1 C I D A R A R & D D AY S E P T 2 1 s t 2 0 2 1

2 F O R WA R D - LO O K I N G S TAT E M E N T S T h e s e s l i d e s c o n t a i n f o r w a r d - l o o k i n g s t a t e m e n t s w i t h i n t h e m e a n i n g o f t h e P r i v a t e S e c u r i t i e s L i t i g a t i o n R e f o r m A c t o f 1 9 9 5 . The words “believe,” “may,” “will,” “estimate,” “promise,” “plan”, “continue,” “anticipate,” “intend,” “expect,” “potential” and similar expressions (including the negative thereof), are intended to identify forward-looking statements. Because such statements are subject to risks and uncertainties, actual results may differ materially from those expressed or implied by such forward- looking statements. Such statements include, but are not limited to, statements regarding Cidara’s research and development efforts; preclinical and clinical development activities; plans, projections and expectations for and the potential effectiveness, safety and benefits of, its product candidates, including rezafungin, the Cloudbreak platform and CD388; Cidara’s ability to successfully commercialize its product candidates, including estimated sales forecasts; the estimated size of the market for its product candidates; and potential ability to achieve milestones under its collaborations with Mundipharma and Janssen, and receipt of the related milestone payments; and advancement of its strategic plans. Additional risks and uncertainties may emerge from time to time, and it is not possible for Cidara’s management to predict all risk factors and uncertainties. All forward-looking statements contained in this presentation speak only as of the date on which they were made. Cidara undertakes no obligation to update such statements to reflect events that occur or circumstances that exist after the date on which they were made. These slides are not intended to and do not constitute an offer to sell or the solicitation of an offer to subscribe for or buy or an invitation to purchase or subscribe for any securities in any jurisdiction, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. This presentation also contains estimates and other statistical data made by independent parties and by Cidara relating to market size and growth and other data about Cidara’s industry. These data involve a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. Projections, assumptions and estimates of the future performance of the markets in which Cidara operates are necessarily subject to a high degree of uncertainty and risk, including, Cidara’s ability to obtain additional financing; the success and timing of Cidara’s preclinical studies, clinical trials and other research and development activities; receipt of necessary regulatory approvals for development and commercialization, as well as changes to applicable statutes and regulations. These and other risks and uncertainties are described more fully in Cidara's filings with the U.S. Securities and Exchange Commission (SEC), under the heading “Risk Factors.”

3 P R O G R A M O V E R V I E W : J E F F R E Y S T E I N , P H D , C E O Taylor Sandison, CMOClinical Program Update REZAFUNGIN Hematology Expert ID/Fungal Expert Mark Levis, Johns Hopkins Kieren Marr, Johns Hopkins Les Tari, CSO CLOUDBREAK Eric Simoes, Univ. of Colorado Commercial Update Paul Daruwala, COO Update on STRIVE, ReSTORE, ReSPECT & DDI-2 trials Challenges in the management of AML patients Research Update Respiratory Viral Expert Large addressable commercial opportunity Unmet needs in preventing invasive fungal infections Respiratory viral infections: prevention & treatment needs Cloudbreak expansion in viral diseases and beyond

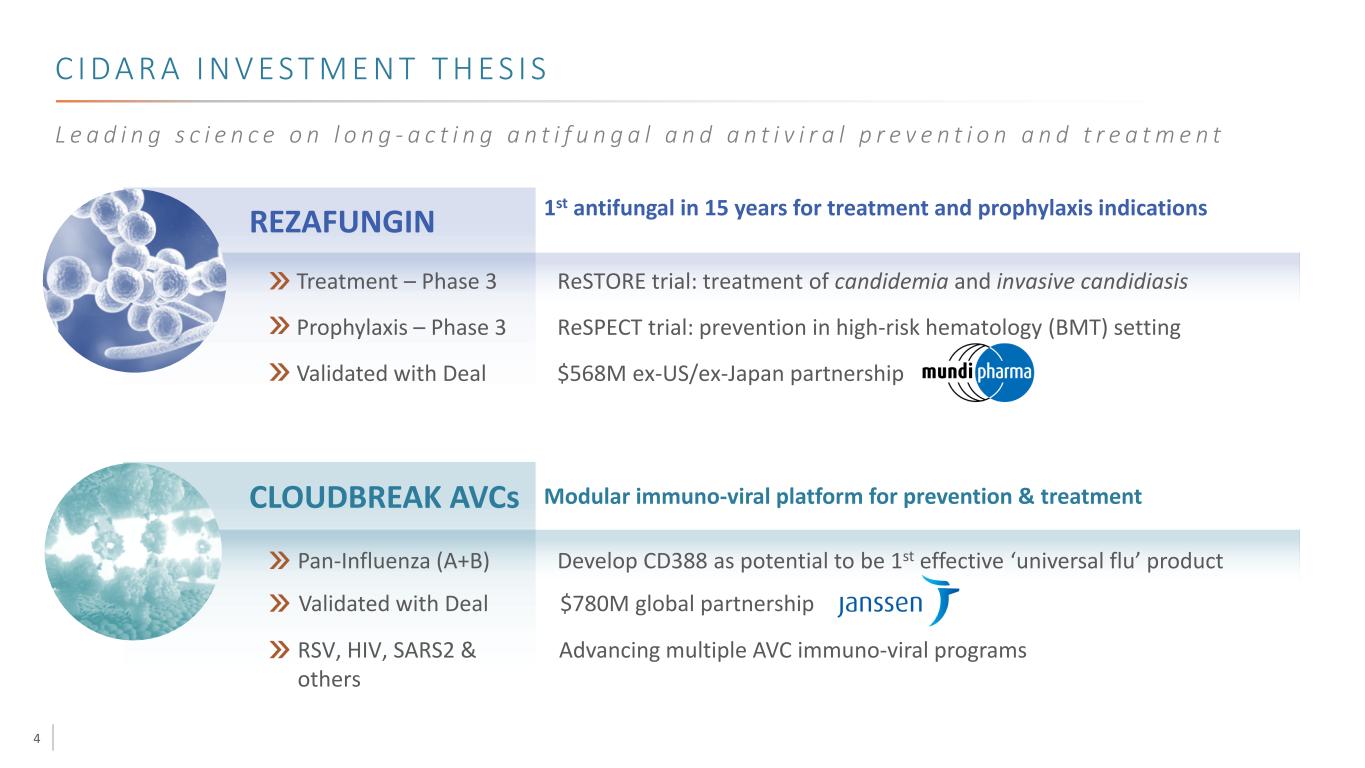

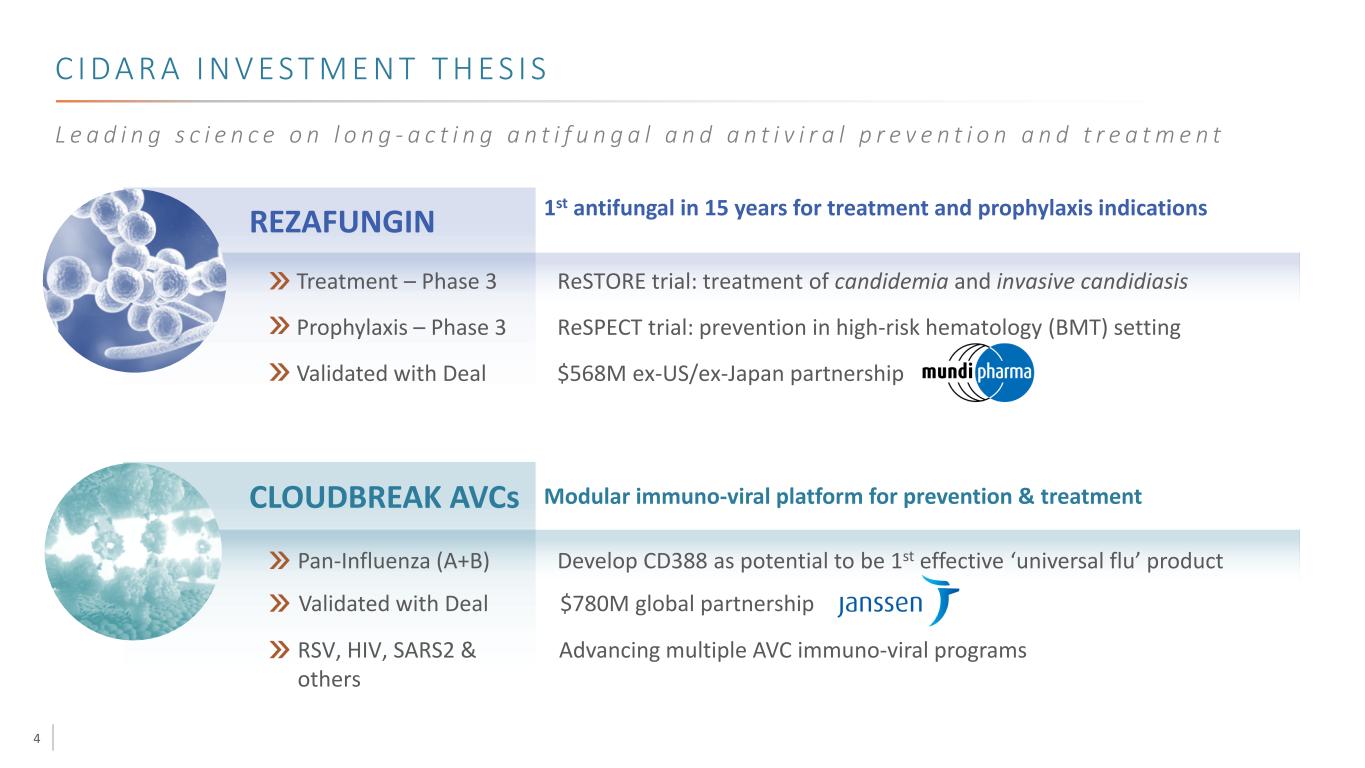

4 C I D A R A I N V E S T M E N T T H E S I S L e a d i n g s c i e n c e o n l o n g - a c t i n g a n t i f u n g a l a n d a n t i v i r a l p r e v e n t i o n a n d t r e a t m e n t REZAFUNGIN 1st antifungal in 15 years for treatment and prophylaxis indications Treatment – Phase 3 Prophylaxis – Phase 3 Validated with Deal ReSTORE trial: treatment of candidemia and invasive candidiasis ReSPECT trial: prevention in high-risk hematology (BMT) setting $568M ex-US/ex-Japan partnership CLOUDBREAK AVCs Modular immuno-viral platform for prevention & treatment Pan-Influenza (A+B) Develop CD388 as potential to be 1st effective ‘universal flu’ product RSV, HIV, SARS2 & others Advancing multiple AVC immuno-viral programs Validated with Deal $780M global partnership

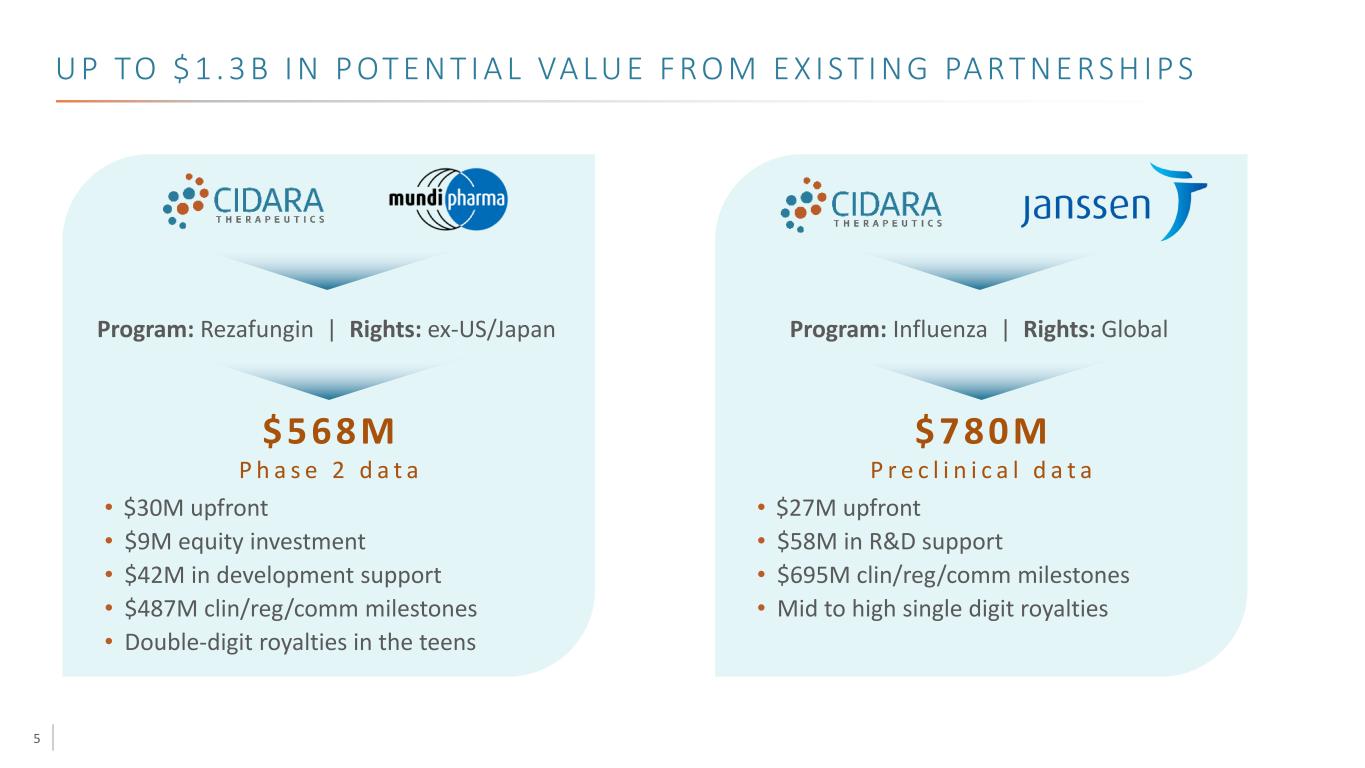

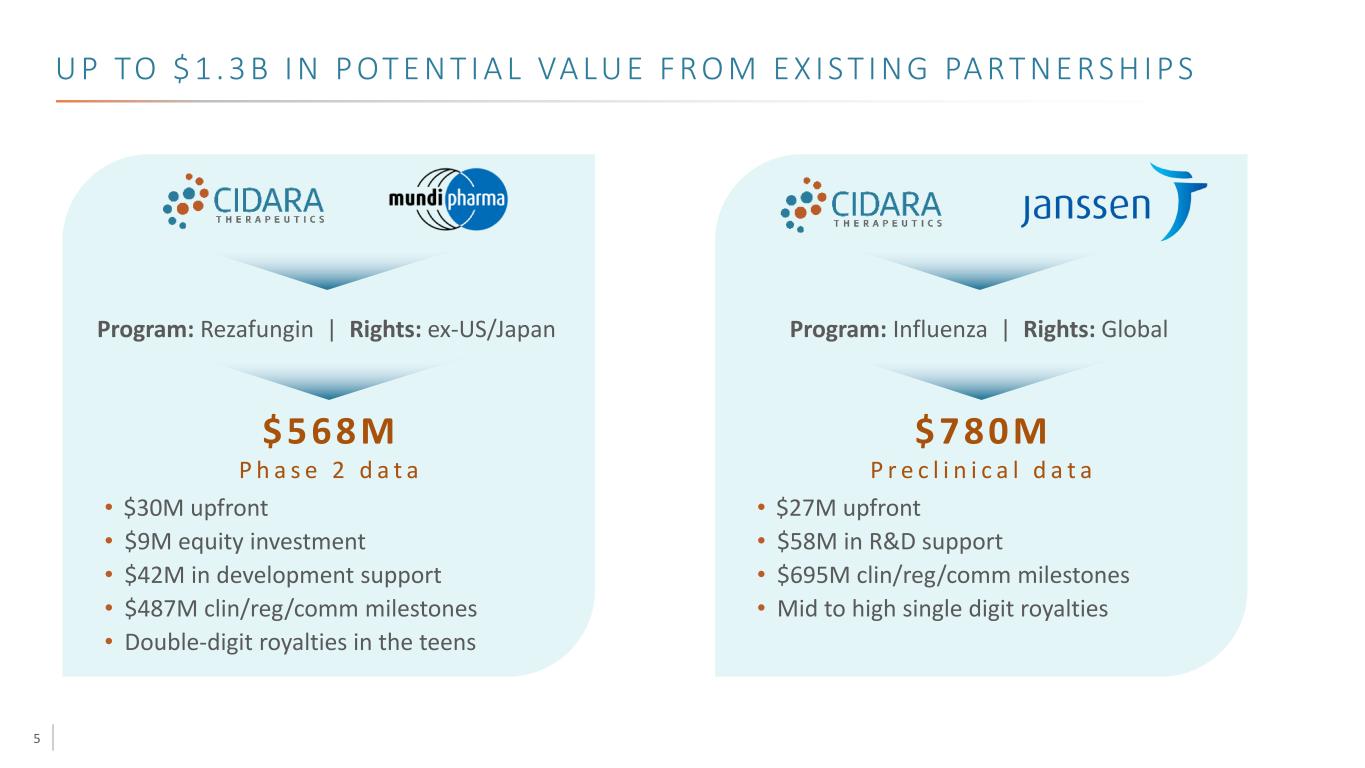

5 U P TO $ 1 . 3 B I N P OT E N T I A L VA LU E F R O M E X I S T I N G PA R T N E RS H I P S • $30M upfront • $9M equity investment • $42M in development support • $487M clin/reg/comm milestones • Double-digit royalties in the teens Program: Rezafungin | Rights: ex-US/Japan $568M P h a s e 2 d a t a • $27M upfront • $58M in R&D support • $695M clin/reg/comm milestones • Mid to high single digit royalties Program: Influenza | Rights: Global $780M P r e c l i n i c a l d a t a

6 REZAFUNGIN UPDATE S E P T E M B E R 2 0 2 1

7 Source: Global sales for Cancidas – IQVIA; Noxafil – 2018 Merck Annual Report. Antifungal market data from IQVIA, as of December 31, 2017. GLOBAL ANTIFUNGAL MARKET $ 4 . 2 B I L L I O N NO NEW CANDIDA TREATMENT NO NEW PROPHYLAXIS 1 5 Y E A R V O I D HIGH MORTALITY DRUG-DRUG INTERACTIONS C L E A R U N M E T N E E D TOXICITIES POOR PK/PD EXTENDED HOSPITALIZATION C U R R E N T A N T I F U N G A L S T A N D A R D S O F C A R E H A V E L I M I T A T I O N S REZAFUNGIN COULD CREATE SIGNIFICANT CLINICAL AND COMMERCIAL VALUE

8 R E Z A F U N G I N C L I N I C A L P R O G R A M TAY LO R S A N D I S O N , M D C H I E F M E D I C A L O F F I C E R , C I D A R A

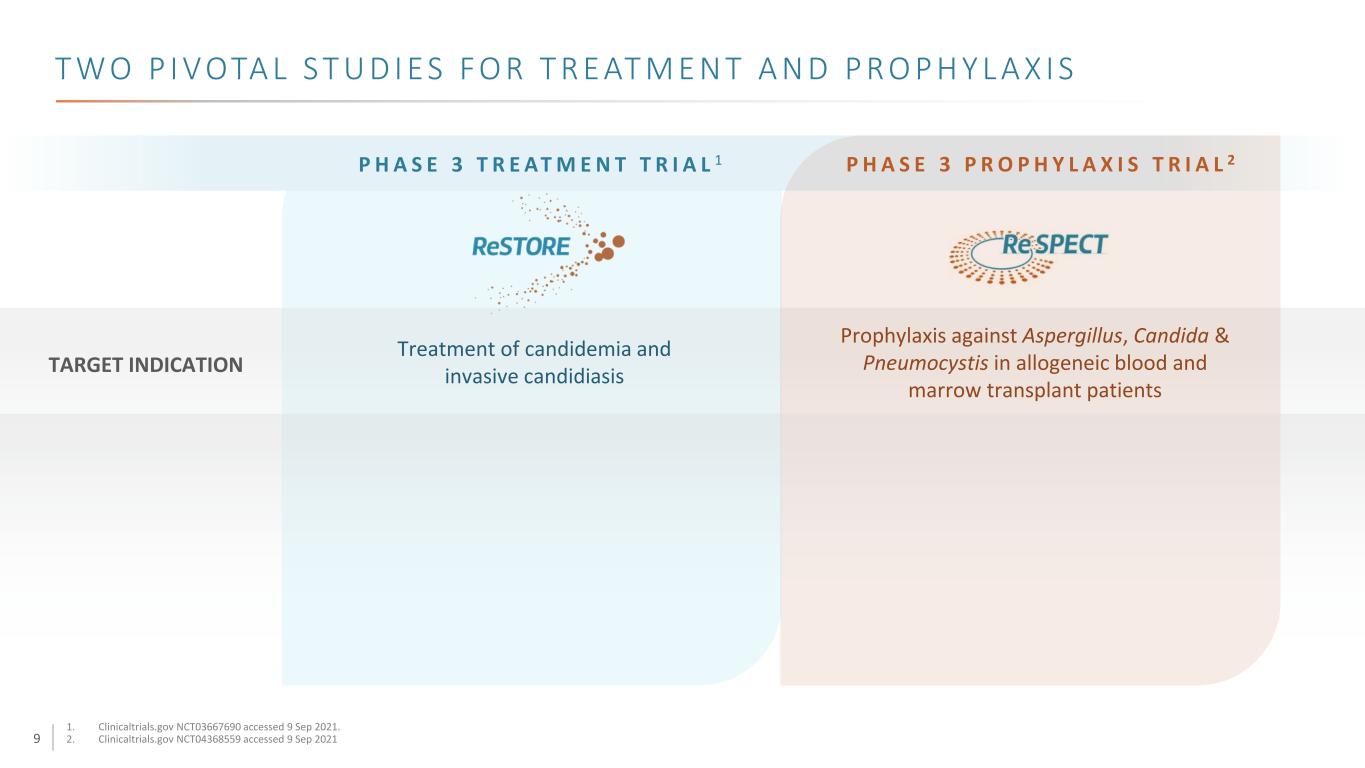

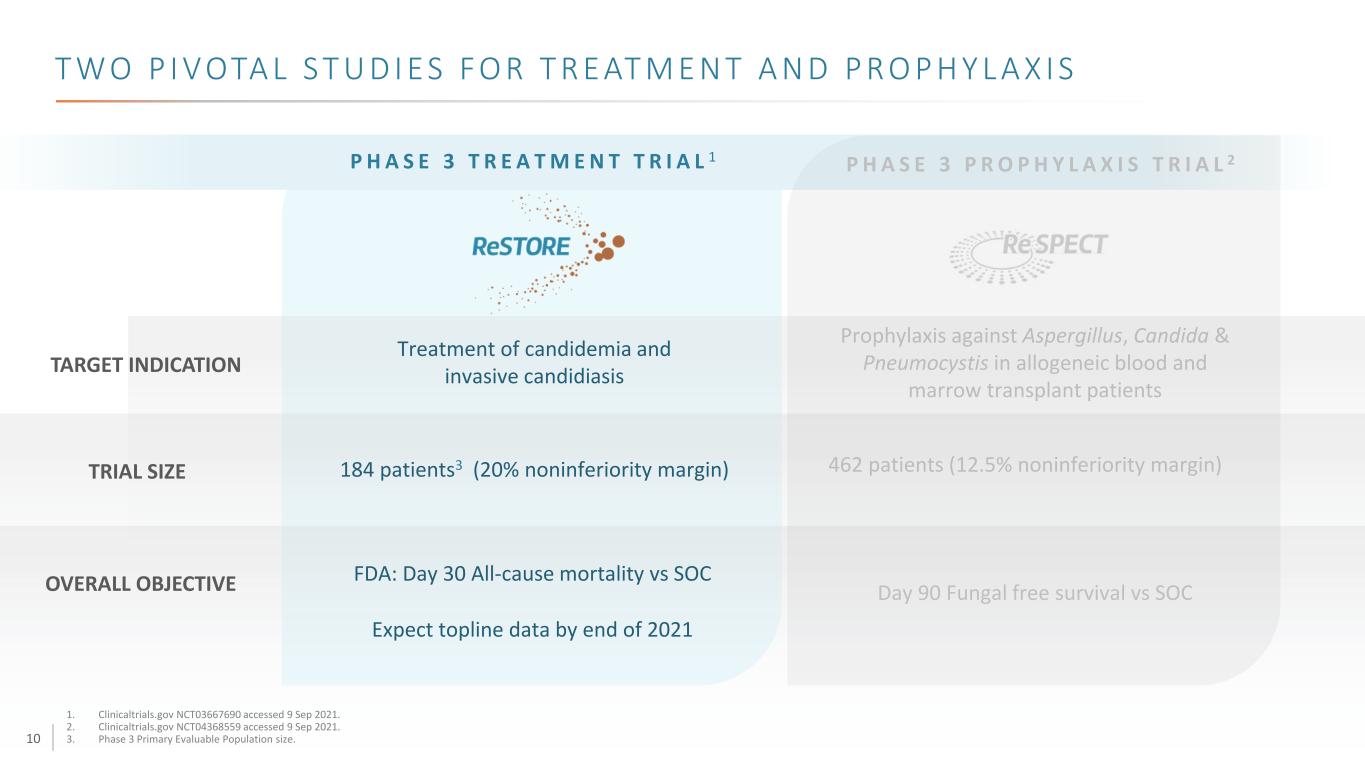

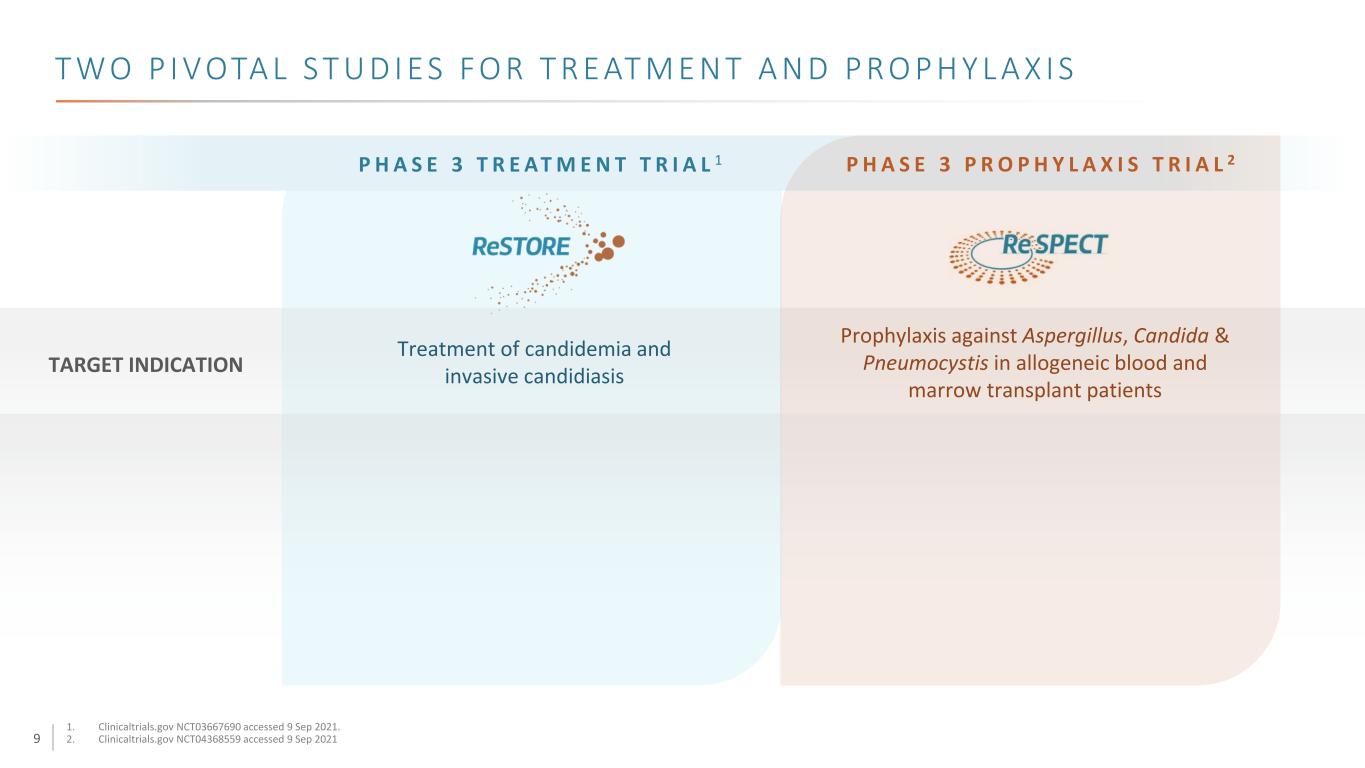

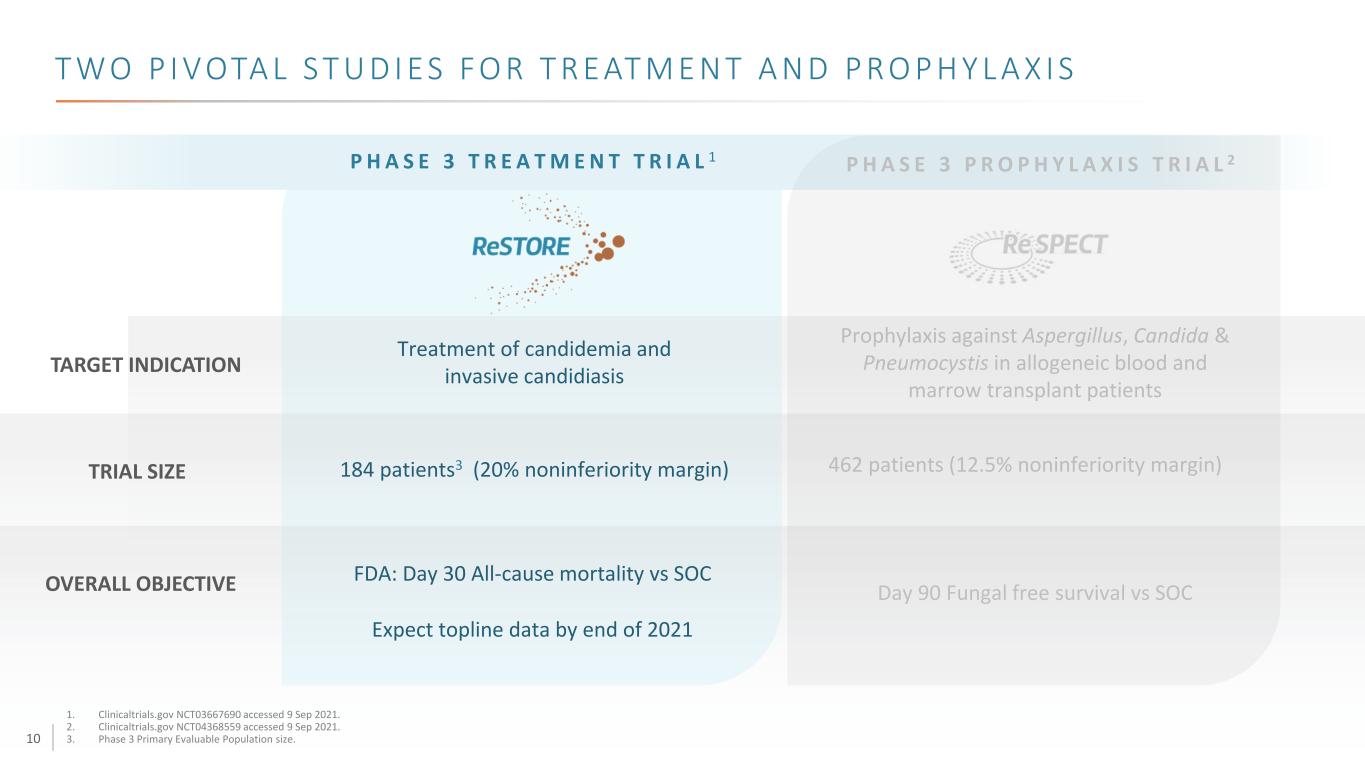

9 T W O P I V OTA L S T U D I E S F O R T R E AT M E N T A N D P R O P H Y L A X I S TARGET INDICATION Treatment of candidemia and invasive candidiasis Prophylaxis against Aspergillus, Candida & Pneumocystis in allogeneic blood and marrow transplant patients P H A S E 3 P R O P H Y L A X I S T R I A L 2 1. Clinicaltrials.gov NCT03667690 accessed 9 Sep 2021. 2. Clinicaltrials.gov NCT04368559 accessed 9 Sep 2021 P H A S E 3 T R E AT M E N T T R I A L 1

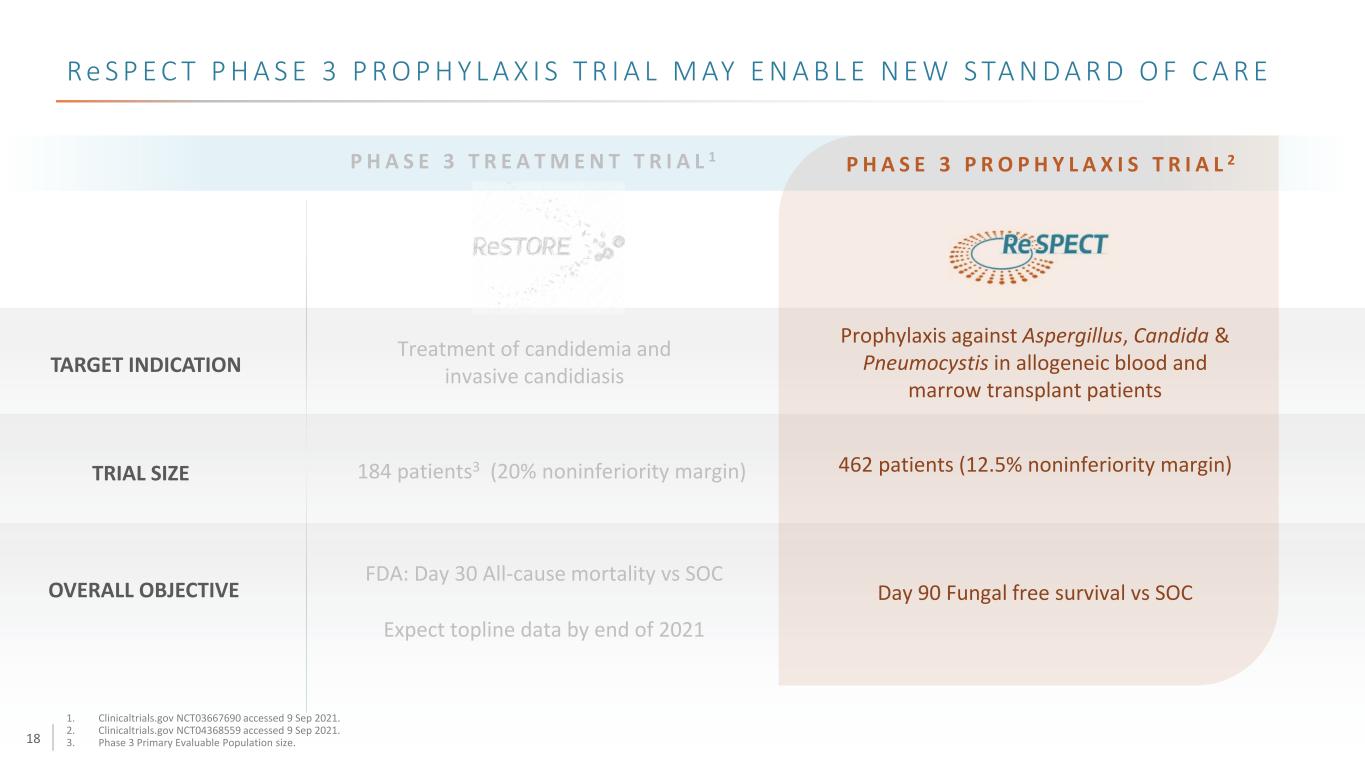

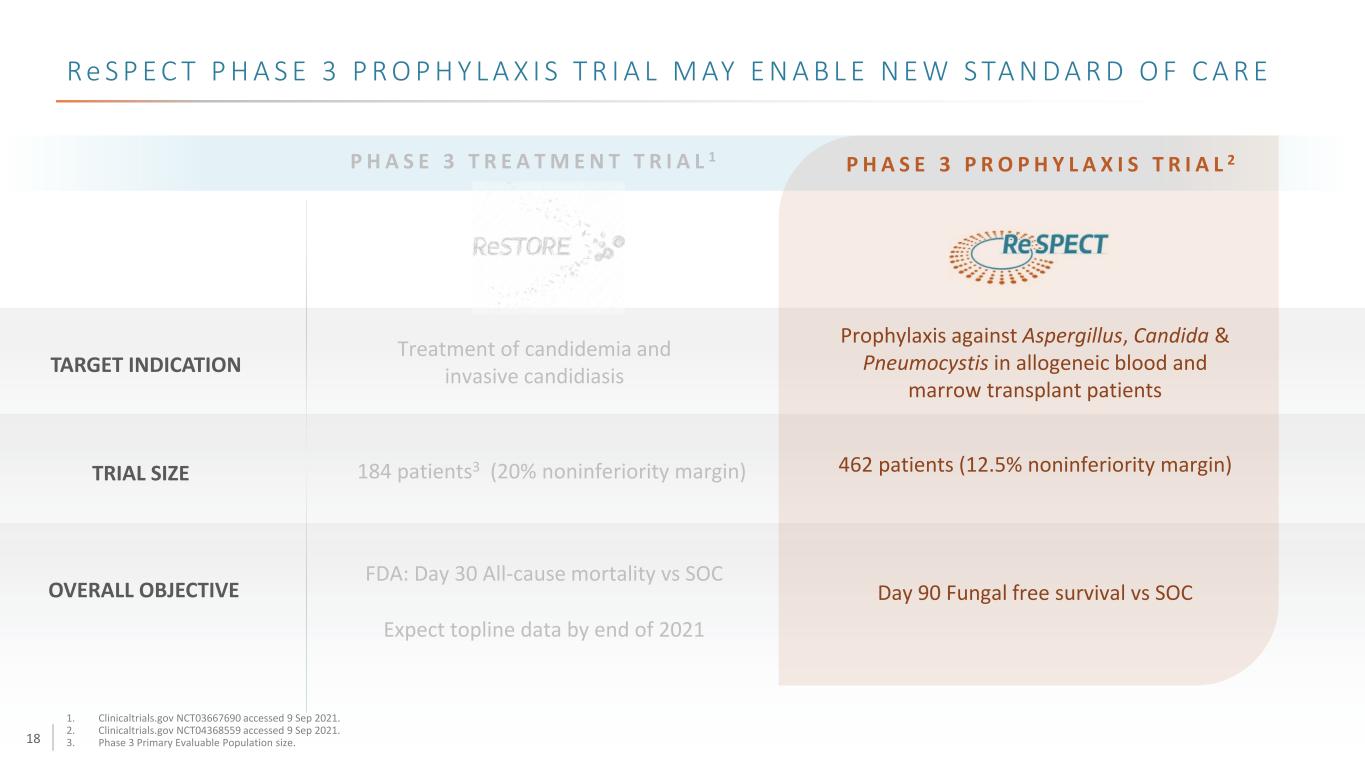

10 T W O P I V OTA L S T U D I E S F O R T R E AT M E N T A N D P R O P H Y L A X I S P H A S E 3 T R E A T M E N T T R I A L 1 TARGET INDICATION OVERALL OBJECTIVE Treatment of candidemia and invasive candidiasis FDA: Day 30 All-cause mortality vs SOC Expect topline data by end of 2021 TRIAL SIZE 184 patients3 (20% noninferiority margin) Prophylaxis against Aspergillus, Candida & Pneumocystis in allogeneic blood and marrow transplant patients 462 patients (12.5% noninferiority margin) Day 90 Fungal free survival vs SOC P H A S E 3 P R O P H Y L A X I S T R I A L 2 1. Clinicaltrials.gov NCT03667690 accessed 9 Sep 2021. 2. Clinicaltrials.gov NCT04368559 accessed 9 Sep 2021. 3. Phase 3 Primary Evaluable Population size.

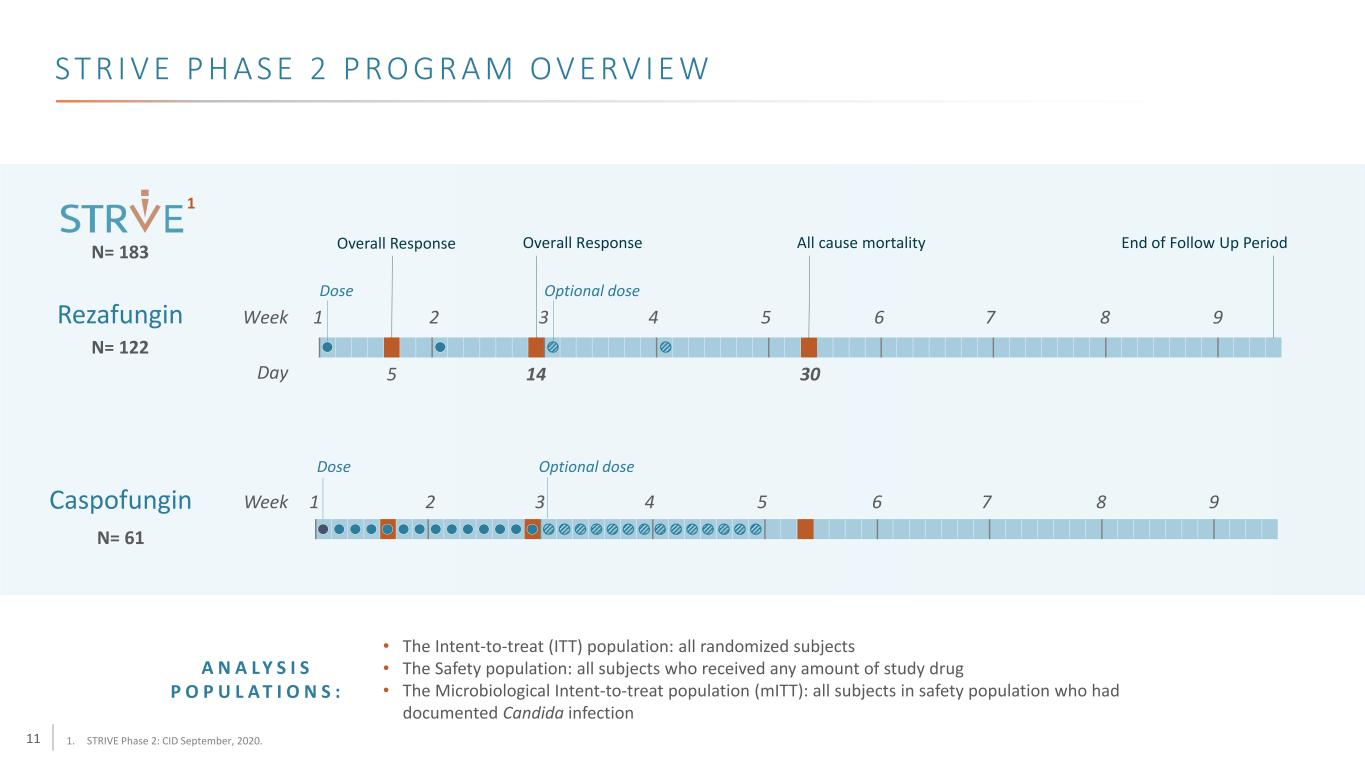

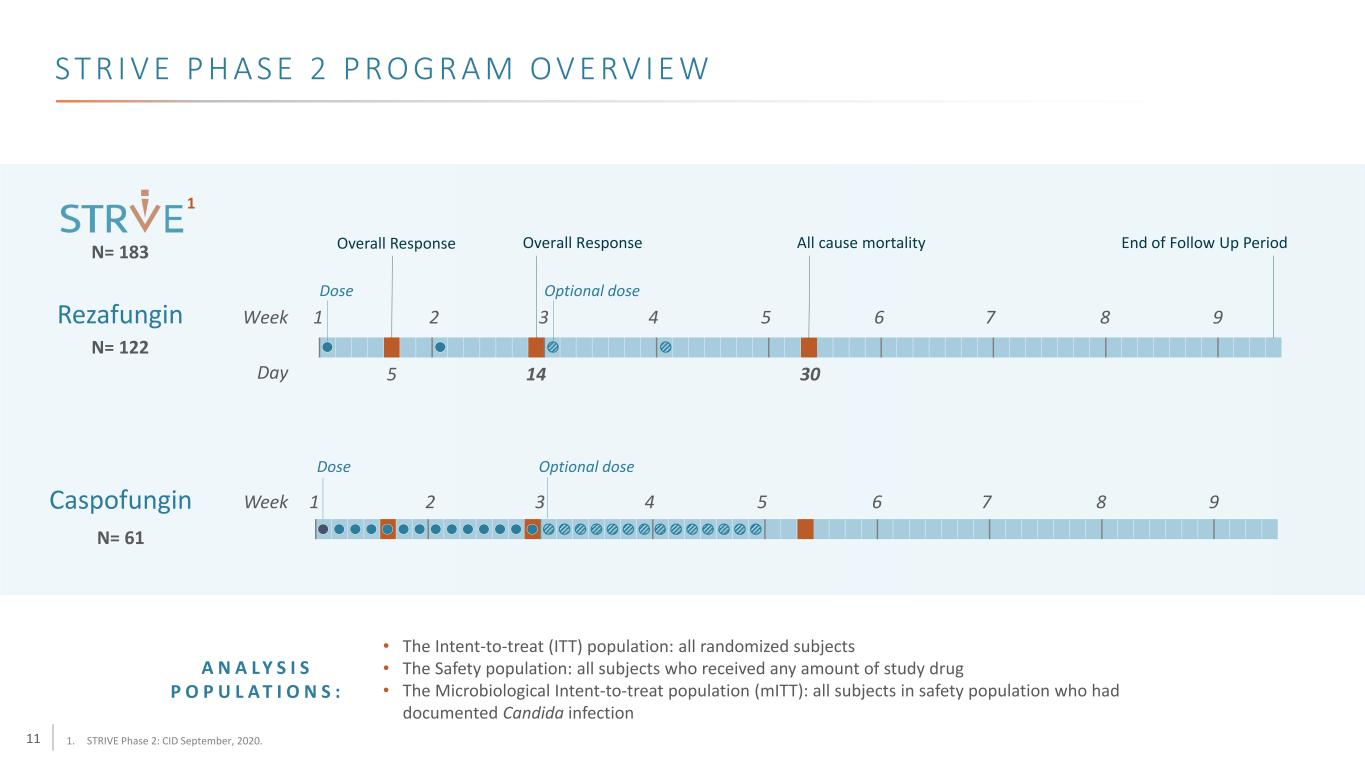

11 S T R I V E P H A S E 2 P R O G R A M O V E RV I E W • The Intent-to-treat (ITT) population: all randomized subjects • The Safety population: all subjects who received any amount of study drug • The Microbiological Intent-to-treat population (mITT): all subjects in safety population who had documented Candida infection N= 122 Caspofungin Rezafungin Week 1 2 3 4 5 6 7 8 9 Day 5 14 30 Dose Optional dose Overall ResponseOverall Response End of Follow Up Period Week 1 2 3 4 5 6 7 8 9 Dose All cause mortality Optional dose N= 61 N= 183 A N A L Y S I S P O P U L A T I O N S : 1. STRIVE Phase 2: CID September, 2020. 1

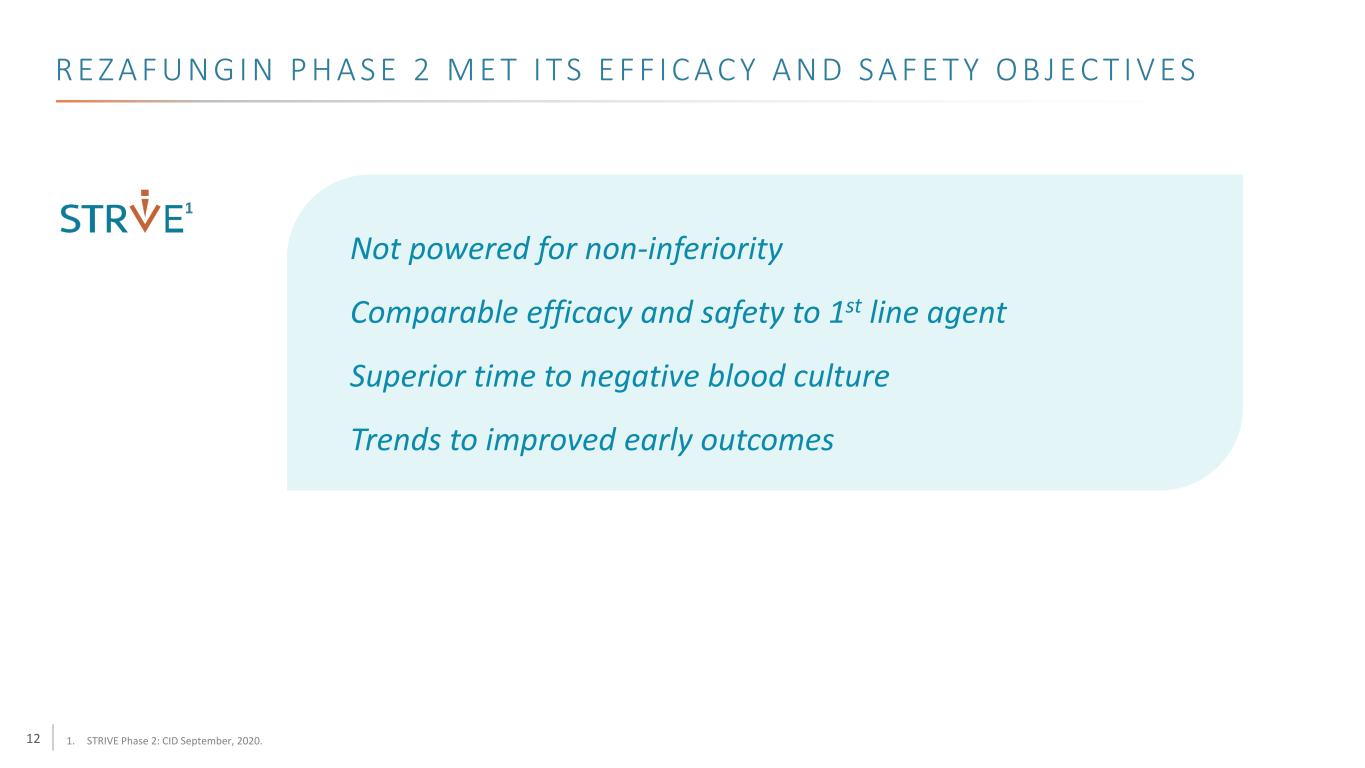

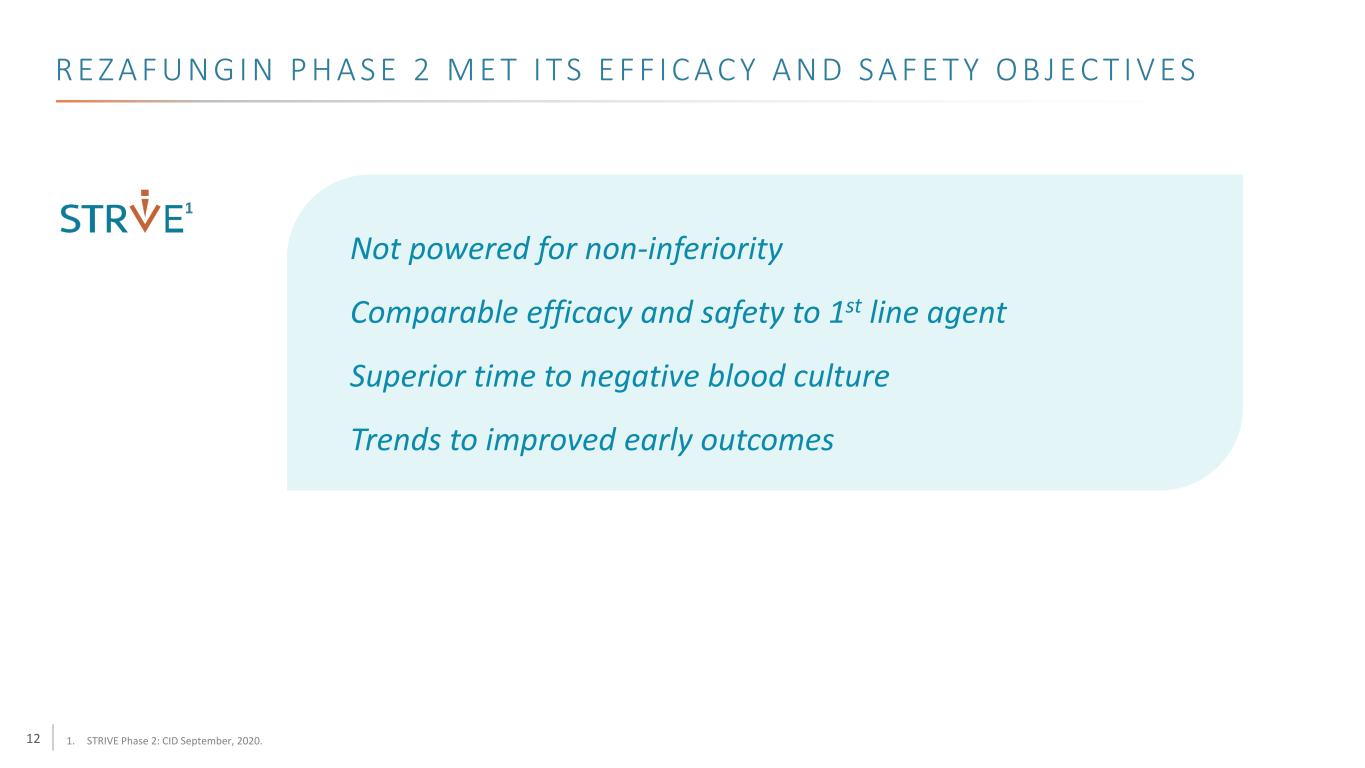

12 R E Z A F U N G I N P H A S E 2 M E T I T S E F F I C A C Y A N D S A F E T Y O B J E C T I V E S Not powered for non-inferiority Comparable efficacy and safety to 1st line agent Superior time to negative blood culture Trends to improved early outcomes 1. STRIVE Phase 2: CID September, 2020. 1

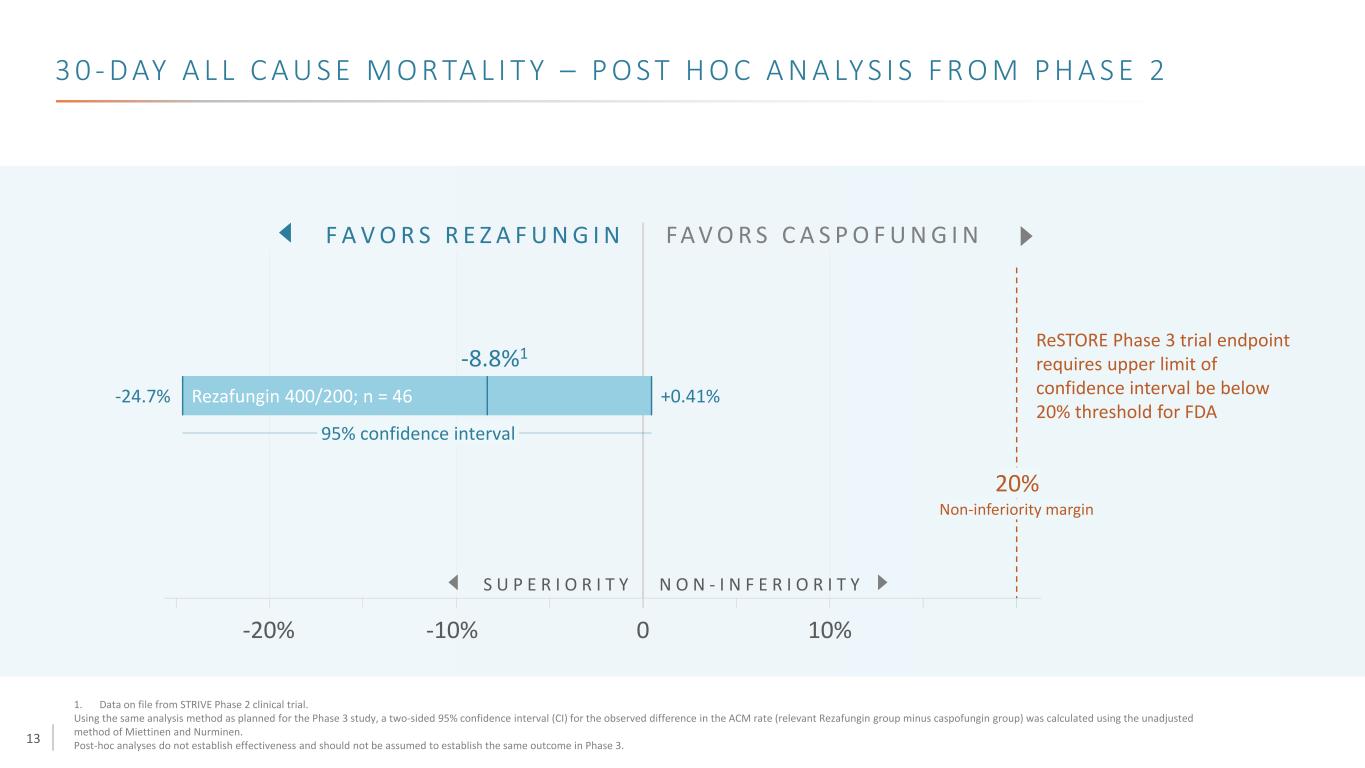

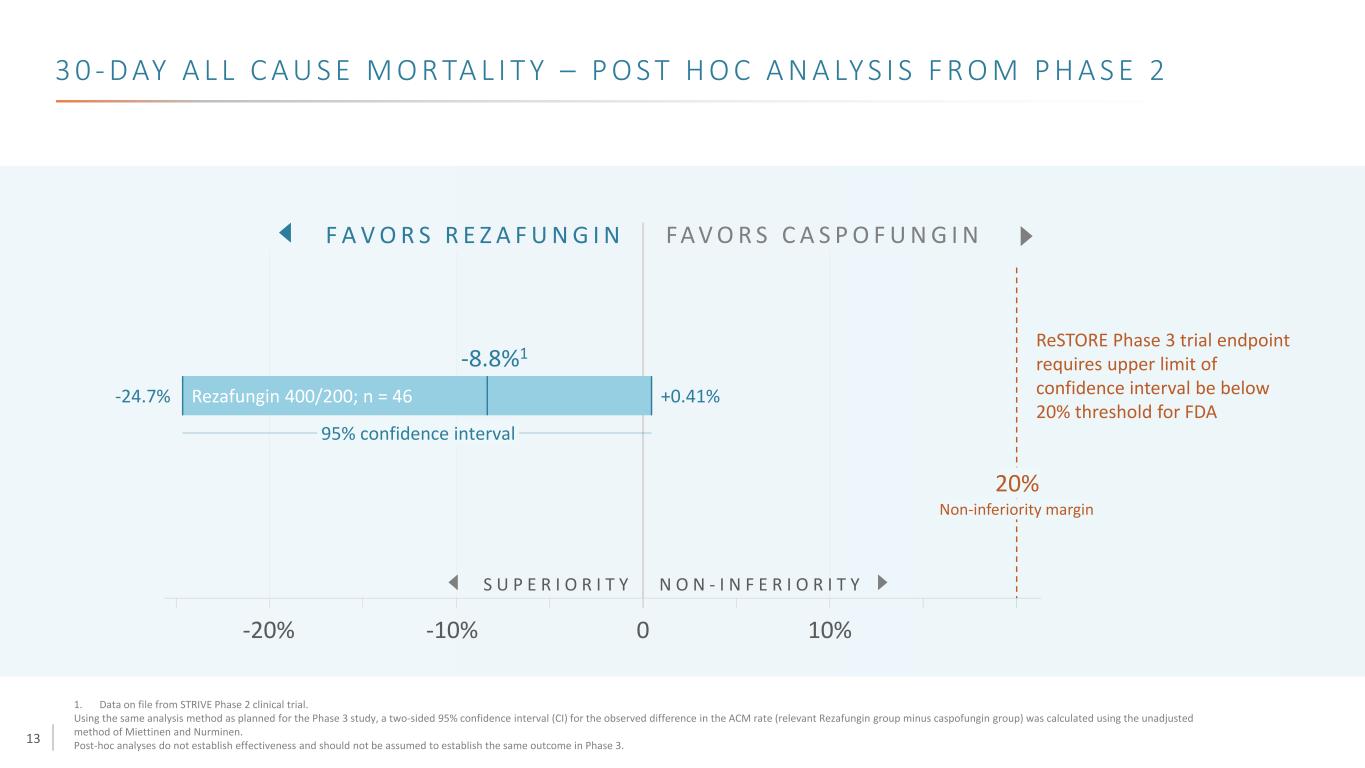

13 3 0 - D AY A L L C A U S E M O R TA L I T Y – P O S T H O C A N A LY S I S F R O M P H A S E 2 S U P E R I O R I T Y N O N - I N F E R I O R I T Y 0-20% 10%-10% F A V O R S R E Z A F U N G I N FA V O R S C A S P O F U N G I N ReSTORE Phase 3 trial endpoint requires upper limit of confidence interval be below 20% threshold for FDA Non-inferiority margin 20% -24.7% +0.41%Rezafungin 400/200; n = 46 95% confidence interval 1. Data on file from STRIVE Phase 2 clinical trial. Using the same analysis method as planned for the Phase 3 study, a two-sided 95% confidence interval (CI) for the observed difference in the ACM rate (relevant Rezafungin group minus caspofungin group) was calculated using the unadjusted method of Miettinen and Nurminen. Post-hoc analyses do not establish effectiveness and should not be assumed to establish the same outcome in Phase 3. -8.8%1

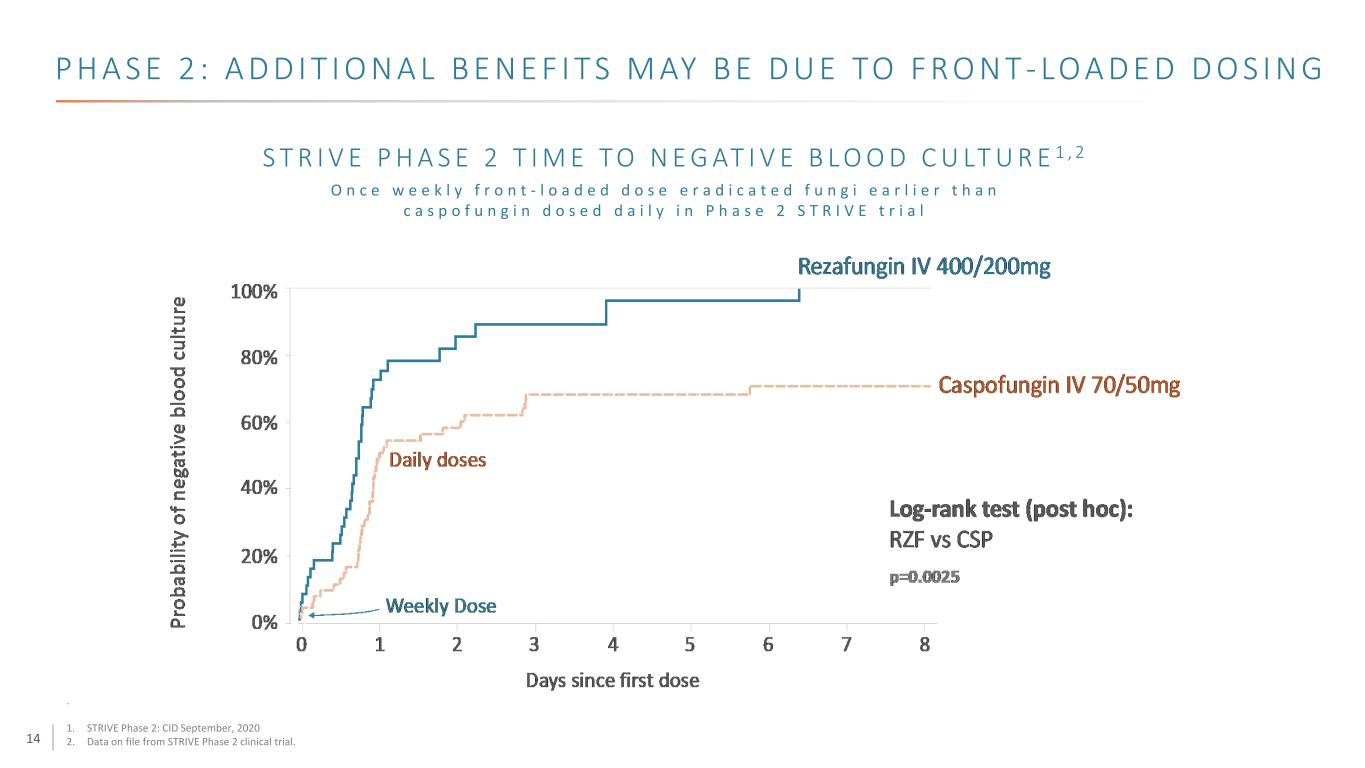

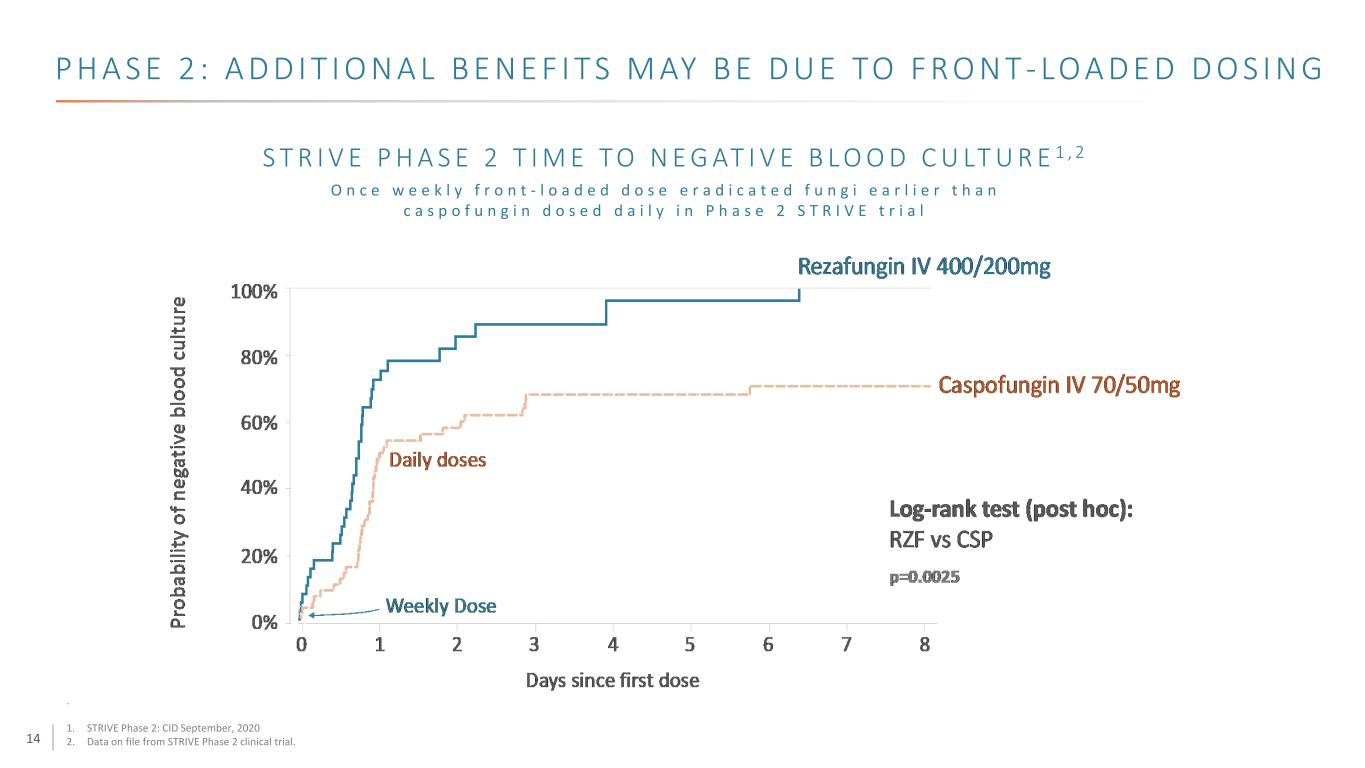

14 S T R I V E P H A S E 2 T I M E T O N E G AT I V E B L O O D C U LT U R E 1 , 2 P H A S E 2 : A D D I T I O N A L B E N E F I T S M AY B E D U E TO F R O N T - LO A D E D D O S I N G O n c e w e e k l y f r o n t - l o a d e d d o s e e r a d i c a t e d f u n g i e a r l i e r t h a n c a s p o f u n g i n d o s e d d a i l y i n P h a s e 2 S T R I V E t r i a l . 1. STRIVE Phase 2: CID September, 2020 2. Data on file from STRIVE Phase 2 clinical trial.

