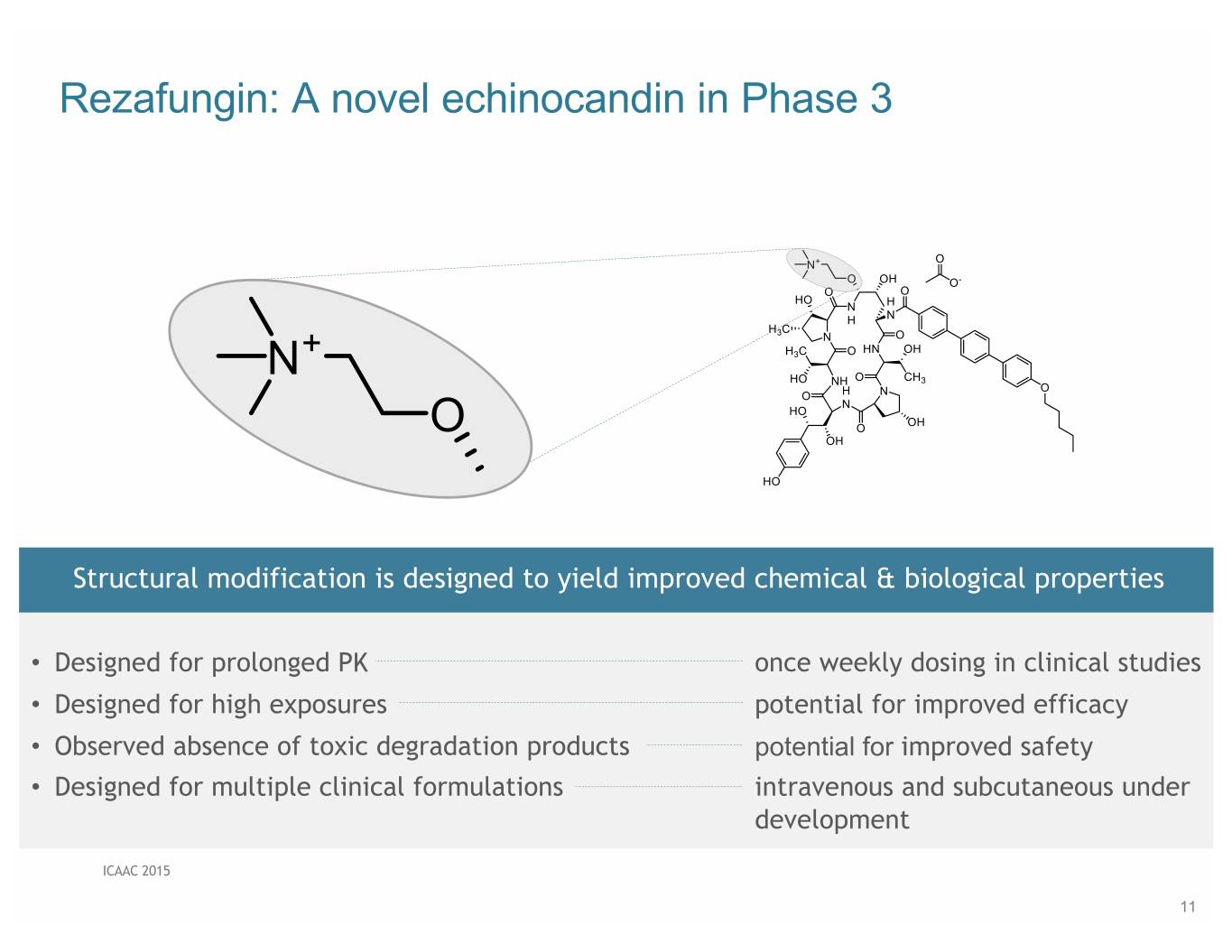

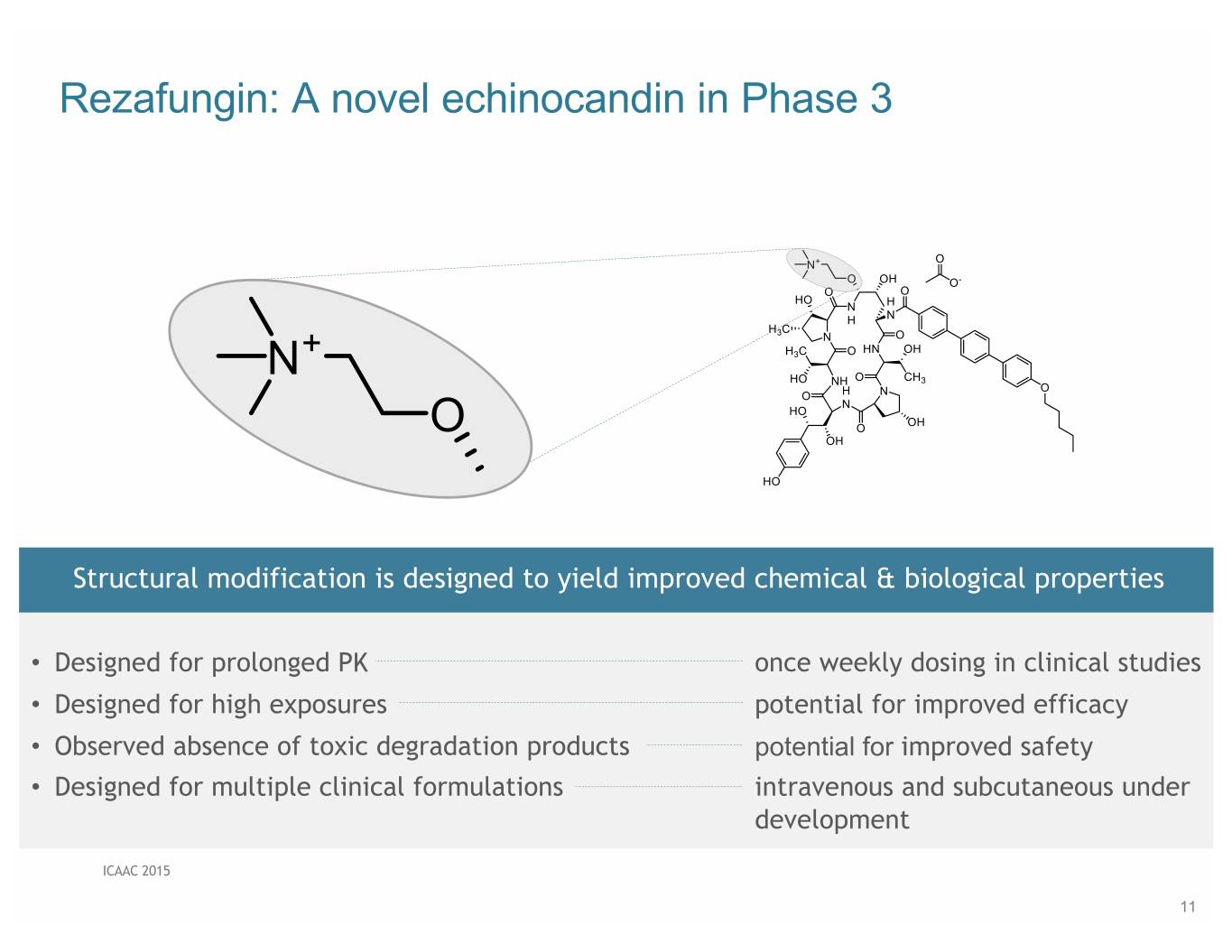

Rezafungin: A novel echinocandin in Phase 3 Structural modification is designed to yield improved chemical & biological properties • Designed for prolonged PK once weekly dosing in clinical studies • Designed for high exposures potential for improved efficacy • Observed absence of toxic degradation products potential for improved safety • Designed for multiple clinical formulations intravenous and subcutaneous under development ICAAC 2015 11

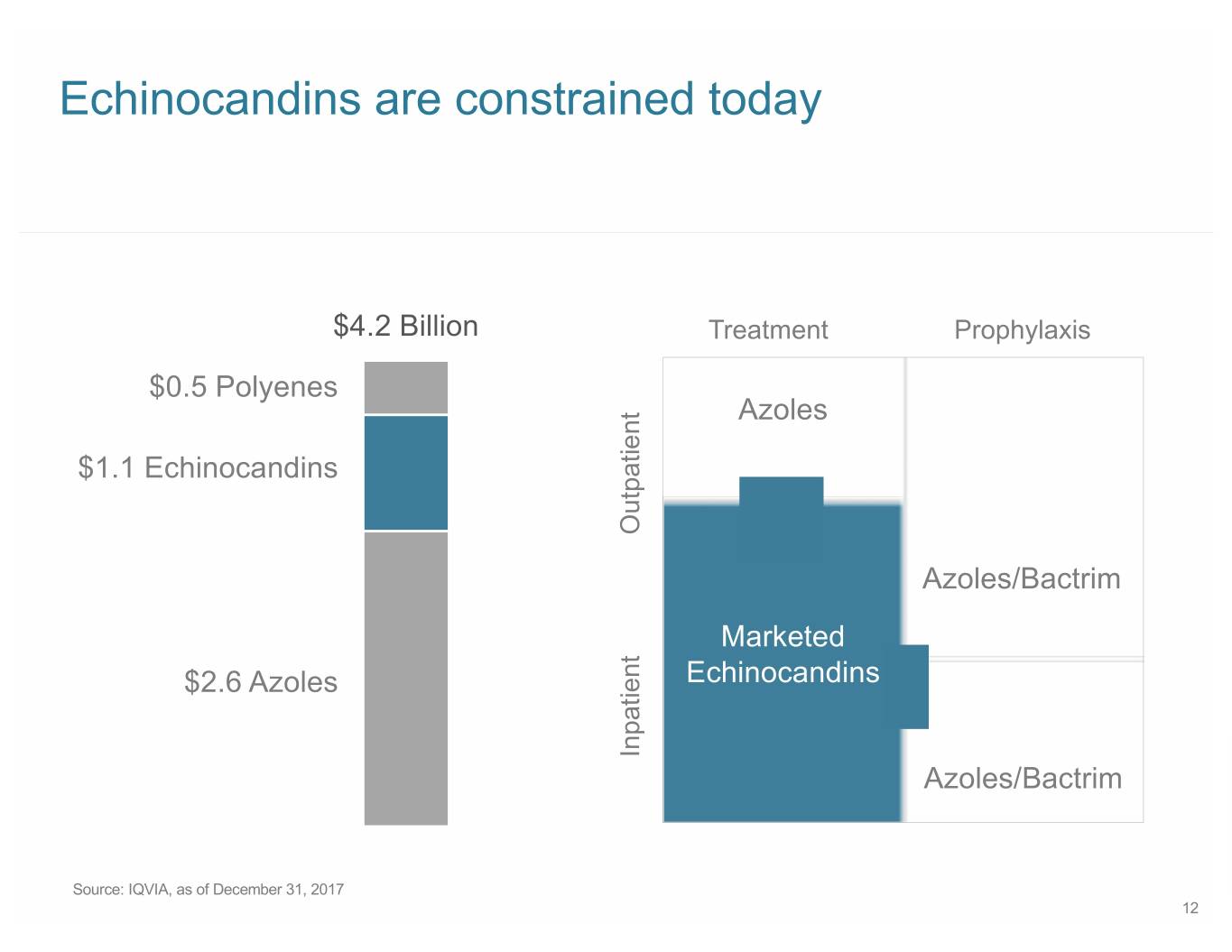

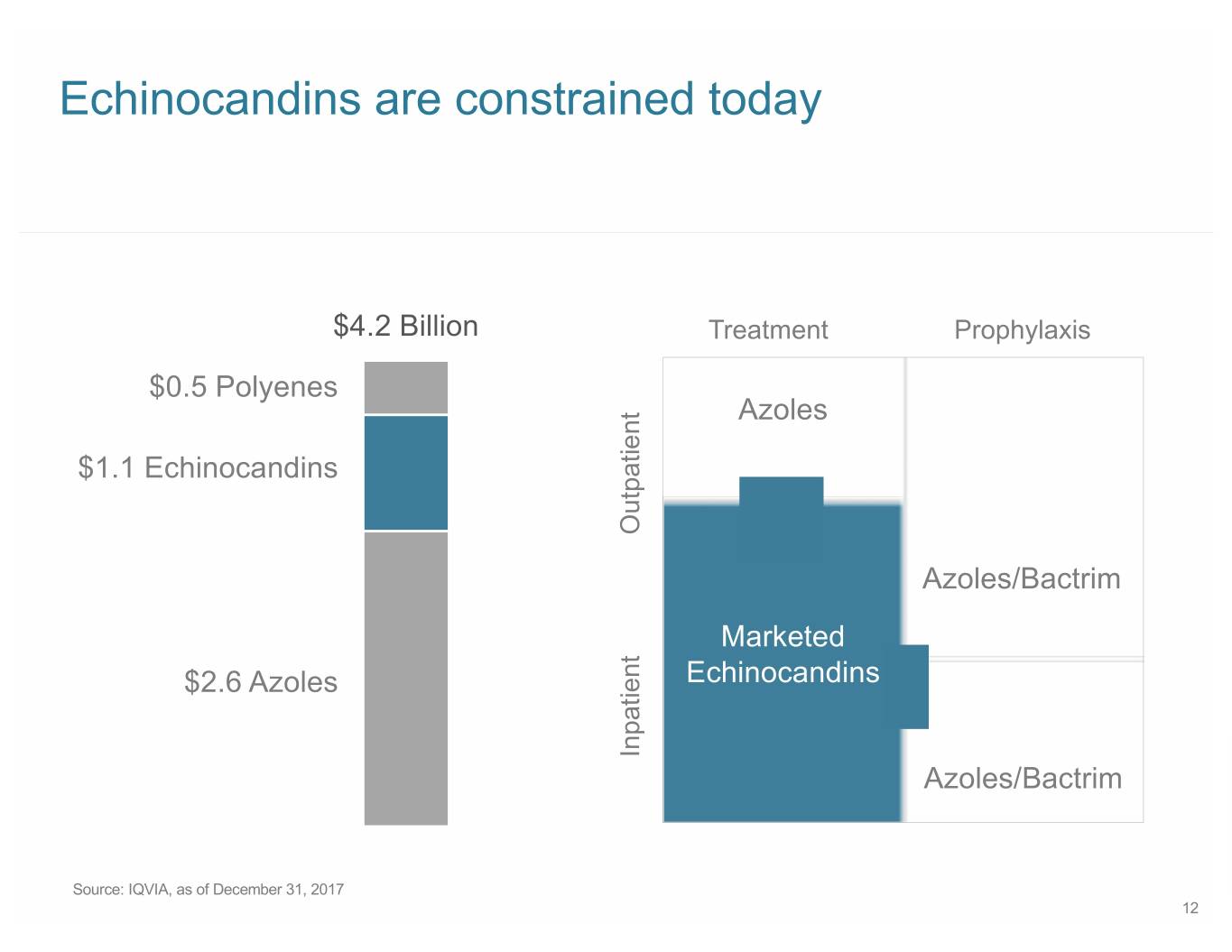

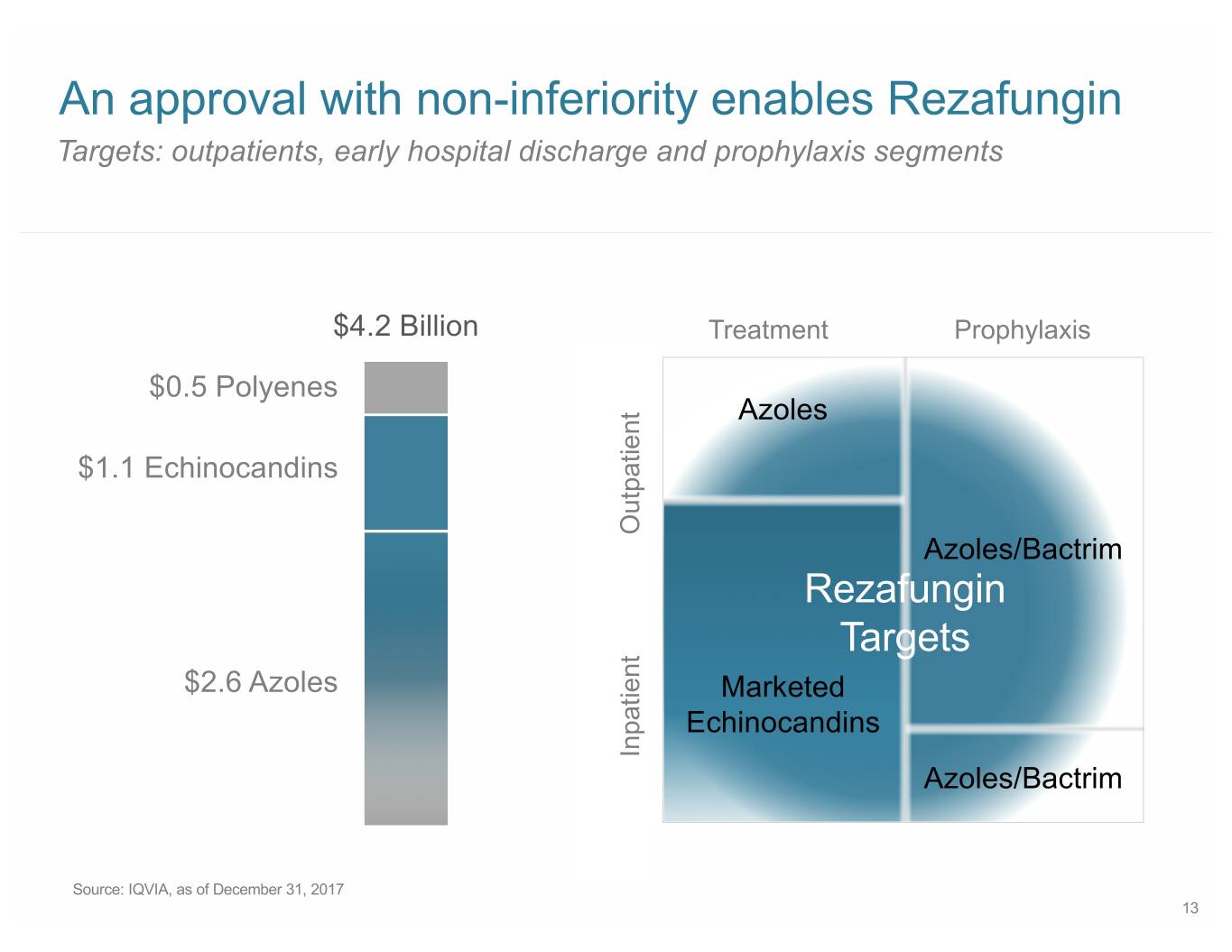

Echinocandins are constrained today $4.2 Billion Treatment Prophylaxis $0.5 Polyenes Azoles $1.1 Echinocandins Outpatient Azoles/Bactrim Marketed $2.6 Azoles Echinocandins Inpatient Azoles/Bactrim Source: IQVIA, as of December 31, 2017 12

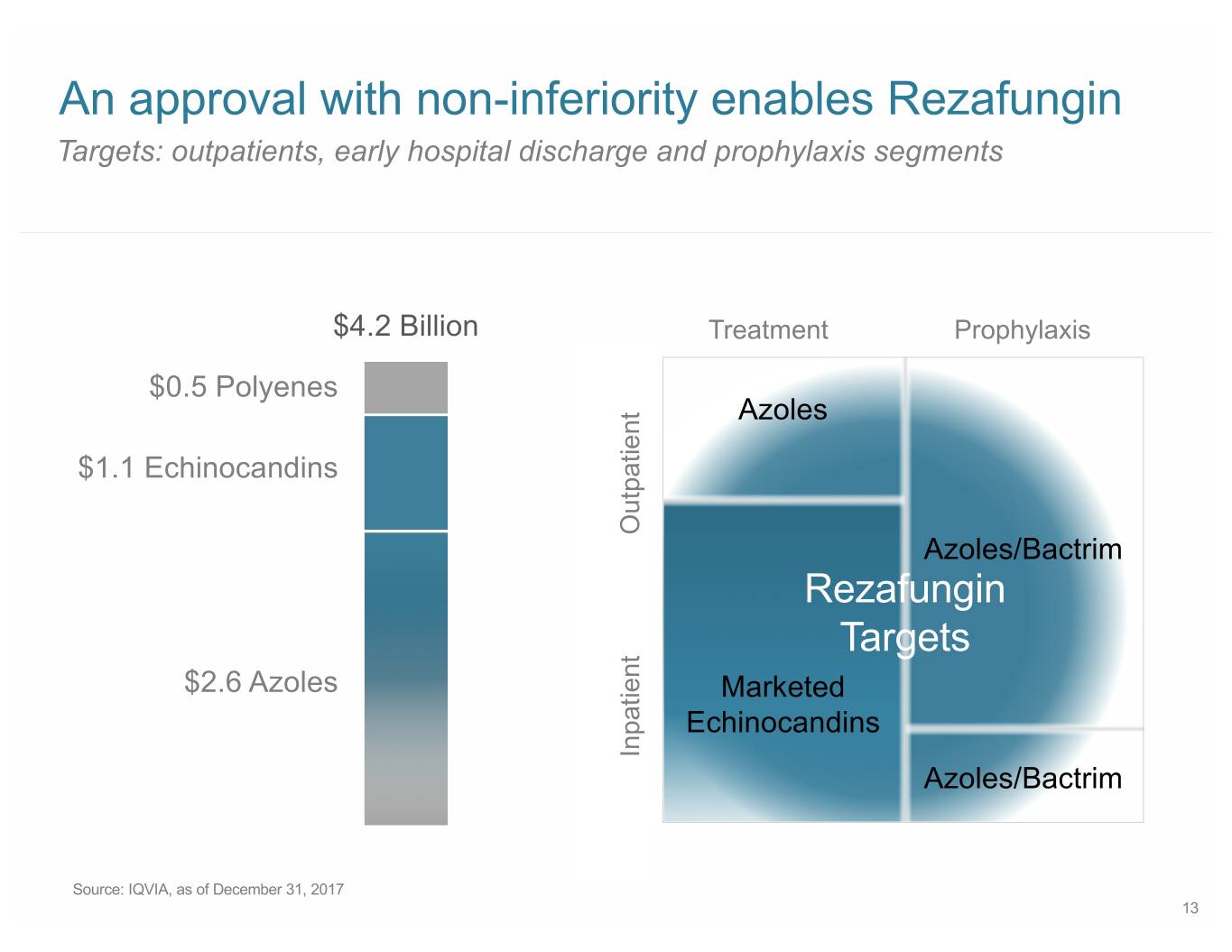

An approval with non-inferiority enables Rezafungin Targets: outpatients, early hospital discharge and prophylaxis segments $4.2 Billion Treatment Prophylaxis $0.5 Polyenes Azoles $1.1 Echinocandins Outpatient Azoles/Bactrim Rezafungin Targets $2.6 Azoles Marketed Echinocandins Inpatient Azoles/Bactrim Source: IQVIA, as of December 31, 2017 13

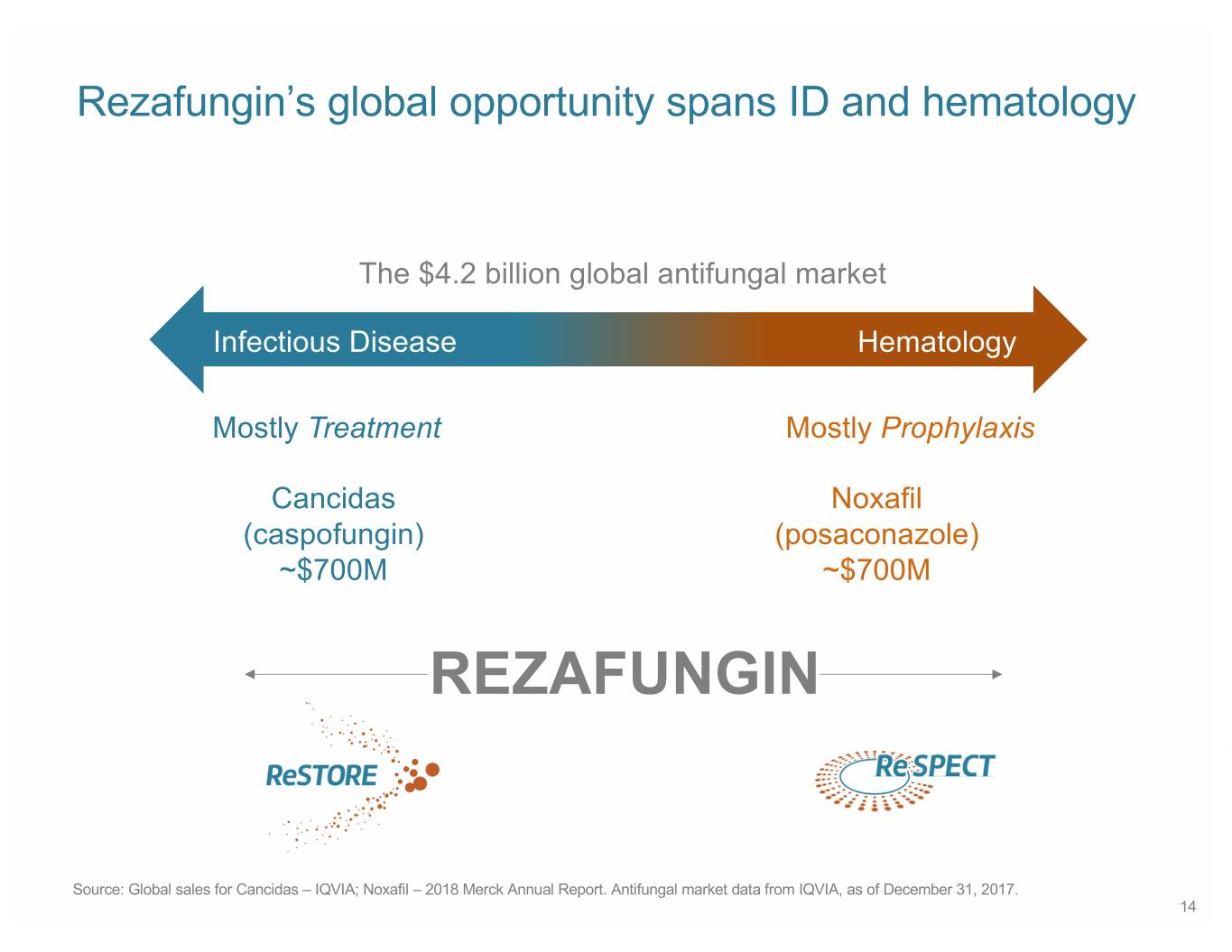

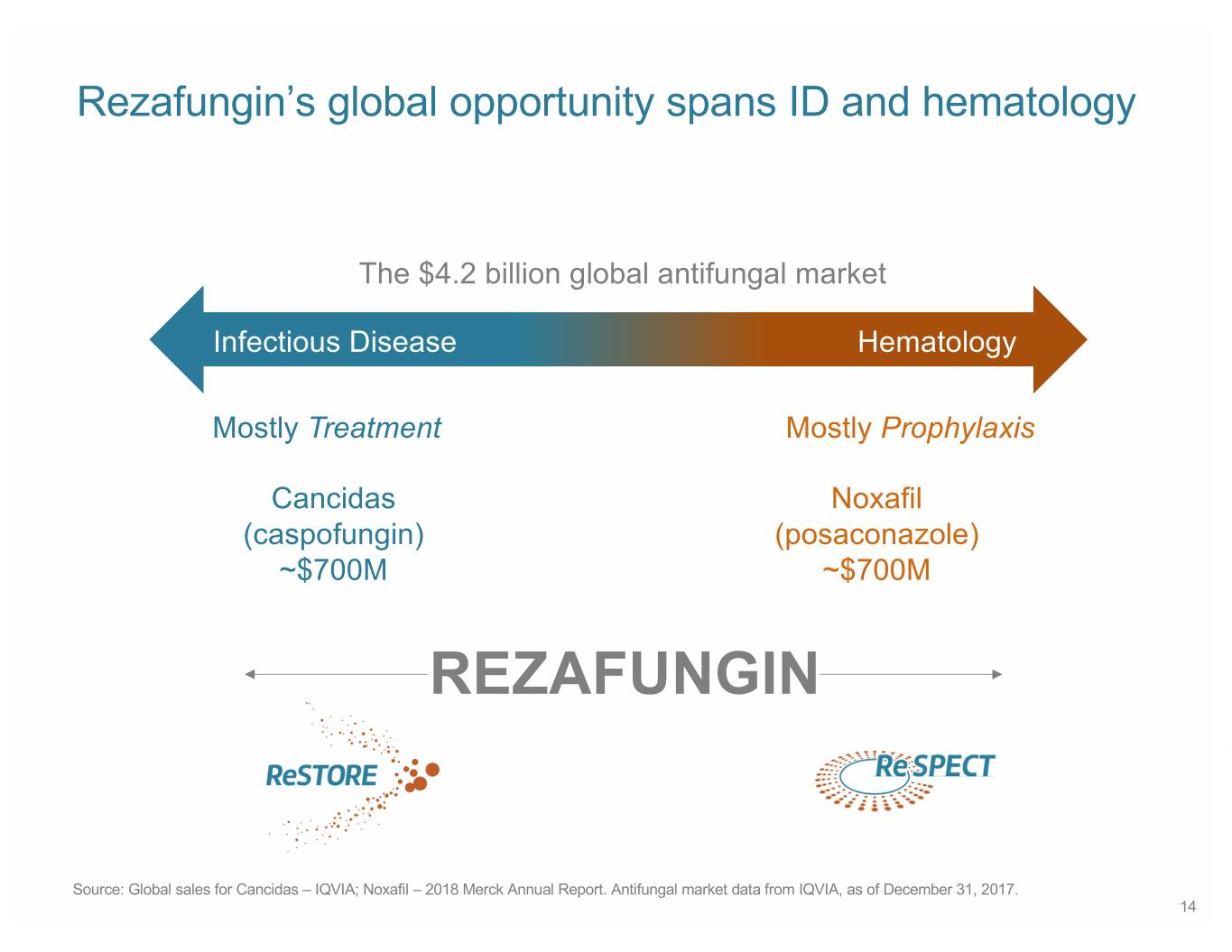

Rezafungin’s global opportunity spans ID and hematology The $4.2 billion global antifungal market Infectious Disease Hematology Mostly Treatment Mostly Prophylaxis Cancidas Noxafil (caspofungin) (posaconazole) ~$700M ~$700M REZAFUNGIN Source: Global sales for Cancidas – IQVIA; Noxafil – 2018 Merck Annual Report. Antifungal market data from IQVIA, as of December 31, 2017. 14

~$745M Rezafungin 2032 peak sales opportunity in US, in ID and hematology Infectious Disease Hematology Mostly Treatment Mostly Prophylaxis Rezafungin in Treatment Rezafungin in Prevention ~$375M ~$370M Revenue projections based on estimates and assumptions, including estimated patient populations, market share and pricing assumptions, made as of the date of this presentation. Cidara does not undertake to update except as required by law. Actual results could differ materially. Prophylaxis revenue includes est. peak potential for spontaneous product use other than in the anticipated initial indication of ~$223M which will not be supported by Company promotion. 15

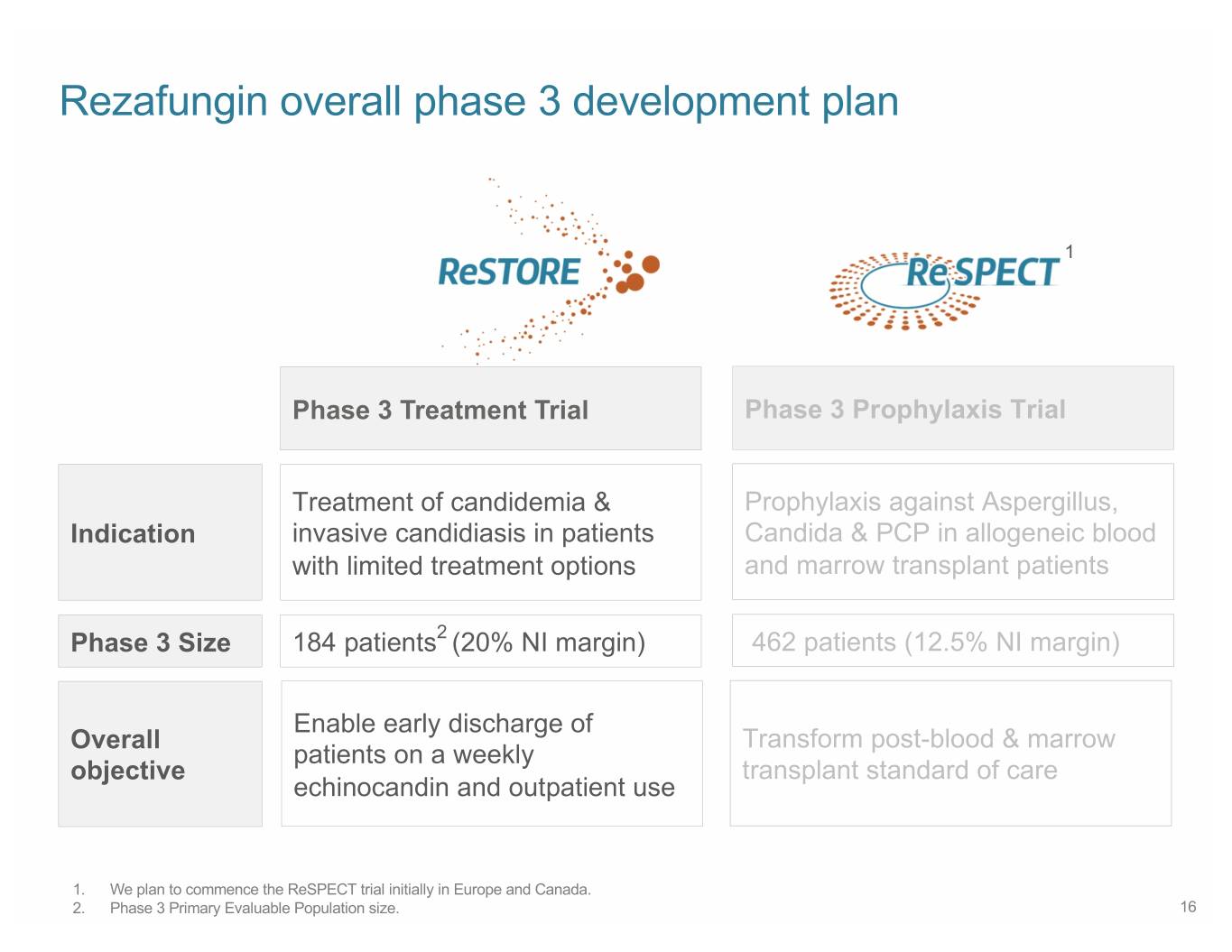

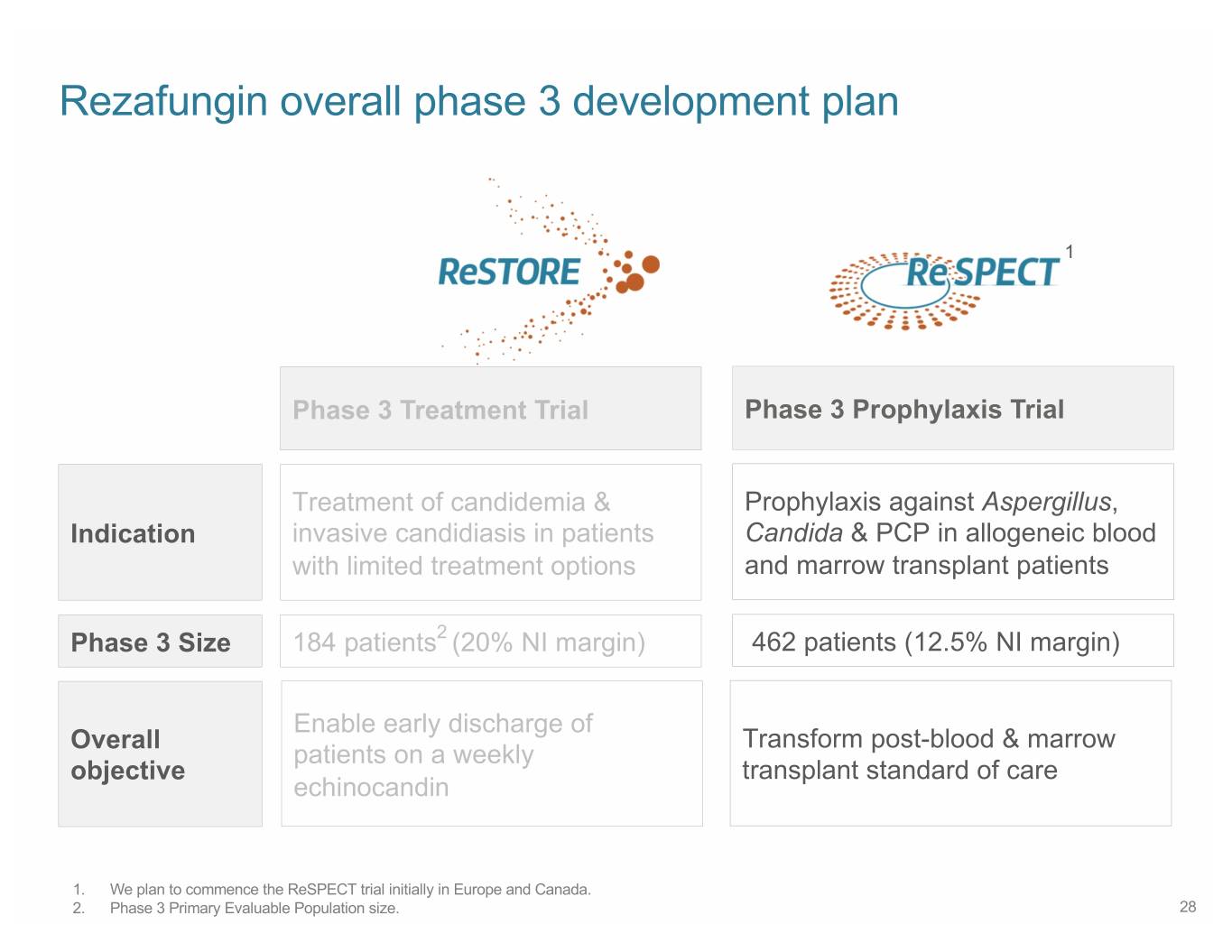

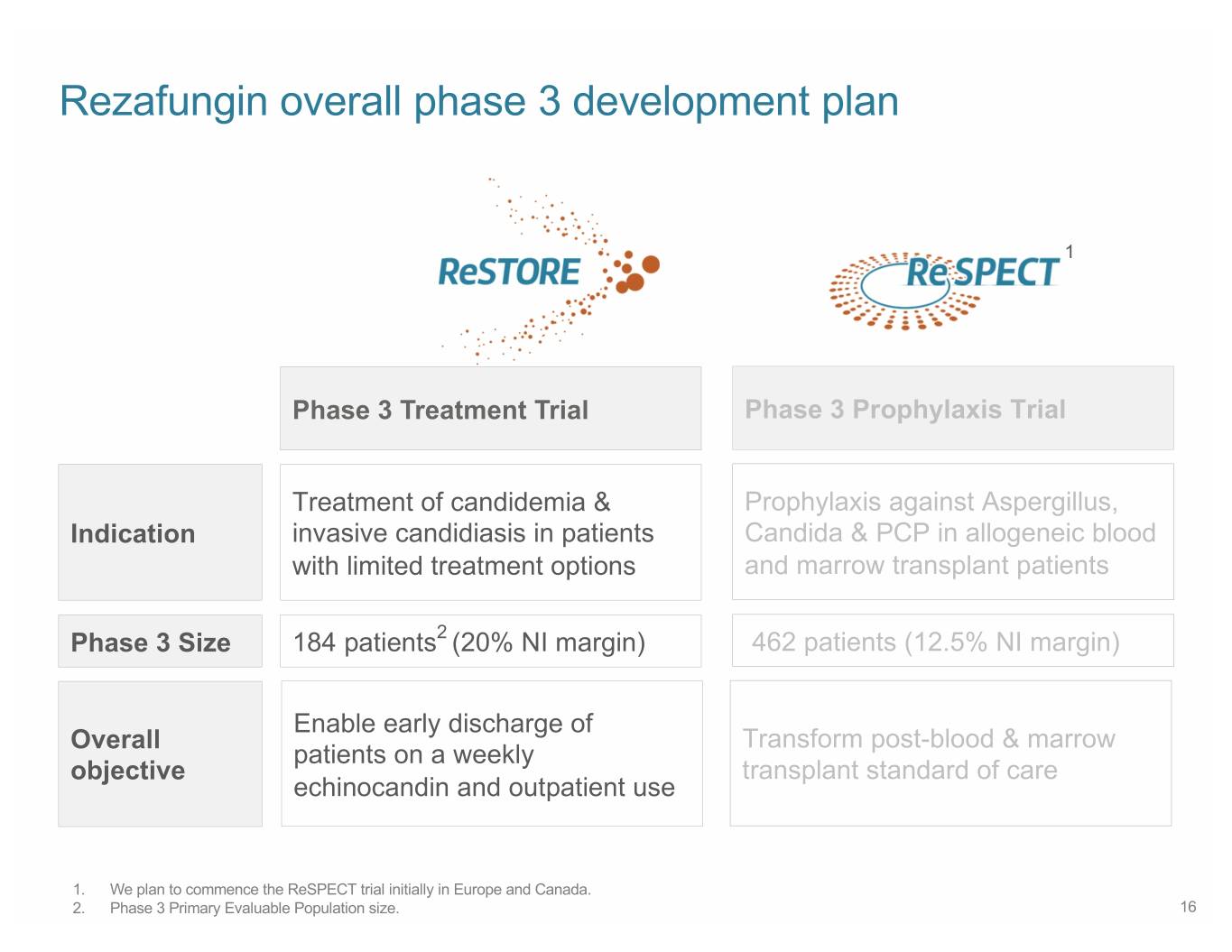

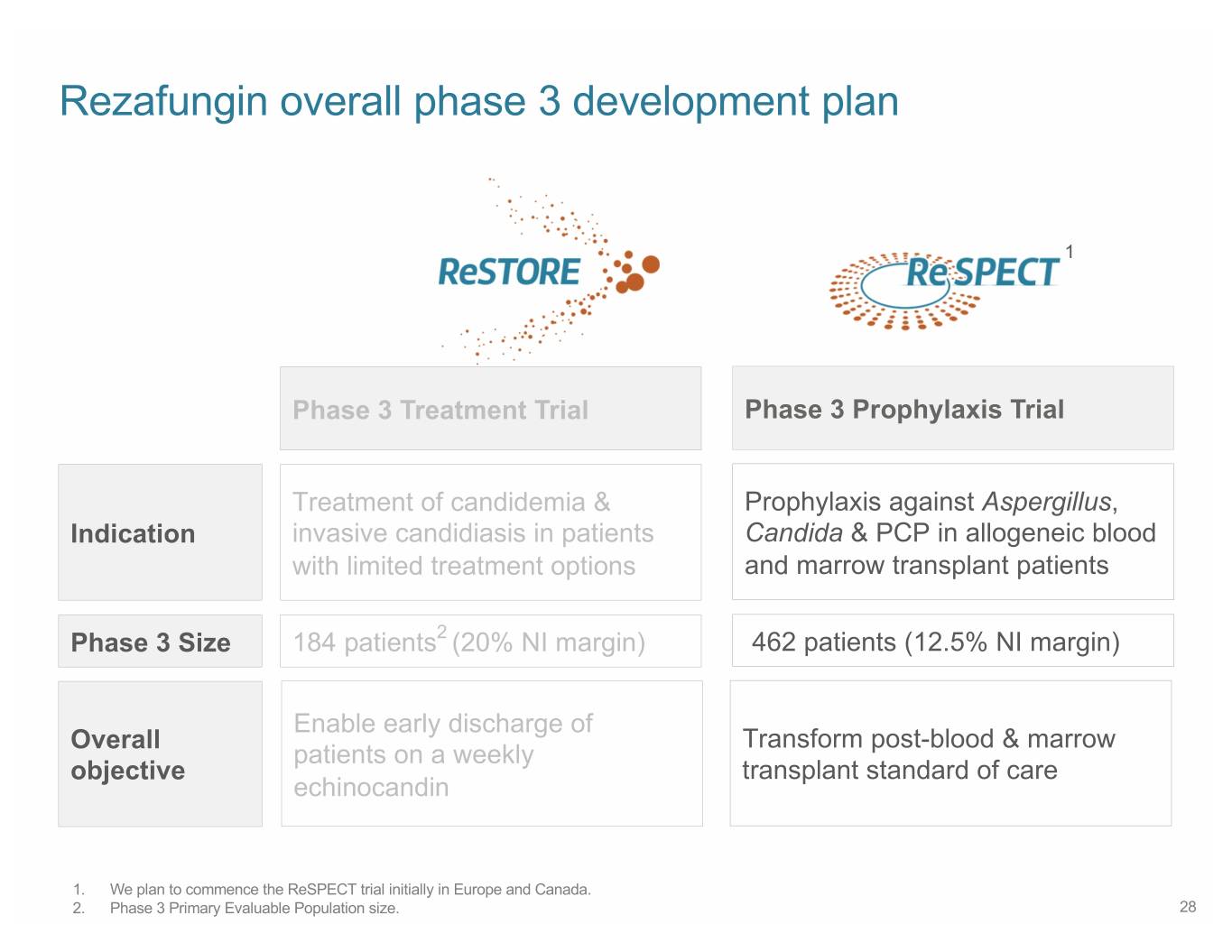

Rezafungin overall phase 3 development plan 1 Phase 3 Treatment Trial Phase 3 Prophylaxis Trial Treatment of candidemia & Prophylaxis against Aspergillus, Indication invasive candidiasis in patients Candida & PCP in allogeneic blood with limited treatment options and marrow transplant patients Phase 3 Size 184 patients2 (20% NI margin) 462 patients (12.5% NI margin) Enable early discharge of Overall Transform post-blood & marrow patients on a weekly objective transplant standard of care echinocandin and outpatient use 1. We plan to commence the ReSPECT trial initially in Europe and Canada. 2. Phase 3 Primary Evaluable Population size. 16

STRIVE B Phase 2 data in candidemia & invasive candidiasis Corroborates STRIVE A results and supports ReSTORE Phase 3 17

P2 STRIVE Program: Candidemia & Invasive Candidiasis Not powered for inferential statistical analysis Mycological & EMA: Overall Response Mycological & N= 183 clinical (Mycological & clinical clinical response Mycological & response response) (IC only) clinical response Dose Optional dose FDA: All cause mortality Week 1 2 3 4 5 6 7 8 9 Rezafungin N= 122 1 5 8 15 22 28 35 42 45 49 56 59 Day Dose Optional dose Week 1 2 3 4 5 6 7 8 9 Caspofungin N= 61 1 5 8 15 22 28 35 42 45 49 56 59 Day Analysis Populations: § The Intent-to-treat (ITT) population: all randomized subjects § The Safety population: all subjects who received any amount of study drug § The Microbiological Intent-to-treat population (mITT): all subjects in safety population who had documented Candida infection 18

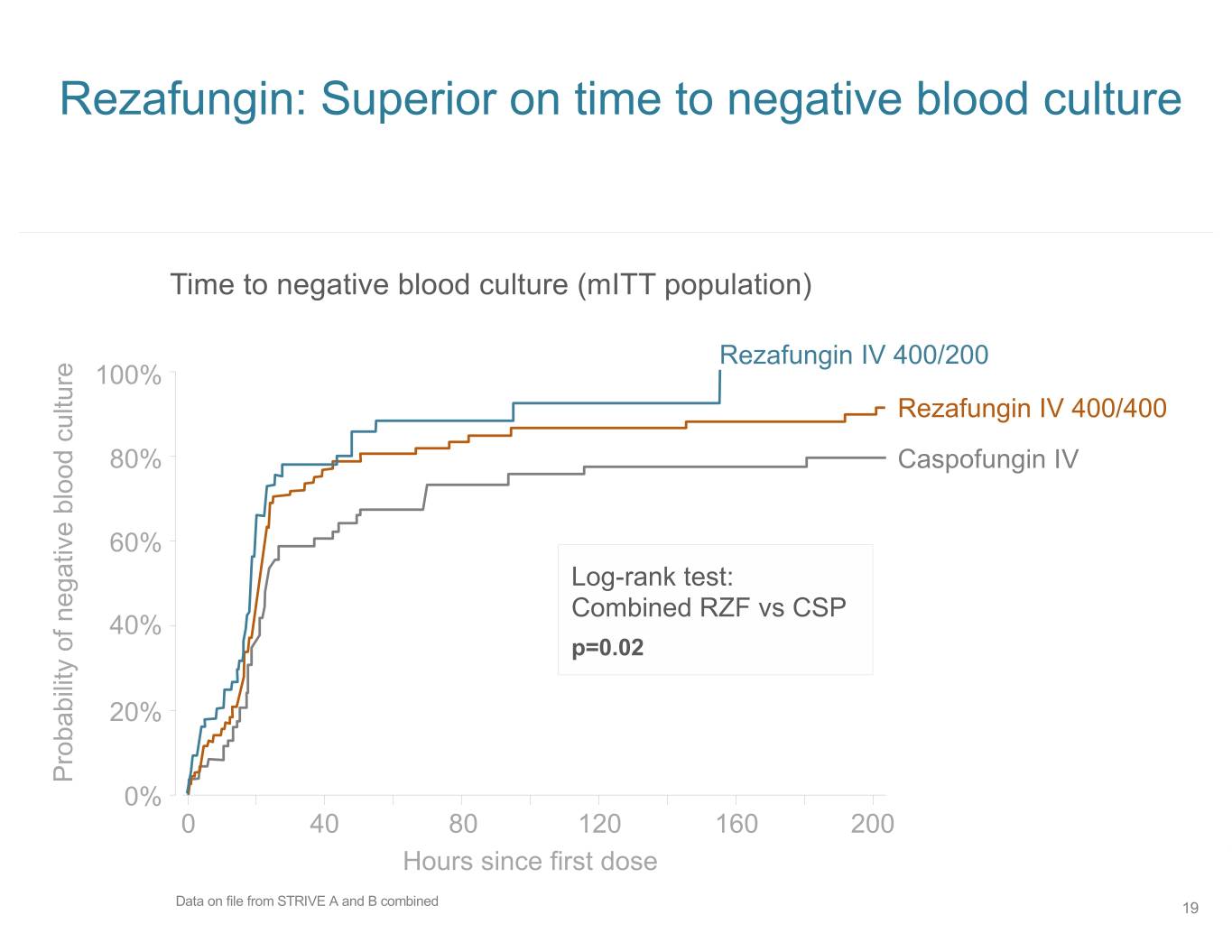

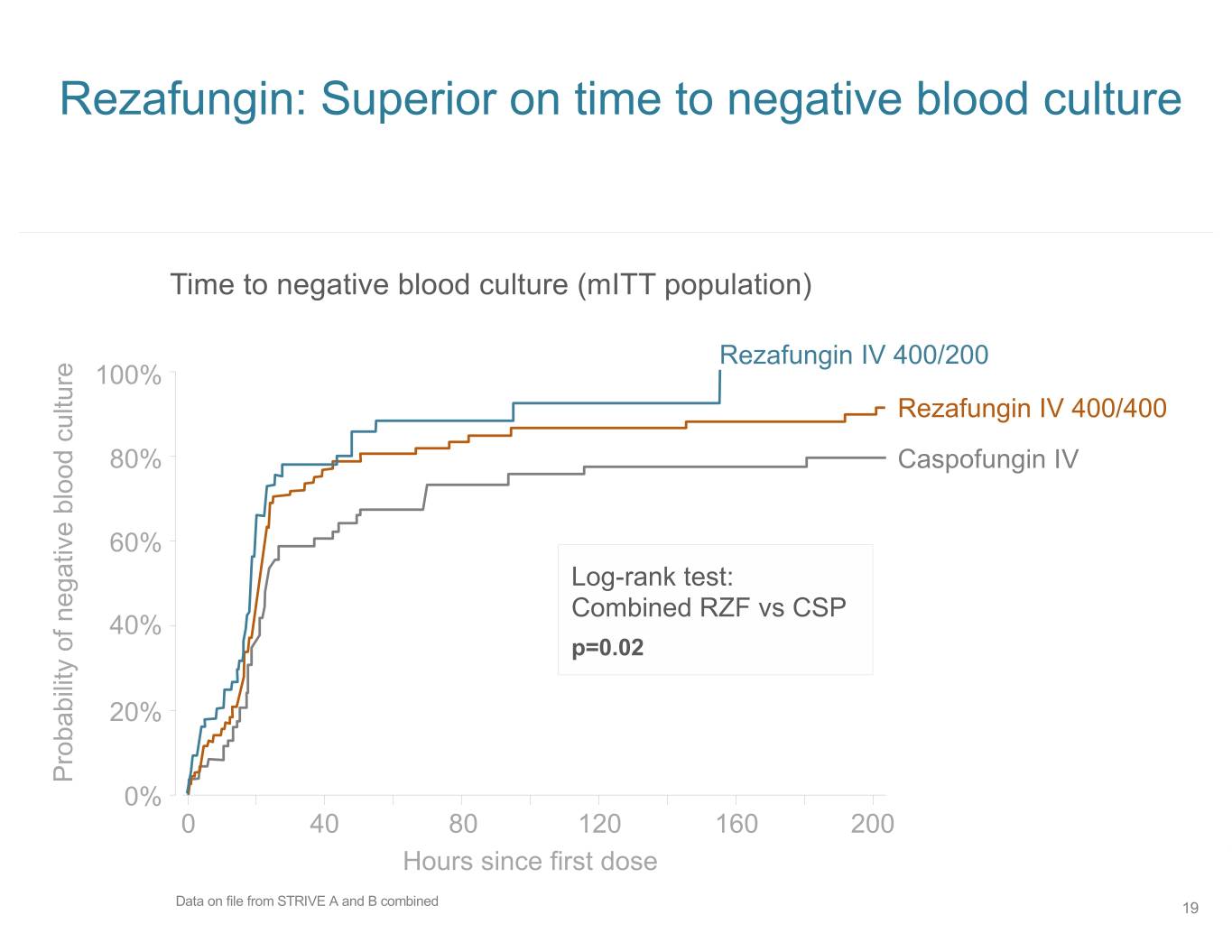

Rezafungin: Superior on time to negative blood culture Time to negative blood culture (mITT population) Rezafungin IV 400/200 100% Rezafungin IV 400/400 80% Caspofungin IV 60% Log-rank test: Combined RZF vs CSP 40% p=0.02 20% Probability of negative blood culture 0% 0 40 80 120 160 200 Hours since first dose Data on file from STRIVE A and B combined 19