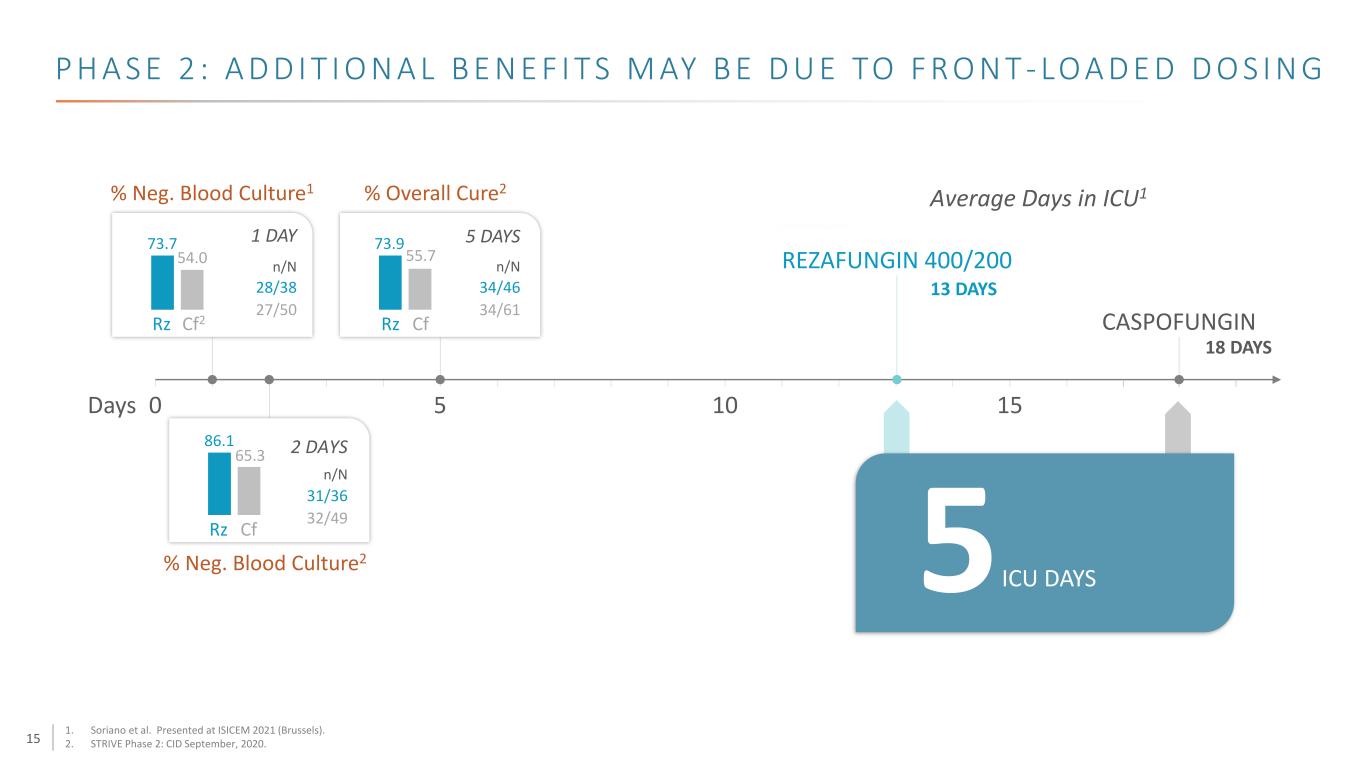

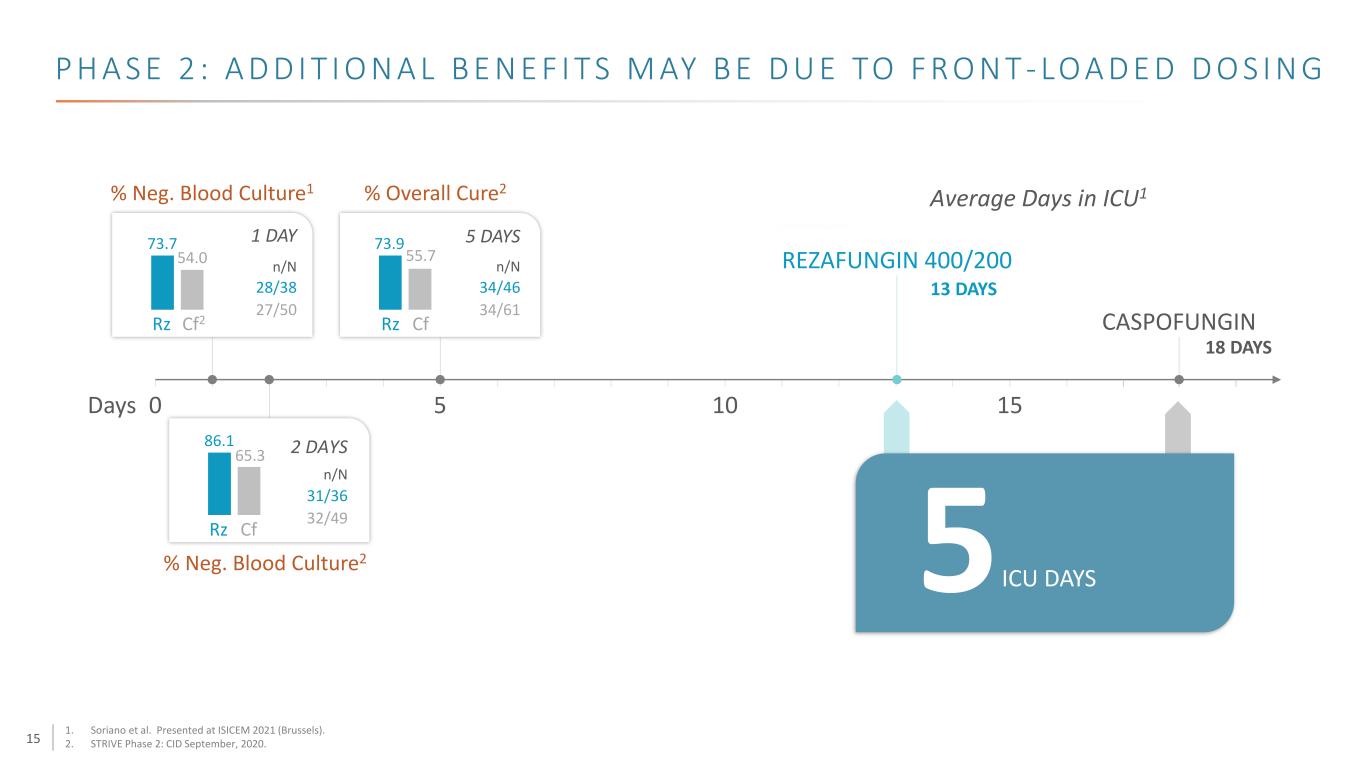

15 0 5 10 15Days REZAFUNGIN 400/200 % Neg. Blood Culture1 % Overall Cure2 Average Days in ICU1 CASPOFUNGINRz Cf2 Rz Cf Rz Cf 5 ICU DAYS 28/38 1 DAY 5 DAYS 2 DAYS 27/50 31/36 32/49 34/46 34/61 % Neg. Blood Culture2 73.7 54.0 73.9 55.7 86.1 65.3 13 DAYS 18 DAYS n/N n/N n/N P H A S E 2 : A D D I T I O N A L B E N E F I T S M AY B E D U E TO F R O N T - LO A D E D D O S I N G 1. Soriano et al. Presented at ISICEM 2021 (Brussels). 2. STRIVE Phase 2: CID September, 2020.

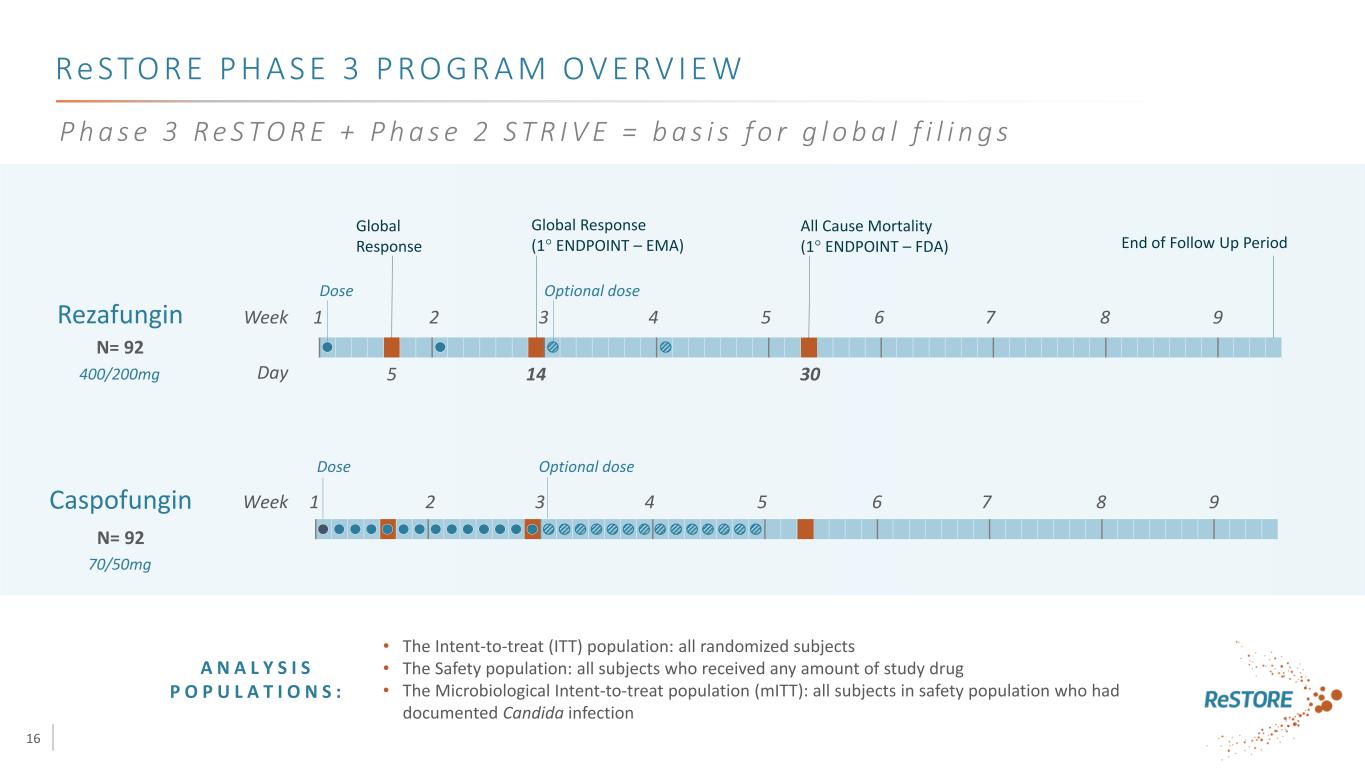

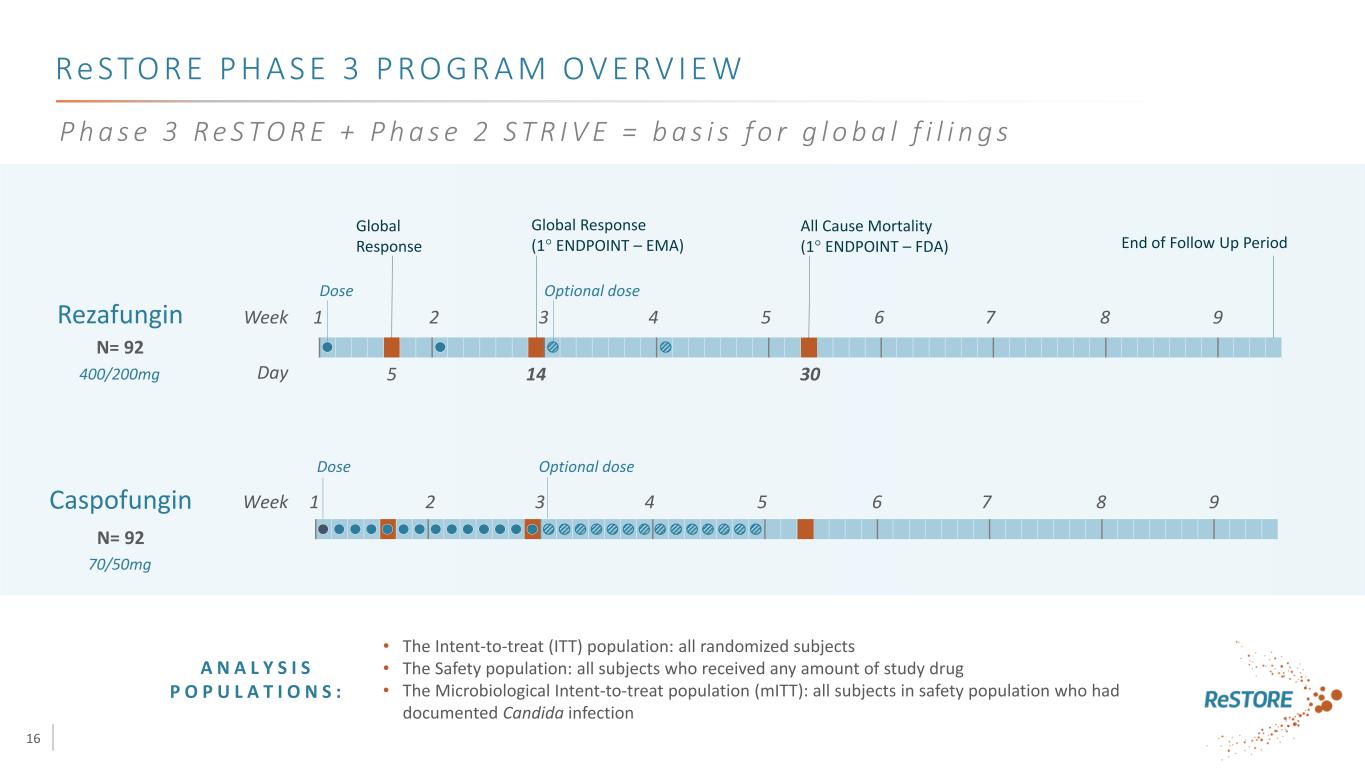

16 Re S TO R E P H A S E 3 P R O G R A M O V E RV I E W • The Intent-to-treat (ITT) population: all randomized subjects • The Safety population: all subjects who received any amount of study drug • The Microbiological Intent-to-treat population (mITT): all subjects in safety population who had documented Candida infection N= 92 Caspofungin Rezafungin Week 1 2 3 4 5 6 7 8 9 Day 5 14 30 Dose Optional dose End of Follow Up Period Week 1 2 3 4 5 6 7 8 9 Dose Optional dose N= 92 A N A L Y S I S P O P U L A T I O N S : Global Response Global Response (1° ENDPOINT – EMA) All Cause Mortality (1° ENDPOINT – FDA) 400/200mg 70/50mg P h a s e 3 R e S T O R E + P h a s e 2 S T R I V E = b a s i s f o r g l o b a l f i l i n g s

17 Rezafungin Rezafungin — Treatment — Prophylaxis

18 R e S P E C T P H A S E 3 P R O P H Y L A X I S T R I A L M AY E N A B L E N E W S TA N D A R D O F C A R E P H A S E 3 T R E A T M E N T T R I A L 1 TARGET INDICATION TRIAL SIZE Treatment of candidemia and invasive candidiasis 184 patients3 (20% noninferiority margin) FDA: Day 30 All-cause mortality vs SOC Expect topline data by end of 2021 P H A S E 3 P R O P H Y L A X I S T R I A L 2 OVERALL OBJECTIVE 1. Clinicaltrials.gov NCT03667690 accessed 9 Sep 2021. 2. Clinicaltrials.gov NCT04368559 accessed 9 Sep 2021. 3. Phase 3 Primary Evaluable Population size. Prophylaxis against Aspergillus, Candida & Pneumocystis in allogeneic blood and marrow transplant patients 462 patients (12.5% noninferiority margin) Day 90 Fungal free survival vs SOC

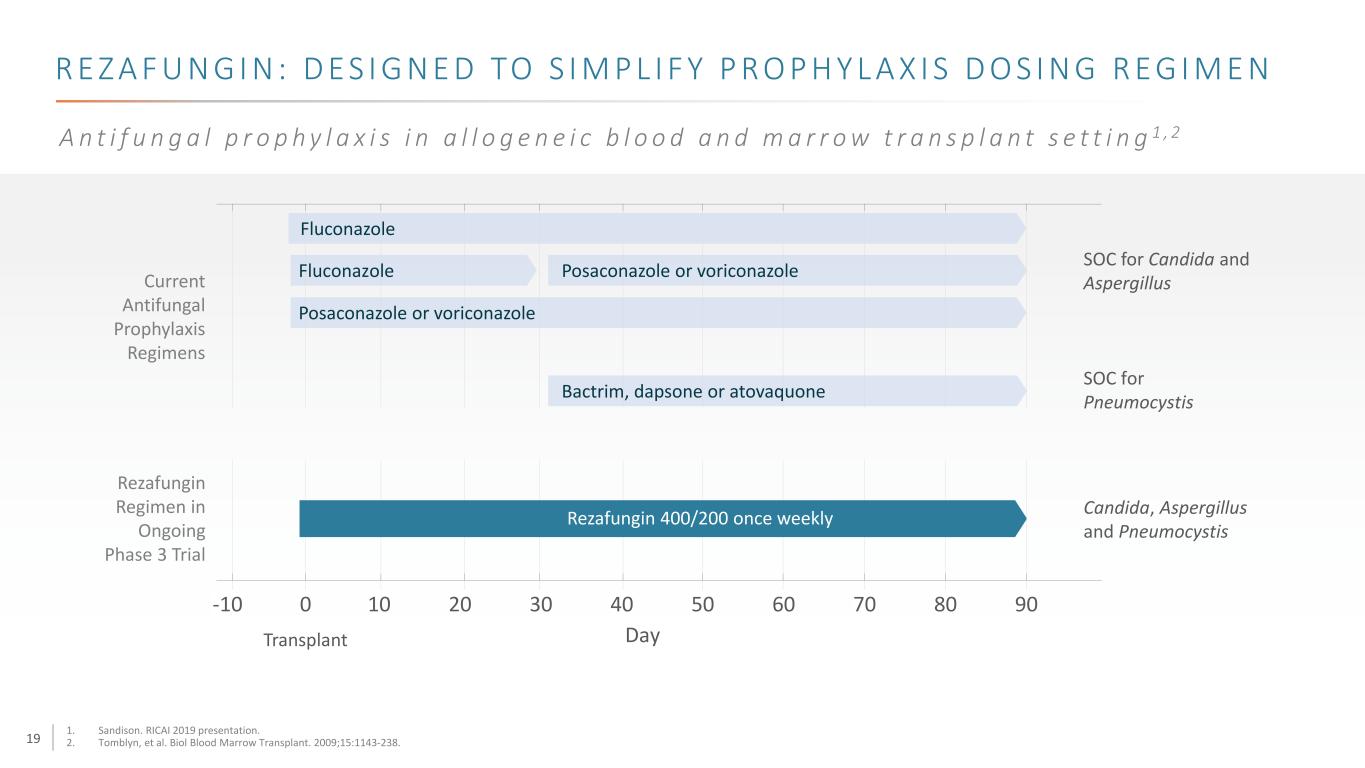

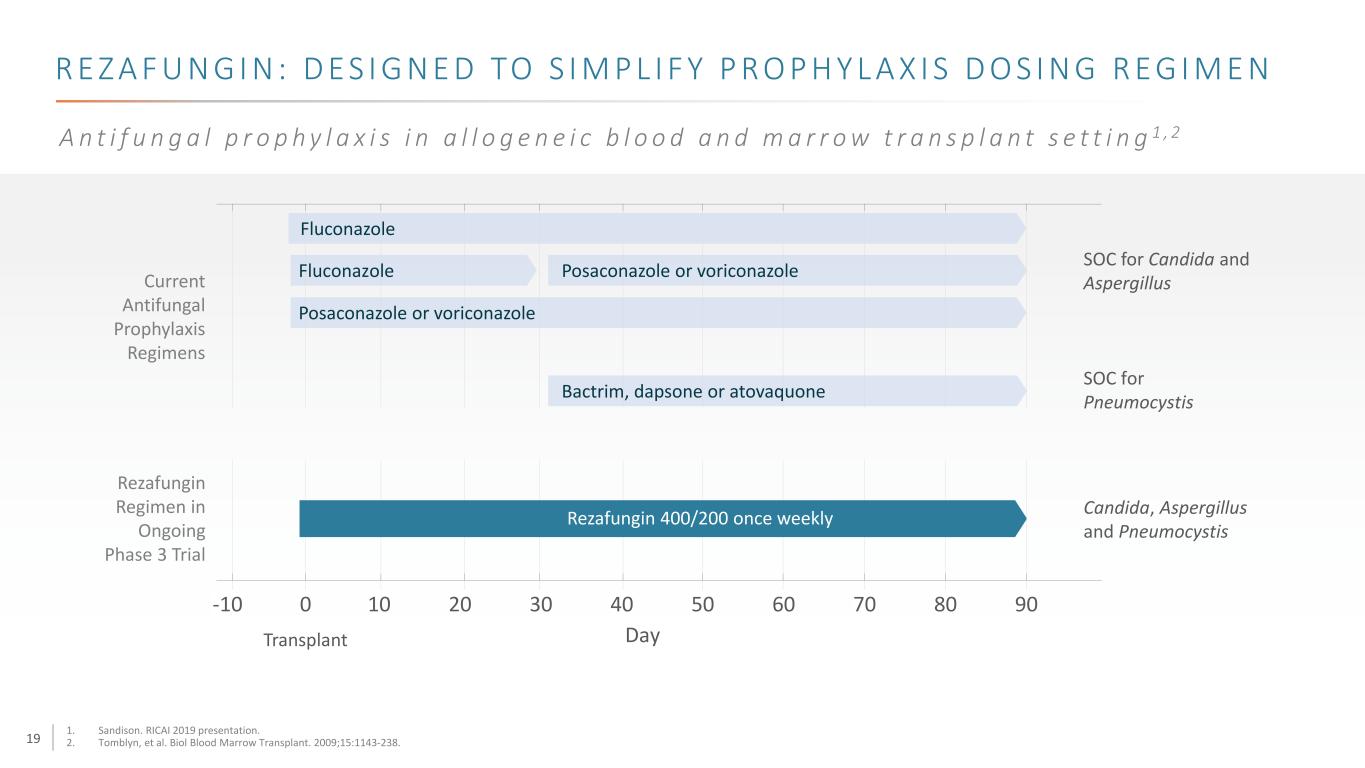

19 R E Z A F U N G I N : D E S I G N E D TO S I M P L I F Y P R O P H Y L A X I S D O S I N G R E G I M E N A n t i f u n g a l p r o p h y l a x i s i n a l l o g e n e i c b l o o d a n d m a r r o w t r a n s p l a n t s e t t i n g 1 , 2 SOC for Candida and Aspergillus Day 8070605040302010-10 0 Transplant SOC for Pneumocystis Rezafungin 400/200 once weekly Candida, Aspergillus and Pneumocystis Current Antifungal Prophylaxis Regimens 90 Posaconazole or voriconazole Bactrim, dapsone or atovaquone Posaconazole or voriconazoleFluconazole Fluconazole Rezafungin Regimen in Ongoing Phase 3 Trial 1. Sandison. RICAI 2019 presentation. 2. Tomblyn, et al. Biol Blood Marrow Transplant. 2009;15:1143-238.

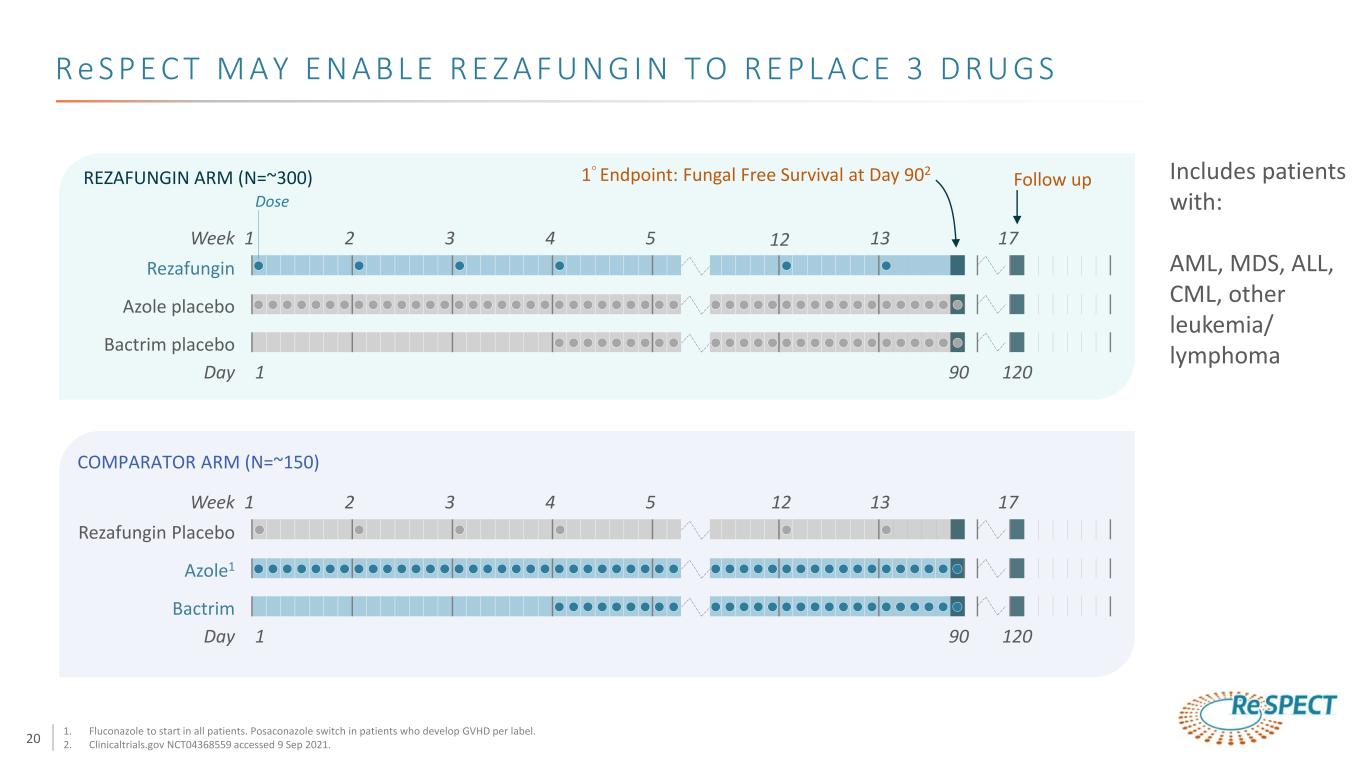

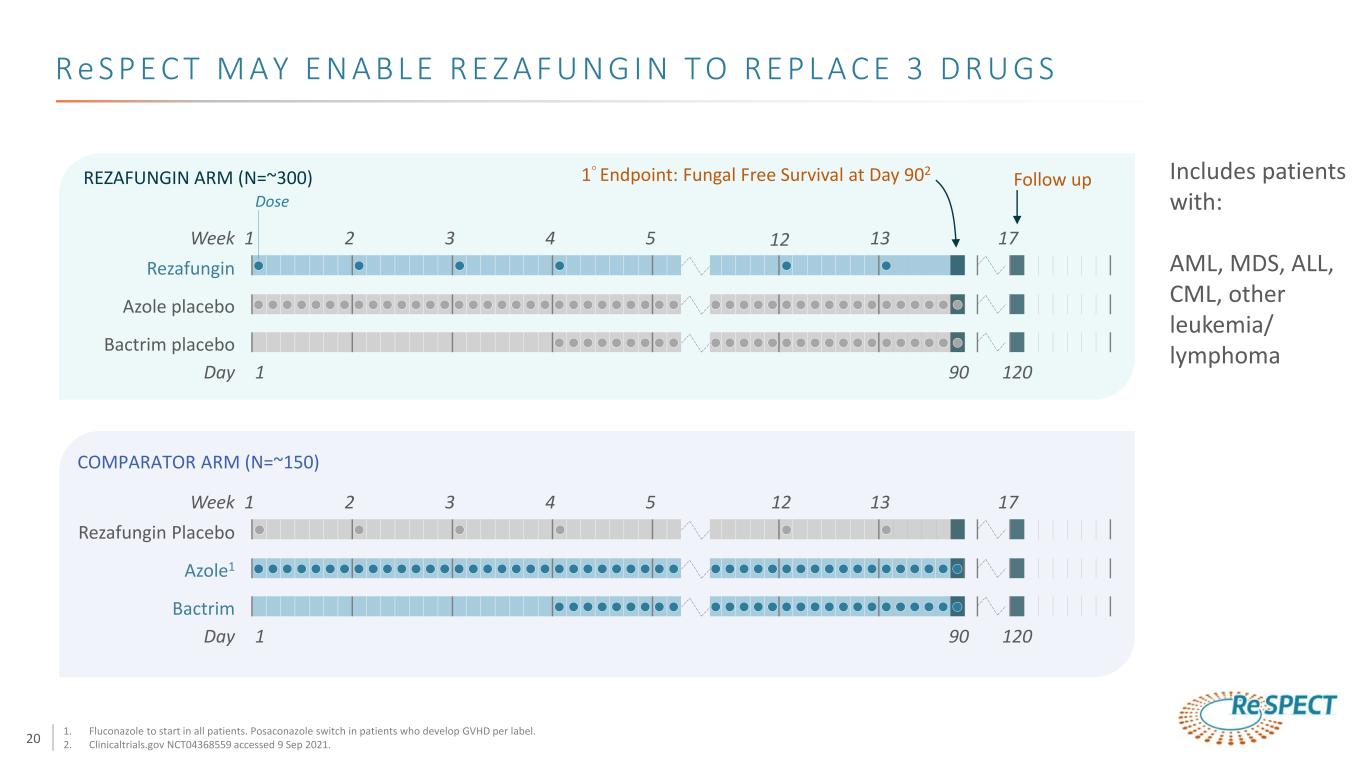

20 Week 1 2 3 4 12 Azole placebo Bactrim placebo Rezafungin 5 13 Day 1 17 90 120 1° Endpoint: Fungal Free Survival at Day 902 Follow upREZAFUNGIN ARM (N=~300) 17Week 1 2 3 4 12 Azole1 Bactrim Rezafungin Placebo 5 13 Day 1 90 120 COMPARATOR ARM (N=~150) Dose Includes patients with: AML, MDS, ALL, CML, other leukemia/ lymphoma 1. Fluconazole to start in all patients. Posaconazole switch in patients who develop GVHD per label. 2. Clinicaltrials.gov NCT04368559 accessed 9 Sep 2021. R e S P E C T M A Y E N A B L E R E Z A F U N G I N T O R E P L A C E 3 D R U G S

21 U N M E T N E E D I N P R E V E N T I O N O F I N VA S I V E F U N G A L D I S E A S E I N C A N C E R A N D T R A N S P L A N T PAT I E N T S M A R K L E V I S , M D A N D K I E R E N M A R R , M D J O H N S H O P K I N S U N I V E R S I T Y

Hematologist Viewpoint - Setting up the problem Management of AML MARK LEVIS, MD P R O G R A M L E A D E R , H E M A T O L O G I C M A L I G N A N C I E S A N D B O N E M A R R O W T R A N S P L A N T P R O G R A M , S I D N E Y K I M M E L C O M P R E H E N S I V E C A N C E R C E N T E R P R O F E S S O R O F O N C O L O G Y J O H N ’ S H O P K I N S U N I V E R S I T Y S C H O O L O F M E D I C I N E 22

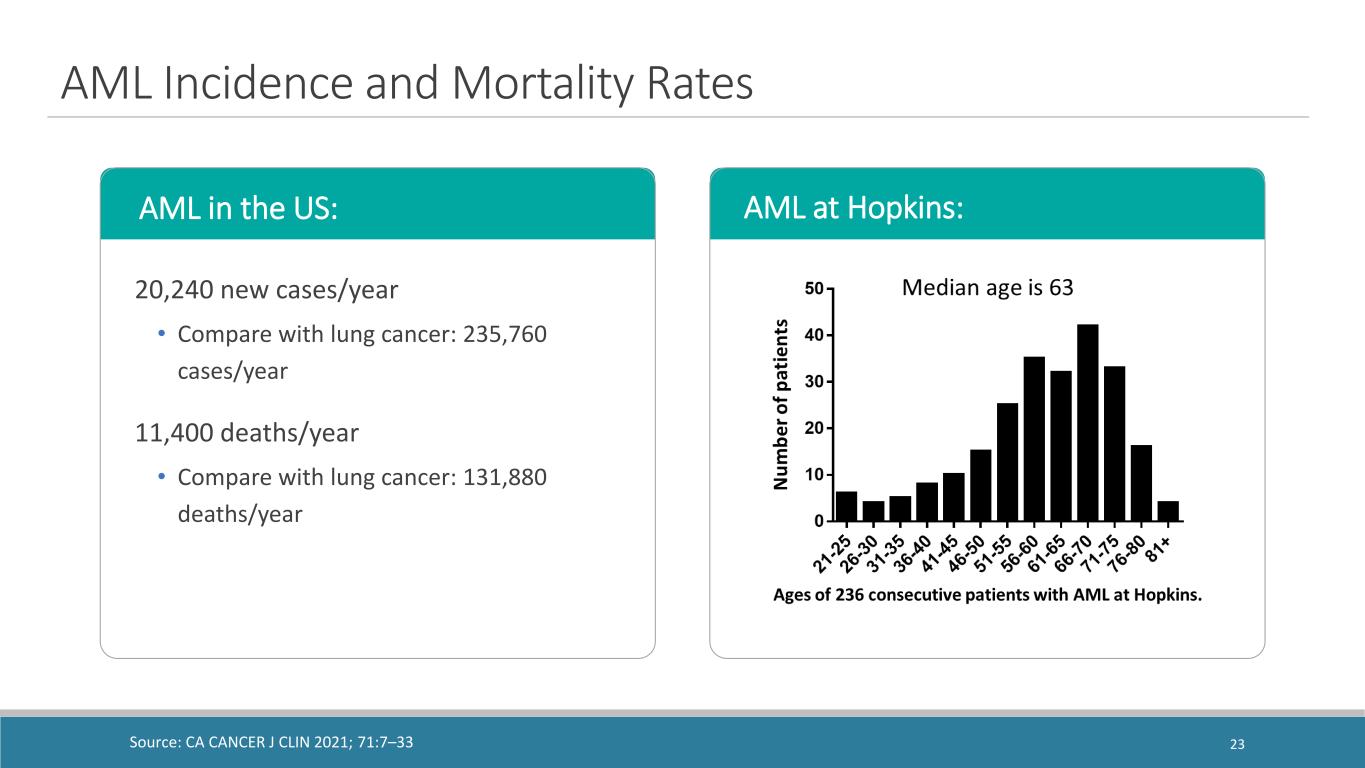

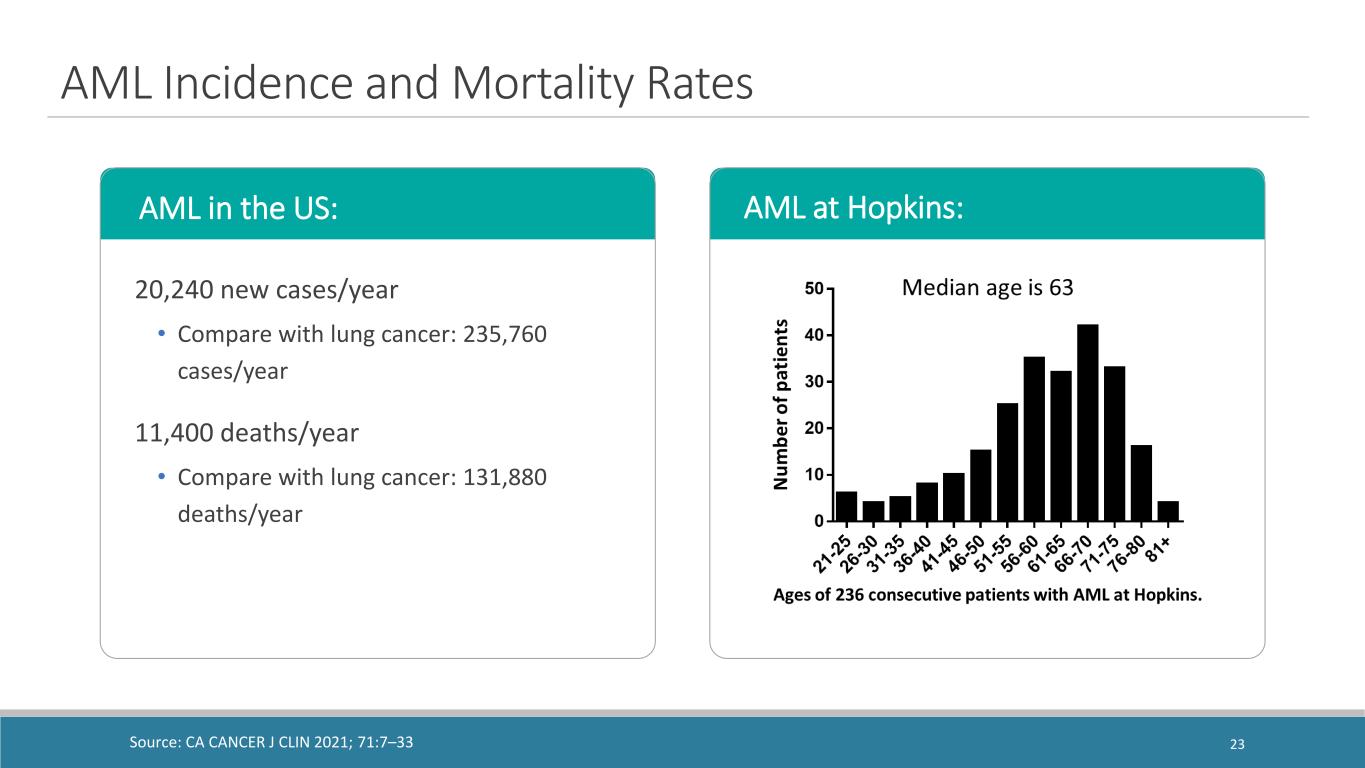

AML Incidence and Mortality Rates 20,240 new cases/year • Compare with lung cancer: 235,760 cases/year 11,400 deaths/year • Compare with lung cancer: 131,880 deaths/year Source: CA CANCER J CLIN 2021; 71:7–33 AML in the US: AML at Hopkins: 23

AML is frequently a medical emergency… Patients routinely present with: o Low platelets, leading to risk of catastrophic bleeding o Low hemoglobin, causing physical exhaustion o Low white blood cells, leading to rapidly fatal infections Best management is to quickly treat the disease into remission Patients with AML or acute leukemia are typically referred to a tertiary care center experienced in treating these patients o Analogous to a Trauma Center 24

AML at The Sidney Kimmel Comprehensive Cancer Center at Johns Hopkins 180 patients admitted each year to the Adult Leukemia Service o All newly-diagnosed (typically transferred from an ER…) o Majority undergo immediate therapy • 50% intensive, 50% non-intensive o Hospital stay of 2-6 weeks • 130 acute myeloid leukemia (AML) • 30 acute lymphoblastic leukemia (ALL) • 20 “other” (mix of different blood malignancies) Probably an equal number seen on referral in clinic after initial treatment elsewhere 25

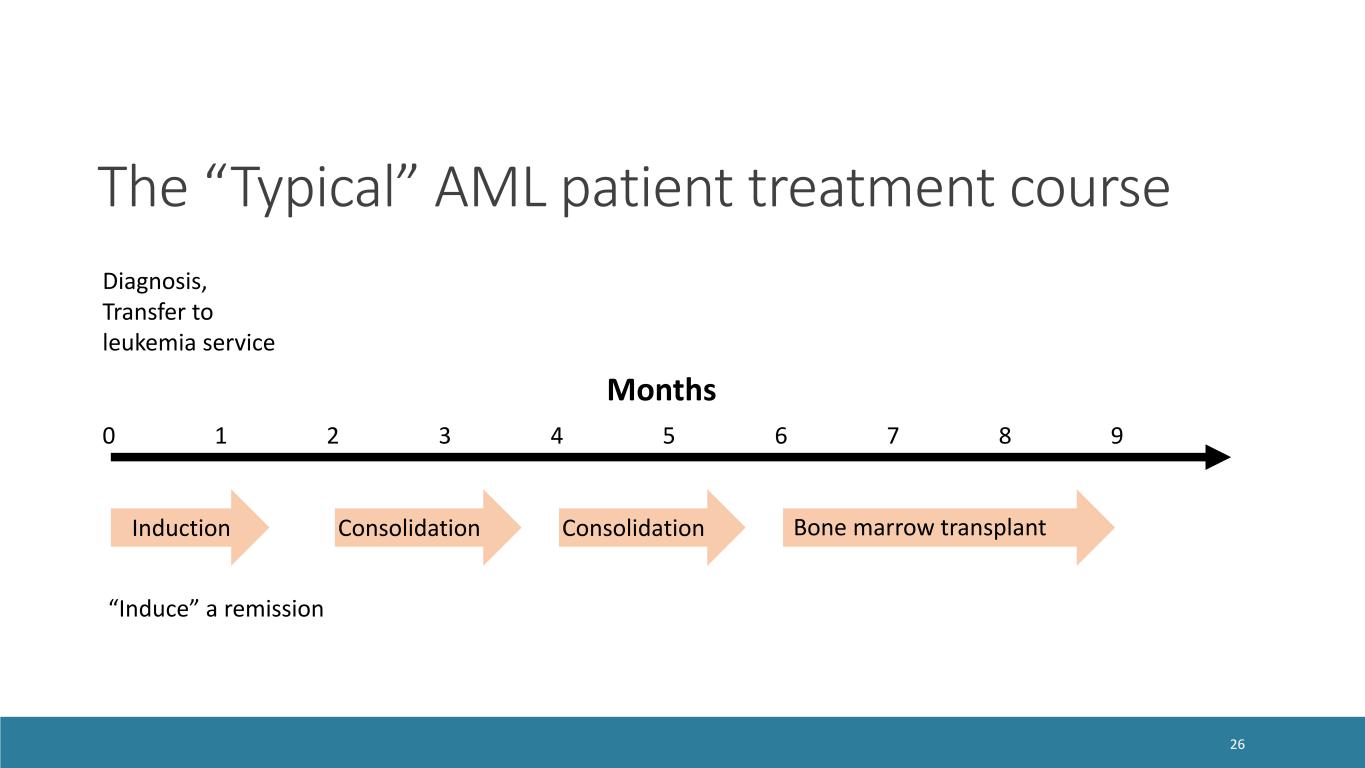

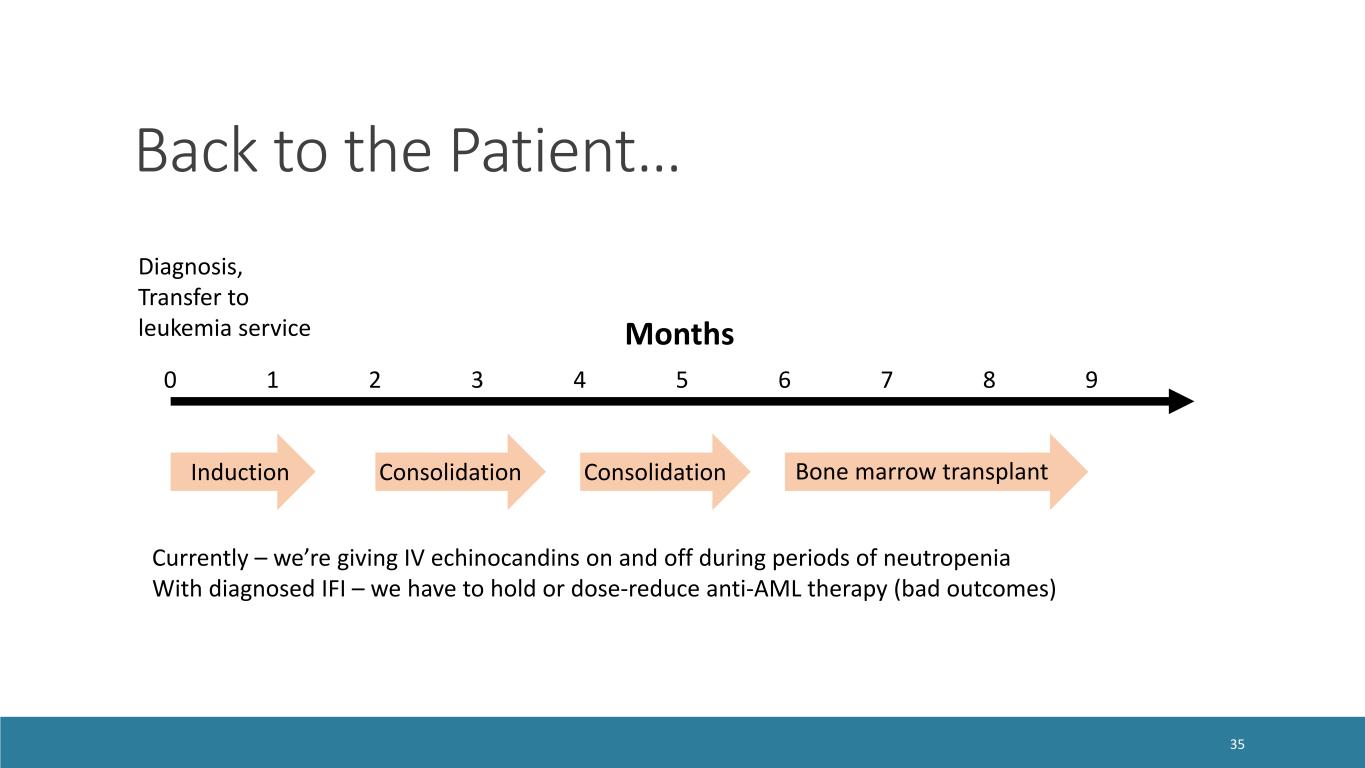

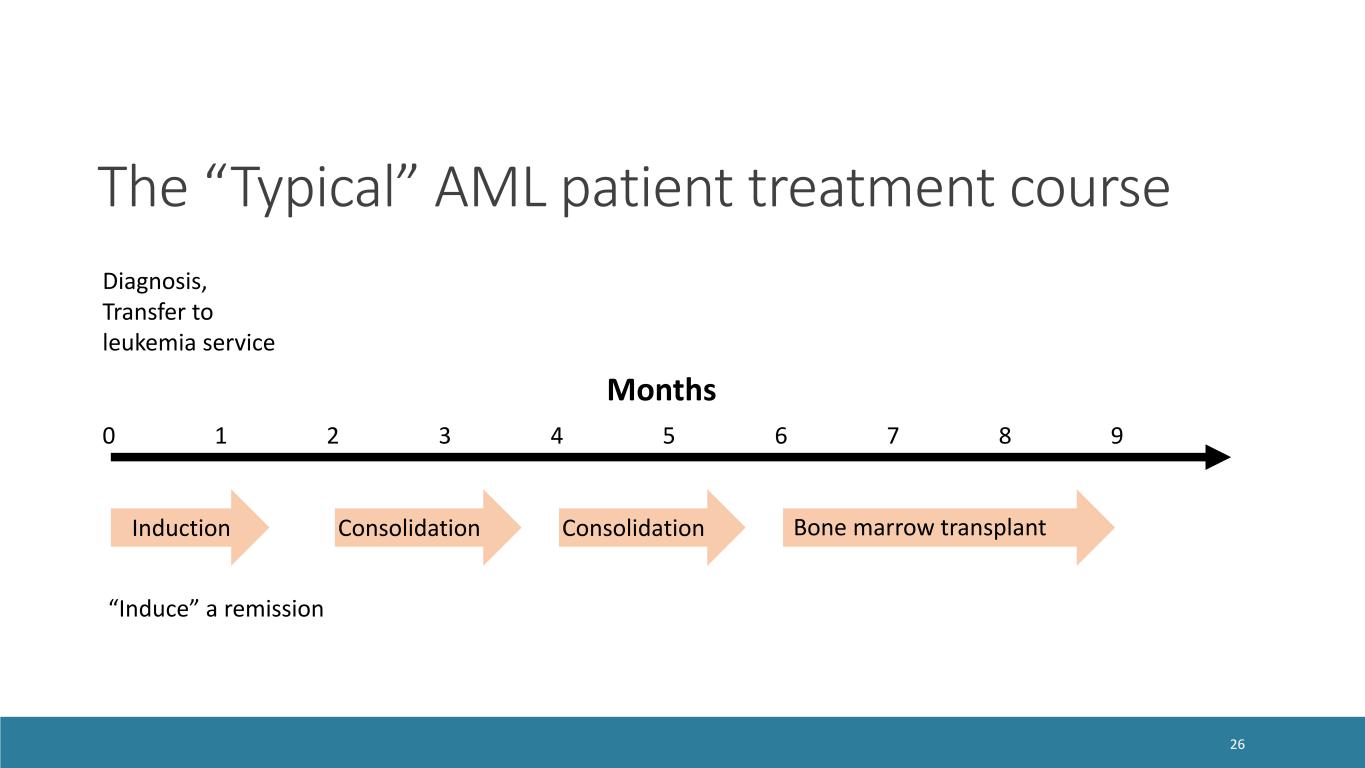

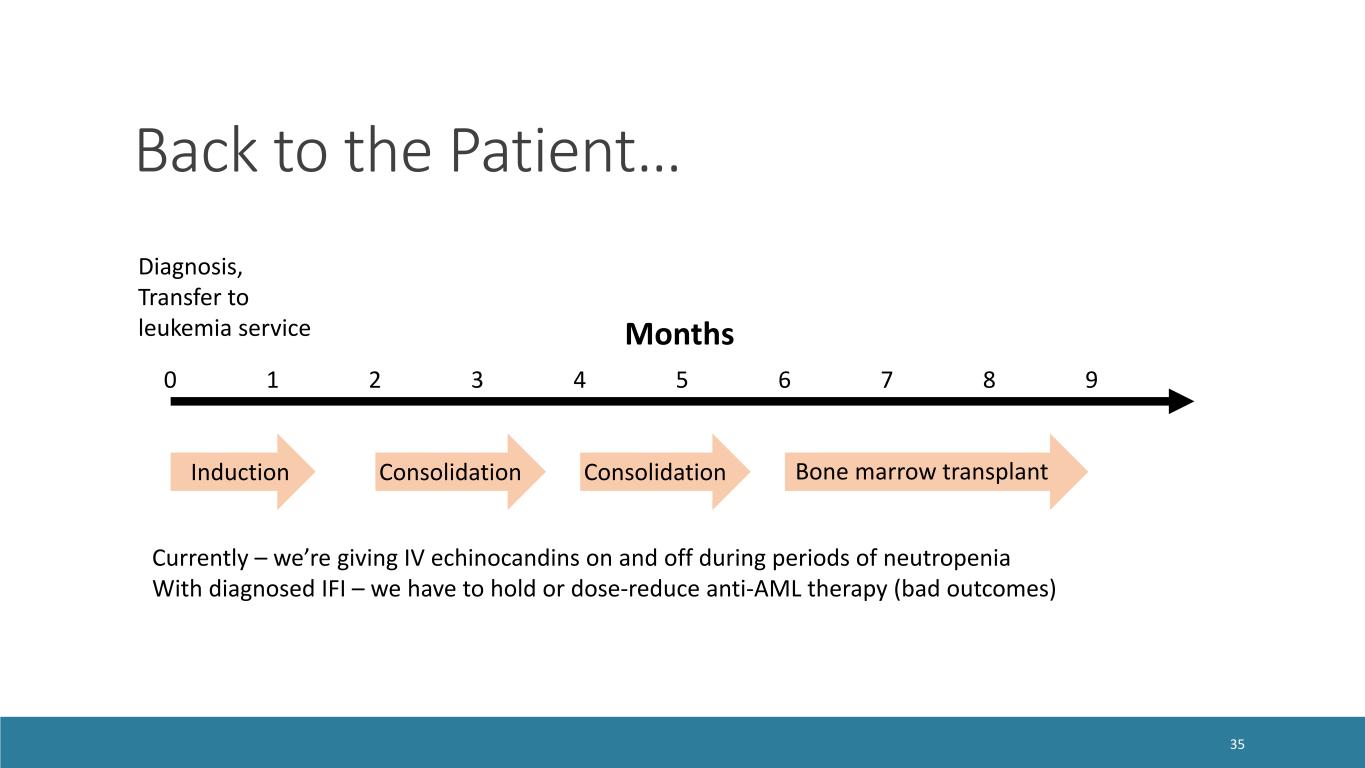

Diagnosis, Transfer to leukemia service Months 0 1 2 3 4 5 6 7 8 9 Induction Consolidation Consolidation Bone marrow transplant “Induce” a remission The “Typical” AML patient treatment course 26

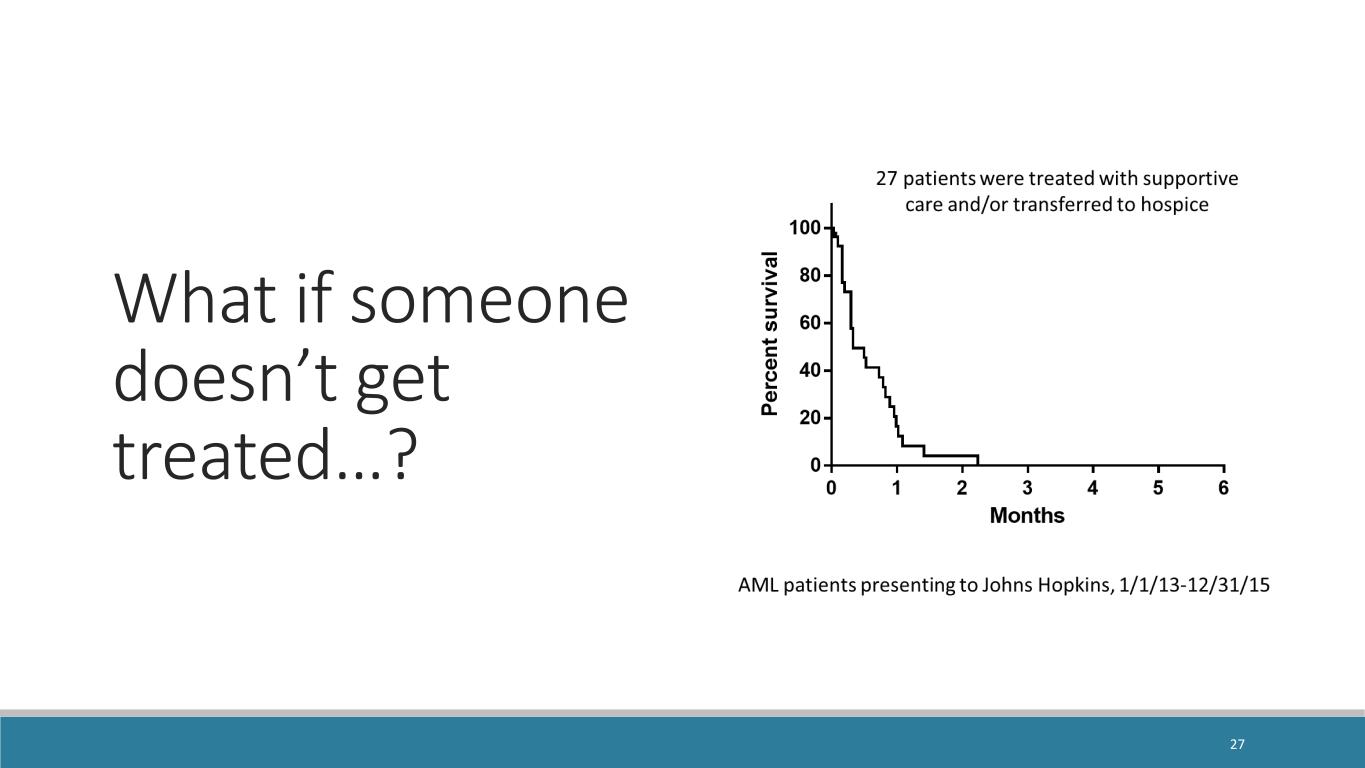

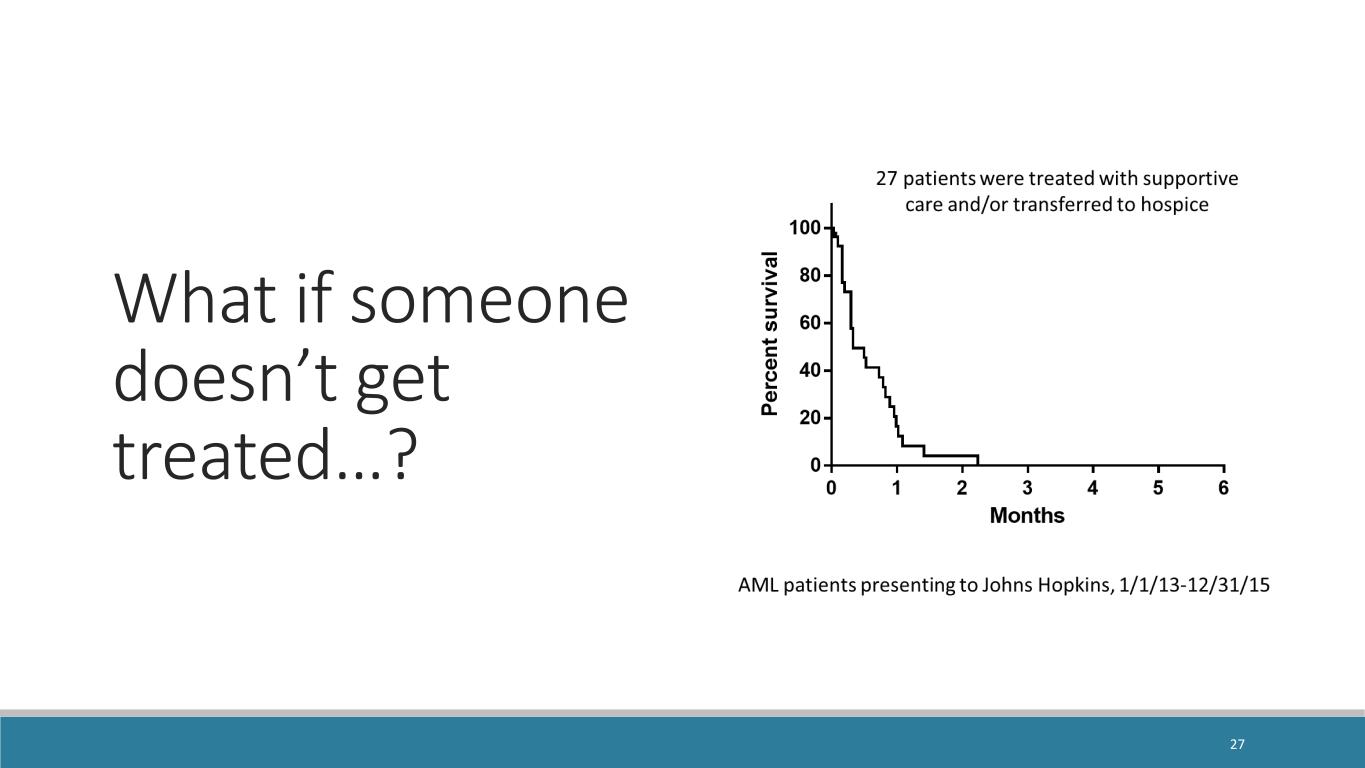

What if someone doesn’t get treated…? 27

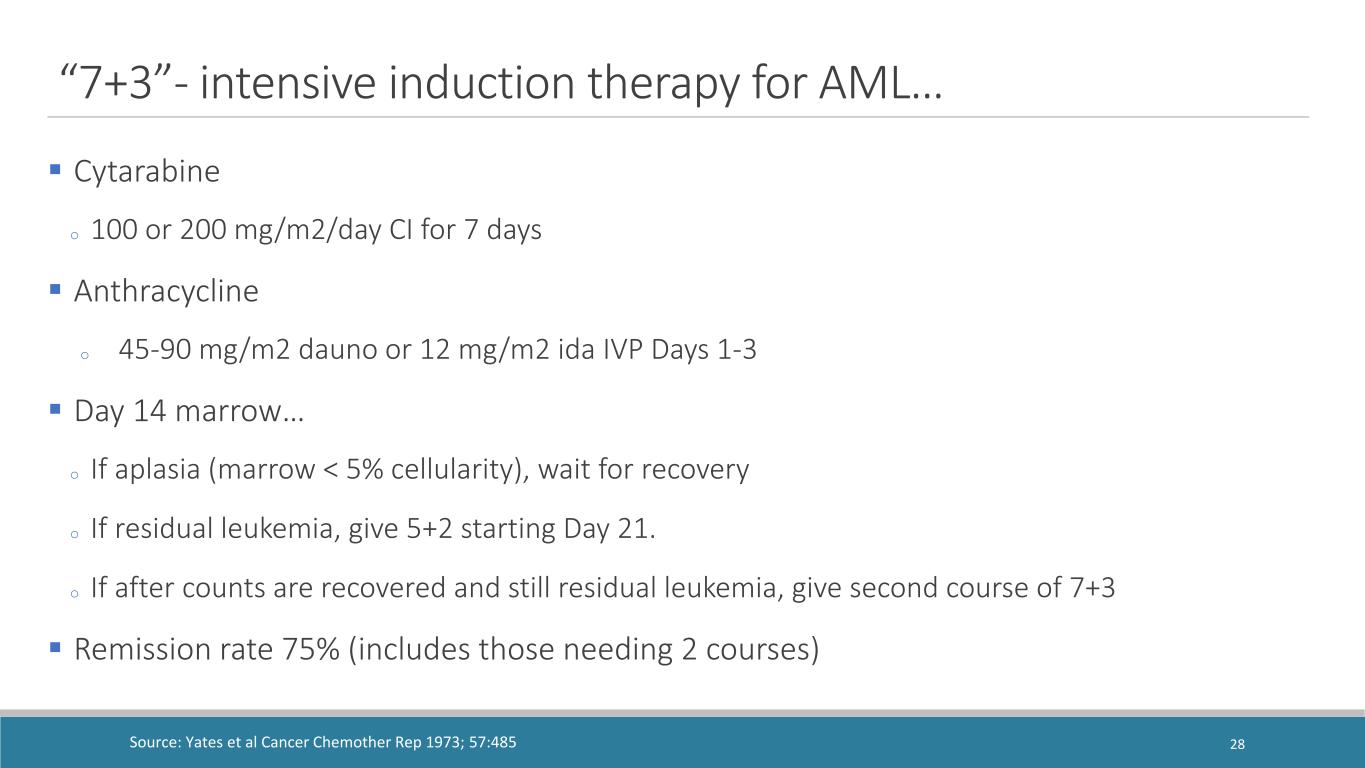

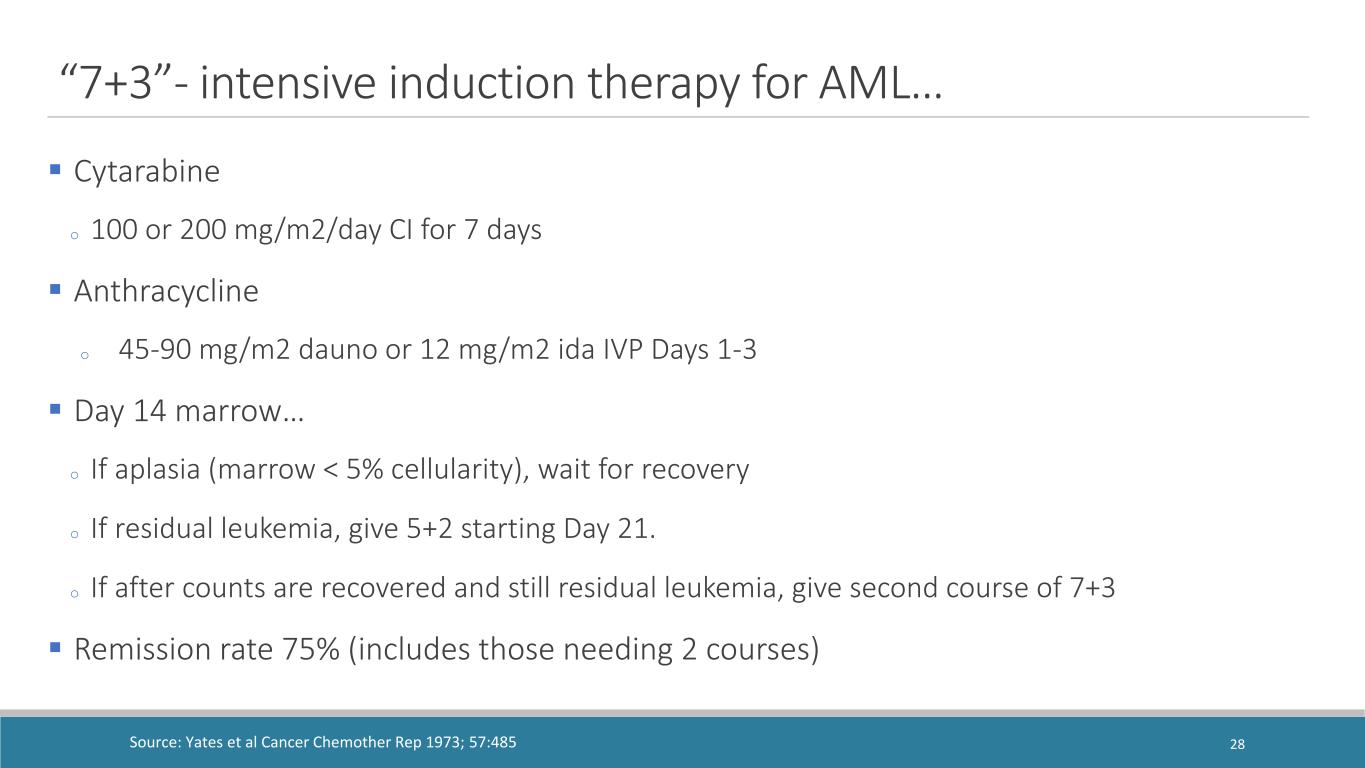

Cytarabine o 100 or 200 mg/m2/day CI for 7 days Anthracycline o 45-90 mg/m2 dauno or 12 mg/m2 ida IVP Days 1-3 Day 14 marrow… o If aplasia (marrow < 5% cellularity), wait for recovery o If residual leukemia, give 5+2 starting Day 21. o If after counts are recovered and still residual leukemia, give second course of 7+3 Remission rate 75% (includes those needing 2 courses) Source: Yates et al Cancer Chemother Rep 1973; 57:485 “7+3”- intensive induction therapy for AML… 28