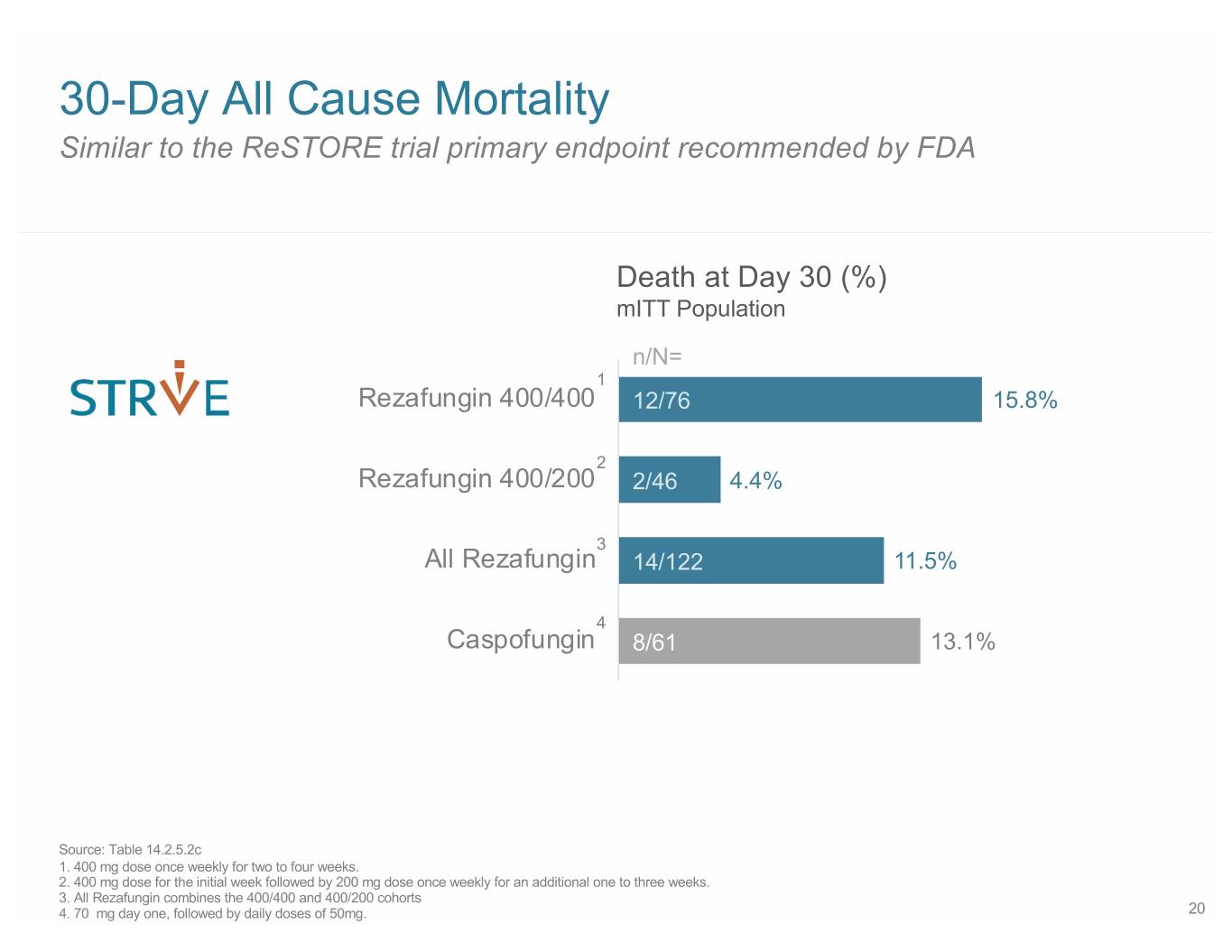

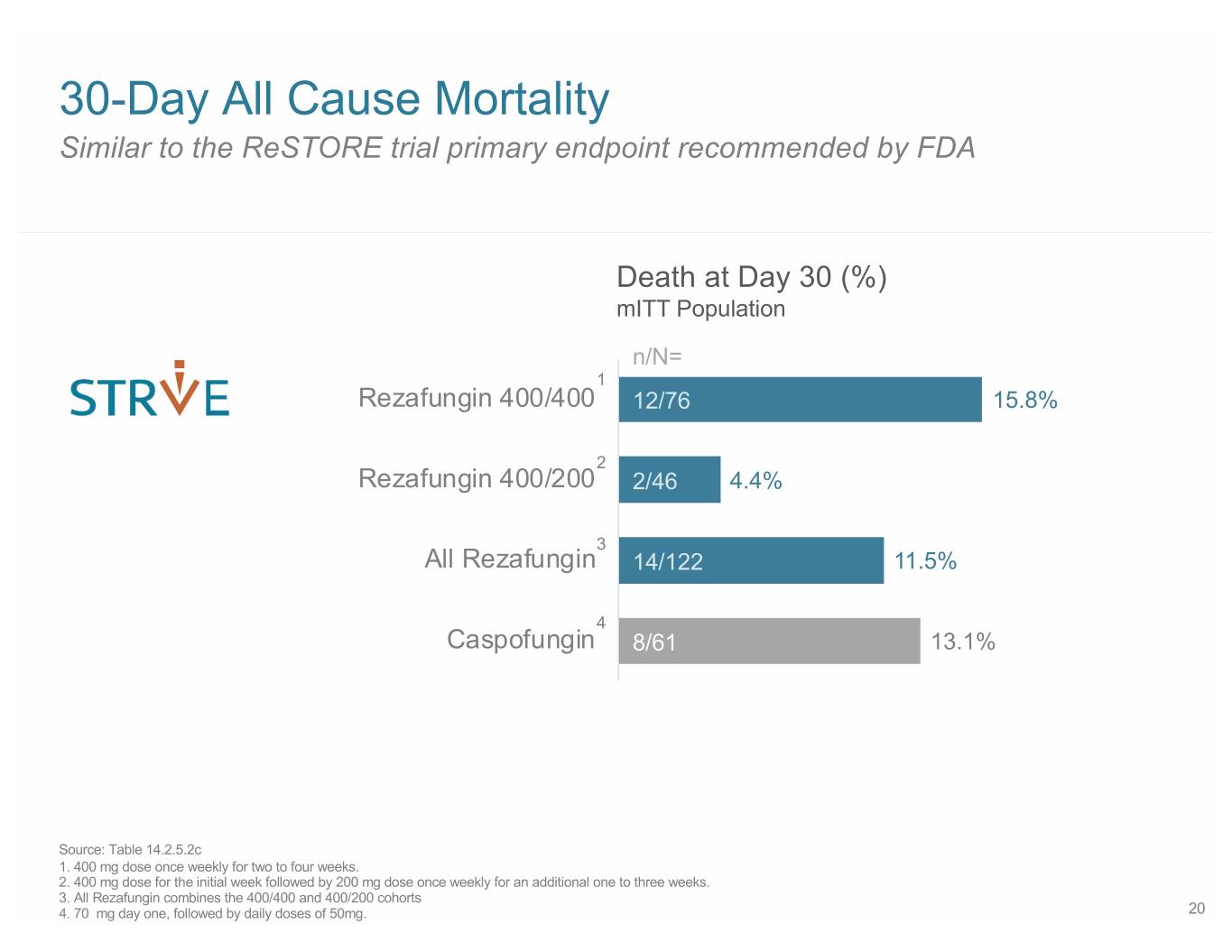

30-Day All Cause Mortality Similar to the ReSTORE trial primary endpoint recommended by FDA Death at Day 30 (%) mITT Population n/N= 1 Rezafungin 400/400 12/76 15.8% 2 Rezafungin 400/200 2/46 4.4% 3 All Rezafungin 14/122 11.5% 4 Caspofungin 8/61 13.1% Source: Table 14.2.5.2c 1. 400 mg dose once weekly for two to four weeks. 2. 400 mg dose for the initial week followed by 200 mg dose once weekly for an additional one to three weeks. 3. All Rezafungin combines the 400/400 and 400/200 cohorts 4. 70 mg day one, followed by daily doses of 50mg. 20

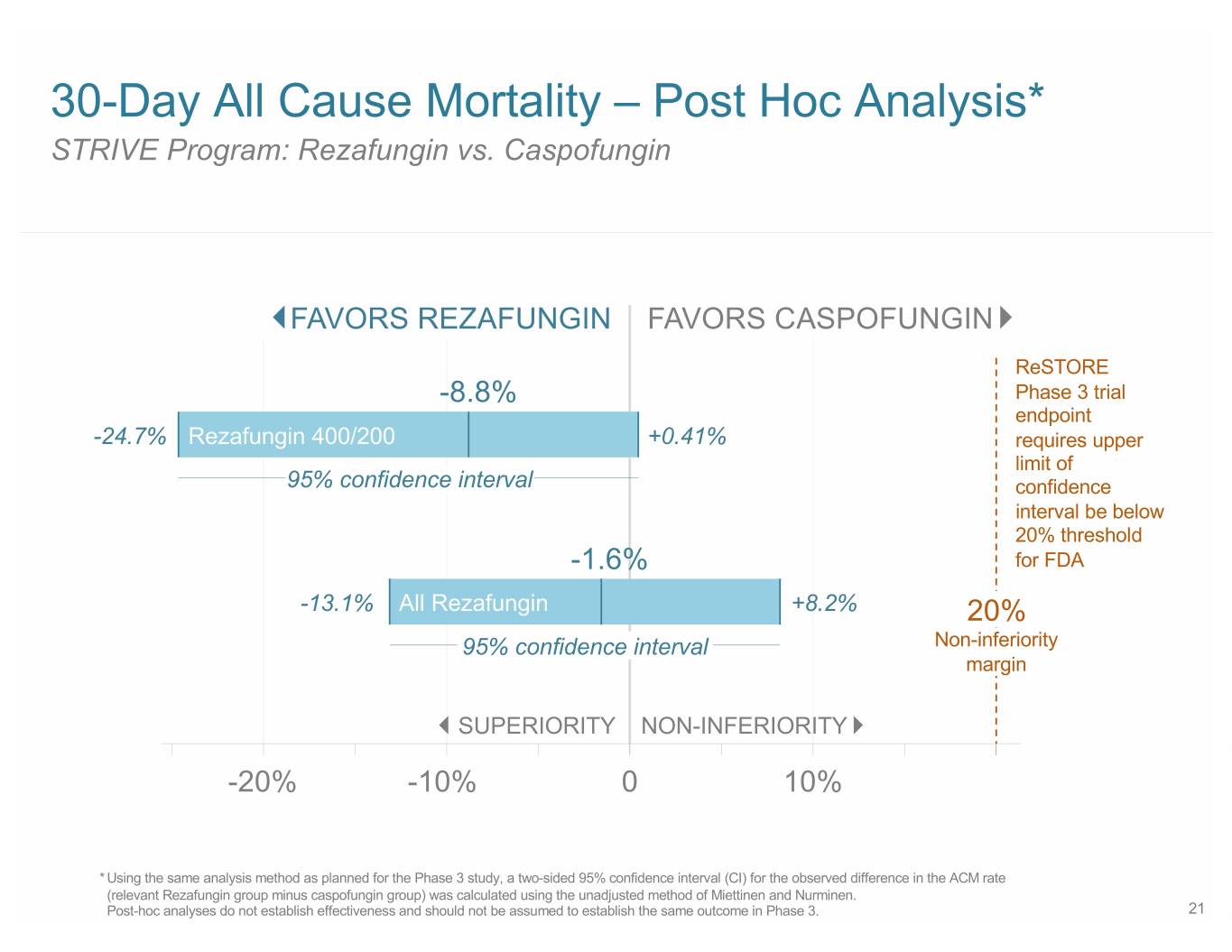

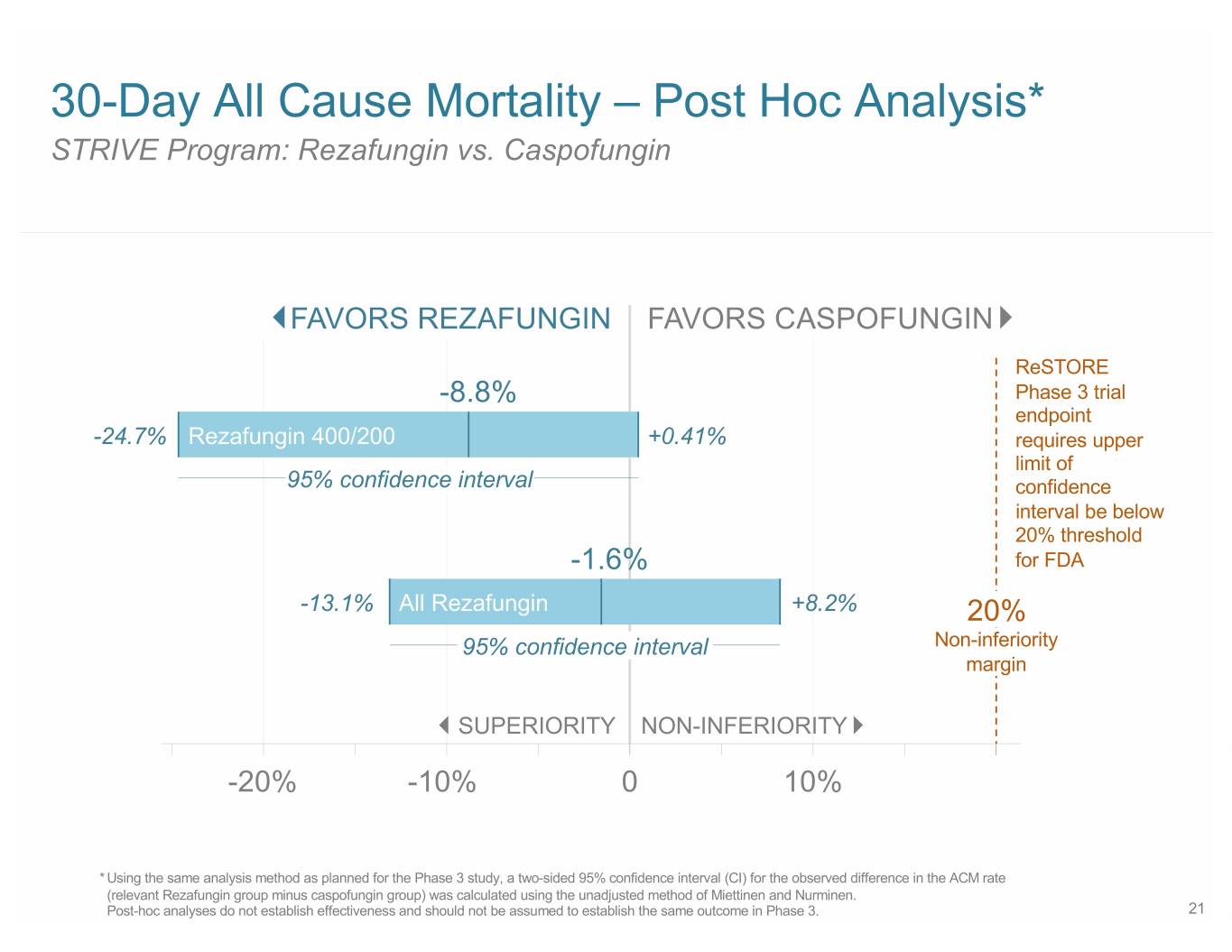

30-Day All Cause Mortality – Post Hoc Analysis* STRIVE Program: Rezafungin vs. Caspofungin FAVORS REZAFUNGIN FAVORS CASPOFUNGIN ReSTORE -8.8% Phase 3 trial endpoint -24.7% Rezafungin 400/200 +0.41% requires upper limit of 95% confidence interval confidence interval be below 20% threshold -1.6% for FDA -13.1% All Rezafungin +8.2% 20% 95% confidence interval Non-inferiority margin SUPERIORITY NON-INFERIORITY -20% -10% 0 10% * Using the same analysis method as planned for the Phase 3 study, a two-sided 95% confidence interval (CI) for the observed difference in the ACM rate (relevant Rezafungin group minus caspofungin group) was calculated using the unadjusted method of Miettinen and Nurminen. Post-hoc analyses do not establish effectiveness and should not be assumed to establish the same outcome in Phase 3. 21

Day 14 Clinical Response Similar to the ReSTORE trial primary endpoint recommended by EMA Clinical Cure (%) at Day 14 mITT Population n/N= 1 Rezafungin 400/400 53/76 69.7% 2 Rezafungin 400/200 37/46 80.4% 3 All Rezafungin 90/122 73.8% 4 Caspofungin 43/61 70.5% Source: Table 14.2.4.1c 1. 400 mg dose once weekly for two to four weeks. 2. 400 mg dose for the initial week followed by 200 mg dose once weekly for an additional one to three weeks. 3. All Rezafungin combines the 400/400 and 400/200 cohorts 4. 70 mg day one, followed by daily doses of 50mg. 22

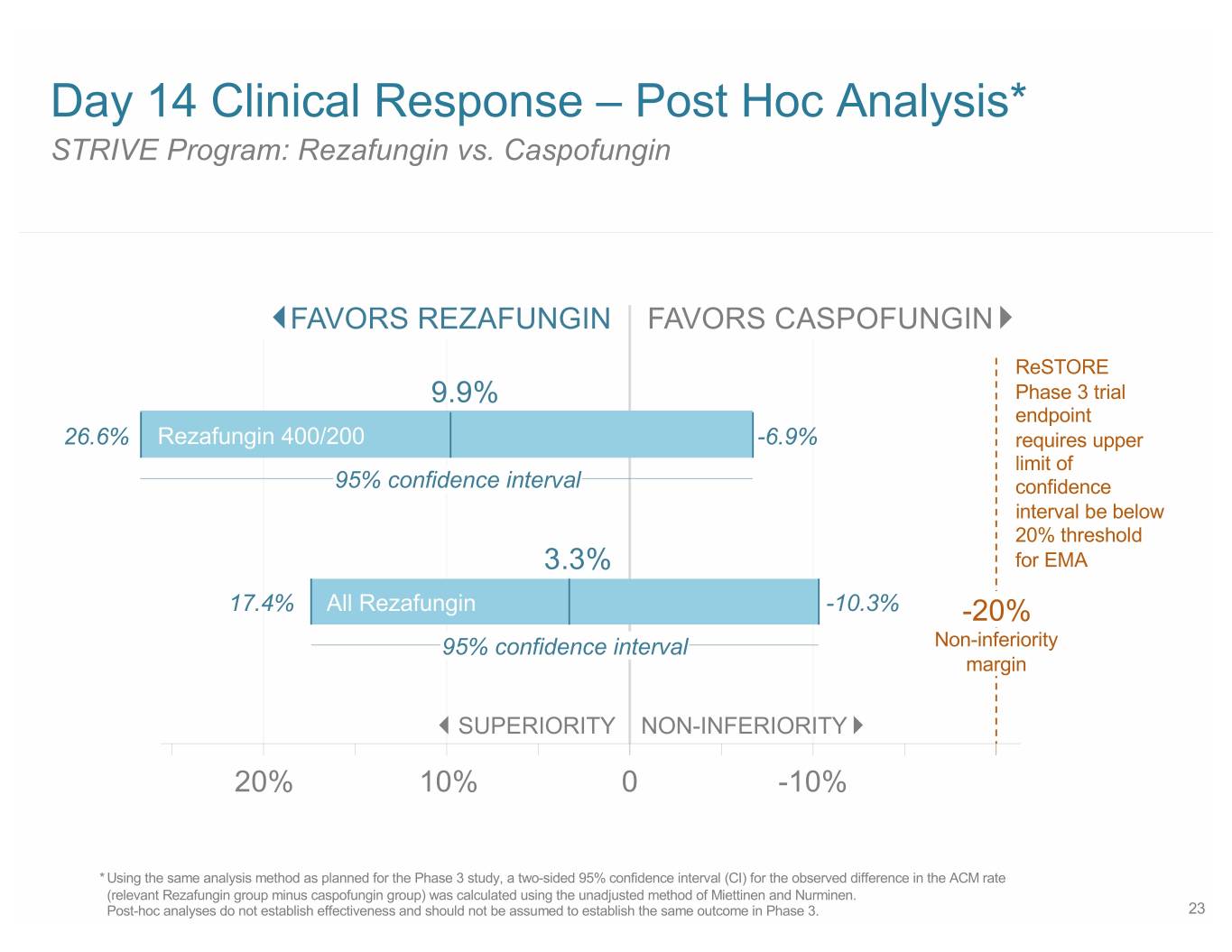

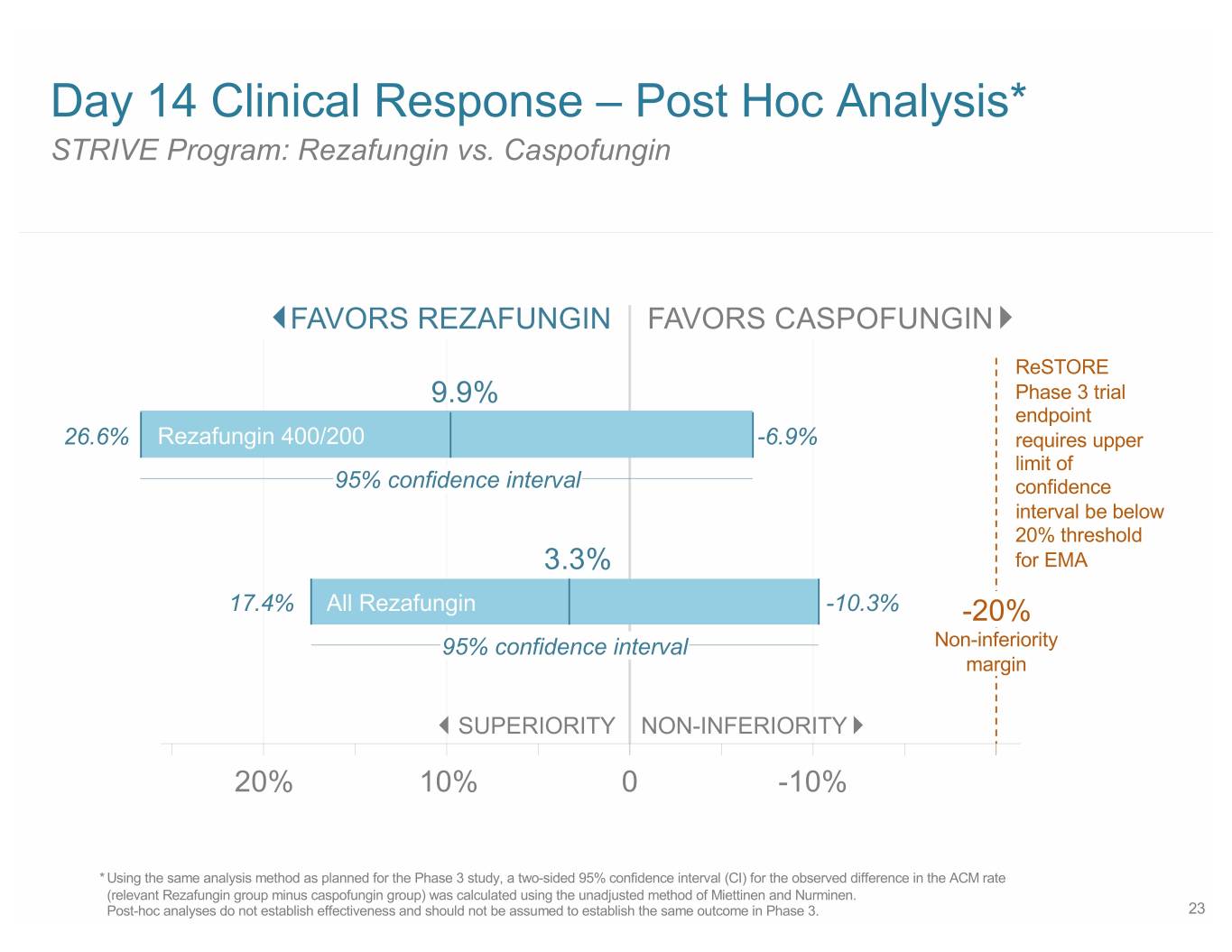

Day 14 Clinical Response – Post Hoc Analysis* STRIVE Program: Rezafungin vs. Caspofungin FAVORS REZAFUNGIN FAVORS CASPOFUNGIN ReSTORE 9.9% Phase 3 trial endpoint 26.6% Rezafungin 400/200 -6.9% requires upper limit of 95% confidence interval confidence interval be below 20% threshold 3.3% for EMA 17.4% All Rezafungin -10.3% -20% 95% confidence interval Non-inferiority margin SUPERIORITY NON-INFERIORITY 20% 10% 0 -10% * Using the same analysis method as planned for the Phase 3 study, a two-sided 95% confidence interval (CI) for the observed difference in the ACM rate (relevant Rezafungin group minus caspofungin group) was calculated using the unadjusted method of Miettinen and Nurminen. Post-hoc analyses do not establish effectiveness and should not be assumed to establish the same outcome in Phase 3. 23

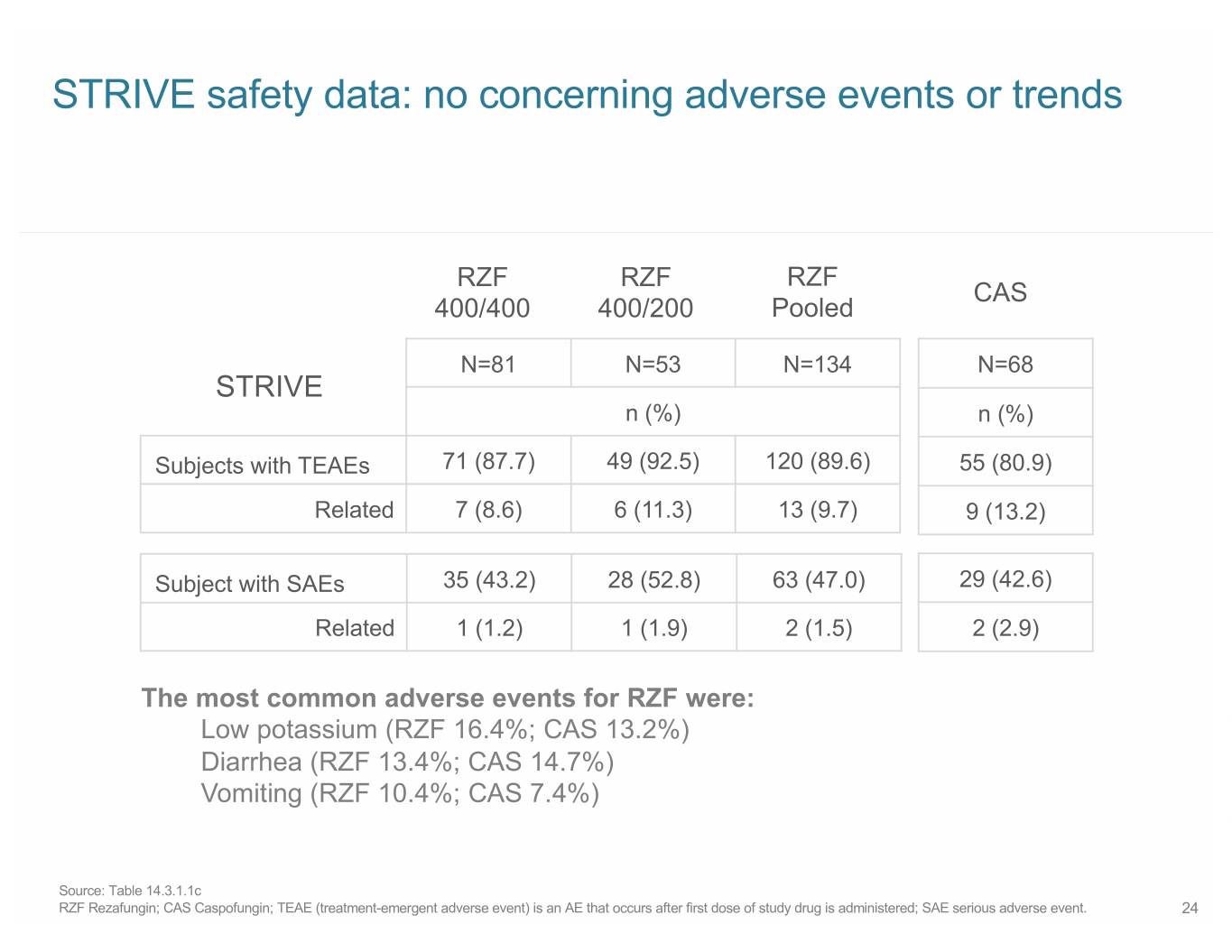

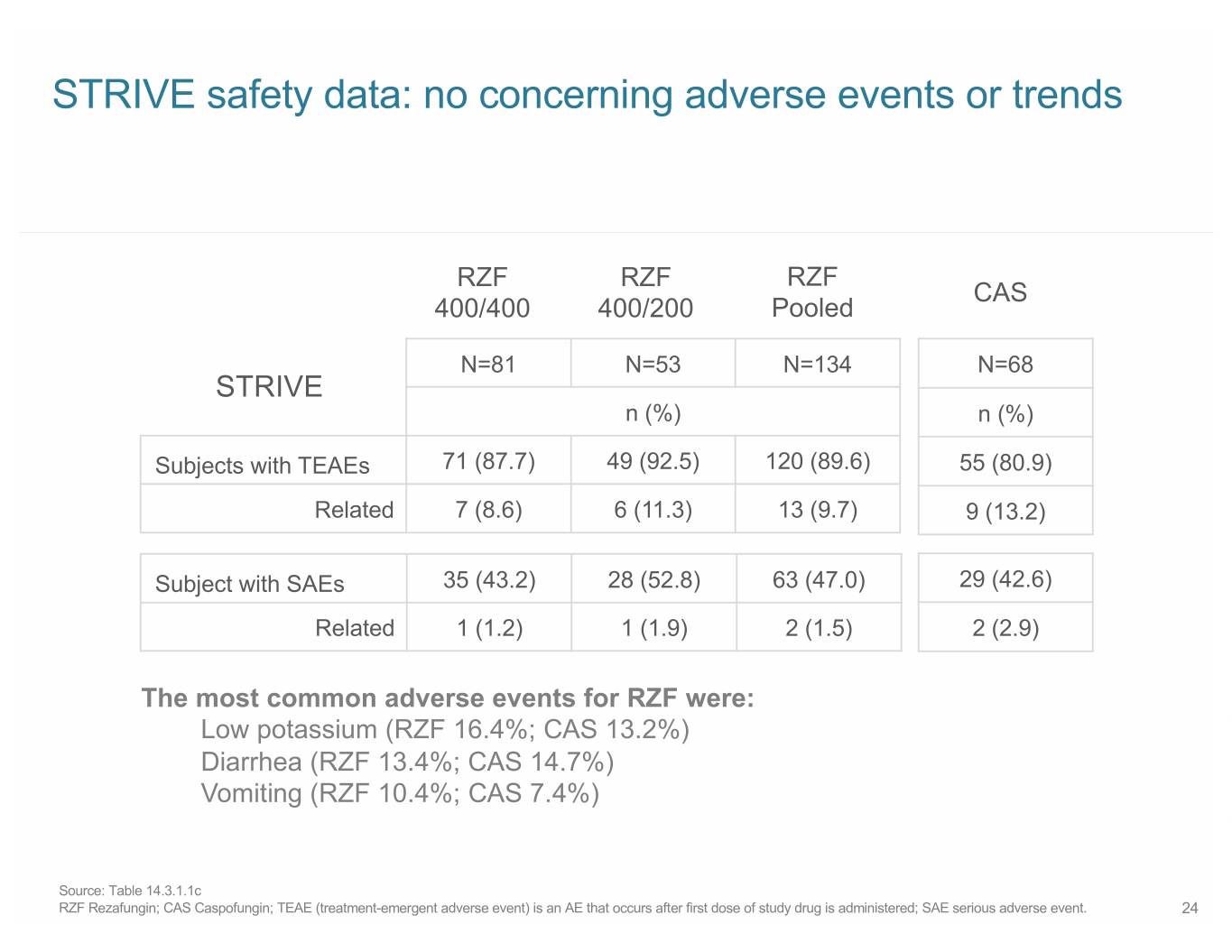

STRIVE safety data: no concerning adverse events or trends RZF RZF RZF CAS 400/400 400/200 Pooled N=81 N=53 N=134 N=68 STRIVE n (%) n (%) Subjects with TEAEs 71 (87.7) 49 (92.5) 120 (89.6) 55 (80.9) Related 7 (8.6) 6 (11.3) 13 (9.7) 9 (13.2) Subject with SAEs 35 (43.2) 28 (52.8) 63 (47.0) 29 (42.6) Related 1 (1.2) 1 (1.9) 2 (1.5) 2 (2.9) The most common adverse events for RZF were: Low potassium (RZF 16.4%; CAS 13.2%) Diarrhea (RZF 13.4%; CAS 14.7%) Vomiting (RZF 10.4%; CAS 7.4%) Source: Table 14.3.1.1c RZF Rezafungin; CAS Caspofungin; TEAE (treatment-emergent adverse event) is an AE that occurs after first dose of study drug is administered; SAE serious adverse event. 24

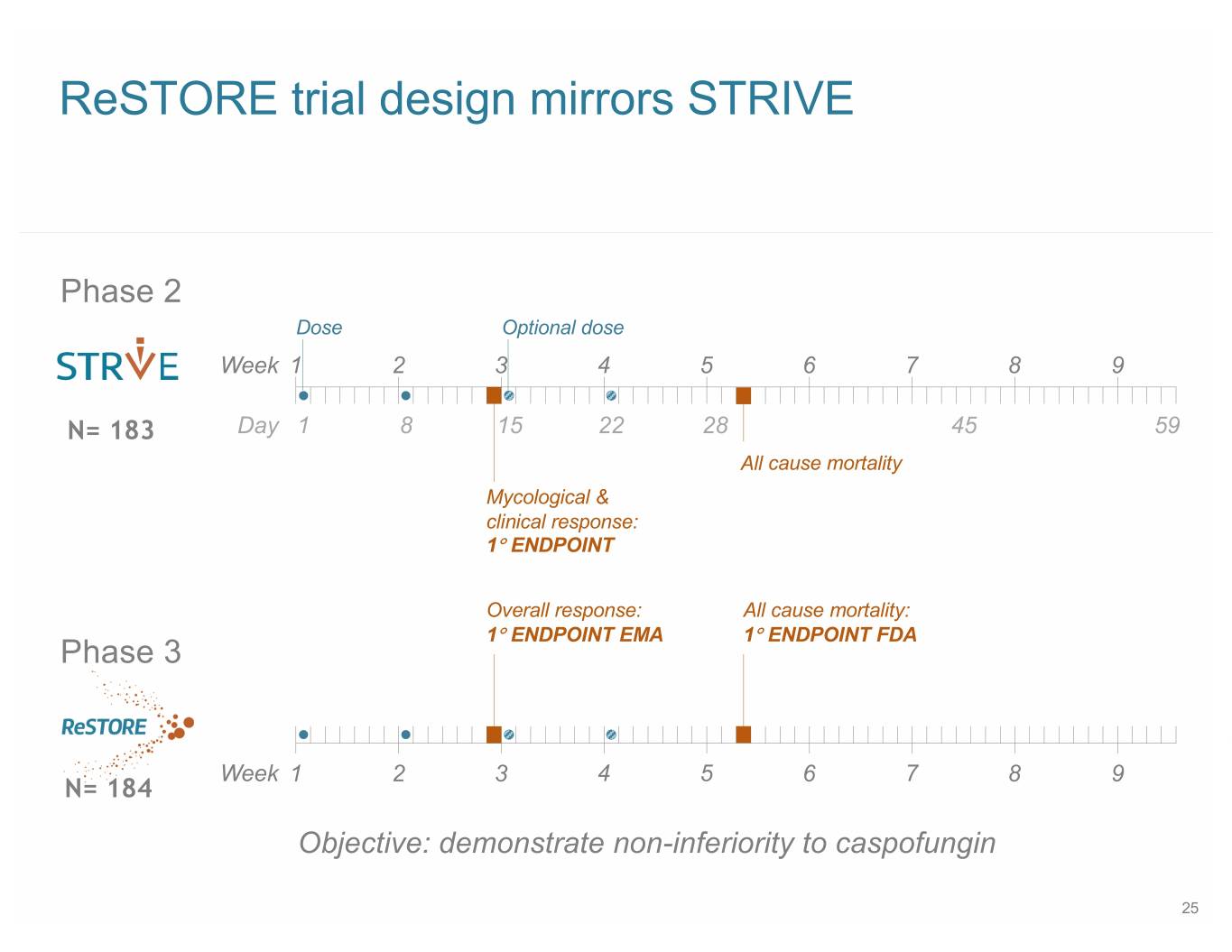

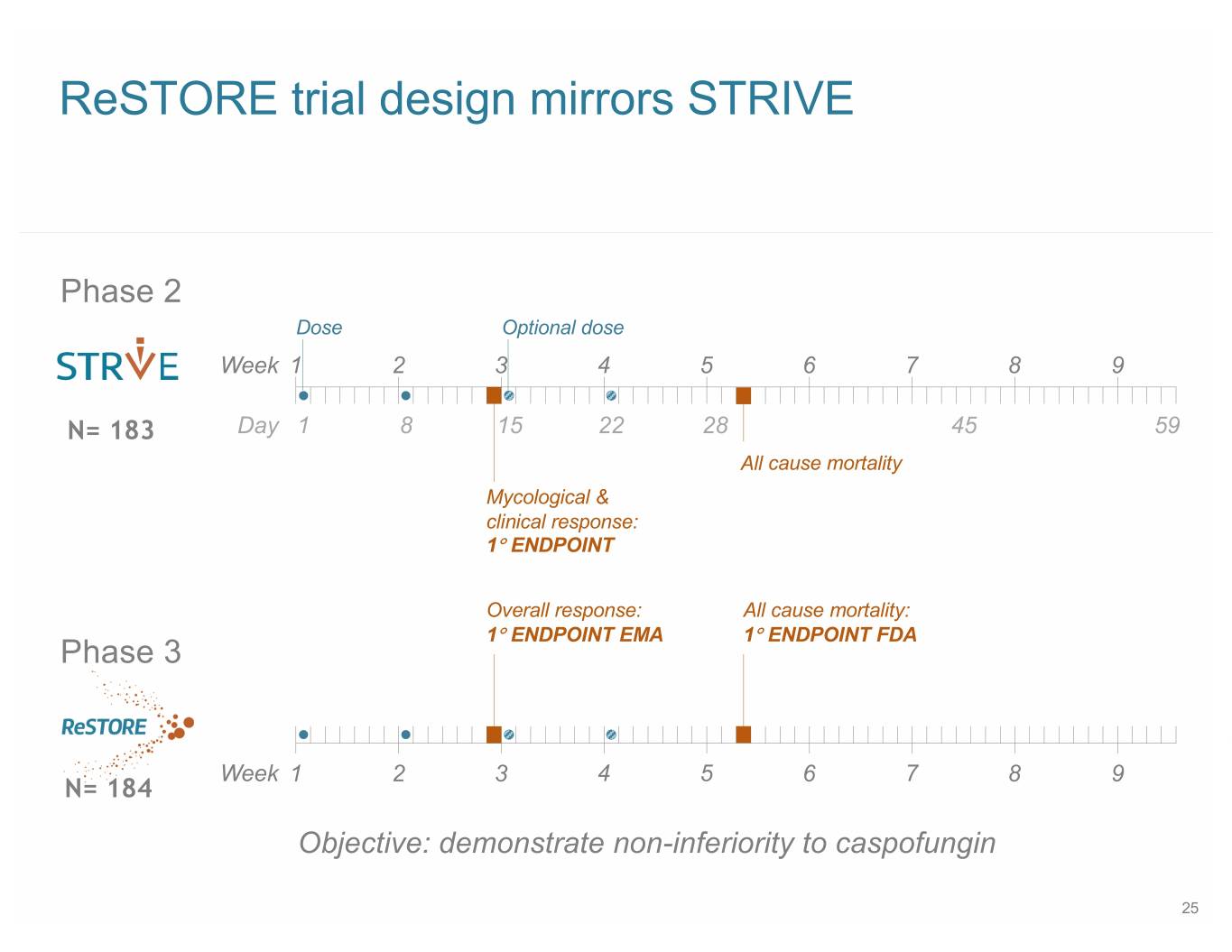

ReSTORE trial design mirrors STRIVE Phase 2 Dose Optional dose Week 1 2 3 4 5 6 7 8 9 N= 183 Day 1 8 15 22 28 45 59 All cause mortality Mycological & clinical response: 1° ENDPOINT Overall response: All cause mortality: 1° ENDPOINT EMA 1° ENDPOINT FDA Phase 3 Week 1 2 3 4 5 6 7 8 9 N= 184 Objective: demonstrate non-inferiority to caspofungin 25

Our partner for Rezafungin ex-US/Japan 120 60 Over €2 50% MARKETS YEARS BILLION Active in Over 60 years of asset- European sales Over 50% revenue derived from new more than 30 led innovation exceeding €1 billion products launched in in Europe Over €2B ex-US the last five years in Europe 26

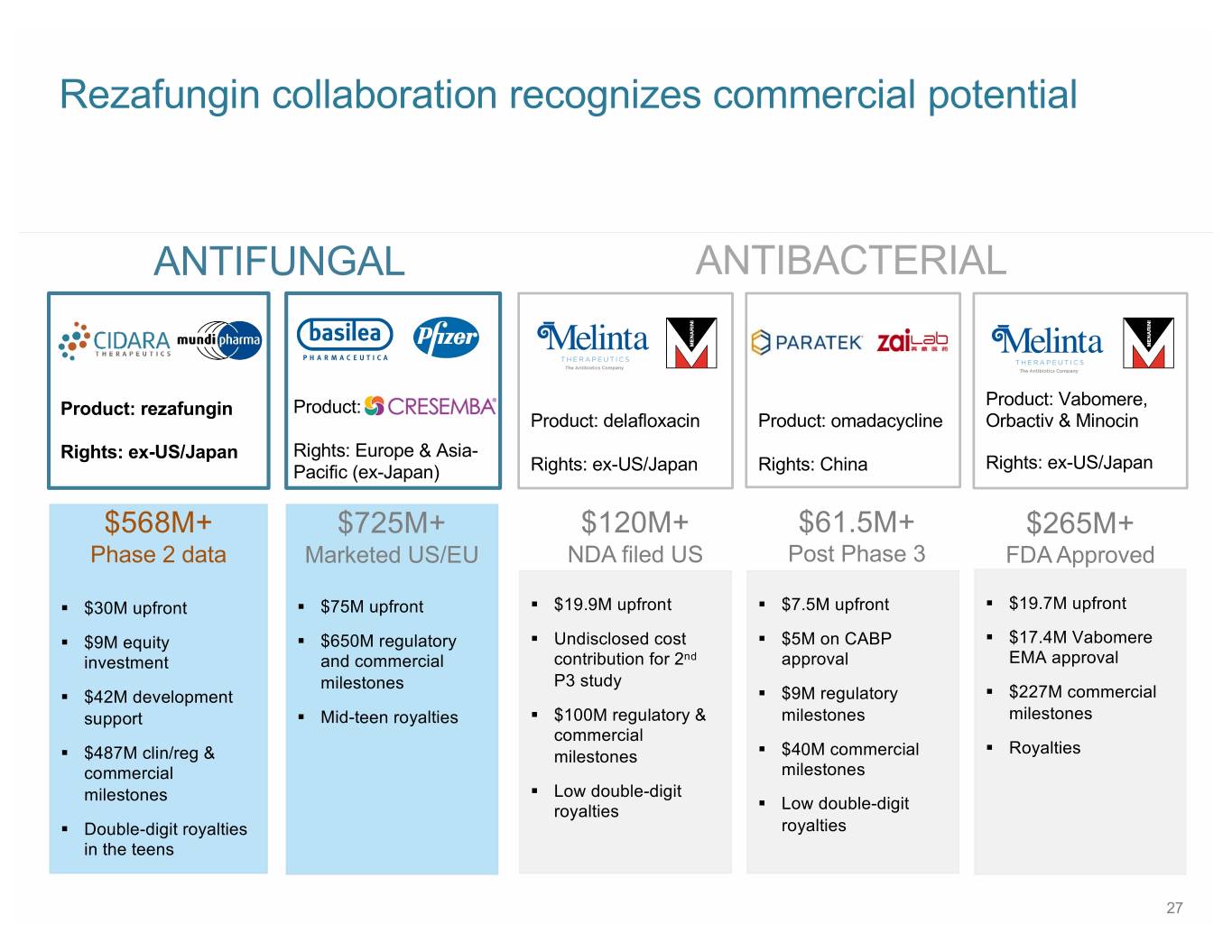

Rezafungin collaboration recognizes commercial potential ANTIFUNGAL ANTIBACTERIAL Product: Vabomere, Product: rezafungin Product: Product: delafloxacin Product: omadacycline Orbactiv & Minocin Rights: ex-US/Japan Rights: Europe & Asia- Rights: ex-US/Japan Pacific (ex-Japan) Rights: ex-US/Japan Rights: China $568M+ $725M+ $120M+ $61.5M+ $265M+ Phase 2 data Marketed US/EU NDA filed US Post Phase 3 FDA Approved § $30M upfront § $75M upfront § $19.9M upfront § $7.5M upfront § $19.7M upfront § $9M equity § $650M regulatory § Undisclosed cost § $5M on CABP § $17.4M Vabomere investment and commercial contribution for 2nd approval EMA approval milestones P3 study § $42M development § $9M regulatory § $227M commercial support § Mid-teen royalties § $100M regulatory & milestones milestones commercial § Royalties § $487M clin/reg & milestones § $40M commercial commercial milestones milestones § Low double-digit royalties § Low double-digit § Double-digit royalties royalties in the teens 27

Rezafungin overall phase 3 development plan 1 Phase 3 Treatment Trial Phase 3 Prophylaxis Trial Treatment of candidemia & Prophylaxis against Aspergillus, Indication invasive candidiasis in patients Candida & PCP in allogeneic blood with limited treatment options and marrow transplant patients Phase 3 Size 184 patients2 (20% NI margin) 462 patients (12.5% NI margin) Enable early discharge of Overall Transform post-blood & marrow patients on a weekly objective transplant standard of care echinocandin 1. We plan to commence the ReSPECT trial initially in Europe and Canada. 2. Phase 3 Primary Evaluable Population size. 28