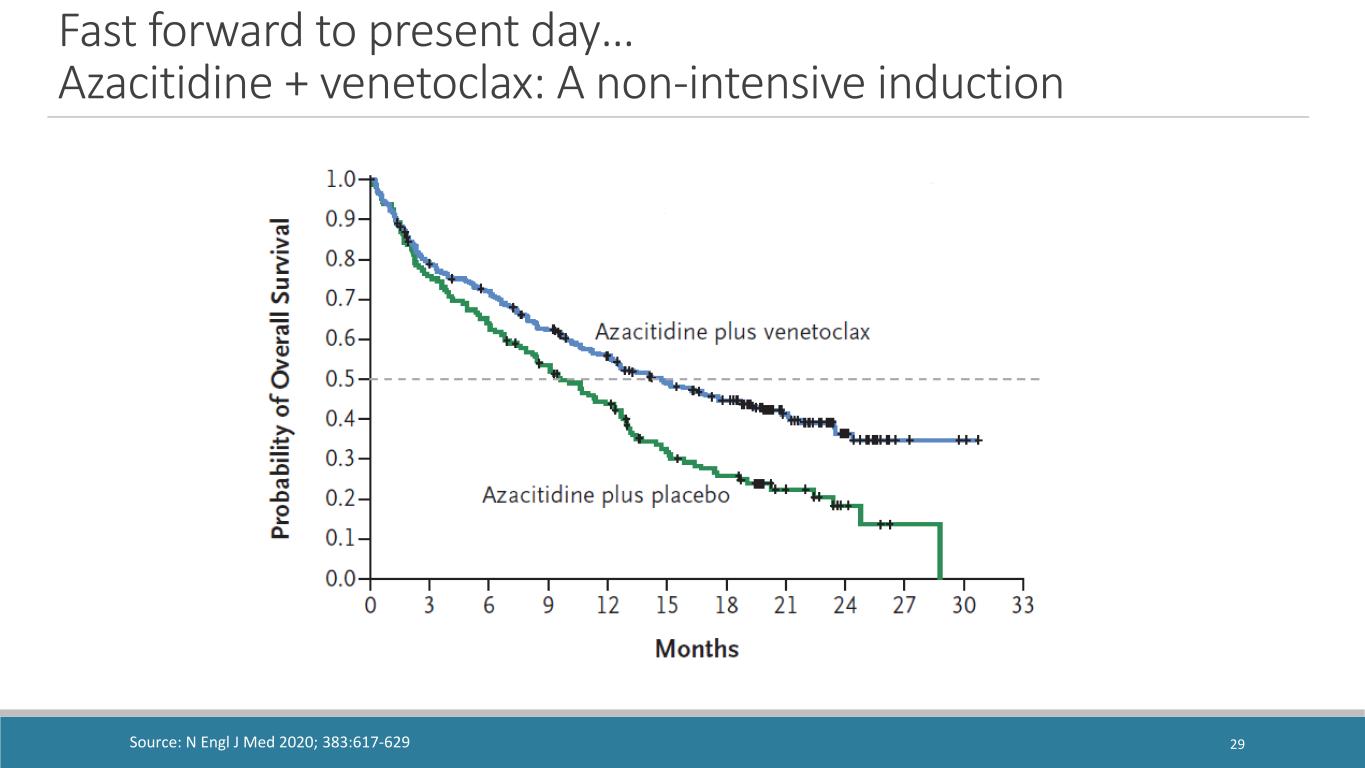

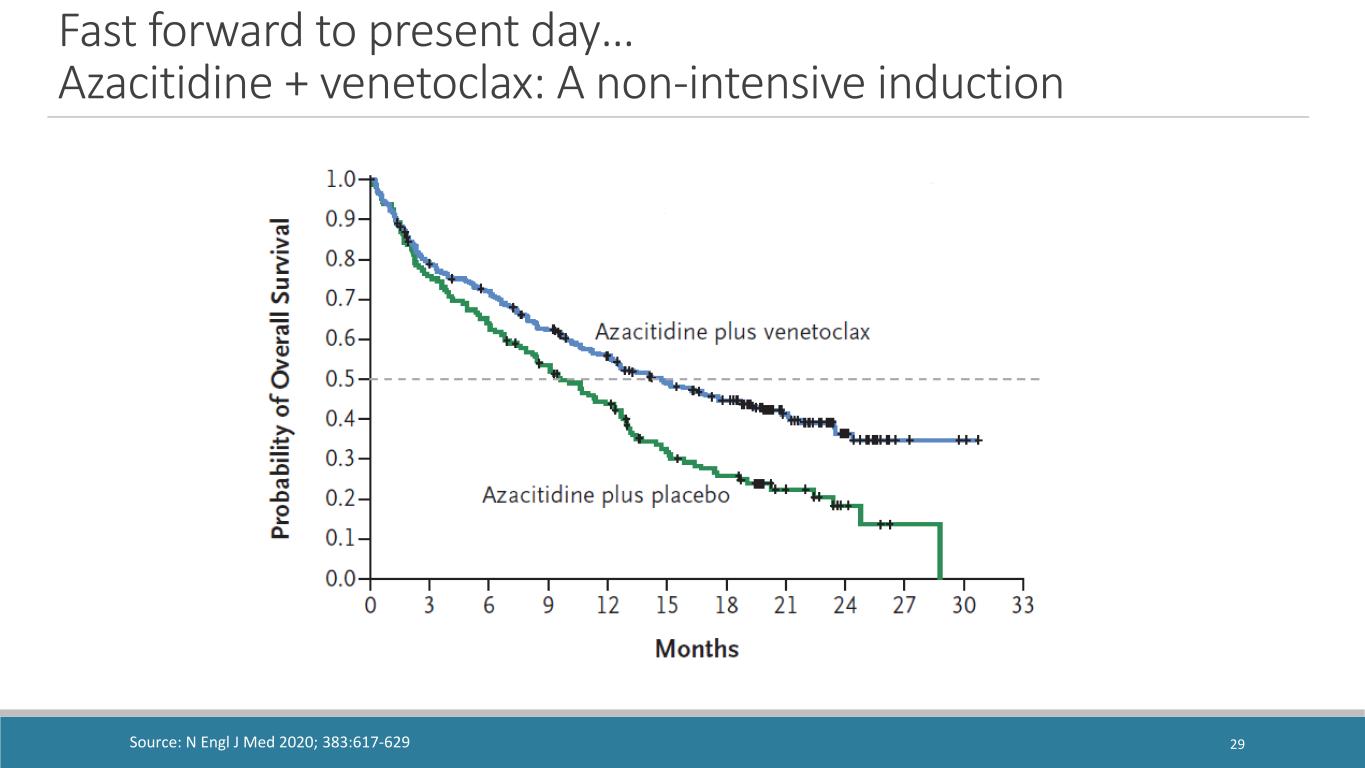

Fast forward to present day… Azacitidine + venetoclax: A non-intensive induction Source: N Engl J Med 2020; 383:617-629 29

ID & Hematologist Facing a team dilemma Preventing Invasive Fungal Infections: Risks and Needs KIEREN MARR MD MBA P RO F ES S O R O F M E D I C I N E , J O H N S H O P K I N S S C H O O L O F M E D I C I N E D I R EC TO R , T R A N S P L A N T A N D O N CO LO GY I N F EC T I O U S D I S EA S ES V I C E C H A I R O F M E D I C I N E FO R I N N OVAT I O N I N H EA LT H C A R E I M P L E M E N TAT I O N 30

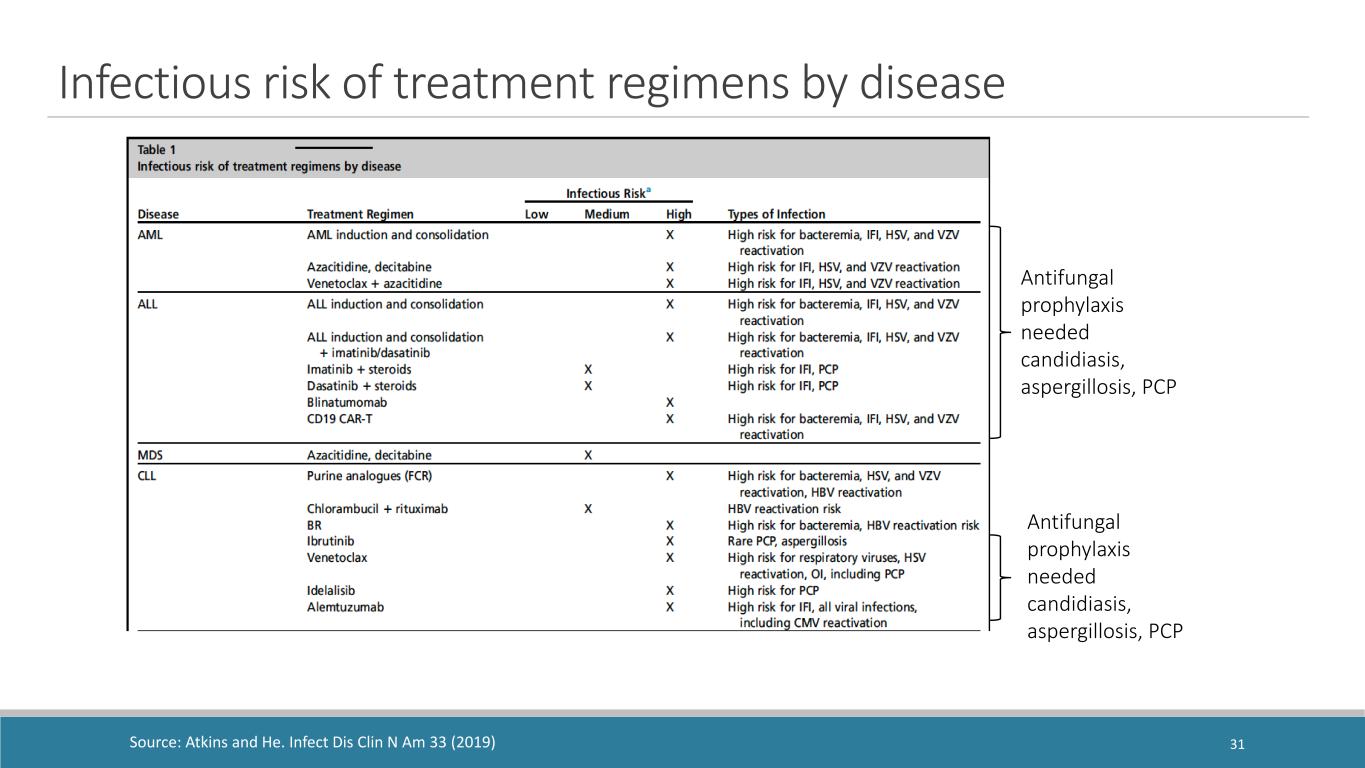

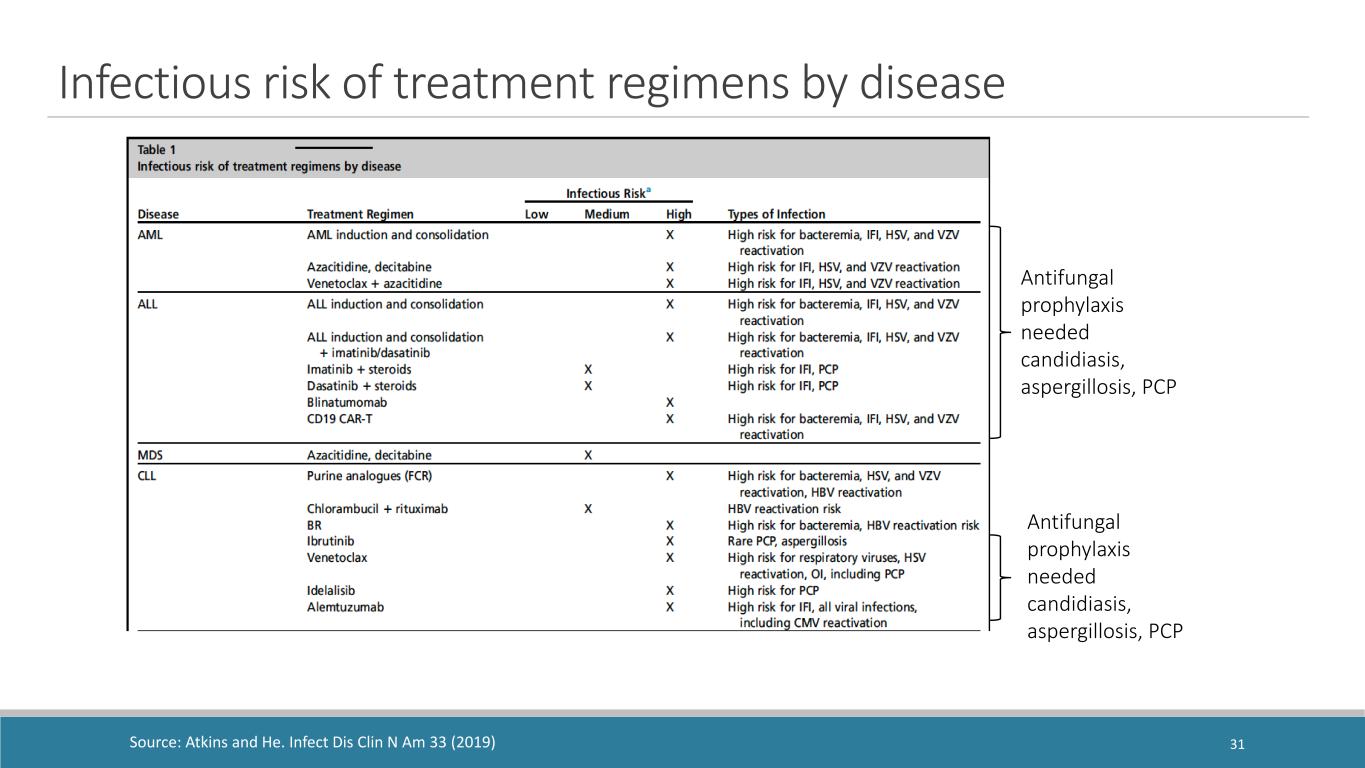

Antifungal prophylaxis needed candidiasis, aspergillosis, PCP Source: Atkins and He. Infect Dis Clin N Am 33 (2019) Infectious risk of treatment regimens by disease 31 Antifungal prophylaxis needed candidiasis, aspergillosis, PCP

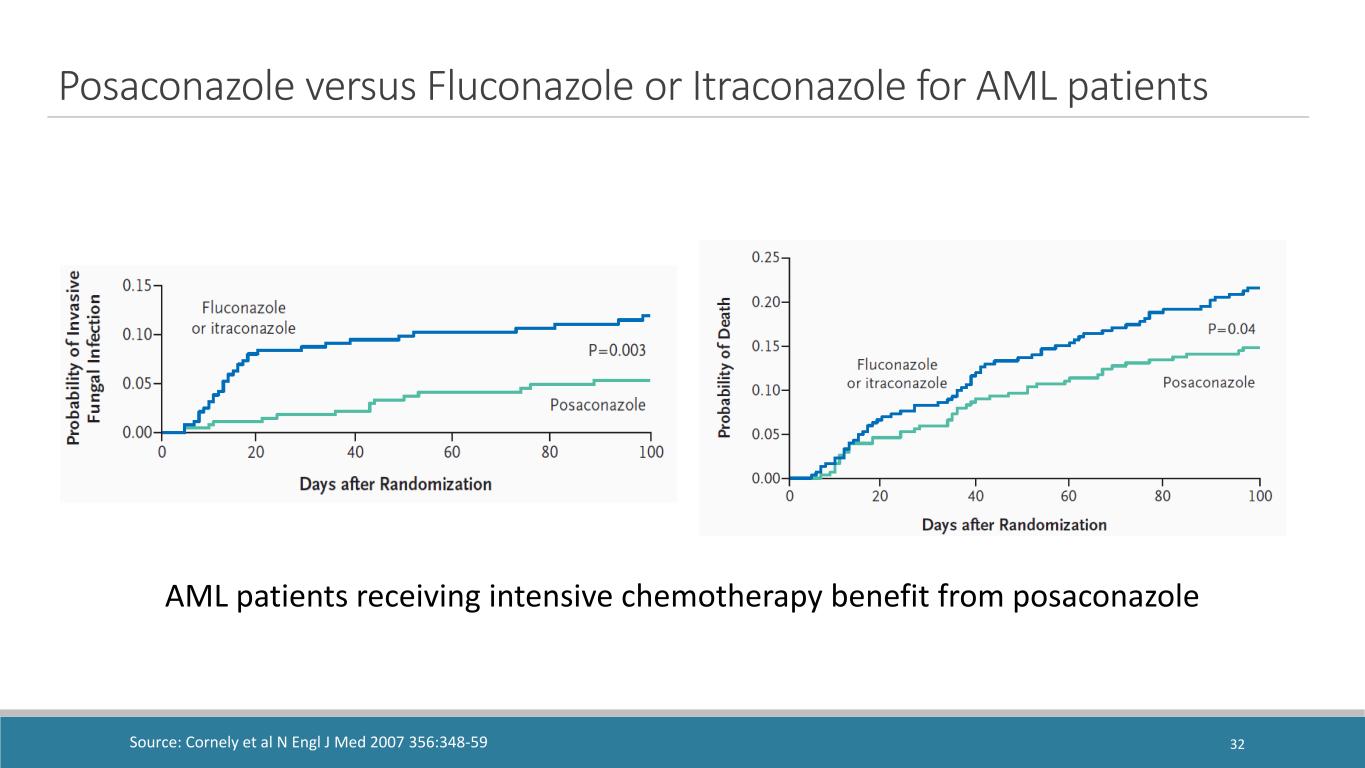

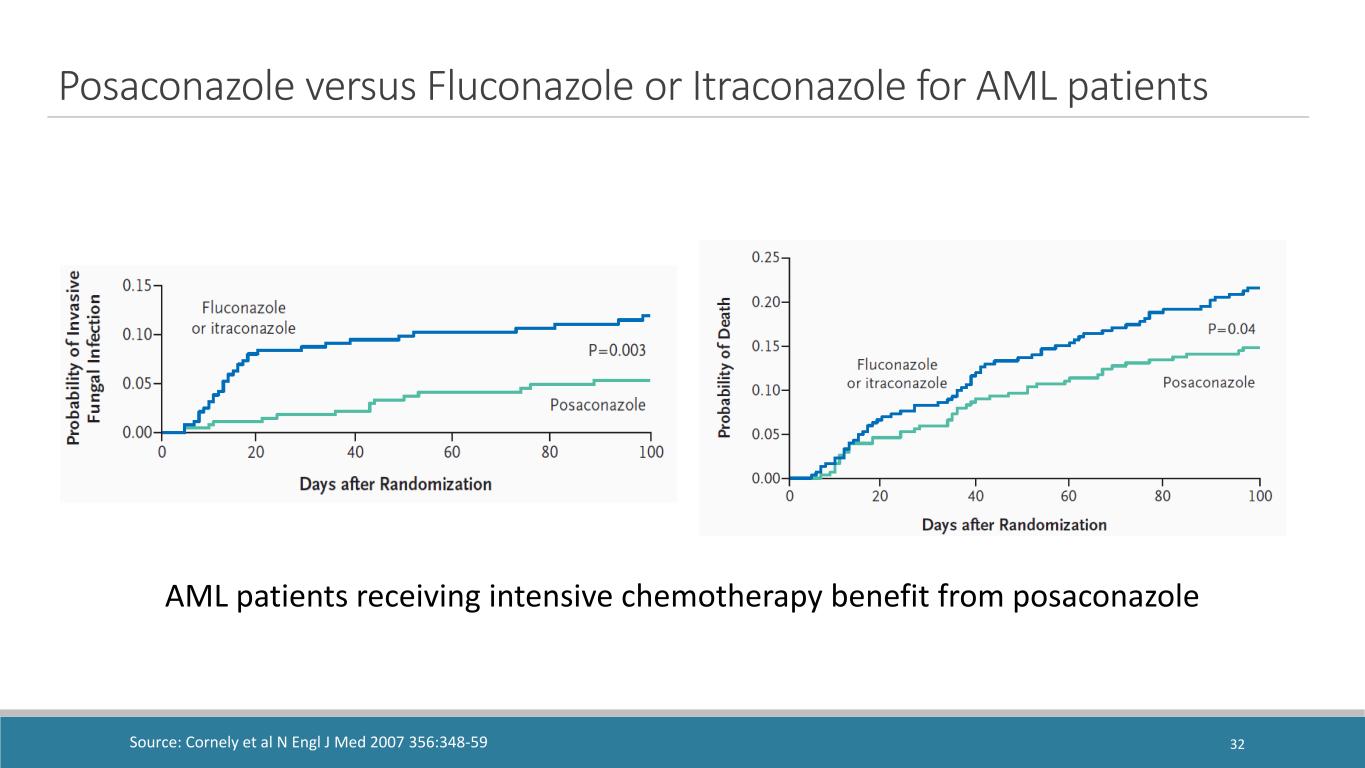

AML patients receiving intensive chemotherapy benefit from posaconazole Posaconazole versus Fluconazole or Itraconazole for AML patients Source: Cornely et al N Engl J Med 2007 356:348-59 32

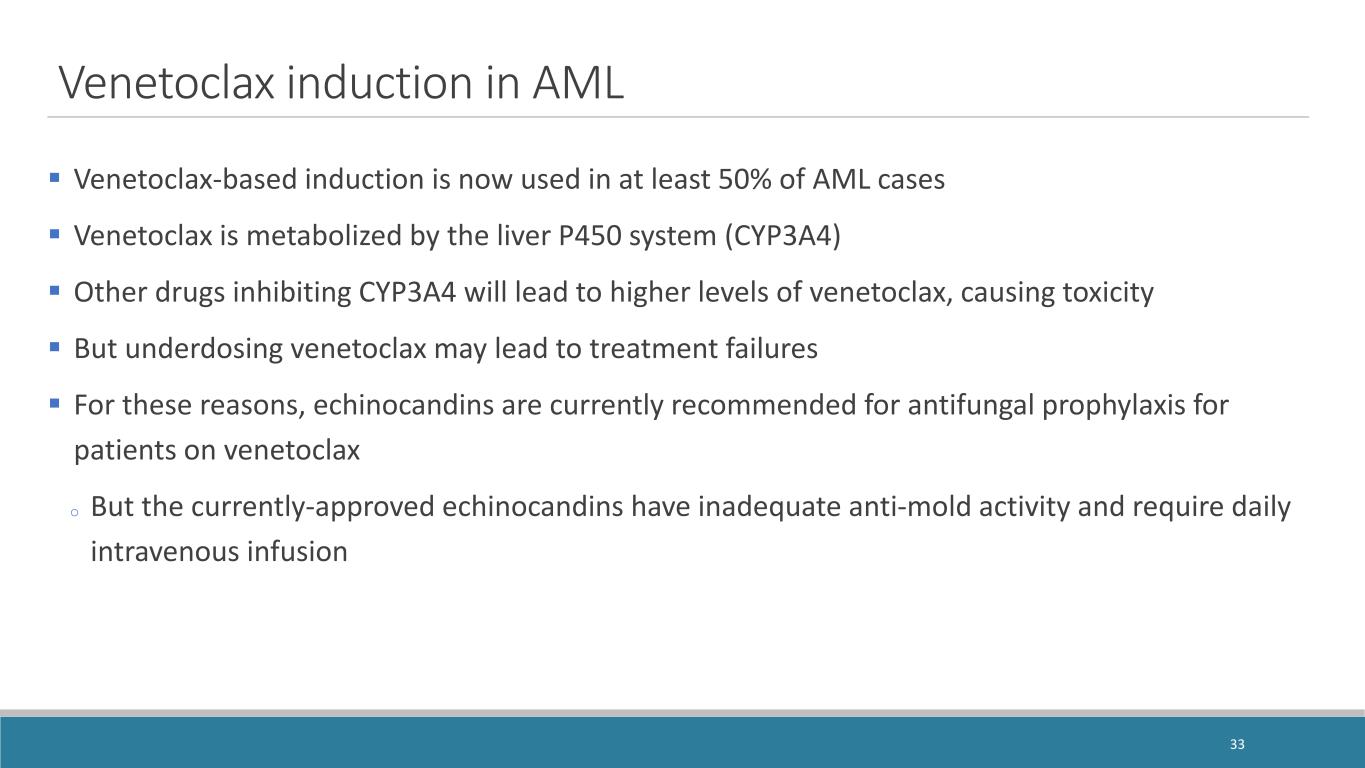

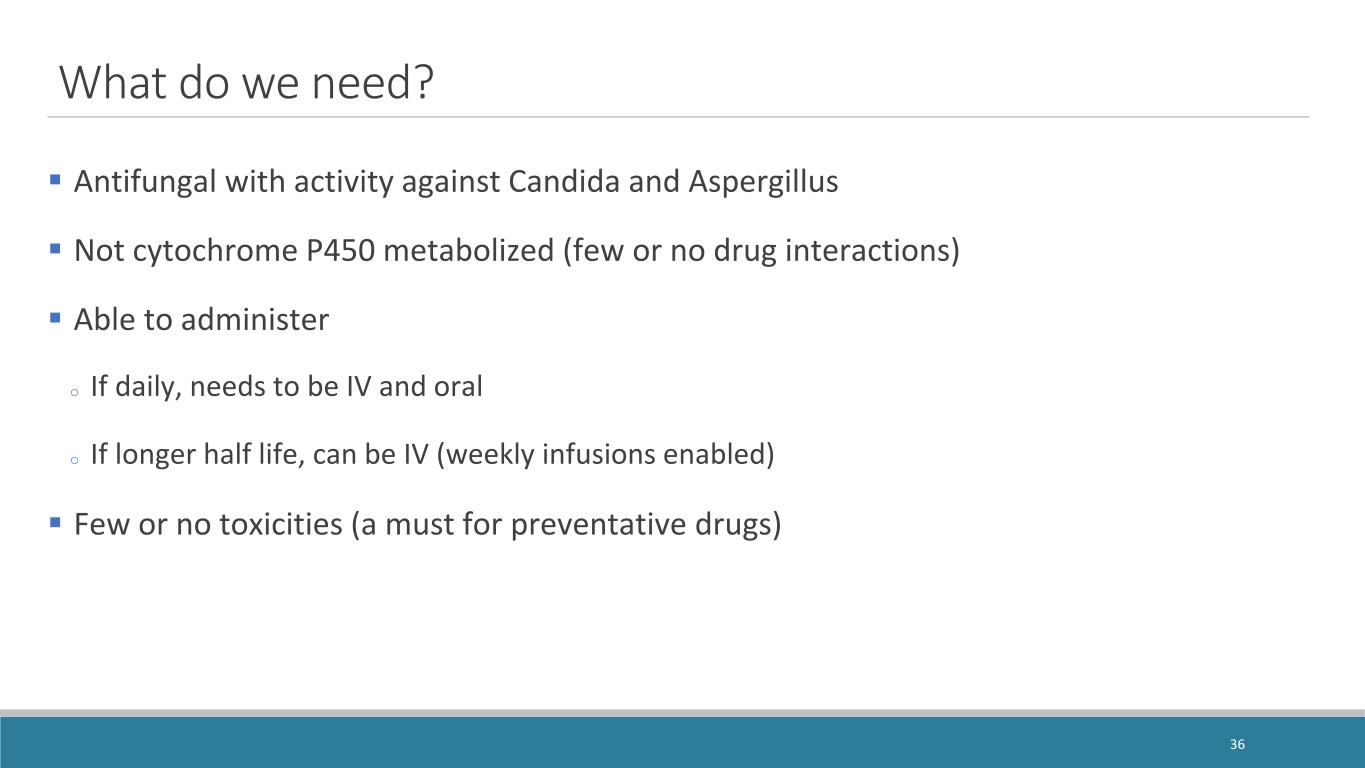

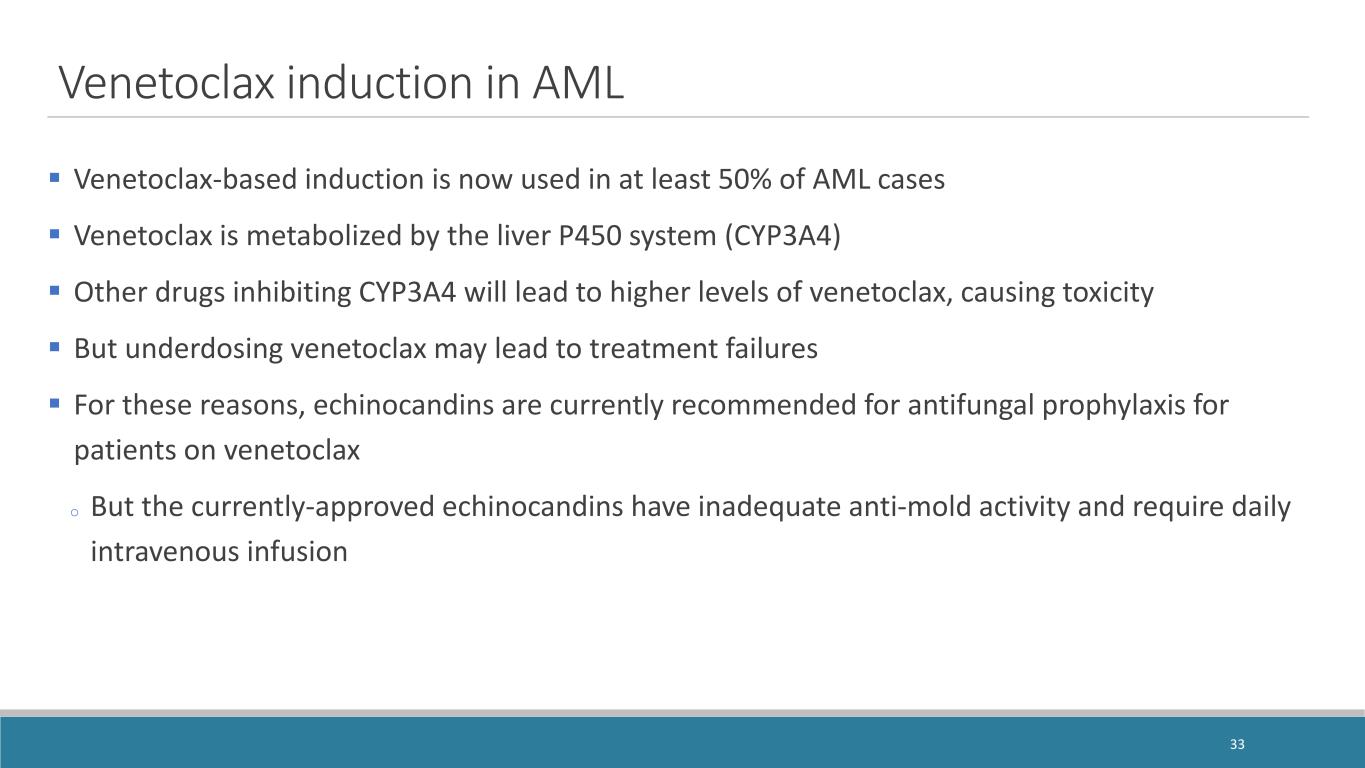

Venetoclax induction in AML Venetoclax-based induction is now used in at least 50% of AML cases Venetoclax is metabolized by the liver P450 system (CYP3A4) Other drugs inhibiting CYP3A4 will lead to higher levels of venetoclax, causing toxicity But underdosing venetoclax may lead to treatment failures For these reasons, echinocandins are currently recommended for antifungal prophylaxis for patients on venetoclax o But the currently-approved echinocandins have inadequate anti-mold activity and require daily intravenous infusion 33

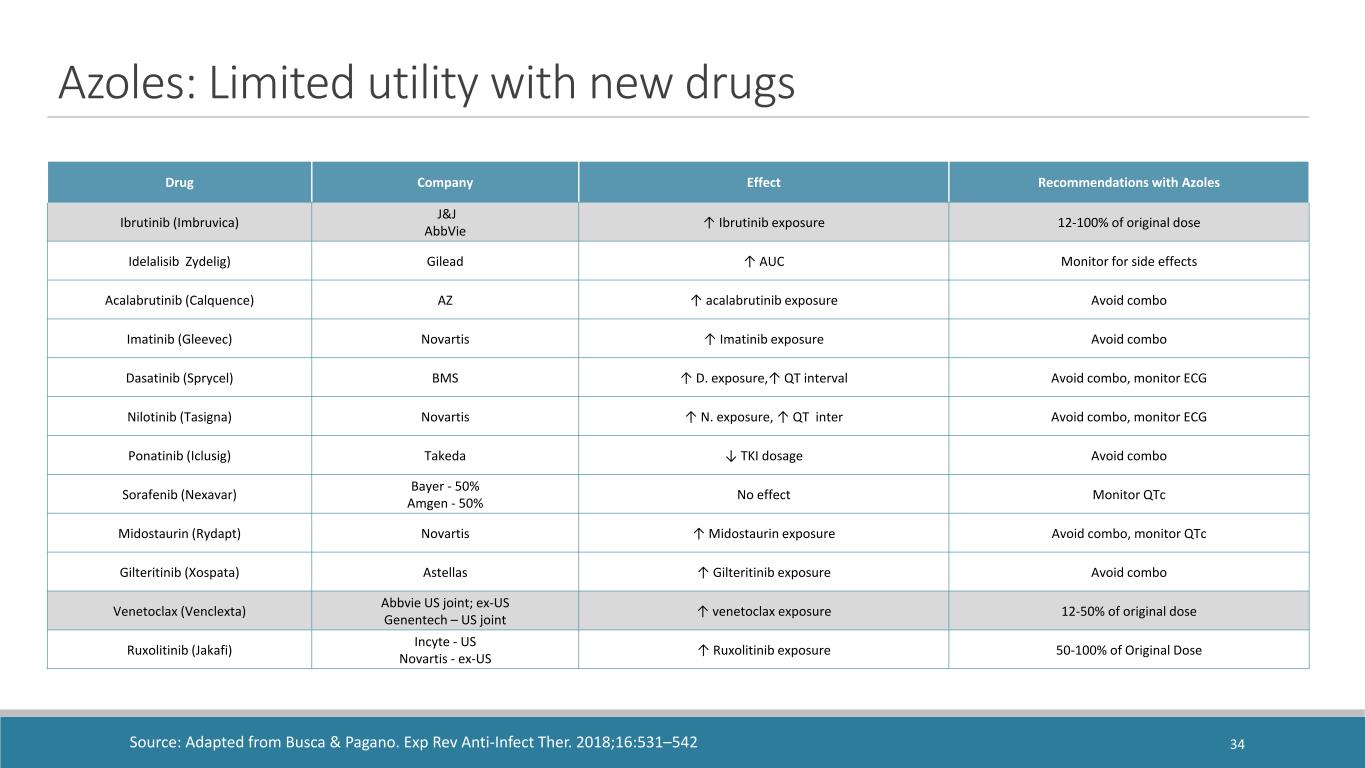

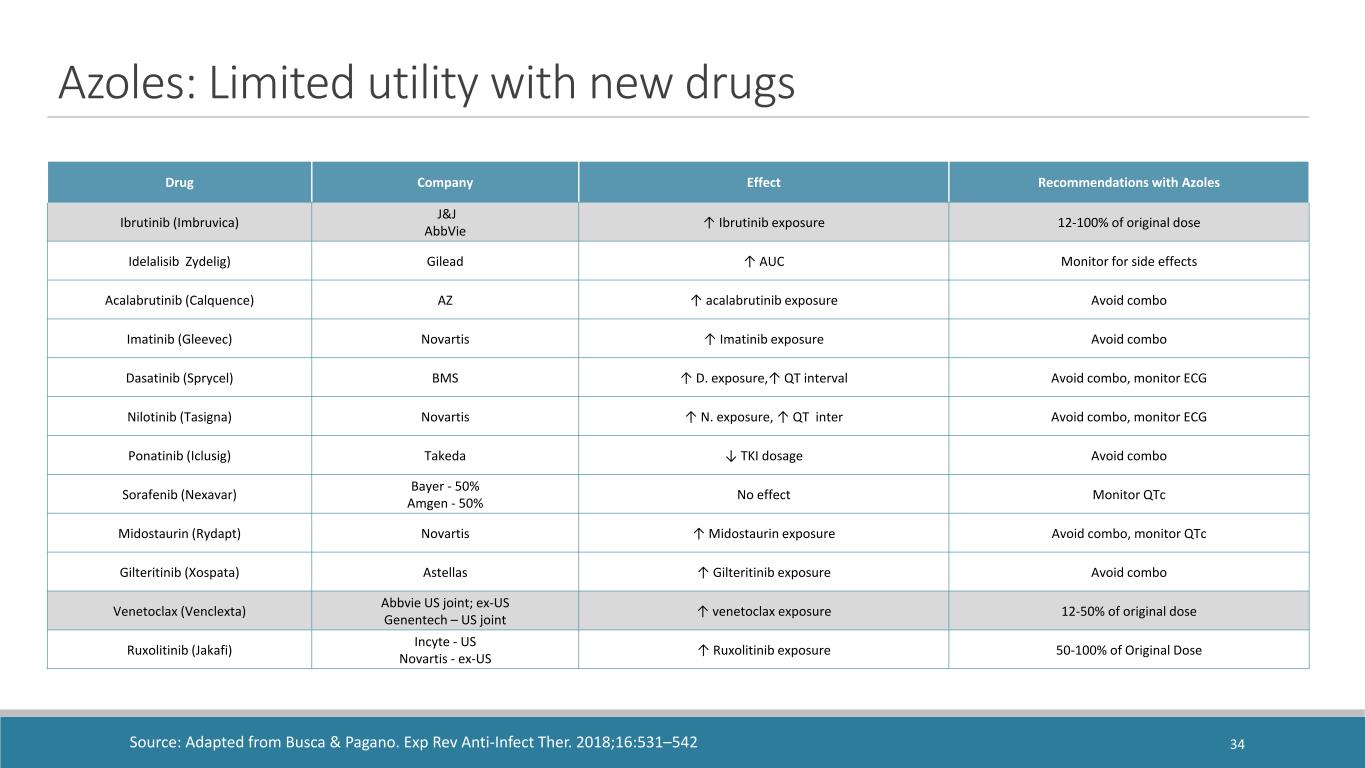

Azoles: Limited utility with new drugs Drug Company Effect Recommendations with Azoles Ibrutinib (Imbruvica) J&J AbbVie ↑ Ibrutinib exposure 12-100% of original dose Idelalisib Zydelig) Gilead ↑ AUC Monitor for side effects Acalabrutinib (Calquence) AZ ↑ acalabrutinib exposure Avoid combo Imatinib (Gleevec) Novartis ↑ Imatinib exposure Avoid combo Dasatinib (Sprycel) BMS ↑ D. exposure,↑ QT interval Avoid combo, monitor ECG Nilotinib (Tasigna) Novartis ↑ N. exposure, ↑ QT inter Avoid combo, monitor ECG Ponatinib (Iclusig) Takeda ↓ TKI dosage Avoid combo Sorafenib (Nexavar) Bayer - 50% Amgen - 50% No effect Monitor QTc Midostaurin (Rydapt) Novartis ↑ Midostaurin exposure Avoid combo, monitor QTc Gilteritinib (Xospata) Astellas ↑ Gilteritinib exposure Avoid combo Venetoclax (Venclexta) Abbvie US joint; ex-US Genentech – US joint ↑ venetoclax exposure 12-50% of original dose Ruxolitinib (Jakafi) Incyte - US Novartis - ex-US ↑ Ruxolitinib exposure 50-100% of Original Dose Source: Adapted from Busca & Pagano. Exp Rev Anti-Infect Ther. 2018;16:531–542 34

Diagnosis, Transfer to leukemia service Months 0 1 2 3 4 5 6 7 8 9 Induction Consolidation Consolidation Bone marrow transplant Currently – we’re giving IV echinocandins on and off during periods of neutropenia With diagnosed IFI – we have to hold or dose-reduce anti-AML therapy (bad outcomes) Back to the Patient… 35

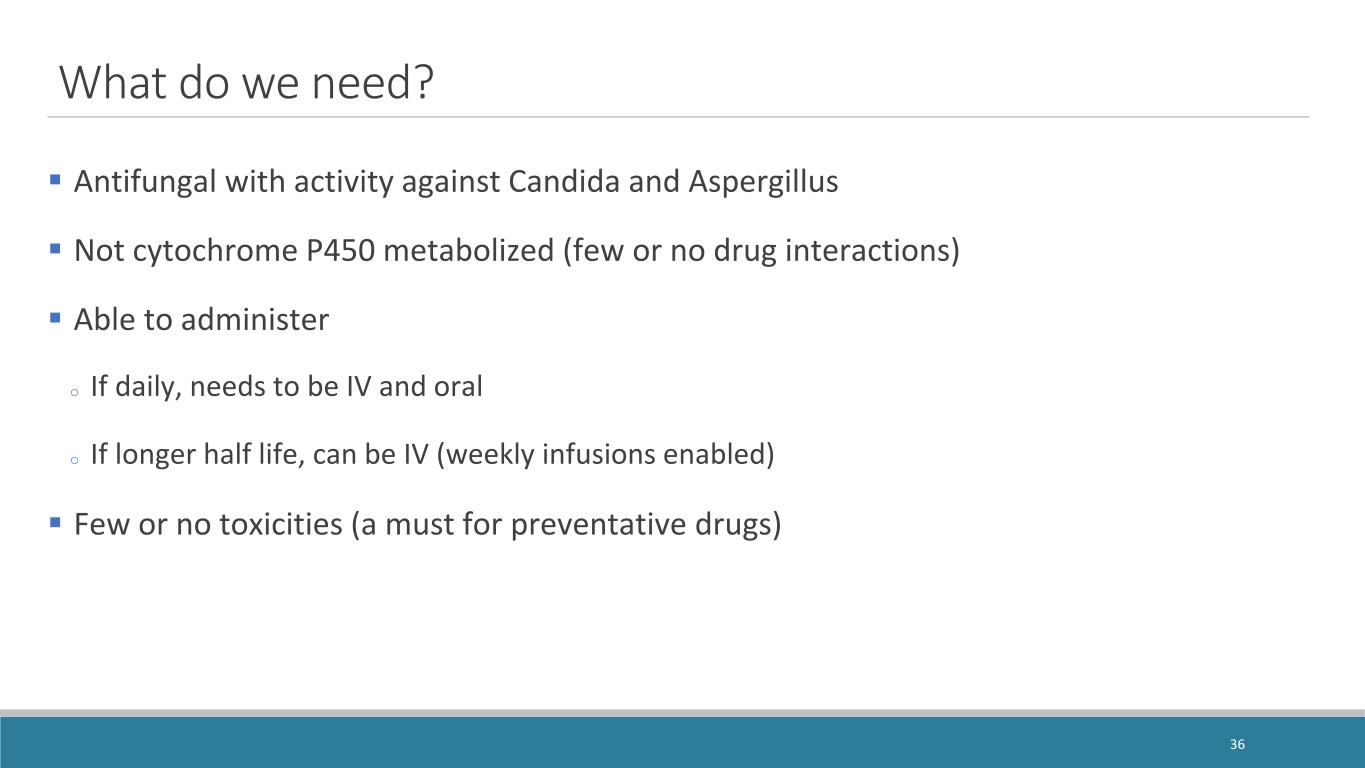

What do we need? Antifungal with activity against Candida and Aspergillus Not cytochrome P450 metabolized (few or no drug interactions) Able to administer o If daily, needs to be IV and oral o If longer half life, can be IV (weekly infusions enabled) Few or no toxicities (a must for preventative drugs) 36

37 R E S U LT S O F ‘ R E Z A H E M E ’ D D I S T U D Y TAY LO R S A N D I S O N , M D C H I E F M E D I C A L O F F I C E R , C I D A R A

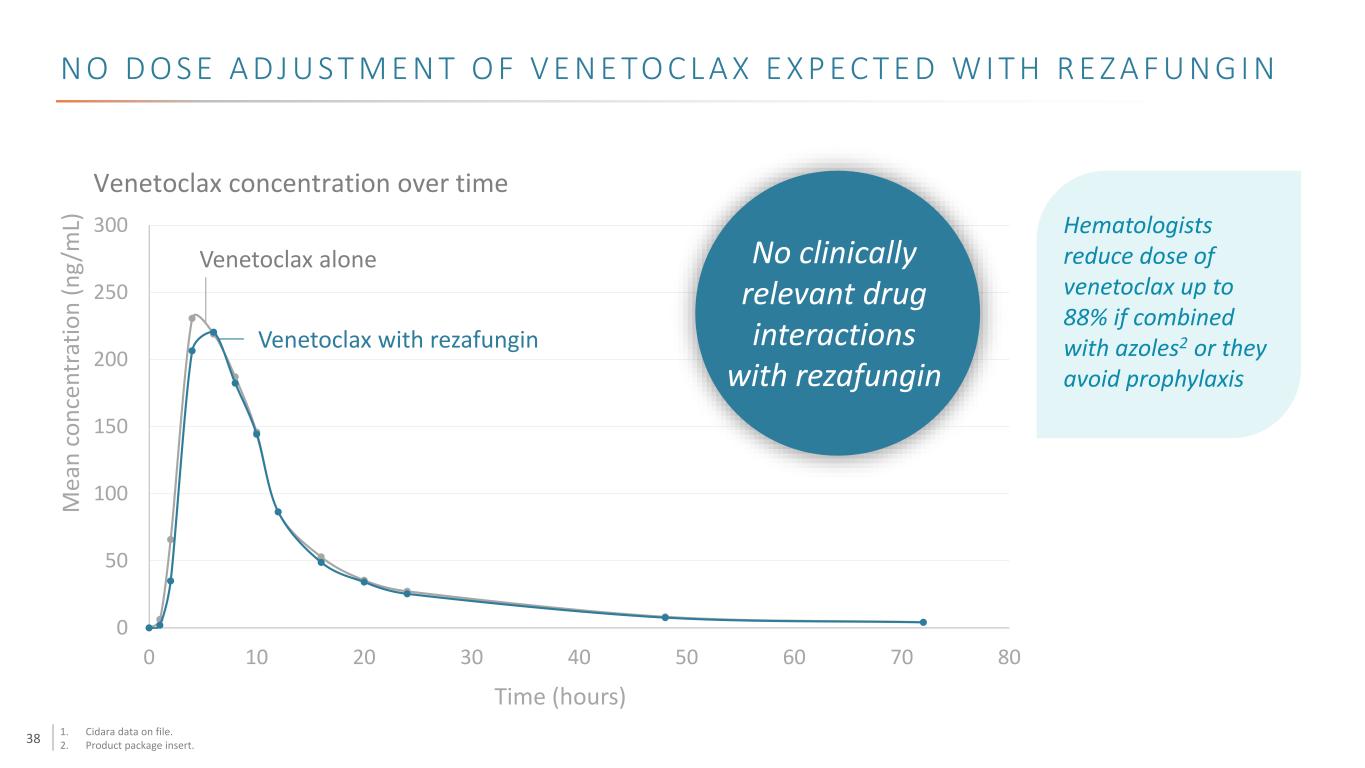

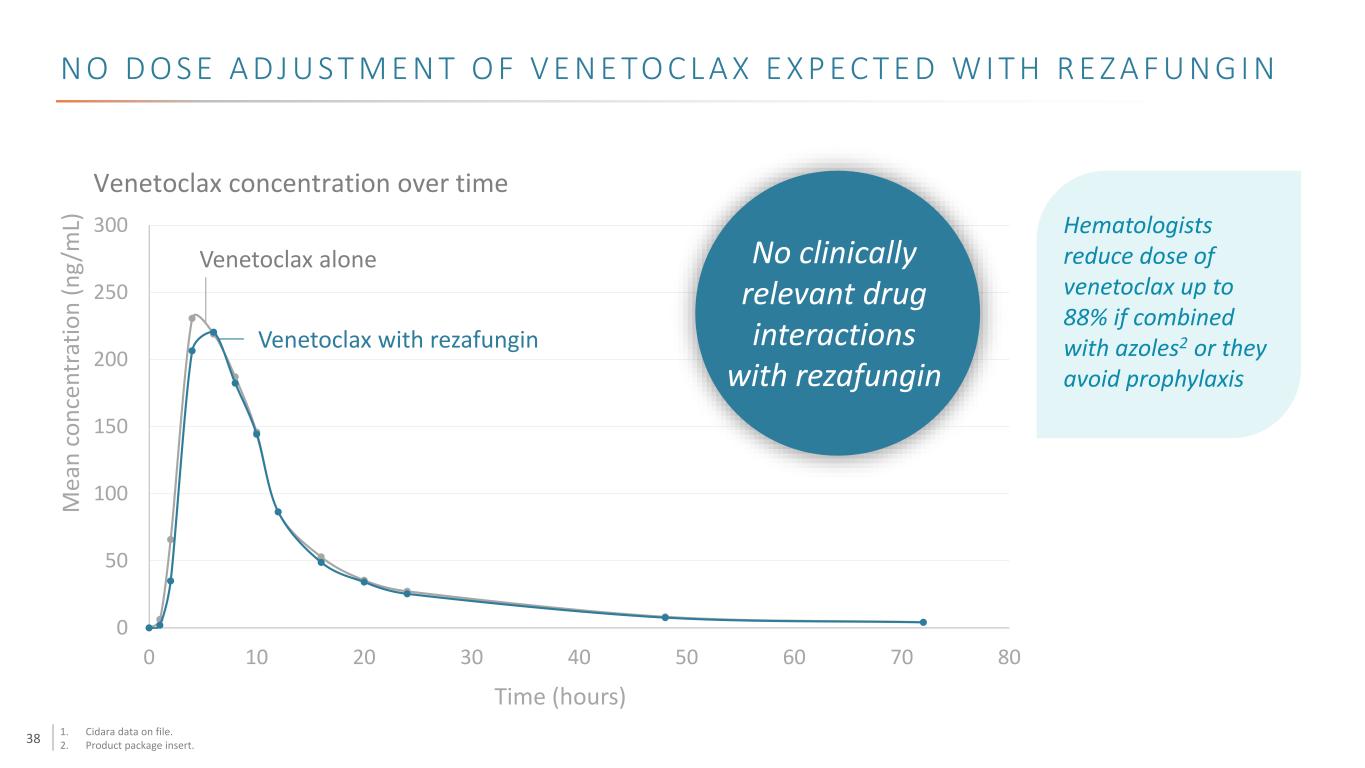

38 N O D O S E A D J U S T M E N T O F V E N E TO C L A X E X P E C T E D W I T H R E Z A F U N G I N 0 50 100 150 200 250 300 0 10 20 30 40 50 60 70 80 Venetoclax alone Venetoclax with rezafungin Time (hours) Venetoclax concentration over time Hematologists reduce dose of venetoclax up to 88% if combined with azoles2 or they avoid prophylaxis M ea n co nc en tr at io n (n g/ m L) No clinically relevant drug interactions with rezafungin 1. Cidara data on file. 2. Product package insert.

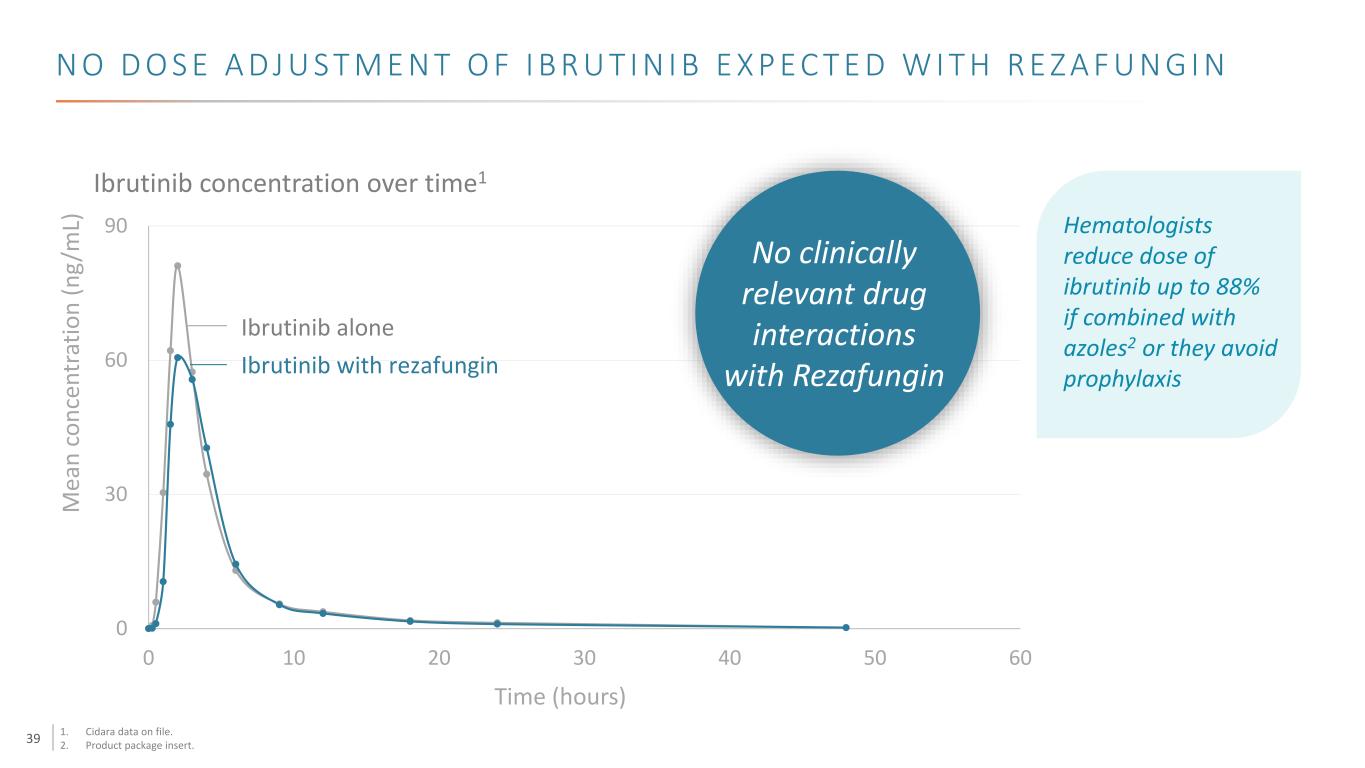

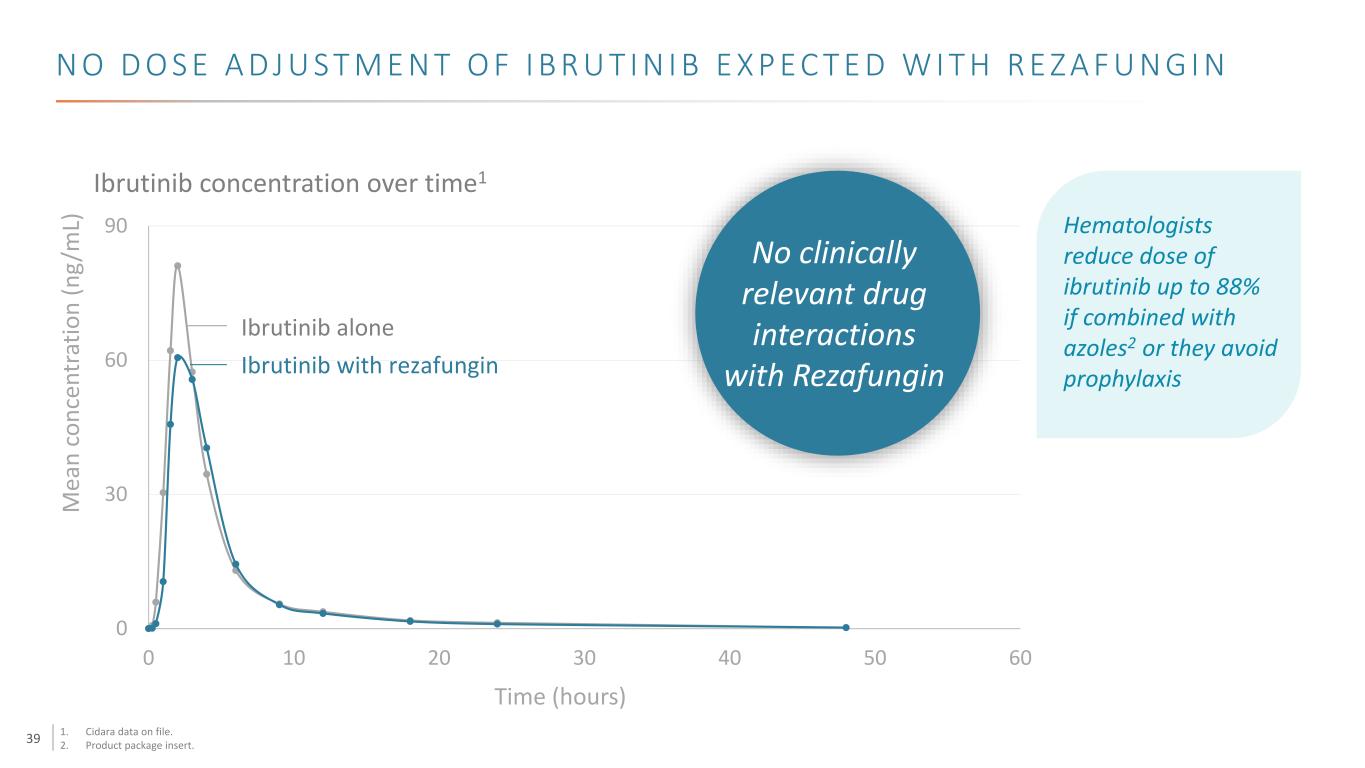

39 N O D O S E A D J U S T M E N T O F I B R U T I N I B E X P E C T E D W I T H R E Z A F U N G I N 0 30 60 90 0 10 20 30 40 50 60 Ibrutinib alone Ibrutinib with rezafungin M ea n co nc en tr at io n (n g/ m L) Time (hours) Ibrutinib concentration over time1 Hematologists reduce dose of ibrutinib up to 88% if combined with azoles2 or they avoid prophylaxis No clinically relevant drug interactions with Rezafungin 1. Cidara data on file. 2. Product package insert.