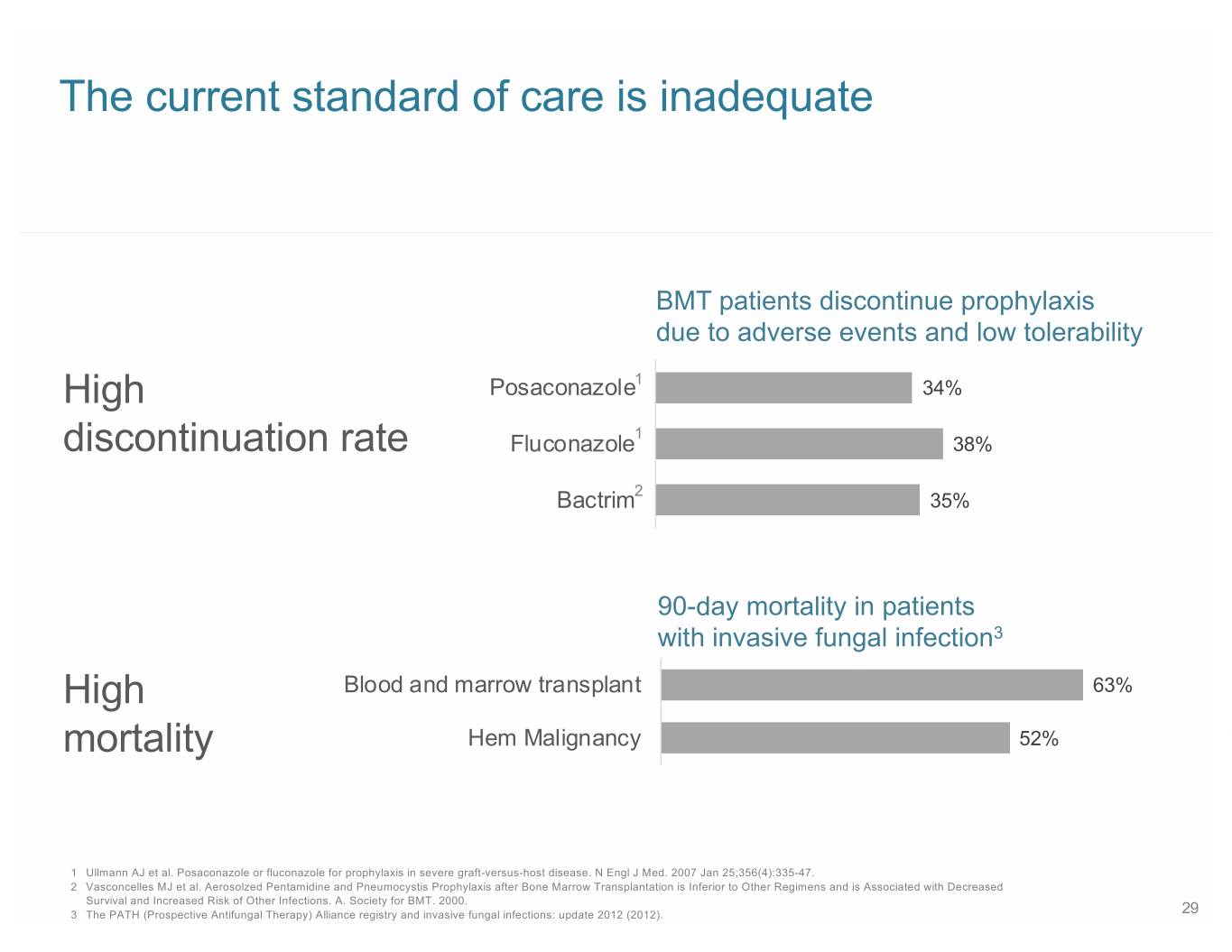

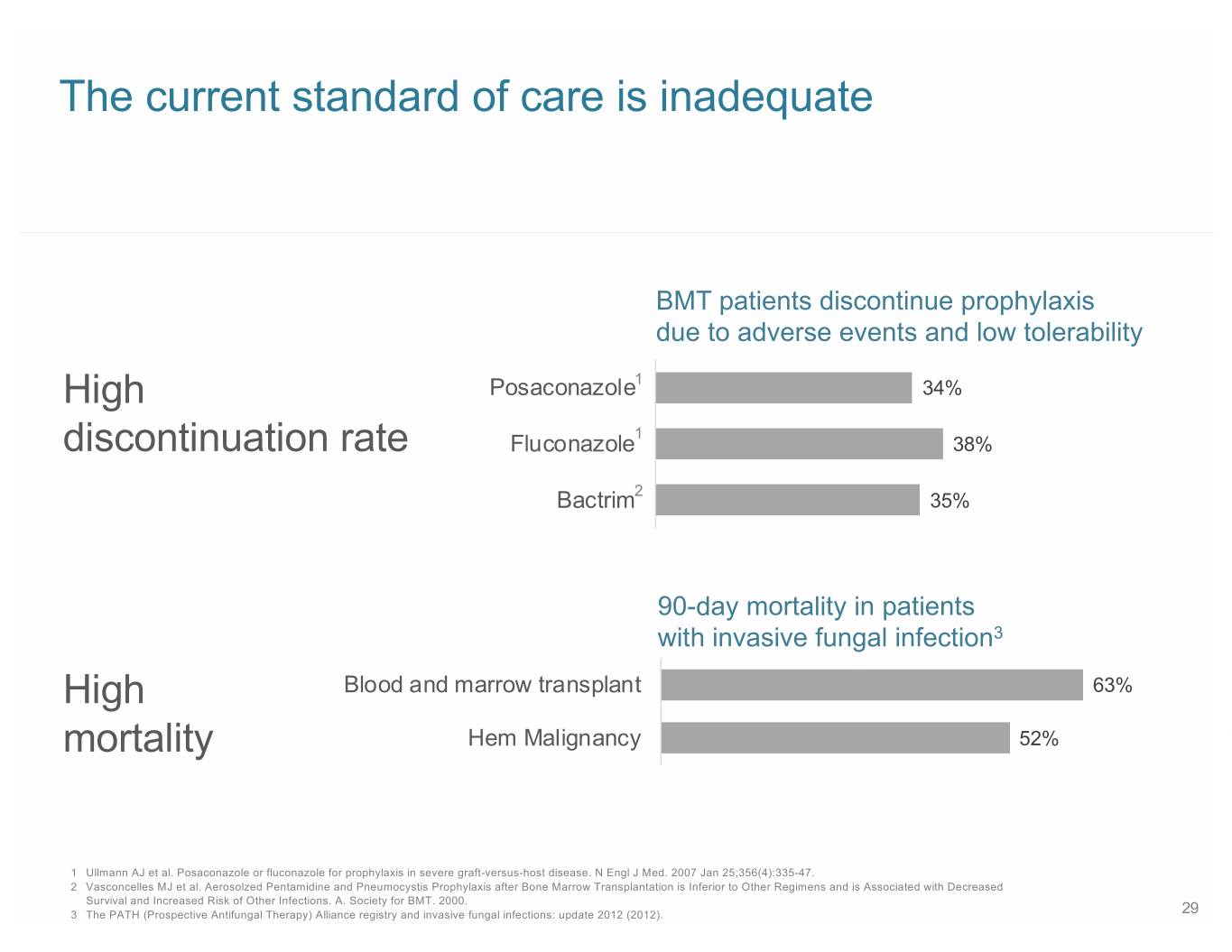

The current standard of care is inadequate BMT patients discontinue prophylaxis due to adverse events and low tolerability High Posaconazole1 34% 1 discontinuation rate Fluconazole 38% 2 Bactrim 35% 90-day mortality in patients with invasive fungal infection3 High Blood and marrow transplant 63% mortality Hem Malignancy 52% 1 Ullmann AJ et al. Posaconazole or fluconazole for prophylaxis in severe graft-versus-host disease. N Engl J Med. 2007 Jan 25;356(4):335-47. 2 Vasconcelles MJ et al. Aerosolzed Pentamidine and Pneumocystis Prophylaxis after Bone Marrow Transplantation is Inferior to Other Regimens and is Associated with Decreased Survival and Increased Risk of Other Infections. A. Society for BMT. 2000. 3 The PATH (Prospective Antifungal Therapy) Alliance registry and invasive fungal infections: update 2012 (2012). 29

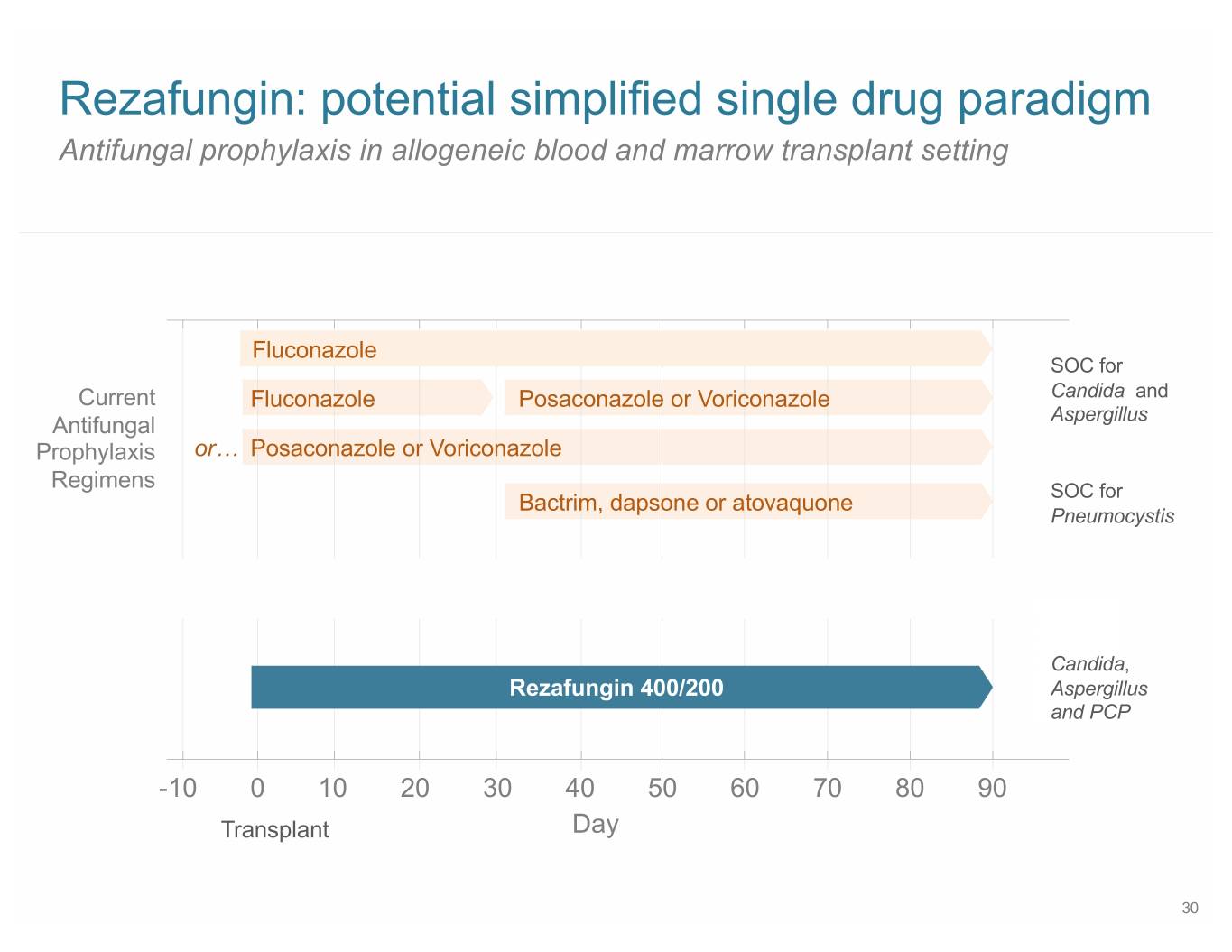

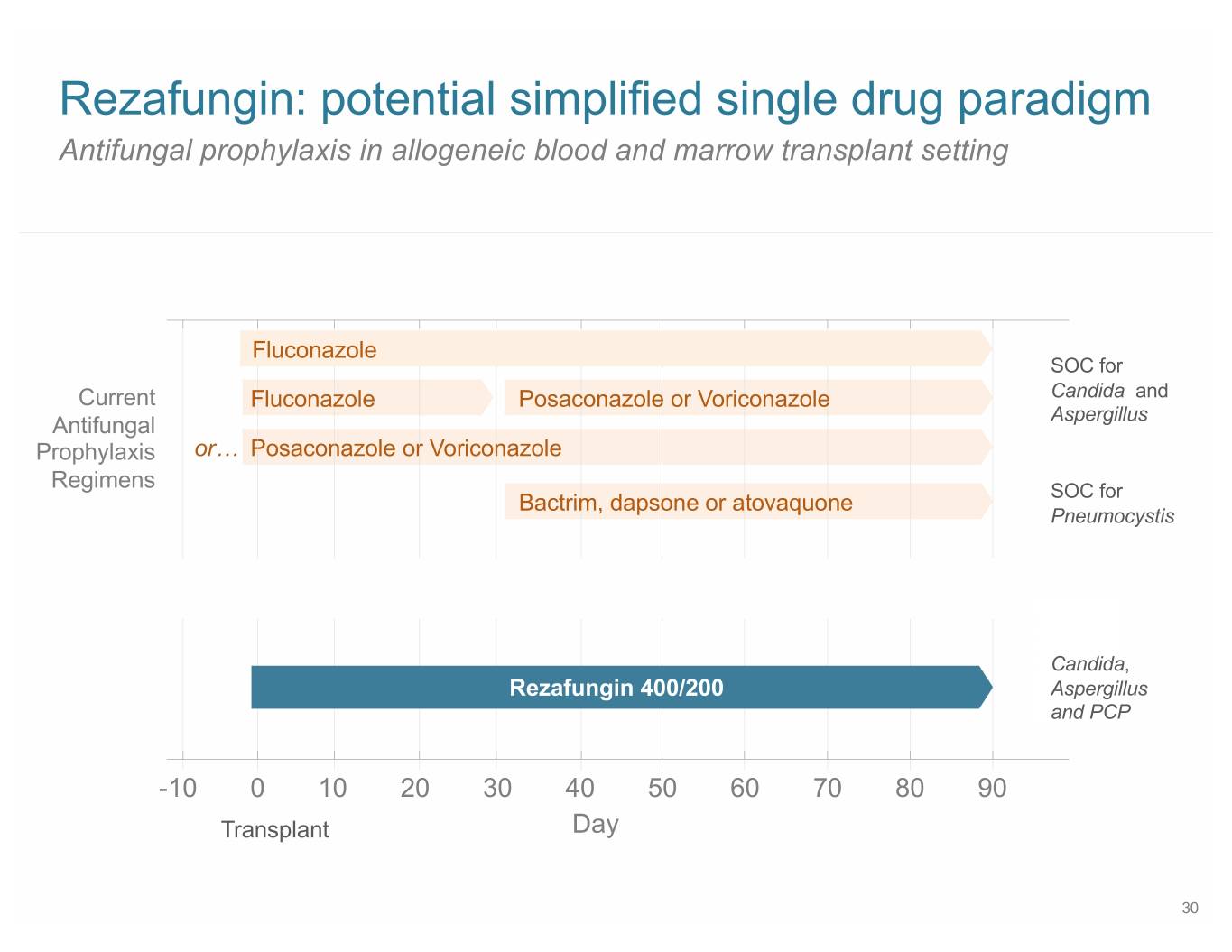

Rezafungin: potential simplified single drug paradigm Antifungal prophylaxis in allogeneic blood and marrow transplant setting Fluconazole SOC for Current Fluconazole Posaconazole or Voriconazole Candida and Antifungal Aspergillus Prophylaxis or… Posaconazole or Voriconazole Regimens SOC for Bactrim, dapsone or atovaquone Pneumocystis Candida, Rezafungin 400/200 Aspergillus and PCP -10 0 10 20 30 40 50 60 70 80 90 Transplant Day 30

Cidara’s pipeline targets multiple unmet medical needs Rezafungin Cloudbreak 31

SB 11 Flu vaccines have well known limitations… Viral coverage Patient Manufacturing Strain-specific, Less effective in elderly & Challenging in a pandemic: variable coverage immune compromised long, complex production 10%-60% effective ~2-week lag time to Difficult to scale, low yields (2004-2018)1 achieve full protection2 can limit production capacity3 1. https://www.cdc.gov/flu/professionals/vaccination/effectiveness-studies.htm 2. https://www.cdc.gov/flu/protect/keyfacts.htm 3. https://www.cdc.gov/flu/professionals/antivirals/summary-clinicians.htm 32

… which place a substantial burden on the US population 49% 40% or less 9M to 45M immunization rate vaccine effectiveness people who get the flu 31.4M 140K – 810K 12K – 80K outpatient visits hospitalizations deaths The top range of these burden estimates are from the 2017-2018 flu season Sources: CDC; https://www.cdc.gov/flu/about/burden/index.html Challenger, Gray, & Christmas, Inc.; https://www.healthline.com/health/influenza/facts-and-statistics#5 33

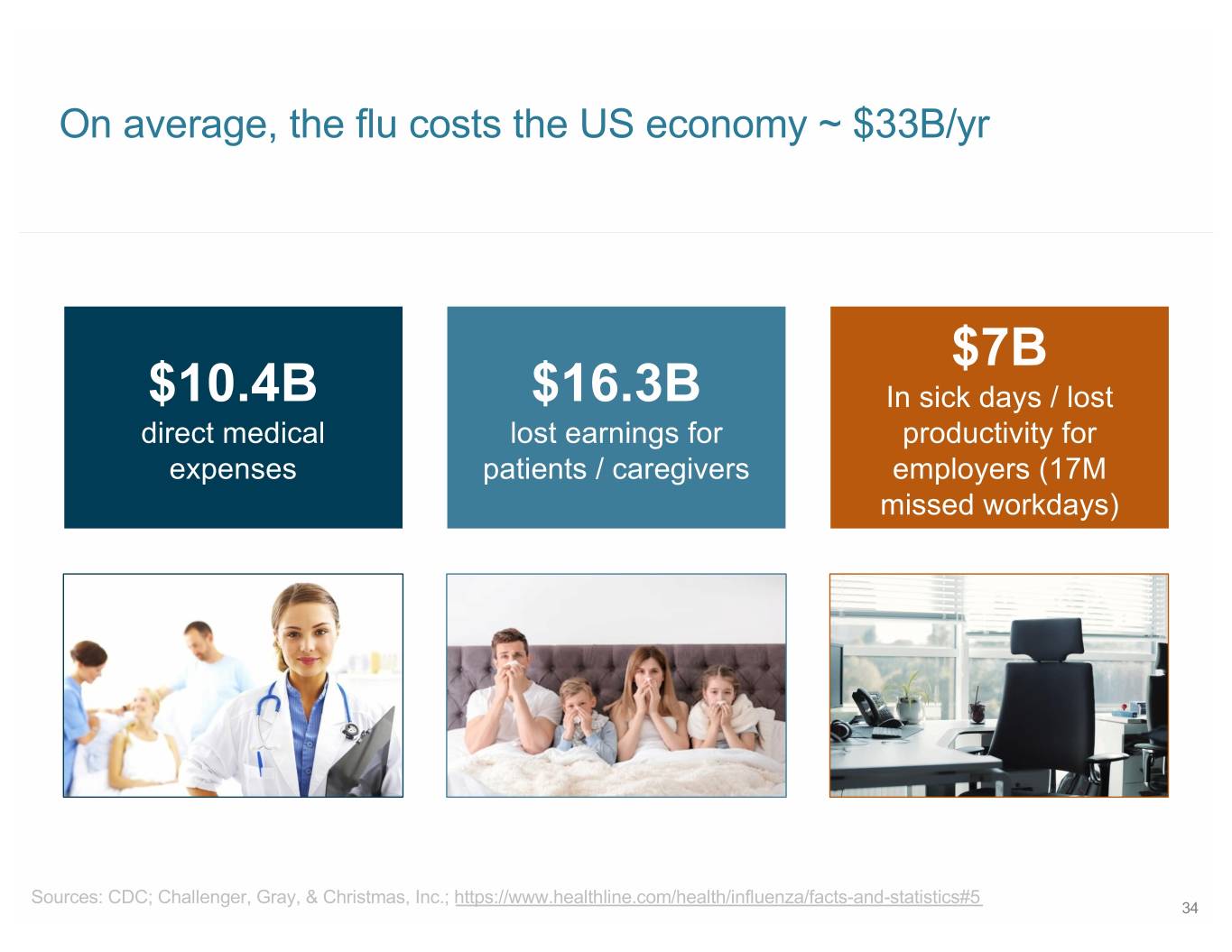

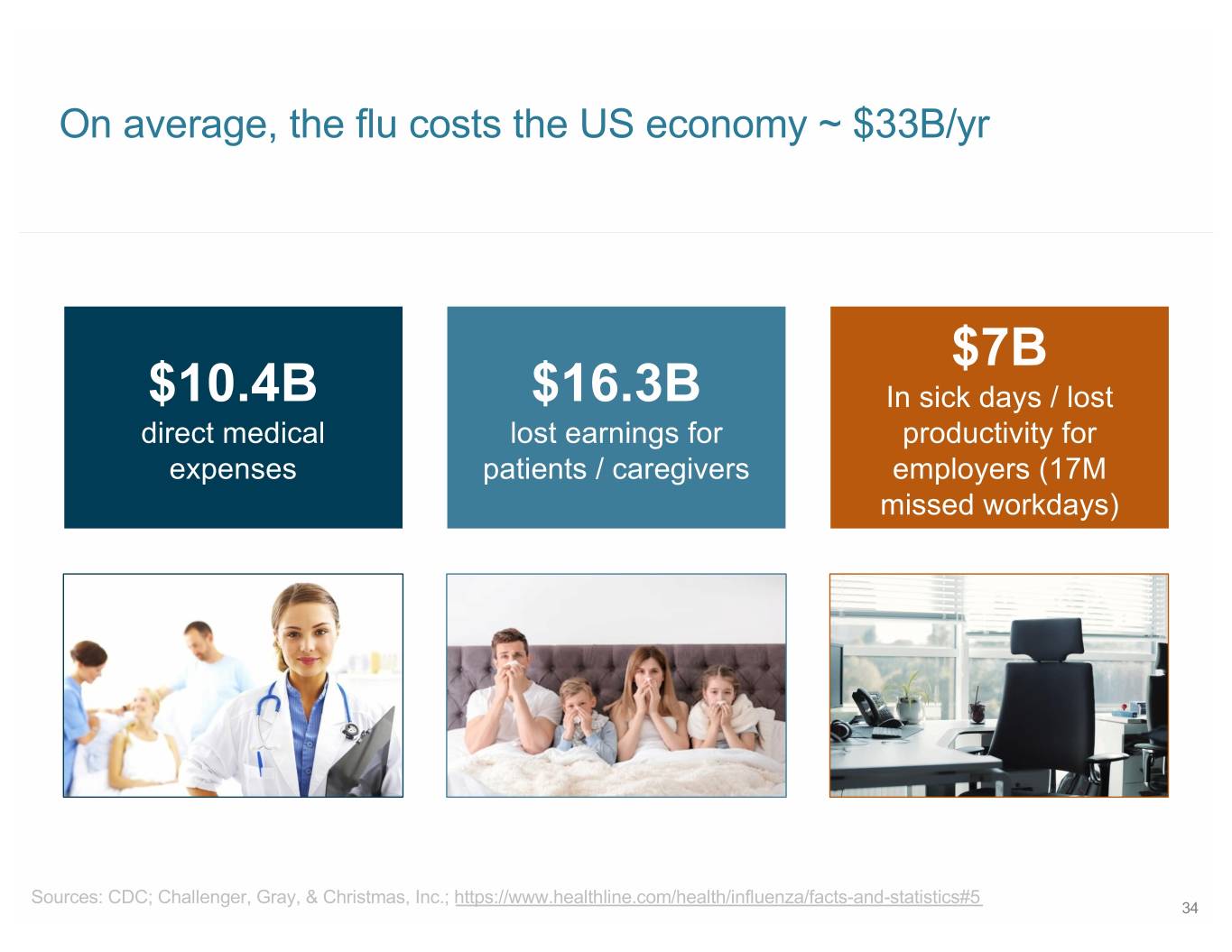

On average, the flu costs the US economy ~ $33B/yr $7B $10.4B $16.3B In sick days / lost direct medical lost earnings for productivity for expenses patients / caregivers employers (17M missed workdays) Sources: CDC; Challenger, Gray, & Christmas, Inc.; https://www.healthline.com/health/influenza/facts-and-statistics#5 34

SB 12 What would an “ideal” product look like? Broad spectrum, universal coverage Superior resistance profile Protection for High-Risk Populations Expanded efficacy window Long duration of action Rapid onset of activity Flexible administration 35

SB 10 Cloudbreak platform – multimodal mechanism of action intrinsic antimicrobial activity & immune engagement Immune Pathogen Component TARGETING MOIETY (TM) Fc MOIETY Binds conserved surface target Engages innate or Direct antimicrobial activity adaptive immune system 36

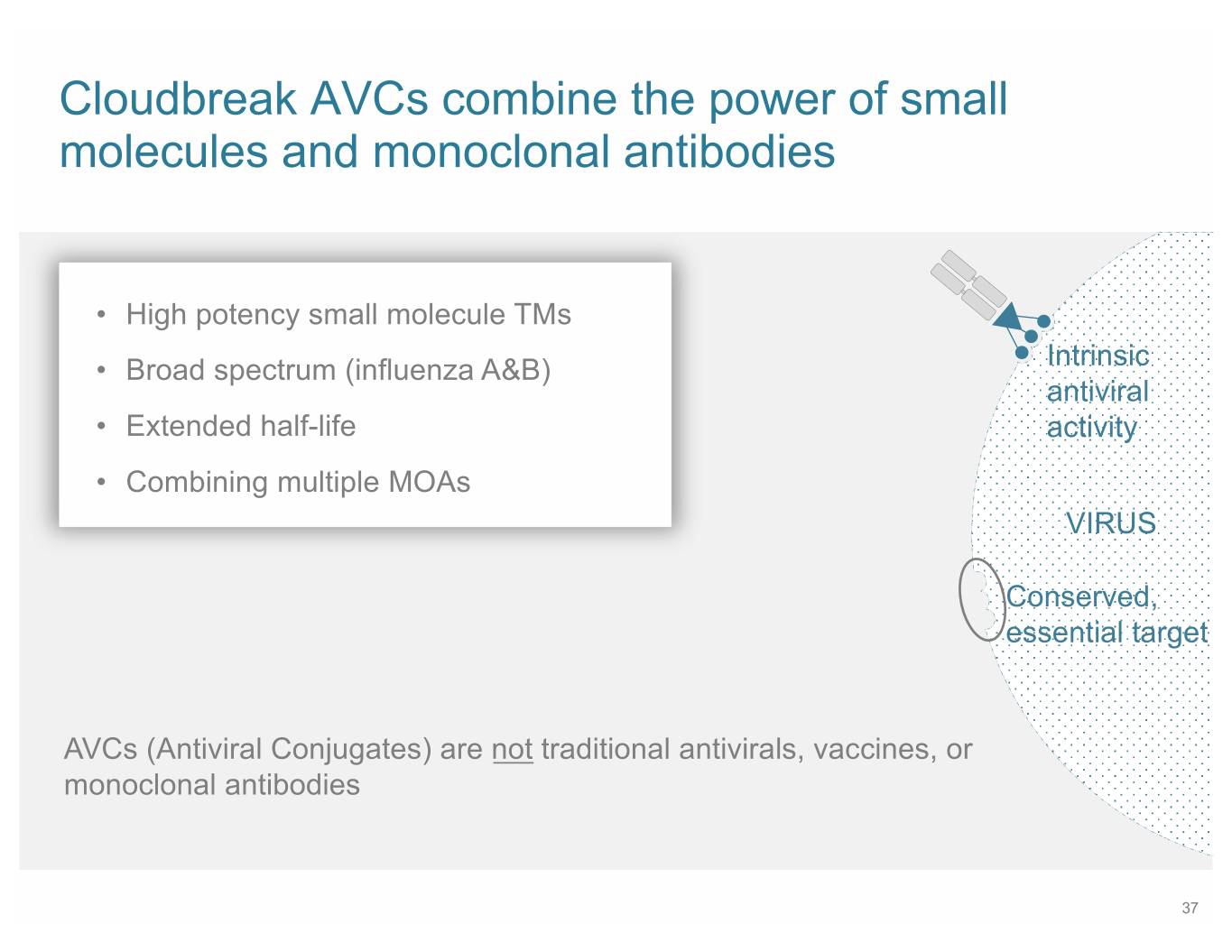

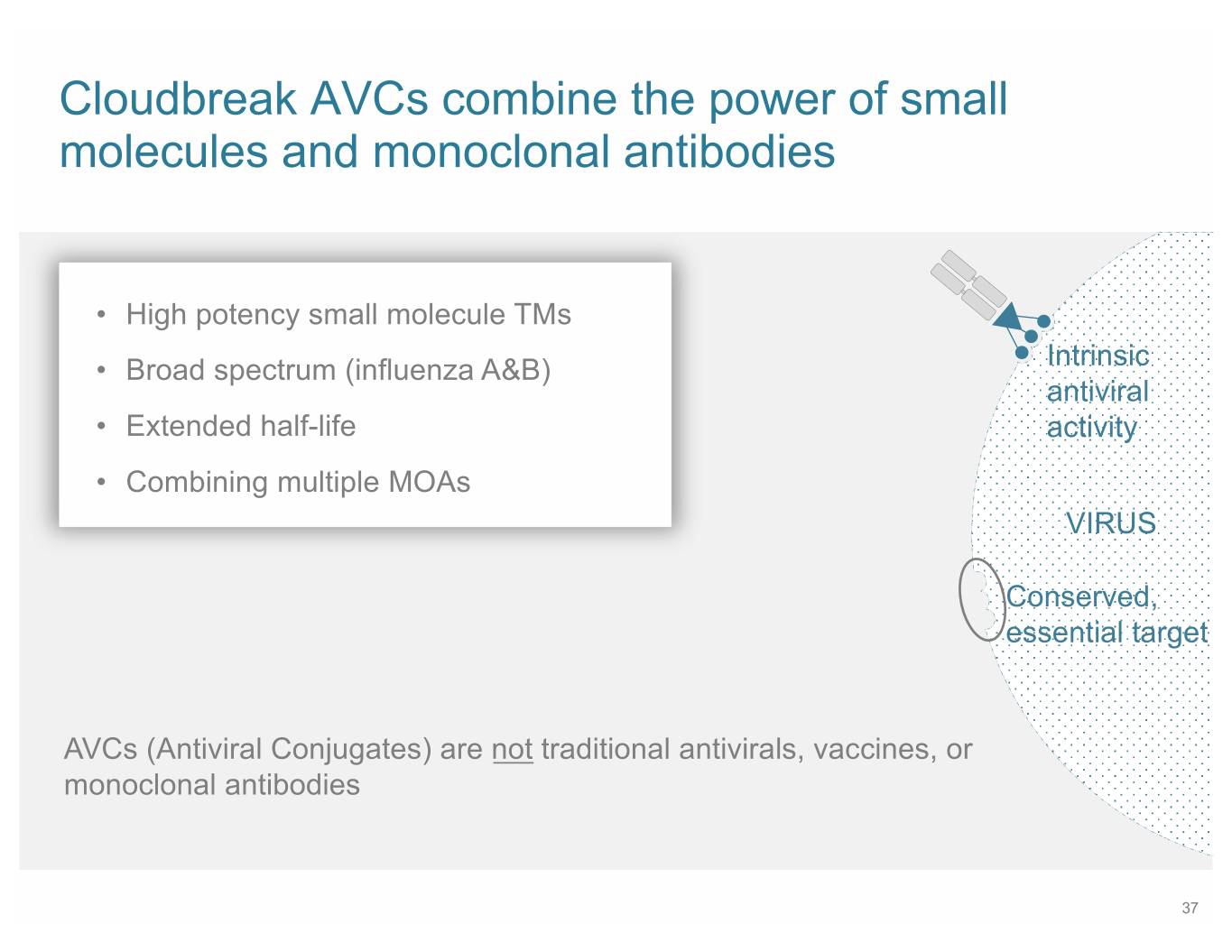

SB 9 Cloudbreak AVCs combine the power of small molecules and monoclonal antibodies • High potency small molecule TMs • Broad spectrum (influenza A&B) Intrinsic antiviral • Extended half-life activity • Combining multiple MOAs VIRUS Conserved, essential target AVCs (Antiviral Conjugates) are not traditional antivirals, vaccines, or monoclonal antibodies 37

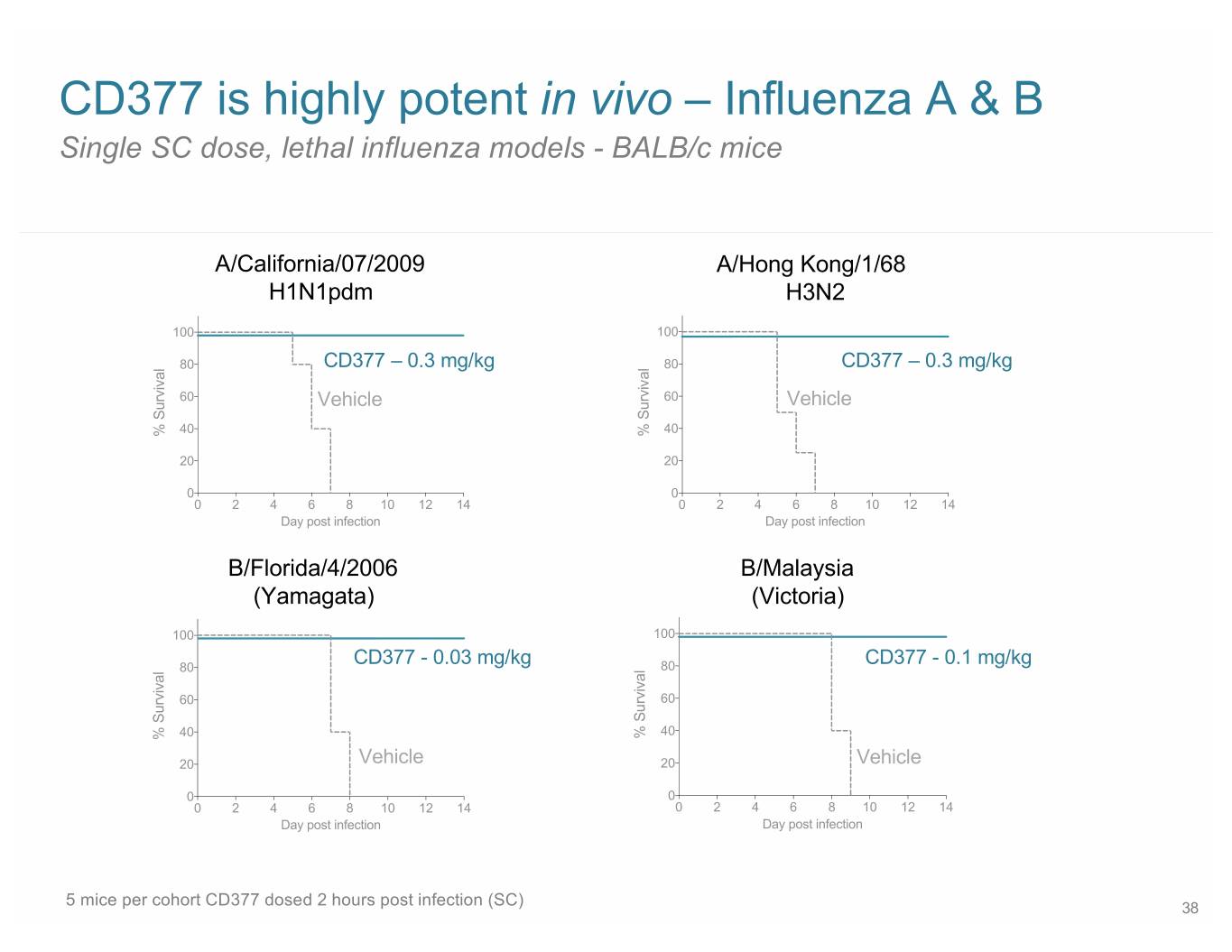

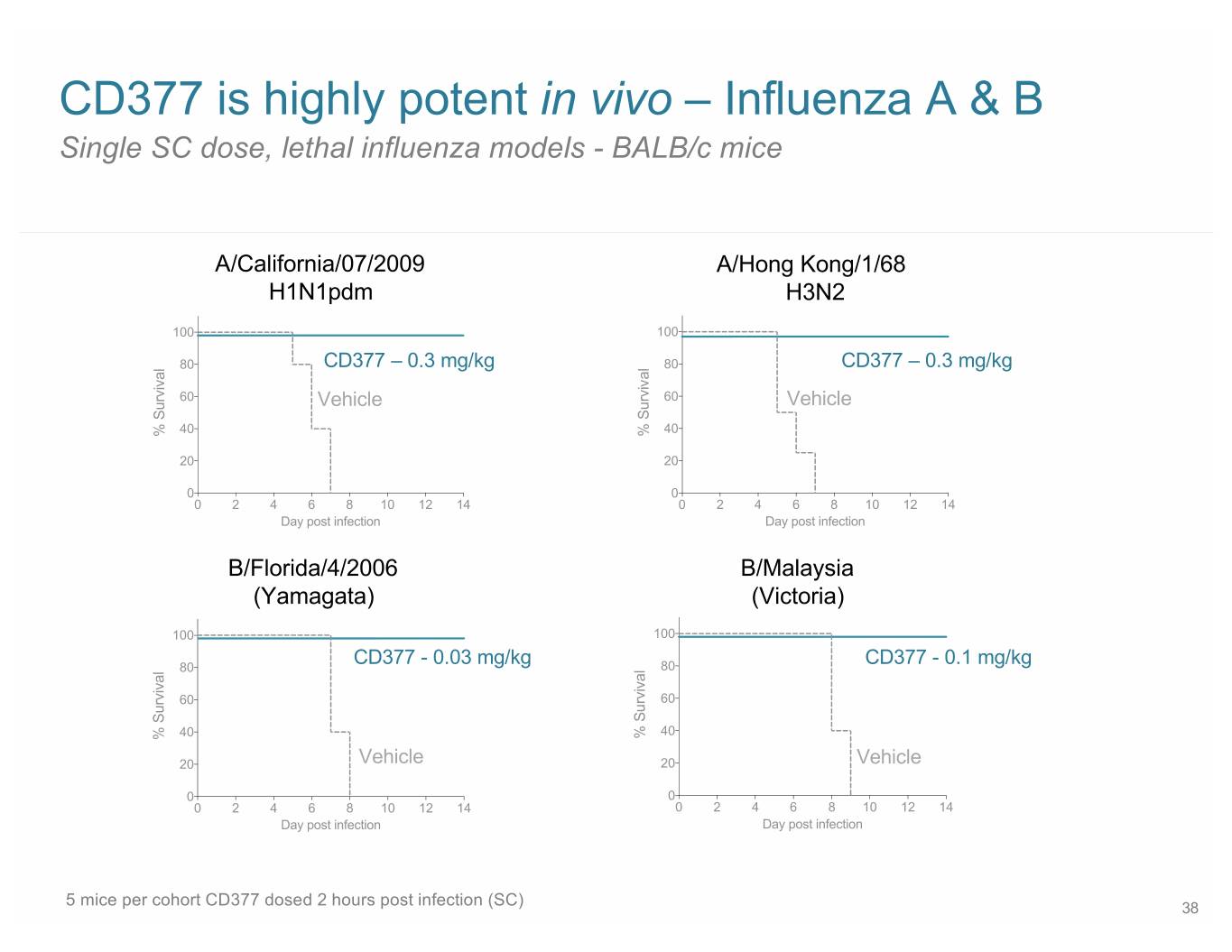

CD377 is highly potent in vivo – Influenza A & B Single SC dose, lethal influenza models - BALB/c mice A/California/07/2009 A/Hong Kong/1/68 H1N1pdm H3N2 100 100 80 CD377 – 0.3 mg/kg 80 CD377 – 0.3 mg/kg 60 Vehicle 60 Vehicle 40 40 % Survival % Survival 20 20 0 0 0 2 4 6 8 10 12 14 0 2 4 6 8 10 12 14 Day post infection Day post infection B/Florida/4/2006 B/Malaysia (Yamagata) (Victoria) 100 100 80 CD377 - 0.03 mg/kg 80 CD377 - 0.1 mg/kg 60 60 40 40 % Survival % Survival 20 Vehicle 20 Vehicle 0 0 0 2 4 6 8 10 12 14 0 2 4 6 8 10 12 14 Day post infection Day post infection 5 mice per cohort CD377 dosed 2 hours post infection (SC) 38

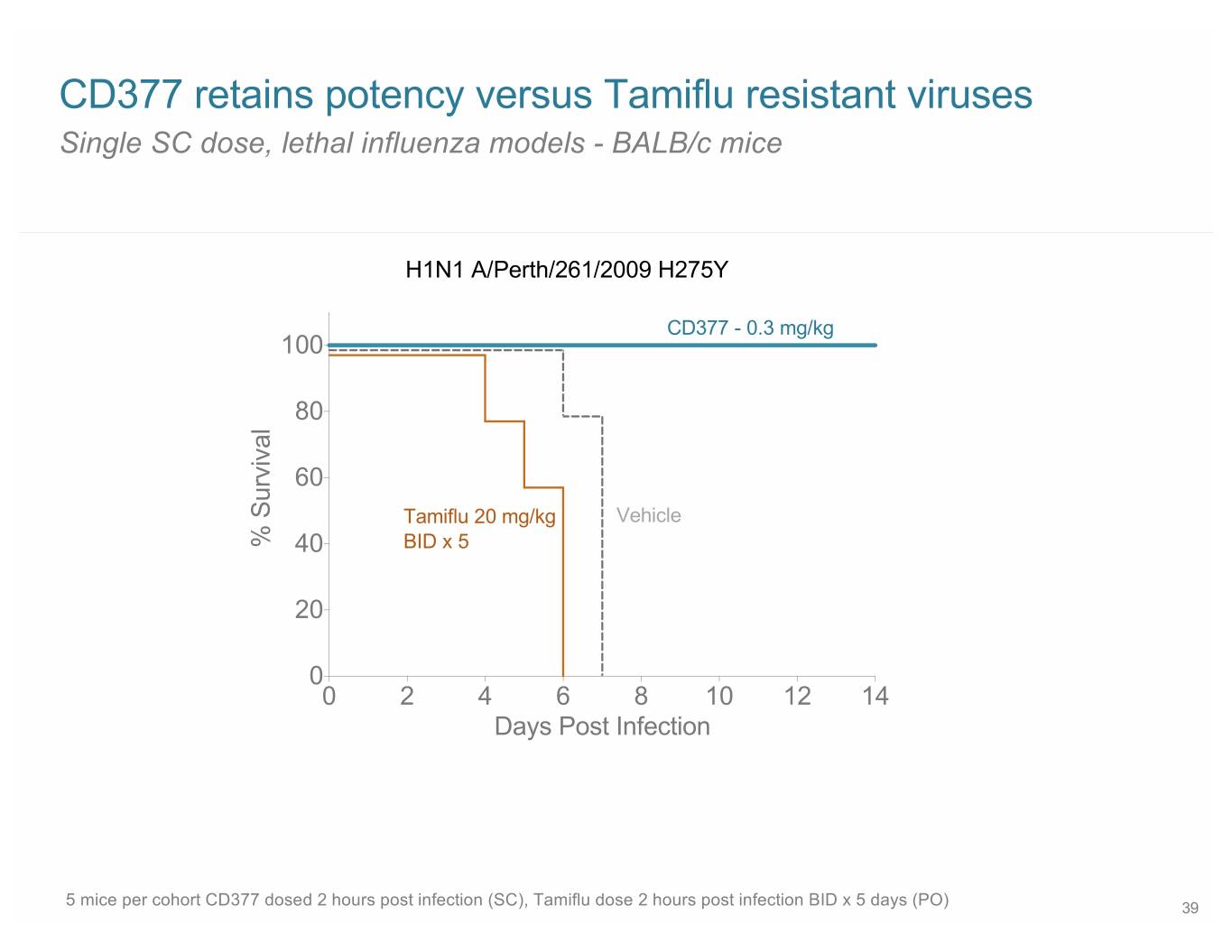

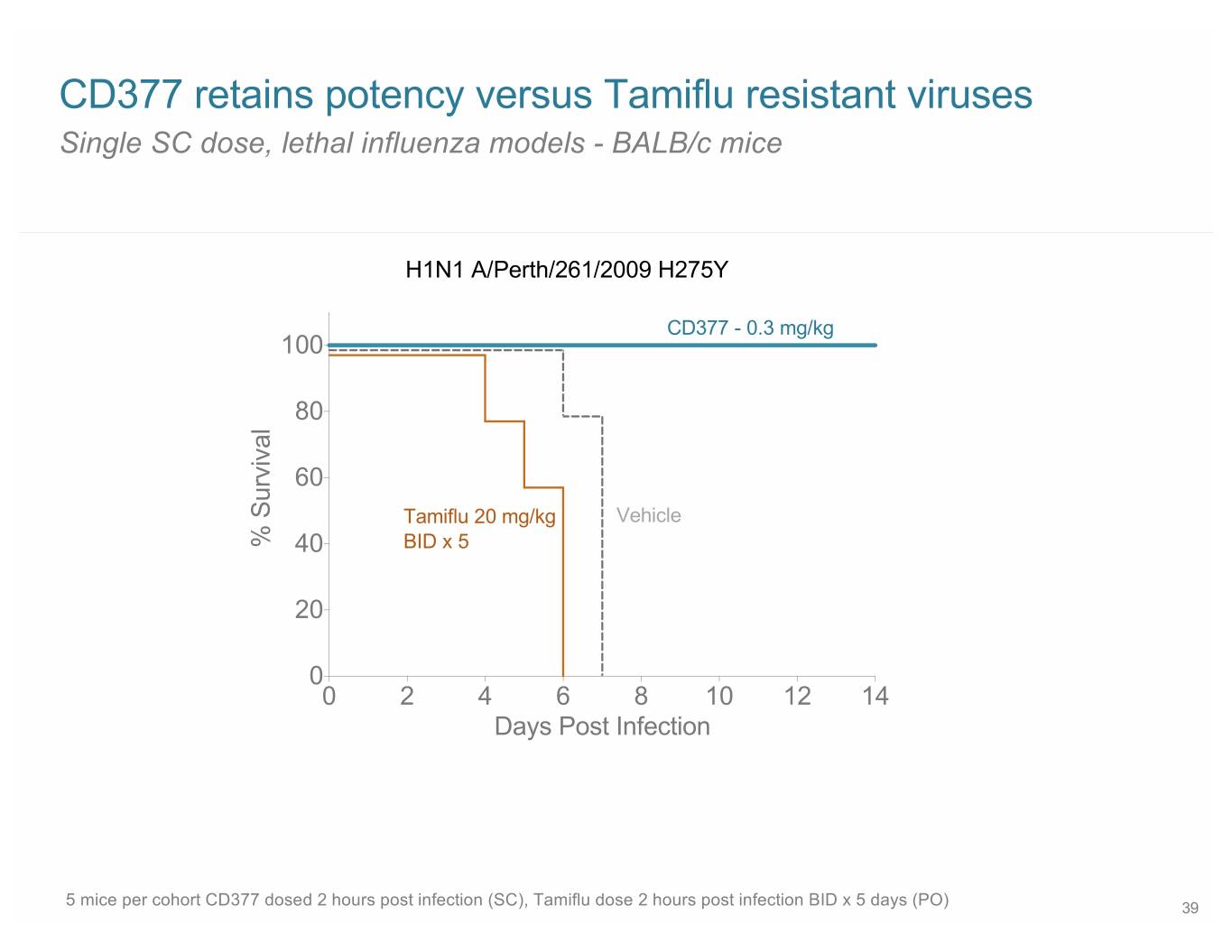

CD377 retains potency versus Tamiflu resistant viruses Single SC dose, lethal influenza models - BALB/c mice H1N1 A/Perth/261/2009 H275Y CD377 - 0.3 mg/kg 100 80 60 Tamiflu 20 mg/kg Vehicle % Survival 40 BID x 5 20 0 0 2 4 6 8 10 12 14 Days Post Infection 5 mice per cohort CD377 dosed 2 hours post infection (SC), Tamiflu dose 2 hours post infection BID x 5 days (PO) 39

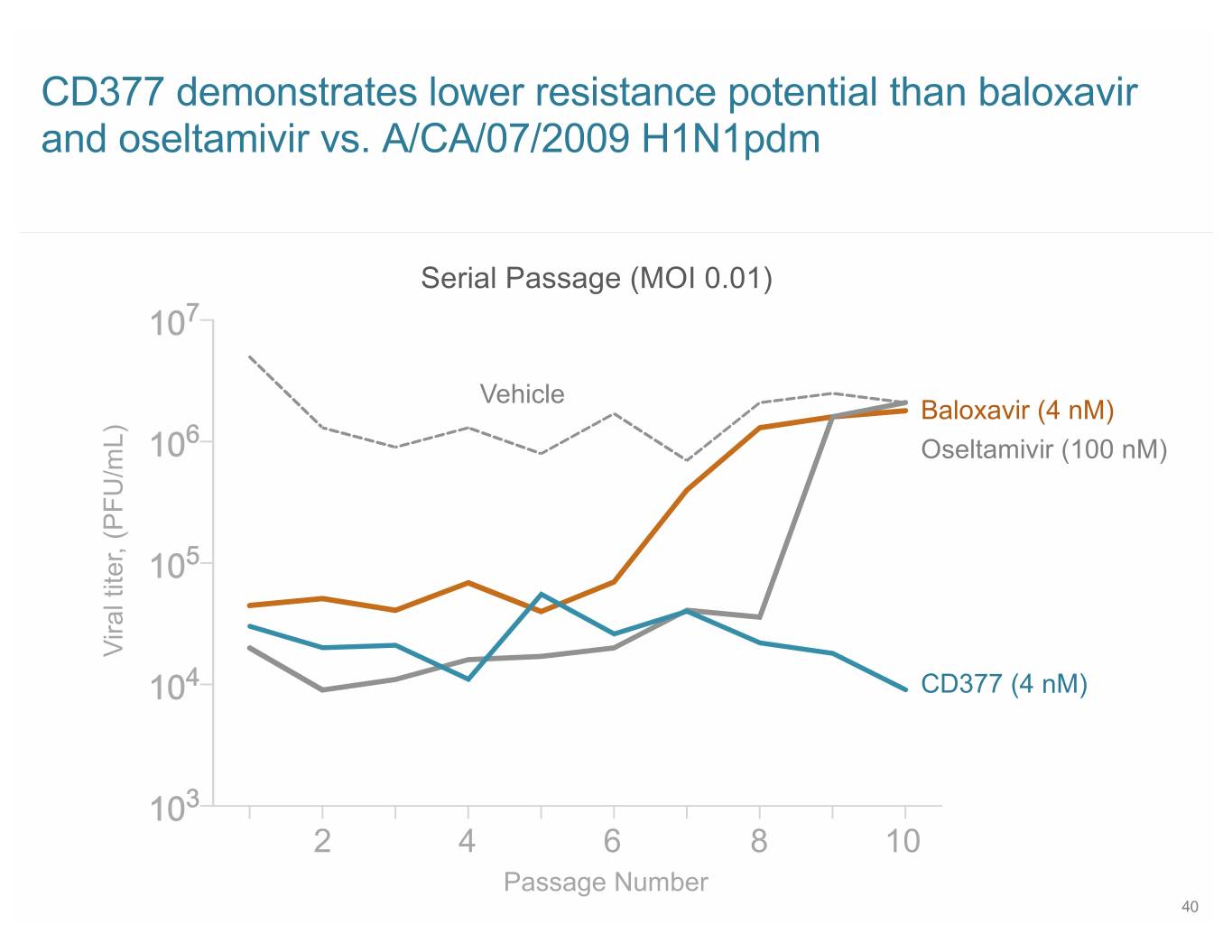

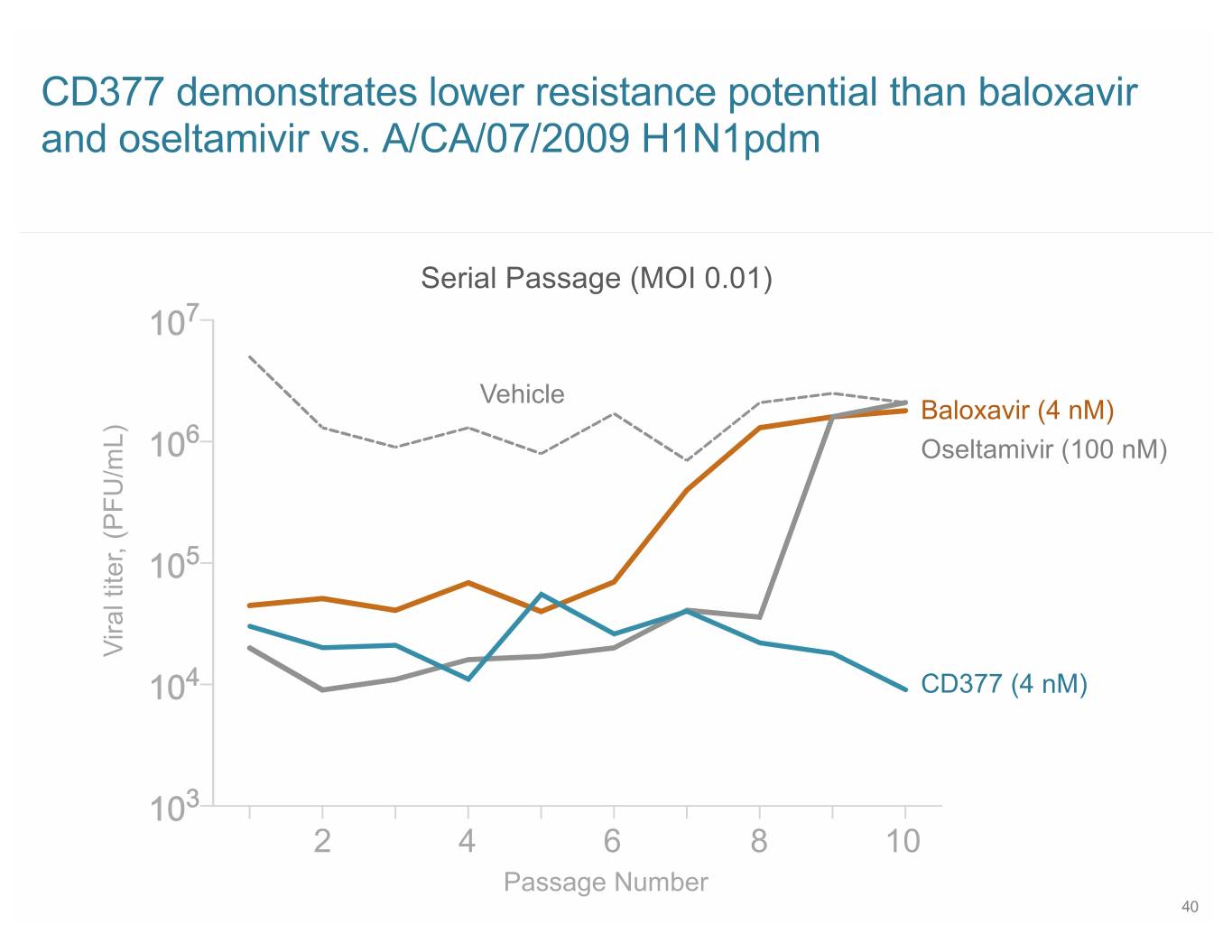

SB 2+3 CD377 demonstrates lower resistance potential than baloxavir and oseltamivir vs. A/CA/07/2009 H1N1pdm Serial Passage (MOI 0.01) 107 Vehicle Baloxavir (4 nM) 6 10 Oseltamivir (100 nM) 105 Viral titer, (PFU/mL) 104 CD377 (4 nM) 103 2 4 6 8 10 Passage Number 40