40 R E Z A F U N G I N C O M M E R C I A L V A L U E P A U L D A R U W A L A C H I E F O P E R A T I N G O F F I C E R , C I D A R A

41 Rezafungin Rezafungin Azole DDI Dilemma/Opportunity Market Potential

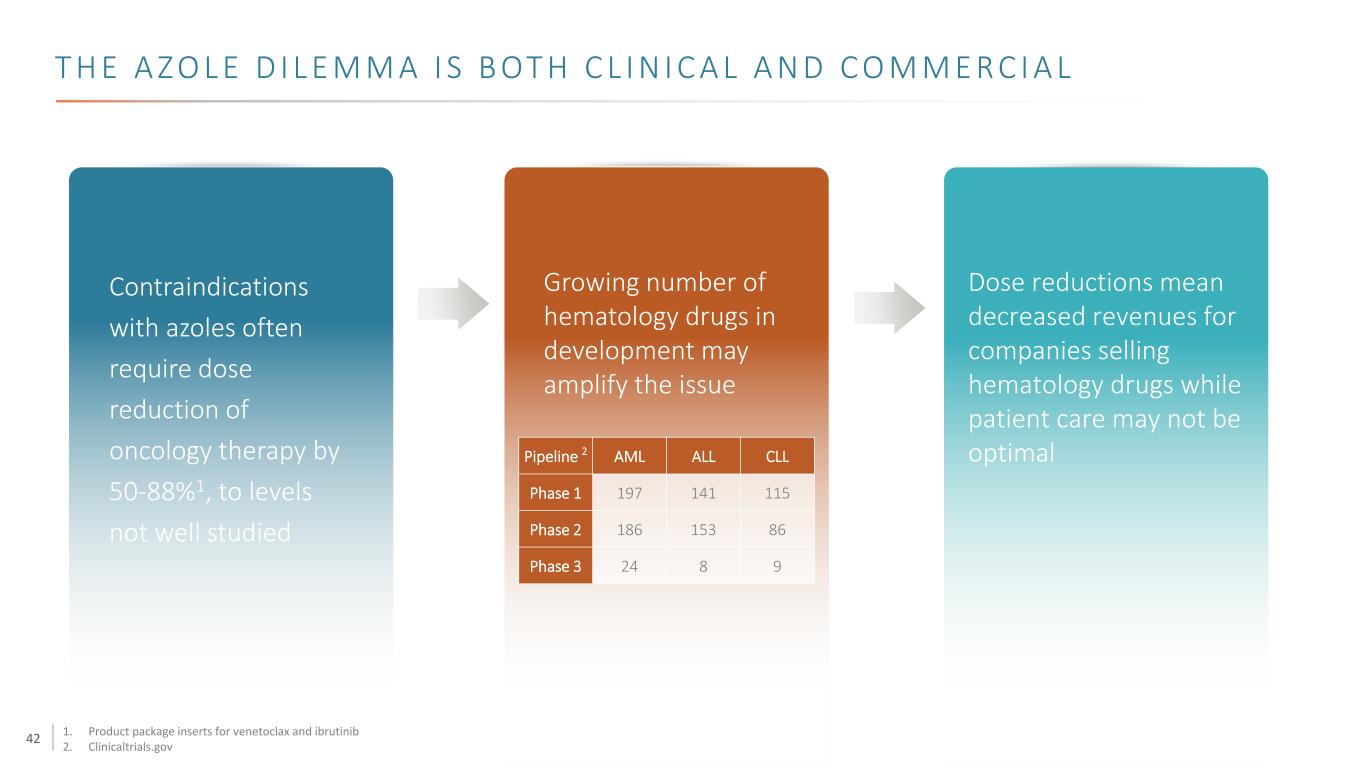

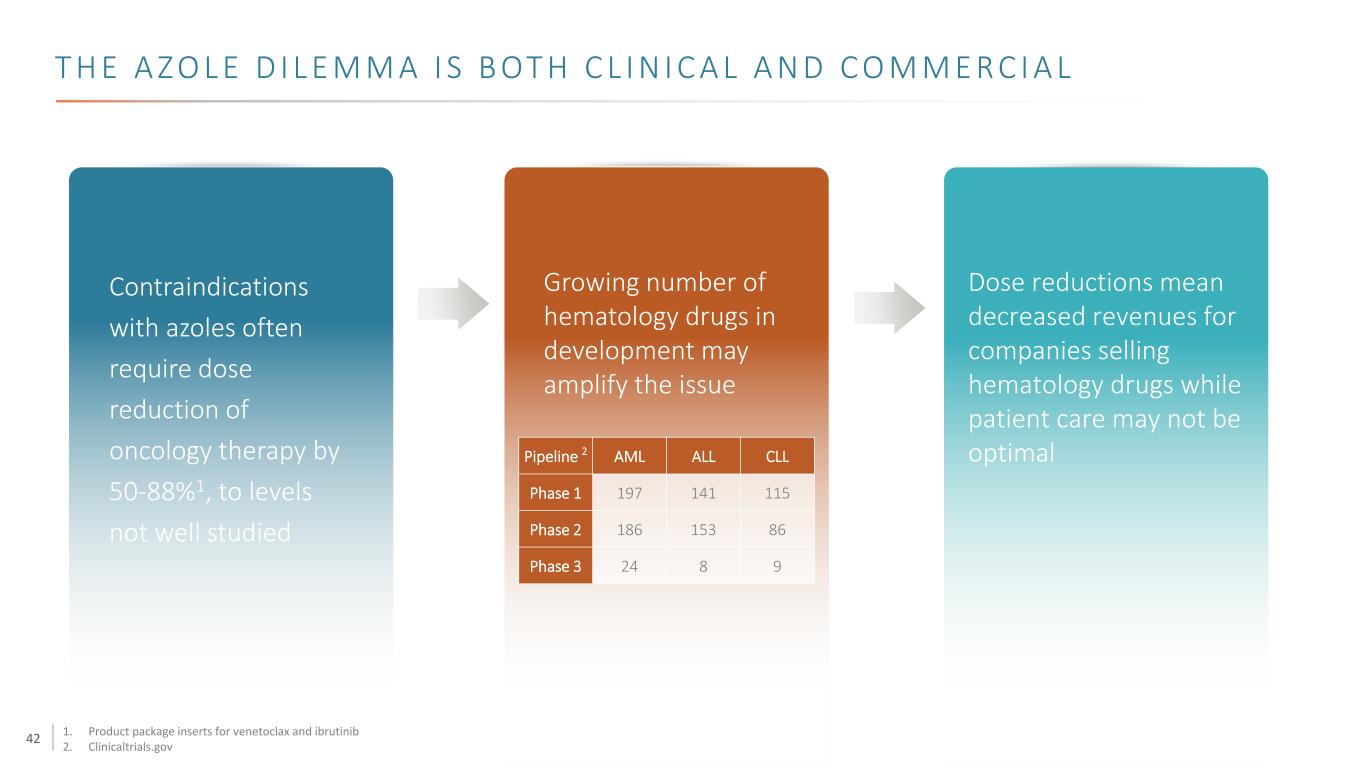

42 T H E A Z O L E D I L E M M A I S B OT H C L I N I C A L A N D C O M M E R C I A L Contraindications with azoles often require dose reduction of oncology therapy by 50-88%1, to levels not well studied Pipeline 2 AML ALL CLL Phase 1 197 141 115 Phase 2 186 153 86 Phase 3 24 8 9 Dose reductions mean decreased revenues for companies selling hematology drugs while patient care may not be optimal Growing number of hematology drugs in development may amplify the issue 1. Product package inserts for venetoclax and ibrutinib 2. Clinicaltrials.gov

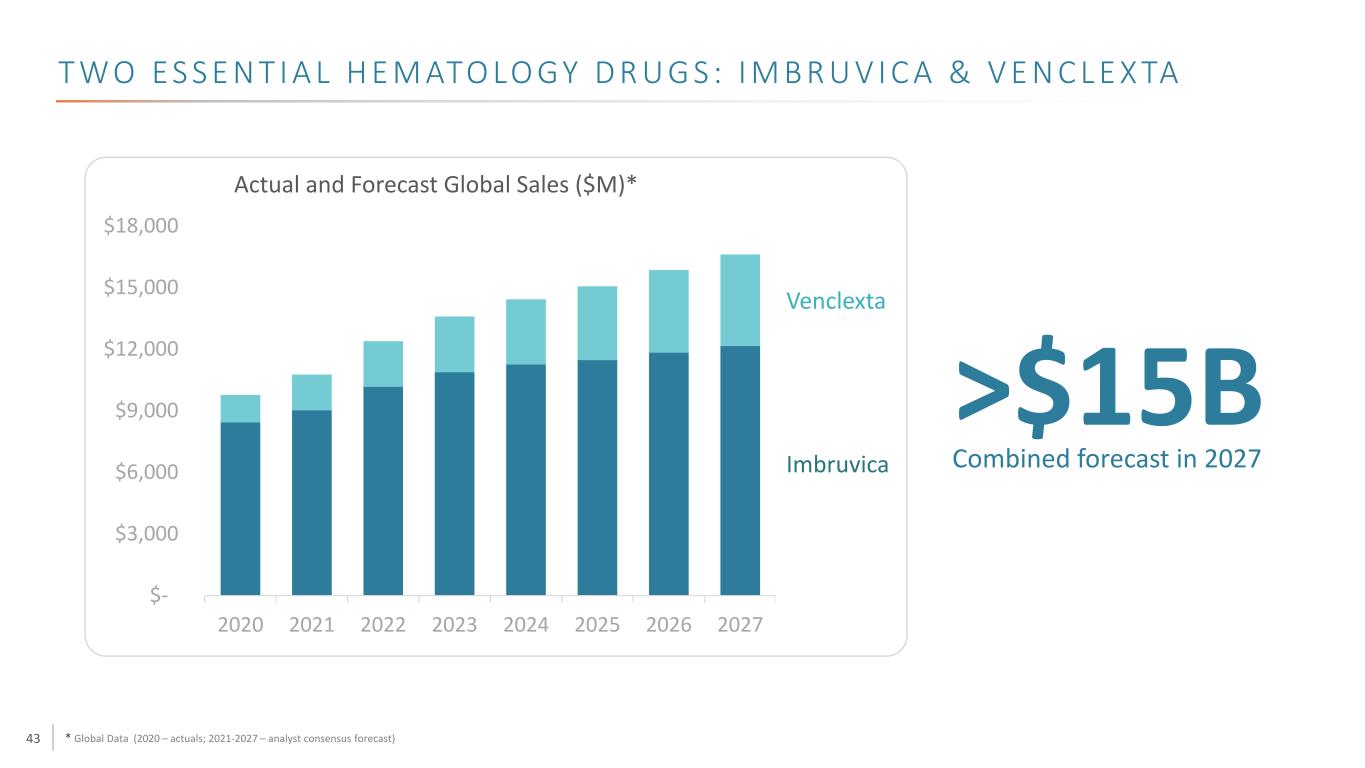

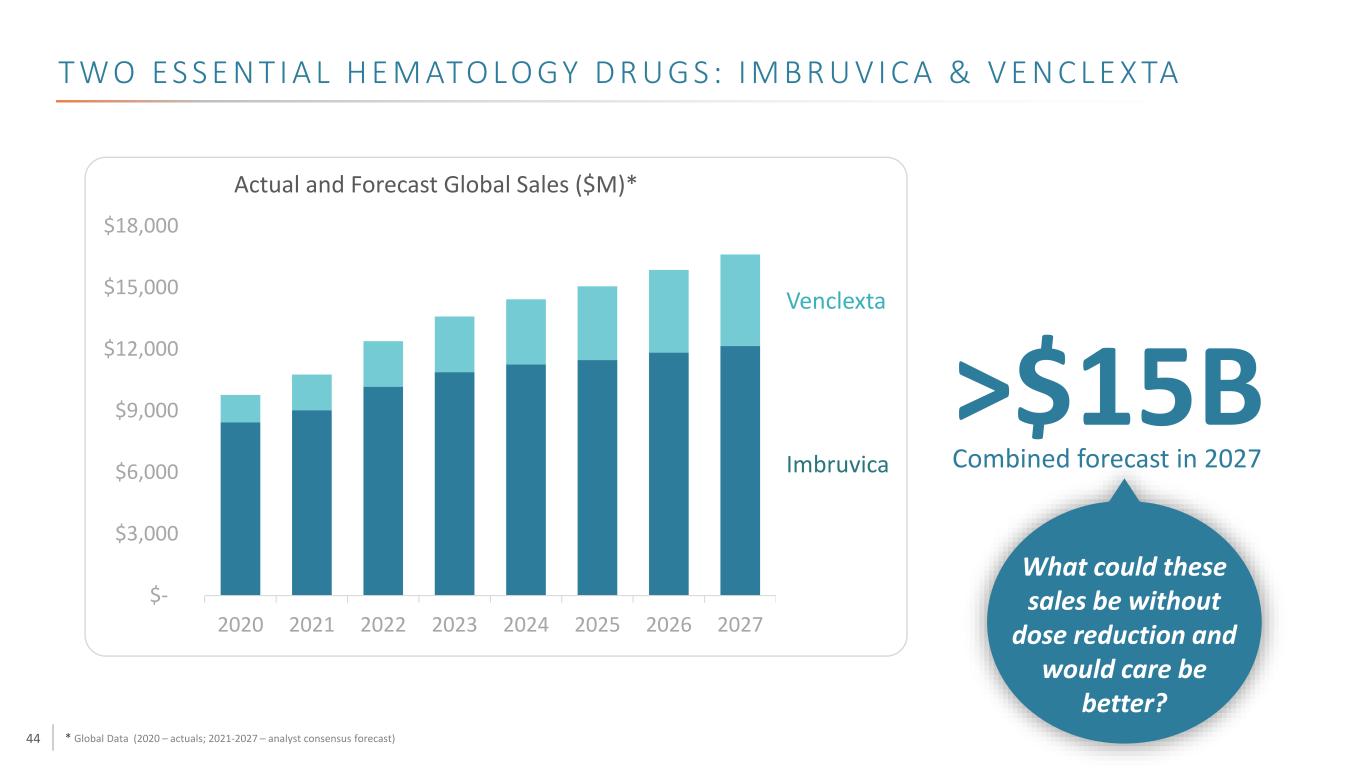

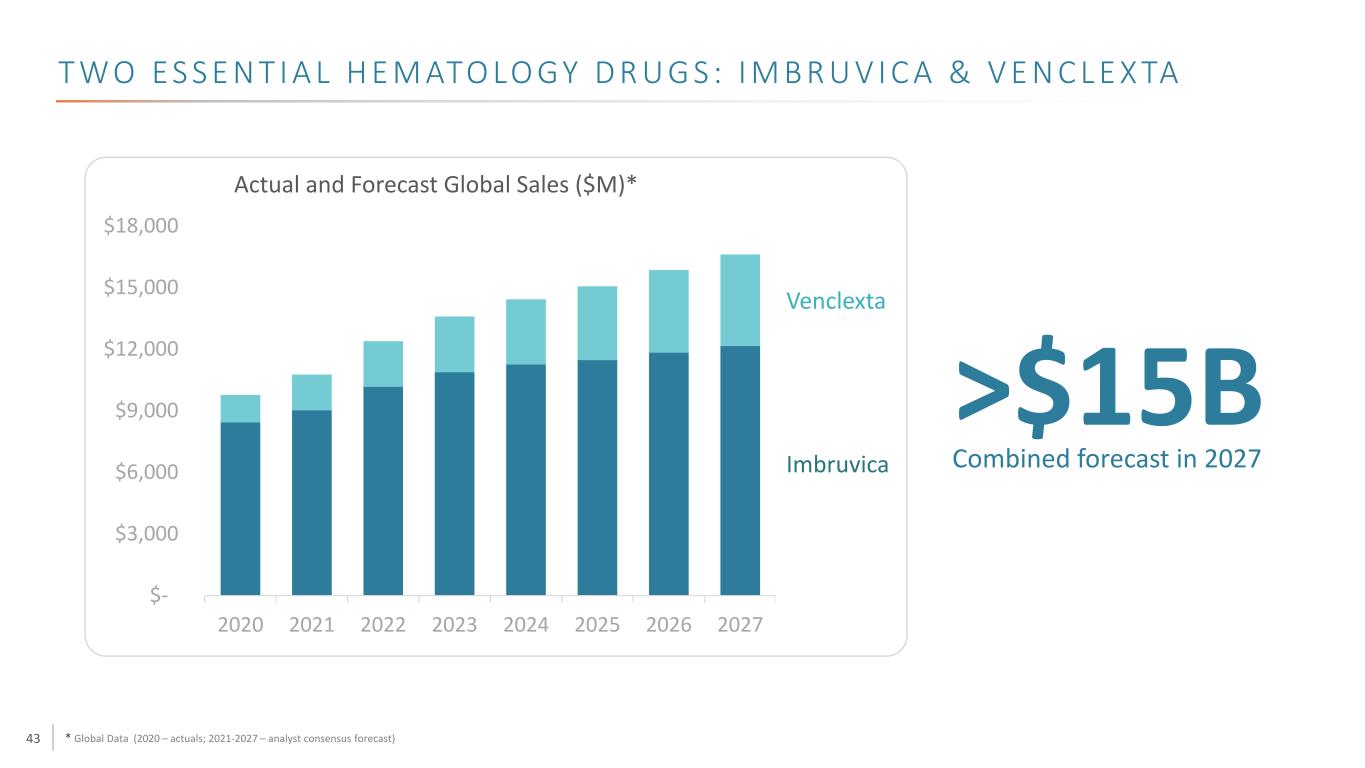

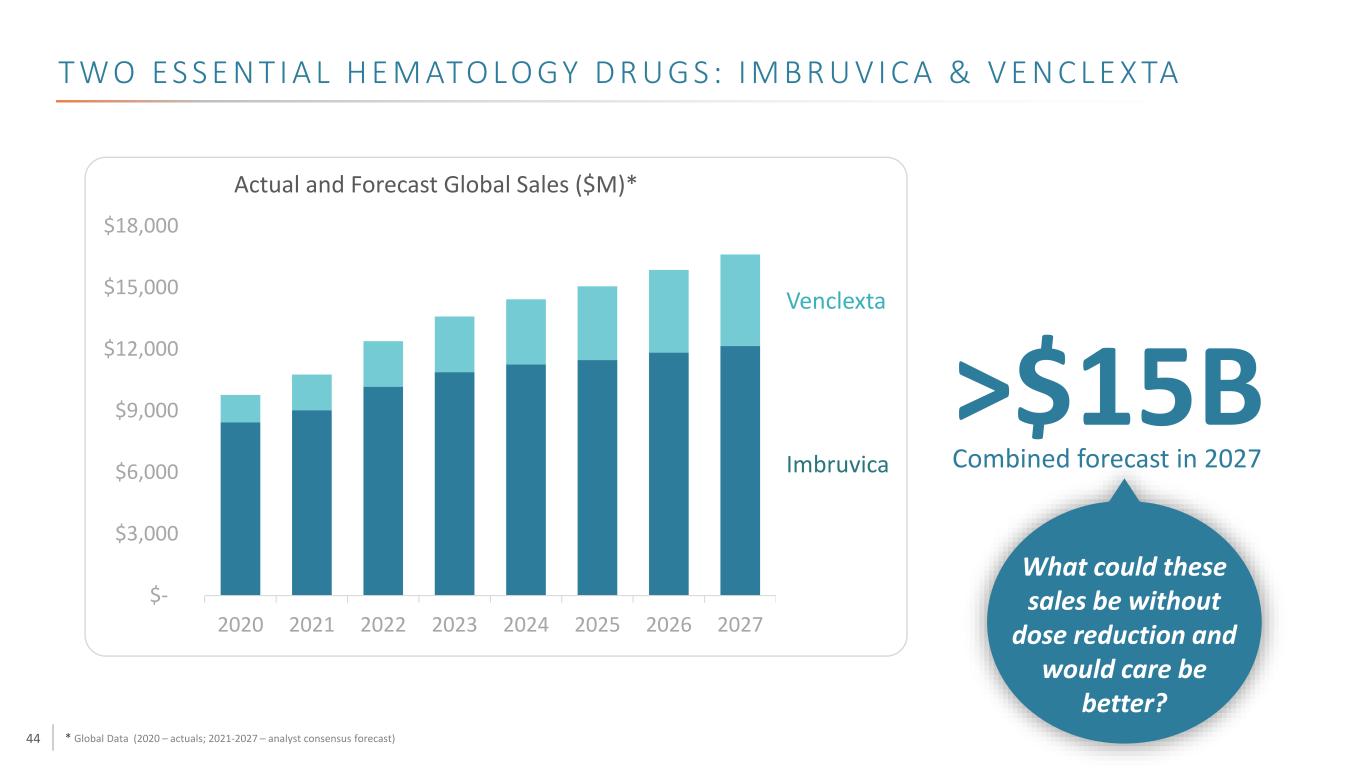

43 T W O E S S E N T I A L H E M ATO LO GY D R U G S : I M B R U V I C A & V E N C L E X TA * Global Data (2020 – actuals; 2021-2027 – analyst consensus forecast) $- $3,000 $6,000 $9,000 $12,000 $15,000 $18,000 2020 2021 2022 2023 2024 2025 2026 2027 Actual and Forecast Global Sales ($M)* >$15B Venclexta Imbruvica Combined forecast in 2027

44 T W O E S S E N T I A L H E M ATO LO GY D R U G S : I M B R U V I C A & V E N C L E X TA * Global Data (2020 – actuals; 2021-2027 – analyst consensus forecast) $- $3,000 $6,000 $9,000 $12,000 $15,000 $18,000 2020 2021 2022 2023 2024 2025 2026 2027 Actual and Forecast Global Sales ($M)* >$15B Venclexta Imbruvica Combined forecast in 2027 What could these sales be without dose reduction and would care be better?

45 Rezafungin Rezafungin Azole DDI Dilemma/Opportunity Market Potential

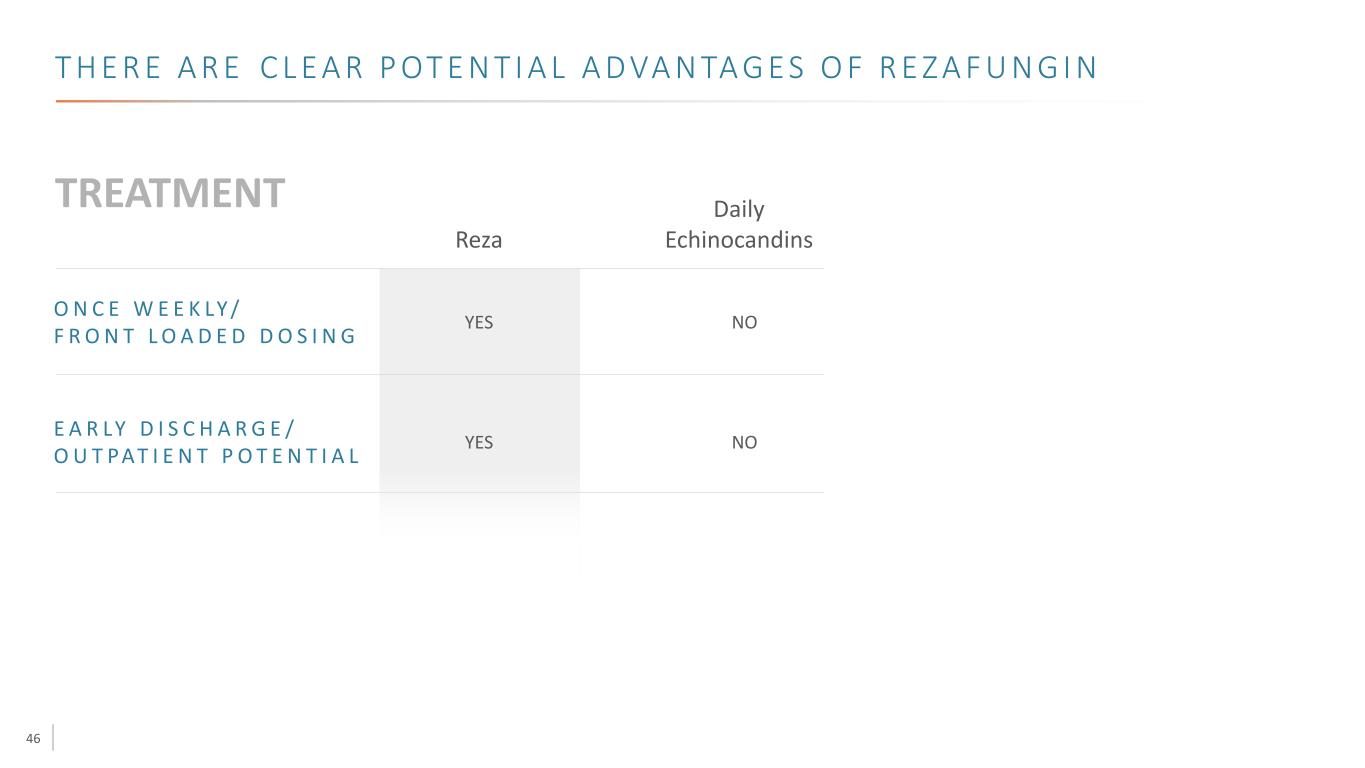

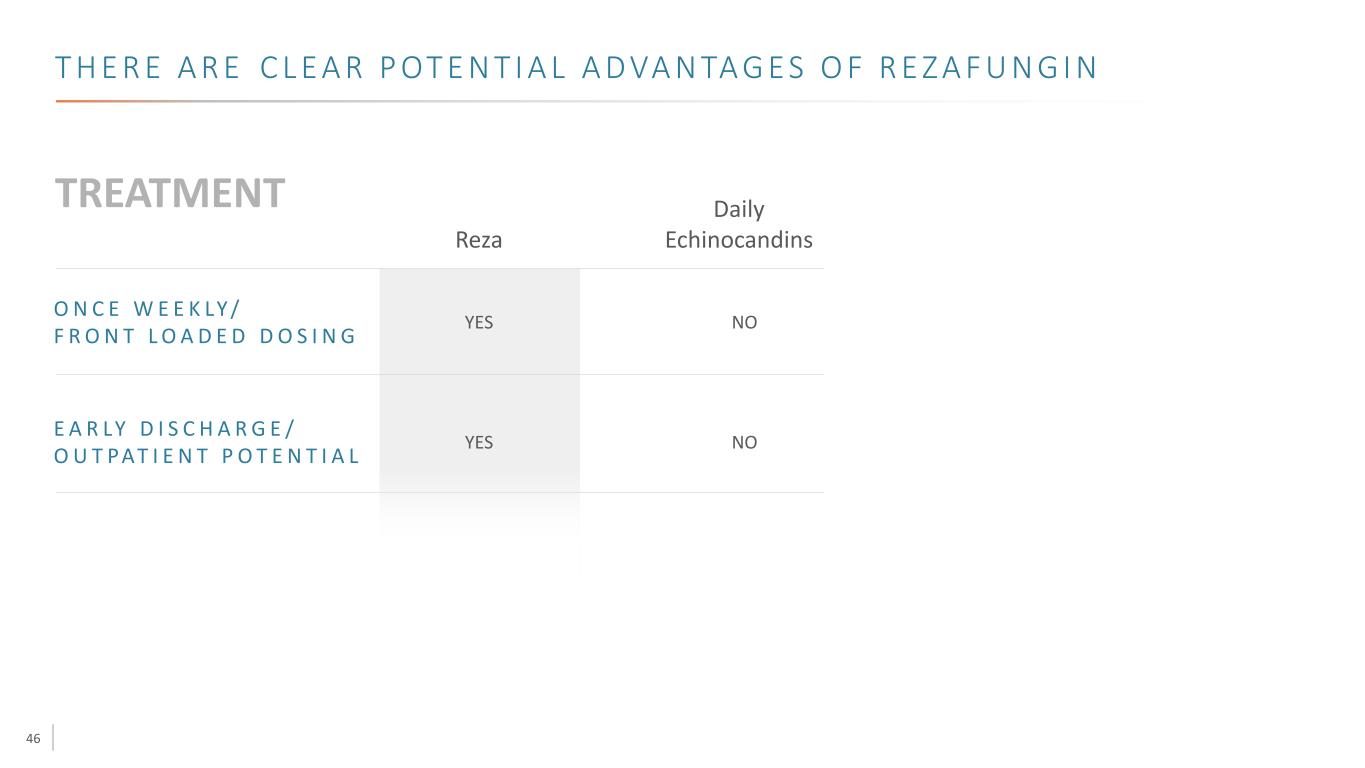

46 T H E R E A R E C L E A R P OT E N T I A L A D VA N TA G E S O F R E Z A F U N G I N E A R LY D I S C H A R G E / O U T PAT I E N T P O T E N T I A L YES Reza O N C E W E E K LY / F R O N T L O A D E D D O S I N G YES Daily Echinocandins NO NO

47 C U R R E N T E S T I M AT E S A S S U M E Re S TO R E M E E T S 2 0 % N I M A R G I N Revenue Time Candida Treatment Infectious Disease Focus BASE CASE: ReSTORE meets 20% NI margin

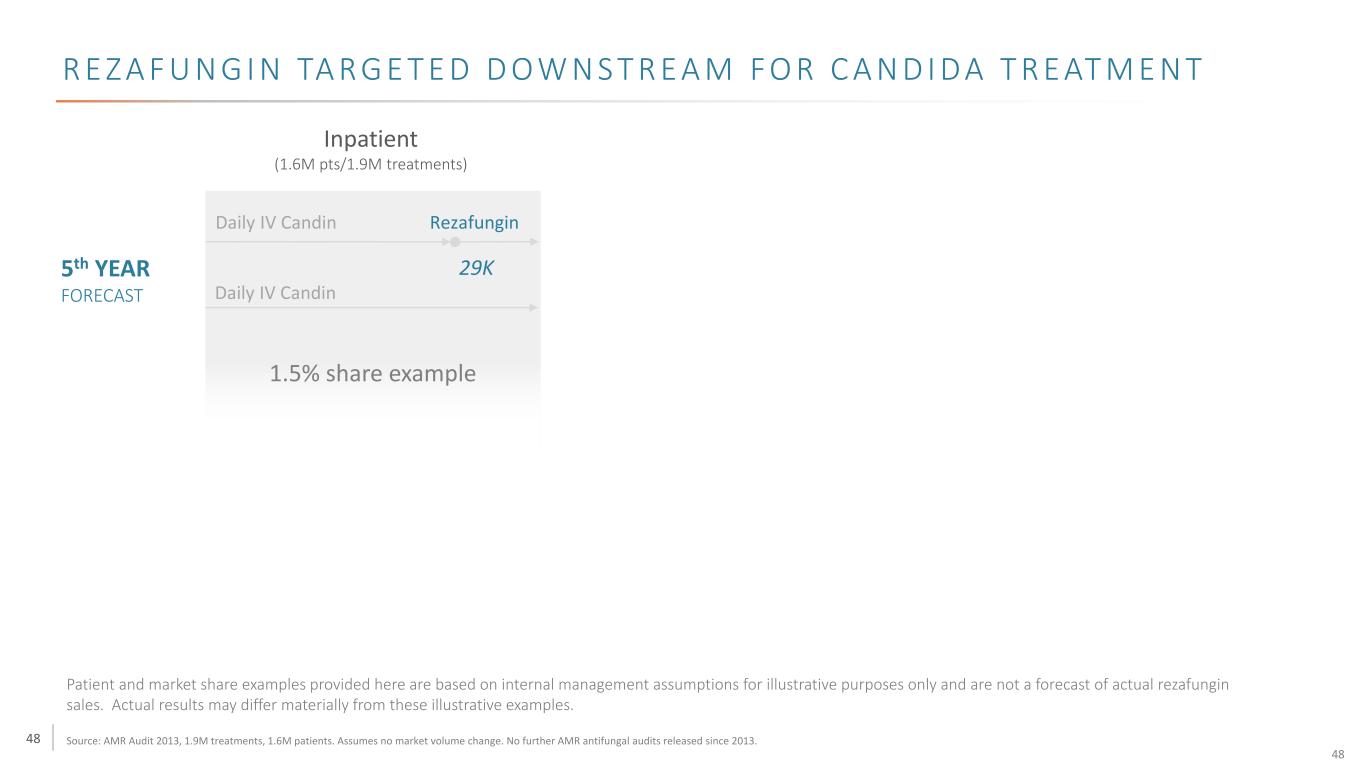

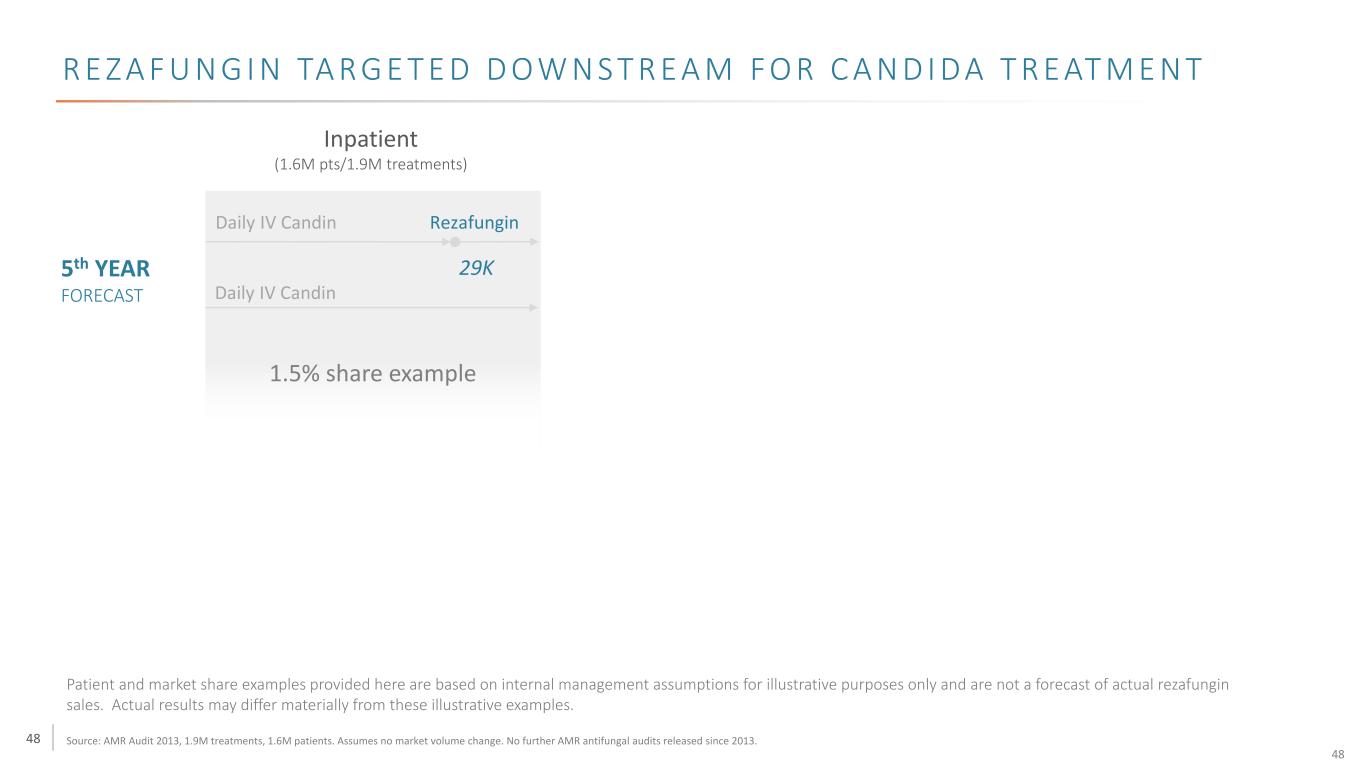

48 R E Z A F U N G I N TA R G E T E D D O W N S T R E A M F O R C A N D I D A T R E AT M E N T Inpatient (1.6M pts/1.9M treatments) Daily IV Candin Daily IV Candin Rezafungin 29K 1.5% share example 5th YEAR FORECAST Patient and market share examples provided here are based on internal management assumptions for illustrative purposes only and are not a forecast of actual rezafungin sales. Actual results may differ materially from these illustrative examples. Source: AMR Audit 2013, 1.9M treatments, 1.6M patients. Assumes no market volume change. No further AMR antifungal audits released since 2013. 48

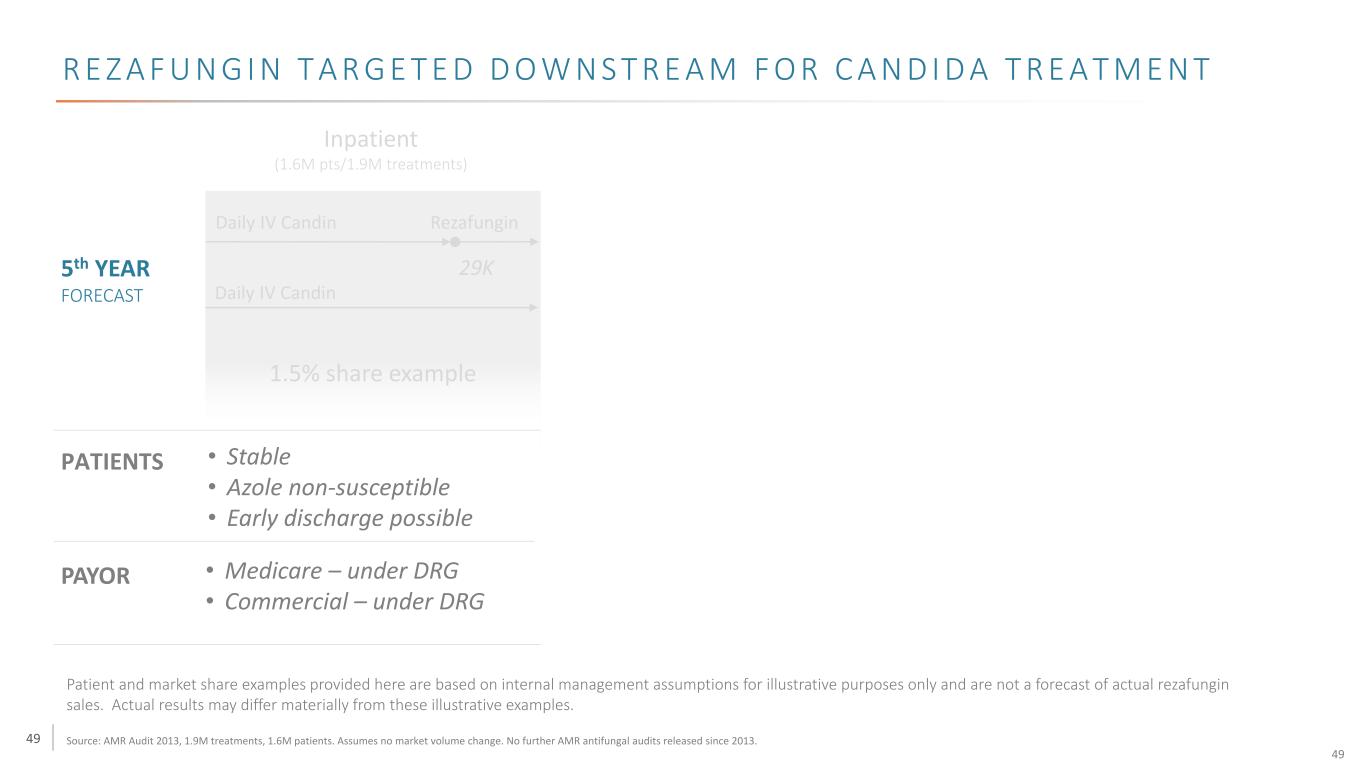

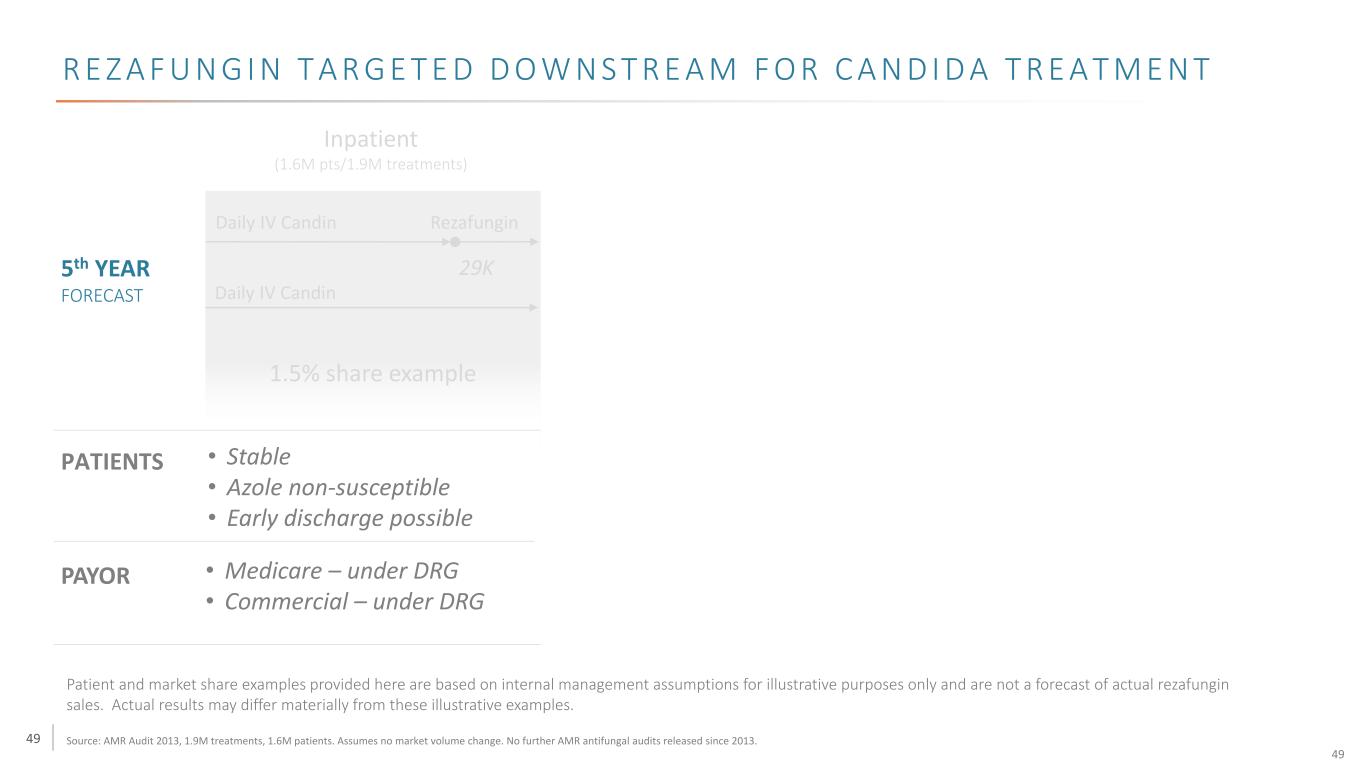

49 R E Z A F U N G I N T A R G E T E D D O W N S T R E A M F O R C A N D I D A T R E A T M E N T Inpatient (1.6M pts/1.9M treatments) Daily IV Candin Daily IV Candin Rezafungin 29K 1.5% share example 5th YEAR FORECAST PATIENTS • Stable • Azole non-susceptible • Early discharge possible PAYOR • Medicare – under DRG • Commercial – under DRG Patient and market share examples provided here are based on internal management assumptions for illustrative purposes only and are not a forecast of actual rezafungin sales. Actual results may differ materially from these illustrative examples. Source: AMR Audit 2013, 1.9M treatments, 1.6M patients. Assumes no market volume change. No further AMR antifungal audits released since 2013. 49

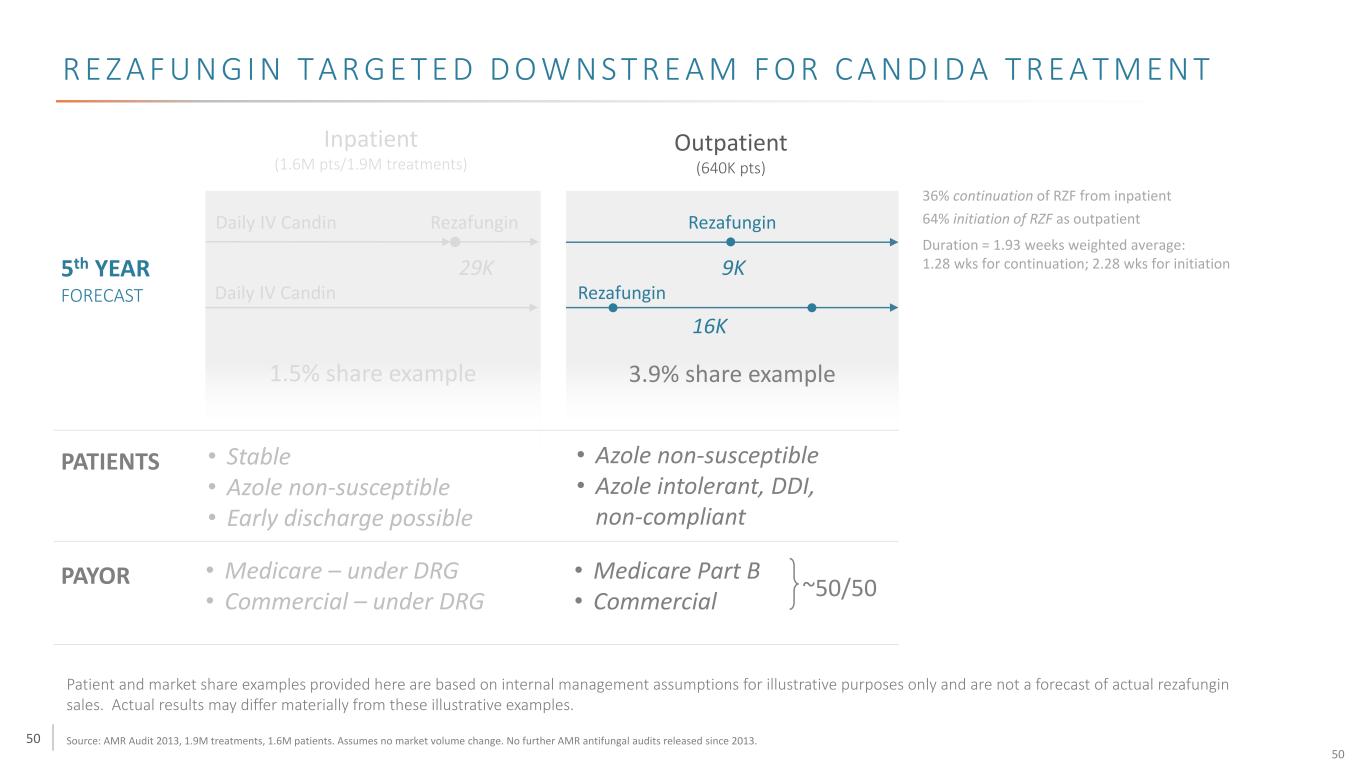

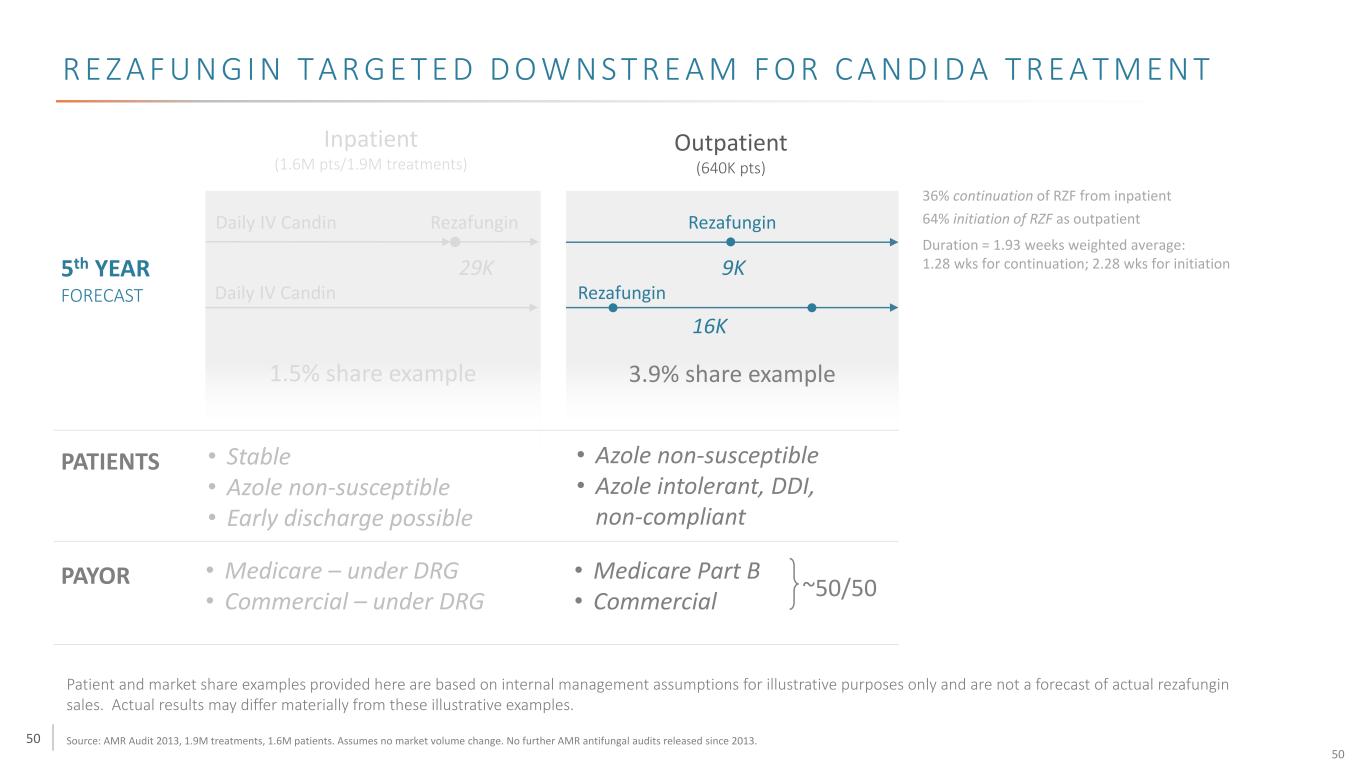

50 R E Z A F U N G I N T A R G E T E D D O W N S T R E A M F O R C A N D I D A T R E A T M E N T Inpatient (1.6M pts/1.9M treatments) Outpatient (640K pts) Daily IV Candin Rezafungin Rezafungin Daily IV Candin Rezafungin 29K 9K 16K 3.9% share example1.5% share example 36% continuation of RZF from inpatient 64% initiation of RZF as outpatient Duration = 1.93 weeks weighted average: 1.28 wks for continuation; 2.28 wks for initiation • Azole non-susceptible • Azole intolerant, DDI, non-compliant • Medicare Part B • Commercial ~50/50 5th YEAR FORECAST PATIENTS • Stable • Azole non-susceptible • Early discharge possible PAYOR • Medicare – under DRG • Commercial – under DRG Patient and market share examples provided here are based on internal management assumptions for illustrative purposes only and are not a forecast of actual rezafungin sales. Actual results may differ materially from these illustrative examples. Source: AMR Audit 2013, 1.9M treatments, 1.6M patients. Assumes no market volume change. No further AMR antifungal audits released since 2013. 50

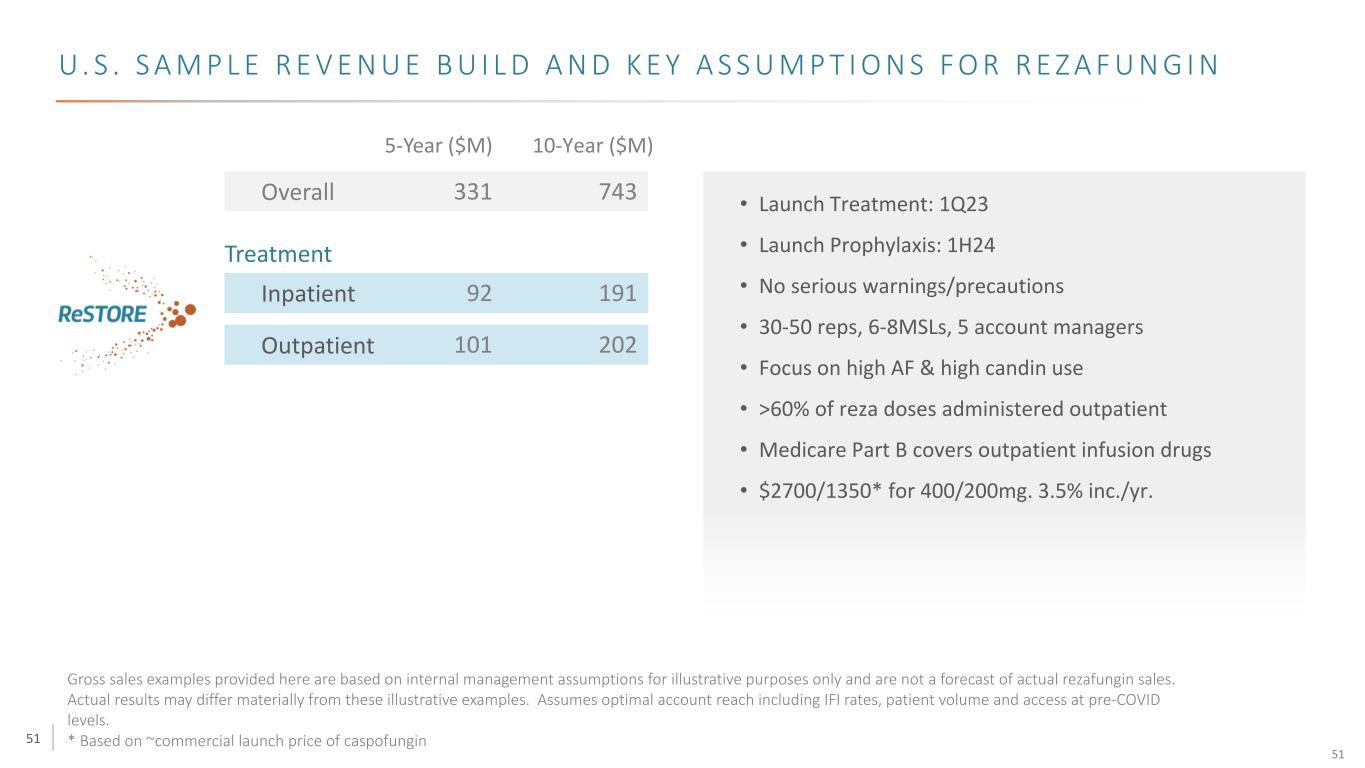

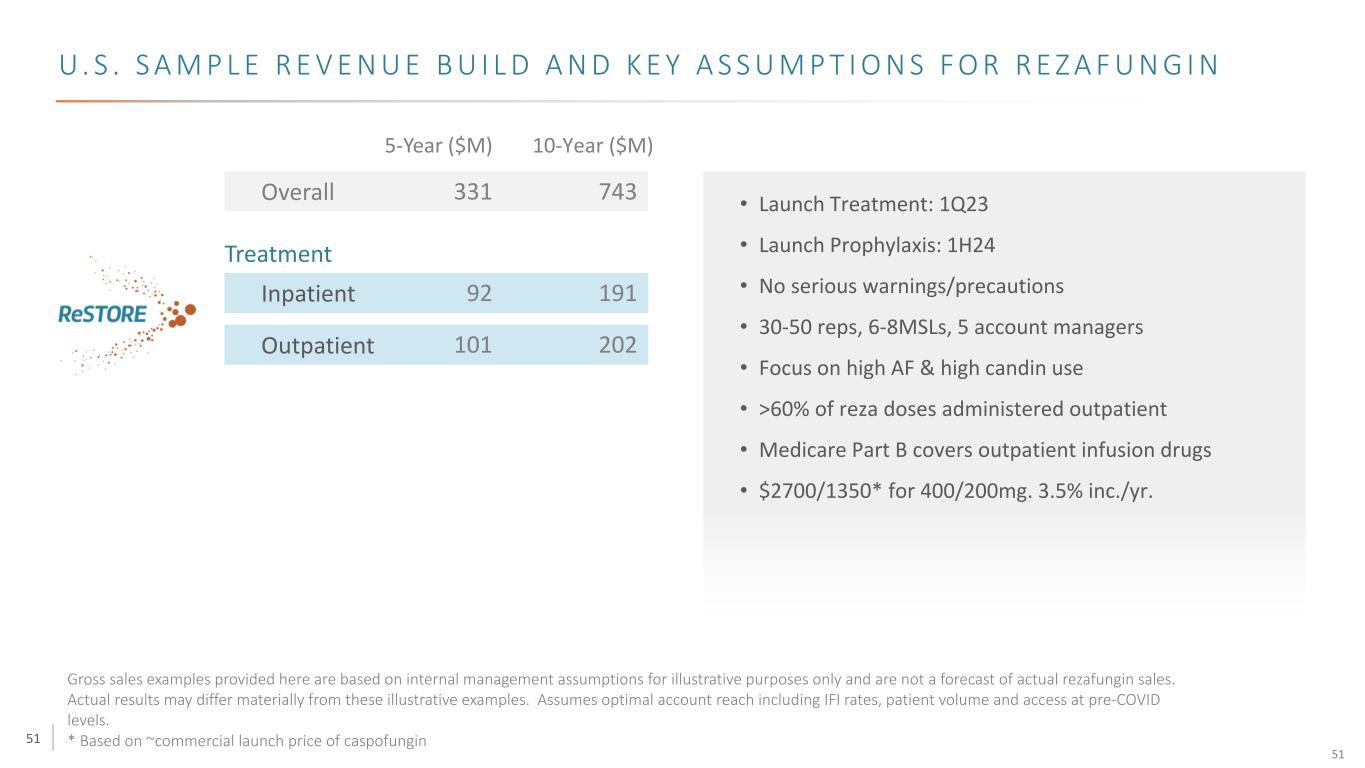

51 U . S . S A M P L E R E V E N U E B U I L D A N D K E Y A S S U M P T I O N S F O R R E Z A F U N G I N Overall Treatment Inpatient Outpatient • Launch Treatment: 1Q23 • Launch Prophylaxis: 1H24 • No serious warnings/precautions • 30-50 reps, 6-8MSLs, 5 account managers • Focus on high AF & high candin use • >60% of reza doses administered outpatient • Medicare Part B covers outpatient infusion drugs • $2700/1350* for 400/200mg. 3.5% inc./yr. 331 743 101 202 92 191 5-Year ($M) 10-Year ($M) Gross sales examples provided here are based on internal management assumptions for illustrative purposes only and are not a forecast of actual rezafungin sales. Actual results may differ materially from these illustrative examples. Assumes optimal account reach including IFI rates, patient volume and access at pre-COVID levels. * Based on ~commercial launch price of caspofungin 51

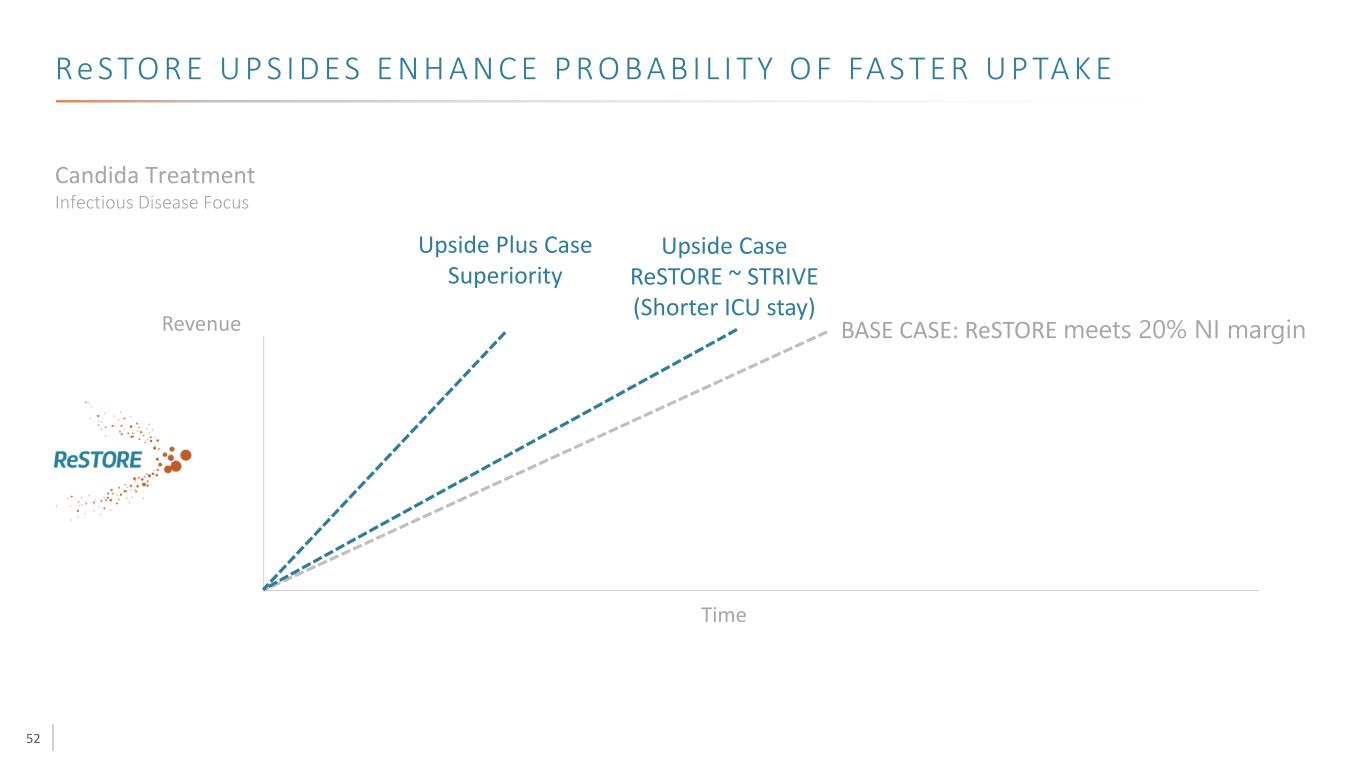

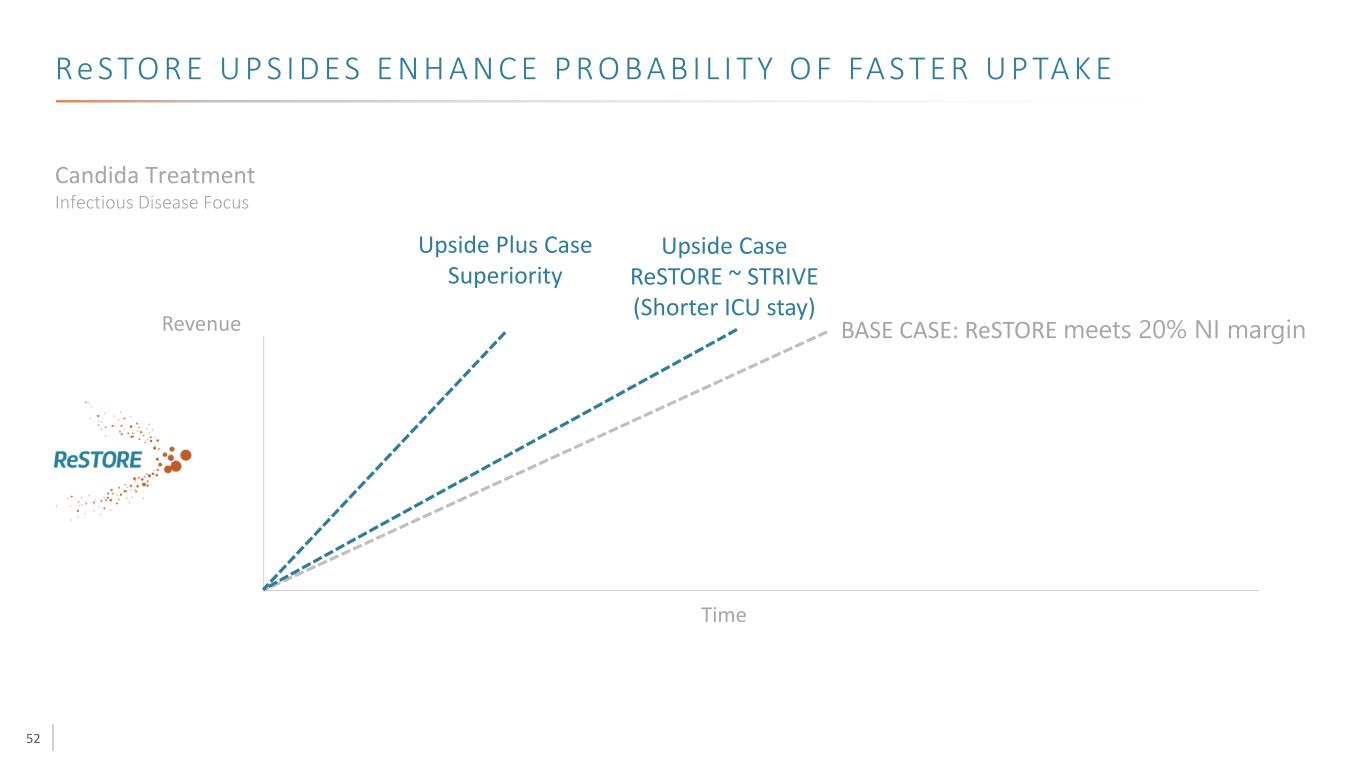

52 Re S TO R E U P S I D E S E N H A N C E P R O B A B I L I T Y O F FA S T E R U P TA K E Revenue Time Candida Treatment Infectious Disease Focus Upside Case ReSTORE ~ STRIVE (Shorter ICU stay) Upside Plus Case Superiority BASE CASE: ReSTORE meets 20% NI margin

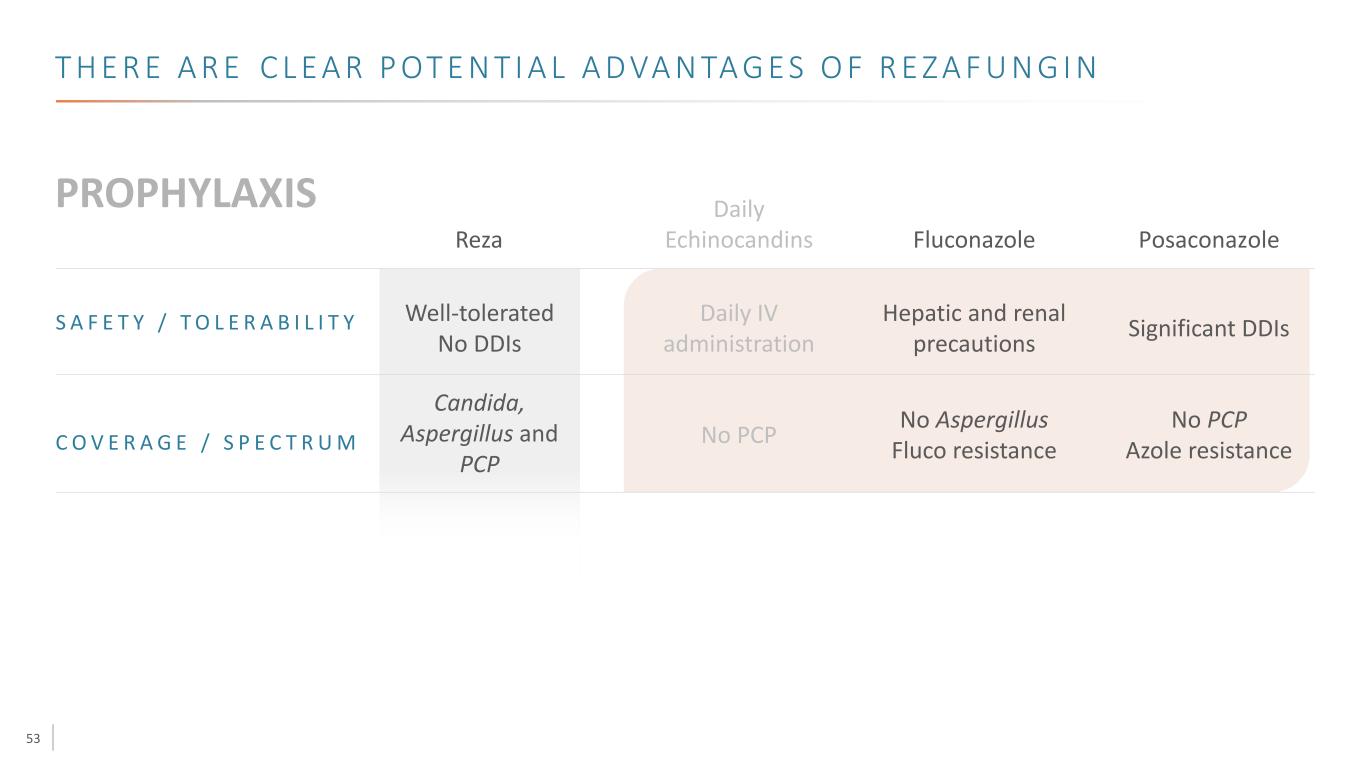

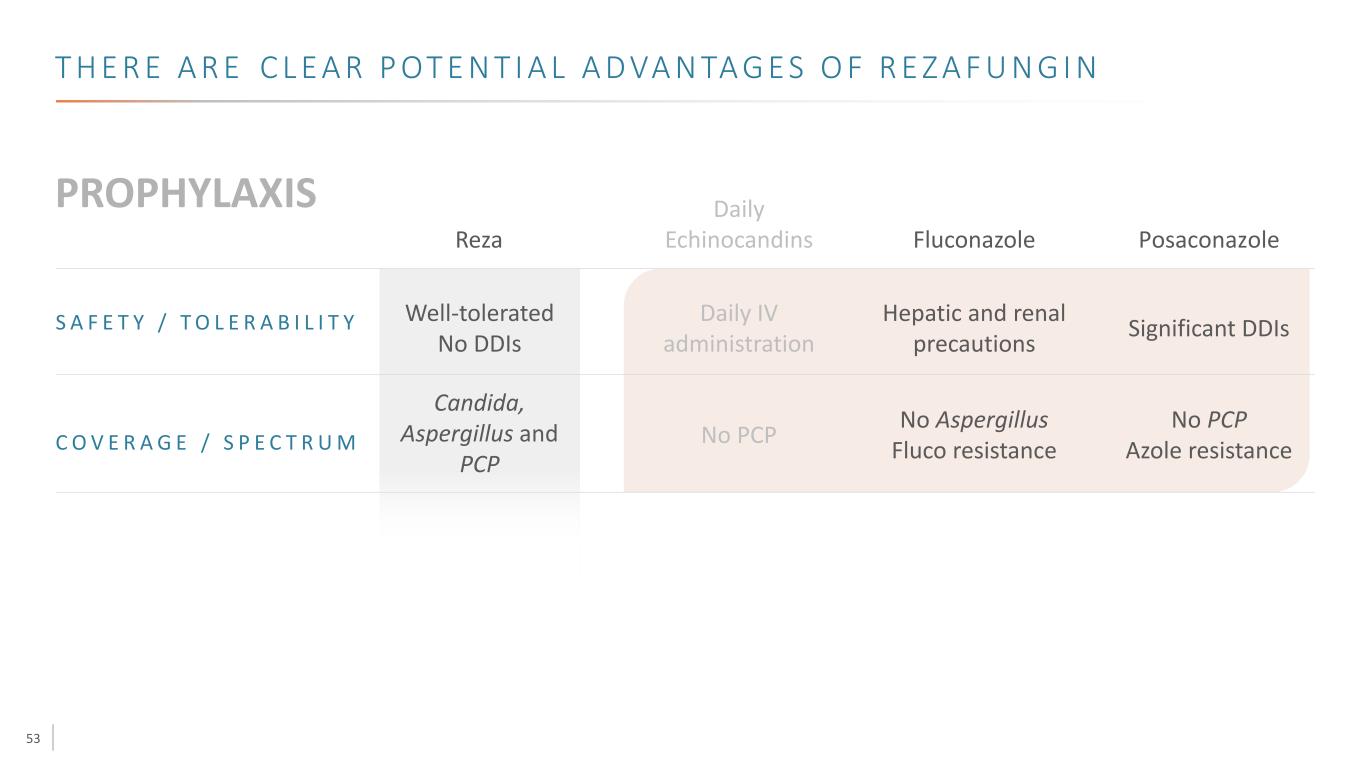

53 T H E R E A R E C L E A R P OT E N T I A L A D VA N TA G E S O F R E Z A F U N G I N Well-tolerated No DDIs Fluconazole Posaconazole S A F E T Y / T O L E R A B I L I T Y Daily IV administration Hepatic and renal precautions Significant DDIs C O V E R A G E / S P E C T R U M Candida, Aspergillus and PCP No PCP No Aspergillus Fluco resistance No PCP Azole resistance Daily EchinocandinsReza