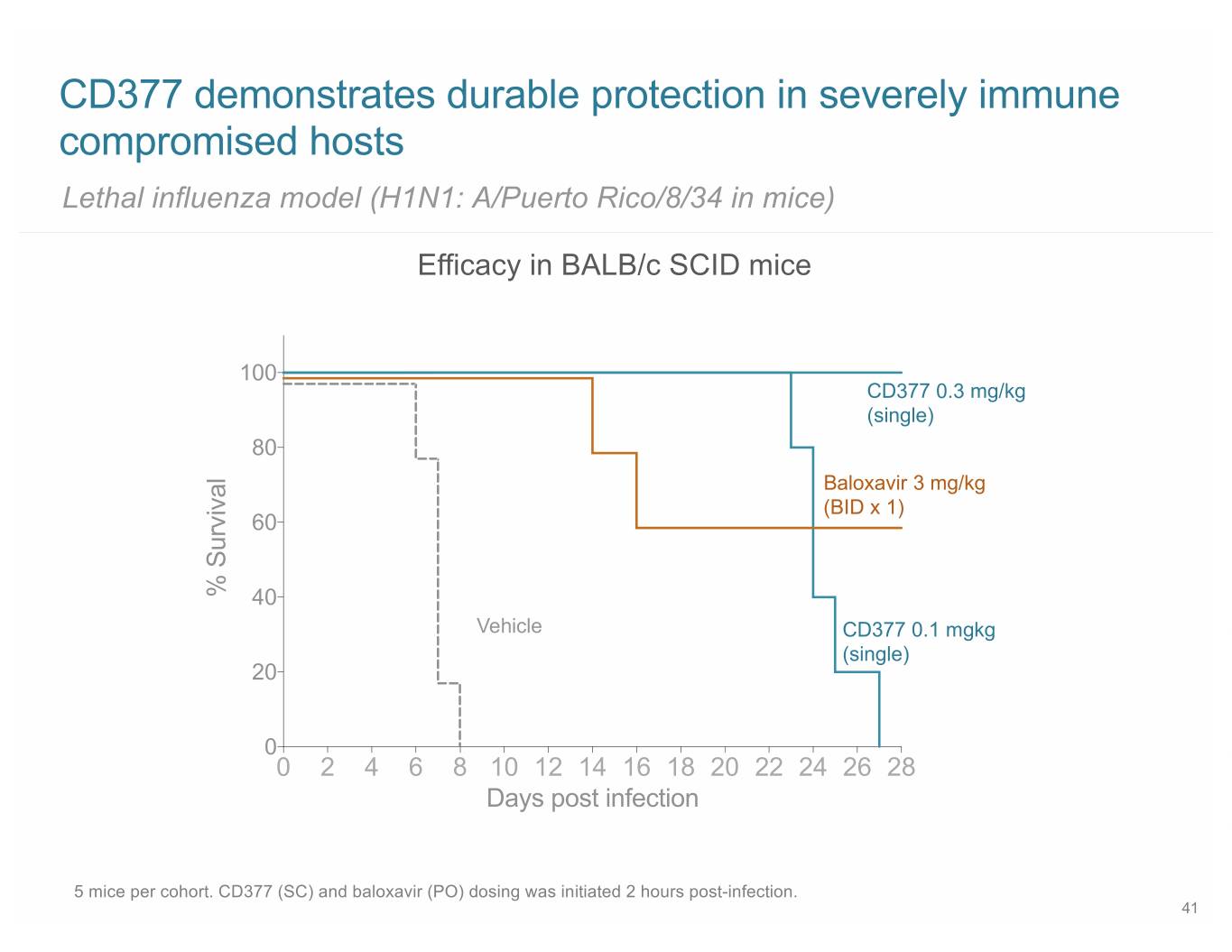

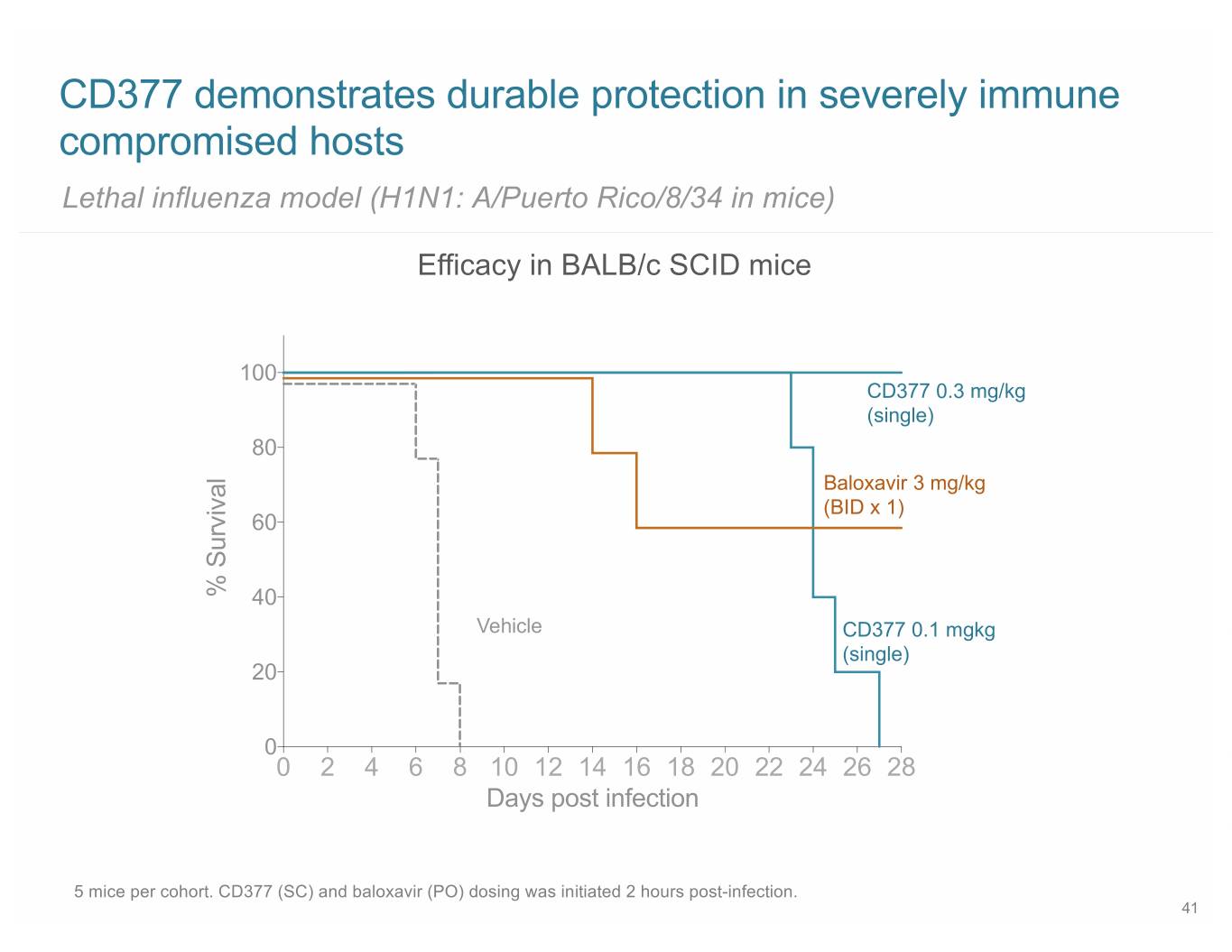

CD377 demonstrates durable protection in severely immune compromised hosts Lethal influenza model (H1N1: A/Puerto Rico/8/34 in mice) Efficacy in BALB/c SCID mice 100 CD377 0.3 mg/kg (single) 80 Baloxavir 3 mg/kg (BID x 1) 60 % Survival 40 Vehicle CD377 0.1 mgkg (single) 20 0 0 2 4 6 8 10 12 14 16 18 20 22 24 26 28 Days post infection 5 mice per cohort. CD377 (SC) and baloxavir (PO) dosing was initiated 2 hours post-infection. 41

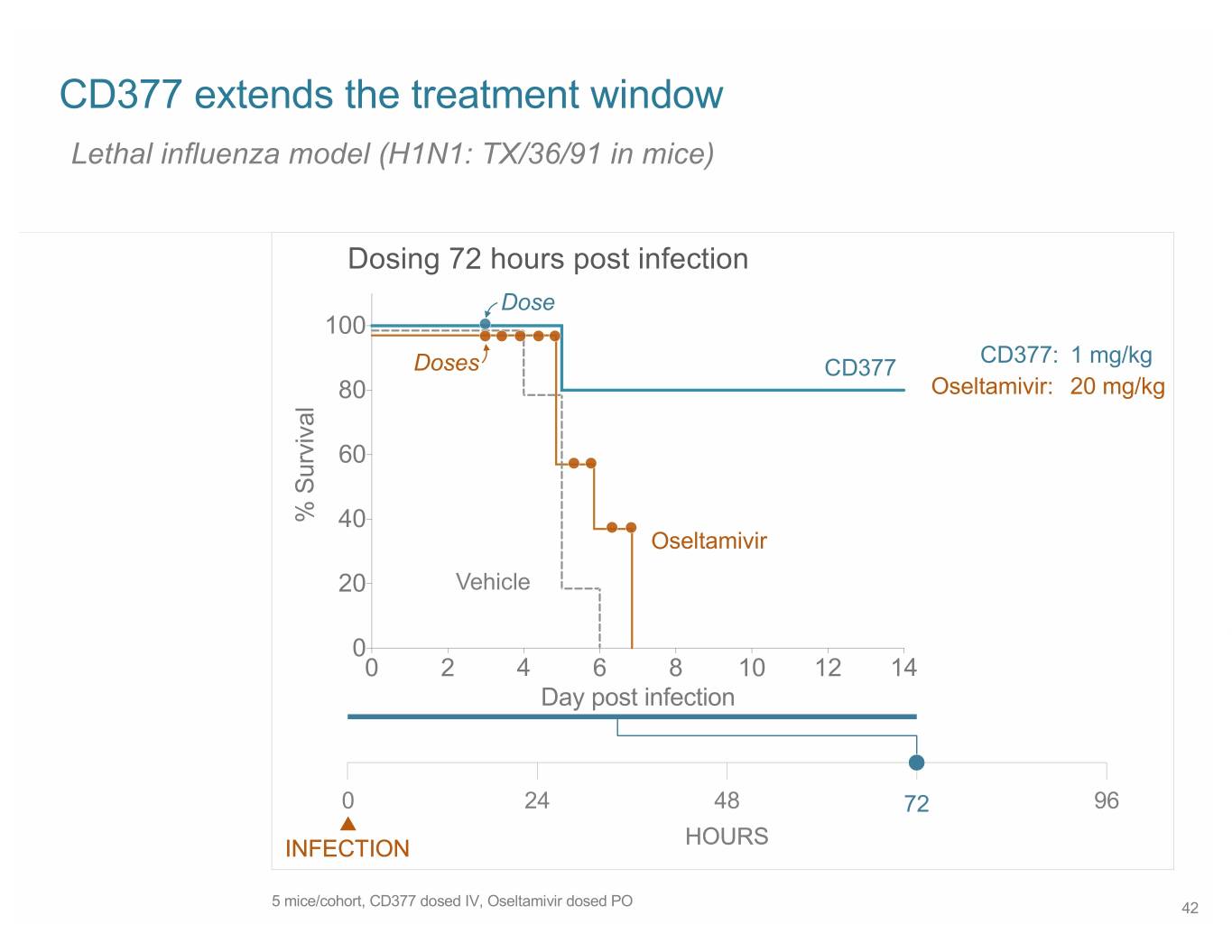

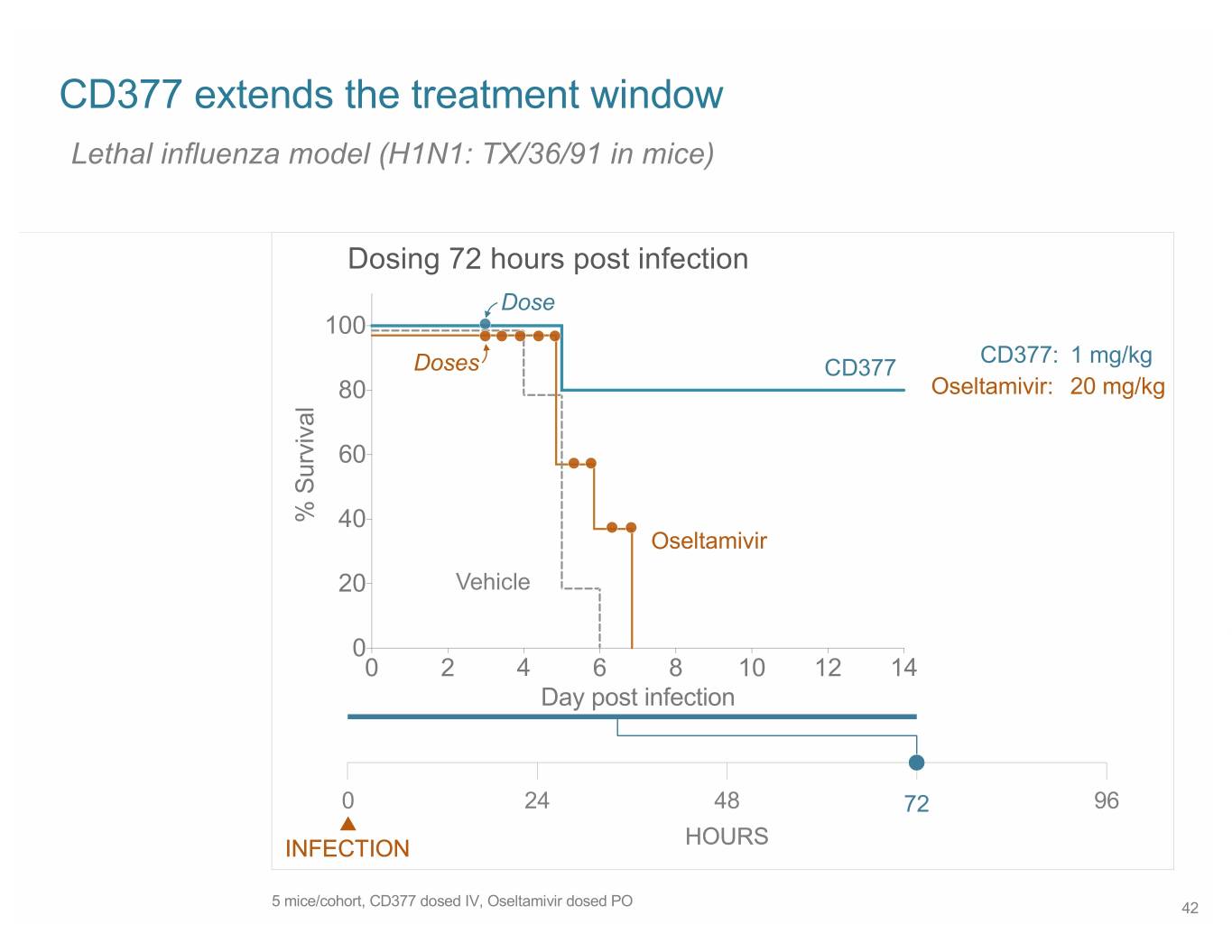

SB 14 CD377 extends the treatment window Lethal influenza model (H1N1: TX/36/91 in mice) Dosing 72 hours post infection Dose 100 CD377: 1 mg/kg Doses CD377 80 Oseltamivir: 20 mg/kg 60 % Survival 40 Oseltamivir 20 Vehicle 0 0 2 4 6 8 10 12 14 Day post infection 0 24 48 72 96 HOURS INFECTION 5 mice/cohort, CD377 dosed IV, Oseltamivir dosed PO 42

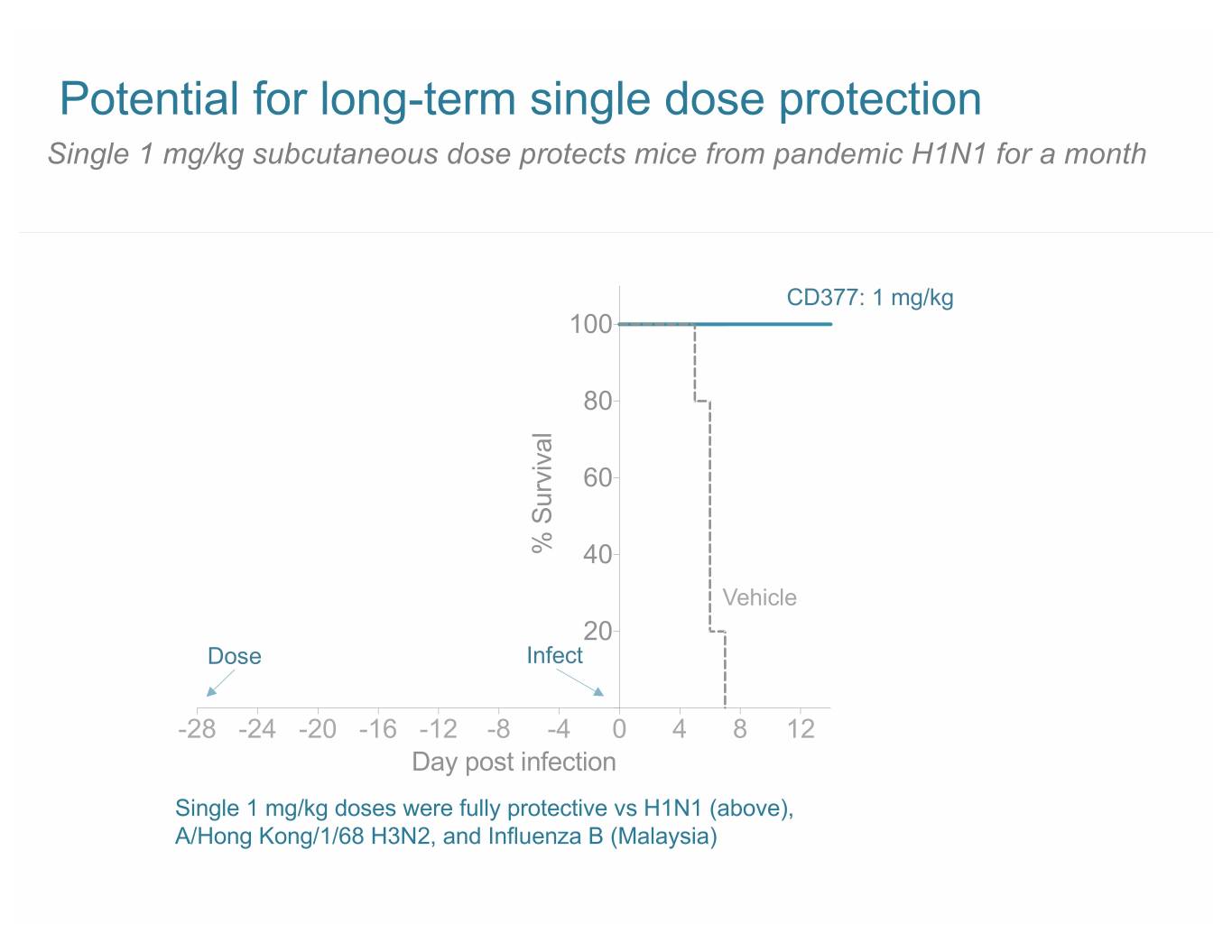

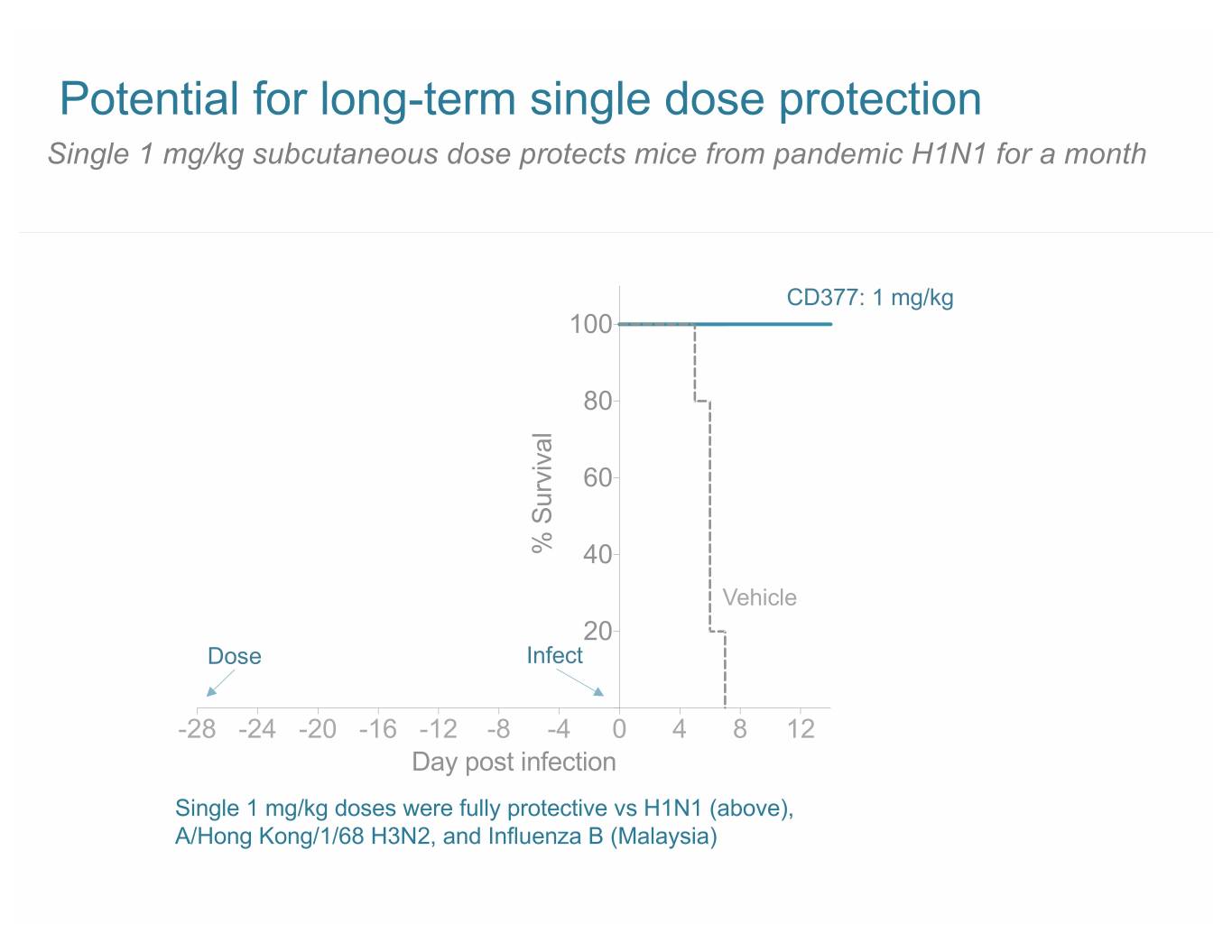

Potential for long-term single dose protection Single 1 mg/kg subcutaneous dose protects mice from pandemic H1N1 for a month CD377: 1 mg/kg 100 80 60 % Survival 40 Vehicle 20 Dose Infect -28 -24 -20 -16 -12 -8 -4 0 4 8 12 Day post infection Single 1 mg/kg doses were fully protective vs H1N1 (above), A/Hong Kong/1/68 H3N2, and Influenza B (Malaysia)

Efficacious by multiple dosing routes Lethal influenza model (A/California/07/2009 H1N1pdm) CD377 dosed once 2 hours after viral challenge Efficacy of CD377 dosed by different routes PK of CD377 dosed by different routes (BALB/c (BALB/c mouse) 0.1 mg/kg mouse) 5 mg/kg IV 100 100 IM SC 80 10 IV 60 IM SC Vehicle (µg/mL) 40 % Survival 1 Plasma levels 20 0.1 0 0 24 48 72 96 120 144 168 0 2 4 6 8 10 12 14 Day post infection Time post dose (hr) 5 mice per cohort CD377 dosed 2 hours post infection 44

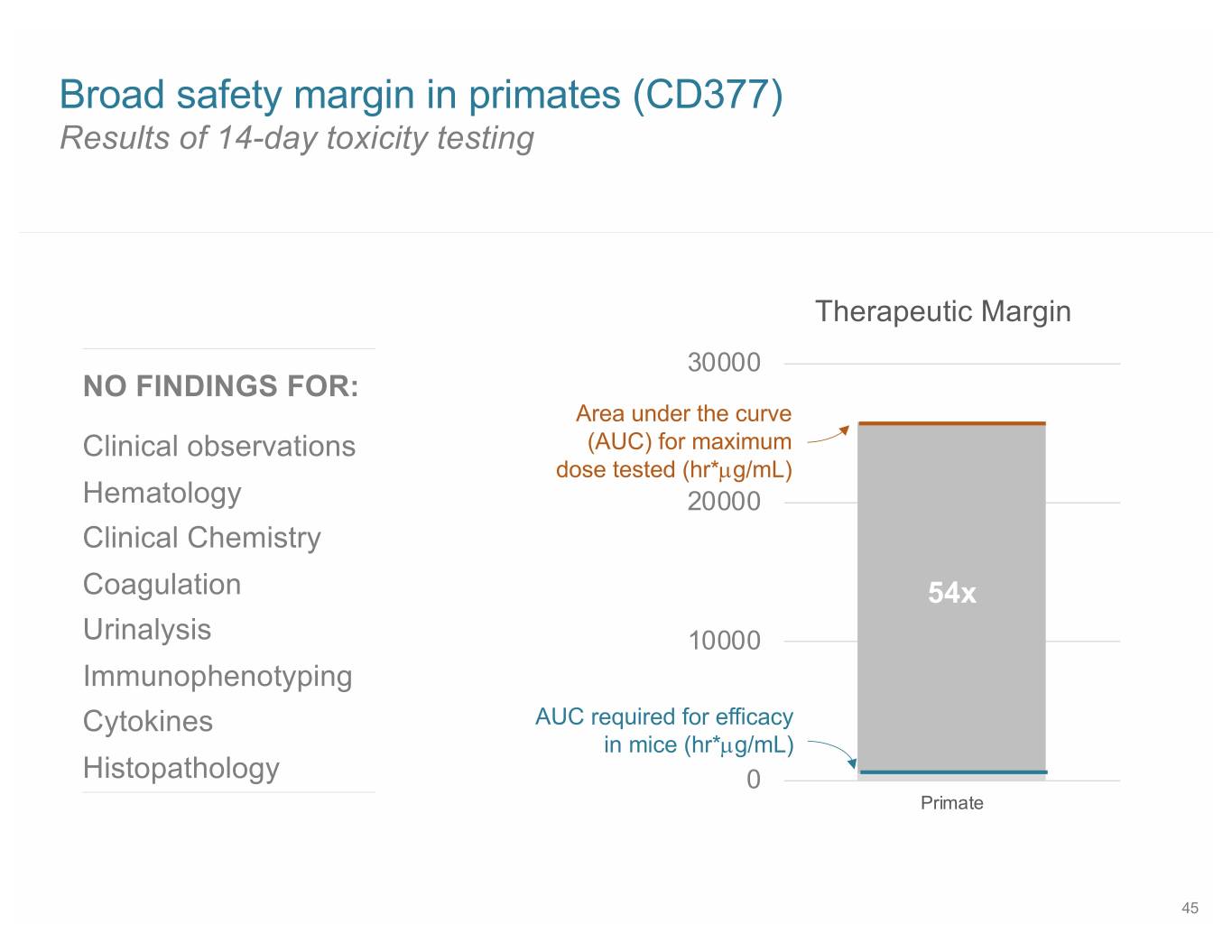

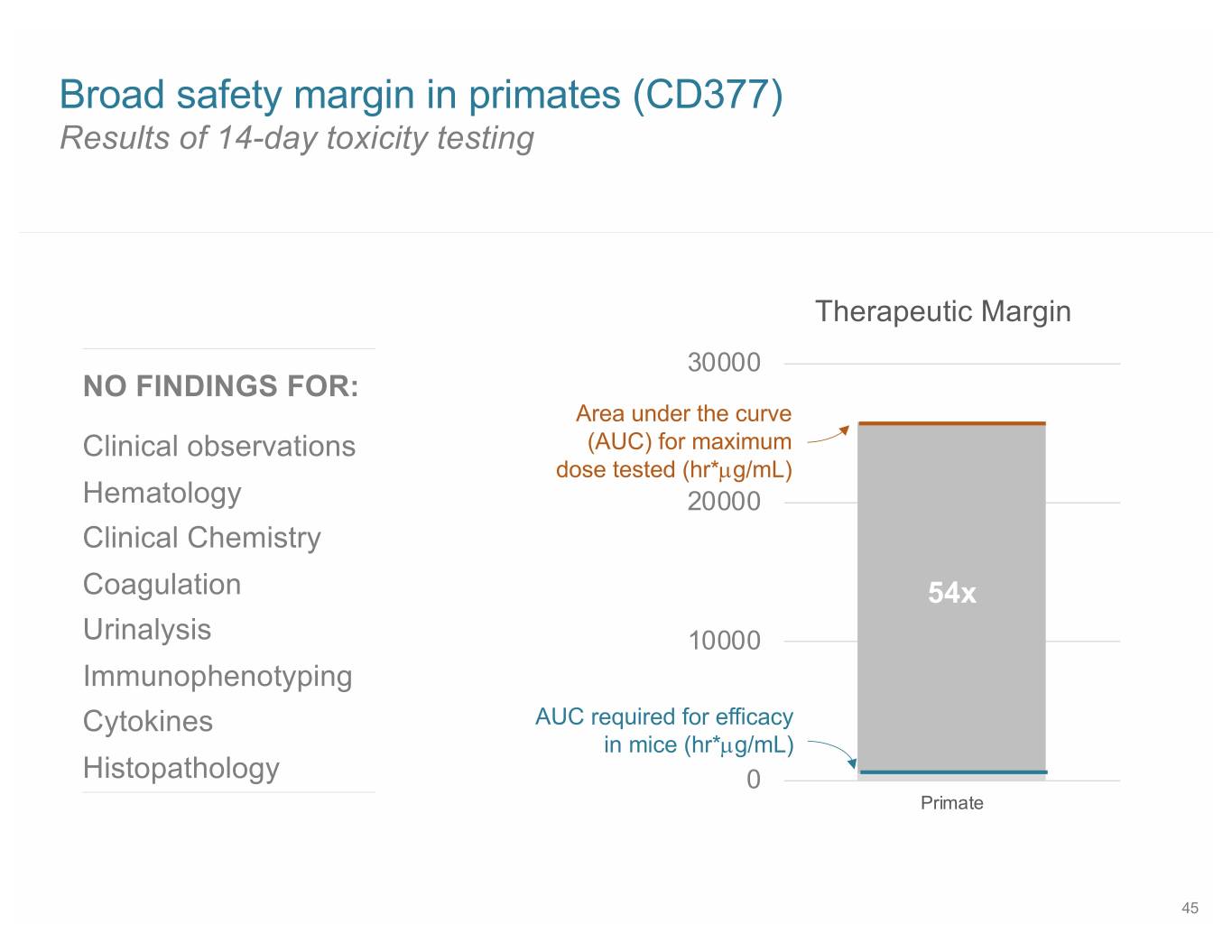

Broad safety margin in primates (CD377) Results of 14-day toxicity testing Therapeutic Margin 30000 NO FINDINGS FOR: Area under the curve Clinical observations (AUC) for maximum dose tested (hr*µg/mL) Hematology 20000 Clinical Chemistry Coagulation 54x Urinalysis 10000 Immunophenotyping Cytokines AUC required for efficacy in mice (hr*µg/mL) Histopathology 0 Primate 45

Cloudbreak platform: potential applications beyond influenza INFLUENZA RSV HIV OTHER VIRUSES 46

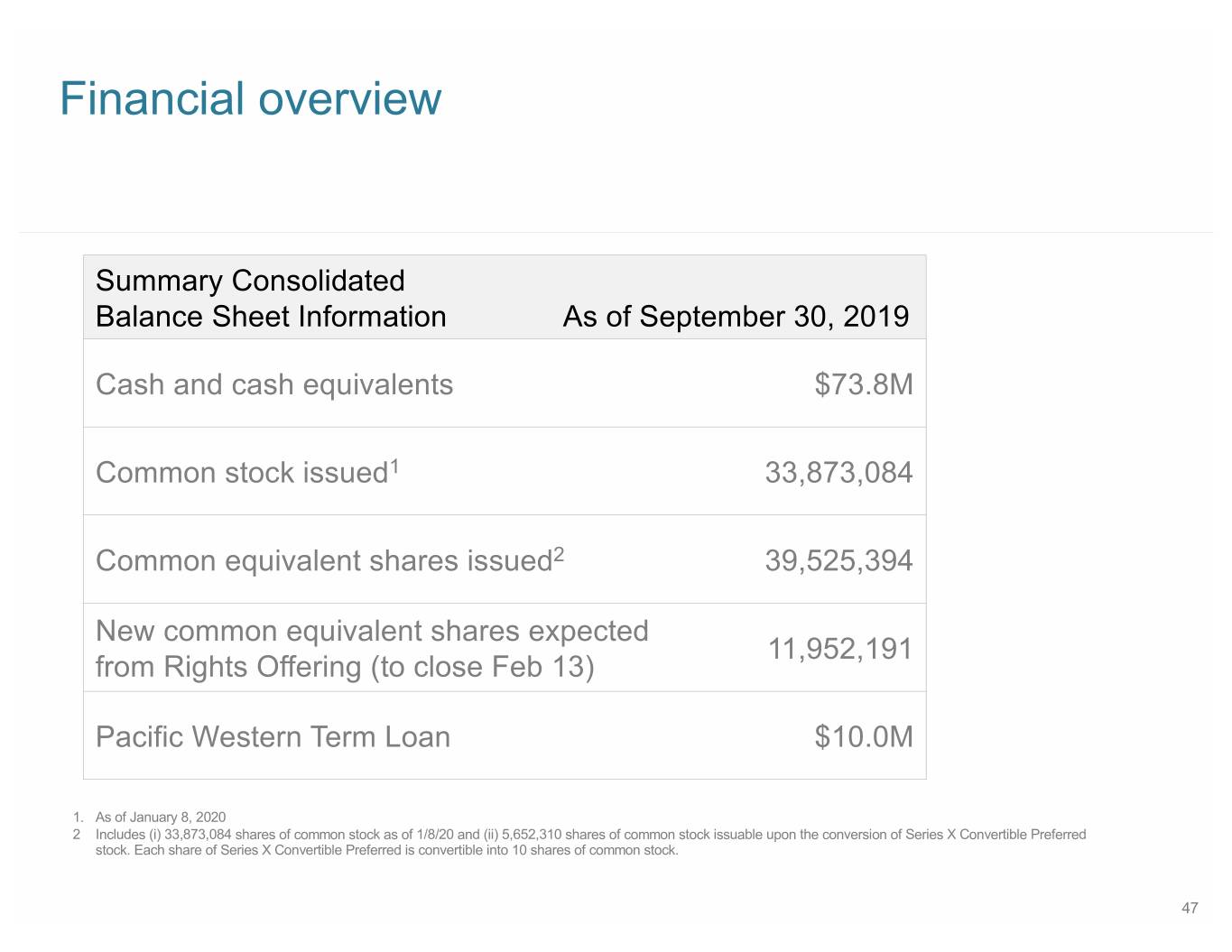

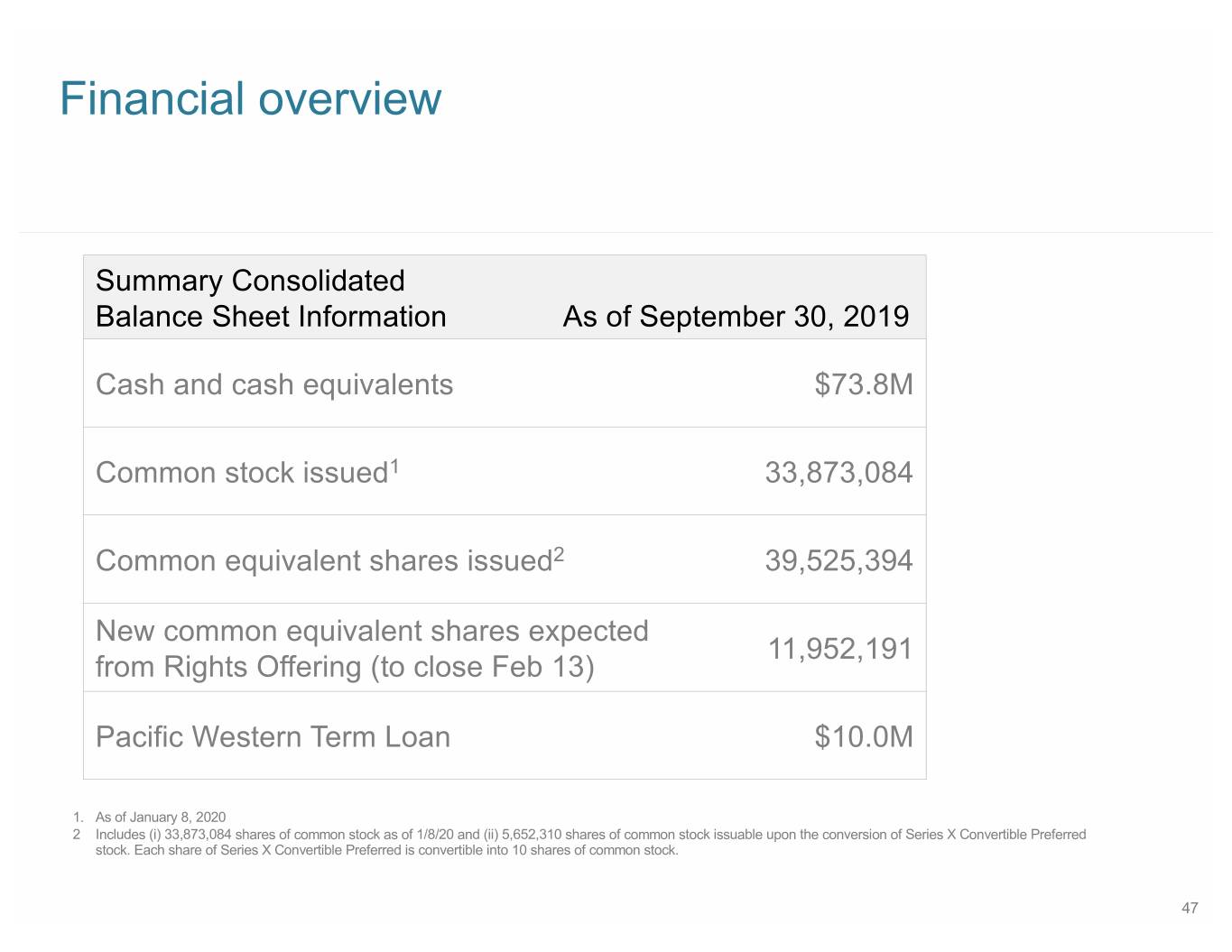

Financial overview Summary Consolidated Balance Sheet Information As of September 30, 2019 Cash and cash equivalents $73.8M Common stock issued1 33,873,084 Common equivalent shares issued2 39,525,394 New common equivalent shares expected 11,952,191 from Rights Offering (to close Feb 13) Pacific Western Term Loan $10.0M 1. As of January 8, 2020 2 Includes (i) 33,873,084 shares of common stock as of 1/8/20 and (ii) 5,652,310 shares of common stock issuable upon the conversion of Series X Convertible Preferred stock. Each share of Series X Convertible Preferred is convertible into 10 shares of common stock. 47

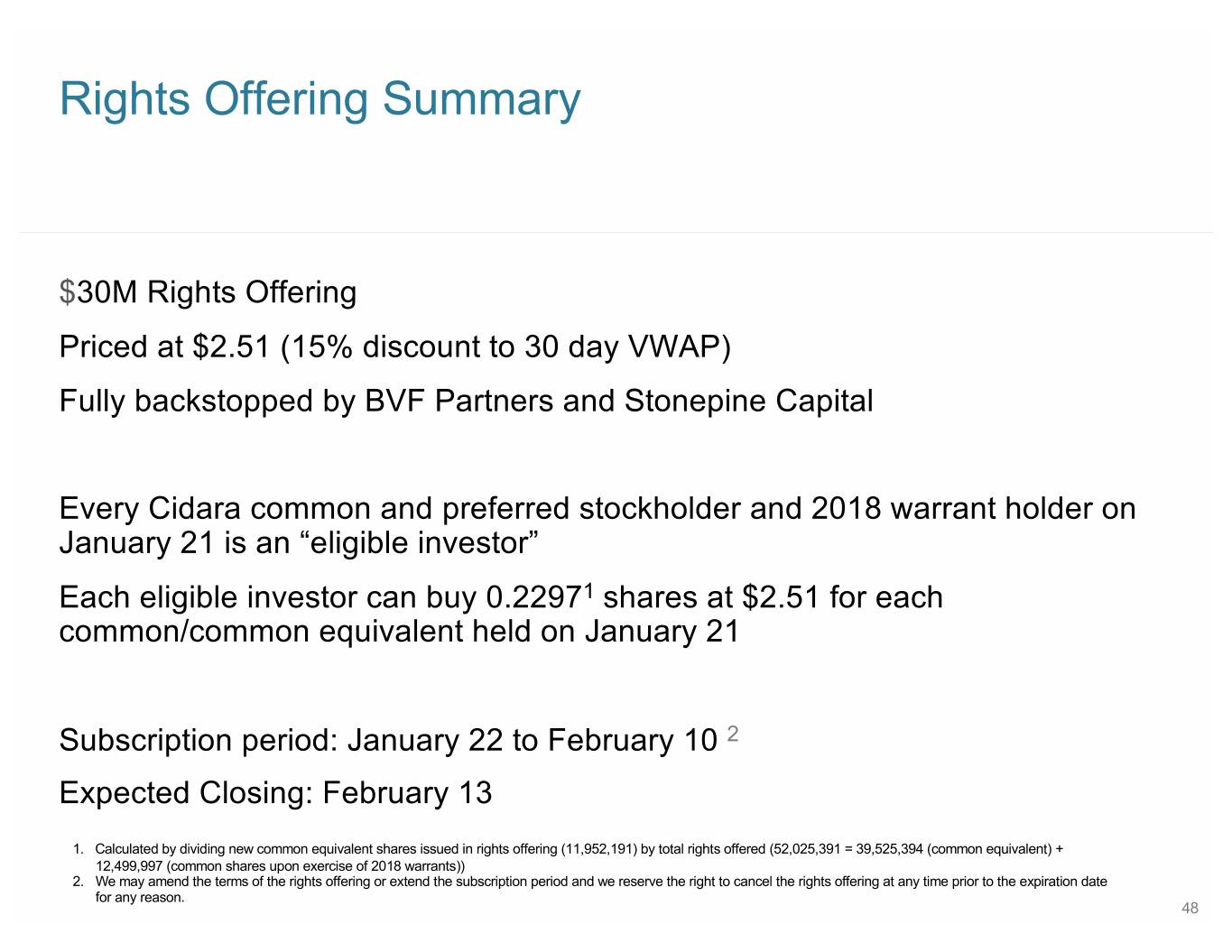

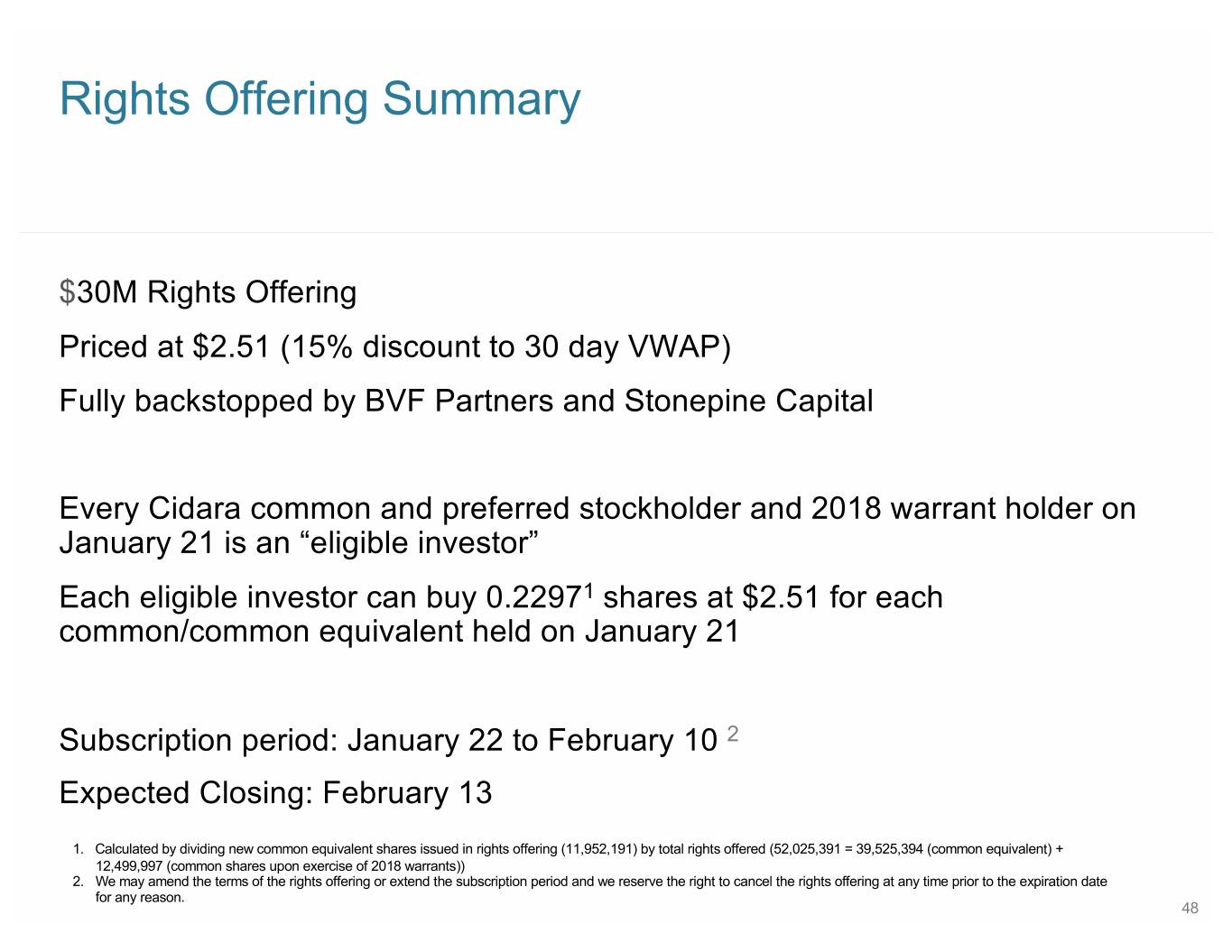

Rights Offering Summary $30M Rights Offering Priced at $2.51 (15% discount to 30 day VWAP) Fully backstopped by BVF Partners and Stonepine Capital Every Cidara common and preferred stockholder and 2018 warrant holder on January 21 is an “eligible investor” Each eligible investor can buy 0.22971 shares at $2.51 for each common/common equivalent held on January 21 Subscription period: January 22 to February 10 2 Expected Closing: February 13 1. Calculated by dividing new common equivalent shares issued in rights offering (11,952,191) by total rights offered (52,025,391 = 39,525,394 (common equivalent) + 12,499,997 (common shares upon exercise of 2018 warrants)) 2. We may amend the terms of the rights offering or extend the subscription period and we reserve the right to cancel the rights offering at any time prior to the expiration date for any reason. 48

Rights Offering Attributes Every eligible investor can buy their pro rata part of the offering • Each share bought/settled by January 21 at 5:00 pm ET receives a “right” • If every eligible investor fully participates, there’s no backstop Demonstrates investors’ support • $30M is guaranteed through the backstop • No warrants being offered Rights offering proceeds, existing cash and cash equivalents, and anticipated near-term Mundipharma payments are expected to fund company past ReSTORE Treatment trial top line data in late 2020 49

SB 12 Cidara is much more than a typical ID company Strategic Focus Transformative approaches to infectious disease Rezafungin Treatment Enable discharge & outpatient treatment on standard of care Rezafungin Prophylaxis Transform the care of BMT patients Cloudbreak AVC Radically different approach to the treatment & prevention of flu Our Team Experienced creators of shareholder value 50

New Hope for Serious Infections Corporate Presentation January 2020 © Cidara Therapeutics 2020