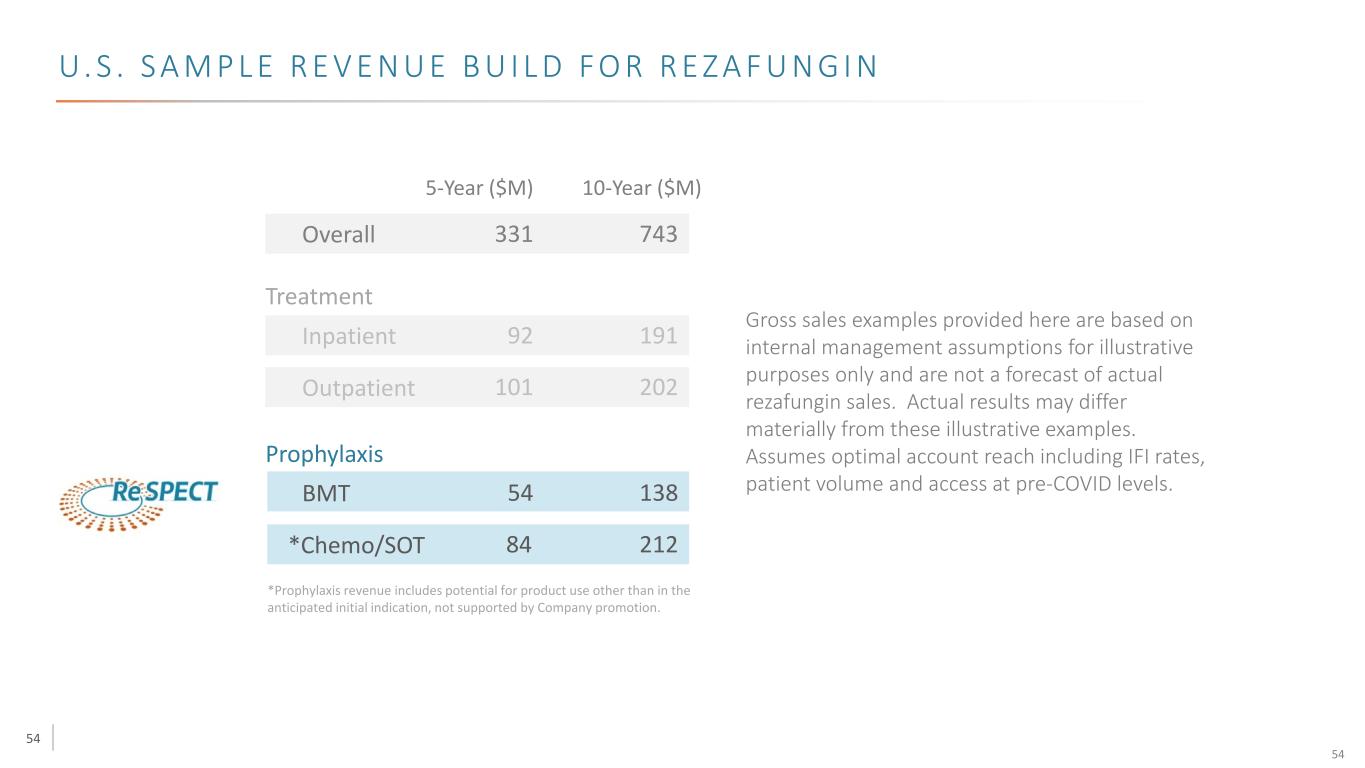

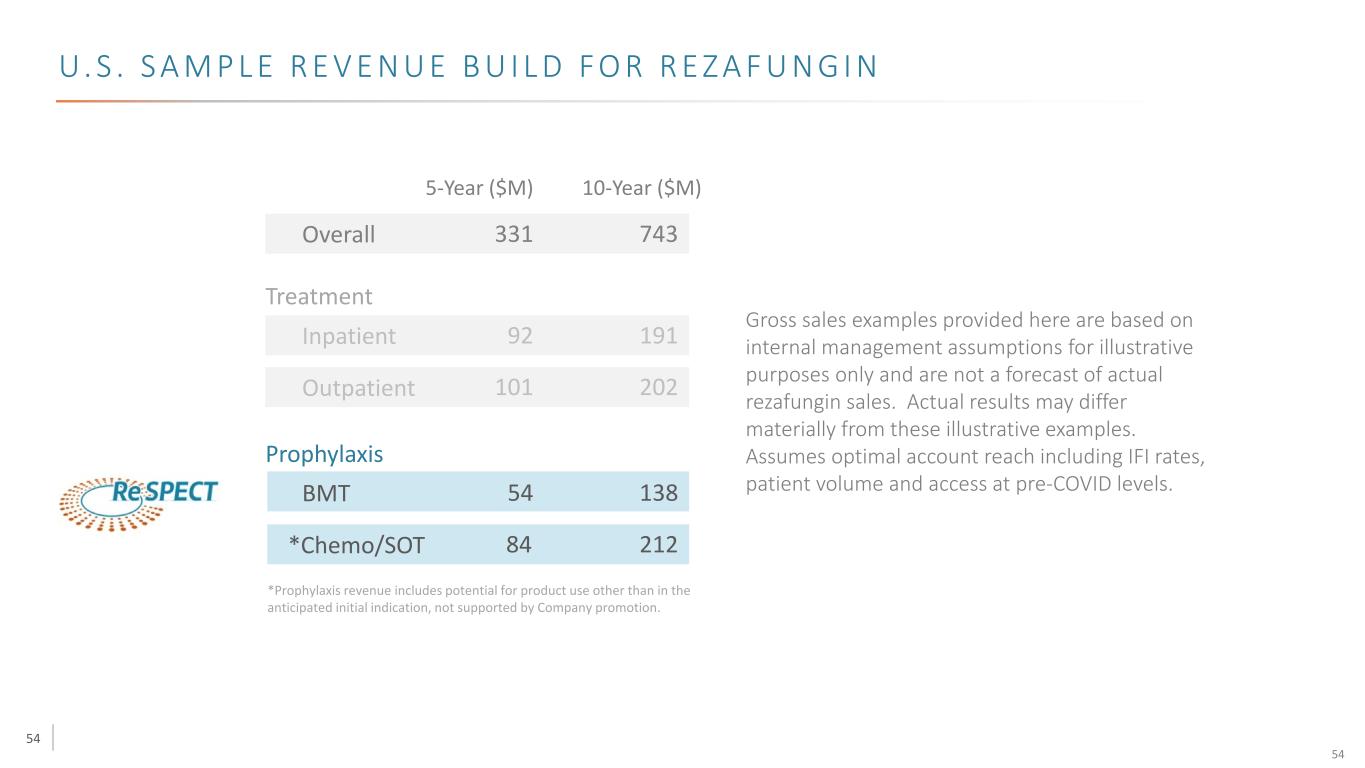

54 U. S . S A M P L E R E V E N U E B U I L D F O R R E Z A F U N G I N *Prophylaxis revenue includes potential for product use other than in the anticipated initial indication, not supported by Company promotion. Overall Treatment Inpatient Outpatient 331 743 101 202 92 191 5-Year ($M) 10-Year ($M) Prophylaxis BMT 54 138 *Chemo/SOT 84 212 Gross sales examples provided here are based on internal management assumptions for illustrative purposes only and are not a forecast of actual rezafungin sales. Actual results may differ materially from these illustrative examples. Assumes optimal account reach including IFI rates, patient volume and access at pre-COVID levels. 54

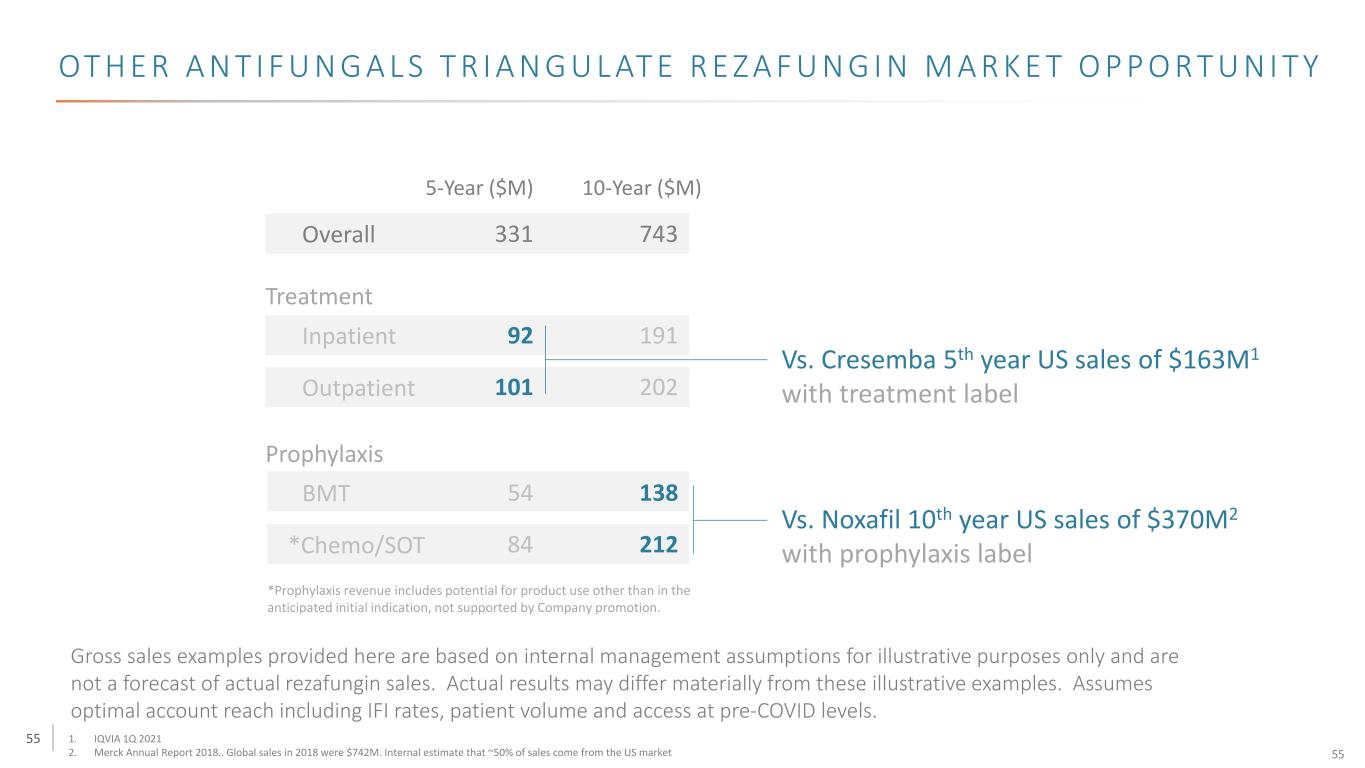

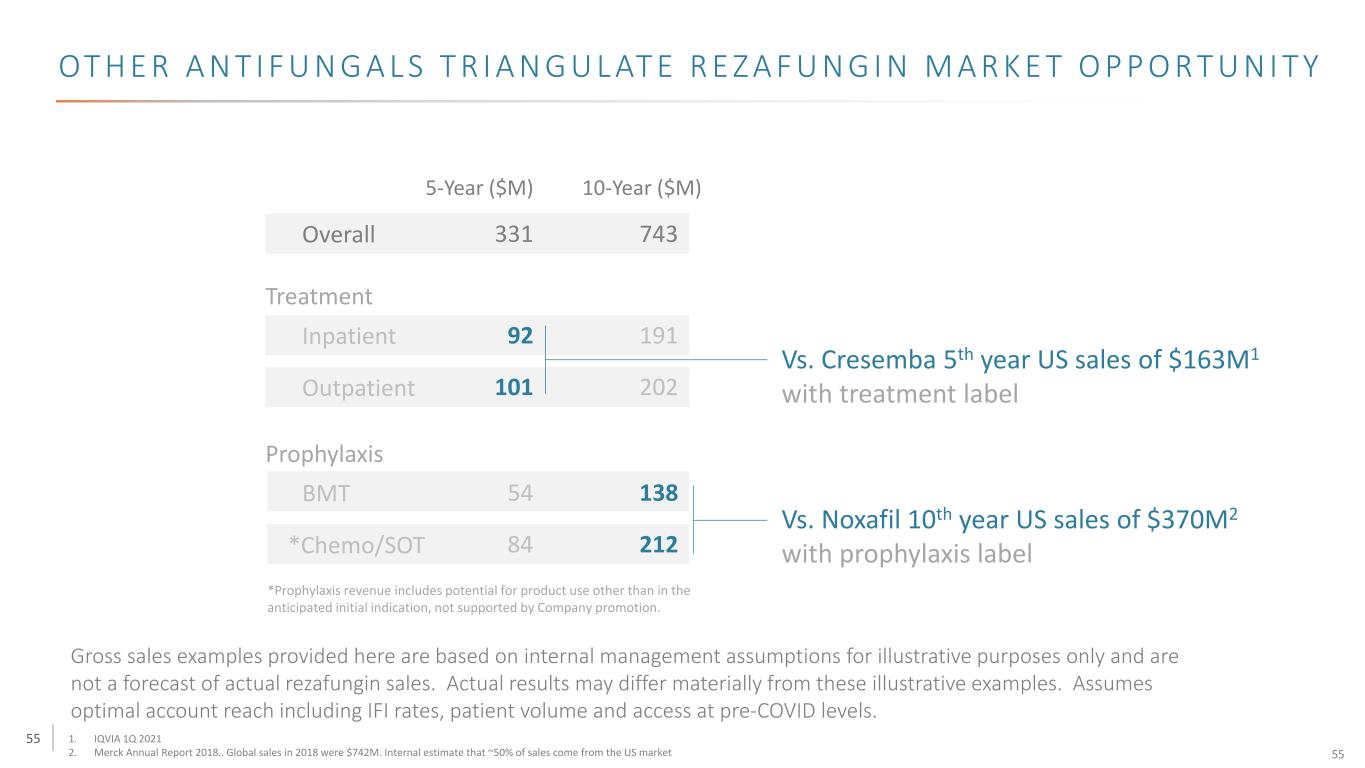

55 OT H E R A N T I F U N G A L S T R I A N G U L AT E R E Z A F U N G I N M A R K E T O P P O R T U N I T Y *Prophylaxis revenue includes potential for product use other than in the anticipated initial indication, not supported by Company promotion. Overall Treatment Inpatient Outpatient 331 743 101 202 92 191 5-Year ($M) 10-Year ($M) Prophylaxis BMT 54 138 *Chemo/SOT 84 212 Vs. Cresemba 5th year US sales of $163M1 with treatment label Vs. Noxafil 10th year US sales of $370M2 with prophylaxis label 1. IQVIA 1Q 2021 2. Merck Annual Report 2018.. Global sales in 2018 were $742M. Internal estimate that ~50% of sales come from the US market Gross sales examples provided here are based on internal management assumptions for illustrative purposes only and are not a forecast of actual rezafungin sales. Actual results may differ materially from these illustrative examples. Assumes optimal account reach including IFI rates, patient volume and access at pre-COVID levels. 55

56 CLOUDBREAK UPDATE S E P T E M B E R 2 0 2 1

57 57 C LO U D B R E A K H A S A D VA N TA G E S O V E R VA C C I N E S A N D T R E AT M E N T S MODERNA Sept 9, R&D Day report COVID-19 and flu combination vaccine REGENERON Sept 15, Endpoints News $2.9B purchase of COVID-19 antibodies (3rd supply deal)

58 C L O U D B R E A K D R U G - F c C O N J U G A T E S : A N E W C L A S S O F D R U G L E S T A R I , P h D C H I E F S C I E N T I F I C O F F I C E R , C I D A R A

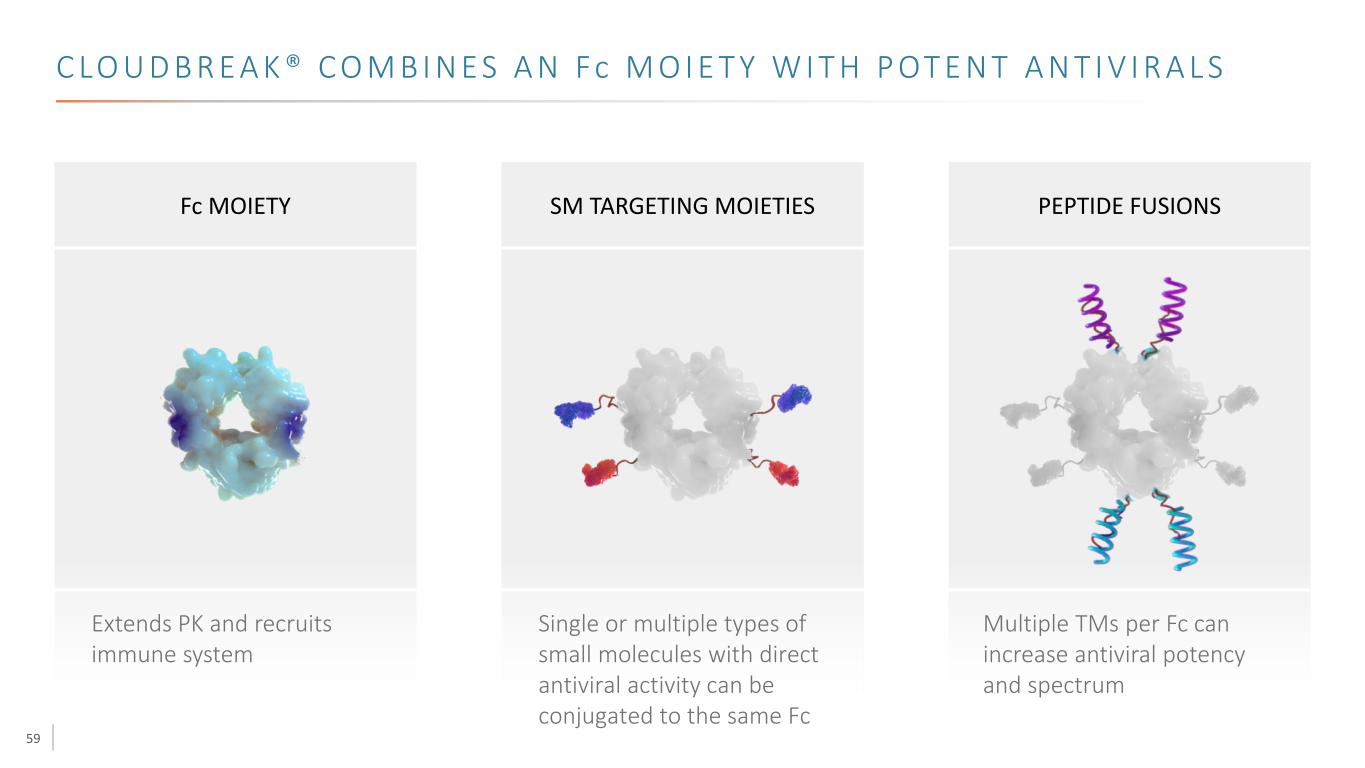

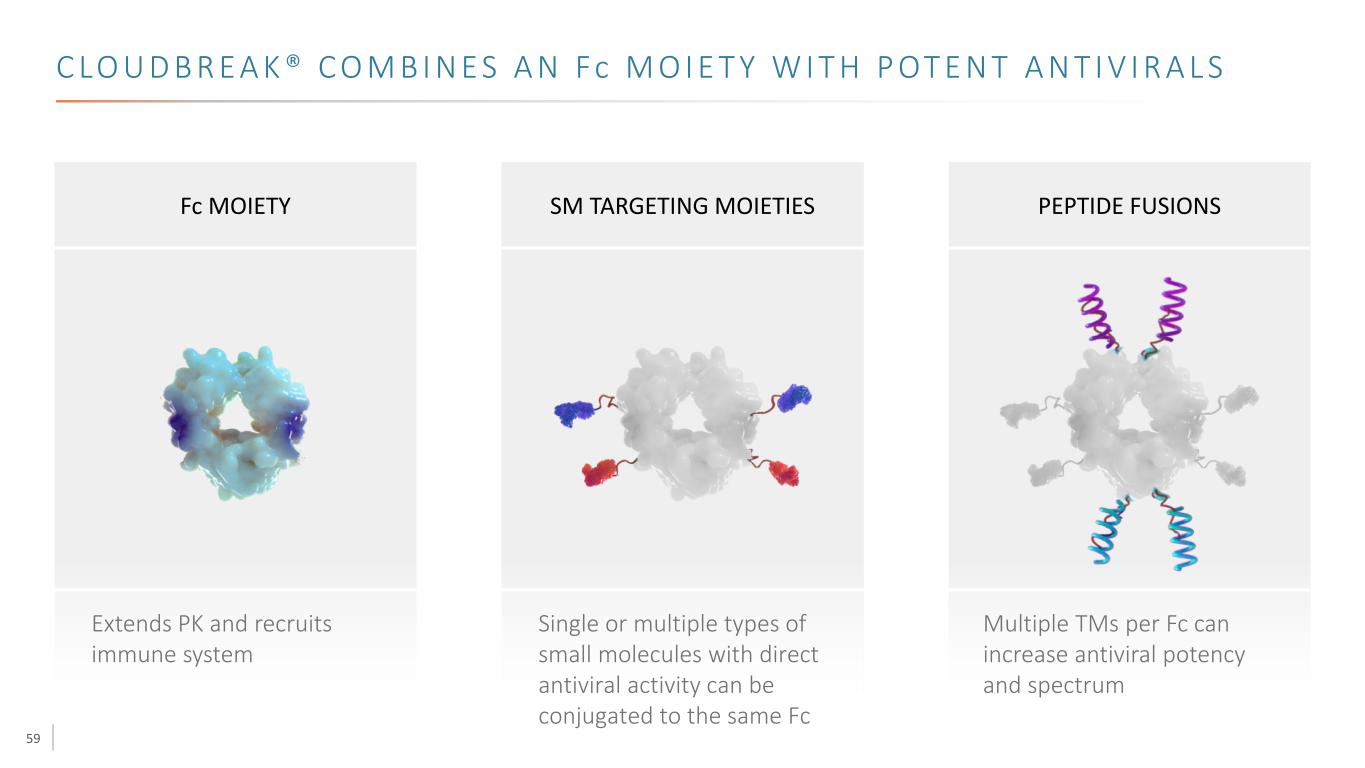

59 C LO U D B R E A K ® C O M B I N E S A N Fc M O I E T Y W I T H P OT E N T A N T I V I R A L S Fc MOIETY SM TARGETING MOIETIES PEPTIDE FUSIONS Extends PK and recruits immune system Single or multiple types of small molecules with direct antiviral activity can be conjugated to the same Fc Multiple TMs per Fc can increase antiviral potency and spectrum

60 C LO U D B R E A K ® I S A N E W C L A S S O F D R U G F C C O N J U G AT E S : “ D F C s ” Drug Fc Conjugate

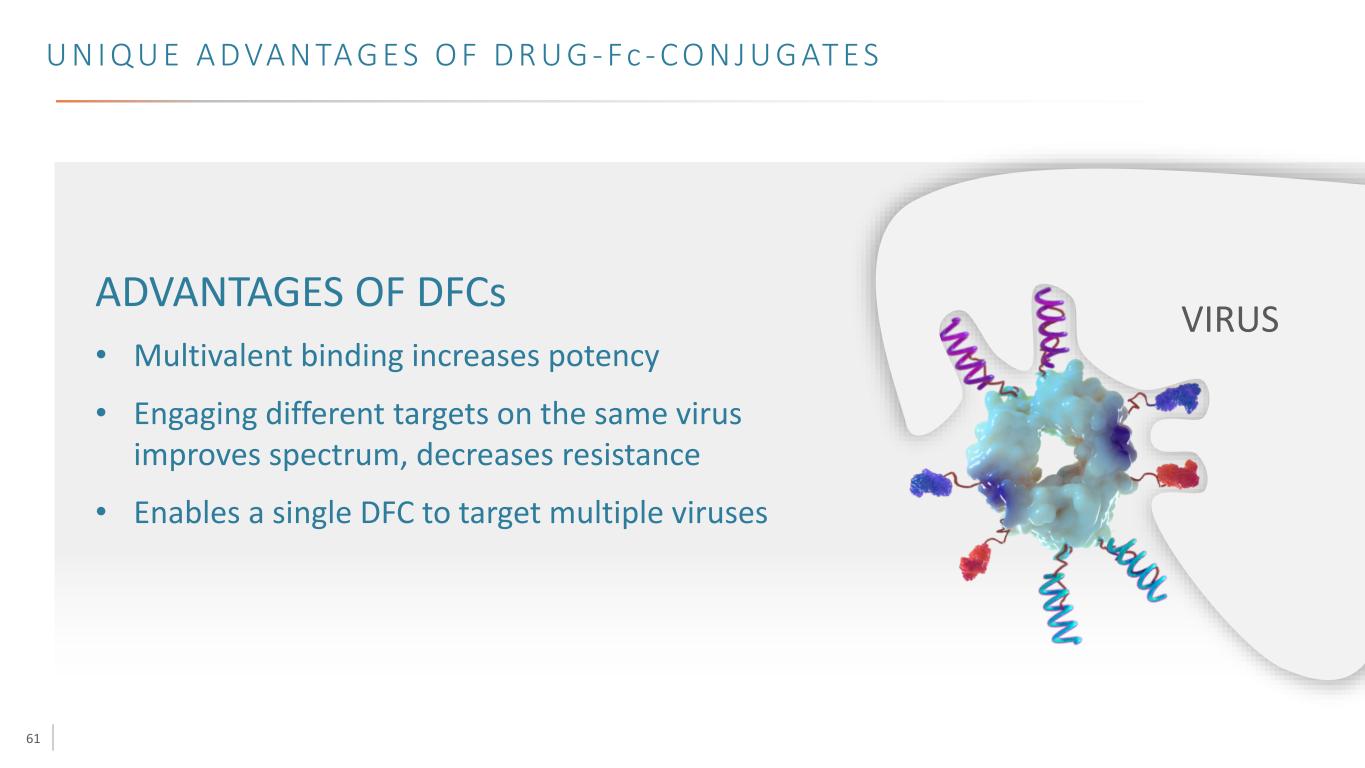

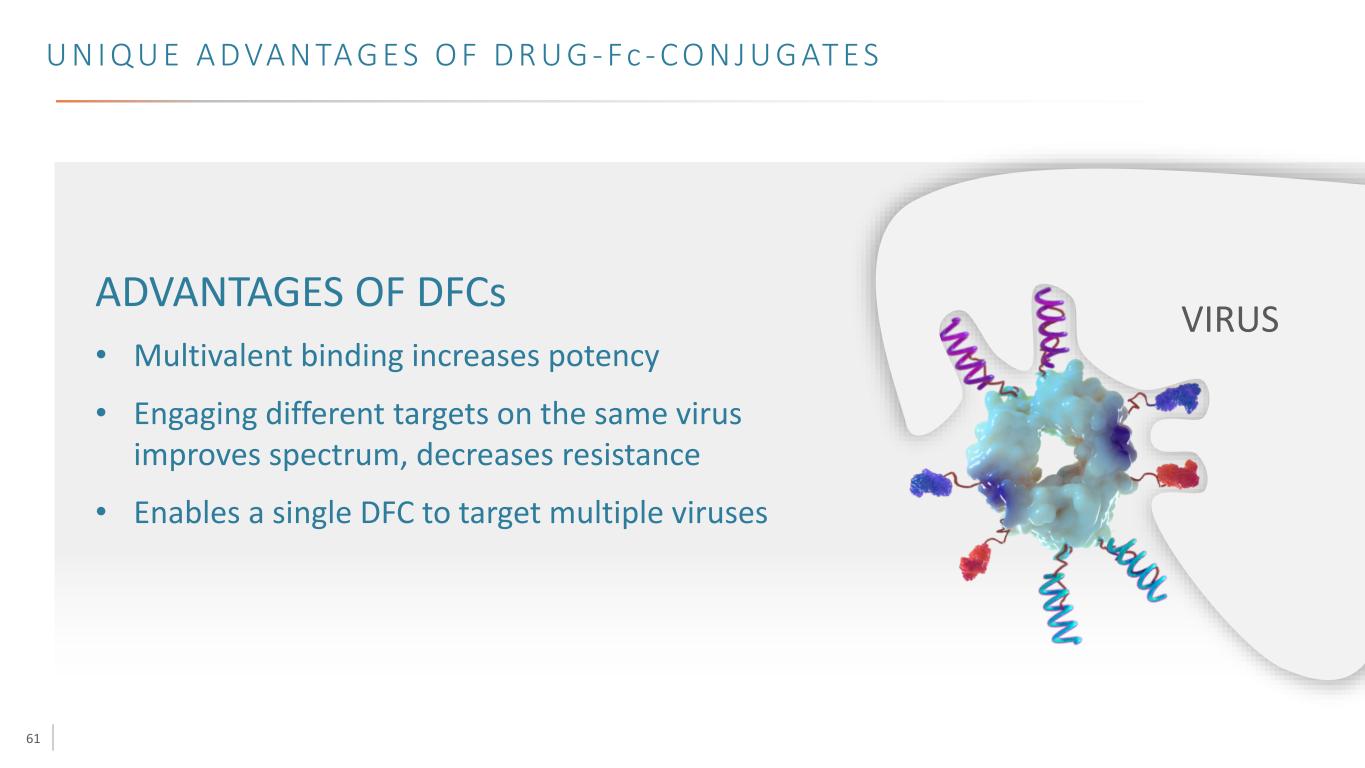

61 U N I Q U E A D VA N TA G E S O F D R U G - Fc - C O N J U G AT E S VIRUS ADVANTAGES OF DFCs • Multivalent binding increases potency • Engaging different targets on the same virus improves spectrum, decreases resistance • Enables a single DFC to target multiple viruses

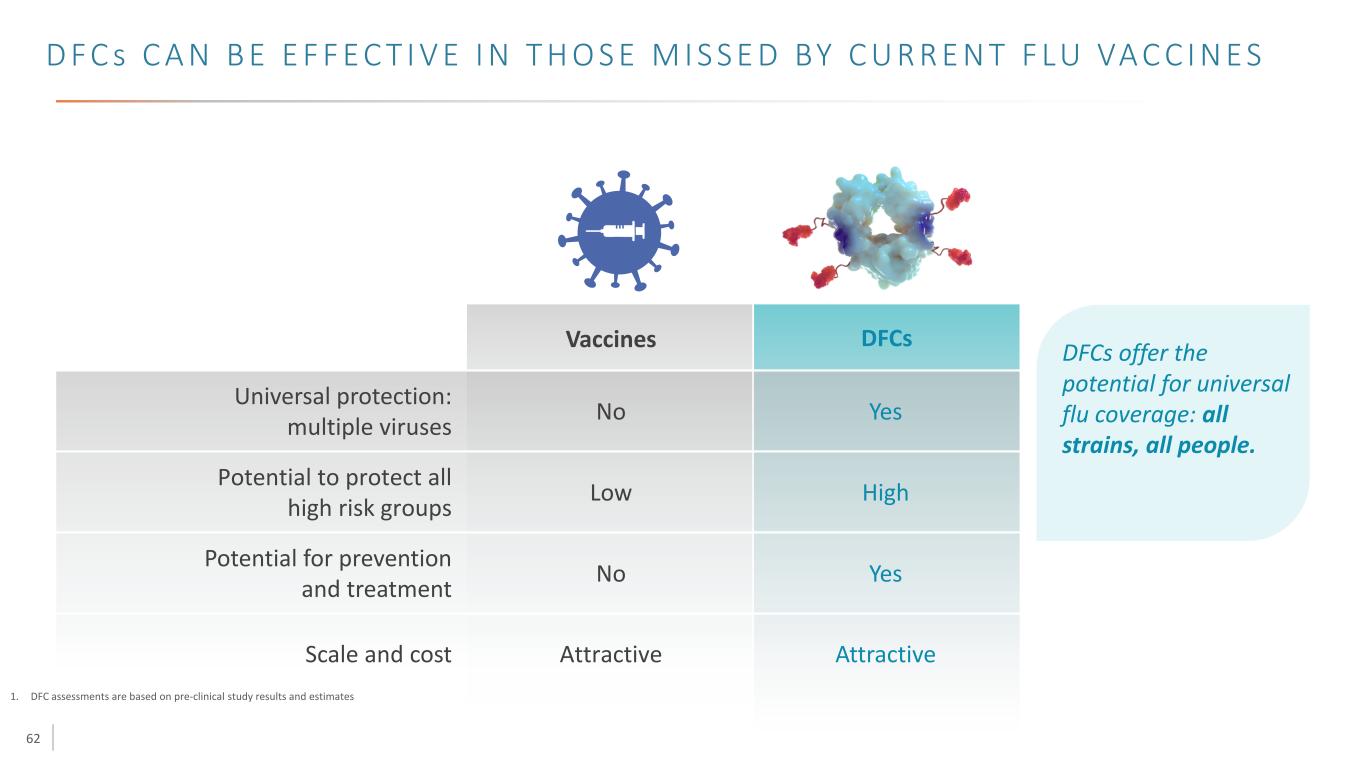

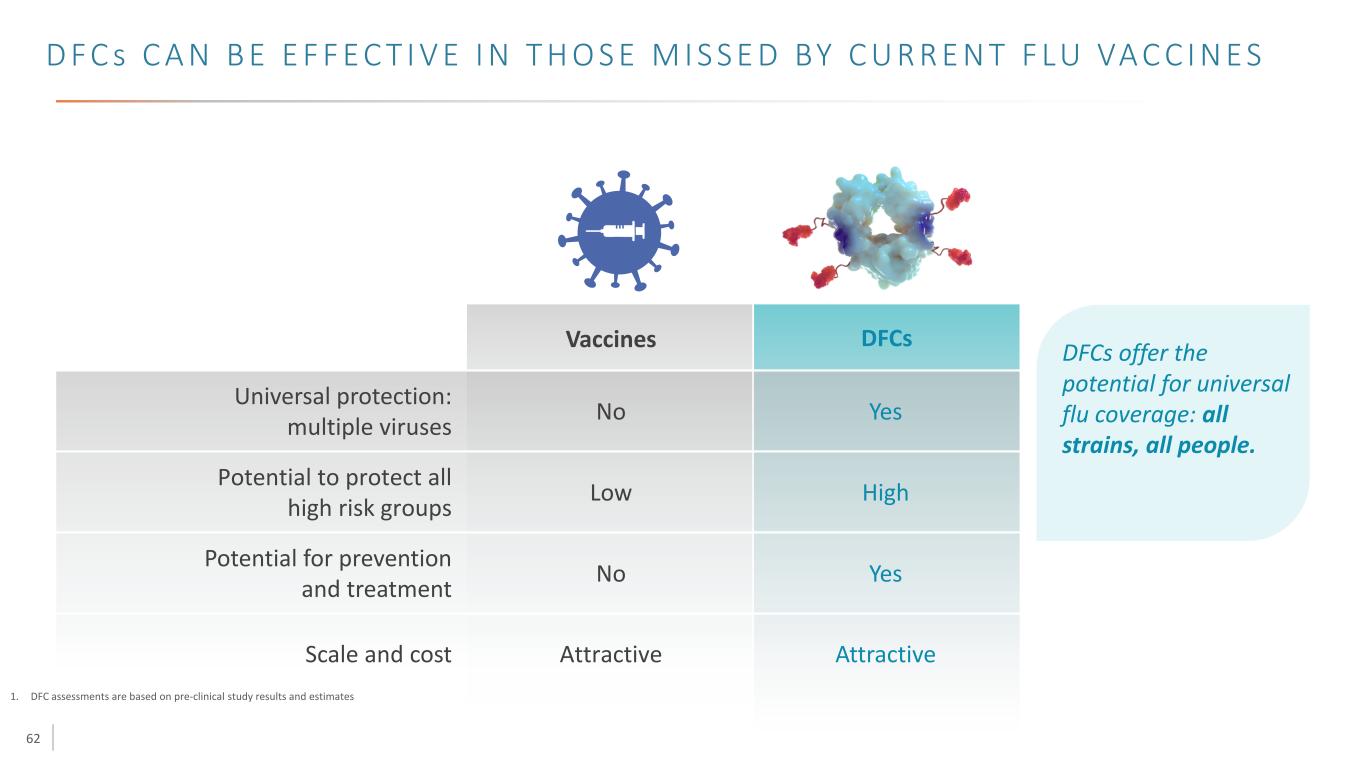

62 D F C s C A N B E E F F E C T I V E I N T H O S E M I S S E D BY C U R R E N T F LU VA C C I N E S 1. DFC assessments are based on pre-clinical study results and estimates Universal protection: multiple viruses Potential to protect all high risk groups Potential for prevention and treatment Scale and cost Vaccines High Yes AttractiveAttractive No Low No DFCs Yes DFCs offer the potential for universal flu coverage: all strains, all people.

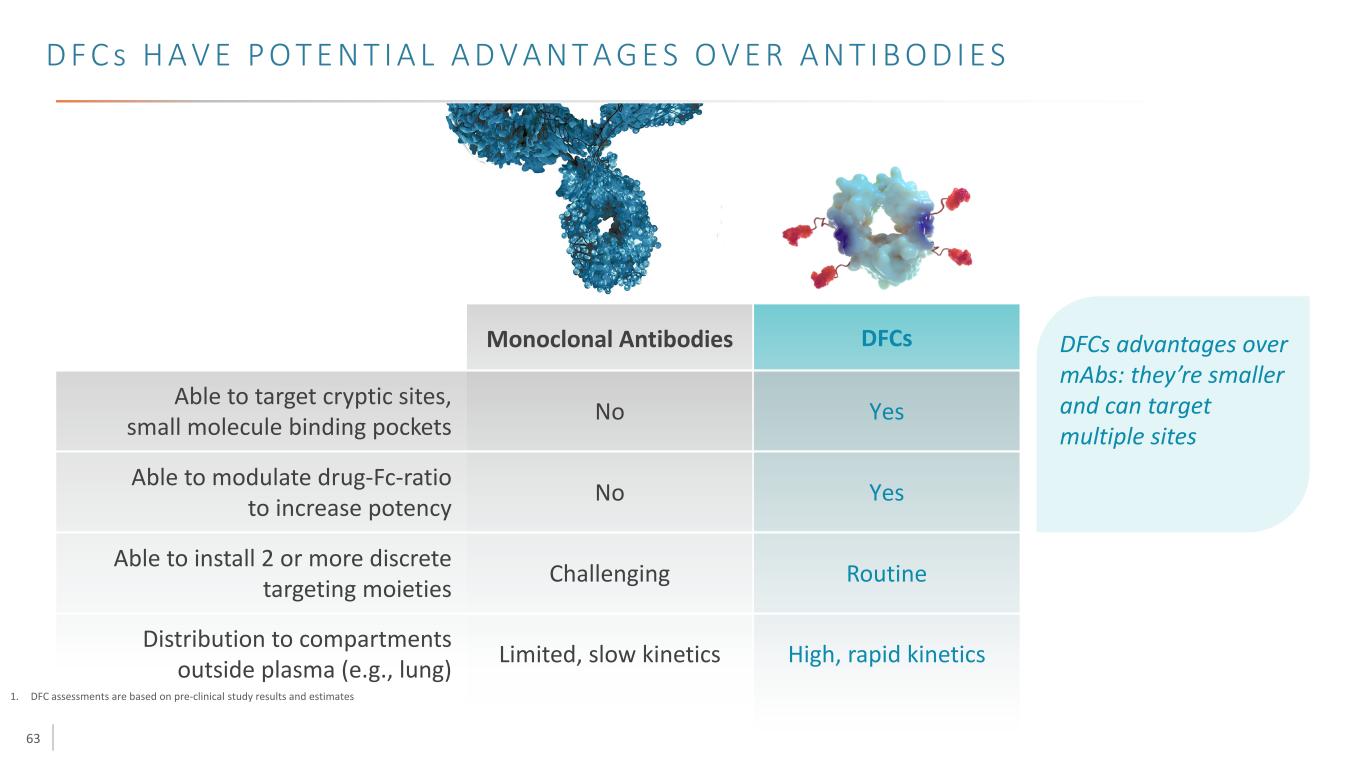

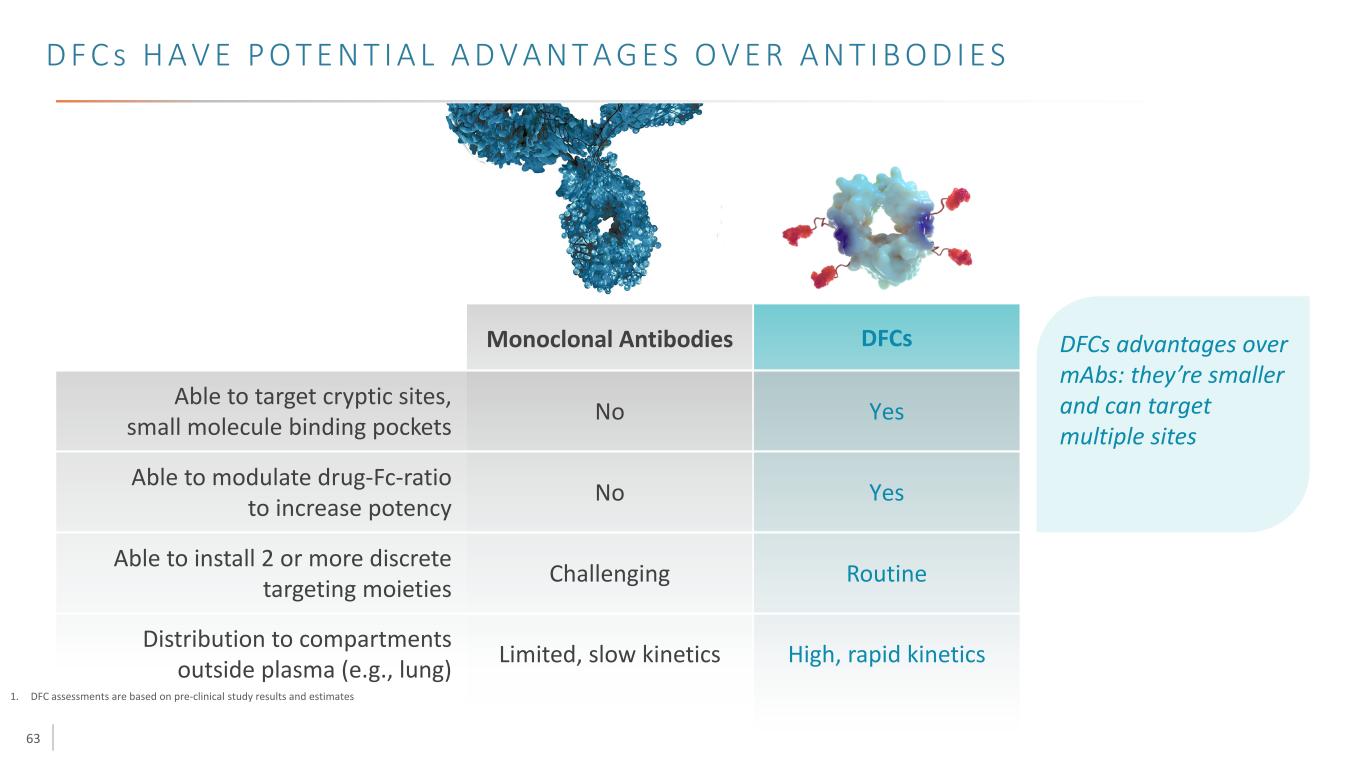

63 D F C s H A V E P O T E N T I A L A D V A N T A G E S O V E R A N T I B O D I E S 1. DFC assessments are based on pre-clinical study results and estimates Able to target cryptic sites, small molecule binding pockets Able to modulate drug-Fc-ratio to increase potency Able to install 2 or more discrete targeting moieties Distribution to compartments outside plasma (e.g., lung) Monoclonal Antibodies Yes Routine High, rapid kineticsLimited, slow kinetics Challenging No No DFCs Yes DFCs advantages over mAbs: they’re smaller and can target multiple sites

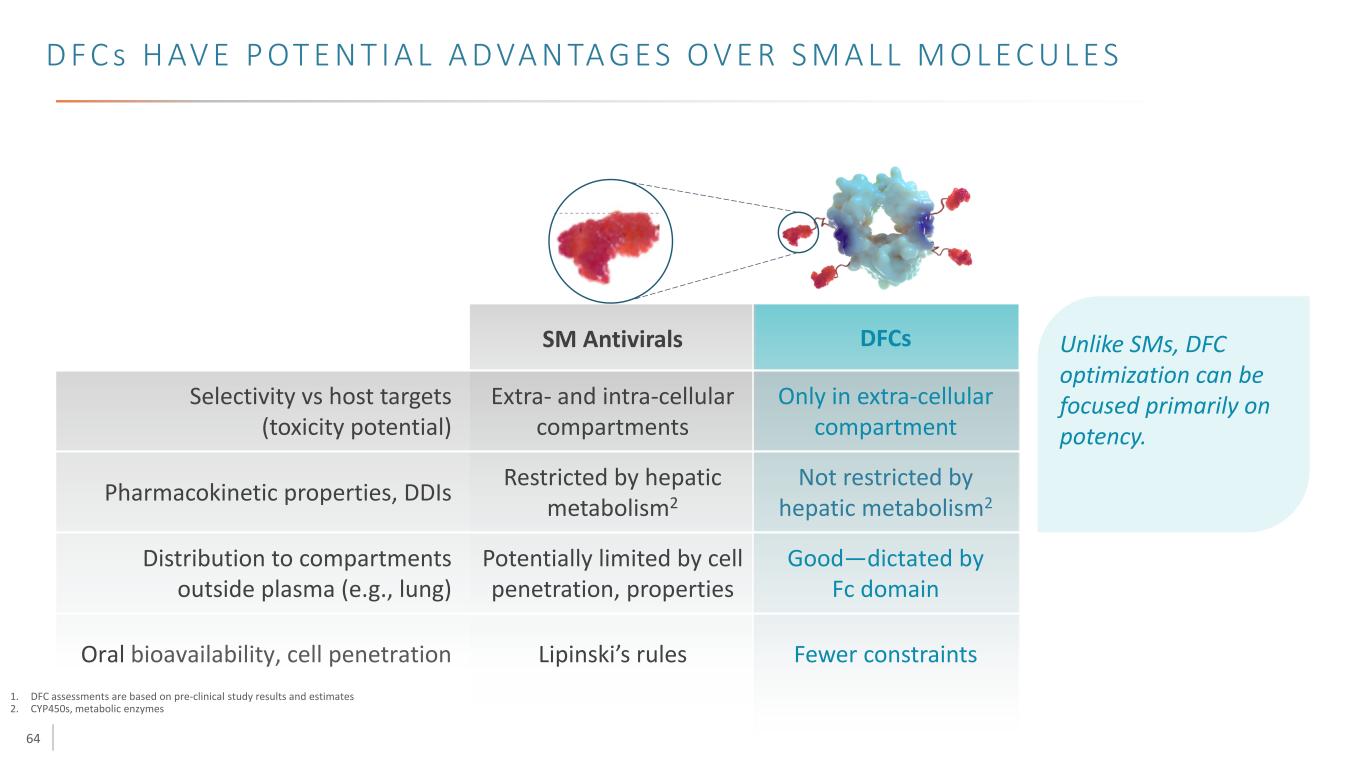

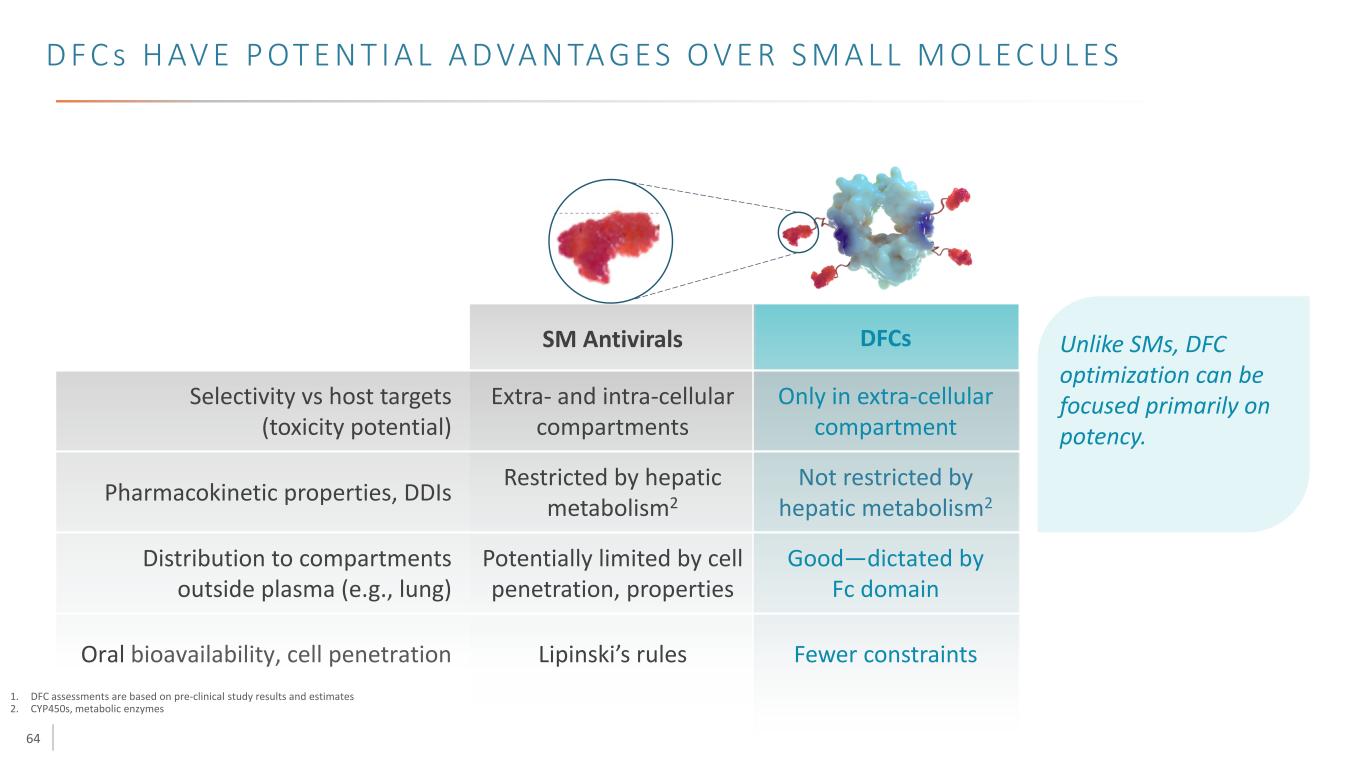

64 D F C s H AV E P OT E N T I A L A D VA N TA G E S O V E R S M A L L M O L E C U L E S 1. DFC assessments are based on pre-clinical study results and estimates 2. CYP450s, metabolic enzymes Selectivity vs host targets (toxicity potential) Pharmacokinetic properties, DDIs Distribution to compartments outside plasma (e.g., lung) Oral bioavailability, cell penetration Lipinski’s rules Potentially limited by cell penetration, properties Restricted by hepatic metabolism2 Extra- and intra-cellular compartments Unlike SMs, DFC optimization can be focused primarily on potency. Not restricted by hepatic metabolism2 Good—dictated by Fc domain Fewer constraints Only in extra-cellular compartment SM Antivirals DFCs

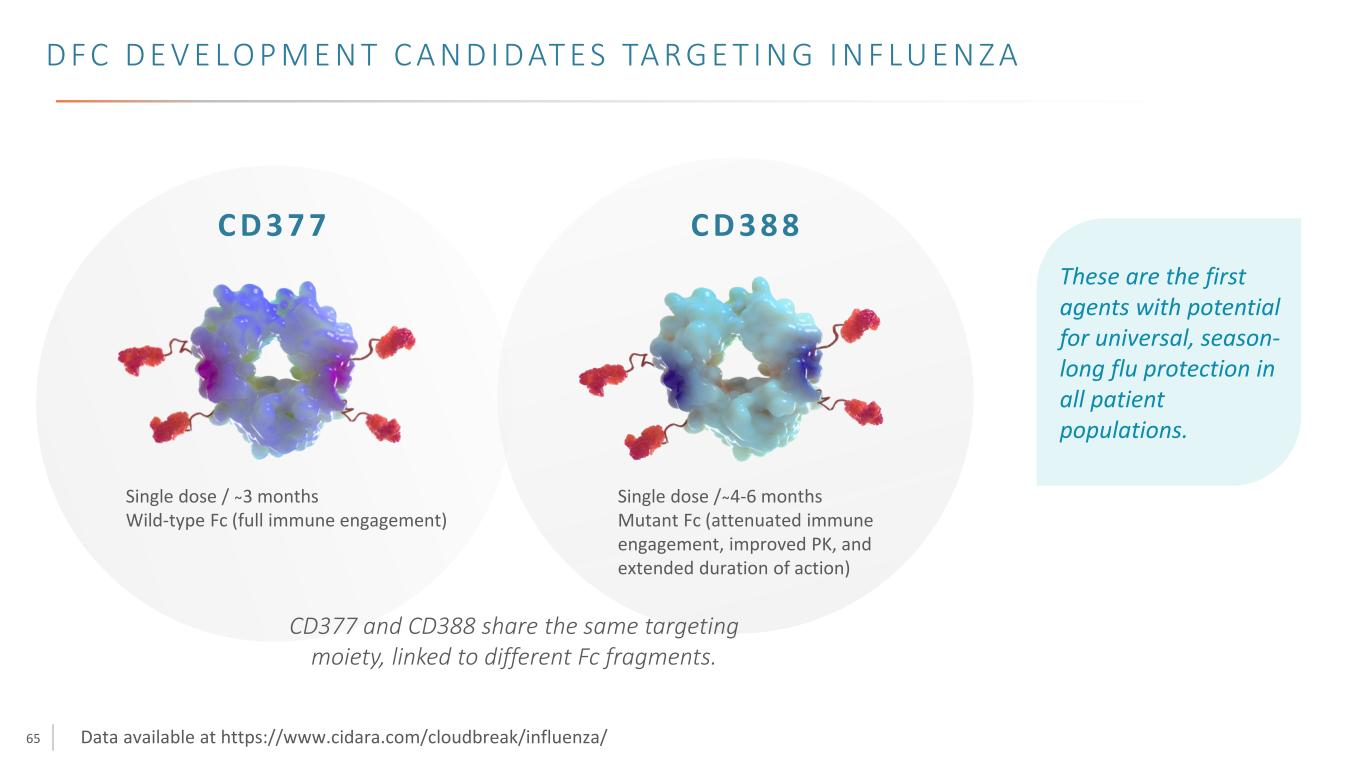

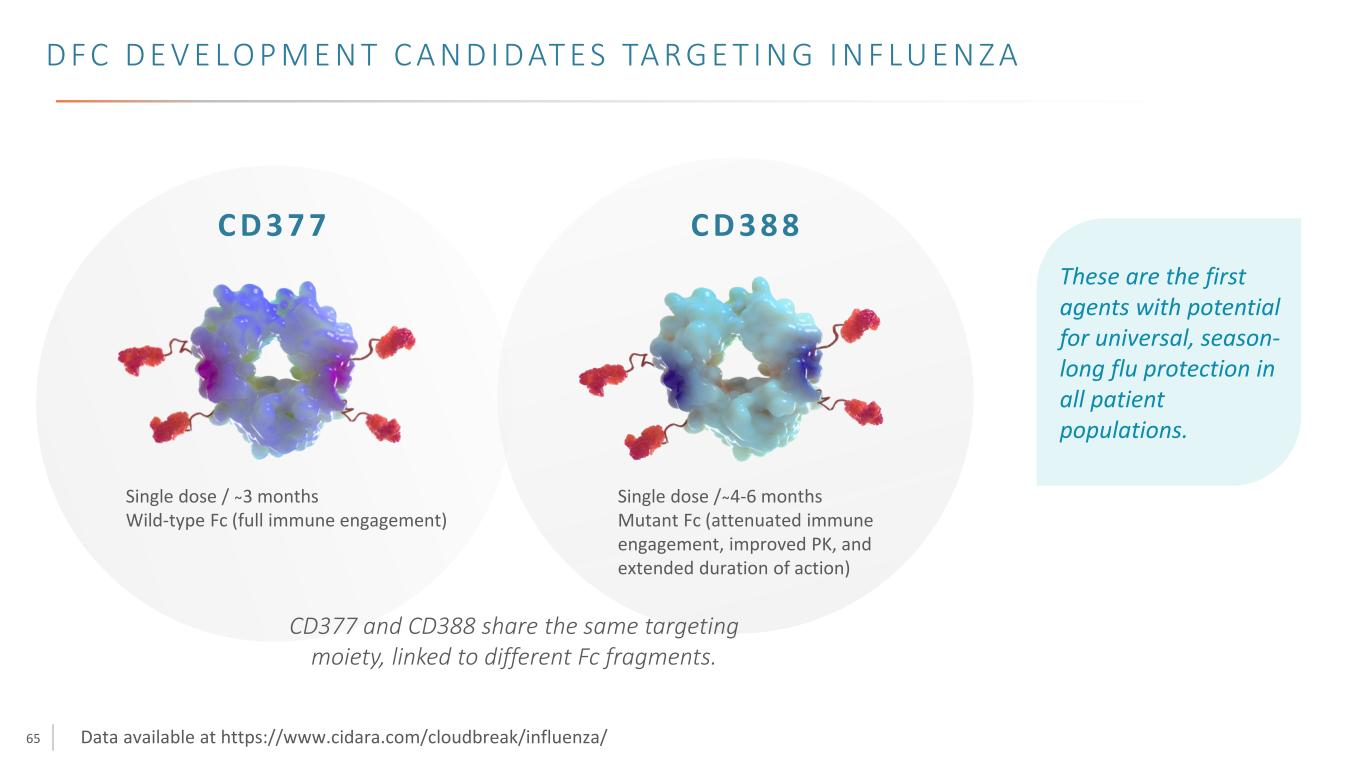

65 Single dose / ̴3 months Wild-type Fc (full immune engagement) C D 3 7 7 C D 3 8 8 Single dose / ̴4-6 months Mutant Fc (attenuated immune engagement, improved PK, and extended duration of action) D F C D E V E LO P M E N T C A N D I D AT E S TA R G E T I N G I N F LU E N Z A These are the first agents with potential for universal, season- long flu protection in all patient populations. CD377 and CD388 share the same targeting moiety, linked to different Fc fragments. Data available at https://www.cidara.com/cloudbreak/influenza/

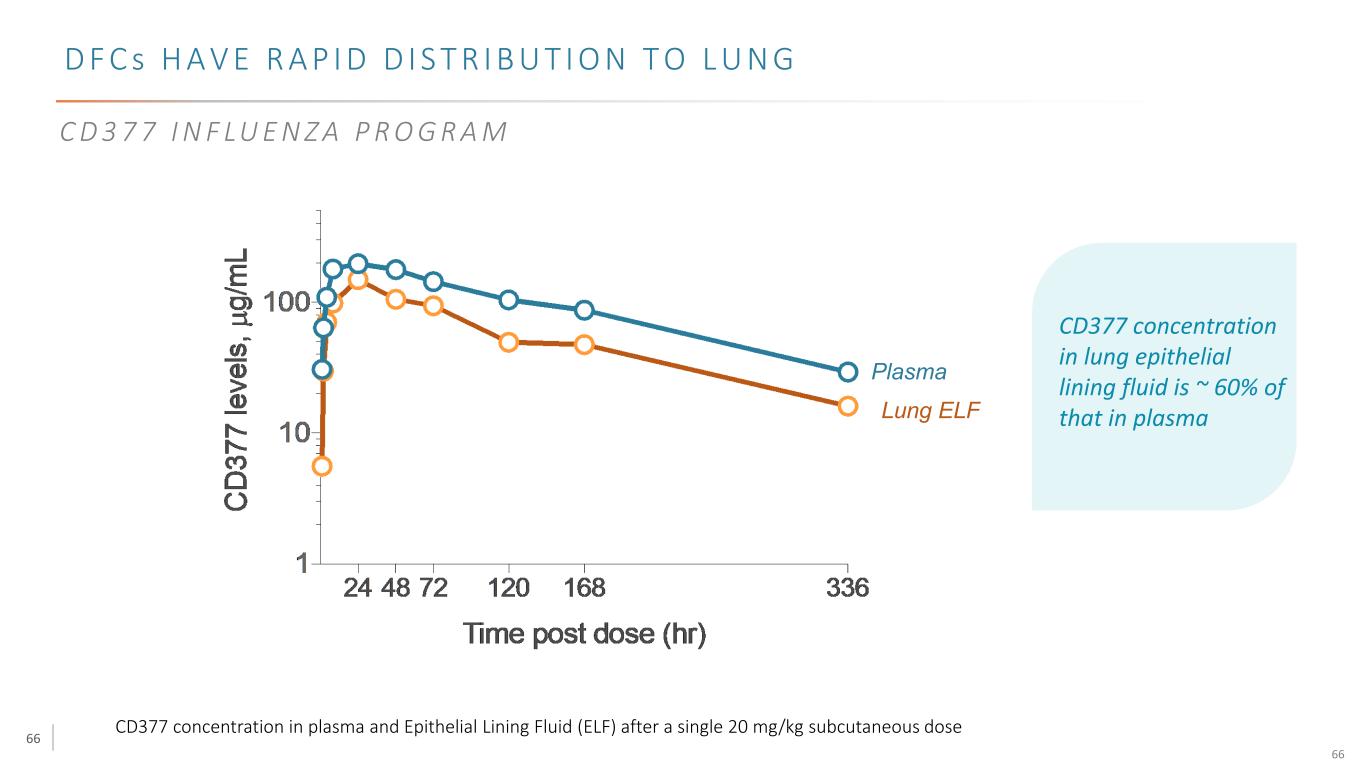

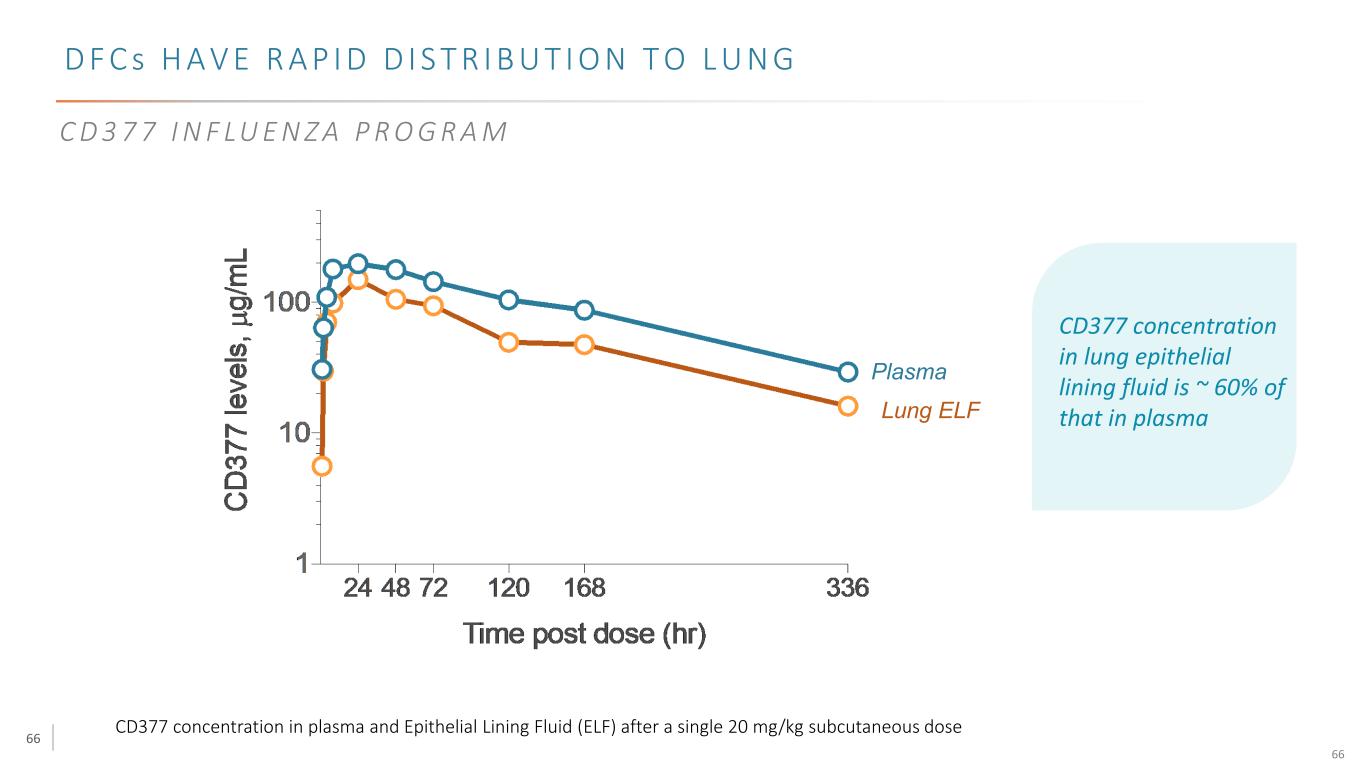

66 66 D F C s H A V E R A P I D D I S T R I B U T I O N T O L U N G CD377 concentration in plasma and Epithelial Lining Fluid (ELF) after a single 20 mg/kg subcutaneous dose Plasma Lung ELF C D 3 7 7 I N F LU E N Z A P R O G R A M CD377 concentration in lung epithelial lining fluid is ~ 60% of that in plasma

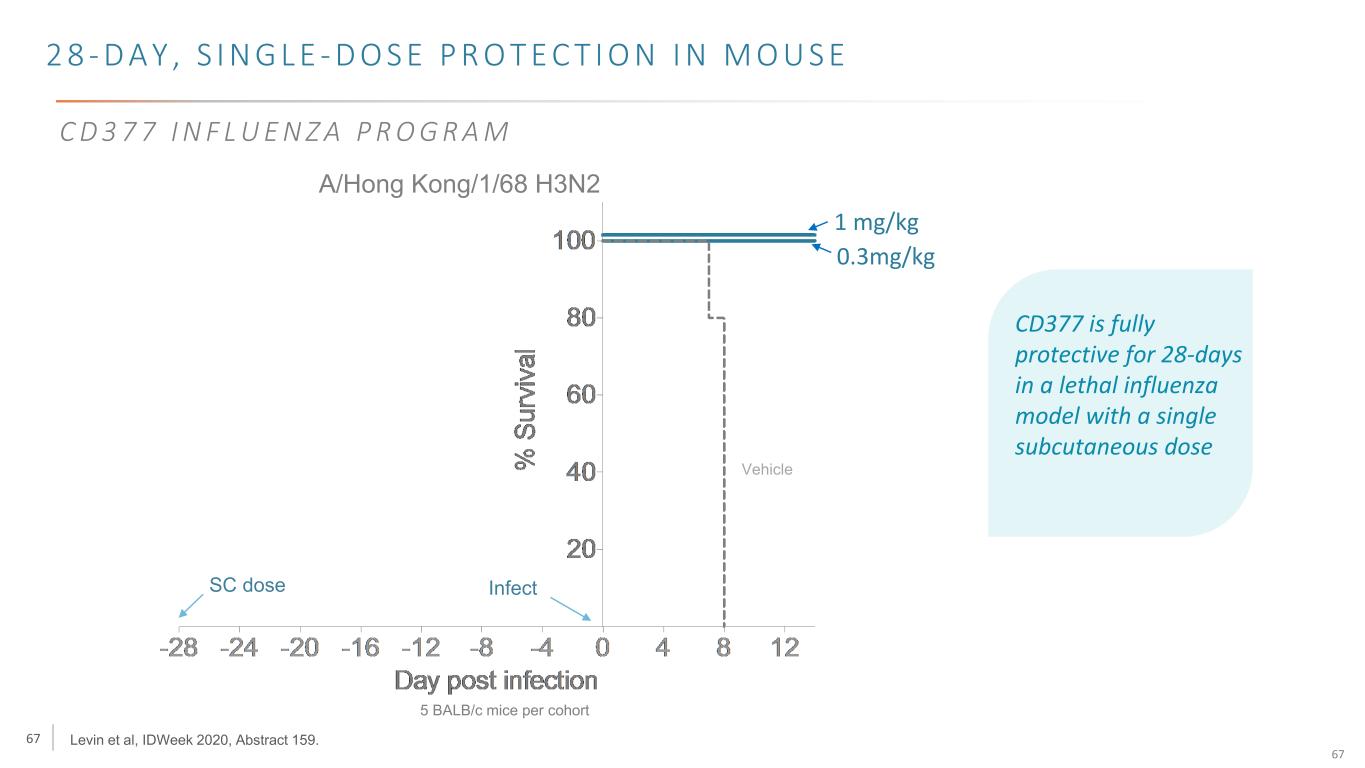

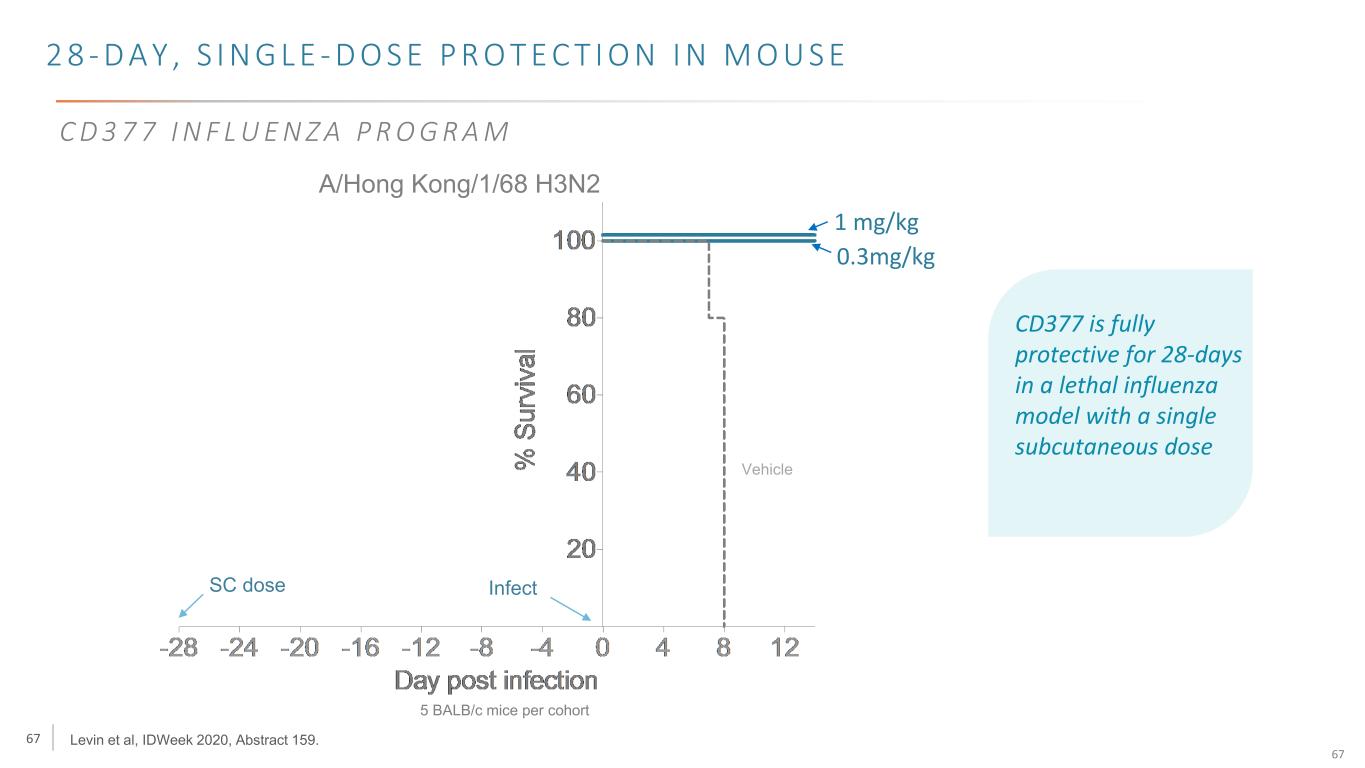

67 67 2 8 - D A Y , S I N G L E - D O S E P R O T E C T I O N I N M O U S E A/Hong Kong/1/68 H3N2 SC dose Infect Vehicle Levin et al, IDWeek 2020, Abstract 159. 5 BALB/c mice per cohort C D 3 7 7 I N F L U E N Z A P R O G R A M CD377 is fully protective for 28-days in a lethal influenza model with a single subcutaneous dose 1 mg/kg 0.3mg/kg

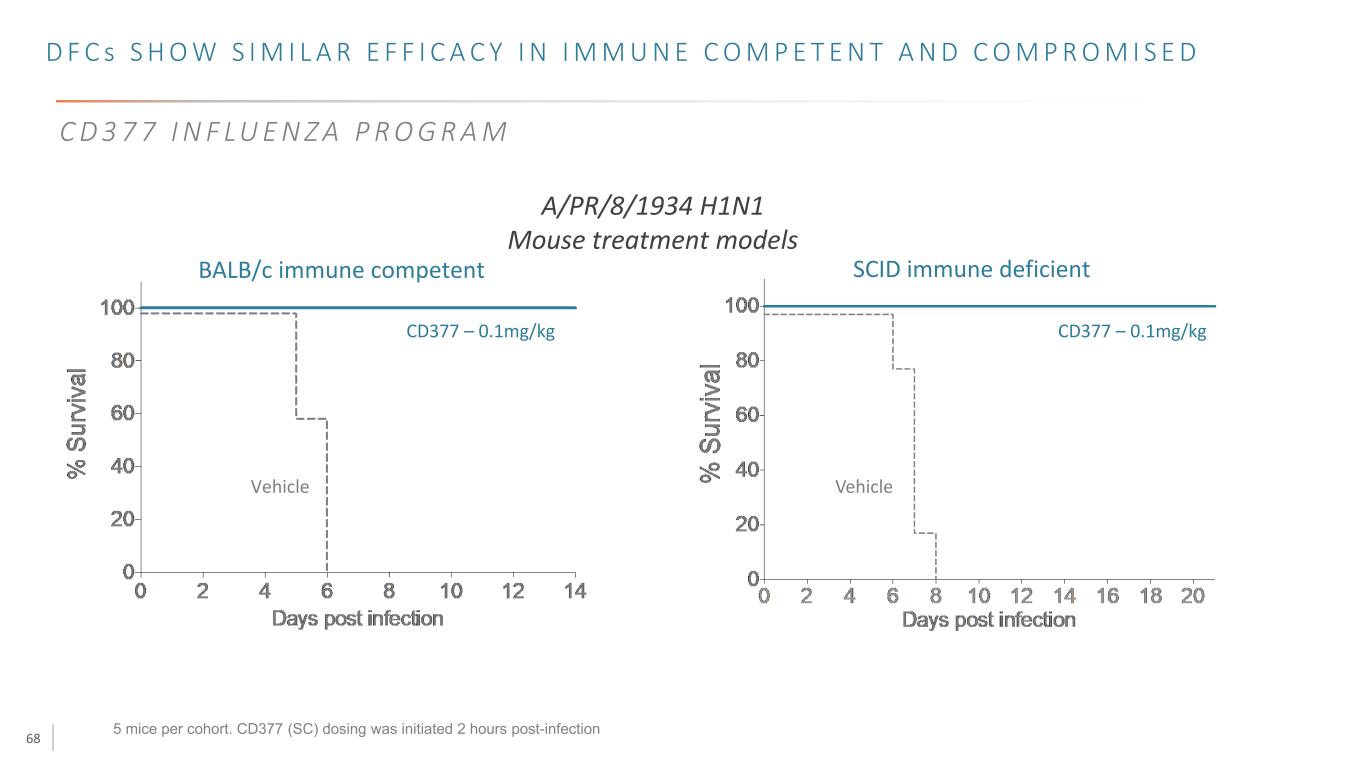

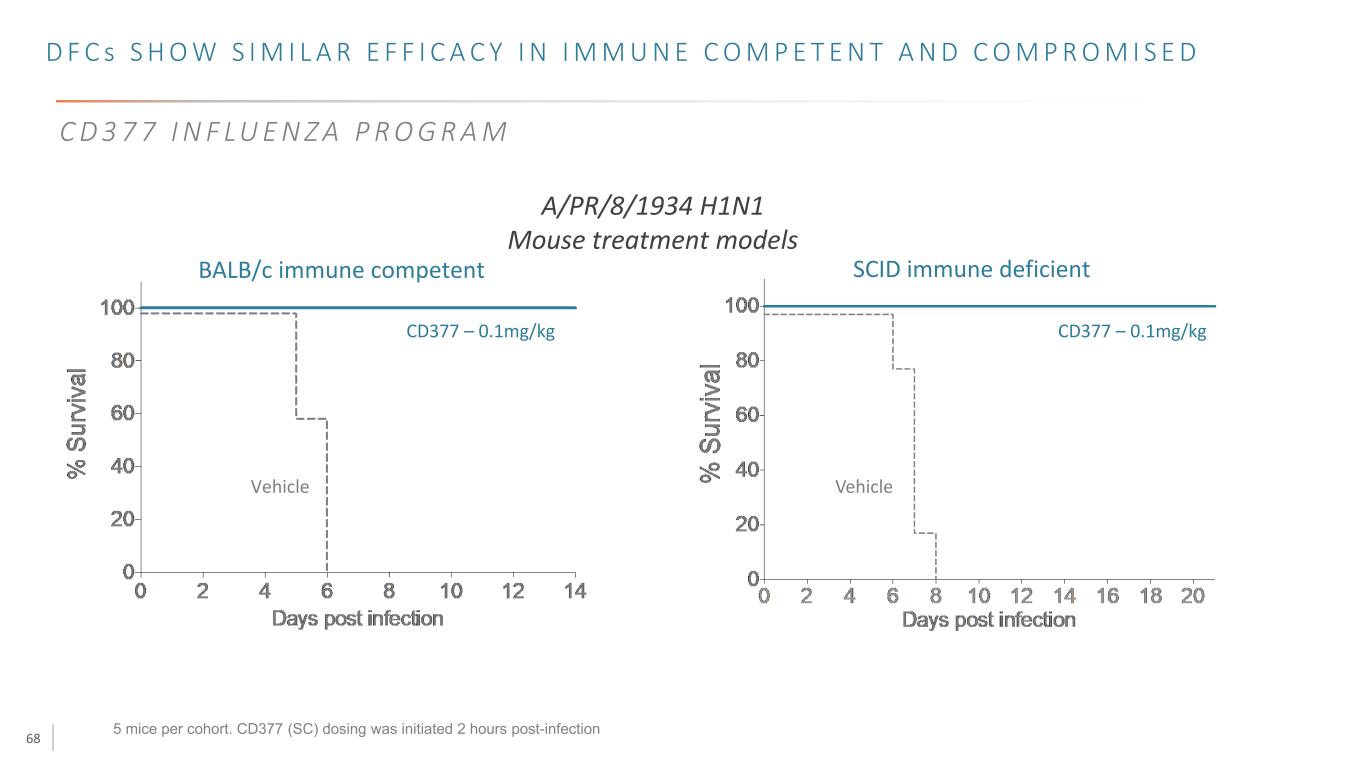

68 5 mice per cohort. CD377 (SC) dosing was initiated 2 hours post-infection CD377 – 0.1mg/kg Vehicle CD377 – 0.1mg/kg Vehicle A/PR/8/1934 H1N1 Mouse treatment models BALB/c immune competent SCID immune deficient D F C s S H O W S I M I L A R E F F I C A C Y I N I M M U N E C O M P E T E N T A N D C O M P R O M I S E D C D 3 7 7 I N F LU E N Z A P R O G R A M

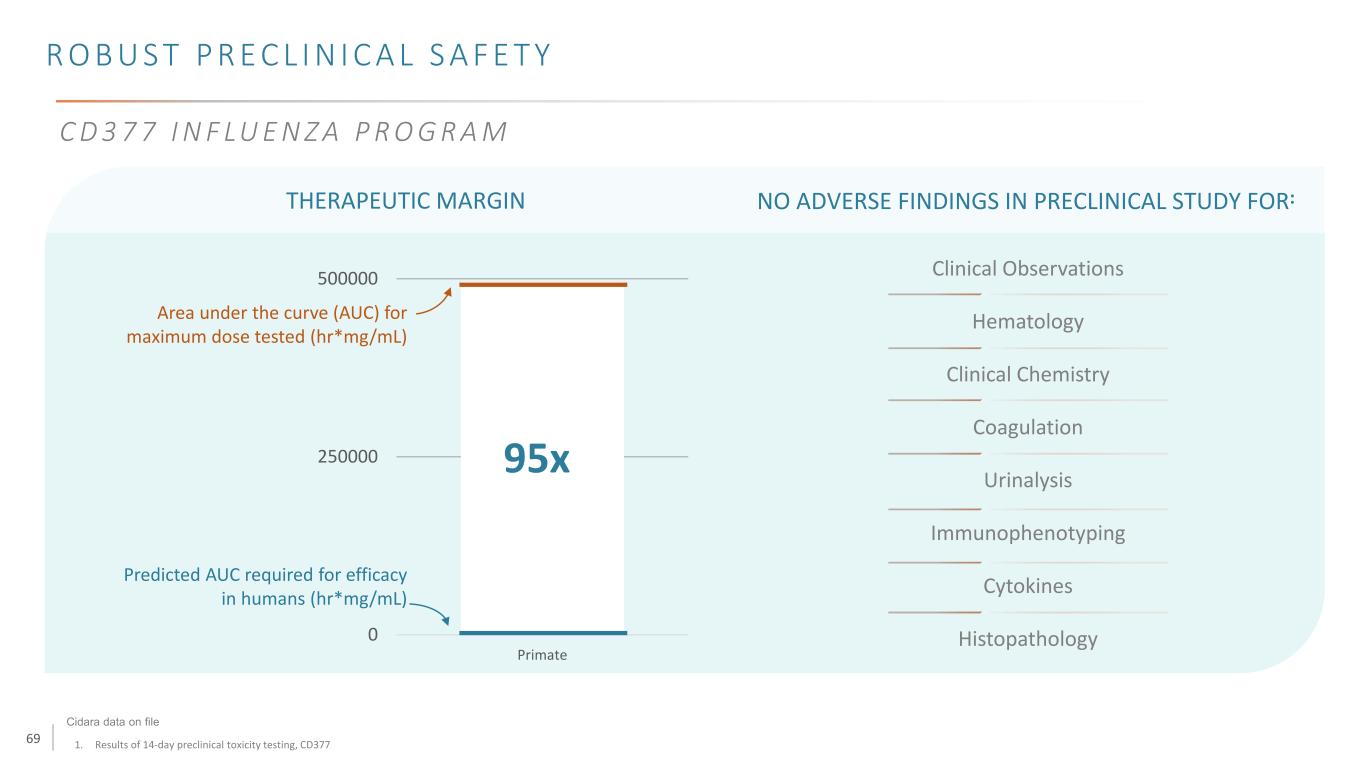

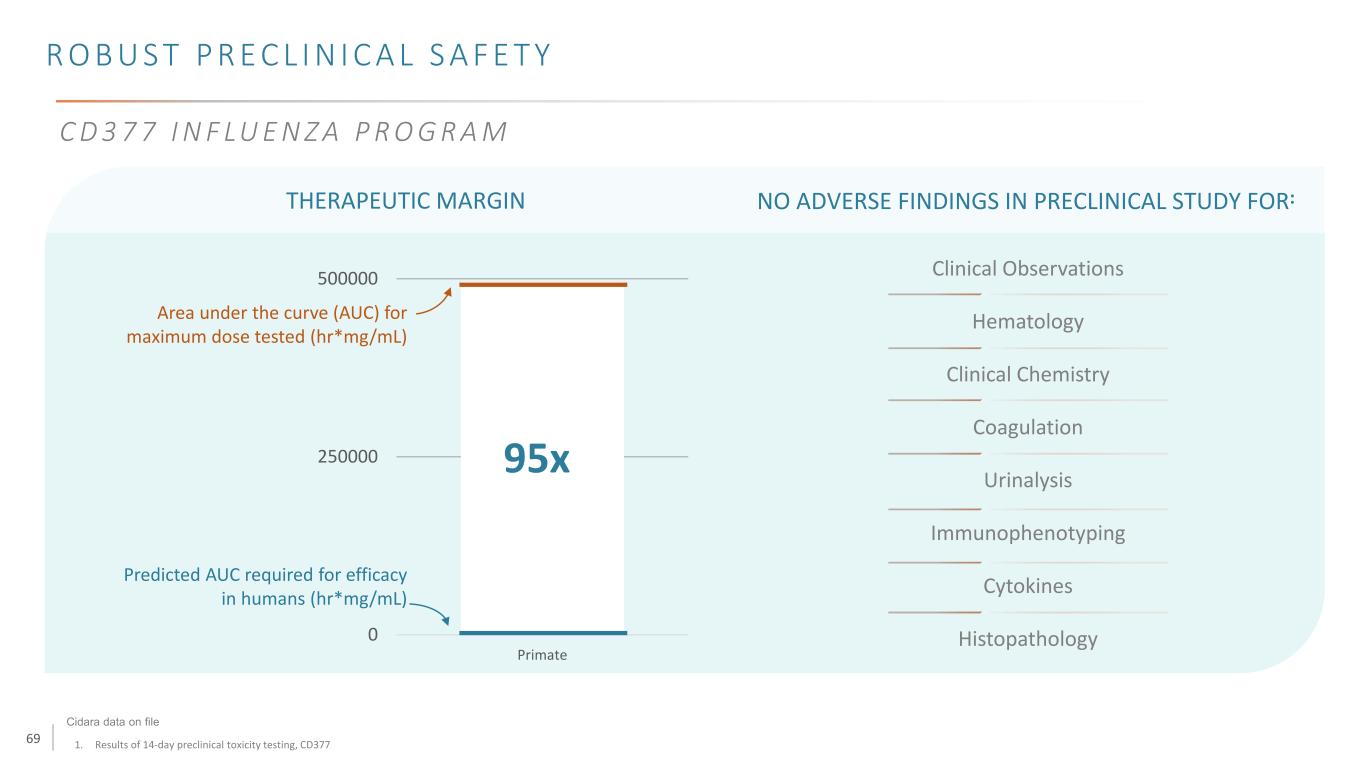

69 R O B U S T P R E C L I N I C A L S A F E T Y 1. Results of 14-day preclinical toxicity testing, CD377 THERAPEUTIC MARGIN 0 250000 500000 Primate Area under the curve (AUC) for maximum dose tested (hr*mg/mL) Predicted AUC required for efficacy in humans (hr*mg/mL) 95x Clinical Observations Hematology Clinical Chemistry Coagulation Urinalysis Immunophenotyping Cytokines Histopathology NO ADVERSE FINDINGS IN PRECLINICAL STUDY FOR: Cidara data on file C D 3 7 7 I N F LU E N Z A P R O G R A M

70 U N M E T N E E D S I N R E S P I R ATO R Y V I R U S E S E R I C S I M O E S , M D U N I V E R S I T Y O F C O LO R A D O

Viral Respiratory Tract infect ions I m p o r t a n c e a n d P r o s p e c t s fo r P r e v e n t i o n a n d Tr e a t m e n t Eric A.F. Simões, Professor of Pediatrics Section of Infectious Diseases, University of Colorado School of Medicine, and Childrenʼs Hospital Colorado Professor of Epidemiology Colorado School of Public Health, and Center for Global Health.

72 M A J O R V I R A L R E S P I R A T O R Y P A T H O G E N S 72 SARS CoV2 Influenza Virus Respiratory Syncytial Virus Rhinovirus Parainfluenza viruses Human Metapneumovirus

73 M A J O R V I R A L R E S P I R A T O R Y P A T H O G E N S 73 SARS CoV2 Influenza Virus Respiratory Syncytial Virus Rhinovirus Parainfluenza viruses Human Metapneumovirus

74 S A RS C O V - 2 : G LO B A L S I T UAT I O N - 1 3 S E P T 2 0 2 1 https://covid19.who.int/ Accessed 13 Sept 2021 224 Million Confirmed Cases, 4.63 Million confirmed Deaths 5.4 Billion Vaccine Doses Administered 74

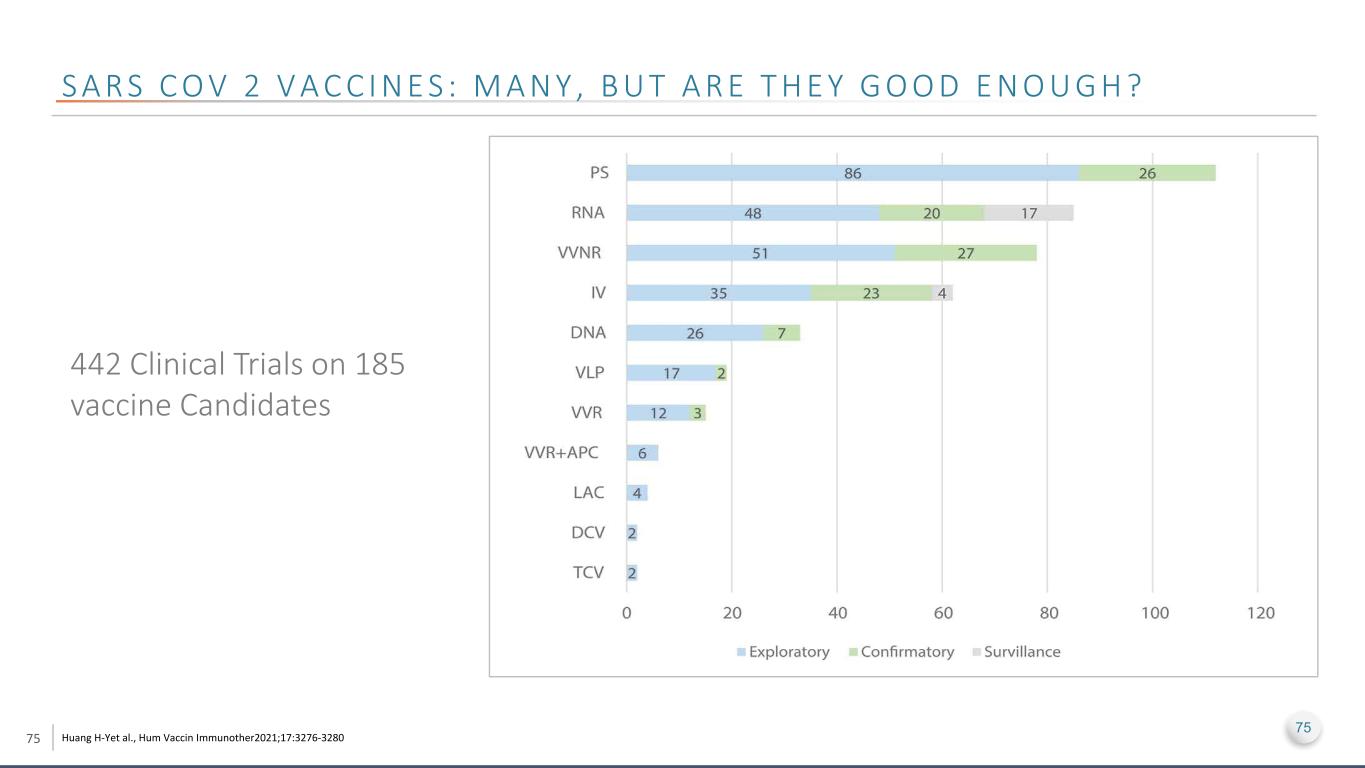

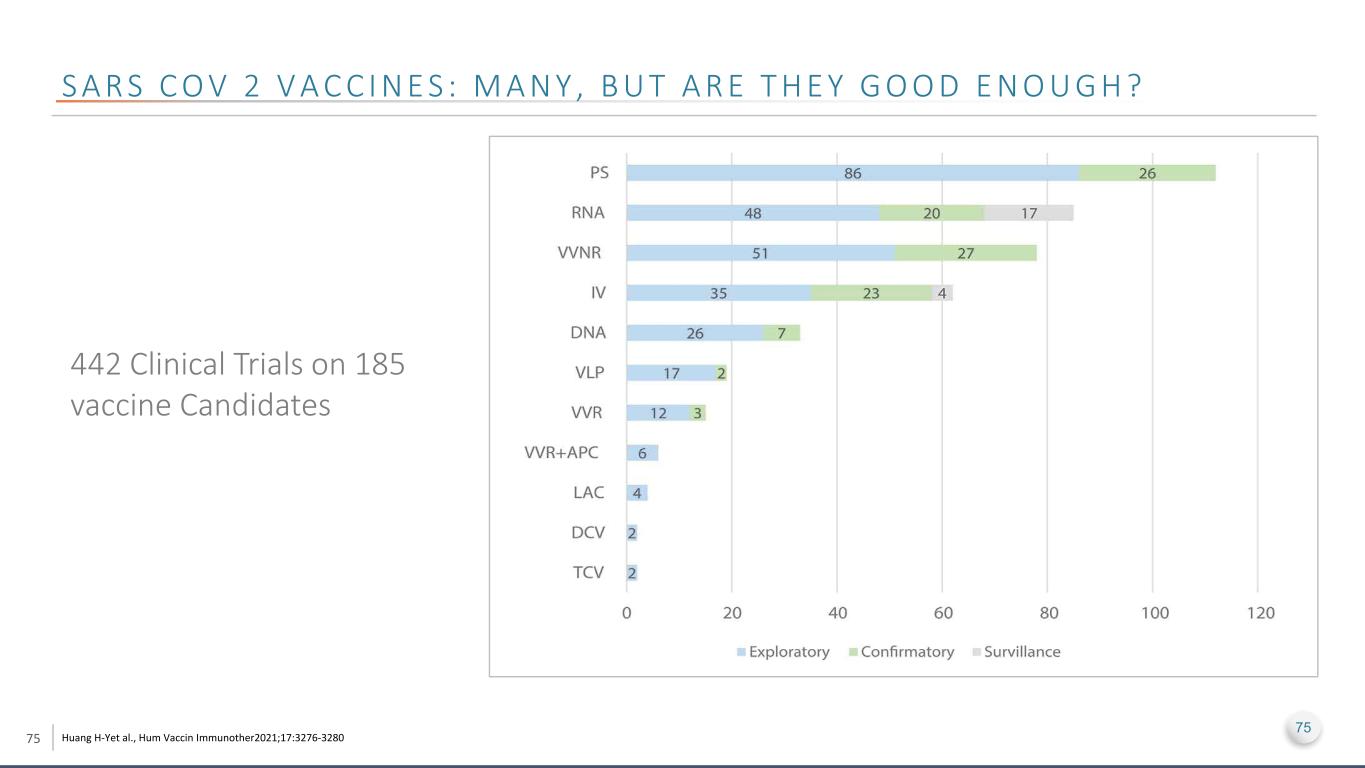

75 S A R S C O V 2 V A C C I N E S : M A N Y , B U T A R E T H E Y G O O D E N O U G H ? Huang H-Yet al., Hum Vaccin Immunother2021;17:3276-3280 75 442 Clinical Trials on 185 vaccine Candidates

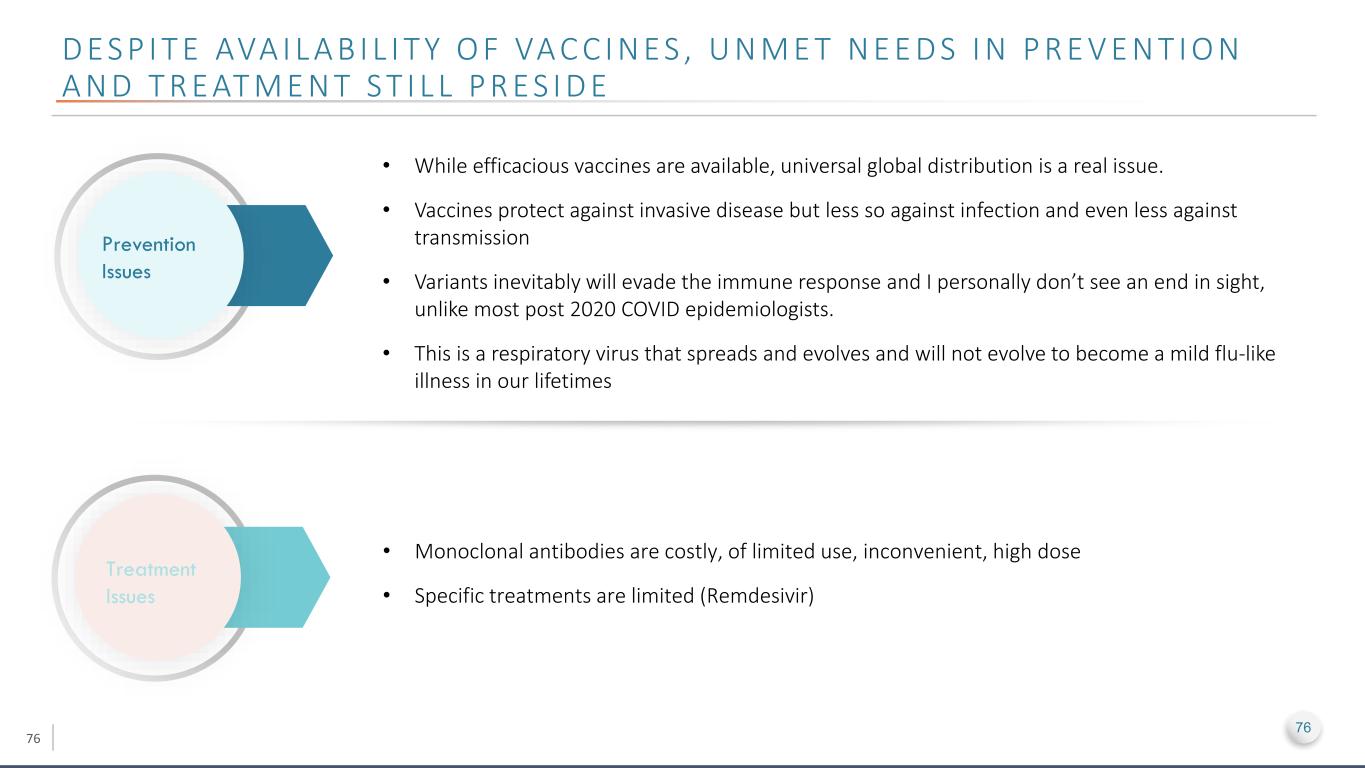

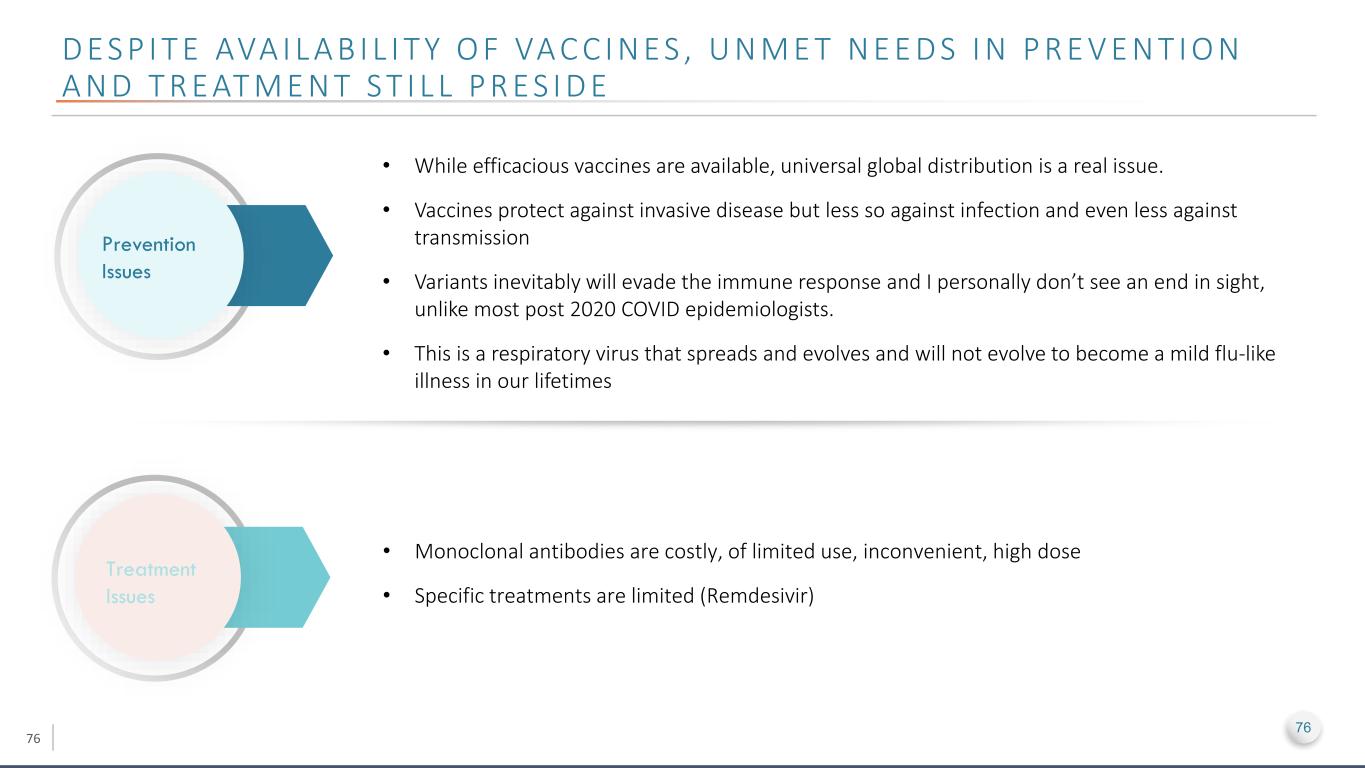

76 D E S P I T E AVA I L A B I L I T Y O F VA C C I N E S , U N M E T N E E D S I N P R E V E N T I O N A N D T R E AT M E N T S T I L L P R E S I D E Prevention Issues Treatment Issues • While efficacious vaccines are available, universal global distribution is a real issue. • Vaccines protect against invasive disease but less so against infection and even less against transmission • Variants inevitably will evade the immune response and I personally don’t see an end in sight, unlike most post 2020 COVID epidemiologists. • This is a respiratory virus that spreads and evolves and will not evolve to become a mild flu-like illness in our lifetimes • Monoclonal antibodies are costly, of limited use, inconvenient, high dose • Specific treatments are limited (Remdesivir) 76

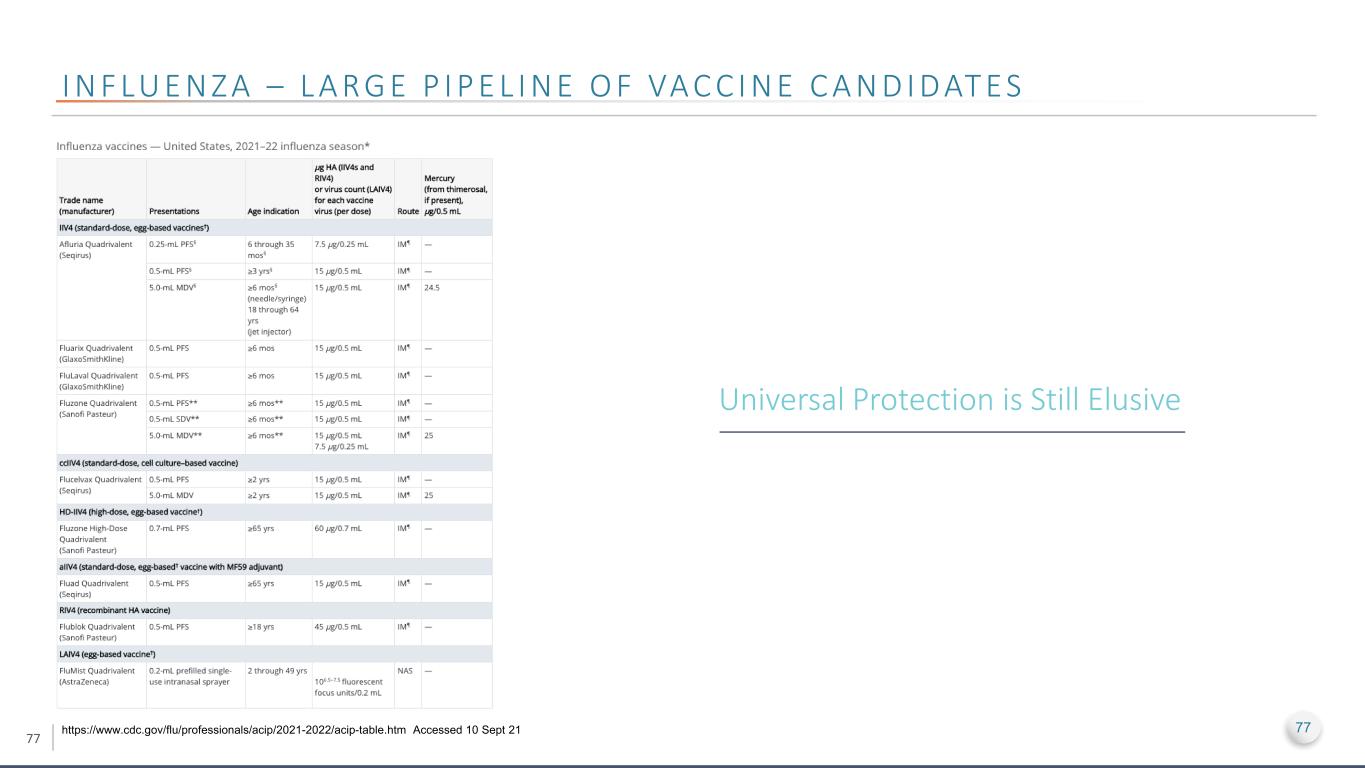

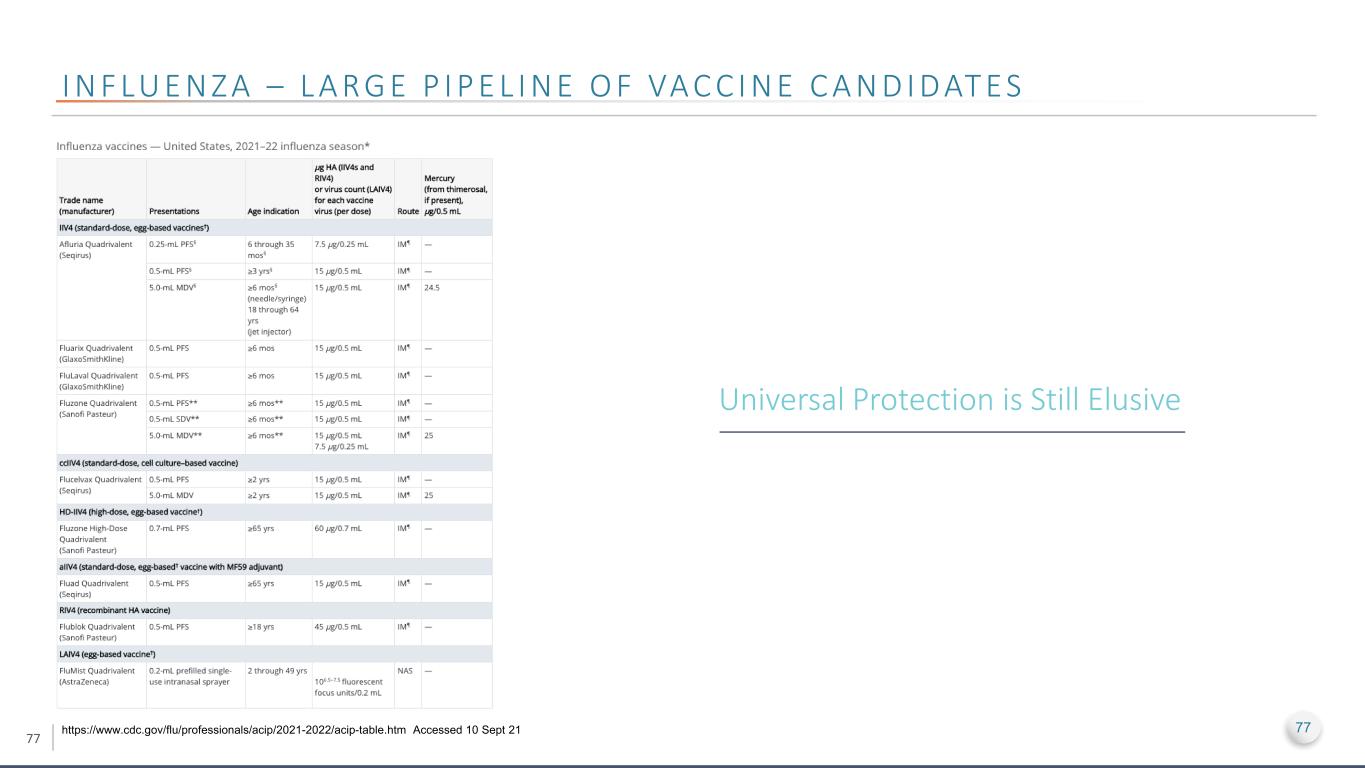

77 I N F LU E N Z A – L A R G E P I P E L I N E O F VA C C I N E C A N D I D AT E S https://www.cdc.gov/flu/professionals/acip/2021-2022/acip-table.htm Accessed 10 Sept 21 Universal Protection is Still Elusive 77

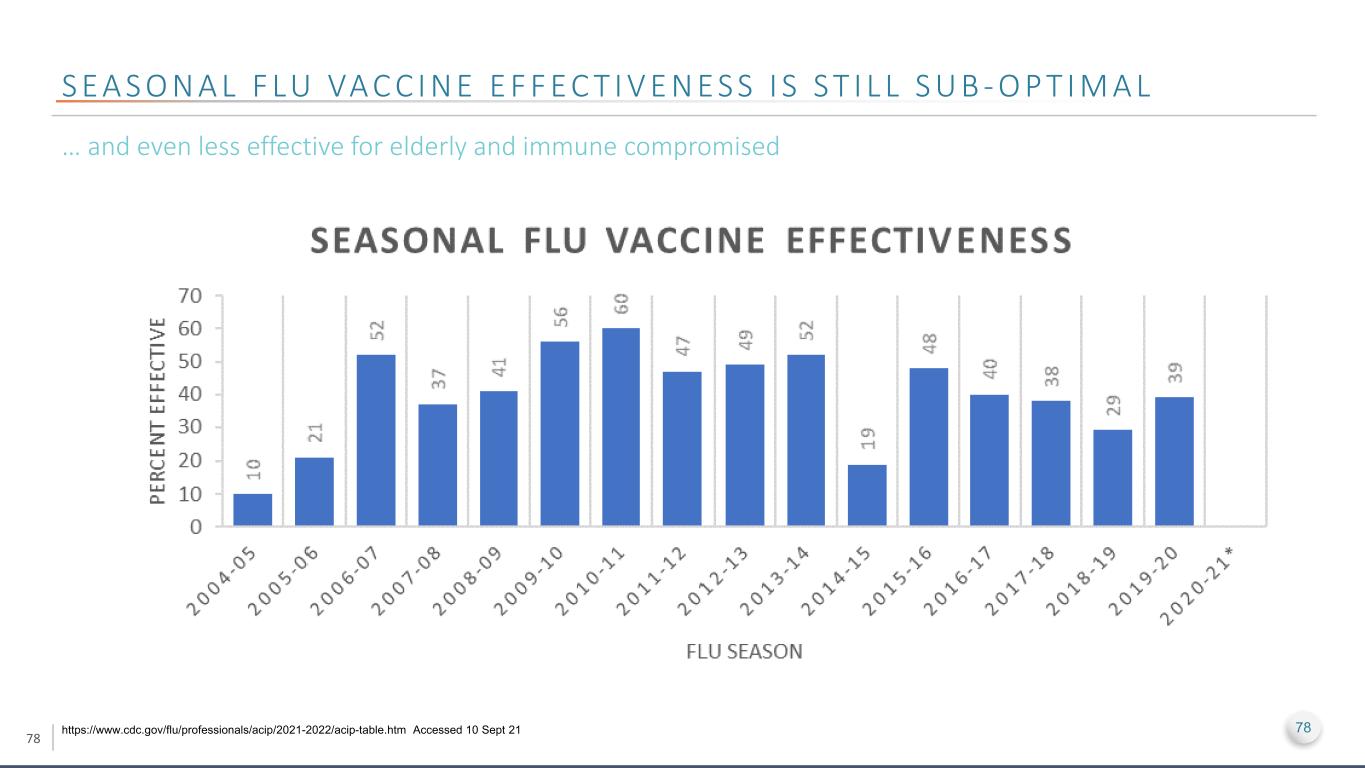

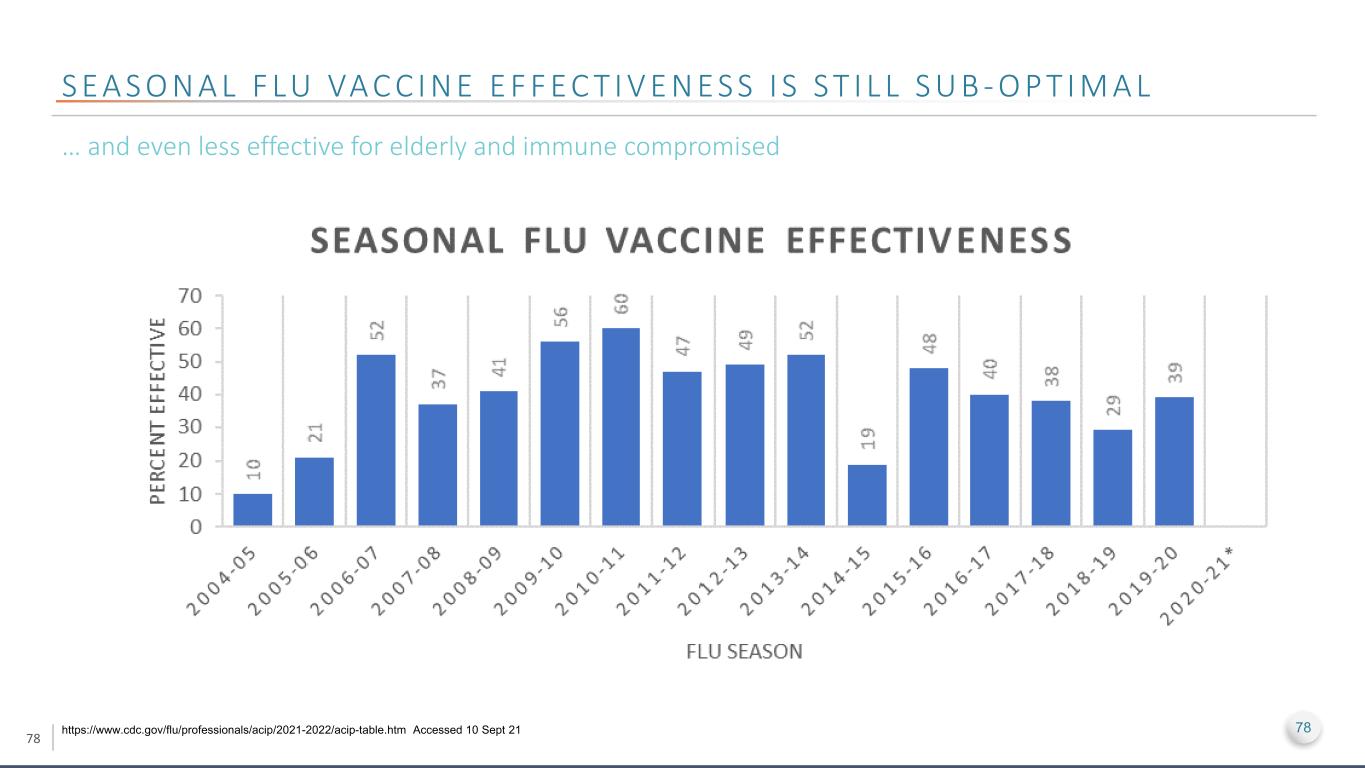

78 S E A S O N A L F LU VA C C I N E E F F E C T I V E N E S S I S S T I L L S U B - O P T I M A L https://www.cdc.gov/flu/professionals/acip/2021-2022/acip-table.htm Accessed 10 Sept 21 … and even less effective for elderly and immune compromised 78

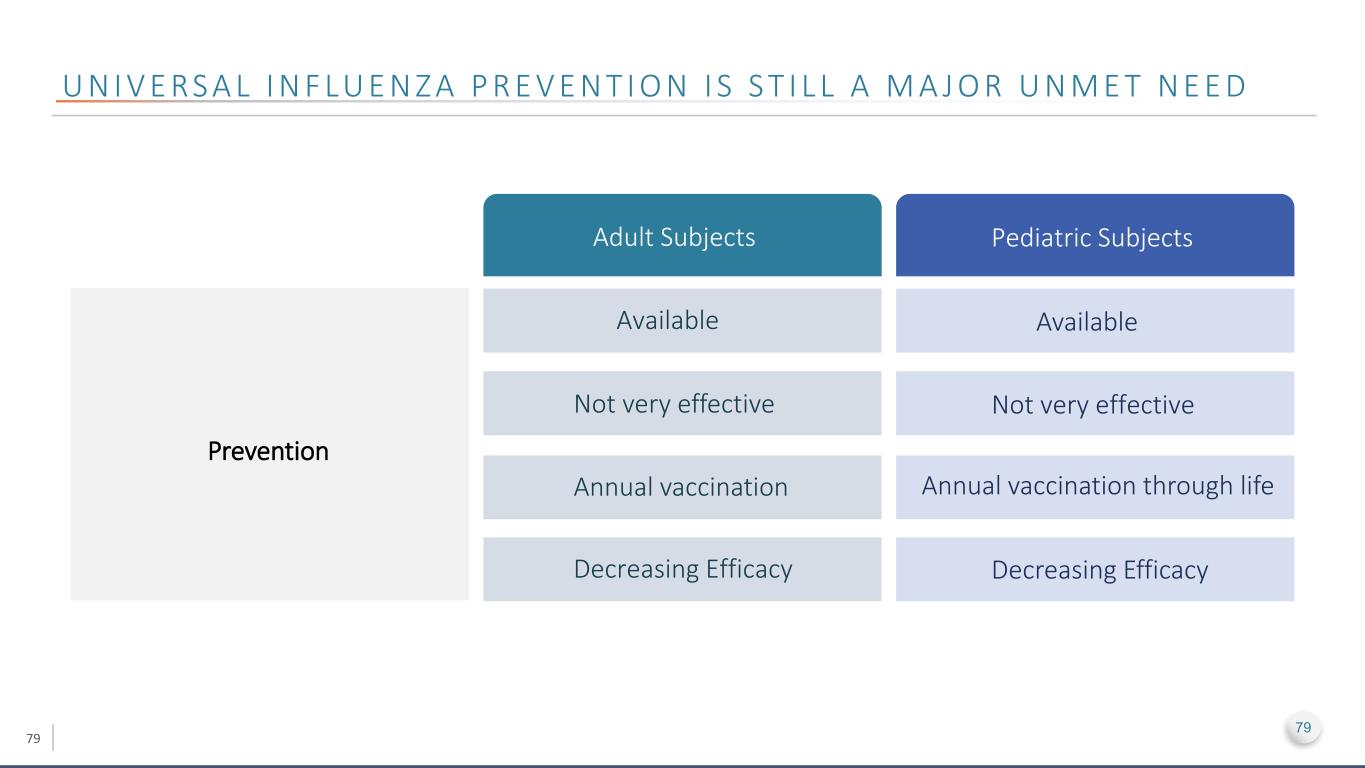

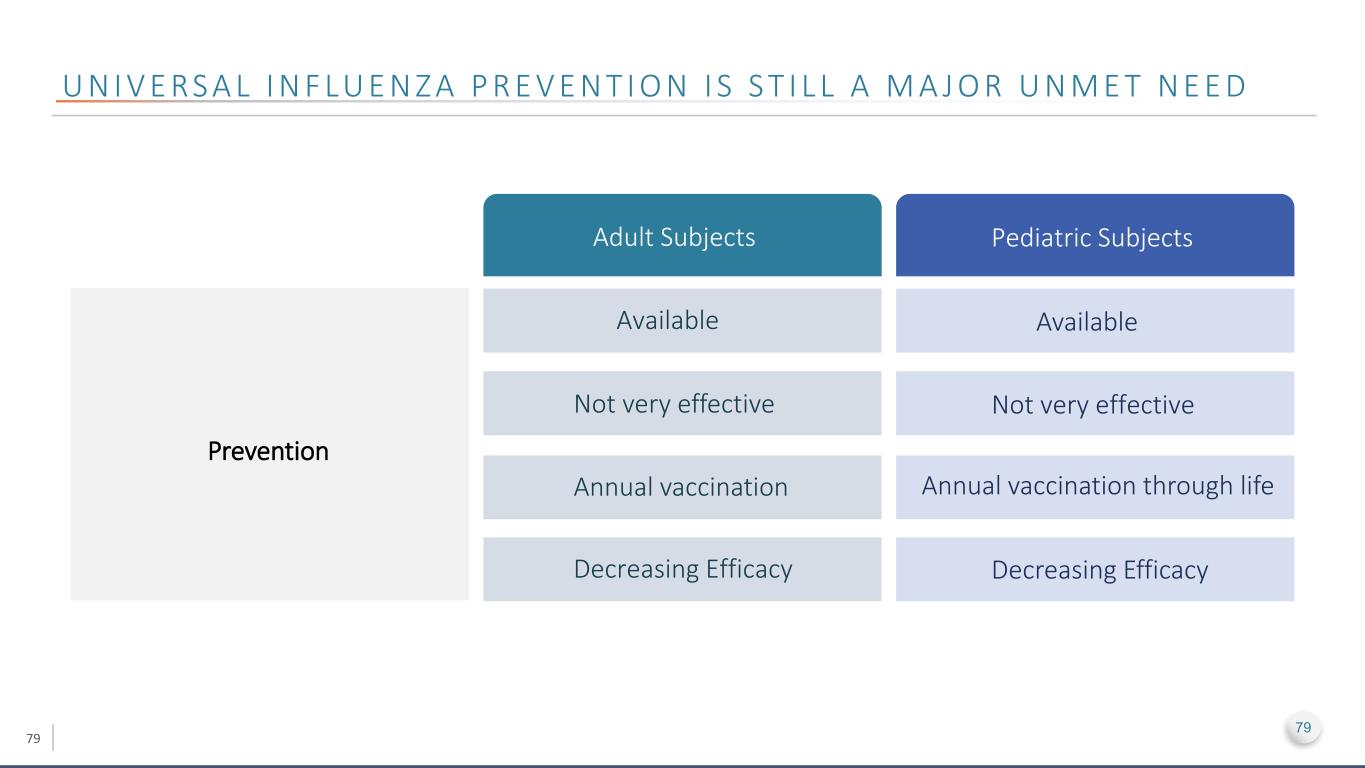

79 U N I V E RS A L I N F LU E N Z A P R E V E N T I O N I S S T I L L A M A J O R U N M E T N E E D Adult Subjects Pediatric Subjects Prevention Available Available Not very effective Not very effective Annual vaccination Annual vaccination through life Decreasing Efficacy Decreasing Efficacy 79

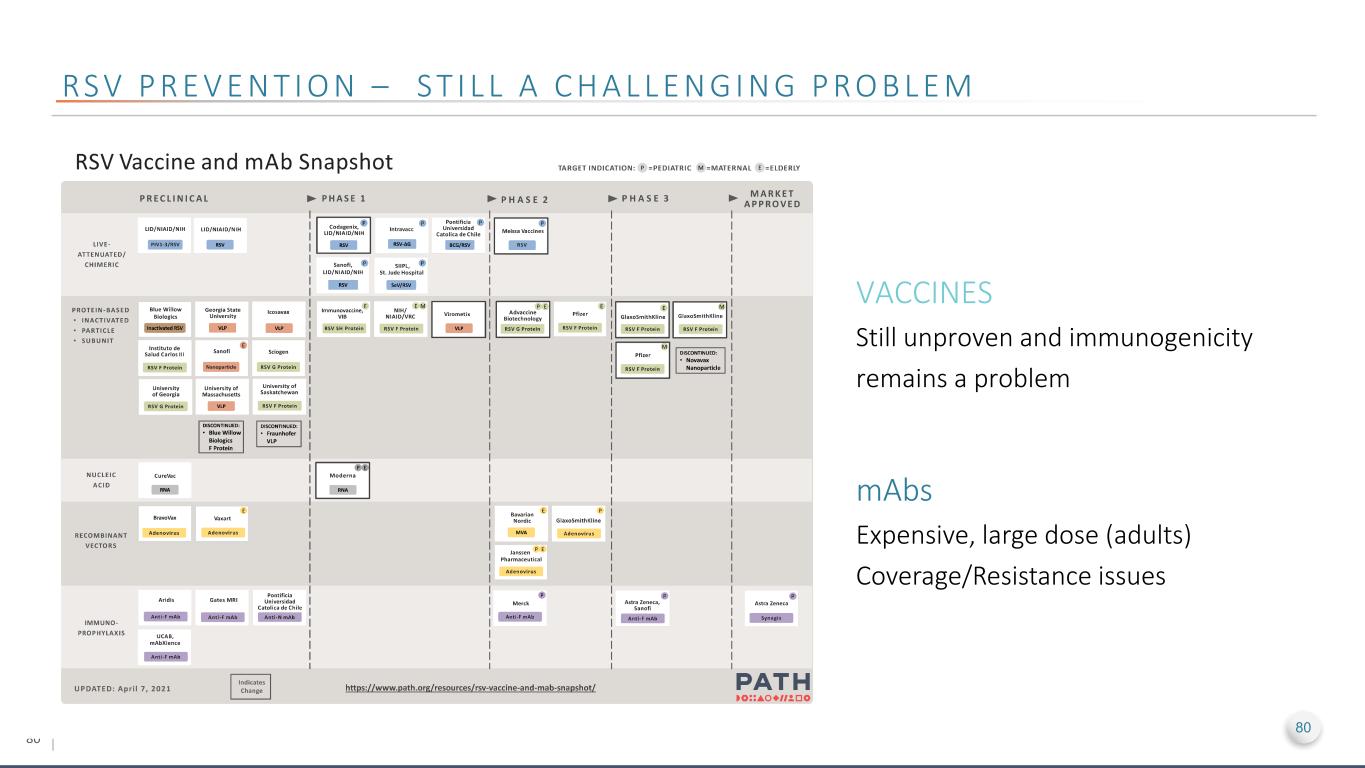

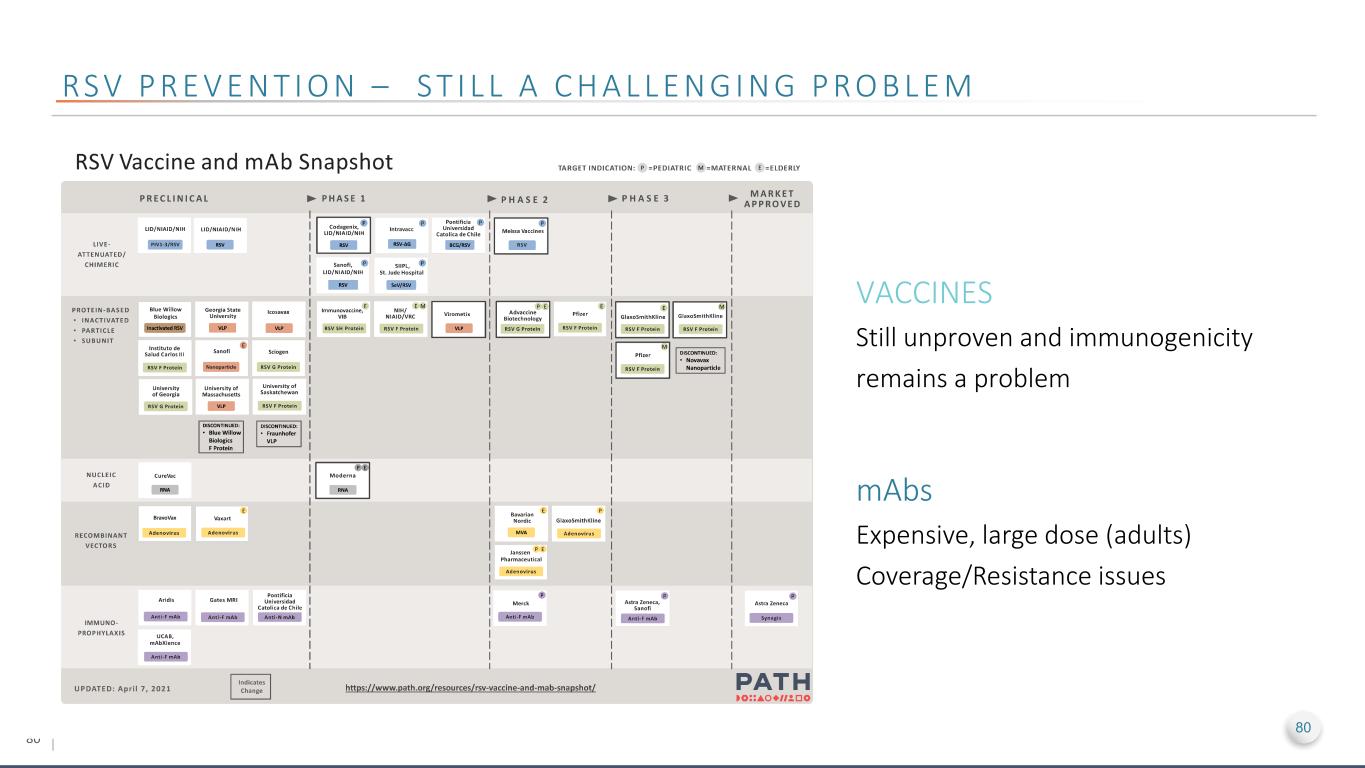

80 RS V P R E V E N T I O N – S T I L L A C H A L L E N G I N G P R O B L E M VACCINES Still unproven and immunogenicity remains a problem mAbs Expensive, large dose (adults) Coverage/Resistance issues 80

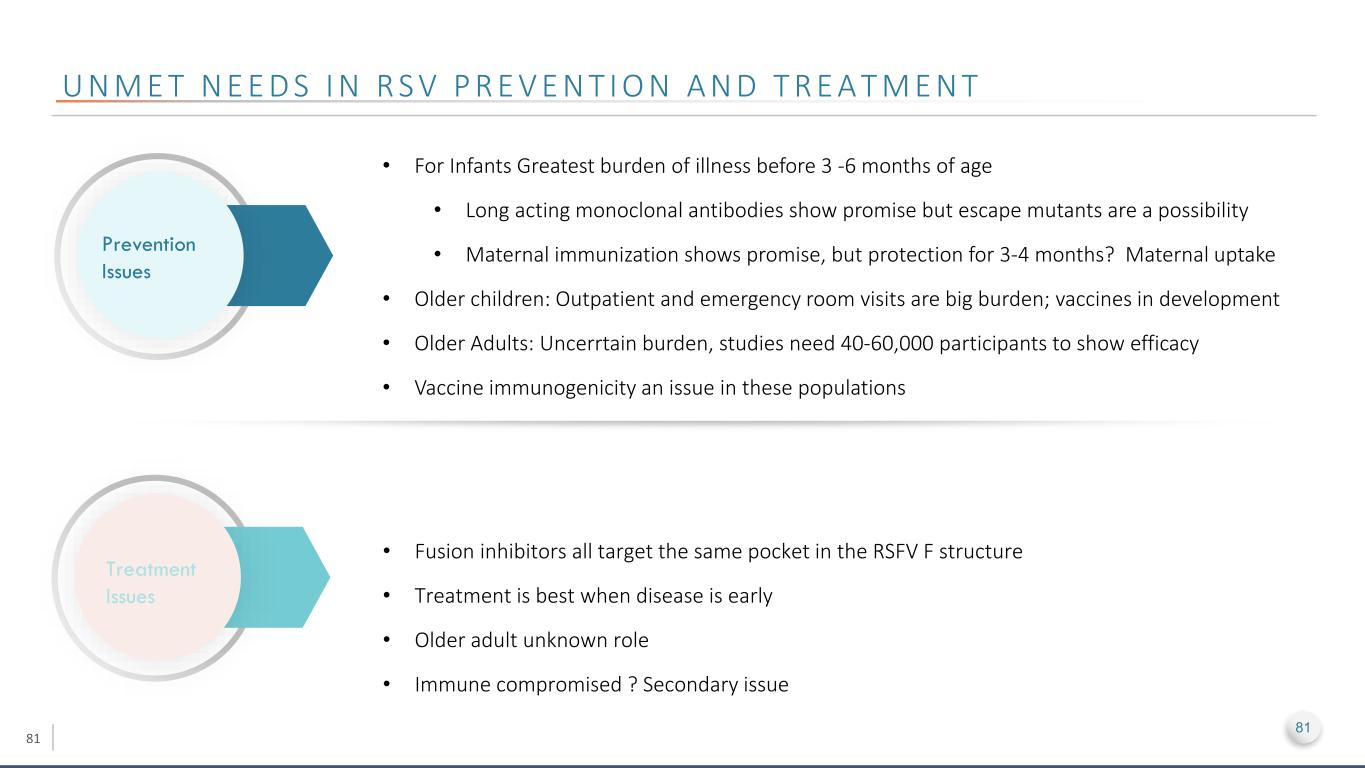

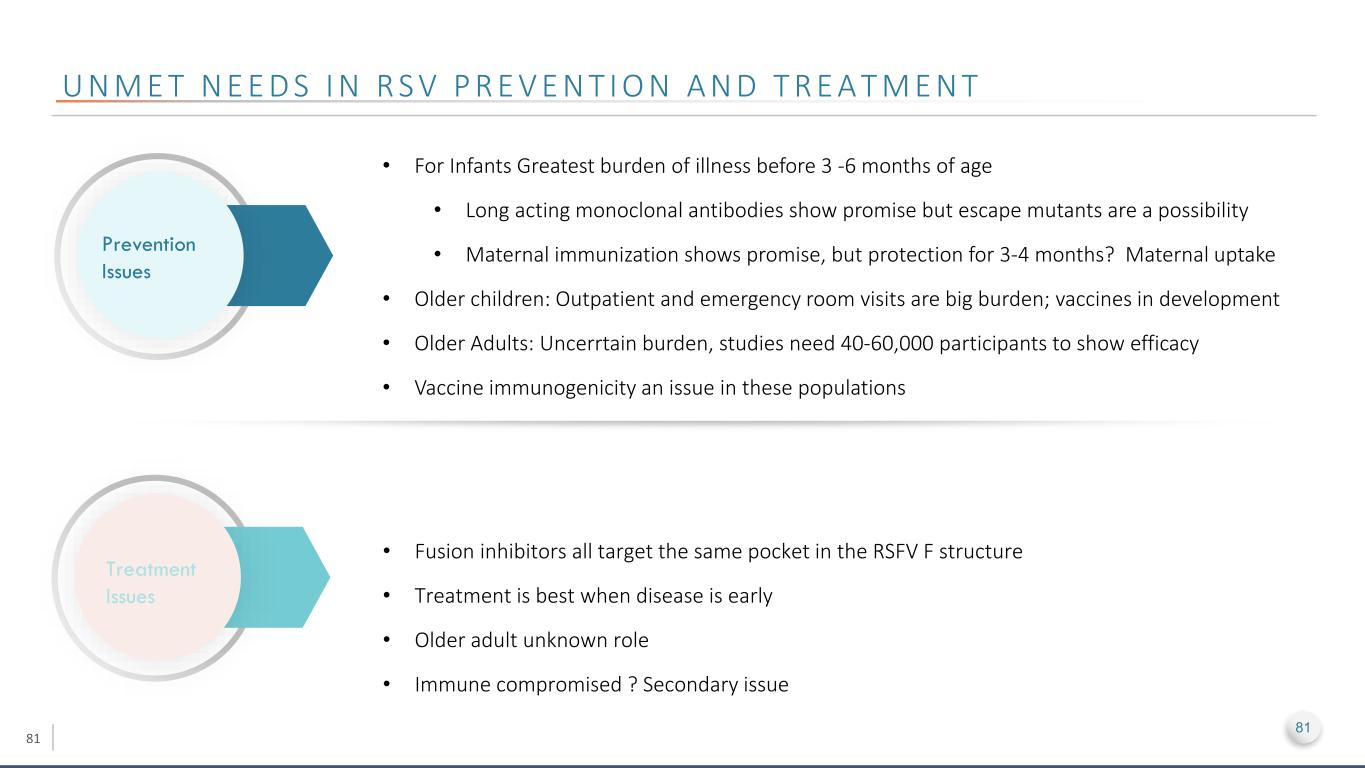

81 U N M E T N E E D S I N R S V P R E V E N T I O N A N D T R E A T M E N T Prevention Issues Treatment Issues • For Infants Greatest burden of illness before 3 -6 months of age • Long acting monoclonal antibodies show promise but escape mutants are a possibility • Maternal immunization shows promise, but protection for 3-4 months? Maternal uptake • Older children: Outpatient and emergency room visits are big burden; vaccines in development • Older Adults: Uncerrtain burden, studies need 40-60,000 participants to show efficacy • Vaccine immunogenicity an issue in these populations • Fusion inhibitors all target the same pocket in the RSFV F structure • Treatment is best when disease is early • Older adult unknown role • Immune compromised ? Secondary issue 81

82 RSV HIV SARS-CoV-2 Others — Improved potency — Broader coverage — Unique modality — Expanding outside of ID

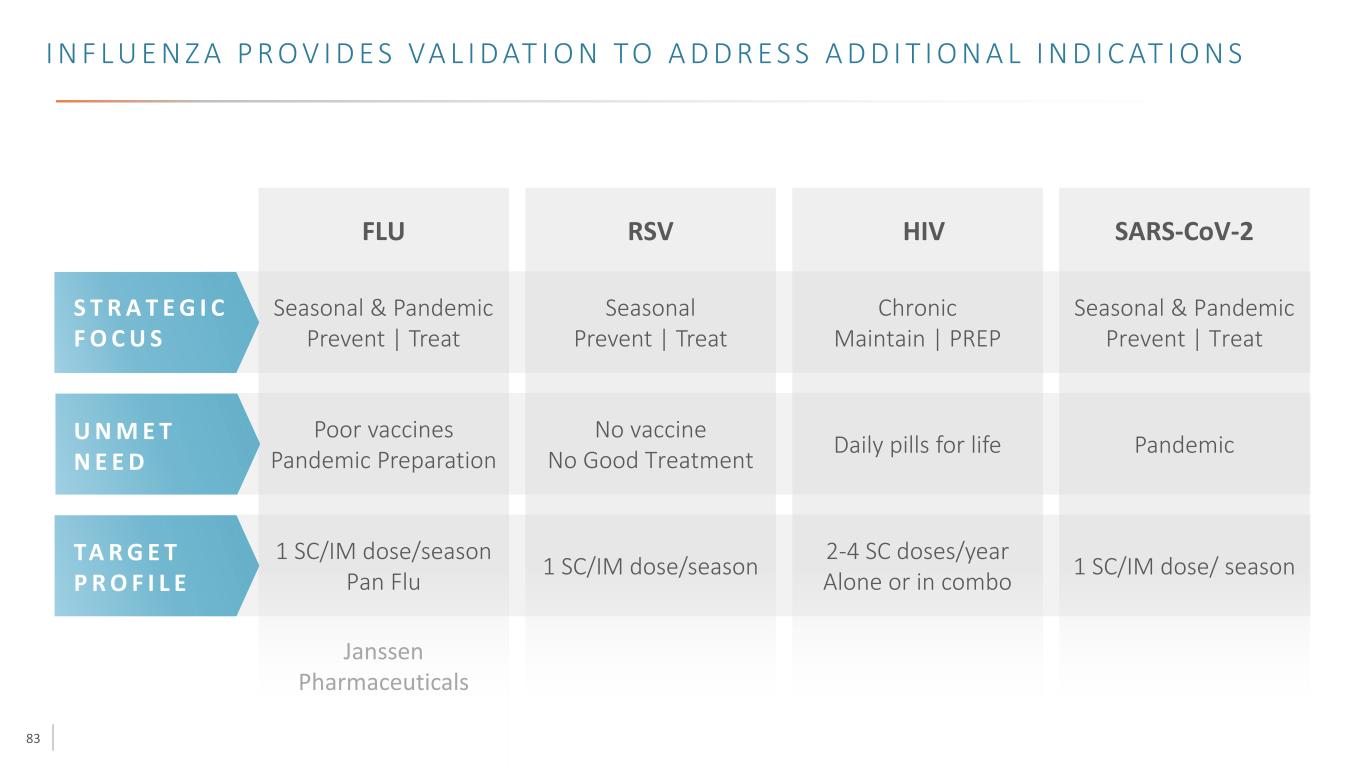

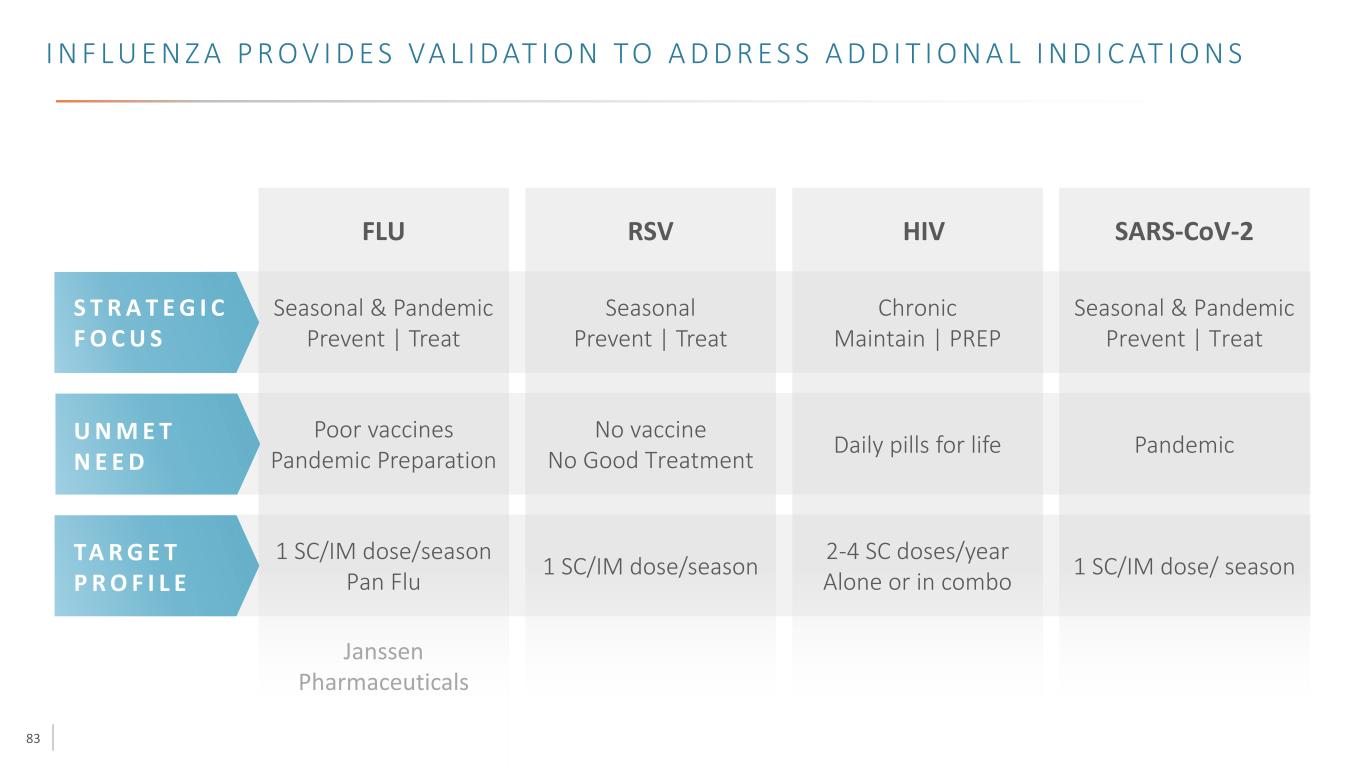

83 1 SC/IM dose/season Pan Flu Poor vaccines Pandemic Preparation FLU Janssen Pharmaceuticals I N F L U E N Z A P R O V I D E S VA L I D AT I O N TO A D D R E S S A D D I T I O N A L I N D I C AT I O N S RSV Seasonal Prevent | Treat 1 SC/IM dose/season No vaccine No Good Treatment HIV Chronic Maintain | PREP 2-4 SC doses/year Alone or in combo Daily pills for life SARS-CoV-2 1 SC/IM dose/ season PandemicU N M E T N E E D S T R A T E G I C F O C U S TA R G E T P R O F I L E Seasonal & Pandemic Prevent | Treat Seasonal & Pandemic Prevent | Treat

84 RSV HIV SARS-CoV-2 Others — Improved potency — Broader coverage — Unique modality — Expanding outside of ID

85 R S V C A S E S O N T H E R I S E I N T H E W A K E O F S U R G I N G C O V I D C A S E S AUGUST 14, 2021 • Leading cause of viral-induced infant mortality globally • No vaccines • Current therapies are suboptimal • New approaches clearly needed

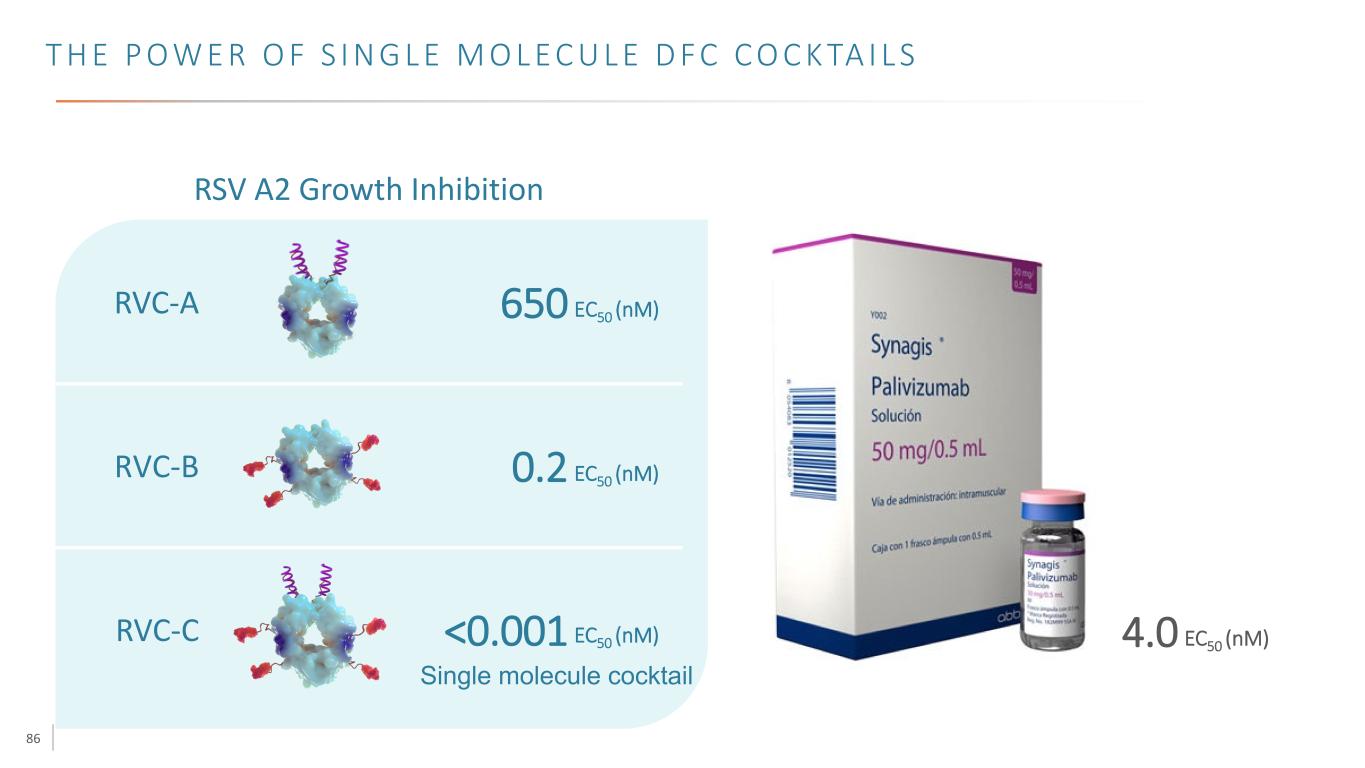

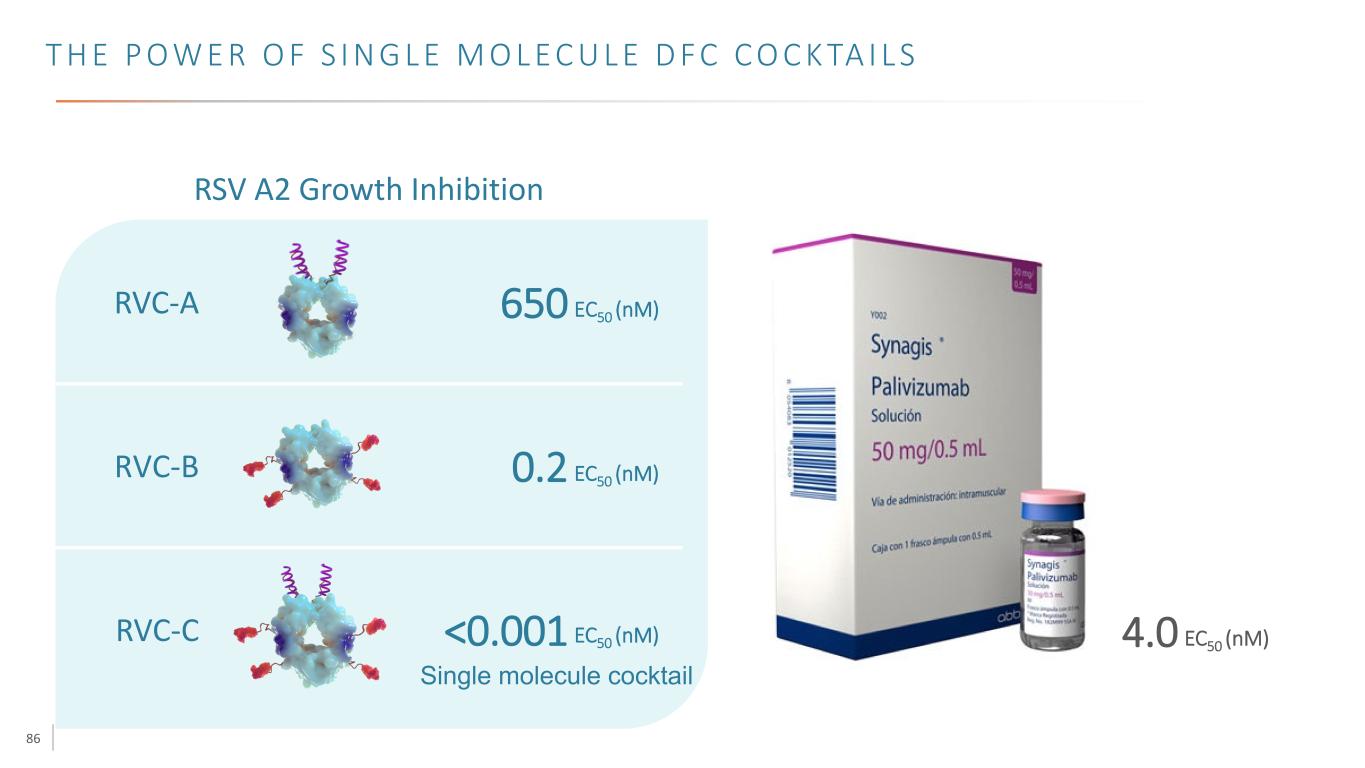

86 T H E P O W E R O F S I N G L E M O L E C U L E D F C C O C K TA I L S RVC-A RVC-B RVC-C 650 EC50 (nM) 0.2 EC50 (nM) <0.001 EC50 (nM) 4.0 EC50 (nM) RSV A2 Growth Inhibition Single molecule cocktail

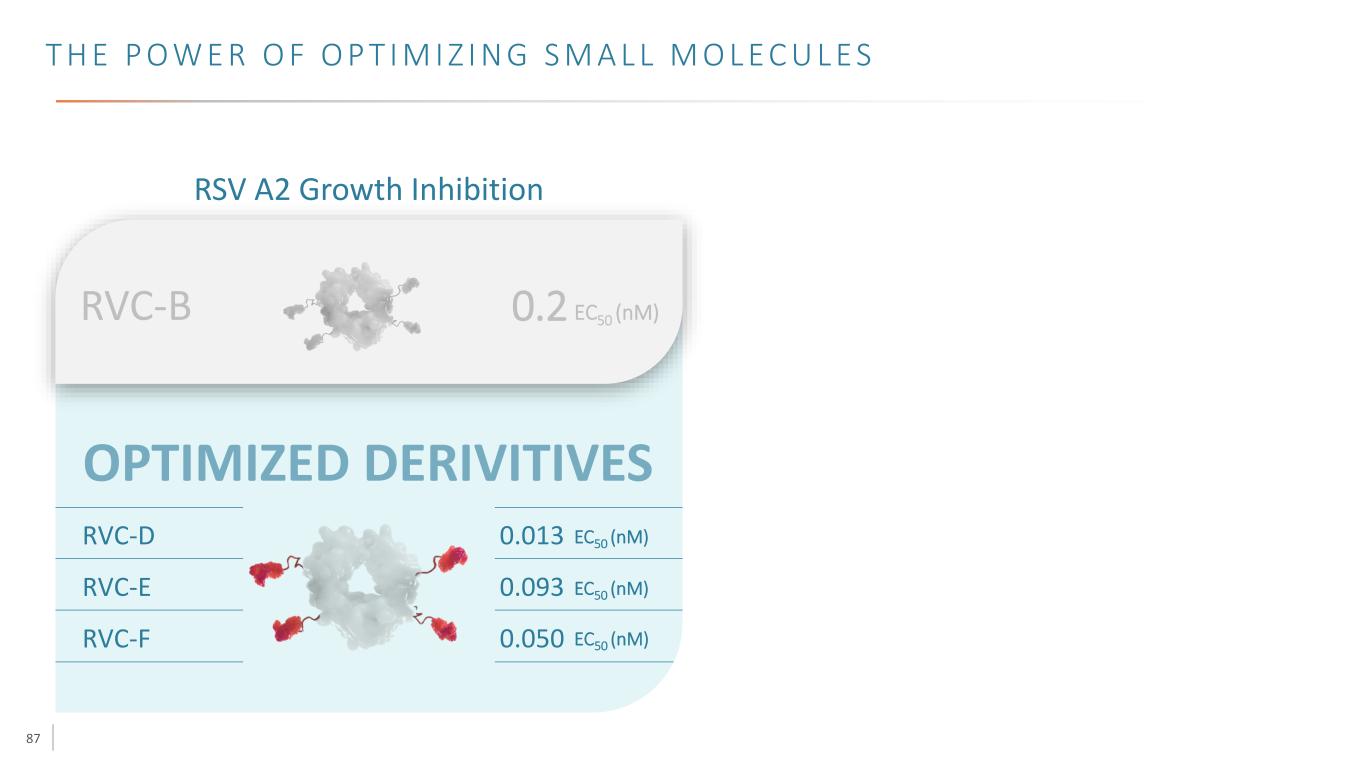

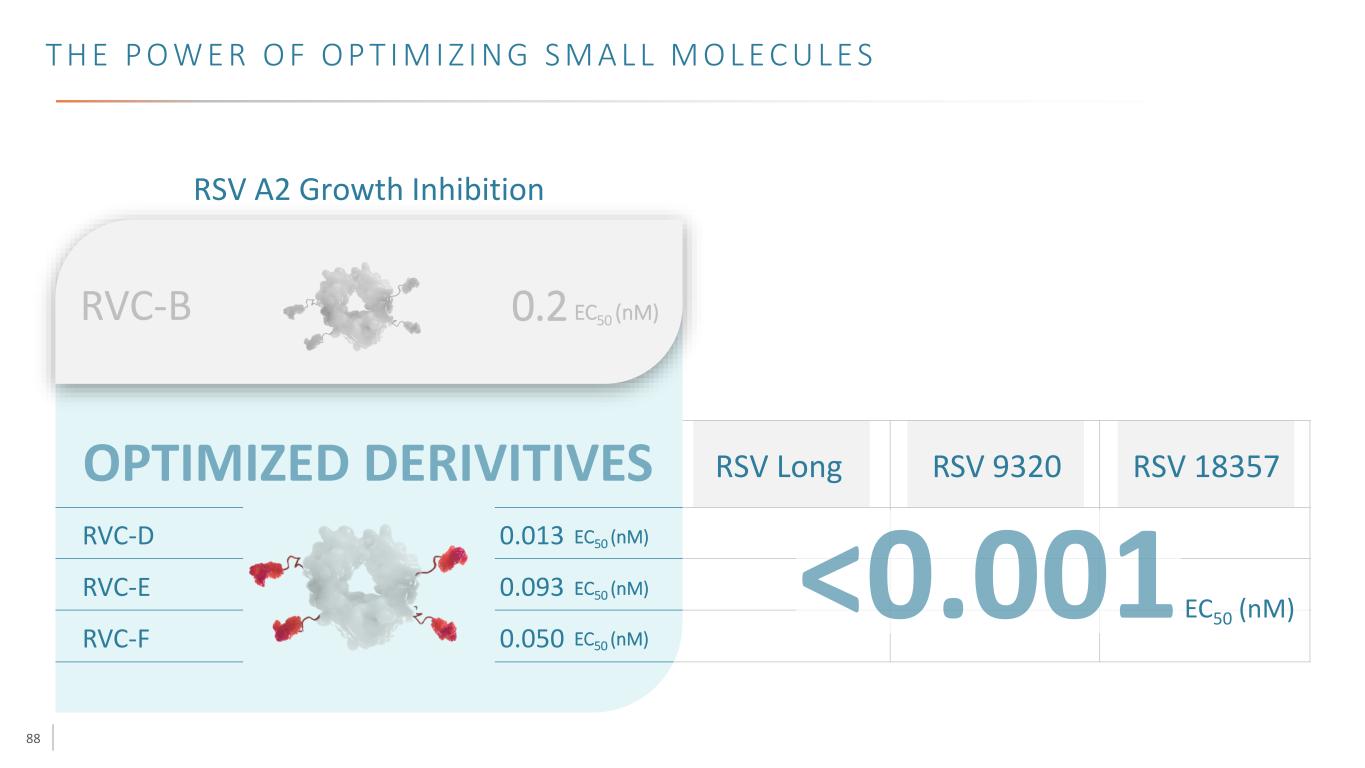

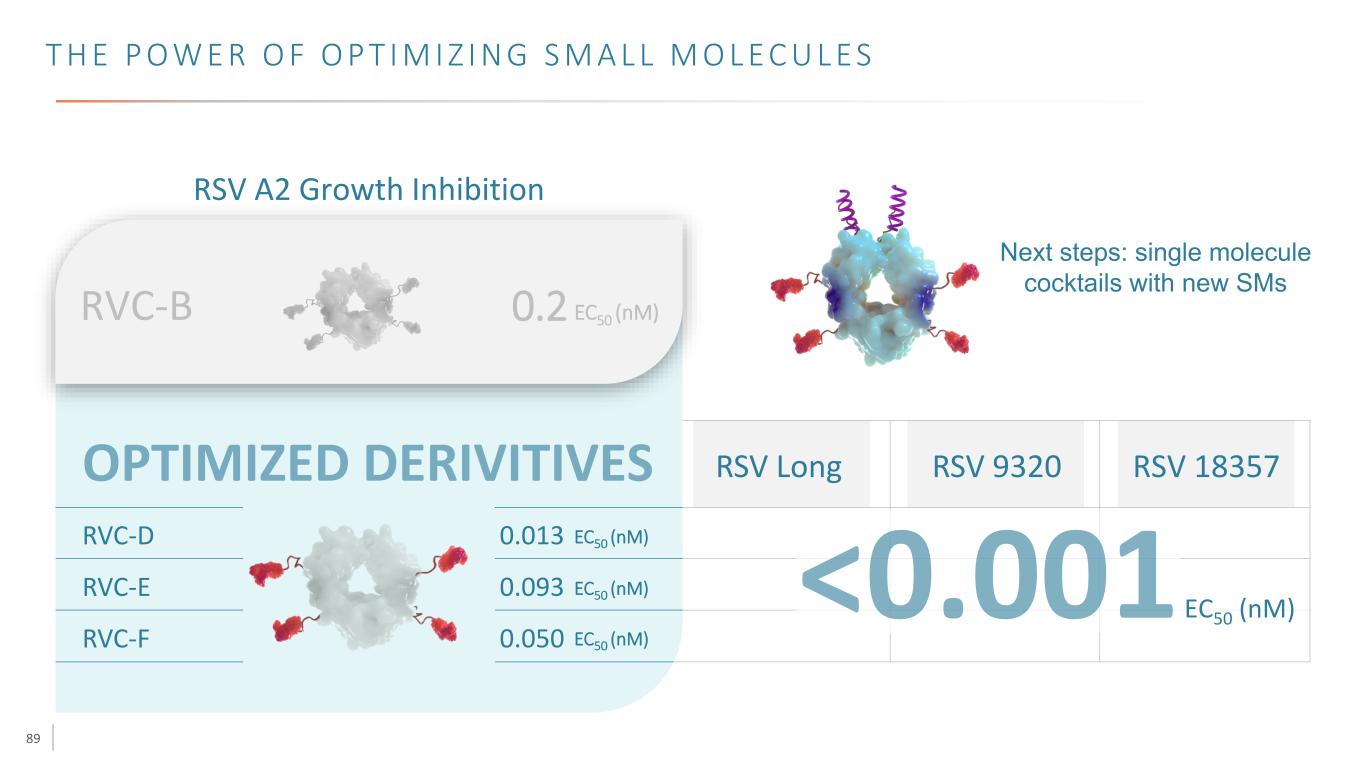

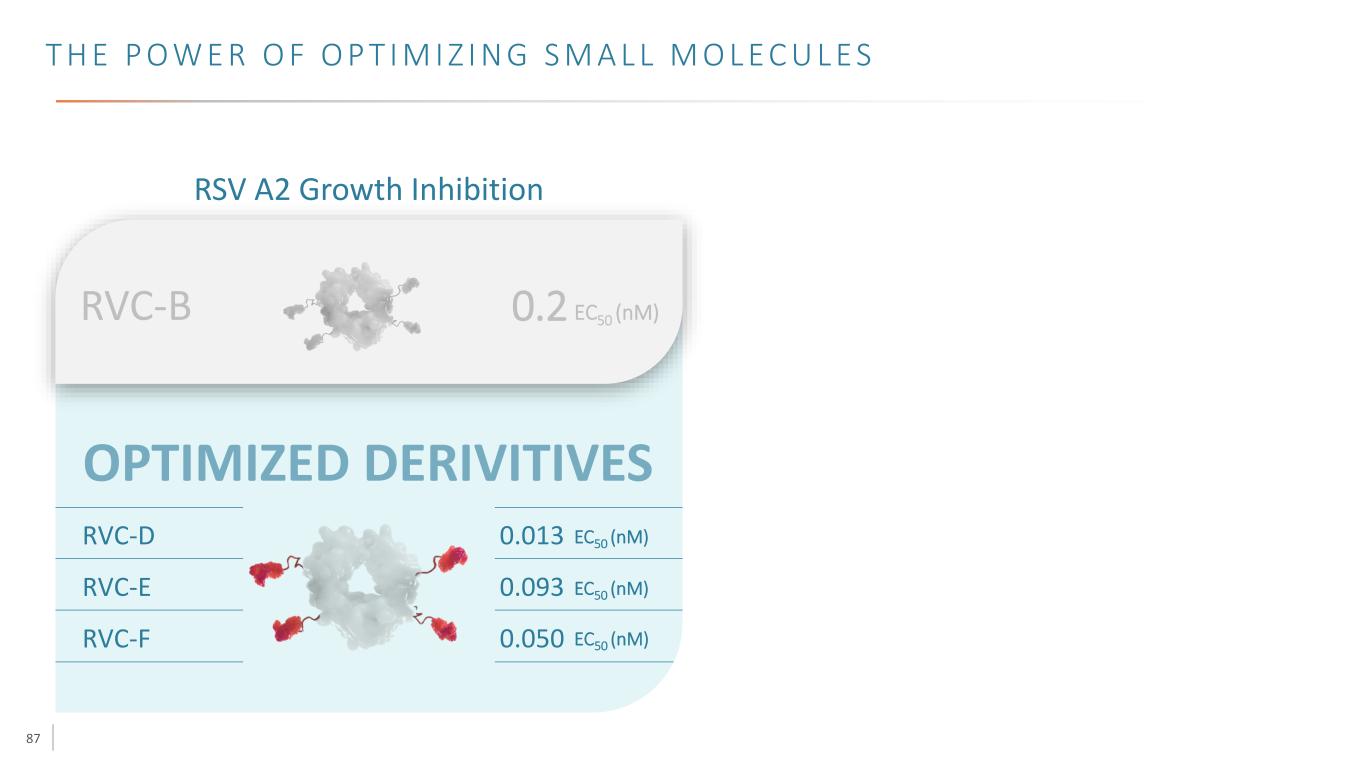

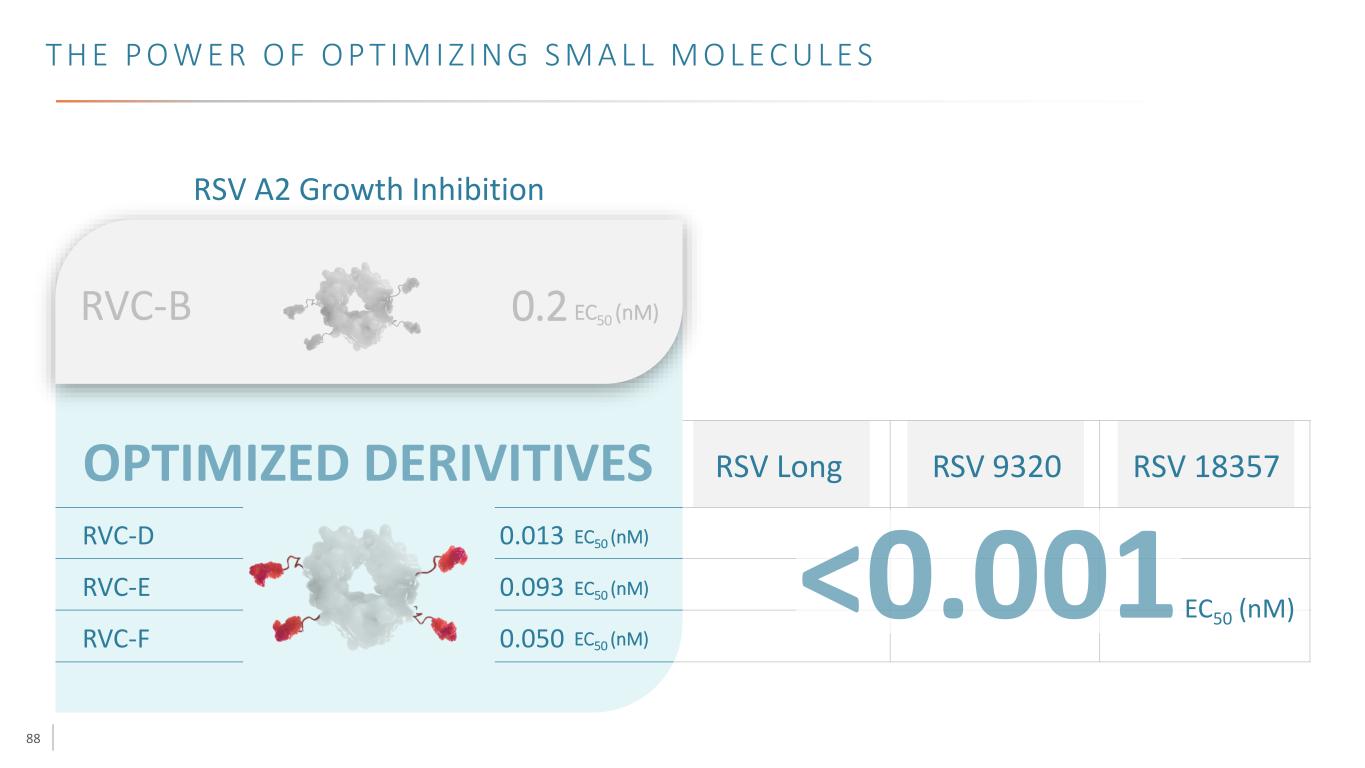

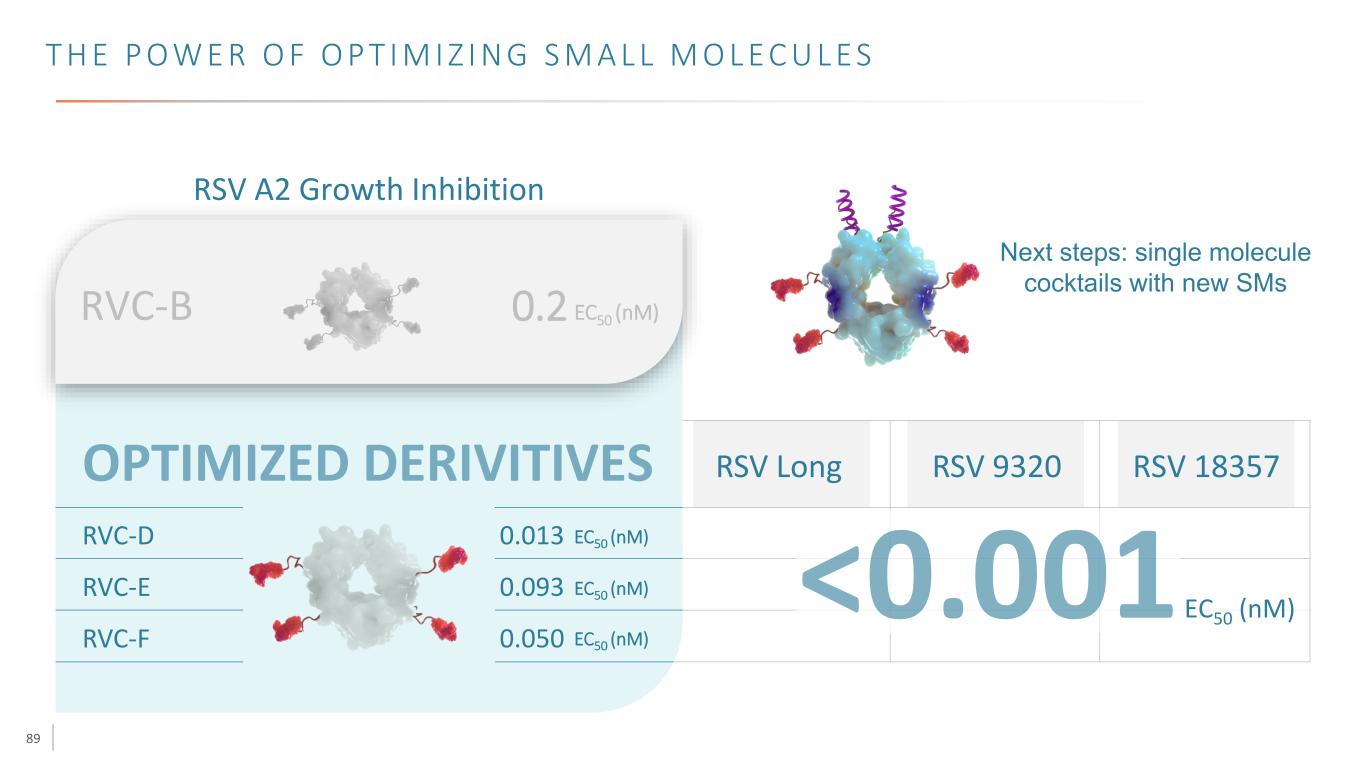

87 T H E P O W E R O F O P T I M I Z I N G S M A L L M O L E C U L E S RSV A2 Growth Inhibition RVC-D 0.013 EC50 (nM) RVC-E 0.093 EC50 (nM) RVC-F 0.050 EC50 (nM) RVC-B 0.2 EC50 (nM)

88 T H E P O W E R O F O P T I M I Z I N G S M A L L M O L E C U L E S RSV A2 Growth Inhibition RVC-D 0.013 EC50 (nM) RVC-E 0.093 EC50 (nM) RVC-F 0.050 EC50 (nM) RVC-B 0.2 EC50 (nM) RSV Long RSV 9320 RSV 18357 EC50 (nM)

89 T H E P O W E R O F O P T I M I Z I N G S M A L L M O L E C U L E S RSV A2 Growth Inhibition RVC-D 0.013 EC50 (nM) RVC-E 0.093 EC50 (nM) RVC-F 0.050 EC50 (nM) RVC-B 0.2 EC50 (nM) RSV Long RSV 9320 RSV 18357 EC50 (nM) Next steps: single molecule cocktails with new SMs

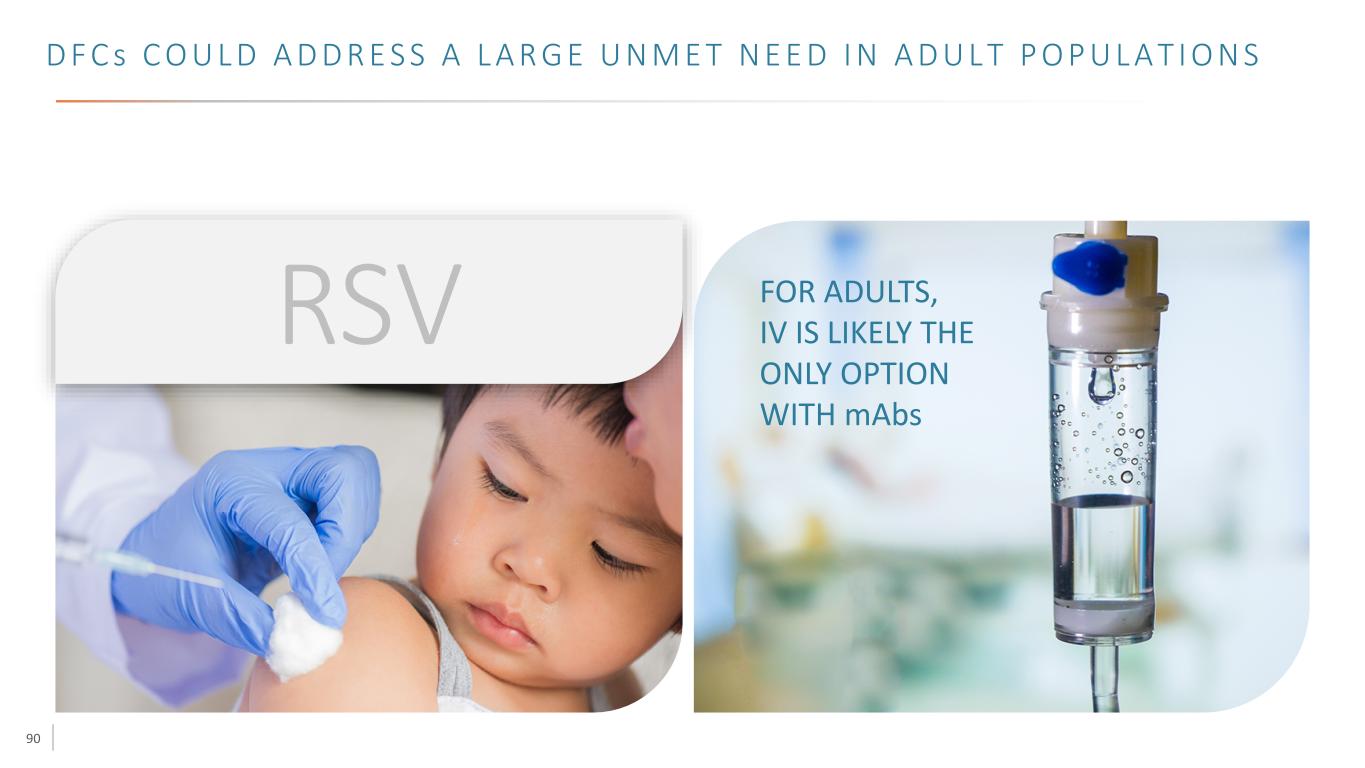

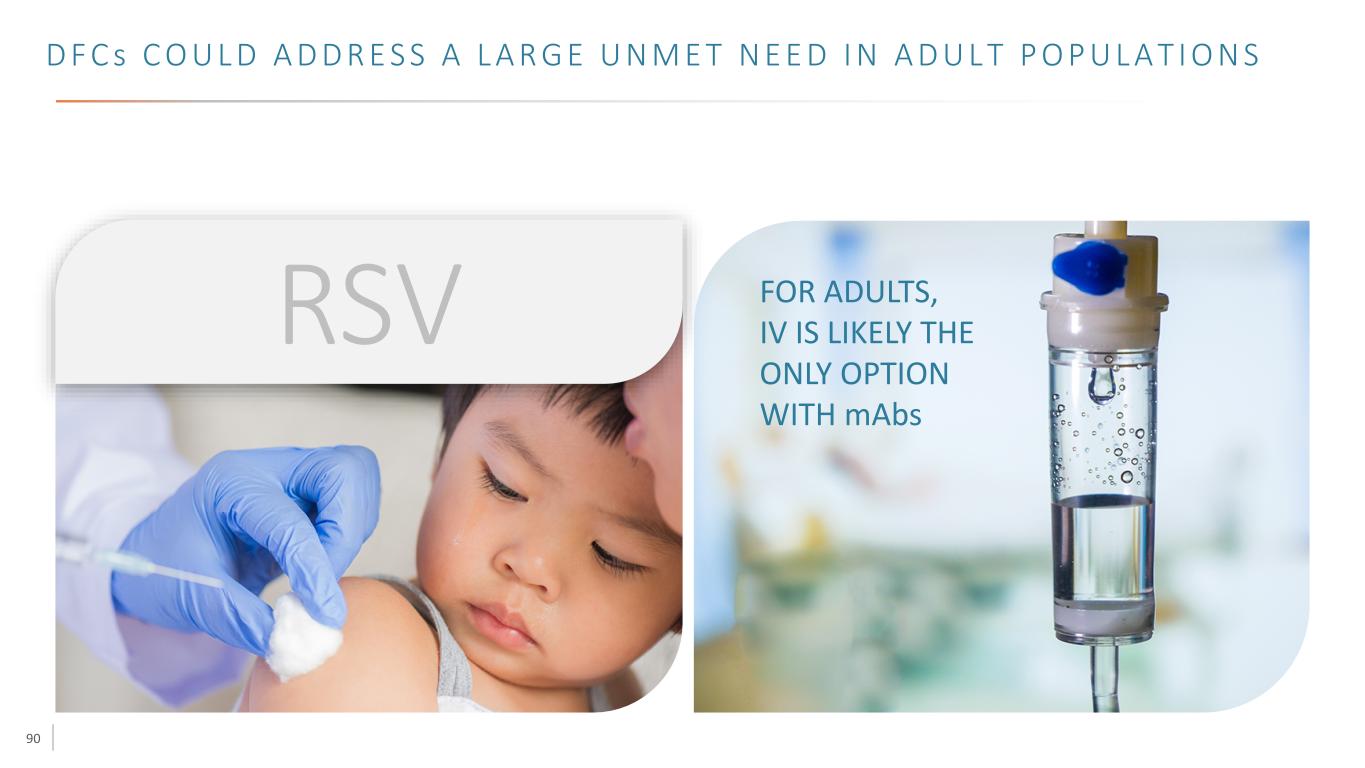

90 D F C s C O U L D A D D R E S S A L A R G E U N M E T N E E D I N A D U L T P O P U L A T I O N S RSV FOR ADULTS, IV IS LIKELY THE ONLY OPTION WITH mAbs

91 RSV HIV SARS-CoV-2 Others — Improved potency — Broader coverage — Unique modality — Expanding outside of ID

92 H I V T R E AT M E N T S A R E M O V I N G TO LO N G - A C T I N G D R U G S DAILY ONE INJECTION PER MONTH1 1. Cabenuva package insert

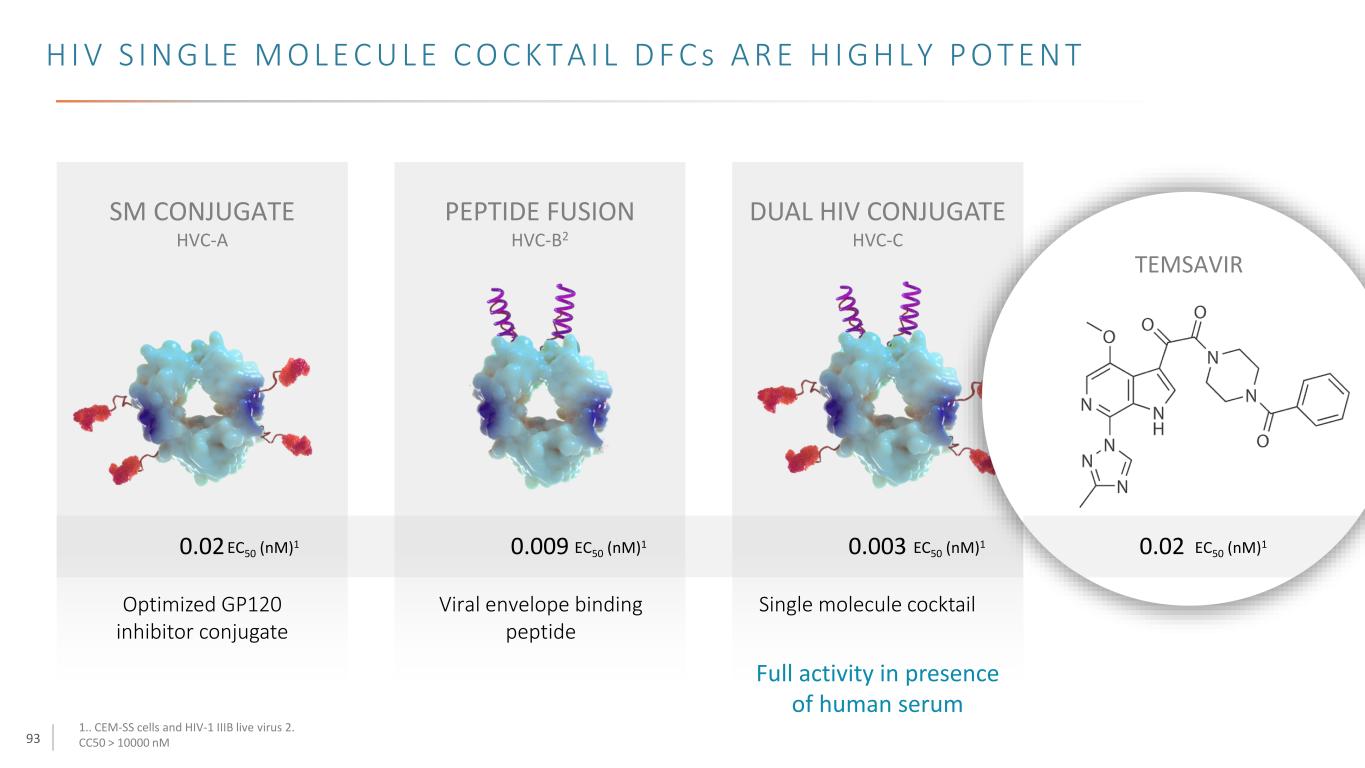

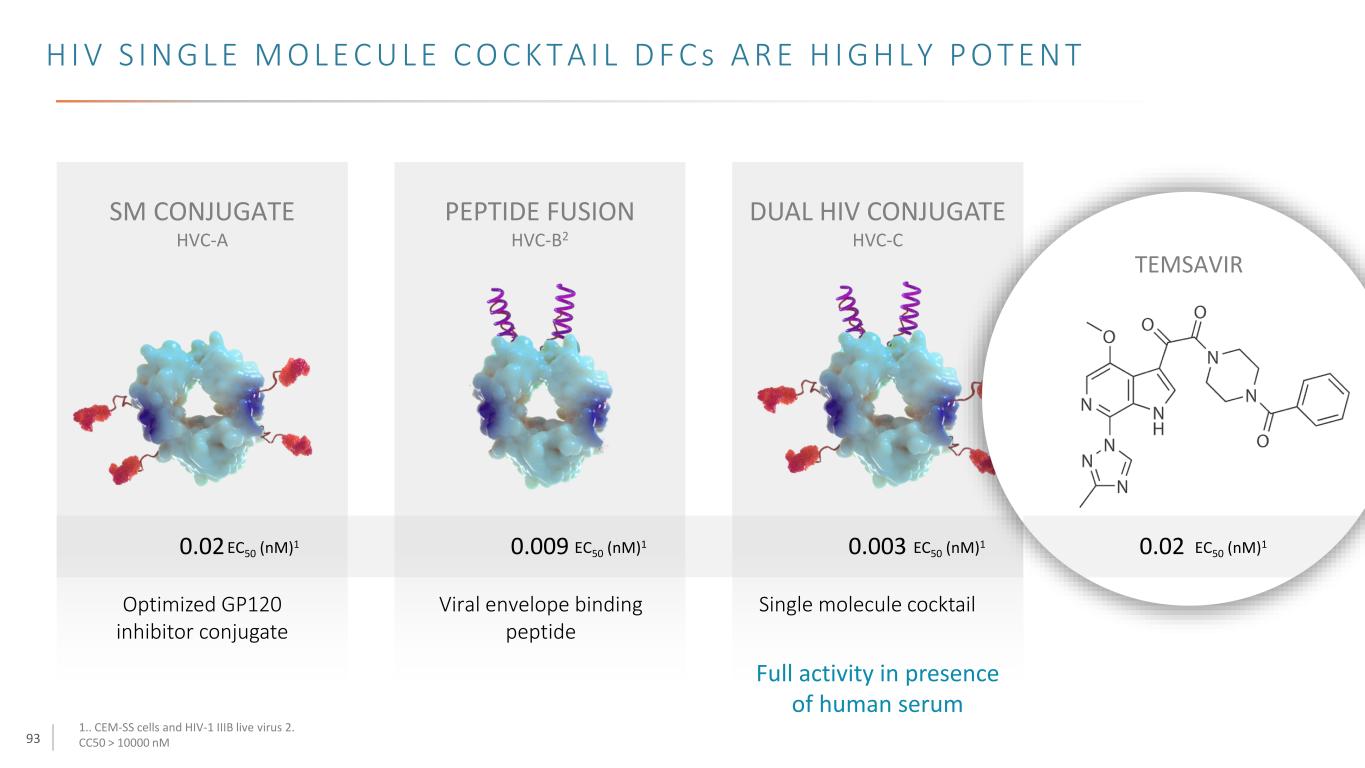

93 H I V S I N G L E M O L E C U L E C O C K T A I L D F C s A R E H I G H L Y P O T E N T SM CONJUGATE PEPTIDE FUSION DUAL HIV CONJUGATE HVC-A HVC-B2 HVC-C 1.. CEM-SS cells and HIV-1 IIIB live virus 2. CC50 > 10000 nM Optimized GP120 inhibitor conjugate Viral envelope binding peptide Single molecule cocktail Full activity in presence of human serum TEMSAVIR EC50 (nM) = 0.020.02 EC50 (nM)1EC50 (nM)10.02 0.009 0.003EC50 (nM)1 EC50 (nM)1

94 H I V D F C s H A V E P O T E N T B R O A D - S P E C T R U M A C T I V I T Y DUAL HIV CONJUGATE HVC-C TEMSAVIR CPE with hPBMCs - EC50 (nM) Single molecule cocktail CCR5 (UG/92/037) CXCR4/CCR5 (RW/92/009) CXCR4 (HT/92/599) CCR5 (US/921727) CCR5 (ZA/97/003) CXCR4/CCR5 (UG/92/001) MDR769 CXCR4/CCR5 (UG/92/001) A17R HVC-C TEMSAVIR A A B B C D AE 0<0.0003 0<0.0003 00.0006 0<0.0003 00.0007 00.0002 1.96 00.0008 0<0.0003 >100.0000 000.927 01.32 01.49 02.17 08.96 >100.0000 000.481 00<0.0003

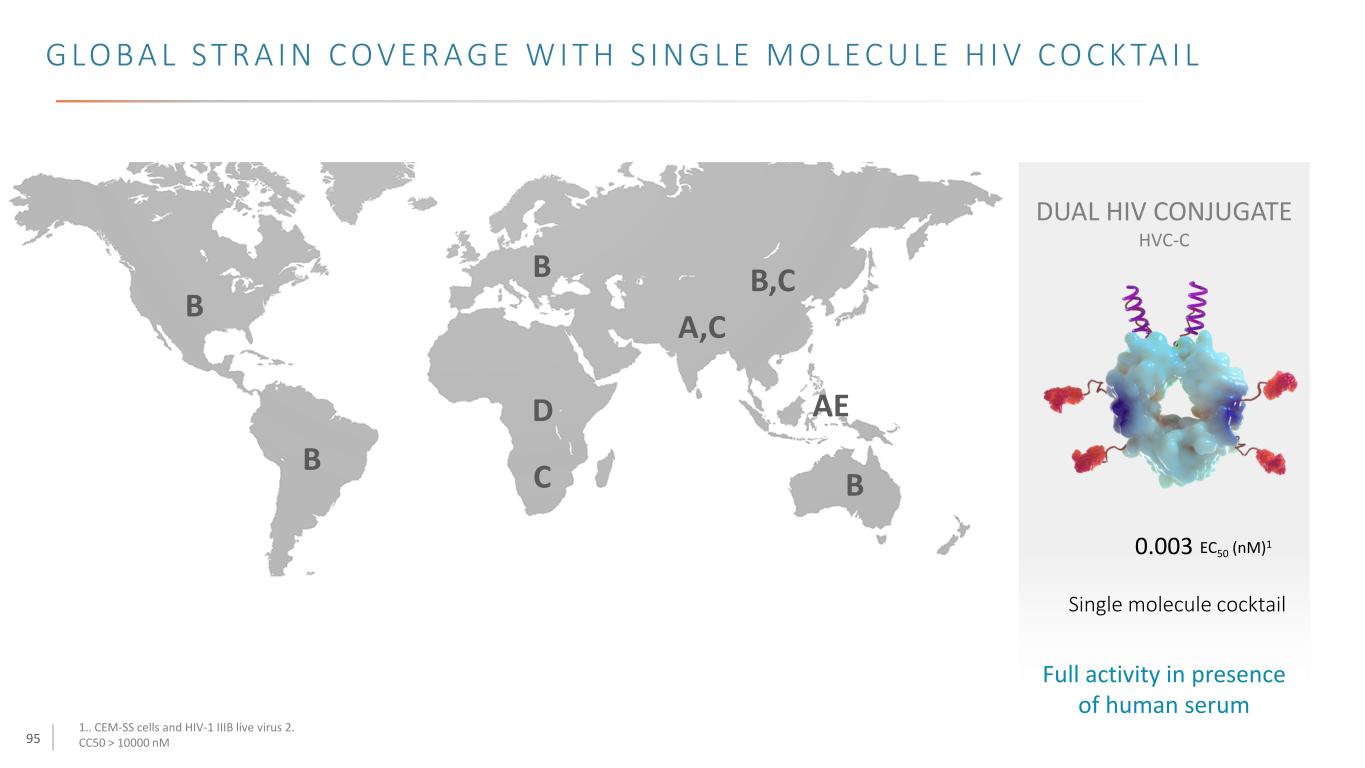

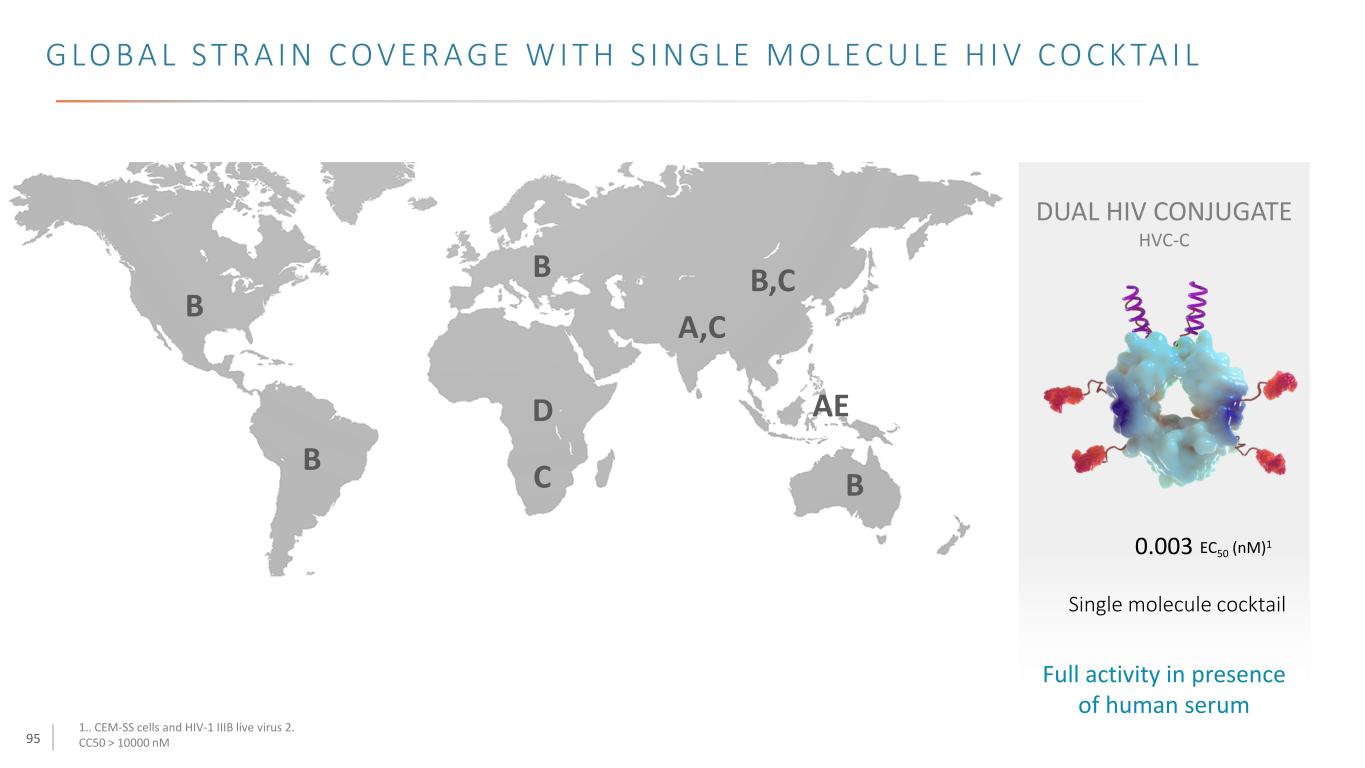

95 G LO B A L S T R A I N C O V E R A G E W I T H S I N G L E M O L E C U L E H I V C O C K TA I L 1.. CEM-SS cells and HIV-1 IIIB live virus 2. CC50 > 10000 nM DUAL HIV CONJUGATE HVC-C 0.003 Single molecule cocktail Full activity in presence of human serum EC50 (nM)1 B B B C D AE A,C B,C B

96 RSV HIV SARS-CoV-2 Others — Superior potency — Broader coverage — Unique modality — Expanding outside of ID

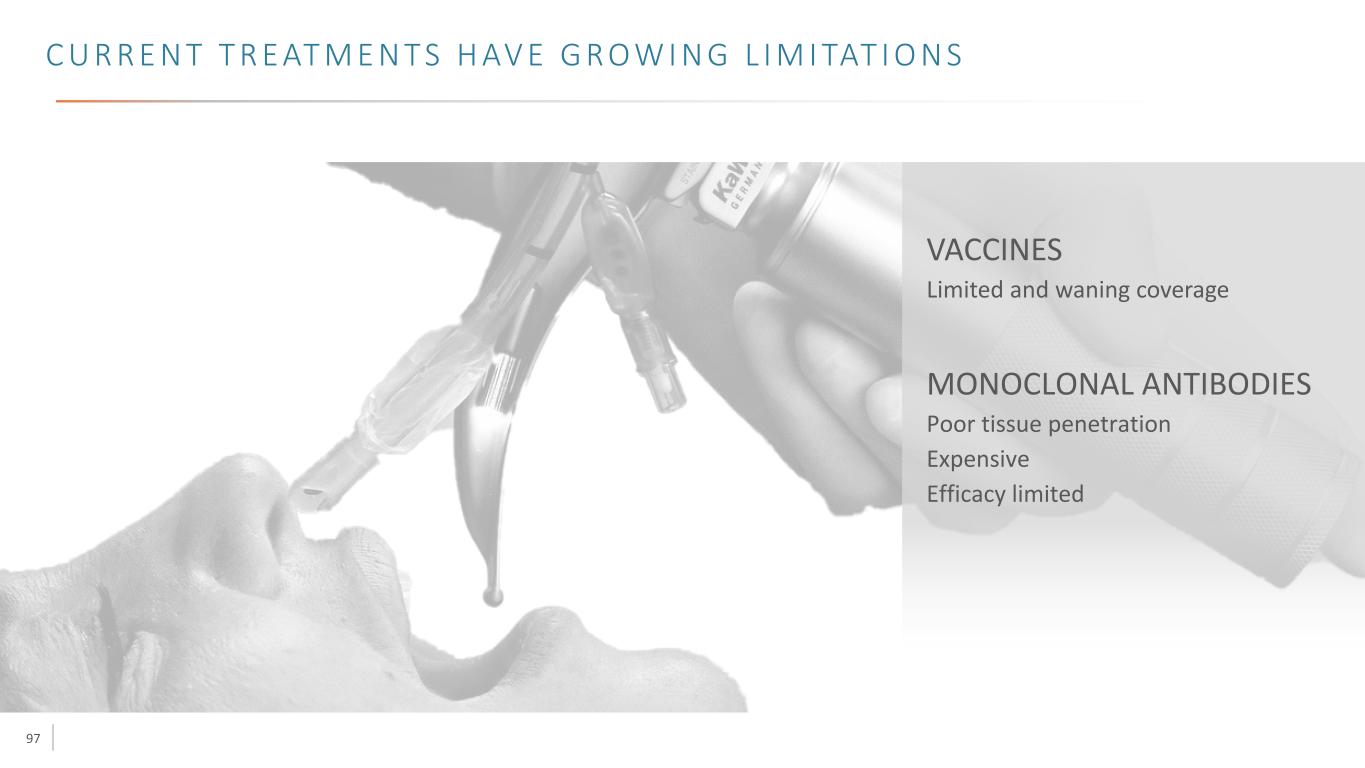

97 C U R R E N T T R E AT M E N T S H AV E G R O W I N G L I M I TAT I O N S VACCINES Limited and waning coverage MONOCLONAL ANTIBODIES Poor tissue penetration Expensive Efficacy limited

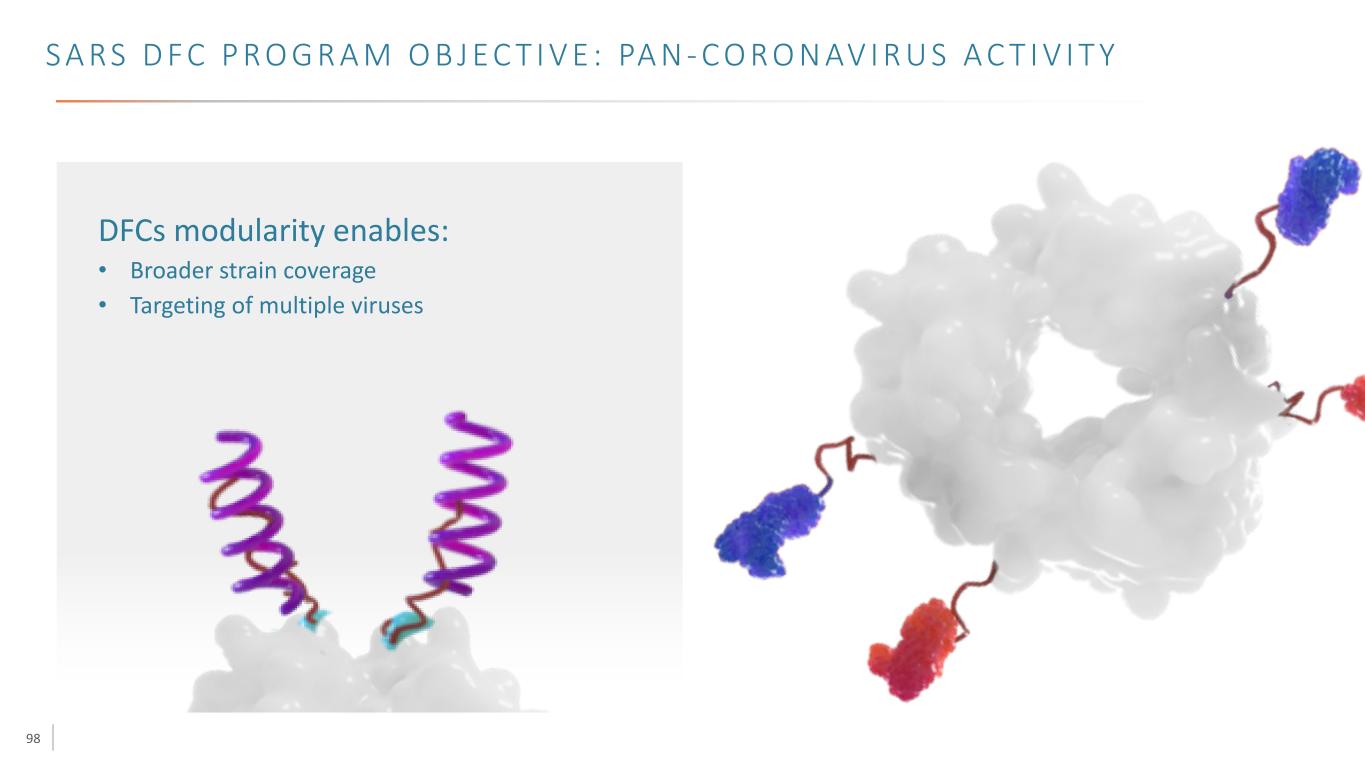

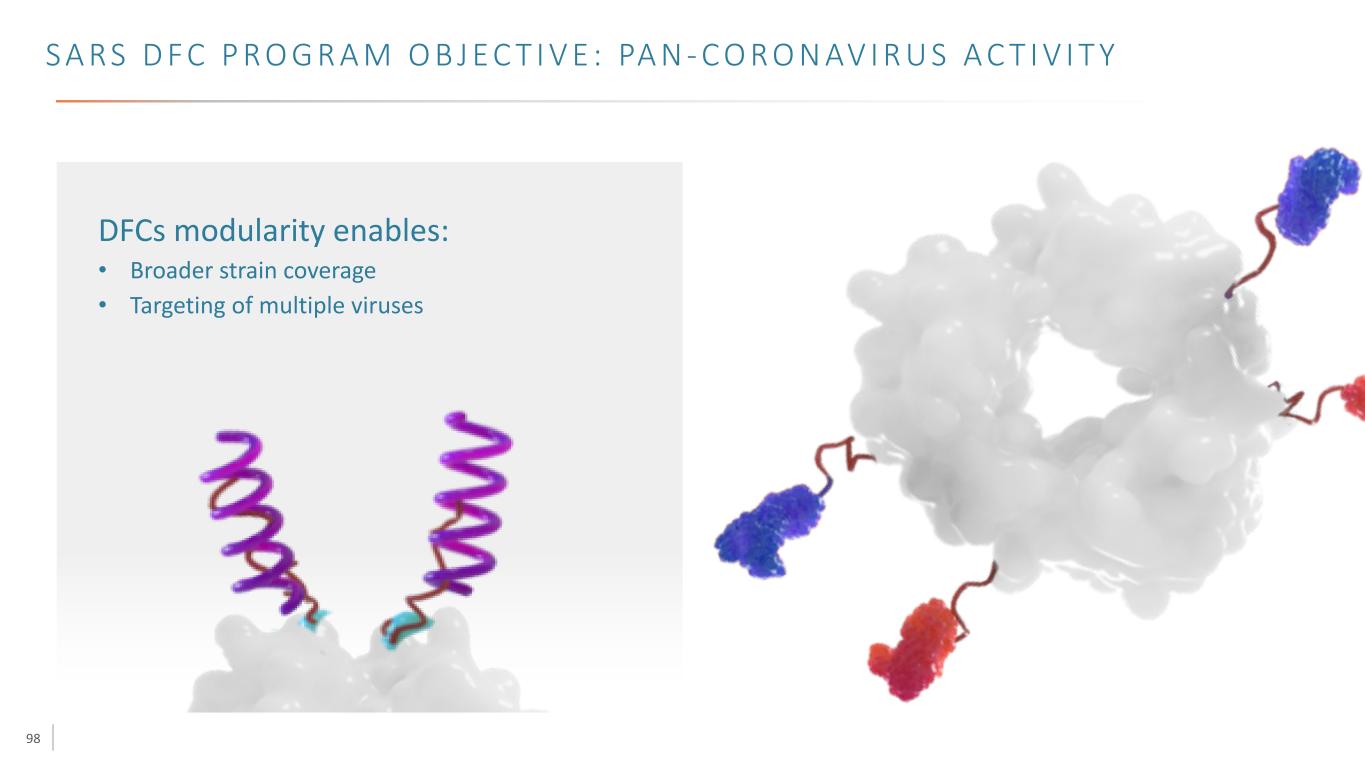

98 S A RS D F C P R O G R A M O B J E C T I V E : PA N - C O R O N AV I R U S A C T I V I T Y DFCs modularity enables: • Broader strain coverage • Targeting of multiple viruses

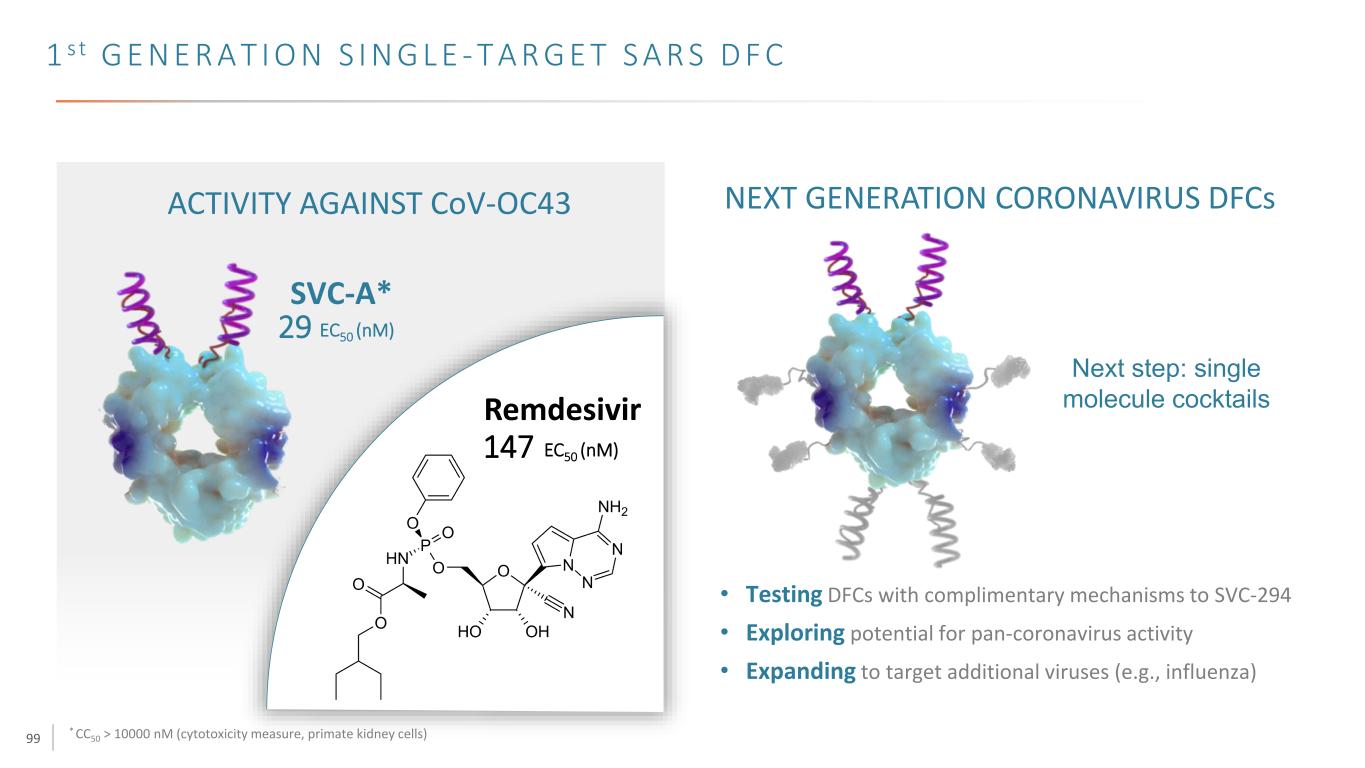

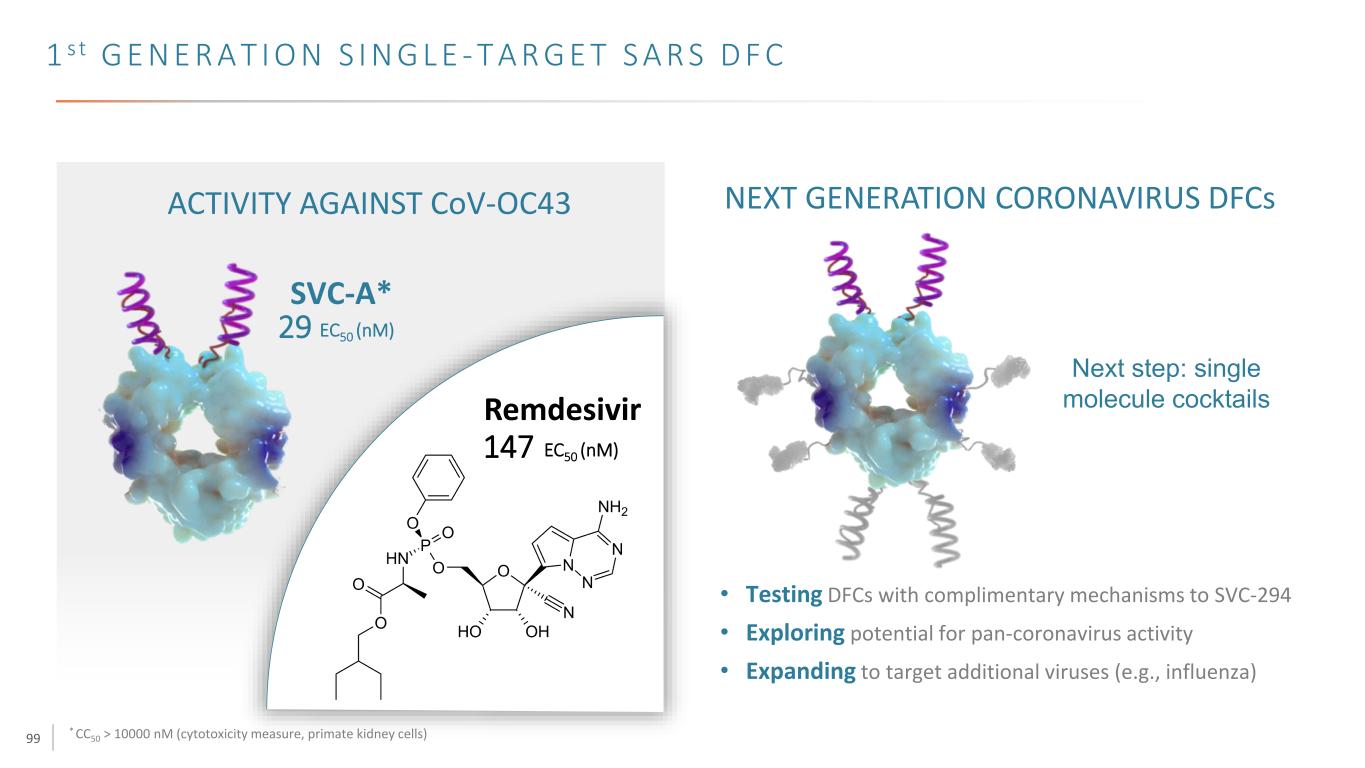

99 1 s t G E N E R A T I O N S I N G L E - T A R G E T S A R S D F C * CC50 > 10000 nM (cytotoxicity measure, primate kidney cells) SVC-A* 29 EC50 (nM) Remdesivir ACTIVITY AGAINST CoV-OC43 147 EC50 (nM) NEXT GENERATION CORONAVIRUS DFCs • Testing DFCs with complimentary mechanisms to SVC-294 • Exploring potential for pan-coronavirus activity • Expanding to target additional viruses (e.g., influenza) Next step: single molecule cocktails

100 FLU SARS RSV N E X T S T E P S : S I N G L E M O L E C U L E C O C K TA I L S TO TA R G E T M U LT I P L E R E S P I R ATO R Y V I R U S E S

101 RSV HIV SARS-CoV-2 Oncology — Improved potency — Broader coverage — Unique modality — A single molecule cocktail

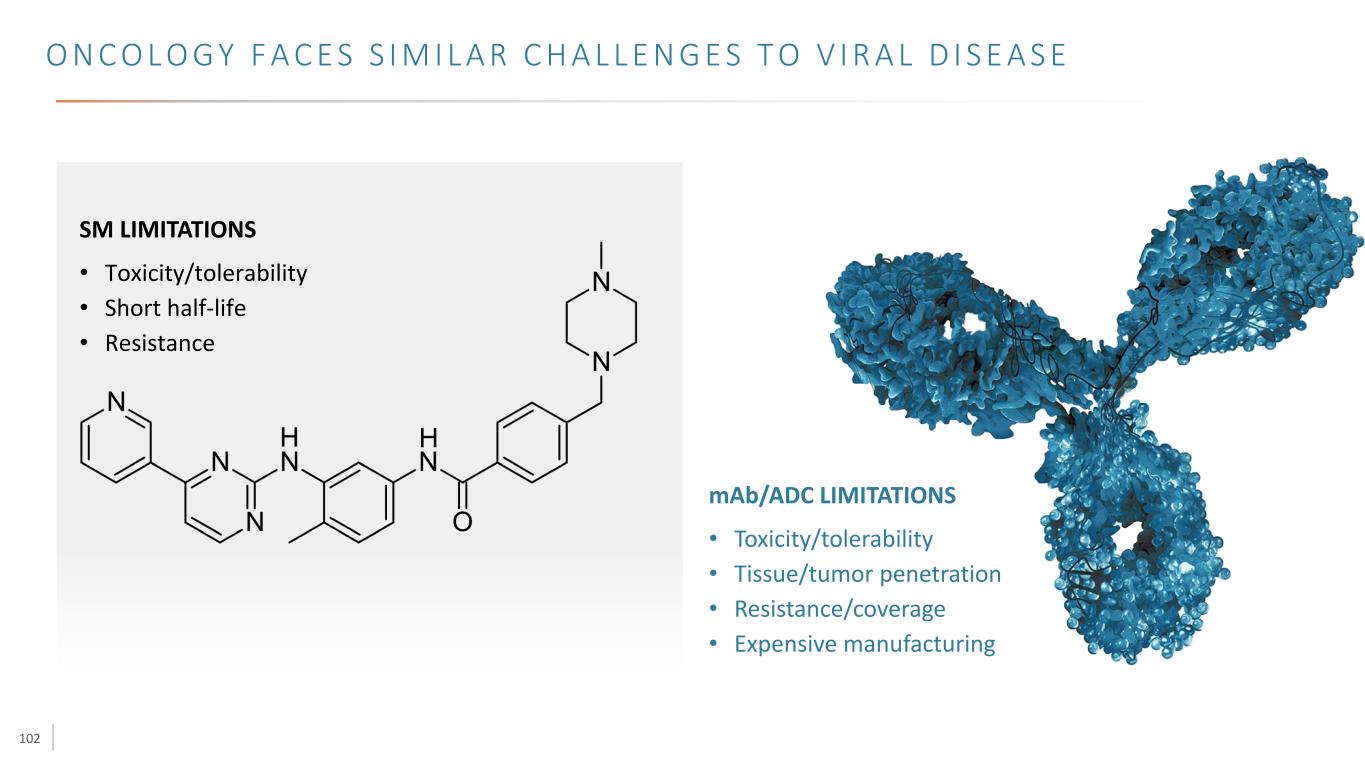

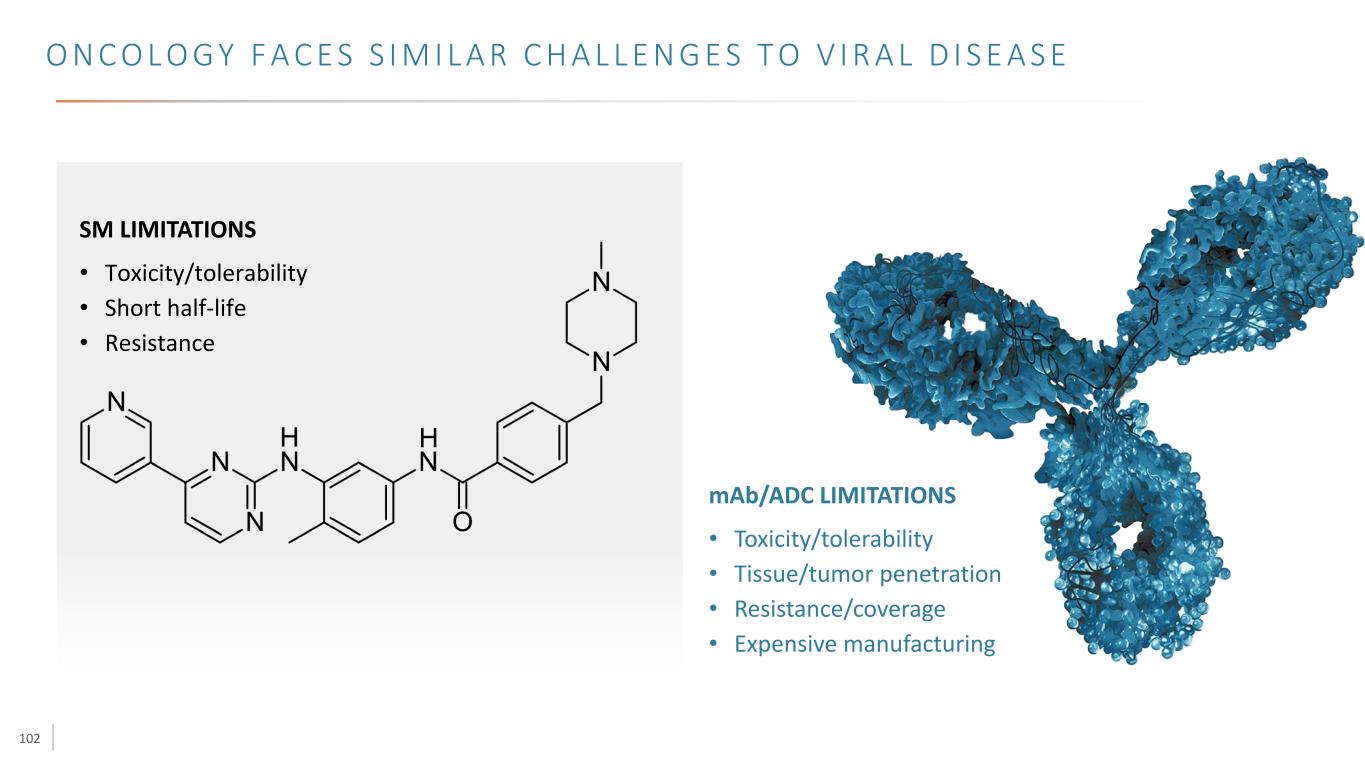

102 O N C O L O G Y F A C E S S I M I L A R C H A L L E N G E S T O V I R A L D I S E A S E mAb/ADC LIMITATIONS • Toxicity/tolerability • Tissue/tumor penetration • Resistance/coverage • Expensive manufacturing SM LIMITATIONS • Toxicity/tolerability • Short half-life • Resistance

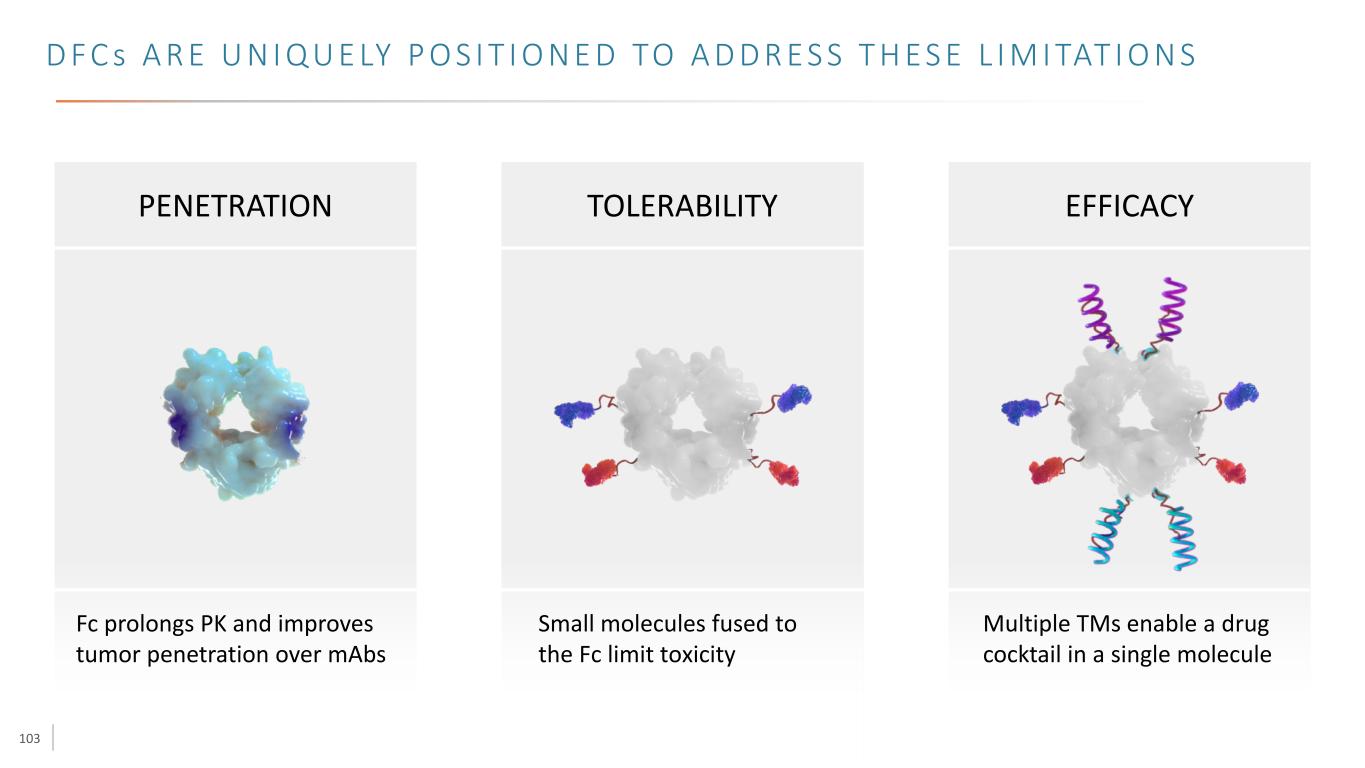

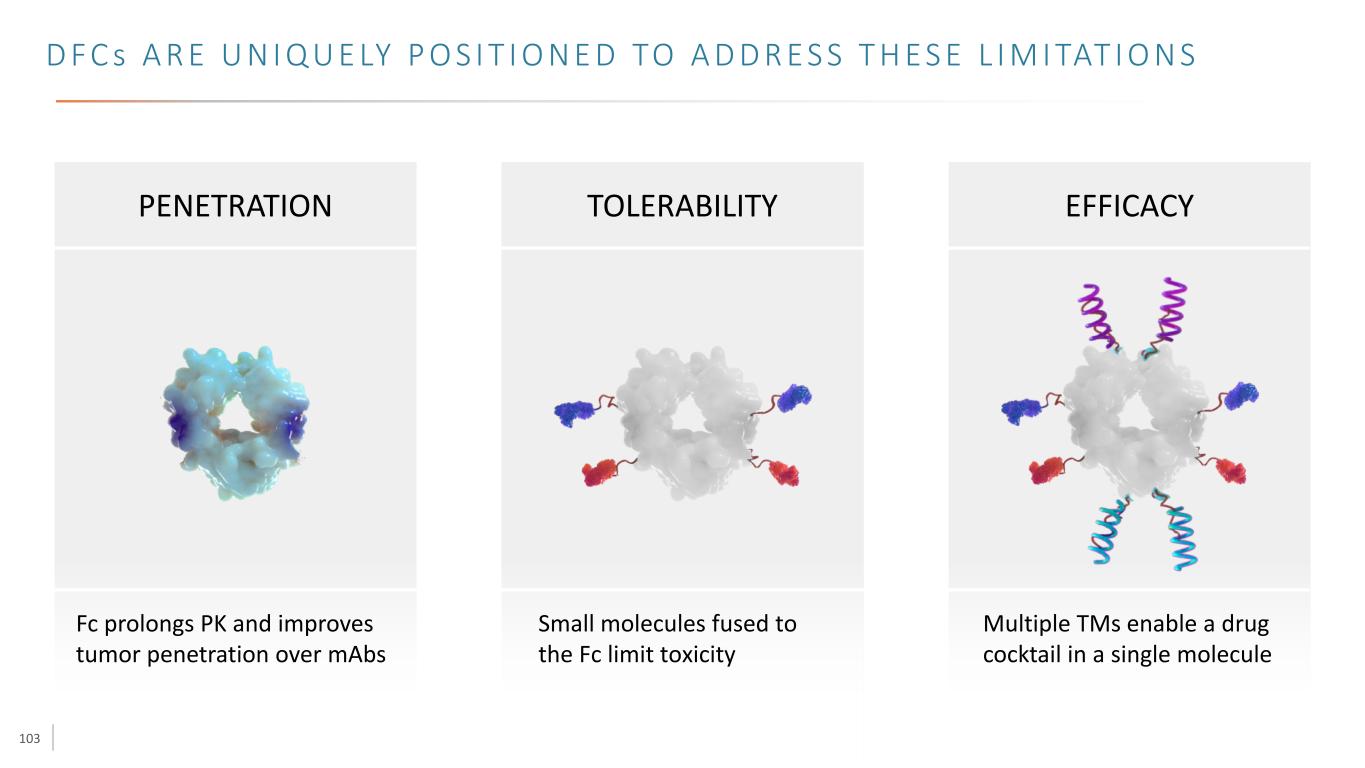

103 D F C s A R E U N I Q U E LY P O S I T I O N E D TO A D D R E S S T H E S E L I M I TAT I O N S Fc prolongs PK and improves tumor penetration over mAbs Small molecules fused to the Fc limit toxicity Multiple TMs enable a drug cocktail in a single molecule PENETRATION TOLERABILITY EFFICACY

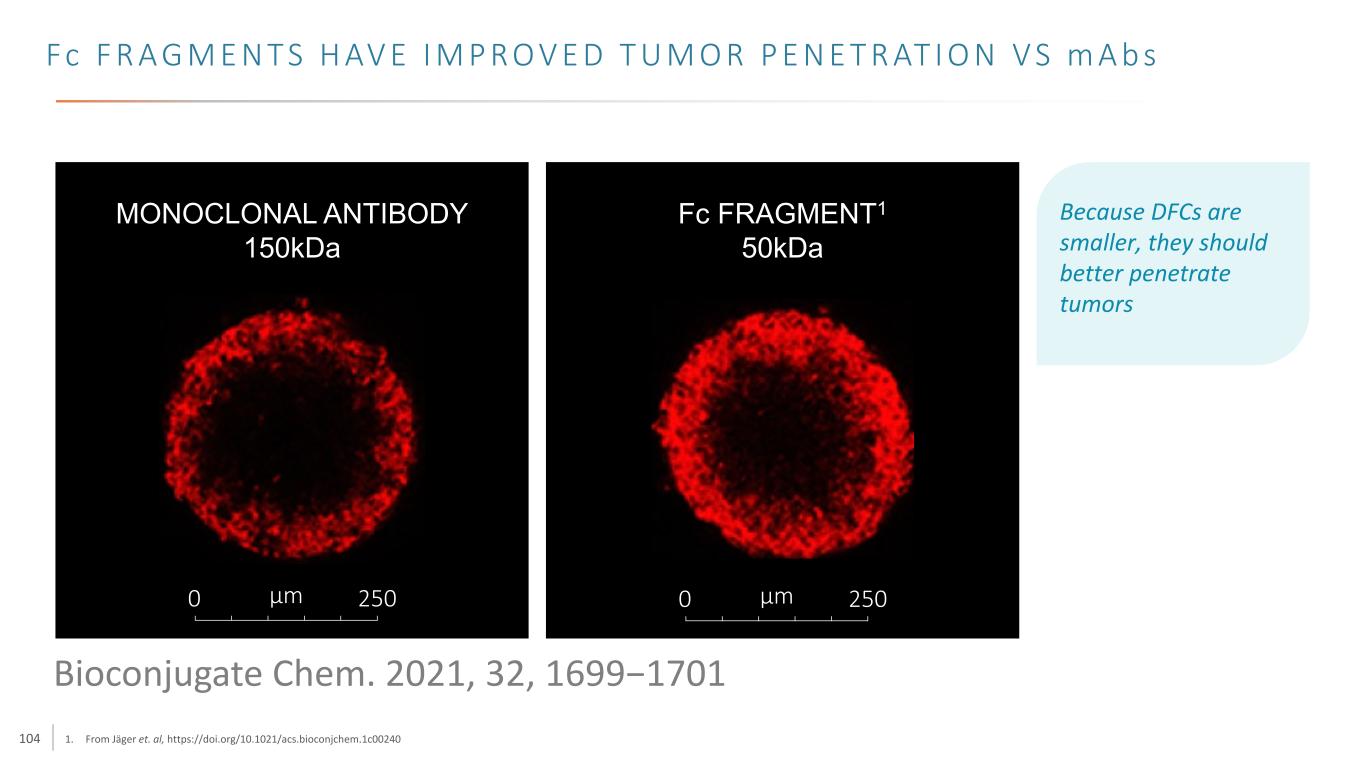

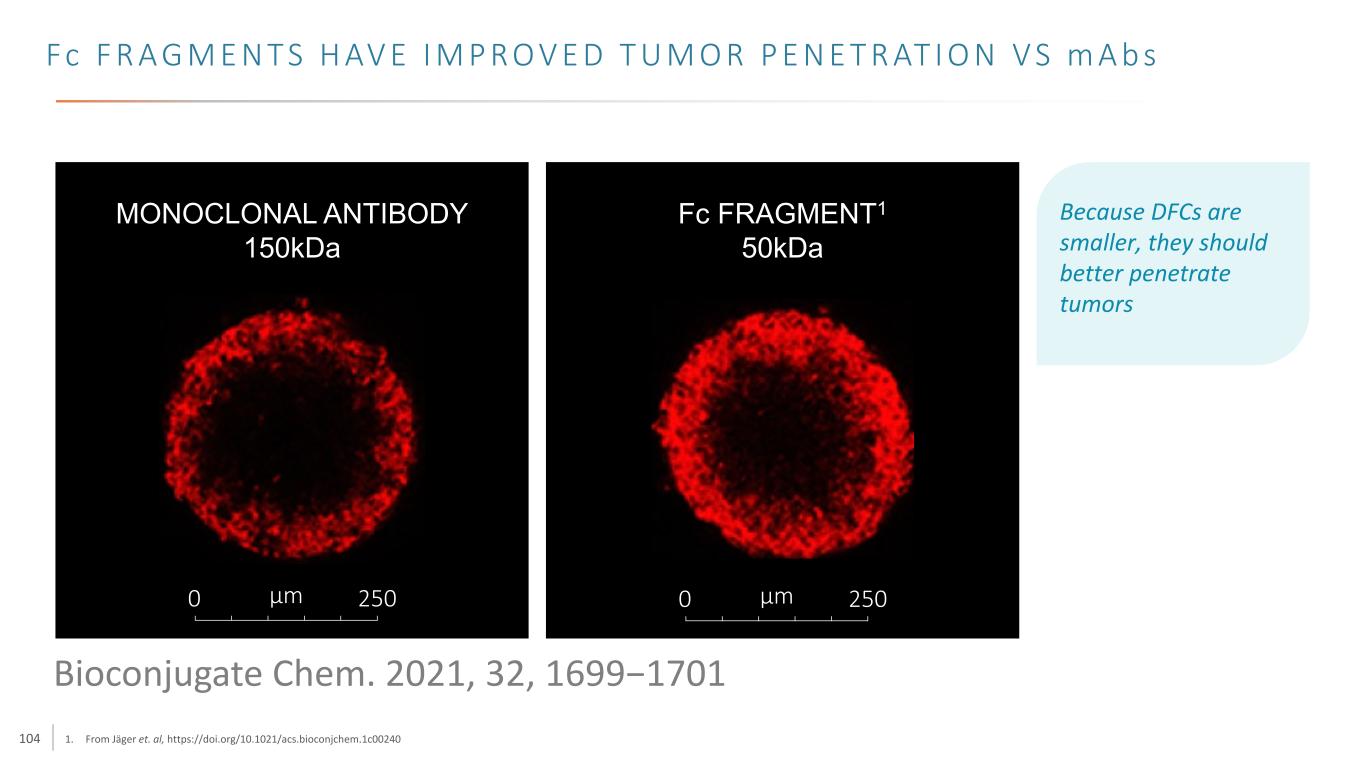

104 Fc F R A G M E N T S H AV E I M P R O V E D T U M O R P E N E T R AT I O N V S m A b s 1. From Jäger et. al, https://doi.org/10.1021/acs.bioconjchem.1c00240 0 250µm MONOCLONAL ANTIBODY 150kDa 0 250µm Fc FRAGMENT1 50kDa Because DFCs are smaller, they should better penetrate tumors Bioconjugate Chem. 2021, 32, 1699−1701

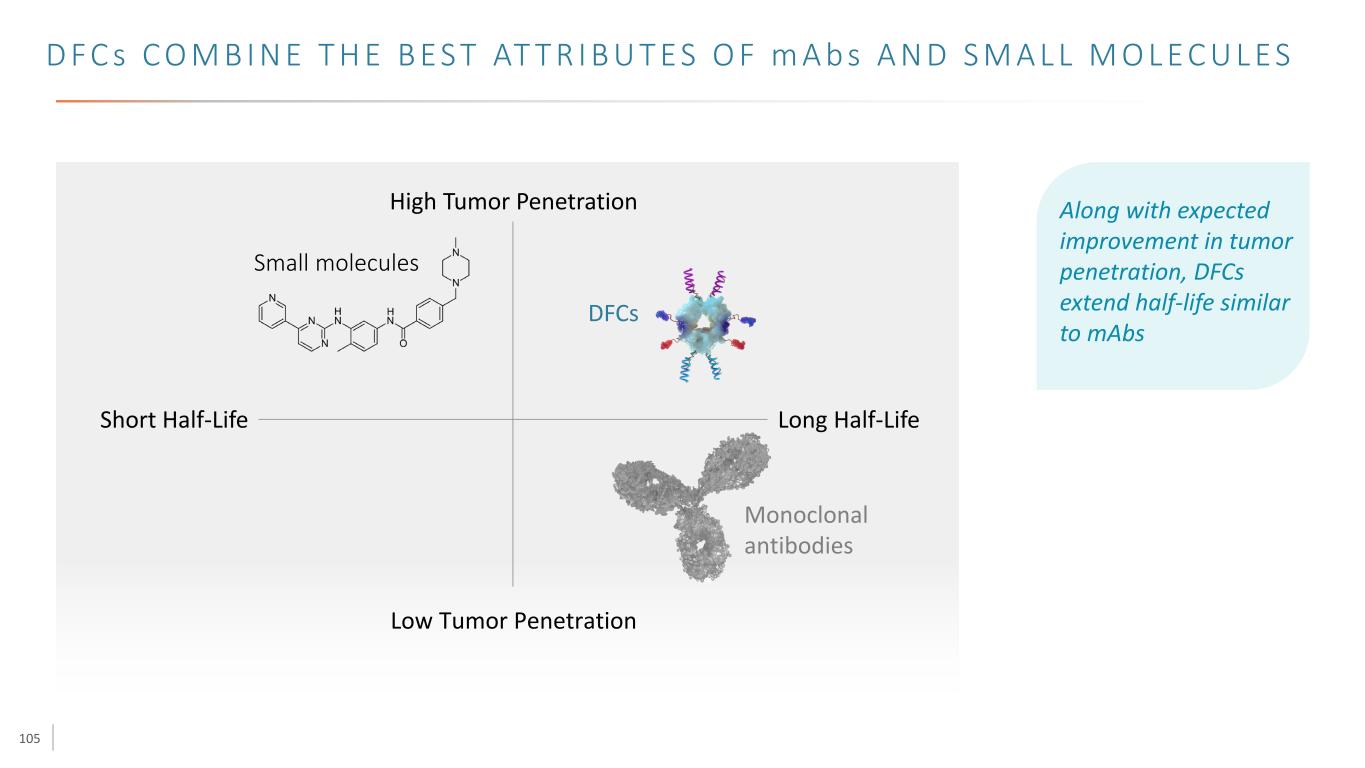

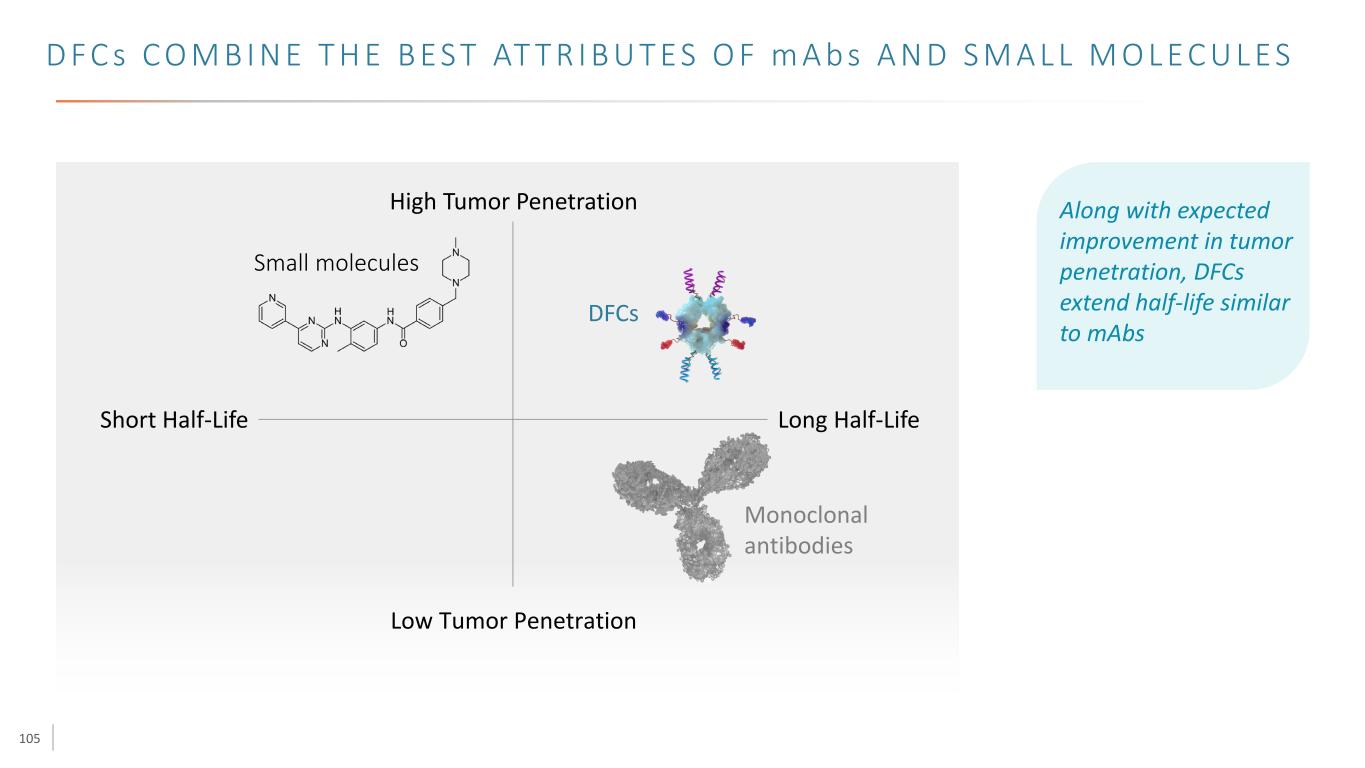

105 D F C s C O M B I N E T H E B E S T AT T R I B U T E S O F m A b s A N D S M A L L M O L E C U L E S Long Half-LifeShort Half-Life Low Tumor Penetration High Tumor Penetration Along with expected improvement in tumor penetration, DFCs extend half-life similar to mAbs DFCs Small molecules Monoclonal antibodies

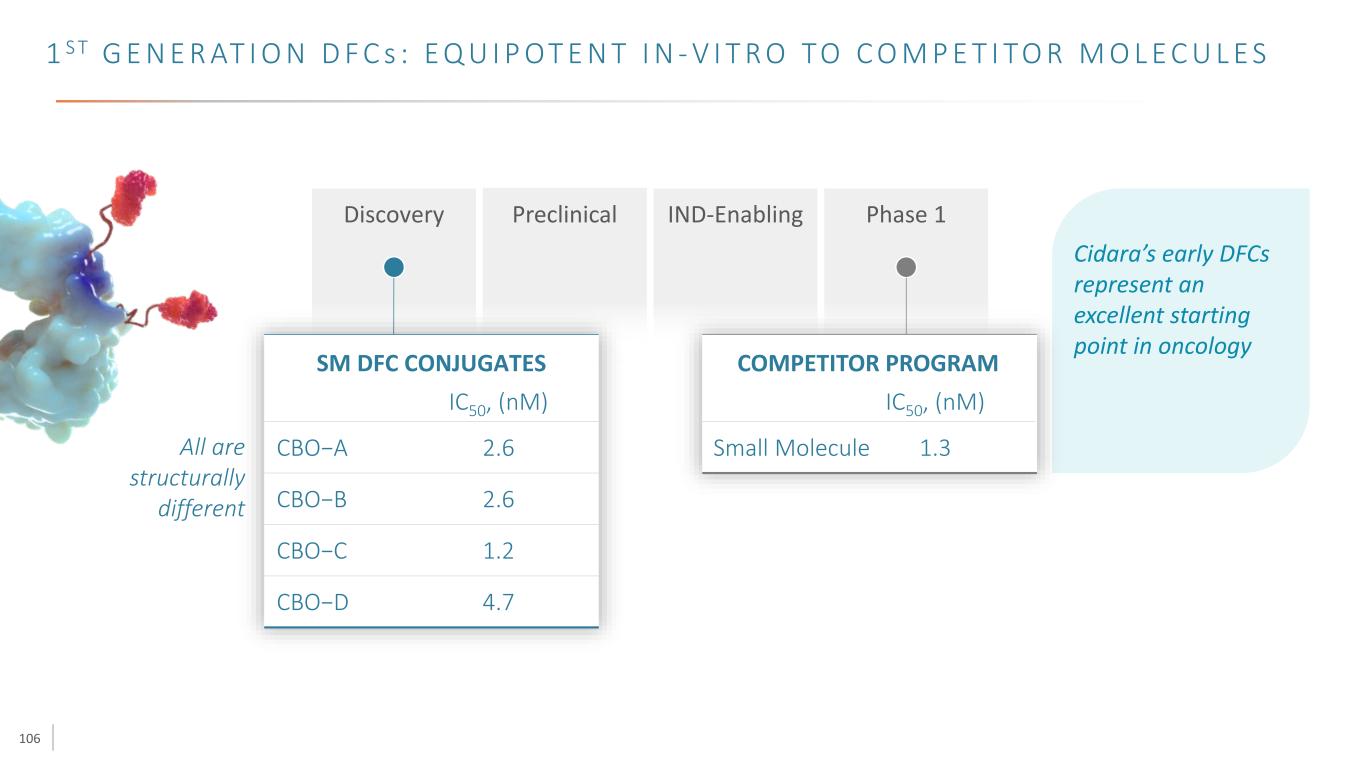

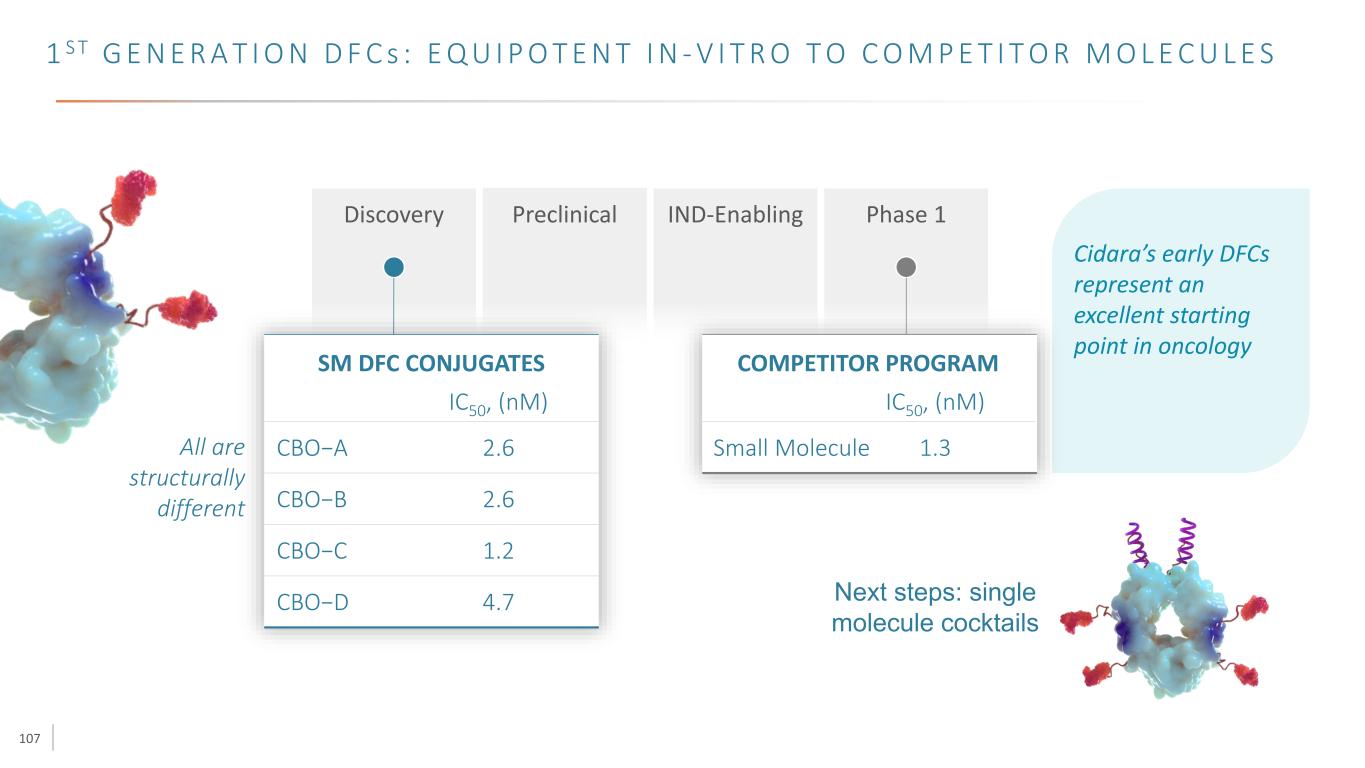

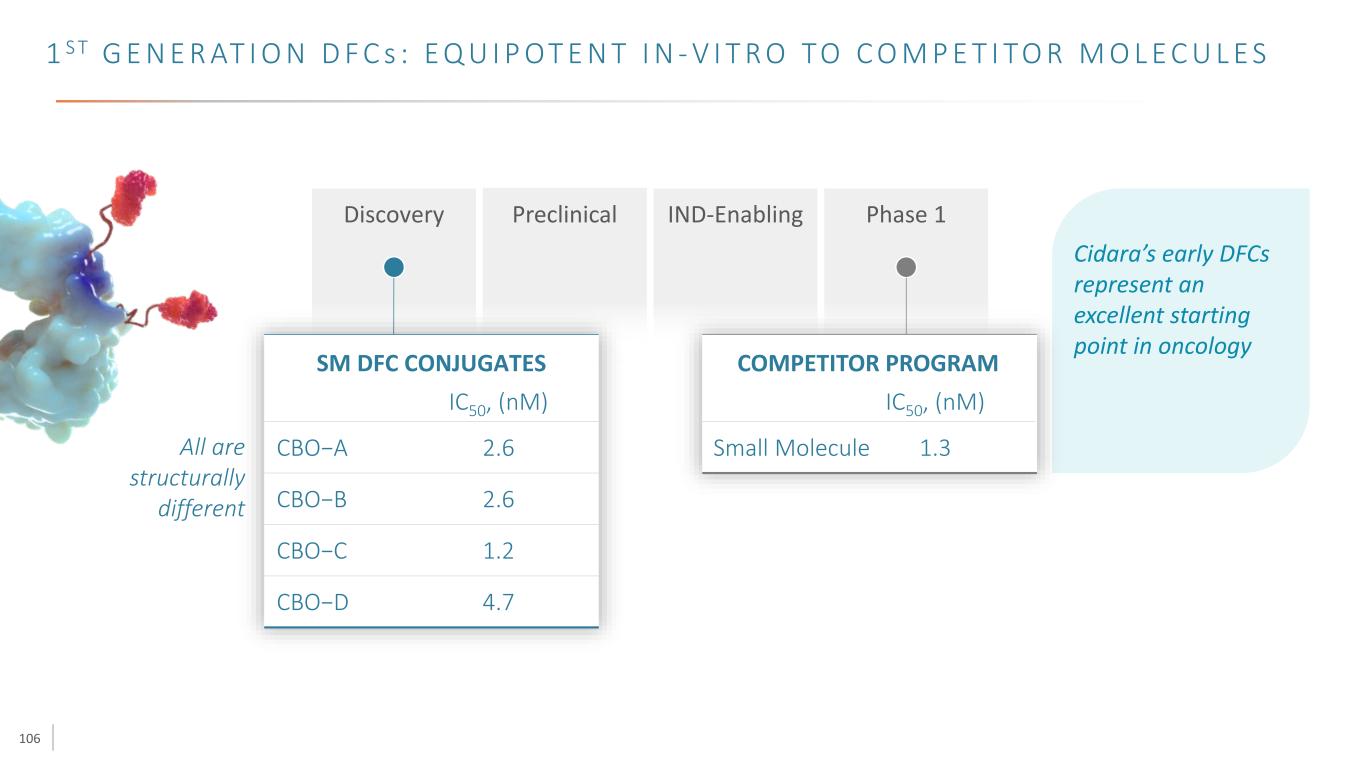

106 1 S T G E N E R AT I O N D F C s : E Q U I P OT E N T I N - V I T R O TO C O M P E T I TO R M O L E C U L E S Discovery Preclinical IND-Enabling Phase 1 CBO−A IC50, (nM) CBO−B CBO−C CBO−D 2.6 2.6 1.2 4.7 SM DFC CONJUGATES Small Molecule IC50, (nM) 1.3 COMPETITOR PROGRAM All are structurally different Cidara’s early DFCs represent an excellent starting point in oncology

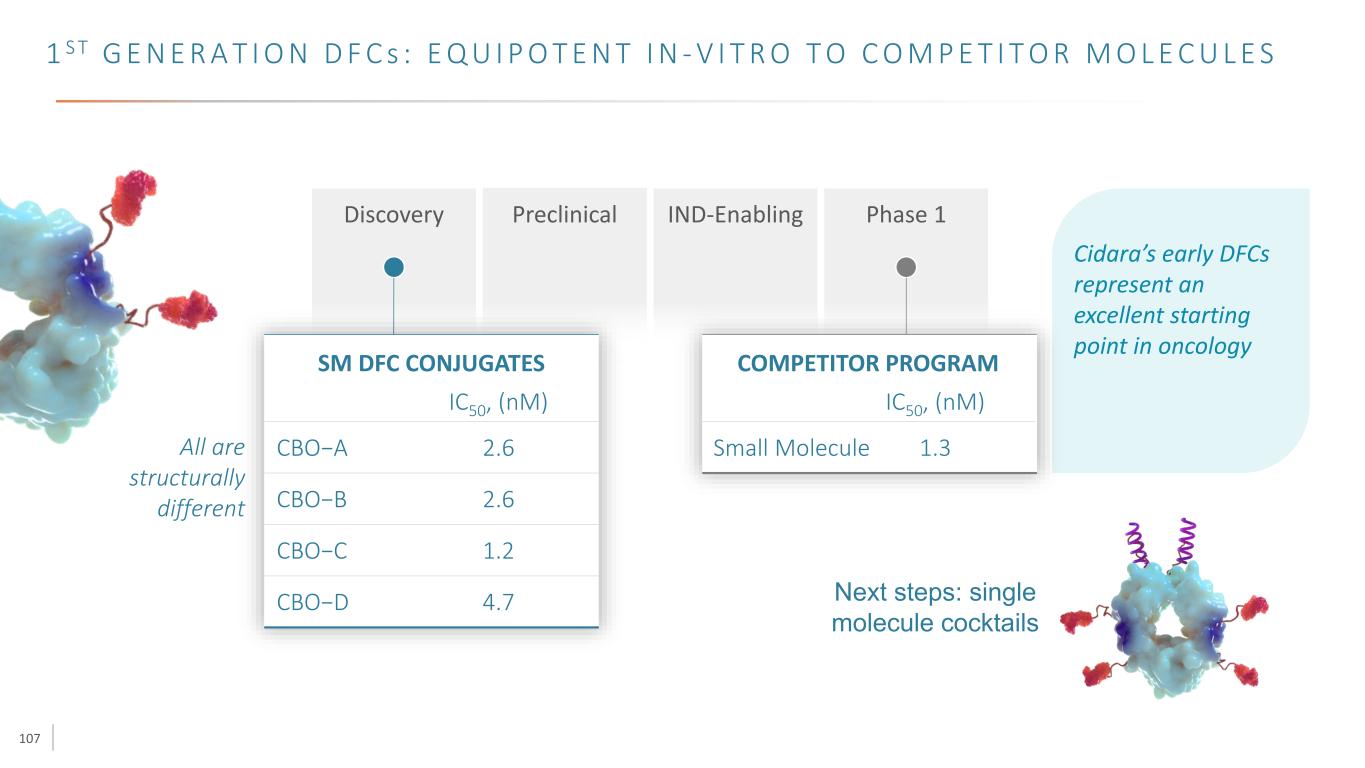

107 1 S T G E N E R A T I O N D F C s : E Q U I P O T E N T I N - V I T R O T O C O M P E T I T O R M O L E C U L E S Discovery Preclinical IND-Enabling Phase 1 CBO−A IC50, (nM) CBO−B CBO−C CBO−D 2.6 2.6 1.2 4.7 SM DFC CONJUGATES Small Molecule IC50, (nM) 1.3 COMPETITOR PROGRAM All are structurally different Cidara’s early DFCs represent an excellent starting point in oncology Next steps: single molecule cocktails

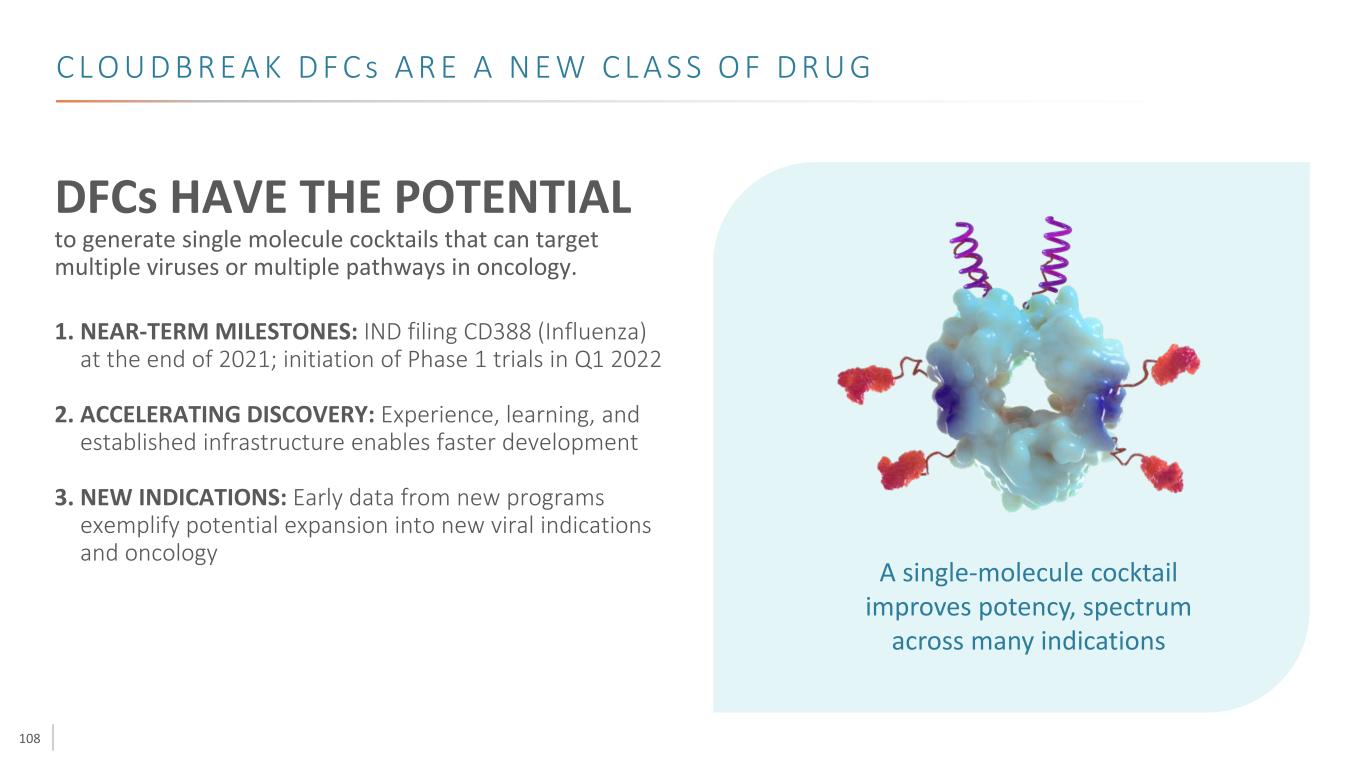

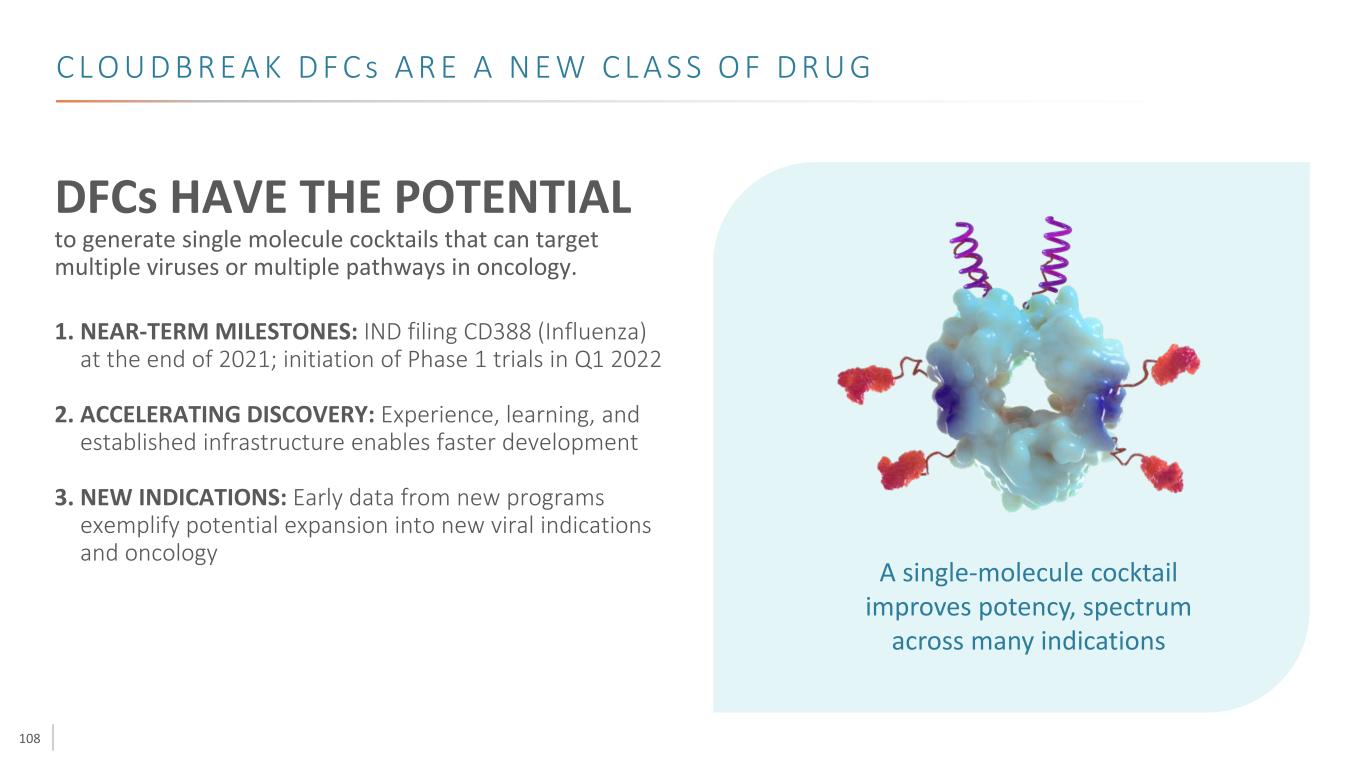

108 C L O U D B R E A K D F C s A R E A N E W C L A S S O F D R U G DFCs HAVE THE POTENTIAL to generate single molecule cocktails that can target multiple viruses or multiple pathways in oncology. 1. NEAR-TERM MILESTONES: IND filing CD388 (Influenza) at the end of 2021; initiation of Phase 1 trials in Q1 2022 2. ACCELERATING DISCOVERY: Experience, learning, and established infrastructure enables faster development 3. NEW INDICATIONS: Early data from new programs exemplify potential expansion into new viral indications and oncology A single-molecule cocktail improves potency, spectrum across many indications

109 S U M M A R Y J E F F R E Y S T E I N , P h D C H I E F E X E C U T I V E O F F I C E R , C I D A R A

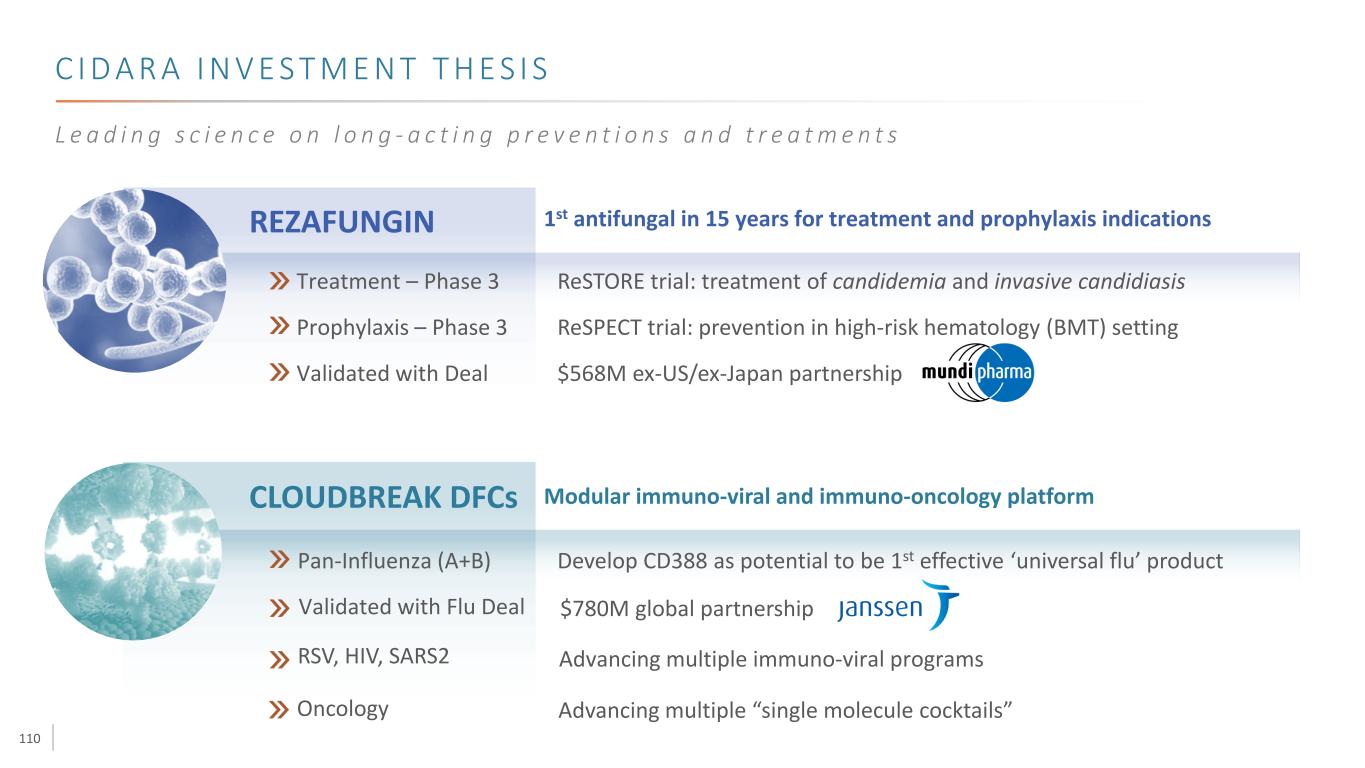

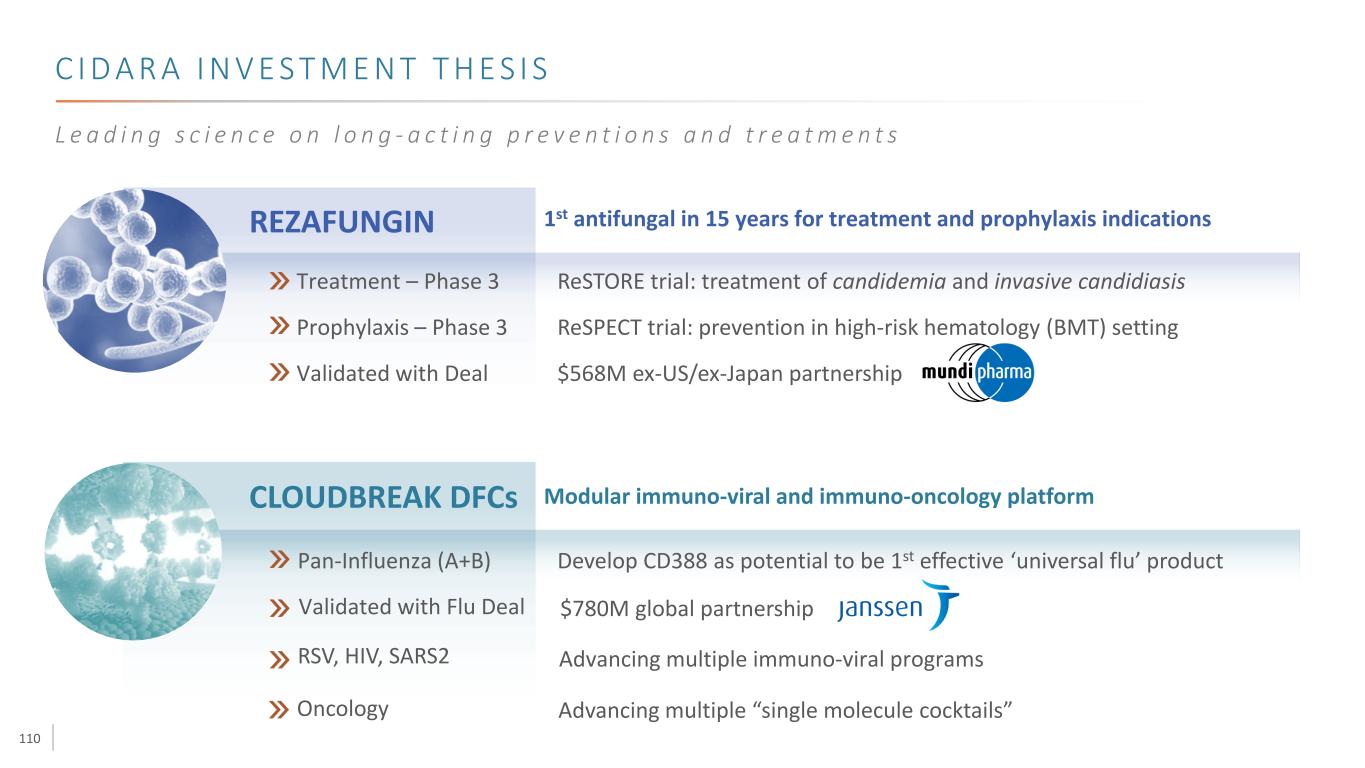

110 C I D A R A I N V E S T M E N T T H E S I S L e a d i n g s c i e n c e o n l o n g - a c t i n g p r e v e n t i o n s a n d t r e a t m e n t s REZAFUNGIN 1st antifungal in 15 years for treatment and prophylaxis indications Treatment – Phase 3 Prophylaxis – Phase 3 Validated with Deal ReSTORE trial: treatment of candidemia and invasive candidiasis ReSPECT trial: prevention in high-risk hematology (BMT) setting $568M ex-US/ex-Japan partnership CLOUDBREAK DFCs Modular immuno-viral and immuno-oncology platform Pan-Influenza (A+B) Develop CD388 as potential to be 1st effective ‘universal flu’ product RSV, HIV, SARS2 Advancing multiple immuno-viral programs Validated with Flu Deal $780M global partnership Oncology Advancing multiple “single molecule cocktails”